|

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| WASHINGTON, D.C. 20549 |

FORM 20-F

(Mark One)

| |

| [ ] | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

| OR |

|

| [X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the fiscal year ended May 31, 2010 |

|

| OR |

|

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

| OR |

|

| [ ] | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| Date of event requiring this shell company report |

| For the transition period from ________________ to ___________________ |

Commission file number:000-26296

|

| Petaquilla Minerals Ltd. |

| (Exact name of Registrant as specified in its charter) |

| |

| Not Applicable |

| (Translation of Registrant's name into English) |

|

| Province of British Columbia, Canada |

| (Jurisdiction of incorporation or organization) |

| |

| Suite 410, 475 West Georgia Street, Vancouver, British Columbia, Canada V6B 4M9 |

| (Address of principal executive offices) |

| |

| Julie van Baarsen, telephone (604) 694-0021, facsimile (604) 694-0063, |

| Suite 410, 475 West Georgia Street,Vancouver, British Columbia, Canada V6B 4M9 |

| (Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) |

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| | | |

| | Title of each class | | Name of each exchange on which registered |

| | None | | Not applicable |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

|

| Common Shares Without Par Value |

| (Title of Class) |

| |

| Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act. |

| |

| Not Applicable |

| (Title of Class) |

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

125,281,951 common shares, without par value, as at May 31, 2010

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

[ ] Yes [X] No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

[ ] Yes [X] No

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding year (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

[X] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding year (or for such shorter period that the registrant was required to submit and post such files).

[ ] Yes [ ] No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer.

See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| | |

| Large accelerated filer [ ] | Accelerated filer [X] | Non-accelerated filer [ ] |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | |

| U.S. GAAP [ ] | International Financial Reporting Standards as issued by the International Accounting Standards Board [ ] | Other [X] |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

[ ] Yes [X] No

| | |

| PETAQUILLA MINERALS LTD.

SECURITIES AND EXCHANGE COMMISSION

FORM 20-F

TABLE OF CONTENTS | Page No. |

| | |

| | |

| | GLOSSARY OF MINING TERMS | 8 |

| | CAUTIONARY NOTE REGARDING RESOURCE AND RESERVE ESTIMATES | 10 |

| | CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION | 10 |

| | CURRENCY PRESENTATION | 11 |

| | INTRODUCTION | 12 |

| | |

| PART I | | 12 |

| | |

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS | 12 |

| | |

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE | 12 |

| | |

| ITEM 3. | KEY INFORMATION | 12 |

| 3.A. | Selected Financial Data | 12 |

| 3.B. | Capitalization and Indebtedness | 15 |

| 3.C. | Reasons for the Offer and Use of Proceeds | 16 |

| 3.D. | Risk Factors | 16 |

| | Mining operations and projects are vulnerable to supply chain disruptions and our operations and development projects could be adversely affected by shortages of, as well aslead times to deliver, strategic spares, critical consumables, mining equipment or metallurgical plant equipment. | 16 |

| | We face uncertainty and risks in our exploration and project evaluation activities. | 16 |

| | We face many risks related to the development of our mining projects that may adversely affect our results of operations and profitability. | 17 |

| | We may require additional funding in order to continue our operations. | 18 |

| | Our level of indebtedness could adversely affect our business. | 18 |

| | We face many risks related to our operations that may adversely affect our cash flows and overall profitability. | 19 |

| | Mineral prices can fluctuate dramatically and have a material adverse effect on our results of operations. | 19 |

| | We face risks related to operations in foreign countries. | 20 |

| | The requirements of the Ley Petaquilla may have an adverse impact on us. | 20 |

| | Our operations are subject to environmental and other regulation. | 21 |

| | Our directors may have conflicts of interest. | 22 |

| | Environmental protestors are present in Panama. | 22 |

| | Our common shares are subject to penny stock rules, which could affect trading in our shares. | 22 |

| | U.S. investors may not be able to enforce their civil liabilities against us or our directors, controlling persons and officers. | 22 |

| | If we are characterized as a Passive Foreign Investment Company (“PFIC”), our U.S. shareholders may be subject to adverse U.S. federal income tax consequences. | 22 |

| ITEM 4. | INFORMATION ON THE COMPANY | 23 |

| | |

| 4.A. | History and Development of the Company | 23 |

| | Molejon Property – Panama | 24 |

| | Principal Capital Expenditures and Divestitures Over Last Three Fiscal Years | 24 |

| | Current Capital Expenditures and Divestitures | 24 |

| | Public Takeover Offers | 25 |

| 4.B. | Business Overview | 25 |

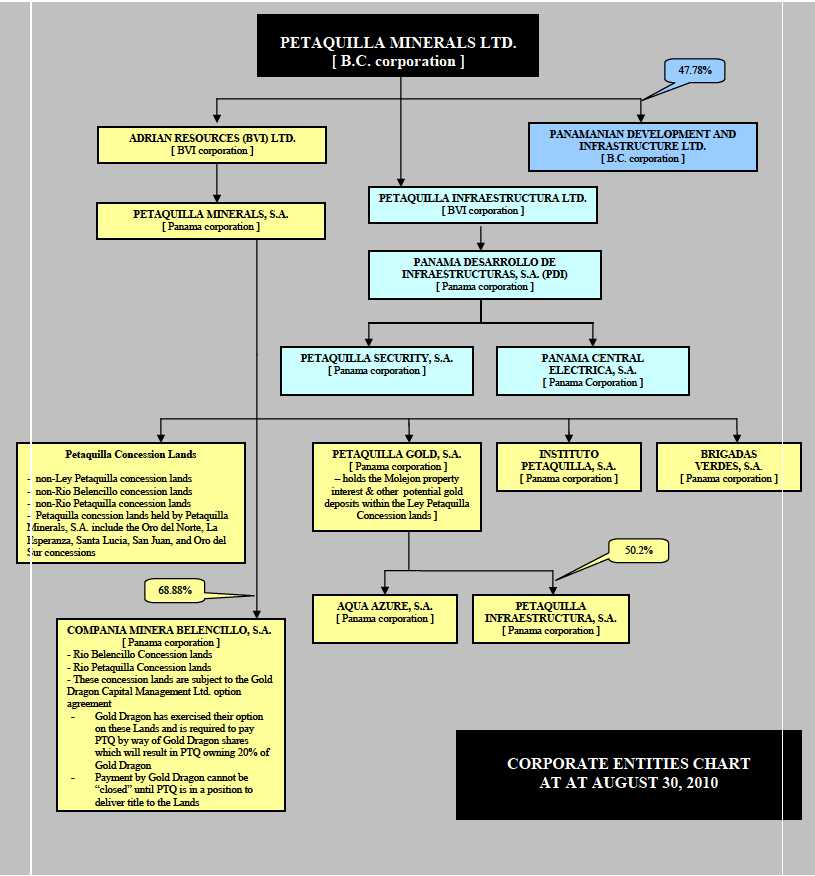

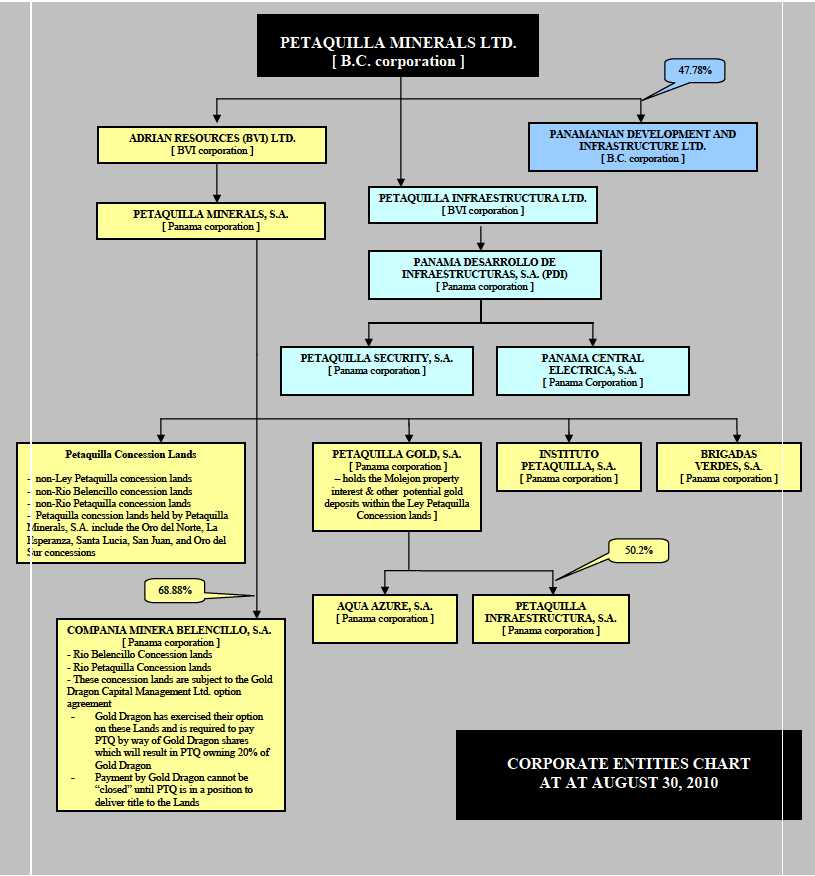

| 4.C. | Organizational Structure | 26 |

| | Corporate Entities Chart as at August 30, 2010 | 27 |

| 4.D. | Property, Plant and Equipment | 28 |

| | Mineral Concession Lands | 28 |

| | Introduction | 28 |

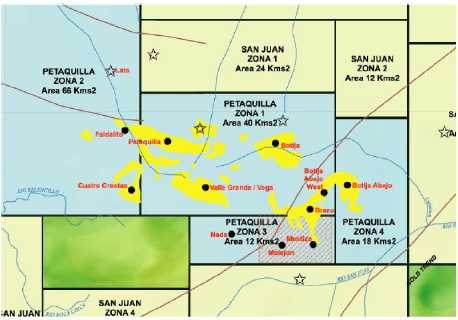

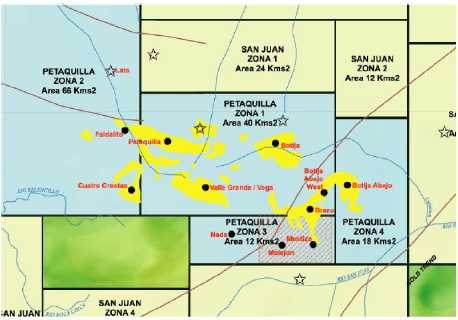

| | Property Location | 28 |

| | Location, Access & Physiography | 30 |

| | Plant and Equipment | 31 |

| | Title | 33 |

| | Exploration History | 34 |

| | Outlook – 2011 | 38 |

| | Regional and Local Geology | 38 |

| | Mineralization | 39 |

| | Doing Business in Panama | 40 |

| | |

| ITEM 4A. | UNRESOLVED STAFF COMMENTS | 42 |

| | |

| ITEM 5. | OPERATING AND FINANCIAL REVIEW AND PROSPECTS | 42 |

| 5.A. | Operating Results | 42 |

| | Year Ended May 31, 2010, Compared to Year Ended May 31, 2009 | 43 |

| | Year Ended May 31, 2009, Compared to Year Ended May 31, 2008 | 44 |

| | One Month Ended May 31, 2008, Compared to One Month Ended May 31, 2007 | 45 |

| | Year Ended April 30, 2008, Compared to Year Ended April 30, 2007 | 46 |

| 5.B | Liquidity and Capital Resources | 48 |

| | May 31, 2010, Compared with May 31, 2009 | 50 |

| | May 31, 2009, Compared with May 31, 2008 | 50 |

| | May 31, 2008, Compared with April 30, 2008 | 51 |

| | April 30, 2008, Compared to April 30, 2007 | 52 |

| 5.C. | Research and Development, Patents and Licenses, etc. | 52 |

| 5.D. | Trend Information | 53 |

| 5.E. | Off-Balance Sheet Arrangements | 53 |

| 5.F. | Tabular Disclosure of Contractual Obligations | 53 |

| 5.G. | Safe Harbour | 55 |

| 5.H. | Non-GAAP Measures | 55 |

| | |

| ITEM 6. | DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | 56 |

| 6.A. | Directors and Senior Management | 56 |

| 6.B. | Compensation | 57 |

| | Cash and Non-Cash Compensation – Directors and Officers | 57 |

| | Option Grants to Directors and Officers During Fiscal Year Ended May 31, 2010 | 58 |

| | Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values | 59 |

| | Defined Benefit or Actuarial Plan Disclosure | 59 |

| | Termination of Employment, Change in Responsibilities and Employment Contracts | 59 |

| | Directors | 60 |

| | |

| 6 .C. | Board Practices | 60 |

| 6 .D. | Employees | 60 |

| 6 .E. | Share Ownership | 61 |

| ITEM 7. | MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | 62 |

| 7 .A. | Major Shareholders | 62 |

| 7 .B. | Related Party Transactions | 62 |

| 7 .C. | Interests of Experts and Counsel | 63 |

| | |

| ITEM 8. | FINANCIAL INFORMATION | 64 |

| 8 .A. | Consolidated Statements and Other Financial Information | 64 |

| 8 .B. | Significant Changes | 64 |

| | |

| ITEM 9. | THE OFFER AND LISTING | 65 |

| 9 .A. | Offer and Listing Details | 65 |

| 9 .B. | Plan of Distribution | 67 |

| 9 .C. | Markets | 67 |

| 9 .D. | Selling Shareholders | 67 |

| 9 .E. | Dilution | 68 |

| 9 .F. | Expenses of the Issue | 68 |

| | |

| ITEM 10. | ADDITIONAL INFORMATION | 68 |

| 10 .A. | Share Capital | 68 |

| 10 .B. | Memorandum and Articles of Association | 68 |

| 10 .C. | Material Contracts | 69 |

| 10 .D. | Exchange Controls | 69 |

| 10 .E. | Taxation | 70 |

| | Material Canadian Federal Income Tax Consequences | 70 |

| | Dividends | 71 |

| | Capital Gains | 71 |

| | Material United States Federal Income Tax Consequences | 72 |

| | U.S. Holders | 72 |

| | Distributions on our Common Shares | 72 |

| | Disposition of our Common Shares | 73 |

| | Passive Foreign Investment Company | 73 |

| | Foreign Tax Credit | 74 |

| | Controlled Foreign Corporation | 74 |

| | Information Reporting; Backup Withholding | 75 |

| 10 .F. | Dividends and Paying Agents | 75 |

| 10 .G. | Statement by Experts | 75 |

| 10 .H. | Documents on Display | 75 |

| 10 .I. | Subsidiary Information | 75 |

| | |

| | |

| ITEM 11. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 75 |

| | |

| | |

| ITEM 12. | DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | 76 |

| | |

| PART II | | 77 |

| | |

| ITEM 13. | DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES | 77 |

| | |

| ITEM 14. | MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | 77 |

| | | |

| ITEM 15. | CONTROLS AND PROCEDURES | 77 |

| | |

| ITEM 16. | [RESERVED] | 79 |

| | |

| ITEM 16.A. | AUDIT COMMITTEE FINANCIAL EXPERTS | 79 |

| | |

| ITEM 16.B. | CODE OF ETHICS | 79 |

| | |

| ITEM 16.C. | PRINCIPAL ACCOUNTANT FEES AND SERVICES | 79 |

| | |

| ITEM 16.D. | EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES | 80 |

| | |

| ITEM 16.E. | PURCHASES OF EQUITY SECURITIES BY OUR COMPANY AND AFFILIATED PURCHASERS | 80 |

| | | |

| ITEM 16.F. | CHANGE IN REGISTRANT’S CERTIFYING ACCOUNTANT | 80 |

| | |

| ITEM 16.G. | CORPORATE GOVERNANCE | 80 |

| | |

| PART III | | 80 |

| | |

| ITEM 17. | FINANCIAL STATEMENTS | 80 |

| | |

| ITEM 18. | FINANCIAL STATEMENTS | 125 |

| | |

| ITEM 19. | EXHIBITS | 125 |

| | |

| | SIGNATURES | 127 |

GLOSSARY OF MINING TERMS

The following is a glossary of some of the terms used in the mining industry and referenced herein:

cuttoff grade | the deemed grade of mineralization, established by reference to economic factors, above which material is included in mineral deposit calculations and below which material is considered waste. May be either an external cutoff grade, which refers to the grade of mineralization used to control the external or design limits of an open pit based upon the expected economic parameters of the operation, or an internal cutoff grade, which refers to the minimum grade required for blocks of mineralization present within the confines of an open pit to be included in mineral deposit estimates |

diamond drill | a machine designed to rotate under pressure an annular diamond-studded cutting tool to produce a more or less continuous solid sample (drill core) of the material that is drilled |

epithermal | a term applied to those mineral deposits formed in and along fissures or other openings in rocks by deposition at shallow depths from ascending hot solutions |

exploration information | geological, geophysical, geochemical, sampling, drilling, trenching, analytical testing, assaying, mineralogical, metallurgical and other similar information concerning a particular property that is derived from activities undertaken to locate, investigate, define or delineate a mineral prospect or mineral deposit |

indicated mineral resource | that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics, can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed |

inferred mineral resource | that part of a Mineral Resource for which quantity, grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes |

junior resource company | as used herein means a company whose mineral resource properties are in the exploration phase only and which is wholly or substantially dependent on equity financing or joint ventures to fund its ongoing activities |

measured mineral resource | that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity |

mineral deposit, deposit or mineralized material | a mineralized body which has been physically delineated by sufficient drilling, trenching and/or underground work and found to contain a sufficient average grade of metal or metals to warrant further exploration and/or development expenditures. Such a deposit does not qualify under standards of the Securities Exchange Commission as a commercially mineable ore body or as containing ore reserves, until final legal, technical and economic factors have been resolved |

mineral reserve | the economically mineable part of a Measured or Indicated Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This Study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A Mineral Reserve includes diluting materials and allowances for losses that may occur when the material is mined |

mineral resource | a concentration or occurrence of diamonds, natural solid inorganic material or natural solid fossilized organic material including base and precious metals, coal and industrial minerals in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge |

open pit mining | the process of mining an ore body from the surface in progressively deeper steps. Sufficient waste rock adjacent to the ore body is removed to maintain mining access and to maintain the stability of the resulting pit |

ore | a natural aggregate of one or more minerals which, at a specified time and place, may be mined and sold at a profit, or from which some part may be profitably separated |

ounces | troy ounces |

oz/tonne | troy ounces per metric ton |

ppb | parts per billion |

ppm | parts per million |

porphyry deposit | a disseminated mineral deposit often closely associated with porphyritic intrusive rocks; |

preliminary feasibility study | a comprehensive study of the viability of a mineral project that has advanced to a stage where the mining method, in the case of underground mining, or the pit configuration, in the case of an open pit, has been established and an effective method of mineral processing has been determined, and includes a financial analysis based on reasonable assumptions of technical, engineering, legal, operating, economic, social and environmental factors and the evaluation of other relevant factors which are sufficient for a Qualified Person, acting reasonably, to determine if all or part of the Mineral Resource may be classified as a Mineral Reserve |

probable mineral reserve | the economically mineable part of an Indicated mineral resource and, in some circumstances, a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. Such Study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified |

proven mineral reserve | the economically mineable part of a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. Such study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified |

qualified person | an individual who is an engineer or geoscientist with at least five years of experience in mineral exploration, mine development or operation or mineral project assessment, or any combination of these; has experience relevant to the subject matter of the mineral project and the technical report; and is a member or licensee in good standing of a professional association |

stockwork | a rock mass so interpenetrated by small veins of ore that the whole must be mined together. Stockworks are distinguished from tabular or sheet deposits, (i.e. veins or beds), which have a small degree of thickness in comparison with their extension in the main plane of the deposit |

strike length | the longest horizontal dimensions of a body or zone of mineralization |

stripping ratio | the ratio of waste material to ore that is experienced in mining an ore |

tonne | body, metric ton (2,204 pounds) |

CAUTIONARY NOTE REGARDING RESOURCE AND RESERVE ESTIMATES

The terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. These definitions differ from the definitions in SEC Industry Guide 7 under the United States Securities Act of 1993, as amended (the “Securities Act”). Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

In addition, the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC Industry Guide 7 standards as in place tonnage and grade without reference to unit measures.

Accordingly, information contained in this Annual Report contains descriptions of our mineral deposits that may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This Annual Report on Form 20-F contains forward-looking information and forward-looking statements as defined in applicable securities laws. These statements relate to future events or our future performance. All statements other than statements of historical fact are forward-looking statements.

Forward-looking statements include, but are not limited to, statements with respect to the future price of gold, silver and other minerals, the estimation of mineral reserves and resources, the realization of mineral reserve estimates, the timing and amount of estimated future production, costs of production, capital expenditures, costs and timing of the development of new deposits, success of exploration activities, permitting time lines, currency exchange rate fluctuations, requirements for additional capital, government regulation of mining operations, environmental risks, unanticipated reclamation expenses, title disputes or claims and limitations on insurance coverage.

Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate” or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”.

Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause our actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: risks related to international operations; risks related to joint venture operations; actual results of current exploration activities; conclusions of economic evaluations; changes in project parameters as plans continue to be refined; future prices of gold and silver; possible variations in ore reserves, grade or recovery rates; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes and other risks of the mining industry; delays in obtaining governmental approvals or financing or in the completion of development or construction activities, as well as those factors discussed in the section entitled “Risk Factors” in this Annual Report on Form 20-F. Although we have attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

Statements in this Annual Report on Form 20-F regarding expected completion dates of feasibility studies, anticipated mining or metal production operations, projected quantities of future metal production and anticipated production rates, operating efficiencies, costs and expenditures are forward-looking statements. Actual results could differ materially depending upon the availability of materials, equipment, required permits or approvals and financing, the occurrence of unusual weather or operating conditions, the accuracy of reserve estimates, lower than expected ore grades or the failure of equipment or processes to operate in accordance with specifications. Additional information about these and other assumptions, risks and uncertainties that may affect our future financial performance are set out inItem 3.D. – Key Information – Risk Factors.

Forward-looking statements in this Annual Report on Form 20-F are as of August 30, 2010. We do not undertake to update any forward-looking statements that are incorporated by reference herein, except in accordance with applicable securities laws.

CURRENCY PRESENTATION

This Annual Report on Form 20-F contains references to United States dollars and Canadian dollars. Unless otherwise indicated, all dollar amounts referred to herein are expressed in United States dollars and all financial information presented has been prepared in accordance with Canadian generally accepted accounting principles. Measurement differences between Canadian generally accepted accounting principles and those in the United States, as applicable to our company, are set forth in Item 3.A. and Note 27 to the accompanying financial statements of our company. Canadian dollars are referred to as “CAD$”.

INTRODUCTION

Petaquilla Minerals Ltd. is organized under the British Columbia Business Corporations Act. As used in this Annual Report on Form 20-F (the “Annual Report”), the terms “Petaquilla”, “we”, “us” and “our” refer to Petaquilla Minerals Ltd. and our subsidiaries unless otherwise indicated or if the context otherwise requires. We refer you to the actual corporate documents for more complete information than may be contained in this Annual Report.

Our principal corporate offices are located at Suite 410, 475 West Georgia Street, Vancouver, British Columbia, Canada V6B 4M9. Our telephone number is 604-694-0021.

We file reports and other information with the Securities and Exchange Commission (the “SEC”) located at 100 F Street NE, Washington, D.C. 20549; you may obtain copies of our filings with the SEC by accessing its website located at www.sec.gov. Further, we file reports under Canadian regulatory requirements on the System for Electronic Document Analysis and Retrieval of the Canadian Securities Administrators (“SEDAR”); you may access our reports filed on SEDAR by accessing the following website: www.sedar.com.

The information set forth in this Annual Report is as at August 30, 2010, unless an earlier or later date is indicated.

PART I

| |

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

| |

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable

| |

| 3.A. | Selected Financial Data |

The following tables summarize our selected consolidated financial data prepared in accordance with Canadian generally accepted accounting principles (“Canadian GAAP”) and reconciled for measurement differences to United States generally accepted accounting principles (“U.S. GAAP”). The information in the tables was extracted from the more detailed financial statements and related notes included with this filing and should be read in conjunction with these financial statements and with the information appearing under the heading “Item 5 – Operating and Financial Review and Prospects”. Note 27 of our consolidated financial statements, included with this filing, sets forth the material variations in U.S. GAAP. Results for the periods presented are not necessarily indicative of results for future periods.

INFORMATION IN ACCORDANCE WITH CANADIAN GAAP:

| | | | | | | | | | | | | | | | | | | | | | |

| | | Year

Ended

May 31 | | | Year

Ended

May 31 | | | 1 Month

Ended

May 31 | | | Year

Ended

April 30 | | | 3 Months

Ended

April 30 | | | Year

Ended

January 31 | |

| | | | 2010 | | | 2009 | | | 2008 | | | 2008 | | | 2007 | | | 2007 | | | 2006 | |

| (a) | Total revenue | | 27,827,935 | | $ | 0 | | $ | 0 | | $ | 0 | | $ | 0 | | $ | 0 | | $ | 0 | |

| (b) | (Loss) before extraordinary items (1) | | | | | | | | | | | | | | | | | | | | | |

| | Total | $ | (26,982,082 | ) | $ | (21,099,866 | ) | $ | (5,544,998 | ) | $ | ( 16,111,007 | ) | $ | (8,492,639 | ) | $ | (30,712,592 | ) | $ | (3,948,102 | ) |

| | Per share(1) | $ | (0.25 | ) | $ | (0.22 | ) | $ | (0.06 | ) | $ | (0.17 | ) | $ | (0.09 | ) | $ | (0.40 | ) | $ | (0.06 | ) |

| (c) | Total assets | $ | 80,262,195 | | $ | 81,543,823 | | $ | 71,208,177 | | $ | 58,789,331 | | $ | 24,981,649 | | $ | 22,743,078 | | $ | 9,279,398 | |

| (d) | Total long-term debt | $ | 520,464 | | $ | 52,939,642 | | $ | 30,939,670 | | $ | 1,367,249 | | $ | 631,775 | | $ | 739,159 | | $ | 0 | |

| (e) | Total shareholders’ equity (deficiency) | $ | (21,353,115 | ) | $ | (8,920,288 | ) | $ | 14,606,134 | | $ | 18,765,944 | | $ | 14,370,149 | | $ | 18,647,224 | | $ | 8,798,091 | |

| (f) | Cash dividends declared per share | | n/a | | | n/a | | | n/a | | | n/a | | | n/a | | | n/a | | | n/a | |

| (g) | Capital stock (number of issued and outstanding common shares) | | 125,281,951 | | | 96,040,121 | | | 95,958,641 | | | 95,958,641 | | | 89,876,951 | | | 89,367,031 | | | 70,246,303 | |

| (h) | Net earnings (loss) for the period | | | | | | | | | | | | | | | | | | | | | |

| | Total | $ | (26,982,082 | ) | $ | (21,099,866 | ) | $ | (5,544,998 | ) | $ | (16,111,007 | ) | $ | (8,492,639 | ) | $ | (30,712,592 | ) | $ | (3,948,102 | ) |

| | Per share(1) | $ | (0.25 | ) | $ | (0.22 | ) | $ | (0.06 | ) | $ | (0.17 | ) | $ | (0.09 | ) | $ | (0.40 | ) | $ | (0.06 | ) |

| | |

| (1) | The effect of potential share issuances pursuant to the exercise of options and warrants would be anti-dilutive and, therefore, basic and diluted losses per share are the same. |

INFORMATION IN ACCORDANCE WITH U.S. GAAP:

| | | | | | | | | | | | | | | | | | | | | | |

| | | Year Ended

May 31 | | | Year Ended

May 31 | | | 1 Month

Ended

May 31 | | | Year Ended

April 30 | | | 3 Months

Ended

April 30 | | | Year

Ended

January 31 | |

| | | | 2010 | | | 2009 | | | 2008 | | | 2008 | | | 2007 | | | 2007 | | | 2006 | |

| (a) | Total revenue | $ | 55,776,410 | | $ | 653,941 | | $ | 0 | | $ | 0 | | $ | 0 | | $ | 0 | | $ | 0 | |

| (b) | (Loss) before extraordinary items (1) | | | | | | | | | | | | | | | | | | | | | |

| | Total | $ | (26,675,905 | ) | $ | (46,852,067 | ) | $ | (3,597,227 | ) | $ | (49,752,062 | ) | $ | (14,635,836 | ) | $ | (35,682,285 | ) | $ | (4,120,582 | ) |

| | Per share(1) | $ | (0.25 | ) | $ | (0.49 | ) | $ | (0.04 | ) | $ | (0.53 | ) | $ | (0.16 | ) | $ | (0.46 | ) | $ | (0.07 | ) |

| (c) | Total assets | $ | 23,745,094 | | $ | 26,542,454 | | $ | 37,419,662 | | $ | 36,108,361 | | $ | 19,470,848 | | $ | 19,202,974 | | $ | 9,106,918 | |

| (d) | Total long-term debt | $ | 5,486,053 | | $ | 59,727,593 | | $ | 17,303,337 | | $ | 1,367,249 | | $ | 631,775 | | $ | 739,159 | | $ | 0 | |

| (e) | Total shareholders’ equity (deficiency) | $ | (83,013,583 | ) | $ | (70,709,608 | ) | $ | (5,546,048 | ) | $ | (3,915,026 | ) | $ | 8,859,348 | | $ | 15,107,120 | | $ | 8,625,611 | |

| (f) | Cash dividends declared per share | | n/a | | | n/a | | | n/a | | | n/a | | | n/a | | | n/a | | | n/a | |

| (g) | Capital stock (number of issued and outstanding common shares) | | 125,281,951 | | | 96,040,121 | | | 95,958,641 | | | 95,958,641 | | | 89,876,951 | | | 89,367,031 | | | 70,246,303 | |

| (h) | Net earnings (loss) for the period | | | | | | | | | | | | | | | | | | | | | |

| | Total | $ | (26,675,095 | ) | $ | (46,852,067 | ) | $ | (3,597,227 | ) | $ | (49,752,062 | ) | $ | (14,635,836 | ) | $ | (35,682,285 | ) | $ | (4,120,582 | ) |

| | Per share(1) | $ | (0.25 | ) | $ | (0.49 | ) | $ | (0.04 | ) | $ | (0.53 | ) | $ | (0.16 | ) | $ | (0.46 | ) | $ | (0.07 | ) |

| | |

| (1) | The effect of potential share issuances pursuant to the exercise of options and warrants would be anti-dilutive and, therefore, basic and diluted losses per share are the same. |

We have not declared nor paid any dividends since incorporation and we do not anticipate doing so in the foreseeable future. Our present policy is to retain all available funds for use in our operations and the expansion of our business.

| | | | | | | | | |

| Difference Between Canadian and Unites States Generally Accepted Accounting Principles Loss for the periods |

| | | Year ended | | | Year ended | | | One month ended | |

| | | May 31 | | | May 31 | | | May 31 | |

| | | 2010 | | | 2009 | | | 2008 | |

| (Loss) for the period – Canadian GAAP | $ | (26,982,082 | ) | $ | (21,099,866 | ) | $ | (5,544,998 | ) |

| Gain on dilution of equity investment | | - | | | (2,238,492 | ) | | - | |

| Mineral properties expensed under U.S. GAAP | | (3,411,935 | ) | | (17,562,548 | ) | | (1,884,160 | ) |

| Revenue recognized | | 27,948,475 | | | 653,941 | | | - | |

| Cost of goods sold | | (24,275,977 | ) | | (1,260,127 | ) | | - | |

| Amortization | | (1,825,067 | ) | | (640,425 | ) | | - | |

Amortization of balls mills included in mineral properties

under U.S. GAAP | | (419,345 | ) | | - | | | - | |

| Depletion of mineral properties under Canadian GAAP | | 3,338,116 | | | - | | | - | |

| Loss of variable interest entity under U.S. GAAP | | 69,765 | | | - | | | - | |

| Expensing of opening inventory reclassified in prior year | | (2,868,999 | ) | | - | | | - | |

| Write down of inventory in finished goods and work in progress | | - | | | (2,404,695 | ) | | - | |

| Change in fair value of warrants denominated in Canadian dollars under U.S. GAAP | | 1,692,320 | | | 22,871,582 | | | - | |

| Change in fair value of share capital issued with warrants denominated in Canadian dollars under U.S. GAAP | | 58,824 | | | - | | | - | |

| Canadian dollars under U.S. GAAP | | | | | | | | | |

| Foreign exchange on difference in mineral properties expensed under U.S. GAAP | | - | | | (9,639,262 | ) | | - | |

| Foreign exchange on difference in senior secured notes under U.S. GAAP | | - | | | 3,180,313 | | | - | |

| Additional loss relating to redemption and modification of senior secured note agreement under U.S. GAAP | | - | | | (18,712,488 | ) | | 3,831,931 | |

| Net loss – U.S. GAAP | $ | (26,675,905 | ) | $ | (46,852,067 | ) | $ | (3,597,227 | ) |

| Basic and diluted loss per share – U.S. GAAP | $ | (0.25 | ) | $ | (0.49 | ) | $ | (0.04 | ) |

| | | | | | | | | |

| | | | | | | | | | |

| | | Year | | | Three months | | | Year | |

| | | ended April 30 | | | ended April 30 | | | ended January 31 | |

| | | 2008 | | | 2007 | | | 2007 | |

| | | | | | | | | |

| (Loss) for the period – Canadian GAAP | $ | (16,111,007 | ) | $ | (8,492,639 | ) | $ | (30,712,592 | ) |

| | | | | | | | | |

| Gain on dilution of equity investment | | (12,582,085 | ) | | (632,396 | ) | | (1,701,589 | ) |

| Mineral properties expensed under U.S. GAAP | | (22,680,970 | ) | | (5,510,801 | ) | | (3,540,104 | ) |

| | | | | | | | | |

| Foreign exchange on difference in mineral properties under U.S. GAAP | | 1,622,000 | | | - | | | 272,000 | |

| Net loss – U.S. GAAP | $ | (49,752,062 | ) | $ | (14,635,836 | ) | $ | (35,682,285 | ) |

| Basic and diluted loss per share – U.S. GAAP | $ | (0.53 | ) | $ | (0.16 | ) | $ | (0.46 | ) |

| | | | | | | | | |

| Balance Sheets | | May 31, | | | May 31, | | | May 31, | |

| | | 2010 | | | 2009 | | | 2008 | |

| Total assets – Canadian GAAP | $ | 80,262,195 | | $ | 81,543,823 | | $ | 71,208,177 | |

| Depletion of mineral properties added to ending inventory | | (281,617 | ) | | - | | | - | |

| Mineral properties expensed or charged to cost of sales and revenue under U.S. GAAP | | (56,235,484 | ) | | (55,001,369 | ) | | (33,788,515 | ) |

| Total assets – U.S. GAAP | $ | 23,745,094 | | $ | 26,542,454 | | $ | 37,419,662 | |

| Long term debt – Canadian GAAP | $ | 520,464 | | $ | 52,939,642 | | $ | 30,939,670 | |

| Allocation of fair value of senior notes under U.S. GAAP | | - | | | - | | | (13,636,333 | ) |

| Derivative liability– warrants | | 4,965,589 | | | 6,292,830 | | | - | |

| Equity component of convertible debt treated as a liability under U.S. GAAP | | - | | | 495,121 | | | - | |

| Long term debt – U.S. GAAP | $ | 5,486,053 | | $ | 59,727,593 | | $ | 17,303,337 | |

| | | | | | | | | |

| Shareholders’ deficiency Canadian – GAAP | | | | | | | | | |

| Mineral properties expensed or charged to cost of sales and revenue | $ | (21,353,115 | ) | $ | (8,920,288 | ) | $ | 14,606,134 | |

| Mineral properties expensed or charged to cost of sales and revenue under U. S. GAAP | | (56,235,484 | ) | | (55,001,369 | ) | | (33,788,515 | ) |

| Exercise of warrants denominated in Canadian dollars under U.S. GAAP | | 272,000 | | | - | | | - | |

| Depletion added to ending inventory | | (281,617 | ) | | - | | | - | |

| (Decrease) increase in retained earnings due to translation of prior year mineral property expenses and senior secured notes | | (4,564,949 | ) | | (4,564,949 | ) | | 1,622,000 | |

| Difference in accumulated other comprehensive income Increase in net income due to the change in fair value of warrants denominated in Canadian dollars under U.S. GAAP | | 4,564,949 | | | 4,564,949 | | | (1,622,000 | ) |

| Increase in net income due to the change in fair value of warrants denominated in Canadian dollars under U.S. | | 22,883,272 | | | 22,871,582 | | | - | |

| Decrease in warrants due to fair value of warrants denominated in Canadian dollars under U. S. GAAP | | (28,120,861 | ) | | (29,164,412 | ) | | - | |

| Additional loss relating to redemption and modification of senior secured note agreement under U.S. GAAP | | (14,591,713 | ) | | (14,903,816 | ) | | 3,831,931 | |

| Allocation of fair value of senior secured notes under U. S. GAAP | | 14,591,713 | | | 14,903,816 | | | 9,804,402 | |

| Equity component of convertible debenture treated as a liability under U.S. GAAP. | | (177,778 | ) | | (495,121 | ) | | - | |

| Shareholders’ deficiency – U.S. GAAP | $ | (83,013,583 | ) | $ | (70,709,608 | ) | $ | (5,546,048 | ) |

| | | | | | | | | |

| | | | | | | | | | |

| Balance Sheets | | April 30, | | | April 30, | | | January 31, | |

| | | 2008 | | | 2007 | | | 2007 | |

| Total assets – Canadian GAAP | $ | 58,789,331 | | $ | 24,981,649 | | $ | 22,743,078 | |

| Mineral properties expensed or charged to cost of sales and revenue under U. S. GAAP | | (22,680,970 | ) | | (5,510,801 | ) | | (3,540,104 | ) |

| Total assets – U.S. GAAP | $ | 36,108,361 | | $ | 19,470,848 | | $ | 19,202,974 | |

| Shareholders’ equity (deficit) -Canadian GAAP | $ | 18,765,944 | | $ | 14,370,149 | | $ | 18,647,224 | |

| Mineral properties expensed under U.S. GAAP | | (22,680,970 | ) | | (5,510,801 | ) | | (3,540,104 | ) |

| Shareholders’ equity (deficit) – U.S. GAAP | $ | (3,915,026 | ) | $ | 8,859,348 | | $ | 15,107,120 | |

| |

| 3. B. | Capitalization and Indebtedness |

Not applicable.

| |

| 3.C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

The following is a brief discussion of those distinctive or special characteristics of our operations and industry, which may have a material impact on, or constitute risk factors in respect of, our financial performance. However, there may be additional risks unknown to us and other risks, currently believed to be immaterial, that could turn out to be material. These risks, either individually or simultaneously, could significantly affect the group’s business and financial results.

We operate in a dynamic and rapidly changing environment that involves numerous risks and uncertainties. Investors should carefully consider the risks described below before investing in our securities. The occurrence of any of the following events could harm us. If these events occur, the trading price of our common shares could decline, and investors may lose part or even all of their investment.

Mining operations and projects are vulnerable to supply chain disruptions and our operations and development projects could be adversely affected by shortages of, as well as lead times to deliver, strategic spares, critical consumables, mining equipment or metallurgical plant equipment.

Our operations and development projects could be adversely affected by shortages of, as well as lead times to deliver, strategic spares, critical consumables and processing equipment. In the past, we and other gold mining companies have experienced shortages in critical consumables, particularly as production capacity in the global mining industry has expanded in response to increased demand for commodities, and we have experienced increased delivery times for these items. These shortages have also resulted in unanticipated increases in the price of certain of these items. Shortages of strategic spares, critical consumables or mining equipment, which could occur in the future, could result in production delays and production shortfalls, and increases in prices result in an increase in both operating costs and the capital expenditure to maintain and develop mining operations. We and other gold mining companies, individually, have limited influence over manufacturers and supplier s of these items. In certain cases there are only limited suppliers for certain strategic spares, critical consumables and processing equipment and they command superior bargaining power relative to us, or we could at times face limited supply or increased lead time in the delivery of such items. If we experience shortages, or increased lead times in delivery of strategic spares, critical consumables or processing equipment our results of operations and our financial condition could be adversely affected.

We face uncertainty and risks in our exploration and project evaluation activities.

Exploration activities are speculative in nature and project evaluation activities necessary to determine whether a viable mining operation exists or can be developed are often unproductive. These activities also often require substantial expenditure to establish the presence, and to quantify the extent and grades (metal content), of mineralized material through exploration drilling. Once mineralization is discovered it can take several years to determine whether adequate ore reserves exist. During this time, the economic feasibility of production may change owing to fluctuations in factors that affect revenue, as well as cash and other operating costs, including:

future metal and other commodity prices;

anticipated tonnage, grades and metallurgical characteristics of the ore to be mined and processed;

anticipated recovery rates of gold from the ore; and

anticipated capital expenditure and cash operating costs.

These estimates depend upon the data available and the assumptions made at the time the relevant estimate is made. Resource estimates are not precise calculations and depend on the interpretation of limited information on the location, shape and continuity of the occurrence and on the available sampling results. Further exploration and studies can result in new data becoming available that may change previous resource estimates which will impact upon both the technical and economic viability of production of the relevant mining project. Changes in the forecast prices of commodities, exchange rates, production costs or recovery rates may change the economic status of resources resulting in revisions to previous resource estimates. These revisions could impact depreciation and amortization rates, asset-carrying values provisions for closedown, restoration and environmental clean-up costs. These estimates depend upon the data available and the assumptions made at the time the rele vant estimate is made.

We undertake revisions to our resource estimate based upon actual exploration and production results, new information on geology and fluctuations in production, operating and other costs and which could adversely affect the life-of-mine plans and consequently the total value of our mining asset base. Resource restatements could negatively affect our results, financial condition and prospects, as well as our reputation. The increased demand for gold and other commodities, combined with a declining rate of discovery, has resulted in existing reserves being depleted at an accelerated rate in recent years. We, therefore, face intense competition for the acquisition of attractive mining properties.

From time to time, we evaluate the acquisition of exploration properties and operating mines, either as stand-alone assets or as part of companies. Our decisions to acquire these properties have historically been based on a variety of factors including estimates of and assumptions regarding the extent of resources, cash and other operating costs, gold prices and projected economic returns and evaluations of existing or potential liabilities associated with the relevant property and our operations and how these factors may change in the future. All of these factors are uncertain and could have an impact upon revenue, cash and other operating issues, as well as the uncertainties related to the process used to estimate resources.

As a result of these uncertainties, the exploration programs and acquisitions engaged in by us may not result in the expansion or replacement of the current production with new resources or operations. Our operating results and financial condition are directly related to the success of our exploration and acquisition efforts and our ability to replace or increase existing resources. If we are not able to maintain or increase our resources, our results of operations and our financial condition and prospects could be adversely affected.

We face many risks related to the development of our mining projects that may adversely affect our results of operations and profitability.

The profitability of mining companies depends, in part, on the actual costs of developing and operating mines, which may differ significantly from estimates determined at the time a relevant mining project was approved. The development of mining projects may also be subject to unexpected problems and delays that could increase the cost of development and the ultimate operating cost of the relevant project. Our decision to develop a mineral property is based on estimates made as to the expected or anticipated project economic returns. These estimates are based on assumptions regarding:

future gold prices;

anticipated tonnage, grades and metallurgical characteristics of ore to be mined and processed;

anticipated recovery rates of gold extracted from the ore; and

anticipated capital expenditure and cash operating costs.

Actual cash operating costs, production and economic returns may differ significantly from those anticipated by such estimates.

There are a number of uncertainties inherent in the development and construction of an extension to an existing mine, or in the development and construction of any new mine. In addition to those discussed above, these uncertainties include the:

timing and cost of the construction of mining and processing facilities, which can be considerable;

availability and cost of skilled labor, power, water and transportation facilities;

need to obtain necessary environmental and other governmental permits and the time to obtain such permits; and

availability of funds to finance construction and development activities.

New mining operations could experience unexpected problems and delays during development, construction and mine start-up. In addition, delays in the commencement of mineral production could occur. Finally, operating cost and capital expenditure estimates could fluctuate considerably as a result of changes in the prices of commodities consumed in the construction and operation of mining projects. Accordingly, our future development activities may not result in the expansion or replacement of current production with new production, or one or more new production sites or facilities may be less profitable than currently anticipated or may not be profitable at all. Our operating results and financial conditions are directly related to the success of our project developments. A failure in our ability to develop and operate mining projects in accordance with, or in excess of, expectations could negatively affect our results of operations and our financial condition and prospects.

We may require additional funding in order to continue our operations.

Although we have commenced commercial production at the Molejon gold property, cash flow to satisfy our operational requirements, debt repayments and cash commitments is not guaranteed from the operations of our Molejon gold plant. In the past, we have relied on sales of equity securities or debt financing to meet most of our cash requirements, together with project management fees, property payments and sales or joint ventures of properties. There can be no assurance that funding from these sources will be sufficient in the future to satisfy our operational requirements, debt repayments and cash commitments.

We do not presently have sufficient financial resources to undertake all of our planned exploration and development programs. The development of our properties depends upon our ability to obtain financing through any or all of the joint venturing of projects, debt financing, equity financing or other means. There is no assurance that we will be successful in obtaining the required financing. Failure to obtain additional financing on a timely basis could cause us to forfeit our interest in our properties and reduce or terminate operations on such properties.

We have a history of losses, an accumulated deficit and there is substantial uncertainty regarding our ability to continue as a going concern.

We have incurred net losses to date. As at May 31, 2010, we have an accumulated deficit of $146,757,018 and for the year ended May 31, 2010, incurred a loss of $26,982,082 from continuing operations. Continuing operations are dependent on us achieving profitable operations and being able to raise capital, as necessary, to meet our obligations and repay liabilities when they come due.

Should we fail to achieve profitability or, if necessary, raise sufficient capital to sustain operations, we may be forced to suspend our operations and possibly even liquidate our assets and wind-up and dissolve our company.

The consolidated financial statements are prepared on a going concern basis, which assumes that we will be able to realize our assets at the amounts recorded and discharge our liabilities in the normal course of business in the foreseeable future. Should this assumption not be appropriate, adjustments in the carrying amounts of the assets and liabilities to their realizable amounts and the classifications thereof will be required and these adjustments and reclassifications may be material.

Our level of indebtedness could adversely affect our business.

We have been unable to meet all of our obligations with respect to scheduled repayments of principal, premium and interest on our Notes and interest on our Convertible Notes. Total payments of $10,272,950 were due in March and May 2010. Of this total, we have paid $1,200,000. Under the terms of the Indenture an event of default has occurred and the Notes and Convertible Notes are currently due on demand at the option of the Note holders and Convertible Note holders or the Trustee.

As of May 31, 2010, we had $71,387,328 in redemption amount of Notes and Convertible Notes outstanding. Subsequent to year end, we entered into a prepaid gold forward facility with Deutsche Bank AG (“Deutsche Bank”) for $45,000,000. Upon the satisfaction of certain conditions precedent and the successful completion of this transaction, net proceeds of approximately $41,000,000 will be used to extinguish a portion of the Company’s Notes and Convertible Notes. (See Note 26 to the Consolidated Financial Statements)

We may also incur additional indebtedness in the future. Our high debt levels may have important consequences for us, including, but not limited to the following:

Our ability to obtain additional financing for working capital, capital expenditures, general corporate and other purposes or to fund future operations may not be available on terms favourable to us or at all;

A significant amount of our operating cash flow is dedicated to the payment of interest and principal on our indebtedness, thereby diminishing funds that would otherwise be available for our operations and for other purposes;

Increasing our vulnerability to current and future adverse economic and industry conditions;

A substantial decrease in net operating cash flows or increase in our expenses could make it more difficult for us to meet our debt service requirements, which could force us to modify our operations;

Our leveraged capital structure may place us at a competitive disadvantage by hindering our ability to adjust rapidly to changing market conditions or by making us vulnerable to a downturn in our business or the economy in general;

We may have to offer debt or equity securities on terms that may not be favourable to us or to our shareholders;

Limiting our flexibility in planning for, or reacting to, changes and opportunities in our business and our industry; and

Our level of indebtedness increases the possibility that we may be unable to generate cash sufficient to pay the principal or interest due in respect of our indebtedness.

We face many risks related to our operations that may adversely affect our cash flows and overall profitability.

Gold mining is susceptible to numerous events that may have an adverse impact on our mining business, our ability to produce gold and meet our production targets. These events include, but are not limited to:

environmental hazards, including discharge of metals, pollutants or hazardous chemicals;

industrial accidents;

fires;

labor disputes;

mechanical breakdowns;

electrical power interruptions;

encountering unexpected geological formations;

unanticipated ground conditions;

ingresses of water;

process water shortages;

failure of mining pit slopes, water dams, waste stockpiles and tailings dam walls;

legal and regulatory restrictions and changes to such restrictions;

safety-related stoppages;

other natural phenomena, such as floods, droughts or inclement weather conditions, potentially exacerbated by climate change.

Mineral prices can fluctuate dramatically and have a material adverse effect on our results of operations.

Our revenues are primarily derived from the sale of gold and the market price for gold fluctuates widely. These fluctuations are caused by numerous factors beyond our control including:

speculative positions taken by investors or traders in gold;

changes in the demand for gold as an investment;

changes in the demand for gold used in jewellery and for other industrial uses, including as a result of prevailing economic conditions;

changes in the supply of gold from production, disinvestment, scrap and hedging;

financial market expectations regarding the rate of inflation;

strength of the US dollar (the currency in which the gold price trades internationally) relative to other currencies;

changes in interest rates;

actual or expected sales or purchases of gold by central banks and the International Monetary Fund;

gold hedging and de-hedging by gold producers;

global or regional political or economic events; and

The market price of gold has recently experienced significant volatility. During 2009, the gold price traded from a record high of $1,226.10 per ounce to a low of $801.65 per ounce. On August 27, 2010, the afternoon fixing price of gold on the London Bullion Market was $1,235.00 per ounce. The price of gold is often subject to sharp, short-term changes resulting from speculative activities. While the overall supply of and demand for gold can affect its market price, because of the considerable size of above-ground stocks of the metal in comparison to other commodities, these factors typically do not affect the gold price in the same manner or degree that the supply of and demand for other commodities tends to affect their market price. In addition, the recent shift in gold demand from physical demand to investment and speculative demand may exacerbate the volatility of gold prices.

A sustained period of significant gold price volatility may adversely affect our ability to evaluate the feasibility of undertaking new capital projects or continuing existing operations or to make other long-term strategic decisions. If revenue from gold sales falls below the cost of production for an extended period, we may experience losses and be forced to curtail or suspend some or all of our capital projects or existing operations. In addition, we would have to assess the economic impact of low gold prices on our ability to recover any losses that may be incurred during that period and on our ability to maintain adequate cash reserves.

We face risks related to operations in foreign countries.

Currently our properties are located only in Panama, a country with a developing mining sector but with no other commercially producing mines. Consequently, we are subject to, and our mineral exploration and mining activities may be affected in varying degrees by, certain risks associated with foreign ownership including inflation, political instability, political conditions and government regulations. Any changes in regulations or shifts in political conditions are beyond our control and may adversely affect our business. Operations may be affected by government regulations with respect to restrictions on production, restrictions on foreign exchange and repatriation, price controls, export controls, restriction of earnings distribution, taxation laws, expropriation of property, environmental legislation, water use, mine safety and renegotiation or nullification of existing concessions, licenses, permits, and contracts. In particular, the status of Panama as a developing countr y may make it more difficult for us to obtain any required production financing for our properties from senior lending institutions.

Failure to comply strictly with applicable laws, regulations and local practices relating to mineral rights applications and tenure could result in loss, reduction or expropriation of entitlements, or the imposition of additional local or foreign parties as joint venture partners with carried or other interests. The occurrence of these various factors and uncertainties cannot be accurately predicted and could have an adverse effect on our operations or profitability.

The requirements of the Ley Petaquilla may have an adverse impact on us.

Our operations in Panama are governed primarily by Law No. 9 of the Legislative Assembly of Panama (the “Ley Petaquilla”), a project-specific piece of legislation enacted in February 1997 to deal with the orderly development of the Cerro Petaquilla Concession.

The Ley Petaquilla granted a mineral exploration and exploitation concession to Minera Panama, S.A. (formerly known as Minera Petaquilla, S.A. (“MPSA”)), a Panamanian company formed in 1997 to hold the Cerro Petaquilla Concession covering approximately 136 square kilometers in north-central Panama. Although we no longer hold an interest in the copper deposits therein, we continue to hold the rights to the Molejon gold deposit and, as the Cerro Petaquilla Concession encompasses this deposit, the Ley Petaquilla governs our exploration activities.

The Ley Petaquilla contains fiscal and legal stability clauses necessary in order to obtain project financing and includes tax exemptions on income, dividends and imports. The Ley Petaquilla also provides for an increase in the annual available infrastructure tax credit, higher depreciation rates for depreciable assets which cannot be used in the infrastructure tax credit pool, and a favorable depletion allowance.

In order to maintain the Cerro Petaquilla Concession in good standing, MPSA must pay to the Government of Panama an annual rental fee of $0.50 per hectare during the first two years of the concession, $1.00 per hectare in the third and fourth years of the concession and $1.50 per hectare thereafter. The concession was granted for a 20-year term with up to two 20-year extensions permitted, subject to the requirement to begin mine development and to make a minimum investment of $400 million in the development of the Cerro Petaquilla Concession.

Under the Ley Petaquilla, MPSA was required to begin mine development by May 2001. However, MPSA was able to defer commencing development operations by one month for every month that the price of copper remained below $1.155 per pound for up to a further five years (i.e. until May 2006 at the latest). In September 2005, the multi-phase Petaquilla Mine Development Plan (the “Plan”) submitted to the Government of Panama by us and MPSA was approved by Ministerial Resolution. The Molejon gold mineral deposit forms part of the Cerro Petaquilla Concession and the first phase of the Plan focused on the advancement of the Molejon gold deposit by us as commenced in 2006. Subsequent phases of the Plan are the responsibility of MPSA.

The Ley Petaquilla also requires MPSA to (i) deliver an environmental report to the General Directorate of Mineral Resources of the Ministry of Commerce and Industries (“MICI”) for evaluation; (ii) submit, prior to extraction, an environmental feasibility study specific to the project area in which the respective extraction will take place; (iii) submit annually a work plan comprising the projections and approximate costs for the respective year to the MICI; (iv) post letters of credit in support of required compliance and environmental protection guarantees; (v) annually pay surface canons; (vi) annually pay royalties for extracted minerals; (vii) annually present to the MICI detailed reports covering operations and employment and training; (viii) create and participate in the administration of a scholarship fund to finance studies and training courses or professional training for the inhabitants of the communities neighboring the Cerro Petaquilla Concession in the p rovinces of Cocle and Colon; and (ix) maintain all mining and infrastructure works and services of the project, always complying with the standards and regulations of general application in force that pertain to occupational safety, health and construction.

For reference, a copy of Law No. 9, as passed by the Legislative Assembly of Panama on February 26, 1997, was provided with our Form 20-F for the fiscal year ended May 31, 2009, as Exhibit 4.V.

Our operations are subject to environmental and other regulation.

Our current or future operations, including development activities and production on our properties, require permits from various governmental authorities and such operations are and will be subject to laws and regulations governing prospecting, development, mining, production, exports, taxes, labour standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety, community services and other matters. Companies engaged in the development and operation of mines and related facilities generally experience increased costs and delays in production and other schedules as a result of the need to comply with applicable laws, regulations and permits. Other than the Molejon gold mine, there can be no assurance that approvals and permits required to commence production on our various properties will be obtained. Additional permits and studies, which may include environmental impact studies conducted before permits can be obtained, may be necessary prior to operation of the properties in which we have interests and there can be no assurance that we will be able to obtain or maintain all necessary permits that may be required to commence construction, development or operation of mining facilities at these properties on terms which enable operations to be conducted at economically justifiable costs.

Our potential mining and processing operations and exploration activities in Panama are subject to various federal and provincial laws governing land use, the protection of the environment, prospecting, development, production, exports, taxes, labour standards, occupational health, waste disposal, toxic substances, mine safety, community services and other matters. Such operations and exploration activities are also subject to substantial regulation under these laws by governmental agencies and may require that we obtain permits from various governmental agencies. We believe that we are in substantial compliance with all material laws and regulations that currently apply to corporate activities. There can be no assurance, however, that all permits which may be required for construction of mining facilities and conduct of mining operations will be obtainable on reasonable terms or that such laws and regulations would not have a material adverse effect on any mining project that we might undertake.

Failure to comply with applicable laws, regulations, and permitting requirements may result in enforcement actions there under, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in mining operations may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations.

Amendments to current laws, regulations and permits governing operations and activities of mining companies, or more stringent implementation thereof, could have a material adverse impact on the Company and cause increases in capital expenditures or production costs or reductions in levels of production at producing properties or abandonment or delays in development of new mining properties.

To the best of our knowledge, we are currently operating in compliance with all applicable environmental regulations except as to matters under mitigation as requested by the government of Panama.

Our directors may have conflicts of interest.

As of November 6, 2009, one of our directors, David Levy, holds a position with Platinum Management (NY) LLC, an investment advising firm to Platinum Partners Value Arbitrage Fund LP, a New York based investment fund. Platinum Partners Value Arbitrage Fund LP holds securities in us and a portion of our debt. However, Mr. Levy is not a director of nor is he an officer of Platinum Partners Value Arbitrage Fund LP nor are any of our directors insiders of any other reporting company. While currently none of our directors beneficially owns a 10% or greater interest in the voting power of any other mineral resource companies, they could in the future. To the extent that these other companies may participate in ventures in which we may participate, such directors may have a conflict of interest in negotiating and concluding terms respecting the extent of such participation, which could result in competitive harm to us. In the event that such a conflict of interest arises at a meeting of the directors, a director who has such a conflict will abstain from voting for or against the approval of such participation or such terms. In appropriate cases, we will establish a special committee of independent directors to review a matter in which several directors, or management, may have a conflict. In accordance with the laws of the Province of British Columbia, the Company’s directors are required to act honestly, in good faith and in our best interests. In determining whether or not we will participate in a particular program and the interest therein to be acquired by it, our directors primarily consider the potential benefits to us, the degree of risk to which we may be exposed and our financial position at that time. Other than as indicated, we have no other procedures or mechanisms to prevent conflicts of interest.

Environmental protestors are present in Panama.

Various independent environmental groups or individuals would like to prevent the operation of mining in Panama. Our operations could be significantly disrupted or suspended by activities such as protests or blockades that may be undertaken by such groups or individuals.

Our common shares are subject to penny stock rules, which could affect trading in our shares.

Our common shares are classified as “penny stock” as defined in Rule 15g-9 promulgated under the Exchange Act. In response to perceived abuse in the penny stock market generally, the Exchange Act was amended in 1990 to add new requirements in connection with penny stocks. In connection with effecting any transaction in a penny stock, a broker or dealer must give the customer a written risk disclosure document that (a) describes the nature and level of risk in the market for penny stocks in both public offerings and secondary trading, (b) describes the broker's or dealer's duties to the customer and the rights and remedies available to such customer with respect to violations of such duties, (c) describes the dealer market, including “bid” and “ask” prices for penny stock and the significance of the spread between the bid and ask prices, (d) contains a toll-free telephone number for inquiries on disciplinary histories of brokers and dealers and (e) defines significant terms used in the disclosure document or the conduct of trading in penny stocks. In addition, the broker-dealer must provide to a penny stock customer a written monthly account statement that discloses the identity and number of shares of each penny stock held in the customer’s account and the estimated market value of such shares. The extensive disclosure and other broker-dealer compliance related to penny stocks may result in reducing the level of trading activity in the secondary market for our common shares, thus limiting the ability of our shareholders to sell their shares.

U.S. investors may not be able to enforce their civil liabilities against us or our directors, controlling persons and officers.

Our company, our officers and some of our directors are residents of countries other than the United States, and all of our assets are located outside the United States. As a result, it may not be possible for investors to effect service of process within the United States upon such persons or enforce in the United States against such persons judgments obtained in United States courts, including judgments predicated upon the civil liability provisions of United States federal securities laws or state securities laws.

We believe that a judgment of a United States court predicated solely upon civil liability under United States securities laws would probably be enforceable in Canada if the United States court in which the judgment was obtained has a basis for jurisdiction in the matter that was recognized by a Canadian court for such purposes. However, there is doubt whether an action could be brought in Canada in the first instance on the basis of liability predicated solely upon such laws.

If we are characterized as a Passive Foreign Investment Company (“PFIC”), our U.S. shareholders may be subject to adverse U.S. federal income tax consequences.

We have not made a determination as to whether we are considered a PFIC as such term is defined in the U.S. Internal Revenue Code of 1986, as amended (the “Code”), for U.S. federal income tax purposes for the current tax year and any prior tax years. A non-U.S. corporation generally will be considered a PFIC for any tax year if either (1) at least 75% of its gross income is passive income or (2) at least 50% of the value of its assets (based on an average of the quarterly values of the assets during a taxable year) is attributable to assets that produce or are held for the production of passive income.

In general, if we are or become a PFIC, any gain recognized on the sale of our common stock and any “excess distributions” (as specifically defined in the Code) paid on the common stock must be ratably allocated to each day in a U.S. taxpayer’s holding period for the common stock. The amount of any such gain or excess distribution allocated to prior years of such U.S. taxpayer’s holding period for the common stock generally will be subject to U.S. federal income tax at the highest tax applicable to ordinary income in each such prior year, and the U.S. taxpayer will be required to pay interest on the resulting tax liability for each such prior year, calculated as if such tax liability had been due in each such prior year. For more information, see “Material United States Federal Income Tax Consequences-Passive Foreign Investment Company”.

| |

| ITEM 4. | INFORMATION ON THE COMPANY |

| |

| 4.A. | History and Development of the Company |

We are a corporation organized under the laws of the Province of British Columbia, Canada. We were incorporated on October 10, 1985, under the name Adrian Resources Ltd. by registration of our Memorandum and Articles of Association with the British Columbia Registrar of Companies pursuant to the Company Act (British Columbia) (the “BCCA”). The BCCA was replaced by the Business Corporations Act (British Columbia) (the “BCA) in March 2004 and we are now governed by the BCA. Our name was changed from Adrian Resources Ltd. to Petaquilla Minerals Ltd. on October 12, 2004.

Our principal office is located at Suite 410, 475 West Georgia Street, Vancouver, British Columbia, Canada, V6B 4M9. The telephone number for our principal office is (604) 694-0021 and the facsimile number is (604) 694-0063.

We have twelve subsidiaries and one joint venture interest as detailed below:

| |

| (i) | We own all of the issued shares of Adrian Resources (BVI) Ltd., which was incorporated in the British Virgin Islands on December 17, 1999. |

| |

| (ii) | Adrian Resources (BVI) Ltd. owns all of the issued shares of Petaquilla Minerals, S.A., which was incorporated in the Republic of Panama on April 28, 1992, and holds title to certain of our exploration concessions in the Republic of Panama. Although originally incorporated under the name Adrian Resources, S.A., the name of such subsidiary was changed to Petaquilla Minerals, S.A on February 3, 2005. |

| |

| (iii) | Petaquilla Minerals, S.A. owns all of the issued shares of Petaquilla Gold, S.A., a Panamanian corporation formed on August 11, 2005. Petaquilla Gold, S.A. holds the Molejon gold property interest and other potential gold deposits within the Cerro Petaquilla Concession lands. |

| |