UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F/A

AMENDMENT NO. 2

(Mark One)

o

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

þ

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended

May 31, 2009

OR

o

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

o

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report

________________________________

For the transition period from__________________ to ____________________

Commission file number:

000-26296

Petaquilla Minerals Ltd.

(Exact name of Registrant as specified in its charter)

Not applicable

(Translation of Registrant's name into English)

Province of British Columbia, Canada

(Jurisdiction of incorporation or organization)

Suite 410, 475 West Georgia Street, Vancouver, British Columbia, Canada V6B 4M9

(Address of principal executive offices)

Bassam Moubarak, telephone (604) 694-0021, facsimile (604) 694-0063,

Suite 410, 475 West Georgia Street,Vancouver, British Columbia, Canada V6B 4M9

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

| |

Form 20-F/A_Amendment No. 2_Fiscal Year Ended 2009 May 31 | Page 1 |

Securities registered or to be registered pursuant to Section 12(b) of the Act.

Title of each class

Name of each exchange on which registered

Securities registered or to be registered pursuant to Section 12(g) of the Act.

Common Shares Without Par Value

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

96,040,121

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

o Yes þ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

o Yesþ No

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

þ Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

o Yes o No

| |

Form 20-F/A_Amendment No. 2_Fiscal Year Ended 2009 May 31 | Page 2 |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

o Large accelerated filer

o Accelerated filer

þ Non-accelerated filer

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

o U.S. GAAP

o International Financial Reporting Standards

þ Other

as issued by the International Accounting

Standards Board

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

þ Item 17 o Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

o Yes þ No

_____________________________________________________________________________________

| |

Form 20-F/A_Amendment No. 2_Fiscal Year Ended 2009 May 31 | Page 3 |

Explanatory Note

Petaquilla Minerals Ltd. (the “Company”) has filed this Amendment No. 2 (“Amendment No. 2 ”) to its Annual Report on Form 20-F for the fiscal year ended May 31, 2009, to (i) expand the Company’s description of the Ley Petaquilla (as defined herein); (ii) update its risk factor disclosure; (iii) present selected financial data in Item 3.A. that has been reconciled to U.S. Generally Accepted Accounting Principles ("U.S. GAAP"); (iv) expand its disclosures to include more specific information about its senior secured notes and convertible senior secured notes; (v) add a total column to its Tabular Disclosure of Contractual Obligations; (vi) correct a typographical error in its management report on internal control over financial reporting; (vii) add disclosure in its notes to the financial statements to clarify that it changed its fiscal year end from January 31 to April 30 in 2007 and from April 30 to May 31 in 2008; (viii) u pdate its disclosure in its financial statement notes regarding a change in the Company’s accounting policy for mineral properties and to clarify the origination of the difference in accounting for mineral properties and deferred costs in the Company’s U.S. GAAP reconciliation; (ix) update its disclosure in its financial statement notes regarding deferral of expenditures and recognizing revenues as a reduction of deferred expenditures in the Company’s U.S. GAAP reconciliation; (x) update its disclosure in its financial statement notes regarding an inventory write-down in the Company’s U.S. GAAP reconciliation; and (xi) file as exhibits certain instruments defining the rights of the Company’s security holders. The Company directs the reader of Amendment No. 2 to the following specific Items in this Amendment No. 2 for further details: Item 3.A. – Key Information – Selected Financial Data, Item 3.D. – Key Information – Risk Factors, Item 5.B. – Operating and Financial Review and Prospects – Liquidity and Capital Resources, Item 5.F. – Operating and Financial Review and Prospects – Tabular Disclosure of Contractual Obligations, Item 15 – Controls and Procedures, Item 17 – Financial Statements and Item 19 – Exhibits.

This Amendment No. 2 sets forth the complete text of the above-referenced Items and all amendments thereto as well as updates the Company’s prior responses to the other Form 20-F Items, and includes new certifications pursuant to Rules 13a-14(a) and 15d-14(a) and Rules 13a-14(b) and 15d-14(b) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

The information set forth in this report on Form 20-F is as at November 6, 2009, unless an earlier or later date is indicated.

Financial information in this Amendment No. 2 is presented in accordance with accounting principles generally accepted in Canada (“Canadian GAAP”). Measurement differences between accounting principles generally accepted in Canada and in the United States, as applicable to the Company, are set forth in Item 3.A. and Note 29 to the accompanying financial statements of the Company.

This Amendment No. 2 contains forward-looking information and forward-looking statements as defined in applicable securities laws. These statements relate to future events or our future performance. All statements other than statements of historical fact are forward-looking statements.

Forward-looking statements include, but are not limited to, statements with respect to the future price of gold, silver and other minerals, the estimation of mineral reserves and resources, the realization of mineral reserve estimates, the timing and amount of estimated future production, costs of production, capital expenditures, costs and timing of the development of new deposits, success of exploration activities, permitting time lines, currency exchange rate fluctuations, requirements for additional capital, government regulation of mining operations, environmental risks, unanticipated reclamation expenses, title disputes or claims and limitations on insurance coverage.

Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate” or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”.

Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause our actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: risks related to international operations; risks related to joint venture operations; actual results of current exploration activities; conclusions of economic evaluations; changes in project parameters as plans continue to be refined; future prices of gold and silver; possible variations in ore reserves, grade or recovery rates; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes and other risks of the mining industry; delays in obtaining governmental approvals or financing or in the completion of development or construction activities, as well as those factors discussed in the section ent itled “Risk Factors” in this Amendment No. 2 . Although we have attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

Statements in this Amendment No. 2 regarding expected completion dates of feasibility studies, anticipated commencement dates of mining or metal production operations, including when our Molejon project is anticipated to begin production, projected quantities of future metal production and anticipated production rates, operating efficiencies, costs and expenditures are forward-looking statements. Actual results could differ materially depending upon the availability of materials, equipment, required permits or approvals and financing, the occurrence of unusual weather or operating conditions, the accuracy of reserve estimates, lower than expected ore grades or the failure of equipment or processes to operate in accordance with specifications. See Item 3.D. – Key Information – Risk Factors for other factors that may affect our future financial performance.

Forward-looking statements in this Amendment No. 2 are as of November 6, 2009. We do not undertake to update any forward-looking statements that are incorporated by reference herein, except in accordance with applicable securities laws.

This Amendment No. 2 contains references to United States dollars and Canadian dollars. All dollar amounts referenced, unless otherwise indicated, are expressed in United States dollars and Canadian dollars are referred to as “CAD$”.

| |

Form 20-F/A_Amendment No. 2_Fiscal Year Ended 2009 May 31 | Page 4 |

| |

| PETAQUILLA MINERALS LTD. |

| SECURITIES AND EXCHANGE COMMISSION |

| FORM 20-F |

| TABLE OF CONTENTS |

|

Page No.

| | | |

| | GLOSSARY OF MINING TERMS | 9 |

| | CAUTIONARY NOTE REGARDING RESOURCE AND RESERVE ESTIMATES | 11 |

| PART 1 | | 12 |

| | | |

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS | 12 |

| | | |

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE | 12 |

| | | |

| ITEM 3. | KEY INFORMATION | 12 |

| 3.A. | Selected Financial Data | 12 |

| 3.B. | Capitalization and Indebtedness | 15 |

| 3.C. | Reasons for The Offer and Use of Proceeds | 15 |

| 3.D. | Risk Factors | 15 |

| | We face risks related to our operations in foreign countries. | 15 |

| | Our operations are subject to environmental and other regulation. | 15 |

| | We do not have probable or proven reserves. | 16 |

| | Mining is subject to various physical hazards. | 17 |

| | We do not have all of the required permits for commencement of commercial production. | 17 |

| | Potential delays in the advancement of the Molejon gold deposit and cost overruns mayoccur. | 17 |

| | We have limited experience with development-stage mining operations. | 17 |

| | Mineral prices can fluctuate dramatically and have a material adverse effect on ourresults of operations. | 18 |

| | We are dependent upon additional funding in order to sustain our operations. | 18 |

| | We have a history of losses, an accumulated deficit and a lack of revenue from operationsand there is substantial uncertainty regarding our ability to continue as a going concern. | 18 |

| | We have a history of material weaknesses at our subsidiaries. | 19 |

| | The requirements of the Ley Petaquilla may have an adverse impact on us. | 19 |

| | Our directors may have conflicts of interest. | 20 |

| | Increased costs to procure labour and materials may affect expenditures relating topotential future production. | 20 |

| | We face strong competition for the acquisition of mining properties. | 20 |

| | Our common shares are subject to penny stock rules, which could affect trading in our

shares. | 20 |

| | U.S. investors may not be able to enforce their civil liabilities against us or our directors,

controlling person and officers. | 20 |

| | If we are characterized as a Passive Foreign Investment Company (“PFIC”), our U.S.shareholders may be subject to

adverse U.S. federal income tax consequences. | 21 |

| ITEM 4. | INFORMATION ON THE COMPANY | 21 |

| 4.A. | History and Development of the Company | 21 |

| | Molejon Property – Panama | 22 |

| | Principal Capital Expenditures and Divestitures Over Last Three Fiscal Years | 23 |

| |

Form 20-F/A_Amendment No. 2_Fiscal Year Ended 2009 May 31 | Page 5 |

| | | |

| | Current Capital Expenditures and Divestitures | 23 |

| | Public Takeover Offers | 23 |

| 4.B. | Business Overview | 23 |

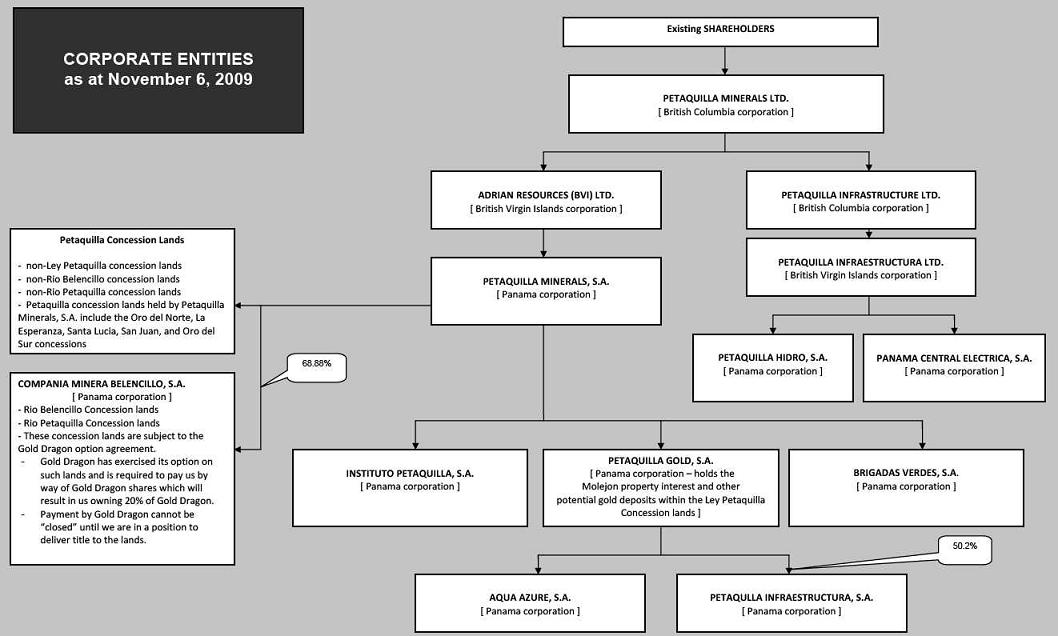

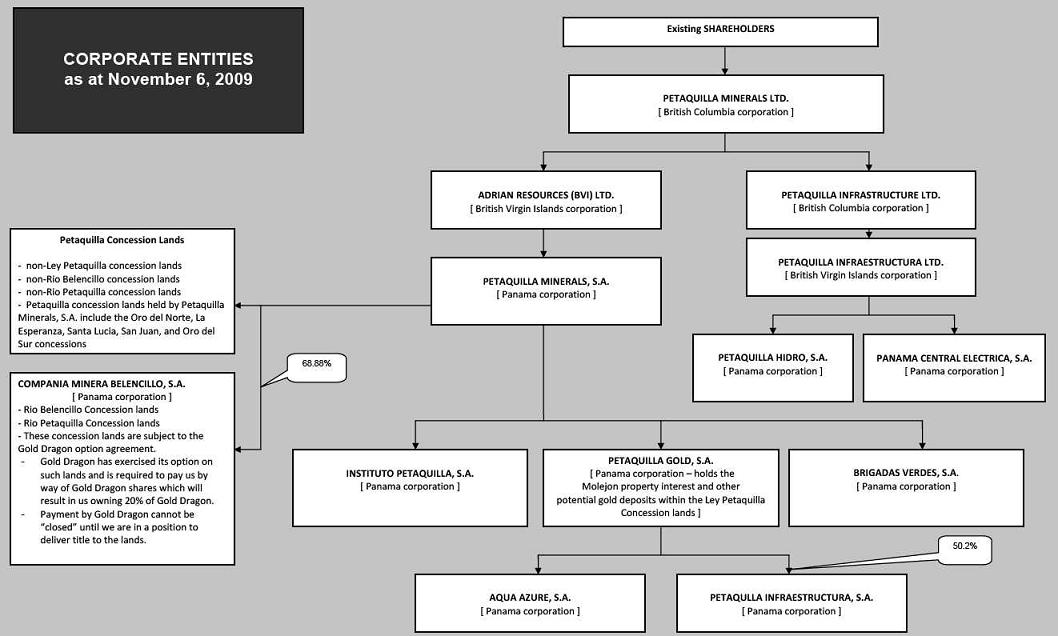

| 4.C. | Organizational Structure | 24 |

| 4.D. | Property, Plants and Equipment | 26 |

| | Mineral Concession Lands | 26 |

| | Introduction | 26 |

| | Property Location | 26 |

| | Location, Access & Physiography | 28 |

| | Plant and Equipment | 29 |

| | Title | 29 |

| | Exploration History | 30 |

| | Outlook – 2010 | 34 |

| | Regional and Local Geology | 34 |

| | Mineralization | 35 |

| | Doing Business in Panama | 35 |

| | | |

| ITEM 4A. | UNRESOLVED STAFF COMMENTS | 38 |

| | | |

| ITEM 5. | OPERATING AND FINANCIAL REVIEW AND PROSPECTS | 38 |

| 5.A. | Operating Results | 38 |

| | 12 Months Ended May 31, 2009, Compared to 12 Months Ended May 31, 2008 | 41 |

| | One Month Ended May 31, 2008, Compared to One Month Ended May 31, 2007 | 43 |

| | 12 Months Ended April 30, 2008, Compared to 12 Months Ended April 30, 2007 | 44 |

| | Three Months Ended April 30, 2008, Compared to Three Months Ended April 30, 2007 | 46 |

| | 12 Months January 31, 2007, Compared to 12 Months Ended January 31, 2006 | 47 |

| 5.B | Liquidity and Capital Resources | 48 |

| | May 31, 2009, Compared with May 31, 2008 | 49 |

| | May 31, 2008, Compared with April 30, 2008 | 50 |

| | April 30, 2008, Compared to April 30, 2007 | 51 |

| | April 30, 2007, Compared to January 31, 2007 | 51 |

| 5.C. | Research and Development, Patents and Licenses, etc. | 52 |

| 5.D. | Trend Information | 52 |

| 5.E. | Off-Balance Sheet Arrangements | 52 |

| 5.F. | Tabular Disclosure of Contractual Obligations | 52 |

| | | |

| ITEM 6. | DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | 54 |

| 6.A. | Directors and Senior Management | 54 |

| 6.B. | Compensation | 55 |

| | Cash and Non-Cash Compensation – Directors and Officers | 55 |

| | Option Grants to Directors and Officers During Fiscal Year Ended May 31, 2009 | 56 |

| | Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values | 57 |

| | Defined Benefit or Actuarial Plan Disclosure | 57 |

| | Termination of Employment, Change in Responsibilities and Employment Contracts | 57 |

| | Directors | 58 |

| 6.C. | Board Practices | 58 |

| 6.D. | Employees | 59 |

| 6.E. | Share Ownership | 59 |

| | | |

| ITEM 7. | MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | 60 |

| 7.A. | Major Shareholders | 60 |

| 7.B. | Related Party Transactions | 61 |

| 7.C. | Interests of Experts and Counsel | 62 |

| ITEM 8. | FINANCIAL INFORMATION | 62 |

| |

Form 20-F/A_Amendment No. 2_Fiscal Year Ended 2009 May 31 | Page 6 |

| | | |

| 8.A. | Consolidated Statements and Other Financial Information | 62 |

| 8.B. | Significant Changes | 62 |

| | | |

| ITEM 9. | THE OFFER AND LISTING | 62 |

| 9.A. | Offer and Listing Details | 62 |

| 9.B. | Plan of Distribution | 64 |

| 9.C. | Markets | 64 |

| 9.D. | Selling Shareholders | 64 |

| 9.E. | Dilution | 64 |

| 9.F. | Expenses of the Issue | 64 |

| | | |

| ITEM 10. | ADDITIONAL INFORMATION | 65 |

| 10.A. | Share Capital | 65 |

| 10.B. | Memorandum and Articles of Association | 65 |

| 10.C. | Material Contracts | 66 |

| 10.D. | Exchange Controls | 67 |

| 10.E. | Taxation | 69 |

| | Material Canadian Federal Income Tax Consequences | 69 |

| | Dividends | 69 |

| | Capital Gains | 69 |

| | Material United States Federal Income Tax Consequences | 70 |

| | U.S. Holders | 70 |

| | Distributions on our Common Shares | 70 |

| | Disposition of our Common Shares | 71 |

| | Passive Foreign Investment Company | 71 |

| | Foreign Tax Credit | 72 |

| | Controlled Foreign Corporation | 73 |

| | Information Reporting; Backup Withholding | 73 |

| 10.F. | Dividends and Paying Agents | 73 |

| 10.G. | Statement by Experts | 73 |

| 10.H. | Documents on Display | 73 |

| 10.I. | Subsidiary Information | 74 |

| | | |

| ITEM 11. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 74 |

| | | |

| ITEM 12. | DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | 75 |

| | | |

| PART II | | 75 |

| | | |

| ITEM 13. | DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES | 75 |

| | | |

| ITEM 14. | MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS ANDUSE OF PROCEEDS | 75 |

| | | |

| ITEM 15. | CONTROLS AND PROCEDURES | 76 |

| | | |

| ITEM 16. | [RESERVED] | 77 |

| ITEM 16.A. | Audit Committee Financial Expert | 78 |

| ITEM 16.B. | Code of Ethics | 78 |

| ITEM 16.C. | Principal Accountant Fees and Services | 78 |

| ITEM 16.D. | Exemptions From the Listing Standards for Audit Committees | 79 |

| ITEM 16.E. | Purchases of Equity Securities by the Issuer and Affiliated Purchasers | 80 |

| ITEM 16.F. | Change in Registrant’s Certifying Accountant | 80 |

| 16.G. | Corporate Governance | 80 |

| |

Form 20-F/A_Amendment No. 2_Fiscal Year Ended 2009 May 31 | Page 7 |

| | | |

| PART III | | 80 |

| | | |

| ITEM 17. | FINANCIAL STATEMENTS | 80 |

| | | |

| ITEM 18. | FINANCIAL STATEMENTS | 130 |

| | | |

| ITEM 19. | EXHIBITS | 130 |

| | | |

| | SIGNATURES | 132 |

| |

Form 20-F/A_Amendment No. 2_Fiscal Year Ended 2009 May 31 | Page 8 |

GLOSSARY OF MINING TERMS

The following is a glossary of some of the terms used in the mining industry and referenced herein:

cutoff grade

thedeemed grade of mineralization, established by reference to economic factors, above which material is included in mineral deposit calculations and below which material is considered waste. May be either an external cutoff grade, which refers to the grade of mineralization used to control the external or design limits of an open pit based upon the expected economic parameters of the operation, or an internal cutoff grade, which refers to the minimum grade required for blocks of mineralization present within the confines of an open pit to be included in mineral deposit estimates;

diamond drill

a machine designed to rotate under pressure an annular diamond-studded cutting tool to produce a more or less continuous solid sample (drill core) of the material that is drilled;

epithermal

a term applied to those mineral deposits formed in and along fissures or other openings in rocks by deposition at shallow depths from ascending hot solutions;

exploration Information

geological, geophysical, geochemical, sampling, drilling, trenching, analytical testing, assaying, mineralogical, metallurgical and other similar information concerning a particular property that is derived from activities undertaken to locate, investigate, define or delineate a mineral prospect or mineral deposit;

indicated mineral resource

that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics, can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed;

inferred mineral resource

that part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes;

junior resource company

as used herein means a company whose mineral resource properties are in the exploration phase only and which is wholly or substantially dependent on equity financing or joint ventures to fund its ongoing activities;

measured mineral resource

that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity;

| |

Form 20-F/A_Amendment No. 2_Fiscal Year Ended 2009 May 31 | Page 9 |

mineral deposit, deposit or mineralized material

a mineralized body which has been physically delineated by sufficient drilling, trenching and/or underground work and found to contain a sufficient average grade of metal or metals to warrant further exploration and/or development expenditures. Such a deposit does not qualify under standards of the Securities Exchange Commission as a commercially mineable ore body or as containing ore reserves, until final legal, technical and economic factors have been resolved;

mineral reserve

the economically mineable part of a Measured or Indicated Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This Study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A Mineral Reserve includes diluting materials and allowances for losses that may occur when the material is mined;

mineral resource

a concentration or occurrence of diamonds, natural solid inorganic material or natural solid fossilized organic material including base and precious metals, coal and industrial minerals in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge;

open pit mining

the process of mining an ore body from the surface in progressively deeper steps. Sufficient waste rock adjacent to the ore body is removed to maintain mining access and to maintain the stability of the resulting pit;

ore

a natural aggregate of one or more minerals which, at a specified time and place, may be mined and sold at a profit, or from which some part may be profitably separated;

ounces

troy ounces;

oz/tonne

troy ounces per metric ton;

ppb

parts per billion;

ppm

parts per million;

porphyry deposit

a disseminated mineral deposit often closely associated with porphyritic intrusive rocks;

preliminary feasibility study

a comprehensive study of the viability of a mineral project that has advanced to a stage where the mining method, in the case of underground mining, or the pit configuration, in the case of an open pit, has been established and an effective method of mineral processing has been determined, and includes a financial analysis based on reasonable assumptions of technical, engineering, legal, operating, economic, social and environmental factors and the evaluation of other relevant factors which are sufficient for a Qualified Person, acting reasonably, to determine if all or part of the Mineral Resource may be classified as a Mineral Reserve;

| |

Form 20-F/A_Amendment No. 2_Fiscal Year Ended 2009 May 31 | Page 10 |

probable mineral reserve

the economically mineable part of an Indicated mineral resource and, in some circumstances, a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. Such Study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified;

proven mineral reserve

the economically mineable part of a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. Such Study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified;

qualified person

an individual who is an engineer or geoscientist with at least five years of experience in mineral exploration, mine development or operation or mineral project assessment, or any combination of these; has experience relevant to the subject matter of the mineral project and the technical report; and is a member or licensee in good standing of a professional association;

stockwork

a rock mass so interpenetrated by small veins of ore that the whole must be mined together. Stockworks are distinguished from tabular or sheet deposits, (i.e. veins or beds), which have a small degree of thickness in comparison with their extension in the main plane of the deposit;

strike length

the longest horizontal dimensions of a body or zone of mineralization;

stripping ratio

the ratio of waste material to ore that is experienced in mining an ore body;

tonne

metric ton (2,204 pounds).

CAUTIONARY NOTE REGARDING RESOURCE AND RESERVE ESTIMATES

The terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) -CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. These definitions differ from the definitions in SEC Industry Guide 7 under the United States Securities Act of 1993, as amended (the “Securities Act”). Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental aut hority.

In addition, the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are caut ioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC Industry Guide 7 standards as in place tonnage and grade without reference to unit measures.

Accordingly, information contained in this Amendment No. 2 contains descriptions of our mineral deposits that may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

| |

Form 20-F/A_Amendment No. 2_Fiscal Year Ended 2009 May 31 | Page 11 |

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

This Amendment No. 2 is being filed as an annual report under the Exchange Act and, as such, there is no requirement to provide the information called for by this item.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

This Amendment No. 2 is being filed as an annual report under the Exchange Act and, as such, there is no requirement to provide the information called for by this item.

ITEM 3. KEY INFORMATION

3.A. Selected Financial Data

The following tables summarize our selected financial data prepared in accordance with Canadian generally accepted accounting principles (“Canadian GAAP”) and reconciled for measurement differences to United States generally accepted accounting principles (“U.S. GAAP”). The information in the tables was extracted from the more detailed financial statements and related notes included with this filing and should be read in conjunction with these financial statements and with the information appearing under the heading “Item 5 – Operating and Financial Review and Prospects”. Note 29 of our consolidated financial statements, included with this filing, sets forth the material variations in U.S. GAAP. Results for the periods presented are not necessarily indicative of results for future periods.

INFORMATION IN ACCORDANCE WITH CANADIAN GAAP:

| | | | | | | | | |

| | | 12 Months | 1 Month | 12 Months | 3 Months | 12 Months |

| | | Ended | Ended | Ended | Ended | Ended |

| | | May 31 | May 31 | April 30 | April 30 | January 31 |

| | | 2009 | 2008(2) | 2008(2) | 2007(2) | 2007(2) | 2006(2) | 2005(2) |

| (a) | Total revenue | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

(b)

| (Loss) beforeextraordinaryitems(1) | | | | | | | |

| | Total | $(21,099,866) | $(5,544,998) | $(16,111,007) | $(8,492,639) | $(30,712,592) | $(3,948,102) | $(1,388,449) |

| | PerShare(1) | $(0.22) | $(0.06) | $(0.17) | $(0.09) | $(0.40) | $(0.06) | $(0.03) |

| (c) | Total assets | $81,543,823 | $71,208,177 | $58,789,331 | $24,981,649 | $22,743,078 | $9,279,398 | $1,607,006 |

| (d) | Total long-term

debt | $52,939,642 | $30,939,670 | $1,367,249 | $631,775 | $739,159 | $0 | $0 |

| (e) | Total shareholderequity (deficiency) | $(8,920,288) | $14,606,134 | $18,765,944 | $14,370,149 | $18,647,224 | $8,798,091 | $1,523,766 |

| (f) | Cash dividendsdeclared per share | n/a | n/a | n/a | n/a | n/a | n/a | n/a |

| (g) | Capital stock

(number of issuedand outstanding

common shares) | 96,040,121 | 95,958,641 | 95,958,641 | 89,876,951 | 89,367,031 | 70,246,303 | 51,264,537 |

| (h) | Net earnings (loss)for the period | | | | | | | |

| | Total | $(21,099,866) | $(5,544,998) | $(16,111,007) | $(8,492,639) | $(30,712,592) | $(3,948,102) | $(1,388,449) |

| | PerShare(1) | $(0.22) | $(0.06) | $(0.17) | $(0.09) | $(0.40) | $(0.06) | $(0.03) |

(1)

The effect of potential share issuances pursuant to the exercise of options and warrants would be anti-dilutive and, therefore, basic and diluted losses per share are the same.

(2) Prior years’ numbers have been restated to reflect a change in accounting policy and change in reporting currency. See Item 5.

| |

Form 20-F/A_Amendment No. 2_Fiscal Year Ended 2009 May 31 | Page 12 |

INFORMATION IN ACCORDANCE WITH U.S. GAAP:

| | | | | | | | | |

| | | 12 Months | 1 Month | 12 Months | 3 Months | 12 Months |

| | | Ended | Ended | Ended | Ended | Ended |

| | | May 31 | May 31 | April 30 | April 30 | January 31 |

| | | 2009 | 2008(2) | 2008(2) | 2007(2) | 2007(2) | 2006(2) | 2005(2) |

| (a) | Total revenue | $653,941 | $0 | $0 | $0 | $0 | $0 | $0 |

| (b) | (Loss) beforeextraordinaryitems | | | | | | | |

| | Total | $(46,852,067) | $(3,597,227) | $(49,752,062) | $(14,635,836) | $(35,682,285) | $(4,120,582) | $(1,388,449) |

| | Per Share(1) | $(0.49) | $(0.04) | $(0.53) | $(0.16) | $(0.46) | $(0.07) | $(0.03) |

| (c) | Total assets | $26,542,454 | $37,419,662 | $36,108,361 | $19,470,848 | $19,202,974 | $9,106,918 | $1,607,006 |

| (d) | Total long-termdebt | $59,727,593 | $17,303,337 | $1,367,249 | $631,775 | $739,159 | $0 | $0 |

| (e) | Totalshareholders’equity

(deficiency) | $(70,709,608) | $(5,546,048) | $(3,915,026) | $8,859,348 | $15,107,120 | $8,625,611 | $1,523,766 |

| (f) | Cash dividendsdeclared per share | n/a | n/a | n/a | n/a | n/a | n/a | n/a |

| (g) | Capital stock(number of issuedand outstandingcommon shares) | 96,040,121 | 95,958,641 | 95,958,641 | 89,876,951 | 89,367,031 | 70,246,303 | 51,264,537 |

| (h) | Net earnings(loss) for theperiod | | | | | | | |

| | Total | $(46,852,067) | $(3,597,227) | $(49,752,062) | $(14,635,836) | $(35,682,285) | $(4,120,582) | $(1,388,449) |

| | PerShare(1) | $(0.49) | $(0.04) | $(0.53) | $(0.16) | $( 0.46) | $(0.07) | $(0.03) |

(1)

The effect of potential share issuances pursuant to the exercise of options and warrants would be anti-dilutive and, therefore, basic and diluted losses per share are the same.

(2) Prior years’ numbers have been restated to reflect a change in reporting currency. See Item 5.

We have not declared or paid any dividends since incorporation and we do not anticipate doing so in the foreseeable future. Our present policy is to retain all available funds for use in our operations and the expansion of our business.

| |

Form 20-F/A_Amendment No. 2_Fiscal Year Ended 2009 May 31 | Page 13 |

Difference Between Canadian and United States Generally Accepted Accounting Principles

Loss for the periods

| | | | | | | | | |

| | | Twelve months ended | | | One month ended | | | Twelve months ended | |

| | | May 31, 2009 | | | May 31, | | | April 30, | |

| | | | | | 2008 | | | 2008 | |

| |

| (Loss) for the period – Canadian GAAP | $ | (21,099,866 | ) | $ | (5,544,998 | ) | $ | (16,111,007 | ) |

| Gain on dilution of equity investment | | (2,238,492 | ) | | - | | | (12,582,085 | ) |

| Mineral properties expensed under U.S. GAAP | | (17,562,548 | ) | | (1,884,160 | ) | | (22,680,970 | ) |

| Revenue recognized | | 653,941 | | | - | | | - | |

| Cost of goods sold | | (1,260,127 | ) | | - | | | - | |

| Amortization | | (640,425 | ) | | - | | | - | |

| Write down of inventory in finished goods andwork in progress | | (2,404,695 | ) | | - | | | - | |

| Change in fair value of warrantsdenominated in Canadian dollars under U.S. | | 22,871,582 | | | - | | | - | |

| Foreign exchange on difference in mineralproperties expensed under U.S. GAAP | | (9,639,262 | ) | | - | | | 1,622,000 | |

| Foreign exchange on difference in seniorsecured notes under U.S. GAAP | | 3,180,313 | | | - | | | - | |

| Additional loss relating to redemption andmodification of senior secured noteagreement under U.S. GAAP | | (18,712,488 | ) | | 3,831,931 | | | - | |

| Net loss – U.S. GAAP | $ | (46,852,067 | ) | $ | (3,597,227 | ) | $ | (49,752,062 | ) |

| Basic and diluted loss per share – U.S. GAAP | $ | (0.49 | ) | $ | (0.04 | ) | $ | (0.53 | ) |

| |

| |

| | | Three months | | | Twelve months | | | Twelve months | |

| | | ended April 30, | | | ended January | | | ended January 31, | |

| | | 2007 | | | 31, | | | 2006 | |

| |

| (Loss) for the period – Canadian GAAP | $ | (8,492,639 | ) | $ | (30,712,592 | ) | $ | (3,948,102 | ) |

| Gain on dilution of equity investment | | (632,396 | ) | | (1,701,589 | ) | | - | |

| Mineral properties expensed under U.S. GAAP | | (5,510,801 | ) | | (3,540,104 | ) | | (172,480 | ) |

| |

| Foreign exchange on difference in mineralproperties under U.S. GAAP | | - | | | 272,000 | | | - | |

| Net loss – U.S. GAAP | $ | (14,635,836 | ) | $ | (35,682,285 | ) | $ | (4,120,582 | ) |

| Basic and diluted loss per share – U.S. GAAP | $ | (0.16 | ) | $ | (0.46 | ) | $ | (0.07 | ) |

| | | | | | | | | |

| Balance Sheets | | May 31 2009 | | | May 31,2008 | | | April 30, 2008 | |

| | | | | | | | | | |

| |

| Total assets – Canadian GAAP | $ | 81,543,823 | | $ | 71,208,177 | | $ | 58,789,331 | |

| Mineral properties expensed or charged to cost ofsales and revenue under U.S. GAAP | | (55,001,369 | ) | | (33,788,515 | ) | | (22,680,970 | ) |

| Total assets – U.S. GAAP | $ | 26,542,454 | | $ | 37,419,662 | | $ | 36,108,361 | |

| Long term debt – Canadian GAAP | $ | 52,939,642 | | $ | 30,939,670 | | $ | 1,367,249 | |

| Allocation of fair value of senior notes under U.S.GAAP | | - | | | (13,636,333 | ) | | - | |

| Derivative liability – warrants | | 6,292,830 | | | - | | | - | |

| Equity component of convertible debt treated as aliability under U.S. GAAP | | 495,121 | | | - | | | - | |

| Long term debt – U.S. GAAP | $ | 59,727,593 | | $ | 17,303,337 | | $ | 1,367,249 | |

| |

| Balance Sheets (cont.) | | May 31 2009 | | | May 31,2008 | | | April 30, 2008 | |

| | | | | | | | | | |

| |

| Shareholder’s equity (deficit) - Canadian GAAP | $ | (8,920,288 | ) | $ | 14,606,134 | | $ | 18,765,944 | |

| Mineral properties expensed or charged to cost of sales and revenue under U.S. GAAP | | (55,001,369 | ) | | (33,788,515 | ) | | (22,680,970 | ) |

| (Decrease) increase in retained earnings due to translation of prior year mineral property expensesand senior secured notes | | (4,564,949 | ) | | 1,622,000 | | | - | |

| Difference in accumulated other comprehensiveincome | | 4,564,949 | | | (1,622,000 | ) | | | |

| Increase in net income due to the change in fair value of warrants denominated in Canadian dollars under U.S. GAAP | | 22,871,582 | | | - | | | - | |

| Decrease in warrants due to fair value of warrants denominated in Canadian dollars under U.S. GAAP | | (29,164,412 | ) | | - | | | - | |

| Additional loss relating to redemption and modification of senior secured note agreement under U.S. GAAP | | (14,903,816 | ) | | 3,831,931 | | | - | |

| Allocation of fair value of senior secured notes under U.S. GAAP | | 14,903,816 | | | 9,804,402 | | | - | |

| Equity component of convertible debenture treated as a liability under U.S. GAAP | | (495,121 | ) | | - | | | - | |

| Shareholders’ equity (deficit) – U.S. GAAP | $ | (70,709,608 | ) | $ | (5,546,048 | ) | $ | (3,915,026 | ) |

| | | | | | | | | |

| Balance Sheets | | April 30, 2007 | | | January 31,2007 | | | January 31, 2006 | |

| | | | | | | | | | |

| |

| Total assets – Canadian GAAP | $ | 24,981,649 | | $ | 22,743,078 | | $ | 9,279,398 | |

| Mineral properties expensed or charged to cost ofsales and revenue under U.S. GAAP | | (5,510,801 | ) | | (3,540,104 | ) | | (172,480 | ) |

| Total assets – U.S. GAAP | $ | 19,470,848 | | $ | 19,202,974 | | $ | 9,106,918 | |

| |

| Shareholder’s equity (deficit) - Canadian GAAP | $ | 14,370,149 | | $ | 18,647,224 | | $ | 8,798,091 | |

| Mineral properties expensed under U.S. GAAP | | (5,510,801 | ) | | (3,540,104 | ) | | (172,480 | ) |

| Shareholders’ equity (deficit) – U.S. GAAP | $ | 8,859,348 | | $ | 15,107,120 | | $ | 8,625,611 | |

| |

Form 20-F/A_Amendment No. 2_Fiscal Year Ended 2009 May 31 | Page 14 |

3.B. Capitalization and Indebtedness

This Amendment No. 2 is being filed as an annual report under the Exchange Act and, as such, there is no requirement to provide the information called for by this item.

3.C. Reasons For The Offer and Use of Proceeds

This Amendment No. 2 is being filed as an annual report under the Exchange Act and, as such, there is no requirement to provide the information called for by this item.

3.D. Risk Factors

We operate in a dynamic and rapidly changing environment that involves numerous risks and uncertainties. Investors should carefully consider the risks described below before investing in our securities. The occurrence of any of the following events could harm us. If these events occur, the trading price of our common shares could decline, and investors may lose part or even all of their investment.

A risk analysis has as yet to be completed for the Molejon deposit. While it is possible to speculate on possible risks associated with an open pit mining operation in Panama, there may be as yet to be identified significant risk factors. Any as yet to be identified risks cannot be completely eliminated and it is possible that the occurrence of one or more of such factors could have a material adverse effect on our financial condition and results of operations.

We face risks related to our operations in foreign countries.

Currently our only properties are located in Panama, a country with a developing mining sector but no commercially producing mines. Consequently, we are subject to and our mineral exploration and mining activities may be affected in varying degrees by certain risks associated with foreign ownership, including inflation, political instability, political conditions and government regulations. Any changes in regulations or shifts in political conditions are beyond our control and may adversely affect our business. Operations may be affected by government regulations with respect to restrictions on production, restrictions on foreign exchange and repatriation, price controls, export controls, restriction of earnings distribution, taxation laws, expropriation of property, environmental legislation, water use and mine safety and renegotiation or nullification of existing concessions, licenses, permits and contracts. In particul ar, the status of Panama as a developing country may make it more difficult for us to obtain any required production financing for our properties from senior lending institutions.

Failure to comply strictly with applicable laws, regulations and local practices relating to mineral rights applications and tenure could result in loss, reduction or expropriation of entitlements or the imposition of additional local or foreign parties as joint venture partners with carried or other interests. The occurrence of these various factors and uncertainties cannot be accurately predicted and could have an adverse effect on our operations or profitability.

Our operations are subject to environmental and other regulation.

Our current or future operations, including development activities and commencement of production on our properties, require permits from various governmental authorities and such operations are and will be subject to laws and regulations governing prospecting, development, mining, production, exports, taxes, labour standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety, community services and other matters. Companies engaged in the development and operation of mines and related facilities generally experience increased costs and delays in production and other schedules as a result of the need to comply with applicable laws, regulations and permits. There can be no assurance that approvals and permits required to commence production on our various properties will be obtained. Additional permits and studies, which may include environmental impact studies conducted before permits can be obtained, may be necessary prior to operation of the properties in which we have interests and there can be no assurance that we will be able to obtain or maintain all necessary permits that may be required to commence construction, development or operation of mining facilities at these properties on terms which enable operations to be conducted at economically justifiable costs.

Our potential mining and processing operations and exploration activities in Panama are subject to various federal and provincial laws governing land use, the protection of the environment, prospecting, development, production, exports, taxes, labour standards, occupational health, waste disposal, toxic substances, mine safety, community services and other matters. Such operations and exploration activities are also subject to substantial regulation under these laws by governmental agencies and may require that we obtain permits from various governmental agencies. We believe we are in substantial compliance with all material laws and regulations that currently apply to our activities. There can be no assurance, however, that all permits we may require for construction of mining facilities and conduct of mining operations will be obtainable on reasonable terms or that such laws and regulations would not have a material adverse e ffect on any mining project we might undertake.

Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment or remedial actions. Parties engaged in mining operations may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations.

| |

Form 20-F/A_Amendment No. 2_Fiscal Year Ended 2009 May 31 | Page 15 |

Amendments to current laws, regulations and permits governing operations and activities of mining companies, or more stringent implementation thereof, could have a material adverse impact on us and cause increases in capital expenditures or production costs or reduction in levels of production at producing properties or abandonment or delays in development of new mining properties.

To the best of our knowledge, we are currently operating in compliance with all applicable environmental regulations. However, Autoridad Nacional del Ambiente (“ANAM”), Panama’s national environmental authority, has established certain conditions to be met before we can place the Molejon property into commercial production as a mine. We have yet to satisfy all of these conditions, and discussions are underway with ANAM to arrive at a consensus on the final conditions to be met. Our position is that Law No. 9 of the Legislative Assembly of Panama (the “Ley Petaquilla”), a project-specific piece of legislation enacted in February 1997 to deal with the orderly development of the Cerro Petaquilla Concession, takes precedence over the resolutions of ANAM, and that we are in compliance with the Ley Petaquilla. The Supreme Court of Panama has issued an order suspending the implementation of a fine levied in 2008 against us by ANAM. There is no guarantee that ANAM will not purport to levy further fines against us, claiming breaches of the environmental statutes and policies of Panama, in the event that we proceed to commercial production without having satisfied conditions set out by ANAM. We intend to strictly comply with the Ley Petaquilla, including the environmental provisions thereof, and will vigorously oppose any such action by ANAM.

There are currently no producing mines in Panama and various independent environmental groups or individuals would like to prevent mining in Panama. As such, our operations could be significantly disrupted or suspended by activities such as protests or blockades that may be undertaken by such groups or individuals.

We do not have probable or proven reserves.

We are engaged in the acquisition, exploration, exploration management and sale of mineral properties, with the primary aim of developing them to a stage where they can be exploited at a profit. Our property interests are in the exploration stage and are without a known body of commercial ore. Although an open pit mine is planned and construction of a gold plant is nearing completion at the Molejon gold property for the processing of gold-bearing ores, there is no guarantee we will realize any profits in the short to medium term. Any profitability in the future from our business will be dependent upon locating mineral reserves, which itself is subject to numerous risk factors.

The business of exploring for minerals and mining involves a high degree of risk. Few properties that are explored are ultimately developed into producing mines. Should our mineral properties reach the developing stage, we will be subjected to an array of complex economic factors and accordingly there is no assurance that a positive feasibility study or any projected results contained in a feasibility study of a mineral deposit will be attained.

Although the ore resource and mineral deposit figures included herein have been carefully prepared by us, or, in some instances have been prepared, reviewed or verified by independent mining experts, these amounts are estimates only and no assurance can be given that any particular level of recovery of minerals from ore resources will in fact be realized or that an identified mineral deposit will ever qualify as a commercially mineable (or viable) ore body which can be legally and economically exploited. Mineral resources are estimates of the size and grade of deposits based on limited sampling and on certain assumptions and parameters and until reserves or mineralization are actually mined and processed, the quantity of mineralization and resource grades must be considered estimates only.

Further exploration, drilling and other engineering analyses are required in order to have any of our resources classified as proven reserves. Estimates of reserves, mineral deposits and potential future production costs can also be affected by such factors as permitting regulations and requirements, weather, environmental factors, unforeseen technical difficulties, unusual or unexpected geological formations and work interruptions. In addition, the grade of ore ultimately mined may differ from that indicated by drilling results. Short-term factors relating to ore reserves, such as the need for orderly exploration of ore bodies or the processing of new or different grades, may also have an adverse effect on mining operations and on the results of operations. There can be no assurance that minerals recovered in small-scale laboratory tests will be duplicated in large-scale tests under on-site conditions. Material changes in ore r eserves, grades, stripping ratios or recovery rates may affect the economic viability of projects. Ore reserves are reported as general indicators of mine life. Reserves should not be interpreted as assurances of mine life or of the profitability of current or future operations.

| |

Form 20-F/A_Amendment No. 2_Fiscal Year Ended 2009 May 31 | Page 16 |

Mining is subject to various physical hazards.

The business of gold mining is subject to a variety of risks such as cave-ins and flooding, environmental hazards, industrial accidents, unusual or unexpected changes to rock formations, changes in the regulatory environment, the discharge of toxic chemicals, gold bullion losses and other hazards. Such occurrences could result in damage to, or destruction of, mineral properties or production facilities, personal injury or death, environmental damage, delays in mining, delays in production, increased production costs, monetary losses and possible legal liability. We have obtained insurance in amounts that we consider to be adequate to protect ourselves against certain risks of mining and processing to the extent that is economically feasible but which may not provide adequate coverage in all circumstances. We may become subject to liability for hazards against which we cannot insure ourselves, or against which we are inadequately insur ed or against which we may elect not to insure because of premium costs or other reasons. In particular, we are not insured against all forms of environmental liability.

We do not have all of the required permits for commencement of commercial production.

Further activities on the Molejon gold property for completion of construction of mill facilities and commencement and continuation of production will require additional approvals, permits and certificates of authorization from different government agencies on an ongoing basis. Obtaining the necessary governmental permits is a complex and time consuming process involving numerous jurisdictions and may involve public hearings and costly undertakings. The duration and success of permitting efforts are contingent upon many variables not within our control. Environmental protection permitting, including the approval of reclamation plans, could increase costs and cause delays in the development of the Molejon gold deposit, depending on the nature of the activity to be permitted and the interpretation of applicable requirements implemented by the permitting authority. There can be no assurance that all necessary permits will be obtained and , if obtained, that the costs involved will not exceed those previously estimated by us. It is possible that the costs and delays associated with the compliance with such standards and regulations could become such that we would not proceed with the development or operation of a mine or mines.

Potential delays in the advancement of the Molejon gold deposit and cost overruns may occur.

Our ability to meet timing and cost estimates for properties cannot be assured. Technical considerations, delays in obtaining governmental approvals, inability to obtain financing or other factors could cause delays in exploring properties and such delays could materially affect our financial performance.

Whilst the Molejon gold deposit development is underway, costs for required equipment remain under review and may escalate beyond original estimates. This possible cost escalation, along with other as yet unresolved logistical and engineering issues relating to the Molejon development, all part of a standard building, construction and anticipated start up of a new mining operation, may result in significant cost experiences that differ from present day estimates. There is no guarantee the Molejon gold project will, after more development and engineering work is completed, together with required capital equipment purchases, be an economically feasible production opportunity.

We have limited experience with development-stage mining operations.

We have limited experience in placing resource properties into production and our ability to do so will be dependent upon using the services of appropriately experienced personnel or entering into agreements with other major resource companies that can provide such expertise. There can be no assurance that we will have available to us the necessary expertise when and if we place our resource properties into production. There also exists significant risk in being able to recruit experienced employees or contractors to allow us to move forward in pursuing development-stage mining operations.

| |

Form 20-F/A_Amendment No. 2_Fiscal Year Ended 2009 May 31 | Page 17 |

Mineral prices can fluctuate dramatically and have a material adverse effect on our results of operations.

The mining industry in general is intensely competitive and there is no assurance that, even if commercial quantities of minerals are discovered, a profitable market will exist for the sale of same. Factors beyond our control may affect the marketability of any substances discovered. Gold prices have experienced volatile and significant price movements over short periods of time and are affected by numerous factors beyond our control, including international economic and political trends, expectations with respect to the rate of inflation, currency exchange rates, interest rates, global and regional consumption patterns and economic crises, speculative activities and increased production due to improved mining and production methods. The supply of and demand for gold is affected by various factors, including political events, economic conditions and production costs in major producing regions and governmental policies with respect to gold holdings by a na tion or its citizens. The demand for and supply of gold affects gold prices but not necessarily in the same manner as demand and supply affect the prices of other commodities. The supply of gold consists of a combination of mine production and existing stocks of bullion and fabricated gold held by governments, public and private financial institutions, industrial organizations and private individuals. There can be no assurance that the price of recovered minerals will be such that our properties can be mined at a profit.

We are dependent upon additional funding in order to sustain our operations.

We have only generated cash of $653,941 from the sale of gold and silver in the past and, although we are preparing for production at the Molejon gold property, cash flow to satisfy our operational requirements, debt repayments and cash commitments is not guaranteed from the operations of the Molejon gold plant. In the past, we have relied on sales of equity securities or debt financing to meet most of our cash requirements, together with project management fees, property payments and sales or joint ventures of properties. There can be no assurance that funding from these sources will be sufficient in the future to satisfy our operational requirements, debt repayments and cash commitments.

We do not presently have sufficient financial resources to undertake all of our planned exploration and development programs. The development of our properties depends upon our ability to obtain financing through any or all of the joint venturing of projects, debt financing, equity financing or other means. There is no assurance that we will be successful in obtaining the required financing. Failure to obtain additional financing on a timely basis could cause us to forfeit our interest in our properties and reduce or terminate our operations on such properties.

We have a history of losses, an accumulated deficit and a lack of revenue from operations and there is substantial uncertainty regarding our ability to continue as a going concern.

In their report on the consolidated financial statements for the period ended May 31, 2009, our independent auditors included an explanatory paragraph regarding concerns about our ability to continue as a going concern. Our financial statements contain additional note disclosures describing the circumstances that lead to this disclosure by our independent auditors.

We have incurred net losses to date. As at May 31, 2009, we had an accumulated operating deficit of $119,774,936, a shareholders’ deficit of $8,920,288 and for the 12-months ended May 31, 2009, incurred a loss of $21,099,866 from continuing operations. Continuing operations are dependent on us achieving profitable operations and being able to raise capital, if and when necessary to meet our obligations and repay liabilities when they come due.

We have not yet had any revenue from the exploration activities on our properties. The Molejon gold property is our most advanced property. Even if we generate future revenue from any of our properties, including the Molejon gold property, we may continue to incur losses beyond the period of commencement of such activity. There is no certainty that we will produce revenue, operate profitably or provide a return on investment in the future and recent significant increases in gold commodity prices may not be sustainable. As such, they may not be reliable as indicators of future consistent realizable values, should any of our mineral deposits reach commercial production.

| |

Form 20-F/A_Amendment No. 2_Fiscal Year Ended 2009 May 31 | Page 18 |

We did not generate revenue from operations during the 12 months ended May 31, 2009, the one month ended May 31, 2008, the 12 months ended May 31, 2008, the three months ended April 30, 2007, and the 12 months ended January 31, 2007. Expenses for the 12-months ended May 31, 2009, were $25,603,711, a decreasefrom $29,284,791 for the 12-months ended May 31, 2008.

We are executing a business plan to allow us to continue as a going concern, which is to achieve profitability through cost containment and increased revenues. We have reduced our losses and intend to reduce them further, ultimately achieving profitability. There is significant uncertainty that we will be successful in executing this plan. Should we fail to achieve profitability, or if necessary, raise sufficient capital to sustain operations, we may be forced to suspend our operations, and possibly even liquidate our assets and wind-up and dissolve.

During the fiscal year ended May 31, 2009, we raised an additional $27,750,000 in gross proceeds by completing our senior secured notes debt financing. We followed with the completion of a supplemental senior secured notes debt financing of $20,000,000 in gross proceeds and a convertible senior secured notes debt financing of $40,000,000 in gross proceeds. In addition, we raised $43,238,852 through the sale of our 20,418,565 common shares of Petaquilla Copper Ltd. and, thus, retired a portion ($43,238,852) of our outstanding senior secured notes.

Our consolidated financial statements are prepared on a going concern basis, which assumes that we will be able to realize our assets at the amounts recorded and discharge our liabilities in the normal course of business in the foreseeable future. Should this assumption not be appropriate, adjustments in the carrying amounts of the assets and liabilities to their realizable amounts and the classifications thereof will be required and these adjustments and reclassifications may be material.

We have a history of material weaknesses at our subsidiaries.

We have a history of material weaknesses at our subsidiaries which resulted in ineffective internal controls. Our Audit Committee, with the assistance of outside independent counsel, has commenced an internal investigation into the continued non-compliance of our subsidiaries. Because the internal review is ongoing, we cannot predict the ultimate consequences of the review.

The requirements of the Ley Petaquilla may have an adverse impact on us.

Our operations in Panama are governed primarily by Law No. 9 of the Legislative Assembly of Panama (the “Ley Petaquilla”), a project-specific piece of legislation enacted in February 1997 to deal with the orderly development of the Cerro Petaquilla Concession.

The Ley Petaquilla granted a mineral exploration and exploitation concession to Minera Petaquilla, S.A. (“MPSA”), a Panamanian company formed in 1997 to hold the Cerro Petaquilla Concession covering approximately 136 square kilometres in north-central Panama. Although we no longer hold an interest in the copper deposits therein, we continue to hold the rights to the Molejon gold deposit and, as the Cerro Petaquilla Concession encompasses this deposit, the Ley Petaquilla governs our exploration activities.

The Ley Petaquilla contains fiscal and legal stability clauses necessary in order to obtain project financing and includes tax exemptions on income, dividends and imports. The Ley Petaquilla also provides for an increase in the annual available infrastructure tax credit, higher depreciation rates for depreciable assets which cannot be used in the infrastructure tax credit pool, and a favorable depletion allowance.

In order to maintain the Cerro Petaquilla Concession in good standing, MPSA must pay to the Government of Panama an annual rental fee of $1.00 per hectare during the first five years of the concession, $2.50 per hectare in the sixth to the tenth years of the concession and $3.50 per hectare thereafter. Initially, the annual rental was approximately $13,600 payable by MPSA and funded pro rata by its shareholders. The current annual rental is approximately $34,000. The concession was granted for a 20-year term with up to two 20-year extensions permitted subject to the requirement to begin mine development and to make a minimum investment of $400 million in the development of the Cerro Petaquilla Concession.

Under the Ley Petaquilla, MPSA was required to begin mine development by May 2001. However, MPSA was able to defer commencing development operations by one month for every month that the price of copper remained below $1.155 per pound for up to a further five years (i.e. until May 2006 at the latest). In September 2005, the multi-phase Petaquilla Mine Development Plan (the “Plan”) submitted to the Government of Panama by us and MPSA was approved by Ministerial Resolution. The Molejon gold mineral deposit forms part of the Cerro Petaquilla Concession and the first phase of the Plan focuses on the advancement of the Molejon gold deposit by us as commenced in 2006. Subsequent phases of the Plan are the responsibility of MPSA.

The Ley Petaquilla also requires MPSA to (i) deliver an environmental report to the General Direction of Mineral Resources of the Ministry of Commerce and Industiries (“MICI”) for evaluation; (ii) submit, prior to extraction, an environmental feasibility study specific to the project area in which the respective extradition will take place; (iii) submit annually a work plan comprising the projections and approximate costs for the respective year to the MICI; (iv) post letters of credit in support of required compliance and environmental protection guarantees; (vi annually pay surface canons; (vi) annually pay royalties for extracted minerals; (vii) annually present to the MICI detailed reports covering operations and employment and training; (viii) create and participate in the administration of a scholarship fund to finance studies and training courses or professional training for the inhabitants of the communities neighboring the Cerro Peta quilla Concession in the provinces of Cocle and Colon; and (ix) maintain all mining and infrastructure works and services of the project, always complying with the standards and regulations of general application in force that pertain to occupational safety, health and construction.

For reference, a copy of Law No. 9 as passed by the Legislative Assembly of Panama on February 26, 1997, was provided with our Form 20-F for the fiscal year ended May 31, 2009, as Exhibit 4.V. An English translation of the law is attached to this Amendment No. 2 as Exhibit 4.W.

| |

Form 20-F/A_Amendment No. 2_Fiscal Year Ended 2009 May 31 | Page 19 |

Our directors may have conflicts of interest.

As at November 6, 2009, two of our directors, David Levy and Daniel Small, hold positions with Platinum Management (NY) LLC, an investment advising firm to Platinum Partners Value Arbitrage Fund LP, a New York based investment fund. Platinum Partners Value Arbitrage Fund LP holds securities in our company and a portion of our debt. However, none of our directors are directors or officers of Platinum Partners Value Arbitrage Fund LP nor are any of our directors insiders of any other reporting company. While currently none of our directors beneficially owns a 10% or greater interest in the voting power of any other mineral resource companies, they could in the future. To the extent that these other companies may participate in ventures in which we may participate, our directors may have a conflict of interest in negotiating and concluding terms respecting the extent of such partic ipation, which could result in competitive harm to us. In the event that such a conflict of interest arises at a meeting of our directors, a director who has such a conflict will abstain from voting for or against the approval of such participation or such terms. In appropriate cases we will establish a special committee of independent directors to review a matter in which several directors, or management, may have a conflict. In accordance with the laws of the Province of British Columbia, our directors are required to act honestly, in good faith and in our best interests. In determining whether or not we will participate in a particular program and the interest therein to be acquired by it, our directors primarily consider the potential benefits to us, the degree of risk to which we may be exposed and our financial position at that time. Other than as indicated, we have no other procedures or mechanisms to prevent conflicts of interest.

Increased costs to procure labour and materials may affect expenditures relating to potential future production.

The mining industry has been impacted by increased demand for critical resources such as input commodities, mining equipment, milling equipment and skilled labour. These shortages have caused unanticipated cost increases and delays in delivery times, thereby impacting capital expenditures and mine and mill completion. These conditions may reoccur in the future and may have an effect on costs of potential future production and the achievement of production targets.

We face strong competition for the acquisition of mining properties.

Significant and increasing competition exists for the limited number of mineral property acquisition opportunities available. As a result of this competition, some of which is with large established mining companies with substantial capabilities and greater financial and technical resources than we have, we may be unable to acquire additional attractive mineral properties on terms we consider acceptable. Accordingly, there can be no assurance that our exploration and acquisition programs will yield any new reserves or result in any commercial mining operation.

Our common shares are subject to penny stock rules, which could affect trading in our shares.

Our common shares are classified as “penny stock” as defined in Rule 15g-9 promulgated under the Exchange Act. In response to perceived abuse in the penny stock market generally, the Exchange Act was amended in 1990 to add new requirements in connection with penny stocks. In connection with effecting any transaction in a penny stock, a broker or dealer must give the customer a written risk disclosure document that (a) describes the nature and level of risk in the market for penny stocks in both public offerings and secondary trading, (b) describes the broker's or dealer's duties to the customer and the rights and remedies available to such customer with respect to violations of such duties, (c) describes the dealer market, including “bid” and “ask” prices for penny stock and the significance of the spread between the bid and ask prices, (d) contains a toll-free telephone number for inquiries on disciplin ary histories of brokers and dealers and (e) defines significant terms used in the disclosure document or the conduct of trading in penny stocks. In addition, the broker-dealer must provide to a penny stock customer a written monthly account statement that discloses the identity and number of shares of each penny stock held in the customer’s account and the estimated market value of such shares. The extensive disclosure and other broker-dealer compliance related to penny stocks may result in reducing the level of trading activity in the secondary market for our common shares, thus limiting the ability of our shareholders to sell their shares.

U.S. investors may not be able to enforce their civil liabilities against us or our directors, controlling persons and officers.

Our company and our officers and directors are residents of countries other than the United States, and all of our assets are located outside the United States. As a result, it may not be possible for investors to effect service of process within the United States upon such persons or enforce in the United States against such persons judgments obtained in United States courts, including judgments predicated upon the civil liability provisions of United States federal securities laws or state securities laws.

| |

Form 20-F/A_Amendment No. 2_Fiscal Year Ended 2009 May 31 | Page 20 |

We believe that a judgment of a United States court predicated solely upon civil liability under United States securities laws would probably be enforceable in Canada if the United States court in which the judgment was obtained has a basis for jurisdiction in the matter that was recognized by a Canadian court for such purposes. However, there is doubt whether an action could be brought in Canada in the first instance on the basis of liability predicated solely upon such laws.

If we are characterized as a Passive Foreign Investment Company (“PFIC”), our U.S. shareholders may be subject to adverse U.S. federal income tax consequences.

We have not made a determination as to whether we are considered a PFIC as such term is defined in the U.S. Internal Revenue Code of 1986, as amended (the “Code”), for U.S. federal income tax purposes for the current tax year and any prior tax years. A non-U.S. corporation generally will be considered a PFIC for any tax year if either (1) at least 75% of its gross income is passive income or (2) at least 50% of the value of its assets (based on an average of the quarterly values of the assets during a taxable year) is attributable to assets that produce or are held for the production of passive income.

In general, if we are or become a PFIC, any gain recognized on the sale of our common stock and any “excess distributions” (as specifically defined in the Code) paid on the common stock must be ratably allocated to each day in a U.S. taxpayer’s holding period for the common stock. The amount of any such gain or excess distribution allocated to prior years of such U.S. taxpayer’s holding period for the common stock generally will be subject to U.S. federal income tax at the highest tax applicable to ordinary income in each such prior year, and the U.S. taxpayer will be required to pay interest on the resulting tax liability for each such prior year, calculated as if such tax liability had been due in each such prior year. For more information, see “Material United States Federal Income Tax Consequences-Passive Foreign Investment Company.”

ITEM 4. INFORMATION ON THE COMPANY

4.A. History and Development of the Company

Our company, Petaquilla Minerals Ltd., is a British Columbia company engaged in the acquisition, exploration and exploration management of mineral properties with the goal of bringing properties to production. We were incorporated under the laws of the Province of British Columbia, Canada, on October 10, 1985, by registration of our Memorandum and Articles of Association (the “Articles”) with the British Columbia Registrar of Companies under the name Adrian Resources Ltd. We changed our name to Petaquilla Minerals Ltd. on October 12, 2004.

Our principal executive office address is Suite 410, 475 West Georgia Street, Vancouver, British Columbia, V6B 4M9 Canada. Our telephone number is (604) 694-0021 and our facsimile number is (604) 694-0063.

We have eleven subsidiaries and one joint venture interest as detailed below:

(i)

We own all of the issued shares of Adrian Resources (BVI) Ltd., which was incorporated in the British Virgin Islands on December 17, 1999.

(ii)