UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-07343 |

| |

| Exact name of registrant as specified in charter: | | The Prudential Investment Portfolios, Inc. |

| |

| Address of principal executive offices: | | Gateway Center 3, 100 Mulberry Street, Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Deborah A. Docs Gateway Center 3, 100 Mulberry Street, Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 973-367-7521 |

| |

| Date of fiscal year end: | | 9/30/2006 |

| |

| Date of reporting period: | | 3/31/2006 |

Item 1 – Reports to Stockholders

Jennison Growth Fund

| | |

| MARCH 31, 2006 | | SEMIANNUAL REPORT |

FUND TYPE

Medium- to large- capitalization stock

OBJECTIVE

Long-term growth of capital

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

The accompanying financial statements as of March 31, 2006, were not audited, and accordingly, no auditor’s opinion is expressed on them.

JennisonDryden is a registered trademark of The Prudential Insurance Company of America.

May 15, 2006

Dear Shareholder:

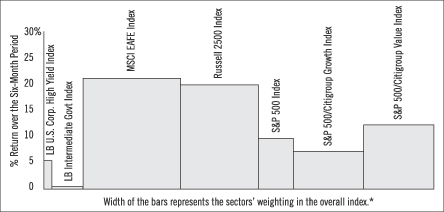

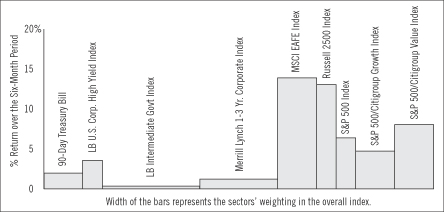

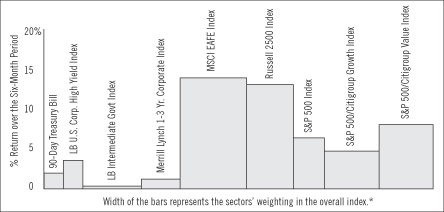

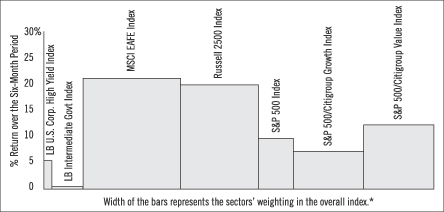

We hope you find the semiannual report for the Jennison Growth Fund informative and useful. As a JennisonDryden mutual fund shareholder, you may be thinking about where you can find additional growth opportunities. You could invest in last year’s top-performing asset class and hope history repeats itself or you could stay in cash while waiting for the “right moment” to invest.

Instead, we believe it is better to take advantage of developing domestic and global investment opportunities through a diversified portfolio of stock and bond mutual funds. A diversified asset allocation offers two potential advantages. It helps you manage downside risk by not being overly exposed to any particular asset class, plus it gives you a better opportunity to have at least some of your assets in the right place at the right time. Your financial professional can help you create a diversified investment plan that may include mutual funds covering all the basic asset classes and that reflects your personal investor profile and tolerance for risk.

JennisonDryden Mutual Funds gives you a wide range of choices that can help you make progress toward your financial goals. Our funds offer the experience, resources, and professional discipline of three leading asset managers. They are recognized and respected in the institutional market and by discerning investors for excellence in their respective strategies. JennisonDryden equity funds are advised by Jennison Associates LLC or Quantitative Management Associates LLC (QMA). Prudential Investment Management, Inc. (PIM) advises the JennisonDryden fixed income and money market funds. Jennison Associates, QMA, and PIM are registered investment advisors and Prudential Financial companies.

Thank you for choosing JennisonDryden Mutual Funds.

Sincerely,

Judy A. Rice, President

The Prudential Investment Portfolios, Inc./Jennison Growth Fund

| | |

| The Prudential Investment Portfolios, Inc./Jennison Growth Fund | | 1 |

Your Fund’s Performance

Fund objective

The investment objective of the Jennison Growth Fund (the Fund) is long-term growth of capital. There can be no assurance that the Fund will achieve its investment objective.

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at www.jennisondryden.com or by calling (800) 225-1852. The maximum initial sales charge is 5.50% (Class A shares).

| | | | | | | | | | | | | | | |

| Cumulative Total Returns1 as of 3/31/06 | | | | | | | | | | | | | |

| | | Six Months | | | One Year | | | Five Years | | | Ten Years | | | Since Inception2 | |

Class A | | 6.99 | % | | 21.78 | % | | 9.57 | % | | 110.35 | % | | 118.55 | % |

Class B | | 6.60 | | | 20.84 | | | 5.55 | | | 95.20 | | | 102.22 | |

Class C | | 6.60 | | | 20.84 | | | 5.55 | | | 95.20 | | | 102.22 | |

Class R | | 6.86 | | | 21.46 | | | N/A | | | N/A | | | 16.50 | |

Class Z | | 7.12 | | | 22.12 | | | 10.94 | | | N/A | | | 117.16 | |

S&P 500 Index3 | | 6.38 | | | 11.72 | | | 21.46 | | | 135.71 | | | *** | |

Russell 1000 Growth Index4 | | 6.16 | | | 13.14 | | | 8.59 | | | 87.65 | | | **** | |

Lipper Large-Cap Growth Funds Avg.5 | | 6.35 | | | 14.24 | | | 5.33 | | | 91.22 | | | ***** | |

| | | | | | | | | | | | | | | | |

| Average Annual Total Returns1 as of 3/31/06 | | | | | | | | | | | | | |

| | | | | | One Year | | | Five Years | | | Ten Years | | | Since Inception2 | |

Class A | | | | | 15.09 | % | | 0.70 | % | | 7.11 | % | | 7.21% | |

Class B | | | | | 15.84 | | | 0.89 | | | 6.92 | | | 7.00 | |

Class C | | | | | 19.84 | | | 1.09 | | | 6.92 | | | 7.00 | |

Class R | | | | | 21.46 | | | N/A | | | N/A | | | 12.60 | |

Class Z | | | | | 22.12 | | | 2.10 | | | N/A | | | 8.10 | |

S&P 500 Index3 | | | | | 11.72 | | | 3.97 | | | 8.95 | | | *** | |

Russell 1000 Growth Index4 | | | | | 13.14 | | | 1.66 | | | 6.50 | | | **** | |

Lipper Large-Cap Growth Funds Avg.5 | | | | | 14.24 | | | 0.93 | | | 6.53 | | | ***** | |

The cumulative total returns do not reflect the deduction of applicable sales charges. If reflected, the applicable sales charges would reduce the cumulative total returns performance quoted. Class A shares are subject to a maximum front-end sales charge of 5.50%. Under certain circumstances, Class A shares may be subject to a contingent deferred sales charge (CDSC) of 1%. Class B and Class C shares are subject to a maximum CDSC of 5% and 1%, respectively. Class R and Class Z shares are not subject to a sales charge.

| | |

| 2 | | Visit our website at www.jennisondryden.com |

1Source: Prudential Investments LLC and Lipper Inc. The average annual total returns take into account applicable sales charges. During certain periods shown, fee waivers and/or expense reimbursements were in effect. Without such fee waivers and expense reimbursements, the returns for the share classes would have been lower. Class A, Class B, and Class C shares are subject to an annual distribution and service (12b-1) fee of up to 0.30%, 1.00%, and 1.00%, respectively. Approximately seven years after purchase, Class B shares will automatically convert to Class A shares on a quarterly basis. Class Z shares are not subject to a 12b-1 fee. The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares.

2Inception dates: Class A, B, and C, 11/2/95; Class R, 12/17/04; and Class Z, 4/15/96. On 9/20/96, The Prudential Institutional Fund/Growth Stock Fund merged into Jennison Growth Fund, Class Z shares. Performance for Class Z shares prior to 9/20/96 is for the Growth Stock Fund, which had an inception date of 11/5/92.

3The Standard & Poor’s 500 Composite Stock Price Index (S&P 500 Index) is an unmanaged index of 500 stocks of large U.S. public companies. It gives a broad look at how U.S. stock prices have performed.

4The Russell 1000 Growth Index is an unmanaged index comprising those securities in the Russell 1000 Index with a greater-than-average growth orientation. Companies in this index tend to exhibit relatively high price-to-book ratios, price-to-earnings ratios and forecasted growth rates, and relatively low dividend yields.

5The Lipper Large-Cap Growth Funds Average (Lipper Average) represents returns based on the average return of all funds in the Lipper Large-Cap Growth Funds category for the periods noted. Funds in the Lipper Average invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) greater than 300% of the dollar-weighted median market capitalization of the middle 1,000 securities of the S&P SuperComposite 1500 Index. Large-cap growth funds typically have an above-average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share growth value compared with the S&P 500 Index.

Investors cannot invest directly in an index. The returns for the S&P 500 Index and the Russell 1000 Growth Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes. Returns for the Lipper Average reflect the deduction of operating expenses, but not sales charges or taxes.

***S&P 500 Index Closest Month-End to Inception cumulative total returns are 164.24% for Class A, B, and C; 9.32% for Class R; and 298.62% for Class Z. S&P 500 Index Closest Month-End to Inception average annual total returns are 9.78% for Class A, B, and C; 7.39% for Class R; and 10.86% for Class Z.

****Russell 1000 Growth Index Closest Month-End to Inception cumulative total returns are 106.59% for Class A, B, and C; 8.52% for Class R; and 201.76% for Class Z. Russell 1000 Growth Index Closest Month-End to Inception average annual total returns are 7.21% for Class A, B, and C; 6.76% for Class R; and 8.58% for Class Z.

*****Lipper Average Closest Month-End to Inception cumulative total returns are 106.43% for Class A, B, and C; 9.05% for Class R; and 208.39% for Class Z. Lipper Average Closest Month-End to Inception average annual total returns are 7.05% for Class A, B, and C; 7.16% for Class R; and 8.61% for Class Z.

| | |

| The Prudential Investment Portfolios, Inc./Jennison Growth Fund | | 3 |

Your Fund’s Performance (continued)

| | | |

Five Largest Holdings expressed as a percentage of net assets as of 3/31/06

(excluding short-term investments) | | | |

Google, Inc. (Class “A” Stock), Internet Software & Services | | 4.4 | % |

eBay, Inc., Internet Software & Services | | 3.2 | |

Procter & Gamble Co., Household Products | | 3.0 | |

Microsoft Corp., Software | | 2.4 | |

Schlumberger Ltd., Energy Equipment & Services | | 2.4 | |

Holdings are subject to change.

| | | |

Five Largest Industries expressed as a percentage of net assets as of 3/31/06

(excluding short-term investments) | | | |

Internet Software & Services | | 9.9 | % |

Software | | 8.9 | |

Semiconductors & Semiconductor Equipment | | 8.7 | |

Capital Markets | | 8.3 | |

Biotechnology | | 6.2 | |

Industry weightings are subject to change.

| | |

| 4 | | Visit our website at www.jennisondryden.com |

Fees and Expenses (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested on October 1, 2005, at the beginning of the period, and held through the six-month period ended March 31, 2006.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to Individual Retirement Accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of JennisonDryden or Strategic Partners Funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information provided in the expense table. Additional fees have the effect of reducing investment returns.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before

| | |

| The Prudential Investment Portfolios, Inc./Jennison Growth Fund | | 5 |

Fees and Expenses (continued)

expenses, which is not the Fund’s actual return. The hypothetical account values and

expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only, and do not reflect any transactional costs such as sales charges (loads). Therefore the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | |

Jennison

Growth Fund | | Beginning Account Value October 1, 2005 | | Ending Account

Value March 31, 2006 | | Annualized Expense Ratio

Based on the

Six-Month

Period | | | Expenses Paid

During the Six-

Month Period* |

| | | | | | | | | | | | | | | |

| Class A | | Actual | | $ | 1,000.00 | | $ | 1,069.90 | | 1.04 | % | | $ | 5.37 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,019.75 | | 1.04 | % | | $ | 5.24 |

| | | | | | | | | | | | | | | |

| Class B | | Actual | | $ | 1,000.00 | | $ | 1,066.00 | | 1.79 | % | | $ | 9.22 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,016.01 | | 1.79 | % | | $ | 9.00 |

| | | | | | | | | | | | | | | |

| Class C | | Actual | | $ | 1,000.00 | | $ | 1,066.00 | | 1.79 | % | | $ | 9.22 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,016.01 | | 1.79 | % | | $ | 9.00 |

| | | | | | | | | | | | | | | |

| Class R | | Actual | | $ | 1,000.00 | | $ | 1,067.80 | | 1.29 | % | | $ | 6.65 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,018.50 | | 1.29 | % | | $ | 6.49 |

| | | | | | | | | | | | | | | |

| Class Z | | Actual | | $ | 1,000.00 | | $ | 1,071.20 | | 0.79 | % | | $ | 4.08 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,020.99 | | 0.79 | % | | $ | 3.98 |

* Fund expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 182 days in the six-month period ended March 31, 2006, and divided by the 365 days in the Fund’s fiscal year ending September 30, 2006 (to reflect the six-month period).

| | |

| 6 | | Visit our website at www.jennisondryden.com |

Portfolio of Investments

as of March 31, 2006 (Unaudited)

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | | |

LONG-TERM INVESTMENTS 98.3% | | | |

COMMON STOCKS | | | |

| |

Beverages 1.7% | | | |

| 896,400 | | PepsiCo, Inc. | | $ | 51,802,956 |

| |

Biotechnology 6.2% | | | |

| 931,800 | | Amgen, Inc.(a)(b) | | | 67,788,450 |

| 695,400 | | Genentech, Inc.(a) | | | 58,768,254 |

| 1,004,000 | | Gilead Sciences, Inc.(a) | | | 62,468,880 |

| | | | |

|

|

| | | | | | 189,025,584 |

| |

Capital Markets 8.3% | | | |

| 3,270,500 | | Charles Schwab Corp. (The) | | | 56,285,305 |

| 303,400 | | Goldman Sachs Group, Inc. | | | 47,621,664 |

| 247,100 | | Legg Mason, Inc. | | | 30,969,043 |

| 788,400 | | Merrill Lynch & Co., Inc. | | | 62,094,384 |

| 518,000 | | UBS AG | | | 56,964,460 |

| | | | |

|

|

| | | | | | 253,934,856 |

| |

Communications Equipment 5.1% | | | |

| 2,886,200 | | Cisco Systems, Inc.(a) | | | 62,543,954 |

| 1,914,500 | | Nokia OYJ ADR (Finland) | | | 39,668,440 |

| 1,057,300 | | QUALCOMM, Inc. | | | 53,509,953 |

| | | | |

|

|

| | | | | | 155,722,347 |

| |

Computers & Peripherals 1.4% | | | |

| 677,500 | | Apple Computer, Inc.(a) | | | 42,492,800 |

| |

Consumer Finance 2.3% | | | |

| 1,352,500 | | American Express Co. | | | 71,073,875 |

| |

Electronic Equipment & Instruments 1.5% | | | |

| 1,264,200 | | Agilent Technologies, Inc.(a) | | | 47,470,710 |

| |

Energy Equipment & Services 2.4% | | | |

| 576,300 | | Schlumberger Ltd. | | | 72,942,291 |

| |

Food & Staples Retailing 1.7% | | | |

| 762,800 | | Whole Foods Market, Inc.(b) | | | 50,680,432 |

| |

Health Care Equipment & Supplies 3.2% | | | |

| 536,300 | | Alcon, Inc. | | | 55,914,638 |

| 1,001,600 | | St. Jude Medical, Inc.(a) | | | 41,065,600 |

| | | | |

|

|

| | | | | | 96,980,238 |

See Notes to Financial Statements.

| | |

| The Prudential Investment Portfolios, Inc./Jennison Growth Fund | | 7 |

Portfolio of Investments

as of March 31, 2006 (Unaudited) Cont’d.

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | | |

Health Care Providers & Services 5.7% | | | |

| 955,600 | | Caremark Rx, Inc.(a) | | $ | 46,996,408 |

| 200,900 | | CIGNA Corp. | | | 26,241,558 |

| 1,095,500 | | UnitedHealth Group, Inc. | | | 61,194,630 |

| 507,400 | | WellPoint, Inc.(a) | | | 39,287,982 |

| | | | |

|

|

| | | | | | 173,720,578 |

| |

Hotels, Restaurants & Leisure 2.3% | | | |

| 676,100 | | Cheesecake Factory (The)(a)(b) | | | 25,319,945 |

| 638,100 | | Marriott International, Inc. (Class A) | | | 43,773,660 |

| | | | |

|

|

| | | | | | 69,093,605 |

| |

Household Products 3.0% | | | |

| 1,588,790 | | Procter & Gamble Co. | | | 91,546,080 |

| |

Industrial Conglomerates 1.8% | | | |

| 1,624,200 | | General Electric Co. | | | 56,489,676 |

| |

Insurance 2.0% | | | |

| 920,600 | | American International Group, Inc. | | | 60,842,454 |

| |

Internet Software & Services 9.9% | | | |

| 2,530,800 | | eBay, Inc.(a)(b) | | | 98,853,048 |

| 343,100 | | Google, Inc. (Class A)(a) | | | 133,809,000 |

| 2,217,800 | | Yahoo!, Inc.(a)(b) | | | 71,546,228 |

| | | | |

|

|

| | | | | | 304,208,276 |

| |

Media 2.7% | | | |

| 2,179,200 | | Disney (Walt) Co. | | | 60,777,888 |

| 275,000 | | Getty Images, Inc.(a)(b) | | | 20,592,000 |

| | | | |

|

|

| | | | | | 81,369,888 |

| |

Multiline Retail 3.2% | | | |

| 733,500 | | Federated Department Stores, Inc. | | | 53,545,500 |

| 850,800 | | Target Corp. | | | 44,250,108 |

| | | | |

|

|

| | | | | | 97,795,608 |

| |

Oil, Gas & Consumable Fuels 2.5% | | | |

| 409,400 | | Occidental Petroleum Corp. | | | 37,930,910 |

| 492,200 | | Suncor Energy, Inc. | | | 37,909,244 |

| | | | |

|

|

| | | | | | 75,840,154 |

See Notes to Financial Statements.

| | |

| 8 | | Visit our website at www.jennisondryden.com |

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | | |

Pharmaceuticals 5.5% | | | |

| 1,092,600 | | Novartis AG ADR (Switzerland) | | $ | 60,573,744 |

| 872,600 | | Roche Holdings AG ADR (Switzerland) | | | 64,801,458 |

| 454,700 | | Sanofi-Aventis (France) | | | 43,255,956 |

| 2,800 | | Sanofi-Aventis ADR (France) | | | 132,860 |

| | | | |

|

|

| | | | | | 168,764,018 |

| |

Semiconductors & Semiconductor Equipment 8.7% | | | |

| 1,627,900 | | Broadcom Corp. (Class A)(a)(b) | | | 70,260,164 |

| 1,186,100 | | Marvell Technology Group Ltd.(a)(b) | | | 64,168,010 |

| 1,819,900 | | Maxim Integrated Products, Inc. | | | 67,609,285 |

| 2,022,900 | | Texas Instruments, Inc.(b) | | | 65,683,563 |

| | | | |

|

|

| | | | | | 267,721,022 |

| |

Software 8.9% | | | |

| 1,980,000 | | Adobe Systems, Inc. | | | 69,141,600 |

| 950,700 | | Electronic Arts, Inc.(a) | | | 52,022,304 |

| 2,742,200 | | Microsoft Corp. | | | 74,615,262 |

| 348,100 | | NAVTEQ Corp.(a)(b) | | | 17,631,265 |

| 1,089,000 | | SAP AG ADR (Germany) | | | 59,154,480 |

| | | | |

|

|

| | | | | | 272,564,911 |

| |

Specialty Retail 5.3% | | | |

| 1,151,400 | | Chico’s FAS, Inc.(a)(b) | | | 46,792,896 |

| 714,900 | | Home Depot, Inc. | | | 30,240,270 |

| 683,900 | | Lowe’s Cos., Inc. | | | 44,070,516 |

| 657,100 | | Urban Outfitters, Inc.(a)(b) | | | 16,125,234 |

| 616,400 | | Williams-Sonoma, Inc.(a)(b) | | | 26,135,360 |

| | | | |

|

|

| | | | | | 163,364,276 |

| |

Textiles, Apparel & Luxury Goods 3.0% | | | |

| 1,319,500 | | Coach, Inc.(a) | | | 45,628,310 |

| 533,800 | | Nike, Inc. (Class B)(b) | | | 45,426,380 |

| | | | |

|

|

| | | | | | 91,054,690 |

| | | | |

|

|

| | | Total long-term investments

(cost $2,169,534,909) | | | 3,006,501,325 |

| | | | |

|

|

See Notes to Financial Statements.

| | |

| The Prudential Investment Portfolios, Inc./Jennison Growth Fund | | 9 |

Portfolio of Investments

as of March 31, 2006 (Unaudited) Cont’d.

| | | | | | |

| Shares | | Description | | Value (Note 1) | |

| | | | | | | |

SHORT-TERM INVESTMENT 8.9% | | | | |

| |

Affiliated Money Market Mutual Fund | | | | |

| | | Dryden Core Investment Fund - Taxable Money Market Series | | | | |

| 272,807,844 | | (cost $272,807,844; includes $237,871,019 of cash collateral received for securities on loan)(Note 3)(c)(d) | | $ | 272,807,844 | |

| | | | |

|

|

|

| | | Total Investments 107.2%

(cost $2,442,342,753; Note 5) | | | 3,279,309,169 | |

| | | Liabilities in excess of other assets (7.2%) | | | (219,326,569 | ) |

| | | | |

|

|

|

| | | Net Assets 100.0% | | $ | 3,059,982,600 | |

| | | | |

|

|

|

The following abbreviation is used in portfolio descriptions:

ADR—American Depositary Receipt

| (a) | Non-income producing security. |

| (b) | All or portion of security on loan. The aggregate market value of such securities is $228,031,571; cash collateral of $237,871,019 (included in liabilities) was received with which the Fund purchased highly liquid short-term investments. |

| (c) | Represents security, or a portion thereof, purchased with cash collateral received for securities on loan. |

| (d) | Prudential Investments LLC, the manager of the Fund, also serves as manager of the Dryden Core Investment Fund-Taxable Money Market Series. |

See Notes to Financial Statements.

| | |

| 10 | | Visit our website at www.jennisondryden.com |

The industry classification of portfolio holdings and liabilities in excess of other assets shown as a percentage of net assets as of March 31, 2006 were as follows:

| | | |

Internet Software & Services | | 9.9 | % |

Affiliated Money Market Mutual Fund | | 8.9 | |

Software | | 8.9 | |

Semiconductors & Semiconductor Equipment | | 8.7 | |

Capital Markets | | 8.3 | |

Biotechnology | | 6.2 | |

Health Care Providers & Services | | 5.7 | |

Pharmaceuticals | | 5.5 | |

Specialty Retail | | 5.3 | |

Communications Equipment | | 5.1 | |

Health Care Equipment & Supplies | | 3.2 | |

Multiline Retail | | 3.2 | |

Household Products | | 3.0 | |

Textiles, Apparel & Luxury Goods | | 3.0 | |

Media | | 2.7 | |

Oil, Gas & Consumable Fuels | | 2.5 | |

Energy Equipment & Services | | 2.4 | |

Consumer Finance | | 2.3 | |

Hotels, Restaurants & Leisure | | 2.3 | |

Insurance | | 2.0 | |

Industrial Conglomerates | | 1.8 | |

Beverages | | 1.7 | |

Food & Staples Retailing | | 1.7 | |

Electronic Equipment & Instruments | | 1.5 | |

Computers & Peripherals | | 1.4 | |

| | |

|

|

Total Investments | | 107.2 | |

Liabilities in excess of other assets | | (7.2 | ) |

| | |

|

|

Total Net Assets | | 100.0 | % |

| | |

|

|

See Notes to Financial Statements.

| | |

| The Prudential Investment Portfolios, Inc./Jennison Growth Fund | | 11 |

Statement of Assets and Liabilities

as of March 31, 2006 (Unaudited)

| | | | |

Assets | | | | |

Investments at value, including securities on loan of $228,031,571: | | | | |

Unaffiliated investments (cost $2,169,534,909) | | $ | 3,006,501,325 | |

Affiliated investments (cost $272,807,844) | | | 272,807,844 | |

Receivable for investments sold | | | 31,374,706 | |

Receivable for Series shares sold | | | 6,438,402 | |

Dividends receivable | | | 3,447,079 | |

Foreign tax reclaim receivable | | | 490,874 | |

Prepaid expenses | | | 6,168 | |

| | |

|

|

|

Total assets | | | 3,321,066,398 | |

| | |

|

|

|

| |

Liabilities | | | | |

Payable to broker for collateral for securities on loan (Note 4) | | | 237,871,019 | |

Payable for investments purchased | | | 11,039,249 | |

Payable for Series shares reacquired | | | 7,751,755 | |

Management fee payable | | | 1,595,542 | |

Transfer agent fee payable | | | 1,149,899 | |

Accrued expenses | | | 868,250 | |

Distribution fee payable | | | 665,265 | |

Payable to custodian | | | 130,759 | |

Deferred directors’ fees | | | 12,060 | |

| | |

|

|

|

Total liabilities | | | 261,083,798 | |

| | |

|

|

|

| |

Net Assets | | $ | 3,059,982,600 | |

| | |

|

|

|

| | | | | |

Net assets were comprised of: | | | | |

Common stock, at par | | $ | 187,066 | |

Paid-in capital in excess of par | | | 3,856,973,432 | |

| | |

|

|

|

| | | | 3,857,160,498 | |

Accumulated net investment loss | | | (2,808,345 | ) |

Accumulated net realized loss on investments and foreign currency transactions | | | (1,631,335,969 | ) |

Net unrealized appreciation on investments and foreign currencies | | | 836,966,416 | |

| | |

|

|

|

Net assets, March 31, 2006 | | $ | 3,059,982,600 | |

| | |

|

|

|

See Notes to Financial Statements.

| | |

| 12 | | Visit our website at www.jennisondryden.com |

| | | |

Class A | | | |

Net asset value and redemption price per share | | | |

($1,408,681,811 ÷ 86,000,993 shares of common stock issued and outstanding) | | $ | 16.38 |

Maximum sales charge (5.50% of offering price) | | | .95 |

| | |

|

|

Maximum offering price to public | | $ | 17.33 |

| | |

|

|

| |

Class B | | | |

Net asset value, offering price and redemption price per share | | | |

($328,983,516 ÷ 21,898,534 shares of common stock issued and outstanding) | | $ | 15.02 |

| | |

|

|

| |

Class C | | | |

Net asset value, offering price and redemption price per share | | | |

($91,372,864 ÷ 6,081,821 shares of common stock issued and outstanding) | | $ | 15.02 |

| | |

|

|

| |

Class R | | | |

Net asset value, offering price and redemption price per share | | | |

($3,208 ÷ 212.16 shares of common stock issued and outstanding) | | $ | 15.12 |

| | |

|

|

| |

Class Z | | | |

Net asset value, offering price and redemption price per share | | | |

($1,230,941,201 ÷ 73,084,541 shares of common stock issued and outstanding) | | $ | 16.84 |

| | |

|

|

See Notes to Financial Statements.

| | |

| The Prudential Investment Portfolios, Inc./Jennison Growth Fund | | 13 |

Statement of Operations

Six Months Ended March 31, 2006 (Unaudited)

| | | | |

Net Investment Loss | | | | |

Income | | | | |

Unaffiliated dividend income (net of foreign withholding taxes of $431,994) | | $ | 13,361,551 | |

Affiliated dividend income | | | 811,112 | |

Affiliated income from securities loaned, net | | | 198,915 | |

| | |

|

|

|

Total income | | | 14,371,578 | |

| | |

|

|

|

| |

Expenses | | | | |

Management fee | | | 9,440,213 | |

Distribution fee—Class A | | | 1,699,040 | |

Distribution fee—Class B | | | 1,826,209 | |

Distribution fee—Class C | | | 452,696 | |

Distribution fee—Class R | | | 13 | |

Transfer agent’s fee and expenses (including affiliated expense of $2,629,300) | | | 3,034,000 | |

Reports to shareholders | | | 173,000 | |

Custodian’s fees and expenses | | | 126,000 | |

Insurance | | | 91,000 | |

Registration fees | | | 45,000 | |

Legal fees and expenses | | | 40,000 | |

Directors’ fees | | | 32,000 | |

Commitment fees | | | 12,000 | |

Audit fee | | | 8,000 | |

Miscellaneous | | | 4,655 | |

| | |

|

|

|

Total expenses | | | 16,983,826 | |

| | |

|

|

|

Net investment loss | | | (2,612,248 | ) |

| | |

|

|

|

| |

Realized And Unrealized Gain (Loss) On Investments And Foreign Currencies | | | | |

Net realized gain (loss) on: | | | | |

Investment transactions | | | 190,918,921 | |

Foreign currency transactions | | | (87,058 | ) |

| | |

|

|

|

| | | | 190,831,863 | |

| | |

|

|

|

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments | | | 29,540,563 | |

Foreign currencies | | | 9,951 | |

| | |

|

|

|

| | | | 29,550,514 | |

| | |

|

|

|

Net gain on investments and foreign currencies | | | 220,382,377 | |

| | |

|

|

|

Net Increase In Net Assets Resulting From Operations | | $ | 217,770,129 | |

| | |

|

|

|

See Notes to Financial Statements.

| | |

| 14 | | Visit our website at www.jennisondryden.com |

Statement of Changes in Net Assets

(Unaudited)

| | | | | | | | |

| | | Six Months

Ended

March 31, 2006 | | | Year

Ended

September 30, 2005 | |

Increase (Decrease) In Net Assets | | | | | | | | |

Operations | | | | | | | | |

Net investment income (loss) | | $ | (2,612,248 | ) | | $ | 743,412 | |

Net realized gain on investments and foreign currency transactions | | | 190,831,863 | | | | 218,340,747 | |

Net change in unrealized appreciation (depreciation) on investments and foreign currencies | | | 29,550,514 | | | | 326,036,307 | |

| | |

|

|

| |

|

|

|

Net increase in net assets resulting from operations | | | 217,770,129 | | | | 545,120,466 | |

| | |

|

|

| |

|

|

|

| | |

Series share transactions (net of share conversions) (Note 6) | | | | | | | | |

Net proceeds from shares sold | | | 364,164,236 | | | | 556,475,402 | |

Net asset value of shares issued in connection with merger (Note 7) | | | — | | | | 1,510,490 | |

Cost of shares reacquired | | | (721,118,059 | ) | | | (956,691,647 | ) |

| | |

|

|

| |

|

|

|

Net decrease in net assets from Series share transactions | | | (356,953,823 | ) | | | (398,705,755 | ) |

| | |

|

|

| |

|

|

|

Total increase (decrease) | | | (139,183,694 | ) | | | 146,414,711 | |

| | |

Net Assets | | | | | | | | |

Beginning of period | | | 3,199,166,294 | | | | 3,052,751,583 | |

| | |

|

|

| |

|

|

|

End of period | | $ | 3,059,982,600 | | | $ | 3,199,166,294 | |

| | |

|

|

| |

|

|

|

See Notes to Financial Statements.

| | |

| The Prudential Investment Portfolios, Inc./Jennison Growth Fund | | 15 |

Notes to Financial Statements

(Unaudited)

The Prudential Investment Portfolios, Inc. (the “Company”) is registered under the Investment Company Act of 1940 as a diversified, open-end management investment company. The Company was incorporated in Maryland on August 10, 1995 and consists of six series: Jennison Growth Fund (the “Series”), Jennison Equity Opportunity Fund, Dryden Active Allocation Fund, JennisonDryden Growth Allocation Fund, JennisonDryden Moderate Allocation Fund and JennisonDryden Conservative Allocation Fund. These financial statements relate to the Jennison Growth Fund. The financial statements of the other series are not presented herein. The Series commenced investment operations on November 2, 1995.

The Series’ investment objective is to achieve long-term growth of capital. The Series seeks to achieve its objective by investing primarily in equity securities (common stock, preferred stock and securities convertible into common stock) of established companies with above-average growth prospects.

Note 1. Accounting Policies

The following is a summary of significant accounting policies followed by the Series in the preparation of its financial statements.

Securities Valuation: Securities listed on a securities exchange are valued at the last sale price on such exchange on the day of valuation or, if there was no sale on such day, at the mean between the last reported bid and asked prices, or at the last bid price on such day in the absence of an asked price. Securities traded via NASDAQ are valued at the NASDAQ official closing price (“NOCP”) on the day of valuation, or if there was no NOCP, at the last sale price. Securities that are actively traded in the over-the-counter market, including listed securities for which the primary market is believed by Prudential Investments LLC (“PI” or “Manager”), in consultation with the subadviser; to be over-the-counter, are valued at market value using prices provided by an independent pricing agent or principal market maker. Securities for which reliable market quotations are not readily available, or whose values have been effected by events occurring after the close of the security’s foreign market and before the Series’ normal pricing time, are valued at fair value in accordance with the Board of Directors’ approved fair valuation procedures. When determining the fair valuation of securities some of the factors influencing the valuation include, the nature of any restrictions on disposition of the securities; assessment of the general liquidity of the securities; the issuer’s financial condition and the markets in which it does business; the cost of the investment; the size of the holding and the capitalization of issuer; the

| | |

| 16 | | Visit our website at www.jennisondryden.com |

prices of any recent transactions or bids/offers for such securities or any comparable securities; any available analyst media or other reports or information deemed reliable by the investment adviser regarding the issuer or the markets or industry in which it operates. Using fair value to price securities may result in a value that is different from a security’s most recent closing price and from the price used by other mutual funds to calculate their net asset values. As of March 31, 2006, there were no securities valued in accordance with such procedures.

Investments in mutual funds are valued at the net asset value as of the close of the New York Stock Exchange on the date of valuation.

Short-term securities which mature in sixty days or less are valued at amortized cost, which approximates market value. The amortized cost method involves valuing a security at its cost on the date of purchase and thereafter assuming a constant amortization to maturity of the difference between the principal amount due at maturity and cost. Short-term securities which mature in more than sixty days are valued at current market quotations.

Securities Lending: The Series may lend its portfolio securities to qualified institutions. The loans are secured by collateral at least equal, at all times, to the market value of the securities loaned. The Series may bear the risk of delay in recovery of, or even loss of rights in, the securities loaned should the borrower of the securities fail financially. The Series receives compensation, net of any rebate, for lending its securities in the form of interest or dividends on the collateral received on the securities loaned, and any gain or loss in the market price of the securities loaned that may occur during the term of the loan.

Foreign Currency Translation: The books and records of the Series are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars on the following basis:

(i) market value of investment securities, other assets and liabilities-at the current rates of exchange;

(ii) purchases and sales of investment securities, income and expenses-at the rates of exchange prevailing on the respective dates of such transactions.

Although the net assets of the Series are presented at the foreign exchange rates and market values at the close of the fiscal period, the Series does not isolate that portion of the results of operations arising as a result of changes in the foreign exchange rates from the fluctuations arising from changes in the market prices of long-term portfolio securities held at the end of the fiscal period. Similarly, the Series does not isolate the

| | |

| The Prudential Investment Portfolios, Inc./Jennison Growth Fund | | 17 |

Notes to Financial Statements

(Unaudited) Cont’d

effect of changes in foreign exchange rates from the fluctuations arising from changes in the market prices of long-term portfolio securities sold during the fiscal period. Accordingly, these realized foreign currency gains or losses are included in the reported net realized gains or losses on investment transactions.

Net realized gains or losses on foreign currency transactions represent net foreign exchange gains or losses from the holding of foreign currencies, currency gains or losses realized between the trade date and settlement dates on security transactions, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the Series’ books and the U.S. dollar equivalent amounts actually received or paid. Net unrealized currency gains or losses from valuing foreign currency denominated assets and liabilities (other than investments) at period end exchange rates are reflected as a component of net unrealized appreciation (depreciation) on foreign currencies.

Foreign security and currency transactions may involve certain considerations and risks not typically associated with those of domestic origin as a result of, among other factors, the possibility of political and economic instability and the level of governmental supervision and regulation of foreign securities markets.

Securities Transactions and Net Investment Income: Securities transactions are recorded on the trade date. Realized gains or losses on sales of securities are calculated on the identified cost basis. Dividend income is recorded on the ex-dividend date and interest income, including amortization of premium and accretion of discount on debt securities, as required, is recorded on the accrual basis.

Net investment income or loss (other than distribution fees which are charged directly to the respective class), realized and unrealized gains or losses, are allocated daily to each class of shares based upon the relative proportion of net assets of each class at the beginning of the day. The Company’s expenses are allocated to the respective Series on the basis of relative net assets except for expenses that are charged directly to the Series level.

Dividends and Distributions: The Series expects to pay dividends of net investment income, if any, semi-annually. Distributions of net realized capital and currency gains, if any, annually.

| | |

| 18 | | Visit our website at www.jennisondryden.com |

Dividends and distributions, which are determined in accordance with federal income tax regulations and which may differ from generally accepted accounting principles, are recorded on the ex-dividend date. Permanent book/tax differences relating to income and gains are reclassified amongst undistributed net investment income, accumulated net realized gain or loss and paid-in capital in excess of par, as appropriate.

Taxes: For federal income tax purposes, each Series in the Company is treated as a separate tax-paying entity. It is the Series’ policy to continue to meet the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable net income and capital gains, if any, to shareholders. Therefore, no federal income tax provision is required.

Withholding taxes on foreign dividends are recorded net of reclaimable amounts, at the time the related income is earned.

Estimates: The preparation of the financial statements requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

Note 2. Agreements

The Company has a management agreement for the Series with PI. Pursuant to this agreement, PI has responsibility for all investment advisory services and supervises the subadvisor’s performance of such services. PI has entered into a subadvisory agreement with Jennison Associates LLC (“Jennison”). The subadvisory agreement provides that Jennison furnishes investment advisory services in connection with the management of the Series. In the connection therewith, Jennison is obligated to keep certain books and records of the Series. PI pays for the services of Jennison, the cost of compensation of officers and employees of the Series, occupancy and certain clerical and bookkeeping costs of the Series. The Series bears all other costs and expenses.

The management fee paid to PI is computed daily and payable monthly at an annual rate of .600 of 1% of the Series’ average daily net assets up to $300 million, .575 of 1% of the next $2.7 billion and .550 of 1% of the Series’ average daily net assets in excess of $3 billion. The effective management fee rate was .575 of 1% of the Series’ average daily net assets for the six months ended March 31, 2006.

The Series has a distribution agreement with Prudential Investment Management Services LLC (“PIMS”), which acts as the distributor of the Class A, Class B, Class C, Class R and Class Z shares of the Series. The Series compensates PIMS for distributing

| | |

| The Prudential Investment Portfolios, Inc./Jennison Growth Fund | | 19 |

Notes to Financial Statements

(Unaudited) Cont’d

and servicing the Series’ Class A, Class B, Class C and Class R shares, pursuant to plans of distribution (the “Class A, B, C and R Plans”), regardless of expenses actually incurred by PIMS. The distribution fees are accrued daily and payable monthly. No distribution or service fees are paid to PIMS as distributor of the Class Z shares of the Series.

Pursuant to the Class A, B, C and R Plans, the Series compensates PIMS for distribution related activities at an annual rate of up to .30 of 1%, 1%, 1% and .75 of 1% of the average daily net assets of the Class A, B, C and R shares, respectively. PIMS contractually agreed to limit such fees to .25 of 1% of the average daily net assets of the Class A shares and .50 of 1% of the average daily net assets of the Class R shares.

PIMS has advised the Series that it received approximately $465,100 in front-end sales charges resulting from sales of Class A shares during the six months ended March 31, 2006. From these fees, PIMS paid such sales charges to affiliated broker/dealers, which in turn paid commissions to salespersons and incurred other distribution costs.

PIMS has advised the Series that for the six months ended March 31, 2006, it received approximately $11, $224,300 and $1,800 in contingent deferred sales charges imposed upon redemptions by certain Class A, Class B and C shareholders, respectively.

PI, PIMS and Jennison are indirect, wholly-owned subsidiaries of Prudential Financial, Inc. (“Prudential”).

The Series, along with other affiliated registered investment companies (the “Funds”), is a party to a syndicated credit agreement (“SCA”) with two banks. The SCA provides for a commitment of $500 million. Interest on any borrowings under the SCA would be incurred at market rates. For the period from October 29, 2004 through October 28, 2005, the Funds paid a commitment fee of .075 of 1% of the unused portion of the agreement. Effective October 29, 2005, the Funds renewed the SCA with the banks. The commitment under the renewed SCA continues to be $500 million. The Funds pays a commitment fee of .0725 of 1% of the unused portion of the renewed SCA. The commitment fee is accrued daily and paid quarterly and is allocated to the Funds pro-rata based on net assets. The purpose of the SCA is to serve

| | |

| 20 | | Visit our website at www.jennisondryden.com |

as an alternative source of funding for capital share redemptions. The expiration date of the renewed SCA is October 27, 2006. The Series did not borrow any amounts pursuant to the SCA during the six months ended March 31, 2006.

Note 3. Other Transactions with Affiliates

Prudential Mutual Fund Services LLC (“PMFS”), an affiliate of PI and an indirect, wholly-owned subsidiary of Prudential, serves as the Series’ transfer agent. Transfer agent’s fees and expenses in the Statement of Operations include certain out-of-pocket expenses paid to non-affiliates, where applicable.

The Series pays networking fees to affiliated and unaffiliated broker/dealers. These networking fees are payments made to broker/dealers that clear mutual fund transactions through a national clearing system. First Clearing Corporation, an affiliate of PI, serves as broker/dealer. For the six months ended March 31, 2006, the Series incurred approximately $376,300 in total networking fees. These amounts are included in transfer agent’s fees and expenses in the Statement of Operations.

For the six months ended March 31, 2006, Prudential Equity Group, LLC, an indirect, wholly-owned subsidiary of Prudential, and Wachovia Securities, LLC, an affiliate of PI, earned approximately $58,000 and $11,000, respectively, in broker commissions from portfolio transactions executed on behalf of the Series.

Prudential Investment Management, Inc. (“PIM”), an indirect, wholly-owned subsidiary of Prudential, is the Series’ security lending agent. For the six months ended March 31, 2006, PIM has been compensated approximately $87,200 for these services.

The Series invests in the Taxable Money Market Series (the “Portfolio”), a portfolio of the Dryden Core Investment Fund, pursuant to an exemptive order received from the Securities and Exchange Commission. The portfolio is a money market mutual fund registered under the Investment Company Act of 1940, as amended, and managed by PI.

Note 4. Portfolio Securities

Purchases and sales of investment securities, other than short-term investments, for the six months ended March 31, 2006 were $1,004,592,196 and $1,402,030,427, respectively.

As of March 31, 2006, the Series had securities on loan with an aggregate market value of $228,031,571. The Series received $237,871,019 in cash as collateral for securities on loan which was used to purchase highly liquid short-term investments in accordance with the Series’ securities lending procedures.

| | |

| The Prudential Investment Portfolios, Inc./Jennison Growth Fund | | 21 |

Notes to Financial Statements

(Unaudited) Cont’d

Note 5. Tax Information

The United States federal income tax basis of the Series’ investments and net unrealized appreciation as of March 31, 2006 were as follows:

| | | | | | |

Tax Basis

| | Appreciation

| | Depreciation

| | Net Unrealized

Appreciation

|

| $2,478,437,484 | | $814,197,701 | | $(13,326,016) | | $800,871,685 |

The differences between book and tax basis are primarily attributable to deferred losses on wash sales.

For federal income tax purposes, the Series had a capital loss carryforwards as of September 30, 2005 of approximately $ 1,794,618,000 of which $898,999,000 expires in 2010, $827,429,000 expires in 2011 and $68,190,000 expires in 2012. In addition, the Series utilized $180,537,000 of its prior year capital loss carryforward to offset net taxable gains realized in the fiscal year ended September 30, 2005.

Accordingly, no capital gains distribution is expected to be paid to shareholders until net gains have been realized in excess of such amounts. The Series has elected to treat post-October currency losses of approximately $184,000 incurred in the eleven months ended September 30, 2005 as having been incurred in the next fiscal year.

Note 6. Capital

The Series offers Class A, Class B, Class C, Class R and Class Z shares. Class A shares are subject to a maximum front-end sales charge of 5.50%. Investors who purchase Class A shares in an amount of $1 million or more and sell these shares within 12 months of purchase are not subject to an initial sales charge but are subject to a contingent deferred sales charge (CDSC) of 1%, including investors who purchase their shares through broker-dealers affiliated with Prudential. Class B shares are subject to a CDSC of 5%, which decreases by 1% annually to 1% in the fifth and sixth years and 0% in the seventh year. The CDSC for Class C shares is 1% for shares redeemed within 12 months of purchase. Class B shares automatically convert to Class A shares on a quarterly basis approximately seven years after purchase. A special exchange privilege is also available for shareholders who qualified to purchase Class A shares at net asset value. Class R and Class Z shares are not subject to any sales or redemption charge and are offered exclusively for sale to a limited group of investors.

| | |

| 22 | | Visit our website at www.jennisondryden.com |

There are 3.25 billion shares of $.001 par value common stock of the Company authorized which are divided into six series, three of which offer five classes, designated Class A, Class B, Class C, Class R and Class Z, each of which consists of 250 million authorized shares and the Series also may offer Class I shares, of which 250 million shares are authorized, but none are currently issued and outstanding. As of March 31, 2006, Prudential Investments Fund Management LLC owned 8 Class A shares, 8 Class B shares and 193 Class R shares of the Series.

Transactions in shares of common stock were as follows:

| | | | | | | |

Class A

| | Shares

| | | Amount

| |

Six months ended March 31, 2006: | | | | | | | |

Shares sold | | 11,695,114 | | | $ | 189,851,221 | |

Shares reacquired | | (16,443,856 | ) | | | (260,059,972 | ) |

| | |

|

| |

|

|

|

Net increase (decrease) in shares outstanding before conversion | | (4,748,742 | ) | | | (70,208,751 | ) |

Shares issued upon conversion from Class B | | 2,686,474 | | | | 43,759,016 | |

| | |

|

| |

|

|

|

Net increase (decrease) in shares outstanding | | (2,062,268 | ) | | $ | (26,449,735 | ) |

| | |

|

| |

|

|

|

Year ended September 30, 2005: | | | | | | | |

Shares sold | | 15,519,269 | | | $ | 217,671,367 | |

Shares issued in connection with the merger | | 31,573 | | | | 442,212 | |

Shares reacquired | | (27,925,177 | ) | | | (391,108,978 | ) |

| | |

|

| |

|

|

|

Net increase (decrease) in shares outstanding before conversion | | (12,374,335 | ) | | | (172,995,399 | ) |

Shares issued upon conversion from Class B | | 6,944,689 | | | | 99,654,807 | |

| | |

|

| |

|

|

|

Net increase (decrease) in shares outstanding | | (5,429,646 | ) | | $ | (73,340,592 | ) |

| | |

|

| |

|

|

|

Class B

| | | | | | |

Six months ended March 31, 2006: | | | | | | | |

Shares sold | | 754,160 | | | $ | 11,242,787 | |

Shares reacquired | | (2,295,963 | ) | | | (34,040,291 | ) |

| | |

|

| |

|

|

|

Net increase (decrease) in shares outstanding before conversion | | (1,541,803 | ) | | | (22,797,504 | ) |

Shares reacquired upon conversion into Class A | | (2,925,347 | ) | | | (43,759,016 | ) |

| | |

|

| |

|

|

|

Net increase (decrease) in shares outstanding | | (4,467,150 | ) | | $ | (66,556,520 | ) |

| | |

|

| |

|

|

|

Year ended September 30, 2005: | | | | | | | |

Shares sold | | 1,357,829 | | | $ | 17,347,458 | |

Shares issued in connection with the merger | | 69,002 | | | | 857,320 | |

Shares reacquired | | (8,017,108 | ) | | | (103,292,759 | ) |

| | |

|

| |

|

|

|

Net increase (decrease) in shares outstanding before conversion | | (6,590,277 | ) | | | (85,087,981 | ) |

Shares reacquired upon conversion into Class A | | (7,521,116 | ) | | | (99,654,807 | ) |

| | |

|

| |

|

|

|

Net increase (decrease) in shares outstanding | | (14,111,393 | ) | | $ | (184,742,788 | ) |

| | |

|

| |

|

|

|

| | |

| The Prudential Investment Portfolios, Inc./Jennison Growth Fund | | 23 |

Notes to Financial Statements

(Unaudited) Cont’d

| | | | | | | |

Class C

| | Shares

| | | Amount

| |

Six months ended March 31, 2006: | | | | | | | |

Shares sold | | 817,943 | | | $ | 12,217,385 | |

Shares reacquired | | (852,735 | ) | | | (12,658,836 | ) |

| | |

|

| |

|

|

|

Net increase (decrease) in shares outstanding | | (34,792 | ) | | $ | (441,451 | ) |

| | |

|

| |

|

|

|

Year ended September 30, 2005: | | | | | | | |

Shares sold | | 597,689 | | | $ | 7,763,311 | |

Shares issued in connection with the merger | | 19,988 | | | | 210,958 | |

Shares reacquired | | (2,586,238 | ) | | | (33,443,434 | ) |

| | |

|

| |

|

|

|

Net increase (decrease) in shares outstanding | | (1,968,561 | ) | | $ | (25,469,165 | ) |

| | |

|

| |

|

|

|

Class R

| | | | | | |

Six months ended March 31, 2006: | | | | | | | |

Shares sold | | 1,558 | | | $ | 23,946 | |

Shares reacquired | | (1,539 | ) | | | (23,292 | ) |

| | |

|

| |

|

|

|

Net increase (decrease) in shares outstanding | | 19 | | | $ | 654 | |

| | |

|

| |

|

|

|

Period ended September 30, 2005*: | | | | | | | |

Shares sold | | 193 | | | $ | 2,500 | |

Shares reacquired | | — | | | | — | |

| | |

|

| |

|

|

|

Net increase (decrease) in shares outstanding | | 193 | | | $ | 2,500 | |

| | |

|

| |

|

|

|

* Commencement of operations on December 17, 2004. | | | | | | | |

Class Z

| | | | | | |

Six months ended March 31, 2006: | | | | | | | |

Shares sold | | 9,096,582 | | | $ | 150,828,897 | |

Shares reacquired | | (24,646,171 | ) | | | (414,335,668 | ) |

| | |

|

| |

|

|

|

Net increase (decrease) in shares outstanding | | (15,549,589 | ) | | $ | (263,506,771 | ) |

| | |

|

| |

|

|

|

Year ended September 30, 2005: | | | | | | | |

Shares sold | | 21,785,045 | | | $ | 313,690,766 | |

Shares reacquired | | (30,088,424 | ) | | | (428,846,476 | ) |

| | |

|

| |

|

|

|

Net increase (decrease) in shares outstanding | | (8,303,379 | ) | | $ | (115,155,710 | ) |

| | |

|

| |

|

|

|

Note 7. Reorganization

On October 29, 2004, Jennison Growth Fund acquired all of the net assets of Strategic Partners Managed Large Cap Growth Fund pursuant to a plan of reorganization approved by the Strategic Partners Managed Large Cap Growth Fund shareholders on January 23, 2004. The acquisition was accomplished by a tax-free issue of Class A, Class B, Class C and Class Z shares for corresponding classes of

| | |

| 24 | | Visit our website at www.jennisondryden.com |

Strategic Partners Managed Large Cap Growth and Class L being exchanged for Class A and Classes M and X for Class B of Jennison Growth Fund.

| | | | | | | | |

Strategic Partners Managed

Large Cap Growth Fund

| | Jennison

Growth Fund

|

Class

| | Shares

| | Class

| | Shares

| | Value

|

A | | 7,878 | | A | | 31,573 | | $442,212 |

B | | 1,413 | | B | | 69,002 | | 857,320 |

C | | 27,712 | | C | | 19,988 | | 210,958 |

L | | 38,655 | | | | | | |

M | | 79,801 | | | | | | |

X | | 14,618 | | | | | | |

The aggregate net assets and unrealized appreciation of Strategic Partners Managed Large Cap Growth Fund immediately before the acquisition was $1,510,490 and $112,267, respectively. The aggregate net assets of Jennison Growth Fund immediately before the acquisition were $3,115,007,120.

Note 8. In-Kind Redemption

During the six months ended March 31, 2006, shareholders redeemed fund shares in exchange for Series’ portfolio securities valued at $122,469,608. The Fund realized a gain of $13,924,737 related to the in-kind redemption transactions. This gain is not taxable for Federal Income Tax purposes.

| | |

| The Prudential Investment Portfolios, Inc./Jennison Growth Fund | | 25 |

Financial Highlights

(Unaudited)

| | | | |

| | | Class A

| |

| | | Six Months Ended

March 31, 2006 | |

Per Share Operating Performance: | | | | |

Net Asset Value, Beginning Of Period | | $ | 15.31 | |

| | |

|

|

|

Income (loss) from investment operations: | | | | |

Net investment income (loss)(a) | | | (.01 | ) |

Net realized and unrealized gain (loss) on investment and foreign currency transactions | | | 1.08 | |

| | |

|

|

|

Total from investment operations | | | 1.07 | |

| | |

|

|

|

Less Distributions: | | | | |

Distributions from net realized gains | | | — | |

| | |

|

|

|

Net asset value, end of period | | $ | 16.38 | |

| | |

|

|

|

Total Return(b): | | | 6.99 | % |

Ratios/Supplemental Data: | | | | |

Net assets, end of period (000) | | $ | 1,408,682 | |

Average net assets (000) | | $ | 1,362,967 | |

Ratios to average net assets: | | | | |

Expenses, including distribution and service (12b-1) fees(c) | | | 1.04 | %(d) |

Expenses, excluding distribution and service (12b-1) fees | | | .79 | %(d) |

Net investment income (loss) | | | (.16 | )%(d) |

For Class A, B, C, R and Z shares: | | | | |

Portfolio turnover rate | | | 31 | %(e) |

| (a) | Calculated based upon average shares outstanding during the period. |

| (b) | Total return does not consider the effects of sales loads. Total return is calculated assuming a purchase of shares on the first day and a sale on the last day of each period reported, and includes reinvestment of dividends and distributions. Total returns for periods less than a full year are not annualized. |

| (c) | The distributor of the Series has contractually agreed to limit its distribution and service 12b-1 fees to .25 of 1% of the average daily net assets of the Class A shares. |

See Notes to Financial Statements.

| | |

| 26 | | Visit our website at www.jennisondryden.com |

| | | | | | | | | | | | | | | | | | |

| Class A | |

| Year Ended September 30, | |

| 2005 | | | 2004 | | | 2003 | | | 2002 | | | 2001 | |

| | | | | | | | | | | | | | | | | | | |

| $ | 12.84 | | | $ | 11.77 | | | $ | 9.73 | | | $ | 12.50 | | | $ | 24.20 | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | | | | | | | | | | | | | |

| | .01 | | | | (.04 | ) | | | (.02 | ) | | | (.04 | ) | | | (.05 | ) |

| | 2.46 | | | | 1.11 | | | | 2.06 | | | | (2.73 | ) | | | (9.50 | ) |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | 2.47 | | | | 1.07 | | | | 2.04 | | | | (2.77 | ) | | | (9.55 | ) |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | | | | | | | | | | | | | |

| | — | | | | — | | | | — | | | | — | | | | (2.15 | ) |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| $ | 15.31 | | | $ | 12.84 | | | $ | 11.77 | | | $ | 9.73 | | | $ | 12.50 | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | 19.24 | % | | | 9.09 | % | | | 20.97 | % | | | (22.16 | )% | | | (42.32 | )% |

| | | | | | | | | | | | | | | | | | | |

| $ | 1,348,039 | | | $ | 1,200,078 | | | $ | 1,134,839 | | | $ | 1,011,241 | | | $ | 1,286,009 | |

| $ | 1,258,500 | | | $ | 1,237,249 | | | $ | 1,034,231 | | | $ | 1,358,013 | | | $ | 1,513,253 | |

| | | | | | | | | | | | | | | | | | | |

| | 1.06 | % | | | 1.05 | % | | | 1.17 | % | | | 1.08 | % | | | 1.06 | % |

| | .81 | % | | | .80 | % | | | .92 | % | | | .83 | % | | | .81 | % |

| | .04 | % | | | (.27 | )% | | | (.21 | )% | | | (.28 | )% | | | (.27 | )% |

| | | | | | | | | | | | | | | | | | | |

| | 57 | % | | | 68 | % | | | 64 | % | | | 71 | % | | | 98 | % |

See Notes to Financial Statements.

| | |

| The Prudential Investment Portfolios, Inc./Jennison Growth Fund | | 27 |

Financial Highlights

(Unaudited) Cont’d

| | | | |

| | | Class B

| |

| | | Six Months Ended

March 31, 2006 | |

Per Share Operating Performance: | | | | |

Net Asset Value, Beginning Of Period | | $ | 14.09 | |

| | |

|

|

|

Income (loss) from investment operations: | | | | |

Net investment loss(a) | | | (.07 | ) |

Net realized and unrealized gain (loss) on investment and foreign currency transactions | | | 1.00 | |

| | |

|

|

|

Total from investment operations | | | .93 | |

| | |

|

|

|

Less Distributions: | | | | |

Distributions from net realized gains | | | — | |

| | |

|

|

|

Net asset value, end of period | | $ | 15.02 | |

| | |

|

|

|

Total Return(b): | | | 6.60 | % |

Ratios/Supplemental Data: | | | | |

Net assets, end of period (000) | | $ | 328,984 | |

Average net assets (000) | | $ | 366,245 | |

Ratios to average net assets: | | | | |

Expenses, including distribution and service (12b-1) fees | | | 1.79 | %(c) |

Expenses, excluding distribution and service (12b-1) fees | | | .79 | %(c) |

Net investment loss | | | (.92 | )%(c) |

| (a) | Calculated based upon average shares outstanding during the period. |

| (b) | Total return does not consider the effects of sales loads. Total return is calculated assuming a purchase of shares on the first day and a sale on the last day of each period reported, and includes reinvestment of dividends and distributions. Total returns for periods less than a full year are not annualized. |

See Notes to Financial Statements.

| | |

| 28 | | Visit our website at www.jennisondryden.com |

| | | | | | | | | | | | | | | | | | |

| Class B | |

| Year Ended September 30, | |

| 2005 | | | 2004 | | | 2003 | | | 2002 | | | 2001 | |

| | | | | | | | | | | | | | | | | | | |

| $ | 11.90 | | | $ | 11.00 | | | $ | 9.16 | | | $ | 11.86 | | | $ | 23.23 | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | | | | | | | | | | | | | |

| | (.09 | ) | | | (.12 | ) | | | (.10 | ) | | | (.13 | ) | | | (.17 | ) |

| | 2.28 | | | | 1.02 | | | | 1.94 | | | | (2.57 | ) | | | (9.05 | ) |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | 2.19 | | | | .90 | | | | 1.84 | | | | (2.70 | ) | | | (9.22 | ) |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | | | | | | | | | | | | | |

| | — | | | | — | | | | — | | | | — | | | | (2.15 | ) |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| $ | 14.09 | | | $ | 11.90 | | | $ | 11.00 | | | $ | 9.16 | | | $ | 11.86 | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | 18.40 | % | | | 8.18 | % | | | 20.09 | % | | | (22.77 | )% | | | (42.70 | )% |

| | | | | | | | | | | | | | | | | | | |

| $ | 371,561 | | | $ | 481,876 | | | $ | 565,727 | | | $ | 653,338 | | | $ | 1,046,581 | |

| $ | 439,078 | | | $ | 560,217 | | | $ | 602,105 | | | $ | 1,007,499 | | | $ | 1,576,226 | |

| | | | | | | | | | | | | | | | | | | |

| | 1.81 | % | | | 1.80 | % | | | 1.92 | % | | | 1.83 | % | | | 1.81 | % |

| | .81 | % | | | .80 | % | | | .92 | % | | | .83 | % | | | .81 | % |

| | (.66 | )% | | | (1.02 | )% | | | (.95 | )% | | | (1.03 | )% | | | (1.02 | )% |

See Notes to Financial Statements.

| | |

| The Prudential Investment Portfolios, Inc./Jennison Growth Fund | | 29 |

Financial Highlights

(Unaudited) Cont’d

| | | | |

| | | Class C

| |

| | | Six Months Ended

March 31, 2006 | |

Per Share Operating Performance: | | | | |

Net Asset Value, Beginning Of Period | | $ | 14.09 | |

| | |

|

|

|

Income (loss) from investment operations: | | | | |

Net investment loss(a) | | | (.07 | ) |

Net realized and unrealized gain (loss) on investment and foreign currency transactions | | | 1.00 | |

| | |

|

|

|

Total from investment operations | | | .93 | |

| | |

|

|

|

Less Distributions: | | | | |

Distributions from net realized gains | | | — | |

| | |

|

|

|

Net asset value, end of period | | $ | 15.02 | |

| | |

|

|

|

Total Return(b): | | | 6.60 | % |

Ratios/Supplemental Data: | | | | |

Net assets, end of period (000) | | $ | 91,373 | |

Average net assets (000) | | $ | 90,788 | |

Ratios to average net assets: | | | | |

Expenses, including distribution and service (12b-1) fees | | | 1.79 | %(c) |

Expenses, excluding distribution and service (12b-1) fees | | | .79 | %(c) |

Net investment loss | | | (.91 | )%(c) |

| (a) | Calculated based upon average shares outstanding during the period. |

| (b) | Total return does not consider the effects of sales loads. Total return is calculated assuming a purchase of shares on the first day and a sale on the last day of each period reported, and includes reinvestment of dividends and distributions. Total returns for periods less than a full year are not annualized. |

See Notes to Financial Statements.

| | |

| 30 | | Visit our website at www.jennisondryden.com |

| | | | | | | | | | | | | | | | | | |

| Class C | |

| Year Ended September 30, | |

| 2005 | | | 2004 | | | 2003 | | | 2002 | | | 2001 | |

| | | | | | | | | | | | | | | | | | | |

| $ | 11.90 | | | $ | 11.00 | | | $ | 9.16 | | | $ | 11.86 | | | $ | 23.23 | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | | | | | | | | | | | | | |

| | (.08 | ) | | | (.12 | ) | | | (.10 | ) | | | (.13 | ) | | | (.17 | ) |

| | 2.27 | | | | 1.02 | | | | 1.94 | | | | (2.57 | ) | | | (9.05 | ) |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | 2.19 | | | | .90 | | | | 1.84 | | | | (2.70 | ) | | | (9.22 | ) |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | | | | | | | | | | | | | |

| | — | | | | — | | | | — | | | | — | | | | (2.15 | ) |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| $ | 14.09 | | | $ | 11.90 | | | $ | 11.00 | | | $ | 9.16 | | | $ | 11.86 | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | 18.40 | % | | | 8.18 | % | | | 20.09 | % | | | (22.77 | )% | | | (42.70 | )% |

| | | | | | | | | | | | | | | | | | | |

| $ | 86,198 | | | $ | 96,253 | | | $ | 106,850 | | | $ | 103,956 | | | $ | 164,216 | |

| $ | 91,313 | | | $ | 107,401 | | | $ | 105,518 | | | $ | 159,096 | | | $ | 226,607 | |

| | | | | | | | | | | | | | | | | | | |

| | 1.81 | % | | | 1.80 | % | | | 1.92 | % | | | 1.83 | % | | | 1.81 | % |

| | .81 | % | | | .80 | % | | | .92 | % | | | .83 | % | | | .81 | % |

| | (.61 | )% | | | (1.02 | )% | | | (.96 | )% | | | (1.03 | )% | | | (1.02 | )% |

See Notes to Financial Statements.

| | |

| The Prudential Investment Portfolios, Inc./Jennison Growth Fund | | 31 |

Financial Highlights

(Unaudited) Cont’d

| | | | | | | | |

| | | Class R

| |

| | | Six Months Ended

March 31, 2006 | | | December 17, 2004(a)

Through

September 30, 2005 | |

Per Share Operating Performance: | | | | | | | | |

Net Asset Value, Beginning Of Period | | $ | 14.15 | | | $ | 12.97 | |

| | |

|

|

| |

|

|

|

Income (loss) from investment operations: | | | | | | | | |

Net investment loss(b) | | | (.03 | ) | | | (.05 | ) |

Net realized and unrealized gain on investment and foreign currency transactions | | | 1.00 | | | | 1.23 | |

| | |

|

|

| |

|

|

|

Total from investment operations | | | .97 | | | | 1.18 | |

| | |

|

|

| |

|

|

|

Net asset value, end of period | | $ | 15.12 | | | $ | 14.15 | |

| | |

|

|

| |

|

|

|

Total Return(c): | | | 6.86 | % | | | 9.10 | % |

Ratios/Supplemental Data: | | | | | | | | |

Net assets, end of period(d) | | $ | 3,208 | | | $ | 2,727 | |

Average net assets(d) | | $ | 5,072 | | | $ | 2,528 | |

Ratios to average net assets: | | | | | | | | |

Expenses, including distribution and service (12b-1) fees(e)(f) | | | 1.29 | % | | | 1.31 | % |

Expenses, excluding distribution and service (12b-1) fees(f) | | | .79 | % | | | .81 | % |

Net investment loss(f) | | | (.43 | )% | | | (.52 | )% |

| (a) | Inception date of Class R shares. |

| (b) | Calculated based on average shares outstanding during the period. |

| (c) | Total return does not consider the effects of sales loads. Total return is calculated assuming a purchase of shares on the first day and a sale on the last day of each period reported, and includes reinvestment of dividends and distributions. Total returns for periods less than a full year are not annualized. |

| (d) | Amount is actual and not rounded. |

| (e) | The distributor of the Series has contractually agreed to limit its distribution and service 12b-1 fees to .50 of 1% of the average daily net assets of the Class R shares. |

See Notes to Financial Statements.

| | |

| 32 | | Visit our website at www.jennisondryden.com |

This Page Intentionally Left Blank

Financial Highlights

(Unaudited) Cont’d

| | | | |

| | | Class Z

| |

| | | Six Months Ended

March 31, 2006 | |

Per Share Operating Performance: | | | | |

Net Asset Value, Beginning Of Period | | $ | 15.72 | |

| | |

|

|

|

Income (loss) from investment operations: | | | | |

Net investment income (loss)(a) | | | .01 | |

Net realized and unrealized gain (loss) on investments and foreign currency transactions | | | 1.11 | |

| | |

|

|

|

Total from investment operations | | | 1.12 | |

| | |

|

|

|

Less Distributions: | | | | |

Distributions from net realized gains | | | — | |

| | |

|

|

|

Net asset value, end of period | | $ | 16.84 | |

| | |

|

|

|

Total Return(c): | | | 7.12 | % |

Ratios/Supplemental Data: | | | | |

Net assets, end of period (000) | | $ | 1,230,941 | |

Average net assets (000) | | $ | 1,472,231 | |

Ratios to average net assets: | | | | |

Expenses, including distribution and service (12b-1) fees | | | .79 | %(d) |

Expenses, excluding distribution and service (12b-1) fees | | | .79 | %(d) |

Net investment income (loss) | | | .08 | %(d) |

| (a) | Calculated based upon average shares outstanding during the period. |

| (b) | Less than $.005 per share. |

| (c) | Total return is calculated assuming a purchase of shares on the first day and a sale on the last day of each period reported, and includes reinvestment of dividends and distributions. Total returns for periods less than a full year are not annualized. |

See Notes to Financial Statements.

| | |

| 34 | | Visit our website at www.jennisondryden.com |

| | | | | | | | | | | | | | | | | | |

| Class Z | |

| Year Ended September 30, | |

| 2005 | | | 2004 | | | 2003 | | | 2002 | | | 2001 | |

| | | | | | | | | | | | | | | | | | | |

| $ | 13.15 | | | $ | 12.03 | | | $ | 9.92 | | | $ | 12.71 | | | $ | 24.50 | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | | | | | | | | | | | | | |

| | .04 | | | | — | (b) | | | — | (b) | | | — | (b) | | | — | (b) |

| | 2.53 | | | | 1.12 | | | | 2.11 | | | | (2.79 | ) | | | (9.64 | ) |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | 2.57 | | | | 1.12 | | | | 2.11 | | | | (2.79 | ) | | | (9.64 | ) |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | | | | | | | | | | | | | |

| | — | | | | — | | | | — | | | | — | | | | (2.15 | ) |

|

|

| |

|

|

| |

|

|

| |

|

|