UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number: | 811-07343 | |||

| Exact name of registrant as specified in charter: | The Prudential Investment Portfolios, Inc. | |||

| Address of principal executive offices: | 655 Broad Street, 17th Floor | |||

| Newark, New Jersey 07102 | ||||

| Name and address of agent for service: | Deborah A. Docs | |||

| 655 Broad Street, 17th Floor | ||||

| Newark, New Jersey 07102 | ||||

| Registrant’s telephone number, including area code: | 800-225-1852 | |||

| Date of fiscal year end: | 9/30/2017 | |||

| Date of reporting period: | 3/31/2017 | |||

| Item 1 – | Reports to Stockholders – [ INSERT REPORT ] |

PRUDENTIAL BALANCED FUND

SEMIANNUAL REPORT

MARCH 31, 2017

To enroll in e-delivery, go to pgiminvestments.com/edelivery

| Objective: Income and long-term growth of capital |

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

The accompanying financial statements as of March 31, 2017 were not audited and, accordingly, no auditor’s opinion is expressed on them.

Mutual funds are distributed by Prudential Investment Management Services LLC, a Prudential Financial company and member SIPC. PGIM Fixed Income is a unit of PGIM, Inc. (PGIM), a registered investment adviser and Prudential Financial company. QMA is the primary business name of Quantitative Management Associates LLC, a wholly owned subsidiary of PGIM. © 2017 Prudential Financial, Inc. and its related entities. The Prudential logo and the Rock symbol are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

| 2 | Visit our website at pgiminvestments.com |

Letter from the President

Dear Shareholder:

We hope you find the semiannual report for the Prudential Balanced Fund informative and useful. The report covers performance for the six-month period ended March 31, 2017. We are proud to announce that Prudential Investments became PGIM® Investments, effective April 3, 2017. Why PGIM? This new name was chosen to further align with the global investment management businesses of Prudential Financial, which rebranded from Prudential Investment Management in January 2016. This new name allows for one brand and reflects our ability and commitment to delivering investment solutions to clients around the globe. Please keep in mind that only the Fund adviser’s name was changed: the name of your Fund and the management and operation did not change.

Since market conditions change over time, we believe it is important to maintain a diversified portfolio of funds consistent with your tolerance for risk, time horizon, and financial goals.

Your financial advisor can help you create a diversified investment plan that may include funds covering all the basic asset classes and that reflects your personal investor profile and risk tolerance. However, diversification and asset allocation strategies do not assure a profit or protect against loss in declining markets.

At PGIM Investments, we consider it a great privilege and responsibility to help investors participate in opportunities across global markets while meeting their toughest investment challenges. We’re part of PGIM, the 9th-largest global investment manager with more than $1 trillion in assets under management. This investment expertise allows us to deliver actively managed funds and strategies to meet the needs of investors around the globe.

Thank you for choosing our family of funds.

Sincerely,

Stuart S. Parker, President

Prudential Balanced Fund

May 15, 2017

| Prudential Balanced Fund | 3 |

Your Fund’s Performance (unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at www.pgiminvestments.com or by calling (800) 225-1852.

Total Returns as of 3/31/17 (without Sales Charges) | Average Annual Total Returns as of 3/31/17 (with Sales Charges) | |||||||

| Six Months* (%) | One Year (%) | Five Years (%) | Ten Years (%) | |||||

| Class A | 4.87 | 3.66 | 7.40 | 4.79 | ||||

| Class B | 4.47 | 3.87 | 7.73 | 4.65 | ||||

| Class C | 4.54 | 7.94 | 7.88 | 4.64 | ||||

| Class R | 4.76 | 9.47 | 8.42 | 5.14 | ||||

| Class Z | 5.00 | 10.03 | 8.97 | 5.69 | ||||

| Customized Blend Index | 5.01 | 10.44 | 8.56 | 6.22 | ||||

| Bloomberg Barclays US Aggregate Bond Index | –2.18 | 0.44 | 2.34 | 4.27 | ||||

| S&P 500 Index | 10.11 | 17.15 | 13.29 | 7.50 | ||||

| Lipper Mixed-Asset Target Allocation Growth Funds Average | 5.55 | 11.16 | 7.63 | 4.91 | ||||

*Not annualized

Source: PGIM Investments LLC and Lipper Inc.

| 4 | Visit our website at pgiminvestments.com |

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. The average annual total returns take into account applicable sales charges, which are described for each share class in the table below.

| Class A | Class B* | Class C | Class R | Class Z | ||||||

| Maximum initial sales charge | 5.50% of the public offering price | None | None | None | None | |||||

Contingent deferred sales charge (CDSC) (as a percentage of the lower of original purchase price or net asset value at redemption) | 1% on sales of $1 million or more made within 12 months of purchase | 5% (Yr. 1) 4% (Yr. 2) 3% (Yr. 3) 2% (Yr. 4) 1% (Yr. 5) 1% (Yr. 6) 0% (Yr. 7) | 1% on sales made within 12 months of purchase | None | None | |||||

| Annual distribution and service (12b-1) fees (shown as a percentage of average daily net assets) | .30% | 1% | 1% | .75% (.50% currently) | None |

*Class B shares are closed to all purchase activity and no additional Class B shares may be purchased or acquired except by exchange from Class B shares of another Fund or through dividend or capital gains reinvestment.

Benchmark Definitions

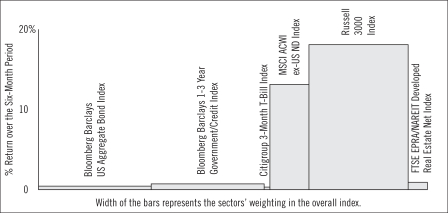

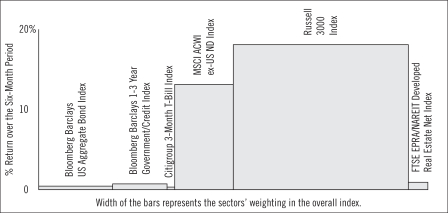

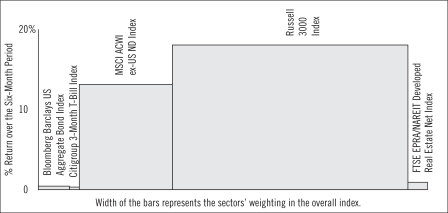

Customized Blend Index—The Customized Blend Index is made up of the S&P 500 Index (50%), the Bloomberg Barclays US Aggregate Bond Index (40%), the Russell 2000 Index (5%), and the Morgan Stanley Capital International Europe, Australasia and Far East Net Dividend (MSCI EAFE ND) Index (5%). The Net Dividend (ND) version of the MSCI EAFE Index reflects the impact of the maximum withholding taxes on reinvested dividends. Each component of the Customized Blend Index is an unmanaged index generally considered to represent the performance of its asset class. The Customized Blend Index is intended to provide a theoretical comparison to the Fund’s performance based on the amounts allocated to each class under the Fund’s investment strategies.

Bloomberg Barclays US Aggregate Bond Index—The Bloomberg Barclays US Aggregate Bond Index is an unmanaged index of investment-grade securities issued by the US Government and its agencies and by corporations with between one and 10 years remaining to maturity on the securities. It gives a broad look at how US investment-grade bonds have performed.

S&P 500 Index—The Standard & Poor’s 500 Composite Stock Price Index (S&P 500 Index) is an unmanaged index of over 500 stocks of large US public companies. It gives a broad look at how stock prices in the United States have performed.

| Prudential Balanced Fund | 5 |

Your Fund’s Performance (continued)

Lipper Mixed-Asset Target Allocation Growth Funds Average—The Lipper Mixed-Asset Target Allocation Growth Funds Average (Lipper Average) is based on the average return of all funds in the Lipper Mixed-Asset Target Allocation Growth Funds universe for the periods noted. Funds in the Lipper Average are funds whose primary objective is to conserve principal by maintaining at all times a balanced portfolio of both stocks and bonds. Typically, the stock:bond ratio ranges around 60%:40%.

Investors cannot invest directly in an index or average. The returns for the Indexes would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes. Returns for the Lipper Average reflect the deduction of operating expenses, but not sales charges or taxes.

| Five Largest Equity Holdings expressed as a percentage of net assets as of 3/31/17 (%) | ||||

| Apple, Inc., Technology Hardware, Storage & Peripherals | 1.4 | |||

| Facebook, Inc., Internet Software & Services | 1.1 | |||

| JPMorgan Chase & Co., Banks | 1.1 | |||

| Bank of America Corp., Banks | 1.0 | |||

| Microsoft Corp., Software | 0.9 | |||

Holdings reflect only long-term equity investments and are subject to change.

| Five Largest Equity Industries expressed as a percentage of net assets as of 3/31/17 (%) | ||||

| Banks | 4.7 | |||

| Oil, Gas & Consumable Fuels | 3.5 | |||

| Software | 2.8 | |||

| Internet Software & Services | 2.8 | |||

| Pharmaceuticals | 2.6 | |||

Industry weightings reflect only long-term equity investments and are subject to change.

| 6 | Visit our website at pgiminvestments.com |

Fees and Expenses (unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 held through the six-month period ended March 31, 2017. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to individual retirement accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of PGIM Investments funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses

| Prudential Balanced Fund | 7 |

Fees and Expenses (continued)

paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information provided in the expense table. Additional fees have the effect of reducing investment returns.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Prudential Balanced Fund | Beginning Account Value October 1, 2016 | Ending Account Value March 31, 2017 | Annualized Expense Ratio Based on the Six-Month Period | Expenses Paid During the Six-Month Period* | ||||||||||||||

| Class A | Actual | $ | 1,000.00 | $ | 1,048.70 | 1.19 | % | $ | 6.08 | |||||||||

| Hypothetical | $ | 1,000.00 | $ | 1,019.00 | 1.19 | % | $ | 5.99 | ||||||||||

| Class B | Actual | $ | 1,000.00 | $ | 1,044.70 | 1.89 | % | $ | 9.63 | |||||||||

| Hypothetical | $ | 1,000.00 | $ | 1,015.51 | 1.89 | % | $ | 9.50 | ||||||||||

| Class C | Actual | $ | 1,000.00 | $ | 1,045.40 | 1.89 | % | $ | 9.64 | |||||||||

| Hypothetical | $ | 1,000.00 | $ | 1,015.51 | 1.89 | % | $ | 9.50 | ||||||||||

| Class R | Actual | $ | 1,000.00 | $ | 1,047.60 | 1.39 | % | $ | 7.10 | |||||||||

| Hypothetical | $ | 1,000.00 | $ | 1,018.00 | 1.39 | % | $ | 6.99 | ||||||||||

| Class Z | Actual | $ | 1,000.00 | $ | 1,050.00 | 0.89 | % | $ | 4.55 | |||||||||

| Hypothetical | $ | 1,000.00 | $ | 1,020.49 | 0.89 | % | $ | 4.48 | ||||||||||

*Fund expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 182 days in the six-month period ended March 31, 2017, and divided by the 365 days in the Fund's fiscal year ending September 30, 2017 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

| 8 | Visit our website at pgiminvestments.com |

Portfolio of Investments (unaudited)

as of March 31, 2017

| Description | Shares | Value | ||||||

LONG-TERM INVESTMENTS 95.5% |

| |||||||

COMMON STOCKS 59.9% |

| |||||||

Aerospace & Defense 1.4% |

| |||||||

Airbus SE (France) | 1,111 | $ | 84,727 | |||||

BAE Systems PLC (United Kingdom) | 6,163 | 49,601 | ||||||

Boeing Co. (The) | 6,600 | 1,167,276 | ||||||

Cobham PLC (United Kingdom) | 3,049 | 5,083 | ||||||

Dassault Aviation SA (France) | 4 | 5,080 | ||||||

Elbit Systems Ltd. (Israel) | 45 | 5,147 | ||||||

Engility Holdings, Inc.* | 3,100 | 89,714 | ||||||

Esterline Technologies Corp.* | 800 | 68,840 | ||||||

Huntington Ingalls Industries, Inc. | 9,300 | 1,862,232 | ||||||

Leonardo SpA (Italy)* | 776 | 11,004 | ||||||

Lockheed Martin Corp. | 8,600 | 2,301,360 | ||||||

Meggitt PLC (United Kingdom) | 1,504 | 8,394 | ||||||

Moog, Inc. (Class A Stock)* | 2,000 | 134,700 | ||||||

Northrop Grumman Corp. | 5,200 | 1,236,768 | ||||||

Rolls-Royce Holdings PLC (United Kingdom)* | 3,449 | 32,583 | ||||||

Safran SA (France) | 601 | 44,855 | ||||||

Singapore Technologies Engineering Ltd. (Singapore) | 3,100 | 8,266 | ||||||

Spirit AeroSystems Holdings, Inc. (Class A Stock) | 1,700 | 98,464 | ||||||

Thales SA (France) | 203 | 19,609 | ||||||

Vectrus, Inc.* | 2,300 | 51,405 | ||||||

Wesco Aircraft Holdings, Inc.* | 3,100 | 35,340 | ||||||

Zodiac Aerospace (France) | 396 | 9,899 | ||||||

|

| |||||||

| 7,330,347 | ||||||||

Air Freight & Logistics 0.4% |

| |||||||

Bollore SA (France) | 1,631 | 6,313 | ||||||

Deutsche Post AG (Germany) | 1,853 | 63,417 | ||||||

FedEx Corp. | 10,100 | 1,971,015 | ||||||

Royal Mail PLC (United Kingdom) | 1,688 | 8,990 | ||||||

Yamato Holdings Co. Ltd. (Japan) | 700 | 14,668 | ||||||

|

| |||||||

| 2,064,403 | ||||||||

Airlines 0.0% |

| |||||||

ANA Holdings, Inc. (Japan) | 2,300 | 7,035 | ||||||

Cathay Pacific Airways Ltd. (Hong Kong) | 2,000 | 2,903 | ||||||

Deutsche Lufthansa AG (Germany) | 458 | 7,430 | ||||||

easyJet PLC (United Kingdom) | 281 | 3,613 | ||||||

International Consolidated Airlines Group SA (United Kingdom) | 1,618 | 10,687 | ||||||

Japan Airlines Co. Ltd. (Japan) | 200 | 6,350 | ||||||

Qantas Airways Ltd. (Australia) | 795 | 2,363 | ||||||

Singapore Airlines Ltd. (Singapore) | 1,000 | 7,198 | ||||||

|

| |||||||

| 47,579 | ||||||||

See Notes to Financial Statements.

| Prudential Balanced Fund | 9 |

Portfolio of Investments (unaudited) (continued)

as of March 31, 2017

| Description | Shares | Value | ||||||

COMMON STOCKS (Continued) | ||||||||

Auto Components 0.4% |

| |||||||

Aisin Seiki Co. Ltd. (Japan) | 350 | $ | 17,238 | |||||

Bridgestone Corp. (Japan) | 1,200 | 48,712 | ||||||

Cie Generale des Etablissements Michelin (France) | 356 | 43,260 | ||||||

Continental AG (Germany) | 215 | 47,139 | ||||||

Cooper-Standard Holding, Inc.* | 1,600 | 177,488 | ||||||

Dana, Inc. | 4,200 | 81,102 | ||||||

Denso Corp. (Japan) | 950 | 41,916 | ||||||

GKN PLC (United Kingdom) | 3,442 | 15,677 | ||||||

Koito Manufacturing Co. Ltd. (Japan) | 200 | 10,424 | ||||||

Lear Corp. | 9,700 | 1,373,326 | ||||||

NGK Spark Plug Co. Ltd. (Japan) | 400 | 9,173 | ||||||

NOK Corp. (Japan) | 200 | 4,671 | ||||||

Nokian Renkaat OYJ (Finland) | 207 | 8,640 | ||||||

Stanley Electric Co. Ltd. (Japan) | 300 | 8,577 | ||||||

Sumitomo Electric Industries Ltd. (Japan) | 1,400 | 23,273 | ||||||

Sumitomo Rubber Industries Ltd. (Japan) | 300 | 5,119 | ||||||

Tenneco, Inc. | 2,900 | 181,018 | ||||||

Toyoda Gosei Co. Ltd. (Japan) | 150 | 3,826 | ||||||

Toyota Industries Corp. (Japan) | 300 | 14,923 | ||||||

Valeo SA (France) | 456 | 30,334 | ||||||

Yokohama Rubber Co. Ltd. (The) (Japan) | 200 | 3,920 | ||||||

|

| |||||||

| 2,149,756 | ||||||||

Automobiles 0.8% |

| |||||||

Bayerische Motoren Werke AG (Germany) | 633 | 57,756 | ||||||

Daimler AG (Germany) | 1,851 | 136,603 | ||||||

Ferrari NV (Italy) | 240 | 17,888 | ||||||

Fiat Chrysler Automobiles NV (United Kingdom)* | 1,718 | 18,770 | ||||||

Ford Motor Co. | 106,100 | 1,235,004 | ||||||

General Motors Co. | 57,900 | 2,047,344 | ||||||

Honda Motor Co. Ltd. (Japan) | 3,100 | 93,586 | ||||||

Isuzu Motors Ltd. (Japan) | 1,150 | 15,231 | ||||||

Mazda Motor Corp. (Japan) | 1,060 | 15,301 | ||||||

Mitsubishi Motors Corp. (Japan) | 1,470 | 8,818 | ||||||

Nissan Motor Co. Ltd. (Japan) | 4,600 | 44,355 | ||||||

Peugeot SA (France)* | 967 | 19,434 | ||||||

Renault SA (France) | 361 | 31,361 | ||||||

Subaru Corp. (Japan) | 1,200 | 44,014 | ||||||

Suzuki Motor Corp. (Japan) | 700 | 29,074 | ||||||

Thor Industries, Inc. | 1,400 | 134,582 | ||||||

Toyota Motor Corp. (Japan) | 5,004 | 271,606 | ||||||

See Notes to Financial Statements.

| 10 |

| Description | Shares | Value | ||||||

COMMON STOCKS (Continued) | ||||||||

Automobiles (cont’d.) |

| |||||||

Volkswagen AG (Germany) | 59 | $ | 8,815 | |||||

Yamaha Motor Co. Ltd. (Japan) | 500 | 12,039 | ||||||

|

| |||||||

| 4,241,581 | ||||||||

Banks 4.7% |

| |||||||

1st Source Corp. | 1,200 | 56,340 | ||||||

ABN AMRO Group NV-CVA (Netherlands), RegS, 144A | 538 | 13,046 | ||||||

American National Bankshares, Inc. | 300 | 11,175 | ||||||

Aozora Bank Ltd. (Japan) | 2,100 | 7,753 | ||||||

Australia & New Zealand Banking Group Ltd. (Australia) | 5,640 | 136,943 | ||||||

BancFirst Corp. | 600 | 53,940 | ||||||

Banco Bilbao Vizcaya Argentaria SA (Spain) | 12,552 | 97,437 | ||||||

Banco de Sabadell SA (Spain) | 10,534 | 19,301 | ||||||

Banco Popular Espanol SA (Spain)* | 5,959 | 5,778 | ||||||

Banco Santander SA (Spain) | 28,095 | 171,979 | ||||||

Bank Hapoalim BM (Israel) | 2,045 | 12,463 | ||||||

Bank Leumi Le-Israel BM (Israel)* | 2,683 | 11,845 | ||||||

Bank of America Corp. | 217,200 | 5,123,748 | ||||||

Bank of East Asia Ltd. (The) (Hong Kong) | 2,200 | 9,102 | ||||||

Bank of Ireland (Ireland)* | 56,454 | 14,122 | ||||||

Bank of Kyoto Ltd. (The) (Japan) | 600 | 4,379 | ||||||

Bank of Queensland Ltd. (Australia) | 843 | 7,826 | ||||||

Bankia SA (Spain) | 9,678 | 11,017 | ||||||

Bankinter SA (Spain) | 1,265 | 10,607 | ||||||

Barclays PLC (United Kingdom) | 32,648 | 92,158 | ||||||

Bendigo & Adelaide Bank Ltd. (Australia) | 837 | 7,755 | ||||||

Berkshire Hills Bancorp, Inc. | 3,700 | 133,385 | ||||||

BNP Paribas SA (France) | 2,041 | 135,817 | ||||||

BOC Hong Kong Holdings Ltd. (China) | 7,000 | 28,611 | ||||||

Bryn Mawr Bank Corp. | 300 | 11,850 | ||||||

CaixaBank SA (Spain) | 6,867 | 29,525 | ||||||

Cathay General BanCorp | 1,900 | 71,592 | ||||||

Central Pacific Financial Corp. | 1,300 | 39,702 | ||||||

Chiba Bank Ltd. (The) (Japan) | 1,500 | 9,652 | ||||||

Chugoku Bank Ltd. (The) (Japan) | 300 | 4,378 | ||||||

Citigroup, Inc. | 61,170 | 3,659,189 | ||||||

Columbia Banking System, Inc. | 1,300 | 50,687 | ||||||

Commerzbank AG (Germany) | 2,152 | 19,498 | ||||||

Commonwealth Bank of Australia (Australia) | 3,386 | 222,037 | ||||||

Concordia Financial Group Ltd. (Japan) | 2,200 | 10,199 | ||||||

Credit Agricole SA (France) | 2,144 | 28,980 | ||||||

Danske Bank A/S (Denmark) | 1,322 | 45,075 | ||||||

See Notes to Financial Statements.

| Prudential Balanced Fund | 11 |

Portfolio of Investments (unaudited) (continued)

as of March 31, 2017

| Description | Shares | Value | ||||||

COMMON STOCKS (Continued) | ||||||||

Banks (cont’d.) |

| |||||||

DBS Group Holdings Ltd. (Singapore) | 3,407 | $ | 47,193 | |||||

DNB ASA (Norway) | 1,833 | 29,105 | ||||||

Enterprise Financial Services Corp. | 2,200 | 93,280 | ||||||

Erste Group Bank AG (Austria)* | 554 | 18,039 | ||||||

Farmers National Banc Corp. | 1,500 | 21,525 | ||||||

FCB Financial Holdings, Inc. (Class A Stock)* | 1,300 | 64,415 | ||||||

Financial Institutions, Inc. | 3,400 | 112,030 | ||||||

First Bancorp | 500 | 14,645 | ||||||

First BanCorp (Puerto Rico)* | 9,800 | 55,370 | ||||||

First Busey Corp. | 1,700 | 49,980 | ||||||

First Citizens BancShares, Inc. (Class A Stock) | 440 | 147,563 | ||||||

First Community Bancshares, Inc. | 1,600 | 39,952 | ||||||

First Financial Bancorp | 3,100 | 85,095 | ||||||

First Financial Corp. | 1,400 | 66,500 | ||||||

First Merchants Corp. | 900 | 35,388 | ||||||

First Midwest Bancorp, Inc. | 6,300 | 149,184 | ||||||

Fukuoka Financial Group, Inc. (Japan) | 1,700 | 7,384 | ||||||

Fulton Financial Corp. | 1,800 | 32,130 | ||||||

Great Southern Bancorp, Inc. | 800 | 40,400 | ||||||

Hachijuni Bank Ltd. (The) (Japan) | 800 | 4,514 | ||||||

Hancock Holding Co. | 3,000 | 136,650 | ||||||

Hang Seng Bank Ltd. (Hong Kong) | 1,500 | 30,430 | ||||||

Heartland Financial USA, Inc. | 1,900 | 94,905 | ||||||

Heritage Financial Corp. | 700 | 17,325 | ||||||

Hilltop Holdings, Inc. | 7,600 | 208,772 | ||||||

Hiroshima Bank Ltd. (The) (Japan) | 1,000 | 4,253 | ||||||

HSBC Holdings PLC (United Kingdom) | 38,188 | 311,493 | ||||||

IBERIABANK Corp. | 1,100 | 87,010 | ||||||

Independent Bank Corp./MI | 2,100 | 43,470 | ||||||

Independent Bank Group, Inc. | 900 | 57,870 | ||||||

ING Groep NV-CVA (Netherlands) | 7,472 | 112,860 | ||||||

International Bancshares Corp. | 1,700 | 60,180 | ||||||

Intesa Sanpaolo SpA (Italy) | 24,284 | 66,055 | ||||||

Intesa Sanpaolo SpA-RSP (Italy) | 1,491 | 3,792 | ||||||

Japan Post Bank Co. Ltd. (Japan) | 800 | 9,933 | ||||||

JPMorgan Chase & Co. | 66,430 | 5,835,211 | ||||||

KBC Group NV (Belgium) | 484 | 32,086 | ||||||

Kyushu Financial Group, Inc. (Japan) | 1,000 | 6,125 | ||||||

Lloyds Banking Group PLC (United Kingdom) | 122,566 | 101,936 | ||||||

MainSource Financial Group, Inc. | 1,000 | 32,930 | ||||||

Mebuki Financial Group, Inc. (Japan) | 1,404 | 5,610 | ||||||

Mediobanca SpA (Italy) | 1,171 | 10,558 | ||||||

See Notes to Financial Statements.

| 12 |

| Description | Shares | Value | ||||||

COMMON STOCKS (Continued) | ||||||||

Banks (cont’d.) |

| |||||||

MidWestOne Financial Group, Inc. | 400 | $ | 13,716 | |||||

Mitsubishi UFJ Financial Group, Inc. (Japan) | 24,500 | 154,330 | ||||||

Mizrahi Tefahot Bank Ltd. (Israel) | 326 | 5,526 | ||||||

Mizuho Financial Group, Inc. (Japan) | 46,060 | 84,547 | ||||||

National Australia Bank Ltd. (Australia) | 5,247 | 133,601 | ||||||

Natixis SA (France) | 1,762 | 10,847 | ||||||

Nordea Bank AB (Sweden) | 5,796 | 66,126 | ||||||

OFG Bancorp (Puerto Rico) | 3,400 | 40,120 | ||||||

Old Second Bancorp, Inc. | 2,100 | 23,625 | ||||||

Oversea-Chinese Banking Corp. Ltd. (Singapore) | 6,027 | 41,864 | ||||||

Peapack Gladstone Financial Corp. | 1,500 | 44,385 | ||||||

Peoples BanCorp, Inc. | 1,200 | 37,992 | ||||||

PNC Financial Services Group, Inc. (The) | 21,000 | 2,525,040 | ||||||

Popular, Inc. (Puerto Rico) | 11,500 | 468,395 | ||||||

Preferred Bank | 500 | 26,830 | ||||||

QCR Holdings, Inc. | 1,200 | 50,820 | ||||||

Raiffeisen Bank International AG (Austria)* | 280 | 6,315 | ||||||

Republic Bancorp, Inc. (Class A Stock) | 500 | 17,195 | ||||||

Resona Holdings, Inc. (Japan) | 4,200 | 22,579 | ||||||

Royal Bank of Scotland Group PLC (United Kingdom)* | 7,070 | 21,438 | ||||||

S&T Bancorp, Inc. | 400 | 13,840 | ||||||

Seven Bank Ltd. (Japan) | 1,200 | 3,930 | ||||||

Shinsei Bank Ltd. (Japan) | 3,200 | 5,896 | ||||||

Shizuoka Bank Ltd. (The) (Japan) | 1,100 | 8,970 | ||||||

Skandinaviska Enskilda Banken AB (Sweden) (Class A Stock) | 2,849 | 31,658 | ||||||

Societe Generale SA (France) | 1,464 | 74,174 | ||||||

Standard Chartered PLC (United Kingdom)* | 6,285 | 60,115 | ||||||

Sumitomo Mitsui Financial Group, Inc. (Japan) | 2,567 | 93,436 | ||||||

Sumitomo Mitsui Trust Holdings, Inc. (Japan) | 618 | 21,415 | ||||||

Suruga Bank Ltd. (Japan) | 400 | 8,443 | ||||||

Svenska Handelsbanken AB (Sweden) (Class A Stock) | 2,913 | 39,920 | ||||||

Swedbank AB (Sweden) (Class A Stock) | 1,768 | 40,909 | ||||||

TriState Capital Holdings, Inc.* | 2,600 | 60,710 | ||||||

Umpqua Holdings Corp. | 900 | 15,966 | ||||||

UniCredit SpA (Italy) | 3,618 | 55,773 | ||||||

Union Bankshares Corp. | 2,500 | 87,950 | ||||||

United Community Banks, Inc. | 4,400 | 121,836 | ||||||

United Overseas Bank Ltd. (Singapore) | 2,504 | 39,551 | ||||||

Wells Fargo & Co. | 32,241 | 1,794,534 | ||||||

West Bancorporation, Inc. | 600 | 13,770 | ||||||

Westpac Banking Corp. (Australia) | 6,424 | 171,729 | ||||||

Wintrust Financial Corp. | 1,200 | 82,944 | ||||||

Yamaguchi Financial Group, Inc. (Japan) | 400 | 4,339 | ||||||

|

| |||||||

| 25,409,136 | ||||||||

See Notes to Financial Statements.

| Prudential Balanced Fund | 13 |

Portfolio of Investments (unaudited) (continued)

as of March 31, 2017

| Description | Shares | Value | ||||||

COMMON STOCKS (Continued) | ||||||||

Beverages 0.8% |

| |||||||

Anheuser-Busch InBev SA (Belgium) | 1,464 | $ | 160,419 | |||||

Asahi Group Holdings Ltd. (Japan) | 750 | 28,398 | ||||||

Carlsberg A/S (Denmark) (Class B Stock) | 214 | 19,761 | ||||||

Coca-Cola Amatil Ltd. (Australia) | 1,132 | 9,359 | ||||||

Coca-Cola Bottlers Japan, Inc. (Japan) | 200 | 6,449 | ||||||

Coca-Cola European Partners PLC (United Kingdom) | 407 | 15,202 | ||||||

Coca-Cola HBC AG (Switzerland)* | 342 | 8,829 | ||||||

Diageo PLC (United Kingdom) | 4,847 | 138,795 | ||||||

Heineken Holding NV (Netherlands) | 189 | 15,012 | ||||||

Heineken NV (Netherlands) | 444 | 37,784 | ||||||

Kirin Holdings Co. Ltd. (Japan) | 1,600 | 30,266 | ||||||

National Beverage Corp.(a) | 1,800 | 152,154 | ||||||

PepsiCo, Inc. | 31,800 | 3,557,148 | ||||||

Pernod Ricard SA (France) | 413 | 48,825 | ||||||

Remy Cointreau SA (France) | 40 | 3,913 | ||||||

Suntory Beverage & Food Ltd. (Japan) | 300 | 12,674 | ||||||

Treasury Wine Estates Ltd. (Australia) | 1,368 | 12,780 | ||||||

|

| |||||||

| 4,257,768 | ||||||||

Biotechnology 2.1% |

| |||||||

AbbVie, Inc. | 40,500 | 2,638,980 | ||||||

Acorda Therapeutics, Inc.* | 3,700 | 77,700 | ||||||

Actelion Ltd. (Switzerland)* | 193 | 54,375 | ||||||

AMAG Pharmaceuticals, Inc.* | 4,400 | 99,220 | ||||||

Amgen, Inc. | 13,300 | 2,182,131 | ||||||

Applied Genetic Technologies Corp.* | 4,000 | 27,600 | ||||||

Biogen, Inc.* | 3,900 | 1,066,338 | ||||||

BioSpecifics Technologies Corp.* | 1,900 | 104,120 | ||||||

Celgene Corp.* | 22,000 | 2,737,460 | ||||||

Chimerix, Inc.* | 9,800 | 62,524 | ||||||

Concert Pharmaceuticals, Inc.* | 5,300 | 90,418 | ||||||

CSL Ltd. (Australia) | 872 | 83,490 | ||||||

Exelixis, Inc.* | 4,900 | 106,183 | ||||||

FibroGen, Inc.* | 7,100 | 175,015 | ||||||

Genmab A/S (Denmark)* | 107 | 20,590 | ||||||

Genomic Health, Inc.* | 4,700 | 148,003 | ||||||

Gilead Sciences, Inc. | 15,500 | 1,052,760 | ||||||

Grifols SA (Spain) | 581 | 14,255 | ||||||

Natera, Inc.* | 1,400 | 12,418 | ||||||

PDL BioPharma, Inc. | 6,200 | 14,074 | ||||||

Shire PLC | 1,735 | 101,093 | ||||||

See Notes to Financial Statements.

| 14 |

| Description | Shares | Value | ||||||

COMMON STOCKS (Continued) | ||||||||

Biotechnology (cont’d.) |

| |||||||

Vanda Pharmaceuticals, Inc.* | 10,400 | $ | 145,600 | |||||

Veracyte, Inc.* | 1,100 | 10,098 | ||||||

|

| |||||||

| 11,024,445 | ||||||||

Building Products 0.2% |

| |||||||

American Woodmark Corp.* | 800 | 73,440 | ||||||

Armstrong World Industries, Inc.* | 3,500 | 161,175 | ||||||

Asahi Glass Co. Ltd. (Japan) | 1,900 | 15,416 | ||||||

Assa Abloy AB (Sweden) (Class B Stock) | 1,931 | 39,697 | ||||||

Cie de Saint-Gobain (France) | 950 | 48,742 | ||||||

Continental Building Products, Inc.* | 5,200 | 127,400 | ||||||

Daikin Industries Ltd. (Japan) | 450 | 45,377 | ||||||

Geberit AG (Switzerland) | 73 | 31,456 | ||||||

LIXIL Group Corp. (Japan) | 500 | 12,708 | ||||||

NCI Building Systems, Inc.* | 1,800 | 30,870 | ||||||

Patrick Industries, Inc.* | 800 | 56,720 | ||||||

TOTO Ltd. (Japan) | 250 | 9,457 | ||||||

Trex Co., Inc.* | 800 | 55,512 | ||||||

Universal Forest Products, Inc. | 1,700 | 167,518 | ||||||

|

| |||||||

| 875,488 | ||||||||

Capital Markets 1.6% |

| |||||||

3i Group PLC (United Kingdom) | 1,959 | 18,393 | ||||||

Aberdeen Asset Management PLC (United Kingdom) | 1,874 | 6,219 | ||||||

Ameriprise Financial, Inc. | 4,300 | 557,624 | ||||||

Associated Capital Group, Inc. (Class A Stock) | 300 | 10,845 | ||||||

ASX Ltd. (Australia) | 375 | 14,462 | ||||||

Credit Suisse Group AG (Switzerland)* | 3,788 | 56,360 | ||||||

Daiwa Securities Group, Inc. (Japan) | 3,000 | 18,305 | ||||||

Deutsche Bank AG (Germany)* | 4,185 | 71,945 | ||||||

Deutsche Boerse AG (Germany)* | 374 | 34,272 | ||||||

Evercore Partners, Inc. (Class A Stock) | 2,300 | 179,170 | ||||||

GAIN Capital Holdings, Inc. | 2,400 | 19,992 | ||||||

GAMCO Investors, Inc. (Class A Stock) | 600 | 17,754 | ||||||

Goldman Sachs Group, Inc. (The) | 12,915 | 2,966,834 | ||||||

Hargreaves Lansdown PLC (United Kingdom) | 491 | 7,998 | ||||||

Hong Kong Exchanges & Clearing Ltd. (Hong Kong) | 2,300 | 58,038 | ||||||

Houlihan Lokey, Inc. | 700 | 24,115 | ||||||

INTL FCStone, Inc.* | 2,100 | 79,716 | ||||||

Investec PLC (South Africa) | 1,252 | 8,537 | ||||||

Japan Exchange Group, Inc. (Japan) | 1,000 | 14,264 | ||||||

Julius Baer Group Ltd. (Switzerland)* | 455 | 22,730 | ||||||

See Notes to Financial Statements.

| Prudential Balanced Fund | 15 |

Portfolio of Investments (unaudited) (continued)

as of March 31, 2017

| Description | Shares | Value | ||||||

COMMON STOCKS (Continued) | ||||||||

Capital Markets (cont’d.) |

| |||||||

London Stock Exchange Group PLC (United Kingdom) | 588 | $ | 23,393 | |||||

LPL Financial Holdings, Inc. | 3,200 | 127,456 | ||||||

Macquarie Group Ltd. (Australia) | 591 | 40,718 | ||||||

Nomura Holdings, Inc. (Japan) | 7,100 | 43,951 | ||||||

OM Asset Management PLC | 3,000 | 45,360 | ||||||

Partners Group Holding AG (Switzerland) | 34 | 18,272 | ||||||

Raymond James Financial, Inc. | 20,100 | 1,532,826 | ||||||

S&P Global, Inc. | 13,800 | 1,804,212 | ||||||

SBI Holdings, Inc. (Japan) | 480 | 6,707 | ||||||

Schroders PLC (United Kingdom) | 241 | 9,146 | ||||||

Singapore Exchange Ltd. (Singapore) | 1,600 | 8,807 | ||||||

State Street Corp. | 8,600 | 684,646 | ||||||

UBS Group AG (Switzerland) | 6,979 | 111,557 | ||||||

|

| |||||||

| 8,644,624 | ||||||||

Chemicals 1.0% |

| |||||||

A. Schulman, Inc. | 4,200 | 132,090 | ||||||

AdvanSix, Inc.* | 804 | 21,965 | ||||||

Air Liquide SA (France) | 742 | 84,721 | ||||||

Air Products & Chemicals, Inc. | 600 | 81,174 | ||||||

Air Water, Inc. (Japan) | 300 | 5,547 | ||||||

Akzo Nobel NV (Netherlands) | 484 | 40,067 | ||||||

Arkema SA (France) | 127 | 12,502 | ||||||

Asahi Kasei Corp. (Japan) | 2,300 | 22,348 | ||||||

BASF SE (Germany) | 1,764 | 174,661 | ||||||

Chase Corp. | 200 | 19,080 | ||||||

Chemours Co. (The) | 8,300 | 319,550 | ||||||

Chr Hansen Holding A/S (Denmark) | 186 | 11,931 | ||||||

Covestro AG (Germany), RegS, 144A | 175 | 13,482 | ||||||

Croda International PLC (United Kingdom) | 272 | 12,149 | ||||||

Daicel Corp. (Japan) | 600 | 7,245 | ||||||

EMS-Chemie Holding AG (Switzerland) | 16 | 9,318 | ||||||

Evonik Industries AG (Germany) | 300 | 9,778 | ||||||

Frutarom Industries Ltd. (Israel) | 73 | 4,080 | ||||||

GCP Applied Technologies, Inc.* | 5,800 | 189,370 | ||||||

Givaudan SA (Switzerland) | 18 | 32,419 | ||||||

Hitachi Chemical Co. Ltd. (Japan) | 200 | 5,556 | ||||||

Incitec Pivot Ltd. (Australia) | 3,496 | 10,037 | ||||||

Innophos Holdings, Inc. | 300 | 16,191 | ||||||

Israel Chemicals Ltd. (Israel) | 996 | 4,224 | ||||||

Johnson Matthey PLC (United Kingdom) | 352 | 13,581 | ||||||

JSR Corp. (Japan) | 350 | 5,922 | ||||||

See Notes to Financial Statements.

| 16 |

| Description | Shares | Value | ||||||

COMMON STOCKS (Continued) | ||||||||

Chemicals (cont’d.) |

| |||||||

K+S AG (Germany) | 354 | $ | 8,228 | |||||

Kaneka Corp. (Japan) | 500 | 3,740 | ||||||

Kansai Paint Co. Ltd. (Japan) | 400 | 8,537 | ||||||

KMG Chemicals, Inc. | 1,300 | 59,891 | ||||||

Koninklijke DSM NV (Netherlands) | 354 | 23,941 | ||||||

Koppers Holdings, Inc.* | 1,800 | 76,230 | ||||||

Kuraray Co. Ltd. (Japan) | 700 | 10,649 | ||||||

LANXESS AG (Germany) | 175 | 11,739 | ||||||

Linde AG (Germany) | 355 | 59,151 | ||||||

LyondellBasell Industries NV (Class A Stock) | 19,900 | 1,814,681 | ||||||

Mitsubishi Chemical Holdings Corp. (Japan) | 2,500 | 19,410 | ||||||

Mitsubishi Gas Chemical Co., Inc. (Japan) | 450 | 9,373 | ||||||

Mitsui Chemicals, Inc. (Japan) | 1,600 | 7,927 | ||||||

Nippon Paint Holdings Co. Ltd. (Japan) | 300 | 10,478 | ||||||

Nissan Chemical Industries Ltd. (Japan) | 200 | 5,834 | ||||||

Nitto Denko Corp. (Japan) | 300 | 23,208 | ||||||

Novozymes A/S (Denmark) (Class B Stock) | 432 | 17,116 | ||||||

Orica Ltd. (Australia) | 716 | 9,624 | ||||||

PolyOne Corp. | 300 | 10,227 | ||||||

Sherwin-Williams Co. (The) | 5,400 | 1,675,026 | ||||||

Shin-Etsu Chemical Co. Ltd. (Japan) | 700 | 60,844 | ||||||

Sika AG (Switzerland) | 4 | 23,991 | ||||||

Solvay SA (Belgium) | 139 | 16,959 | ||||||

Stepan Co. | 500 | 39,405 | ||||||

Sumitomo Chemical Co. Ltd. (Japan) | 2,800 | 15,683 | ||||||

Symrise AG (Germany) | 252 | 16,758 | ||||||

Syngenta AG (Switzerland) | 177 | 78,170 | ||||||

Taiyo Nippon Sanso Corp. (Japan) | 300 | 3,512 | ||||||

Teijin Ltd. (Japan) | 380 | 7,175 | ||||||

Toray Industries, Inc. (Japan) | 2,800 | 24,920 | ||||||

Trinseo SA | 2,800 | 187,880 | ||||||

Umicore SA (Belgium) | 172 | 9,795 | ||||||

Yara International ASA (Norway) | 345 | 13,289 | ||||||

|

| |||||||

| 5,622,379 | ||||||||

Commercial Services & Supplies 0.2% |

| |||||||

Babcock International Group PLC (United Kingdom) | 446 | 4,928 | ||||||

Brambles Ltd. (Australia) | 2,975 | 21,246 | ||||||

Brink’s Co. (The) | 3,600 | 192,420 | ||||||

Dai Nippon Printing Co. Ltd. (Japan) | 1,100 | 11,903 | ||||||

Edenred (France) | 375 | 8,851 | ||||||

Ennis, Inc. | 2,900 | 49,300 | ||||||

See Notes to Financial Statements.

| Prudential Balanced Fund | 17 |

Portfolio of Investments (unaudited) (continued)

as of March 31, 2017

| Description | Shares | Value | ||||||

COMMON STOCKS (Continued) | ||||||||

Commercial Services & Supplies (cont’d.) |

| |||||||

G4S PLC (United Kingdom) | 3,243 | $ | 12,363 | |||||

Herman Miller, Inc. | 2,000 | 63,100 | ||||||

ISS A/S (Denmark) | 338 | 12,778 | ||||||

Knoll, Inc. | 5,400 | 128,574 | ||||||

Park24 Co. Ltd. (Japan) | 200 | 5,255 | ||||||

Secom Co. Ltd. (Japan) | 400 | 28,743 | ||||||

Securitas AB (Sweden) (Class B Stock) | 587 | 9,164 | ||||||

Societe BIC SA (France) | 55 | 6,852 | ||||||

Sohgo Security Services Co. Ltd. (Japan) | 100 | 3,746 | ||||||

Steelcase, Inc. (Class A Stock) | 9,700 | 162,475 | ||||||

Toppan Printing Co. Ltd. (Japan) | 1,100 | 11,243 | ||||||

West Corp. | 4,800 | 117,216 | ||||||

|

| |||||||

| 850,157 | ||||||||

Communications Equipment 0.7% |

| |||||||

Black Box Corp. | 1,900 | 17,005 | ||||||

Cisco Systems, Inc. | 54,266 | 1,834,191 | ||||||

CommScope Holding Co., Inc.* | 12,100 | 504,691 | ||||||

Extreme Networks, Inc.* | 3,200 | 24,032 | ||||||

F5 Networks, Inc.* | 5,000 | 712,850 | ||||||

NETGEAR, Inc.* | 3,200 | 158,560 | ||||||

Nokia OYJ (Finland) | 11,183 | 60,107 | ||||||

Plantronics, Inc. | 3,000 | 162,330 | ||||||

Telefonaktiebolaget LM Ericsson (Sweden) (Class B Stock) | 5,913 | 39,477 | ||||||

Viavi Solutions, Inc.* | 2,200 | 23,584 | ||||||

|

| |||||||

| 3,536,827 | ||||||||

Construction & Engineering 0.2% |

| |||||||

ACS Actividades de Construccion y Servicios SA (Spain) | 398 | 13,529 | ||||||

Argan, Inc. | 1,700 | 112,455 | ||||||

Boskalis Westminster (Netherlands) | 165 | 5,685 | ||||||

Bouygues SA (France) | 403 | 16,380 | ||||||

CIMIC Group Ltd. (Australia) | 169 | 4,637 | ||||||

Comfort Systems USA, Inc. | 1,400 | 51,310 | ||||||

Eiffage SA (France) | 122 | 9,548 | ||||||

EMCOR Group, Inc. | 3,300 | 207,735 | ||||||

Ferrovial SA (Spain) | 944 | 18,868 | ||||||

HOCHTIEF AG (Germany) | 37 | 6,115 | ||||||

JGC Corp. (Japan) | 400 | 6,966 | ||||||

Kajima Corp. (Japan) | 1,600 | 10,466 | ||||||

KBR, Inc. | 20,500 | 308,115 | ||||||

MasTec, Inc.* | 2,000 | 80,100 | ||||||

See Notes to Financial Statements.

| 18 |

| Description | Shares | Value | ||||||

COMMON STOCKS (Continued) | ||||||||

Construction & Engineering (cont’d.) |

| |||||||

Obayashi Corp. (Japan) | 1,200 | $ | 11,252 | |||||

Shimizu Corp. (Japan) | 1,200 | 10,776 | ||||||

Skanska AB (Sweden) (Class B Stock) | 638 | 15,015 | ||||||

Taisei Corp. (Japan) | 1,900 | 13,895 | ||||||

Vinci SA (France) | 979 | 77,741 | ||||||

|

| |||||||

| 980,588 | ||||||||

Construction Materials 0.0% |

| |||||||

Boral Ltd. (Australia) | 2,275 | 10,142 | ||||||

CRH PLC (Ireland) | 1,605 | 56,559 | ||||||

Fletcher Building Ltd. (New Zealand) | 1,286 | 7,492 | ||||||

HeidelbergCement AG (Germany) | 284 | 26,596 | ||||||

Imerys SA (France) | 75 | 6,361 | ||||||

James Hardie Industries PLC (Ireland) | 843 | 13,245 | ||||||

LafargeHolcim Ltd. (Switzerland)* | 885 | 52,214 | ||||||

Taiheiyo Cement Corp. (Japan) | 2,500 | 8,389 | ||||||

United States Lime & Minerals, Inc. | 500 | 39,490 | ||||||

|

| |||||||

| 220,488 | ||||||||

Consumer Finance 0.5% |

| |||||||

Acom Co. Ltd. (Japan)* | 700 | 2,802 | ||||||

AEON Financial Service Co. Ltd. (Japan) | 200 | 3,777 | ||||||

Capital One Financial Corp. | 22,800 | 1,975,848 | ||||||

Credit Saison Co. Ltd. (Japan) | 300 | 5,376 | ||||||

Discover Financial Services | 10,800 | 738,612 | ||||||

Enova International, Inc.* | 4,100 | 60,885 | ||||||

Nelnet, Inc. (Class A Stock) | 2,400 | 105,264 | ||||||

Provident Financial PLC (United Kingdom) | 277 | 10,408 | ||||||

|

| |||||||

| 2,902,972 | ||||||||

Containers & Packaging 0.1% |

| |||||||

Amcor Ltd. (Australia) | 2,172 | 24,983 | ||||||

Greif, Inc. (Class A Stock) | 3,400 | 187,306 | ||||||

Owens-Illinois, Inc.* | 26,800 | 546,184 | ||||||

Toyo Seikan Group Holdings Ltd. (Japan) | 300 | 4,882 | ||||||

|

| |||||||

| 763,355 | ||||||||

Distributors 0.0% |

| |||||||

Jardine Cycle & Carriage Ltd. (Singapore) | 200 | 6,264 | ||||||

See Notes to Financial Statements.

| Prudential Balanced Fund | 19 |

Portfolio of Investments (unaudited) (continued)

as of March 31, 2017

| Description | Shares | Value | ||||||

COMMON STOCKS (Continued) | ||||||||

Diversified Consumer Services 0.1% |

| |||||||

American Public Education, Inc.* | 1,000 | $ | 22,900 | |||||

Benesse Holdings, Inc. (Japan) | 150 | 4,695 | ||||||

Capella Education Co. | 1,000 | 85,025 | ||||||

Grand Canyon Education, Inc.* | 2,900 | 207,669 | ||||||

|

| |||||||

| 320,289 | ||||||||

Diversified Financial Services 0.7% |

| |||||||

AMP Ltd. (Australia) | 5,710 | 22,589 | ||||||

Berkshire Hathaway, Inc. (Class B Stock)* | 18,800 | 3,133,584 | ||||||

Challenger Ltd. (Australia) | 1,072 | 10,274 | ||||||

Eurazeo SA (France) | 66 | 4,342 | ||||||

EXOR NV (Netherlands) | 227 | 11,738 | ||||||

First Pacific Co. Ltd. (Hong Kong) | 4,000 | 2,907 | ||||||

Groupe Bruxelles Lambert SA (Belgium) | 151 | 13,704 | ||||||

Industrivarden AB (Sweden) (Class C Stock) | 317 | 6,860 | ||||||

Investor AB (Sweden) (Class B Stock) | 878 | 36,917 | ||||||

Kinnevik AB (Sweden) (Class B Stock) | 478 | 12,742 | ||||||

L E Lundbergforetagen AB (Sweden) | 73 | 4,948 | ||||||

Leucadia National Corp. | 18,800 | 488,800 | ||||||

Mitsubishi UFJ Lease & Finance Co. Ltd. (Japan) | 900 | 4,498 | ||||||

NewStar Financial, Inc. | 1,100 | 11,638 | ||||||

ORIX Corp. (Japan) | 2,540 | 37,700 | ||||||

Pargesa Holding SA (Switzerland) | 80 | 5,654 | ||||||

Wendel SA (France) | 54 | 6,838 | ||||||

|

| |||||||

| 3,815,733 | ||||||||

Diversified Telecommunication Services 1.6% |

| |||||||

AT&T, Inc. | 99,074 | 4,116,525 | ||||||

Bezeq the Israeli Telecommunication Corp. Ltd. (Israel) | 3,777 | 6,783 | ||||||

BT Group PLC (United Kingdom) | 16,101 | 64,293 | ||||||

Deutsche Telekom AG (Germany) | 6,307 | 110,516 | ||||||

Elisa OYJ (Finland) | 302 | 10,676 | ||||||

HKT Trust & HKT Ltd. (Hong Kong) | 6,720 | 8,665 | ||||||

IDT Corp. (Class B Stock) | 1,400 | 17,808 | ||||||

Iliad SA (France) | 54 | 12,060 | ||||||

Inmarsat PLC (United Kingdom) | 788 | 8,395 | ||||||

Koninklijke KPN NV (Netherlands) | 6,408 | 19,265 | ||||||

Nippon Telegraph & Telephone Corp. (Japan) | 1,300 | 55,579 | ||||||

Orange SA (France) | 3,807 | 59,106 | ||||||

PCCW Ltd. (Hong Kong) | 7,400 | 4,365 | ||||||

Proximus SADP (Belgium) | 275 | 8,618 | ||||||

SFR Group SA (France)* | 209 | 6,564 | ||||||

See Notes to Financial Statements.

| 20 |

| Description | Shares | Value | ||||||

COMMON STOCKS (Continued) | ||||||||

Diversified Telecommunication Services (cont’d.) |

| |||||||

Singapore Telecommunications Ltd. (Singapore) | 15,600 | $ | 43,716 | |||||

Spark New Zealand Ltd. (New Zealand) | 3,547 | 8,695 | ||||||

Swisscom AG (Switzerland) | 49 | 22,587 | ||||||

TDC A/S (Denmark) | 1,587 | 8,174 | ||||||

Telecom Italia SpA (Italy)* | 21,847 | 19,666 | ||||||

Telecom Italia SpA-RSP (Italy)* | 10,793 | 7,880 | ||||||

Telefonica Deutschland Holding AG (Germany) | 1,276 | 6,326 | ||||||

Telefonica SA (Spain) | 8,704 | 97,427 | ||||||

Telenor ASA (Norway) | 1,486 | 24,720 | ||||||

Telia Co. AB (Sweden) | 4,946 | 20,735 | ||||||

Telstra Corp. Ltd. (Australia) | 8,027 | 28,563 | ||||||

TPG Telecom Ltd. (Australia) | 611 | 3,253 | ||||||

Verizon Communications, Inc. | 77,050 | 3,756,188 | ||||||

Vocus Group Ltd. (Australia) | 927 | 3,059 | ||||||

|

| |||||||

| 8,560,207 | ||||||||

Electric Utilities 1.0% |

| |||||||

AusNet Services (Australia) | 4,251 | 5,472 | ||||||

Cheung Kong Infrastructure Holdings Ltd. (Hong Kong) | 1,300 | 10,209 | ||||||

Chubu Electric Power Co., Inc. (Japan) | 1,200 | 16,120 | ||||||

Chugoku Electric Power Co., Inc. (The) (Japan) | 600 | 6,657 | ||||||

CLP Holdings Ltd. (Hong Kong) | 3,000 | 31,405 | ||||||

Contact Energy Ltd. (New Zealand) | 1,594 | 5,652 | ||||||

DONG Energy A/S (Denmark), RegS, 144A | 282 | 10,859 | ||||||

EDP—Energias de Portugal SA (Portugal) | 4,553 | 15,395 | ||||||

El Paso Electric Co. | 1,400 | 70,700 | ||||||

Electricite de France SA (France) | 684 | 5,747 | ||||||

Endesa SA (Spain) | 596 | 13,988 | ||||||

Enel SpA (Italy) | 14,559 | 68,507 | ||||||

Exelon Corp. | 50,000 | 1,799,000 | ||||||

FirstEnergy Corp. | 49,800 | 1,584,636 | ||||||

Fortum OYJ (Finland) | 833 | 13,185 | ||||||

HK Electric Investments & HK Electric Investments Ltd. (Hong Kong), 144A | 6,000 | 5,530 | ||||||

Hokuriku Electric Power Co. (Japan) | 300 | 2,918 | ||||||

Iberdrola SA (Spain) | 10,566 | 75,493 | ||||||

Kansai Electric Power Co., Inc. (The) (Japan) | 1,400 | 17,227 | ||||||

Kyushu Electric Power Co., Inc. (Japan) | 800 | 8,549 | ||||||

Mercury NZ Ltd. (New Zealand) | 1,083 | 2,392 | ||||||

Portland General Electric Co. | 1,000 | 44,420 | ||||||

Power Assets Holdings Ltd. (Hong Kong) | 2,500 | 21,565 | ||||||

PPL Corp. | 39,700 | 1,484,383 | ||||||

Red Electrica Corp. SA (Spain) | 812 | 15,570 | ||||||

See Notes to Financial Statements.

| Prudential Balanced Fund | 21 |

Portfolio of Investments (unaudited) (continued)

as of March 31, 2017

| Description | Shares | Value | ||||||

COMMON STOCKS (Continued) | ||||||||

Electric Utilities (cont’d.) |

| |||||||

SSE PLC (United Kingdom) | 1,947 | $ | 35,983 | |||||

Terna Rete Elettrica Nazionale SpA (Italy) | 2,745 | 13,608 | ||||||

Tohoku Electric Power Co., Inc. (Japan) | 900 | 12,225 | ||||||

Tokyo Electric Power Co. Holdings, Inc. (Japan)* | 2,800 | 10,975 | ||||||

|

| |||||||

| 5,408,370 | ||||||||

Electrical Equipment 0.5% |

| |||||||

ABB Ltd. (Switzerland)* | 3,592 | 84,073 | ||||||

Atkore International Group, Inc.* | 3,700 | 97,236 | ||||||

AZZ, Inc. | 800 | 47,600 | ||||||

Babcock & Wilcox Enterprises, Inc.* | 14,150 | 132,161 | ||||||

Emerson Electric Co. | 31,600 | 1,891,576 | ||||||

EnerSys | 2,500 | 197,350 | ||||||

Fuji Electric Co. Ltd. (Japan) | 1,000 | 5,955 | ||||||

Legrand SA (France) | 501 | 30,159 | ||||||

Mabuchi Motor Co. Ltd. (Japan) | 100 | 5,645 | ||||||

Mitsubishi Electric Corp. (Japan) | 3,500 | 50,429 | ||||||

Nidec Corp. (Japan) | 450 | 42,977 | ||||||

OSRAM Licht AG (Germany) | 174 | 10,912 | ||||||

Prysmian SpA (Italy) | 383 | 10,125 | ||||||

Schneider Electric SE (France) | 1,073 | 78,832 | ||||||

Vestas Wind Systems A/S (Denmark) | 423 | 34,407 | ||||||

|

| |||||||

| 2,719,437 | ||||||||

Electronic Equipment, Instruments & Components 0.2% |

| |||||||

Alps Electric Co. Ltd. (Japan) | 400 | 11,342 | ||||||

Anixter International, Inc.* | 1,800 | 142,740 | ||||||

ePlus, Inc.* | 400 | 54,020 | ||||||

Hamamatsu Photonics KK (Japan) | 300 | 8,659 | ||||||

Hexagon AB (Sweden) (Class B Stock) | 517 | 20,750 | ||||||

Hirose Electric Co. Ltd. (Japan) | 52 | 7,204 | ||||||

Hitachi High-Technologies Corp. (Japan) | 150 | 6,127 | ||||||

Hitachi Ltd. (Japan) | 8,800 | 47,782 | ||||||

Ingenico Group SA (France) | 117 | 11,035 | ||||||

Insight Enterprises, Inc.* | 1,100 | 45,199 | ||||||

Itron, Inc.* | 2,700 | 163,890 | ||||||

Keyence Corp. (Japan) | 180 | 72,211 | ||||||

Kyocera Corp. (Japan) | 600 | 33,520 | ||||||

Murata Manufacturing Co. Ltd. (Japan) | 350 | 49,863 | ||||||

Nippon Electric Glass Co. Ltd. (Japan) | 900 | 5,452 | ||||||

Omron Corp. (Japan) | 400 | 17,576 | ||||||

PC Connection, Inc. | 1,900 | 56,601 | ||||||

See Notes to Financial Statements.

| 22 |

| Description | Shares | Value | ||||||

COMMON STOCKS (Continued) | ||||||||

Electronic Equipment, Instruments & Components (cont’d.) |

| |||||||

Sanmina Corp.* | 4,300 | $ | 174,580 | |||||

ScanSource, Inc.* | 500 | 19,625 | ||||||

Shimadzu Corp. (Japan) | 500 | 7,957 | ||||||

SYNNEX Corp. | 1,700 | 190,298 | ||||||

TDK Corp. (Japan) | 250 | 15,874 | ||||||

Tech Data Corp.* | 1,500 | 140,850 | ||||||

Yaskawa Electric Corp. (Japan) | 500 | 10,069 | ||||||

Yokogawa Electric Corp. (Japan) | 400 | 6,308 | ||||||

|

| |||||||

| 1,319,532 | ||||||||

Energy Equipment & Services 0.2% | ||||||||

Diamond Offshore Drilling, Inc.* | 7,900 | 132,009 | ||||||

Ensco PLC (Class A Stock) | 85,600 | 766,120 | ||||||

Matrix Service Co.* | 2,400 | 39,600 | ||||||

McDermott International, Inc.* | 24,000 | 162,000 | ||||||

Petrofac Ltd. (United Kingdom) | 519 | 5,995 | ||||||

Saipem SpA (Italy)* | 11,091 | 5,038 | ||||||

Tenaris SA (Luxembourg) | 966 | 16,704 | ||||||

Unit Corp.* | 5,200 | 125,632 | ||||||

|

| |||||||

| 1,253,098 | ||||||||

Equity Real Estate Investment Trusts (REITs) 1.7% | ||||||||

American Assets Trust, Inc. | 3,500 | 146,440 | ||||||

American Tower Corp. | 15,800 | 1,920,332 | ||||||

Ascendas Real Estate Investment Trust (Singapore) | 4,700 | 8,464 | ||||||

Ashford Hospitality Prime, Inc. | 6,100 | 64,721 | ||||||

Ashford Hospitality Trust, Inc. | 12,800 | 81,536 | ||||||

British Land Co. PLC (The) (United Kingdom) | 1,781 | 13,614 | ||||||

Brixmor Property Group, Inc. | 10,200 | 218,892 | ||||||

CapitaLand Commercial Trust (Singapore) | 4,000 | 4,417 | ||||||

CapitaLand Mall Trust (Singapore) | 4,700 | 6,617 | ||||||

Chatham Lodging Trust | 5,000 | 98,750 | ||||||

Chesapeake Lodging Trust | 6,200 | 148,552 | ||||||

CoreCivic, Inc. | 26,300 | 826,346 | ||||||

Crown Castle International Corp. | 18,000 | 1,700,100 | ||||||

Daiwa House REIT Investment Corp. (Japan) | 3 | 7,813 | ||||||

Dexus Property Group (Australia) | 1,946 | 14,524 | ||||||

DiamondRock Hospitality Co. | 6,200 | 69,130 | ||||||

First Potomac Realty Trust | 1,500 | 15,420 | ||||||

Fonciere Des Regions (France) | 71 | 5,919 | ||||||

Forest City Realty Trust, Inc. (Class A Stock) | 14,500 | 315,810 | ||||||

Franklin Street Properties Corp. | 11,400 | 138,396 | ||||||

See Notes to Financial Statements.

| Prudential Balanced Fund | 23 |

Portfolio of Investments (unaudited) (continued)

as of March 31, 2017

| Description | Shares | Value | ||||||

COMMON STOCKS (Continued) | ||||||||

Equity Real Estate Investment Trusts (REITs) (cont’d.) |

| |||||||

Gecina SA (France) | 85 | $ | 11,525 | |||||

GEO Group, Inc. (The) | 5,200 | 241,124 | ||||||

Goodman Group (Australia) | 3,336 | 19,724 | ||||||

GPT Group (The) (Australia) | 3,611 | 14,212 | ||||||

Hammerson PLC (United Kingdom) | 1,610 | 11,512 | ||||||

ICADE (France) | 67 | 4,901 | ||||||

InfraREIT, Inc. | 4,600 | 82,800 | ||||||

Intu Properties PLC (United Kingdom) | 1,709 | 5,979 | ||||||

Japan Prime Realty Investment Corp. (Japan) | 2 | 7,759 | ||||||

Japan Real Estate Investment Corp. (Japan) | 2 | 10,617 | ||||||

Japan Retail Fund Investment Corp. (Japan) | 5 | 9,814 | ||||||

Kite Realty Group Trust | 3,400 | 73,100 | ||||||

Klepierre (France) | 443 | 17,211 | ||||||

Land Securities Group PLC (United Kingdom) | 1,483 | 19,696 | ||||||

Lexington Realty Trust | 2,000 | 19,960 | ||||||

Link REIT (Hong Kong) | 4,500 | 31,539 | ||||||

Mirvac Group (Australia) | 6,944 | 11,617 | ||||||

NexPoint Residential Trust, Inc. | 2,200 | 53,152 | ||||||

Nippon Building Fund, Inc. (Japan) | 3 | 16,446 | ||||||

Nippon Prologis REIT, Inc. (Japan) | 3 | 6,503 | ||||||

Nomura Real Estate Master Fund, Inc. (Japan) | 8 | 12,442 | ||||||

Outfront Media, Inc. | 5,800 | 153,990 | ||||||

Prologis, Inc. | 21,900 | 1,136,172 | ||||||

RLJ Lodging Trust | 5,000 | 117,550 | ||||||

Ryman Hospitality Properties, Inc. | 2,100 | 129,843 | ||||||

Scentre Group (Australia) | 9,988 | 32,744 | ||||||

Segro PLC (United Kingdom) | 1,912 | 10,932 | ||||||

Spirit Realty Capital, Inc. | 22,000 | 222,860 | ||||||

Stockland (Australia) | 4,619 | 16,379 | ||||||

Summit Hotel Properties, Inc. | 10,900 | 174,182 | ||||||

Suntec Real Estate Investment Trust (Singapore) | 5,100 | 6,528 | ||||||

Tier REIT, Inc. | 600 | 10,416 | ||||||

Unibail-Rodamco SE (France) | 193 | 45,002 | ||||||

United Urban Investment Corp. (Japan) | 6 | 9,224 | ||||||

VEREIT, Inc. | 46,100 | 391,389 | ||||||

Vicinity Centres (Australia) | 6,128 | 13,255 | ||||||

Westfield Corp. (Australia) | 3,830 | 25,981 | ||||||

Xenia Hotels & Resorts, Inc. | 9,400 | 160,458 | ||||||

|

| |||||||

| 9,144,331 | ||||||||

Food & Staples Retailing 1.4% | ||||||||

Aeon Co. Ltd. (Japan) | 1,300 | 19,035 | ||||||

Carrefour SA (France) | 1,082 | 25,493 | ||||||

See Notes to Financial Statements.

| 24 |

| Description | Shares | Value | ||||||

COMMON STOCKS (Continued) | ||||||||

Food & Staples Retailing (cont’d.) |

| |||||||

Casino Guichard Perrachon SA (France) | 107 | $ | 5,979 | |||||

Colruyt SA (Belgium) | 134 | 6,581 | ||||||

CVS Health Corp. | 2,100 | 164,850 | ||||||

Distribuidora Internacional de Alimentacion SA (Spain) | 1,105 | 6,387 | ||||||

FamilyMart UNY Holdings Co. Ltd. (Japan) | 200 | 11,933 | ||||||

ICA Gruppen AB (Sweden) | 166 | 5,662 | ||||||

Ingles Markets, Inc. (Class A Stock) | 1,400 | 60,410 | ||||||

J Sainsbury PLC (United Kingdom) | 3,021 | 10,006 | ||||||

Jeronimo Martins SGPS SA (Portugal) | 494 | 8,827 | ||||||

Koninklijke Ahold Delhaize NV (Netherlands) | 2,454 | 52,442 | ||||||

Kroger Co. (The) | 44,700 | 1,318,203 | ||||||

Lawson, Inc. (Japan) | 100 | 6,800 | ||||||

METRO AG (Germany) | 337 | 10,768 | ||||||

Seven & i Holdings Co. Ltd. (Japan) | 1,450 | 56,961 | ||||||

SpartanNash Co. | 2,300 | 80,477 | ||||||

Sundrug Co. Ltd. (Japan) | 200 | 6,729 | ||||||

SUPERVALU, Inc.* | 5,300 | 20,458 | ||||||

Tesco PLC (United Kingdom)* | 16,069 | 37,398 | ||||||

Tsuruha Holdings, Inc. (Japan) | 100 | 9,275 | ||||||

Village Super Market, Inc. (Class A Stock) | 900 | 23,850 | ||||||

Wal-Mart Stores, Inc. | 39,700 | 2,861,576 | ||||||

Walgreens Boots Alliance, Inc. | 27,600 | 2,292,180 | ||||||

Wesfarmers Ltd. (Australia) | 2,179 | 75,019 | ||||||

WM Morrison Supermarkets PLC (United Kingdom) | 4,161 | 12,522 | ||||||

Woolworths Ltd. (Australia) | 2,451 | 49,623 | ||||||

|

| |||||||

| 7,239,444 | ||||||||

Food Products 1.2% | ||||||||

AdvancePierre Foods Holdings, Inc. | 1,500 | 46,755 | ||||||

Ajinomoto Co., Inc. (Japan) | 1,100 | 21,765 | ||||||

Archer-Daniels-Midland Co. | 8,200 | 377,528 | ||||||

Aryzta AG (Switzerland)* | 173 | 5,555 | ||||||

Associated British Foods PLC (United Kingdom) | 673 | 21,984 | ||||||

Barry Callebaut AG (Switzerland)* | 4 | 5,230 | ||||||

Bunge Ltd. | 2,100 | 166,446 | ||||||

Calbee, Inc. (Japan) | 200 | 6,831 | ||||||

Chocoladefabriken Lindt & Spruengli AG (Switzerland) | 2 | 11,333 | ||||||

ConAgra Brands, Inc. | 39,800 | 1,605,532 | ||||||

Danone SA (France) | 1,126 | 76,596 | ||||||

Fresh Del Monte Produce, Inc. | 2,700 | 159,921 | ||||||

General Mills, Inc. | 23,100 | 1,363,131 | ||||||

Golden Agri-Resources Ltd. (Singapore) | 16,600 | 4,571 | ||||||

See Notes to Financial Statements.

| Prudential Balanced Fund | 25 |

Portfolio of Investments (unaudited) (continued)

as of March 31, 2017

| Description | Shares | Value | ||||||

COMMON STOCKS (Continued) | ||||||||

Food Products (cont’d.) | ||||||||

Kerry Group PLC (Ireland) (Class A Stock) | 311 | $ | 24,452 | |||||

Kikkoman Corp. (Japan) | 300 | 8,966 | ||||||

Lancaster Colony Corp. | 270 | 34,787 | ||||||

Marine Harvest ASA (Norway)* | 735 | 11,212 | ||||||

MEIJI Holdings Co. Ltd. (Japan) | 200 | 16,689 | ||||||

Nestle SA (Switzerland) | 5,996 | 460,204 | ||||||

NH Foods Ltd. (Japan) | 300 | 8,059 | ||||||

Nisshin Seifun Group, Inc. (Japan) | 405 | 6,055 | ||||||

Nissin Foods Holdings Co. Ltd. (Japan) | 100 | 5,555 | ||||||

Omega Protein Corp. | 400 | 8,020 | ||||||

Orkla ASA (Norway) | 1,529 | 13,697 | ||||||

Sanderson Farms, Inc.(a) | 1,600 | 166,144 | ||||||

Tate & Lyle PLC (United Kingdom) | 890 | 8,529 | ||||||

Toyo Suisan Kaisha Ltd. (Japan) | 200 | 7,462 | ||||||

Tyson Foods, Inc. (Class A Stock) | 26,100 | 1,610,631 | ||||||

WH Group Ltd. (Hong Kong), RegS, 144A | 15,500 | 13,366 | ||||||

Wilmar International Ltd. (Singapore) | 3,600 | 9,085 | ||||||

Yakult Honsha Co. Ltd. (Japan) | 150 | 8,348 | ||||||

Yamazaki Baking Co. Ltd. (Japan) | 300 | 6,177 | ||||||

|

| |||||||

| 6,300,616 | ||||||||

Gas Utilities 0.3% | ||||||||

APA Group (Australia) | 2,239 | 15,325 | ||||||

Atmos Energy Corp. | 3,600 | 284,364 | ||||||

Chesapeake Utilities Corp. | 700 | 48,440 | ||||||

Gas Natural SDG SA (Spain) | 657 | 14,371 | ||||||

Hong Kong & China Gas Co. Ltd. (Hong Kong) | 14,990 | 29,991 | ||||||

ONE Gas, Inc. | 2,800 | 189,280 | ||||||

Osaka Gas Co. Ltd. (Japan) | 3,400 | 12,964 | ||||||

Southwest Gas Holdings, Inc. | 2,100 | 174,111 | ||||||

Toho Gas Co. Ltd. (Japan) | 800 | 5,674 | ||||||

Tokyo Gas Co. Ltd. (Japan) | 4,000 | 18,268 | ||||||

UGI Corp. | 13,100 | 647,140 | ||||||

|

| |||||||

| 1,439,928 | ||||||||

Health Care Equipment & Supplies 1.8% | ||||||||

Abbott Laboratories | 53,300 | 2,367,053 | ||||||

AngioDynamics, Inc.* | 4,500 | 78,075 | ||||||

Atrion Corp. | 60 | 28,092 | ||||||

Baxter International, Inc. | 35,300 | 1,830,658 | ||||||

Becton Dickinson & Co. | 10,600 | 1,944,464 | ||||||

C.R. Bard, Inc. | 300 | 74,562 | ||||||

See Notes to Financial Statements.

| 26 |

| Description | Shares | Value | ||||||

COMMON STOCKS (Continued) | ||||||||

Health Care Equipment & Supplies (cont’d.) | ||||||||

Cantel Medical Corp. | 2,200 | $ | 176,220 | |||||

Cardiovascular Systems, Inc.* | 2,700 | 76,342 | ||||||

Cochlear Ltd. (Australia) | 107 | 11,053 | ||||||

Coloplast A/S (Denmark) (Class B Stock) | 240 | 18,743 | ||||||

CYBERDYNE, Inc. (Japan)* | 200 | 2,874 | ||||||

Danaher Corp. | 23,700 | 2,027,061 | ||||||

Essilor International SA (France) | 396 | 48,079 | ||||||

Exactech, Inc.* | 600 | 15,120 | ||||||

Getinge AB (Sweden) (Class B Stock) | 367 | 6,435 | ||||||

Halyard Health, Inc.* | 1,900 | 72,371 | ||||||

Hoya Corp. (Japan) | 800 | 38,649 | ||||||

IDEXX Laboratories, Inc.* | 1,100 | 170,071 | ||||||

LeMaitre Vascular, Inc. | 2,200 | 54,186 | ||||||

Masimo Corp.* | 2,700 | 251,802 | ||||||

Medtronic PLC | 2,100 | 169,176 | ||||||

NxStage Medical, Inc.* | 500 | 13,415 | ||||||

Olympus Corp. (Japan) | 580 | 22,386 | ||||||

OraSure Technologies, Inc.* | 4,500 | 58,185 | ||||||

Orthofix International NV* | 2,800 | 106,820 | ||||||

Smith & Nephew PLC (United Kingdom) | 1,740 | 26,493 | ||||||

Sonova Holding AG (Switzerland) | 107 | 14,843 | ||||||

SurModics, Inc.* | 1,100 | 26,455 | ||||||

Sysmex Corp. (Japan) | 300 | 18,252 | ||||||

Terumo Corp. (Japan) | 700 | 24,334 | ||||||

William Demant Holding A/S (Denmark)* | 205 | 4,284 | ||||||

|

| |||||||

| 9,776,553 | ||||||||

Health Care Providers & Services 1.8% | ||||||||

Aetna, Inc. | 4,800 | 612,240 | ||||||

Alfresa Holdings Corp. (Japan) | 400 | 6,954 | ||||||

Anthem, Inc. | 5,800 | 959,204 | ||||||

Express Scripts Holding Co.* | 26,800 | 1,766,388 | ||||||

Fresenius Medical Care AG & Co. KGaA (Germany) | 411 | 34,656 | ||||||

Fresenius SE & Co. KGaA (Germany) | 783 | 62,919 | ||||||

HCA Holdings, Inc.* | 10,900 | 969,991 | ||||||

Healthscope Ltd. (Australia) | 3,777 | 6,548 | ||||||

Humana, Inc. | 4,000 | 824,560 | ||||||

Magellan Health, Inc.* | 2,100 | 145,005 | ||||||

Mediclinic International PLC (South Africa) | 668 | 5,966 | ||||||

Medipal Holdings Corp. (Japan) | 300 | 4,714 | ||||||

Miraca Holdings, Inc. (Japan) | 100 | 4,592 | ||||||

Molina Healthcare, Inc.* | 2,300 | 104,880 | ||||||

See Notes to Financial Statements.

| Prudential Balanced Fund | 27 |

Portfolio of Investments (unaudited) (continued)

as of March 31, 2017

| Description | Shares | Value | ||||||

COMMON STOCKS (Continued) | ||||||||

Health Care Providers & Services (cont’d.) | ||||||||

National HealthCare Corp. | 900 | $ | 64,170 | |||||

Providence Service Corp. (The)* | 2,700 | 119,988 | ||||||

Ramsay Health Care Ltd. (Australia) | 265 | 14,146 | ||||||

Ryman Healthcare Ltd. (New Zealand) | 734 | 4,325 | ||||||

Select Medical Holdings Corp.* | 9,100 | 121,485 | ||||||

Sonic Healthcare Ltd. (Australia) | 739 | 12,485 | ||||||

Suzuken Co. Ltd. (Japan) | 165 | 5,422 | ||||||

UnitedHealth Group, Inc. | 20,900 | 3,427,809 | ||||||

WellCare Health Plans, Inc.* | 2,200 | 308,462 | ||||||

|

| |||||||

| 9,586,909 | ||||||||

Health Care Technology 0.1% | ||||||||

Cotiviti Holdings, Inc.*(a) | 3,700 | 154,031 | ||||||

HMS Holdings Corp.* | 7,200 | 146,376 | ||||||

M3, Inc. (Japan) | 400 | 9,969 | ||||||

|

| |||||||

| 310,376 | ||||||||

Hotels, Restaurants & Leisure 1.1% | ||||||||

Accor SA (France) | 313 | 13,019 | ||||||

Aramark | 12,300 | 453,501 | ||||||

Aristocrat Leisure Ltd. (Australia) | 1,016 | 13,946 | ||||||

Biglari Holdings, Inc.* | 110 | 47,518 | ||||||

Bloomin’ Brands, Inc. | 8,300 | 163,759 | ||||||

Bojangles’, Inc.* | 1,600 | 32,800 | ||||||

Carnival PLC | 357 | 20,462 | ||||||

Compass Group PLC (United Kingdom) | 3,141 | 59,303 | ||||||

Crown Resorts Ltd. (Australia) | 735 | 6,631 | ||||||

Domino’s Pizza Enterprises Ltd. (Australia) | 109 | 4,839 | ||||||

Extended Stay America, Inc. | 56,000 | 892,640 | ||||||

Flight Centre Travel Group Ltd. (Australia) | 85 | 1,875 | ||||||

Galaxy Entertainment Group Ltd. (Hong Kong) | 4,400 | 24,100 | ||||||

Genting Singapore PLC (Singapore) | 12,000 | 8,751 | ||||||

InterContinental Hotels Group PLC (United Kingdom) | 361 | 17,681 | ||||||

International Game Technology PLC | 16,400 | 388,680 | ||||||

Intrawest Resorts Holdings Inc* | 1,600 | 40,016 | ||||||

Marcus Corp. (The) | 1,000 | 32,100 | ||||||

McDonald’s Corp. | 21,868 | 2,834,311 | ||||||

McDonald’s Holdings Co. Japan Ltd. (Japan) | 100 | 2,920 | ||||||

Melco Crown Entertainment Ltd. (Hong Kong), ADR | 338 | 6,267 | ||||||

Merlin Entertainments PLC (United Kingdom), 144A | 1,367 | 8,217 | ||||||

MGM China Holdings Ltd. (Macau) | 1,600 | 3,336 | ||||||

Monarch Casino & Resort, Inc.* | 500 | 14,770 | ||||||

See Notes to Financial Statements.

| 28 |

| Description | Shares | Value | ||||||

COMMON STOCKS (Continued) | ||||||||

Hotels, Restaurants & Leisure (cont’d.) | ||||||||

Oriental Land Co. Ltd. (Japan) | 400 | $ | 22,994 | |||||

Paddy Power Betfair PLC (Ireland) | 163 | 17,528 | ||||||

Papa John’s International, Inc. | 800 | 64,032 | ||||||

Ruth’s Hospitality Group, Inc. | 7,000 | 140,350 | ||||||

Sands China Ltd. (Hong Kong) | 4,800 | 22,251 | ||||||

Shangri-La Asia Ltd. (Hong Kong) | 2,000 | 2,912 | ||||||

SJM Holdings Ltd. (Hong Kong) | 3,000 | 2,442 | ||||||

Sodexo SA (France) | 172 | 20,209 | ||||||

Tabcorp Holdings Ltd. (Australia) | 1,794 | 6,510 | ||||||

Tatts Group Ltd. (Australia) | 2,841 | 9,613 | ||||||

Texas Roadhouse, Inc. | 4,200 | 187,026 | ||||||

TUI AG (Germany) | 965 | 13,364 | ||||||

Whitbread PLC (United Kingdom) | 368 | 18,260 | ||||||

William Hill PLC (United Kingdom) | 1,603 | 5,846 | ||||||

Wynn Macau Ltd. (Macau) | 2,900 | 5,907 | ||||||

|

| |||||||

| 5,630,686 | ||||||||

Household Durables 0.7% | ||||||||

Barratt Developments PLC (United Kingdom) | 1,880 | 12,878 | ||||||

Berkeley Group Holdings PLC (United Kingdom) | 279 | 11,219 | ||||||

Casio Computer Co. Ltd. (Japan) | 400 | 5,577 | ||||||

Century Communities, Inc.* | 1,600 | 40,640 | ||||||

D.R. Horton, Inc. | 49,000 | 1,632,190 | ||||||

Electrolux AB (Sweden) Series B | 444 | 12,326 | ||||||

Flexsteel Industries, Inc. | 900 | 45,360 | ||||||

Husqvarna AB (Sweden) (Class B Stock) | 847 | 7,426 | ||||||

Iida Group Holdings Co. Ltd. (Japan) | 300 | 4,617 | ||||||

La-Z-Boy, Inc. (Class Z Stock) | 5,200 | 140,400 | ||||||

Lennar Corp. (Class A Stock) | 2,600 | 133,094 | ||||||

NACCO Industries, Inc. (Class A Stock) | 400 | 27,920 | ||||||

Nikon Corp. (Japan) | 700 | 10,172 | ||||||

NVR, Inc.* | 640 | 1,348,403 | ||||||

Panasonic Corp. (Japan) | 4,200 | 47,532 | ||||||

Persimmon PLC (United Kingdom) | 597 | 15,663 | ||||||

Rinnai Corp. (Japan) | 70 | 5,576 | ||||||

SEB SA (France) | 43 | 6,006 | ||||||

Sekisui Chemical Co. Ltd. (Japan) | 800 | 13,487 | ||||||

Sekisui House Ltd. (Japan) | 1,200 | 19,787 | ||||||

Sharp Corp. (Japan)* | 2,800 | 11,779 | ||||||

Sony Corp. (Japan) | 2,400 | 80,996 | ||||||

Taylor Morrison Home Corp. (Class A Stock)* | 6,100 | 130,052 | ||||||

Taylor Wimpey PLC (United Kingdom) | 6,355 | 15,371 | ||||||

Techtronic Industries Co. Ltd. (Hong Kong) | 2,500 | 10,121 | ||||||

|

| |||||||

| 3,788,592 | ||||||||

See Notes to Financial Statements.

| Prudential Balanced Fund | 29 |

Portfolio of Investments (unaudited) (continued)

as of March 31, 2017

| Description | Shares | Value | ||||||

COMMON STOCKS (Continued) | ||||||||

Household Products 1.0% | ||||||||

Central Garden & Pet Co. (Class A Stock)* | 1,200 | $ | 41,664 | |||||

Clorox Co. (The) | 5,200 | 701,116 | ||||||

Henkel AG & Co. KGaA (Germany) | 203 | 22,575 | ||||||

Kimberly-Clark Corp. | 15,100 | 1,987,613 | ||||||

Lion Corp. (Japan) | 300 | 5,407 | ||||||

Procter & Gamble Co. (The) | 24,375 | 2,190,094 | ||||||

Reckitt Benckiser Group PLC (United Kingdom) | 1,207 | 110,189 | ||||||

Svenska Cellulosa AB SCA (Sweden) (Class B Stock) | 1,171 | 37,737 | ||||||

Unicharm Corp. (Japan) | 800 | 19,226 | ||||||

|

| |||||||

| 5,115,621 | ||||||||

Independent Power & Renewable Electricity Producers 0.3% | ||||||||

AES Corp. | 80,900 | 904,462 | ||||||

Atlantica Yield PLC (Spain) | 7,200 | 150,912 | ||||||

Electric Power Development Co. Ltd. (Japan) | 300 | 7,050 | ||||||

Meridian Energy Ltd. (New Zealand) | 2,404 | 4,717 | ||||||

NRG Energy, Inc. | 42,700 | 798,490 | ||||||

|

| |||||||

| 1,865,631 | ||||||||

Industrial Conglomerates 0.9% | ||||||||

3M Co. | 7,900 | 1,511,507 | ||||||

Carlisle Cos., Inc. | 5,300 | 563,973 | ||||||

CK Hutchison Holdings Ltd. (Hong Kong) | 5,357 | 65,955 | ||||||

DCC PLC (United Kingdom) | 177 | 15,582 | ||||||

General Electric Co. | 25,670 | 764,966 | ||||||

Honeywell International, Inc. | 13,700 | 1,710,719 | ||||||

Jardine Matheson Holdings Ltd. (Hong Kong) | 500 | 32,125 | ||||||

Jardine Strategic Holdings Ltd. (Hong Kong) | 400 | 16,800 | ||||||

Keihan Holdings Co. Ltd. (Japan) | 1,000 | 6,126 | ||||||

Keppel Corp. Ltd. (Singapore) | 2,700 | 13,393 | ||||||

Koninklijke Philips NV (Netherlands) | 1,810 | 58,145 | ||||||

NWS Holdings Ltd. (Hong Kong) | 2,900 | 5,295 | ||||||

Seibu Holdings, Inc. (Japan) | 300 | 4,962 | ||||||

Sembcorp Industries Ltd. (Singapore) | 2,300 | 5,227 | ||||||

Siemens AG (Germany) | 1,469 | 201,213 | ||||||

Smiths Group PLC (United Kingdom) | 732 | 14,873 | ||||||

Toshiba Corp. (Japan)* | 7,700 | 16,597 | ||||||

|

| |||||||

| 5,007,458 | ||||||||

Insurance 1.3% | ||||||||

Admiral Group PLC (United Kingdom) | 440 | 10,963 | ||||||

Aegon NV (Netherlands) | 3,452 | 17,584 | ||||||

See Notes to Financial Statements.

| 30 |

| Description | Shares | Value | ||||||

COMMON STOCKS (Continued) | ||||||||

Insurance (cont’d.) | ||||||||

Aflac, Inc. | 13,200 | $ | 955,944 | |||||

Ageas (Belgium) | 374 | 14,605 | ||||||

AIA Group Ltd. (Hong Kong) | 23,100 | 145,806 | ||||||

Allianz SE (Germany) | 878 | 162,822 | ||||||

Allstate Corp. (The) | 22,900 | 1,866,121 | ||||||

American Equity Investment Life Holding Co. | 8,600 | 203,218 | ||||||

American Financial Group, Inc. | 1,300 | 124,046 | ||||||

Assicurazioni Generali SpA (Italy) | 2,195 | 34,826 | ||||||

Aviva PLC (United Kingdom) | 7,892 | 52,664 | ||||||

AXA SA (France) | 3,700 | 95,593 | ||||||

Baldwin & Lyons, Inc. (Class B Stock) | 1,200 | 29,340 | ||||||

Baloise Holding AG (Switzerland) | 105 | 14,428 | ||||||

CNP Assurances (France) | 354 | 7,199 | ||||||

Dai-ichi Life Holdings, Inc. (Japan) | 2,027 | 36,282 | ||||||

Direct Line Insurance Group PLC (United Kingdom) | 2,579 | 11,221 | ||||||

FBL Financial Group, Inc. (Class A Stock) | 700 | 45,815 | ||||||

Genworth Financial, Inc. (Class A Stock)* | 24,000 | 98,880 | ||||||

Gjensidige Forsikring ASA (Norway) | 423 | 6,444 | ||||||

Hannover Rueck SE (Germany) | 113 | 13,021 | ||||||

Hanover Insurance Group, Inc. (The) | 1,000 | 90,060 | ||||||

Insurance Australia Group Ltd. (Australia) | 4,536 | 20,959 | ||||||

Japan Post Holdings Co. Ltd. (Japan) | 900 | 11,318 | ||||||

Kinsale Capital Group, Inc. | 1,800 | 57,672 | ||||||

Legal & General Group PLC (United Kingdom) | 11,160 | 34,556 | ||||||

Mapfre SA (Spain) | 2,259 | 7,737 | ||||||

Medibank Pvt Ltd. (Australia) | 5,681 | 12,236 | ||||||

MetLife, Inc. | 2,600 | 137,332 | ||||||

MS&AD Insurance Group Holdings, Inc. (Japan) | 990 | 31,621 | ||||||

Muenchener Rueckversicherungs-Gesellschaft AG (Germany) | 308 | 60,292 | ||||||

National General Holdings Corp. | 4,000 | 95,040 | ||||||

National Western Life Group, Inc. (Class A Stock) | 80 | 24,333 | ||||||

NN Group NV (Netherlands) | 594 | 19,292 | ||||||

Old Mutual PLC (United Kingdom) | 9,643 | 24,268 | ||||||

Poste Italiane SpA (Italy), RegS, 144A | 927 | 6,175 | ||||||

Progressive Corp. (The) | 14,200 | 556,356 | ||||||

Prudential PLC (United Kingdom) | 4,969 | 104,962 | ||||||

QBE Insurance Group Ltd. (Australia) | 2,677 | 26,355 | ||||||

RSA Insurance Group PLC (United Kingdom) | 1,969 | 14,460 | ||||||

Sampo OYJ (Finland) (Class A Stock) | 861 | 40,855 | ||||||

SCOR SE (France) | 317 | 11,980 | ||||||

Selective Insurance Group, Inc. | 200 | 9,430 | ||||||

Sompo Holdings, Inc. (Japan) | 675 | 24,798 | ||||||

Sony Financial Holdings, Inc. (Japan) | 300 | 4,818 | ||||||

See Notes to Financial Statements.

| Prudential Balanced Fund | 31 |

Portfolio of Investments (unaudited) (continued)

as of March 31, 2017

| Description | Shares | Value | ||||||

COMMON STOCKS (Continued) | ||||||||

Insurance (cont’d.) | ||||||||

St. James’s Place PLC (United Kingdom) | 964 | $ | 12,832 | |||||

Standard Life PLC (United Kingdom) | 3,958 | 17,599 | ||||||

Suncorp Group Ltd. (Australia) | 2,483 | 25,057 | ||||||

Swiss Life Holding AG (Switzerland)* | 60 | 19,348 | ||||||

Swiss Re AG (Switzerland) | 626 | 56,225 | ||||||

T&D Holdings, Inc. (Japan) | 1,100 | 15,944 | ||||||

Tokio Marine Holdings, Inc. (Japan) | 1,300 | 54,944 | ||||||

Tryg A/S (Denmark) | 267 | 4,841 | ||||||

UnipolSai Assicurazioni SpA (Italy) | 2,596 | 5,734 | ||||||

Unum Group | 31,900 | 1,495,791 | ||||||

Zurich Insurance Group AG (Switzerland) | 287 | 76,589 | ||||||

|

| |||||||

| 7,158,631 | ||||||||

Internet & Direct Marketing Retail 1.0% | ||||||||

1-800-Flowers.com, Inc. (Class A Stock)* | 2,200 | 22,440 | ||||||

Amazon.com, Inc.* | 2,500 | 2,216,350 | ||||||

FTD Cos., Inc.* | 4,300 | 86,602 | ||||||

HSN, Inc. | 900 | 33,390 | ||||||

Liberty Interactive Corp. QVC Group (Class A Stock)* | 14,900 | 298,298 | ||||||

Liberty TripAdvisor Holdings, Inc. (Class A Stock)* | 3,000 | 42,300 | ||||||

Netflix, Inc.* | 16,200 | 2,394,522 | ||||||

Nutrisystem, Inc. | 2,900 | 160,950 | ||||||

Rakuten, Inc. (Japan) | 1,910 | 19,191 | ||||||

Start Today Co. Ltd. (Japan) | 300 | 6,667 | ||||||

Zalando SE (Germany), RegS, 144A* | 157 | 6,346 | ||||||

|

| |||||||

| 5,287,056 | ||||||||

Internet Software & Services 2.8% | ||||||||

Alphabet, Inc. (Class A Stock)* | 4,000 | 3,391,200 | ||||||

Alphabet, Inc. (Class C Stock)* | 5,615 | 4,657,979 | ||||||

Auto Trader Group PLC (United Kingdom), RegS, 144A | 1,777 | 8,721 | ||||||

Bankrate, Inc.* | 12,200 | 117,730 | ||||||

Bazaarvoice, Inc.* | 3,700 | 15,910 | ||||||

Blucora, Inc.* | 3,200 | 55,360 | ||||||

DeNa Co. Ltd. (Japan) | 200 | 4,072 | ||||||

Endurance International Group Holdings, Inc.* | 16,500 | 129,525 | ||||||

Facebook, Inc. (Class A Stock)* | 42,600 | 6,051,330 | ||||||

Kakaku.com, Inc. (Japan) | 300 | 4,096 | ||||||

LogMeIn, Inc. | 1,000 | 97,500 | ||||||

Mixi, Inc. (Japan) | 100 | 4,837 | ||||||

NIC, Inc. | 5,600 | 113,120 | ||||||

RetailMeNot, Inc.* | 5,400 | 43,740 | ||||||

See Notes to Financial Statements.

| 32 |

| Description | Shares | Value | ||||||

COMMON STOCKS (Continued) | ||||||||