UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811- 07343 |

| |

| Exact name of registrant as specified in charter: | | The Prudential Investment Portfolios, Inc. |

| |

| Address of principal executive offices: | | 655 Broad Street, 17th Floor |

| | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Andrew R. French |

| | 655 Broad Street, 17th Floor |

| | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

| Date of fiscal year end: | | 9/30/2019 |

| |

| Date of reporting period: | | 9/30/2019 |

Item 1 – Reports to Stockholders

PGIM BALANCED FUND

ANNUAL REPORT

SEPTEMBER 30, 2019

COMING SOON: PAPERLESS SHAREHOLDER REPORTS

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s annual and semiannual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website (pgiminvestments.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 1-800-225-1852 or by sending an email request to PGIM Investments at shareholderreports@pgim.com.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary or follow instructions included with this notice to elect to continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can call 1-800-225-1852 or send an email request to shareholderreports@pgim.com to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held with the fund complex if you invest directly with the Fund.

To enroll in e-delivery, go to pgiminvestments.com/edelivery

|

| Objective:Income and long-term growth of capital |

Highlights(unaudited)

| • | | The segment of the Fund invested in bonds outperformed the Bloomberg Barclays US Aggregate Bond Index by 0.25% during the reporting period. |

| • | | Sector allocation within the fixed income portion of the Fund was a strong contributor to performance, highlighted by overweights in commercial mortgage-backed securities, collateralized loan obligations, and emerging market bonds. |

| • | | The equity segment of the Fund underperformed the blended equity benchmark by 3.81% during the period. |

| • | | Within the equity segment of the Fund, relatively expensive stocks outperformed their cheaper counterparts, detracting from performance. Overweighting companies with better growth prospects and higher-quality financial metrics also detracted within large-capitalization stocks. |

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

Mutual funds are distributed by Prudential Investment Management Services LLC, a Prudential Financial company and member SIPC. PGIM Fixed Income is a unit of PGIM, Inc. (PGIM), a registered investment adviser and Prudential Financial company. QMA is the primary business name of QMA LLC, a wholly owned subsidiary of PGIM.© 2019 Prudential Financial, Inc. and its related entities. PGIM and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

| | |

| 2 | | Visit our website at pgiminvestments.com |

Table of Contents

This Page Intentionally Left Blank

Letter from the President

Dear Shareholder:

We hope you find the annual report for the PGIM Balanced Fund informative and useful. The report covers performance for the12-month period that ended September 30, 2019.

While the US economy remained healthy, with rising corporate profits and strong job growth, the Federal Reserve cut interest rates late in the period for the first time since the Great Recession more than a decade ago. After nine rate increases in

recent years, the cut was a proactive attempt by the Fed to extend the longest domestic economic expansion on record as growth in many other regions weakened. China in particular showed signs of slowing amid trade tensions with the US, and turmoil in the United Kingdom continued as it negotiated an exit from the European Union.

Despite the growing US economy, volatility returned to the equity markets during the period. After corporate tax cuts and regulatory reforms helped boost US stocks early in the period, equities declined significantly at the end of 2018 on concerns about China’s economy, a potential global trade war, higher interest rates, and worries that profit growth might slow. Stocks reversed course early in 2019, rising sharply after the Fed moderated its position on additional rate hikes for the remainder of the year. For the period overall,large-cap US equities rose whilesmall-cap US stocks fell. Stocks also declined in developed foreign and emerging markets.

The overall US bond market posted strong returns during the period on a significant rally in interest rates that saw the10-year US Treasury yield decline from around 3% to 2%. Investment grade corporate bonds led the way with a double-digit gain, while corporate high yield and municipal bonds each had a high single-digit return. Globally, bonds in developed markets delivered solid returns, while emerging markets debt also posted positive results. A continuing trend during the period was the inversion of a portion of the US Treasury yield curve, as the yield on certain shorter maturities exceeded the yield on the10-year bond.

Regarding your investments with PGIM, we believe it is important to maintain a diversified portfolio of funds consistent with your tolerance for risk, time horizon, and financial goals. Your financial advisor can help you create a diversified investment plan that may include funds covering all the basic asset classes and that reflects your personal investor profile and risk tolerance. However, diversification and asset allocation strategies do not assure a profit or protect against loss in declining markets.

At PGIM Investments, we consider it a great privilege and responsibility to help investors participate in opportunities across global markets while meeting their toughest investment challenges. PGIM is atop-10 global investment manager with more than $1 trillion in assets under management. This scale and investment expertise allow us to deliver actively managed funds and strategies to meet the needs of investors around the globe.

Thank you for choosing our family of funds.

Sincerely,

Stuart S. Parker, President

PGIM Balanced Fund

November 15, 2019

Your Fund’s Performance(unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website atpgiminvestments.com or by calling (800) 225-1852.

| | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns as of 9/30/19 (with sales charges) | |

| | | One Year (%) | | Five Years (%) | | | Ten Years (%) | | | Since Inception (%) | |

| Class A | | –1.05 | | | 5.66 | | | | 8.39 | | | | — | |

| Class B | | –3.46 | | | 5.36 | | | | 7.95 | | | | — | |

| Class C | | 0.67 | | | 5.62 | | | | 8.00 | | | | — | |

| Class R | | 2.04 | | | 6.07 | | | | 8.49 | | | | — | |

| Class Z | | 2.59 | | | 6.66 | | | | 9.08 | | | | — | |

| Class R6 | | 2.69 | | | N/A | | | | N/A | | | | 4.77 (11/28/17) | |

| Customized Blend Index | |

| | 6.12 | | | 7.52 | | | | 9.11 | | | | — | |

| Bloomberg Barclays US Aggregate Bond Index | |

| | 10.30 | | | 3.38 | | | | 3.75 | | | | — | |

| S&P 500 Index | |

| | | 4.25 | | | 10.83 | | | | 13.23 | | | | — | |

| | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns as of 9/30/19 (without sales charges) | |

| | | One Year (%) | | Five Years (%) | | | Ten Years (%) | | | Since Inception (%) | |

| Class A | | 2.28 | | | 6.36 | | | | 8.75 | | | | — | |

| Class B | | 1.31 | | | 5.51 | | | | 7.95 | | | | — | |

| Class C | | 1.62 | | | 5.62 | | | | 8.00 | | | | — | |

| Class R | | 2.04 | | | 6.07 | | | | 8.49 | | | | — | |

| Class Z | | 2.59 | | | 6.66 | | | | 9.08 | | | | — | |

| Class R6 | | 2.69 | | | N/A | | | | N/A | | | | 4.77 (11/28/17) | |

| Customized Blend Index | | | | | | | | | | | | | | |

| | 6.12 | | | 7.52 | | | | 9.11 | | | | — | |

| Bloomberg Barclays US Aggregate Bond Index | |

| | 10.30 | | | 3.38 | | | | 3.75 | | | | — | |

| S&P 500 Index | | | | | | | | | | | | | | |

| | | 4.25 | | | 10.83 | | | | 13.23 | | | | — | |

| | |

| 6 | | Visit our website at pgiminvestments.com |

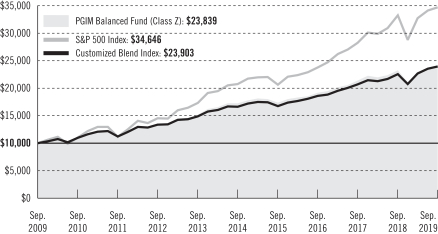

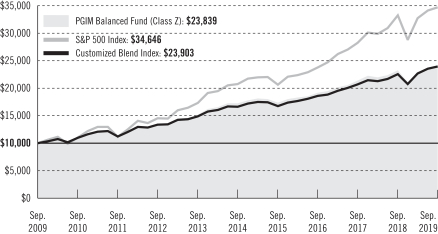

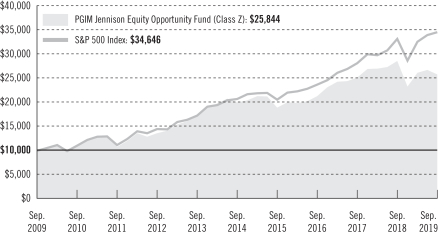

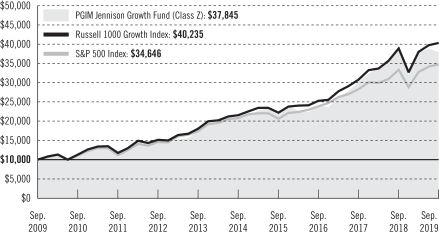

Growth of a $10,000 Investment(unaudited)

The graph compares a $10,000 investment in the Fund’s Class Z shares with a similar investment in the Customized Blend Index and the S&P 500 Index by portraying the initial account values at the beginning of the 10-year period (September 30, 2009) and the account values at the end of the current fiscal year (September 30, 2019) as measured on a quarterly basis. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted; and (b) all dividends and distributions were reinvested. The line graph provides information for Class Z shares only. As indicated in the tables provided earlier, performance for other share classes will vary due to the differing charges and expenses applicable to each share class (as indicated in the following paragraphs). Without waiver of fees and/or expense reimbursement, if any, the Fund’s returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graphs include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

Source: PGIM Investments LLC and Lipper Inc.

Since Inception returns are provided for any share class with less than 10 fiscal years of returns. Since Inception returns for the Indexes are measured from the closest month-end to the class’ inception date.

Your Fund’s Performance(continued)

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. The average annual total returns take into account applicable sales charges, which are described for each share class in the table below.

| | | | | | | | | | | | |

| | | | | | | |

| | | Class A | | Class B* | | Class C | | Class R | | Class Z | | Class R6 |

| Maximum initial sales charge | | 3.25% of the public offering price (5.50% of the public offering price for purchases prior to July 15, 2019) | | None | | None | | None | | None | | None |

Contingent deferred sales charge (CDSC) (as a percentage of the lower of the original purchase price or the net asset value at redemption) | | 1.00% on sales of $500,000 or more made within 12 months of purchase (1.00% on sales of $1 million or more made within 12 months of purchase for purchases prior to July 15, 2019) | | 5.00% (Yr. 1) 4.00% (Yr. 2) 3.00% (Yr. 3) 2.00% (Yr. 4) 1.00% (Yr. 5) 1.00% (Yr. 6) 0.00% (Yr. 7) | | 1.00% on sales made within 12 months of purchase | | None | | None | | None |

| Annual distribution and service (12b-1) fees (shown as a percentage of average daily net assets) | | 0.30% | | 1.00% | | 1.00% | | 0.75% (0.50% currently) | | None | | None |

*Class B shares are closed to all purchase activity and no additional Class B shares may be purchased or acquired except by exchange from Class B shares of another Fund or through dividend or capital gains reinvestment.

Benchmark Definitions

Customized Blend Index—The Customized Blend Index is a model portfolio consisting of the S&P 500 Index (50%), the Bloomberg Barclays US Aggregate Bond Index (40%), the Russell 2000 Index (5%), and the Morgan Stanley Capital International Europe, Australasia, and Far East Net Dividend (MSCI EAFE ND) Index

| | |

| 8 | | Visit our website at pgiminvestments.com |

(5%). The Net Dividend (ND) version of the MSCI EAFE Index reflects the impact of the maximum withholding taxes on reinvested dividends. Each component of the Customized Blend Index is an unmanaged index generally considered to represent the performance of its asset class. The Customized Blend Index is intended to provide a theoretical comparison to the Fund’s performance based on the amounts allocated to each class under the Fund’s investment strategies. The average annual total return for the Index measured from the month-end closest to the inception date of the Fund’s Class R6 shares is 6.59%.

Bloomberg Barclays US Aggregate Bond Index—The Bloomberg Barclays US Aggregate Bond Index is unmanaged and represents securities that are SEC-registered, taxable, and dollar denominated. It covers the US investment-grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. Index returns do not include the effect of any sales charges, mutual fund operating expenses or taxes. These returns would be lower if they included the effect of these expenses. The average annual total return for the Index measured from the month-end closest to the inception date of the Fund’s Class R6 shares is 4.83%.

S&P 500 Index—The S&P 500 Index is an unmanaged index of over 500 stocks of large US public companies. It gives a broad look at how stock prices in the United States have performed. The average annual total return for the Index measured from the month-end closest to the inception date of the Fund’s Class R6 shares is 8.71%.

Investors cannot invest directly in an index or average. The returns for the Indexes would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes.

Presentation of Fund Holdingsas of 9/30/19

| | | | |

| Ten Largest Holdings | | Line of Business | | % of Net Assets |

| Microsoft Corp. | | Software | | 2.5% |

| Apple, Inc. | | Technology Hardware, Storage & Peripherals | | 2.3% |

Federal National Mortgage Assoc.,

3.000%, TBA | | US Government Agency Obligations | | 1.4% |

| Facebook, Inc. (Class A Stock) | | Interactive Media & Services | | 1.2% |

| Amazon.com, Inc. | | Internet & Direct Marketing Retail | | 1.0% |

| Visa, Inc. (Class A Stock) | | IT Services | | 0.9% |

| Alphabet, Inc. (Class C Stock) | | Interactive Media & Services | | 0.8% |

| Procter & Gamble Co. (The) | | Household Products | | 0.8% |

| Alphabet, Inc. (Class A Stock) | | Interactive Media & Services | | 0.8% |

| Verizon Communications, Inc. | | Diversified Telecommunication Services | | 0.8% |

For a complete list of holdings, please refer to the Schedule of Investments section of this report. Holdings reflect only long-term investments.

Strategy and Performance Overview(unaudited)

How did the Fund perform?

ThePGIM Balanced Fund’s Class Z shares returned 2.59% in the 12-month reporting period that ended September 30, 2019, underperforming the 6.12% return of the Customized Blend Index (the Index).

What were the market conditions?

| • | | During the reporting period, markets fluctuated throughout geopolitical tensions, a slowdown in global growth, and eventually concerted global monetary easing as an antidote to these challenges. Against this backdrop, equities underperformed perceived safe-haven bonds, with the broad-based S&P 500 Index returning 4.25% during the period and the Bloomberg Barclays US Aggregate Bond Index returning 10.30%. |

| • | | US equity markets experienced a major correction in the fourth quarter of 2018. The Federal Reserve’s (the Fed’s) persistent interest rate tightening, which began in late 2016, sparked fears of a policy mistake amid weakening global growth and the escalation of US-China trade tensions. |

| • | | The markets then staged a sharp “relief rally” in the first four months of 2019 after an abrupt dovish pivot by the Fed and progress on trade relations. Following its January meeting, the Fed signaled a new “patient” stance (i.e., an intention to put interest rate rises on hold). Meanwhile, the US and China commenced trade talks, which appeared to be progressing smoothly. |

| • | | The rally was cut short in March when the US yield curve inverted. A yield curve inversion occurs when yields on short-term US Treasuries rise above yields on long-term Treasuries. Such an inversion has preceded past recessions, and its occurrence earlier this year triggered investors’ fears and remained at the epicenter of debates over the looming end of the US business cycle. |

| • | | In May 2019, investors learned of a breakdown in the US-China trade talks. It soon became apparent that this was not a mere hiccup on a path to a resolution but rather a standoff of two major geopolitical rivals. Equity markets retreated as retaliatory rounds of tariffs followed swiftly on both the US and China side. |

| • | | Beyond US-China trade tensions, other global risks flared, including Brexit uncertainty, violent protests in Hong Kong over the legitimacy of a controversial extradition law, and growing tension in the Middle East, underscored by attacks on the Saudi oil fields. |

| • | | The trade war and a wave of tariffs had an adverse effect on global growth via a slowdown in global trade flows, increases in uncertainty, and reduction in global demand for manufactured goods. Europe, Japan, and emerging markets showed clear signs of economic slowing. While tariffs did not significantly reduce US economic growth during the period, they did catalyze investors’ fears about a possible slowdown in the US. |

| | |

| 10 | | Visit our website at pgiminvestments.com |

| • | | US growth remained on solid footing, with gross domestic product (GDP) growth in excess of 2% in the first half of 2019. While signs of a slowdown appeared in manufacturing, the sector most exposed to global trade, the economy continued to be powered by a buoyant consumer, whose confidence was underpinned by the resiliency of the US job market. |

| • | | Geopolitical instability and mounting risks to global growth caused central banks around the globe to ease their monetary policies. The Fed cut rates twice during the reporting period as insurance against disruptions sparked by the US-China standoff, while the European Central Bank launched a new round of easing measures. Meanwhile, China continued stimulating its economy, with many emerging-market central banks following suit. |

| • | | The remainder of the period was characterized by sharp rallies and pullbacks as global markets were caught in the crosscurrents of monetary easing and the adverse effects of geopolitical instability. |

| • | | All the geopolitical and economic uncertainty initiated a rally in safe-haven assets, such as government bonds. US 10-year Treasury yields dipped from about 3% to under 2% during the period, pulled down by a global search for yield. The interest rate differential between the US and the rest of the world widened, resulting in further appreciation of the US dollar. |

| • | | The US economy outperformed the rest of the world during the period due to its resilient growth and an accommodating Fed. US large-cap stocks fared better than their small-cap peers, which tend to underperform in the late-cycle environment due to rising costs and margin pressures. |

What worked?

| • | | The segment of the Fund invested in bonds outperformed the Bloomberg Barclays US Aggregate Bond Index by 0.25% during the reporting period. |

| • | | Sector allocation within the fixed income portion of the Fund was a strong contributor to performance, highlighted by overweights in commercial mortgage-backed securities (CMBS), collateralized loan obligations (CLOs), and emerging market bonds. |

| • | | Although security selection within the fixed income segment of the Fund detracted from performance, selection of asset-backed securities, CMBS, and emerging market bonds contributed positively. |

| • | | Within the fixed income portion of the Fund, duration and yield curve positioning added to performance. Duration measures the sensitivity of the price (the value of principal) of a bond to a change in interest rates. |

| • | | Among quantitative factors, quality and growth contributed to favorable stock selection within small-capitalization stocks. Stock selection was strongest in the energy sector. |

Strategy and Performance Overview(continued)

What didn’t work?

| • | | The equity segment of the Fund underperformed the blended equity benchmark by 3.81% during the period. |

| • | | Within the equity segment of the Fund, relatively expensive stocks outperformed their cheaper counterparts, detracting from performance. Overweighting companies with better growth prospects and higher-quality financial metrics also detracted within large-capitalization stocks. |

| • | | Asset allocation detracted from the Fund’s performance during the period, led by a general overweight in equities, which significantly underperformed bonds during the period. |

| • | | Security selection overall among bonds hampered results, with negative positioning in Treasury securities, swaps, and CLOs. |

Did the Fund use derivatives and, if so, how did they affect performance?

| • | | The Fund utilized S&P 500 equity futures to equitize cash positions and for liquidity purposes. This exposure had a small positive impact on the Fund’s performance. |

| • | | The US equity sleeves did not hold any derivatives. The international equity sleeve held stock index futures, including Topix (Tokyo Stock Index) futures, DJ Euro Stoxx futures, FTSE 100 futures, and MSCI EAFE mini futures. These derivatives were used to maintain exposure to equities and provide portfolio liquidity. The futures had minimal impact on performance. |

| • | | The fixed income sleeve of the Fund uses derivatives when they facilitate implementation of the overall investment approach. During the reporting period, the Fund used interest rate futures, options, and swaps to help manage duration positioning and yield curve exposure. Over the period, futures and swaps hurt performance, while options had a negligible impact. In addition, the Fund traded foreign exchange derivatives, which also had a minimal impact on performance during the period. |

Current outlook

| • | | Global economic growth continues to be weak, buffeted by powerful crosscurrents of the US-China trade war on one hand and global monetary easing on the other. |

| • | | The trade standoff has taken a toll on business confidence, industrial production, and trade flows. It also has weighed heavily on global manufacturing and hit export-oriented economies—including China, Europe, and Japan—the hardest. |

| • | | Powered by a healthy consumer, US growth remains resilient while eurozone growth is anemic, with Germany and Italy teetering on the edge of recession. Brexit uncertainty is finally catching up with the UK economy, which contracted in the second quarter of 2019. Japanese growth is decent, but risks are tilted to the downside given weak global growth, yen appreciation, and a pending consumer tax hike. |

| | |

| 12 | | Visit our website at pgiminvestments.com |

| • | | The greatest threat to the global economy is an escalation of the trade war, which would lead to an even deeper downturn in global manufacturing. This could progressively weaken the more healthy components of the global economy, namely the services sector and the US consumer. |

| • | | Given this backdrop, the Fund’s portfolio managers see the potential for significant market swings between now and year-end. Accordingly, the managers plan to stay close to the Fund’s policy benchmark and maintain a shorter-than-normal investment horizon in order to quickly reposition the Fund’s portfolios. |

| • | | For now, the Fund is maintaining only a slight overweight to global equities relative to fixed income. Within equities, the portfolio is tilted toward the US and away from international developed markets, given the clear relative growth advantage of the US. |

Fees and Expenses(unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 held through the six-month period ended September 30, 2019. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to individual retirement accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of PGIM funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses paid over the period

| | |

| 14 | | Visit our website at pgiminvestments.com |

and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information provided in the expense table. Additional fees have the effect of reducing investment returns.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | |

| | | | |

PGIM

Balanced Fund | | Beginning Account

Value

April 1, 2019 | | | Ending Account

Value

September 30, 2019 | | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the

Six-Month Period* | |

| Class A | | Actual | | $ | 1,000.00 | | | $ | 1,038.80 | | | | 1.00 | % | | $ | 5.11 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,020.05 | | | | 1.00 | % | | $ | 5.06 | |

| Class B | | Actual | | $ | 1,000.00 | | | $ | 1,034.00 | | | | 1.95 | % | | $ | 9.94 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,015.29 | | | | 1.95 | % | | $ | 9.85 | |

| Class C | | Actual | | $ | 1,000.00 | | | $ | 1,035.30 | | | | 1.71 | % | | $ | 8.72 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,016.50 | | | | 1.71 | % | | $ | 8.64 | |

| Class R | | Actual | | $ | 1,000.00 | | | $ | 1,039.10 | | | | 1.26 | % | | $ | 6.44 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,018.75 | | | | 1.26 | % | | $ | 6.38 | |

| Class Z | | Actual | | $ | 1,000.00 | | | $ | 1,039.80 | | | | 0.73 | % | | $ | 3.73 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,021.41 | | | | 0.73 | % | | $ | 3.70 | |

| Class R6 | | Actual | | $ | 1,000.00 | | | $ | 1,041.00 | | | | 0.65 | % | | $ | 3.33 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,021.81 | | | | 0.65 | % | | $ | 3.29 | |

*Fund expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 183 days in the six-month period ended September 30, 2019, and divided by the 365 days in the Fund’s fiscal year ended September 30, 2019 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

Schedule of Investments

as of September 30, 2019

| | | | | | | | |

| Description | | Shares | | | Value | |

LONG-TERM INVESTMENTS 98.7% | | | | | | | | |

| | |

COMMON STOCKS 60.6% | | | | | | | | |

| | |

Aerospace & Defense 1.9% | | | | | | | | |

Aerojet Rocketdyne Holdings, Inc.* | | | 1,806 | | | $ | 91,221 | |

Airbus SE (France) | | | 1,894 | | | | 245,896 | |

Arconic, Inc. | | | 119,382 | | | | 3,103,932 | |

BAE Systems PLC (United Kingdom) | | | 10,227 | | | | 71,530 | |

Dassault Aviation SA (France) | | | 8 | | | | 11,344 | |

Elbit Systems Ltd. (Israel) | | | 76 | | | | 12,594 | |

General Dynamics Corp. | | | 17,110 | | | | 3,126,510 | |

Leonardo SpA (Italy) | | | 1,303 | | | | 15,346 | |

Lockheed Martin Corp. | | | 11,137 | | | | 4,344,098 | |

Meggitt PLC (United Kingdom) | | | 2,491 | | | | 19,358 | |

Moog, Inc. (Class A Stock) | | | 1,052 | | | | 85,338 | |

MTU Aero Engines AG (Germany) | | | 166 | | | | 44,179 | |

Northrop Grumman Corp. | | | 1,000 | | | | 374,790 | |

Rolls-Royce Holdings PLC (United Kingdom)* | | | 5,504 | | | | 53,485 | |

Safran SA (France) | | | 1,052 | | | | 165,647 | |

Singapore Technologies Engineering Ltd. (Singapore) | | | 5,100 | | | | 14,172 | |

Spirit AeroSystems Holdings, Inc. (Class A Stock) | | | 10,849 | | | | 892,222 | |

Thales SA (France) | | | 342 | | | | 39,338 | |

United Technologies Corp. | | | 32,817 | | | | 4,480,177 | |

Vectrus, Inc.* | | | 5,300 | | | | 215,445 | |

| | | | | | | | |

| | | | | | | 17,406,622 | |

| | |

Air Freight & Logistics 0.1% | | | | | | | | |

Bollore SA (France) | | | 2,857 | | | | 11,837 | |

Deutsche Post AG (Germany) | | | 3,190 | | | | 106,582 | |

DSV A/S (Denmark) | | | 707 | | | | 67,251 | |

Hub Group, Inc. (Class A Stock)* | | | 6,669 | | | | 310,108 | |

Radiant Logistics, Inc.* | | | 16,519 | | | | 85,403 | |

SG Holdings Co. Ltd. (Japan) | | | 500 | | | | 12,242 | |

Yamato Holdings Co. Ltd. (Japan) | | | 1,000 | | | | 15,095 | |

| | | | | | | | |

| | | | | | | 608,518 | |

| | |

Airlines 0.0% | | | | | | | | |

ANA Holdings, Inc. (Japan) | | | 380 | | | | 12,819 | |

Deutsche Lufthansa AG (Germany) | | | 768 | | | | 12,207 | |

easyJet PLC (United Kingdom) | | | 513 | | | | 7,242 | |

Japan Airlines Co. Ltd. (Japan) | | | 400 | | | | 11,877 | |

Singapore Airlines Ltd. (Singapore) | | | 1,700 | | | | 11,253 | |

Spirit Airlines, Inc.* | | | 533 | | | | 19,348 | |

| | | | | | | | |

| | | | | | | 74,746 | |

See Notes to Financial Statements.

Schedule of Investments(continued)

as of September 30, 2019

| | | | | | | | |

| Description | | Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Auto Components 0.1% | | | | | | | | |

Aisin Seiki Co. Ltd. (Japan) | | | 550 | | | $ | 17,356 | |

Bridgestone Corp. (Japan) | | | 1,860 | | | | 72,249 | |

Cie Generale des Etablissements Michelin SCA (France) | | | 551 | | | | 61,456 | |

Continental AG (Germany) | | | 355 | | | | 45,453 | |

Dana, Inc. | | | 12,602 | | | | 181,973 | |

Denso Corp. (Japan) | | | 1,400 | | | | 61,820 | |

Faurecia SE (France) | | | 243 | | | | 11,539 | |

Koito Manufacturing Co. Ltd. (Japan) | | | 300 | | | | 14,760 | |

NGK Spark Plug Co. Ltd. (Japan) | | | 600 | | | | 11,502 | |

Nokian Renkaat OYJ (Finland) | | | 397 | | | | 11,206 | |

Pirelli & C SpA (Italy), 144A | | | 1,291 | | | | 7,640 | |

Stanley Electric Co. Ltd. (Japan) | | | 500 | | | | 13,313 | |

Sumitomo Electric Industries Ltd. (Japan) | | | 2,400 | | | | 30,643 | |

Sumitomo Rubber Industries Ltd. (Japan) | | | 600 | | | | 7,147 | |

Toyoda Gosei Co. Ltd. (Japan) | | | 170 | | | | 3,428 | |

Toyota Industries Corp. (Japan) | | | 450 | | | | 25,967 | |

Valeo SA (France) | | | 776 | | | | 25,118 | |

Yokohama Rubber Co. Ltd. (The) (Japan) | | | 300 | | | | 6,039 | |

| | | | | | | | |

| | | | | | | 608,609 | |

| | |

Automobiles 0.6% | | | | | | | | |

Bayerische Motoren Werke AG (Germany) | | | 1,076 | | | | 75,719 | |

Daimler AG (Germany) | | | 2,930 | | | | 145,510 | |

Ferrari NV (Italy) | | | 390 | | | | 60,293 | |

Fiat Chrysler Automobiles NV (United Kingdom) | | | 3,494 | | | | 45,265 | |

Ford Motor Co. | | | 310,077 | | | | 2,840,305 | |

General Motors Co. | | | 37,100 | | | | 1,390,508 | |

Honda Motor Co. Ltd. (Japan) | | | 5,300 | | | | 137,872 | |

Isuzu Motors Ltd. (Japan) | | | 1,750 | | | | 19,357 | |

Mazda Motor Corp. (Japan) | | | 1,860 | | | | 16,568 | |

Mitsubishi Motors Corp. (Japan) | | | 2,170 | | | | 9,466 | |

Nissan Motor Co. Ltd. (Japan) | | | 7,500 | | | | 46,916 | |

Peugeot SA (France) | | | 1,897 | | | | 47,314 | |

Renault SA (France) | | | 626 | | | | 35,927 | |

Subaru Corp. (Japan) | | | 2,000 | | | | 56,663 | |

Suzuki Motor Corp. (Japan) | | | 1,200 | | | | 51,047 | |

Toyota Motor Corp. (Japan) | | | 7,354 | | | | 493,624 | |

Volkswagen AG (Germany) | | | 105 | | | | 18,035 | |

Yamaha Motor Co. Ltd. (Japan) | | | 900 | | | | 16,378 | |

| | | | | | | | |

| | | | | | | 5,506,767 | |

| | |

Banks 3.3% | | | | | | | | |

1st Source Corp. | | | 299 | | | | 13,673 | |

See Notes to Financial Statements.

| | | | | | | | |

| Description | | Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Banks (cont’d.) | | | | | | | | |

ABN AMRO Bank NV (Netherlands), 144A, CVA | | | 1,369 | | | $ | 24,138 | |

ACNB Corp. | | | 188 | | | | 6,448 | |

AIB Group PLC (Ireland) | | | 2,655 | | | | 7,898 | |

Aozora Bank Ltd. (Japan) | | | 360 | | | | 9,022 | |

Australia & New Zealand Banking Group Ltd. (Australia) | | | 9,182 | | | | 176,680 | |

Banco Bilbao Vizcaya Argentaria SA (Spain) | | | 21,451 | | | | 111,795 | |

Banco de Sabadell SA (Spain) | | | 18,479 | | | | 17,933 | |

Banco Santander SA (Spain) | | | 54,155 | | | | 220,725 | |

Bancorp, Inc. (The)* | | | 19,390 | | | | 191,961 | |

Bank Hapoalim BM (Israel)* | | | 3,669 | | | | 28,936 | |

Bank LeumiLe-Israel BM (Israel) | | | 4,813 | | | | 34,246 | |

Bank of America Corp. | | | 240,570 | | | | 7,017,427 | |

Bank of East Asia Ltd. (The) (Hong Kong) | | | 4,200 | | | | 10,348 | |

Bank of Ireland Group PLC (Ireland) | | | 3,132 | | | | 12,429 | |

Bank of Kyoto Ltd. (The) (Japan) | | | 220 | | | | 8,661 | |

Bank of NT Butterfield & Son Ltd. (The) (Bermuda) | | | 7,738 | | | | 229,354 | |

Bank of Queensland Ltd. (Australia) | | | 1,297 | | | | 8,679 | |

Bankia SA (Spain) | | | 3,981 | | | | 7,513 | |

Bankinter SA (Spain) | | | 2,181 | | | | 13,779 | |

Barclays PLC (United Kingdom) | | | 55,073 | | | | 101,630 | |

Bendigo & Adelaide Bank Ltd. (Australia) | | | 1,566 | | | | 12,152 | |

BNP Paribas SA (France) | | | 3,624 | | | | 176,506 | |

BOC Hong Kong Holdings Ltd. (China) | | | 12,000 | | | | 40,828 | |

Cadence BanCorp | | | 17,363 | | | | 304,547 | |

CaixaBank SA (Spain) | | | 11,642 | | | | 30,574 | |

Chiba Bank Ltd. (The) (Japan) | | | 1,800 | | | | 9,313 | |

CIT Group, Inc. | | | 14,500 | | | | 656,995 | |

Citigroup, Inc. | | | 84,016 | | | | 5,803,825 | |

Civista Bancshares, Inc. | | | 1,400 | | | | 30,422 | |

CNB Financial Corp. | | | 876 | | | | 25,141 | |

Commerzbank AG (Germany) | | | 3,259 | | | | 18,914 | |

Commonwealth Bank of Australia (Australia) | | | 5,708 | | | | 311,164 | |

Concordia Financial Group Ltd. (Japan) | | | 3,500 | | | | 13,510 | |

ConnectOne Bancorp, Inc. | | | 5,099 | | | | 113,198 | |

Credit Agricole SA (France) | | | 3,697 | | | | 44,888 | |

Customers Bancorp, Inc.* | | | 2,800 | | | | 58,072 | |

Danske Bank A/S (Denmark) | | | 2,184 | | | | 30,430 | |

DBS Group Holdings Ltd. (Singapore) | | | 5,813 | | | | 105,189 | |

DNB ASA (Norway) | | | 3,097 | | | | 54,543 | |

Eagle Bancorp, Inc. | | | 1,900 | | | | 84,778 | |

Enterprise Financial Services Corp. | | | 2,000 | | | | 81,500 | |

Erste Group Bank AG (Austria)* | | | 980 | | | | 32,406 | |

Farmers National Banc Corp. | | | 3,602 | | | | 52,157 | |

Fifth Third Bancorp | | | 9,700 | | | | 265,586 | |

See Notes to Financial Statements.

Schedule of Investments(continued)

as of September 30, 2019

| | | | | | | | |

| Description | | Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Banks (cont’d.) | | | | | | | | |

Financial Institutions, Inc. | | | 7,592 | | | $ | 229,127 | |

FinecoBank Banca Fineco SpA (Italy) | | | 1,957 | | | | 20,744 | |

First Bancorp | | | 800 | | | | 28,720 | |

First BanCorp. (Puerto Rico) | | | 24,300 | | | | 242,514 | |

First Internet Bancorp | | | 1,588 | | | | 33,999 | |

Flushing Financial Corp. | | | 1,000 | | | | 20,205 | |

Fukuoka Financial Group, Inc. (Japan) | | | 640 | | | | 12,181 | |

Hancock Whitney Corp. | | | 8,272 | | | | 316,776 | |

Hang Seng Bank Ltd. (Hong Kong) | | | 2,500 | | | | 53,954 | |

Hanmi Financial Corp. | | | 2,800 | | | | 52,584 | |

Heartland Financial USA, Inc. | | | 1,800 | | | | 80,532 | |

Hilltop Holdings, Inc. | | | 3,600 | | | | 86,004 | |

HSBC Holdings PLC (United Kingdom) | | | 65,227 | | | | 500,520 | |

IBERIABANK Corp. | | | 4,455 | | | | 336,531 | |

ING Groep NV (Netherlands) | | | 12,518 | | | | 131,133 | |

International Bancshares Corp. | | | 2,200 | | | | 84,964 | |

Intesa Sanpaolo SpA (Italy) | | | 47,857 | | | | 113,667 | |

Investar Holding Corp. | | | 598 | | | | 14,232 | |

Israel Discount Bank Ltd. (Israel) (Class A Stock) | | | 3,769 | | | | 16,560 | |

Japan Post Bank Co. Ltd. (Japan) | | | 1,300 | | | | 12,644 | |

JPMorgan Chase & Co. | | | 35,364 | | | | 4,161,989 | |

KBC Group NV (Belgium) | | | 802 | | | | 52,127 | |

Live Oak Bancshares, Inc. | | | 1,100 | | | | 19,910 | |

Lloyds Banking Group PLC (United Kingdom) | | | 229,430 | | | | 152,608 | |

Mebuki Financial Group, Inc. (Japan) | | | 2,904 | | | | 7,178 | |

Mediobanca Banca di Credito Finanziario SpA (Italy) | | | 1,993 | | | | 21,786 | |

Metropolitan Bank Holding Corp.* | | | 1,600 | | | | 62,928 | |

MidWestOne Financial Group, Inc. | | | 3,403 | | | | 103,860 | |

Mitsubishi UFJ Financial Group, Inc. (Japan) | | | 39,800 | | | | 202,720 | |

Mizrahi Tefahot Bank Ltd. (Israel) | | | 452 | | | | 11,239 | |

Mizuho Financial Group, Inc. (Japan) | | | 78,260 | | | | 120,269 | |

National Australia Bank Ltd. (Australia) | | | 9,059 | | | | 181,561 | |

Nordea Bank Abp (Finland) | | | 10,561 | | | | 74,955 | |

OFG Bancorp (Puerto Rico) | | | 11,627 | | | | 254,631 | |

Old Second Bancorp, Inc. | | | 4,838 | | | | 59,120 | |

Orrstown Financial Services, Inc. | | | 887 | | | | 19,425 | |

Oversea-Chinese Banking Corp. Ltd. (Singapore) | | | 10,623 | | | | 83,397 | |

PCB Bancorp | | | 800 | | | | 13,160 | |

Peapack Gladstone Financial Corp. | | | 1,800 | | | | 50,454 | |

Peoples Bancorp, Inc. | | | 1,100 | | | | 34,991 | |

Popular, Inc. (Puerto Rico) | | | 13,500 | | | | 730,080 | |

QCR Holdings, Inc. | | | 2,693 | | | | 102,280 | |

Raiffeisen Bank International AG (Austria) | | | 479 | | | | 11,127 | |

RBB Bancorp | | | 1,100 | | | | 21,659 | |

See Notes to Financial Statements.

| | | | | | | | |

| Description | | Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Banks (cont’d.) | | | | | | | | |

Republic Bancorp, Inc. (Class A Stock) | | | 500 | | | $ | 21,725 | |

Resona Holdings, Inc. (Japan) | | | 6,900 | | | | 29,731 | |

Royal Bank of Scotland Group PLC (United Kingdom) | | | 15,585 | | | | 39,678 | |

Sandy Spring Bancorp, Inc. | | | 2,593 | | | | 87,410 | |

SB One Bancorp | | | 1,900 | | | | 42,864 | |

Seven Bank Ltd. (Japan) | | | 1,900 | | | | 5,220 | |

Shinsei Bank Ltd. (Japan) | | | 520 | | | | 7,596 | |

Shizuoka Bank Ltd. (The) (Japan) | | | 1,500 | | | | 11,260 | |

Sierra Bancorp | | | 793 | | | | 21,062 | |

Simmons First National Corp. (Class A Stock) | | | 12,460 | | | | 310,254 | |

Skandinaviska Enskilda Banken AB (Sweden) (Class A Stock) | | | 5,232 | | | | 48,101 | |

Societe Generale SA (France) | | | 2,488 | | | | 68,224 | |

Southern National Bancorp of Virginia, Inc. | | | 5,900 | | | | 90,801 | |

Standard Chartered PLC (United Kingdom) | | | 9,029 | | | | 75,835 | |

Sumitomo Mitsui Financial Group, Inc. (Japan) | | | 4,317 | | | | 148,097 | |

Sumitomo Mitsui Trust Holdings, Inc. (Japan) | | | 1,068 | | | | 38,717 | |

Svenska Handelsbanken AB (Sweden) (Class A Stock) | | | 4,955 | | | | 46,416 | |

Swedbank AB (Sweden) (Class A Stock) | | | 2,907 | | | | 41,867 | |

Texas Capital Bancshares, Inc.* | | | 4,624 | | | | 252,702 | |

Triumph Bancorp, Inc.* | | | 800 | | | | 25,512 | |

UniCredit SpA (Italy) | | | 6,455 | | | | 76,136 | |

United Overseas Bank Ltd. (Singapore) | | | 4,086 | | | | 75,869 | |

Veritex Holdings, Inc. | | | 3,758 | | | | 91,188 | |

Wells Fargo & Co. | | | 61,682 | | | | 3,111,240 | |

Westpac Banking Corp. (Australia) | | | 11,126 | | | | 222,459 | |

| | | | | | | | |

| | | | | | | 30,540,922 | |

| | |

Beverages 0.9% | | | | | | | | |

Anheuser-Busch InBev SA/NV (Belgium) | | | 2,452 | | | | 234,047 | |

Asahi Group Holdings Ltd. (Japan) | | | 1,200 | | | | 59,617 | |

Carlsberg A/S (Denmark) (Class B Stock) | | | 342 | | | | 50,560 | |

Coca-Cola Amatil Ltd. (Australia) | | | 1,639 | | | | 11,788 | |

Coca-Cola Bottlers Japan Holdings, Inc. (Japan) | | | 400 | | | | 9,007 | |

Coca-Cola Co. (The) | | | 79,955 | | | | 4,352,750 | |

Coca-Cola European Partners PLC (United Kingdom) | | | 766 | | | | 42,475 | |

Coca-Cola HBC AG (Switzerland)* | | | 649 | | | | 21,177 | |

Davide Campari-Milano SpA (Italy) | | | 1,889 | | | | 17,075 | |

Diageo PLC (United Kingdom) | | | 7,670 | | | | 313,479 | |

Heineken Holding NV (Netherlands) | | | 371 | | | | 36,935 | |

Heineken NV (Netherlands) | | | 833 | | | | 90,013 | |

Keurig Dr. Pepper, Inc. | | | 88,525 | | | | 2,418,503 | |

Kirin Holdings Co. Ltd. (Japan) | | | 2,700 | | | | 57,259 | |

National Beverage Corp.(a) | | | 1,964 | | | | 87,123 | |

Pernod Ricard SA (France) | | | 686 | | | | 122,228 | |

See Notes to Financial Statements.

Schedule of Investments(continued)

as of September 30, 2019

| | | | | | | | |

| Description | | Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Beverages (cont’d.) | | | | | | | | |

Remy Cointreau SA (France) | | | 73 | | | $ | 9,698 | |

Suntory Beverage & Food Ltd. (Japan) | | | 450 | | | | 19,272 | |

Treasury Wine Estates Ltd. (Australia) | | | 2,339 | | | | 29,437 | |

| | | | | | | | |

| | | | | | | 7,982,443 | |

| | |

Biotechnology 1.8% | | | | | | | | |

AbbVie, Inc. | | | 23,245 | | | | 1,760,111 | |

ACADIA Pharmaceuticals, Inc.* | | | 7,443 | | | | 267,874 | |

Acorda Therapeutics, Inc.* | | | 5,600 | | | | 16,072 | |

Aeglea BioTherapeutics, Inc.* | | | 13,135 | | | | 101,008 | |

Albireo Pharma, Inc.* | | | 1,200 | | | | 24,000 | |

Alexion Pharmaceuticals, Inc.* | | | 5,382 | | | | 527,113 | |

AMAG Pharmaceuticals, Inc.* | | | 600 | | | | 6,930 | |

Amgen, Inc. | | | 8,000 | | | | 1,548,080 | |

Anika Therapeutics, Inc.* | | | 500 | | | | 27,445 | |

Arrowhead Pharmaceuticals, Inc.* | | | 700 | | | | 19,726 | |

Audentes Therapeutics, Inc.* | | | 2,000 | | | | 56,180 | |

BeiGene Ltd. (China), ADR* | | | 111 | | | | 13,593 | |

Biogen, Inc.* | | | 14,203 | | | | 3,306,742 | |

Biohaven Pharmaceutical Holding Co. Ltd.* | | | 3,000 | | | | 125,160 | |

BioSpecifics Technologies Corp.* | | | 1,900 | | | | 101,688 | |

CareDx, Inc.* | | | 619 | | | | 13,996 | |

Chimerix, Inc.* | | | 2,408 | | | | 5,659 | |

Concert Pharmaceuticals, Inc.* | | | 16,277 | | | | 95,709 | |

CSL Ltd. (Australia) | | | 1,462 | | | | 231,178 | |

CytomX Therapeutics, Inc.* | | | 7,457 | | | | 55,033 | |

Eagle Pharmaceuticals, Inc.* | | | 1,300 | | | | 73,541 | |

Emergent BioSolutions, Inc.* | | | 4,684 | | | | 244,879 | |

FibroGen, Inc.* | | | 7,302 | | | | 270,028 | |

Genmab A/S (Denmark)* | | | 197 | | | | 40,011 | |

Gilead Sciences, Inc. | | | 60,669 | | | | 3,845,201 | |

Grifols SA (Spain) | | | 956 | | | | 28,192 | |

Immunomedics, Inc.* | | | 1,300 | | | | 17,238 | |

Jounce Therapeutics, Inc.* | | | 6,700 | | | | 22,311 | |

OPKO Health, Inc.*(a) | | | 14,500 | | | | 30,305 | |

PeptiDream, Inc. (Japan)* | | | 300 | | | | 14,336 | |

PTC Therapeutics, Inc.* | | | 6,366 | | | | 215,298 | |

Repligen Corp.* | | | 3,926 | | | | 301,085 | |

Retrophin, Inc.* | | | 9,400 | | | | 108,946 | |

Vanda Pharmaceuticals, Inc.* | | | 18,877 | | | | 250,686 | |

Veracyte, Inc.*(a) | | | 11,053 | | | | 265,272 | |

Vertex Pharmaceuticals, Inc.* | | | 14,300 | | | | 2,422,706 | |

| | | | | | | | |

| | | | | | | 16,453,332 | |

See Notes to Financial Statements.

| | | | | | | | |

| Description | | Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Building Products 0.5% | | | | | | | | |

Advanced Drainage Systems, Inc. | | | 1,900 | | | $ | 61,313 | |

AGC, Inc. (Japan) | | | 640 | | | | 19,922 | |

Assa Abloy AB (Sweden) (Class B Stock) | | | 3,205 | | | | 71,325 | |

Builders FirstSource, Inc.* | | | 6,654 | | | | 136,906 | |

Cie de Saint-Gobain (France) | | | 1,602 | | | | 62,901 | |

Continental Building Products, Inc.* | | | 3,900 | | | | 106,431 | |

Cornerstone Building Brands, Inc.* | | | 5,600 | | | | 33,880 | |

Daikin Industries Ltd. (Japan) | | | 780 | | | | 103,181 | |

Geberit AG (Switzerland) | | | 120 | | | | 57,273 | |

Griffon Corp. | | | 1,400 | | | | 29,358 | |

Johnson Controls International PLC | | | 69,847 | | | | 3,065,585 | |

Kingspan Group PLC (Ireland) | | | 496 | | | | 24,221 | |

LIXIL Group Corp. (Japan) | | | 900 | | | | 15,880 | |

PGT Innovations, Inc.* | | | 4,100 | | | | 70,807 | |

TOTO Ltd. (Japan) | | | 450 | | | | 16,937 | |

Universal Forest Products, Inc. | | | 8,017 | | | | 319,718 | |

| | | | | | | | |

| | | | | | | 4,195,638 | |

| | |

Capital Markets 1.6% | | | | | | | | |

3i Group PLC (United Kingdom) | | | 3,144 | | | | 45,040 | |

Affiliated Managers Group, Inc. | | | 26,942 | | | | 2,245,616 | |

Ameriprise Financial, Inc. | | | 14,197 | | | | 2,088,379 | |

Amundi SA (France), 144A | | | 195 | | | | 13,606 | |

ASX Ltd. (Australia) | | | 619 | | | | 33,819 | |

Brightsphere Investment Group, Inc. | | | 22,300 | | | | 220,993 | |

Credit Suisse Group AG (Switzerland)* | | | 8,341 | | | | 102,230 | |

Daiwa Securities Group, Inc. (Japan) | | | 4,900 | | | | 21,909 | |

Deutsche Bank AG (Germany) | | | 6,400 | | | | 47,927 | |

Deutsche Boerse AG (Germany) | | | 613 | | | | 95,804 | |

Donnelley Financial Solutions, Inc.* | | | 6,440 | | | | 79,341 | |

GAMCO Investors, Inc. (Class A Stock) | | | 400 | | | | 7,820 | |

Goldman Sachs Group, Inc. (The) | | | 18,190 | | | | 3,769,514 | |

Hargreaves Lansdown PLC (United Kingdom) | | | 934 | | | | 23,845 | |

Hong Kong Exchanges & Clearing Ltd. (Hong Kong) | | | 3,900 | | | | 114,891 | |

Invesco Ltd. | | | 34,447 | | | | 583,532 | |

Investec PLC (South Africa) | | | 2,200 | | | | 11,311 | |

Japan Exchange Group, Inc. (Japan) | | | 1,600 | | | | 25,285 | |

Julius Baer Group Ltd. (Switzerland)* | | | 727 | | | | 32,165 | |

London Stock Exchange Group PLC (United Kingdom) | | | 1,008 | | | | 90,604 | |

LPL Financial Holdings, Inc. | | | 12,000 | | | | 982,800 | |

Macquarie Group Ltd. (Australia) | | | 1,042 | | | | 92,232 | |

Magellan Financial Group Ltd. (Australia) | | | 399 | | | | 13,868 | |

Morgan Stanley | | | 79,857 | | | | 3,407,498 | |

Natixis SA (France) | | | 3,067 | | | | 12,744 | |

See Notes to Financial Statements.

Schedule of Investments(continued)

as of September 30, 2019

| | | | | | | | |

| Description | | Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Capital Markets (cont’d.) | | | | | | | | |

Nomura Holdings, Inc. (Japan) | | | 10,700 | | | $ | 45,682 | |

Partners Group Holding AG (Switzerland) | | | 61 | | | | 46,729 | |

SBI Holdings, Inc. (Japan) | | | 780 | | | | 16,790 | |

Schroders PLC (United Kingdom) | | | 397 | | | | 14,989 | |

Singapore Exchange Ltd. (Singapore) | | | 2,600 | | | | 15,943 | |

St. James’s Place PLC (United Kingdom) | | | 1,712 | | | | 20,587 | |

Standard Life Aberdeen PLC (United Kingdom) | | | 8,036 | | | | 28,230 | |

Stifel Financial Corp. | | | 5,800 | | | | 332,804 | |

UBS Group AG (Switzerland)* | | | 12,501 | | | | 141,930 | |

| | | | | | | | |

| | | | | | | 14,826,457 | |

| | |

Chemicals 1.1% | | | | | | | | |

Air Liquide SA (France) | | | 1,381 | | | | 196,741 | |

Air Water, Inc. (Japan) | | | 500 | | | | 8,993 | |

Akzo Nobel NV (Netherlands) | | | 732 | | | | 65,285 | |

Arkema SA (France) | | | 225 | | | | 20,981 | |

Asahi Kasei Corp. (Japan) | | | 4,000 | | | | 39,644 | |

BASF SE (Germany) | | | 2,965 | | | | 207,342 | |

CF Industries Holdings, Inc. | | | 39,600 | | | | 1,948,320 | |

Chr Hansen Holding A/S (Denmark) | | | 337 | | | | 28,605 | |

Clariant AG (Switzerland)* | | | 646 | | | | 12,562 | |

Covestro AG (Germany), 144A | | | 561 | | | | 27,746 | |

Croda International PLC (United Kingdom) | | | 413 | | | | 24,622 | |

Daicel Corp. (Japan) | | | 800 | | | | 6,818 | |

Dow, Inc. | | | 16,005 | | | | 762,638 | |

DuPont de Nemours, Inc. | | | 46,915 | | | | 3,345,509 | |

EMS-Chemie Holding AG (Switzerland) | | | 26 | | | | 16,194 | |

Evonik Industries AG (Germany) | | | 600 | | | | 14,847 | |

Givaudan SA (Switzerland) | | | 30 | | | | 83,784 | |

Hawkins, Inc. | | | 602 | | | | 25,585 | |

Hitachi Chemical Co. Ltd. (Japan) | | | 400 | | | | 13,055 | |

Huntsman Corp. | | | 4,700 | | | | 109,322 | |

Incitec Pivot Ltd. (Australia) | | | 5,156 | | | | 11,781 | |

Israel Chemicals Ltd. (Israel) | | | 2,284 | | | | 11,344 | |

Johnson Matthey PLC (United Kingdom) | | | 624 | | | | 23,415 | |

JSR Corp. (Japan) | | | 650 | | | | 10,465 | |

Kaneka Corp. (Japan) | | | 200 | | | | 6,269 | |

Kansai Paint Co. Ltd. (Japan) | | | 600 | | | | 14,017 | |

Koninklijke DSM NV (Netherlands) | | | 587 | | | | 70,648 | |

Koppers Holdings, Inc.* | | | 5,301 | | | | 154,842 | |

Kronos Worldwide, Inc. | | | 2,700 | | | | 33,399 | |

Kuraray Co. Ltd. (Japan) | | | 1,000 | | | | 12,347 | |

LANXESS AG (Germany) | | | 279 | | | | 17,059 | |

Mitsubishi Chemical Holdings Corp. (Japan) | | | 4,100 | | | | 29,358 | |

See Notes to Financial Statements.

| | | | | | | | |

| Description | | Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Chemicals (cont’d.) | | | | | | | | |

Mitsubishi Gas Chemical Co., Inc. (Japan) | | | 550 | | | $ | 7,400 | |

Mitsui Chemicals, Inc. (Japan) | | | 600 | | | | 13,521 | |

Nippon Paint Holdings Co. Ltd. (Japan) | | | 450 | | | | 23,630 | |

Nissan Chemical Corp. (Japan) | | | 400 | | | | 16,811 | |

Nitto Denko Corp. (Japan) | | | 530 | | | | 25,717 | |

Novozymes A/S (Denmark) (Class B Stock) | | | 715 | | | | 30,056 | |

Orica Ltd. (Australia) | | | 1,227 | | | | 18,662 | |

Orion Engineered Carbons SA (Luxembourg) | | | 3,900 | | | | 65,169 | |

PolyOne Corp. | | | 9,000 | | | | 293,850 | |

PQ Group Holdings, Inc.* | | | 9,842 | | | | 156,882 | |

Sherwin-Williams Co. (The) | | | 3,300 | | | | 1,814,571 | |

Shin-Etsu Chemical Co. Ltd. (Japan) | | | 1,160 | | | | 125,224 | |

Showa Denko KK (Japan) | | | 400 | | | | 10,584 | |

Sika AG (Switzerland) | | | 411 | | | | 60,136 | |

Solvay SA (Belgium) | | | 238 | | | | 24,711 | |

Sumitomo Chemical Co. Ltd. (Japan) | | | 4,800 | | | | 21,706 | |

Symrise AG (Germany) | | | 411 | | | | 39,995 | |

Taiyo Nippon Sanso Corp. (Japan) | | | 500 | | | | 10,161 | |

Teijin Ltd. (Japan) | | | 580 | | | | 11,201 | |

Toray Industries, Inc. (Japan) | | | 4,400 | | | | 32,836 | |

Tosoh Corp. (Japan) | | | 800 | | | | 10,687 | |

Trinseo SA | | | 7,963 | | | | 342,011 | |

Umicore SA (Belgium) | | | 638 | | | | 24,082 | |

Yara International ASA (Norway) | | | 573 | | | | 24,703 | |

| | | | | | | | |

| | | | | | | 10,557,843 | |

| | |

Commercial Services & Supplies 0.3% | | | | | | | | |

ACCO Brands Corp. | | | 6,900 | | | | 68,103 | |

Brambles Ltd. (Australia) | | | 5,138 | | | | 39,469 | |

Brink’s Co. (The) | | | 700 | | | | 58,065 | |

CECO Environmental Corp.* | | | 8,408 | | | | 58,730 | |

Cimpress NV (Netherlands)* | | | 900 | | | | 118,656 | |

Copart, Inc.* | | | 4,200 | | | | 337,386 | |

Dai Nippon Printing Co. Ltd. (Japan) | | | 750 | | | | 19,429 | |

Deluxe Corp. | | | 5,049 | | | | 248,209 | |

Edenred (France) | | | 766 | | | | 36,777 | |

G4S PLC (United Kingdom) | | | 4,980 | | | | 11,556 | |

Herman Miller, Inc. | | | 4,701 | | | | 216,669 | |

ISS A/S (Denmark) | | | 507 | | | | 12,552 | |

Knoll, Inc. | | | 11,585 | | | | 293,680 | |

Park24 Co. Ltd. (Japan) | | | 400 | | | | 9,314 | |

Rentokil Initial PLC (United Kingdom) | | | 5,975 | | | | 34,362 | |

Secom Co. Ltd. (Japan) | | | 640 | | | | 58,621 | |

Securitas AB (Sweden) (Class B Stock) | | | 1,011 | | | | 15,499 | |

See Notes to Financial Statements.

Schedule of Investments(continued)

as of September 30, 2019

| | | | | | | | |

| Description | | Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Commercial Services & Supplies (cont’d.) | | | | | | | | |

Societe BIC SA (France) | | | 84 | | | $ | 5,641 | |

Sohgo Security Services Co. Ltd. (Japan) | | | 250 | | | | 13,150 | |

SP Plus Corp.* | | | 2,300 | | | | 85,100 | |

Steelcase, Inc. (Class A Stock) | | | 7,100 | | | | 130,640 | |

Tetra Tech, Inc. | | | 1,300 | | | | 112,788 | |

Toppan Printing Co. Ltd. (Japan) | | | 750 | | | | 13,347 | |

UniFirst Corp. | | | 1,603 | | | | 312,777 | |

| | | | | | | | |

| | | | | | | 2,310,520 | |

| | |

Communications Equipment 0.8% | | | | | | | | |

Acacia Communications, Inc.* | | | 5,700 | | | | 372,780 | |

Cisco Systems, Inc. | | | 137,817 | | | | 6,809,538 | |

Clearfield, Inc.* | | | 1,114 | | | | 13,201 | |

Comtech Telecommunications Corp. | | | 2,200 | | | | 71,500 | |

Extreme Networks, Inc.* | | | 34,563 | | | | 251,446 | |

NetScout Systems, Inc.* | | | 3,399 | | | | 78,381 | |

Nokia OYJ (Finland) | | | 18,115 | | | | 91,600 | |

Telefonaktiebolaget LM Ericsson (Sweden) (Class B Stock) | | | 9,937 | | | | 79,303 | |

| | | | | | | | |

| | | | | | | 7,767,749 | |

| | |

Construction & Engineering 0.3% | | | | | | | | |

ACS Actividades de Construccion y Servicios SA (Spain) | | | 842 | | | | 33,661 | |

Bouygues SA (France) | | | 720 | | | | 28,884 | |

CIMIC Group Ltd. (Australia) | | | 314 | | | | 6,687 | |

Comfort Systems USA, Inc. | | | 4,013 | | | | 177,495 | |

Eiffage SA (France) | | | 252 | | | | 26,124 | |

EMCOR Group, Inc. | | | 4,470 | | | | 384,956 | |

Ferrovial SA (Spain) | | | 1,559 | | | | 45,041 | |

HOCHTIEF AG (Germany) | | | 79 | | | | 9,022 | |

JGC Holdings Corp. (Japan) | | | 700 | | | | 9,240 | |

Kajima Corp. (Japan) | | | 1,500 | | | | 19,770 | |

MasTec, Inc.* | | | 4,400 | | | | 285,692 | |

Obayashi Corp. (Japan) | | | 2,100 | | | | 21,039 | |

Primoris Services Corp. | | | 1,400 | | | | 27,454 | |

Quanta Services, Inc. | | | 35,491 | | | | 1,341,560 | |

Shimizu Corp. (Japan) | | | 1,900 | | | | 17,243 | |

Skanska AB (Sweden) (Class B Stock) | | | 1,097 | | | | 22,205 | |

Taisei Corp. (Japan) | | | 630 | | | | 24,529 | |

Vinci SA (France) | | | 1,652 | | | | 177,863 | |

| | | | | | | | |

| | | | | | | 2,658,465 | |

See Notes to Financial Statements.

| | | | | | | | |

| Description | | Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Construction Materials 0.5% | | | | | | | | |

Boral Ltd. (Australia) | | | 3,788 | | | $ | 12,332 | |

CRH PLC (Ireland) | | | 2,621 | | | | 90,241 | |

Fletcher Building Ltd. (New Zealand) | | | 2,786 | | | | 8,995 | |

HeidelbergCement AG (Germany) | | | 481 | | | | 34,830 | |

Imerys SA (France) | | | 113 | | | | 4,550 | |

James Hardie Industries PLC | | | 1,426 | | | | 23,972 | |

LafargeHolcim Ltd. (Switzerland)* | | | 1,621 | | | | 79,705 | |

Martin Marietta Materials, Inc. | | | 9,500 | | | | 2,603,950 | |

Taiheiyo Cement Corp. (Japan) | | | 450 | | | | 12,104 | |

U.S. Concrete, Inc.* | | | 2,019 | | | | 111,610 | |

United States Lime & Minerals, Inc. | | | 200 | | | | 15,300 | |

Vulcan Materials Co. | | | 11,189 | | | | 1,692,225 | |

| | | | | | | | |

| | | | | | | 4,689,814 | |

| | |

Consumer Finance 0.6% | | | | | | | | |

Acom Co. Ltd. (Japan) | | | 1,300 | | | | 5,124 | |

AEON Financial Service Co. Ltd. (Japan) | | | 300 | | | | 4,539 | |

Ally Financial, Inc. | | | 4,900 | | | | 162,484 | |

Capital One Financial Corp. | | | 36,008 | | | | 3,276,008 | |

Credit Saison Co. Ltd. (Japan) | | | 500 | | | | 6,740 | |

Navient Corp. | | | 41,500 | | | | 531,200 | |

OneMain Holdings, Inc. | | | 42,600 | | | | 1,562,568 | |

Regional Management Corp.* | | | 500 | | | | 14,080 | |

| | | | | | | | |

| | | | | | | 5,562,743 | |

| | |

Containers & Packaging 0.0% | | | | | | | | |

Greif, Inc. (Class A Stock) | | | 5,800 | | | | 219,762 | |

Smurfit Kappa Group PLC (Ireland) | | | 728 | | | | 21,649 | |

Toyo Seikan Group Holdings Ltd. (Japan) | | | 400 | | | | 6,237 | |

| | | | | | | | |

| | | | | | | 247,648 | |

| | |

Distributors 0.3% | | | | | | | | |

Core-Mark Holding Co., Inc. | | | 7,835 | | | | 251,621 | |

Genuine Parts Co. | | | 14,436 | | | | 1,437,681 | |

Jardine Cycle & Carriage Ltd. (Singapore) | | | 300 | | | | 6,513 | |

LKQ Corp.* | | | 27,300 | | | | 858,585 | |

| | | | | | | | |

| | | | | | | 2,554,400 | |

| | |

Diversified Consumer Services 0.4% | | | | | | | | |

Adtalem Global Education, Inc.* | | | 2,900 | | | | 110,461 | |

Benesse Holdings, Inc. (Japan) | | | 250 | | | | 6,513 | |

See Notes to Financial Statements.

Schedule of Investments(continued)

as of September 30, 2019

| | | | | | | | |

| Description | | Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Diversified Consumer Services (cont’d.) | | | | | | | | |

Career Education Corp.* | | | 4,800 | | | $ | 76,272 | |

Carriage Services, Inc. | | | 8,100 | | | | 165,564 | |

Collectors Universe, Inc. | | | 800 | | | | 22,784 | |

frontdoor, Inc.* | | | 55,071 | | | | 2,674,799 | |

Laureate Education, Inc. (Class A Stock)* | | | 15,600 | | | | 258,570 | |

WW International, Inc.* | | | 3,638 | | | | 137,589 | |

| | | | | | | | |

| | | | | | | 3,452,552 | |

| | |

Diversified Financial Services 0.5% | | | | | | | | |

AMP Ltd. (Australia) | | | 9,470 | | | | 11,685 | |

Berkshire Hathaway, Inc. (Class B Stock)* | | | 13,554 | | | | 2,819,503 | |

Challenger Ltd. (Australia) | | | 1,773 | | | | 8,846 | |

Eurazeo SE (France) | | | 130 | | | | 9,676 | |

EXOR NV (Netherlands) | | | 347 | | | | 23,261 | |

FGL Holdings | | | 32,331 | | | | 258,001 | |

Groupe Bruxelles Lambert SA (Belgium) | | | 260 | | | | 24,979 | |

Industrivarden AB (Sweden) (Class C Stock) | | | 537 | | | | 11,756 | |

Investor AB (Sweden) (Class B Stock) | | | 1,465 | | | | 71,603 | |

Jefferies Financial Group, Inc. | | | 75,900 | | | | 1,396,560 | |

Kinnevik AB (Sweden) (Class B Stock) | | | 777 | | | | 20,459 | |

L E Lundbergforetagen AB (Sweden) (Class B Stock) | | | 243 | | | | 9,150 | |

Mitsubishi UFJ Lease & Finance Co. Ltd. (Japan) | | | 1,300 | | | | 7,561 | |

ORIX Corp. (Japan) | | | 4,240 | | | | 63,480 | |

Pargesa Holding SA (Switzerland) | | | 148 | | | | 11,376 | |

Tokyo Century Corp. (Japan) | | | 100 | | | | 4,652 | |

Wendel SA (France) | | | 90 | | | | 12,416 | |

| | | | | | | | |

| | | | | | | 4,764,964 | |

| | |

Diversified Telecommunication Services 1.6% | | | | | | | | |

AT&T, Inc. | | | 123,116 | | | | 4,658,710 | |

ATN International, Inc. | | | 1,700 | | | | 99,229 | |

BT Group PLC (United Kingdom) | | | 27,072 | | | | 59,420 | |

Cellnex Telecom SA (Spain), 144A* | | | 624 | | | | 25,797 | |

CenturyLink, Inc. | | | 131,300 | | | | 1,638,624 | |

Deutsche Telekom AG (Germany) | | | 10,757 | | | | 180,520 | |

Elisa OYJ (Finland) | | | 456 | | | | 23,484 | |

HKT Trust & HKT Ltd. (Hong Kong) | | | 12,720 | | | | 20,191 | |

Iliad SA (France) | | | 86 | | | | 8,081 | |

Koninklijke KPN NV (Netherlands) | | | 11,541 | | | | 35,987 | |

Nippon Telegraph & Telephone Corp. (Japan) | | | 2,100 | | | | 100,338 | |

Orange SA (France) | | | 6,433 | | | | 100,911 | |

PCCW Ltd. (Hong Kong) | | | 11,400 | | | | 6,402 | |

Proximus SADP (Belgium) | | | 488 | | | | 14,479 | |

See Notes to Financial Statements.

| | | | | | | | |

| Description | | Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Diversified Telecommunication Services (cont’d.) | | | | | | | | |

Singapore Telecommunications Ltd. (Singapore) | | | 26,200 | | | $ | 58,764 | |

Spark New Zealand Ltd. (New Zealand) | | | 5,900 | | | | 16,323 | |

Swisscom AG (Switzerland) | | | 83 | | | | 40,962 | |

Telecom Italia SpA (Italy)* | | | 29,361 | | | | 16,784 | |

Telecom Italia SpA (Italy), RSP | | | 19,334 | | | | 10,591 | |

Telefonica Deutschland Holding AG (Germany) | | | 2,888 | | | | 8,063 | |

Telefonica SA (Spain) | | | 15,065 | | | | 115,055 | |

Telenor ASA (Norway) | | | 2,371 | | | | 47,531 | |

Telia Co. AB (Sweden) | | | 9,072 | | | | 40,612 | |

Telstra Corp. Ltd. (Australia) | | | 13,427 | | | | 31,813 | |

TPG Telecom Ltd. (Australia) | | | 979 | | | | 4,577 | |

United Internet AG (Germany) | | | 398 | | | | 14,235 | |

Verizon Communications, Inc. | | | 123,300 | | | | 7,442,388 | |

| | | | | | | | |

| | | | | | | 14,819,871 | |

| | |

Electric Utilities 0.9% | | | | | | | | |

ALLETE, Inc. | | | 1,906 | | | | 166,603 | |

AusNet Services (Australia) | | | 5,756 | | | | 7,050 | |

Chubu Electric Power Co., Inc. (Japan) | | | 2,100 | | | | 30,489 | |

Chugoku Electric Power Co., Inc. (The) (Japan) | | | 900 | | | | 11,584 | |

CK Infrastructure Holdings Ltd. (Hong Kong) | | | 2,300 | | | | 15,465 | |

CLP Holdings Ltd. (Hong Kong) | | | 5,200 | | | | 54,601 | |

EDP - Energias de Portugal SA (Portugal) | | | 8,212 | | | | 31,883 | |

Electricite de France SA (France) | | | 1,943 | | | | 21,741 | |

Endesa SA (Spain) | | | 1,021 | | | | 26,860 | |

Enel SpA (Italy) | | | 26,155 | | | | 195,498 | |

Exelon Corp. | | | 69,628 | | | | 3,363,729 | |

FirstEnergy Corp. | | | 33,200 | | | | 1,601,236 | |

Fortum OYJ (Finland) | | | 1,433 | | | | 33,884 | |

HK Electric Investments & HK Electric Investments Ltd. (Hong Kong) | | | 8,500 | | | | 8,105 | |

Iberdrola SA (Spain) | | | 19,309 | | | | 200,791 | |

Kansai Electric Power Co., Inc. (The) (Japan) | | | 2,300 | | | | 25,767 | |

Kyushu Electric Power Co., Inc. (Japan) | | | 1,200 | | | | 11,335 | |

MGE Energy, Inc. | | | 700 | | | | 55,909 | |

Orsted A/S (Denmark), 144A | | | 601 | | | | 55,915 | |

Portland General Electric Co. | | | 6,833 | | | | 385,176 | |

Power Assets Holdings Ltd. (Hong Kong) | | | 4,500 | | | | 30,235 | |

Red Electrica Corp. SA (Spain) | | | 1,395 | | | | 28,339 | |

Southern Co. (The) | | | 29,533 | | | | 1,824,253 | |

SSE PLC (United Kingdom) | | | 3,304 | | | | 50,582 | |

Terna Rete Elettrica Nazionale SpA (Italy) | | | 4,518 | | | | 29,034 | |

Tohoku Electric Power Co., Inc. (Japan) | | | 1,400 | | | | 13,670 | |

See Notes to Financial Statements.

Schedule of Investments(continued)

as of September 30, 2019

| | | | | | | | |

| Description | | Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Electric Utilities (cont’d.) | | | | | | | | |

Tokyo Electric Power Co. Holdings, Inc. (Japan)* | | | 4,900 | | | $ | 24,032 | |

Verbund AG (Austria) | | | 219 | | | | 11,954 | |

| | | | | | | | |

| | | | | | | 8,315,720 | |

| | |

Electrical Equipment 0.2% | | | | | | | | |

ABB Ltd. (Switzerland) | | | 5,940 | | | | 116,836 | |

Atkore International Group, Inc.* | | | 6,900 | | | | 209,415 | |

Encore Wire Corp. | | | 1,300 | | | | 73,164 | |

Fuji Electric Co. Ltd. (Japan) | | | 400 | | | | 12,357 | |

Hubbell, Inc. | | | 6,594 | | | | 866,451 | |

Legrand SA (France) | | | 855 | | | | 61,053 | |

Melrose Industries PLC (United Kingdom) | | | 15,598 | | | | 38,644 | |

Mitsubishi Electric Corp. (Japan) | | | 5,900 | | | | 78,794 | |

Nidec Corp. (Japan) | | | 700 | | | | 94,893 | |

nVent Electric PLC | | | 15,700 | | | | 346,028 | |

Prysmian SpA (Italy) | | | 772 | | | | 16,591 | |

Schneider Electric SE (France) | | | 1,766 | | | | 154,836 | |

Siemens Gamesa Renewable Energy SA (Spain) | | | 766 | | | | 10,396 | |

Vestas Wind Systems A/S (Denmark) | | | 631 | | | | 48,876 | |

| | | | | | | | |

| | | | | | | 2,128,334 | |

| | |

Electronic Equipment, Instruments & Components 0.5% | | | | | | | | |

Alps Alpine Co. Ltd. (Japan) | | | 700 | | | | 13,162 | |

Anixter International, Inc.* | | | 4,089 | | | | 282,632 | |

Belden, Inc. | | | 1,483 | | | | 79,103 | |

Benchmark Electronics, Inc. | | | 1,200 | | | | 34,872 | |

CDW Corp. | | | 10,400 | | | | 1,281,696 | |

Halma PLC (United Kingdom) | | | 1,217 | | | | 29,454 | |

Hamamatsu Photonics KK (Japan) | | | 450 | | | | 16,821 | |

Hexagon AB (Sweden) (Class B Stock) | | | 837 | | | | 40,314 | |

Hirose Electric Co. Ltd. (Japan) | | | 73 | | | | 9,001 | |

Hitachi High-Technologies Corp. (Japan) | | | 250 | | | | 14,524 | |

Hitachi Ltd. (Japan) | | | 3,060 | | | | 114,685 | |

Ingenico Group SA (France) | | | 196 | | | | 19,098 | |

Insight Enterprises, Inc.* | | | 1,300 | | | | 72,397 | |

Itron, Inc.* | | | 4,573 | | | | 338,219 | |

Jabil, Inc. | | | 4,400 | | | | 157,388 | |

Keyence Corp. (Japan) | | | 295 | | | | 183,863 | |

Keysight Technologies, Inc.* | | | 11,762 | | | | 1,143,854 | |

Kyocera Corp. (Japan) | | | 1,040 | | | | 64,875 | |

Murata Manufacturing Co. Ltd. (Japan) | | | 1,890 | | | | 91,412 | |

Nippon Electric Glass Co. Ltd. (Japan) | | | 280 | | | | 6,266 | |

Omron Corp. (Japan) | | | 600 | | | | 33,159 | |

See Notes to Financial Statements.

| | | | | | | | |

| Description | | Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Electronic Equipment, Instruments & Components (cont’d.) | | | | | | | | |

PC Connection, Inc. | | | 1,205 | | | $ | 46,875 | |

Sanmina Corp.* | | | 2,000 | | | | 64,220 | |

ScanSource, Inc.* | | | 3,000 | | | | 91,650 | |

Shimadzu Corp. (Japan) | | | 700 | | | | 17,816 | |

TDK Corp. (Japan) | | | 380 | | | | 34,316 | |

Tech Data Corp.* | | | 3,117 | | | | 324,916 | |

Venture Corp. Ltd. (Singapore) | | | 900 | | | | 9,991 | |

Yaskawa Electric Corp. (Japan) | | | 800 | | | | 29,700 | |

Yokogawa Electric Corp. (Japan) | | | 700 | | | | 12,897 | |

| | | | | | | | |

| | | | | | | 4,659,176 | |

| | |

Energy Equipment & Services 0.1% | | | | | | | | |

Archrock, Inc. | | | 19,646 | | | | 195,871 | |

DMC Global, Inc. | | | 1,770 | | | | 77,844 | |

John Wood Group PLC (United Kingdom) | | | 2,211 | | | | 10,304 | |

Matrix Service Co.* | | | 12,252 | | | | 209,999 | |

Parker Drilling Co.* | | | 2,600 | | | | 49,192 | |

Tenaris SA (Luxembourg) | | | 1,510 | | | | 16,051 | |

Tidewater, Inc.* | | | 900 | | | | 13,599 | |

WorleyParsons Ltd. (Australia) | | | 1,033 | | | | 9,115 | |

| | | | | | | | |

| | | | | | | 581,975 | |

| | |

Entertainment 0.6% | | | | | | | | |

Activision Blizzard, Inc. | | | 16,445 | | | | 870,269 | |

Electronic Arts, Inc.* | | | 25,000 | | | | 2,445,500 | |

Konami Holdings Corp. (Japan) | | | 300 | | | | 14,547 | |

Marcus Corp. (The) | | | 4,100 | | | | 151,741 | |

Nexon Co. Ltd. (Japan)* | | | 1,600 | | | | 19,489 | |

Nintendo Co. Ltd. (Japan) | | | 365 | | | | 136,010 | |

Toho Co. Ltd. (Japan) | | | 400 | | | | 17,600 | |

Ubisoft Entertainment SA (France)* | | | 268 | | | | 19,395 | |

Viacom, Inc. (Class B Stock) | | | 77,000 | | | | 1,850,310 | |

Vivendi SA (France) | | | 2,953 | | | | 80,992 | |

| | | | | | | | |

| | | | | | | 5,605,853 | |

| | |

Equity Real Estate Investment Trusts (REITs) 1.9% | | | | | | | | |

American Assets Trust, Inc. | | | 3,300 | | | | 154,242 | |

American Tower Corp. | | | 20,770 | | | | 4,592,870 | |

Apartment Investment & Management Co. (Class A Stock) | | | 12,044 | | | | 627,974 | |

Apple Hospitality REIT, Inc. | | | 118,008 | | | | 1,956,573 | |

Armada Hoffler Properties, Inc. | | | 6,200 | | | | 112,158 | |

Ascendas Real Estate Investment Trust (Singapore) | | | 8,100 | | | | 18,289 | |

See Notes to Financial Statements.

Schedule of Investments(continued)

as of September 30, 2019

| | | | | | | | |

| Description | | Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Equity Real Estate Investment Trusts (REITs) (cont’d.) | | | | | | | | |

Ashford Hospitality Trust, Inc. | | | 9,300 | | | $ | 30,783 | |

Braemar Hotels & Resorts, Inc. | | | 1,100 | | | | 10,329 | |

Brandywine Realty Trust | | | 65,243 | | | | 988,432 | |

British Land Co. PLC (The) (United Kingdom) | | | 2,922 | | | | 21,011 | |

Brixmor Property Group, Inc. | | | 28,400 | | | | 576,236 | |

CapitaLand Commercial Trust (Singapore) | | | 8,364 | | | | 12,529 | |

CapitaLand Mall Trust (Singapore) | | | 8,300 | | | | 15,791 | |

Chatham Lodging Trust | | | 800 | | | | 14,520 | |

City Office REIT, Inc. | | | 6,497 | | | | 93,492 | |

CoreCivic, Inc. | | | 32,755 | | | | 566,006 | |

CorePoint Lodging, Inc. | | | 400 | | | | 4,044 | |

Covivio (France) | | | 148 | | | | 15,666 | |

Crown Castle International Corp. | | | 24,400 | | | | 3,391,844 | |

Daiwa House REIT Investment Corp. (Japan) | | | 6 | | | | 16,893 | |

Dexus (Australia) | | | 3,509 | | | | 28,317 | |

DiamondRock Hospitality Co. | | | 28,336 | | | | 290,444 | |

Franklin Street Properties Corp. | | | 27,361 | | | | 231,474 | |

Gecina SA (France) | | | 147 | | | | 23,101 | |

GEO Group, Inc. (The) | | | 16,803 | | | | 291,364 | |

Gladstone Commercial Corp. | | | 1,800 | | | | 42,300 | |

Goodman Group (Australia) | | | 5,198 | | | | 49,844 | |

GPT Group (The) (Australia) | | | 6,045 | | | | 25,158 | |

Hersha Hospitality Trust | | | 3,300 | | | | 49,104 | |

Host Hotels & Resorts, Inc. | | | 60,000 | | | | 1,037,400 | |

ICADE (France) | | | 96 | | | | 8,588 | |

Japan Prime Realty Investment Corp. (Japan) | | | 3 | | | | 14,260 | |

Japan Real Estate Investment Corp. (Japan) | | | 4 | | | | 26,848 | |

Japan Retail Fund Investment Corp. (Japan) | | | 8 | | | | 16,924 | |

Kite Realty Group Trust | | | 17,095 | | | | 276,084 | |

Klepierre SA (France) | | | 668 | | | | 22,691 | |

Land Securities Group PLC (United Kingdom) | | | 2,276 | | | | 23,961 | |

Lexington Realty Trust | | | 5,900 | | | | 60,475 | |

Link REIT (Hong Kong) | | | 6,800 | | | | 75,310 | |

Mirvac Group (Australia) | | | 12,548 | | | | 25,893 | |

Nippon Building Fund, Inc. (Japan) | | | 4 | | | | 30,734 | |

Nippon Prologis REIT, Inc. (Japan) | | | 6 | | | | 16,451 | |

Nomura Real Estate Master Fund, Inc. (Japan) | | | 13 | | | | 23,481 | |

Office Properties Income Trust | | | 169 | | | | 5,178 | |

Park Hotels & Resorts, Inc. | | | 6,382 | | | | 159,359 | |

Pebblebrook Hotel Trust | | | 1,500 | | | | 41,730 | |

RLJ Lodging Trust | | | 17,858 | | | | 303,407 | |

RPT Realty | | | 2,100 | | | | 28,455 | |

Ryman Hospitality Properties, Inc. | | | 4,125 | | | | 337,466 | |

Scentre Group (Australia) | | | 17,045 | | | | 45,215 | |

See Notes to Financial Statements.

| | | | | | | | |

| Description | | Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Equity Real Estate Investment Trusts (REITs) (cont’d.) | | | | | | | | |

Segro PLC (United Kingdom) | | | 3,501 | | | $ | 34,923 | |

Senior Housing Properties Trust | | | 12,800 | | | | 118,464 | |

Spirit MTA REIT | | | 2,130 | | | | 17,977 | |