UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-07343 |

| |

| Exact name of registrant as specified in charter: | | The Prudential Investment Portfolios, Inc. |

| |

| Address of principal executive offices: | | 655 Broad Street, 6th Floor |

| | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Andrew R. French |

| | 655 Broad Street, 6th Floor |

| | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

| Date of fiscal year end: | | 9/30/2022 |

| |

| Date of reporting period: | | 9/30/2022 |

Item 1 – Reports to Stockholders

PGIM BALANCED FUND

ANNUAL REPORT

SEPTEMBER 30, 2022

To enroll in e-delivery, go to pgim.com/investments/resource/edelivery

Table of Contents

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

Mutual funds are distributed by Prudential Investment Management Services LLC, a Prudential Financial companyand member SIPC. PGIM Fixed Income is a unit of PGIM, Inc. (PGIM), a registered investment adviser and Prudential Financial company. PGIM Quantitative Solutions is the primary business name of PGIM Quantitative Solutions LLC, a wholly owned subsidiary of PGIM, Inc. (PGIM), a registered investment adviser and Prudential Financial company. © 2022 Prudential Financial, Inc. and its related entities. PGIM and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

2 Visit our website at pgim.com/investments

Letter from the President

| | |

| | Dear Shareholder: |

| | We hope you find the annual report for the PGIM Balanced Fund informative and useful. The report covers performance for the 12-month period that ended September 30, 2022. |

| | The attention of the global economy and financial markets pivoted during the period from the COVID-19 pandemic to the challenge of rapidly rising inflation. While job growth and corporate profits remained strong, prices for a wide range of goods and services rose in response to economic re-openings, supply-chain disruptions, governmental stimulus, and |

Russia’s invasion of Ukraine. With inflation surging to a 40-year high, the US Federal Reserve and other central banks aggressively hiked interest rates, prompting recession concerns.

After rising to record levels at the end of 2021, stocks have fallen sharply in 2022 as investors worried about higher prices, slowing economic growth, geopolitical uncertainty, and new COVID-19 outbreaks. Equities rallied for a time during the summer but began falling again in late August on fears that the Fed would keep raising rates to tame inflation. For the entire 12-month period, equities suffered a broad-based global decline, although large-cap US stocks outperformed their small-cap counterparts by a significant margin. International developed and emerging markets trailed the US market during this time.

Rising rates and economic uncertainty drove fixed income prices broadly lower as well. US and global investment-grade bonds, along with US high yield corporate bonds and emerging market debt, all posted negative returns during the period.

Regarding your investments with PGIM, we believe it is important to maintain a diversified portfolio of funds consistent with your tolerance for risk, time horizon, and financial goals. Your financial advisor can help you create a diversified investment plan that may include funds covering all the basic asset classes and that reflects your personal investor profile and risk tolerance. However, diversification and asset allocation strategies do not assure a profit or protect against loss in declining markets.

At PGIM Investments, we provide access to active investment strategies across the global markets in the pursuit of consistent outperformance for investors. PGIM is the world’s 11th-largest investment manager with more than $1.5 trillion in assets under management. Our scale and investment expertise allow us to deliver a diversified suite of actively managed solutions across a broad spectrum of asset classes and investment styles.

Thank you for choosing our family of funds.

Sincerely,

Stuart S. Parker, President

PGIM Balanced Fund

November 15, 2022

PGIM Balanced Fund 3

Your Fund’s Performance (unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at pgim.com/investments or by calling (800) 225-1852.

| | | | | | | | |

| |

| | | Average Annual Total Returns as of 9/30/22 |

| | One Year (%) | | Five Years (%) | | Ten Years (%) | | Since Inception (%) |

| | | | |

Class A | | | | | | | | |

| | | | |

(with sales charges) | | -19.65 | | 2.30 | | 5.69 | | — |

| | | | |

(without sales charges) | | -16.95 | | 2.98 | | 6.04 | | — |

| | | | |

Class C (with sales charges) | | -18.32 | | 2.20 | | 5.28 | | — |

| | | | |

(without sales charges) | | -17.58 | | 2.20 | | 5.28 | | — |

| | | | |

Class R (without sales charges) | | -17.36 | | 2.48 | | 5.68 | | — |

| | | | |

Class Z (without sales charges) | | -16.74 | | 3.23 | | 6.33 | | — |

| | | | |

Class R6 (without sales charges) | | -16.66 | | N/A | | N/A | | 2.87 (11/28/2017) |

| | | | |

Customized Blend Index | | | | | | | | |

| | | | |

| | -16.40 | | 4.29 | | 6.38 | | — |

| | | | |

Bloomberg US Aggregate Bond Index | | | | | | | | |

| | | | |

| | -14.60 | | -0.27 | | 0.89 | | — |

| | | | |

S&P 500 Index | | | | | | | | |

| | | -15.46 | | 9.24 | | 11.70 | | — |

| | |

|

| Average Annual Total Returns as of 9/30/22 Since Inception (%) |

| | | Class R6

(11/28/2017) |

| |

Customized Blend Index | | 3.84 |

| |

Bloomberg US Aggregate Bond Index | | -0.27 |

| |

S&P 500 Index | | 8.37 |

Since Inception returns are provided for any share class with less than 10 fiscal years of returns. Since Inception returns for the Indexes are measured from the closest month-end to the class’s inception date.

4 Visit our website at pgim.com/investments

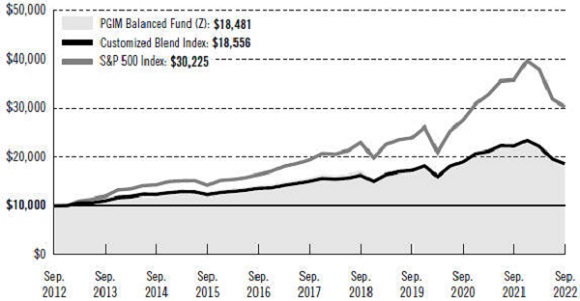

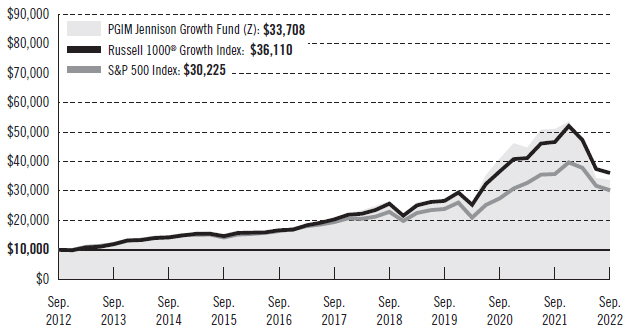

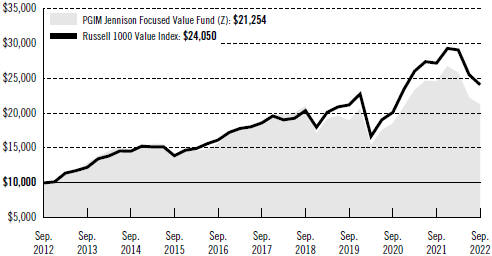

Growth of a $10,000 Investment (unaudited)

The graph compares a $10,000 investment in the Fund’s Class Z shares with a similar investment in the Customized Blend Index and the S&P 500 Index by portraying the initial account values at the beginning of the 10-year period (September 30, 2012) and the account values at the end of the current fiscal year (September 30, 2022), as measured on a quarterly basis. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted and (b) all dividends and distributions were reinvested. The line graph provides information for Class Z shares only. As indicated in the tables provided earlier, performance for other share classes will vary due to the differing fees and expenses applicable to each share class (as indicated in the following paragraphs). Without waiver of fees and/or expense reimbursements, if any, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

PGIM Balanced Fund 5

Your Fund’s Performance (continued)

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. The average annual total returns take into account applicable sales charges, which are described for each share class in the table below.

| | | | | | | | | | |

| | | | | | |

| | | Class A | | Class C | | Class R | | Class Z | | Class R6 |

| | | | | | |

Maximum initial sales charge | | 3.25% of the public offering price | | None | | None | | None | | None |

| Contingent deferred sales charge (CDSC) (as a percentage of the lower of the original purchase price or the net asset value at redemption) | | 1.00% on sales of $500,000 or more made within 12 months of purchase | | 1.00% on sales made within 12 months of purchase | | None | | None | | None |

| Annual distribution and service (12b-1) fees (shown as a percentage of average daily net assets) | | 0.30% | | 1.00% | | 0.75% (0.50% currently) | | None | | None |

Benchmark Definitions

Customized Blend Index*—The Customized Blend Index is unmanaged and intended to provide a theoretical comparison to the Fund’s performance based on the amounts allocated to each asset class. S&P 500 Index (44%) provides a broad indicator of domestic stock price movements in large cap stocks; Bloomberg US Aggregate Bond Index (40%) includes investment grade securities issued by the US government, its agencies, and by corporations with between 1 and 10 years remaining to maturity; Russell 2000 Index (4%) contains the 2,000 smallest US companies included in the Russell 3000 Index, which gives a broad look at how stock prices of smaller companies have performed; and MSCI ACWI ex US Index (12%) is a stock market index comprising of non-US stocks from 23 developed markets and 26 emerging markets.

Note: Prior to February 3, 2020, the Customized Blend Index consisted of the S&P 500 Index (50%), the Bloomberg US Aggregate Bond Index (40%), the Russell 2000 Index (5%), and the MSCI Europe, Australasia and Far East (EAFE) Net Dividend (ND) Index (5%).

Bloomberg US Aggregate Bond Index—The Bloomberg US Aggregate Bond Index is unmanaged and represents securities that are taxable and US dollar denominated. It covers the US investment-grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

S&P 500 Index*—The S&P 500 Index is an unmanaged index of over 500 stocks of large US public companies. It gives a broad look at how stock prices in the United States have performed.

6 Visit our website at pgim.com/investments

*The S&P 500 Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by PGIM, Inc. and/or its affiliates. Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P Global, Inc., and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of S&P Global and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC.

Investors cannot invest directly in an index. The returns for the Indexes would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes that may be paid by an investor.

Presentation of Fund Holdings as of 9/30/22

| | | | |

| | |

| Ten Largest Holdings | | Line of Business | | % of Net Assets |

Apple, Inc. | | Technology Hardware, Storage & Peripherals | | 2.8% |

| | |

Microsoft Corp. | | Software | | 2.6% |

U.S. Treasury Bonds, 2.250%, 05/15/41 | | U.S. Treasury Obligations | | 2.0% |

| | |

Amazon.com, Inc. | | Internet & Direct Marketing Retail | | 1.2% |

Tesla, Inc. | | Automobiles | | 1.1% |

| | |

Alphabet, Inc. (Class A Stock) | | Interactive Media & Services | | 0.9% |

Alphabet, Inc. (Class C Stock) | | Interactive Media & Services | | 0.9% |

| | |

U.S. Treasury Bonds, 2.500%, 02/15/46 | | U.S. Treasury Obligations | | 0.9% |

UnitedHealth Group, Inc. | | Health Care Providers & Services | | 0.8% |

| | |

Federal National Mortgage Assoc., 4.500%, TBA | | U.S. Government Agency Obligations | | 0.8% |

Holdings reflect only long-term investments and are subject to change.

PGIM Balanced Fund 7

Strategy and Performance Overview* (unaudited)

How did the Fund perform?

The PGIM Balanced Fund’s Class Z shares returned –16.74% in the 12-month reporting period that ended September 30, 2022, underperforming the –16.40% return of the Customized Blend Index (the Index). The Index consists of the S&P 500 Index (44%), the Bloomberg US Aggregate Bond Index (40%), the Russell 2000 Index (4%), and the MSCI ACWI ex US Index (12%).

What were the market conditions?

| · | | During the reporting period, high inflation caused central banks around the world to do a U-turn and aggressively tighten policy, resulting in sharp declines among both equity and bond markets. Markets experienced one of the worst periods for 60/40 portfolios in history, with the S&P 500 Index down 15.46% and the Bloomberg US Bond Aggregate Index falling 14.60%. |

| · | | Aggressive monetary policy tightening, sky-high energy prices in Europe, high inflation, and heightened geopolitical risk all raised the specter of a global recession. |

| · | | The US economy suffered two consecutive quarters of negative GDP growth during the first half of 2022, although PGIM Quantitative Solutions believes these negative numbers could be revised upward. For this and other reasons, PGIM Quantitative Solutions does not expect 2022 to constitute an “official” US recession. |

| · | | The eurozone economy wilted under the pressure of rising natural gas and electricity prices, stemming from the disruption of Russia’s ongoing war in Ukraine. More dire outcomes are possible should Russia permanently cut off gas flows to the eurozone. |

| · | | Following the sharp pullback during the first half of 2022, global equity markets staged a partial recovery at the start of the third quarter but generally gave back most of their gains by the end of the period, as inflation failed to decline as expected, and central banks became increasingly hawkish. |

What worked?

| · | | Asset allocation contributed positively to performance during the reporting period. The Fund held an overweight to equities relative to their strategic allocation in the fourth quarter of 2021 as stocks rose almost 9%. Timely shifts during the first nine months of 2022 also had a minor positive impact on relative performance. |

| · | | Performance relative to the S&P 500 Index within the large-cap US equity segment of the Fund benefited from a tilt toward stocks that were comparatively inexpensive relative to industry peers, represented in the Fund’s value factors. To a lesser extent, growth and quality factors also contributed positively. |

| · | | Relative performance within the small-cap US equity segment of the Fund benefited from a tilt toward comparatively inexpensive, high-quality stocks with improving growth prospects. Relative valuation was the chief positive contributor during the period. |

| · | | In the international equity segment of the Fund, value factors worked especially well for the trailing 12 months and were the predominant drivers of the Fund’s relatively |

8 Visit our website at pgim.com/investments

| | strong performance. Relative returns benefited from favoring reasonably priced energy and consumer staples names, and from avoiding expensive names in communication services, particularly in Korea and Singapore. Growth measures also contributed positively; however, their impact proved much more muted. |

| · | | In terms of markets, China contributed the strongest returns, driven by broadly effective stock selection and an overweight in energy—China’s only positive sector in absolute terms. |

| · | | On a sector basis, the best relative performers were information technology and utilities. |

| · | | Within the fixed income segment, the Fund’s yield curve positioning, principally along the US Treasury yield curve, added to performance. (A yield curve is a line graph that illustrates the relationship between the yields and maturities of fixed income securities. It is created by plotting the yields of different maturities for the same type of bonds.) |

| · | | Based on spread duration positioning, an underweight in mortgage-backed securities (MBS), including/collateralized mortgage obligations (CMOs), also contributed positively to the fixed income segment. (Duration measures the sensitivity of the price—the value of principal—of a bond to a change in interest rates.) |

What didn’t work?

| · | | Within the large-cap US equity segment of the Fund, stock selection in the consumer discretionary sector lagged the S&P 500 Index during the reporting period. |

| · | | The small-cap US equity segment of the Fund underperformed the Russell 2000 Index in the real estate sector. |

| · | | Within the international equity segment of the Fund, quality and top-down measures struggled, particularly since the top- and bottom-ranked names were the worst and best performers, respectively, in each component. A tilt to high-quality industrials and materials names, and away from low-quality consumer discretionary and energy names, hurt performance. On a top-down basis, losses were driven by an overweight among highly ranked names in consumer staples, financials, and healthcare, and an underweight among bottom-ranked names in financials in South Korea. |

| · | | By market, underperformance was driven by positions in the UK, primarily due to an underweight to materials and stock selection in consumer discretionary; and in Russia, where a modest tilt proved detrimental when Russian securities were valued at close to zero in the wake of the country’s invasion of Ukraine. |

| · | | The materials and financials sectors detracted the most. |

| · | | The fixed income segment of the Fund underperformed the Bloomberg US Aggregate Bond Index during the period. Sector allocation within this segment detracted from performance, with allocations to high yield corporate bonds, commercial mortgage-backed securities (CMBS), collateralized loan obligations (CLOs), emerging market debt, bank loans, agency securities, and municipal securities hurting returns. |

PGIM Balanced Fund 9

Strategy and Performance Overview* (continued)

| · | | Security selection in the fixed income segment of the Fund also undermined relative performance, particularly within investment-grade corporates, emerging market debt, and high yield. In the corporate sector, the Fund’s positions in healthcare and pharmaceuticals detracted from returns. |

| · | | The largest detractor within fixed income was a position in the Republic of Ukraine in emerging markets. |

Did the Fund use derivatives?

| · | | The Fund used S&P 500 equity futures to equitize cash positions and for liquidity purposes. This exposure had a small negative impact on the Fund’s performance during the reporting period. |

| · | | The US equity sleeves did not hold any derivatives. The international equity sleeve held derivatives, which were used to maintain exposure to equities and provide portfolio liquidity. The futures were fully collateralized and had minimal impact on performance. |

| · | | The Fund’s fixed income sleeve uses derivatives when they facilitate implementation of the overall investment approach. During the period, the Fund used interest rate futures, options, and swaps to help manage duration positioning and yield curve exposure. Over the period, futures and swaps hurt Fund performance, while options had a positive impact. In addition, the Fund traded foreign exchange derivatives, which added to performance. |

Current outlook

| · | | PGIM Quantitative Solutions doubts the US will make it through the ongoing interest rate hiking cycle without a recession, especially given the current high level of inflation and the low unemployment rate, but sees little evidence that a recession is imminent and thinks the recession could occur later rather than sooner. |

| · | | The inflation problem might not be easily solved, but central banks are laser beam focused on trying to stem it by aggressively hiking interest rates, even at the risk of creating substantial economic pain. The US Federal Reserve (Fed) has signaled that it intends to do whatever it takes to bring inflation down. |

| · | | China’s economy continues to be hobbled by ongoing COVID-19 restrictions and its real estate bust (and associated deleveraging). A host of structural problems (political, economic, geopolitical, and demographic) plague China’s long-term growth prospects. |

| · | | Monetary tightening works, in part, by tightening financial conditions, and the Fed has indicated that tight financial conditions (i.e., risk-off markets and higher rates) are a feature, not a bug, of their current policy stance. |

| · | | Given this environment, PGIM Quantitative Solutions maintains cautious tactical positioning on asset allocation relative to policy benchmarks; the Fund holds overweight exposure to cash and modestly underweight exposure to global equities. |

10 Visit our website at pgim.com/investments

| · | | While equities have already experienced the type of declines one might expect from a mild recession, still-larger declines are a real possibility given the odds of monetary policy over-tightening (and thus more significant economic contraction) in the current inflationary environment. |

| · | | On the brighter side, longer-term value in financial markets is being restored as interest rates rise, and stock valuations fall. The typical 60/40 balanced portfolio based on global equities and global bonds has seen a substantially improved long-term return profile given the recent carnage. |

| · | | Have equity valuations adjusted downward too much? A good case can be made for this proposition outside the US, where a host of developed and emerging market countries are trading at what appear to be bargain-basement prices. |

| · | | Valuations have improved in the US as well, but the equity market remains expensive on a historical basis and relative to other countries. |

*This strategy and performance overview, which discusses what strategies or holdings (including derivatives, if applicable) affected the Fund’s performance, is compiled based on how the Fund performed relative to the Fund’s benchmark index and is viewed for performance attribution purposes at the aggregate Fund level, which in most instances will not directly correlate to the amounts disclosed in the Statement of Operations which conform to US generally accepted accounting principles.

PGIM Balanced Fund 11

Fees and Expenses (unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 held through the six-month period ended September 30, 2022. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to individual retirement accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of PGIM funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information

12 Visit our website at pgim.com/investments

provided in the expense table. Additional fees have the effect of reducing investment returns.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | |

| | | | | |

| PGIM Balanced Fund | | Beginning Account Value April 1, 2022 | | Ending Account Value September 30, 2022 | | Annualized Expense Ratio Based on the Six-Month Period | | Expenses Paid During the Six-Month Period* |

| | | | | |

Class A | | Actual | | $1,000.00 | | $ 830.40 | | 1.00% | | $4.59 |

| | | | | |

| | Hypothetical | | $1,000.00 | | $1,020.05 | | 1.00% | | $5.06 |

| | | | | |

Class C | | Actual | | $1,000.00 | | $ 827.00 | | 1.80% | | $8.24 |

| | | | | |

| | Hypothetical | | $1,000.00 | | $1,016.04 | | 1.80% | | $9.10 |

| | | | | |

Class R | | Actual | | $1,000.00 | | $ 828.40 | | 1.47% | | $6.74 |

| | | | | |

| | Hypothetical | | $1,000.00 | | $1,017.70 | | 1.47% | | $7.44 |

| | | | | |

Class Z | | Actual | | $1,000.00 | | $ 831.60 | | 0.77% | | $3.54 |

| | | | | |

| | Hypothetical | | $1,000.00 | | $1,021.21 | | 0.77% | | $3.90 |

| | | | | |

Class R6 | | Actual | | $1,000.00 | | $ 831.80 | | 0.65% | | $2.98 |

| | | | | |

| | | Hypothetical | | $1,000.00 | | $1,021.81 | | 0.65% | | $3.29 |

* Fund expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 183 days in the six-month period ended September 30, 2022, and divided by the 365 days in the Fund’s fiscal year ended September 30, 2022 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

PGIM Balanced Fund 13

Schedule of Investments

as of September 30, 2022

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

LONG-TERM INVESTMENTS 98.6% | | | | | | | | |

| | |

COMMON STOCKS 57.5% | | | | | | | | |

| | |

Aerospace & Defense 1.0% | | | | | | | | |

| | |

AerSale Corp.* | | | 3,700 | | | $ | 68,598 | |

BAE Systems PLC (United Kingdom) | | | 13,340 | | | | 117,211 | |

Bharat Electronics Ltd. (India) | | | 41,076 | | | | 50,653 | |

General Dynamics Corp. | | | 7,500 | | | | 1,591,275 | |

Howmet Aerospace, Inc. | | | 23,200 | | | | 717,576 | |

Lockheed Martin Corp. | | | 4,277 | | | | 1,652,163 | |

Maxar Technologies, Inc. | | | 4,200 | | | | 78,624 | |

Moog, Inc. (Class A Stock) | | | 1,700 | | | | 119,595 | |

Northrop Grumman Corp. | | | 3,300 | | | | 1,552,056 | |

Parsons Corp.* | | | 1,400 | | | | 54,880 | |

Raytheon Technologies Corp. | | | 15,557 | | | | 1,273,496 | |

Thales SA (France) | | | 378 | | | | 41,653 | |

TransDigm Group, Inc. | | | 3,400 | | | | 1,784,388 | |

V2X, Inc.* | | | 1,480 | | | | 52,392 | |

| | | | | | | | |

| | |

| | | | | | | 9,154,560 | |

| | |

Air Freight & Logistics 0.3% | | | | | | | | |

| | |

FedEx Corp. | | | 15,600 | | | | 2,316,132 | |

Hub Group, Inc. (Class A Stock)* | | | 1,500 | | | | 103,470 | |

Radiant Logistics, Inc.* | | | 7,939 | | | | 45,173 | |

| | | | | | | | |

| | |

| | | | | | | 2,464,775 | |

| | |

Airlines 0.3% | | | | | | | | |

| | |

Alaska Air Group, Inc.* | | | 48,900 | | | | 1,914,435 | |

Frontier Group Holdings, Inc.* | | | 3,000 | | | | 29,100 | |

SkyWest, Inc.* | | | 3,560 | | | | 57,885 | |

Southwest Airlines Co.* | | | 18,100 | | | | 558,204 | |

Turk Hava Yollari AO (Turkey)* | | | 11,319 | | | | 42,978 | |

| | | | | | | | |

| | |

| | | | | | | 2,602,602 | |

| | |

Auto Components 0.2% | | | | | | | | |

| | |

Adient PLC* | | | 6,700 | | | | 185,925 | |

American Axle & Manufacturing Holdings, Inc.* | | | 16,300 | | | | 111,329 | |

BorgWarner, Inc. | | | 40,900 | | | | 1,284,260 | |

Goodyear Tire & Rubber Co. (The)* | | | 14,200 | | | | 143,278 | |

Hyundai Mobis Co. Ltd. (South Korea) | | | 325 | | | | 42,901 | |

Visteon Corp.* | | | 2,100 | | | | 222,726 | |

| | | | | | | | |

| | |

| | | | | | | 1,990,419 | |

See Notes to Financial Statements.

PGIM Balanced Fund 15

Schedule of Investments (continued)

as of September 30, 2022

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Automobiles 1.9% | | | | | | | | |

| | |

Astra International Tbk PT (Indonesia) | | | 1,288,500 | | | $ | 557,598 | |

BYD Co. Ltd. (China) (Class H Stock) | | | 25,000 | | | | 615,889 | |

Ferrari NV (Italy) | | | 286 | | | | 52,963 | |

Ford Motor Co. | | | 176,100 | | | | 1,972,320 | |

Ford Otomotiv Sanayi A/S (Turkey) | | | 24,047 | | | | 423,614 | |

General Motors Co. | | | 17,000 | | | | 545,530 | |

Kia Corp. (South Korea) | | | 11,671 | | | | 580,889 | |

Mahindra & Mahindra Ltd. (India) | | | 28,930 | | | | 447,601 | |

Mazda Motor Corp. (Japan) | | | 9,400 | | | | 62,417 | |

Mercedes-Benz Group AG (Germany) | | | 4,002 | | | | 202,369 | |

Stellantis NV | | | 54,290 | | | | 641,298 | |

Suzuki Motor Corp. (Japan) | | | 7,500 | | | | 233,476 | |

Tesla, Inc.* | | | 37,400 | | | | 9,920,350 | |

Toyota Motor Corp. (Japan) | | | 8,270 | | | | 108,093 | |

| | | | | | | | |

| | |

| | | | | | | 16,364,407 | |

| | |

Banks 3.5% | | | | | | | | |

| | |

Amalgamated Financial Corp. | | | 2,000 | | | | 45,100 | |

Ameris Bancorp | | | 2,400 | | | | 107,304 | |

Associated Banc-Corp. | | | 2,200 | | | | 44,176 | |

Banc of California, Inc. | | | 5,500 | | | | 87,835 | |

Banco do Brasil SA (Brazil) | | | 93,600 | | | | 667,165 | |

Bank Hapoalim BM (Israel) | | | 15,035 | | | | 126,917 | |

Bank Leumi Le-Israel BM (Israel) | | | 73,952 | | | | 631,607 | |

Bank Mandiri Persero Tbk PT (Indonesia) | | | 181,000 | | | | 111,141 | |

Bank of America Corp. | | | 97,600 | | | | 2,947,520 | |

Bank of Chengdu Co. Ltd. (China) (Class A Stock) | | | 51,300 | | | | 117,256 | |

Bank of China Ltd. (China) (Class H Stock) | | | 1,183,000 | | | | 386,362 | |

Bank of Communications Co. Ltd. (China) (Class H Stock) | | | 221,000 | | | | 116,506 | |

Bank of Georgia Group PLC (Georgia) | | | 10,814 | | | | 238,073 | |

Bank of Jiangsu Co. Ltd. (China) (Class A Stock) | | | 152,200 | | | | 158,073 | |

Bank of NT Butterfield & Son Ltd. (The) (Bermuda) | | | 2,698 | | | | 87,577 | |

BankUnited, Inc. | | | 1,300 | | | | 44,421 | |

Barclays PLC (United Kingdom) | | | 401,218 | | | | 638,392 | |

Cathay General Bancorp | | | 2,100 | | | | 80,766 | |

China CITIC Bank Corp. Ltd. (China) (Class H Stock) | | | 120,000 | | | | 47,621 | |

China Construction Bank Corp. (China) (Class H Stock) | | | 1,503,000 | | | | 867,535 | |

Citigroup, Inc. | | | 53,800 | | | | 2,241,846 | |

Citizens Financial Group, Inc. | | | 49,000 | | | | 1,683,640 | |

Civista Bancshares, Inc. | | | 1,400 | | | | 29,064 | |

CNB Financial Corp. | | | 4,876 | | | | 114,927 | |

Coastal Financial Corp.* | | | 800 | | | | 31,792 | |

Customers Bancorp, Inc.* | | | 1,360 | | | | 40,093 | |

DBS Group Holdings Ltd. (Singapore) | | | 39,900 | | | | 923,021 | |

See Notes to Financial Statements.

16

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Banks (cont’d.) | | | | | | | | |

| | |

DGB Financial Group, Inc. (South Korea) | | | 18,914 | | | $ | 91,703 | |

DNB Bank ASA (Norway) | | | 36,442 | | | | 578,264 | |

Eastern Bankshares, Inc. | | | 1,000 | | | | 19,640 | |

Enterprise Financial Services Corp. | | | 700 | | | | 30,828 | |

Eurobank Ergasias Services and Holdings SA (Greece)* | | | 62,738 | | | | 52,368 | |

Financial Institutions, Inc. | | | 6,552 | | | | 157,707 | |

First BanCorp. (Puerto Rico) | | | 17,000 | | | | 232,560 | |

First Commonwealth Financial Corp. | | | 2,800 | | | | 35,952 | |

First Financial Bancorp | | | 800 | | | | 16,864 | |

First Internet Bancorp | | | 4,688 | | | | 158,736 | |

Fulton Financial Corp. | | | 800 | | | | 12,640 | |

Haci Omer Sabanci Holding A/S (Turkey) | | | 380,002 | | | | 527,153 | |

Hana Financial Group, Inc. (South Korea) | | | 21,901 | | | | 537,779 | |

Hancock Whitney Corp. | | | 5,500 | | | | 251,955 | |

Hanmi Financial Corp. | | | 1,200 | | | | 28,416 | |

Heartland Financial USA, Inc. | | | 4,780 | | | | 207,261 | |

Hope Bancorp, Inc. | | | 2,620 | | | | 33,117 | |

Horizon Bancorp, Inc. | | | 3,300 | | | | 59,268 | |

HSBC Holdings PLC (United Kingdom) | | | 29,722 | | | | 153,896 | |

Industrial & Commercial Bank of China Ltd. (China) (Class H Stock) | | | 209,000 | | | | 98,043 | |

Industrial Bank Co. Ltd. (China) (Class A Stock) | | | 68,600 | | | | 159,321 | |

Israel Discount Bank Ltd. (Israel) (Class A Stock) | | | 8,148 | | | | 41,028 | |

JPMorgan Chase & Co. | | | 28,624 | | | | 2,991,208 | |

KB Financial Group, Inc. (South Korea) | | | 19,192 | | | | 579,570 | |

Lloyds Banking Group PLC (United Kingdom) | | | 1,485,064 | | | | 671,232 | |

M&T Bank Corp. | | | 1,400 | | | | 246,848 | |

Metropolitan Bank Holding Corp.* | | | 1,200 | | | | 77,232 | |

MidWestOne Financial Group, Inc. | | | 4,483 | | | | 122,341 | |

NatWest Group PLC (United Kingdom) | | | 228,837 | | | | 569,970 | |

Nordea Bank Abp (Finland) | | | 46,282 | | | | 396,092 | |

OceanFirst Financial Corp. | | | 4,700 | | | | 87,608 | |

OFG Bancorp (Puerto Rico) | | | 10,487 | | | | 263,538 | |

Old National Bancorp | | | 3,700 | | | | 60,939 | |

Old Second Bancorp, Inc. | | | 4,418 | | | | 57,655 | |

Origin Bancorp, Inc. | | | 800 | | | | 30,776 | |

Orrstown Financial Services, Inc. | | | 787 | | | | 18,825 | |

Oversea-Chinese Banking Corp. Ltd. (Singapore) | | | 60,400 | | | | 494,911 | |

Peoples Bancorp, Inc. | | | 400 | | | | 11,572 | |

Primis Financial Corp. | | | 3,180 | | | | 38,573 | |

QCR Holdings, Inc. | | | 1,873 | | | | 95,411 | |

RBB Bancorp | | | 2,000 | | | | 41,560 | |

Renasant Corp. | | | 1,000 | | | | 31,280 | |

Royal Bank of Canada (Canada) | | | 900 | | | | 81,032 | |

See Notes to Financial Statements.

PGIM Balanced Fund 17

Schedule of Investments (continued)

as of September 30, 2022

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Banks (cont’d.) | | | | | | | | |

| | |

S&T Bancorp, Inc. | | | 300 | | | $ | 8,793 | |

Sberbank of Russia PJSC (Russia)*^ | | | 202,510 | | | | — | |

Shinhan Financial Group Co. Ltd. (South Korea) | | | 4,584 | | | | 106,482 | |

Simmons First National Corp. (Class A Stock) | | | 1,700 | | | | 37,043 | |

Skandinaviska Enskilda Banken AB (Sweden) (Class A Stock) | | | 8,018 | | | | 76,418 | |

Swedbank AB (Sweden) (Class A Stock) | | | 43,091 | | | | 565,602 | |

Towne Bank | | | 1,500 | | | | 40,245 | |

Truist Financial Corp. | | | 47,400 | | | | 2,063,796 | |

Turkiye Is Bankasi A/S (Turkey) (Class C Stock) | | | 558,106 | | | | 224,759 | |

U.S. Bancorp | | | 2,700 | | | | 108,864 | |

Valley National Bancorp | | | 11,260 | | | | 121,608 | |

Wells Fargo & Co. | | | 107,920 | | | | 4,340,542 | |

WesBanco, Inc. | | | 1,000 | | | | 33,370 | |

Woori Financial Group, Inc. (South Korea) | | | 5,229 | | | | 38,805 | |

| | | | | | | | |

| | |

| | | | | | | 30,834,729 | |

| | |

Beverages 1.2% | | | | | | | | |

| | |

Coca-Cola Co. (The) | | | 85,400 | | | | 4,784,108 | |

Coca-Cola Consolidated, Inc. | | | 340 | | | | 139,988 | |

Heineken Holding NV (Netherlands) | | | 609 | | | | 41,691 | |

Heineken NV (Netherlands) | | | 1,296 | | | | 113,181 | |

National Beverage Corp. | | | 2,360 | | | | 90,955 | |

PepsiCo, Inc. | | | 30,100 | | | | 4,914,126 | |

| | | | | | | | |

| | |

| | | | | | | 10,084,049 | |

| | |

Biotechnology 1.6% | | | | | | | | |

| | |

AbbVie, Inc. | | | 17,505 | | | | 2,349,346 | |

Agenus, Inc.* | | | 52,100 | | | | 106,805 | |

Alkermes PLC* | | | 4,500 | | | | 100,485 | |

Amgen, Inc. | | | 800 | | | | 180,320 | |

Catalyst Pharmaceuticals, Inc.* | | | 20,720 | | | | 265,838 | |

Cerevel Therapeutics Holdings, Inc.* | | | 4,900 | | | | 138,474 | |

Chongqing Zhifei Biological Products Co. Ltd. (China) (Class A Stock) | | | 13,300 | | | | 160,481 | |

Daan Gene Co. Ltd. (China) (Class A Stock) | | | 18,400 | | | | 42,648 | |

Eagle Pharmaceuticals, Inc.* | | | 3,480 | | | | 91,942 | |

Eiger BioPharmaceuticals, Inc.* | | | 7,600 | | | | 57,228 | |

Emergent BioSolutions, Inc.* | | | 4,964 | | | | 104,194 | |

Exact Sciences Corp.* | | | 4,000 | | | | 129,960 | |

Forma Therapeutics Holdings, Inc.* | | | 1,500 | | | | 29,925 | |

Geron Corp.* | | | 23,200 | | | | 54,288 | |

Gilead Sciences, Inc. | | | 43,289 | | | | 2,670,498 | |

Horizon Therapeutics PLC* | | | 9,200 | | | | 569,388 | |

See Notes to Financial Statements.

18

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Biotechnology (cont’d.) | | | | | | | | |

| | |

ImmunoGen, Inc.* | | | 30,300 | | | $ | 144,834 | |

Immunovant, Inc.* | | | 4,400 | | | | 24,552 | |

Insmed, Inc.* | | | 9,700 | | | | 208,938 | |

IVERIC bio, Inc.* | | | 700 | | | | 12,558 | |

Karuna Therapeutics, Inc.* | | | 170 | | | | 38,238 | |

Keros Therapeutics, Inc.* | | | 1,000 | | | | 37,620 | |

Kodiak Sciences, Inc.* | | | 1,600 | | | | 12,384 | |

Kronos Bio, Inc.* | | | 4,400 | | | | 14,740 | |

Mersana Therapeutics, Inc.* | | | 2,400 | | | | 16,224 | |

MiMedx Group, Inc.* | | | 4,200 | | | | 12,054 | |

Mirum Pharmaceuticals, Inc.* | | | 7,700 | | | | 161,777 | |

Moderna, Inc.* | | | 9,400 | | | | 1,111,550 | |

Organogenesis Holdings, Inc.* | | | 27,400 | | | | 88,776 | |

PTC Therapeutics, Inc.* | | | 6,180 | | | | 310,236 | |

Regeneron Pharmaceuticals, Inc.* | | | 1,000 | | | | 688,870 | |

United Therapeutics Corp.* | | | 3,100 | | | | 649,078 | |

Vanda Pharmaceuticals, Inc.* | | | 15,877 | | | | 156,865 | |

Vaxcyte, Inc.* | | | 2,100 | | | | 50,400 | |

Veracyte, Inc.* | | | 10,400 | | | | 172,640 | |

Vertex Pharmaceuticals, Inc.* | | | 9,300 | | | | 2,692,722 | |

Vir Biotechnology, Inc.* | | | 4,400 | | | | 84,832 | |

| | | | | | | | |

| | |

| | | | | | | 13,741,708 | |

| | |

Building Products 0.1% | | | | | | | | |

| | |

Cie de Saint-Gobain (France) | | | 16,995 | | | | 607,667 | |

Griffon Corp. | | | 2,500 | | | | 73,800 | |

Inwido AB (Sweden) | | | 5,973 | | | | 46,972 | |

Nibe Industrier AB (Sweden) (Class B Stock) | | | 11,388 | | | | 101,583 | |

Resideo Technologies, Inc.* | | | 2,900 | | | | 55,274 | |

UFP Industries, Inc. | | | 3,277 | | | | 236,468 | |

| | | | | | | | |

| | |

| | | | | | | 1,121,764 | |

| | |

Capital Markets 1.3% | | | | | | | | |

| | |

3i Group PLC (United Kingdom) | | | 19,603 | | | | 235,382 | |

Ameriprise Financial, Inc. | | | 1,000 | | | | 251,950 | |

AURELIUS Equity Opportunities SE & Co. KGaA (Germany) | | | 6,058 | | | | 112,324 | |

Bank of New York Mellon Corp. (The) | | | 12,100 | | | | 466,092 | |

BGC Partners, Inc. (Class A Stock) | | | 28,000 | | | | 87,920 | |

Brookfield Asset Management, Inc. (Canada) (Class A Stock) | | | 7,900 | | | | 323,183 | |

Charles Schwab Corp. (The) | | | 16,500 | | | | 1,185,855 | |

Deutsche Bank AG (Germany) | | | 38,909 | | | | 288,081 | |

Goldman Sachs Group, Inc. (The) | | | 13,510 | | | | 3,959,105 | |

Macquarie Group Ltd. (Australia) | | | 5,854 | | | | 571,118 | |

See Notes to Financial Statements.

PGIM Balanced Fund 19

Schedule of Investments (continued)

as of September 30, 2022

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Capital Markets (cont’d.) | | | | | | | | |

| | |

Morgan Stanley | | | 18,300 | | | $ | 1,445,883 | |

Onex Corp. (Canada) | | | 6,800 | | | | 311,904 | |

Piper Sandler Cos. | | | 1,100 | | | | 115,214 | |

Raymond James Financial, Inc. | | | 2,700 | | | | 266,814 | |

State Street Corp. | | | 3,600 | | | | 218,916 | |

StoneX Group, Inc.* | | | 700 | | | | 58,058 | |

TMX Group Ltd. (Canada) | | | 500 | | | | 45,991 | |

UBS Group AG (Switzerland) | | | 36,035 | | | | 522,794 | |

Virtu Financial, Inc. (Class A Stock) | | | 18,300 | | | | 380,091 | |

Virtus Investment Partners, Inc. | | | 740 | | | | 118,045 | |

| | | | | | | | |

| | |

| | | | | | | 10,964,720 | |

| | |

Chemicals 0.8% | | | | | | | | |

| | |

AdvanSix, Inc. | | | 4,300 | | | | 138,030 | |

Avient Corp. | | | 300 | | | | 9,090 | |

Cabot Corp. | | | 1,100 | | | | 70,279 | |

Chemours Co. (The) | | | 4,200 | | | | 103,530 | |

China BlueChemical Ltd. (China) (Class H Stock) | | | 418,000 | | | | 86,397 | |

Dow, Inc. | | | 15,700 | | | | 689,701 | |

Ecovyst, Inc.* | | | 11,600 | | | | 97,904 | |

Elkem ASA (Norway), 144A* | | | 60,536 | | | | 194,542 | |

Koppers Holdings, Inc. | | | 500 | | | | 10,390 | |

Kronos Worldwide, Inc. | | | 4,700 | | | | 43,898 | |

Kumho Petrochemical Co. Ltd. (South Korea) | | | 3,113 | | | | 249,235 | |

Livent Corp.* | | | 7,900 | | | | 242,135 | |

Lotte Chemical Titan Holding Bhd (Malaysia), 144A | | | 295,000 | | | | 85,164 | |

LyondellBasell Industries NV (Class A Stock) | | | 29,100 | | | | 2,190,648 | |

Minerals Technologies, Inc. | | | 900 | | | | 44,469 | |

Nutrien Ltd. (Canada) | | | 2,900 | | | | 241,850 | |

Olin Corp. | | | 17,100 | | | | 733,248 | |

Orion Engineered Carbons SA (Germany) | | | 2,160 | | | | 28,836 | |

Petronas Chemicals Group Bhd (Malaysia) | | | 311,400 | | | | 560,015 | |

SABIC Agri-Nutrients Co. (Saudi Arabia) | | | 16,329 | | | | 678,300 | |

Sahara International Petrochemical Co. (Saudi Arabia) | | | 3,200 | | | | 34,991 | |

Sasol Ltd. (South Africa) | | | 2,976 | | | | 46,550 | |

Saudi Basic Industries Corp. (Saudi Arabia) | | | 4,585 | | | | 107,298 | |

Shin-Etsu Chemical Co. Ltd. (Japan) | | | 500 | | | | 49,478 | |

Tronox Holdings PLC (Class A Stock) | | | 2,600 | | | | 31,850 | |

Valhi, Inc. | | | 1,300 | | | | 32,708 | |

Westlake Corp. | | | 1,700 | | | | 147,696 | |

Yara International ASA (Brazil) | | | 1,000 | | | | 35,095 | |

| | | | | | | | |

| | |

| | | | | | | 6,983,327 | |

See Notes to Financial Statements.

20

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Commercial Services & Supplies 0.3% | | | | | | | | |

| | |

BrightView Holdings, Inc.* | | | 4,500 | | | $ | 35,730 | |

Brink’s Co. (The) | | | 200 | | | | 9,688 | |

CoreCivic, Inc.* | | | 5,000 | | | | 44,200 | |

Harsco Corp.* | | | 8,900 | | | | 33,286 | |

Interface, Inc. | | | 2,700 | | | | 24,273 | |

Matthews International Corp. (Class A Stock) | | | 500 | | | | 11,205 | |

Securitas AB (Sweden) (Class B Stock) | | | 4,893 | | | | 33,967 | |

SP Plus Corp.* | | | 1,900 | | | | 59,508 | |

Waste Management, Inc. | | | 13,800 | | | | 2,210,898 | |

| | | | | | | | |

| | |

| | | | | | | 2,462,755 | |

| | |

Communications Equipment 0.7% | | | | | | | | |

| | |

Arista Networks, Inc.* | | | 10,300 | | | | 1,162,767 | |

Aviat Networks, Inc.* | | | 400 | | | | 10,952 | |

Calix, Inc.* | | | 4,300 | | | | 262,902 | |

Cisco Systems, Inc. | | | 98,637 | | | | 3,945,480 | |

Extreme Networks, Inc.* | | | 2,100 | | | | 27,447 | |

NetScout Systems, Inc.* | | | 4,659 | | | | 145,920 | |

Nokia OYJ (Finland) | | | 144,722 | | | | 621,300 | |

| | | | | | | | |

| | |

| | | | | | | 6,176,768 | |

| | |

Construction & Engineering 0.1% | | | | | | | | |

| | |

API Group Corp.* | | | 5,300 | | | | 70,331 | |

Arcadis NV (Netherlands) | | | 3,302 | | | | 107,468 | |

Dycom Industries, Inc.* | | | 300 | | | | 28,659 | |

Eiffage SA (France) | | | 480 | | | | 38,493 | |

EMCOR Group, Inc. | | | 2,950 | | | | 340,666 | |

Greentown Management Holdings Co. Ltd. (China), 144A | | | 228,000 | | | | 192,855 | |

Koninklijke BAM Groep NV (Netherlands)* | | | 21,138 | | | | 51,935 | |

Metallurgical Corp. of China Ltd. (China) (Class A Stock) | | | 134,100 | | | | 55,914 | |

Primoris Services Corp. | | | 2,300 | | | | 37,375 | |

Sterling Infrastructure, Inc.* | | | 3,000 | | | | 64,410 | |

Vinci SA (France) | | | 2,664 | | | | 215,413 | |

| | | | | | | | |

| | |

| | | | | | | 1,203,519 | |

| | |

Construction Materials 0.2% | | | | | | | | |

| | |

Eagle Materials, Inc. | | | 13,000 | | | | 1,393,340 | |

Summit Materials, Inc. (Class A Stock)* | | | 5,300 | | | | 126,988 | |

| | | | | | | | |

| | |

| | | | | | | 1,520,328 | |

See Notes to Financial Statements.

PGIM Balanced Fund 21

Schedule of Investments (continued)

as of September 30, 2022

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Consumer Finance 0.3% | | | | | | | | |

| | |

Atlanticus Holdings Corp.* | | | 400 | | | $ | 10,492 | |

Bread Financial Holdings, Inc. | | | 1,200 | | | | 37,740 | |

Capital One Financial Corp. | | | 24,100 | | | | 2,221,297 | |

Enova International, Inc.* | | | 6,400 | | | | 187,328 | |

LendingClub Corp.* | | | 7,400 | | | | 81,770 | |

Navient Corp. | | | 5,300 | | | | 77,857 | |

Oportun Financial Corp.* | | | 2,300 | | | | 10,051 | |

Synchrony Financial | | | 14,100 | | | | 397,479 | |

| | | | | | | | |

| | |

| | | | | | | 3,024,014 | |

| | |

Containers & Packaging 0.3% | | | | | | | | |

| | |

Greif, Inc. (Class A Stock) | | | 4,080 | | | | 243,046 | |

International Paper Co. | | | 11,800 | | | | 374,060 | |

O-I Glass, Inc.* | | | 2,300 | | | | 29,785 | |

Pactiv Evergreen, Inc. | | | 5,900 | | | | 51,507 | |

Westrock Co. | | | 62,400 | | | | 1,927,536 | |

| | | | | | | | |

| | |

| | | | | | | 2,625,934 | |

| | |

Diversified Consumer Services 0.1% | | | | | | | | |

| | |

Laureate Education, Inc. (Class A Stock) | | | 16,200 | | | | 170,910 | |

MegaStudyEdu Co. Ltd. (South Korea) | | | 5,055 | | | | 250,972 | |

PowerSchool Holdings, Inc. (Class A Stock)* | | | 2,300 | | | | 38,387 | |

Stride, Inc.* | | | 400 | | | | 16,812 | |

Universal Technical Institute, Inc.* | | | 8,100 | | | | 44,064 | |

Vivint Smart Home, Inc.* | | | 3,200 | | | | 21,056 | |

| | | | | | | | |

| | |

| | | | | | | 542,201 | |

| | |

Diversified Financial Services 0.6% | | | | | | | | |

| | |

Berkshire Hathaway, Inc. (Class B Stock)* | | | 17,074 | | | | 4,559,099 | |

Cannae Holdings, Inc.* | | | 1,380 | | | | 28,511 | |

ECN Capital Corp. (Canada) | | | 72,100 | | | | 238,533 | |

Element Fleet Management Corp. (Canada) | | | 44,800 | | | | 528,642 | |

Jackson Financial, Inc. (Class A Stock) | | | 4,700 | | | | 130,425 | |

| | | | | | | | |

| | |

| | | | | | | 5,485,210 | |

| | |

Diversified Telecommunication Services 0.8% | | | | | | | | |

| | |

AT&T, Inc. | | | 149,900 | | | | 2,299,466 | |

Bezeq The Israeli Telecommunication Corp. Ltd. (Israel) | | | 251,337 | | | | 410,859 | |

China Tower Corp. Ltd. (China) (Class H Stock), 144A | | | 1,232,000 | | | | 131,629 | |

Deutsche Telekom AG (Germany) | | | 28,306 | | | | 481,816 | |

Koninklijke KPN NV (Netherlands) | | | 182,484 | | | | 493,868 | |

See Notes to Financial Statements.

22

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Diversified Telecommunication Services (cont’d.) | | | | | | | | |

| | |

Liberty Latin America Ltd. (Chile) (Class A Stock)* | | | 11,800 | | | $ | 73,042 | |

Liberty Latin America Ltd. (Chile) (Class C Stock)* | | | 18,500 | | | | 113,775 | |

Ooredoo QPSC (Qatar) | | | 37,584 | | | | 91,594 | |

Spark New Zealand Ltd. (New Zealand) | | | 13,780 | | | | 38,553 | |

Telekom Malaysia Bhd (Malaysia) | | | 33,600 | | | | 39,526 | |

Verizon Communications, Inc. | | | 80,940 | | | | 3,073,292 | |

| | | | | | | | |

| | |

| | | | | | | 7,247,420 | |

| | |

Electric Utilities 0.8% | | | | | | | | |

| | |

ALLETE, Inc. | | | 1,500 | | | | 75,075 | |

Avangrid, Inc. | | | 15,000 | | | | 625,500 | |

Centrais Eletricas Brasileiras SA (Brazil) | | | 5,600 | | | | 44,722 | |

CESC Ltd. (India) | | | 152,880 | | | | 144,444 | |

CPFL Energia SA (Brazil) | | | 28,200 | | | | 176,487 | |

Edison International | | | 38,700 | | | | 2,189,646 | |

Exelon Corp. | | | 59,088 | | | | 2,213,437 | |

FirstEnergy Corp. | | | 2,900 | | | | 107,300 | |

Inter RAO UES PJSC (Russia)^ | | | 4,433,000 | | | | 7 | |

Otter Tail Corp. | | | 2,980 | | | | 183,330 | |

Power Grid Corp. of India Ltd. (India) | | | 275,515 | | | | 715,377 | |

SSE PLC (United Kingdom) | | | 31,320 | | | | 528,870 | |

| | | | | | | | |

| | |

| | | | | | | 7,004,195 | |

| | |

Electrical Equipment 0.3% | | | | | | | | |

| | |

Atkore, Inc.* | | | 3,160 | | | | 245,880 | |

AZZ, Inc. | | | 1,200 | | | | 43,812 | |

Bloom Energy Corp. (Class A Stock)* | | | 2,500 | | | | 49,975 | |

Encore Wire Corp. | | | 1,980 | | | | 228,769 | |

Fujikura Ltd. (Japan) | | | 43,200 | | | | 257,662 | |

Hubbell, Inc. | | | 7,600 | | | | 1,694,800 | |

Idec Corp. (Japan) | | | 2,500 | | | | 50,668 | |

LG Energy Solution Ltd. (South Korea)* | | | 147 | | | | 43,344 | |

TBEA Co. Ltd. (China) (Class A Stock) | | | 42,500 | | | | 128,161 | |

| | | | | | | | |

| | |

| | | | | | | 2,743,071 | |

| | |

Electronic Equipment, Instruments & Components 0.4% | | | | | | | | |

| | |

Belden, Inc. | | | 2,200 | | | | 132,044 | |

BH Co. Ltd. (South Korea) | | | 3,068 | | | | 54,421 | |

Citizen Watch Co. Ltd. (Japan) | | | 14,000 | | | | 58,424 | |

Compeq Manufacturing Co. Ltd. (Taiwan) | | | 198,000 | | | | 280,299 | |

Corning, Inc. | | | 14,400 | | | | 417,888 | |

Daeduck Electronics Co. Ltd./New (South Korea) | | | 2,626 | | | | 38,474 | |

See Notes to Financial Statements.

PGIM Balanced Fund 23

Schedule of Investments (continued)

as of September 30, 2022

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Electronic Equipment, Instruments & Components (cont’d.) | | | | | | | | |

| | |

ePlus, Inc.* | | | 1,460 | | | $ | 60,648 | |

Gold Circuit Electronics Ltd. (Taiwan) | | | 37,900 | | | | 110,284 | |

Hamamatsu Photonics KK (Japan) | | | 2,300 | | | | 98,583 | |

Hon Hai Precision Industry Co. Ltd. (Taiwan) | | | 64,000 | | | | 204,935 | |

Insight Enterprises, Inc.* | | | 500 | | | | 41,205 | |

Jabil, Inc. | | | 9,700 | | | | 559,787 | |

LG Innotek Co. Ltd. (South Korea) | | | 1,784 | | | | 336,258 | |

PC Connection, Inc. | | | 1,000 | | | | 45,090 | |

Sanmina Corp.* | | | 5,680 | | | | 261,734 | |

ScanSource, Inc.* | | | 6,980 | | | | 184,342 | |

Sensirion Holding AG (Switzerland), 144A* | | | 1,798 | | | | 146,374 | |

TTM Technologies, Inc.* | | | 2,400 | | | | 31,632 | |

Unimicron Technology Corp. (Taiwan) | | | 28,000 | | | | 102,500 | |

| | | | | | | | |

| | |

| | | | | | | 3,164,922 | |

| | |

Energy Equipment & Services 0.2% | | | | | | | | |

| | |

Bristow Group, Inc.* | | | 1,500 | | | | 35,235 | |

Halliburton Co. | | | 46,000 | | | | 1,132,520 | |

Liberty Energy, Inc. (Class A Stock)* | | | 6,600 | | | | 83,688 | |

Newpark Resources, Inc.* | | | 17,100 | | | | 43,092 | |

NexTier Oilfield Solutions, Inc.* | | | 1,700 | | | | 12,580 | |

ProPetro Holding Corp.* | | | 11,900 | | | | 95,795 | |

RPC, Inc. | | | 1,900 | | | | 13,167 | |

Select Energy Services, Inc. (Class A Stock)* | | | 16,600 | | | | 115,702 | |

Solaris Oilfield Infrastructure, Inc. (Class A Stock) | | | 4,900 | | | | 45,864 | |

TETRA Technologies, Inc.* | | | 16,400 | | | | 58,876 | |

U.S. Silica Holdings, Inc.* | | | 4,100 | | | | 44,895 | |

| | | | | | | | |

| | |

| | | | | | | 1,681,414 | |

| | |

Entertainment 0.6% | | | | | | | | |

| | |

37 Interactive Entertainment Network Technology Group Co. Ltd. (China) (Class A Stock) | | | 36,600 | | | | 88,944 | |

Activision Blizzard, Inc. | | | 5,780 | | | | 429,685 | |

GungHo Online Entertainment, Inc. (Japan) | | | 17,700 | | | | 271,900 | |

Lions Gate Entertainment Corp. (Class A Stock)* | | | 9,700 | | | | 72,071 | |

Lions Gate Entertainment Corp. (Class B Stock)* | | | 14,100 | | | | 97,995 | |

Marcus Corp. (The) | | | 1,200 | | | | 16,668 | |

Mixi, Inc. (Japan) | | | 3,300 | | | | 52,384 | |

NetEase, Inc. (China) | | | 11,000 | | | | 165,984 | |

Spotify Technology SA* | | | 3,000 | | | | 258,900 | |

Tencent Music Entertainment Group (China), ADR* | | | 10,000 | | | | 40,600 | |

Walt Disney Co. (The)* | | | 35,000 | | | | 3,301,550 | |

See Notes to Financial Statements.

24

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Entertainment (cont’d.) | | | | | | | | |

| | |

Warner Bros. Discovery, Inc.* | | | 64,600 | | | $ | 742,900 | |

Webzen, Inc. (South Korea)* | | | 4,560 | | | | 46,703 | |

| | | | | | | | |

| | |

| | | | | | | 5,586,284 | |

| | |

Equity Real Estate Investment Trusts (REITs) 1.2% | | | | | | | | |

| | |

Acadia Realty Trust | | | 2,100 | | | | 26,502 | |

American Assets Trust, Inc. | | | 700 | | | | 18,004 | |

American Tower Corp. | | | 800 | | | | 171,760 | |

Americold Realty Trust, Inc. | | | 17,000 | | | | 418,200 | |

Apple Hospitality REIT, Inc. | | | 19,200 | | | | 269,952 | |

Artis Real Estate Investment Trust (Canada) | | | 26,600 | | | | 182,745 | |

Braemar Hotels & Resorts, Inc. | | | 3,900 | | | | 16,770 | |

Chatham Lodging Trust* | | | 4,800 | | | | 47,376 | |

City Office REIT, Inc. | | | 2,200 | | | | 21,934 | |

DiamondRock Hospitality Co. | | | 25,600 | | | | 192,256 | |

Diversified Healthcare Trust | | | 47,600 | | | | 47,129 | |

Douglas Emmett, Inc. | | | 6,400 | | | | 114,752 | |

EPR Properties | | | 8,900 | | | | 319,154 | |

Equinix, Inc. | | | 1,300 | | | | 739,492 | |

Franklin Street Properties Corp. | | | 15,921 | | | | 41,872 | |

Goodman Group (Australia) | | | 51,999 | | | | 525,544 | |

Hersha Hospitality Trust (Class A Stock) | | | 7,600 | | | | 60,648 | |

Highwoods Properties, Inc. | | | 15,200 | | | | 409,792 | |

Host Hotels & Resorts, Inc. | | | 36,700 | | | | 582,796 | |

Hudson Pacific Properties, Inc. | | | 20,400 | | | | 223,380 | |

Kilroy Realty Corp. | | | 8,600 | | | | 362,146 | |

Kite Realty Group Trust | | | 8,000 | | | | 137,760 | |

Klepierre SA (France)* | | | 2,160 | | | | 37,552 | |

National Health Investors, Inc. | | | 3,100 | | | | 175,243 | |

Paramount Group, Inc. | | | 14,500 | | | | 90,335 | |

Park Hotels & Resorts, Inc. | | | 77,400 | | | | 871,524 | |

Pebblebrook Hotel Trust | | | 10,500 | | | | 152,355 | |

Piedmont Office Realty Trust, Inc. (Class A Stock) | | | 12,660 | | | | 133,690 | |

Public Storage | | | 4,100 | | | | 1,200,521 | |

RLJ Lodging Trust | | | 13,800 | | | | 139,656 | |

Ryman Hospitality Properties, Inc. | | | 2,400 | | | | 176,616 | |

Safestore Holdings PLC (United Kingdom) | | | 14,913 | | | | 138,791 | |

Service Properties Trust | | | 35,800 | | | | 185,802 | |

Simon Property Group, Inc. | | | 1,800 | | | | 161,550 | |

Ventas, Inc. | | | 25,700 | | | | 1,032,369 | |

Weyerhaeuser Co. | | | 33,500 | | | | 956,760 | |

Xenia Hotels & Resorts, Inc. | | | 14,500 | | | | 199,955 | |

| | | | | | | | |

| | |

| | | | | | | 10,582,683 | |

See Notes to Financial Statements.

PGIM Balanced Fund 25

Schedule of Investments (continued)

as of September 30, 2022

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Food & Staples Retailing 0.7% | | | | | | | | |

| | |

Albertson’s Cos., Inc. (Class A Stock) | | | 81,300 | | | $ | 2,021,118 | |

Alimentation Couche-Tard, Inc. (Canada) | | | 16,200 | | | | 652,175 | |

Andersons, Inc. (The) | | | 500 | | | | 15,515 | |

Cencosud SA (Chile) | | | 88,350 | | | | 111,748 | |

Coles Group Ltd. (Australia) | | | 6,612 | | | | 69,706 | |

Costco Wholesale Corp. | | | 3,600 | | | | 1,700,172 | |

Koninklijke Ahold Delhaize NV (Netherlands) | | | 28,613 | | | | 728,814 | |

Loblaw Cos. Ltd. (Canada) | | | 8,100 | | | | 641,386 | |

Metro, Inc. (Canada) | | | 1,200 | | | | 60,089 | |

Sonae SGPS SA (Portugal) | | | 46,873 | | | | 37,806 | |

Sprouts Farmers Market, Inc.* | | | 500 | | | | 13,875 | |

United Natural Foods, Inc.* | | | 5,600 | | | | 192,472 | |

Woolworths Group Ltd. (Australia) | | | 5,918 | | | | 128,602 | |

| | | | | | | | |

| | |

| | | | | | | 6,373,478 | |

| | |

Food Products 1.1% | | | | | | | | |

| | |

Archer-Daniels-Midland Co. | | | 23,500 | | | | 1,890,575 | |

Bunge Ltd. | | | 6,600 | | | | 544,962 | |

First Pacific Co. Ltd. (Indonesia) | | | 836,000 | | | | 254,194 | |

Indofood Sukses Makmur Tbk PT (Indonesia) | | | 702,600 | | | | 277,612 | |

JBS SA | | | 111,800 | | | | 523,109 | |

Kraft Heinz Co. (The) | | | 9,400 | | | | 313,490 | |

Mowi ASA (Norway) | | | 1,980 | | | | 25,185 | |

Nestle SA | | | 7,993 | | | | 864,501 | |

Pilgrim’s Pride Corp.* | | | 44,500 | | | | 1,024,390 | |

Post Holdings, Inc.* | | | 8,800 | | | | 720,808 | |

TreeHouse Foods, Inc.* | | | 4,700 | | | | 199,374 | |

Tyson Foods, Inc. (Class A Stock) | | | 36,800 | | | | 2,426,224 | |

Vital Farms, Inc.* | | | 2,900 | | | | 34,713 | |

WH Group Ltd. (Hong Kong), 144A | | | 70,000 | | | | 44,026 | |

Wilmar International Ltd. (China) | | | 235,600 | | | | 626,787 | |

| | | | | | | | |

| | |

| | | | | | | 9,769,950 | |

| | |

Gas Utilities 0.1% | | | | | | | | |

| | |

Beijing Enterprises Holdings Ltd. (China) | | | 46,000 | | | | 128,918 | |

Brookfield Infrastructure Corp. (Canada) (Class A Stock) | | | 650 | | | | 26,455 | |

GAIL India Ltd. (India) | | | 245,105 | | | | 260,491 | |

New Jersey Resources Corp. | | | 500 | | | | 19,350 | |

Northwest Natural Holding Co. | | | 2,600 | | | | 112,788 | |

Spire, Inc. | | | 300 | | | | 18,699 | |

UGI Corp. | | | 6,600 | | | | 213,378 | |

| | | | | | | | |

| | |

| | | | | | | 780,079 | |

See Notes to Financial Statements.

26

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Health Care Equipment & Supplies 1.2% | | | | | | | | |

| | |

Abbott Laboratories | | | 32,820 | | | $ | 3,175,663 | |

Avanos Medical, Inc.* | | | 5,000 | | | | 108,900 | |

Axonics, Inc.* | | | 600 | | | | 42,264 | |

Baxter International, Inc. | | | 15,200 | | | | 818,672 | |

Becton, Dickinson & Co. | | | 500 | | | | 111,415 | |

Edwards Lifesciences Corp.* | | | 18,900 | | | | 1,561,707 | |

Haemonetics Corp.* | | | 1,500 | | | | 111,045 | |

Integer Holdings Corp.* | | | 3,100 | | | | 192,913 | |

iRhythm Technologies, Inc.* | | | 1,400 | | | | 175,392 | |

Jeol Ltd. (Japan) | | | 1,400 | | | | 45,958 | |

Lantheus Holdings, Inc.* | | | 4,400 | | | | 309,452 | |

Medtronic PLC | | | 30,800 | | | | 2,487,100 | |

Merit Medical Systems, Inc.* | | | 4,500 | | | | 254,295 | |

Shockwave Medical, Inc.* | | | 970 | | | | 269,728 | |

STAAR Surgical Co.* | | | 2,900 | | | | 204,595 | |

Zimmer Biomet Holdings, Inc. | | | 3,600 | | | | 376,380 | |

| | | | | | | | |

| | |

| | | | | | | 10,245,479 | |

| | |

Health Care Providers & Services 2.1% | | | | | | | | |

| | |

AdaptHealth Corp.* | | | 1,300 | | | | 24,414 | |

Alignment Healthcare, Inc.* | | | 14,700 | | | | 174,048 | |

Aveanna Healthcare Holdings, Inc.* | | | 17,200 | | | | 25,800 | |

Bangkok Chain Hospital PCL (Thailand) | | | 264,300 | | | | 124,411 | |

Centene Corp.* | | | 2,400 | | | | 186,744 | |

Cigna Corp. | | | 12,200 | | | | 3,385,134 | |

CorVel Corp.* | | | 800 | | | | 110,744 | |

CVS Health Corp. | | | 38,100 | | | | 3,633,597 | |

Elevance Health, Inc. | | | 5,000 | | | | 2,271,200 | |

Ensign Group, Inc. (The) | | | 1,880 | | | | 149,460 | |

McKesson Corp. | | | 700 | | | | 237,909 | |

ModivCare, Inc.* | | | 100 | | | | 9,968 | |

National HealthCare Corp. | | | 200 | | | | 12,668 | |

OPKO Health, Inc.* | | | 19,660 | | | | 37,157 | |

Privia Health Group, Inc.* | | | 5,900 | | | | 200,954 | |

Progyny, Inc.* | | | 3,900 | | | | 144,534 | |

Select Medical Holdings Corp. | | | 1,734 | | | | 38,321 | |

Sonic Healthcare Ltd. (Australia) | | | 22,605 | | | | 440,915 | |

UnitedHealth Group, Inc. | | | 13,260 | | | | 6,696,831 | |

| | | | | | | | |

| | |

| | | | | | | 17,904,809 | |

| | |

Health Care Technology 0.1% | | | | | | | | |

| | |

Allscripts Healthcare Solutions, Inc.* | | | 800 | | | | 12,184 | |

Computer Programs & Systems, Inc.* | | | 2,600 | | | | 72,488 | |

See Notes to Financial Statements.

PGIM Balanced Fund 27

Schedule of Investments (continued)

as of September 30, 2022

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Health Care Technology (cont’d.) | | | | | | | | |

| | |

Evolent Health, Inc. (Class A Stock)* | | | 4,200 | | | $ | 150,906 | |

Multiplan Corp.* | | | 32,100 | | | | 91,806 | |

NextGen Healthcare, Inc.* | | | 6,975 | | | | 123,457 | |

| | | | | | | | |

| | |

| | | | | | | 450,841 | |

| | |

Hotels, Restaurants & Leisure 1.2% | | | | | | | | |

| | |

Accel Entertainment, Inc.* | | | 4,100 | | | | 32,021 | |

Aristocrat Leisure Ltd. (Australia) | | | 27,010 | | | | 569,549 | |

Biglari Holdings, Inc. (Class B Stock)* | | | 270 | | | | 31,212 | |

Bloomin’ Brands, Inc. | | | 6,600 | | | | 120,978 | |

Booking Holdings, Inc.* | | | 1,260 | | | | 2,070,445 | |

Century Casinos, Inc.* | | | 15,100 | | | | 99,056 | |

Cheesecake Factory, Inc. (The) | | | 400 | | | | 11,712 | |

Chipotle Mexican Grill, Inc.* | | | 600 | | | | 901,656 | |

Chuy’s Holdings, Inc.* | | | 500 | | | | 11,590 | |

Compass Group PLC (United Kingdom) | | | 8,910 | | | | 177,420 | |

Evolution AB (Sweden), 144A | | | 930 | | | | 73,514 | |

Expedia Group, Inc.* | | | 5,700 | | | | 534,033 | |

Golden Entertainment, Inc.* | | | 1,800 | | | | 62,802 | |

Hilton Grand Vacations, Inc.* | | | 4,100 | | | | 134,849 | |

Hilton Worldwide Holdings, Inc. | | | 2,200 | | | | 265,364 | |

Kura Sushi USA, Inc. (Class A Stock)* | | | 600 | | | | 44,148 | |

Light & Wonder, Inc.* | | | 3,900 | | | | 167,232 | |

Marriott International, Inc. (Class A Stock) | | | 18,300 | | | | 2,564,562 | |

McDonald’s Corp. | | | 2,220 | | | | 512,243 | |

ONE Group Hospitality, Inc. (The)* | | | 2,900 | | | | 19,256 | |

Oriental Land Co. Ltd. (Japan) | | | 4,700 | | | | 637,456 | |

RCI Hospitality Holdings, Inc. | | | 587 | | | | 38,354 | |

Round One Corp. (Japan) | | | 12,000 | | | | 52,016 | |

Starbucks Corp. | | | 2,100 | | | | 176,946 | |

Toridoll Holdings Corp. (Japan) | | | 20,400 | | | | 422,354 | |

Travel + Leisure Co. | | | 15,400 | | | | 525,448 | |

| | | | | | | | |

| | |

| | | | | | | 10,256,216 | |

| | |

Household Durables 0.1% | | | | | | | | |

| | |

Century Communities, Inc. | | | 700 | | | | 29,946 | |

M/I Homes, Inc.* | | | 1,700 | | | | 61,591 | |

MDC Holdings, Inc. | | | 2,500 | | | | 68,550 | |

Meritage Homes Corp.* | | | 1,480 | | | | 104,000 | |

Tamron Co. Ltd. (Japan) | | | 2,100 | | | | 42,104 | |

See Notes to Financial Statements.

28

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Household Durables (cont’d.) | | | | | | | | |

| | |

Taylor Morrison Home Corp.* | | | 9,400 | | | $ | 219,208 | |

Tri Pointe Homes, Inc.* | | | 11,400 | | | | 172,254 | |

| | | | | | | | |

| | |

| | | | | | | 697,653 | |

| | |

Household Products 0.6% | | | | | | | | |

| | |

Central Garden & Pet Co.* | | | 300 | | | | 10,812 | |

Central Garden & Pet Co. (Class A Stock)* | | | 2,100 | | | | 71,736 | |

Kimberly-Clark Corp. | | | 15,900 | | | | 1,789,386 | |

Procter & Gamble Co. (The) | | | 21,679 | | | | 2,736,974 | |

Reckitt Benckiser Group PLC (United Kingdom) | | | 7,975 | | | | 528,595 | |

| | | | | | | | |

| | |

| | | | | | | 5,137,503 | |

| | |

Independent Power & Renewable Electricity Producers 0.2% | | | | | | | | |

| | |

AES Corp. (The) | | | 47,180 | | | | 1,066,268 | |

Altus Power, Inc.* | | | 3,500 | | | | 38,535 | |

Clearway Energy, Inc. (Class A Stock) | | | 1,400 | | | | 40,740 | |

Clearway Energy, Inc. (Class C Stock) | | | 5,800 | | | | 184,730 | |

NTPC Ltd. (India) | | | 184,973 | | | | 361,264 | |

Ormat Technologies, Inc. | | | 700 | | | | 60,340 | |

| | | | | | | | |

| | |

| | | | | | | 1,751,877 | |

| | |

Industrial Conglomerates 0.6% | | | | | | | | |

| | |

CITIC Ltd. (China) | | | 548,000 | | | | 516,304 | |

GS Holdings Corp. (South Korea) | | | 1,768 | | | | 51,184 | |

Honeywell International, Inc. | | | 15,300 | | | | 2,554,641 | |

Industries Qatar QSC (Qatar) | | | 166,065 | | | | 766,604 | |

Jardine Matheson Holdings Ltd. (Hong Kong) | | | 12,100 | | | | 611,752 | |

KOC Holding A/S (Turkey) | | | 124,984 | | | | 304,220 | |

Mytilineos SA (Greece) | | | 3,129 | | | | 42,734 | |

Samsung C&T Corp. (South Korea) | | | 483 | | | | 34,611 | |

SK, Inc. (South Korea) | | | 273 | | | | 36,247 | |

Smiths Group PLC (United Kingdom) | | | 5,678 | | | | 94,578 | |

| | | | | | | | |

| | |

| | | | | | | 5,012,875 | |

| | |

Insurance 1.7% | | | | | | | | |

| | |

American International Group, Inc. | | | 47,900 | | | | 2,274,292 | |

Argo Group International Holdings Ltd. | | | 2,000 | | | | 38,520 | |

AXA SA (France) | | | 16,838 | | | | 367,623 | |

Bright Health Group, Inc.* | | | 9,200 | | | | 9,660 | |

Chubb Ltd. | | | 13,500 | | | | 2,455,380 | |

Coface SA (France) | | | 44,444 | | | | 424,706 | |

See Notes to Financial Statements.

PGIM Balanced Fund 29

Schedule of Investments (continued)

as of September 30, 2022

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Insurance (cont’d.) | | | | | | | | |

| | |

Dai-ichi Life Holdings, Inc. (Japan) | | | 43,700 | | | $ | 694,844 | |

DB Insurance Co. Ltd. (South Korea) | | | 1,020 | | | | 39,077 | |

eHealth, Inc.* | | | 4,900 | | | | 19,159 | |

Enstar Group Ltd.* | | | 1,050 | | | | 178,069 | |

Fairfax Financial Holdings Ltd. (Canada) | | | 1,200 | | | | 548,064 | |

Genworth Financial, Inc. (Class A Stock)* | | | 24,200 | | | | 84,700 | |

Hartford Financial Services Group, Inc. (The) | | | 12,900 | | | | 799,026 | |

Japan Post Holdings Co. Ltd. (Japan) | | | 59,100 | | | | 391,550 | |

Japan Post Insurance Co. Ltd. (Japan) | | | 3,100 | | | | 43,419 | |

Kinsale Capital Group, Inc. | | | 1,020 | | | | 260,528 | |

MS&AD Insurance Group Holdings, Inc. (Japan) | | | 21,900 | | | | 579,972 | |

NN Group NV (Netherlands) | | | 14,925 | | | | 580,492 | |

Palomar Holdings, Inc.* | | | 1,800 | | | | 150,696 | |

PICC Property & Casualty Co. Ltd. (China) (Class H Stock) | | | 48,000 | | | | 49,636 | |

Progressive Corp. (The) | | | 19,300 | | | | 2,242,853 | |

Reinsurance Group of America, Inc. | | | 6,200 | | | | 780,022 | |

Sampo OYJ (Finland) (Class A Stock) | | | 15,794 | | | | 674,272 | |

Samsung Fire & Marine Insurance Co. Ltd. (South Korea) | | | 315 | | | | 40,288 | |

SiriusPoint Ltd. (Bermuda)* | | | 9,500 | | | | 47,025 | |

Sompo Holdings, Inc. (Japan) | | | 15,300 | | | | 612,174 | |

Stewart Information Services Corp. | | | 1,000 | | | | 43,640 | |

Zurich Insurance Group AG (Switzerland) | | | 735 | | | | 293,008 | |

| | | | | | | | |

| | |

| | | | | | | 14,722,695 | |

| | |

Interactive Media & Services 2.5% | | | | | | | | |

| | |

Alphabet, Inc. (Class A Stock)* | | | 83,800 | | | | 8,015,470 | |

Alphabet, Inc. (Class C Stock)* | | | 81,440 | | | | 7,830,456 | |

Bumble, Inc. (Class A Stock)* | | | 2,600 | | | | 55,874 | |

Cargurus, Inc.* | | | 7,900 | | | | 111,943 | |

Meta Platforms, Inc. (Class A Stock)* | | | 35,094 | | | | 4,761,554 | |

Outbrain, Inc.* | | | 8,700 | | | | 31,755 | |

Tencent Holdings Ltd. (China) | | | 15,400 | | | | 520,155 | |

TrueCar, Inc.* | | | 25,400 | | | | 38,354 | |

Yelp, Inc.* | | | 400 | | | | 13,564 | |

| | | | | | | | |

| | |

| | | | | | | 21,379,125 | |

| | |

Internet & Direct Marketing Retail 1.3% | | | | | | | | |

| | |

Alibaba Group Holding Ltd. (China)* | | | 21,900 | | | | 218,548 | |

Amazon.com, Inc.* | | | 90,940 | | | | 10,276,220 | |

Duluth Holdings, Inc. (Class B Stock)* | | | 9,500 | | | | 66,880 | |

Pinduoduo, Inc. (China), ADR* | | | 10,600 | | | | 663,348 | |

| | | | | | | | |

| | |

| | | | | | | 11,224,996 | |

See Notes to Financial Statements.

30

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

IT Services 2.3% | | | | | | | | |

| | |

Accenture PLC (Class A Stock) | | | 9,030 | | | $ | 2,323,419 | |

Amadeus IT Group SA (Spain)* | | | 1,170 | | | | 54,244 | |

Automatic Data Processing, Inc. | | | 8,700 | | | | 1,967,853 | |

Capgemini SE (France) | | | 4,014 | | | | 642,644 | |

CGI, Inc. (Canada)* | | | 8,600 | | | | 647,420 | |

Cognizant Technology Solutions Corp. (Class A Stock) | | | 14,300 | | | | 821,392 | |

Computacenter PLC (United Kingdom) | | | 1,740 | | | | 37,376 | |

Conduent, Inc.* | | | 5,700 | | | | 19,038 | |

Digital Garage, Inc. (Japan) | | | 7,800 | | | | 187,018 | |

Edenred (France) | | | 1,247 | | | | 57,450 | |

EPAM Systems, Inc.* | | | 2,000 | | | | 724,380 | |

Fiserv, Inc.* | | | 5,500 | | | | 514,635 | |

GMO internet group, Inc. (Japan) | | | 2,900 | | | | 50,904 | |

Hackett Group, Inc. (The) | | | 7,380 | | | | 130,774 | |

Information Services Group, Inc. | | | 2,300 | | | | 10,948 | |

International Business Machines Corp. | | | 9,494 | | | | 1,127,982 | |

Mastercard, Inc. (Class A Stock) | | | 17,400 | | | | 4,947,516 | |

Nomura Research Institute Ltd. (Japan) | | | 1,800 | | | | 43,962 | |

NTT Data Corp. (Japan) | | | 44,000 | | | | 568,353 | |

Payoneer Global, Inc.* | | | 34,800 | | | | 210,540 | |

Paysafe Ltd.* | | | 44,800 | | | | 61,824 | |

Sabre Corp.* | | | 2,600 | | | | 13,390 | |

SS&C Technologies Holdings, Inc. | | | 16,000 | | | | 764,000 | |

TTEC Holdings, Inc. | | | 1,400 | | | | 62,034 | |

Visa, Inc. (Class A Stock) | | | 25,155 | | | | 4,468,786 | |

| | | | | | | | |

| | |

| | | | | | | 20,457,882 | |

| | |

Leisure Products 0.0% | | | | | | | | |

| | |

GOLFZON Co. Ltd. (South Korea) | | | 1,575 | | | | 117,785 | |

MasterCraft Boat Holdings, Inc.* | | | 3,359 | | | | 63,317 | |

Topgolf Callaway Brands Corp.* | | | 3,000 | | | | 57,780 | |

Vista Outdoor, Inc.* | | | 1,200 | | | | 29,184 | |

| | | | | | | | |

| | |

| | | | | | | 268,066 | |

| | |

Life Sciences Tools & Services 0.5% | | | | | | | | |

| | |

Agilent Technologies, Inc. | | | 1,800 | | | | 218,790 | |

Avantor, Inc.* | | | 15,200 | | | | 297,920 | |

Danaher Corp. | | | 5,660 | | | | 1,461,921 | |

Divi’s Laboratories Ltd. (India) | | | 912 | | | | 41,291 | |

Eurofins Scientific SE (Luxembourg) | | | 702 | | | | 41,674 | |

IQVIA Holdings, Inc.* | | | 3,600 | | | | 652,104 | |