UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

| | |

Investment Company Act file number: | | 811-07343 |

| |

| Exact name of registrant as specified in charter: | | The Prudential Investment Portfolios, Inc. |

| |

| Address of principal executive offices: | | 655 Broad Street, 17th Floor |

| | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Andrew R. French |

| | 655 Broad Street, 17th Floor |

| | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

| Date of fiscal year end: | | 9/30/2021 |

| |

| Date of reporting period: | | 9/30/2021 |

Item 1 – Reports to Stockholders

PGIM BALANCED FUND

ANNUAL REPORT

SEPTEMBER 30, 2021

To enroll in e-delivery, go to pgim.com/investments/resource/edelivery

Table of Contents

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

Mutual funds are distributed by Prudential Investment Management Services LLC, a Prudential Financial companyand member SIPC. PGIM Fixed Income is a unit of PGIM, Inc. (PGIM), a registered investment adviser and Prudential Financial company. PGIM Quantitative Solutions is the primary business name of PGIM Quantitative Solutions LLC (formerly known as QMA LLC), a wholly owned subsidiary of PGIM, Inc. (PGIM), a registered investment adviser and Prudential Financial company. © 2021 Prudential Financial, Inc. and its related entities. PGIM and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

2 Visit our website at pgim.com/investments

Letter from the President

Dear Shareholder:

We hope you find the annual report for the PGIM Balanced Fund informative and useful. The report covers performance for the 12-month period that ended September 30, 2021.

The COVID-19 pandemic had a significant impact on the global economy and markets early in 2020, but a dramatic recovery was underway as the period began. The Federal Reserve slashed interest rates to encourage borrowing. Congress passed stimulus bills worth several trillion dollars to help consumers and businesses. And several effective COVID-19 vaccines received regulatory approval later in the year.

At the start of the period, stocks had recovered most of the steep losses they had suffered at the onset of the pandemic. Equities rallied as states reopened their economies but became more volatile in the fall as investors worried that a surge in COVID-19 infections would stall the recovery. However, rising corporate profits and economic growth, the resolution of the US presidential election, and the global rollout of approved vaccines lifted equity markets to record levels, helping stocks around the globe post gains for the full period.

Throughout this volatile period, investors sought safety in fixed income. Investment-grade bonds in the US and the overall global bond market declined slightly during the period as the economy recovered, but emerging market debt rose. While the 10-year US Treasury yield hovered near record lows early in the period after a significant rally in interest rates, rates moved higher later on as investors began to focus on stronger economic growth and the prospects of higher inflation. The Fed also took several aggressive actions to keep the bond markets running smoothly, implementing many of the relief programs that proved to be successful in helping end the global financial crisis in 2008-09.

Regarding your investments with PGIM, we believe it is important to maintain a diversified portfolio of funds consistent with your tolerance for risk, time horizon, and financial goals. Your financial advisor can help you create a diversified investment plan that may include funds covering all the basic asset classes and that reflects your personal investor profile and risk tolerance. However, diversification and asset allocation strategies do not assure a profit or protect against loss in declining markets.

At PGIM Investments, we consider it a great privilege and responsibility to help investors participate in opportunities across global markets while meeting their toughest investment challenges. PGIM is a top-10 global investment manager with more than $1 trillion in assets under management. This scale and investment expertise allow us to deliver actively managed funds and strategies to meet the needs of investors around the globe.

Thank you for choosing our family of funds.

Sincerely,

Stuart S. Parker, President

PGIM Balanced Fund

November 15, 2021

PGIM Balanced Fund 3

Your Fund’s Performance (unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at pgim.com/investments or by calling (800) 225-1852.

| | | | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns as of 9/30/21 | |

| | | One Year (%) | | | Five Years (%) | | | Ten Years (%) | | | Since Inception (%) | |

| | | | |

Class A | | | | | | | | | | | | | | | | |

| | | | |

(with sales charges) | | | 14.90 | | | | 8.41 | | | | 9.66 | | | | — | |

| | | | |

(without sales charges) | | | 18.76 | | | | 9.13 | | | | 10.02 | | | | — | |

| | | | |

Class C | | | | | | | | | | | | | | | | |

| | | | |

(with sales charges) | | | 16.82 | | | | 8.32 | | | | 9.24 | | | | — | |

| | | | |

(without sales charges) | | | 17.82 | | | | 8.32 | | | | 9.24 | | | | — | |

| | | | |

Class R | | | | | | | | | | | | | | | | |

| | | | |

(without sales charges) | | | 18.15 | | | | 8.66 | | | | 9.68 | | | | — | |

| | | | |

Class Z | | | | | | | | | | | | | | | | |

| | | | |

(without sales charges) | | | 18.99 | | | | 9.40 | | | | 10.33 | | | | — | |

| | | | |

Class R6 | | | | | | | | | | | | | | | | |

| | | | |

(without sales charges) | | | 19.12 | | | | N/A | | | | N/A | | | | 8.66 (11/28/2017) | |

| | | | |

Customized Blend Index | | | | | | | | | | | | | | | | |

| | | | |

| | | 16.91 | | | | 10.41 | | | | 10.13 | | | | — | |

| | | | |

Bloomberg US Aggregate Bond Index | | | | | | | | | | | | | | | | |

| | | | |

| | | -0.90 | | | | 2.94 | | | | 3.01 | | | | — | |

| | | | |

S&P 500 Index | | | | | | | | | | | | | | | | |

| | | | |

| | | | 30.00 | | | | 16.89 | | | | 16.62 | | | | — | |

| | |

| |

| Average Annual Total Returns as of 9/30/21 Since Inception (%) | | |

| |

| | | Class R6

(11/28/2017) |

| |

Customized Blend Index | | 9.89 |

| |

Bloomberg US Aggregate Bond Index | | 3.85 |

| |

S&P 500 Index | | 15.62 |

Since Inception returns are provided for any share class with less than 10 fiscal years of returns. Since Inception returns for the Indexes are measured from the closest month-end to the class’ inception date.

Source: PGIM Investments LLC.

4 Visit our website at pgim.com/investments

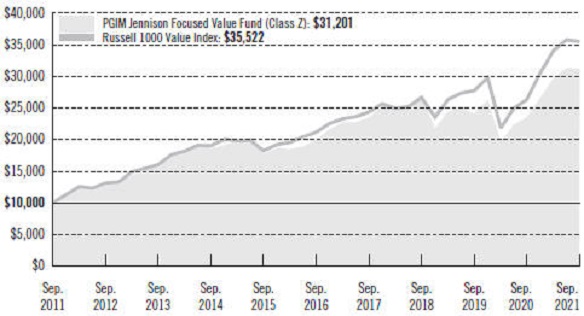

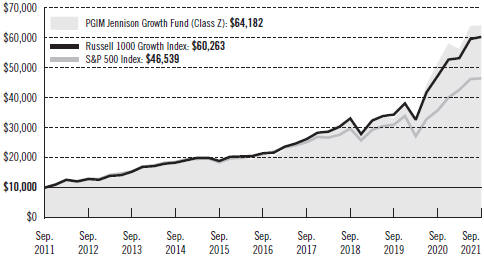

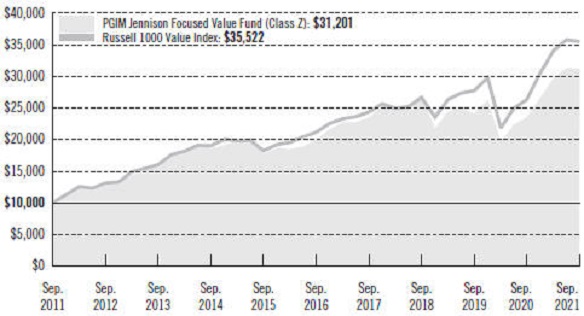

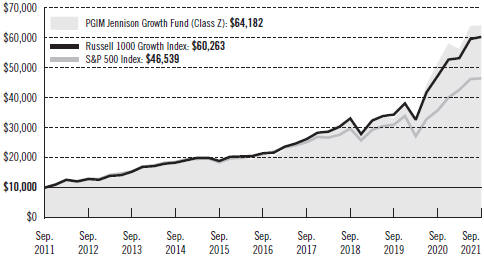

Growth of a $10,000 Investment (unaudited)

The graph compares a $10,000 investment in the Fund’s Class Z shares with a similar investment in the Customized Blend Index and the S&P 500 Index by portraying the initial account values at the beginning of the 10-year period (September 30, 2011) and the account values at the end of the current fiscal year (September 30, 2021), as measured on a quarterly basis. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted and (b) all dividends and distributions were reinvested. The line graph provides information for Class Z shares only. As indicated in the tables provided earlier, performance for other share classes will vary due to the differing fees and expenses applicable to each share class (as indicated in the following paragraphs). Without waiver of fees and/or expense reimbursements, if any, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graphs include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

PGIM Balanced Fund 5

Your Fund’s Performance (continued)

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. The average annual total returns take into account applicable sales charges, which are described for each share class in the table below.

| | | | | | | | | | |

| | | | | | |

| | | Class A | | Class C | | Class R | | Class Z | | Class R6 |

| | | | | | |

| Maximum initial sales charge | | 3.25% of the public offering price | | None | | None | | None | | None |

| | | | | | |

| Contingent deferred sales charge (CDSC) (as a percentage of the lower of the original purchase price or the net asset value at redemption) | | 1.00% on sales of $500,000 or more made within 12 months of purchase | | 1.00% on sales made within 12 months of purchase | | None | | None | | None |

| | | | | | |

| Annual distribution and service (12b-1) fees (shown as a percentage of average daily net assets) | | 0.30% | | 1.00% | | 0.75% (0.50% currently) | | None | | None |

Benchmark Definitions

Customized Blend Index*—The Customized Blend Index is unmanaged and intended to provide a theoretical comparison to the Fund’s performance based on the amounts allocated to each asset class. S&P 500 Index (44%) provides a broad indicator of domestic stock price movements in large cap stocks; Bloomberg US Aggregate Bond Index (40%) includes investment grade securities issued by the US government, its agencies, and by corporations with between 1 and 10 years remaining to maturity; Russell 2000 Index (4%) contains the 2,000 smallest US companies included in the Russell 3000 Index, which gives a broad look at how stock prices of smaller companies have performed; and MSCI ACWI ex US Index (12%) is a stock market index comprising of non-US stocks from 23 developed markets and 26 emerging markets. Note: Prior to February 3, 2020, the Customized Blend Index consisted of the S&P 500 Index (50%), the Bloomberg Barclays US Aggregate Bond Index (40%), the Russell 2000 Index (5%), and the MSCI Europe, Australasia and Far East (EAFE) Net Dividend (ND) Index (5%).

Bloomberg US Aggregate Bond Index—The Bloomberg US Aggregate Bond Index is unmanaged and represents securities that are taxable and dollar denominated. It covers the US investment-grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

S&P 500 Index*—The S&P 500 Index is an unmanaged index of over 500 stocks of large US public companies. It gives a broad look at how stock prices in the United States have performed.

*The S&P 500 Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by PGIM, Inc. and/or its affiliates. Copyright © 2021 S&P Dow Jones Indices LLC, a

6 Visit our website at pgim.com/investments

division of S&P Global, Inc., and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of S&P Global and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC.

Investors cannot invest directly in an index. The returns for the Indexes would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes that may be paid by an investor.

Presentation of Fund Holdings as of 9/30/21

| | | | | | |

| | |

| Ten Largest Holdings | | Line of Business | | % of Net Assets | |

| | |

Microsoft Corp. | | Software | | | 3.0% | |

| | |

Apple, Inc. | | Technology Hardware, Storage & Peripherals | | | 2.4% | |

| | |

U.S. Treasury Bonds, 2.250%, 05/15/41 | | U.S. Treasury Obligations | | | 1.7% | |

| | |

Amazon.com, Inc. | | Internet & Direct Marketing Retail | | | 1.5% | |

| | |

Alphabet, Inc. (Class A Stock) | | Interactive Media & Services | | | 1.1% | |

| | |

Facebook, Inc. (Class A Stock) | | Interactive Media & Services | | | 1.1% | |

| | |

Alphabet, Inc. (Class C Stock) | | Interactive Media & Services | | | 1.1% | |

| | |

U.S. Treasury Bonds, 2.500%, 05/15/46 | | U.S. Treasury Obligations | | | 1.0% | |

| | |

Johnson & Johnson | | Pharmaceuticals | | | 0.8% | |

| | |

U.S. Treasury Notes, 1.250%, 04/30/28 | | U.S. Treasury Obligations | | | 0.8% | |

| | |

| Holdings reflect only long-term investments. | | | | |

PGIM Balanced Fund 7

Strategy and Performance Overview (unaudited)

How did the Fund perform?

The PGIM Balanced Fund’s Class Z shares returned 18.99% in the 12-month reporting period that ended September 30, 2021, outperforming the 16.91% return of the Customized Blend Index (the Index). The Index consists of the S&P 500 Index (44%), the Bloomberg US Aggregate Bond Index (40%), the Russell 2000 Index (4%), and the MSCI ACWI ex US Index (12%).

What were the market conditions?

| · | | During the reporting period, highly effective COVID-19 vaccines were developed and deployed. Coupled with massive fiscal and monetary stimulus, the availability of these vaccines unleashed strong economic and earnings growth. This fueled a sharp increase in US equity prices while bond returns, as measured by the Bloomberg US Aggregate Bond Index, fell nearly 1%. |

| · | | The emergency approval of two effective COVID-19 vaccines in the US in the fourth quarter of 2020 gave the markets visibility into and conviction for a potential global economic reopening in 2021. In that environment, PGIM Quantitative Solutions believed that equity returns would be driven by earnings rather than price-to-earnings (P/E) multiples. That essentially transpired, as earnings rose during the first half of 2021 and P/E multiples fell compared to the beginning of the year. |

| · | | In addition, PGIM Quantitative Solutions believed that US/technology/secular growth stocks would likely perform reasonably well in 2021 and would continue to be supported by structural trends (e.g., increased digitalization), despite ceding market leadership after significant gains in 2020. Though style performance varied at different points during the period, value stocks outperformed growth stocks overall during the period. |

| · | | Along this same theme, PGIM Quantitative Solutions believed that small-cap stocks and non-US equities would also perform well as these markets are more cyclical and would highly benefit from the global economic reopening. During the period, US small caps outperformed large caps; however, non-US equities lagged the performance of US equities. |

| · | | Positive economic growth developments, along with elevated inflation, weighed on bond returns during the period. As the overall US bond market posted negative returns, Treasury inflation-protected securities and high yield corporate bonds, one of the riskiest segments of the bond market, both posted gains. |

What worked?

| · | | Asset allocation was a positive contributor to the Fund’s performance during the reporting period, as the portfolio was overweight equities. |

| · | | Within the large-cap US equity segment of the Fund, favoring stocks that are comparatively inexpensive to industry peers (value factors) helped the portfolio outperform its Index during the period. Quality factors also contributed positively. |

8 Visit our website at pgim.com/investments

| · | | Within the small-cap US equity segment of the Fund, favoring comparatively inexpensive, high-quality stocks with improving growth prospects helped the portfolio outpace its Index during the period. Value factors drove the outperformance. |

| · | | Within the international equity segment of the Fund, growth and value stocks performed exceptionally well, helping the portfolio outpace its Index during the period. |

| · | | Value stocks within the Fund’s international equity segment posted a stellar bounce-back during the period, particularly in the beginning of 2021 after struggling in recent years. The portfolio was well-positioned to take advantage of the correction of expensive stocks, particularly those with multiples that significantly expanded after the pandemic began early in 2020. Avoiding expensive internet stocks (e.g., consumer discretionary), most notably in China, was a successful strategy in the second half of the period, as the Chinese government’s tightening of regulatory controls sent these stock prices tumbling. |

| · | | Although value stocks had a noteworthy bounce-back, the main driver of the Fund’s outperformance was growth. Favoring the highest-growth stocks across the information technology, financials, and consumer discretionary sectors was advantageous. Within consumer discretionary, the Fund’s tilt toward high-growth companies and away from low-growth companies was well rewarded given their striking return differentials. |

| · | | The fixed income segment of the Fund outperformed its Index during the period. Sector allocation within this segment contributed to performance, with positions in investment-grade corporate bonds, high yield bonds, emerging markets debt, sovereign government bonds, asset-backed securities, commercial mortgage-backed securities (CMBS), collateralized loan obligations (CLOs), bank loans, agency securities, and municipal securities generating positive excess returns. Additionally regarding sector allocation in this segment, based on spread duration positioning, overweight positions in high yield bonds, CMBS, and municipal securities—and an underweight in mortgage-backed securities (MBS)/collateralized mortgage obligations—contributed positively. Positioning in CLOs led to outperformance. (Duration measures the sensitivity of the price—the value of principal—of a bond to a change in interest rates.) |

| · | | Security selection in the fixed income segment of the Fund also contributed to performance, including positions in investment-grade corporate bonds, non-agency MBS, emerging markets debt, foreign non-corporate debt, and upstream energy bonds. |

What didn’t work?

| · | | Within the large-cap US equity segment of the Fund, growth-factor performance was negative during the reporting period but did not offset the strong performance of value and quality factors. In addition, the Fund lagged its Index in the communication services sector. |

PGIM Balanced Fund 9

Strategy and Performance Overview (continued)

| · | | Within the small-cap US equity segment of the Fund, the portfolio underperformed its benchmark Index in the consumer discretionary sector. |

| · | | Within the international equity segment of the Fund, the quality factor struggled and detracted considerably from the Fund’s performance, particularly as investors’ appetite for growth superseded their appetite for companies with strong balance sheets. |

| · | | Within the fixed income segment, the Fund’s yield curve positioning, principally along the US Treasury yield curve, detracted from results. (A yield curve is a line graph that illustrates the relationship between the yields and maturities of fixed income securities. It is created by plotting the yields of different maturities for the same type of bonds.) |

| · | | Security selection within MBS was negative. Within credit, positioning in the cable & satellite and building materials & home construction sectors detracted from the Fund’s returns. |

| · | | Also within the fixed income segment, the largest detractor from performance was an overweight (relative to the Index) to Citigroup Inc. in the banking sector. |

Did the Fund use derivatives?

| · | | The Fund utilized S&P 500 Index equity futures to equitize cash positions and for liquidity purposes. This exposure had a small positive impact on the Fund’s performance during the reporting period. |

| · | | The Fund’s US equity sleeves did not hold any derivatives during the period. The international equity sleeve held MSCI Emerging Markets Index mini futures. These derivatives were used to maintain exposure to equities and to provide portfolio liquidity. The futures were fully collateralized and had a minimal impact on the Fund’s performance during the period. |

| · | | The Fund’s fixed income sleeve uses derivatives when they facilitate implementation of the overall investment approach. During the period, the Fund used interest rate futures, options, and swaps to help manage duration positioning and yield curve exposure. Over the period, futures and swaps helped Fund performance, while options had a negligible impact. In addition, the Fund traded foreign exchange derivatives, which hurt performance during the period. |

Current outlook

| · | | A robust global recovery from the pandemic-induced economic downturn was continuing at the end of the reporting period, despite signs that activity may have hit a speed bump in the third quarter of 2021 as the COVID-19 Delta variant spread around the world. Renewed lockdowns in certain countries and more cautious consumer behavior appeared to push down third-quarter growth expectations from earlier estimates and from the rapid pace of growth in the second quarter of 2021. |

10 Visit our website at pgim.com/investments

| · | | Given the headwinds caused by the Delta variant, US gross domestic product (GDP) likely slowed in the third quarter of 2021, in PGIM Quantitative Solutions’ view. In contrast, eurozone GDP growth likely grew in the third quarter due to significant vaccination rates. |

| · | | Prices of goods and services remained stubbornly elevated at the end of the period as the debate over inflation continued. In the near term, prices likely will continue to face upward pressure by factors related to the pandemic (e.g., supply chain issues), in PGIM Quantitative Solutions’ view, and any reduction is likely to be gradual in an environment of strong demand growth and lean inventory positions. |

| · | | On the whole, advanced economy central banks continue to maintain their accommodative policies, though there was a modest tilt toward hawkishness at the end of the period. (Hawkishness suggests higher interest rates.) |

| · | | In emerging markets, central banks remained divided between those hiking rates due to rising inflation (Russia, Brazil, Mexico, Peru, Pakistan, and Chile) and others supporting their economies from virus-related downside risks (India, China, and ASEAN countries). (ASEAN, officially the Association of Southeast Asian Nations, is an economic union comprising 10 member states in Southeast Asia.) |

| · | | PGIM Quantitative Solutions believes economic growth likely will reaccelerate into the end of 2021 as the economic impact of the Delta variant recedes and global monetary policy conditions stay accommodative. |

| · | | In terms of asset allocation, the Fund remains overweight stocks relative to cash and fixed income. In PGIM Quantitative Solutions’ view, equities should continue to perform strongly and interest rates should rise as risks from the Delta variant recede and investors focus on a post-Delta recovery. |

| · | | A credit event in China, such as major corporate bond default, could spark a correction in global stock markets; however, PGIM Quantitative Solutions thinks this would be a buying opportunity given the underlying strength in the global economy and earnings. |

| · | | As for bond yields, PGIM Quantitative Solutions expects them to rise back toward the levels seen earlier in 2021, as Delta variant risks peak and decline. However, interest rates should stay historically low, at least in the near term, anchored by structural trends and central bank policies. |

PGIM Balanced Fund 11

Fees and Expenses (unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 held through the six-month period ended September 30, 2021. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to individual retirement accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of PGIM funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information

12 Visit our website at pgim.com/investments

provided in the expense table. Additional fees have the effect of reducing investment returns.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | |

| | | | |

| PGIM Balanced Fund | | Beginning Account Value April 1, 2021 | | Ending Account Value

September 30, 2021 | | Annualized Expense Ratio Based on the Six-Month Period | | Expenses Paid During the Six-Month Period* |

Class A | | Actual | | $1,000.00 | | $1,048.50 | | 1.00% | | $5.14 |

| | | | | |

| | Hypothetical | | $1,000.00 | | $1,020.05 | | 1.00% | | $5.06 |

| | | | | |

Class C | | Actual | | $1,000.00 | | $1,043.80 | | 1.78% | | $9.12 |

| | | | | |

| | Hypothetical | | $1,000.00 | | $1,016.14 | | 1.78% | | $9.00 |

| | | | | |

Class R | | Actual | | $1,000.00 | | $1,045.60 | | 1.47% | | $7.54 |

| | | | | |

| | Hypothetical | | $1,000.00 | | $1,017.70 | | 1.47% | | $7.44 |

| | | | | |

Class Z | | Actual | | $1,000.00 | | $1,049.30 | | 0.78% | | $4.01 |

| | | | | |

| | Hypothetical | | $1,000.00 | | $1,021.16 | | 0.78% | | $3.95 |

| | | | | |

Class R6 | | Actual | | $1,000.00 | | $1,049.80 | | 0.65% | | $3.34 |

| | | | | |

| | | Hypothetical | | $1,000.00 | | $1,021.81 | | 0.65% | | $3.29 |

*Fund expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 183 days in the six-month period ended September 30, 2021, and divided by the 365 days in the Fund’s fiscal year ended September 30, 2021 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

PGIM Balanced Fund 13

Schedule of Investments

as of September 30, 2021

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

LONG-TERM INVESTMENTS 98.3% | | | | | | | | |

| | |

COMMON STOCKS 61.9% | | | | | | | | |

| | |

Aerospace & Defense 0.9% | | | | | | | | |

| | |

Curtiss-Wright Corp. | | | 1,400 | | | $ | 176,652 | |

General Dynamics Corp. | | | 17,100 | | | | 3,352,113 | |

Lockheed Martin Corp. | | | 10,677 | | | | 3,684,633 | |

Moog, Inc. (Class A Stock) | | | 200 | | | | 15,246 | |

Northrop Grumman Corp. | | | 1,700 | | | | 612,255 | |

Raytheon Technologies Corp. | | | 21,157 | | | | 1,818,656 | |

Vectrus, Inc.* | | | 2,680 | | | | 134,750 | |

| | | | | | | | |

| | |

| | | | | | | 9,794,305 | |

| | |

Air Freight & Logistics 0.2% | | | | | | | | |

| | |

Deutsche Post AG (Germany) | | | 19,415 | | | | 1,220,918 | |

FedEx Corp. | | | 3,800 | | | | 833,302 | |

Radiant Logistics, Inc.* | | | 13,639 | | | | 87,153 | |

SG Holdings Co. Ltd. (Japan) | | | 4,600 | | | | 130,851 | |

| | | | | | | | |

| | |

| | | | | | | 2,272,224 | |

| | |

Airlines 0.0% | | | | | | | | |

| | |

Mesa Air Group, Inc.* | | | 3,700 | | | | 28,342 | |

SkyWest, Inc.* | | | 3,560 | | | | 175,650 | |

| | | | | | | | |

| | |

| | | | | | | 203,992 | |

| | |

Auto Components 0.3% | | | | | | | | |

| | |

Adient PLC* | | | 7,600 | | | | 315,020 | |

Aisin Corp. (Japan) | | | 1,500 | | | | 54,017 | |

American Axle & Manufacturing Holdings, Inc.* | | | 9,600 | | | | 84,576 | |

ARB Corp. Ltd. (Australia) | | | 8,505 | | | | 297,355 | |

Bridgestone Corp. (Japan) | | | 17,100 | | | | 807,508 | |

Cie Generale des Etablissements Michelin SCA (France) | | | 2,582 | | | | 395,771 | |

Dana, Inc. | | | 9,802 | | | | 217,996 | |

Goodyear Tire & Rubber Co. (The)* | | | 19,500 | | | | 345,150 | |

Hankook Tire & Technology Co. Ltd. (South Korea) | | | 8,005 | | | | 289,419 | |

KYB Corp. (Japan) | | | 8,200 | | | | 222,216 | |

Modine Manufacturing Co.* | | | 1,700 | | | | 19,261 | |

Sumitomo Rubber Industries Ltd. (Japan) | | | 60,800 | | | | 770,759 | |

Tenneco, Inc. (Class A Stock)* | | | 1,100 | | | | 15,697 | |

| | | | | | | | |

| | |

| | | | | | | 3,834,745 | |

| | |

Automobiles 1.0% | | | | | | | | |

| | |

BYD Co. Ltd. (China) (Class H Stock) | | | 4,000 | | | | 124,713 | |

See Notes to Financial Statements.

PGIM Balanced Fund 15

Schedule of Investments (continued)

as of September 30, 2021

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Automobiles (cont’d.) | | | | | | | | |

| | |

Ford Motor Co.* | | | 201,100 | | | $ | 2,847,576 | |

Ford Otomotiv Sanayi A/S (Turkey) | | | 11,172 | | | | 209,568 | |

General Motors Co.* | | | 24,460 | | | | 1,289,287 | |

Isuzu Motors Ltd. (Japan) | | | 6,000 | | | | 78,509 | |

Kia Corp. (South Korea) | | | 11,671 | | | | 788,339 | |

Tesla, Inc.* | | | 5,400 | | | | 4,187,592 | |

Toyota Motor Corp. (Japan) | | | 8,270 | | | | 146,801 | |

Trigano SA (France) | | | 3,861 | | | | 727,482 | |

Winnebago Industries, Inc. | | | 3,700 | | | | 268,065 | |

Yamaha Motor Co. Ltd. (Japan) | | | 2,000 | | | | 55,792 | |

| | | | | | | | |

| | |

| | | | | | | 10,723,724 | |

| | |

Banks 3.4% | | | | | | | | |

| | |

Australia & New Zealand Banking Group Ltd. (Australia) | | | 17,328 | | | | 348,426 | |

Banco Santander Chile (Chile) | | | 6,511,743 | | | | 326,245 | |

Bank Hapoalim BM (Israel) | | | 6,620 | | | | 58,205 | |

Bank Leumi Le-Israel BM (Israel) | | | 6,860 | | | | 58,494 | |

Bank of America Corp. | | | 11,800 | | | | 500,910 | |

Bank of China Ltd. (China) (Class H Stock) | | | 422,000 | | | | 149,333 | |

Bank of Communications Co. Ltd. (China) (Class H Stock) | | | 1,295,000 | | | | 766,197 | |

Bank of Montreal (Canada) | | | 3,300 | | | | 329,453 | |

Bank of NT Butterfield & Son Ltd. (The) (Bermuda) | | | 6,498 | | | | 230,744 | |

BNP Paribas SA (France) | | | 5,676 | | | | 362,378 | |

Canadian Imperial Bank of Commerce (Canada) | | | 6,200 | | | | 690,194 | |

Capstar Financial Holdings, Inc. | | | 1,700 | | | | 36,108 | |

China CITIC Bank Corp. Ltd. (China) (Class H Stock) | | | 120,000 | | | | 54,194 | |

China Construction Bank Corp. (China) (Class H Stock) | | | 1,362,000 | | | | 969,987 | |

Citigroup, Inc. | | | 69,656 | | | | 4,888,458 | |

Civista Bancshares, Inc. | | | 2,000 | | | | 46,460 | |

CNB Financial Corp. | | | 3,676 | | | | 89,474 | |

ConnectOne Bancorp, Inc. | | | 3,199 | | | | 96,002 | |

Credit Agricole SA (France) | | | 5,800 | | | | 79,832 | |

Customers Bancorp, Inc.* | | | 8,160 | | | | 351,043 | |

DBS Group Holdings Ltd. (Singapore) | | | 43,500 | | | | 962,613 | |

DGB Financial Group, Inc. (South Korea) | | | 29,547 | | | | 246,192 | |

DNB Bank ASA (Norway) | | | 4,154 | | | | 94,773 | |

Fifth Third Bancorp | | | 6,000 | | | | 254,640 | |

Financial Institutions, Inc. | | | 7,052 | | | | 216,144 | |

First Internet Bancorp | | | 2,988 | | | | 93,166 | |

First Merchants Corp. | | | 400 | | | | 16,736 | |

Flushing Financial Corp. | | | 1,800 | | | | 40,680 | |

Great Western Bancorp, Inc. | | | 500 | | | | 16,370 | |

Hana Financial Group, Inc. (South Korea) | | | 21,901 | | | | 849,842 | |

Hancock Whitney Corp. | | | 6,800 | | | | 320,416 | |

See Notes to Financial Statements.

16

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Banks (cont’d.) | | | | | | | | |

| | |

Hanmi Financial Corp. | | | 2,400 | | | $ | 48,144 | |

Heartland Financial USA, Inc. | | | 5,780 | | | | 277,902 | |

Hope Bancorp, Inc. | | | 15,020 | | | | 216,889 | |

Industrial & Commercial Bank of China Ltd. (China) (Class H Stock) | | | 320,000 | | | | 177,384 | |

Industrial Bank Co. Ltd. (China) (Class A Stock) | | | 84,200 | | | | 237,639 | |

Japan Post Bank Co. Ltd. (Japan) | | | 13,200 | | | | 113,044 | |

JPMorgan Chase & Co. | | | 25,224 | | | | 4,128,917 | |

KB Financial Group, Inc. (South Korea) | | | 19,192 | | | | 895,100 | |

KBC Group NV (Belgium) | | | 1,292 | | | | 115,943 | |

Lloyds Banking Group PLC (United Kingdom) | | | 368,549 | | | | 228,392 | |

Metropolitan Bank Holding Corp.* | | | 1,100 | | | | 92,730 | |

Midland States Bancorp, Inc. | | | 1,800 | | | | 44,514 | |

MidWestOne Financial Group, Inc. | | | 4,283 | | | | 129,175 | |

Mitsubishi UFJ Financial Group, Inc. (Japan) | | | 197,500 | | | | 1,160,259 | |

Mizuho Financial Group, Inc. (Japan) | | | 12,100 | | | | 171,361 | |

National Bank of Canada (Canada) | | | 13,000 | | | | 998,453 | |

Nordea Bank Abp (Finland) | | | 68,007 | | | | 878,575 | |

OceanFirst Financial Corp. | | | 800 | | | | 17,128 | |

OFG Bancorp (Puerto Rico) | | | 13,187 | | | | 332,576 | |

Old Second Bancorp, Inc. | | | 3,318 | | | | 43,333 | |

Orrstown Financial Services, Inc. | | | 1,087 | | | | 25,436 | |

Oversea-Chinese Banking Corp. Ltd. (Singapore) | | | 17,200 | | | | 144,403 | |

Popular, Inc. (Puerto Rico) | | | 4,900 | | | | 380,583 | |

Primis Financial Corp. | | | 5,180 | | | | 74,903 | |

QCR Holdings, Inc. | | | 4,073 | | | | 209,515 | |

RBB Bancorp | | | 2,000 | | | | 50,420 | |

Regions Financial Corp. | | | 82,500 | | | | 1,758,075 | |

Riyad Bank (Saudi Arabia) | | | 23,582 | | | | 169,076 | |

Royal Bank of Canada (Canada) | | | 7,600 | | | | 756,220 | |

S&T Bancorp, Inc. | | | 1,000 | | | | 29,470 | |

Sberbank of Russia PJSC (Russia) | | | 234,080 | | | | 1,098,551 | |

Skandinaviska Enskilda Banken AB (Sweden) (Class A Stock) | | | 61,307 | | | | 865,047 | |

SouthState Corp. | | | 600 | | | | 44,802 | |

Svenska Handelsbanken AB (Sweden) (Class A Stock) | | | 46,340 | | | | 520,009 | |

Synovus Financial Corp. | | | 6,800 | | | | 298,452 | |

Toronto-Dominion Bank (The) (Canada) | | | 11,800 | | | | 781,170 | |

U.S. Bancorp | | | 7,500 | | | | 445,800 | |

United Overseas Bank Ltd. (Singapore) | | | 5,900 | | | | 111,364 | |

Valley National Bancorp | | | 13,860 | | | | 184,477 | |

Wells Fargo & Co. | | | 119,020 | | | | 5,523,718 | |

WesBanco, Inc. | | | 2,200 | | | | 74,976 | |

| | | | | | | | |

| | |

| | | | | | | 37,397,634 | |

See Notes to Financial Statements.

PGIM Balanced Fund 17

Schedule of Investments (continued)

as of September 30, 2021

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Beverages 1.0% | | | | | | | | |

| | |

Anadolu Efes Biracilik Ve Malt Sanayii A/S (Turkey) | | | 41,552 | | | $ | 99,933 | |

Carlsberg A/S (Denmark) (Class B Stock) | | | 532 | | | | 86,870 | |

Coca-Cola Co. (The) | | | 101,600 | | | | 5,330,952 | |

National Beverage Corp. | | | 2,460 | | | | 129,125 | |

PepsiCo, Inc. | | | 35,200 | | | | 5,294,432 | |

| | | | | | | | |

| | |

| | | | | | | 10,941,312 | |

| | |

Biotechnology 1.1% | | | | | | | | |

| | |

AbbVie, Inc. | | | 31,405 | | | | 3,387,657 | |

Agios Pharmaceuticals, Inc.* | | | 500 | | | | 23,075 | |

Akebia Therapeutics, Inc.* | | | 21,000 | | | | 60,480 | |

Alkermes PLC* | | | 8,800 | | | | 271,392 | |

Amgen, Inc. | | | 3,300 | | | | 701,745 | |

Arena Pharmaceuticals, Inc.* | | | 300 | | | | 17,865 | |

Arrowhead Pharmaceuticals, Inc.* | | | 5,300 | | | | 330,879 | |

Blueprint Medicines Corp.* | | | 2,100 | | | | 215,901 | |

Bridgebio Pharma, Inc.* | | | 400 | | | | 18,748 | |

CareDx, Inc.* | | | 4,000 | | | | 253,480 | |

Catalyst Pharmaceuticals, Inc.* | | | 49,020 | | | | 259,806 | |

Cerevel Therapeutics Holdings, Inc.* | | | 1,300 | | | | 38,350 | |

Daan Gene Co. Ltd. (China) (Class A Stock) | | | 18,400 | | | | 52,937 | |

Denali Therapeutics, Inc.* | | | 5,200 | | | | 262,340 | |

Eagle Pharmaceuticals, Inc.* | | | 5,380 | | | | 300,096 | |

Emergent BioSolutions, Inc.* | | | 4,464 | | | | 223,512 | |

Gilead Sciences, Inc. | | | 23,689 | | | | 1,654,677 | |

Halozyme Therapeutics, Inc.* | | | 2,300 | | | | 93,564 | |

ImmunityBio, Inc.* | | | 2,300 | | | | 22,402 | |

Ironwood Pharmaceuticals, Inc.* | | | 22,800 | | | | 297,768 | |

Kodiak Sciences, Inc.* | | | 600 | | | | 57,588 | |

Myriad Genetics, Inc.* | | | 6,500 | | | | 209,885 | |

OPKO Health, Inc.* | | | 71,360 | | | | 260,464 | |

Organogenesis Holdings, Inc.* | | | 14,900 | | | | 212,176 | |

Prothena Corp. PLC (Ireland)* | | | 3,000 | | | | 213,690 | |

PTC Therapeutics, Inc.* | | | 3,580 | | | | 133,212 | |

Puma Biotechnology, Inc.* | | | 10,560 | | | | 74,026 | |

Regeneron Pharmaceuticals, Inc.* | | | 1,900 | | | | 1,149,842 | |

Vanda Pharmaceuticals, Inc.* | | | 17,377 | | | | 297,842 | |

Veracyte, Inc.* | | | 600 | | | | 27,870 | |

Vertex Pharmaceuticals, Inc.* | | | 4,300 | | | | 779,977 | |

| | | | | | | | |

| | |

| | | | | | | 11,903,246 | |

| | |

Building Products 0.5% | | | | | | | | |

| | |

American Woodmark Corp.* | | | 680 | | | | 44,452 | |

See Notes to Financial Statements.

18

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Building Products (cont’d.) | | | | | | | | |

| | |

Carlisle Cos., Inc. | | | 3,000 | | | $ | 596,370 | |

Carrier Global Corp. | | | 36,900 | | | | 1,909,944 | |

Cie de Saint-Gobain (France) | | | 16,026 | | | | 1,079,302 | |

Geberit AG (Switzerland) | | | 990 | | | | 728,402 | |

JELD-WEN Holding, Inc.* | | | 10,100 | | | | 252,803 | |

Kingspan Group PLC (Ireland) | | | 744 | | | | 73,113 | |

Nibe Industrier AB (Sweden) (Class B Stock) | | | 4,420 | | | | 55,828 | |

Resideo Technologies, Inc.* | | | 4,200 | | | | 104,118 | |

UFP Industries, Inc. | | | 4,977 | | | | 338,336 | |

Xinyi Glass Holdings Ltd. (Hong Kong) | | | 16,000 | | | | 47,784 | |

Zhuzhou Kibing Group Co. Ltd. (China) (Class A Stock) | | | 79,600 | | | | 212,088 | |

| | | | | | | | |

| | |

| | | | | | | 5,442,540 | |

| | |

Capital Markets 1.6% | | | | | | | | |

| | |

3i Group PLC (United Kingdom) | | | 39,791 | | | | 682,843 | |

Abrdn PLC (United Kingdom) | | | 22,906 | | | | 78,561 | |

Ameriprise Financial, Inc. | | | 2,497 | | | | 659,508 | |

Amundi SA (France), 144A | | | 7,006 | | | | 590,146 | |

Anima Holding SpA (Italy), 144A | | | 73,166 | | | | 349,573 | |

Azimut Holding SpA (Italy) | | | 20,068 | | | | 549,748 | |

Cohen & Steers, Inc. | | | 300 | | | | 25,131 | |

Daiwa Securities Group, Inc. (Japan) | | | 11,000 | | | | 64,144 | |

Donnelley Financial Solutions, Inc.* | | | 3,100 | | | | 107,322 | |

Goldman Sachs Group, Inc. (The) | | | 14,110 | | | | 5,334,003 | |

Julius Baer Group Ltd. (Switzerland) | | | 1,144 | | | | 75,959 | |

Macquarie Group Ltd. (Australia) | | | 2,168 | | | | 281,916 | |

Man Group PLC (United Kingdom) | | | 48,457 | | | | 133,847 | |

Pendal Group Ltd. (Australia) | | | 37,209 | | | | 219,748 | |

Piper Sandler Cos. | | | 2,300 | | | | 318,458 | |

Raymond James Financial, Inc. | | | 24,750 | | | | 2,283,930 | |

Schroders PLC (United Kingdom) | | | 1,218 | | | | 58,664 | |

State Street Corp. | | | 34,800 | | | | 2,948,256 | |

Stifel Financial Corp. | | | 15,100 | | | | 1,026,196 | |

StoneX Group, Inc.* | | | 800 | | | | 52,720 | |

UBS Group AG (Switzerland) | | | 67,901 | | | | 1,088,895 | |

Value Partners Group Ltd. (Hong Kong) | | | 783,000 | | | | 393,465 | |

Virtus Investment Partners, Inc. | | | 970 | | | | 301,011 | |

| | | | | | | | |

| | |

| | | | | | | 17,624,044 | |

| | |

Chemicals 0.9% | | | | | | | | |

| | |

Cabot Corp. | | | 5,600 | | | | 280,672 | |

CF Industries Holdings, Inc. | | | 7,400 | | | | 413,068 | |

Chemours Co. (The) | | | 19,500 | | | | 566,670 | |

See Notes to Financial Statements.

PGIM Balanced Fund 19

Schedule of Investments (continued)

as of September 30, 2021

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Chemicals (cont’d.) | | | | | | | | |

| | |

China BlueChemical Ltd. (China) (Class H Stock) | | | 330,000 | | | $ | 120,078 | |

Covestro AG (Germany), 144A | | | 11,342 | | | | 774,610 | |

Dow, Inc. | | | 25,100 | | | | 1,444,756 | |

DuPont de Nemours, Inc. | | | 35,000 | | | | 2,379,650 | |

Hawkins, Inc. | | | 1,104 | | | | 38,507 | |

Ingevity Corp.* | | | 3,180 | | | | 226,957 | |

Kronos Worldwide, Inc. | | | 6,400 | | | | 79,424 | |

Kumho Petrochemical Co. Ltd. (South Korea) | | | 4,121 | | | | 651,567 | |

Lotte Chemical Titan Holding Bhd (Malaysia), 144A | | | 442,800 | | | | 278,601 | |

Minerals Technologies, Inc. | | | 800 | | | | 55,872 | |

Mitsui Chemicals, Inc. (Japan) | | | 1,800 | | | | 60,127 | |

Mosaic Co. (The) | | | 21,600 | | | | 771,552 | |

Nan Ya Plastics Corp. (Taiwan) | | | 28,000 | | | | 91,516 | |

Olin Corp. | | | 8,500 | | | | 410,125 | |

Orion Engineered Carbons SA (Germany)* | | | 7,460 | | | | 135,996 | |

Sumitomo Chemical Co. Ltd. (Japan) | | | 11,000 | | | | 57,321 | |

Tosoh Corp. (Japan) | | | 3,000 | | | | 54,447 | |

Trinseo SA | | | 5,100 | | | | 275,298 | |

Westlake Chemical Corp. | | | 8,500 | | | | 774,690 | |

| | | | | | | | |

| | |

| | | | | | | 9,941,504 | |

| | |

Commercial Services & Supplies 0.1% | | | | | | | | |

| | |

ABM Industries, Inc. | | | 4,200 | | | | 189,042 | |

BrightView Holdings, Inc.* | | | 6,500 | | | | 95,940 | |

Clean Harbors, Inc.* | | | 1,800 | | | | 186,966 | |

HNI Corp. | | | 3,600 | | | | 132,192 | |

Okamura Corp. (Japan) | | | 16,000 | | | | 233,972 | |

Tetra Tech, Inc. | | | 500 | | | | 74,670 | |

| | | | | | | | |

| | |

| | | | | | | 912,782 | |

| | |

Communications Equipment 0.3% | | | | | | | | |

| | |

Cisco Systems, Inc. | | | 32,837 | | | | 1,787,318 | |

EchoStar Corp. (Class A Stock)* | | | 1,500 | | | | 38,265 | |

NetScout Systems, Inc.* | | | 4,659 | | | | 125,560 | |

Nokia OYJ (Finland)* | | | 27,816 | | | | 153,133 | |

Ubiquiti, Inc. | | | 3,100 | | | | 925,877 | |

Viavi Solutions, Inc.* | | | 7,400 | | | | 116,476 | |

| | | | | | | | |

| | |

| | | | | | | 3,146,629 | |

| | |

Construction & Engineering 0.1% | | | | | | | | |

| | |

EMCOR Group, Inc. | | | 3,650 | | | | 421,137 | |

See Notes to Financial Statements.

20

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Construction & Engineering (cont’d.) | | | | | | | | |

| | |

Primoris Services Corp. | | | 4,700 | | | $ | 115,103 | |

Skanska AB (Sweden) (Class B Stock) | | | 2,100 | | | | 52,673 | |

| | | | | | | | |

| | |

| | | | | | | 588,913 | |

| | |

Construction Materials 0.2% | | | | | | | | |

| | |

Buzzi Unicem SpA (Italy) | | | 16,450 | | | | 374,503 | |

HeidelbergCement AG (Germany) | | | 3,456 | | | | 258,097 | |

Holcim Ltd. (Switzerland)* | | | 17,121 | | | | 826,892 | |

Vicat SA (France) | | | 4,903 | | | | 218,762 | |

| | | | | | | | |

| | |

| | | | | | | 1,678,254 | |

| | |

Consumer Finance 0.7% | | | | | | | | |

| | |

Capital One Financial Corp. | | | 27,400 | | | | 4,437,978 | |

Discover Financial Services | | | 3,600 | | | | 442,260 | |

Enova International, Inc.* | | | 1,000 | | | | 34,550 | |

LendingClub Corp.* | | | 900 | | | | 25,416 | |

Navient Corp. | | | 3,400 | | | | 67,082 | |

Nelnet, Inc. (Class A Stock) | | | 600 | | | | 47,544 | |

OneMain Holdings, Inc. | | | 25,200 | | | | 1,394,316 | |

PROG Holdings, Inc. | | | 6,300 | | | | 264,663 | |

Regional Management Corp. | | | 1,300 | | | | 75,634 | |

Synchrony Financial | | | 23,000 | | | | 1,124,240 | |

| | | | | | | | |

| | |

| | | | | | | 7,913,683 | |

| | |

Containers & Packaging 0.0% | | | | | | | | |

| | |

Greif, Inc. (Class A Stock) | | | 4,080 | | | | 263,568 | |

O-I Glass, Inc.* | | | 13,400 | | | | 191,218 | |

| | | | | | | | |

| | |

| | | | | | | 454,786 | |

| | |

Distributors 0.4% | | | | | | | | |

| | |

Genuine Parts Co. | | | 15,700 | | | | 1,903,311 | |

LKQ Corp.* | | | 41,100 | | | | 2,068,152 | |

| | | | | | | | |

| | |

| | | | | | | 3,971,463 | |

| | |

Diversified Financial Services 0.4% | | | | | | | | |

| | |

A-Mark Precious Metals, Inc. | | | 800 | | | | 48,016 | |

Berkshire Hathaway, Inc. (Class B Stock)* | | | 14,374 | | | | 3,923,240 | |

Cannae Holdings, Inc.* | | | 6,680 | | | | 207,815 | |

FirstRand Ltd. (South Africa) | | | 25,764 | | | | 110,260 | |

See Notes to Financial Statements.

PGIM Balanced Fund 21

Schedule of Investments (continued)

as of September 30, 2021

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Diversified Financial Services (cont’d.) | | | | | | | | |

| | |

Industrivarden AB (Sweden) (Class C Stock) | | | 1,617 | | | $ | 50,082 | |

Yuanta Financial Holding Co. Ltd. (Taiwan) | | | 69,000 | | | | 60,901 | |

| | | | | | | | |

| | |

| | | | | | | 4,400,314 | |

| | |

Diversified Telecommunication Services 1.1% | | | | | | | | |

| | |

AT&T, Inc. | | | 181,356 | | | | 4,898,426 | |

ATN International, Inc. | | | 1,580 | | | | 74,023 | |

Chunghwa Telecom Co. Ltd. (Taiwan) | | | 45,000 | | | | 178,606 | |

Deutsche Telekom AG (Germany) | | | 4,521 | | | | 90,788 | |

Emirates Telecommunications Group Co. PJSC (United Arab Emirates) | | | 9,408 | | | | 61,470 | |

Koninklijke KPN NV (Netherlands) | | | 18,060 | | | | 56,866 | |

Liberty Latin America Ltd. (Chile) (Class A Stock)* | | | 1,100 | | | | 14,388 | |

Liberty Latin America Ltd. (Chile) (Class C Stock)* | | | 4,800 | | | | 62,976 | |

Nippon Telegraph & Telephone Corp. (Japan) | | | 18,500 | | | | 511,265 | |

Swisscom AG (Switzerland) | | | 1,376 | | | | 792,917 | |

Telefonica SA (Spain) | | | 26,450 | | | | 123,561 | |

Telkom Indonesia Persero Tbk PT (Indonesia) | | | 1,351,000 | | | | 346,726 | |

Verizon Communications, Inc. | | | 90,240 | | | | 4,873,862 | |

| | | | | | | | |

| | |

| | | | | | | 12,085,874 | |

| | |

Electric Utilities 0.6% | | | | | | | | |

| | |

CESC Ltd. (India) | | | 152,880 | | | | 188,757 | |

Endesa SA (Spain) | | | 19,070 | | | | 384,517 | |

Enerjisa Enerji A/S (Turkey), 144A | | | 327,089 | | | | 382,827 | |

Entergy Corp. | | | 21,500 | | | | 2,135,165 | |

Exelon Corp. | | | 37,588 | | | | 1,817,004 | |

Fortum OYJ (Finland) | | | 2,272 | | | | 69,043 | |

Inter RAO UES PJSC (Russia) | | | 4,433,000 | | | | 282,972 | |

OGE Energy Corp. | | | 4,800 | | | | 158,208 | |

Otter Tail Corp. | | | 5,280 | | | | 295,522 | |

Portland General Electric Co. | | | 2,200 | | | | 103,378 | |

Power Grid Corp. of India Ltd. (India) | | | 300,034 | | | | 768,032 | |

SSE PLC (United Kingdom) | | | 4,940 | | | | 104,419 | |

| | | | | | | | |

| | |

| | | | | | | 6,689,844 | |

| | |

Electrical Equipment 0.7% | | | | | | | | |

| | |

ABB Ltd. (Switzerland) | | | 32,446 | | | | 1,086,253 | |

Acuity Brands, Inc. | | | 12,180 | | | | 2,111,647 | |

AMETEK, Inc. | | | 7,200 | | | | 892,872 | |

Atkore, Inc.* | | | 4,560 | | | | 396,355 | |

AZZ, Inc. | | | 400 | | | | 21,280 | |

See Notes to Financial Statements.

22

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Electrical Equipment (cont’d.) | | | | | | | | |

| | |

Emerson Electric Co. | | | 26,400 | | | $ | 2,486,880 | |

Encore Wire Corp. | | | 1,780 | | | | 168,797 | |

EnerSys | | | 1,100 | | | | 81,884 | |

Nitto Kogyo Corp. (Japan) | | | 8,300 | | | | 130,225 | |

Regal Beloit Corp. | | | 1,800 | | | | 270,612 | |

WEG SA (Brazil) | | | 77,100 | | | | 559,234 | |

| | | | | | | | |

| | |

| | | | | | | 8,206,039 | |

| | |

Electronic Equipment, Instruments & Components 0.4% | | | | | | | | |

| | |

ALSO Holding AG (Switzerland)* | | | 335 | | | | 96,966 | |

Arrow Electronics, Inc.* | | | 2,800 | | | | 314,412 | |

Comet Holding AG (Switzerland) | | | 273 | | | | 94,830 | |

ePlus, Inc.* | | | 1,180 | | | | 121,080 | |

Esprinet SpA (Italy) | | | 8,690 | | | | 113,362 | |

Hon Hai Precision Industry Co. Ltd. (Taiwan) | | | 44,000 | | | | 164,280 | |

Jabil, Inc. | | | 11,340 | | | | 661,916 | |

Kimball Electronics, Inc.* | | | 1,100 | | | | 28,347 | |

Kingboard Laminates Holdings Ltd. (Hong Kong) | | | 175,000 | | | | 288,083 | |

LG Innotek Co. Ltd. (South Korea) | | | 336 | | | | 58,408 | |

Maxscend Microelectronics Co. Ltd. (China) (Class A Stock) | | | 2,900 | | | | 157,315 | |

Murata Manufacturing Co. Ltd. (Japan) | | | 2,300 | | | | 205,051 | |

Redington India Ltd. (India) | | | 115,224 | | | | 216,263 | |

Samsung Electro-Mechanics Co. Ltd. (South Korea) | | | 321 | | | | 47,552 | |

Sanmina Corp.* | | | 8,180 | | | | 315,257 | |

ScanSource, Inc.* | | | 6,880 | | | | 239,355 | |

Sensirion Holding AG (Switzerland), 144A* | | | 968 | | | | 117,781 | |

Shimadzu Corp. (Japan) | | | 1,300 | | | | 57,075 | |

SYNNEX Corp. | | | 8,300 | | | | 864,030 | |

Vishay Intertechnology, Inc. | | | 11,500 | | | | 231,035 | |

| | | | | | | | |

| | |

| | | | | | | 4,392,398 | |

| | |

Energy Equipment & Services 0.3% | | | | | | | | |

| | |

ChampionX Corp.* | | | 13,500 | | | | 301,860 | |

Halliburton Co. | | | 122,700 | | | | 2,652,774 | |

Newpark Resources, Inc.* | | | 42,000 | | | | 138,600 | |

Oceaneering International, Inc.* | | | 19,240 | | | | 256,277 | |

TETRA Technologies, Inc.* | | | 15,200 | | | | 47,424 | |

| | | | | | | | |

| | |

| | | | | | | 3,396,935 | |

| | |

Entertainment 0.6% | | | | | | | | |

| | |

Activision Blizzard, Inc. | | | 37,980 | | | | 2,939,272 | |

Electronic Arts, Inc. | | | 8,860 | | | | 1,260,335 | |

See Notes to Financial Statements.

PGIM Balanced Fund 23

Schedule of Investments (continued)

as of September 30, 2021

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Entertainment (cont’d.) | | | | | | | | |

| | |

GungHo Online Entertainment, Inc. (Japan) | | | 12,000 | | | $ | 220,721 | |

Konami Holdings Corp. (Japan) | | | 7,800 | | | | 488,216 | |

Lions Gate Entertainment Corp. (Class A Stock)* | | | 3,600 | | | | 51,084 | |

Lions Gate Entertainment Corp. (Class B Stock)* | | | 5,800 | | | | 75,400 | |

Netflix, Inc.* | | | 1,900 | | | | 1,159,646 | |

Nintendo Co. Ltd. (Japan) | | | 565 | | | | 273,165 | |

Walt Disney Co. (The)* | | | 3,700 | | | | 625,929 | |

| | | | | | | | |

| | |

| | | | | | | 7,093,768 | |

| | |

Equity Real Estate Investment Trusts (REITs) 1.2% | | | | | | | | |

| | |

Acadia Realty Trust | | | 700 | | | | 14,287 | |

American Assets Trust, Inc. | | | 900 | | | | 33,678 | |

Apple Hospitality REIT, Inc. | | | 18,600 | | | | 292,578 | |

Charter Hall Group (Australia) | | | 26,607 | | | | 323,857 | |

City Office REIT, Inc. | | | 7,800 | | | | 139,308 | |

Columbia Property Trust, Inc. | | | 4,160 | | | | 79,123 | |

CorePoint Lodging, Inc.* | | | 1,500 | | | | 23,250 | |

Corporate Office Properties Trust | | | 3,500 | | | | 94,430 | |

Dexus (Australia) | | | 25,740 | | | | 199,685 | |

Diversified Healthcare Trust | | | 46,600 | | | | 157,974 | |

Extra Space Storage, Inc. | | | 6,300 | | | | 1,058,337 | |

Franklin Street Properties Corp. | | | 23,221 | | | | 107,746 | |

Gaming & Leisure Properties, Inc. | | | 4,193 | | | | 194,220 | |

GEO Group, Inc. (The)(a) | | | 22,603 | | | | 168,844 | |

Global Net Lease, Inc. | | | 1,600 | | | | 25,632 | |

Goodman Group (Australia) | | | 30,591 | | | | 472,708 | |

Hersha Hospitality Trust* | | | 1,500 | | | | 13,995 | |

Lamar Advertising Co. (Class A Stock) | | | 1,900 | | | | 215,555 | |

National Health Investors, Inc. | | | 480 | | | | 25,680 | |

Pebblebrook Hotel Trust | | | 5,340 | | | | 119,669 | |

Piedmont Office Realty Trust, Inc. (Class A Stock) | | | 16,160 | | | | 281,669 | |

PotlatchDeltic Corp. | | | 5,500 | | | | 283,690 | |

Prologis, Inc. | | | 15,000 | | | | 1,881,450 | |

PS Business Parks, Inc. | | | 400 | | | | 62,696 | |

Retail Properties of America, Inc. (Class A Stock) | | | 12,500 | | | | 161,000 | |

RLJ Lodging Trust | | | 5,100 | | | | 75,786 | |

Ryman Hospitality Properties, Inc.* | | | 1,100 | | | | 92,070 | |

Sabra Health Care REIT, Inc. | | | 13,720 | | | | 201,958 | |

Safestore Holdings PLC (United Kingdom) | | | 14,913 | | | | 210,962 | |

SBA Communications Corp. | | | 7,900 | | | | 2,611,503 | |

Service Properties Trust | | | 13,000 | | | | 145,730 | |

Stockland (Australia) | | | 23,780 | | | | 75,875 | |

Terreno Realty Corp. | | | 200 | | | | 12,646 | |

Urban Edge Properties | | | 3,840 | | | | 70,310 | |

See Notes to Financial Statements.

24

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Equity Real Estate Investment Trusts (REITs) (cont’d.) | | | | | | | | |

| | |

Weyerhaeuser Co. | | | 86,760 | | | $ | 3,086,053 | |

Whitestone REIT | | | 10,700 | | | | 104,646 | |

| | | | | | | | |

| | |

| | | | | | | 13,118,600 | |

| | |

Food & Staples Retailing 0.5% | | | | | | | | |

| | |

Alimentation Couche-Tard, Inc. (Canada) (Class B Stock) | | | 24,000 | | | | 918,238 | |

Andersons, Inc. (The) | | | 500 | | | | 15,415 | |

BJ’s Wholesale Club Holdings, Inc.* | | | 1,060 | | | | 58,215 | |

Koninklijke Ahold Delhaize NV (Netherlands) | | | 29,803 | | | | 991,163 | |

Loblaw Cos. Ltd. (Canada) | | | 1,000 | | | | 68,625 | |

Magnit PJSC (Russia), GDR | | | 3,360 | | | | 56,821 | |

North West Co., Inc. (The) (Canada) | | | 5,100 | | | | 136,177 | |

Performance Food Group Co.* | | | 300 | | | | 13,938 | |

Tesco PLC (United Kingdom) | | | 108,238 | | | | 368,245 | |

Walgreens Boots Alliance, Inc. | | | 4,200 | | | | 197,610 | |

Walmart, Inc. | | | 19,949 | | | | 2,780,492 | |

| | | | | | | | |

| | |

| | | | | | | 5,604,939 | |

| | |

Food Products 1.0% | | | | | | | | |

| | |

Archer-Daniels-Midland Co. | | | 25,700 | | | | 1,542,257 | |

First Pacific Co. Ltd. (Indonesia) | | | 836,000 | | | | 300,191 | |

Hershey Co. (The) | | | 3,200 | | | | 541,600 | |

Indofood Sukses Makmur Tbk PT (Indonesia) | | | 758,400 | | | | 336,269 | |

JBS SA | | | 111,000 | | | | 753,758 | |

Kraft Heinz Co. (The) | | | 58,400 | | | | 2,150,288 | |

La Doria SpA (Italy) | | | 7,924 | | | | 154,082 | |

Mondelez International, Inc. (Class A Stock) | | | 4,500 | | | | 261,810 | |

Nestle SA (Switzerland) | | | 7,993 | | | | 963,905 | |

Sanderson Farms, Inc. | | | 1,800 | | | | 338,760 | |

Simply Good Foods Co. (The)* | | | 1,100 | | | | 37,939 | |

Tyson Foods, Inc. (Class A Stock) | | | 38,500 | | | | 3,039,190 | |

Wilmar International Ltd. (China) | | | 199,900 | | | | 616,775 | |

| | | | | | | | |

| | |

| | | | | | | 11,036,824 | |

| | |

Gas Utilities 0.0% | | | | | | | | |

| | |

Beijing Enterprises Holdings Ltd. (China) | | | 46,000 | | | | 183,511 | |

New Jersey Resources Corp. | | | 700 | | | | 24,367 | |

ONE Gas, Inc. | | | 2,980 | | | | 188,843 | |

Southwest Gas Holdings, Inc. | | | 1,700 | | | | 113,696 | |

| | | | | | | | |

| | |

| | | | | | | 510,417 | |

See Notes to Financial Statements.

PGIM Balanced Fund 25

Schedule of Investments (continued)

as of September 30, 2021

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Health Care Equipment & Supplies 2.4% | | | | | | | | |

| | |

Abbott Laboratories | | | 27,220 | | | $ | 3,215,499 | |

Align Technology, Inc.* | | | 2,000 | | | | 1,330,860 | |

AngioDynamics, Inc.* | | | 540 | | | | 14,008 | |

Ansell Ltd. (Australia) | | | 18,986 | | | | 466,060 | |

Baxter International, Inc. | | | 3,800 | | | | 305,634 | |

Bioventus, Inc. (Class A Stock)* | | | 2,600 | | | | 36,816 | |

Boston Scientific Corp.* | | | 79,900 | | | | 3,466,861 | |

CONMED Corp. | | | 1,200 | | | | 156,996 | |

Danaher Corp. | | | 16,360 | | | | 4,980,638 | |

DENTSPLY SIRONA, Inc. | | | 5,000 | | | | 290,250 | |

Edwards Lifesciences Corp.* | | | 7,200 | | | | 815,112 | |

Hoya Corp. (Japan) | | | 2,000 | | | | 312,224 | |

Inogen, Inc.* | | | 600 | | | | 25,854 | |

Intco Medical Technology Co. Ltd. (China) (Class A Stock) | | | 21,711 | | | | 196,957 | |

Integer Holdings Corp.* | | | 3,200 | | | | 285,888 | |

Intuitive Surgical, Inc.* | | | 1,700 | | | | 1,690,055 | |

Lantheus Holdings, Inc.* | | | 7,900 | | | | 202,872 | |

LeMaitre Vascular, Inc. | | | 500 | | | | 26,545 | |

LivaNova PLC* | | | 300 | | | | 23,757 | |

Medtronic PLC | | | 22,600 | | | | 2,832,910 | |

Merit Medical Systems, Inc.* | | | 4,200 | | | | 301,560 | |

Natus Medical, Inc.* | | | 8,260 | | | | 207,161 | |

Neogen Corp.* | | | 3,000 | | | | 130,290 | |

Olympus Corp. (Japan) | | | 2,800 | | | | 61,442 | |

Ortho Clinical Diagnostics Holdings PLC* | | | 7,100 | | | | 131,208 | |

Sonova Holding AG (Switzerland) | | | 2,123 | | | | 804,560 | |

STAAR Surgical Co.* | | | 200 | | | | 25,706 | |

Stryker Corp. | | | 14,400 | | | | 3,797,568 | |

| | | | | | | | |

| | |

| | | | | | | 26,135,291 | |

| | |

Health Care Providers & Services 1.5% | | | | | | | | |

| | |

Agiliti, Inc.* | | | 3,400 | | | | 64,736 | |

AMN Healthcare Services, Inc.* | | | 3,100 | | | | 355,725 | |

Anthem, Inc. | | | 10,600 | | | | 3,951,680 | |

Community Health Systems, Inc.* | | | 18,900 | | | | 221,130 | |

CVS Health Corp. | | | 24,700 | | | | 2,096,042 | |

Ensign Group, Inc. (The) | | | 2,280 | | | | 170,749 | |

Fresenius SE & Co. KGaA (Germany) | | | 16,942 | | | | 811,681 | |

HCA Healthcare, Inc. | | | 7,200 | | | | 1,747,584 | |

LHC Group, Inc.* | | | 840 | | | | 131,804 | |

Medipal Holdings Corp. (Japan) | | | 28,000 | | | | 528,338 | |

National HealthCare Corp. | | | 200 | | | | 13,996 | |

Select Medical Holdings Corp. | | | 10,134 | | | | 366,547 | |

Sonic Healthcare Ltd. (Australia) | | | 8,265 | | | | 240,528 | |

See Notes to Financial Statements.

26

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Health Care Providers & Services (cont’d.) | | | | | | | | |

| | |

Tenet Healthcare Corp.* | | | 4,600 | | | $ | 305,624 | |

UnitedHealth Group, Inc. | | | 14,360 | | | | 5,611,026 | |

| | | | | | | | |

| | |

| | | | | | | 16,617,190 | |

| | |

Health Care Technology 0.1% | | | | | | | | |

| | |

Computer Programs & Systems, Inc.* | | | 5,200 | | | | 184,392 | |

HealthStream, Inc.* | | | 1,200 | | | | 34,296 | |

Multiplan Corp.* | | | 8,300 | | | | 46,729 | |

NextGen Healthcare, Inc.* | | | 14,875 | | | | 209,738 | |

Omnicell, Inc.* | | | 2,943 | | | | 436,829 | |

| | | | | | | | |

| | |

| | | | | | | 911,984 | |

| | |

Hotels, Restaurants & Leisure 1.1% | | | | | | | | |

| | |

888 Holdings PLC (United Kingdom) | | | 41,870 | | | | 244,500 | |

Biglari Holdings, Inc. (Class B Stock)* | | | 270 | | | | 46,389 | |

Bloomin’ Brands, Inc.* | | | 4,000 | | | | 100,000 | |

Booking Holdings, Inc.* | | | 700 | | | | 1,661,709 | |

Brinker International, Inc.* | | | 300 | | | | 14,715 | |

Century Casinos, Inc.* | | | 7,600 | | | | 102,372 | |

Del Taco Restaurants, Inc. | | | 15,160 | | | | 132,347 | |

Evolution AB (Sweden), 144A | | | 2,401 | | | | 365,170 | |

Jack in the Box, Inc. | | | 1,000 | | | | 97,330 | |

Kindred Group PLC (Malta), SDR | | | 52,691 | | | | 792,813 | |

McDonald’s Corp. | | | 21,420 | | | | 5,164,576 | |

RCI Hospitality Holdings, Inc. | | | 2,587 | | | | 177,235 | |

Red Rock Resorts, Inc. (Class A Stock)* | | | 6,000 | | | | 307,320 | |

Scientific Games Corp.* | | | 2,800 | | | | 232,596 | |

Starbucks Corp. | | | 25,200 | | | | 2,779,812 | |

Texas Roadhouse, Inc. | | | 3,200 | | | | 292,256 | |

Yum! Brands, Inc. | | | 1,300 | | | | 159,003 | |

| | | | | | | | |

| | |

| | | | | | | 12,670,143 | |

| | |

Household Durables 0.3% | | | | | | | | |

| | |

Cavco Industries, Inc.* | | | 150 | | | | 35,511 | |

Ecovacs Robotics Co. Ltd. (China) (Class A Stock) | | | 8,300 | | | | 194,073 | |

Iida Group Holdings Co. Ltd. (Japan) | | | 2,400 | | | | 61,704 | |

LG Electronics, Inc. (South Korea) | | | 1,744 | | | | 184,690 | |

M/I Homes, Inc.* | | | 1,900 | | | | 109,820 | |

Meritage Homes Corp.* | | | 2,980 | | | | 289,060 | |

Panasonic Corp. (Japan) | | | 66,100 | | | | 820,017 | |

Persimmon PLC (United Kingdom) | | | 1,664 | | | | 59,886 | |

PulteGroup, Inc. | | | 5,300 | | | | 243,376 | |

See Notes to Financial Statements.

PGIM Balanced Fund 27

Schedule of Investments (continued)

as of September 30, 2021

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Household Durables (cont’d.) | | | | | | | | |

| | |

Sekisui House Ltd. (Japan) | | | 2,600 | | | $ | 54,624 | |

Skyline Champion Corp.* | | | 6,200 | | | | 372,372 | |

Sony Group Corp. (Japan) | | | 6,550 | | | | 726,779 | |

Tri Pointe Homes, Inc.* | | | 4,100 | | | | 86,182 | |

| | | | | | | | |

| | |

| | | | | | | 3,238,094 | |

| | |

Household Products 0.3% | | | | | | | | |

| | |

Procter & Gamble Co. (The) | | | 22,379 | | | | 3,128,584 | |

Vinda International Holdings Ltd. (Hong Kong) | | | 30,000 | | | | 88,598 | |

| | | | | | | | |

| | |

| | | | | | | 3,217,182 | |

| | |

Independent Power & Renewable Electricity Producers 0.2% | | | | | | | | |

| | |

AES Corp. (The) | | | 113,180 | | | | 2,583,899 | |

NTPC Ltd. (India) | | | 36,880 | | | | 70,337 | |

| | | | | | | | |

| | |

| | | | | | | 2,654,236 | |

| | |

Industrial Conglomerates 1.0% | | | | | | | | |

| | |

3M Co. | | | 21,880 | | | | 3,838,190 | |

CITIC Ltd. (China) | | | 694,000 | | | | 732,475 | |

DCC PLC (United Kingdom) | | | 4,785 | | | | 398,305 | |

General Electric Co. | | | 23,112 | | | | 2,381,229 | |

Honeywell International, Inc. | | | 15,200 | | | | 3,226,656 | |

Industries Qatar QSC (Qatar) | | | 102,924 | | | | 436,181 | |

| | | | | | | | |

| | |

| | | | | | | 11,013,036 | |

| | |

Insurance 1.7% | | | | | | | | |

| | |

Allianz SE (Germany) | | | 1,752 | | | | 394,326 | |

American International Group, Inc. | | | 52,800 | | | | 2,898,192 | |

Argo Group International Holdings Ltd. | | | 1,200 | | | | 62,664 | |

Cathay Financial Holding Co. Ltd. (Taiwan) | | | 298,000 | | | | 618,408 | |

Chubb Ltd. | | | 8,000 | | | | 1,387,840 | |

Dai-ichi Life Holdings, Inc. (Japan) | | | 43,700 | | | | 962,832 | |

Employers Holdings, Inc. | | | 1,300 | | | | 51,337 | |

Enstar Group Ltd.* | | | 500 | | | | 117,365 | |

Fairfax Financial Holdings Ltd. (Canada) | | | 200 | | | | 80,738 | |

Fubon Financial Holding Co. Ltd. (Taiwan) | | | 394,200 | | | | 1,077,406 | |

Great-West Lifeco, Inc. (Canada) | | | 16,900 | | | | 514,232 | |

Hartford Financial Services Group, Inc. (The) | | | 26,900 | | | | 1,889,725 | |

Heritage Insurance Holdings, Inc. | | | 4,280 | | | | 29,147 | |

Japan Post Holdings Co. Ltd. (Japan) | | | 87,300 | | | | 736,453 | |

Manulife Financial Corp. (Canada) | | | 48,900 | | | | 941,246 | |

See Notes to Financial Statements.

28

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Insurance (cont’d.) | | | | | | | | |

| | |

MetLife, Inc. | | | 53,556 | | | $ | 3,306,012 | |

NN Group NV (Netherlands) | | | 15,534 | | | | 811,470 | |

Old Republic International Corp. | | | 71,080 | | | | 1,644,080 | |

Poste Italiane SpA (Italy), 144A | | | 4,246 | | | | 58,358 | |

Reinsurance Group of America, Inc. | | | 11,100 | | | | 1,234,986 | |

Selective Insurance Group, Inc. | | | 576 | | | | 43,505 | |

SiriusPoint Ltd. (Bermuda)* | | | 4,700 | | | | 43,522 | |

Stewart Information Services Corp. | | | 3,800 | | | | 240,388 | |

| | | | | | | | |

| | |

| | | | | | | 19,144,232 | |

| | |

Interactive Media & Services 3.4% | | | | | | | | |

| | |

Alphabet, Inc. (Class A Stock)* | | | 4,755 | | | | 12,712,587 | |

Alphabet, Inc. (Class C Stock)* | | | 4,387 | | | | 11,692,715 | |

Cars.com, Inc.* | | | 8,280 | | | | 104,742 | |

Facebook, Inc. (Class A Stock)* | | | 37,094 | | | | 12,589,333 | |

QuinStreet, Inc.* | | | 4,580 | | | | 80,425 | |

Tencent Holdings Ltd. (China) | | | 16,600 | | | | 999,881 | |

| | | | | | | | |

| | |

| | | | | | | 38,179,683 | |

| | |

Internet & Direct Marketing Retail 1.7% | | | | | | | | |

| | |

Alibaba Group Holding Ltd. (China)* | | | 37,900 | | | | 700,117 | |

Amazon.com, Inc.* | | | 5,137 | | | | 16,875,250 | |

momo.com, Inc. (Taiwan) | | | 2,000 | | | | 115,989 | |

Shutterstock, Inc. | | | 1,900 | | | | 215,308 | |

ZOZO, Inc. (Japan) | | | 11,600 | | | | 434,069 | |

| | | | | | | | |

| | |

| | | | | | | 18,340,733 | |

| | |

IT Services 2.6% | | | | | | | | |

| | |

Accenture PLC (Class A Stock) | | | 12,830 | | | | 4,104,574 | |

Adyen NV (Netherlands), 144A* | | | 166 | | | | 463,345 | |

Amdocs Ltd. | | | 5,860 | | | | 443,661 | |

Automatic Data Processing, Inc. | | | 9,800 | | | | 1,959,216 | |

Capgemini SE (France) | | | 867 | | | | 180,155 | |

Cognizant Technology Solutions Corp. (Class A Stock) | | | 36,620 | | | | 2,717,570 | |

Computacenter PLC (United Kingdom) | | | 1,740 | | | | 63,844 | |

Conduent, Inc.* | | | 27,200 | | | | 179,248 | |

CSG Systems International, Inc. | | | 500 | | | | 24,100 | |

EPAM Systems, Inc.* | | | 480 | | | | 273,830 | |

Evo Payments, Inc. (Class A Stock)* | | | 2,700 | | | | 63,936 | |

ExlService Holdings, Inc.* | | | 600 | | | | 73,872 | |

Fiserv, Inc.* | | | 3,100 | | | | 336,350 | |

Fujitsu Ltd. (Japan) | | | 5,830 | | | | 1,057,443 | |

See Notes to Financial Statements.

PGIM Balanced Fund 29

Schedule of Investments (continued)

as of September 30, 2021

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

IT Services (cont’d.) | | | | | | | | |

| | |

Gartner, Inc.* | | | 2,500 | | | $ | 759,700 | |

Hackett Group, Inc. (The) | | | 6,480 | | | | 127,138 | |

International Business Machines Corp. | | | 25,594 | | | | 3,555,774 | |

Mastercard, Inc. (Class A Stock) | | | 4,400 | | | | 1,529,792 | |

Maximus, Inc. | | | 3,780 | | | | 314,496 | |

PayPal Holdings, Inc.* | | | 6,800 | | | | 1,769,428 | |

Sonata Software Ltd. (India) | | | 16,994 | | | | 199,483 | |

Tech Mahindra Ltd. (India) | | | 41,888 | | | | 775,991 | |

Transcosmos, Inc. (Japan) | | | 4,400 | | | | 144,349 | |

TTEC Holdings, Inc. | | | 2,500 | | | | 233,825 | |

Uchida Yoko Co. Ltd. (Japan) | | | 4,600 | | | | 224,027 | |

Visa, Inc. (Class A Stock) | | | 33,055 | | | | 7,363,001 | |

Wipro Ltd. (India) | | | 7,916 | | | | 67,439 | |

| | | | | | | | |

| | |

| | | | | | | 29,005,587 | |

| | |

Leisure Products 0.3% | | | | | | | | |

| | |

Brunswick Corp. | | | 24,600 | | | | 2,343,642 | |

Giant Manufacturing Co. Ltd. (Taiwan) | | | 5,000 | | | | 56,927 | |

Johnson Outdoors, Inc. (Class A Stock) | | | 1,300 | | | | 137,540 | |

Malibu Boats, Inc. (Class A Stock)* | | | 700 | | | | 48,986 | |

MasterCraft Boat Holdings, Inc.* | | | 1,959 | | | | 49,132 | |

Shimano, Inc. (Japan) | | | 3,500 | | | | 1,028,754 | |

Smith & Wesson Brands, Inc. | | | 4,400 | | | | 91,344 | |

| | | | | | | | |

| | |

| | | | | | | 3,756,325 | |

| | |

Life Sciences Tools & Services 1.0% | | | | | | | | |

| | |

Eurofins Scientific SE (Luxembourg) | | | 7,668 | | | | 983,614 | |

Inotiv, Inc.* | | | 500 | | | | 14,620 | |

IQVIA Holdings, Inc.* | | | 11,800 | | | | 2,826,572 | |

Medpace Holdings, Inc.* | | | 2,280 | | | | 431,558 | |

Mettler-Toledo International, Inc.* | | | 500 | | | | 688,680 | |

Sartorius Stedim Biotech (France) | | | 1,069 | | | | 598,826 | |

Thermo Fisher Scientific, Inc. | | | 10,033 | | | | 5,732,154 | |

Waters Corp.* | | | 1,000 | | | | 357,300 | |

| | | | | | | | |

| | |

| | | | | | | 11,633,324 | |

| | |

Machinery 1.4% | | | | | | | | |

| | |

AGCO Corp. | | | 13,240 | | | | 1,622,297 | |

Alamo Group, Inc. | | | 100 | | | | 13,953 | |

Altra Industrial Motion Corp. | | | 5,160 | | | | 285,606 | |

Atlas Copco AB (Sweden) (Class A Stock) | | | 3,535 | | | | 213,808 | |

Atlas Copco AB (Sweden) (Class B Stock) | | | 2,056 | | | | 104,682 | |

See Notes to Financial Statements.

30

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Machinery (cont’d.) | | | | | | | | |

| | |

Caterpillar, Inc. | | | 6,100 | | | $ | 1,171,017 | |

CNH Industrial NV (United Kingdom) | | | 47,312 | | | | 790,438 | |

Cummins, Inc. | | | 13,300 | | | | 2,986,648 | |

Deere & Co. | | | 2,900 | | | | 971,703 | |

Dover Corp. | | | 1,700 | | | | 264,350 | |

Franklin Electric Co., Inc. | | | 1,000 | | | | 79,850 | |

Hillenbrand, Inc. | | | 6,700 | | | | 285,755 | |

Meritor, Inc.* | | | 7,900 | | | | 168,349 | |

MISUMI Group, Inc. (Japan) | | | 1,400 | | | | 59,400 | |

Mueller Industries, Inc. | | | 6,300 | | | | 258,930 | |

NN, Inc.* | | | 3,000 | | | | 15,750 | |

Otis Worldwide Corp. | | | 5,900 | | | | 485,452 | |

Parker-Hannifin Corp. | | | 9,500 | | | | 2,656,390 | |

REV Group, Inc. | | | 14,000 | | | | 240,240 | |

Rexnord Corp. | | | 1,260 | | | | 81,005 | |

SPX Corp.* | | | 660 | | | | 35,277 | |

SPX FLOW, Inc. | | | 2,300 | | | | 168,130 | |

Stanley Black & Decker, Inc. | | | 8,800 | | | | 1,542,728 | |

Techtronic Industries Co. Ltd. (Hong Kong) | | | 37,500 | | | | 737,456 | |

Terex Corp. | | | 3,000 | | | | 126,300 | |

Titan International, Inc.* | | | 2,000 | | | | 14,320 | |

| | | | | | | | |

| | |

| | | | | | | 15,379,834 | |

| | |