UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-07343 |

| |

| Exact name of registrant as specified in charter: | | The Prudential Investment Portfolios, Inc. |

| |

| Address of principal executive offices: | | 655 Broad Street, 6 th Floor |

| | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Andrew R. French |

| | 655 Broad Street, 6 th Floor |

| | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | |

| |

| Date of fiscal year end: | | 9/30/2024 |

| |

| Date of reporting period: | | 9/30/2024 |

Item 1 – Reports to Stockholders

| | (a) | Report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1). |

ANNUAL SHAREHOLDER REPORT – September 30, 2024

This annual shareholder report contains important information about the Class A shares of PGIM Balanced Fund (the “Fund”) for the period of

October 1, 2023 to September 30, 2024.

You can find additional information about the Fund at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

. You can also request

this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PGIM Balanced Fund—Class A | | |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD?

■

During the reporting period, strong market conditions drove equities more than 25% higher, while bonds returned over 10%. Several trends—

including solid economic and earnings growth, enthusiasm related to developments in artificial intelligence, inflation trending toward the US

Federal Reserve’s 2% target, and easing interest rates—fueled the market advance despite elevated geopolitical risks.

■

The Fund’s performance relative to the Custom Blended Index benefited from asset allocation positioning, with a consistent overweight to

equities and underweight to bonds adding value as equities sharply outperformed.

■

Exposure to cash detracted from the Fund’s relative performance, as cash returns lagged both equities and bonds. Other detractors included

value factors within US large-cap equities, top-down factors within international equities, and yield curve positioning within bonds. (A yield curve

is a line graph that illustrates the relationship between the yields and maturities of fixed income securities. It is created by plotting the yields of

different maturities for the same type of bonds.)

■

The Fund uses derivatives for various reasons, including to equitize cash positions, for liquidity purposes, to help manage duration positions

and yield curve exposure, and to facilitate implementation of the overall investment approach. During the reporting period, the Fund held stock

index futures, interest rate futures, forward foreign currency exchange contracts, options and swaps, and credit default swap indexes.

Collectively, the use of such derivatives had a small, positive impact on the Fund's performance.

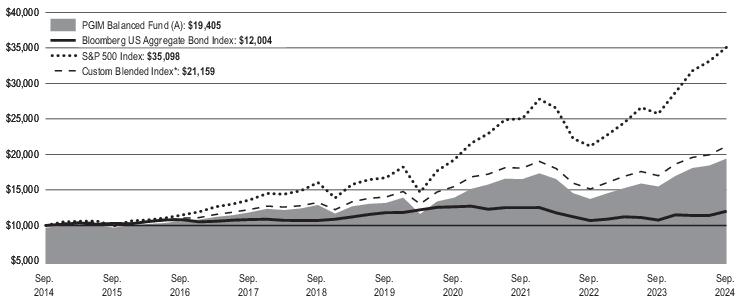

HOW HAS THE FUND PERFORMED OVER THE PAST 10 YEARS?

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The returns do not reflect the deduction of

taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

The line graph reflects a hypothetical $10,000 investment in Class A shares and assumes that all recurring fees (including management fees)

were deducted and dividend and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would

have been lower.

Cumulative Performance: September 30, 2014 to September 30, 2024 Initial Investment of $10,000 |

The line graph reflects the return on the Fund's Class A shares with sales charges.

Average Annual Total Returns as of 9/30/2024 |

| | | |

Class A with sales charges | | | |

Class A without sales charges | | | |

Broad-Based Securities Market Index: Bloomberg US Aggregate Bond Index

| | | |

Broad-Based Securities Market Index: S&P 500 Index | | | |

| | | |

* Prior to February 3, 2020, the Custom Blended Index consisted of the S&P 500 Index (50%), the Bloomberg US Aggregate Bond Index (40%), the Russell 2000 Index (5%), and the

MSCI Europe, Australasia and Far East (EAFE) Net Dividend (ND) Index (5%). Effective as of February 3, 2020, the Custom Blended Index consists of the S&P 500 Index (44%), the

Bloomberg US Aggregate Bond Index (40%), the Russell 2000 Index (4%), and the MSCI All Country World Ex-US Index (12%).

WHAT ARE SOME KEY FUND STATISTICS AS OF

9/

30/2024?

| |

| |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE SOME CHARACTERISTICS OF

TH

E FUND’S HOLDINGS AS OF 9/30/2024?

| |

| |

U.S. Government Agency Obligations | |

Semiconductors & Semiconductor Equipment | |

Commercial Mortgage-Backed Securities | |

| |

U.S. Treasury Obligations | |

Technology Hardware, Storage & Peripherals | |

| |

Collateralized Loan Obligations | |

Interactive Media & Services | |

Oil, Gas & Consumable Fuels | |

| |

| |

| |

| |

| |

| |

| |

Affiliated Mutual Fund - Short-Term Investment (0.3% represents investments purchased with collateral from securities on loan) | |

| |

Health Care Equipment & Supplies | |

| |

| |

| |

Consumer Staples Distribution & Retail | |

Health Care Providers & Services | |

Diversified Telecommunication Services | |

| |

Life Sciences Tools & Services | |

Residential Mortgage-Backed Securities | |

| |

| |

| |

| |

Hotels, Restaurants & Leisure | |

| |

Real Estate Investment Trusts (REITs) | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Electronic Equipment, Instruments & Components | |

| |

| |

| |

| |

| |

Other assets in excess of liabilities | |

| |

* Consists of Industries that each make up less than 0.5% of the Fund's net assets

WERE THERE ANY CHANGES TO THE FUND THIS YEAR?

The following is a summary of certain changes to the Fund since October 1, 2023:

■

The Fund's principal risk disclosure was revised to include Sector Exposure Risk as a principal risk of the Fund due to changes in the Fund's

portfolio which may result in greater exposure to certain economic sectors.

For more complete information, you should review the Fund’s next prospectus, which we expect to be available by November 30, 2024

at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by request at (800) 225-1852.

You can find additional information at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by scanning the QR code below,

including the Fund’s prospectus, financial information, fund holdings, and proxy voting information. You can also request this information by

contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

To receive your fund documents online, go to

pgim.com/investments/resource/edelivery

and enroll.

ANNUAL SHAREHOLDER REPORT – September 30, 2024

This annual shareholder report contains important information about the Class C shares of PGIM Balanced Fund (the “Fund”) for the period of

October 1, 2023 to September 30, 2024.

You can find additional information about the Fund at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

. You can also request

this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PGIM Balanced Fund—Class C | | |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD?

■

During the reporting period, strong market conditions drove equities more than 25% higher, while bonds returned over 10%. Several trends—

including solid economic and earnings growth, enthusiasm related to developments in artificial intelligence, inflation trending toward the US

Federal Reserve’s 2% target, and easing interest rates—fueled the market advance despite elevated geopolitical risks.

■

The Fund’s performance relative to the Custom Blended Index benefited from asset allocation positioning, with a consistent overweight to

equities and underweight to bonds adding value as equities sharply outperformed.

■

Exposure to cash detracted from the Fund’s relative performance, as cash returns lagged both equities and bonds. Other detractors included

value factors within US large-cap equities, top-down factors within international equities, and yield curve positioning within bonds. (A yield curve

is a line graph that illustrates the relationship between the yields and maturities of fixed income securities. It is created by plotting the yields of

different maturities for the same type of bonds.)

■

The Fund uses derivatives for various reasons, including to equitize cash positions, for liquidity purposes, to help manage duration positions

and yield curve exposure, and to facilitate implementation of the overall investment approach. During the reporting period, the Fund held stock

index futures, interest rate futures, forward foreign currency exchange contracts, options and swaps, and credit default swap indexes.

Collectively, the use of such derivatives had a s

mal

l, positive impact on the Fund's performance.

HOW HAS THE FUND PERFORMED OVER THE PAST 10 YEARS?

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The returns do not reflect the deduction of

taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

The line graph reflects a hypothetical $10,000 investment in Class C shares and assumes that all recurring fees (including management fees)

were deducted and dividend and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would

have been lower.

Cumulative Performance: September 30, 2014 to September 30, 2024 Initial Investment of $10,000 |

Average Annual Total Returns as of 9/30/2024 |

| | | |

Class C with sales charges | | | |

Class C without sales charges | | | |

Broad-Based Securities Market Index: Bloomberg US Aggregate Bond | | | |

Broad-Based Securities Market Index: S&P 500 Index | | | |

| | | |

* Prior to February 3, 2020, the Custom Blended Index consisted of the S&P 500 Index (50%), the Bloomberg US Aggregate Bond Index (40%), the Russell 2000 Index (5%), and the

MSCI Europe, Australasia and Far East (EAFE) Net Dividend (ND) Index (5%). Effective as of February 3, 2020, the Custom Blended Index consists of the S&P 500 Index (44%), the

Bloomberg US Aggregate Bond Index (40%), the R

usse

ll 2000 Index (4%), and the MSCI All Country World Ex-US Index (12%).

WHAT ARE SOME KEY FUND STATISTICS AS OF 9/30/2024?

| |

| |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT

A

RE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 9/30/2024?

| |

| |

U.S. Government Agency Obligations | |

Semiconductors & Semiconductor Equipment | |

Commercial Mortgage-Backed Securities | |

| |

U.S. Treasury Obligations | |

Technology Hardware, Storage & Peripherals | |

| |

Collateralized Loan Obligations | |

Interactive Media & Services | |

Oil, Gas & Consumable Fuels | |

| |

| |

| |

| |

| |

| |

| |

Affiliated Mutual Fund - Short-Term Investment (0.3% represents investments purchased with collateral from securities on loan) | |

| |

Health Care Equipment & Supplies | |

| |

| |

| |

Consumer Staples Distribution & Retail | |

Health Care Providers & Services | |

Diversified Telecommunication Services | |

| |

Life Sciences Tools & Services | |

Residential Mortgage-Backed Securities | |

| |

| |

| |

| |

Hotels, Restaurants & Leisure | |

| |

Real Estate Investment Trusts (REITs) | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Electronic Equipment, Instruments & Components | |

| |

| |

| |

| |

| |

Other assets in excess of liabilities | |

| |

* Consists of Industries that each make up less than 0.5% of the Fund's net assets

WERE THERE ANY CHANGES TO THE FUND THIS YEAR?

The following is a summary of certain changes to the Fund since October 1, 2023:

■

The Fund's principal risk disclosure was revised to include Sector Exposure Risk as a principal risk of the Fund due to changes in the Fund's

portfolio which may result in greater exposure to certain economic sectors.

For more complete information, you should review the Fund’s next prospectus, which we expect to be available by November 30, 2024

at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by request at (800) 225-1852.

You can find additional information at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by scanning the QR code below,

including the Fund’s prospectus, financial information, fund holdings, and proxy voting information. You can also request this information by

contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

To receive your fund documents online, go to

pgim.com/investments/resource/edelivery

and enroll.

ANNUAL SHAREHOLDER REPORT – September 30, 2024

This annual shareholder report contains important information about the Class R shares of PGIM Balanced Fund (the “Fund”) for the period of

October 1, 2023 to September 30, 2024.

You can find additional information about the Fund at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

. You can also request

this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PGIM Balanced Fund—Class R | | |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD?

■

During the reporting period, strong market conditions drove equities more than 25% higher, while bonds returned over 10%. Several trends—

including solid economic and earnings growth, enthusiasm related to developments in artificial intelligence, inflation trending toward the US

Federal Reserve’s 2% target, and easing interest rates—fueled the market advance despite elevated geopolitical risks.

■

The Fund’s performance relative to the Custom Blended Index benefited from asset allocation positioning, with a consistent overweight to

equities and underweight to bonds adding value as equities sharply outperformed.

■

Exposure to cash detracted from the Fund’s relative performance, as cash returns lagged both equities and bonds. Other detractors included

value factors within US large-cap equities, top-down factors within international equities, and yield curve positioning within bonds. (A yield curve

is a line graph that illustrates the relationship between the yields and maturities of fixed income securities. It is created by plotting the yields of

different maturities for the same type of bonds.)

■

The Fund uses derivatives for various reasons, including to equitize cash positions, for liquidity purposes, to help manage duration positions

and yield curve exposure, and to facilitate implementation of the overall investment approach. During the reporting period, the Fund held stock

index futures, interest rate futures, forward foreign currency exchange contracts, options and swaps, and credit default swap indexes.

Collectively, the use of such der

ivati

ves had a small, positive impact on the Fund's performance.

HOW HAS THE FUND PERFORMED OVER THE PAST 10 YEARS?

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The returns do not reflect the deduction of

taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

The line graph reflects a hypothetical $10,000 investment in Class R shares and assumes that all recurring fees (including management fees)

were deducted and dividend and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would

have been lower.

Cumulative Performance: September 30, 2014 to September 30, 2024 Initial Investment of $10,000 |

Average Annual Total Returns as of 9/30/2024 |

| | | |

| | | |

Broad-Based Securities Market Index: Bloomberg US Aggregate Bond | | | |

Broad-Based Securities Market Index: S&P 500 Index | | | |

| | | |

* Prior to February 3, 2020, the Custom Blended Index co

nsis

ted of the S&P 500 Index (50%), the Bloomberg US Aggregate Bond Index (40%), the Russell 2000 Index (5%), and the

MSCI Europe, Australasia and Far East (EAFE) Net Dividend (ND) Index (5%). Effective as of February 3, 2020, the Custom Blended Index consists of the S&P 500 Index (44%), the

Bloomberg US Aggregate Bond Index (40%), the Ru

sse

ll 2000 Index (4%), and the MSCI All Country World Ex-US Index (12%).

WHAT ARE SOME KEY FUND STATISTICS AS OF 9/30/2024?

| |

| |

Total advisory fe e s paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 9/30/2024?

| |

| |

U.S. Government Agency Obligations | |

Semiconductors & Semiconductor Equipment | |

Commercial Mortgage-Backed Securities | |

| |

U.S. Treasury Obligations | |

Technology Hardware, Storage & Peripherals | |

| |

Collateralized Loan Obligations | |

Interactive Media & Services | |

Oil, Gas & Consumable Fuels | |

| |

| |

| |

| |

| |

| |

| |

Affiliated Mutual Fund - Short-Term Investment (0.3% represents investments purchased with collateral from securities on loan) | |

| |

Health Care Equipment & Supplies | |

| |

| |

| |

Consumer Staples Distribution & Retail | |

Health Care Providers & Services | |

Diversified Telecommunication Services | |

| |

Life Sciences Tools & Services | |

Residential Mortgage-Backed Securities | |

| |

| |

| |

| |

Hotels, Restaurants & Leisure | |

| |

Real Estate Investment Trusts (REITs) | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Electronic Equipment, Instruments & Components | |

| |

| |

| |

| |

| |

Other assets in excess of liabilities | |

| |

* Consists of Ind

ustries

that each make up less than 0.5% of the Fund's net assets

WERE THERE ANY CHANGES TO THE FUND THIS YEAR?

The following is a summary of certain changes to the Fund since October 1, 2023:

■

The Fund's principal risk disclosure was revised to include Sector Exposure Risk as a principal risk of the Fund due to changes in the Fund's

portfolio which may result in greater exposure to certain economic sectors.

For more complete information, you should review the Fund’s next prospectus, which we expect to be available by November 30, 2024

at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by request at (800) 225-1852.

You can find additional information at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by scanning the QR code below,

including the Fund’s prospectus, financial information, fund holdings, and proxy voting information. You can also request this information by

contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

To receive your fund documents online, go to

pgim.com/investments/resource/edelivery

and enroll.

ANNUAL SHAREHOLDER REPORT – September 30, 2024

This annual shareholder report contains important information about the Class Z shares of PGIM Balanced Fund (the “Fund”) for the period of

October 1, 2023 to September 30, 2024.

You can find additional information about the Fund at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

. You can also request

this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PGIM Balanced Fund—Class Z | | |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD?

■

During the reporting period, strong market conditions drove equities more than 25% higher, while bonds returned over 10%. Several trends—

including solid economic and earnings growth, enthusiasm related to developments in artificial intelligence, inflation trending toward the US

Federal Reserve’s 2% target, and easing interest rates—fueled the market advance despite elevated geopolitical risks.

■

The Fund’s performance relative to the Custom Blended Index benefited from asset allocation positioning, with a consistent overweight to

equities and underweight to bonds adding value as equities sharply outperformed.

■

Exposure to cash detracted from the Fund’s relative performance, as cash returns lagged both equities and bonds. Other detractors included

value factors within US large-cap equities, top-down factors within international equities, and yield curve positioning within bonds. (A yield curve

is a line graph that illustrates the relationship between the yields and maturities of fixed income securities. It is created by plotting the yields of

different maturities for the same type of bonds.)

■

The Fund uses derivatives for various reasons, including to equitize cash positions, for liquidity purposes, to help manage duration positions

and yield curve exposure, and to facilitate implementation of the overall investment approach. During the reporting period, the Fund held stock

index futures, interest rate futures, forward foreign currency exchange contracts, options and swaps, and credit default swap indexes.

Collectively, the use of such derivatives had a small, positive impact on the Fund's performance.

HOW HAS THE FUND PERFORMED OVER THE PAST 10 YEARS?

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The returns do not reflect the deduction of

taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

The line graph reflects a hypothetical $10,000 investment in Class Z shares and assumes that all recurring fees (including management fees)

were deducted and dividend and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would

have been lower.

Cumulative Performance: September 30, 2014 to September 30, 2024 Initial Investment of $10,000 |

Average Annual Total Returns as of 9/30/2024 |

| | | |

| | | |

Broad-Based Securities Market Index: Bloomberg US Aggregate Bond | | | |

Broad-Based Securities Market Index: S&P 500 Index | | | |

| | | |

* Prior to February 3, 2020, the Custom Blended Index consisted of the S&P 500 Index (50%), the Bloomberg US Aggregate Bond Index (40%), the Russell 2000 Index (5%), and the

MSCI Europe, Australasia and Far East (EAFE) Net Dividend (ND) Index (5%). Effective as of February 3, 2020, the Custom Blended Index consists of the S&P 500 Index (44%), the

Bloomberg US Aggregate Bond Index (40%), the Russell 2000 Index (4%), and the MSCI All Country World Ex-US Index (12%).

WHAT ARE SOME KEY FUND STATISTICS AS OF 9/30/2024?

| |

| |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE

SOME

CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 9/30/2024?

| |

| |

U.S. Government Agency Obligations | |

Semiconductors & Semiconductor Equipment | |

Commercial Mortgage-Backed Securities | |

| |

U.S. Treasury Obligations | |

Technology Hardware, Storage & Peripherals | |

| |

Collateralized Loan Obligations | |

Interactive Media & Services | |

Oil, Gas & Consumable Fuels | |

| |

| |

| |

| |

| |

| |

| |

Affiliated Mutual Fund - Short-Term Investment (0.3% represents investments purchased with collateral from securities on loan) | |

| |

Health Care Equipment & Supplies | |

| |

| |

| |

Consumer Staples Distribution & Retail | |

Health Care Providers & Services | |

Diversified Telecommunication Services | |

| |

Life Sciences Tools & Services | |

Residential Mortgage-Backed Securities | |

| |

| |

| |

| |

Hotels, Restaurants & Leisure | |

| |

Real Estate Investment Trusts (REITs) | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Electronic Equipment, Instruments & Components | |

| |

| |

| |

| |

| |

Other assets in excess of liabilities | |

| |

* Consists of Industries that each make up less than 0.5% of the Fund's net assets

WERE THERE ANY CHANGES TO THE FUND THIS YEAR?

The following is a summary of certain changes to the Fund since October 1, 2023:

■

The Fund's principal risk disclosure was revised to include Sector Exposure Risk as a principal risk of the Fund due to changes in the Fund's

portfolio which may result in greater exposure to certain economic sectors.

For more complete information, you should review the Fund’s next prospectus, which we expect to be available by November 30, 2024

at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by request at (800) 225-1852.

You can find additional information at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by scanning the QR code below,

including the Fund’s prospectus, financial information, fund holdings, and proxy voting information. You can also request this information by

contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

To receive your fund documents online, go to

pgim.com/investments/resource/edelivery

and enroll.

ANNUAL SHAREHOLDER REPORT – September 30, 2024

This annual shareholder report contains important information about the Class R6 shares of PGIM Balanced Fund (the “Fund”) for the period of

October 1, 2023 to September 30, 2024.

You can find additional information about the Fund at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

. You can also request

this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PGIM Balanced Fund—Class R6 | | |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD?

■

During the reporting period, strong market conditions drove equities more than 25% higher, while bonds returned over 10%. Several trends—

including solid economic and earnings growth, enthusiasm related to developments in artificial intelligence, inflation trending toward the US

Federal Reserve’s 2% target, and easing interest rates—fueled the market advance despite elevated geopolitical risks.

■

The Fund’s performance relative to the Custom Blended Index benefited from asset allocation positioning, with a consistent overweight to

equities and underweight to bonds adding value as equities sharply outperformed.

■

Exposure to cash detracted from the Fund’s relative performance, as cash returns lagged both equities and bonds. Other detractors included

value factors within US large-cap equities, top-down factors within international equities, and yield curve positioning within bonds. (A yield curve

is a line graph that illustrates the relationship between the yields and maturities of fixed income securities. It is created by plotting the yields of

different maturities for the same type of bonds.)

■

The Fund uses derivatives for various reasons, including to equitize cash positions, for liquidity purposes, to help manage duration positions

and yield curve exposure, and to facilitate implementation of the overall investment approach. During the reporting period, the Fund held stock

index futures, interest rate futures, forward foreign currency exchange contracts, options and swaps, and credit default swap indexes.

Collectively, the use of such derivatives had a small, positive impact on the Fund's performance.

HOW HAS THE FUND PERFORMED OVER THE PAST 10 YEARS?

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The returns do not reflect the deduction of

taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

The line graph reflects a hypothetical $10,000 investment in Class R6 shares and assumes that all recurring fees (including management fees)

were deducted and dividend and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would

have been lower.

Cumulative Performance: November 28, 2017 to September 30, 2024 Initial Investment of $10,000 |

Average Annual Total Returns as of 9/30/2024 |

| | | |

| | | |

Broad-Based Securities Market Index: Bloomberg US Aggregate | | | |

Broad-Based Securities Market Index: S&P 500 Index | | | |

| | | |

* Prior to February 3, 2020, the Custom Blended Index consisted of the S&P 500 Index (50%), the Bloomberg US Aggregate Bond Index (40%), the Russell 2000 Index (5%), and the

MSCI Europe, Australasia and Far East (EAFE) Net Dividend (ND) Index (5%). Effective as of February 3, 2020, the Custom Blended Index consists of the S&P 500 Index (44%), the

Bloomberg US Aggregate Bond Index (40%), the Russell 2000 Index (4%), and the MSCI All Country World Ex-US Index (12%).

Since Inception returns are provided for the share class since it has less than 10 fiscal years of returns. Since Inception returns for the Indexes are measured from the closest

month-end to the class’s inception date.

WHAT ARE SOME KEY FUND STATISTICS AS OF 9/30/2024?

| |

| |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 9/30/2024?

| |

| |

U.S. Government Agency Obligations | |

Semiconductors & Semiconductor Equipment | |

Commercial Mortgage-Backed Securities | |

| |

U.S. Treasury Obligations | |

Technology Hardware, Storage & Peripherals | |

| |

Collateralized Loan Obligations | |

Interactive Media & Services | |

Oil, Gas & Consumable Fuels | |

| |

| |

| |

| |

| |

| |

| |

Affiliated Mutual Fund - Short-Term Investment (0.3% represents investments purchased with collateral from securities on loan) | |

| |

Health Care Equipment & Supplies | |

| |

| |

| |

Consumer Staples Distribution & Retail | |

Health Care Providers & Services | |

Diversified Telecommunication Services | |

| |

Life Sciences Tools & Services | |

Residential Mortgage-Backed Securities | |

| |

| |

| |

| |

Hotels, Restaurants & Leisure | |

| |

Real Estate Investment Trusts (REITs) | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Electronic Equipment, Instruments & Components | |

| |

| |

| |

| |

| |

Other assets in excess of liabilities | |

| |

* Consists of Industries that each make up less than 0.5% of the Fund's net assets

WERE THERE ANY CHANGES TO THE FUND THIS YEAR?

The following is a summary of certain changes to the Fund since October 1, 2023:

■

The Fund's principal risk disclosure was revised to include Sector Exposure Risk as a principal risk of the Fund due to changes in the Fund's

portfolio which may result in greater exposure to certain economic sectors.

For more complete information, you should review the Fund’s next prospectus, which we expect to be available by November 30, 2024

at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by request at (800) 225-1852.

You can find additional information at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by scanning the QR code below,

including the Fund’s prospectus, financial information, fund holdings, and proxy voting information. You can also request this information by

contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

To receive your fund documents online, go to

pgim.com/investments/resource/edelivery

and enroll.

PGIM Jennison Focused Value Fund

ANNUAL SHAREHOLDER REPORT – September 30, 2024

This annual shareholder report contains important information about the Class A shares of PGIM Jennison Focused Value Fund (the “Fund”) for

the period of October 1, 2023 to September 30, 2024.

You can find additional information about the Fund at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

. You can also request

this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PGIM Jennison Focused Value Fund—Class A | | |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD?

■

Capital asset prices increased over the reporting period as investors reacted positively to the slowing pace of inflation and sustained economic

growth. The US Federal Reserve (Fed) moved to lower the federal funds rate by 50 basis points at its September meeting. (One basis point

equals 0.01%.) Markets reacted positively to the move, as well as the tone of the accompanying statement by the Fed, which expressed

confidence that favorable economic trends would likely permit further policy easing in the future.

■

Positions within the information technology (driven by semiconductors and software), consumer staples (led by consumer staples distribution &

retail), communication services (boosted by interactive media & services), and health care (led by pharmaceuticals and biotechnology) added

the most to the Fund’s strong positive performance relative to the Russell 1000 Value Index during the reporting period.

■

Conversely, positions within consumer discretionary (driven by hotels, restaurants & leisure), real estate (led by health care real estate

investment trusts (REITs)), and energy (led by oil & gas exploration) detracted the most from relative results in the Fund’s performance during

the reporting period.

HOW HAS THE FUND PERFORMED OVER THE PAST 10 YEARS?

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The returns do not reflect the deduction of

taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

The line graph reflects a hypothetical $10,000 investment in Class A shares and assumes that all recurring fees (including management fees)

were deducted and dividend and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would

have been lower.

Cumulative Performance: September 30, 2014 to September 30, 2024 Initial Investment of $10,000 |

The line graph reflects the return on the Fund's Class A shares with sales charges.

Average Annual Total Returns as of 9/30/2024 |

| | | |

Class A with sales charges | | | |

Class A without sales charges | | | |

Broad-Based Securities Market Index: S&P 500 Index* | | | |

| | | |

*The Fund has added this broad-based index in response to the new regulatory requirements.

WHAT ARE SOME KEY FUND STATISTICS AS OF 9/30/2024?

| |

| |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 9/30/2024?

| |

| |

Oil, Gas & Consumable Fuels | |

| |

| |

Consumer Staples Distribution & Retail | |

| |

| |

Semiconductors & Semiconductor Equipment | |

| |

| |

| |

Health Care Providers & Services | |

| |

| |

| |

| |

Affiliated Mutual Fund - Short-Term Investment | |

| |

Interactive Media & Services | |

| |

| |

| |

Technology Hardware, Storage & Peripherals | |

| |

| |

Liabilities in excess of other assets | |

| |

WERE THERE ANY CHANGES TO THE FUND THIS YEAR?

The following is a summary of certain changes to the Fund since

October 1, 2023

:

■

The Fund's principal risk disclosure was revised to include Sector Exposure Risk as a principal risk of the Fund due to changes in the Fund's

portfolio which may result in greater exposure to certain economic sectors.

For more complete information, you should review the Fund’s next prospectus, which we expect to be available by November 30, 2024

at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by request at

(800) 225-1852

.

You can find additional information at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by scanning the QR code below,

including the Fund’s prospectus, financial information, fund holdings, and proxy voting information. You can also request this information by

contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

To receive your fund documents online, go to

pgim.com/investments/resource/edelivery

and enroll.

PGIM Jennison Focused Value Fund

PGIM Jennison Focused Value Fund

ANNUAL SHAREHOLDER REPORT – September 30, 2024

This annual shareholder report contains important information about the Class C shares of PGIM Jennison Focused Value Fund (the “Fund”) for

the period of October 1, 2023 to September 30, 2024.

You can find additional information about the Fund at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

. You can also request

this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PGIM Jennison Focused Value Fund—Class C | | |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD?

■

Capital asset prices increased over the reporting period as investors reacted positively to the slowing pace of inflation and sustained economic

growth. The US Federal Reserve (Fed) moved to lower the federal funds rate by 50 basis points at its September meeting. (One basis point

equals 0.01%.) Markets reacted positively to the move, as well as the tone of the accompanying statement by the Fed, which expressed

confidence that favorable economic trends would likely permit further policy easing in the future.

■

Positions within the information technology (driven by semiconductors and software), consumer staples (led by consumer staples distribution &

retail), communication services (boosted by interactive media & services), and health care (led by pharmaceuticals and biotechnology) added

the most to the Fund’s strong positive performance relative to the Russell 1000 Value Index during the reporting period.

■

Conversely, positions within consumer discretionary (driven by hotels, restaurants & leisure), real estate (led by health care real estate

investment trusts (REITs)), and energy (led by oil & gas exploration) detracted the most from relative results in the Fund’s performance during

the reporting period.

HOW HAS THE FUND PERFORMED OVER THE PAST 10 YEARS?

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The returns do not reflect the deduction of

taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

The line graph reflects a hypothetical $10,000 investment in Class C shares and assumes that all recurring fees (including management fees)

were deducted and dividend and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would

have been lower.

Cumulative Performance: September 30, 2014 to September 30, 2024 Initial Investment of $10,000 |

Average Annual Total Returns as of 9/30/2024 |

| | | |

Class C with sales charges | | | |

Class C without sales charges | | | |

Broad-Based Securities Market Index: S&P 500 Index* | | | |

| | | |

*The Fund has added this broad-based index in response to the new regulatory requirements.

WHAT ARE SOME KEY FUND STATISTICS AS OF 9/30/2024?

| |

| |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 9/30/2024?

| |

| |

Oil, Gas & Consumable Fuels | |

| |

| |

Consumer Staples Distribution & Retail | |

| |

| |

Semiconductors & Semiconductor Equipment | |

| |

| |

| |

Health Care Providers & Services | |

| |

| |

| |

| |

Affiliated Mutual Fund - Short-Term Investment | |

| |

Interactive Media & Services | |

| |

| |

| |

Technology Hardware, Storage & Peripherals | |

| |

| |

Liabilities in excess of other assets | |

| |

WERE THERE ANY CHANGES TO THE FUND THIS YEAR?

The following is a summary of certain changes to the Fund since

October 1, 2023

:

■

The Fund's principal risk disclosure was revised to include Sector Exposure Risk as a principal risk of the Fund due to changes in the Fund's

portfolio which may result in greater exposure to certain economic sectors.

For more complete information, you should review the Fund’s next prospectus, which we expect to be available by November 30, 2024

at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by request at

(800) 225-1852

.

You can find additional information at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by scanning the QR code below,

including the Fund’s prospectus, financial information, fund holdings, and proxy voting information. You can also request this information by

contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

To receive your fund documents online, go to

pgim.com/investments/resource/edelivery

and enroll.

PGIM Jennison Focused Value Fund

PGIM Jennison Focused Value Fund

ANNUAL SHAREHOLDER REPORT – September 30, 2024

This annual shareholder report contains important information about the Class R shares of PGIM Jennison Focused Value Fund (the “Fund”) for

the period of October 1, 2023 to September 30, 2024.

You can find additional information about the Fund at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

. You can also request

this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PGIM Jennison Focused Value Fund—Class R | | |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD?

■

Capital asset prices increased over the reporting period as investors reacted positively to the slowing pace of inflation and sustained economic

growth. The US Federal Reserve (Fed) moved to lower the federal funds rate by 50 basis points at its September meeting. (One basis point

equals 0.01%.) Markets reacted positively to the move, as well as the tone of the accompanying statement by the Fed, which expressed

confidence that favorable economic trends would likely permit further policy easing in the future.

■

Positions within the information technology (driven by semiconductors and software), consumer staples (led by consumer staples distribution &

retail), communication services (boosted by interactive media & services), and health care (led by pharmaceuticals and biotechnology) added

the most to the Fund’s strong positive performance relative to the Russell 1000 Value Index during the reporting period.

■

Conversely, positions within consumer discretionary (driven by hotels, restaurants & leisure), real estate (led by health care real estate

investment trusts (REITs)), and energy (led by oil & gas exploration) detracted the most from relative results in the Fund’s performance during

the reporting period.

HOW HAS THE FUND PERFORMED OVER THE PAST 10 YEARS?

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The returns do not reflect the deduction of

taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

The line graph reflects a hypothetical $10,000 investment in Class R shares and assumes that all recurring fees (including management fees)

were deducted and dividend and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would

have been lower.

Cumulative Performance: September 30, 2014 to September 30, 2024 Initial Investment of $10,000 |

Average Annual Total Returns as of 9/30/2024 |

| | | |

| | | |

Broad-Based Securities Market Index: S&P 500 Index* | | | |

| | | |

*The Fund has added this broad-based index in response to the new regulatory requirements.

WHAT ARE SOME KEY FUND STATISTICS AS OF 9/30/2024?

| |

| |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 9/30/2024?

| |

| |

Oil, Gas & Consumable Fuels | |

| |

| |

Consumer Staples Distribution & Retail | |

| |

| |

Semiconductors & Semiconductor Equipment | |

| |

| |

| |

Health Care Providers & Services | |

| |

| |

| |

| |

Affiliated Mutual Fund - Short-Term Investment | |

| |

Interactive Media & Services | |

| |

| |

| |

Technology Hardware, Storage & Peripherals | |

| |

| |

Liabilities in excess of other assets | |

| |

WERE THERE ANY CHANGES TO THE FUND THIS YEAR?

The following is a summary of certain changes to the Fund since October 1, 2023:

■

The Fund's principal risk disclosure was revised to include Sector Exposure Risk as a principal risk of the Fund due to changes in the Fund's

portfolio which may result in greater exposure to certain economic sectors.

For more complete information, you should review the Fund’s next prospectus, which we expect to be available by November 30, 2024

at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by request at (800) 225-1852.

You can find additional information at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by scanning the QR code below,

including the Fund’s prospectus, financial information, fund holdings, and proxy voting information. You can also request this information by

contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

To receive your fund documents online, go to

pgim.com/investments/resource/edelivery

and enroll.

PGIM Jennison Focused Value Fund

PGIM Jennison Focused Value Fund

ANNUAL SHAREHOLDER REPORT – September 30, 2024

This annual shareholder report contains important information about the Class Z shares of PGIM Jennison Focused Value Fund (the “Fund”) for

the period of October 1, 2023 to September 30, 2024.

You can find additional information about the Fund at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

. You can also request

this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PGIM Jennison Focused Value Fund—Class Z | | |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD?

■

Capital asset prices increased over the reporting period as investors reacted positively to the slowing pace of inflation and sustained economic

growth. The US Federal Reserve (Fed) moved to lower the federal funds rate by 50 basis points at its September meeting. (One basis point

equals 0.01%.) Markets reacted positively to the move, as well as the tone of the accompanying statement by the Fed, which expressed

confidence that favorable economic trends would likely permit further policy easing in the future.

■

Positions within the information technology (driven by semiconductors and software), consumer staples (led by consumer staples distribution &

retail), communication services (boosted by interactive media & services), and health care (led by pharmaceuticals and biotechnology) added

the most to the Fund’s strong positive performance relative to the Russell 1000 Value Index during the reporting period.

■

Conversely, positions within consumer discretionary (driven by hotels, restaurants & leisure), real estate (led by health care real estate

investment trusts (REITs)), and energy (led by oil & gas exploration) detracted the most from relative results in the Fund’s performance during

the reporting period.

HOW HAS THE FUND PERFORMED OVER THE PAST 10 YEARS?

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The returns do not reflect the deduction of

taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

The line graph reflects a hypothetical $10,000 investment in Class Z shares and assumes that all recurring fees (including management fees)

were deducted and dividend and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would

have been lower.

Cumulative Performance: September 30, 2014 to September 30, 2024 Initial Investment of $10,000 |

Average Annual Total Returns as of 9/30/2024 |

| | | |

| | | |

Broad-Based Securities Market Index: S&P 500 Index* | | | |

| | | |

*The Fund has added this broad-based index in response to the new regulatory requirements.

WHAT ARE SOME KEY FUND STATISTICS AS OF 9/30/2024?

| |

| |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 9/30/2024?

| |

| |

Oil, Gas & Consumable Fuels | |

| |

| |

Consumer Staples Distribution & Retail | |

| |

| |

Semiconductors & Semiconductor Equipment | |

| |

| |

| |

Health Care Providers & Services | |

| |

| |

| |

| |

Affiliated Mutual Fund - Short-Term Investment | |

| |

Interactive Media & Services | |

| |

| |

| |

Technology Hardware, Storage & Peripherals | |

| |

| |

Liabilities in excess of other assets | |

| |

WERE THERE ANY CHANGES TO THE FUND THIS YEAR?

The following is a summary of certain changes to the Fund since

October 1, 2023

:

■

The Fund's principal risk disclosure was revised to include Sector Exposure Risk as a principal risk of the Fund due to changes in the Fund's

portfolio which may result in greater exposure to certain economic sectors.

For more complete information, you should review the Fund’s next prospectus, which we expect to be available by November 30, 2024

at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by request at

(800) 225-1852

.

You can find additional information at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by scanning the QR code below,

including the Fund’s prospectus, financial information, fund holdings, and proxy voting information. You can also request this information by

contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

To receive your fund documents online, go to

pgim.com/investments/resource/edelivery

and enroll.

PGIM Jennison Focused Value Fund

PGIM Jennison Focused Value Fund

ANNUAL SHAREHOLDER REPORT – September 30, 2024

This annual shareholder report contains important information about the Class R6 shares of PGIM Jennison Focused Value Fund (the “Fund”) for

the period of October 1, 2023 to September 30, 2024.

You can find additional information about the Fund at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

. You can also request

this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PGIM Jennison Focused Value Fund—Class R6 | | |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD?

■

Capital asset prices increased over the reporting period as investors reacted positively to the slowing pace of inflation and sustained economic

growth. The US Federal Reserve (Fed) moved to lower the federal funds rate by 50 basis points at its September meeting. (One basis point

equals 0.01%.) Markets reacted positively to the move, as well as the tone of the accompanying statement by the Fed, which expressed

confidence that favorable economic trends would likely permit further policy easing in the future.

■

Positions within the information technology (driven by semiconductors and software), consumer staples (led by consumer staples distribution &

retail), communication services (boosted by interactive media & services), and health care (led by pharmaceuticals and biotechnology) added

the most to the Fund’s strong positive performance relative to the Russell 1000 Value Index during the reporting period.

■

Conversely, positions within consumer discretionary (driven by hotels, restaurants & leisure), real estate (led by health care real estate

investment trusts (REITs)), and energy (led by oil & gas exploration) detracted the most from relative results in the Fund’s performance during

the reporting period.

HOW HAS THE FUND PERFORMED OVER THE PAST 10 YEARS?

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The returns do not reflect the deduction of

taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

The line graph reflects a hypothetical $10,000 investment in Class R6 shares and assumes that all recurring fees (including management fees)

were deducted and dividend and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would

have been lower.

Cumulative Performance: November 25, 2014 to September 30, 2024 Initial Investment of $10,000 |

Average Annual Total Returns as of 9/30/2024 |

| | | |

| | | |

Broad-Based Securities Market Index: S&P 500 Index* | | | |

| | | |

*The Fund has added this broad-based index in response to new regulatory requirements.

Since Inception returns are provided for the share class since it has less than 10 fiscal years of returns. Since Inception returns for the Index are measured from the closest

month-end to the class’s inception date.

WHAT ARE SOME KEY FUND STATISTICS AS OF 9/30/2024?

| |

| |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 9/30/2024?

| |

| |

Oil, Gas & Consumable Fuels | |

| |

| |

Consumer Staples Distribution & Retail | |

| |

| |

Semiconductors & Semiconductor Equipment | |

| |

| |

| |

Health Care Providers & Services | |

| |

| |

| |

| |

Affiliated Mutual Fund - Short-Term Investment | |

| |

Interactive Media & Services | |

| |

| |

| |

Technology Hardware, Storage & Peripherals | |

| |

| |

Liabilities in excess of other assets | |

| |

WERE THERE ANY CHANGES TO THE FUND THIS YEAR?

The following is a summary of certain changes to the Fund since October 1, 2023:

■

The Fund's principal risk disclosure was revised to include Sector Exposure Risk as a principal risk of the Fund due to changes in the Fund's

portfolio which may result in greater exposure to certain economic sectors.

For more complete information, you should review the Fund’s next prospectus, which we expect to be available by November 30, 2024

at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by request at (800) 225-1852.

You can find additional information at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by scanning the QR code below,

including the Fund’s prospectus, financial information, fund holdings, and proxy voting information. You can also request this information by

contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

To receive your fund documents online, go to

pgim.com/investments/resource/edelivery

and enroll.

PGIM Jennison Focused Value Fund

PGIM Jennison Growth Fund

ANNUAL SHAREHOLDER REPORT – September 30, 2024

This annual shareholder report contains important information about the Class A shares of PGIM Jennison Growth Fund (the “Fund”) for the

period of October 1, 2023 to September 30, 2024.

You can find additional information about the Fund at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

. You can also request

this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PGIM Jennison Growth Fund—Class A | | |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD?

■

Capital asset prices increased over the reporting period as investors reacted positively to the slowing pace of inflation and sustained economic

growth. The US Federal Reserve (Fed) moved to lower the federal funds rate by 50 basis points at its September meeting. (One basis point

equals 0.01%.) Markets reacted positively to the move, as well as the tone of the accompanying statement by the Fed, which expressed

confidence that favorable economic trends would likely permit further policy easing in the future.

■

Positions within information technology (especially semiconductors & semiconductor equipment), health care (led by health care equipment &

supplies), and communication services (driven by interactive media & services) added the most to the Fund’s strong absolute performance and

its positive performance relative to the Russell 1000 Growth Index during the reporting period.

■

Conversely, stock selection within consumer discretionary (led by apparel & luxury goods) and an overweight position to that sector detracted

the most from relative results.

HOW HAS THE FUND PERFORMED OVER THE PAST 10 YEARS?

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The returns do not reflect the deduction of

taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

The line graph reflects a hypothetical $10,000 investment in Class A shares and assumes that all recurring fees (including management fees)

were deducted and dividend and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would

have been lower.

Cumulative Performance: September 30, 2014 to September 30, 2024 Initial Investment of $10,000 |

The line graph reflects the return on the Fund's Class A shares with sales charges.

Average Annual Total Returns as of 9/30/2024 |

| | | |

Class A with sales charges | | | |

Class A without sales charges | | | |

Broad-Based Securities Market Index: S&P 500 Index | | | |

Russell 1000 Growth Index | | | |

WHAT ARE SOME KEY FUND STATISTICS AS OF 9/30/2024?

| |

| |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 9/30/2024?

| |

Semiconductors & Semiconductor Equipment | |

| |

Interactive Media & Services | |

| |

| |

Technology Hardware, Storage & Peripherals | |

| |

| |

Consumer Staples Distribution & Retail | |

| |

| |

Hotels, Restaurants & Leisure | |

| |

| |

| |

| |

Health Care Equipment & Supplies | |

| |

| |

| |

| |

| |

Textiles, Apparel & Luxury Goods | |

Affiliated Mutual Fund - Short-Term Investment | |

| |

| |

Liabilities in excess of other assets | |

| |

* Consists of Industries that each make up less than 0.5% of the Fund's net assets

WERE THERE ANY CHANGES TO THE FUND THIS YEAR?

The following is a summary of certain changes to the Fund since October 1, 2023:

■

The Fund's principal risk disclosure was revised to include Sector Exposure Risk as a principal risk of the Fund due to changes in the Fund's

portfolio which may result in greater exposure to certain economic sectors.

For more complete information, you should review the Fund’s next prospectus, which we expect to be available by November 30, 2024

at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by request at (800) 225-1852.

You can find additional information at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by scanning the QR code below,

including the Fund’s prospectus, financial information, fund holdings, and proxy voting information. You can also request this information by

contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

To receive your fund documents online, go to

pgim.com/investments/resource/edelivery

and enroll.

PGIM Jennison Growth Fund

PGIM Jennison Growth Fund

ANNUAL SHAREHOLDER REPORT – September 30, 2024

This annual shareholder report contains important information about the Class C shares of PGIM Jennison Growth Fund (the “Fund”) for the

period of October 1, 2023 to September 30, 2024.

You can find additional information about the Fund at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

. You can also request

this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PGIM Jennison Growth Fund—Class C | | |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD?

■

Capital asset prices increased over the reporting period as investors reacted positively to the slowing pace of inflation and sustained economic

growth. The US Federal Reserve (Fed) moved to lower the federal funds rate by 50 basis points at its September meeting. (One basis point

equals 0.01%.) Markets reacted positively to the move, as well as the tone of the accompanying statement by the Fed, which expressed

confidence that favorable economic trends would likely permit further policy easing in the future.

■

Positions within information technology (especially semiconductors & semiconductor equipment), health care (led by health care equipment &

supplies), and communication services (driven by interactive media & services) added the most to the Fund’s strong absolute performance and

its positive performance relative to the Russell 1000 Growth Index during the reporting period.

■

Conversely, stock selection within consumer discretionary (led by apparel & luxury goods) and an overweight position to that sector detracted

the most from relative results.

HOW HAS THE FUND PERFORMED OVER THE PAST 10 YEARS?

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The returns do not reflect the deduction of

taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

The line graph reflects a hypothetical $10,000 investment in Class C shares and assumes that all recurring fees (including management fees)

were deducted and dividend and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would

have been lower.

Cumulative Performance: September 30, 2014 to September 30, 2024 Initial Investment of $10,000 |

Average Annual Total Returns as of 9/30/2024 |

| | | |

Class C with sales charges | | | |

Class C without sales charges | | | |

Broad-Based Securities Market Index: S&P 500 Index | | | |

Russell 1000 Growth Index | | | |

WHAT ARE SOME KEY FUND STATISTICS AS OF 9/30/2024?

| |

| |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 9/30/2024?

| |

Semiconductors & Semiconductor Equipment | |

| |

Interactive Media & Services | |

| |

| |

Technology Hardware, Storage & Peripherals | |

| |

| |

Consumer Staples Distribution & Retail | |

| |

| |

Hotels, Restaurants & Leisure | |

| |

| |

| |

| |

Health Care Equipment & Supplies | |

| |

| |

| |

| |

| |

Textiles, Apparel & Luxury Goods | |

Affiliated Mutual Fund - Short-Term Investment | |

| |

| |

Liabilities in excess of other assets | |

| |

* Consists of Industries that each make up less than 0.5% of the Fund's net assets

WERE THERE ANY CHANGES TO THE FUND THIS YEAR?

The following is a summary of certain changes to the Fund since October 1, 2023:

■

The Fund's principal risk disclosure was revised to include Sector Exposure Risk as a principal risk of the Fund due to changes in the Fund's

portfolio which may result in greater exposure to certain economic sectors.

For more complete information, you should review the Fund’s next prospectus, which we expect to be available by November 30, 2024

at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by request at (800) 225-1852.

You can find additional information at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by scanning the QR code below,

including the Fund’s prospectus, financial information, fund holdings, and proxy voting information. You can also request this information by

contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

To receive your fund documents online, go to

pgim.com/investments/resource/edelivery

and enroll.

PGIM Jennison Growth Fund

PGIM Jennison Growth Fund

ANNUAL SHAREHOLDER REPORT – September 30, 2024

This annual shareholder report contains important information about the Class R shares of PGIM Jennison Growth Fund (the “Fund”) for the

period of October 1, 2023 to September 30, 2024.

You can find additional information about the Fund at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

. You can also request

this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PGIM Jennison Growth Fund—Class R | | |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD?

■

Capital asset prices increased over the reporting period as investors reacted positively to the slowing pace of inflation and sustained economic

growth. The US Federal Reserve (Fed) moved to lower the federal funds rate by 50 basis points at its September meeting. (One basis point

equals 0.01%.) Markets reacted positively to the move, as well as the tone of the accompanying statement by the Fed, which expressed

confidence that favorable economic trends would likely permit further policy easing in the future.

■

Positions within information technology (especially semiconductors & semiconductor equipment), health care (led by health care equipment &

supplies), and communication services (driven by interactive media & services) added the most to the Fund’s strong absolute performance and

its positive performance relative to the Russell 1000 Growth Index during the reporting period.

■

Conversely, stock selection within consumer discretionary (led by apparel & luxury goods) and an overweight position to that sector detracted

the most from relative results.

HOW HAS THE FUND PERFORMED OVER THE PAST 10 YEARS?

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The returns do not reflect the deduction of

taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or call

(800) 225-1852 or (973)

367-3529 from outside the US for more recent performance data.

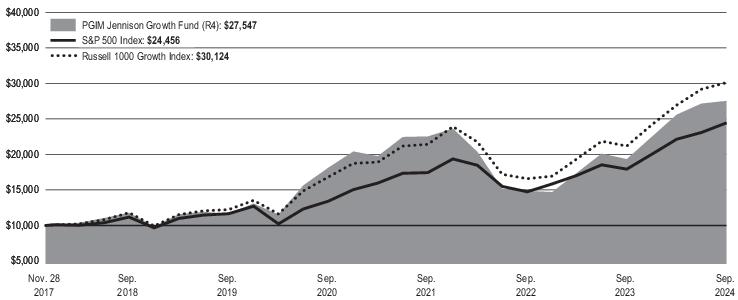

The line graph reflects a hypothetical $10,000 investment in Class R shares and assumes that all recurring fees (including management fees)

were deducted and dividend and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would

have been lower.

Cumulative Performance: September 30, 2014 to September 30, 2024 Initial Investment of $10,000 |

Average Annual Total Returns as of 9/30/2024 |

| | | |

| | | |

Broad-Based Securities Market Index: S&P 500 Index | | | |

Russell 1000 Growth Index | | | |

WHAT ARE SOME KEY FUND STATISTICS AS OF 9/30/2024?

| |

| |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 9/30/2024?

| |

Semiconductors & Semiconductor Equipment | |

| |

Interactive Media & Services | |

| |

| |

Technology Hardware, Storage & Peripherals | |

| |

| |

Consumer Staples Distribution & Retail | |

| |

| |

Hotels, Restaurants & Leisure | |

| |

| |

| |

| |

Health Care Equipment & Supplies | |

| |

| |

| |

| |

| |

Textiles, Apparel & Luxury Goods | |

Affiliated Mutual Fund - Short-Term Investment | |

| |

| |

Liabilities in excess of other assets | |

| |

* Consists of Industries that each make up less than 0.5% of the Fund's net assets

WERE THERE ANY CHANGES TO THE FUND THIS YEAR?

The following is a summary of certain changes to the Fund since October 1, 2023:

■

The Fund's principal risk disclosure was revised to include Sector Exposure Risk as a principal risk of the Fund due to changes in the Fund's

portfolio which may result in greater exposure to certain economic sectors.

For more complete information, you should review the Fund’s next prospectus, which we expect to be available by November 30, 2024

at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets