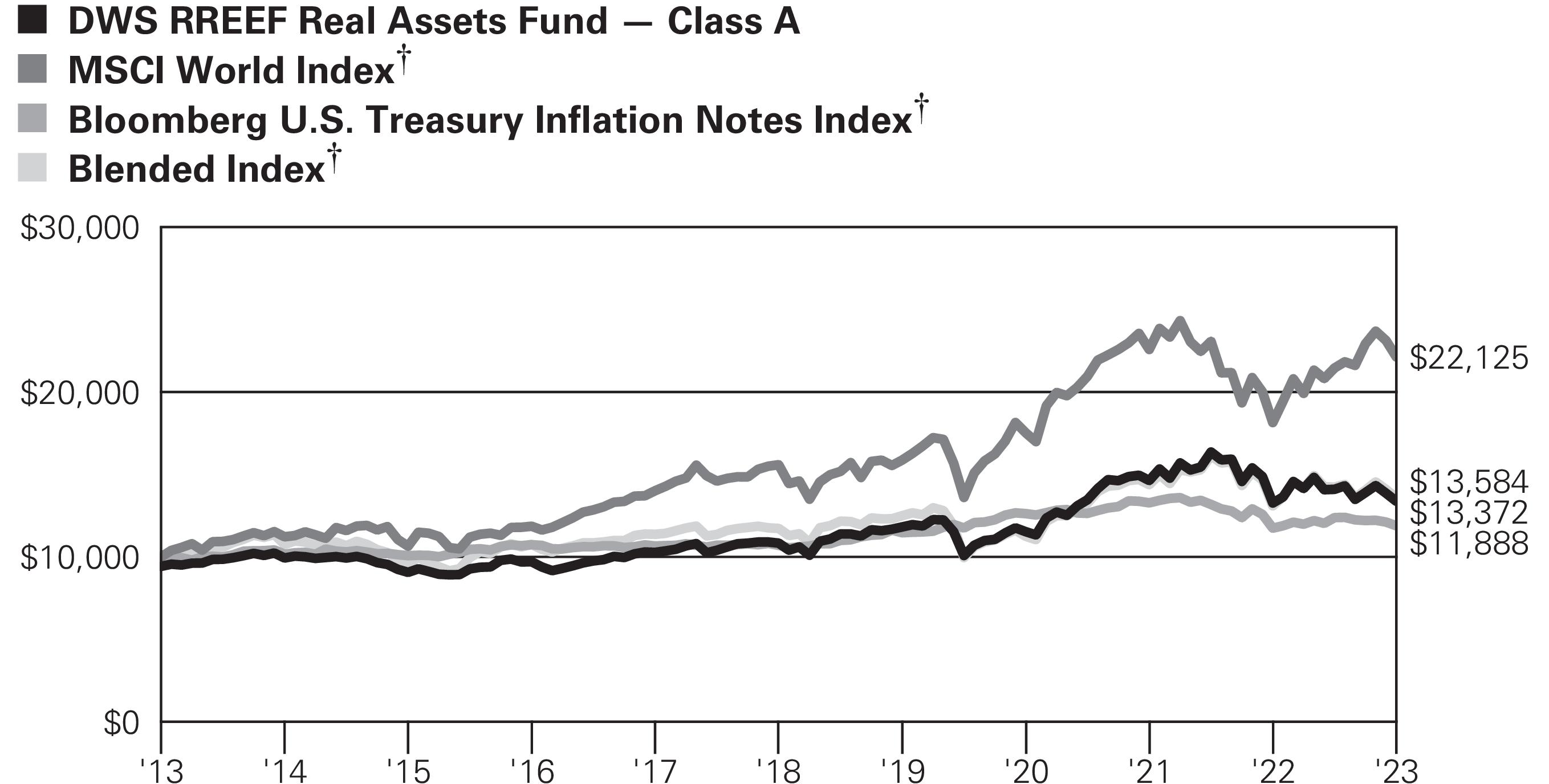

The Bloomberg U.S. Treasury Inflation Notes Index includes all publicly issued

U.S. Treasury inflation-protected securities that have at least one year remaining to

maturity, are rated investment grade, and have $250 million or more of outstanding

face value.

The Blended Index is composed of 30% in the Dow Jones Brookfield Infrastructure

Index, 30% in the FTSE EPRA/NAREIT Developed Index, 15% in the Bloomberg

Commodity Index, 15% in the S&P Global Natural Resources Index and 10% in the

Bloomberg U.S. Treasury Inflation Notes Index. Dow Jones Brookfield Infrastructure Index

measures the stock performance of companies worldwide whose primary business is

the ownership and operation of (rather than service of) infrastructure assets. To be

included in the indices, a company must have more than 70% of estimated cash flows

(based on publicly available information) derived from the following infrastructure sectors:

airports, toll roads, ports, communications, electricity transmission and distribution, oil

and gas storage and transportation, water, and other sectors. FTSE EPRA/NAREIT

Developed Index is an unmanaged, market-weighted index designed to track the

performance of listed real estate companies and REITS worldwide. Bloomberg

Commodity Index is an unmanaged index that tracks a diversified group of commodities

and commodities futures contracts traded on both U.S. and London exchanges. S&P

Global Natural Resources Index includes 90 of the largest publicly-traded companies in

natural resources and commodities businesses that meet specific investability

requirements, offering investors diversified and investable equity exposure across

3 primary commodity-related sectors: agribusiness, energy, and metals & mining.

Yearly periods ended September 30

Yearly periods ended September 30