MANAGEMENT’S DISCUSSION AND ANALYSIS | RISK MANAGEMENT

Net impaired loans, after deducting the allowance for credit losses, were $3,453 million as at October 31, 2018, an increase of $1,210 million from a year ago. Net impaired loans as a percentage of loans and acceptances were 0.60% as at October 31, 2018, an increase of 17 basis points from 0.43% a year ago.

Allowance for credit losses

The total allowance for credit losses was up $997 million to $5,065 million as at October 31, 2018 from $4,068 million last year (excluding $259 million related to loans acquired under FDIC guarantee related to the acquisition of R-G Premier Bank of Puerto Rico), due primarily to the impact of the implementation of IFRS 9 and impact of Day 1 provision for credit losses on acquired performing loans.

Allowance for credit losses on impaired loans in Canadian Banking decreased by $399 million to $380 million, due primarily to the impact of the implementation of IFRS 9.

In International Banking, allowance for credit losses on impaired loans decreased by $508 million to $1,222 million, due primarily to the impact of the implementation of IFRS 9.

Global Banking and Markets’ allowances for Impaired Loans decreased by $38 million to $75 million, due mainly to resolutions during the year.

Allowance for credit losses on performing loans have increased to $3,388 million compared to $1,446 million as at Oct 31, 2017 due primarily to the impact of the implementation of IFRS 9 and impact of Day 1 provision for credit losses on acquired performing loans.

Portfolio review

Canadian Banking

Gross impaired loans in the retail portfolio decreased by $42 million or 5%. Total provision for credit losses in the retail portfolio was $746 million, down $111 million or 15% from last year.

In the commercial loan portfolio, gross impaired loans decreased by $16 million to $158 million. The provision for credit losses was $48 million, down $8 million or 14% from last year.

International Banking

In retail, gross impaired loans decreased by $147 million to $2,026 million, with a decrease attributable mainly due to the impact of the implementation of IFRS 9, which was partially offset by increases due to acquisitions. The total provision for credit losses in the retail portfolio increased to $1,667 million from $1,090 million last year, primarily due to one-time provisions related to acquisitions and the impact of acquisition related benefits in the prior year.

In commercial banking, gross impaired loans were $1,823 million, an increase of $559 million over the prior year, due primarily to the impact of the implementation of IFRS 9, and purchased credit-impaired loans resulting from acquisitions. The total provision for credit losses in the commercial portfolio was $200 million compared with $204 million last year, down $4 million or 2%.

Global Banking and Markets

Gross impaired loans in Global Banking and Markets decreased by $89 million to $283 million, due primarily to resolutions during the year partially offset by the impact of the implementation of IFRS 9. The total provision for credit losses was a net reversal of $50 million compared with $42 million last year.

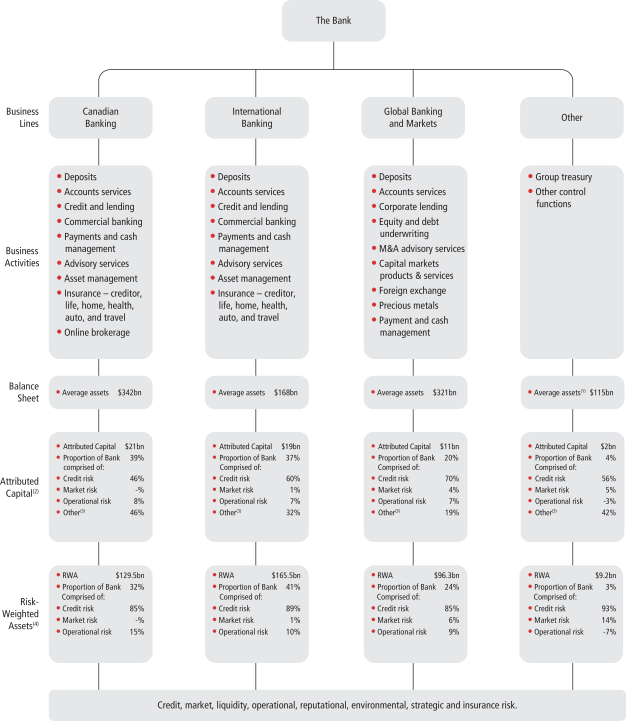

Risk diversification

The Bank’s exposure to various countries and types of borrowers are well diversified (see T59 and T63). Chart C24 shows loans and acceptances by geography. Ontario represents the largest Canadian exposure at 32% of the total. Latin America was 20% of the total exposure and the U.S. was 7%.

Chart C25 shows loans and acceptances by type of borrower (see T63). Excluding loans to households, the largest industry exposures were real estate and construction (5.1%), financial services (5.1% including banks and non-banks), wholesale and retail (4.4%), and energy (2.6%).

Risk mitigation

To mitigate exposures in its performing corporate portfolios, the Bank uses diversification by company, industry, and country, with loan sales and credit derivatives used sparingly. In 2018, loan sales totaled $25 million, compared to $242 million in 2017. The largest volume of loan sales in 2018 related to loans in the metals industry. As at October 31, 2018, credit derivatives used to mitigate exposures in the portfolios totaled $13 million (notional amount), compared to $23 million as at October 31, 2017.

The Bank actively monitors industry and country concentrations. As is the case with all industry exposures, the Bank continues to closely follow developing trends and takes additional steps to mitigate risk as warranted. Energy, mining, and shipping portfolios are being closely managed.

Overview of loan portfolio

The Bank has a well-diversified portfolio by product, business and geography. Details of certain portfolios of current focus are highlighted below.

Climate Change Risks

In February 2018, Scotiabank announced its support of the Financial Stability Board (FSB) Task Force on Climate-related Financial Disclosures (TCFD). This particular disclosure relates to the Bank’snon-retail loan book. Additional disclosures relating to thenon-retail loan book as well as other aspects of the Bank’s operations will be included in the 2018 Corporate Social Responsibility Report.

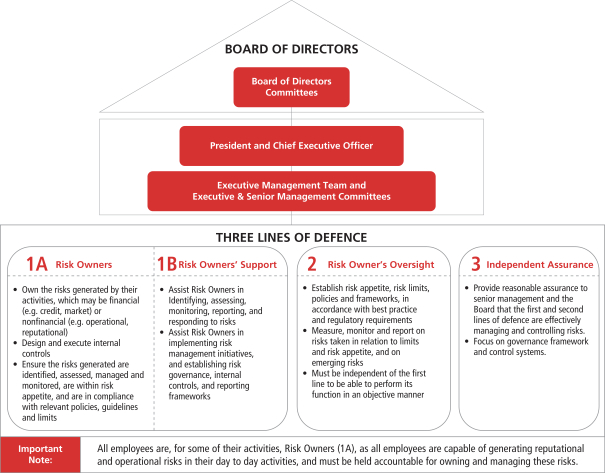

Governance

Board Oversight

Climate Change risk and related disclosure is reviewed and discussed at several committees within the Board, including the Risk Committee and Audit and Conduct Review Committee, as well as by the full Board of Directors.

The Risk Committee, however, retains primary oversight responsibility for climate change related risks and opportunities with respect to the Bank’s loan portfolio. As part of this responsibility, in 2018 the Risk Committee reviewed a Future of Energy report as part of its industry analyses and review of climate change risks. The Risk Committee advises the Board on key and emerging risks and related policies (e.g., Environmental Policy and Credit Risk Appetite) and reviews the Bank’s management of key risks such as climate change. Reporting on such risks and opportunities is provided to

2 0 1 8 S C O T I A B A N K A N N U A L R E P O R T | 87