UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-01735

fpa NEW Income, inc.

(Exact name of registrant as specified in charter)

11601 WILSHIRE BLVD., STE. 1200

LOS ANGELES, CALIFORNIA 90025

(Address of principal executive offices)(Zip code)

| (Name and Address of Agent for Service) | Copy to: |

J. RICHARD ATWOOD, PRESIDENT FPA NEW INCOME, INC. 11601 WILSHIRE BLVD., STE. 1200 LOS ANGELES, CALIFORNIA 90025 | MARK D. PERLOW, ESQ. DECHERT LLP ONE BUSH STREET, STE. 1600 SAN FRANCISCO, CA 94104 |

Registrant’s telephone number, including area code: (310) 473-0225

Date of fiscal year end: September 30

Date of reporting period: September 30, 2022

Item 1: Report to Shareholders.

| (a) | The Report to Shareholders is attached herewith. |

Distributor:

UMB DISTRIBUTION SERVICES, LLC

235 West Galena Street

Milwaukee, Wisconsin 53212

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

Dear Fellow Shareholders,

FPA New Income, Inc. (the "Fund") returned -0.96% in the third quarter of 2022 and -3.68% year-to-date through September 30, 2022.

Sector | | As of 9/30/2022 | |

Yield-to-worst1 | | | 5.70 | % | |

Effective Duration | | | 1.71 years | | |

High Quality Exposure2 | | | 90.3 | % | |

Credit Exposure3 | | | 9.7 | % | |

As of September 30, 2022, the portfolio had a yield-to-worst of 5.70% and an effective duration of 1.71 years. Inflation remains at 40-year highs and well above the Federal Reserve's target of 2%. In response, the Federal Reserve further tightened monetary policy during the quarter with two additional 75 basis point (bps) increases in the Fed Funds rate. Moreover, Federal Reserve Chairman Jerome Powell publicly committed to tight monetary policy until there is "compelling evidence that inflation is moving down."4 Consequently, Treasury yields continued to increase during the quarter, with yields on 1- to 5-year maturity Treasuries increasing by approximately 145-170 bps, bringing the year-to-date increase to 260-370 bps and the increase over the last 12 months to 300-400 bps. The increase in risk-free rates over the last 12 months represents the largest 12-month increase in risk-free rates since 1981.5 At the same time, longer maturity Treasury yields have also increased, but to a lesser extent. That led to a significant inversion of the Treasury yield curve, where 10-year maturity Treasuries yields are less than 2-year maturity Treasury yields. Historically, such inversions have presaged economic recessions.

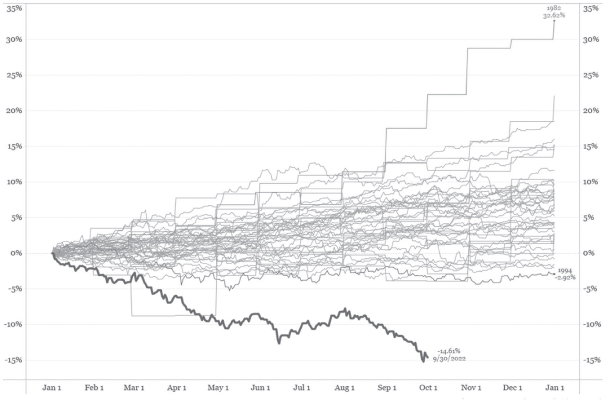

In combination with extremely low starting yields in 2021, this year's increase in risk-free rates has led to significant declines in bond prices and the worst performing bond market in generations, if not ever. During this time, the Fund has experienced limited drawdowns and we believe has done a relatively good job of preserving capital, as evidenced by the Fund's year-to-date (thru 9/30/2022) return of -3.68% versus -4.58%, -6.35%, and -14.61% for the Bloomberg U.S. Aggregate 1-3 Year Bond Index, Morningstar Short-term Bond Category and Bloomberg U.S. Aggregate Bond Index, respectively.

On the other hand, the worst bond market in generations, while painful to endure, has created what we believe to be the most attractive bond market we have seen in at least a decade. In sympathy with the increase in risk-free rates, yields on investment grade bonds also increased during the quarter and year-to-date. Though spreads on investment grade bonds have increased as well, most of the yield increase in investment grade bonds

1 Yield to Worst ("YTW") is presented gross of fees and reflects the lowest possible yield on a callable bond without the issuer defaulting. It does not represent the yield an investor should expect to receive. As of September 30, 2022, the Fund's subsidized/unsubsidized 30-day SEC standardized yield ("SEC Yield") was 3.23%/3.06% respectively. The SEC Yield calculation is an annualized measure of the Fund's dividend and interest payments for the last 30 days, less the Fund expenses. Subsidized yield reflects fee waivers and/or expense reimbursements during the period. Without waivers and/or reimbursements, yields would be reduced. Unsubsidized yield does not adjust for any fee waivers and/or expense reimbursements in effect. The SEC Yield calculation shows investors what they would earn in yield over the course of a 12-month period if the fund continued earning the same rate for the rest of the year.

2 Represents the Fund's exposure to investments rated A or higher, Treasuries, and cash and equivalents.

3 Represents the Fund's exposure to investments rated BBB or lower.

4 Source: The Federal Reserve, September 21, 2022 https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20220921.pdf.

5 Bloomberg as of 9/30/2022.

Past performance is no guarantee, nor is it indicative, of future results.

1

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

is due to higher risk-free rates with spreads still within historical norms. Similarly, looking to the high-yield market as a proxy for credit markets, high-yield bond yields increased meaningfully during the quarter and year-to-date, though the majority of the increase is attributable to an increase in risk-free rates as high-yield bond spreads also remain within historical norms.

Consistent with our past practice, we continue to take advantage of the higher yield environment to buy incrementally longer duration, high-quality bonds (rated single-A or higher) since we believe these bonds now offer sufficient compensation for the duration risk (i.e., duration is cheaper). We anticipate these investments will improve the long-term return profile of the Fund while preserving capital over the next 12 months if risk-free rates were to increase by a further 100 bps or more. While we believe Treasuries are valuable to own, higher spreads increase the opportunity cost of owning Treasuries, enhancing the appeal of high-quality bonds other than Treasuries. Meanwhile, higher spreads and yields have also made credit (investments rated BBB or lower) more attractive. We are selectively investing in credit as we remain cautious due to concerns about credit risk (particularly in the face of a possible recession) and near-term mark-to-market risk.

Cash and equivalents represented 0.6% of the portfolio at September 30, 2022 versus 1.0% on June 30, 2022. In addition, 9.0% of the Fund was held in Treasuries at the end of the quarter.

Portfolio Attribution6

The largest contributors to performance during the quarter were non-agency commercial mortgage-backed securities, predominantly due to holdings of collateralized loan obligations (CLOs) backed by commercial real estate. These high-quality (rated single-A or higher) commercial real estate CLOs have floating rate coupons and thus their prices were not meaningfully impacted directly by the increase in risk-free rates during the quarter. Further, these CLOs also benefited from an increase in their floating coupons related to increases in the Fed Funds rate.

The second-largest contributors to performance during the quarter were CLOs backed by broadly syndicated or middle market corporate loans. Nearly all of these high-quality CLO holdings are floating rate, and thus their prices were not meaningfully impacted directly by the increase in risk-free rates during the quarter, although they did experience lower prices as a result of an increase in spreads. However, these price declines were more than offset by coupon payments. These bonds benefited from an increase in their coupons during the quarter related to increases in the Fed Funds rate.

While there were other individual bonds that contributed to performance during the quarter, there were no other meaningful contributors at the sector level.

The largest detractors from performance during the quarter were fixed rate Treasury bonds, which experienced lower prices due to an increase in risk-free rates. The second-largest detractors from performance were fixed rate asset-backed securities (ABS) backed by equipment. Prices on these mostly high-quality ABS were also negatively impacted by an increase in risk-free rates.

The third-largest detractors from performance during the quarter were the corporate holdings, where higher spreads led to lower prices on floating rate bank loans and higher risk-free rates led to lower high-yield bond prices. Lastly, lower market-wide equity valuations negatively impacted prices of the common stock holdings. Common stock represented approximately 1.3% of the portfolio, on average, during the quarter.

Despite the Fund's overall negative return during the quarter, we believe the portfolio continues to perform well relative to the overall bond market and relevant indices.

6 This information is not a recommendation for a specific security or sector and these securities/sectors may not be in the Fund at the time you receive this report. The information provided does not reflect all positions purchased, sold or recommended by FPA during the quarter. The portfolio holdings as of the most recent quarter-end may be obtained at www.fpa.com.

2

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

Portfolio Activity7

The table below shows the portfolio's sector-level exposures of September 30, 2022 compared to June 30, 2022:

| Sector | | % Portfolio

9/30/2022 | | % Portfolio

6/30/2022 | |

ABS | | | 66.3 | | | | 64.9 | | |

Mortgage Backed (CMO)8 | | | 5.2 | | | | 5.7 | | |

Stripped Mortgage-backed | | | 0.4 | | | | 0.4 | | |

Corporate | | | 5.8 | | | | 5.4 | | |

CMBS8 | | | 10.7 | | | | 8.4 | | |

Mortgage Pass-through | | | 2.0 | | | | 2.2 | | |

U.S. Treasury | | | 9.0 | | | | 12.0 | | |

Cash and equivalents | | | 0.6 | | | | 1.0 | | |

Total | | | 100.0 | % | | | 100.0 | % | |

Yield-to-worst9 | | | 5.70 | % | | | 4.41 | % | |

Effective Duration (years) | | | 1.71 | | | | 1.60 | | |

Average Life (years) | | | 2.44 | | | | 2.29 | | |

As yields have increased (see below for more details), we have been actively buying longer duration, high-quality bonds rated single-A or higher. The duration of these investments has been guided by our 100 bps duration stress test, which seeks to identify the longest bonds that we expect will produce at least a breakeven return over a 12 month period if we assume the yield on a bond increases by 100 bps during that 12 month period. In line with this test, in addition to extending the duration of our Treasury holdings, we bought high-quality bonds including agency guaranteed commercial mortgage-backed securities, equipment asset-backed securities, utility cost recovery bonds, prime auto loan asset-backed securities, asset-backed securities backed by insurance premium loans, investment grade corporate bonds and non-agency commercial mortgage-backed securities that, on average, had a duration of 3.7 years and yield-to-worst of 4.99%.10 In addition, we bought BBB-rated corporate bonds that had an average duration of 3.9 years and yield-to-worst of 8.09%.10 We include these BBB bonds within our credit holdings. These investments were funded with a combination of cash and proceeds from maturing investments and selling short duration, high-quality bonds and Treasuries.

7 Portfolio composition will change due to ongoing management of the Fund.

8 Collateralized mortgage obligations ("CMO") are mortgage-backed bonds that separate mortgage pools into different maturity classes. Commercial mortgage-backed securities ("CMBS") are securities backed by commercial mortgages rather than residential mortgages.

9 Yield to Worst ("YTW") is presented gross of fees and reflects the lowest possible yield on a callable bond without the issuer defaulting. It does not represent the yield an investor should expect to receive. As of September 30, 2022, the Fund's subsidized/unsubsidized 30-day SEC standardized yield ("SEC Yield") was 3.23%/3.06% respectively. The SEC Yield calculation is an annualized measure of the Fund's dividend and interest payments for the last 30 days, less the Fund expenses. Subsidized yield reflects fee waivers and/or expense reimbursements during the period. Without waivers and/or reimbursements, yields would be reduced. Unsubsidized yield does not adjust for any fee waivers and/or expense reimbursements in effect. The SEC Yield calculation shows investors what they would earn in yield over the course of a 12-month period if the fund continued earning the same rate for the rest of the year.

10 Based on quarter-end pricing.

Past performance is no guarantee, nor is it indicative, of future results.

3

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

Floating rate investments represented 30% of the Fund's holdings at September 30, 2022. We believe these floating rate investments could support higher returns in a rising rate environment.

Market Commentary

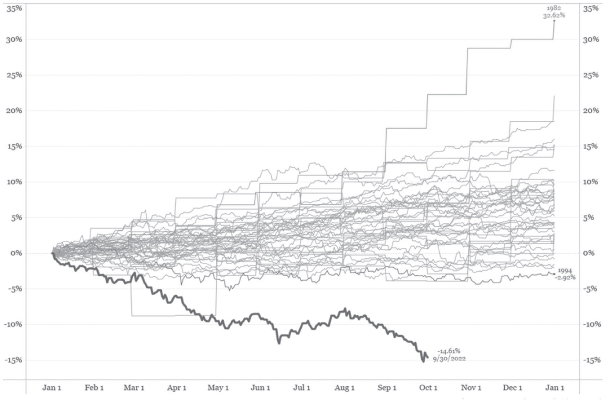

We are in one of the worst bond markets in generations, possibly ever. As one measure, the chart below shows that the Bloomberg Aggregate Bond Index's year-to-date return of -14.61% puts this index on track for its worst performance since its inception in 1976.

Year-to-Date Total Return for the Bloomberg U.S. Aggregate Index

Source: Bloomberg. Data for calendar years 1976-2021 and 2022 through 9/30/2022.

Until this year, the Bloomberg Aggregate Bond Index's return of -2.92% in 1994 was the reigning champion of negative returns. It's striking how poor 2022 has been in comparison.

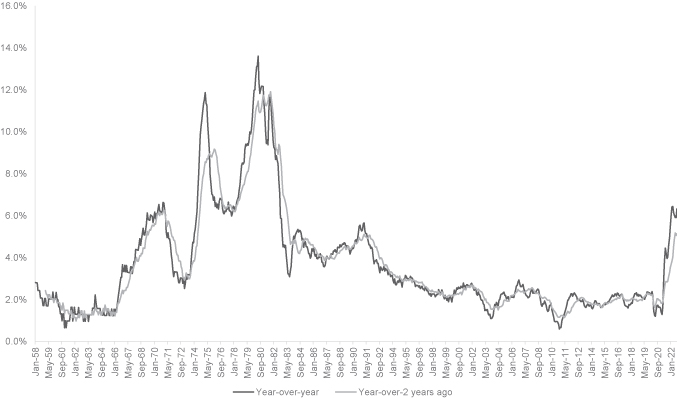

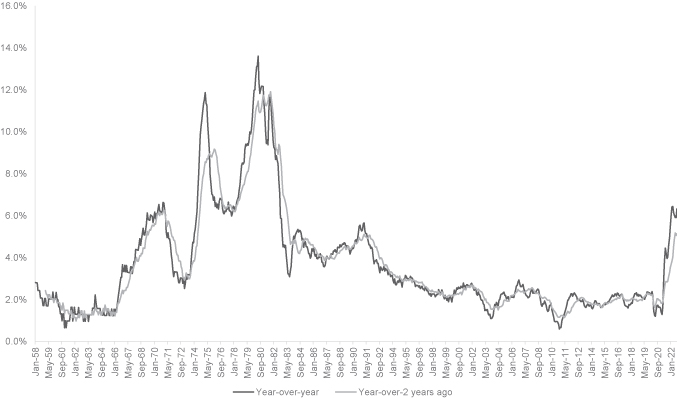

The driver of this year's poor bond market returns has been inflation, and specifically the Federal Reserve's efforts to combat inflation. As shown below, inflation excluding food and energy prices is at 40-year highs.

4

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

CPI Urban Consumers less Food and Energy

Source: US Department of Labor. As of 8/31/2022. The Consumer Price Index, or CPI, reflects the average change over time in prices paid by urban consumers for a market basket of consumer goods and services.

In response, the Federal Reserve has been aggressively tightening monetary policy. The Federal Reserve instituted two 75 bps increases in the Fed Funds rate in the third quarter alone, bringing the year-to-date increase in the Fed Funds rate to 300 bps. As of September 30, 2022 the market expected an additional 116 bps of Fed Funds rate increases by the end of the year, with more to come next year. The market's expectation was that the Fed Funds rate would peak around 4.5% sometime next year. But as the macroeconomic data changes, the market's expectations change and, with that, rates have risen further since the end of September.

5

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

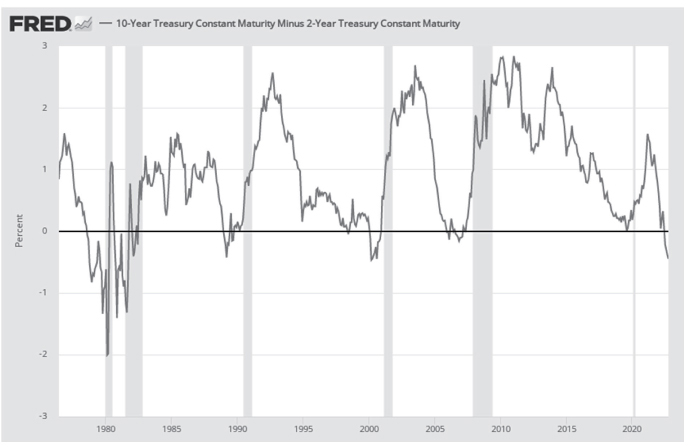

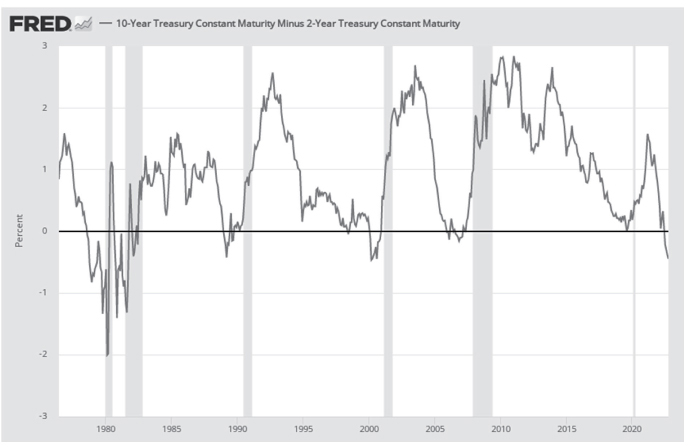

With a significant tightening of monetary policy has come a dramatic shift in the yield curve:

Treasury Yield

| | Maturity | |

| | 1Y | | 2Y | | 3Y | | 5Y | | 7Y | | 10Y | | 20Y | | 30Y | |

Q3 2022 change in yields (bps) | | | 119 | | | | 133 | | | | 128 | | | | 105 | | | | 91 | | | | 82 | | | | 65 | | | | 59 | | |

YTD 2022 change in yields (bps) | | | 356 | | | | 355 | | | | 333 | | | | 283 | | | | 255 | | | | 232 | | | | 216 | | | | 187 | | |

Source: Bloomberg. Chart data as of the dates shown.

6

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

Significantly higher yields across the yield curve, with a greater increase in 1- to 5-year maturity Treasuries has resulted in an inversion of the yield curve — where 10-year maturity bond yields are less than 2-year maturity bond yields. Inverted yield curves have historically portended economic recessions:

Source: Federal Reserve Bank of St. Louis. Data through 9/30/22. Shaded areas reflect recessions.

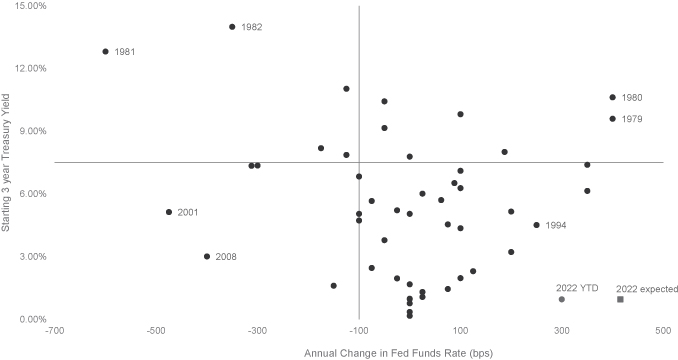

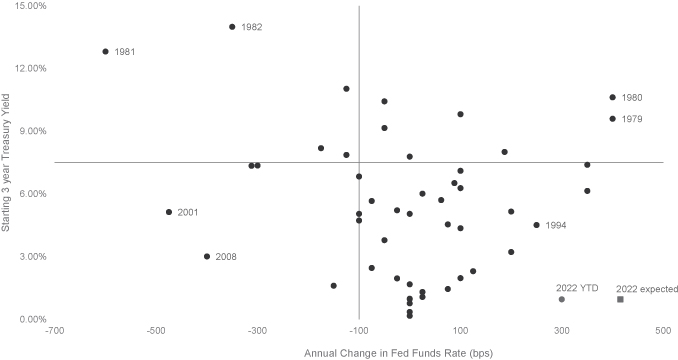

Treasury yields now sit at levels last seen 15 years ago in 2007. Normally, we suspect investors would be excited about risk-free rates greater than 4%. However, today's yields have come about after Treasury yields were at historical lows not too long ago in 2020 and 2021. The rapid increase in yields in a short period of time has led to historically poor bond market returns this year. To help explain why bond returns have been so extraordinarily poor, the chart below plots annual changes in the Fed Funds rate since 1972 against the yield on the 3-year Treasury at the start of each year. The red dot shows the year-to-date change in the Fed Funds rate through September 2022, and the red square shows the expected change in the Fed Funds rate for the full calendar year — assuming that the market's expectations for Fed Funds rate increases for the rest of the year end up being correct. The red dot and red square sit at the extremes of the lower right quadrant.

7

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

Starting 3-Year Treasury Yield and annual change in Fed Funds rate since 1972

Source: Bloomberg.

After only nine months, we have already experienced one of the largest annual increases in Fed Funds rates in 50 years and the year isn't even over yet. If the market's expectations for the rest of this year prove to be correct, 2022 would match or exceed the largest increase in the Fed Funds rate in 50 years. However, while there have been years in the past where Fed Funds increased by 300 bps or more — for example in 1980 or 1979 — it has never been the case that this magnitude of increase has happened when starting yields were so low, practically near zero. When yields are low, bond prices are more sensitive to change in yields. Because yields were so low to start 2022, bond prices were unusually sensitive to changes in yield. Once an unusually large increase in yield was applied to these conditions, that led to an unusually large decline in bond prices. Exacerbating lower bond prices is the fact that, because starting yields were so low, there has not been much coupon or income to offset the decline in prices this year. In contrast, when Fed Funds increased by 250 bps in 1994, starting Treasury yields were at 4.5%, offering meaningfully more coupon to offset price declines that occurred when yields rose in 1994. Of note, price declines in 1994 were less severe than they have been this year, all things being equal, because higher yields then meant that duration was lower and bond prices were less sensitive to changes in yield.

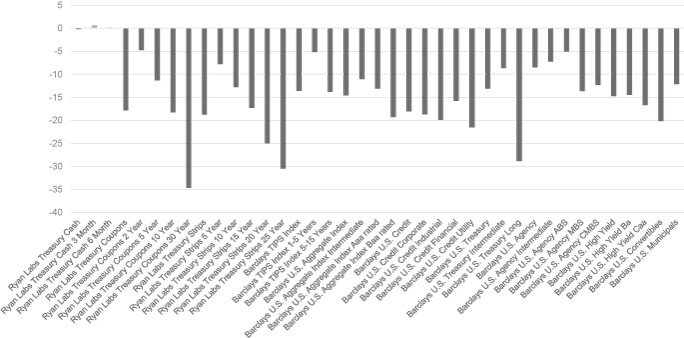

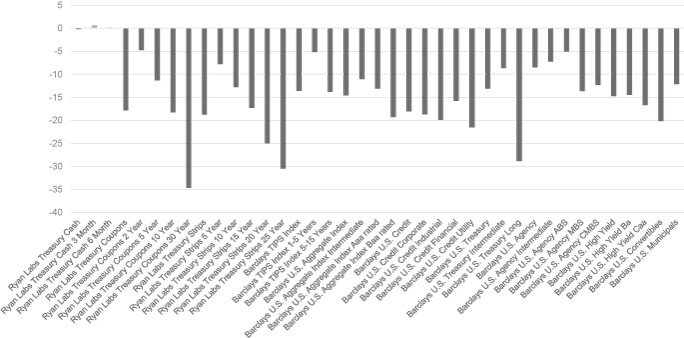

As a consequence of significantly higher yields this year, nearly every part of the fixed income market has lost money year-to-date, as shown below. Even TIPS (Treasury inflation-protected securities), which were supposed to be a panacea for an inflationary environment, have lost 5-14%, depending on the maturity. One-year Treasury Bills have also lost money year-to-date. The only part of the fixed income market, defined loosely, that has not lost money this year was 3- to 6-month Treasury Bills, which is essentially cash (though cash and equivalents have lost money on a real basis).

8

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

U.S. Fixed Income Total Returns (% YTD as of 9/30/22)

Source: Ryan Labs, Bloomberg, Barclays. Ryan Labs Treasury Cash: Equal-weighted total-return average of the Treasury yield curve from 3 to 12 month maturities. Ryan Labs Treasury Coupons: Equal-weighted total-return average of the Treasury yield curve from 2 to 30 year maturities. Ryan Labs Treasury Strips: Equal-weighted total-return average of Treasury Strips from 1 year to 30 years.

In a sea of poor performance, we believe that the Fund has held up relatively well. The table below shows that the Fund returned -3.68% year-to-date, better than the Bloomberg 1-3 year U.S. Aggregate Bond Index and much better than the Bloomberg U.S. Aggregate Bond Index.

As of Date: 9/30/22 | | QTD | | YTD | | 1 Year | | 3 Years | | 5 Years | | 10 Years | |

FPA New Income, Inc. ("Fund") | | -0.96% | | -3.68% | | -3.87% | | 0.00% | | 1.21% | | 1.31% | |

Bloomberg U.S. Agg 1-3 Year

Bond Index | | -1.50% | | -4.58% | | -5.11% | | -0.52% | | 0.64% | | 0.78% | |

Bloomberg U.S. Agg Bond Index | | -4.75% | | -14.61% | | -14.60% | | -3.26% | | -0.27% | | 0.89% | |

CPI + 100 | | 0.74% | | 6.73% | | 9.30% | | 6.02% | | 4.83% | | 3.56% | |

Morningstar Short-Term Bond

Category Percentile Rank —

FPA New Income, Inc. | | | | | | Top 4% | | Top 18% | | Top 14% | | Top 19% | |

Source: Morningstar Direct. As of 9/30/2022. Fund Inception is July 11, 1984. Morningstar Short-Term Bond Category ("Category") Rankings are as of September 30, 2022 and are based on total returns. The Category returns for the periods noted through September 30, 2022 were: 1-year: -6.80%; 3-year: -0.61%; 5-year: 0.66%;

9

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

and 10-year: 0.94%. Time periods greater than one-year are annualized. As of September 30, 2022, there were the following number of funds in the Category: 1 year: 582; 3 year: 544; 5-year: 481, and 10 year: 338. Source: Morningstar. Past performance is no guarantee, nor is it indicative, of future results.

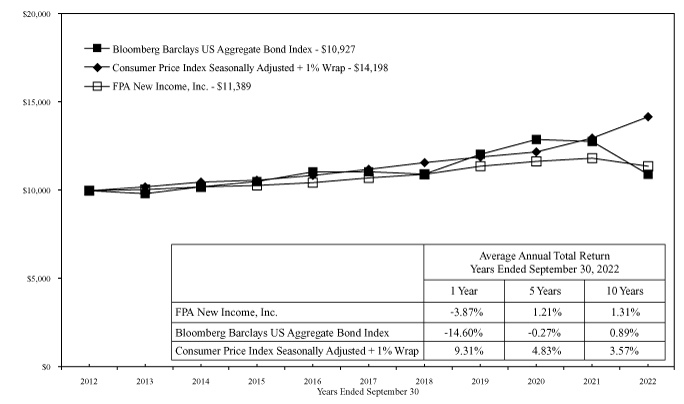

Over the last year, the Fund's performance is in the top 4% of the Morningstar Short-Term Bond Category. Longer-term, the Fund's performance ranks in the top 14-19% of the category over the last 3 to 10 years. The goal of investing is to make money and the Fund has made more money for its investors over the last 10 years versus what investors could have earned if they had owned the short-term bond category, generically, the Bloomberg 1-3 year U.S. Aggregate Bond Index or the Bloomberg U.S. Aggregate Bond Index.11 Moreover, these higher long-term returns have been accomplished with lower volatility as evidenced by the Fund's higher Sharpe and Sortino ratios and lower maximum drawdown.

| 10/1/2012-9/30/2022 | | Sharpe

Ratio | | Sortino

Ratio | | Max

Drawdown | |

FPA New Income | | | 0.45 | | | | 0.57 | | | | -3.87 | % | |

Morningstar US Fund Short-Term Bond | | | 0.09 | | | | 0.12 | | | | -6.99 | % | |

Bloomberg U.S. 1-3 yr Aggregate Bond Index | | | 0.07 | | | | 0.08 | | | | -5.19 | % | |

Source: Morningstar Direct. As of 9/30/2022. FPNIX Inception is July 11, 1984.

Of course, in addition to our stated goal of positive returns over a rolling 12-month period, our other goal is to deliver positive real returns over the long term (specifically, CPI+100 bps over rolling five-year periods). We believe the Fund is one of the few fixed income funds with that as a goal, but it is consistent with our absolute return investment philosophy. We are not shy about the fact that we have not beaten inflation over the last five years. The following chart shows rolling 5-year, inflation-adjusted returns for the Fund, the Bloomberg Aggregate Bond Index, the Bloomberg 1-3 year Aggregate Bond Index and the Morningstar Short-Term Bond Category. None of these have beaten inflation over the last five years, but the Fund has come the closest. Not even TIPS12 have beaten inflation over the last five years.

11 Comparison to the indices and the Category is for illustrative purposes only. An investor cannot invest directly in an index or in the Morningstar Short-Term Bond Category. Past results are no guarantee of future results.

12 As measured by the iShares TIPS ETF which had annualized nominal return of 1.76% for the 5-year period ending 9/30/22. TIPS is Treasury Inflation Protected Securities..

10

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

Rolling 5-Year Real Total Return (%)

Chart covers the period July 31, 1985 through September 30, 2022. Source: Morningstar Direct. Comparison to the indices and the Morningstar US Short-Term Bond category is for illustrative purposes only. FPNIX does not include outperformance of any index or peer group in its investment objectives. An investor cannot invest directly in an index or Morningstar category. Real Return is nominal return minus inflation.

Given that we are currently dealing with inflation of approximately 8%, we are not surprised that the Fund is not beating inflation. The reason we are not surprised is that, as we have stated in the past, the first step in beating inflation long-term is not losing money in nominal terms. Had we invested with the sole objective of beating inflation in the short term, that would have required taking on a lot of duration risk and/or credit risk in an attempt to get more nominal yield, especially if one were trying to solve for 8% inflation. If we had done that, then the Fund might have a year-to-date return that's similar to the -14.61% year-to-date return of the longer duration Bloomberg U.S. Aggregate Bond Index or the -14.74% year-to-date return of the lower credit quality Bloomberg High Yield Index rather than the Fund's actual year-to-date return of -3.68%. Moreover, if we had taken on more duration risk and/or credit risk, we still would not have beaten inflation over the long-term. In fact, because we focused on capital preservation in nominal terms, the Fund has a higher return than the Bloomberg U.S. Aggregate Bond Index on a nominal and real basis over the last five years. While the Bloomberg High Yield Index has returned an annualized 36 bps more per year than the Fund over the last five years (on a nominal basis) while taking on significantly more credit risk, that Index was still unable to beat inflation over a five-year period.13

13 Source: Bloomberg. The Bloomberg High Yield Index annualized 5-year nominal returns were 1.57% through Sept 30, 2022.

Past performance is no guarantee, nor is it indicative, of future results.

11

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

The dashed green line in the chart above shows the real yield on five-year maturity TIPS but with a five-year lag. Historically, when real yields were negative, subsequent five-year real returns tended to be negative and when real yields were positive, subsequent real returns tended to be positive. When nominal yields were historically low in 2021 and real yields were negative, we focused on capital preservation, which entailed lower duration risk and lower credit risk. Though the Fund's defensive posturing was not enough to prevent nominal losses year-to-date this year, we have been able to achieve much lower losses compared to others and have done a better job than others of preserving capital. We believe that puts the Fund in a good position to achieve inflation-beating returns going forward, especially because real yields are now positive. Finally, we would add that it may be premature to pass judgement on our inflation-adjusted returns because we are in the middle of an interest rate cycle. It seems to us that we're only partway through this cycle, and we believe we're already ahead in the game given our better relative performance.

With so much discussion about bond market losses, it's worthwhile to define "loss." Losses on bonds are typically not permanent losses, particularly for investment grade bonds. As long as one believes that a bond will ultimately be repaid in full at its maturity, and holds to maturity, then the losses that bond investors are experiencing this year, and we believe that the Fund is experiencing, are temporary. Losses become permanent if a bond is not repaid in full or if bonds are sold prior to maturity such that investors receive today's price rather than par. With this in mind, we have always tried to be thoughtful about duration risk and credit risk. By avoiding uncompensated risk, we can have lower drawdowns when the market sells off, which we expect will then put us in a good position to redeploy capital closer to par into more attractively priced bonds, which is the situation we find ourselves in today. Ultimately, we expect this approach to lead to better and lower volatility long-term returns for the Fund's investors, as has been the case in the past.

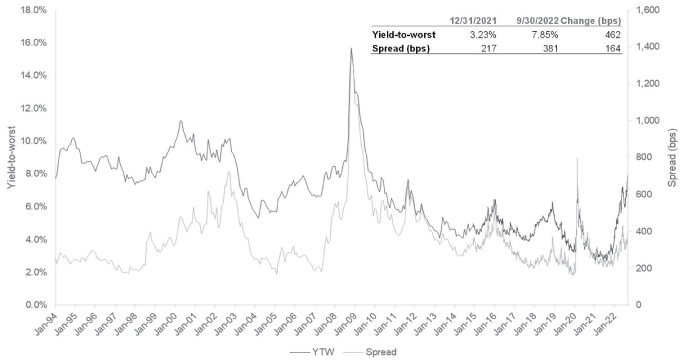

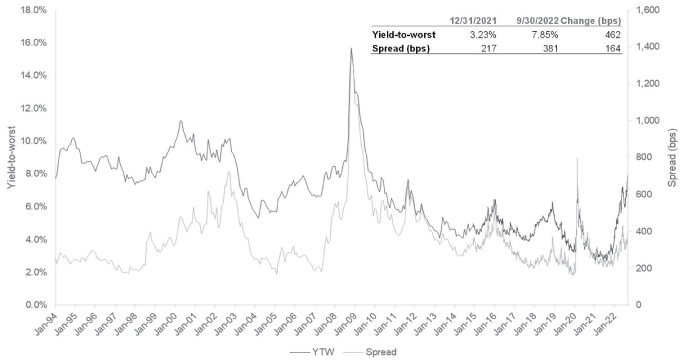

That leads us to the exciting part: we believe this is the most attractive bond market we have seen in at least a decade! For reference, the charts below show the yield and spread on the Bloomberg U.S. Aggregate Bond Index and Bloomberg 1-3 year U.S. Aggregate Bond Index. Yields on investment grade bonds are now at levels we haven't seen since 2007. Most of the increase in yield through September 2022 has been due to higher risk-free rates, with a smaller component due to higher spreads.

12

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

Bloomberg U.S. Aggregate Bond Index

Source: Bloomberg. As of 9/30/2022. YTW is Yield-to-Worst. Spread reflects the quoted spread of a bond that is relative to the security off which it is priced, typically an on the-run treasury.

13

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

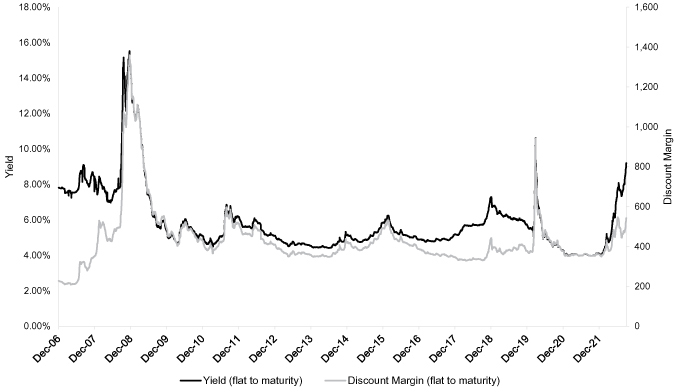

Bloomberg 1-3 year U.S. Aggregate Bond Index

Source: Bloomberg. As of 9/30/2022. YTW is Yield-to-Worst. Spread reflects the quoted spread of a bond that is relative to the security off which it is priced, typically an on the-run treasury.

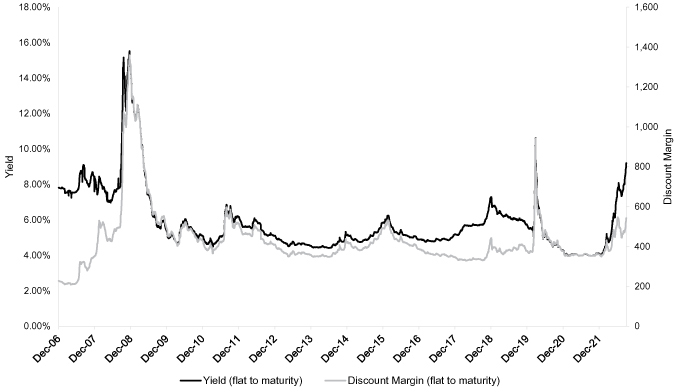

Elsewhere, credit markets have also become cheaper, but it's important to think about price relative to risk. The following chart shows the yield and spread on the BB component of the high-yield index excluding energy, an index we monitor to give us what we believe is a better indication of high yield bond pricing because it excludes noise related to changes in ratings composition found in the overall high-yield index over time and the more volatile energy sector. Also shown below is a similar chart for the leveraged loan index. In both cases, overall yields are higher, mostly due to higher risk-free rates, though spreads have increased meaningfully this year.

14

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

Bloomberg U.S. High Yield BB excl. Energy

Source: Bloomberg. As of 9/30/2022. YTW is Yield-to-Worst. Spread reflects the quoted spread of a bond that is relative to the security off which it is priced, typically an on the-run treasury.

15

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

JP Morgan BB/B Leveraged Loan Index

Source: JPMorgan. As of 9/30/2022. Yield is Yield-to-Maturity.

We have long viewed credit as an episodic asset class that is periodically attractive. On a prospective return or yield basis, today we view credit markets as certainly cheaper and more attractive than they have been in a long time, but not everything in high yield is a buying opportunity because of the risk versus reward. To own high yield-rated debt, we need sufficient absolute yield because we believe that compensates us for the possibility of permanent impairment of capital. We also need sufficient spread because we need to be compensated for the extra credit risk we are taking over and above the risk of investment grade alternatives. The difficulty with high yield-rated debt these days is that the credit quality is concerning to us. We see increased leverage at high yield-rated borrowers and weaker protections for lenders (i.e., bond and loan investors like us). Both are symptoms of the historically expensive market in prior years. Looking at the risk-versus-reward equation, we see that the yield (or reward) is higher, but so is the risk, which is why we think that high yield-rated debt is not that enticing even though it is more attractive from a yield perspective than it has been in a long time. Having said that, we don't like to paint markets with a broad brush. We're always looking for attractively-priced investments, and we have found attractive credit investments here and there.

As a general statement, we believe that the best investment opportunity these days is in investment-grade bonds. Specifically, as yields increase, we try to buy longer duration investment-grade bonds. We do this based on risk and reward and upside versus downside. We do not do this based on macroeconomic views because we are not macroeconomic investors. We don't know where rates are going to go or when. We don't tweet about

16

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

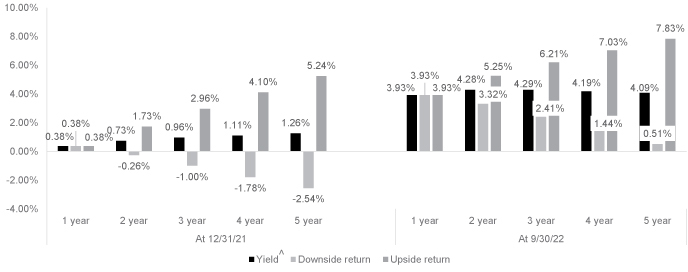

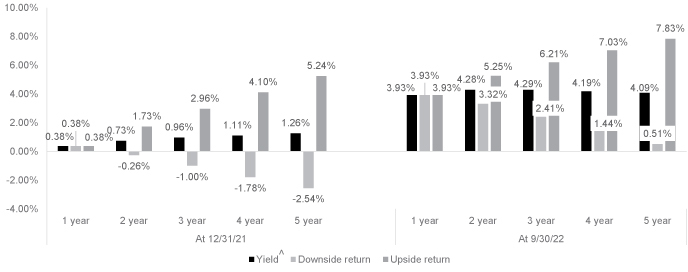

what we think the bond market is going to do, and we don't speculate on which parts of the market are going to outperform. Instead, we focus on absolute value investing. In other words, we strive to be bond investors, not bond speculators. To that end, we determine the duration of our investments by following our aforementioned 100 bps duration test which is illustrated below using Treasuries.

Hypothetical 12-month Treasury Returns

Source: Bloomberg. ^ Yield-to-Maturity is the total return anticipated on a bond if the bond is held until it matures and assumes all payments are made as scheduled and are reinvested at the same rate. The expected return assumes no change in interest rates over the next 12 months. Upside return estimates the 12-month total return assuming yields decline by 100 bps over 12 months. Downside return estimates the 12-month total return assuming yields increase by 100 bps over 12 months. Simulated 12-month total return scenarios assume 100 basis point gradual increase or decrease in interest rates over 12 months. The hypothetical stress test data provided herein is for illustrative and informational purposes only, and is intended to demonstrate the mathematical impact of a change in interest rates on Treasury yields. No representation is being made that any account, product or strategy will or is likely to achieve profits, losses, or results similar to those shown. Hypothetical results do not reflect trading in actual accounts, and does not reflect the impact that economic, market or other factors may have on the management of the account. Hypothetical results have certain inherent limitations and are designed with the benefit of hindsight. There are frequently sharp differences between simulated results and the actual results subsequently achieved by any particular account, product or strategy.

Past performance is no guarantee, nor is it indicative, of future results.

The left-hand side of the chart above represents our opportunity set as of the end of 2021 and the right-hand side represents our opportunity set as of the end of September 2022. The dark blue bars on each side show the yield on Treasury maturities of 1 to 5 years. The green bars show the results of our 100 bps duration test. For example, at the end of 2021, a 2-year Treasury purchased at a yield of 0.73% would produce a return of -0.26% if yields increased by 100 bps over 12 months. Based on this analysis, in 2021, we focused our investment activity on bonds with a duration between 1 and 2 years, which is where our duration test would breakeven.

17

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

The light blue bars show the upside return potential that's available if yields were to decrease by 100 bps over 12 months. Using the 2-year treasury at the end of 2021 again as an example, if the yield were to decrease by 100 bps, the 2-year Treasury would have a potential upside return of 1.73%. It's hard to contemplate that upside being realized because a 100 bps decrease in yield results in a meaningfully negative yield. Negative yields are or were possible, but that outcome highlights the leap of faith one has to make to realize upside return in a really expensive market.

At the end of September 2022, a 5-year Treasury purchased at a yield of 4.09% would generate a downside return of 0.51% if that bond's yield increased by 100 bps over the next 12 months. On the other hand, if yields on the 5-year Treasury were to decline by 100 bps over the next 12 months, the potential upside return is 7.83%. Because yields have risen so much, we now have on our menu not only the opportunities of a short-duration fund but also the opportunities of a core bond fund. Higher yields on longer duration bonds allow us to maintain our downside protection against rates rising an additional 100 bps from today while significantly improving the upside return potential if yields decline. We believe that over time, this investment approach of maintaining downside protection while opportunistically buying better upside potential will help us deliver an attractive return with less volatility, much as we have done in the past.14 With that in mind, we have been actively buying incrementally longer duration bonds and gradually increasing the duration of the portfolio.

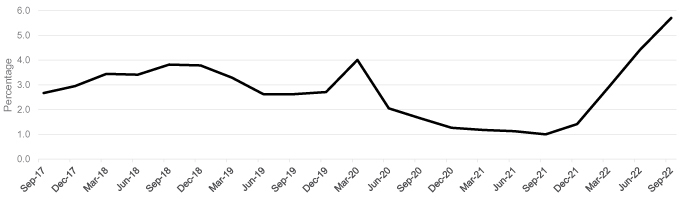

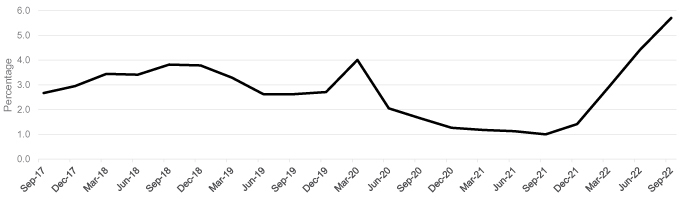

Because of our active management, higher yields and our efforts to take advantage of the current environment, the Fund's yield-to-worst is higher than it has been in years, without significantly extending the Fund's duration and without meaningfully increasing its credit exposure.15

FPA New Income Yield-to-worst

Source: FactSet. As of September 30, 2022. Portfolio composition will change due to ongoing management of FPNIX. Yield-to-Worst ("YTW") is presented gross of fees and expenses and reflects the lowest possible yield on a callable bond without the issuer defaulting. It does not represent the yield an investor should expect to receive. As of September 30, 2022, the FPNIX subsidized/unsubsidized 30-day standardized SEC yield ("SEC Yield") was 3.23%/3.06% respectively. The SEC Yield calculation is an annualized measure of FPNIX's dividend and

14 Past performance is no guarantee, nor is it indicative, of future results.

15 Over the past five years, the Fund's exposure to credit sensitive (BBB & below) securities ranged from 5.2%-11.5%. As of September 30, 2022, the exposure was 9.7%, which is within that range. Over the past five years, the Fund's effective duration ranged from 1.1-1.9 years. As of September 30, 2022, the Fund had duration of 1.7 years, which is within that range.

18

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

interest payments for the last 30 days, less FPNIX expenses. Subsidized yield reflects fee waivers and/or expense reimbursements during the period. Without waivers and/or reimbursements, yields would be reduced. Unsubsidized yield does not adjust for any fee waivers and/or expense reimbursements in effect. The SEC Yield calculation is based on the price of FPNIX at the beginning of the month. The SEC Yield calculation shows investors what they would earn in yield over the course of a 12-month period if FPNIX continued earning the same rate for the rest of the year.

Past performance is no guarantee, nor is it indicative, of future results.

With that said, investors are understandably concerned about yields rising further and may be wondering whether it's better to own short maturity Treasury bonds rather than other investment-grade bonds or the Fund. Investors may think they cannot go wrong or cannot be faulted for owning short maturity Treasury bonds. On the contrary, we believe that investors can indeed make a mistake by only owning short maturity Treasuries.

First, it's worth noting that Treasuries, like any other bond, can lose money over short periods of time. 1-year and 2-year Treasury bonds have experienced mark-to-market losses year-to-date. It's also worth noting that the Fund's returns year-to-date have been better than 2-year Treasury bonds, even after fees (see two charts below).16

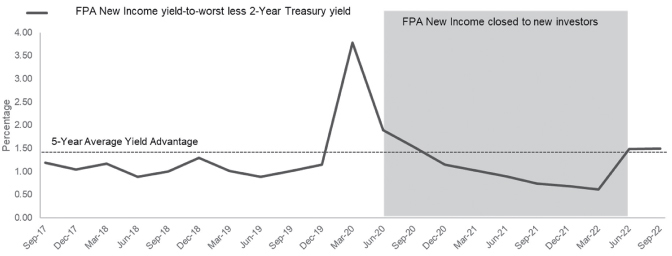

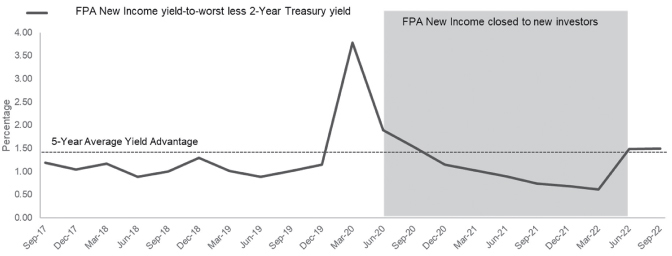

Second, we believe there is an opportunity cost to owning short maturity Treasuries. Owning short maturity Treasuries means giving up the extra yield that is available on other highly rated bonds like AAA-rated asset-backed securities, agency guaranteed mortgages, investment grade corporates, etc. As a measure of this extra yield, the chart below shows the difference between the yield-to-worst on New Income and the 2-year Treasury over time. The extra yield available in New Income — or the opportunity cost of owning Treasuries — is the highest it has been in five years, excluding the COVID-induced selloff in March 2020. The reason the Fund has this yield advantage is because of our security selection, predominantly in investment-grade bonds.

FPA New Income Yield Advantage over 2-Year Treasury (%)

Source: Factset, Bloomberg. Data from 9/30/2017-9/30/2022. Shaded areas reflect when FPNIX was soft-closed, August 2020 through June 2022.

16 Year-to-date through 9/30/2022, the Fund's return after fees was -3.37% and 2-year Treasury return was -4.76%.

19

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

(As an aside, the grey highlighted area in this chart marks the time period where the Fund was soft-closed. We had soft-closed the Fund in 2020 because we didn't see a lot of value in bonds and we didn't think there was a great opportunity to earn more than Treasuries. Indeed, the Fund had a below-average yield advantage for much of the time that it was soft-closed. The opportunity set is much more attractive now which is why the Fund was re-opened earlier this year.)

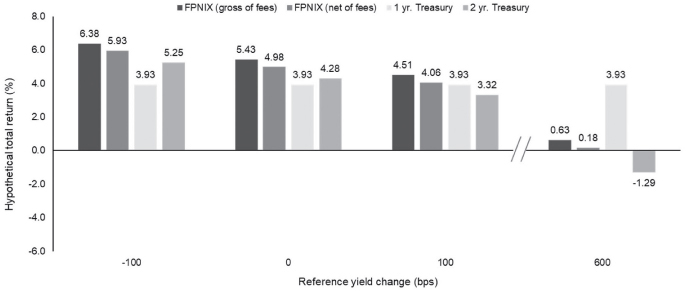

The opportunity cost of owning Treasuries can also be seen when comparing potential returns under various interest rate scenarios. Short maturity Treasuries do not have the upside return potential that longer bonds can offer when yields decline but, at the same time, short maturity Treasuries also do not offer as much downside protection when yields increase.

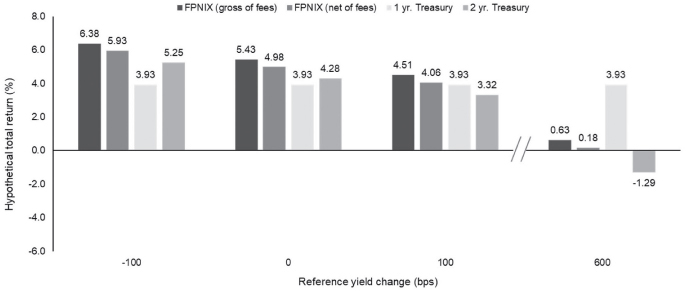

The chart below compares potential returns for the Fund over the next 12 months versus the potential returns from owning a 1-year Treasury or a 2-year Treasury. We believe the 2-year Treasury is the more appropriate comparison to the Fund given that the Fund has a duration closer to 2 years than 1 year. For each change in risk-free rates — not spreads — shown on the X-axis, the bars show the expected total return over the next 12 months before and after fees, assuming that yields change in a gradual and parallel manner over 12 months, bonds or not bought or sold and maturing bonds are not reinvested. The 1-year Treasury return equals the yield under all scenarios because a 1-year Treasury is expected to mature at par. We observe:

• From a downside perspective, the Fund could endure a 600 bps increase in yield and have a positive return after fees. A 1-year Treasury would have a higher return in this scenario. A two-year Treasury would lose money, giving New Income a nearly 1.5% return advantage after fees.

• When comparing the 1-year Treasury and the Fund, the breakeven point occurs around a 125 bps increase in yields, which is where an investor would be indifferent between New Income and a 1-year Treasury. In other words, if you feel strongly that yields will rise by more than 125 bps, own a 1-year Treasury.

• If yields increase by 100 bps, the Fund could return more than the one-year Treasury after fees. Compared to the 2-year Treasury, the Fund could return 74 bps more after fees, a greater than 20% improvement over the Treasury return.

• From an upside perspective, if yields decline by 100 bps over the next 12 months, the Fund could have a return advantage after fees of 200 bps over the 1-year Treasury. Under the same scenario, the Fund could have a nearly 70 bps return advantage over the 2-year Treasury after fees, a greater than 10% improvement over the Treasury return.

20

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

As of 9/30/2022. Fees of 0.45% are used for net of fee calculation. The Chart shows the hypothetical impact of rate changes on the portfolio's performance in one year as of the month end noted assuming: (i) a gradual shift in yield over a 12-month period; (ii) zero reinvestment rate; (iii) new securities are not purchased to replace securities that mature within the 12 months. The hypothetical performance is presented gross of investment management fees, transactions costs, and operating expenses, which if included, would reduce the returns presented. Stress Test data is hypothetical and provided for illustrative purposes only, and is intended to demonstrate the mathematical impact of changes in yield. No representation is being made that FPNIX will or is likely to achieve results similar to those shown. Hypothetical results do not reflect trading in actual accounts, and does not reflect the impact that economic or market factors might have on the results shown. Hypothetical results have certain inherent limitations. There are frequently sharp differences between simulated results and the actual results subsequently achieved by any particular account, product or strategy.

In today's market, we think Treasuries are attractive. However, we do not own short maturity Treasuries because we think the upside-versus-downside in longer Treasuries is too compelling. We also do not limit ourselves to Treasuries because we think the Fund's investors will ultimately be better off also owning other investment grade bonds which are also compelling. In summary, by adding duration in a disciplined manner, we believe that New Income offers a lot of downside protection while also offering upside return that short maturity Treasuries don't offer.

We understand that investors may be shell-shocked by the mark-to-market losses that they may have experienced on their fixed income investments this year. Over the past 30 to 40 years, bonds usually made money and, when they have lost money, those losses have paled in comparison to this year's bond market losses. As such, this year has been hard for investors to fathom. There is a temptation to climb into a hole and wait for things to get better, but the danger in doing that is missing the opportunity to make attractive long-term investments.

21

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

There's also a temptation to try to bet on what's going to happen with inflation and where rates are going to go. Macroeconomic forecasting is hard. Even the Fed can't get it right despite the resources at its disposal. That's not a criticism; that's just a recognition of how hard it is to forecast the economy and markets. We repeat what we have said many times before: if investors truly believe they can see the future and have a lot of conviction about when rates are going to move, in what direction and by how much, then investors should not own our funds or any other bond funds because we believe investors can make more money trading Treasuries themselves, owning more or less duration depending on their views. For those who believe they fall into this camp, we encourage an honest self-assessment — were you prescient enough to predict this year's rate increases, act accordingly and make money?

We cannot see the future nor do we try to. We can merely see the numbers in front of us, which tell us that, from an absolute return perspective, bonds are more attractive than they have been in at least a decade. There's a lot not to like in the world, but history shows that some of the best buying opportunities come when everyone else is pessimistic. To be clear, we are not calling a market bottom. No one can do that. No one is going to ring a bell and tell us now is the time to buy. Bonds are appealing to us because ultimately the investment boils down to the math, particularly for investment-grade bonds. Assuming that we will be repaid at par on our bonds, then we can see today what our return will be and we can measure the mark-to-market risk. Of course, yields can go higher and prices can go lower, but we think we can buy bonds today at yields and prices that will still result in positive returns over short periods of time even if yields rise further, within reason. There may be some short-term mark-to-market losses due to lower prices if yields rise further but, at today's yields, we believe that pain is mitigated (maybe even avoided) because now there is meaningfully more yield available to offset potential price declines and we are set up for potentially attractive long-term returns. That investment thesis is not based on a speculative bet on rates; that's just the math of bonds.

In summary, bonds have had a historically bad year thus far, but the silver lining is that yields and potential future returns are more attractive than they have been in a long time. We do not like to lose money, even temporarily. While we are disappointed that our returns have not met our high standards so far this year, investors should be pleased about their decision to invest in the Fund given that the Fund's relative performance is better year-to-date than its comparative indices, and better than the Morningstar Short-Term Bond Category, generally, over the past one-year. What matters now is whether investors take advantage of the opportunities in front of them. Low yields may have been nice because they drove up prices in the short term, but they reduced long-term prospective returns. Going forward, though the process of getting to higher yields is painful, we believe investors are ultimately better off long-term with higher yields.

Those who have known us for a long time know that we don't get excited about anything. Our glass is always half empty and about to break. This is the first time in over a decade that we are excited about the investing opportunities we see. With the higher yields and increased volatility that we are seeing this year, we are reminded of some advice from a very wealthy individual who once told us that getting rich is easy: just buy when everyone else is selling. Right now, everyone is selling. We think it's a good time to buy.

22

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

Appendix: Attribution and portfolio activity for the fiscal year ending September 30, 2022

Portfolio Attribution17

Largest contributors to performance:

• Asset-backed securities (ABS) backed by servicer advances

• Ginne Mae project loan interest only bonds

There were other individual bonds that contributed to performance during the fiscal year but there were no other meaningful contributors at the sector level.

Largest detractors from performance:

• Treasuries

• ABS backed by auto loans or leases

• ABS backed by equipment

Portfolio Activity

| | % Portfolio

9/30/2022 | | % Portfolio

9/30/2021 | |

ABS | | | 66.3 | | | | 52.3 | | |

Mortgage Backed (CMO) | | | 5.2 | | | | 5.9 | | |

Stripped Mortgage-backed | | | 0.4 | | | | 0.5 | | |

Corporate | | | 5.8 | | | | 3.8 | | |

CMBS | | | 10.7 | | | | 8.7 | | |

Mortgage Pass-through | | | 2.0 | | | | 0.1 | | |

U.S. Treasury | | | 9.0 | | | | 28.3 | | |

Cash and equivalents | | | 0.6 | | | | 0.4 | | |

Total | | | 100.0 | % | | | 100.0 | % | |

Yield-to-worst18 | | | 5.70 | % | | | 1.00 | % | |

Effective Duration (years) | | | 1.71 | | | | 1.32 | | |

Average Life (years) | | | 2.44 | | | | 1.63 | | |

Important Disclosures

This Commentary is for informational and discussion purposes only and does not constitute, and should not be construed as, an offer or solicitation for the purchase or sale of any securities, products or services discussed, and neither does it provide investment advice. Any such offer or solicitation shall only be made pursuant to the Fund's Prospectus, which supersedes the information contained herein in its entirety.

17 This information is not a recommendation for a specific security or sector and these securities/sectors may not be in the Fund at the time you receive this report. The information provided does not reflect all positions purchased, sold or recommended by FPA during the fiscal year ending September 30, 2022. The portfolio holdings as of the most recent quarter-end may be obtained at www.fpa.com.

18 Please refer to Footnote 1 for important information regarding Yield-to-Worst and SEC Yield.

Past performance is no guarantee, nor is it indicative, of future results.

23

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

The views expressed herein and any forward-looking statements are as of the date of the publication and are those of the portfolio management team. Future events or results may vary significantly from those expressed and are subject to change at any time in response to changing circumstances and industry developments. This information and data has been prepared from sources believed reliable, but the accuracy and completeness of the information cannot be guaranteed and is not a complete summary or statement of all available data. You should not construe the contents of this document as legal, tax, accounting, investment or other advice or recommendations.

Abhijeet Patwardhan has been portfolio manager for the Fund since November 2015. Thomas Atteberry managed/co-managed the Fund from November 2004 through June 2022. Effective July 1, 2022, Mr. Atteberry transitioned to a Senior Advisory role. There were no material changes to the investment process due to this transition.

Portfolio composition will change due to ongoing management of the Fund. References to individual securities or sectors are for informational purposes only and should not be construed as recommendations by the Fund, the portfolio manager, the Adviser, or the distributor. It should not be assumed that future investments will be profitable or will equal the performance of the security or sector examples discussed. The portfolio holdings as of the most recent quarter-end may be obtained at www.fpa.com.

The statements made herein may be forward-looking and/or based on current expectations, projections, and/or information currently available. Actual results may differ from those anticipated. The portfolio manager and/or FPA cannot assure future results and disclaims any obligation to update or alter any statistical data and/or references thereto, as well as any forward-looking statements, whether as a result of new information, future events, or otherwise. Such statements may or may not be accurate over the long-term.

Investments, including investments in mutual funds, carry risks and investors may lose principal value. Capital markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. The Fund may purchase foreign securities, including American Depository Receipts (ADRs) and other depository receipts, which are subject to interest rate, currency exchange rate, economic and political risks; this may be enhanced when investing in emerging markets. Foreign investments, especially those of companies in emerging markets, can be riskier, less liquid, harder to value, and more volatile than investments in the United States. The securities of smaller, less well-known companies can be more volatile than those of larger companies.

The return of principal in a bond fund is not guaranteed. Bond funds have the same issuer, interest rate, inflation and credit risks that are associated with underlying bonds owned by the Fund. Lower rated bonds, convertible securities and other types of debt obligations involve greater risks than higher rated bonds.

Interest rate risk is the risk that when interest rates go up, the value of fixed income instruments, such as bonds, typically go down and investors may lose principal value. Credit risk is the risk of loss of principal due to the issuer's failure to repay a loan. Generally, the lower the quality rating of a fixed income instrument, the greater the risk that the issuer will fail to pay interest fully and return principal in a timely manner. If an issuer defaults the fixed income instrument may lose some or all of its value.

Mortgage securities and collateralized mortgage obligations (CMOs) are subject to prepayment risk and the risk of default on the underlying mortgages or other assets; such derivatives may increase volatility. Convertible securities are generally not investment grade and are subject to greater credit risk than higher-rated investments. High yield securities can be volatile and subject to much higher instances of default.

24

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

Collateralized debt obligations ("CDOs"), which include collateralized loan obligations ("CLOs"), collateralized bond obligations ("CBOs"), and other similarly structured securities, carry additional risks in addition to interest rate risk and default risk. This includes, but is not limited to: (i) distributions from the underlying collateral may not be adequate to make interest or other payments; (ii) the quality of the collateral may decline in value or default; and (iii) the complex structure of the security may not be fully understood at the time of investment and may produce disputes with the issuer or unexpected investment results. Investments in CDOs are also more difficult to value than other investments.

Value style investing presents the risk that the holdings or securities may never reach their full market value because the market fails to recognize what the portfolio management team considers the true business value or because the portfolio management team has misjudged those values. In addition, value style investing may fall out of favor and underperform growth or other styles of investing during given periods.

The ratings agencies that provide ratings are Standard and Poor's, Moody's, and Fitch. Credit ratings range from AAA (highest) to D (lowest). Bonds rated BBB or above are considered investment grade. Credit ratings of BB and below are lower-rated securities (junk bonds). High-yielding, non-investment grade bonds (junk bonds) involve higher risks than investment grade bonds. Bonds with credit ratings of CCC or below have high default risk.

Please refer to the Fund's Prospectus for a complete overview of the primary risks associated with the Fund.

The Fund is not authorized for distribution unless preceded or accompanied by a current prospectus. The prospectus can be accessed at: https://fpa.com/request-funds-literature.

Index / Category Definitions

Comparison to any index is for illustrative purposes only and should not be relied upon as a fully accurate measure of comparison. The Fund will be less diversified than the indices noted herein and may hold non-index securities or securities that are not comparable to those contained in an index. Indices will hold positions that are not within the Fund's investment strategy. Indices are unmanaged, do not reflect any commissions, fees or expenses which would be incurred by an investor purchasing the underlying securities. The Fund does not include outperformance of any index or benchmark in its investment objectives. Investors cannot invest directly in an index.

Bloomberg U.S. Aggregate Bond Index provides a measure of the performance of the U.S. investment grade bonds market, which includes investment grade U.S. Government bonds, investment grade corporate bonds, mortgage pass-through securities and asset-backed securities that are publicly offered for sale in the United States. The securities in the Index must have at least 1 year remaining in maturity. In addition, the securities must be denominated in U.S. dollars and must be fixed rate, nonconvertible, and taxable.

Bloomberg U.S. Aggregate 1-3 Year Bond Index provides a measure of the performance of the U.S. investment grade bonds market, which includes investment grade U.S. Government bonds, investment grade corporate bonds, mortgage pass-through securities and asset-backed securities that are publicly offered for sale in the United States. The securities in the Index must have a remaining maturity of 1 to 3 years. In addition, the securities must be denominated in U.S. dollars and must be fixed rate, nonconvertible, and taxable.

Bloomberg U.S. High Yield Index measures the market of USD-denominated, non-investment grade, fixed-rate, taxable corporate bonds.

25

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

The Consumer Price Index (CPI) is an unmanaged index representing the rate of the inflation of U.S. consumer prices as determined by the U.S. Department of Labor Statistics. There can be no guarantee that the CPI will reflect the exact level of inflation at any given time. This index reflects non-seasonally adjusted returns.

CPI + 100 bps is the measure of the CPI plus an additional 100 basis points.

JPM Leveraged Loan Index is designed to mirror the investable universe of U.S. dollar institutional leveraged loans, including U.S. and international borrowers (issuers from developed countries are included; issuers from developing countries are excluded). The index is composed of all fully funded term loan facilities trading the syndicated loan market.

Morningstar Short-term Bond Category portfolios invest primarily in corporate and other investment-grade U.S. fixed-income issues and typically have durations of 1.0 to 3.5 years. These portfolios are attractive to fairly conservative investors, because they are less sensitive to interest rates than portfolios with longer durations. Morningstar calculates monthly breakpoints using the effective duration of the Morningstar Core Bond Index in determining duration assignment. Short-term is defined as 25% to 75% of the three-year average effective duration of the Morningstar Core Bond Index. As of September 30, 2022, there were 603 funds in this category.

Other Definitions

Basis Point (bps) is equal to one hundredth of one percent, or 0.01%. 100 basis points = 1%.

Coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity.

Corporate holdings include bank debt, corporate bonds and common stock.

Credit Spread or Spread is the difference in yield between a U.S. Treasury bond and another debt security of the same maturity but different credit quality

A discount margin to maturity is the average expected return of a floating-rate security (typically a bond) that's earned in addition to the index underlying, or reference rate of, the security. The size of the discount margin depends on the price of the floating- or variable-rate security.

Effective Duration (years) is the duration calculation for bonds with embedded options. Effective duration takes into account that expected cash flows will fluctuate as interest rates change.

Mark-to-market is a method of measuring the fair value of accounts that can fluctuate over time, such as assets and liabilities.

Maximum drawdown is the maximum observed loss from a peak to a trough of a portfolio, before a new peak is attained. Maximum drawdown is an indicator of downside risk over a specified time period.

The nominal rate of return is the amount of money generated by an investment before factoring in expenses such as taxes, investment fees, and inflation.

Nominal yield is the coupon rate on a bond.

A bond premium occurs when the price of the bond has increased in the secondary market. A bond might trade at a premium because its interest rate is higher than current rates in the market.

Real return is what is earned on an investment after accounting for taxes and inflation.

Real yield is the nominal yield of a bond minus the rate of inflation

26

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

Reflation is a fiscal or monetary policy designed to expand output, stimulate spending, and curb the effects of deflation, which usually occurs after a period of economic uncertainty or a recession.

Repo (Repurchase Agreement) is a form of short-term borrowing for dealers in government securities.

The risk-free rate reflects the yield of the Treasury bond matching the investment's duration.

Sharpe Ratio measures risk-adjusted performance. The Sharpe ratio is calculated by subtracting the risk-free rate — such as that of the 10-year U.S. Treasury bond — from the rate of return for a portfolio and dividing the result by the standard deviation of the portfolio returns.

Sortino Ratio differentiates between good and bad volatility in the Sharpe ratio. This differentiation of upwards and downwards volatility allows the calculation to provide a risk-adjusted measure of a security or fund's performance without penalizing it for upward price changes.

Weighted Average Life (years) is the average length of time that each dollar of unpaid principal on a loan, a mortgage or an amortizing bond remains outstanding.

Yield to Maturity is the rate of return anticipated on a bond if held until the end of its lifetime. YTM is considered a long-term bond yield expressed as an annual rate. The YTM calculation takes into account the bond's current market price, par value, coupon interest rate and time to maturity. It is also assumed that all coupon payments are reinvested at the same rate as the bond's current yield.

©2022 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted by Morningstar to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

The FPA Funds are distributed by UMB Distribution Services, LLC, ("UMBDS"), 235 W. Galena Street, Milwaukee, WI, 53212. UMBDS is not affiliated with FPA.

27

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

The discussions of Fund investments represent the views of the Fund's managers at the time of this report and are subject to change without notice. References to individual securities are for informational purposes only and should not be construed as recommendations to purchase or sell individual securities.

FUND RISKS

Investments in mutual funds carry risks and investors may lose principal value. Stock markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. The funds may purchase foreign securities which are subject to interest rate, currency exchange rate, economic and political risks: this may be enhanced when investing in emerging markets. The securities of smaller, less well-known companies can be more volatile than those of larger companies. The return of principal in a bond fund is not guaranteed. Bond funds have the same issuer, interest rate, inflation and credit risks that are associated with underlying bonds owned by the fund. Lower rated bonds, convertible securities and other types of debt obligations involve greater risks than higher rated bonds. Mortgage securities and collateralized mortgage obligations (CMOs) are subject to prepayment risk and the risk of default on the underlying mortgages or other assets; derivatives may increase volatility. High yield securities can be volatile and subject to much higher instances of default.

FORWARD LOOKING STATEMENT DISCLOSURE

As mutual fund managers, one of our responsibilities is to communicate with shareholders in an open and direct manner. Insofar as some of our opinions and comments in our letters to shareholders are based on our current expectations, they are considered "forward-looking statements" which may or may not prove to be accurate over the long term. While we believe we have a reasonable basis for our comments and we have confidence in our opinions, actual results may differ materially from those we anticipate. You can identify forward-looking statements by words such as "believe," "expect," "may," "anticipate," and other similar expressions when discussing prospects for particular portfolio holdings and/or the markets, generally. We cannot, however, assure future results and disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise. Further, information provided in this report should not be construed as a recommendation to purchase or sell any particular security.

28

FPA NEW INCOME, INC.

HISTORICAL PERFORMANCE

(Unaudited)

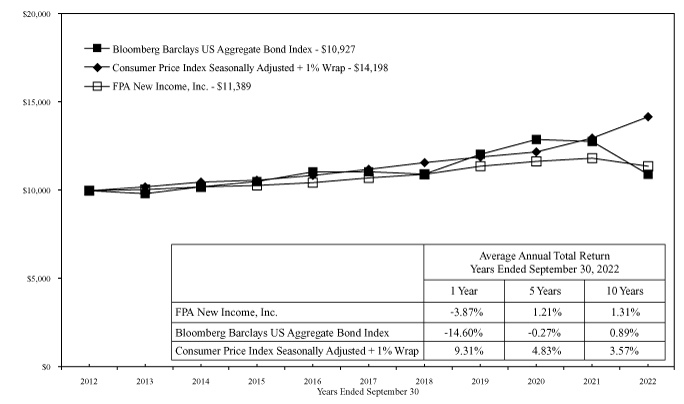

Change in Value of a $10,000 Investment in FPA New Income, Inc. vs. Barclays U.S. Aggregate Index and Consumer Price Index + 100 Basis Points from October 1, 2012 to September 30, 2022. The Average Annual Total Return table and Growth of Assumed $10,000 Investment graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past performance is not indicative of future performance. The Bloomberg Barclays U.S. Aggregate Bond Index a broad-based unmanaged composite of four major subindexes: U.S. Government Index; U.S. Credit Index; U.S. Mortgage-Backed Securities Index; and U.S. Asset-Backed Securities Index. The index holds investment quality bonds. The Consumer Price Index is an unmanaged index representing the rate of inflation of U.S. consumer prices as determined by the US Department of Labor Statistics. The performance of the Fund and of the Averages is computed on a total return basis which includes reinvestment of all distributions.

Past performance is no guarantee of future results, and current performance may be higher or lower than the performance shown. This data represents past performance, and investors should understand that investment returns and principal values fluctuate, so that when you redeem your investment it may be worth more or less than its original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Current month-end performance data can be obtained by visiting the website at www.fpa.com or by calling toll-free, 1-800-982-4372. Information regarding the Fund's expense ratio and redemption fees can be found in the Financial Highlights section of this report.

The Prospectus details the Fund's objective and policies, charges, and other matters of interest to prospective investors. Please read the prospectus carefully before investing. The Prospectus may be obtained by visiting the website at www.fpa.com, by email at crm@fpa.com, toll-free by calling 1-800-982-4372 or by contacting the Fund in writing.

29

FPA NEW INCOME, INC.

PORTFOLIO SUMMARY

September 30, 2022

Common Stocks | | | | | 1.2 | % | |

Energy | | | 0.5 | % | | | | | |

Industrials | | | 0.6 | % | | | | | |

Retailing | | | 0.1 | % | | | | | |

Bonds & Debentures | | | | | 98.2 | % | |

Asset-Backed Securities | | | 66.3 | % | | | | | |

Commercial Mortgage-Backed Securities | | | 11.1 | % | | | | | |

U.S. Treasuries | | | 9.0 | % | | | | | |

Residential Mortgage-Backed Securities | | | 7.2 | % | | | | | |

Corporate Bank Debt | | | 2.5 | % | | | | | |

Corporate Bonds & Notes | | | 2.1 | % | | | | | |

Short-term Investments | | | | | 0.7 | % | |

Other Assets And Liabilities, Net | | | | | (0.1 | )% | |

Net Assets | | | | | 100.0 | % | |

30

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS

September 30, 2022

COMMON STOCKS | | Shares or

Principal

Amount | | Fair

Value | |

ENERGY — 0.5% | |

PHI Group, Inc., Restricted(a)(b)(c)(m) | | | 3,806,420 | | | $ | 47,580,250 | | |

| | | $ | 47,580,250 | | |

INDUSTRIALS — 0.6% | |

Boart Longyear Group Ltd.(d)(m) | | | 43,018,605 | | | $ | 60,537,070 | | |

| | | $ | 60,537,070 | | |

RETAILING — 0.1% | |

Copper Earn Out Trust(a)(b)(c) | | | 69,361 | | | $ | 381,486 | | |

Copper Property CTL Pass Through Trust(a)(b)(c) | | | 520,208 | | | | 6,762,704 | | |

| | | $ | 7,144,190 | | |

| TOTAL COMMON STOCKS — 1.2% (Cost $139,264,410) | | $ | 115,261,510 | | |

BONDS & DEBENTURES | |

COMMERCIAL MORTGAGE-BACKED SECURITIES — 11.1% | |

AGENCY — 3.1% | |

Federal Home Loan Mortgage Corp. K057 A2 — 2.570% 7/25/2026 | | $ | 87,324,000 | | | $ | 81,197,479 | | |

Federal Home Loan Mortgage Corp. K058 A2 — 2.653% 8/25/2026 | | | 13,173,000 | | | | 12,239,941 | | |

Federal Home Loan Mortgage Corp. K054 A2 — 2.745% 1/25/2026 | | | 3,600,000 | | | | 3,405,051 | | |

Federal Home Loan Mortgage Corp. K066 A2 — 3.117% 6/25/2027 | | | 7,223,000 | | | | 6,775,983 | | |

Federal Home Loan Mortgage Corp. K065 A2 — 3.243% 4/25/2027 | | | 9,702,802 | | | | 9,192,060 | | |

Federal Home Loan Mortgage Corp. K051 A2 — 3.308% 9/25/2025 | | | 38,614,000 | | | | 37,175,327 | | |

Federal Home Loan Mortgage Corp. K061 A2 — 3.347% 11/25/2026 | | | 78,855,000 | | | | 75,067,815 | | |

Federal Home Loan Mortgage Corp. K073 A2 — 3.350% 1/25/2028 | | | 2,600,000 | | | | 2,448,870 | | |

Federal Home Loan Mortgage Corp. K062 A2 — 3.413% 12/25/2026 | | | 41,061,276 | | | | 39,131,589 | | |

Federal Home Loan Mortgage Corp. K063 A2 — 3.430% 1/25/2027 | | | 16,539,000 | | | | 15,766,341 | | |

Federal Home Loan Mortgage Corp. K072 A2 — 3.444% 12/25/2027 | | | 11,587,000 | | | | 10,971,680 | | |

| | | $ | 293,372,136 | | |

AGENCY STRIPPED — 0.4% | |

Government National Mortgage Association 2012-25 IO —

0.000% 8/16/2052(e) | | $ | 11,743,715 | | | $ | 55 | | |

Government National Mortgage Association 2012-45 IO —

0.000% 4/16/2053(e) | | | 1,114,031 | | | | 4 | | |

Government National Mortgage Association 2013-45 IO —

0.093% 12/16/2053(e) | | | 22,996,479 | | | | 55,447 | | |

Government National Mortgage Association 2012-125 IO —

0.172% 2/16/2053(e) | | | 38,957,248 | | | | 182,558 | | |

Government National Mortgage Association 2014-157 IO —

0.192% 5/16/2055(e) | | | 25,227,866 | | | | 249,574 | | |

31

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2022

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair

Value | |

Government National Mortgage Association 2013-125 IO —

0.206% 10/16/2054(e) | | $ | 9,222,771 | | | $ | 116,926 | | |

Government National Mortgage Association 2015-169 IO —

0.262% 7/16/2057(e) | | | 46,115,987 | | | | 748,822 | | |

Government National Mortgage Association 2014-110 IO —

0.271% 1/16/2057(e) | | | 18,772,232 | | | | 287,936 | | |

Government National Mortgage Association 2015-19 IO —

0.282% 1/16/2057(e) | | | 28,649,772 | | | | 487,189 | | |

Government National Mortgage Association 2015-41 IO —

0.292% 9/16/2056(e) | | | 7,487,900 | | | | 124,442 | | |

Government National Mortgage Association 2015-108 IO —

0.322% 10/16/2056(e) | | | 1,557,741 | | | | 38,859 | | |

Government National Mortgage Association 2014-153 IO —

0.327% 4/16/2056(e) | | | 40,660,068 | | | | 621,400 | | |

Government National Mortgage Association 2015-150 IO —

0.364% 9/16/2057(e) | | | 7,762,212 | | | | 194,111 | | |

Government National Mortgage Association 2012-79 IO —

0.388% 3/16/2053(e) | | | 47,384,848 | | | | 418,413 | | |

Government National Mortgage Association 2012-150 IO —

0.487% 11/16/2052(e) | | | 18,030,548 | | | | 141,370 | | |

Government National Mortgage Association 2016-65 IO —

0.507% 1/16/2058(e) | | | 31,049,309 | | | | 806,810 | | |

Government National Mortgage Association 2015-7 IO —

0.514% 1/16/2057(e) | | | 19,957,071 | | | | 428,077 | | |

Government National Mortgage Association 2014-175 IO —

0.561% 4/16/2056(e) | | | 71,552,398 | | | | 1,632,554 | | |

Government National Mortgage Association 2014-138 IO —

0.579% 4/16/2056(e) | | | 6,007,593 | | | | 127,657 | | |

Government National Mortgage Association 2014-77 IO —

0.607% 12/16/2047(e) | | | 13,970,952 | | | | 171,526 | | |

Government National Mortgage Association 2012-114 IO —

0.621% 1/16/2053(e) | | | 17,413,614 | | | | 255,484 | | |

Government National Mortgage Association 2014-187 IO —

0.628% 5/16/2056(e) | | | 74,596,142 | | | | 1,828,038 | | |

Government National Mortgage Association 2016-125 IO —

0.828% 12/16/2057(e) | | | 60,821,931 | | | | 2,340,738 | | |

Government National Mortgage Association 2020-75 IO —

0.871% 2/16/2062(e) | | | 102,242,273 | | | | 6,726,765 | | |

Government National Mortgage Association 2020-42 IO —

0.937% 3/16/2062(e) | | | 128,704,971 | | | | 8,802,699 | | |

32

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2022

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair

Value | |

Government National Mortgage Association 2016-106 IO —

0.978% 9/16/2058(e) | | $ | 89,025,383 | | | $ | 3,940,112 | | |

Government National Mortgage Association 2020-71 IO —

1.087% 1/16/2062(e) | | | 56,511,141 | | | | 4,179,592 | | |

Government National Mortgage Association 2020-43 IO —

1.260% 11/16/2061(e) | | | 43,215,922 | | | | 3,406,720 | | |

| | | $ | 38,313,878 | | |

NON-AGENCY — 7.6% | |

A10 Bridge Asset Financing 2021-D A1FX — 2.589% 10/1/2038(f) | | $ | 9,411,850 | | | $ | 8,907,715 | | |

A10 Bridge Asset Financing LLC 2020-C A — 2.021% 8/15/2040(f) | | | 1,229,928 | | | | 1,215,953 | | |

ACRE Commercial Mortgage Ltd. 2021-FL4 A, 1M USD LIBOR +

0.830% — 3.823% 12/18/2037(e)(f) | | | 11,562,681 | | | | 11,441,622 | | |

ACRES Commercial Realty Ltd. 2021-FL1 A, 1M USD LIBOR +

1.200% — 4.139% 6/15/2036(e)(f) | | | 59,792,000 | | | | 58,714,255 | | |

ACRES Commercial Realty Ltd. 2021-FL2 A, 1M USD LIBOR +

1.400% — 4.339% 1/15/2037(e)(f) | | | 13,444,000 | | | | 12,986,689 | | |

Arbor Realty Commercial Real Estate Notes Ltd. 2022-FL1 A,

SOFR30A + 1.450% — 3.735% 1/15/2037(e)(f) | | | 57,822,000 | | | | 56,763,395 | | |

Arbor Realty Commercial Real Estate Notes Ltd. 2021-FL1 A,

1M USD LIBOR + 0.970% — 3.788% 12/15/2035(e)(f) | | | 54,525,000 | | | | 53,522,362 | | |

Arbor Realty Commercial Real Estate Notes Ltd. 2021-FL2 A,

1M USD LIBOR + 1.100% — 3.918% 5/15/2036(e)(f) | | | 45,859,000 | | | | 44,965,038 | | |

Arbor Realty Commercial Real Estate Notes Ltd. 2021-FL4 A,

1M USD LIBOR + 1.350% — 4.168% 11/15/2036(e)(f) | | | 59,062,000 | | | | 58,146,592 | | |

Arbor Realty Commercial Real Estate Notes Ltd. 2022-FL2 A,

1M TSFR + 1.850% — 4.695% 5/15/2037(e)(f) | | | 35,540,000 | | | | 35,042,596 | | |