Pay Me Now, Say Closed-End Fund Holders

BY RANDALL W. FORSYTH

SHOW ME THE MONEY. That’s apparently what investors in closed-end funds want to see these days.

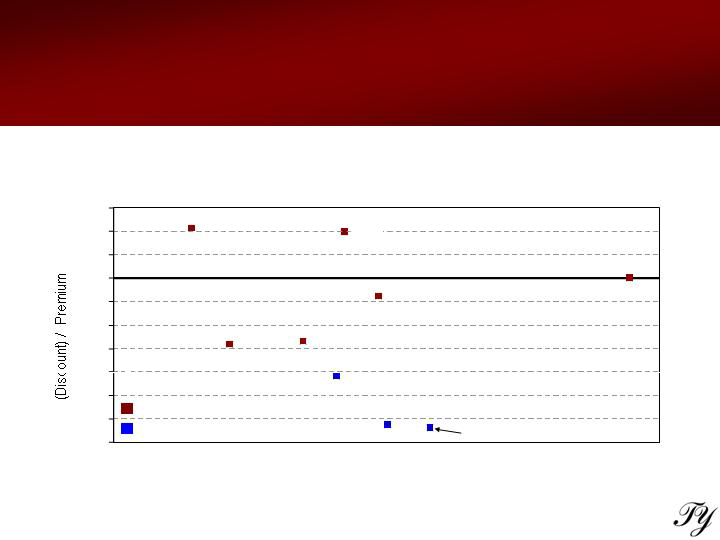

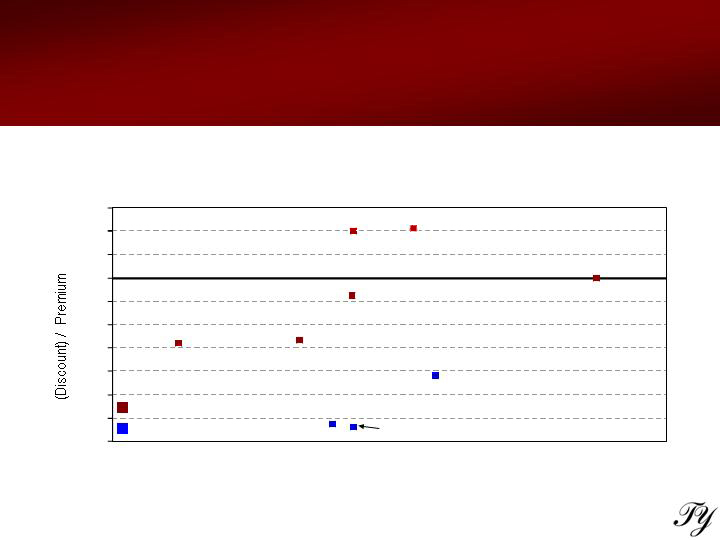

Closed-end funds that have chosen to share the wealth with their shareholders have seen their share prices rise sharply recently. But that doesn’t necessarily make these funds a good buy in every case.

The most recent example is Tri-Continental Corp. (ticker: TY), which was discussed in this space last year (“Diamond in the Rough? Nov. 15.) I wrote then that the venerable fund — whose initial public offering took place back in 1929, and is managed by the even more venerable J&W Seligman, whose roots extend all the way back to the Civil War — offered the opportunity to invest in a portfolio of blue-chip stocks at 87 cents on the dollar.

While the stock market was shuttered for Good Friday, Tri-Continental announced an agreement to include a proposal in the proxy statement for the 2007 annual meeting to make quarterly distributions equal to 2.75% of net-asset value (11% annually). At the same time, Tri-Continental also announced an agreement with a shareholder group including Western Investment that it would not to pursue a proxy fight at the election of directors at the annual meeting.

The news resulted in a 5% jump in Tri-Continental’s shares after investors returned from their Easter holiday, with over 1 million shares traded Monday, more than eight times the daily average. While shareholders won’t vote on the proposed change in payout policy until the annual meeting May 30, the stock’s pop implies the market think it’s a good bet to be passed.

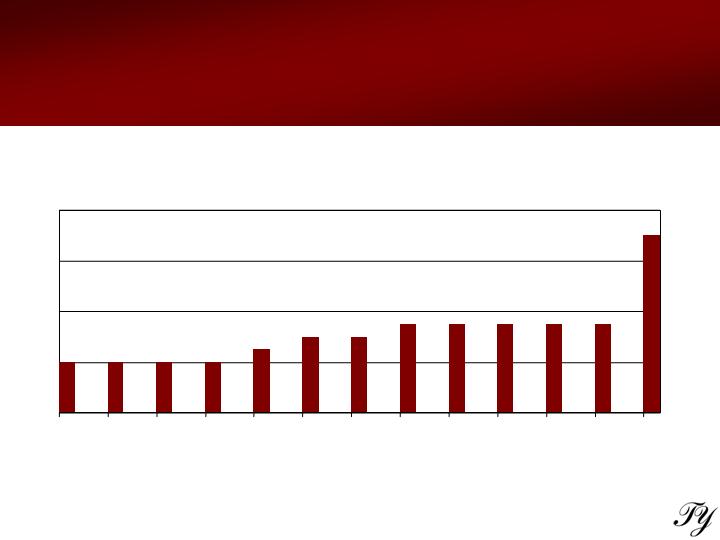

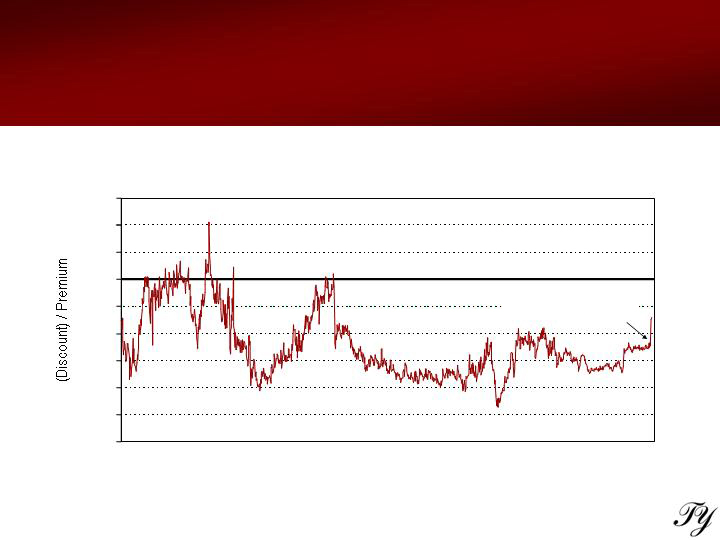

Monday’s jump effectively cut Tri-Continental’s share price’s discount from NAV by a third, to 7.42%, according to ETFConnect.com. As much as anything, trimming that discount was the aim of the activist shareholders. (For an explanation of the workings of CEFs, see “Closed-End Funds 101,” June 7.)

Regular generous payouts match the needs of Tri-Continental shareholders, many of whom are retirees looking for current income, says Art Lipson of Western Investment, which owns the closed-end fund. If these shareholders needed cash, their only recourse was to sell off a slice of their holdings, resulting in a persistent double-digit discount, he explains.

A jump in payout yielded also yielded big returns for the Boulder Growth & Income Fund (BIF.) In February, it announced a 15% increase in the monthly dividend, putting it up to 14.6% of its then-current NAV. Moreover, the February, March and April payouts would represent a return of capital to shareholders, making them free from taxes.

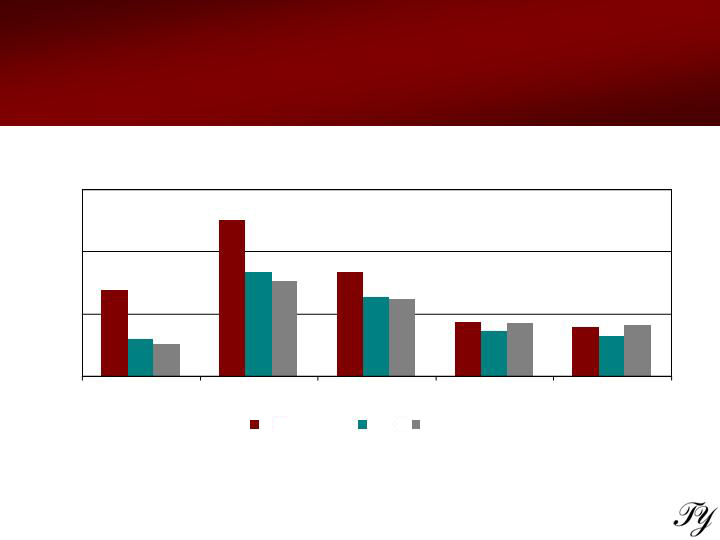

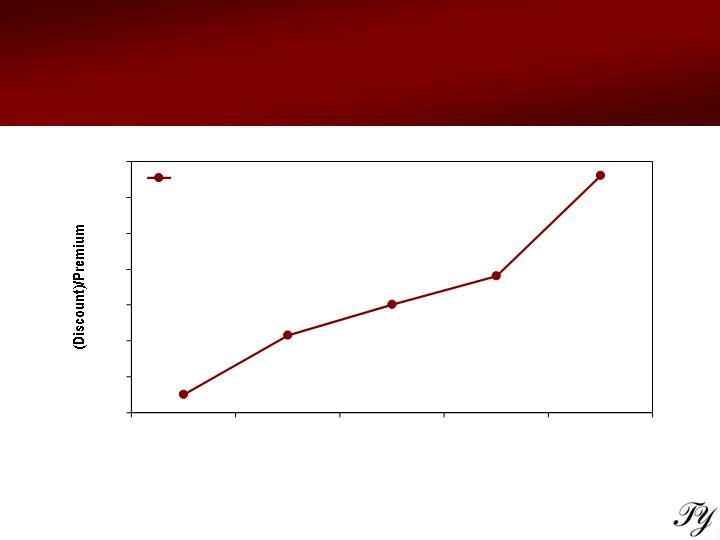

Even though Boulder simply was handing back their own money to shareholders in that event, the stock soared, returning 28.67% in the first quarter, tops among all closed-end funds. In the process, Boulder Growth & Income’s premium over NAV swelled to a huge 40% by Monday.

What’s especially ironic about Boulder Growth & Income’s fat premium is that its biggest holding is Berkshire Hathaway A shares (BRK.A), which comprised almost 26% of the fund’s holdings, as of Nov. 30. Berkshire’s Warren Buffett made his billions by buying a dollar’s worth of assets for a handful of cents, not $1.40.

Yield hogs appear to be behind the run-up in Boulder Growth & Income, which only a year ago sold at a modest discount of 7.65%. But CEFs that balloon to huge premiums for dubious reasons can deflate quickly. (Perhaps reflecting that, BIF dropped a hefty 5% in Tuesday’s trading.)

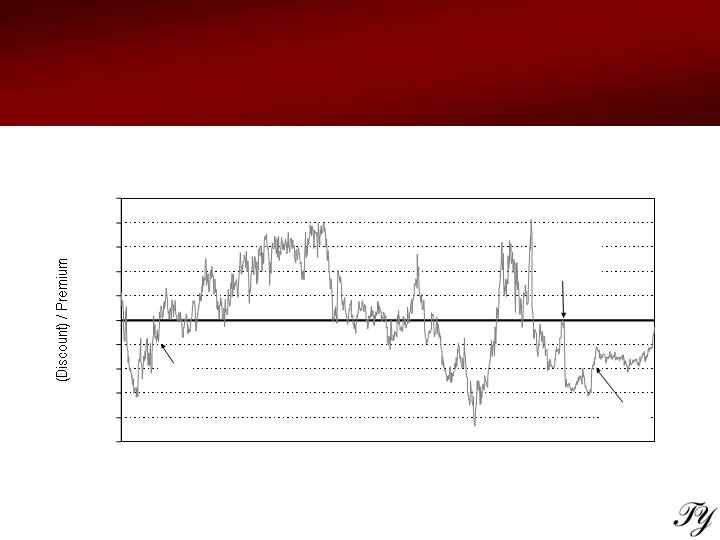

In another example, the shares of Morgan Stanley Global Opportunity Bond Fund (MGB) suffered a negative total return of 15.81% during the first quarter — even though its assets returned a positive 2.34% for the same span.

How could that be? Like the British sports car of 1960s and 1970s, MGB was a lively performer until it broke down. By Feb. 28, its shares fetched a huge, 34.5% premium. As risky assets took a hit in the next month, MGB’s shares plunged from 11 and change to eight bucks — about 27%. During that violent sell-off, MGB’s NAV edged down a mere three pennies, to $8.20.

But that’s the thing about closed-end funds. Sometimes they get bid up to crazy premiums, often by unsophisticated investors who don’t look beyond their current yield. Others languish at undeserved discounts, sometimes for frustratingly long stretches for value buyers.

Yet, as Western Investment’s Lip-son points out, holders of Tri-Conti-

| | |

|

THE PUBLISHER’S SALE OF THIS REPRINT DOES NOT CONSTITUTE OR IMPLY ANY ENDORSEMENT OR SPONSORSHIP OF ANY PRODUCT, SERVICE, COMPANY OR ORGANIZATION |

JOURNALREPRINTS (609) 520-4328 P.O. BOX 300 PRINCETON, NJ 08543-0300. DO NOT EDIT OR ALTER REPRINTS, REPRODUCTIONS NOT PERMITTED |

|

|

|

nental at a 7% discount would actually realize a higher yield than holders of CEFs that have hefty payout policies but fetch a fat premium.

For instance, Boulder Growth & Income yields a hair over 11% based on its $1.38 annual dividend and Tuesday’s close of 12.51, which represents about a 35% premium over NAV. If, as proposed, Tri-Continental pays out 11% of its NAV, the yield on its shares trading at a 7.4% discount would be 11.9%.

Value investors like to say good things happen to cheap stocks. That also goes for cheap closed-end funds — and vice versa.

Diamond in the Rough?

BY RANDALL W. FORSYTH

WHAT IF YOU COULD BUY the Dow Industrials at right around its midsummer lows, before it embarked on its nice 13% advance? What if you could pocket those gains with little, if any, tax consequences?

It is possible. Tri-Continental Corp. (ticker: TY), one of the oldest closed-end funds extant, is offering this free lunch. But Tri-Continental’s manager, the even more venerable J&W Seligman, doesn’t think it’s such a hot idea for you partake in it.

Tri-Continental dates back to the Roaring’ Twenties, offered to the public just months before the Great Crash, by J&W Seligman, whose roots go back before the Civil War. From the original $52 million in common and preferred shares originally sold in January 1929, Tri-Continental has grown to a formidable $2.5 billion fund.

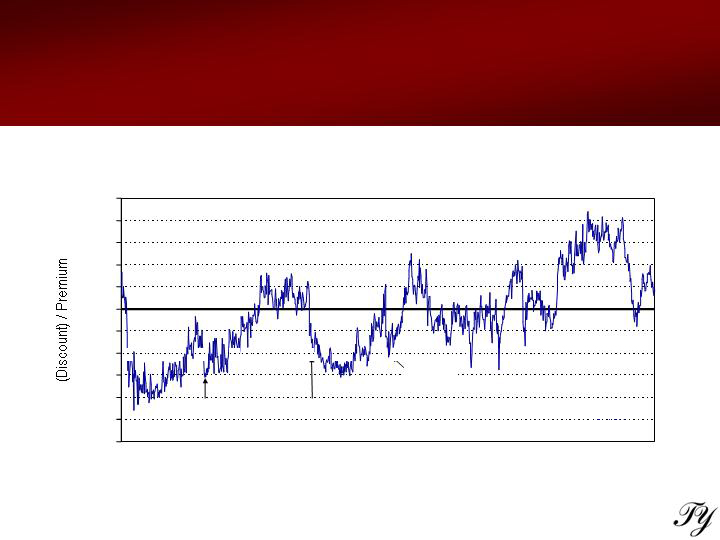

As with many older closed-end funds, Tri-Continental trades at a persistent discount to its net-asset value. (For an explanation of the mechanics of closed-end funds, see my June 7 column, “Closed-End Funds 101.”) Tri-Continental’s shares closed at $21.75 Monday, a 12.58% discount to its NAV of $24.88, according to ETF-Connect.com.

The possibility of buying $1.00 of assets for about 87 cents is the biggest attraction of closed-end funds. Sometimes there are good reasons for that discount. High expenses often weigh down closed-end funds; some are laden with expense ratios that are half-again or even twice that of the typical open-end funds, for which shareholders pay a hefty 1.5% on average. That’s not the case with Tri-Continental, which has a rather thrifty 0.74% expense ratio.

Older funds, either closed- or open-end, can have an embedded capital gains liability, A fund may have bought a stock years ago, and held onto them as they went from pennies to dollars. That’s great; it’s what’s made Warren Buffett a billionaire.

But because of the way mutual funds work, latecomers can get socked with a big tax bill if those shares purchased long ago at low prices are sold — even if they didn’t get to participate in their upswing. It’s like getting the hangover without having been to the party.

That doesn’t apply to Tri-Continental. According to its latest financials, it had a total accumulated loss of $228.6 million, as of June 30. The stock market’s recent rally probably has narrowed some of those losses, but it’s unlikely that that it produced a significant gain.

Tri-Continental’s portfolio looks a lot like the Dow, which is up about 13% from its mid-summer lows, and it has moved pretty much in lockstep with the blue chip average. Moreover, one of the reasons for closed-end funds to trade at a discount is that some hold illiquid securities, in which case the market gives a haircut to the portfolio’s valuation, which can be iffy in such cases.

That hardly describes Tri-Continental. Eight of its top 10 holdings are Dow stocks — General Electric (GE), Exxon Mobil (XOM), Altria (MO), Citigroup (C), Microsoft (MSFT), JPMorgan Chase (JPM), Chevron (CVX), and Pfizer (PFE). Add in another blue chip, Bank of America (BAC), and you’ve got 20% of the portfolio.

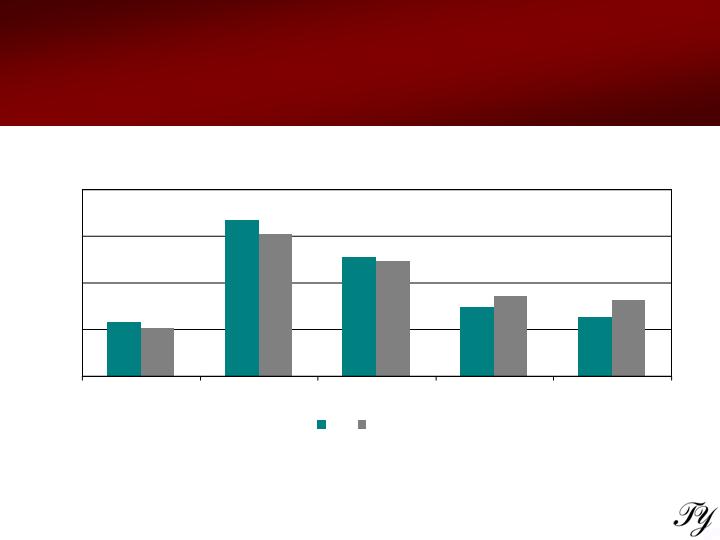

Over the three years ended Sept. 30, Tri-Continental returned 12.40%, based on its NAV, a hair better than the Standard & Poor’s 500’s return of 12.29%. In other words, it has roughly performed in line with the market.

You’d think the ability to buy the market for 87 cents on the dollar — and to pocket those 13 cents — would be irresistible. And you’d be right. Various activist hedge funds have been pressing Tri-Continental to take steps to narrow or eliminate the discount. This year, Western Investment Hedged Partners sought to elect a slate of directors, which Tri-Continental was able to fend off at a special election.

Western Investment’s Art Lipson says the process of unlocking the discount in a closed-end fund such as Tri-Continental frequently is a long one. “It may take one year or five,” he says, but in about 90% of the cases, the funds eventually take steps to shrink the discount.

This can be done by a tender offer or open ending the fund, which the funds invariably oppose. Why? Says another activist, somewhat cynically, it’s because those steps reduce assets and thus the fund’s fees. (As for Seligman, Tri-Continental’s manager, no comment was provided by deadline.)

Regardless if the activists are successful in getting at Tri-Continental’s discount, fund investors mulling a large-cap fund or an exchange-traded fund such as the Diamonds Trust

| | |

|

THE PUBLISHER’S SALE OF THIS REPRINT DOES NOT CONSTITUTE OR IMPLY ANY ENDORSEMENT OR SPONSORSHIP OF ANY PRODUCT, SERVICE, COMPANY OR ORGANIZATION |

JOURNALREPRINTS (609) 520-4328 P.O. BOX 300 PRINCETON, NJ 08543-0300. DO NOT EDIT OR ALTER REPRINTS, REPRODUCTIONS NOT PERMITTED |

|

|

|

(DIA) could consider this alternative. At a 13% discount, you might say Tri-Continental is a Diamond in the rough.