Annual Report

September 30, 2019

LEUTHOLD FUNDS

| Leuthold Core Investment Fund | Leuthold Global Fund |

| Retail Class Shares LCORX | Retail Class Shares GLBLX |

| Institutional Class Shares LCRIX | Institutional Class Shares GLBIX |

| | |

| Leuthold Select Industries Fund | Grizzly Short Fund |

| LSLTX | GRZZX |

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Funds’ annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website https://funds.leutholdgroup.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically anytime by contacting your financial intermediary (such as a broker-dealer or a bank) or, if you are a direct investor, by calling 1-800-273-6886, sending an e-mail request to publicinfo@sec.gov, or by enrolling at https://funds.leutholdgroup.com.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Funds, you can call 1-800-273-6886 or send an email request to publicinfo@sec.gov to let the Funds know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds held in your account if you invest through your financial intermediary or all Funds held with the fund complex if you invest directly with the Funds.

The Securities and Exchange Commission has not approved or disapproved these securities or determined if this semi-annual report is accurate or complete. Any representation to the contrary is a criminal offense. An investment in the Funds is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Inside Cover - blank

The Leuthold Funds

Dear Fellow Shareholders:

One year ago, cyclical conditions seemed to be as strong as ever, with analysts and financial journalists, alike, endorsing the stock market like a stock analyst with a “BUY” recommendation. Contrary to that pervasive optimism, our market analysis was suggesting a cautious posture. The divergent picture supplied by our indicators reminded us of a peculiar “SELL” recommendation we came across nearly 30 years ago. The internal memo cited confusingly incompatible reasons for endorsing a “sell”: booming new orders, a record backlog, recent increases in selling prices, and a big dividend hike to boot. The rationale for “selling” instead read like reasons for a “Strong BUY” recommendation. At closer look, that cryptic sell memo’s summary statement explained, “Business conditions are so good that they’re unlikely to show material improvement in the year ahead.” Within a few weeks, the subject stock of that memo made a cyclical (and, in retrospect, “terminal”) price high and the company subsequently failed.

Reminiscent of the counsel from that 30-year-old sell memo’s summary explanation, were business conditions and optimism also “too good” in October 2018? It seems so. Our cautionary stance turned out to be warranted; the S&P 500 fell to within 0.1% of correction territory last October and proceeded to decline until breaching that threshold the day after Thanksgiving. A fast and furious six-day 6% rally ensued, followed by a two-day collapse in early December that was deep enough to challenge the November low. Global central bank liquidity was eroding with the U.S. economy operating beyond full employment and with domestic valuations still historically rich. When Christmas Eve arrived—not with snowfall but with a single-day market freefall of 3%—Leuthold tactical accounts were defensively aligned with 30% net equities. The December 24th decline was the worst-ever recorded for the last trading day before Christmas. Amidst that day’s decline, our tactical accounts took the opportunity to cover a portion of the equity hedge at the lows, lifting exposure back up to 37% from 30%.

That late-2018 stock market setback was the fifteenth S&P 500 decline of 19% or more since WWII, and trader sentiment took a sharp blow. But long-term optimism among consumers and investors was deeply embedded, and stocks bounced 16.2% from the Christmas Eve low through early February 2019. Market breadth accompanying that rally was compelling. The consensus view—with a Powell Put in the back pocket—was that a run toward new highs for U.S. stocks was likely. The strong rebound was persuasive enough that we allowed tactical Funds’ net equity allocations to drift up alongside the market, to around 45%. Our market analysis then officially improved from negative to neutral, so net equities were actively increased to over 50% by April.

Despite the impressive rebound, our quantitative stock market model never improved beyond its neutral zone. The cyclical negatives continued to pile up and, combined with a nudge from May’s technical action, the model moved back down to negative territory at the end of May. Tactical Funds’ net equity exposure was reduced to 45% in response, and it remained at that level through fiscal year end.

U.S. equity valuations are very high, global business cycle indicators continue to erode, and long-term technical non-confirmations remain in place. The chart shows that most equities are not sharing the same experience of the large caps, reflected by the inability of these indices to follow suit with the S&P 500’s repeated attempts to challenge prior highs. However, long-term non-confirmations can persist for many months with no ill effects. One concession for the bulls is that sentiment has stayed remarkably restrained in the face of the market’s stubborn rise. The gradual loss of enthusiasm, though, during the final phase of a bull market likely reflects the underperformance of broadly diversified equity portfolios. Mid caps, small caps, and foreign stocks usually fail to keep up with the blue-chip averages in the later stages of the cycle.

| The Leuthold Funds - 2019 Annual Report | 1 |

Through September 30th, it has now been 20 months since global stocks peaked on January 26th, 2018. Those lucky enough to have been invested solely in the S&P 500 and held on for the volatile ride from that point forward, would have a return of +3.6% to show for it. Those who prudently sought to “de-worsify” away from expensive U.S. large caps have paid a heavy price. Returns for mid, small, and micro-cap stocks are at -3%, -3%, and -12%, respectively, since the January 2018 top; EAFE and Emerging Market index results are -14% and -21%, respectively.

The silver lining is that the global bear market, in terms of length, is well advanced. Among many value-oriented, cyclical, non-U.S., and/or small cap stocks, it is quite well advanced based on price as well. Two-tiered markets like the current one eventually present active managers with career-making opportunities, as experienced by those who resisted the overvalued mega caps in early 2000. In that unusual case, the best day to sell the S&P 500 (March 24th, 2000) turned out to be an outstanding day to buy everything else that had been out of favor up to that time.

This year’s rebound closely tracks the 1998-99 rally, and leadership has become just as dangerously concentrated. We don’t expect an identical buying opportunity as 2000, but one never knows. Following the March 2000 stock market peak, the economy expanded for eleven more months while large cap growth investors racked up large losses—losses of which undoubtedly contributed to the onset of the 2001 recession. A similar economic sequence is likely to play out in 2020 if U.S. large caps break down in coming months.

The last decade has been incredible for the S&P 500—but that’s partly because the index was oversold almost half the time in the prior decade (2000-2009). The 2009-2019 experience has been truly passively driven, “set it and forget it” for investment success. The upcoming ten years are likely to be much more challenging; however, we expect this will present the conditions for active managers to add great value and demonstrate the benefits of having flexibility to adjust asset exposures and shift between the range of equity styles as needed.

| 2 | The Leuthold Funds - 2019 Annual Report |

ANNUAL PERFORMANCE REVIEW

Tactical Asset Allocation—Domestic & Global

The Leuthold Core Investment Fund and Leuthold Global Fund began the fiscal year with a cautious stance toward the stock market. Net equity exposure for each averaged about 40% during the fourth quarter of 2018, thus both Funds fared well versus their respective 100% equity benchmarks as the market sold off in December. As a response to the December plunge, the Fed capitulated and eased off its policy guidance for “measured tightening,” emphasizing that it would be patient with future rate decisions. The market rallied and our quantitative work began to improve due to strong momentum across price indices and breadth measures. By April, these factors had driven our stance up to a neutral posture toward stocks and the net equity positions were lifted to the 54% range. This was short-lived, as technical gauges and economic trends deteriorated, pushing our indicators back to a negative outlook in June. Net equities were cut back to 45% and remained there through fiscal year end.

For the twelve months through September, the Leuthold Core Investment Fund posted a +1.21% total return (retail share class). Its peer group, Morningstar Tactical Allocation, trailed the Leuthold Core Investment Fund with a total return of -0.32%. The fully invested S&P 500 benchmark produced a +4.25% total return.

The Leuthold Global Fund had a -3.97% total return for the fiscal year (retail share class), lagging its peer-fund category, the Morningstar World Allocation average (+1.50% total return) by nearly 550 basis points. Compared to the fully invested MSCI All Country World Index (ACWI) +1.38% total return, the Leuthold Global Fund underperformed by a similar spread.

Underperformance disparities versus each Fund’s fully invested benchmark are partially linked to long stock allocations being confined at much lower levels during the strong rallies of the last twelve months. Further widening of the performance gaps was directly related to long equity results.

Tactical Long Equity Exposure

The monthly-average long stock position during the fiscal year was 56% for both Leuthold tactical Funds. Mirroring U.S. stocks’ dominance over foreign stocks, there was a conspicuous difference between the two Funds’ equity results; the Leuthold Core Investment Fund’s U.S.-traded stocks returned +1.13%, in contrast to the more globally concentrated Leuthold Global Fund’s equity performance of -7.26%. The Leuthold Core Investment Fund’s long equity segment was behind its benchmark’s corresponding allotment by 300 basis points, and the Leuthold Global Fund’s long stock holdings lagged by an appreciably higher spread of about 860 basis points. In June, the Leuthold Core Investment Fund added a small allocation to emerging market equities, but it was not value-added through fiscal year end (-3.15%). Specifics of tactical Funds’ long stock performance will follow under “Long Equity Exposure—Domestic & Global.”

Tactical Equity Hedge

With the market freefall into the Christmas Eve low, both Funds benefited from their defensive postures. The hedge added nearly 3% to the Leuthold Core Investment Fund in the last three months of 2018, and it boosted the Leuthold Global Fund by 2%. With the ensuing stock market recovery in 2019, the equity hedge experienced gains in only two other months, May and August. For the full fiscal year, with a monthly average weight of 11-12%, the equity hedge had net negative performance, but it did not detract from either Funds’ results because the gains from earlier in the year nullified the losses.

| The Leuthold Funds - 2019 Annual Report | 3 |

Tactical Fixed Income

The Funds were underweight fixed income all year, with a 21% average weight (normal minimum is 30%). Duration was kept at the short end of the scale compared to the benchmark. Assets were spread across securities with varying risk profiles and exposures. Developed Market Sovereign Debt was the largest subclass at a 13% average weight; Quality Corporate Bonds and Emerging Market Sovereign Debt were also full-year components with small positions of 4% and 1-1.5%, respectively. MBS Bond Funds were acquired in January at an average monthly holding of 1%, while a persistent lack of inflation triggered the July sale of the 1-1.5% allocation to TIPs. All the fixed income subsets had net gains, but the bearing on performance was immaterial because of the relatively insignificant weights in relation to net returns.

We look forward to raising our fixed income stake when interest rates progress enough to create more attractive opportunities.

Commodities

This 3% portfolio share was initiated in May of 2018, due to expectations that inflation pressures were heating up while interest rates and commodities’ prices appeared to be on the upswing. The focus initially included economic exposure to a mixed basket of heavily traded commodities from the sectors of energy, industrial metals, precious metals, and agriculture. With the Fed putting the brakes on normalizing interest rates in early 2019, inflation fears diminished. That, along with the continuation of a broad-based global manufacturing sector slowdown and a weaker dollar, the cyclical case for industrial metals was no longer justifiable, so that segment of the investment was deactivated in mid-2019. The sale proceeds were added to the gold portion, which offers defense, diversification, and it benefits from a softening dollar. The Funds’ commodities allocation, overall, returned 5% for the fiscal year but it did not have a measurable effect on performance.

Long Equity Exposure—Domestic & Global

Leuthold Select Industries (SI) Fund and Leuthold Global Industries (GI) Strategy are fully invested stock portfolios. Both use the firm’s decades’ old group-based investment model—a top-down methodology which, firstly, identifies industry groups that appear poised to become market leaders in the given environment, and next, invests in a selection of representative stocks that are highly attractive using a disciplined value-oriented process. Leuthold SI Fund is the domestic version and employs U.S.-traded securities. The Leuthold GI Strategy targets at least 40% of assets in stocks traded on global exchanges outside the United States.

For the fiscal year ended September 30, 2019, the Leuthold SI Fund had a total return of -0.19%; it outperformed its peer category, Morningstar Mid Cap Blend (-1.45% total return), but lagged the relative resiliency of the S&P 500 (+4.25% total return). The Leuthold GI strategy produced an -8.52% total return (Global Industries, L.P., net performance), which trailed both the MSCI ACWI and the Morningstar World Large Stock peer category (+1.38% and +0.87% total returns, respectively).

Equity Sector And Industry Group Drivers

The Funds’ equity rotation-driven approach will often result in lopsided weights among broad sectors and industry groups versus the benchmarks. The quantitative methodology intends to find themes that appear intact to expand market leadership and/or uphold existing strength; it attempts to avoid industries that may be on the cusp of a downturn because of the market backdrop or other economic dynamics. Concentrating holdings among the highest rated industries, per our model, has proven successful in providing alpha over the long term.

| 4 | The Leuthold Funds - 2019 Annual Report |

Communication Services, Information Technology (IT), and Consumer Staples were the top three sectors that drove the U.S. stock market higher over the last twelve months; Communication Services and IT were also two of the best sector performers in the SI Fund. The IT weight in the SI Fund was about the same as that of the benchmark, at 21%, although IT group/stock selection within the Fund was far better, adding over 250 basis points over the index IT results. The SI Fund’s Communication Services average position during the year (7%) was underweight the benchmark by about 200 basis points and, while it was additive to Fund performance, having a smaller share prompted the underperformance when compared to the benchmark’s corresponding sector results. Industry group concentrations that boosted SI Fund performance from these two sectors were: Semiconductor Equipment, Data Processing/Outsourced Services, Integrated Telecom, Cable & Satellite, and Communications Equipment.

The market sectors of Consumer Discretionary, Financials, and Industrials were also strong performers for the SI Fund, each of which outpaced the benchmark’s sector returns. Among these, the SI Fund’s weight in Consumer Discretionary (22% average) and Industrials (17%) were nearly double those of the index, while it had about half (6%) of the benchmark’s Financials weight. These sectors’ outperformance in the SI Fund was attributable to a wide range of industry positions; the leading groups were: General Merchandise Stores, Homebuilding, Environmental & Facilities Services, Consumer Finance, Automotive Retail, Railroads, and Airlines.

As has been the case throughout this ten-plus-year bull market, global stocks were weak over the last twelve months in comparison to U.S. large caps. Global equity sector performance was led by Consumer Staples, Information Technology, Utilities, and Real Estate. Of those, Consumer Staples was a small positive contributor to GI Strategy return, but it was only a 1.5% average weight during the year. Utilities and Real Estate were not represented in the GI Strategy at all; hence, there was no benefit from the upside of those global sectors as reflected by the benchmark. IT was held at an overweight in the GI Strategy (23% versus the benchmark’s 15%), but industry/stock allocation was ineffective, as despite the big emphasis, its contribution to GI Strategy performance trailed the benchmark by 71 basis points. Semiconductor Equipment and Data Processing/Outsourced Services were two IT holdings in the GI Strategy that did outperform.

Consumer Discretionary and Financials were the best performing sectors in the GI Strategy and, in spite of being underweight, each outperformed the corresponding benchmark sector. This indicates that the GI Strategy’s industry selection within those sectors was especially productive. Outperforming groups related to these sectors were: Homebuilding, Consumer Finance, and Property & Casualty Insurance. Communication Services (14% average weight) and Industrials (4%) were the other small net-additive sector contributors to the GI Strategy return.

Domestically, unfavorable results came from the Health Care and Energy sectors and, among global sectors, these were also the biggest detractors, in addition to Materials. Lingering policy risks within the U.S. Health Care industry increasingly rattled investor confidence and we can point to the SI Fund’s overexposure to that sector as the key dynamic that led to its disappointing underperformance. Health Care was an average weight of 21% in the SI Fund versus the benchmark’s 15% weight and, although the position was actively reduced from 26% last October, to an underweight 12% as of fiscal year end, it was costly. The Fund experienced a loss of over 580 basis points compared to the benchmark’s 60 basis point offset from Health Care. Within the GI Strategy, Health Care was also overweight the index by the same degree as the SI Fund and it assembled a loss of 200 basis points versus the benchmark’s minimal 27 basis point downside. The SI Fund benefited from having zero Energy investments during the year, while its benchmark yielded a 130 basis point loss with its related interest. The GI Strategy, on the other hand, had an Energy overweight (12% versus the benchmark’s 6%). This impaired the GI Strategy by nearly 400 basis points against the MSCI ACWI loss of 100 basis points. The other net detractor for the GI Strategy, Materials (6% weight, on par with the benchmark), triggered a 350 basis point loss relative to the 20 basis point decline affiliated with the MSCI ACWI.

| The Leuthold Funds - 2019 Annual Report | 5 |

At the industry group level, detractors aligned with the poor sector results specific to the SI Fund included Health Care Services, Biotechnology, and Drug Retail. Managed Health Care and Health Care Facilities were letdowns for both SI and GI portfolios. GI Strategy group losses associated with Energy and Materials were plentiful. The largest involved Oil & Gas Refining, Oil & Gas Exploration, Paper & Forest Products, Diversified/Precious Metals, Integrated Oil & Gas, Steel, Commodity Chemicals, and Coal.

Global/Foreign Exposure Attribution

With the SI Fund and, to a larger extent the GI portfolio, concentrations in developed market and emerging market stocks are essentially arbitrary, the result of: 1) the composition of groups identified as quantitatively attractive; and, 2) valuation appeal based on the quantitative stock-selection model. Some industries are inclined to have a stronger presence in developed markets versus emerging markets, and the other way around.

The domestically traded Leuthold SI Fund can, at times, have a significant level of foreign stocks, which is obtained through ADR/ADS securities traded on U.S. exchanges. The degree thereof has the potential to materially affect SI Fund performance, both on an absolute basis and relative to the S&P 500. For the full fiscal year, there was an average foreign weight of 7% in the SI Fund. This broke down to 53% in developed markets (ex-U.S.) and 47% in emerging markets. As illustrated by the twelve-month MSCI ACWI Ex-USA and the MSCI EM index returns of -1.23% and -2.02%, respectively, through September 30th, the SI Fund’s foreign-domiciled stocks were a hindrance to the portfolio’s overall underperformance gap.

The Leuthold GI Strategy aims to have a minimum of 40% in foreign-traded stocks; however, specific countries or regions are not openly targeted. The quantitative approach builds the portfolio by selecting stocks across the globe that appear to best characterize the industry concentrations of which the disciplines identify as having the most attractive growth potential. During the last twelve months, on average, U.S. stocks comprised 54% of portfolio assets; developed market stocks (ex-U.S.) incorporated 33% of assets, and emerging market stocks consisted of a 13% weight. Over the fiscal year, there was little fluctuation between the three segments’ portfolio weights.

The configuration of sector/industry investments in the GI Strategy’s U.S. position was detractive to performance for the fiscal year. Alternatively, the 53% portion of its benchmark (MSCI ACWI) that is dedicated to U.S. stocks returned solid results, over 350 basis points above that of the GI Strategy. As far as GI Strategy country exposure, a handful were additive. Taiwan, Ireland, Thailand, and Denmark had profitable results; allocation weights ranged in size from 0.3% to 1.7% and each outperformed the corresponding segment of the MSCI ACWI.

The largest country detractors for the GI Strategy were Japan, Australia, United Kingdom, South Korea, Finland, and the United States. All had losses and underperformed the benchmark’s associated allocations, again indicating that the Fund’s selection of industries/stocks within these countries was not constructive. Based on the disciplines that determined industry groups in which to invest, there were 33 countries that the GI Strategy was exposed to at some point during the year.

Concerning global currency movements, the Leuthold GI Strategy does not proactively make adjustments for the effects of fluctuation. While some global investment approaches do use currency-hedging practices, they are expensive and are not guaranteed to be value-added. The GI Strategy incorporates a U.S. dollar-based relative strength component among its quantitative inputs; this aims to distinguish broad FX-market trends of which to potentially capitalize. Currency movement was generally not a big driver of portfolio performance during the last twelve months. The U.S. dollar was moderately higher over this time, up about 4%. The GI Strategy has been equal-to-overweight the dollar, which contributed about 20 basis points to the portfolio’s relative performance. During the prior fiscal year, strength in the U.S. dollar created a headwind for our global equity strategy. In the end, the forces behind U.S. dollar strength/weakness largely balance out over time, just as the last two years’ experience illustrates.

| 6 | The Leuthold Funds - 2019 Annual Report |

Short-Only Domestic Equity

The Grizzly Short Fund is 100% short individual stocks. The goal is to profit when stock prices fall. This is an actively managed and quantitative methodology that identifies mid/large cap stocks which appear to be overvalued and vulnerable to a price decline. These are companies with ample liquidity and are not thought to be at risk of going out of business.

For the fiscal year ended September 30, 2019, the Grizzly Short Fund produced a -7.62% total return, trailing the average total return of -5.46% of its peer group, the Lipper Dedicated Short Bias category. The Grizzly Short Fund also fell behind the inverse results of the S&P MidCap 400 (-2.49% total return) and the inverse S&P 500 (+4.25% total return).

The Grizzly Short Fund often has well-defined sector/group overweights and/or underweights due to the disciplines that may detect common frailties among stocks across the same industry (which results in an overweight within the Fund); industries exhibiting collective stock market strength will either be underweight or have zero allocation in the portfolio. Because the S&P 500 maintains a static allotment to sectors/industries, regardless of shifting market leadership, we expect any Grizzly Short Fund/S&P 500 sector deviations to ultimately result in a meaningful advantage for the Fund. Outsized sector/group positions in the Fund may also be a drawback during times of short-term leadership collisions or erratic market reversals.

Short-Equity Sector And Industry Group Drivers

Nine of the eleven broad sectors incorporated in the Grizzly Short Fund’s portfolio detracted from performance. The worst came from Consumer Discretionary exposure on both an absolute and relative basis; its average portfolio weight was about the same as the benchmark (14%), yet it trailed that corresponding position by 275 basis points. The Fund’s Information Technology investment was similarly detractive; despite being underweight the benchmark allocation (23% versus 26%, respectively), its result was 44 basis points worse and was subtractive by 300 basis points on the whole. Among these sectors, stocks sold short that were the most damaging to return were from the industries of: Internet & Direct Marketing Retail, Restaurants, Semiconductors, and Electronic Manufacturing Services.

The sectors of Health Care (11% weight) and Materials (7%) each detracted by 1.6% on average, while Financials (8%) and Industrials (14%) contributed 1% apiece to the year’s decline. All underperformed the benchmark’s associated sector results, with divergences ranging from -15 to -200 basis points. Group concentrations from these sectors with the most sizable effect on the Fund’s fiscal year loss included Health Care Equipment, Health Care Supplies, Gold Miners, Thrifts & Mortgage Finance, and Research/Consulting Services.

Sector losses from Utilities (2% average weight), Real Estate (2%), and Communication Services (1%) combined to detract over 120 basis points from the Grizzly Short Fund’s fiscal year return; each was underweight the benchmark. There were not any specific industries that had a particularly large influence from these areas, as losses were spread out across miscellaneous stock investments. On a relative basis, Utilities and Real Estate did outperform by losing less than the benchmark’s related shares.

| The Leuthold Funds - 2019 Annual Report | 7 |

The Energy sector (8% weight) was the sole winner for the Grizzly Short Fund over the last twelve months; it was an overweight compared to the benchmark (5%) and it outperformed by over 300 basis points. Each of the Energy group investments throughout the year had net positive contributions to return. The most successful was Oil & Gas Equipment/Services, followed by Oil & Gas Exploration/Production. The Consumer Staples sector did not have an impact on the year’s results, and it was underweight at a 5% share. In comparison, the benchmark’s 7% weight earned a loss of over 100 basis points.

As noted, unlike the static S&P 500 sector/group weights, sector concentrations and industry group compositions have the potential to fluctuate considerably in the Grizzly Short Fund. Due to that, sector and sub-industry group concentrations utilize weighting controls to avoid the vulnerability of overexposure to a limited range. There are disciplined measures incorporated that will initiate short-covering action to: 1) lock in a partial gain; or, 2) rein in a loss. In addition, the Fund’s individual stocks are similarly weighted across the portfolio. It is therefore unlikely that a select few stocks could have an overwhelming effect on performance, as is the case in a cap-weighted index like the S&P 500. Stocks in the portfolio are closely monitored on an intra-day basis and investors should expect high turnover.

It was a volatile twelve months for the stock market and the Grizzly Short Fund experienced the same performance roundtrips (up and down) on an inverse basis. Current economic uncertainty continues to weigh on the minds of investors, and the Grizzly Short Fund is situated to capitalize on impending market weakness. In the meantime, as the bull market seems to be tracing out a market top, investors should expect it to be difficult for a short-selling strategy. However, the increasingly narrow market breadth offers opportunities for the Grizzly Short Fund. Frontpage emphasis on “new market highs” disguises the level of weakness among stocks not represented by the blue-chip index headliners.

“The Broader The Top, The Deeper The Drop.” … Anonymous

On October 4th, the average global stock (measured by the equal-weighted MSCI ACWI) closed down 15.5% from its January 2018 peak, while the “ex-U.S.” version of that index is near bear territory, with a loss of 19.8%. The Value Line Arithmetic Composite—probably the best proxy for the average domestic stock portfolio—still trades about 10% below its August 2018 peak. And, it has been more than 20 months since the NYSE Composite printed a new bull market high. These numbers, buried on the back page, support our less-fashionable opinion that the action of the last 20+ months represents a drawn-out cyclical topping process. Despite record earnings, record profit margins, and an historic U-turn in Fed policy, the most weatherproof equity benchmark in the world—the S&P 500—has gained less than 4% since global stocks topped-out in January 2018.

Valuations and the economic backdrop call for extreme caution. Technically, though, the hardiness of U.S. blue chips has prevented our market analysis from suffering a serious collapse deep into the negative zone. Our tactical Funds are positioned with net equities of 45% in early October 2019, and the allotment to overvalued mega caps is especially light.

Looking forward, we think the U.S. market will eventually revisit (and probably undercut) last December’s lows. Although, a two-tiered market like the last 20 months can produce some surprising opportunities, just like the late 1990s’ two-tiered market. We’ll look to our disciplines and analysis tools to direct changes within our equity concentrations and to adjust tactical Funds’ net equity levels as needed; however, tactical equity levels will likely remain below average until valuations see a significant reset.

| 8 | The Leuthold Funds - 2019 Annual Report |

Whether the next year brings more record stock market highs, more volatility, or a bear market and a recession, Leuthold long stock portfolios have the means to navigate and do relatively well throughout. All strategies experience shortcomings and headwinds with certain market dynamics, but overall, our equity group rotation has historically guided the portfolios to concentrations of leadership in all types of markets. In unproductive conditions there will continue to be profitable themes; the goal is that our technical analyses will expose opportunities of which our portfolios can take advantage and result in outperformance against the benchmarks—and sometimes that means “losing less.” Within our tactical Funds, being effective at both preserving and growing shareholder principal entails the tall task of minimizing losses on the downside. Our quantitative disciplines and our hedging capability render our approach better equipped than most of our peers during difficult stock market environments.

This has been an unprecedented bull market, both in terms of duration and return. Currently there are many red flags, including stretched corporate balance sheets with extreme leverage, and cyclically high profitability; we believe that a very challenging phase is imminent. The timing of the ultimate U.S. market peak is the X-factor. Admittedly, we’ve been anticipating the manifestation of this for some time. Luckily, unlike most firms, our strategies are not required to follow rigid mandates and align portfolios to comply with a narrow set of stock characteristics. The flexibility built into Leuthold Funds’ investment strategies offers the latitude to adapt as market leadership and the economic environment develop through their natural cycles. We will always manage the Funds with shareholders’ interests at heart. Being shareholders, ourselves, we can assure you that we strive to obtain the best possible outcomes under the given circumstances.

We welcome you to contact us at any time if you have questions or would like to give us feedback.

Sincerely,

| | | | |

| Doug Ramsey, CFA, CMT | | | | |

| CIO & Co-Portfolio Manager | | | | |

| | | | | |

| | | | | |

| |  | |  |

| Chun Wang, CFA, PRM | | Scott Opsal, CFA | | Jun Zhu, CFA, CAIA |

| Co-Portfolio Manager | | Co-Portfolio Manager | | Co-Portfolio Manager |

| | | | | |

| | | | | |

| |  | | |

| Greg Swenson, CFA | | Kristen Perleberg, CFA | | |

| Co-Portfolio Manager | | Co-Portfolio Manager | | |

| The Leuthold Funds - 2019 Annual Report | 9 |

| 10 | The Leuthold Funds - 2019 Annual Report |

The Leuthold Funds

Expense Examples – September 30, 2019 (Unaudited)

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, including redemption fees and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held the entire period (April 1, 2019 – September 30, 2019).

Actual Expenses

The first line of the following tables provides information about actual account values and actual expenses. Although the Funds charge no sales load (the Leuthold Core Investment Fund and Leuthold Global Fund charge a 2% redemption fee for redemptions made within five business days after a purchase), you will be assessed fees for outgoing wire transfers, returned checks, or stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Funds’ transfer agent. If you request a redemption be made by wire transfer, currently a $15.00 fee is charged by the Funds’ transfer agent. To the extent that the Funds invest in shares of other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which a Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary by fund. These expenses are not included in the following examples. The examples include, but are not limited to, management fees, shareholder servicing fees, fund accounting, custody, and transfer agent fees. However, the following examples do not include portfolio trading commissions and related expenses, and extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Examples for Comparison Purposes

The second line of the following tables provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or exchange fees. Therefore, the second line of the tables is useful in comparing ongoing costs only and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| The Leuthold Funds - 2019 Annual Report | 11 |

The Leuthold Funds

Expense Example Tables (Unaudited)

Leuthold Core Investment Fund - Retail Class - LCORX

| | | Beginning

Account Value

April 1, 2019 | | Ending

Account Value

September 30, 2019 | | Expenses Paid

During Period*

April 1, 2019 - September 30, 2019 |

| Actual** | | $1,000.00 | | $1,036.10 | | $ 6.58 |

| Hypothetical (5% return before expenses)*** | | 1,000.00 | | 1,018.60 | | 6.53 |

* | Expenses are equal to the Fund’s annualized expense ratio of 1.29%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

** | Excluding dividends and interest on securities sold short, your actual cost of investment in the Fund would be $6.13 and the Fund’s annualized expense ratio would be 1.20%. |

*** | Excluding dividends and interest on securities sold short, your hypothetical cost of investment in the Fund would be $6.07 and the Fund’s annualized expense ratio would be 1.20%. |

Leuthold Core Investment Fund - Institutional Class - LCRIX

| | | Beginning

Account Value

April 1, 2019 | | Ending

Account Value

September 30, 2019 | | Expenses Paid

During Period*

April 1, 2019 - September 30, 2019 |

| Actual** | | $1,000.00 | | $1,037.10 | | $ 6.08 |

| Hypothetical (5% return before expenses)*** | | 1,000.00 | | 1,019.10 | | 6.02 |

* | Expenses are equal to the Fund’s annualized expense ratio of 1.19%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

** | Excluding dividends and interest on securities sold short, your actual cost of investment in the Fund would be $5.62 and the Fund’s annualized expense ratio would be 1.10%. |

*** | Excluding dividends and interest on securities sold short, your hypothetical cost of investment in the Fund would be $5.57 and the Fund’s annualized expense ratio would be 1.10%. |

Leuthold Global Fund - Retail Class - GLBLX

| | | Beginning

Account Value

April 1, 2019 | | Ending

Account Value

September 30, 2019 | | Expenses Paid

During Period*

April 1, 2019 - September 30, 2019 |

| Actual** | | $1,000.00 | | $1,006.50 | | $ 9.46 |

| Hypothetical (5% return before expenses)*** | | 1,000.00 | | 1,015.64 | | 9.50 |

* | Expenses are equal to the Fund’s annualized expense ratio of 1.88%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

** | Excluding dividends and interest on securities sold short, your actual cost of investment in the Fund would be $8.25 and the Fund’s annualized expense ratio would be 1.64%. |

*** | Excluding dividends and interest on securities sold short, your hypothetical cost of investment in the Fund would be $8.29 and the Fund’s annualized expense ratio would be 1.64%. |

Leuthold Global Fund - Institutional Class - GLBIX

| | | Beginning

Account Value

April 1, 2019 | | Ending

Account Value

September 30, 2019 | | Expenses Paid

During Period*

April 1, 2019 - September 30, 2019 |

| Actual** | | $1,000.00 | | $1,007.80 | | $ 8.20 |

| Hypothetical (5% return before expenses)*** | | 1,000.00 | | 1,016.90 | | 8.24 |

* | Expenses are equal to the Fund’s annualized expense ratio of 1.63%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

** | Excluding dividends and interest on securities sold short, your actual cost of investment in the Fund would be $7.00 and the Fund’s annualized expense ratio would be 1.39%. |

*** | Excluding dividends and interest on securities sold short, your hypothetical cost of investment in the Fund would be $7.03 and the Fund’s annualized expense ratio would be 1.39%. |

| 12 | The Leuthold Funds - 2019 Annual Report |

The Leuthold Funds

Expense Example Tables (Unaudited) (continued)

Leuthold Select Industries Fund - Retail Class - LSLTX

| | | Beginning

Account Value

April 1, 2019 | | Ending

Account Value

September 30, 2019 | | Expenses Paid

During Period*

April 1, 2019 - September 30, 2019 |

| Actual | | $1,000.00 | | $1,056.10 | | $7.73 |

| Hypothetical (5% return before expenses) | | 1,000.00 | | 1,017.55 | | 7.59 |

* | Expenses are equal to the Fund’s annualized expense ratio of 1.50%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half period. |

Grizzly Short Fund - Retail Class - GRZZX

| | | Beginning

Account Value

April 1, 2019 | | Ending

Account Value

September 30, 2019 | | Expenses Paid

During Period*

April 1, 2019 - September 30, 2019 |

| Actual** | | $1,000.00 | | $ 978.10 | | $ 11.65 |

| Hypothetical (5% return before expenses)*** | | 1,000.00 | | 1,013.29 | | 11.86 |

* | Expenses are equal to the Fund’s annualized expense ratio of 2.35%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half period. |

** | Excluding dividends and interest on securities sold short, your actual cost of investment in the Fund would be $7.88 and the Fund’s annualized expense ratio would be 1.59%. |

*** | Excluding dividends and interest on securities sold short, your hypothetical cost of investment in the Fund would be $8.04 and the Fund’s annualized expense ratio would be 1.59%. |

| The Leuthold Funds - 2019 Annual Report | 13 |

The Leuthold Funds

(Unaudited)

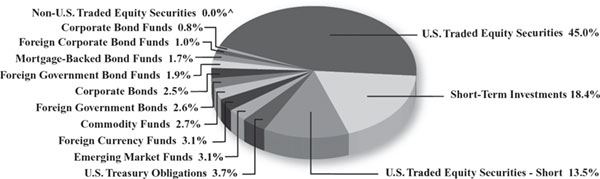

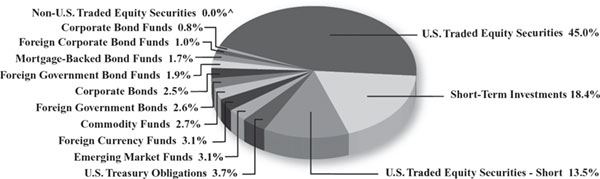

Leuthold Core Investment Fund

Allocation of Portfolio Holdings

September 30, 2019

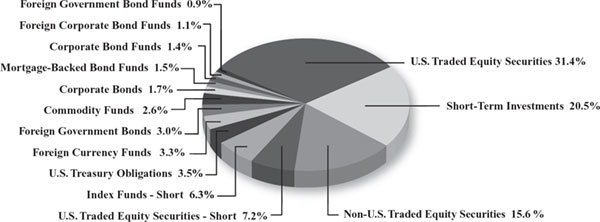

Leuthold Global Fund

Allocation of Portfolio Holdings

September 30, 2019

^ | Amount is less than 0.05%. |

Reflected as a percent of absolute value of investments and securities sold short.

| 14 | The Leuthold Funds - 2019 Annual Report |

The Leuthold Funds

(Unaudited)

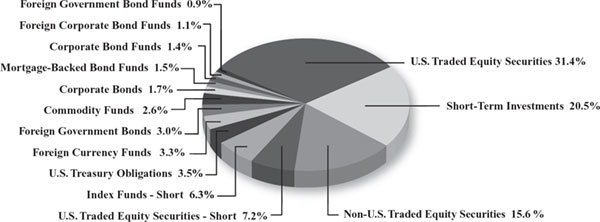

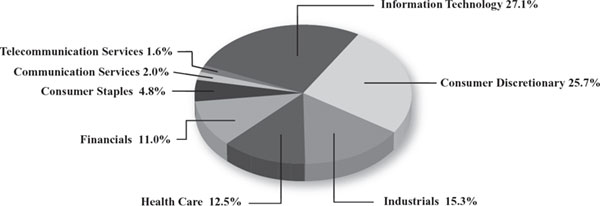

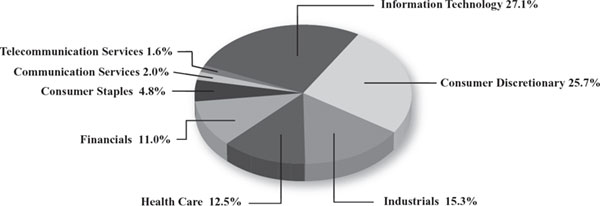

Leuthold Select Industries Fund

Allocation of Portfolio Holdings

September 30, 2019*

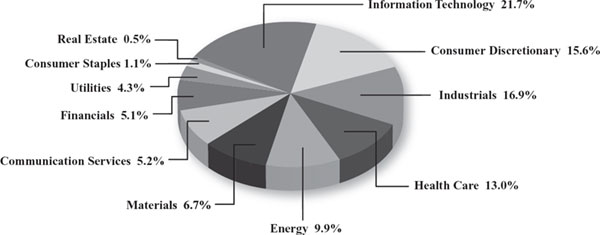

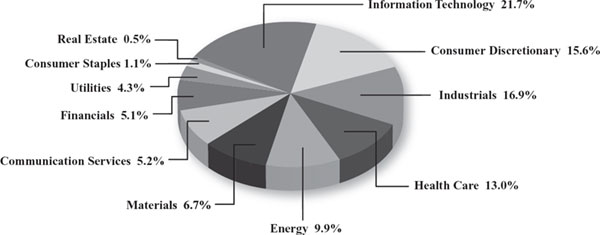

Grizzly Short Fund

Allocation of Securities Sold Short

September 30, 2019

* | Excludes short-term investments less than 5% of net assets. |

Reflected as a percent of absolute value of investments and securities sold short.

| The Leuthold Funds - 2019 Annual Report | 15 |

Leuthold Core Investment Fund - Retail Class - LCORX

(Unaudited)

Average Annual Rate of Return For Periods Ended

September 30, 2019

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | Since

Inception |

| Leuthold Core Investment Fund - Retail Class - LCORX | | 1.21% | | 6.09% | | 4.80% | | 5.62% | | 8.04% |

| Lipper Flexible Portfolio Fund Index | | 3.68% | | 7.18% | | 5.17% | | 7.36% | | 6.37% |

| S&P 500 Index | | 4.25% | | 13.39% | | 10.84% | | 13.24% | | 9.02% |

| Morningstar Tactical Allocation Index | | (0.32)% | | 4.55% | | 2.71% | | 4.51% | | 4.97% |

| Bloomberg Barclays Global Aggregate Index | | 7.60% | | 1.59% | | 1.99% | | 2.34% | | n/a |

A $10,000 investment in the Leuthold Core Investment Fund – Retail Class - LCORX

The Lipper Flexible Portfolio Funds Index is composed of funds that allocate investments across various asset classes with a focus on total return, as defined by Lipper.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks, which represent all major industries.

The Morningstar Tactical Allocation Index is comprised of funds that incorporate a tactical asset allocation strategy which is the process by which the asset of a fund is changed on a short-term basis to take advantage of perceived differences in relative values of the various asset classes.

The Bloomberg Barclays Global Agregate Index provides a broad-based measure of the global investment grade fixed-rate debt markets. It is comprised of the U.S. Aggregate, Pan-European Aggregate, the Asian-Pacific Aggregate Indices, and the Canadian Aggregate Indices. It also includes a wide range of standard and customized sub-indices by liquidity constraint, sector, quality, and maturity.

Index figures do not take any expenses, fees, or taxes into account, but mutual fund returns do. The indices are used herein for comparative purposes in accordance with the U.S Securities and Exchange Commission regulations.

This chart assumes an initial gross investment of $10,000 made on November 20,1995 (commencement of operations). Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

| 16 | The Leuthold Funds - 2019 Annual Report |

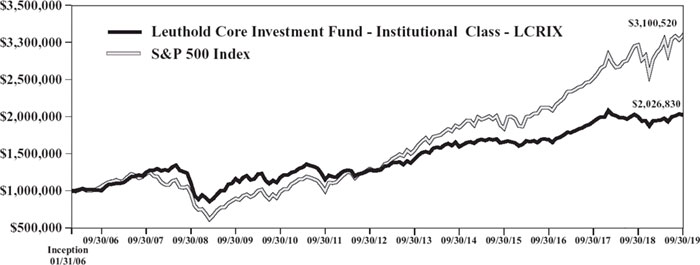

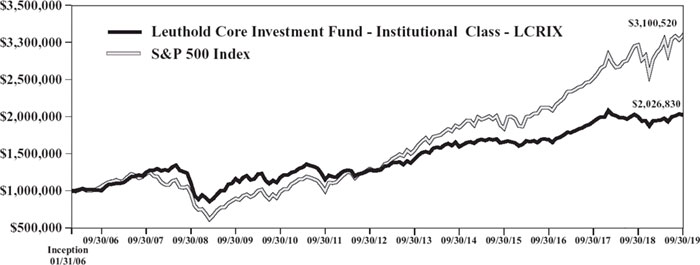

Leuthold Core Investment Fund - Institutional Class - LCRIX

(Unaudited)

Average Annual Rate of Return For Periods Ended

September 30, 2019

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | Since

Inception |

| Leuthold Core Investment Fund - Institutional Class - LCRIX | | 1.33% | | 6.22% | | 4.91% | | 5.73% | | 5.31% |

| Lipper Flexible Portfolio Fund Index | | 3.68% | | 7.18% | | 5.17% | | 7.36% | | 5.64% |

| S&P 500 Index | | 4.25% | | 13.39% | | 10.84% | | 13.24% | | 8.63% |

| Morningstar Tactical Allocation Index | | (0.32)% | | 4.55% | | 2.71% | | 4.51% | | 3.26% |

| Bloomberg Barclays Global Aggregate Index | | 7.60% | | 1.59% | | 1.99% | | 2.34% | | 3.71% |

A $1,000,000 investment in the Leuthold Core Investment Fund – Institutional Class - LCRIX

The Lipper Flexible Portfolio Funds Index is composed of funds that allocate investments across various asset classes with a focus on total return, as defined by Lipper.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks, which represent all major industries.

The Morningstar Tactical Allocation Index is comprised of funds that incorporate a tactical asset allocation strategy which is the process by which the asset of a fund is changed on a short-term basis to take advantage of perceived differences in relative values of the various asset classes.

The Bloomberg Barclays Global Aggregate Index provides a broad-based measure of the global investment grade fixed-rate debt markets. It is comprised of the U.S. Aggregate, Pan-European Aggregate, the Asian-Pacific Aggregate Indices, and the Canadian Aggregate Indices. It also includes a wide range of standard and customized sub-indices by liquidity constraint, sector, quality, and maturity.

Index figures do not take any expenses, fees, or taxes into account, but mutual fund returns do. The indices are used herein for comparative purposes in accordance with the U.S Securities and Exchange Commission regulations.

This chart assumes an initial gross investment of $1,000,000 made on January 31, 2006 (commencement of operations). Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

| The Leuthold Funds - 2019 Annual Report | 17 |

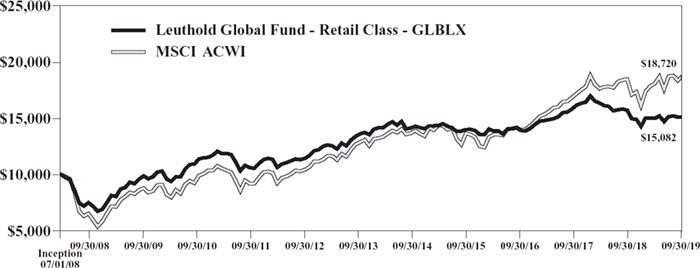

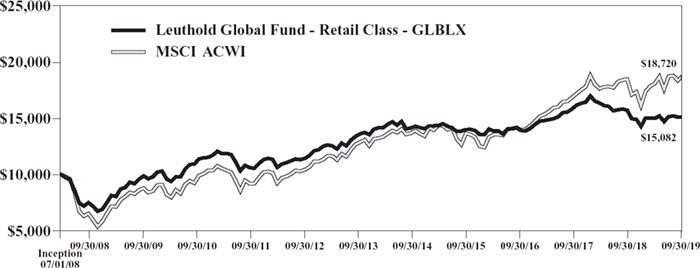

Leuthold Global Fund - Retail Class - GLBLX

(Unaudited)

Average Annual Rate of Return For Periods Ended

September 30, 2019

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | Since

Inception |

| Leuthold Global Fund - Retail Class - GLBLX | | (3.97)% | | 2.24% | | 1.43% | | 4.94% | | 3.72% |

| MSCI ACWI | | 1.38% | | 9.71% | | 6.65% | | 8.35% | | 5.73% |

| Bloomberg Barclays Global Aggregate Index | | 7.60% | | 1.59% | | 1.99% | | 2.34% | | 2.89% |

| S&P 500 Index | | 4.25% | | 13.39% | | 10.84% | | 13.24% | | 10.08% |

A $10,000 investment in the Leuthold Global Fund - Retail Class - GLBLX

The MSCI ACWI (All Country World Index) captures large- and mid-cap representation across 23 Developed Market (DM) and 26 Emerging Market (EM) countries.

The Bloomberg Barclays Global Aggregate Index provides a broad-based measure of the global investment grade fixed-rate debt markets. It is comprised of the U.S. Aggregate, Pan-European Aggregate, the Asian-Pacific Aggregate Indices, and the Canadian Aggregate Indices. It also includes a wide range of standard and customized sub-indices by liquidity constraint, sector, quality, and maturity.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks, which represent all major industries.

Index figures do not take any expenses, fees, or taxes into account, but mutual fund returns do. The indices are used herein for comparative purposes in accordance with the U.S Securities and Exchange Commission regulations.

This chart assumes an initial gross investment of $10,000 made on July 1, 2008 (commencement of operations). Returns shown include the reinvestment of all dividends. The Fund��s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

| 18 | The Leuthold Funds - 2019 Annual Report |

Leuthold Global Fund - Institutional Class - GLBIX

(Unaudited)

Average Annual Rate of Return For Periods Ended

September 30, 2019

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | Since

Inception |

| Leuthold Global Fund - Institutional Class - GLBIX | | (3.70)% | | 2.49% | | 1.66% | | 5.17% | | 3.80% |

| MSCI ACWI | | 1.38% | | 9.71% | | 6.65% | | 8.35% | | 4.92% |

| Bloomberg Barclays Global Aggregate Index | | 7.60% | | 1.59% | | 1.99% | | 2.34% | | 2.74% |

| S&P 500 Index | | 4.25% | | 13.39% | | 10.84% | | 13.24% | | 9.24% |

A $1,000,000 investment in the Leuthold Global Fund - Institutional Class - GLBIX

The MSCI ACWI (All Country World Index) captures large- and mid-cap representation across 23 Developed Market (DM) and 26 Emerging Market (EM) countries.

The Bloomberg Barclays Global Aggregate Index provides a broad-based measure of the global investment grade fixed-rate debt markets. It is comprised of the U.S. Aggregate, Pan-European Aggregate, the Asian-Pacific Aggregate Indices, and the Canadian Aggregate Indices. It also includes a wide range of standard and customized sub-indices by liquidity constraint, sector, quality, and maturity.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks, which represent all major industries.

Index figures do not take any expenses, fees, or taxes into account, but mutual fund returns do. The indices are used herein for comparative purposes in accordance with the U.S Securities and Exchange Commission regulations.

This chart assumes an initial gross investment of $1,000,000 made on April 30, 2008 (commencement of operations). Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

| The Leuthold Funds - 2019 Annual Report | 19 |

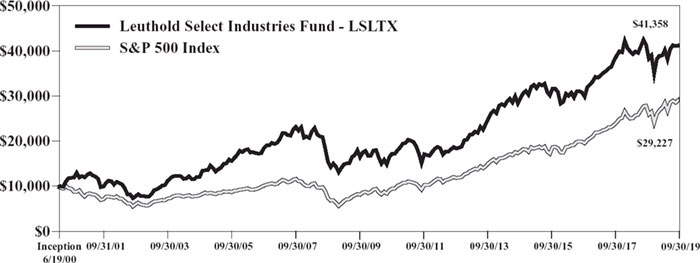

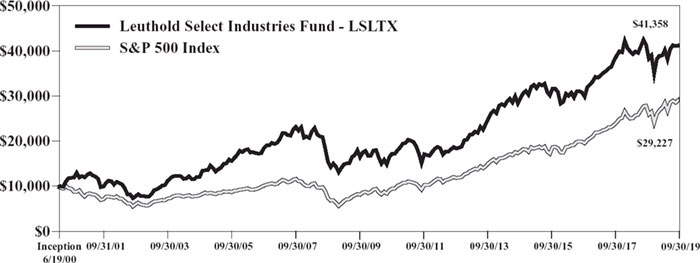

Leuthold Select Industries Fund - LSLTX

(Unaudited)

Average Annual Rate of Return For Periods Ended September 30, 2019

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | Since

Inception |

| Leuthold Select Industries Fund - LSLTX | | (0.19)% | | 10.14% | | 7.70% | | 8.60% | | 7.64% |

| Russell 2000 Index | | (8.89)% | | 8.23% | | 8.19% | | 11.19% | | 7.13% |

| S&P 600 Index | | (9.34)% | | 9.33% | | 9.89% | | 13.02% | | 9.34% |

| Lipper Multi-Cap Core Funds Index | | 0.98% | | 11.09% | | 8.82% | | 11.50% | | 5.54% |

| S&P 500 Index | | 4.25% | | 13.39% | | 10.84% | | 13.24% | | 5.72% |

A $10,000 investment in the Leuthold Select Industries Fund - LSLTX

The Russell 2000 Index is comprised of approximately 2000 of the smallest companies in the Russell 3000 Index, representing approximately 10% of the Russell 3000 total market capitalization.

The S&P 600 Index is an index of small-cap stocks which tracks a broad range of small-sized companies that meet specific liquidity and stability requirements. This is determined by specific metrics such as public float, market capitalization, and financial viability among a few other factors. Market capitalization, for instance, must fall between $450 million and $2.1 billion to ensure individual assets do not overlap with the larger S&P 500 or mid-cap S&P 400 indexes.

The Lipper Multi-Cap Core Funds Index is an average of funds that invest in a variety of market capitalization ranges without concentrating 75% of their equity assets in any one market capitalization range over an extended period of time. Multi-cap funds typically have between 25% and 75% of their assets invested in companies with market capitalizations (on a three-year weighted basis) above 300% of the dollar-weighted median market capitalization of the middle 1,000 securities of the S&P SuperComposite 1500 Index. These funds typically have an average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share growth value, compared to the S&P SuperComposite 1500 Index.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks, which represent all major industries.

Index figures do not take any expenses, fees, or taxes into account, but mutual fund returns do. The indices are used herein for comparative purposes in accordance with the U.S Securities and Exchange Commission regulations.

This chart assumes an initial gross investment of $10,000 made on June 19, 2000 (commencement of operations). Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

| 20 | The Leuthold Funds - 2019 Annual Report |

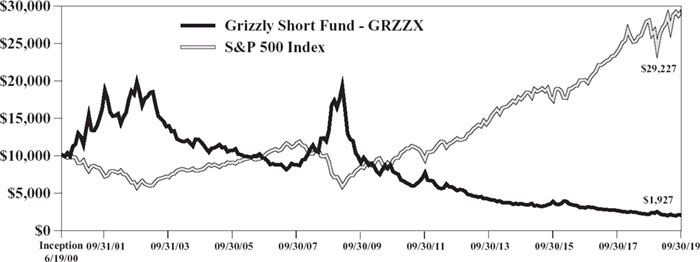

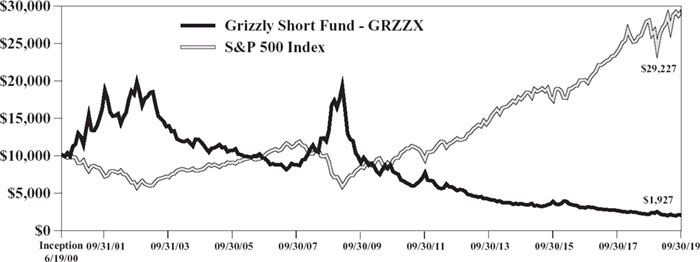

Grizzly Short Fund - GRZZX

(Unaudited)

Average Annual Rate of Return For Periods Ended September 30, 2019

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | Since

Inception |

| Grizzly Short Fund - GRZZX | | (7.62)% | | (12.90)% | | (11.17)% | | (14.27)% | | (8.18)% |

| Lipper Dedicated Short Bias Fund Index | | (5.46)% | | (15.63)% | | (15.65)% | | (19.55)% | | n/a* |

| S&P MidCap 400 Index | | (2.49)% | | 9.38% | | 8.88% | | 12.56% | | 8.75% |

| S&P 500 Index | | 4.25% | | 13.39% | | 10.84% | | 13.24% | | 5.72% |

A $10,000 investment in the Grizzly Short Fund - GRZZX

The Lipper Dedicated Short Bias Funds Index is an equally weighted representation of funds in the Lipper Dedicated Short Bias category. These funds employ a hedge fund strategy that maintains a net short exposure to the market through a combination of short and long positions. A dedicated short bias investment strategy attempts to capture profits when the market declines, by holding investments that are overall biased to the short side.

The S&P MidCap 400 Index is a capitalization-weighted index, which measures the performance of the mid-range sector of the U.S. stock market. The index was developed with a base level of 100 as of December 31, 1990.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks, which represent all major industries.

Index figures do not take any expenses, fees, or taxes into account, but mutual fund returns do. The indices are used herein for comparative purposes in accordance with the U.S Securities and Exchange Commission regulations.

This chart assumes an initial gross investment of $10,000 made on June 19, 2000 (commencement of operations). Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

* Index was introduced in July 2003.

| The Leuthold Funds - 2019 Annual Report | 21 |

The Leuthold Funds

Statements of Assets and Liabilities

September 30, 2019

| | | Leuthold

Core

Investment

Fund | | | Leuthold

Global

Fund | |

| ASSETS: | | | | | | | | |

| Investments, at cost | | | | | | | | |

| Unaffiliated Securities | | $ | 546,019,393 | * | | $ | 57,241,163 | * |

| Affiliated Securities | | | 19,045,784 | | | | — | |

| Total Investments, at cost | | | 565,065,177 | | | | 57,241,163 | |

| | | | | | | | | |

| Investments, at fair value | | | | | | | | |

| Unaffiliated Securities | | | 635,040,452 | | | | 58,418,713 | |

| Affiliated Securities | | | 19,614,081 | | | | — | |

| Total Investments, at fair value | | | 654,654,533 | | | | 58,418,713 | |

| Foreign currency (cost $10,484 and $164,963, respectively) | | | 10,480 | | | | 164,963 | |

| Receivable for Fund shares sold | | | 904,018 | | | | 5,583 | |

| Receivable for investments sold | | | 13,744,944 | | | | 2,840,527 | |

| Collateral at broker for securities sold short | | | 95,067,095 | | | | 8,322,758 | |

| Tri-party collateral held at custodian | | | 20,000,001 | | | | 1,500,001 | |

| Interest receivable | | | 559,893 | | | | 47,043 | |

| Dividends receivable | | | 144,193 | | | | 203,039 | |

| Securities lending income receivable | | | 38,428 | | | | 3,035 | |

| Other assets | | | 175,071 | | | | 23,786 | |

| Total Assets | | | 785,298,656 | | | | 71,529,448 | |

| | | | | | | | | |

| LIABILITIES: | | | | | | | | |

| Securities sold short, at fair value (proceeds $96,429,317 and $8,313,816, respectively) | | | 91,932,355 | | | | 8,129,436 | |

| Collateral received for securities loaned | | | 58,159,492 | | | | 7,331,745 | |

| Payable for investments purchased | | | 12,590,401 | | | | 2,734,193 | |

| Payable for Fund shares redeemed | | | 3,377,277 | | | | — | |

| Payable to Adviser | | | 475,233 | | | | 39,978 | |

| Payable to Custodian | | | 15,330 | | | | 11,513 | |

| Payable to Directors | | | 34,910 | | | | 2,999 | |

| Dividends payable on securities sold short | | | 46,113 | | | | 1,909 | |

| Distribution (Rule 12b-1) fees payable | | | 7,361 | | | | 19,902 | |

| Shareholder servicing fees payable | | | 54,335 | | | | — | |

| Accrued expenses and other liabilities | | | 331,540 | | | | 95,365 | |

| Total Liabilities | | | 167,024,347 | | | | 18,367,040 | |

| NET ASSETS | | $ | 618,274,309 | | | $ | 53,162,408 | |

| | | | | | | | | |

| * Includes loaned securities with market value of: | | $ | 57,032,547 | | | $ | 7,193,841 | |

| 22 | The Leuthold Funds - 2019 Annual Report | See Notes to the Financial Statements. |

The Leuthold Funds

Statements of Assets and Liabilities (continued)

September 30, 2019

| | | Leuthold

Core

Investment

Fund | | | Leuthold

Global

Fund | |

| NET ASSETS CONSIST OF: | | | | | | | | |

| Capital stock | | $ | 514,675,079 | | | $ | 53,383,579 | |

| Total distributable earnings | | | 103,599,230 | | | | (221,171 | ) |

| Total Net Assets | | $ | 618,274,309 | | | $ | 53,162,408 | |

| | | | | | | | | |

| Retail Class Shares | | | | | | | | |

| Net assets | | $ | 316,887,197 | | | $ | 7,485,394 | |

| Shares outstanding (1,000,000,000 shares of $0.0001 par value authorized) | | | 16,878,500 | | | | 924,892 | |

| Net Asset Value, Redemption Price, and Offering Price Per Share | | $ | 18.77 | ** | | $ | 8.09 | ** |

| | | | | | | | | |

| Institutional Class Shares | | | | | | | | |

| Net assets | | $ | 301,387,112 | | | $ | 45,677,014 | |

| Shares outstanding (1,000,000,000 shares of $0.0001 par value authorized) | | | 16,024,823 | | | | 5,562,748 | |

| Net Asset Value, Redemption Price, and Offering Price Per Share | | $ | 18.81 | ** | | $ | 8.21 | ** |

** Redemption price may differ from NAV if redemption fee is applied.

| See Notes to the Financial Statements. | The Leuthold Funds - 2019 Annual Report | 23 |

The Leuthold Funds

Statements of Assets and Liabilities (continued)

September 30, 2019

| | | Leuthold

Select

Industries

Fund | | | Grizzly

Short

Fund | |

| ASSETS: | | | | | | | | |

| Investments, at cost | | $ | 8,991,668 | | | $ | 70,599,843 | |

| | | | | | | | | |

| Investments, at fair value | | | 11,808,278 | | | | 70,599,843 | |

| Foreign currency (cost $333 and $0, respectively) | | | 333 | | | | — | |

| Receivable for Fund shares sold | | | — | | | | 41,087 | |

| Receivable for investments sold | | | — | | | | 4,188,090 | |

| Collateral at broker for securities sold short | | | — | | | | 93,047,892 | |

| Tri-party collateral held at custodian | | | — | | | | 18,000,001 | |

| Interest receivable | | | 90 | | | | 120,598 | |

| Dividends receivable | | | 4,370 | | | | — | |

| Other assets | | | 26,678 | | | | 136,141 | |

| Total Assets | | | 11,839,749 | | | | 186,133,652 | |

| | | | | | | | | |

| LIABILITIES: | | | | | | | | |

| Securities sold short, at fair value (proceeds $0 and $97,324,483, respectively) | | | — | | | | 90,328,624 | |

| Payable for investments purchased | | | — | | | | 3,163,910 | |

| Payable for Fund shares redeemed | | | 1,074 | | | | 177,592 | |

| Payable to Adviser | | | 13,334 | | | | 94,762 | |

| Payable to Custodian | | | 1,841 | | | | 1,715 | |

| Payable to Directors | | | 653 | | | | 5,088 | |

| Dividends payable on securities sold short | | | — | | | | 43,719 | |

| Shareholder servicing fees payable | | | 2,244 | | | | 14,917 | |

| Accrued expenses and other liablities | | | 36,719 | | | | 65,239 | |

| Total Liabilities | | | 55,865 | | | | 93,895,566 | |

| NET ASSETS | | $ | 11,783,884 | | | $ | 92,238,086 | |

| 24 | The Leuthold Funds - 2019 Annual Report | See Notes to the Financial Statements. |

The Leuthold Funds

Statements of Assets and Liabilities (continued)

September 30, 2019

| | | Leuthold

Select

Industries

Fund | | | Grizzly

Short

Fund | |

| NET ASSETS CONSIST OF: | | | | | | | | |

| Capital stock | | $ | 8,906,886 | | | $ | 322,148,551 | |

| Total distributable earnings | | | 2,876,998 | | | | (229,910,465 | ) |

| Total Net Assets | | $ | 11,783,884 | | | $ | 92,238,086 | |

| | | | | | | | | |

| Retail Class Shares | | | | | | | | |

| Net assets | | $ | 11,783,884 | | | $ | 92,238,086 | |

| Shares outstanding (1,000,000,000 shares of $0.0001 par value authorized) | | | 470,948 | | | | 5,712,018 | |

| Net Asset Value, Redemption Price, and Offering Price Per Share | | $ | 25.02 | | | $ | 16.15 | |

| See Notes to the Financial Statements. | The Leuthold Funds - 2019 Annual Report | 25 |

The Leuthold Funds

Statements of Operations

For the Year Ended September 30, 2019

| | | Leuthold

Core

Investment

Fund | | | Leuthold

Global

Fund | |

| INVESTMENT INCOME: | | | | | | | | |

| Dividend income (net of foreign taxes withheld of $13,734 and $50,757, respectively) | | $ | 6,338,839 | | | $ | 858,590 | |

| Interest income | | | 6,009,802 | | | | 557,354 | |

| Income from securities lending, net | | | 307,317 | | | | 47,845 | |

| Total investment income | | | 12,655,958 | | | | 1,463,789 | |

| | | | | | | | | |

| EXPENSES: | | | | | | | | |

| Investment advisory fees (Note 3) | | | 6,334,568 | | | | 611,718 | |

| Administration fees | | | 349,774 | | | | 49,999 | |

| Transfer agent fees (Note 5) | | | 371,921 | | | | 63,787 | |

| Legal fees | | | 26,144 | | | | 5,483 | |

| Audit fees | | | 89,560 | | | | 64,260 | |

| Fund accounting fees | | | 132,492 | | | | 21,734 | |

| Custody fees | | | 55,915 | | | | 51,784 | |

| Shareholder servicing fees - Retail Class (Note 5) | | | 344,903 | | | | — | |

| Registration fees | | | 62,666 | | | | 35,542 | |

| Report to shareholders | | | 88,833 | | | | 7,989 | |

| Directors’ fees | | | 154,173 | | | | 14,757 | |

| Distribution (Rule 12b-1) fees - Retail Class (Note 4) | | | — | | | | 25,346 | |

| Other | | | 55,499 | | | | 6,965 | |

| Total expenses before dividends and interest on securities sold short | | | 8,066,448 | | | | 959,364 | |

| Dividends and interest on securities sold short | | | 879,847 | | | | 177,412 | |

| Total expenses | | | 8,946,295 | | | | 1,136,776 | |

| NET INVESTMENT INCOME | | $ | 3,709,663 | | | $ | 327,013 | |

| 26 | The Leuthold Funds - 2019 Annual Report | See Notes to the Financial Statements. |

The Leuthold Funds

Statements of Operations (continued)

For the Year Ended September 30, 2019

| | | Leuthold

Core

Investment

Fund | | | Leuthold

Global

Fund | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS, INVESTMENT COMPANIES, SECURITIES SOLD SHORT, AND FOREIGN CURRENCY AND FOREIGN CURRENCY TRANSLATION: | | | | | | | | |

| Net realized gain (loss) on: | | | | | | | | |

| Investments | | $ | 20,902,154 | | | $ | (1,668,846 | ) |

| Investment companies | | | (3,484,692 | ) | | | (112,450 | ) |

| Realized gain distributions received from investment companies | | | 219,720 | | | | — | |

| Securities sold short | | | 186,123 | | | | 441,852 | |

| Foreign currency and foreign currency translation | | | 130,233 | | | | 43,616 | |

| Net unrealized appreciation (depreciation) during the year on: | | | | | | | | |

| Investments | | | (24,726,380 | ) | | | (2,889,560 | ) |

| Investment companies | | | 5,611,887 | | | | 419,709 | |

| Securities sold short | | | 2,560,305 | | | | (83,437 | ) |

| Foreign currency and foreign currency translation | | | (1,751,541 | ) | | | (231,915 | ) |

| Net realized and unrealized loss on investments, investment companies, securities sold short, and foreign currency and foreign currency translation | | | (352,191 | ) | | | (4,081,031 | ) |

| NET INCREASE (DECREASE) IN NET ASSETS | | | | | | | | |

| RESULTING FROM OPERATIONS | | $ | 3,357,472 | | | $ | (3,754,018 | ) |

| See Notes to the Financial Statements. | The Leuthold Funds - 2019 Annual Report | 27 |

The Leuthold Funds

Statements of Operations (continued)

For the Year Ended September 30, 2019

| | | Leuthold

Select

Industries

Fund | | | Grizzly

Short

Fund | |

| INVESTMENT INCOME: | | | | | | | | |

| Dividend income (net of foreign taxes withheld of $465 and $0, respectively) | | $ | 179,502 | | | $ | 8,912 | |

| Interest income | | | 2,638 | | | | 3,646,896 | |

| Total investment income | | | 182,140 | | | | 3,655,808 | |

| | | | | | | | | |

| EXPENSES: | | | | | | | | |

| Investment advisory fees (Note 3) | | | 131,926 | | | | 1,236,441 | |

| Administration fees | | | 20,939 | | | | 58,785 | |

| Transfer agent fees (Note 5) | | | 9,923 | | | | 54,489 | |

| Legal fees | | | 512 | | | | 2,791 | |

| Audit fees | | | 28,184 | | | | 28,260 | |

| Fund accounting fees | | | 5,598 | | | | 19,453 | |

| Custody fees | | | 5,477 | | | | 7,278 | |

| Shareholder servicing fees - Retail Class (Note 5) | | | 14,034 | | | | 87,789 | |

| Registration fees | | | 9,283 | | | | 39,324 | |

| Report to shareholders | | | 2,353 | | | | 14,279 | |

| Directors’ fees | | | 2,808 | | | | 22,148 | |

| Other | | | 2,065 | | | | 9,259 | |

| Total expenses before dividends and interest on securities sold short and reimbursement from Adviser | | | 233,102 | | | | 1,580,296 | |

| Dividends and interest on securities sold short | | | — | | | | 1,004,931 | |

| Reimbursement from Adviser (Note 3) | | | (35,213 | ) | | | — | |

| Total expenses | | | 197,889 | | | | 2,585,227 | |

| NET INVESTMENT INCOME (LOSS) | | $ | (15,749 | ) | | $ | 1,070,581 | |

| 28 | The Leuthold Funds - 2019 Annual Report | See Notes to the Financial Statements. |

The Leuthold Funds

Statements of Operations (continued)

For the Year Ended September 30, 2019

| | | Leuthold

Select

Industries

Fund | | | Grizzly

Short

Fund | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS, INVESTMENT COMPANIES, SECURITIES SOLD SHORT, AND FOREIGN CURRENCY AND FOREIGN CURRENCY TRANSLATION: | | | | | | | | |

| Net realized gain (loss) on: | | | | | | | | |

| Investments | | $ | 405,578 | | | $ | — | |

| Investment companies | | | 7,920 | | | | — | |

| Securities sold short | | | — | | | | (12,327,226 | ) |

| Foreign currency and foreign currency translation | | | 2 | | | | — | |

| Net unrealized appreciation (depreciation) during the year on: | | | | | | | | |

| Investments | | | (946,731 | ) | | | — | |

| Securities sold short | | | — | | | | 3,713,595 | |

| Foreign currency and foreign currency translation | | | (3 | ) | | | — | |

| Net realized and unrealized loss on investments, investment companies, securities sold short, and foreign currency and foreign currency translation | | | (533,234 | ) | | | (8,613,631 | ) |

| NET DECREASE IN NET ASSETS | | | | | | | | |

| RESULTING FROM OPERATIONS | | $ | (548,983 | ) | | $ | (7,543,050 | ) |

| See Notes to the Financial Statements. | The Leuthold Funds - 2019 Annual Report | 29 |

Leuthold Core Investment Fund

Statements of Changes in Net Assets

| | | Year Ended

September 30, 2019 | | | Year Ended

September 30, 2018 | |

| OPERATIONS: | | | | | | | | |

| Net investment income | | $ | 3,709,663 | | | $ | 2,708,840 | |

| Net realized gain on investments, investment companies, securities sold short, and foreign currency and foreign currency translation | | �� | 17,953,538 | | | | 84,625,374 | |

| Net unrealized depreciation on investments, investment companies, securities sold short, and foreign currency and foreign currency translation | | | (18,305,729 | ) | | | (59,527,356 | ) |

| Net increase in net assets from operations | | | 3,357,472 | | | | 27,806,858 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| Distributions - Retail Class | | | (36,279,698 | ) | | | (15,722,617 | ) |

| Distributions - Institutional Class | | | (39,291,618 | ) | | | (13,500,115 | ) |

| Total distributions | | | (75,571,316 | ) | | | (29,222,732 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Proceeds from shares sold - Retail Class | | | 23,071,159 | | | | 49,574,688 | |

| Proceeds from shares sold - Institutional Class | | | 99,334,788 | | | | 99,394,031 | |

| Proceeds from shares issued to holders in reinvestment of dividends - Retail Class | | | 34,048,341 | | | | 14,973,202 | |

| Proceeds from shares issued to holders in reinvestment of dividends - Institutional Class | | | 35,405,269 | | | | 11,741,082 | |

| Cost of shares redeemed - Retail Class* | | | (108,678,134 | ) | | | (125,626,684 | ) |

| Cost of shares redeemed - Institutional Class** | | | (229,952,506 | ) | | | (61,432,479 | ) |

| Net decrease in net assets from capital share transactions | | | (146,771,083 | ) | | | (11,376,160 | ) |

| | | | | | | | | |

| TOTAL DECREASE IN NET ASSETS: | | | (218,984,927 | ) | | | (12,792,034 | ) |

| NET ASSETS | | | | | | | | |

| Beginning of year | | | 837,259,236 | | | | 850,051,270 | |

| End of year | | $ | 618,274,309 | | | $ | 837,259,236 | |

| | | | | | | | | |

| | | | | | | | | |

| CHANGES IN SHARES OUTSTANDING: | | | | | | | | |

| Shares sold - Retail Class | | | 1,246,916 | | | | 2,391,128 | |

| Shares sold - Institutional Class | | | 5,471,510 | | | | 4,806,861 | |

| Shares issued to holders in reinvestment of dividends - Retail Class | | | 1,878,824 | | | | 734,892 | |

| Shares issued to holders in reinvestment of dividends - Institutional Class | | | 1,950,355 | | | | 575,096 | |

| Shares redeemed - Retail Class | | | (5,911,248 | ) | | | (6,082,213 | ) |

| Shares redeemed - Institutional Class | | | (12,549,398 | ) | | | (2,972,534 | ) |

| Net decrease in shares outstanding | | | (7,913,041 | ) | | | (546,770 | ) |

| | | | | | | | | |

| * Net of redemption fees of (Retail Class): | | $ | 132 | | | $ | 299 | |

| ** Net of redemption fees of (Institutional Class): | | $ | 142 | | | $ | 262 | |

| 30 | The Leuthold Funds - 2019 Annual Report | See Notes to the Financial Statements. |

Leuthold Global Fund

Statements of Changes in Net Assets

| | | Year Ended

September 30, 2019 | | | Year Ended

September 30, 2018 | |

| OPERATIONS: | | | | | | | | |

| Net investment income | | $ | 327,013 | | | $ | 456,785 | |

| Net realized gain (loss) on investments, investment companies, securities sold short, and foreign currency and foreign currency translation | | | (1,295,828 | ) | | | 7,014,480 | |

| Net unrealized depreciation on investments, investment companies, securities sold short, and foreign currency and foreign currency translation | | | (2,785,203 | ) | | | (7,628,313 | ) |

| Net decrease in net assets from operations | | | (3,754,018 | ) | | | (157,048 | ) |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| Distributions - Retail Class | | | (898,152 | ) | | | (2,138,468 | ) |

| Distributions - Institutional Class | | | (4,756,056 | ) | | | (6,753,470 | ) |

| Total distributions | | | (5,654,208 | ) | | | (8,891,938 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Proceeds from shares sold - Retail Class | | | 2,174,839 | | | | 2,028,207 | |

| Proceeds from shares sold - Institutional Class | | | 20,930,190 | | | | 15,052,597 | |

| Proceeds from shares issued to holders in reinvestment of dividends - Retail Class | | | 861,148 | | | | 2,063,968 | |