Annual Report

September 30, 2017

The Leuthold Funds

Leuthold Core Investment Fund

Retail Class Shares LCORX

Institutional Class Shares LCRIX

Leuthold Global Fund

Retail Class Shares GLBLX

Institutional Class Shares GLBIX

Leuthold Select Industries Fund LSLTX

Leuthold Global Industries Fund

Retail Class Shares LGINX

Institutional Class Shares LGIIX

Grizzly Short Fund GRZZX

The Leuthold Funds

Table of Contents

| 1 |

| | |

| 12 |

| | |

| 15 |

| | |

| 18 |

| | |

| 26 |

| | |

| 30 |

| | |

| 34 |

| | |

| 39 |

| | |

| Schedules of Investments and Securities Sold Short | |

| | |

| 47 |

| | |

| 59 |

| | |

| 68 |

| | |

| 72 |

| | |

| 77 |

| | |

| 81 |

| | |

| 96 |

| | |

| 97 |

| | |

| 98 |

The Leuthold Funds

Dear Fellow Shareholders:

One year ago, after months of buildup, the U.S. presidential election was a market-moving event. The commonly accepted wisdom, and feared for months in advance, was that a Trump win would crater the market. To the contrary, the Trump victory ignited a rally that was led by U.S. cyclicals; the smaller the market cap the better. Along with higher stock prices, bond yields jumped and the dollar surged in anticipation of Trump’s new policies.

Confidence likewise surged in the weeks following the presidential election, and 2017 commenced with fairly uniform intensity across all capitalization tiers and most equity sectors. Interest-sensitive groups—like Banks, Brokerage, and Insurers—also strengthened on a relative basis as bond yields climbed, suggesting that interest rates hadn’t moved up enough to provide serious competition for stocks.

Driven by an increase in consumer and business sentiment, global equities soared; international stocks, especially Emerging Markets, performed even better than U.S. stocks. The most impressive part may be that this happened in the face of the now-uncertain future of the Trump administration policies that boosted stocks at the end of 2016. While most of the attention was focused on Washington D.C. and Trump Twitter, the rest of the world was showing higher economic growth than expected.

Despite disappointments in fiscal policy and macro-economic data, the “Goldilocks” environment persevered. Global economic expansion broadened further, while inflation remained muted. Interest rates were well-contained despite multiple central banks embarking on the tightening path. A weaker dollar helped international stocks and loosened U.S. financial conditions. Our economic and market analyses together supported above-average exposure to equities, and our tactical portfolios were positioned this year with an average 65% in stocks—near the upper end of the strategy parameters.

The Leuthold Funds’ domestic and global long-equity strategies and tactical portfolios flourished in the environment of the last twelve months. The late phase of a bull market generally features well-defined trends in industry group leadership; this is an environment that’s ideal for our quantitative approach. Our equity portfolios were well ahead of their benchmarks for the year, with the models correctly capturing big moves in several sectors, while sidestepping underperformers. Despite the upward trajectory for risk assets, our short-only strategy also did not disappoint; it outperformed its peer fund category by a very wide margin, and convincingly surpassed the inverse comparators of the broad market indexes.

From a purely technical point of view, if a bear market is born in the near future, it would have to be considered the result of some sort of “immaculate conception.” New S&P 500 highs have been confirmed by all of the other benchmarks considered ‘critically needed’ to sustain the bull, and a secondary set of indexes that we consider less critical—but still ‘nice to have’ —has also been making new highs in virtual lockstep with the blue chips. There remain leaders and laggards, but that’s very different from saying there are major internal divergences.

While it doesn’t rule out the possibility of a short-term setback, this remarkable level of bullish “agreement” across the U.S. market stacks the odds heavily against an imminent cyclical top. Notwithstanding the higher risk, ever-pricier stock market valuations, it is evident that the bull market is beckoning for even more elevated levels before giving up the ghost.

Herein, we examine investment allocations and portfolio characteristics that materially influenced the performance of each Leuthold Fund strategy during the fiscal year ended September 30, 2017.

The Leuthold Funds - 2017 Annual Report | 1 |

ANNUAL PERFORMANCE REVIEW

Leuthold Core Investment Fund

Our market disciplines maintained a generally positive stance toward stocks for the fiscal year ended September 30, 2017; equity exposure was held in the upper bounds of the parameters, at 65% on average. Elevated stock valuations—the product of an eight and a half year old bull market—prompted us to stop short of the Fund’s 70% maximum level for equities that would normally accompany our bullish outlook.

For the fiscal year, the Leuthold Core Investment Fund posted a strong +14.31% total return (retail share class). This was markedly better than the Morningstar Tactical Allocation peer group +9.31% total return. Versus the fully-invested S&P 500 +18.61% total return, the Fund trailed by a spread of about 4%. Bearing in mind the Fund’s stock exposure is curbed at a level about one-third lower, we are very pleased with its relatively small performance deficit to the fully-invested benchmark.

The best performing portfolio component was U.S.-traded long stocks; the allocation, via the Leuthold Select Industries strategy, outdid both its peer-group average and the S&P 500. This is a turnaround from 2015-16 when the allocation substantially trailed both comparators. The year’s outperformance in this allocation is attributable almost entirely to its overweight sector positions in Information Technology and Industrials. More performance details related to this equity exposure can be found under the Leuthold Select Industries section.

U.S.-traded stock exposure is accompanied by the Fund’s long-time position in globally traded Emerging Market (EM) equities. This is an important diversification segment among global market opportunities. Having integrated it as a distinct equity subset twenty years ago, the Leuthold Core Investment Fund’s management team recognized the theme’s significance earlier than most.

The Fund held 6.2% on average in EM stocks during the fiscal year—almost double that of the prior year. The larger position was rewarded, as EM stocks maintained a steady track of recovery. Improving on the 2015-16 FY result of nearly +15%, this position’s last twelve months’ cumulative total return was +23%, nearly on par with the MSCI Emerging Market (EM) Index +25% total return. On a stand-alone return basis, this was the Fund’s number one performer; however, contribution to the Fund’s overall return translated to just +1.32% after factoring in its relatively minor share of portfolio assets.

| ● | China and South Korea were the Fund’s two most additive EM exposures with a joint contribution of +9.97%; this, however, trailed the benchmark’s respective exposure results (+11.47%). An overweight Hong Kong holding was an advantage over the benchmark’s exposure as it provided a meaningfully larger contribution, +3.02% versus +0.82%, respectively. Other heavyweight country allocations outperforming in the Fund, versus corresponding MSCI EM positions, included Poland, Greece, Chile, Thailand, and Turkey. |

| ● | Indian stocks, in general, had relatively strong results during the year but the Fund was underweight here. Moreover, based on the Fund’s particular holdings, India was its largest country detractor, providing a small loss. This indicates that while the country allocation was well-chosen, the Fund’s Indian stock selection was poor. Equity selection was likewise inferior with the Fund’s positions in Hungary, Mexico, and the Philippines; these contributed small losses to the Fund versus net gains of the respective MSCI EM holdings. The only other small country detractor to performance was the Fund’s Singapore holding. |

2 | The Leuthold Funds - 2017 Annual Report |

Due to the deterioration of a variety of Attitudinal measures we monitor, in late July the Fund incorporated a small equity hedge to position more defensively in the near-term. The hedge was value-added in August as Small and Mid Caps suffered losses, while Large Caps were flat. As the market rebounded in September, the hedge lost money, more than offsetting its prior month’s gain. The position’s overall net loss for the FY had negligible impact, as the brief holding period did not pull enough weight to make a difference. Overall, the hedge equated to an average 6% weight during the roughly two-month holding period.

Fixed income is determined by a top-down tactical allocation framework. A multi-factor model is employed to first evaluate “risk”and assess whether lower-risk vehicles, such as Developed Market government securities, or higher-risk vehicles (credits) should be favored. The lower-risk category includes nominal and inflation-linked government securities, whereas the higher-risk segment contains vehicles across a range of credit classes.

The Fund remained underweight fixed income through the year, and held very short duration. Multiple central banks have embarked on a tightening path, the Federal Reserve has lifted the Funds rate four times thus far, the Fed is also expected to soon begin contracting its expansive balance sheet, and yields are anticipated to continue on an upward trend. Considering the substantial risk, we don’t see any reason to be aggressive in this space. Over the last twelve months, fixed income was held at an average 22% of assets—a little higher than the 19% average during FY 2015-16. The position has been slowly creeping toward the Fund’s normal guideline minimum of 30%, but there is still a sizable gap to close. At present, the overall allocation is viewed as a shock absorber to potentially negative surprises in the equity market.

As a means of diversification, fixed income assets were distributed across a range of securities with varying risk profiles, including government securities and credits. Similar to the last two years, Developed Market Sovereign Debt was the largest subclass at 12% average weight. Quality Corporate Bonds, MBS Bond Funds, and Emerging Market Sovereign Debt were also full-year allocations with FY average weights of 4%, 2%, and 2%, respectively. Municipal Bonds and High Yield Bonds were sold before year end (partial-year average weights were each less than 1%). Collectively, the small gains and losses from these assorted fixed income components provided a relatively inconsequential net loss of seven basis points.

Leuthold Global Fund

This tactical allocation fund is the global counterpart of the Leuthold Core Investment Fund. In our quant work, U.S. and foreign stock market risk is evaluated by a single macro-analysis tool. Accordingly, major defensive (or offensive) asset allocation modifications described in this section will echo those of the Leuthold Core Investment Fund; investment vehicles, allocation weights, and performance may vary.

Our market disciplines maintained a generally positive stance toward stocks for the fiscal year ended September 30, 2017; equity exposure was held in the upper bounds of the parameters, at 65% on average. Elevated stock valuations—the product of an eight and a half year old bull market—prompted us to stop short of the Fund’s 70% maximum level for equities that would normally accompany our bullish outlook.

For the fiscal year, the Leuthold Global Fund produced a solid +12.02% total return (retail-share class), besting the Morningstar World Allocation average +8.36% total return. Versus the fully-invested MSCI All Country World Index (ACWI) +19.29% total return, the Fund trailed by a 7.3% spread. The Fund’s return computes to 62% of the gain in the MSCI ACWI, which is effectively explained by the percentage difference between the Fund’s lower average long stock exposure (65%) versus the index’s 100% stock portfolio.

The Leuthold Funds - 2017 Annual Report | 3 |

The best performing portfolio component was the Fund’s long stock exposure; the allocation, via the Leuthold Global Industries strategy, outdid both its peer-group average and the MSCI ACWI. This was a turnaround from 2015-16 when, despite strong returns for global equities, the Fund’s stocks substantially trailed its benchmark comparators. The last twelve months’ outperformance in this allocation is primarily attributable to its overweight positions in the Materials, Financials, and Industrials sectors. Additional performance details related to this holding are included in the Leuthold Global Industries section.

Due to the deterioration of a variety of Attitudinal measures we monitor, in late July the Fund incorporated an equity hedge to position more defensively for the near-term. The hedge was value-added in August as U.S. Small and Mid Caps suffered losses, while global Large Caps were relatively flat. As the market rebounded in September, the hedge lost money, more than offsetting its prior month’s gain. The position’s overall net loss for the FY had negligible impact, as the brief holding period did not pull enough weight to make a difference. Overall, the hedge equated to an average 6% weight during the roughly two-month holding period.

Fixed income is determined by a top-down tactical allocation framework. A multi-factor model is employed to first evaluate “risk” and assess whether lower-risk vehicles, such as Developed Market government securities, or higher-risk vehicles (credits) should be favored. The lower-risk category includes nominal and inflation-linked government securities, whereas the higher-risk segment contains vehicles across a range of credit classes.

Versus the normal guideline minimum, the Fund was underweight fixed income through the year, and held very short duration. Multiple central banks have embarked on a tightening path, the Federal Reserve has lifted the Funds rate four times thus far, the Fed is also expected to soon begin contracting its expansive balance sheet, and yields are anticipated to continue on an upward trend. Considering the substantial risk, we don’t see any reason to be aggressive in this space. Over the last twelve months, fixed income was held at an average 25% of assets—a little higher than the 24% average of 2015-16. This is still below the normal guideline minimum of 30%, but following a four-year string of 20% exposure levels (prior to late-2015), there has been progress toward closing the gap. The overall allocation continues to be viewed as a shock absorber to potentially negative surprises in the equity market.

As a means of diversification, fixed income assets were distributed across a range of securities with varying risk profiles, including government securities and credits. Similar to the last two years, Developed Market Sovereign Debt was the largest subclass at 14% average weight. Quality Corporate Bonds, MBS Bond Funds, and Emerging Market Sovereign Debt were also full-year allocations with FY average weights of 5%, 3%, and 3%, respectively. Municipal Bonds and High Yield Bonds were sold before year end (partial-year average weights were 0.6% and 1.2%, respectively). Collectively, the small gains and losses from these assorted fixed income components resulted in a relatively inconsequential net loss of two basis points.

Leuthold Select Industries Fund

This fully-invested portfolio composed of U.S.-traded stocks had a strong total return of +22.93% for the fiscal year ended September 30, 2017. The Fund outperformed its peer category, Morningstar Mid Cap Blend by a significant margin (+15.75% total return), and was value-added over the S&P 500 (+18.61% total return).

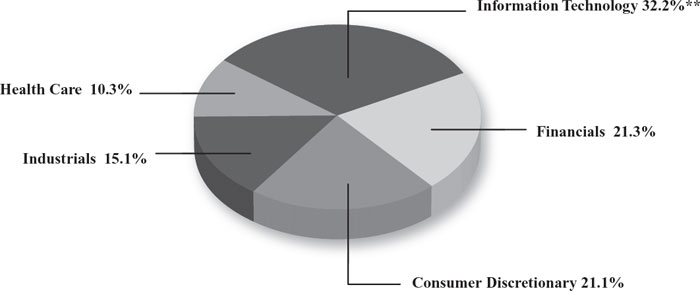

Three of the Fund’s heaviest equity-sector concentrations during the previous three fiscal years remained among the top four largest weights, on average, for the fourth year running: Information Technology, Consumer Discretionary, and Industrials. Financials replaced Health Care to round out the latest year’s top four weights; Health Care had consistent exposure, though it was held below market weight. There was a particularly large concentration of assets constrained to three of the Fund’s

4 | The Leuthold Funds - 2017 Annual Report |

heaviest-weighted sectors: Information Technology, Industrials, and Financials, which together comprised an average 71% portfolio weight. Alternatively, Materials and Utilities sector exposures were virtually nonexistent (average FY weights of 1.43% and 1.16%, respectively), and there was zero exposure to four major market sectors: Energy, Telecom, Consumer Staples, and Real Estate.

The Fund’s most additive industry group concentrations came from the Information Technology sector. Semiconductor Equipment was particularly strong, with three times better results than the next best IT group holdings: Electronic Manufacturing Services and Home Entertainment Software. The Industrials sector exposure was the second best concentration; the portfolio’s industry leaders from that sector were Aerospace & Defense, Airlines, Trading Companies & Distributors, and Railroads. The Financials, Health Care, and Consumer Discretionary leading portfolio industries were Banks, Managed Health Care, and Auto Parts & Equipment. Fund investments among these five sectors made up 97% of the year’s assets, on average; four of these sector concentrations combined to contribute a spread of 8% more to return than that of the corresponding sectors within the S&P 500.

None of the Fund’s sector concentrations contributed a loss to overall return. At the industry group level, there was only a handful among the Fund’s holdings which contributed losses. Combined, these results offset the overall FY gain by less than 1%. The largest portfolio group detractors were positions in Advertising, Homefurnishing Retail, and Semiconductors.

This portfolio construction of disproportionate sector weights versus the S&P 500 exemplifies the ‘concentrated assets’ approach intended to set the Fund strategy apart and add alpha. The quantitative methodology aims to identify themes that are in position to expand their market leadership and/or uphold existing positions of strength. More often than not, this is a very effective tactic.

The Fund’s fiscal year average weight of 10% to foreign-domiciled stocks (ADR/ADS traded on U.S. exchanges) had minimal fluctuation from one month to the next. Roughly 40% of this foreign exposure was in Emerging Markets (EM), unlike the prior two fiscal years when foreign exposure was almost exclusively from stocks of Developed Markets (DM). This year’s EM-based exposure primarily came from holdings via the Emerging Diversified Banks group. Concentrations in either DM or EM stocks are mostly arbitrary, the result of: 1) the composition of the groups identified as quantitatively attractive; and, 2) valuation appeal based on the quantitative stock selection model. Some industries are inclined to have a stronger presence in Developed Markets versus Emerging Markets, and vice versa.

The Fund had over two-thirds of assets exposed to just three of the eleven broad market sectors during the year, and these were the S&P 500’s top three performing sectors. Essentially absent from the Fund’s investments were four broad market sectors that equate to about 21% of the S&P 500 composition, but this deficiency had no relative adverse consequences on Fund performance. Over the long run, the Fund strategy has proven the advantage of centering on the themes it determines to be exhibiting the strongest leadership momentum, versus that of quasi-mirroring the exposures of the S&P 500 or other benchmark. As with all actively-managed styles, there will be market environments when the Fund’s approach does not prevail and Fund performance will disappoint.

The Fund’s sector heavyweights have been generally consistent since 2013, and relative to both the S&P 500 and its peer group comparator, the Leuthold Select Industries Fund has outperformed in four of the five fiscal years since that time. This additive relative performance reinforces the Fund’s methodology that longer-term equity leadership trends largely exist, and sticking with those themes, as long as the disciplines continue to assert the presence of underlying strength, can be rewarding.

The Leuthold Funds - 2017 Annual Report | 5 |

Leuthold Global Industries Fund

As stocks rallied worldwide, this globally-focused equity portfolio followed suit with a competitive total return of +20.90% for the fiscal year ended September 30, 2017 (retail-share class). The Fund outdid both the Morningstar World Large Stock average and the MSCI All Country World Index (ACWI) total returns of +17.68% and +19.29%, respectively.

The Fund’s overall FY outperformance masks three consecutive months of dreadfully lagging results from March-May, the result of temporarily disadvantageous positions in the Materials and Industrials sectors. That downside reversal dissolved the Fund’s previously extra-strong performance advantage; over that March-May period, the Fund relinquished nearly 400 basis points versus the MSCI ACWI, and nearly 500 basis points versus the Morningstar World Large Stock average. A crucial rebound for the Fund in June allowed it to recover an average of nearly 130 basis points against each benchmark, and it proceeded to lead in the remaining four months to claw back another 180 basis points on average, ending the fiscal year with a small performance edge.

The Fund’s last twelve months’ allotment to Developed Market (DM) countries was consistently in the 79% range. U.S.-traded stocks were the largest DM share (average 41%); this concentration hovered within a small spread of less than seven basis points, up or down, all year. In comparison, the 90% DM exposure of the MSCI ACWI held U.S. stocks at a higher level of 51%. Emerging Market (EM) holdings in the Fund, at 21% on average, were about twice the weight of the MSCI ACWI’s customary 10% allocation; however, despite EM stocks experiencing a powerful upswing all year, the Fund’s much heavier EM position didn’t likewise benefit to the same degree from its specific positions. The Fund’s combined contribution to return from its EM exposure amounted to just 68% of the gain contributed by the respective exposure of the MSCI EM benchmark’s smaller allocations.

At the broad sector level, only three exposures detracted from performance during the fiscal year (Telecom, Utilities, Real Estate), albeit the combined tally had minimal impact amounting to just under -1.25%. Meanwhile, the corresponding sector exposures in the MSCI ACWI were additive by 1.84%. On the up side, overweight allocations to Materials, Financials, Industrials, and Consumer Discretionary were the Fund’s leading sector contributors to return (+21% combined); these were also more additive to return than the MSCI ACWI counterparts, which provided a collective +11%. Information Technology, Energy, and Health Care exposures in the Fund added to gains, but to a lesser degree, and none of the three kept up with the benchmark’s corresponding sector gains.

From an industry group perspective, most of those providing the largest positive contributions to Fund return were constituents of the top sector contributors. From the Materials sector, strong contributors were Commodity Chemicals, Paper & Forest Products, and Steel. The top Financials groups included Emerging Diversified Banks, Diversified Financial Services, and Life & Health Insurance. Among the portfolio’s largest gainers from Industrials were Airlines and Trading Companies & Distributors, while the Fund’s Consumer Discretionary sector’s biggest contributors were Auto Components and Automobiles. Electronic Equipment & Instruments, from the Information Technology sector, rounds out the list of the most significant group outperformers. All of these group concentrations also outperformed the related MSCI ACWI positions by a considerable margin. Industries detracting the most from Fund performance were Real Estate Management & Development, Data Processing & Outsourced Services, Emerging Electric Utilities, Emerging Diversified Telecom Services, and Advertising.

Most foreign-focused funds concentrate on specific countries or regions. Segmenting the marketplace into specialized subsets, to limit the scope of expertise required, is a long-established approach used to manage the vast global universe of potential

6 | The Leuthold Funds - 2017 Annual Report |

investments. Alternatively, the Leuthold Global Industries Fund methodology allows it to incorporate all investable global equities in its universe of potential investments. For the most part, the Fund’s exposures to specific countries and regions of the world are not deliberately targeted. The goal of the Leuthold Global Industries Fund is to build concentrated investments in attractive industries, regardless of country-origin, and modify such exposure as opportunities evolve. We believe our country-impartial tactic will generate superior returns in the long run, as the Fund is not dependent on selecting from a compartmentalized group of stocks that may revolve in and out of favor, or be subject to the cyclical occurrences of regional or country-specific political and economic ups and downs. The entire investable global universe is at the Fund’s disposal, which we view as a distinct advantage. We summarize details of the meaningful exposures herein to assess how the Fund was geographically diversified—or specialized, however inadvertent.

On the whole, the Fund incorporated investments among 33 countries outside the U.S. during the fiscal year. U.S. stocks were the most additive to both the Fund and the benchmark return. Outside the U.S., the Fund’s relatively larger DM country exposure (and average weight) included Japan (10%), U.K. (6%), Hong Kong (3%), Germany (3%), Canada (3%), France (3%), and Australia (3%). Overweight Fund positions to Japan and Hong Kong (relative to the MSCI ACWI), resulted in far superior results than those country exposures of the benchmark. A relative overweight position in Finland was not a Fund advantage, however, as it severely lagged the return of the minuscule exposure of that held by the MSCI ACWI. This indicates that the country allocation, itself, wasn’t a relative detractor; rather, it was the Fund’s industry group/stock investments within Finland that were substandard. Underweight allocations to Switzerland and the Netherlands had opposite results. The Fund’s Swiss holdings (made up of miscellaneous sector exposures) trailed the benchmark, while the Fund’s Dutch allocation, primarily composed of Financials stocks, significantly outperformed the heavier country allocation of the MSCI ACWI. The Fund’s outperformance in the Netherland’s allocation suggests the Fund’s choice of industries/stocks was higher quality.

The Fund’s biggest EM country weights were South Korea (4%), Taiwan (3%), China (3%), Brazil (3%), and South Africa (2%). Versus the MSCI ACWI, the Fund’s materially heavier exposure to Thailand, Brazil, Malaysia, and South Korea paid off, contributing significantly more to return than corresponding MSCI ACWI exposure to those countries; however, relative overweight exposure to South Africa and Taiwan did not outperform the benchmark’s smaller allocations, which tells us the Fund’s group/stock selection was substandard versus the benchmark, not necessarily the country allocation, itself.

With no targeted-weight prerequisites, the Fund freely migrates across the spectrum of countries, a dynamic approach in contrast to the essentially static construction of the MSCI ACWI. Unlike the benchmark, this flexibility enables the Fund to change focus and/or fluidly shift portfolio characteristics if there are red flags to avoid certain industries, or to incorporate other concentrations when the quantitative disciplines draw attention to newly appealing investment themes.

With regards to the potential risk of currency fluctuations, the Leuthold Global Industries Fund does not implement special practices to circumvent the possibility of adverse influences. While some funds employ currency hedging programs, they are costly, and there is no assurance that such campaigns will be additive to performance. The Leuthold Global Industries Fund does, however, attempt to identify and capitalize on broad FX-market trends through a U.S. dollar-based relative strength component which is incorporated in the model. In recent years, U.S. dollar strength had been a headwind for a global equity portfolio that does not hedge currency exposure, like ours, but this year a weaker U.S. dollar added some tailwind. The effects of U.S. dollar strength/weakness should balance out over time.

In summary, our global-investment process is distinctive in that the quantitative analysis employed aims to identify attractive industries. The Fund attempts to profit from those themes by accumulating applicable exposure through reasonably-priced

The Leuthold Funds - 2017 Annual Report | 7 |

stocks which may be trading on any viable global stock exchange. Conventional global investment styles aim to assemble expertise in subclasses of equities, typically based on commonalities such as locale, and thereby have both less diversification and much smaller stock universes from which to pick. We believe the borderless approach of the Leuthold Global Industries Fund has an advantage over the traditional country-focused style.

Grizzly Short Fund

This Fund is 100% short individual stocks; the goal is to profit when stock prices decline. For the fiscal year ended September 30, 2017, the Grizzly Short Fund produced a -12.97% total return; this is nearly two times better than its peer group average, the Morningstar Bear Market fund category, which returned -25.44%. The Fund also improved on the inverse results of both the S&P MidCap 400 and S&P 500 total returns of +17.52% and +18.61%, respectively. (Compared to inverse results of these two market indexes, the Grizzly Short Fund exceeded each by an average of 500 basis points).

In the past we’ve noted that a large performance difference between the Fund and a benchmark can be attributable to disproportionate market capitalization. With the Grizzly Short Fund more closely tracking the cap size of the S&P MidCap, historically performance between the two has been quite narrow, a reflection that the MidCap index serves as a more equitable comparator than the three-times larger S&P 500. Over the last two years, the extraordinarily broad nature of bull market breadth appears to have, at least temporarily, suspended this size trait as a performance factor.

Most of the Grizzly Short Fund’s sector allocations detracted from performance. Information Technology and Financials, both underweight versus the S&P 500, were the largest contributors to the twelve-month loss (-6% combined). Within the Financials exposure, the Fund’s investments amassed much deeper losses than the inverse S&P 500 holdings, but due to the Fund’s significantly lower overall exposure (average 6% weight versus S&P 500 14% weight), the downside effect was muted. The opposite occurred with the Information Technology exposure; the benchmark accumulated bigger losses among its Information Technology positions, hence the Fund’s selection of investments within the sector was superior (by losing less). These sectors’ collective contribution to Fund return being less negative than that of the associated S&P 500 sectors explains the bulk of the Grizzly Short Fund’s overall fiscal year relative outperformance. Among other sector exposure, Consumer Discretionary, Materials, Industrials, Telecom, and Health Care each tacked on -1.2% on average to the year’s loss. Energy, Real Estate, Utilities, and Consumer Staples positions were relatively flat. Among these, additional boosts to the Fund’s FY relative outperformance came from Consumer Staples, Utilities, Health Care, and Industrials sector holdings, which were additive (by losing 2% less) compared to the inverse S&P 500 sector allocations.

Out of the 235 stock positions that were held at one time or another over the course of the year, 65 had a positive contribution to Fund return and delivered a solid offset to the losing positions (+1,011 basis points). Those industry groups detracting the most were components of the Fund’s two biggest sector detractors: Financials’ Regional Banks and Investment Banking/ Brokerage groups, and the Information Technology groups of Internet Software & Services and Application Software. Pharmaceuticals and Health Care Equipment groups combined for the Fund’s largest group losers in its Health Care sector exposure.

Single industry group concentrations that provided the best returns (offsetting losses) were Apparel Accessories & Luxury Goods (Consumer Discretionary sector), Packaged Foods & Meats (Consumer Staples), and Biotechnology (Health Care). Within the Energy sector, the combined holdings of Oil & Gas Exploration and Oil & Gas Equipment also served to contribute a gain.

8 | The Leuthold Funds - 2017 Annual Report |

Typically, having well-defined sector overweights and/or underweights can be either a meaningful advantage or disadvantage with the Grizzly Short Fund. With the exception of Energy, this past year’s sector weighting divergences in the Fund (versus the S&P 500) were not very extensive. Energy’s huge underweight did serve the Fund well, as did the less pronounced Health Care underweight. None of the other tilts were particularly significant size-wise, or notable performance-wise. This comparatively low level of disproportionate sector weight versus the S&P 500 is likely the result of the deep-seated market breadth which developed this year, evidenced by the remarkable level of bullish agreement across capitalization tiers, sectors, styles, and factors.

The Grizzly Short Fund is an extremely disciplined methodology, with stock positions monitored on a daily basis. High turnover is characteristic; sector concentrations and industry-group compositions have the potential to fluctuate considerably, unlike the S&P 500 sector/group weights. Safeguards in the Fund include specific gain/loss constraints that trigger short-covering action to lock-in gains and/or stop losses, and sector and sub-industry group concentrations employ weighting restrictions as a means to avoid the vulnerability of being overexposed to a specific area. As opposed to a market-capitalization weighted index, such as the S&P 500, the Grizzly Short Fund stock positions are similarly weighted across the portfolio. It’s unlikely that a relatively small number of stocks could have an enormous effect on Fund performance, as can occur in a cap-weighted index, such as the YTD bias of six big Tech stocks (Alphabet, Microsoft, Amazon, Netflix, Facebook, and Apple) on the S&P 500, which are exclusively responsible for 24% of the index’s +16% return through late October.

The year’s seemingly unstoppable procession of new equity market highs tells us that the bull market is in an extended topping process, which is a challenging environment for short-sellers. Broadly rising stock prices lead to negative returns for the Grizzly Short Fund, yet, the Fund was value-added with solid outperformance versus the inverse of both the S&P 500 and S&P MidCap 400, and it was sharply ahead of its Morningstar peer group of bear market funds. Ultimately, market breadth will begin to deteriorate in advance of the final bull market peak, a condition which should greatly benefit the Grizzly Short Fund. Such a transition, however, does not appear to be imminent. For now, the Fund is positioned to pick out market laggards and take advantage of downside weakness, which is inevitable even as the market advances further and stock valuations get stretched to even higher highs.

Investors who are not experienced in short-selling and who do not monitor for changing risk profiles should consider one of our tactical asset allocation funds: the Leuthold Core Investment Fund or the Leuthold Global Fund. These diversified Funds have the latitude to implement this short-selling strategy within their portfolio allocations to hedge downside equity risk when the stock market is viewed as overvalued and vulnerable to a correction.

Year Of The G.O.A.T.?

The stock market began October with a surge into the S&P 500 target zone of 2,550-2,600 that we established at the beginning of 2017, and it did so with the backing of much broader leadership than we had expected at the onset of the year. Blue chip stocks (both domestic and international) have been the biggest winners—which fits the historical tendency for those stocks to perform well in the late stages of a cyclical bull market. But, Mid and Small Caps managed to match the blue chips’ gains over the last three months after lagging during the first half of 2017.

The newest bull market highs recorded in late October were some of the broadest we’ve observed throughout the entire eight and a half year bull market, extending beyond the capitalization tier subsets to include traditional leading groups like Transportation stocks, Banks, and Utilities, along with various cyclical industries that have also tended to roll over prior to the

The Leuthold Funds - 2017 Annual Report | 9 |

final bull market peak. From the perspective of pure price action, the latest market highs look nothing like those observed at the last several bull market peaks. In each of those instances, the market had suffered significant “internal” damage by the time the S&P 500 and Dow Jones Industrial Average made their final highs; secondary stocks and various bellwether industry groups usually underperform for many months in advance.

Based solely on the market’s favorable momentum, breadth, and leadership trends, we expect stocks to be trading at even higher levels in the next three to six months. But these bullish “technical” considerations have been partly offset by deterioration in our Intrinsic Value measures. The current 20-month bull market rally commenced from valuation levels that were already fairly lofty, and the breadth of the upside move—while bullish from a technical point of view—has resulted in a market that is now more broadly overvalued than even that of the late 1990s’ market mania.

Valuations are not the stock market’s only challenge. With the U.S. unemployment rate recently falling to the 4.2% level, we must consider the likelihood that this cycle’s best news on inflation and corporate profitability may already be behind us. In fact, several of our economic measures have reached thresholds where they’ve historically proven “too hot” for both the stock and bond markets. Our leading inflation indicators continue to trend slowly upward, and the Federal Reserve will soon announce the details of its plan to begin to shrink the $4.5 trillion balance sheet it built up during the years of Quantitative Easing. It’s difficult to imagine that even a small liquidation of the Fed’s massive bond holdings will be pulled-off without some stock market hitch.

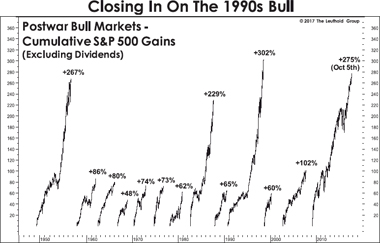

In this cycle, the Fed has been notorious for “moving the goalposts,” regarding which economic conditions are required for rate hikes. That, in turn, requires us to move our goalpost by 100 S&P 500 points, to a 2017 year-end zone of 2,650-2,700. If the S&P 500 notches a close above 2,717, this bull market will become the Greatest (postwar) cyclical bull Of All Time—eclipsing even the 1990-1998 gain of 302%. It’s already been a good year for the G.O.A.T., with Tom Brady, Roger Federer, and Floyd Mayweather all cementing their claims. With the S&P 500 less than 7% away from the requisite threshold, why not?

10 | The Leuthold Funds - 2017 Annual Report |

Thank you for your interest and support of the Leuthold Funds. We welcome your comments and questions.

Sincerely,

Doug Ramsey, CFA, CMT

CIO & Co-Portfolio Manager

| | |

| Chun Wang, CFA, PRM | Jun Zhu, CFA | Greg Swenson, CFA |

| Co-Portfolio Manager | Co-Portfolio Manager | Co-Portfolio Manager |

Kristen Perleberg, CFA

Co-Portfolio Manager

The Leuthold Funds - 2017 Annual Report | 11 |

The Leuthold Funds

Expense Examples – September 30, 2017 (Unaudited)

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, including reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held the entire period (April 1, 2017 – September 30, 2017).

Actual Expenses

The first line of the following table provides information about actual account values and actual expenses. Although the Funds charge no sales load (the Leuthold Core Investment Fund, Leuthold Global Fund, and Leuthold Global Industries Fund charge a 2% redemption fee for redemptions made within five business days after a purchase), you will be assessed fees for outgoing wire transfers, returned checks, or stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Funds’ transfer agent. If you request a redemption be made by wire transfer, currently a $15.00 fee is charged by the Funds’ transfer agent. To the extent that the Funds invest in shares of other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which a Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary by fund. These expenses are not included in the following examples. The examples include, but are not limited to, management fees, shareholder servicing fees, fund accounting, custody, and transfer agent fees. However, the following examples do not include portfolio trading commissions and related expenses, and extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Examples for Comparison Purposes

The second line of the following tables provide information about hypothetical account values and hypothetical expenses based on the Funds’actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or exchange fees. Therefore, the second line of the tables is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

12 | The Leuthold Funds - 2017 Annual Report |

The Leuthold Funds

Expense Example Tables (Unaudited)

Leuthold Core Investment Fund - Retail Class - LCORX

| | | Beginning

Account Value

April 1, 2017 | | | Ending

Account Value

September 30, 2017 | | | Expenses Paid

During Period*

April 1, 2017 - September 30, 2017 | |

| Actual** | | $ | 1,000.00 | | | | $ | 1,082.40 | | | | $ | 6.42 | | |

| Hypothetical (5% return before expenses)*** | | | 1,000.00 | | | | | 1,018.90 | | | | | 6.23 | | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.23%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period.

** Excluding dividends and interest on securities sold short, your actual cost of investment in the Fund would be $6.16 and the Fund’s annualized expense ratio would be 1.18%.

*** Excluding dividends and interest on securities sold short, your hypothetical cost of investment in the Fund would be $5.97 and the Fund’s annualized expense ratio would be 1.18%.

Leuthold Core Investment Fund - Institutional Class - LCRIX

| | | Beginning

Account Value

April 1, 2017 | | | Ending

Account Value

September 30, 2017 | | | Expenses Paid

During Period*

April 1, 2017 - September 30, 2017 | |

| Actual** | | $ | 1,000.00 | | | | $ | 1,083.10 | | | | $ | 5.90 | | |

| Hypothetical (5% return before expenses)*** | | | 1,000.00 | | | | | 1,019.40 | | | | | 5.72 | | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.13%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period.

** Excluding dividends and interest on securities sold short, your actual cost of investment in the Fund would be $5.64 and the Fund’s annualized expense ratio would be 1.08%.

*** Excluding dividends and interest on securities sold short, your hypothetical cost of investment in the Fund would be $5.47 and the Fund’s annualized expense ratio would be 1.08%.

Leuthold Global Fund - Retail Class - GLBLX

| | | Beginning

Account Value

April 1, 2017 | | | Ending

Account Value

September 30, 2017 | | | Expenses Paid

During Period*

April 1, 2017 - September 30, 2017 | |

| Actual** | | $ | 1,000.00 | | | | $ | 1,069.10 | | | | $ | 7.26 | | |

| Hypothetical (5% return before expenses)*** | | | 1,000.00 | | | | | 1,018.05 | | | | | 7.08 | | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.40%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period.

** Excluding dividends and interest on securities sold short, your actual cost of investment in the Fund would be $7.21 and the Fund’s annualized expense ratio would be 1.39%.

*** Excluding dividends and interest on securities sold short, your hypothetical cost of investment in the Fund would be $7.03 and the Fund’s annualized expense ratio would be 1.39%.

Leuthold Global Fund - Institutional Class - GLBIX

| | | Beginning

Account Value April 1, 2017 | | | Ending

Account Value

September 30, 2017 | | | Expenses Paid

During Period*

April 1, 2017 - September 30, 2017 | |

| Actual** | | $ | 1,000.00 | | | | $ | 1,070.20 | | | | $ | 6.49 | | |

| Hypothetical (5% return before expenses)*** | | | 1,000.00 | | | | | 1,018.80 | | | | | 6.33 | | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.25%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period.

** Excluding dividends and interest on securities sold short, your actual cost of investment in the Fund would be $6.44 and the Fund’s annualized expense ratio would be 1.24%.

*** Excluding dividends and interest on securities sold short, your hypothetical cost of investment in the Fund would be $6.28 and the Fund’s annualized expense ratio would be 1.24%.

| The Leuthold Funds - 2017 Annual Report | 13 |

The Leuthold Funds

Expense Example Tables (Unaudited) (continued)

Leuthold Select Industries Fund - Retail Class - LSLTX

| | | Beginning

Account Value April 1, 2017 | | | Ending

Account Value

September 30, 2017 | | | Expenses Paid

During Period*

April 1, 2017 - September 30, 2017 | |

| Actual | | $ | 1,000.00 | | | | $ | 1,111.50 | | | | $ | 7.94 | | |

| Hypothetical (5% return before expenses) | | | 1,000.00 | | | | | 1,017.55 | | | | | 7.59 | | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.50%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period.

Leuthold Global Industries Fund - Retail Class - LGINX

| | | Beginning

Account Value April 1, 2017 | | | Ending

Account Value

September 30, 2017 | | | Expenses Paid

During Period*

April 1, 2017 - September 30, 2017 | |

| Actual | | $ | 1,000.00 | | | | $ | 1,097.50 | | | | $ | 7.89 | | |

| Hypothetical (5% return before expenses) | | | 1,000.00 | | | | | 1,017.55 | | | | | 7.59 | | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.50%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period.

Leuthold Global Industries Fund - Institutional Class - LGIIX

| | | Beginning

Account Value April 1, 2017 | | | Ending

Account Value

September 30, 2017 | | | Expenses Paid

During Period*

April 1, 2017 - September 30, 2017 | |

| Actual | | $ | 1,000.00 | | | | $ | 1,098.90 | | | | $ | 6.58 | | |

| Hypothetical (5% return before expenses) | | | 1,000.00 | | | | | 1,018.80 | | | | | 6.33 | | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.25%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period.

Grizzly Short Fund - GRZZX

| | | Beginning

Account Value

April 1, 2017 | | | Ending

Account Value

September 30, 2017 | | | Expenses Paid

During Period*

April 1, 2017 - September 30, 2017 | |

Actual** | | $ | 1,000.00 | | | | $ | 925.90 | | | | $ | 13.18 | | |

Hypothetical (5% return before expenses)*** | | | 1,000.00 | | | | | 1,011.38 | | | | | 13.77 | | |

* Expenses are equal to the Fund’s annualized expense ratio of 2.73%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period.

** Excluding dividends and interest on securities sold short, your actual cost of investment in the Fund would be $7.48 and the Fund’s annualized expense ratio would be 1.55%.

*** Excluding dividends and interest on securities sold short, your hypothetical cost of investment in the Fund would be $7.84 and the Fund’s annualized expense ratio would be 1.55%.

| 14 | The Leuthold Funds - 2017 Annual Report |

The Leuthold Funds

(Unaudited)

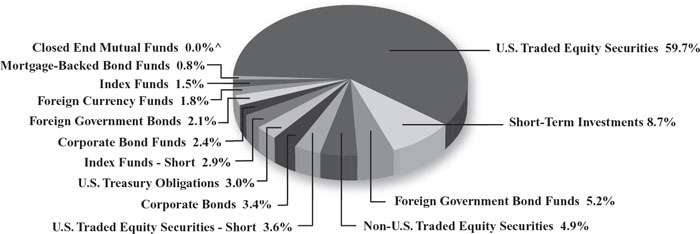

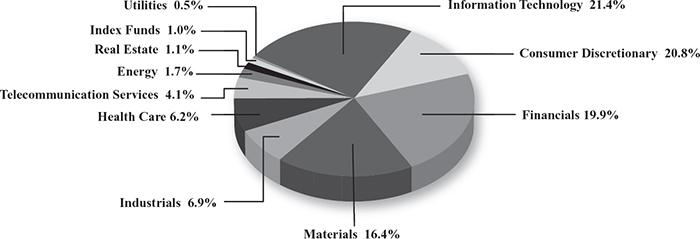

Leuthold Core Investment Fund

Allocation of Portfolio Holdings

September 30, 2017

Leuthold Global Fund

Allocation of Portfolio Holdings

September 30, 2017

^ Amount is less than 0.05%.

The Leuthold Funds - 2017 Annual Report | 15 |

The Leuthold Funds

(Unaudited)

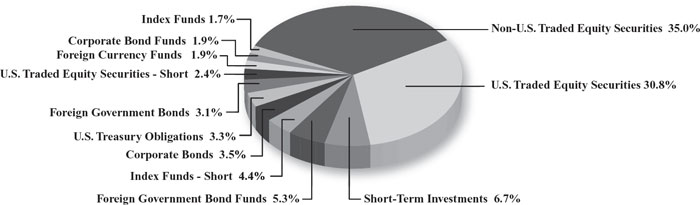

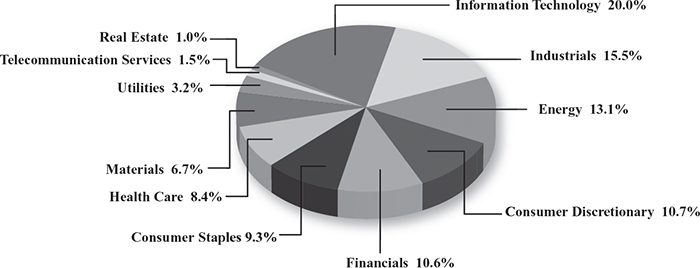

Leuthold Select Industries Fund

Allocation of Portfolio Holdings

September 30, 2017*

Leuthold Global Industries Fund

Allocation of Portfolio Holdings

September 30, 2017*

* Excludes short-term investments less than 5% of net assets.

** For presentation purposes, the Fund has grouped some of the industry classifications. For purposes of categorizing securities for compliance with Section 8(b)(1) of the Investment Company Act of 1940, the Fund uses more specific industry classifications.

16 | The Leuthold Funds - 2017 Annual Report |

The Leuthold Funds

(Unaudited)

Grizzly Short Fund

Allocation of Securities Sold Short

September 30, 2017

The Leuthold Funds - 2017 Annual Report | 17 |

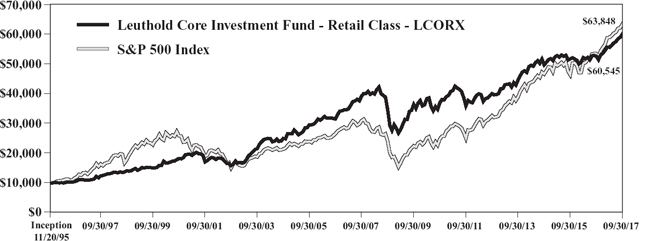

| Leuthold Core Investment Fund - Retail Class - LCORX |

(Unaudited)

Average Annual Rate of Return For Periods Ended

September 30, 2017

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | Since

Inception |

| Leuthold Core Investment Fund - Retail Class - LCORX | | 14.31% | | 6.56% | | 8.47% | | 4.38% | | 8.59% |

| Lipper Flexible Portfolio Fund Index | | 12.17% | | 5.43% | | 7.43% | | 4.86% | | 6.52% |

| S&P 500 Index | | 18.61% | | 10.81% | | 14.22% | | 7.44% | | 8.85% |

| Morningstar Tactical Allocation Index | | 9.31% | | 3.38% | | 4.89% | | 3.34% | | 5.12% |

| Bloomberg Barclays Global Aggregate Index | | (1.26)% | | 1.30% | | 0.48% | | 3.31% | | 4.61% |

A $10,000 investment in the Leuthold Core Investment Fund – Retail Class - LCORX

The Lipper Flexible Portfolio Funds Index is composed of funds that allocate investments across various asset classes with a focus on total return, as defined by Lipper.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks, which represent all major industries.

The Morningstar Tactical Allocation Index is comprised of funds that incorporate a tactical asset allocation strategy which is the process by which the asset of a fund is changed on a short-term basis to take advantage of perceived differences in relative values of the various asset classes.

The Bloomberg Barclays Global Aggregate Index provides a broad-based measure of the global investment grade fixed-rate debt markets. It is comprised of the U.S. Aggregate, Pan-European Aggregate, the Asian-Pacific Aggregate Indices, and the Canadian Aggregate Indices. It also includes a wide range of standard and customized sub-indices by liquidity constraint, sector, quality, and maturity.

This chart assumes an initial gross investment of $10,000 made on September 30, 2007. Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

18 | The Leuthold Funds - 2017 Annual Report |

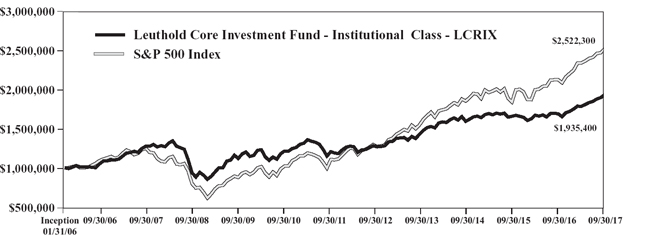

Leuthold Core Investment Fund - Institutional Class - LCRIX

(Unaudited)

Average Annual Rate of Return For Periods Ended

September 30, 2017

| | | | | | | | | | | |

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | Since

Inception |

| Leuthold Core Investment Fund - Institutional Class - LCRIX | | 14.43% | | 6.66% | | 8.58% | | 4.49% | | 5.82% |

| Lipper Flexible Portfolio Fund Index | | 12.17% | | 5.43% | | 7.43% | | 4.86% | | 5.79% |

| S&P 500 Index | | 18.61% | | 10.81% | | 14.22% | | 7.44% | | 8.26% |

| Morningstar Tactical Allocation Index | | 9.31% | | 3.38% | | 4.89% | | 3.34% | | 3.47% |

| Bloomberg Barclays Global Aggregate Index | | (1.26)% | | 1.30% | | 0.48% | | 3.31% | | 3.81% |

A $1,000,000 investment in the Leuthold Core Investment Fund – Institutional Class - LCRIX

The Lipper Flexible Portfolio Funds Index is composed of funds that allocate investments across various asset classes with a focus on total return, as defined by Lipper.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks, which represent all major industries.

The Morningstar Tactical Allocation Index is comprised of funds that incorporate a tactical asset allocation strategy which is the process by which the asset of a fund is changed on a short-term basis to take advantage of perceived differences in relative values of the various asset classes.

The Bloomberg Barclays Global Aggregate Index provides a broad-based measure of the global investment grade fixed-rate debt markets. It is comprised of the U.S. Aggregate, Pan-European Aggregate, the Asian-Pacific Aggregate Indices, and the Canadian Aggregate Indices. It also includes a wide range of standard and customized sub-indices by liquidity constraint, sector, quality, and maturity.

This chart assumes an initial gross investment of $1,000,000 made on September 30, 2007. Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

The Leuthold Funds - 2017 Annual Report | 19 |

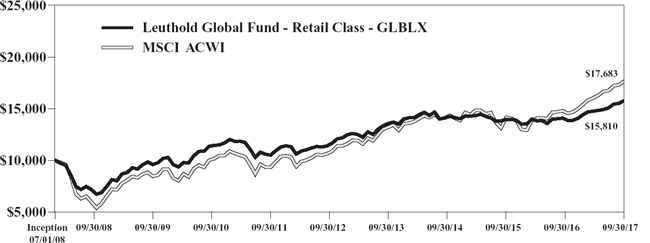

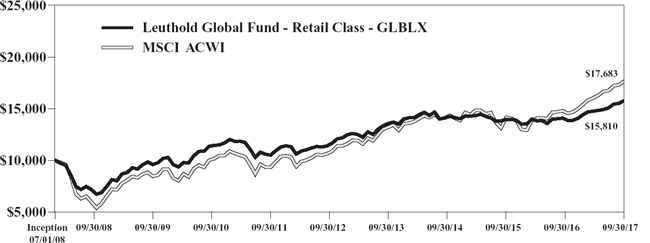

Leuthold Global Fund - Retail Class - GLBLX

(Unaudited)

Average Annual Rate of Return For Periods Ended

September 30, 2017

| | | 1 Year | | 3 Year | | 5 Year | | Since

Inception | |

| Leuthold Global Fund - Retail Class - GLBLX | | 12.02% | | 4.01% | | 6.82% | | 5.08% | |

| MSCI ACWI | | 19.29% | | 8.02% | | 10.79% | | 6.36% | |

| Bloomberg Barclays Global Aggregate Index | | (1.26)% | | 1.30% | | 0.48% | | 2.86% | |

| S&P 500 Index | | 18.61% | | 10.81% | | 14.22% | | 9.91% | |

A $10,000 investment in the Leuthold Global Fund - Retail Class - GLBLX

The MSCI ACWI (All Country World Index) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI ACWI consists of 47 country indices comprising 23 developed and 24 emerging market country indices. The developed market country indices included are: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States. The emerging market country indices included are: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Pakistan, Peru, Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey, and United Arab Emirates.

The Bloomberg Barclays Global Aggregate Index provides a broad-based measure of the global investment grade fixed-rate debt markets. It is comprised of the U.S. Aggregate, Pan-European Aggregate, the Asian-Pacific Aggregate Indices, and the Canadian Aggregate Indices. It also includes a wide range of standard and customized sub-indices by liquidity constraint, sector, quality, and maturity.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks, which represent all major industries.

This chart assumes an initial gross investment of $10,000 made on July 1, 2008 (commencement of operations). Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

20 | The Leuthold Funds - 2017 Annual Report |

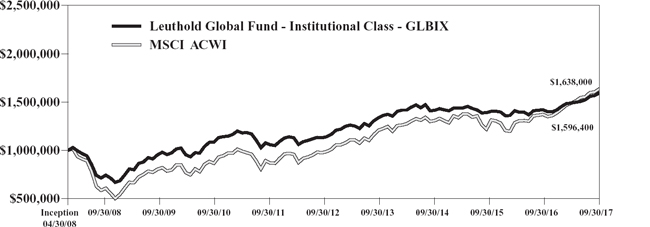

Leuthold Global Fund - Institutional Class - GLBIX

(Unaudited)

Average Annual Rate of Return For Periods Ended

September 30, 2017

| | | | | | | | | | |

| | | 1 Year | | 3 Year | | 5 Year | | Since

Inception | |

| Leuthold Global Fund - Institutional Class - GLBIX | | 12.28% | | 4.23% | | 7.06% | | 5.09% | |

| MSCI ACWI | | 19.29% | | 8.02% | | 10.79% | | 5.38% | |

| Bloomberg Barclays Global Aggregate Index | | (1.26)% | | 1.30% | | 0.48% | | 2.68% | |

| S&P 500 Index | | 18.61% | | 10.81% | | 14.22% | | 8.90% | |

A $1,000,000 investment in the Leuthold Global Fund - Institutional Class - GLBIX

The MSCI ACWI (All Country World Index) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI ACWI consists of 47 country indices comprising 23 developed and 24 emerging market country indices. The developed market country indices included are: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States. The emerging market country indices included are: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Pakistan, Peru, Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey, and United Arab Emirates.

The Bloomberg Barclays Global Aggregate Index provides a broad-based measure of the global investment grade fixed-rate debt markets. It is comprised of the U.S. Aggregate, Pan-European Aggregate, the Asian-Pacific Aggregate Indices, and the Canadian Aggregate Indices. It also includes a wide range of standard and customized sub-indices by liquidity constraint, sector, quality, and maturity.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks, which represent all major industries.

This chart assumes an initial gross investment of $1,000,000 made onApril 30, 2008 (commencement of operations). Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

The Leuthold Funds - 2017 Annual Report | 21 |

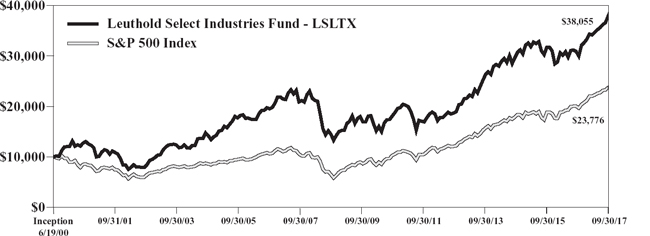

Leuthold Select Industries Fund - LSLTX

(Unaudited)

Average Annual Rate of Return For Periods Ended

September 30, 2017

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | Since

Inception |

| Leuthold Select Industries Fund - LSLTX | | 22.93% | | 10.07% | | 15.10% | | 5.29% | | 8.04% |

| Russell 2000 Index | | 20.74% | | 12.18% | | 13.79% | | 7.85% | | 7.68% |

| Lipper Multi-Cap Core Funds Index | | 17.81% | | 9.46% | | 13.25% | | 6.67% | | 5.40% |

| S&P 500 Index | | 18.61% | | 10.81% | | 14.22% | | 7.44% | | 5.14% |

A $10,000 investment in the Leuthold Select Industries Fund - LSLTX

The Russell 2000 Index is comprised of approximately 2000 of the smallest companies in the Russell 3000 Index, representing approximately 10% of the Russell 3000 total market capitalization.

The Lipper Multi-Cap Core Funds Index is an average of funds that invest in a variety of market capitalization ranges without concentrating 75% of their equity assets in any one market capitalization range over an extended period of time. Multi-cap funds typically have between 25% and 75% of their assets invested in companies with market capitalizations (on a three-year weighted basis) above 300% of the dollar-weighted median market capitalization of the middle 1,000 securities of the S&P SuperComposite 1500 Index. These funds typically have an average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share growth value, compared to the S&P SuperComposite 1500 Index.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks, which represent all major industries.

This chart assumes an initial gross investment of $10,000 made on September 30, 2007. Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

22 | The Leuthold Funds - 2017 Annual Report |

Leuthold Global Industries Fund - Retail Class - LGINX

(Unaudited)

Average Annual Rate of Return For Periods Ended

September 30, 2017

| | | 1 Year | | 3 Year | | 5 Year | | Since Inception | |

| Leuthold Global Industries Fund - Retail Class - LGINX | | 20.90% | | 6.72% | | 12.22% | | 10.33% | |

| MSCI ACWI | | 19.29% | | 8.02% | | 10.79% | | 10.36% | |

| Lipper Global Multi-Cap Value Index | | 18.12% | | 6.00% | | 10.21% | | 9.56% | |

| S&P 500 Index | | 18.61% | | 10.81% | | 14.22% | | 13.78% | |

A $10,000 investment in the Leuthold Global Industries Fund - Retail Class - LGINX

The MSCI ACWI (All Country World Index) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI ACWI consists of 47 country indices comprising 23 developed and 24 emerging market country indices. The developed market country indices included are: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States. The emerging market country indices included are: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Pakistan, Peru, Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey, and United Arab Emirates.

The Lipper Global Multi-Cap Value Index is an index that measures investment in a variety of market capitalization ranges without concentrating 75% of their equity assets in any one market capitalization range over an extended period of time. Typically this index has 25% to 75% of their assets invested in companies both inside and outside of the U.S. with market capitalizations (on a three-year weighted basis) above 400% of the 75th market capitalization percentile of the S&P/Citigroup World Broad Market Index.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks, which represent all major industries.

This chart assumes an initial gross investment of $10,000 made on May 17, 2010 (commencement of operations). Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

The Leuthold Funds - 2017 Annual Report | 23 |

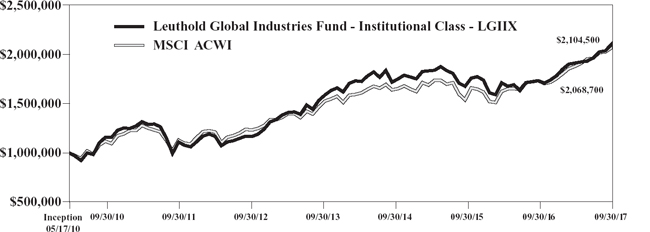

Leuthold Global Industries Fund - Institutional Class - LGIIX

(Unaudited)

Average Annual Rate of Return For Periods Ended

September 30, 2017

| | | 1 Year | | 3 Year | | 5 Year | | Since Inception | |

| Leuthold Global Industries Fund - Institutional Class - LGIIX | | 21.25% | | 6.96% | | 12.48% | | 10.62% | |

| MSCI ACWI | | 19.29% | | 8.02% | | 10.79% | | 10.36% | |

| Lipper Global Multi-Cap Value Index | | 18.12% | | 6.00% | | 10.21% | | 9.56% | |

| S&P 500 Index | | 18.61% | | 10.81% | | 14.22% | | 13.78% | |

A $1,000,000 investment in the Leuthold Global Industries Fund - Institutional Class - LGIIX

The MSCI ACWI (All Country World Index) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI ACWI consists of 47 country indices comprising 23 developed and 24 emerging market country indices. The developed market country indices included are: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States. The emerging market country indices included are: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Pakistan, Peru, Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey, and United Arab Emirates.

The Lipper Global Multi-Cap Value Index is an index that measures investment in a variety of market capitalization ranges without concentrating 75% of their equity assets in any one market capitalization range over an extended period of time. Typically this index has 25% to 75% of their assets invested in companies both inside and outside of the U.S. with market capitalizations (on a three-year weighted basis) above 400% of the 75th market capitalization percentile of the S&P/Citigroup World Broad Market Index.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks, which represent all major industries.

This chart assumes an initial gross investment of $1,000,000 made on May 17, 2010 (commencement of operations). Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

24 | The Leuthold Funds - 2017 Annual Report |

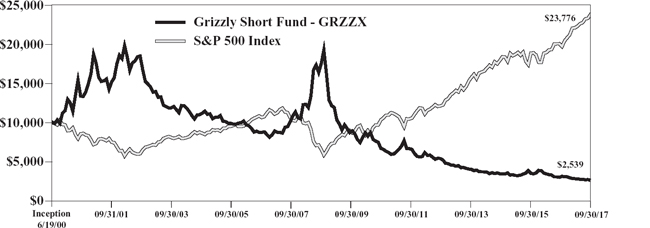

Grizzly Short Fund - GRZZX

(Unaudited)

Average Annual Rate of Return For Periods Ended

September 30, 2017

| | | | | | | | | | | Since |

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | Inception |

| Grizzly Short Fund - GRZZX | | (12.97)% | | (10.02)% | | (13.45)% | | (11.57)% | | (7.63)% |

| Lipper Dedicated Short Bias | | (22.48)% | | (18.02)% | | (21.60)% | | (17.14)% | | n/a* |

| S&P MidCap 400 Index | | 17.52% | | 11.18% | | 14.43% | | 9.00% | | 9.13% |

| S&P 500 Index | | 18.61% | | 10.81% | | 14.22% | | 7.44% | | 5.14% |

A $10,000 investment in the Grizzly Short Fund - GRZZX

The Lipper Dedicated Short Bias Funds Index is an equally weighted representation of funds in the Lipper Dedicated Short Bias category. These funds employ a hedge fund strategy that maintains a net short exposure to the market through a combination of short and long positions. A dedicated short bias investment strategy attempts to capture profits when the market declines, by holding investments that are overall biased to the short side.

The S&P MidCap 400 Index is a capitalization-weighted index, which measures the performance of the mid-range sector of the U.S. stock market. The index was developed with a base level of 100 as of December 31, 1990.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks, which represent all major industries.

This chart assumes an initial gross investment of $10,000 made on September 30, 2007. Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

*Index was introduced in July 2003.

The Leuthold Funds - 2017 Annual Report | 25 |

| Statements of Assets and Liabilities |

| September 30, 2017 |

| | | Leuthold | | | | | | | |

| | | Core | | | Leuthold | | | Leuthold | |

| | | Investment | | | Global | | | Select | |

| | Fund | | | Fund | | | Industries | |

| | | (Consolidated) | | | (Consolidated) | | | Fund | |

| ASSETS: | | | | | | | | | |

| Investments, at cost | | | | | | | | | | | | |

| Unaffiliated Securities | | $ | 721,834,912 | * | | $ | 99,819,875 | * | | $ | 11,061,393 | |

| Affiliated Securities | | | 15,975,666 | | | | — | | | | — | |

| Total Investments, at cost | | | 737,810,578 | | | | 99,819,875 | | | | 11,061,393 | |

| | | | | | | | | | | | | |

| Investments, at fair value | | | | | | | | | | | | |

| Unaffiliated Securities | | | 894,501,308 | | | | 111,768,382 | | | | 15,067,352 | |

| Affiliated Securities | | | 16,031,974 | | | | — | | | | — | |

| Total Investments, at fair value | | | 910,533,282 | | | | 111,768,382 | | | | 15,067,352 | |

| Cash | | | 16,002 | | | | 554 | | | | 410 | |

Foreign currency

(cost $12,052, $19,280, and $0, respectively) | | | 12,081 | | | | 19,334 | | | | — | |

| Receivable for Fund shares sold | | | 591,848 | | | | 45,119 | | | | 16,170 | |

| Collateral at broker for securities sold short | | | 60,784,141 | | | | 7,581,152 | | | | — | |

| Tri-party collateral held at custodian | | | 11,500,001 | | | | 1,500,001 | | | | — | |

| Interest receivable | | | 885,906 | | | | 133,962 | | | | 122 | |

| Dividends receivable | | | 307,157 | | | | 515,857 | | | | 6,910 | |

| Securities lending income receivable | | | 18,255 | | | | 6,053 | | | | — | |

| Other assets | | | 48,771 | | | | 8,300 | | | | 9,770 | |

| Total Assets | | | 984,697,444 | | | | 121,578,714 | | | | 15,100,734 | |

| | | | | | | | | | | | | |

| LIABILITIES: | | | | | | | | | | | | |

Securities sold short, at fair value

(proceeds $57,151,617, $7,186,012, and $0, respectively) | | | 57,964,906 | | | | 7,343,769 | | | | — | |

| Collateral received for securities loaned | | | 74,692,474 | | | | 11,234,557 | | | | — | |

| Payable for investments purchased | | | 295,602 | | | | 23,329 | | | | — | |

| Payable for Fund shares redeemed | | | 202,593 | | | | 36,411 | | | | 4,002 | |

| Payable to Adviser | | | 622,527 | | | | 75,785 | | | | 4,506 | |

| Payable to Custodian | | | 43,646 | | | | 17,880 | | | | 3,185 | |

| Payable to Directors | | | 37,783 | | | | 4,969 | | | | 638 | |

| Dividends payable on securities sold short | | | 146,222 | | | | 1,657 | | | | — | |

| Distribution (Rule 12b-1) fees payable | | | 7,361 | | | | 39,294 | | | | 89 | |

| Shareholder servicing fees payable | | | 45,404 | | | | — | | | | 1,090 | |

| Accrued expenses and other liabilities | | | 587,656 | | | | 146,779 | | | | 41,358 | |

| Total Liabilities | | | 134,646,174 | | | | 18,924,430 | | | | 54,868 | |

| NET ASSETS | | $ | 850,051,270 | | | $ | 102,654,284 | | | $ | 15,045,866 | |

| * Includes loaned securities with market value of: | | $ | 73,267,883 | | | $ | 10,977,352 | | | | n/a | |

| 26 The Leuthold Funds - 2017 Annual Report | See Notes to the Financial Statements. |

| Statements of Assets and Liabilities (continued) |

| September 30, 2017 |

| | | Leuthold | | | | | | | |

| | | Core | | | Leuthold | | | Leuthold | |

| | | Investment | | | Global | | | Select | |

| | | Fund | | | Fund | | | Industries | |

| | | (Consolidated) | | | (Consolidated) | | | Fund | |

| NET ASSETS CONSIST OF: | | | | | | | | | | | | |

| Capital stock | | $ | 651,333,761 | | | $ | 82,985,897 | | | $ | 10,531,563 | |

| Accumulated net investment income (loss) | | | 1,613 | | | | 19,636 | | | | (14,651 | ) |

| Accumulated net realized gain on investments and securities sold short | | | 26,800,898 | | | | 7,887,159 | | | | 522,995 | |

| Net unrealized appreciation on investments and securities sold short | | | 171,914,998 | | | | 11,761,592 | | | | 4,005,959 | |

| Total Net Assets | | $ | 850,051,270 | | | $ | 102,654,284 | | | $ | 15,045,866 | |

| | | | | | | | | | | | | |

| Retail Class Shares | | | | | | | | | | | | |

| Net assets | | $ | 464,660,913 | | | $ | 24,040,140 | | | $ | 15,045,866 | |

Shares outstanding

(1,000,000,000 shares of $0.0001 par value authorized) | | | 22,620,201 | | | | 2,391,758 | | | | 571,652 | |

| Net Asset Value, Redemption Price, and Offering Price Per Share | | $ | 20.54 | ** | | $ | 10.05 | ** | | $ | 26.32 | |

| | | | | | | | | | | | | |

| Institutional Class Shares | | | | | | | | | | | | |

| Net assets | | $ | 385,390,357 | | | $ | 78,614,144 | | | | n/a | |

Shares outstanding

(1,000,000,000 shares of $0.0001 par value authorized) | | | 18,742,933 | | | | 7,739,606 | | | | n/a | |

| Net Asset Value, Redemption Price, and Offering Price Per Share | | $ | 20.56 | ** | | $ | 10.16 | ** | | | n/a | |

** Redemption price may differ from NAV if redemption fee is applied.

| See Notes to the Financial Statements. | The Leuthold Funds - 2017 Annual Report 27 |

| Statements of Assets and Liabilities (continued) |

| September 30, 2017 |

| | | Leuthold | | | | |

| | | Global | | | Grizzly | |

| | | Industries | | | Short | |

| | | Fund | | | Fund | |

| ASSETS: | | | | | | |

| Investments, at cost | | $ | 9,113,432 | | | $ | 174,298,921 | |

| | | | | | | | | |

| Investments, at fair value | | | 10,941,410 | | | | 174,298,921 | |

| Cash | | | 86 | | | | — | |

| Foreign currency (cost $894 and $0, respectively) | | | 895 | | | | — | |

| Receivable for Fund shares sold | | | 2,764 | | | | 289,841 | |

| Collateral at broker for securities sold short | | | — | | | | 203,800,965 | |

| Tri-party collateral held at custodian | | | — | | | | 31,500,001 | |

| Interest receivable | | | 75 | | | | 131,617 | |

| Dividends receivable | | | 40,440 | | | | — | |

| Other assets | | | 13,731 | | | | 144,689 | |

| Total Assets | | | 10,999,401 | | | | 410,166,034 | |

| | | | | | | | | |