Annual Report

September 30, 2018

The Leuthold Funds

Leuthold Core Investment Fund

Retail Class Shares LCORX

Institutional Class Shares LCRIX

Leuthold Global Fund

Retail Class Shares GLBLX

Institutional Class Shares GLBIX

Leuthold Select Industries Fund LSLTX

Leuthold Global Industries Fund

Retail Class Shares LGINX

Institutional Class Shares LGIIX

Grizzly Short Fund GRZZX

The Leuthold Funds

Table of Contents

| 1 |

| 12 |

| 15 |

| 18 |

| 26 |

| 30 |

| 34 |

| 39 |

| Schedules of Investments and Securities Sold Short | |

| 47 |

| 55 |

| 64 |

| 67 |

| 72 |

| 77 |

| 92 |

| 93 |

| 94 |

The Leuthold Funds

De

ar Fellow Shareholders:

A year ago, the bull market was characterized as the “most hated” in history. This was evidenced by an obsession with “safety-first” equity investments and the absence of “cocktail-party buzz” ever since the bull market began over nine years earlier. However, we were seeing signs last year that the public-participation phase was underway, probably having begun (with the clarity of hindsight) way back on election night 2016. There was little evidence that tighter policy had yet adversely affected either the economy or the stock market. Many economic measures were not just making “cycle highs,” but 17- and 18-year highs. From a technical point of view, there were “new highs all around,” across all capitalization tiers, including nearly all breadth measures, and throughout the bellwether indicators that would typically be the forerunners to signal impending weakness.

In late 2017, market strength pushed several key valuation measures up to new bull market extremes and, although we anticipated cracks to develop in 2018, cyclical and technical conditions suggested valuations had room to move higher. Our tactical asset allocation funds were therefore bullishly positioned with net equity exposure of 62%—near the maximum level of 70% allowed per strategy guidelines. The global equity-market rally did indeed accelerate, and most major indices made new all-time highs. The synchronized global economic expansion continued to broaden out, and anemic inflation capped the rise in global interest rates. A crucial tax reform bill was passed in the U.S., further fueling optimism and animal spirits.

Set up for perfection, 2018 started off with markets at full throttle and stocks climbed even higher in January. The headlines didn’t deliver, however, and volatility returned to the equity market in a big way. An escalated deterioration of several economic and monetary factors drove our stock market analysis down to a neutral reading, hence, on January 25th, Leuthold tactical asset allocation funds reduced net equities down to 58% from 67%, a day in advance of the major market indexes once again setting new highs on January 26th. But, trade wars, tech regulation concerns, and rising interest rates slapped the market back into reality; the S&P 500 and MSCI ACWI pulled back by -10% and -8%, respectively, between late January and early February.

In March, our quantitatively-driven assessment regarding the outlook for stocks moved down to negative territory for the first time in two years and our tactical asset allocation funds reduced net equity exposure further, closing the month at 42-43%. Through March, gains produced by Leuthold Funds’ domestically-oriented tactical asset allocation fund and U.S.-traded long-equity fund were striking against the backdrop of losses experienced by most major indexes and peer-fund groups. Aligning with the market downtrend, both of Leuthold Funds’ globally-leaning strategies bore losses.

Continued economic growth, domestically, was given a shot in the arm by corporate tax cuts, and U.S. stocks staged a rebound in the months to follow, while international developed markets turned in lackluster performance and emerging markets performed poorly. The threat of a trade war was the dominant market theme and a big surge in the U.S. dollar also drove return differences. While volatility was lower across most asset classes, the macro headwind of central-bank liquidity reduction remained. Mega-cap growth stocks prolonged their rally while cheap stocks lagged.

In August, the S&P 500 fully erased the loss experienced from its nine-day swoon of late January to early February and it proceeded to advance even further in September, making a fresh all-time high. September’s stock market highs, however, were accompanied by something that the index highs of January 26th were not afflicted by: signs of internal distribution. Earlier in 2018, the market could alternatively be characterized as “divergent,” “disjointed,” or maybe even “discombobulated,” yet

The Leuthold Funds - 2018 Annual Report 1

despite enormous performance disparities—between the U.S. and the rest of the world, growth stocks versus value stocks, and momentum relative to ‘everything else’—the stock market still could not be dubbed “distributive” due to persistent strength in mid caps, small caps, advance/decline lines, and equal-weighted versions of major indexes. Contrary to that general strength of earlier-year market action, in late September, mid caps and small caps did hit air pockets, and breadth figures at September’s scattered highs in the DJIA and S&P 500 were exceptionally poor.

September’s brand-new signs of internal weakness prompted us to trim our tactical asset allocation funds’ net equity exposure to 40% in early October. Are we jumping the gun? Chart 1 illustrates that the “tape” has not exactly collapsed. Only two of the eight bellwethers shown had issued “official” warnings (i.e., failing to make a bull market high in the month leading up to the most recent S&P 500 high). Nevertheless, the combination of a full-employment U.S. economy, continued (and accelerating) global monetary tightening, and extremely high U.S. valuations suggest there’s substantial risk in waiting for “too much” market confirmation. There have been other times when the “tape” neglected to provide much forewarning—such as 1987 (Chart 2). In the coming fiscal year, we anticipate added market volatility, more risk than reward, and those invested solely in passively-managed funds to become acquainted with the reality of downside—the depths of which Leuthold Funds’ actively-managed strategies intend to bypass.

2 The Leuthold Funds - 2018 Annual Report

ANNUAL PERFORMANCE REVIEW

Tactical Asset Allocation—Domestic & Global Funds

One year ago, the Leuthold Core Investment Fund and Leuthold Global Fund were positioned with relatively aggressive net equity exposure of 62%. Even though our market analysis was firmly positive, extremely high stock market valuations were an impetus to keep exposure below the Funds’ maximum stock-allocation guideline of 70%. Entering 2018, market momentum indicators began to deteriorate, which steered incremental reductions to stock market exposure; by the end of March, both tactical asset allocation funds’ net equities had been scaled back to 42%. The Leuthold Global Fund’s equity reductions were accomplished by adding to the equity hedge while the Leuthold Core Investment Fund, in addition to increasing the equity hedge, sold stocks related to its Emerging Market allocation. During the remainder of the fiscal year, both Funds remained defensively positioned in the range of 42-45%.

For the fiscal year, the Leuthold Core Investment Fund posted a +3.23% total return (retail share class). Its peer group, Morningstar Tactical Allocation, bested the Fund with a total return of +5.60%. When evaluating against the fully-invested S&P 500 benchmark (+17.91% total return), the Fund substantially underperformed.

The Leuthold Global Fund produced a -0.67% total return (retail share class) for the fiscal year. The Fund trailed its peer-fund category, the Morningstar World Allocation average (+3.46% total return) by over 400 basis points. Compared to the fully-invested MSCI All Country World Index (ACWI) +9.77% total return, the Fund underperformed by over a 10% spread.

Indeed, holding net equity exposure roughly 55% less than the fully-invested benchmarks for two-thirds of the year partially accounts for the Leuthold Core Investment and Leuthold Global Funds’ performance disparities versus the S&P 500 and MSCI ACWI. Lower equity exposure, however, was ancillary to lagging results. There were deeper undercurrents behind the breadth of the Funds’ wide underperformance gaps which revolved around an abnormal reversal of momentum and value factor dynamics. This was a two-fold blow, agitating both the long stock and the short-stock investments. The Leuthold Core Investment Fund and Leuthold Global Fund were likewise negatively impacted in varying amounts by their foreign stock market coverage, which did not share the same degree of upside as major U.S. stock market indexes.

Long Equity Exposure

Over the last twelve months, the average monthly long-stock exposure in the Leuthold Core Investment Fund and Leuthold Global Fund was 63% and 62%, respectively. Of the portfolios’ sub-asset classes, this was the best performing component for the fiscal year. Reflecting the domination of U.S. stock performance versus foreign stock performance, there was a sizeable difference between the two Funds’ equity results; the domestically-oriented Leuthold Core Investment Fund’s equities (+7.99%) performed considerably better than that of the more globally-concentrated Leuthold Global Fund’s equity performance (+2.57%). Specifics related to each Fund’s long-stock performance dynamics are to follow under the heading, “Long Equity Exposure—Domestic & Global Funds.”

Supplementing its U.S.-traded equities, the Leuthold Core Investment Fund began the fiscal year with a long-equity allocation to Emerging Market (EM) stocks; this exposure provided additive performance during the first four months. In early 2018, an internally-tracked model gauging the strength of foreign developed markets/emerging markets began to deteriorate, and due to that, the EM allocation in the Leuthold Core Investment Fund was cut in half during April and finally eliminated in July. The segment experienced a loss of nearly 11% from April through June, reversing the gain captured earlier, and then some. Ultimately, due to its small weight, this partial-year EM equity slice had little impact on full-year results. At this time, EM valuations are attractive compared to the U.S. market, yet relative strength and earnings expectations have both worsened. We don’t believe a

The Leuthold Funds - 2018 Annual Report 3

true reversal in fortune for EM stocks will occur until a cyclical bear market erupts in the U.S. The Leuthold Core Investment Fund will be receptive to again commence investment here when our models indicate that an attractive entry point has been established.

Equity Hedge

Although our stock market outlook was essentially positive at the beginning of the fiscal year, the Leuthold Core Investment Fund and Leuthold Global Fund each maintained an equity hedge throughout the full twelve months. Initially, the hedge was employed as a defensive measure because several key valuation gauges had reached new extremes for the cycle, and long-term forecasts looked weak. From October through January, this was a 7% allocation, on average. In late January, deterioration across several economic and attitudinal inputs convinced us to become more cautious and the equity hedge was therefore upped to 14% between February and March; this served to reduce net equity exposure to about 42%. Reflecting our still-negative outlook for stocks, the hedge was maintained at that level, on average, through fiscal year end.

In a rising market scenario, such as the last twelve months, we presume the equity hedge will be largely subtractive; the intent is to diminish volatility and potentially add some value on the downside, in the case of intermittent market distress. The hedge was constructive in the midst of the sharp decline in early 2018, but following that correction, as overvalued growth stocks continued to get even pricier throughout the summer, the hedge detracted from performance. The losses from this allocation were intensified due to the impact of low-quality (and expensive) momentum stocks leading the upside—these are the type of stocks the short-selling strategy targets. This action amplified losses in the equity-hedge position. For the fiscal year, the negative return from this allocation resulted in a deduction to performance of 2% and 1%, respectively, for the Leuthold Core Investment Fund and Leuthold Global Fund.

Fixed Income

The Leuthold tactical asset allocation funds were underweight fixed income all year, with a 20-21% average weight (versus their customary 30% minimum levels), and the duration was kept at the short end of the scale. Assets were dispensed across securities containing varying risk profiles and exposures. Developed Market Sovereign Debt was the largest subclass at a 12% average weight; Quality Corporate Bonds, Emerging Market Sovereign Debt, and TIPS were the other main components held during the year, with small weights of 5%, 2%, and 1%, respectively. None of the positions had a measurable impact on performance during this fiscal year.

Looking ahead, for the first time in many years, we expect to see rising interest rates across the maturity spectrum which will create more attractive opportunities among fixed income securities. This should allow the Funds to boost exposure in this asset class and generate more measurable levels of income.

Commodities

Worries about inflation pressures heating up while the Fed is seemingly overly fixated on still well-behaved wage inflation figures, rising interest expenses, and commodities on the upswing all motivated the introduction of a 2% position in commodities during May. The holding offers economic exposure to an assorted basket of heavily-traded commodities in the energy, industrial metals, precious metals, and agriculture sectors. We’re not anticipating substantial upside here. Commodities provide the Leuthold tactical asset allocation funds with more diversification and the likelihood for measured gains. Investors putting all their eggs into U.S. equities will likely be disappointed in the next two-to-three years (and probably sooner). Over the short holding period through September 30th, the Funds’ commodities allocations were down slightly, although the size of the positions was too small to influence fiscal year performance.

4 The Leuthold Funds - 2018 Annual Report

Long Equity Exposure—Domestic & Global Funds

Leuthold Select Industries (SI) Fund and Leuthold Global Industries (GI) Fund are fully-invested stock portfolios. Both strategies use the firm’s decades old group-based investment research—a top-down methodology which, firstly, identifies industry groups that appear poised to become market leaders in the given environment, and next, invests in a selection of representative stocks that are highly attractive using a disciplined and quantitative value-oriented process. The archetype, Leuthold Select Industries Fund, became available in mutual fund format in June 2000; it is the domestic version and employs U.S.-traded securities. Global market exposure can also be gained in the SI Fund through foreign companies that list their stocks domestically via American Depositary Shares/Receipts (ADS/ADR). As world equity-market correlations strengthened throughout the decade, we saw the opportunity to extend our group-based investing to the global level, and The Leuthold Global Industries Fund was introduced in May 2010. The GI Fund aims to invest at least 40% of assets in stocks traded on global exchanges outside the U.S.

For the fiscal year ended September 30, 2018, the Leuthold Select Industries Fund had a total return of +8.89%; it underperformed its peer category, Morningstar Mid Cap Blend (+11.68% total return), and the tech-stock powered +17.91% total return of the S&P 500. The Leuthold Global Industries Fund produced a +0.95% total return (retail share class), which trailed both the MSCI ACWI and the Morningstar World Large Stock peer category (+9.77% and +8.87% total returns, respectively).

An uncharacteristic reversal of dynamics between momentum and value factors has been a big burden for many equity funds this year, ours included. Our equity strategies focus on less expensive, high-quality companies within industry groups that have good price and growth trends, and which trade at reasonable valuations. Over time that works very well; however, from January through September 2018, expensive lower-quality momentum stocks outperformed the cheapest stocks by almost 40%. This market attribute in 2018 was the prominent factor behind the Leuthold Select Industries Fund’s relative underperformance compared to the S&P 500; Leuthold Global Industries Fund was obstructed by the same element and had the added unfavorable effect of its international-predisposition, which did not possess the same strength that advanced the U.S. stock market.

Equity Sector And Industry Group Drivers

The Leuthold Select Industries and Leuthold Global Industries Funds’ portfolio construction will have disproportionate broad sector and industry group weights versus the benchmarks. The quantitative methodology intends to identify themes in a position to expand market leadership and/or uphold ongoing strength while avoiding those that may be prone to weakness based on the underlying investment-market backdrop. Selectively concentrating exposures is typically a very effective tactic to add alpha over the long term.

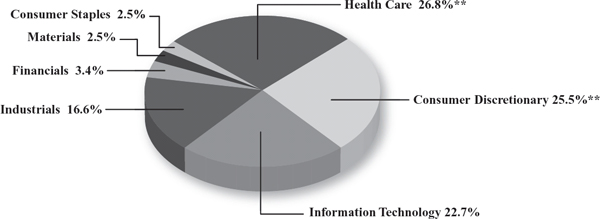

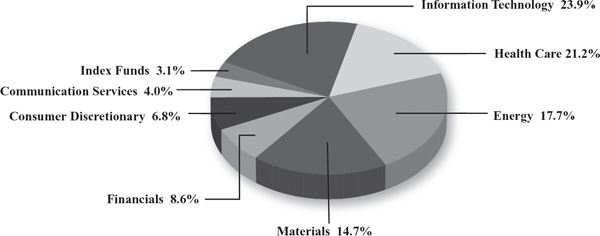

Over the last twelve months, the top two performing equity sectors were Consumer Discretionary and Information Technology (IT). These were the two largest allocations in both the Leuthold Select Industries Fund and Leuthold Global Industries Fund and each contained overweight exposures compared to the benchmarks. The Consumer Discretionary allocation was 29% and 17%, respectively, in the Leuthold Select Industries Fund and Leuthold Global Industries Fund, while Information Technology was held at average weights of 28% and 23%, respectively. Rightly possessing overweight allocations in the best performing sectors is a testament to the effectiveness of the Funds’ sector-rotation approach. Under normal circumstances, this dynamic should translate to impressive outperformance, but this year the underlying holdings in these two sectors contributed the worst relative performance of all the Funds’ sector allocations. The strangely-deficient results of the two Funds’ Consumer Discretionary and IT exposures, versus the benchmarks, was in large part the result of a lack of exposure to industries containing the year’s U.S.-headline dynamo

The Leuthold Funds - 2018 Annual Report 5

stocks, including the FAANG segment and others related to the Social/Mobile/Cloud crusade. Additionally, there was poor performance on an absolute basis from some of the industries that the Funds did have exposure to within the related sectors. These included IT stock positions from Semiconductor Equipment (both Funds), Semiconductors (GI Fund), Electronic Manufacturing Services (SI Fund), and Electronic Equipment & Instruments (GI Fund).

The Health Care (HC) sector was the third largest exposure in the Leuthold Select Industries Fund during the year and it was the third best performing equity sector; its overweight position (18% versus 14% in the S&P 500) was an advantage as it outperformed the benchmark’s corresponding HC allocation by over 200 basis points. The quantitative model correctly recognized continued leadership among the HC segment and thereby directed the SI Fund to retain heavy exposure. Contrary to the circumstances revolving around the Fund’s Consumer Discretionary and IT holdings, in this case the Fund’s productive results reflect the expected benefit of having a large allocation to one of the best performing sectors. Among the SI Fund holdings, stocks from Managed HC and HC Facilities drove performance. The Leuthold Global Industries Fund had a lower weight of 9% within the global Health Care sector (primarily via the Managed HC and HC Equipment & Supplies groups), which ranked as its fifth heaviest sector weighting. This was a smaller position than that of the MSCI ACWI. The globally-traded HC groups produced a positive return for the GI Fund but were not additive against the benchmarks’ exposure, which was ahead by about 50 basis points.

The Financials sector was underweight the benchmarks, in both the SI Fund (12% of assets versus S&P 500’s 15%) and GI Fund (15% of assets versus MSCI ACWI’s 17%). In the SI Fund this sector was a neutral influence; strong stock selection within the Investment Banking & Brokerage group far outperformed that of the S&P 500’s related exposure, while a big SI Fund overweight to poorly performing U.S. Life & Health Insurance stocks detracted to an equitable degree. The GI Fund’s Financials exposure, on the other hand, had additive results from its allocations to the globally-traded Investment Banking & Brokerage and Life & Health Insurance groups; this served to offset the GI Fund’s outsized loss from an overweight exposure in Emerging Diversified Banks. Overall, during the last twelve months, Financials exposure in the GI Fund matched the performance of the benchmark’s corresponding segment.

Energy was held just above a market weight (6.6% of assets on average) in the GI Fund over the last twelve months and contributed similar results as the MSCI ACWI benchmark allocation. The global group exposure to Oil & Gas Refining/Marketing and Coal & Consumable Fuels outperformed, while the Fund’s selection of global stocks within Oil & Gas Exploration/Production was poor. The SI Fund did not have exposure to the relatively strong-performing domestic Energy sector during the fiscal year. However, it’s noteworthy that the 14% twelve-month gain in Energy was entirely attributable to the period from April through June, hence the sector’s results are fairly misleading, and it wasn’t necessarily a disadvantage that our equity-model disciplines did not find domestic Energy stocks appealing for investment.

The GI Fund held a large overweight position to the global Materials sector (16% of assets versus 5% MSCI ACWI), while the SI Fund’s 1.7% allocation was about one percent less than the S&P 500’s weight. The GI Fund benefited from its substantial Materials weight through the industry investments of Paper & Forest Products and Steel—both were large overweights (nearly 11% of assets collectively). These groups combined to contribute 120 basis points to return versus the benchmark’s 11 basis points earned from its minuscule 0.64% exposure to the same groups. Offsetting those global Materials groups’ gains by about 60 basis points was an overweight position in Commodity Chemicals. Domestically, the SI Fund’s minimal exposure to Steel and Forest Products did not materially impact its fiscal year results.

Superior group selection within the Industrials sector (average 9% weight versus 10% S&P 500 weight) provided outstanding results in our domestically-traded SI Fund, which had overweight allocations specifically to Human Resources & Employment Services and Railroads. Together, these two SI Fund groups accounted for a gain of about 150 basis points versus 35 basis points

6 The Leuthold Funds - 2018 Annual Report

achieved by the S&P 500’s corresponding group exposure of less than 1%. The globally-traded GI Fund’s Industrials sector exposure (7% versus 11% for the MSCI ACWI), attained through investments in Transportation Infrastructure and Airlines, did not substantively add nor detract from its fiscal year results.

The Communication Services sector (3% weight versus 4% MSCI ACWI) was valued added for the GI Fund; it held just one underlying industry, Developed Wireless Telecom Services. By avoiding other groups in this sector, the GI Fund bested the benchmark by 50 basis points. For the domestically-oriented SI Fund, the Communication Services sector was immaterial, both in portfolio weight and performance-wise.

Industry groups within Consumer Staples, Real Estate, and Utilities sectors were universally absent from the “Attractive” rankings of our quantitative scoring system throughout the year. There was therefore little-to-no-exposure in either the SI Fund or the GI Fund, and where present, the performance effect thereof was not of consequence.

Foreign/Global Exposure Attribution

With both Funds, concentrations in developed market and emerging market stocks are predominantly arbitrary, the result of: 1) the composition of the groups identified as quantitatively attractive; and, 2) valuation appeal based on the quantitative stock-selection model. Some industries are inclined to have a stronger presence in developed markets versus emerging markets, and vice versa.

Although not part of the strategy objective, the domestically-traded Leuthold Select Industries Fund can, at times, have significant foreign stock exposure which is obtained through ADR/ADS traded on U.S. exchanges. The level thereof, be it minimal or extensive, has the potential to materially affect SI Fund performance, both on an absolute basis and relative to the S&P 500, because foreign stock markets do not perform in lock-step with the U.S. During the fiscal year, there was a 10% weight, on average, to foreign exposure in the SI Fund and it was not advantageous. This was composed of a 70/30 mix in developed markets (ex-USA) and emerging markets, respectively. As illustrated by the MSCI ACWI Ex-USA and the MSCI EM index returns of just +1.76% and -0.81%, respectively, compared to the S&P 500 +17.91% twelve-month return through September 30th, the SI Fund’s foreign-domiciled holdings negatively contributed to its overall underperformance gap.

Leuthold Global Industries Fund aims to have a minimum of 40% in foreign stock exposure; however, specific countries or regions are not explicitly targeted. Rather, the quantitative approach builds the portfolio by selecting stocks from across the globe that appear to best characterize the industry concentrations that the disciplines identify as having the most attractive growth potential. During the last twelve months, on average, U.S. stocks comprised 44% of portfolio assets; developed market stocks (ex-USA) incorporated 38% of assets, and emerging market stocks consisted of an 11% weight. The most notable transformation occurred between the U.S. and emerging market weights. Through the course of the year, U.S. exposure declined from 49% to 39%, whereas stocks comprising emerging markets climbed from 13% to 21%. From a country perspective, the GI Fund’s U.S. stock exposure was the most positive contributor to return. The corresponding U.S. allocation in the MSCI ACWI was a larger position of 51%; it outperformed the Fund’s holdings by about 650 basis points. The GI Fund’s most productive foreign country allocations were Japan, Australia, and Finland, which combined to add 230 basis points, and each outperformed its respective country position in the MSCI ACWI. The largest country detractors for the GI Fund were South Korea, Taiwan, Switzerland, Hong Kong, and Turkey; all of these positions had losses and underperformed the benchmark’s corresponding allocations, which had gains, indicating the Fund’s selection of industries/stocks was substandard. Overall, the

The Leuthold Funds - 2018 Annual Report 7

GI Fund had exposure to 34 countries during the year, the majority of which had flat performance year-over-year and contributed little—either positively or negatively—to fiscal year results.

With regards to the potential risk of currency fluctuations, the Leuthold Global Industries Fund does not implement special practices to circumvent the possibility of unfavorable effects. Some funds employ costly currency-hedging programs, but there is no assurance that such campaigns will be additive to performance. The Leuthold Global Industries Fund does, however, attempt to identify and capitalize on broad FX-market trends through a U.S. dollar-based relative strength component, which is incorporated in the model. This year, strength in the U.S. dollar created a headwind for global equity portfolios, like ours, that do not hedge currency exposure. On an absolute return basis, the last twelve months’ effect of a stronger U.S. dollar undermined the Fund’s return by around 1%. When considered relative to the MSCI ACWI, the currency impact detracted by a much more subdued 40 basis points. This was a reversal of conditions in the prior fiscal year, when weakness in the U.S. dollar added some tailwind. In general, the forces behind U.S. dollar strength/weakness should equalize over time.

Short-Only Equity Fund

100% short individual stocks, the Grizzly Short Fund’s goal is to profit when stock prices decline. For the fiscal year ended September 30, 2018, it produced a -17.83% total return; this was ahead of its peer group average, the Morningstar Bear Market fund category, which returned -19.14%. The Grizzly Short Fund trailed the inverse results of the S&P MidCap 400 (+14.21% total return) and was on par with the inverse S&P 500 (+17.91% total return).

Equity Sector And Industry Group Drivers

Three-quarters of the Grizzly Short Fund’s sector allocations detracted from performance. The heaviest portfolio allocation, Information Technology (18% average weight), was the worst performer by far, dragging down results by over 650 basis points. The underlying IT industries that detracted the most were stocks sold short from Application Software, Internet Software & Services, Semiconductors, and Systems Software.

Health Care was the second worst performing sector for the Fund; it detracted over 350 basis points from return and underperformed the S&P 500 HC sector by 100 basis points. The Fund’s relative underperformance, despite containing only about one-half the weight of the benchmark (8% versus S&P 500 sector weight of 14%), indicates the Fund’s quantitative selection with identifying vulnerable HC-industry stocks was not constructive. Specifically, stocks from the industries of HC Equipment and HC Technology provided most of the sector’s negative contribution.

Consumer Discretionary (13% weight) and Industrials (12% weight) detracted from return by nearly 300 basis points apiece. Consumer Discretionary, however, was 60 basis points additive over the S&P 500 sector, while Industrials underperformed the corresponding S&P 500 sector by 160 basis points. Groups that caused the biggest negative impact within these allocations were Household Appliances, Internet & Direct Marketing Retail, Restaurants, Construction/Engineering, Construction/Machinery/ Heavy Trucks, Industrial Machinery, and Trucking.

A 9% weight in the Energy sector and a 4% weight in Real Estate (overweights versus the benchmark’s sector allocations) further pulled down the fiscal year return by over 260 basis points; they also underperformed their respective S&P 500 sectors’ losses by about 170 basis points. Poor results were almost entirely due to multiple stock positions from Oil & Gas Exploration/Production and the Specialized REITs group.

8 The Leuthold Funds - 2018 Annual Report

Positions within Financials and Utilities sectors had annual average weights on par with the S&P 500 sectors, 14% and 3%, respectively. Each contributed a comparable loss which combined to detract from performance by about 55 basis points. Within these sector exposures, Regional Banks, Reinsurance, Water Utilities, and Electric Utilities contributed the most on the downside.

Materials, Communication Services, and Consumer Staples sectors were constructive allocations during the year and collectively produced a small absolute positive contribution to return of 95 basis points. The respective S&P 500 sectors all had losses, thus comparatively, the Fund’s positions in these sectors also outperformed from a relative perspective, by 138 basis points. It’s worth mentioning that, over the last twelve months, these three sectors were the worst performers among S&P 500 sectors; hence, the presence of these concentrations in the Fund’s portfolio of stocks sold short speaks to the effectiveness of the quantitative approach employed to detect stock market weakness. The most productive industry positions among these sector allocations were Packaged Foods & Meats, Commodity Chemicals, Specialty Chemicals, Fertilizer & Agricultural Chemicals, and Alternative Carriers.

Often the Grizzly Short Fund contains well-defined sector overweights and/or underweights due to the disciplines either identifying mutual weakness across an industry—which results in an overweight exposure—or industries exhibiting stock market strength—which materializes as underweight, or zero exposure in the portfolio. Because the S&P 500 maintains a static allocation to industries/sectors, regardless of shifting market weakness and strength, we expect such Grizzly Short Fund/S&P 500 sector deviations to eventually result in a meaningful advantage for the Fund. Needless to say, outsized sector/group wagers in the Fund can also be upended and become a detriment during times of short-term reshuffling of leadership or inexplicably powerful market reversals.

The Grizzly Short Fund is a quantitative methodology for identifying mid/large cap stocks with ample liquidity that appear to be overvalued and, therefore, vulnerable to decline in price; the strategy does not attempt to identify “terminal shorts” —public companies which may be on the brink of collapse or failure. Portfolio stock positions are closely monitored intra-day and high turnover should be expected. As noted, sector concentrations and industry group compositions have the potential to fluctuate considerably, unlike the S&P 500 sector/group weights. Fund safeguards include specific procedures that trigger short-covering action to lock in certain gains and/or stop losses, while sector and sub-industry group concentrations utilize weighting controls to avoid the susceptibility of overexposure. In addition, the Fund’s individual stock positions are similarly weighted across the portfolio; it’s therefore unlikely that a select few stocks could have an overwhelming effect on performance, as can occur in a cap-weighted index—illustrated this year by the gains in Amazon, Apple, and Microsoft which were responsible for 37% of the S&P 500 YTD return through September 30th.

It should go without saying, bull markets are not conducive to short selling, and this year was no exception. Multiple new market highs, passive management outperforming active management, and low-quality momentum stocks crushing inexpensive value stocks made the last twelve months ever- more challenging for the Grizzly Short Fund. At present, our quantitative analysis implies that we have entered a phase that will be difficult for the stock market. If that is correct, the Grizzly Short Fund’s opportunities will surely multiply. If we have indeed entered the bear market stage of this cycle, the Fund should be in a solid position to attempt to secure strong additive returns to counterbalance recent years’ losses, as well as assemble a positive performance cushion against the unavoidable setbacks of the bull market next in line.

The Leuthold Funds - 2018 Annual Report 9

Fake-Out Or Break-Out?

Life was simpler in 2017. Markets were in gear on the upside, our monetary measures were bullish, tax cuts were in the offing, and the only tariff in sight was the one imposed on those pesky Canadian-softwood producers. And stocks were… well, a bit less overvalued than they are now. The weight of the evidence was decisively bullish one year ago.

Today, our stock market disciplines are negative and, as of late October, our Leuthold tactical asset allocation funds are positioned with very defensive net equity exposure of 36%. The rally off the early-2018 lows has been disjointed (if not conventionally narrow) and even as the S&P 500 climbed to a new bull market high on September 20th, our stock market analysis continued to deteriorate—a negative sign. On the whole, our disciplines advise that we treat the September break-out as a potential head-fake.

Perhaps it’s pure coincidence, but the last three “recession-induced” bear markets (1990, 2000, and 2007) all suffered a final correction similar in size to that seen in the S&P 500 earlier this year. The market recovered more quickly in all three cases than it did this year, but the relief turned out to be short-lived. In each case, a bear market loomed within either a few days (2007) or weeks (1990 and 2000), and recessions eventually followed.

We think the odds are better-than-even that the S&P 500 high on September 20th will stand as the stock market peak for 2018, and perhaps the ultimate top for this extraordinary bull market that began back in 2009. Supplementary evidence that the long-forgotten bear may be emerging from hibernation are the “bear paw prints” on four relative performance ratios. These series represent the enduring leadership themes that have defined this cyclical bull market: growth over value, U.S. over foreign, financial over real assets and, obviously, momentum over ‘everything else.’ Yes, there have been occasional interruptions within these themes during the course of the bull run, but each managed to eventually reassert itself and, fittingly, become even more dominant as the bull persevered.

While the bull might be able to deal with the loss of one or two of these long-term themes, we don’t think it can survive losing them all. The relative strength of momentum stocks has broken below its 200-day moving average, suggesting the bear has already claimed one of its ringleaders. Additional failures among these ratios would be viewed as more paw prints corroborating the bear’s revival.

We’d be more definitive that a new bear market is underway had there been more of the traditional signs of market fracturing leading up to last month’s high, but we won’t obsess over the absence of such warnings. The catalyst for market weakness is the decline in accommodation by the Fed and other central banks, and the pace of this tightening has been accelerating. Furthermore, the technical backdrop has been worsening and key trend measures have broken down; in our view, if one has the flexibility to manage stock market exposure, the proper position is a very defensive one.

10 The Leuthold Funds - 2018 Annual Report

It will be some time before we’ll know whether or not our current cautionary stance toward stocks is warranted. In the interim, we’ll rely on our market disciplines to guide us, and portfolios will be adjusted where appropriate to position shareholder assets with the investment vehicles that we believe fit the conditions to deliver the desired outcomes. We endeavor to preserve shareholder principal and minimize losses in the case of a down market and, when the stock market looks attractive based on our measures, we strive to accrue gains and growth of capital. As fellow shareholders, having your best interests at heart and our own best interests at heart is not mutually exclusive; we work hard to achieve the best possible results, given the circumstances, for us all.

Sincerely,

Doug Ramsey, CFA, CMT

CIO & Co-Portfolio Manager

|  |  |

| Chun Wang, CFA, PRM | Jun Zhu, CFA | Greg Swenson, CFA |

| Co-Portfolio Manager | Co-Portfolio Manager | Co-Portfolio Manager |

Kristen Perleberg, CFA

Co-Portfolio Manager

The Leuthold Funds - 2018 Annual Report 11

Expense Examples – September 30

, 2018 (Unaudited)

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, including reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held the entire period (April 1, 2018 – September 30, 2018).

Actual Expenses

The first line of the following tables provide information about actual account values and actual expenses. Although the Funds charge no sales load (the Leuthold Core Investment Fund, Leuthold Global Fund, and Leuthold Global Industries Fund charge a 2% redemption fee for redemptions made within five business days after a purchase), you will be assessed fees for outgoing wire transfers, returned checks, or stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Funds’ transfer agent. If you request a redemption be made by wire transfer, currently a $15.00 fee is charged by the Funds’ transfer agent. To the extent that the Funds invest in shares of other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which a Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary by fund. These expenses are not included in the following examples. The examples include, but are not limited to, management fees, shareholder servicing fees, fund accounting, custody, and transfer agent fees. However, the following examples do not include portfolio trading commissions and related expenses, and extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Examples for Comparison Purposes

The second line of the following tables provide information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or exchange fees. Therefore, the second line of the tables is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| 12 | The Leuthold Funds - 2018 Annual Report |

| The Leuthold Funds |

| Expense Example Tables (Unaudited) |

Leuthold Core Investment Fund - Retail Class - LCORX

| | | Beginning

Account Value

April 1, 2018 | | Ending

Account Value

September 30, 2018 | | Expenses Paid

During Period*

April 1, 2018 - September 30, 2018 |

| Actual** | | $ | 1,000.00 | | | $ | 991.80 | | | $ | 7.14 | |

| Hypothetical (5% return before expenses)*** | | | 1,000.00 | | | | 1,017.90 | | | | 7.23 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.43%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| ** | Excluding dividends and interest on securities sold short, your actual cost of investment in the Fund would be $5.94 and the Fund’s annualized expense ratio would be 1.19%. |

| *** | Excluding dividends and interest on securities sold short, your hypothetical cost of investment in the Fund would be $6.02 and the Fund’s annualized expense ratio would be 1.19% |

Leuthold Core Investment Fund - Institutional Class - LCRIX

| | | Beginning

Account Value

April 1, 2018 | | Ending

Account Value

September 30, 2018 | | Expenses Paid

During Period*

April 1, 2018 - September 30, 2018 |

| Actual** | | $ | 1,000.00 | | | $ | 992.30 | | | $ | 6.59 | |

| Hypothetical (5% return before expenses)*** | | | 1,000.00 | | | | 1,018.45 | | | | 6.68 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.32%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| ** | Excluding dividends and interest on securities sold short, your actual cost of investment in the Fund would be $5.44 and the Fund’s annualized expense ratio would be 1.09%. |

| *** | Excluding dividends and interest on securities sold short, your hypothetical cost of investment in the Fund would be $5.52 and the Fund’s annualized expense ratio would be 1.09%. |

Leuthold Global Fund - Retail Class - GLBLX

| | | Beginning

Account Value

April 1, 2018 | | Ending

Account Value

September 30, 2018 | | Expenses Paid

During Period*

April 1, 2018 - September 30, 2018 |

| Actual** | | $ | 1,000.00 | | | $ | 961.20 | | | $ | 9.78 | |

| Hypothetical (5% return before expenses)*** | | | 1,000.00 | | | | 1,015.09 | | | | 10.05 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.99%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| ** | Excluding dividends and interest on securities sold short, your actual cost of investment in the Fund would be $8.26 and the Fund’s annualized expense ratio would be 1.68%. |

| *** | Excluding dividends and interest on securities sold short, your hypothetical cost of investment in the Fund would be $8.49 and the Fund’s annualized expense ratio would be 1.68%. |

Leuthold Global Fund - Institutional Class - GLBIX

| | | Beginning

Account Value

April 1, 2018 | | Ending

Account Value

September 30, 2018 | | Expenses Paid

During Period*

April 1, 2018 - September 30, 2018 |

| Actual** | | $ | 1,000.00 | | | $ | 963.30 | | | $ | 7.92 | |

| Hypothetical (5% return before expenses)*** | | | 1,000.00 | | | | 1017.00 | | | | 8.14 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.61%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| ** | Excluding dividends and interest on securities sold short, your actual cost of investment in the Fund would be $6.40 and the Fund’s annualized expense ratio would be 1.30%. |

| *** | Excluding dividends and interest on securities sold short, your hypothetical cost of investment in the Fund would be $6.58 and the Fund’s annualized expense ratio would be 1.30%. |

| The Leuthold Funds - 2018 Annual Report | 13 |

| The Leuthold Funds |

| Expense Example Tables (Unaudited) (continued) |

Leuthold Select Industries Fund - Retail Class - LSLTX

| | | Beginning

Account Value

April 1, 2018 | | Ending

Account Value

September 30, 2018 | | Expenses Paid

During Period*

April 1, 2018 - September 30, 2018 |

| Actual | | $ | 1,000.00 | | | $ | 1,033.60 | | | $ | 7.65 | |

| Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,017.55 | | | | 7.59 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.50%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half period. |

Leuthold Global Industries Fund - Retail Class - LGINX

| | | Beginning

Account Value

April 1, 2018 | | Ending

Account Value

September 30, 2018 | | Expenses Paid

During Period*

April 1, 2018 - September 30, 2018 |

| Actual | | $ | 1,000.00 | | | $ | 967.40 | | | $ | 7.40 | |

| Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,017.55 | | | | 7.59 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.50%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half period. |

Leuthold Global Industries Fund - Institutional Class - LGIIX

| | | Beginning

Account Value

April 1, 2018 | | Ending

Account Value

September 30, 2018 | | Expenses Paid

During Period*

April 1, 2018 - September 30, 2018 |

| Actual | | $ | 1,000.00 | | | $ | 968.70 | | | $ | 6.17 | |

| Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.80 | | | | 6.33 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.25%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half period. |

Grizzly Short Fund - Retail Class - GRZZX

| | | Beginning

Account Value

April 1, 2018 | | Ending

Account Value

September 30, 2018 | | Expenses Paid

During Period*

April 1, 2018 - September 30, 2018 |

Actual** | | $ | 1,000.00 | | | $ | 886.00 | | | $ | 12.67 | |

Hypothetical (5% return before expenses)*** | | | 1,000.00 | | | | 1,011.63 | | | | 13.51 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 2.68%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half period. |

| ** | Excluding dividends and interest on securities sold short, your actual cost of investment in the Fund would be $7.47 and the Fund’s annualized expense ratio would be 1.58%. |

| *** | Excluding dividends and interest on securities sold short, your hypothetical cost of investment in the Fund would be $7.99 and the Fund’s annualized expense ratio would be 1.58%. |

| 14 | The Leuthold Funds - 2018 Annual Report |

| The Leuthold Funds |

| (Unaudited) |

Leuthold Core Investment Fund

Allocation of Portfolio Holdings

September 30, 2018

Leuthold Global Fund

Allocation of Portfolio Holdings

September 30, 2018

| ^ | Amount is less than 0.05%. |

| | Reflected as a percent of absolute value of investments and securities sold short. |

| The Leuthold Funds - 2018 Annual Report | 15 |

| The Leuthold Funds |

| (Unaudited) |

Leuthold Select Industries Fund

Allocation of Portfolio Holdings

September 30, 2018*

Leuthold Global Industries Fund

Allocation of Portfolio Holdings

September 30, 2018*

| * | Excludes short-term investments less than 5% of net assets. |

| ** | For presentation purposes, the Fund has grouped some of the industry classifications. For purposes of categorizing securities for compliance with Section 8(b)(1) of the Investment Company Act of 1940, the Fund uses more specific industry classifications. |

| Reflected as a percent of absolute value of investments and securities sold short. |

| 16 | The Leuthold Funds - 2018 Annual Report |

The Leuthold Funds |

| (Unaudited) |

Grizzly Short Fund

Allocation of Securities Sold Short

September 30, 2018

Reflected as a percent of absolute value of investments and securities sold short.

| The Leuthold Funds - 2018 Annual Report | 17 |

| Leuthold Core Investment Fund - Retail Class - LCORX |

| (Unaudited) |

Average Annual Rate of Return For Periods Ended

September 30, 2018

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | Since

Inception |

| | | | | | | | | | | | | | | | |

| Leuthold Core Investment Fund - Retail Class - LCORX | | | 3.23 | % | | | 6.29 | % | | | 6.85 | % | | | 6.00 | % | | | 8.35 | % |

| Lipper Flexible Portfolio Fund Index | | | 5.89 | % | | | 9.25 | % | | | 6.35 | % | | | 7.28 | % | | | 6.49 | % |

| S&P 500 Index | | | 17.91 | % | | | 17.31 | % | | | 13.95 | % | | | 11.97 | % | | | 9.23 | % |

| Morningstar Tactical Allocation Index | | | 5.60 | % | | | 7.02 | % | | | 4.66 | % | | | 5.96 | % | | | 5.21 | % |

| Bloomberg Barclays Global Aggregate Index | | | (1.32 | )% | | | 1.98 | % | | | 0.75 | % | | | 2.89 | % | | | 2.29 | % |

A $10,000 investment in the Leuthold Cor

e Investment Fund – Retail Class - LCORX

The Lipper Flexible Portfolio Funds Index is composed of funds that allocate investments across various asset classes with a focus on total return, as defined by Lipper.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks, which represent all major industries.

The Morningstar Tactical Allocation Index is comprised of funds that incorporate a tactical asset allocation strategy which is the process by which the asset of a fund is changed on a short-term basis to take advantage of perceived differences in relative values of the various asset classes.

The Bloomberg Barclays Global Aggregate Index provides a broad-based measure of the global investment grade fixed-rate debt markets. It is comprised of the U.S. Aggregate, Pan-European Aggregate, the Asian-Pacific Aggregate Indices, and the Canadian Aggregate Indices. It also includes a wide range of standard and customized sub-indices by liquidity constraint, sector, quality, and maturity.

This chart assumes an initial gross investment of $10,000 made on November 20, 1995 (commencement of operations). Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

| 18 | The Leuthold Funds - 2018 Annual Report |

| Leuthold Core Investment Fund - Institutional Class - LCRIX |

| (Unaudited) |

Average Annual Rate of Return For Periods Ended

September 30, 2018

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | Since

Inception |

| | | | | | | | | | | | | | | | |

| Leuthold Core Investment Fund - Institutional Class - LCRIX | | | 3.35 | % | | | 6.43 | % | | | 6.96 | % | | | 6.12 | % | | | 5.63 | % |

| Lipper Flexible Portfolio Fund Index | | | 5.89 | % | | | 9.25 | % | | | 6.35 | % | | | 7.28 | % | | | 5.80 | % |

| S&P 500 Index | | | 17.91 | % | | | 17.31 | % | | | 13.95 | % | | | 11.97 | % | | | 8.99 | % |

| Morningstar Tactical Allocation Index | | | 5.60 | % | | | 7.02 | % | | | 4.66 | % | | | 5.96 | % | | | 3.41 | % |

| Bloomberg Barclays Global Aggregate Index | | | (1.32 | )% | | | 1.98 | % | | | 0.75 | % | | | 2.89 | % | | | 3.39 | % |

A $1,000,000 investment in the Leuthold Core Investment Fund – Institutional Class - LCRIX

The Lipper Flexible Portfolio Funds Index is composed of funds that allocate investments across various asset classes with a focus on total return, as defined by Lipper.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks, which represent all major industries.

The Morningstar Tactical Allocation Index is comprised of funds that incorporate a tactical asset allocation strategy which is the process by which the asset of a fund is changed on a short-term basis to take advantage of perceived differences in relative values of the various asset classes.

The Bloomberg Barclays Global Aggregate Index provides a broad-based measure of the global investment grade fixed-rate debt markets. It is comprised of the U.S. Aggregate, Pan-European Aggregate, the Asian-Pacific Aggregate Indices, and the Canadian Aggregate Indices. It also includes a wide range of standard and customized sub-indices by liquidity constraint, sector, quality, and maturity.

This chart assumes an initial gross investment of $1,000,000 made on January 31, 2006 (commencement of operations). Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

| The Leuthold Funds - 2018 Annual Report | 19 |

| Leuthold Global Fund - Retail Class - GLBLX |

| (Unaudited) |

Average Annual Rate of Return For Periods Ended

September 30, 2018

| | 1 Year | | 3 Year | | 5 Year | | 10 Year | | Since

Inception |

| | | | | | | | | | |

| Leuthold Global Fund - Retail Class - GLBLX | (0.67)% | | 4.27% | | 3.78% | | 6.21% | | 4.50% |

| MSCI ACWI | 9.77% | | 13.40% | | 8.67% | | 8.19% | | 6.17% |

| Bloomberg Barclays Global Aggregate Index | (1.32)% | | 1.98% | | 0.75% | | 2.89% | | 2.44% |

| S&P 500 Index | 17.91% | | 17.31% | | 13.95% | | 11.97% | | 10.67% |

A $10,000 investment in the Leuthold Global Fund - Retail Class - GLBLX

The MSCI ACWI (All Country World Index) is designed to represent performance of the full opportunity set of large- and mid-cap stocks across 23 developed and 24 emerging markets.

The Bloomberg Barclays Global Aggregate Index provides a broad-based measure of the global investment grade fixed-rate debt markets. It is comprised of the U.S. Aggregate, Pan-European Aggregate, the Asian-Pacific Aggregate Indices, and the Canadian Aggregate Indices. It also includes a wide range of standard and customized sub-indices by liquidity constraint, sector, quality, and maturity.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks, which represent all major industries.

This chart assumes an initial gross investment of $10,000 made on July 1, 2008 (commencement of operations). Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

| 20 | The Leuthold Funds - 2018 Annual Report |

| Leuthold Global Fund - Institutional Class - GLBIX |

| (Unaudited) |

Average Annual Rate of Return For Periods Ended

September 30, 2018

| | 1 Year | | 3 Year | | 5 Year | | 10 Year | | Since

Inception |

| | | | | | | | | | |

| Leuthold Global Fund - Institutional Class - GLBIX | (0.43)% | | 4.53% | | 4.01% | | 6.45% | | 4.55% |

| MSCI ACWI | 9.77% | | 13.40% | | 8.67% | | 8.19% | | 5.27% |

| Bloomberg Barclays Global Aggregate Index | (1.32)% | | 1.98% | | 0.75% | | 2.89% | | 2.29% |

| S&P 500 Index | 17.91% | | 17.31% | | 13.95% | | 11.97% | | 9.73% |

A $1,000,000 investment in the Leuthold Global Fund - Institutional Class - GLBIX

The MSCI ACWI (All Country World Index) is designed to represent performance of the full opportunity set of large- and mid-cap stocks across 23 developed and 24 emerging markets.

The Bloomberg Barclays Global Aggregate Index provides a broad-based measure of the global investment grade fixed-rate debt markets. It is comprised of the U.S. Aggregate, Pan-European Aggregate, the Asian-Pacific Aggregate Indices, and the Canadian Aggregate Indices. It also includes a wide range of standard and customized sub-indices by liquidity constraint, sector, quality, and maturity.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks, which represent all major industries.

This chart assumes an initial gross investment of $1,000,000 made onApril 30, 2008 (commencement of operations). Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

| The Leuthold Funds - 2018 Annual Report | 21 |

| Leuthold Select Industries Fund - LSLTX |

| (Unaudited) |

Average Annual Rate of Return For Periods Ended

September 30, 2018

| | 1 Year | | 3 Year | | 5 Year | | 10 Year | | Since

Inception |

| | | | | | | | | | |

| Leuthold Select Industries Fund - LSLTX | 8.89% | | 10.97% | | 11.56% | | 8.44% | | 8.09% |

| Russell 2000 Index | 15.24% | | 17.12% | | 11.07% | | 11.11% | | 8.08% |

| Lipper Multi-Cap Core Funds Index | 15.25% | | 15.49% | | 11.76% | | 11.13% | | 5.92% |

| S&P 500 Index | 17.91% | | 17.31% | | 13.95% | | 11.97% | | 5.80% |

A $10,000 investment in the Leuthold Select Industries Fund - LSLTX

The Russell 2000 Index is comprised of approximately 2000 of the smallest companies in the Russell 3000 Index, representing approximately 10% of the Russell 3000 total market capitalization.

The Lipper Multi-Cap Core Funds Index is an average of funds that invest in a variety of market capitalization ranges without concentrating 75% of their equity assets in any one market capitalization range over an extended period of time. Multi-cap funds typically have between 25% and 75% of their assets invested in companies with market capitalizations (on a three-year weighted basis) above 300% of the dollar-weighted median market capitalization of the middle 1,000 securities of the S&P SuperComposite 1500 Index. These funds typically have an average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share growth value, compared to the S&P SuperComposite 1500 Index.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks, which represent all major industries.

This chart assumes an initial gross investment of $10,000 made on June 19, 2000 (commencement of operations). Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

| 22 | The Leuthold Funds - 2018 Annual Report |

| Leuthold Global Industries Fund - Retail Class - LGINX |

| (Unaudited) |

Average Annual Rate of Return For Periods Ended

September 30, 2018

| | | 1 Year | | 3 Year | | 5 Year | | Since Inception |

| | | | | | | | | | | | | |

| Leuthold Global Industries Fund - Retail Class - LGINX | | | 0.95 | % | | | 8.01 | % | | | 6.53 | % | | | 9.16 | % |

| MSCI ACWI | | | 9.77 | % | | | 13.40 | % | | | 8.67 | % | | | 9.77 | % |

| Lipper Global Multi-Cap Value Index | | | 5.18 | % | | | 10.78 | % | | | 6.52 | % | | | 9.03 | % |

| S&P 500 Index | | | 17.91 | % | | | 17.31 | % | | | 13.95 | % | | | 14.26 | % |

A $10,000 investment in the Leuthold Global Industries Fund - Retail Class - LGINX

The MSCI ACWI (All Country World Index) is designed to represent performance of the full opportunity set of large- and mid-cap stocks across 23 developed and 24 emerging markets.

The Lipper Global Multi-Cap Value Index is an index that measures investment in a variety of market capitalization ranges without concentrating 75% of their equity assets in any one market capitalization range over an extended period of time. Typically this index has 25% to 75% of their assets invested in companies both inside and outside of the U.S. with market capitalizations (on a three-year weighted basis) above 400% of the 75th market capitalization percentile of the S&P/Citigroup World Broad Market Index.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks, which represent all major industries.

This chart assumes an initial gross investment of $10,000 made on May 17, 2010 (commencement of operations). Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

| The Leuthold Funds - 2018 Annual Report | 23 |

| Leuthold Global Industries Fund - Institutional Class - LGIIX |

| (Unaudited) |

Average Annual Rate of Return For Periods Ended

September 30, 2018

| | | 1 Year | | 3 Year | | 5 Year | | Since Inception |

| | | | | | | | | | | | | |

| Leuthold Global Industries Fund - Institutional Class - LGIIX | | | 1.17 | % | | | 8.27 | % | | | 6.79 | % | | | 9.45 | % |

| MSCI ACWI | | | 9.77 | % | | | 13.40 | % | | | 8.67 | % | | | 9.77 | % |

| Lipper Global Multi-Cap Value Index | | | 5.18 | % | | | 10.78 | % | | | 6.52 | % | | | 9.03 | % |

| S&P 500 Index | | | 17.91 | % | | | 17.31 | % | | | 13.95 | % | | | 14.26 | % |

A $1,000,000 investment in the Leuthold Global Industries Fund - Institutional Class - LGIIX

The MSCI ACWI (All Country World Index) is designed to represent performance of the full opportunity set of large- and mid-cap stocks across 23 developed and 24 emerging markets.

The Lipper Global Multi-Cap Value Index is an index that measures investment in a variety of market capitalization ranges without concentrating 75% of their equity assets in any one market capitalization range over an extended period of time. Typically this index has 25% to 75% of their assets invested in companies both inside and outside of the U.S. with market capitalizations (on a three-year weighted basis) above 400% of the 75th market capitalization percentile of the S&P/Citigroup World Broad Market Index.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks, which represent all major industries.

This chart assumes an initial gross investment of $1,000,000 made on May 17, 2010 (commencement of operations). Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

| 24 | The Leuthold Funds - 2018 Annual Report |

| Grizzly Short Fund - GRZZX |

| (Unaudited) |

Average Annual Rate of Return For Periods Ended

September 30, 2018

| | 1 Year | | 3 Year | | 5 Year | | 10 Year | | Since

Inception |

| | | | | | | | | | |

| Grizzly Short Fund - GRZZX | (17.83)% | | (17.96)% | | (12.47)% | | (16.92)% | | (8.21)% |

| Lipper Dedicated Short Bias | (18.06)% | | (23.19)% | | (19.35)% | | (20.35)% | | n/a* |

| S&P MidCap 400 Index | 14.21% | | 15.68% | | 11.91% | | 12.49% | | 9.40% |

| S&P 500 Index | 17.91% | | 17.31% | | 13.95% | | 11.97% | | 5.80% |

A $10,000 investment in the Grizzly Short Fund - GRZZX

The Lipper Dedicated Short Bias Funds Index is an equally weighted representation of funds in the Lipper Dedicated Short Bias category. These funds employ a hedge fund strategy that maintains a net short exposure to the market through a combination of short and long positions. A dedicated short bias investment strategy attempts to capture profits when the market declines, by holding investments that are overall biased to the short side.

The S&P MidCap 400 Index is a capitalization-weighted index, which measures the performance of the mid-range sector of the U.S. stock market. The index was developed with a base level of 100 as of December 31, 1990.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks, which represent all major industries.

This chart assumes an initial gross investment of $10,000 made on June 19, 2000 (commencement of operations). Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

| *Index was introduced in July 2003. | The Leuthold Funds - 2018 Annual Report | 25 |

| The Leuthold Funds |

S tatements of Assets and Liabilities |

| September 30, 2018 |

| | | Leuthold

Core

Investment

Fund | | | Leuthold

Global

Fund | | | Leuthold

Select

Industries

Fund | |

| ASSETS: | | | | | | | | | |

| Investments, at cost | | | | | | | | | |

| Unaffiliated Securities | | $ | 786,315,052 | * | | $ | 88,532,136 | * | | $ | 14,384,129 | |

| Affiliated Securities | | | 24,721,848 | | | | — | | | | — | |

| Total Investments, at cost | | | 811,036,900 | | | | 88,532,136 | | | | 14,384,129 | |

| | | | | | | | | | | | | |

| Investments, at fair value | | | | | | | | | | | | |

| Unaffiliated Securities | | | 897,340,301 | | | | 92,413,122 | | | | 18,147,472 | |

| Affiliated Securities | | | 24,151,976 | | | | — | | | | — | |

| Total Investments, at fair value | | | 921,492,277 | | | | 92,413,122 | | | | 18,147,472 | |

| Foreign currency (cost $0, $114,719, and $0, respectively) | | | — | | | | 114,617 | | | | — | |

| Receivable for Fund shares sold | | | 560,287 | | | | 11,033 | | | | — | |

| Receivable for investments sold | | | 52,120,856 | | | | 7,413,295 | | | | 1,369,607 | |

| Collateral at broker for securities sold short | | | 120,187,945 | | | | 12,192,043 | | | | — | |

| Tri-party collateral held at custodian | | | 20,000,001 | | | | 2,200,001 | | | | — | |

| Interest receivable | | | 885,475 | | | | 98,919 | | | | 82 | |

| Dividends receivable | | | 297,739 | | | | 272,857 | | | | 10,550 | |

| Securities lending income receivable | | | 75,690 | | | | 6,909 | | | | — | |

| Other assets | | | 193,596 | | | | 25,791 | | | | 11,288 | |

| Total Assets | | | 1,115,813,866 | | | | 114,748,587 | | | | 19,538,999 | |

| | | | | | | | | | | | | |

| LIABILITIES: | | | | | | | | | | | | |

Securities sold short, at fair value

(proceeds $120,163,825, $12,161,374, and $0, respectively) | | | 118,227,168 | | | | 11,893,558 | | | | — | |

| Collateral received for securities loaned | | | 106,078,956 | | | | 12,218,224 | | | | — | |

| Payable for investments purchased | | | 52,394,129 | | | | 7,308,235 | | | | 1,367,352 | |

| Payable for Fund shares redeemed | | | 209,257 | | | | 301,047 | | | | — | |

| Payable to Adviser | | | 625,655 | | | | 61,831 | | | | 9,428 | |

| Payable to Custodian | | | 61,844 | | | | 26,760 | | | | 5,458 | |

| Payable to Directors | | | 42,305 | | | | 4,711 | | | | 960 | |

| Dividends payable on securities sold short | | | 368,264 | | | | 3,750 | | | | — | |

| Distribution (Rule 12b-1) fees payable | | | — | | | | 60,910 | | | | — | |

| Shareholder servicing fees payable | | | 76,777 | | | | — | | | | 3,754 | |

| Accrued expenses and other liabilities | | | 470,275 | | | | 118,403 | | | | 40,115 | |

| Total Liabilities | | | 278,554,630 | | | | 31,997,429 | | | | 1,427,067 | |

| NET ASSETS | | $ | 837,259,236 | | | $ | 82,751,158 | | | $ | 18,111,932 | |

| | | | | | | | | | | | | |

| * Includes loaned securities with market value of: | | $ | 103,834,675 | | | $ | 11,900,300 | | | | n/a | |

| 26 | The Leuthold Funds - 2018 Annual Report | See Notes to the Financial Statements. |

| The Leuthold Funds |

| Statements of Assets and Liabilities (continued) |

| September 30, 2018 |

| | | Leuthold

Core

Investment

Fund | | | Leuthold

Global

Fund | | | Leuthold

Select

Industries

Fund | |

| NET ASSETS CONSIST OF: | | | | | | | | | |

| Capital stock | | $ | 652,745,224 | | | $ | 73,564,244 | | | $ | 13,279,126 | |

| Total distributable earnings | | | 184,514,012 | | | | 9,186,914 | | | | 4,832,806 | |

| Total Net Assets | | $ | 837,259,236 | | | $ | 82,751,158 | | | $ | 18,111,932 | |

| | | | | | | | | | | | | |

| Retail Class Shares | | | | | | | | | | | | |

| Net assets | | $ | 403,095,456 | | | $ | 18,362,218 | | | $ | 18,111,932 | |

Shares outstanding

(1,000,000,000 shares of $0.0001 par value authorized) | | | 19,664,008 | | | | 2,014,623 | | | | 663,131 | |

| Net Asset Value, Redemption Price, and Offering Price Per Share | | $ | 20.50 | ** | | $ | 9.11 | ** | | $ | 27.31 | |

| | | | | | | | | | | | | |

| Institutional Class Shares | | | | | | | | | | | | |

| Net assets | | $ | 434,163,780 | | | $ | 64,388,940 | | | | n/a | |

Shares outstanding

(1,000,000,000 shares of $0.0001 par value authorized) | | | 21,152,356 | | | | 6,973,013 | | | | n/a | |

| Net Asset Value, Redemption Price, and Offering Price Per Share | | $ | 20.53 | ** | | $ | 9.23 | ** | | | n/a | |

** Redemption price may differ from NAV if redemption fee is applied.

| See Notes to the Financial Statements. | The Leuthold Funds - 2018 Annual Report | 27 |

| The Leuthold Funds |

| Statements of Assets and Liabilities (continued) |

| September 30, 2018 |

| | | Leuthold

Global

Industries

Fund | | | Grizzly

Short

Fund | |

| ASSETS: | | | | | | |

| Investments, at cost | | $ | 9,568,025 | | | $ | 81,840,809 | |

| | | | | | | | | |

| Investments, at fair value | | | 10,420,676 | | | | 81,840,809 | |

| Cash | | | — | | | | — | |

| Foreign currency (cost $27,183, and $0, respectively) | | | 27,158 | | | | — | |

| Receivable for Fund shares sold | | | 550 | | | | 179,998 | |

| Receivable for investments sold | | | 1,126,091 | | | | — | |

| Collateral at broker for securities sold short | | | — | | | | 96,900,383 | |

| Tri-party collateral held at custodian | | | — | | | | 15,000,001 | |

| Interest receivable | | | 149 | | | | 125,060 | |

| Dividends receivable | | | 36,219 | | | | — | |

| Receivable from Advisor | | | 8,049 | | | | — | |

| Other assets | | | 17,234 | | | | 137,234 | |

| Total Assets | | | 11,636,126 | | | | 194,183,485 | |

| | | | | | | | | |

| LIABILITIES: | | | | | | | | |

Securities sold short, at fair value

(proceeds $0 and $98,232,054, respectively) | | | — | | | | 94,949,790 | |

| Payable for investments purchased | | | 1,132,904 | | | | — | |

| Payable for Fund shares redeemed | | | — | | | | 12,347 | |

| Payable to Adviser | | | — | | | | 100,653 | |

| Payable to Custodian | | | 17,776 | | | | 3,802 | |

| Payable to Directors | | | 538 | | | | 5,346 | |

| Dividends payable on securities sold short | | | — | | | | 59,683 | |

| Distribution (Rule 12b-1) fees payable | | | 4,315 | | | | — | |

| Shareholder servicing fees payable | | | — | | | | 15,064 | |

| Accrued expenses and other liablities | | | 40,836 | | | | 88,043 | |

| Total Liabilities | | | 1,196,369 | | | | 95,234,728 | |

| NET ASSETS | | $ | 10,439,757 | | | $ | 98,948,757 | |

| 28 | The Leuthold Funds - 2018 Annual Report | See Notes to the Financial Statements. |

| The Leuthold Funds |

| Statements of Assets and Liabilities (continued) |

| September 30, 2018 |

| | | Leuthold

Global

Industries

Fund | | | Grizzly

Short

Fund | |

| NET ASSETS CONSIST OF: | | | | | | |

| Capital stock | | $ | 8,581,697 | | | $ | 345,858,908 | |

| Total distributable earnings | | | 1,858,060 | | | | (246,910,151 | ) |

| Total Net Assets | | $ | 10,439,757 | | | $ | 98,948,757 | |

| | | | | | | | | |

| Retail Class Shares | | | | | | | | |

| Net assets | | $ | 1,798,973 | | | $ | 98,948,757 | |

Shares outstanding

(1,000,000,000 shares of $0.0001 par value authorized) | | | 106,480 | | | | 5,606,226 | |

| Net Asset Value, Redemption Price, and Offering Price Per Share | | $ | 16.90 | * | | $ | 17.65 | |

| | | | | | | | | |

| Institutional Class Shares | | | | | | | | |

| Net assets | | $ | 8,640,784 | | | | n/a | |

Shares outstanding

(1,000,000,000 shares of $0.0001 par value authorized) | | | 507,644 | | | | n/a | |

| Net Asset Value, Redemption Price, and Offering Price Per Share | | $ | 17.02 | * | | | n/a | |

* Redemption price may differ from NAV if redemption fee is applied.

| See Notes to the Financial Statements. | The Leuthold Funds - 2018 Annual Report | 29 |

| The Leuthold Funds |

|

| For the Year Ended September 30, 2018 |

| | | Leuthold

Core

Investment

Fund

(Consolidated) | | | Leuthold

Global

Fund

(Consolidated) | | | Leuthold

Select

Industries

Fund | |

| INVESTMENT INCOME: | | | | | | | | | |

| Dividend income (net of foreign taxes withheld of $203,161, $102,481, and $5,327 respectively) | | $ | 8,743,673 | | | $ | 1,314,941 | | | $ | 280,012 | |

| Interest income | | | 4,819,401 | | | | 535,615 | | | | 2,847 | |