UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-09094

Leuthold Funds, Inc.

(Exact name of registrant as specified in charter)

33 S. Sixth Street, Suite 4600, Minneapolis, MN 55402

(Address of principal executive offices) (Zip code)

John Mueller

Leuthold Weeden Capital Management

33 S. Sixth Street, Suite 4600, Minneapolis, MN 55402

(Name and address of agent for service)

612-332-9141

Registrant's telephone number, including area code

Date of fiscal year end: September 30, 2015

Date of reporting period: September 30, 2015

Item 1. Reports to Stockholders.

Annual Report

September 30, 2015

The Leuthold Funds

Leuthold Core Investment Fund

Retail Class Shares LCORX

Institutional Class Shares LCRIX

Leuthold Global Fund

Retail Class Shares GLBLX

Institutional Class Shares GLBIX

Leuthold Select Industries Fund LSLTX

Leuthold Global Industries Fund

Retail Class Shares LGINX

Institutional Class Shares LGIIX

Grizzly Short Fund GRZZX

| The Leuthold Funds |

| Table of Contents |

| | |

| 1 |

| 14 |

| 17 |

| 20 |

| 28 |

| 32 |

| 36 |

| 41 |

| Schedules of Investments and Securities Sold Short | |

| 49 |

| 61 |

| 70 |

| 73 |

| 78 |

| 83 |

| 98 |

| 99 |

| 100 |

Dear Fellow Shareholders:

The fiscal year began in late 2014 with Blue Chip stocks rallying to new nominal highs. It was the most widely-anticipated “Santa Claus” rally in our memory…until the final two days in December which sent the DJIA and S&P 500 to small monthly losses. A rocky start to 2015 followed that pullback, and the weight of the evidence suggested to us that the bull market had indeed embarked on a broad topping process.

However, tracing out a top can be long and tortuous. For much of the past year, the stock market had an impressive ability to shrug off bad news: a string of weaker domestic economic reports, several high profile earnings misses, the oil carnage, and the continuing horror show of the Eurozone. In early March, the “Big Four” (DJIA, S&P 500, NASDAQ, and Russell 2000 Indexes) all made new bull market highs; those highs were confirmed by major indices’ daily breadth measures, and many important cyclical groups.

Another new S&P 500 bull market high was achieved in late April and it had a lot of company, including Large Caps, Small Caps, foreign stocks, and NYSE Weekly and Daily A/D Lines. Yet, at close inspection, the market was quietly becoming more disjointed. While stock market breadth was healthy, sector leadership – via Cyclicals, Transports, Financials, and Utilities – was behaving in a manner that was consistent with an approaching market top. Generally, both breadth and leadership break down in advance of the peak. At that point in the year, only the latter was showing signs of weakness.

On May 21st, the S&P 500 reached another new bull market high, and the consensus was that the stock market would be able to ignore the first couple of interest rate hikes in the (presumed) upcoming tightening cycle. But our stock market indicators, while still positive, were deteriorating and we expected that U.S. stocks would mark their final bull market highs before the Fed lifted the Funds rate at all. By early July, we advised that a terminal, bull market distribution process had been underway for at least a few months. As China’s four-week, -28% market collapse was grabbing the headlines, an alarming number of U.S. stocks and industry groups were experiencing significant corrections, if not “personal” bear markets. In early July, only 35% of NYSE-traded issues were above their 30-week moving averages, and a huge 15% performance gap had opened up between the NASDAQ and the NYSE Composites. All of this pointed to a fragmented, and more dangerous, stock market environment.

In August, the U.S. stock market largely marginalized the latest round of worries related to China’s market collapse, a new down-leg in crude oil prices, a more hawkish tone in Fed-speak, and sizeable second-quarter declines in S&P 500 sales and earnings. Additional red flags were the DJ Transports, DJ Utilities, NYSE breadth, and Corporate bonds, as they simultaneously entered 40-week downtrends for the first time since 2008-2009. Market breadth, leadership, and momentum were all showing characteristics of a very late stage bull market. To us, the broader picture was clearly one of fracturing and we projected the next big move in stocks would be down. Our quantitative stock market analysis ultimately worsened to a convincingly “negative” outlook during the second week of August; this prompted us to get very defensive in our tactical allocation funds in advance of the August stock market plunge.

Currently, our view is that a cyclical bear market in equities is underway, and we expect the S&P 500 will bottom out fairly close to its long-term median valuation level. In the big picture, this would involve a”relatively” tolerable peak-to-trough decline in

| The Leuthold Funds - 2015 Annual Report | 1 |

the neighborhood of -21% to -22%. (The prior two bear markets, 2007-2009 and 2000-2002, were of the severe variety in comparison, losing over -50% and -35%, respectively, in the process.)

During the fiscal year ended September 30, 2015, the Leuthold Core Investment Fund had a solid gain and significantly outperformed its peer fund average, measured by the Morningstar Tactical Allocation category, as well as the all-equity S&P 500 benchmark. The Leuthold Global Fund had a small loss for the year, but its decline appears relatively negligible compared to the average loss of peer fund strategies, represented by the Morningstar World Allocation category, and also compared to the all-equity MSCI All Country World Index (ACWI) benchmark. Our tactical allocation funds’flexibility to lower equity exposure proved its value in a year when underlying market dynamics grew increasingly unbalanced, and internal market breakdowns went unnoticed leading into the August nosedive.

The Leuthold Select Industries Fund performed exceptionally well for the fiscal year, posting a strong gain. Its peer fund average via the Morningstar Mid Cap Blend category, and the broad equity market indexes, both produced losses. As a result of foreign equity markets’ relatively higher instability and outsized losses compared to the U.S., the Leuthold Global Industries Fund produced a small loss. However, it fared much better than its peer funds in the Morningstar World Equity category, and its global equity benchmark. The outperformance by both of these funds reflects the successful extension of having identified investments with strong, long-term leadership trends.

The Grizzly Short Fund’s fiscal year gain significantly exceeded its peer funds, as represented by the Morningstar Bear Market category and its benchmark indexes. In fact, this actively managed (non-leveraged) short selling strategy outshined the inverse of virtually every variety of equity index, be it Small Caps, Mid Caps, Large Caps, or Developed World stocks. Besides the event of the August stock market decline, there were a variety of other factors throughout the year that contributed to the Grizzly Fund’s strong results. This included the downward pressure on commodity stocks, deterioration in market breadth, and sector leadership breakdowns. In general, the Grizzly Short Fund is apt to effectively capitalize when underlying market internals are disintegrating. As we enter the new fiscal year, we don’t expect conditions to improve in the near term, and the Grizzly Short Fund should be poised to continue to take advantage of this weakness.

Following, we review each Leuthold Fund strategy in depth to present the attributes that drove performance results during the fiscal year ended September 30, 2015.

| 2 | The Leuthold Funds - 2015 Annual Report |

FUND OVERVIEWS

Leuthold Core Investment Fund

Opened on November 20, 1995, this is our firm’s flagship tactical asset allocation strategy, with $858 million of assets under management. The strategy is flexible, with exposure to asset class investments routinely adjusted to suit the environment. These changes are determined by the quantitative assessment of market conditions and economic factors. The goal is to identify areas of the market that appear poised to perform well and to side-step those areas that appear to contain more risk than reward. Assets are allocated between stocks, bonds, foreign securities, alternative investments, and money market instruments. The Fund may employ hedging techniques for tactical purposes, to take advantage of pricing excesses, or for major defensive moves against a particular asset class. The Fund’s objective is capital appreciation and income over the long-term, attained through relatively risk averse, prudent investment selection. When the stock market is in a strong uptrend, the Leuthold Core Investment Fund’s diversified portfolio will unlikely match returns of a fully invested equity portfolio. However, over a full market cycle, it is our goal to outperform the stock market.

| | | |

| | ● | The primary vehicle for the Fund’s U.S.-traded stock market exposure is the Leuthold Select Industries strategy. |

| | | |

| | ● | Investment Guidelines: 30%-70% equity exposure; 30%-70% fixed income exposure (certain market conditions may prompt a departure from these guidelines). There is no foreign investment minimum criterion. |

Leuthold Global Fund

Opened on April 30, 2008, with current assets under management of $314 million, this tactical asset allocation strategy is the “global” equivalent of our flagship Leuthold Core Investment Fund. The strategy and objective of this Fund are equivalent to that of the Leuthold Core Investment Fund in terms of guiding disciplines, flexibility, asset class exposure, and risk aversion; however, this global version intends to maintain at least 40% of assets in foreign-traded securities. The Leuthold Global Fund invests in domestic and foreign-traded stocks, bonds, alternative investments, and money market instruments. It may employ hedging techniques for tactical purposes, to take advantage of pricing excesses, or for major defensive moves against a particular asset class.

| | | |

| | ● | The primary vehicle for the Fund’s stock market investments is the Leuthold Global Industries strategy. |

| | | |

| | ● | Investment Guidelines: 30%-70% equity exposure; 30%-70% fixed income exposure; 40% minimum in foreign-traded securities. Certain market conditions may prompt a departure from these guidelines. |

Leuthold Select Industries Fund

This Fund opened on June 19, 2000, and has total assets under management of $13 million. It maintains 100% long exposure in domestically traded stocks. Being fully invested in the stock market results in the potential for considerably higher volatility, higher risk, and the probability that investors will lose money when the stock market is trending down. The Leuthold Select Industries Fund employs a top-down approach, based on industry group rotation, and sector concentrations. Driven by extensive quantitative analysis, the strategy aims to identify collective areas of strength and leadership opportunities in the making.

| | | |

| | ● | 100% long stock exposure equates to more risk than our diversified tactical allocation funds. Higher risk offers the potential to achieve larger gains in market upswings, and conversely, deeper losses in market declines. |

| The Leuthold Funds - 2015 Annual Report | 3 |

Leuthold Global Industries Fund

Launched on May 17, 2010, this Fund has total assets under management of $19 million. It is an extension of our domestic approach to equity industry group rotation and thereby aims to identify collective areas of global strength and global leadership opportunities in the making. This Fund will normally invest at least 40% of its assets in foreign-traded equity securities.

| | | |

| | ● | 100% long stock exposure equates to more risk than our diversified tactical allocation funds. Higher risk offers the potential to achieve larger gains in market upswings, and conversely, deeper losses in market declines. There is added risk when employing foreign-traded securities. |

Grizzly Short Fund

Opened June 19, 2000, this is an unleveraged, actively managed Fund that is 100% invested in securities sold short; the intent is to profit from declining stock prices. The Fund has assets under management of $266 million. Policy mandates the Grizzly Short Fund target 100% exposure in stocks sold short at all times.

| | | |

| | ● | The Grizzly Short Fund typically maintains approximately equal-weighted securities sold short in roughly 60-90 individual stocks, initially selected by a multi-factor quantitative discipline. Each position is monitored daily and subject to a set of short covering disciplines. |

| | | |

| | ● | It is most likely the Fund will lose money when stock prices rise. |

This is not a Fund for buy and hold investors. The Grizzly Short Fund is a tool for experienced investors, traders, and advisors to employ as a means of pre-emptively moderating risk from stock price fluctuations. It is often used in varying degrees with other multi-faceted portfolio strategies.

| 4 | The Leuthold Funds - 2015 Annual Report |

ANNUAL PERFORMANCE REVIEW

Leuthold Core Investment Fund

The Fund began the fiscal year in October 2014 with a defensive position of just 42% net equity exposure. This was a short-lived stance, as our market analysis improved to a neutral outlook by November; net equity exposure was thus increased to a neutral 50% and remained there through January 2015. By early February, underlying market data had improved enough to upgrade our market analysis back to positive, and net equity exposure was likewise increased in subsequent months as the reading remained stable. In June, average net equity exposure reached its high point for the year, at 62%. Throughout July, our indicators reversed course and settled in negative territory by early August. In response, net equity exposure was reduced to near 40%. Further weakness spurred more reductions; the Fund ended the fiscal year with average net equity exposure of 35%.

For the fiscal year ended September 30, 2015, the Leuthold Core Investment Fund posted a total return gain of +4.03% (retail share class), outperforming the -5.47% total return loss of the Morningstar Tactical Allocation fund average by a wide margin. The all-equity S&P 500 benchmark also trailed behind, producing a total return loss of -0.61% for the fiscal year.

This performance demonstrates the merits of asset allocation flexibility in an unstable equity market environment. At the same time, the Morningstar Tactical Allocation category average lagged our Fund by a spread of nearly 10%, exhibiting that these strategies are not created equal in terms of curtailing losses. In sum, over the last twelve months, when evaluated against both the all-equity S&P 500 benchmark and the benchmark of peer tactical allocation funds, the Leuthold Core Investment Fund clearly delivered the results intended by its objective.

One of the key contributors to the Fund’s fiscal year outperformance was its U.S.-traded long stocks, provided via the firm’s Leuthold Select Industries equity selection. In the face of stock market volatility and uncertainty leading up to the August correction, the Leuthold Select Industries exposure provided a gain of +7.34% for the twelve months ended September 30, 2015, surpassing the -0.61% S&P 500 loss by a large margin. For the performance highlights related to these stocks, refer to the performance discussion detailed under the Leuthold Select Industries Fund section in this letter.

A separate long stock allocation maintained in the Fund is Emerging Market (EM) Equities. Following suit with foreign markets in general, this subset performed poorly over the course of the last twelve months; the MSCI Emerging Market (EM) Index was, in fact, the worst performing global index with a twelve month loss of -18.98%. In comparison, our particular EM holdings produced a loss of -15.30% during that time. This very long-term EM play (15+ years) was held at a small 4% of portfolio assets, on average; therefore, the seemingly outsized loss only minimally subtracted from performance by -0.58%.

| | | |

| | ● | A severe decline in Brazilian-traded stocks contributed the most to our EM loss, as our holdings were down nearly 50% for the fiscal year. Hong Kong and South Korean-traded stocks were the next largest detractors to the Fund’s EM performance, followed by Indonesia and India. The only country allocation producing a tiny positive contribution to return was Ukraine. |

| | | |

| | ● | Sector concentrations (and biggest industry group detractors) that produced the largest losses among our EM equities were Consumer Discretionary (Automobiles, Auto Components, Specialty Retail, Casinos, Homebuilding); Financials (Emerging Diversified Banks, Real Estate Management); and Information Technology (Computers & Peripherals, Electronic Equipment, Semiconductors). |

| The Leuthold Funds - 2015 Annual Report | 5 |

| | | |

| | ● | There were industry group exposures that produced positive results and thereby somewhat scaled back the EM allocation’s overall loss. The most additive contributors were: Data Processing & Outsourced Services, Mid & Small Cap Pharmaceuticals, Media, Internet Software & Services, Household Durables, and Biotechnology. |

The Fund maintained an Equity Hedge over the last twelve months, in varying degrees. As with last year, this tool served different functions depending on our market outlook: 1) to tactically rein in net equity exposure when market gains boosted the position above target; and, 2) to become risk averse and meaningfully lower net equity exposure. The fiscal year began with a very defensive hedge near 18% of assets; the position was reduced in ensuing months until June, when it dipped to 4% of average assets, the year’s low point. With our disciplines turning cautionary in July, and then outright negative by early August, the equity hedge was expanded and ended the fiscal year at 21%, its largest weight of the year. Strong gains for the Equity Hedge in January, and the last four months of the fiscal year, resulted in an impressive twelve month gain of +10.16% through September; it was the best performing allocation in the portfolio.

For the Fund’s Fixed Income selection, we employ a top-down tactical asset allocation framework, using a multi-factor model to first evaluate “risk” and determine whether to favor lower risk vehicles, such as Developed Market government securities, or higher risk vehicles (credits). In the lower risk category, we consider nominal and inflation-linked government securities, whereas the higher risk allocation includes vehicles across a range of credit classes.

With the perpetually low interest rate environment, we remain underweight Fixed Income and only hold very short duration. Considering the substantial risk, we do not see any reason to be aggressive in this space. Over the last twelve months, the Fixed Income allocations averaged 20% of assets, similar to the prior three fiscal years; this is below our normal guideline minimum of 30%. We continue to view the overall allocation as a potential shock absorber to unexpected equity jolts.

To diversify, Fixed Income assets were distributed across a range of securities with varying risk profiles, including government securities and credits. The largest single allocation was Developed Market Sovereign Debt with a 10.8% average portfolio weight; it produced the largest loss among the various exposures (-6.3% return). MBS Bond Funds, a 3.6% average weight, was the best performing allocation with a twelve month gain of +3.0%. Quality Corporate Bonds (3.2% average weight) produced a small loss, and Municipal Bonds (0.7% average weight) delivered a small gain, but neither materially affected performance due to the small positions. Allocations not held for the full twelve months included Emerging Market Sovereign Debt (1.0% average weight), High Yield Bonds (0.4% average weight), and TIPS (0.1% average weight). Performance among those was also mixed, but due to the underweight positions, the impact on performance was nil.

Leuthold Global Fund

This is the global variation of the Leuthold Core Investment Fund, and it thereby follows the same macro analysis of stock market risk. As a result, one should expect that the two funds will make parallel moves when it comes to major defensive or offensive market adjustments. Like the Leuthold Core Investment Fund, the Leuthold Global Fund began the fiscal year in October 2014 with a defensive position of just 42% net equity exposure. This was a short-lived stance, as our market analysis improved to a neutral outlook by November; net equity exposure was thus increased to a neutral 50% and remained there through January 2015. By early February, underlying market data had improved enough to upgrade our market analysis back to positive, and net equity exposure was likewise increased in subsequent months, as the reading remained stable. In June, average net equity exposure reached its high point for the year, at 62%. Throughout July our indicators reversed course and settled in

| 6 | The Leuthold Funds - 2015 Annual Report |

negative territory by early August. In response, net equity exposure was reduced to near 40%. Further weakness spurred more reductions; the Fund ended the fiscal year with average net equity exposure of 35%.

For the fiscal year ended September 30, 2015, the Leuthold Global Fund produced a total return loss of -1.41% (retail share class), outperforming the -6.46% total return loss of the Morningstar World Allocation fund average by a spread of over 5%. The all-equity MSCI All Country World Index (ACWI) also lagged the Fund by a similar margin, with a loss of -6.16%.

While the Fund’s small loss is disappointing, it is certainly not surprising, given its high dose of global stock exposure. Global equities have not performed as strongly as U.S. stocks during the extent of the bull market that commenced in the spring of 2009. This past year, the underlying weakness among non-U.S. equities was accentuated, as markets around the globe transitioned into a downtrend. The Leuthold Global Fund’s performance relative to its all-equity benchmark and the benchmark of peer tactical world allocation funds demonstrates that our asset allocation flexibility achieved its goal of minimizing losses. Furthermore, the extent of the Morningstar World Allocation category’s lagging return shows that flexible allocation strategies are not created equal in terms of curtailing losses.

As noted, foreign stock performance was much worse than that in the U.S., which explains the Fund’s loss within its Global Industries equity allocation. This composes the Fund’s entire long stock exposure. In the face of stock market volatility and uncertainty leading up to the August correction, the Leuthold Global Industries exposure produced a small loss of -1.36% for the twelve months ended September 30, 2015; it was the key detractor to overall Fund performance for the fiscal year. Yet, many of its fellow global equity fund strategies experienced much wider losses, illustrated by the average loss of -5.19% for the Morningstar World Equity category. For key performance contributors related to this equity exposure, refer to the performance discussion detailed under the Leuthold Global Industries Fund section in this letter.

The Fund maintained an Equity Hedge over the last twelve months, in varying degrees. As with last year, this tool served different functions depending on our market outlook: 1) to tactically rein in net equity exposure when market gains boosted the position above target; and, 2) to become risk averse and meaningfully lower net equity exposure. The fiscal year began with a very defensive hedge at 17% of assets; the position was reduced in ensuing months until June, when it dipped to 4% of average assets, the year’s low point. With our disciplines turning cautionary in July, and then outright negative by early August, the equity hedge was expanded and ended the fiscal year at 19%, its largest weight of the year. Strong gains for the Equity Hedge in January, and the last five months of the fiscal year, resulted in a strong twelve month gain of +5.73% through September; it was the best performing allocation in the portfolio.

For the Fund’s Fixed Income selection, we employ a top-down tactical asset allocation framework, using a multi-factor model to first evaluate “risk” and determine whether to favor lower risk vehicles, such as Developed Market government securities, or higher risk vehicles (credits). In the lower risk category, we consider nominal and inflation-linked government securities, whereas the higher risk allocation includes vehicles across a range of credit classes.

With the perpetually low interest rate environment, we remain underweight Fixed Income and only hold very short duration. Considering the substantial risk, we do not see any reason to be aggressive in this space. Over the last twelve months, the Fixed Income allocations averaged 20% of assets, similar to the prior three fiscal years; this is below our normal guideline minimum of 30%. We continue to view the overall allocation as a potential shock absorber to unexpected equity jolts.

To diversify, Fixed Income assets were distributed across a range of securities with varying risk profiles, including government securities and credits. The largest single allocation was Developed Market Sovereign Debt with a 10.5% average portfolio

| The Leuthold Funds - 2015 Annual Report | 7 |

weight; it produced the largest loss among the various exposures (-6.2% return). Quality Corporate Bonds (4.2% average weight) produced a loss of -1.7%. MBS Bond Funds and Municipal Bonds (4.1% and 0.6% average weights, respectively) were the best performing allocations; each delivered twelve-month gains of about +2.7%. Unfortunately, neither materially affected performance due to the underweight positions. Allocations not held for the full twelve months were Emerging Market Sovereign Debt (0.7% average weight, -2.9% loss) and High Yield Bonds (0.4% average weight, +0.2% gain). Performance from those also had a negligible effect because of the small size of the allocations.

Leuthold Select Industries Fund

This all-equity Fund had a solid total return gain of +6.24% for the fiscal year ended September 30, 2015. While not as strong as last year’s result, this return was exceptional for the environment compared to funds with similar characteristics, as well as compared to long-only funds in general (most long-only equity funds recorded losses over the last twelve months). The Morningstar Mid Cap Blend category, which represents peer fund strategies, delivered a total return loss of -2.57%, while the broad market recorded a total return loss of -0.61%, as signified by the S&P 500. These results demonstrate that the Leuthold Select Industries Fund’s approach to uncover industry leadership trends functioned effectively.

The Fund’s heaviest equity sector concentrations from last fiscal year, 2013-2014, remained the largest weights, on average, for the 2014-2015 fiscal year. This included Information Technology, Consumer Discretionary, Health Care, and Industrials. These sectors have been overweight positions in the Fund, versus their respective weights in the S&P 500, for two consecutive years. Additionally, three of these four sectors were among the heaviest portfolio weights in 2012-2013. Identifying leadership, and particularly the continuity of leadership, is a principal concept of the Leuthold Select Industries methodology. Solid outperformance can be achieved when concentrating exposure in the themes that the Fund’s quantitative model calls attention to. Equally, underperformance can result when market volatility puts such trends in question as leadership can fluctuate irrationally while the market seeks a return to stabilization.

During the fiscal year, the four sector heavyweights noted above were the most significant positive contributors to return. Combined, these exposures resulted in an +11% gain. Within the S&P 500, performance of those same sectors provided a more ordinary, collective return gain of +2.6%. This enormous performance variation reveals how the selection and weighting of investments within sectors can have a big impact on results. The Fund’s results were far better than that of buying exposure to mimic the S&P 500, which exemplifies the philosophy behind the Fund’s approach. On the flip side, sector exposures that detracted from the gains included Materials, Financials, and Energy. Those three allocations were each underweight their corresponding S&P 500 sector weight, but offset the Fund’s gain by nearly -3.7%.

Over the course of the year, the Information Technology weight declined to 12% (versus 31% last September), whereas Consumer Discretionary and Health Care weights each rose twelve percentage points, to 26% and 24%, respectively. Underweight a year ago, the Financials weight grew to 13% (up from 5%), while Energy declined to a 5% weight (down from 11%), and the Materials weight declined to zero (down from 5%). Telecommunication Services and Utilities sectors also have zero portfolio weight.

At the industry level, nearly all the gains were contributed by group exposures within the largest four sector allocations. Five of the most additive contributors to performance were repeats from the prior two years, again reinforcing our stance that areas

| 8 | The Leuthold Funds - 2015 Annual Report |

of market leadership can be long-term, and concentrating exposure in those areas can provide superior results. For three consecutive years now, the Select Industries Fund disciplines effectively identified particularly strong (and prolonged) leadership trends with these groups: Airlines, Automotive Retail, Managed Health Care, Data Processing & Outsourced Services, and Drug Retail. And, for two successive years, Technology Hardware & Storage and Aerospace & Defense were among the biggest gainers. Other strong results this year came from Semiconductors, Health Care Facilities, and IT Consulting.

There were few industry group allocations that materially detracted from return. Commodity Chemicals was the most significant, which alone subtracted from performance by -1.4%. Contributing to losses by less than -1% were: Asset Management & Custody Banks, Consumer Finance, Health Care Distributors, Oil & Gas Refining, Integrated Oil & Gas, Homebuilding, and Hypermarkets & Super Centers. (Integrated Oil & Gas and Oil & Gas Refining groups have been detractors to performance for two consecutive years.)

Twelve months ago, approximately 9% of portfolio exposure came from foreign-domiciled stocks (i.e. ADR/ADS traded on U.S. exchanges). This amount decreased over the next few months, until it reached a month-end low point of just 2% in August. As of September 30, 2015, the percentage had increased slightly to 3.5%. Of the foreign market exposure, Developed Markets comprised a yearly average of 99%, and the minuscule Emerging Market exposure was sold by the end of June. The Fund’s foreign exposure, and the mix of Developed versus Emerging Market, is not deliberate; rather it is the by-product of the industry group investments selected, based on their quantitative attractiveness. Some industries are inclined to have a stronger presence in Developed Markets versus Emerging Markets, and vice versa. During this most recent fiscal year, Emerging Market exposure was phased out primarily due to deactivating Integrated Oil & Gas and Semiconductors from the portfolio.

Leuthold Global Industries Fund

This all-equity Fund had total return loss of -2.61% (retail share class) for the fiscal year ended September 30, 2015. This result was better than the Morningstar World Stock average total return loss of -5.18%, and the MSCI All Country World Index (ACWI), which performed even worse, with a total return loss of -6.16%.

In nine of the last twelve months, the Leuthold Global Industries Fund either outperformed or matched performance of the Morningstar World Stock average and the MSCI ACWI. During those months, the Fund led the Morningstar World Stock average by 725 basis points, and had an advantage of 915 basis points over the MSCI ACWI. The Fund underperformed in the other three months, giving back most of those leadership spreads, but as depicted by performance, it retained its overall edge. During the three months of underperformance, the Fund lagged behind the Morningstar World Stock average and the MSCI ACWI by 561 and 686 basis points, respectively.

Note that the mixture of countries, regions of the world, types of economies, business sectors, industry groups, and market capitalizations within the Fund are not deliberated or openly targeted. That is how the majority of other global funds operate. Such characteristics of the Leuthold Global Industries Fund composition are the unique product of the Fund’s quantitative methodology; the intent is to eliminate the possibility that emotions, biases, and/or gut feelings will impact investment decisions. We believe that building concentrated investments in attractive industries, which may mutually benefit from an interdependent global economy, will generate superior returns versus the traditional approach of focusing on location and/or style box.

With that in mind, here we review the characteristics of the Leuthold Global Industries Fund’s portfolio versus that of the MSCI ACWI benchmark for the fiscal year ended September 30, 2015.

| The Leuthold Funds - 2015 Annual Report | 9 |

The Fund’s U.S. stock exposure increased throughout the year, from 47% in September 2014, to a fiscal year end weight of 55%, the higher end of its twelve-month range; the year’s average weight was 53%. The MSCI ACWI maintained a steady 49-50% in U.S. stock exposure during the fiscal year. Developed Market versus Emerging Market holdings in the Fund drifted in the reverse manner as that of the prior fiscal year: Emerging Market exposure largely retreated, ending the year with a relatively undersized position of 6% (versus a high of 22% near the beginning of the year). In comparison, the MSCI ACWI generally maintained a standard 90/10 percent mix of Developed versus Emerging Market exposure. The Fund’s ability to migrate up and down demonstrates its dynamic approach. This enables us to exchange opportunities and/or shift portfolio characteristics as the quantitative disciplines pinpoint new areas of value. This is in contrast to the mostly static construction of the MSCI ACWI.

During the fiscal year, the Fund had losses in six of its ten broad equity sector exposures. Those with the most significant impact on performance were Financials, Energy, Materials, and Utilities; together they detracted by -5.4%. The Fund’s overweight Financials and Utilities underperformed the benchmark sector weights, while the Fund’s underweight Energy and Materials holdings had smaller losses than those sectors in the benchmark. Offsetting the Fund’s sector losses were gains in three sectors, although only two were measurably meaningful: Industrials and Health Care had a combined additive effect of +4.4%. These two sectors held larger weights in the Fund versus the MSCI ACWI, and outperformed the corresponding benchmark sectors’ combined loss (-0.6%) by a wide margin.

Looking at the detail beneath the sector level, the industry group concentrations that provided the lion’s share of the sector losses were: Emerging Diversified Banks, Integrated Oil & Gas, Commodity Chemicals, Automobiles, Emerging Electric Utilities, Asset Management & Custody Banks, and Consumer Finance. The best industry group performance, by far, came from Airlines, an Industrials sector group, which contributed over +2.5% to return. This was followed by strong performance in Managed Health Care (+1.8% contribution) and Auto Components (roughly +1% additive).

During the year, the Fund had investments in 31 countries outside the U.S., with an average of 26 country investments in any given month. Developed Market allocations (outside of the U.S.) that carried the heaviest weights during the year were Japan, United Kingdom, Germany, Canada, Switzerland, and Hong Kong. Of the Emerging Market exposures, the biggest country weights included investments in stocks from Taiwan, Thailand, South Korea, India, and South Africa.

Performance-wise, the Fund benefited greatly from its U.S. equity overweight and its industry group/stock selection among domestic stocks, versus the MSCI ACWI. The MSCI ACWI received a small negative contribution to return from its U.S. holdings (-0.3%), compared to the Leuthold Global Industries Fund’s strong +4.6% contribution from its U.S. stock concentrations. Few other countries offered a positive contribution to return for the Fund. Positions in the United Kingdom, Italy, France, Singapore, and Ireland provided a small positive value with a collective +0.7%. Meanwhile, the corresponding country exposures in the MSCI ACWI were all detractors to the benchmark’s return. This tells us that our stock positions in these countries were more value-added; our industry group and/or stock selection within groups was higher-quality.

The Fund’s country exposures that provided the worst performance outcomes were Brazil, Canada, Japan, South Korea, and Australia. Of these, the Canadian and Australian positions were the only two that outperformed (by losing less) than the respective country allocations within the MSCI ACWI. The combined losses of these country allocations in the Fund detracted from performance by -3.0%.

The Leuthold Global Industries Fund does not hedge currency exposure. We feel it is more prudent to accept the effects of currency fluctuation rather than to implement costly hedging programs that may or may not ultimately be additive to

| 10 | The Leuthold Funds - 2015 Annual Report |

performance. Additionally, we believe U.S. dollar-based relative strength components, within our propriety global industry group selection model, help us to identify and capitalize on broad FX market trends. U.S. dollar strength during the past couple of years has been a headwind for a global equity portfolio that does not hedge currency exposure, but over time this should balance out.

In summary, our global equity selection is unusual because the country-specific exposures are not planned. The exposure is the by-product of the Fund’s quantitative approach, which attempts to identify attractive global industry group investments. The traditional global investment style targets “location.” We believe our non-traditional approach is able to cast a more far-reaching net to capture a higher quality collection of global opportunities, rather than limit options based on locality.

Grizzly Short Fund

This Fund is 100% short individual stocks, and is intended to profit when stock prices decline. For the fiscal year ended September 30, 2015, the Grizzly Short Fund produced an +8.41% total return gain, outpacing the -4.03% Morningstar Bear Market fund average by a whopping spread of 12.44%. The Grizzly Short Fund results were also exceptional compared to the benchmark S&P MidCap 400 Index, which had total return gain of +1.40% (measured against the inverse performance, the Grizzly Short Fund was ahead by about 980 basis points). Compared to the S&P 500 (-0.61% total return), the Fund was roughly 780 basis points better than the corresponding inverse of that index.

The Grizzly Short Fund has a median market capitalization of about $2.5 billion. This is more comparable to the S&P MidCap 400 Index ($3.4 billion market capitalization) than the S&P 500 ($17.0 billion market capitalization). Usually this size characteristic explains some performance variations with the S&P 500 benchmark, but this recent fiscal year the Grizzly Short Fund results deviated extensively from both benchmarks, signaling that the environment was particularly ripe for our actively managed approach to short selling. After a six-year, +200%-plus bull market gain, these conditions seemed long overdue. Since the Fund wasn’t fashioned with the expectation that it would profit every year, it’s a plus to gather excess relative gains against index shorts during a market decline.

Among the Grizzly Short Fund’s sector allocations for the last twelve months, the Energy sector was easily the lead contributor to its positive return. The Fund’s big Energy overweight provided a nice advantage over the 100% short S&P 500. Lesser, but still strong gains were received from short selling stocks in Materials, Utilities, and Industrials sectors. Only two sector exposures, Consumer Discretionary and Information Technology, had a real adverse effect on performance; both experienced bigger losses than corresponding S&P 500 sector results.

Examining the Fund’s leading performance at the industry group level shows plentiful representation from among the subsets of the Energy sector. These included Oil & Gas Exploration & Production, Coal & Consumable Fuels, Oil & Gas Storage/Transportation, and Oil & Gas Equipment & Services. Strong Materials sector results came from short selling stocks in Steel, Specialty Chemicals, Commodity Chemicals, and Aluminum. Renewable Electricity and Independent Power Producers groups provided the Utilities sector gain, while Industrials sector groups that executed well for the Fund were Construction Machinery, Industrial Machinery, and Air Freight & Logistics.

The worst performing industry group exposures were mostly those comprising the Fund’s two sector detractors, Consumer Discretionary and Information Technology. Those that detracted most from performance included Specialty Stores, Consumer

| The Leuthold Funds - 2015 Annual Report | 11 |

Electronics, Internet Software & Services, Semiconductor Equipment, Internet Retail, Casinos & Gaming, Automobile Manufacturers, Electronic Components, Application Software, and Restaurants. Other particularly poorly performing stocks came from the Packaged Foods & Meats industry (Consumer Staples sector), and Pharmaceuticals (Health Care Sector).

The Grizzly Short Fund is a highly disciplined methodology, with portfolio positions monitored on a daily basis. High turnover is characteristic; sector concentrations and industry group exposures have the potential to fluctuate considerably throughout the year. As opposed to a market capitalization weighted index, such as the S&P MidCap 400 or the S&P 500, the Grizzly Short Fund positions are similarly weighted across the portfolio. Due to this, the Fund is not subject to the shortcomings of having a limited variety of oversized positions driving results. Additional features of the Fund’s strategy include policies that trigger specific short-covering action, such as capturing gains and stop-loss tactics, and weighting limitations on sector and sub-industry group concentrations.

This past year the Fund realized its objective by outperforming its benchmark index short products, and it far exceeded its peer fund average as represented by the Morningstar Bear Market category (which peculiarly produced a loss in solid bear market conditions). When the cycle turns, and the stock market returns to a clearly rising trend, investors should expect the Grizzly Short Fund to lose money. Under those circumstances, the Fund’s goal is to add value by declining less than an index short.

Investors who are not experienced in short-selling and adjusting portfolios for changing risk profiles should consider one of our tactical asset allocation funds: the Leuthold Core Investment Fund and the Leuthold Global Fund. Both of those funds have the ability to implement this short-selling strategy to reduce risk when the stock market is viewed as overvalued and appears in danger of a correction.

IN CLOSING

At present, it is our view that we are in the midst of a bear market, as our multi-factor analysis turned convincingly “negative” in early August. The major market indexes have so far held above the lows made during August’s plunge, but we believe the bearish case still deserves the benefit of the doubt. Unweighted measures, like the S&P 500 Equal Weight Index, did undercut their August lows in late September, joining most of the major foreign market indexes in the process. In late September, the broadest foreign composite, the MSCI All Country World Ex-USA Index was down 22% from its high; while the Emerging Market Index had dropped 30% from its 2014-2015 high (bear markets are classified as a decline of 20%). While major domestic market indexes have rebounded from their August low points, remember, blue chip U.S. stock indexes are almost always the last ones to break down during corrections or bear markets. This time appears to be no different.

Our opinion is not the majority view. Following the stock market’s re-test of its August lows in late September, bullish sentiment rapidly re-emerged. There’s currently an overwhelming consensus that stocks will rally into year-end, but we’re doubtful. Leadership trends still have us questioning the sustainability of the rally. While there’s been a big relief-bounce in commodity-oriented stocks, the relative weakness in Small Caps, Banks, Brokers, and High Yield is worrisome.

The August market break did not emerge from the blue, and we detailed the warning signs that we saw along the way. The foundation for the bear case was put in place many months before those four ugly days in late August. Market internals had warned for months that trouble was coming. High Yield bonds began to warn of trouble 14 months earlier than the August

| 12 | The Leuthold Funds - 2015 Annual Report |

decline, and stock market breadth and sector leadership traced out typical distribution patterns over the five months leading up to the S&P 500 bull market high on May 21st. We think the bear market’s second leg down is imminent or already underway; however, we are not expecting severe declines akin to the prior two bear markets. When it’s all said and done, we anticipate a garden-variety bear market decline in the range of 22%, with the S&P 500 falling to around 1700.

Nonetheless, our quantitative processes continually monitor an extensive range of market data; asset class and equity group attractiveness are reassessed and adjusted on an ongoing basis. If our bear market theory is premature, the numbers in our analysis will strengthen and reverse course.

Investment markets are dynamic mechanisms; they are continuously swayed by world events and global economic conditions. Our goal is to add value over the long-term by being adaptable to switch gears and change our stance when the market undercurrents shift course. Our disciplined approach to investment selection removes the emotions that can cloud judgement and eliminates the potential for ego or bias to cause us to overlook developing opportunities. We believe our long-term track record bears out the success of our processes.

Thank you for your support of the Leuthold Fund strategies. We welcome your comments and questions.

Sincerely,

| | | |

Doug Ramsey, CFA, CMT CIO & Co-Portfolio Manager | | |

| | | |

Chun Wang, CFA, PRM Co-Portfolio Manager | Jun Zhu, CFA Co-Portfolio Manager | Greg Swenson, CFA Co-Portfolio Manager |

| | | |

Kristen Hendrickson, CFA Co-Portfolio Manager | | |

| The Leuthold Funds - 2015 Annual Report | 13 |

Expense Example – September 30, 2015 (Unaudited)

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, including reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held the entire period (April 1, 2015 – September 30, 2015).

Actual Expenses

The first line of the following table provides information about actual account values and actual expenses. Although the Funds charge no sales load (the Leuthold Core Investment Fund, Leuthold Global Fund, and Leuthold Global Industries Fund charge a 2% redemption fee for redemptions made within five business days after a purchase), you will be assessed fees for outgoing wire transfers, returned checks, or stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Funds’ transfer agent. If you request a redemption be made by wire transfer, currently a $15.00 fee is charged by the Funds’ transfer agent. To the extent that the Funds invest in shares of other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which a Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary by fund. These expenses are not included in the following example. The example includes, but is not limited to, management fees, shareholder servicing fees, fund accounting, custody, and transfer agent fees. However, the following example does not include portfolio trading commissions and related expenses, and extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| 14 | The Leuthold Funds - 2015 Annual Report |

| The Leuthold Funds |

| Expense Example Tables (Unaudited) |

| | | | | | | | | | |

| Leuthold Core Investment Fund - Retail Class - LCORX | | | | | | |

| | | | | | | | | | |

| | | Beginning Account Value April 1, 2015 | | Ending Account Value September 30, 2015 | | Expenses Paid During Period* April 1, 2015 - September 30, 2015 |

| Actual** | | $ | 1,000.00 | | | $ | 1,040.30 | | | $ | 6.75 | |

| Hypothetical (5% return before expenses)*** | | | 1,000.00 | | | | 1,018.45 | | | | 6.68 | |

| * | | Expenses are equal to the Fund’s annualized expense ratio of 1.32%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| ** | | Excluding dividends and interest on securities sold short, your actual cost of investment in the Fund would be $5.98 and the Fund’s annualized expense ratio would be 1.17%. |

| *** | | Excluding dividends and interest on securities sold short, your hypothetical cost of investment in the Fund would be $5.92 and the Fund’s annualized expense ratio would be 1.17%. |

| | | | | | | | | | | | | |

| Leuthold Core Investment Fund - Institutional Class - LCRIX | | | | | | |

| | | Beginning Account Value April 1, 2015 | | Ending Account Value September 30, 2015 | | Expenses Paid During Period* April 1, 2015 - September 30, 2015 |

| Actual** | | $ | 1,000.00 | | | $ | 1,040.30 | | | $ | 6.24 | |

| Hypothetical (5% return before expenses)*** | | | 1,000.00 | | | | 1,018.95 | | | | 6.17 | |

| * | | Expenses are equal to the Fund’s annualized expense ratio of 1.22%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| ** | | Excluding dividends and interest on securities sold short, your actual cost of investment in the Fund would be $5.42 and the Fund’s annualized expense ratio would be 1.06%. |

| *** | | Excluding dividends and interest on securities sold short, your hypothetical cost of investment in the Fund would be $5.37 and the Fund’s annualized expense ratio would be 1.06%. |

| Leuthold Global Fund - Retail Class - GLBLX | | | | | |

| | | | | | | | | | | |

| | | Beginning Account Value April 1, 2015 | | Ending Account Value September 30, 2015 | | Expenses Paid During Period* April 1, 2015 - September 30, 2015 |

| Actual** | | $ | 1,000.00 | | | $ | 985.90 | | | $ | 8.56 | |

| Hypothetical (5% return before expenses)*** | | | 1,000.00 | | | | 1,016.44 | | | | 8.69 | |

| * | | Expenses are equal to the Fund’s annualized expense ratio of 1.72%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| ** | | Excluding dividends and interest on securities sold short, your actual cost of investment in the Fund would be $7.72 and the Fund’s annualized expense ratio would be 1.55%. |

| *** | | Excluding dividends and interest on securities sold short, your hypothetical cost of investment in the Fund would be $7.84 and the Fund’s annualized expense ratio would be 1.55%. |

| Leuthold Global Fund - Institutional Class - GLBIX | | | | | | |

| | | | | | | | | | | | | |

| | | Beginning Account Value April 1, 2015 | | Ending Account Value September 30, 2015 | | Expenses Paid During Period* April 1, 2015 - September 30, 2015 |

| Actual** | | $ | 1,000.00 | | | $ | 987.00 | | | $ | 7.52 | |

| Hypothetical (5% return before expenses)*** | | | 1,000.00 | | | | 1,017.50 | | | | 7.64 | |

| * | | Expenses are equal to the Fund’s annualized expense ratio of 1.51%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| ** | | Excluding dividends and interest on securities sold short, your actual cost of investment in the Fund would be $6.67 and the Fund’s annualized expense ratio would be 1.34%. |

| *** | | Excluding dividends and interest on securities sold short, your hypothetical cost of investment in the Fund would be $6.78 and the Fund’s annualized expense ratio would be 1.34%. |

| The Leuthold Funds - 2015 Annual Report | 15 |

| The Leuthold Funds |

| Expense Example Tables (Unaudited) (continued) |

| Leuthold Select Industries Fund - LSLTX | | | | | | |

| | | | | | | | | | | | | |

| | | Beginning Account Value April 1, 2015 | | Ending Account Value September 30, 2015 | | Expenses Paid During Period* April 1, 2015 - September 30, 2015 |

| Actual | | $ | 1,000.00 | | | $ | 1,062.40 | | | $ | 7.76 | |

| Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,017.55 | | | | 7.59 | |

| * | | Expenses are equal to the Fund’s annualized expense ratio of 1.50%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| Leuthold Global Industries Fund - Retail Class- LGINX | | | | | |

| | | | | | | | | | | | | |

| | | Beginning Account Value April 1, 2015 | | Ending Account Value September 30, 2015 | | Expenses Paid During Period* April 1, 2015 - September 30, 2015 |

| Actual | | $ | 1,000.00 | | | $ | 973.90 | | | $ | 7.42 | |

| Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,017.55 | | | | 7.59 | |

| * | | Expenses are equal to the Fund’s annualized expense ratio of 1.50%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| Leuthold Global Industries Fund - Institutional Class - LGIIX | | | | | |

| | | | | | | | | | | | | |

| | | Beginning Account Value April 1, 2015 | | Ending Account Value September 30, 2015 | | Expenses Paid During Period* April 1, 2015 - September 30, 2015 |

| | $ | 1,000.00 | | | $ | 975.60 | | | $ | 6.19 | |

| Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.80 | | | | 6.33 | |

| * | | Expenses are equal to the Fund’s annualized expense ratio of 1.25%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| Grizzly Short Fund - GRZZX | | | | | |

| | | | | | | | | | | | | |

| | | Beginning Account Value April 1, 2015 | | Ending Account Value September 30, 2015 | | Expenses Paid During Period* April 1, 2015 - September 30, 2015 |

| | $ | 1,000.00 | | | $ | 1,084.10 | | | $ | 15.73 | |

Hypothetical (5% return before expenses)*** | | | 1,000.00 | | | | 1,009.98 | | | | 15.17 | |

| * | | Expenses are equal to the Fund’s annualized expense ratio of 3.01%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| ** | | Excluding dividends and interest on securities sold short, your actual cost of investment in the Fund would be $7.99 and the Fund’s annualized expense ratio would be 1.53%. |

| *** | | Excluding dividends and interest on securities sold short, your hypothetical cost of investment in the Fund would be $7.74 and the Fund’s annualized expense ratio would be 1.53%. |

| 16 | The Leuthold Funds - 2015 Annual Report |

| The Leuthold Funds |

| (Unaudited) |

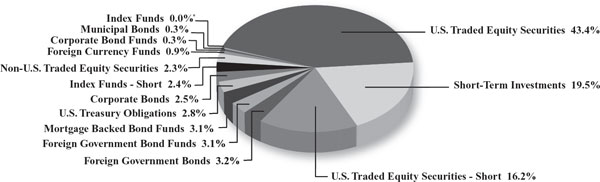

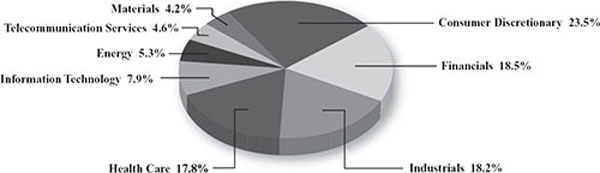

Leuthold Core Investment Fund

September 30, 2015

Leuthold Global Fund

Allocation of Portfolio Holdings

September 30, 2015

* Amount is less than 0.05%.

| The Leuthold Funds - 2015 Annual Report | 17 |

| The Leuthold Funds |

| (Unaudited) |

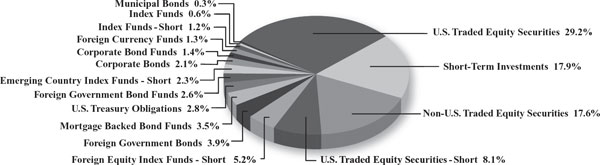

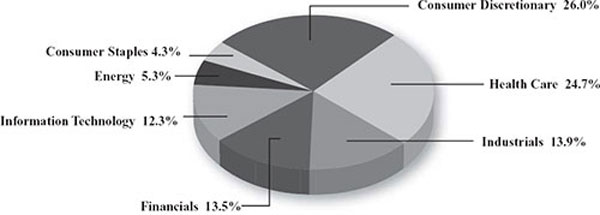

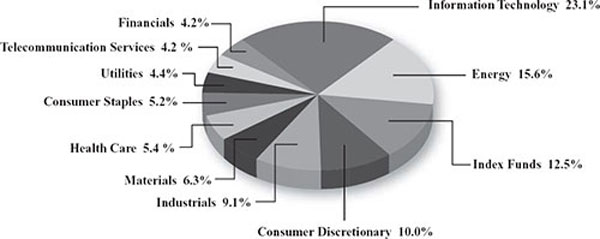

Leuthold Select Industries Fund

Allocation of Portfolio Holdings

September 30, 2015

Leuthold Global Industries Fund

Allocation of Portfolio Holdings

September 30, 2015

| 18 | The Leuthold Funds - 2014 Annual Report |

| The Leuthold Funds |

| (Unaudited) |

Grizzly Short Fund

Allocation of Securities Sold Short

September 30, 2015

| The Leuthold Funds - 2015 Annual Report | 19 |

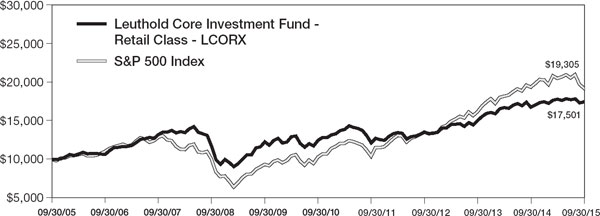

| Leuthold Core Investment Fund - Retail Class - LCORX |

| (Unaudited) |

Average Annual Rate of Return For Periods Ended

September 30, 2015

| | | | | | | | | |

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year |

| Leuthold Core Investment Fund - Retail Class - LCORX | | 4.03% | | 8.88% | | 6.96% | | 5.76% |

| Lipper Flexible Portfolio Funds Index | | (4.83%) | | 5.13% | | 6.58% | | 5.12% |

| S&P 500 Index | | (0.61%) | | 12.40% | | 13.34% | | 6.80% |

A $10,000 investment in the Leuthold Core Investment Fund – Retail Class - LCORX

The Lipper Flexible Portfolio Funds Index is composed of funds that allocate investments across various asset classes with a focus on total return, as defined by Lipper.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries.

This chart assumes an initial gross investment of $10,000 made on September 30, 2005. Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

| 20 | The Leuthold Funds - 2015 Annual Report |

| Leuthold Core Investment Fund - Institutional Class - LCRIX |

| (Unaudited) |

Average Annual Rate of Return For Periods Ended

September 30, 2015

| | | | | | | | | |

| | | 1 Year | | 3 Year | | 5 Year | | Since Inception |

| Leuthold Core Investment Fund - Institutional Class - LCRIX | | 4.03% | | 8.98% | | 7.05% | | 5.38% |

| Lipper Flexible Portfolio Funds Index | | (4.83%) | | 5.13% | | 6.58% | | 4.75% |

| S&P 500 Index | | (0.61%) | | 12.40% | | 13.34% | | 6.53% |

A $1,000,000 investment in the Leuthold Core Investment Fund – Institutional Class - LCRIX

The Lipper Flexible Portfolio Funds Index is composed of funds that allocate investments across various asset classes with a focus on total return, as defined by Lipper.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries.

This chart assumes an initial gross investment of $1,000,000 made on January 31, 2006 (commencement of operations). Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

| The Leuthold Funds - 2015 Annual Report | 21 |

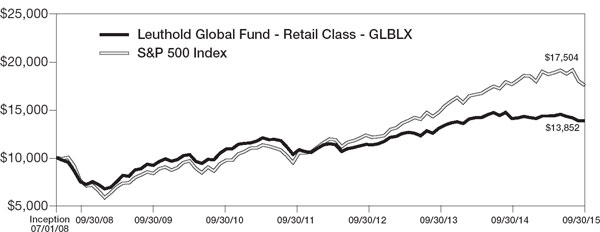

| Leuthold Global Fund - Retail Class - GLBLX |

| (Unaudited) |

Average Annual Rate of Return For Periods Ended

September 30, 2015

| | | | | | | | | |

| | | 1 Year | | 3 Year | | 5 Year | | Since Inception |

| Leuthold Global Fund - Retail Class - GLBLX | | (1.41%) | | 6.81% | | 5.78% | | 4.60% |

| MSCI ACWI | | (6.16%) | | 7.52% | | 7.39% | | 3.87% |

| Barclays Global Aggregate Index | | (3.27%) | | (1.59%) | | 0.81% | | 2.64% |

| S&P 500 Index | �� | (0.61%) | | 12.40% | | 13.34% | | 8.03% |

A $10,000 investment in the Leuthold Global Fund - Retail Class - GLBLX

The MSCI ACWI (All Country World Index) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI ACWI consists of 46 country indices comprising 23 developed and 23 emerging market country indices. The developed market country indices included are: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States. The emerging market country indices included are: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey, and United Arab Emirates.

The Barclays Global Aggregate Index provides a broad-based measure of the global investment grade fixed-rate debt markets. It is comprised of the U.S. Aggregate, Pan-European Aggregate, the Asian-Pacific Aggregate Indices, and the Canadian Aggregate Indices. It also includes a wide range of standard and customized sub-indices by liquidity constraint, sector, quality, and maturity.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries.

This chart assumes an initial gross investment of $10,000 made on July 1, 2008 (commencement of operations). Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

| 22 | The Leuthold Funds - 2015 Annual Report |

| Leuthold Global Fund - Institutional Class - GLBIX |

| (Unaudited) |

Average Annual Rate of Return For Periods Ended

September 30, 2015

| | | | | | | | | |

| | | 1 Year | | 3 Year | | 5 Year | | Since Inception |

| Leuthold Global Fund - Institutional Class - GLBIX | | (1.30%) | | 7.03% | | 5.99% | | 4.55% |

| MSCI ACWI | | (6.16%) | | 7.52% | | 7.39% | | 2.71% |

| Barclays Global Aggregate Index | | (3.27%) | | (1.59%) | | 0.81% | | 2.41% |

| S&P 500 Index | | (0.61%) | | 12.40% | | 13.34% | | 6.81% |

A $1,000,000 investment in the Leuthold Global Fund - Institutional Class - GLBIX

The MSCI ACWI (All Country World Index) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI ACWI consists of 46 country indices comprising 23 developed and 23 emerging market country indices. The developed market country indices included are: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States. The emerging market country indices included are: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey, and United Arab Emirates.

The Barclays Global Aggregate Index provides a broad-based measure of the global investment grade fixed-rate debt markets. It is comprised of the U.S. Aggregate, Pan-European Aggregate, the Asian-Pacific Aggregate Indices, and the Canadian Aggregate Indices. It also includes a wide range of standard and customized sub-indices by liquidity constraint, sector, quality, and maturity.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries.

This chart assumes an initial gross investment of $1,000,000 made on April 30, 2008 (commencement of operations). Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

| The Leuthold Funds - 2015 Annual Report | 23 |

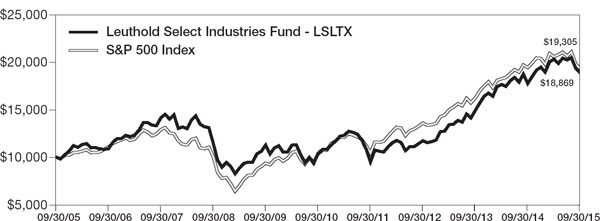

| Leuthold Select Industries Fund - LSLTX |

| (Unaudited) |

Average Annual Rate of Return For Periods Ended

September 30, 2015

| | | | | | | | | |

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year |

| Leuthold Select Industries Fund - LSLTX | | 6.24% | | 17.19% | | 12.65% | | 6.56% |

| Russell 2000 Index | | 1.25% | | 11.02% | | 11.73% | | 6.55% |

| Lipper Multi-Cap Core Funds Index | | (1.88%) | | 11.71% | | 11.50% | | 6.29% |

| S&P 500 Index | | (0.61%) | | 12.40% | | 13.34% | | 6.80% |

A $10,000 investment in the Leuthold Select Industries Fund - LSLTX

The Russell 2000 Index is comprised of approximately 2000 of the smallest companies in the Russell 3000 Index, representing approximately 10% of the Russell 3000 total market capitalization.

The Lipper Multi-Cap Core Funds Index is an average of funds that invest in a variety of market capitalization ranges without concentrating 75% of their equity assets in any one market capitalization range over an extended period of time. Multi-cap funds typically have between 25% and 75% of their assets invested in companies with market capitalizations (on a three-year weighted basis) above 300% of the dollar-weighted median market capitalization of the middle 1,000 securities of the S&P SuperComposite 1500 Index. These funds typically have an average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share growth value, compared to the S&P SuperComposite 1500 Index.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries.

This chart assumes an initial gross investment of $10,000 made on September 30, 2005. Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

| 24 | The Leuthold Funds - 2015 Annual Report |

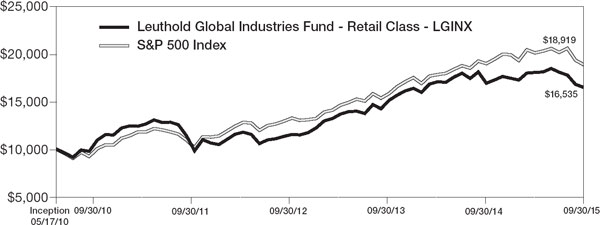

| Leuthold Global Industries Fund - Retail Class - LGINX |

| (Unaudited) |

Average Annual Rate of Return For Periods Ended

September 30, 2015

| | | | | | | | | |

| | | 1 Year | | 3 Year | | 5 Year | | Since Inception |

| Leuthold Global Industries Fund - Retail Class - LGINX | | (2.61%) | | 12.55% | | 8.47% | | 9.81% |

| MSCI ACWI | | (6.16%) | | 7.52% | | 7.39% | | 8.37% |

| Lipper Global Multi-Cap Value Index | | (7.86%) | | 7.95% | | 7.05% | | 8.06% |

| S&P 500 Index | | (0.61%) | | 12.40% | | 13.34% | | 12.60% |

A $10,000 investment in the Leuthold Global Industries Fund - Retail Class - LGINX

The MSCI ACWI (All Country World Index) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI ACWI consists of 46 country indices comprising 23 developed and 23 emerging market country indices. The developed market country indices included are: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States. The emerging market country indices included are: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey, and United Arab Emirates.

The Lipper Global Multi-Cap Value Index is an index that measures investment in a variety of market capitalization ranges without concentrating 75% of their equity assets in any one market capitalization range over an extended period of time. Typically this index has 25% to 75% of their assets invested in companies both inside and outside of the U.S. with market capitalizations (on a three-year weighted basis) above 400% of the 75th market capitalization percentile of the S&P/Citigroup World Broad Market Index.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries.

This chart assumes an initial gross investment of $10,000 made on May 17, 2010 (commencement of operations). Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

| The Leuthold Funds - 2015 Annual Report | 25 |

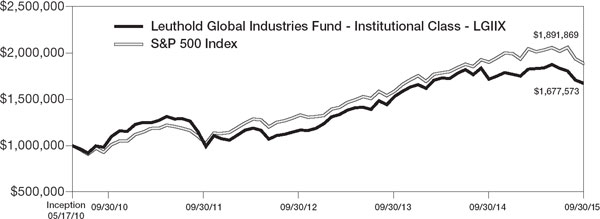

| Leuthold Global Industries Fund - Institutional Class - LGIIX |

| (Unaudited) |

Average Annual Rate of Return For Periods Ended

September 30, 2015

| | | | | | | | | |

| | | 1 Year | | 3 Year | | 5 Year | | Since Inception |

Leuthold Global Industries Fund - Institutional Class - LGIIX | | (2.44%) | | 12.80% | | 8.79% | | 10.11% |

| MSCI ACWI | | (6.16%) | | 7.52% | | 7.39% | | 8.37% |

| Lipper Global Multi-Cap Value Index | | (7.86%) | | 7.95% | | 7.05% | | 8.06% |

| S&P 500 Index | | (0.61%) | | 12.40% | | 13.34% | | 12.60% |

A $1,000,000 investment in the Leuthold Global Industries Fund - Institutional Class - LGIIX

The MSCI ACWI (All Country World Index) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI ACWI consists of 46 country indices comprising 23 developed and 23 emerging market country indices. The developed market country indices included are: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States. The emerging market country indices included are: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey, and United Arab Emirates.

The Lipper Global Multi-Cap Value Index is an index that measures investment in a variety of market capitalization ranges without concentrating 75% of their equity assets in any one market capitalization range over an extended period of time. Typically this index has 25% to 75% of their assets invested in companies both inside and outside of the U.S. with market capitalizations (on a three-year weighted basis) above 400% of the 75th market capitalization percentile of the S&P/Citigroup World Broad Market Index.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries.

This chart assumes an initial gross investment of $1,000,000 made on May 17, 2010 (commencement of operations). Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

| 26 | The Leuthold Funds - 2015 Annual Report |

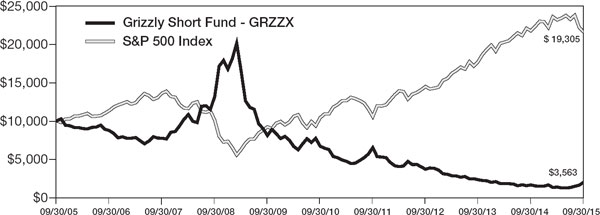

| Grizzly Short Fund - GRZZX |

| (Unaudited) |

Average Annual Rate of Return For Periods Ended

September 30, 2015

| | | | | | | | | |

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year |

| Grizzly Short Fund - GRZZX | | 8.41% | | (10.27%) | | (13.48%) | | (9.81%) |

| Lipper Dedicated Short Bias | | (0.39%) | | (18.80%) | | (19.65%) | | (13.26%) |

| S&P MidCap 400 Index | | 1.40% | | 13.12% | | 12.93% | | 8.25% |

| S&P 500 Index | | (0.61%) | | 12.40% | | 13.34% | | 6.80% |

A $10,000 investment in the Grizzly Short Fund - GRZZX

The Lipper Dedicated Short Bias Funds Index is an equally weighted representation of funds in the Lipper Dedicated Short Bias category. These funds employ a hedge fund strategy that maintains a new short exposure to the market through a combination of short and long positions. A dedicated short bias investment strategy attempts to capture profits when the market declines, by holding investments that are overall biased to the short side.

The S&P MidCap 400 Index is a capitalization-weighted index which measures the performance of the mid-range sector of the U.S. stock market. The index was developed with a base level of 100 as of December 31, 1990.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries.

This chart assumes an initial gross investment of $10,000 made on September 30, 2005. Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

| The Leuthold Funds - 2015 Annual Report | 27 |

| The Leuthold Funds |

Statements of Assets and Liabilities |

| September 30, 2015 |

| | | | | | | | | | | |

| | | Leuthold Core Investment Fund (Consolidated) | | Leuthold Global Fund (Consolidated) | | Leuthold Select Industries Fund | |

| ASSETS: | | | | | | | | | | |

| Investments, at cost | | | | | | | | | | |

| Unaffiliated securities | | $ | 722,258,884 | | $ | 281,704,569 | | $ | 9,894,598 | |

| Affiliated securities | | | 9,441,924 | | | — | | | — | |

| Total Investments, at cost | | | 731,700,808 | | | 281,704,569 | | | 9,894,598 | |

| | | | | | | | | | | |

| Investments, at fair value | | | | | | | | | | |

| Unaffiliated securities | | | 807,892,892 | | | 296,861,047 | | | 12,412,145 | |

| Affiliated securities | | | 9,485,077 | | | — | | | — | |

| Total Investments, at fair value | | | 817,377,969 | | | 296,861,047 | | | 12,412,145 | |

| Cash | | | 1,997,634 | | | 914,576 | | | — | |

Foreign currency

(cost $7,432, $28,285, and $0, respectively) | | | 7,433 | | | 28,274 | | | — | |