UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-09094

| | Leuthold Funds, Inc. | |

| (Exact name of registrant as specified in charter) |

| | 33 S. Sixth Street, Suite 4600, Minneapolis, MN 55402 | |

| (Address of principal executive offices) (Zip code) |

| | Leuthold Weeden Capital Management | |

| | 33 S. Sixth Street, Suite 4600, Minneapolis, MN 55402 | |

| (Name and address of agent for service) |

| | 612-332-9141 | |

| Registrant’s telephone number, including area code |

Date of fiscal year end: September 30, 2012

Date of reporting period: September 30, 2012

Item 1. Reports to Stockholders.

Annual Report

September 30, 2012

The Leuthold Funds

Leuthold Core Investment Fund

Leuthold Asset Allocation Fund

Leuthold Global Fund

Leuthold Select Industries Fund

Leuthold Global Industries Fund

Leuthold Global Clean Technology Fund

Grizzly Short Fund

| The Leuthold Funds |

| Table of Contents |

| Letter to Shareholders | | 1 |

| | | |

| Expense Examples | | 16 |

| | | |

| Allocation of Portfolio Holdings | | 20 |

| | | |

| Components of Portfolio Holdings | | 24 |

| | | |

| Investment Graphs | | 26 |

| | | |

| Statements of Assets and Liabilities | | 38 |

| | | |

| Statements of Operations | | 42 |

| | | |

| Statements of Changes in Net Assets | | 46 |

| | | |

| Financial Highlights | | 53 |

| | | |

| Schedule of Investments | | |

| | | |

| Leuthold Core Investment Fund | | 65 |

| | | |

| Leuthold Asset Allocation Fund | | 75 |

| | | |

| Leuthold Global Fund | | 86 |

| | | |

| Leuthold Select Industries Fund | | 95 |

| | | |

| Leuthold Global Industries Fund | | 98 |

| | | |

| Leuthold Global Clean Technology Fund | | 103 |

| | | |

| Grizzly Short Fund | | 106 |

| | | |

| Notes to the Financial Statements | | 110 |

| | | |

| Report of Independent Registered Public Accounting Firm | | 122 |

| | | |

| Additional Information | | 123 |

| | | |

| Directors and Officers | | 124 |

Dear Fellow Shareholders:

One year ago, stock markets around the world made a bear market bottom in the early days of October, and spent the last three months of the year recouping losses suffered during the summer of 2011. U.S. markets were the primary beneficiaries during that time, with gains ranging from 12-16%. Global market action was strangely disparate, with foreign developed markets turning in a much less robust gain of under 4% for the last three months of 2011. Stocks continued to rally across the board through the first quarter of 2012, benefitting U.S. Small Caps, Mid Caps, and Large Caps alike, with gains of between 12-14%; foreign developed markets also kept relatively close pace in the first quarter, up 11%. The best part of the year’s performance was achieved in these first six months of the fiscal year, with the S&P 500 up 25.89%, the S&P MidCap 400 up 28.23%, and the small cap Russell 2000 Index up 29.83% from October 2011 through March 2012. Foreign developed markets trailed with a 15% gain during that six month time frame.

U.S. and global markets moved down in April and May, surrendering some of the year’s earlier gains. Domestic stocks saw moderate losses ranging from between -6% to -8%, while foreign developed markets were hit especially hard, -13% in those two months. The remaining four months of the fiscal year were positive, with U.S. market gains of between 7% (Mid Cap stocks) to 11% (Small and Large Caps) during that time, while foreign developed markets outperformed (+15%) during the June-September period.

The summer rally pushed the S&P 500 to new bull market highs in September. While foreign markets also rallied, no major global or foreign stock market composite was able to better the highs they recorded back in April. Through September 2012, the S&P 500 is now up a remarkable 30% from last year’s October 4th low, yet this rally surely ranks among the least enjoyed and least exploited gain of that magnitude in history. Neither the average U.S. stock, nor many professionally managed portfolios, have kept pace with these gains. Overseas stocks have fared even worse.

We have generally referred to the 3 1/2-year-old bull market as a global one, but the U.S. did the heavy-lifting over all but the first six months of the bull market dating back to March 2009. The MSCI World “Ex USA” Index is down -1.3% in the last three years through September 2012, and the MSCI Emerging Markets Index is up only 9.7% over the same period. Such U.S. stock market dominance would have been hard to envision in the world of three years ago, when boundless opportunities in emerging markets – versus a sclerotic, “New Normal” United States – were taken for granted.

The past three years have been difficult for equity managers relying heavily on quantitative tools, and we are no exception. All six of our quantitatively-driven strategies have underperformed their benchmarks during this time. It is not unusual for “quant” managers to lag their benchmarks during the first year or so of a new bull market, but the effect has lasted much longer than we’ve traditionally experienced.

The stock market low of 2009 was a rare event attended by nearly apocalyptic investor psychology and 80-year extremes in market action. One might have expected the rebound from this extreme to be just as unprecedented, and in many ways it has been. But our models rely on consistent and repetitive patterns that are a necessary by-product of a capitalistic system – repetitive patterns that are probably ultimately tied to hard-wired biases in human behavior. No approach can be expected to outperform in all environments, and tinkering excessively with models that have stood the test of time is typically counterproductive. We know the historical market biases will eventually re-assert themselves, and accordingly, we are sticking with the core of our quantitative investment disciplines.

We now wonder whether the preference for U.S. assets (and “safe” assets in general) has swung too far. The S&P 500 normalized Price/Earnings ratio is more than six points above the comparable non-U.S. measure (20.2x versus 13.8x), and we have run out of superlatives/profanities to describe the overvaluation of U.S. bonds. We doubt the hoarding of all things American will prove the best strategy for the next three years. In the meantime, our disciplines have us tactically bullish on stocks globally – with the emphasis on “global.”

|

The Leuthold Funds - 2012 Annual Report | 1 |

The summer’s stock market upswing drove the S&P 500 beyond the “typical” or “median” experience for a cyclical bull market, based on analysis back to 1932. From its low on March 9, 2009, through the most recent high on September 14, 2012, the S&P 500 has risen 116% (price only) over a period of 43 months, while the medians for previous bull markets are +90%, and 42 months, respectively. Our most reliable valuation measures today trade at levels we’d label as “mildly” overvalued. Valuations are far from levels that mandate an immediate run for cover, but they are not cheap. While our market analysis has correctly remained on the bullish side since late October 2011, weakening readings of late suggest that defensive portfolio moves might be required in coming months. The U.S. bull market is mature and we are on higher alert for signs of an impending breakdown; we think the odds are better than even that 2013 will see a cyclical top.

Despite these benchmark comparisons and statistics, and regardless of our expectations and predictions, it is our disciplines that drive our investment strategies. The increasingly interdependent relationships of global markets and economies have created seemingly limitless and unpredictable dynamics that can affect market action, both in the short term and over the long term. Having disciplines removes the emotions and eliminates the potential for responding to headlines in an imprudent manner; they offer a balanced means for weighing information through more contemplative risk/reward analysis. We will remain flexible with our asset allocation strategies and abide by the disciplines to change course throughout the year, as necessary.

FUND OVERVIEWS

Leuthold Core Investment Fund

This Fund began trading on November 20, 1995. The strategy is flexible and value-oriented. The Leuthold Core Investment Fund adjusts asset class exposure depending on market conditions and the economic environment, with the objective of identifying areas that appear poised to outperform while attempting to avoid undue risk. Assets are allocated between stocks, bonds, money market instruments, foreign securities, and other alternative investments. The Fund may hedge equity exposure and fixed income exposure through short-selling strategies when our disciplines indicate potential market vulnerabilities. While at times individual portfolio positions may appear unconventional, they are intended to integrate as complementing allocations in an effort to carry out the Fund’s guiding principle: capital appreciation over the long-term, attained through relatively risk averse, prudent investment selection.

| ● | Leuthold Core Investment Fund uses the Leuthold Select Industries strategy as the primary vehicle for directing its U.S.-traded stock exposure. |

| Investment Guidelines: 30%-70% equity exposure and 30%-70% fixed income exposure. Under extreme market conditions, there may be a departure from these guidelines. |

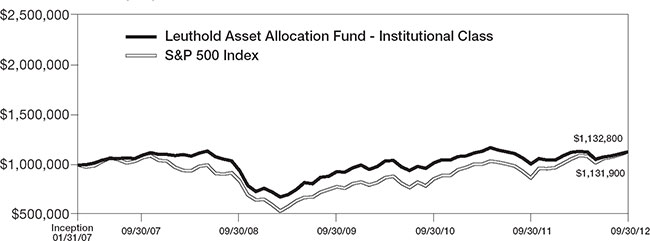

Leuthold Asset Allocation Fund

This Fund began trading on May 24, 2006. The strategy and objective of this Fund are the same as those of the Leuthold Core Investment Fund in terms of guiding disciplines, flexibility, asset class exposure, and risk aversion. This Fund uses other strategies, however, to obtain its targeted U.S.-traded stock exposure.

|

| 2 | The Leuthold Funds - 2012 Annual Report |

| ● | Leuthold Asset Allocation Fund uses a combination of two quantitative, stock screening methodologies for its U.S.-traded stock selection. These are proprietary disciplines of the adviser, referred to as: 1) Leuthold Select Equities, and; 2) Leuthold Undervalued & Unloved. |

| ● | Effective December 3, 2012, changes will begin to be implemented within the investment strategy of the Leuthold Asset Allocation Fund in order to reflect a more broadly diversified product (greater variety of asset class exposures), with more formal risk controls. Going forward, these changes will clearly differentiate it from the Leuthold Core Investment Fund investment strategy. Please see the Supplement to the Prospectus dated November 5, 2012, for more details. |

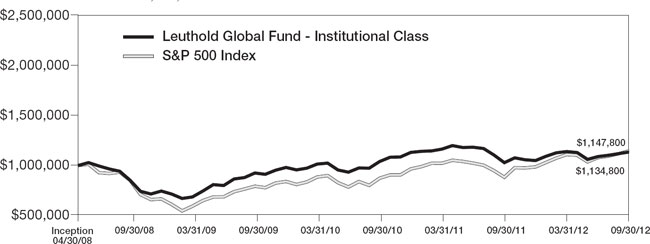

Leuthold Global Fund

This asset allocation strategy was introduced on April 30, 2008, and can be considered the “global” equivalent of our flagship Leuthold Core Investment Fund. The strategy and objective of this Fund are analogous to that of the Leuthold Core Investment Fund in terms of guiding disciplines, flexibility, asset class exposure, and risk aversion; however, this global version requires a minimum level of investment in foreign-traded securities. The Leuthold Global Fund invests in U.S. and foreign-traded stocks, bonds, money market instruments, and alternative investments; when market conditions are deemed unfavorable, the Fund may sell short certain securities in order to hedge exposure to a particular asset class. The Leuthold Global Fund intends to invest at least 40% of assets in foreign-traded securities, be it stocks, bonds, and/or other asset classes.

| ● | Leuthold Global Fund uses the Leuthold Global Industries strategy as the primary vehicle for directing its investments in global stock markets. |

| ● | Investment Guidelines: 30%-70% equity exposure and 30%-70% fixed income exposure. Under extreme market conditions, there may be a departure from these guidelines. |

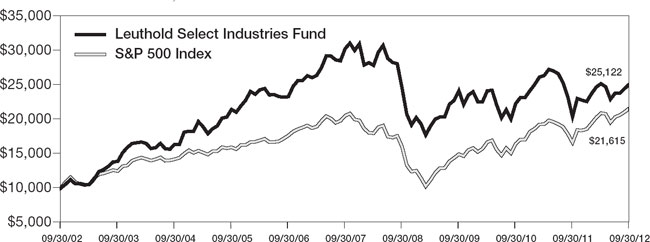

Leuthold Select Industries Fund

This Fund began trading on June 19, 2000, and unlike our asset allocation strategies, it will maintain 100% long exposure in stocks regardless of market conditions. This attribute results in the potential for considerably higher volatility, higher risk, and the probability that investors will lose money when the stock market declines. The Leuthold Select Industries Fund strategy is a top-down approach, based on industry group selection and rotation, and sector concentrations. Driven by extensive quantitative analysis, the strategy attempts to identify collective areas of strength and emerging leadership opportunities.

| ● | The elements of industry group rotation and sector concentrations result in the potential for higher volatility; it is potentially more risky while offering potentially more reward. |

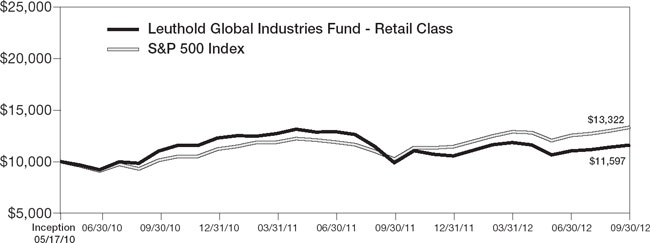

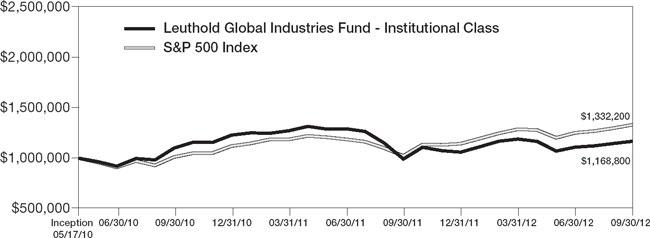

Leuthold Global Industries Fund

This is a relatively new Fund, launched on May 17, 2010; however, this Fund’s strategy is an extension of our domestic industry group selection/rotation approach which was established in the late 1990s as our Select Industries strategy, described above. This global version of our disciplined, quantitative approach to concentrated equity group investing employs many of the same factors as our domestic group selection strategy. The intent is to identify those industry groups that appear most attractive at the global level. This Fund will normally invest at least 40% of its assets in equity securities traded in foreign markets.

|

The Leuthold Funds - 2012 Annual Report | 3 |

| ● | The elements of industry group rotation and sector concentrations result in the potential for higher volatility. It is potentially more risky while offering potentially more reward. |

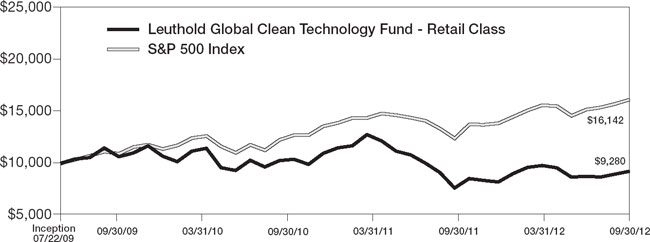

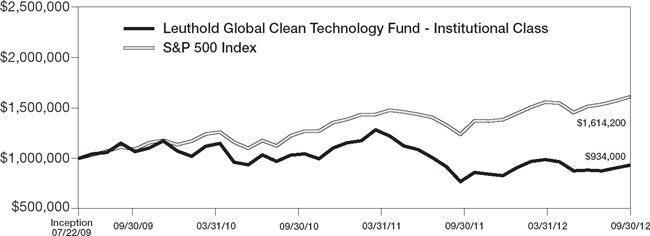

Leuthold Global Clean Technology Fund

This Fund became available on July 22, 2009, and unlike our other equity strategies, this Fund employs fundamental stock-selection. The Fund allocates its investments globally, in companies that endeavor to reduce the negative effects on the environment that may come about as by-products of society and modern technology. This is achieved through energy efficient and “clean” technologies, innovations, and solutions. A confluence of factors will help increase the demand for products from firms focused on technologies that clean, preserve, and/or maximize the earth’s resources, making these firms intriguing long-term investment opportunities. In brief, noteworthy dynamics benefitting these efforts include: political pressure for new/improved resources, higher fossil fuel prices, growing world population, changing energy source preferences, commodity price volatility, increasingly scarce resources, and significant and growing markets.

The Fund invests primarily across four clean technology sectors: Alternative Energy, Resource Conservation, Clean Water, and Clean Environment. The universe of stocks maintained for security selection is further organized among over 30 different sub-industries. This helps identify specific clean technology industries showing signs of unusual strength or weakness, and may be used as a basis for establishing overweight and underweight industry exposures.

| ● | The nature of this strategy combined with the inherently smaller capitalization of the eligible stock universe results in a high level of volatility in performance. |

| ● | On November 12, 2012, the Fund’s Board of Directors approved the closing and liquidation of the Leuthold Global Clean Technology Fund. Shareholders were sent notification with a letter of instruction outlining the course of action. Please see the Supplement to the Prospectus dated November 12, 2012 for more details. |

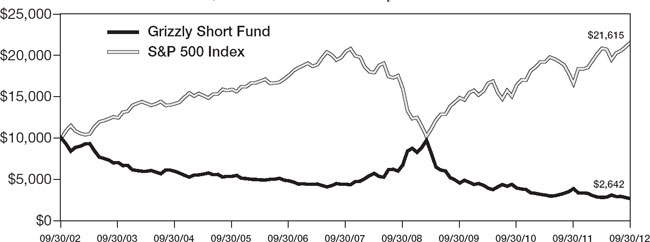

Grizzly Short Fund

Introduced on June 19, 2000, this unleveraged, actively managed Fund is 100% short individual stocks. (The intent of short-selling stocks is to profit when stock prices decline.) Policy mandates the Grizzly Short Fund target 100% exposure in stocks sold short at all times, even when the stock market is in a rising trend.

| ● | The Grizzly Short Fund typically maintains approximately equal-weighted short positions in around 60-90 individual stocks, initially selected by a multi-factor quantitative discipline. Each position is monitored daily and subject to a set of short covering disciplines. |

| ● | Shareholders should anticipate they will most likely lose money investing in this Fund when stock prices are rising. |

The Grizzly Short Fund is a tool for stock market sophisticates, traders, advisors, and experienced investors to employ, as a means to tactically moderate stock market risk, when they anticipate the market may decline. It is also used in varying degrees with other multi-faceted portfolio strategies. This is not a Fund for buy and hold investors.

|

| 4 | The Leuthold Funds - 2012 Annual Report |

ANNUAL PERFORMANCE REVIEW

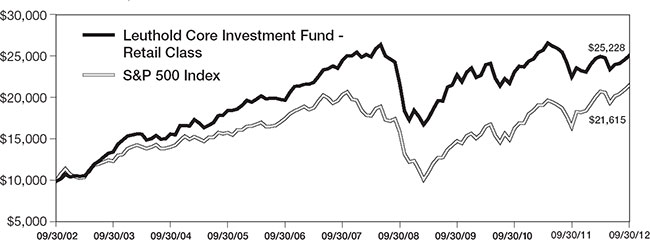

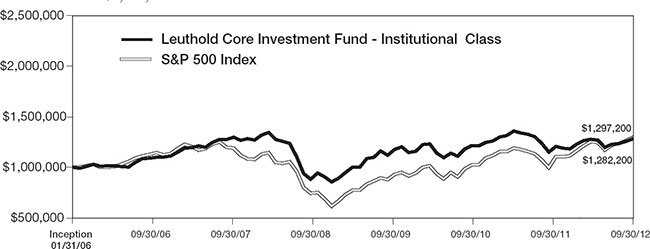

Leuthold Core Investment Fund

This is our firm’s flagship asset allocation strategy, with $791 million of assets under management. For the fiscal year ended September 30, 2012, the Leuthold Core Investment Fund (retail share class) posted a total return gain of 11.34%. During the same time frame, the S&P 500 had a total return gain of 30.20%.

The fiscal year commenced in October 2011 with the portfolio positioned near its maximum defensive level of just 31% net equity exposure. Our market analysis improved to a cautiously positive outlook for stocks by the end of October and equity exposure was increased to 50-55%. In late December, our indicators strengthened further and equity exposure was increased to near 60%. We were fairly bullish the remainder of the year with average equity exposure of 62% from January through September 2012.

The Fund’s near maximum defensive posture in October 2011 was inopportune and created an immediate 6% performance disadvantage in the first month of the fiscal year, as the S&P 500 rallied with an 11% gain that month, versus the Fund’s 4.84% gain. Additionally contributing to the year’s underperformance was the Fund’s lower average exposure to stocks. Even when in fully bullish mode, the Fund’s upside limit to stocks is 70%; hence, during market advances it is unlikely that the aggregate portfolio will be able to compete head to head with a 100% invested benchmark. It is, however, our intention that the long stock exposure in the Fund will outperform the S&P 500, and this was not accomplished over the last twelve months.

There were four months in which the Fund’s U.S. equity exposure outperformed the S&P 500, by an average of 0.8%, but these advantage months were more than offset by seven months in which the U.S. equities lagged the S&P 500 by an average of 1% (there was one month of even performance). Adding to the equity underperformance were two months in which the Emerging Market Equities position trailed the S&P 500 by a considerable margin of between 5%-6% each of those months.

For specifics related to the Leuthold Core Investment Fund’s U.S.-traded stock investments during the last twelve months, see the performance discussion of the Leuthold Select Industries Fund on subsequent pages.

The Leuthold Core Investment Fund held an average of 7.7% of assets in Emerging Market Equities over the last twelve months, just slightly above the normal base target of 5%. This was quite the reverse of fiscal year 2011, when there was an oversized position of 15% of assets. For the fiscal year ended September 30th, the Emerging Market Equities produced a solid 13% gain, a welcome turnaround from the prior year’s double digit loss, but trailing the S&P 500 by about 17 percentage points.

For the majority of the last twelve months, the characteristics of this Emerging Market Equities exposure were the same as last year, with all investments focused in Asia, the majority of which consisted of individual stocks of Chinese companies. A new approach was implemented at the end of August in order to attain a more comprehensive exposure to all accessible emerging markets, thereby diversifying the risk outside of Asia and increasing the potential for uncovering opportunities. Although the largest regional exposure still comes from the Pacific Rim, as of the end of September 2012, the portfolio includes investments from South America, Eastern Europe, Africa, and North America. The largest country exposure is now Brazil; followed by China, South Korea, South Africa, Hong Kong, Thailand, Indonesia, and Russia. There is also exposure to Singapore, Turkey, Poland, Taiwan, Malaysia, Mexico, Philippines, Chile, and Hungary.

|

| The Leuthold Funds - 2012 Annual Report | 5 |

Our asset allocation strategy’s normal guideline minimum for Fixed Income is 30% of assets. Prior to the last twelve months, we had been maintaining a drastically lower exposure with an average of just 5.75% in 2011 and 9% in 2010, due to the inherent risk of rising rates. The Federal Reserve has been holding interest rates at excessively low levels for an unprecedented period of time and it is inevitable that rates will rise from these artificially low levels. However, our attempt to avoid the risk by minimizing exposure here has been a losing proposition. By primarily avoiding this asset class, we’ve passed up some rather robust gains, particularly with U.S. Treasuries in 2011. To address this portfolio deficiency and bulk up the Fund’s income generating assets, last December an initiative was launched to increase fixed income exposure back up toward the normal minimum level. This was achieved by evaluating the landscape for tactical, prudent income opportunities through the use of a multi-factor risk aversion analysis tool. This has been a gradual process, but by the end of the fiscal year, the Fund’s fixed income exposure had been boosted to about 24%.

During the year, fixed income holdings included Quality Corporate Bonds (8.2% average position); Aggregate Bond Funds composed of corporate debt, developed market sovereign debt, and mortgage backed securities (6.7% average position); and Emerging Market Sovereign Debt (2.3% average position). An allocation to High Yield Bonds was initiated in February (1.5% average position). Although it was one of the smaller allocations, the Emerging Market Sovereign Debt was by far the best performer, with a 22% gain. The other fixed income allocations also had solid gains, with the Aggregate Bond Funds up 4.4%, High Yield Bonds up 5.2%, and Quality Corporate Bonds up 9%.

The Leuthold Core Investment Fund had an average allocation of 4.9% to the Real Estate asset class during the 2012 fiscal year. Established in November of 2011, there was an emphasis on Retail and Residential segments, but there was also exposure to the Industrial, Health Care, and Office segments. The real estate exposure was attained through a package of REITs, versus physical real estate, as REITs allow for greater transparency, efficient portfolio rebalancing, ease of diversification through specialty subsets of properties, and liquidity of the stock market, all the while offering performance dynamics akin to physical real estate values. Real Estate was one of the best performing asset classes for the year, with the Fund’s holdings gaining over 17% for the eleven month holding period.

We held an average allocation of 4.4% in Precious Metals during the 2012 fiscal year, obtained via holdings in physical Gold and Silver. The physical Gold was held for the full year, while the Silver portion of the allocation was eliminated in March. The combined allocation performed very well, contributing an 11% gain to the portfolio for the twelve months ended September 30th. This position was initiated in April 2009 as a means to incorporate some defense against the longer-term risk of inflation and debasement of the dollar. We believe these concerns are still valid and expect this holding to be maintained for the foreseeable future.

While it was a very strong year for the S&P 500, the average stock, and most professional managers, did not participate in the rally to the same degree as exemplified by the major market indexes. Although our asset allocation strategy was not alone in its underperformance, the extent of the underperformance over the last twelve months was much more than that with which we are comfortable. We are, however, encouraged that our U.S. stock selection strategy has been showing relative improvement over the last six months, as volatility has moderated and highly correlated action has been unwinding. These developments are heartening, as our stock selection strategy is one of the underlying drivers behind the Fund’s potential to outperform over the long term. We anticipate that if the market continues its migration back to a more historically normal level of stability and correlation relationships, there will be opportunities to recoup the shorter-term performance disadvantage experienced of late.

|

| 6 | The Leuthold Funds - 2012 Annual Report |

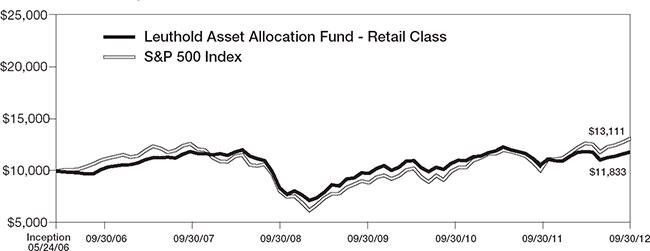

Leuthold Asset Allocation Fund

This Fund has assets under management of $627 million. For the fiscal year ended September 30, 2012, the Leuthold Asset Allocation Fund (retail share class) generated a total return gain of 11.73%, underperforming the S&P 500’s total return gain of 30.20% over the same time frame.

The fiscal year commenced in October 2011 with the portfolio positioned near its maximum defensive level of just 31% net equity exposure. Our market analysis improved to a cautiously positive outlook for stocks by the end of October and equity exposure was increased to 50-55%. In late December, our indicators strengthened further and equity exposure was increased to near 60%. We were fairly bullish the remainder of the year with average equity exposure of 62% from January through September 2012.

The Fund’s near maximum defensive posture in October 2011 was inopportune and created an immediate 5.6% performance disadvantage in the first month of the fiscal year, as the S&P 500 rallied with an 11% gain that month, versus the Fund’s 5.35% gain. Additionally contributing to the year’s underperformance was the Fund’s lower average exposure to stocks. Even when in fully bullish mode, the Fund’s upside limit to stocks is 70%; hence, during market advances it is unlikely that the aggregate portfolio will be able to compete head to head with a 100% invested benchmark. It is, however, our intention that the long stock exposure in the Fund will outperform the S&P 500, and this was not accomplished over the last twelve months.

There were four months in which the Fund’s U.S. equity exposure outperformed the S&P 500, by an average of 1.4%, but these advantage months were more than offset by the other eight months in which the U.S. equity exposure lagged the S&P 500 by an average of 1%. Adding to the equity underperformance were two months in which the Emerging Market Equities position trailed the S&P 500 by a considerable margin of between 5%-6% each of those months.

For its U.S.-traded equity exposure, the Fund has been using a multi-strategy approach, employing a combination of the Leuthold Select Equities and Leuthold Undervalued & Unloved strategies. Both are bottom-up, quantitative methodologies and each generally contributes a different type of stock market exposure. When used in tandem, they allow us to construct an equity portfolio with overall characteristics suitable for an asset allocation approach, and afford us the flexibility to adjust the mix to align with our market outlook. For the fiscal year ended September 30, 2012, the combined allocation to this stock mix contributed a total return gain of 26.31%, about 4% behind the S&P 500 gain of 30.20%.

Within this U.S. equity exposure, all of the broad sector concentrations had net gains for the year, and the largest sector concentrations produced the best performance. The Information Technology and Health Care sectors each carried between an 18%-19% average portfolio weight during the year, and had the most positive contributions to return, with gains of 36% and 30%, respectively. Within these two sectors, the most profitable industry group exposures included Pharmaceuticals, Managed Health Care, Computer & Storage Peripherals, Biotechnology, Semiconductor Equipment, and Data Processing/Outsourced Services. The next best performing sector concentrations were Financials and Energy, followed by Consumer Staples and Industrials. Industry group exposures with the most positive results from these sectors included: Oil & Gas Refining/Marketing, Tobacco, Integrated Oil & Gas, Consumer Finance, Regional Banks, Industrial Machinery, and Construction/Farm/Heavy Trucks. Two other industry group investments that produced strong results were Fertilizers & Agricultural Chemicals (Materials sector); and Apparel Retail (Consumer Discretionary sector).

|

| The Leuthold Funds - 2012 Annual Report | 7 |

The Utilities and Telecommunications sector concentrations contributed the least to this equity allocation’s performance, yet still provided solid total returns of over 13%. From an industry group perspective, the Fund experienced losses in group investments from a range of sectors, but the Consumer Discretionary sector investments were most heavily represented among the losers. These group investments included: Home Furnishings, Apparel Accessories & Luxury Goods, Automotive Retail, and Education Services. Rounding out the list of the biggest detractors to performance were losses from industry group investments in Coal & Consumable Fuels (Energy sector), Personal Products (Consumer Staples sector), and Multi-line Insurance (Financials sector).

Investments in domestic stocks held in a relatively steady range throughout the year, at an average of 84%. The foreign domiciled market exposure included in this U.S.-traded equity mix composed an average of 14% in Developed Markets and 2% in Emerging Markets. This composition is comparable to prior years.

The Leuthold Asset Allocation Fund follows the same investment mandates and asset mix shifts as the Leuthold Core Investment Fund. Therefore, aside from the U.S.-traded equities, the Fund holds the very same investments as the Leuthold Core Investment Fund; hence, for the annual review of the Fund’s Emerging Market Equities, Fixed Income, REITs, and Alternatives (Gold and Silver), refer to the performance details outlined in the preceding section for the Leuthold Core Investment Fund.

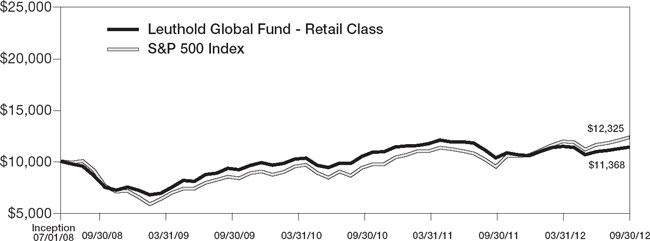

Leuthold Global Fund

This Fund has assets under management of $387 million. It offers investors a global alternative to our proprietary tactical asset allocation disciplines. For the fiscal year ended September 30, 2012, the Leuthold Global Fund (retail share class) produced a total return gain of 10.14%, underperforming the total return gain of 21.67% in the MSCI ACWI (All Country World Index).

As with our domestic asset allocation funds, the fiscal year commenced in October 2011 with the Leuthold Global Fund positioned with just 32% net equity exposure, near its maximum defensive level. In the second half of October, our global market analysis improved to reflect a cautiously positive outlook for stocks and the Fund’s equity exposure was increased to a more neutral range of 50-55%, where it stayed through the end of 2011. During January our market indicators strengthened further and net equity exposure was increased to 60%. This more optimistic stance was upheld for the rest of the year, and average equity exposure was 62% from January through September 2012.

The Fund’s near maximum defensive posture in October 2011 was inopportune and created an immediate 6% performance disadvantage in the first month of the fiscal year, as the MSCI ACWI rallied by nearly +11% that month, versus the Fund’s 4.73% gain. Additionally contributing to the year’s underperformance was the Fund’s lower average exposure to stocks. Even when in fully bullish mode, the Fund’s upside limit to stocks is 70%; hence, during market advances it is unlikely that the aggregate portfolio will be able to compete head to head with a 100% invested benchmark. It is, however, our intention that the long stock exposure in the Fund will outperform the MSCI ACWI, and this was not accomplished over the last twelve months.

There were five months in which the Fund’s global equities outperformed the MSCI ACWI, by an average of just 0.6%; this slim margin was not enough to offset six months in which the equities lagged the MSCI ACWI by an average of 0.8% (there was one month in which performance matched the MSCI ACWI). In January and February, two of the strongest months of the year for the MSCI ACWI, the Fund’s equities held up fairly well, but there were outsized losses experienced in each of those months by the portfolio’s residual equity hedge. This hedge position resulted in the Fund lagging the fully invested MSCI ACWI by nearly 2% in each of those months.

The Leuthold Global Fund employs the strategy of the Leuthold Global Industries Fund for directing its long stock exposure. Please see that section for the performance details of the global equities.

|

| 8 | The Leuthold Funds - 2012 Annual Report |

The Fund’s normal guideline minimum for Fixed Income is 30% of assets, and prior to the last twelve months, we had been maintaining a drastically lower exposure of just 10% in 2011 and 2010, due to the inherent risk of rising rates. The Federal Reserve has been holding interest rates at excessively low levels for an unprecedented period of time, and it is inevitable that rates will rise from these artificially low levels. However, our attempt to avoid the risk by minimizing exposure here has been a losing proposition, as we’ve passed up some rather robust gains, particularly with U.S. Treasuries during fiscal year 2011. To address this portfolio deficiency and bulk up the Fund’s income generating assets, last December an initiative was launched to increase fixed income exposure back up toward the normal minimum level. This was achieved by evaluating the landscape for tactical, prudent income opportunities through the use of a multi-factor risk aversion analysis tool. This has been a gradual process, but by the end of the fiscal year, the Fund’s fixed income exposure had been boosted to 25%.

For the full year, the fixed income holdings included Quality Corporate Bonds (7.6% average weight), Developed Market Sovereign Debt (5.7% average weight), Emerging Market Sovereign Debt (2.4% average weight), Municipal Bonds (1.5% average weight), and Treasury Inflation Protection (TIP) Securities (1.5% average weight). An allocation to High Yield Bonds was initiated in February (1.6% average weight). The Emerging Market Sovereign Debt allocation was the best performer, with a +14% total return. The other positions also had solid gains: Municipal Bonds were up 8.4%, Corporate Bonds were up 6.3%, High Yield Bonds up 5.2%, Developed Market Sovereign Debt up 4.5%, and TIPS up 3.3%.

The Leuthold Global Fund had an average allocation of 5.0% to the Real Estate asset class during the 2012 fiscal year. Established in November of 2011, there was an emphasis on the Retail and Residential segments, but there was also exposure to the Diversified, Health Care, and Office segments. The real estate exposure was attained through a package of REITs, versus physical real estate, as REITs allow for greater transparency, efficient portfolio rebalancing, ease of diversification through specialty subsets of properties, and liquidity of the stock market, all the while offering performance dynamics akin to physical real estate values. Real Estate was one of the best performing asset classes for the year, with the holdings in the Leuthold Global Fund gaining about 15% for the eleven month holding period during the 2012 fiscal year ended September 30th.

There was an average allocation of 4.5% in Precious Metals during the 2012 fiscal year, obtained via holdings in physical Gold and Silver. The physical Gold was held for the full year, while the Silver portion of the allocation was eliminated in early March. The combined allocation performed very well, contributing a 15.5% gain to the portfolio for the twelve months ended September 30th. With the U.S. and other foreign governments pumping money into the global economy, we made this allocation back in early 2009 due to our concerns about the long-term inflation implications related to the excess liquidity and debasement of the dollar. We believe these concerns are still valid and expect this holding to be maintained for the foreseeable future.

Leuthold Select Industries Fund

This all-equity Fund, with total assets under management of $13.5 million, had a solid total return gain of 23.34% for the fiscal year ended September 30, 2012; however, this strong performance trailed the benchmark by nearly 7%, as the S&P 500 turned in an exceptional 30.20% total return gain over the same time frame.

The Leuthold Select Industries Fund was a perennial laggard versus the S&P 500 during the last twelve months, underperforming in eight of the months by an average of 1%. There was only one month of convincing outperformance, which occurred in October 2011, as the Fund gained over 2% more than the S&P 500. In two of the months this strategy was +0.5% additive against the S&P 500 and there was one month of relatively flat results. Our quantitative group selection approach does best in periods when there is a strong distinction between winners and losers among equity groups and themes. The last twelve months continued to be a challenge in this sense, as risk-on/risk-off market dynamics are not favorable conditions for the stock market to establish the trends and equity leadership themes that this strategy thrives on.

|

| The Leuthold Funds - 2012 Annual Report | 9 |

There were considerable changes in portfolio sector and group concentrations as the year progressed. This was due to a concerted effort to broaden exposure, when possible, to attempt to moderate the negative effects that cross-asset correlations and volatility were having on our industry group approach. This was accomplished by spreading out exposure more evenly across sectors, as well as increasing the number of industry group investments.

In addition to widening our exposures to accommodate a more diversified collection of industry group investments, we have been gradually increasing the market capitalization of new purchases, as we expect that Large Cap stocks are poised for a period of leadership. Despite these efforts, the Fund still has a Mid/Small Cap bias due to certain industry group exposures and the residual effect of the past Mid/Small Cap leadership cycle, so we were not able to fully capitalize on Large Cap stock outperformance during the last six months.

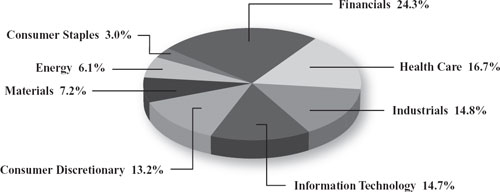

The fiscal year began with a substantial overweight concentration of 46% in the Health Care sector, with the Materials sector weight a distant second at 17% of assets. The next heaviest sector weights were Consumer Discretionary (13%), Energy (10%), and Financials (9%). These were followed by Information Technology (4%) and Industrials (1%). There was no exposure to Consumer Staples, Telecommunications, or Utilities. By year end, sector exposure was built out as follows: Financials (24%), Health Care (17%), Information Technology (15%), Industrials (15%), Consumer Discretionary (13%), Materials (7%), Energy (6%), and Consumer Staples (3%). Both Telecom and Utilities continued to be de-emphasized, with no exposure to these sectors. Individual industry group investments expanded from ten groups in October 2011, to 15 groups as of September 30, 2012.

The leading contributor to the Fund’s positive performance from the broad sector level was provided by the heavy-weight Health Care sector, which, as noted above, was pared back from a 46% portfolio weight, to 17% by year end (this is still overweight relative to the S&P 500 Health Care weight of 12%). Financials, Consumer Discretionary, and Energy sector investments were the next biggest contributors to the Fund’s return, followed by Materials and Consumer Staples.

From an industry group perspective, the Leuthold Select Industries Fund’s most beneficial exposure during the year came from group investments in Managed Health Care, Pharmaceuticals, Oil & Gas Refining/Marketing, Fertilizers & Agricultural Chemicals, Department Stores, Oil & Gas Drilling, Diversified Financial Services, and Tobacco.

The least productive broad sector exposures came from investments in Industrials and Information Technology. From an industry group perspective, performance detractors came from a range of sectors; these groups included Computer Storage & Peripherals, Construction/Farm Machinery/Heavy Trucks, Integrated Oil & Gas, Computer Hardware, Office Electronics, Trading Companies & Distributors, Commodity Chemicals, and Homefurnishing Retail.

Exposure to foreign-domiciled stocks in the Leuthold Select Industries Fund has primarily been on a downtrend this year, having begun the year at 17%, and declining to a low of 8% by June before increasing some to end the year at 13%. Within this foreign exposure, Developed Market stocks composed an average of 10%, with Emerging Market stock exposure at about a 3% average allocation.

Since the market lows of 2009, there has been an extremely high level of performance correlation with no regard for size or quality of stocks, making it difficult to navigate and gain traction with this strategy. We expect to see a reversion of the high cross-asset correlations to a lower level, which should benefit the process employed in this Fund’s industry group approach. While this strategy is not ideal for all market conditions, we believe over the longer term it is more typical than not for the market to be driven by macro-theme dynamics, allowing this Fund to uncover more persistent areas of strength.

|

| 10 | The Leuthold Funds - 2012 Annual Report |

Leuthold Global Industries Fund

This all-equity Fund, with total assets under management of $7.9 million, had a strong total return gain of 17.33% (retail share class) for the fiscal year ended September 30, 2012. Its benchmark comparator, the MSCI ACWI (All Country World Index) had total return gain of 21.67% over that time frame.

The Leuthold Global Industries Fund trailed the MSCI ACWI in six of the last twelve months, by about 1% on average; it outperformed in three months by 0.9%; and was about even with the benchmark in three of the months. While it is our goal to outperform the index, our quantitative group selection approach does best in periods when there is a strong distinction between winners and losers among equity groups and themes. The last twelve months continued to be a challenge in this sense, as risk-on/risk-off market dynamics are not favorable conditions for the market to establish the trends and equity leadership themes upon which this strategy thrives.

U.S. stock exposure within the Fund rose from 40% last October to a high of 53% from March through May, before declining back down to 48% by fiscal year end. The MSCI ACWI had a steady average exposure of 45% to U.S. stocks. Of the foreign-traded securities in the Leuthold Global Industries Fund, typically 83% was invested in Developed Markets over the last twelve months, versus 17% in Emerging Market stocks.

Equity exposure in this Fund is dictated by the industry groups that appear most attractive according to our quantitative disciplines; we do not direct investments based on attempting to identify opportunities specific to countries or regions. We believe that industry group leadership on a global basis will generate superior returns over the more traditional approach of “country” or “regional” concentrations, as the global economy has become increasingly interdependent.

During the fiscal year ended September 30, 2012, all broad sector exposures, with the exception of Information Technology, had a positive contribution to return. Sectors with the most significant overall contribution to return were Financials, Health Care, Consumer Discretionary, and Industrials. Compared to the MSCI ACWI sector exposures, the Fund had generous overweight positions in Health Care, Telecommunications, and Utilities, and results from these allocations were particularly value-added versus the benchmark’s corresponding results. At the global industry group level, the best results came from the Fund’s investments in stocks from Consumer Finance, Integrated Oil & Gas, Water Utilities, Automotive Components, Managed Health Care, and Agricultural Products.

As noted above, the only sector exposure detracting from performance, compared to the benchmark, was Information Technology. This was the second best performing sector in the MSCI ACWI; however, our disciplines led us to have a significant underweight here, resulting in a large performance differential. Our Energy and Consumer Staples sector exposures were also underweight versus the index, so while still additive to the Fund’s performance, the results were not as value added compared to the MSCI ACWI’s corresponding sector results. The specific industry groups that detracted most from performance included investments in stocks from Computers & Peripherals, Paper & Forest Products, Developed Diversified Telecom Services, and Multi-line Insurance.

The Fund had investments in 35 different countries during the year, with an average of 27 country investments in any given month. The country exposures are the by-product of the companies that make up the industry groups purchased in the Fund; they are not purely intentional choices. As a point of interest, however, foreign market allocations that were consistently larger weights throughout the year included Japan, United Kingdom, Hong Kong, Germany, Taiwan, and Brazil. Australia and China also each had a relatively steady presence as heavier weighted allocations. From a performance stance, the most positive contributors at the country level came from investments in the U.S., Brazil, Thailand, Germany, Sweden, and South Africa. With the exception of the U.S. and Germany, each of these allocations was also more value-added to performance than corresponding MSCI ACWI results from investments in these countries. The biggest detractors from performance at the country level included investments in China, Japan, Spain, and Belgium.

|

| The Leuthold Funds - 2012 Annual Report | 11 |

The Leuthold Global Industries Fund became available during an unprecedented period of high correlation and market volatility, which has persisted since the Fund’s inception in May 2010. These dynamics are counterproductive to the objective of finding groups that demonstrate the likelihood of establishing and maintaining leadership for a period of time. Over the last twelve months, however, our model has been showing consistent improvement and it appears the markets may be slowly returning to a more classic environment where identifiable trends and well-defined industry leadership are characteristic to the marketplace.

Leuthold Global Clean Technology Fund

The Leuthold Global Clean Technology Fund has $8.7 million in assets under management. For the fiscal year ended September 30, 2012, the Fund (retail share class) had a total return gain of 21.15% compared to a total return loss of -10.78% in the Ardour Composite Global Alternative Energy Index. The MSCI ACWI (All Country World Index) produced a total return gain of 21.67% during that time.

The Fund’s strong performance for the full year was secured during the first six months, from October 2011 through March 2012, when it produced a total return gain of 28.33%. With the exception of the Alternative Energy sector which had a small 1% loss in the fourth quarter of 2011, all sector returns were otherwise very solid during that six month period, and particularly robust from January through March.

The most noteworthy contributors to the Fund’s gain during the first six months were investments in renewable & non-renewable power producers, energy and water conservation stocks, pollution control businesses, filtration & emissions control companies, energy efficiency, recycled building materials, and clean water subsectors. There was a small exposure to photovoltaics in the fourth quarter of 2011 that was a minor drag, and holdings in battery manufacturers and filtration companies were small detractors from performance during the January through March period. Acknowledging that many of the positions had risen in value very quickly during that six month time frame, in March the portfolio began to be repositioned to reflect a somewhat more defensive approach, in anticipation of a potential pullback in ensuing months.

The April through June period did indeed experience a correction, resulting in a -10.58% total return loss for the Fund. Efforts to become more defensive helped to minimize the extent of the losses, but the inherently smaller market capitalization of the portfolio still hampered results. Specific areas of portfolio weakness during this time came from holdings in energy efficiency, raw and recycled materials, and emission control companies. There was some value added from investments in battery manufacturers, water-related companies, and instrumentation firms.

The Fund gained back 5.57% total return during the last three months of the fiscal year ended September 30, 2012. Benefiting the portfolio were holdings in energy efficiency, biofuel stocks, and process manufacturing companies; while exposure to hydroelectric companies and waste treatment corporations detracted from results during that three month period.

Throughout the year, the Fund was consistently overweight in stocks from the Clean Environment sector (33% average weight). Exposure to the Resource Conservation and Clean Water sectors increased throughout the year, both overweight holdings compared to the universe, at average weights of 22% and 15%, respectively. The Alternative Energy sector was an underweight holding compared to the investable universe; however, while its portfolio exposure was on a downtrend most of the year, on average it composed the second heaviest weight (23%) relative to the Fund’s other exposures, ranging from a high of 30% in October 2011 down to a low of 17% in late June 2012. For the full year, the Clean Water sector was the clear winner, with a gain of 26%; this was followed by the Resource Conservation gain of 10%, and the Clean Environment gain of 9%. The Alternative Energy sector trailed with a loss of -7%.

|

| 12 | The Leuthold Funds - 2012 Annual Report |

The largest non-U.S. exposures within the Fund during the year were: Brazil, Japan, Switzerland, Germany, Canada, and Belgium. Smaller concentrations among foreign countries came from the United Kingdom, France, Spain, Taiwan, Singapore, Netherlands, and Denmark. The U.S.-traded stock exposure during the fiscal year was 63% on average, with foreign country investments averaging about 37% of portfolio assets.

Comparing this year’s gain of 21.15% with last year’s loss of -25.63% demonstrates the inherent volatility of stocks in this industry. Over the short term, performance can be influenced by a range of diverse factors including political, regulatory, commodity prices, population growth, and technological advances or failures, to name a few. This is a multi-decade venture expected to benefit from a cyclical upswing in demand for goods, services, and increasingly scarce resources.

Grizzly Short Fund

This Fund is 100% short individual stocks, with assets under management of about $136 million. For the fiscal year ended September 30, 2012, the Grizzly Short Fund produced a -31.47% total return loss. This compares to the S&P MidCap 400 Index, which had a total return gain of 28.54% (short-selling that index would have produced a loss of around -28%); the S&P 500 had a total return gain of 30.20% for the fiscal year. The Grizzly Short Fund lagged the inverse of each of these benchmarks by a relatively small margin, but it is our objective for the Fund to outperform – in this case by losing less than the inverse of the benchmark’s gain – hence, this Fund was not value-added over the last twelve months when measured against these yardsticks.

The market maintained a surprisingly forceful recovery during the last twelve months, making short-selling a losing enterprise. The S&P MidCap 400 Index produced concrete gains in seven months, and about flat performance in four months, leaving just one really good month to profit from short-selling. In May, the S&P MidCap 400 was down -6.48%, while the Grizzly Short Fund outperformed with a 9.24% gain. As a prelude to May’s gain, the Fund had a small 1% gain in April; with a 0.3% gain in July offering the only other respite from the year’s losses. The remaining nine months of the year the Grizzly Short Fund lost money, with seven of those months experiencing substantial underperformance – lagging the S&P MidCap 400 benchmark by 2% on average.

At the broad sector level, the Grizzly Short Fund’s full year performance was clearly influenced by heavy concentrations in Information Technology, Consumer Discretionary, and Financials. Information Technology was the heaviest sector exposure all year, with an average weight of 23%. The Consumer Discretionary weight declined steadily all year, but at 17% on average it was the second heaviest weight overall. The Financials sector exposure had no clear trend as its weight fluctuated up and down, with an average weight of 13% for the year. These three largest sector weights had the biggest contribution to the Fund’s losses. Industrials, Materials, and Health Care sector exposures were the next most significant contributors to the Fund’s negative return.

From an industry group perspective, the largest detractors from performance were: Communications Equipment, Life Sciences Tools & Services, Construction & Engineering, Building Products, Construction Materials, Health Care Facilities, Alternative Carriers, Cable & Satellite, Semiconductors, Forest Products, Investment Banking & Brokerage, and Internet Retail.

|

| The Leuthold Funds - 2012 Annual Report | 13 |

While none of the Fund’s broad sector exposures had a net positive contribution to return, Consumer Staples, Energy, Utilities, and Telecommunications sector exposure contributed the least to the Fund’s losses, primarily because these were undersized portfolio weights. As far as value-added positions (investments which helped to offset the Fund’s losses), specific industry group investments that contributed the most in this respect were: Thrifts & Mortgage Finance, Systems Software, Restaurants, Consumer Electronics, Electronic Components, Coal & Consumable Fuels, Internet Software & Services, IT Consulting & Services, and Integrated Oil & Gas.

The Grizzly Short Fund has extremely high turnover, and sector concentrations and industry group exposure have the potential to fluctuate considerably throughout the year. This is a highly disciplined methodology, however. As opposed to a market capitalization weighted index, the Fund is not predisposed to the risk of performance being heavily influenced from a handful of stocks with an oversized percentage of assets, because the Grizzly Short Fund positions are similarly weighted across the portfolio. There are policies in place that trigger specific short-covering action, such as capturing gains and stop-loss tactics. Additionally, there are limitations on how much of the portfolio can be concentrated within a particular sector or sub-industry group therein.

In a decisively rising market environment such as the last twelve months, investors should expect the Grizzly Short Fund to produce net losses. During those periods, the Fund will aim to add value by losing less than an index short, as there will be vulnerable areas of the stock market regardless of the underlying trend. With the recent year’s unusually high level of cross-asset correlations, the low quality stocks have moved in tandem with the high quality stocks, making our short-selling strategy difficult to outperform versus the benchmark indexes.

Investors who are not experienced in short-selling and adjusting market risk should consider the Leuthold Core Investment Fund, Leuthold Asset Allocation Fund, or Leuthold Global Fund. These three Funds have the flexibility built into their disciplines to overlay our short-selling strategies and hedge against market declines when the stock market is viewed as overvalued and vulnerable to a downside correction.

IN CLOSING

Last year in this shareholder letter we wrote that we believed the market rally being experienced at that time was likely an interim rally in a new cyclical bear market. We could not have been more wrong! Rather, the S&P 500 proceeded to amass a gain of over 30% during the subsequent twelve months. As noted earlier, with another year under its belt, the bull market is now over 43 months old, having lasted longer than the average cyclical bull market, based on data back to 1932, and gaining nearly 30% more than the median bull market gain (as of September 2012). Our current U.S. market analysis is only mildly bullish and it is inevitable the market will transition either into a clear downtrend at some point or maintain in a trading range; such is the nature of the stock market. It is our opinion this is very likely to occur during 2013.

When the markets do move into correction mode or a trading zone, be it 2013 or later, there will still be opportunities to add value within the Leuthold Fund strategies. In times of market declines, our asset allocation funds have the flexibility to reduce and/or hedge equity exposure, minimizing the risk of losses compared to a fully invested benchmark. There will typically still be areas of stock leadership and themes to profit from during market weakness, and this is where our long stock strategies aim to create an advantage – by identifying values, and avoiding areas with higher vulnerabilities. Clearly, our 100% short-selling strategy should be the biggest beneficiary of a market decline, but its objective is to add value over an index short. This actively managed short-selling methodology aims to achieve that edge over an index short through its strict set of disciplines which allow for a higher level of scrutiny and selectivity in identifying stocks which appear most susceptible to decline.

|

| 14 | The Leuthold Funds - 2012 Annual Report |

Regardless of market direction, our quantitative processes continually monitor an extensive range of market data, and the attractiveness of investments are reassessed and adjusted as these measures dictate. We believe all of our strategies have the potential to add value in any market environment.

Our firm is majority employee-owned and independent. We believe that the high level of employee-directed investments in Leuthold Funds exemplifies the dedication to the firm’s success and the motivation to produce steady, market-beating performance over the long term. Every member of the Leuthold team recognizes the importance of our shareholders; we work hard every day to meet or exceed client expectations. The interests of shareholders are at the top of our list.

We welcome you to contact us if you have any questions. Thank you for your support.

Sincerely,

| | | | | |

| | | | |

| Doug Ramsey, CFA, CMT | | | | |

| CIO & Co-Portfolio Manager | | | | |

| | | | | |

| | | | |

| Matt Paschke, CFA | | Chun Wang, CFA, PRM | | Eric Weigel |

| Co-Portfolio Manager | | Co-Portfolio Manager | | Co-Portfolio Manager |

| | | | | |

| | | | |

| Greg Swenson, CFA | | David Kurzman | | |

| Co-Portfolio Manager | | Co-Portfolio Manager | | |

|

| The Leuthold Funds - 2012 Annual Report | 15 |

Expense Example – September 30, 2012 (Unaudited)

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, including reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held the entire period (April 1, 2012 – September 30, 2012).

Actual Expenses

The first line of the following table provides information about actual account values and actual expenses. Although the Funds charge no sales load (the Leuthold Core Investment Fund, Leuthold Asset Allocation Fund, Leuthold Global Fund, and Leuthold Global Industries Fund charge a 2% redemption fee for redemptions made within five business days after a purchase and the Leuthold Global Clean Technology Fund charges a 2% redemption fee for redemptions made within 30 days after a purchase), you will be assessed fees for outgoing wire transfers, returned checks, or stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Funds’ transfer agent. If you request a redemption be made by wire transfer, currently a $15.00 fee is charged by the Funds’ transfer agent. To the extent that the Funds invest in shares of other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which a Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary by fund. These expenses are not included in the following example. The example includes, but is not limited to, management fees, shareholder servicing fees, fund accounting, custody, and transfer agent fees. However, the following example does not include portfolio trading commissions and related expenses, and extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

|

| 16 | The Leuthold Funds - 2012 Annual Report |

| The Leuthold Funds |

| Expense Example Tables (Unaudited) |

Leuthold Core Investment Fund - Retail Class

| | | | | | | | | | | | | | |

| | | Beginning Account Value April 1, 2012 | | Ending Account Value September 30, 2012 | | Expenses Paid During Period* April 1, 2012 - September 30, 2012 | |

| Actual** | | $ | 1,000.00 | | | $ | 1,002.70 | | | $ | 5.86 | | |

| Hypothetical (5% return before expenses)*** | | | 1,000.00 | | | | 1,019.15 | | | | 5.91 | | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.17%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period.

** Excluding dividends and interest on short positions, your actual cost of investment in the Fund would be $5.76 and the Fund’s annualized expense ratio would be 1.15%.

*** Excluding dividends and interest on short positions, your hypothetical cost of investment in the Fund would be $5.81 and the Fund’s annualized expense ratio would be 1.15%.

Leuthold Core Investment Fund - Institutional Class

| | | | | | | | | | | | | | |

| | | Beginning Account Value April 1, 2012 | | Ending Account Value September 30, 2012 | | Expenses Paid During Period* April 1, 2012 - September 30, 2012 | |

| Actual** | | $ | 1,000.00 | | | $ | 1,003.20 | | | $ | 5.36 | | |

| Hypothetical (5% return before expenses)*** | | | 1,000.00 | | | | 1,019.65 | | | | 5.40 | | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.07%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period.

** Excluding dividends and interest on short positions, your actual cost of investment in the Fund would be $5.21 and the Fund’s annualized expense ratio would be 1.04%.

*** Excluding dividends and interest on short positions, your hypothetical cost of investment in the Fund would be $5.25 and the Fund’s annualized expense ratio would be 1.04%.

Leuthold Asset Allocation Fund - Retail Class

| | | | | | | | | | | | | | |

| | | Beginning Account Value April 1, 2012 | | Ending Account Value September 30, 2012 | | Expenses Paid During Period* April 1, 2012 - September 30, 2012 | |

| Actual** | | $ | 1,000.00 | | | $ | 994.70 | | | $ | 6.93 | | |

| Hypothetical (5% return before expenses)*** | | | 1,000.00 | | | | 1,018.05 | | | | 7.01 | | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.39%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period.

** Excluding dividends and interest on short positions, your actual cost of investment in the Fund would be $6.78 and the Fund’s annualized expense ratio would be 1.36%.

*** Excluding dividends and interest on short positions, your hypothetical cost of investment in the Fund would be $6.86 and the Fund’s annualized expense ratio would be 1.36%.

Leuthold Asset Allocation Fund - Institutional Class

| | | | | | | | | | | | | | |

| | | Beginning Account Value April 1, 2012 | | Ending Account Value September 30, 2012 | | Expenses Paid During Period* April 1, 2012 - September 30, 2012 | |

| Actual** | | $ | 1,000.00 | | | $ | 995.10 | | | $ | 5.79 | | |

| Hypothetical (5% return before expenses)*** | | | 1,000.00 | | | | 1,019.20 | | | | 5.86 | | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.16%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period.

** Excluding dividends and interest on short positions, your actual cost of investment in the Fund would be $5.69 and the Fund’s annualized expense ratio would be 1.14%.

*** Excluding dividends and interest on short positions, your hypothetical cost of investment in the Fund would be $5.75 and the Fund’s annualized expense ratio would be 1.14%.

|

| The Leuthold Funds - 2012 Annual Report | 17 |

| The Leuthold Funds |

| Expense Example Tables (Unaudited) |

Leuthold Global Fund - Retail Class

| | | | | | | | | | | | | | |

| | | Beginning Account Value April 1, 2012 | | Ending Account Value September 30, 2012 | | Expenses Paid During Period* April 1, 2012 - September 30, 2012 | |

| Actual** | | $ | 1,000.00 | | | $ | 994.20 | | | $ | 7.58 | | |

| Hypothetical (5% return before expenses)*** | | | 1,000.00 | | | | 1,017.40 | | | | 7.67 | | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.52%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period.

** Excluding dividends and interest on short positions, your actual cost of investment in the Fund would be $7.53 and the Fund’s annualized expense ratio would be 1.51%.

*** Excluding dividends and interest on short positions, your hypothetical cost of investment in the Fund would be $7.62 and the Fund’s annualized expense ratio would be 1.51%.

Leuthold Global Fund - Institutional Class

| | | | | | | | | | | | | | |

| | | Beginning Account Value April 1, 2012 | | Ending Account Value September 30, 2012 | | Expenses Paid During Period* April 1, 2012 - September 30, 2012 | |

| Actual** | | $ | 1,000.00 | | | $ | 995.00 | | | $ | 6.48 | | |

| Hypothetical (5% return before expenses)*** | | | 1,000.00 | | | | 1,018.50 | | | | 6.56 | | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.30%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period.

** Excluding dividends and interest on short positions, your actual cost of investment in the Fund would be $6.48 and the Fund’s annualized expense ratio would be 1.30%.

*** Excluding dividends and interest on short positions, your hypothetical cost of investment in the Fund would be $6.56 and the Fund’s annualized expense ratio would be 1.30%.

Leuthold Select Industries Fund

| | | | | | | | | | | | | | |

| | | Beginning Account Value April 1, 2012 | | Ending Account Value September 30, 2012 | | Expenses Paid During Period* April 1, 2012 - September 30, 2012 | |

| Actual | | $ | 1,000.00 | | | $ | 997.60 | | | $ | 7.99 | | |

| Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,017.00 | | | | 8.07 | | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.60%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period.

Leuthold Global Industries Fund - Retail Class

| | | | | | | | | | | | | | |

| | | Beginning Account Value April 1, 2012 | | Ending Account Value September 30, 2012 | | Expenses Paid During Period* April 1, 2012 - September 30, 2012 | |

| Actual | | $ | 1,000.00 | | | $ | 979.50 | | | $ | 9.85 | | |

| Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,015.05 | | | | 10.02 | | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.99%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period.

|

| 18 | The Leuthold Funds - 2012 Annual Report |

| The Leuthold Funds |

| Expense Example Tables (Unaudited) |

Leuthold Global Industries Fund - Institutional Class

| | | | | | | | | | | | | | |

| | | Beginning Account Value April 1, 2012 | | Ending Account Value September 30, 2012 | | Expenses Paid During Period* April 1, 2012 - September 30, 2012 | |

| Actual | | $ | 1,000.00 | | | $ | 982.10 | | | $ | 8.47 | | |

| Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,016.45 | | | | 8.62 | | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.71%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period.

Leuthold Global Clean Technology Fund - Retail Class

| | | | | | | | | | | | | | |

| | | Beginning Account Value April 1, 2012 | | Ending Account Value September 30, 2012 | | Expenses Paid During Period* April 1, 2012 - September 30, 2012 | |

| Actual | | $ | 1,000.00 | | | $ | 944.00 | | | $ | 9.38 | | |

| Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,015.35 | | | | 9.72 | | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.93%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period.

Leuthold Global Clean Technology Fund - Institutional Class

| | | | | | | | | | | | | | |

| | | Beginning Account Value April 1, 2012 | | Ending Account Value September 30, 2012 | | Expenses Paid During Period* April 1, 2012 - September 30, 2012 | |

| Actual | | $ | 1,000.00 | | | $ | 944.40 | | | $ | 8.22 | | |

| Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,016.55 | | | | 8.52 | | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.69%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period.

Grizzly Short Fund

| | | | | | | | | | | | | | |

| | | Beginning Account Value April 1, 2012 | | Ending Account Value September 30, 2012 | | Expenses Paid During Period* April 1, 2012 - September 30, 2012 | |

Actual** | | $ | 1,000.00 | | | $ | 946.90 | | | $ | 15.28 | | |

Hypothetical (5% return before expenses)*** | | | 1,000.00 | | | | 1,009.30 | | | | 15.77 | | |

* Expenses are equal to the Fund’s annualized expense ratio of 3.14%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period.

** Excluding dividends and interest on short positions, your actual cost of investment in the Fund would be $7.50 and the Fund’s annualized expense ratio would be 1.54%.

*** Excluding dividends and interest on short positions, your hypothetical cost of investment in the Fund would be $7.74 and the Fund’s annualized expense ratio would be 1.54%.

|

| The Leuthold Funds - 2012 Annual Report | 19 |

| The Leuthold Funds |

| (Unaudited) |

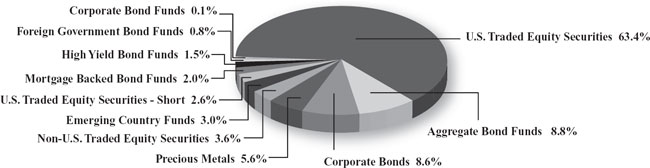

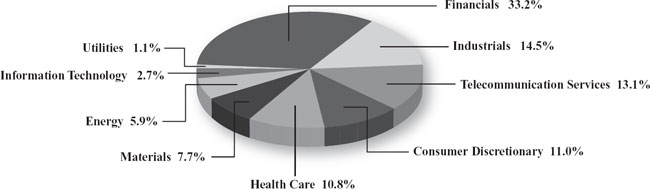

Leuthold Core Investment Fund

Allocation of Portfolio Holdings

September 30, 2012*

Leuthold Asset Allocation Fund

Allocation of Portfolio Holdings

September 30, 2012*

*Excludes short-term investments

|

| 20 | The Leuthold Funds - 2012 Annual Report |

| The Leuthold Funds |

| (Unaudited) |

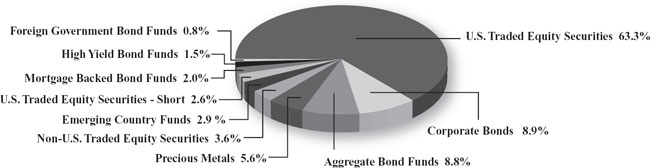

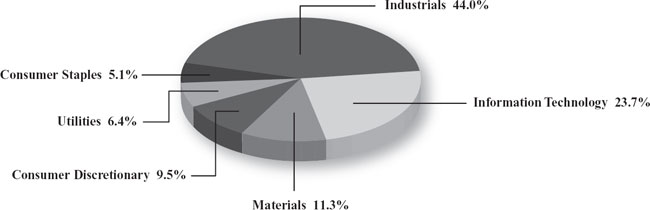

Leuthold Global Fund

Allocation of Portfolio Holdings

September 30, 2012*

Leuthold Select Industries Fund

Allocation of Portfolio Holdings

September 30, 2012*

*Excludes short-term investments

|

| The Leuthold Funds - 2012 Annual Report | 21 |

| The Leuthold Funds |

| (Unaudited) |

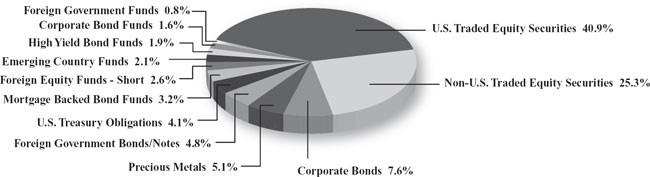

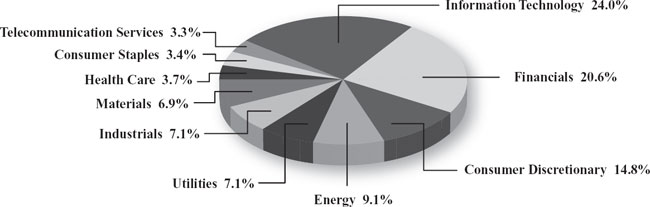

Leuthold Global Industries Fund

Allocation of Portfolio Holdings

September 30, 2012*

Leuthold Global Clean Technology Fund

Allocation of Portfolio Holdings

September 30, 2012*

*Excludes short-term investments

|

| 22 | The Leuthold Funds - 2012 Annual Report |

| The Leuthold Funds |

| (Unaudited) |

Grizzly Short Fund

Allocation of Portfolio Holdings

September 30, 2012*

*Excludes short-term investments

|

| The Leuthold Funds - 2012 Annual Report | 23 |

| | | | | |

| Leuthold Core Investment Fund (Unaudited) |

| Components of Portfolio Holdings* | | Fair Value | |

| U.S. Traded Equity Securities | | $ | 484,829,767 | |

| Aggregate Bond Funds | | | 67,477,763 | |

| Corporate Bonds | | | 65,830,749 | |

| Precious Metals | | | 43,019,237 | |

| Non-U.S. Traded Equity Securities | | | 27,429,932 | |

| Emerging Country Funds | | | 22,584,519 | |

| U.S. Traded Equity Securities - Short | | | 19,627,038 | |

| Mortgage Backed Bond Funds | | | 15,174,113 | |

| High Yield Bond Funds | | | 11,806,115 | |

| Foreign Government Bond Funds | | | 6,368,148 | |

| Corporate Bond Funds | | | 1,053,798 | |

| Total: | | $ | 765,201,179 | |

| | | | | |

| Leuthold Asset Allocation Fund (Unaudited) | | | | |

| Components of Portfolio Holdings* | | Fair Value | |

| U.S. Traded Equity Securities | | $ | 387,126,194 | |

| Corporate Bonds | | | 54,104,986 | |

| Aggregate Bond Funds | | | 53,986,204 | |

| Precious Metals | | | 34,254,042 | |

| Non-U.S. Traded Equity Securities | | | 21,883,061 | |

| Emerging Country Funds | | | 18,001,294 | |

| U.S. Traded Equity Securities - Short | | | 15,744,312 | |

| Mortgage Backed Bond Funds | | | 12,102,132 | |

| High Yield Bond Funds | | | 9,375,830 | |

| Foreign Government Bond Funds | | | 5,062,857 | |

| Total: | | $ | 611,640,912 | |

| | | | | |

| Leuthold Global Fund (Unaudited) | | | | |

| Components of Portfolio Holdings* | | Fair Value | |

| U.S. Traded Equity Securities | | $ | 152,235,117 | |

| Non-U.S. Traded Equity Securities | | | 94,031,854 | |

| Corporate Bonds | | | 28,087,646 | |

| Precious Metals | | | 18,785,720 | |

| Foreign Government Bonds/Notes | | | 18,014,662 | |

| U.S. Treasury Obligations | | | 15,406,791 | |

| Mortgage Backed Bond Funds | | | 11,834,909 | |

| Foreign Equity Funds - Short | | | 9,497,176 | |

| Emerging Country Funds | | | 7,961,427 | |

| High Yield Bond Funds | | | 6,902,242 | |

| Corporate Bond Funds | | | 6,101,278 | |

| Foreign Government Funds | | | 3,055,649 | |

| Total: | | $ | 371,914,471 | |

| | | | | |

| Leuthold Select Industries Fund (Unaudited) | | | | |

| Components of Portfolio Holdings* | | Fair Value | |

| Financials | | $ | 3,280,350 | |

| Health Care | | | 2,245,352 | |

| Industrials | | | 1,996,371 | |

| Information Technology | | | 1,981,390 | |

| Consumer Discretionary | | | 1,785,496 | |

| Materials | | | 966,444 | |

| Energy | | | 825,740 | |

| Consumer Staples | | | 407,772 | |

| Total: | | $ | 13,488,915 | |

| | | | | |

| Leuthold Global Industries Fund (Unaudited) | | | | |

| Components of Portfolio Holdings* | | Fair Value | |

| Financials | | $ | 2,592,621 | |

| Industrials | | | 1,135,359 | |

| Telecommunication Services | | | 1,023,425 | |

| Consumer Discretionary | | | 857,294 | |

| Health Care | | | 843,988 | |

| Materials | | | 606,840 | |

| Energy | | | 461,355 | |

| Information Technology | | | 211,331 | |

| Utilities | | | 85,288 | |

| Total: | | $ | 7,817,501 | |

| | | | | |

| Leuthold Global Clean Technology Fund (Unaudited) | | | | |