Washington, D.C. 20549

Leuthold Funds, Inc.

33 S. Sixth Street, Suite 4600, Minneapolis, MN 55402

33 S. Sixth Street, Suite 4600, Minneapolis, MN 55402

Item 1. Reports to Stockholders.

Annual Report

September 30, 2011

The Leuthold Funds

Leuthold Core Investment Fund

Leuthold Asset Allocation Fund

Leuthold Global Fund

Leuthold Select Industries Fund

Leuthold Global Industries Fund

Leuthold Global Clean Technology Fund

Leuthold Hedged Equity Fund

Grizzly Short Fund

This page is intentionally left blank

Please do not print this text

| The Leuthold Funds |

| Table of Contents |

| Letter to Shareholders | 1 |

| | |

| Expense Examples | 19 |

| | |

| Allocation of Portfolio Holdings | 24 |

| | |

| Components of Portfolio Holdings | 28 |

| | |

| Investment Graphs | 30 |

| | |

| Statements of Assets and Liabilities | 44 |

| | |

| Statements of Operations | 48 |

| | |

| Statements of Changes in Net Assets | 52 |

| | |

| Financial Highlights | 60 |

| | |

| Schedule of Investments | |

| | |

| Leuthold Core Investment Fund | 74 |

| | |

| Leuthold Asset Allocation Fund | 83 |

| | |

| Leuthold Global Fund | 92 |

| | |

| Leuthold Select Industries Fund | 102 |

| | |

| Leuthold Global Industries Fund | 105 |

| | |

| Leuthold Global Clean Technology Fund | 109 |

| | |

| Leuthold Hedged Equity Fund | 112 |

| | |

| Grizzly Short Fund | 118 |

| | |

| Notes to the Financial Statements | 122 |

| | |

| Report of Independent Registered Public Accounting Firm | 135 |

| | |

| Additional Information | 136 |

| | |

| Directors and Officers | 138 |

This page is intentionally left blank

Please do not print this text

Dear Fellow Shareholders:

Leuthold Weeden was established in 1987 by Steve Leuthold, whose reputation for insightful research had been firmly established for decades. Steve’s proprietary calculations, contrarian views, and market insights are well followed and widely regarded throughout the industry. He has had a huge influence on those of us who work with him. It takes a special, forward-thinking mentality to share knowledge generously and cultivate talent. Steve built a team and culture that is broad and deep, ensuring the reputation and honor Leuthold Weeden was founded on will continue into the future.

Over the years Steve broadened responsibilities of portfolio management teams and solidified the fact that Leuthold Weeden isn’t a one-man show. His approach has been to foster genuine collaboration across disciplines and quantitative methodologies. Recently Steve turned over his Chief Investment Officer responsibilities to Leuthold veteran Doug Ramsey. But Steve is still very much part of the collaborative process here. As he likes to say, “Even after 50 years, investing remains both my vocation and my avocation.” As the bluegrass music drifts down the hallway from the boom box in his office, we are lucky that Steve is just not a retirement kind of guy.

Steve continues to be a very actively involved partner—contributing to asset allocation disciplines; writing commentary; acting in an Advisory role to the portfolio management team; continuing his role on the Funds’ Board of Directors; and managing some private accounts and his family foundation assets.

Steve’s longstanding reputation and process are the backbone of the Leuthold Funds. All of us at Leuthold continue to be steadfastly focused on managing the Funds with that same diligence and care.

The 2010-2011 fiscal year started out strong, with impressive market gains through December 2010 securing a big victory for the bulls, both domestically and globally. With double-digit performance gains across every size and style index, this served to change the tone of the market from conservative and overly pessimistic to more widespread optimism by early 2011. The global bull market turned two years old in March 2011, and despite a range of bad news between January and March, including higher oil prices, Middle East unrest, the catastrophes in Japan, and the European Sovereign debt crisis, the stock market did not break stride. Throughout this, both our domestic and global Major Trend Index analyses remained bullish, and we were anticipating the potential for additional global market gains as 2011 progressed.

The market remained strong through April, but as soft economic numbers hit the tape, a sell-off began in May and continued into June. Fears about the impact of the tsunami in Japan morphed into an economic slowdown at home, which was exacerbated by more European debt issues. Despite all the headwinds, our market analysis remained with a positive bias, and a powerful rally in the final four days of June erased moderate market losses suffered during May and the first half of June. With our market analysis still positive on balance, we viewed the May-June decline as an overdue bull market correction. We did not – at the time –suspect that the spring highs in the stock market would turn out to be the final highs of the cyclical bull market.

However, the market reversed back to a downtrend in July, and by early August, our Major Trend disciplines turned decisively negative. This change in outlook prompted a shift in our asset allocation portfolios to a defensive stance before the worst of the bear market hit. Despite this timely defensive move, our remaining long equity holdings performed considerably worse than the benchmark indexes. Had our equities merely been able to match their respective market benchmarks, our tactical asset allocation Funds’ downside protection during those months would have been excellent.

| | The Leuthold Funds - 2011 Annual Report | 1 |

Why did our equities suffer such a disproportionate decline? From a technical perspective, market strength in 2011 had been fairly uniform across key sub-sectors, and we would normally expect internal market performance to become more disparate, or “fractured” before stocks made their final bull market highs. These dynamics did not materialize leading up to the conclusion of this bull market. The lack of these more customary “warning” signals resulted in most of our Funds’ long stock exposure being ill-positioned to navigate the volatile market decline commencing in August. The decline caught us with stock exposure heavily weighted toward cyclicals, materials, and energy; which are not traditionally defensive areas to seek shelter during a market decline.

The last three months of the fiscal year saw a cascade of global risk events that brought down all markets around the world. The worsening sovereign credit crisis in Europe, loss of confidence due to the U.S. debt ceiling debate, S&P downgrade of U.S. Treasuries, and the fear of a global recession, all contributed to a global risk-off trade. As a result, both volatility and cross-asset correlation shot up and economically sensitive industries and higher beta small/mid cap stocks were hit much harder.

For the fiscal year ended September 30, 2011, all eight of the Leuthold Funds had negative results, with six underperforming relative to their benchmarks, and two outperforming on a relative basis. The net losses in our Funds over the last twelve months are almost entirely the result of the market collapse during the last three months of the fiscal year, which saw a -13.87% loss in the S&P 500, and the DJIA decline of -11.49%. Broader market indexes and global markets experienced even steeper losses, as illustrated by the Russell 2000 decline of -21.87%, and the MSCI ACWI (All Country World Index) -17.33% loss.

Looking ahead, we believe the major market risk for the remainder of 2011 is the refocus on the U.S. deficit dilemma and our political system that may once again demonstrate it is incapable of taking meaningful action. If some meaningful deficit reductions are implemented, the U.S. stock market could run to new highs or better by year-end. We are less worried over the potential for accelerating U.S. inflation than we were six months ago, thanks to recent declines in commodity prices which have been as large, or even larger than, the fall in stock prices. The immediate danger of the Eurozone crisis now seems to be behind us and the fear of a new recession in late 2011-early 2012 is no longer a primary psychological stock market negative. The consensus currently believes the economic expansion, although modest, will continue and more economists are saying 2012 might be a better year than 2011, with unemployment even coming down a few notches.

Regardless of the consensus, the economists, and even our own expectations and predictions, it is our disciplines that drive our investment strategies. With countless forces affecting market action both in the short term and over the long term, we think it is most prudent to remain flexible and make adjustments along the way. The last three months of the fiscal year was a particularly challenging period for most of our strategies, but this is a very short time to measure, and we remain confident in the processes involved. Within each of our strategies we attempt to be poised to add value and find opportunities in all market conditions, and doing so requires a level of portfolio dexterity that is atypical in most mutual fund organizations. We believe this autonomy affords us the opportunity to produce market-beating returns over the long term.

| 2 | The Leuthold Funds - 2011 Annual Report | |

FUND OVERVIEWS

Leuthold Core Investment Fund (re-opened to all investors on May 16, 2011)

This Fund began trading on November 20, 1995. The strategy is flexible and value-oriented. The Leuthold Core Investment Fund adjusts asset class exposure based on underlying market dynamics and trends in order to attempt to avoid undue risk and take advantage of areas that appear poised to outperform. Assets are actively allocated between stocks, bonds, money market instruments, foreign securities, and other alternative investments. The Fund may also hedge equity exposure and fixed income exposure through short-selling strategies when our disciplines indicate potential market vulnerabilities. While at times individual portfolio allocations may appear unconventional, they are intended to assemble as complementing positions in an effort to carry out the Fund’s guiding principle: capital appreciation over the long-term, attained through relatively risk averse, prudent investment selection.

● | Leuthold Core Investment Fund uses the Leuthold Select Industries strategy as the primary vehicle for its U.S.-traded stock exposure. |

| Investment Guidelines: 30%-70% equity exposure and 30%-70% fixed income exposure. Under extreme market conditions, there may be a departure from these guidelines. Equity exposure is determined by our Major Trend Index which was designed to attempt to identify major (longer-term) market trends. This proprietary Leuthold index has been formally calculated on a weekly basis for 40+ years, and is currently composed of over 190 individual factors. |

Leuthold Asset Allocation Fund

This Fund began trading on May 24, 2006, as the successor to the then-closed Leuthold Core Investment Fund. The strategy and objective of this Fund are identical to those of the Leuthold Core Investment Fund in terms of guiding disciplines, flexibility, asset class exposure, and risk aversion. The difference between the two portfolios is in the stock selection approach employed for the primary U.S.-traded stock exposure.

| Leuthold Asset Allocation Fund currently uses a multi-strategy approach for its U.S.-traded stock exposure. This multi-strategy approach employs a combination of the Leuthold Select Equities and Leuthold Undervalued & Unloved methodologies. |

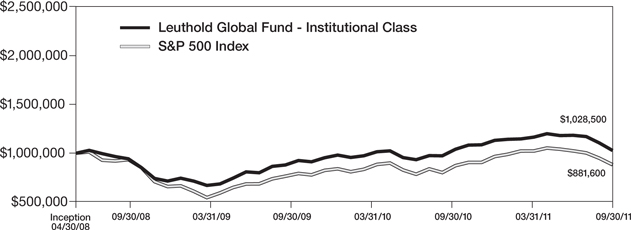

Leuthold Global Fund

This asset allocation strategy was introduced on April 30, 2008, and can be considered the “global” equivalent of the Leuthold Core Investment Fund. The strategy and objective of this Fund are analogous to that of the Leuthold Core Investment Fund in terms of guiding disciplines, flexibility, asset class exposure, and risk aversion. The Leuthold Global Fund invests in U.S. and foreign-traded stocks, bonds, money market instruments, and alternative investments. When market conditions are deemed unfavorable, the Fund may also sell short certain securities in order to hedge exposure to a particular asset class. The key distinction is that the Leuthold Global Fund intends to invest at least 40% of assets in foreign-traded securities, including stocks, bonds, and other asset classes.

| | The Leuthold Funds - 2011 Annual Report | 3 |

| Leuthold Global Fund uses the Leuthold Global Industries strategy as the primary vehicle for its stock exposure. |

| Investment Guidelines: 30%-70% equity exposure and 30%-70% fixed income exposure. Under extreme market conditions, there may be a departure from these guidelines. Equity exposure is determined by our Global Major Trend Index which was designed to attempt to identify major (longer-term) market trends on a global basis. This proprietary Leuthold index is composed of around 100 individual factors. |

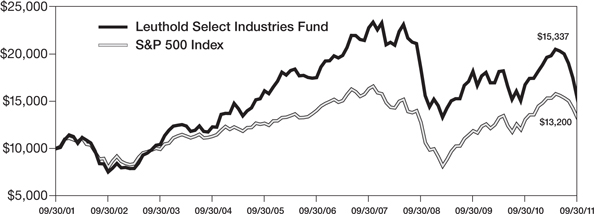

Leuthold Select Industries Fund (re-opened to all investors on May 16, 2011)

This Fund began trading on June 19, 2000, and unlike our asset allocation strategies, it is mandated to remain 100% invested in stocks at all times. This attribute results in the potential for considerably higher volatility, higher risk, and the probability that investors will lose money when the stock market declines. The Leuthold Select Industries Fund strategy is a top-down approach, based on industry group selection and rotation, and sector concentrations. Driven by a quantitative evaluation of around 120 equity-industry groups, it attempts to detect collective strength and emerging leadership potential, while exposing areas that appear vulnerable and should be avoided.

| The elements of industry group rotation and sector concentrations result in this Fund’s potential for higher volatility; it is potentially more risky while offering potentially more reward. |

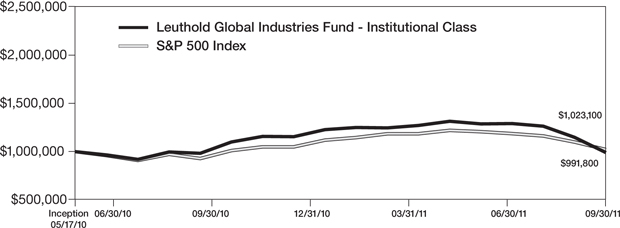

Leuthold Global Industries Fund

This Fund became available on May 17, 2010. The Leuthold Global Industries Fund invests in common stocks and other equity securities from around the world, based on a disciplined, unemotional, and quantitative approach to concentrated equity group investments. The strategy employs an industry group selection/rotation approach based on the methodology of our Leuthold Select Industries strategy; however, under normal conditions at least 40% of the Leuthold Global Industries Fund’s assets will be invested in securities from non-U.S. markets.

| As with the Leuthold Select Industries Fund, the elements of industry group rotation and sector concentrations result in the potential for higher volatility in the Leuthold Global Industries Fund; it is potentially more risky while offering potentially more reward. |

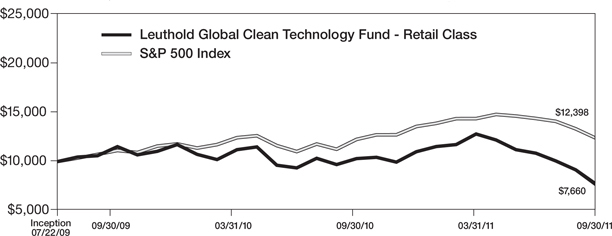

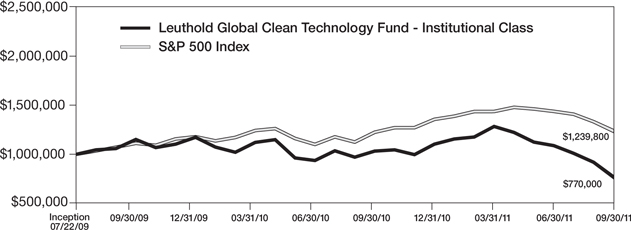

Leuthold Global Clean Technology Fund

This Fund became available on July 22, 2009, and unlike our other equity strategies, this Fund employs fundamental stock-selection. The Fund allocates its investments globally, in companies that endeavor to reduce humans’ impact on the environment through energy efficient and “clean” technologies, innovations, and solutions. A confluence of factors will help increase the demand for products from firms focused on technologies that clean, preserve, and/or maximize the earth’s resources, making these firms excellent long-term investments. In brief, noteworthy dynamics include: political influence, higher fossil fuel prices, growing world population, changing energy source preferences, commodity price volatility, and significant and growing markets.

| 4 | The Leuthold Funds - 2011 Annual Report | |

The Fund invests primarily across four clean technology sectors: Alternative Energy, Resource Conservation, Clean Water, and Clean Environment. The universe of stocks maintained for security selection is further organized among over 30 different “sub-industries”. This helps identify specific clean technology industries showing signs of unusual strength or weakness, and may be used as a basis for establishing overweight and underweight industry exposures in the Fund’s portfolio.

| The nature of this strategy combined with the inherently smaller capitalization of the eligible stock universe results in a high level of volatility in performance. Investors should have a very long term outlook when employing this Fund. |

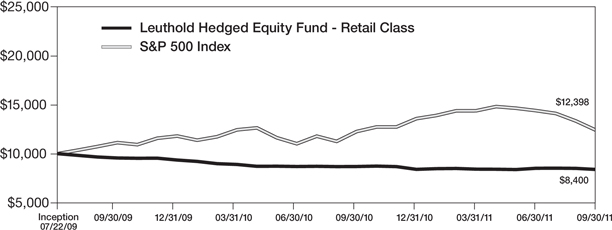

Leuthold Hedged Equity Fund

This Fund began trading on July 22, 2009, and employs a combination of our short-selling strategy and our domestic industry-group selection/rotation approach of the Leuthold Select Industries strategy. The Leuthold Hedged Equity Fund pursues its investment objective by establishing long and short positions in common stocks. This is an unleveraged Fund which seeks to maintain approximately equal weightings of gross long exposure and gross short exposure, but its objective is to produce absolute returns.

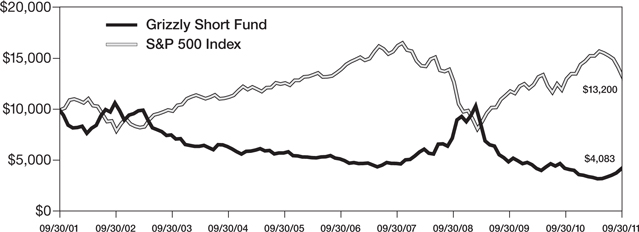

Grizzly Short Fund

Introduced on June 19, 2000, this unleveraged, actively managed Fund is 100% short individual stocks. (Short-selling strategies are aimed at profiting when stock prices decline.) Policy mandates the Grizzly Short Fund target 100% exposure in stocks sold short at all times, even when the stock market is in a rising trend, and regardless of whether our firm is bullish toward stocks.

| The Grizzly Short Fund typically maintains approximately equal-weighted short positions in around 60-90 individual stocks, initially selected by a multi-factor quantitative discipline. Each position is monitored daily and subject to a set of short covering disciplines. |

| Shareholders should anticipate they will most likely lose money investing in this Fund when stock prices are in a rising trend. |

The Grizzly Short Fund is a tool for sophisticated users. Traders, experienced investors, and speculators who anticipate the market may decline will employ the Grizzly Short Fund to tactically regulate stock market risk. It is also used in varying degrees with other multi-faceted portfolio strategies. This is not a Fund for buy and hold investors.

| | The Leuthold Funds - 2011 Annual Report | 5 |

ANNUAL PERFORMANCE REVIEW

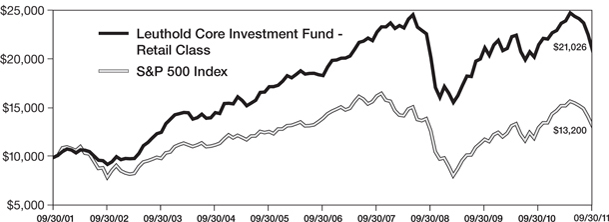

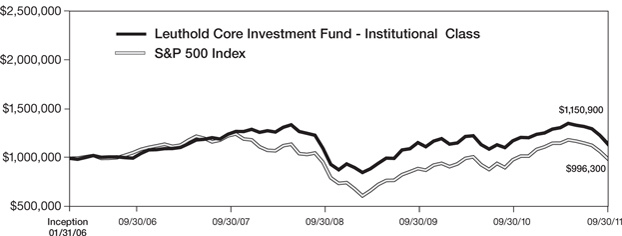

Leuthold Core Investment Fund (re-opened to all investors on May 16, 2011)

This is our firm’s flagship asset allocation strategy, with $1.01 billion of assets under management. For the fiscal year ended September 30, 2011, the Leuthold Core Investment Fund (retail share class) posted a total return loss of -2.61%, underperforming the S&P 500’s total return gain of +1.14% over the same time frame.

From the beginning of the fiscal year, October 1, 2010, through late July 2011, the Fund maintained a bullish stance with an average 62% net allocation to stocks. In early August 2011, our market analysis turned decisively negative and equity exposure was thus significantly reduced, initially targeting 45%, with further reductions taking net exposure down to 31% by the end of September. This was accomplished through a combination of reducing U.S. stock positions, lowering Emerging Market equity exposure, and initiating an equity hedge. This lowered exposure was well-timed, as the S&P 500 lost -12.08% total return from August 1 through September 30, while our equity hedge produced a strong +17.30% total return gain. However, more than offsetting this gain was the Core Fund’s U.S.-traded stock exposure, which produced a -19.51% total return loss during those two months. Hence, despite the Fund’s timely move to a defensive stance in early August, the success of the equity hedge was obscured by the outsized losses in the Fund’s U.S.-traded stocks. One of our Fund’s objectives is to outperform the S&P 500 with our long stock exposure, therefore when our stocks underperform when we are in a defensive mode, it is especially disappointing as it reduces the net effectiveness of the equity hedge.

For full details regarding the allocations affecting the Leuthold Core Investment Fund’s U.S.-traded long stock exposure, please refer to the performance discussion of the Leuthold Select Industries Fund on subsequent pages.

The Leuthold Core Investment Fund’s Emerging Market Equities exposure maintained an overweight position most of the year, at 14.5% on average. In contrast with last year, this allocation was a large performance drag, turning in a loss of over -19.5%. The majority of this loss was experienced in August and September; hence the effect on overall performance was not nearly as damaging as it might have been, because we had significantly reduced exposure in early August as part of our shift to become more defensive. As of the end of September, the Emerging Market Equities exposure is 8%, much closer to our long-term average position of about 5%. Worth mentioning is the gradual phasing-out, during the last twelve months, of our exposure attained via Emerging Market ETFs and open-end funds. Global markets continue to develop, becoming more accessible. In addition, we have built out our global trading capabilities allowing us to establish direct exposure to Emerging Markets; hence our holdings are now composed of individual stocks. We believe this offers an excellent opportunity to better identify and target specific market segments. Currently, due to strong conviction about the long term consumer-driven story, we have been overweighting consumer related sectors in Emerging Markets. At present, the majority of this exposure is through Chinese companies, but there is also exposure to South Korea, Thailand, Indonesia, Taiwan, Singapore, Hong Kong, Malaysia, and the Philippines.

Our Fund’s normal guideline minimum for Fixed Income is 30% of assets. However, as we’ve noted for a number of years, we see very few opportunities in the fixed income market so we’ve continued to maintain a much lower-than-normal minimum exposure. Including a Fixed Income Hedge employed for eight months during the fiscal year ended September 30, 2011, we had an average of just 5.75% of net fixed income exposure.

| 6 | The Leuthold Funds - 2011 Annual Report | |

The constant fixed income holdings for the last twelve months were Brazilian Bonds and Quality Corporate Bonds. High Yield Floating Rate Bonds were introduced in January, followed by Emerging Market Bonds in April, and Australian Bonds in July. Of these, only the Quality Corporate Bonds (3% average holding) and Australian Bonds (1% holding) produced net gains, +3% and +6% total returns, respectively. Prior to 2011, our Brazilian Bond holding had a multi-year run of returns near +30%, but the opportunity has run its course. Results over the last twelve months were a muted mix of gains and losses, and in September the holding lost over -21%. This was a 4% portfolio allocation and ended the year with a total return loss of nearly -6%. High Yield Floating Rate Bonds (2% holding) lost about -1% total return, and the Emerging Market Bonds (1% holding) were down -7% total return for the fiscal year ended September 30, 2011. The Fixed Income Hedge was also a portfolio negative, with a total return loss of nearly -4%.

Originally purchased in early 2009, we maintained the allocation to a diversified portfolio of REITs until early August 2011, when it was sold to fund the equity hedge. This position posted a -4% total return loss for the 11 months held during the fiscal year.

Alternatives: On average, we held a 5% combined allocation to physical Gold and Silver during the last twelve months. This position, which was initiated in April 2009, was established due to our concern regarding the potential risk of very dangerous long-term inflation as physical gold and silver offer some defense. While it is just a small allocation, it has been the portfolio standout. On the heels of a +31% gain in the 2009-2010 fiscal year, this physical metals allocation produced a total return gain of over +35% for the fiscal year ended September 30, 2011.

In summary, there were occurrences when our long stock exposure via the Select Industries strategy did not perform in a complementary manner, and this was the key portfolio component which detracted from performance. While we are always disappointed to report negative results, the differential between the Core Fund’s fiscal year total return loss of -2.61%, versus the S&P 500’s modest total return gain of +1.14%, is a relatively low hurdle to attempt to make up for in the new fiscal year. Overall, we believe the past year underscores the power of our asset allocation strategy’s flexibility to adjust exposure to risk. In particular, the latitude to be able to initiate relevant portfolio defense via the equity hedge from August through September was tremendously additive and demonstrates the effectiveness of our asset allocation strategy’s underlying principle: attempting to minimize risk in declining – or uncertain - market environments.

| The longer-term results of the Fund make it evident the strategy goals are being achieved. For the 10-year time frame ended September 30, 2011, the Leuthold Core Investment Fund has a cumulative total return gain of +110.26% (+7.71% annualized), compared to the S&P 500’s +32.00% cumulative total return gain (+2.82% annualized). |

| We will adhere to the disciplined market analysis that has driven our long-term performance. As market conditions change, you can expect the Fund to adapt exposures attempting to take part in gains of rising markets and/or take measures to minimize risk when our disciplines indicate conditions warrant a defensive position. |

| | The Leuthold Funds - 2011 Annual Report | 7 |

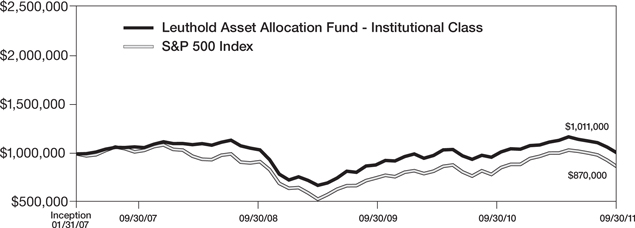

Leuthold Asset Allocation Fund

This Fund has assets under management of $993 million. For the fiscal year ended September 30, 2011, the Leuthold Asset Allocation Fund (retail share class) generated a total return loss of -1.34%, underperforming the S&P 500’s total return gain of +1.14% over the same time frame.

From the beginning of the fiscal year, October 1, 2010, through late July 2011, the Fund maintained a bullish stance with an average 62% net allocation to stocks. In early August 2011, our market analysis turned decisively negative and equity exposure was thus significantly reduced, initially targeting 45%, with further reductions taking net exposure down to 31% by the end of September. This was accomplished through a combination of reducing U.S. stock positions, lowering Emerging Market equity exposure, and initiating an equity hedge. This lowered exposure was well-timed, as the S&P 500 lost -12.08% total return from August 1 through September 30, while our equity hedge produced a strong +17.30% total return gain. Almost counterbalancing this gain was the Asset Allocation Fund’s U.S.-traded long stock exposure, which produced a -14.76% total return loss during those two months, losing more than the S&P 500. Hence, despite the Fund’s timely move to a defensive stance in early August, the success of the equity hedge was obscured by the outsized losses in the Fund’s long stock exposure. One of our Fund’s objectives is to outperform the S&P 500 with our long stock exposure; therefore, when our stocks underperform when we are in a defensive mode, it is especially disappointing as it reduces the net effectiveness of the equity hedge.

For its U.S.-traded equity exposure, this Fund has used a multi-strategy approach. Since inception, this multi-strategy approach has employed a combination of the Leuthold Select Equities and Leuthold Undervalued & Unloved strategies. Both are bottom-up, quantitative methodologies and each generally contributes a different type of stock market exposure. Individually these two strategies are quite different, but when used in tandem, they allow us to construct an equity portfolio with overall characteristics suitable for an asset allocation approach, and afford us the flexibility to adjust the mix to align with our market outlook. For the fiscal year ended September 30, 2011, the combined allocation to the Leuthold Select Equities strategy and the Leuthold Undervalued & Unloved strategy contributed a total return loss of -3.35%.

This U.S.-traded equity exposure via Select Equities/Undervalued & Unloved underperformed the S&P 500 during six of the last twelve months, and matched or slightly outperformed in the other six months. While there was no extreme divergence in any particular month, the months of underperformance overwhelmed the results, as the majority of those months lagged in the range of 1% to over 2%, whereas the months of outperformance typically added less than one-half percent more than the S&P 500’s gain.

For the fiscal year ended September 30, 2011, there were only three broad sectors that contributed overall net gains in this combined Select Equities/Undervalued & Unloved stock allocation: Consumer Discretionary, Telecommunication Services, and Utilities. The Consumer Discretionary sector had the biggest contribution to return, which included additive investments in a broad range of groups including: Apparel Retail, Footwear, Apparel Accessories/Luxury Goods, Home Furnishings, and Auto Parts/Equipment. The Telecommunication Services sector had positive results from the Integrated Telecom and Wireless Telecom Services groups. The best Utilities sector results were primarily attributed to investments in Electric Utilities stocks. Other significant positive group contributors came from a range of other sectors: Integrated Oil & Gas (Energy sector); Tobacco (Consumer Staples sector); and Electronic Components and Electronic Manufacturing Services (Information Technology Sector).

| 8 | The Leuthold Funds - 2011 Annual Report | |

Sector investments which detracted the most from performance were Materials, Industrials, Information Technology, and Financials. Within the Materials sector, the worst group investments included Diversified Metals & Mining, Aluminum, and Steel. The Industrials sector group detracting the most was Industrial Machinery. Performance detractors from the Information Technology sector included Technology Distributors, Semiconductor Equipment, and Semiconductors. Financials groups which were the most negative contributors included Regional Banks and Diversified Financial Services. There were a handful of other group investments from miscellaneous sectors that also were performance detractors: Pharmaceuticals (Health Care sector); and Oil & Gas Drilling and Oil & Gas Refining (Energy sector).

Exposure to foreign stocks within the Select Equities/Undervalued & Unloved mix has remained steady over the course of the year. There was an average 16% exposure to foreign stocks, with just under 2% of that coming from Emerging Market equities.

Aside from the U.S.-traded Select Equities/Undervalued & Unloved stock selection strategy, the Leuthold Asset Allocation Fund otherwise follows the very same investment mandates, asset mix shifts, and asset class investment vehicles as the Leuthold Core Investment Fund. To minimize repetition, for the performance review of all the other asset classes held by this Fund during the last 12 months: Emerging Market Equities, Fixed Income, REITs, and Alternatives (Gold and Silver), please refer to the preceding discussion of the Leuthold Core Investment Fund performance details.

| The Leuthold Asset Allocation Fund now has a five year record which we believe reflects favorably that the objective is being achieved, especially considering the gamut of events that occurred during this time: bull and bear markets, financial/liquidity crises, bailouts, housing bust, recession, recovery, and multiple “QE” endeavors. For the five year time frame ended September 30, 2011, the Leuthold Asset Allocation Fund has a cumulative total return gain of +8.84% (+1.71% annualized), compared to the S&P 500’s -5.76% cumulative total return loss (-1.18% annualized). |

| We will adhere to the disciplined market analysis that has driven our long-term performance. As market conditions change, you can expect the Fund to adapt exposures attempting to take part in gains of rising markets and/or take measures to minimize risk when our disciplines indicate conditions warrant a defensive position. |

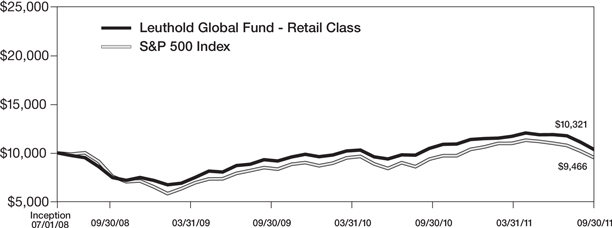

Leuthold Global Fund

This Fund has assets under management of $445 million. It offers investors a global alternative to our domestically focused tactical asset allocation strategies of the Leuthold Core Investment Fund and the Leuthold Asset Allocation Fund. For the fiscal year ended September 30, 2011, the Leuthold Global Fund (retail share class) produced a total return loss of -1.33%, outperforming the -5.54% total return loss in the MSCI ACWI (All Country World Index) and the -2.60% total return loss of the Lipper Global Flexible Portfolio Funds Index.

From the beginning of the fiscal year, October 1, 2010, through late July 2011, the Fund maintained a bullish stance with an average 62% net allocation to stocks. In early August 2011, as with our domestic market analysis, our global market analysis turned decisively negative and equity exposure was thus significantly reduced, initially targeting 50%, with further reductions taking net exposure down to 32% by the end of September. This was accomplished through a combination of reducing global stock positions and employing an equity hedge. This lowered exposure was well-timed, with the MSCI ACWI

| | The Leuthold Funds - 2011 Annual Report | 9 |

losing -15.99% total return from August 1 through September 30, while our global equity hedge position produced a +15.77% total return gain. However, similar to the experience of our domestic asset allocation Funds, the Leuthold Global Fund’s long stock exposure performed poorly. This global stock exposure produced a -21.68% total return loss during those two months, more than offsetting the shelter provided by the gain of the equity hedge. Hence, despite the Fund’s timely move to a defensive stance in early August, the success of the equity hedge was obscured by the outsized losses in the Fund’s long stock exposure. One of the Fund’s objectives is to outperform the MSCI ACWI with our long stock exposure; therefore, when our stocks underperform when we are defensively positioned, it is especially disappointing as it reduces the net effectiveness of the equity hedge.

For full details regarding the allocations affecting the Leuthold Global Fund’s long stock exposure, please refer to the performance discussion of the Leuthold Global Industries Fund on subsequent pages.

The Leuthold Global Fund normally has a guideline minimum level of 30% invested in Fixed Income; however, as with last year the Fund remained far below the normal minimum for the entire fiscal year, with an average allocation of just 10%. As we noted in our commentary for the Leuthold Core/Asset Allocation Funds, there is very little that is attractive to us on a risk/reward basis in the fixed income markets, be it domestic fixed income or foreign fixed income.

We began the fiscal year with allocations to Global Government Bonds (average 3% of assets), Global High Yield Bonds (average 3% of assets), Global Corporate Bond Funds (average 3% of assets), Treasury Inflation Protected Securities (average 2% of assets), and a package of foreign Convertible Bonds (average 1% of assets). In June, a new 1% holding was established in U.S. Municipal Bonds. With the exception of Global Government Bonds, each of these fixed income subsets contributed solid positive performance during the year, with results ranging from +2.5% to +6% total return. Global Government Bonds had relatively flat results, +0.42% total return for the twelve months ended September 30, 2011. As a means to offset the risk of rising interest rates, the Fund also employed a Fixed Income Hedge – shorting U.S. Treasury Bonds - on and off during the fiscal year. The hedge was employed from October 2010 – January 2011, and produced positive net results. It was not successful the second time around, turning in losses after being re-deployed in late May and held through fiscal year-end. The allocation ranged from 1.5% to 3% of assets, and the result of the combined holding periods was a net total return loss, of about -3.8% for the fiscal year ended September 30, 2011.

The Leuthold Global Fund had an allocation to REITs, specifically targeting exposure to mortgage REITs and global real estate. This 4% allocation contributed a strong total return gain of +15.50% for the holding period between October 1, 2010, and early August 2011. The position was eliminated in early August as our outlook became defensive, and the proceeds were used to increase the equity hedge.

Alternatives: This physical Gold and Silver holding was initiated in 2009, and over the last twelve months, on average, we maintained a 5% combined allocation. With the U.S. and other foreign governments pumping money into the global economy, we made this allocation due to our concerns about the long-term inflation implications related to the excess liquidity. While it is just a small allocation, it has been the portfolio standout. On the heels of a +32% gain in the 2009-2010 fiscal year, this physical metals allocation produced a total return gain of nearly +35% for the fiscal year ended September 30, 2011.

| 10 | The Leuthold Funds - 2011 Annual Report | |

Leuthold Select Industries Fund (re-opened to all investors May 16, 2011)

This all-equity Fund, with total assets under management of $16 million, had a very disappointing total return loss of -8.60% for the fiscal year ended September 30, 2011, compared to a +1.14% total return gain for the S&P 500.

This year’s substantial underperformance is primarily attributable to the last three months of the fiscal year ended September 30, 2011. During this three month period, the Leuthold Select Industries Fund had a total return loss of -23.51%, versus the S&P 500 total return loss of -13.87%. The third quarter of 2011 saw a cascade of global risk events, and as the market veered sharply south, this Select Industries equity portfolio was ill-positioned to absorb the impact, with large concentrations in Energy, Consumer Discretionary, and Materials stocks – not areas associated with a defensive stance. Additionally, our quantitative equity strategy does best in periods when there is a strong distinction between winners and losers among equity groups and themes. The changes in the market took place so rapidly that the 2011 bear market offered virtually no place to hide.

There were quite a few changes in the portfolio sector exposure as the year progressed, which is another indication of a trendless market and lack of leadership. Again, this is an environment where the group selection strategy does not thrive. The 2010-2011 fiscal year began with the heaviest exposure to Health Care and Information Technology. The third heaviest sector weight traded off between Consumer Discretionary and Consumer Staples until April, when Consumer Staples faded and Energy and Materials exposure was boosted. The Financials sector exposure was also being boosted as Information Technology was being significantly reduced by late July. Health Care maintained one of the top two heaviest weights during the entire twelve month period, and ended the year at a sizeable 46% of assets, followed by Materials, Energy, Consumer Discretionary, and Financials. As of September 30, 2011, there was little to no exposure in Information Technology, Consumer Staples, Industrials, Telecommunications and Utilities.

The best performance from the sector level was provided by the heavy Information Technology exposure held between October 2010 and April 2011. This was followed by outperformance from our Health Care sector stocks, and to a lesser degree, Consumer Staples and Industrials sector exposure. The largest losses by far came from the Fund’s Materials sector exposure, which wasn’t even a significant portfolio weight until July. The Financials and Energy sectors also contributed large portfolio losses.

From an industry group perspective, for the full fiscal year, the Leuthold Select Industries Fund’s most beneficial exposure came from group investments in Semiconductors and Electronic Components (Information Technology sector); Managed Health Care and Pharmaceuticals (Health Care sector); and Hypermarkets & Super Centers (Consumer Staples sector).

The least productive industry group investments in the Fund for the year ended September 30, 2011, were from those allocations which were the biggest detractors (as noted above) from a sector level: Oil & Gas Drilling (Energy sector); Steel, Aluminum, and Fertilizers & Ag Chemicals (Materials sector); and Diversified Financial Services and Diversified Capital Markets (Financials sector).

Exposure to foreign stocks in the Leuthold Select Industries Fund is now at 17%, versus an average of 25% last fiscal year. Within this foreign exposure, Developed Market stock exposure remained relatively consistent at around a 15% allocation while there has been a migration away from Emerging Market stocks, now at 3% exposure versus 10% in October 2010.

| | The Leuthold Funds - 2011 Annual Report | 11 |

With the exception of the Health Care sector holdings in Managed Health Care and Pharmaceuticals, current portfolio group holdings bear little resemblance to the holdings a year ago. This is unusual as the strategy intends to uncover longer-term industry group trends. (It is more typical for the portfolio to have at least one-half of its positions being held a year or longer at any given time.)

In summary, the rapidly changing conditions beginning in the third quarter of 2011 put us at a great disadvantage considering our lack of defensive allocations. Since the market lows of 2009, there has been an extremely high level of performance correlation with no regard for size or quality of stocks, making it additionally difficult to navigate and gain traction with this strategy. We expect to see a reversion of the currently high cross-asset correlations to a lower level, which should benefit the process employed in this Fund’s industry group approach. While this strategy is not ideal for all market conditions, we believe over the longer term it is more typical than not for the market to be driven by macro-theme dynamics, allowing this Fund to uncover more persistent areas of strength. Our longer term results illustrate how the Leuthold Select Industries Fund was designed to take advantage of those trends.

| Since inception on June 19, 2000, through September 30, 2011, the Leuthold Select Industries Fund has produced a +52.76% cumulative total return gain (+3.83% annualized) versus a -6.05% cumulative total return loss for the S&P 500 (-0.55% annualized). |

Leuthold Global Industries Fund

This all-equity Fund, with total assets under management of $20 million, had a disappointing total return loss of -10.23% (retail share class) for the fiscal year ended September 30, 2011, compared to the -5.54% total return loss of the MSCI ACWI (All Country World Index).

This is a relatively new Fund, launched on May 17, 2010; however, this Fund’s strategy is an extension of our domestic industry group selection/rotation approach which was established in the late 1990s and known as our Select Industries strategy. This global version of our disciplined, unemotional and quantitative approach employs many of the same factors as our domestic group selection strategy; it attempts to uncover those industry groups that appear most attractive at the global level. This Fund will normally invest at least 40% of its assets in equity securities from international markets.

Within the Leuthold Global Industries Fund, foreign-traded stocks composed 66% and U.S.-traded stocks composed 34%, on average, during the 2010-2011 fiscal year ended September 30, 2011. Of the foreign-traded securities, typically 77% has been invested in Developed Markets over the last twelve months, versus 23% Emerging Market stock exposure. In general, the largest foreign market country concentrations that were consistent throughout the year were spread among Japan, Germany, South Korea, Hong Kong, and Taiwan. Sweden and France also each had a relatively steady presence as heavier weighted allocations. From a performance stance, the most positive contributors at the country level came from investments in Mexico, South Korea, Taiwan, and the Philippines. The biggest detractors from performance at the country level included investments in the U.S., Hong Kong, Sweden, Germany, and Japan.

| 12 | The Leuthold Funds - 2011 Annual Report | |

While the country exposures may be of interest, equity exposure is dictated by the industry groups (not countries) that appear most attractive according to our quantitative disciplines. The Leuthold Global Industries Fund employs a top-down industry group approach for its equity selection. We believe that industry group leadership on a global basis will generate superior returns over the more traditional approach of “country” or “regional” concentrations, as the global economy has become increasingly interdependent.

As with our domestic Leuthold Select Industries Fund, the Leuthold Global Industries Fund’s underperformance is primarily attributable to the last three months of the fiscal year ended September 30, 2011. During this three month period, the Leuthold Global Industries Fund had a total return loss of -23.34%, versus the MSCI ACWI total return loss of -17.33%. Our Leuthold Global Industries Fund had too many cyclical, non-dollar, emerging bets on the table and as correlations surged to all-time highs, those positions were severely punished. This Global Industries equity portfolio was positioned with its largest concentrations in Materials, Consumer Discretionary and Industrials stocks – very unfavorable areas during a market plunge. Additionally, our quantitative equity strategy does best in periods when there is a strong distinction between winners and losers among equity groups and themes. The changes in the market took place so rapidly that the 2011 bear market offered virtually no place to hide, neither domestically nor globally.

During the fiscal year ended September 30, 2011, the areas of strength among our global equity exposure primarily came from the broad sectors of Financials, Telecommunication Services, and to a much lesser degree, Utilities. At the global industry group level, these sectors were represented by Consumer Finance (Financials sector); Developed Wireless Telecom Services (Telecommunication Services sector); and Water Utilities (Utilities sector).

There was much more impact on portfolio results from the sectors contributing overall negative results. The largest negative contributors were: Information Technology, Materials, Energy, Industrials, and Consumer Discretionary. The specific industry group investments that produced the biggest losses included: Industrial Machinery and Airlines (Industrials sector); Semiconductor Equipment (Information Technology sector); Auto Components and Automobiles (Consumer Discretionary sector); Integrated Oil & Gas (Energy sector); and Fertilizers/Agricultural Chemicals and Diversified Chemicals/Industrial Gases (Materials sector).

As markets topped-out in late April/early May, the warning flags that typically wave as market tops are formed were simply not present. These flags have historically offered enough lead time for our disciplines to incorporate the trend change, allowing for some advance portfolio repositioning to a more defensive slant, as market tops are normally a “process”, not an “event.” We felt that our valuation bias would help us in such an environment, but this proved false over this limited window. This approach to global industry investing is not managed for the short term, however, and it was introduced during an unprecedented period of high correlation, which has persisted through this year. Looking ahead, our Leuthold Global Industries Fund contains companies with cheaper valuations and better growth prospects than the market as a whole, and we believe the disciplines will prevail over time.

| | The Leuthold Funds - 2011 Annual Report | 13 |

Leuthold Global Clean Technology Fund

The Leuthold Global Clean Technology Fund has $16 million in assets under management. For the fiscal year ended September 30, 2011, the Fund (retail share class) had a -25.63% total return loss, versus a total return loss of -39.66% in the Ardour Composite Global Alternative Energy Index, and a total return loss of -5.54% in the MSCI ACWI (All Country World Index).

The Fund began the year with strong results, as a significant portfolio overweight to the Resource Conservation sector and a large overweight to the Alternative Energy sector drove the Fund’s performance, turning in a +24.37% total return for the first six months through March 31, 2011. In particular, during this time frame, investments in solar, water, and emission-control companies were especially productive. The extension of tax credits and cash grants in the U.S. for renewable energy projects and cleaner fossil fuels additionally benefited a number of portfolio positions, boosting our returns considerably.

The Fund’s overall performance for the fiscal year ended September 30, 2011, was the result of a six month string of losses from April through September, where this Fund experienced a big -40.20% total return loss. During that time the Fund was heavily overweight in stocks from the Clean Environment sector, and moderately overweight in Alternative Energy and Resource Conservation. Significant contributors to this performance were losses related to investment in a wind turbine stock and our exposure to solar stocks, which took a big hit following Germany’s and Italy’s reductions in incentives for new solar installations. Positions in economically sensitive stocks, such as filtration and emissions control companies, were particularly poor performers as investors’ fears of a double-dip recession were inflamed by the downward revision of domestic economic data. Furthermore, investments in equipment manufacturers to the renewable sector underperformed, dragging the Fund’s results lower.

During the last three months of the fiscal year ended September 30, 2011, the Leuthold Global Clean Technology Fund was also generally affected by the decline in the overall stock market, and in particular, investors’ risk-aversion to smaller capitalization securities.

There were two major changes in the Fund’s sector exposure during the fiscal year. Exposure to the Clean Environment sector increased from 10% in October 2010 to 33% of portfolio assets at the end of September 2011. The Alternative Energy sector experienced the reverse action, with 50% exposure in October 2010 being reduced down to 30% as of September 30, 2011. The other three sectors experienced moderate to negligible change in portfolio exposure, with the Resource Conservation sector exposure being lowered to 14% during the year, down from 20%; Clean Water sector exposure was reduced from 12% in October 2010 to 10% by September 2011; and the Diversified sector, which will normally have very minimal exposure, ended the year with 3% of assets, down from 10% in October 2010.

The largest non-U.S. exposures during the year within the Fund were: China, Canada, Germany, Spain, Brazil, Taiwan, Japan, Switzerland, and France. Other, smaller concentrations among foreign countries were: Singapore, Denmark, Austria, Belgium, and Hong Kong. The U.S.-traded stock exposure during fiscal year 2010-2011 was 47% on average, with foreign country investments averaging about 53% of portfolio assets. (The Fund intends to invest at least 40% of assets in foreign-traded securities.)

While the Fund experienced a large loss for the 2010-2011 fiscal year (-25.63% total return), when weighed against the Ardour Composite Global Alternative Energy Index (-39.66% total return), which is the most comparable benchmark, our results are

| 14 | The Leuthold Funds - 2011 Annual Report | |

clearly superior, with over a 1400 basis point advantage. We appreciate that investors don’t take pleasure in realizing this level of losses; however, this theme is very long term oriented. We manage the Fund for long-term total return as the sector is likely to benefit from a multi-decade, cyclical upswing in demand for goods and services. As this past year’s experience demonstrates, results will be very volatile due to the inherent nature of the strategy and small capitalization of stocks in this fledgling industry.

Our approach is to identify and invest in best-in-class, profitable growth companies expected to increase revenues by about 20% per annum. Our focus remains on identifying cash-generating businesses with excellent revenue and profit growth outlooks. Though harder to find these days, they exist and we are selectively making investments that we believe will be productive over the longer term. We attempt to acquire shares when we deem them to be undervalued. We prefer to hold shares in companies for extended periods of time, though we will reduce or eliminate positions we deem overvalued. In short, we view this opportunity akin to a marathon, not a sprint, and we invest the Fund’s capital accordingly.

Leuthold Hedged Equity Fund

The Leuthold Hedged Equity Fund has $6 million in assets under management. For the fiscal year ended September 30, 2011, the Fund (retail share class) had a total return loss of -3.34%, versus the S&P 500 total return gain of +1.14%. This Fund is managed with equal allocations to both long and short equities, but its objective is to produce positive net performance. To do so, we require enough relative outperformance on one or both sides in order to yield a positive result. This objective has yet to be achieved, as we are still digging out of a relative performance hole since the Fund was introduced in July 2009. Over the last fiscal year, both the long-stock exposure and the short-stock exposure employed in this Fund had net losses.

For the Fund’s long-stock investments, the Leuthold Hedged Equity Fund employs the group selection and rotation approach of the Leuthold Select Industries Fund, which had a total return loss of -8.60% for the fiscal year ended September 30, 2011. On the short-side, the Fund’s exposure was attained through the investment strategy of the Grizzly Short Fund, and this strategy produced a total return loss of -2.06% for the fiscal year.

To minimize repetition, the performance review of key performance drivers for each of these equity strategies are presented in the discussions covering the Leuthold Select Industries Fund and the Grizzly Short Fund.

Overall performance since inception remains far below our expectations, based on how the two underlying component strategies have performed, historically. In general, market conditions since the Fund’s inception have been unusual. The stock market has been in a period where leadership at the industry group level has been short-lived, accompanied by fast-rotation trends. These conditions are not conducive to our long-side, industry group selection approach, which attempts to uncover longer-term leadership trends. Additionally, since the market lows of 2009, there has been an extremely high level of correlation among stocks, with no regard for size or quality, making it additionally difficult for our short-selling strategy.

Historically, both the short-stock and long-stock selection strategies employed in this Fund have shown the potential to flourish and/or serve to balance each other in most market environments, and we are confident performance will bear this out given a longer time frame.

| | The Leuthold Funds - 2011 Annual Report | 15 |

Grizzly Short Fund

This Fund is 100% short individual stocks, with assets under management of about $263 million. For the fiscal year ended September 30, 2011, the Grizzly Short Fund produced a -2.06% total return loss. This compares unfavorably to the S&P Mid Cap Index, which had -1.28% total return loss (short-selling that index would have produced over a +1% gain for the fiscal year). The Grizzly Short Fund also underperformed the S&P 500’s +1.14% total return gain, as shorting the S&P 500 would have produced a smaller loss (about -1%) than the Grizzly Short Fund produced.

For the October 2010 through April 2011 period of the fiscal year, short selling was not a winning strategy, as the market was still running in bull market mode. However, during that time, December 2010 was the only month of significant underperformance as a strong year-end rally continued to promote stocks of every size and style, regardless of quality. For the October 2010 through April 2011 period, the Fund had a total return loss of -24.76% versus the S&P Mid Cap Index total return gain of +27.49%.

The bull market topped out in late April/early May 2011, and the Grizzly Short Fund produced gains in each of the next five months, through September 2011. For the last five months of the fiscal year, the Grizzly Short Fund solidly outperformed with a total return gain of +30.16% versus the S&P Mid Cap Index -22.57% total return loss (short-selling the S&P Mid Cap Index would have produced a lagging +22% gain).

The Grizzly Short Fund has extremely high turnover, and sector concentrations and industry group exposure have the potential to fluctuate considerably throughout the year. This is a highly disciplined methodology, however. As opposed to a market capitalization weighted index, our Fund is not predisposed to the risk of performance being heavily influenced from a small number of individual stocks, because the Grizzly Short Fund positions are similarly weighted across the portfolio. There are policies in place that trigger specific short-covering action, such as capturing gains and stop-loss tactics. Additionally, there are limitations on how much of the portfolio can be concentrated within a particular sector or sub-industry group therein.

At the sector level, the Grizzly Short Fund’s performance was clearly influenced by heavy concentrations, during the entire year, in Consumer Discretionary, Information Technology, and Financials sectors. During June, the Industrials weight was increased and this sector also had a significant positive influence for full-year results. Industry groups from these sectors that most contributed to positive results included: Building Products and Airlines (Industrials sector); Investment Banking/Brokerage and Regional Banks (Financials sector); Electronic Components and Semiconductors (Information Technology sector); and Hotels/Resorts/Cruise Lines, Movies & Entertainment, and Homebuilders (Consumer Discretionary sector). There was a miscellaneous stock from Oil & Gas Services (Energy sector), and a particular Steel stock (Materials sector) included among the significant positive contributors.

The biggest overall detractors from performance from a sector perspective were Health Care, Consumer Staples, Materials, and Energy. Industry group investments within these sectors included Packaged Foods/Meats and Food Retail (Consumer Staples sector); Steel and Paper Packaging (Materials sector); Oil & Gas Equipment and Oil & Gas Storage/Transportation (Energy sector); and Biotechnology and Pharmaceuticals (Health Care sector). The Information Technology sector was also represented among the industry group detractors, and these included stocks from Application Software and Internet Software & Services.

| 16 | The Leuthold Funds - 2011 Annual Report | |

When our market analysis indicates a bullish environment for stocks, we expect the Fund may still uncover selective opportunities to profit, as there will be vulnerable areas of the stock market regardless of the underlying trend. However, in a decisively rising market environment, investors should expect the Grizzly Short Fund to produce net losses. During those periods, the Fund will aim to add value by losing less than an index short. When the market trend is decisively negative, the Grizzly Short Fund should produce net gains, and historically, our actively managed strategy has been able to add value versus an index short in this environment as well.

The Grizzly Short Fund’s year-by-year results are volatile, and while the advantage for employing a short-selling strategy in down-market cycles is clear (as evidenced by results of 2007-2008, and the recent May-September 2011 period), the tremendous risk of short-selling in rising market conditions should also be very apparent considering the Fund’s losses during the bull market period of 2009- early 2011. Yet, for those experienced with short-selling, there are viable uses for this strategy in all market conditions.

Investors who are not experienced in short-selling and adjusting market risk should consider the Leuthold Core Investment Fund, Leuthold Asset Allocation Fund, or Leuthold Global Fund. These three Funds have the flexibility built into their disciplines to overlay our short-selling strategies and hedge against market declines when the stock market is viewed as overvalued and vulnerable to a downside correction.

IN CLOSING

Our current U.S. market analysis, via our domestic Major Trend Index, has recently moved back up into positive territory – which, based on the 40+ years history of this work, would normally indicate to us that the stock market has transitioned into a decisively rising trend. However, based on a variety of historical measures we look to as a means of confirming impending transitions, we believe this may instead be an interim bear market rally. There are still major hurdles facing the stock market; most imminently the European crisis, but the U.S. is also struggling with its own deficit issues, and the specter of a global recession is still lurking. Nevertheless, our quantitative market analysis drives our process, and we will abide by the disciplines directing us to increase equity exposure. Because of the many hurdles still present, we are taking a cautiously bullish stance, and will be limiting our increased equity exposure to around 55% for the time being (up from 31% equity exposure as of fiscal year-end September 30, 2011). If our instincts that this may be a bear market rally prove correct, we will again begin building up more defense when our quantitative analysis exhibits enough weakness to point us to the exit as market conditions deteriorate. Over its long history, more often than not our Major Trend Index discipline has been successful in its guidance to adjust our asset allocation equity exposure through the changing market cycles.

We like to remind shareholders that our firm is majority employee-owned and independent; and we are proud to mention that employee-directed investment in Leuthold Funds is at an impressive level. We think this demonstrates the judicious character of the team, as we are firm believers that in view of the volatile and unpredictable nature of the stock market, Leuthold Funds has the vehicles to provide diversification and shelter for one’s long-term, serious money.

| | The Leuthold Funds - 2011 Annual Report | 17 |

We thank you for your support, and welcome you to contact us if you have any questions.

| Sincerely, | | |

| | | |

| | |

| Doug Ramsey, CFA, CMT | | |

| CIO & Co-Portfolio Manager | | |

| | | |

| | |

| Andy Engel, CFA | James Floyd, CFA | Matt Paschke, CFA |

| Co-Portfolio Manager | Co-Portfolio Manager | Co-Portfolio Manager |

| | | |

| | |

| Greg Swenson, CFA | Chun Wang, CFA | David Kurzman |

| Co-Portfolio Manager | Co-Portfolio Manager | Co-Portfolio Manager |

| 18 | The Leuthold Funds - 2011 Annual Report | |

Expense Example – September 30, 2011 (Unaudited)

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, including reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held the entire period (April 1, 2011 – September 30, 2011).

Actual Expenses

The first line of the following table provides information about actual account values and actual expenses. Although the Funds charge no sales load (the Leuthold Core Investment Fund, Leuthold Asset Allocation Fund, Leuthold Global Fund, Leuthold Global Industries Fund, and Leuthold Hedged Equity Fund charge a 2% redemption fee for redemptions made within five business days after a purchase and the Leuthold Global Clean Technology Fund charges a 2% redemption fee for redemptions made within 30 days after a purchase), you will be assessed fees for outgoing wire transfers, returned checks, or stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Funds’ transfer agent. If you request a redemption be made by wire transfer, currently a $15.00 fee is charged by the Funds’ transfer agent. To the extent that the Funds invest in shares of other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which a Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary by fund. These expenses are not included in the following example. The example includes, but is not limited to, management fees, shareholder servicing fees, fund accounting, custody, and transfer agent fees. However, the following example does not include portfolio trading commissions and related expenses, and extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | The Leuthold Funds - 2011 Annual Report | 19 |

Expense Example Tables (Unaudited)

Leuthold Core Investment Fund - Retail Class

| | | Beginning | | | Ending | | | Expenses Paid | |

| | | Account Value | | | Account Value | | | During Period* | |

| | | April 1, 2011 | | | September 30, 2011 | | | April 1, 2011 - September 30, 2011 | |

| Actual** | | $ | 1,000.00 | | | $ | 874.60 | | | $ | 6.02 | |

| Hypothetical (5% return before expenses)*** | | | 1,000.00 | | | | 1,018.65 | | | | 6.48 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.28%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| ** | Excluding dividends and interest on short positions, your actual cost of investment in the Fund would be $5.36 and the Fund’s annualized expense ratio would be 1.14%. |

| *** | Excluding dividends and interest on short positions, your hypothetical cost of investment in the Fund would be $5.77 and the Fund’s annualized expense ratio would be 1.14%. |

Leuthold Core Investment Fund - Institutional Class

| | | Beginning | | | Ending | | | Expenses Paid | |

| | | Account Value | | | Account Value | | | During Period* | |

| | | April 1, 2011 | | | September 30, 2011 | | | April 1, 2011 - September 30, 2011 | |

| Actual** | | $ | 1,000.00 | | | $ | 875.20 | | | $ | 5.45 | |

| Hypothetical (5% return before expenses)*** | | | 1,000.00 | | | | 1,019.25 | | | | 5.87 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.16%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| ** | Excluding dividends and interest on short positions, your actual cost of investment in the Fund would be $4.79 and the Fund’s annualized expense ratio would be 1.02%. |

| *** | Excluding dividends and interest on short positions, your hypothetical cost of investment in the Fund would be $5.16 and the Fund’s annualized expense ratio would be 1.02%. |

Leuthold Asset Allocation Fund - Retail Class

| | | Beginning | | | Ending | | | Expenses Paid | |

| | | Account Value | | | Account Value | | | During Period* | |

| | | April 1, 2011 | | | September 30, 2011 | | | April 1, 2011 - September 30, 2011 | |

| Actual** | | $ | 1,000.00 | | | $ | 886.00 | | | $ | 6.90 | |

| Hypothetical (5% return before expenses)*** | | | 1,000.00 | | | | 1,017.75 | | | | 7.38 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.46%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| ** | Excluding dividends and interest on short positions, your actual cost of investment in the Fund would be $6.24 and the Fund’s annualized expense ratio would be 1.32%. |

| *** | Excluding dividends and interest on short positions, your hypothetical cost of investment in the Fund would be $6.68 and the Fund’s annualized expense ratio would be 1.32%. |

| 20 | The Leuthold Funds - 2011 Annual Report | |

Expense Example Tables (Unaudited)

Leuthold Asset Allocation Fund - Institutional Class

| | | Beginning | | | Ending | | | Expenses Paid | |

| | | Account Value | | | Account Value | | | During Period* | |

| | | April 1, 2011 | | | September 30, 2011 | | | April 1, 2011 - September 30, 2011 | |

| Actual** | | $ | 1,000.00 | | | $ | 887.60 | | | $ | 5.87 | |

| Hypothetical (5% return before expenses)*** | | | 1,000.00 | | | | 1018.85 | | | | 6.28 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.24%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| ** | Excluding dividends and interest on short positions, your actual cost of investment in the Fund would be $5.21 and the Fund’s annualized expense ratio would be 1.10%. |

| *** | Excluding dividends and interest on short positions, your hypothetical cost of investment in the Fund would be $5.57 and the Fund’s annualized expense ratio would be 1.10%. |

Leuthold Global Fund - Retail Class

| | | Beginning | | | Ending | | | Expenses Paid | |

| | | Account Value | | | Account Value | | | During Period* | |

| | | April 1, 2011 | | | September 30, 2011 | | | April 1, 2011 - September 30, 2011 | |

| Actual** | | $ | 1,000.00 | | | $ | 882.00 | | | $ | 7.88 | |

| Hypothetical (5% return before expenses)*** | | | 1,000.00 | | | | 1,016.70 | | | | 8.44 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.67%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| ** | Excluding dividends and interest on short positions, your actual cost of investment in the Fund would be $6.98 and the Fund’s annualized expense ratio would be 1.48%. |

| *** | Excluding dividends and interest on short positions, your hypothetical cost of investment in the Fund would be $7.49 and the Fund’s annualized expense ratio would be 1.48%. |

Leuthold Global Fund - Institutional Class

| | | Beginning | | | Ending | | | Expenses Paid | |

| | | Account Value | | | Account Value | | | During Period* | |

| | | April 1, 2011 | | | September 30, 2011 | | | April 1, 2011 - September 30, 2011 | |

| Actual** | | $ | 1,000.00 | | | $ | 882.80 | | | $ | 7.13 | |

| Hypothetical (5% return before expenses)*** | | | 1,000.00 | | | | 1,017.50 | | | | 7.64 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.51%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| ** | Excluding dividends and interest on short positions, your actual cost of investment in the Fund would be $6.23 and the Fund’s annualized expense ratio would be 1.32%. |

| *** | Excluding dividends and interest on short positions, your hypothetical cost of investment in the Fund would be $6.68 and the Fund’s annualized expense ratio would be 1.32%. |

| | The Leuthold Funds - 2011 Annual Report | 21 |

Expense Example Tables (Unaudited)

Leuthold Select Industries Fund

| | | Beginning | | | Ending | | | Expenses Paid | |

| | | Account Value | | | Account Value | | | During Period* | |

| | | April 1, 2011 | | | September 30, 2011 | | | April 1, 2011 - September 30, 2011 | |

| Actual | | $ | 1,000.00 | | | $ | 772.60 | | | $ | 6.22 | |

| Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.05 | | | | 7.08 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.40%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

Leuthold Global Industries Fund - Retail Class

| | | Beginning | | | Ending | | | Expenses Paid | |

| | | Account Value | | | Account Value | | | During Period* | |

| | | April 1, 2011 | | | September 30, 2011 | | | April 1, 2011 - September 30, 2011 | |

| Actual | | $ | 1,000.00 | | | $ | 778.00 | | | $ | 9.27 | |

| Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,014.64 | | | | 10.50 | |

| * | Expenses are equal to the Fund's annualized expense ratio of 2.08%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

Leuthold Global Industries Fund - Institutional Class

| | | Beginning | | | Ending | | | Expenses Paid | |

| | | Account Value | | | Account Value | | | During Period | |

| | | April 1, 2011 | | | September 30, 2011 | | | April 1, 2011 - September 30, 2011 | |

| Actual | | $ | 1,000.00 | | | $ | 779.10 | | | $ | 8.03 | |

| Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,016.04 | | | | 9.10 | |

| * | Expenses are equal to the Fund's annualized expense ratio of 1.80%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

Leuthold Global Clean Technology Fund - Retail Class

| | | Beginning | | | Ending | | | Expenses Paid | |

| | | Account Value | | | Account Value | | | During Period* | |

| | | April 1, 2011 | | | September 30, 2011 | | | April 1, 2011 - September 30, 2011 | |

| Actual | | $ | 1,000.00 | | | $ | 598.00 | | | $ | 7.85 | |

| Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,015.24 | | | | 9.90 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.96%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| 22 | The Leuthold Funds - 2011 Annual Report | |

Expense Example Tables (Unaudited)

Leuthold Global Clean Technology Fund - Institutional Class

| | | Beginning | | | Ending | | | Expenses Paid | |

| | | Account Value | | | Account Value | | | During Period | |

| | | April 1, 2011 | | | September 30, 2011 | | | April 1, 2011 - September 30, 2011 | |

| Actual | | $ | 1,000.00 | | | $ | 599.20 | | | $ | 6.37 | |

| Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,017.10 | | | | 8.04 | |

| * | Expenses are equal to the Fund's annualized expense ratio of 1.59%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

Leuthold Hedged Equity Fund - Retail Class

| | | Beginning | | | Ending | | | Expenses Paid | |

| | | Account Value | | | Account Value | | | During Period* | |

| | | April 1, 2011 | | | September 30, 2011 | | | April 1, 2011 - September 30, 2011 | |

Actual** | | $ | 1,000.00 | | | $ | 997.60 | | | $ | 15.22 | |

Hypothetical (5% return before expenses)*** | | | 1,000.00 | | | | 1,009.83 | | | | 15.32 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 3.04%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| ** | Excluding dividends and interest on short positions, your actual cost of investment in the Fund would be $11.27 and the Fund’s annualized expense ratio would be 2.25%. |

| *** | Excluding dividends and interest on short positions, your hypothetical cost of investment in the Fund would be $11.36 and the Fund’s annualized expense ratio would be 2.25%. |

Leuthold Hedged Equity Fund - Institutional Class

| | | Beginning | | | Ending | | | Expenses Paid | |

| | | Account Value | | | Account Value | | | During Period* | |

| | | April 1, 2011 | | | September 30, 2011 | | | April 1, 2011 - September 30, 2011 | |

Actual** | | $ | 1,000.00 | | | $ | 998.80 | | | $ | 13.43 | |

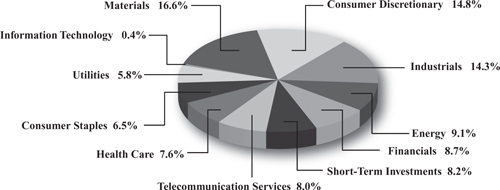

Hypothetical (5% return before expenses)*** | | | 1,000.00 | | | | 1,011.63 | | | | 13.51 | |