UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-09094

(Exact name of registrant as specified in charter)

| 33 S. Sixth Street, Suite 4600, Minneapolis, MN 55402 |

(Address of principal executive offices) (Zip code)

John Mueller

Leuthold Weeden Capital Management

33 S. Sixth Street, Suite 4600, Minneapolis, MN 55402

(Name and address of agent for service)

612-332-9141

Registrant’s telephone number, including area code

Date of fiscal year end: September 30, 2013

Date of reporting period: September 30, 2013

Item 1. Reports to Stockholders.

Annual Report

September 30, 2013

The Leuthold Funds

Leuthold Core Investment Fund

Leuthold Asset Allocation Fund

Leuthold Global Fund

Leuthold Select Industries Fund

Leuthold Global Industries Fund

Grizzly Short Fund

| The Leuthold Funds |

| Table of Contents |

| Letter to Shareholders | 1 |

| | |

| Expense Examples | 14 |

| | |

| Allocation of Portfolio Holdings | 18 |

| | |

| Components of Portfolio Holdings | 21 |

| | |

| Investment Graphs | 23 |

| | |

| Statements of Assets and Liabilities | 34 |

| | |

| Statements of Operations | 38 |

| | |

| Statements of Changes in Net Assets | 42 |

| | |

| Financial Highlights | 48 |

| | |

| Schedule of Investments | |

| | |

| Leuthold Core Investment Fund | 58 |

| | |

| Leuthold Asset Allocation Fund | 69 |

| | |

| Leuthold Global Fund | 75 |

| | |

| Leuthold Select Industries Fund | 85 |

| | |

| Leuthold Global Industries Fund | 88 |

| | |

| Grizzly Short Fund | 93 |

| | |

| Notes to the Financial Statements | 97 |

| | |

| Report of Independent Registered Public Accounting Firm | 114 |

| | |

| Additional Information | 115 |

| | |

| Directors and Officers | 116 |

Dear Fellow Shareholders:

The past twelve months have provided another example of our frequent reminder that the stock market is not the economy. Real U.S. Gross Domestic Product over the last year has grown only +1.6%, just slightly more than half the rate expected by the consensus of economic forecasters one year ago. Prior to this economic recovery, a level of growth this low was generally only experienced immediately before the country fell into recession. But in its often-contrarian way, the U.S. stock market has responded to the economy’s shortfall by rallying +30% from last fall’s lows, bringing the cumulative gain in the S&P 500 from its March 2009 low to +158%. The current cyclical bull market has now lasted 55 months and ranks among the five best of the 16 cyclical bulls since 1932 – even though the accompanying economic recovery has been the weakest of all those recorded over the same period.

During the fiscal year ended September 30, 2013, the Leuthold Core Investment Fund matched the return of the Lipper Flexible Portfolio Funds Index, while the Leuthold Global Fund outperformed the Lipper Global Flexible Funds Index by nearly 4.5%. When compared to all-equity benchmarks, both Funds trailed. The lag versus all-equity benchmarks was largely the consequence of simply not being 100% invested in stocks during a strong market. By design, these Funds’ portfolios will diversify investments across a range of asset classes, and there is a limitation on the amount that can be directed to stocks. Due to this, during strong market upswings, we would not expect these two Funds to match or outperform 100% invested benchmarks. But, it is our objective to outperform these benchmarks over the course of a full market cycle. When the market is in the decline phase of the cycle, these two Funds can make up lost ground because their lower stock exposure reduces their downside risk, versus their respective all-equity benchmarks, and the Funds have the capability of offsetting losses with gains achieved through their equity hedging tactics.

The multi-asset class framework of the Leuthold Asset Allocation Fund helped it to outperform its Blended Benchmark, by about 1%, for the fiscal year. This was achieved chiefly due to the Fund’s strong performance in the last three months, ended September 2013, where it gained 2% more than its benchmark. The Fund was more aggressively positioned all year versus the Blended Benchmark, averaging nearly 60% in equities, whereas the Blended Benchmark maintains 50% exposure to equities. Of that equity exposure, the Fund was overweight in U.S. stocks (about 73% of its equity exposure), versus the Blended Benchmark’s 35% weight to U.S. stocks, which was an additional advantage to the Leuthold Asset Allocation Fund.

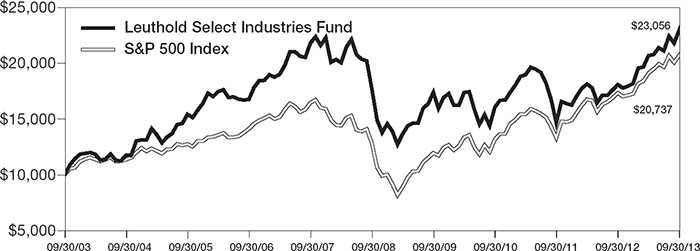

Our domestic long-only equity strategy, the Leuthold Select Industries Fund, considerably outperformed the S&P 500 for the fiscal year with a gain nearly 8% ahead of that benchmark. The market environment continued to improve over the last year and became much more favorable for our investment process. Correlations decreased and group leadership trends became more apparent within our industry selection model. We believe the improved quality of our group selection strategy, and the portfolio construction enhancements that were made in early 2012, helped the Leuthold Select Industries Fund successfully navigate the market environment of the last twelve months. The best performance for the Fund came in the fourth quarter of 2012, and the first and third quarters of 2013, where it outperformed the S&P 500 by 1.0%, 3.1%, and 3.8%, respectively.

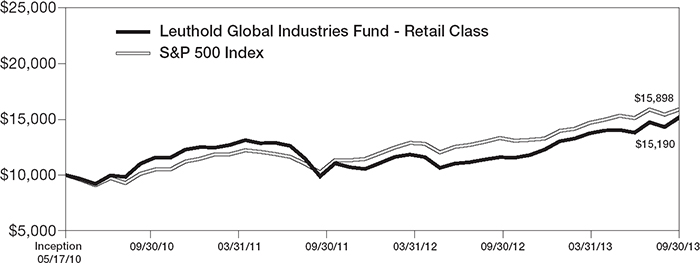

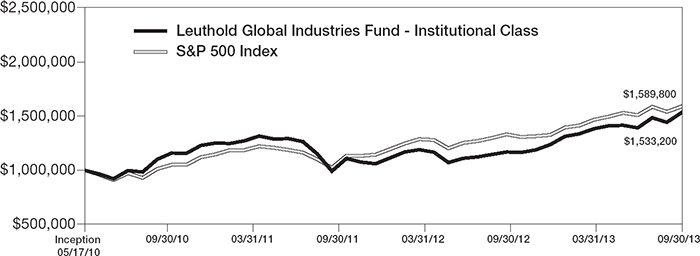

The Leuthold Global Industries Fund followed suit, outperforming its global equity benchmark, the MSCI ACWI (All Country World Index) in all four quarters of the last twelve months. It ended the fiscal year with a gain over 12.5% better than the

| The Leuthold Funds - 2013 Annual Report | 1 |

benchmark. These results are attributable to a combination of the strategy’s selection dynamics, including: consistently successful allocations, both within equity sectors and within industry groups; and strong results from individual stock selection. Specific country investments, at times, contributed an additional boost to results.

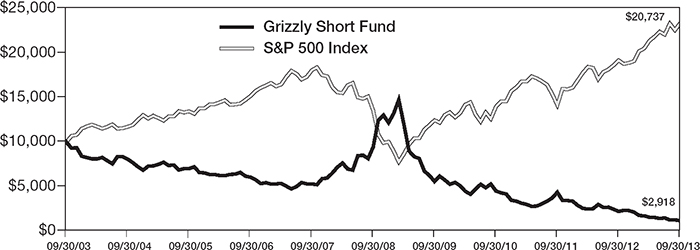

The Grizzly Short Fund outperformed its S&P MidCap 400 benchmark during the fiscal year by losing 5% less than the inverse of the index. The best relative performance came during the first six months of the fiscal year, October 2012 through March 2013, where the Fund mostly benefited from sectors and stocks which it avoided. Specifically, the Fund was underweight Health Care and Financials during October through December, when those areas appeared very strong from both a valuation and price action perspective. From January through March, maintaining the underweight allocation to Health Care, as well as underweighting Consumer Staples, was an advantage because defensive sectors, like these, drove the market’s gains.

Looking Ahead

Even though U.S. valuation measures have begun to look elevated, they’re not yet stretched enough to offset the bullish elements exhibited by our stock market disciplines. Investor sentiment surrounding the stock market seems fairly restrained, particularly given the size of the last twelve months’ gains. The market’s technical picture also remains bullish. Market subgroups we monitor for leading cues – like the Financials, Small Caps, and Transportation stocks – have been making new highs alongside the Dow Jones Industrials and S&P 500, and market breadth measures don’t yet show the narrowing of participation that usually precedes a major market top.

The environment is shaping up as one in which stocks could become even more overvalued before finally topping out for this business cycle. Enthusiasm for U.S. stocks remains constrained, particularly considering the huge four-year gains already on the books and the near-daily occurrence of new highs during much of 2013. Net inflows into U.S. focus equity mutual funds remain depressed, and we suspect there could be a phase of great public participation ahead before the bull market is over.

Foreign equities have badly lagged U.S. equities since early 2011, after largely keeping pace during the first two years of the bull market. Developed country and Emerging Market valuations are much lower than those in the U.S., with some Emerging Market readings bordering on the “undervaluation” zone. Today’s valuation disparity sets the stage for a period of foreign market leadership in the years ahead, assuming that comparative valuation relationships return to some semblance of normalcy. We expect that our global industry analysis will increasingly lead us to these cheap locales, ultimately providing us with higher expected returns from there than we currently estimate for U.S. equities over the next several years. We’re pretty confident this will happen; we just don’t know when. We’ll rely on our quantitative stock and industry group selection models to help us with the timing of this shift, if and when it occurs.

| 2 | The Leuthold Funds - 2013 Annual Report |

FUND OVERVIEWS

Leuthold Core Investment Fund

This Fund opened on November 20, 1995. The strategy is flexible and value-oriented. The Leuthold Core Investment Fund adjusts asset class exposure, depending on market conditions and the economic environment, with the objective of identifying areas that appear poised to outperform while attempting to avoid undue risk. Assets are allocated between stocks, bonds, foreign securities, alternative investments, and money market instruments. The Fund may sell short certain securities in order to hedge exposure to a particular asset class. The Fund’s objective is capital appreciation and income over the long-term, attained through relatively risk averse, prudent investment selection. When the stock market is in a strong uptrend, the Leuthold Core Investment Fund’s diversified portfolio will unlikely match stock returns. However, over a full market cycle, it is our goal to outperform the stock market.

| ● | Leuthold Core Investment Fund uses the Leuthold Select Industries strategy as the primary vehicle for directing its U.S.- traded stock exposure. |

| | |

| ● | Investment Guidelines: 30%-70% equity exposure and 30%-70% fixed income exposure. Certain market conditions may prompt a departure from these guidelines. |

Leuthold Asset Allocation Fund

This Fund opened on May 24, 2006, as a replacement strategy for the Leuthold Core Investment Fund which had hard closed earlier that year. During the latter part of 2012, the Leuthold Asset Allocation Fund was repositioned to reflect an enhanced multi-asset framework, specifically differentiating it from the Leuthold Core Investment Fund as a more broadly diversified product. The strategy attempts to capture the evolving nature of capital markets and return patterns from a multitude of asset classes: stocks, bonds, real estate, commodities, and cash. It will typically have a greater variety of asset class exposure, higher (on average) allocation to alternatives, and a slightly different risk profile than our more equity-focused asset allocation offerings.

| ● | Investment Guidelines: 30%-70% equity exposure and 20%-60% fixed income exposure. Certain market conditions may prompt a departure from these guidelines. |

| | |

| ● | Pursuant to the Prospectus Supplement dated 8/30/13, the Leuthold Asset Allocation Fund assets merged into the Leuthold Core Investment Fund. The merger became effective on November 8, 2013. This action was recommended by the Adviser due to similarities between the investment objectives, investment strategies, risks, and portfolios of the two Funds. In addition, the Investment Adviser believes the acquisition will provide the potential to achieve economies of scale due to the larger combined asset base of the Funds. |

Leuthold Global Fund

This asset allocation strategy opened on April 30, 2008, and can be considered the “global” equivalent of our flagship Leuthold Core Investment Fund. The strategy and objective of this Fund are analogous to that of the Leuthold Core Investment Fund in terms of guiding disciplines, flexibility, asset class exposure, and risk aversion; however, this global version will invest at least 40% of assets in foreign-traded securities. The Leuthold Global Fund invests in U.S. and foreign-traded stocks, bonds, alternative investments, and money market instruments. The Fund may sell short certain securities in order to hedge exposure to a particular asset class.

| The Leuthold Funds - 2013 Annual Report | 3 |

| ● | Leuthold Global Fund uses the Leuthold Global Industries strategy as the primary vehicle for selecting its stock investments. |

| | |

| ● | Investment Guidelines: 30%-70% equity exposure and 30%-70% fixed income exposure. Certain market conditions may prompt a departure from these guidelines. |

Leuthold Select Industries Fund

This Fund opened on June 19, 2000, and unlike our asset allocation strategies, it will maintain 100% long exposure in domestically traded stocks, regardless of market conditions. This attribute results in the potential for considerably higher volatility, higher risk, and the probability that investors will lose money when the stock market declines. The Leuthold Select Industries Fund strategy is a top-down approach, based on industry group rotation, and sector concentrations. Driven by extensive quantitative analysis, the strategy attempts to identify collective areas of strength and emerging leadership opportunities in which to invest.

| ● | This strategy contains more risk as it offers the potential for superior gains. |

Leuthold Global Industries Fund

Launched on May 17, 2010, this Fund’s strategy is an extension of our domestic industry group rotation approach. This global version of our quantitative industry group investing employs many of the same disciplines as our domestic version. The intent is to identify collective areas of strength and emerging leadership opportunities in the global marketplace. This Fund will normally invest at least 40% of its assets in equity securities traded in foreign markets.

| ● | This strategy contains more risk as it offers the potential for superior gains. |

Grizzly Short Fund

Opened June 19, 2000, this is an unleveraged, actively managed Fund that is 100% invested in stocks sold short, intended to profit when stock prices decline. Policy mandates the Grizzly Short Fund target 100% exposure in stocks sold short at all times, even when the stock market is in a rising trend.

| ● | The Grizzly Short Fund maintains approximately equal-weighted short positions in around 60-90 individual stocks, initially selected by a multi-factor quantitative discipline. Each position is monitored daily and subject to a set of short covering disciplines. |

| | |

| ● | Shareholders should anticipate they will most likely lose money investing in this Fund when stock prices are rising. |

The Grizzly Short Fund is a tool for experienced investors, traders, and advisors to employ as a means of tactically moderating risk from stock price fluctuations. It is also used in varying degrees with other multi-faceted portfolio strategies. This is not a Fund for buy and hold investors.

| 4 | The Leuthold Funds - 2013 Annual Report |

ANNUAL PERFORMANCE REVIEW

Leuthold Core Investment Fund

This is our firm’s flagship asset allocation strategy, with $606 million of assets under management. For the fiscal year ended September 30, 2013, the Leuthold Core Investment Fund posted a total return gain of 11.29% (retail share class), about matching the 11.35% total return gain of the Lipper Flexible Portfolio Funds Index. During the same time frame, the all-equity S&P 500 benchmark had a total return gain of 19.34%.

Average net equity exposure during the year was moderately bullish at 57.5%. It ranged from a low of 51% (November/December 2012), to a high of 64% (early April). There were three instances when our market analysis deteriorated to a “neutral” position during the year, thereby triggering an increase to the Fund’s equity hedge. Each of these moves to a neutral reading ultimately reversed back to “positive,” as the stock market recovered to new cyclical highs in all three cases. It is not uncommon to experience this type of volatility in our market analysis during late stage cyclical bull markets.

As noted, the Core Fund matched the performance of the Lipper Flexible Portfolio Funds Index, which is composed of funds that allocate their investments across various asset classes, akin to the Core Fund approach. The Core Fund trailed the all-equity S&P 500 during the fiscal year, but this was not due to disappointing performance from the Select Industries equity allocation (56.7% of assets on average), which contributed a very strong 28.11% gain, outdoing the S&P 500 gain of 19.34% by nearly 9%. The Core Fund’s principal investment strategy requires investments to be allocated across a variety of asset classes, versus being 100% invested in stocks; therefore, the overall underperformance, when compared to the S&P 500 Index, was essentially the result of having a portion of investments in assets other than U.S. stocks. As this year’s results demonstrate, during strong market upswings, the Core Fund’s overall performance is unlikely to keep up with equity returns because it is a portfolio of diversified assets.

For specifics related to the Fund’s U.S.-traded stock investments during the last twelve months, see the performance discussion of the Leuthold Select Industries Fund on subsequent pages.

As noted, there was a small Equity Hedge (average 4.2% position) employed during eleven months of the year, which ranged from a low 1.1% allocation in February, up to a high mark of 8.3% in July. The holding itself posted a big net loss of -20.2%, but due to the minimal size allocation, the effect on overall performance was limited to -1.6%.

The Leuthold Core Investment Fund held an average of 5.1% of assets in Emerging Market (EM) Equities over the last twelve months, which is down from 7.7% last fiscal year, and back in line with our normal long-term base target of 5%. For the fiscal year ended September 30, 2013, the EM equities produced a solid 10.68% gain, far outpacing the MSCI Emerging Market index gain of 1.33% over that time frame.

Within the EM equity allocation, as of the end of September 2013, the portfolio’s highest concentration is in stocks from the Pacific Rim (ex-Japan), at nearly 62% weight. This is followed by the Latin America region (16%), Eastern Europe (13%), and Africa/MidEast (9%). This has generally been the case all year. Over the last twelve months, the largest country exposures have been in China, Brazil, and South Korea, whereas the most significant positive contributors to performance came from China, Thailand, Hong Kong, and Russia. Small detractors to performance at the country level were holdings in Chile, Indonesia, and Mexico.

| The Leuthold Funds - 2013 Annual Report | 5 |

Financials stocks had the heaviest weight within the EM investments during the fiscal year, followed by Information Technology and Consumer Discretionary. The top contributors to performance were these same three sectors. Of the ten broad sectors, only the Utilities exposure had a small negative impact on results.

While our asset allocation strategy’s normal guideline minimum for Fixed Income is 30% of assets, over the last twelve months we maintained a lower average level of 23%, similar to the prior fiscal year. We employ a top-down tactical asset allocation framework within our fixed income exposure, using a multi-factor model to first evaluate “risk,” and determine whether to favor low risk (developed government securities), or higher risk assets (credit). For low risk vehicles, a multi-factor model is used to select between nominal and inflation-linked government securities, whereas the high risk allocation uses a two factor Momentum and Relative Yield model to assess relative attractiveness among the five credit classes.

Attractive fixed income prospects have been generally nonexistent in this interest rate environment. As a result, to attempt to diversify the risks, we spread investments across seven varieties of fixed income, about equally divided between developed government securities and credit. Holdings included: Aggregate Bond Funds, Quality Corporate Bonds, Developed & Emerging Market Sovereign Debt, High Yield Bonds, Treasury Inflation Protected Securities, and Municipal Bonds. Due to the small sizes of the various allocations, none of these holdings were materially additive or detractive to the Fund’s overall results.

There was an average allocation of 4.5% to the Real Estate asset class for nine months of the 2012-2013 fiscal year. Within this allocation there was an emphasis on the Specialized segment and the Office segment, with additional exposure to Retail, Residential, Diversified, and Industrial segments. Our real estate exposure was attained through a package of REITS, versus physical real estate, as REITS allow for greater transparency, efficient portfolio rebalancing, ease of diversification through specialty subsets of properties, and liquidity of the stock market, while offering performance dynamics akin to physical real estate values. This allocation was eliminated from the portfolio in July. During its holding period it returned +6.9%; this contributed only one half of one percent to overall performance, due to the undersized allocation.

We opened the year with a 6% allocation to physical Gold but this was gradually reduced over the course of the year, ending with a 2.6% position. This is a minor holding employed for its hedging role against U.S. dollar depreciation. It was an abysmal year for this precious metal, and our holding lost 24.4%. The overall impact on Fund performance, when taking into account the small size of the allocation, was a detraction of 1%.

Leuthold Asset Allocation Fund

This Fund has assets under management of $248 million. For the fiscal year ended September 30, 2013, the Leuthold Asset Allocation Fund generated a total return gain of 8.86% (retail share class), outperforming the Blended Benchmark’s total return gain of 7.86% over the same time frame. The Blended Benchmark is composed of: 35% S&P 500, 15% MSCI All Country World Index ex-USA, 40% Barclays Aggregate, 5% MSCI REIT Index, and 5% DJ/UBS Commodities Index.

During the latter part of 2012, we repositioned the strategy of the Leuthold Asset Allocation Fund to reflect an enhanced multi-asset framework, specifically differentiating it from the Leuthold Core Investment Fund as a more broadly diversified product. As part of this strategy revamp, the equity management was streamlined into one single portfolio, with top-down tilts driven by our ongoing research efforts. The Blended Benchmark was introduced as a more realistic comparator to the revised approach, versus the fully invested S&P 500.

| 6 | The Leuthold Funds - 2013 Annual Report |

Following the transition to the new strategy in mid-December, the Fund was aggressively positioned, relative to its Blended Benchmark, for the full fiscal year. It upheld an overweight toward Equities and REITS, with a commensurate underweight to Fixed Income and Commodities.

Equity exposure was the principal contributor to the Fund’s positive results for the fiscal year ended September 30, 2013. It maintained average equity exposure of 58.77% during this time, and outperformed its equity benchmark in seven of the twelve months. The most significant positive contributor to equity performance was the Fund’s tilt to overweighting Developed Markets and Growth stocks, versus Emerging Markets and Value stocks. Based on broad equity sector exposure, results were further driven by concentrations in: Health Care, Industrials, Financials, Information Technology, and Consumer Discretionary. The exposure to Telecommunications stocks was the only equity concentration that detracted from performance, at the sector level, during the fiscal year.

Within the Fund’s tilt favoring Developed Markets, it was overweight U.S.-traded stocks, with an average exposure of 73%, compared to the Blended Benchmark’s 35% U.S. stock allocation. This domestic tilt proved beneficial, with U.S. stocks gaining 19.79% since January, well ahead of the 10.47% gain of the rest of the world (MSCI All Country World Index ex-USA). The Fund’s tilt toward Developed Europe and Developed Asian Markets were also beneficial exposures. The most profitable equity investments by country, after the U.S., came from Canada, France, United Kingdom, Ireland, and China.

The Leuthold Asset Allocation Fund’s various Fixed Income investments did not have much overall impact on the Fund’s performance. The current role played by fixed income for this Fund is that of downside protection, and an offset to the higher levels of risk dictated by our positive view of riskier assets such as Equities and REITS.

There was an average of 25% of assets invested across seven segments of fixed income. Holdings included: Quality Corporate Bonds, Aggregate Bond Funds, Developed & Emerging Market Sovereign Debt, Treasury Inflation Protected Securities, High Yield Bonds, and Municipal Bonds. Due to the small sizes of the various allocations, none of these holdings was materially additive or detractive to the Fund’s overall results.

A strategic component of the Leuthold Asset Allocation Fund is to continuously attempt to identify the best diversification opportunities among global capital markets. Within the alternative asset category we have been bullishly positioned in terms of REITS. The favorable stance on the asset class has been driven by our models supporting across asset class relative strength, and the constructive macroeconomic environment. We started the fiscal year with a 4.6% allocation to REITS. Beginning in December, this position was incrementally increased for the next few months, reaching a high near 11%. The holding flourished through April, up nearly 21% total return. Following the initial talk of Federal Reserve tapering, late in the second quarter, risky assets experienced a significant downdraft and we began to tactically cut back REITS, ending the fiscal year with a 6.4% allocation. Volatility in the last five months resulted in giving back nearly half of that early year gain. For the full fiscal year, the REIT allocation was up 11.28%, contributing 0.95% to the Fund’s overall twelve month gain. Holdings here were diversified across a wide variety of sub-industries, including: Hotels, Housing, Office, Retail, Health Care, and Specialty.

The Fund maintained a position in physical Gold, with an average allocation of 4.41% during the fiscal year. This is a minor holding employed for its hedging role against U.S. dollar depreciation. This Gold position lost 29% over the last twelve months, which detracted from the Fund’s overall return by nearly 1.5%.

| The Leuthold Funds - 2013 Annual Report | 7 |

Leuthold Global Fund

This Fund has assets under management of $366 million. It is the global adaptation of the tactical asset allocation disciplines of the Leuthold Core Investment Fund. For the fiscal year ended September 30, 2013, the Leuthold Global Fund produced a total return gain of 14.78% (retail share class), outperforming the Lipper Global Flexible Funds Index total return gain of 10.42%. During the same time frame, the all-equity MSCI ACWI (All Country World Index) had a total return gain of 18.37%.

The Leuthold Global Fund follows the same market analysis disciplines as the Leuthold Core Investment Fund, therefore asset allocation shifts and the timing there of are essentially identical. As with the Core Fund, the Leuthold Global Fund’s average net equity exposure during the year was moderately bullish at 57.6%. It ranged from a low of 51% (November/December 2012), to a high of 63% (early April). There were three instances when our market analysis deteriorated to a “neutral” position during the year, thereby triggering an increase to the Fund’s equity hedge. Each of these moves to a neutral reading ultimately reversed back to “positive,” as the stock market recovered to new cyclical highs in all three cases. It is not uncommon to experience this type of volatility in our market analysis during late stage cyclical bull markets.

As noted, the Global Fund bettered the performance of the Lipper Global Flexible Funds Index, which consists of funds that allocate their investments across various asset classes composed of global securities, akin to the Leuthold Global Fund approach. The Leuthold Global Fund trailed the all-equity MSCI ACWI, but this was not due to disappointing performance from the Global Industries equity allocation (60.7% of assets on average), which contributed an outstanding 33.77% gain, outdoing the MSCI ACWI gain of 18.37% by over 15%. The Leuthold Global Fund’s principal investment strategy requires investments to be allocated across a variety of asset classes, versus being 100% invested in stocks; therefore, the overall underperformance, when compared to the MSCI ACWI, was essentially the result of having a portion of investments in assets other than global stocks. As this year’s results demonstrate, during strong market upswings, the Global Fund’s overall performance is unlikely to keep up with equity returns, because it is a portfolio of diversified assets.

For specifics related to the Fund’s global equities component during the last twelve months, see the performance discussion of the Leuthold Global Industries Fund on subsequent pages.

There was a small Equity Hedge (average 3.2% position) employed during ten months of the year, which ranged from a low 0.7% allocation in January, up to a high mark of 6.7% in July. The holding itself posted a big net loss of -18.5%, but due to the minimal size allocation, the effect on overall performance was limited to -1.2%.

While our strategy’s normal guideline minimum for Fixed Income is 30% of assets, over the last twelve months we maintained a lower average level of 25%. We employ a top-down tactical asset allocation framework within our fixed income exposure, using a multi-factor model to first evaluate “risk,” and determine whether to favor low risk (developed government securities), or higher risk assets (credit). For low risk vehicles, a multi-factor model is used to select between nominal and inflation-linked government securities; whereas the high risk allocation uses a two factor Momentum and Relative Yield model to assess relative attractiveness among the five credit classes.

Attractive fixed income prospects have been generally nonexistent in this interest rate environment. As a result, to attempt to diversify the risks, we spread investments across seven varieties of fixed income, about equally divided between developed government securities and credit. Holdings included: Developed & Emerging Market Sovereign Debt, Quality Corporate Bonds, Aggregate Bond Funds, Municipal Bonds, High Yield Bonds, and Treasury Inflation Protected Securities. Due to the small sizes of the various allocations, none of these holdings were materially additive or detractive to the Fund’s overall results.

| 8 | The Leuthold Funds - 2013 Annual Report |

There was an average allocation of 4.5% to the Real Estate asset class for nine months of the 2012-2013 fiscal year. Within this allocation there was an emphasis on the Specialized segment and the Office segment, with additional exposure to Retail, Residential, Diversified, and Industrial segments. Our real estate exposure was attained through a package of REITS, versus physical real estate, as REITS allow for greater transparency, efficient portfolio rebalancing, ease of diversification through specialty subsets of properties, and liquidity of the stock market, while offering performance dynamics akin to physical real estate values. This allocation was eliminated from the portfolio in July. During its holding period it returned +6.9%; this contributed only one half of one percent to overall performance, due to the undersized allocation.

We opened the year with a 6% allocation to physical Gold but this was gradually reduced over the course of the year, ending with a 2.4% position. This is a minor holding employed for its hedging role against U.S. dollar depreciation. For the year, the allocation averaged out to a 4.1% holding. It was an abysmal year for this precious metal, and our holding lost 25.2%. The impact of this loss, taking into account the small allocation, detracted 1% from the Fund’s overall performance.

Leuthold Select Industries Fund

This all-equity Fund, with total assets under management of $9.8 million, had a strong total return gain of 27.26% for the fiscal year ended September 30, 2013, bettering the S&P 500’s 19.34% total return gain by nearly 8%, and outperforming the 23.15% total return gain of the Lipper Multi-Cap Core Funds Index by just over 4%.

The last twelve months’ market environment was much more favorable for our investment process. Our industry group model gained significant traction, as correlations decreased and group leadership trends became more evident and stronger. After a number of years of struggling with the challenges of high volatility and high correlations among stocks, this past year our industry group approach was clearly back on track and able to identify areas of strength that were sustainable. The Leuthold Select Industries Fund outperformed the S&P 500 by an average of 1.01% in nine of the last twelve months.

Broad sector concentrations in the Fund changed a great deal over the course of the year, although Financials and Industrials, two of the top three weights at the beginning of the year, remained in the top three as of fiscal year end. Information Technology is now the heaviest sector weight, up from fourth a year ago, while Health Care decreased to the fifth position, down from the second heaviest weight a year ago. There was no exposure to Utilities all year, and since late July the Fund has had zero exposure to the Energy, Materials, and Telecommunication Services sectors. This absence of exposure to that number of sectors is unusual, but it is a sign of the presence of robust leadership trends in the marketplace, a state in which our strategy should prosper.

Industrials, Health Care, Financials, and Consumer Discretionary were the most value-added sector concentrations over the last twelve months. Information Technology, Energy, and Consumer Staples were also positive contributors, but to a lesser degree. While there were no sector concentrations that detracted from performance, the exposures (when existent) to Materials and Telecommunication Services had barely traceable contributions, with each offering less than one half of one percent to the Fund’s results.

From an equity industry group perspective, the Leuthold Select Industries Fund’s most beneficial exposure came from investments scattered across a variety of sectors. Among the top contributors were: Airlines, Railroads, Data Processing & Outsourced Services, Consumer Finance, Health Care Facilities, Advertising, Oil & Gas Refining & Marketing, Specialized Finance, Drug Retail, Automotive Retail, and Managed Health Care.

| The Leuthold Funds - 2013 Annual Report | 9 |

As noted, none of the broad sector concentrations were subtractive to performance, but there were some industry group holdings which had relatively significant negative contribution to return: Regional Banks, General Merchandise Stores, Computer Hardware, Biotechnology, and Hypermarkets & Super Centers.

The year’s exposure to foreign-domiciled stocks averaged 14.6% of the equity allocation. This actively fluctuated all year, beginning with 12% exposure in October 2012, and slowly increasing to a high level of 20% by the end of January. From there the exposure incrementally declined to end the year at just over 8%. Of this foreign exposure, Developed Market stocks composed an average of 11%, with Emerging Market stocks at 3% on average.

Leuthold Global Industries Fund

This all-equity Fund, with total assets under management of $14.5 million, had an outstanding total return gain of 30.98% (retail share class) for the fiscal year ended September 30, 2013. Its benchmark comparator, the MSCI ACWI (All Country World Index) returned 18.37% total return, over that time frame, and the Lipper Global Multi-Cap Value Index had a total return gain of 24.71%.

The Leuthold Global Industries Fund outperformed the MSCI ACWI by an average of 1.24% in ten of the last twelve months. The Fund’s quantitative group selection approach does best in periods when there is a strong distinction between winners and losers among equity groups and themes, and despite the continued presence of global macro-driven uncertainties, this past year was very favorable for the strategy.

U.S. stock exposure within the Fund averaged 48% for the year. It migrated down to a low of 44% by the end of January, and then slowly increased to reach a high point of 53% at the end of July, before moving back down to end the fiscal year at 50%. The MSCI ACWI had a steady average exposure of 46% to U.S. stocks, only fluctuating by one percent up/down from there. Of the foreign-traded securities in the Leuthold Global Industries Fund, an average of 84% was invested in Developed Markets, with 16% on average invested in Emerging Market stocks.

Equity exposure in this Fund is determined by selecting the industry groups that appear most attractive according to our quantitative disciplines, and investing in the highest rated stocks from those groups regardless of country of domicile. The traditional approach of first attempting to identify opportunities specific to countries or regions is not part of the equation. We believe that industry group concentrations will generate superior returns over the traditional approach of “country” or “regional” concentrations, because the global economy has become increasingly interdependent.

During the fiscal year ended September 30, 2013, all broad sector exposures had a positive contribution to return. Sectors with the most significant contribution were: Consumer Discretionary, Financials, and Industrials – three of last year’s top four contributors. Each of these sectors was overweight versus the corresponding MSCI ACWI sector exposure, particularly Consumer Discretionary and Financials. At the global industry group level, the best results came from the Fund’s investments in stocks from: Auto Components, Airlines, Reinsurance, Health Care Facilities, Media, and Multi-line Insurance.

We were underweight Health Care, Energy, Consumer Staples, and Information Technology versus the MSCI ACWI sector weights. Despite this, individual stock selection in these sectors was very effective, with two of the sectors outperforming the corresponding index sectors, and the other two only marginally underperforming. Although no overall sector exposure had a negative impact on performance, the Utilities sector was just marginally additive; this was primarily due to having a big underweight, with less than 1% average exposure all year. There were only four industry group investments that had negative

| 10 | The Leuthold Funds - 2013 Annual Report |

contributions to return: Fertilizers & Agricultural Chemicals, Emerging Wireless Telecom Services, Computers & Peripherals, and Household Durables.

During the year, the Fund had investments in 35 countries outside the U.S., with an average of 29 country investments in any given month. Foreign market allocations that were consistently larger weights throughout the year included: Germany, Japan, Canada, France, and the United Kingdom. Exposure to Thailand, Brazil, China, South Africa, and Australia were relatively heavier portfolio exposures initially, but dwindled to minimal or zero weight by year end. Country exposures that conspicuously increased in weight during the year were: South Korea, Taiwan, Sweden, and Switzerland. Performance-wise, the most positive contributors at the country level came from investments in the U.S., Germany, United Kingdom, Thailand, France, Japan, Canada, and Ireland. With the exception of Ireland, our investments associated with these countries were also more value-added than corresponding MSCI ACWI allocations in these countries, which tells us our stock selection within countries was high-quality. Our South Africa exposure was the biggest negative, yet it was so minimal that it detracted less than one half of one percent overall.

As noted above, the country-specific exposures are not deliberate. Rather, they are the by-product of the quantitative stock selection approach used to gain exposure to the attractive global industry groups. This method is uncharacteristic of global investment strategies, where it is customary to target location of interest before selecting securities in which to invest.

Grizzly Short Fund

This Fund is 100% short individual stocks, with assets under management of $95 million. For the fiscal year ended September 30, 2013, the Grizzly Short Fund produced a -22.33% total return loss, outperforming the Lipper Dedicated Short Bias Funds Index loss of -28.87%, and the benchmark S&P MidCap 400 Index, which had total return gain of 27.68% (short-selling the benchmark would have produced a loss of around -28%, which is over 5.5% worse than the Grizzly Short Fund return). Compared to the S&P 500 (+19.34% total return), the Fund lagged the corresponding inverse of that index. Taking into account that the median market capitalization of the Grizzly Short Fund is about $4.0 million, the S&P MidCap 400 Index median market capitalization is $3.4 million, and the S&P 500 median market capitalization is $15.4 million, the Grizzly Short Fund is more comparable to the S&P MidCap 400. Therefore, measured against the S&P MidCap 400, which most resembles the Grizzly Short Fund’s typical stock position, we regard the Fund’s results as value-added over the last twelve months.

At the broad sector level, the Grizzly Short Fund did not have any sector concentrations which produced a positive contribution to return over the last twelve months. On average, the heaviest sector concentrations (Information Technology, Industrials, and Consumer Discretionary) detracted the most from performance, contributing about -13.6% to the Fund’s twelve month loss. Energy, Financials, and Health Care concentrations each detracted from performance by 1% to 1.8%. Unsurprisingly, the sectors contributing the least damage to performance were those with generally lower average weights in the portfolio: Utilities, Telecommunications Services, Materials, and Consumer Staples. Often, the sectors and stocks we avoid are just as important as the ones we target.

Breaking it down by industry groups, there were constructive exposures which provided positive contribution to return (investments which helped to offset the Fund’s losses), and thereby played a role in the Fund’s outperformance versus the S&P MidCap 400. The most noteworthy in this respect were: Diversified Metals & Mining, Precious Metals & Minerals, Computer Storage & Peripherals, Diversified Support Services, Application Software, IT Consulting, Internet Software & Services,

| The Leuthold Funds - 2013 Annual Report | 11 |

Communications Equipment, Oil & Gas Exploration/Production, Coal & Consumable Fuels, Independent Power Producers/Energy Traders, Department Stores, and Apparel Accessories & Luxury Goods. In sum, the productive industry group investments over the last twelve months were concentrated in Materials, Information Technology, Energy, and Consumer Discretionary sectors.

The industry group detractors were concentrated in the Information Technology sector. Interestingly, some of the group contributors on the positive side (listed above) were also significant performance detractors: Internet Software & Services, Application Software, and Systems Software. This imbalance of strength and weakness among stocks belonging to the same industry group is a sign that there is no common trend benefiting the group as a whole. In a similar vein, while some Consumer Discretionary groups had a notable presence in the positive contributor segment, there was also a strong presence from this sector in the performance detractor division, specifically: Internet Retail, Casinos & Gaming, and Specialized Consumer Services.

The Grizzly Short Fund is a highly disciplined methodology, with portfolio positions monitored on a daily basis. High turnover is inherent; sector concentrations and industry group exposures have the potential to fluctuate considerably throughout the year. As opposed to a market capitalization weighted index, such as the S&P MidCap 400 or the S&P 500, the Grizzly Short Fund positions are similarly weighted across the portfolio. Due to this, the Fund is not subject to the idiosyncrasies of being heavily dependent on a handful of stocks that compose an oversized percentage of assets. Additional features of the strategy include policies that trigger specific short-covering action, such as capturing gains and stop-loss tactics, and weighting limitations on sector and sub-industry group concentrations.

When the stock market is in a clearly rising trend, investors should expect the Grizzly Short Fund to lose money. Under those circumstances, the Fund’s goal is to add value over an index short by losing less. Investors who are not experienced in short-selling and adjusting portfolios for changing risk profiles should consider one of our asset allocation funds: the Leuthold Core Investment Fund or the Leuthold Global Fund. These two Funds have equity hedging flexibility built into their disciplines, and they will execute this short-selling strategy alongside their other allocations, when the stock market is viewed as overvalued and vulnerable to a downside correction.

IN CLOSING

As we wrap up the fiscal year, we see strong economic measures and overall healthy underpinnings for the stock market. The ISM Manufacturing Composite averaged 55.8 in the third quarter of 2013, which is consistent with real GDP growth of about 3% annualized. Weekly unemployment claims have fallen to the low 300,000 level, and the unemployment rate has fallen from 9.0% two years ago to a recovery low of 7.3% in August. The Citi Economic Surprise Index trades near the high end of its post-recession range, and finally, the S&P 500 is up 55% in the last two years and +158% since March 2009.

When the market sank to near 30-year valuation lows in the spring of 2009, we certainly didn’t expect it would recover to such elevated levels within the confines of a single cyclical bull market. The last two years have been an impressive, late-cycle move that’s stirred daily controversy over how much of it is “fundamental” versus “ephemeral,” or QE-induced. Unfortunately, that won’t be known until well after the fact.

Cyclical bull market tops typically feature action that is far more diffuse in nature, with groups like Small Caps, Financials, Transportation stocks and Utilities falling away one by one leading into the final S&P 500 high. Of these, currently only the

| 12 | The Leuthold Funds - 2013 Annual Report |

Utilities sector has shown serious relative weakness. When the epitaph on the current bull market is eventually written, the April 30th top in the Dow Jones Utilities may turn out to be the beginning of the end. But we’ll need more negative evidence before we adopt a defensive market stance.

It is primarily the market action work in our disciplined analysis that has kept us invested during the last couple of innings of this bull market, and that work remains bullish today. Therefore, as we begin the new fiscal year, with our stock market disciplines indicating the environment can accommodate additional gains in this cycle, our allocation portfolios will continue to be well-exposed to equities.

Regardless of market direction, our quantitative processes continually monitor an extensive range of market data, and the attractiveness of investments are reassessed and adjusted as these measures dictate. It is our objective that each of our strategies will add value in all market environments.

We are a majority employee-owned, small independent firm. Employee ownership in Leuthold Funds is strong, and all are committed to the firm’s success. We measure our success by our ability to attain steady, market-beating performance over the long term, for the benefit of our shareholders - which includes ourselves.

We welcome you to contact us if you have any questions. Thank you for your support.

Sincerely,

| Doug Ramsey, CFA, CMT |

| CIO & Co-Portfolio Manager |

|  |  |

| Matt Paschke, CFA | Chun Wang, CFA, PRM | Greg Swenson, CFA |

| Co-Portfolio Manager | Co-Portfolio Manager | Co-Portfolio Manager |

| The Leuthold Funds - 2013 Annual Report | 13 |

Expense Example – September 30, 2013 (Unaudited)

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, including reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held the entire period (April 1, 2013 – September 30, 2013).

Actual Expenses

The first line of the following table provides information about actual account values and actual expenses. Although the Funds charge no sales load (the Leuthold Core Investment Fund, Leuthold Asset Allocation Fund, Leuthold Global Fund and Leuthold Global Industries Fund charge a 2% redemption fee for redemptions made within five business days after a purchase), you will be assessed fees for outgoing wire transfers, returned checks, or stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Funds’ transfer agent. If you request a redemption be made by wire transfer, currently a $15.00 fee is charged by the Funds’ transfer agent. To the extent that the Funds invest in shares of other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which a Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary by fund. These expenses are not included in the following example. The example includes, but is not limited to, management fees, shareholder servicing fees, fund accounting, custody, and transfer agent fees. However, the following example does not include portfolio trading commissions and related expenses, and extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| 14 | The Leuthold Funds - 2013 Annual Report |

| The Leuthold Funds |

| Expense Example Tables (Unaudited) |

Leuthold Core Investment Fund - Retail Class

| | | Beginning | | Ending | | Expenses Paid |

| | | Account Value | | Account Value | | During Period* |

| | | April 1, 2013 | | September 30, 2013 | | April 1, 2013 - September 30, 2013 |

| Actual** | | $ | 1,000.00 | | | $ | 1,035.50 | | | $ | 6.43 | |

| Hypothetical (5% return before expenses)*** | | | 1,000.00 | | | | 1,018.78 | | | | 6.38 | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.26%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period.

** Excluding dividends and interest on short positions, your actual cost of investment in the Fund would be $5.97 and the Fund's annualized expense ratio would be 1.17%.

*** Excluding dividends and interest on short positions, your hypothetical cost of investment in the Fund would be $5.92 and the Fund's annualized expense ratio would be 1.17%.

Leuthold Core Investment Fund - Institutional Class

| | | Beginning | | Ending | | Expenses Paid |

| | | Account Value | | Account Value | | During Period* |

| | | April 1, 2013 | | September 30, 2013 | | April 1, 2013 - September 30, 2013 |

| Actual** | | $ | 1,000.00 | | | $ | 1,036.00 | | | $ | 5.92 | |

| Hypothetical (5% return before expenses)*** | | | 1,000.00 | | | | 1,019.28 | | | | 5.87 | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.16%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period.

** Excluding dividends and interest on short positions, your actual cost of investment in the Fund would be $5.41 and the Fund's annualized expense ratio would be 1.06%.

*** Excluding dividends and interest on short positions, your hypothetical cost of investment in the Fund would be $5.37 and the Fund's annualized expense ratio would be 1.06%.

Leuthold Asset Allocation Fund - Retail Class

| | | Beginning | | Ending | | Expenses Paid |

| | | Account Value | | Account Value | | During Period* |

| | | April 1, 2013 | | September 30, 2013 | | April 1, 2013 - September 30, 2013 |

| Actual | | $ | 1,000.00 | | | $ | 1,034.10 | | | $ | 6.58 | |

| Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.63 | | | | 6.53 | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.29%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period.

Leuthold Asset Allocation Fund - Institutional Class

| | | Beginning | | Ending | | Expenses Paid |

| | | Account Value | | Account Value | | During Period* |

| | | April 1, 2013 | | September 30, 2013 | | April 1, 2013 - September 30, 2013 |

| Actual | | $ | 1,000.00 | | | $ | 1,034.90 | | | $ | 6.02 | |

| Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,019.18 | | | | 5.97 | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.18%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period.

| The Leuthold Funds - 2013 Annual Report | 15 |

| The Leuthold Funds | |

| Expense Example Tables (Unaudited) | |

Leuthold Global Fund - Retail Class

| | | Beginning | | Ending | | Expenses Paid |

| | | Account Value | | Account Value | | During Period* |

| | | April 1, 2013 | | September 30, 2013 | | April 1, 2013 - September 30, 2013 |

| Actual** | | $ | 1,000.00 | | | $ | 1,043.60 | | | $ | 8.30 | |

| Hypothetical (5% return before expenses)*** | | | 1,000.00 | | | | 1,016.98 | | | | 8.19 | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.62%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period.

** Excluding dividends and interest on short positions, your actual cost of investment in the Fund would be $7.68 and the Fund’s annualized expense ratio would be 1.50%.

*** Excluding dividends and interest on short positions, your hypothetical cost of investment in the Fund would be $7.58 and the Fund's annualized expense ratio would be 1.50%.

Leuthold Global Fund - Institutional Class

| | | Beginning | | Ending | | Expenses Paid |

| | | Account Value | | Account Value | | During Period* |

| | | April 1, 2013 | | September 30, 2013 | | April 1, 2013 - September 30, 2013 |

| Actual** | | $ | 1,000.00 | | | $ | 1,044.80 | | | $ | 7.38 | |

| Hypothetical (5% return before expenses)*** | | | 1,000.00 | | | | 1,017.88 | | | | 7.28 | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.44%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period.

** Excluding dividends and interest on short positions, your actual cost of investment in the Fund would be $6.72 and the Fund's annualized expense ratio would be 1.31%.

*** Excluding dividends and interest on short positions, your hypothetical cost of investment in the Fund would be $6.63 and the Fund's annualized expense ratio would be 1.31%.

Leuthold Select Industries Fund

| | | Beginning | | Ending | | Expenses Paid |

| | | Account Value | | Account Value | | During Period* |

| | | April 1, 2013 | | September 30, 2013 | | April 1, 2013 - September 30, 2013 |

| Actual | | $ | 1,000.00 | | | $ | 1,112.20 | | | $ | 8.47 | |

| Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,017.08 | | | | 8.09 | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.60%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period.

| 16 | The Leuthold Funds - 2013 Annual Report |

| The Leuthold Funds | |

| Expense Example Tables (Unaudited) | |

Leuthold Global Industries Fund - Retail Class

| | | Beginning | | Ending | | Expenses Paid |

| | | Account Value | | Account Value | | During Period* |

| | | April 1, 2013 | | September 30, 2013 | | April 1, 2013 - September 30, 2013 |

| Actual | | $ | 1,000.00 | | | $ | 1,105.50 | | | $ | 10.29 | |

| Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,015.32 | | | | 9.85 | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.95%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period.

Leuthold Global Industries Fund - Institutional Class

| | | Beginning | | Ending | | Expenses Paid |

| | | Account Value | | Account Value | | During Period* |

| | | April 1, 2013 | | September 30, 2013 | | April 1, 2013 - September 30, 2013 |

| Actual | | $ | 1,000.00 | | | $ | 1,107.30 | | | $ | 8.98 | |

| Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,016.58 | | | | 8.59 | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.70%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period.

Grizzly Short Fund

| | | Beginning | | Ending | | Expenses Paid |

| | | Account Value | | Account Value | | During Period* |

| | | April 1, 2013 | | September 30, 2013 | | April 1, 2013 - September 30, 2013 |

Actual** | | $ | 1,000.00 | | | $ | 902.30 | | | $ | 15.83 | |

Hypothetical (5% return before expenses)*** | | | 1,000.00 | | | | 1,008.45 | | | | 16.72 | |

* Expenses are equal to the Fund’s annualized expense ratio of 3.32%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period.

** Excluding dividends and interest on short positions, your actual cost of investment in the Fund would be $7.25 and the Fund's annualized expense ratio would be 1.52%.

*** Excluding dividends and interest on short positions, your hypothetical cost of investment in the Fund would be $7.65 and the Fund's annualized expense ratio would be 1.52%.

| The Leuthold Funds - 2013 Annual Report | 17 |

| The Leuthold Funds |

| (Unaudited) |

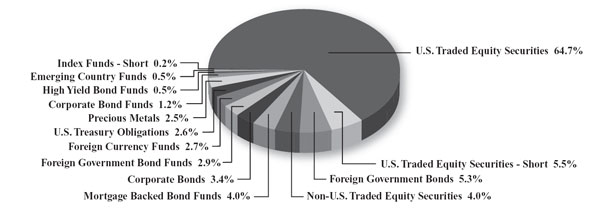

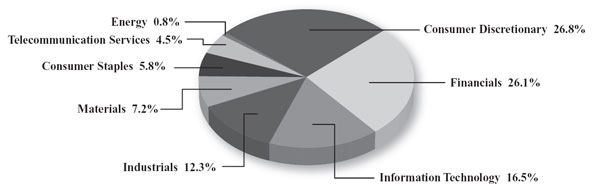

Leuthold Core Investment Fund

Allocation of Portfolio Holdings

September 30, 2013*

Leuthold Asset Allocation Fund

Allocation of Portfolio Holdings

September 30, 2013*

| | | *Excludes short-term investments less than 5% of net assets. |

| 18 | The Leuthold Funds - 2013 Annual Report | |

| The Leuthold Funds |

| (Unaudited) |

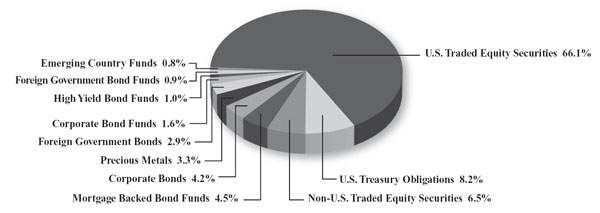

Leuthold Global Fund

Allocation of Portfolio Holdings

September 30, 2013

Leuthold Select Industries Fund

Allocation of Portfolio Holdings

September 30, 2013*

| *Excludes short-term investments less than 5% of net assets. | | |

| | The Leuthold Funds - 2013 Annual Report | 19 |

| The Leuthold Funds |

| (Unaudited) |

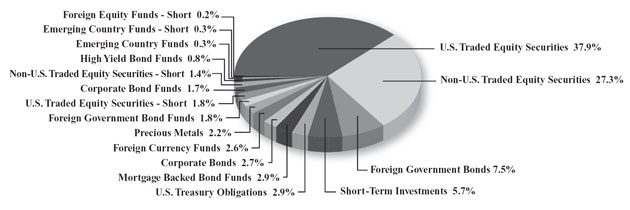

Leuthold Global Industries Fund

Allocation of Portfolio Holdings

September 30, 2013*

Grizzly Short Fund

Allocation of Portfolio Holdings

September 30, 2013*

| | | *Excludes short-term investments less than 5% of net assets. |

| 20 | The Leuthold Funds - 2013 Annual Report | |

| Leuthold Core Investment Fund (Unaudited) | |

| Components of Portfolio Holdings* | | Fair Value | |

| U.S. Traded Equity Securities | | $ | 378,287,542 | |

| U.S. Traded Equity Securities - Short | | | 31,807,214 | |

| Foreign Government Bonds | | | 31,136,373 | |

| Non-U.S. Traded Equity Securities | | | 23,140,328 | |

| Mortgage Backed Bond Funds | | | 23,028,993 | |

| Corporate Bonds | | | 19,877,777 | |

| Foreign Government Bond Funds | | | 16,849,119 | |

| Foreign Currency Funds | | | 15,930,618 | |

| U.S. Treasury Obligations | | | 15,284,334 | |

| Precious Metals | | | 14,648,492 | |

| Corporate Bond Funds | | | 7,165,594 | |

| High Yield Bond Funds | | | 3,061,727 | |

| Emerging Country Funds | | | 2,997,500 | |

| Index Funds - Short | | | 1,163,982 | |

| Total: | | $ | 584,379,593 | |

| | | | | |

| Leuthold Asset Allocation Fund (Unaudited) | |

| Components of Portfolio Holdings* | | Fair Value | |

| U.S. Traded Equity Securities | | $ | 158,914,747 | |

| U.S. Treasury Obligations | | | 19,710,437 | |

| Non-U.S. Traded Equity Securities | | | 15,662,702 | |

| Mortgage Backed Bond Funds | | | 10,854,979 | |

| Corporate Bonds | | | 10,026,071 | |

| Precious Metals | | | 7,958,550 | |

| Foreign Government Bonds | | | 7,070,423 | |

| Corporate Bond Funds | | | 3,883,759 | |

| High Yield Bond Funds | | | 2,391,748 | |

| Foreign Government Bond Funds | | | 2,056,200 | |

| Emerging Country Funds | | | 2,025,166 | |

| Total: | | $ | 240,554,782 | |

| | | | |

| Leuthold Global Fund (Unaudited) | | | |

| Components of Portfolio Holdings | | Fair Value | |

| U.S. Traded Equity Securities | | $ | 137,999,291 | |

| Non-U.S. Traded Equity Securities | | | 99,471,679 | |

| Foreign Government Bonds | | | 27,422,727 | |

| Short-Term Investments | | | 20,926,701 | |

| U.S. Treasury Obligations | | | 10,660,585 | |

| Mortgage Backed Bond Funds | | | 10,486,338 | |

| Corporate Bonds | | | 9,697,854 | |

| Foreign Currency Funds | | | 9,456,414 | |

| Precious Metals | | | 7,943,138 | |

| Foreign Government Bond Funds | | | 6,739,046 | |

| U.S. Traded Equity Securities - Short | | | 6,535,934 | |

| Corporate Bond Funds | | | 6,083,061 | |

| Non-U.S. Traded Equity Securities - Short | | | 5,102,087 | |

| High Yield Bond Funds | | | 3,084,138 | |

| Emerging Country Funds | | | 1,041,168 | |

| Emerging Country Funds - Short | | | 982,648 | |

| Foreign Equity Funds - Short | | | 817,022 | |

| Total: | | $ | 364,449,831 | |

| | | | | |

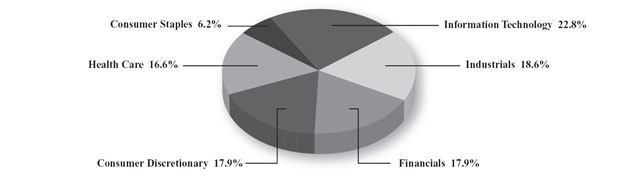

| Leuthold Select Industries Fund (Unaudited) | |

| Components of Portfolio Holdings* | | Fair Value | |

| Information Technology | | $ | 2,207,487 | |

| Industrials | | | 1,796,808 | |

| Financials | | | 1,725,984 | |

| Consumer Discretionary | | | 1,725,443 | |

| Health Care | | | 1,602,446 | |

| Consumer Staples | | | 598,679 | |

| Total: | | $ | 9,656,847 | |

| *Excludes short-term investments less than 5% of net assets. | | |

| | The Leuthold Funds - 2013 Annual Report | 21 |

| Leuthold Global Industries Fund (Unaudited) | |

| Components of Portfolio Holdings* | | Fair Value | |

| Consumer Discretionary | | $ | 3,758,845 | |

| Financials | | | 3,654,159 | |

| Information Technology | | | 2,311,924 | |

| Industrials | | | 1,717,727 | |

| Materials | | | 1,005,022 | |

| Consumer Staples | | | 816,822 | |

| Telecommunication Services | | | 637,136 | |

| Energy | | | 106,420 | |

| Total: | | $ | 14,008,055 | |

| Grizzly Short Fund (Unaudited) | | | | |

| Components of Portfolio Holdings* | | Fair Value | |

| Information Technology | | $ | 16,301,128 | |

| Financials | | | 15,157,229 | |

| Energy | | | 13,426,188 | |

| Materials | | | 9,874,924 | |

| Industrials | | | 8,820,424 | |

| Consumer Discretionary | | | 7,401,419 | |

| Consumer Staples | | | 5,923,877 | |

| Utilities | | | 5,092,609 | |

| Health Care | | | 4,121,476 | |

| Telecommunication Services | | | 1,480,464 | |

| Total: | | $ | 87,599,738 | |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

| | | *Excludes short-term investments less than 5% of net assets. |

| 22 | The Leuthold Funds - 2013 Annual Report | |

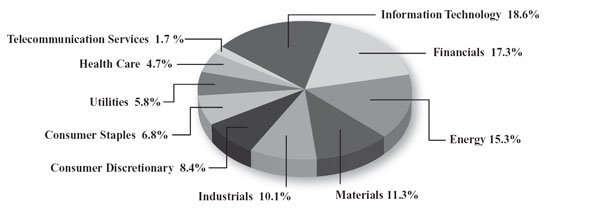

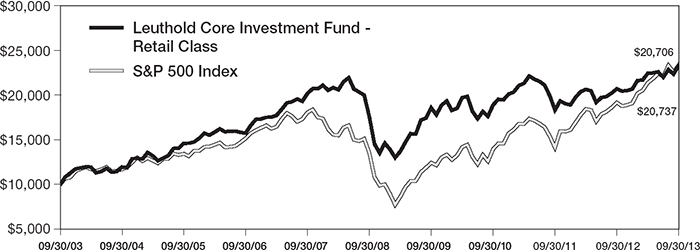

| Leuthold Core Investment Fund - Retail Class | |

| (Unaudited) | |

Average Annual Rate of Return For Periods Ended

September 30, 2013

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year |

| Leuthold Core Investment Fund - Retail Class | | | 11.29 | % | | | 6.47 | % | | | 5.16 | % | | | 7.55 | % |

| Lipper Flexible Portfolio Funds Index | | | 11.35 | % | | | 9.64 | % | | | 8.21 | % | | | 7.02 | % |

| S&P 500 Index | | | 19.34 | % | | | 16.27 | % | | | 10.02 | % | | | 7.57 | % |

A $10,000 Investment in the Leuthold Core Investment Fund – Retail Class

The Lipper Flexible Portfolio Funds Index is composed of funds that allocate investments across various asset classes with a focus on total return, as defined by Lipper.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries.

This chart assumes an initial gross investment of $10,000 made on 9/30/03. Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

The Leuthold Funds - 2013 Annual Report 23 |

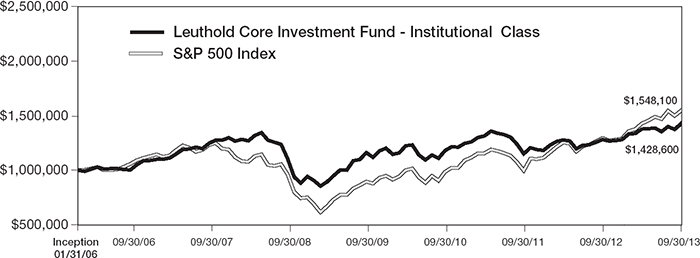

| Leuthold Core Investment Fund - Institutional Class | |

| (Unaudited) | |

Average Annual Rate of Return For Periods Ended

September 30, 2013

| | | 1 Year | | 3 Year | | 5 Year | | Since Inception |

| Leuthold Core Investment Fund - | | | | | | | | | | | | |

| Institutional Class | | | 11.42 | % | | | 6.57 | % | | | 5.28 | % | | | 4.76 | % |

| Lipper Flexible Portfolio Funds Index | | | 11.35 | % | | | 9.64 | % | | | 8.21 | % | | | 5.44 | % |

| S&P 500 Index | | | 19.34 | % | | | 16.27 | % | | | 10.02 | % | | | 5.87 | % |

A $1,000,000 Investment in the Leuthold Core Investment Fund – Institutional Class

The Lipper Flexible Portfolio Funds Index is composed of funds that allocate investments across various asset classes with a focus on total return, as defined by Lipper.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries.

This chart assumes an initial gross investment of $1,000,000 made on 1/31/06 (commencement of operations). Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

24 The Leuthold Funds - 2013 Annual Report |

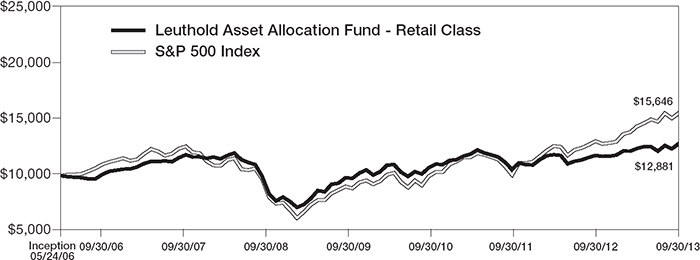

| Leuthold Asset Allocation Fund - Retail Class | |

| (Unaudited) | |

Average Annual Rate of Return For Periods Ended

September 30, 2013

| | | 1 Year | | 3 Year | | 5 Year | | Since Inception |

| Leuthold Asset Allocation Fund - Retail Class | | | 8.86 | % | | | 6.27 | % | | | 5.31 | % | | | 3.50 | % |

| Lipper Flexible Portfolio Funds Index | | | 11.35 | % | | | 9.64 | % | | | 8.21 | % | | | 5.80 | % |

| Blended Benchmark | | | 7.86 | % | | | 8.43 | % | | | 7.35 | % | | | 5.65 | % |

| S&P 500 Index | | | 19.34 | % | | | 16.27 | % | | | 10.02 | % | | | 6.28 | % |

A $10,000 Investment in the Leuthold Asset Allocation Fund – Retail Class

The Lipper Flexible Portfolio Funds Index is composed of funds that allocate investments across various asset classes with a focus on total return, as defined by Lipper.

The Blended Benchmark is made up of 40% of the Barclays Aggregate Bond Index, 35% of the S&P 500 Index, 15% of the MSCI AC World Index ex USA, 5% of the Dow Jones-UBS Commodity Index and 5% of the MSCI US REIT Index. The Barclays Aggregate Bond Index covers the USD-denominated, investment-grade, fixed-rate, taxable bond market of SEC-registered securities. The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries. MSCI AC World Index ex USA is a market capitalization weighted index designed to provide a broad measure of equity-market performance throughout the world. The Dow Jones-UBS Commodity Index is a broadly diversified index that allows investors to track commodity futures through a single, simple measure. The MSCI US REIT Index broadly and fairly represents the equity REIT opportunity set with proper investability screens to ensure that the index is investable and replicable. The index represents approximately 85% of the US REIT universe.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries.

This chart assumes an initial gross investment of $10,000 made on 5/24/06 (commencement of operations). Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

The Leuthold Funds - 2013 Annual Report 25 |

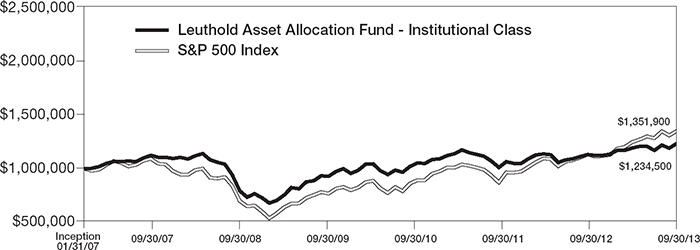

| Leuthold Asset Allocation Fund - Institutional Class | |

| (Unaudited) | |

Average Annual Rate of Return For Periods Ended

September 30, 2013

| | | 1 Year | | 3 Year | | 5 Year | | Since Inception |

| Leuthold Asset Allocation Fund - | | | | | | | | | | | | |

| Institutional Class | | | 9.06 | % | | | 6.54 | % | | | 5.58 | % | | | 3.21 | % |

| Lipper Flexible Portfolio Funds Index | | | 11.35 | % | | | 9.64 | % | | | 8.21 | % | | | 4.70 | % |

| Blended Benchmark | | | 7.86 | % | | | 8.43 | % | | | 7.35 | % | | | 4.49 | % |

| S&P 500 Index | | | 19.34 | % | | | 16.27 | % | | | 10.02 | % | | | 4.63 | % |

A $1,000,000 Investment in the Leuthold Asset Allocation Fund – Institutional Class

The Lipper Flexible Portfolio Funds Index is composed of funds that allocate investments across various asset classes with a focus on total return, as defined by Lipper.

The Blended Benchmark is made up of 40% of the Barclays Aggregate Bond Index, 35% of the S&P 500 Index, 15% of the MSCI AC World Index ex USA, 5% of the Dow Jones-UBS Commodity Index and 5% of the MSCI US REIT Index. The Barclays Aggregate Bond Index covers the USD-denominated, investment-grade, fixed-rate, taxable bond market of SEC-registered securities. The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries. MSCI AC World Index ex USA is a market capitalization weighted index designed to provide a broad measure of equity-market performance throughout the world. The Dow Jones-UBS Commodity Index is a broadly diversified index that allows investors to track commodity futures through a single, simple measure. The MSCI US REIT Index broadly and fairly represents the equity REIT opportunity set with proper investability screens to ensure that the index is investable and replicable. The index represents approximately 85% of the US REIT universe.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries.

This chart assumes an initial gross investment of $1,000,000 made on 1/31/07 (commencement of operations). Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

26 The Leuthold Funds - 2013 Annual Report |

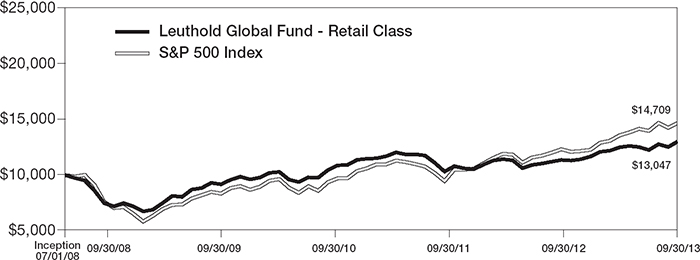

| Leuthold Global Fund - Retail Class | |

| (Unaudited) | |

Average Annual Rate of Return For Periods Ended

September 30, 2013

| | | 1 Year | | 3 Year | | 5 Year | | Since Inception |

| Leuthold Global Fund - Retail Class | | | 14.78 | % | | | 7.64 | % | | | 8.70 | % | | | 5.20 | % |

| Lipper Global Flexible Funds Index | | | 10.42 | % | | | 7.16 | % | | | 6.02 | % | | | 3.27 | % |

| MSCI ACWI | | | 18.37 | % | | | 10.81 | % | | | 8.30 | % | | | 4.40 | % |

| S&P 500 Index | | | 19.34 | % | | | 16.27 | % | | | 10.02 | % | | | 7.63 | % |

A $10,000 Investment in the Leuthold Global Fund - Retail Class

The Lipper Global Flexible Funds Index is an equally weighted representation of the largest funds in the Lipper Global Flexible Portfolio Funds category. These funds allocate their investments across various asset classes, including both domestic and foreign stocks, bonds, and money market instruments, with a focus on total return.

The MSCI ACWI (All Country World Index) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. As of December 31, 2012, the MSCI ACWI consisted of 45 country indices comprising 24 developed and 21 emerging market country indices. The developed market country indices included are: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States. The emerging market country indices included are: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries.

This chart assumes an initial gross investment of $10,000 made on 7/1/08 (commencement of operations). Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

The Leuthold Funds - 2013 Annual Report 27 |

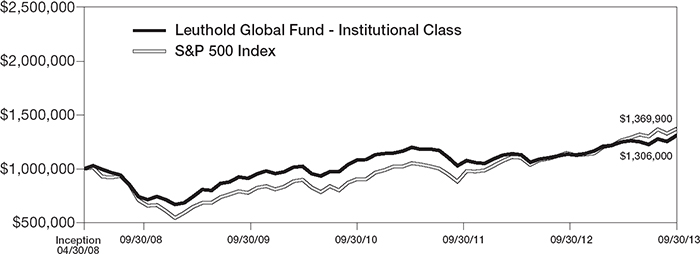

| Leuthold Global Fund - Institutional Class | |

| (Unaudited) | |

Average Annual Rate of Return For Periods Ended

September 30, 2013

| | | 1 Year | | 3 Year | | 5 Year | | Since Inception |

| Leuthold Global Fund - Institutional Class | | | 15.08 | % | | | 7.88 | % | | | 8.94 | % | | | 5.05 | % |

| Lipper Global Flexible Funds Index | | | 10.42 | % | | | 7.16 | % | | | 6.02 | % | | | 2.24 | % |

| MSCI ACWI | | | 18.37 | % | | | 10.81 | % | | | 8.30 | % | | | 2.80 | % |