Washington, D.C. 20549

Leuthold Funds, Inc.

33 S. Sixth Street, Suite 4600, Minneapolis, MN 55402

33 S. Sixth Street, Suite 4600, Minneapolis, MN 55402

Item 1. Reports to Stockholders.

Annual Report

September 30, 2014

The Leuthold Funds

Leuthold Core Investment Fund

Retail Class Shares LCORX

Institutional Class Shares LCRIX

Leuthold Global Fund

Retail Class Shares GLBLX

Institutional Class Shares GLBIX

Leuthold Select Industries Fund LSLTX

Leuthold Global Industries Fund

Retail Class Shares LGINX

Institutional Class Shares LGIIX

Grizzly Short Fund GRZZX

| The Leuthold Funds |

| Table of Contents |

| Letter to Shareholders | | 1 |

| | | |

| Expense Examples | | 14 |

| | | |

| Allocation of Portfolio Holdings | | 17 |

| | | |

| Components of Portfolio Holdings | | 20 |

| | | |

| Investment Graphs | | 21 |

| | | |

| Statements of Assets and Liabilities | | 30 |

| | | |

| Statements of Operations | | 34 |

| | | |

| Statements of Changes in Net Assets | | 38 |

| | | |

| Financial Highlights | | 43 |

| | | |

| Schedule of Investments | | |

| | | |

| Leuthold Core Investment Fund | | 51 |

| | | |

| Leuthold Global Fund | | 63 |

| | | |

| Leuthold Select Industries Fund | | 73 |

| | | |

| Leuthold Global Industries Fund | | 77 |

| | | |

| Grizzly Short Fund | | 82 |

| | | |

| Notes to the Financial Statements | | 87 |

| | | |

| Report of Independent Registered Public Accounting Firm | | 102 |

| | | |

| Additional Information | | 103 |

| | | |

| Directors and Officers | | 104 |

Dear Fellow Shareholders:

It’s often said that the best bull markets surprise even the bulls, and the current one has certainly done that. Five years ago, when this bull market commenced, we didn’t even consider that the NASDAQ could possibly reach 5000 during the advance; on September 2, 2014, it closed within 8% of that target. Another milestone – the inflation-adjusted S&P 500 peak, recorded in March 2000, looms just 3.3% above its September 30, 2014, close. (At its September 18th high, it was just 1.3% short of that milestone.)

Our disciplined, quantitative market analysis kept us in harmony with the market advance for the majority of the last twelve months. In July our indicators began to deteriorate, a signal to us that a near-term setback was at hand. The combination of less Fed liquidity, elevated sentiment readings, and internally divergent stock market action all pointed to elevated risks.

While we expected a near-term correction, persistent strength in most stock market breadth measures in early September made it difficult to argue that a final bull market high was imminent. The NYSE Daily Advance/Decline Line joined the S&P 500 in record high territory on September 5th, and historically, such a “breadth confirmation” suggests a final bull market high is not likely for three to four more months, at a minimum. Hence, chances were good that any market decline would be measured in weeks (not months) and contained within the parameters of either a shallow (under 7%) or intermediate (7-12%) correction, before commencing to new – (and final?) – highs for this bull market cycle.

In the ensuing weeks, the S&P 500, propped up by mega cap stocks, experienced a loss of 1.4% for the month of September 2014, the close of our fiscal year. Our worry, however, is the weakness of Mid Cap, and especially Small Cap stocks. The trivial loss for the S&P 500 in September disguised the plight of the “average stock” performance, and that of smaller cap indices, which ranged from losses of between 4.6% (S&P 400 MidCap) to 6.1% (Russell 2000). Most active managers, including us, tend to be under-exposed to mega cap stocks and therefore experienced equity losses in September along the lines of the “average stock.”

There has also been pronounced underperformance in equal-weighted measures in relation to capweighted ones, all across the capitalization spectrum – a reason the indexes have recently become so difficult for managers to beat. While Mid and Small Cap equal-weighted averages have shown a weakening trend throughout 2014, the underperformance of the equal-weighted S&P 500 is a newer development. All three equal-weighted measures experienced a free-fall in September. Yet, bull markets can persist for an extended time in the face of Small Cap underperformance. (Does 1995-1999 ring a bell?)

In the end, neither the duration nor the extent of a cyclical bull move can be projected in advance. We will continue to focus our analyses on current conditions, such as valuations, Fed policy, inflation pressures, investor sentiment, and stock market action itself. These disciplines helped us stay aboard a bull that far exceeded our expectations, and currently they are indicating we may be poised for a healthy near-term correction. Nonetheless, while the signs are not as robust as earlier in the year, the five-plus-year-old upswing likely has a little more life left.

During the fiscal year ended September 30, 2014, the Leuthold Core Investment Fund performance surpassed the return of its peer average as measured by the Lipper Flexible Portfolio Funds Index. The Leuthold Global Fund had solid results, but not

| The Leuthold Funds - 2014 Annual Report | 1 |

as strong as the Leuthold Core Investment Fund; foreign markets have trailed the U.S. stock market over the past year. Predictably, when compared to all-equity benchmarks in a strong year for stocks, both Funds trailed. As with last year, the performance gap between these tactical asset allocation funds versus all-equity benchmarks is explained by the Prospectus mandate which caps the Funds’ upper limit on stock market exposure at 70%. By the same token, the Funds’ maximum exposure threshold, and the flexibility to tactically lower equity exposure further, reduces downside risk during market declines. This allows the occasion for the Funds to make up the ground they lost against all-equity benchmarks during the stronger market advances. Considering the advanced age (5+ years) of the bull market, and some of the greatest bull market gains in history, the “catch up” phase for these tactical strategies is getting closer.

Both the Leuthold Select Industries Fund and the Leuthold Global Industries Fund (long-only equities) were strong performers for the first nine months of the fiscal year, each leading their benchmark comparators by between 400 – 700 basis points through June. Their results reflected the perpetuation of strong group leadership trends that were established in the prior fiscal year. The last three months of the year posed more of a challenge, especially September, when the “average stock” suffered a serious breakdown. During that time, the Leuthold Select Industries Fund and the Leuthold Global Industries Fund forfeited their performance advantage against their mega cap benchmarks, the S&P 500 and MSCI All Country World Index, respectively, each ending the year with performance about on par comparatively. Versus their Lipper peer fund index benchmarks, during the last three months of the fiscal year, Leuthold Select Industries and Leuthold Global Industries Funds also lost some of their performance edge, but overall preserved their leadership positions over those peer fund indices for the full twelve months ended September 30th.

The Grizzly Short Fund had mixed performance against its benchmarks for the 2013-2014 fiscal year. Its most comparable benchmark based on market capitalization is the inverse of the S&P 400 MidCap Index, which outperformed by losing 2.4% less than the Grizzly Short Fund. However, when compared to its peer fund group, the Lipper Dedicated Short Bias Funds Index, the Grizzly Short Fund outperformed by 1,023 basis points, and the Fund also outdid the mega cap S&P 500 (inverse benchmark) by over 550 basis points. These variable fiscal year comparisons of the Grizzly Short Fund results against several benchmarks illustrate how severely and suddenly the market’s seemingly uniform strength broke down. Especially in September, as noted earlier, the Small Cap, Mid Cap, and average stock experienced a free-fall while the mega cap S&P 500 survived relatively unscathed. The Grizzly Short Fund results compared so much more favorably against the S&P 500 than the S&P 400 MidCap because those short-selling the mega cap index had much less opportunity to profit from declining prices compared to those, like the Grizzly Short Fund, with smaller capitalization characteristics.

Following, we review the results of each Leuthold Fund strategy in depth, and present the fine points of portfolio performance drivers – good and bad – for the fiscal year ended September 30, 2014.

| 2 | The Leuthold Funds - 2014 Annual Report |

FUND OVERVIEWS

Leuthold Core Investment Fund

Opened on November 20, 1995, this is our firm’s flagship tactical asset allocation strategy, with $846 million of assets under management. The strategy is flexible, with exposure to asset class investments routinely adjusted to suit the environment; these adjustments are determined by the ongoing study of market conditions and economic factors. The objective is to identify areas of value that appear poised for strong performance while attempting to avoid excessive risk. Assets are allocated between stocks, bonds, foreign securities, alternative investments, and money market instruments. The Fund may employ hedging techniques for tactical purposes, to take advantage of pricing excesses, or for major defensive moves against a particular asset class. The Fund’s objective is capital appreciation and income over the long-term, attained through relatively risk averse, prudent investment selection. When the stock market is in a strong uptrend, the Leuthold Core Investment Fund’s diversified portfolio will unlikely match returns of a fully invested equity portfolio. However, over a full market cycle, it is our goal to outperform the stock market.

| | | |

| | ● | Leuthold Core Investment Fund uses the Leuthold Select Industries strategy as the primary vehicle for its U.S.-traded stock market exposure. |

| | | |

| | ● | Investment Guidelines: 30%-70% equity exposure; 30%-70% fixed income exposure. There is no foreign investment minimum criterion. Certain market conditions may prompt a departure from these guidelines. |

| | | |

| | ● | Effective on November 8, 2013, the Leuthold Core Investment Fund acquired the assets and liabilities of the Leuthold Asset Allocation Fund. The investment adviser recommended the acquisition because of the similarities of the two Funds’ investment objectives, investment strategies, risks, and portfolios. In addition, the acquisition provides the potential to achieve economies of scale due to the larger combined asset base and shared costs. |

Leuthold Global Fund

Opened on April 30, 2008, with current assets under management of $362 million, this tactical asset allocation strategy is the “global” equivalent of our flagship Leuthold Core Investment Fund. The strategy and objective of this Fund are analogous to that of the Leuthold Core Investment Fund in terms of guiding disciplines, flexibility, asset class exposure, and risk aversion; however, this global version intends to maintain at least 40% of assets in foreign-traded securities. The Leuthold Global Fund invests in U.S. and foreign-traded stocks, bonds, alternative investments, and money market instruments. The Fund may employ hedging techniques for tactical purposes, to take advantage of pricing excesses, or for major defensive moves against a particular asset class.

| | | |

| | ● | Leuthold Global Fund uses the Leuthold Global Industries strategy as the primary vehicle for its global stock market investments. |

| | | |

| | ● | Investment Guidelines: 30%-70% equity exposure; 30%-70% fixed income exposure; 40% minimum in foreign-traded securities. Certain market conditions may prompt a departure from these guidelines. |

| The Leuthold Funds - 2014 Annual Report | 3 |

Leuthold Select Industries Fund

This Fund opened on June 19, 2000, and has total assets under management of $15 million. It maintains 100% long exposure in domestically traded stocks, regardless of market conditions. This attribute results in the potential for considerably higher volatility, higher risk, and the probability that investors will lose money when the stock market declines. The Leuthold Select Industries Fund employs a top-down approach, based on industry group rotation, and sector concentrations. Driven by extensive quantitative analysis, the strategy attempts to identify collective areas of strength and emerging leadership opportunities.

| | | |

| | ● | This strategy contains more risk as it is more aggressive and thereby offers the potential to achieve larger gains in market upswings, or deeper losses in market corrections. |

Leuthold Global Industries Fund

Launched on May 17, 2010, this Fund has total assets under management of $28 million. It is an extension of our domestic approach to equity industry group rotation. The intent of this equity strategy is to identify collective areas of strength and emerging leadership opportunities at the global level. This Fund will normally invest at least 40% of its assets in equity securities traded in foreign markets.

| | | |

| | ● | This strategy contains more risk as it is more aggressive and thereby offers the potential to achieve larger gains in market upswings, or deeper losses in market corrections. Foreign investment carries additional risks. |

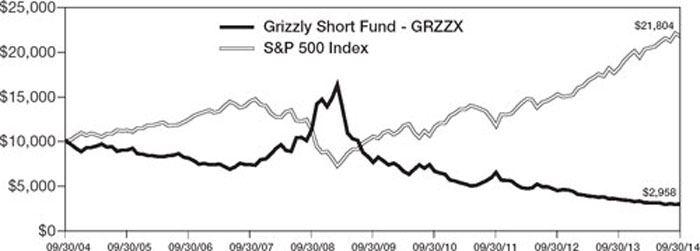

Grizzly Short Fund

Opened June 19, 2000, this is an unleveraged, actively managed Fund that is 100% invested in stocks sold short, intended to profit when stock prices decline. The Fund has assets under management of $72 million. Policy mandates the Grizzly Short Fund target 100% exposure in stocks sold short at all times, even when the stock market is in a rising trend.

| | | |

| | ● | The Grizzly Short Fund typically maintains approximately equal-weighted short positions in roughly 60-90 individual stocks, initially selected by a multi-factor quantitative discipline. Each position is monitored daily and subject to a set of short covering disciplines. |

| | | |

| | ● | Shareholders should anticipate they would most likely lose money investing in this Fund when stock prices are rising. |

This is not a Fund for buy and hold investors. The Grizzly Short Fund is a tool for experienced investors, traders, and advisors to employ as a means of tactically moderating risk from stock price fluctuations. It is also used in varying degrees with other multi-faceted portfolio strategies.

| 4 | The Leuthold Funds - 2014 Annual Report |

ANNUAL PERFORMANCE REVIEW

Leuthold Core Investment Fund

The Fund maintained a bullish posture from October 2013 through July 2014, with average net equity exposure of 63%, a heavier level than the prior fiscal year. Throughout July, however, our market analysis reversed course, and by early August a “neutral” reading was triggered; it was the first neutral reading in over a year. This weaker pattern of scores resulted in a more cautious stance toward stocks, and net equity exposure was thus reduced to 56% for August and September.

For the fiscal year ended September 30, 2014, the Leuthold Core Investment Fund posted a total return gain of 11.49% (retail share class), soundly outperforming the 9.63% total return gain of the Lipper Flexible Portfolio Funds Index. The all-equity S&P 500 benchmark had a total return gain of 19.73% for the year.

Over the course of a full market cycle the goal is to outperform the S&P 500; however, during strong intra-cycle market advances (like the last twelve months), we don’t expect the Fund will be able to match the returns of a fully-invested equity index. On the other hand, like the Leuthold Core Investment Fund, the Lipper Flexible Portfolio Funds Index is composed of funds that allocate investments across several asset classes. Because of that similitude, it is a reasonable benchmark to use as a performance gauge with the Leuthold Core Investment Fund throughout the course of market cycles. Over the last twelve months, when evaluated against the more comparable Lipper Flexible Portfolio Funds Index, the Leuthold Core Investment Fund exceeded its peers’ average results.

Among the Fund’s sub-asset class exposures is our Leuthold Select Industries equity allocation (U.S.- traded long stocks), and we do endeavor to surpass, over the long-term, the results of the S&P 500 within that allocation. For the twelve months ended September 30, 2014, Leuthold Select Industries performed very well, nearly matching the return of the S&P 500. For performance specifics related to the Fund’s U.S.-traded stock investments, see the performance discussion of the Leuthold Select Industries Fund on subsequent pages.

The Fund maintained an Equity Hedge in varying degrees, even though we were positive toward stocks the majority of the year. This position served different functions at different times: 1) hold net equities at/below the 70% maximum threshold when market gains propped up exposure; and, 2) lessen the impact of losses amidst volatility and mid-cycle market corrections. From October through July, the hedge was a relatively negligible 5% position, on average. When our market analysis declined to neutral in early August, the hedge was boosted to a 10% allocation and provided some shelter when the market corrected in September. The holding delivered a cumulative 13.8% net loss during the year, yet because of the allocation’s relatively insignificant size, the effect on Fund performance overall was immaterial.

Emerging Market (EM) Equities continued their long tenure in the portfolio (14+ years), averaging 4% of portfolio assets – in the vicinity of last year’s average holding of 5% (our normal long-term base target). For the fiscal year ended September 30, 2014, these EM equities outperformed with a 6.90% gain versus the MSCI Emerging Market Index gain of 4.66%.

| | | |

| | ● | Within the EM equity allocation, the portfolio’s highest concentration continued to be in the Pacific Rim (ex-Japan), at nearly 70% weight. This was followed by Europe (13%), Latin America (8%), Africa/MidEast (7%), and North America (1%). The largest change occurred with the exposure to Latin America, which dropped from a 16% weight one year ago — 10% less than the benchmark weight of 18%. Countries with positive contributions to return of at least 1% during the fiscal year were South Korea, China, India, and Hong Kong. Countries that detracted from performance by at least 1% were Russia and Brazil. |

| The Leuthold Funds - 2014 Annual Report | 5 |

| | ● | From a sector view, Information Technology was the largest weight in the EM exposure, up from being the second largest weight twelve months ago. It was also by far the most positive sector contributor to the Fund’s EM return, providing over 3% to results. Financials and Consumer Discretionary were the next biggest sector weights in the EM allocation. The biggest change among the sector exposure was a 4% reduction in the Telecommunications weight, which dropped it from the fourth heaviest portfolio weight one year ago, to the third smallest EM weight now. EM stocks from Consumer Discretionary, Consumer Staples, and Health Care each provided over 1% to the allocation’s return, while EM stocks from Materials, Energy, and Industrials had negative contributions to return. |

For the Fund’s Fixed Income selection, we employ a top-down tactical asset allocation framework, using a multi-factor model to first evaluate “risk” and determine whether to favor low risk assets (Developed Market government securities), or higher risk assets (credit). For low risk vehicles, a multi-factor model is used to select between nominal and inflation-linked government securities, whereas the high-risk allocation applies a two-factor model (Momentum and Yield) to assess relative attractiveness among the five credit classes.

| | | |

| | ● | In this interest rate environment we do not believe potential rewards outweigh the substantial risks in Fixed Income, so our exposure has been lower than our guideline minimum target of 30%. Over the last twelve months we maintained an average level of 21% in this asset class, similar to the prior two fiscal years; we view the overall allocation as a potential shock absorber to unexpected equity jolts. |

| | | |

| | ● | To diversify risk, Fixed Income investments were apportioned over a range of security types, including government securities and credit. The largest single allocation was Developed Sovereign Debt at a 12.8% average portfolio weight. This was followed by Quality Corporate Bonds (3.7%), MBS Bond Funds (3.0%), Municipal Bonds (0.7%), and High Yield Bonds (0.5%). The small remaining position in Emerging Sovereign Debt (0.4% average weight) was sold out of the portfolio by March. With the exception of Developed Sovereign Debt (small 0.6% loss), all holdings had cumulative gains for the fiscal year. |

Our physical Gold allocation had dwindled to a 2.5% weight by October 2013, and was completely sold-off in December, as we believed the gold play had run its course. This position lost 8% during the final three-month holding period, but its minuscule weight resulted in negligible adverse impact on overall Fund results.

Leuthold Global Fund

This is the global variation of the Leuthold Core Investment Fund, and it thereby follows the same macro analysis of stock market risk. Due to this, one should expect that the two Funds will make parallel moves when it comes to major defensive or offensive market strategy adjustments. As with the Leuthold Core Investment Fund, from October 2013 through July 2014, the Leuthold Global Fund maintained a bullish posture with average net equity exposure of 63%, a heavier level than the prior fiscal year. Throughout July, however, our market analysis reversed course, and by early August a “neutral” reading was triggered; it was the first neutral reading in over a year. This weaker pattern of scores resulted in a more cautious stance toward stocks, and net equity exposure was thus reduced to 56% for August and September.

For the fiscal year ended September 30, 2014, the Leuthold Global Fund posted a total return gain of 7.68% (retail share class), lagging the 11.89% total return gain of the all-equity MSCI All Country World Index (ACWI). Because the MSCI ACWI is 100%

| 6 | The Leuthold Funds - 2014 Annual Report |

invested in equities, we don’t consider the Fund’s 4% performance lag as disappointing, especially in light of the Fund’s further reduced equity exposure the last few months of the fiscal year.

In contrast to the all-equity MSCI ACWI, the Leuthold Global Fund strategy requires investments to be allocated across a variety of asset classes, with maximum exposure to the stock market capped at 70%. Therefore, while over the course of a full market cycle the objective is to outperform the MSCI ACWI, this all-equity benchmark is not an ideal measure for appraising the Leuthold Global Fund’s intra-cycle results. During strong intra-cycle market advances (like the last twelve months), we don’t expect the Fund will be able to match the returns of a fully invested equity index. In prior years we also used the Lipper Global Flexible Funds Index as comparator because it was a better representation of peer group, flexible asset allocation performance throughout the course of a market cycle. Lipper eliminated this classification in August; hence, for now we do not have a suitable replacement to present true ‘like for like’ performance comparisons.

The Leuthold Global Fund’s long stock exposure, on the other hand, does endeavor to exceed the results of the MSCI ACWI throughout market cycles. In the latest fiscal year ended September 30, 2014, performance of the Fund’s global equities was solid, matching the return of the MSCI ACWI. For fiscal year performance details related to the global equity allocation employed here, see the discussion of the Leuthold Global Industries Fund on subsequent pages.

The Fund maintained an Equity Hedge in varying degrees even though we were positive toward stocks the majority of the year. This position served a few different functions: 1) hold net equities at/below the 70% maximum threshold when market gains propped up exposure; 2) lessen the impact of losses amidst volatility and mid-cycle market corrections; and, 3) preserve a minor foothold in foreign stocks sold short as this process can be more complex and inefficient to initiate when trading on foreign exchanges. From October through July, the hedge was a relatively negligible 4% position, on average. When our market analysis declined to neutral in early August, the hedge was boosted to a 10% allocation and provided some shelter when the market corrected in September. The holding delivered a cumulative net loss of 10.6% during the year, yet because of the allocation’s relatively insignificant size, the effect on Fund performance overall was immaterial.

For the Fund’s Fixed Income selection, we employ a top-down tactical asset allocation framework, using a multi-factor model to first evaluate “risk” and determine whether to favor low risk assets (Developed Market government securities), or higher risk assets (credit). For low risk vehicles, a multi-factor model is used to select between nominal and inflation-linked government securities, whereas the high-risk allocation applies a two-factor model (Momentum and Yield) to assess relative attractiveness among the five credit classes.

| | | |

| | ● | In this interest rate environment we do not believe potential rewards outweigh the substantial risks in Fixed Income, so our exposure has been lower than our guideline minimum target of 30%. Over the last twelve months we maintained an average level of 22% in this asset class, similar to the prior two fiscal years; we view the overall allocation as a potential shock absorber to unexpected equity jolts. |

| | | |

| | ● | To diversify risk, Fixed Income investments were apportioned over a range of security types, including government securities and credit. The largest single allocation was Developed Sovereign Debt at a 12.3% average portfolio weight. This was followed by Quality Corporate Bonds (4.4%), MBS Bond Funds (3.5%), High Yield Bonds (0.7%), and Municipal Bonds (0.5%). The small remaining position in Emerging Sovereign Debt (0.1% average weight) was sold out of the portfolio by March. With the exception of Developed Sovereign Debt (small 0.6% loss), all holdings had cumulative gains for the fiscal year. |

| The Leuthold Funds - 2014 Annual Report | 7 |

Our physical Gold allocation had dwindled to a 2.2% weight by October 2013, and was completely sold-off in December, as we believed the gold play had run its course. This position lost 8% during the final three-month holding period, but its minuscule weight resulted in negligible adverse impact on overall Fund results.

Leuthold Select Industries Fund

This all-equity Fund had a competitive total return gain of 19.02% for the fiscal year ended September 30, 2014, outperforming the 15.37% total return gain of the Lipper Multi-Cap Core Funds Index and about matching the S&P 500’s 19.73% total return gain.

Other than a short lapse in May, our industry group model sustained its traction of the prior year uninterrupted from October 2013 through June 2014. During those months, the Fund outperformed the S&P 500 by nearly 500 basis points and it was ahead of the Lipper Multi-Cap Core Funds Index by nearly 700 basis points. That leadership cushion was important during the final three months, especially in September, as volatility jumped and risk-off mentality spread across stocks. Medium-term trends abruptly disappeared, posing a challenge to the Leuthold Select Industries Fund. From July through September, the Fund lost 460 and 263 basis points more than the S&P 500 and Lipper Multi-Cap Core Funds Index, respectively.

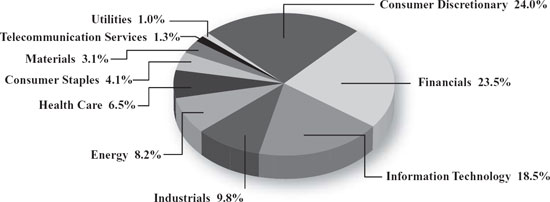

Three of the four heaviest broad sector concentrations at the beginning of the fiscal year are still among the top four. This includes Information Technology, Industrials, and Consumer Discretionary. That stability of corresponding exposure over the course of twelve months underscores the firmness of leadership trends present in the market. This is an elemental characteristic or the long-term success of Select Industries; the impressive outperformance during the first nine months illustrates the edge the Fund can gain from the strategy’s ability to identify trends early on. Equally, the underperformance of the last three months shows how the removal of trends can be a disadvantage.

Our holdings in Industrials, Information Technology, and Health Care were the most significant positive contributors to return. Each allocation outperformed its respective S&P 500 sector, which indicates our selection of investments within each was superior to owning the S&P 500 sector. The same can be said of our Consumer Staples and Consumer Discretionary holdings, as each was a positive contributor to return and outperformed the corresponding S&P 500 sector. Our Financials holdings added solid performance but did not outperform the S&P 500 Financials sector. Just two sector allocations had negative contributions to performance, Utilities and Energy, which, when combined, provided a 1% loss.

The most notable changes among sector exposure were in the Financials and Energy sectors. Financials declined to a 5% weight versus 18% a year ago, while Energy rose to a 12% weight versus a zero weight at the beginning of the fiscal year. Market exposure broadened further during the year with the addition of small weights to the Materials and Utilities sectors, both of which were at zero exposure a year ago. Telecommunication Services is the sole sector that remains at a zero weight.

At the industry level, few groups were subtractive to performance. Consequently, the Fund’s most favorable exposures were a diversified lot as far as sector affiliation. Five of the most positive contributors were reprises from last year, indicating that the disciplines effectively identified particularly strong and prolonged leadership trends with these groups: Airlines, Data Processing & Outsourced Services, Drug Retail, Automotive Retail, and Managed Health Care. Other groups with large positive contributions to return were Health Care Distributors, Technology Hardware & Storage, Aerospace & Defense, and Multi-Line Insurance.

| 8 | The Leuthold Funds - 2014 Annual Report |

Those industry group holdings with minor subtractive contributions to return included Integrated Oil & Gas, Water Utilities, Oil & Gas Refining, and Advertising. With the exception of Advertising, these group detractors aligned with the performance detractors at the sector-level (Energy and Utilities).

For the first nine months of the fiscal year, foreign-domiciled stocks (traded on U.S. exchanges, i.e. via ADR/ADS) comprised about 8% of the portfolio, with Developed Markets capturing 99% of that exposure. These ratios underwent a relatively noteworthy change in late June, as foreign-domiciled stocks expanded to a 14% weight. Additionally, within that foreign market exposure, Developed Market stocks decreased to a 95% weight and Emerging Market stocks increased to 5%. This illustrates how just one group allocation can have a conspicuous effect on portfolio attributes, as these foreign weight changes were triggered by the new purchase of an Energy sector group, Integrated Oil & Gas, of which 80% of the component stocks are from non-U.S. companies, and have a particularly strong Emerging Market presence.

Leuthold Global Industries Fund

This all-equity Fund had a solid total return gain of 11.78% (retail share class) for the fiscal year ended September 30, 2014. The Lipper Global Multi-Cap Value Index lagged the Fund with a total return gain of 9.47%, and the MSCI All Country World Index (ACWI) returned slightly more, 11.89% total return.

As with our domestic equity strategy, our global industry group model upheld its performance leadership for the first nine months of the fiscal year. During those months, the Fund outperformed the S&P 500 by over 400 basis points and it led the Lipper Global Multi-Cap Value Index by about 500 basis points. That leadership cushion was important during the final three months, especially in September, as volatility jumped and risk-off mentality spread across stocks. Medium-term trends abruptly disappeared, posing a challenge to this Global Industries strategy. From July through September, the Fund lost 699 and 207 basis points more than the MSCI ACWI and Lipper Global Multi-Cap Value Index, respectively.

The Fund’s U.S. stock exposure ended the year at a weight of 45%, the lower end of its twelve-month range. During the year it fluctuated by 11%, reaching a high point of 55% by the end of December before migrating down to a low of 44% in May. The MSCI ACWI stayed in a much narrower range, with 46-47% directed to U.S. stocks from September through July; it then trended a small degree higher, to about 49% by September 30th. The Fund’s Developed Market and Emerging Market exposures also drifted much more than did those of the MSCI ACWI. Of the foreign-traded securities in the Global Industries Fund, Developed Market exposure ranged from 92% down to 78%, and Emerging Market stocks spanned from 8% to 22%, differentials of 14% for each subset. Rather than random fluctuation, there was a distinct trend as the year progressed toward higher exposure in Emerging Markets and a lowered weight in Developed Markets. These variations demonstrate the Fund’s dynamic approach (versus the MSCI benchmark) to actively shift allocations as the quantitative disciplines identify value and potential opportunities, based on changing conditions in the marketplace.

As noted, the levels of Developed and EM exposure are not deliberate choices. Rather, they are guided solely by the results of the quantitative scoring of the equity groups and stocks within groups. This Fund’s investments are determined by: 1) selecting the industry groups that appear most attractive according to our quantitative disciplines; and, 2) investing in the highest rated stocks from those groups. Our global selection approach does not consider, or target, specific countries of domicile or regions of the world as do most global investment tactics. We believe that building investments in concentrations of industries, which may mutually benefit from the interdependent global economy, will generate superior returns over the traditional approach of focusing on location.

| The Leuthold Funds - 2014 Annual Report | 9 |

During the fiscal year, five broad sector exposures were responsible for the bulk of the Fund’s gain. Information Technology, Industrials, and Financials had the biggest effect, followed by Consumer Discretionary and Health Care. The Fund’s Info Tech and Consumer Discretionary positions were about double the weight of their corresponding MSCI ACWI sector weights, while the other three sector weights were about in line comparatively. At the global industry group level, the best results came from the Fund’s allocations to equity investments in Computers & Peripherals, Airlines (repeat from 2013), Managed Health Care, Semiconductors, Auto Components (repeat from 2013), Multi-Line Insurance (repeat from 2013), and Road & Rail. Note the three group investments that carried over (repeats) from last year and continued to outperform. This indicates that the disciplines effectively identified particularly strong and prolonged leadership trends with these groups.

Sector allocations that subtracted from performance were Energy, Materials, and Consumer Staples. Each of these performed considerably worse than its equivalent MSCI ACWI sector, indicating poor selection of industry group investments and/or stock positions within those related industry groups. The specific industry group investments with the most negative contributions to return were Oil & Gas Exploration, Integrated Oil & Gas, Casinos & Gaming, Steel, Automobiles, Oil & Gas Refining, and Paper & Forest Products.

During the year, the Fund had investments in 31 countries outside the U.S., with an average of 27 country investments in any given month. Developed Market allocations that carried the heaviest weights all year (outside of the U.S.) were Japan, Germany, France, Canada, United Kingdom, Switzerland, and Hong Kong. During the front half of the year, Sweden was also a heavier weighted country, but that exposure incrementally decreased during the second half. In the latter half of the year, new allocations to Italy, Australia, and Spain grew to become some of the larger positions by fiscal year-end.

| | | |

| | ● | Of the Emerging Market exposures, the biggest weights all year were investments in Taiwan, South Korea, and Poland. The number of different EM country investments began to expand quite rapidly in early 2014, reaching 16 countries by June, compared to an average of eight from October through January. Countries with larger positions from this expanded, second half EM exposure included Brazil, Czech Republic, Malaysia, and Thailand. China and India were full year holdings, but neither held a material weight until the last few months of the fiscal year. |

| | | |

| | ● | Performance-wise, U.S. investments provided the most positive contribution to return. This was followed by investments in Germany, Taiwan, Japan, and Brazil. Each was an overweight position compared to the equivalent MSCI ACWI country exposure; our holdings associated with these countries were more value-added as they outperformed the corresponding MSCI ACWI country allocations. This tells us our group and/or stock selection within groups was high-quality. On the downside, South Korea, one of the heaviest weights in our EM exposure for the full year, was the largest country detractor to performance, contributing a loss of 80 basis points. Hong Kong investments produced the next most significant country level loss, subtracting 25 basis points from return. |

Again, our global equity selection is unusual because the country-specific exposures are not intentional. Rather, they are the by-product of the quantitative approach used to gain exposure to the attractively-rated global industry groups. The traditional approach is to target the “locations” that appear to have upside potential, and then select stocks within that country or region that may benefit from its merits. We believe our non-traditional approach is able to cast a more expansive net to capture a higher quality collection of global opportunities, rather than limit our choices based on locality.

| 10 | The Leuthold Funds - 2014 Annual Report |

Grizzly Short Fund

This Fund is 100% short individual stocks, and is intended to profit when stock prices decline. For the fiscal year ended September 30, 2014, the Grizzly Short Fund produced a total return loss of 14.20%, appreciably better (+1,023 basis points) than the Lipper Dedicated Short Bias Funds Index total return loss of 24.43%. The Grizzly Short Fund results trailed the benchmark S&P MidCap 400 Index, which had total return gain of 11.82% (measured against the inverse performance, the Grizzly Short Fund was 238 basis points worse). Compared to the S&P 500 (19.73% total return), the Fund was 553 basis points better than the corresponding inverse of this index.

Bearing in mind that the median market capitalization of the Grizzly Short Fund is about $2.5 billion, compared with that of the S&P MidCap 400 Index ($3.6 billion), and the S&P 500 ($17.1 billion), the Grizzly Short Fund is more comparable to the S&P MidCap 400. Hence, the Grizzly Short Fund was not value-added over the last twelve months when compared to the index that most resembles the Fund’s typical stock positions, but it was value-added over its Large Cap counterpart.

Despite all broad sector exposures in the S&P 500 producing strong gains over the last twelve months, the Grizzly Short Fund still had two portfolio sector concentrations which produced positive contributions to its return. The Fund’s quantitative analysis was effective in identifying collections of stocks from the Consumer Staples and Industrials sectors which were vulnerable to decline in the face of strong market gains. These combined positions helped to offset Fund losses by 173 basis points.

Health Care holdings were relatively neutral performers, while Utilities and Telecommunications allocations were each subtractive by less than 100 basis points – these three sector weights were small allocations of about 4% each. (Frequently, the sectors and stocks we avoid are just as important as the ones we target.)

As is predictable in a market advance, the heaviest sector weight in the short portfolio, Information Technology, produced the largest negative contribution to return. This was followed by portfolio losses from stocks in the Financials and Materials sectors. Consumer Discretionary and Energy sector holdings each detracted by just over 100 basis points.

Dissecting by industry groups, there were constructive exposures which helped to offset the Fund’s losses, and thereby played a role in the Fund’s outperformance versus the S&P 500. The leading positive contributors included Packaged Foods & Meats, Electrical Components, Homefurnishing Retail, Research & Consulting Services, Coal & Consumable Fuels, Commercial Services, Airlines, Aerospace & Defense, and Silver. Of these groups, over half are constituents of the two sectors which generated gains, as noted earlier: Industrials and Consumer Staples.

There was no consistent sector theme among the industry group detractors. Those subtracting the most from results included Communications Equipment, Oil & Gas Storage/Transport, Steel, Semiconductors, Internet Software & Services, Specialized REITs, Environmental & Facilities Services, Homebuilding, and Regional Banks.

The Grizzly Short Fund is a highly disciplined methodology, with portfolio positions monitored on a daily basis. High turnover is characteristic; sector concentrations and industry group exposures have the potential to fluctuate considerably throughout the year. As opposed to a market capitalization weighted index, such as the S&P MidCap 400 or the S&P 500, the Grizzly Short Fund positions are similarly weighted across the portfolio. Due to this, the Fund is not subject to the shortcomings of having a small selection of oversized positions driving results. Additional features of the strategy include policies that trigger specific short-covering action, such as capturing gains and stop-loss tactics, and weighting limitations on sector and sub-industry group concentrations.

| The Leuthold Funds - 2014 Annual Report | 11 |

When the stock market is in a clearly rising trend, investors should expect the Grizzly Short Fund to lose money. Under those circumstances, the Fund’s goal is to add value over an index short by losing less. This past year the Fund’s objective was met when compared to the S&P 500 benchmark, but it fell short versus the S&P 400 MidCap Index.

Investors who are not experienced in short-selling and adjusting portfolios for changing risk profiles should consider one of our tactical asset allocation funds: the Leuthold Core Investment Fund or the Leuthold Global Fund. Those two Funds have the ability to implement this exact short-selling strategy to reduce risk when the stock market is viewed as overvalued and appears susceptible to a downside correction.

IN CLOSING

At this time our stock market analysis is bordering on a neutral/negative near-term outlook toward stocks. We would not be surprised to see a peak-to-trough correction in global stocks of 12-15%, with considerably larger losses in Small Caps and Emerging Market equities. However, the duration or extent of a market correction (or a rebound, for that matter) is an unknown factor, and there’s certainly the chance that any decline will fall short of our expectation.

Investor sentiment had been fairly restrained since the beginning of the bull market back in March 2009, but the big gains of 2013 seemed to finally drive away the last of any lingering memories from the 2008 debacle. In fact, in March of this year, our proprietary composite reading of investor sentiment shot up to the most optimistic reading in its 36-year history, sending a strong negative signal from a contrarian point of view.

While damage to any capitalization-weighted stock market measure has so far been limited, the DJIA, Russell 2000, and MSCI All Country World Index have broken below major trend-lines drawn off their 2009 bear market lows. Similar trend breaks in mid-2011 led immediately to a 19.4% decline in the S&P 500, along with much larger losses in Small Caps, cyclical stocks, and almost all foreign markets. Today, the breakdowns are occurring in the context of: 1) one of the longer cyclical bull markets on record (67 months through September); 2) elevated levels of investor confidence; 3) valuation readings above all but the “bubble era” market tops; 4) multiple “tapers” in the monthly level of Fed bond buying; and, 5) a severe breakdown in internal stock market participation (Small Cap and the “average stock” performance versus Mega Caps).

Still, the combination of elevated stock market valuations (especially in the U.S.) and inflated investor expectations can persist for extended periods…the market advance throughout the Technology mania provides the most memorable historical example. Inflated sentiment and valuation readings generally don’t become dangerous until stock market “liquidity” (or Federal Reserve policy accommodation) begins to contract. We believe the succession of Fed “tapers” in the monthly level of Quantitative Easing (QE) throughout 2014 has finally triggered such a liquidity contraction. In other words, this unusual form of Fed “tightening” has been underway for several months—even though the Fed isn’t expected to increase its benchmark Federal Funds Rate above the zero level until mid-2015 at the earliest.

Regardless of market direction, our quantitative processes continually monitor an extensive range of market data; asset class and equity group attractiveness are reassessed and adjusted on an ongoing basis. We anticipate increasingly difficult conditions in the coming year, especially with long equities, and we will embrace the challenge of finding routes to prosper in each of our strategies. Our goal is to add value over the long-term.

| 12 | The Leuthold Funds - 2014 Annual Report |

Your comments and questions are always welcome. We appreciate your interest and support of the Leuthold Fund strategies.

Sincerely,

| | | |

| | |

| | | |

| Doug Ramsey, CFA, CMT | | |

| CIO & Co-Portfolio Manager | | |

| | | |

|  |  |

| | | |

| Matt Paschke, CFA | Chun Wang, CFA, PRM | Greg Swenson, CFA |

| Co-Portfolio Manager | Co-Portfolio Manager | Co-Portfolio Manager |

| The Leuthold Funds - 2014 Annual Report | 13 |

Expense Example – September 30, 2014 (Unaudited)

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, including reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held the entire period (April 1, 2014 – September 30, 2014).

Actual Expenses

The first line of the following table provides information about actual account values and actual expenses. Although the Funds charge no sales load (the Leuthold Core Investment Fund, Leuthold Global Fund and Leuthold Global Industries Fund charge a 2% redemption fee for redemptions made within five business days after a purchase), you will be assessed fees for outgoing wire transfers, returned checks, or stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Funds’ transfer agent. If you request a redemption be made by wire transfer, currently a $15.00 fee is charged by the Funds’ transfer agent. To the extent that the Funds invest in shares of other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which a Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary by fund. These expenses are not included in the following example. The example includes, but is not limited to, management fees, shareholder servicing fees, fund accounting, custody, and transfer agent fees. However, the following example does not include portfolio trading commissions and related expenses, and extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| 14 | The Leuthold Funds - 2014 Annual Report |

| The Leuthold Funds |

| Expense Example Tables (Unaudited) |

Leuthold Core Investment Fund - Retail Class - LCORX

| | | | | | | | | | | |

| | | Beginning Account Value April 1, 2014 | | Ending Account Value September 30, 2014 | | Expenses Paid During Period* April 1, 2014 - September 30, 2014 | |

| Actual** | | $1,000.00 | | | $1,003.30 | | | $ 6.48 | | |

| Hypothetical (5% return before expenses)*** | | 1,000.00 | | | 1,018.60 | | | 6.53 | | |

| | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.29%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| ** | Excluding dividends and interest on short positions, your actual cost of investment in the Fund would be $5.78 and the Fund’s annualized expense ratio would be 1.15%. |

| *** | Excluding dividends and interest on short positions, your hypothetical cost of investment in the Fund would be $5.82 and the Fund’s annualized expense ratio would be 1.15%. |

Leuthold Core Investment Fund - Institutional Class - LCRIX

| | | | | | | | | | | |

| | | Beginning Account Value April 1, 2014 | | Ending Account Value September 30, 2014 | | Expenses Paid During Period* April 1, 2014 - September 30, 2014 | |

| Actual** | | $1,000.00 | | | $1,004.30 | | | $ 5.98 | | |

| Hypothetical (5% return before expenses)*** | | 1,000.00 | | | 1,019.10 | | | 6.02 | | |

| | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.19%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| ** | Excluding dividends and interest on short positions, your actual cost of investment in the Fund would be $5.33 and the Fund’s annualized expense ratio would be 1.06%. |

| *** | Excluding dividends and interest on short positions, your hypothetical cost of investment in the Fund would be $5.37 and the Fund’s annualized expense ratio would be 1.06%. |

Leuthold Global Fund - Retail Class - GLBLX

| | | | | | | | | | | |

| | | Beginning Account Value April 1, 2014 | | Ending Account Value September 30, 2014 | | Expenses Paid During Period* April 1, 2014 - September 30, 2014 | |

| Actual** | | $1,000.00 | | | $ 993.20 | | | $ 8.29 | | |

| Hypothetical (5% return before expenses)*** | | 1,000.00 | | | 1,016.75 | | | 8.39 | | |

| | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.66%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| ** | Excluding dividends and interest on short positions, your actual cost of investment in the Fund would be $7.59 and the Fund’s annualized expense ratio would be 1.52%. |

| *** | Excluding dividends and interest on short positions, your hypothetical cost of investment in the Fund would be $7.68 and the Fund’s annualized expense ratio would be 1.52%. |

Leuthold Global Fund - Institutional Class - GLBIX

| | | | | | | | | | | |

| | | Beginning Account Value April 1, 2014 | | Ending Account Value September 30, 2014 | | Expenses Paid During Period* April 1, 2014 - September 30, 2014 | |

| Actual** | | $1,000.00 | | | $ 994.30 | | | $ 7.35 | | |

| Hypothetical (5% return before expenses)*** | | 1,000.00 | | | 1,017.70 | | | 7.44 | | |

| | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.47%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| ** | Excluding dividends and interest on short positions, your actual cost of investment in the Fund would be $6.65 and the Fund’s annualized expense ratio would be 1.33%. |

| *** | Excluding dividends and interest on short positions, your hypothetical cost of investment in the Fund would be $6.73 and the Fund’s annualized expense ratio would be 1.33%. |

| | |

| The Leuthold Funds - 2014 Annual Report | 15 |

| The Leuthold Funds |

| Expense Example Tables (Unaudited) |

Leuthold Select Industries Fund - LSLTX

| | | | | | | | | | | |

| | | Beginning Account Value April 1, 2014 | | Ending Account Value September 30, 2014 | | Expenses Paid During Period* April 1, 2014 - September 30, 2014 | |

| Actual | | $1,000.00 | | | $1,006.00 | | | $ 7.84 | | |

| Hypothetical (5% return before expenses) | | 1,000.00 | | | 1,017.25 | | | 7.89 | | |

| | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.56%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

Leuthold Global Industries Fund - Retail Class - LGINX

| | | | | | | | | | | |

| | | Beginning Account Value April 1, 2014 | | Ending Account Value September 30, 2014 | | Expenses Paid During Period* April 1, 2014 - September 30, 2014 | |

| Actual | | $1,000.00 | | | $ 990.80 | | | $ 8.43 | | |

| Hypothetical (5% return before expenses) | | 1,000.00 | | | 1,016.59 | | | 8.54 | | |

| | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.69%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

Leuthold Global Industries Fund - Institutional Class - LGIIX

| | | | | | | | | | | |

| | | Beginning | | Ending | | Expenses Paid | |

| | | Account Value | | Account Value | | During Period* | |

| | | April 1, 2014 | | September 30, 2014 | | April 1, 2014 - September 30, 2014 | |

| Actual | | $1,000.00 | | | $ 992.30 | | | $ 7.19 | | |

| Hypothetical (5% return before expenses) | | 1,000.00 | | | 1,017.85 | | | 7.28 | | |

| | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.44%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

Grizzly Short Fund - GRZZX

| | | | | | | | | | | |

| | | Beginning | | Ending | | Expenses Paid | |

| | | Account Value | | Account Value | | During Period* | |

| | | April 1, 2014 | | September 30, 2014 | | April 1, 2014 - September 30, 2014 | |

Actual** | | $1,000.00 | | | $ 960.90 | | | $ 15.44 | | |

Hypothetical (5% return before expenses)*** | | 1,000.00 | | | 1,009.32 | | | 15.82 | | |

| | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 3.14%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| ** | Excluding dividends and interest on short positions, your actual cost of investment in the Fund would be $7.62 and the Fund’s annualized expense ratio would be 1.55%. |

| *** | Excluding dividends and interest on short positions, your hypothetical cost of investment in the Fund would be $7.81 and the Fund’s annualized expense ratio would be 1.55%. |

| | |

| 16 | The Leuthold Funds - 2014 Annual Report |

| The Leuthold Funds |

| (Unaudited) |

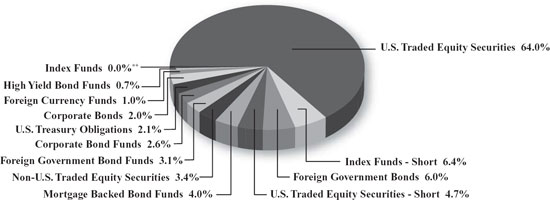

Leuthold Core Investment Fund

Allocation of Portfolio Holdings

September 30, 2014*

Leuthold Global Fund

Allocation of Portfolio Holdings

September 30, 2014

| * | Excludes short-term investments less than 5% of net assets. |

| ** | Amount is less than 0.05%. |

| The Leuthold Funds - 2014 Annual Report | 17 |

| The Leuthold Funds |

| (Unaudited) |

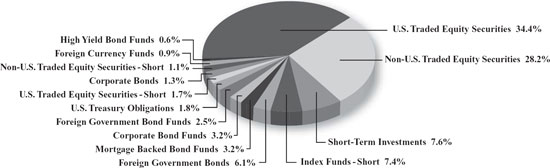

Leuthold Select Industries Fund

Allocation of Portfolio Holdings

September 30, 2014*

Leuthold Global Industries Fund

Allocation of Portfolio Holdings

September 30, 2014

| | * Excludes short-term investments less than 5% of net assets. |

| 18 | The Leuthold Funds - 2014 Annual Report |

| The Leuthold Funds |

| (Unaudited) |

Grizzly Short Fund

Allocation of Portfolio Holdings

September 30, 2014*

| *Excludes short-term investments less than 5% of net assets. | | |

| | The Leuthold Funds - 2014 Annual Report | 19 |

| Leuthold Core Investment Fund (Unaudited) | |

| Components of Portfolio Holdings* | | Fair Value | |

| U.S. Traded Equity Securities | | $ | 532,210,468 | |

| Index Funds - Short | | | 53,169,884 | |

| Foreign Government Bonds | | | 51,026,320 | |

| U.S. Traded Equity Securities - Short | | | 39,108,074 | |

| Mortgage Backed Bond Funds | | | 32,970,928 | |

| Non-U.S. Traded Equity Securities | | | 28,051,939 | |

| Foreign Government Bond Funds | | | 25,582,367 | |

| Corporate Bond Funds | | | 21,652,720 | |

| U.S. Treasury Obligations | | | 17,390,649 | |

| Corporate Bonds | | | 16,390,474 | |

| Foreign Currency Funds | | | 7,964,206 | |

| High Yield Bond Funds | | | 5,882,940 | |

| Index Funds | | | 237,975 | |

| Total: | | $ | 831,638,944 | |

| | | | | |

| Leuthold Global Fund (Unaudited) | | | | |

| Components of Portfolio Holdings | | Fair Value | |

| U.S. Traded Equity Securities | | $ | 127,698,925 | |

| Non-U.S. Traded Equity Securities | | | 104,881,297 | |

| Short-Term Investments | | | 28,089,171 | |

| Index Funds - Short | | | 27,335,689 | |

| Foreign Government Bonds | | | 22,685,885 | |

| Mortgage Backed Bond Funds | | | 12,071,558 | |

| Corporate Bond Funds | | | 11,868,149 | |

| Foreign Government Bond Funds | | | 9,202,959 | |

| U.S. Treasury Obligations | | | 6,618,023 | |

| U.S. Traded Equity Securities - Short | | | 6,320,865 | |

| Corporate Bonds | | | 4,929,325 | |

| Non-U.S. Traded Equity Securities - Short | | | 4,153,446 | |

| Foreign Currency Funds | | | 3,195,379 | |

| High Yield Bond Funds | | | 2,104,353 | |

| Total: | | $ | 371,155,024 | |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

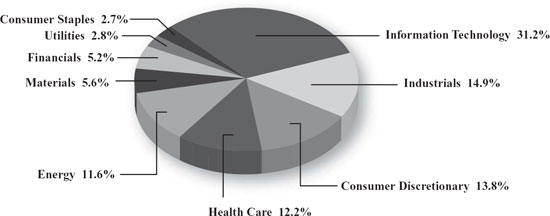

| Leuthold Select Industries Fund (Unaudited) | |

| Components of Portfolio Holdings* | | Fair Value | |

| Information Technology | | $ | 4,662,521 | |

| Industrials | | | 2,225,879 | |

| Consumer Discretionary | | | 2,058,293 | |

| Health Care | | | 1,827,715 | |

| Energy | | | 1,722,226 | |

| Materials | | | 833,582 | |

| Financials | | | 777,286 | |

| Utilities | | | 413,851 | |

| Consumer Staples | | | 404,238 | |

| Total: | | $ | 14,925,591 | |

| | | | | |

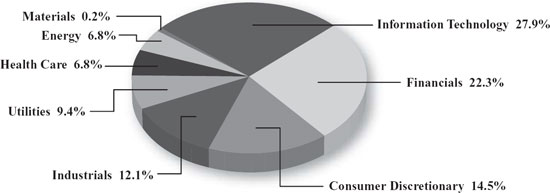

| Leuthold Global Industries Fund (Unaudited) | |

| Components of Portfolio Holdings | | Fair Value | |

| Information Technology | | $ | 7,800,799 | |

| Financials | | | 6,246,831 | |

| Consumer Discretionary | | | 4,062,453 | |

| Industrials | | | 3,376,736 | |

| Utilities | | | 2,624,451 | |

| Health Care | | | 1,915,156 | |

| Energy | | | 1,889,159 | |

| Materials | | | 65,176 | |

| Total: | | $ | 27,980,761 | |

| | | | | |

| Grizzly Short Fund (Unaudited) | | | | |

| Components of Portfolio Holdings* | | Fair Value | |

| Consumer Discretionary | | $ | 16,292,924 | |

| Financials | | | 15,974,814 | |

| Information Technology | | | 12,550,359 | |

| Industrials | | | 6,640,305 | |

| Energy | | | 5,559,709 | |

| Health Care | | | 4,404,034 | |

| Consumer Staples | | | 2,783,304 | |

| Materials | | | 2,072,706 | |

| Telecommunication Services | | | 885,032 | |

| Utilities | | | 705,648 | |

| Total: | | $ | 67,868,835 | |

| | *Excludes short-term investments less than 5% of net assets. |

| 20 | The Leuthold Funds - 2014 Annual Report |

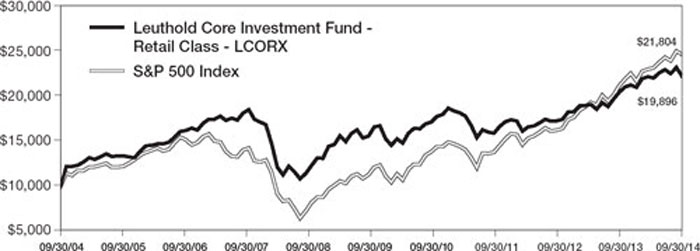

| Leuthold Core Investment Fund - Retail Class - LCORX |

| (Unaudited) |

Average Annual Rate of Return For Periods Ended

September 30, 2014

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year |

Leuthold Core Investment Fund - Retail Class - LCORX | | 11.49% | | | 11.38% | | | 6.44% | | | 7.12% | |

| Lipper Flexible Portfolio Fund Index | | 9.63% | | | 13.14% | | | 9.59% | | | 6.89% | |

| S&P 500 Index | | 19.73% | | | 22.99% | | | 15.70% | | | 8.11% | |

A $10,000 Investment in the Leuthold Core Investment Fund – Retail Class - LCORX

The Lipper Flexible Portfolio Funds Index is composed of funds that allocate investments across various asset classes with a focus on total return, as defined by Lipper.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries.

This chart assumes an initial gross investment of $10,000 made on 9/30/04. Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

| | |

| The Leuthold Funds - 2014 Annual Report | 21 |

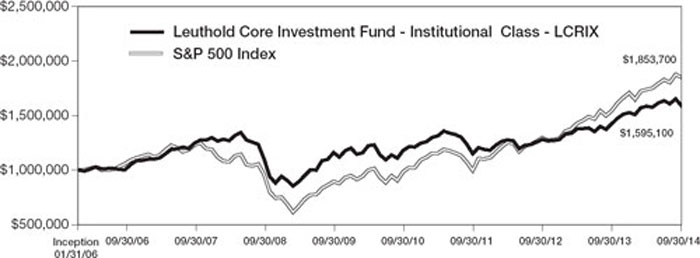

| Leuthold Core Investment Fund - Institutional Class - LCRIX |

| (Unaudited) |

Average Annual Rate of Return For Periods Ended

September 30, 2014

| | | | | | | | | | | | | |

| | | 1 Year | | 3 Year | | 5 Year | | Since Inception |

Leuthold Core Investment Fund - Institutional Class - LCRIX | | 11.66% | | | 11.49% | | | 6.55% | | | 5.54% | |

| Lipper Flexible Portfolio Fund Index | | 9.63% | | | 13.14% | | | 9.59% | | | 5.92% | |

| S&P 500 Index | | 19.73% | | | 22.99% | | | 15.70% | | | 7.38% | |

A $1,000,000 Investment in the Leuthold Core Investment Fund – Institutional Class - LCRIX

The Lipper Flexible Portfolio Funds Index is composed of funds that allocate investments across various asset classes with a focus on total return, as defined by Lipper.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries.

This chart assumes an initial gross investment of $1,000,000 made on 1/31/06 (commencement of operations). Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

| | |

| 22 | The Leuthold Funds - 2014 Annual Report |

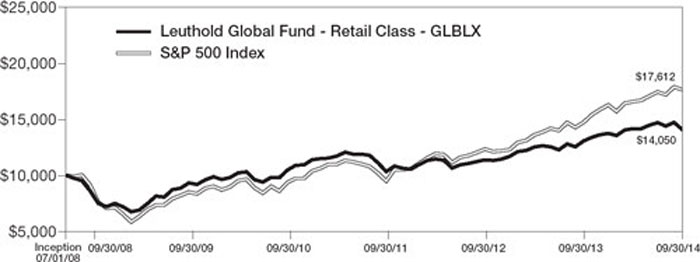

| Leuthold Global Fund - Retail Class - GLBLX |

| (Unaudited) |

Average Annual Rate of Return For Periods Ended

September 30, 2014

| | | | | | | | | | | | | |

| | | 1 Year | | 3 Year | | 5 Year | | Since Inception |

Leuthold Global Fund - Retail Class - GLBLX | | 7.68% | | | 10.83% | | | 8.58% | | | 5.59% | |

| MSCI ACWI | | 11.89% | | | 17.24% | | | 10.65% | | | 5.57% | |

| Barclays Global Aggregate Index | | 1.19% | | | 1.16% | | | 2.69% | | | 3.61% | |

| S&P 500 Index | | 19.73% | | | 22.99% | | | 15.70% | | | 9.48% | |

A $10,000 Investment in the Leuthold Global Fund - Retail Class - GLBLX

The MSCI ACWI (All Country World Index) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. As of June 2, 2014, the MSCI ACWI consisted of 46 country indices comprising 23 developed and 23 emerging market country indices. The developed market country indices included are: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States. The emerging market country indices included are: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey, and United Arab Emirates.

The Barclays Global Aggregate Index provides a broad-based measure of the global investment grade fixed-rate debt markets. It is comprised of the U.S. Aggregate, Pan-European Aggregate, and the Asian-Pacific Aggregate Indices. It also includes a wide range of standard and customized sub-indices by liquidity constraint, sector, quality, and maturity.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries.

This chart assumes an initial gross investment of $10,000 made on 7/1/08 (commencement of operations). Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

| | |

| The Leuthold Funds - 2014 Annual Report | 23 |

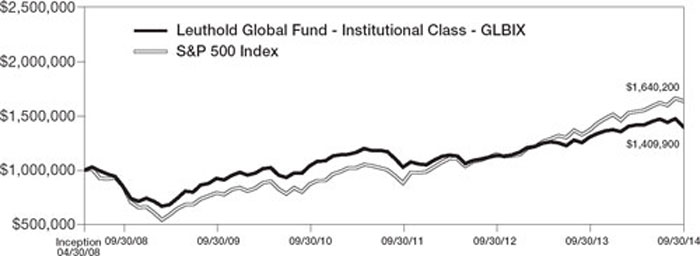

| Leuthold Global Fund - Institutional Class - GLBIX |

| (Unaudited) |

Average Annual Rate of Return For Periods Ended

September 30, 2014

| | | | | | | | | | | | | |

| | | 1 Year | | 3 Year | | 5 Year | | Since Inception |

Leuthold Global Fund - Institutional Class - GLBIX | | 7.95% | | | 11.08% | | | 8.81% | | | 5.50% | |

| MSCI ACWI | | 11.89% | | | 17.24% | | | 10.65% | | | 4.17% | |

| Barclays Global Aggregate Index | | 1.19% | | | 1.16% | | | 2.69% | | | 3.32% | |

| S&P 500 Index | | 19.73% | | | 22.99% | | | 15.70% | | | 8.01% | |

A $1,000,000 Investment in the Leuthold Global Fund - Institutional Class - GLBIX

The MSCI ACWI (All Country World Index) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. As of June 2, 2014, the MSCI ACWI consisted of 46 country indices comprising 23 developed and 23 emerging market country indices. The developed market country indices included are: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States. The emerging market country indices included are: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey, and United Arab Emirates.

The Barclays Global Aggregate Index provides a broad-based measure of the global investment grade fixed-rate debt markets. It is comprised of the U.S. Aggregate, Pan-European Aggregate, and the Asian-Pacific Aggregate Indices. It also includes a wide range of standard and customized sub-indices by liquidity constraint, sector, quality, and maturity.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries.

This chart assumes an initial gross investment of $1,000,000 made on 4/30/08 (commencement of operations). Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

| | |

| 24 | The Leuthold Funds - 2014 Annual Report |

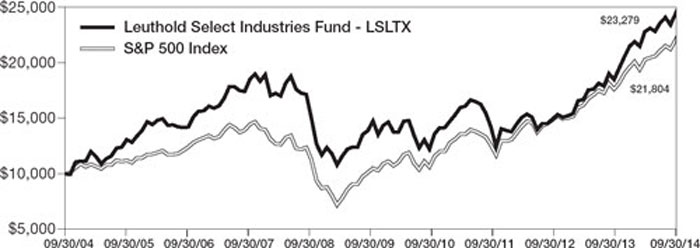

| Leuthold Select Industries Fund - LSLTX |

| (Unaudited) |

Average Annual Rate of Return For Periods Ended

September 30, 2014

| | | | | | | | | | | | | |

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year |

| Leuthold Select Industries Fund - LSLTX | | 19.02% | | | 23.16% | | | 9.51% | | | 8.82% | |

| Russell 2000 Index | | 3.93% | | | 21.26% | | | 14.29% | | | 8.19% | |

| Lipper Multi-Cap Core Funds Index | | 15.37% | | | 21.46% | | | 14.25% | | | 8.09% | |

| S&P 500 Index | | 19.73% | | | 22.99% | | | 15.70% | | | 8.11% | |

A $10,000 Investment in the Leuthold Select Industries Fund - LSLTX

The Russell 2000 Index is comprised of approximately 2000 of the smallest companies in the Russell 3000 Index, representing approximately 10% of the Russell 3000 total market capitalization.

The Lipper Multi-Cap Core Funds Index is an average of funds that invest in a variety of market capitalization ranges without concentrating 75% of their equity assets in any one market capitalization range over an extended period of time. Multi-cap funds typically have between 25% and 75% of their assets invested in companies with market capitalizations (on a three-year weighted basis) above 300% of the dollar-weighted median market capitalization of the middle 1,000 securities of the S&P SuperComposite 1500 Index. These funds typically have an average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share growth value, compared to the S&P SuperComposite 1500 Index.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries.

This chart assumes an initial gross investment of $10,000 made on 9/30/04. Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

| | |

| The Leuthold Funds - 2014 Annual Report | 25 |

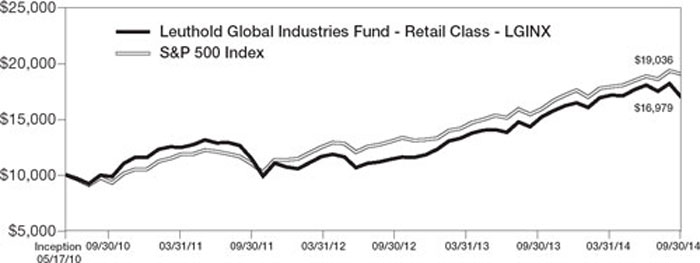

| Leuthold Global Industries Fund - Retail Class - LGINX |

| (Unaudited) |

Average Annual Rate of Return For Periods Ended

September 30, 2014

| | | | | | | | | | | | | |

| | | 1 Year | | 3 Year | | 5 Year | | Since Inception |

Leuthold Global Industries Fund - Retail Class - LGINX | | 11.78% | | | 19.76% | | | n/a | | | 12.87% | |

| MSCI ACWI | | 11.89% | | | 17.24% | | | 10.65 | % | | 12.00% | |

| Lipper Global Multi-Cap Value Index | | 9.47% | | | 17.13% | | | n/a | | | 12.07% | |

| S&P 500 Index | | 19.73% | | | 22.99% | | | 15.70 | % | | 15.86% | |

A $10,000 Investment in the Leuthold Global Industries Fund - Retail Class - LGINX

The MSCI ACWI (All Country World Index) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. As of June 2, 2014, the MSCI ACWI consisted of 46 country indices comprising 23 developed and 23 emerging market country indices. The developed market country indices included are: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States. The emerging market country indices included are: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey, and United Arab Emirates.

The Lipper Global Multi-Cap Value Index is an index that measures investment in a variety of market capitalization ranges without concentrating 75% of their equity assets in any one market capitalization range over an extended period of time. Typically this index has 25% to 75% of their assets invested in companies both inside and outside of the U.S. with market capitalizations (on a three-year weighted basis) above 400% of the 75th market capitalization percentile of the S&P/Citigroup World Broad Market Index.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries.

This chart assumes an initial gross investment of $10,000 made on 5/17/10 (commencement of operations). Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

| | |

| 26 | The Leuthold Funds - 2014 Annual Report |

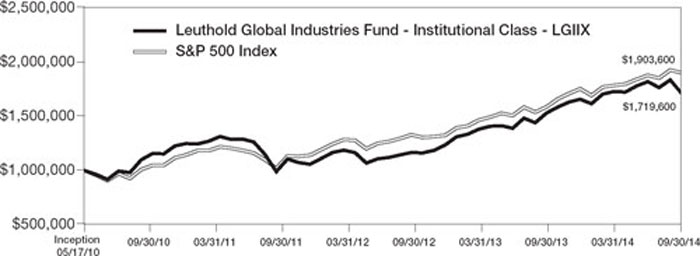

| Leuthold Global Industries Fund - Institutional Class - LGIIX |

| (Unaudited) |

Average Annual Rate of Return For Periods Ended

September 30, 2014

| | | | | | | | | | | | | |

| | | 1 Year | | 3 Year | | 5 Year | | Since Inception |

Leuthold Global Industries Fund - Institutional Class - LGIIX | | 12.16% | | | 20.13% | | | n/a | | | 13.20% | |

| MSCI ACWI | | 11.89% | | | 17.24% | | | 10.65 | % | | 12.00% | |

| Lipper Global Multi-Cap Value Index | | 9.47% | | | 17.13% | | | n/a | | | 12.07% | |

| S&P 500 Index | | 19.73% | | | 22.99% | | | 15.70 | % | | 15.86% | |

A $1,000,000 Investment in the Leuthold Global Industries Fund - Institutional Class - LGIIX

The MSCI ACWI (All Country World Index) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. As of June 2, 2014, the MSCI ACWI consisted of 46 country indices comprising 23 developed and 23 emerging market country indices. The developed market country indices included are: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States. The emerging market country indices included are: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey, and United Arab Emirates.

The Lipper Global Multi-Cap Value Index is an index that measures investment in a variety of market capitalization ranges without concentrating 75% of their equity assets in any one market capitalization range over an extended period of time. Typically this index has 25% to 75% of their assets invested in companies both inside and outside of the U.S. with market capitalizations (on a three-year weighted basis) above 400% of the 75th market capitalization percentile of the S&P/Citigroup World Broad Market Index.