Washington, D.C. 20549

Leuthold Funds, Inc.

33 S. Sixth Street, Suite 4600, Minneapolis, MN 55402

Steven C. Leuthold

33 S. Sixth Street, Suite 4600, Minneapolis, MN 55402

Item 1. Reports to Stockholders.

September 30, 2010

The Leuthold Funds

Leuthold Core Investment Fund

Leuthold Asset Allocation Fund

Leuthold Global Fund

Leuthold Select Industries Fund

Leuthold Global Industries Fund

Leuthold Undervalued & Unloved Fund

Leuthold Global Clean Technology Fund

Leuthold Hedged Equity Fund

Grizzly Short Fund

| Letter to Shareholders | 1 |

| Expense Examples | 19 |

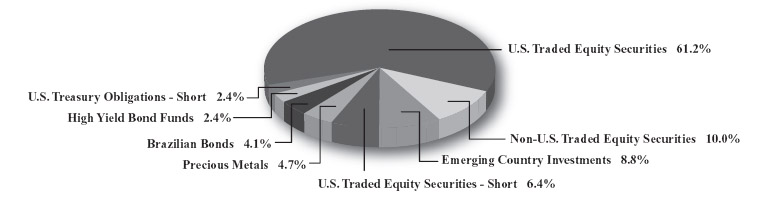

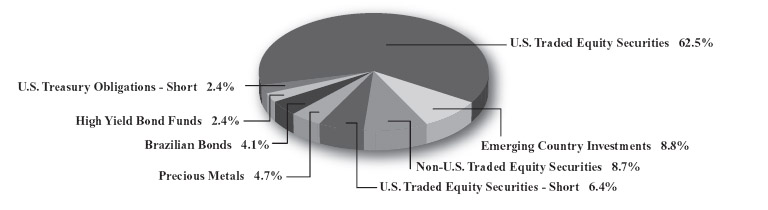

| Allocation of Portfolio Holdings | 25 |

| Components of Portfolio Holdings | 28 |

| Investment Graphs | 30 |

| Statements of Assets and Liabilities | 45 |

| Statements of Operations | 49 |

| Statements of Changes in Net Assets | 53 |

| Financial Highlights | 62 |

| Schedule of Investments | |

Leuthold Core Investment Fund | 77 |

Leuthold Asset Allocation Fund | 85 |

Leuthold Global Fund | 94 |

Leuthold Select Industries Fund | 103 |

Leuthold Global Industries Fund | 106 |

Leuthold Undervalued & Unloved Fund | 110 |

Leuthold Global Clean Technology Fund | 112 |

Leuthold Hedged Equity Fund | 115 |

Grizzly Short Fund | 121 |

| Notes to the Financial Statements | 125 |

| Report of Independent Registered Public Accounting Firm | 138 |

| Directors and Officers | 140 |

This page is intentionally left blank

Please do not print this text

Dear Fellow Shareholders:

The last 12-month period has been a challenging investment environment. During the fiscal year ended September 30, 2010, Leuthold Funds had mixed results; with three of our Funds solidly outperforming, two Funds about matching their respective benchmarks, and four Funds underperforming in varying degrees. Overall, we had a comparatively favorable showing for the fiscal year ended September 30, 2010. Leuthold Fund strategies are primarily long-term methodologies, and these shorter-term results should be viewed as a part of the process of building a successful long-term record. We believe that most of our shareholders understand this, as Leuthold Fund client investments over the last 12 months have held steady, while broad domestic equity mutual funds, overall, have experienced net outflows. Your support is of the utmost importance to us. We sincerely appreciate your continued commitment to Leuthold Funds.

One year ago we had a very positive, intermediate term outlook for the stock market, and anticipated we were likely in the second half of the cyclical bull market which began in mid-March 2009. We expected the bull market to prolong into at least the first half of 2010. As it turned out, by the end of March 2010 the market had gained about 75% over the preceding 13-month period. While this sounds substantial, this seemingly huge market rise only served to restore the market to the levels first achieved 12 years ago. Based on the still reasonable market valuations, and the lack of broad-based support, among other factors, we believed the market still had solid upside.

In April of 2010, it appeared that Main Street investors finally became enthusiastic toward the rising stock market, but this enthusiasm was short-lived, as a market high reached on April 23rd gave way to a steep, painful correction. This correction stretched through June and settled at lows on July 2nd, producing an S&P 500 peak-to-trough decline of -16%. This will stand as the deepest intermediate market correction in 30 years. Our stock market analysis turned “cautious” in early July, but we expected this reading would likely be reversed back to positive in the weeks ahead. Yet, in response to this cautionary reading, asset allocation portfolio equity exposure was trimmed down to a 50% level – a level we view as “neutral” – and a more prudent stance while we awaited either: 1) confirmatio n that a more defensive outlook was, in fact, suitable for market conditions, or 2) that a reversal of the signal back to a positive stance was forthcoming.

Our expectations for a reversal back to positive were met in late-September. In spite of the reduced equity exposure during what was a relatively strong rebound (July-September), performance in our asset allocation portfolios was not significantly affected by this temporary neutral equity stance. All three asset allocation portfolios posted healthy gains during this period.

| • | The 2010 action of our quantitative market analysis is similar to that of 2006, which had us reducing equity exposure in the summer…and buying new highs in September. As with this past year, the defensive adjustment back then did not produce a significant drag on performance, and the bull market at that time would go on to last another 13 months. |

| • | Because a primary objective of our asset allocation strategies is to attempt to minimize losses when market conditions appear uncertain, our disciplined market analysis is designed to alert us to potentially uncertain or negative conditions. Tactical asset allocation is a messy, humbling, and sometimes lonely endeavor. But, those are not good reasons to not attempt it. By and large, we believe our disciplines have functioned very well to aid us in achieving our intended asset allocation goals. |

The Leuthold Funds - 2010 Annual Report 1

Now, as we begin the new fiscal year for Leuthold Funds, we are back where we started 12 months ago, officially back aboard the “bull”, with both our domestic and global Major Trend Index analyses firmly positive toward the stock market.

Looking forward, we believe this ongoing cyclical bull market will carry into 2011. Emerging market indexes should move to new all-time highs before it is over, and the U.S. and most developed country markets will also move substantially higher. Additionally, the U.S. economy is slowly improving as unemployment claims edge lower and small business employment improves. With the economic trough occurring about 18 months ago, a median-duration expansion would put the current cyclical expansion peak in the second half of 2012.

As reflected by our asset allocation portfolios’ low fixed income exposure, we continue to believe that buying U.S. bonds at current levels will be a loser’s game over the next two years. It is only a matter of time before interest rates rise. Many investors are not aware that one can lose money with fixed income investments.

As with last year, we maintain the opinion that we will be experiencing a series of cyclical bull and bear markets over the next three to five years. We believe this will be the necessary base-building to the next secular bull market, perhaps commencing in the years of 2015 - 2016. This pattern would correspond to the typical market action expected when recovering from the very low multiples (bottom quartile of valuations) seen at the March 2009 market lows.

Regardless of our expectations and predictions, we believe it is more important to trust the strategy disciplines. We will always remain flexible with our asset allocation portfolios, and we will change course as necessary, if (when) the disciplines direct us to make adjustments due to changing market conditions.

FUND OVERVIEWS

Leuthold Core Investment Fund (soft-closed; available only to existing shareholders)

This Fund began trading on November 20, 1995. The strategy is flexible, value-oriented, and risk-averse. The Leuthold Core Investment Fund adjusts asset class exposure based on underlying market dynamics and trends, in order to attempt to avoid undue risk, and take advantage of areas that appear poised to outperform. Assets are actively allocated between stocks, bonds, money market instruments, foreign securities, and other alternative investments. The Fund may also hedge equity exposure and fixed income exposure through short-selling strategies when our disciplines indicate potential market vulnerabilities. While at times individual portfolio allocations may appear unconventional, they are intended to assemble as complementing positions in an effort to carry out the Fund’s guiding principle: capital appreciation over the long-te rm, attained through relatively risk averse, prudent investment selection.

| • | Through September 30, 2010, Lipper rankings placed this Fund’s ten-year performance in the top 9% of funds included within their “Flexible Portfolio Funds” category which contained 44 funds over that time frame. For the five-year period ended September 30, 2010, Lipper ranks this Fund’s performance among the top 20% out of the 82 funds in this same category. |

2 The Leuthold Funds - 2010 Annual Report

| • | Leuthold Core Investment Fund uses the Leuthold Select Industries equity selection as the primary vehicle for its U.S.-traded equity component. |

| • | Investment Guidelines: 30%-70% equity exposure and 30%-70% fixed income exposure. Under extreme market conditions, there may be a departure from these guidelines. Equity exposure is determined by our Major Trend Index which was designed to attempt to identify major (longer-term) market trends. This proprietary Leuthold index has been formally calculated on a weekly basis for 40+ years, and is currently composed of over 190 individual factors. |

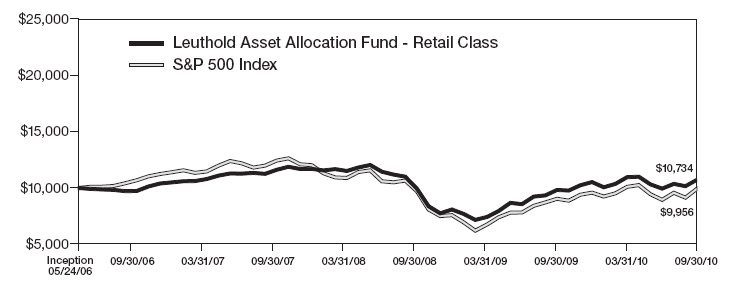

Leuthold Asset Allocation Fund

This successor to the soft-closed Leuthold Core Investment Fund began trading on May 24, 2006. The strategy and objective of this Fund are identical to those of the Leuthold Core Investment Fund in terms of guiding disciplines, flexibility, asset class exposure, and risk aversion. The difference between the two portfolios is in the stock selection approach employed for the primary U.S.-traded equity allocation.

| • | The Leuthold Asset Allocation Fund currently uses a multi-strategy approach for domestic equity selection. This multi-strategy approach employs a combination of the Leuthold Select Equities and Leuthold Undervalued & Unloved strategies. |

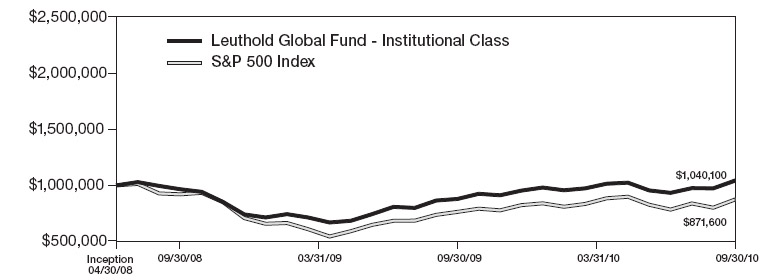

Leuthold Global Fund

This asset allocation strategy was introduced on April 30, 2008, and can be considered the “global” equivalent of the Leuthold Core Investment Fund. The strategy and objective of this Fund are analogous to that of the Leuthold Core Investment Fund in terms of guiding disciplines, flexibility, asset class exposure, and risk aversion. The primary difference is the Leuthold Global Fund intends to invest at least 40% of assets in foreign-traded securities, including stocks, bonds, and other asset classes.

| • | The Leuthold Global Fund uses a top-down industry group approach for its equity selection. This allows us to construct a global equity portfolio based on industry group leadership trends rather than the traditional country-focused strategies typically employed by other global fund managers. We believe a focus on industry overweights and underweights, rather than countries or regions, increases the likelihood of generating superior returns as the global economy becomes increasingly interdependent. |

| • | The Leuthold Global Fund invests in U.S. and foreign-traded stocks, bonds, money market instruments, and alternative investments. When market conditions are deemed unfavorable, the Fund may also sell short certain securities in order to hedge exposure to a particular asset class. |

| • | Investment Guidelines: 30%-70% equity exposure and 30%-70% fixed income exposure. Under extreme market conditions, there may be a departure from these guidelines. Equity exposure is determined by our Global Major Trend Index which was designed to attempt to identify major (longer-term) market trends on a global basis. This proprietary Leuthold index is composed of around 110 individual factors. |

The Leuthold Funds - 2010 Annual Report 3

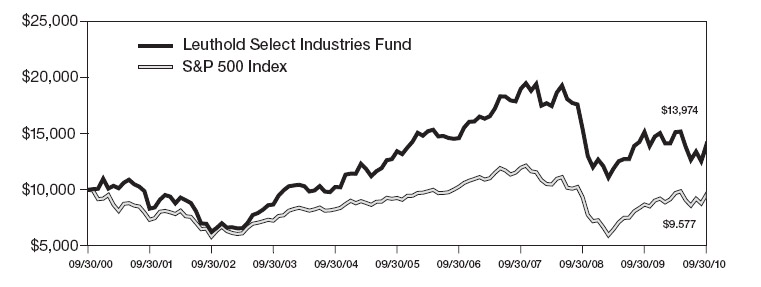

Leuthold Select Industries Fund (soft-closed; available only to existing shareholders)

This Fund began trading on June 19, 2000, and unlike our asset allocation strategies, it is mandated to remain 100% invested in stocks at all times. This attribute results in the potential for considerably higher volatility, higher risk, and the probability that investors will lose money when the stock market declines. The Leuthold Select Industries Fund strategy is a top-down approach, based on industry group selection and rotation, and sector concentrations. Driven by a quantitative evaluation of over 150 equity-industry groups, it attempts to detect collective strength and emerging leadership potential, while exposing areas that appear vulnerable and should be avoided.

| • | Through September 30, 2010, Lipperranked this Fund’s ten-year performance in the top 32% of funds included within their “Multi-Cap Growth” category which contained 254 funds over that time frame. |

| • | The elements of industry group rotation and sector concentrations result in this Fund’s potential for higher volatility; it is potentially more risky while offering potentially more reward. |

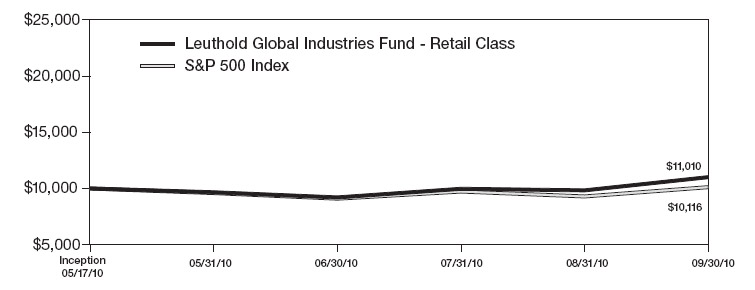

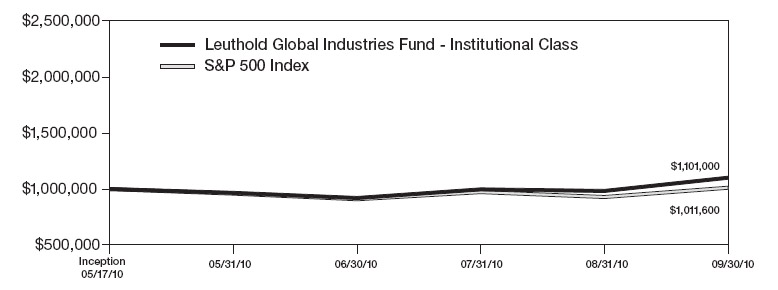

NEW Leuthold Global Industries Fund

This Fund became available on May 17, 2010. The Leuthold Global Industries Fund invests in common stocks and other equity securities from around the world, based on a disciplined, unemotional, and quantitative approach to concentrated equity group investments. The strategy employs an industry group selection/rotation approach based on the methodology of our Leuthold Select Industries strategy; however, under normal conditions at least 40% of the Leuthold Global Industries Fund’s assets will be invested in securities from non-U.S. markets.

Leuthold Undervalued & Unloved Fund

This actively managed Fund, which became available on November 14, 2006, employs a “value” stock screening methodology developed by The Leuthold Group in the mid-1970s. The strategy attempts to identify stocks with low expectations built into the price – stocks which appear undervalued and/or overlooked by Wall Street.

| • | Prior to becoming available as a mutual fund, this Undervalued & Unloved stock selection approach was actively employed as an investment theme within the Leuthold Select Industries Fund’s group framework. |

| • | This Fund was closed to investors as of end of day November 8, 2010. It will be liquidated on December 20, 2010. |

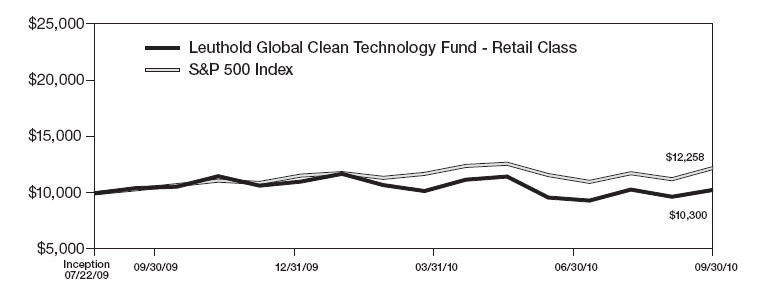

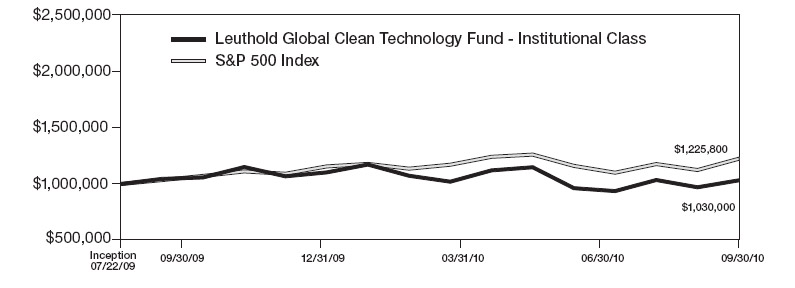

Leuthold Global Clean Technology Fund

This Fund became available on July 22, 2009, and unlike our other equity strategies, this Fund employs fundamental stock selection. The Fund allocates its investments globally, in companies that endeavor to reduce humans’ impact on the environment through energy efficient and “clean” technologies, innovations, and solutions. A confluence of factors will help increase the demand for products from firms focused on technologies that clean, preserve, and/or maximize the earth’s resources, making these firms excellent long-term investments. In brief, noteworthy dynamics include: political influence, higher fossil fuel prices, growing world population, changing energy source preferences, c ommodity price volatility, and significant and growing markets.

4 The Leuthold Funds - 2010 Annual Report

The Fund invests primarily across four clean technology sectors: Alternative Energy, Resource Conservation, Clean Water, and Clean Environment. The universe of stocks maintained for security selection is further organized among over 30 different “sub-industries”. This helps identify specific clean technology industries showing signs of unusual strength or weakness, and may be used as a basis for establishing overweight and underweight industry exposures in the Fund’s portfolio.

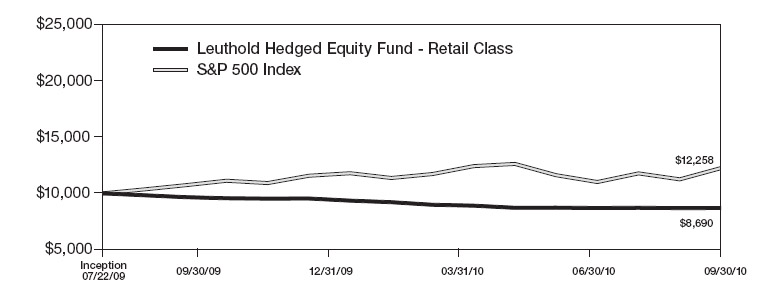

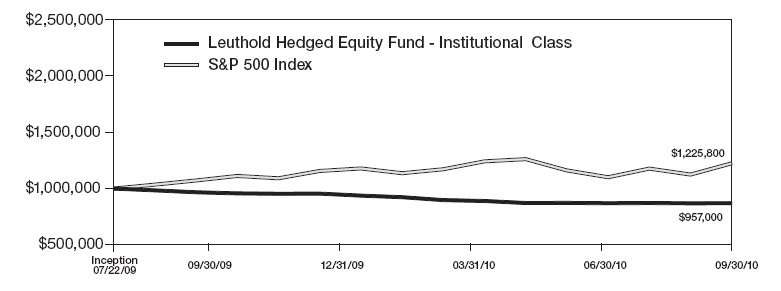

Leuthold Hedged Equity Fund

This Fund began trading on July 22, 2009, and employs a combination of our short-selling strategy and our domestic industry group selection/rotation approach. The Leuthold Hedged Equity Fund pursues its investment objective by establishing long and short positions in common stocks. This is an unleveraged Fund which seeks to maintain approximately equal weightings of gross long exposure and gross short exposure, but its objective is to produce positive net performance.

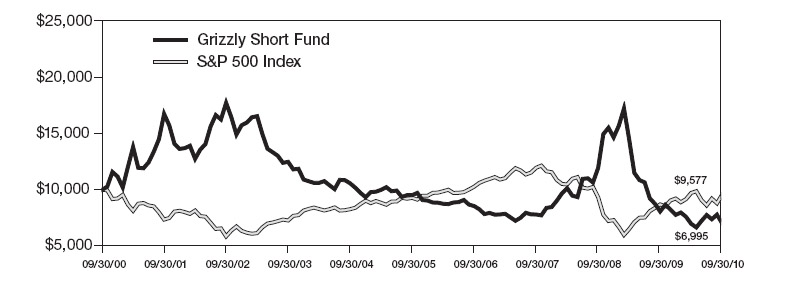

Grizzly Short Fund

Introduced on June 19, 2000, this unleveraged, actively managed Fund is 100% short individual stocks. (Short-selling strategies are aimed at profiting when stock prices decline.) Policy mandates the Grizzly Short Fund target 100% exposure in stocks sold short at all times, even when the stock market is in a rising trend; and regardless of whether our firm is bullish toward stocks.

| • | The Grizzly Short Fund typically maintains approximately equal-weighted short positions in about 60-70 individual stocks, initially selected by a multi-factor quantitative discipline. Each position is monitored daily and subject to a set of short covering disciplines. |

| • | Shareholders should anticipate they will most likely lose money investing in this Fund when stock prices are in a rising trend. |

The Grizzly Short Fund is a tool for sophisticated users. Traders, experienced investors, and speculators who anticipate the market may decline will employ the Grizzly Short Fund to tactically regulate stock market risk. It is also used in varying degrees with other multi-faceted portfolio strategies. This is not a Fund for buy and hold investors!

ANNUAL PERFORMANCE REVIEW

Herein we examine the performance dynamics, both the good and the bad, of each of the Leuthold Funds for the fiscal year ended September 30, 2010. For a number of our Leuthold Funds, performance for the fiscal year was influenced by two separate periods within this 12-month time frame: 1) The first phase was the continuation of the powerful bull market recovery between September 30, 2009, through a high on April 23, 2010, and 2) the second phase, which included a swift and steep -16% market correction between May and July 2nd, and the ensuing extension of the bull market between July and September 2010. In the performance discussions below, we make note of those Funds with performance dynamics being influenced by those two market phases.

The Leuthold Funds - 2010 Annual Report 5

Leuthold Core Investment Fund (soft-closed; available only to existing shareholders)

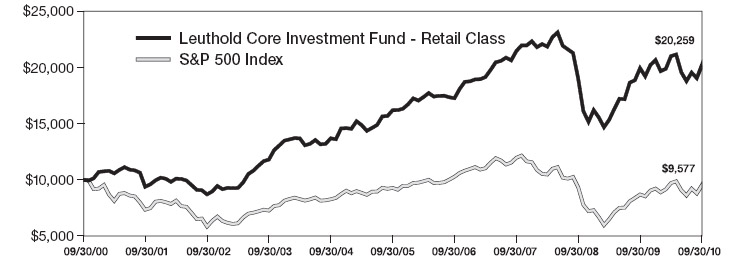

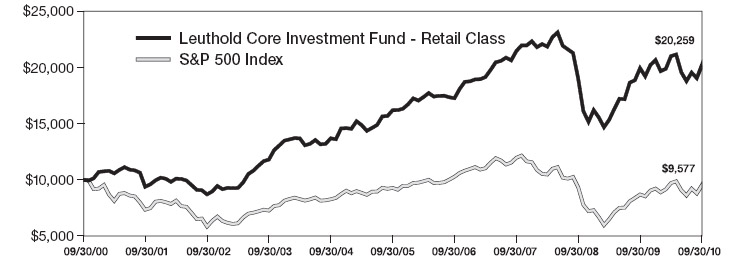

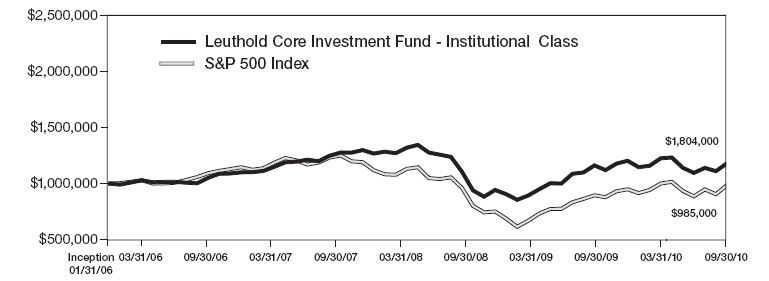

This is our firm’s flagship asset allocation strategy, with current assets of about $1.3 billion. For the fiscal year ended September 30th, 2010, the Core Fund (retail share class) posted a total return gain of +1.53%, significantly underperforming the S&P 500’s total return gain of +10.16% over the same time frame.

The Core Fund’s net allocation to stocks was in bullish mode between October 2009 and June 2010, then turned “cautious” from early July 2010 through late-September 2010. This cautious reading resulted in the Core Fund reducing net equity exposure to a neutral stance of 50% in early July. The lowered equity exposure was accomplished via an equity hedge, as we often do when making tactical shifts.

While the market rebounded in the July through September period, our lower equity exposure made it difficult to fully keep pace with the broad equity market. However, it was the Core Fund’s U.S.-traded equity allocation, the Leuthold Select Industries strategy, which was the root of the Core Investment Fund’s underperformance this last fiscal year. The Leuthold Select Industries equities in the Fund averaged about 46% of assets during the fiscal year ended September 30, 2010, and this strategy turned in a total return loss of -7.76% during this time frame, versus the S&P 500 total return gain of +10.16%. This equity underperformance can be directly correlated to the first nine months of the fiscal year (Oct. 2009 – June 2010). Since July 2010, the results have been much improved, in that the Select Industries equities have performed on par with the S&P 500.To us, this improvement since July is a strong indication that the more typical rotation of U.S. stock market leadership is becoming discernable; and that is a condition in which the Select Industries equity strategy thrives. We are encouraged by this turnaround over the last three months and believe this equity allocation is positioned to benefit from these more conventional market qualities in coming months. For the full details regarding Leuthold Select Industries equity strategy’s results for the fiscal year, please see the performance discussion of the Leuthold Select Industries Fund.

On the positive side, the Leuthold Core Investment Fund’s Emerging Market Equities exposure turned in a nearly +25% gain for the fiscal year ended September 30, 2010. As with last year, exposure here remained a significant overweight in this asset allocation strategy – on average around 18% of assets throughout the year. This emerging market equity exposure is composed of a basket of Asian-traded stocks, primarily Chinese companies, as well as emerging market open-end funds, and emerging market ETFs.

Our Fund’s normal guideline minimum for Fixed Income is 30% of assets. However, as has been the case for a number of years, our comparative analysis this last year continued to indicate that attractive fixed income opportunities on a risk-reward basis were very limited, which led us to maintain a much lower than normal minimum exposure. During the full fiscal year ended September 30, 2010, we had an average of just 9% of portfolio assets allocated to fixed income. This was carried out through relatively low allocations to select fixed income vehicles, as well as a Fixed Income Hedge, which served to additionally lower the Fund’s overall net fixed income exposure.

During the year, the Leuthold Core Investment Fund’s fixed income exposure was composed of High Yield bond funds, Brazilian bonds, and Quality Corporate bonds. We attained additional “income” through a package of REITs, as well as a short-lived investment in a package of common stocks with high dividend yields, which we dubbed, “Better Than Bonds”.

6 The Leuthold Funds - 2010 Annual Report

The Brazilian bonds and the REITs were the only allocations within our fixed income exposure that were held for the full fiscal year. These were also our best performing allocations, with the Brazilian bonds up nearly +27% and the REITs returning about +31% for the 12 months ended September 30, 2010. Due to their high correlation to the stock market, the High Yield bond funds were eliminated as the market correction escalated in May 2010. Despite the correction, during our partial year holding period the High Yield bond funds’ performance was additive, up over +4%. The Quality Corporate bonds were also a partial-year holding (purchased in June); and this small allocation (2% of assets) was a performance additive, up nearly +7% though September 30, 2010.

The remaining fixed income “proxy”, Better Than Bonds, proved to be “worse than bonds” from a performance perspective during its short 4-month holding period. This makeshift fixed income holding generated a total return loss of nearly -5%. Ironically, the Fixed Income Hedge, which was designed to offset risk of loss from our traditional fixed income investments, was the allocation providing the worst performance in the Fund for the fiscal year ended September 30, 2010. This allocation was down nearly -13%.

Despite the strong gains for most of our Fixed Income holdings, this exposure did not appreciably benefit the portfolio due to the very small allocations that we maintained. In general, bond yields remained at extremely low levels throughout the year, thereby generating strong gains for traditional bond market securities. Our portfolio’s lack of material bond market exposure prohibited the Fund from participating in this opportunity.

Although we missed opportunities in fixed income this past fiscal year, we remain extremely concerned about the coming prospects. The secular bull market in bonds, which began in the early 1980s, is ending. Our timing with reduced exposure in the Fund may be considered premature in hindsight, but we’d prefer to err on the side of caution. All of our bond analysis risk-reward studies point to impending risk. Rising interest rates are inevitable, and investors will lose money. We believe it is just a matter of time.

Alternatives: During the prior fiscal year - in early April 2009 - a small starter position in physical Gold was established, followed by an allocation to physical Silver. Combined, this physical precious metals position began the 2009-2010 fiscal year as 3% of portfolio assets. This holding was established due to our concern regarding the potential for very dangerous long-term inflation risk. The U.S. risk of monetary debasement inflation (10% - 20%) is now the highest we’ve ever seen, and the physical gold and silver offer some defense. In a sense, one could view this as an insurance policy, which, if we’re lucky we may never need to collect on. This holding was increased to 4% in September 2010, and it is anticipated to continue to be tactically increased during the coming 2010-2011 fiscal year. While it is a small portfolio allocation, it has been a big frontrunner, from a performance stance. For the fiscal year ended September 30, 2010, this physical metals allocation has produced a total return gain of over +31%.

In summary, while we are disappointed that the Leuthold Core Investment Fund’s U.S.-traded stock exposure’s lagging performance earlier in the year led to overall Core Investment Fund underperformance for the full year, remember that the Fund’s objectives, which include long-term capital appreciation and minimization of risk, are directed by very long-standing principles and disciplines. A year’s underperformance in one of the Fund’s key strategy allocations will not cause us to question the underlying methodology of the Fund as a whole.

The Leuthold Funds - 2010 Annual Report 7

| • | We believe our longer-term results testify to our success in achieving the strategy goals. For the 10-year period ended September 30, 2010, the Leuthold Core Investment Fund has a cumulative total return gain of +102.59% (+7.32% annualized), compared to the S&P 500’s -4.20% cumulative total return loss (-0.43% annualized). |

| • | We will adhere to the disciplined market analysis that drives our long-term performance. As market conditions change, you can expect the Fund to adapt exposures to attempt to best take advantage of rising markets and/or take measures to minimize risk when our disciplines indicate conditions warrant a defensive position. |

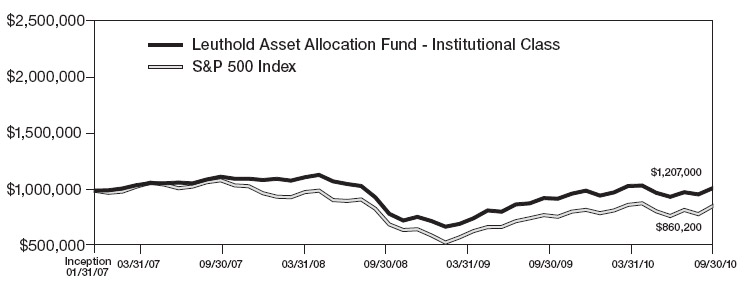

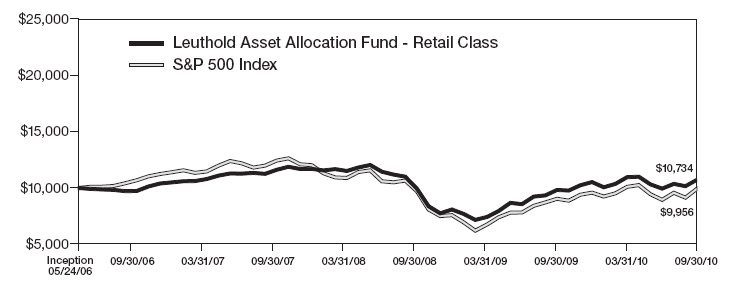

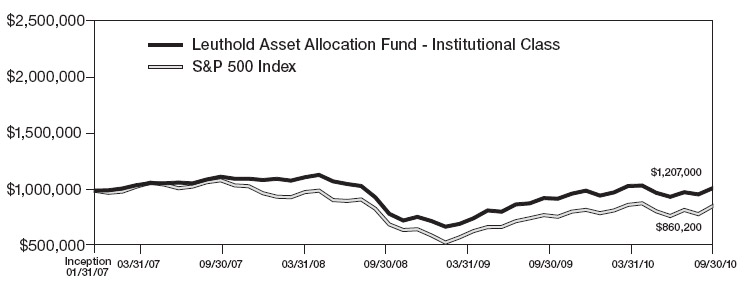

Leuthold Asset Allocation Fund

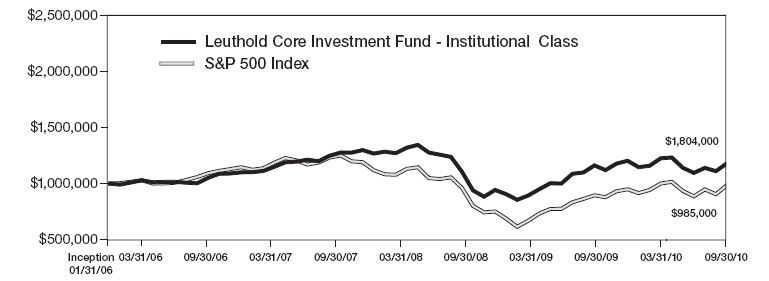

This is the successor Fund to the soft-closed Leuthold Core Investment Fund, with current assets of about $1.2 billion. For the fiscal year ended September 30, 2010, the Leuthold Asset Allocation Fund (retail share class) generated a total return gain of +9.26%, a little shy of the S&P 500’s total return gain of +10.16% over the same time frame.

As with the Leuthold Core Investment Fund, the Asset Allocation Fund’s net allocation to stocks was in bullish mode between October 2009 and June 2010; then turned “cautious” from early July 2010 through late-September 2010. This cautious reading resulted in the Asset Allocation Fund reducing net equity exposure to a neutral stance of 50% in early July. The lowered equity exposure was accomplished via an equity hedge, as we often do when making tactical shifts.

The Leuthold Asset Allocation Fund did have improved results over the Leuthold Core Investment Fund because its U.S.-traded equity selection, which is different than the Core Fund’s, did not have the same leadership challenges, and in fact, had a relatively strong, competitive return for the full fiscal year ended September 30, 2010.

For its U.S.-traded equity exposure, this Fund has used a multi-strategy approach. Since inception, this multi-strategy approach has employed a combination of the Leuthold Select Equities and Leuthold Undervalued & Unloved strategies. Both are bottom-up, quantitative methodologies and each generally contributes a different type of stock market exposure. Individually these two strategies are quite different, but when used in tandem, they allow us to construct an equity portfolio with overall characteristics suitable for an asset allocation approach, and afford us the flexibility to adjust the mix to align with our market outlook. For the fiscal year ended September 30, 2010, the combined allocations of the Leuthold Select Equities strategy and the Leuthold Undervalued & Unloved strategy contributed a total return gain of about + 9%.

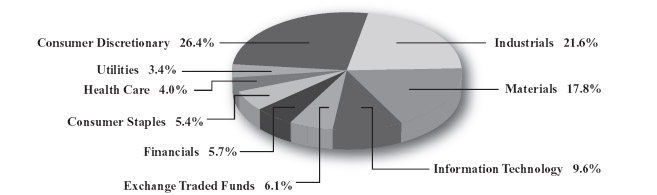

The entire gain for this Fund’s U.S.-traded equity allocation can be attributed to the “pre-correction” period: September 30, 2009 through April 23, 2010. During this time frame, this position was up over +18% total return. The biggest contributors during this portion of the year were from the Industrials sector, Consumer Discretionary sector, and the Materials sector. From an industry group perspective, the most additive areas were: Construction & Farm Machinery and Industrial Conglomerates (Industrials sector); Personal Products (Consumer Staples sector); Department Stores and Apparel Retail (Consumer Discretionary sector); Managed Health Care (Health Care sector); and Diversified Metals & Mining, Specialty Chemicals, and Steel (Materials sector). No broad sector exposure contributed net losses ov er this time frame.

8 The Leuthold Funds - 2010 Annual Report

During the correction/post-correction time frame, April 23rd through fiscal year end, September 30th, this combined U.S.-traded equity exposure of the Select Equities and Undervalued & Unloved strategies gave back almost half (-8%) of the pre-correction gains. The hardest hit exposures were from the same broad sectors that contributed the pre-correction gains (Industrials, Consumer Discretionary, and Materials), with the addition of stocks from the Information Technology sector. Some of the industry groups contributing the largest losses during this portion of the year were: Computer Storage & Peripherals and Semiconductors (Information Technology sector); Department Stores, Apparel Retail, Footwear, and Apparel Accessories/Luxury Goods (Consumer Discretionary sector); Industrial Conglomerates (Industrials sector); and Hea lth Care Services (Health Care sector). Within this stock mix, there were only three broad sectors that contributed overall net gains, to a small degree, during this portion of the year: Health Care sector, Consumer Staples sector, and the Utilities sector.

Although the Leuthold Asset Allocation Fund uses a different U.S.-traded stock selection strategy, it otherwise follows the very same asset allocation directives, allocations, and asset class investment vehicles as the Leuthold Core Investment Fund. Hence, for the performance review of all the other asset classes held by this Fund during the last 12 months, aside from the U.S.-traded equities, please refer to the preceding discussion of the Leuthold Core Investment Fund performance details.

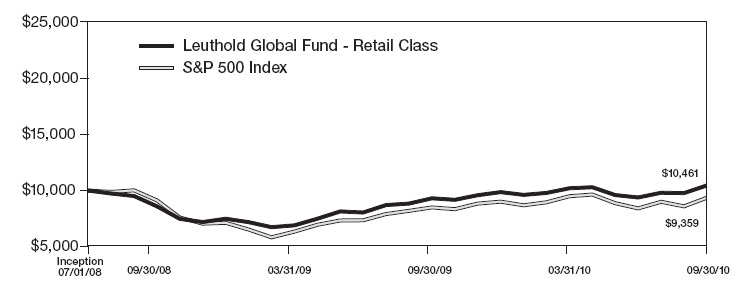

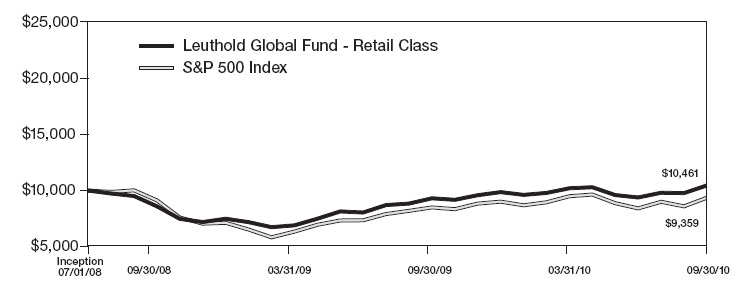

Leuthold Global Fund

This Fund began trading on April 30, 2008, and assets under management are now nearly $300 million. This Fund offers investors a global alternative to our domestically focused tactical asset allocation strategies of the Leuthold Core Investment Fund and the Leuthold Asset Allocation Fund.

For the fiscal year ended September 30, 2010, the Leuthold Global Fund has outperformed its benchmark by a healthy margin. The Leuthold Global Fund (retail share class) produced a total return gain of +12.39% for the 12 months ended September 30, 2010, compared to the total return gain of +8.95% in the MSCI All Country World Index. Over the same time frame, the S&P 500 had a total return gain of +10.16%.

As suggested by performance, there were few detractors from the Leuthold Global Fund’s results over the last 12 months. Net equity exposure during the year ranged from highs of 69%-70% (October 2009 – December 2009) down to a neutral zone around 50% (July – mid-September). The foreign-traded stocks composed 59% and U.S.-traded stocks composed 41%, on average, of the equity allocation during the 2009-2010 fiscal year ended September 30, 2010. Within the foreign-traded securities, the largest country concentrations were spread between the United Kingdom, South Korea, Taiwan, Brazil, Sweden, and Japan. Other foreign countries boasting heavy weights in this equity portfolio this past year included Canada, Mexico, Norway, Hong Kong, China, and Australia.

While the country allocations are worthy of note from a curiosity standpoint, equity exposure is dictated by the industry groups (not countries) that appear most attractive according to our quantitative disciplines. The Leuthold Global Fund employs a top-down industry group approach for its equity selection. We believe that industry group leadership on a global basis will generate superior returns over the more traditional approach of “country” or “regional” concentrations, as the global economy has become increasingly interdependent.

The Leuthold Funds - 2010 Annual Report 9

Over the last fiscal year ended September 30, 2010, the areas of strength among our global equity exposure primarily came from the broad sectors of: Consumer Discretionary, Materials, and to a lesser degree, Information Technology. Breaking this down to the global industry group level, the biggest outperformers included Commodity Chemicals (Materials sector); Media, Automobiles, Auto Components, and Internet & Catalog Retail (Consumer Discretionary sector); Industrial Conglomerates (Industrials sector); Food & Staples Retailing (Consumer Staples sector); and Internet Software & Services (Information Technology sector).

The only broad sector contributing overall negative results to the equity portfolio was Telecommunication Services. From that sector, the specific industry group investments producing negative contributions included Emerging Diversified Telecom Services, Developed Diversified Telecom Services, and Developed Wireless Telecom Services. While there were no other overall negative contributors at the broad sector level, other industry group investments which were performance detractors included: Aerospace & Defense, Electronic Equipment, and Professional Services (Industrials sector); Energy Equipment & Services (Energy sector); Reinsurance and Diversified Banks (Financials sector); and Paper/Forest Products (Materials sector).

| • | As with our domestic asset allocation strategies, our quantitative analysis on the global stock market outlook (Global Major Trend Index) turned “cautious” in early July 2010, and this discipline required us to reduce net equity exposure – which was achieved by establishing an equity hedge (short-selling stocks). This equity hedge, which lowered equity exposure down to a “neutral” stance of 50%, was employed from July through mid/late-September. All in all, despite the market’s relatively strong rebound during this time frame, this lowered equity exposure did not have a material impact on the Fund’s performance during the July through September period. |

The Leuthold Global Fund normally has a guideline minimum level of 30% invested in Fixed Income; however, as with last year the Fund remained far below the normal minimum for the entire fiscal year, with an average allocation of just 10%. As we noted in our commentary for the Leuthold Core/Asset Allocation Funds, it continues to be extremely difficult to find anything attractive on a risk/reward basis in the fixed income markets, be it domestic fixed income or foreign fixed income.

We began the fiscal year with allocations to Global High Yield bonds (average 4.5% of assets); Global Government bonds (average 4.5% of assets); Miscellaneous Global bond funds (average 3% of assets); and a package of domestic and foreign Convertible bonds (average 1.5% of assets). In March, a small 2% allocation was invested in Treasury Inflation Protection bonds (TIPs). Each of these Fixed Income subsets contributed positive performance to overall Fund results during the year. As a means to offset the risk of rising interest rates, the Fund also invested in a Fixed Income Hedge, consisting of U.S. Treasury bonds (average 4% of assets). However, rates held steady or moved lower during the year, so this Fixed Income Hedge was a performance detractor to the Fund’s net fixed income results.

As with our other asset allocation Funds, our low fixed income exposure caused this Fund to largely miss out on the last year’s gains achieved by traditional fixed income vehicles. Yet, all of our bond analysis risk-reward studies point to impending risk. Rising interest rates are inevitable, and investors will lose money. It is just a matter of time. We believe it is more important to continue to attempt to minimize the risk of loss that we see on the horizon.

10 The Leuthold Funds - 2010 Annual Report

Alternatives: During the prior fiscal year (2008-2009), a 1% starter position in physical Gold was established, and subsequently increased to 2%. During the 2009-2010 fiscal year we added physical Silver to the mix, and the overall position was increased to about 3% of assets. With the U.S. and other foreign governments pumping money into the global economy, we made this allocation due to our concerns about the long-term inflation implications related to the excess liquidity. This Gold and Silver investment, while small, was a strong performance contributor to the Fund’s results, having produced a +32% total return gain for the fiscal year ended September 30, 2010.

Leuthold Select Industries Fund (soft-closed; available only to existing shareholders)

This all-equity Fund, with total assets under management of $39 million, had a very disappointing total return loss of -7.76% for the fiscal year ended September 30, 2010, compared to a +10.16% total return gain for the S&P 500.

| • | This underperformance can be directly correlated to the first nine months of the fiscal year (Oct. 2009 – June 2010). Since July 2010, the results have been much improved, in that the Select Industries equities have performed on par with the S&P 500. To us, this improvement since July is a strong indication that the more typical rotation of U.S. stock market leadership is becoming discernable; and that is a condition in which the Select Industries Fund thrives. We are encouraged by this turnaround over the last three months and believe this Fund is positioned to benefit from these more conventional market qualities in coming months. |

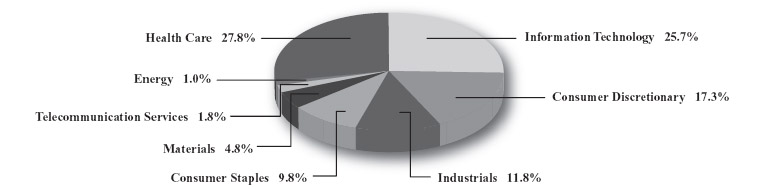

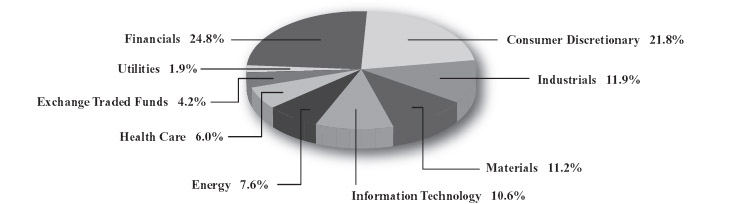

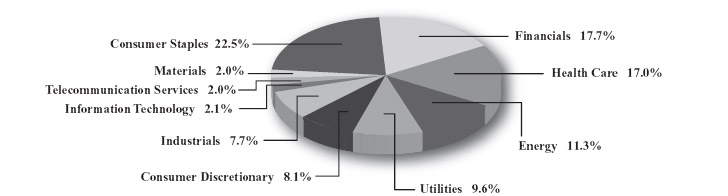

Back in October 2009, as we began the 2009-2010 fiscal year, the Leuthold Select Industries Fund was heavily exposed to three market sectors: Information Technology, Financials, and Health Care. The combined weight of these sectors made up 63% of portfolio assets, with Information Technology, specifically, representing a significant overweight in the Fund (28%), compared to the Info Tech sector weighting of 19% in the S&P 500.

As the year progressed, the Fund’s exposure to the Info Tech sector fluctuated between 19% and 32%, a relatively consistent presence throughout the year. At fiscal year end, exposure here is now at 26%. The Health Care exposure dropped to as low as 10% by mid-year, but was recently boosted significantly to end the year with a 28% portfolio weighting – now the largest exposure as we begin the new fiscal year. In contrast, the Financial sector exposure steadily declined all year, and there has been little to no exposure to this sector over the last 5 months. It was the Consumer Discretionary sector which replaced the Financials as the 3rd heaviest portfolio exposure by February 2010 and it remains among the top three heaviest portfolio wei ghts as of September 30, 2010. Other noteworthy sector weight changes included reduced exposure in Telecommunication Services and Utilities, each now between 0-1% weights versus 7%-8% a year ago; and the Consumer Staples sector rose from zero weight a year ago, to a 10% weight now. There was little change to the portfolio exposure in Industrials, Materials, and Energy, now 12%, 5%, and 1% weights, respectively.

From an industry group perspective, for the full fiscal year, the Leuthold Select Industries Fund’s most beneficial exposure came from group investments in Paper Products (Materials sector); Managed Health Care and Pharmaceuticals (Health Care sector); and Systems Software and Semiconductors (Information Technology sector).

Just as there were no driving trends among U.S. market leadership during much of the last 12 months, there was no theme among the Select Industries Fund’s performance detractors during the fiscal year. The least productive industry group investments in the Fund for the year ended September 30, 2010 were: Airlines (Industrials sector); Independent Power Producers (Utilities sector); Biotechnology (Health Care sector); Consumer Electronics (Consumer Discretionary sector); and Integrated Telecommunication Services (Telecommunication sector).

The Leuthold Funds - 2010 Annual Report 11

As with last year, there remains a relatively high exposure to foreign stocks in the Leuthold Select Industries Fund, now at 25%, versus 31% last year and just 9% two years ago.

The current portfolio group holdings bear no resemblance to the holdings a year ago, despite Information Technology and Health Care remaining as the largest sector weights. This is unusual as the strategy intends to uncover longer-term industry group trends. (It is more typical for the portfolio to have at least one-half of its positions being held a year or longer at any given time.)

In summary, the biggest contributor to the Fund’s performance struggle over the last year has been the lack of group leadership driving the U.S. stock market rebound. Rather, the U.S. stock market has been in a period where leadership at the industry group level has been fleeting, accompanied by a fast-churning, stock picker’s environment. This condition has occurred at times in the past and will happen again. Therefore, we are not questioning our general strategy approach as no stock selection method will be ideal for all market conditions. It is helpful to look at our longer-term performance record as a reminder that the industry group concentration strategy we employ has been a successful approach to generating market beating returns more often than it has not.

| • | Since inception on June 19, 2000, through September 30, 2010, the Leuthold Select Industries Fund has produced a cumulative total return gain of +67.13% (+5.12% annualized) versus a cumulative total return loss of -7.11% for the S&P 500 (-0.72% annualized). |

Historically, the “fast rotation” trends experienced in 2009-2010, which are unfavorable to our strategy, tend to be transitory in nature, and eventually give way to a more macro-themed stock market environment. As noted above, this Fund’s performance since July has been competitive with the S&P 500. We are encouraged that this improvement is an indication that the market is getting back in synch with its more traditional style of exposing longer-term trends of strength and weakness to constructively guide our industry group approach as we enter the 2010-2011 fiscal year.

Leuthold Global Industries Fund

This is our newest Fund, which opened on May 17, 2010. However, this Fund’s strategy is not new-found; rather, it is an extension of our domestic industry group selection/rotation approach which was established in the late 1990s and known as our Select Industries strategy. This global version of our disciplined, unemotional, and quantitative approach employs many of the same factors as our domestic group selection strategy, as it attempts to uncover those industry groups that appear most attractive at the global level. This Fund will normally invest at least 40% of its assets in equity securities from international markets.

As of the fiscal year ended September 30, 2010, the Leuthold Global Industries Fund has $10 million in assets under management. Since this Fund began trading on May 17th, it does not have a full year of performance to discuss in this annual review. However, thus far it has performed extremely well. Since inception on May 17, 2010 through September 30, 2010, the Fund has a total return gain of +10.10% versus the MSCI All Country World Index total return gain of +7.82% and the S&P 500 total return gain of just +1.16%.

12 The Leuthold Funds - 2010 Annual Report

During this short inception-to-date time frame, the Fund’s investments in every sector except Health Care and Energy contributed positive performance; most particularly, the Materials sector, Consumer Discretionary sector, and the Consumer Staples sector. From an industry group perspective, the most valued-added investments came from: Commodity Chemicals, Food & Staples Retail, Auto Components, Automobiles, and Industrial Conglomerates. Industry group investments detracting the most from performance included: Energy Equipment & Services, Aerospace & Defense, and Health Care Services & Technology.

Leuthold Undervalued & Unloved Fund

The Leuthold Undervalued & Unloved Fund, launched on November 14, 2006, has $8 million in assets under management. During the 12 months ended September 30, 2010, the Fund outperformed its benchmarks with a total return gain of +10.88% compared to the +9.15% total return gain for the Russell 3000 Value index and the +8.90% total return gain in the Russell 1000 Value index. Over the same time frame, the S&P 500 turned in a total return gain of +10.16%, slightly lagging the Undervalued & Unloved Fund.

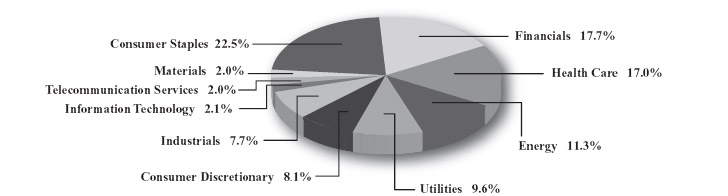

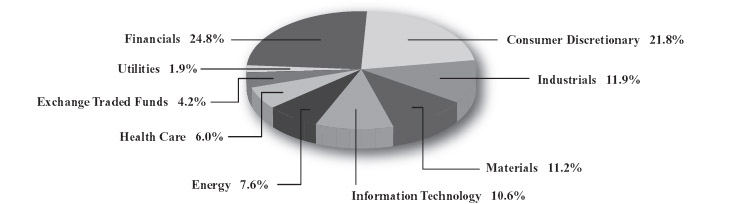

Twelve months ago the Fund began this fiscal year with the somewhat unorthodox appearance of having a “growth” and “cyclical” bias, as Information Technology sector stocks composed the heaviest portfolio weight, while the more conventionally “value” oriented sectors of Utilities, Consumer Staples, and Health Care composed minuscule portfolio exposure. This is because the market meltdown from 2008 to early-2009 had stocks beaten down to extreme valuation lows not seen since 1982. Traditional “growth” and “cyclical” stocks were selling at cheap “value” stock earnings multiples. This allowed “value” style portfolio managers the rare opportunity to buy beaten down blue-chip growth stocks at discount prices.

Information Technology composed a relatively heavy portfolio weight until near the end of the second quarter of 2010. This coincided with when the more traditional value sectors began to reclaim their status as the “heavy-weights” in the portfolio. The more traditional “value” configuration now consists of heavy exposure to: Consumer Staples, Financials, Health Care, Energy, and Utilities.

Not surprisingly, the additive performance contributors leading up to the year’s market high on April 23rd were less-traditional portfolio exposures in Industrials, Materials, Consumer Discretionary, and Financials stocks. Following the April 23rd peak, the traditional value sectors held sway, with Consumer Staples, Health Care, and Utilities stocks contributing the most, on an additive basis from April 23rd through fiscal year end, September 30, 2010. Despite its relatively heavy weight for most of the year, the Information Technology sector exposure was a performance detractor when measuring the full year’s results. In fact, the Info Tech sector was the only area that turned in an overall negative contribution to return for the 12 months ended Se ptember 30th.

From an equity industry group standpoint, the top contributors to performance for the full year were stocks from: Construction & Farm Machinery (Industrials sector); Tobacco (Consumer Staples sector); Specialized REITs (Financials sector); and Pharmaceuticals (Health Care sector). Considering this, the more value-oriented sector exposure was obviously most beneficial to the full year results – likely because these areas offered some defensive characteristics during the steep (-16%) market correction between early May and July 2nd.

The Leuthold Funds - 2010 Annual Report 13

There were no equity groups that contributed substantial losses to the full year’s performance. The handful of portfolio equity groups which detracted from performance for the full year were a mixed bag: Technology Distributors and Computer Hardware (Info Tech sector); Department Stores (Consumer Discretionary sector); Industrial Conglomerates (Industrials sector); and Managed Health Care (Health Care sector).

Despite the Leuthold Undervalued & Unloved Fund’s favorable fiscal year performance, we have been unable to attract sufficient assets into the Fund. As such, we closed the Fund to new investment after November 8, 2010, and will liquidate the Fund on December 20, 2010.

Leuthold Global Clean Technology Fund

The Leuthold Global Clean Technology Fund opened just over a year ago, and has $27 million in assets under management. For the fiscal year ended September 30, 2010, the Fund had a disappointing total return loss of -10.59% (retail share class), versus a total return loss of -16.43% in the Ardour Global Alternative Energy Index, and a total return gain of +8.95% in the MSCI All Country World Index.

The Fund’s overall net losses for the fiscal year were primarily the result of a significant portfolio overweight to the Alternative Energy sector, which composed an average of 48% of assets for the fiscal year. This Alternative Energy sector in particular had a debilitating performance year, with most of its sub-groups contributing negative performance results. The most significant group detractors to performance within this sector included: Wind Turbines/Wind Power, Turbines/Flywheel/Energy Transmission, Solar/Photovoltaic Cells, Uranium Mining, Hydro Electricity, Diversified Renewable Power Generation, and Nuclear Energy Equipment/Services. Additional contributors to portfolio losses came from sub-industry groups of the Resource Conservation sect or (Batteries/Energy Storage Systems, and Water Conservation Systems) and the Clean Environment sector (Environmental Services and Clean Transportation).

Somewhat offsetting portfolio losses were net gains from a range of sub-industry groups from a variety of the Clean Technology universe sectors. Among the best performing groups were: Clean Agriculture and Pollution/Emissions Controls (Clean Environment sector); Renewable/Conventional Power Generation and Biofuels/Ethanol/Cellulosic (Alternative Energy sector); Water Infrastructure and Water Utilities (Clean Water sector); and Efficient Lighting/LEDs (Resource Conservation sector).

The largest non-U.S. exposures during the year within the Leuthold Global Clean Technology Fund included: Germany, China, Spain, Canada, and Switzerland. Other sizeable concentrations among foreign countries were: Denmark, France, Taiwan, Austria, Japan, and Belgium. U.S.-traded stock exposure during fiscal year 2009-2010 was 47% on average, with foreign country investments averaging about 53% of portfolio assets. (Under normal circumstances, the Fund intends to invest at least 40% of assets in foreign-traded securities.)

While the Leuthold Global Clean Technology Fund’s first full fiscal year resulted in disappointing performance, we consider this time frame to be too short to use as a guide for future expectations. We manage the Fund for long-term total return as the sector is likely to benefit from a multi-decade, cyclical upswing in demand for goods and services. Our approach is to identify and invest in Best-in-Class, profitable growth companies expected to increase revenues by about 20% per annum. We attempt to acquire shares when we deem them to be undervalued. We prefer to hold shares in companies for extended periods of time, though we will reduce or eliminate positions we dee m overvalued. In short, we view this opportunity akin to a marathon, not a sprint, and we invest the Fund’s capital accordingly.

14 The Leuthold Funds - 2010 Annual Report

We are confident our approach to investing in “Best-In-Class” Clean Technology companies will generate above-average returns for investors in the Leuthold Global Clean Technology Fund over the long haul.

Leuthold Hedged Equity Fund

The Leuthold Hedged Equity Fund opened a little over a year ago, and currently contains $5 million in assets under management. For the fiscal year ended September 30, 2010, the Fund had a total return loss of -9.10%, versus the S&P 500 total return gain of +10.16%. This Fund is managed with equal allocations to both long and short equities, but its objective is to produce positive net performance. To do so, we require enough relative outperformance on one or both sides in order to yield a positive result, and, disappointingly, this has not occurred over the last year. Both our long-stock exposure and the short-stock exposure employed in this Fund lost money during the fiscal year ended September 30, 2010.

For the Fund’s long-stock investments, the Leuthold Hedged Equity Fund employed the group selection and rotation approach of the Leuthold Select Industries Fund, which had a total return loss of -7.76% for the fiscal year ended September 30, 2010. On the short-side, the Fund’s exposure was attained through the investment strategy of the Grizzly Short Fund, and this strategy produced a total return loss of -13.26% for the 12 months ended September 30, 2010. Specifics on the key performance drivers for each of these equity strategies are presented in the discussions covering the Leuthold Selec t Industries Fund and the Grizzly Short Fund.

Overall performance is falling far below our expectations, based on how the two underlying component strategies have performed, historically. In general, market conditions since the Fund’s inception have been unusual. The stock market has been in a period where leadership at the industry group level has been short-lived, accompanied by fast-rotation trends. These conditions are not conducive to our long-side, industry group selection approach, which attempts to uncover longer-term leadership trends. Additionally, the market theme for over a year has been that weak, lower-quality stocks have been driving market upside. In this environment, our approach to short-selling can prove to be extremely challenging as the intent is to profit from lower- quality stocks declining in price.

Historically, both the short-stock and long-stock selection strategies employed in this Fund have shown the potential to flourish and/or serve to balance each other in most market environments, and we are confident performance will bear this out given a longer time frame.

Grizzly Short Fund

The Grizzly Short Fund lost ground again this year as the market continued its rebound from the March 9, 2009, low. As investors should expect, a strategy designed to profit in down market conditions is unlikely to prosper when the market is in recovery mode.

The Leuthold Funds - 2010 Annual Report 15

For the fiscal year ended September 30, 2010, the Grizzly Short Fund produced a total return loss of -13.26%, which compares relatively favorably with the +17.78% total return gain of the S&P Mid Cap 400 Index. The Grizzly Short Fund underperformed, however, when compared to the S&P 500’s total return gain of +10.16%, as shorting the S&P 500 would have produced a smaller loss than the Grizzly Short Fund produced. As of September 30, 2010, the Grizzly Short Fund contained $196 million in assets under management.

Shorting was very difficult in the first half of the 2009-2010 fiscal year. In many respects the bull market increased momentum as almost all major indices hit new highs, market breadth accelerated, and volatility continued to decline. That trend completely reversed at the end of April when a steep correction began. Subsequently, May and June were two of the best months for the Grizzly Short Fund this last year. Previous to this interim correction, low-quality stocks had been driving the market rebound; but as of May, all of a sudden quality mattered again, and investors were looking to sell risky assets and hold on to companies that could turn a profit. This type of environment almost always bodes well for our short-selling strategy, and this tendency continu ed through the last three months of the fiscal year, benefiting the Grizzly Short Fund with competitive relative performance results.

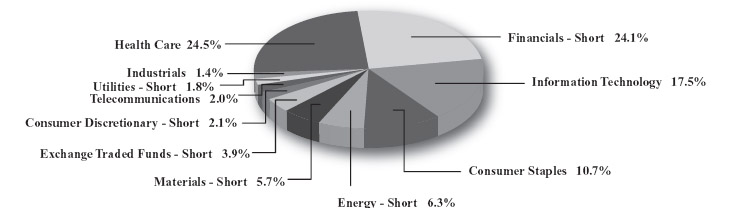

The Grizzly Short Fund has extremely high turnover, and sector concentrations and industry group exposure can fluctuate from day to day. The individual stock positions are similarly weighted across the portfolio, and there are limitations on how much of the portfolio can be concentrated within a particular sector or sub-industry group therein.

These features, combined with the Fund’s quantitative methodology, make it impractical to attribute specific performance dynamics to isolated short positions. Sector concentrations and stock market themes are more effective for discussing the portfolio dynamics when reviewing Grizzly Short Fund performance drivers. Following are the concentrations and themes that were among the most significant contributors to the Fund’s performance, compared to index shorts, over the fiscal year ended September 30, 2010.

The Grizzly Short Fund’s past year’s performance was clearly influenced by the pre-correction period and the correction/ post-correction period. During the pre-correction phase, September 30, 2009 through April 23, 2010, the Grizzly Short Fund had no positive contributors to its performance, based on its broad sector exposure. The biggest losses came from the Fund’s sector exposure to: Consumer Discretionary, Financials, Information Technology, Industrials, and Energy. In contrast, during the correction/post-correction phase following the market high on April 23, 2010 through September 30, 2010, nine of the ten broad sector weights in the Grizzly Short Fund were positive contributors to performance, with the best perform ance being contributed by: Financials, Information Technology, Energy, and Consumer Discretionary (all sectors that had contributed the worst results during the pre-correction phase).

There were no consistent themes among equity industry group performers. Those contributing the most to positive performance results for the Grizzly Short Fund during the fiscal year were Semiconductor Equipment, Investment Banking/Brokerage, and Home Entertainment Software. On the negative side, the biggest detractors to performance based on the Grizzly Short Fund’s exposure during the year were: Application Software, Airlines, and Hotels/Resorts & Cruise Lines.

16 The Leuthold Funds - 2010 Annual Report

Additional Comments Related to the Grizzly Short Fund

Our most recent market analysis leaves us firmly “bullish” in our outlook for the stock market going forward through the end of 2010 and likely the first part of 2011. We would therefore expect the Grizzly Short Fund to continue to produce net losses during this time. However, as demonstrated since the steep correction in May through early July, the market has begun paying closer attention to quality rather than beta. This transition benefited our short-selling approach over the last five months, and we expect it will allow the Fund to uncover opportunities to profit going forward, as there will be vulnerable areas of the stock market regardless of the underlying trend.

Investors who are not experienced in short-selling and adjusting market risk should consider the Leuthold Asset Allocation Fund or Leuthold Global Fund. These two Funds have the flexibility built into their disciplines to overlay our short-selling strategies and hedge against market declines when the stock market is viewed as overvalued and vulnerable to a downside correction.

The Grizzly Short Fund’s year-by-year results are volatile, and while the advantage for employing a short-selling strategy during down-market years is clear (as evidenced by results of 2007-2008), the tremendous risk of short-selling in rising market conditions should also now be very apparent considering the more recent results during the bull market which commenced after the March 9, 2009, market lows. There are viable uses for this strategy in all market conditions. For those less experienced, however, please note that one should expect to lose money when employing this Fund during rising market conditions.

IN CLOSING

We believe this is still a cyclical bull market, and the steep -16% decline from the April 23rd high to the early July low was an abnormally deep bull market correction, not the first leg down in a new cyclical bear market. The huge advance from the March 2009 low through the April 2010 high was probably too far too fast. In May of 2010, what first appeared to be a normal 6%-8% bull market correction was hit by a bad news tornado, financial fears in Europe, and the ecological disaster in the Gulf.

The result was a correction “overshoot” causing buyers (both institutional and individual) to freeze, letting the high frequency traders play ping pong with the market averages. This is why we choose to rely on quantitative disciplines to direct our asset allocation decisions. We are confident that the disciplines of our numbers will continue to be more reliable than our gut feelings and market opinions. Our firm’s Major Trend Index discipline has a 40+ year history, and more often than not it has prudently and successfully guided us through the changing market cycles.

All of our strategies employ quantitative disciplines, and we will continue to abide by these respective disciplines to guide the course of each strategy in the months and years ahead. These quantitative systems allow us to identify opportunities, uncover apparent weakness, and attempt to protect assets as the investment environment progresses through the various phases of market cycles. Regardless of whether it is one of our asset allocation strategies, or one of our 100% equity investments, these tools were designed to remove emotions, severely restrict judgments, and diminish the potential for personal bias to come into play with portfolio decisions.

The Leuthold Funds - 2010 Annual Report 17

We like to remind shareholders that our firm is majority employee-owned and independent; and we are always proud to note that employee-directed investments in Leuthold Funds is at an impressive level. With over 16,000 mutual fund choices in the U.S., we believe that our combined employee and outside shareholders’ commitment to Leuthold Funds reflects a loyalty and confidence that is uncommon in the investment management business today.

Thank you for sharing our conviction in Leuthold Funds.

Sincerely,

18 The Leuthold Funds - 2010 Annual Report

Expense Example – September 30, 2010 (Unaudited)

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, including reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held the entire period (April 1, 2010 – September 30, 2010).

Actual Expenses

The first line of the following table provides information about actual account values and actual expenses. Although the Funds charge no sales load (the Leuthold Core Investment Fund, Leuthold Asset Allocation Fund, Leuthold Global Fund, Leuthold Global Industries Fund, Leuthold Undervalued & Unloved Fund, and Leuthold Hedged Equity Fund charge a 2% redemption fee for redemptions made within five business days after a purchase and the Leuthold Global Clean Technology Fund charges a 2% redemption fee for redemptions made within 30 days after a purchase), you will be assessed fees for outgoing wire transfers, returned checks, or stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Funds’ transfer agent. If you re quest a redemption be made by wire transfer, currently a $15.00 fee is charged by the Funds’ transfer agent. To the extent that the Funds invest in shares of other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which a Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary by fund. These expenses are not included in the following example. The example includes, but is not limited to, management fees, shareholder servicing fees, fund accounting, custody, and transfer agent fees. However, the following example does not include portfolio trading commissions and related expenses, interest expense, and extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expense s that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

The Leuthold Funds - 2010 Annual Report 19Expense Example Tables (Unaudited)

Leuthold Core Investment Fund - Retail Class

| | | Beginning | | | Ending | | | Expenses Paid |

| | | Account Value | | | Account Value | | | During Period* |

| | | April 1, 2010 | | | September 30, 2010 | | | April 1, 2010 - September 30, 2010 |

| | | | | | | | | | |

| Actual** | | $ | 1,000.00 | | | $ | 963.20 | | | $ | 7.14 | |

| Hypothetical (5% return before expenses)*** | | | 1,000.00 | | | | 1,017.80 | | | | 7.33 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.45%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| ** | Excluding dividends and interest on short positions, your actual cost of investment in the Fund would be $5.46 and the Fund’s annualized expense ratio would be 1.11%. |

| *** | Excluding dividends and interest on short positions, your hypothetical cost of investment in the Fund would be $5.62 and the Fund’s annualized expense ratio would be 1.11%. |

Leuthold Core Investment Fund - Institutional Class

| | | Beginning | | | Ending | | | Expenses Paid |

| | | Account Value | | | Account Value | | | During Period* |

| | | April 1, 2010 | | | September 30, 2010 | | | April 1, 2010 - September 30, 2010 |

| | | | | | | | | | |

| Actual** | | $ | 1,000.00 | | | $ | 963.80 | | | $ | 6.60 | |

| Hypothetical (5% return before expenses)*** | | | 1,000.00 | | | | 1,018.35 | | | | 6.78 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.34%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| ** | Excluding dividends and interest on short positions, your actual cost of investment in the Fund would be $4.97 and the Fund’s annualized expense ratio would be 1.01%. |

| *** | Excluding dividends and interest on short positions, your hypothetical cost of investment in the Fund would be $5.11 and the Fund’s annualized expense ratio would be 1.01%. |

Leuthold Asset Allocation Fund - Retail Class

| | | Beginning | | | Ending | | | Expenses Paid |

| | | Account Value | | | Account Value | | | During Period* |

| | | April 1, 2010 | | | September 30, 2010 | | | April 1, 2010 - September 30, 2010 |

| | | | | | | | | | |

| Actual** | | $ | 1,000.00 | | | $ | 979.20 | | | $ | 8.14 | |

| Hypothetical (5% return before expenses)*** | | | 1,000.00 | | | | 1,016.85 | | | | 8.29 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.64%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| ** | Excluding dividends and interest on short positions, your actual cost of investment in the Fund would be $6.55 and the Fund’s annualized expense ratio would be 1.32%. |

| *** | Excluding dividends and interest on short positions, your hypothetical cost of investment in the Fund would be $6.68 and the Fund’s annualized expense ratio would be 1.32%. |

20 The Leuthold Funds - 2010 Annual Report

Expense Example Tables (Unaudited)

Leuthold Asset Allocation Fund - Institutional Class

| | | Beginning | | | Ending | | | Expenses Paid |

| | | Account Value | | | Account Value | | | During Period* |

| | | April 1, 2010 | | | September 30, 2010 | | | April 1, 2010 - September 30, 2010 |

| | | | | | | | | | |

| Actual** | | $ | 1,000.00 | | | $ | 980.30 | | | $ | 7.05 | |

| Hypothetical (5% return before expenses)*** | | | 1,000.00 | | | | 1,017.95 | | | | 7.18 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.42%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| ** | Excluding dividends and interest on short positions, your actual cost of investment in the Fund would be $5.46 and the Fund’s annualized expense ratio would be 1.10%. |

| *** | Excluding dividends and interest on short positions, your hypothetical cost of investment in the Fund would be $5.57 and the Fund’s annualized expense ratio would be 1.10%. |

Leuthold Global Fund - Retail Class

| | | Beginning | | | Ending | | | Expenses Paid |

| | | Account Value | | | Account Value | | | During Period* |

| | | April 1, 2010 | | | September 30, 2010 | | | April 1, 2010 - September 30, 2010 |

| | | | | | | | | | |

| Actual** | | $ | 1,000.00 | | | $ | 1,025.20 | | | $ | 10.00 | |

| Hypothetical (5% return before expenses)*** | | | 1,000.00 | | | | 1,015.19 | | | | 9.95 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.97%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| ** | Excluding dividends and interest on short positions, your actual cost of investment in the Fund would be $8.43 and the Fund’s annualized expense ratio would be 1.74%. |

| *** | Excluding dividends and interest on short positions, your hypothetical cost of investment in the Fund would be $8.39 and the Fund’s annualized expense ratio would be 1.74%. |

Leuthold Global Fund - Institutional Class

| | | Beginning | | | Ending | | | Expenses Paid |

| | | Account Value | | | Account Value | | | During Period* |

| | | April 1, 2010 | | | September 30, 2010 | | | April 1, 2010 - September 30, 2010 |

| | | | | | | | | | |

| Actual** | | $ | 1,000.00 | | | $ | 1,025.10 | | | $ | 9.24 | |

| Hypothetical (5% return before expenses)*** | | | 1,000.00 | | | | 1,015.94 | | | | 9.20 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.82%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| ** | Excluding dividends and interest on short positions, your actual cost of investment in the Fund would be $7.97 and the Fund’s annualized expense ratio would be 1.57%. |

| *** | Excluding dividends and interest on short positions, your hypothetical cost of investment in the Fund would be $7.94 and the Fund’s annualized expense ratio would be 1.57%. |

The Leuthold Funds - 2010 Annual Report 21

Expense Example Tables (Unaudited)

Leuthold Select Industries Fund

| | | Beginning | | | Ending | | | Expenses Paid |

| | | Account Value | | | Account Value | | | During Period* |

| | | April 1, 2010 | | | September 30, 2010 | | | April 1, 2010 - September 30, 2010 |

| | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 923.10 | | | $ | 6.17 | |

| Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.65 | | | | 6.48 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.28%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

Leuthold Global Industries Fund - Retail Class

| | | Beginning | | | Ending | | | Expenses Paid |

| | | Account Value | | | Account Value | | | During Period* |

| | | April 1, 2010 | | | September 30, 2010 | | | April 1, 2010 - September 30, 2010 |

| | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,101.00 | | | $ | 7.67 | * |

| Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,008.80 | | | | 9.87 | ** |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.96%, multiplied by the average account value over the period, multiplied by 136/365 (to reflect the period from May 17, 2010 to September 30, 2010, the Fund’s commencement of operations date to the end of the period) to reflect the Fund’s actual expenses. |

| ** | Expenses are equal to the Fund’s annualized expense ratio of 1.96%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

Leuthold Global Industries Fund - Institutional Class

| | | Beginning | | | Ending | | | Expenses Paid |

| | | Account Value | | | Account Value | | | During Period* |

| | | April 1, 2010 | | | September 30, 2010 | | | April 1, 2010 - September 30, 2010 |

| | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,101.00 | | | $ | 6.69 | * |

| Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,010.06 | | | | 8.62 | ** |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.71%, multiplied by the average account value over the period, multiplied by 136/365 (to reflect the period from May 17, 2010 to September 30, 2010, the Fund’s commencement of operations date to the end of the period) to reflect the Fund’s actual expenses. |

| ** | Expenses are equal to the Fund’s annualized expense ratio of 1.71%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

22 The Leuthold Funds - 2010 Annual Report

Expense Example Tables (Unaudited)

Leuthold Undervalued & Unloved Fund

| | | Beginning | | | Ending | | | Expenses Paid |

| | | Account Value | | | Account Value | | | During Period* |

| | | April 1, 2010 | | | September 30, 2010 | | | April 1, 2010 - September 30, 2010 |

| | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 969.30 | | | $ | 7.41 | |

| Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,017.55 | | | | 7.59 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.50%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

Leuthold Global Clean Technology Fund - Retail Class

| | | Beginning | | | Ending | | | Expenses Paid |

| | | Account Value | | | Account Value | | | During Period* |

| | | April 1, 2010 | | | September 30, 2010 | | | April 1, 2010 - September 30, 2010 |

| | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 918.80 | | | $ | 8.85 | |

| Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,015.84 | | | | 9.30 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.84%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

Leuthold Global Clean Technology Fund - Institutional Class

| | | Beginning | | | Ending | | | Expenses Paid |

| | | Account Value | | | Account Value | | | During Period* |

| | | April 1, 2010 | | | September 30, 2010 | | | April 1, 2010 - September 30, 2010 |

| | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 920.70 | | | $ | 7.32 | |

| Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,017.45 | | | | 7.69 | |

| * | Expenses are equal to the Fund's annualized expense ratio of 1.52%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

The Leuthold Funds - 2010 Annual Report 23

Expense Example Tables (Unaudited)

Leuthold Hedged Equity Fund - Retail Class

| | | Beginning | | | Ending | | | Expenses Paid |

| | | Account Value | | | Account Value | | | During Period* |

| | | April 1, 2010 | | | September 30, 2010 | | | April 1, 2010 - September 30, 2010 |

| | | | | | | | | | |

| Actual** | | $ | 1,000.00 | | | $ | 976.40 | | | $ | 14.07 | |

| Hypothetical (5% return before expenses)*** | | | 1,000.00 | | | | 1,010.83 | | | | 14.32 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 2.84%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| ** | Excluding dividends and interest on short positions, your actual cost of investment in the Fund would be $10.95 and the Fund’s annualized expense ratio would be 2.21%. |

| *** | Excluding dividends and interest on short positions, your hypothetical cost of investment in the Fund would be $11.16 and the Fund’s annualized expense ratio would be 2.21%. |

Leuthold Hedged Equity Fund - Institutional Class

| | | Beginning | | | Ending | | | Expenses Paid |