UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-07537

Name of Registrant: Royce Capital Fund

Address of Registrant: 745 Fifth Avenue

New York, NY 10151

| Name and address of agent for service: | John E. Denneen, Esquire

745 Fifth Avenue

New York, NY 10151 |

Registrant’s telephone number, including area code: (212) 508-4500

Date of fiscal year end: December 31

Date of reporting period: January 1, 2018 – December 31, 2018

Item 1. Reports to Shareholders.

| | | DECEMBER 31, 2018 |

| | | |

| | | |

| | | |

| | | 2018 Annual |

| | | Review and Report to Shareholders |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | Royce Capital Fund– |

| | | Micro-Cap Portfolio |

| | | | |

| | | Royce Capital Fund– |

| | | Small-Cap Portfolio |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Funds’ shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your financial intermediary (such as a broker-dealer or bank). Instead, the reports will be made available on the Funds’ website (www.roycefunds.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically anytime by contacting your financial intermediary or, if you are a direct investor with the Funds, by calling 1-800-841-1180. Beginning on January 1, 2019, you may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Funds, you can call 1-800-841-1180 to let the Funds know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds held in your account if you invest through your financial intermediary or all Funds held with our fund complex if you invest directly with the Funds. |

| | | | |

| | | | |

| | | roycefunds.com |  |

| | | | |

| | | | |

| | | | |

| Table of Contents | | | |

| | | | |

| | | | |

| Annual Review | | | |

| | | | |

| Letter to Our Shareholders | | 1 | |

| | | | |

| Performance and Expenses | | 5 | |

| | | | |

| | | | |

| Annual Report to Shareholders | | | |

| | | | |

| Managers’ Discussions of Fund Performance and Schedules of Investments | | | |

| | | | |

Royce Capital Fund–Micro-Cap Portfolio | | 6 | |

| | | | |

Royce Capital Fund–Small-Cap Portfolio | | 12 | |

| | | | |

| Financial Statements | | 16 | |

| | | | |

| Notes to Financial Statements | | 20 | |

| | | | |

| Report of Independent Registered Public Accounting Firm | | 25 | |

| | | | |

| Understanding Your Fund’s Expenses | | 26 | |

| | | | |

| Trustees and Officers | | 27 | |

| | | | |

| Notes to Performance and Other Important Information | | 28 | |

| This page is not part of the Royce Capital Fund 2018 Annual Report to Shareholders |

Letter to Our Shareholders

2018: ANNUS HORRIBILIS

This was quite a memorable year for the equity markets—for reasons most investors would prefer to forget. A bull market ended with a bang that left many investors whimpering. Of course, the end of any upswing for share prices is bound to be disappointing—what made this pullback so jarring was its speed and severity. Back in the summer, everyone seemed to agree that valuations were stretched to the point where an adjustment to prices was all but inevitable, yet the force of the decline felt more like the engine of a precision-engineered sports car suddenly seizing than the anticipated tapping of the brakes. So while 2018’s downturn initially looked as if it would assume a place among the most predicted in history, no one, including us, was expecting a fall as steep and fast as this one has been. It has also, however, performed the role down markets do—which is to provide active managers with an ample supply of potential long-term opportunities.

Part of the reason the jolt was so unexpected may be due to the placid nature of the bull market it wrenched to a stop. For much of 2018, the U.S. market cruised confidently ahead, with very little congestion and few potholes. Through the first three quarters of the year, volatility barely registered in the small-cap market, with only 22% of the trading days having intraday moves of at least 1% in the small-cap Russell 2000 Index (and our chosen asset class has |

historically been the most volatile precinct of the equity world). Of course, this all changed dramatically later in the year. For small-caps, it began after the Russell 2000 reached an all-time high on August 31, following which a wave of volatility hit. In the fourth quarter, 54% of the trading days for the Russell 2000 had intraday moves of at least 1%.

The volatility itself would have perhaps been more bearable if it had not also taken returns in the year’s last three months from ‘bad’ to ‘historically awful’—the Russell 2000 fell 20.2% for the fourth quarter. Its worst month by far was December. In fact, the first few months of the corrective phase had enough push and pull that the year-to-date return at the end of November for the Russell 2000 was 1.0%. From our perspective, then, the downturn had two phases—the first was the widely expected recalibration from late August through mid-December. The second was a blur of panic selling between December 12th and 24th. Losses mounted as the gentler slope of the initial stage gave way to a wild downhill. The markets careened downhill at breakneck speed as the calendar approached year-end, with small-caps reaching a 2018 bottom on Christmas Eve before stabilizing over the next week, giving the Russell 2000 a loss of 11.9% for December. In the context of its 11.0% decline for calendar 2018, it may be easy to forget that year-to-date through August 31, the Russell 2000 was up 14.3%. |

| This page is not part of the Royce Capital Fund 2018 Annual Report to Shareholders | 1 |

LETTER TO OUR SHAREHOLDERS

| |

A Tale of Two Markets

Russell 2000 2018 |

So 2018 was truly A Tale of Two Markets, and offered yet another lesson from history that the market can—and often does—turn in a hurry. For an additional sense of the tumult and—we want to stress again—the opportunities the correction created, consider that the average stock in the Russell 2000 declined 37.2% from its previous 52-week high through year-end. Many declined more than that: energy stocks in the Russell 2000 fell more than 50%, materials slid 42.5%, and transportation was down 42.3% from their respective highs.

“WHAT JUST HAPPENED?” |

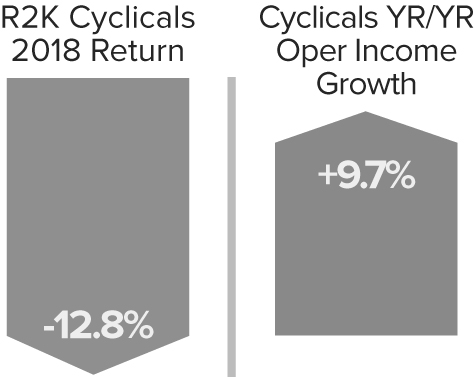

Retrospect offers the opportunity to look at the contour of the correction and at the confluence of factors that may have led to and exacerbated it. In spite of its historic awfulness, the downturn displayed some familiar traits: small-caps lost more than large-caps, for example, which is consistent with most bear markets, as is the fact that small-caps entered ‘classic’ bear market territory before their larger counterparts. (By a ‘classic’ bear, we mean a decline of 20% or more from a previous peak—the Russell 2000 lost 22.1% from 8/31/18-12/31/18.) Within small-cap, we also saw value beat growth, dividend payers lose less than non-payers, earners hold up better than non-earners, and defensives outpace cyclicals. All of this is also essentially consistent with history, which was reassuring (though painful in the short run).

Identifying this mix of the familiar and the unexpected helps to shed light on the question of what drove shares down in such

| |

| A Familiar Pattern in 4Q18 Decline |

precipitous fashion, turning what at first looked like a historically typical bull market detour into the bear market ditch. First, there was the by-now familiar cloud of tariffs and trade wars looming over the market, arguably the major factor in underperformance for economically sensitive cyclical stocks in 2018. Oil prices began to collapse in October, while shortly afterward slowdowns were reported in both housing and auto sales. Consumer confidence began to dip, and Europe and China continued to weaken. Yet all of this was, if not old news, then at least well established news by the end of November. Moreover, much of the economic news in the U.S. remained positive. Job and wage gain growth remained robust (as they continue to do as of this writing) as did corporate profits.

In mid-December, however, other factors came into play that helped to bring the witches’ brew to a boil. Investors looked at the coincidence of a flattening yield curve and the abrupt drop in oil prices as a surefire recession warning. Ratcheting up the already high level of anxiety, the December Fed meeting announcement and subsequent press conference were widely seen as conveying an unhealthy detachment from current financial conditions, which exacerbated the downward spiral. This is how ‘bad’ became ‘worse.’

A SENSE OF WHERE WE ARE

A month into 2019, which featured a welcome rally that recovered most of December’s losses, the signals remain decidedly mixed. The PMI (Purchasing Managers’ Index) report for December issued in early January perhaps best distills the mixed, if not confusing, state of play in the U.S. economy. The report is designed to show the health of the manufacturing and service sectors. The index hit a 15-month low in December, which is admittedly concerning, especially given the marked fall-off from November. However, of its 18 manufacturing sectors, 11 showed growth in December. Additionally, the 54.1% number reported for that month was comfortably in the range of a growing economy because any number north of 50% typically indicates growth. Even with the uncertain course of U.S. growth, it seems clear to us that in 2018 many investors reacted as if the economy has only two gears—forward and reverse. |

| 2 | This page is not part of the Royce Capital Fund 2018 Annual Report to Shareholders |

LETTER TO OUR SHAREHOLDERS

| We see a more nuanced picture that’s closer to the midpoint of these extremes. The economy looks essentially healthy and capable of expansion to us, though probably at a slower pace than we saw over the last two years. There are undoubtedly risks on the horizon—political, financial, and economic. Yet we believe that these have already been reflected, in some cases excessively so, in current small-cap valuations. The market shifted in short order from a period when small-cap’s extended valuations seemed out of sync in light of the index’s high levels of debt and low profitability, to one at the end of the year when valuations reflected more pessimism than we think is warranted—at least in select instances. |

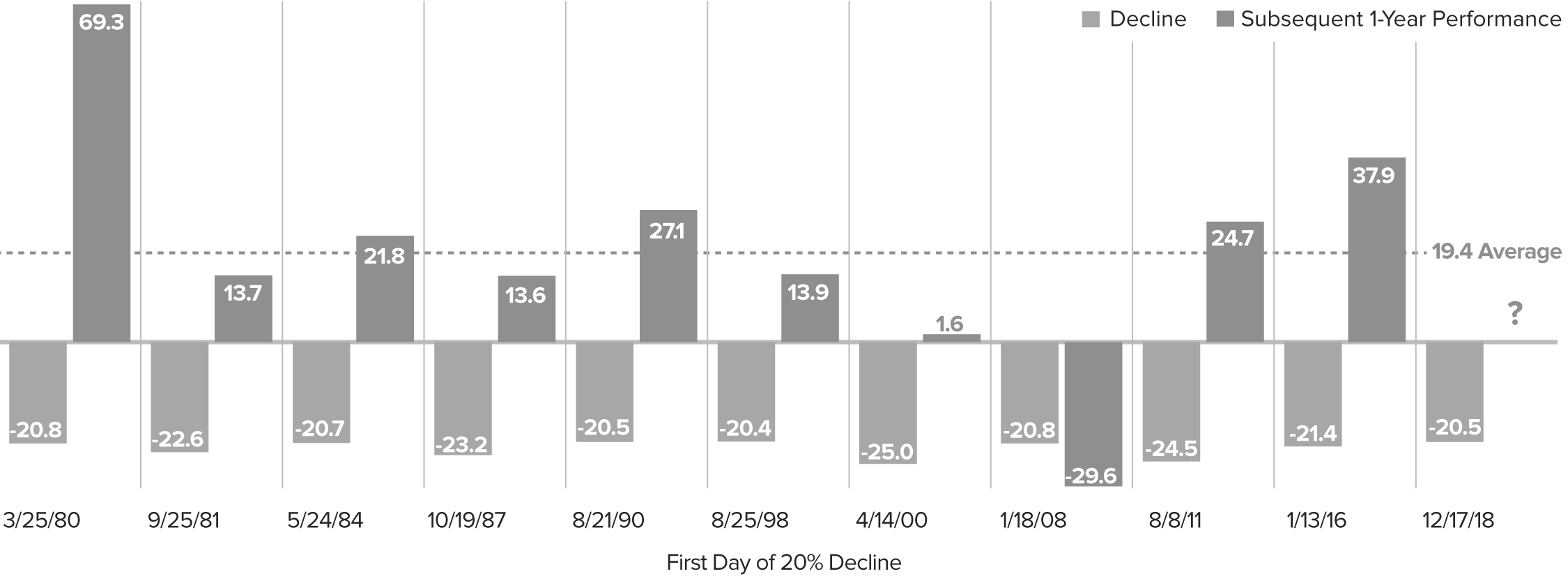

THE LESSONS OF HISTORY

We examined the recent bear phase from a calendar-year and market cycle perspective and uncovered encouraging data. First, 2018 was the twelfth negative calendar year in the 40-year history of the Russell 2000. In 10 of the previous 11 years, a positive calendar-year return followed—with an average one-year return of 21.1%. (Unsurprisingly, the lone exception was 2007-08.) Turning to market cycles also shows compelling positive news. 2018 saw the eleventh decline of 20% or more from a previous small-cap peak. In nine of the previous 10 periods, the subsequent average one-year return from the first day on which the index declined 20% from its peak was a positive 19.4%. (The exception, again unsurprisingly, came in 2008-09.) These historical examples certainly suggest the possibility of a solid 2019. |

| |

Historical Comparison

CRSP 6-10 Declines and Subsequent 12-Month Performance |

| To be sure, our belief is that we are a long way from the crisis era of a decade ago. We are also in a stronger position economically than we were in the two prior bear markets in 2011-12 or 2015-16. In fact, we see the closest historical parallels farther back. In our view, 1987 or 1962 are the more relevant comparisons—two cases in which the markets experienced a deep decline before recovering in the midst of a still growing economy. Moreover, we also see little resemblance between the present and prior bearish periods such as 1998, 2001-02, or 2008-09, when there were more than enough reasons for investors to sell in the form of financial crises and/or recessions (while contrarians like us were casting about for opportunities). It’s worth emphasizing that the only decline over the last 10-plus years that featured both a recession and a financial crisis was 2008-09. Unless investors are expecting something in the way of a repeat performance—and we are obviously not—history suggests this may be a good time to consider committing more money to small-caps. |

| |

After the Bear Market, Then What?

Subsequent 1-Year Performance of Russell 2000 after a 20% Decline as of 12/31/18 |

| This page is not part of the Royce Capital Fund 2018 Annual Report to Shareholders | 3 |

LETTER TO OUR SHAREHOLDERS

A DELIBERATE PACE ON THE ROAD TO NORMAL

We would, however, add a note or two mixing intermediate-term caution for the small-cap market with long-term optimism for small-cap active management. 2019 may well be a terrific year for small-cap performance, particularly if January is any kind of bellwether. However, we suspect that annualized small-cap returns over the next three to five years may be in the mid to high single digits. From our perspective as disciplined small-cap specialists, this is not necessarily bad news. Lower-than-average returns for the Russell 2000 have historically benefited active management approaches, including a number of our own strategies, especially coming out of periods of deep pessimism such as we saw late in 2018, when investors often miss the long-term opportunities falling markets create.

We also believe that the long and winding road back to more normal terrain for the capital markets will be marked by three occurrences: a normalizing rate structure, with rates moving higher, resulting in a steepening yield curve; more historically average levels of volatility (which was higher in 2018 than it was over the previous two years); and the more historically typical returns that we mentioned above. All three of these market conditions have been supportive for small-cap active management in the past.

The overall state of small-cap, however, still has several unresolved issues. Of the three that worried us most about the Russell 2000 over the summer—lofty valuations, many companies with barely manageable debt, and too many with no earnings—only the first is no longer a pressing matter. We think that the fundamentals we value most—such as high returns on invested capital, positive cash flow, and an identifiable catalyst (or two) for earnings growth or recovery—should be rewarded in the coming market environment, as they have often been over the long term. |

IDENTIFYING OPPORTUNITIES IN A VOLATILE CLIMATE

In all of our strategies, we’ve been working to take advantage of long-term buying opportunities across a broad spectrum of sectors and industries. This includes companies involved in energy services, RV parts, infrastructure, laser-based photonics, shipping, trucking, banking, outpatient healthcare facilities that bend the cost curve, and semiconductor capital equipment, to name just a few. Within our high-quality strategies, we’ve also been buying more of the companies that we know best, those in which we have the highest confidence, because of their demonstrated ability to deal effectively with adversity in previous down markets.

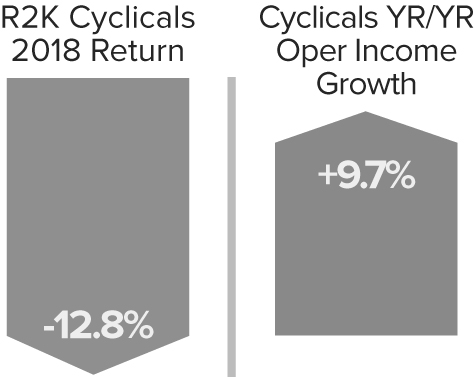

Within these cyclical sectors, especially in the broad industrial and technology spaces, there are diverse industry groups with distinct business cycle dynamics. Each responds to multiple company- or industry-specific factors that help to determine performance as a business—they seldom march in lockstep. That diversity is very attractive to us as selective active managers. So while there’s no question that we were incorrect in thinking that investors would more readily recognize and then close the gap between operating income and stock prices, we think that many small-cap cyclical companies were disproportionately punished in the downturn to the point where many look as if a recession has already been priced in—which makes them even more attractive to us. |

| |

| Cyclical Market Disconnect |

| Across each of our small-cap strategies, we are confident in our holdings, which generally possess some combination of solid cash flows, modest valuations, effective managements, and encouraging prospects. These are the businesses that look most likely to weather or even thrive in a period with even more volatility and uncertainty than usual. |

| |  | |  |

| Charles M. Royce | | Christopher D. Clark | | Francis D. Gannon |

| Chairman, | | Chief Executive Officer, and | | Co-Chief Investment Officer, |

| Royce & Associates, LP | | Co-Chief Investment Officer, | | Royce & Associates, LP |

| | | Royce & Associates, LP | | |

| | | | | |

| January 31, 2019 | | | | |

| 4 | This page is not part of the Royce Capital Fund 2018 Annual Report to Shareholders |

Performance and Expenses

| |

| Performance and Expenses |

| As of December 31, 2018 |

| | | 1-YR | | 3-YR | | 5-YR | | 10-YR | | 15-YR | | 20-YR | | SINCE

INCEPTION

(12/27/96) | | ANNUAL OPERATING

EXPENSES (%)

GROSS/NET |

| |

| Royce Capital Fund–Micro-Cap Portfolio | | -9.04 | | 4.63 | | -0.67 | | 8.55 | | 4.94 | | 8.68 | | 9.01 | | 1.47/1.42 |

| |

| Royce Capital Fund–Small-Cap Portfolio | | -8.34 | | 5.32 | | 1.24 | | 9.78 | | 7.21 | | 9.40 | | 9.76 | | 1.11/1.08 |

| |

INDEX | | | | | | | | | | | | | | | | |

| |

| Russell Microcap Index | | -13.08 | | 5.79 | | 3.08 | | 11.71 | | 5.67 | | N/A | | N/A | | N/A |

| |

| Russell 2000 Index | | -11.01 | | 7.36 | | 4.41 | | 11.97 | | 7.50 | | 7.40 | | N/A | | N/A |

| |

Important Performance, Expense, and Risk Information

All performance information in this Review and Report reflects past performance, is presented on a total return basis, reflects the reinvestment of distributions, and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when redeemed. Current performance may be higher or lower than performance quoted and may be obtained at www.roycefunds.com. The Funds’ total returns do not reflect any deduction for charges or expenses of the variable contracts investing in the Funds. All performance and expense information reflects the result for each Fund’s Investment Class Shares. Gross annual operating expenses reflect each Fund’s gross total annual operating expenses and include management fees, operating expenses, and any applicable acquired fund fees and expenses. Net annual operating expenses reflect contractual fee waivers and/or expense reimbursements. All expense information is reported as of each fund’s most current prospectus. Royce & Associates has contractually agreed to waive fees and/or reimburse operating expenses, excluding brokerage commissions, taxes, interest litigation expenses, acquired fund fees and expenses, and other expenses not borne in the ordinary cost of business, to the extent necessary to maintain net operating expenses at or below 1.33% for Royce Capital Fund–Micro-Cap Portfolio, and at or below 1.08% for Royce Capital Fund–Small-Cap Portfolio through April 30, 2019. Acquired fund fees and expenses reflect the estimated amount of fees and expenses incurred indirectly by the Fund through its investment in mutual funds, hedge funds, private equity funds, and other investment companies.

Service Class Shares bear an annual distribution expense that is not borne by the Investment Class; if those expenses were reflected, total returns would have been lower. Royce Micro-Cap Portfolio invests primarily in micro-cap companies while Royce Small-Cap Portfolio invests primarily in small-cap companies. Investments in micro-cap and small-cap companies may involve considerably more risk than investments in securities of larger-cap companies. (Please see “Primary Risks for Fund Investors” in the prospectus.) Each series of Royce Capital Fund may invest up to 25% of its net assets in foreign securities. Investments in foreign securities may involve political, economic, currency, and other risks not encountered in U.S. investments. (Please see “Investing in Foreign Securities” in the prospectus.) As of 12/31/18, Royce Small-Cap Portfolio invested a significant portion of its assets in a limited number of stocks, which may involve considerably more risk than a more broadly diversified portfolio because a decline in the value of any one of these stocks would cause the Portfolio’s overall value to decline to a greater degree. Royce Micro-Cap Portfolio’s broadly diversified portfolio does not ensure a profit or guarantee against loss. (Please see “Primary Risks for Fund Investors” in the prospectus.) This Review and Report must be preceded or accompanied by a prospectus. Please read the prospectus carefully before investing or sending money. Russell Investment Group is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Russell® is a trademark of Russell Investment Group. The Russell Microcap Index includes 1,000 of the smallest securities in the small-cap Russell 2000 Index along with the next smallest eligible securities as determined by Russell. The Russell 2000 Index is an unmanaged, capitalization-weighted index of domestic small-cap stocks. It measures the performance of the 2,000 smallest publicly traded U.S. companies in the Russell 3000 Index. The performance of an index does not represent exactly any particular investment, as you cannot invest directly in an index. Distributor: Royce Fund Services, LLC.

| This page is not part of the Royce Capital Fund 2018 Annual Report to Shareholders | 5 |

| MANAGERS’ DISCUSSION |

| Royce Capital Fund–Micro-Cap Portfolio (RCM) |

|

Jim Stoeffel

Brendan Hartman |

| |

| FUND PERFORMANCE |

| Royce Capital Fund–Micro-Cap Portfolio held an advantage over its benchmarks for the calendar-year period, in large part due to losing less during the downturn that hit the markets from September through the end of the year. The Fund fell 9.0% in 2018 compared to the Russell Microcap and Russell 2000 Indexes, which fell 13.1% and 11.0%, respectively, for the same period. |

| |

| WHAT WORKED... AND WHAT DIDN’T |

| Six of the portfolio’s 10 equity sectors detracted from performance in 2018. Financials, Industrials, and Energy made the largest negative impacts while Health Care made the biggest positive contribution, followed by Information Technology, historically one of our heaviest weightings. We were pleased to see these contributions because accruing positive performance was no small feat during such a difficult year. In fact, most of the cyclical areas where we focus struggled in 2018, including machinery (Industrials), which was the portfolio’s top detractor at the industry level. This group was followed by energy equipment & services holdings (Energy), which were mostly hurt by plummeting oil prices, while holdings in capital markets (Financials) slumped because most of our positions are asset management companies, an industry that is often sensitive to market pullbacks. |

| Lydall, the Fund’s top-detracting position in 2018, is a machinery company that manufactures an assortment of specialized products with automotive and industrial applications. A multi-year restructuring effort in the company’s Thermal/Acoustical Solutions segment has been slow to generate positive returns, a problem exacerbated by slowing light vehicle sales. We built our position as we believe recent data points to a bottom for its margins while we remain cognizant of the risks inherent in its end market exposure. Ultra Clean Holdings provides gas panel subsystems to semiconductor equipment manufacturers. Its shares were hurt by the global slowdown in semiconductor equipment production. We added to our position as we believe the recent acquisition of Quantum Global, which provides ultra-purity cleaning solutions to the semiconductor equipment industry, can strengthen Ultra Clean’s already formidable competitive position. |

| Health care equipment & supplies (Health Care) was the Fund’s top-contributing industry, with results driven by positive performance for five of our six holdings, including AtriCure, Tactile Systems Technology, and CryoLife. Positive results also came from electronic equipment, instruments & components (Information Technology), where Fabrinet and laser solutions company Electro Scientific Industries, which was acquired at a 100% premium, boosted performance. The Fund’s top contributor at the position level was Attunity, which makes database management software that addresses the increasing need for rapid access to data. Its shares benefited from the accelerating adoption of its products, which lifted enterprise sales. We trimmed our stake but maintained a position as we see its opportunity as relatively open ended in the intermediate term. |

| Relative to the Russell Microcap, stock selection drove calendar-year results while sector allocation detracted somewhat. The largest stock selection advantage came from Information Technology, where our holdings in electronic equipment, instruments & components, specifically Fabrinet and Electro Scientific Industries, did most to drive results. Stock picking in Health Care, Consumer Discretionary, and Industrials also boosted relative performance. In the first sector, health care equipment & supplies dominated. In Industrials, electrical equipment did best while auto components and household durables stood out in Consumer Discretionary. Financials was the largest detractor for the calendar-year period, mostly due to stock picking issues in the aforementioned capital markets group, where Westwood Holdings Group detracted most. Energy also had a negative relative effect, mostly due to poor stock selection in energy equipment & services. Smaller detractions came from Consumer Staples and Utilities. |

| | | | | |

| | Top Contributors to Performance | | | |

| | For 2018 (%)1 | | | |

| | | | | |

| | Attunity | | 1.03 | |

| | | |

| | American Superconducter | | 0.68 | |

| | | |

| | QuinStreet | | 0.55 | |

| | | |

| | Electro Scientific Industries | | 0.54 | |

| | | |

| | AtriCure | | 0.48 | |

| | | |

| | 1 Includes dividends | | | |

| | Top Detractors from Performance | | | |

| | For 2018 (%)2 | | | |

| | | | | |

| | Lydall | | -0.55 | |

| | | |

| | Ultra Clean Holdings | | -0.55 | |

| | | |

| | Paratek Pharmaceuticals | | -0.51 | |

| | | |

| | FreightCar America | | -0.47 | |

| | | |

| | Francesca’s Holdings | | -0.43 | |

| | | |

| | 2 Net of dividends | | | |

| | | | | |

| CURRENT POSITIONING AND OUTLOOK |

| We used the sharp pullback to allocate capital from lower-conviction names into those in which we had greater confidence, including several in Information Technology, which saw many stocks particularly hard hit on concerns over slowing global growth, a trade war with China, tariff-related supply chain issues, and short-term oversupply in memory semiconductors. We believe all of the longer-term positive demand drivers in the technology sector, a long list that includes growing storage demand, increasing mobility, and connectedness encompassing the “Internet of Things,” remain intact and should benefit the industry’s high-quality micro-cap companies. We also maintained a sizable exposure to Consumer Discretionary. Health Care was one of our most underweighted sectors, although we began to add a few new ideas in the fourth quarter when valuations looked particularly attractive to us. These weightings are consistent with the portfolio’s historical emphasis on cyclical areas while also reflecting our confidence in the ongoing growth of the U.S. economy. We remain optimistic about the prospects for micro-cap stocks in this still-vibrant environment. Anticipating more robust growth in the U.S. relative to the rest of the globe, we stayed primarily focused on companies that derive most of their revenues from the U.S. economy. |

| 6 | Royce Capital Fund 2018 Annual Report to Shareholders |

| PERFORMANCE AND PORTFOLIO REVIEW | | TICKER SYMBOLS RCMCX RCMSX |

| Performance and Expenses |

| Average Annual Total Return (%) Through 12/31/18 |

| | | JUL-DEC 20181 | | 1-YR | | 3-YR | | 5-YR | | 10-YR | | 15-YR | | 20-YR | | SINCE INCEPTION (12/27/96) |

| |

| RCM | | -17.54 | | -9.04 | | 4.63 | | -0.67 | | 8.55 | | 4.94 | | 8.68 | | 9.01 |

| |

| Annual Gross Operating Expenses: 1.47% Annual Net Operating Expenses: 1.42% |

| |

| 1 Not annualized | | | | | | | | | | | | | | | | |

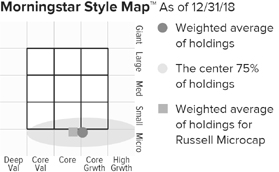

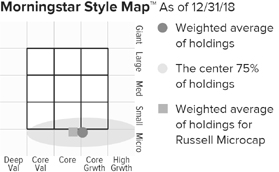

The Morningstar Style Map is the Morningstar Style BoxTM with the center 75% of fund holdings plotted as the Morningstar Ownership ZoneTM. The Morningstar Style Box is designed to reveal a fund’s investment strategy. The Morningstar Ownership Zone provides detail about a portfolio’s investment style by showing the range of stock sizes and styles. The Ownership Zone is derived by plotting each stock in the portfolio within the proprietary Morningstar Style Box. Over time, the shape and location of a fund’s ownership zone may vary. See page 28 for additional information. |

Value of $10,000Invested on 6/30/00 (Russell Microcap Inception)

as of 12/31/18 ($)

Includes reinvestment of distributions.

| |

| Top 10 Positions | | |

| % of Net Assets | | |

| | | |

| Attunity | | 1.1 |

| |

| American Superconducter | | 1.1 |

| |

| QuinStreet | | 1.1 |

| |

| Northwest Pipe | | 1.1 |

| |

| BioSpecifics Technologies | | 1.1 |

| |

| Stoneridge | | 1.1 |

| |

| Photronics | | 1.1 |

| |

| Kornit Digital | | 1.1 |

| |

| AtriCure | | 1.1 |

| |

| Graham Corporation | | 1.0 |

| |

| |

| Portfolio Sector Breakdown | | |

| % of Net Assets | | |

| | | |

| Industrials | | 22.0 |

| |

| Information Technology | | 20.5 |

| |

| Financials | | 13.7 |

| |

| Consumer Discretionary | | 13.6 |

| |

| Health Care | | 11.5 |

| |

| Energy | | 4.3 |

| |

| Materials | | 3.4 |

| |

| Consumer Staples | | 2.5 |

| |

| Real Estate | | 2.4 |

| |

| Communication Services | | 1.9 |

| |

| Cash and Cash Equivalents | | 4.2 |

| |

| |

| Calendar Year Total Returns (%) | | |

| | | |

| YEAR | | RCM |

| |

| 2018 | | -9.0 |

| |

| 2017 | | 5.2 |

| |

| 2016 | | 19.7 |

| |

| 2015 | | -12.5 |

| |

| 2014 | | -3.6 |

| |

| 2013 | | 21.0 |

| |

| 2012 | | 7.6 |

| |

| 2011 | | -12.1 |

| |

| 2010 | | 30.1 |

| |

| 2009 | | 57.9 |

| |

| 2008 | | -43.3 |

| |

| 2007 | | 4.0 |

| |

| 2006 | | 21.1 |

| |

| 2005 | | 11.6 |

| |

| 2004 | | 13.8 |

| |

| |

| Upside/Downside Capture Ratios | | | | |

| Periods Ended 12/31/18 (%) | | | | |

| | | UPSIDE | | DOWNSIDE |

| |

| 10-Year | | 77 | | 83 |

| |

From 6/30/00 (Russell

Microcap Inception) | | 89 | | 79 |

| |

| |

| Portfolio Diagnostics | | |

| | | |

| Fund Net Assets | | $142 million |

| |

| Number of Holdings | | 142 |

| |

| Turnover Rate | | 28% |

| |

| Average Market Capitalization1 | | $399 million |

| |

| Weighted Average P/B Ratio2 | | 1.7x |

| |

| Active Share3 | | 90% |

| |

| U.S. Investments (% of Net Assets) | | 84.0% |

| |

| Non-U.S. Investments (% of Net Assets) | | 11.8% |

| |

| 1 | Geometric Average. This weighted calculation uses each portfolio holding’s market cap in a way designed to not skew the effect of very large or small holdings; instead, it aims to better identify the portfolio’s center, which Royce believes offers a more accurate measure of average market cap than a simple mean or median. |

| 2 | Harmonic Average. This weighted calculation evaluates a portfolio as if it were a single stock and measures it overall. It compares the total market value of the portfolio to the portfolio’s share in the earnings or book value, as the case may be, of its underlying stocks. |

| 3 | Active Share is the sum of the absolute values of the different weightings of each holding in the Fund versus each holding in the benchmark, divided by two. |

| Important Performance and Expense Information

All performance information in this Report reflects past performance, is presented on a total return basis, reflects the reinvestment of distributions, and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when redeemed. Current performance may be higher or lower than performance quoted. The Fund’s total returns do not reflect any deduction for charges or expenses of the variable contracts investing in the Fund. Returns as of the most recent month-end may be obtained at www.roycefunds.com. All performance and risk information reflects the result of the Investment Class (its oldest class). Shares of RCM’s Service Class bear an annual distribution expense that is not borne by the Investment Class; if those expenses were reflected, total returns would have been lower. Certain immaterial adjustments were made to the net assets of Royce Capital Fund-Micro-Cap Portfolio at 12/31/17 for financial reporting purposes, and as a result the calendar year total returns based on those net assets values differ from the adjusted net values and calendar year total returns reported in the Financial Highlights. The Fund’s total returns do not reflect any deduction for charges or expenses of the variable contracts investing in the Fund. Gross operating expenses reflect the Fund’s total gross operating expenses for the Investment Class and include management fees, other expenses, and acquired fund fees and expenses. Net operating expenses reflect contractual fee waivers and/or expense reimbursements. All expense information is reported as of the Fund’s most current prospectus. Royce & Associates has contractually agreed, without right of termination, to waive fees and/or reimburse expenses to the extent necessary to maintain the Investment Class’s net annual operating expenses (excluding brokerage commissions, taxes, interest, litigation expenses, acquired fund fees and expenses, and other expenses not borne in the ordinary course of business) at or below 1.33% through April 30, 2019. Acquired fund fees and expenses reflect the estimated amount of the fees and expenses incurred indirectly by the Fund through its investments in mutual funds, hedge funds, private equity funds, and other investment companies. Regarding the “Top Contributors” and “Top Detractors” tables shown above, the sum of all contributors to, and all detractors from, performance for all securities in the portfolio would approximate the Fund’s year-to-date performance for 2018. Upside Capture Ratio measures a manager’s performance in up markets relative to the Fund’s benchmark. It is calculated by measuring the Fund’s performance in quarters when the benchmark went up and dividing it by the benchmark’s return in those quarters. Downside Capture Ratio measures a manager’s performance in down markets relative to the Fund’s benchmark (Russell Microcap). It is calculated by measuring the Fund’s performance in quarters when the benchmark goes down and dividing it by the benchmark’s return in those quarters.

|

| Royce Capital Fund 2018 Annual Report to Shareholders | 7 |

Schedule of Investments

| |

| Royce Capital Fund - Micro-Cap Portfolio | | | | | | | |

| Common Stocks - 95.8% | | | | | | | |

| | | SHARES | | | | VALUE | |

| |

| |

| COMMUNICATION SERVICES – 1.9% | | | | | | | |

| DIVERSIFIED TELECOMMUNICATION SERVICES - 0.7% | | | | | | | |

ORBCOMM 1 | | 117,500 | | | $ | 970,550 | |

| | | | | | | |

| INTERACTIVE MEDIA & SERVICES - 1.1% | | | | | | | |

QuinStreet 1 | | 97,500 | | | | 1,582,425 | |

| | | | | | | |

| MEDIA - 0.1% | | | | | | | |

†Marchex Cl. B | | 77,500 | | | | 205,375 | |

| |

| Total (Cost $1,291,450) | | | | | | 2,758,350 | |

| |

| | | | | | | | |

| CONSUMER DISCRETIONARY – 13.6% | | | | | | | |

| AUTO COMPONENTS - 2.9% | | | | | | | |

Fox Factory Holding 1 | | 16,500 | | | | 971,355 | |

Standard Motor Products | | 18,900 | | | | 915,327 | |

Stoneridge 1 | | 63,400 | | | | 1,562,810 | |

Unique Fabricating | | 165,000 | | | | 696,300 | |

| | | | | | | |

| | | | | | | 4,145,792 | |

| | | | | | | |

| HOTELS, RESTAURANTS & LEISURE - 2.7% | | | | | | | |

†Century Casinos 1 | | 108,600 | | | | 802,554 | |

Del Taco Restaurants 1 | | 101,500 | | | | 1,013,985 | |

†Lindblad Expeditions Holdings 1 | | 62,400 | | | | 839,904 | |

Red Lion Hotels 1 | | 146,300 | | | | 1,199,660 | |

| | | | | | | |

| | | | | | | 3,856,103 | |

| | | | | | | |

| HOUSEHOLD DURABLES - 1.4% | | | | | | | |

Cavco Industries 1 | | 5,504 | | | | 717,611 | |

†Lovesac Company 1, 2 | | 56,600 | | | | 1,298,404 | |

| | | | | | | |

| | | | | | | 2,016,015 | |

| | | | | | | |

| INTERNET & DIRECT MARKETING RETAIL - 0.7% | | | | | | | |

Gaia Cl. A 1 | | 89,900 | | | | 931,364 | |

| | | | | | | |

| LEISURE PRODUCTS - 1.4% | | | | | | | |

MasterCraft Boat Holdings 1 | | 46,817 | | | | 875,478 | |

Nautilus 1 | | 102,500 | | | | 1,117,250 | |

| | | | | | | |

| | | | | | | 1,992,728 | |

| | | | | | | |

| SPECIALTY RETAIL - 3.5% | | | | | | | |

Build-A-Bear Workshop 1 | | 97,700 | | | | 385,915 | |

Citi Trends | | 47,886 | | | | 976,396 | |

Haverty Furniture | | 65,700 | | | | 1,233,846 | |

Kirkland’s 1 | | 113,900 | | | | 1,085,467 | |

Shoe Carnival | | 39,600 | | | | 1,326,996 | |

| | | | | | | |

| | | | | | | 5,008,620 | |

| | | | | | | |

| TEXTILES, APPAREL & LUXURY GOODS - 1.0% | | | | | | | |

Culp | | 30,649 | | | | 579,266 | |

Vera Bradley 1 | | 102,500 | | | | 878,425 | |

| | | | | | | |

| | | | | | | 1,457,691 | |

| |

| Total (Cost $18,385,203) | | | | | | 19,408,313 | |

| |

| | | | | | | | |

| CONSUMER STAPLES – 2.5% | | | | | | | |

| BEVERAGES - 0.7% | | | | | | | |

Primo Water 1 | | 69,900 | | | | 979,299 | |

| | | | | | | |

| FOOD PRODUCTS - 1.8% | | | | | | | |

Farmer Bros. 1 | | 47,800 | | | | 1,115,174 | |

John B. Sanfilippo & Son | | 18,100 | | | | 1,007,446 | |

†Landec Corporation 1 | | 34,900 | | | | 413,216 | |

| | | | | | | |

| | | | | | | 2,535,836 | |

| |

| Total (Cost $3,661,937) | | | | | | 3,515,135 | |

| |

| | | | | | | | |

| ENERGY – 4.3% | | | | | | | |

| ENERGY EQUIPMENT & SERVICES - 3.8% | | | | | | | |

Gulf Island Fabrication 1 | | 92,634 | | | | 668,818 | |

Independence Contract Drilling 1 | | 301,600 | | | | 940,992 | |

Natural Gas Services Group 1 | | 59,600 | | | | 979,824 | |

Newpark Resources 1 | | 164,300 | | | | 1,128,741 | |

Profire Energy 1 | | 486,229 | | | | 705,032 | |

Total Energy Services | | 139,300 | | | | 996,895 | |

| | | | | | | |

| | | | | | | 5,420,302 | |

| | | | | | | |

| OIL, GAS & CONSUMABLE FUELS - 0.5% | | | | | | | |

Ardmore Shipping 1 | | 136,000 | | | | 635,120 | |

| |

| Total (Cost $7,343,600) | | | | | | 6,055,422 | |

| |

| | | | | | | | |

| FINANCIALS – 13.7% | | | | | | | |

| BANKS - 7.3% | | | | | | | |

Allegiance Bancshares 1 | | 29,000 | | | | 938,730 | |

†BayCom Corporation 1 | | 34,682 | | | | 800,807 | |

Brookline Bancorp | | 64,200 | | | | 887,244 | |

Caribbean Investment Holdings 1 | | 1,751,547 | | | | 379,529 | |

County Bancorp | | 52,400 | | | | 910,188 | |

HarborOne Bancorp 1 | | 74,200 | | | | 1,179,038 | |

†HomeTrust Bancshares | | 44,700 | | | | 1,170,246 | |

†Investar Holding | | 46,200 | | | | 1,145,760 | |

Midway Investments 1, 3 | | 1,751,577 | | | | 0 | |

Stewardship Financial | | 92,000 | | | | 837,200 | |

TriState Capital Holdings 1 | | 51,072 | | | | 993,861 | |

Two River Bancorp | | 72,400 | | | | 1,104,824 | |

| | | | | | | |

| | | | | | | 10,347,427 | |

| | | | | | | |

| CAPITAL MARKETS - 2.9% | | | | | | | |

B. Riley Financial | | 71,600 | | | | 1,016,720 | |

Canaccord Genuity Group | | 260,000 | | | | 1,098,887 | |

Silvercrest Asset Management Group Cl. A | | 94,200 | | | | 1,246,266 | |

Westwood Holdings Group | | 23,427 | | | | 796,518 | |

| | | | | | | |

| | | | | | | 4,158,391 | |

| | | | | | | |

| DIVERSIFIED FINANCIAL SERVICES - 0.3% | | | | | | | |

Waterloo Investment Holdings 1, 3 | | 1,302,000 | | | | 390,600 | |

| | | | | | | |

| INSURANCE - 0.5% | | | | | | | |

†Health Insurance Innovations Cl. A 1, 2 | | 28,500 | | | | 761,805 | |

| | | | | | | |

| THRIFTS & MORTGAGE FINANCE - 2.7% | | | | | | | |

PCSB Financial | | 65,700 | | | | 1,285,092 | |

Territorial Bancorp | | 43,700 | | | | 1,135,326 | |

Western New England Bancorp | | 142,354 | | | | 1,429,234 | |

| | | | | | | |

| | | | | | | 3,849,652 | |

| |

| Total (Cost $22,816,140) | | | | | | 19,507,875 | |

| |

| | | | | | | | |

| HEALTH CARE – 11.5% | | | | | | | |

| BIOTECHNOLOGY - 3.2% | | | | | | | |

AMAG Pharmaceuticals 1 | | 19,600 | | | | 297,724 | |

BioSpecifics Technologies 1 | | 25,900 | | | | 1,569,540 | |

Dynavax Technologies 1 | | 53,900 | | | | 493,185 | |

Progenics Pharmaceuticals 1 | | 215,200 | | | | 903,840 | |

Zealand Pharma 1, 2 | | 101,258 | | | | 1,280,390 | |

| | | | | | | |

| | | | | | | 4,544,679 | |

| | | | | | | |

| HEALTH CARE EQUIPMENT & SUPPLIES - 5.0% | | | | | | | |

AtriCure 1 | | 48,800 | | | | 1,493,280 | |

†Chembio Diagnostics 1 | | 142,400 | | | | 805,984 | |

CryoLife 1 | | 49,489 | | | | 1,404,498 | |

OrthoPediatrics Corporation 1 | | 41,200 | | | | 1,437,056 | |

Surmodics 1 | | 23,178 | | | | 1,095,392 | |

Tactile Systems Technology 1, 2 | | 18,400 | | | | 838,120 | |

| | | | | | | |

| | | | | | | 7,074,330 | |

| | | | | | | |

| LIFE SCIENCES TOOLS & SERVICES - 2.4% | | | | | | | |

Harvard Bioscience 1 | | 336,868 | | | | 1,071,240 | |

| 8 | Royce Capital Fund 2018 Annual Report to Shareholders | | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS |

| |

| Royce Capital Fund - Micro-Cap Portfolio (continued) | | | | | | | |

| | | SHARES | | | | VALUE | |

| |

| |

| HEALTH CARE (continued) | | | | | | | |

| LIFE SCIENCES TOOLS & SERVICES (continued) | | | | | | | |

NeoGenomics 1 | | 88,900 | | | $ | 1,121,029 | |

†Quanterix Corporation 1 | | 67,800 | | | | 1,241,418 | |

| | | | | | | |

| | | | | | | 3,433,687 | |

| | | | | | | |

| PHARMACEUTICALS - 0.9% | | | | | | | |

Correvio Pharma 1 | | 198,800 | | | | 495,012 | |

Paratek Pharmaceuticals 1 | | 94,600 | | | | 485,298 | |

†Tetraphase Pharmaceuticals 1 | | 235,200 | | | | 265,776 | |

| | | | | | | |

| | | | | | | 1,246,086 | |

| |

| Total (Cost $13,969,418) | | | | | | 16,298,782 | |

| |

| | | | | | | | |

| INDUSTRIALS – 22.0% | | | | | | | |

| AEROSPACE & DEFENSE - 1.6% | | | | | | | |

Astronics Corporation 1 | | 37,226 | | | | 1,133,532 | |

CPI Aerostructures 1 | | 174,344 | | | | 1,110,571 | |

| | | | | | | |

| | | | | | | 2,244,103 | |

| | | | | | | |

| COMMERCIAL SERVICES & SUPPLIES - 2.1% | | | | | | | |

| Acme United | | 50,865 | | | | 724,826 | |

Heritage-Crystal Clean 1 | | 47,334 | | | | 1,089,155 | |

Viad Corporation | | 22,100 | | | | 1,106,989 | |

| | | | | | | |

| | | | | | | 2,920,970 | |

| | | | | | | |

| CONSTRUCTION & ENGINEERING - 1.7% | | | | | | | |

†Construction Partners Cl. A 1 | | 103,000 | | | | 909,490 | |

Northwest Pipe 1 | | 67,800 | | | | 1,579,062 | |

| | | | | | | |

| | | | | | | 2,488,552 | |

| | | | | | | |

| ELECTRICAL EQUIPMENT - 2.0% | | | | | | | |

American Superconducter 1 | | 144,300 | | | | 1,608,945 | |

Encore Wire | | 23,900 | | | | 1,199,302 | |

| | | | | | | |

| | | | | | | 2,808,247 | |

| | | | | | | |

| INDUSTRIAL CONGLOMERATES - 0.6% | | | | | | | |

Raven Industries | | 25,700 | | | | 930,083 | |

| | | | | | | |

| MACHINERY - 8.9% | | | | | | | |

Alimak Group | | 84,500 | | | | 1,048,748 | |

Exco Technologies | | 156,700 | | | | 1,036,479 | |

FreightCar America 1 | | 86,091 | | | | 575,949 | |

Global Brass and Copper Holdings | | 37,400 | | | | 940,610 | |

Graham Corporation | | 65,220 | | | | 1,489,625 | |

Greenbrier Companies (The) | | 16,600 | | | | 656,364 | |

Kadant | | 11,931 | | | | 971,899 | |

Kornit Digital 1, 2 | | 79,900 | | | | 1,495,728 | |

Lindsay Corporation | | 11,900 | | | | 1,145,375 | |

†Luxfer Holdings | | 42,000 | | | | 740,460 | |

Lydall 1 | | 37,000 | | | | 751,470 | |

Sun Hydraulics | | 20,100 | | | | 667,119 | |

†Twin Disc 1 | | 46,200 | | | | 681,450 | |

†Westport Fuel Systems 1 | | 312,300 | | | | 415,359 | |

| | | | | | | |

| | | | | | | 12,616,635 | |

| | | | | | | |

| MARINE - 0.6% | | | | | | | |

Clarkson | | 38,100 | | | | 922,683 | |

| | | | | | | |

| PROFESSIONAL SERVICES - 3.8% | | | | | | | |

CRA International | | 22,106 | | | | 940,610 | |

GP Strategies 1 | | 85,208 | | | | 1,074,473 | |

Heidrick & Struggles International | | 33,500 | | | | 1,044,865 | |

Kforce | | 32,600 | | | | 1,007,992 | |

Resources Connection | | 89,354 | | | | 1,268,827 | |

| | | | | | | |

| | | | | | | 5,336,767 | |

| | | | | | | |

| ROAD & RAIL - 0.7% | | | | | | | |

Marten Transport | | 59,841 | | | | 968,826 | |

| |

| Total (Cost $26,355,659) | | | | | | 31,236,866 | |

| |

| | | | | | | | |

| INFORMATION TECHNOLOGY – 20.5% | | | | | | | |

| COMMUNICATIONS EQUIPMENT - 1.2% | | | | | | | |

Digi International 1 | | 102,600 | | | | 1,035,234 | |

EMCORE Corporation 1 | | 149,300 | | | | 627,060 | |

| | | | | | | |

| | | | | | | 1,662,294 | |

| | | | | | | |

| ELECTRONIC EQUIPMENT, INSTRUMENTS & COMPONENTS - 5.9% | | | | | | | |

Airgain 1 | | 45,200 | | | | 447,932 | |

CUI Global 1 | | 298,762 | | | | 367,477 | |

ePlus 1 | | 13,792 | | | | 981,577 | |

Fabrinet 1 | | 23,769 | | | | 1,219,587 | |

Mesa Laboratories | | 6,100 | | | | 1,271,179 | |

†nLIGHT 1, 2 | | 40,300 | | | | 716,534 | |

Novanta 1 | | 16,200 | | | | 1,020,600 | |

PC Connection | | 40,000 | | | | 1,189,200 | |

Vishay Precision Group 1 | | 41,100 | | | | 1,242,453 | |

| | | | | | | |

| | | | | | | 8,456,539 | |

| | | | | | | |

| IT SERVICES - 0.9% | | | | | | | |

Cass Information Systems | | 24,048 | | | | 1,272,620 | |

| | | | | | | |

| SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT - 8.3% | | | | | | | |

†Adesto Technologies 1, 2 | | 223,100 | | | | 981,640 | |

†Aehr Test Systems 1 | | 349,500 | | | | 492,795 | |

AXT 1 | | 33,100 | | | | 143,985 | |

Brooks Automation | | 33,500 | | | | 877,030 | |

†Cohu | | 30,700 | | | | 493,349 | |

CyberOptics Corporation 1 | | 29,600 | | | | 521,848 | |

Everspin Technologies 1, 2 | | 92,500 | | | | 518,925 | |

NeoPhotonics Corporation 1 | | 165,900 | | | | 1,075,032 | |

†Nova Measuring Instruments 1 | | 53,900 | | | | 1,227,842 | |

PDF Solutions 1 | | 85,700 | | | | 722,451 | |

Photronics 1 | | 160,100 | | | | 1,549,768 | |

Rudolph Technologies 1 | | 66,793 | | | | 1,367,253 | |

Silicon Motion Technology ADR | | 26,900 | | | | 928,050 | |

Ultra Clean Holdings 1 | | 103,200 | | | | 874,104 | |

| | | | | | | |

| | | | | | | 11,774,072 | |

| | | | | | | |

| SOFTWARE - 3.6% | | | | | | | |

Agilysys 1 | | 71,700 | | | | 1,028,178 | |

Amber Road 1 | | 155,400 | | | | 1,278,942 | |

Attunity 1 | | 82,500 | | | | 1,623,600 | |

QAD Cl. A | | 31,700 | | | | 1,246,761 | |

| | | | | | | |

| | | | | | | 5,177,481 | |

| | | | | | | |

| TECHNOLOGY HARDWARE, STORAGE & PERIPHERALS - 0.6% | | | | | | | |

†AstroNova | | 43,700 | | | | 819,375 | |

| |

| Total (Cost $25,152,354) | | | | | | 29,162,381 | |

| |

| | | | | | | | |

| MATERIALS – 3.4% | | | | | | | |

| CHEMICALS - 2.1% | | | | | | | |

FutureFuel Corporation | | 62,400 | | | | 989,664 | |

Quaker Chemical | | 5,888 | | | | 1,046,356 | |

Trecora Resources 1 | | 115,400 | | | | 900,120 | |

| | | | | | | |

| | | | | | | 2,936,140 | |

| | | | | | | |

| METALS & MINING - 1.3% | | | | | | | |

Haynes International | | 38,570 | | | | 1,018,248 | |

Major Drilling Group International 1 | | 254,700 | | | | 858,204 | |

| | | | | | | |

| | | | | | | 1,876,452 | |

| |

| Total (Cost $4,952,111) | | | | | | 4,812,592 | |

| |

| | | | | | | | |

| REAL ESTATE – 2.4% | | | | | | | |

| EQUITY REAL ESTATE INVESTMENT TRUSTS (REITS) - 0.8% | | | | | | | |

Community Healthcare Trust | | 40,200 | | | | 1,158,966 | |

| | | | | | | |

| REAL ESTATE MANAGEMENT & DEVELOPMENT - 1.6% | | | | | | | |

FRP Holdings 1 | | 23,440 | | | | 1,078,474 | |

| THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS | | Royce Capital Fund 2018 Annual Report to Shareholders | 9 |

Schedule of Investments

| |

| Royce Capital Fund - Micro-Cap Portfolio (continued) |

| | | SHARES | | | VALUE | |

| |

| |

| REAL ESTATE (continued) | | | | | | | |

| REAL ESTATE MANAGEMENT & DEVELOPMENT (continued) | | | | | | | |

Marcus & Millichap 1 | | 35,300 | | | $ | 1,211,849 | |

| | | | | | | |

| | | | | | | 2,290,323 | |

| |

| Total (Cost $2,478,277) | | | | | | 3,449,289 | |

| |

| | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | |

| |

| (Cost $126,406,149) | | | | | | 136,205,005 | |

| |

| | | | | | | | |

| REPURCHASE AGREEMENT – 3.7% | | | | | | | |

Fixed Income Clearing Corporation, 0.50% dated 12/31/18, due 1/2/19, maturity value

$5,267,146 (collateralized by obligations of various U.S. Government Agencies, 2.125%

due 07/31/24, valued at $5,372,613) |

| | | | | | | | |

| |

| (Cost $5,267,000) | | | | | | 5,267,000 | |

| |

| | | | | | | | |

| COLLATERAL RECEIVED FOR SECURITIES LOANED – 2.8% | | | | | | | |

| Money Market Funds | | | | | | | |

Federated Government Obligations Fund (7 day yield-2.2268%) | | | | | | | |

| |

| (Cost $3,911,179) | | | | | | 3,911,179 | |

| |

| | | | | | | | |

| TOTAL INVESTMENTS – 102.3% | | | | | | | |

| |

| (Cost $135,584,328) | | | | | | 145,383,184 | |

| |

| | | | | | | | |

| LIABILITIES LESS CASH AND OTHER ASSETS – (2.3)% | | | | | | (3,282,344 | ) |

| | | | | | | |

| | | | | | | | |

| |

| NET ASSETS – 100.0% | | | | | $ | 142,100,840 | |

| |

| | ADR – American Depository Receipt |

| | |

| † | New additions in 2018. |

| 1 | Non-income producing. |

| 2 | All or a portion of these securities were on loan at December 31, 2018. |

| 3 | Securities for which market quotations are not readily available represent 0.3% of net assets. These securities have been valued at their fair value under procedures approved by the Fund’s Board of Trustees. These securities are defined as Level 3 securities due to the use of significant unobservable inputs in the determination of fair value. See Notes to Financial Statements. |

| | |

| | Bold indicates the Fund’s 20 largest equity holdings in terms of December 31, 2018, market value. |

| 10 | Royce Capital Fund 2018 Annual Report to Shareholders | | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS |

This page is intentionally left blank.

| Royce Capital Fund 2018 Annual Report to Shareholders | 11 |

| MANAGER’S DISCUSSION |

| Royce Capital Fund—Small-Cap Portfolio (RCS) |

|

| Jay Kaplan, CFA |

| |

| FUND PERFORMANCE |

| In the context of a down year, we were about as pleased as we could be with the performance for Royce Capital Fund–Small-Cap Portfolio. Demonstrating better downside protection, the Fund was down 8.3% in 2018 versus a loss of 11.0% for the Russell 2000 Index, its small-cap benchmark, for the same period. |

| |

| WHAT WORKED... AND WHAT DIDN’T |

| Six of the Fund’s 10 equity sectors finished 2018 in the red, with the largest negative impact coming from Financials, with Industrials following. These broad and diverse cyclical sectors were also the portfolio’s largest at year-end, along with Information Technology. Modest positive contributions could be found in Health Care, Consumer Staples, Real Estate, and Consumer Discretionary. Banks (Financials) detracted most at the industry level by a wide margin in 2018, followed by semiconductors & semiconductor equipment companies (Information Technology), capital markets, and thrifts & mortgage finance, the latter two also from Financials. We were overweight versus the benchmark in all three of these financial industries at the end of 2018. Our positive stance on banks—our largest exposure among Financials—is based on two factors: First is our belief that the long-term direction of interest rates is upward, with a steepening yield curve. Second, and at least equally important, is that the banks we hold are smaller, generally community-centered businesses that we chose because we saw attributes that go beyond overall improved conditions for the industry which should help them recover. They have some combination of a strong deposit franchise, impressive loan growth, and/or a strong geographic moat. |

| The electronic equipment, instruments & components (Information Technology) group was home to five of the portfolio’s top 20 contributors, including Electro Scientific Industries, which was acquired by MKS Instruments at a 100% premium, and contract manufacturer Fabrinet. However, this group was also home to the Fund’s biggest detractor at the position level, Methode Electronics, which has a global business in component manufacturing. The costs of an acquisition as well as a slowdown in its automotive end market helped to depress earnings. Wabash National is an industrial company that makes a variety of truck trailers. We like its core business and record of successful execution, but its earnings were adversely affected in 2018 by rising supply and labor costs as well as freight issues that made picking up trailers difficult for many customers. Hawaiian Holdings operates a regional airline in that state as well as on the West Coast and in the South Pacific. Weather-related scares and the prospect of increased competition helped to ground its stock, but we see the first issue as temporary and like the firm’s ability to successfully compete in its core geographic region. |

| For the portfolio as a whole in 2018, stock selection was a greater factor in relative outperformance than allocation, though both contributed. Energy was by far the worst-performing sector in the Russell 2000 in 2018. It also provided the Fund with its largest advantage versus the benchmark, driven by a combination of having no exposure to its oil, gas & consumable fuels group and better stock picking in its energy equipment & services industry. Savvy stock selection in Consumer Discretionary provided another significant relative edge, most impactfully in specialty retail where Shoe Carnival and DSW led. Stock selection was also a strength in Industrials, most notably in machinery. |

| A stock selection disadvantage in Financials hurt relative performance most, the capital markets group disappointing in large part due to poor results for asset managers such as Federated Investors, a position we exited in the fourth quarter. The portfolio’s low exposure to Utilities also dampened relative returns. The sector is often seen as a relatively safe haven during challenging markets, and 2018 was no exception as it was the only Russell 2000 sector to finish the year in the black. Both ineffective stock picking and our lower weighting also led to a modest detraction in Communication Services. |

| | | | | |

| | Top Contributors to Performance | | | |

| | For 2018 (%)1 | | | |

| | | | | |

| | Electro Scientific Industries | | 1.61 | |

| | | |

| | Fabrinet | | 1.09 | |

| | | |

| | Shoe Carnival | | 0.67 | |

| | | |

| | DSW Cl. A | | 0.51 | |

| | | |

| | Nutrisystem | | 0.49 | |

| | | |

| | 1 Includes dividends | | | |

| | Top Detractors from Performance | | | |

| | For 2018 (%)2 | | | |

| | | | | |

| | Methode Electronics | | -0.92 | |

| | | |

| | Wabash National | | -0.83 | |

| | | |

| | Hawaiian Holdings | | -0.77 | |

| | | |

| | Cooper-Standard Holdings | | -0.73 | |

| | | |

| | Advanced Energy Industries | | -0.72 | |

| | | |

| | 2 Net of dividends | | | |

| | | | | |

| CURRENT POSITIONING AND OUTLOOK |

| Risks can be found throughout the economy and markets. Stocks continue to trade as if investors see an imminent recession; inflation is apparent in supply chains and labor costs, which threatens margin expansion; the anniversary of the tax cuts has arrived, which will slow earnings growth; and the Fed’s subsequent path is unclear, even in light of Chair Powell’s slightly more dovish tone in early January. Our own view is that a recession looks unlikely over the next several months—and may be even further out than that. In our view, growth does not appear ready to contract but rather continue to slow. Given the severity of the market’s decline, we believe this has created interesting valuations within the small-cap marketplace. Within the portfolio, we think the risk/return relationship looks more attractive than it has in some time. We have therefore been adding to those holdings where we see both good value and strong potential while also initiating positions where our analyses have uncovered the same combination among a diverse set of companies involved in aerospace & defense, trucking, investment management, banks, and technology. |

| 12 | Royce Capital Fund 2018 Annual Report to Shareholders |

| PERFORMANCE AND PORTFOLIO REVIEW | | TICKER SYMBOLS RCPFX RCSSX |

| Performance and Expenses |

| Average Annual Total Return (%) Through 12/31/18 |

| | | JUL-DEC 20181 | | 1-YR | | 3-YR | | 5-YR | | 10-YR | | 15-YR | | 20-YR | | SINCE INCEPTION (12/27/96) |

| |

| RCS | | -14.39 | | -8.34 | | 5.32 | | 1.24 | | 9.78 | | 7.21 | | 9.40 | | 9.76 |

| |

| Annual Gross Operating Expenses: 1.11% Annual Net Operating Expenses: 1.08% |

| |

| 1 Not annualized | | | | | | | | | | | | | | | | |

Relative Returns: Monthly Rolling Average Annual Return Periods20 Years Through 12/31/18

| On a monthly rolling basis, the Fund outperformed the Russell 2000 in 64% of all 10-year periods; 61% of all 5-year periods; and 50% of all 1-year periods. |

| |

| | | PERIODS BEATING THE INDEX | | | | FUND AVG (%)1 | | INDEX AVG (%)1 |

| |

| 10-year | | 77/121 | | | | | | 64% | | 8.7 | | 7.2 |

| |

| 5-year | | 110/181 | | | | | | 61% | | 10.2 | | 8.8 |

| |

| 1-year | | 115/229 | | | | | | 50% | | 12.1 | | 10.3 |

| |

1Average of monthly rolling average annual total returns over the specified periods.

The Morningstar Style Map is the Morningstar Style BoxTM with the center 75% of fund holdings plotted as the Morningstar Ownership ZoneTM. The Morningstar Style Box is designed to reveal a fund’s investment strategy. The Morningstar Ownership Zone provides detail about a portfolio’s investment style by showing the range of stock sizes and styles. The Ownership Zone is derived by plotting each stock in the portfolio within the proprietary Morningstar Style Box. Over time, the shape and location of a fund’s ownership zone may vary. See page 28 for additional information. |

Value of $10,000Invested on 12/27/96 as of 12/31/18 ($)

Includes reinvestment of distributions.

| |

| Top 10 Positions | | |

| % of Net Assets | | |

| | | |

| Insight Enterprises | | 2.5 |

| |

| Miller Industries | | 2.5 |

| |

| Genworth MI Canada | | 2.5 |

| |

| Vishay Intertechnology | | 2.4 |

| |

| Kulicke & Soffa Industries | | 2.3 |

| |

| Saga Communications Cl. A | | 2.2 |

| |

| PC Connection | | 2.2 |

| |

| Village Super Market Cl. A | | 2.2 |

| |

| Advanced Energy Industries | | 2.1 |

| |

| Celestica | | 2.1 |

| |

| |

| Portfolio Sector Breakdown | | |

| % of Net Assets | | |

| | | |

| Financials | | 27.7 |

| |

| Industrials | | 23.5 |

| |

| Information Technology | | 21.3 |

| |

| Consumer Discretionary | | 13.5 |

| |

| Communication Services | | 2.2 |

| |

| Consumer Staples | | 2.2 |

| |

| Energy | | 1.4 |

| |

| Real Estate | | 1.0 |

| |

| Health Care | | 0.7 |

| |

| Utilities | | 0.4 |

| |

| Cash and Cash Equivalents | | 6.1 |

| |

| |

| Calendar Year Total Returns (%) | | |

| | | |

| YEAR | | RCS |

| |

| 2018 | | -8.3 |

| |

| 2017 | | 5.4 |

| |

| 2016 | | 21.0 |

| |

| 2015 | | -11.8 |

| |

| 2014 | | 3.2 |

| |

| 2013 | | 34.8 |

| |

| 2012 | | 12.5 |

| |

| 2011 | | -3.3 |

| |

| 2010 | | 20.5 |

| |

| 2009 | | 35.2 |

| |

| 2008 | | -27.2 |

| |

| 2007 | | -2.1 |

| |

| 2006 | | 15.6 |

| |

| 2005 | | 8.6 |

| |

| 2004 | | 25.0 |

| |

| |

| Upside/Downside Capture Ratios | | | | |

| Periods Ended 12/31/18 (%) | | | | |

| | | UPSIDE | | DOWNSIDE |

| |

| 10-Year | | 76 | | 72 |

| |

From 12/31/96 (Start of

Fund’s First Full Quarter) | | 93 | | 75 |

| |

| |

| Portfolio Diagnostics | | |

| | | |

| Fund Net Assets | | $276 million |

| |

| Number of Holdings | | 77 |

| |

| Turnover Rate | | 56% |

| |

| Average Market Capitalization1 | | $1,023 million |

| |

| Weighted Average P/B Ratio2 | | 1.6x |

| |

| Active Share3 | | 96% |

| |

| U.S. Investments (% of Net Assets) | | 83.7% |

| |

| Non-U.S. Investments (% of Net Assets) | | 10.2% |

| |

| 1 | Geometric Average. This weighted calculation uses each portfolio holding’s market cap in a way designed to not skew the effect of very large or small holdings; instead, it aims to better identify the portfolio’s center, which Royce believes offers a more accurate measure of average market cap than a simple mean or median. |

| 2 | Harmonic Average. This weighted calculation evaluates a portfolio as if it were a single stock and measures it overall. It compares the total market value of the portfolio to the portfolio’s share in the earnings or book value, as the case may be, of its underlying stocks. |

| 3 | Active Share is the sum of the absolute values of the different weightings of each holding in the Fund versus each holding in the benchmark, divided by two. |

| Important Performance and Expense Information

All performance information in this Report reflects past performance, is presented on a total return basis, reflects the reinvestment of distributions, and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when redeemed. Current performance may be higher or lower than performance quoted. The Fund’s total returns do not reflect any deduction for charges or expenses of the variable contracts investing in the Fund. Returns as of the most recent month-end may be obtained at www.roycefunds.com. All performance and risk information reflects the result of the Investment Class (its oldest class). Shares of RCS’s Service Class bear an annual distribution expense that is not borne by the Investment Class; if those expenses were reflected, total returns would have been lower. Certain immaterial adjustments were made to the net assets of Royce Capital Fund-Small-Cap Portfolio at 12/31/17 for financial reporting purposes, and as a result the calendar year total returns based on those net assets values differ from the adjusted net values and calendar year total returns reported in the Financial Highlights. All performance information reflects past performance, is presented on a total return basis, reflects the reinvestment of distributions, and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when redeemed. Current month-end performance may be higher or lower than performance quoted and may be obtained at www.roycefunds.com. The Fund’s total returns do not reflect any deduction for charges or expenses of the variable contracts investing in the Fund. Gross operating expenses reflect the Fund’s total gross operating expenses for the Investment Class and include management fees and other expenses. Net operating expenses reflect contractual fee waivers and/or expense reimbursements. All expense information is reported as of the Fund’s most current prospectus. Royce & Associates has contractually agreed, without right of termination, to waive fees and/or reimburse expenses to the extent necessary to maintain the Investment Class’s net annual operating expenses (excluding brokerage commissions, taxes, interest, litigation expenses, acquired fund fees and expenses, and other expenses not borne in the ordinary course of business) at or below 1.08% through April 30, 2019. Regarding the “Top Contributors” and “Top Detractors” tables shown above, the sum of all contributors to, and all detractors from, performance for all securities in the portfolio would approximate the Fund’s year-to-date performance for 2018. Upside Capture Ratio measures a manager’s performance in up markets relative to the Fund’s benchmark. It is calculated by measuring the Fund’s performance in quarters when the benchmark went up and dividing it by the benchmark’s return in those quarters. Downside Capture Ratio measures a manager’s performance in down markets relative to the Fund’s benchmark (Russell 2000). It is calculated by measuring the Fund’s performance in quarters when the benchmark goes down and dividing it by the benchmark’s return in those quarters.

|

| Royce Capital Fund 2018 Annual Report to Shareholders | 13 |

Schedule of Investments

| |

| Royce Capital Fund - Small-Cap Portfolio |

| Common Stocks – 93.9% | | | | | | | |

| | | SHARES | | | VALUE | |

| |

| | | | | | | | |

| COMMUNICATION SERVICES – 2.2% | | | | | | | |

| MEDIA - 2.2% | | | | | | | |

Saga Communications Cl. A | | 185,596 | | | $ | 6,167,355 | |

| |

| Total (Cost $7,850,276) | | | | | | 6,167,355 | |

| |

| |

| CONSUMER DISCRETIONARY – 13.5% | | | | | | | |

| AUTO COMPONENTS - 5.3% | | | | | | | |

†Cooper-Standard Holdings 1 | | 70,800 | | | | 4,398,096 | |

Gentex Corporation | | 180,416 | | | | 3,646,208 | |

Stoneridge 1 | | 111,405 | | | | 2,746,133 | |

†Visteon Corporation 1 | | 67,100 | | | | 4,044,788 | |

| | | | | | | |

| | | | | | | 14,835,225 | |

| | | | | | | |

| HOTELS, RESTAURANTS & LEISURE - 1.9% | | | | | | | |

Cheesecake Factory | | 15,615 | | | | 679,408 | |

†Hilton Grand Vacations 1 | | 172,056 | | | | 4,540,558 | |

| | | | | | | |

| | | | | | | 5,219,966 | |

| | | | | | | |

| HOUSEHOLD DURABLES - 1.0% | | | | | | | |

La-Z-Boy | | 98,286 | | | | 2,723,505 | |

| | | | | | | |

| SPECIALTY RETAIL - 4.8% | | | | | | | |

American Eagle Outfitters | | 215,465 | | | | 4,164,939 | |

†Caleres | | 137,417 | | | | 3,824,315 | |

DSW Cl. A | | 106,816 | | | | 2,638,355 | |

Shoe Carnival | | 76,312 | | | | 2,557,215 | |

| | | | | | | |

| | | | | | | 13,184,824 | |

| | | | | | | |

| TEXTILES, APPAREL & LUXURY GOODS - 0.5% | | | | | | | |

Steven Madden | | 44,706 | | | | 1,352,804 | |

| |

| Total (Cost $38,409,324) | | | | | | 37,316,324 | |

| |

| |

| CONSUMER STAPLES – 2.2% | | | | | | | |

| FOOD & STAPLES RETAILING - 2.2% | | | | | | | |

Village Super Market Cl. A | | 223,677 | | | | 5,981,123 | |

| |

| Total (Cost $5,774,465) | | | | | | 5,981,123 | |

| |

| |

| ENERGY – 1.4% | | | | | | | |

| ENERGY EQUIPMENT & SERVICES - 1.4% | | | | | | | |

Helmerich & Payne | | 69,800 | | | | 3,346,212 | |

Unit Corporation 1 | | 32,413 | | | | 462,858 | |

| |

| Total (Cost $3,235,014) | | | | | | 3,809,070 | |

| |

| |

| FINANCIALS – 27.7% | | | | | | | |

| BANKS - 13.4% | | | | | | | |

Ames National | | 173,504 | | | | 4,410,472 | |

†Bar Harbor Bankshares | | 94,631 | | | | 2,122,573 | |

Camden National | | 155,096 | | | | 5,578,803 | |

City Holding Company | | 38,910 | | | | 2,629,927 | |

CNB Financial | | 169,185 | | | | 3,882,796 | |

Codorus Valley Bancorp | | 66,696 | | | | 1,417,290 | |

†Financial Institutions | | 112,082 | | | | 2,880,507 | |

Landmark Bancorp | | 47,091 | | | | 1,078,619 | |

MidWestOne Financial Group | | 134,574 | | | | 3,341,472 | |

National Bankshares | | 121,632 | | | | 4,431,054 | |

Northrim BanCorp | | 86,181 | | | | 2,832,770 | |

Unity Bancorp | | 108,936 | | | | 2,261,511 | |

| | | | | | | |

| | | | | | | 36,867,794 | |

| | | | | | | |

| CAPITAL MARKETS - 3.7% | | | | | | | |

Houlihan Lokey Cl. A | | 114,615 | | | | 4,217,832 | |

Moelis & Company Cl. A | | 119,020 | | | | 4,091,908 | |

†Pzena Investment Management Cl. A | | 228,000 | | | | 1,972,200 | |

| | | | | | | |

| | | | | | | 10,281,940 | |

| | | | | | | |

| INSURANCE - 3.1% | | | | | | | |

James River Group Holdings | | 74,635 | | | | 2,727,163 | |

Kingstone Companies | | 100,220 | | | | 1,772,892 |

Reinsurance Group of America | | 29,536 | | | | 4,141,833 |

| | | | | | |

| | | | | | | 8,641,888 |

| | | | | | |

| THRIFTS & MORTGAGE FINANCE - 7.5% | | | | | | |

Genworth MI Canada | | 229,950 | | | | 6,771,162 |

Southern Missouri Bancorp | | 93,351 | | | | 3,164,599 |

Timberland Bancorp | | 98,931 | | | | 2,206,161 |

TrustCo Bank Corp. NY | | 827,682 | | | | 5,677,898 |

†WSFS Financial | | 73,100 | | | | 2,771,221 |

| | | | | | |

| | | | | | | 20,591,041 |

| |

| Total (Cost $67,807,829) | | | | | | 76,382,663 |

| |

| |

| HEALTH CARE – 0.7% | | | | | | |

| HEALTH CARE PROVIDERS & SERVICES - 0.7% | | | | | | |

AMN Healthcare Services 1 | | 13,541 | | | | 767,233 |

Ensign Group (The) | | 29,214 | | | | 1,133,211 |

| |

| Total (Cost $1,180,143) | | | | | | 1,900,444 |

| |

| |

| INDUSTRIALS – 23.5% | | | | | | |

| AEROSPACE & DEFENSE - 0.4% | | | | | | |

†Magellan Aerospace | | 92,100 | | | | 1,010,590 |

| | | | | | |

| AIRLINES - 3.5% | | | | | | |

Allegiant Travel | | 26,893 | | | | 2,695,217 |

Hawaiian Holdings | | 209,255 | | | | 5,526,425 |

Spirit Airlines 1 | | 23,432 | | | | 1,357,181 |

| | | | | | |

| | | | | | | 9,578,823 |

| | | | | | |

| BUILDING PRODUCTS - 1.3% | | | | | | |

Apogee Enterprises | | 120,047 | | | | 3,583,403 |

| | | | | | |

| COMMERCIAL SERVICES & SUPPLIES - 3.0% | | | | | | |

Herman Miller | | 118,203 | | | | 3,575,641 |

Kimball International Cl. B | | 337,282 | | | | 4,786,031 |

| | | | | | |

| | | | | | | 8,361,672 |

| | | | | | |

| CONSTRUCTION & ENGINEERING - 0.6% | | | | | | |

Comfort Systems USA | | 36,969 | | | | 1,614,806 |

| | | | | | |

| ELECTRICAL EQUIPMENT - 0.5% | | | | | | |

EnerSys | | 17,400 | | | | 1,350,414 |

| | | | | | |

| MACHINERY - 7.6% | | | | | | |

Alamo Group | | 52,807 | | | | 4,083,037 |

Federal Signal | | 44,422 | | | | 883,998 |

†Meritor 1 | | 302,429 | | | | 5,114,075 |

Miller Industries | | 254,879 | | | | 6,881,733 |

Wabash National | | 315,754 | | | | 4,130,062 |

| | | | | | |

| | | | | | | 21,092,905 |

| | | | | | |

| PROFESSIONAL SERVICES - 4.4% | | | | | | |

Heidrick & Struggles International | | 87,508 | | | | 2,729,375 |

Kforce | | 89,746 | | | | 2,774,946 |

Korn Ferry | | 100,871 | | | | 3,988,439 |

Robert Half International | | 22,264 | | | | 1,273,501 |

TrueBlue 1 | | 59,368 | | | | 1,320,938 |

| | | | | | |

| | | | | | | 12,087,199 |

| | | | | | |

| ROAD & RAIL - 2.2% | | | | | | |

Old Dominion Freight Line | | 10,404 | | | | 1,284,790 |

Saia 1 | | 38,561 | | | | 2,152,475 |

Werner Enterprises | | 89,361 | | | | 2,639,724 |

| | | | | | |

| | | | | | | 6,076,989 |

| |

| Total (Cost $65,904,022) | | | | | | 64,756,801 |

| |

| 14 | Royce Capital Fund 2018 Annual Report to Shareholders | | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS |

| |

| Royce Capital Fund - Small-Cap Portfolio (continued) |

| | | SHARES | | | VALUE |

| |

| | | | | | | |

| INFORMATION TECHNOLOGY – 21.3% | | | | | | |

| ELECTRONIC EQUIPMENT, INSTRUMENTS & COMPONENTS - 13.4% | | | | | | |

Benchmark Electronics | | 194,435 | | | $ | 4,118,133 |

Celestica 1 | | 663,372 | | | | 5,817,772 |

Fabrinet 1 | | 26,486 | | | | 1,358,997 |

Insight Enterprises 1 | | 170,302 | | | | 6,939,807 |

Methode Electronics | | 92,815 | | | | 2,161,661 |

PC Connection | | 202,422 | | | | 6,018,006 |

Sanmina Corporation 1 | | 171,393 | | | | 4,123,716 |

Vishay Intertechnology | | 360,099 | | | | 6,485,383 |

| | | | | | |

| | | | | | | 37,023,475 |

| | | | | | |

| SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT - 7.9% | | | | | | |

Advanced Energy Industries 1 | | 137,950 | | | | 5,922,193 |

Kulicke & Soffa Industries | | 312,726 | | | | 6,338,956 |

MKS Instruments | | 84,691 | | | | 5,471,886 |

Silicon Motion Technology ADR | | 115,500 | | | | 3,984,750 |

| | | | | | |

| | | | | | | 21,717,785 |

| |

| Total (Cost $61,175,882) | | | | | | 58,741,260 |

| |

| |

| REAL ESTATE – 1.0% | | | | | | |

| REAL ESTATE MANAGEMENT & DEVELOPMENT - 1.0% | | | | | | |

Marcus & Millichap 1 | | 79,572 | | | | 2,731,707 |

| |

| Total (Cost $1,981,040) | | | | | | 2,731,707 |

| |

| |

| UTILITIES – 0.4% | | | | | | |

| GAS UTILITIES - 0.4% | | | | | | |

Star Group L.P. | | 112,383 | | | | 1,049,657 |

| |

| Total (Cost $1,032,389) | | | | | | 1,049,657 |

| |

| |