UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-07537

Name of Registrant: Royce Capital Fund

Address of Registrant: 745 Fifth Avenue

New York, NY 10151

Name and address of agent for service: John E. Denneen, Esq. 745 Fifth Avenue New York, NY 10151 |

Registrant’s telephone number, including area code: (212) 508-4500

Date of fiscal year end: December 31, 2023

Date of reporting period: January 1, 2023 – June 30, 2023

Item 1. Reports to Shareholders.

royceinvest.com

Royce Capital Fund 2023 Semiannual

Review and Report to Shareholders

June 30, 2023

Royce Capital Fund–Micro-Cap Portfolio

Royce Capital Fund–Small-Cap Portfolio

Table of Contents

This page is not part of the Royce Capital Fund 2023 Semiannual Report to Shareholders | 1

Letter to Our Shareholders

THE BIGGER THE BETTER?

U.S. stocks finished the first six months of 2023 in strong shape, with all the major domestic indexes squarely in the black at the end of June. Several factors seemed to play a role in fostering a more optimistic mindset: returns in April and May were low for the large-cap Russell 1000 Index and negative for the small-cap Russell 2000 Index, which likely encouraged some investors to give equities a fresh look. Investors may also have begun looking past concerns about inflation and recession toward a more stable, perhaps even vibrant period of economic growth. Employment stayed strong while recession talk moderated in terms of both coverage and volume. Both were encouraging developments, though the Fed’s decision to skip an interest rate hike in June, even as the central bank all but promised increases in July and September, was almost certainly an even bigger factor.

How well stocks performed during 2023’s first half varied considerably depending on where one looked along the market capitalization spectrum. In general, the farther upward one traveled, the higher the returns ran. Interestingly (and somewhat frustratingly), 2023 began with an advantage for

small-cap stocks. It was short-lived, however, lasting only until this year’s high for the Russell 2000 on Groundhog Day (2/2/23) before giving way to a rather dramatic reversal. As of 1/31/23, the small-cap index was 300 basis points ahead of the Russell 1000 for the year-to-date period (+9.7% versus +6.7%). At the end of June, however, the Russell 2000 was running 859 basis points behind the Russell 1000 for the year-to-date period ended 6/30/23.

Returns for the Russell Microcap, Russell 2000, Russell 1000, and Russell Top 50

Year-to-Date through 6/30/23

Past performance is no guarantee of future results.

LETTER TO OUR SHAREHOLDERS

And although returns were lower, large-cap outperformance was also the pattern among non-U.S. stocks, with the difference being that the year-to-date spread was much narrower: the MSCI ACWI ex USA Small Cap Index rose 6.8% in 2023’s first half while the MSCI ACWI ex USA Large Cap Index increased 9.8%.

ARTIFICIAL INTELLIGENCE: A MARKET-SHAPING FORCE?

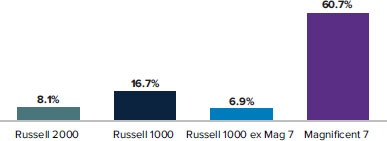

We think a couple of related observations are relevant from the standpoint of small-cap specialists like us: first, two factors affected the shift in leadership between U.S. small- and large-cap stocks, one that disproportionately hurt small caps and another that disproportionately helped a few mega-cap names. Small caps bore the brunt of the damage from the banking crisis, which had its most adverse effects on the share prices of smaller regional players. (It came as no surprise to us that banks were the top-detracting industry in the Russell 2000 for 2023’s first half.) The factor that helped large cap, and in our view the primary driver of that asset class’s higher returns in the first half of the year, was the promise of artificial intelligence (“AI”), a major secular trend whose impacts have just begun to register.

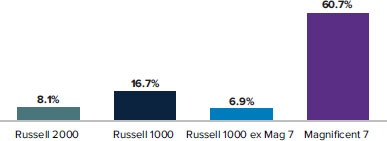

Widespread positive performance masked how top heavy and tightly concentrated returns have become since stocks began rallying near the end of 2022. Looking closer at first-half results reveals the degree to which the prospects for AI drove large-cap performance, which was dominated by impressive results for “The Magnificent Seven,” a handful of mostly familiar behemoths: Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla. The combined market capitalizations of these seven companies accounted for 25.1% of the Russell 1000’s total market capitalization at the end of June. To get an additional sense of how enormous they are: Apple, the largest of them as of June 30, had a market cap of $3.05 trillion—which was more than the market cap of the entire Russell 2000 as of that

same date. Considering there are more than 4,000 publicly traded companies in the U.S., this is an almost absurd level of concentration, one that appears unsustainable to us. It is a level of concentration the market has not seen since the ‘Nifty Fifty’ market of the early to mid 1970s. Each of “The Magnificent Seven” is considered one of the primary beneficiaries of AI’s vast untapped potential. Without them, the Russell 2000 would have beaten the Russell 1000 in the first half of 2023. (We feel it’s also worth mentioning that the fall of the Nifty Fifty, all of them established large-cap stocks at the time, precipitated a long run of small-cap outperformance.)

The Russell 2000 Beat the Russell 1000, Excluding the “Magnificent Seven”

Year-to Date Performance for the Russell 2000, Russell 1000, Russell 1000 ex. the Magnificent 7, and the Magnificent 7

Past performance is no guarantee of future results.

ARE SMALL CAPS MOVING FROM BEAR TO BULL?

Unlike their bigger siblings, small caps remained in a bear market at the end of June. The Russell 2000 was down -20.8% from its last peak on 11/8/21, though a positive July brought it out of bear territory—a decline of at least -20.0% from its prior peak. By way of contrast, the Russell 1000 was down only -6.2% from its last peak on 1/3/22, and the tech-heavy Nasdaq fell just -12.9% from its most recent high on 11/19/21, through 6/30/23. Yet we are optimistic both in spite of the relative disadvantage of small-caps and, in some ways, because of it.

The average stock in the Russell 2000 was -28% off its 52-week high at the end of June, which gives

some sense of the opportunity set that exists within small cap—and with it, the potential for improved

performance going forward. Our expectation is that this potential will be realized over the next few years.

This page is not part of the Royce Capital Fund 2023 Semiannual Report to Shareholders | 3

LETTER TO OUR SHAREHOLDERS

First, significant multiple compression has occurred over the last several months among small caps, particularly small-cap value stocks. The result is that valuations looked highly favorable for the Russell 2000, on both an absolute basis and relative to the Russell 1000, where they remain close to a 20-year low, based on our preferred valuation metric, enterprise value over earnings before interest & taxes (“EV/EBIT”). Unsurprisingly in light of how it has recently lagged growth, the Russell 2000 Value Index finished June much more attractively valued than the Russell 2000 Growth Index, based on that same EV/EBIT metric. It is also worth noting that concerns about elevated valuations in the overall market have played out in an inflationary climate with rising interest rates and widespread anxiety that the economy is about to slip into a recession. We suspect that these concerns will continue to recede as economic news continues to skew more positively. Of course, we are more focused on the absolute valuations of individual companies, which in many instances look appealingly inexpensive to us. The average stock in the Russell 2000 was -28% off its 52-week high at the end of June, which gives some sense of the opportunity set that exists within small cap—and with it, the potential for improved performance going forward. Our expectation is that this potential will be realized over the next few years.

LISTENING TO CLIO, OR A SMALL-CAP HISTORY IN 3 CHARTS

We also see history (and Clio is the Muse of that discipline) showing several reasons why small-cap investors may currently have reasons to be cheerful. We are of course mindful of the fact that history seldom repeats itself. But it often rhymes—and always offers valuable lessons for those of us who take the time to examine previous performance patterns. We began with an analysis of what has happened at the end of past rate hike cycles. While our current era has seen the fastest pace of interest rate hikes on record, there have been other interest rate increase cycles. We looked at the subsequent one-year returns for small cap over four previous periods with rate hikes, going back to 1993. The Russell 2000 had positive performance in three of the four periods, and in each of those three, returns were in the double digits. Over all four periods, the small-cap index averaged an impressive 18.4% gain.

Historical Performance Post Final Fed Rate Hikes

Subsequent Average Annual 1-Year Returns for the Russell 2000 Following Final Rate Hikes from 3/31/93 through 6/30/23

Past performance is no guarantee of future results.

Looking more closely at the present, we find that January and June were the only months so far in 2023 when the Russell 2000 had positive returns. There were four straight down months in between, a rare occurrence that has happened only nine times since the inception of the index on 12/31/78. We wanted to see what shape performance took over the subsequent one-, three-, and five-year spans. What we found was very encouraging, with each period coming in comfortably above the one-, three-, and five-year monthly rolling averages for the Russell 2000 since inception. For the eight periods for which we have data, subsequent one-year returns averaged 24.7%; subsequent three-year returns averaged 21.0%; and subsequent five-year returns averaged 16.8%.

Russell 2000 Average Returns Following Four Consecutive Months with Negative Returns

From Russell 2000 Inception (12/31/78) through 6/30/23

Past performance is no guarantee of future results.

The Russell 2000 has had four consecutive down months in 9 out 534 periods.

4 | This page is not part of the Royce Capital Fund 2023 Semiannual Report to Shareholders

LETTER TO OUR SHAREHOLDERS

We are all hoping for a robust rebound for the U.S. economy for many reasons, not the

least of which is that small caps, in particular the cyclical industries that mostly populate our

portfolios, tend to do especially well in a thriving economy.

We also looked at data that demonstrates how strong and lasting a rebound small caps have enjoyed after low annualized five-year periods such as we had at the end of June, when the small-cap index’s average annualized 5-year return was a paltry 4.2%. The Russell 2000 had positive annualized five-year returns 100% of the time—in all 81 five-year periods— averaging an impressive 14.9%, which was well above its monthly rolling five-year return since inception of 10.4%.

Why Better Small-Cap Performance May Be Ahead

Subsequent Average Annualized 5-Year Performance for the Russell 2000 Following 5-Year Annualized Return Ranges of Less Than 5% from 12/31/83 through 6/30/23

Past performance is no guarantee of future results.

It appears to us that history is on the side of strong small-cap performance going forward.

THE FUTURE’S SO BRIGHT?

We are all hoping for a robust rebound for the U.S. economy for many reasons, not the least of which is that small caps, in particular the cyclical industries that mostly populate our portfolios, tend to do especially well in a thriving economy. And while some data points remain concerning—most notably higher rates, wobbly industrial production, and a stubbornly inverted yield curve—there are also many signs that the economy is inching closer to recovery. To be sure, a soft landing looks more and more likely to us, while the kind of deep and potentially lengthy recession many have been anticipating since late 2021 looks less and less likely. As Neil

Dutta at Renaissance Macro recently put it, “The statute of limitations has now kicked in” regarding a recession in the U.S.

The U.S. Commerce Department reported a 0.9% seasonally adjusted increase in construction spending for May, which included a significant jump in spending on new manufacturing facilities. There was a 76.3% increase from a year earlier, as well as a 1% advance in May over April. The Commerce Department also showed that spending on manufacturing construction accounted for almost 0.5% of first-quarter GDP, its largest share since 1991. And its second-quarter share of GDP is expected to be even higher. Homebuilding rose by 21.7% in May, a record monthly surge that defied expectations of a slowdown. CapEx has been steady and has shown signs of improving, with the ISM services index re-accelerating in June. Durable goods orders rose for the fourth consecutive month in that same month, hitting a record high for nondefense capital goods (excluding aircraft or core capital goods, a proxy for business equipment investment). Moreover, retail and vehicle sales rose in June while the University of Michigan’s consumer sentiment measure rose in July. Most important, however, was that second-quarter GDP came in higher than expected, thanks to resilient consumers and robust business investment, as inflation continued to moderate, rising at the slowest rate in more than two years. We think investors should also keep in mind that rate hikes and inflation will likely be sunsetting over the next year or so, when the positive impacts of reshoring, the infrastructure bill, and the CHIPs Act will begin to take effect.

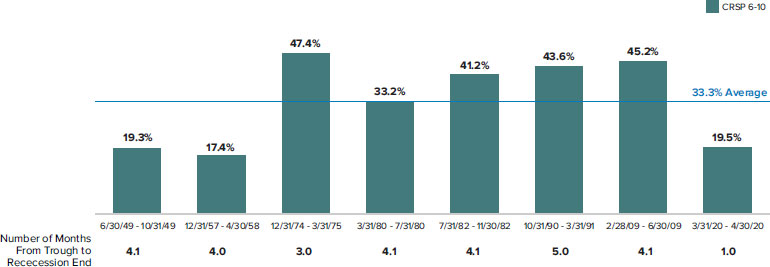

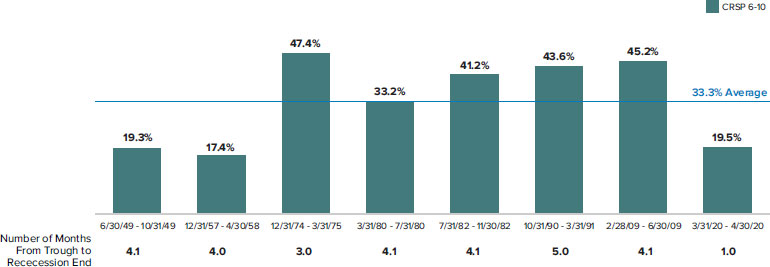

All this encouraging news may be of special relevance to small-cap investors. We looked at data going back to the 1940s, using the Center for Research in Securities Prices data where the CRSP 6-10 is the small-cap proxy, to see what happened to small caps in recessionary periods. The historical pattern is that small caps tend to trough before recessions end, advancing 33.3% on average from the small-cap trough to the end of the recession. As we have said previously, investors typically pay a steep price for waiting, whether for the market to bottom or a recession to end. And a recession remains a possibility, despite recent developments.

This page is not part of the Royce Capital Fund 2023 Semiannual Report to Shareholders | 5

LETTER TO OUR SHAREHOLDERS

The Price of Waiting for Recessions to End

Average Small-Cap Return from Market Trough to Recession’s End Was 33.3% from 6/30/49 through 4/30/20

Past performance is no guarantee of future results.

Ultimately, of course, we are bottom-up stock pickers. Our knowledge and experience lie in analyzing companies and managing portfolios. So, as important as we think all this data is, we put more trust into what we are hearing from company management teams. In our conversations, there continues to be a sense of cautious optimism—which was reflected in generally solid earnings for many holdings for

the second quarter and few, if any, profit warnings so far for the third. All of this is consistent with our contention that small caps are due—arguably overdue—for a breakout in the coming months. Our confidence in the prospects for disciplined and patient active management within small cap remains high.

Sincerely,

|  |  |

| Charles M. Royce | Christopher D. Clark | Francis D. Gannon |

| Chairman, | Chief Executive Officer, and | Co-Chief Investment Officer, |

| Royce Investment Partners | Co-Chief Investment Officer, | Royce Investment Partners |

| | Royce Investment Partners | |

| July 31, 2023 | | |

6 | This page is not part of the Royce Capital Fund 2023 Semiannual Report to Shareholders

Performance and Expenses

Performance and Expenses

As of June 30, 2023

| | YTD1 | 1-YR | 3-YR | 5-YR | 10-YR | 15-YR | 20-YR | 25-YR | SINCE

INCEPTION

(12/27/96) | ANNUAL OPERATING

EXPENSES (%) |

| Royce Capital Fund–Micro-Cap Portfolio | 9.20 | 17.80 | 15.43 | 6.08 | 6.32 | 5.58 | 7.55 | 8.91 | 9.42 | 1.16 |

| Royce Capital Fund–Small-Cap Portfolio | 8.13 | 21.26 | 17.96 | 3.59 | 5.92 | 6.39 | 8.36 | 8.79 | 9.40 | 1.15 |

| INDEX | | | | | | | | | | |

| Russell Microcap Index | 2.32 | 6.63 | 9.09 | 2.07 | 7.29 | 7.70 | 7.55 | N/A | N/A | N/A |

| Russell 2000 Value Index | 2.50 | 6.01 | 15.43 | 3.54 | 7.29 | 7.72 | 8.29 | 7.62 | N/A | N/A |

| Russell 2000 Index | 8.09 | 12.31 | 10.82 | 4.21 | 8.26 | 8.43 | 8.89 | 7.26 | N/A | N/A |

1 Not annualized.

Important Performance, Expense, and Risk Information

All performance information in this Review and Report reflects past performance, is presented on a total return basis, reflects the reinvestment of distributions, and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when redeemed. Current performance may be higher or lower than performance quoted and may be obtained at www.royceinvest.com. The Funds’ total returns do not reflect any deduction for charges or expenses of the variable contracts investing in the Funds. All performance and expense information reflects the result for each Fund’s Investment Class Shares. Annual operating expenses reflect the total gross operating expenses for each Fund’s Investment Class as of each Fund’s most current prospectus and include management fees and other expenses. All expense information is reported as of each Fund’s most current prospectus.

Service Class Shares bear an annual distribution expense that is not borne by the Investment Class; if those expenses were reflected, total returns would have been lower. Each series of Royce Capital Fund is subject to market risk—the possibility that common stock prices will decline, sometimes sharply and unpredictably, over short or extended periods of time. Such declines may be caused by various factors, including market, financial, and economic conditions, governmental or central bank actions, and other factors, such as the recent Covid-19 pandemic, that may not be directly related to the issuer of a security held by a Fund. This pandemic could adversely affect global market, financial, and economic conditions in ways that cannot necessarily be foreseen. Royce Micro-Cap Portfolio invests primarily in micro-cap companies while Royce Small-Cap Portfolio invests primarily in small-cap companies. Investments in micro-cap and small-cap companies may involve considerably more risk than investments in securities of larger-cap companies. (Please see “Primary Risks for Fund Investors” in the prospectus.) Each series of Royce Capital Fund may invest up to 25% of its net assets in foreign securities. Investments in foreign securities may involve political, economic, currency, and other risks not encountered in U.S. investments. (Please see “Investing in Foreign Securities” in the prospectus.) As of 6/30/23, Royce Small-Cap Portfolio invested a significant portion of its assets in a limited number of stocks, which may involve considerably more risk than a more broadly diversified portfolio because a decline in the value of any one of these stocks would cause the Portfolio’s overall value to decline to a greater degree. Royce Micro-Cap Portfolio’s broadly diversified portfolio does not ensure a profit or guarantee against loss. (Please see “Primary Risks for Fund Investors” in the prospectus.) This Review and Report must be preceded or accompanied by a prospectus. Please read the prospectus carefully before investing or sending money. Russell Investment Group is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Russell® is a trademark of Russell Investment Group. The Russell Microcap Index includes 1,000 of the smallest securities in the small-cap Russell 2000 Index along with the next smallest eligible securities as determined by Russell. The Russell 2000 Index is an unmanaged, capitalization-weighted index of domestic small-cap stocks. It measures the performance of the 2,000 smallest publicly traded U.S. companies in the Russell 3000 Index. The Russell 2000 Value Index consists of the respective value stocks within the Russell 2000 as determined by Russell Investments. The performance of an index does not represent exactly any particular investment, as you cannot invest directly in an index. Distributor: Royce Fund Services, LLC.

This page is not part of the Royce Capital Fund 2023 Semiannual Report to Shareholders | 7

MANAGERS’ DISCUSSION (UNAUDITED)

Royce Capital Fund–Micro-Cap Portfolio (RCM)

Jim Stoeffel

Brendan Hartman

FUND PERFORMANCE

Royce Capital Fund–Micro-Cap Portfolio beat both its primary benchmark, the Russell Microcap Index, and its secondary benchmark, the Russell 2000 Index, for the one-, three-, and five-year periods ended 6/30/23. The Fund also outperformed the Russell 2000 for the 25-year and since inception (12/27/96) periods ended 6/30/23 (data for the Russell Microcap only goes back to 2000). For the year-to-date period ended 6/30/23, the Fund advanced 9.2%, outpacing both the Russell Microcap, which was up 2.3%, and the Russell 2000, which gained 8.1%, for the same period.

WHAT WORKED… AND WHAT DIDN’T

Seven of the Fund’s nine equity sectors made a positive contribution to performance in the first half of 2023, led by Information Technology, Industrials, and Health Care. Financials and Communications Services detracted while Real Estate made the smallest contribution. The top-contributing industries were semiconductors & semiconductor equipment (Information Technology), machinery (Industrials), and electronic equipment, instruments & components (Information Technology) while banks (Financials), specialty retail (Consumer Discretionary), and professional services (Industrials) were the biggest detractors.

The Fund’s two top contributing positions in the first half of 2023 are benefiting from the growing significance of silicon carbide semiconductors in electric vehicles. While we have been selling shares of each, we continue to hold solid positions because we believe this is a long-term secular trend in its early stages. Axcelis Technologies makes and services ion implantation, dry strip, thermal processing, and curing equipment used in semiconductor chip fabrication. Axcelis is a predominant player in providing ion implantation systems for the semiconductor industry, which is becoming increasingly important as power management devices have become critical in numerous industries. Aehr Test Systems has unique semiconductor testing systems that address processes where the cost of chip failure is especially high. Arlo Technologies provides home security cameras and related security monitoring services. For the past year or so, Arlo has been transforming its business from a legacy, low margin hardware focus to a subscription model with recurring revenues and high margins. We believe the stock hit an inflection point in this transition during the second quarter of 2023 when the superior economics of the subscription model and its impact on growth and margins became evident to investors.

| | Top Contributors to Performance Year-to-Date Through 6/30/23 (%)1 | | | Top Detractors from Performance Year-to-Date Through 6/30/23 (%)2 | | |

| | Axcelis Technologies | 1.15 | | Cutera | -0.64 | |

| | Aehr Test Systems | 0.91 | | Investar Holding Corporation | -0.62 | |

| | Arlo Technologies | 0.81 | | DZS | -0.62 | |

| | CIRCOR International | 0.80 | | Western New England Bancorp | -0.56 | |

| | Universal Stainless & Alloy Products | 0.79 | | QuinStreet | -0.51 | |

| | 1 Includes dividends | | | 2 Net of dividends | | |

| | | | | | | |

The top detractor was aesthetic medical device maker, Cutera, which suffered through an earnings guidance cut as its core business slowed. An ensuing boardroom battle resulted in the firing of the well regarded CEO and Chair, creating more uncertainty. This individual has since rejoined the company as an advisor while the Board looks for a permanent CEO. We held shares as we believe there is significant asset value in the business that, once stabilized by new management, should make it an appealing part of a larger company. Regional bank Investar Holding Corporation was hurt by the recent banking crisis and concerns about increased credit losses in a slowing economy. However, we think these risks are outweighed by its longer-term prospects in a growing economy. DZS manufactures communications network equipment that helps deliver high speed fiber access. DZS lowered earnings guidance and was also in non-compliance with loan covenants that it is working with lenders to renegotiate while also dealing with a revenue recognition issue that DZS described as a one-off discovered during the collection process. We held a small position at the end of June.

Relative to the Russell Microcap, both sector allocation and stock selection were additive to Fund performance. The combination of our larger weighting and stock picks in Information Technology and Industrials helped most, along with our lower exposure to Financials. Offsetting our relative edge somewhat were lower exposure to Health Care, stock selection and our higher weight in Communication Services, and stock picks in Consumer Discretionary.

CURRENT POSITIONING AND OUTLOOK

While Artificial Intelligence (“AI”) has seen ample hype, we see it as one more secular trend that is driving demand for semiconductors and processing bandwidth. This plays into our portfolio positioning as select smaller technology names are providing critical components in this value chain. We view our technology companies as “picks and shovel” providers into a myriad of long-term technology trends and view many of our industrial companies as possessing similar characteristics. We also expect many industrial companies to benefit from the increasing use of AI to drive efficiencies in their operations. More significantly, however, we believe many of these large macro trends require substantial infrastructure investments and have underlying government support, one example being the shift to green energy, which requires significant investments in electrical transmission capabilities. While we are excited about our positioning in the intermediate term, we are also cognizant of short-term market pressures, most notably the unprecedented pace of Fed rate hikes. Although inflationary pressures have meaningfully moderated, the Fed remains in a hawkish mode. These pressures are likely to be exacerbated by commercial banks tightening lending standards. Likewise, the attempted coup in Russia highlighted the ever-present black swan risks that are hard to underwrite. That said, we believe the intermediate-term opportunities outweigh the short-term risks, and our outlook remains constructive.

8 | Royce Capital Fund 2023 Semiannual Report to Shareholders

| PERFORMANCE AND PORTFOLIO REVIEW (UNAUDITED) | TICKER SYMBOLS RCMCX RCMSX |

Performance and Expenses

Average Annual Total Return (%) Through 6/30/23

| | JAN-JUN 20231 | 1-YR | 3-YR | 5-YR | 10-YR | 15-YR | 20-YR | 25-YR | SINCE INCEPTION (12/27/96) |

| RCM | 9.20 | 17.80 | 15.43 | 6.08 | 6.32 | 5.58 | 7.55 | 8.91 | 9.42 |

| Annual Operating Expenses: 1.16% | | | |

1 Not annualized

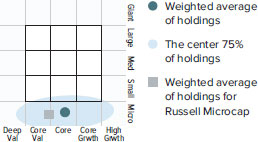

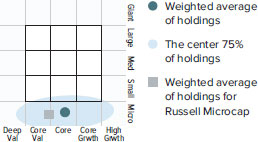

Morningstar Style Map™ As of 6/30/23

The Morningstar Style Map is the Morningstar Style Box™ with the center 75% of fund holdings plotted as the Morningstar Ownership Zone™. The Morningstar Style Box is designed to reveal a fund’s investment strategy. The Morningstar Ownership Zone provides detail about a portfolio’s investment style by showing the range of stock sizes and styles. The Ownership Zone is derived by plotting each stock in the portfolio within the proprietary Morningstar Style Box. Over time, the shape and location of a fund’s ownership zone may vary. See page 32 for additional information.

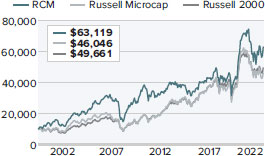

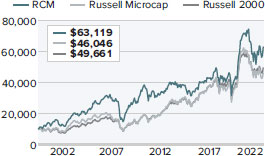

Value of $10,000

Invested on 6/30/00 (Russell Microcap Inception)

as of 6/30/23 ($)

Includes reinvestment of distributions.

Top 10 Positions

% of Net Assets

| Photronics | 1.4 |

| Universal Stainless & Alloy Products | 1.4 |

| Newpark Resources | 1.4 |

| Modine Manufacturing | 1.3 |

| Axcelis Technologies | 1.2 |

| Distribution Solutions Group | 1.2 |

| Aehr Test Systems | 1.2 |

| Quanex Building Products | 1.1 |

| Cohu | 1.1 |

| VSE Corporation | 1.1 |

Portfolio Sector Breakdown

% of Net Assets

| Information Technology | 26.3 |

| Industrials | 23.5 |

| Consumer Discretionary | 11.7 |

| Financials | 10.8 |

| Health Care | 7.6 |

| Materials | 4.7 |

| Communication Services | 3.9 |

| Energy | 2.8 |

| Real Estate | 0.5 |

| Cash and Cash Equivalents | 8.2 |

Calendar Year Total Returns (%)

| YEAR | RCM |

| 2022 | -22.4 |

| 2021 | 30.0 |

| 2020 | 23.8 |

| 2019 | 19.6 |

| 2018 | -9.0 |

| 2017 | 5.2 |

| 2016 | 19.7 |

| 2015 | -12.5 |

| 2014 | -3.6 |

| 2013 | 21.0 |

| 2012 | 7.6 |

| 2011 | -12.1 |

| 2010 | 30.1 |

| 2009 | 57.9 |

| 2008 | -43.3 |

Upside/Downside Capture Ratios

Periods Ended 6/30/23 (%)

| | UPSIDE | DOWNSIDE |

| 10-Year | 85 | 85 |

| From 6/30/00 (Russell Microcap Inception) | 92 | 80 |

Portfolio Diagnostics

| Fund Net Assets | $141 million |

| Number of Holdings | 125 |

| Turnover Rate | 13% |

| Average Market Capitalization 1 | $545 million |

| Weighted Average P/B Ratio 2 | 1.7x |

| Active Share 3 | 90% |

| U.S. Investments (% of Net Assets) | 81.9% |

| Non-U.S. Investments (% of Net Assets) | 9.9% |

| 1 | Geometric Average. This weighted calculation uses each portfolio holding’s market cap in a way designed to not skew the effect of very large or small holdings; instead, it aims to better identify the portfolio’s center, which Royce believes offers a more accurate measure of average market cap than a simple mean or median. |

| 2 | Harmonic Average. This weighted calculation evaluates a portfolio as if it were a single stock and measures it overall. It compares the total market value of the portfolio to the portfolio’s share in the earnings or book value, as the case may be, of its underlying stocks. |

| 3 | Active Share is the sum of the absolute values of the different weightings of each holding in the Fund versus each holding in the benchmark, divided by two. |

Important Performance and Expense Information

All performance information in this Report reflects past performance, is presented on a total return basis, reflects the reinvestment of distributions, and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when redeemed. Current performance may be higher or lower than performance quoted. The Fund’s total returns do not reflect any deduction for charges or expenses of the variable contracts investing in the Fund. Returns as of the most recent month-end may be obtained at www.royceinvest.com. All performance and risk information reflects the result of the Investment Class (its oldest class). Shares of RCM’s Service Class bear an annual distribution expense that is not borne by the Investment Class; if those expenses were reflected, total returns would have been lower. Annual operating expenses reflect the total gross operating expenses for the Fund’s Investment Class as of the Fund’s most current prospectus and include management fees and other expenses. Regarding the “Top Contributors” and “Top Detractors” tables shown above, the sum of all contributors to, and all detractors from, performance for all securities in the portfolio would approximate the Fund’s year-to-date performance for 2023. Upside Capture Ratio measures a manager’s performance in up markets relative to the Fund’s primary benchmark. It is calculated by measuring the Fund’s performance in quarters when the primary benchmark went up and dividing it by such benchmark’s return in those quarters. Downside Capture Ratio measures a manager’s performance in down markets relative to the Fund’s primary benchmark. It is calculated by measuring the Fund’s performance in quarters when the primary benchmark goes down and dividing it by such benchmark’s return in those quarters.

Royce Capital Fund 2023 Semiannual Report to Shareholders | 9

Schedule of Investments

Royce Capital Fund - Micro-Cap Portfolio

Common Stocks – 91.8%

| | | SHARES | | | VALUE |

| COMMUNICATION SERVICES – 3.9% | | | | | | | |

| ENTERTAINMENT - 1.1% | | | | | | | |

| Chicken Soup for the Soul Entertainment Cl. A 1 | | | 182,316 | | | $ | 216,045 |

| Gaia Cl. A 1 | | | 73,746 | | | | 170,353 |

| IMAX Corporation 1 | | | 72,700 | | | | 1,235,173 |

| | | | | | | | 1,621,571 |

| INTERACTIVE MEDIA & SERVICES - 0.7% | | | | | | | |

| QuinStreet 1 | | | 107,400 | | | | 948,342 |

| MEDIA - 2.1% | | | | | | | |

| Entravision Communications Cl. A | | | 84,600 | | | | 371,394 |

| †Innovid Corp. 1 | | | 209,700 | | | | 228,573 |

| Magnite 1 | | | 96,900 | | | | 1,322,685 |

| Thryv Holdings 1 | | | 41,800 | | | | 1,028,280 |

| | | | | | | | 2,950,932 |

| Total (Cost $6,678,246) | | | | | | | 5,520,845 |

| | | | | | | | |

| CONSUMER DISCRETIONARY – 11.7% | | | | | | | |

| AUTOMOBILE COMPONENTS - 2.2% | | | | | | | |

| Modine Manufacturing 1 | | | 55,500 | | | | 1,832,610 |

| Stoneridge 1 | | | 63,600 | | | | 1,198,860 |

| | | | | | | | 3,031,470 |

| DIVERSIFIED CONSUMER SERVICES - 0.2% | | | | | | | |

| Lincoln Educational Services 1 | | | 49,931 | | | | 336,535 |

| HOTELS, RESTAURANTS & LEISURE - 1.6% | | | | | | | |

| Century Casinos 1 | | | 141,300 | | | | 1,003,230 |

| Lindblad Expeditions Holdings 1,2 | | | 115,200 | | | | 1,253,376 |

| | | | | | | | 2,256,606 |

| HOUSEHOLD DURABLES - 1.9% | | | | | | | |

| †Hovnanian Enterprises Cl. A 1 | | | 15,400 | | | | 1,527,834 |

| Legacy Housing 1 | | | 51,096 | | | | 1,184,916 |

| | | | | | | | 2,712,750 |

| LEISURE PRODUCTS - 1.4% | | | | | | | |

| American Outdoor Brands 1 | | | 103,245 | | | | 896,167 |

| MasterCraft Boat Holdings 1 | | | 36,317 | | | | 1,113,116 |

| | | | | | | | 2,009,283 |

| SPECIALTY RETAIL - 3.6% | | | | | | | |

| Barnes & Noble Education 1 | | | 46,700 | | | | 58,842 |

| Chico’s FAS 1 | | | 211,200 | | | | 1,129,920 |

| Citi Trends 1 | | | 59,986 | | | | 1,059,353 |

| JOANN 1 | | | 95,388 | | | | 83,369 |

| OneWater Marine Cl. A 1 | | | 19,800 | | | | 717,552 |

| Shoe Carnival | | | 48,300 | | | | 1,134,084 |

| Zumiez 1 | | | 53,300 | | | | 887,978 |

| | | | | | | | 5,071,098 |

| TEXTILES, APPAREL & LUXURY GOODS - 0.8% | | | | | | | |

| Fossil Group 1 | | | 178,900 | | | | 459,773 |

| Vera Bradley 1 | | | 103,900 | | | | 663,921 |

| | | | | | | | 1,123,694 |

| Total (Cost $14,316,051) | | | | | | | 16,541,436 |

| | | | | | | | |

| ENERGY – 2.8% | | | | | | | |

| ENERGY EQUIPMENT & SERVICES - 2.8% | | | | | | | |

| Natural Gas Services Group 1 | | | 129,866 | | | | 1,285,673 |

| Newpark Resources 1 | | | 365,900 | | | | 1,913,657 |

| Profire Energy 1 | | | 623,429 | | | | 766,818 |

| Total (Cost $3,045,022) | | | | | | | 3,966,148 |

| | | | | | | | |

| FINANCIALS – 10.8% | | | | | | | |

| BANKS - 6.5% | | | | | | | |

| BayCom Corporation | | | 68,582 | | | | 1,143,948 |

| Customers Bancorp 1 | | | 32,000 | | | | 968,320 |

| HarborOne Bancorp | | | 108,491 | | | | 941,702 |

| HBT Financial | | | 74,388 | | | | 1,371,715 |

| HomeTrust Bancshares | | | 51,400 | | | | 1,073,746 |

| Investar Holding Corporation | | | 78,710 | | | | 953,178 |

| Midway Investments 1,3 | | | 1,751,577 | | | | 0 |

| Stellar Bancorp | | | 42,845 | | | | 980,722 |

| Territorial Bancorp | | | 50,308 | | | | 617,782 |

| Western New England Bancorp | | | 176,862 | | | | 1,032,874 |

| | | | | | | | 9,083,987 |

| CAPITAL MARKETS - 3.6% | | | | | | | |

| B. Riley Financial | | | 23,500 | | | | 1,080,530 |

| Canaccord Genuity Group | | | 73,682 | | | | 464,423 |

| Silvercrest Asset Management Group Cl. A | | | 74,684 | | | | 1,512,351 |

| Sprott | | | 30,380 | | | | 983,581 |

| StoneX Group 1 | | | 12,600 | | | | 1,046,808 |

| | | | | | | | 5,087,693 |

| FINANCIAL SERVICES - 0.7% | | | | | | | |

| Cass Information Systems | | | 26,548 | | | | 1,029,531 |

| Total (Cost $14,774,795) | | | | | | | 15,201,211 |

| | | | | | | | |

| HEALTH CARE – 7.6% | | | | | | | |

| BIOTECHNOLOGY - 2.0% | | | | | | | |

| †ARS Pharmaceuticals 1 | | | 75,600 | | | | 506,520 |

| CareDx 1 | | | 67,000 | | | | 569,500 |

| Dynavax Technologies 1 | | | 82,600 | | | | 1,067,192 |

| MeiraGTx Holdings 1 | | | 99,200 | | | | 666,624 |

| | | | | | | | 2,809,836 |

| HEALTH CARE EQUIPMENT & SUPPLIES - 4.1% | | | | | | | |

| Apyx Medical 1 | | | 212,000 | | | | 1,066,360 |

| Artivion 1 | | | 78,089 | | | | 1,342,350 |

| AtriCure 1 | | | 17,500 | | | | 863,800 |

| Cutera 1 | | | 21,600 | | | | 326,808 |

| OrthoPediatrics Corp. 1 | | | 21,600 | | | | 947,160 |

| Profound Medical 1 | | | 97,500 | | | | 1,248,971 |

| | | | | | | | 5,795,449 |

| LIFE SCIENCES TOOLS & SERVICES - 1.0% | | | | | | | |

| Harvard Bioscience 1 | | | 257,880 | | | | 1,415,761 |

| PHARMACEUTICALS - 0.5% | | | | | | | |

| †Harrow Health 1 | | | 33,600 | | | | 639,744 |

| Total (Cost $8,613,774) | | | | | | | 10,660,790 |

| | | | | | | | |

| INDUSTRIALS – 23.5% | | | | | | | |

| AEROSPACE & DEFENSE - 2.0% | | | | | | | |

| Astronics Corporation 1 | | | 58,955 | | | | 1,170,846 |

| Cadre Holdings | | | 48,905 | | | | 1,066,129 |

| CPI Aerostructures 1 | | | 151,879 | | | | 590,809 |

| | | | | | | | 2,827,784 |

| BUILDING PRODUCTS - 1.1% | | | | | | | |

| Quanex Building Products | | | 58,900 | | | | 1,581,465 |

| COMMERCIAL SERVICES & SUPPLIES - 3.3% | | | | | | | |

| Acme United | | | 35,185 | | | | 877,514 |

| †CECO Environmental 1 | | | 72,900 | | | | 973,944 |

| Heritage-Crystal Clean 1 | | | 32,534 | | | | 1,229,460 |

| VSE Corporation | | | 28,300 | | | | 1,547,727 |

| | | | | | | | 4,628,645 |

| CONSTRUCTION & ENGINEERING - 3.7% | | | | | | | |

| Concrete Pumping Holdings 1 | | | 132,600 | | | | 1,064,778 |

| 10 | Royce Capital Fund 2023 Semiannual Report to Shareholders | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS |

June 30, 2023 (unaudited)

Royce Capital Fund - Micro-Cap Portfolio (continued)

| | | SHARES | | | VALUE |

| INDUSTRIALS (continued) | | | | | |

| CONSTRUCTION & ENGINEERING (continued) | | | | | |

| Construction Partners Cl. A 1 | | | 49,100 | | | $ | 1,541,249 |

| IES Holdings 1 | | | 25,700 | | | | 1,461,816 |

| Northwest Pipe 1 | | | 38,978 | | | | 1,178,695 |

| | | | | | | | 5,246,538 |

| ELECTRICAL EQUIPMENT - 0.8% | | | | | | | |

| American Superconductor 1 | | | 174,900 | | | | 1,094,874 |

| MACHINERY - 5.5% | | | | | | | |

| Alimak Group 4 | | | 85,400 | | | | 667,739 |

| Commercial Vehicle Group 1 | | | 106,245 | | | | 1,179,320 |

| Graham Corporation 1 | | | 108,796 | | | | 1,444,811 |

| Luxfer Holdings | | | 68,700 | | | | 977,601 |

| Porvair 4 | | | 130,796 | | | | 1,053,892 |

| Shyft Group (The) | | | 40,800 | | | | 900,048 |

| Wabash National | | | 57,200 | | | | 1,466,608 |

| | | | | | | | 7,690,019 |

| MARINE TRANSPORTATION - 0.9% | | | | | | | |

| Clarkson 4 | | | 33,900 | | | | 1,274,386 |

| PROFESSIONAL SERVICES - 4.1% | | | | | | | |

| CRA International | | | 12,196 | | | | 1,243,992 |

| Forrester Research 1 | | | 33,300 | | | | 968,697 |

| Kforce | | | 17,400 | | | | 1,090,284 |

| NV5 Global 1 | | | 10,700 | | | | 1,185,239 |

| Resources Connection | | | 86,654 | | | | 1,361,334 |

| | | | | | | | 5,849,546 |

| TRADING COMPANIES & DISTRIBUTORS - 2.1% | | | | | | | |

| Distribution Solutions Group 1 | | | 32,324 | | | | 1,682,787 |

| Transcat 1 | | | 15,745 | | | | 1,343,206 |

| | | | | | | | 3,025,993 |

| Total (Cost $23,070,399) | | | | | | | 33,219,250 |

| | | | | | | | |

| INFORMATION TECHNOLOGY – 26.3% | | | | | | | |

| COMMUNICATIONS EQUIPMENT - 5.0% | | | | | | | |

| Applied Optoelectronics 1 | | | 234,088 | | | | 1,395,165 |

| Clearfield 1,2 | | | 23,700 | | | | 1,122,195 |

| Comtech Telecommunications | | | 67,363 | | | | 615,698 |

| Digi International 1 | | | 32,259 | | | | 1,270,682 |

| DZS 1 | | | 114,900 | | | | 456,153 |

| EMCORE Corporation 1 | | | 241,100 | | | | 181,452 |

| Genasys 1 | | | 215,039 | | | | 559,101 |

| Harmonic 1 | | | 87,400 | | | | 1,413,258 |

| | | | | | | | 7,013,704 |

| ELECTRONIC EQUIPMENT, INSTRUMENTS & COMPONENTS - 6.3% | | | | | | | |

| Arlo Technologies 1 | | | 130,400 | | | | 1,422,664 |

| FARO Technologies 1 | | | 39,500 | | | | 639,900 |

| LightPath Technologies Cl. A 1 | | | 383,700 | | | | 517,995 |

| Luna Innovations 1 | | | 169,182 | | | | 1,542,940 |

| nLIGHT 1 | | | 97,700 | | | | 1,506,534 |

| PAR Technology 1 | | | 33,800 | | | | 1,113,034 |

| PowerFleet 1 | | | 157,594 | | | | 472,782 |

| VIA optronics ADR 1 | | | 116,260 | | | | 306,926 |

| Vishay Precision Group 1 | | | 35,200 | | | | 1,307,680 |

| | | | | | | | 8,830,455 |

| IT SERVICES - 0.8% | | | | | | | |

| Computer Task Group 1 | | | 145,841 | | | | 1,109,850 |

| SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT - 12.0% | | | | | | | |

| Aehr Test Systems 1,2 | | | 39,600 | | | | 1,633,500 |

| Amtech Systems 1 | | | 83,889 | | | | 801,979 |

| Axcelis Technologies 1 | | | 9,300 | | | | 1,704,969 |

| AXT 1 | | | 216,200 | | | | 743,728 |

| Camtek 1 | | | 40,552 | | | | 1,444,868 |

| Cohu 1 | | | 37,600 | | | | 1,562,656 |

| Ichor Holdings 1 | | | 36,200 | | | | 1,357,500 |

| Nova 1,2 | | | 11,300 | | | | 1,325,490 |

| NVE Corporation | | | 15,800 | | | | 1,539,552 |

| PDF Solutions 1 | | | 34,100 | | | | 1,537,910 |

| Photronics 1 | | | 77,200 | | | | 1,990,988 |

| Ultra Clean Holdings 1 | | | 35,400 | | | | 1,361,484 |

| | | | | | | | 17,004,624 |

| SOFTWARE - 0.8% | | | | | | | |

| Agilysys 1 | | | 16,200 | | | | 1,111,968 |

| TECHNOLOGY HARDWARE, STORAGE & PERIPHERALS - 1.4% | | | | | | | |

| AstroNova 1 | | | 87,885 | | | | 1,274,332 |

| Intevac 1 | | | 198,336 | | | | 743,760 |

| | | | | | | | 2,018,092 |

| Total (Cost $25,225,604) | | | | | | | 37,088,693 |

| | | | | | | | |

| MATERIALS – 4.7% | | | | | | | |

| CHEMICALS - 0.4% | | | | | | | |

| Aspen Aerogels 1 | | | 75,017 | | | | 591,884 |

| METALS & MINING - 4.3% | | | | | | | |

| Altius Minerals | | | 49,700 | | | | 821,612 |

| Ferroglobe 1 | | | 124,300 | | | | 592,911 |

| Haynes International | | | 26,870 | | | | 1,365,533 |

| Major Drilling Group International 1 | | | 201,400 | | | | 1,389,542 |

| Universal Stainless & Alloy Products 1 | | | 136,647 | | | | 1,914,425 |

| | | | | | | | 6,084,023 |

| Total (Cost $4,938,269) | | | | | | | 6,675,907 |

| | | | | | | | |

| REAL ESTATE – 0.5% | | | | | | | |

| REAL ESTATE MANAGEMENT & DEVELOPMENT - 0.5% | | | | | | | |

| FRP Holdings 1 | | | 13,040 | | | | 750,713 |

| Total (Cost $249,122) | | | | | | | 750,713 |

| | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | |

| (Cost $100,911,282) | | | | | | | 129,624,993 |

| THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS | Royce Capital Fund 2023 Semiannual Report to Shareholders | 11 |

| Schedule of Investments | June 30, 2023 (unaudited) |

Royce Capital Fund - Micro-Cap Portfolio (continued)

| | | SHARES | | | VALUE |

| | | | | | |

REPURCHASE AGREEMENT– 4.3% | | | | | |

Fixed Income Clearing Corporation, 3.00% dated 6/30/23, due 7/3/23, maturity value $6,103,321 (collateralized by obligations of U.S. Government Agencies, 4.25% due 11/15/40, valued at $6,223,835) |

| (Cost $6,101,795) | | | | | | $ | 6,101,795 |

| | | | | | | | |

| COLLATERAL RECEIVED FOR SECURITIES LOANED – 0.2% | | | | | | | |

Money Market Funds Federated Hermes Government Obligations Fund - Institutional Shares (7 day yield-4.92%) | |

| (Cost $273,634) | | | 273,634 | | | | 273,634 |

| | | | | | | | |

| TOTAL INVESTMENTS – 96.3% | | | | | | | |

| (Cost $107,286,711) | | | | | | | 136,000,422 |

| | | | | | | | |

| CASH AND OTHER ASSETS LESS LIABILITIES – 3.7% | | | | | | | 5,258,459 |

| | | | | | | | |

| NET ASSETS – 100.0% | | | | | | $ | 141,258,881 |

ADR- American Depository Receipt

† New additions in 2023.

| 2 | All or a portion of these securities were on loan as of June 30, 2023. |

| 3 | A security for which market quotations are not readily available represents 0.0% of net assets. This security has been valued at its fair value under procedures approved by the Fund’s Board of Trustees. This security is defined as a Level 3 security due to the use of significant unobservable inputs in the determination of fair value. See Notes to Financial Statements. |

| 4 | These securities are defined as Level 2 securities due to fair value being based on quoted prices for similar securities and/or due to the application of fair value factors. See Notes to Financial Statements. |

Bold indicates the Fund’s 20 largest equity holdings in terms of June 30, 2023, market value.

| 12 | Royce Capital Fund 2023 Semiannual Report to Shareholders | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS |

This page is intentionally left blank.

Royce Capital Fund 2023 Semiannual Report to Shareholders | 13

MANAGER’S DISCUSSION (UNAUDITED)

Royce Capital Fund–Small-Cap Portfolio (RCS)

Jay Kaplan, CFA

FUND PERFORMANCE

Royce Capital Fund–Small-Cap Portfolio gained 8.1% for the year-to-date period ended 6/30/23 versus a gain of 2.5% for its primary benchmark, the Russell 2000 Value Index, and an advance of 8.1% for its secondary benchmark, the Russell 2000 Index, for the same period. The Fund also outperformed the Russell 2000 Value for the 1-, 3-, 5-, 20-, 25-year, and since inception (12/27/96) periods ended 6/30/23 while also beating the Russell 2000 for the same 1-, 3-, 25-year, and since inception periods through the end of June.

WHAT WORKED… AND WHAT DIDN’T

Six of the portfolio’s 10 equity sectors made a positive impact on performance in 2023’s first half. The sectors making the largest positive contributions were Information Technology, Industrials, and Consumer Discretionary while the largest negative impacts came from Financials, Health Care, and Consumer Staples. At the industry level, electronic equipment, instruments & components (Information Technology), household durables (Consumer Discretionary), and oil, gas & consumable fuels (Energy) contributed most while banks (Financials), biotechnology (Health Care), and professional services (Industrials) were the largest detractors.

The portfolio’s top contributor at the position level in 2023’s first half was Sterling Infrastructure, which provides advanced, large-scale site development services for data centers, manufacturing facilities, and e-commerce distribution centers. Sterling began to reposition itself six years ago, moving from a highly levered highway builder to its current businesses. Its 2023’s first quarter earnings release highlighted double-digit revenue growth and gross margin expansion. Preformed Line Products manufactures products that support, protect, connect, and secure cables and wires for the energy, communications, cable television, and information industries. The company passed on price increases as raw material costs climbed, which led to improved profitability, as demonstrated by its record earnings per share in 2023’s first quarter. Jabil provides digital prototyping, printed electronics, device integration, circuit designing, and volume board assembly services for the automotive, energy, and defense and aerospace industries. As package preparation and shipping has grown more detailed and specialized, the company’s business has grown, as have profit margins.

| | | | | | | |

| | Top Contributors to Performance | | | Top Detractors from Performance | | |

| | Year-to-Date Through 6/30/23 (%)1 | | | Year-to-Date Through 6/30/23 (%)2 | | |

| | | | | | | |

| | Sterling Infrastructure | 1.09 | | Timberland Bancorp | -0.42 | |

| | Preformed Line Products | 0.95 | | Western New England Bancorp | -0.35 | |

| | Jabil | 0.92 | | CNB Financial | -0.33 | |

| | PulteGroup | 0.84 | | Mid Penn Bancorp | -0.29 | |

| | M/I Homes | 0.69 | | SIGA Technologies | -0.29 | |

| | 1 Includes dividends | | | 2 Net of dividends | | |

| | | | | | | |

Four of the Fund’s top five detractors at the position level were banks. While the challenges faced by small-cap banks were exacerbated by the failures of Silicon Valley and Signature Bank earlier this year, we believe earnings and profits are being pressured to a greater degree, in our estimation, by the stubbornly inverted yield curve and the higher yields offered by money markets. However, credit appears to be in good shape, and we see attributes in each of these positions that should help them when the industry rebounds. Timberland Bancorp is a profitable and, in our view, well-managed bank based in Washington state. Western New England Bancorp has been making an effective transition from a thrift to a more commercial bank, while both CNB Financial and Mid Penn Bancorp have been expanding successfully, the former in an interesting and creative way by setting up local banks in small and mid-sized cities.

The Fund’s advantage over the Russell 2000 Value in 2023’s first half came from sector allocation decisions. At the sector level, much higher exposure to the resurgent Information Technology sector, a lower weighting in Financials (particularly in banks), and a bigger weighting in Consumer Discretionary did most to boost relative results while stock selection in Health Care and Real Estate, along with a much lower weighting in Materials, detracted most from performance relative to the Fund’s primary benchmark.

CURRENT POSITIONING AND OUTLOOK

The current environment is uncertain and has so far not been great for small-cap stocks relative to their large-cap peers. 2Q23 saw continued strength for the Nasdaq, especially its mega-cap stocks, which helped companies in the Russell 2000 Growth Index more than those in the Russell 2000 Value Index. Both indexes, however, significantly underperformed large-cap indexes and those that are more broadly based in terms of market capitalization. This extends a trend that began earlier this year, and it’s worth noting that the Russell 2000 remained in a bear market at the end of June, down -20.8% from its most recent peak on 11/8/21. In spite of the skip in June, the Fed remains committed to raising rates until inflation comes down to its 2% target. In addition, as long as employment remains as strong as it has been over the last couple of years, we believe the Fed will stay hawkish. We saw a pronounced falloff in volumes for trucking and transportation companies as economic activity cooled in 2Q23, which strongly suggests that we are still shy of any widespread recovery for cyclicals. Therefore, we believe the bond market properly reflects the current economic circumstances while the equity market looks wrong in that many valuations—even within small cap—still look stretched. In this light, portfolio positioning has not appreciably changed, though we trimmed some semiconductor capital equipment positions and bought a few bulk shipping companies, which looked inexpensive from a long-term perspective.

14 | Royce Capital Fund 2023 Semiannual Report to Shareholders

| PERFORMANCE AND PORTFOLIO REVIEW (UNAUDITED) | TICKER SYMBOLS RCPFX RCSSX |

Performance and Expenses

Average Annual Total Return (%) Through 6/30/23

| | JAN-JUN 20231 | 1-YR | 3-YR | 5-YR | 10-YR | 15-YR | 20-YR | 25-YR | SINCE INCEPTION (12/27/96) |

| RCS | 8.13 | 21.26 | 17.96 | 3.59 | 5.92 | 6.39 | 8.36 | 8.79 | 9.40 |

| Annual Operating Expenses: 1.15% |

1 Not annualized

Morningstar Style Map™ As of 6/30/23

The Morningstar Style Map is the Morningstar Style Box™ with the center 75% of fund holdings plotted as the Morningstar Ownership Zone™. The Morningstar Style Box is designed to reveal a fund’s investment strategy. The Morningstar Ownership Zone provides detail about a portfolio’s investment style by showing the range of stock sizes and styles. The Ownership Zone is derived by plotting each stock in the portfolio within the proprietary Morningstar Style Box. Over time, the shape and location of a fund’s ownership zone may vary. See page 32 for additional information.

Value of $10,000

Invested on 12/27/96 as of 6/30/23 ($)

Includes reinvestment of distributions.

Top 10 Positions

% of Net Assets

| Vishay Intertechnology | 1.9 |

| Jabil | 1.9 |

| Sterling Infrastructure | 1.9 |

| Flex | 1.9 |

| PulteGroup | 1.8 |

| Evercore Cl. A | 1.7 |

| Kimball Electronics | 1.7 |

| Schneider National Cl. B | 1.7 |

| Bloomin’ Brands | 1.6 |

| Sanmina Corporation | 1.6 |

Portfolio Sector Breakdown

% of Net Assets

| Information Technology | 20.2 |

| Industrials | 19.8 |

| Consumer Discretionary | 18.3 |

| Financials | 12.5 |

| Energy | 9.0 |

| Health Care | 5.3 |

| Communication Services | 2.6 |

| Consumer Staples | 2.3 |

| Materials | 1.3 |

| Real Estate | 0.9 |

| Cash and Cash Equivalents | 7.8 |

Calendar Year Total Returns (%)

| YEAR | RCS |

| 2022 | -9.2 |

| 2021 | 28.8 |

| 2020 | -7.2 |

| 2019 | 18.7 |

| 2018 | -8.3 |

| 2017 | 5.4 |

| 2016 | 21.0 |

| 2015 | -11.8 |

| 2014 | 3.2 |

| 2013 | 34.8 |

| 2012 | 12.5 |

| 2011 | -3.3 |

| 2010 | 20.5 |

| 2009 | 35.2 |

| 2008 | -27.2 |

Upside/Downside Capture Ratios

Periods Ended 6/30/23 (%)

| | UPSIDE | DOWNSIDE |

| 10-Year | 89 | 94 |

| From 12/31/96 (Start of Fund’s First Full Quarter) | 98 | 90 |

Portfolio Diagnostics

| Fund Net Assets | $313 million |

| Number of Holdings | 89 |

| Turnover Rate | 41% |

| Average Market Capitalization 1 | $1,430 million |

| Weighted Average P/E Ratio 2,3 | 7.8x |

| Weighted Average P/B Ratio 2 | 1.6x |

| Active Share 4 | 94% |

| U.S. Investments (% of Net Assets) | 92.0% |

| Non-U.S. Investments (% of Net Assets) | 0.2% |

| 1 | Geometric Average. This weighted calculation uses each portfolio holding’s market cap in a way designed to not skew the effect of very large or small holdings; instead, it aims to better identify the portfolio’s center, which Royce believes offers a more accurate measure of average market cap than a simple mean or median. |

| 2 | Harmonic Average. This weighted calculation evaluates a portfolio as if it were a single stock and measures it overall. It compares the total market value of the portfolio to the portfolio’s share in the earnings or book value, as the case may be, of its underlying stocks. |

| 3 | The Fund’s P/E Ratio calculation excludes companies with zero or negative earnings (3% of portfolio holdings as of 6/30/23). |

| 4 | Active Share is the sum of the absolute values of the different weightings of each holding in the Fund versus each holding in the benchmark, divided by two. |

Important Performance and Expense Information

All performance information in this Report reflects past performance, is presented on a total return basis, reflects the reinvestment of distributions, and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when redeemed. Current performance may be higher or lower than performance quoted. The Fund’s total returns do not reflect any deduction for charges or expenses of the variable contracts investing in the Fund. Returns as of the most recent month-end may be obtained at www.royceinvest.com. All performance and risk information reflects the result of the Investment Class (its oldest class). Shares of RCS’s Service Class bear an annual distribution expense that is not borne by the Investment Class; if those expenses were reflected, total returns would have been lower. Annual operating expenses reflect the total gross operating expenses for the Fund’s Investment Class as of the Fund’s most current prospectus and include management fees and other expenses. Regarding the “Top Contributors” and “Top Detractors” tables shown above, the sum of all contributors to, and all detractors from, performance for all securities in the portfolio would approximate the Fund’s year-to-date performance for 2023. Upside Capture Ratio measures a manager’s performance in up markets relative to the Fund’s primary benchmark. It is calculated by measuring the Fund’s performance in quarters when the primary benchmark went up and dividing it by such benchmark’s return in those quarters. Downside Capture Ratio measures a manager’s performance in down markets relative to the Fund’s primary benchmark. It is calculated by measuring the Fund’s performance in quarters when the primary benchmark goes down and dividing it by such benchmark’s return in those quarters.

Royce Capital Fund 2023 Semiannual Report to Shareholders | 15

Schedule of Investments

Royce Capital Fund - Small-Cap Portfolio

Common Stocks – 92.2%

| | | SHARES | | | VALUE |

| | | | | | |

| COMMUNICATION SERVICES – 2.6% | | | | | | | |

| MEDIA - 2.6% | | | | | | | |

| Entravision Communications Cl. A | | | 335,618 | | | $ | 1,473,363 |

| Saga Communications Cl. A | | | 141,443 | | | | 3,021,222 |

| †TEGNA | | | 224,700 | | | | 3,649,128 |

| Total (Cost $9,358,772) | | | | | | | 8,143,713 |

| | | | | | | | |

| CONSUMER DISCRETIONARY – 18.3% | | | | | | | |

| DIVERSIFIED CONSUMER SERVICES - 0.6% | | | | | | | |

| Lincoln Educational Services 1 | | | 307,919 | | | | 2,075,374 |

| HOTELS, RESTAURANTS & LEISURE - 1.6% | | | | | | | |

| Bloomin' Brands | | | 187,500 | | | | 5,041,875 |

| HOUSEHOLD DURABLES - 3.2% | | | | | | | |

| M/I Homes 1 | | | 49,424 | | | | 4,309,279 |

| PulteGroup | | | 72,450 | | | | 5,627,916 |

| | | | | | | | 9,937,195 |

| LEISURE PRODUCTS - 1.2% | | | | | | | |

| Malibu Boats Cl. A 1 | | | 39,618 | | | | 2,323,992 |

| MasterCraft Boat Holdings 1 | | | 43,534 | | | | 1,334,317 |

| | | | | | | | 3,658,309 |

| SPECIALTY RETAIL - 6.5% | | | | | | | |

| Buckle (The) | | | 72,965 | | | | 2,524,589 |

| †Chico's FAS 1 | | | 436,100 | | | | 2,333,135 |

| †Destination XL Group 1 | | | 497,200 | | | | 2,436,280 |

| Haverty Furniture | | | 77,100 | | | | 2,329,962 |

| OneWater Marine Cl. A 1 | | | 70,928 | | | | 2,570,431 |

| Shoe Carnival | | | 165,225 | | | | 3,879,483 |

| †Signet Jewelers | | | 31,700 | | | | 2,068,742 |

| Williams-Sonoma | | | 17,500 | | | | 2,189,950 |

| | | | | | | | 20,332,572 |

| TEXTILES, APPAREL & LUXURY GOODS - 5.2% | | | | | | | |

| Carter's | | | 54,466 | | | | 3,954,232 |

| Kontoor Brands | | | 84,600 | | | | 3,561,660 |

| Movado Group | | | 74,227 | | | | 1,991,510 |

| Steven Madden | | | 109,718 | | | | 3,586,681 |

| Tapestry | | | 73,500 | | | | 3,145,800 |

| | | | | | | | 16,239,883 |

| Total (Cost $48,965,288) | | | | | | | 57,285,208 |

| | | | | | | | |

| CONSUMER STAPLES – 2.3% | | | | | | | |

| CONSUMER STAPLES DISTRIBUTION & RETAIL - 2.3% | | | | | | | |

| Ingles Markets Cl. A | | | 42,311 | | | | 3,497,004 |

| Village Super Market Cl. A | | | 163,902 | | | | 3,740,244 |

| Total (Cost $7,371,231) | | | | | | | 7,237,248 |

| | | | | | | | |

| ENERGY – 9.0% | | | | | | | |

| OIL, GAS & CONSUMABLE FUELS - 9.0% | | | | | | | |

| †Berry Corporation | | | 298,284 | | | | 2,052,194 |

| Chord Energy | | | 32,073 | | | | 4,932,827 |

| Civitas Resources | | | 67,400 | | | | 4,675,538 |

| Dorchester Minerals L.P. | | | 148,605 | | | | 4,452,206 |

| Matador Resources | | | 72,300 | | | | 3,782,736 |

| Riley Exploration Permian | | | 113,400 | | | | 4,050,648 |

| SilverBow Resources 1 | | | 144,696 | | | | 4,213,548 |

| Total (Cost $23,943,141) | | | | | | | 28,159,697 |

| | | | | | | | |

| FINANCIALS – 12.5% | | | | | | | |

| BANKS - 7.8% | | | | | | | |

| Citizens Community Bancorp | | | 204,774 | | | | 1,812,250 |

| CNB Financial | | | 184,467 | | | | 3,255,842 |

| Landmark Bancorp | | | 28,140 | | | | 613,452 |

| Mid Penn Bancorp | | | 112,288 | | | | 2,479,319 |

| National Bankshares | | | 21,234 | | | | 619,820 |

| Princeton Bancorp | | | 77,018 | | | | 2,104,132 |

| Riverview Bancorp | | | 302,892 | | | | 1,526,576 |

| Timberland Bancorp | | | 143,686 | | | | 3,675,488 |

| TrustCo Bank Corp NY | | | 96,877 | | | | 2,771,651 |

| Unity Bancorp | | | 153,236 | | | | 3,614,837 |

| Western New England Bancorp | | | 342,600 | | | | 2,000,784 |

| | | | | | | | 24,474,151 |

| CAPITAL MARKETS - 1.9% | | | | | | | |

| Evercore Cl. A | | | 44,200 | | | | 5,462,678 |

| Houlihan Lokey Cl. A | | | 5,442 | | | | 535,003 |

| | | | | | | | 5,997,681 |

| FINANCIAL SERVICES - 1.2% | | | | | | | |

| †International Money Express 1 | | | 148,939 | | | | 3,653,474 |

| INSURANCE - 1.6% | | | | | | | |

| Tiptree | | | 318,672 | | | | 4,783,267 |

| Total (Cost $38,444,097) | | | | | | | 38,908,573 |

| | | | | | | | |

| HEALTH CARE – 5.3% | | | | | | | |

| BIOTECHNOLOGY - 1.2% | | | | | | | |

| Catalyst Pharmaceuticals 1 | | | 285,501 | | | | 3,837,134 |

| HEALTH CARE PROVIDERS & SERVICES - 3.0% | | | | | | | |

| Cross Country Healthcare 1 | | | 158,375 | | | | 4,447,170 |

| Ensign Group (The) | | | 5,364 | | | | 512,047 |

| Molina Healthcare 1 | | | 14,000 | | | | 4,217,360 |

| | | | | | | | 9,176,577 |

| PHARMACEUTICALS - 1.1% | | | | | | | |

| SIGA Technologies | | | 701,599 | | | | 3,543,075 |

| Total (Cost $13,926,786) | | | | | | | 16,556,786 |

| | | | | | | | |

| INDUSTRIALS – 19.8% | | | | | | | |

| AIR FREIGHT & LOGISTICS - 1.2% | | | | | | | |

| Hub Group Cl. A 1 | | | 46,272 | | | | 3,716,567 |

| BUILDING PRODUCTS - 2.9% | | | | | | | |

| Insteel Industries | | | 36,405 | | | | 1,132,924 |

| Quanex Building Products | | | 153,223 | | | | 4,114,037 |

| UFP Industries | | | 39,200 | | | | 3,804,360 |

| | | | | | | | 9,051,321 |

| CONSTRUCTION & ENGINEERING - 2.9% | | | | | | | |

| Northwest Pipe 1 | | | 105,525 | | | | 3,191,076 |

| Sterling Infrastructure 1 | | | 105,747 | | | | 5,900,683 |

| | | | | | | | 9,091,759 |

| ELECTRICAL EQUIPMENT - 1.3% | | | | | | | |

| Preformed Line Products | | | 25,705 | | | | 4,012,550 |

| GROUND TRANSPORTATION - 4.2% | | | | | | | |

| ArcBest Corporation | | | 49,649 | | | | 4,905,321 |

| Schneider National Cl. B | | | 187,800 | | | | 5,393,616 |

| †Universal Logistics Holdings | | | 74,512 | | | | 2,146,691 |

| Werner Enterprises | | | 17,085 | | | | 754,815 |

| | | | | | | | 13,200,443 |

| MARINE TRANSPORTATION - 1.7% | | | | | | | |

| †Genco Shipping & Trading | | | 245,162 | | | | 3,439,623 |

| †Pangaea Logistics Solutions | | | 271,791 | | | | 1,840,025 |

| | | | | | | | 5,279,648 |

| PROFESSIONAL SERVICES - 4.5% | | | | | | | |

| Barrett Business Services | | | 44,148 | | | | 3,849,706 |

| IBEX 1 | | | 163,686 | | | | 3,475,054 |

| 16 | Royce Capital Fund 2023 Semiannual Report to Shareholders | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS |

June 30, 2023 (unaudited)

Royce Capital Fund - Small-Cap Portfolio (continued)

| | | SHARES | | | VALUE |

| | | | | | |

| INDUSTRIALS (continued) | | | | | | | |

| PROFESSIONAL SERVICES (continued) | | | | | | | |

| Kforce | | | 9,214 | | | $ | 577,349 |

| Korn Ferry | | | 47,635 | | | | 2,359,838 |

| Resources Connection | | | 246,367 | | | | 3,870,425 |

| | | | | | | | 14,132,372 |

| TRADING COMPANIES & DISTRIBUTORS - 1.1% | | | | | | | |

| †Veritiv | | | 26,700 | | | | 3,353,787 |

| Total (Cost $48,399,370) | | | | | | | 61,838,447 |

| | | | | | | | |

| INFORMATION TECHNOLOGY – 20.2% | | | | | | | |

| COMMUNICATIONS EQUIPMENT - 1.2% | | | | | | | |

| Aviat Networks 1 | | | 110,816 | | | | 3,697,930 |

| ELECTRONIC EQUIPMENT, INSTRUMENTS & COMPONENTS - 14.0% | | | | | | | |

| ePlus 1 | | | 79,588 | | | | 4,480,804 |

| Flex 1 | | | 210,100 | | | | 5,807,164 |

| Insight Enterprises 1 | | | 30,365 | | | | 4,443,614 |

| Jabil | | | 55,000 | | | | 5,936,150 |

| Kimball Electronics 1 | | | 196,416 | | | | 5,426,974 |

| PC Connection | | | 75,026 | | | | 3,383,673 |

| Sanmina Corporation 1 | | | 83,343 | | | | 5,023,083 |

| TD SYNNEX | | | 35,442 | | | | 3,331,548 |

| Vishay Intertechnology | | | 202,661 | | | | 5,958,233 |

| | | | | | | | 43,791,243 |

| IT SERVICES - 0.8% | | | | | | | |

| Computer Task Group 1 | | | 346,086 | | | | 2,633,715 |

| SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT - 2.6% | | | | | | | |

| Alpha and Omega Semiconductor 1 | | | 90,546 | | | | 2,969,909 |

| Amkor Technology | | | 105,584 | | | | 3,141,124 |

| Cohu 1 | | | 15,936 | | | | 662,300 |

| Kulicke & Soffa Industries | | | 10,813 | | | | 642,833 |

| Ultra Clean Holdings 1 | | | 16,738 | | | | 643,743 |

| | | | | | | | 8,059,909 |

| SOFTWARE - 1.6% | | | | | | | |

| Adeia | | | 448,210 | | | | 4,934,792 |

| Total (Cost $44,276,958) | | | | | | | 63,117,589 |

| | | | | | | | |

| MATERIALS – 1.3% | | | | | | | |

| METALS & MINING - 1.3% | | | | | | | |

| †Ryerson Holding Corporation | | | 96,300 | | | | 4,177,494 |

| Total (Cost $3,590,056) | | | | | | | 4,177,494 |

| | | | | | | | |

| REAL ESTATE – 0.9% | | | | | | | |

| REAL ESTATE MANAGEMENT & DEVELOPMENT - 0.9% | | | | | | | |

| RMR Group (The) Cl. A | | | 124,876 | | | | 2,893,377 |

| Total (Cost $3,419,731) | | | | | | | 2,893,377 |

| | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | |

| (Cost $241,695,430) | | | | | | | 288,318,132 |

| | | | | | | | |

| REPURCHASE AGREEMENT – 4.8% | | | | | | |

Fixed Income Clearing Corporation, 3.00% dated 6/30/23, due 7/3/23, maturity value $14,969,488 (collateralized by obligations of U.S. Government Agencies, 3.75% due 5/31/30, valued at $15,265,147) |

| (Cost $14,965,747) | | | | | | $ | 14,965,747 |

| | | | | | | | |

| TOTAL INVESTMENTS – 97.0% | | | | | | | |

| (Cost $256,661,177) | | | | | | | 303,283,879 |

| | | | | | | | |

| CASH AND OTHER ASSETS LESS LIABILITIES – 3.0% | | | | | | | 9,339,401 |

| | | | | | | | |

| NET ASSETS – 100.0% | | | | | | $ | 312,623,280 |

Bold indicates the Fund’s 20 largest equity holdings in terms of June 30, 2023, market value.

| THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS | Royce Capital Fund 2023 Semiannual Report to Shareholders | 17 |

| Statements of Assets and Liabilities | June 30, 2023 (unaudited) |

| | | Micro-Cap | | | Small-Cap | |

| | | Portfolio | | | Portfolio | |

| ASSETS: | | | | | | |

| Investments at value (including collateral on loaned securities)1 | | $ | 129,898,627 | | | $ | 288,318,132 | |

| Repurchase agreements (at cost and value) | | | 6,101,795 | | | | 14,965,747 | |

| Foreign currency2 | | | 2,551 | | | | – | |

| Receivable for investments sold | | | 18,491 | | | | 295,286 | |

| Receivable for capital shares sold | | | 6,278,495 | | | | 13,516,295 | |

| Receivable for dividends and interest | | | 20,958 | | | | 85,586 | |

| Receivable for securities lending income | | | 348 | | | | – | |

| Prepaid expenses and other assets | | | 3,618 | | | | 7,065 | |

| Total Assets | | | 142,324,883 | | | | 317,188,111 | |

| LIABILITIES: | | | | | | | | |

| Payable for collateral on loaned securities | | | 273,634 | | | | – | |

| Payable for investments purchased | | | 420,341 | | | | 4,110,972 | |

| Payable for capital shares redeemed | | | 152,996 | | | | 46,953 | |

| Payable for investment advisory fees | | | 106,847 | | | | 211,081 | |

| Payable for trustees' fees | | | 9,668 | | | | 20,360 | |

| Accrued expenses | | | 102,516 | | | | 175,465 | |

| Total Liabilities | | | 1,066,002 | | | | 4,564,831 | |

| Net Assets | | $ | 141,258,881 | | | $ | 312,623,280 | |

| ANALYSIS OF NET ASSETS: | | | | | | | | |

| Paid-in capital | | $ | 108,216,038 | | | $ | 239,462,059 | |

| Total distributable earnings (loss) | | | 33,042,843 | | | | 73,161,221 | |

| Net Assets | | $ | 141,258,881 | | | $ | 312,623,280 | |

| Investment Class | | $ | 120,805,045 | | | $ | 154,108,480 | |

| Service Class | | | 20,453,836 | | | | 158,514,800 | |

| SHARES OUTSTANDING (unlimited number of $.001 par value): | | | | | | | | |

| Investment Class | | | 14,338,713 | | | | 17,054,703 | |

| Service Class | | | 2,504,010 | | | | 17,957,063 | |

| NET ASSET VALUES (Net Assets ÷ Shares Outstanding): | | | | | | | | |

| (offering and redemption price per share) | | | | | | | | |

| Investment Class | | $ | 8.43 | | | $ | 9.04 | |

| Service Class | | | 8.17 | | | | 8.83 | |

| Investments at identified cost | | $ | 101,184,916 | | | $ | 241,695,430 | |

| Market value of loaned securities3 | | | 2,943,958 | | | | – | |

1 See Notes to Financial Statements for information on non-cash collateral on loaned securities.

2 The cost of foreign currency is $2,553 for Micro-Cap Portfolio.

3 Market value of loaned securities backed by non-cash collateral is as of prior business day.

| 18 | Royce Capital Fund 2023 Semiannual Report to Shareholders | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS |

| Statements of Operations | Six Months Ended June 30, 2023 (unaudited) |

| | | Micro-Cap | | | Small-Cap | |

| | | Portfolio | | | Portfolio | |

| INVESTMENT INCOME: | | | | | | | | |

| INCOME: | | | | | | | | |

| Dividends | | $ | 469,159 | | | $ | 3,171,181 | |

| Foreign withholding tax | | | (5,466 | ) | | | – | |

| Interest | | | 52,235 | | | | 106,635 | |

| Securities lending | | | 5,896 | | | | 539 | |

| Total income | | | 521,824 | | | | 3,278,355 | |

| EXPENSES: | | | | | | | | |

| Investment advisory fees | | | 644,564 | | | | 1,422,504 | |

| Distribution fees | | | 21,005 | | | | 181,284 | |

| Administrative and office facilities | | | 40,886 | | | | 75,340 | |

| Trustees' fees | | | 18,487 | | | | 41,153 | |

| Audit | | | 17,217 | | | | 17,472 | |

| Custody | | | 13,190 | | | | 22,357 | |

| Shareholder reports | | | 9,801 | | | | 12,679 | |

| Shareholder servicing | | | 8,468 | | | | 8,111 | |

| Legal | | | 2,260 | | | | 4,843 | |

| Other expenses | | | 5,811 | | | | 11,000 | |

| Total expenses | | | 781,689 | | | | 1,796,743 | |

| Compensating balance credits | | | (79 | ) | | | (72 | ) |

| Fees waived by investment adviser | | | (29,797 | ) | | | (28,330 | ) |

| Expenses reimbursed by investment adviser | | | (12,267 | ) | | | (13,249 | ) |

| Net expenses | | | 739,546 | | | | 1,755,092 | |

| Net investment income (loss) | | | (217,722 | ) | | | 1,523,263 | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY: | | | | | | | | |

| NET REALIZED GAIN (LOSS): | | | | | | | | |

| Investments | | | 5,544,504 | | | | (471,157 | ) |

| Foreign currency transactions | | | (573 | ) | | | – | |

| NET CHANGE IN UNREALIZED APPRECIATION (DEPRECIATION): | | | | | | | | |

| Investments | | | 5,278,776 | | | | 17,322,062 | |

| Other assets and liabilities denominated in foreign currency | | | 11 | | | | – | |

| Net realized and unrealized gain (loss) on investments and foreign currency | | | 10,822,718 | | | | 16,850,905 | |

| NET INCREASE (DECREASE) IN NET ASSETS FROM INVESTMENT OPERATIONS | | $ | 10,604,996 | | | $ | 18,374,168 | |

| THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS | Royce Capital Fund 2023 Semiannual Report to Shareholders | 19 |

Statements of Changes in Net Assets

| | | Micro-Cap Portfolio | | | Small-Cap Portfolio | |

| | | Six Months Ended 6/30/23 (unaudited) | | | Year Ended 12/31/22 | | | Six Months Ended 6/30/23 (unaudited) | | | Year Ended 12/31/22 | |

| INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | $ | (217,722 | ) | | $ | (661,115 | ) | | $ | 1,523,263 | | | $ | 2,214,727 | |

| Net realized gain (loss) on investments and foreign currency | | | 5,543,931 | | | | (940,974 | ) | | | (471,157 | ) | | | 23,593,936 | |

| Net change in unrealized appreciation (depreciation) on investments and | | | | | | | | | | | | | | | | |

| foreign currency | | | 5,278,787 | | | | (37,955,019 | ) | | | 17,322,062 | | | | (66,154,197 | ) |

| Net increase (decrease) in net assets from investment operations | | | 10,604,996 | | | | (39,557,108 | ) | | | 18,374,168 | | | | (40,345,534 | ) |

| DISTRIBUTIONS: | | | | | | | | | | | | | | | | |

| Total distributable earnings | | | | | | | | | | | | | | | | |

| Investment Class | | | – | | | | (35,639,401 | ) | | | – | | | | (3,069,857 | ) |

| Service Class | | | – | | | | (4,335,006 | ) | | | – | | | | (3,038,165 | ) |

| Total distributions | | | – | | | | (39,974,407 | ) | | | – | | | | (6,108,022 | ) |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | | | | | | | | | |

| Value of shares sold | | | | | | | | | | | | | | | | |

| Investment Class | | | 13,453,659 | | | | 9,925,000 | | | | 16,106,484 | | | | 10,505,441 | |

| Service Class | | | 14,236,872 | | | | 1,132,977 | | | | 66,680,746 | | | | 109,240,664 | |

| Distributions reinvested | | | | | | | | | | | | | | | | |

| Investment Class | | | – | | | | 35,639,401 | | | | – | | | | 3,069,857 | |

| Service Class | | | – | | | | 4,335,006 | | | | – | | | | 3,038,165 | |

| Value of shares redeemed | | | | | | | | | | | | | | | | |

| Investment Class | | | (12,071,013 | ) | | | (23,050,585 | ) | | | (12,759,198 | ) | | | (26,631,982 | ) |

| Service Class | | | (7,834,323 | ) | | | (11,854,731 | ) | | | (74,865,320 | ) | | | (135,322,249 | ) |

| Net increase (decrease) in net assets from capital share transactions | | | 7,785,195 | | | | 16,127,068 | | | | (4,837,288 | ) | | | (36,100,104 | ) |

| Net Increase (Decrease) in Net Assets | | | 18,390,191 | | | | (63,404,447 | ) | | | 13,536,880 | | | | (82,553,660 | ) |

| NET ASSETS: | | | | | | | | | | | | | | | | |

| Beginning of period | | | 122,868,690 | | | | 186,273,137 | | | | 299,086,400 | | | | 381,640,060 | |

| End of period | | $ | 141,258,881 | | | $ | 122,868,690 | | | $ | 312,623,280 | | | $ | 299,086,400 | |

| 20 | Royce Capital Fund 2023 Semiannual Report to Shareholders | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS |

Financial Highlights

This table is presented to show selected data for a share outstanding throughout each year or other indicated period and to assist shareholders in evaluating a Fund’s performance for the periods presented. Per share amounts have been determined on the basis of the weighted average number of shares outstanding during the period.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Ratio of Expenses to Average Net Assets | | | | | |