UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-07537

Name of Registrant: Royce Capital Fund

Address of Registrant: 745 Fifth Avenue

New York, NY 10151

Name and address of agent for service: John E. Denneen, Esq.

745 Fifth Avenue

New York, NY 10151

Registrant’s telephone number, including area code: (212) 508-4500

Date of fiscal year end: December 31, 2023

Date of reporting period: January 1, 2024 – June 30, 2024

Item 1. Reports to Shareholders.

| | |

| The Royce Funds | June 30, 2024 |

| | |

Royce Capital Fund—Micro-Cap Portfolio Investment Class—RCMCX |  |

Semiannual Shareholder Report

This semiannual shareholder report contains important information about Royce Capital Fund—Micro-Cap Portfolio for the period of January 1, 2024 to June 30, 2024. You can find additional information at www.royceinvest.com/literature. You can also request this information by contacting us at 1-800-221-4268.

What Were the Fund Costs for the Last Six-Months?

Based on a hypothetical $10,000 investment

| | COSTS OF A | COSTS PAID AS A PERCENTAGE |

| FUND/CLASS | $10,000 INVESTMENT | OF A $10,000 INVESTMENT¹ |

| Royce Capital Fund—Micro-Cap Portfolio—Investment Class | $60 | 1.18% |

| ¹Annualized | | |

Key Fund Statistics

As of 6/30/24

| Fund Size (Millions) | $132 |

| Number of Holdings | 123 |

| Turnover Rate | 11% |

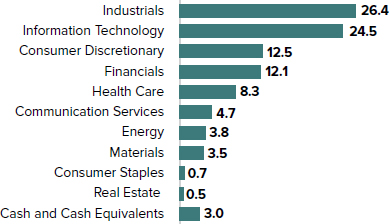

What Did The Fund Invest In?

Representing percentage of total net assets of the Fund as of 6/30/24 (%)

| Top 10 Positions | | | Portfolio Sector Breakdown |

| CECO Environmental | 1.6 | |

|

| Artivion | 1.4 | |

| Newpark Resources | 1.4 | |

| Graham Corporation | 1.3 | |

| American Superconductor | 1.3 | |

| VSE Corporation | 1.3 | |

| QuinStreet | 1.3 | |

| Shoe Carnival | 1.3 | |

| CRA International | 1.3 | |

| Arlo Technologies | 1.3 | |

| | | |

| Sector Breakdown |

| Industrials | 26.4 |

| Information Technology | 24.5 |

| Consumer Discretionary | 12.5 |

| Financials | 12.1 |

| Health Care | 8.3 |

| Communication Services | 4.7 |

| Energy | 3.8 |

| Materials | 3.5 |

| Consumer Staples | 0.7 |

| Real Estate | 0.5 |

| Cash And Cash Equivalents | 3.0 |

Where Can I Find Additional Information About The Fund?

Additional information is available at www.royceinvest.com/literature, including its:

| • Prospectus • Financial Information | • Fund Holdings • Proxy Voting Information |

Householding

We will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send you only one copy of these materials for as long as you remain a shareholder of the Fund. If you would like to receive individual mailings, please call 1-800-221-4268. Please allow 30 days for your request to be processed. Shareholders may also elect to receive these reports electronically. Please go to www.royceinvest.com for more details.

Important Information

Sector weightings are determined using the Global Industry Classification Standard (“GICS”). GICS was developed by, and is the exclusive property of, Standard & Poor’s Financial Services LLC (“S&P”) and MSCI Inc. (“MSCI”). GICS is the trademark of S&P and MSCI. “Global Industry Classification Standard (GICS)” and “GICS Direct” are service marks of S&P and MSCI. Distributor: Royce Fund Services, LLC.

| NOT FDIC INSURED • MAY LOSE VALUE • NOT BANK GUARANTEED | RCM-IC-STSR-0624 |

| | |

| The Royce Funds | June 30, 2024 |

| | |

Royce Capital Fund—Micro-Cap Portfolio Service Class—RCMSX |  |

Semiannual Shareholder Report

This semiannual shareholder report contains important information about Royce Capital Fund—Micro-Cap Portfolio for the period of January 1, 2024 to June 30, 2024. You can find additional information at www.royceinvest.com/literature. You can also request this information by contacting us at 1-800-221-4268.

What Were the Fund Costs for the Last Six-Months?

Based on a hypothetical $10,000 investment

| | COSTS OF A | COSTS PAID AS A PERCENTAGE |

| FUND/CLASS | $10,000 INVESTMENT | OF A $10,000 INVESTMENT¹ |

| Royce Capital Fund—Micro-Cap Portfolio—Service Class | $73 | 1.45% |

| ¹Annualized | | |

Key Fund Statistics

As of 6/30/24

| Fund Size (Millions) | $132 |

| Number of Holdings | 123 |

| Turnover Rate | 11% |

What Did The Fund Invest In?

Representing percentage of total net assets of the Fund as of 6/30/24 (%)

| Top 10 Positions | | | Portfolio Sector Breakdown |

| CECO Environmental | 1.6 | |

|

| Artivion | 1.4 | |

| Newpark Resources | 1.4 | |

| Graham Corporation | 1.3 | |

| American Superconductor | 1.3 | |

| VSE Corporation | 1.3 | |

| QuinStreet | 1.3 | |

| Shoe Carnival | 1.3 | |

| CRA International | 1.3 | |

| Arlo Technologies | 1.3 | |

| | | |

| Sector Breakdown |

| Industrials | 26.4 |

| Information Technology | 24.5 |

| Consumer Discretionary | 12.5 |

| Financials | 12.1 |

| Health Care | 8.3 |

| Communication Services | 4.7 |

| Energy | 3.8 |

| Materials | 3.5 |

| Consumer Staples | 0.7 |

| Real Estate | 0.5 |

| Cash And Cash Equivalents | 3.0 |

Where Can I Find Additional Information About The Fund?

Additional information is available at www.royceinvest.com/literature, including its:

| • Prospectus • Financial Information | • Fund Holdings • Proxy Voting Information |

Householding

We will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send you only one copy of these materials for as long as you remain a shareholder of the Fund. If you would like to receive individual mailings, please call 1-800-221-4268. Please allow 30 days for your request to be processed. Shareholders may also elect to receive these reports electronically. Please go to www.royceinvest.com for more details.

Important Information

Sector weightings are determined using the Global Industry Classification Standard (“GICS”). GICS was developed by, and is the exclusive property of, Standard & Poor’s Financial Services LLC (“S&P”) and MSCI Inc. (“MSCI”). GICS is the trademark of S&P and MSCI. “Global Industry Classification Standard (GICS)” and “GICS Direct” are service marks of S&P and MSCI. Distributor: Royce Fund Services, LLC.

| NOT FDIC INSURED • MAY LOSE VALUE • NOT BANK GUARANTEED | RCM-SC-STSR-0624 |

| The Royce Funds | June 30, 2024 |

Royce Capital Fund—Small-Cap Portfolio Investment Class—RCPFX |  |

Semiannual Shareholder Report

This semiannual shareholder report contains important information about Royce Capital Fund—Small-Cap Portfolio for the period of January 1, 2024 to June 30, 2024. You can find additional information at www.royceinvest.com/literature. You can also request this information by contacting us at 1-800-221-4268.

What Were the Fund Costs for the Last Six-Months?

Based on a hypothetical $10,000 investment

| | COSTS OF A | COSTS PAID AS A PERCENTAGE |

| FUND/CLASS | $10,000 INVESTMENT | OF A $10,000 INVESTMENT¹ |

| Royce Capital Fund—Small-Cap Portfolio—Investment Class | $56 | 1.14% |

| ¹Annualized | | |

Key Fund Statistics

As of 6/30/24

| Fund Size (Millions) | $282 |

| Number of Holdings | 83 |

| Turnover Rate | 16% |

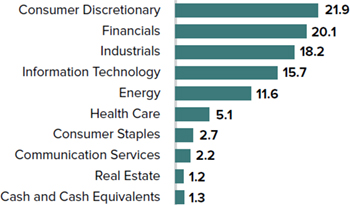

What Did The Fund Invest In?

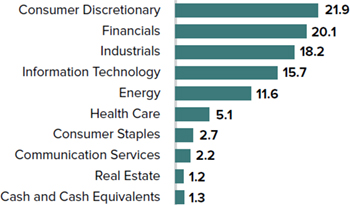

Representing percentage of total net assets of the Fund as of 6/30/24 (%)

| Top 10 Positions | | |

| Sanmina Corporation | 1.8 | |

| M/I Homes | 1.8 | |

| SilverBow Resources | 1.8 | |

| PulteGroup | 1.8 | |

| Chord Energy | 1.7 | |

| Flex | 1.7 | |

| ePlus | 1.7 | |

| Shoe Carnival | 1.6 | |

| Evercore Cl. A | 1.6 | |

| Univest Financial | 1.6 | |

Portfolio Sector Breakdown

| Consumer Discretionary | 21.9 |

| Financials | 20.1 |

| Industrials | 18.2 |

| Information Technology | 15.7 |

| Energy | 11.6 |

| Health Care | 5.1 |

| Consumer Staples | 2.7 |

| Communication Services | 2.2 |

| Real Estate | 1.2 |

| Cash And Cash Equivalents | 1.3 |

Where Can I Find Additional Information About The Fund?

Additional information is available at www.royceinvest.com/literature, including its:

| • Prospectus • Financial Information | • Fund Holdings • Proxy Voting Information |

Householding

We will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send you only one copy of these materials for as long as you remain a shareholder of the Fund. If you would like to receive individual mailings, please call 1-800-221-4268. Please allow 30 days for your request to be processed. Shareholders may also elect to receive these reports electronically. Please go to www.royceinvest.com for more details.

Important Information

Sector weightings are determined using the Global Industry Classification Standard (“GICS”). GICS was developed by, and is the exclusive property of, Standard & Poor’s Financial Services LLC (“S&P”) and MSCI Inc. (“MSCI”). GICS is the trademark of S&P and MSCI. “Global Industry Classification Standard (GICS)” and “GICS Direct” are service marks of S&P and MSCI. Distributor: Royce Fund Services, LLC

| NOT FDIC INSURED • MAY LOSE VALUE • NOT BANK GUARANTEED | RCS-IC-STSR-0624 |

| The Royce Funds | June 30, 2024 |

Royce Capital Fund—Small-Cap Portfolio Service Class—RCSSX |  |

Semiannual Shareholder Report

This semiannual shareholder report contains important information about Royce Capital Fund—Small-Cap Portfolio for the period of January 1, 2024 to June 30, 2024. You can find additional information at www.royceinvest.com/literature. You can also request this information by contacting us at 1-800-221-4268.

What Were the Fund Costs for the Last Six-Months?

Based on a hypothetical $10,000 investment

| | COSTS OF A | COSTS PAID AS A PERCENTAGE |

| FUND/CLASS | $10,000 INVESTMENT | OF A $10,000 INVESTMENT¹ |

| Royce Capital Fund—Small-Cap Portfolio—Service Class | $67 | 1.37% |

| ¹Annualized | | |

Key Fund Statistics

As of 6/30/24

| Fund Size (Millions) | $282 |

| Number of Holdings | 83 |

| Turnover Rate | 16% |

What Did The Fund Invest In?

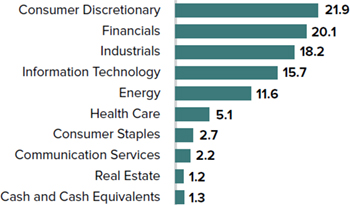

Representing percentage of total net assets of the Fund as of 6/30/24 (%)

| Top 10 Positions | | |

| Sanmina Corporation | 1.8 | |

| M/I Homes | 1.8 | |

| SilverBow Resources | 1.8 | |

| PulteGroup | 1.8 | |

| Chord Energy | 1.7 | |

| Flex | 1.7 | |

| ePlus | 1.7 | |

| Shoe Carnival | 1.6 | |

| Evercore Cl. A | 1.6 | |

| Univest Financial | 1.6 | |

Portfolio Sector Breakdown

| Consumer Discretionary | 21.9 |

| Financials | 20.1 |

| Industrials | 18.2 |

| Information Technology | 15.7 |

| Energy | 11.6 |

| Health Care | 5.1 |

| Consumer Staples | 2.7 |

| Communication Services | 2.2 |

| Real Estate | 1.2 |

| Cash And Cash Equivalents | 1.3 |

Where Can I Find Additional Information About The Fund?

Additional information is available at www.royceinvest.com/literature, including its:

| • Prospectus • Financial Information | • Fund Holdings • Proxy Voting Information |

Householding

We will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send you only one copy of these materials for as long as you remain a shareholder of the Fund. If you would like to receive individual mailings, please call 1-800-221-4268. Please allow 30 days for your request to be processed. Shareholders may also elect to receive these reports electronically. Please go to www.royceinvest.com for more details.

Important Information

Sector weightings are determined using the Global Industry Classification Standard (“GICS”). GICS was developed by, and is the exclusive property of, Standard & Poor’s Financial Services LLC (“S&P”) and MSCI Inc. (“MSCI”). GICS is the trademark of S&P and MSCI. “Global Industry Classification Standard (GICS)” and “GICS Direct” are service marks of S&P and MSCI. Distributor: Royce Fund Services, LLC.

| NOT FDIC INSURED • MAY LOSE VALUE • NOT BANK GUARANTEED | RCS-SC-STSR-0624 |

Item 2. Code(s) of Ethics. Not applicable to this semi-annual report.

Item 3. Audit Committee Financial Expert. Not applicable to this semi-annual report.

Item 4. Principal Accountant Fees and Services. Not applicable to this semi-annual report.

Item 5. Audit Committee of Listed Registrants. Not Applicable.

Item 6. Investments.

(a) Please see the Schedule of Investments contained in the Financial Statements included under Item 7 of this Form N-CSR.

(b) Not Applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

Royce Capital Fund |  |

Financial Statements and Other Important Information Semiannual—June 30, 2024 Royce Capital Fund—Micro-Cap Portfolio Royce Capital Fund—Small-Cap Portfolio |

Schedule of Investments

| Royce Capital Fund - Micro-Cap Portfolio | | | | | | |

| Common Stocks – 97.0% | | | | | | |

| | | SHARES | | | VALUE | |

| | | | | | | |

| COMMUNICATION SERVICES – 4.7% | | | | | | |

| ENTERTAINMENT - 0.9% | | | | | | |

| IMAX Corporation 1 | | | 70,200 | | | $ | 1,177,254 | |

| INTERACTIVE MEDIA & SERVICES - 1.7% | | | | | | | | |

| DHI Group 1 | | | 152,503 | | | | 318,731 | |

| QuinStreet 1 | | | 103,436 | | | | 1,716,003 | |

| †Vimeo 1 | | | 49,837 | | | | 185,892 | |

| | | | | | | | 2,220,626 | |

| MEDIA - 2.1% | | | | | | | | |

| Entravision Communications Cl. A | | | 51,367 | | | | 104,275 | |

| Innovid Corp. 1 | | | 401,839 | | | | 743,402 | |

| Magnite 1 | | | 93,633 | | | | 1,244,383 | |

| Thryv Holdings 1 | | | 41,800 | | | | 744,876 | |

| | | | | | | | 2,836,936 | |

| Total (Cost $4,849,239) | | | | | | | 6,234,816 | |

| | | | | | | | | |

| CONSUMER DISCRETIONARY – 12.5% | | | | | | | | |

| AUTOMOBILE COMPONENTS - 2.0% | | | | | | | | |

| Modine Manufacturing 1 | | | 14,383 | | | | 1,441,033 | |

| Stoneridge 1 | | | 71,782 | | | | 1,145,641 | |

| | | | | | | | 2,586,674 | |

| DIVERSIFIED CONSUMER SERVICES - 0.9% | | | | | | | | |

| Lincoln Educational Services 1 | | | 98,346 | | | | 1,166,384 | |

| HOTELS, RESTAURANTS & LEISURE - 1.3% | | | | | | | | |

| Century Casinos 1 | | | 178,185 | | | | 493,572 | |

| Lindblad Expeditions Holdings 1 | | | 124,204 | | | | 1,198,569 | |

| | | | | | | | 1,692,141 | |

| HOUSEHOLD DURABLES - 1.8% | | | | | | | | |

| Hovnanian Enterprises Cl. A 1 | | | 8,872 | | | | 1,259,114 | |

| Legacy Housing 1 | | | 51,096 | | | | 1,172,142 | |

| | | | | | | | 2,431,256 | |

| LEISURE PRODUCTS - 1.4% | | | | | | | | |

| American Outdoor Brands 1 | | | 123,777 | | | | 1,113,993 | |

| MasterCraft Boat Holdings 1 | | | 36,317 | | | | 685,665 | |

| | | | | | | | 1,799,658 | |

| SPECIALTY RETAIL - 4.4% | | | | | | | | |

| Beyond 1 | | | 54,867 | | | | 717,660 | |

| Citi Trends 1 | | | 56,594 | | | | 1,203,189 | |

| OneWater Marine Cl. A 1 | | | 42,041 | | | | 1,159,070 | |

| Shoe Carnival | | | 46,300 | | | | 1,708,007 | |

| Zumiez 1 | | | 54,100 | | | | 1,053,868 | |

| | | | | | | | 5,841,794 | |

| TEXTILES, APPAREL & LUXURY GOODS - 0.7% | | | | | | | | |

| Fossil Group 1 | | | 76,926 | | | | 110,773 | |

| Vera Bradley 1 | | | 133,380 | | | | 834,959 | |

| | | | | | | | 945,732 | |

| Total (Cost $12,737,103) | | | | | | | 16,463,639 | |

| | | | | | | | | |

| CONSUMER STAPLES – 0.7% | | | | | | | | |

| FOOD PRODUCTS - 0.7% | | | | | | | | |

| Seneca Foods Cl. A 1 | | | 15,855 | | | | 910,077 | |

| Total (Cost $869,495) | | | | | | | 910,077 | |

| | | | | | | | | |

| ENERGY – 3.8% | | | | | | | | |

| ENERGY EQUIPMENT & SERVICES - 3.8% | | | | | | | | |

| Natural Gas Services Group 1 | | | 76,829 | | | | 1,545,800 | |

| Newpark Resources 1 | | | 221,300 | | | | 1,839,003 | |

| Profire Energy 1 | | | 607,729 | | | | 862,975 | |

| Ranger Energy Services Cl. A | | | 66,723 | | | | 701,926 | |

| Total (Cost $2,695,581) | | | | | | | 4,949,704 | |

| | | | | | | |

| FINANCIALS – 12.1% | | | | | | |

| BANKS - 7.7% | | | | | | |

| BayCom Corp. | | | 64,651 | | | | 1,315,648 | |

| Customers Bancorp 1 | | | 30,300 | | | | 1,453,794 | |

| HarborOne Bancorp | | | 108,591 | | | | 1,208,618 | |

| HBT Financial | | | 66,727 | | | | 1,362,565 | |

| HomeTrust Bancshares | | | 48,800 | | | | 1,465,464 | |

| Investar Holding | | | 78,710 | | | | 1,212,134 | |

| Midway Investments 1,2 | | | 1,751,577 | | | | 0 | |

| Stellar Bancorp | | | 42,845 | | | | 983,721 | |

| Western New England Bancorp | | | 167,162 | | | | 1,150,075 | |

| | | | | | | | 10,152,019 | |

| CAPITAL MARKETS - 3.6% | | | | | | | | |

| Canaccord Genuity Group | | | 175,658 | | | | 1,086,267 | |

| Silvercrest Asset Management Group Cl. A | | | 71,263 | | | | 1,110,990 | |

| Sprott | | | 30,380 | | | | 1,259,791 | |

| StoneX Group 1 | | | 17,181 | | | | 1,293,901 | |

| | | | | | | | 4,750,949 | |

| FINANCIAL SERVICES - 0.8% | | | | | | | | |

| Cass Information Systems | | | 25,348 | | | | 1,015,694 | |

| Total (Cost $12,920,173) | | | | | | | 15,918,662 | |

| | | | | | | | | |

| HEALTH CARE – 8.3% | | | | | | | | |

| BIOTECHNOLOGY - 2.5% | | | | | | | | |

| ARS Pharmaceuticals 1 | | | 88,576 | | | | 753,782 | |

| CareDx 1 | | | 78,424 | | | | 1,217,925 | |

| Dynavax Technologies 1 | | | 80,400 | | | | 902,892 | |

| MeiraGTx Holdings 1 | | | 104,907 | | | | 441,658 | |

| | | | | | | | 3,316,257 | |

| HEALTH CARE EQUIPMENT & SUPPLIES - 2.8% | | | | | | | | |

| Apyx Medical 1 | | | 263,036 | | | | 352,468 | |

| Artivion 1 | | | 74,189 | | | | 1,902,948 | |

| Profound Medical 1 | | | 96,663 | | | | 828,106 | |

| †Zynex 1 | | | 70,280 | | | | 655,009 | |

| | | | | | | | 3,738,531 | |

| LIFE SCIENCES TOOLS & SERVICES - 2.0% | | | | | | | | |

| BioLife Solutions 1 | | | 47,176 | | | | 1,010,982 | |

| Harvard Bioscience 1 | | | 277,680 | | | | 791,388 | |

| Mesa Laboratories | | | 9,920 | | | | 860,758 | |

| | | | | | | | 2,663,128 | |

| PHARMACEUTICALS - 1.0% | | | | | | | | |

| Harrow 1 | | | 60,184 | | | | 1,257,244 | |

| Total (Cost $10,848,206) | | | | | | | 10,975,160 | |

| | | | | | | | | |

| INDUSTRIALS – 26.4% | | | | | | | | |

| AEROSPACE & DEFENSE - 1.2% | | | | | | | | |

| Astronics Corporation 1 | | | 56,055 | | | | 1,122,782 | |

| CPI Aerostructures 1 | | | 143,579 | | | | 354,640 | |

| †Park Aerospace | | | 6,097 | | | | 83,407 | |

| | | | | | | | 1,560,829 | |

| BUILDING PRODUCTS - 1.0% | | | | | | | | |

| Quanex Building Products | | | 48,806 | | | | 1,349,486 | |

| COMMERCIAL SERVICES & SUPPLIES - 4.5% | | | | | | | | |

| Acme United | | | 33,682 | | | | 1,181,228 | |

| CECO Environmental 1 | | | 71,493 | | | | 2,062,573 | |

| Montrose Environmental Group 1 | | | 21,255 | | | | 947,123 | |

| VSE Corporation | | | 19,890 | | | | 1,755,889 | |

| | | | | | | | 5,946,813 | |

| CONSTRUCTION & ENGINEERING - 3.3% | | | | | | | | |

| †Bowman Consulting Group 1 | | | 24,385 | | | | 775,199 | |

| See Notes to Financial Statements | 1 |

June 30, 2024 (unaudited)

| | | | | | |

| Royce Capital Fund - Micro-Cap Portfolio (continued) | | | | | |

| | | | | | |

| | | SHARES | | | VALUE |

| | | | | | |

| INDUSTRIALS (continued) | | | | | | | |

| CONSTRUCTION & ENGINEERING (continued) | | | | | | | |

| Concrete Pumping Holdings 1 | | | 121,121 | | | $ | 727,937 |

| IES Holdings 1 | | | 9,372 | | | | 1,305,801 |

| Northwest Pipe 1 | | | 45,746 | | | | 1,553,992 |

| | | | | | | | 4,362,929 |

| ELECTRICAL EQUIPMENT - 1.3% | | | | | | | |

| American Superconductor 1 | | | 75,761 | | | | 1,772,050 |

| GROUND TRANSPORTATION - 0.7% | | | | | | | |

| Covenant Logistics Group Cl. A | | | 18,773 | | | | 925,321 |

| MACHINERY - 5.9% | | | | | | | |

| Alimak Group 3 | | | 87,303 | | | | 948,946 |

| Commercial Vehicle Group 1 | | | 127,241 | | | | 623,481 |

| Graham Corporation 1 | | | 62,975 | | | | 1,773,376 |

| Luxfer Holdings | | | 77,812 | | | | 901,841 |

| Porvair 3 | | | 146,872 | | | | 1,224,999 |

| Shyft Group (The) | | | 81,905 | | | | 971,393 |

| Wabash National | | | 59,844 | | | | 1,306,993 |

| | | | | | | | 7,751,029 |

| MARINE TRANSPORTATION - 1.2% | | | | | | | |

| Clarkson 3 | | | 31,114 | | | | 1,629,031 |

| PROFESSIONAL SERVICES - 4.7% | | | | | | | |

| CRA International | | | 9,754 | | | | 1,679,834 |

| Forrester Research 1 | | | 39,153 | | | | 668,733 |

| Kforce | | | 17,400 | | | | 1,081,062 |

| NV5 Global 1 | | | 10,300 | | | | 957,591 |

| Resources Connection | | | 94,854 | | | | 1,047,188 |

| TrueBlue 1 | | | 75,424 | | | | 776,867 |

| | | | | | | | 6,211,275 |

| TRADING COMPANIES & DISTRIBUTORS - 2.6% | | | | | | | |

| †Alta Equipment Group | | | 34,949 | | | | 280,990 |

| Distribution Solutions Group 1 | | | 49,280 | | | | 1,478,400 |

| Transcat 1 | | | 13,364 | | | | 1,599,403 |

| | | | | | | | 3,358,793 |

| Total (Cost $23,194,721) | | | | | | | 34,867,556 |

| INFORMATION TECHNOLOGY – 24.5% | | | | | | | |

| COMMUNICATIONS EQUIPMENT - 3.4% | | | | | | | |

| Applied Optoelectronics 1 | | | 88,209 | | | | 731,253 |

| Clearfield 1 | | | 31,652 | | | | 1,220,501 |

| Digi International 1 | | | 44,859 | | | | 1,028,617 |

| Genasys 1 | | | 247,185 | | | | 522,796 |

| Harmonic 1 | | | 87,400 | | | | 1,028,698 |

| | | | | | | | 4,531,865 |

| ELECTRONIC EQUIPMENT, INSTRUMENTS & COMPONENTS - 7.9% | | | | | | | |

| Arlo Technologies 1 | | | 128,175 | | | | 1,671,402 |

| †Bel Fuse Cl. B | | | 17,287 | | | | 1,127,804 |

| FARO Technologies 1 | | | 73,731 | | | | 1,179,696 |

| LightPath Technologies Cl. A 1 | | | 383,700 | | | | 483,462 |

| Luna Innovations 1 | | | 201,227 | | | | 643,926 |

| nLIGHT 1 | | | 118,093 | | | | 1,290,757 |

| PAR Technology 1 | | | 32,800 | | | | 1,544,552 |

| Powerfleet NJ 1 | | | 235,628 | | | | 1,076,820 |

| †SmartRent Cl. A 1 | | | 140,298 | | | | 335,312 |

| Vishay Precision Group 1 | | | 35,200 | | | | 1,071,488 |

| | | | | | | | 10,425,219 |

| SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT - 10.8% | | | | | | | |

| Aehr Test Systems 1,4 | | | 52,109 | | | | 582,058 |

| Amtech Systems 1 | | | 125,369 | | | | 734,662 |

| AXT 1 | | | 221,200 | | | | 747,656 |

| Camtek | | | 11,723 | | | | 1,468,189 |

| Cohu 1 | | | 36,100 | | | | 1,194,910 |

| Ichor Holdings 1 | | | 37,200 | | | | 1,434,060 |

| inTEST Corporation 1 | | | 93,495 | | | | 923,731 |

| Kopin Corporation 1 | | | 348,243 | | | | 292,489 |

| Nova 1 | | | 7,085 | | | | 1,661,645 |

| NVE Corporation | | | 14,973 | | | | 1,118,333 |

| PDF Solutions 1 | | | 30,100 | | | | 1,095,038 |

| Photronics 1 | | | 53,036 | | | | 1,308,398 |

| Ultra Clean Holdings 1 | | | 33,711 | | | | 1,651,839 |

| | | | | | | | 14,213,008 |

| SOFTWARE - 0.9% | | | | | | | |

| Agilysys 1 | | | 11,531 | | | | 1,200,838 |

| TECHNOLOGY HARDWARE, STORAGE & PERIPHERALS - 1.5% | | | | | | | |

| AstroNova 1 | | | 71,761 | | | | 1,107,990 |

| Intevac 1 | | | 222,067 | | | | 857,178 |

| | | | | | | | 1,965,168 |

| Total (Cost $24,050,090) | | | | | | | 32,336,098 |

| | | | | | | | |

| MATERIALS – 3.5% | | | | | | | |

| CHEMICALS - 1.1% | | | | | | | |

| Aspen Aerogels 1 | | | 35,305 | | | | 842,024 |

| Core Molding Technologies 1 | | | 41,201 | | | | 656,744 |

| | | | | | | | 1,498,768 |

| METALS & MINING - 2.4% | | | | | | | |

| Altius Minerals | | | 47,900 | | | | 741,933 |

| Ferroglobe | | | 173,862 | | | | 931,900 |

| Major Drilling Group International 1 | | | 221,100 | | | | 1,467,482 |

| | | | | | | | 3,141,315 |

| Total (Cost $3,657,160) | | | | | | | 4,640,083 |

| | | | | | | | |

| REAL ESTATE – 0.5% | | | | | | | |

| REAL ESTATE MANAGEMENT & DEVELOPMENT - 0.5% | | | | | | | |

| FRP Holdings 1 | | | 24,880 | | | | 709,577 |

| Total (Cost $214,356) | | | | | | | 709,577 |

| | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | |

| (Cost $96,036,124) | | | | | | | 128,005,372 |

| See Notes to Financial Statements | 2 |

Schedule of Investments

Royce Capital Fund - Micro-Cap Portfolio (continued)

| | | SHARES | | | VALUE |

| | | | | | |

| REPURCHASE AGREEMENT– 3.1% | | | | | |

Fixed Income Clearing Corporation, 4.75% dated 6/28/24, due 7/1/24, maturity value

$4,100,910 (collateralized by obligations of U.S. Government Agencies, 3.625%

due 5/15/26, valued at $4,181,387) |

| (Cost $4,099,288) | | | | | | $ | 4,099,288 |

| | | | | | | | |

| COLLATERAL RECEIVED FOR SECURITIES LOANED – 0.3% | | | | | | | |

| Money Market Funds | | | | | | | |

| Federated Hermes Government Obligations Fund - Institutional Shares (7 day yield-5.18%) | | | | | | | |

| (Cost $347,266) | | | 347,266 | | | | 347,266 |

| | | | | | | | |

| TOTAL INVESTMENTS – 100.4% | | | | | | | |

| (Cost $100,482,678) | | | | | | | 132,451,926 |

| | | | | | | | |

| LIABILITIES LESS CASH AND OTHER ASSETS – (0.4)% | | | | | | | (528,642) |

| | | | | | | | |

| NET ASSETS – 100.0% | | | | | | $ | 131,923,284 |

| 2 | A security for which market quotations are not readily available represents 0.0% of net assets. This security has been valued at its fair value under procedures approved by the Fund’s Board of Trustees. This security is defined as a Level 3 security due to the use of significant unobservable inputs in the determination of fair value. See Notes to Financial Statements. |

| 3 | These securities are defined as Level 2 securities due to fair value being based on quoted prices for similar securities and/or due to the application of fair value factors. See Notes to Financial Statements. |

| 4 | All or a portion of this security was on loan as of June 30, 2024. |

Bold indicates the Fund’s 20 largest equity holdings in terms of June 30, 2024, market value.

| See Notes to Financial Statements | 3 |

Schedule of Investments

| Royce Capital Fund - Small-Cap Portfolio | | | | |

| Common Stocks – 98.7% | | | | |

| | | SHARES | | | VALUE |

| COMMUNICATION SERVICES – 2.2% | | | | | | | |

| MEDIA - 2.2% | | | | | | | |

| Saga Communications Cl. A | | | 150,195 | | | $ | 2,365,571 |

| TEGNA | | | 264,231 | | | | 3,683,380 |

| Total (Cost $8,567,084) | | | | | | | 6,048,951 |

| | | | | | | | |

| CONSUMER DISCRETIONARY – 21.9% | | | | | | | |

| AUTOMOBILE COMPONENTS - 1.2% | | | | | | | |

| Visteon Corporation 1 | | | 32,355 | | | | 3,452,279 |

| DIVERSIFIED CONSUMER SERVICES - 1.0% | | | | | | | |

| †frontdoor 1 | | | 83,653 | | | | 2,826,635 |

| HOTELS, RESTAURANTS & LEISURE - 1.3% | | | | | | | |

| Bloomin' Brands | | | 185,288 | | | | 3,563,088 |

| HOUSEHOLD DURABLES - 6.3% | | | | | | | |

| M/I Homes 1 | | | 41,555 | | | | 5,075,528 |

| Meritage Homes | | | 23,735 | | | | 3,841,510 |

| PulteGroup | | | 45,465 | | | | 5,005,696 |

| Tri Pointe Homes 1 | | | 104,381 | | | | 3,888,192 |

| | | | | | | | 17,810,926 |

| SPECIALTY RETAIL - 8.7% | | | | | | | |

| Buckle (The) | | | 109,024 | | | | 4,027,346 |

| Caleres | | | 127,716 | | | | 4,291,258 |

| Destination XL Group 1 | | | 740,191 | | | | 2,694,295 |

| Haverty Furniture | | | 118,696 | | | | 3,001,822 |

| Shoe Carnival | | | 125,580 | | | | 4,632,646 |

| Signet Jewelers | | | 40,822 | | | | 3,656,835 |

| Williams-Sonoma | | | 7,694 | | | | 2,172,555 |

| | | | | | | | 24,476,757 |

| TEXTILES, APPAREL & LUXURY GOODS - 3.4% | | | | | | | |

| Carter's | | | 53,370 | | | | 3,307,339 |

| Kontoor Brands | | | 58,028 | | | | 3,838,552 |

| †Oxford Industries | | | 21,546 | | | | 2,157,832 |

| Steven Madden | | | 3,185 | | | | 134,725 |

| | | | | | | | 9,438,448 |

| Total (Cost $49,233,712) | | | | | | | 61,568,133 |

| | | | | | | | |

| CONSUMER STAPLES – 2.7% | | | | | | | |

| CONSUMER STAPLES DISTRIBUTION & RETAIL - 2.7% | | | | | | | |

| Ingles Markets Cl. A | | | 49,232 | | | | 3,377,808 |

| Village Super Market Cl. A | | | 162,566 | | | | 4,293,368 |

| Total (Cost $7,858,879) | | | | | | | 7,671,176 |

| | | | | | | | |

| ENERGY – 11.6% | | | | | | | |

| ENERGY EQUIPMENT & SERVICES - 1.2% | | | | | | | |

| Helmerich & Payne | | | 94,127 | | | | 3,401,750 |

| OIL, GAS & CONSUMABLE FUELS - 10.4% | | | | | | | |

| Chord Energy | | | 28,579 | | | | 4,792,126 |

| Civitas Resources | | | 55,458 | | | | 3,826,602 |

| Dorchester Minerals L.P. | | | 134,408 | | | | 4,146,487 |

| Matador Resources | | | 56,088 | | | | 3,342,845 |

| Riley Exploration Permian | | | 146,403 | | | | 4,144,669 |

| SilverBow Resources 1 | | | 133,252 | | | | 5,040,923 |

| SM Energy | | | 93,586 | | | | 4,045,723 |

| | | | | | | | 29,339,375 |

| Total (Cost $26,224,762) | | | | | | | 32,741,125 |

| | | | | | | | |

| FINANCIALS – 20.1% | | | | | | | |

| BANKS - 15.6% | | | | | | | |

| †Burke & Herbert Financial Services | | | 71,237 | | | | 3,631,662 |

| Citizens Community Bancorp | | | 141,851 | | | | 1,641,216 |

| CNB Financial | | | 196,739 | | | | 4,015,443 |

| Dime Community Bancshares | | | 200,352 | | | | 4,087,181 |

| Heritage Financial | | | 206,812 | | | | 3,728,820 |

| Mid Penn Bancorp | | | 178,361 | | | | 3,915,024 |

| †Premier Financial | | | 105,520 | | | | 2,158,939 |

| Princeton Bancorp | | | 47,885 | | | | 1,584,994 |

| Riverview Bancorp | | | 246,534 | | | | 983,671 |

| Timberland Bancorp | | | 139,775 | | | | 3,786,505 |

| TrustCo Bank Corp NY | | | 117,790 | | | | 3,388,818 |

| Unity Bancorp | | | 147,820 | | | | 4,371,037 |

| Univest Financial | | | 193,284 | | | | 4,412,674 |

| Western New England Bancorp | | | 312,688 | | | | 2,151,293 |

| | | | | | | | 43,857,277 |

| CAPITAL MARKETS - 1.6% | | | | | | | |

| Evercore Cl. A | | | 21,245 | | | | 4,428,095 |

| FINANCIAL SERVICES - 1.5% | | | | | | | |

| International Money Express 1 | | | 209,991 | | | | 4,376,213 |

| INSURANCE - 1.4% | | | | | | | |

| Tiptree | | | 247,985 | | | | 4,089,273 |

| Total (Cost $50,818,676) | | | | | | | 56,750,858 |

| | | | | | | | |

| HEALTH CARE – 5.1% | | | | | | | |

| BIOTECHNOLOGY - 1.5% | | | | | | | |

| Catalyst Pharmaceuticals 1 | | | 276,200 | | | | 4,278,338 |

| HEALTH CARE PROVIDERS & SERVICES - 1.5% | | | | | | | |

| Cross Country Healthcare 1 | | | 37,725 | | | | 522,114 |

| Molina Healthcare 1 | | | 12,175 | | | | 3,619,628 |

| | | | | | | | 4,141,742 |

| PHARMACEUTICALS - 2.1% | | | | | | | |

| Collegium Pharmaceutical 1 | | | 110,194 | | | | 3,548,247 |

| SIGA Technologies | | | 326,109 | | | | 2,475,167 |

| | | | | | | | 6,023,414 |

| Total (Cost $10,354,029) | | | | | | | 14,443,494 |

| | | | | | | | |

| INDUSTRIALS – 18.2% | | | | | | | |

| AIR FREIGHT & LOGISTICS - 0.9% | | | | | | | |

| Hub Group Cl. A | | | 58,903 | | | | 2,535,774 |

| BUILDING PRODUCTS - 1.9% | | | | | | | |

| Quanex Building Products | | | 111,831 | | | | 3,092,127 |

| UFP Industries | | | 21,033 | | | | 2,355,696 |

| | | | | | | | 5,447,823 |

| CONSTRUCTION & ENGINEERING - 0.9% | | | | | | | |

| Sterling Infrastructure 1 | | | 21,810 | | | | 2,580,996 |

| ELECTRICAL EQUIPMENT - 0.5% | | | | | | | |

| Preformed Line Products | | | 10,042 | | | | 1,250,631 |

| GROUND TRANSPORTATION - 3.1% | | | | | | | |

| ArcBest Corporation | | | 35,868 | | | | 3,840,745 |

| Schneider National Cl. B | | | 112,461 | | | | 2,717,058 |

| Universal Logistics Holdings | | | 54,200 | | | | 2,199,978 |

| | | | | | | | 8,757,781 |

| MACHINERY - 4.2% | | | | | | | |

| †Allison Transmission Holdings | | | 46,744 | | | | 3,547,870 |

| Commercial Vehicle Group 1 | | | 255,309 | | | | 1,251,014 |

| †Terex Corporation | | | 63,753 | | | | 3,496,214 |

| Wabash National | | | 164,989 | | | | 3,603,360 |

| | | | | | | | 11,898,458 |

| MARINE TRANSPORTATION - 2.8% | | | | | | | |

| Genco Shipping & Trading | | | 178,866 | | | | 3,811,635 |

| See Notes to Financial Statements | 4 |

June 30, 2024 (unaudited)

| Royce Capital Fund - Small-Cap Portfolio (continued) | | | | |

| | | | | |

| | | SHARES | | | VALUE |

| | | | | | |

| INDUSTRIALS (continued) | | | | | | | |

| MARINE TRANSPORTATION (continued) | | | | | | | |

| Pangaea Logistics Solutions | | | 532,180 | | | $ | 4,166,969 |

| | | | | | | | 7,978,604 |

| PROFESSIONAL SERVICES - 3.9% | | | | | | | |

| Barrett Business Services | | | 118,692 | | | | 3,889,537 |

| IBEX 1 | | | 266,699 | | | | 4,315,190 |

| Korn Ferry | | | 40,262 | | | | 2,703,190 |

| | | | | | | | 10,907,917 |

| Total (Cost $38,613,370) | | | | | | | 51,357,984 |

| | | | | | | | |

| INFORMATION TECHNOLOGY – 15.7% | | | | | | | |

| COMMUNICATIONS EQUIPMENT - 1.3% | | | | | | | |

| Aviat Networks 1 | | | 133,401 | | | | 3,827,275 |

| ELECTRONIC EQUIPMENT, INSTRUMENTS & COMPONENTS - 13.0% | | | | | | | |

| Bel Fuse Cl. B | | | 60,018 | | | | 3,915,574 |

| ePlus 1 | | | 63,234 | | | | 4,659,081 |

| Flex 1 | | | 159,875 | | | | 4,714,714 |

| Insight Enterprises 1 | | | 11,686 | | | | 2,318,035 |

| Jabil | | | 32,673 | | | | 3,554,496 |

| Kimball Electronics 1 | | | 158,775 | | | | 3,489,875 |

| PC Connection | | | 35,382 | | | | 2,271,524 |

| Sanmina Corporation 1 | | | 76,984 | | | | 5,100,190 |

| TD SYNNEX | | | 27,426 | | | | 3,164,960 |

| Vishay Intertechnology | | | 151,319 | | | | 3,374,414 |

| | | | | | | | 36,562,863 |

| SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT - 1.0% | | | | | | | |

| Amkor Technology | | | 69,209 | | | | 2,769,744 |

| SOFTWARE - 0.4% | | | | | | | |

| Adeia | | | 93,165 | | | | 1,042,050 |

| Total (Cost $25,708,278) | | | | | | | 44,201,932 |

| | | | | | | | |

| REAL ESTATE – 1.2% | | | | | | | |

| REAL ESTATE MANAGEMENT & DEVELOPMENT - 1.2% | | | | | | | |

| RMR Group (The) Cl. A | | | 151,127 | | | | 3,415,470 |

| Total (Cost $4,034,492) | | | | | | | 3,415,470 |

| | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | |

| (Cost $221,413,282) | | | | | | | 278,199,123 |

| | | | | | | | |

| REPURCHASE AGREEMENT– 1.1% | | | | | | | |

Fixed Income Clearing Corporation, 4.75% dated 6/28/24, due 7/1/24, maturity value

$3,080,073 (collateralized by obligations of U.S. Government Agencies, 3.625%

due 5/15/26, valued at $3,140,566) |

| (Cost $3,078,854) | | | | | | | 3,078,854 |

| | | | | | | | |

| TOTAL INVESTMENTS – 99.8% | | | | | | | |

| (Cost $224,492,136) | | | | | | | 281,277,977 |

| | | | | | | | |

| CASH AND OTHER ASSETS LESS LIABILITIES – 0.2% | | | | | | | 451,788 |

| | | | | | | | |

| NET ASSETS – 100.0% | | | | | | $ | 281,729,765 |

† New additions in 2024.

1 Non-income producing.

Bold indicates the Fund’s 20 largest equity holdings in terms of June 30, 2024, market value.

| See Notes to Financial Statements | 5 |

| Statements of Assets and Liabilities | June 30, 2024 (unaudited) |

| | | Micro-Cap Portfolio | | Small-Cap Portfolio |

| ASSETS: | | | | | | | | |

| Investments at value (including collateral on loaned securities)1 | | $ | 128,352,638 | | | $ | 278,199,123 | |

| Repurchase agreements (at cost and value) | | | 4,099,288 | | | | 3,078,854 | |

| Cash | | | 207 | | | | – | |

| Receivable for investments sold | | | – | | | | 676,913 | |

| Receivable for capital shares sold | | | 27,096 | | | | 140,921 | |

| Receivable for dividends and interest | | | 17,207 | | | | 102,120 | |

| Receivable for securities lending income | | | 108 | | | | – | |

| Prepaid expenses and other assets | | | 3,903 | | | | 8,667 | |

| Total Assets | | | 132,500,447 | | | | 282,206,598 | |

| LIABILITIES: | | | | | | | | |

| Payable for collateral on loaned securities | | | 347,266 | | | | – | |

| Payable for capital shares redeemed | | | 57,863 | | | | 137,570 | |

| Payable for investment advisory fees | | | 107,773 | | | | 231,621 | |

| Payable for trustees' fees | | | 8,661 | | | | 19,416 | |

| Accrued expenses | | | 55,600 | | | | 88,226 | |

| Total Liabilities | | | 577,163 | | | | 476,833 | |

| Net Assets | | $ | 131,923,284 | | | $ | 281,729,765 | |

| ANALYSIS OF NET ASSETS: | | | | | | | | |

| Paid-in capital | | $ | 84,109,729 | | | $ | 200,782,958 | |

| Total distributable earnings (loss) | | | 47,813,555 | | | | 80,946,807 | |

| Net Assets | | $ | 131,923,284 | | | $ | 281,729,765 | |

| Investment Class | | $ | 112,394,253 | | | $ | 134,196,856 | |

| Service Class | | | 19,529,031 | | | | 147,532,909 | |

| SHARES OUTSTANDING (unlimited number of $.001 par value): | | | | | | | | |

| Investment Class | | | 11,908,705 | | | | 14,383,982 | |

| Service Class | | | 2,139,969 | | | | 16,196,132 | |

| NET ASSET VALUES (Net Assets ÷ Shares Outstanding): | | | | | | | | |

| (offering and redemption price per share) | | | | | | | | |

| Investment Class | | $ | 9.44 | | | $ | 9.33 | |

| Service Class | | | 9.13 | | | | 9.11 | |

| Investments at identified cost | | $ | 96,383,390 | | | $ | 221,413,282 | |

| Market value of loaned securities2 | | | 370,297 | | | | – | |

1 See Notes to Financial Statements for information on non-cash collateral on loaned securities.

2 Market value of loaned securities backed by non-cash collateral is as of prior business day.

| See Notes to Financial Statements | 6 |

| Statements of Operations | Six Months Ended June 30, 2024 (unaudited) |

| | | Micro-Cap Portfolio | | Small-Cap Portfolio |

| INVESTMENT INCOME: | | | | | | | | |

| INCOME: | | | | | | | | |

| Dividends | | $ | 448,503 | | | $ | 3,770,972 | |

| Foreign withholding tax | | | (15,344 | ) | | | – | |

| Interest | | | 115,538 | | | | 112,623 | |

| Securities lending | | | 2,859 | | | | 18 | |

| Total income | | | 551,556 | | | | 3,883,613 | |

| EXPENSES: | | | | | | | | |

| Investment advisory fees | | | 660,394 | | | | 1,467,681 | |

| Distribution fees | | | 24,635 | | | | 193,019 | |

| Administrative and office facilities | | | 42,308 | | | | 83,273 | |

| Audit | | | 18,204 | | | | 18,276 | |

| Trustees' fees | | | 17,274 | | | | 38,975 | |

| Custody | | | 15,610 | | | | 21,848 | |

| Shareholder reports | | | 8,861 | | | | 6,703 | |

| Shareholder servicing | | | 8,481 | | | | 8,161 | |

| Legal | | | 2,722 | | | | 6,124 | |

| Other expenses | | | 6,172 | | | | 12,556 | |

| Total expenses | | | 804,661 | | | | 1,856,616 | |

| Compensating balance credits | | | (144 | ) | | | (122 | ) |

| Fees waived by distributor | | | – | | | | (7,940 | ) |

| Net expenses | | | 804,517 | | | | 1,848,554 | |

| Net investment income (loss) | | | (252,961 | ) | | | 2,035,059 | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY: | | | | | | | | |

| NET REALIZED GAIN (LOSS): | | | | | | | | |

| Investments | | | 7,042,834 | | | | 13,250,819 | |

| Foreign currency transactions | | | 860 | | | | – | |

| NET CHANGE IN UNREALIZED APPRECIATION (DEPRECIATION): | | | | | | | | |

| Investments | | | (3,089,997 | ) | | | (23,672,610 | ) |

| Other assets and liabilities denominated in foreign currency | | | 124 | | | | – | |

| Net realized and unrealized gain (loss) on investments and foreign currency | | | 3,953,821 | | | | (10,421,791 | ) |

| NET INCREASE (DECREASE) IN NET ASSETS FROM INVESTMENT OPERATIONS | | $ | 3,700,860 | | | $ | (8,386,732 | ) |

| See Notes to Financial Statements | 7 |

Statements of Changes in Net Assets

| | | Micro-Cap Portfolio | | | Small-Cap Portfolio | |

| | | Six Months Ended

6/30/24 (unaudited) | | | Year Ended 12/31/23 | | | Six Months Ended

6/30/24 (unaudited) | | | Year Ended 12/31/23 | |

| INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | $ | (252,961 | ) | | $ | (476,253 | ) | | $ | 2,035,059 | | | $ | 3,204,200 | |

| Net realized gain (loss) on investments and foreign currency | | | 7,043,694 | | | | 10,049,964 | | | | 13,250,819 | | | | 7,394,893 | |

| Net change in unrealized appreciation (depreciation) on investments and foreign currency | | | (3,089,873 | ) | | | 11,624,338 | | | | (23,672,610 | ) | | | 51,157,812 | |

| Net increase (decrease) in net assets from investment operations | | | 3,700,860 | | | | 21,198,049 | | | | (8,386,732 | ) | | | 61,756,905 | |

| DISTRIBUTIONS: | | | | | | | | | | | | | | | | |

| Total distributable earnings | | | | | | | | | | | | | | | | |

| Investment Class | | | – | | | | – | | | | – | | | | (12,810,854 | ) |

| Service Class | | | – | | | | – | | | | – | | | | (14,399,565 | ) |

| Total distributions | | | – | | | | – | | | | – | | | | (27,210,419 | ) |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | | | | | | | | | |

| Value of shares sold | | | | | | | | | | | | | | | | |

| Investment Class | | | 2,760,635 | | | | 16,367,277 | | | | 4,425,542 | | | | 23,941,849 | |

| Service Class | | | 300,993 | | | | 20,890,050 | | | | 1,324,902 | | | | 96,770,854 | |

| Distributions reinvested | | | | | | | | | | | | | | | | |

| Investment Class | | | – | | | | – | | | | – | | | | 12,810,854 | |

| Service Class | | | – | | | | – | | | | – | | | | 14,399,565 | |

| Value of shares redeemed | | | | | | | | | | | | | | | | |

| Investment Class | | | (10,003,713 | ) | | | (28,684,375 | ) | | | (12,893,295 | ) | | | (49,910,329 | ) |

| Service Class | | | (1,798,576 | ) | | | (15,676,606 | ) | | | (15,060,382 | ) | | | (119,325,949 | ) |

| Net increase (decrease) in net assets from capital share transactions | | | (8,740,661 | ) | | | (7,103,654 | ) | | | (22,203,233 | ) | | | (21,313,156 | ) |

| Net Increase (Decrease) in Net Assets | | | (5,039,801 | ) | | | 14,094,395 | | | | (30,589,965 | ) | | | 13,233,330 | |

| NET ASSETS: | | | | | | | | | | | | | | | | |

| Beginning of period | | | 136,963,085 | | | | 122,868,690 | | | | 312,319,730 | | | | 299,086,400 | |

| End of period | | $ | 131,923,284 | | | $ | 136,963,085 | | | $ | 281,729,765 | | | $ | 312,319,730 | |

| See Notes to Financial Statements | 8 |

Financial Highlights

This table is presented to show selected data for a share outstanding throughout each period and to assist shareholders in evaluating a Fund’s performance for the periods presented. Per share amounts have been determined on the basis of the weighted average number of shares outstanding during the period.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Ratio of Expenses to Average Net Assets | | | | | | | |

| | | Net Asset Value,

Beginning of

Period | | Net Investment

Income (Loss) | | Net Realized and

Unrealized Gain (Loss) on

Investments and

Foreign Currency | | Total from

Investment

Operations | | Distributions

from Net

Investment

Income | | Distributions from Net

Realized Gain on

Investments and

Foreign Currency | | Total

Distributions | | Net Asset Value,

End of Period | | Total Return | | Net Assets,

End of Period

(in thousands) | | Prior to Fee

Waivers,

Expense

Reimbursements

and Balance

Credits | | Prior to Fee

Waivers and

Expense

Reimbursements | | Net of Fee

Waivers and

Expense

Reimbursements | | Ratio of Net

Investment

Income (Loss) to

Average Net

Assets | | Portfolio

Turnover Rate |

| Micro-Cap Portfolio––Investment Class | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2024† | | $ | 9.17 | | | $ | (0.02 | ) | | $ | 0.29 | | | $ | 0.27 | | | $ | – | | | $ | – | | | $ | – | | | $ | 9.44 | | | | 2.94 | %1 | | $ | 112,394 | | | | 1.18 | %2 | | | 1.18 | %2 | | | 1.18 | %2 | | | (0.34 | )%2 | | | 11 | % |

| 2023 | | | 7.72 | | | | (0.03 | ) | | | 1.48 | | | | 1.45 | | | | – | | | | – | | | | – | | | | 9.17 | | | | 18.78 | | | | 116,468 | | | | 1.18 | | | | 1.18 | | | | 1.15 | | | | (0.33 | ) | | | 24 | |

| 2022 | | | 14.77 | | | | (0.05 | ) | | | (3.28 | ) | | | (3.33 | ) | | | – | | | | (3.72 | ) | | | (3.72 | ) | | | 7.72 | | | | (22.43 | ) | | | 109,600 | | | | 1.31 | | | | 1.31 | | | | 1.21 | | | | (0.46 | ) | | | 12 | |

| 2021 | | | 11.91 | | | | (0.08 | ) | | | 3.61 | | | | 3.53 | | | | – | | | | (0.67 | ) | | | (0.67 | ) | | | 14.77 | | | | 29.98 | | | | 157,042 | | | | 1.37 | | | | 1.37 | | | | 1.33 | | | | (0.56 | ) | | | 25 | |

| 2020 | | | 9.75 | | | | (0.05 | ) | | | 2.36 | | | | 2.31 | | | | – | | | | (0.15 | ) | | | (0.15 | ) | | | 11.91 | | | | 23.79 | | | | 134,109 | | | | 1.47 | | | | 1.47 | | | | 1.33 | | | | (0.51 | ) | | | 25 | |

| 2019 | | | 8.97 | | | | (0.04 | ) | | | 1.77 | | | | 1.73 | | | | – | | | | (0.95 | ) | | | (0.95 | ) | | | 9.75 | | | | 19.55 | | | | 132,008 | | | | 1.43 | | | | 1.43 | | | | 1.33 | | | | (0.41 | ) | | | 26 | |

| Micro-Cap Portfolio–Service Class | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2024† | | $ | 8.88 | | | $ | (0.03 | ) | | $ | 0.28 | | | $ | 0.25 | | | $ | – | | | $ | – | | | $ | – | | | $ | 9.13 | | | | 2.82 | %1 | | $ | 19,529 | | | | 1.45 | %2 | | | 1.45 | %2 | | | 1.45 | %2 | | | (0.62 | )%2 | | | 11 | % |

| 2023 | | | 7.49 | | | | (0.05 | ) | | | 1.44 | | | | 1.39 | | | | – | | | | – | | | | – | | | | 8.88 | | | | 18.56 | | | | 20,495 | | | | 1.46 | | | | 1.46 | | | | 1.42 | | | | (0.61 | ) | | | 24 | |

| 2022 | | | 14.37 | | | | (0.08 | ) | | | (3.18 | ) | | | (3.26 | ) | | | – | | | | (3.62 | ) | | | (3.62 | ) | | | 7.49 | | | | (22.65 | ) | | | 13,269 | | | | 1.61 | | | | 1.61 | | | | 1.47 | | | | (0.74 | ) | | | 12 | |

| 2021 | | | 11.63 | | | | (0.11 | ) | | | 3.50 | | | | 3.39 | | | | – | | | | (0.65 | ) | | | (0.65 | ) | | | 14.37 | | | | 29.52 | | | | 29,231 | | | | 1.64 | | | | 1.64 | | | | 1.58 | | | | (0.81 | ) | | | 25 | |

| 2020 | | | 9.54 | | | | (0.07 | ) | | | 2.31 | | | | 2.24 | | | | – | | | | (0.15 | ) | | | (0.15 | ) | | | 11.63 | | | | 23.55 | | | | 28,039 | | | | 1.72 | | | | 1.72 | | | | 1.58 | | | | (0.75 | ) | | | 25 | |

| 2019 | | | 8.80 | | | | (0.06 | ) | | | 1.73 | | | | 1.67 | | | | – | | | | (0.93 | ) | | | (0.93 | ) | | | 9.54 | | | | 19.24 | | | | 27,090 | | | | 1.71 | | | | 1.71 | | | | 1.58 | | | | (0.66 | ) | | | 26 | |

| Small-Cap Portfolio–Investment Class | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2024† | | $ | 9.59 | | | $ | 0.07 | | | $ | (0.33 | ) | | $ | (0.26 | ) | | $ | – | | | $ | – | | | $ | – | | | $ | 9.33 | | | | (2.71 | )%1 | | $ | 134,197 | | | | 1.14 | %2 | | | 1.14 | %2 | | | 1.14 | %2 | | | 1.51 | %2 | | | 16 | % |

| 2023 | | | 8.36 | | | | 0.11 | | | | 2.04 | | | | 2.15 | | | | (0.08 | ) | | | (0.84 | ) | | | (0.92 | ) | | | 9.59 | | | | 25.93 | | | | 146,549 | | | | 1.15 | | | | 1.15 | | | | 1.13 | | | | 1.26 | | | | 69 | |

| 2022 | | | 9.41 | | | | 0.08 | | | | (0.94 | ) | | | (0.86 | ) | | | (0.04 | ) | | | (0.15 | ) | | | (0.19 | ) | | | 8.36 | | | | (9.20 | ) | | | 139,807 | | | | 1.15 | | | | 1.15 | | | | 1.08 | | | | 0.96 | | | | 88 | |

| 2021 | | | 7.41 | | | | 0.03 | | | | 2.10 | | | | 2.13 | | | | (0.13 | ) | | | – | | | | (0.13 | ) | | | 9.41 | | | | 28.82 | | | | 172,388 | | | | 1.11 | | | | 1.11 | | | | 1.08 | | | | 0.37 | | | | 51 | |

| 2020 | | | 8.19 | | | | 0.06 | | | | (0.65 | ) | | | (0.59 | ) | | | (0.07 | ) | | | (0.12 | ) | | | (0.19 | ) | | | 7.41 | | | | (7.15 | ) | | | 153,953 | | | | 1.19 | | | | 1.19 | | | | 1.08 | | | | 0.90 | | | | 95 | |

| 2019 | | | 7.87 | | | | 0.09 | | | | 1.37 | | | | 1.46 | | | | (0.06 | ) | | | (1.08 | ) | | | (1.14 | ) | | | 8.19 | | | | 18.67 | | | | 173,492 | | | | 1.15 | | | | 1.15 | | | | 1.08 | | | | 1.04 | | | | 111 | |

| Small-Cap Portfolio–Service Class | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2024† | | $ | 9.37 | | | $ | 0.06 | | | $ | (0.32 | ) | | $ | (0.26 | ) | | $ | – | | | $ | – | | | $ | – | | | $ | 9.11 | | | | (2.77 | )%1 | | $ | 147,533 | | | | 1.38 | %2 | | | 1.38 | %2 | | | 1.37 | %2 | | | 1.28 | %2 | | | 16 | % |

| 2023 | | | 8.18 | | | | 0.08 | | | | 1.99 | | | | 2.07 | | | | (0.06 | ) | | | (0.82 | ) | | | (0.88 | ) | | | 9.37 | | | | 25.53 | | | | 165,771 | | | | 1.39 | | | | 1.39 | | | | 1.37 | | | | 0.96 | | | | 69 | |

| 2022 | | | 9.20 | | | | 0.06 | | | | (0.92 | ) | | | (0.86 | ) | | | (0.01 | ) | | | (0.15 | ) | | | (0.16 | ) | | | 8.18 | | | | (9.41 | ) | | | 159,279 | | | | 1.40 | | | | 1.40 | | | | 1.33 | | | | 0.68 | | | | 88 | |

| 2021 | | | 7.25 | | | | 0.01 | | | | 2.05 | | | | 2.06 | | | | (0.11 | ) | | | – | | | | (0.11 | ) | | | 9.20 | | | | 28.45 | | | | 209,252 | | | | 1.35 | | | | 1.35 | | | | 1.33 | | | | 0.10 | | | | 51 | |

| 2020 | | | 8.01 | | | | 0.05 | | | | (0.64 | ) | | | (0.59 | ) | | | (0.05 | ) | | | (0.12 | ) | | | (0.17 | ) | | | 7.25 | | | | (7.33 | ) | | | 205,500 | | | | 1.43 | | | | 1.43 | | | | 1.33 | | | | 0.73 | | | | 95 | |

| 2019 | | | 7.69 | | | | 0.06 | | | | 1.35 | | | | 1.41 | | | | (0.04 | ) | | | (1.05 | ) | | | (1.09 | ) | | | 8.01 | | | | 18.44 | | | | 225,250 | | | | 1.39 | | | | 1.39 | | | | 1.33 | | | | 0.86 | | | | 111 | |

† Six months ended June 30, 2024 (unaudited).

1 Not annualized

2 Annualized

| See Notes to Financial Statements | 9 |

Notes to Financial Statements (unaudited)

Summary of Significant Accounting Policies:

Royce Capital Fund – Micro-Cap Portfolio and Royce Capital Fund – Small-Cap Portfolio (each, a “Fund,” and together, the “Funds”) are the two series of Royce Capital Fund (the “Trust”), an open-end management investment company organized as a Delaware statutory trust. Shares of the Funds are offered to life insurance companies for allocation to certain separate accounts established for the purpose of funding qualified and non-qualified variable annuity contracts and variable life insurance contracts. Micro-Cap Portfolio and Small-Cap Portfolio commenced operations on December 27, 1996.

Classes of shares have equal rights as to earnings and assets, except that each class may bear different fees and expenses for distribution, shareholder servicing and shareholder reports, and receive different transfer agent balance credits and expense reimbursements. Investment income, realized and unrealized capital gains or losses on investments and foreign currency, and expenses other than those attributable to a specific class are allocated to each class of shares based on its relative net assets.

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Each Fund is an investment company registered under the Investment Company Act of 1940 (the “1940 Act”) and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standard Codification Topic 946 “Financial Services-Investment Companies.”

Royce & Associates, LP, the Funds’ investment adviser, is a majority-owned subsidiary of Franklin Resources, Inc. and primarily conducts business using the name Royce Investment Partners (“Royce”).

VALUATION OF INVESTMENTS:

Portfolio securities held by the Funds are valued as of the close of trading on the New York Stock Exchange (“NYSE”) (generally 4:00 p.m. Eastern time) on the valuation date. Investments in money market funds are valued at net asset value per share. Values for non-U.S. dollar denominated equity securities are converted to U.S. dollars daily based upon prevailing foreign currency exchange rates as quoted by a major bank.

Portfolio securities that are listed on an exchange or Nasdaq, or traded on OTC Market Group Inc.’s OTC Link ATS or other alternative trading system, are valued: (i) on the basis of their last reported sales prices or official closing prices, as applicable, on a valuation date; or (ii) at their highest reported bid prices in the event such equity securities did not trade on a valuation date. Such inputs are generally referred to as “Level 1” inputs because they represent reliable quoted prices in active markets for identical securities.

If the value of a portfolio security held by a Fund cannot be determined solely by reference to Level 1 inputs, such portfolio security will be “fair valued.” The Trust’s Board of Trustees has designated Royce as valuation designee to perform fair value determinations for such portfolio securities in accordance with Rule 2a-5 under the 1940 Act (“Rule 2a-5”). Pursuant to Rule 2a-5, fair values are determined in accordance with policies and procedures approved by the Trust's Board of Trustees and policies and procedures adopted by Royce in its capacity as valuation designee for the Trust. Fair valued securities are reported as either “Level 2” or “Level 3” securities.

As a general principle, the fair value of a security is the amount which a Fund might reasonably expect to receive for the security upon its current sale. However, in light of the judgment involved in fair valuations, no assurance can be given that a fair value assigned to a particular portfolio security will be the amount which the Fund might be able to receive upon its current sale. When a fair value pricing methodology is used, the fair value prices used by the Fund for such securities will likely differ from the quoted or published prices for the same securities.

Level 2 inputs are other significant observable inputs (e.g., dealer bid side quotes and quoted prices for securities with comparable characteristics). Examples of situations in which Level 2 inputs are used to fair value portfolio securities held by the Funds on a particular valuation date include:

| ● | Over-the-counter equity securities other than those traded on OTC Market Group Inc.’s OTC Link ATS or other alternative trading system (collectively referred to herein as “Other OTC Equity Securities”) are fair valued at their highest bid price when Royce receives at least two bid side quotes from dealers who make markets in such securities; |

| ● | Certain bonds and other fixed income securities may be fair valued by reference to other securities with comparable ratings, interest rates, and maturities in accordance with valuation methodologies maintained by certain independent pricing services; and |

| ● | The Funds use an independent pricing service to fair value certain non-U.S. equity securities when U.S. market volatility exceeds a certain threshold. This pricing service uses proprietary correlations it has developed between the movement of prices of non-U.S. equity securities and indices of U.S.-traded securities, futures contracts, and other indications to estimate the fair value of such non-U.S. securities. |

Notes to Financial Statements (unaudited) (continued)

VALUATION OF INVESTMENTS (continued):

Level 3 inputs are significant unobservable inputs. Examples of Level 3 inputs include (without limitation) the last trade price for a security before trading was suspended or terminated; discounts to last trade price for lack of marketability or otherwise; market price information regarding other securities; information received from the issuer and/or published documents, including SEC filings and financial statements; and other publicly available information. Pursuant to the above-referenced policies and procedures, Royce may use various techniques in making fair value determinations based upon Level 3 inputs, which techniques may include (without limitation): (i) workout valuation methods (e.g., earnings multiples, discounted cash flows, liquidation values, derivations of book value, firm or probable offers from qualified buyers for the issuer’s ongoing business, etc.); (ii) discount or premium from market, or compilation of other observable market information, for other similar freely traded securities; (iii) conversion from the readily available market price of a security into which an affected security is convertible or exchangeable; and (iv) pricing models or other formulas. In the case of restricted securities, fair value determinations generally start with the inherent or intrinsic worth of the relevant security, without regard to the restrictive feature, and are reduced for any diminution in value resulting from the restrictive feature. Due to the inherent uncertainty of such valuations, these fair values may differ significantly from the values that would have been used had an active market existed.

A security that is valued by reference to Level 1 or Level 2 inputs may drop to Level 3 on a particular valuation date for several reasons, including if:

| ● | an equity security that is listed on an exchange or Nasdaq, or traded on OTC Market Group Inc.’s OTC Link ATS or other alternative trading system, has not traded and there are no bids; |

| ● | Royce does not receive at least two bid side quotes for an Other OTC Equity Security; |

| ● | the independent pricing services are unable to supply fair value prices; or |

| ● | the Level 1 or Level 2 inputs become otherwise unreliable for any reason (e.g., a significant event occurs after the close of trading for a security but prior to the time a Fund prices its shares). |

The table below shows the aggregate value of the various Level 1, Level 2, and Level 3 securities held by the Funds as of June 30, 2024. Any Level 2 or Level 3 securities held by a Fund are noted in its Schedule of Investments. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with owning those securities.

| | | LEVEL 1 | | LEVEL 2 | | LEVEL 3 | | TOTAL |

| Micro-Cap Portfolio | | | | | | | | | | | | | | | | |

| Common Stocks | | | $124,202,397 | | | | $3,802,975 | | | | $0 | | | | $128,005,372 | |

| Repurchase Agreement | | | – | | | | 4,099,288 | | | | – | | | | 4,099,288 | |

| Money Market Fund/Collateral Received for Securities Loaned | | | 347,266 | | | | – | | | | – | | | | 347,266 | |

| Small-Cap Portfolio | | | | | | | | | | | | | | | | |

| Common Stocks | | | 278,199,123 | | | | – | | | | – | | | | 278,199,123 | |

| Repurchase Agreement | | | – | | | | 3,078,854 | | | | – | | | | 3,078,854 | |

REPURCHASE AGREEMENTS:

The Funds may enter into repurchase agreements with institutions that the Funds’ investment adviser has determined are creditworthy. Each Fund restricts repurchase agreements to maturities of no more than seven days. Securities pledged as collateral for repurchase agreements, which are held until maturity of the repurchase agreements, are marked-to-market daily and maintained at a value at least equal to the principal amount of the repurchase agreement (including accrued interest). Repurchase agreements could involve certain risks in the event of default or insolvency of the counter-party, including possible delays or restrictions upon the ability of each Fund to dispose of its underlying securities. The remaining contractual maturities of repurchase agreements held by the Funds as of June 30, 2024, are next business day and continuous.

FOREIGN CURRENCY:

Net realized foreign exchange gains or losses arise from sales and maturities of short-term securities, sales of foreign currencies, expiration of currency forward contracts, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on each Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities, other than investments in securities at the end of the reporting period, as a result of changes in foreign currency exchange rates.

The Funds do not isolate that portion of the results of operations resulting from fluctuations in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Notes to Financial Statements (unaudited) (continued)

SECURITIES LENDING:

The Funds loan securities through a lending agent, State Street Bank and Trust Company, to qualified institutional investors for the purpose of earning additional income. The lending agent receives and holds collateral from such borrowers to secure their obligations to the Funds. Such loans must be secured at all times by collateral in an amount at least equal to the market value of the loaned securities. The market values of the loaned securities and the collateral fluctuate and are determined at the close of each business day by the lending agent. Borrowers are required to post additional collateral to the lending agent on the next succeeding business day in the event of a collateral shortfall. Counterparty risk is further reduced by loaning securities only to parties that participate in a Global Securities Lending Program organized and monitored by the lending agent and that are deemed by it to satisfy its requirements and by having the lending agent enter into securities lending agreements with such borrowers. The lending agent is not affiliated with Royce.

Collateral may be in the form of cash or U.S. Treasuries. Cash collateral is invested in certain money market pooled investment vehicles. The Funds record a liability in their respective Statements of Assets and Liabilities for the return of such cash collateral during periods in which securities are on loan. The Funds bear the risk of loss for any decrease in the market value of the loaned securities or the investments purchased with cash collateral received from the borrowers.

Pursuant to the agreement in place between the Funds and the lending agent, if a borrower fails to return loaned securities, and the cash collateral being maintained by the lending agent on behalf of such borrower is insufficient to cover the value of loaned securities and provided such collateral insufficiency is not the result of investment losses, the lending agent shall, at its option, either replace the loaned securities or pay the amount of the shortfall to the Funds. In the event of the bankruptcy of a borrower, the Funds could experience delay in recovering the loaned securities or only recover cash or a security of equivalent value.

Loans of securities generally do not have stated maturity dates, and the Funds may recall a security at any time. The Funds’ securities lending income consists of the income earned on investing cash collateral, plus any premium payments received for lending certain securities, less any rebates paid to borrowers and lending agent fees associated with the loan. Pursuant to the agreement in place between the Funds and the lending agent, the Funds are responsible for any shortfall in the event the value of the investments purchased with cash collateral is insufficient to pay the rebate fee to the borrower.

The following table presents cash collateral and the market value of securities on loan collateralized by cash collateral held by the Funds as of June 30, 2024:

| CASH COLLATERAL1 | SECURITIES ON LOAN COLLATERALIZED

BY CASH COLLATERAL | NET AMOUNT |

| Micro-Cap Portfolio | $347,266 | $(337,300) | $9,966 |

| 1 | Absent an event of default, assets and liabilities are presented gross and not offset in the Statements of Assets and Liabilities. The contractual maturity of cash collateral is overnight and continuous. |

The following table presents non-cash collateral and the market value of securities on loan collateralized by non-cash collateral held by the Funds’ custodian as of June 30, 2024:

| NON-CASH COLLATERAL | SECURITIES ON LOAN COLLATERALIZED

BY NON-CASH COLLATERAL | NET AMOUNT |

| Micro-Cap Portfolio | $34,072 | $(32,997) | $1,075 |

DISTRIBUTIONS AND TAXES:

As qualified regulated investment companies under Subchapter M of the Internal Revenue Code, the Funds are not subject to income taxes to the extent that each Fund distributes substantially all of its taxable income for its fiscal year.

The Funds pay any dividends and capital gain distributions annually in December. Dividends from net investment income and distributions from capital gains are determined at a class level. Because federal income tax regulations differ from generally accepted accounting principles, income and capital gain distributions determined in accordance with tax regulations may differ from net investment income and realized gains recognized for financial reporting purposes. Accordingly, the character of distributions and composition of net assets for tax purposes differ from those reflected in the accompanying financial statements.

INVESTMENT TRANSACTIONS AND RELATED INVESTMENT INCOME:

Investment transactions are accounted for on the trade date. Dividend income is recorded on the ex-dividend date except for certain dividends from securities where the dividend rate is not available. In such cases, the dividend is recorded as soon as the information is received by the Funds. Non-cash dividend income is recorded at the fair market value of the securities received. Interest income is recorded on an accrual basis. Realized gains and losses from investment transactions are determined on the basis of identified cost for book and tax purposes.

Notes to Financial Statements (unaudited) (continued)

EXPENSES:

The Funds incur direct and indirect expenses. Expenses directly attributable to a Fund are charged to the Fund, while expenses applicable to more than one of the Royce Funds are allocated equitably. Certain personnel, occupancy costs and other administrative expenses related to all of the Royce Funds are allocated by Royce under an administration agreement and are included in administrative and office facilities and legal expenses.

COMPENSATING BALANCE CREDITS:

The Funds have an arrangement with their transfer agent, whereby a portion of the transfer agent’s fee is paid indirectly by credits earned on a Fund’s cash on deposit with the transfer agent.

LINE OF CREDIT:

The Funds, along with certain other Royce Funds, participate in a $65 million line of credit (“Credit Agreement”) with State Street Bank and Trust Company to be used for short-term working capital purposes, to include the funding of shareholder redemptions and trade settlements. This revolving Credit Agreement expires on October 4, 2024. Pursuant to the Credit Agreement, each participating Fund is liable for a portion of the commitment fee for the credit facility (i.e., 0.25% of any unused portion of the line of credit) and for principal and interest payments related to borrowings made by that Fund. Borrowings under the Credit Agreement bear interest at a variable rate equal to the Applicable Rate plus the Applicable Margin. The term Applicable Rate means, for any day, a rate equal to the sum of (a) 0.10%, plus (b) the higher of (i) the Federal Funds Effective Rate for such day, or (ii) the Overnight Bank Funding Rate for such day. The term Applicable Margin means 1.25%. The Funds did not utilize the line of credit during the six months ended June 30, 2024.

INDEMNIFICATION PROVISIONS:

Reference is made to Delaware law and the Trust’s Certificate of Trust, Trust Instrument, and By-laws, as amended and supplemented, each of which provides for the indemnification by the Trust of the Trust’s officers and trustees under the circumstances and to the extent set forth therein. Reference is also made to the investment advisory agreement between the Trust, on behalf of each Fund, and Royce which provides for the indemnification by the relevant Fund of Royce under the circumstances and to the extent set forth therein. Additionally, in the normal course of business, the Trust, on behalf of both Funds, enters into contracts with service providers that contain general indemnification provisions in favor of such service providers and other covered persons. The amount of any potential Fund liability under these indemnification arrangements, if any, currently cannot be determined with any degree of specificity. The Trust is not currently in possession of any information that would cause it to believe that any Fund is reasonably likely to be subject to any material adverse impact from the operation of these indemnification arrangements. No assurance can be given, however, that any Fund will not incur any liability from the operation of these indemnification arrangements. Any future liability to a Fund that may arise from the operation of such arrangements will be publicly disclosed to the extent required by relevant accounting guidance and applicable laws, rules, and regulations.

Capital Share Transactions (in shares):

| | | SHARES SOLD | | SHARES ISSUED FOR REINVESTMENT OF DISTRIBUTIONS | | SHARES REDEEMED | | NET INCREASE (DECREASE) IN SHARES OUTSTANDING |

| | | Six Months Ended

6/30/24

(unaudited) | | Year Ended

12/31/23 | | Six Months Ended

6/30/24

(unaudited) | | Year Ended

12/31/23 | | Six Months Ended

6/30/24

(unaudited) | | Year Ended

12/31/23 | | Six Months Ended

6/30/24

(unaudited) | | Year Ended

12/31/23 |

| Micro-Cap Portfolio | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investment Class | | | 299,772 | | | | 2,000,011 | | | | – | | | | – | | | | (1,088,735 | ) | | | (3,507,726 | ) | | | (788,963 | ) | | | (1,507,715 | ) |

| Service Class | | | 33,790 | | | | 2,595,908 | | | | – | | | | – | | | | (201,585 | ) | | | (2,059,573 | ) | | | (167,795 | ) | | | 536,335 | |

| Small-Cap Portfolio | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investment Class | | | 470,110 | | | | 2,655,530 | | | | – | | | | 1,362,857 | | | | (1,367,551 | ) | | | (5,453,895 | ) | | | (897,441 | ) | | | (1,435,508 | ) |

| Service Class | | | 144,905 | | | | 11,036,795 | | | | – | | | | 1,566,873 | | | | (1,632,207 | ) | | | (14,391,550 | ) | | | (1,487,302 | ) | | | (1,787,882 | ) |

Investment Adviser and Distributor:

INVESTMENT ADVISER:

Under the Trust’s investment advisory agreement with Royce, Royce is entitled to receive investment advisory fees in respect of each Fund that are computed daily and payable monthly.

| | | | | | | | COMMITTED NET ANNUAL

OPERATING EXPENSE RATIO CAP | | | | SIX MONTHS ENDED

JUNE 30, 2024 (UNAUDITED) | |

| | | | ANNUAL CONTRACTUAL

ADVISORY FEE AS A

PERCENTAGE OF AVERAGE

NET ASSETS | | | | Investment Class | | | | Service Class | | | | Net advisory fees | | | | Advisory fees waived | |

| Micro-Cap Portfolio | | | 1.00% | | | | N/A | | | | N/A | | | $ | 660,394 | | | $ | – | |

| Small-Cap Portfolio | | | 1.00% | | | | N/A | | | | N/A | | | | 1,467,681 | | | | – | |

Notes to Financial Statements (unaudited) (continued)

DISTRIBUTOR:

Royce Fund Services, LLC (“RFS”), the distributor of the Trust’s shares, is a wholly owned subsidiary of Royce. RFS is entitled to receive distribution fees from each Fund’s Service Class that are computed daily and payable monthly, at an annual rate of 0.25% of the average net assets of each Class. For the six months ended June 30, 2024, Micro-Cap Portfolio-Service Class recorded distribution fees of $24,635 and Small-Cap Portfolio-Service Class recorded distribution fees of $185,079 (net of $7,940 fees waived).

Purchases and Sales of Investment Securities:

For the six months ended June 30, 2024, the costs of purchases and the proceeds from sales of investment securities, other than short-term securities and collateral received for securities loaned, were as follows:

| | | PURCHASES | | | SALES | |

| Micro-Cap Portfolio | | $ | 14,131,120 | | | $ | 20,550,394 | |

| Small-Cap Portfolio | | | 48,127,046 | | | | 64,446,688 | |

Cross trades were executed by the Funds pursuant to Rule 17a-7 under the 1940 Act. Cross trading is the buying or selling of portfolio securities between funds to which Royce or an affiliate of Franklin Resources, Inc. serves as investment adviser. The Trust’s Chief Compliance Officer reviews such transactions each quarter for compliance with the requirements and restrictions set forth by Rule 17a-7, and reports the results of that review to the Board of Trustees. Cross trades for the six months ended June 30, 2024, were as follows:

| | | COSTS OF PURCHASES | | PROCEEDS FROM SALES | | REALIZED GAIN (LOSS) |

| Micro-Cap Portfolio | | $113,237 | | $ – | | $ – |

Class Specific Expenses:

Class specific expenses were as follows for the six months ended June 30, 2024:

| | | NET DISTRIBUTION FEES | | | SHAREHOLDER

SERVICING | | | SHAREHOLDER REPORTS | | | TRANSFER AGENT BALANCE CREDITS | | | TOTAL | | | CLASS LEVEL EXPENSES REIMBURSED BY INVESTMENT ADVISER | |

| Micro-Cap Portfolio – Investment Class | | $ | – | | | $ | 4,829 | | | $ | 7,875 | | | $ | (105 | ) | | $ | 12,599 | | | $ | – | |

| Micro-Cap Portfolio – Service Class | | | 24,635 | | | | 3,652 | | | | 986 | | | | (39 | ) | | | 29,234 | | | | – | |

| | | | 24,635 | | | | 8,481 | | | | 8,861 | | | | (144 | ) | | | | | | | – | |

| Small-Cap Portfolio – Investment Class | | | – | | | | 4,357 | | | | 4,815 | | | | (87 | ) | | | 9,085 | | | | – | |

| Small-Cap Portfolio – Service Class | | | 185,079 | | | | 3,804 | | | | 1,888 | | | | (35 | ) | | | 190,736 | | | | – | |

| | | | 185,079 | | | | 8,161 | | | | 6,703 | | | | (122 | ) | | | | | | | – | |

Tax Information:

As of June 30, 2024, net unrealized appreciation (depreciation) based on identified cost for tax purposes was as follows:

| | | | | NET UNREALIZED | | GROSS UNREALIZED |

| | | TAX BASIS COST | | APPRECIATION (DEPRECIATION) | | Appreciation | | (Depreciation) |

| Micro-Cap Portfolio | | $100,609,854 | | $31,842,072 | | $44,423,221 | | $12,581,149 |

| Small-Cap Portfolio | | 227,022,968 | | 54,255,009 | | 64,080,374 | | 9,825,365 |

The primary cause of the difference between book and tax basis cost is the timing of the recognition of losses on securities sold.

New Accounting Pronouncements and Regulations:

On October 26, 2022, the SEC adopted rule and form amendments which require open-end mutual funds to transmit streamlined annual and semi-annual reports to shareholders that highlight key information to investors. In connection with these amendments, certain information that was previously disclosed in fund shareholder reports will instead be made available online, delivered free of charge upon request, and filed on a semi-annual basis on Form N-CSR. The rule and form amendments have a compliance date of July 24, 2024, and will have no effect on the Funds' accounting policies or financial statements.

Subsequent Events:

Subsequent events have been evaluated through the date the financial statements were issued and it has been determined that no events have occurred that require disclosure.

Understanding Your Fund’s Expenses (unaudited)