UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-07537

Name of Registrant: Royce Capital Fund

Address of Registrant: 745 Fifth Avenue

New York, NY 10151

Name and address of agent for service: John E. Denneen, Esq. 745 Fifth Avenue New York, NY 10151 |

Registrant’s telephone number, including area code: (212) 508-4500

Date of fiscal year end: December 31, 2022

Date of reporting period: January 1, 2022 – June 30, 2022

Item 1. Reports to Shareholders.

Royce Capital Fund 2022 Semiannual

Review and Report to Shareholders

June 30, 2022

Royce Capital Fund–Micro-Cap Portfolio

Royce Capital Fund–Small-Cap Portfolio

Table of Contents

Semiannual Review

This page is not part of the Royce Capital Fund 2022 Semiannual Report to Shareholders | 1

Letter to Our Shareholders

THE FIRST HALF OF 2022: A SEASON OF WORSTS FOR THE CAPITAL MARKETS

The first half of 2022—in particular its more tumultuous second quarter—offered few if any safe havens for investors, regardless of the investment focus. To be sure, the list of negative superlatives is long. As measured by the Russell Indexes, for example, it was the worst calendar first half since the shared 12/31/78 inception dates for the large-cap Russell 1000 Index (-20.9%), the Russell Midcap Index (-21.57%), the small-cap Russell 2000 Index (-23.4%), and the Russell Microcap Index (-25.1% and whose start goes back to 6/30/00). For the large-cap S&P 500 Index, its 20.0% decline marked its worst first half return since 1970 and its most volatile first six months since 2009. Using Center for Research in Securities Prices (CRSP) data that dates back to 1926 shows that the small-cap proxy, the CRSP 6-10 Index, had its fourth-worst first half in nearly 100 years. The three others occurred in 1932 (during the depth of the Great Depression), 1970, and 1973. For the CRSP 1-5—the large-cap cohort—it was the third-worst first half, with only 1932 and 1962 (during the “Kennedy Slide” that followed a decade of rising share prices) faring worse.

Outside the U.S., the results were equally grim. The MSCI ACWI Small Cap (-22.3%) and MSCI ACWI ex USA Small Cap (-22.9%) Indexes each suffered their worst first half since their 1994 inception while the MSCI Emerging Market Index (-17.9%) turned in its second worst. And the damage was not limited to equities. Bonds also posted negative returns in the

first half, declining in both the first and second quarters. This is especially notable because stocks and bonds seldom decline in tandem. They have both had negative returns in just 20 quarters since 1976 (a period that encompasses 186 quarters) and have experienced negative returns for two consecutive quarters only five times—as was the case in 2022—since that same year. In addition, cryptocurrencies are estimated to have lost roughly $2 trillion in value during 2022’s first half, while it is estimated that the amount of wealth in the U.S. has shrunk by as much as $5 trillion so far in 2022. The first half of 2022 saw a significant resetting of asset values on a global scale in a series of deep and broad-based declines that offered, in the words of the Motown classic, “nowhere to run to, nowhere to hide.”

The reasons for this extensive simultaneous swoon have been well rehearsed: Inflation, rising interest rates, an aggressively tightening Fed (with central banks through much of the developed world following suit), lingering supply chain issues, ongoing Covid variants, a sluggish Chinese economy, and the war in Ukraine. Many of these developments are interrelated, with continued Covid outbreaks hampering both a resolution to supply chain delays and growth in China while the war and supply chain delays are exacerbating inflation. The headwinds can be seen in recent economic data, with behemoths such as Walmart, a bellwether for moderate- and low-income U.S. consumers, reporting lower-than-anticipated quarterly earnings and underwhelming near-term prospects while the J.P. Morgan Global Manufacturing PMI™ hit a

2 | This page is not part of the Royce Capital Fund 2022 Semiannual Report to Shareholders

LETTER TO OUR SHAREHOLDERS

22-month low at the end of June. The U.S. manufacturing PMI new orders component ended June at 49.2—and any number below 50 signals a contraction in activity. However, U.S. home and durable good sales rose in June, while as of this writing the U.S. labor market remains strong—and surprisingly resilient in the face of so much dire news. An added positive came from recent bank results, which included reassuring news about the health of consumer credit, as well as the banks’ own balance sheets. The shared health of banks and household balance sheets is important from our perspective as it bolsters the view that any U.S. slowdown seems likely to be both shallow and short-lived. Other dynamics create a different picture outside of the U.S., where a global slowdown looks more worrisome in Europe than in Asia, with the U.S. in between. Regardless of the near-term economic forecast, however, we have examined several small-cap data points that point to potentially better times ahead for investors with the fortitude to remain invested. Much of our case rests on an admittedly counterintuitive and somewhat ironic reason: Improved results for small-cap stocks are rooted in the fact that the environment has been so difficult.

SMALL-CAP IS A DIFFERENT WORLD

Throughout our five decades of investing, we have found that there are two critical features about the overall small-cap market that many investors miss or forget: First, small-cap operates in its own way—frequently diverging from large-cap. This is borne out not only by the differences—often significant—in long-term performance, but also in the varying market cycles,

responses to various economic and monetary regimes and sector and industry concentrations. Second, small-cap is a highly heterogeneous asset class. Its roughly 3,000 publicly traded companies can be found in ample supply in every sector and industry and are involved in almost every imaginable kind of business. Equally important, the depth and breadth of the universe means that there are nearly always potential opportunities for disciplined and discerning investors with the requisite patience for long-term investing.

So, while we can appreciate that investors may feel more comfortable focusing on large-caps in these anxious times, we would counsel resisting that temptation, particularly in the current environment. For example, one of the primary differences between small- and large-cap stocks at the end of June was the radically different valuation picture for each asset class. Despite the dramatic decline in stock prices so far during 2022—which might lead some to believe that valuations throughout the U.S. equity market have been falling to attractively inexpensive levels—large-cap stocks on average remain expensive. And this is true not only in light of their own history, but also versus small-caps. In fact, there has been little change in the extreme valuation gap between the Russell 2000 and Russell 1000 since late 2020. On 6/30/22 the Russell 2000 was at a 20% discount—which marked its lowest relative valuation versus the large-cap index in more than two decades. This stands in stark contrast to the past 20 years, a period in which small-caps have averaged a 3% premium to their larger siblings.

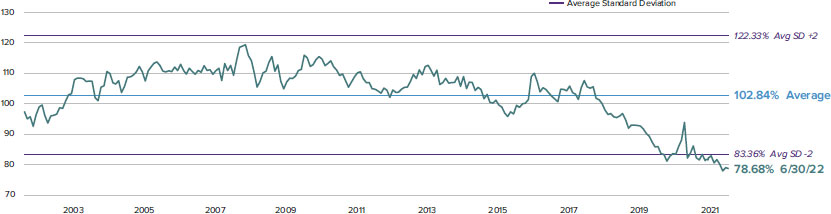

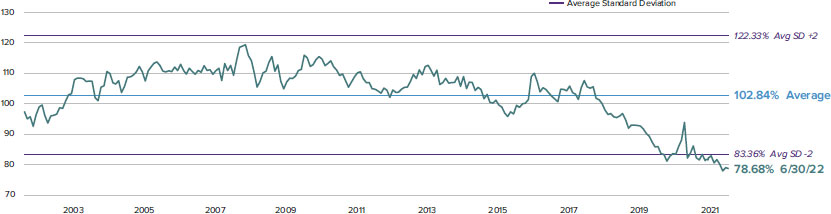

Russell 2000 vs. Russell 1000 Median LTM EV/EBIT1 (ex. Negative EBIT Companies)

From 6/30/02 to 6/30/22

1Earnings before interest and taxes.

The average standard deviation (+/-2) shows how extreme the relative valuation of the indexes is from the average relative valuation over the period shown. Average standard deviation +2 indicates the highest 2.5% of relative valuation observations (i.e., small-caps are relatively expensive), while the average standard deviation -2 indicates the lowest 2.5% of relative valuation observations (i.e., small-caps are relatively inexpensive).

This page is not part of the Royce Capital Fund 2022 Semiannual Report to Shareholders | 3

LETTER TO OUR SHAREHOLDERS

Median EV/EBIT1 (ex-Negative EBIT) Levels for Russell Indexes

As of 6/30/22

1Enterprise value divided by earnings before interest and taxes.

WHEN VALUATION IS A MATTER OF STYLE

Within small-cap, valuations continue to favor value, even as the Russell 2000 Value Index continued to outpace the Russell 2000 Growth Index in small-cap’s miserable first half—in this case by losing less, down 17.3% versus 29.5% for the year-to-date period ended 6/30/22. There were four additional observations from the chart above that we found equally relevant when comparing valuations for the various segments of the U.S. equity market:

| 1. | Small-Cap Value and Small-Cap Core were the cheapest segments of U.S. equities as of 6/30/22. |

| 2. | These segments were the only ones that were below their 25-year average valuation. |

| 3. | While all three value segments (Small-Cap, Mid-Cap, and Large-Cap) had nearly identical 25-year average valuations, their valuations at the end of June were vastly different. |

| 4. | Large-Cap and Mid-Cap Growth valuations remained well above their 25-year average valuations at the end of 2022’s first half. |

These valuation disparities are particularly pertinent now because it seems likely that U.S. equity valuations, at least for some asset classes or styles, may take years to surpass their earlier respective peaks. Our view is that an environment featuring somewhat higher interest rates and inflation, along with a less accommodative Federal Reserve and

increased geopolitical rivalries, will combine for a greater risk environment. (It will also be nearly the reverse of the period from 2009-2021, which saw unprecedented levels of liquidity and near-zero interest rates.) We believe that we will therefore probably see somewhat lower equity valuations in the new climate than we have seen over much of the last 10 years. We think that one important consequence of this shifting and uncertain environment is that investors should consider allocating away from higher valuation assets, which may have stiff headwinds to appreciation, into lower valuation assets, which may receive help from at least a neutral environment or perhaps modest tailwinds. Small-caps in general, and small-cap value specifically, look relatively attractive in this context.

SO BAD IT’S GOOD? REASONS FOR LONG-TERM SMALL-CAP OPTIMISM

Even with a more attractive valuation than large-caps—and a further valuation advantage for small-cap value—we can appreciate that investors may be reticent to put fresh capital to work in the asset class or its value style subset, having just endured the worst first half in the more than 40-year history of the Russell 2000 Index. We also understand their weariness and anxiety as they survey the litany of challenges we have reviewed above. No one, it would seem, needs a reason not to invest these days. Yet that negative perception—substantiated by record lows in both investor and consumer sentiment—is exactly why

4 | This page is not part of the Royce Capital Fund 2022 Semiannual Report to Shareholders

LETTER TO OUR SHAREHOLDERS

we are so emphatic that this looks like a genuinely attractive time to invest in small-caps. We think the case is even stronger, particularly if an investor uses large-cap stocks—with their relatively much higher valuations—as a source of funds.

A little-known dynamic exists between large- and small-cap stock performance as investors’ fears wax and wane. We have found it useful to watch the CBOE S&P 500 Volatility Index (VIX) as a barometer for risk tolerance. (The VIX measures market expectations of near-term volatility conveyed by S&P 500 stock index option prices.) Risk tolerance tends to ebb and flow with events. However, regardless of the specific event (e.g., Long-Term Capital Management’s 1998 meltdown, 9/11, the Great Financial Crisis of 2008-09, the Greek Debt Crisis in 2011, 2020’s Covid shutdown), risk tolerance initially plummets before investors show their resilience and acclimatize to the new development, leading to a normalizing of risk tolerance.

This pattern forms the history of markets. Yet there is another revealing and consistent pattern within U.S. equities: In general, small-cap stocks have absorbed a greater proportion of heightened fear than large-caps as overall stock prices fall—which paradoxically creates an opportunity, as the chart below shows. Using above-average VIX levels as a proxy for markets in the grip of high anxiety shows that these periods have historically supplied two attractive elements for small-cap investors: strong absolute subsequent returns and, equally compelling, often excellent entry points for small-cap outperformance over large-caps. When the VIX has had an average monthly reading of 25 or more, as it did in June 2022, the subsequent three-year annualized returns for the Russell 2000 have been 14.1%, compared with 9.4% for the Russell 1000. Even more striking than the spread of outperformance has been the 83% frequency with which small-caps have beaten large-caps over the subsequent three years from similar starting points of higher-than-average volatility. We think of small-caps as being like a coiled spring in these periods of high investor anxiety, contracting more as fear builds and bouncing robustly back as fear recedes.

Subsequent Average Annualized Three-Year Return for the Russell 2000 Starting in Monthly Rolling VIX Return Ranges

From 12/31/89 to 6/30/22

Past performance is no guarantee of future results. Batting Average refers to the percentage of monthly three-year periods in which the Russell 2000 Index outperformed the Russell 1000 Index. The monthly average VIX from 12/31/89-6/30/22 was 19.6. Higher VIX readings occur when market volatility is higher.

THE VALUE OF STAYING INVESTED

We are certainly in what we would call a “sum of all fears” environment, with war, inflation, slower growth, and rising rates all understandably frightening investors. The anxious realities of our current conditions notwithstanding, we would challenge investors to think about whether our present moment is markedly worse than previous periods—including the Internet Bubble era, the months following the attacks on 9/11, and the Great Financial Crisis. In other words, we would argue against the current sentiment.

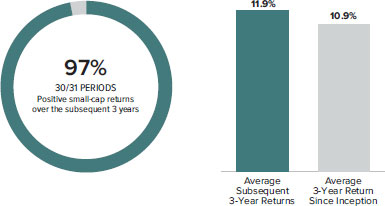

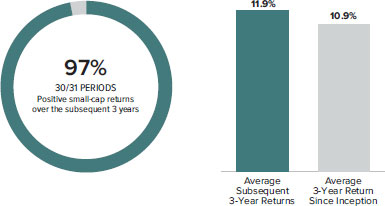

More importantly, we have found that the most opportune times to invest are when fear is high and trailing returns are low. Subsequent returns from these levels have been attractive for those investors with the discipline to stay invested. For instance, the annualized three-year return for the Russell 2000 at the end of June was 4.2% compared to its three-year monthly rolling average since inception of 10.9%. Subsequent annualized three-year returns for small-cap from comparable trailing low-return entry points have been positive 97% of the time since the Russell 2000’s inception, averaging 11.9%. Coming off a record negative first half and enduring what may well be a late stage of the bear market, the current period looks, to us, like a pretty good entry point for long-term small-cap returns going forward. We think all of this makes a very convincing argument for ongoing small-cap investment.

We think of small-caps as being like a coiled spring in these periods of high investor anxiety,

contracting more as fear builds and bouncing robustly back as fear recedes.

This page is not part of the Royce Capital Fund 2022 Semiannual Report to Shareholders | 5

LETTER TO OUR SHAREHOLDERS

Subsequent Average Annualized 3-Year Performance for the Russell 2000 Following 3-Year Annualized Return Ranges of 0-5%

From 12/31/78-6/30/22

Past performance is no guarantee of future results.

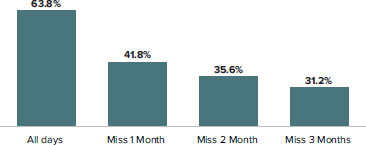

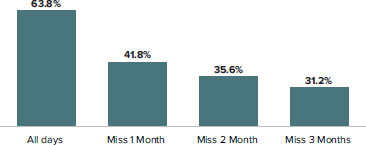

We have one final observation—which is that small-cap recoveries have historically happened very quickly, so investors who miss even a few months would have forfeited a sizable share of their return. We looked at the one-year results coming off market bottoms—declines of at least 15% from the previous peak—and then tracked the average returns for investors who missed the first one, two, or three months of each one-year recovery. The results were striking. On average, if an investor were to miss only the first month of the

recovery, their one-year return was on average about one third lower than if they had been investing throughout the trough (+63.8% vs. +41.8%). For an investor who missed the first three months of the recovery, their subsequent one-year return was less than half of what investors experienced by investing at the bottom (+63.8% vs. +31.2%).

Average and Median Returns for the Russell 2000 During the First 12 Months of a Recovery Depending on Entry Point

From 12/31/78-6/30/22

Past performance is no guarantee of future results. Royce defines the starting date of a recovery as the market cycle trough of a decline of 15% or more from the index’s prior historical high.

Our final counsel then, is to follow the wisdom of the investment maxim, “Be fearful when others are greedy and greedy when others are fearful.”

Sincerely,

|  |  |

Charles M. Royce

Chairman,

Royce Investment Partners | Christopher D. Clark

Chief Executive Officer, and

Co-Chief Investment Officer,

Royce Investment Partners | Francis D. Gannon

Co-Chief Investment Officer,

Royce Investment Partners |

July 29, 2022

| 6 | This page is not part of the Royce Capital Fund 2022 Semiannual Report to Shareholders | Past performance is no guarantee of future results. |

Performance and Expenses

Performance and Expenses

As of June 30, 2022

| | YTD1 | 1-YR | 3-YR | 5-YR | 10-YR | 15-YR | 20-YR | 25-YR | SINCE

INCEPTION

(12/27/96) | ANNUAL OPERATING

EXPENSES (%)

GROSS/NET |

| Royce Capital Fund–Micro-Cap Portfolio | -28.10 | -25.35 | 7.70 | 5.40 | 5.45 | 3.58 | 6.48 | 9.12 | 9.10 | 1.12/1.08 |

| Royce Capital Fund–Small-Cap Portfolio | -19.02 | -15.52 | 1.93 | 2.98 | 5.83 | 4.31 | 6.86 | 8.66 | 8.96 | 1.11/1.08 |

| INDEX | | | | | | | | | | |

| Russell Microcap Index | -25.11 | -30.73 | 5.05 | 4.55 | 9.04 | 5.16 | 7.45 | N/A | N/A | N/A |

| Russell 2000 Value Index | -17.31 | -16.28 | 6.18 | 4.89 | 9.05 | 5.58 | 7.77 | 8.15 | N/A | N/A |

| Russell 2000 Index | -23.43 | -25.20 | 4.21 | 5.17 | 9.35 | 6.33 | 8.17 | 7.41 | N/A | N/A |

1 Not annualized.

Important Performance, Expense, and Risk Information

All performance information in this Review and Report reflects past performance, is presented on a total return basis, reflects the reinvestment of distributions, and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when redeemed. Current performance may be higher or lower than performance quoted and may be obtained at www.royceinvest.com. The Funds’ total returns do not reflect any deduction for charges or expenses of the variable contracts investing in the Funds. All performance and expense information reflects the result for each Fund’s Investment Class Shares. Gross annual operating expenses reflect each Fund’s gross total annual operating expenses and include management fees, operating expenses, and any applicable acquired fund fees and expenses. Net annual operating expenses reflect contractual fee waivers and/or expense reimbursements. All expense information is reported as of each fund’s most current prospectus and, for Royce Micro-Cap Portfolio, reflects the reduction in its investment advisor fee rate from 1.25% to 1.00% of its average daily net assets that will go into effect on July 1, 2022. Royce & Associates has contractually agreed to waive fees and/or reimburse operating expenses, excluding brokerage commissions, taxes, interest litigation expenses, acquired fund fees and expenses, and other expenses not borne in the ordinary cost of business, to the extent necessary to maintain net operating expenses at or below 1.08% for both Royce Capital Fund–Micro-Cap Portfolio and Royce Capital Fund–Small-Cap Portfolio through April 30, 2023.

Service Class Shares bear an annual distribution expense that is not borne by the Investment Class; if those expenses were reflected, total returns would have been lower. Each series of Royce Capital Fund is subject to market risk—the possibility that common stock prices will decline, sometimes sharply and unpredictably, over short or extended periods of time. Such declines may be caused by various factors, including market, financial, and economic conditions, governmental or central bank actions, and other factors, such as the recent Covid-19 pandemic, that may not be directly related to the issuer of a security held by a Fund. This pandemic could adversely affect global market, financial, and economic conditions in ways that cannot necessarily be foreseen. Royce Micro-Cap Portfolio invests primarily in micro-cap companies while Royce Small-Cap Portfolio invests primarily in small-cap companies. Investments in micro-cap and small-cap companies may involve considerably more risk than investments in securities of larger-cap companies. (Please see “Primary Risks for Fund Investors” in the prospectus.) Each series of Royce Capital Fund may invest up to 25% of its net assets in foreign securities. Investments in foreign securities may involve political, economic, currency, and other risks not encountered in U.S. investments. (Please see “Investing in Foreign Securities” in the prospectus.) As of 6/30/22, Royce Small-Cap Portfolio invested a significant portion of its assets in a limited number of stocks, which may involve considerably more risk than a more broadly diversified portfolio because a decline in the value of any one of these stocks would cause the Portfolio’s overall value to decline to a greater degree. Royce Micro-Cap Portfolio’s broadly diversified portfolio does not ensure a profit or guarantee against loss. (Please see “Primary Risks for Fund Investors” in the prospectus.) This Review and Report must be preceded or accompanied by a prospectus. Please read the prospectus carefully before investing or sending money. Russell Investment Group is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Russell® is a trademark of Russell Investment Group. The Russell Microcap Index includes 1,000 of the smallest securities in the small-cap Russell 2000 Index along with the next smallest eligible securities as determined by Russell. The Russell 2000 Index is an unmanaged, capitalization-weighted index of domestic small-cap stocks. It measures the performance of the 2,000 smallest publicly traded U.S. companies in the Russell 3000 Index. The Russell 2000 Value Index consists of the respective value stocks within the Russell 2000 as determined by Russell Investments. The performance of an index does not represent exactly any particular investment, as you cannot invest directly in an index. Distributor: Royce Fund Services, LLC.

This page is not part of the Royce Capital Fund 2022 Semiannual Report to Shareholders | 7

MANAGERS’ DISCUSSION (UNAUDITED)

Royce Capital Fund–Micro-Cap Portfolio (RCM)

Jim Stoeffel

Brendan Hartman

FUND PERFORMANCE

Royce Capital Fund–Micro-Cap Portfolio was down 28.1% for the year-to-date period ended 06/30/22, versus a loss of 25.1% for its primary benchmark, the Russell Microcap Index, and a 23.4% loss for the small-cap Russell 2000 Index, its secondary benchmark. The portfolio outperformed the Russell Microcap and the Russell 2000 for the one-, three-, and five-year periods ended 6/30/22.

WHAT WORKED... AND WHAT DIDN’T

Seven of the portfolio’s nine sectors made a negative impact on year-to-date performance. Information Technology, Industrials, and Consumer Discretionary detracted most at the sector level, while the only positive impact came from Energy and Real Estate—as well as the Fund’s cash holdings. Semiconductors & semiconductor equipment (Information Technology), specialty retail (Consumer Discretionary), and machinery (Industrials) detracted most for the year-to-date period at the industry level, while software (Information Technology), energy equipment & services (Energy), and real estate management & development (Real Estate) were the largest contributors.

The Fund’s top detractor at the position level was value-priced apparel retailer Citi Trends. The company reduced its second-half outlook given inflationary pressures that are crimping the spending patterns of its core customer base. We think its shares offered attractive value at the end of June in light of the successful turnaround engineered by current management and the long-term outlook for continued growth in its niche markets. Although Aspen Aerogels has enjoyed success winning new customers in the electric vehicle original equipment manufacturer (OEM) space for its unique automotive battery insulation materials, its stock fell when the company announced an equity and debt offering to fund a doubling of capacity. The offering was subsequently pulled while the company explored alternative financing options. MeiraGTx Holdings develops ocular gene therapy and has a partnership with Johnson. The two companies continue to make progress on a drug that treats retinitis pigmentosa, and data from recent clinical studies was positive. Its shares nonetheless sold off along with many in the Health Care sector when valuations compressed.

The Fund’s top contributor was financial services firm StoneX Group, which benefited from the robust operating environment in its global payments business and strong margin growth rooted in the effective management of its cost structure. Rising interest rates have also benefited the company’s asset sensitivity. Resources Connection is a professional services and consulting firm whose turnaround efforts and execution have been solid in a strong demand climate for its mid-level finance and accounting professionals. Investar Holding Corporation owns Investar Bank. The company successfully reduced costs while favorable loan growth and expanding net interest margin have been driving earnings growth.

The portfolio’s disadvantage versus the Russell Microcap came from both stock selection and sector allocation in 2022’s first half. A lower weight in Energy, stock picks in Consumer Discretionary, and much greater exposure to Information Technology had the biggest negative impact versus the primary benchmark. Conversely, our substantially lower weight in Health Care and the Fund’s cash holdings contributed to relative results.

| | | | | |

| | Top Contributors to Performance | | Top Detractors from Performance | |

| | Year-to-Date Through 6/30/22 (%)1 | | Year-to-Date Through 6/30/22 (%)2 | |

| | | | | |

| | StoneX Group | 0.19 | | Citi Trends | -0.83 | |

| | Resources Connection | 0.19 | | Aspen Aerogels | -0.82 | |

| | Investar Holding Corporation | 0.18 | | MeiraGTx Holdings | -0.74 | |

| | Agilysys | 0.14 | | Shyft Group (The) | -0.70 | |

| | Profire Energy | 0.13 | | Bioventus Cl. A | -0.66 | |

| | 1 Includes dividends | | | 2 Net of dividends | | |

| | | | | | | |

CURRENT POSITIONING AND OUTLOOK

The ongoing war, rising interest rates, and inflationary pressures presented challenges in the first half. How much the Fed tightens into a slowing economy and whether we enter a recession appear to be the key determinants as to when stock prices recover. There is a strong possibility inflation peaked in 2Q22, as yields and energy prices reached highs in mid-June. Consumer confidence is at an all-time low—which is remarkable, considering it is lower than during the crash of the dot com bubble, the Financial Crisis, and Covid. Current uncertainties notwithstanding, we remain confident in what we are holding. Many of our micro-cap holdings boast strong balance sheets that should help them weather whatever economic slowdown or recession we ultimately endure, as well as help them gain market share and acquire attractive assets as seller expectations are reset. We have been trimming some inflation beneficiaries, most notably in areas such as basic materials. Infrastructure and construction firms continue to benefit from steady demand for steel and other materials to build roads and bridges, and we expect the federal infrastructure bill to begin positively impacting spend in the next several quarters. We also remain constructive on the aerospace OEM build cycle for narrow-body aircraft, which is seeing strong demand. The global need for communications equipment has not diminished, despite current conditions. The same is generally true for many healthcare companies—so we are adding to existing names and researching potential new ideas. Conversely, we see Consumer Discretionary as likely to remain weak, at least until it is clear that inflation is stabilizing. Given the sharp market selloff, we are also looking for new investment opportunities among small-cap companies that have fallen into the micro-cap universe, particularly hard hit small-cap growth companies. As always, we seek companies that we believe offer the best combination of attractively low valuations with strong long-term growth potential.

8 | Royce Capital Fund 2022 Semiannual Report to Shareholders

| PERFORMANCE AND PORTFOLIO REVIEW (UNAUDITED) | TICKER SYMBOLS RCMCX RCMSX |

Performance and Expenses

Average Annual Total Return (%) Through 6/30/22

| | JAN-JUN 20221 | 1-YR | 3-YR | 5-YR | 10-YR | 15-YR | 20-YR | 25-YR | SINCE INCEPTION (12/27/96) |

| RCM | -28.10 | -25.35 | 7.70 | 5.40 | 5.45 | 3.58 | 6.48 | 9.12 | 9.10 |

| Annual Gross Operating Expenses: 1.12% | Annual Net Operating Expenses: 1.08% |

1 Not annualized

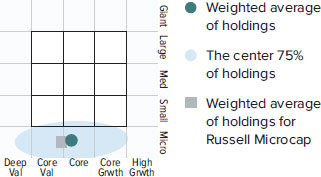

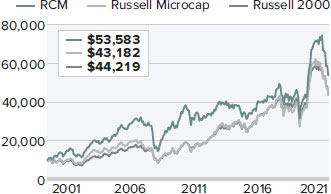

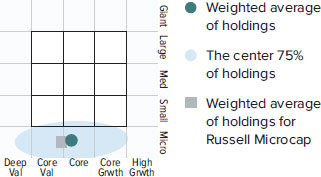

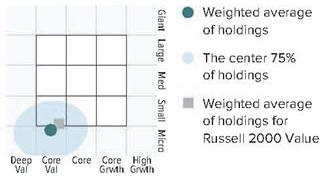

Morningstar Style Map™ As of 6/30/22

The Morningstar Style Map is the Morningstar Style Box™ with the center 75% of fund holdings plotted as the Morningstar Ownership Zone™. The Morningstar Style Box is designed to reveal a fund’s investment strategy. The Morningstar Ownership Zone provides detail about a portfolio’s investment style by showing the range of stock sizes and styles. The Ownership Zone is derived by plotting each stock in the portfolio within the proprietary Morningstar Style Box. Over time, the shape and location of a fund's ownership zone may vary. See page 32 for additional information.

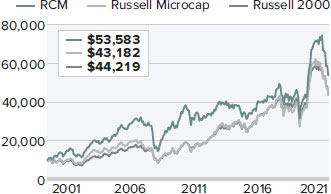

Value of $10,000

Invested on 6/30/00 (Russell Microcap Inception)

as of 6/30/22 ($)

Includes reinvestment of distributions.

Top 10 Positions

% of Net Assets

| Digi International | | 1.5 |

| Photronics | | 1.4 |

| Resources Connection | | 1.4 |

| Northwest Pipe | | 1.4 |

| Investar Holding Corporation | | 1.4 |

| Distribution Solutions Group | | 1.3 |

| HarborOne Bancorp | | 1.2 |

| HBT Financial | | 1.2 |

| BayCom Corporation | | 1.2 |

| Agilysys | | 1.1 |

Portfolio Sector Breakdown

% of Net Assets

| Information Technology | | 25.0 |

| Industrials | | 24.5 |

| Financials | | 14.2 |

| Consumer Discretionary | | 10.1 |

| Health Care | | 9.4 |

| Materials | | 4.4 |

| Communication Services | | 4.3 |

| Energy | | 2.8 |

| Real Estate | | 0.6 |

| Cash and Cash Equivalents | | 4.7 |

Calendar Year Total Returns (%)

| YEAR | | RCM |

| 2021 | | 30.0 |

| 2020 | | 23.8 |

| 2019 | | 19.6 |

| 2018 | | -9.0 |

| 2017 | | 5.2 |

| 2016 | | 19.7 |

| 2015 | | -12.5 |

| 2014 | | -3.6 |

| 2013 | | 21.0 |

| 2012 | | 7.6 |

| 2011 | | -12.1 |

| 2010 | | 30.1 |

| 2009 | | 57.9 |

| 2008 | | -43.3 |

| 2007 | | 4.0 |

Upside/Downside Capture Ratios

Periods Ended 6/30/22 (%)

| | | UPSIDE | | DOWNSIDE |

| 10-Year | | 75 | | 86 |

| From 6/30/00 (Russell Microcap Inception) | | 90 | | 81 |

Portfolio Diagnostics

| Fund Net Assets | | $119 million |

| Number of Holdings | | 129 |

| Turnover Rate | | 6% |

| Average Market Capitalization 1 | | $441 million |

| Weighted Average P/B Ratio 2 | | 1.6x |

| Active Share 3 | | 92% |

| U.S. Investments (% of Net Assets) | | 84.4% |

| Non-U.S. Investments (% of Net Assets) | | 10.9% |

| 1 | Geometric Average. This weighted calculation uses each portfolio holding’s market cap in a way designed to not skew the effect of very large or small holdings; instead, it aims to better identify the portfolio’s center, which Royce believes offers a more accurate measure of average market cap than a simple mean or median. |

| 2 | Harmonic Average. This weighted calculation evaluates a portfolio as if it were a single stock and measures it overall. It compares the total market value of the portfolio to the portfolio’s share in the earnings or book value, as the case may be, of its underlying stocks. |

| 3 | Active Share is the sum of the absolute values of the different weightings of each holding in the Fund versus each holding in the benchmark, divided by two. |

Important Performance and Expense Information

All performance information in this Report reflects past performance, is presented on a total return basis, reflects the reinvestment of distributions, and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when redeemed. Current performance may be higher or lower than performance quoted. The Fund’s total returns do not reflect any deduction for charges or expenses of the variable contracts investing in the Fund. Returns as of the most recent month-end may be obtained at www.royceinvest.com. All performance and risk information reflects the result of the Investment Class (its oldest class). Shares of RCM’s Service Class bear an annual distribution expense that is not borne by the Investment Class; if those expenses were reflected, total returns would have been lower. Gross operating expenses reflect the Fund’s total gross operating expenses for the Investment Class and include management fees and other expenses. Net operating expenses reflect contractual fee waivers and/or expense reimbursements. All expense information is reported as of the Fund’s most current prospectus and reflect the reduction in RCM’s investment advisory fee rate from 1.25% to 1.00% of its average daily net assets that will go into effect on July 1, 2022. Royce & Associates has contractually agreed, without right of termination, to waive fees and/or reimburse expenses to the extent necessary to maintain the Investment Class’s net annual operating expenses (excluding brokerage commissions, taxes, interest, litigation expenses, acquired fund fees and expenses, and other expenses not borne in the ordinary course of business) at or below 1.08% through April 30, 2023. Regarding the “Top Contributors” and “Top Detractors” tables shown above, the sum of all contributors to, and all detractors from, performance for all securities in the portfolio would approximate the Fund’s year-to-date performance for 2022. Upside Capture Ratio measures a manager’s performance in up markets relative to the Fund’s benchmark (Russell Microcap). It is calculated by measuring the Fund’s performance in quarters when the benchmark went up and dividing it by the benchmark’s return in those quarters. Downside Capture Ratio measures a manager’s performance in down markets relative to the Fund’s benchmark. It is calculated by measuring the Fund’s performance in quarters when the benchmark goes down and dividing it by the benchmark’s return in those quarters.

Royce Capital Fund 2022 Semiannual Report to Shareholders | 9

Schedule of Investments

Royce Capital Fund - Micro-Cap Portfolio

Common Stocks – 95.3%

| | | SHARES | | | VALUE |

| | | | | | |

| COMMUNICATION SERVICES – 4.3% | | | | | |

| ENTERTAINMENT - 2.2% | | | | | |

| Chicken Soup for the Soul Entertainment Cl. A 1 | | 92,516 | | $ | 685,544 |

| Gaia Cl. A 1 | | 144,990 | | | 616,207 |

| IMAX Corporation 1 | | 72,000 | | | 1,216,080 |

| | | | | | 2,517,831 |

| INTERACTIVE MEDIA & SERVICES - 1.1% | | | | | |

| Enthusiast Gaming Holdings 1 | | 174,000 | | | 344,702 |

| QuinStreet 1 | | 97,600 | | | 981,856 |

| | | | | | 1,326,558 |

| MEDIA - 1.0% | | | | | |

| Magnite 1 | | 32,500 | | | 288,600 |

| Thryv Holdings 1 | | 41,000 | | | 917,990 |

| | | | | | 1,206,590 |

| Total (Cost $6,933,432) | | | | | 5,050,979 |

| | | | | | |

| CONSUMER DISCRETIONARY – 10.1% | | | | | |

| AUTO COMPONENTS - 2.2% | | | | | |

| Modine Manufacturing 1 | | 122,400 | | | 1,288,872 |

| Stoneridge 1 | | 62,800 | | | 1,077,020 |

| Unique Fabricating 1 | | 148,830 | | | 202,408 |

| | | | | | 2,568,300 |

| HOTELS, RESTAURANTS & LEISURE - 1.4% | | | | | |

| Century Casinos 1 | | 141,300 | | | 1,017,360 |

| Lindblad Expeditions Holdings 1,2 | | 88,100 | | | 713,610 |

| | | | | | 1,730,970 |

| HOUSEHOLD DURABLES - 0.5% | | | | | |

| Legacy Housing 1 | | 50,400 | | | 657,720 |

| LEISURE PRODUCTS - 0.8% | | | | | |

| MasterCraft Boat Holdings 1 | | 45,317 | | | 953,923 |

| SPECIALTY RETAIL - 4.2% | | | | | |

| Barnes & Noble Education 1 | | 119,600 | | | 350,428 |

| Chico’s FAS 1 | | 196,400 | | | 976,108 |

| Citi Trends 1 | | 35,086 | | | 829,784 |

| †JOANN | | 60,000 | | | 465,000 |

| OneWater Marine Cl. A 1 | | 23,900 | | | 789,895 |

| Shoe Carnival | | 45,800 | | | 989,738 |

| Zumiez 1 | | 22,400 | | | 582,400 |

| | | | | | 4,983,353 |

| TEXTILES, APPAREL & LUXURY GOODS - 1.0% | | | | | |

| Fossil Group 1 | | 80,300 | | | 415,151 |

| Vera Bradley 1 | | 172,300 | | | 747,782 |

| | | | | | 1,162,933 |

| Total (Cost $13,674,113) | | | | | 12,057,199 |

| | | | | | |

| ENERGY – 2.8% | | | | | |

| ENERGY EQUIPMENT & SERVICES - 2.8% | | | | | |

| Natural Gas Services Group 1 | | 119,366 | | | 1,313,026 |

| Newpark Resources 1 | | 356,800 | | | 1,102,512 |

| Profire Energy 1 | | 612,129 | | | 881,466 |

| Total (Cost $2,885,696) | | | | | 3,297,004 |

| | | | | | |

| FINANCIALS – 14.2% | | | | | |

| BANKS - 7.3% | | | | | |

| Allegiance Bancshares | | 30,207 | | | 1,140,616 |

| BayCom Corporation | | 68,582 | | | 1,418,276 |

| Caribbean Investment Holdings 1,3 | | 1,751,547 | | | 350,309 |

| HarborOne Bancorp | | 104,791 | | | 1,445,068 |

| HBT Financial | | 80,394 | | | 1,436,641 |

| HomeTrust Bancshares | | 51,400 | | | 1,285,000 |

| Investar Holding Corporation | | 74,410 | | | 1,629,579 |

| Midway Investments 1,3 | | 1,751,577 | | | 0 |

| | | | | | 8,705,489 |

| CAPITAL MARKETS - 4.6% | | | | | |

| B. Riley Financial | | 22,300 | | | 942,175 |

| Canaccord Genuity Group | | 141,982 | | | 929,854 |

| Silvercrest Asset Management Group Cl. A | | 72,484 | | | 1,189,463 |

| Sprott | | 30,380 | | | 1,055,464 |

| StoneX Group 1 | | 17,400 | | | 1,358,418 |

| | | | | | 5,475,374 |

| THRIFTS & MORTGAGE FINANCE - 2.3% | | | | | |

| PCSB Financial | | 15,800 | | | 301,622 |

| Territorial Bancorp | | 50,308 | | | 1,048,922 |

| Western New England Bancorp | | 175,148 | | | 1,306,604 |

| | | | | | 2,657,148 |

| Total (Cost $16,638,663) | | | | | 16,838,011 |

| | | | | | |

| HEALTH CARE – 9.4% | | | | | |

| BIOTECHNOLOGY - 1.7% | | | | | |

| CareDx 1 | | 15,200 | | | 326,496 |

| Dynavax Technologies 1 | | 82,600 | | | 1,039,934 |

| MeiraGTx Holdings 1 | | 81,400 | | | 616,198 |

| | | | | | 1,982,628 |

| HEALTH CARE EQUIPMENT & SUPPLIES - 5.9% | | | | | |

| Apyx Medical 1 | | 123,100 | | | 721,366 |

| Artivion 1 | | 72,089 | | | 1,361,040 |

| AtriCure 1 | | 17,500 | | | 715,050 |

| Bioventus Cl. A 1 | | 122,247 | | | 833,725 |

| Cutera 1,2 | | 22,800 | | | 855,000 |

| OrthoPediatrics Corp. 1 | | 22,100 | | | 953,615 |

| Profound Medical 1 | | 83,400 | | | 609,043 |

| Surmodics 1 | | 25,878 | | | 963,438 |

| | | | | | 7,012,277 |

| HEALTH CARE PROVIDERS & SERVICES - 0.3% | | | | | |

| Sharps Compliance 1 | | 137,843 | | | 402,501 |

| LIFE SCIENCES TOOLS & SERVICES - 1.5% | | | | | |

| Harvard Bioscience 1 | | 271,568 | | | 977,645 |

| Inotiv 1 | | 20,069 | | | 192,662 |

| NeoGenomics 1 | | 19,500 | | | 158,925 |

| Quanterix Corporation 1 | | 30,700 | | | 497,033 |

| | | | | | 1,826,265 |

| Total (Cost $9,879,810) | | | | | 11,223,671 |

| | | | | | |

| INDUSTRIALS – 24.5% | | | | | |

| AEROSPACE & DEFENSE - 2.0% | | | | | |

| Astronics Corporation 1 | | 103,100 | | | 1,048,527 |

| Cadre Holdings | | 51,205 | | | 1,007,202 |

| CPI Aerostructures 1,4 | | 202,231 | | | 323,570 |

| | | | | | 2,379,299 |

| BUILDING PRODUCTS - 1.1% | | | | | |

| Quanex Building Products | | 56,400 | | | 1,283,100 |

| COMMERCIAL SERVICES & SUPPLIES - 2.8% | | | | | |

| Acme United | | 29,379 | | | 930,433 |

| Heritage-Crystal Clean 1 | | 50,334 | | | 1,357,004 |

| VSE Corporation | | 29,000 | | | 1,089,820 |

| | | | | | 3,377,257 |

| CONSTRUCTION & ENGINEERING - 4.7% | | | | | |

| Concrete Pumping Holdings 1 | | 110,400 | | | 669,024 |

| 10 | Royce Capital Fund 2022 Semiannual Report to Shareholders | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS |

June 30, 2022 (unaudited)

Royce Capital Fund - Micro-Cap Portfolio (continued)

| | | SHARES | | | VALUE |

| | | | | | |

| INDUSTRIALS (continued) | | | | | |

| CONSTRUCTION & ENGINEERING (continued) | | | | | |

| Construction Partners Cl. A 1 | | 60,900 | | $ | 1,275,246 |

| IES Holdings 1 | | 24,400 | | | 736,148 |

| Northwest Pipe 1 | | 55,300 | | | 1,655,682 |

| NV5 Global 1 | | 10,700 | | | 1,249,118 |

| | | | | | 5,585,218 |

| ELECTRICAL EQUIPMENT - 0.5% | | | | | |

| American Superconductor 1 | | 114,400 | | | 592,592 |

| MACHINERY - 5.0% | | | | | |

| Alimak Group | | 80,500 | | | 609,077 |

| CIRCOR International 1 | | 34,100 | | | 558,899 |

| †Commercial Vehicle Group 1 | | 62,990 | | | 367,862 |

| Graham Corporation 1 | | 91,796 | | | 635,228 |

| Luxfer Holdings | | 66,100 | | | 999,432 |

| Porvair | | 130,700 | | | 862,328 |

| Shyft Group (The) | | 38,300 | | | 711,997 |

| Wabash National | | 85,500 | | | 1,161,090 |

| Westport Fuel Systems 1 | | 16,800 | | | 16,968 |

| | | | | | 5,922,881 |

| MARINE - 1.0% | | | | | |

| Clarkson | | 32,000 | | | 1,172,504 |

| PROFESSIONAL SERVICES - 5.2% | | | | | |

| CRA International | | 13,796 | | | 1,232,259 |

| Forrester Research 1 | | 24,200 | | | 1,157,728 |

| Heidrick & Struggles International | | 33,200 | | | 1,074,352 |

| Kforce | | 17,400 | | | 1,067,316 |

| Resources Connection | | 81,454 | | | 1,659,218 |

| | | | | | 6,190,873 |

| TRADING COMPANIES & DISTRIBUTORS - 2.2% | | | | | |

| Distribution Solutions Group 1 | | 29,187 | | | 1,499,920 |

| Transcat 1 | | 19,845 | | | 1,127,394 |

| | | | | | 2,627,314 |

| Total (Cost $24,156,322) | | | | | 29,131,038 |

| | | | | | |

| INFORMATION TECHNOLOGY – 25.0% | | | | | |

| COMMUNICATIONS EQUIPMENT - 4.7% | | | | | |

| Clearfield 1 | | 16,500 | | | 1,022,175 |

| Comtech Telecommunications | | 44,863 | | | 406,907 |

| Digi International 1 | | 71,999 | | | 1,743,816 |

| EMCORE Corporation 1 | | 188,100 | | | 577,467 |

| Genasys 1 | | 218,400 | | | 709,800 |

| Harmonic 1 | | 109,400 | | | 948,498 |

| Sierra Wireless 1 | | 5,400 | | | 126,360 |

| | | | | | 5,535,023 |

| ELECTRONIC EQUIPMENT, INSTRUMENTS & COMPONENTS - 5.3% | | |

| Arlo Technologies 1 | | 83,200 | | | 521,664 |

| FARO Technologies 1 | | 28,900 | | | 890,987 |

| LightPath Technologies Cl. A 1 | | 368,300 | | | 453,009 |

| Luna Innovations 1 | | 192,600 | | | 1,122,858 |

| nLIGHT 1 | | 63,500 | | | 648,970 |

| PAR Technology 1 | | 24,100 | | | 903,509 |

| PowerFleet 1 | | 229,500 | | | 498,015 |

| VIA optronics ADR 1 | | 58,888 | | | 124,842 |

| Vishay Precision Group 1 | | 40,200 | | | 1,171,026 |

| | | | | | 6,334,880 |

| IT SERVICES - 1.7% | | | | | |

| Cass Information Systems | | 26,048 | | | 880,423 |

| Computer Task Group 1 | | 134,920 | | | 1,154,915 |

| | | | | | 2,035,338 |

| SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT - 10.8% | | | | | |

| Aehr Test Systems 1 | | 79,500 | | | 596,250 |

| Amtech Systems 1 | | 65,487 | | | 478,055 |

| Axcelis Technologies 1 | | 20,000 | | | 1,096,800 |

| AXT 1 | | 189,100 | | | 1,108,126 |

| Camtek 1 | | 39,752 | | | 988,235 |

| Cohu 1 | | 39,400 | | | 1,093,350 |

| CyberOptics Corporation 1 | | 30,037 | | | 1,049,493 |

| Ichor Holdings 1 | | 35,000 | | | 909,300 |

| Nova 1,2 | | 11,300 | | | 1,000,389 |

| NVE Corporation | | 18,100 | | | 843,822 |

| PDF Solutions 1 | | 45,200 | | | 972,252 |

| Photronics 1 | | 86,000 | | | 1,675,280 |

| Ultra Clean Holdings 1 | | 33,600 | | | 1,000,272 |

| | | | | | 12,811,624 |

| SOFTWARE - 1.1% | | | | | |

| Agilysys 1 | | 28,900 | | | 1,366,103 |

| TECHNOLOGY HARDWARE, STORAGE & PERIPHERALS - 1.4% | | | |

| AstroNova 1 | | 90,862 | | | 1,088,527 |

| Intevac 1 | | 110,681 | | | 535,696 |

| | | | | | 1,624,223 |

| Total (Cost $24,805,986) | | | | | 29,707,191 |

| | | | | | |

| MATERIALS – 4.4% | | | | | |

| CHEMICALS - 0.4% | | | | | |

| Aspen Aerogels 1 | | 44,917 | | | 443,780 |

| METALS & MINING - 4.0% | | | | | |

| Altius Minerals | | 52,600 | | | 741,271 |

| Ferroglobe 1 | | 84,300 | | | 500,742 |

| Haynes International | | 35,770 | | | 1,172,183 |

| Major Drilling Group International 1 | | 183,600 | | | 1,287,995 |

| Universal Stainless & Alloy Products 1 | | 140,247 | | | 1,037,828 |

| | | | | | 4,740,019 |

| Total (Cost $4,885,695) | | | | | 5,183,799 |

| | | | | | |

| REAL ESTATE – 0.6% | | | | | |

| REAL ESTATE MANAGEMENT & DEVELOPMENT - 0.6% | | | | | |

| FRP Holdings 1 | | 12,240 | | | 738,684 |

| Total (Cost $202,768) | | | | | 738,684 |

| | | | | | |

| TOTAL COMMON STOCKS | | | | | |

| (Cost $104,062,485) | | | | | 113,227,576 |

| THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS | Royce Capital Fund 2022 Semiannual Report to Shareholders | 11 |

| Schedule of Investments | June 30, 2022 (unaudited) |

Royce Capital Fund - Micro-Cap Portfolio (continued)

| | | VALUE |

| | | |

| REPURCHASE AGREEMENT– 4.6% | | |

| Fixed Income Clearing Corporation, 0.24% dated 6/30/22, due 7/1/22, maturity value $5,519,359 (collateralized by obligations of various U.S. Government Agencies, 3.25% due 6/30/27, valued at $5,629,794) |

| (Cost $5,519,322) | $ | 5,519,322 |

| | | |

| TOTAL INVESTMENTS – 99.9% | | |

| (Cost $109,581,807) | | 118,746,898 |

| | | |

| CASH AND OTHER ASSETS LESS LIABILITIES – 0.1% | | 92,514 |

| | | |

| NET ASSETS – 100.0% | $ | 118,839,412 |

ADR- American Depository Receipt

| 2 | All or a portion of these securities were on loan as of June 30, 2022. |

| 3 | Securities for which market quotations are not readily available represent 0.3% of net assets. These securities have been valued at their fair value under procedures approved by the Fund’s Board of Trustees. These securities are defined as Level 3 securities due to the use of significant unobservable inputs in the determination of fair value. See Notes to Financial Statements. |

| 4 | These securities are defined as Level 2 securities due to fair value being based on quoted prices for similar securities and/or due to the application of fair value factors. See Notes to Financial Statements. |

Bold indicates the Fund’s 20 largest equity holdings in terms of June 30, 2022, market value.

| 12 | Royce Capital Fund 2022 Semiannual Report to Shareholders | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS |

This page is intentionally left blank.

Royce Capital Fund 2022 Semiannual Report to Shareholders | 13

MANAGER’S DISCUSSION (UNAUDITED)

Royce Capital Fund–Small-Cap Portfolio (RCS)

Jay Kaplan, CFA

FUND PERFORMANCE

Royce Capital Fund–Small-Cap Portfolio fell 19.0% for the year-to-date period ended 6/30/22 versus a 17.3% decline for its primary benchmark, the Russell 2000 Value Index, and a loss of 23.4% for the Russell 2000, its secondary benchmark for the same period. The portfolio outperformed both small-cap indexes for the one-, 25-year, and since inception (12/27/96) periods ended 6/30/22. In addition, its relative performance improved through the first half of 2022. After substantially trailing the Russell 2000 Value in 1Q22—down 9.1% versus a loss of 2.4%—the Fund fell 10.9% versus a decline of 15.3% for its primary benchmark in 2Q22.

What Worked… And What Didn’t

Seven of the portfolio’s nine equity sectors had a negative impact on year-to-date performance. The sectors making the largest detractions were Consumer Discretionary, Information Technology, and Industrials. Health Care and Consumer Staples (along with a contribution from the Fund’s cash holdings) made the only positive impact while Communication Services had the smallest negative effect. At the industry level, specialty retail, household durables (both in Consumer Discretionary), and electronic equipment, instruments & components (Information Technology) detracted most for the year-to-date period, while pharmaceuticals (Health Care), entertainment (Communication Services), and IT services (Information Technology) were the largest contributors.

The portfolio’s top detractor at the position level in the first half of 2022 was family footwear retailer Shoe Carnival. The company continues to execute well, in particular compared to its competitors, by reducing costs, opening new stores, and renovating older sites. Shoe Carnival also released strong 1Q22 earnings in May and maintained its top-line guidance, but saw its shares fall amidst the inhospitable climate for retailers. We held shares at the end of June. Rent-A-Center operates rent-to-own stores. Investors shied away from its stock after the company said that both the end of Covid relief funds and rising inflation would likely hurt its customers’ ability to buy and/or make payments. We were equally concerned about how the company’s 2021 acquisition of lease-to-own solutions provider Acima Holdings put leverage on Rent-A-Center’s balance sheet while also adding credit losses to recent financial results. We sold the last of our shares in March.

The top contributor at the position level was SIGA Technologies, which sells a treatment for smallpox that has also been approved in some countries to treat monkey pox. Its growth has historically been lumpy, driven by government contracts by which purchases of SIGA’s TPOXX smallpox treatment are made in large amounts to stockpile. More recently, however, the monkey pox outbreak has attracted a fresh round of investor interest in its shares. We trimmed our stake in the first half. BioDelivery Sciences International is a specialty pharmaceutical company that makes pain management and neurology products that treat patients living with serious and complex conditions such as chronic pain and acute migraines. In February, Collegium Pharmaceutical, which we also hold and which also specializes in pain management medicines, announced it would acquire BioDelivery at a sizable premium, leading us to begin selling our position.

The portfolio’s disadvantage versus the Russell 2000 Value came entirely from sector allocation in the year-to-date period; stock selection was additive, though not enough to outweigh the effects of sector positioning. Both our substantially larger exposure and stock picks hurt relative results in Consumer Discretionary. Our low weighting in Energy and lack of exposure to Utilities also made an appreciable negative impact versus the benchmark. Conversely, savvy stock selection boosted relative performance in Health Care. Stock picking and our lower weighting in Communication Services also helped results versus the small-cap value index, as did stock selection in Information Technology.

| | | | | | | |

| | Top Contributors to Performance | | | Top Detractors from Performance | | |

| | Year-to-Date Through 6/30/22 (%)1 | | | Year-to-Date Through 6/30/22 (%)2 | | |

| | | | | | | |

| | SIGA Technologies | 0.68 | | Shoe Carnival | -0.95 | |

| | BioDelivery Sciences International | 0.64 | | Rent-A-Center | -0.92 | |

| | Resources Connection | 0.28 | | OneWater Marine Cl. A | -0.91 | |

| | IBEX | 0.16 | | American Eagle Outfitters | -0.83 | |

| | Dorchester Minerals L.P. | 0.14 | | ArcBest | -0.71 | |

| | 1 Includes dividends | | | 2 Net of dividends | | |

| | | | | | | |

CURRENT POSITIONING AND OUTLOOK

We typically adhere to the wisdom in the adage, “Don’t fight the Fed.” However, as the Fed continues to raise rates—and may do so even more aggressively in its attempts to curb inflation—the yield curve has been flipping back and forth from inversion and ended June nearly flat. In addition, credit spreads keep widening, commodity prices have softened, and the bond market is signaling that the economy may be headed for recession—though we may already be there. Needless to say, this has made for a highly challenging investment environment, made even more difficult by the market’s downward moves, which are casting doubt on many earnings estimates. We will be paying especially close attention to any changes in guidance from last quarter once earnings announcements begin in mid-July. With the economic outlook unpromising, several small-cap companies with what seem like transitory issues to us have become attractively inexpensive. We have been focusing primarily on those that combine strong fundamentals—particularly low-debt balance sheets and positive cash flows—with effective operations and execution as well as tangible evidence of efforts to improve their business through the current uncertain period. During the first half, we increased our exposure to certain areas in Information Technology—most notably semiconductor and component makers and contract manufacturers—and Energy while reducing our weightings in big-ticket consumer areas such as boats and housing.

14 | Royce Capital Fund 2022 Semiannual Report to Shareholders

| PERFORMANCE AND PORTFOLIO REVIEW (UNAUDITED) | TICKER SYMBOLS RCPFX RCSSX |

Performance and Expenses

Average Annual Total Return (%) Through 6/30/22

| | JAN-JUN 20221 | 1-YR | 3-YR | 5-YR | 10-YR | 15-YR | 20-YR | 25-YR | SINCE INCEPTION (12/27/96) |

| RCS | -19.02 | -15.52 | 1.93 | 2.98 | 5.83 | 4.31 | 6.86 | 8.66 | 8.96 |

| Annual Gross Operating Expenses: 1.11% Annual Net Operating Expenses: 1.08% |

1 Not annualized

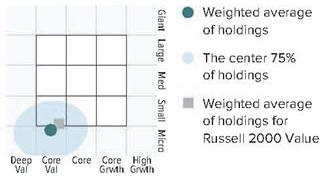

Morningstar Style Map™ As of 6/30/22

The Morningstar Style Map is the Morningstar Style Box™ with the center 75% of fund holdings plotted as the Morningstar Ownership Zone™. The Morningstar Style Box is designed to reveal a fund’s investment strategy. The Morningstar Ownership Zone provides detail about a portfolio’s investment style by showing the range of stock sizes and styles. The Ownership Zone is derived by plotting each stock in the portfolio within the proprietary Morningstar Style Box. Over time, the shape and location of a fund’s ownership zone may vary. See page 32 for additional information.

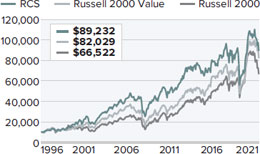

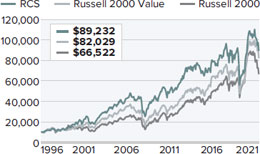

Value of $10,000

Invested on 12/27/96 as of 6/30/22 ($)

Includes reinvestment of distributions.

Top 10 Positions

% of Net Assets

| Resources Connection | 1.7 |

| Lincoln Educational Services | 1.7 |

| Catalyst Pharmaceuticals | 1.6 |

| Sanmina Corporation | 1.6 |

| Kimball Electronics | 1.6 |

| Schneider National Cl. B | 1.6 |

| ArcBest | 1.5 |

| TD SYNNEX | 1.5 |

| Amkor Technology | 1.5 |

| ePlus | 1.5 |

Portfolio Sector Breakdown

% of Net Assets

| Information Technology | 23.4 |

| Financials | 20.4 |

| Industrials | 18.6 |

| Consumer Discretionary | 13.9 |

| Health Care | 8.3 |

| Energy | 6.3 |

| Communication Services | 2.9 |

| Consumer Staples | 1.8 |

| Real Estate | 1.5 |

| Cash and Cash Equivalents | 2.9 |

Calendar Year Total Returns (%)

| YEAR | RCS |

| 2021 | 28.8 |

| 2020 | -7.2 |

| 2019 | 18.7 |

| 2018 | -8.3 |

| 2017 | 5.4 |

| 2016 | 21.0 |

| 2015 | -11.8 |

| 2014 | 3.2 |

| 2013 | 34.8 |

| 2012 | 12.5 |

| 2011 | -3.3 |

| 2010 | 20.5 |

| 2009 | 35.2 |

| 2008 | -27.2 |

| 2007 | -2.1 |

Upside/Downside Capture Ratios

Periods Ended 6/30/22 (%)

| | UPSIDE | DOWNSIDE |

| 10-Year | 84 | 100 |

| From 12/31/96 (Start of Fund’s First Full Quarter) | 97 | 92 |

Portfolio Diagnostics

| Fund Net Assets | $223 million |

| Number of Holdings | 97 |

| Turnover Rate | 34% |

| Average Market Capitalization1 | $1,069 million |

| Weighted Average P/B Ratio2 | 1.5x |

| Active Share3 | 96% |

| U.S. Investments (% of Net Assets) | 94.6% |

| Non-U.S. Investments (% of Net Assets) | 2.5% |

| 1 | Geometric Average. This weighted calculation uses each portfolio holding’s market cap in a way designed to not skew the effect of very large or small holdings; instead, it aims to better identify the portfolio’s center, which Royce believes offers a more accurate measure of average market cap than a simple mean or median. |

| 2 | Harmonic Average. This weighted calculation evaluates a portfolio as if it were a single stock and measures it overall. It compares the total market value of the portfolio to the portfolio’s share in the earnings or book value, as the case may be, of its underlying stocks. |

| 3 | Active Share is the sum of the absolute values of the different weightings of each holding in the Fund versus each holding in the benchmark, divided by two. |

Important Performance and Expense Information

All performance information in this Report reflects past performance, is presented on a total return basis, reflects the reinvestment of distributions, and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when redeemed. Current performance may be higher or lower than performance quoted. The Fund’s total returns do not reflect any deduction for charges or expenses of the variable contracts investing in the Fund. Returns as of the most recent month-end may be obtained at www.royceinvest.com. All performance and risk information reflects the result of the Investment Class (its oldest class). Shares of RCS’s Service Class bear an annual distribution expense that is not borne by the Investment Class; if those expenses were reflected, total returns would have been lower. Gross operating expenses reflect the Fund’s total gross operating expenses for the Investment Class and include management fees and other expenses. Net operating expenses reflect contractual fee waivers and/or expense reimbursements. All expense information is reported as of the Fund’s most current prospectus. Royce & Associates has contractually agreed, without right of termination, to waive fees and/or reimburse expenses to the extent necessary to maintain the Investment Class’s net annual operating expenses (excluding brokerage commissions, taxes, interest, litigation expenses, acquired fund fees and expenses, and other expenses not borne in the ordinary course of business) at or below 1.08% through April 30, 2023. Regarding the “Top Contributors” and “Top Detractors” tables shown above, the sum of all contributors to, and all detractors from, performance for all securities in the portfolio would approximate the Fund’s year-to-date performance for 2022. Upside Capture Ratio measures a manager’s performance in up markets relative to the Fund’s benchmark (Russell 2000 Value). It is calculated by measuring the Fund’s performance in quarters when the benchmark went up and dividing it by the benchmark’s return in those quarters. Downside Capture Ratio measures a manager’s performance in down markets relative to the Fund’s benchmark. It is calculated by measuring the Fund’s performance in quarters when the benchmark goes down and dividing it by the benchmark’s return in those quarters.

Royce Capital Fund 2022 Semiannual Report to Shareholders | 15

Schedule of Investments

Royce Capital Fund - Small-Cap Portfolio

Common Stocks – 97.1%

| | | SHARES | | | VALUE | |

| | | | | | | | | |

| COMMUNICATION SERVICES – 2.9% | | | | | | | | |

| ENTERTAINMENT - 1.1% | | | | | | | | |

| SciPlay Corporation Cl. A 1 | | | 183,300 | | | $ | 2,560,701 | |

| MEDIA - 1.8% | | | | | | | | |

| Entravision Communications Cl. A | | | 490,242 | | | | 2,235,504 | |

| Saga Communications Cl. A | | | 68,413 | | | | 1,700,063 | |

| | | | | | | | 3,935,567 | |

| Total (Cost $7,611,298) | | | | | | | 6,496,268 | |

| | | | | | | | | |

| CONSUMER DISCRETIONARY – 13.9% | | | | | | | | |

| DIVERSIFIED CONSUMER SERVICES - 1.7% | | | | | | | | |

| Lincoln Educational Services 1 | | | 584,466 | | | | 3,687,980 | |

| HOTELS, RESTAURANTS & LEISURE - 1.1% | | | | | | | | |

| †Bloomin’ Brands | | | 147,200 | | | | 2,446,464 | |

| HOUSEHOLD DURABLES - 3.0% | | | | | | | | |

| La-Z-Boy | | | 59,650 | | | | 1,414,301 | |

| M/I Homes 1 | | | 35,624 | | | | 1,412,848 | |

| Meritage Homes 1 | | | 13,307 | | | | 964,757 | |

| PulteGroup | | | 72,750 | | | | 2,883,083 | |

| | | | | | | | 6,674,989 | |

| LEISURE PRODUCTS - 1.3% | | | | | | | | |

| Malibu Boats Cl. A 1 | | | 25,618 | | | | 1,350,325 | |

| MasterCraft Boat Holdings 1 | | | 74,134 | | | | 1,560,521 | |

| | | | | | | | 2,910,846 | |

| SPECIALTY RETAIL - 5.1% | | | | | | | | |

| Aaron’s Company (The) | | | 45,086 | | | | 656,001 | |

| American Eagle Outfitters | | | 150,753 | | | | 1,685,419 | |

| Container Store Group (The) 1 | | | 243,008 | | | | 1,513,940 | |

| Haverty Furniture | | | 61,500 | | | | 1,425,570 | |

| Lazydays Holdings 1 | | | 164,468 | | | | 1,937,433 | |

| OneWater Marine Cl. A 1 | | | 40,833 | | | | 1,349,531 | |

| Shoe Carnival | | | 127,825 | | | | 2,762,298 | |

| | | | | | | | 11,330,192 | |

| TEXTILES, APPAREL & LUXURY GOODS - 1.7% | | | | | | | | |

| Carter’s | | | 32,566 | | | | 2,295,252 | |

| †Skechers U.S.A. Cl. A 1 | | | 44,700 | | | | 1,590,426 | |

| | | | | | | | 3,885,678 | |

| Total (Cost $35,472,585) | | | | | | | 30,936,149 | |

| | | | | | | | | |

| CONSUMER STAPLES – 1.8% | | | | | | | | |

| FOOD & STAPLES RETAILING - 1.8% | | | | | | | | |

| †Ingles Markets Cl. A | | | 20,600 | | | | 1,787,050 | |

| Village Super Market Cl. A | | | 101,276 | | | | 2,310,106 | |

| Total (Cost $4,092,883) | | | | | | | 4,097,156 | |

| | | | | | | | | |

| ENERGY – 6.3% | | | | | | | | |

| OIL, GAS & CONSUMABLE FUELS - 6.3% | | | | | | | | |

| †Chord Energy | | | 18,695 | | | | 2,274,247 | |

| Civitas Resources | | | 47,300 | | | | 2,473,317 | |

| Dorchester Minerals L.P. | | | 114,805 | | | | 2,738,099 | |

| †Matador Resources | | | 40,000 | | | | 1,863,600 | |

| †SilverBow Resources 1 | | | 79,596 | | | | 2,257,343 | |

| †Whiting Petroleum | | | 34,600 | | | | 2,353,838 | |

| Total (Cost $13,830,231) | | | | | | | 13,960,444 | |

| | | | | | | | | |

| FINANCIALS – 20.4% | | | | | | | | |

| BANKS - 8.2% | | | | | | | | |

| Ames National | | | 18,134 | | | | 402,212 | |

| †Bank of Princeton | | | 60,161 | | | | 1,652,021 | |

| Camden National | | | 8,738 | | | | 384,909 | |

| Chemung Financial | | | 28,286 | | | | 1,329,442 | |

| Citizens Community Bancorp | | | 127,582 | | | | 1,764,459 | |

| CNB Financial | | | 69,552 | | | | 1,682,463 | |

| Financial Institutions | | | 64,263 | | | | 1,672,123 | |

| Landmark Bancorp | | | 45,711 | | | | 1,158,317 | |

| †Mid Penn Bancorp | | | 65,660 | | | | 1,770,850 | |

| MidWestOne Financial Group | | | 40,739 | | | | 1,210,763 | |

| National Bankshares | | | 88,344 | | | | 2,774,002 | |

| Unity Bancorp | | | 94,008 | | | | 2,489,332 | |

| | | | | | | | 18,290,893 | |

| CAPITAL MARKETS - 3.5% | | | | | | | | |

| Evercore Cl. A | | | 35,600 | | | | 3,332,516 | |

| Houlihan Lokey Cl. A | | | 21,142 | | | | 1,668,738 | |

| Moelis & Company Cl. A | | | 69,401 | | | | 2,730,929 | |

| | | | | | | | 7,732,183 | |

| INSURANCE - 4.9% | | | | | | | | |

| CNO Financial Group | | | 118,930 | | | | 2,151,444 | |

| Employers Holdings | | | 80,134 | | | | 3,356,813 | |

| James River Group Holdings | | | 94,084 | | | | 2,331,402 | |

| Tiptree | | | 291,644 | | | | 3,097,259 | |

| | | | | | | | 10,936,918 | |

| THRIFTS & MORTGAGE FINANCE - 3.8% | | | | | | | | |

| Southern Missouri Bancorp | | | 38,384 | | | | 1,737,260 | |

| Timberland Bancorp | | | 111,870 | | | | 2,796,750 | |

| TrustCo Bank Corp NY | | | 75,677 | | | | 2,333,878 | |

| †Western New England Bancorp | | | 211,372 | | | | 1,576,835 | |

| | | | | | | | 8,444,723 | |

| Total (Cost $41,076,613) | | | | | | | 45,404,717 | |

| | | | | | | | | |

| HEALTH CARE – 8.3% | | | | | | | | |

| BIOTECHNOLOGY - 3.3% | | | | | | | | |

| Catalyst Pharmaceuticals 1 | | | 523,338 | | | | 3,668,600 | |

| Ironwood Pharmaceuticals Cl. A 1 | | | 292,411 | | | | 3,371,499 | |

| Vanda Pharmaceuticals 1 | | | 18,577 | | | | 202,489 | |

| | | | | | | | 7,242,588 | |

| HEALTH CARE PROVIDERS & SERVICES - 3.3% | | | | | | | | |

| Cross Country Healthcare 1 | | | 159,275 | | | | 3,317,698 | |

| Ensign Group (The) | | | 13,564 | | | | 996,547 | |

| Molina Healthcare 1 | | | 10,900 | | | | 3,047,749 | |

| | | | | | | | 7,361,994 | |

| PHARMACEUTICALS - 1.7% | | | | | | | | |

| Collegium Pharmaceutical 1 | | | 159,230 | | | | 2,821,556 | |

| SIGA Technologies | | | 84,099 | | | | 973,866 | |

| | | | | | | | 3,795,422 | |

| Total (Cost $15,645,020) | | | | | | | 18,400,004 | |

| | | | | | | | | |

| INDUSTRIALS – 18.6% | | | | | | | | |

| BUILDING PRODUCTS - 2.7% | | | | | | | | |

| Builders FirstSource 1 | | | 19,130 | | | | 1,027,281 | |

| Quanex Building Products | | | 127,223 | | | | 2,894,323 | |

| UFP Industries | | | 31,500 | | | | 2,146,410 | |

| | | | | | | | 6,068,014 | |

| CONSTRUCTION & ENGINEERING - 3.5% | | | | | | | | |

| Northwest Pipe 1 | | | 58,007 | | | | 1,736,730 | |

| Primoris Services | | | 129,890 | | | | 2,826,406 | |

| Sterling Infrastructure 1 | | | 152,049 | | | | 3,332,914 | |

| | | | | | | | 7,896,050 | |

| ELECTRICAL EQUIPMENT - 0.8% | | | | | | | | |

| †Preformed Line Products | | | 27,825 | | | | 1,711,237 | |

| 16 | Royce Capital Fund 2022 Semiannual Report to Shareholders | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS |

June 30, 2022 (unaudited)

Royce Capital Fund - Small-Cap Portfolio (continued)

| | | SHARES | | | VALUE | |

| | | | | | | | | |

| INDUSTRIALS (continued) | | | | | | | | |

| PROFESSIONAL SERVICES - 6.8% | | | | | | | | |

| Barrett Business Services | | | 33,648 | | | $ | 2,451,930 | |

| Heidrick & Struggles International | | | 98,889 | | | | 3,200,048 | |

| Kforce | | | 37,814 | | | | 2,319,511 | |

| Korn Ferry | | | 42,435 | | | | 2,462,079 | |

| †Mastech Digital 1 | | | 61,182 | | | | 909,164 | |

| Resources Connection | | | 183,602 | | | | 3,739,973 | |

| | | | | | | | 15,082,705 | |

| ROAD & RAIL - 4.8% | | | | | | | | |

| ArcBest | | | 48,949 | | | | 3,444,541 | |

| Heartland Express | | | 123,567 | | | | 1,718,817 | |

| Schneider National Cl. B | | | 155,500 | | | | 3,480,090 | |

| Werner Enterprises | | | 53,750 | | | | 2,071,525 | |

| | | | | | | | 10,714,973 | |

| Total (Cost $34,673,055) | | | | | | | 41,472,979 | |

| | | | | | | | | |

| INFORMATION TECHNOLOGY – 23.4% | | | | | | | | |

| COMMUNICATIONS EQUIPMENT - 1.0% | | | | | | | | |

| †Aviat Networks 1 | | | 93,314 | | | | 2,336,583 | |

| ELECTRONIC EQUIPMENT, INSTRUMENTS & COMPONENTS - 12.8% | | | | | | | | |

| ePlus 1 | | | 63,888 | | | | 3,393,731 | |

| Flex 1 | | | 223,100 | | | | 3,228,257 | |

| Insight Enterprises 1 | | | 26,454 | | | | 2,282,451 | |

| Jabil | | | 64,500 | | | | 3,303,045 | |

| Kimball Electronics 1 | | | 178,216 | | | | 3,582,142 | |

| PC Connection | | | 53,505 | | | | 2,356,895 | |

| Sanmina Corporation 1 | | | 88,143 | | | | 3,590,064 | |

| TD SYNNEX | | | 37,642 | | | | 3,429,186 | |

| Vishay Intertechnology | | | 189,261 | | | | 3,372,631 | |

| | | | | | | | 28,538,402 | |

| IT SERVICES - 1.8% | | | | | | | | |

| †Computer Task Group 1 | | | 188,320 | | | | 1,612,019 | |

| IBEX 1 | | | 141,460 | | | | 2,386,430 | |

| | | | | | | | 3,998,449 | |

| SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT - 6.7% | | | | | | | | |

| †Alpha & Omega Semiconductor 1 | | | 52,900 | | | | 1,763,686 | |

| Amkor Technology | | | 200,484 | | | | 3,398,204 | |

| Cohu 1 | | | 111,260 | | | | 3,087,465 | |

| Kulicke & Soffa Industries | | | 76,413 | | | | 3,271,241 | |

| MKS Instruments | | | 15,091 | | | | 1,548,789 | |

| Ultra Clean Holdings 1 | | | 62,838 | | | | 1,870,687 | |

| | | | | | | | 14,940,072 | |

| SOFTWARE - 1.1% | | | | | | | | |

| Xperi Holding Corporation | | | 164,000 | | | | 2,366,520 | |

| Total (Cost $47,367,860) | | | | | | | 52,180,026 | |

| REAL ESTATE – 1.5% | | | | | | |

| REAL ESTATE MANAGEMENT & DEVELOPMENT - 1.5% | | | | | | |

| Marcus & Millichap | | | 45,625 | | | | 1,687,669 | |

| †RMR Group (The) Cl. A | | | 59,522 | | | | 1,687,448 | |

| Total (Cost $3,338,975) | | | | | | | 3,375,117 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $203,108,520) | | | | | | | 216,322,860 | |

| | | | | | | | | |

REPURCHASE AGREEMENT– 3.0%

Fixed Income Clearing Corporation, 0.24% dated 6/30/22, due 7/1/22, maturity value $6,604,774 (collateralized by obligations of various U.S. Government Agencies, 3.25% due 6/30/27, valued at $6,736,887)

| (Cost $6,604,730) | | | 6,604,730 | |

| | | | | |

| TOTAL INVESTMENTS – 100.1% | | | | |

| (Cost $209,713,250) | | | 222,927,590 | |

| LIABILITIES LESS CASH AND OTHER ASSETS – (0.1)% | | | (169,423 | ) |

| | | | | |

| NET ASSETS – 100.0% | | $ | 222,758,167 | |

Bold indicates the Fund’s 20 largest equity holdings in terms of June 30, 2022, market value.

| THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS | Royce Capital Fund 2022 Semiannual Report to Shareholders | 17 |

| Statements of Assets and Liabilities | June 30, 2022 (unaudited) |

| | | Micro-Cap

Portfolio | | | Small-Cap

Portfolio | |

| ASSETS: | | | | | | |

| Investments at value (including collateral on loaned securities)1 | | $ | 113,227,576 | | | $ | 216,322,860 | |

| Repurchase agreements (at cost and value) | | | 5,519,322 | | | | 6,604,730 | |

| Foreign currency2 | | | 10,382 | | | | – | |

| Receivable for investments sold | | | – | | | | 352,081 | |

| Receivable for capital shares sold | | | 386,831 | | | | 12,544 | |

| Receivable for dividends and interest | | | 15,034 | | | | 132,416 | |

| Receivable for securities lending income | | | 226 | | | | 4 | |

| Prepaid expenses and other assets | | | 3,784 | | | | 7,754 | |

| Total Assets | | | 119,163,155 | | | | 223,432,389 | |

| LIABILITIES: | | | | | | | | |

| Payable for investments purchased | | | 61,890 | | | | 160,365 | |

| Payable for capital shares redeemed | | | 55,173 | | | | 178,948 | |

| Payable for investment advisory fees | | | 118,668 | | | | 179,933 | |

| Payable for trustees’ fees | | | 10,620 | | | | 21,751 | |

| Accrued expenses | | | 77,392 | | | | 133,225 | |

| Total Liabilities | | | 323,743 | | | | 674,222 | |

| Net Assets | | $ | 118,839,412 | | | $ | 222,758,167 | |

| ANALYSIS OF NET ASSETS: | | | | | | | | |

| Paid-in capital | | $ | 66,337,779 | | | $ | 182,532,195 | |

| Total distributable earnings (loss) | | | 52,501,633 | | | | 40,225,972 | |

| Net Assets | | $ | 118,839,412 | | | $ | 222,758,167 | |

| Investment Class | | $ | 106,087,250 | | | $ | 132,604,741 | |

| Service Class | | | 12,752,162 | | | | 90,153,426 | |

| SHARES OUTSTANDING (unlimited number of $.001 par value): | | | | | | | | |

| Investment Class | | | 9,990,066 | | | | 17,413,395 | |

| Service Class | | | 1,235,321 | | | | 12,128,536 | |

| NET ASSET VALUES (Net Assets ÷ Shares Outstanding): | | | | | | | | |

| (offering and redemption price per share) | | | | | | | | |

| Investment Class | | | $10.62 | | | | $7.62 | |

| Service Class | | | 10.32 | | | | 7.43 | |

| Investments at identified cost | | $ | 104,062,485 | | | $ | 203,108,520 | |

| Market value of loaned securities3 | | | 2,598,681 | | | | – | |

| 1 | See Notes to Financial Statements for information on non-cash collateral on loaned securities. |

| 2 | The cost of foreign currency is $10,380 for Micro-Cap Portfolio. |

| 3 | Market value of loaned securities backed by non-cash collateral is as of prior business day. |

| 18 | Royce Capital Fund 2022 Semiannual Report to Shareholders | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS |

| Statements of Operations | Six Months Ended June 30, 2022 (unaudited) |

| | | Micro-Cap

Portfolio | | | Small-Cap

Portfolio | |

| INVESTMENT INCOME: | | | | | | | | |

| INCOME: | | | | | | | | |

| Dividends | | $ | 519,900 | | | $ | 2,224,719 | |

| Foreign withholding tax | | | (10,458 | ) | | | – | |

| Interest | | | 890 | | | | 1,023 | |

| Securities lending | | | 7,485 | | | | 365 | |

| Total income | | | 517,817 | | | | 2,226,107 | |

| EXPENSES: | | | | | | | | |

| Investment advisory fees | | | 888,135 | | | | 1,347,026 | |

| Distribution fees | | | 21,061 | | | | 147,372 | |

| Administrative and office facilities | | | 44,858 | | | | 82,185 | |

| Trustees’ fees | | | 19,895 | | | | 39,466 | |

| Audit | | | 16,891 | | | | 16,304 | |

| Custody | | | 15,998 | | | | 27,665 | |

| Shareholder reports | | | 8,105 | | | | 12,685 | |

| Shareholder servicing | | | 7,867 | | | | 7,570 | |

| Legal | | | 4,171 | | | | 8,625 | |

| Other expenses | | | 6,178 | | | | 11,758 | |

| Total expenses | | | 1,033,159 | | | | 1,700,656 | |

| Compensating balance credits | | | (2 | ) | | | (9 | ) |

| Fees waived by investment adviser | | | (51,704 | ) | | | (83,189 | ) |

| Expenses reimbursed by investment adviser | | | (15,436 | ) | | | (15,323 | ) |

| Net expenses | | | 966,017 | | | | 1,602,135 | |

| Net investment income (loss) | | | (448,200 | ) | | | 623,972 | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY: | | | | | | | | |

| NET REALIZED GAIN (LOSS): | | | | | | | | |

| Investments | | | 3,874,928 | | | | 20,601,888 | |

| Foreign currency transactions | | | (3,161 | ) | | | – | |

| NET CHANGE IN UNREALIZED APPRECIATION (DEPRECIATION): | | | | | | | | |

| Investments | | | (52,224,790 | ) | | | (82,240,497 | ) |

| Other assets and liabilities denominated in foreign currency | | | (84 | ) | | | – | |

| Net realized and unrealized gain (loss) on investments and foreign currency | | | (48,353,107 | ) | | | (61,638,609 | ) |

| NET INCREASE (DECREASE) IN NET ASSETS FROM INVESTMENT OPERATIONS | | $ | (48,801,307 | ) | | $ | (61,014,637 | ) |

| THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS | Royce Capital Fund 2022 Semiannual Report to Shareholders | 19 |

Statements of Changes in Net Assets

| | | Micro-Cap Portfolio | | | Small-Cap Portfolio | |

| | | Six Months Ended

6/30/22 (unaudited) | | | Year Ended 12/31/21 | | | Six Months Ended

6/30/22 (unaudited) | | | Year Ended 12/31/21 | |

| INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | $ | (448,200 | ) | | $ | (1,126,184 | ) | | $ | 623,972 | | | $ | 851,477 | |

| Net realized gain (loss) on investments and foreign currency | | | 3,871,767 | | | | 41,059,554 | | | | 20,601,888 | | | | 73,334,166 | |