UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-07537

Name of Registrant: Royce Capital Fund

Address of Registrant: 745 Fifth Avenue

New York, NY 10151

Name of agent for service: John E. Denneen, Esquire

Address of agent for service: 745 Fifth Avenue

New York, NY 10151

Registrant's telephone number, including area code: (212) 508-4500

Date of fiscal year end: December 31

Date of reporting period: January 1, 2023 – December 31, 2023

| Item 1. | Reports to Shareholders. |

royceinvest.com

Royce Capital Fund 2023 Annual

Review and Report to Shareholders

December 31, 2023

Royce Capital Fund–Micro-Cap Portfolio

Royce Capital Fund–Small-Cap Portfolio

Table of Contents

This page is not part of the Royce Capital Fund 2023 Annual Report to Shareholders | 1

Letter to Our Shareholders

2023: THE DOG THAT DIDN’T BARK

While every year is eventful and interesting in its own right, we think 2023 held particular interest for equity investors—specifically those of us who focus on small-cap stocks. There was no shortage of consequential geopolitical developments. Some, like the war in Ukraine, showed no evidence of ending or abating, while others, like the terrorist attack on Israel and consequent bombings in Gaza, were new events, as were the well publicized implosions of Silicon Valley, Signature, and First Republic Banks. The contagion was contained, however, and the rest the of the economic news was much brighter, at least here in the U.S. The year began with inflation still stubbornly high and, as a consequence, the Fed still hiking rates and committed to doing so until the rate of rising prices slowed. This commitment bred a curious form of cognitive dissonance, with every public statement from a Fed official pledging adherence to the central bank’s target of 2% inflation almost immediately meeting with word from a financial or investment pundit insisting that they really meant 3-4%.

This was understandable to some degree. Many observers pointed to both inflation’s moderating pace (after peaking in June of 2022) and the resilience of the U.S. economy as evidence that the Fed should take a victory lap and leave rates untouched—or cut them. Many investors shared these views while no doubt hoping that the positive returns for equities through the first half of 2023 would not be put at risk by another round of rate hikes. To be sure, some investors were concerned that “higher for longer” might be all it took to snuff out a nascent recovery for stocks. We shared some of this anxiety. After all, 2022 saw the most aggressive rate hike cycle in the Fed’s history. And it was not just a bad year for the capital markets, it was historically awful: the third-worst calendar year performance for both the small-cap Russell 2000 Index and the large-cap Russell 1000 Index since their shared inception date at the end of 1978, with each posting their lowest respective returns since 2008. It was the seventh worst year for the S&P 500 since its inception in 1928, and the worst ever for the Bloomberg Barclays US Aggregate Bond Index since its inception in 1976. As we wrote one year ago, 2022 offered nowhere to run and nowhere to hide.

2 | This page is not part of the Royce Capital Fund 2023 Annual Report to Shareholders

LETTER TO OUR SHAREHOLDERS

The most interesting, and ultimately most significant, element to 2023 was perhaps what did not happen.

The most consistently predicted and regularly anticipated recession—said to be imminent since 2021—

once again failed to materialize in 2023.

In this context, the fear of a second straight down year for stocks, which periodically rattled the U.S. equity markets at various times in 2023, seemed almost logical, hitting small- and large-cap stocks at different points—and with different intensities—throughout the year. However, by the end of December these worries had mostly dissipated. With the Fed holding the line on rates, higher for longer ultimately did not hold back returns. A growing economy, burgeoning optimism about a soft landing for inflation, and confidence that the rate hike cycle had ended combined to lift share prices, as did optimism for rate reductions in 2024. Despite these developments, however, the most interesting, and ultimately most significant, element to 2023 was perhaps what did not happen. The most consistently predicted and regularly anticipated recession—said to be imminent since 2021—once again failed to materialize in 2023. Its absence reminded us of “the curious incident of the dog in the night-time” from the famous Sherlock Holmes story, “The Adventure of Silver Blaze.” The iconic detective solves the case by pointing out how odd it was that the dog guarding the pen where the titular racehorse was stabled failed to bark when Silver Blaze was stolen. The phrase has since been used as shorthand to describe situations when what doesn’t happen matters at least as much, if not more, than what does. Which is about as apt a description of 2023 as we think can be found.

THE STATE OF SMALL-CAP

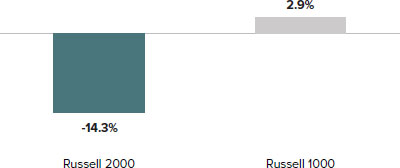

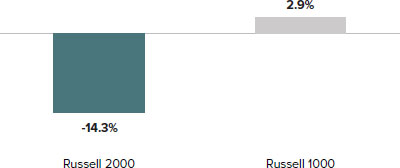

As measured by the Russell 2000 Index, small-cap stocks did quite well in 2023, advancing 16.9%. Yet most of this gain came in a robust rally from the 2023 low on October 31st through the end of the year. So, although small-caps kicked off the year with high returns, they trended mostly downward from early February into Halloween. All told, the Russell 2000 had a positive return in just five months in 2023: January, June, July, November, and December, with the last two months combining to post an impressive gain of 22.4%. Thanks to this exceptional close, the Russell 2000 escaped a bear market at the end of

2023, though the small-cap index remained down -14.3% from its last peak on 11/8/21, while large-caps continued to establish new highs in December and into January 2024. Moreover, as of 12/31/23, the average stock in the small-cap index was -25.1% off its 52-week high. In this context, it was not terribly surprising that small-cap’s excellent finish could not lift its calendar-year return above large-cap’s. The Russell 1000 Index gained 26.5% in 2023 while also beating small-cap for the 3-, 5-, and 10-year periods ended 12/31/23. In fact, large-caps outpaced small-caps in nine of the last 10 calendar years.

Small-Caps Lagged Large-Caps from the Russell 2000’s Last Peak

Russell 2000 and Russell 1000 Cumulative Returns, 11/8/21-12/31/23

Past performance is no guarantee of future results.

This seemingly chronic bout of underperformance has made the current cycle a deeply frustrating one for small-cap investors. At the end of January 2024, 594 days had passed from the current cycle low for the Russell 2000, making it the second longest stretch without recovering its prior peak on record. The two other lengthy small-cap cycles each encompassed dramatic developments: the implosion of high-flying technology stocks in 2000-02, when the Russell 2000 needed 456 days from its trough to match its previous peak, and the 2008-09 Financial Crisis, when 704 days passed before small-caps recovered from the trough during that global financial catastrophe. So, while the current small-cap cycle has taken place amid ample uncertainty along with a record pace of interest rate increases, it

This page is not part of the Royce Capital Fund 2023 Annual Report to Shareholders | 3

LETTER TO OUR SHAREHOLDERS

has lacked the existential threats that characterized the Internet Bubble and, even more so, the Financial Crisis. The latter period also saw less bifurcation between small- and large-cap returns. The key question, then, is when will this cycle end and potentially usher in a small-cap outperformance run? It’s a point we’ll touch on later in this letter.

Within small-cap, both the value and growth indexes had strong finishes to the year, with the 4Q23 advantage squarely in value’s favor: the Russell 2000 Value Index advanced 15.3% versus 12.7% for the Russell 2000 Growth Index. It’s comparatively rare for small-cap value to beat its growth sibling in a positive quarter, particularly one with double-digit gains. It’s happened in only 42 of 119 positive quarters, or 35% of the time since the Russell 2000’s inception on 12/31/78. The Russell 2000 Value also led from the previous 2023 small-cap high on July 31st, up 4.0% versus -0.2% through the end of December. For 2023 as a whole, however, growth led, gaining 18.7% versus 14.6%. It’s worth noting that 2023’s results contributed to something of a sawtooth pattern of relative performance. The Russell 2000 Value led for the 3-year (in which the Russell 2000 Growth lost -3.5%) and 5-year periods while small-cap growth, in addition to its 1-year advantage, also outperformed for the 10-year period ended 12/31/23.

THE VALUATION SITUATION

Reviewing long-term performance patterns, we find that small-cap enjoyed a longstanding advantage over large-cap—just as small-cap value did versus small-cap growth. Each of these dynamics began to shift in the aftermath of the Financial Crisis, starting in earnest in 2011. In eight of the last 13 years, the Russell 1000 and Russell 2000 Growth each had higher returns than both the Russell 2000 and Russell 2000 Value. Yet prior to that, the long-term edge was with the Russell 2000 and Russell 2000 Value. In light of this dominance from large-caps—and more recently mega-cap stocks—it appears that many investors may have forgotten how anomalous the backdrop to the last 13 years has been until just recently, with anemic economic growth and record low interest rates.

Now that both GDP and rates are returning to more historically typical levels, we expect to see some meaningful long-term mean reversion going forward. To that end, large-cap outperformance cycles have historically peaked when a relatively small number of the largest stocks were winning the lion’s share of performance—which was the case with the S&P 500 and the Nasdaq Composite Indexes in 1973 and March 2000.

We therefore see something of a silver lining to the recent relative performance woes for small-cap stocks versus their

Large-Cap Cycles Peak at Market Tops Crowded with Mega-Caps

Weight of Top 5 S&P 500 Stocks vs. Small-Cap Relative Performance, 9/29/72-12/31/23

Source: Furey Research Partners

Past performance is no guarantee of future results.

4 | This page is not part of the Royce Capital Fund 2023 Annual Report to Shareholders

LETTER TO OUR SHAREHOLDERS

Relative Valuations for Small Caps vs. Large Caps Are Near Their Lowest in 25 Years

Russell 2000 vs. Russell 1000 Median LTM EV/EBIT¹ (ex. Negative EBIT Companies), 12/31/98 through 12/31/23

1 Earnings Before Interest and Taxes

Past performance is no guarantee of future results. Source: FactSet

larger peers. The Russell 2000 sported a far more attractive valuation than its large-cap counterpart at the end of last year. Using our preferred index valuation metric of enterprise value to earnings before interest and taxes, or EV/EBIT, the Russell 2000 finished 2023 not far from its 25-year low relative to the Russell 1000.

Similarly, small-cap value continued to sell at a below average valuation compared to small-cap growth at the end of the year, as measured by EV/EBIT. Micro-cap stocks also remain very attractively valued relative to large-cap based on EV/EBIT. As small-cap specialists, we see the combination of more attractive valuations and reversals in long-term performance patterns as showing the significant performance potential that exists for small-cap, small-cap value, and micro-cap stocks—especially when stacked against their large- and mega-cap counterparts.

SMALL-CAP OPPORTUNITIES

To be sure, with the Fed’s decision on 1/31/24 to leave interest rates unchanged for a third consecutive time, the backdrop of normalized interest rates, tamer inflation, and a growing, nicely resilient U.S. economy appears amenable to strong equity performance. It also looks to us that small-cap’s

lengthy stretch in the relative performance wilderness has run its course. Our reasoning is rooted in the notion that, as the economy continues to stabilize, valuations are likely to rise for those businesses that have largely sat out the mega-cap performance regime. Such a move looks more likely to benefit small-cap companies than larger ones. Moreover, the early tracking estimates for real GDP in 1Q24 are highly favorable, and ongoing positive GDP growth brings the U.S. economy that much closer to the Fed’s desired “soft landing.”

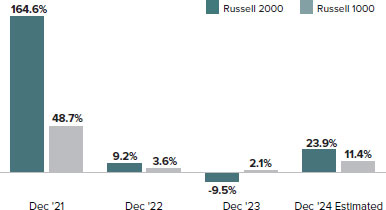

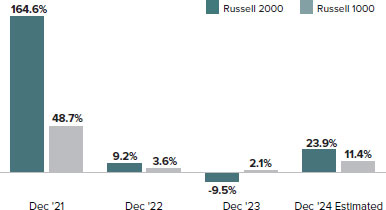

Of course, we are bottom-up stock pickers and portfolio managers, not economists—and we eschew predictions. But we also understand that long-term mean reversion to small-cap leadership requires a catalyst. For all of the encouraging developments, the U.S. economy is at this writing in something of a schizoid condition, with high levels of consumer spending on one hand and a manufacturing and industrial slowdown on the other. Yet in 2024, the U.S. economy will see more tangible benefits from reshoring, the CHIPS Act, and several infrastructure projects. Closer to our zone of expertise, earnings growth for small-cap companies is currently expected to be higher than for larger-cap businesses in 2024.

This page is not part of the Royce Capital Fund 2023 Annual Report to Shareholders | 5

LETTER TO OUR SHAREHOLDERS

We are looking forward to what we think should be a favorable cycle for small-cap stocks

and active management. We are more optimistic about the long-term prospects

for select small-caps than we have been in several years.

Small-Cap’s Estimated Earnings Growth Is Expected to Be Higher in 2024 than Large-Cap’s

One Year EPS Growth as of 12/31/23

Earnings per share (EPS) is calculated as a company’s profit divided by the outstanding shares of its common stock. The EPS Growth Estimates are the pre-calculated mean long-term EPS growth rate estimates by brokerage analysts. Long Term Growth (LTG) is the annual EPS growth that the company can sustain over the next 3 or 5 years. Both estimates are the average of those provided by analysts working for brokerage firms who provide research coverage on each individual security as reported by FactSet. All non-equity securities, investment companies, and companies without brokerage analyst coverage are excluded.

One critical consequence of interest rates normalizing is that access to capital now has real costs—which should benefit conservatively capitalized, fiscally prudent small-cap companies and the asset managers who hold them. The price of carrying

leverage on the balance sheet began to climb when the Fed first started raising rates in March of 2022—and its increased cost means that advantages should accrue to those businesses with low debt, the ability to generate free cash flow, and proven skill allocating capital prudently and effectively. Returns are thus likely to be spread more widely over the next few years, with the reign of the Magnificent 7—the mega-cap cohort of Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla—likely coming to an end and with it, small-cap’s long stretch of underperformance. To be sure, attractively priced, high-quality and/or growing small-cap businesses that have largely sat out the mega-cap performance regime could be clear beneficiaries. To us, this represents a great opportunity for active managers seeking to identify those small-cap businesses best positioned for long-term success. Our outlook is therefore constructive. Of course, we always put the most stock in what we’re hearing from management teams—most of whom remain cautiously optimistic about 2024. We are therefore looking forward to what we think should be a favorable cycle for small-cap stocks and active management. We are more optimistic about the long-term prospects for select small-caps than we have been in several years.

Sincerely,

|  |  | |

| Charles M. Royce | Christopher D. Clark | Francis D. Gannon | |

| Chairman, | Chief Executive Officer, and | Co-Chief Investment Officer, | |

| Royce Investment Partners | Co-Chief Investment Officer, | Royce Investment Partners | |

| January 31, 2024 | Royce Investment Partners | | |

| | | |

6 | This page is not part of the Royce Capital Fund 2023 Annual Report to Shareholders

Performance and Expenses

Performance and Expenses

As of December 31, 2023

| | 1-YR | 3-YR | 5-YR | 10-YR | 15-YR | 20-YR | 25-YR | SINCE

INCEPTION

(12/27/96) | ANNUAL OPERATING

EXPENSES (%) |

| Royce Capital Fund–Micro-Cap Portfolio | 18.78 | 6.19 | 12.13 | 5.53 | 9.73 | 6.69 | 9.36 | 9.58 | 1.16 |

| Royce Capital Fund–Small-Cap Portfolio | 25.93 | 13.78 | 10.17 | 5.61 | 9.91 | 7.94 | 9.55 | 9.83 | 1.15 |

| INDEX | | | | | | | | | |

| Russell Microcap Index | 9.33 | 0.61 | 8.56 | 5.79 | 10.65 | 6.39 | N/A | N/A | N/A |

| Russell 2000 Value Index | 14.65 | 7.94 | 10.00 | 6.76 | 10.27 | 7.68 | 8.58 | N/A | N/A |

| Russell 2000 Index | 16.93 | 2.22 | 9.97 | 7.16 | 11.30 | 8.11 | 7.91 | N/A | N/A |

Important Performance, Expense, and Risk Information

All performance information in this Review and Report reflects past performance, is presented on a total return basis, reflects the reinvestment of distributions, and does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when redeemed. Current performance may be higher or lower than performance quoted and may be obtained at www.royceinvest.com. The Funds’ total returns do not reflect any deduction for charges or expenses of the variable contracts investing in the Funds. All performance and expense information reflects the result for each Fund’s Investment Class Shares. Annual operating expenses reflect the total gross operating expenses for each Fund’s Investment Class as of each Fund’s most current prospectus and include management fees and other expenses. All expense information is reported as of each Fund’s most current prospectus.

Service Class Shares bear an annual distribution expense that is not borne by the Investment Class; if those expenses were reflected, total returns would have been lower. Each series of Royce Capital Fund is subject to market risk—the possibility that common stock prices will decline, sometimes sharply and unpredictably, over short or extended periods of time. Such declines may be caused by various factors, including market, financial, and economic conditions, governmental or central bank actions, and other factors, such as the recent Covid pandemic or the recent conflicts in Ukraine and the Middle East, that may not be directly related to the issuer of a security held by a Fund. These conflicts and the recent pandemic could adversely affect global market, financial, and economic conditions in ways that cannot necessarily be foreseen. Royce Micro-Cap Portfolio invests primarily in micro-cap companies while Royce Small-Cap Portfolio invests primarily in small-cap companies. Investments in micro-cap and small-cap companies may involve considerably more risk than investments in securities of larger-cap companies. (Please see “Primary Risks for Fund Investors” in the prospectus.) Each series of Royce Capital Fund may invest up to 25% of its net assets in foreign securities. Investments in foreign securities may involve political, economic, currency, and other risks not encountered in U.S. investments. (Please see “Investing in Foreign Securities” in the prospectus.) As of 12/31/23, Royce Small-Cap Portfolio invested a significant portion of its assets in a limited number of stocks, which may involve considerably more risk than a more broadly diversified portfolio because a decline in the value of any one of these stocks would cause the Portfolio’s overall value to decline to a greater degree. Royce Micro-Cap Portfolio’s broadly diversified portfolio does not ensure a profit or guarantee against loss. (Please see “Primary Risks for Fund Investors” in the prospectus.) This Review and Report must be preceded or accompanied by a prospectus. Please read the prospectus carefully before investing or sending money. Russell Investment Group is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Russell® is a trademark of Russell Investment Group. The Russell Microcap Index includes 1,000 of the smallest securities in the small-cap Russell 2000 Index along with the next smallest eligible securities as determined by Russell. The Russell 2000 Index is an unmanaged, capitalization-weighted index of domestic small-cap stocks. It measures the performance of the 2,000 smallest publicly traded U.S. companies in the Russell 3000 Index. The Russell 2000 Value Index consists of the respective value stocks within the Russell 2000 as determined by Russell Investments. The performance of an index does not represent exactly any particular investment, as you cannot invest directly in an index. Distributor: Royce Fund Services, LLC.

This page is not part of the Royce Capital Fund 2023 Annual Report to Shareholders | 7

MANAGERS’ DISCUSSION (UNAUDITED)

Royce Capital Fund–Micro-Cap Portfolio (RCM)

Jim Stoeffel

Brendan Hartman

FUND PERFORMANCE

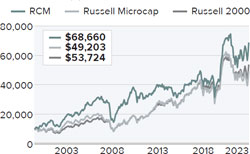

Royce Capital Fund–Micro-Cap Portfolio advanced 18.8% in 2023, beating its primary benchmark, the Russell Microcap Index, which was up 9.3%, and its secondary benchmark, the Russell 2000 Index, which climbed 16.9% for the same period.

The Fund also beat the Russell Microcap for the 3-, 5-, and 20-year, periods ended 12/31/23.

WHAT WORKED… AND WHAT DIDN’T

Seven of the Fund’s 10 equity sectors finished 2023 in the black, led by Industrials, Information Technology, and Consumer Discretionary, while Health Care, Communication Services, and Consumer Staples made small detractions. At the industry level, semiconductors & semiconductor equipment (Information Technology), commercial services & supplies (Industrials), and metals & mining (Materials) contributed most, while health care equipment & supplies (Health Care), professional services (Industrials), and entertainment (Communication Services) were the largest detractors.

The Fund’s top-contributing position was Applied Optoelectronics, which manufactures optical communications products. Microsoft selected the company to provide a significant number of leading-edge components to support Microsoft’s build out of data centers for AI applications. While we were excited about Applied Optoelectronic’s prospects prior to this announcement, we see the relationship as a potential long-term game changer for the company. Modine Manufacturing provides thermal management systems for several industries and was added to the portfolio as a turnaround candidate as the company was moving from its historical core of automotive radiators toward newer high growth opportunities. The shift is now paying dividends as the company sees significant wins in areas such as data centers and electric vehicles. Camtek manufactures metrology and inspection tools for the semiconductor equipment industry. Its Advanced Packaging segment has been benefiting from the shrinking line widths of semiconductors and the corresponding need to stack many semiconductors together to drive improved performance. This phenomenon is even more acute for semiconductors being developed for AI applications, where Camtek is beginning to see significant orders.

| | | | | | | |

| | Top Contributors to Performance | | | Top Detractors from Performance | | |

| | For 2023 (%)1 | | | For 2023 (%)2 | | |

| | Applied Optoelectronics | 2.73 | | Cutera | -1.09 | |

| | Modine Manufacturing | 1.70 | | Clearfield | -0.89 | |

| | Camtek | 1.48 | | DZS | -0.84 | |

| | Universal Stainless & Alloy Products | 1.45 | | Territorial Bancorp | -0.67 | |

| | American Superconductor | 1.30 | | Chicken Soup for the Soul Entertainment Cl. A | -0.59 | |

| | 1 Includes dividends | | | 2 Net of dividends | | |

| | | | | | | |

The Fund’s top detractor was aesthetic medical device maker Cutera, whose acne treatment Aviclear was supposed to drive its business but has been slower to ramp up than anticipated. This combined with weakened demand for aesthetic procedures, which we see as relating to a weakening economy, and the general lack of insurer reimbursement for such procedures, caused the shares to correct meaningfully. Clearfield provides equipment and cable products principally to more rural cable companies. Like many telecom related infrastructure providers, it has been hurt by inventory corrections as supply chains have normalized post Covid. DZS manufactures mobile transport and broadband access solutions. Its telecom equipment end markets were weak throughout 2023 as customers worked off excess inventory. DZS also faced additional challenges managing its working capital as it faced payment issues with certain customers in Asia. Finally, the company announced that it would restate financials for 2023’s first quarter because a certain amount of inventory in Asia was not properly accounted for. However, DZS was able to execute a financing plan with its parent company, selling its Asian assets to the parent in early 2023, which we believe enables DZS to strengthen its balance sheet and focus on selling higher margin products into the North American and European markets.

The Fund’s advantage over the Russell Microcap came overwhelmingly from stock selection in 2023, though sector allocation was also additive. Stock selection boosted relative performance most in Industrials, Information Technology, and Consumer Discretionary—and our larger weighting in the first and third of these sectors also helped. Conversely, stock selection in Health Care, stock selection and a higher weighting in Communication Services, and stock selection in Financials each detracted from relative performance.

CURRENT POSITIONING AND OUTLOOK

The fourth quarter saw a much needed rally during an otherwise challenging year for most micro-cap stocks. As 2023 drew to a close, investors became more hopeful that the Fed had reached the end of its tightening cycle and may be on the verge of cutting rates in 2024. We view financial liquidity as a key element of micro-cap performance, which could be seen in 4Q23 results. Although we believe we have not yet seen the full lagged impact of the Fed’s tightening cycle, the U.S. economy remains fairly resilient and inflationary pressures have eased as supply chains have normalized from Covid related disruptions. In spite of lingering macro uncertainty, we remain upbeat on the intermediate to long-term opportunities for companies in our domestically focused portfolio. Key among these is the ongoing trend towards re-industrialization of the U.S. economy, which we believe is being driven by a desire to shorten supply chains as well as an increasing realization of the strategic importance of domestic semiconductor manufacturing. The increased fiscal spending on domestic infrastructure projects is also just beginning to take hold, which we expect to provide tailwinds to many of our companies in the near to intermediate term.

8 | Royce Capital Fund 2023 Annual Report to Shareholders

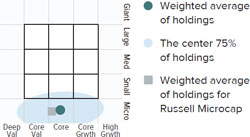

| PERFORMANCE AND PORTFOLIO REVIEW (UNAUDITED) | TICKER SYMBOLS RCMCX RCMSX |

Performance and Expenses

Average Annual Total Return (%) Through 12/31/23

| | JUL-DEC 20231 | 1-YR | 3-YR | 5-YR | 10-YR | 15-YR | 20-YR | 25-YR | SINCE INCEPTION (12/27/96) |

| RCM | 8.78 | 18.78 | 6.19 | 12.13 | 5.53 | 9.73 | 6.69 | 9.36 | 9.58 |

| Annual Operating Expenses: 1.16% | | | |

1 Not annualized

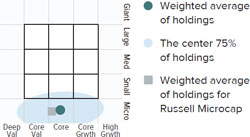

Morningstar Style Map™ As of 12/31/23

The Morningstar Style Map is the Morningstar Style Box™ with the center 75% of fund holdings plotted as the Morningstar Ownership Zone™. The Morningstar Style Box is designed to reveal a fund’s investment strategy. The Morningstar Ownership Zone provides detail about a portfolio’s investment style by showing the range of stock sizes and styles. The Ownership Zone is derived by plotting each stock in the portfolio within the proprietary Morningstar Style Box. Over time, the shape and location of a fund’s ownership zone may vary. See page 30 for additional information.

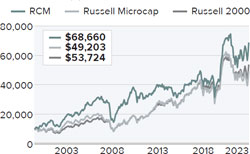

Value of $10,000

Invested on 6/30/00 (Russell Microcap Inception)

as of 12/31/23 ($)

Includes reinvestment of distributions.

Top 10 Positions

% of Net Assets

| Hovnanian Enterprises Cl. A | 1.5 |

| Photronics | 1.5 |

| Modine Manufacturing | 1.4 |

| Applied Optoelectronics | 1.3 |

| Customers Bancorp | 1.3 |

| Universal Stainless & Alloy Products | 1.3 |

| Graham Corporation | 1.3 |

| Natural Gas Services Group | 1.3 |

| IES Holdings | 1.2 |

| Citi Trends | 1.2 |

Portfolio Sector Breakdown

% of Net Assets

| Information Technology | 24.4 |

| Industrials | 23.6 |

| Consumer Discretionary | 13.2 |

| Financials | 12.9 |

| Health Care | 6.4 |

| Materials | 6.2 |

| Communication Services | 4.1 |

| Energy | 3.4 |

| Real Estate | 0.6 |

| Consumer Staples | 0.5 |

| Cash and Cash Equivalents | 4.7 |

Calendar Year Total Returns (%)

| YEAR | RCM |

| 2023 | 18.8 |

| 2022 | -22.4 |

| 2021 | 30.0 |

| 2020 | 23.8 |

| 2019 | 19.6 |

| 2018 | -9.0 |

| 2017 | 5.2 |

| 2016 | 19.7 |

| 2015 | -12.5 |

| 2014 | -3.6 |

| 2013 | 21.0 |

| 2012 | 7.6 |

| 2011 | -12.1 |

| 2010 | 30.1 |

| 2009 | 57.9 |

Upside/Downside Capture Ratios

Periods Ended 12/31/23 (%)

| | UPSIDE | DOWNSIDE |

| 10-Year | 85 | 83 |

| From 6/30/00 (Russell Microcap Inception) | 91 | 79 |

Portfolio Diagnostics

| Fund Net Assets | $137 million |

| Number of Holdings | 125 |

| Turnover Rate | 24% |

| Average Market Capitalization 1 | $578 million |

| Weighted Average P/B Ratio 2 | 1.7x |

| Active Share 3 | 90% |

| U.S. Investments (% of Net Assets) | 84.8% |

| Non-U.S. Investments (% of Net Assets) | 10.5% |

| 1 | Geometric Average. This weighted calculation uses each portfolio holding’s market cap in a way designed to not skew the effect of very large or small holdings; instead, it aims to better identify the portfolio’s center, which Royce believes offers a more accurate measure of average market cap than a simple mean or median. |

| 2 | Harmonic Average. This weighted calculation evaluates a portfolio as if it were a single stock and measures it overall. It compares the total market value of the portfolio to the portfolio’s share in the earnings or book value, as the case may be, of its underlying stocks. |

| 3 | Active Share is the sum of the absolute values of the different weightings of each holding in the Fund versus each holding in the benchmark, divided by two. |

Important Performance and Expense Information

All performance information in this Report reflects past performance, is presented on a total return basis, reflects the reinvestment of distributions, and does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when redeemed. Current performance may be higher or lower than performance quoted. The Fund’s total returns do not reflect any deduction for charges or expenses of the variable contracts investing in the Fund. Returns as of the most recent month-end may be obtained at www.royceinvest.com. All performance and risk information reflects the result of the Investment Class (its oldest class). Shares of RCM’s Service Class bear an annual distribution expense that is not borne by the Investment Class; if those expenses were reflected, total returns would have been lower. Annual operating expenses reflect the total gross operating expenses for the Fund’s Investment Class as of the Fund’s most current prospectus and include management fees and other expenses. Regarding the “Top Contributors” and “Top Detractors” tables shown above, the sum of all contributors to, and all detractors from, performance for all securities in the portfolio would approximate the Fund’s year-to-date performance for 2023. Upside Capture Ratio measures a manager’s performance in up markets relative to the Fund’s primary benchmark. It is calculated by measuring the Fund’s performance in quarters when the primary benchmark went up and dividing it by such benchmark’s return in those quarters. Downside Capture Ratio measures a manager’s performance in down markets relative to the Fund’s primary benchmark. It is calculated by measuring the Fund’s performance in quarters when the primary benchmark goes down and dividing it by such benchmark’s return in those quarters.

Royce Capital Fund 2023 Annual Report to Shareholders | 9

Schedule of Investments

Royce Capital Fund - Micro-Cap Portfolio

Common Stocks – 95.3%

| | | SHARES | | | VALUE |

| COMMUNICATION SERVICES – 4.1% | | | | | | | |

| ENTERTAINMENT - 0.8% | | | | | | | |

| IMAX Corporation 1 | | | 70,200 | | | $ | 1,054,404 |

| INTERACTIVE MEDIA & SERVICES - 1.1% | | | | | | | |

| QuinStreet 1 | | | 115,500 | | | | 1,480,710 |

| MEDIA - 2.2% | | | | | | | |

| Entravision Communications Cl. A | | | 194,579 | | | | 811,394 |

| †Innovid Corp. 1 | | | 352,519 | | | | 528,779 |

| Magnite 1 | | | 96,900 | | | | 905,046 |

| Thryv Holdings 1 | | | 41,800 | | | | 850,630 |

| | | | | | | | 3,095,849 |

| Total (Cost $5,016,647) | | | | | | | 5,630,963 |

| CONSUMER DISCRETIONARY – 13.2% | | | | | | | |

| AUTOMOBILE COMPONENTS - 2.4% | | | | | | | |

| Modine Manufacturing 1 | | | 32,312 | | | | 1,929,027 |

| Stoneridge 1 | | | 65,400 | | | | 1,279,878 |

| | | | | | | | 3,208,905 |

| DIVERSIFIED CONSUMER SERVICES - 0.7% | | | | | | | |

| Lincoln Educational Services 1 | | | 90,776 | | | | 911,391 |

| HOTELS, RESTAURANTS & LEISURE - 1.4% | | | | | | | |

| Century Casinos 1 | | | 141,300 | | | | 689,544 |

| Lindblad Expeditions Holdings 1 | | | 112,000 | | | | 1,262,240 |

| | | | | | | | 1,951,784 |

| HOUSEHOLD DURABLES - 2.4% | | | | | | | |

| †Hovnanian Enterprises Cl. A 1 | | | 13,095 | | | | 2,037,844 |

| Legacy Housing 1 | | | 51,096 | | | | 1,288,641 |

| | | | | | | | 3,326,485 |

| LEISURE PRODUCTS - 1.3% | | | | | | | |

| American Outdoor Brands 1 | | | 115,545 | | | | 970,578 |

| MasterCraft Boat Holdings 1 | | | 36,317 | | | | 822,217 |

| | | | | | | | 1,792,795 |

| SPECIALTY RETAIL - 4.2% | | | | | | | |

| Beyond 1 | | | 27,900 | | | | 772,551 |

| Citi Trends 1 | | | 59,786 | | | | 1,690,748 |

| JOANN 1 | | | 95,388 | | | | 42,543 |

| OneWater Marine Cl. A 1 | | | 22,200 | | | | 750,138 |

| Shoe Carnival | | | 46,300 | | | | 1,398,723 |

| Zumiez 1 | | | 54,100 | | | | 1,100,394 |

| | | | | | | | 5,755,097 |

| TEXTILES, APPAREL & LUXURY GOODS - 0.8% | | | | | | | |

| Fossil Group 1 | | | 185,300 | | | | 270,538 |

| Vera Bradley 1 | | | 107,400 | | | | 826,980 |

| | | | | | | | 1,097,518 |

| Total (Cost $13,449,570) | | | | | | | 18,043,975 |

| CONSUMER STAPLES – 0.5% | | | | | | | |

| FOOD PRODUCTS - 0.5% | | | | | | | |

| †Seneca Foods Cl. A 1 | | | 12,156 | | | | 637,461 |

| Total (Cost $664,861) | | | | | | | 637,461 |

| ENERGY – 3.4% | | | | | | | |

| ENERGY EQUIPMENT & SERVICES - 3.4% | | | | | | | |

| Natural Gas Services Group 1 | | | 107,031 | | | | 1,721,058 |

| Newpark Resources 1 | | | 221,300 | | | | 1,469,432 |

| Profire Energy 1 | | | 597,729 | | | | 1,081,890 |

| †Ranger Energy Services Cl. A | | | 45,739 | | | | 467,910 |

| Total (Cost $2,739,012) | | | | | | | 4,740,290 |

| FINANCIALS – 12.9% | | | | | |

| BANKS - 8.3% | | | | | |

| BayCom Corporation | | | 64,651 | | | | 1,525,117 |

| Customers Bancorp 1 | | | 30,300 | | | | 1,745,886 |

| HarborOne Bancorp | | | 103,591 | | | | 1,241,020 |

| HBT Financial | | | 66,727 | | | | 1,408,607 |

| HomeTrust Bancshares | | | 48,800 | | | | 1,313,696 |

| Investar Holding Corporation | | | 78,710 | | | | 1,173,566 |

| Midway Investments 1,2 | | | 1,751,577 | | | | 0 |

| Stellar Bancorp | | | 42,845 | | | | 1,192,805 |

| Territorial Bancorp | | | 25,297 | | | | 282,062 |

| Western New England Bancorp | | | 170,062 | | | | 1,530,558 |

| | | | | | | | 11,413,317 |

| CAPITAL MARKETS - 3.7% | | | | | | | |

| B. Riley Financial | | | 33,380 | | | | 700,646 |

| Canaccord Genuity Group | | | 152,749 | | | | 876,112 |

| Silvercrest Asset Management Group Cl. A | | | 71,263 | | | | 1,211,471 |

| Sprott | | | 30,380 | | | | 1,028,984 |

| StoneX Group 1 | | | 17,181 | | | | 1,268,473 |

| | | | | | | | 5,085,686 |

| FINANCIAL SERVICES - 0.9% | | | | | | | |

| Cass Information Systems | | | 25,348 | | | | 1,141,927 |

| Total (Cost $14,080,926) | | | | | | | 17,640,930 |

| HEALTH CARE – 6.4% | | | | | | | |

| BIOTECHNOLOGY - 1.7% | | | | | | | |

| †ARS Pharmaceuticals 1,3 | | | 77,026 | | | | 422,102 |

| CareDx 1 | | | 12,900 | | | | 154,800 |

| Dynavax Technologies 1 | | | 80,400 | | | | 1,123,992 |

| MeiraGTx Holdings 1 | | | 93,600 | | | | 657,072 |

| | | | | | | | 2,357,966 |

| HEALTH CARE EQUIPMENT & SUPPLIES - 3.0% | | | | | | | |

| Apyx Medical 1 | | | 244,000 | | | | 639,280 |

| Artivion 1 | | | 78,089 | | | | 1,396,231 |

| AtriCure 1 | | | 17,000 | | | | 606,730 |

| OrthoPediatrics Corp. 1 | | | 21,600 | | | | 702,216 |

| Profound Medical 1 | | | 95,800 | | | | 802,521 |

| | | | | | | | 4,146,978 |

| LIFE SCIENCES TOOLS & SERVICES - 1.2% | | | | | | | |

| †BioLife Solutions 1 | | | 15,246 | | | | 247,748 |

| Harvard Bioscience 1 | | | 267,680 | | | | 1,432,088 |

| | | | | | | | 1,679,836 |

| PHARMACEUTICALS - 0.5% | | | | | | | |

| †Harrow 1,3 | | | 53,000 | | | | 593,600 |

| Total (Cost $8,084,455) | | | | | | | 8,778,380 |

| INDUSTRIALS – 23.6% | | | | | | | |

| AEROSPACE & DEFENSE - 1.0% | | | | | | | |

| Astronics Corporation 1 | | | 56,055 | | | | 976,478 |

| CPI Aerostructures 1 | | | 143,579 | | | | 391,971 |

| | | | | | | | 1,368,449 |

| BUILDING PRODUCTS - 1.1% | | | | | | | |

| Quanex Building Products | | | 51,200 | | | | 1,565,184 |

| COMMERCIAL SERVICES & SUPPLIES - 3.7% | | | | | | | |

| Acme United | | | 33,682 | | | | 1,443,610 |

| †CECO Environmental 1 | | | 82,700 | | | | 1,677,156 |

| †Montrose Environmental Group 1 | | | 9,147 | | | | 293,893 |

| VSE Corporation | | | 25,200 | | | | 1,628,172 |

| | | | | | | | 5,042,831 |

| 10 | Royce Capital Fund 2023 Annual Report to Shareholders | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS |

December 31, 2023

Royce Capital Fund - Micro-Cap Portfolio (continued)

| | | SHARES | | | VALUE |

| INDUSTRIALS (continued) | | | | | | | |

| CONSTRUCTION & ENGINEERING - 3.5% | | | | | | | |

| Concrete Pumping Holdings 1 | | | 138,400 | | | $ | 1,134,880 |

| Construction Partners Cl. A 1 | | | 15,400 | | | | 670,208 |

| IES Holdings 1 | | | 21,500 | | | | 1,703,230 |

| Northwest Pipe 1 | | | 43,846 | | | | 1,326,780 |

| | | | | | | | 4,835,098 |

| ELECTRICAL EQUIPMENT - 0.9% | | | | | | | |

| American Superconductor 1 | | | 109,700 | | | | 1,222,058 |

| MACHINERY - 5.3% | | | | | | | |

| Alimak Group | | | 87,303 | | | | 710,643 |

| Commercial Vehicle Group 1 | | | 111,945 | | | | 784,734 |

| Graham Corporation 1 | | | 91,281 | | | | 1,731,601 |

| Luxfer Holdings | | | 63,166 | | | | 564,704 |

| Porvair | | | 146,872 | | | | 1,153,216 |

| Shyft Group (The) | | | 60,333 | | | | 737,269 |

| Wabash National | | | 60,000 | | | | 1,537,200 |

| | | | | | | | 7,219,367 |

| MARINE TRANSPORTATION - 1.0% | | | | | | | |

| Clarkson | | | 32,700 | | | | 1,319,205 |

| PROFESSIONAL SERVICES - 4.7% | | | | | | | |

| CRA International | | | 11,596 | | | | 1,146,265 |

| Forrester Research 1 | | | 35,289 | | | | 946,098 |

| Kforce | | | 17,400 | | | | 1,175,544 |

| NV5 Global 1 | | | 10,300 | | | | 1,144,536 |

| Resources Connection | | | 90,854 | | | | 1,287,401 |

| †TrueBlue 1 | | | 51,200 | | | | 785,408 |

| | | | | | | | 6,485,252 |

| TRADING COMPANIES & DISTRIBUTORS - 2.4% | | | | | | | |

| Distribution Solutions Group 1 | | | 50,280 | | | | 1,586,837 |

| Transcat 1 | | | 14,945 | | | | 1,633,937 |

| | | | | | | | 3,220,774 |

| Total (Cost $21,573,169) | | | | | | | 32,278,218 |

| INFORMATION TECHNOLOGY – 24.4% | | | | | | | |

| COMMUNICATIONS EQUIPMENT - 4.3% | | | | | | | |

| Applied Optoelectronics 1 | | | 92,799 | | | | 1,792,877 |

| Clearfield 1 | | | 23,800 | | | | 692,104 |

| Comtech Telecommunications | | | 70,169 | | | | 591,524 |

| Digi International 1 | | | 42,359 | | | | 1,101,334 |

| EMCORE Corporation 1 | | | 241,100 | | | | 117,898 |

| Genasys 1 | | | 230,326 | | | | 467,562 |

| Harmonic 1 | | | 87,400 | | | | 1,139,696 |

| | | | | | | | 5,902,995 |

| ELECTRONIC EQUIPMENT, INSTRUMENTS & COMPONENTS - 6.8% | | | | | | | |

| Arlo Technologies 1 | | | 130,400 | | | | 1,241,408 |

| FARO Technologies 1 | | | 59,900 | | | | 1,349,547 |

| LightPath Technologies Cl. A 1 | | | 383,700 | | | | 483,462 |

| Luna Innovations 1 | | | 194,632 | | | | 1,294,303 |

| nLIGHT 1 | | | 114,500 | | | | 1,545,750 |

| PAR Technology 1 | | | 32,800 | | | | 1,428,112 |

| Powerfleet NJ 1,3 | | | 186,109 | | | | 636,493 |

| VIA optronics ADR 1 | | | 116,260 | | | | 90,810 |

| Vishay Precision Group 1 | | | 35,200 | | | | 1,199,264 |

| | | | | | | | 9,269,149 |

| SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT - 10.8% | | | | | | | |

| Aehr Test Systems 1,3 | | | 30,853 | | | | 818,530 |

| Amtech Systems 1 | | | 81,889 | | | | 343,934 |

| Axcelis Technologies 1 | | | 7,700 | | | | 998,613 |

| AXT 1 | | | 221,200 | | | | 530,880 |

| Camtek 1 | | | 24,302 | | | | 1,686,073 |

| Cohu 1 | | | 36,100 | | | | 1,277,579 |

| Ichor Holdings 1 | | | 38,200 | | | | 1,284,666 |

| †inTEST Corporation 1 | | | 53,831 | | | | 732,101 |

| †Kopin Corporation 1 | | | 183,596 | | | | 372,700 |

| Nova 1,3 | | | 10,400 | | | | 1,428,856 |

| NVE Corporation | | | 14,973 | | | | 1,174,332 |

| PDF Solutions 1 | | | 30,100 | | | | 967,414 |

| Photronics 1 | | | 64,870 | | | | 2,034,972 |

| Ultra Clean Holdings 1 | | | 35,400 | | | | 1,208,556 |

| | | | | | | | 14,859,206 |

| SOFTWARE - 0.8% | | | | | | | |

| Agilysys 1 | | | 13,000 | | | | 1,102,660 |

| TECHNOLOGY HARDWARE, STORAGE & PERIPHERALS - 1.7% | | | | | | | |

| AstroNova 1 | | | 81,515 | | | | 1,325,434 |

| Intevac 1 | | | 216,483 | | | | 935,207 |

| | | | | | | | 2,260,641 |

| Total (Cost $24,131,671) | | | | | | | 33,394,651 |

| MATERIALS – 6.2% | | | | | | | |

| CHEMICALS - 1.6% | | | | | | | |

| Aspen Aerogels 1 | | | 97,417 | | | | 1,537,240 |

| †Core Molding Technologies 1 | | | 35,152 | | | | 651,367 |

| | | | | | | | 2,188,607 |

| METALS & MINING - 4.6% | | | | | | | |

| Altius Minerals | | | 47,900 | | | | 666,598 |

| Ferroglobe 1 | | | 139,200 | | | | 906,192 |

| Haynes International | | | 27,538 | | | | 1,571,043 |

| Major Drilling Group International 1 | | | 212,700 | | | | 1,478,410 |

| Universal Stainless & Alloy Products 1 | | | 86,305 | | | | 1,733,004 |

| | | | | | | | 6,355,247 |

| Total (Cost $5,457,037) | | | | | | | 8,543,854 |

| REAL ESTATE – 0.6% | | | | | | | |

| REAL ESTATE MANAGEMENT & DEVELOPMENT - 0.6% | | | | | | | |

| FRP Holdings 1 | | | 12,440 | | | | 782,227 |

| Total (Cost $214,356) | | | | | | | 782,227 |

| TOTAL COMMON STOCKS | | | | | | | |

| (Cost $95,411,704) | | | | | | | 130,470,949 |

| THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS | Royce Capital Fund 2023 Annual Report to Shareholders | 11 |

| Schedule of Investments | December 31, 2023 |

Royce Capital Fund - Micro-Cap Portfolio (continued)

| | | SHARES | | | VALUE |

REPURCHASE AGREEMENT – 4.9% | | | | | |

Fixed Income Clearing Corporation, 4.75% dated 12/29/23, due 1/2/24, maturity value $6,792,281 (collateralized by obligations of U.S. Government Agencies, 2.375% due 5/15/27, valued at $6,924,533) |

| (Cost $6,788,698) | | | | | | $ | 6,788,698 |

| | | | | | | | |

| COLLATERAL RECEIVED FOR SECURITIES LOANED – 0.8% | | | | | | | |

Money Market Funds Federated Hermes Government Obligations Fund - Institutional Shares (7 day yield-5.23%) | |

| (Cost $1,057,690) | | | 1,057,690 | | | | 1,057,690 |

| | | | | | | | |

| TOTAL INVESTMENTS – 101.0% | | | | | | | |

| (Cost $103,258,092) | | | | | | | 138,317,337 |

| | | | | | | | |

| LIABILITIES LESS CASH AND OTHER ASSETS – (1.0)% | | | | | | | (1,354,252) |

| | | | | | | | |

| NET ASSETS – 100.0% | | | | | | $ | 136,963,085 |

ADR- American Depository Receipt

| 2 | A security for which market quotations are not readily available represents 0.0% of net assets. This security has been valued at its fair value under procedures approved by the Fund’s Board of Trustees. This security is defined as a Level 3 security due to the use of significant unobservable inputs in the determination of fair value. See Notes to Financial Statements. |

| 3 | All or a portion of these securities were on loan as of December 31, 2023. |

Bold indicates the Fund’s 20 largest equity holdings in terms of December 31, 2023, market value.

| 12 | Royce Capital Fund 2023 Annual Report to Shareholders | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS |

This page is intentionally left blank.

Royce Capital Fund 2023 Annual Report to Shareholders | 13

MANAGER’S DISCUSSION (UNAUDITED)

Royce Capital Fund–Small-Cap Portfolio (RCS)

Jay Kaplan, CFA

FUND PERFORMANCE

Royce Capital Fund–Small-Cap Portfolio had a very strong year on both an absolute and relative basis. The Fund advanced 25.9% in 2023, handily outperforming its primary small-cap benchmark, the Russell 2000 Value Index, which was up 14.6%, and the 16.9% gain for its secondary benchmark, the Russell 2000 Index, for the same period. The Fund also beat both benchmarks for the 3-, 5-, 25-year, and since inception (12/27/96) periods ended 12/31/23—and outpaced the Russell 2000 Value for the 20-year period.

WHAT WORKED… AND WHAT DIDN’T

Eight of the portfolio’s 10 equity sectors made a positive impact on calendar year performance, led by Consumer Discretionary, Information Technology, and Industrials. The only negative impacts came from Health Care and Materials while Consumer Staples made the smallest contribution. At the industry level, electronic equipment, instruments & components (Information Technology), household durables (Consumer Discretionary), and specialty retail (Consumer Discretionary) contributed most for the calendar year period, while biotechnology (Health Care), leisure products (Consumer Discretionary), and metals & mining (Materials) were the largest detractors.

The portfolio’s top contributor at the position level in 2023 was Sterling Infrastructure, which provides advanced, large-scale site development services for data centers, manufacturing facilities, and e-commerce distribution centers. The company continues to execute effectively in fast-growing markets in the U.S. as it has transitioned from primarily being a highly levered highway builder to its current mix of businesses. M/I Homes builds single-family homes primarily in the Midwest and Southeast U.S. The company has a low-debt balance sheet, steady cash flows, and strong earnings. Perhaps counterintuitively, M/I benefited from higher mortgage rates as homeowners put off selling to avoid purchasing a new home at increased rates—which spurred demand for newly built homes for first-time home buyers. PulteGroup, which builds homes all over the U.S., benefited from this same dynamic. Each homebuilder company held by the portfolio was a top-10 holding at the end of December.

| | Top Contributors to Performance | | | Top Detractors from Performance | | |

| | For 2023 (%)1 | | | For 2023 (%)2 | | |

| | Sterling Infrastructure | 2.09 | | Resources Connection | -0.33 | |

| | M/I Homes | 1.73 | | Northwest Pipe | -0.24 | |

| | PulteGroup | 1.63 | | Financial Institutions | -0.22 | |

| | Jabil | 1.50 | | Cross Country Healthcare | -0.21 | |

| | ePlus | 1.09 | | Ironwood Pharmaceuticals Cl. A | -0.21 | |

| | 1 Includes dividends | | | 2 Net of dividends | | |

| | | | | | | |

Resources Connection was the top detractor in 2023. A professional services firm that provides accounting and finance, human resources management, and information technology professionals to clients on a project-by-project basis, the company faced slumping demand as many businesses cut back on spending for discretionary services. Northwest Pipe makes large diameter, high pressure steel pipe products used for water transmission and smaller diameter, electric resistance welded pipe for a variety of applications. Its stock suffered from the combination of higher steel prices and projects being pushed forward. We held small positions in both Resources Connection and Northwest Pipe at year end. We opted to sell our shares of Financial Institutions, an upstate New York community bank, based on the belief that it was undercapitalized in what we think may continue to be a challenging period for smaller regional players in the banking industry.

Both sector allocation decisions and, to a lesser degree, stock selection contributed to the Fund’s performance edge over the Russell 2000 Value in 2023. All told, eight of 10 equity sectors outperformed the benchmark, with the most impactful advantages coming from stock selection and our higher weighting in Consumer Discretionary, as well as our higher weighting and stock selection in both Information Technology and Industrials. Conversely, stock selection and a lower weight in Materials and stock selection in the Real Estate and Consumer Staples sectors detracted most (though marginally) from relative performance.

CURRENT POSITIONING AND OUTLOOK

The market rally that ushered out 2023 was rooted more in the momentum fueled by economic hope than in material earnings growth—which in our experience seldom if ever makes for a lasting recovery. This appears particularly true in our current situation as many stocks seem to have priced in significant rate cuts in 2024 in the absence of any clear signals from the Fed about the specific timing and magnitude of those decreases. In our view, the tension between investors’ assumptions and actual Fed actions creates a lot of risk for equity investors. We still do not know whether or not the U.S. economy will achieve the much desired soft landing or slide into recession. As investors are faced with the potential for underwhelming or disappointing earnings in the first half of 2024, we could endure a rough first six months. We would argue that an earnings recession is more likely to occur than an economic contraction. However, we also see the probability of more clarity about the state of the U.S. economy in the second half of 2024, which we see as a potentially rewarding period for small-cap investors. We have not made many significant changes to portfolio positioning. We trimmed positions, most prominently in banks, where we felt share prices had climbed past near-term earnings prospects. We added to holdings in trucking and transportation—which we think are well positioned for a stronger second half of the year. We otherwise held sector and industry weights more or less steadily.

14 | Royce Capital Fund 2023 Annual Report to Shareholders

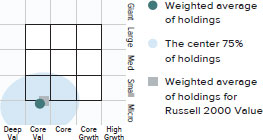

| PERFORMANCE AND PORTFOLIO REVIEW (UNAUDITED) | TICKER SYMBOLS RCPFX RCSSX |

Performance and Expenses

Average Annual Total Return (%) Through 12/31/23

| | JUL-DEC 20231 | 1-YR | 3-YR | 5-YR | 10-YR | 15-YR | 20-YR | 25-YR | SINCE INCEPTION

(12/27/96) |

| RCS | 16.45 | 25.93 | 13.78 | 10.17 | 5.61 | 9.91 | 7.94 | 9.55 | 9.83 |

| Annual Operating Expenses: 1.15% | | | | | |

| 1 Not annualized | | | | | | | |

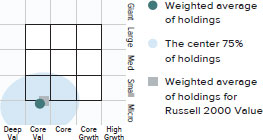

Morningstar Style Map™ As of 12/31/23

The Morningstar Style Map is the Morningstar Style Box™ with the center 75% of fund holdings plotted as the Morningstar Ownership Zone™. The Morningstar Style Box is designed to reveal a fund’s investment strategy. The Morningstar Ownership Zone provides detail about a portfolio’s investment style by showing the range of stock sizes and styles. The Ownership Zone is derived by plotting each stock in the portfolio within the proprietary Morningstar Style Box. Over time, the shape and location of a fund’s ownership zone may vary. See page 30 for additional information.

Value of $10,000

Invested on 12/27/96 as of 12/31/23 ($)

Includes reinvestment of distributions.

Top 10 Positions

| % of Net Assets | |

| M/I Homes | 2.0 |

| Evercore Cl. A | 2.0 |

| Flex | 2.0 |

| ePlus | 1.9 |

| PulteGroup | 1.9 |

| Tiptree | 1.8 |

| Shoe Carnival | 1.7 |

| Bloomin’ Brands | 1.7 |

| Buckle (The) | 1.7 |

| Jabil | 1.6 |

Portfolio Sector Breakdown

% of Net Assets

| Consumer Discretionary | 21.3 |

| Financials | 18.6 |

| Industrials | 18.4 |

| Information Technology | 17.2 |

| Energy | 7.9 |

| Health Care | 6.3 |

| Communication Services | 2.9 |

| Consumer Staples | 2.6 |

| Real Estate | 1.3 |

| Materials | 1.1 |

| Cash and Cash Equivalents | 2.4 |

Calendar Year Total Returns (%)

| YEAR | RCS |

| 2023 | 25.9 |

| 2022 | -9.2 |

| 2021 | 28.8 |

| 2020 | -7.2 |

| 2019 | 18.7 |

| 2018 | -8.3 |

| 2017 | 5.4 |

| 2016 | 21.0 |

| 2015 | -11.8 |

| 2014 | 3.2 |

| 2013 | 34.8 |

| 2012 | 12.5 |

| 2011 | -3.3 |

| 2010 | 20.5 |

| 2009 | 35.2 |

Upside/Downside Capture Ratios

Periods Ended 12/31/23 (%)

| | UPSIDE | DOWNSIDE |

| 10-Year | 88 | 91 |

| From 12/31/96 (Start of Fund’s First Full Quarter) | 98 | 90 |

Portfolio Diagnostics

| Fund Net Assets | $312 million |

| Number of Holdings | 83 |

| Turnover Rate | 69% |

| Average Market Capitalization 1 | $1,596 million |

| Weighted Average P/E Ratio 2,3 | 10.8x |

| Weighted Average P/B Ratio 2 | 1.7x |

| Active Share 4 | 94% |

| U.S. Investments (% of Net Assets) | 97.6% |

| Non-U.S. Investments (% of Net Assets) | 0.0% |

| 1 | Geometric Average. This weighted calculation uses each portfolio holding’s market cap in a way designed to not skew the effect of very large or small holdings; instead, it aims to better identify the portfolio’s center, which Royce believes offers a more accurate measure of average market cap than a simple mean or median. |

| 2 | Harmonic Average. This weighted calculation evaluates a portfolio as if it were a single stock and measures it overall. It compares the total market value of the portfolio to the portfolio’s share in the earnings or book value, as the case may be, of its underlying stocks. |

| 3 | The Fund’s P/E Ratio calculation excludes companies with zero or negative earnings (1% of portfolio holdings as of 12/31/23). |

| 4 | Active Share is the sum of the absolute values of the different weightings of each holding in the Fund versus each holding in the benchmark, divided by two. |

Important Performance and Expense Information

All performance information in this Report reflects past performance, is presented on a total return basis, reflects the reinvestment of distributions, and does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when redeemed. Current performance may be higher or lower than performance quoted. The Fund’s total returns do not reflect any deduction for charges or expenses of the variable contracts investing in the Fund. Returns as of the most recent month-end may be obtained at www.royceinvest.com. All performance and risk information reflects the result of the Investment Class (its oldest class). Shares of RCS’s Service Class bear an annual distribution expense that is not borne by the Investment Class; if those expenses were reflected, total returns would have been lower. Annual operating expenses reflect the total gross operating expenses for the Fund’s Investment Class as of the Fund’s most current prospectus and include management fees and other expenses. Regarding the “Top Contributors” and “Top Detractors” tables shown above, the sum of all contributors to, and all detractors from, performance for all securities in the portfolio would approximate the Fund’s year-to-date performance for 2023. Upside Capture Ratio measures a manager’s performance in up markets relative to the Fund’s primary benchmark. It is calculated by measuring the Fund’s performance in quarters when the primary benchmark went up and dividing it by such benchmark’s return in those quarters. Downside Capture Ratio measures a manager’s performance in down markets relative to the Fund’s primary benchmark. It is calculated by measuring the Fund’s performance in quarters when the primary benchmark goes down and dividing it by such benchmark’s return in those quarters.

Royce Capital Fund 2023 Annual Report to Shareholders | 15

Schedule of Investments

Royce Capital Fund - Small-Cap Portfolio

Common Stocks – 97.6%

| | | SHARES | | | VALUE |

| COMMUNICATION SERVICES – 2.9% | | | | | | | |

| MEDIA - 2.9% | | | | | | | |

| Entravision Communications Cl. A | | | 455,765 | | | $ | 1,900,540 |

| Saga Communications Cl. A | | | 153,519 | | | | 3,417,333 |

| †TEGNA | | | 240,987 | | | | 3,687,101 |

| Total (Cost $10,206,433) | | | | | | | 9,004,974 |

| | | | | | | | |

| CONSUMER DISCRETIONARY – 21.3% | | | | | | | |

| DIVERSIFIED CONSUMER SERVICES - 0.2% | | | | | | | |

| Lincoln Educational Services 1 | | | 67,356 | | | | 676,254 |

| HOTELS, RESTAURANTS & LEISURE - 1.7% | | | | | | | |

| Bloomin' Brands | | | 186,123 | | | | 5,239,363 |

| HOUSEHOLD DURABLES - 5.7% | | | | | | | |

| M/I Homes 1 | | | 44,871 | | | | 6,180,532 |

| Meritage Homes | | | 20,627 | | | | 3,593,223 |

| PulteGroup | | | 58,158 | | | | 6,003,069 |

| †Tri Pointe Homes 1 | | | 58,616 | | | | 2,075,006 |

| | | | | | | | 17,851,830 |

| SPECIALTY RETAIL - 9.3% | | | | | | | |

| †Arhaus Cl. A 1 | | | 118,602 | | | | 1,405,434 |

| Buckle (The) | | | 109,560 | | | | 5,206,291 |

| Caleres | | | 127,716 | | | | 3,924,713 |

| †Destination XL Group 1 | | | 573,553 | | | | 2,523,633 |

| Haverty Furniture | | | 90,420 | | | | 3,209,910 |

| Shoe Carnival | | | 174,234 | | | | 5,263,609 |

| †Signet Jewelers | | | 40,822 | | | | 4,378,568 |

| Williams-Sonoma | | | 15,958 | | | | 3,220,005 |

| | | | | | | | 29,132,163 |

| TEXTILES, APPAREL & LUXURY GOODS - 4.4% | | | | | | | |

| Carter's | | | 42,523 | | | | 3,184,547 |

| Kontoor Brands | | | 80,128 | | | | 5,001,590 |

| Movado Group | | | 75,858 | | | | 2,287,119 |

| Steven Madden | | | 73,131 | | | | 3,071,502 |

| | | | | | | | 13,544,758 |

| Total (Cost $45,569,847) | | | | | | | 66,444,368 |

| | | | | | | | |

| CONSUMER STAPLES – 2.6% | | | | | | | |

| CONSUMER STAPLES DISTRIBUTION & RETAIL - 2.6% | | | | | | | |

| Ingles Markets Cl. A | | | 44,281 | | | | 3,824,550 |

| Village Super Market Cl. A | | | 162,566 | | | | 4,264,106 |

| Total (Cost $7,489,123) | | | | | | | 8,088,656 |

| | | | | | | | |

| ENERGY – 7.9% | | | | | | | |

| OIL, GAS & CONSUMABLE FUELS - 7.9% | | | | | | | |

| †Berry Corporation | | | 65,690 | | | | 461,801 |

| Chord Energy | | | 29,820 | | | | 4,956,978 |

| Civitas Resources | | | 60,268 | | | | 4,121,126 |

| Dorchester Minerals L.P. | | | 141,886 | | | | 4,516,231 |

| Matador Resources | | | 64,652 | | | | 3,676,113 |

| Riley Exploration Permian | | | 112,683 | | | | 3,069,485 |

| SilverBow Resources 1 | | | 134,836 | | | | 3,921,031 |

| Total (Cost $20,142,634) | | | | | | | 24,722,765 |

| | | | | | | | |

| FINANCIALS – 18.6% | | | | | | | |

| BANKS - 13.4% | | | | | | | |

| Citizens Community Bancorp | | | 178,538 | | | | 2,090,680 |

| CNB Financial | | | 196,739 | | | | 4,444,334 |

| †Dime Community Bancshares | | | 160,078 | | | | 4,310,901 |

| †Heritage Financial | | | 121,370 | | | | 2,596,104 |

| Mid Penn Bancorp | | | 141,848 | | | | 3,444,069 |

| National Bankshares | | | 12,861 | | | | 416,053 |

| Princeton Bancorp | | | 45,514 | | | | 1,633,953 |

| Riverview Bancorp | | | 249,282 | | | | 1,595,405 |

| †Summit Financial Group | | | 101,569 | | | | 3,117,153 |

| Timberland Bancorp | | | 141,629 | | | | 4,455,648 |

| TrustCo Bank Corp NY | | | 117,790 | | | | 3,657,379 |

| Unity Bancorp | | | 151,471 | | | | 4,482,027 |

| †Univest Financial | | | 142,489 | | | | 3,139,033 |

| Western New England Bancorp | | | 282,565 | | | | 2,543,085 |

| | | | | | | | 41,925,824 |

| CAPITAL MARKETS - 2.0% | | | | | | | |

| Evercore Cl. A | | | 35,826 | | | | 6,128,037 |

| FINANCIAL SERVICES - 1.4% | | | | | | | |

| †International Money Express 1 | | | 203,086 | | | | 4,486,170 |

| INSURANCE - 1.8% | | | | | | | |

| Tiptree | | | 295,400 | | | | 5,600,784 |

| Total (Cost $46,269,420) | | | | | | | 58,140,815 |

| | | | | | | | |

| HEALTH CARE – 6.3% | | | | | | | |

| BIOTECHNOLOGY - 1.4% | | | | | | | |

| Catalyst Pharmaceuticals 1 | | | 255,552 | | | | 4,295,829 |

| HEALTH CARE PROVIDERS & SERVICES - 2.8% | | | | | | | |

| Cross Country Healthcare 1 | | | 169,965 | | | | 3,848,007 |

| Molina Healthcare 1 | | | 13,702 | | | | 4,950,670 |

| | | | | | | | 8,798,677 |

| PHARMACEUTICALS - 2.1% | | | | | | | |

| Collegium Pharmaceutical 1 | | | 71,629 | | | | 2,204,741 |

| SIGA Technologies | | | 795,885 | | | | 4,456,956 |

| | | | | | | | 6,661,697 |

| Total (Cost $15,430,428) | | | | | | | 19,756,203 |

| | | | | | | | |

| INDUSTRIALS – 18.4% | | | | | | | |

| AIR FREIGHT & LOGISTICS - 1.4% | | | | | | | |

| Hub Group Cl. A 1 | | | 46,113 | | | | 4,239,629 |

| BUILDING PRODUCTS - 2.9% | | | | | | | |

| Quanex Building Products | | | 152,637 | | | | 4,666,113 |

| UFP Industries | | | 35,277 | | | | 4,429,027 |

| | | | | | | | 9,095,140 |

| CONSTRUCTION & ENGINEERING - 2.1% | | | | | | | |

| Northwest Pipe 1 | | | 61,195 | | | | 1,851,760 |

| Sterling Infrastructure 1 | | | 53,961 | | | | 4,744,791 |

| | | | | | | | 6,596,551 |

| ELECTRICAL EQUIPMENT - 1.1% | | | | | | | |

| Preformed Line Products | | | 25,293 | | | | 3,385,721 |

| GROUND TRANSPORTATION - 3.6% | | | | | | | |

| ArcBest Corporation | | | 37,345 | | | | 4,489,243 |

| Schneider National Cl. B | | | 184,265 | | | | 4,689,544 |

| †Universal Logistics Holdings | | | 75,644 | | | | 2,119,545 |

| | | | | | | | 11,298,332 |

| MACHINERY - 1.0% | | | | | | | |

| Wabash National | | | 122,945 | | | | 3,149,851 |

| MARINE TRANSPORTATION - 2.0% | | | | | | | |

| †Genco Shipping & Trading | | | 172,800 | | | | 2,866,752 |

| †Pangaea Logistics Solutions | | | 423,032 | | | | 3,485,784 |

| | | | | | | | 6,352,536 |

| PROFESSIONAL SERVICES - 4.3% | | | | | | | |

| Barrett Business Services | | | 41,682 | | | | 4,826,776 |

| IBEX 1 | | | 254,885 | | | | 4,845,364 |

| Korn Ferry | | | 54,865 | | | | 3,256,238 |

| 16 | Royce Capital Fund 2023 Annual Report to Shareholders | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS |

December 31, 2023

Royce Capital Fund - Small-Cap Portfolio (continued)

| | | SHARES | | | VALUE |

| INDUSTRIALS (continued) | | | | | | | |

| PROFESSIONAL SERVICES (continued) | | | | | | | |

| Resources Connection | | | 35,325 | | | $ | 500,555 |

| | | | | | | | 13,428,933 |

| Total (Cost $39,797,038) | | | | | | | 57,546,693 |

| | | | | | | | |

| INFORMATION TECHNOLOGY – 17.2% | | | | | | | |

| COMMUNICATIONS EQUIPMENT - 1.4% | | | | | | | |

| Aviat Networks 1 | | | 127,318 | | | | 4,158,206 |

| ELECTRONIC EQUIPMENT, INSTRUMENTS & COMPONENTS - 14.0% | | | | | | | |

| Bel Fuse Cl. B | | | 35,832 | | | | 2,392,503 |

| ePlus 1 | | | 75,591 | | | | 6,035,186 |

| Flex 1 | | | 201,121 | | | | 6,126,146 |

| Insight Enterprises 1 | | | 18,702 | | | | 3,313,807 |

| Jabil | | | 39,268 | | | | 5,002,743 |

| Kimball Electronics 1 | | | 147,475 | | | | 3,974,451 |

| PC Connection | | | 66,421 | | | | 4,464,155 |

| Sanmina Corporation 1 | | | 82,682 | | | | 4,247,374 |

| TD SYNNEX | | | 31,888 | | | | 3,431,468 |

| Vishay Intertechnology | | | 200,486 | | | | 4,805,649 |

| | | | | | | | 43,793,482 |

| SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT - 1.1% | | | | | | | |

| Amkor Technology | | | 104,150 | | | | 3,465,070 |

| SOFTWARE - 0.7% | | | | | | | |

| Adeia | | | 183,963 | | | | 2,279,302 |

| Total (Cost $32,088,459) | | | | | | | 53,696,060 |

| | | | | | | | |

| MATERIALS – 1.1% | | | | | | | |

| METALS & MINING - 1.1% | | | | | | | |

| †Ryerson Holding Corporation | | | 101,801 | | | | 3,530,459 |

| Total (Cost $3,668,673) | | | | | | | 3,530,459 |

| | | | | | | | |

| REAL ESTATE – 1.3% | | | | | | | |

| REAL ESTATE MANAGEMENT & DEVELOPMENT - 1.3% | | | | | | | |

| RMR Group (The) Cl. A | | | 142,032 | | | | 4,009,563 |

| Total (Cost $3,820,050) | | | | | | | 4,009,563 |

| | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | |

| (Cost $224,482,105) | | | | | | | 304,940,556 |

| | | | | | | | |

| REPURCHASE AGREEMENT– 2.2% | | | | | | | |

Fixed Income Clearing Corporation, 4.75% dated 12/29/23, due 1/2/24, maturity value $6,870,811 (collateralized by obligations of U.S. Government Agencies, 2.75% due 2/15/28, valued at $7,004,545) |

| (Cost $6,867,186) | | | 6,867,186 |

| | | | |

| TOTAL INVESTMENTS – 99.8% | | | |

| (Cost $231,349,291) | | | 311,807,742 |

| | | | |

| CASH AND OTHER ASSETS LESS LIABILITIES – 0.2% | | | 511,988 |

| | | | |

| NET ASSETS – 100.0% | | $ | 312,319,730 |

† New additions in 2023.

1 Non-income producing.

Bold indicates the Fund’s 20 largest equity holdings in terms of December 31, 2023, market value.

| THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS | Royce Capital Fund 2023 Annual Report to Shareholders | 17 |

| Statements of Assets and Liabilities | December 31, 2023 |

| | | Micro-Cap Portfolio | | | Small-Cap Portfolio | |

| ASSETS: | | | | | | |

| Investments at value (including collateral on loaned securities)1 | | $ | 131,528,639 | | | $ | 304,940,556 | |

| Repurchase agreements (at cost and value) | | | 6,788,698 | | | | 6,867,186 | |

| Cash | | | – | | | | 67,926 | |

| Receivable for capital shares sold | | | 11,588 | | | | 629,820 | |

| Receivable for dividends and interest | | | 17,822 | | | | 469,476 | |

| Receivable for securities lending income | | | 885 | | | | 40 | |

| Prepaid expenses and other assets | | | 1,790 | | | | 3,694 | |

| Total Assets | | | 138,349,422 | | | | 312,978,698 | |

| LIABILITIES: | | | | | | | | |

| Payable for collateral on loaned securities | | | 1,057,690 | | | | – | |

| Payable for investments purchased | | | 60,229 | | | | 176,121 | |

| Payable for capital shares redeemed | | | 82,921 | | | | 84,058 | |

| Payable for investment advisory fees | | | 111,261 | | | | 258,173 | |

| Payable for trustees’ fees | | | 11,756 | | | | 26,242 | |

| Accrued expenses | | | 62,480 | | | | 114,374 | |

| Total Liabilities | | | 1,386,337 | | | | 658,968 | |

| Net Assets | | $ | 136,963,085 | | | $ | 312,319,730 | |

| ANALYSIS OF NET ASSETS: | | | | | | | | |

| Paid-in capital | | $ | 92,850,390 | | | $ | 222,986,191 | |

| Total distributable earnings (loss) | | | 44,112,695 | | | | 89,333,539 | |

| Net Assets | | $ | 136,963,085 | | | $ | 312,319,730 | |

| Investment Class | | $ | 116,467,607 | | | $ | 146,549,073 | |

| Service Class | | | 20,495,478 | | | | 165,770,657 | |

| SHARES OUTSTANDING (unlimited number of $.001 par value): | | | | | | | | |

| Investment Class | | | 12,697,668 | | | | 15,281,423 | |

| Service Class | | | 2,307,764 | | | | 17,683,434 | |

| NET ASSET VALUES (Net Assets ÷ Shares Outstanding): | | | | | | | | |

| (offering and redemption price per share) | | | | | | | | |

| Investment Class | | $ | 9.17 | | | $ | 9.59 | |

| Service Class | | | 8.88 | | | | 9.37 | |

| Investments at identified cost | | $ | 96,469,394 | | | $ | 224,482,105 | |

| Market value of loaned securities2 | | | 3,896,989 | | | | – | |

1 See Notes to Financial Statements for information on non-cash collateral on loaned securities.

2 Market value of loaned securities backed by non-cash collateral is as of prior business day.

| 18 | Royce Capital Fund 2023 Annual Report to Shareholders | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS |

| Statements of Operations | Year Ended December 31, 2023 |

| | | Micro-Cap Portfolio | | | Small-Cap Portfolio | |

| INVESTMENT INCOME: | | | | | | |

| INCOME: | | | | | | |

| Dividends | | $ | 924,386 | | | $ | 6,611,888 | |

| Foreign withholding tax | | | (11,033 | ) | | | – | |

| Interest | | | 133,555 | | | | 237,834 | |

| Securities lending | | | 8,663 | | | | 579 | |

| Total income | | | 1,055,571 | | | | 6,850,301 | |

| EXPENSES: | | | | | | | | |

| Investment advisory fees | | | 1,289,621 | | | | 2,902,705 | |

| Distribution fees | | | 43,431 | | | | 371,627 | |

| Administrative and office facilities | | | 83,456 | | | | 162,638 | |

| Trustees’ fees | | | 40,652 | | | | 91,326 | |

| Audit | | | 35,663 | | | | 35,436 | |

| Custody | | | 31,734 | | | | 64,209 | |

| Shareholder servicing | | | 17,282 | | | | 16,608 | |

| Shareholder reports | | | 15,465 | | | | 8,901 | |

| Legal | | | 4,800 | | | | 10,835 | |

| Other expenses | | | 12,010 | | | | 23,592 | |

| Total expenses | | | 1,574,114 | | | | 3,687,877 | |

| Compensating balance credits | | | (225 | ) | | | (197 | ) |

| Fees waived by investment adviser | | | (29,797 | ) | | | (28,330 | ) |

| Expenses reimbursed by investment adviser | | | (12,268 | ) | | | (13,249 | ) |

| Net expenses | | | 1,531,824 | | | | 3,646,101 | |

| Net investment income (loss) | | | (476,253 | ) | | | 3,204,200 | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY: | | | | | | | | |

| NET REALIZED GAIN (LOSS): | | | | | | | | |

| Investments | | | 10,050,510 | | | | 7,394,893 | |

| Foreign currency transactions | | | (546 | ) | | | – | |

| NET CHANGE IN UNREALIZED APPRECIATION (DEPRECIATION): | | | | | | | | |

| Investments | | | 11,624,313 | | | | 51,157,812 | |

| Other assets and liabilities denominated in foreign currency | | | 25 | | | | – | |

| Net realized and unrealized gain (loss) on investments and foreign currency | | | 21,674,302 | | | | 58,552,705 | |

| NET INCREASE (DECREASE) IN NET ASSETS FROM INVESTMENT OPERATIONS | | $ | 21,198,049 | | | $ | 61,756,905 | |

| THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS | Royce Capital Fund 2023 Annual Report to Shareholders | 19 |

Statements of Changes in Net Assets

| | | Micro-Cap Portfolio | | | Small-Cap Portfolio | |

| | | Year Ended 12/31/23 | | | Year Ended 12/31/22 | | | Year Ended 12/31/23 | | | Year Ended 12/31/22 | |

| INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | $ | (476,253 | ) | | $ | (661,115 | ) | | $ | 3,204,200 | | | $ | 2,214,727 | |

| Net realized gain (loss) on investments and foreign currency | | | 10,049,964 | | | | (940,974 | ) | | | 7,394,893 | | | | 23,593,936 | |

| Net change in unrealized appreciation (depreciation) on investments and foreign currency | | | 11,624,338 | | | | (37,955,019 | ) | | | 51,157,812 | | | | (66,154,197 | ) |

| Net increase (decrease) in net assets from investment operations | | | 21,198,049 | | | | (39,557,108 | ) | | | 61,756,905 | | | | (40,345,534 | ) |

| DISTRIBUTIONS: | | | | | | | | | | | | | | | | |

| Total distributable earnings | | | | | | | | | | | | | | | | |

| Investment Class | | | – | | | | (35,639,401 | ) | | | (12,810,854 | ) | | | (3,069,857 | ) |

| Service Class | | | – | | | | (4,335,006 | ) | | | (14,399,565 | ) | | | (3,038,165 | ) |

| Total distributions | | | – | | | | (39,974,407 | ) | | | (27,210,419 | ) | | | (6,108,022 | ) |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | | | | | | | | | |

| Value of shares sold | | | | | | | | | | | | | | | | |

| Investment Class | | | 16,367,277 | | | | 9,925,000 | | | | 23,941,849 | | | | 10,505,441 | |

| Service Class | | | 20,890,050 | | | | 1,132,977 | | | | 96,770,854 | | | | 109,240,664 | |

| Distributions reinvested | | | | | | | | | | | | | | | | |

| Investment Class | | | – | | | | 35,639,401 | | | | 12,810,854 | | | | 3,069,857 | |

| Service Class | | | – | | | | 4,335,006 | | | | 14,399,565 | | | | 3,038,165 | |

| Value of shares redeemed | | | | | | | | | | | | | | | | |

| Investment Class | | | (28,684,375 | ) | | | (23,050,585 | ) | | | (49,910,329 | ) | | | (26,631,982 | ) |

| Service Class | | | (15,676,606 | ) | | | (11,854,731 | ) | | | (119,325,949 | ) | | | (135,322,249 | ) |

| Net increase (decrease) in net assets from capital share transactions | | | (7,103,654 | ) | | | 16,127,068 | | | | (21,313,156 | ) | | | (36,100,104 | ) |

| Net Increase (Decrease) in Net Assets | | | 14,094,395 | | | | (63,404,447 | ) | | | 13,233,330 | | | | (82,553,660 | ) |

| NET ASSETS: | | | | | | | | | | | | | | | | |

| Beginning of year | | | 122,868,690 | | | | 186,273,137 | | | | 299,086,400 | | | | 381,640,060 | |

| End of year | | $ | 136,963,085 | | | $ | 122,868,690 | | | $ | 312,319,730 | | | $ | 299,086,400 | |

| 20 | Royce Capital Fund 2023 Annual Report to Shareholders | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS |

Financial Highlights

This table is presented to show selected data for a share outstanding throughout each period and to assist shareholders in evaluating a Fund’s performance for the periods presented. Per share amounts have been determined on the basis of the weighted average number of shares outstanding during the period.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Ratio of Expenses to Average Net Assets | | | | | | | |

| | | Net Asset Value, Beginning of Period | | | Net Investment Income (Loss) | | Net Realized and Unrealized Gain (Loss) on Investments and Foreign Currency | | | Total from Investment Operations | | | Distributions from Net Investment Income | | | Distributions from Net Realized Gain on Investments and Foreign Currency | | | Total Distributions | | | Net Asset Value, End of Period | | | Total Return | | | Net Assets, End of Period (in thousands) | | | Prior to Fee Waivers, Expense Reimbursements and Balance Credits | | | Prior to Fee Waivers and Expense Reimbursements | | | Net of Fee Waivers and Expense Reimbursements | | | Ratio of Net Investment Income (Loss) to Average Net Assets | | | Portfolio Turnover Rate | |

| Micro-Cap Portfolio–Investment Class | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2023 | | $ | 7.72 | | | $ | (0 .03 | ) | $ | 1.48 | | | $ | 1.45 | | | $ | – | | | $ | – | | | $ | – | | | $ | 9 .17 | | | | 18.78 | % | | $ | 116,468 | | | 1.18 | % | | 1.18 | % | | 1.15 | % | | (0.33 | )% | | 24 | % |

| 2022 | | | 14.77 | | | | (0 .05 | ) | | (3.28 | ) | | | (3.33 | ) | | | – | | | | (3.72 | ) | | | (3.72 | ) | | | 7 .72 | | | | (22.43 | ) | | | 109,600 | | | 1.31 | | | 1.31 | | | 1.21 | | | (0.46 | ) | | 12 | |

| 2021 | | | 11.91 | | | | (0 .08 | ) | | 3.61 | | | | 3.53 | | | | – | | | | (0.67 | ) | | | (0.67 | ) | | | 14 .77 | | | | 29.98 | | | | 157,042 | | | 1.37 | | | 1.37 | | | 1.33 | | | (0.56 | ) | | 25 | |

| 2020 | | | 9.75 | | | | (0 .05 | ) | | 2.36 | | | | 2.31 | | | | – | | | | (0.15 | ) | | | (0.15 | ) | | | 11 .91 | | | | 23.79 | | | | 134,109 | | | 1.47 | | | 1.47 | | | 1.33 | | | (0.51 | ) | | 25 | |