UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-07619

Nuveen Investment Trust

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive, Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Kevin J. McCarthy

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: August 31

Date of reporting period: August 31, 2012

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss.3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

Mutual Funds

Nuveen Asset Allocation Funds

For investors seeking a risk-managed approach to asset allocation.

Annual Report

August 31, 2012

| | | | | | | | |

| | | Share Class / Ticker Symbol |

| | | | |

| Fund Name | | Class A | | Class C | | Class R3 | | Class I |

Nuveen Intelligent Risk Growth Allocation Fund | | NIGAX | | NIGCX | | NIGRX | | NIGIX |

Nuveen Intelligent Risk Moderate Allocation Fund | | NIDAX | | NIMCX | | NIMRX | | NIMIX |

Nuveen Intelligent Risk Conservative Allocation Fund | | NICAX | | NICCX | | NICRX | | NICIX |

LIFE IS COMPLEX.

Nuveen makes things e-simple.

It only takes a minute to sign up for e-Reports. Once enrolled, you’ll receive an e-mail as soon as your Nuveen Fund information is ready. No more waiting for delivery by regular mail. Just click on the link within the e-mail to see the report and save it on your computer if you wish.

Free e-Reports right to your e-mail!

www.investordelivery.com

If you receive your Nuveen Fund distributions and statements from your financial advisor or brokerage account.

OR

www.nuveen.com/accountaccess

If you receive your Nuveen Fund distributions and statements directly from Nuveen.

| | | | | | |

| Must be preceded by or accompanied by a prospectus. | | NOT FDIC INSURED | | MAY LOSE VALUE | | NO BANK GUARANTEE |

Table of Contents

Chairman’s

Letter to Shareholders

Dear Shareholders,

Investors have many reasons to remain cautious. The challenges in the Euro area are casting a shadow over global economies and financial markets. The political support for addressing fiscal issues is eroding as the economic and social impacts become more visible. At the same time, member nations appear unwilling to provide adequate financial support or to surrender sufficient sovereignty to strengthen the banks or unify the Euro area financial system. The gains made in reducing deficits, and the hard-won progress on winning popular acceptance of the need for economic austerity, are at risk. To their credit, European political leaders press on to find compromise solutions, but there is increasing concern that time will begin to run out.

In the U.S., strong corporate earnings have enabled the equity markets to withstand much of the downward pressures coming from weakening job creation, slower economic growth and political uncertainty. The Fed remains committed to low interest rates and announced on September 13, 2012 (after the close of this reporting period) another program of quantitative easing (QE3) to continue until mid-2015. Pre-election maneuvering has added to the already highly partisan atmosphere in Congress. The end of the Bush-era tax cuts and implementation of the spending restrictions of the Budget Control Act of 2011, both scheduled to take place at year-end, loom closer.

During the last year, U.S. based investors have experienced a sharp decline and a strong recovery in the equity markets. The experienced investment teams at Nuveen keep their eye on a longer time horizon and use their practiced investment disciplines to negotiate through market peaks and valleys to achieve long-term goals for investors. Experienced professionals pursue investments that will weather short-term volatility and at the same time, seek opportunities that are created by markets that overreact to negative developments. Monitoring this process is an important consideration for the Fund Board as it oversees your Nuveen Fund on your behalf.

As always, I encourage you to contact your financial consultant if you have any questions about your investment in a Nuveen Fund. On behalf of the other members of your Fund Board, we look forward to continuing to earn your trust in the months and years ahead.

Sincerely,

Robert P. Bremner

Chairman of the Board

October 22, 2012

Portfolio Managers’ Comments

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Funds disclaim any obligation to update publicly or revise any forward-looking statements or views expressed herein.

Nuveen Intelligent Risk Allocation Funds

These Funds feature portfolio management by Nuveen Asset Management, LLC, an affiliate of Nuveen Investments. Portfolio managers James Colon and Derek Bloom discuss the key investment strategies and the Funds’ performance during the period ending August 31, 2012. James and Derek have managed the Funds since their inception on May 4, 2012.

While this is an annual report, the Funds’ performance discussions encompass an abbreviated reporting period from inception on May 4, 2012 through August 31, 2012.

How did the Funds perform during this abbreviated reporting period ending August 31, 2012?

The tables in the Fund Performance and Expense Ratios section of this report provide total return performance information for the since inception period ended August 31, 2012. Each Fund’s Class A Share total returns at net asset value (NAV) are compared with the performance of the appropriate Morningstar Index and Lipper classification average.

What strategies were used to manage the Funds during the abbreviated reporting period? How did these strategies influence performance?

All three Nuveen Intelligent Risk Allocation Funds launched and became fully invested during the reporting period. We manage each of the three risk categories of our Intelligent Risk Funds, Growth, Moderate and Conservative, using the same investment process. Our goal with each Fund is to provide investors with a stable level of risk that matches their risk tolerance through changing market conditions. Therefore, each Fund targets its own explicite daily volatility range that we believe to be appropriate for its risk category:

| | |

| Fund | | Daily Volatility Target (Annualized) |

Nuveen Intelligent Risk Growth Allocation Fund | | 12% to 18% |

Nuveen Intelligent Risk Moderate Allocation Fund | | 7% to 12% |

Nuveen Intelligent Risk Conservative Allocation Fund | | 3.5% to 7% |

To keep volatility within the target range, we use our proprietary risk forecasting models to forecast future volatility across asset classes, and in turn, use that information to construct a risk-targeted portfolio. Risk forecasting and portfolio construction processes attempt to limit fluctuations in each portfolio’s volatility primarily by having exposure to a variety of different asset classes and periodically adjusting its exposure to different asset classes. To gain exposure to these different asset classes, the Funds are currently invested in a diverse blend of exchange-traded funds (ETFs) with broad exposures in equities, fixed income, real estate, commodities and cash.

Each Fund’s wide ranging investable universe gives us the flexibility to reduce exposure to risky assets during periods of high volatility and increase exposure to risky assets during periods of low volatility, while maintaining a stable risk profile. This strategy offers the potential to meet each Fund’s investment objective in a range of economic environments and to capitalize on market upswings, while mitigating risk in down markets. Our goal is to proactively anticipate market volatility to help protect investors from unintentionally taking on risk that is inconsistent with each Fund’s respective risk tolerance.

What was the overall volatility environment during the abbreviated reporting period?

During the last two months of the second quarter, volatility levels across asset classes remained fairly consistent with long-term averages. While Moody’s downgraded 28 Spanish banks in June, this news was tempered by a positive outcome in the second Greek election (i.e., the pro-bailout New Democracy party won the election) that occurred in the weeks preceding the downgrade. Throughout July and August, however, volatility across asset classes fell to levels not seen since the low-volatility environment of 2004 to 2007. Many believed that the European holiday season was to blame for the falling trading volumes and declining volatility. However, the volatility that hit markets in August of 2011, when the VIX Index rose above 48, stands as a reminder that volatility can change quickly, even when many Europeans are “on holiday.”

During the Funds’ abbreviated fiscal year, our volatility forecasts remained fairly stable across most asset classes before declining at the end of August 2012. Our estimates for U.S. large cap annualized daily volatility fell from 14.5% at the beginning of May to 10.7% by the end of August 2012. One exception to the declining volatility environment was 20+ year Treasuries. Our forecasts for 20+ year Treasuries increased from 11.9% at the beginning of May 2012, to 17.5% by the end of the month, before declining to 14.2% at the end of August 2012. In response to our changing volatility forecasts, we made several adjustments to the compositions of each portfolio to keep their volatility profiles stable, as discussed in the following sections.

How did the Funds perform and what changes were made to their portfolio allocations during this reporting period?

Nuveen Intelligent Risk Growth Allocation Fund

The Fund’s Class A Shares at NAV underperformed the Morningstar Index and Lipper average for the since inception period May 4, 2012 through August 31, 2012. Also during the abbreviated fiscal period, the Intelligent Risk Growth Allocation Fund stayed within its expected volatility range 81% of the time. Due to the uncertainty in Europe and the potential for an increase in volatility as a result of several macro events, we decided to target a volatility level toward the bottom of the Fund’s range. However, volatility remained lower than expected during most of the reporting period. Consequently, when the strategy did deliver volatility outside the target range, it was mostly under the lower end of the target (i.e., we seldom delivered volatility levels higher than the top of our target).

In an effort to keep the Fund’s expected volatility between 12% and 18%, we continued to increase its exposure to higher risk assets during the reporting period. At the beginning of May, the Fund maintained a target allocation to fixed income. While we did increase the Fund’s exposure to 20+ year U.S. Treasuries during the first two months of the reporting period, we ultimately sold the majority of the position going into September. The proceeds from that sale largely were reallocated to large-cap U.S. equities and gold ETFs.

The shift from lower risk assets to higher risk assets proved beneficial to Fund shareholders. During May, higher risk assets generated mostly negative returns. Large cap U.S. equities and emerging market equities were down during the month, while 20+ year U.S. Treasuries rose. As volatility receded toward the end of the reporting period, returns in the higher risk assets turned positive. From the beginning of June through the end of August, large cap U.S. equities, commodities and U.S. public real estate generated positive returns.

Nuveen Intelligent Risk Moderate Allocation Fund

The Fund’s Class A Shares at NAV outperformed the Morningstar Index and Lipper average for the since inception period May 4, 2012 through August 31, 2012. Also during the abbreviated fiscal period, the Intelligent Risk Moderate Allocation Fund stayed within its expected volatility range 100% of the time.

In an effort to keep the Fund’s expected volatility between 7% and 12% during the reporting period, we made several adjustments to increase its exposure to higher risk assets. As volatility levels fell, we sold the remainder of the Fund’s exposures in low duration, fixed income securities and invested much of the proceeds in emerging market equities, commodities and 20+ year U.S. Treasuries.

At the beginning of May, the Fund maintained a target allocation to low duration asset classes. As volatility fell, we repeatedly reduced the Fund’s low duration fixed income exposure, and by the end of August, we had removed all low duration exposure. Concurrently, we increased the Fund’s target exposure to 20+ year U.S. Treasuries during the May to August period. We also increased exposure to international developed equities.

The shift from lower risk assets to higher risk assets proved beneficial to Fund shareholders. During May, higher risk assets generated mostly negative returns. Large cap U.S. equities and emerging market equities were down, while 20+ year U.S. Treasuries rose. As volatility receded toward the end of the reporting period, returns in the higher risk assets turned positive. From the beginning of June through the end of August, large cap U.S. equities, commodities, and U.S. public real estate generated positive returns.

Nuveen Intelligent Risk Conservative Allocation Fund

The Fund’s Class A Shares at NAV outperformed the Morningstar Index and performed in line with the Lipper average for the since inception period May 4, 2012 through August 31, 2012. Also during the abbreviated fiscal period, the Intelligent Risk Conservative Allocation Fund stayed within its expected volatility range 100% of the time.

In an effort to keep the Fund’s expected volatility between 3.5% and 7% during the reporting period, we reallocated assets away from lower risk to higher risk asset classes. We reduced the Fund’s target allocations to most of its low-duration fixed income exposures, and increased its target allocations to U.S. corporate high yield, U.S. public real estate and other higher risk asset classes.

At the beginning of May 2012, the Fund maintained an allocation to one-three year U.S. Treasuries. As volatility fell, we continued to reduce the Fund’s exposure to the asset class, and by the end of August 2012, its target exposure was zero. Alternatively, we increased the Fund’s target exposure to U.S. corporate high yield from the beginning of May through August.

The shift from lower risk assets to higher risk assets proved beneficial to Fund shareholders. During May, higher risk assets generated mostly negative returns. Large cap U.S. equities and emerging market equities were both down during the month, while municipals and 20+ year U.S. Treasuries rose. As volatility receded toward the end of the reporting period, returns in the higher risk assets turned positive. From the beginning of June through the end of August 2012, large-cap U.S. equities, commodities and U.S. public real estate each generated positive returns.

Risk Considerations

Mutual fund investing involves risk; principal loss is possible. There is no guarantee that the Funds will achieve their investment objectives and the portfolio managers’ asset allocation decisions may adversely affect Fund performance. Each Fund is exposed to the risks of the underlying derivative instruments, ETFs, municipal bonds, corporate bonds, foreign government bonds, equity securities, commodities, real estate, asset-backed securities, mortgage-backed securities, inflation-protected securities and short-term securities that may be held in the portfolio. These risks include market risk, frequent trading risk, index methodology risk, other investment companies risk, liquidity risk, interest rate risk, and credit risk. As interest rates rise, bond prices fall. The credit risk and liquidity risk is heightened for non-investment grade or high-yield securities. The use of derivatives involves substantial financial risks and transaction costs. Commodities may be highly volatile and foreign investments are subject to additional risks including currency fluctuations, and economic or political instability. These risks are magnified in emerging markets. In addition, each Fund will bear its proportionate share of any fees and expenses paid by the ETFs in which it invests.

Fund Performance and Expense Ratios

The Fund Performance and Expense Ratios for each Fund are shown on the following six pages.

Returns quoted represent past performance, which is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment returns and principal value will fluctuate so that when shares are redeemed, they may be worth more or less than their original cost. Returns without sales charges would be lower if the sales charge were included. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Returns may reflect a contractual agreement between certain Funds and the investment adviser to waive certain fees and expenses; see Notes to Financial Statements, Footnote 7 — Management Fees and Other Transactions with Affiliates for more information. In addition, returns may reflect a voluntary expense limitation by the Funds’ investment adviser that may be modified or discontinued at any time without notice. For the most recent month-end performance visit www.nuveen.com or call (800) 257-8787.

Returns reflect differences in sales charges and expenses, which are primarily differences in distribution and service fees. Fund returns assume reinvestment of dividends and capital gains.

Comparative index and Lipper return information is provided for the Funds’ Class A Shares at net asset value (NAV) only.

The expense ratios shown reflect the Funds’ total operating expenses (before fee waivers and/or expense reimbursements, if any) as shown in the Funds’ most recent prospectus. The expense ratios include management fees and other fees and expenses.

Fund Performance and Expense Ratios (continued)

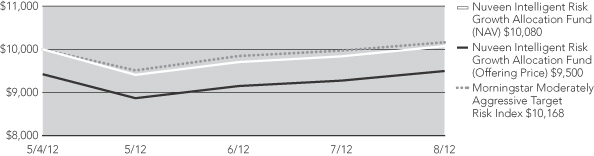

Nuveen Intelligent Risk Growth Allocation Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this page.

Fund Performance

Cumulative Total Returns as of August 31, 2012

| | | | |

| | | Cumulative | |

| | | Since

Inception* | |

Class A Shares at NAV | | | 0.80% | |

Class A Shares at maximum Offering Price | | | -5.00% | |

Morningstar Moderately Aggressive Target Risk Index** | | | 1.68% | |

Lipper Mixed-Asset Target Allocation Growth Funds Classification Average** | | | 1.91% | |

| |

Class C Shares | | | 0.55% | |

Class R3 Shares | | | 0.70% | |

Class I Shares | | | 0.90% | |

Cumulative Total Returns as of September 30, 2012 (Most Recent Calendar Quarter)

| | | | |

| | | Cumulative | |

| | | Since

Inception* | |

Class A Shares at NAV | | | 3.35% | |

Class A Shares at maximum Offering Price | | | -2.59% | |

Class C Shares | | | 3.05% | |

Class R3 Shares | | | 3.25% | |

Class I Shares | | | 3.45% | |

Class A Shares have a maximum 5.75% sales charge (Offering Price). Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC), also known as a back-end sales charge, if redeemed within twelve months of purchase. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class R3 Shares have no sales charge and are available only to certain retirement plans. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

Expense Ratios as of Most Recent Prospectus

| | | | | | | | |

| | |

| | | Gross

Expense

Ratios*** | | | Net

Expense

Ratios*** | |

Class A Shares | | | 1.77% | | | | 1.37% | |

Class C Shares | | | 2.52% | | | | 2.12% | |

Class R3 Shares | | | 2.02% | | | | 1.62% | |

Class I Shares | | | 1.52% | | | | 1.12% | |

The Fund’s investment adviser has agreed to waive fees and/or reimburse expenses through October 31, 2014 so that total annual Fund operating expenses (excluding 12b-1 distribution and/or service fees, interest expenses, taxes, fees incurred in acquiring and disposing of portfolio securities, acquired fund fees and expenses, and extraordinary expenses) do not exceed 0.71% of the average daily net assets of any class of Fund shares. The expense limitation expiring October 31, 2014 may be terminated or modified prior to that date only with the approval of the Board of Trustees of the Fund.

| * | Returns less than one-year are cumulative. Since inception returns are from 5/04/12. |

| ** | Refer to the Glossary of Terms Used in the Report for definitions. Indexes and Lipper averages are not available for direct investment. |

| *** | The expense ratios include acquired fund fees and expenses of 0.41%, which reflect the fees and expenses of the exchange-traded funds in which the Fund invests. |

Growth of an Assumed $10,000 Investment as of August 31, 2012 – Class A Shares

The graphs do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

Fund Performance and Expense Ratios (continued)

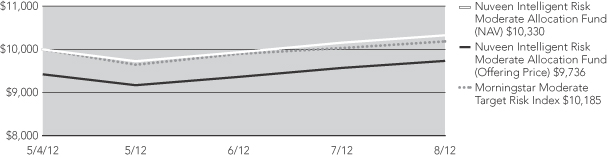

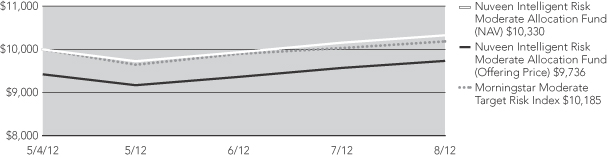

Nuveen Intelligent Risk Moderate Allocation Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this page.

Fund Performance

Cumulative Total Returns as of August 31, 2012

| | | | |

| | | Cumulative | |

| | | Since

Inception* | |

Class A Shares at NAV | | | 3.30% | |

Class A Shares at maximum Offering Price | | | -2.64% | |

Morningstar Moderate Target Risk Index** | | | 1.85% | |

Lipper Mixed-Asset Target Allocation Moderate Funds Classification Average** | | | 2.06% | |

| |

Class C Shares | | | 3.05% | |

Class R3 Shares | | | 3.20% | |

Class I Shares | | | 3.40% | |

Cumulative Total Returns as of September 30, 2012 (Most Recent Calendar Quarter)

| | | | |

| | | Cumulative | |

| | | Since

Inception* | |

Class A Shares at NAV | | | 4.74% | |

Class A Shares at maximum Offering Price | | | -1.29% | |

Class C Shares | | | 4.39% | |

Class R3 Shares | | | 4.62% | |

Class I Shares | | | 4.80% | |

Class A Shares have a maximum 5.75% sales charge (Offering Price). Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC), also known as a back-end sales charge, if redeemed within twelve months of purchase. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class R3 Shares have no sales charge and are available only to certain retirement plans. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

Expense Ratios as of Most Recent Prospectus

| | | | | | | | |

| | |

| | | Gross

Expense

Ratios*** | | | Net

Expense

Ratios*** | |

Class A Shares | | | 1.71% | | | | 1.31% | |

Class C Shares | | | 2.46% | | | | 2.06% | |

Class R3 Shares | | | 1.96% | | | | 1.56% | |

Class I Shares | | | 1.46% | | | | 1.06% | |

The Fund’s investment adviser has agreed to waive fees and/or reimburse expenses through October 31, 2014 so that total annual Fund operating expenses (excluding 12b-1 distribution and/or service fees, interest expenses, taxes, fees incurred in acquiring and disposing of portfolio securities, acquired fund fees and expenses, and extraordinary expenses) do not exceed 0.71% of the average daily net assets of any class of Fund shares. The expense limitation expiring October 31, 2014 may be terminated or modified prior to that date only with the approval of the Board of Trustees of the Fund.

| * | Returns less than one-year are cumulative. Since inception returns are from 5/04/12. |

| ** | Refer to the Glossary of Terms Used in the Report for definitions. Indexes and Lipper averages are not available for direct investment. |

| *** | The expense ratios include acquired fund fees and expenses of 0.35%, which reflect the fees and expenses of the exchange-traded funds in which the Fund invests. |

Growth of an Assumed $10,000 Investment as of August 31, 2012 – Class A Shares

The graphs do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

Fund Performance and Expense Ratios (continued)

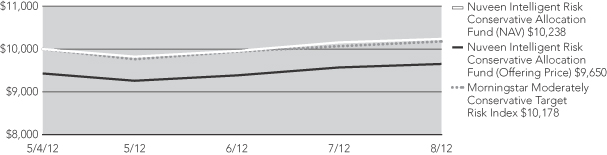

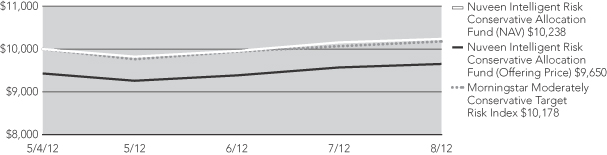

Nuveen Intelligent Risk Conservative Allocation Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this page.

Fund Performance

Cumulative Total Returns as of August 31, 2012

| | | | |

| | | Cumulative | |

| | | Since

Inception* | |

Class A Shares at NAV | | | 2.17% | |

Class A Shares at maximum Offering Price | | | -3.71% | |

Morningstar Moderately Conservative Target Risk Index** | | | 1.78% | |

Lipper Mixed-Asset Target Allocation Conservative Funds Classification Average** | | | 2.15% | |

| |

Class C Shares | | | 1.94% | |

Class R3 Shares | | | 2.11% | |

Class I Shares | | | 2.27% | |

Cumulative Total Returns as of September 30, 2012 (Most Recent Calendar Quarter)

| | | | |

| | | Cumulative | |

| | | Since

Inception* | |

Class A Shares at NAV | | | 3.20% | |

Class A Shares at maximum Offering Price | | | -2.73% | |

Class C Shares | | | 2.91% | |

Class R3 Shares | | | 3.12% | |

Class I Shares | | | 3.33% | |

Class A Shares have a maximum 5.75% sales charge (Offering Price). Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC), also known as a back-end sales charge, if redeemed within twelve months of purchase. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class R3 Shares have no sales charge and are available only to certain retirement plans. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

Expense Ratios as of Most Recent Prospectus

| | | | | | | | |

| | |

| | | Gross

Expense

Ratios*** | | | Net

Expense

Ratios*** | |

Class A Shares | | | 1.69% | | | | 1.29% | |

Class C Shares | | | 2.44% | | | | 2.04% | |

Class R3 Shares | | | 1.94% | | | | 1.54% | |

Class I Shares | | | 1.44% | | | | 1.04% | |

The Fund’s investment adviser has agreed to waive fees and/or reimburse expenses through October 31, 2014 so that total annual Fund operating expenses (excluding 12b-1 distribution and/or service fees, interest expenses, taxes, fees incurred in acquiring and disposing of portfolio securities, acquired fund fees and expenses, and extraordinary expenses) do not exceed 0.71% of the average daily net assets of any class of Fund shares. The expense limitation expiring October 31, 2014 may be terminated or modified prior to that date only with the approval of the Board of Trustees of the Fund.

| * | Returns less than one-year are cumulative. Since inception returns are from 5/04/12. |

| ** | Refer to the Glossary of Terms Used in the Report for definitions. Indexes and Lipper averages are not available for direct investment. |

| *** | The expense ratios include acquired fund fees and expenses of 0.33%, which reflect the fees and expenses of the exchange-traded funds in which the Fund invests. |

Growth of an Assumed $10,000 Investment as of August 31, 2012 – Class A Shares

The graphs do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

Holding Summaries as of August 31, 2012

This data relates to the securities held in each Fund’s portfolio of investments. It should not be construed as a measure of performance for the Fund itself.

A copy of the most recent financial statements for the exchange-traded funds in which the Fund invests can be obtained directly from the Securities and Exchange Commission on its website at http://www.sec.gov.

Nuveen Intelligent Risk Growth Allocation Fund

| | | | | | | | |

| Exchange-Traded Funds | | Weighting1 | | | 1-Year

Total Returns2 | |

iShares Barclays 20+ Year Treasury Bond Fund | | | 5.4% | | | | 22.02% | |

iShares Barclays Aggregate Bond Fund | | | 1.9% | | | | 5.63% | |

iShares Barclays Credit Bond Fund | | | 2.0% | | | | 9.42% | |

iShares Barclays TIPS Bond Fund | | | 1.9% | | | | 8.10% | |

iShares Dow Jones U.S. Real Estate Index Fund | | | 14.0% | | | | 18.99% | |

iShares MSCI EAFE Index Fund | | | 11.1% | | | | (0.14)% | |

iShares Russell 1000 Index Fund | | | 10.1% | | | | 17.18% | |

iShares Russell 2000 Index Fund | | | 10.0% | | | | 13.47% | |

iShares S&P North American Natural Resources Sector Index Fund | | | 11.8% | | | | (4.07)% | |

PowerShares DB Commodity Index Tracking Fund | | | 6.2% | | | | (4.87)% | |

PowerShares DB Gold Fund | | | 15.1% | | | | (9.36)% | |

Vanguard MSCI Emerging Markets ETF | | | 11.2% | | | | (6.14)% | |

| | | | |

| Short-Term Investments | | Weighting1 | |

First American Treasury Obligations Fund (Class Z) | | | 0.4% | |

| 1 | As a percentage of total net assets as of August 31, 2012. Holdings are subject to change. Percentages will not add to 100% due to the exclusion of Other Assets Less Liabilities. |

Nuveen Intelligent Risk Moderate Allocation Fund

| | | | | | | | |

| Exchange-Traded Funds | | Weighting1 | | | 1-Year

Total Returns2 | |

iShares Barclays 20+ Year Treasury Bond Fund | | | 32.0% | | | | 22.02% | |

iShares Barclays Aggregate Bond Fund | | | 0.5% | | | | 5.63% | |

iShares Barclays Credit Bond Fund | | | 0.4% | | | | 9.42% | |

iShares Barclays TIPS Bond Fund | | | 0.6% | | | | 8.10% | |

iShares Dow Jones U.S. Real Estate Index Fund | | | 7.0% | | | | 18.99% | |

iShares MSCI EAFE Index Fund | | | 9.2% | | | | (0.14)% | |

iShares Russell 1000 Index Fund | | | 8.2% | | | | 17.18% | |

iShares Russell 2000 Index Fund | | | 6.9% | | | | 13.47% | |

iShares S&P National AMT-Free Municipal Bond Fund | | | 0.9% | | | | 8.73% | |

iShares S&P North American Natural Resources Sector Index Fund | | | 6.2% | | | | (4.07)% | |

PowerShares DB Commodity Index Tracking Fund | | | 9.0% | | | | (4.87)% | |

PowerShares DB Gold Fund | | | 9.4% | | | | (9.36)% | |

SPDR Barclays Capital High Yield Bond Fund | | | 0.6% | | | | 13.06% | |

Vanguard MSCI Emerging Markets ETF | | | 8.8% | | | | (6.14)% | |

| | | | |

| Short-Term Investments | | Weighting1 | |

First American Treasury Obligations Fund (Class Z) | | | 0.4% | |

| 1 | As a percentage of total net assets as of August 31, 2012. Holdings are subject to change. Percentages will not add to 100% due to the exclusion of Other Assets Less Liabilities. |

Holding Summaries (continued) as of August 31, 2012

Nuveen Intelligent Risk Conservation Allocation Fund

| | | | | | | | |

| Exchange-Traded Funds | | Weighting1 | | | 1-Year

Total Returns2 | |

iShares Barclays 20+ Year Treasury Bond Fund | | | 15.1% | | | | 22.02% | |

iShares Dow Jones U.S. Real Estate Index Fund | | | 5.3% | | | | 18.99% | |

iShares MSCI EAFE Index Fund | | | 2.9% | | | | (0.14)% | |

iShares Russell 1000 Index Fund | | | 4.6% | | | | 17.18% | |

iShares Russell 2000 Index Fund | | | 3.9% | | | | 13.47% | |

iShares S&P National AMT-Free Municipal Bond Fund | | | 33.8% | | | | 8.73% | |

iShares S&P North American Natural Resources Sector Index Fund | | | 1.6% | | | | (4.07)% | |

PowerShares DB Commodity Index Tracking Fund | | | 3.4% | | | | (4.87)% | |

PowerShares DB Gold Fund | | | 5.1% | | | | (9.36)% | |

SPDR Barclays Capital High Yield Bond Fund | | | 21.3% | | | | 13.06% | |

Vanguard MSCI Emerging Markets ETF | | | 3.6% | | | | (6.14)% | |

| | | | |

| Short-Term Investments | | Weighting1 | |

First American Treasury Obligations Fund (Class Z) | | | 2.5% | |

| 1 | As a percentage of total net assets as of August 31, 2012. Holdings are subject to change. Percentages will not add to 100% due to the exclusion of Other Assets Less Liabilities. |

Expense Examples

As a shareholder of one or more of the Funds, you incur two types of costs: (1) transaction costs, including up-front and back-end sales charges (loads) or redemption fees, where applicable; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees, where applicable; and other Fund expenses. The Examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. Since the Funds expense examples below reflect only the first 120 days of the Funds’ operations they may not provide a meaningful understanding of the Funds’ ongoing expenses.

The Examples below are based on an investment of $1,000 invested at the beginning of the period and held for the period.

The information under “Actual Performance,” together with the amount you invested, allows you to estimate actual expenses incurred over the reporting period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60) and multiply the result by the cost shown for your share class, in the row entitled “Expenses Incurred During Period” to estimate the expenses incurred on your account during this period.

The information under “Hypothetical Performance,” provides information about hypothetical account values and hypothetical expenses based on the respective Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expense you incurred for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the hypothetical information is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds or share classes. In addition, if these transaction costs were included, your costs would have been higher.

In addition to the fees and expenses which the Funds bear directly; the Funds indirectly bear a pro rata share of the fees and expenses of the exchange-traded funds in which the Funds invest. Because the exchange-traded funds have varied expenses and fee levels and the Funds may own different proportions at different times, the amount of fees and expenses incurred indirectly by the Funds will vary. These exchange-traded fund fees and expenses are not included in the expenses shown in the table.

Expense Examples (continued)

Nuveen Intelligent Risk Growth Allocation Fund

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | Hypothetical Performance | |

| | | Actual Performance | | | | | (5% annualized return before expenses) | |

| | | A Shares | | | C Shares | | | R3 Shares | | | I Shares | | | | | A Shares | | | C Shares | | | R3 Shares | | | I Shares | |

| Beginning Account Value (5/04/12) | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | |

| Ending Account Value (8/31/12) | | $ | 1,008.00 | | | $ | 1,005.50 | | | $ | 1,007.00 | | | $ | 1,009.00 | | | | | $ | 1,013.38 | | | $ | 1,010.92 | | | $ | 1,012.56 | | | $ | 1,014.20 | |

| Expenses Incurred During Period | | $ | 3.07 | | | $ | 5.54 | | | $ | 3.89 | | | $ | 2.25 | | | | | $ | 3.08 | | | $ | 5.55 | | | $ | 3.90 | | | $ | 2.25 | |

For each class of the Fund, expenses are equal to the Fund’s annualized net expense ratio of .93%, 1.68%, 1.18% and .68% for Classes A, C, R3 and I, respectively, multiplied by the average account value over the period, multiplied by 120/365 (to reflect the 120 days in the period since commencement of operations).

Nuveen Intelligent Risk Moderate Allocation Fund

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | Hypothetical Performance | |

| | | Actual Performance | | | | | (5% annualized return before expenses) | |

| | | A Shares | | | C Shares | | | R3 Shares | | | I Shares | | | | | A Shares | | | C Shares | | | R3 Shares | | | I Shares | |

| Beginning Account Value (5/04/12) | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | |

| Ending Account Value (8/31/12) | | $ | 1,033.00 | | | $ | 1,030.50 | | | $ | 1,032.00 | | | $ | 1,034.00 | | | | | $ | 1,013.38 | | | $ | 1,010.92 | | | $ | 1,012.56 | | | $ | 1,014.20 | |

| Expenses Incurred During Period | | $ | 3.11 | | | $ | 5.61 | | | $ | 3.94 | | | $ | 2.27 | | | | | $ | 3.08 | | | $ | 5.55 | | | $ | 3.90 | | | $ | 2.25 | |

For each class of the Fund, expenses are equal to the Fund’s annualized net expense ratio of .93%, 1.68%, 1.18% and .68% for Classes A, C, R3 and I, respectively, multiplied by the average account value over the period, multiplied by 120/365 (to reflect the 120 days in the period since commencement of operations.).

Nuveen Intelligent Risk Conservative Allocation Fund

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | Hypothetical Performance | |

| | | Actual Performance | | | | | (5% annualized return before expenses) | |

| | | A Shares | | | C Shares | | | R3 Shares | | | I Shares | | | | | A Shares | | | C Shares | | | R3 Shares | | | I Shares | |

| Beginning Account Value (5/04/12) | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | |

| Ending Account Value (8/31/12) | | $ | 1,021.70 | | | $ | 1,019.40 | | | $ | 1,021.10 | | | $ | 1,022.70 | | | | | $ | 1,013.38 | | | $ | 1,010.92 | | | $ | 1,012.56 | | | $ | 1,014.20 | |

| Expenses Incurred During Period | | $ | 3.09 | | | $ | 5.58 | | | $ | 3.92 | | | $ | 2.26 | | | | | $ | 3.08 | | | $ | 5.55 | | | $ | 3.90 | | | $ | 2.25 | |

For each class of the Fund, expenses are equal to the Fund’s annualized net expense ratio of .93%, 1.68%, 1.18% and .68% for Classes A, C, R3 and I, respectively, multiplied by the average account value over the period, multiplied by 120/365 (to reflect the 120 days in the period since commencement of operations.).

Report of Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders of

Nuveen Investment Trust:

In our opinion, the accompanying statements of assets and liabilities, including the portfolios of investments, and the related statements of operations, of changes in net assets, and the financial highlights present fairly, in all material respects, the financial position of Nuveen Intelligent Risk Growth Allocation Fund, Nuveen Intelligent Risk Moderate Allocation Fund, and Nuveen Intelligent Risk Conservative Allocation Fund (each a series of the Nuveen Investment Trust, hereinafter referred to as the “Funds”) at August 31, 2012, the results of each of their operations, the changes in each of their net assets and the financial highlights for the period May 4, 2012 (commencement of operations) through August 31, 2012, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Funds’ management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at August 31, 2012 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Chicago, IL

October 26, 2012

Portfolio of Investments

Nuveen Intelligent Risk Growth Allocation Fund

August 31, 2012

| | | | | | | | | | | | | | |

| Shares | | | Description (1)(4) | | | | | | | | Value | |

| | | | | | | | | | | | | | |

| | | | EXCHANGE-TRADED FUNDS – 100.7% | | | | | | | | | | |

| | | | | |

| | | | Commodity Funds – 21.3% | | | | | | | | | | |

| | | | | |

| | 2,184 | | | PowerShares DB Commodity Index Tracking Fund, (2) | | | | | | | | $ | 62,877 | |

| | | | | |

| | 2,607 | | | PowerShares DB Gold Fund, (2) | | | | | | | | | 151,962 | |

| | | | Total Commodity Funds | | | | | | | | | 214,839 | |

| | | | Equity Funds – 68.2% | | | | | | | | | | |

| | | | | |

| | 2,145 | | | iShares Dow Jones U.S. Real Estate Index Fund | | | | | | | | | 140,776 | |

| | | | | |

| | 2,165 | | | iShares MSCI EAFE Index Fund | | | | | | | | | 111,714 | |

| | | | | |

| | 1,314 | | | iShares Russell 1000 Index Fund | | | | | | | | | 102,282 | |

| | | | | |

| | 1,237 | | | iShares Russell 2000 Index Fund | | | | | | | | | 100,432 | |

| | | | | |

| | 3,126 | | | iShares S&P North American Natural Resources Sector Index Fund | | | | | | | | | 119,069 | |

| | | | | |

| | 2,829 | | | Vanguard MSCI Emerging Markets ETF | | | | | | | | | 113,585 | |

| | | | Total Equity Funds | | | | | | | | | 687,858 | |

| | | | Fixed Income Funds – 11.2% | | | | | | | | | | |

| | | | | |

| | 427 | | | iShares Barclays 20+ Year Treasury Bond Fund | | | | | | | | | 54,536 | |

| | | | | |

| | 172 | | | iShares Barclays Aggregate Bond Fund | | | | | | | | | 19,328 | |

| | | | | |

| | 173 | | | iShares Barclays Credit Bond Fund | | | | | | | | | 19,677 | |

| | | | | |

| | 161 | | | iShares Barclays TIPS Bond Fund | | | | | | | | | 19,504 | |

| | | | Total Fixed Income Funds | | | | | | | | | 113,045 | |

| | | | Total Exchange-Traded Funds (cost $995,784) | | | | | | | | | 1,015,742 | |

| | | | | |

| Shares | | | Description (1) | | | | | | | | Value | |

| | | | SHORT-TERM INVESTMENTS – 0.4% | | | | | | | | | | |

| | | | | |

| | | | Money Market Funds – 0.4% | | | | | | | | | | |

| | | | | |

| | 3,976 | | | First American Treasury Obligations Fund, Class Z, 0.000%, (3) | | | | | | | | $ | 3,976 | |

| | | | Total Short-Term Investments (cost $3,976) | | | | | | | | | 3,976 | |

| | | | Total Investments (cost $999,760) – 101.1% | | | | | | | | | 1,019,718 | |

| | | | Other Assets Less Liabilities – (1.1)% | | | | | | | | | (11,193) | |

| | | | Net Assets – 100% | | | | | | | | $ | 1,008,525 | |

| | (1) | | All percentages shown in the Portfolio of Investments are based on net assets. |

| | (2) | | Non-income producing; fund has not declared a dividend within the past twelve months. |

| | (3) | | The rate shown is the annualized seven-day yield as of August 31, 2012. |

| | (4) | | A copy of the most recent financial statements for the exchange-traded funds in which the Fund invests can be obtained directly from the Securities and Exchange Commission on its website at http://www.sec.gov. |

See accompanying notes to financial statements.

Portfolio of Investments

Nuveen Intelligent Risk Moderate Allocation Fund

August 31, 2012

| | | | | | | | | | | | | | |

| Shares | | | Description (1)(4) | | | | | | | | Value | |

| | | | | | | | | | | | | | |

| | | | EXCHANGE-TRADED FUNDS – 99.7% | | | | | | | | | | |

| | | | | |

| | | | Commodity Funds – 18.4% | | | | | | | | | | |

| | | | | |

| | 3,450 | | | PowerShares DB Commodity Index Tracking Fund, (2) | | | | | | | | $ | 99,326 | |

| | | | | |

| | 1,783 | | | PowerShares DB Gold Fund, (2) | | | | | | | | | 103,931 | |

| | | | Total Commodity Funds | | | | | | | | | 203,257 | |

| | | | Equity Funds – 46.9% | | | | | | | | | | |

| | | | | |

| | 1,181 | | | iShares Dow Jones U.S. Real Estate Index Fund | | | | | | | | | 77,509 | |

| | | | | |

| | 1,972 | | | iShares MSCI EAFE Index Fund | | | | | | | | | 101,755 | |

| | | | | |

| | 1,165 | | | iShares Russell 1000 Index Fund | | | | | | | | | 90,684 | |

| | | | | |

| | 947 | | | iShares Russell 2000 Index Fund | | | | | | | | | 76,887 | |

| | | | | |

| | 1,799 | | | iShares S&P North American Natural Resources Sector Index Fund | | | | | | | | | 68,524 | |

| | | | | |

| | 157 | | | SPDR Barclays Capital High Yield Bond Fund | | | | | | | | | 6,302 | |

| | | | | |

| | 2,421 | | | Vanguard MSCI Emerging Markets ETF | | | | | | | | | 97,202 | |

| | | | Total Equity Funds | | | | | | | | | 518,863 | |

| | | | Fixed Income Funds – 34.4% | | | | | | | | | | |

| | | | | |

| | 2,766 | | | iShares Barclays 20+ Year Treasury Bond Fund | | | | | | | | | 353,274 | |

| | | | | |

| | 51 | | | iShares Barclays Aggregate Bond Fund | | | | | | | | | 5,731 | |

| | | | | |

| | 38 | | | iShares Barclays Credit Bond Fund | | | | | | | | | 4,322 | |

| | | | | |

| | 55 | | | iShares Barclays TIPS Bond Fund | | | | | | | | | 6,663 | |

| | | | | |

| | 86 | | | iShares S&P National AMT-Free Municipal Bond Fund | | | | | | | | | 9,600 | |

| | | | Total Fixed Income Funds | | | | | | | | | 379,590 | |

| | | | Total Exchange-Traded Funds (cost $1,062,138) | | | | | | | | | 1,101,710 | |

| | | | | |

| Shares | | | Description (1) | | | | | | | | Value | |

| | | | SHORT-TERM INVESTMENTS – 0.4% | | | | | | | | | | |

| | | | | |

| | | | Money Market Funds – 0.4% | | | | | | | | | | |

| | | | | |

| | 4,570 | | | First American Treasury Obligations Fund, Class Z, 0.000%, (3) | | | | | | | | $ | 4,570 | |

| | | | Total Short-Term Investments (cost $4,570) | | | | | | | | | 4,570 | |

| | | | Total Investments (cost $1,066,708) – 100.1% | | | | | | | | | 1,106,280 | |

| | | | Other Assets Less Liabilities – (0.1)% | | | | | | | | | (743) | |

| | | | Net Assets – 100% | | | | | | | | $ | 1,105,537 | |

| | (1) | | All percentages shown in the Portfolio of Investments are based on net assets. |

| | (2) | | Non-income producing; fund has not declared a dividend within the past twelve months. |

| | (3) | | The rate shown is the annualized seven-day yield as of August 31, 2012. |

| | (4) | | A copy of the most recent financial statements for the exchange-traded funds in which the Fund invests can be obtained directly from the Securities and Exchange Commission on its website at http://www.sec.gov. |

See accompanying notes to financial statements.

Portfolio of Investments

Nuveen Intelligent Risk Conservative Allocation Fund (continued)

August 31, 2012

| | | | | | | | | | | | | | |

| Shares | | | Description (1)(4) | | | | | | | | Value | |

| | | | | | | | | | | | | | |

| | | | EXCHANGE-TRADED FUNDS – 100.6% | | | | | | | | | | |

| | | | | |

| | | | Commodity Funds – 8.5% | | | | | | | | | | |

| | | | | |

| | 1,273 | | | PowerShares DB Commodity Index Tracking Fund, (2) | | | | | | | | $ | 36,650 | |

| | | | | |

| | 920 | | | PowerShares DB Gold Fund, (2) | | | | | | | | | 53,627 | |

| | | | Total Commodity Funds | | | | | | | | | 90,277 | |

| | | | Equity Funds – 43.2% | | | | | | | | | | |

| | | | | |

| | 847 | | | iShares Dow Jones U.S. Real Estate Index Fund | | | | | | | | | 55,589 | |

| | | | | |

| | 601 | | | iShares MSCI EAFE Index Fund | | | | | | | | | 31,012 | |

| | | | | |

| | 624 | | | iShares Russell 1000 Index Fund | | | | | | | | | 48,572 | |

| | | | | |

| | 502 | | | iShares Russell 2000 Index Fund | | | | | | | | | 40,757 | |

| | | | | |

| | 441 | | | iShares S&P North American Natural Resources Sector Index Fund | | | | | | | | | 16,798 | |

| | | | | |

| | 5,587 | | | SPDR Barclays Capital High Yield Bond Fund | | | | | | | | | 224,262 | |

| | | | | |

| | 936 | | | Vanguard MSCI Emerging Markets ETF | | | | | | | | | 37,580 | |

| | | | Total Equity Funds | | | | | | | | | 454,570 | |

| | | | Fixed Income Funds – 48.9% | | | | | | | | | | |

| | | | | |

| | 1,245 | | | iShares Barclays 20+ Year Treasury Bond Fund | | | | | | | | | 159,011 | |

| | | | | |

| | 3,184 | | | iShares S&P National AMT-Free Municipal Bond Fund | | | | | | | | | 355,430 | |

| | | | Total Fixed Income Funds | | | | | | | | | 514,441 | |

| | | | Total Exchange-Traded Funds (cost $1,038,837) | | | | | | | | | 1,059,288 | |

| | | | | |

| Shares | | | Description (1) | | | | | | | | Value | |

| | | | SHORT-TERM INVESTMENTS – 2.5% | | | | | | | | | | |

| | | | | |

| | | | Money Market Funds – 2.5% | | | | | | | | | | |

| | | | | |

| | 25,875 | | | First American Treasury Obligations Fund, Class Z, 0.000%, (3) | | | | | | | | $ | 25,875 | |

| | | | Total Short-Term Investments (cost $25,875) | | | | | | | | | 25,875 | |

| | | | Total Investments (cost $1,064,712) – 103.1% | | | | | | | | | 1,085,163 | |

| | | | Other Assets Less Liabilities – (3.1)% | | | | | | | | | (32,968) | |

| | | | Net Assets – 100% | | | | | | | | $ | 1,052,195 | |

| | (1) | | All percentages shown in the Portfolio of Investments are based on net assets. |

| | (2) | | Non-income producing; fund has not declared a dividend within the past twelve months. |

| | (3) | | The rate shown is the annualized seven-day yield as of August 31, 2012. |

| | (4) | | A copy of the most recent financial statements for the exchange-traded funds in which the Fund invests can be obtained directly from the Securities and Exchange Commission on its website at http://www.sec.gov. |

See accompanying notes to financial statements.

Statement of Assets and Liabilities

August 31, 2012

| | | | | | | | | | | | |

| | | Intelligent Risk

Growth Allocation | | | Intelligent Risk

Moderate Allocation | | | Intelligent Risk

Conservative Allocation | |

Assets | | | | | | | | | | | | |

Investments, at value (cost $999,760, $1,066,708 and $1,064,712, respectively) | | $ | 1,019,718 | | | $ | 1,106,280 | | | $ | 1,085,163 | |

Receivables: | | | | | | | | | | | | |

From Adviser | | | 5,472 | | | | 5,432 | | | | 5,482 | |

Shares sold | | | — | | | | 10,495 | | | | — | |

Other assets | | | 262 | | | | 263 | | | | 263 | |

Total assets | | | 1,025,452 | | | | 1,122,470 | | | | 1,090,908 | |

Liabilities | | | | | | | | | | | | |

Payables: | | | | | | | | | | | | |

Dividends | | | — | | | | — | | | | 1,929 | |

Investments purchased | | | — | | | | — | | | | 19,856 | |

Accrued expenses: | | | | | | | | | | | | |

Trustees’ Fees | | | 3 | | | | 3 | | | | 3 | |

12b-1 distribution and service fees | | | 74 | | | | 80 | | | | 75 | |

Other | | | 16,850 | | | | 16,850 | | | | 16,850 | |

Total liabilities | | | 16,927 | | | | 16,933 | | | | 38,713 | |

Net assets | | $ | 1,008,525 | | | $ | 1,105,537 | | | $ | 1,052,195 | |

Class A Shares | | | | | | | | | | | | |

Net assets | | $ | 50,400 | | | $ | 97,755 | | | $ | 70,921 | |

Shares outstanding | | | 2,500 | | | | 4,732 | | | | 3,488 | |

Net asset value per share | | $ | 20.16 | | | $ | 20.66 | | | $ | 20.33 | |

Offering price per share (net asset value per share plus maximum sales charge of 5.75% of offering price) | | $ | 21.39 | | | $ | 21.92 | | | $ | 21.57 | |

Class C Shares | | | | | | | | | | | | |

Net assets | | $ | 50,276 | | | $ | 62,014 | | | $ | 50,794 | |

Shares outstanding | | | 2,500 | | | | 3,009 | | | | 2,500 | |

Net asset value and offering price per share | | $ | 20.11 | | | $ | 20.61 | | | $ | 20.32 | |

Class R3 Shares | | | | | | | | | | | | |

Net assets | | $ | 50,358 | | | $ | 51,604 | | | $ | 50,817 | |

Shares outstanding | | | 2,500 | | | | 2,500 | | | | 2,500 | |

Net asset value and offering price per share | | $ | 20.14 | | | $ | 20.64 | | | $ | 20.33 | |

Class I Shares | | | | | | | | | | | | |

Net assets | | $ | 857,491 | | | $ | 894,164 | | | $ | 879,663 | |

Shares outstanding | | | 42,500 | | | | 43,248 | | | | 43,255 | |

Net asset value and offering price per share | | $ | 20.18 | | | $ | 20.68 | | | $ | 20.34 | |

Net assets consist of: | | | | | | | | | | | | |

Capital paid-in | | $ | 999,793 | | | $ | 1,070,516 | | | $ | 1,034,842 | |

Undistributed (Over-distribution of) net investment income | | | 3,334 | | | | 3,312 | | | | 414 | |

Accumulated net realized gain (loss) | | | (14,560 | ) | | | (7,863 | ) | | | (3,512 | ) |

Net unrealized appreciation (depreciation) | | | 19,958 | | | | 39,572 | | | | 20,451 | |

Net assets | | $ | 1,008,525 | | | $ | 1,105,537 | | | $ | 1,052,195 | |

Authorized shares | | | Unlimited | | | | Unlimited | | | | Unlimited | |

Par value per share | | $ | 0.01 | | | $ | 0.01 | | | $ | 0.01 | |

See accompanying notes to financial statements.

Statement of Operations

For the period May 4, 2012 (commencement of operations) through August 31, 2012

| | | | | | | | | | | | |

| | | Intelligent Risk

Growth Allocation | | | Intelligent Risk

Moderate Allocation | | | Intelligent Risk

Conservative Allocation | |

Investment Income | | $ | 5,578 | | | $ | 5,646 | | | $ | 8,248 | |

Expenses | | | | | | | | | | | | |

Management fees | | | 2,461 | | | | 2,555 | | | | 2,539 | |

12b-1 service fees – Class A | | | 40 | | | | 46 | | | | 41 | |

12b-1 distribution and service fees – Class C | | | 159 | | | | 163 | | | | 163 | |

12b-1 distribution and service fees – Class R3 | | | 79 | | | | 81 | | | | 81 | |

Shareholders’ servicing agent fees and expenses | | | 35 | | | | 34 | | | | 35 | |

Custodian’s fees and expenses | | | 481 | | | | 477 | | | | 506 | |

Trustees’ fees and expenses | | | 8 | | | | 8 | | | | 8 | |

Professional fees | | | 15,022 | | | | 15,022 | | | | 15,022 | |

Shareholders’ reports – printing and mailing expenses | | | 2,928 | | | | 2,928 | | | | 2,928 | |

Federal and state registration fees | | | 296 | | | | 296 | | | | 296 | |

Other expenses | | | 1,639 | | | | 1,639 | | | | 1,640 | |

Total expenses before expense reimbursement | | | 23,148 | | | | 23,249 | | | | 23,259 | |

Expense reimbursement | | | (20,697 | ) | | | (20,703 | ) | | | (20,732 | ) |

Net expenses | | | 2,451 | | | | 2,546 | | | | 2,527 | |

Net investment income (loss) | | | 3,127 | | | | 3,100 | | | | 5,721 | |

Realized and Unrealized Gain (Loss) | | | | | | | | | | | | |

Net realized gain (loss) from investments | | | (14,560 | ) | | | (7,863 | ) | | | (3,512 | ) |

Change in net unrealized appreciation (depreciation) of investments | | | 19,958 | | | | 39,572 | | | | 20,451 | |

Net realized and unrealized gain (loss) | | | 5,398 | | | | 31,709 | | | | 16,939 | |

Net increase (decrease) in net assets from operations | | $ | 8,525 | | | $ | 34,809 | | | $ | 22,660 | |

See accompanying notes to financial statements.

Statement of Changes in Net Assets

| | | | | | | | | | | | |

| | | Intelligent Risk

Growth Allocation | | | Intelligent Risk

Moderate Allocation | | | Intelligent Risk

Conservative Allocation | |

| | | For the Period 5/04/12

(commencement

of operations)

through 8/31/12 | | | For the Period 5/04/12

(commencement

of operations)

through 8/31/12 | | | For the Period 5/04/12

(commencement

of operations)

through 8/31/12 | |

Operations | | | | | | | | | | | | |

Net investment income (loss) | | $ | 3,127 | | | $ | 3,100 | | | $ | 5,721 | |

Net realized gain (loss) from investments | | | (14,560 | ) | | | (7,863 | ) | | | (3,512 | ) |

Change in net unrealized appreciation (depreciation) of investments | | | 19,958 | | | | 39,572 | | | | 20,451 | |

Net increase (decrease) in net assets from operations | | | 8,525 | | | | 34,809 | | | | 22,660 | |

Distributions to Shareholders | | | | | | | | | | | | |

From net investment income: | | | | | | | | | | | | |

Class A | | | — | | | | — | | | | (258 | ) |

Class C | | | — | | | | — | | | | (167 | ) |

Class R3 | | | — | | | | — | | | | (227 | ) |

Class I | | | — | | | | — | | | | (4,868 | ) |

Decrease in net assets from distributions to shareholders | | | — | | | | — | | | | (5,520 | ) |

Fund Share Transactions | | | | | | | | | | | | |

Proceeds from sale of shares | | | 1,000,000 | | | | 1,070,728 | | | | 1,035,000 | |

Proceeds from shares issued to shareholders due to reinvestment of distributions | | | — | | | | — | | | | 55 | |

| | | 1,000,000 | | | | 1,070,728 | | | | 1,035,055 | |

Cost of shares redeemed | | | — | | | | — | | | | — | |

Net increase (decrease) in net assets from Fund share transactions | | | 1,000,000 | | | | 1,070,728 | | | | 1,035,055 | |

Net increase (decrease) in net assets | | | 1,008,525 | | | | 1,105,537 | | | | 1,052,195 | |

Net assets at the beginning of period | | | — | | | | — | | | | — | |

Net assets at the end of period | | $ | 1,008,525 | | | $ | 1,105,537 | | | $ | 1,052,195 | |

Undistributed (Over-distribution of) net investment income at the end of period | | $ | 3,334 | | | $ | 3,312 | | | $ | 414 | |

See accompanying notes to financial statements.

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Selected data for a share outstanding throughout each period: | |

| | | | | | |

| Class (Commencement Date) | | | | | | | | | | | | | | | | | | | |

| | | | | | Investment Operations | | | Less Distributions | | | | |

| | | | | | |

| INTELLIGENT RISK GROWTH ALLOCATION | | | | | | | | | | | | | | | | | | | |

Year Ended

August 31, | | Beginning

Net

Asset

Value | | | Net

Invest-

ment

Income

(Loss)(a) | | |

Net

Realized/

Unrealized

Gain

(Loss) | | | Total | | | Net

Invest-

ment

Income | | | Capital

Gains(b) | | | Total | | | Ending

Net

Asset

Value | |

CLASS A (5/12) | | | | | | | | | | | | | | | | | | | | | | | | | |

2012(e) | | $ | 20.00 | | | $ | .05 | | | $ | .11 | | | $ | .16 | | | $ | — | | | $ | — | | | $ | — | | | $ | 20.16 | |

CLASS C (5/12) | | | | | | | | | | | | | | | | | | | | | | | | | |

2012(e) | | | 20.00 | | | | — | ** | | | .11 | | | | .11 | | | | — | | | | — | | | | — | | | | 20.11 | |

CLASS R3 (5/12) | | | | | | | | | | | | | | | | | | | | | | | | | |

2012(e) | | | 20.00 | | | | .04 | | | | .10 | | | | .14 | | | | — | | | | — | | | | — | | | | 20.14 | |

CLASS I (5/12) | | | | | | | | | | | | | | | | | | | | | | | | | |

2012(e) | | | 20.00 | | | | .07 | | | | .11 | | | | .18 | | | | — | | | | — | | | | — | | | | 20.18 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | |

| Ratios/Supplemental Data | |

| | | | | | |

Ratios to Average

Net Assets Before

Reimbursement | | | Ratios to Average

Net Assets After

Reimbursement(d) | | | | |

| | | | | | |

Total

Return(c) | | | Ending

Net

Assets

(000) | | | Expenses(f) | | | Net

Invest-

ment

Income

(Loss) | | | Expenses(f) | | | Net

Invest-

ment

Income

(Loss) | | | Portfolio

Turnover

Rate | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | .80 | % | | $ | 50 | | | | 7.41 | %* | | | (5.66 | )%* | | | .93 | %* | | | .82 | %* | | | 25 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | .55 | | | | 50 | | | | 8.16 | * | | | (6.41 | )* | | | 1.68 | * | | | .07 | * | | | 25 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | .70 | | | | 50 | | | | 7.66 | * | | | (5.91 | )* | | | 1.18 | * | | | .57 | * | | | 25 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | .90 | | | | 857 | | | | 7.16 | * | | | (5.42 | )* | | | .68 | * | | | 1.07 | * | | | 25 | |

| (a) | Per share Net Investment Income (Loss) is calculated using the average daily shares method. |

| (b) | Distributions from Capital Gains include short-term capital gains, if any. |

| (c) | Total return is the combination of changes in net asset value without any sales charge, reinvested dividend income at net asset value and reinvested capital gains distributions at net asset value, if any. Total returns are not annualized. |

| (d) | After expense reimbursement from the Adviser, where applicable. |

| (e) | For the period May 4, 2012 (commencement of operations) through August 31, 2012. |

| (f) | In addition to the fees and expenses which the Fund bears directly; the Fund indirectly bears a pro rata share of the fees and expenses of the exchange-traded funds in which the Fund invests. These exchange-traded fund fees and expenses are not reflected in the expense ratios. Because the exchange-traded funds have varied expenses and fee levels and the Fund may own different proportions at different times, the amount of fees and expenses incurred indirectly by the Fund will vary. |

| ** | Rounds to less than $.01 per share. |

See accompanying notes to financial statements.

Financial Highlights (continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Selected data for a share outstanding throughout each period: | |

| | | | | | |

| Class (Commencement Date) | | | | | | | | | | | | | | | | | | | |

| | | | | | Investment Operations | | | Less Distributions | | | | |

| | | | | | |

| INTELLIGENT RISK MODERATE ALLOCATION | | | | | | | | | | | | | | | | | | | |

Year Ended

August 31, | | Beginning

Net

Asset

Value | | |

Net

Invest-

ment

Income

(Loss)(a) | | | Net

Realized/

Unrealized

Gain

(Loss) | | | Total | | | Net

Invest-

ment

Income | | | Capital

Gains(b) | | | Total | | | Ending

Net

Asset

Value | |

CLASS A (5/12) | | | | | | | | | | | | | | | | | | | | | | | | | |

2012(e) | | $ | 20.00 | | | $ | .04 | | | $ | .62 | | | $ | .66 | | | $ | — | | | $ | — | | | $ | — | | | $ | 20.66 | |

CLASS C (5/12) | | | | | | | | | | | | | | | | | | | | | | | | | |

2012(e) | | | 20.00 | | | | — | ** | | | .61 | | | | .61 | | | | — | | | | — | | | | — | | | | 20.61 | |

CLASS R3 (5/12) | | | | | | | | | | | | | | | | | | | | | | | | | |

2012(e) | | | 20.00 | | | | .04 | | | | .60 | | | | .64 | | | | — | | | | — | | | | — | | | | 20.64 | |

CLASS I (5/12) | | | | | | | | | | | | | | | | | | | | | | | | | |

2012(e) | | | 20.00 | | | | .07 | | | | .61 | | | | .68 | | | | — | | | | — | | | | — | | | | 20.68 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | |

| Ratios/Supplemental Data | |

| | | | | | |

Ratios to Average

Net Assets Before

Reimbursement | | | Ratios to Average

Net Assets After

Reimbursement(d) | | | | |

| | | | | | |

Total

Return(c) | | | Ending

Net

Assets

(000) | | | Expenses(f) | | | Net

Invest-

ment

Income

(Loss) | | | Expenses(f) | | | Net

Invest-

ment

Income

(Loss) | | | Portfolio

Turnover

Rate | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 3.30 | % | | $ | 98 | | | | 7.40 | %* | | | (5.86 | )%* | | | .93 | %* | | | .60 | %* | | | 21 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 3.05 | | | | 62 | | | | 7.90 | * | | | (6.18 | )* | | | 1.68 | * | | | .04 | * | | | 21 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 3.20 | | | | 52 | | | | 7.41 | * | | | (5.68 | )* | | | 1.18 | * | | | .54 | * | | | 21 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 3.40 | | | | 894 | | | | 6.91 | * | | | (5.20 | )* | | | .68 | * | | | 1.03 | * | | | 21 | |

| (a) | Per share Net Investment Income (Loss) is calculated using the average daily shares method. |

| (b) | Distributions from Capital Gains include short-term capital gains, if any. |

| (c) | Total return is the combination of changes in net asset value without any sales charge, reinvested dividend income at net asset value and reinvested capital gains distributions at net asset value, if any. Total returns are not annualized. |

| (d) | After expense reimbursement from the Adviser, where applicable. |

| (e) | For the period May 4, 2012 (commencement of operations) through August 31, 2012. |

| (f) | In addition to the fees and expenses which the Fund bears directly; the Fund indirectly bears a pro rata share of the fees and expenses of the exchange-traded funds in which the Fund invests. These exchange-traded fund fees and expenses are not reflected in the expense ratios. Because the exchange-traded funds have varied expenses and fee levels and the Fund may own different proportions at different times, the amount of fees and expenses incurred indirectly by the Fund will vary. |

| ** | Rounds to less than $.01 per share. |

See accompanying notes to financial statements.

Financial Highlights (continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Selected data for a share outstanding throughout each period: | |

| | | | | | |

| Class (Commencement Date) | | | | | | | | | | | | | | | | | | | |

| | | | | | Investment Operations | | | Less Distributions | | | | |

| | | | | |

| INTELLIGENT RISK CONSERVATIVE ALLOCATION | | | | | | | | | | | | | | | | |

Year Ended

August 31, | | Beginning

Net

Asset

Value | | | Net

Invest-

ment

Income

(Loss)(a) | | |

Net

Realized/

Unrealized

Gain

(Loss) | | | Total | | | Net

Invest-

ment

Income | | | Capital

Gains(b) | | | Total | | | Ending

Net

Asset

Value | |

CLASS A (5/12) | | | | | | | | | | | | | | | | | | | | | | | | | |

2012(e) | | $ | 20.00 | | | $ | .10 | | | $ | .33 | | | $ | .43 | | | $ | (.10 | ) | | $ | — | | | $ | (.10 | ) | | $ | 20.33 | |

CLASS C (5/12) | | | | | | | | | | | | | | | | | | | | | | | | | |

2012(e) | | | 20.00 | | | | .05 | | | | .34 | | | | .39 | | | | (.07 | ) | | | — | | | | (.07 | ) | | | 20.32 | |

CLASS R3 (5/12) | | | | | | | | | | | | | | | | | | | | | | | | | |

2012(e) | | | 20.00 | | | | .09 | | | | .33 | | | | .42 | | | | (.09 | ) | | | — | | | | (.09 | ) | | | 20.33 | |

CLASS I (5/12) | | | | | | | | | | | | | | | | | | | | | | | | | |

2012(e) | | | 20.00 | | | | .12 | | | | .33 | | | | .45 | | | | (.11 | ) | | | — | | | | (.11 | ) | | | 20.34 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | |

| Ratios/Supplemental Data | |

| | | | | | |

Ratios to Average

Net Assets Before

Reimbursement | | | Ratios to Average

Net Assets After

Reimbursement(d) | | | | |

| | | | | | |

Total

Return(c) | | | Ending

Net

Assets

(000) | | | Expenses(f) | | | Net

Invest-

ment

Income

(Loss) | | | Expenses(f) | | | Net

Invest-

ment

Income

(Loss) | | | Portfolio

Turnover

Rate | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2.17 | % | | $ | 71 | | | | 7.34 | %* | | | (4.84 | )%* | | | .93 | %* | | | 1.57 | %* | | | 25 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 1.94 | | | | 51 | | | | 7.95 | * | | | (5.45 | )* | | | 1.68 | * | | | .83 | * | | | 25 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2.11 | | | | 51 | | | | 7.46 | * | | | (4.95 | )* | | | 1.18 | * | | | 1.33 | * | | | 25 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2.27 | | | | 880 | | | | 6.97 | * | | | (4.47 | )* | | | .68 | * | | | 1.82 | * | | | 25 | |

| (a) | Per share Net Investment Income (Loss) is calculated using the average daily shares method. |

| (b) | Distributions from Capital Gains include short-term capital gains, if any. |

| (c) | Total return is the combination of changes in net asset value without any sales charge, reinvested dividend income at net asset value and reinvested capital gains distributions at net asset value, if any. Total returns are not annualized. |

| (d) | After expense reimbursement from the Adviser, where applicable. |

| (e) | For the period May 4, 2012 (commencement of operations) through August 31, 2012. |

| (f) | In addition to the fees and expenses which the Fund bears directly; the Fund indirectly bears a pro rata share of the fees and expenses of the exchange-traded funds in which the Fund invests. These exchange-traded fund fees and expenses are not reflected in the expense ratios. Because the exchange-traded funds have varied expenses and fee levels and the Fund may own different proportions at different times, the amount of fees and expenses incurred indirectly by the Fund will vary. |

See accompanying notes to financial statements.

Notes to Financial Statements

1. General Information and Significant Accounting Policies

General Information

The Nuveen Investment Trust (the “Trust”), is an open-end management investment company registered under the Investment Company Act of 1940, as amended. The Trust is comprised of the Nuveen Intelligent Risk Growth Allocation Fund (“Intelligent Risk Growth Allocation”), Nuveen Intelligent Risk Moderate Allocation Fund (“Intelligent Risk Moderate Allocation”) and Nuveen Intelligent Risk Conservative Allocation Fund (“Intelligent Risk Conservative Allocation”), (each a “Fund” and collectively, the “Funds”), among others. The Funds commenced operations on May 4, 2012. The Trust was organized as a Massachusetts business trust in 1996.

Each Fund’s investment objective is to seek total return. Under normal market conditions, each Fund attempts to maintain a consistent risk level through changing market conditions by investing in exchange-traded funds (“ETFs”) and certain derivatives whose performance is expected to correspond to a variety of different asset classes. Intelligent Risk Growth Allocation, Intelligent Risk Moderate Allocation and Intelligent Risk Conservative Allocation seek to maintain a consistent risk level by attempting to keep their daily volatility range (i.e., fluctuations in value) within 12% to 18% (annualized), 7% to 12% (annualized) and 3.5% to 7% (annualized), respectively.

Each Fund may invest in ETFs and derivatives in order to gain exposure to any asset class, including: any commodity; any currency; U.S. and foreign (including emerging markets) equity securities; U.S. and foreign (including emerging markets) real estate; U.S. and foreign (including emerging markets) corporate bonds; U.S. and foreign (including emerging markets) government bonds; asset-backed securities; mortgage-backed securities; inflation-protected securities; and municipal bonds. The equity securities to which a Fund may have exposure may be of any market capitalization. The bonds to which a Fund may have exposure may be of any maturity and of any credit quality, including high yield or “junk” bonds. Each Fund may also invest in cash and cash equivalent instruments, some of which may serve as margin or collateral for the Fund’s obligations under derivative transactions.

The Funds’ most recent prospectus provides further descriptions of each Fund’s investment objective, principal investment strategies and principal risks.

Significant Accounting Policies

The following is a summary of significant accounting policies followed by the Funds in the preparation of their financial statements in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”).

Investment Valuation

ETFs are valued at the last sales price on the securities exchange on which such securities are primarily traded and are generally classified as Level 1 for fair value measurement purposes.

Investments in investment companies are valued at their respective net asset values on the valuation date. These investment vehicles are generally classified as Level 1.