UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-07619

Nuveen Investment Trust

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive, Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Kevin J. McCarthy

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: June 30

Date of reporting period: June 30, 2010

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss.3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

Mutual Funds

Nuveen Asset Allocation Funds

For investors seeking attractive long-term total return.

Annual Report

June 30, 2010

| | | | | | | | | | | | |

| Nuveen Growth Allocation Fund | | | | Nuveen Moderate Allocation Fund | | | | Nuveen Conservative Allocation Fund | | | | |

NUVEEN INVESTMENTS ANNOUNCES STRATEGIC COMBINATION WITH FAF ADVISORS

On July 29, 2010, Nuveen Investments, Inc. announced that U.S. Bancorp will receive a 9.5% stake in Nuveen Investments and cash consideration in exchange for the long-term asset business of U.S. Bancorp’s FAF Advisors (FAF). Nuveen Investments is the parent of Nuveen Asset Management (NAM), the investment adviser for the Funds included in this report.

FAF Advisors, which currently manages about $25 billion of long-term assets and serves as the advisor of the First American Funds, will be combined with NAM, which currently manages about $75 billion in municipal fixed income assets. Upon completion of the transaction, Nuveen Investments, which currently manages about $150 billion of assets across several high-quality affiliates, will manage a combined total of about $175 billion in institutional and retail assets.

This combination will not affect the investment objectives, strategies or policies of the Funds in this report. Over time, Nuveen Investments expects that the combination will provide even more ways to meet the needs of investors who work with financial advisors and consultants by enhancing the multi-boutique model of Nuveen Investments, which also includes highly respected investment teams at NWQ Investment Management, Santa Barbara Asset Management, Symphony Asset Management, Tradewinds Global Investors, Winslow Capital and Nuveen HydePark.

The transaction is expected to close late in 2010, subject to customary conditions.

| | | | | | |

| Must be preceded by or accompanied by a prospectus. | | NOT FDIC INSURED | | MAY LOSE VALUE | | NO BANK GUARANTEE |

Chairman’s

Letter to Shareholders

Dear Shareholder,

The economic environment in which your Fund operates reflects continuing but uneven economic recovery. The U.S. and other major industrial countries are experiencing steady but comparatively low levels of economic growth, while emerging market countries are seeing a resumption of relatively strong economic expansion. The potential impact of steps being considered by many governments to counteract the extraordinary governmental spending and credit expansion to deal with the recent financial and economic crisis is injecting uncertainty into global financial markets. The implications for future tax rates, government spending, interest rates and the pace of economic recovery in the U.S. and other leading economies are extremely difficult to predict at the present time. The long term health of the global economy depends on restoring some measure of fiscal discipline around the world, but since all of the corrective steps require economic pain, it is not surprising that governments are reluctant to undertake them.

In the near term, governments remain committed to furthering economic recovery and realizing a meaningful reduction in their national unemployment rates. Such an environment should produce continued economic growth and, consequently, attractive investment opportunities. Over the longer term, the larger uncertainty mentioned earlier carries the risk of unexpected potholes in the road to sustained recovery. For this reason, Nuveen’s investment management teams are working hard to balance return and risk by building well-diversified portfolios, among other strategies. I encourage you to read the following commentary on the management of your Fund. As always, I also encourage you to contact your financial consultant if you have any questions about your Nuveen Fund investment. Please consult the Nuveen website for the most recent information on your Nuveen Fund at: www.nuveen.com.

On behalf of the other members of your Fund’s Board, we look forward to continuing to earn your trust in the months and years ahead.

Sincerely,

Robert P. Bremner

Chairman of the Board

August 17, 2010

Portfolio Manager’s Comments

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio manager as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Funds disclaim any obligation to update publicly or revise any forward-looking statements or views expressed herein.

The Nuveen Growth Allocation, the Nuveen Moderate Allocation and the Nuveen Conservative Allocation Funds feature portfolio management by Nuveen Investment Solutions, Inc. (NIS), an affiliate of Nuveen Investments. For most of this period, the Funds were managed by Thomas Richards, CFA, Senior Managing Director of NIS, and John Simmons, CFA, Managing Director and Portfolio Manager for NIS.

Effective March 1, 2010, Thomas Richards relinquished his duties as a portfolio manager of the Funds, with John Simmons remaining as portfolio manager. We recently asked John to discuss general market conditions, key portfolio management strategies and the performance of these three Funds for the twelve-month period ended June 30, 2010.

What were the general market conditions for the reporting period?

As the reporting period began, there continued to be considerable downward pressure on the economy and both the Federal Reserve (Fed) and the federal government continued their efforts to improve the overall economic environment. For its part, the Fed continued to hold the benchmark fed funds rate in a target range of zero to 0.25% after cutting it to this record low level in December 2008.

At its June 2010 meeting, the central bank renewed its pledge to keep the fed funds rate “exceptionally low” for an “extended period.” As part of its efforts, the federal government put into place the American Recovery and Reinvestment Act of 2009, a $787 billion economic stimulus package intended to provide job creation, tax relief, fiscal assistance to state and local governments and expansion of unemployment benefits and other federal social welfare programs.

During the twelve-month period, these and other measures taken by the Fed and the government to ease the economic recession have helped to produce some signs of improvement. Over the four calendar quarters comprising this period, the U.S. economy, as measured by the U.S. gross domestic product (GDP), grew at annualized rates of 1.6%, 5.0%, 3.7% and an estimated 2.4%. This marked the first time since 2007 that the economy managed to string together four consecutive positive quarters. Housing also provided something of a bright spot, as the S&P/Case-Shiller Home Price Index of average residential prices from 20 large urban areas gained 4.6% for the twelve months ended May 2010 (the most recent data available at the time this report was produced). This moved average home prices across the United States to levels similar to where they were in the autumn of 2003.

Inflation also continued to be relatively tame, as the Consumer Price Index (CPI) rose 1.1% year-over-year as of June 2010. While labor markets remained weak, recent months have seen some improvement. As of June 2010, the national unemployment rate was 9.5%, the same level as June 2009 but below the 26-year high of 10.1% in October 2009.

Equity markets across the globe rallied during the reporting period and many indexes reached highs in April 2010 that had not been seen since 2008. Nevertheless, financial markets faced numerous obstacles throughout the period. Some rating agencies downgraded the sovereign debt of Greece and Spain. Dubai World announced over Thanksgiving that it would need to restructure its debt. In response to the financial crisis, the Bank for International Settlements issued the so-called “Basel III” guidelines, proposing stricter regulations regarding banks’ capital and liquidity requirements. Investors were divided over how the various proposals to address U.S. health care coverage would impact industry participants. Each new event seemed to be followed by market volatility.

How did the Funds perform during the twelve-month period ended June 30, 2010?

The table on page seven provides performance information for the three Funds (Class A shares at net asset value) for the one-year, five-year, ten-year and since inception periods ended June 30, 2010. The table also compares each Fund’s performance to a peer group, appropriate composite benchmark and general market index. A more detailed discussion of each Fund’s relative performance is provided later in this report.

What strategies were used to manage the Funds during the reporting period?

All of these Funds are managed using the same strategic approach. This involves seeking to: (1) identify a universe of investable asset classes with different risks, returns and relationships, (2) determine an allocation policy among these asset classes that produces the highest expected return consistent with a targeted level of investment risk, (3) utilize liquid, transparent, and value-added investment funds within each asset class, (4) structure these funds to produce value-added performance consistent with the Funds’ active management risk budgets, and (5) monitor, refine and revise all the investment inputs that go into each Fund’s portfolio building process.

How did these strategies influence performance?

Nuveen Growth Allocation Fund

The Fund’s Class A shares at net asset value outperformed the Lipper Global Multi-Cap Core Funds Index and the Growth Allocation Composite over the twelve-month reporting period. The Class A Shares at NAV slightly underperformed the S&P 500 Index.

The Growth Allocation Fund’s policy allocation as of June 30, 2010, is presented below:

| | |

| Asset Class | | Asset Class Policy Weight |

Domestic Equity | | 27% |

International Equity | | 41% |

Global Resources | | 3% |

U.S. Public Real Estate | | 5% |

Domestic Fixed Income | | 4% |

Domestic High Yield | | 12% |

Treasury Inflation-Protected Securities (TIPS) | | 4% |

Short Duration & Cash | | 4% |

Total | | 100% |

As noted above, NIS monitors and manages the risk factors that impact the Fund’s performance, including (1) Investment Policy/Capital Market Risk, (2) Investment Style Risk, (3) Active Management Risk, and (4) Allocation Tactics Risk. The impact of each of these factors is quantified and analyzed as a part of our ongoing feedback and control management process.

Investment policy/capital market risk typically will have a large performance impact on the Fund. For the twelve-month reporting period, our asset class allocations produced a negative return, primarily because the last three months of the period saw materially negative absolute returns across most equity-oriented capital market segments.

Investment style risk involves an allocation policy to investment managers whose styles, in aggregate, differ from the asset class market target. NIS attempts to minimize this risk by investing in the Nuveen U.S. Equity Completeness Fund to gain exposure to the domestic equity asset class and in various exchange-traded funds to gain exposure to the international equity asset class. The return impact from investment style risk was slightly positive within international equity and negligible elsewhere during the reporting period.

Active management risk consists of the performance differential between an investment manager’s actual performance and the performance of the respective benchmark. NIS seeks to manage this active management risk by structuring teams of managers within asset classes that are believed to have the best chance of outperforming, in aggregate, their asset class target. During the reporting period, the Fund’s investment managers, in aggregate, generated positive incremental returns relative to their benchmarks. Manager performance within the global natural resources asset class, which consists of one mutual fund manager, generated the greatest level of outperformance. Strong manager performance was also realized in the international equity and domestic equity asset classes.

Allocation tactics risk involves the deviations of actual allocations versus the policy allocation weights. These deviations are often due to movements in the capital markets as well as to daily cash flows into and out of the Fund. During the reporting period, the performance impact due to allocation tactics has had a small, negative impact on total Fund performance.

Nuveen Moderate Allocation Fund

The Fund’s Class A shares at net asset value outperformed the Lipper Mixed-Asset Target Allocation Moderate Funds Index, the Moderate Allocation Composite and the S&P 500 Index during the twelve-month reporting period.

The Moderate Allocation Fund’s policy allocation as of June 30, 2010, is presented below:

| | |

| Asset Class | | Asset Class Policy Weight |

Domestic Equity | | 24% |

International Equity | | 28% |

Global Resources | | 2% |

U.S. Public Real Estate | | 3% |

Domestic Fixed Income | | 7% |

Domestic High Yield | | 16% |

Treasury Inflation-Protected Securities (TIPS) | | 13% |

Short Duration & Cash | | 7% |

Total | | 100% |

As noted above, NIS monitors and manages the risk factors that impact the Fund’s performance, including (1) Investment Policy/Capital Market Risk, (2) Investment Style Risk, (3) Active Management Risk, and (4) Allocation Tactics Risk. The impact of each of these factors is quantified and analyzed as a part of our ongoing feedback and control management process.

Investment policy/capital market risk will typically have a large performance impact on the Fund. During the reporting period, our asset class allocations produced a negative return, primarily because the last three months of the period saw materially negative absolute returns across most equity-oriented capital market segments.

Investment style risk involves an allocation policy to investment managers whose styles, in aggregate, differ from the asset class market target. NIS attempts to minimize this risk by investing in the Nuveen U.S. Equity Completeness Fund to gain exposure to the domestic equity asset class and various exchange traded funds to gain exposure to the international equity class. The return impact from investment style risk was slightly positive within international equity and negligible elsewhere during the reporting period.

Active management risk consists of the performance differential between an investment manager’s actual performance and the performance of the respective benchmark. NIS seeks to manage active management risk by structuring teams of managers within asset classes that are believed to have the best chance of outperforming, in aggregate, their asset class target. During the reporting period, the Fund’s investment managers, in aggregate, generated positive incremental returns, relative to their benchmarks. Manager performance within the global natural resources asset class, which consists of one mutual fund manager, generated the greatest level of outperformance. Strong manager performance was also realized in the international equity and domestic equity asset classes.

Allocation tactics risk involves the deviations of actual allocations versus the policy allocation weights. These deviations are often due to movements in the capital markets as well as to daily cash flows into and out of the Fund. During the reporting period the performance impact due to allocation tactics has had a small, negative impact on total Fund performance.

Nuveen Conservative Allocation Fund

The Fund’s Class A shares at net asset value outperformed the Conservative Allocation Composite during the twelve-month reporting period, but underperformed the Lipper Mixed-Asset Target Allocation Conservative Funds Index and the S&P 500 Index.

The Conservative Allocation Fund’s policy allocation as of June 30, 2010, is presented in the accompanying table:

| | |

| Asset Class | | Asset Class Policy Weight |

Domestic Equity | | 16% |

International Equity | | 14% |

Global Resources | | 3% |

U.S. Public Real Estate | | 3% |

Domestic Fixed Income | | 18% |

Domestic High Yield | | 12% |

Treasury Inflation-Protected Securities (TIPS) | | 14% |

Short Duration & Cash | | 20% |

Total | | 100% |

As noted above, NIS monitors and manages the risk factors that impact the Fund’s performance, including (1) Investment Policy/Capital Market Risk, (2) Investment Style Risk, (3) Active Management Risk, and (4) Allocation Tactics Risk. The impact of each of these factors is quantified and analyzed as a part of our ongoing feedback and control management process.

Investment policy/capital market risk will typically have a large performance impact on the Fund. For the twelve-month reporting period, our asset class allocations produced a negative return, primarily because the last three months of the period saw materially negative absolute returns across most equity-oriented capital market segments.

Investment style risk involves an allocation policy to investment managers whose styles, in aggregate, differ from the asset class market target. NIS attempts to minimize this risk by investing in the Nuveen U.S. Equity Completeness Fund to gain exposure to the domestic equity asset class and various exchange traded funds to gain exposure to the international equity class. The return impact from investment style risk was positive within international equity and negligible elsewhere during the reporting period.

Active management risk consists of the performance differential between an investment manager’s actual performance and the performance of the respective benchmarks. NIS seeks to manage active management risk by structuring teams of managers within asset classes that are believed to have the best chance of outperforming their asset class target. During the period, the Fund’s investment managers, in aggregate, generated positive incremental returns, relative to their benchmarks. Manager performance within the global natural resources asset class, which consists of one mutual fund manager, generated the greatest level of outperformance. Strong manager performance was also realized in the international equity and domestic equity asset classes.

Allocation tactics risk involves the deviations of actual allocations versus the policy allocation weights. These deviations are often due to movements in the capital markets as well as to cash flows into and out of the Fund. During the reporting period the performance impact due to allocation tactics has had a small, positive impact on total Fund performance.

| 1 | Since inception return for the Nuveen Growth Allocation Fund is from 12/09/04; index and composite returns are from 12/31/04. Since inception returns for the Nuveen Moderate Allocation and Nuveen Conservative Allocation Funds are from 8/7/96; index and composite returns are form 8/31/96. |

| 2 | The Lipper Global Multi-Cap Core Funds Index is a managed index that represents the average annualized total return of the 10 largest funds in the Lipper Global Multi-Cap Core Funds category. The returns assume reinvestment of dividends and do not reflect any applicable sales charges. You cannot invest directly in an index. |

| 3 | The Growth Allocation Composite is an index comprised of a 76% weighting in the S&P 500 Index, a 19% weighting in the Barclays Capital U.S. Aggregate Bond Index, and a 5% weighting in Citigroup 3-Month U.S. Treasury Bill Index. The composite returns assume reinvestment of dividends and do not reflect any applicable sales charges. You cannot invest directly in a composite. |

| 4 | The S&P 500 Index is an unmanaged index generally considered representative of the U.S. stock market. The index returns assume reinvestment of dividends, but do not reflect any applicable sales charges. You cannot invest directly in an index. |

| 5 | The Lipper Mixed-Asset Target Allocation Moderate Funds Index is a managed index that represents the average annualized total return of the 10 largest funds in the Lipper Mixed Asset Target Allocation Moderate Funds category. The returns assume reinvestment of dividends and do not reflect any applicable sales charges. You cannot invest directly in an index. |

| 6 | The Moderate Allocation Composite is an index comprised of a 57% weighting in the S&P 500 Index, a 38% weighting in the Barclays Capital U.S. Aggregate Bond Index, and a 5% weighting in Citigroup 3-Month U.S. Treasury Bill Index. The composite returns assume reinvestment of dividends and do not reflect any applicable sales charges. You cannot invest directly in a composite. |

| 7 | The Lipper Mixed-Asset Target Allocation Conservative Funds Index is a managed index that represents the average annualized total return of the 10 largest funds in the Lipper Mixed-Asset Target Allocation Conservative Funds category. The returns assume reinvestment of dividends and do not reflect any applicable sales charges. You cannot invest directly in an index. |

| 8 | The Conservative Allocation Composite is an index comprised of a 38% weighting in the S&P 500 Index, a 57% weighting in the Barclays Capital U.S. Aggregate Bond Index, and a 5% weighting in Citigroup 3-Month U.S. Treasury Bill Index. The composite returns assume reinvestment of dividends and do not reflect any applicable sales charges. You cannot invest directly in a composite. |

Class A Shares – Average Annual Total Returns

As of 6/30/2010

| | | | | | | | |

| | | Average Annual |

| | | 1-Year | | 5-Year | | 10-Year | | Since

Inception1 |

Nuveen Growth Allocation Fund | | | | | | | | |

A Shares at NAV | | 13.56% | | 3.00% | | N/A | | 3.34% |

A Shares at Offer | | 7.03% | | 1.79% | | N/A | | 2.25% |

Lipper Global Multi-Cap Core Funds Index2 | | 11.54% | | 1.48% | | N/A | | 1.54% |

Growth Allocation Composite3 | | 13.01% | | 0.82% | | N/A | | 0.73% |

S&P 500 Index4 | | 14.43% | | -0.79% | | N/A | | -0.87% |

Nuveen Moderate Allocation Fund | | | | | | | | |

A Shares at NAV | | 14.49% | | 3.21% | | 3.80% | | 6.01% |

A Shares at Offer | | 7.93% | | 2.00% | | 3.18% | | 5.56% |

Lipper Mixed-Asset Target Allocation Moderate Funds Index5 | | 12.92% | | 1.56% | | 2.72% | | 5.48% |

Moderate Allocation Composite6 | | 12.17% | | 2.10% | | 1.98% | | 5.99% |

S&P 500 Index4 | | 14.43% | | -0.79% | | -1.59% | | 5.20% |

Nuveen Conservative Allocation Fund | | | | | | | | |

A Shares at NAV | | 12.93% | | 3.02% | | 2.94% | | 4.70% |

A Shares at Offer | | 6.46% | | 1.81% | | 2.33% | | 4.25% |

Lipper Mixed-Asset Target Allocation Conservative Funds Index7 | | 13.79% | | 3.87% | | 3.70% | | 5.54% |

Conservative Allocation Composite8 | | 11.22% | | 3.29% | | 3.50% | | 6.24% |

S&P 500 Index4 | | 14.43% | | -0.79% | | -1.59% | | 5.20% |

Returns quoted represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment returns and principal value will fluctuate so that when shares are redeemed, they may be worth more or less than their original cost. Class A Shares have a 5.75% maximum sales charge. Returns at NAV would be lower if the sales charge were included. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. Returns may reflect a contractual agreement between certain Funds and the investment adviser to waive certain fees and expenses; see Notes to Financial Statements, Footnote 6 — Management Fees and Other Transactions with Affiliates for more information. In addition, returns may reflect a voluntary expense limitation by the Funds’ investment adviser that may be modified or discontinued at any time without notice. For the most recent month-end performance, visit www.nuveen.com or call (800) 257-8787.

Please see each Fund’s Spotlight Page later in this report for more complete performance data and expense ratios.

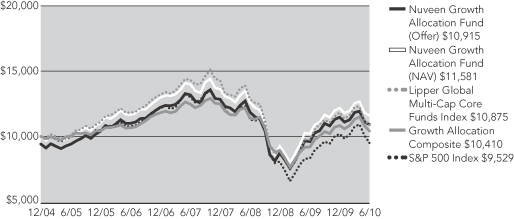

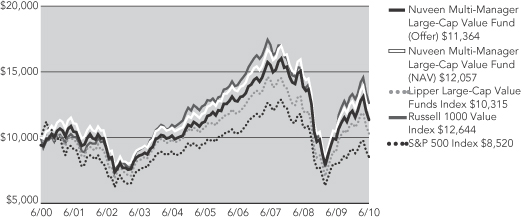

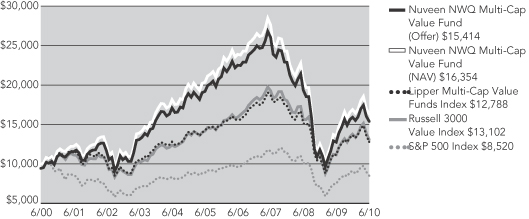

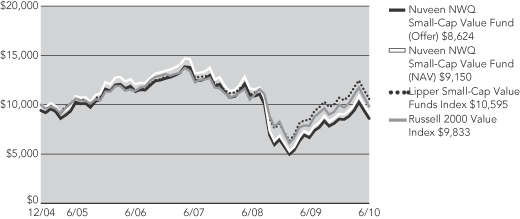

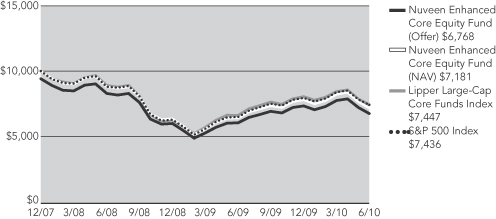

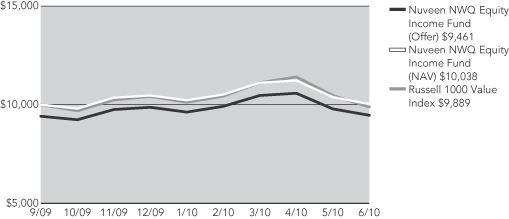

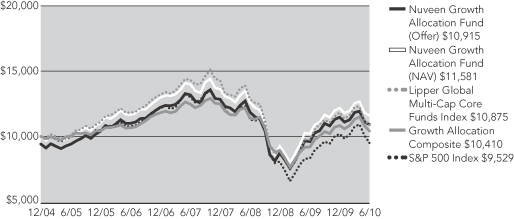

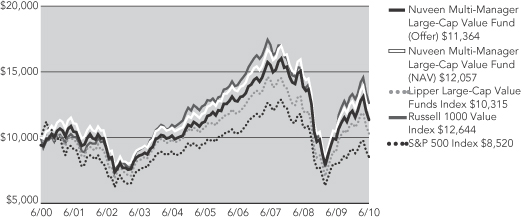

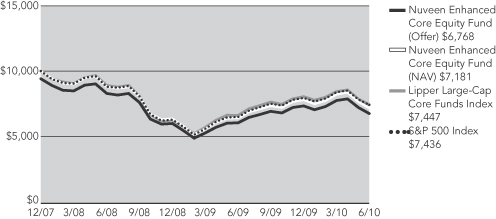

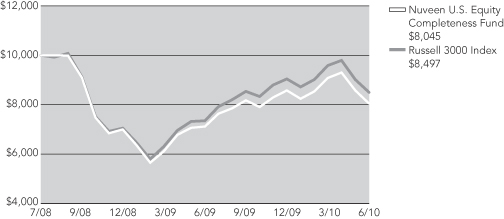

Nuveen Growth Allocation Fund

Growth of an Assumed $10,000 Investment

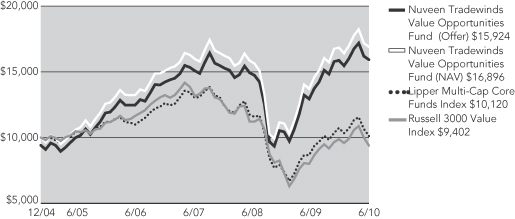

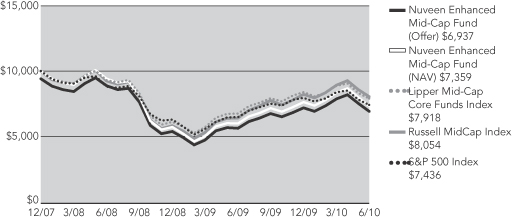

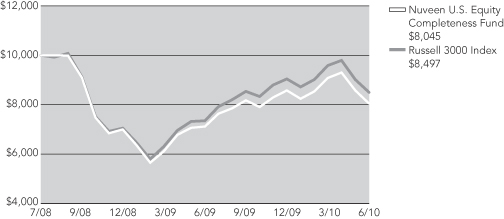

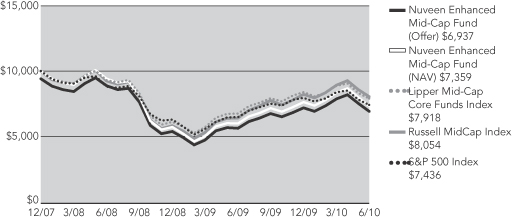

Nuveen Moderate Allocation Fund

Growth of an Assumed $10,000 Investment

The graphs do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

The index comparisons show the change in value of a $10,000 investment in the Class A Shares of the Nuveen Funds compared with the corresponding indexes. The Lipper Global Multi-Cap Core Funds Index is a managed index that represents the average annualized returns of the 10 largest funds in the Lipper Global Multi-Cap Core Funds category. The Growth Allocation Composite is an index comprised of a 76% weighting in the S&P 500 Index, a 19% weighting in the Barclays Capital U.S. Aggregate Bond Index, and a 5% weighting in Citigroup 3-Month U.S. Treasury Bill Index. Growth Allocation Fund returns are from 12/09/04; index and composite returns are from 12/31/04. The Lipper Mixed-Asset Target Allocation Moderate Funds Index is a managed index that represents the average annualized total return of the 10 largest funds in the Lipper Mixed-Asset Target Allocation Moderate Funds category. The Moderate Allocation Composite is an index comprised of a 57% weighting in the S&P 500 Index, a 38% weighting in the Barclays Capital U.S. Aggregate Bond Index, and a 5% weighting in Citigroup 3-Month U.S. Treasury Bill Index. The S&P 500 Index is an unmanaged index generally considered representative of the U.S. stock market. The index returns assume reinvestment of dividends and do not reflect any initial or ongoing expenses. You cannot invest directly in an index or composite. The Nuveen Funds’ returns include reinvestment of all dividends and distributions, and the Funds’ returns at the offer price depicted in the charts reflect the initial maximum sales charge applicable to Class A Shares (5.75%) and all ongoing Fund expenses. The performance data quoted represents past performance, which is not indicative of future results. Current performance may be lower or higher than the performance shown.

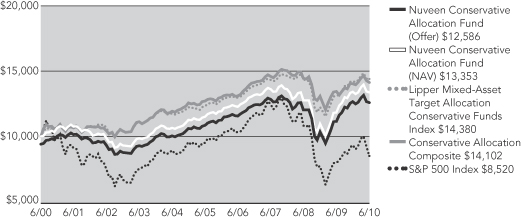

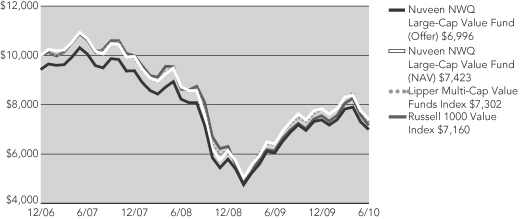

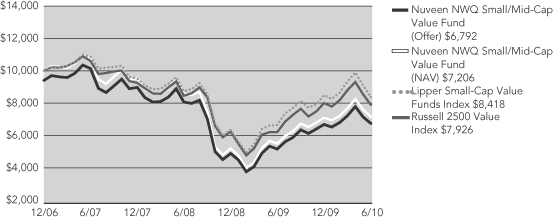

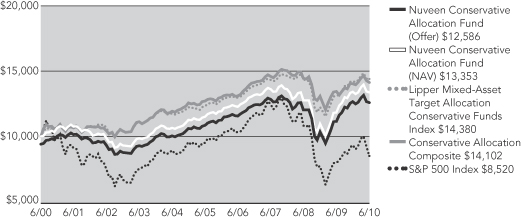

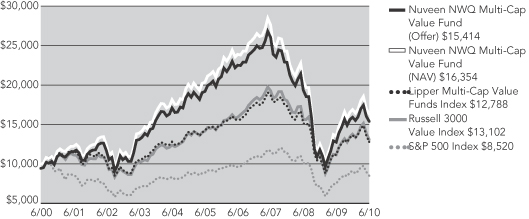

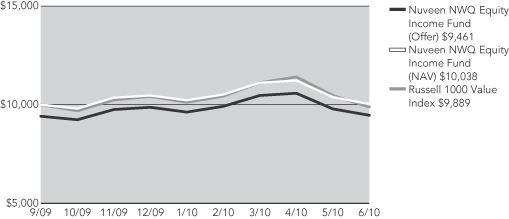

Nuveen Conservative Allocation Fund

Growth of an Assumed $10,000 Investment

The graph does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

The index comparisons show the change in value of a $10,000 investment in the Class A Shares of the Nuveen Conservative Allocation Fund compared with the corresponding indexes. The Lipper Mixed-Asset Target Allocation Conservative Funds Index is a managed index that represents the average annualized total return of the 10 largest funds in the Lipper Mixed-Asset Target Allocation Conservative Funds category. The Conservative Allocation Composite is an index comprised of a 38% weighting in the S&P 500 Index, a 57% weighting in the Barclays Capital U.S. Aggregate Bond Index, and a 5% weighting in Citigroup 3-Month U.S. Treasury Bill Index. The S&P 500 Index is an unmanaged index generally considered representative of the U.S. stock market. The index returns assume reinvestment of dividends and do not reflect any initial or ongoing expenses. You cannot invest directly in an index or composite. The Nuveen Conservative Allocation Fund’s returns include reinvestment of all dividends and distributions, and the Fund’s returns at the offer price depicted in the chart reflects the initial maximum sales charge applicable to Class A Shares (5.75%) and all ongoing Fund expenses. The performance data quoted represents past performance, which is not indicative of future results. Current performance may be lower or higher than the performance shown.

Fund Spotlight as of 6/30/10 Nuveen Growth Allocation Fund

| | | | | | | | | | |

| Quick Facts | | | | | | | | | | |

| | | A Shares | | B Shares | | C Shares | | R3 Shares | | I Shares |

Fund Symbols | | NGOAX | | NGVBX | | NGVCX | | NGATX | | NGVRX |

NAV | | $19.66 | | $19.34 | | $19.35 | | $19.73 | | $19.69 |

Latest Ordinary Income Distribution1 | | $0.4521 | | $0.3131 | | $0.3134 | | $0.4090 | | $0.4976 |

Inception Date | | 12/09/04 | | 12/09/04 | | 12/09/04 | | 8/04/08 | | 12/09/04 |

Returns quoted represent past performance which is no guarantee of future results. Investment returns and principal value will fluctuate so that when shares are redeemed, they may be worth more or less than their original cost. Current performance may be higher or lower than the performance shown. Returns without sales charges would be lower if the sales charge were included. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. For the most recent month-end performance visit www.nuveen.com or call (800) 257-8787.

Class A, B, C and I Share returns are actual. The returns for Class R3 Shares are actual for the period since class inception on 8/04/08; returns prior to class inception are Class I Share returns adjusted for differences in sales charges and expenses, which are primarily differences in distribution and service fees. Fund returns assume reinvestment of dividends and capital gains. Class A Shares have a 5.75% maximum sales charge. Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC), also known as a back-end sales charge, if redeemed within twelve months of purchase. Class B Shares have a CDSC that begins at 5% for redemptions during the first year and declines periodically until after six years when the charge becomes 0%. Class B Shares automatically convert to Class A Shares eight years after purchase. Class C Shares have a 1% CDSC for redemptions within less than one year, which is not reflected in the one-year total return. Class R3 Shares have no sales charge and are available to only certain retirement plans. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors. Returns may reflect an expense limitation by the Fund’s investment adviser.

Returns prior to August 1, 2008, are not indicative of the performance that the Fund, as currently managed, would have generated.

| | | | |

| Average Annual Total Returns as of 6/30/10 |

| | |

| A Shares | | NAV | | Offer |

1-Year | | 13.56% | | 7.03% |

5-Year | | 3.00% | | 1.79% |

Since Inception | | 3.34% | | 2.25% |

| | |

| B Shares | | w/o CDSC | | w/CDSC |

1-Year | | 12.72% | | 8.72% |

5-Year | | 2.23% | | 2.06% |

Since Inception | | 2.57% | | 2.42% |

| | |

| C Shares | | NAV | | |

1-Year | | 12.65% | | |

5-Year | | 2.24% | | |

Since Inception | | 2.58% | | |

| | |

| R3 Shares | | NAV | | |

1-Year | | 13.27% | | |

5-Year | | 2.75% | | |

Since Inception | | 3.09% | | |

| | |

| I Shares | | NAV | | |

1-Year | | 13.78% | | |

5-Year | | 3.26% | | |

Since Inception | | 3.60% | | |

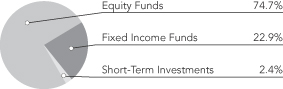

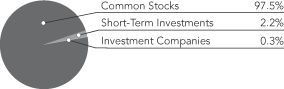

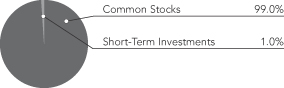

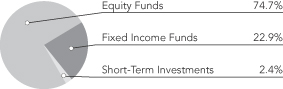

Portfolio Allocation2

| | |

| Portfolio Statistics |

| Net Assets ($000) | | $8,341 |

| Number of Holdings | | 16 |

| | | | |

| Expense Ratios | | | | |

| Share Class | | Gross

Expense

Ratios | | Net

Expense

Ratios |

| Class A | | 3.05% | | 1.29% |

| Class B | | 3.89% | | 2.04% |

| Class C | | 3.83% | | 2.04% |

| Class R3 | | 3.66% | | 1.54% |

| Class I | | 2.90% | | 1.04% |

The expense ratios shown factor in Total Annual Fund Operating Expenses including management fees and other fees and expenses, including the estimated fees and expenses of the Underlying Funds in which the Fund invests. The Net Expense Ratios reflect a contractual commitment by the Fund’s investment adviser to waive fees and reimburse expenses through October 31, 2011. Theses expense ratios will vary from the expense ratios included in the Financial Highlights of this report as they exclude the expenses of the Underlying Funds. The expense ratios are those shown in the most recent Fund prospectus.

| 2 | As a percentage of total investments as of June 30, 2010. Holdings are subject to change. |

Fund Spotlight as of 6/30/10 Nuveen Growth Allocation Fund

| | |

| Holding | | Weighting1 |

Nuveen NWQ Large-Cap Value Fund (Class I) | | 4.6% |

Nuveen Santa Barbara Growth Fund (Class I) | | 1.7% |

Nuveen Symphony Large-Cap Growth Fund (Class I) | | 6.0% |

Nuveen Tradewinds Global Resources Fund (Class I) | | 3.0% |

Nuveen Tradewinds International Value Fund (Class I) | | 13.2% |

Nuveen Tradewinds Value Opportunities Fund (Class I) | | 3.9% |

Nuveen U.S. Equity Completeness Fund | | 7.7% |

Nuveen Winslow Large-Cap Growth Fund (Class I) | | 2.6% |

Total Affiliated Equity Funds | | 42.7% |

| |

iShares Dow Jones U.S. Real Estate Index Fund | | 4.9% |

iShares MSCI EAFE Growth Index Fund | | 12.5% |

iShares MSCI Emerging Markets Index Fund | | 14.6% |

Total Non-Affiliated Equity Funds | | 32.0% |

| Total Equity Funds | | 74.7% |

| |

Nuveen High Yield Bond Fund (Class I) | | 12.4% |

Nuveen Multi-Strategy Core Bond Fund (Class I) | | 4.2% |

Nuveen Short Duration Bond Fund (Class I) | | 2.0% |

Total Affiliated Fixed Income Funds | | 18.6% |

| |

iShares Barclays U.S. Treasury Inflation Protected Securities Index Fund | | 4.3% |

Total Non-Affiliated Fixed Income Funds | | 4.3% |

| Total Fixed Income Funds | | 22.9% |

| Total Short-Term Investments | | 2.4% |

| Total Investments | | 100.0% |

| | |

| Affiliated Equity Funds | | 1-Year Average Annual

Total Returns as of 6/30/10 |

Nuveen NWQ Large-Cap Value Fund (Class I) | | 16.13% |

Nuveen Santa Barbara Growth Fund (Class I) | | 10.93% |

Nuveen Symphony Large-Cap Growth Fund (Class I) | | 20.26% |

Nuveen Tradewinds Global Resources Fund (Class I) | | 20.30% |

Nuveen Tradewinds International Value Fund (Class I) | | 4.77% |

Nuveen Tradewinds Value Opportunities Fund (Class I) | | 23.48% |

Nuveen U.S. Equity Completeness Fund | | 13.25% |

Nuveen Winslow Large-Cap Growth Fund (Class I) | | 10.33% |

| |

| Non-Affiliated Equity Funds | | |

iShares Dow Jones U.S. Real Estate Index Fund | | 50.80% |

iShares MSCI EAFE Growth Index Fund | | 8.40% |

iShares MSCI Emerging Markets Index Fund | | 19.11% |

| |

| Affiliated Fixed Income Funds | | |

Nuveen High Yield Bond Fund (Class I) | | 24.27% |

Nuveen Multi-Strategy Core Bond Fund (Class I) | | 11.23% |

Nuveen Short Duration Bond Fund (Class I) | | 5.40% |

| |

| Non-Affiliated Fixed Income Funds | | |

iShares Barclays U.S. Treasury Inflation Protected Securities Index Fund | | 9.36% |

| 1 | As a percentage of total investments as of June 30, 2010. Holdings are subject to change. |

Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including front- and back-end sales charges (loads) or redemption fees, where applicable; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees, where applicable; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example below is based on an investment of $1,000 invested at the beginning of the period and held for the period.

The information under “Actual Performance,” together with the amount you invested, allows you to estimate actual expenses incurred over the reporting period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60) and multiply the result by the cost shown for your share class, in the row entitled “Expenses Incurred During Period” to estimate the expenses incurred on your account during this period.

The information under “Hypothetical Performance,” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expense you incurred for the period. You may use this information to compare the ongoing costs of investing in the Fund and other Funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front- and back-end sales charges (loads) or redemption fees, where applicable. Therefore, the hypothetical information is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds or share classes. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Hypothetical Performance |

| | | Actual Performance | | | | (5% return before expenses) |

| | | A Shares | | B Shares | | C Shares | | R3 Shares | | I Shares | | | | A Shares | | B Shares | | C Shares | | R3 Shares | | I Shares |

| Beginning Account Value (1/01/10) | | $ | 1,000.00 | | $ | 1,000.00 | | $ | 1,000.00 | | $ | 1,000.00 | | $ | 1,000.00 | | | | $ | 1,000.00 | | $ | 1,000.00 | | $ | 1,000.00 | | $ | 1,000.00 | | $ | 1,000.00 |

| Ending Account Value (6/30/10) | | $ | 952.10 | | $ | 948.50 | | $ | 948.10 | | $ | 950.80 | | $ | 952.60 | | | | $ | 1,021.57 | | $ | 1,017.85 | | $ | 1,017.85 | | $ | 1,020.33 | | $ | 1,022.81 |

| Expenses Incurred During Period | | $ | 3.15 | | $ | 6.76 | | $ | 6.76 | | $ | 4.35 | | $ | 1.94 | | | | $ | 3.26 | | $ | 7.00 | | $ | 7.00 | | $ | 4.51 | | $ | 2.01 |

For each class of the Fund, expenses are equal to the Fund’s annualized net expense ratio of 0.65%, 1.40%, 1.40%, 0.90% and 0.40% for Classes A, B, C, R3 and I, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

Fund Spotlight as of 6/30/10 Nuveen Moderate Allocation Fund

| | | | | | | | | | |

| Quick Facts | | | | | | | | | | |

| | | A Shares | | B Shares | | C Shares | | R3 Shares | | I Shares |

Fund Symbols | | NNSAX | | NNSBX | | NUVCX | | NMATX | | NNSRX |

NAV | | $21.08 | | $21.07 | | $21.10 | | $21.08 | | $21.08 |

Latest Ordinary Income Distribution1 | | $0.5761 | | $0.4336 | | $0.4342 | | $0.5288 | | $0.6235 |

Inception Date | | 8/07/96 | | 8/07/96 | | 8/07/96 | | 8/04/08 | | 8/07/96 |

Returns quoted represent past performance which is no guarantee of future results. Investment returns and principal value will fluctuate so that when shares are redeemed, they may be worth more or less than their original cost. Current performance may be higher or lower than the performance shown. Returns without sales charges would be lower if the sales charge were included. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. For the most recent month-end performance visit www.nuveen.com or call (800) 257-8787.

Class A, B, C and I Share returns are actual. The returns for Class R3 Shares are actual for the period since class inception on 8/04/08; returns prior to class inception are Class I Share returns adjusted for differences in sales charges and expenses, which are primarily differences in distribution and service fees. Fund returns assume reinvestment of dividends and capital gains. Class A Shares have a 5.75% maximum sales charge. Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC), also known as a back-end sales charge, if redeemed within twelve months of purchase. Class B Shares have a CDSC that begins at 5% for redemptions during the first year and declines periodically until after six years when the charge becomes 0%. Class B Shares automatically convert to Class A Shares eight years after purchase. Class C Shares have a 1% CDSC for redemptions within less than one year, which is not reflected in the one-year total return. Class R3 Shares have no sales charge and are available to only certain retirement plans. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors. Returns may reflect an expense limitation by the Fund’s investment adviser.

Returns prior to August 1, 2008, are not indicative of the performance that the Fund, as currently managed, would have generated.

| | | | |

| Average Annual Total Returns as of 6/30/10 |

| | |

| A Shares | | NAV | | Offer |

1-Year | | 14.49% | | 7.93% |

5-Year | | 3.21% | | 2.00% |

10-Year | | 3.80% | | 3.18% |

| | |

| B Shares | | w/o CDSC | | w/CDSC |

1-Year | | 13.64% | | 9.64% |

5-Year | | 2.44% | | 2.29% |

10-Year | | 3.16% | | 3.16% |

| | |

| C Shares | | NAV | | |

1-Year | | 13.62% | | |

5-Year | | 2.44% | | |

10-Year | | 3.03% | | |

| | |

| R3 Shares | | NAV | | |

1-Year | | 14.19% | | |

5-Year | | 2.94% | | |

10-Year | | 3.54% | | |

| | |

| I Shares | | NAV | | |

1-Year | | 14.80% | | |

5-Year | | 3.47% | | |

10-Year | | 4.06% | | |

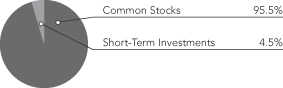

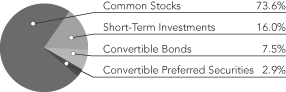

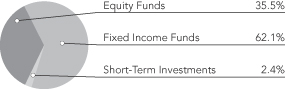

Portfolio Allocation2

| | |

| Portfolio Statistics |

| Net Assets ($000) | | $45,390 |

| Number of Holdings | | 16 |

| | | | |

| Expense Ratios | | | | |

| Share Class | | Gross

Expense

Ratios | | Net

Expense

Ratios |

| Class A | | 1.82% | | 1.14% |

| Class B | | 2.55% | | 1.89% |

| Class C | | 2.56% | | 1.89% |

| Class R3 | | 2.17% | | 1.39% |

| Class I | | 1.56% | | 0.89% |

The expense ratios shown factor in Total Annual Fund Operating Expenses including management fees and other fees and expenses, including the estimated fees and expenses of the Underlying Funds in which the Fund invests. The Net Expense Ratios reflect a contractual commitment by the Fund’s investment adviser to waive fees and reimburse expenses through October 31, 2011. Theses expense ratios will vary from the expense ratios included in the Financial Highlights of this report as they exclude the expenses of the Underlying Funds. The expense ratios are those shown in the most recent Fund prospectus.

| 2 | As a percentage of total investments as of June 30, 2010. Holdings are subject to change. |

Fund Spotlight as of 6/30/10 Nuveen Moderate Allocation Fund

| | |

| Holding | | Weighting1 |

Nuveen NWQ Large-Cap Value Fund (Class I) | | 4.2% |

Nuveen Santa Barbara Growth Fund (Class I) | | 1.5% |

Nuveen Symphony Large-Cap Growth Fund (Class I) | | 5.8% |

Nuveen Tradewinds Global Resources Fund (Class I) | | 2.0% |

Nuveen Tradewinds International Value Fund (Class I) | | 8.5% |

Nuveen Tradewinds Value Opportunities Fund (Class I) | | 3.6% |

Nuveen U.S. Equity Completeness Fund | | 7.2% |

Nuveen Winslow Large-Cap Growth Fund (Class I) | | 2.4% |

Total Affiliated Equity Funds | | 35.2% |

| |

iShares Dow Jones U.S. Real Estate Index Fund | | 3.1% |

iShares MSCI EAFE Growth Index Fund | | 8.0% |

iShares MSCI Emerging Markets Index Fund | | 10.9% |

Total Non-Affiliated Equity Funds | | 22.0% |

| Total Equity Funds | | 57.2% |

| |

Nuveen High Yield Bond Fund (Class I) | | 15.6% |

Nuveen Multi-Strategy Core Bond Fund (Class I) | | 7.4% |

Nuveen Short Duration Bond Fund (Class I) | | 5.9% |

Total Affiliated Fixed Income Funds | | 28.9% |

| |

iShares Barclays U.S. Treasury Inflation Protected Securities Index Fund | | 12.7% |

Total Non-Affiliated Fixed Income Funds | | 12.7% |

| Total Fixed Income Funds | | 41.6% |

| Total Short-Term Investments | | 1.2% |

| Total Investments | | 100.0% |

| | |

| Affiliated Equity Funds | | 1-Year

Average Annual

Total Returns

as of 6/30/10 |

Nuveen NWQ Large-Cap Value Fund (Class I) | | 16.13% |

Nuveen Santa Barbara Growth Fund (Class I) | | 10.93% |

Nuveen Symphony Large-Cap Growth Fund (Class I) | | 20.26% |

Nuveen Tradewinds Global Resources Fund (Class I) | | 20.30% |

Nuveen Tradewinds International Value Fund (Class I) | | 4.77% |

Nuveen Tradewinds Value Opportunities Fund (Class I) | | 23.48% |

Nuveen U.S. Equity Completeness Fund | | 13.25% |

Nuveen Winslow Large-Cap Growth Fund (Class I) | | 10.33% |

| |

| Non-Affiliated Equity Funds | | |

iShares Dow Jones U.S. Real Estate Index Fund | | 50.80% |

iShares MSCI EAFE Growth Index Fund | | 8.40% |

iShares MSCI Emerging Markets Index Fund | | 19.11% |

| |

| Affiliated Fixed Income Funds | | |

Nuveen High Yield Bond Fund (Class I) | | 24.27% |

Nuveen Multi-Strategy Core Bond Fund (Class I) | | 11.23% |

Nuveen Short Duration Bond Fund (Class I) | | 5.40% |

| |

| Non-Affiliated Fixed Income Funds | | |

iShares Barclays U.S. Treasury Inflation Protected Securities Index Fund | | 9.36% |

| 1 | As a percentage of total investments as of June 30, 2010. Holdings are subject to change. |

Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including front- and back-end sales charges (loads) or redemption fees, where applicable; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees, where applicable; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example below is based on an investment of $1,000 invested at the beginning of the period and held for the period.

The information under “Actual Performance,” together with the amount you invested, allows you to estimate actual expenses incurred over the reporting period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60) and multiply the result by the cost shown for your share class, in the row entitled “Expenses Incurred During Period” to estimate the expenses incurred on your account during this period.

The information under “Hypothetical Performance,” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expense you incurred for the period. You may use this information to compare the ongoing costs of investing in the Fund and other Funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front- and back-end sales charges (loads) or redemption fees, where applicable. Therefore, the hypothetical information is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds or share classes. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Hypothetical Performance |

| | | Actual Performance | | | | (5% return before expenses) |

| | | A Shares | | B Shares | | C Shares | | R3 Shares | | I Shares | | | | A Shares | | B Shares | | C Shares | | R3 Shares | | I Shares |

| Beginning Account Value (1/01/10) | | $ | 1,000.00 | | $ | 1,000.00 | | $ | 1,000.00 | | $ | 1,000.00 | | $ | 1,000.00 | | | | $ | 1,000.00 | | $ | 1,000.00 | | $ | 1,000.00 | | $ | 1,000.00 | | $ | 1,000.00 |

| Ending Account Value (6/30/10) | | $ | 974.60 | | $ | 971.00 | | $ | 971.00 | | $ | 973.20 | | $ | 975.90 | | | | $ | 1,022.12 | | $ | 1,018.40 | | $ | 1,018.40 | | $ | 1,020.88 | | $ | 1,023.36 |

| Expenses Incurred During Period | | $ | 2.64 | | $ | 6.30 | | $ | 6.30 | | $ | 3.87 | | $ | 1.42 | | | | $ | 2.71 | | $ | 6.46 | | $ | 6.46 | | $ | 3.96 | | $ | 1.45 |

For each class of the Fund, expenses are equal to the Fund’s annualized net expense ratio of 0.54%, 1.29%, 1.29%, 0.79% and 0.29% for Classes A, B, C, R3 and I, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

Fund Spotlight as of 6/30/10 Nuveen Conservative Allocation Fund

| | | | | | | | | | |

| Quick Facts | | | | | | | | | | |

| | | A Shares | | B Shares | | C Shares | | R3 Shares | | I Shares |

Fund Symbols | | NBMSX | | NMNBX | | NBMCX | | NALTX | | NMNRX |

NAV | | $22.07 | | $23.67 | | $23.64 | | $21.49 | | $21.48 |

Latest Ordinary Income Distribution1 | | $0.7932 | | $0.6874 | | $0.6865 | | $0.7229 | | $0.8211 |

Inception Date | | 8/07/96 | | 8/07/96 | | 8/07/96 | | 8/04/08 | | 8/07/96 |

Returns quoted represent past performance which is no guarantee of future results. Investment returns and principal value will fluctuate so that when shares are redeemed, they may be worth more or less than their original cost. Current performance may be higher or lower than the performance shown. Returns without sales charges would be lower if the sales charge were included. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. For the most recent month-end performance visit www.nuveen.com or call (800) 257-8787.

Class A, B, C and I Share returns are actual. The returns for Class R3 Shares are actual for the period since class inception on 8/04/08; returns prior to class inception are Class I Share returns adjusted for differences in sales charges and expenses, which are primarily differences in distribution and service fees. Fund returns assume reinvestment of dividends and capital gains. Class A Shares have a 5.75% maximum sales charge. Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC), also known as a back-end sales charge, if redeemed within twelve months of purchase. Class B Shares have a CDSC that begins at 5% for redemptions during the first year and declines periodically until after six years when the charge becomes 0%. Class B Shares automatically convert to Class A Shares eight years after purchase. Class C Shares have a 1% CDSC for redemptions within less than one year, which is not reflected in the one-year total return. Class R3 Shares have no sales charge and are available to only certain retirement plans. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors. Returns may reflect an expense limitation by the Fund’s investment adviser.

Returns prior to July 7, 2008, are not indicative of the performance that the Fund, as currently managed, would have generated.

| | | | |

| Average Annual Total Returns as of 6/30/10 |

| | |

| A Shares | | NAV | | Offer |

1-Year | | 12.93% | | 6.46% |

5-Year | | 3.02% | | 1.81% |

10-Year | | 2.94% | | 2.33% |

| | |

| B Shares | | w/o CDSC | | w/CDSC |

1-Year | | 12.11% | | 8.11% |

5-Year | | 2.26% | | 2.08% |

10-Year | | 2.32% | | 2.32% |

| | |

| C Shares | | NAV | | |

1-Year | | 12.12% | | |

5-Year | | 2.25% | | |

10-Year | | 2.18% | | |

| | |

| R3 Shares | | NAV | | |

1-Year | | 12.67% | | |

5-Year | | 2.77% | | |

10-Year | | 2.69% | | |

| | |

| I Shares | | NAV | | |

1-Year | | 13.24% | | |

5-Year | | 3.29% | | |

10-Year | | 3.21% | | |

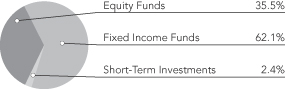

Portfolio Allocation2

| | |

| Portfolio Statistics |

| Net Assets ($000) | | $45,425 |

| Number of Holdings | | 16 |

| | | | |

| Expense Ratios | | | | |

| Share Class | | Gross

Expense

Ratios | | Net

Expense

Ratios |

| Class A | | 1.62% | | 1.21% |

| Class B | | 2.35% | | 1.96% |

| Class C | | 2.39% | | 1.96% |

| Class R3 | | 1.94% | | 1.46% |

| Class I | | 1.33% | | 0.96% |

The expense ratios shown factor in Total Annual Fund Operating Expenses including management fees and other fees and expenses, including the estimated fees and expenses of the Underlying Funds in which the Fund invests. The Net Expense Ratios reflect a contractual commitment by the Fund’s investment adviser to waive fees and reimburse expenses through October 31, 2011. Theses expense ratios will vary from the expense ratios included in the Financial Highlights of this report, as they exclude the expenses of the Underlying Funds. The expense ratios are those shown in the most recent Fund prospectus.

| 2 | As a percentage of total investments as of June 30, 2010. Holdings are subject to change. |

Fund Spotlight as of 6/30/10 Nuveen Conservative Allocation Fund

| | |

| Holding | | Weighting1 |

Nuveen NWQ Large-Cap Value Fund (Class I) | | 2.7% |

Nuveen Santa Barbara Growth Fund (Class I) | | 1.0% |

Nuveen Symphony Large-Cap Growth Fund (Class I) | | 3.7% |

Nuveen Tradewinds Global Resources Fund (Class I) | | 2.8% |

Nuveen Tradewinds International Value Fund (Class I) | | 4.3% |

Nuveen Tradewinds Value Opportunities Fund (Class I) | | 2.3% |

Nuveen U.S. Equity Completeness Fund | | 4.7% |

Nuveen Winslow Large-Cap Growth Fund (Class I) | | 1.6% |

Total Affiliated Equity Funds | | 23.1% |

| |

iShares Dow Jones U.S. Real Estate Index Fund | | 2.9% |

iShares MSCI EAFE Growth Index Fund | | 4.0% |

iShares MSCI Emerging Markets Index Fund | | 5.5% |

Total Non-Affiliated Equity Funds | | 12.4% |

| Total Equity Funds | | 35.5% |

| |

Nuveen High Yield Bond Fund (Class I) | | 12.3% |

Nuveen Multi-Strategy Core Bond Fund (Class I) | | 17.9% |

Nuveen Short Duration Bond Fund (Class I) | | 17.3% |

Total Affiliated Fixed Income Funds | | 47.5% |

| |

iShares Barclays U.S. Treasury Inflation Protected Securities Index Fund | | 14.6% |

Total Non-Affiliated Fixed Income Funds | | 14.6% |

| Total Fixed Income Funds | | 62.1% |

| Total Short-Term Investments | | 2.4% |

| Total Investments | | 100.0% |

| | |

| Affiliated Equity Funds | | 1-Year

Average Annual

Total Returns

as of 6/30/10 |

Nuveen NWQ Large-Cap Value Fund (Class I) | | 16.13% |

Nuveen Santa Barbara Growth Fund (Class I) | | 10.93% |

Nuveen Symphony Large-Cap Growth Fund (Class I) | | 20.26% |

Nuveen Tradewinds Global Resources Fund (Class I) | | 20.30% |

Nuveen Tradewinds International Value Fund (Class I) | | 4.77% |

Nuveen Tradewinds Value Opportunities Fund (Class I) | | 23.48% |

Nuveen U.S. Equity Completeness Fund | | 13.25% |

Nuveen Winslow Large-Cap Growth Fund (Class I) | | 10.33% |

| |

| Non-Affiliated Equity Funds | | |

iShares Dow Jones U.S. Real Estate Index Fund | | 50.80% |

iShares MSCI EAFE Growth Index Fund | | 8.40% |

iShares MSCI Emerging Markets Index Fund | | 19.11% |

| |

| Affiliated Fixed Income Funds | | |

Nuveen High Yield Bond Fund (Class I) | | 24.27% |

Nuveen Multi-Strategy Core Bond Fund (Class I) | | 11.23% |

Nuveen Short Duration Bond Fund (Class I) | | 5.40% |

| |

| Non-Affiliated Fixed Income Funds | | |

iShares Barclays U.S. Treasury Inflation Protected Securities Index Fund | | 9.36% |

| 1 | As a percentage of total investments as of June 30, 2010. Holdings are subject to change. |

Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including front- and back-end sales charges (loads) or redemption fees, where applicable; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees, where applicable; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example below is based on an investment of $1,000 invested at the beginning of the period and held for the period.

The information under “Actual Performance,” together with the amount you invested, allows you to estimate actual expenses incurred over the reporting period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60) and multiply the result by the cost shown for your share class, in the row entitled “Expenses Incurred During Period” to estimate the expenses incurred on your account during this period.

The information under “Hypothetical Performance,” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expense you incurred for the period. You may use this information to compare the ongoing costs of investing in the Fund and other Funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front- and back-end sales charges (loads) or redemption fees, where applicable. Therefore, the hypothetical information is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds or share classes. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Hypothetical Performance |

| | | Actual Performance | | | | (5% return before expenses) |

| | | A Shares | | B Shares | | C Shares | | R3 Shares | | I Shares | | | | A Shares | | B Shares | | C Shares | | R3 Shares | | I Shares |

| Beginning Account Value (1/01/10) | | $ | 1,000.00 | | $ | 1,000.00 | | $ | 1,000.00 | | $ | 1,000.00 | | $ | 1,000.00 | | | | $ | 1,000.00 | | $ | 1,000.00 | | $ | 1,000.00 | | $ | 1,000.00 | | $ | 1,000.00 |

| Ending Account Value (6/30/10) | | $ | 995.50 | | $ | 992.00 | | $ | 992.00 | | $ | 994.40 | | $ | 997.20 | | | | $ | 1,021.72 | | $ | 1,018.00 | | $ | 1,018.00 | | $ | 1,020.48 | | $ | 1,022.96 |

| Expenses Incurred During Period | | $ | 3.07 | | $ | 6.77 | | $ | 6.77 | | $ | 4.30 | | $ | 1.83 | | | | $ | 3.11 | | $ | 6.85 | | $ | 6.85 | | $ | 4.36 | | $ | 1.86 |

For each class of the Fund, expenses are equal to the Fund’s annualized net expense ratio of 0.62%, 1.37%, 1.37%, 0.87% and 0.37% for Classes A, B, C, R3 and I, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

Report of

Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders of

Nuveen Investment Trust:

In our opinion, the accompanying statement of assets and liabilities, including the portfolios of investments, and the related statements of operations, of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Nuveen Growth Allocation Fund, Nuveen Moderate Allocation Fund, and Nuveen Conservative Allocation (each a series of the Nuveen Investment Trust, hereafter referred to as the “Funds”) at June 30, 2010, the results of their operations for the year then ended, the changes in their net assets for each of the two years in the period then ended and the financial highlights for the periods presented in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Funds’ management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at June 30, 2010 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

PRICEWATERHOUSECOOPERS LLP

Chicago, IL

August 25, 2010

Portfolio of Investments

Nuveen Growth Allocation Fund

June 30, 2010

| | | | | | | | | | | | |

| Shares | | Description (1) | | | | | | | | Value |

| | | | | | | | | | | | |

| | | EQUITY FUNDS – 74.9% | | | | | | | | | |

| | | | | |

| | | Affiliated Equity Funds – 42.8% | | | | | | | | | |

| | | | | |

| | 26,019 | | Nuveen NWQ Large-Cap Value Fund (Class I) | | | | | | | | $ | 383,782 |

| | | | | |

| | 8,432 | | Nuveen Santa Barbara Growth Fund (Class I) | | | | | | | | | 137,698 |

| | | | | |

| | 27,008 | | Nuveen Symphony Large-Cap Growth Fund (Class I) | | | | | | | | | 500,188 |

| | | | | |

| | 12,742 | | Nuveen Tradewinds Global Resources Fund (Class I) | | | | | | | | | 252,038 |

| | | | | |

| | 49,804 | | Nuveen Tradewinds International Value Fund (Class I) | | | | | | | | | 1,100,669 |

| | | | | |

| | 11,044 | | Nuveen Tradewinds Value Opportunities Fund (Class I) | | | | | | | | | 329,888 |

| | | | | |

| | 40,737 | | Nuveen U.S. Equity Completeness Fund, (2) | | | | | | | | | 642,825 |

| | | | | |

| | 9,465 | | Nuveen Winslow Large-Cap Growth Fund (Class I) | | | | | | | | | 221,190 |

| | | Total Affiliated Equity Funds (cost $4,021,651) | | | | | | | | | 3,568,278 |

| | | Non-Affiliated Equity Funds – 32.1% | | | | | | | | | |

| | | | | |

| | 8,585 | | iShares Dow Jones U.S. Real Estate Index Fund | | | | | | | | | 405,298 |

| | | | | |

| | 21,785 | | iShares MSCI EAFE Growth Index Fund | | | | | | | | | 1,047,205 |

| | | | | |

| | 32,780 | | iShares MSCI Emerging Markets Index Fund | | | | | | | | | 1,223,349 |

| | | Total Non-Affiliated Equity Funds (cost $2,626,044) | | | | | | | | | 2,675,852 |

| | | Total Equity Funds (cost $6,647,695) | | | | | | | | | 6,244,130 |

| | | FIXED INCOME FUNDS – 22.9% | | | | | | | | | |

| | | | | |

| | | Affiliated Fixed Income Funds – 18.7% | | | | | | | | | |

| | | | | |

| | 62,942 | | Nuveen High Yield Bond Fund (Class I) | | | | | | | | | 1,039,804 |

| | | | | |

| | 16,715 | | Nuveen Multi-Strategy Core Bond Fund (Class I) | | | | | | | | | 347,001 |

| | | | | |

| | 8,730 | | Nuveen Short Duration Bond Fund (Class I) | | | | | | | | | 170,582 |

| | | Total Affiliated Fixed Income Funds (cost $1,315,087) | | | | | | | | | 1,557,387 |

| | | Non-Affiliated Fixed Income Funds – 4.2% | | | | | | | | | |

| | | | | |

| | 3,320 | | iShares Barclays U.S. Treasury Inflation Protected Securities Index Fund | | | | | | | | | 354,941 |

| | | Total Non-Affiliated Fixed Income Funds (cost $341,405) | | | | | | | | | 354,941 |

| | | Total Fixed Income Funds (cost $1,656,492) | | | | | | | | | 1,912,328 |

| | | | | |

Principal

Amount (000) | | Description (1) | | | | Coupon | | Maturity | | Value |

| | | SHORT-TERM INVESTMENTS – 2.4% | | | | | | | | | |

| | | | | |

| $ | 200 | | Repurchase Agreement with Fixed Income Clearing Corporation, dated 6/30/10, repurchase price $200,099, collateralized by $205,000 U.S. Treasury Notes, 2.500%, due 6/30/17, value $204,231 | | | | 0.000% | | 7/01/10 | | $ | 200,099 |

| | | Total Short-Term Investments (cost $200,099) | | | | | | | | | 200,099 |

| | | Total Investments (cost $8,504,286) – 100.2% | | | | | | | | | 8,356,557 |

| | | Other Assets Less Liabilities – (0.2)% | | | | | | | | | (15,311) |

| | | Net Assets – 100% | | | | | | | | $ | 8,341,246 |

| | (1) | | All percentages shown in the Portfolio of Investments are based on net assets. |

| | (2) | | For fair value measurement disclosure purposes, Nuveen U.S. Equity Completeness Fund categorized as Level 2, as it is not publicly available to shareholders and may only be purchased by the Nuveen Conservative Allocation Fund, Nuveen Moderate Allocation Fund and Nuveen Growth Allocation Fund. See Notes to Financial Statements, Footnote 1– General Information and Significant Accounting Policies, Investment Valuation for more information. |

See accompanying notes to financial statements.

Portfolio of Investments

Nuveen Moderate Allocation Fund

June 30, 2010

| | | | | | | | | | | | |

| Shares | | Description (1) | | | | | | | | Value |

| | | | | | | | | | | | |

| | | EQUITY FUNDS – 56.1% | | | | | | | | | |

| | | | | |

| | | Affiliated Equity Funds – 34.6% | | | | | | | | | |

| | | | | |

| | 125,959 | | Nuveen NWQ Large-Cap Value Fund (Class I) | | | | | | | | $ | 1,857,902 |

| | | | | |

| | 40,140 | | Nuveen Santa Barbara Growth Fund (Class I) | | | | | | | | | 655,478 |

| | | | | |

| | 138,809 | | Nuveen Symphony Large-Cap Growth Fund (Class I) | | | | | | | | | 2,570,736 |

| | | | | |

| | 46,099 | | Nuveen Tradewinds Global Resources Fund (Class I) | | | | | | | | | 911,831 |

| | | | | |

| | 172,341 | | Nuveen Tradewinds International Value Fund (Class I) | | | | | | | | | 3,808,734 |

| | | | | |

| | 54,386 | | Nuveen Tradewinds Value Opportunities Fund (Class I) | | | | | | | | | 1,624,498 |

| | | | | |

| | 203,913 | | Nuveen U.S. Equity Completeness Fund, (2) | | | | | | | | | 3,217,749 |

| | | | | |

| | 44,861 | | Nuveen Winslow Large-Cap Growth Fund (Class I) | | | | | | | | | 1,048,403 |

| | | Total Affiliated Equity Funds (cost $17,109,100) | | | | | | | | | 15,695,331 |

| | | Non-Affiliated Equity Funds – 21.5% | | | | | | | | | |

| | | | | |

| | 28,750 | | iShares Dow Jones U.S. Real Estate Index Fund | | | | | | | | | 1,357,288 |

| | | | | |

| | 74,365 | | iShares MSCI EAFE Growth Index Fund | | | | | | | | | 3,574,726 |

| | | | | |

| | 130,005 | | iShares MSCI Emerging Markets Index Fund | | | | | | | | | 4,851,787 |

| | | Total Non-Affiliated Equity Funds (cost $8,620,311) | | | | | | | | | 9,783,801 |

| | | Total Equity Funds (cost $25,729,411) | | | | | | | | | 25,479,132 |

| | | FIXED INCOME FUNDS – 40.9% | | | | | | | | | |

| | | | | |

| | | Affiliated Fixed Income Funds – 28.4% | | | | | | | | | |

| | | | | |

| | 420,243 | | Nuveen High Yield Bond Fund (Class I) | | | | | | | | | 6,942,411 |

| | | | | |

| | 159,488 | | Nuveen Multi-Strategy Core Bond Fund (Class I) | | | | | | | | | 3,310,964 |

| | | | | |

| | 134,839 | | Nuveen Short Duration Bond Fund (Class I) | | | | | | | | | 2,634,759 |

| | | Total Affiliated Fixed Income Funds (cost $11,728,584) | | | | | | | | | 12,888,134 |

| | | Non-Affiliated Fixed Income Funds – 12.5% | | | | | | | | | |

| | | | | |

| | 52,965 | | iShares Barclays U.S. Treasury Inflation Protected Securities Index Fund | | | | | | | | | 5,662,488 |

| | | Total Non-Affiliated Fixed Income Funds (cost $5,515,383) | | | | | | | | | 5,662,488 |

| | | Total Fixed Income Funds (cost $17,243,967) | | | | | | | | | 18,550,622 |

| | | | | |

Principal

Amount (000) | | Description (1) | | | | Coupon | | Maturity | | Value |

| | | SHORT-TERM INVESTMENTS – 1.2% | | | | | | | | | |

| | | | | |

| $ | 553 | | Repurchase Agreement with Fixed Income Clearing Corporation, dated 6/30/10, repurchase price $552,846, collateralized by $540,000 U.S. Treasury Notes, 3.000%, due 2/28/17, value $564,975 | | | | 0.000% | | 7/01/10 | | $ | 552,846 |

| | | Total Short-Term Investments (cost $552,846) | | | | | | | | | 552,846 |

| | | Total Investments (cost $43,526,224) – 98.2% | | | | | | | | | 44,582,600 |

| | | Other Assets Less Liabilities – 1.8% | | | | | | | | | 807,599 |

| | | Net Assets – 100% | | | | | | | | $ | 45,390,199 |

| | (1) | | All percentages shown in the Portfolio of Investments are based on net assets. |

| | (2) | | For fair value measurement disclosure purposes, Nuveen U.S. Equity Completeness Fund categorized as Level 2, as it is not publicly available to shareholders and may only be purchased by the Nuveen Conservative Allocation Fund, Nuveen Moderate Allocation Fund and Nuveen Growth Allocation Fund. See Notes to Financial Statements, Footnote 1– General Information and Significant Accounting Policies, Investment Valuation for more information. |

See accompanying notes to financial statements.

Portfolio of Investments

Nuveen Conservative Allocation Fund

June 30, 2010

| | | | | | | | | | | | |

| Shares | | Description (1) | | | | | | | | Value |

| | | | | | | | | | | | |

| | | EQUITY FUNDS – 35.5% | | | | | | | | | |

| | | | | |

| | | Affiliated Equity Funds – 23.1% | | | | | | | | | |

| | | | | |

| | 82,760 | | Nuveen NWQ Large-Cap Value Fund (Class I) | | | | | | | | $ | 1,220,709 |

| | | | | |

| | 27,154 | | Nuveen Santa Barbara Growth Fund (Class I) | | | | | | | | | 443,424 |

| | | | | |

| | 91,852 | | Nuveen Symphony Large-Cap Growth Fund (Class I) | | | | | | | | | 1,701,098 |

| | | | | |

| | 64,397 | | Nuveen Tradewinds Global Resources Fund (Class I) | | | | | | | | | 1,273,763 |

| | | | | |

| | 87,865 | | Nuveen Tradewinds International Value Fund (Class I) | | | | | | | | | 1,941,811 |

| | | | | |

| | 35,558 | | Nuveen Tradewinds Value Opportunities Fund (Class I) | | | | | | | | | 1,062,118 |

| | | | | |

| | 135,445 | | Nuveen U.S. Equity Completeness Fund, (2) | | | | | | | | | 2,137,316 |

| | | | | |

| | 30,309 | | Nuveen Winslow Large-Cap Growth Fund (Class I) | | | | | | | | | 708,331 |

| | | Total Affiliated Equity Funds (cost $11,158,257) | | | | | | | | | 10,488,570 |

| | | Non-Affiliated Equity Funds – 12.4% | | | | | | | | | |

| | | | | |

| | 28,275 | | iShares Dow Jones U.S. Real Estate Index Fund | | | | | | | | | 1,334,863 |

| | | | | |

| | 38,060 | | iShares MSCI EAFE Growth Index Fund | | | | | | | | | 1,829,544 |

| | | | | |

| | 66,340 | | iShares MSCI Emerging Markets Index Fund | | | | | | | | | 2,475,809 |

| | | Total Non-Affiliated Equity Funds (cost $5,142,749) | | | | | | | | | 5,640,216 |

| | | Total Equity Funds (cost $16,301,006) | | | | | | | | | 16,128,786 |

| | | FIXED INCOME FUNDS – 62.1% | | | | | | | | | |

| | | | | |

| | | Affiliated Fixed Income Funds – 47.5% | | | | | | | | | |

| | | | | |

| | 338,094 | | Nuveen High Yield Bond Fund (Class I) | | | | | | | | | 5,585,316 |

| | | | | |

| | 391,407 | | Nuveen Multi-Strategy Core Bond Fund (Class I) | | | | | | | | | 8,125,612 |

| | | | | |

| | 403,414 | | Nuveen Short Duration Bond Fund (Class I) | | | | | | | | | 7,882,708 |

| | | Total Affiliated Fixed Income Funds (cost $20,383,502) | | | | | | | | | 21,593,636 |

| | | Non-Affiliated Fixed Income Funds – 14.6% | | | | | | | | | |

| | | | | |

| | 62,020 | | iShares Barclays U.S. Treasury Inflation Protected Securities Index Fund | | | | | | | | | 6,630,558 |

| | | Total Non-Affiliated Fixed Income Funds (cost $6,548,171) | | | | | | | | | 6,630,558 |

| | | Total Fixed Income Funds (cost $26,931,673) | | | | | | | | | 28,224,194 |

| | | | | |

Principal

Amount (000) | | Description (1) | | | | Coupon | | Maturity | | Value |

| | | SHORT-TERM INVESTMENTS – 2.4% | | | | | | | | | |

| | | | | |

| $ | 1,068 | | Repurchase Agreement with Fixed Income Clearing Corporation, dated 6/30/10, repurchase price $1,068,163, collateralized by $1,045,000 U.S. Treasury Notes, 3.000%, due 2/28/17, value $1,093,331 | | | | 0.000% | | 7/01/10 | | $ | 1,068,163 |

| | | Total Short-Term Investments (cost $1,068,163) | | | | | | | | | 1,068,163 |

| | | Total Investments (cost $44,300,842) – 100.0% | | | | | | | | | 45,421,143 |

| | | Other Assets Less Liabilities – 0.0% | | | | | | | | | 4,333 |

| | | Net Assets – 100% | | | | | | | | $ | 45,425,476 |

| | (1) | | All percentages shown in the Portfolio of Investments are based on net assets. |

| | (2) | | For fair value measurement disclosure purposes, Nuveen U.S. Equity Completeness Fund categorized as Level 2, as it is not publicly available to shareholders and may only be purchased by the Nuveen Conservative Allocation Fund, Nuveen Moderate Allocation Fund and Nuveen Growth Allocation Fund. See Notes to Financial Statements, Footnote 1– General Information and Significant Accounting Policies, Investment Valuation for more information. |

See accompanying notes to financial statements.

Statement of Assets and Liabilities

June 30, 2010

| | | | | | | | | | | | |

| | | Growth

Allocation | | | Moderate

Allocation | | | Conservative

Allocation | |

Assets | | | | | | | | | | | | |

Affiliated investments, at value (cost $5,336,738, $28,837,684 and $31,541,759, respectively) | | $ | 5,125,665 | | | $ | 28,583,465 | | | $ | 32,082,206 | |

Non-affiliated investments, at value (cost $3,167,548, $14,688,540 and $12,759,083, respectively) | | | 3,230,892 | | | | 15,999,135 | | | | 13,338,937 | |

Receivables: | | | | | | | | | | | | |

Dividends | | | 9,839 | | | | 75,907 | | | | 104,990 | |

From Adviser | | | 22,427 | | | | 5,886 | | | | — | |

Investments sold | | | — | | | | 575,505 | | | | — | |

Reclaims | | | 834 | | | | 6,058 | | | | 5,489 | |

Shares sold | | | 5,801 | | | | 251,280 | | | | 51,625 | |

Other assets | | | 11 | | | | 11,998 | | | | 20,592 | |

Total assets | | | 8,395,469 | | | | 45,509,234 | | | | 45,603,839 | |

Liabilities | | | | | | | | | | | | |

Payable for shares redeemed | | | 764 | | | | 7,302 | | | | 63,727 | |

Accrued expenses: | | | | | | | | | | | | |

Management fees | | | — | | | | — | | | | 3,381 | |

12b-1 distribution and service fees | | | 3,355 | | | | 12,721 | | | | 14,889 | |

Other | | | 50,104 | | | | 99,012 | | | | 96,366 | |

Total liabilities | | | 54,223 | | | | 119,035 | | | | 178,363 | |

Net assets | | $ | 8,341,246 | | | $ | 45,390,199 | | | $ | 45,425,476 | |