UNITED STATES

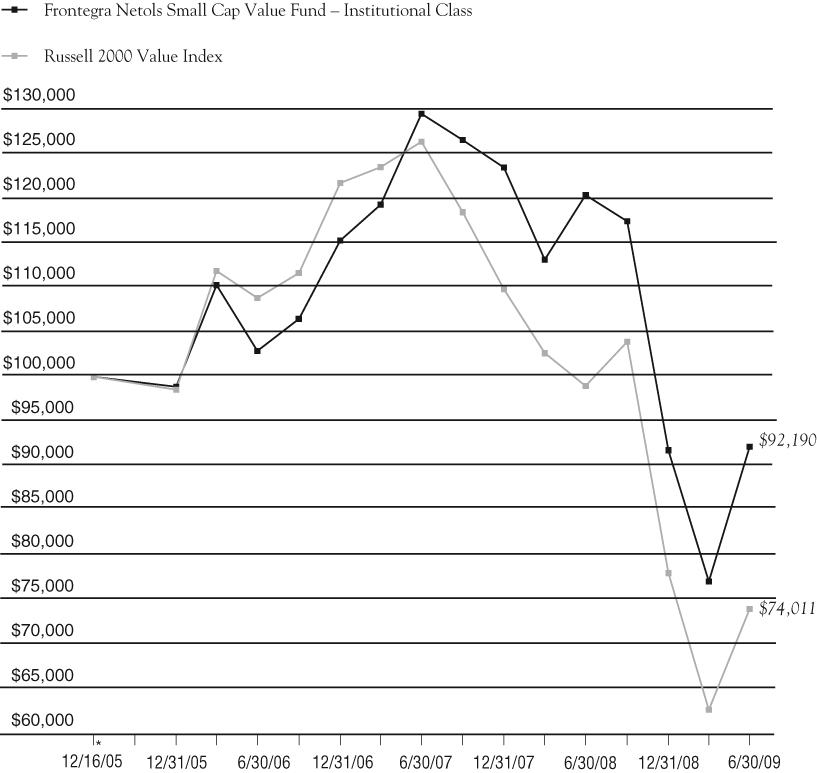

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07685

Frontegra Funds, Inc.

(Exact name of registrant as specified in charter)

400 Skokie Blvd.

Suite 500

Northbrook, Illinois 60062

(Address of principal executive offices) (Zip code)

William D. Forsyth III

400 Skokie Blvd., Suite 500

Northbrook, Illinois 60062

(Name and address of agent for service)

(847) 509-9860

Registrant's telephone number, including area code

Date of fiscal year end: June 30, 2009

Date of reporting period: June 30, 2009

Item 1. Reports to Stockholders.

ANNUAL REPORT

Frontegra Columbus Core Plus Fund

Frontegra Columbus Core Fund

Frontegra IronBridge Small Cap Fund

Frontegra IronBridge SMID Fund

Frontegra New Star International Equity Fund

Frontegra Netols Small Cap Value Fund

Frontegra Asset Management, Inc.

June 30, 2009

TABLE OF CONTENTS

| Shareholder Letter | 1 |

| Expense Example | 2 |

| Frontegra Columbus Core Plus Fund | |

| Frontegra Columbus Core Fund | |

| Report from Reams Asset Management Company, LLC | 5 |

| Investment Highlights | 7 |

| Schedule of Investments | 8 |

| Statement of Assets and Liabilities | 16 |

| Statement of Operations | 17 |

| Statements of Changes in Net Assets | 18 |

| Financial Highlights | 19 |

| Investment Highlights | 20 |

| Schedule of Investments | 21 |

| Statement of Assets and Liabilities | 26 |

| Statement of Operations | 27 |

| Statements of Changes in Net Assets | 28 |

| Financial Highlights | 29 |

| Frontegra IronBridge Small Cap Fund | |

| Frontegra IronBridge SMID Fund | |

| Report from IronBridge Capital Management, L.P. | 31 |

| Investment Highlights | 34 |

| Schedule of Investments | 35 |

| Statement of Assets and Liabilities | 39 |

| Statement of Operations | 40 |

| Statements of Changes in Net Assets | 41 |

| Financial Highlights | 42 |

| Investment Highlights | 43 |

| Schedule of Investments | 44 |

| Statement of Assets and Liabilities | 48 |

| Statement of Operations | 49 |

| Statements of Changes in Net Assets | 50 |

| Financial Highlights | 51 |

| | |

| Frontegra New Star International Equity Fund | |

| Report from New Star Institutional Managers Limited | 53 |

| Investment Highlights | 55 |

| Schedule of Investments | 56 |

| Portfolio Diversification | 59 |

| Statement of Assets and Liabilities | 60 |

| Statement of Operations | 61 |

| Statements of Changes in Net Assets | 62 |

| Financial Highlights | 63 |

| Frontegra Netols Small Cap Value Fund | |

| Report from Netols Asset Management, Inc. | 65 |

| Investment Highlights | 66 |

| Schedule of Investments | 67 |

| Statement of Assets and Liabilities | 70 |

| Statement of Operations | 71 |

| Statements of Changes in Net Assets | 72 |

| Financial Highlights | 73 |

| Notes to Financial Statements | 75 |

| Report of Independent Registered Public Accounting Firm | 85 |

| Board of Directors’ Approval of Interim and New Subadvisory Agreements and Advisory Agreement | 86 |

| Additional Information | |

| Directors and Officers | 89 |

| Foreign Tax Credit | 92 |

| Qualified Dividend Income/Dividends Received Deduction | 92 |

| Additional Information Applicable to Foreign Shareholders Only | 93 |

| | |

This report is submitted for the general information of the shareholders of the Funds. It is not authorized for distribution to prospective investors unless accompanied or preceded by an effective Prospectus for the applicable Fund. The Prospectus may be obtained by calling 1-888-825-2100. Each Prospectus includes more complete information about management fees and expenses, investment objectives, risks and operating policies of the applicable Fund. Please read the Prospectus carefully.

Frontegra Funds, Inc. are distributed by Frontegra Strategies, LLC, 400 Skokie Blvd., Suite 500, Northbrook, IL 60062. Frontegra Strategies, LLC, member of FINRA and SIPC, is an affiliate of Frontegra Asset Management, Inc., the Funds’ investment adviser.

| This page intentionally left blank. |

DEAR FELLOW SHAREHOLDERS:

We are pleased to report on the progress of the Frontegra Funds over the past twelve months ending June 30, 2009. This has been a particularly volatile period for both equity and bond markets. The S&P 500 Index was down -26.21%, and small capitalization stocks were also down, with the Russell 2000 Index returning -25.01%. International stocks, as measured by the MSCI EAFE Index, returned -30.96% over the same time frame. The U.S. bond market, as measured by the Barclays Capital U.S. Aggregate Bond Index, was up 6.05% for the twelve-month period, due almost entirely to the strength of U.S. Treasury securities; other sectors of the bond market experienced historically negative returns relative to Treasurys.

Fund Results

For the twelve month period ending June 30, 2009, the Funds generated the following net (i.e. after fee) returns:

The Frontegra Columbus Core Plus Fund, managed by Reams Asset Management, returned 10.52% versus the 6.05% return of the Barclays Capital U.S. Aggregate Bond Index. The Frontegra Columbus Core Fund, also managed by Reams Asset Management, returned 8.64%.

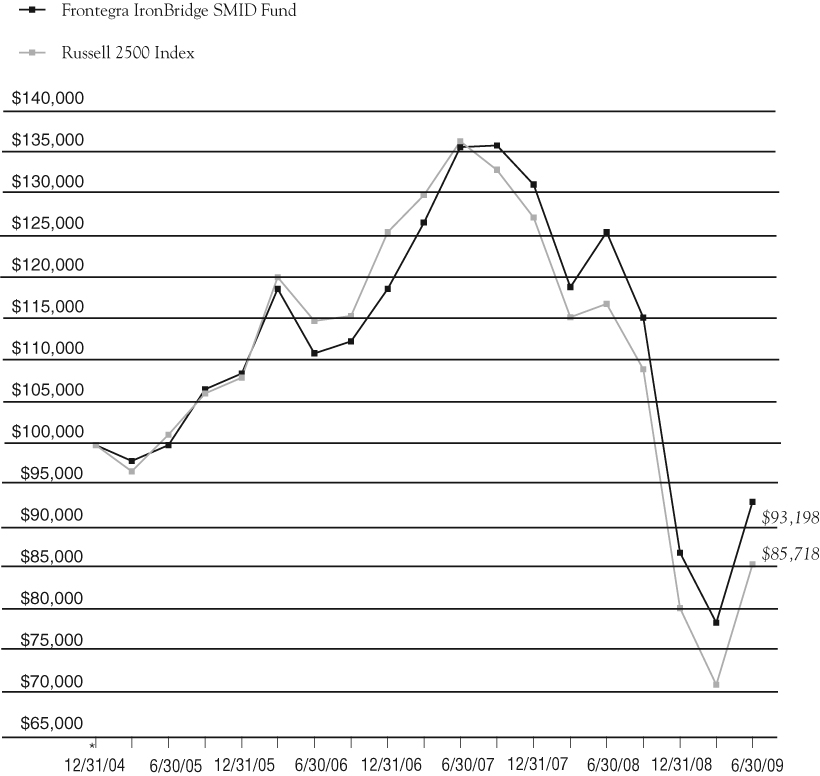

The Frontegra IronBridge Small Cap Fund, managed by IronBridge Capital Management, returned -26.00% versus the -25.01% return for the Russell 2000 Index; the Frontegra IronBridge SMID Fund returned -25.78% versus the Russell 2500 Index return of -26.72%.

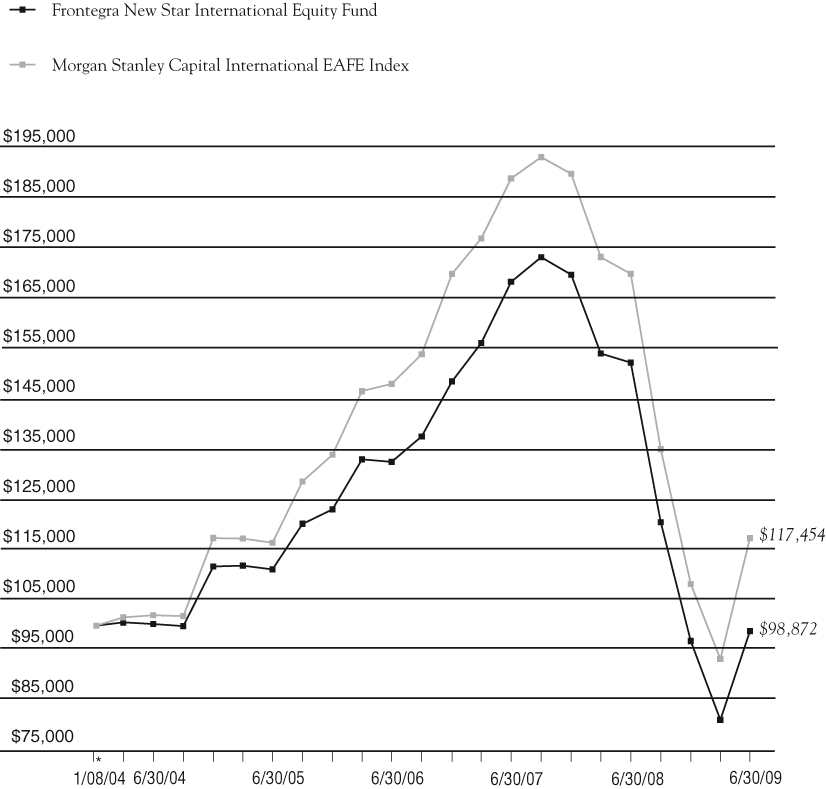

The Frontegra New Star International Equity Fund, managed by New Star Institutional Managers, returned -35.13% versus the benchmark return of -30.96% for the MSCI EAFE Index.

The Frontegra Netols Small Cap Value Fund (Institutional Class), managed by Netols Asset Management, returned -23.42% versus the Russell 2000 Value Index return of - -25.24%.

Outlook

Major economic factors expected to affect the capital markets over the next twelve months include the mortgage and credit crisis, the steep decline in housing prices, the slowing of the economy and the potential rise in inflation. We and the subadvisers of the Frontegra Funds will strive to navigate these turbulent waters with skill and dexterity.

We will continue to oversee the investment management of the Frontegra Funds with the care and diligence that have served our shareholders well in the past. As always, we appreciate your investment and continued confidence in the Frontegra Funds.

Best regards,

William D. Forsyth, CFA

William D. Forsyth, CFAPresident

Frontegra Funds, Inc.

Frontegra Funds

EXPENSE EXAMPLE

June 30, 2009

As a shareholder of a mutual fund, you incur two types of costs: (1) transaction costs, including redemption fees, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other fund expenses. Although the Funds charge no sales loads, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Funds’ transfer agent. If you request that a redemption be made by wire transfer, currently the Funds’ transfer agent charges a $15.00 fee. A redemption fee of 2.00% of the then current value of the shares redeemed may be imposed on certain redemptions of shares made within 30 days of purchase for the Frontegra New Star International Equity Fund.

This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (1/1/09 – 6/30/09).

Actual Expenses

The first line of the table on the following page for each Fund provides information about actual account values and actual expenses. The Example includes management fees, registration fees, fee waivers/reimbursements and other expenses. However, the Example does not include portfolio trading commissions and related expenses and other extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period’’ to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table for each Fund provides information about hypothetical account values and hypothetical expenses based on each of the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in each of the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs could have been higher.

Frontegra Funds

EXPENSE EXAMPLE (continued)

June 30, 2009

| | Beginning Account | Ending Account | Annualized | Expenses Paid |

| Frontegra Fund | Value 1/1/2009 | Value 6/30/2009 | Expense Ratio* | During the Period* |

| | | | | |

| Columbus Core Plus Fund | | | | |

| Actual Fund Return | $1,000.00 | $1,217.70 | 0.35% | $1.92 |

| Hypothetical 5% Return | $1,000.00 | $1,023.06 | 0.35% | $1.76 |

| | | | | |

| Columbus Core Fund | | | | |

| Actual Fund Return | $1,000.00 | $1,174.10 | 0.35% | $1.89 |

| Hypothetical 5% Return | $1,000.00 | $1,023.06 | 0.35% | $1.76 |

| | | | | |

| IronBridge Small Cap Fund | | | | |

| Actual Fund Return | $1,000.00 | $1,039.60 | 1.09% | $5.51 |

| Hypothetical 5% Return | $1,000.00 | $1,019.39 | 1.09% | $5.46 |

| | | | | |

| IronBridge SMID Fund | | | | |

| Actual Fund Return | $1,000.00 | $1,070.20 | 0.95% | $4.88 |

| Hypothetical 5% Return | $1,000.00 | $1,020.08 | 0.95% | $4.76 |

| | | | | |

| New Star International Equity Fund | | | | |

| Actual Fund Return | $1,000.00 | $1,020.90 | 0.75% | $3.76 |

| Hypothetical 5% Return | $1,000.00 | $1,021.08 | 0.75% | $3.76 |

| | | | | |

| Netols Small Cap Value | | | | |

| Fund – Institutional Class | | | | |

| Actual Fund Return | $1,000.00 | $1,004.50 | 1.10% | $5.47 |

| Hypothetical 5% Return | $1,000.00 | $1,019.34 | 1.10% | $5.51 |

| | | | | |

| Netols Small Cap | | | | |

| Value Fund – Class Y | | | | |

| Actual Fund Return | $1,000.00 | $1,001.10 | 1.50% | $7.44 |

| Hypothetical 5% Return | $1,000.00 | $1,017.36 | 1.50% | $7.50 |

| * | Expenses are equal to each Fund’s annualized expense ratio indicated above, multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period. |

FRONTEGRA

COLUMBUS CORE PLUS FUND

FRONTEGRA

COLUMBUS CORE FUND

REPORT FROM REAMS ASSET

MANAGEMENT COMPANY, LLC:

Dear Fellow Shareholders:

The Frontegra Columbus Core Plus Fund strives to achieve a high level of total return consistent with the preservation of capital by investing in a diversified portfolio of fixed income securities of varying maturities. This objective is relative to and measured against the Barclays Capital U.S. Aggregate Bond Index.

The Frontegra Columbus Core Fund strives to achieve a high level of total return consistent with the preservation of capital by investing in a diversified portfolio of investment grade bonds of varying maturities. This objective is relative to and measured against the Barclays Capital U.S. Aggregate Bond Index.

Performance Review

For the 12 month fiscal year ending June 30, 2009, the Frontegra Columbus Core Plus Fund had a net return of 10.52% compared to a return of 6.05% for the Barclays Capital U.S. Aggregate Bond Index. The difference in performance was 4.47%. Macro factors were mixed for the period, with duration strategy adding 32 basis points as the portfolio was positioned defensively and rates rose. Yield curve strategy subtracted 72 basis points. Sector decisions subtracted 190 basis points while security selection added 712 basis points. Within these categories, the high yield sector added 585 basis points and investment grade holdings added 245 basis points as spreads tightened in their overweighted sectors. Government-related holdings added 41 basis points and asset backed holdings added 12 basis points to performance. Commercial mortgage backed securities (“CMBS”) subtracted 249 basis points from performance as strong performance in the 2Q of 2009 could not offset the negative performance in the previous three quarters. Mortgage backed securities (“MBS”) holdings subtracted 112 basis points from performance as spreads tightened in this under-weighted sector.

For the 12 month fiscal year ending June 30, 2009, the Frontegra Columbus Core Fund had a net return of 8.64% compared to a return of 6.05% for the Barclays Capital U.S. Aggregate Bond Index. The difference in performance was 2.59%. Macro factors were mixed for the period, with duration strategy adding 14 basis points as the portfolio was positioned defensively and rates rose. Yield curve strategy subtracted 50 basis points. Sector decisions subtracted 287 basis points and security selection added 617 basis points. Within these categories, the investment grade sector added 740 basis points to performance as the sector outperformed and was overweighted. Government-related holdings added 19 basis points and Asset-Backed Securities added 9 basis points. CMBS subtracted 339 basis points from performance as strong performance in the second quarter of 2009 could not offset the negative performance in the previous three quarters. MBS holdings subtracted 99 basis points from performance as spreads tightened in this underweighted sector.

Fixed Income Outlook

U.S. fixed income markets experienced significant outperformance in all non government-guaranteed sectors in the second quarter 2009. This was a sharp reversal from the negative performance these sectors witnessed in the previous quarter. The financial system saw liquidity begin to slowly return during the second quarter after the near freezing of these markets during the worst of the credit crisis. The return of liquidity was most important for financial companies.

| • | We believe spreads reached their crest last November driven by technical considerations more so than fundamental. The collapse of two broker-dealers, coupled with the unprecedented deleveraging that transpired, appeared to be a major driver of spreads. The financial firms that were at the epicenter of the crisis experienced a loss of confidence early in the year, but government support through multiple programs designed to improve liquidity took hold and sentiment steadily improved. The financial sector was further helped by the release of the bank stress test results in early May. The results were better than initial concerns and helped to restore confidence to the battered financial sector. Many banks quickly demonstrated their ability to raise capital, issuing debt and equity offerings, while some affected exchange offers of debt into common stock. In June, ten banks were given approval to repay TARP (Troubled Asset Relief Program) funds as many financial firms were able to raise needed capital. |

| • | The improvement in sentiment in financial firms provided the backdrop for corporate spreads to tighten 235 basis points in the quarter. The high yield sector had its best month on record in April and spreads tightened 570 basis points in the quarter. Notwithstanding the |

| | strong returns experienced in both high yield and investment grade corporate bonds during the last three months, spreads remain wide on a historic basis. Although the healing has commenced, the ultimate repair to the markets will take multiple quarters. |

| • | CMBS spreads tightened 285 basis points over the past three months as the market became increasingly confident that these securities would be included in the Federal Reserve’s TALF (Term Asset-Backed Securities Loan Facility) program. Although official inclusion of the securities in the program was not announced until May, much of the improved returns for this sector were based on the anticipation of this inclusion in the program. Despite the sharp spread tightening from exceptionally wide levels, CMBS spreads remain attractive on a historic basis. MBS spreads tightened 65 basis points during the last three months to levels that are currently very tight. |

| • | Long-term Treasury rates rose during the quarter as market participants began to look past the current economic slowdown and also became increasingly focused on the future supply the Treasury will need to issue to pay for current spending. The Fed attempted to combat the higher rates in March by announcing plans to buy an additional $750 billion in agency MBS and $300 billion in Treasurys. The initial news moved long Treasury rates down, but the overwhelming size of market forces quickly reversed this move and rates continued higher. A steeper yield curve resulted since the Fed funds target rate remained at 0-0.25%, keeping short rates anchored at very low levels. |

Columbus Core Plus Portfolio Strategy

| • | Credit exposure remains heavily overweighted with an emphasis on investment grade financial issuers. We continue to view the investment grade credit sector as the most attractive opportunity in the fixed income markets going forward. |

| • | High yield holdings have been reduced as spreads have tightened on the considerable outperformance for this sector. High yield holdings remain diversified over many sectors and industries. |

| • | In the mortgage market, the CMBS sector continues to be overweighted. While we view this as an attractive sector, spreads have tightened significantly prompting us to reduce the magnitude of our overweight. All holdings in this sector remain at the senior-most structural level. |

| • | We continue to be underweighted in the Treasury sector, but some of the proceeds from the CMBS sales have been re-invested in this sector. Mortgage pass-through holdings remain in an underweight position as we believe these spreads to be very unattractive relative to corporate and CMBS holdings. |

Columbus Core Portfolio Strategy

| • | Credit exposure remains heavily overweighted with an emphasis on investment grade financial issuers. We continue to view the investment grade credit sector as the most attractive opportunity in the fixed income markets going forward. |

| • | In the mortgage market, the CMBS sector continues to be overweighted. While we view this as an attractive sector, spreads have tightened significantly prompting us to reduce the magnitude of our overweight. All holdings in this sector remain at the senior-most structural level. |

| • | We continue to be underweighted in the Treasury sector, but some of the proceeds from the CMBS sales have been re-invested in this sector. |

| • | Mortgage pass-through holdings remain in an underweight position as we believe these spreads to be very unattractive relative to corporate and CMBS holdings. |

We appreciate your continued support as fellow shareholders in the Funds.

Regards,

|  |

| Mark M. Egan, CFA, CPA | Robert A. Crider, CFA |

| Reams Asset Management Company, LLC | Reams Asset Management Company, LLC |

INVESTMENT HIGHLIGHTS

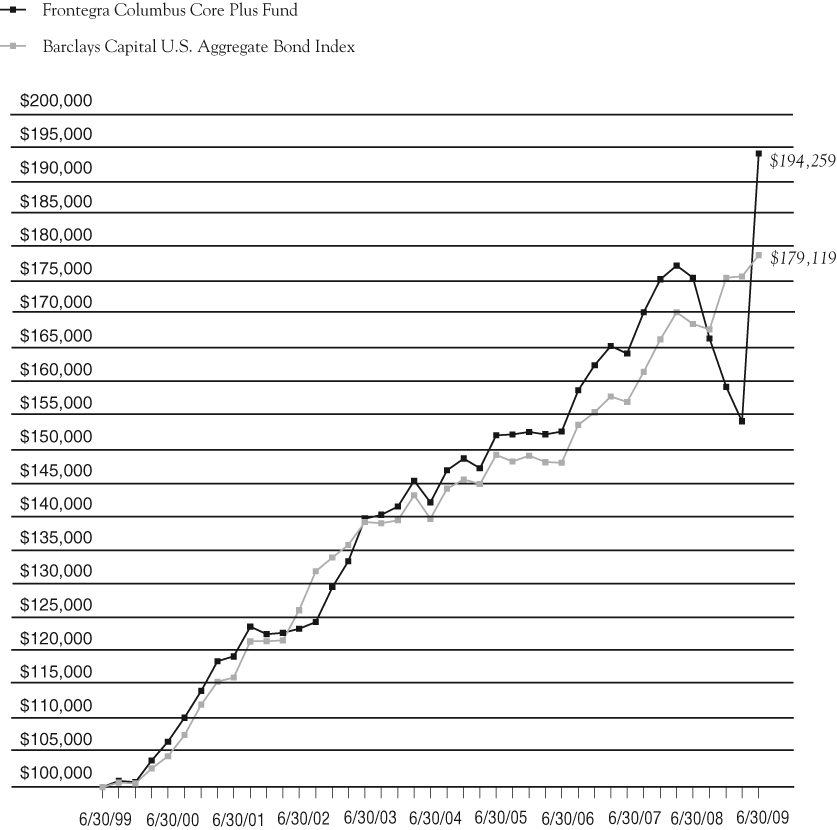

Growth of a $100,000 Investment (Unaudited)

| | | | | |

| | Portfolio Total Return* | | | |

| | FOR PERIODS ENDED 6/30/09 | FUND | INDEX | |

| | | | | |

| | SIX MONTHS | 21.77% | 1.90% | |

| | | | | |

| | ONE YEAR | 10.52% | 6.05% | |

| | | | | |

| | FIVE YEAR | | | |

| | AVERAGE ANNUAL | 6.41% | 5.01% | |

| | | | | |

| | TEN YEAR | | | |

| | AVERAGE ANNUAL | 6.86% | 5.98% | |

| | | | | |

This chart assumes an initial gross investment of $100,000 made on 6/30/99. Returns shown include the reinvestment of all distributions. Past performance is not predictive of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. In the absence of existing fee waivers, total return would be reduced. To receive current to the most recent month-end performance, please call 1-888-825-2100.

The Barclays Capital U.S. Aggregate Bond Index (formerly the Lehman Brothers Aggregate Bond Index) is an unmanaged market value-weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset backed and mortgage backed securities, with maturities of at least one year. The Index does not reflect investment management fees, brokerage commissions and other expenses associated with investing in fixed income securities. A direct investment in the index is not possible.

| * | The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

Frontegra Columbus Core Plus Fund

SCHEDULE OF INVESTMENTS

June 30, 2009

| Principal Amount | | Value | |

| | | | | | |

| ASSET BACKED SECURITIES 3.7% | | | |

| | | Americredit Automobile | | | |

| | | Receivables Trust | | | |

| $ | 1,630,000 | | 2008-AF, Class A4, | | | |

| | | | 6.960%, 10/14/2014 | | $ | 1,488,543 | |

| | | | Countrywide | | | | |

| | | | Asset-Backed Certificates | | | | |

| | 492,108 | | 2006-S3, Class A1, | | | | |

| | | | 0.424%, 06/25/2021 (c) | | | 307,009 | |

| | 576,304 | | 2006-S2, Class A2, | | | | |

| | | | 5.627%, 07/25/2027 | | | 406,128 | |

| | 4,449,261 | | 2006-S2, Class A3, | | | | �� |

| | | | 5.841%, 07/25/2027 | | | 1,086,793 | |

| | 1,909,617 | | 2006-S2, Class A4, | | | | |

| | | | 6.091%, 07/25/2027 | | | 317,428 | |

| | 1,148,889 | | 2006-S5, Class A3, | | | | |

| | | | 5.762%, 06/25/2035 | | | 242,873 | |

| | 3,296,290 | | 2006-S7, Class A3, | | | | |

| | | | 5.712%, 11/25/2035 (c) | | | 621,836 | |

| | 1,765,949 | | 2007-S2, Class A, | | | | |

| | | | 5.779%, 05/25/2037 | | | 629,752 | |

| | | | GMAC Mortgage | | | | |

| | | | Corporation Loan Trust | | | | |

| | 1,295,000 | | 2006-HE2, Class A3, | | | | |

| | | | 6.320%, 05/25/2036 | | | 396,700 | |

| | 2,270,000 | | 2006-HE3, Class A3, | | | | |

| | | | 5.805%, 10/25/2036 | | | 748,749 | |

| | | | GSAA Home Equity Trust | | | | |

| | 1,370,712 | | 2006-S1, Class 1A1, | | | | |

| | | | 0.474%, 01/25/2037 | | | 235,716 | |

| | | | Hertz Vehicle Financing LLC | | | | |

| | 715,000 | | 2005-1A, Class A4, 0.564%, | | | | |

| | | | 11/25/2011 (Acquired 08/21/2008 and | | | | |

| | | | 12/10/2008, Cost $645,183) (a)(c) | | | 643,586 | |

| | 880,000 | | 2005-2A, Class A5, 0.564%, | | | | |

| | | | 11/25/2011 (Acquired 08/01/2008 and | | | | |

| | | | 12/10/2008, Cost $810,589) (a)(c) | | | 817,606 | |

| | 2,715,000 | | 2005-2A, Class A6, 5.080%, | | | | |

| | | | 11/25/2011 (Acquired Multiple | | | | |

| | | | Dates, Cost $2,643,134) (a) | | | 2,648,768 | |

| | | | Home Equity Mortgage Trust | | | | |

| | 1,440,000 | | 2005-5, Class A1F2, | | | | |

| | | | 5.150%, 04/25/2036 | | | 249,404 | |

| | 4,606,040 | | 2006-5, Class A1, | | | | |

| | | | 5.500%, 01/25/2037 | | | 595,085 | |

| | | | Keystone Owner Trust | | | | |

| | 6,759 | | 1998-P1, Class M1, 7.530%, | | | | |

| | | | 05/25/2025 (Acquired 12/10/2008, | | | | |

| | | | Cost $5,762) (a) | | | 6,039 | |

| | | | Mid-State Trust | | | | |

| | 868,147 | | 11, Class A1, 4.864%, 07/15/2038 | | | 470,001 | |

| | | | Residential Funding | | | | |

| | | | Mortgage Securities | | | | |

| | 300,035 | | 2005-HS1, Class AI2, | | | | |

| | | | 4.660%, 07/25/2020 | | | 252,967 | |

| | 704,377 | | 2003-HS1, Class AI6, | | | | |

| | | | 3.830%, 02/25/2033 | | | 474,472 | |

| | 630,000 | | 2005-HS1, Class AI4, | | | | |

| | | | 5.110%, 09/25/2035 | | | 91,258 | |

| | 1,350,000 | | 2006-HSA1, Class A3, | | | | |

| | | | 5.230%, 02/25/2036 | | | 476,952 | |

| | 2,169,360 | | 2006-HSA1, Class A5, | | | | |

| | | | 5.310%, 02/25/2036 | | | 652,547 | |

| | 1,460,000 | | 2006-HSA1, Class A4, | | | | |

| | | | 5.490%, 02/25/2036 | | | 246,306 | |

| | 590,000 | | 2006-HSA2, Class AI3, | | | | |

| | | | 5.550%, 03/25/2036 | | | 186,454 | |

| | 820,000 | | 2006-HSA2, Class AI4, | | | | |

| | | | 5.810%, 03/25/2036 | | | 68,074 | |

| | | | Saco I Trust | | | | |

| | 1,427,280 | | 2006-9, Class A1, | | | | |

| | | | 0.464%, 08/25/2036 | | | 188,348 | |

| | | | Total Asset Backed Securities | | | | |

| | | | (Cost $17,251,907) | | | 14,549,394 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

SCHEDULE OF INVESTMENTS (continued)

June 30, 2009

| Principal Amount | | Value | |

| | | | | | |

| CORPORATE BONDS 61.7% | | | |

| | | | | | |

| | | Airlines 4.9% | | | |

| | | American Airlines | | | |

| $ | 2,420,000 | | 10.375%, 07/02/2019 | | $ | 2,420,000 | |

| | | | Continental Airlines | | | | |

| | 3,565,000 | | 5.983%, 04/19/2022 | | | 2,941,125 | |

| | | | Delta Air Lines, Inc. | | | | |

| | 7,489,941 | | Series 2002-1, 6.718%, 07/02/2024 | | | 5,692,355 | |

| | | | Northwest Airlines, Inc. | | | | |

| | 5,856,605 | | 7.027%, 11/01/2019 | | | 4,538,869 | |

| | | | United Airlines | | | | |

| | 4,999,634 | | 6.636%, 07/02/2022 | | | 3,749,726 | |

| | | | | | | 19,342,075 | |

| | | | Auto Components 0.2% | | | | |

| | | | Arvinmeritor, Inc. | | | | |

| | 300,000 | | 8.125%, 09/15/2015 | | | 157,500 | |

| | | | TRW Automotive Inc. | | | | |

| | 995,000 | | 7.250%, 03/15/2017 (Acquired | | | | |

| | | | Multiple Dates, Cost $868,077) (a) | | | 686,550 | |

| | | | | | | 844,050 | |

| | | | Building Products 0.2% | | | | |

| | | | USG Corp. | | | | |

| | 1,070,000 | | 7.750%, 01/15/2018 | | | 909,500 | |

| | | | | | | | |

| | | | Commercial Banks 9.2% | | | | |

| | | | Barclays Bank PLC | | | | |

| | 280,000 | | 6.050%, 12/04/2017 (Acquired | | | | |

| | | | 10/31/2008 and 12/10/2008, | | | | |

| | | | Cost $225,628) (a)(b)(c) | | | 242,807 | |

| | 9,845,000 | | 7.434%, 12/15/2017 | | | | |

| | | | (Acquired Multiple Dates, | | | | |

| | | | Cost $6,405,461) (a)(b) | | | 6,596,150 | |

| | 3,395,000 | | 6.750%, 05/22/2019 (b) | | | 3,367,066 | |

| | | | BB&T Corp. | | | | |

| | 3,045,000 | | 6.850%, 04/30/2019 | | | 3,166,690 | |

| | | | Deutsche Bank, LLC | | | | |

| | 4,785,000 | | 5.628%, 01/19/2016 (Acquired | | | | |

| | | | Multiple Dates, Cost $3,235,018) (a) | | | 3,110,250 | |

| | | | Manufacturers & Traders Trust Co. | | | | |

| | 2,200,000 | | 2.708%, 04/01/2013 | | | | |

| | | | (Acquired Multiple Dates, | | | | |

| | | | Cost $2,015,279) (a)(c) | | | 1,729,171 | |

| | 1,685,000 | | 5.629%, 12/01/2021 (c) | | | 1,271,660 | |

| | | | Marshall & Ilsley Bank | | | | |

| | 6,235,000 | | 0.916%, 12/04/2012 (c) | | | 4,334,759 | |

| | | | Regions Bank | | | | |

| | 1,955,000 | | 7.500%, 05/15/2018 | | | 1,722,906 | |

| | | | Wachovia Corp. | | | | |

| | 9,989,000 | | 5.800%, 03/29/2049 | | | 5,993,400 | |

| | | | Wells Fargo Alternative Loan Trust | | | | |

| | 5,560,000 | | 7.700%, 12/29/2049 (c) | | | 4,614,800 | |

| | 500,000 | | 7.980%, 12/31/2049 (c) | | | 415,000 | |

| | | | | | | 36,564,659 | |

| | | | Computers & Peripherals 0.3% | | | | |

| | | | Tyco Electronics Group SA | | | | |

| | 1,135,000 | | 5.950%, 01/15/2014 (b) | | | 1,059,946 | |

| | | | | | | | |

| | | | Consumer Finance 6.1% | | | | |

| | | | American Express Co. | | | | |

| | 3,975,000 | | 8.125%, 05/20/2019 | | | 4,124,973 | |

| | | | Ford Motor Credit Co. | | | | |

| | 3,580,000 | | 7.800%, 06/01/2012 | | | 3,080,307 | |

| | 650,000 | | 7.000%, 10/01/2013 | | | 522,621 | |

| | 10,820,000 | | 8.000%, 12/15/2016 | | | 8,272,204 | |

| | | | GMAC LLC | | | | |

| | 10,557,000 | | 6.750%, 12/01/2014 | | | | |

| | | | (Acquired Multiple Dates, | | | | |

| | | | Cost $8,353,146) (a) | | | 8,287,245 | |

| | | | | | | 24,287,350 | |

| | | | Diversified Financial Services 14.9% | | | | |

| | | | American General Finance | | | | |

| | 3,680,000 | | 5.200%, 12/15/2011 | | | 2,310,278 | |

| | 1,350,000 | | 5.900%, 09/15/2012 | | | 805,752 | |

| | 210,000 | | 5.375%, 10/01/2012 | | | 123,827 | |

| | 4,115,000 | | 6.900%, 12/15/2017 | | | 2,228,198 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

SCHEDULE OF INVESTMENTS (continued)

June 30, 2009

| Principal Amount | | Value | |

| | | | | | |

| CORPORATE BONDS 61.7% (continued) | | | |

| | | | |

| | | Diversified Financial | | | |

| | | Services 14.9% (continued) | | | |

| | | Bank of America Corp. | | | |

| $ | 6,315,000 | | 5.750%, 12/01/2017 | | $ | 5,623,053 | |

| | 3,265,000 | | 5.420%, 03/15/2017 | | | 2,711,393 | |

| | 2,025,000 | | 7.625%, 06/01/2019 | | | 2,034,034 | |

| | | | CIT Group Inc. | | | | |

| | 1,110,000 | | 1.306%, 11/03/2010 | | | 827,931 | |

| | 635,000 | | 5.600%, 11/02/2011 (b) | | | 466,036 | |

| | 990,000 | | 1.170%, 02/13/2012 | | | 584,148 | |

| | 2,840,000 | | 7.625%, 11/30/2012 | | | 1,944,679 | |

| | 1,655,000 | | 1.010%, 12/21/2012 | | | 927,296 | |

| | | | Citigroup, Inc. | | | | |

| | 9,800,000 | | 8.500%, 05/22/2019 | | | 9,968,942 | |

| | | | Credit Suisse Guernsey | | | | |

| | 10,179,000 | | 5.860%, 05/15/2017 (b)(c) | | | 6,616,350 | |

| | | | Credit Suisse New York | | | | |

| | 60,000 | | 6.000%, 02/15/2018 (b) | | | 59,900 | |

| | | | General Motors Acceptance Corp. | | | | |

| | 785,000 | | 6.875%, 08/28/2012 | | | 639,759 | |

| | 3,605,000 | | 6.750%, 12/01/2014 | | | 2,771,437 | |

| | | | International Lease Finance Corp. | | | | |

| | 815,000 | | 4.750%, 01/13/2012 | | | 641,931 | |

| | 2,925,000 | | 5.350%, 03/01/2012 | | | 2,283,115 | |

| | 995,000 | | 5.300%, 05/01/2012 | | | 771,291 | |

| | 4,280,000 | | 5.625%, 09/20/2013 | | | 3,233,360 | |

| | 2,000,000 | | 6.625%, 11/15/2013 | | | 1,539,416 | |

| | | | JPMorgan Chase & Co. | | | | |

| | 2,495,000 | | 6.300%, 04/23/2019 | | | 2,509,531 | |

| | | | Lehman Brothers Holdings | | | | |

| | 7,000,000 | | 6.875%, 05/02/2018 (e) | | | 1,120,000 | |

| | | | PNC Funding Corp. | | | | |

| | 1,975,000 | | 6.700%, 06/10/2019 | | | 2,037,013 | |

| | | | Societe Generale | | | | |

| | 7,060,000 | | 5.922%, 04/05/2017 | | | | |

| | | | (Acquired Multiple Dates, | | | | |

| | | | Cost $3,275,520) (a)(b)(c) | | | 4,377,200 | |

| | | | | | | 59,155,870 | |

| | | | Diversified Telecommunication | | | | |

| | | | Services 3.0% | | | | |

| | | | British Telecom PLC | | | | |

| | 3,370,000 | | 5.950%, 01/15/2018 (b) | | | 3,037,186 | |

| | | | Deutsche Telekom | | | | |

| | | | International Finance B.V. | | | | |

| | 6,570,000 | | 6.000%, 07/08/2019 (b) | | | 6,628,473 | |

| | | | Qwest Corporation | | | | |

| | 3,115,000 | | 7.125%, 11/15/2043 | | | 2,164,925 | |

| | | | | | | 11,830,584 | |

| | | | Electric Utilities 1.3% | | | | |

| | | | AES Eastern Energy | | | | |

| | 705,811 | | 9.000%, 01/02/2017 | | | 656,404 | |

| | | | Entergy Louisiana LLC | | | | |

| | 590,000 | | 5.500%, 04/01/2019 | | | 556,702 | |

| | | | Great River Energy | | | | |

| | 490,000 | | 7.233%, 07/01/2038 (Acquired | | | | |

| | | | 4/23/2008 and 12/10/2008, | | | | |

| | | | Cost $493,609) (a) | | | 476,216 | |

| | | | Indianapolis Power & Light Co. | | | | |

| | 1,100,000 | | 6.050%, 10/01/2036 (Acquired | | | | |

| | | | Multiple Dates, Cost $1,060,828) (a) | | | 852,188 | |

| | | | Mackinaw Power LLC | | | | |

| | 1,203,094 | | 6.296%, 10/31/2023 (Acquired | | | | |

| | | | Multiple Dates, Cost $1,158,461) (a) | | | 991,963 | |

| | | | Tenaska Gateway Partners Ltd. | | | | |

| | 566,065 | | 6.052%, 12/30/2023 (Acquired | | | | |

| | | | 05/31/2007 and 08/03/2007, | | | | |

| | | | Cost $566,065) (a) | | | 475,942 | |

| | | | Windsor Financing LLC | | | | |

| | 1,060,497 | | 5.881%, 07/15/2017 (Acquired | | | | |

| | | | 02/07/2006 and 08/03/2007, | | | | |

| | | | Cost $1,064,469) (a) | | | 932,919 | |

| | | | | | | 4,942,334 | |

| | | | Food & Staples Retailing 0.1% | | | | |

| | | | CVS Caremark Corp. | | | | |

| | 179,751 | | 6.943%, 01/10/2030 (Acquired | | | | |

| | | | 03/05/2009, Cost $142,226) (a) | | | 162,645 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

SCHEDULE OF INVESTMENTS (continued)

June 30, 2009

| Principal Amount | | Value | |

| | | | | | |

| CORPORATE BONDS 61.7% (continued) | | | |

| | | | | | |

| | | Gas Utilities 0.1% | | | |

| | | Source Gas LLC | | | |

| $ | 765,000 | | 5.900%, 04/01/2017 (Acquired | | | |

| | | | Multiple Dates, Cost $744,555) (a) | | $ | 579,455 | |

| | | | | | | | |

| | | | Industrial Consumer | | | | |

| | | | Services 1.3% | | | | |

| | | | ERAC USA Finance Company | | | | |

| | 5,480,000 | | 6.375%, 10/15/2017 | | | | |

| | | | (Acquired Multiple Dates, | | | | |

| | | | Cost $4,717,157) (a) | | | 4,947,930 | |

| | | | | | | | |

| | | | Insurance 13.3% | | | | |

| | | | Aflac, Inc. | | | | |

| | 3,025,000 | | 8.500%, 05/15/2019 | | | 3,232,315 | |

| | | | AIG, Inc. | | | | |

| | 1,755,000 | | 6.300%, 05/10/2011 (Acquired | | | | |

| | | | Multiple Dates, Cost $1,589,159) (a) | | | 1,648,744 | |

| | | | Allstate Corp. | | | | |

| | 2,715,000 | | 7.450%, 05/16/2019 | | | 2,937,250 | |

| | | | ASIF I | | | | |

| | 280,000 | | 1.242%, 07/26/2010 | | | 253,400 | |

| | | | ASIF Global Financing XIX | | | | |

| | 330,000 | | 4.900%, 01/17/2013 (Acquired | | | | |

| | | | 05/01/2009, Cost $239,007) (a) | | | 280,741 | |

| | | | Farmers Insurance Exchange | | | | |

| | 485,000 | | 8.625%, 05/01/2024 (Acquired | | | | |

| | | | 04/20/2009, Cost $313,509) (a) | | | 391,308 | |

| | 1,570,000 | | 7.050%, 07/15/2028 (Acquired | | | | |

| | | | 04/17/2009 and 04/20/2009, | | | | |

| | | | Cost $960,968) (a) | | | 1,086,870 | |

| | | | Genworth Global Funding | | | | |

| | 545,000 | | 5.200%, 10/08/2010 | | | 531,007 | |

| | 430,000 | | 5.250%, 05/15/2012 | | | 404,326 | |

| | | | Hartford Financial Services Group | | | | |

| | 1,400,000 | | 5.375%, 03/15/2017 | | | 1,110,159 | |

| | 2,020,000 | | 6.300%, 03/15/2018 | | | 1,642,610 | |

| | 540,000 | | 6.000%, 10/15/2036 | | | 368,698 | |

| | 540,000 | | 6.100%, 10/01/2041 | | | 373,216 | |

| | 875,000 | | 8.125%, 06/15/2068 (c) | | | 612,500 | |

| | | | Hartford Life Global Funding | | | | |

| | 430,000 | | 0.729%, 03/15/2011 (c) | | | 392,140 | |

| | | | Jackson National Life Global Funding | | | | |

| | 860,000 | | 5.125%, 02/10/2011 (Acquired | | | | |

| | | | Multiple Dates, Cost $856,179) (a) | | | 831,714 | |

| | 930,000 | | 5.375%, 05/08/2013 (Acquired | | | | |

| | | | 05/01/2008 and 12/10/2008, | | | | |

| | | | Cost $924,074) (a) | | | 895,227 | |

| | | | Lincoln National Corp. | | | | |

| | 1,135,000 | | 8.750%, 07/01/2019 | | | 1,144,617 | |

| | 4,195,000 | | 6.050%, 04/20/2067 | | | 2,663,825 | |

| | | | Metlife, Inc. | | | | |

| | 460,000 | | 6.817%, 08/15/2018 | | | 463,270 | |

| | 5,842,000 | | 7.875%, 12/15/2037 | | | | |

| | | | (Acquired Multiple Dates, | | | | |

| | | | Cost $3,966,802) (a)(c) | | | 4,732,020 | |

| | 3,205,000 | | 9.250%, 04/08/2038 | | | | |

| | | | (Acquired Multiple Dates, | | | | |

| | | | Cost $2,104,047) (a)(c) | | | 2,852,450 | |

| | | | Metropolitan Life Global Funding | | | | |

| | 4,380,000 | | 5.125%, 06/10/2014 (Acquired | | | | |

| | | | 06/03/2009 and 06/04/2009, | | | | |

| | | | Cost $4,374,846) (a) | | | 4,345,915 | |

| | | | Monumental Global Funding | | | | |

| | 1,455,000 | | 1.262%, 01/25/2013 | | | | |

| | | | (Acquired Multiple Dates, | | | | |

| | | | Cost $1,355,433) (a)(c) | | | 1,109,109 | |

| | 1,605,000 | | 5.500%, 04/22/2013 (Acquired | | | | |

| | | | Multiple Dates, Cost $1,603,246) (a) | | | 1,548,594 | |

| | 885,000 | | 5.250%, 01/15/2014 (Acquired | | | | |

| | | | 05/06/2009 and 06/10/2009, | | | | |

| | | | Cost $823,112) (a) | | | 834,728 | |

| | | | Nationwide Financial Services, Inc. | | | | |

| | 645,000 | | 6.750%, 05/15/2067 | | | 381,048 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

SCHEDULE OF INVESTMENTS (continued)

June 30, 2009

| Principal Amount | | Value | |

| | | | | | |

| CORPORATE BONDS 61.7% (continued) | | | |

| | | | | | |

| | | Insurance 13.3% (continued) | | | |

| | | Nationwide Life Global Fund | | | |

| $ | 340,000 | | 1.199%, 10/09/2009 (Acquired | | | |

| | | | 02/18/2009, Cost $327,414) (a)(c) | | $ | 338,274 | |

| | 795,000 | | 5.450%, 10/02/2012 (Acquired | | | | |

| | | | 09/25/2007 and 12/10/2008, | | | | |

| | | | Cost $792,876) (a) | | | 778,608 | |

| | | | Nationwide Mutual Insurance Co. | | | | |

| | 895,000 | | 7.875%, 04/01/2033 (Acquired | | | | |

| | | | 05/07/2009, Cost $591,075) (a) | | | 634,110 | |

| | 415,000 | | 6.600%, 04/15/2034 (Acquired | | | | |

| | | | 04/28/2009, Cost $240,916) (a) | | | 249,377 | |

| | | | Pricoa Global Funding I | | | | |

| | 1,955,000 | | 5.400%, 10/18/2012 | | | | |

| | | | (Acquired Multiple Dates, | | | | |

| | | | Cost $1,945,087) (a) | | | 1,896,682 | |

| | 3,180,000 | | 5.450%, 06/11/2014 (Acquired | | | | |

| | | | 06/04/2009 and 06/05/2009, | | | | |

| | | | Cost $3,170,509) (a) | | | 3,174,502 | |

| | | | Protective Life Corp. | | | | |

| | 855,000 | | 5.450%, 09/28/2012 | | | 853,628 | |

| | | | Prudential Financial, Inc. | | | | |

| | 1,265,000 | | 6.100%, 06/15/2017 | | | 1,203,458 | |

| | 2,510,000 | | 6.000%, 12/01/2017 | | | 2,361,300 | |

| | 1,040,000 | | 7.375%, 06/15/2019 | | | 1,021,103 | |

| | 980,000 | | 8.875%, 06/15/2068 | | | 813,400 | |

| | | | Torchmark Corp. | | | | |

| | 2,485,000 | | 9.250%, 06/15/2019 | | | 2,536,862 | |

| | | | | | | 52,929,105 | |

| | | | Media 1.1% | | | | |

| | | | Time Warner, Inc. | | | | |

| | 365,000 | | 9.150%, 02/01/2023 | | | 395,757 | |

| | 1,585,000 | | 7.700%, 05/01/2032 | | | 1,557,525 | |

| | | | Viacom, Inc. | | | | |

| | 2,430,000 | | 6.250%, 04/30/2016 | | | 2,393,939 | |

| | | | | | | 4,347,221 | |

| | | | | | | | |

| | | | | | | | |

| | | | Metals & Mining 1.2% | | | | |

| | | | Alcoa Inc. | | | | |

| | 2,690,000 | | 6.750%, 07/15/2018 | | | 2,386,517 | |

| | 1,175,000 | | 5.950%, 02/01/2037 | | | 800,570 | |

| | | | U.S. Steel Corp. | | | | |

| | 1,830,000 | | 5.650%, 06/01/2013 | | | 1,647,044 | |

| | | | | | | 4,834,131 | |

| | | | Multi-Utilities & | | | | |

| | | | Unregulated Power 1.2% | | | | |

| | | | Borger Energy Funding | | | | |

| | 2,545,716 | | 7.260%, 12/31/2022 (Acquired | | | | |

| | | | 08/14/2008 and 12/10/2008, | | | | |

| | | | Cost $2,450,094) (a) | | | 2,208,409 | |

| | | | Homer City Funding LLC | | | | |

| | 2,074,800 | | 8.137%, 10/01/2019 | | | 1,867,320 | |

| | | | Kiowa Power Partners LLC | | | | |

| | 686,659 | | 4.811%, 12/30/2013 (Acquired | | | | |

| | | | Multiple Dates, Cost $685,060) (a) | | | 632,715 | |

| | | | | | | 4,708,444 | |

| | | | Oil, Gas & Consumable Fuels 1.0% | | | | |

| | | | Tennessee Gas Pipeline Co. | | | | |

| | 1,110,000 | | 7.500%, 04/01/2017 | | | 1,161,334 | |

| | | | USX Marathon Group | | | | |

| | 665,000 | | 8.125%, 07/15/2023 | | | 660,295 | |

| | | | Valero Energy Corp. | | | | |

| | 2,655,000 | | 6.625%, 06/15/2037 | | | 2,265,034 | |

| | | | | | | 4,086,663 | |

| | | | Real Estate Investment Trusts 2.3% | | | | |

| | | | AMB Property LP | | | | |

| | 2,345,000 | | 6.300%, 06/01/2013 | | | 2,174,643 | |

| | | | Liberty Property LP | | | | |

| | 1,245,000 | | 6.625%, 10/01/2017 | | | 1,056,503 | |

| | | | Prologis Trust | | | | |

| | 985,000 | | 5.625%, 11/15/2016 | | | 757,165 | |

| | 1,050,000 | | 6.625%, 05/15/2018 | | | 826,773 | |

| | | | Regency Centers LP | | | | |

| | 1,945,000 | | 5.875%, 06/15/2017 | | | 1,575,703 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

SCHEDULE OF INVESTMENTS (continued)

June 30, 2009

| Principal Amount | | Value | |

| | | | | | |

| CORPORATE BONDS 61.7% (continued) | | | |

| | | | | | |

| | | Real Estate Investment | | | |

| | | Trusts 2.3% (continued) | | | |

| | | Simon Property Group LP | | | |

| $ | 1,300,000 | | 5.100%, 06/15/2015 | | $ | 1,187,062 | |

| | 950,000 | | 5.750%, 12/01/2015 | | | 874,934 | |

| | 160,000 | | 6.100%, 05/01/2016 | | | 149,313 | |

| | 665,000 | | 5.250%, 12/01/2016 | | | 590,708 | |

| | | | | | | 9,192,804 | |

| | | | Total Corporate Bonds | | | | |

| | | | (Cost $240,232,645) | | | 244,724,766 | |

| | | | | | | | |

| MORTGAGE BACKED SECURITIES 13.0% | | | | |

| | | | Bank of America | | | | |

| | | | Commercial Mortgage Inc. | | | | |

| | 3,680,000 | | Series 2006-5, Class A4, | | | | |

| | | | 5.414%, 09/10/2016 | | | 2,934,244 | |

| | 3,830,000 | | Series 2009-UB1, Class A4, | | | | |

| | | | 5.699%, 05/24/2017 (Acquired | | | | |

| | | | 06/18/2009, Cost $3,099,607) (a) | | | 3,190,869 | |

| | 3,045,000 | | Series 2006-3, Class A4, | | | | |

| | | | 5.889%, 07/10/2044 | | | 2,417,861 | |

| | 3,080,000 | | Series 2007-3, Class A2, | | | | |

| | | | 5.837%, 06/10/2049 | | | 2,801,124 | |

| | | | Citigroup/Deutsche Bank | | | | |

| | | | Commercial Mortgage Trust | | | | |

| | 2,290,000 | | Series 2006-CD2, Class A4, | | | | |

| | | | 5.545%, 01/15/2046 | | | 1,901,981 | |

| | 2,375,000 | | Series 2006-CD3, Class A5, | | | | |

| | | | 5.617%, 10/15/2048 | | | 1,932,965 | |

| | | | CitiMortgage Alternative Loan Trust | | | | |

| | 1,789,016 | | Series 2007-A4, Class 2A1, | | | | |

| | | | 5.500%, 04/25/2022 | | | 1,335,612 | |

| | | | Credit Suisse First Boston | | | | |

| | | | Mortgage Securities Corp. | | | | |

| | 371,232 | | Pool # 2005-10, 5.000%, 09/25/2015 | | | 309,863 | |

| | 78,956 | | Pool # 2003-1, 7.000%, 02/25/2033 | | | 76,340 | |

| | | | FNMA REMIC | | | | |

| | 77,502 | | Series 1994-3, Class PL, | | | | |

| | | | 5.500%, 01/25/2024 (g) | | | 82,821 | |

| | | | FNMA TBA | | | | |

| | 7,700,000 | | Pool #000TBA, | | | | |

| | | | 4.500%, 08/15/2035 (f)(g) | | | 7,654,277 | |

| | | | GNMA Pool | | | | |

| | 1,720 | | Pool #36629, 9.500%, 10/15/2009 (f) | | | 1,745 | |

| | | | GS Mortgage Securities Corp. II | | | | |

| | 3,225,119 | | Series 2007-EOP, Class A1, | | | | |

| | | | 0.409%, 03/06/2020 | | | | |

| | | | (Acquired Multiple Dates, | | | | |

| | | | Cost $3,163,003) (a)(c) | | | 2,762,464 | |

| | | | LB-UBS Commercial Mortgage Trust | | | | |

| | 6,195,000 | | Series 2006-C1, Class A4, | | | | |

| | | | 5.156%, 02/15/2031 | | | 5,159,177 | |

| | 4,075,000 | | Series 2006-C6, Class A4, | | | | |

| | | | 5.372%, 09/15/2039 | | | 3,304,054 | |

| | 2,610,000 | | Series 2007-C1, Class A4, | | | | |

| | | | 5.424%, 02/15/2040 | | | 1,897,154 | |

| | 3,695,000 | | Series 2007-C2, Class A3, | | | | |

| | | | 5.430%, 02/15/2040 | | | 2,670,685 | |

| | 335,000 | | Series 2007-C3, Class A4, | | | | |

| | | | 6.136%, 07/15/2044 (c) | | | 243,256 | |

| | | | Master Asset Securitization Trust | | | | |

| | 350,067 | | Pool # 2004-3, 4.750%, 01/25/2014 | | | 344,707 | |

| | | | Residential Accredit Loans, Inc. | | | | |

| | 1,192,675 | | Series 2005-QS3, Class 2A1, | | | | |

| | | | 5.000%, 03/25/2020 | | | 1,069,855 | |

| | 1,392,480 | | Series 2004-QS4, Class A1, | | | | |

| | | | 4.350%, 03/25/2034 | | | 1,241,917 | |

| | | | Wachovia Bank | | | | |

| | | | Commercial Mortgage Trust | | | | |

| | 2,650,000 | | Series 2006-C23, Class A4, | | | | |

| | | | 5.418%, 01/15/2045 | | | 2,115,791 | |

| | 2,855,000 | | Series 2006-C24, Class A3, | | | | |

| | | | 5.558%, 03/15/2045 | | | 2,442,048 | |

| | 935,000 | | Series 2007-C31, Class A2, | | | | |

| | | | 5.421%, 04/15/2047 | | | 858,196 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

SCHEDULE OF INVESTMENTS (continued)

June 30, 2009

| Principal Amount | | Value | |

| | | | | | |

| MORTGAGE BACKED | | | |

SECURITIES 13.0% (continued) | | | |

| | | Wells Fargo Alternative Loan Trust | | | |

| $ | 1,575,676 | | Series 2007-PA3, Class 6A1, | | | |

| | | | 5.500%, 07/25/2037 | | $ | 1,018,773 | |

| | | | Wells Fargo Mortgage | | | | |

| | | | Backed Securities Trust | | | | |

| | 2,256,183 | | Pool # 2006-3, 5.500%, 03/25/2036 | | | 1,929,893 | |

| | | | Total Mortgage Backed Securities | | | | |

| | | | (Cost $54,851,942) | | | 51,697,672 | |

| | | | | | | | |

| INSTITUTIONAL TERM LOANS 0.0% | | | | |

| | | | Chrysler LLC | | | | |

| | 7,319,322 | | 6.467%, 11/29/2013 (e) | | | 77,804 | |

| | | | Total Institutional Term Loans | | | | |

| | | | (Cost $3,516,368) | | | 77,804 | |

| | | | | | | | |

| Number of Shares | | | | |

| PREFERRED STOCKS 0.1% | | | | |

| | | | | | | | |

| | | | Thrifts & Mortgage Finance 0.1% | | | | |

| | 169,732 | | Fannie Mae | | | | |

| | | | 8.25%, 12/31/2010 (c)(g) | | | 227,441 | |

| | 141,065 | | Freddie Mac | | | | |

| | | | 8.375%, 12/31/2012 (c)(g) | | | 172,099 | |

| | | | Total Preferred Stocks | | | | |

| | | | (Cost $4,155,967) | | | 399,540 | |

| | | | | | | | |

| Principal Amount | | | |

| U.S. TREASURY OBLIGATIONS 15.3% | | | | |

| | | | | | | | |

| | | | United States Treasury Bonds 0.2% | | | | |

| | 515,000 | | 4.500%, 05/15/2038 | | | 531,657 | |

| | | | | | | | |

| | | | United States Treasury Notes 15.1% | | | | |

| | 25,845,000 | | 0.875%, 05/31/2011 | | | 25,752,217 | |

| | 23,000,000 | | 1.125%, 06/30/2011 | | | 23,001,840 | |

| | 10,859,867 | | 2.125%, 01/15/2019 | | | 11,216,201 | |

| | | | | | | 59,970,258 | |

| | | | Total U.S. Treasury Obligations | | | | |

| | | | (Cost $60,448,066) | | | 60,501,915 | |

| | | | | | | | |

| SHORT-TERM INVESTMENTS 1.8% | | | | |

| | | | | | | | |

| | | | Variable Rate Demand Notes (d) 1.8% | | | | |

| | 2,509,227 | | American Family Financial | | | | |

| | | | Services, Inc., 0.100% | | | 2,509,227 | |

| | 4,713,324 | | U.S. Bank, N.A. | | | 4,713,324 | |

| | | | Total Short-Term Investments | | | | |

| | | | (Cost $7,222,551) | | | 7,222,551 | |

| | | | | | | | |

| | | | Total Investments 95.6% | | | | |

| | | | (Cost $387,679,446) | | | 379,173,642 | |

| | | | | | | | |

| | | | Other Assets in Excess | | | | |

| | | | of Liabilities 4.4% | | | 17,537,483 | |

| | | | | | | | |

| | | | TOTAL NET ASSETS 100.0% | | $ | 396,711,125 | |

| (a) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration normally to qualified institutional buyers. The total value of these securities amounted to $74,988,060 (18.9% of net assets) at June 30, 2009. |

| (b) | U.S.-dollar denominated security of foreign issuer. |

| (d) | Variable rate demand notes are considered short-term obligations and are payable upon demand. Interest rates change periodically on specified dates. The rates listed are as of June 30, 2009. |

| (e) | Security is in default. |

| (g) | Entity under conservatorship of the federal government. |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

SCHEDULE OF INVESTMENTS (continued)

June 30, 2009

Credit Default Swaps

| | | | Rating of | Pay/ | | | | Unrealized |

| | Reference | Buy/Sell | Reference Entity | Receive | Fixed | Expiration | Notional | Appreciation/ |

| Counterparty | Entity | Protection(1) | (Moody’s/S&P) | Fixed Rate | Rate | Date | Value(2) | (Depreciation) |

| JPMorgan | Dow Jones | | | | | | | |

| | North American | Sell | B2/B | Receive | 5.000% | 6/20/14 | $17,404,800 | $422,098 |

| | High Yield Index | | | | | | | |

| (1) | If the Fund is a seller of protection and a credit event occurs, as defined under the terms of that particular swap agreement, the Fund will either (i) pay to the buyer of protection an amount equal to the notional amount of the swap and take delivery of the referenced obligation or underlying securities comprising the referenced index or (ii) pay a net settlement amount in the form of cash or securities equal to the notional amount of the swap less the recovery value of the referenced obligation or underlying securities comprising the referenced index. |

| (2) | The maximum potential amount the Fund could be required to make as a seller of credit protection or receive as a buyer of credit protection if a credit event occurs as defined under the terms of that particular swap agreement. |

ALLOCATION OF PORTFOLIO HOLDINGS

At June 30, 2009, the allocation of portfolio holdings as a percentage of the Fund’s total net assets were:

| Asset-Backed Securities | | | 3.7 | % | Preferred Stocks | | | 0.1 | |

| Corporate Bonds | | | 61.7 | | U.S. Treasury Obligations | | | 15.3 | |

| Mortgage-Backed Securities | | | 13.0 | | Short-Term Investments | | | 1.8 | |

| Institutional Term Loans | | | 0.0 | * | Other Assets in Excess of Liabilities | | | 4.4 | |

| | | | | | Total | | | 100.0 | % |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

STATEMENT OF ASSETS AND LIABILITIES

June 30, 2009

| Assets: | | | |

| Investments at value (cost $387,679,446) | | $ | 379,173,642 | |

| Cash | | | 12,088 | |

| Interest receivable | | | 4,086,525 | |

| Deposit with broker and custodian for swaps | | | 3,110,000 | |

| Receivable for Fund shares sold | | | 83,753 | |

| Receivable for investments sold | | | 45,389,201 | |

| Unrealized appreciation on swaps | | | 422,098 | |

| Prepaid expenses and other assets | | | 19,130 | |

| Total assets | | | 432,296,437 | |

| | | | | |

| Liabilities: | | | | |

| Payable for investments purchased | | | 32,242,517 | |

| Payable for Fund shares redeemed | | | 1,689 | |

| Accrued investment advisory fee | | | 85,040 | |

| Accrued expenses | | | 64,773 | |

| Swap payments received | | | 3,046,844 | |

| Payable to swap counterparty | | | 144,449 | |

| Total liabilities | | | 35,585,312 | |

| Net Assets | | $ | 396,711,125 | |

| | | | | |

| Net Assets Consist of: | | | | |

| Paid in capital | | $ | 414,135,638 | |

| Undistributed net investment income | | | 1,273,273 | |

| Accumulated net realized loss on investments sold, swap contracts and foreign currency | | | (10,614,080 | ) |

| Net unrealized depreciation on investments | | | (8,505,804 | ) |

| Net unrealized appreciation on swap contracts | | | 422,098 | |

| Net Assets | | $ | 396,711,125 | |

| | | | | |

| Capital Stock, $0.01 Par Value | | | | |

| Authorized | | | 100,000,000 | |

| Issued and outstanding | | | 13,047,886 | |

| Net Asset Value, Redemption Price and Offering Price Per Share | | $ | 30.40 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

STATEMENT OF OPERATIONS

| | | Year Ended | |

| | | June 30, 2009 | |

| Investment Income: | | | |

| Interest income | | $ | 36,455,407 | |

| Dividend income | | | 94,510 | |

| Total investment income | | | 36,549,917 | |

| | | | | |

| Expenses: | | | | |

| Investment advisory fees (Note 3) | | | 1,594,707 | |

| Fund administration and accounting fees | | | 138,164 | |

| Custody fees | | | 39,400 | |

| Audit fees | | | 35,105 | |

| Legal fees | | | 33,568 | |

| Shareholder servicing fees | | | 26,840 | |

| Federal and state registration fees | | | 23,962 | |

| Reports to shareholders | | | 11,985 | |

| Directors’ fees and related expenses | | | 8,145 | |

| Compliance related expenses | | | 5,618 | |

| Other | | | 20,822 | |

| Total expenses before waiver and reimbursement | | | 1,938,316 | |

| Waiver and reimbursement of expenses by Adviser (Note 3) | | | (542,331 | ) |

| Net expenses | | | 1,395,985 | |

| Net Investment Income | | | 35,153,932 | |

| | | | | |

| Realized and Unrealized Gain (Loss) on Investments: | | | | |

| Net realized gain (loss) on: | | | | |

| Investments | | | (8,895,311 | ) |

| Swap contracts | | | 2,197,511 | |

| Futures | | | 831,878 | |

| Change in net unrealized appreciation/(depreciation) on: | | | | |

| Investments | | | 354,573 | |

| Swap contracts | | | 1,390,660 | |

| Net Realized and Unrealized Loss on Investments | | | (4,120,689 | ) |

| Net Increase in Net Assets Resulting from Operations | | $ | 31,033,243 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

STATEMENTS OF CHANGES IN NET ASSETS

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| | | June 30, 2009 | | | June 30, 2008 | |

| Operations: | | | | | | |

| Net investment income | | $ | 35,153,932 | | | $ | 21,156,499 | |

| Net realized gain (loss) on: | | | | | | | | |

| Investments | | | (8,895,311 | ) | | | 14,888,690 | |

| Swap contracts | | | 2,197,511 | | | | 513,045 | |

| Futures | | | 831,878 | | | | — | |

| Foreign currency translation | | | — | | | | 24,984 | |

| Change in net unrealized appreciation/(depreciation) on: | | | | | | | | |

| Investments | | | 354,573 | | | | (7,299,904 | ) |

| Swap contracts | | | 1,390,660 | | | | (1,217,325 | ) |

| Net increase in net assets resulting from operations | | | 31,033,243 | | | | 28,065,989 | |

| | | | | | | | | |

| Distributions From: | | | | | | | | |

| Net investment income | | | (33,077,660 | ) | | | (21,303,876 | ) |

| Net realized gain | | | (9,661,730 | ) | | | (3,906,915 | ) |

| Total distributions | | | (42,739,390 | ) | | | (25,210,791 | ) |

| | | | | | | | | |

| Capital Share Transactions: | | | | | | | | |

| Shares issued in connection with acquisition of Columbus Core Plus Fund (see Note 6) | | | — | | | | 139,917,106 | |

| Shares sold | | | 110,670,953 | | | | 106,418,312 | |

| Shares issued to holders in reinvestment of distributions | | | 33,980,127 | | | | 23,395,411 | |

| Shares redeemed | | | (170,148,652 | ) | | | (115,500,980 | ) |

| Net increase (decrease) in net assets resulting from capital share transactions | | | (25,497,572 | ) | | | 154,229,849 | |

| Total Increase (Decrease) in Net Assets | | | (37,203,719 | ) | | | 157,085,047 | |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of Year | | | 433,914,844 | | | | 276,829,797 | |

| End of Year (includes undistributed net investment | | | | | | | | |

| income of $1,273,273 and $968,538, respectively) | | $ | 396,711,125 | | | $ | 433,914,844 | |

| | | | | | | | | |

| Share Transactions: | | | | | | | | |

| Shares issued in connection with acquisition of Columbus Core Plus Fund (see Note 6) | | | — | | | | 4,545,718 | |

| Shares sold | | | 4,019,040 | | | | 3,393,596 | |

| Shares issued to holders in reinvestment of distributions | | | 1,277,512 | | | | 749,094 | |

| Shares redeemed | | | (6,367,246 | ) | | | (3,675,366 | ) |

| Net increase (decrease) in shares outstanding | | | (1,070,694 | ) | | | 5,013,042 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

FINANCIAL HIGHLIGHTS

| | | Year | | | Year | | | Year | | | Year | | | Year | |

| | | Ended | | | Ended | | | Ended | | | Ended | | | Ended | |

| | | June 30, | | | June 30, | | | June 30, | | | June 30, | | | June 30, | |

| | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

| Net Asset Value, Beginning of Year | | $ | 30.73 | | | $ | 30.40 | | | $ | 29.72 | | | $ | 31.50 | | | $ | 30.51 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income (Loss) from | | | | | | | | | | | | | | | | | | | | |

| Investment Operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 2.50 | | | | 1.48 | | | | 1.54 | | | | 1.41 | | | | 1.13 | |

| Net realized and unrealized gain (loss) on investments | | | 0.16 | | | | 0.61 | | | | 0.68 | | | | (1.30 | ) | | | 0.98 | |

| Total Income from Investment Operations | | | 2.66 | | | | 2.09 | | | | 2.22 | | | | 0.11 | | | | 2.11 | |

| | | | | | | | | | | | | | | | | | | | | |

| Less Distributions: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (2.33 | ) | | | (1.49 | ) | | | (1.54 | ) | | | (1.45 | ) | | | (1.12 | ) |

| From net realized gain on investments | | | (0.66 | ) | | | (0.27 | ) | | | — | | | | (0.44 | ) | | | — | |

| Total Distributions | | | (2.99 | ) | | | (1.76 | ) | | | (1.54 | ) | | | (1.89 | ) | | | (1.12 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, End of Year | | $ | 30.40 | | | $ | 30.73 | | | $ | 30.40 | | | $ | 29.72 | | | $ | 31.50 | |

| Total Return | | | 10.52 | % | | | 6.92 | % | | | 7.52 | % | | | 0.36 | % | | | 7.00 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Supplemental Data and Ratios: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 396,711 | | | $ | 433,915 | | | $ | 276,830 | | | $ | 313,880 | | | $ | 316,474 | |

| Ratio of expenses to average net assets | | | | | | | | | | | | | | | | | | | | |

| Before waivers and reimbursements | | | 0.49 | % | | | 0.49 | % | | | 0.50 | % | | | 0.50 | % | | | 0.50 | % |

| Net of waivers and reimbursements | | | 0.35 | % | | | 0.30 | % | | | 0.20 | % | | | 0.20 | % | | | 0.41 | % |

| Ratio of net investment income to average net assets | | | | | | | | | | | | | | | | | | | | |

| Before waivers and reimbursements | | | 8.68 | % | | | 4.68 | % | | | 4.65 | % | | | 4.29 | % | | | 3.21 | % |

| Net of waivers and reimbursements | | | 8.82 | % | | | 4.87 | % | | | 4.95 | % | | | 4.59 | % | | | 3.30 | % |

| Portfolio turnover rate | | | 424 | % | | | 1,093 | % | | | 978 | % | | | 1,247 | % | | | 1,222 | % |

The accompanying notes are an integral part of these financial statements.

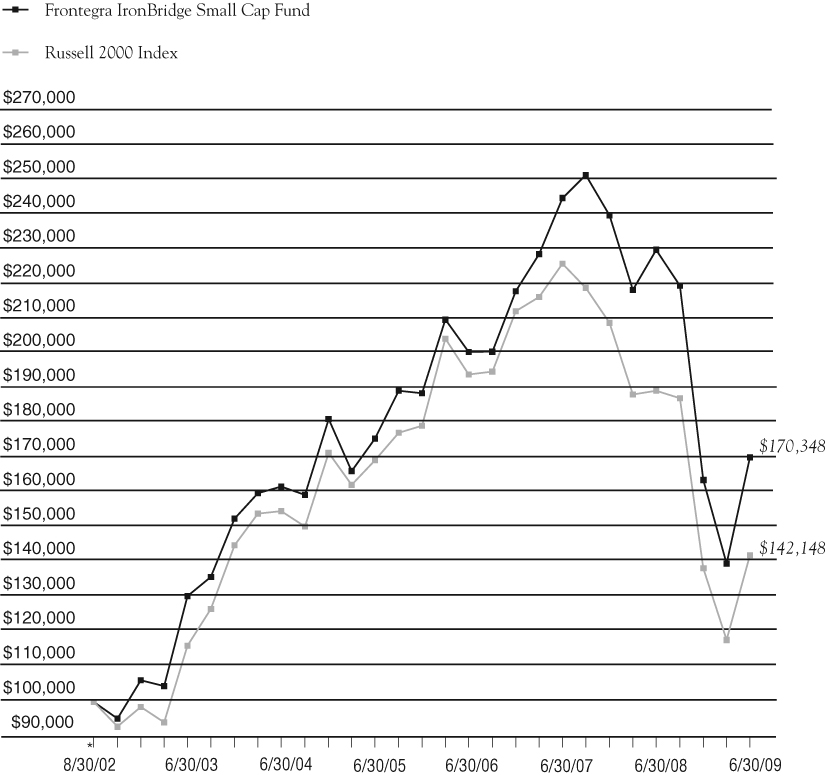

Growth of a $100,000 Investment (Unaudited)

| * | 2/23/01 commencement of operations. |

| | | | | |

| | Portfolio Total Return** | | | |

| | FOR PERIODS ENDED 6/30/09 | FUND | INDEX | |

| | | | | |

| | SIX MONTHS | 17.40% | 1.90% | |

| | | | | |

| | ONE YEAR | 8.64% | 6.05% | |

| | | | | |

| | FIVE YEAR | | | |

| | AVERAGE ANNUAL | 5.75% | 5.01% | |

| | | | | |

| | SINCE COMMENCEMENT | | | |

| | AVERAGE ANNUAL | 5.66% | 5.52% | |

| | | | | |

This chart assumes an initial gross investment of $100,000 made on 2/23/01 (commencement of operations). Returns shown include the reinvestment of all distributions. Past performance is not predictive of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. In the absence of existing fee waivers, total return would be reduced. To receive current to the most recent month-end performance, please call 1-888-825-2100.

The Barclays Capital U.S. Aggregate Bond Index (formerly the Lehman Brothers Aggregate Bond Index) is an unmanaged market value-weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset backed and mortgage backed securities, with maturities of at least one year. The Index does not reflect investment management fees, brokerage commissions and other expenses associated with investing in fixed income securities. A direct investment in the index is not possible.

| ** | The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

Frontegra Columbus Core Fund

SCHEDULE OF INVESTMENTS

June 30, 2009

| Principal Amount | | Value | |

| | | | | | |

| ASSET BACKED SECURITIES 2.5% | | | |

| | | Americredit Automobile | | | |

| | | Receivables Trust | | | |

| $ | 355,000 | | 2008-AF, Class A4, | | | |

| | | | 6.960%, 10/14/2014 | | $ | 324,192 | |

| | | | Hertz Vehicle Financing LLC | | | | |

| | 160,000 | | 2005-1A, Class A4, 0.564%, | | | | |

| | | | 11/25/2011 (Acquired 08/21/2008, | | | | |

| | | | Cost $147,448) (a)(c) | | | 144,019 | |

| | 200,000 | | 2005-2A, Class A5, 0.564%, | | | | |

| | | | 11/25/2011 (Acquired 08/01/2008, | | | | |

| | | | Cost $187,856) (a)(c) | | | 185,820 | |

| | 440,000 | | 2005-2A, Class A6, 5.080%, | | | | |

| | | | 11/25/2011 (Acquired Multiple | | | | |

| | | | Dates, Cost $433,307) (a) | | | 429,266 | |

| | | | Keystone Owner Trust | | | | |

| | 30,415 | | 1998-P1, Class M1, 7.530%, | | | | |

| | | | 05/25/2025 (Acquired 04/22/2003, | | | | |

| | | | Cost $31,484) (a) | | | 27,173 | |

| | | | Mid-State Trust | | | | |

| | 253,965 | | 11, Class A1, 4.864%, 07/15/2038 | | | 137,493 | |

| | | | Total Asset Backed Securities | | | | |

| | | | (Cost $1,407,776) | | | 1,247,963 | |

| | | | | | | | |

| CORPORATE BONDS 63.3% | | | | |

| | | | | | | | |

| | | | Airlines 3.7% | | | | |

| | | | American Airlines | | | | |

| | 310,000 | | 10.375%, 07/02/2019 | | | 310,000 | |

| | | | Continental Airlines | | | | |

| | 585,000 | | 5.983%, 04/19/2022 | | | 482,625 | |

| | | | Delta Air Lines, Inc. | | | | |

| | 932,621 | | Series 2002-1, 6.718%, 07/02/2024 | | | 708,792 | |

| | | | Northwest Airlines, Inc. | | | | |

| | 468,528 | | 7.027%, 11/01/2019 | | | 363,109 | |

| | | | | | | 1,864,526 | |

| | | | Commercial Banks 9.9% | | | | |

| | | | Barclays Bank PLC | | | | |

| | 1,080,000 | | 7.434%, 12/15/2017 | | | | |

| | | | (Acquired Multiple Dates, | | | | |

| | | | Cost $503,886) (a)(b)(c) | | | 723,600 | |

| | 465,000 | | 6.750%, 05/22/2019 | | | 461,174 | |

| | | | BB&T Corp. | | | | |

| | 390,000 | | 6.850%, 04/30/2019 | | | 405,586 | |

| | | | Deutsche Bank, LLC | | | | |

| | 1,310,000 | | 5.628%, 01/31/2049 | | | | |

| | | | (Acquired Multiple Dates, | | | | |

| | | | Cost $898,230) (a) | | | 851,500 | |

| | | | Manufacturers & Traders Trust Co. | | | | |

| | 335,000 | | 5.629%, 12/01/2021 | | | 252,822 | |

| | | | Marshall & Ilsley Bank | | | | |

| | 1,655,000 | | 5.413%, 12/04/2012 | | | 1,150,606 | |

| | | | Wachovia Corp. | | | | |

| | 955,000 | | 5.800%, 03/29/2049 (c) | | | 573,000 | |

| | | | Wells Fargo Alternative Loan Trust | | | | |

| | 730,000 | | 7.700%, 12/29/2049 (c) | | | 605,900 | |

| | | | | | | 5,024,188 | |

| | | | Computers & Peripherals 0.2% | | | | |

| | | | Tyco Electronics Group SA | | | | |

| | 135,000 | | 5.950%, 01/15/2014 (b) | | | 126,073 | |

| | | | | | | | |

| | | | Consumer Finance 1.1% | | | | |

| | | | American Express Co. | | | | |

| | 515,000 | | 8.125%, 05/20/2019 | | | 534,431 | |

| | | | | | | | |

| | | | Diversified Financial Services 13.5% | | | | |

| | | | American General Finance | | | | |

| | 135,000 | | 5.900%, 09/15/2012 | | | 80,575 | |

| | 305,000 | | 6.900%, 12/15/2017 | | | 165,152 | |

| | | | Bank of America Corp. | | | | |

| | 1,525,000 | | 5.420%, 03/15/2017 | | | 1,266,424 | |

| | 265,000 | | 7.625%, 06/01/2019 | | | 266,182 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Fund

SCHEDULE OF INVESTMENTS (continued)

June 30, 2009

| Principal Amount | | Value | |

| | | | | | |

| CORPORATE BONDS 63.3% (continued) | | | |

| | | | | | |

| | | Diversified Financial | | | |

| | | Services 13.5% (continued) | | | |

| | | CIT Group Inc. | | | |

| $ | 200,000 | | 5.168%, 11/03/2010 | | $ | 149,177 | |

| | 40,000 | | 5.600%, 11/02/2011(b) | | | 29,357 | |

| | 170,000 | | 5.610%, 02/13/2012 | | | 100,308 | |

| | 310,000 | | 5.638%, 12/21/2012 | | | 173,693 | |

| | | | Citigroup, Inc. | | | | |

| | 920,000 | | 6.125%, 05/15/2018 | | | 804,688 | |

| | 840,000 | | 8.500%, 05/22/2019 | | | 854,481 | |

| | | | Credit Suisse Guernsey | | | | |

| | 1,225,000 | | 5.860%, 05/15/2017 (b)(c) | | | 796,250 | |

| | | | General Electric Company | | | | |

| | 310,000 | | 5.900%, 05/13/2014 | | | 316,405 | |

| | | | International Lease Finance Corp. | | | | |

| | 175,000 | | 5.300%, 05/01/2012 | | | 135,654 | |

| | 565,000 | | 5.625%, 09/20/2013 | | | 426,834 | |

| | | | JPMorgan Chase & Co. | | | | |

| | 325,000 | | 6.300%, 04/23/2019 | | | 326,893 | |

| | | | PNC Funding Corp. | | | | |

| | 260,000 | | 6.700%, 06/10/2019 | | | 268,164 | |

| | | | Societe Generale | | | | |

| | 1,080,000 | | 5.922%, 04/05/2017 | | | | |

| | | | (Acquired Multiple Dates, | | | | |

| | | | Cost $531,491) (a)(b)(c) | | | 669,600 | |

| | | | | | | 6,829,837 | |

| | | | Diversified Telecommunication | | | | |

| | | | Services 2.3% | | | | |

| | | | British Telecom PLC | | | | |

| | 385,000 | | 5.950%, 01/15/2018 (b) | | | 346,978 | |

| | | | Deutsche Telekom | | | | |

| | | | International Finance B.V. | | | | |

| | 810,000 | | 6.000%, 07/08/2019 (b) | | | 817,209 | |

| | | | | | | 1,164,187 | |

| | | | Electric Utilities 1.8% | | | | |

| | | | Entergy Arkansas Inc. | | | | |

| | 175,000 | | 5.000%, 07/01/2018 | | | 161,547 | |

| | | | Entergy Louisiana LLC | | | | |

| | 70,000 | | 5.500%, 04/01/2019 | | | 66,049 | |

| | | | Great River Energy | | | | |

| | 100,000 | | 7.233%, 07/01/2038 (Acquired | | | | |

| | | | 04/23/2008, Cost $100,000) (a) | | | 97,187 | |

| | | | Indianapolis Power & Light Co. | | | | |

| | 290,000 | | 6.050%, 10/01/2036 (Acquired | | | | |

| | | | Multiple Dates, Cost $276,407) (a) | | | 224,668 | |

| | | | Mackinaw Power LLC | | | | |

| | 274,470 | | 6.296%, 10/31/2023 (Acquired | | | | |

| | | | Multiple Dates, Cost $267,835) (a) | | | 226,303 | |

| | | | Windsor Financing LLC | | | | |

| | 182,216 | | 5.881%, 07/15/2017 (Acquired | | | | |

| | | | Multiple Dates, Cost $182,095) (a) | | | 160,295 | |

| | | | | | | 936,049 | |

| | | | Food & Staples Retailing 0.9% | | | | |

| | | | CVS Caremark Corp. | | | | |

| | 529,538 | | 6.943%, 01/10/2030 (Acquired | | | | |

| | | | 02/19/2009, Cost $409,735) (a) | | | 479,142 | |

| | | | | | | | |

| | | | Gas Utilities 0.6% | | | | |

| | | | EQT Corp. | | | | |

| | 270,000 | | 8.125%, 06/01/2019 | | | 288,999 | |

| | | | | | | | |

| | | | Industrial Consumer Services 1.2% | | | | |

| | | | ERAC USA Finance Company | | | | |

| | 665,000 | | 6.375%, 10/15/2017 (Acquired | | | | |

| | | | Multiple Dates, Cost $511,241) (a) | | | 600,433 | |

| | | | | | | | |

| | | | Insurance 19.4% | | | | |

| | | | Aflac, Inc. | | | | |

| | 390,000 | | 8.500%, 05/15/2019 | | | 416,728 | |

| | | | Allstate Corp. | | | | |

| | 355,000 | | 7.450%, 05/16/2019 | | | 384,060 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Fund

SCHEDULE OF INVESTMENTS (continued)

June 30, 2009

| Principal Amount | | Value | |

| | | | | | |

| CORPORATE BONDS 63.3% (continued) | | | |

| | | | | | |

| | | Insurance 19.4% (continued) | | | |

| | | Genworth Global Funding | | | |

| $ | 795,000 | | 5.875%, 05/03/2013 (Acquired | | | |

| | | | Multiple Dates, Cost $572,678) (a) | | $ | 715,123 | |

| | 45,000 | | 5.750%, 05/15/2013 | | | 40,746 | |

| | | | Hartford Financial Services Group | | | | |

| | 280,000 | | 5.375%, 03/15/2017 | | | 222,032 | |

| | | | Hartford Life Global Funding | | | | |

| | 85,000 | | 2.096%, 03/15/2011 (c) | | | 77,516 | |

| | 165,000 | | 1.231%, 01/17/2012 | | | 142,441 | |

| | 520,000 | | 1.203%, 08/15/2013 (Acquired | | | | |

| | | | 08/28/2008, Cost $485,445) (a) | | | 459,722 | |

| | | | Jackson National Life Global Funding | | | | |

| | 155,000 | | 5.125%, 02/10/2011 (Acquired | | | | |

| | | | Multiple Dates, Cost $154,198) (a) | | | 149,902 | |

| | 180,000 | | 5.375%, 05/08/2013 (Acquired | | | | |

| | | | 05/01/2008 and 05/28/2008, | | | | |

| | | | Cost $179,526) (a) | | | 173,270 | |

| | | | Lincoln National Corp. | | | | |

| | 235,000 | | 8.750%, 07/01/2019 | | | 236,991 | |

| | 1,256,000 | | 7.000%, 05/17/2066 | | | 791,280 | |

| | 795,000 | | 6.050%, 04/20/2067 | | | 504,825 | |

| | | | Metlife, Inc. | | | | |

| | 555,000 | | 5.125%, 06/10/2014 (Acquired | | | | |

| | | | 06/3/2009 and 06/4/2009, | | | | |

| | | | Cost $554,348) (a) | | | 550,681 | |

| | 550,000 | | 6.817%, 08/15/2018 | | | 553,910 | |

| | | | Monumental Global Funding | | | | |

| | 355,000 | | 1.262%, 01/25/2013 (Acquired | | | | |

| | | | Multiple Dates, Cost $330,299) (a)(c) | | | 270,607 | |

| | 260,000 | | 5.500%, 04/22/2013 (Acquired | | | | |

| | | | 4/18/2008, Cost $259,888) (a) | | | 250,863 | |

| | 110,000 | | 5.250%, 01/15/2014 (Acquired | | | | |

| | | | 06/10/2009, Cost $103,768) (a) | | | 103,751 | |

| | | | Nationwide Life Global Fund | | | | |

| | 795,000 | | 5.450%, 10/02/2012 (Acquired | | | | |

| | | | 09/25/2007, Cost $794,006) (a) | | | 778,608 | |

| | | | Principal Financial Group, Inc. | | | | |

| | 170,000 | | 8.875%, 05/15/2019 | | | 178,469 | |

| | | | Principal Life Funding | | | | |

| | 295,000 | | 5.150%, 06/17/2011 | | | 296,638 | |

| | | | Pricoa Global Funding I | | | | |

| | 350,000 | | 5.400%, 10/18/2012 (Acquired | | | | |

| | | | 10/11/2007 and 04/25/2008, | | | | |

| | | | Cost $349,431) (a) | | | 339,560 | |

| | 395,000 | | 5.450%, 06/11/2014 (Acquired | | | | |

| | | | 06/4/2009 and 06/5/2009, | | | | |

| | | | Cost $393,825) (a) | | | 394,317 | |

| | | | Protective Life Corp. | | | | |

| | 730,000 | | 5.450%, 09/28/2012 | | | 728,829 | |

| | | | Prudential Financial Inc. | | | | |

| | 290,000 | | 6.100%, 06/15/2017 | | | 275,892 | |

| | 315,000 | | 6.000%, 12/01/2017 | | | 296,339 | |

| | 130,000 | | 7.375%, 06/15/2019 | | | 127,638 | |

| | | | Torchmark Corp. | | | | |

| | 325,000 | | 9.250%, 06/15/2019 | | | 331,783 | |

| | | | | | | 9,792,521 | |

| | | | Machinery Manufacturing 0.5% | | | | |

| | | | Weatherford International | | | | |

| | 290,000 | | 6.500%, 08/01/2036 | | | 262,447 | |

| | | | | | | | |

| | | | Media 0.5% | | | | |

| | | | Time Warner, Inc. | | | | |

| | 75,000 | | 9.150%, 02/01/2023 | | | 81,320 | |

| | 185,000 | | 7.700%, 05/01/2032 | | | 181,793 | |

| | | | | | | 263,113 | |

| | | | Metals & Mining 1.6% | | | | |

| | | | Alcoa Inc. | | | | |

| | 140,000 | | 6.750%, 07/15/2018 | | | 124,205 | |

| | 275,000 | | 5.900%, 02/01/2027 | | | 196,090 | |

| | 235,000 | | 5.950%, 02/01/2037 | | | 160,114 | |

| | | | Arcelormittal SA Luxembourg | | | | |

| | 285,000 | | 9.850%, 06/01/2019 | | | 307,576 | |

| | | | | | | 787,985 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Fund

SCHEDULE OF INVESTMENTS (continued)

June 30, 2009

| Principal Amount | | Value | |

| | | | | | |

| CORPORATE BONDS 63.3% (continued) | | | |

| | | | | | |

| | | Multi-Utilities & | | | |

| | | Unregulated Power 0.3% | | | |

| | | Kiowa Power Partners LLC | | | |

| $ | 172,383 | | 4.811%, 12/30/2013 (Acquired | | | |

| | | | 08/03/2007 and 11/22/2004, | | | |

| | | | Cost $172,224) (a) | | $ | 158,841 | |

| | | | | | | | |

| | | | Oil, Gas & Consumable Fuels 1.9% | | | | |

| | | | PF Export Receivables Master Trust | | | | |

| | 286,404 | | 3.748%, 06/01/2013 (Acquired | | | | |

| | | | Multiple Dates, Cost $286,449) (a) | | | 293,624 | |

| | | | Talisman Energy, Inc. | | | | |

| | 280,000 | | 7.750%, 06/01/2019 | | | 310,182 | |

| | | | Valero Energy Corp. | | | | |

| | 405,000 | | 6.625%, 06/15/2037 | | | 345,514 | |

| | | | | | | 949,320 | |

| | | | Real Estate Investment Trusts 3.9% | | | | |

| | | | AMB Property LP | | | | |

| | 165,000 | | 6.300%, 06/01/2013 | | | 153,013 | |

| | | | Boston Properties LP | | | | |

| | 225,000 | | 6.250%, 01/15/2013 | | | 223,956 | |

| | | | Federal Realty Investment Trust | | | | |

| | 235,000 | | 5.650%, 06/01/2016 | | | 205,845 | |

| | 105,000 | | 6.200%, 01/15/2017 | | | 93,008 | |

| | | | Liberty Property LP | | | | |

| | 455,000 | | 6.625%, 10/01/2017 | | | 386,112 | |

| | | | Realty Income Corp. | | | | |

| | 275,000 | | 5.950%, 09/15/2016 | | | 244,610 | |

| | | | Regency Centers LP | | | | |

| | 265,000 | | 5.250%, 08/01/2015 | | | 215,126 | |

| | | | Simon Property Group LP | | | | |

| | 250,000 | | 5.100%, 06/15/2015 | | | 228,281 | |

| | 125,000 | | 5.750%, 12/01/2015 | | | 115,123 | |

| | 20,000 | | 6.100%, 05/01/2016 | | | 18,664 | |

| | 75,000 | | 5.250%, 12/01/2016 | | | 66,621 | |

| | | | | | | 1,950,359 | |

| | | | Total Corporate Bonds | | | | |

| | | | (Cost $30,450,882) | | | 32,012,451 | |

| | | | | |

| MORTGAGE BACKED SECURITIES 12.9% | | | | |

| | | | Banc of America Commercial Mortgage Inc. | | | | |

| | 405,000 | | Series 2006-5, Class A4, | | | | |

| | | | 5.414%, 09/10/2016 | | | 322,926 | |

| | 495,000 | | Series 2009-UB1, Class A4, | | | | |

| | | | 5.699%, 05/24/2017 (Acquired | | | | |