UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-07685 |

|

Frontegra Funds, Inc. |

(Exact name of registrant as specified in charter) |

|

400 Skokie Blvd. Suite 500 Northbrook, Illinois | | 60062 |

(Address of principal executive offices) | | (Zip code) |

|

William D. Forsyth III 400 Skokie Blvd., Suite 500 Northbrook, Illinois 60062 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (847) 509-9860 | |

|

Date of fiscal year end: | June 30 | |

|

Date of reporting period: | June 30, 2011 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

1

ANNUAL REPORT

Frontegra Mastholm International Equity Fund

Frontegra SAM Global Equity Fund

Frontegra HEXAM Emerging Markets Fund

Frontegra Timpani Small Cap Growth Fund

Frontegra Netols Small Cap Value Fund

Frontegra Phocas Small Cap Value Fund

Frontegra Asset Management, Inc.

June 30, 2011

TABLE OF CONTENTS

| Shareholder Letter | | | 1 | | |

|

| Expense Example | | | 2 | | |

|

| Frontegra Mastholm International Equity Fund | |

|

| Report from Mastholm Asset Management, LLC | | | 6 | | |

|

| Investment Highlights | | | 8 | | |

|

| Schedule of Investments | | | 9 | | |

|

| Portfolio Diversification | | | 11 | | |

|

| Statement of Assets and Liabilities | | | 12 | | |

|

| Statement of Operations | | | 13 | | |

|

| Statements of Changes in Net Assets | | | 14 | | |

|

| Financial Highlights | | | 15 | | |

|

| Frontegra SAM Global Equity Fund | |

|

| Report from Sustainable Asset Management USA, Inc. | | | 17 | | |

|

| Investment Highlights | | | 19 | | |

|

| Schedule of Investments | | | 20 | | |

|

| Portfolio Diversification | | | 22 | | |

|

| Statement of Assets and Liabilities | | | 23 | | |

|

| Statement of Operations | | | 24 | | |

|

| Statements of Changes in Net Assets | | | 25 | | |

|

| Financial Highlights | | | 26 | | |

|

| Frontegra HEXAM Emerging Markets Fund | |

|

| Report from HEXAM Capital Partners, LLP | | | 28 | | |

|

| Investment Highlights | | | 30 | | |

|

| Schedule of Investments | | | 31 | | |

|

| Portfolio Diversification | | | 32 | | |

|

| Statement of Assets and Liabilities | | | 33 | | |

|

| Statement of Operations | | | 34 | | |

|

| Statement of Changes in Net Assets | | | 35 | | |

|

| Financial Highlights | | | 36 | | |

|

| Frontegra Timpani Small Cap Growth Fund | |

|

| Report from Timpani Capital Management LLC | | | 38 | | |

|

| Schedule of Investments | | | 40 | | |

|

| Portfolio Diversification | | | 43 | | |

|

| Statement of Assets and Liabilities | | | 44 | | |

|

| Statement of Operations | | | 45 | | |

|

| Statements of Changes in Net Assets | | | 46 | | |

|

| Financial Highlights | | | 47 | | |

|

| Frontegra Netols Small Cap Value Fund | |

|

| Report from Netols Asset Management, Inc. | | | 49 | | |

|

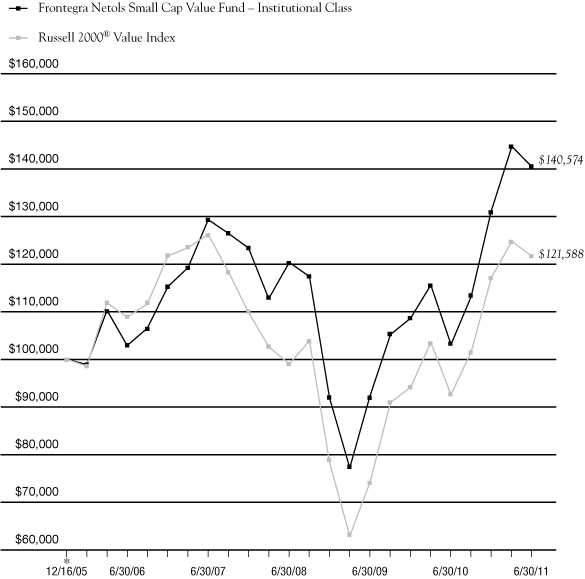

| Investment Highlights | | | 50 | | |

|

| Schedule of Investments | | | 51 | | |

|

| Portfolio Diversification | | | 53 | | |

|

| Statement of Assets and Liabilities | | | 54 | | |

|

| Statement of Operations | | | 55 | | |

|

| Statements of Changes in Net Assets | | | 56 | | |

|

| Financial Highlights | | | 57 | | |

|

| Frontegra Phocas Small Cap Value Fund | |

|

| Report from Phocas Financial Corporation | | | 60 | | |

|

| Investment Highlights | | | 61 | | |

|

| Schedule of Investments | | | 62 | | |

|

| Portfolio Diversification | | | 66 | | |

|

| Statement of Assets and Liabilities | | | 67 | | |

|

| Statement of Operations | | | 68 | | |

|

| Statements of Changes in Net Assets | | | 69 | | |

|

| Financial Highlights | | | 70 | | |

|

| Notes to Financial Statements | | | 72 | | |

|

| Report of Independent Registered Public Accounting Firm | | | 82 | | |

|

| Board of Directors' Approval of Advisory and Subadvisory Agreements | | | 83 | | |

|

| Voting Results of Special Meetings of Shareholders | | | 91 | | |

|

| Additional Information | |

|

| Directors and Officers | | | 92 | | |

|

| Foreign Tax Credit | | | 96 | | |

|

| Qualified Dividend Income/Dividends Received Deduction | | | 97 | | |

|

| Additional Information Applicable to Foreign Shareholders Only | | | 97 | | |

|

This report is submitted for the general information of the shareholders of the Funds. It is not authorized for distribution to prospective investors unless accompanied or preceded by an effective Prospectus for the applicable Fund. The Prospectus may be obtained by calling 1-888-825-2100. Each Prospectus includes more complete information about management fees and expenses, investment objectives, risks and operating policies of the applicable Fund. Please read the Prospectus carefully.

Frontegra Funds, Inc. are distributed by Frontegra Strategies, LLC, 400 Skokie Blvd., Suite 500, Northbrook, IL 60062. Frontegra Strategies, LLC, member of FINRA and SIPC, is an affiliate of Frontegra Asset Management, Inc., the Funds' investment adviser.

This page intentionally left blank.

DEAR FELLOW SHAREHOLDERS:

We are pleased to report on the progress of the Frontegra Funds over the past twelve months ending June 30, 2011. Despite increased volatility of late, global markets have produced strong returns over the past twelve months, as memories of the Great Recession move to the background. The S&P 500 Index was up 30.69%, and small capitalization stocks advanced strongly, with the Russell 2000® Index returning 37.41%. International stocks, as measured by the MSCI EAFE Index, returned 30.93% over the twelve-month period.

Fund Results

For the twelve month period ending June 30, 2011, the Frontegra Mastholm International Equity Fund, managed by Mastholm Asset Management, returned 32.58%, net, versus the benchmark return of 30.93% for the MSCI EAFE Index.

For the ten month period ending June 30, 2011, the Frontegra SAM Global Equity Fund, managed by Sustainable Asset Management USA, returned 25.64%, net, versus the MSCI World Index (Net) return of 25.41%.

For the period from December 20, 2010 (inception) through June 30, 2011, the Frontegra HEXAM Emerging Markets Fund, managed by HEXAM Capital Partners, returned -5.00%, net, versus the MSCI Emerging Markets Index (Net) return of 4.59%.

For the period from March 23, 2011 (inception) through June 30, 2011, the Frontegra Timpani Small Cap Growth Fund, managed by Timpani Capital Management, returned 7.60%, net, versus the Russell 2000® Growth Index return of 4.11%.

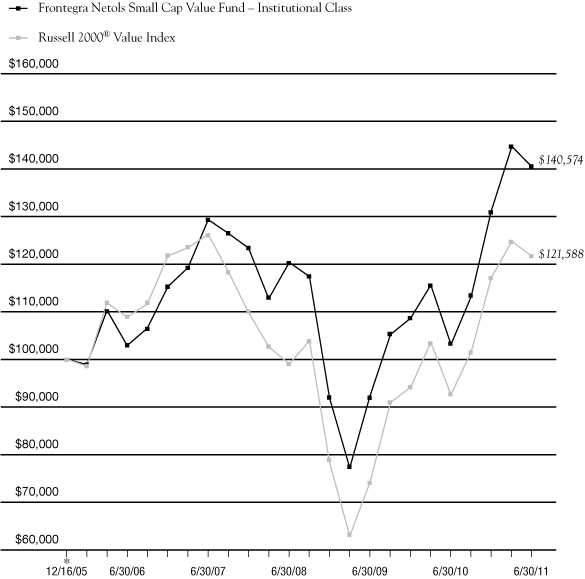

For the twelve month period ending June 30, 2011, the Frontegra Netols Small Cap Value Fund - Institutional Class, managed by Netols Asset Management, returned 36.43%, net, versus the Russell 2000® Value Index return of 31.35%. The Frontegra Netols Small Cap Value Fund - Class Y, returned 35.90%, net, over the same time period.

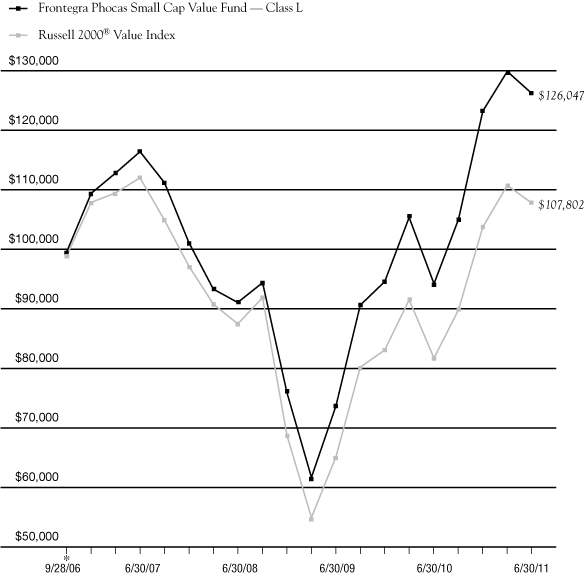

The Frontegra Phocas Small Cap Value Fund - Class L, returned 33.55%, net, versus the Russell 2000 Value Index return of 31.35% for the twelve month period ending June 30, 2011. For the period from April 7, 2011 (inception) through June 30, 2011, the Frontegra Phocas Small Cap Value Fund - Class I, managed by Phocas Financial, returned -3.66%, net, versus the Russell 2000 Value Index return of -3.29%.

Outlook

Despite the rebound in markets around the world over the past twelve months, lingering questions remain with regard to the U.S. government's debt limit, a European debt crisis looms and unemployment in the U.S. remains stubbornly high. As we enter a new fiscal year, we will do our best to manage your assets with the thoughtfulness and skill needed in these volatile times.

We will continue to oversee the investment management of the Frontegra Funds with the care and diligence that have served our shareholders well in the past. As always, we appreciate your investment and continued confidence in the Frontegra Funds.

Best regards,

William D. Forsyth, CFA

President

Frontegra Funds, Inc.

page 1

Frontegra Funds

EXPENSE EXAMPLE

June 30, 2011 (Unaudited)

As a shareholder of a mutual fund, you incur two types of costs: (1) transaction costs, including redemption fees, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other fund expenses. Although the Funds charge no sales loads, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Funds' transfer agent. If you request that a redemption be made by wire transfer, currently the Funds' transfer agent charges a $15.00 fee. A redemption fee of 2.00% of the then current value of the shares redeemed may be imposed on certain redemptions of shares made within 30 days of purchase for the Frontegra Mastholm International Equity, Frontegra SAM Global Equity and Frontegra HEXAM Emerging Markets Funds.

This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (1/1/11 – 06/30/11).

Actual Expenses

The first line of the table on the following page for each Fund provides information about actual account values and actual expenses. The Example includes management fees, registration fees, fee waivers/reimbursements and other expenses. However, the Example does not include portfolio trading commissions and related expenses and other extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During the Period'' to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table for each Fund provides information about hypothetical account values and hypothetical expenses based on each of the Fund's actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in each of the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs could have been higher.

page 2

Frontegra Funds

EXPENSE EXAMPLE (continued)

June 30, 2011 (Unaudited)

| Frontegra Funds | | Beginning Account

Value 1/1/2011 | | Ending Account

Value 6/30/2011 | | Annualized

Expense Ratio* | | Expenses Paid

During the Period* | |

| Mastholm International Equity Fund | |

| Actual Fund Return | | $ | 1,000.00 | | | $ | 1,042.50 | | | | 0.75 | % | | $ | 3.80 | | |

| Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,021.08 | | | | 0.75 | % | | $ | 3.76 | | |

| SAM Global Equity Fund | |

| Actual Fund Return | | $ | 1,000.00 | | | $ | 1,049.50 | | | | 1.20 | % | | $ | 6.10 | | |

| Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,018.84 | | | | 1.20 | % | | $ | 6.01 | | |

| HEXAM Emerging Markets Fund | |

| Actual Fund Return | | $ | 1,000.00 | | | $ | 934.10 | | | | 1.30 | % | | $ | 6.23 | | |

| Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,018.35 | | | | 1.30 | % | | $ | 6.50 | | |

Netols Small Cap Value

Fund – Institutional Class | |

| Actual Fund Return | | $ | 1,000.00 | | | $ | 1,070.90 | | | | 1.10 | % | | $ | 5.65 | | |

| Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,019.34 | | | | 1.10 | % | | $ | 5.51 | | |

Netols Small Cap

Value Fund – Class Y | |

| Actual Fund Return | | $ | 1,000.00 | | | $ | 1,068.40 | | | | 1.50 | % | | $ | 7.70 | | |

| Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,017.35 | | | | 1.50 | % | | $ | 7.51 | | |

Phocas Small Cap

Value Fund – Class L | |

| Actual Fund Return | | $ | 1,000.00 | | | $ | 1,023.40 | | | | 0.99 | % | | $ | 4.97 | | |

| Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,019.89 | | | | 0.99 | % | | $ | 4.96 | | |

* Expenses are equal to each Fund's annualized expense ratio indicated above, multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period.

page 3

Frontegra Funds

EXPENSE EXAMPLE (continued)

June 30, 2011 (Unaudited)

| Frontegra Funds | | Beginning Account

Value | | Ending Account

Value 6/30/2011 | | Annualized

Expense Ratio | | Expenses Paid

During the Period | |

Timpani Small Cap Growth

Fund – Institutional Class | |

| Actual Fund Return* | | $ | 1,000.00 | | | $ | 1,076.00 | | | | 1.10 | % | | $ | 2.60 | | |

| Hypothetical 5% Return** | | $ | 1,000.00 | | | $ | 1,019.34 | | | | 1.10 | % | | $ | 5.51 | | |

Phocas Small Cap Value

Fund – Class I | |

| Actual Fund Return*** | | $ | 1,000.00 | | | $ | 963.40 | | | | 1.10 | % | | $ | 2.46 | | |

| Hypothetical 5% Return**** | | $ | 1,000.00 | | | $ | 1,019.34 | | | | 1.10 | % | | $ | 5.51 | | |

* Actual expenses are equal to the Fund's annualized expense ratio of 1.10% multiplied by the average account value over the period, multiplied by 99/365 to reflect the most recent fiscal period end since the Timpani Small Cap Growth Fund - Institutional Class commenced operations on March 23, 2011.

** Hypothetical expenses are equal to the Fund's annualized expense ratio of 1.10% multiplied by the average account value over the period commencing January 1, 2011, multiplied by 181/365 to reflect information had the Timpani Small Cap Growth Fund - Institutional Class been in operation for the entire fiscal half year.

*** Actual expenses are equal to the Fund's annualized expense ratio of 1.10% multiplied by the average account value over the period, multiplied by 83/365 to reflect the most recent fiscal period end since the Phocas Small Cap Value Fund - Class I commenced operations on April 7, 2011.

**** Hypothetical expenses are equal to the Fund's annualized expense ratio of 1.10% multiplied by the average account value over the period commencing January 1, 2011, multiplied by 181/365 to reflect information had the Phocas Small Cap Value Fund - Class I been in operation for the entire fiscal half year.

page 4

FRONTEGRA

MASTHOLM INTERNATIONAL EQUITY FUND

REPORT FROM MASTHOLM ASSET

MANAGEMENT, LLC

Dear Shareholders:

The Frontegra Mastholm International Equity Fund strives to achieve capital appreciation by investing in a diversified portfolio of securities of large- and mid-cap companies located outside the United States. The objective is relative to and measured against the MSCI EAFE Index.

Performance Review

The Frontegra Mastholm International Equity Fund returned 32.58%, net of fees, for the fiscal year ending June 30, 2011. The Fund's return outperformed the 30.93% return of its benchmark, the MSCI EAFE Index.

Portfolio Review and Strategy

International equity markets were volatile during the fiscal year. In July and August of 2010, the portfolio trailed the benchmark due to profit taking among Japanese and other Asian holdings. A strong rally began in September, and the Fund outperformed the benchmark due to overweighting in consumer discretionary and materials stocks, while also being underweighted in financials and utilities. During the first two quarters of 2011, most growth oriented international managers trailed the broader MSCI EAFE Index due to a retreat among materials stocks and several brief rallies in European banks and utilities.

The backdrop for this volatile market performance pattern was a series of significant macroeconomic events that have occurred during the past twelve months. The failure of the European Central Bank, the European Commission and the various governments involved, particularly Germany, to lead the Eurozone out of a crisis of sovereign credit led to IMF-led bailouts in Greece, Portugal and Ireland. At the time of publication of this report, the European Union seems to have come up with a viable intermediate term solution to the borrowing needs of these countries, but the underlying problems remain which include high borrowing costs, a lack of competitiveness and government debt at an unsustainable level relative to GDP. European bank stocks remain historically cheap even when compared to the market low in March of 2009.

The other major events during this fiscal year included unrest in the Middle East, which led to rapidly rising oil prices, spiraling food inflation costs globally, rising interest rates in China to curb excessive growth, higher interest rates in Europe to curb inflation and the earthquake and subsequent tsunami in Japan which led to a nuclear power crisis.

The investment team reduced the portfolio exposure to Japan immediately after the nuclear accident and then took advantage of the dramatic market fall to redeploy assets back into the country and participate in the subsequent strong rally. Japanese investments have added over 200 basis points to returns during the year. Other Asian markets including Hong Kong and South Korea were among our largest contributors to performance.

From a sector perspective, consumer discretionary stocks have driven performance higher, the portfolio is significantly overweighted in autos and auto parts companies which in aggregate advanced more than 65% during the fiscal year. The massive increase in auto production and earnings is a result of a multi-year rebound in auto sales after the global recession. Currently, the portfolio is invested in automotive stocks in Germany, Japan and South Korea.

From a sector perspective, the portfolio has been underweighted in financials throughout the period. In addition, our financial exposure has been concentrated in higher quality names which have lagged the market during bank stock rallies.

The portfolio also benefitted during the fiscal year by being underweighted in the troubled peripheral European countries including Greece, Italy, Ireland, Portugal and Spain. Over the past several months, the investment team selectively added a few banking and retail companies to the portfolio in Spain and Italy as these markets began to stabilize.

page 6

The portfolio remains underweighted in the United Kingdom and Australia, while overweighted in Europe and slightly underweighted in Japan. Emerging market exposure was about 7% at the end of the fiscal year, primarily in South Korea, which was additive during the year due to a strong currency and outperformance among carmakers such as Hyundai and KIA. Overall, investments in emerging markets added about 100 basis points to the Fund's returns during the measurement period.

Throughout the credit crisis, market rebound and current environment of uncertainty, the portfolio team has followed its strict discipline to identify companies with top and bottom line fundamental improvement, while closely monitoring holdings that lag the index. Portfolio holdings continue to exceed expectations for earnings growth in a period of slowing global growth. The Mastholm investment process is designed to identify companies with accelerating top and bottom line growth, regardless of the economic environment.

Thank you for your continued support.

Robert L. Gernstetter

Managing Director

Mastholm Asset Management, LLC

page 7

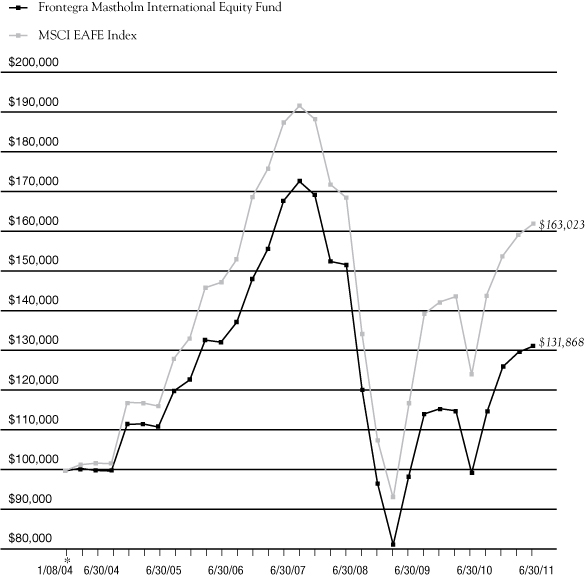

INVESTMENT HIGHLIGHTS

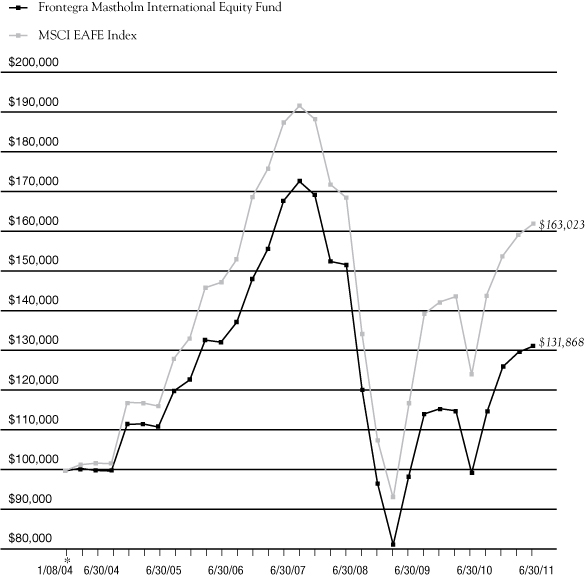

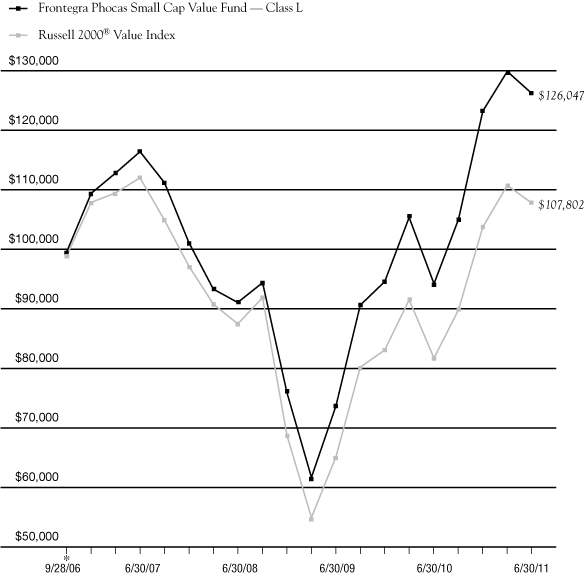

Growth of a $100,000 Investment (Unaudited)

* 1/08/04 commencement of operations.

This chart assumes an initial gross investment of $100,000 made on 1/08/04 (commencement of operations). Returns shown include the reinvestment of all distributions. Past performance is not predictive of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. In the absence of existing fee waivers, total return would be reduced. Effective October 12, 2009, Mastholm Asset Management, LLC became subadviser to the Fund. New Star Institutional Managers Limited served as subadviser prior to Mastholm Asset Management, LLC. To receive current to the most recent month-end performance, please call 1-888-825-2100.

The MSCI EAFE Index measures the overall performance of stock markets in 21 countries within Europe, Australasia and the Far East. The Index does not reflect investment management fees, brokerage commissions and other expenses associated with investing in equity securities. A direct investment in the index is not possible.

** The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Portfolio Total Return**

| FOR PERIODS ENDED 6/30/11 | | FUND | | INDEX | |

| SIX MONTHS | | | 4.25 | % | | | 5.35 | % | |

| ONE YEAR | | | 32.58 | % | | | 30.93 | % | |

FIVE YEAR

AVERAGE ANNUAL | | | (0.13 | )% | | | 1.96 | % | |

AVERAGE ANNUAL

SINCE INCEPTION | | | 3.77 | % | | | 6.75 | % | |

page 8

Frontegra Mastholm International Equity Fund

SCHEDULE OF INVESTMENTS

June 30, 2011

| Number of Shares | | | | Value | |

| COMMON STOCKS 97.0% | | | |

| | | Australia 3.0% | |

| | 19,200 | | | Brambles Ltd. | | $ | 148,681 | | |

| | 17,000 | | | Incitec Pivot Ltd. | | | 70,381 | | |

| | 2,300 | | | Rio Tinto Ltd. | | | 204,724 | | |

| | | | 423,786 | | |

| | | Belgium 2.5% | |

| | 2,300 | | | Anheuser-Busch InBev NV | | | 133,415 | | |

| | 1,400 | | | Solvay SA | | | 216,320 | | |

| | | | 349,735 | | |

| | | China 0.5% | |

| | 1,350 | | | 51job, Inc. - ADR (a) | | | 75,775 | | |

| | | Finland 0.5% | |

| | 1,300 | | | Metso OYJ | | | 73,844 | | |

| | | France 14.1% | |

| | 1,600 | | | Accor SA | | | 71,228 | | |

| | 2,497 | | | BNP Paribas | | | 192,748 | | |

| | 3,400 | | | Cie de St-Gobain | | | 220,173 | | |

| | 3,000 | | | Cie Generale des

Etablissements

Michelin - Class B | | | 293,396 | | |

| | 2,200 | | | Pernod-Ricard SA | | | 216,848 | | |

| | 2,600 | | | Safran SA | | | 111,039 | | |

| | 2,700 | | | Sanofi | | | 217,071 | | |

| | 600 | | | Schneider Electric SA | | | 100,235 | | |

| | 2,300 | | | Valeo SA | | | 157,029 | | |

| | 1,700 | | | Vallourec SA | | | 207,058 | | |

| | 3,500 | | | Vinci SA | | | 224,187 | | |

| | | | 2,011,012 | | |

| | | Germany 10.1% | |

| | 1,789 | | | Bayer AG | | | 143,830 | | |

| | 800 | | | Bayerische Motoren Werke AG | | | 79,828 | | |

| | 1,100 | | | Deutsche Bank AG | | | 65,003 | | |

| | 5,100 | | | E.ON AG | | | 144,847 | | |

| | 1,800 | | | Fresenius SE & Co. KGaA | | | 187,888 | | |

| Number of Shares | | | | Value | |

| | | Germany 10.1% (continued) | |

| | 7,400 | | | Kloeckner & Co. SE (a) | | $ | 222,725 | | |

| | 500 | | | Muenchener

Rueckversicherungs AG | | | 76,460 | | |

| | 2,400 | | | SAP AG | | | 145,306 | | |

| | 1,600 | | | Siemens AG | | | 219,728 | | |

| | 800 | | | Volkswagen AG | | | 146,988 | | |

| | | | 1,432,603 | | |

| | | Hong Kong 1.1% | |

| | 75,400 | | | Galaxy Entertainment

Group Ltd. (a) | | | 161,232 | | |

| | | Ireland 1.8% | |

| | 4,400 | | | Kerry Group PLC | | | 181,945 | | |

| | 6,300 | | | Smurfit Kappa Group PLC (a) | | | 75,098 | | |

| | | | 257,043 | | |

| | | Italy 2.6% | |

| | 66,000 | | | Intesa Sanpaolo SpA | | | 175,725 | | |

| | 10,200 | | | Lottomatica SpA | | | 197,912 | | |

| | | | 373,637 | | |

| | | Japan 17.5% | |

| | 8,800 | | | Bridgestone Corp. | | | 201,786 | | |

| | 3,000 | | | Canon, Inc. | | | 141,979 | | |

| | 22,900 | | | Fuji Heavy Industries Ltd. | | | 176,931 | | |

| | 9,600 | | | Gree, Inc. | | | 208,802 | | |

| | 3,100 | | | K's Holdings Corp. | | | 133,812 | | |

| | 37,000 | | | Nachi-Fujikoshi Corp. | | | 218,309 | | |

| | 1,660 | | | ORIX Corp. | | | 160,628 | | |

| | 198 | | | Rakuten, Inc. | | | 204,382 | | |

| | 3,800 | | | Sanrio Co. Ltd. | | | 147,742 | | |

| | 11,400 | | | Sega Sammy Holdings, Inc. | | | 219,348 | | |

| | 19,100 | | | Sekisui Chemical Co. Ltd. | | | 162,518 | | |

| | 3,800 | | | Softbank Corp. | | | 143,025 | | |

| | 41,000 | | | Tokyo Gas Co. Ltd. | | | 184,870 | | |

| | 2,400 | | | Yamada Denki Co. Ltd. | | | 194,671 | | |

| | | | 2,498,803 | | |

The accompanying notes are an integral part of these financial statements.

page 9

Frontegra Mastholm International Equity Fund

SCHEDULE OF INVESTMENTS (continued)

June 30, 2011

| Number of Shares | | | | Value | |

| COMMON STOCKS 97.0% (continued) | | | |

| | | Netherlands 5.0% | |

| | 28,800 | | | ING Groep NV (a) | | $ | 354,539 | | |

| | 1,100 | | | Koninklijke DSM NV | | | 71,392 | | |

| | 3,900 | | | Royal Dutch Shell PLC | | | 138,449 | | |

| | 5,500 | | | SBM Offshore NV | | | 145,480 | | |

| | | | 709,860 | | |

| | | Norway 2.7% | |

| | 2,100 | | | Algeta ASA (a) | | | 75,318 | | |

| | 5,500 | | | Yara International ASA | | | 309,602 | | |

| | | | 384,920 | | |

| | | Portugal 0.5% | |

| | 3,900 | | | Jeronimo Martins SGPS SA | | | 74,880 | | |

| | | Singapore 1.8% | |

| | 27,700 | | | Keppel Corp. Ltd. | | | 249,871 | | |

| | | South Korea 6.3% | |

| | 1,400 | | | Cheil Industries, Inc. | | | 167,190 | | |

| | 1,060 | | | Hyundai Motor Co. | | | 235,302 | | |

| | 3,111 | | | Kia Motors Corp. | | | 210,673 | | |

| | 500 | | | LG Household &

Health Care Ltd. | | | 214,958 | | |

| | 84 | | | Samsung Electronics Co. Ltd. | | | 64,988 | | |

| | | | 893,111 | | |

| | | Spain 2.2% | |

| | 11,600 | | | Banco Santander SA | | | 133,953 | | |

| | 1,900 | | | Inditex SA | | | 173,143 | | |

| | | | 307,096 | | |

| | | Switzerland 9.2% | |

| | 7,000 | | | Clariant AG (a) | | | 133,797 | | |

| | 1,600 | | | Meyer Burger Technology AG (a) | | | 70,279 | | |

| | 6,200 | | | Nestle SA | | | 385,311 | | |

| | 7,000 | | | Novartis AG | | | 428,784 | | |

| | 275 | | | The Swatch Group AG | | | 138,620 | | |

| | 8,600 | | | UBS AG (a) | | | 156,810 | | |

| | | | 1,313,601 | | |

| Number of Shares | | | | Value | |

| | | United Kingdom 15.6% | |

| | 10,320 | | | BG Group PLC | | $ | 234,203 | | |

| | 8,200 | | | BHP Billiton PLC | | | 322,699 | | |

| | 3,300 | | | Burberry Group PLC | | | 76,797 | | |

| | 23,000 | | | HSBC Holdings PLC | | | 228,276 | | |

| | 5,700 | | | Imperial Tobacco Group PLC | | | 189,460 | | |

| | 17,300 | | | Prudential PLC | | | 199,913 | | |

| | 5,300 | | | Reckitt Benckiser Group PLC | | | 292,616 | | |

| | 45,200 | | | Tesco | | | 291,627 | | |

| | 4,600 | | | Unilever PLC | | | 148,099 | | |

| | 10,600 | | | Xstrata PLC | | | 233,327 | | |

| | | | 2,217,017 | | |

| | | Total Common Stocks | |

| | | | | (Cost $12,335,045) | | | 13,807,826 | | |

| SHORT-TERM INVESTMENTS 4.2% | | | |

| | | Investment Company 4.2% | |

| | 598,076 | | | Fidelity Institutional Money

Market Portfolio | | | 598,076 | | |

| | | Total Short-Term Investments | |

| | | | | (Cost $598,076) | | | 598,076 | | |

| | | Total Investments 101.2% | |

| | | | | (Cost $12,933,121) | | | 14,405,902 | | |

| | | | | Liabilities in Excess of

Other Assets (1.2)% | | | (169,481 | ) | |

| | | | | TOTAL NET ASSETS 100.0% | | $ | 14,236,421 | | |

(a) Non-Income Producing.

ADR - American Depositary Receipt.

The accompanying notes are an integral part of these financial statements.

page 10

Frontegra Mastholm International Equity Fund

SCHEDULE OF INVESTMENTS (continued)

June 30, 2011

PORTFOLIO DIVERSIFICATION

| Sectors | | Percentage | |

| Consumer Discretionary | | | 23.8 | % | |

| Consumer Staples | | | 15.0 | | |

| Industrials | | | 14.4 | | |

| Materials | | | 13.3 | | |

| Financials | | | 12.3 | | |

| Health Care | | | 7.4 | | |

| Information Technology | | | 3.9 | | |

| Energy | | | 3.6 | | |

| Utilities | | | 2.3 | | |

| Telecomm Service | | | 1.0 | | |

| Total Common Stocks | | | 97.0 | | |

| Total Short-Term Investments | | | 4.2 | | |

| Total Investments | | | 101.2 | | |

| Liabilities in Excess of Other Assets | | | (1.2 | ) | |

| Total Net Assets | | | 100.0 | % | |

The accompanying notes are an integral part of these financial statements.

page 11

Frontegra Mastholm International Equity Fund

STATEMENT OF ASSETS AND LIABILITIES

June 30, 2011

| ASSETS: | |

| Investments at value (cost $12,933,121) | | $ | 14,405,902 | | |

| Foreign currency at value (cost $3,284) | | | 3,362 | | |

| Cash | | | 16,974 | | |

| Interest and dividends receivable | | | 79,540 | | |

| Receivable for investments sold | | | 12,905 | | |

| Receivable from Adviser | | | 20,825 | | |

| Receivable for foreign currency | | | 212,854 | | |

| Prepaid expenses and other assets | | | 8,738 | | |

| Total assets | | | 14,761,100 | | |

| LIABILITIES: | |

| Payable for investments purchased | | | 212,851 | | |

| Payable for foreign currency | | | 212,744 | | |

| Accrued expenses | | | 99,084 | | |

| Total liabilities | | | 524,679 | | |

| Net Assets | | $ | 14,236,421 | | |

| NET ASSETS CONSIST OF: | |

| Paid in capital | | $ | 19,093,222 | | |

| Undistributed net investment income | | | 329,115 | | |

| Accumulated net realized loss | | | (6,669,993 | ) | |

| Net unrealized appreciation on: | |

| Investments | | | 1,472,781 | | |

| Foreign currency | | | 11,296 | | |

| Net Assets | | $ | 14,236,421 | | |

| CAPITAL STOCK, $0.01 PAR VALUE | |

| Authorized | | | 100,000,000 | | |

| Issued and outstanding | | | 1,451,922 | | |

| Net Asset Value, Redemption Price and Offering Price Per Share | | $ | 9.81 | | |

The accompanying notes are an integral part of these financial statements.

page 12

Frontegra Mastholm International Equity Fund

STATEMENT OF OPERATIONS

| | | Year Ended

June 30, 2011 | |

| INVESTMENT INCOME: | |

| Dividend income(1) | | $ | 480,368 | | |

| Interest income | | | 107 | | |

| Total Investment Income | | | 480,475 | | |

| EXPENSES: | |

| Investment advisory fees | | | 358,219 | | |

| Custody fees | | | 101,976 | | |

| Fund administration and accounting fees | | | 52,152 | | |

| Audit fees | | | 39,853 | | |

| Legal fees | | | 39,320 | | |

| Federal and state registration fees | | | 24,138 | | |

| Reports to shareholders | | | 11,928 | | |

| Directors' fees and related expenses | | | 11,768 | | |

| Shareholder servicing fees | | | 10,082 | | |

| Other | | | 11,149 | | |

| Total expenses before waiver and reimbursement | | | 660,585 | | |

| Waiver and reimbursement of expenses by Adviser | | | (377,781 | ) | |

| Net expenses | | | 282,804 | | |

| Net Investment Income | | | 197,671 | | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: | |

| Net realized gain on: | |

| Investments | | | 9,872,480 | | |

| Foreign currency transactions | | | 105,137 | | |

| Change in net unrealized appreciation/(depreciation) on: | |

| Investments | | | 1,738,867 | | |

| Foreign currency transactions | | | (26,555 | ) | |

| Net Realized and Unrealized Gain on Investments | | | 11,689,929 | | |

| Net Increase in Net Assets Resulting from Operations | | $ | 11,887,600 | | |

(1) Net of $61,202 in foreign withholding taxes

The accompanying notes are an integral part of these financial statements.

page 13

Frontegra Mastholm International Equity Fund

STATEMENTS OF CHANGES IN NET ASSETS

| | | For the

Year Ended

June 30, 2011 | | For the

Year Ended

June 30, 2010 | |

| OPERATIONS: | |

| Net investment income | | $ | 197,671 | | | $ | 906,816 | | |

| Net realized gain (loss) on: | |

| Investments | | | 9,872,480 | | | | 16,444,788 | | |

| Foreign currency transactions | | | 105,137 | | | | (104,437 | ) | |

| Change in net unrealized appreciation/(depreciation) on: | |

| Investments | | | 1,738,867 | | | | 6,049,436 | | |

| Foreign currency transactions | | | (26,555 | ) | | | 36,238 | | |

| Net increase in net assets resulting from operations | | | 11,887,600 | | | | 23,332,841 | | |

| DISTRIBUTIONS PAID FROM: | |

| Net investment income | | | (944,668 | ) | | | (5,738,700 | ) | |

| Net realized gain on investments | | | — | | | | — | | |

| Net decrease in net assets resulting from distributions paid | | | (944,668 | ) | | | (5,738,700 | ) | |

| CAPITAL SHARE TRANSACTIONS: | |

| Shares sold | | | 6,660,977 | | | | 12,774,821 | | |

| Shares issued to holders in reinvestment of distributions | | | 944,668 | | | | 5,738,700 | | |

| Shares redeemed | | | (42,828,671 | ) | | | (197,476,360 | ) | |

| Redemption fees | | | — | | | | 1,445 | | |

| Net decrease in net assets resulting from capital share transactions | | | (35,223,026 | ) | | | (178,961,394 | ) | |

| Total Decrease in Net Assets | | | (24,280,094 | ) | | | (161,367,253 | ) | |

| NET ASSETS: | |

| Beginning of Period | | | 38,516,515 | | | | 199,883,768 | | |

End of Period (includes undistributed net investment

income of $329,115 and $590,856 respectively) | | $ | 14,236,421 | | | $ | 38,516,515 | | |

| TRANSACTIONS IN SHARES: | |

| Shares sold | | | 733,550 | | | | 1,454,683 | | |

| Shares issued to holders in reinvestment of distributions | | | 101,687 | | | | 664,201 | | |

| Shares redeemed | | | (4,486,262 | ) | | | (22,584,239 | ) | |

| Net decrease in shares outstanding | | | (3,651,025 | ) | | | (20,465,355 | ) | |

The accompanying notes are an integral part of these financial statements.

page 14

Frontegra Mastholm International Equity Fund

FINANCIAL HIGHLIGHTS

| | | Year

Ended

June 30,

2011 | | Year

Ended

June 30,

2010(1) | | Year

Ended

June 30,

2009(2) | | Year

Ended

June 30,

2008(2) | | Year

Ended

June 30,

2007(2) | |

| Net Asset Value, Beginning of Period | | $ | 7.55 | | | $ | 7.82 | | | $ | 13.24 | | | $ | 16.11 | | | $ | 13.08 | | |

INCOME (LOSS) FROM

INVESTMENT OPERATIONS: | |

| Net investment income (loss) | | | 0.30 | | | | 0.27 | | | | 0.29 | | | | 0.31 | | | | 0.25 | | |

| Net realized and unrealized gain (loss) on investments | | | 2.15 | | | | (0.18 | ) | | | (4.97 | ) | | | (1.75 | ) | | | 3.25 | | |

| Total Income (Loss) from Investment Operations | | | 2.45 | | | | 0.09 | | | | (4.68 | ) | | | (1.44 | ) | | | 3.50 | | |

| LESS DISTRIBUTIONS: | |

| From net investment income | | | (0.19 | ) | | | (0.36 | ) | | | (0.35 | ) | | | (0.25 | ) | | | (0.22 | ) | |

| From net realized gain on investments | | | — | | | | — | | | | (0.39 | ) | | | (1.18 | ) | | | (0.25 | ) | |

| Total Distributions | | | (0.19 | ) | | | (0.36 | ) | | | (0.74 | ) | | | (1.43 | ) | | | (0.47 | ) | |

| Net Asset Value, End of Period | | $ | 9.81 | | | $ | 7.55 | | | $ | 7.82 | | | $ | 13.24 | | | $ | 16.11 | | |

| Total Return | | | 32.58 | % | | | 0.52 | % | | | (35.13 | )% | | | (9.60 | )% | | | 27.12 | % | |

| SUPPLEMENTAL DATA AND RATIOS: | |

| Net assets, end of period (in thousands) | | $ | 14,236 | | | $ | 38,517 | | | $ | 199,884 | | | $ | 474,087 | | | $ | 712,620 | | |

| Ratio of expenses to average net assets: | |

| Before waivers and reimbursements | | | 1.75 | % | | | 1.34 | % | | | 1.16 | % | | | 1.06 | % | | | 1.07 | % | |

| Net of waivers and reimbursements | | | 0.75 | % | | | 0.75 | % | | | 0.75 | % | | | 0.75 | % | | | 0.75 | % | |

| Ratio of net investment income (loss) to average net assets: | |

| Before waivers and reimbursements | | | (0.48 | )% | | | 0.07 | % | | | 1.78 | % | | | 1.44 | % | | | 1.30 | % | |

| Net of waivers and reimbursements | | | 0.52 | % | | | 0.66 | % | | | 2.19 | % | | | 1.75 | % | | | 1.62 | % | |

| Portfolio turnover rate | | | 264 | % | | | 268 | % | | | 57 | % | | | 54 | % | | | 62 | % | |

(1) Effective October 12, 2009, Mastholm Asset Management, LLC became subadviser to the Fund.

(2) New Star Institutional Managers Limited served as subadviser.

The accompanying notes are an integral part of these financial statements.

page 15

FRONTEGRA

SAM GLOBAL EQUITY FUND

REPORT FROM SUSTAINABLE ASSET

MANAGEMENT USA, INC.

Dear Shareholders:

The Frontegra SAM Global Equity Fund strives to achieve capital appreciation by investing in a non-diversified portfolio of equity and equity-related securities issued by U.S. and non-U.S. companies that combine their market and financial strategy with a high level of environmental awareness and a clearly defined social policy. The objective is measured against the MSCI World Index (Net).

Performance Review

The Frontegra SAM Global Equity Fund returned 25.64%, net of fees, for the ten month period ending June 30, 2011. The Fund's return outperformed the 25.41% return of its benchmark, the MSCI World Index (Net).

Stock selection was the main driver of strategy performance as sustainability leader companies with attractive valuations outperformed the market. Stock selection worked well across all sectors but was particularly effective in Financials, Consumer Discretionary, Energy and Utilities stocks. Within Financials, the positive extra-performance was also achieved by overweighting insurance companies while underweighting the banking sector, which was most sensitive to the sovereign debt crisis. Stock selection was less effective within Industrial and IT stocks. In particular, within the Industrial sector, the negative contribution came from exposure in Japanese stocks underperforming the market after the earthquake.

Over the period, deviations in portfolio regional and currency allocations relative to the benchmark were not large and as a result, the performance contribution from such exposure was not significant. On a regional level, Europe and the U.S. were the best performing regions, while Asian equities (as measured by MSCI AC Asia ex-Japan) underperformed in relative terms.

Portfolio Outlook and Strategy

Major historic events, both politically and environmentally, have affected financial markets. Radical political changes started to spread out from Tunisia to a number of countries in Northern Africa and the Middle East. In countries such as Libya and Bahrain, the situations escalated and now threaten to turn into long-lasting military conflicts. In addition, Australia and Japan were victims of extreme natural disasters whose full measure of damage is difficult to capture.

The debate about the European sovereign debt crisis and potential contagion over the rest of Europe continued to keep markets volatile. While the situation is far from being resolved, European Union leaders agreed on a longer-term financial stability mechanism that should preserve the solvency of its individual members and re-establish confidence in the European currency union.

Economic data released over the period remained positive but showed the global economy clearly growing at a much slower pace. Signs of softening momentum in the global economy are confirmed by the latest data released in June by the Conference Board Consumer Confidence Index. U.S. consumer sentiment remains weak as consumers are pessimistic about the outlook for the job market over the next several months.

The current macroeconomic recovery is increasingly showing some signs of fatigue, as also reflected by deteriorating macro indicators like the consumer index and housing market in the U.S. At the same time, the quantitative easing program in the U.S. came to the end of its term at the end of June, leading investors to increasingly take a more defensive stance.

Given the current environment, it is very likely that the U.S. Federal Reserve and the European Central Bank will continue with accommodative monetary policies for the foreseeable future. Overall, we expect the stock market to remain lukewarm until the overall picture of the future strength of the economies and the outcome of the sovereign debt crisis becomes more visible.

page 17

Despite our cautious outlook, from a valuation perspective we see attractive investment opportunities in global equity markets. The current valuation level of companies in the portfolio is attractive, and the strategy should benefit from its positioning in companies that offer growth at a reasonable price.

While the investment strategy remains focused on investing in sustainable companies with attractive valuation and stable earnings outlook, we also keep underweighting sectors where earnings visibility is lower, namely Financials.

Sincerely,

Diego d'Argenio

Sustainable Asset Management USA, Inc.

page 18

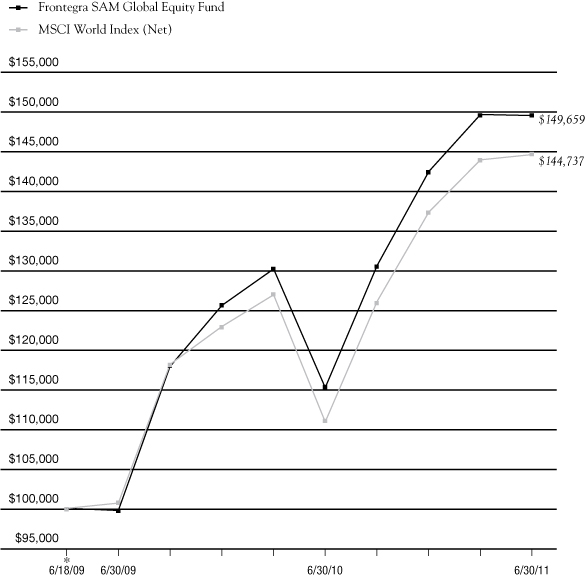

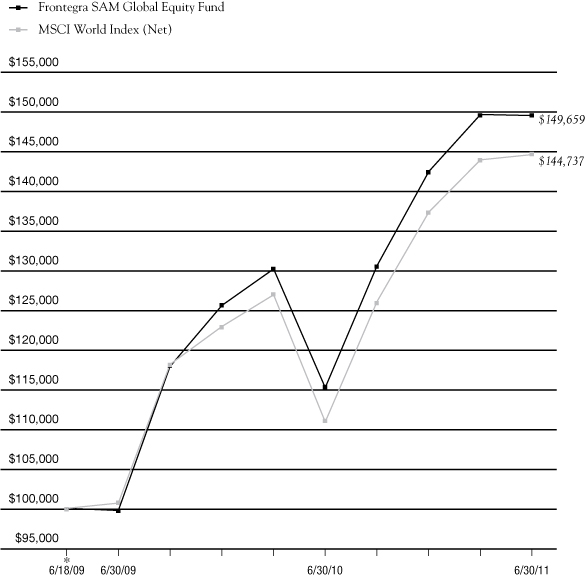

INVESTMENT HIGHLIGHTS

Growth of a $100,000 Investment (Unaudited)

* 6/18/2009 commencement of operations.

This chart assumes an initial gross investment of $100,000 made on 6/18/2009 (commencement of operations). Returns shown include the reinvestment of all distributions. Past performance is not predictive of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. In the absence of existing fee waivers, total return would be reduced. Effective June 10, 2011, Sustainable Asset Management USA, Inc. ("SAM") became subadviser to the Fund. Prior to June 10, 2011, SAM served as adviser to the Fund. To receive current to the most recent month-end performance, please call 1-888-825-2100.

The MSCI World Index measures the overall performance of stock markets in 23 developed market countries in North America, Europe, and the Asia/Pacific Region. The Index does not reflect investment management fees, brokerage commissions and other expenses associated with investing in equity securities. A direct investment in the index is not possible.

** The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Portfolio Total Return**

| FOR PERIODS ENDED 6/30/11 | | FUND | | INDEX | |

| SIX MONTHS | | | 4.95 | % | | | 5.29 | % | |

| ONE YEAR | | | 29.89 | % | | | 30.51 | % | |

AVERAGE ANNUAL

SINCE INCEPTION | | | 21.94 | % | | | 19.95 | % | |

page 19

Frontegra SAM Global Equity Fund

SCHEDULE OF INVESTMENTS

June 30, 2011

| Number of Shares | | | | Value | |

| COMMON STOCKS 97.9% | | | |

| | | Australia 1.6% | |

| | 11,010 | | | National Australia Bank Ltd. | | $ | 302,540 | | |

| | | Canada 9.0% | |

| | 4,350 | | | Bank of Nova Scotia | | | 261,740 | | |

| | 4,990 | | | Canadian Imperial Bank of

Commerce | | | 393,995 | | |

| | 78,720 | | | Sherritt International Corp. | | | 501,157 | | |

| | 2,224 | | | Teck Resources Ltd. - Class B | | | 113,039 | | |

| | 8,320 | | | TELUS Corp. | | | 458,077 | | |

| | | | 1,728,008 | | |

| | | France 4.8% | |

| | 3,980 | | | Cie de St-Gobain | | | 257,732 | | |

| | 1,850 | | | Technip SA | | | 198,339 | | |

| | 6,940 | | | Valeo SA | | | 473,818 | | |

| | | | 929,889 | | |

| | | Germany 5.5% | |

| | 6,470 | | | Deutsche Bank AG | | | 382,338 | | |

| | 4,696 | | | Henkel AG & Co. KGaA | | | 325,991 | | |

| | 2,282 | | | Muenchener

Rueckversicherungs AG | | | 348,962 | | |

| | | | 1,057,291 | | |

| | | Israel 1.6% | |

| | 6,470 | | | Teva Pharmaceutical

Industries Ltd. - ADR | | | 311,983 | | |

| | | Italy 2.8% | |

| | 92,500 | | | Snam Rete Gas SpA | | | 547,826 | | |

| | | Japan 6.7% | |

| | 15,600 | | | Asahi Group Holdings Ltd. | | | 312,950 | | |

| | 36,700 | | | ITOCHU Corp. | | | 379,742 | | |

| | 10,100 | | | Mitsubishi Corp. | | | 250,916 | | |

| | 65,000 | | | Mitsui OSK Lines Ltd. | | | 347,991 | | |

| | | | 1,291,599 | | |

| Number of Shares | | | | Value | |

| | | Netherlands 1.3% | |

| | 9,603 | | | Koninklijke Philips

Electronics NV | | $ | 246,627 | | |

| | | Norway 4.8% | |

| | 16,650 | | | DnB NOR ASA | | | 232,075 | | |

| | 31,613 | | | Norsk Hydro ASA | | | 242,057 | | |

| | 27,750 | | | Telenor ASA | | | 454,429 | | |

| | | | 928,561 | | |

| | | Spain 2.6% | |

| | 14,340 | | | Repsol YPF SA | | | 497,838 | | |

| | | Sweden 2.0% | |

| | 5,922 | | | Boliden AB | | | 109,355 | | |

| | 19,700 | | | Svenska Cellulosa AB | | | 277,348 | | |

| | | | 386,703 | | |

| | | Switzerland 2.0% | |

| | 1,530 | | | Zurich Financial Services AG | | | 386,890 | | |

| | | United Kingdom 12.0% | |

| | 6,507 | | | AstraZeneca PLC | | | 324,582 | | |

| | 93,670 | | | Barclays PLC | | | 385,537 | | |

| | 14,181 | | | BG Group PLC | | | 321,825 | | |

| | 69,370 | | | BT Group PLC | | | 224,342 | | |

| | 148,000 | | | Legal & General Group PLC | | | 280,765 | | |

| | 183,980 | | | Logica PLC | | | 395,675 | | |

| | 24,737 | | | Travis Perkins PLC | | | 392,849 | | |

| | | | 2,325,575 | | |

| | | United States 41.2% | |

| | 3,171 | | | Chevron Corp. | | | 326,106 | | |

| | 16,000 | | | Dell, Inc. (a) | | | 266,720 | | |

| | 4,541 | | | Forest Oil Corp. (a) | | | 121,290 | | |

| | 11,560 | | | General Cable Corp. (a) | | | 492,225 | | |

| | 24,230 | | | Hartford Financial Services

Group, Inc. | | | 638,945 | | |

| | 17,931 | | | Health Net, Inc. (a) | | | 575,405 | | |

| | 15,768 | | | Hewlett-Packard Co. | | | 573,955 | | |

The accompanying notes are an integral part of these financial statements.

page 20

Frontegra SAM Global Equity Fund

SCHEDULE OF INVESTMENTS (continued)

June 30, 2011

| Number of Shares | | | | Value | |

| COMMON STOCKS 97.9% (continued) | | | |

| | | United States 41.2% (continued) | |

| | 2,655 | | | International Business

Machines Corp. | | $ | 455,465 | | |

| | 11,650 | | | Johnson Controls, Inc. | | | 485,339 | | |

| | 5,336 | | | Kimberly Clark Corp. | | | 355,164 | | |

| | 7,436 | | | Limited Brands, Inc. | | | 285,914 | | |

| | 2,456 | | | McDonalds Corp. | | | 207,090 | | |

| | 16,090 | | | Microsoft Corp. | | | 418,340 | | |

| | 16,650 | | | Mylan, Inc. (a) | | | 410,756 | | |

| | 8,510 | | | Northeast Utilities | | | 299,297 | | |

| | 4,831 | | | Occidental Petroleum Corp. | | | 502,617 | | |

| | 25,306 | | | Pfizer, Inc. | | | 521,304 | | |

| | 8,292 | | | Procter & Gamble Co. | | | 527,122 | | |

| | 12,950 | | | Reynolds American, Inc. | | | 479,798 | | |

| | | | 7,942,852 | | |

| | | Total Common Stocks | |

| | | | | (Cost $16,224,835) | | | 18,884,182 | | |

| Number of Shares | | | | Value | |

| SHORT-TERM INVESTMENTS 1.6% | |

| | 310,814 | | | AIM STIT-STIC Prime

Portfolio - Institutional Class | | $ | 310,814 | | |

| | | Total Short-Term Investments | |

| | | (Cost $310,814) | | | 310,814 | | |

| | | Total Investments 99.5% | |

| | | (Cost $16,535,649) | | | 19,194,996 | | |

| | | Other Assets in Excess of

Liabilities 0.5% | | | 96,741 | | |

| | | TOTAL NET ASSETS 100.0% | | $ | 19,291,737 | | |

(a) Non-Income Producing.

ADR - American Depositary Receipt.

The accompanying notes are an integral part of these financial statements.

page 21

Frontegra SAM Global Equity Fund

SCHEDULE OF INVESTMENTS (continued)

June 30, 2011

PORTFOLIO DIVERSIFICATION

| Sectors | | Percentage | |

| Financial | | | 18.7 | % | |

| Industrials | | | 12.3 | | |

| Health Care | | | 11.1 | | |

| Information Technology | | | 11.0 | | |

| Consumer Staples | | | 10.4 | | |

| Energy | | | 10.2 | | |

| Consumer Discretionary | | | 7.5 | | |

| Materials | | | 6.4 | | |

| Telecommunication Services | | | 5.9 | | |

| Utilities | | | 4.4 | | |

| Total Common Stocks | | | 97.9 | | |

| Total Short-Term Investments | | | 1.6 | | |

| Total Investments | | | 99.5 | | |

| Other Assets in Excess of Liabilities | | | 0.5 | | |

| Total Net Assets | | | 100.0 | % | |

The accompanying notes are an integral part of these financial statements.

page 22

Frontegra SAM Global Equity Fund

STATEMENT OF ASSETS AND LIABILITIES

June 30, 2011

| ASSETS: | |

| Investments at value (cost $16,535,649) | | $ | 19,194,996 | | |

| Interest and dividends receivable | | | 103,146 | | |

| Receivable for investments sold | | | 265,709 | | |

| Receivable from Adviser | | | 17,065 | | |

| Prepaid expenses and other assets | | | 3,031 | | |

| Total assets | | | 19,583,947 | | |

| LIABILITIES: | |

| Payable for investments purchased | | | 257,031 | | |

| Accrued expenses | | | 35,179 | | |

| Total liabilities | | | 292,210 | | |

| Net Assets | | $ | 19,291,737 | | |

| NET ASSETS CONSIST OF: | |

| Paid in capital | | $ | 15,337,644 | | |

| Undistributed net investment income | | | 256,065 | | |

| Accumulated net realized gain | | | 1,036,823 | | |

| Net unrealized appreciation on: | |

| Investments | | | 2,659,347 | | |

| Foreign currency | | | 1,858 | | |

| Net Assets | | $ | 19,291,737 | | |

| CAPITAL STOCK, $0.01 PAR VALUE | |

| Authorized | | | 50,000,000 | | |

| Issued and outstanding | | | 1,467,183 | | |

| Net Asset Value, Redemption Price and Offering Price Per Share | | $ | 13.15 | | |

The accompanying notes are an integral part of these financial statements.

page 23

Frontegra SAM Global Equity Fund

STATEMENT OF OPERATIONS

| | | Period Ended

June 30, 2011 | | Year Ended

August 31, 2010 | |

| INVESTMENT INCOME: | |

| Dividend income(1) | | $ | 567,323 | | | $ | 424,367 | | |

| Interest income | | | 176 | | | | 92 | | |

| Income from securities loaned(2) | | | 515 | | | | 545 | | |

| Total Investment Income | | | 568,014 | | | | 425,004 | | |

| EXPENSES: | |

| Investment advisory fees | | | 132,326 | | | | 122,289 | | |

| Fund administration and accounting fees | | | 72,661 | | | | 85,712 | | |

| Shareholder servicing fees | | | 52,956 | | | | 62,752 | | |

| Custody fees | | | 38,694 | | | | 35,961 | | |

| Audit fees | | | 36,611 | | | | 23,926 | | |

| Federal and state registration fees | | | 28,196 | | | | 63,114 | | |

| Legal fees | | | 11,484 | | | | 12,222 | | |

| Compliance related expenses | | | 9,096 | | | | — | | |

| Reports to shareholders | | | 4,892 | | | | 1,393 | | |

| Directors' fees and related expenses | | | 3,522 | | | | 20,257 | | |

| Other | | | 8,788 | | | | 2,614 | | |

| Total expenses before waiver and reimbursement | | | 399,226 | | | | 430,240 | | |

| Waiver and reimbursement of expenses by Adviser | | | (200,711 | ) | | | (246,789 | ) | |

| Net expenses | | | 198,515 | | | | 183,451 | | |

| Net Investment Income | | | 369,499 | | | | 241,553 | | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: | |

| Net realized gain (loss) on: | |

| Investments | | | 1,123,497 | | | | 853,885 | | |

| Foreign currency transactions | | | (9,469 | ) | | | 6,421 | | |

| Change in net unrealized appreciation/(depreciation) on: | |

| Investments | | | 2,694,665 | | | | (694,954 | ) | |

| Foreign currency transactions | | | 1,829 | | | | (1,805 | ) | |

| Net Realized and Unrealized Gain on Investments | | | 3,810,522 | | | | 163,547 | | |

| Net Increase in Net Assets Resulting from Operations | | $ | 4,180,021 | | | $ | 405,100 | | |

(1) Net of foreign withholding taxes of $43,421 and $28,719 respectively

(2) Prior to the reorganization as discussed in Note 1, the Frontegra SAM Global Equity Fund engaged in securities lending.

The accompanying notes are an integral part of these financial statements.

page 24

Frontegra SAM Global Equity Fund

STATEMENTS OF CHANGES IN NET ASSETS

| | | For the

Period Ended

June 30, 2011 | | For the

Year Ended

August 31, 2010 | | For the Period

June 18, 2009(1)

through

August 31, 2009 | |

| OPERATIONS: | |

| Net investment income | | $ | 369,499 | | | $ | 241,553 | | | $ | 5,576 | | |

| Net realized gain (loss) on: | |

| Investments | | | 1,123,497 | | | | 853,885 | | | | 635,679 | | |

| Foreign currency transactions | | | (9,469 | ) | | | 6,421 | | | | 4,574 | | |

| Change in net unrealized appreciation/(depreciation) on: | |

| Investments | | | 2,694,665 | | | | (694,954 | ) | | | 659,636 | | |

| Foreign currency transactions | | | 1,829 | | | | (1,805 | ) | | | 1,834 | | |

| Net increase in net assets resulting from operations | | | 4,180,021 | | | | 405,100 | | | | 1,307,299 | | |

DISTRIBUTIONS PAID TO INSTITUTIONAL CLASS

SHAREHOLDERS FROM: | |

| Net investment income | | | (311,090 | ) | | | (51,677 | ) | | | — | | |

| Net realized gain on investments | | | (638,890 | ) | | | (936,892 | ) | | | — | | |

| Net decrease in net assets resulting from distributions paid | | | (949,980 | ) | | | (988,569 | ) | | | — | | |

DISTRIBUTIONS PAID TO INVESTOR CLASS

SHAREHOLDERS FROM: | |

| Net investment income | | | — | | | | (21 | ) | | | — | | |

| Net realized gain on investments | | | — | | | | (456 | ) | | | — | | |

| Net decrease in net assets resulting from distributions paid | | | — | | | | (477 | ) | | | — | | |

| CAPITAL SHARE TRANSACTIONS: | |

| Shares sold - Institutional Class | | | 1,190,996 | | | | 6,210,174 | | | | 10,306,820 | | |

| Shares sold - Investor Class | | | — | | | | 5,500 | | | | 3,000 | | |

| Shares issued to holders in reinvestment of distributions - Institutional Class | | | 918,565 | | | | 861,288 | | | | — | | |

| Shares issued to holders in reinvestment of distributions - Investor Class | | | — | | | | 477 | | | | — | | |

| Shares redeemed - Institutional Class | | | (2,813,237 | ) | | | (1,345,517 | ) | | | — | | |

| Shares redeemed - Investor Class | | | — | | | | — | | | | — | | |

| Redemption fees - Institutional Class | | | — | | | | 277 | | | | — | | |

| Net increase (decrease) in net assets resulting from capital share transactions | | | (703,676 | ) | | | 5,732,199 | | | | 10,309,820 | | |

| Total Increase in Net Assets | | | 2,526,365 | | | | 5,148,253 | | | | 11,617,119 | | |

| NET ASSETS: | |

| Beginning of Period | | | 16,765,372 | | | | 11,617,119 | | | | — | | |

End of Period (includes undistributed net investment income of

$256,065, $206,426, and $10,150 respectively) | | $ | 19,291,737 | | | $ | 16,765,372 | | | $ | 11,617,119 | | |

| TRANSACTIONS IN SHARES – INSTITUTIONAL CLASS: | |

| Shares sold | | | 88,951 | | | | 536,115 | | | | 1,027,702 | | |

| Conversion of Investor Class shares(2) | | | 1,839 | | | | — | | | | — | | |

| Shares issued to holders in reinvestment of distributions | | | 74,459 | | | | 75,551 | | | | — | | |

| Shares redeemed | | | (221,931 | ) | | | (115,503 | ) | | | — | | |

| Net increase (decrease) in shares outstanding | | | (56,682 | ) | | | 496,163 | | | | 1,027,702 | | |

| TRANSACTIONS IN SHARES – INVESTOR CLASS:(2) | |

| Shares sold | | | — | | | | 472 | | | | 310 | | |

| Shares issued to holders in reinvestment of distributions | | | — | | | | 42 | | | | — | | |

| Net increase in shares outstanding | | | — | | | | 514 | | | | 310 | | |

(1) Commencement of operations

(2) All Investor Class shares converted into the Institutional Class on June 10, 2011

The accompanying notes are an integral part of these financial statements.

page 25

Frontegra SAM Global Equity Fund

FINANCIAL HIGHLIGHTS

| | | Period

Ended

June 30,

2011(1)(2) | | Year

Ended

August 31,

2010 | | Period

Ended

August 31,

2009(3) | |

| Net Asset Value, Beginning of Period | | $ | 11.00 | | | $ | 11.30 | | | $ | 10.00 | | |

INCOME FROM

INVESTMENT OPERATIONS: | |

| Net investment income | | | 0.25 | | | | 0.18 | (4) | | | 0.01 | (4) | |

| Net realized and unrealized gain on investments | | | 2.53 | | | | 0.47 | | | | 1.29 | | |

| Total Income from Investment Operations | | | 2.78 | | | | 0.65 | | | | 1.30 | | |

| LESS DISTRIBUTIONS: | |

| From net investment income | | | (0.21 | ) | | | (0.05 | ) | | | — | | |

| From net realized gain on investments | | | (0.42 | ) | | | (0.90 | ) | | | — | | |

| Total Distributions | | | (0.63 | ) | | | (0.95 | ) | | | 0.00 | | |

| Redemption fees retained | | | — | | | | — | (5) | | | — | | |

| Net Asset Value, End of Period | | $ | 13.15 | | | $ | 11.00 | | | $ | 11.30 | | |

| Total Return | | | 25.64 | %(6) | | | 5.42 | % | | | 13.00 | %(6) | |

| SUPPLEMENTAL DATA AND RATIOS: | |

| Net assets, end of period (in thousands) | | $ | 19,292 | | | $ | 16,756 | | | $ | 11,614 | | |

| Ratio of expenses to average net assets: | |

| Before waivers and reimbursements | | | 2.41 | %(7) | | | 2.81 | % | | | 4.06 | %(7) | |

| Net of waivers and reimbursements | | | 1.20 | %(7) | | | 1.20 | % | | | 1.20 | %(7) | |

| Ratio of net investment income (loss) to average net assets: | |

| Before waivers and reimbursements | | | 1.02 | %(7) | | | (0.03 | )% | | | (2.59 | )%(7) | |

| Net of waivers and reimbursements | | | 2.23 | %(7) | | | 1.58 | % | | | 0.27 | %(7) | |

| Portfolio turnover rate | | | 33 | %(6) | | | 88 | % | | | 72 | %(6) | |

(1) Effective June 30, 2011, the Fund changed its fiscal year end to June 30 from August 31.

(2) Effective June 10, 2011 Frontegra Asset Management, Inc. became adviser and Sustainable Asset Management USA, Inc. became subadviser to the Fund.

(3) Commenced operations on June 18, 2009.

(4) Per share net investment income has been calculated using the daily average share method.

(5) Less than one cent per share.

(6) Not annualized.

(7) Annualized.

The accompanying notes are an integral part of these financial statements.

page 26

FRONTEGRA

HEXAM EMERGING MARKETS FUND

REPORT FROM HEXAM CAPITAL

PARTNERS, LLP

Dear Shareholders:

The Frontegra HEXAM Emerging Markets Fund aims to achieve long-term capital growth by investing in a high conviction portfolio of up to 80 global emerging markets stocks. The Fund's benchmark is the MSCI Emerging Markets Index (Net).

Performance Review

The Fund returned -5.00% since its inception on December 20, 2010 through June 30, 2011 against a 4.59% return for the MSCI Emerging Markets Index (Net).

At a country level, the main detractors to performance were stock selection in China and Russia, as well as not owning South Korean automakers and heavy manufacturers. Positive performance was generated from the underweight to India, as well as stock selection in Zambian copper miner First Quantum Minerals and Indonesian company Straits Asia Resources.

Portfolio Review and Strategy

While the Fund saw relative underperformance from certain individual stocks since its inception to June 30, 2011, a considerable portion of the underperformance was a function of what the Fund was not invested in.

Following the devastating Japanese earthquake and tsunami, South Korean automakers benefitted significantly from the loss of key Japanese rivals in the dominant U.S. car market. A number of auto stocks and associated companies — which included Hyundai Motors, Kia Motors, Hyundai Heavy Industries and Hyundai Mobis — saw share price rises of up to 50% following the tsunami. However, we are comfortable being out of these stocks as we cannot foresee these companies replicating the selling prices and volume sales growth that they have seen over the last few months. With the Japanese automakers set to bring production back to pre-tsunami levels well before the end of the year, we do not believe the Korean stocks are going to get a similar opportunity to perform unless there is another similar disruption in Japan.

Another detractor for the Fund was the zero exposure to Gazprom, which again was boosted by the effects of the Japanese tsunami. Gazprom was one of the major beneficiaries from the negativity toward nuclear energy and the sudden positivity towards gas. While rhetoric such as that from German Chancellor Angela Merkel led to fears for the future of nuclear power and impacted on the price of uranium, we still believe clean and efficient nuclear power has a major part to play in future energy needs. The Chinese and Indians still plan on building a number of power stations and it will continue to be an important source of energy in Europe. Again, we believe this was about short-term perceptions, not fundamentals.

In addition to this, a large part of the index performance over the first few months of the year can also be attributed to the central European states. While the markets of Czech, Hungary and Poland were largely muted in local currency terms, these markets are linked to the euro currency which rose considerably against the U.S. dollar over the period.

While the above describes a significant part of the underperformance, there have also been stock selection factors, particularly Nine Dragons Paper ("NDP"), a Chinese packaging company. The recent Chinese slowdown has had an impact on the stock, with the company geared to Chinese retail sales. The largest factor for NDP's underperformance in Q2 was probably the rise in input costs. In addition, the Japanese tsunami has had a considerable impact, with NDP typically sourcing 10%-15% of its packaging cardboard from Japan — which effectively stopped.

Another area that has lagged has been our overweight to Turkey — which has been affected by the Middle East crisis, with many investors using the country as a proxy for the region. With the oil prices up at $125, there was a massive liquidity drain of investment out of Turkey

page 28

and into Russian energy, an area we had little exposure to. However, the market remains very negative on bank earnings, but bank earnings have been very robust and we expect results coming out in August to be strong.

With a high conviction concentrated fund like ours, the stock specific detraction has been very visible. However, it is not unusual for us to see these sorts of periods of underperformance when the market moves against us in the short term. We are constantly checking our convictions and believe the current portfolio will reverse the relative losses in the coming months.

Outlook

With the emerging market tightening cycle likely to largely come to an end over the next quarter, particularly in China, we believe many global emerging markets remain strongly undervalued. Emerging equities now trade on a forward P/E of between 10x and 10.5x, which is about one standard deviation lower than the long-term average. Global emerging markets also offer strong value compared to developed markets, trading at a discount of about 11%. We still think the markets will finish higher this year, perhaps even by 15%-20%, and the Fund will show strong relative performance.

Thank you for your continued support.

| | | |

|

| Bryan Collings, CFA | | Grant Shotter, CFA | |

|

| Managing Partner and Portfolio Manager | | Partner and Portfolio Manager | |

|

| HEXAM Capital Partners, LLP | | HEXAM Capital Partners, LLP | |

|

| | | |

|

| Stuart Richards | | Marina Akopian | |

|

| Partner and Portfolio Manager | | Partner and Portfolio Manager | |

|

| HEXAM Capital Partners, LLP | | HEXAM Capital Partners, LLP | |

|

page 29

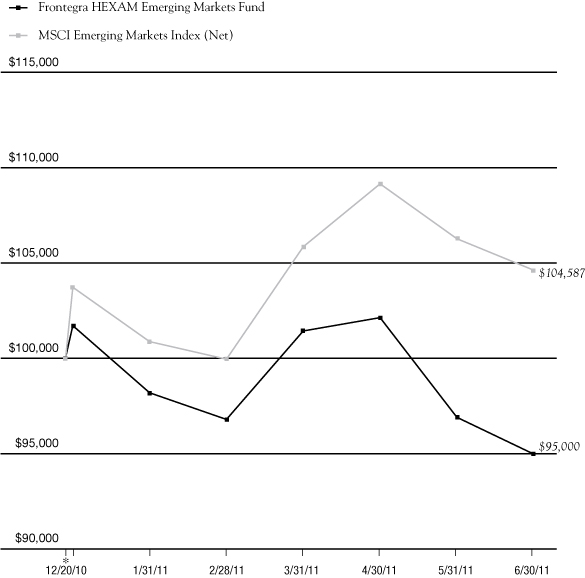

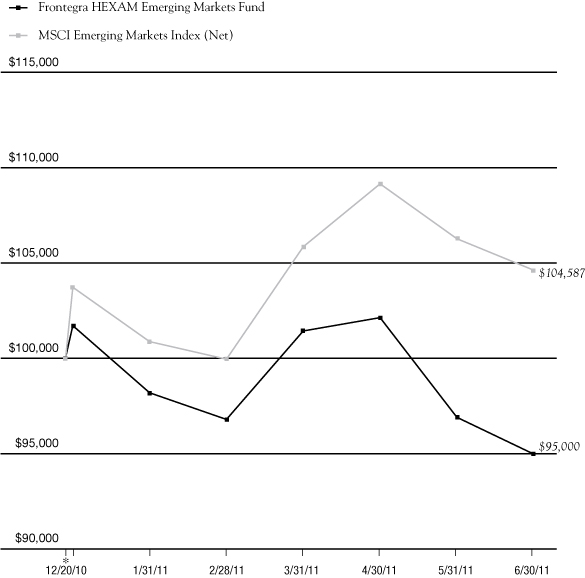

INVESTMENT HIGHLIGHTS

Growth of a $100,000 Investment (Unaudited)

* 12/20/10 commencement of operations.

This chart assumes an initial gross investment of $100,000 made on 12/20/10 (commencement of operations). Returns shown include the reinvestment of all distributions. Past performance is not predictive of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. In the absence of existing fee waivers, total return would be reduced. To receive current to the most recent month-end performance, please call 1-888-825-2100.

The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The Index does not reflect investment management fees, brokerage commissions and other expenses associated with investing in equity securities. A direct investment in the index is not possible.

** The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Portfolio Total Return**

| FOR PERIODS ENDED 6/30/11 | | FUND | | INDEX | |

| SIX MONTHS | | | (6.59 | )% | | | 0.88 | % | |

| SINCE INCEPTION | | | (5.00 | )% | | | 4.59 | % | |

page 30

Frontegra HEXAM Emerging Markets Fund

SCHEDULE OF INVESTMENTS

June 30, 2011

| Number of Shares | | | | Value | |

| COMMON STOCKS 88.2% | | | |

| | | Brazil 17.7% | |

| | 37,201 | | | Cosan Ltd. | | $ | 457,200 | | |

| | 18,799 | | | Gafisa SA | | | 177,839 | | |

| | 22,954 | | | Localiza Rent a Car SA | | | 408,293 | | |

| | 20,826 | | | NOMOS-BANK (a) | | | 371,744 | | |

| | 45,619 | | | Petroleo Brasileiro SA - ADR | | | 1,544,659 | | |

| | 47,013 | | | Vale SA - ADR | | | 1,502,065 | | |

| | | | 4,461,800 | | |

| | | China 2.6% | |

| | 800,000 | | | China Construction Bank Corp. | | | 663,094 | | |

| | | Hong Kong 15.0% | |

| | 439,000 | | | China Overseas Land &

Investment Ltd. (b) | | | 940,992 | | |

| | 72,500 | | | China Shenhua Energy Co. Ltd. | | | 345,651 | | |

| | 1,276,000 | | | Industrial & Commercial

Bank of China | | | 969,090 | | |

| | 964,712 | | | Nine Dragons Paper

Holdings Ltd. (b) | | | 839,290 | | |

| | 468,000 | | | PetroChina Co. Ltd. Class H (b) | | | 684,406 | | |

| | | | 3,779,429 | | |

| | | Kazakhstan 3.3% | |

| | 24,940 | | | Kazakhmys PLC (b) | | | 552,381 | | |

| | 99,999 | | | Uranium One, Inc. (a)(b) | | | 275,802 | | |

| | | | 828,183 | | |

| | | Russian Federation 16.3% | |

| | 16,771 | | | Evraz Group SA (a)(b) | | | 522,417 | | |

| | 53,794 | | | Magnitogorsk Iron &

Steel Works (b) | | | 612,176 | | |

| | 18,559 | | | Mechel (b) | | | 443,375 | | |

| | 28,530 | | | MMC Norilsk Nickel - ADR | | | 747,485 | | |

| | 310,654 | | | Sberbank of Russia | | | 1,143,206 | | |

| | 51,352 | | | VimpelCom Ltd. | | | 655,252 | | |

| | | | 4,123,911 | | |

| | | Singapore 1.7% | |

| | 181,773 | | | Straits Asia Resources Ltd. (b) | | | 442,482 | | |

| Number of Shares | | | | Value | |

| | | South Africa 7.4% | |

| | 7,150 | | | Anglo American PLC | | $ | 354,304 | | |

| | 24,726 | | | Impala Platinum Holdings Ltd. (b) | | | 666,217 | | |

| | 14,952 | | | Naspers Ltd. | | | 844,585 | | |

| | | | 1,865,106 | | |

| | | South Korea 10.8% | |

| | 14,319 | | | KB Financial Group, Inc. (b) | | | 677,291 | | |

| | 7,900 | | | POSCO - ADR | | | 858,098 | | |

| | 1,550 | | | Samsung Electronics Co. Ltd. (b) | | | 1,199,176 | | |

| | | | 2,734,565 | | |

| | | Thailand 1.5% | |

| | 73,715 | | | Bangkok Bank PCL (b) | | | 379,071 | | |

| | | Turkey 10.7% | |

| | 113,020 | | | Haci Omer Sabanci

Holding AS (b) | | | 474,921 | | |

| | 163,554 | | | Tekfen Holding AS (b) | | | 564,327 | | |

| | 276,239 | | | Turk Hava Yollari (a)(b) | | | 723,362 | | |

| | 167,565 | | | Turkiye Garanti Bankasi AS (b) | | | 759,876 | | |

| | 58,459 | | | Turkiye Is Bankasi, Class C (b) | | | 179,375 | | |

| | | | 2,701,861 | | |

| | | Zambia 1.2% | |

| | 2,040 | | | First Quantum Minerals Ltd. (b) | | | 297,439 | | |

| | | Total Common Stocks | |

| | | | | (Cost $23,036,283) | | | 22,276,941 | | |

| PREFERRED STOCKS 7.3% | | | |

| | | Brazil 7.3% | |

| | 36,111 | | | Banco Bradesco SA - ADR | | | 739,914 | | |

| | 47,387 | | | Itau Unibanco Holding SA - ADR | | | 1,115,964 | | |

| | | | 1,855,878 | | |

| | | Total Preferred Stocks | |

| | | | | (Cost $1,694,241) | | | 1,855,878 | | |

| EXCHANGE TRADED FUNDS 1.5% | | | |

| | 25,229 | | | iShare MSCI Taiwan Index Fund | | | 382,976 | | |

| | | Total Exchange Traded Funds | |

| | | | | (Cost $353,085) | | | 382,976 | | |

The accompanying notes are an integral part of these financial statements.

page 31

Frontegra HEXAM Emerging Markets Fund

SCHEDULE OF INVESTMENTS (continued)

June 30, 2011

| PARTICIPATORY NOTES 1.0% | |

| | 5,558 | | | JPMorgan, 3/28/2016

(Bharat Heavy Electricals Ltd.) | | $ | 255,057 | | |

| | | Total Participatory Notes | |

| | | (Cost $256,281) | | | 255,057 | | |

| | | Total Investments 98.0% | |

| | | (Cost $25,339,890) | | | 24,770,852 | | |

| | | Assets in Excess

of Other Liabilities 2.0% | | | 504,093 | | |

| | | TOTAL NET ASSETS 100.0% | | $ | 25,274,945 | | |

(a) Non-Income Producing.

(b) U.S. traded security of a foreign issuer.

ADR - American Depositary Receipt.

PORTFOLIO DIVERSIFICATION

| Sectors | | Percentage | |

| Financials | | | 32.9 | % | |

| Basic Materials | | | 29.6 | | |

| Oil & Gas | | | 9.5 | | |

| Consumer Services | | | 6.3 | | |

| Technology | | | 4.5 | | |

| Consumer Goods | | | 4.2 | | |

| Industrials | | | 1.2 | | |

| Total Common Stocks | | | 88.2 | | |

| Total Preferred Stocks | | | 7.3 | | |

| Total Exchange Traded Funds | | | 1.5 | | |

| Total Participatory Notes | | | 1.0 | | |

| Total Investments | | | 98.0 | | |

| Other Assets in Excess of Liabilities | | | 2.0 | | |

| Total Net Assets | | | 100.0 | % | |

The accompanying notes are an integral part of these financial statements.

page 32

Frontegra HEXAM Emerging Markets Fund

STATEMENT OF ASSETS AND LIABILITIES

June 30, 2011

| ASSETS: | |

| Investments at value (cost $25,339,890) | | $ | 24,770,852 | | |

| Foreign currency at value (cost $118,056) | | | 119,520 | | |

| Interest and dividends receivable | | | 97,046 | | |

| Receivable for investments sold | | | 486,233 | | |

| Prepaid expenses and other assets | | | 535 | | |

| Total assets | | | 25,474,186 | | |

| LIABILITIES: | |

| Accrued investment advisory fee | | | 26,234 | | |

| Payable to the custodian | | | 112,455 | | |

| Accrued expenses | | | 60,552 | | |

| Total liabilities | | | 199,241 | | |

| Net Assets | | $ | 25,274,945 | | |

| NET ASSETS CONSIST OF: | |

| Paid in capital | | $ | 25,575,894 | | |

| Undistributed net investment income | | | 83,636 | | |

| Accumulated net realized gain | | | 182,685 | | |

| Net unrealized depreciation on: | |

| Investments | | | (569,038 | ) | |

| Foreign currency | | | 1,768 | | |

| Net Assets | | $ | 25,274,945 | | |

| CAPITAL STOCK, $0.01 PAR VALUE | |

| Authorized | | �� | 50,000,000 | | |

| Issued and outstanding | | | 2,661,514 | | |

| Net Asset Value, Redemption Price and Offering Price Per Share | | $ | 9.50 | | |

The accompanying notes are an integral part of these financial statements.

page 33

Frontegra HEXAM Emerging Markets Fund

STATEMENT OF OPERATIONS

| | | For the Period

December 20, 2010(1)

through

June 30, 2011 | |

| INVESTMENT INCOME: | |

| Dividend income(2) | | $ | 215,522 | | |

| Interest income | | | 620 | | |

| Total Investment Income | | | 216,142 | | |

| EXPENSES: | |

| Investment advisory fees | | | 66,196 | | |

| Audit fees | | | 31,345 | | |

| Custody fees | | | 26,495 | | |

| Legal fees | | | 15,872 | | |

| Fund administration and accounting fees | | | 15,586 | | |

| Directors' fees and related expenses | | | 4,832 | | |

| Shareholder servicing fees | | | 3,940 | | |

| Reports to shareholders | | | 3,389 | | |

| Federal and state registration fees | | | 1,990 | | |

| Other | | | 1,865 | | |

| Total expenses before waiver and reimbursement | | | 171,510 | | |

| Waiver and reimbursement of expenses by Adviser | | | (75,925 | ) | |

| Net expenses | | | 95,585 | | |

| Net Investment Income | | | 120,557 | | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: | |

| Net realized gain (loss) on: | |

| Investments | | | 182,685 | | |

| Foreign currency transactions | | | (36,921 | ) | |

| Change in net unrealized appreciation/(depreciation) on: | |

| Investments | | | (569,038 | ) | |

| Foreign currency transactions | | | 1,768 | | |

| Net Realized and Unrealized Loss on Investments | | | (421,506 | ) | |

| Net Decrease in Net Assets Resulting from Operations | | $ | (300,949 | ) | |

(1) Commencement of operations

(2) Net of $23,327 in foreign withholding taxes

The accompanying notes are an integral part of these financial statements.

page 34

Frontegra HEXAM Emerging Markets Fund

STATEMENT OF CHANGES IN NET ASSETS

| | | For the Period

December 20, 2010(1)

through

June 30, 2011 | |

| OPERATIONS: | |

| Net investment income | | $ | 120,557 | | |

| Net realized gain (loss) on: | |

| Investments | | | 182,685 | | |

| Foreign currency transactions | | | (36,921 | ) | |

| Change in net unrealized appreciation/(depreciation) on: | |

| Investments | | | (569,038 | ) | |

| Foreign currency transactions | | | 1,768 | | |

| Net decrease in net assets resulting from operations | | | (300,949 | ) | |

| DISTRIBUTIONS PAID FROM: | |

| Net investment income | | | — | | |

| Net realized gain on investments | | | — | | |

| Net decrease in net assets resulting from distributions paid | | | — | | |

| CAPITAL SHARE TRANSACTIONS: | |

| Shares sold | | | 25,615,894 | | |

| Shares issued to holders in reinvestment of distributions | | | — | | |

| Shares redeemed | | | (40,000 | ) | |

| Net increase in net assets resulting from capital share transactions | | | 25,575,894 | | |

| Total Increase in Net Assets | | | 25,274,945 | | |

| NET ASSETS: | |

| Beginning of Period | | | — | | |

| End of Period (includes undistributed net investment income of $83,636) | | $ | 25,274,945 | | |

| TRANSACTIONS IN SHARES: | |

| Shares sold | | | 2,665,635 | | |

| Shares issued to holders in reinvestment of distributions | | | — | | |

| Shares redeemed | | | (4,121 | ) | |

| Net increase in shares outstanding | | | 2,661,514 | | |

(1) Commencement of operations

The accompanying notes are an integral part of these financial statements.

page 35

Frontegra HEXAM Emerging Markets Fund

FINANCIAL HIGHLIGHTS

| | | Period

Ended

June 30,

2011(1) | |