UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07685

Frontegra Funds, Inc.

(Exact name of registrant as specified in charter)

400 Skokie Blvd.

Suite 500

Northbrook, Illinois 60062

(Address of principal executive offices) (Zip code)

William D. Forsyth III

400 Skokie Blvd., Suite 500

Northbrook, Illinois 60062

(Name and address of agent for service)

(847) 509-9860

Registrant’s telephone number, including area code

Date of fiscal year end: June 30

Date of reporting period: June 30, 2010

Item 1. Reports to Stockholders.

ANNUAL REPORT

Frontegra Columbus Core Plus Fund

Frontegra Columbus Core Fund

Frontegra IronBridge Small Cap Fund

Frontegra IronBridge SMID Fund

Frontegra IronBridge Global Focus Fund

Frontegra Mastholm International Equity Fund

Frontegra Netols Small Cap Value Fund

Frontegra Asset Management, Inc.

TABLE OF CONTENTS

| Shareholder Letter | 1 |

| Expense Example | 2 |

| Frontegra Columbus Core Plus Fund | |

| Frontegra Columbus Core Fund | |

| Report from Reams Asset Management Company, LLC | 5 |

| Investment Highlights | 8 |

| Schedule of Investments | 9 |

| Statement of Assets and Liabilities | 16 |

| Statement of Operations | 17 |

| Statements of Changes in Net Assets | 18 |

| Financial Highlights | 19 |

| Investment Highlights | 21 |

| Schedule of Investments | 22 |

| Statement of Assets and Liabilities | 28 |

| Statement of Operations | 29 |

| Statements of Changes in Net Assets | 30 |

| Financial Highlights | 31 |

| Frontegra IronBridge Small Cap Fund | |

| Frontegra IronBridge SMID Fund | |

| Report from IronBridge Capital Management, L.P. | 33 |

| Investment Highlights | 36 |

| Schedule of Investments | 37 |

| Statement of Assets and Liabilities | 41 |

| Statement of Operations | 42 |

| Statements of Changes in Net Assets | 43 |

| Financial Highlights | 44 |

| Investment Highlights | 45 |

| Schedule of Investments | 46 |

| Statement of Assets and Liabilities | 50 |

| Statement of Operations | 51 |

| Statements of Changes in Net Assets | 52 |

| Financial Highlights | 53 |

| Frontegra IronBridge Global Focus Fund | |

| Report from IronBridge Capital Management, L.P. | 55 |

| Investment Highlights | 57 |

| Schedule of Investments | 58 |

| Portfolio Diversification | 60 |

| Statement of Assets and Liabilities | 61 |

| Statement of Operations | 62 |

| Statements of Changes in Net Assets | 63 |

| Financial Highlights | 64 |

| Frontegra Mastholm International Equity Fund | |

| Report from Mastholm Asset Management, LLC | 66 |

| Investment Highlights | 68 |

| Schedule of Investments | 69 |

| Portfolio Diversification | 71 |

| Statement of Assets and Liabilities | 72 |

| Statement of Operations | 73 |

| Statements of Changes in Net Assets | 74 |

| Financial Highlights | 75 |

| Frontegra Netols Small Cap Value Fund | |

| Report from Netols Asset Management, Inc. | 77 |

| Investment Highlights | 78 |

| Schedule of Investments | 79 |

| Statement of Assets and Liabilities | 82 |

| Statement of Operations | 83 |

| Statements of Changes in Net Assets | 84 |

| Financial Highlights | 85 |

| Notes to Financial Statements | 87 |

| Report of Independent Registered Public Accounting Firm | 101 |

| Board of Directors’ Approval of Interim and New Subadvisory Agreements and Advisory Agreement | 102 |

| Voting Results of Special Meetings of Shareholders | 107 |

| Additional Information | |

| Directors and Officers | 108 |

| Foreign Tax Credit | 111 |

| Qualified Dividend Income/Dividends Received Deduction | 111 |

| Additional Information Applicable to Foreign Shareholders Only | 112 |

This report is submitted for the general information of the shareholders of the Funds. It is not authorized for distribution to prospective investors unless accompanied or preceded by an effective Prospectus for the applicable Fund. The Prospectus may be obtained by calling 1-888-825-2100. Each Prospectus includes more complete information about management fees and expenses, investment objectives, risks and operating policies of the applicable Fund. Please read the Prospectus carefully.

Frontegra Funds, Inc. are distributed by Frontegra Strategies, LLC, 400 Skokie Blvd., Suite 500, Northbrook, IL 60062. Frontegra Strategies, LLC, member of FINRA and SIPC, is an affiliate of Frontegra Asset Management, Inc., the Funds’ investment adviser.

| This page intentionally left blank. |

DEAR FELLOW SHAREHOLDERS:

We are pleased to report on the progress of the Frontegra Funds over the past twelve months ending June 30, 2010. The past twelve months have seen a general rebound following the volatile markets of late 2008 and early 2009. The S&P 500 Index was up 14.43%, and small capitalization stocks advanced strongly, with the Russell 2000 Index returning 21.48%. International stocks, as measured by the MSCI EAFE Index, returned 6.38% over the twelve-month period. The U.S. bond market, as measured by the Barclays Capital U.S. Aggregate Bond Index, was up 9.50% for the year.

Fund Results

For the twelve month period ending June 30, 2010, the Funds generated the following net (i.e. after fee) returns:

The Frontegra Columbus Core Plus Fund - Institutional Class, managed by Reams Asset Management Company, returned 19.12% versus the 9.50% return of the Barclays Capital U.S. Aggregate Bond Index; the Frontegra Columbus Core Fund, also managed by Reams Asset Management Company, returned 15.60%.

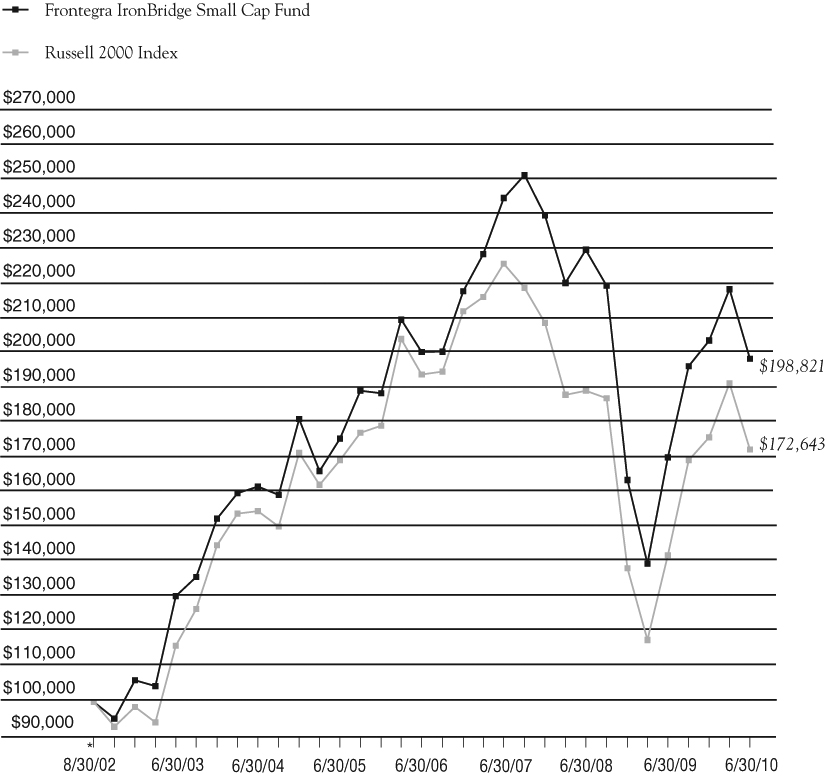

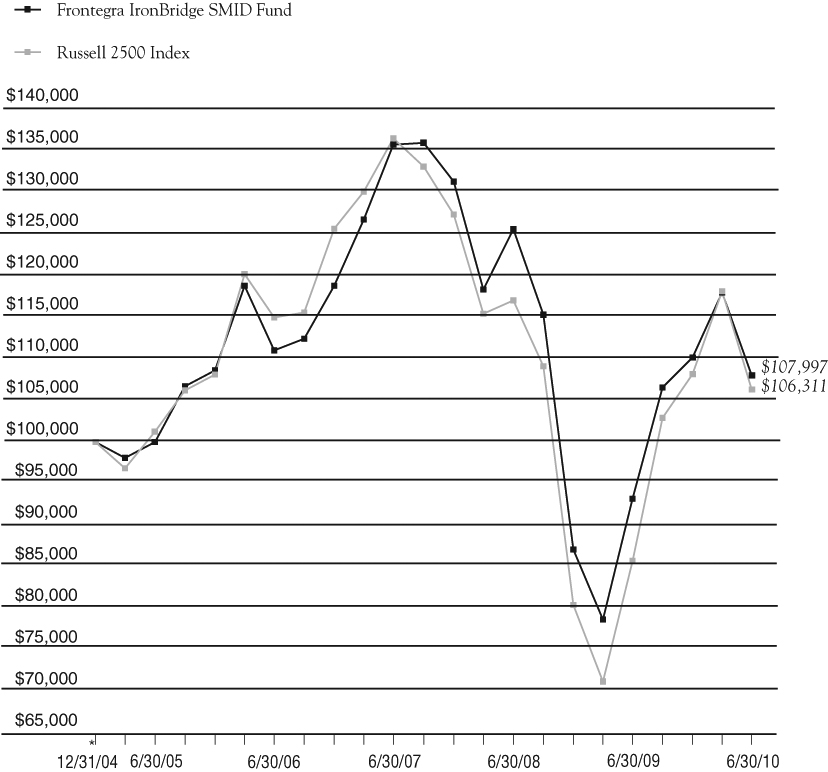

The Frontegra IronBridge Small Cap Fund, managed by IronBridge Capital Management, returned 16.72% versus the 21.48% return for the Russell 2000 Index; the Frontegra IronBridge SMID Fund returned 15.88% versus the Russell 2500 Index return of 24.03%.

The Frontegra Mastholm International Equity Fund, managed by Mastholm Asset Management since mid-October 2009, returned 0.52% versus the benchmark return of 6.38% for the MSCI EAFE Index.

The Frontegra Netols Small Cap Value Fund - Institutional Class, managed by Netols Asset Management, returned 11.76% versus the Russell 2000 Value Index return of 25.07%.

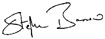

For the period from September 18, 2009, through June 30, 2010, the Frontegra IronBridge Global Focus Fund, also managed by IronBridge Capital Management, returned -8.60% versus the MSCI World Index Net return of -7.10%.

Outlook

While markets have rebounded from their lows, they remain tentative and volatile. As we embark on a new fiscal year, we will endeavor to navigate these turbulent waters with agility and skill.

We will continue to oversee the investment management of the Frontegra Funds with the care and diligence that have served our shareholders well in the past. As always, we appreciate your investment and continued confidence in the Frontegra Funds.

Best regards,

William D. Forsyth, CFA

President

Frontegra Funds, Inc.

Frontegra Funds

EXPENSE EXAMPLE

June 30, 2010 (Unaudited)

As a shareholder of a mutual fund, you incur two types of costs: (1) transaction costs, including redemption fees, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other fund expenses. Although the Funds charge no sales loads, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Funds’ transfer agent. If you request that a redemption be made by wire transfer, currently the Funds’ transfer agent charges a $15.00 fee. A redemption fee of 2.00% of the then current value of the shares redeemed may be imposed on certain redemptions of shares made within 30 days of purchase for the Frontegra IronBridge Global Focus and Mastholm International Equity Funds.

This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (1/1/10 – 6/30/10).

Actual Expenses

The first line of the table on the following page for each Fund provides information about actual account values and actual expenses. The Example includes management fees, registration fees, fee waivers/reimbursements and other expenses. However, the Example does not include portfolio trading commissions and related expenses and other extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period’’ to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table for each Fund provides information about hypothetical account values and hypothetical expenses based on each of the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in each of the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefo re, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs could have been higher.

EXPENSE EXAMPLE (continued)

June 30, 2010 (Unaudited)

| | Beginning Account | Ending Account | Annualized | Expenses Paid |

| Frontegra Fund | Value 1/1/2010 | Value 6/30/2010 | Expense Ratio* | During the Period* |

| | | | | |

| Columbus Core Plus | | | | |

| Fund – Institutional Class | | | | |

| Actual Fund Return | $1,000.00 | $1,073.00 | 0.35% | $1.80 |

| Hypothetical 5% Return | $1,000.00 | $1,023.00 | 0.35% | $1.76 |

| | | | | |

| Columbus Core Plus | | | | |

| Fund – Class Y | | | | |

| Actual Fund Return | $1,000.00 | $1,070.80 | 0.75% | $3.85 |

| Hypothetical 5% Return | $1,000.00 | $1,021.08 | 0.75% | $3.76 |

| | | | | |

| Columbus Core Fund | | | | |

| Actual Fund Return | $1,000.00 | $1,057.00 | 0.35% | $1.79 |

| Hypothetical 5% Return | $1,000.00 | $1,023.00 | 0.35% | $1.76 |

| | | | | |

| IronBridge Small Cap Fund | | | | |

| Actual Fund Return | $1,000.00 | $ 974.00 | 1.07% | $5.24 |

| Hypothetical 5% Return | $1,000.00 | $1,019.00 | 1.07% | $5.36 |

| | | | | |

| IronBridge SMID Fund | | | | |

| Actual Fund Return | $1,000.00 | $ 980.00 | 0.95% | $4.66 |

| Hypothetical 5% Return | $1,000.00 | $1,020.00 | 0.95% | $4.76 |

| | | | | |

| IronBridge Global Focus Fund | | | | |

| Actual Fund Return | $1,000.00 | $ 902.20 | 1.00% | $4.72 |

| Hypothetical 5% Return | $1,000.00 | $1,019.84 | 1.00% | $5.01 |

| | | | | |

| Mastholm International Equity Fund | | | | |

| Actual Fund Return | $1,000.00 | $ 859.00 | 0.75% | $3.46 |

| Hypothetical 5% Return | $1,000.00 | $1,021.00 | 0.75% | $3.76 |

| | | | | |

| Netols Small Cap Value | | | | |

| Fund – Institutional Class | | | | |

| Actual Fund Return | $1,000.00 | $ 948.00 | 1.10% | $5.31 |

| Hypothetical 5% Return | $1,000.00 | $1,019.00 | 1.10% | $5.51 |

| | | | | |

| Netols Small Cap | | | | |

| Value Fund – Class Y | | | | |

| Actual Fund Return | $1,000.00 | $ 946.00 | 1.50% | $7.24 |

| Hypothetical 5% Return | $1,000.00 | $1,017.00 | 1.50% | $7.50 |

| * | Expenses are equal to each Fund’s annualized expense ratio indicated above, multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period. |

FRONTEGRA

COLUMBUS CORE PLUS FUND

FRONTEGRA

COLUMBUS CORE FUND

REPORT FROM REAMS ASSET

MANAGEMENT COMPANY, LLC:

Dear Fellow Shareholders:

The Frontegra Columbus Core Plus Fund strives to achieve a high level of total return consistent with the preservation of capital by investing in a diversified portfolio of fixed income securities of varying maturities. This objective is relative to and measured against the Barclays Capital U.S. Aggregate Bond Index.

The Frontegra Columbus Core Fund strives to achieve a high level of total return consistent with the preservation of capital by investing in a diversified portfolio of investment grade bonds of varying maturities. This objective is relative to and measured against the Barclays Capital U.S. Aggregate Bond Index.

Performance Review

For the 12 month fiscal year ending June 30, 2010, the Frontegra Columbus Core Plus Fund, Institutional Class, had a net return of 19.12% compared to a return of 9.50% for the Barclays Capital U.S. Aggregate Bond Index. Macro factors were positive, with duration strategy adding 26 basis points and the yield curve strategy adding 7 basis points. Sector decisions added 481 basis points while security selection added 483 basis points. Within these categories, investment grade credit added 400 basis points and high yield added 271 basis points as spreads tightened in these overweighted sectors particularly in the last two quarters of 2009. An overweight position in asset backed securities (“ABS”) and commercial mortgage backed securities (“CMBS”) added 215 and 115 basis po ints to performance, respectively. Non-dollar added 2 basis points to performance. Government related subtracted 21 basis points and mortgage backed securities (“MBS”) subtracted 18 basis points as the portfolio was underweight in these two outperforming sectors.

For the 12 month fiscal year ending June 30, 2010, the Frontegra Columbus Core Fund had a net return of 15.60% compared to a return of 9.50% for the Barclays Capital U.S. Aggregate Bond Index. Macro factors were positive, with duration strategy adding 48 basis points and the yield curve strategy neither adding to nor subtracting from performance. Sector decisions added 340 basis points while security selection added 257 basis points. Within these categories, investment grade credit added 460 basis points due to an overweight position in this outperforming sector as well as superior issue selection. An overweight position in CMBS and ABS added 70 and 47 basis points, respectively. MBS added 41 basis points to performance. Government related subtracted 21 basis points as t he portfolio was underweight in this outperforming sector. For both Funds, outperformance for the fiscal year was largely attributable to sector and security selection and the portfolios’ defensive positioning in the second half of the year.

Fixed Income Outlook

| • | During the second quarter, global capital markets weathered multiple storms. The largest and most far reaching of these storms has been sovereign debt problems in Europe, with Greece being the hardest hit. In a desperate attempt to find a solution to the crisis, government officials presented a series of small bailout plans. When these failed to pacify investor concerns, a massive €750 billion bailout package was approved by the European Union and the International Monetary Fund. In addition to the bailout proposals, Germany announced a ban on short selling of sovereign debt and financial equities in an attempt to settle the volatile markets. |

| • | All of the proposed government bailout packages focused on liquidity in hopes that the crises could be averted. Despite the massive size of the final bailout, investors were unsatisfied as they arrived at the sobering conclusion that abundant liquidity cannot rectify a problem rooted in inadequate solvency. A not-unexpected chain reaction to investors’ displeasure has been a pummeling of the Euro currency (approximately a 9.3% decline vs. the U.S. dollar in the second quarter), as the bailout compromises the credibility of the European Union. |

| • | Domestically, the oil spill tragedy in the Gulf of Mexico cast a pall over the capital markets after the Deepwater Horizon drilling rig exploded and sank. Each mitigation attempt initially inspired hope, but quickly faded to frustration as oil continued to flow. While oil washed up on shores, estimates of the flow-rate of the spill crept higher, the scope of liabilities broadened, and the nation’s patience grew increasingly thin, BP was persuaded by the Obama administration to contribute $20 billion to a claims fund. Relief well drilling is currently underway but not expected to be operational until August at the earliest. |

| • | The announcement that Goldman Sachs was being sued by the SEC and the shock of the “flash crash” provided added momentum for passage of the financial reform legislation. The “flash crash” occurred when an already jittery market (a result of the social unrest in Greece) saw the Dow Jones Industrial Average suddenly fall nearly 1,000 points intra-day before recovering almost 700 points in approximately 20 minutes. Lawmakers seized the moment and passed separate bills in both the House and the Senate. An agreement in a House-Senate conference committee was announced, but the passing of Senator Byrd and a last minute addition of a $19 billion charge to banks for the government bailout left the Democratic members uncertain of securing the 60 votes necessary for passage of the final bill in the Senate. |

| • | Concerns rose late in the quarter that unemployment and personal debt continue to weigh down many U.S. consumers, impeding their ability to assist in the nation’s economic recovery. Consumer spending is now needed to replace government spending; however, anemic housing numbers, retail sales, and the consumer confidence index all paint a picture that consumer strength may be weaker than most economists expected. The U.S. government has provided abundant deficit spending, but pressure from record outstanding debt and budget deficits is mounting. When government spending declines and if consumers remain weak, economic growth will be disappointing and market volatility is likely to remain elevated. |

| • | In regard to market performance during the second quarter, nearly all risk sectors underperformed. High yield option-adjusted spreads widened 129 basis points, as initial strength gave way to selling pressure (a result of heightened investors’ concern over the European debt crisis). CMBS widened 51 basis points. Investment grade credit and ABS option-adjusted spreads widened 44 and 14 basis points, respectively. The MBS sector witnessed modest positive excess returns during the second quarter. The historically steep Treasury yield curve flattened and yields declined in a flight to quality rally. The 30-year Treasury rate declined 82 basis points, but the 2-year Treasury declined only 41 basis points. |

Columbus Core Plus Portfolio Strategy

| • | As spreads widened in May and June, we increased our allocation to the corporate sector. The portfolio is overweight in the credit sector with holdings focused on bank, insurance and utility issues that we expect to outperform. |

| • | Our weighting in Treasury securities declined during the quarter to make room in the portfolio for the additions in the corporate sector. |

| • | We maintain a “barbell” positioning to take advantage of the historically steep yield curve. If the yield curve flattens further, as we anticipate it might, the portfolio should outperform. |

| • | The portfolio is defensively positioned in MBS and, as a result, we are underweight the sector. Our focus is on 10-year amortization, low coupon, agency mortgage securities. We believe these shorter maturity securities have attractive spreads and a lower risk profile relative to other agency securities in the MBS sector. |

| • | We maintain our overweight position in the ABS sector. The holdings in this sector are focused on auto finance, which is backed by solid collateral. |

Columbus Core Portfolio Strategy

| • | The portfolio remains overweight in Treasury securities as we maintain a lower risk profile and also as a result of our “barbell” positioning to take advantage of the historically steep yield curve. If the yield curve flattens further, as we anticipate it might, the portfolio should outperform. |

| • | After initially reducing some positions in April, we increased our allocation to the corporate sector as spreads widened in May and June. The portfolio is focused on bank, insurance and utility issues that we expect to outperform. |

| • | The portfolio is defensively positioned in MBS and, as a result, we are underweight the sector. Our focus is on 10-year amortization, low coupon, agency mortgage securities. We believe these shorter maturity securities have attractive spreads and a lower risk profile relative to other agency securities in the MBS sector. |

| • | We maintain our overweight position in the ABS sector. The holdings in this sector are focused on auto finance, which is backed by solid collateral. |

We appreciate your continued support as fellow shareholders in the Funds.

Regards,

|  |

| Mark M. Egan, CFA, CPA | Thomas M. Fink, CFA |

| Reams Asset Management Company, LLC | Reams Asset Management Company, LLC |

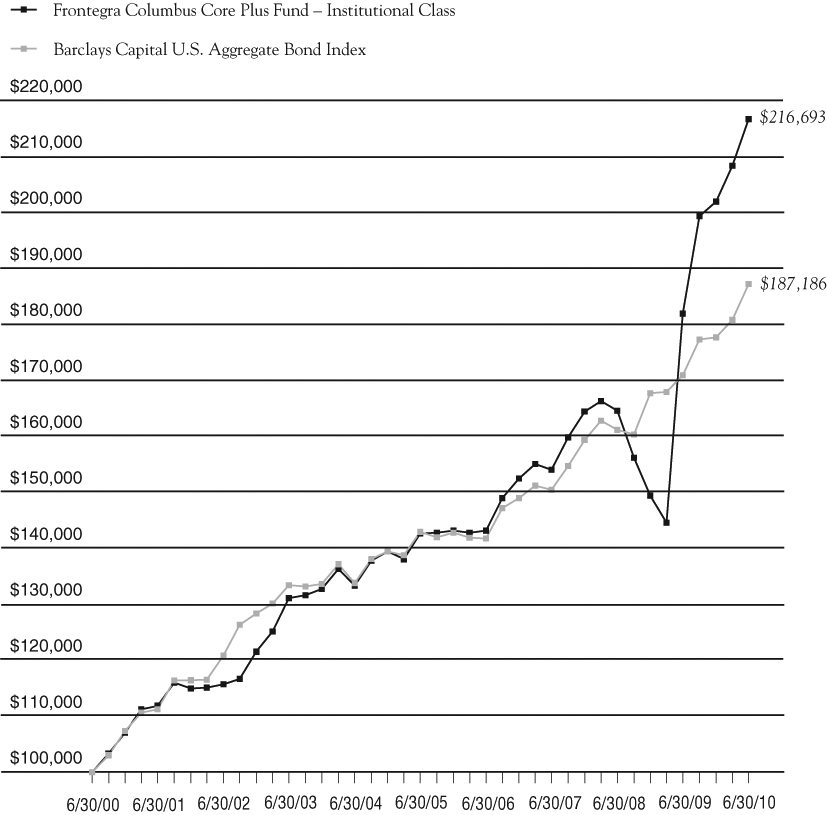

Growth of a $100,000 Investment (Unaudited)

| | | | | |

| | Portfolio Total Return* | | | |

| | FOR PERIODS ENDED 6/30/10 | FUND | INDEX | |

| | | | | |

| | SIX MONTHS | 7.30% | 5.33% | |

| | | | | |

| | ONE YEAR | 19.12% | 9.50% | |

| | | | | |

| | FIVE YEAR | | | |

| | AVERAGE ANNUAL | 8.72% | 5.54% | |

| | | | | |

| | TEN YEAR | | | |

| | AVERAGE ANNUAL | 8.04% | 6.47% | |

| | | | | |

This chart assumes an initial gross investment of $100,000 made on 6/30/00. Returns shown include the reinvestment of all distributions. Past performance is not predictive of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. In the absence of existing fee waivers, total return would be reduced. The recent growth rate in the fixed income market has helped to produce short-term returns for some asset classes that are not typical and may not continue in the future. Because of ongoing market volatility, Fund performance may be subject to substantial short-term changes. To receive current to the most recent month-end performance, please call 1-888-825-2100.

The Barclays Capital U.S. Aggregate Bond Index (formerly the Lehman Brothers Aggregate Bond Index) is an unmanaged market value-weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset backed and mortgage backed securities, with maturities of at least one year. The Index does not reflect investment management fees, brokerage commissions and other expenses associated with investing in fixed income securities. A direct investment in the index is not possible.

| * | The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

The above graph relates to Institutional Class shares of the Fund. Performance for Class Y shares will vary from the performance of the Institutional Class shares shown above due to differences in expenses.Frontegra Columbus Core Plus Fund SCHEDULE OF INVESTMENTS

June 30, 2010

| Principal Amount | | Value | |

| | | | | | |

| ASSET BACKED SECURITIES 10.3% | | | |

| | | Americredit Automobile | | | |

| | | Receivables Trust | | | |

| $ | 1,630,000 | | Series 2008-AF, Class A4, | | | |

| | | | 6.960%, 10/14/2014 | | $ | 1,741,994 | |

| | | | Capital One Multi-Asset | | | | |

| | | | Execution Trust | | | | |

| | 1,395,000 | | Series 2006-9A, Class A9, | | | | |

| | | | 0.365%, 05/15/2013 | | | 1,394,893 | |

| | | | Chase Issuance Trust | | | | |

| | 1,545,000 | | Series 2009-A7, Class A7, | | | | |

| | | | 0.8000%, 09/17/2012 | | | 1,546,025 | |

| | 1,570,000 | | Series 2005-A13, Class A13, | | | | |

| | | | 0.390%, 02/15/2013 | | | 1,569,129 | |

| | | | Chrysler Financial Auto | | | | |

| | | | Securitization Trust | | | | |

| | 2,225,000 | | Series 2009-B, Class A-2, | | | | |

| | | | 1.150%, 11/08/2011 | | | 2,228,554 | |

| | | | Chrysler Financial Automobile TALF | | | | |

| | 1,010,000 | | Series 2009-AF, Class A3, | | | | |

| | | | 2.820%, 01/15/2016 | | | 1,030,068 | |

| | | | Countrywide Asset-Backed Certificates | | | | |

| | 3,630,588 | | Series 2006-S2, Class A3, | | | | |

| | | | 5.841%, 07/25/2027 | | | 1,185,430 | |

| | 1,558,244 | | Series 2006-S2, Class A4, | | | | |

| | | | 6.091%, 07/25/2027 | | | 314,531 | |

| | 850,409 | | Series 2006-S5, Class A3, | | | | |

| | | | 5.762%, 06/25/2035 | | | 242,722 | |

| | 1,444,276 | | Series 2007-S2, Class A6, | | | | |

| | | | 5.779%, 05/25/2037 | | | 818,445 | |

| | | | Credit Suisse Mortgage | | | | |

| | | | Capital Certificates | | | | |

| | 1,865,756 | | Series 2009-12R, Class 41A1, | | | | |

| | | | 5.250%, 03/27/2037 | | | | |

| | | | (Acquired 10/06/2009, | | | | |

| | | | Cost $1,858,760) (b) | | | 1,865,756 | |

| | | | Fifth Third Auto Trust | | | | |

| | 1,602,632 | | Series 2008-1, Class A3A, | | | | |

| | | | 4.070%, 01/17/2012 | | | 1,611,395 | |

| | | | Ford Credit Auto Owner Trust | | | | |

| | 4,025,000 | | Series 2009-A, Class A3B, | | | | |

| | | | 2.850%, 05/15/2013 | | | 4,102,633 | |

| | 2,355,000 | | Series 2009-D, Class A3, | | | | |

| | | | 2.170%, 10/15/2013 | | | 2,386,859 | |

| | | | GE Capital Credit Card | | | | |

| | | | Master Note Trust | | | | |

| | 2,450,000 | | Series 2009-3, Class A, | | | | |

| | | | 2.540%, 09/15/2014 | | | 2,478,999 | |

| | | | GMAC Mortgage | | | | |

| | | | Corporation Loan Trust | | | | |

| | 1,921,232 | | Series 2006-HE3, Class A3, | | | | |

| | | | 5.805%, 10/25/2036 | | | 1,000,528 | |

| | | | GSAA Home Equity Trust | | | | |

| | 1,246,229 | | Series 2006-S1, Class 1A1, | | | | |

| | | | 0.507%, 01/25/2037 | | | 159,125 | |

| | | | Hertz Vehicle Financing LLC | | | | |

| | 595,833 | | Series 2005-1A, Class A4, | | | | |

| | | | 0.597%, 11/25/2011 | | | | |

| | | | (Acquired 08/21/2008 and | | | | |

| | | | 12/10/2008, Cost $575,908) (a)(b) | | | 594,393 | |

| | 733,333 | | Series 2005-2A, Class A5, | | | | |

| | | | 0.597%, 11/25/2011 | | | | |

| | | | (Acquired 08/01/2008 and | | | | |

| | | | 12/10/2008, Cost $713,583) (a)(b) | | | 731,561 | |

| | 1,825,000 | | Series 2009-2A, Class A1, | | | | |

| | | | 4.260%, 03/25/2014 | | | | |

| | | | (Acquired 10/16/2009, | | | | |

| | | | Cost $1,824,891) (a)(b) | | | 1,901,780 | |

| | | | Home Equity Mortgage Trust | | | | |

| | 4,384,619 | | Series 2006-5, Class A1, | | | | |

| | | | 5.500%, 01/25/2037 | | | 569,115 | |

| | | | Hyundai Auto Receivables Trust | | | | |

| | 4,140,000 | | Series 2009-A, Class A3, | | | | |

| | | | 2.030%, 08/15/2013 | | | 4,195,854 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund SCHEDULE OF INVESTMENTS (continued)

June 30, 2010

| Principal Amount | | Value | |

| | | | | | |

ASSET BACKED SECURITIES 10.3% (continued) | | | |

| | | Keystone Owner Trust | | | |

| $ | 6,224 | | Series 1998-P1, Class M1, | | | |

| | | | 7.530%, 05/25/2025 | | | |

| | | | (Acquired 12/10/2008, | | | |

| | | | Cost $5,734)(b) | | $ | 6,074 | |

| | | | Mid-State Trust | | | | |

| | 900,398 | | Series 11, Class A1, | | | | |

| | | | 4.864%, 07/15/2038 | | | 865,537 | |

| | | | Residential Funding Mortgage Securities | | | | |

| | 129,137 | | Series 2005-HS1, Class AI2, | | | | |

| | | | 4.660%, 09/25/2035 | | | 122,096 | |

| | 470,582 | | Series 2003-HS1, Class AI6, | | | | |

| | | | 3.830%, 02/25/2033 | | | 412,248 | |

| | 630,000 | | Series 2005-HS1, Class AI4, | | | | |

| | | | 5.110%, 09/25/2035 | | | 151,034 | |

| | 1,677,901 | | Series 2006-HSA1, Class A3, | | | | |

| | | | 5.230%, 02/25/2036 | | | 742,213 | |

| | 1,360,964 | | Series 2006-HSA1, Class A4, | | | | |

| | | | 5.490%, 02/25/2036 | | | 232,776 | |

| | 1,867,874 | | Series 2006-HSA1, Class A5, | | | | |

| | | | 5.310%, 02/25/2036 | | | 889,351 | |

| | 472,445 | | Series 2006-HSA2, Class AI2, | | | | |

| | | | 5.500%, 03/25/2036 | | | 426,161 | |

| | 1,160,000 | | Series 2006-HSA2, Class AI3, | | | | |

| | | | 5.543%, 03/25/2036 | | | 539,094 | |

| | 820,000 | | Series 2006-HSA2, Class AI4, | | | | |

| | | | 5.810%, 03/25/2036 | | | 164,609 | |

| | | | SACO I Trust | | | | |

| | 973,649 | | Series 2006-9, Class A1, | | | | |

| | | | 0.497%, 08/25/2036 | | | 169,518 | |

| | | | SLM Student Loan Trust | | | | |

| | 1,220,594 | | Series 2008-1, Class A1, | | | | |

| | | | 0.511%, 07/25/2013 | | | 1,221,347 | |

| | 3,479,380 | | Series 2008-2, Class A1, | | | | |

| | | | 0.613%, 01/25/2015 | | | 3,480,907 | |

| | | | Total Asset Backed Securities | | | | |

| | | | (Cost $47,423,273) | | | 43,092,754 | |

| | | | | |

| CORPORATE BONDS 24.5% | | | | |

| | | | | | | | |

| | | | Airlines 1.2% | | | | |

| | | | Northwest Airlines, Inc. | | | | |

| | 3,261,371 | | 7.027%, 11/01/2019 | | | 3,098,303 | |

| | | | United Airlines | | | | |

| | 1,899,132 | | 6.636%, 07/02/2022 | | | 1,747,202 | |

| | | | | | | 4,845,505 | |

| | | | Commercial Banks 1.2% | | | | |

| | | | Manufacturers & Traders Trust Co. | | | | |

| | 1,860,000 | | 5.629%, 12/01/2021 | | | 1,758,163 | |

| | | | Marshall & Ilsley Bank | | | | |

| | 3,405,000 | | 0.808%, 12/04/2012 (a) | | | 3,071,092 | |

| | | | | | | 4,829,255 | |

| | | | Consumer Finance 1.6% | | | | |

| | | | Ford Motor Credit Co. | | | | |

| | 1,540,000 | | 8.000%, 12/15/2016 | | | 1,574,790 | |

| | 1,605,000 | | 8.125%, 01/15/2020 | | | 1,638,211 | |

| | | | GMAC, Inc. | | | | |

| | 1,767,000 | | 6.750%, 12/01/2014 | | | 1,709,573 | |

| | 1,955,000 | | 8.300%, 02/12/2015 | | | | |

| | | | (Acquired 02/09/2010 and | | | | |

| | | | 03/04/2010, Cost $1,945,313) (b) | | | 1,979,437 | |

| | | | | | | 6,902,011 | |

| | | | Diversified Financial Services 7.1% | | | | |

| | | | Bank of America Corp. | | | | |

| | 1,730,000 | | 5.750%, 12/01/2017 | | | 1,794,150 | |

| | 4,270,000 | | 7.625%, 06/01/2019 | | | 4,891,319 | |

| | 1,630,000 | | 5.625%, 07/01/2020 | | | 1,642,947 | |

| | | | Capital One Bank | | | | |

| | 1,260,000 | | 8.800%, 07/15/2019 | | | 1,572,998 | |

| | | | Citigroup, Inc. | | | | |

| | 5,875,000 | | 8.500%, 05/22/2019 | | | 7,003,728 | |

| | | | Credit Suisse AG | | | | |

| | 1,605,000 | | 5.400%, 01/14/2020 | | | 1,595,794 | |

| | | | Goldman Sachs Group, Inc. / The | | | | |

| | 3,290,000 | | 6.000%, 06/15/2020 | | | 3,392,427 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund SCHEDULE OF INVESTMENTS (continued)

June 30, 2010

| Principal Amount | | Value | |

| | | | | | |

CORPORATE BONDS 24.5% (continued) | | | |

| | | | | | |

| | | Diversified Financial | | | |

| | | Services 7.1% (continued) | | | |

| | | Lehman Brothers Holdings | | | |

| $ | 7,000,000 | | 6.875%, 05/02/2018 | | | |

| | | | (Acquired 09/16/2008, | | | |

| | | | Cost $2,343,205) (d) | | $ | 1,426,250 | |

| | | | Lloyds TSB Bank PLC | | | | |

| | 2,525,000 | | 5.800%, 01/13/2020 | | | | |

| | | | (Acquired Multiple Dates, | | | | |

| | | | Cost $2,452,897) (b)(c) | | | 2,383,335 | |

| | | | Morgan Stanley | | | | |

| | 4,170,000 | | 5.500%, 01/26/2020 | | | 4,034,058 | |

| | | | | | | 29,737,006 | |

| | | | Diversified Telecommunication | | | | |

| | | | Services 0.3% | | | | |

| | | | Qwest Corp. | | | | |

| | 1,515,000 | | 7.125%, 11/15/2043 | | | 1,306,688 | |

| | | | | | | | |

| | | | Electric Utilities 5.0% | | | | |

| | | | AES Eastern Energy | | | | |

| | 1,235,524 | | 9.000%, 01/02/2017 | | | 1,272,590 | |

| | 3,020,000 | | 9.670%, 01/02/2029 | | | 3,261,600 | |

| | | | AES Red Oak LLC | | | | |

| | 253,485 | | 8.540%, 11/30/2019 | | | 250,317 | |

| | | | Borger Energy Funding | | | | |

| | 2,413,025 | | 7.260%, 12/31/2022 | | | | |

| | | | (Acquired 08/14/2008 and | | | | |

| | | | 12/10/2008, Cost $2,330,242) (b) | | | 2,250,146 | |

| | | | Bruce Mansfield Unit | | | | |

| | 843,751 | | 6.850%, 06/01/2034 | | | 881,432 | |

| | | | Homer City Funding LLC | | | | |

| | 4,060,060 | | 8.734%, 10/01/2026 | | | 3,735,255 | |

| | | | Indianapolis Power & Light Co. | | | | |

| | 1,100,000 | | 6.050%, 10/01/2036 | | | | |

| | | | (Acquired Multiple Dates, | | | | |

| | | | Cost $1,061,374) (b) | | | 1,173,199 | |

| | | | Indiantown Cogeneration LP | | | | |

| | 2,680,000 | | 9.770%, 12/15/2020 | | | 2,962,392 | |

| | | | Kiowa Power Partners LLC | | | | |

| | 584,512 | | 4.811%, 12/30/2013 | | | | |

| | | | (Acquired Multiple Dates, | | | | |

| | | | Cost $582,248) (b) | | | 594,255 | |

| | | | Mackinaw Power LLC | | | | |

| | 1,147,297 | | 6.296%, 10/31/2023 | | | | |

| | | | (Acquired Multiple Dates, | | | | |

| | | | Cost $1,109,805) (b) | | | 1,175,613 | |

| | | | Selkirk Cogen Funding Corp. | | | | |

| | 723,577 | | 8.980%, 06/26/2012 | | | 768,793 | |

| | | | Tenaska Gateway Partners Ltd. | | | | |

| | 539,477 | | 6.052%, 12/30/2023 | | | | |

| | | | (Acquired 05/31/2007 and | | | | |

| | | | 08/03/2007, Cost $539,477) (b) | | | 554,442 | |

| | | | Windsor Financing LLC | | | | |

| | 1,811,892 | | 5.881%, 07/15/2017 | | | | |

| | | | (Acquired Multiple Dates, | | | | |

| | | | Cost $1,633,223) (b) | | | 1,697,399 | |

| | | | | | | 20,577,433 | |

| | | | Industrial Consumer Services 0.3% | | | | |

| | | | ERAC USA Finance Company | | | | |

| | 975,000 | | 6.375%, 10/15/2017 | | | | |

| | | | (Acquired 10/23/2008 and | | | | |

| | | | 12/10/2008, Cost $744,635) (b) | | | 1,097,537 | |

| | | | | | | | |

| | | | Insurance 6.7% | | | | |

| | | | AIG, Inc. | | | | |

| | 2,020,000 | | 4.250%, 05/15/2013 | | | 1,949,300 | |

| | | | AIG Sunamerica | | | | |

| | 280,000 | | 0.000%, 07/26/2010 | | | 278,600 | |

| | | | AIG Sunamerica Global Financial | | | | |

| | 3,760,000 | | 6.300%, 05/10/2011 | | | | |

| | | | (Acquired Multiple Dates, | | | | |

| | | | Cost $3,640,140) (b) | | | 3,797,600 | |

| | 1,090,000 | | 6.900%, 03/15/2032 | | | | |

| | | | (Acquired 02/23/2010, | | | | |

| | | | Cost $1,014,310) (b) | | | 1,008,250 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund SCHEDULE OF INVESTMENTS (continued)

June 30, 2010

| Principal Amount | | Value | |

| | | | | | |

CORPORATE BONDS 24.5% (continued) | | | |

| | | | | | |

| | | Insurance 6.7% (continued) | | | |

| | | ASIF Global Financing XIX | | | |

| $ | 3,945,000 | | 4.900%, 01/17/2013 | | | |

| | | | (Acquired Multiple Dates, | | | |

| | | | Cost $3,878,206) (b) | | $ | 3,866,100 | |

| | | | Genworth Global Funding | | | | |

| | 430,000 | | 5.250%, 05/15/2012 | | | 442,427 | |

| | 2,590,000 | | 5.875%, 05/03/2013 | | | | |

| | | | (Acquired 02/10/2010, | | | | |

| | | | Cost $2,604,096) (b) | | | 2,677,902 | |

| | | | Hartford Financial | | | | |

| | | | Services Group, Inc. | | | | |

| | 965,000 | | 4.000%, 03/30/2015 | | | 947,421 | |

| | 560,000 | | 8.125%, 06/15/2038 | | | 508,200 | |

| | 1,350,000 | | 6.625%, 03/30/2040 | | | 1,253,572 | |

| | | | Jackson National Life Global Funding | | | | |

| | 830,000 | | 5.375%, 05/08/2013 | | | | |

| | | | (Acquired 05/01/2008 and | | | | |

| | | | 12/10/2008, Cost $825,359) (b) | | | 891,671 | |

| | | | Lincoln National Corp. | | | | |

| | 1,270,000 | | 6.250%, 02/15/2020 | | | 1,360,575 | |

| | 1,315,000 | | 7.000%, 06/15/2040 | | | 1,385,017 | |

| | | | Monumental Global Funding | | | | |

| | 1,605,000 | | 5.500%, 04/22/2013 | | | | |

| | | | (Acquired Multiple Dates, | | | | |

| | | | Cost $1,603,546) (b) | | | 1,716,698 | |

| | 885,000 | | 5.250%, 01/15/2014 | | | | |

| | | | (Acquired 05/06/2009 and | | | | |

| | | | 06/10/2009, Cost $835,130) (b) | | | 963,386 | |

| | | | Nationwide Life Global Fund | | | | |

| | 795,000 | | 5.450%, 10/02/2012 | | | | |

| | | | (Acquired 09/25/2007 and | | | | |

| | | | 12/10/2008, Cost $793,225) (b) | | | 824,856 | |

| | | | Prudential Financial, Inc. | | | | |

| | 1,080,000 | | 5.375%, 06/21/2020 | | | 1,093,798 | |

| | 1,295,000 | | 6.625%, 06/21/2040 | | | 1,317,910 | |

| | | | Prudential Holdings LLC | | | | |

| | 1,045,000 | | 7.245%, 12/18/2023 | | | | |

| | | | (Acquired 02/11/2010 and | | | | |

| | | | 04/08/2010, Cost $1,137,154) (b) | | | 1,171,905 | |

| | 490,000 | | 8.695%, 12/18/2023 | | | | |

| | | | (Acquired Multiple Dates, | | | | |

| | | | Cost $570,568) (b) | | | 585,241 | |

| | | | | | | 28,040,429 | |

| | | | Oil and Gas 0.4% | | | | |

| | | | Shell International Finance BV | | | | |

| | 1,885,000 | | 3.100%, 06/28/2015 | | | 1,914,170 | |

| | | | | | | | |

| | | | Oil, Gas & Consumable Fuels 0.8% | | | | |

| | | | Anadarko Petroleum Corporation | | | | |

| | 905,000 | | 6.200%, 03/15/2040 | | | 716,019 | |

| | | | El Paso Corp. | | | | |

| | 1,355,000 | | 7.000%, 06/15/2017 | | | 1,347,370 | |

| | | | Valero Energy Corp. | | | | |

| | 1,430,000 | | 6.125%, 02/01/2020 | | | 1,469,462 | |

| | | | | | | 3,532,851 | |

| | | | Total Corporate Bonds | | | | |

| | | | (Cost $97,423,067) | | | 102,782,885 | |

| | | | | |

| MORTGAGE BACKED SECURITIES 21.9% | | | | |

| | | | Bank of America | | | | |

| | | | Commercial Mortgage, Inc. | | | | |

| | 3,935,000 | | Series 2006-3, Class A4, | | | | |

| | | | 5.889%, 07/10/2044 | | | 3,996,971 | |

| | 4,440,000 | | Series 2009-UB1, Class A4, | | | | |

| | | | 5.621%, 06/24/2050 | | | | |

| | | | (Acquired 06/18/2009 and | | | | |

| | | | 07/07/2009, Cost $3,670,269) (b) | | | 4,708,724 | |

| | | | CitiMortgage Alternative Loan Trust | | | | |

| | 1,858,421 | | Series 2007-A4, Class 2A1, | | | | |

| | | | 5.500%, 04/25/2022 | | | 1,585,943 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund SCHEDULE OF INVESTMENTS (continued)

June 30, 2010

| Principal Amount | | Value | |

| | | | | | |

| MORTGAGE BACKED | | | |

SECURITIES 21.9% (continued) | | | |

| | | Credit Suisse First Boston | | | |

| | | Mortgage Securities Corp. | | | |

| $ | 306,375 | | Pool # 2005-10, | | | |

| | | | 5.000%, 09/25/2015 | | $ | 305,828 | |

| | 64,319 | | Pool # 2003-1, 7.000%, 02/25/2033 | | | 69,269 | |

| | | | Credit Suisse Mortgage | | | | |

| | 2,625,000 | | Pool #2009-RR1, | | | | |

| | | | 5.383%, 11/15/2016 | | | | |

| | | | (Acquired 07/09/2009 and | | | | |

| | | | 12/29/2009, Cost $2,154,493) (b) | | | 2,700,770 | |

| | | | FHLMC REMIC (e) | | | | |

| | 8,559,600 | | Series 3609, 4.000%, 12/15/2024 | | | 8,996,839 | |

| | 249,241 | | Series 2750, 4.000%, 05/15/2026 | | | 251,233 | |

| | | | FNMA Pool (e) | | | | |

| | 4,518,873 | | Pool #MA0357, 4.000%, 04/25/2019 | | | 4,778,598 | |

| | 4,518,005 | | Pool #931711, 4.000%, 08/01/2019 | | | 4,777,680 | |

| | 2,308,865 | | Pool #MA0174, 4.000%, 09/25/2019 | | | 2,441,568 | |

| | 5,055,926 | | Pool #MA0235, 4.000%, 09/25/2019 | | | 5,346,518 | |

| | 4,629,250 | | Pool #932108, 4.000%, 11/25/2019 | | | 4,895,318 | |

| | 15,161,453 | | Pool #MA0298, 4.000%, 06/25/2019 | | | 16,032,864 | |

| | 6,781,940 | | Pool #MA0380, 4.000%, 05/25/2020 | | | 7,171,736 | |

| | 727,158 | | Pool #464398, 5.970%, 01/25/2040 | | | 807,639 | |

| | 562,800 | | Pool #464400, 5.970%, 01/25/2040 | | | 625,090 | |

| | | | FNMA REMIC (e) | | | | |

| | 62,815 | | Series 1994-3, Class PL, | | | | |

| | | | 5.500%, 01/25/2024 | | | 69,540 | |

| | | | FNMA TBA (e) | | | | |

| | 2,552,637 | | Pool #000TBA, 3.330%, 01/01/2020 | | | 2,598,099 | |

| | | | GS Mortgage Securities Corp. II | | | | |

| | 2,445,811 | | Series 2007-EOP, Class A1, | | | | |

| | | | 0.444%, 03/06/2020 | | | | |

| | | | (Acquired Multiple Dates, | | | | |

| | | | Cost $2,372,656) (a)(b) | | | 2,367,455 | |

| | 4,405,000 | | Series 2007-GG10, Class A4, | | | | |

| | | | 5.999%, 08/10/2045 (a) | | | 4,330,867 | |

| | | | LB-UBS Commercial Mortgage Trust | | | | |

| | 1,280,000 | | Series 2007-C2, Class A3, | | | | |

| | | | 5.430%, 02/15/2040 | | | 1,283,869 | |

| | | | Master Asset Securitization Trust | | | | |

| | 207,338 | | Pool # 2004-3, 4.750%, 01/25/2014 | | | 211,569 | |

| | | | Morgan Stanley Mortgage Loan Trust | | | | |

| | 735,591 | | Series 2006-7, 5.000%, 06/25/2021 | | | 667,944 | |

| | | | Morgan Stanley REMIC Trust | | | | |

| | 4,045,000 | | Series 2009-GG10, Class A4A, | | | | |

| | | | 5.805%, 08/12/2045 | | | | |

| | | | (Acquired 01/04/2010 and | | | | |

| | | | 01/25/2010, Cost $3,784,247) (b) | | | 4,240,486 | |

| | | | Residential Accredit Loans, Inc. | | | | |

| | 991,855 | | Series 2005-QS3, Class A1, | | | | |

| | | | 5.000%, 03/25/2020 | | | 924,544 | |

| | 1,113,795 | | Series 2004-QS4, Class A1, | | | | |

| | | | 4.350%, 03/25/2034 | | | 1,096,989 | |

| | | | Wachovia Bank | | | | |

| | | | Commercial Mortgage Trust | | | | |

| | 1,220,000 | | Series 2006-C23, Class A4, | | | | |

| | | | 5.418%, 01/15/2045 | | | 1,272,140 | |

| | | | Wells Fargo Alternative Loan Trust | | | | |

| | 1,697,613 | | Series 2007-PA3, Class 6A1, | | | | |

| | | | 5.500%, 07/25/2022 | | | 1,376,109 | |

| | | | Wells Fargo Mortgage | | | | |

| | | | Backed Securities Trust | | | | |

| | 1,730,556 | | Pool # 2006-3, 5.500%, 03/25/2036 | | | 1,658,851 | |

| | | | Total Mortgage Backed Securities | | | | |

| | | | (Cost $87,082,916) | | | 91,591,050 | |

| | | | | |

| U.S. GOVERNMENT AGENCY ISSUE 3.6% | | | | |

| | | | FHLMC (e) | | | | |

| | 6,995,000 | | 0.308%, 09/19/2011 (a) | | | 6,993,223 | |

| | 8,060,000 | | 0.270%, 01/11/2012 (a) | | | 8,049,853 | |

| | | | Total U.S. Government | | | | |

| | | | Agency Issue | | | | |

| | | | (Cost $15,044,328) | | | 15,043,076 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund SCHEDULE OF INVESTMENTS (continued)

June 30, 2010

| Principal Amount | | Value | |

| | | | | | |

| U.S. TREASURY OBLIGATIONS 30.4% | | | |

| | | United States Treasury Bonds 1.7% | | | |

| $ | 6,645,000 | | 4.375%, 05/15/2040 | | $ | 7,186,966 | |

| | | | | | | | |

| | | | United States Treasury Notes 28.7% | | | | |

| | 50,635,000 | | 1.000%, 09/30/2011 | | | 50,983,116 | |

| | 40,685,000 | | 0.875%, 02/29/2012 | | | 40,902,665 | |

| | 7,255,000 | | 3.250%, 03/31/2017 | | | 7,644,956 | |

| | 13,430,000 | | 3.125%, 04/30/2017 | | | 14,038,540 | |

| | 6,265,000 | | 2.750%, 05/31/2017 | | | 6,397,154 | |

| | | | | | | 119,966,431 | |

| | | | Total U.S. Treasury Obligations | | | | |

| | | | (Cost $125,778,417) | | | 127,153,397 | |

| | | | | | | | |

| SHORT-TERM INVESTMENTS 14.0% | | | | |

| | | | Commercial Paper 13.3% | | | | |

| | 14,084,000 | | Intesa Funding LLC, | | | | |

| | | | 0.000%, 07/01/2010 | | | 14,084,000 | |

| | 41,400,000 | | U.S. Bank, N.A., | | | | |

| | | | 0.000%, 07/01/2010 | | | 41,400,000 | |

| | | | | | | 55,484,000 | |

| | | | Variable Rate Demand Notes 0.7% | | | | |

| | 3,074,877 | | American Family Financial | | | | |

| | | | Services, Inc., 0.100% (f) | | | 3,074,877 | |

| | | | Total Short-Term Investments | | | | |

| | | | (Cost $58,558,877) | | | 58,558,877 | |

| | | | | | | | |

| | | | Total Investments 104.7% | | | | |

| | | | (Cost $431,310,878) | | | 438,222,039 | |

| | | | | | | | |

| | | | Liabilities in Excess of | | | | |

| | | | Other Assets (4.7)% | | | (19,783,417 | ) |

| | | | | | | | |

| | | | TOTAL NET ASSETS 100.0% | | $ | 418,438,622 | |

| (b) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration normally to qualified institutional buyers. The total value of these securities amounted to $49,525,971 (11.8% of net assets) at June 30, 2010. |

| (c) | U.S. Dollar denominated security of a foreign issuer. |

| (d) | Security is in default. |

| (e) | Entity under conservatorship of the federal government. |

| (f) | Variable rate demand notes are considered short-term obligations and are payable upon demand. Interest rates change periodically on specified dates. The rates listed are as of June 30, 2010. |

ALLOCATION OF PORTFOLIO HOLDINGS

At June 30, 2010, the allocation of portfolio holdings as a percentage of the Fund’s total net assets were:

| Asset-Backed Securities | | | 10.3 | % | | U.S. Treasury Obligations | | | 30.4 | |

| Corporate Bonds | | | 24.5 | | | Short-Term Investments | | | 14.0 | |

| Mortgage-Backed Securities | | | 21.9 | | | Liabilities in Excess of Other Assets | | | (4.7 | ) |

U.S. Government Agency Issue | | | 3.6 | | | | | | 100.0 | % |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund SCHEDULE OF INVESTMENTS (continued)

June 30, 2010

Credit Default Swaps

| | | | | Rating of | | (Pay)/ | | | | | | | | | Unrealized | |

| | Reference | Buy/Sell | | Reference Entity | | Receive | | Fixed | | Expiration | | Notional | | | Appreciation/ | |

| Counterparty | Entity | Protection(1) | | (Moody’s/S&P) | | Fixed Rate | | Rate | | Date | | Value(2) | | | (Depreciation) | |

| JPMorgan | CDX North American | | | | | | | | | | | | | | | |

| | Investment Grade Index | Sell | | B2/B | | Receive | | 5.00% | | 6/20/15 | | $ | 4,460,000 | | | $ | 68,414 | |

| JPMorgan | CDX North American | | | | | | | | | | | | | | | | | |

| | High Yield Index | Sell | | Baa1/BBB | | Receive | | 1.00% | | 6/20/15 | | | 14,150,000 | | | | 62,411 | |

| JPMorgan | General Electric | | | | | | | | | | | | | | | | | |

| | Capital Corp. | Sell | | Aa2/AA+ | | Receive | | 1.00% | | 6/20/15 | | | 3,530,000 | | | | 77,133 | |

| | | | | | | | | | | | | $ | 22,140,000 | | | $ | 207,958 | |

| (1) | If the Fund is a seller of protection and a credit event occurs, as defined under the terms of that particular swap agreement, the Fund will either (i) pay to the buyer of protection an amount equal to the notional amount of the swap and take delivery of the referenced obligation or underlying securities comprising the referenced index or (ii) pay a net settlement amount in the form of cash or securities equal to the notional amount of the swap less the recovery value of the referenced obligation of underlying securities comprising the referenced index. |

| (2) | The maximum potential amount the Fund could be required to make as a seller of credit protection or receive as a buyer of credit protection if a credit event occurs as defined under the terms of that particular swap agreement. |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund STATEMENT OF ASSETS AND LIABILITIES

June 30, 2010

| Assets: | | | |

| Investments at value (cost $431,310,878) | | $ | 438,222,039 | |

| Interest receivable | | | 2,226,520 | |

| Deposit with broker and custodian for swaps | | | 440,055 | |

| Receivable for Fund shares sold | | | 519,587 | |

| Receivable for investments sold | | | 273,351 | |

| Unrealized appreciation on swaps | | | 207,958 | |

| Unrealized appreciation on foreign currency contracts | | | 343,893 | |

| Prepaid expenses and other assets | | | 188,254 | |

| Total assets | | | 442,421,657 | |

| Liabilities: | | | | |

| Payable for investments purchased | | | 22,422,239 | |

| Payable for Fund shares purchased | | | 10,532 | |

| Payable to the custodian | | | 610,687 | |

| Accrued investment advisory fee | | | 96,368 | |

| Accrued distribution and shareholder servicing fees | | | 4,385 | |

| Accrued expenses | | | 99,363 | |

| Swap payments received | | | 739,461 | |

| Total liabilities | | | 23,983,035 | |

| Net Assets | | $ | 418,438,622 | |

| Net Assets Consist of: | | | | |

| Paid in capital | | $ | 404,328,214 | |

| Undistributed net investment income | | | 2,076,318 | |

| Accumulated net realized gain on investments sold, swap contracts and foreign currency | | | 4,571,078 | |

| Net unrealized appreciation/(depreciation) on: | | | | |

| Investments | | | 6,911,161 | |

| Swap contracts | | | 207,958 | |

| Foreign currency | | | 343,893 | |

| Net Assets | | $ | 418,438,622 | |

| Capital Stock, $0.01 Par Value | | | | |

| Institutional Class Shares Authorized | | | 100,000,000 | |

| Class Y Shares Authorized | | | 50,000,000 | |

| Institutional Class: | | | | |

| Net Assets | | $ | 414,336,584 | |

| Issued and Outstanding | | | 12,670,375 | |

| Net Asset Value, Redemption Price and Offering Price Per Share | | $ | 32.70 | |

| Class Y: | | | | |

| Net Assets | | $ | 4,102,038 | |

| Issued and outstanding | | | 125,472 | |

| Net Asset Value, Redemption Price and Offering Price Per Share | | $ | 32.69 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund STATEMENT OF OPERATIONS

| | | Year Ended | |

| | | June 30, 2010 | |

| Investment Income: | | | |

| Interest income | | $ | 24,206,207 | |

| Total Investment Income | | | 24,206,207 | |

| | | | | |

| Expenses: | | | | |

| Investment advisory fees (Note 3) | | | 1,660,169 | |

| Fund administration and accounting fees | | | 117,318 | |

| Custody fees | | | 41,975 | |

| Federal and state registration fees | | | 43,430 | |

| Audit fees | | | 36,316 | |

| Legal fees | | | 36,034 | |

| Shareholder servicing fees | | | 33,513 | |

| Reports to shareholders | | | 13,745 | |

| Directors’ fees and related expenses | | | 8,395 | |

| Distribution and shareholder servicing fees - Class Y (Note 8) | | | 6,426 | |

| Compliance related expenses | | | 553 | |

| Other | | | 22,162 | |

| Total expenses before waiver and reimbursement | | | 2,020,036 | |

| Waiver and reimbursement of expenses by Adviser (Note 3) | | | (562,186 | ) |

| Net expenses | | | 1,457,850 | |

| Net Investment Income | | | 22,748,357 | |

| | | | | |

| Realized and Unrealized Gain (Loss) on Investments: | | | | |

| Net realized gain (loss) on : | | | | |

| Investments | | | 31,203,341 | |

| Swap contracts | | | 2,960,659 | |

| Foreign currency contracts | | | (513,824 | ) |

| Change in net unrealized appreciation/(depreciation) on: | | | | |

| Investments | | | 15,416,965 | |

| Swap contracts | | | (214,140 | ) |

| Foreign currency contracts | | | 343,893 | |

| Net Realized and Unrealized Gain on Investments | | | 49,196,894 | |

| Net Increase in Net Assets Resulting from Operations | | $ | 71,945,251 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund STATEMENTS OF CHANGES IN NET ASSETS

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| | | June 30, 2010 | | | June 30, 2009 | |

| Operations: | | | | | | |

| Net investment income | | $ | 22,748,357 | | | $ | 35,153,932 | |

| Net realized gain (loss) on: | | | | | | | | |

| Investments | | | 31,203,341 | | | | (8,895,311 | ) |

| Swap contracts | | | 2,960,659 | | | | 2,197,511 | |

| Foreign currency | | | (513,824 | ) | | | — | |

| Futures | | | — | | | | 831,878 | |

| Change in net unrealized appreciation/(depreciation) on: | | | | | | | | |

| Investments | | | 15,416,965 | | | | 354,573 | |

| Swap contracts | | | (214,140 | ) | | | 1,390,660 | |

| Foreign currency contracts | | | 343,893 | | | | — | |

| Net increase in net assets resulting from operations | | | 71,945,251 | | | | 31,033,243 | |

| Distributions Paid to Institutional Class Shareholders From: | | | | | | | | |

| Net investment income | | | (23,504,203 | ) | | | (33,077,660 | ) |

| Net realized gain | | | (16,735,772 | ) | | | (9,661,730 | ) |

| Net decrease in net assets resulting from distributions paid | | | (40,239,975 | ) | | | (42,739,390 | ) |

| Distributions Paid to Class Y Shareholders From: | | | | | | | | |

| Net investment income | | | (99,014 | ) | | | — | |

| Net realized gain | | | (71,341 | ) | | | — | |

| Net decrease in net assets resulting from distributions paid | | | (170,355 | ) | | | — | |

| Capital Share Transactions: | | | | | | | | |

| Shares sold - Institutional Class | | | 146,415,967 | | | | 110,670,953 | |

| Shares sold - Class Y | | | 4,020,332 | | | | — | |

| Shares issued to holders in reinvestment of distributions - Institutional Class | | | 33,641,301 | | | | 33,980,127 | |

| Shares issued to holders in reinvestment of distributions - Class Y | | | 170,089 | | | | — | |

| Shares redeemed - Institutional Class | | | (193,952,206 | ) | | | (170,148,652 | ) |

| Shares redeemed - Class Y | | | (102,907 | ) | | | — | |

| Net decrease in net assets resulting from capital share transactions | | | (9,807,424 | ) | | | (25,497,572 | ) |

| Total Increase (Decrease) in Net Assets | | | 21,727,497 | | | | (37,203,719 | ) |

| Net Assets: | | | | | | | | |

| Beginning of Period | | | 396,711,125 | | | | 433,914,844 | |

| End of Period (includes undistributed net investment income of $2,076,318 and $1,273,273 respectively) | | $ | 418,438,622 | | | $ | 396,711,125 | |

| Transactions In Shares – Institutional Class: | | | | | | | | |

| Shares sold | | | 4,546,295 | | | | 4,019,040 | |

| Shares issued to holders in reinvestment of distributions | | | 1,057,362 | | | | 1,277,512 | |

| Shares redeemed | | | (5,981,168 | ) | | | (6,367,246 | ) |

| Net decrease in shares outstanding | | | (377,511 | ) | | | (1,070,694 | ) |

| Transactions In Shares – Class Y: | | | | | | | | |

| Shares sold | | | 123,322 | | | | — | |

| Shares issued to holders in reinvestment of distributions | | | 5,351 | | | | — | |

| Shares redeemed | | | (3,201 | ) | | | — | |

| Net increase in shares outstanding | | | 125,472 | | | | — | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund FINANCIAL HIGHLIGHTS

| | | Institutional Class | |

| | | Year | | | Year | | | Year | | | Year | | | Year | |

| | | Ended | | | Ended | | | Ended | | | Ended | | | Ended | |

| | | June 30, | | | June 30, | | | June 30, | | | June 30, | | | June 30, | |

| | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| Net Asset Value, Beginning of Period | | $ | 30.40 | | | $ | 30.73 | | | $ | 30.40 | | | $ | 29.72 | | | $ | 31.50 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income (Loss) from | | | | | | | | | | | | | | | | | | | | |

| Investment Operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 1.84 | | | | 2.50 | | | | 1.48 | | | | 1.54 | | | | 1.41 | |

| Net realized and unrealized gain (loss) on investments | | | 3.80 | | | | 0.16 | | | | 0.61 | | | | 0.68 | | | | (1.30 | ) |

| Total Income from Investment Operations | | | 5.64 | | | | 2.66 | | | | 2.09 | | | | 2.22 | | | | 0.11 | |

| | | | | | | | | | | | | | | | | | | | | |

| Less Distributions: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (1.90 | ) | | | (2.33 | ) | | | (1.49 | ) | | | (1.54 | ) | | | (1.45 | ) |

| From net realized gain on investments | | | (1.44 | ) | | | (0.66 | ) | | | (0.27 | ) | | | — | | | | (0.44 | ) |

| Total Distributions | | | (3.34 | ) | | | (2.99 | ) | | | (1.76 | ) | | | (1.54 | ) | | | (1.89 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, End of Period | | $ | 32.70 | | | $ | 30.40 | | | $ | 30.73 | | | $ | 30.40 | | | $ | 29.72 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Return | | | 19.12 | % | | | 10.52 | % | | | 6.92 | % | | | 7.52 | % | | | 0.36 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Supplemental Data and Ratios: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 414,337 | | | $ | 396,711 | | | $ | 433,915 | | | $ | 276,830 | | | $ | 313,880 | |

| Ratio of expenses to average net assets | | | | | | | | | | | | | | | | | | | | |

| Before waivers and reimbursements | | | 0.49 | % | | | 0.49 | % | | | 0.49 | % | | | 0.50 | % | | | 0.50 | % |

| Net of waivers and reimbursements | | | 0.35 | % | | | 0.35 | % | | | 0.30 | % | | | 0.20 | % | | | 0.20 | % |

| Ratio of net investment income to average net assets | | | | | | | | | | | | | | | | | | | | |

| Before waivers and reimbursements | | | 5.35 | % | | | 8.68 | % | | | 4.68 | % | | | 4.65 | % | | | 4.29 | % |

| Net of waivers and reimbursements | | | 5.49 | % | | | 8.82 | % | | | 4.87 | % | | | 4.95 | % | | | 4.59 | % |

| Portfolio turnover rate | | | 1,006 | % | | | 424 | % | | | 1,093 | % | | | 978 | % | | | 1,247 | % |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund FINANCIAL HIGHLIGHTS

| | | Class Y | |

| | | Period | |

| | | Ended | |

| | | June 30, | |

| | | 2010(1) | |

| Net Asset Value, Beginning of Period | | $ | 33.08 | |

| | | | | |

| Income (Loss) from | | | | |

| Investment Operations: | | | | |

| Net investment income | | | 0.98 | |

| Net realized and unrealized gain on investments | | | 1.30 | |

| Total Income from Investment Operations | | | 2.28 | |

| | | | | |

| Less Distributions: | | | | |

| From net investment income | | | (1.23 | ) |

| From net realized gain on investments | | | (1.44 | ) |

| Total Distributions | | | (2.67 | ) |

| | | | | |

| Net Asset Value, End of Period | | $ | 32.69 | |

| | | | | |

| Total Return | | | 7.33 | %(2) |

| | | | | |

| Supplemental Data and Ratios: | | | | |

| Net assets, end of period (in thousands) | | $ | 4,102 | |

| Ratio of expenses to average net assets | | | | |

| Before waivers and reimbursements | | | 0.89 | %(3) |

| Net of waivers and reimbursements | | | 0.75 | %(3) |

| Ratio of net investment income to average net assets | | | | |

| Before waivers and reimbursements | | | 3.98 | %(3) |

| Net of waivers and reimbursements | | | 4.12 | %(3) |

| Portfolio turnover rate | | | 1,006 | %(2) |

| (1) | Commenced operations on November 12, 2009. |

The accompanying notes are an integral part of these financial statements.

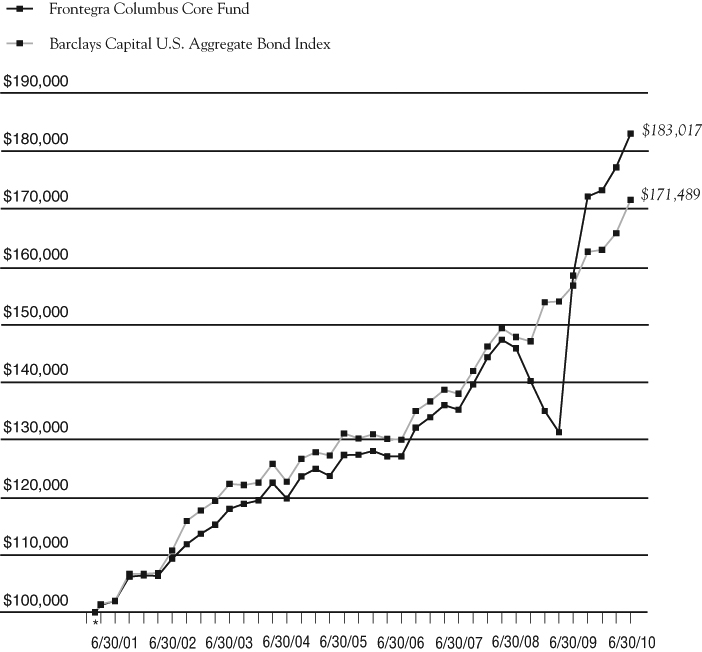

Growth of a $100,000 Investment (Unaudited)

* 2/23/01 commencement of operations.

| | | | | |

| | Portfolio Total Return** | | | |

| | FOR PERIODS ENDED 6/30/10 | FUND | INDEX | |

| | | | | |

| | SIX MONTHS | 5.73% | 5.33% | |

| | | | | |

| | ONE YEAR | 15.60% | 9.50% | |

| | | | | |

| | FIVE YEAR | | | |

| | AVERAGE ANNUAL | 7.54% | 5.54% | |

| | | | | |

| | SINCE COMMENCEMENT | | | |

| | AVERAGE ANNUAL | 6.68% | 5.94% | |

| | | | | |

This chart assumes an initial gross investment of $100,000 made on 2/23/01 (commencement of operations). Returns shown include the reinvestment of all distributions. Past performance is not predictive of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. In the absence of existing fee waivers, total return would be reduced. The recent growth rate in the fixed income market has helped to produce short-term returns for some asset classes that are not typical and may not continue in the future. Because of ongoing market volatility, Fund performance may be subject to substantial short-term changes. To receive current to the most recent month-end performance, please call 1-888-825-2100.

The Barclays Capital U.S. Aggregate Bond Index (formerly the Lehman Brothers Aggregate Bond Index) is an unmanaged market value-weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset backed and mortgage backed securities, with maturities of at least one year. The Index does not reflect investment management fees, brokerage commissions and other expenses associated with investing in fixed income securities. A direct investment in the index is not possible.

| ** | The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

Frontegra Columbus Core Fund SCHEDULE OF INVESTMENTS

June 30, 2010

| Principal Amount | | Value | |

| | | | | | |

| ASSET BACKED SECURITIES 9.2% | | | |

| | | Americredit Automobile | | | |

| | | Receivables Trust | | | |

| $ | 355,000 | | Series 2008-AF, Class A4, | | | |

| | | | 6.960%, 10/14/2014 | | $ | 379,391 | |

| | | | Capital One Multi-Asset | | | | |

| | | | Execution Trust | | | | |

| | 235,000 | | Series 2006-9A, Class A9, | | | | |

| | | | 0.365%, 05/15/2013 | | | 234,982 | |

| | | | Chase Issuance Trust | | | | |

| | 230,000 | | Series 2009-A7, Class A7, | | | | |

| | | | 0.800%, 09/17/2012 | | | 230,153 | |

| | 260,000 | | Series 2005-A13, Class A13, | | | | |

| | | | 0.390%, 02/15/2013 | | | 259,856 | |

| | | | Chrysler Financial Auto | | | | |

| | | | Securitization Trust | | | | |

| | 360,000 | | Series 2009-B, Class A-2, | | | | |

| | | | 1.150%, 11/08/2011 | | | 360,575 | |

| | | | Chrysler Financial Automobile TALF | | | | |

| | 155,000 | | Series 2009-AF, Class A3, | | | | |

| | | | 2.820%, 01/15/2016 | | | 158,080 | |

| | | | Credit Suisse Mortgage | | | | |

| | | | Capital Certificates | | | | |

| | 286,185 | | Series 2009-12R, Class 41A1, | | | | |

| | | | 5.250%, 03/27/2037 | | | | |

| | | | (Acquired 10/06/2009, | | | | |

| | | | Cost $285,112) (b) | | | 286,185 | |

| | | | Fifth Third Auto Trust | | | | |

| | 266,781 | | Series 2008-1, Class A3A, | | | | |

| | | | 4.070%, 01/17/2012 | | | 268,240 | |

| | | | Ford Credit Auto Owner Trust | | | | |

| | 550,000 | | Series 2009-A, Class A3B, | | | | |

| | | | 2.850%, 05/15/2013 | | | 560,608 | |

| | 375,000 | | Series 2009-D, Class A3, | | | | |

| | | | 2.170%, 10/15/2013 | | | 380,073 | |

| | | | GE Capital Credit Card | | | | |

| | | | Master Note Trust | | | | |

| | 385,000 | | Series 2009-3, Class A, | | | | |

| | | | 2.540%, 09/15/2014 | | | 389,557 | |

| | | | Hertz Vehicle Financing LLC | | | | |

| | 112,500 | | Series 2005-1A, Class A4, | | | | |

| | | | 0.597%, 11/25/2011 | | | | |

| | | | (Acquired 08/21/2008, | | | | |

| | | | Cost $109,487) (a)(b) | | | 112,228 | |

| | 166,667 | | Series 2005-2A, Class A5, | | | | |

| | | | 0.597%, 11/25/2011 | | | | |

| | | | (Acquired 08/01/2008, | | | | |

| | | | Cost $163,226) (a)(b) | | | 166,264 | |

| | 280,000 | | Series 2009-2A, Class A1, | | | | |

| | | | 4.260%, 03/25/2014 | | | | |

| | | | (Acquired 10/16/2009, | | | | |

| | | | Cost $279,983) (a)(b) | | | 291,780 | |

| | | | Hyundai Auto Receivables Trust | | | | |

| | 640,000 | | Series 2009-A, Class A3, | | | | |

| | | | 2.030%, 08/15/2013 | | | 648,634 | |

| | | | Keystone Owner Trust | | | | |

| | 28,009 | | Series 1998-P1, Class M1, | | | | |

| | | | 7.530%, 05/25/2025 | | | | |

| | | | (Acquired 04/22/2003, | | | | |

| | | | Cost $28,479) (b) | | | 27,333 | |

| | | | Mid-State Trust | | | | |

| | 127,230 | | Series 11, Class A1, | | | | |

| | | | 4.864%, 07/15/2038 | | | 122,304 | |

| | | | Sears Credit Account Master Trust | | | | |

| | 445,000 | | Series 2002-3, Class A, | | | | |

| | | | 1.000%, 05/17/2016 | | | 441,959 | |

| | | | SLM Student Loan Trust | | | | |

| | 201,969 | | Series 2008-1, Class A1, | | | | |

| | | | 0.511%, 07/25/2013 | | | 202,093 | |

| | 575,061 | | Series 2008-2, Class A1, | | | | |

| | | | 0.613%, 01/25/2015 | | | 575,313 | |

| | | | Total Asset Backed Securities | | | | |

| | | | (Cost $6,035,041) | | | 6,095,608 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Fund SCHEDULE OF INVESTMENTS (continued)

June 30, 2010

| Principal Amount | | Value | |

| | | | | | |

| CORPORATE BONDS 20.8% | | | |

| | | Airlines 0.7% | | | |

| | | Northwest Airlines, Inc. | | | |

| $ | 505,826 | | 7.027%, 11/01/2019 | | $ | 480,534 | |

| | | | | | | | |

| | | | Commercial Banks 1.2% | | | | |

| | | | Manufacturers & Traders Trust Co. | | | | |

| | 285,000 | | 5.629%, 12/01/2021 | | | 269,396 | |

| | | | Marshall & Ilsley Bank | | | | |

| | 570,000 | | 0.808%, 12/04/2012(a) | | | 514,103 | |

| | | | | | | 783,499 | |

| | | | Construction Materials 0.1% | | | | |

| | | | Lafarge Coppee SA | | | | |

| | 70,000 | | 6.500%, 07/15/2016 | | | 72,514 | |

| | | | | | | | |

| | | | Diversified Financial Services 7.3% | | | | |

| | | | Bank of America Corp. | | | | |

| | 80,000 | | 5.750%, 12/01/2017 | | | 82,966 | |

| | 660,000 | | 7.625%, 06/01/2019 | | | 756,035 | |

| | 245,000 | | 5.625%, 07/01/2020 | | | 246,946 | |

| | | | Capital One Bank | | | | |

| | 155,000 | | 8.800%, 07/15/2019 | | | 193,504 | |

| | | | Citigroup, Inc. | | | | |

| | 905,000 | | 8.500%, 05/22/2019 | | | 1,078,872 | |

| | | | Credit Suisse AG | | | | |

| | 245,000 | | 5.400%, 01/14/2020 | | | 243,595 | |

| | | | Goldman Sachs Group, Inc. / The | | | | |

| | 510,000 | | 6.000%, 06/15/2020 | | | 525,878 | |

| | | | JPMorgan Chase & Co. | | | | |

| | 280,000 | | 5.150%, 10/01/2015 | | | 299,580 | |

| | 230,000 | | 4.950%, 03/25/2020 | | | 239,028 | |

| | | | Lloyds TSB Bank PLC | | | | |

| | 370,000 | | 5.800%, 01/13/2020 | | | | |

| | | | (Acquired Multiple Dates, | | | | |

| | | | Cost $361,326) (b)(d) | | | 349,241 | |

| | | | Morgan Stanley | | | | |

| | 645,000 | | 5.500%, 01/26/2020 | | | 623,973 | |

| | | | Wachovia Corp. | | | | |

| | 130,000 | | 5.625%, 10/15/2016 | | | 140,305 | |

| | | | | | | 4,779,923 | |

| | | | Electric Utilities 2.8% | | | | |

| | | | Bruce Mansfield Unit | | | | |

| | 392,443 | | 6.850%, 06/01/2034 | | | 409,969 | |

| | | | Entergy Arkansas, Inc. | | | | |

| | 175,000 | | 5.000%, 07/01/2018 | | | 175,324 | |

| | | | Entergy Texas, Inc. | | | | |

| | 360,000 | | 3.600%, 06/01/2015 | | | 365,318 | |

| | | | Indianapolis Power & Light Co. | | | | |

| | 165,000 | | 6.050%, 10/01/2036 | | | | |

| | | | (Acquired Multiple Dates, | | | | |

| | | | Cost $152,372) (b) | | | 175,980 | |

| | | | Kiowa Power Partners LLC | | | | |

| | 163,859 | | 4.811%, 12/30/2013 | | | | |

| | | | (Acquired 11/22/2004 and | | | | |

| | | | 08/03/2007, Cost $163,625) (b) | | | 166,590 | |

| | | | Mackinaw Power LLC | | | | |

| | 279,195 | | 6.296%, 10/31/2023 | | | | |

| | | | (Acquired Multiple Dates, | | | | |

| | | | Cost $268,813) (b) | | | 286,086 | |

| | | | Ohio Power Co. | | | | |

| | 60,000 | | 6.000%, 06/01/2016 | | | 67,952 | |

| | | | Oncor Electric Delivery Co. LLC | | | | |

| | 175,000 | | 7.000%, 09/01/2022 | | | 210,970 | |

| | | | | | | 1,858,189 | |

| | | | Industrial Consumer Services 0.2% | | | | |

| | | | ERAC USA Finance Company | | | | |

| | 135,000 | | 6.375%, 10/15/2017 | | | | |

| | | | (Acquired 10/23/2008, | | | | |

| | | | Cost $103,631) (b) | | | 151,967 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Fund SCHEDULE OF INVESTMENTS (continued)

June 30, 2010

| Principal Amount | | Value | |

| | | | | | |

CORPORATE BONDS 20.8% (continued) | | | |

| | | Insurance 6.8% | | | |

| | | AIG Sunamerica Global Financial | | | |

| $ | 250,000 | | 6.300%, 05/10/2011 | | | |

| | | | (Acquired 09/30/2009, | | | |

| | | | Cost $248,081) (b) | | $ | 252,500 | |

| | | | ASIF Global Financing XIX | | | | |

| | 594,000 | | 4.900%, 01/17/2013 | | | | |

| | | | (Acquired Multiple Dates, | | | | |

| | | | Cost $587,401) (b) | | | 582,120 | |

| | 185,000 | | 6.900%, 03/15/2032 | | | | |

| | | | (Acquired 02/23/2010, | | | | |

| | | | Cost $172,154) (b) | | | 171,125 | |

| | | | Farmers Insurance Exchange | | | | |

| | 230,000 | | 6.000%, 08/01/2014 | | | | |

| | | | (Acquired 07/15/2009, | | | | |

| | | | Cost $198,841) (b) | | | 235,832 | |

| | | | Genworth Global Funding | | | | |

| | 450,000 | | 5.875%, 05/03/2013 | | | | |

| | | | (Acquired 11/25/2008 and | | | | |

| | | | 01/20/2009, Cost $328,962) (b) | | | 465,273 | |

| | | | Hartford Financial Services Group, Inc. | | | | |

| | 390,000 | | 4.000%, 03/30/2015 | | | 382,896 | |

| | | | Jackson National Life Global Funding | | | | |

| | 235,000 | | 5.375%, 05/08/2013 | | | | |

| | | | (Acquired Multiple Dates, | | | | |

| | | | Cost $235,360) (b) | | | 252,461 | |

| | | | Lincoln National Corp. | | | | |

| | 170,000 | | 6.250%, 02/15/2020 | | | 182,124 | |

| | 205,000 | | 7.000%, 06/15/2040 | | | 215,915 | |

| | | | Monumental Global Funding | | | | |

| | 390,000 | | 5.500%, 04/22/2013 | | | | |

| | | | (Acquired Multiple Dates, | | | | |

| | | | Cost $393,011) (b) | | | 417,142 | |

| | 135,000 | | 5.250%, 01/15/2014 | | | | |

| | | | (Acquired 0/10/2009 and | | | | |

| | | | 09/30/2009, Cost $130,306) (b) | | | 146,957 | |

| | | | Nationwide Life Global Fund | | | | |

| | 300,000 | | 5.450%, 10/02/2012 | | | | |

| | | | (Acquired 09/25/2007 and | | | | |

| | | | 09/30/2009, Cost $298,605) (b) | | | 311,266 | |

| | | | Prudential Financial, Inc. | | | | |

| | 165,000 | | 5.375%, 06/21/2020 | | | 167,108 | |

| | 205,000 | | 6.625%, 06/21/2040 | | | 208,626 | |

| | | | Prudential Holdings LLC | | | | |

| | 360,000 | | 8.695%, 12/18/2023 | | | | |

| | | | (Acquired 01/06/2010, | | | | |

| | | | Cost $421,073) (b) | | | 429,973 | |

| | | | | | | 4,421,318 | |

| | | | Oil and Gas 0.6% | | | | |

| | | | Merey Sweeny LP | | | | |

| | 330,260 | | 8.850%, 12/18/2019 | | | | |

| | | | (Acquired 01/19/2010, | | | | |

| | | | Cost $378,594) (b) | | | 391,041 | |

| | | | | | | | |

| | | | Oil and Gas Extraction 0.6% | | | | |

| | | | Devon OEI Operating, Inc. | | | | |

| | 345,000 | | 7.500%, 09/15/2027 | | | 412,024 | |

| | | | | | | | |

| | | | Support Activities for Mining 0.5% | | | | |

| | | | Shell International Finance BV | | | | |

| | 290,000 | | 3.100%, 06/28/2015 | | | 294,488 | |

| | | | Total Corporate Bonds | | | | |

| | | | (Cost $12,912,752) | | | 13,645,497 | |

| | | | | |

| MORTGAGE BACKED SECURITIES 19.8% | | | | |

| | | | Bank of America | | | | |

| | | | Commercial Mortgage, Inc. | | | | |

| | 385,000 | | Series 2006-3, Class A4, | | | | |

| | | | 5.889%, 07/10/2044 | | | 391,063 | |

| | 725,000 | | Series 2009-UB1, Class A4, | | | | |

| | | | 5.621%, 06/24/2050 | | | | |

| | | | (Acquired Multiple Dates, | | | | |

| | | | Cost $611,344) (b) | | | 768,879 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Fund SCHEDULE OF INVESTMENTS (continued)

June 30, 2010

| Principal Amount | | Value | |

| | | | | | |

| MORTGAGE BACKED | | | |

SECURITIES 19.8% (continued) | | | |

| | | CitiMortgage Alternative Loan Trust | | | |

| $ | 1,037,782 | | Series 2007-A7, Class 3A1, | | | |

| | | | 5.750%, 07/25/2022 | | $ | 880,193 | |

| | | | Credit Suisse First Boston | | | | |

| | | | Mortgage Securities Corp. | | | | |

| | 81,099 | | Pool # 2005-10, 5.000%, 09/25/2015 | | | 80,954 | |

| | 18,341 | | Pool # 2003-1, 7.000%, 02/25/2033 | | | 19,753 | |

| | | | Fannie Mae-Aces (c) | | | | |

| | 249,249 | | Series 2010-M1, Class A1, | | | | |

| | | | 3.305%, 06/25/2019 | | | 256,550 | |

| | | | FHLMC REMIC (c) | | | | |

| | 1,470,227 | | Series 3609, 4.000%, 12/15/2024 | | | 1,545,329 | |

| | 37,676 | | Series 2750, 4.000%, 05/15/2026 | | | 37,977 | |

| | | | FNMA Pool (c) | | | | |

| | 27,651 | | Pool #735065, 4.498%, 08/25/2013 | | | 29,237 | |

| | 624,951 | | Pool #MA0357, 4.000%, 04/25/2019 | | | 660,870 | |

| | 596,066 | | Pool #931711, 4.000%, 08/25/2019 | | | 630,325 | |

| | 244,417 | | Pool #MA0174, 4.000%, 09/25/2019 | | | 258,465 | |

| | 657,462 | | Pool #932108, 4.000%, 11/25/2019 | | | 695,250 | |

| | 957,260 | | Pool #MA0235, 4.000%, 09/25/2019 | | | 1,012,279 | |

| | 2,195,218 | | Pool #MA0298, 4.000%, 06/25/2019 | | | 2,321,389 | |

| | 954,316 | | Pool #MA0380, 4.000%, 05/25/2020 | | | 1,009,166 | |

| | 124,513 | | Pool #464398, 5.970%, 01/25/2040 | | | 138,294 | |

| | 94,630 | | Pool #464400, 5.970%, 01/25/2040 | | | 105,104 | |

| | | | FNMA TBA (c) | | | | |

| | 396,432 | | Pool #000TBA, 3.330%, 01/01/2020 | | | 403,493 | |

| | | | GS Mortgage Securities Corp. II | | | | |

| | 358,477 | | Series 2007-EOP, Class A1, | | | | |

| | | | 0.444%, 03/06/2020 | | | | |

| | | | (Acquired 09/17/2007 through | | | | |

| | | | 04/22/2008, Cost $352,035) (a)(b) | | | 346,992 | |

| | | | LB-UBS Commercial Mortgage Trust | | | | |

| | 125,000 | | Series 2007-C2, Class A3, | | | | |

| | | | 5.430%, 02/15/2040 | | | 125,378 | |

| | | | Master Asset Securitization Trust | | | | |

| | 54,782 | | Pool # 2004-3, 4.750%, 01/25/2014 | | | 55,900 | |

| | | | Morgan Stanley REMIC Trust | | | | |

| | 675,000 | | Series 2009-GG10, Class A4A, | | | | |

| | | | 5.805%, 08/12/2045 | | | | |

| | | | (Acquired 01/04/2010 and | | | | |

| | | | 01/25/2010, Cost $631,056) (b) | | | 707,621 | |

| | | | Residential Accredit Loans, Inc. | | | | |

| | 233,506 | | Series 2004-QS4, Class A1, | | | | |

| | | | 4.350%, 03/25/2034 | | | 229,983 | |

| | | | Residential Asset Securitization Trust | | | | |

| | 140,277 | | Series 2003-A6, Class A1, | | | | |

| | | | 4.500%, 07/25/2033 | | | 137,471 | |

| | | | Wachovia Bank Commercial Mortgage Trust | | | | |

| | 205,000 | | Series 2006-C23, Class A4, | | | | |