UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-07685 |

|

Frontegra Funds, Inc. |

(Exact name of registrant as specified in charter) |

|

400 Skokie Blvd. Suite 500 Northbrook, Illinois | | 60062 |

(Address of principal executive offices) | | (Zip code) |

|

William D. Forsyth III 400 Skokie Blvd., Suite 500 Northbrook, Illinois 60062 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (847) 509-9860 | |

|

Date of fiscal year end: | June 30 | |

|

Date of reporting period: | June 30, 2014 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

ANNUAL REPORT

Frontegra RobecoSAM Global Equity Fund

Frontegra MFG Global Equity Fund

Frontegra MFG Core Infrastructure Fund

Frontegra Timpani Small Cap Growth Fund

Frontegra Netols Small Cap Value Fund

Frontegra Phocas Small Cap Value Fund

Frontegra Asset Management, Inc.

June 30, 2014

TABLE OF CONTENTS

Shareholder Letter | | | 1 | | |

Frontegra RobecoSAM Global Equity Fund | |

Report from RobecoSAM USA, Inc. | | | 4 | | |

Investment Highlights | | | 6 | | |

Frontegra MFG Global Equity Fund | |

Report from MFG Asset Management | | | 8 | | |

Investment Highlights | | | 10 | | |

Frontegra MFG Core Infrastructure Fund | |

Report from MFG Asset Management | | | 12 | | |

Investment Highlights | | | 14 | | |

Frontegra Timpani Small Cap Growth Fund | |

Report from Timpani Capital Management LLC | | | 16 | | |

Investment Highlights | | | 18 | | |

Frontegra Netols Small Cap Value Fund | |

Report from Netols Asset Management, Inc. | | | 20 | | |

Investment Highlights | | | 21 | | |

Frontegra Phocas Small Cap Value Fund | |

Report from Phocas Financial Corporation | | | 24 | | |

Investment Highlights | | | 25 | | |

Expense Example | | | 26 | | |

Schedules of Investments | |

Frontegra RobecoSAM Global Equity Fund | | | 29 | | |

Frontegra MFG Global Equity Fund | | | 31 | | |

Frontegra MFG Core Infrastructure Fund | | | 32 | | |

Frontegra Timpani Small Cap Growth Fund | | | 35 | | |

Frontegra Netols Small Cap Value Fund | | | 37 | | |

Frontegra Phocas Small Cap Value Fund | | | 39 | | |

Statements of Assets and Liabilities | | | 42 | | |

Statements of Operations | | | 44 | | |

Statements of Changes in Net Assets | | | 46 | | |

Financial Highlights | | | 49 | | |

Notes to Financial Statements | | | 57 | | |

Report of Independent Registered Public Accounting Firm | | | 65 | | |

Board of Directors' Approval of Advisory and Subadvisory Agreements | | | 66 | | |

Additional Information | |

Directors and Officers | | | 73 | | |

Foreign Tax Credit | | | 78 | | |

Qualified Dividend Income/Dividends Received Deduction | | | 79 | | |

Additional Information Applicable to Foreign Shareholders Only | | | 79 | | |

This report is submitted for the general information of the shareholders of the Funds. It is not authorized for distribution to prospective investors unless accompanied or preceded by an effective Prospectus for the applicable Fund. The Prospectus may be obtained by calling 1-888-825-2100. Each Prospectus includes more complete information about management fees and expenses, investment objectives, risks and operating policies of the applicable Fund. Please read the Prospectus carefully.

Frontegra Funds, Inc. are distributed by Frontegra Strategies, LLC, 400 Skokie Blvd., Suite 500, Northbrook, IL 60062. Frontegra Strategies, LLC, member of FINRA and SIPC, is an affiliate of Frontegra Asset Management, Inc., the Funds' investment adviser.

DEAR FELLOW SHAREHOLDERS:

As we embark on a new fiscal year, I want to inform you of a name change for the funds — from the Frontegra Funds to the Frontier Funds — that will formally take place in the fourth quarter of 2014. Absolutely nothing will change with regard to your investments or the advisers and subadvisers managing the funds; the name change is strictly cosmetic in nature.

We are pleased to report on the progress of the Frontegra Funds over the past twelve months ending June 30, 2014. The S&P 500 Index was up 24.61%, and small capitalization stocks were up, with the Russell 2000® Index returning 23.64%. International stocks, as measured by the MSCI EAFE Index, returned 23.57% over the twelve-month period.

Fund Results

For the twelve month period ending June 30, 2014, the Frontegra RobecoSAM Global Equity Fund, managed by RobecoSAM USA, returned 22.72% (net) versus the MSCI World Index (Net) return of 24.05%.

The Frontegra MFG Global Equity Fund, managed by MFG Asset Management, returned 15.76% (net) versus the MSCI World Index (Net) return of 24.05% for the twelve month period ending June 30, 2014.

The Frontegra MFG Core Infrastructure Fund, also managed by MFG Asset Management, returned 24.22% (net) versus the UBS Developed Infrastructure & Utilities Index (Net) return of 24.70% and the MSCI World Index (Net) return of 24.05% for the twelve month period ending June 30, 2014.

The Frontegra Timpani Small Cap Growth Fund — Institutional Class, managed by Timpani Capital Management, returned 24.16% (net) versus the Russell 2000® Growth Index return of 24.73% for the twelve month period ending June 30, 2014. The Class Y shares returned -1.90% (net) since inception on January 6, 2014, versus the Russell 2000® Growth Index return of 3.63%.

For the twelve month period ending June 30, 2014, the Frontegra Netols Small Cap Value Fund — Institutional Class, managed by Netols Asset Management, returned 24.63% (net) versus the Russell 2000® Value Index return of 22.54%. The Class Y shares returned 23.84% (net) over the same time period.

The Frontegra Phocas Small Cap Value Fund, managed by Phocas Financial, returned 32.72% (net) versus the Russell 2000 Value Index return of 22.54% for the twelve month period ending June 30, 2014.

Outlook

As of mid-2014, developed equity markets around the globe have performed remarkably well over the past twelve months, especially in North America and Europe. Moreover, the unemployment rate in the U.S. has dropped appreciably over the same period. Despite relatively rosy equity markets, fixed income markets have produced far more modest returns, and there is continuing speculation as to how the unwinding of the Fed's quantitative easing program will impact markets around the world. As we enter a new fiscal year, we will work as judiciously as ever to manage your assets with the skill and agility necessary in these vacillating markets.

We will continue to oversee the investment management of the Frontegra Funds with the care and diligence that have served our shareholders well in the past. As always, we appreciate your investment and continued confidence in the Frontegra Funds.

Best regards,

William D. Forsyth, CFA

President

Frontegra Funds, Inc.

page 1

This page intentionally left blank.

FRONTEGRA

ROBECOSAM GLOBAL EQUITY FUND

REPORT FROM ROBECOSAM USA, INC.

Dear Shareholders:

The Frontegra RobecoSAM Global Equity Fund strives to achieve capital appreciation by investing in a diversified portfolio of equity and equity-related securities issued by U.S. and non-U.S. companies that combine their market and financial strategy with a high level of environmental awareness and a clearly defined social policy. The Fund's performance is measured against the MSCI World Index (Net).

Performance Review

The Frontegra RobecoSAM Global Equity Fund returned 22.72%, net of fees, for the year ended June 30, 2014. The Fund underperformed the 24.05% return of its benchmark, the MSCI World Index (Net).

The portfolio's underperformance relative to the benchmark is primarily attributed to weak stock selection within Health Care, Information Technology and Consumer Discretionary. Stock selection had a positive contribution within the Energy, Telecommunication Services and Consumer Staples sectors.

The largest positive contributions at the stock level included overweight positions in Japanese oil and gas company Inpex, telecom operator Swisscom and U.S. energy company ONEOK. ONEOK's outperformance was driven by strong business fundamentals which led the company to increase the dividend in the first quarter by USD 0.16 to USD 0.56 per share. Swisscom's positive stock performance reflects a solid underlying business. Inpex's strong outperformance in the Energy sector was supported by good earnings results and also the confirmation that one of the largest liquefied natural gas projects, Ichthys, is progressing on schedule. The largest negative contributors included positions in IBM (IT), Barclays (Financials) and Pfizer (Health Care). Pfizer's underperformance over the period follows the decision to drop its takeover bid for UK pharmaceutical firm AstraZeneca.

The portfolio sector allocation was positioned with overweights in Energy, Consumer Staples and Telecommunication Services combined with underweight positions in Financials, Materials, Industrials and Consumer Discretionary. In terms of performance contribution, sector allocation had a slight negative impact.

Portfolio Outlook and Strategy

Over the period, sentiment on the global equity market has remained positive. The positive momentum was largely driven by still very accommodative global monetary conditions which have caused investors to seek exposure to the equity markets. In Europe, the European Central Bank announced an aggressive monetary policy action to fight the threat of deflation. The package of measures includes cuts to its policy rates, negative rates on its deposit facility and a so-called targeted longer-term refinancing operation (TLTRO). The TLTRO will provide cheap, fixed rate four year funding to European banks. The goal is to discourage banks from using the cheap public funds to buy sovereign bonds by giving them an incentive to increase credit origination and ultimately increase lending activity to the real economy.

On the macroeconomic front, it is worth highlighting the data released for Chinese manufacturing activity. The HSBC Chinese PMI Index rose to 50.7 in June from 49.4 in May. This was the first time this year that the index moved above 50. The recovery in the eurozone manufacturing sector was extended to a twelfth successive month in June. However, the upturn is losing momentum. The Markit Eurozone Manufacturing PMI dipped to a seven-month low of 51.8 down from 52.2 in the prior month. The average figure for the second quarter was also slightly below that for the first quarter.

page 4

In the coming quarters, we expect global monetary conditions to remain highly accommodative. Our focus remains on investing in sustainable companies with attractive valuations and stable earnings outlooks. We also maintain an underweight in sectors where earnings visibility and valuation upside is limited, such as Financials, Industrials and Materials. Our outlook for the Financial sector remains cautious, and our approach in this space remains very selective with focus on companies with solid cash generation, strong balance sheets and acceptable leverage. In addition, we remain underweight in Materials. Such positioning comes mainly from not investing in large benchmark holdings in the mining and chemical space where we see limited investment opportunities.

Sincerely,

Diego d'Argenio

RobecoSAM USA, Inc.

page 5

INVESTMENT HIGHLIGHTS

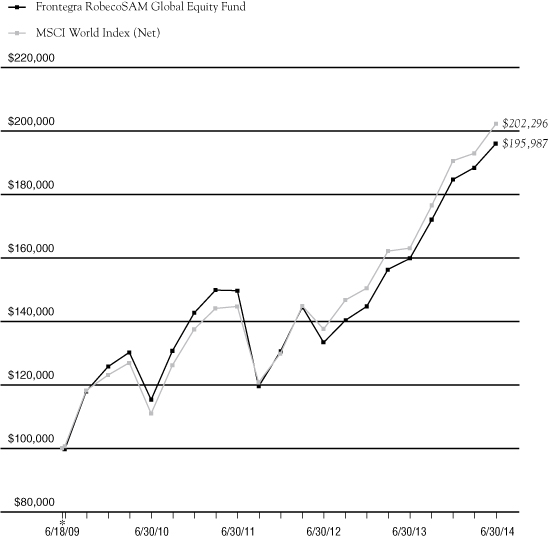

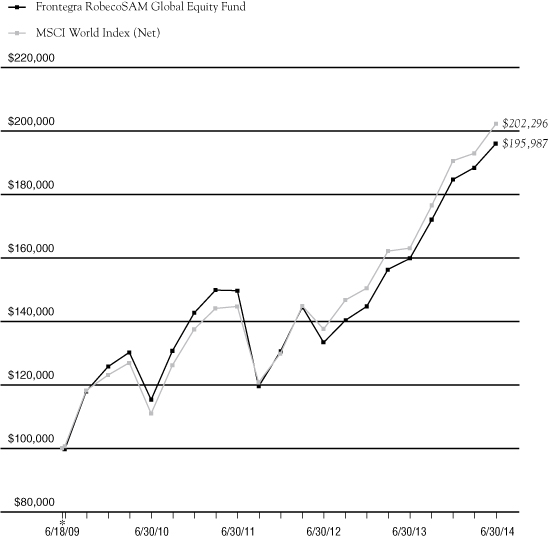

Growth of a $100,000 Investment (Unaudited)

* 6/18/09 commencement of operations.

This chart assumes an initial gross investment of $100,000 made on 6/18/09 (commencement of operations). Returns shown include the reinvestment of all distributions. Past performance is not predictive of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. In the absence of existing fee waivers, total return would be reduced. Effective June 10, 2011, RobecoSAM USA, Inc. ("RobecoSAM") became subadviser to the Fund and Frontegra Asset Management, Inc. became adviser to the Fund. Prior to June 10, 2011, RobecoSAM served as adviser to the Fund. Effective February 20, 2013, the Fund changed its name from Frontegra SAM Global Equity Fund to Frontegra RobecoSAM Global Equity Fund. To receive current to the most recent month-end performance, please call 1-888-825-2100.

The MSCI World Index measures the overall performance of stock markets in 24 developed market countries in North America, Europe, and the Asia/Pacific Region. The Index does not reflect investment management fees, brokerage commissions and other expenses associated with investing in equity securities. A direct investment in the index is not possible.

Frontegra Asset Management, Inc. has contractually agreed through October 31, 2015 to waive its management fee and/or reimburse the Fund's operating expenses to the extent necessary to ensure that the Fund's total operating expenses (excluding taxes, interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) do not exceed 1.20% of the Fund's average daily net assets. The expense ratios presented are based on the annualized expense ratios as reported in the Fund's current prospectus, which may differ from the expense ratios presented in the Fund's financial highlights.

** The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Portfolio Total Return**

FOR PERIODS

ENDED 6/30/14 | | FUND | | INDEX | |

SIX MONTHS | | | 6.17 | % | | | 6.18 | % | |

ONE YEAR | | | 22.72 | % | | | 24.05 | % | |

FIVE YEAR

AVERAGE ANNUAL | | | 14.47 | % | | | 14.99 | % | |

AVERAGE ANNUAL

SINCE INCEPTION | | | 14.30 | % | | | 15.03 | % | |

Fund Expenses | |

GROSS EXPENSE RATIO | | | 1.63 | % | |

NET EXPENSE RATIO | | | 1.20 | % | |

page 6

FRONTEGRA

MFG GLOBAL EQUITY FUND

REPORT FROM MFG ASSET MANAGEMENT

Dear Fellow Shareholders:

The investment objective of the Frontegra MFG Global Equity Fund is capital appreciation. The Fund's performance is measured against the MSCI World Index (Net).

Performance Review

The Frontegra MFG Global Equity Fund returned 15.76%, net of fees, for the year ended June 30, 2014. The Fund's return underperformed the 24.05% return of its benchmark, the MSCI World Index (Net).

We feel strongly that people cannot retire on "relative investment returns"; only by generating investment returns that exceed the rate of inflation (ideally by a satisfactory margin) will investors increase their wealth over time. As such, we are happy to be judged on the absolute returns of our strategy over time.

Fund Outlook and Strategy

In general, equity markets have been strong over the past twelve months. This is reflected in the performance of the MSCI World Index (Net) which has risen by 24.05%. The current investment environment is extraordinary. Many world equity indices ended June at or near all-time record highs. The 10-year bond yields of Spanish, Irish and Italian government debt closed below 2.85%, credit default swaps on major banks are now below 2007 levels, and the European Central Bank has recently reduced the interest rate on deposits by banks to minus 0.1%.

We continue to see capital flows that are distorting markets and causing asset prices and currencies to diverge from underlying economic trends. The enormous U.S.$600 billion per annum quantitative easing (QE) being undertaken by the Bank of Japan, as part of Prime Minister Abe's economic plan, is encouraging Japanese banks, insurers and pension funds to sell Japanese government bonds and invest in other assets, including foreign sovereign bonds. This may, in part, explain the rally in U.S. and European government bonds over the past 6 months (as well as the strong Australian dollar), when economic data would have suggested that the opposite might have been expected. We also note recent reports that China's State Administration of Foreign Exchange, which manages China's vast foreign exchange reserves, has become the world's largest public sector equity investor; elsewhere, numerous other central banks have also increased their exposure to equity markets.

Against this backdrop, we would expect the Fund to lag general equity market indices. Despite this, we will not chase momentum and will always have a conservative, defensive bias built into our portfolio. As Warren Buffett has often said, "To finish first you must first finish."

It is a little surreal that equity market volatility and other risk measures appear benign as we edge closer to a cycle of increasing long-term interest rates, with the U.S. Federal Reserve and the Bank of England ending their QE programmes and China appearing to be entering a period of lower growth. While we are not predicting a major downturn in equity markets (in the absence of a major global event), they have become more challenging and value has become harder to find as share prices have continued to rise. While nothing is certain in investing, we predict that the next three years will be challenging for equities as they battle the headwind of rising long-term interest rates.

The Fund

The Fund was invested in 28 companies on June 30, 2014, compared to 25 on June 30, 2013. The top ten investments represented 52.7% of the Fund, while they represented 51.6% on June 30, 2013. Over the twelve months ending June 30, 2014, the three stocks with the strongest returns in local currency were DIRECTV (+43.3%), Bank of New York Mellon (+35.8%) and Oracle (+33.2%), while the stocks with the weakest returns were Target (-13.9%), Tesco (-10.4%) and Adidas (-9.9%). On an absolute basis, the three largest stock

page 8

contributors, in local currency, were Oracle, DIRECTV and Microsoft which added +1.9%, +1.7% and +1.6%, respectively. Conversely, the three bottom contributors were Target, Tesco and Adidas which detracted -0.7%, -0.6% and -0.2%, respectively. Over the past twelve months, we have made the following major changes to the portfolio:

• We added a new position in global beverages giant Diageo, enterprise software vendor SAP and European pharmaceutical Sanofi.

• In September 2013, we also made a new investment in DIRECTV, the world's largest pay television company by subscriber numbers. Our initial purchase price was around $60 per share. In May 2014, AT&T made a cash and share takeover offer which valued DIRECTV at $95 per share. The transaction is subject to regulatory and shareholder approval and, assuming AT&T receives the necessary approvals, is anticipated to close in around twelve months. DIRECTV is currently trading at around $85 per share, reflecting the transaction uncertainty and time to completion.

• We exited the holding in Colgate-Palmolive and reduced the positions in Google, American Express, McDonald's and Johnson & Johnson.

• We increased the positions in Nestle, Visa, Target and Tesco.

Sincerely,

Hamish Douglass

Portfolio Manager

MFG Asset Management

page 9

INVESTMENT HIGHLIGHTS

Growth of a $1,000,000 Investment (Unaudited)

* 12/28/11 commencement of operations.

This chart assumes an initial gross investment of $1,000,000 made on 12/28/11 (commencement of operations). Returns shown include the reinvestment of all distributions. Past performance is not predictive of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. In the absence of existing fee waivers, total return would be reduced. To receive current to the most recent month-end performance, please call 1-888-825-2100.

The MSCI World Index measures the overall performance of stock markets in 24 developed market countries in North America, Europe, and the Asia/Pacific Region. The Index does not reflect investment management fees, brokerage commissions and other expenses associated with investing in equity securities. A direct investment in the index is not possible.

Frontegra Asset Management, Inc. has contractually agreed through October 31, 2015 to waive its management fee and/or reimburse the Fund's operating expenses to the extent necessary to ensure that the Fund's total operating expenses (excluding taxes, interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) do not exceed 0.80% of the Fund's average daily net assets. The expense ratios presented are based on the annualized expense ratios as reported in the Fund's current prospectus, which may differ from the expense ratios presented in the Fund's financial highlights.

** The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Portfolio Total Return**

FOR PERIODS ENDED 6/30/14 | | FUND | | INDEX | |

SIX MONTHS | | | 2.68 | % | | | 6.18 | % | |

ONE YEAR | | | 15.76 | % | | | 24.05 | % | |

AVERAGE ANNUAL

SINCE INCEPTION | | | 20.18 | % | | | 19.94 | % | |

Fund Expenses | |

GROSS EXPENSE RATIO | | | 0.97 | % | |

NET EXPENSE RATIO | | | 0.80 | % | |

page 10

FRONTEGRA

MFG CORE INFRASTRUCTURE FUND

REPORT FROM MFG ASSET MANAGEMENT

Dear Fellow Shareholders:

The investment objective of the Frontegra MFG Core Infrastructure Fund is long-term capital appreciation. The Fund's performance is measured against the UBS Developed Infrastructure & Utilities Index (Net).

The types of infrastructure assets in which the Fund invests are natural monopolies that provide an essential service to the community. Infrastructure assets offer investors protection from the impacts of inflation because their earnings generally have some direct linkage to inflation. Over time, the stable, reliable earnings of infrastructure assets are expected to lead to a combination of income and capital growth for investors.

The universe of infrastructure assets that are held by the Fund is made up of two main sectors:

• Utilities, including both regulated energy utilities and regulated water utilities. Utilities comprise approximately 70% of the Fund. Utilities are typically subject to economic regulation. This requires the utility to efficiently provide an essential service to the community and, in return, permits the utility to earn a fair rate of return on the capital it has invested in its operations. As the utility provides a basic necessity, e.g. energy or water, there is minimal fluctuation in demanded volumes in response to the economic cycle and the price charged for the utility service can be adjusted with limited impact upon demand volumes. As a result, the earnings of regulated utilities have been, and are expected to continue to be, stable irrespective of economic conditions; and

• Infrastructure, which includes airports, toll roads, broadcast communications infrastructure and ports. Regulation of infrastructure companies is generally done through contracts that regulate the prices the company can charge (rather than the earnings) and allows companies to accrue the benefits of volume growth (i.e. the returns of infrastructure companies are linked to growth in passengers, vehicles, spectrum usage or containers). As a result, the revenues and earnings derived by infrastructure assets are expected to grow over time.

Performance Review

The Frontegra MFG Core Infrastructure Fund returned 24.22%, net of fees, for the year ending June 30, 2014. The Fund's return underperformed the 24.70% return of its benchmark, the UBS Developed Markets Infrastructure & Utilities Index (Net). While underperformance may be seen as disappointing, it was not surprising given the strong rise in the benchmark for the year. As discussed below, the investment strategy used in this Fund results in a much lower beta than the benchmark and the return for risk of the Fund was materially better than the benchmark for the year.

Most sectors held in the Core Infrastructure strategy performed well during the year with Toll Roads generating a Total Shareholder Return (TSR) of 43%, Airports a TSR of 29%, and Water and Gas Utilities TSRs of 26% and 25%, respectively. The Ports sector was the worst performing sector held by the Fund, and the only one not generating a positive return, generating a TSR of -13% for the year.

Geographically, European stocks were the strongest performers providing a TSR of 38% for the year, while USA and Canada were at the lower end with TSRs of 19% and 14% respectively.

The best performing stocks in the Fund during the year were Italian toll road company Atlantia (TSR of 73%), Spanish utility Red Electrica (67%), Vienna Airport (58%), another Italian toll road company, SIAS (59%) and Australian utility Envestra, which is the subject of a takeover battle (45%). Pleasingly, only one stock of the 90 in the portfolio generated a negative TSR for the year. Dutch company Vopak, which owns oil and chemical tank facilities in key strategically located ports around the world, was impacted by the backwardation of the oil curve and the troubles in Crimea resulting in a TSR of -19%.

page 12

In terms of the stocks included in the benchmark index but excluded from the Fund because they do not meet our stringent definition of investment grade infrastructure, Japanese electrical utilities (which were up over 60% on average in the previous year) fell sharply producing TSRs ranging from -6% to -42%. These stocks had also been very poor performers in previous years. In contrast, large, vertically integrated power companies in Europe with significant exposure to unregulated power generation and which had performed poorly for a number of years finally rewarded their shareholders with some decent returns.

Portfolio Outlook and Strategy

The Core Infrastructure strategy is designed to provide reliable returns in all but the most extreme market conditions. The Fund exceeded that expectation during the last year, partly reflecting the continued recovery of stocks held by the Fund that had been over-sold in previous years. We now see the utilities market as broadly in equilibrium while infrastructure stocks, particularly those in Europe, remain cheap.

We believe that infrastructure and utility assets, with requisite earnings reliability and a linkage of earnings to inflation offer an attractive, long-term investment proposition. Furthermore, given the predictable nature of earnings and the structural linkage of those earnings to inflation, the investment returns generated by infrastructure assets are different from standard asset classes and offer investors valuable diversification when included in an investment portfolio. In the current uncertain economic and investment climate, the reliable financial performance of infrastructure investments makes them particularly attractive and an investment in listed infrastructure can be expected to reward patient investors with a three to five year timeframe.

Sincerely,

Dennis Eagar

Portfolio Manager

MFG Asset Management

page 13

INVESTMENT HIGHLIGHTS

Growth of a $100,000 Investment (Unaudited)

* 1/18/12 commencement of operations.

This chart assumes an initial gross investment of $100,000 made on 1/18/12 (commencement of operations). Returns shown include the reinvestment of all distributions. Past performance is not predictive of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. In the absence of existing fee waivers, total return would be reduced. To receive current to the most recent month-end performance, please call 1-888-825-2100.

The MSCI World Index measures the overall performance of stock markets in 24 developed market countries in North America, Europe, and the Asia/Pacific Region. The UBS Developed Infrastructure & Utilities Index is a global developed markets infrastructure and utilities benchmark. Neither index reflects investment management fees, brokerage commissions or other expenses associated with investing in equity securities. A direct investment in an index is not possible.

Frontegra Asset Management, Inc. has contractually agreed through October 31, 2015 to waive its management fee and/or reimburse the Fund's operating expenses to the extent necessary to ensure that the Fund's total operating expenses (excluding taxes, interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) do not exceed 0.70% of the Fund's average daily net assets. The expense ratios presented are based on the annualized expense ratios as reported in the Fund's current prospectus, which may differ from the expense ratios presented in the Fund's financial highlights.

** The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Portfolio Total Return**

FOR PERIODS

ENDED 6/30/14 | | FUND | | UBS

INDEX | | MSCI

INDEX | |

SIX MONTHS | | | 14.78 | % | | | 15.38 | % | | | 6.18 | % | |

ONE YEAR | | | 24.22 | % | | | 24.70 | % | | | 24.05 | % | |

AVERAGE ANNUAL

SINCE INCEPTION | | | 17.72 | % | | | 15.09 | % | | | 18.22 | % | |

Fund Expenses | |

GROSS EXPENSE RATIO | | | 3.66 | % | |

NET EXPENSE RATIO | | | 0.70 | % | |

page 14

FRONTEGRA

TIMPANI SMALL CAP GROWTH FUND

REPORT FROM TIMPANI CAPITAL MANAGEMENT LLC

Dear Fellow Shareholders:

The Frontegra Timpani Small Cap Growth Fund strives to achieve capital appreciation by investing in a diversified portfolio of growth companies with small market capitalizations. Timpani seeks to:

• Invest in companies where growth is robust, sustainable and underestimated by the market.

• Conduct fundamental research that provides unique insights into the perception gap that exists between market expectations and a company's true growth rate.

• Manage risk by continuously evaluating the size of the perception gap relative to market expectations and monitoring market sentiment.

• Act on new relevant incremental data points, both positive and negative, in an effort to exploit investor biases.

Performance Review

For the year ended June 30, 2014, the Fund modestly trailed its benchmark, the Russell 2000® Growth Index, returning 24.16% (net of fees) vs. 24.73% for the benchmark. It was a tale of two halves. The relative performance in the second half of calendar 2013 was strong while the relative performance in the first half of calendar 2014 was weak.

The strength from 2013 was caused by several company-specific fundamental drivers along with a fairly benign macro environment, which resulted in a stylistic tailwind for Timpani. That tailwind became a headwind in the spring of 2014, as high-growth, small capitalization stocks fell victim to a fierce, targeted correction. Broadly speaking, underlying fundamentals were not worsening prior to, or during this correction. Instead, the correction was primarily stock valuation-driven. The rally in small capitalization stocks in 2013 was largely driven by improving valuation, or multiple expansion. During the spring of 2014, we saw some of that multiple expansion unwind. We are not alarmed by this. A digestion of some of the gains from 2013 is healthy long term, however, can be modestly painful to live through while it is happening.

During the period, sector allocation was a slight negative contributor to performance. An overweight in Energy and Health Care were positive contributors to performance, while an overweight in Consumer Discretionary and Technology were negative contributors. Stock selection was fairly neutral during the period as a driver of performance. Similar to the overall portfolio performance, stock selection was notably positive in the second half of 2013 and notably negative in the first half of 2014. For the full period, stock selection was most positive for Consumer Discretionary and Health Care, and most negative for Technology and Producer Durables. Stand-out individual positive contributors included health care companies, Lannett Company, BioDelivery Sciences, Repligen and Horizon Pharma as well as energy stock, Diamondback Energy. While fundamentally unrelated to one another, these companies are similar in that they all have a sustainable growth profile and are consistently meeting or exceeding analyst and investor expectations. Negative outliers included Conn's, PowerSecure International and TearLab. These three companies provided negative data points which delayed or halted the expected growth trajectory. All three were sold from the portfolio.

Portfolio Outlook

While the spring 2014 correction arrived seemingly overnight, we are hopeful the worst is behind us. We struggled from late March through May, however, we saw strength in absolute and relative performance in June. This is encouraging and perhaps, is evidence that the style correction has concluded and going forward, we can expect a more style-neutral environment.

While there are always minor macro concerns in the news, the environment is fairly benign. The domestic and global economy is growing modestly, there are very few impactful global disruptions, and most central banks are accommodating. While we know interest rate

page 16

increases by the U.S. Federal Reserve are inevitable and likely to start in mid-2015, those have been well telegraphed by the marketplace, thus, we expect the news to be digested without much fanfare. More importantly, we understand interest rate increases are most likely to be accompanied by a sharply stronger economy, which should be favorable for stocks.

On a micro level, things also appear favorable. Confirming the macro economic recovery, we are beginning to see pockets of the economy where pricing is improving. For example, over the past few weeks, we have had several meetings with companies within the transportation, pharmaceuticals, and oil services industries where management teams are seeing evidence of pricing improvement. In addition, corporate balance sheets are generally sound, and companies are generating cash which enables them to increase cash deployment in the form of dividends, share buybacks or accretive acquisitions. We believe that positive corporate fundamentals will lead to the potential for increased M&A activity, which could benefit the companies we own as both buyers and potential sellers. Our analysis continues to confirm our optimism regarding the fundamental strength of the companies in our portfolio.

During the period, we continued to focus on finding robust and sustainable growers where the growth is being underestimated. That research has resulted in sector weights that vary from the benchmark weights. Key overweights include Consumer Discretionary, Energy, and Producer Durables, while notable underweights include Financial Services, Materials & Processing and Technology.

While the volatility in the marketplace may or may not remain elevated, we will continue to make it our mission to find companies that have characteristics consistent with our investment process. We believe this approach is most value-added for shareholders over the long term.

Thank you for your continued support.

Sincerely,

Brandon Nelson, CFA

Chief Investment Officer

Timpani Capital Management LLC

page 17

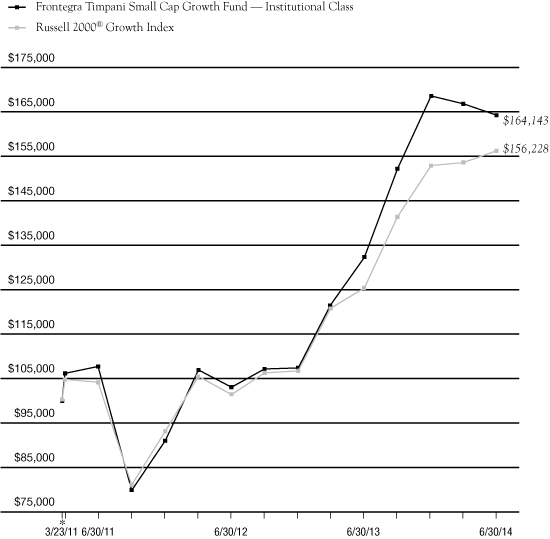

INVESTMENT HIGHLIGHTS

Growth of a $100,000 Investment (Unaudited)

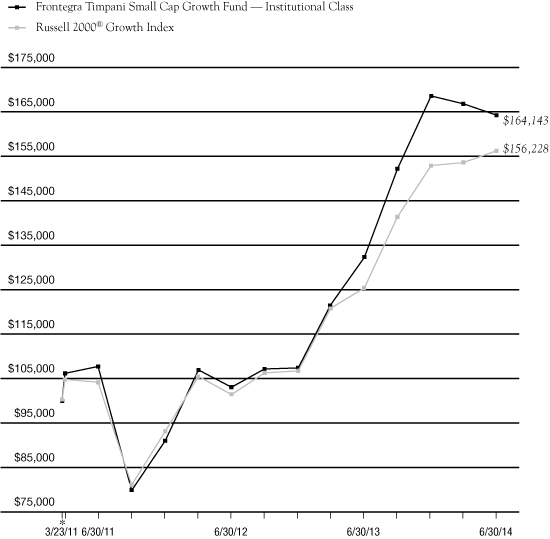

* 3/23/11 commencement of operations.

This chart assumes an initial gross investment of $100,000 made on 3/23/11. Returns shown include the reinvestment of all distributions. Past performance is not predictive of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. In the absence of fee waivers, total return would be reduced. To receive current to the most recent month-end performance, please call 1-888-825-2100.

The Russell 2000® Growth Index measures the performance of the small-cap growth segment of the U.S. equity universe. The Index does not reflect investment management fees, brokerage commissions and other expenses associated with investing in equity securities. A direct investment in the index is not possible.

Timpani Capital Management LLC has contractually agreed through October 31, 2015 to waive its management fee and/or reimburse the Fund's operating expenses to the extent necessary to ensure that the Fund's total operating expenses (excluding taxes, interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) do not exceed 1.10% of the Fund's average daily net assets of the Institutional Class. The expense ratios presented are based on the annualized expense ratios as reported in the Fund's current prospectus, which may differ from the expense ratios presented in the Fund's financial highlights.

** The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The above graph relates to Institutional Class shares of the Fund. Performance for Class Y shares will vary from the performance of the Institutional Class shares shown above due to differences in expenses.

Portfolio Total Return**

FOR PERIODS ENDED 6/30/14 | | FUND | | INDEX | |

SIX MONTHS | | | (2.61 | )% | | | 2.22 | % | |

ONE YEAR | | | 24.16 | % | | | 24.73 | % | |

AVERAGE ANNUAL

SINCE INCEPTION | | | 16.36 | % | | | 14.61 | % | |

Fund Expenses | |

GROSS EXPENSE RATIO | | | 4.02 | % | |

NET EXPENSE RATIO | | | 1.10 | % | |

page 18

FRONTEGRA

NETOLS SMALL CAP VALUE FUND

REPORT FROM NETOLS ASSET MANAGEMENT, INC.

Dear Fellow Shareholders:

The Frontegra Netols Small Cap Value Fund strives to achieve capital appreciation by investing at least 80% of its assets in equity securities of small capitalization companies. The Fund's performance is measured against the Russell 2000® Value Index.

Performance Review

Since its inception on December 16, 2005, the Frontegra Netols Small Cap Value Fund (Institutional Class) has outperformed the benchmark after fees, returning 8.82% annualized, compared to 7.35% annualized for the Russell 2000 Value Index. For the year ended June 30, 2014, the Fund outperformed the benchmark, returning 24.63% net of fees, compared to 22.54% for the Index.

Portfolio Review

The dominant market factor over the past twelve months continues to be a slowly strengthening domestic economy and the implications for Federal Reserve Policy. Stronger payroll numbers have been a key factor in the improved outlook for the economy. This outlook drove the market higher as investors looked past the uncertainty associated with a new Fed Chairperson, unusually severe winter weather in the first quarter, and geopolitical concerns in many parts of the world. During the past year, the Fund's portfolio was positioned for a stable to slightly stronger economy. As this outlook played out, Energy, Health Care and Industrial sectors outperformed. Conversely, less cyclical Financials and Consumer Staples sectors underperformed during the period.

Positive Contributions to Relative Performance July 2013 through June 2014

• Stock Selection — Energy, Materials, and Financials

• Overweight — Health Care, Industrials, and Information Technology

• Best Performing Stocks — Zale, United Rentals, Willbros Group, VeriFone Systems and Acuity Brands

Negative Contributions to Relative Performance July 2013 through June 2014

• Stock Selection — Health Care and Utilities

• Underweight — Energy and Utilities

• Worst Performing Stocks — Liquidity Services, Haemonetics, Ethan Allen Interiors, Kraton Performance Polymers and Intrepid Potash

Overall, we believe the domestic economy continues to move forward. As employment trends strengthen, consumer confidence should improve and drive further economic activity. Improved business sentiment should eventually result in higher levels of business investment and commercial construction. These factors have been slow to materialize in the current recovery and could potentially provide another leg of economic growth.

Thank you for your continued support.

Jeff Netols

President

Netols Asset Management, Inc.

page 20

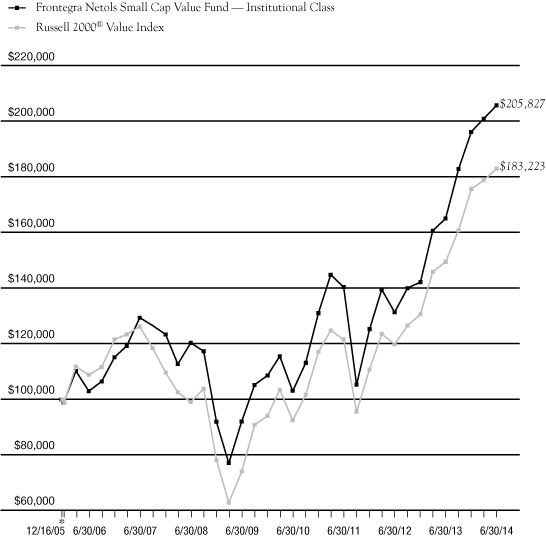

INVESTMENT HIGHLIGHTS

Growth of a $100,000 Investment (Unaudited)

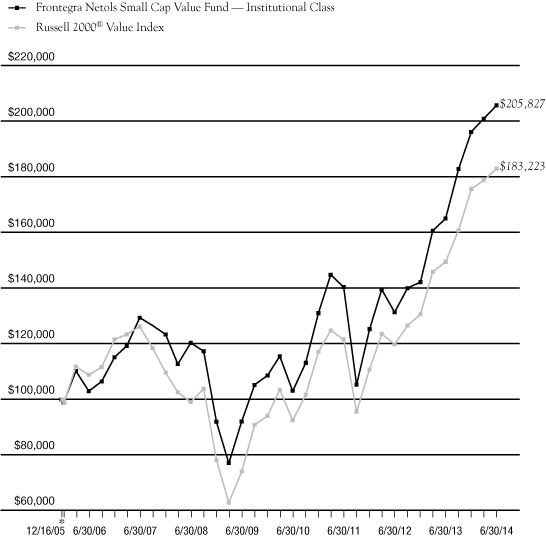

* 12/16/05 commencement of operations.

This chart assumes an initial gross investment of $100,000 made on 12/16/05 (commencement of operations). Returns shown include the reinvestment of all distributions. Past performance is not predictive of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. In the absence of existing fee waivers, total return would be reduced. To receive current to the most recent month-end performance, please call 1-888-825-2100.

The Russell 2000 Value Index measures the performance of those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values. The Index does not reflect investment management fees, brokerage commissions and other expenses associated with investing in equity securities. A direct investment in the index is not possible.

Frontegra Asset Management, Inc. has contractually agreed through October 31, 2015 to waive its management fee and/or reimburse the Fund's operating expenses to the extent necessary to ensure that the Fund's total operating expenses (excluding taxes, interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) do not exceed 1.10% of the Fund's average daily net assets for the Institutional Class. The expense ratios presented are based on the annualized expense ratios as reported in the Fund's current prospectus, which may differ from the expense ratios presented in the Fund's financial highlights.

** The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The above graph relates to Institutional Class shares of the Fund. Performance for Class Y shares will vary from the performance of the Institutional Class shares shown above due to differences in expenses.

Portfolio Total Return**

FOR PERIODS

ENDED 6/30/14 | | FUND | | INDEX | |

SIX MONTHS | | | 4.71 | % | | | 4.20 | % | |

ONE YEAR | | | 24.63 | % | | | 22.54 | % | |

FIVE YEAR

AVERAGE ANNUAL | | | 17.42 | % | | | 19.88 | % | |

AVERAGE ANNUAL

SINCE INCEPTION | | | 8.82 | % | | | 7.35 | % | |

Fund Expenses | |

GROSS EXPENSE RATIO | | | 1.19 | % | |

NET EXPENSE RATIO | | | 1.11 | % | |

page 21

This page intentionally left blank.

FRONTEGRA

PHOCAS SMALL CAP VALUE FUND

REPORT FROM PHOCAS FINANCIAL CORPORATION

Dear Fellow Shareholders:

The Frontegra Phocas Small Cap Value Fund strives to achieve capital appreciation by investing in a diversified portfolio of equity securities of companies with small market capitalizations. The Fund's performance is measured against the Russell 2000® Value Index.

Performance Review

During the twelve month period ended June 30, 2014, the Frontegra Phocas Small Cap Value Fund returned 32.72%, net of fees, compared to the 22.54% return of the benchmark, the Russell 2000 Value Index (the "Benchmark").

The challenges for the year have been steady: economic headwinds continue in Europe, weakness in China, and continued uncertainty in the Middle East. In the U.S., mixed data suggesting a sluggish domestic expansion continue in the background. Despite all of these ongoing issues, the U.S. equities markets continued to climb up the wall of worry and deliver positive total returns for investors for the twelve-month period.

For the year ended June 30, the Benchmark's sector performances were all up. The sector performance leaders were Energy and Health Care (+34.3%). Those sectors were followed by Industrials (+25.4%), Information Technology (+24.5%), Utilities (+22.7%), Materials (+22.2%), Consumer Discretionary (+21.6%), Consumer Staples (+18.4%), Financials (+18.3%) and Telecommunication Services (4.7%).

For the Fund, the Financials sector was the strongest contributor to returns over the twelve-month period. Despite being a little underweight the Benchmark's sector weight, our holdings outperformed the Benchmark. Strong contributions were also made by our holdings in the Industrials, Energy, and Information Technology sectors. Health Care, Materials, Consumer Discretionary, and Utilities also kicked in. The smallest sector contribution was from the Consumer Staples sector. Cash also added slightly to performance for the period.

Portfolio Review and Strategy

Within Financials, banks were attractive performers as a group. The Fund's positions in SVB Financial, Wilshire Bancorp, Bladex and First Republic Bank each contributed solidly to the return for the period. The REIT holdings in the Fund were also strong. NorthStar Realty Finance and Pebblebrook Hotel Trust were the standouts in that group, but Hudson Pacific Properties, Strategic Hotels & Resorts and First Industrial Realty Trust also put in attractive contributions. Strong Energy names were Goodrich Petroleum, Carrizo Oil & Gas, Comstock Resources, Kodiak Oil & Gas and Gulfport Energy.

In the Industrials sector, Trinity Industries and Aceto each added strongly to performance for the period, atop attractive showings by Esterline Technologies and Timken. Spirit Airlines and AMERCO were also major contributors from the transportation group.

Because it is quite difficult, if not impossible, to time markets or sectors on a consistent basis, our core investment strategy remains to concentrate on identifying undervalued stocks in each sector. We believe that this will continue to be the best strategy, longer-term. We also feel that the best performing companies remain those that are finding new growth opportunities, are overhauling their operations to reduce costs significantly, or are investing their free cash flow and cash on their balance sheets to acquire promising businesses. In addition, we continue to search for companies with greatly discounted valuations based on concerns that we think can be repaired in a timely fashion. We remain fully invested with less than 5% cash or equivalents.

Thank you for your continued support.

William Schaff, CFA | | Steve Block, CFA | |

Chief Executive Officer and Portfolio Manager | | Portfolio Manager | |

Phocas Financial Corporation | | Phocas Financial Corporation | |

page 24

INVESTMENT HIGHLIGHTS

Growth of a $100,000 Investment (Unaudited)

* 9/29/06 commencement of operations.

This chart assumes an initial gross investment of $100,000 made on 9/29/06. Returns shown include the reinvestment of all distributions. Past performance is not predictive of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. In the absence of fee waivers, total return would be reduced. Effective October 8, 2010, Phocas Financial Corp. ("Phocas") became subadviser to the Fund and Frontegra Asset Management, Inc. became adviser to the Fund. Prior to October 8, 2010, Phocas served as adviser to the Fund. To receive current to the most recent month-end performance, please call 1-888-825-2100.

The Russell 2000® Value Index measures the performance of those Russell 2000® companies with lower price-to-book ratios and lower forecasted growth values. The Index does not reflect investment management fees, brokerage commissions and other expenses associated with investing in equity securities. A direct investment in the index is not possible.

Frontegra Asset Management, Inc. has contractually agreed through October 31, 2015 to waive its management fee and/or reimburse the Fund's operating expenses to the extent necessary to ensure that the Fund's total operating expenses (excluding taxes, interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) do not exceed 1.10% of the Fund's average daily net assets. The expense ratios presented are based on the annualized expense ratios as reported in the Fund's current prospectus, which may differ from the expense ratios presented in the Fund's financial highlights.

** The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Portfolio Total Return**

FOR PERIODS ENDED 6/30/14 | | FUND | | INDEX | |

SIX MONTHS | | | 6.83 | % | | | 4.20 | % | |

ONE YEAR | | | 32.72 | % | | | 22.54 | % | |

FIVE YEAR

AVERAGE ANNUAL | | | 21.70 | % | | | 19.88 | % | |

AVERAGE ANNUAL

SINCE INCEPTION | | | 9.26 | % | | | 6.60 | % | |

Fund Expenses | |

GROSS EXPENSE RATIO | | | 2.62 | % | |

NET EXPENSE RATIO | | | 1.22 | % | |

page 25

Frontegra Funds

EXPENSE EXAMPLE

June 30, 2014 (Unaudited)

As a shareholder of a mutual fund, you incur two types of costs: (1) transaction costs, including redemption fees, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other fund expenses. Although the Funds charge no sales loads, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Funds' transfer agent. If you request that a redemption be made by wire transfer, currently the Funds' transfer agent charges a $15.00 fee. A redemption fee of 2.00% of the then current value of the shares redeemed may be imposed on certain redemptions of shares made within 30 days of purchase for the Frontegra RobecoSAM Global Equity, Frontegra MFG Global Equity and Frontegra MFG Core Infrastructure Funds.

This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (1/1/14 – 6/30/14).

Actual Expenses

The first line of the table on the following page for each Fund provides information about actual account values and actual expenses. The Example includes management fees, registration fees, fee waivers/reimbursements and other expenses. However, the Example does not include portfolio trading commissions and related expenses and other extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During the Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table for each Fund provides information about hypothetical account values and hypothetical expenses based on each of the Fund's actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in each of the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs could have been higher.

page 26

Frontegra Funds

EXPENSE EXAMPLE (continued)

June 30, 2014 (Unaudited)

| | | Beginning Account

Value 1/1/2014 | | Ending Account

Value 6/30/2014 | | Annualized

Expense Ratio* | | Expenses Paid

During the Period* | |

RobecoSAM Global Equity Fund | |

Actual Fund Return | | $ | 1,000.00 | | | $ | 1,061.70 | | | | 1.20 | % | | $ | 6.13 | | |

Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,018.84 | | | | 1.20 | % | | $ | 6.01 | | |

MFG Global Equity Fund | |

Actual Fund Return | | $ | 1,000.00 | | | $ | 1,026.80 | | | | 0.80 | % | | $ | 4.02 | | |

Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,020.83 | | | | 0.80 | % | | $ | 4.01 | | |

MFG Core Infrastructure Fund | |

Actual Fund Return | | $ | 1,000.00 | | | $ | 1,147.80 | | | | 0.70 | % | | $ | 3.73 | | |

Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,021.32 | | | | 0.70 | % | | $ | 3.51 | | |

Timpani Small Cap Growth

Fund – Institutional Class | |

Actual Fund Return | | $ | 1,000.00 | | | $ | 973.90 | | | | 1.10 | % | | $ | 5.38 | | |

Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,019.34 | | | | 1.10 | % | | $ | 5.51 | | |

Netols Small Cap Value

Fund – Institutional Class | |

Actual Fund Return | | $ | 1,000.00 | | | $ | 1,047.10 | | | | 1.10 | % | | $ | 5.58 | | |

Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,019.34 | | | | 1.10 | % | | $ | 5.51 | | |

Netols Small Cap Value

Fund – Class Y | |

Actual Fund Return | | $ | 1,000.00 | | | $ | 1,045.80 | | | | 1.50 | % | | $ | 7.61 | | |

Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,017.36 | | | | 1.50 | % | | $ | 7.50 | | |

Phocas Small Cap Value Fund | |

Actual Fund Return | | $ | 1,000.00 | | | $ | 1,068.30 | | | | 1.10 | % | | $ | 5.64 | | |

Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,019.34 | | | | 1.10 | % | | $ | 5.51 | | |

* Expenses are equal to each Fund's annualized expense ratio indicated above, multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period.

page 27

Frontegra Funds

EXPENSE EXAMPLE (continued)

June 30, 2014 (Unaudited)

| | | Beginning Account

Value | | Ending Account

Value 6/30/2014 | | Annualized

Expense Ratio | | Expenses Paid

During the Period | |

Timpani Small Cap Growth

Fund – Class Y | |

Actual Fund Return* | | $ | 1,000.00 | | | $ | 981.00 | | | | 1.50 | % | | $ | 7.12 | | |

Hypothetical 5% Return** | | $ | 1,000.00 | | | $ | 1,017.36 | | | | 1.50 | % | | $ | 7.50 | | |

* Actual expenses are equal to the Fund's annualized expense ratio of 1.50% multiplied by the average account value over the period, multiplied by 175/365 to reflect the most recent fiscal period end since the Timpani Small Cap Growth Fund — Class Y commenced operations on January 6, 2014.

** Hypothetical expenses are equal to the Fund's annualized expense ratio of 1.50% multiplied by the average account value over the period commencing January 1, 2014, multiplied by 181/365 to reflect information had the Timpani Small Cap Growth Fund — Class Y been in operation for the entire fiscal half year.

page 28

Frontegra RobecoSAM Global Equity Fund

SCHEDULE OF INVESTMENTS

June 30, 2014

Number of Shares | | | | Value | |

COMMON STOCKS 93.0% | | | |

| | | Australia 6.1% | |

| | 23,943 | | | AGL Energy Ltd. | | $ | 349,493 | | |

| | 8,638 | | | National Australia Bank Ltd. | | | 267,000 | | |

| | 7,084 | | | Westpac Banking Corp. | | | 226,314 | | |

| | 6,515 | | | Woodside Petroleum Ltd. | | | 252,307 | | |

| | | | 1,095,114 | | |

| | | France 4.0% | |

| | 9,838 | | | Total SA | | | 711,009 | | |

| | | Israel 1.4% | |

| | 19,080 | | | Mizrahi Tefahot Bank Ltd. | | | 246,764 | | |

| | | Italy 0.9% | |

| | 6,278 | | | Eni SpA | | | 171,757 | | |

| | | Japan 7.0% | |

| | 4,700 | | | Honda Motor Co. Ltd. | | | 164,097 | | |

| | 37,900 | | | Inpex Corp. | | | 576,141 | | |

| | 13,800 | | | Keihin Corp. | | | 219,318 | | |

| | 11,200 | | | Stanley Electric Co. Ltd. | | | 291,982 | | |

| | | | 1,251,538 | | |

| | | Netherlands 2.7% | |

| | 4,827 | | | Koninklijke DSM NV | | | 351,565 | | |

| | 3,957 | | | Koninklijke Philips NV | | | 125,570 | | |

| | | | 477,135 | | |

| | | Norway 1.9% | |

| | 18,454 | | | DNB ASA | | | 337,559 | | |

| | | Philippines 0.4% | |

| | 133,500 | | | Manila Water Co., Inc. | | | 77,990 | | |

| | | Sweden 1.7% | |

| | 4,183 | | | Atlas Copco AB - Class A | | | 120,891 | | |

| | 3,672 | | | Svenska Handelsbanken AB -

Class A | | | 179,765 | | |

| | | | 300,656 | | |

Number of Shares | | | | Value | |

| | | Switzerland 8.0% | |

| | 3,943 | | | Nestle SA | | $ | 305,463 | | |

| | 1,761 | | | Roche Holding AG | | | 525,242 | | |

| | 868 | | | Schindler Holding AG | | | 131,942 | | |

| | 643 | | | Swisscom AG | | | 373,778 | | |

| | 279 | | | Zurich Insurance Group AG | | | 84,096 | | |

| | | | 1,420,521 | | |

| | | United Kingdom 10.2% | |

| | 4,294 | | | AstraZeneca PLC | | | 318,971 | | |

| | 53,891 | | | Barclays PLC | | | 196,262 | | |

| | 65,796 | | | BT Group PLC | | | 433,408 | | |

| | 2,629 | | | Croda International PLC | | | 99,028 | | |

| | 17,469 | | | Drax Group PLC | | | 191,486 | | |

| | 6,689 | | | GlaxoSmithKline PLC | | | 179,039 | | |

| | 46,529 | | | Legal & General Group PLC | | | 179,485 | | |

| | 8,250 | | | SSE PLC | | | 221,244 | | |

| | | | 1,818,923 | | |

| | | United States 48.7% | |

| | 7,335 | | | Abbott Laboratories | | | 300,001 | | |

| | 3,592 | | | Celanese Corp. - Class A | | | 230,894 | | |

| | 13,762 | | | Cisco Systems, Inc. | | | 341,986 | | |

| | 4,145 | | | Colgate-Palmolive Co. | | | 282,606 | | |

| | 4,478 | | | Dollar Tree, Inc. (a) | | | 243,872 | | |

| | 1,347 | | | E.I. du Pont de Nemours & Co. | | | 88,148 | | |

| | 3,628 | | | Emerson Electric Co. | | | 240,754 | | |

| | 1,956 | | | Fluor Corp. | | | 150,416 | | |

| | 1,836 | | | Fossil Group, Inc. (a) | | | 191,899 | | |

| | 2,839 | | | Franklin Resources, Inc. | | | 164,208 | | |

| | 2,769 | | | GNC Holdings, Inc. | | | 94,423 | | |

| | 3,401 | | | Illinois Tool Works, Inc. | | | 297,792 | | |

| | 2,067 | | | International Business

Machines Corp. | | | 374,685 | | |

| | 6,631 | | | L Brands, Inc. | | | 388,974 | | |

| | 4,147 | | | MasterCard, Inc. - Class A | | | 304,680 | | |

| | 4,623 | | | McDonald's Corp. | | | 465,721 | | |

| | 2,512 | | | Mead Johnson Nutrition Co. | | | 234,043 | | |

| | 10,697 | | | Microsoft Corp. | | | 446,065 | | |

The accompanying notes are an integral part of these financial statements.

page 29

Frontegra RobecoSAM Global Equity Fund

SCHEDULE OF INVESTMENTS (continued)

June 30, 2014

Number of Shares | | | | Value | |

| COMMON STOCKS 93.0% (continued) | | | |

| | | United States 48.7% (continued) | |

| | 1,440 | | | National Oilwell Varco, Inc. | | $ | 118,584 | | |

| | 6,022 | | | Occidental Petroleum Corp. | | | 618,038 | | |

| | 6,150 | | | ONE Gas, Inc. | | | 232,163 | | |

| | 9,302 | | | Oracle Corp. | | | 377,010 | | |

| | 1,491 | | | Parker-Hannifin Corp. | | | 187,463 | | |

| | 17,519 | | | Pfizer, Inc. | | | 519,964 | | |

| | 4,747 | | | The Chubb Corp. | | | 437,531 | | |

| | 5,069 | | | The Coca-Cola Co. | | | 214,723 | | |

| | 7,788 | | | The Hartford Financial

Services Group, Inc. | | | 278,888 | | |

| | 3,737 | | | UnitedHealth Group, Inc. | | | 305,500 | | |

| | 7,982 | | | Wells Fargo & Co. | | | 419,534 | | |

| | 3,279 | | | Xylem, Inc. | | | 128,143 | | |

| | | | 8,678,708 | | |

| | | Total Common Stocks | |

| | | | | (Cost $12,722,762) | | | 16,587,674 | | |

PREFERRED STOCKS 2.9% | | | |

| | | Germany 2.9% | |

| | 2,591 | | | Henkel AG & Co. KGaA | | | 299,546 | | |

| | 804 | | | Volkswagen AG | | | 211,156 | | |

| | | | 510,702 | | |

| | | Total Preferred Stocks | |

| | | | | (Cost $315,499) | | | 510,702 | | |

Number of Shares | | | | Value | |

SHORT-TERM INVESTMENTS 4.6% | |

| | | Investment Company 4.6% | |

| | 815,977 | | | STIT-STIC Prime Portfolio -

Institutional Class, 0.01% | | $ | 815,977 | | |

| | | Total Short-Term Investments | |

| | | (Cost $815,977) | | | 815,977 | | |

| | | Total Investments 100.5% | |

| | | (Cost $13,854,238) | | | 17,914,353 | | |

| | | Liabilities in Excess of

Other Assets (0.5)% | | | (83,963 | ) | |

| | | TOTAL NET ASSETS 100.0% | | $ | 17,830,390 | | |

(a) Non-Income Producing.

PORTFOLIO DIVERSIFICATION

Sectors | | Percentage | |

Financials | | | 16.9 | % | |

Energy | | | 13.7 | | |

Consumer Discretionary | | | 12.7 | | |

Health Care | | | 12.1 | | |

Information Technology | | | 10.4 | | |

Industrials | | | 7.8 | | |

Consumer Staples | | | 7.5 | | |

Utilities | | | 6.0 | | |

Telecommunication Services | | | 4.5 | | |

Materials | | | 4.3 | | |

Total Common and Preferred Stocks | | | 95.9 | | |

Total Short-Term Investments | | | 4.6 | | |

Total Investments | | | 100.5 | | |

Liabilities in Excess of Other Assets | | | (0.5 | ) | |

Total Net Assets | | | 100.0 | % | |

The accompanying notes are an integral part of these financial statements.

page 30

Frontegra MFG Global Equity Fund

SCHEDULE OF INVESTMENTS

June 30, 2014

Number of Shares | | | | Value | |

COMMON STOCKS 97.8% | | | |

| | | France 7.4% | |

| | 358,283 | | | Danone | | $ | 26,609,982 | | |

| | 300,087 | | | Sanofi | | | 31,878,337 | | |

| | | | 58,488,319 | | |

| | | Germany 3.1% | |

| | 114,678 | | | Adidas AG | | | 11,615,407 | | |

| | 168,274 | | | SAP SE | | | 12,995,554 | | |

| | | | 24,610,961 | | |

| | | Netherlands 1.3% | |

| | 246,324 | | | Unilever NV | | | 10,778,151 | | |

| | | Switzerland 7.0% | |

| | 442,828 | | | Nestle SA | | | 34,305,687 | | |

| | 233,987 | | | Novartis AG | | | 21,187,592 | | |

| | | | 55,493,279 | | |

| | | United Kingdom 6.6% | |

| | 258,167 | | | Diageo PLC | | | 8,244,449 | | |

| | 9,034,582 | | | Tesco PLC | | | 43,942,158 | | |

| | | | 52,186,607 | | |

| | | United States 72.4% | |

| | 156,687 | | | American Express Co. | | | 14,864,896 | | |

| | 519,715 | | | DIRECTV (a) | | | 44,180,972 | | |

| | 920,555 | | | eBay, Inc. (a) | | | 46,082,983 | | |

| | 24,157 | | | Google, Inc. - Class A (a) | | | 14,123,873 | | |

| | 24,157 | | | Google, Inc. - Class C (a) | | | 13,897,039 | | |

| | 99,435 | | | Johnson & Johnson | | | 10,402,890 | | |

| | 973,302 | | | Lowe's Companies, Inc. | | | 46,708,763 | | |

| | 301,588 | | | MasterCard, Inc. - Class A | | | 22,157,670 | | |

| | 157,505 | | | McDonald's Corp. | | | 15,867,054 | | |

| | 1,226,730 | | | Microsoft Corp. | | | 51,154,641 | | |

| | 832,422 | | | Oracle Corp. | | | 33,738,064 | | |

| | 257,340 | | | State Street Corp. | | | 17,308,688 | | |

| | 719,314 | | | Target Corp. | | | 41,684,246 | | |

| | 848,786 | | | The Bank of New York

Mellon Corp. | | | 31,812,499 | | |

| | 219,051 | | | The Coca-Cola Co. | | | 9,279,000 | | |

| | 487,756 | | | U.S. Bancorp | | | 21,129,590 | | |

Number of Shares | | | | Value | |

| | | United States 72.4% (continued) | |

| | 170,208 | | | Visa, Inc. - Class A | | $ | 35,864,528 | | |

| | 413,342 | | | Wal-Mart Stores, Inc. | | | 31,029,584 | | |

| | 637,033 | | | Wells Fargo & Co. | | | 33,482,455 | | |

| | 463,884 | | | Yum! Brands, Inc. | | | 37,667,381 | | |

| | | | 572,436,816 | | |

| | | Total Common Stocks | |

| | | | | (Cost $676,820,393) | | | 773,994,133 | | |

SHORT-TERM INVESTMENTS 1.9% | | | |

| | | Investment Company 1.9% | |

| | 14,835,097 | | | STIT Liquid Assets Portfolio -

Institutional Class, 0.06% | | | 14,835,097 | | |

| | | Total Short-Term Investments | |

| | | | | (Cost $14,835,097) | | | 14,835,097 | | |

| | | Total Investments 99.7% | |

| | | | | (Cost $691,655,490) | | | 788,829,230 | | |

| | | | | Other Assets in Excess of

Liabilities 0.3% | | | 2,213,906 | | |

| | | | | TOTAL NET ASSETS 100.0% | | $ | 791,043,136 | | |

(a) Non-Income Producing.

PORTFOLIO DIVERSIFICATION

Sectors | | Percentage | |

Information Technology | | | 29.1 | % | |

Consumer Discretionary | | | 25.0 | | |

Consumer Staples | | | 20.7 | | |

Financials | | | 15.0 | | |

Health Care | | | 8.0 | | |

Total Common Stocks | | | 97.8 | | |

Total Short-Term Investments | | | 1.9 | | |

Total Investments | | | 99.7 | | |

Other Assets in Excess of Liabilities | | | 0.3 | | |

Total Net Assets | | | 100.0 | % | |

The accompanying notes are an integral part of these financial statements.

page 31

Frontegra MFG Core Infrastructure Fund

SCHEDULE OF INVESTMENTS

June 30, 2014

Number of Shares | | | | Value | |

COMMON STOCKS 97.6% | | | |

| | | Australia 7.9% | |

| | 107,109 | | | APA Group | | $ | 695,880 | | |

| | 162,751 | | | DUET Group | | | 371,388 | | |

| | 230,282 | | | Envestra Ltd. | | | 295,317 | | |

| | 434,028 | | | SP AusNet | | | 542,279 | | |

| | 184,598 | | | Spark Infrastructure Group | | | 322,024 | | |

| | 284,030 | | | Sydney Airport | | | 1,130,228 | | |

| | 259,223 | | | Transurban Group | | | 1,806,372 | | |

| | | | 5,163,488 | | |

| | | Austria 0.4% | |

| | 2,690 | | | Flughafen Wien AG | | | 250,472 | | |

| | | Belgium 0.6% | |

| | 7,215 | | | Elia System Operator SA/NV | | | 364,554 | | |

| | | Canada 8.3% | |

| | 18,210 | | | Emera, Inc. | | | 582,112 | | |

| | 42,591 | | | Enbridge, Inc. | | | 2,020,882 | | |

| | 27,489 | | | Fortis, Inc. | | | 836,482 | | |

| | 40,345 | | | TransCanada Corp. | | | 1,925,656 | | |

| | 3,649 | | | Valener, Inc. | | | 54,031 | | |

| | | | 5,419,163 | | |

| | | France 6.9% | |

| | 13,525 | | | Aeroports de Paris | | | 1,781,974 | | |

| | 28,197 | | | Eutelsat Communications SA | | | 979,733 | | |

| | 46,140 | | | SES SA - ADR | | | 1,750,072 | | |

| | | | 4,511,779 | | |

| | | Germany 1.6% | |

| | 11,827 | | | Fraport AG Frankfurt Airport

Services Worldwide | | | 835,647 | | |

| | 8,975 | | | Hamburger Hafen und

Logistik AG | | | 238,355 | | |

| | | | 1,074,002 | | |

| | | Hong Kong 2.9% | |

| | 219,862 | | | Power Assets Holdings Ltd. | | | 1,921,920 | | |

Number of Shares | | | | Value | |

| | | Italy 8.9% | |

| | 71,427 | | | Atlantia SpA | | $ | 2,036,300 | | |

| | 336,360 | | | Snam SpA | | | 2,026,543 | | |

| | 28,108 | | | Societa Iniziative Autostradali

e Servizi SpA | | | 361,020 | | |

| | 274,744 | | | Terna Rete Elettrica

Nazionale SpA | | | 1,449,150 | | |

| | | | 5,873,013 | | |

| | | Mexico 2.6% | |

| | 43,527 | | | Grupo Aeroportuario del Centro

Norte SAB de CV | | | 175,571 | | |

| | 59,032 | | | Grupo Aeroportuario del Pacifico

SAB de CV - Class B | | | 399,780 | | |

| | 35,498 | | | Grupo Aeroportuario del Sureste

SAB de CV - Class B | | | 451,061 | | |

| | 221,944 | | | OHL Mexico SAB de CV (a) | | | 677,457 | | |

| | | | 1,703,869 | | |

| | | Netherlands 1.2% | |

| | 16,381 | | | Koninklijke Vopak NV | | | 800,769 | | |

| | | New Zealand 1.2% | |

| | 152,502 | | | Auckland International

Airport Ltd. | | | 520,739 | | |

| | 127,604 | | | Vector Ltd. | | | 283,778 | | |

| | | | 804,517 | | |

| | | Spain 7.0% | |

| | 84,174 | | | Abertis Infraestructuras SA | | | 1,936,936 | | |

| | 30,592 | | | Enagas SA | | | 984,406 | | |

| | 18,489 | | | Red Electrica Corp. SA | | | 1,691,175 | | |

| | | | 4,612,517 | | |

| | | Switzerland 0.7% | |

| | 786 | | | Flughafen Zuerich AG | | | 483,052 | | |

| | | United Kingdom 7.7% | |

| | 141,647 | | | National Grid PLC | | | 2,036,273 | | |

| | 48,928 | | | Pennon Group PLC | | | 657,319 | | |

The accompanying notes are an integral part of these financial statements.

page 32

Frontegra MFG Core Infrastructure Fund

SCHEDULE OF INVESTMENTS (continued)

June 30, 2014

Number of Shares | | | | Value | |

| COMMON STOCKS 97.6% (continued) | | | |

| | | United Kingdom 7.7% (continued) | |

| | 30,670 | | | Severn Trent PLC | | $ | 1,014,075 | | |

| | 87,319 | | | United Utilities Group PLC | | | 1,318,034 | | |

| | | | 5,025,701 | | |

| | | United States 39.7% | |

| | 2,910 | | | ALLETE, Inc. | | | 149,428 | | |

| | 6,542 | | | Alliant Energy Corp. | | | 398,146 | | |

| | 15,043 | | | Ameren Corp. | | | 614,958 | | |

| | 25,346 | | | American Electric Power Co., Inc. | | | 1,413,546 | | |

| | 1,922 | | | American States Water Co. | | | 63,868 | | |

| | 16,163 | | | American Tower Corp. | | | 1,454,347 | | |

| | 11,099 | | | American Water Works Co., Inc. | | | 548,846 | | |

| | 11,649 | | | Aqua America, Inc. | | | 305,437 | | |

| | 6,883 | | | Atmos Energy Corp. | | | 367,552 | | |

| | 2,981 | | | Avista Corp. | | | 99,923 | | |

| | 2,767 | | | California Water Service Group | | | 66,961 | | |

| | 28,253 | | | CenterPoint Energy, Inc. | | | 721,582 | | |

| | 4,147 | | | Cleco Corp. | | | 244,466 | | |

| | 16,708 | | | CMS Energy Corp. | | | 520,454 | | |

| | 18,158 | | | Consolidated Edison, Inc. | | | 1,048,443 | | |

| | 19,382 | | | Crown Castle International Corp. | | | 1,439,307 | | |

| | 10,975 | | | DTE Energy Co. | | | 854,623 | | |

| | 19,028 | | | Duke Energy Corp. | | | 1,411,687 | | |

| | 1,998 | | | El Paso Electric Co. | | | 80,340 | | |

| | 10,131 | | | Great Plains Energy, Inc. | | | 272,220 | | |

| | 3,456 | | | IDACORP, Inc. | | | 199,860 | | |

| | 5,494 | | | Integrys Energy Group, Inc. | | | 390,788 | | |

| | 10,830 | | | ITC Holdings Corp. | | | 395,078 | | |

| | 19,521 | | | NiSource, Inc. | | | 767,956 | | |

| | 19,590 | | | Northeast Utilities | | | 926,019 | | |

| | 1,345 | | | Northwest Natural Gas Co. | | | 63,417 | | |

| | 1,940 | | | NorthWestern Corp. | | | 101,249 | | |

| | 17,247 | | | Pepco Holdings, Inc. | | | 473,948 | | |

| | 28,813 | | | PG&E Corp. | | | 1,383,600 | | |

| | 5,369 | | | Piedmont Natural Gas Co., Inc. | | | 200,854 | | |

| | 7,582 | | | Pinnacle West Capital Corp. | | | 438,543 | | |

Number of Shares | | | | Value | |

| | | United States 39.7% (continued) | |

| | 5,472 | | | PNM Resources, Inc. | | $ | 160,494 | | |

| | 5,371 | | | Portland General Electric Co. | | | 186,213 | | |

| | 39,165 | | | PPL Corp. | | | 1,391,532 | | |

| | 12,033 | | | Questar Corp. | | | 298,418 | | |

| | 9,728 | | | SCANA Corp. | | | 523,464 | | |

| | 13,481 | | | Sempra Energy | | | 1,411,595 | | |

| | 263 | | | SJW Corp. | | | 7,154 | | |

| | 3,195 | | | Southwest Gas Corp. | | | 168,664 | | |

| | 14,963 | | | TECO Energy, Inc. | | | 276,516 | | |

| | 2,344 | | | The Empire District Electric Co. | | | 60,194 | | |

| | 2,963 | | | The Laclede Group, Inc. | | | 143,854 | | |

| | 31,122 | | | The Southern Co. | | | 1,412,316 | | |

| | 3,884 | | | UIL Holdings Corp. | | | 150,350 | | |

| | 2,865 | | | UNS Energy Corp. | | | 173,075 | | |

| | 5,665 | | | Vectren Corp. | | | 240,762 | | |

| | 8,856 | | | Westar Energy, Inc. | | | 338,211 | | |

| | 14,830 | | | Wisconsin Energy Corp. | | | 695,824 | | |

| | 31,120 | | | Xcel Energy, Inc. | | | 1,002,998 | | |

| | | | 26,059,080 | | |

| | | Total Common Stocks | |

| | | | | (Cost $59,746,544) | | | 64,067,896 | | |

CLOSED-END FUNDS 0.9% | | | |

| | | United Kingdom 0.9% | |

| | 154,540 | | | HICL Infrastructure Co. Ltd. | | | 370,005 | | |

| | 97,355 | | | International Public

Partnerships Ltd. | | | 222,095 | | |

| | | | 592,100 | | |

| | | Total Closed-End Funds | |

| | | | | (Cost $550,089) | | | 592,100 | | |

The accompanying notes are an integral part of these financial statements.

page 33

Frontegra MFG Core Infrastructure Fund

SCHEDULE OF INVESTMENTS (continued)

June 30, 2014

Number of Shares | | | | Value | |

SHORT-TERM INVESTMENTS 2.4% | |

| | | Investment Company 2.4% | |

| | 1,585,604 | | | STIT Liquid Assets Portfolio -

Institutional Class, 0.06% | | $ | 1,585,604 | | |

| | | Total Short-Term Investments | |

| | | (Cost $1,585,604) | | | 1,585,604 | | |

| | | Total Investments 100.9% | |

| | | (Cost $61,882,237) | | | 66,245,600 | | |

| | | Liabilities in Excess of

Other Assets (0.9)% | | | (579,680 | ) | |

| | | TOTAL NET ASSETS 100.0% | | $ | 65,665,920 | | |

(a) Non-Income Producing.

ADR - American Depositary Receipt

PORTFOLIO DIVERSIFICATION

Sectors | | Percentage | |

Integrated Power | | | 28.1 | % | |

Transmission & Distribution | | | 17.7 | | |

Gas | | | 16.0 | | |

Toll Road | | | 10.4 | | |

Airport | | | 9.2 | | |

Communications | | | 8.6 | | |

Water Utility | | | 6.0 | | |

Port | | | 1.6 | | |

Total Common Stocks | | | 97.6 | | |

Social | | | 0.9 | | |

Total Closed-End Funds | | | 0.9 | | |

Total Short-Term Investments | | | 2.4 | | |

Total Investments | | | 100.9 | | |

Liabilities in Excess of Other Assets | | | (0.9 | ) | |

Total Net Assets | | | 100.0 | % | |

The accompanying notes are an integral part of these financial statements.

page 34

Frontegra Timpani Small Cap Growth Fund

SCHEDULE OF INVESTMENTS

June 30, 2014

Number of Shares | | | | Value | |

COMMON STOCKS 96.4% | | | |

| | | Consumer Discretionary 25.3% | |

| | 2,402 | | | Century Communities, Inc. (a) | | $ | 53,204 | | |

| | 5,634 | | | Fiesta Restaurant Group, Inc. (a) | | | 261,474 | | |

| | 3,261 | | | Gentherm, Inc. (a) | | | 144,951 | | |

| | 2,409 | | | G-III Apparel Group Ltd. (a) | | | 196,719 | | |

| | 7,380 | | | Grand Canyon Education, Inc. (a) | | | 339,259 | | |

| | 5,862 | | | Jack In the Box, Inc. | | | 350,782 | | |

| | 4,723 | | | JAKKS Pacific, Inc. (a) | | | 36,556 | | |

| | 5,215 | | | Kate Spade & Co. (a) | | | 198,900 | | |

| | 8,960 | | | Kona Grill, Inc. (a) | | | 173,914 | | |

| | 3,777 | | | Lithia Motors, Inc. - Class A | | | 355,302 | | |

| | 31,061 | | | Marchex, Inc. - Class B | | | 373,353 | | |

| | 1,246 | | | Monro Muffler Brake, Inc. | | | 66,275 | | |

| | 9,406 | | | Motorcar Parts of America, Inc. (a) | | | 229,036 | | |

| | 14,517 | | | Nautilus, Inc. (a) | | | 160,994 | | |

| | 4,220 | | | Penske Automotive Group, Inc. | | | 208,890 | | |

| | 1,234 | | | Shutterstock, Inc. (a) | | | 102,397 | | |

| | 1,863 | | | Skechers U.S.A., Inc. - Class A (a) | | | 85,139 | | |

| | 6,834 | | | The Finish Line, Inc. - Class A | | | 203,243 | | |

| | 9,726 | | | Tuesday Morning Corp. (a) | | | 173,317 | | |

| | | | 3,713,705 | | |

| | | Consumer Staples 2.9% | |

| | 3,767 | | | Inventure Foods, Inc. (a) | | | 42,454 | | |

| | 2,124 | | | J&J Snack Foods Corp. | | | 199,911 | | |

| | 722 | | | The Hain Celestial Group, Inc. (a) | | | 64,070 | | |

| | 1,515 | | | TreeHouse Foods, Inc. (a) | | | 121,306 | | |

| | | | 427,741 | | |

| | | Energy 12.2% | |

| | 5,105 | | | American Eagle Energy Corp. (a) | | | 30,579 | | |

| | 5,287 | | | Basic Energy Services, Inc. (a) | | | 154,486 | | |

| | 7,502 | | | C&J Energy Services, Inc. (a) | | | 253,418 | | |

| | 4,981 | | | Diamondback Energy, Inc. (a) | | | 442,313 | | |

| | 4,759 | | | Natural Gas Services Group, Inc. (a) | | | 157,332 | | |

| | 15,624 | | | Precision Drilling Corp. | | | 221,236 | | |

| | 9,410 | | | Sanchez Energy Corp. (a) | | | 353,722 | | |

| | 17,971 | | | Vertex Energy, Inc. (a) | | | 174,498 | | |

| | | | 1,787,584 | | |

Number of Shares | | | | Value | |

| | | Financial Services 1.8% | |

| | 8,847 | | | Tree.com, Inc. (a) | | $ | 257,802 | | |

| | | Health Care 20.7% | |

| | 5,955 | | | Air Methods Corp. (a) | | | 307,576 | | |

| | 2,807 | | | ANI Pharmaceuticals, Inc. (a) | | | 96,673 | | |

| | 31,677 | | | BioDelivery Sciences

International, Inc. (a) | | | 382,341 | | |

| | 2,612 | | | Cantel Medical Corp. | | | 95,652 | | |

| | 5,577 | | | Cardiovascular Systems, Inc. (a) | | | 173,779 | | |

| | 8,494 | | | Dipexium Pharmaceuticals,

Inc. (a) | | | 82,392 | | |

| | 12,591 | | | Horizon Pharma, Inc. (a) | | | 199,190 | | |

| | 1,313 | | | Jazz Pharmaceuticals PLC (a) | | | 193,024 | | |