UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-07685 |

|

Frontier Funds, Inc. |

(Exact name of registrant as specified in charter) |

|

400 Skokie Blvd. Suite 500 Northbrook, IL | | 60062 |

(Address of principal executive offices) | | (Zip code) |

|

William D. Forsyth III 400 Skokie Blvd., Suite 500 Northbrook, Illinois 60062 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (847) 509-9860 | |

|

Date of fiscal year end: | June 30 | |

|

Date of reporting period: | December 31, 2016 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

SEMI-ANNUAL REPORT

Frontier MFG Global Equity Fund

Frontier MFG Global Plus Fund

Frontier MFG Core Infrastructure Fund

Frontier Timpani Small Cap Growth Fund

Frontier Netols Small Cap Value Fund

Frontier Phocas Small Cap Value Fund

Frontegra Asset Management, Inc.

December 31, 2016

TABLE OF CONTENTS

Shareholder Letter | | | 1 | | |

Frontier MFG Global Equity Fund and Frontier MFG Global Plus Fund | |

Report from MFG Asset Management | | | 4 | | |

Investment Highlights | | | 6 | | |

Frontier MFG Core Infrastructure Fund | |

Report from MFG Asset Management | | | 10 | | |

Investment Highlights | | | 12 | | |

Frontier Timpani Small Cap Growth Fund | |

Report from Timpani Capital Management LLC | | | 14 | | |

Investment Highlights | | | 16 | | |

Frontier Netols Small Cap Value Fund | |

Report from Netols Asset Management, Inc. | | | 18 | | |

Investment Highlights | | | 20 | | |

Frontier Phocas Small Cap Value Fund | |

Report from Phocas Financial Corporation | | | 22 | | |

Investment Highlights | | | 23 | | |

Expense Example | | | 24 | | |

Schedules of Investments | |

Frontier MFG Global Equity Fund | | | 27 | | |

Frontier MFG Global Plus Fund | | | 28 | | |

Frontier MFG Core Infrastructure Fund | | | 29 | | |

Frontier Timpani Small Cap Growth Fund | | | 32 | | |

Frontier Netols Small Cap Value Fund | | | 35 | | |

Frontier Phocas Small Cap Value Fund | | | 37 | | |

Statements of Assets and Liabilities | | | 40 | | |

Statements of Operations | | | 42 | | |

Statements of Changes in Net Assets | | | 44 | | |

Financial Highlights | | | 47 | | |

Notes to Financial Statements | | | 59 | | |

This report is submitted for the general information of the shareholders of the above-listed Funds. It is not authorized for distribution to prospective investors unless accompanied or preceded by an effective Prospectus for the applicable Fund. The Prospectuses may be obtained by calling 1-888-825-2100. Each Prospectus includes more complete information about management fees and expenses, investment objectives, risks and operating policies of the applicable Fund. Please read the applicable Prospectus carefully.

Frontier Funds, Inc. are distributed by Frontegra Strategies, LLC, 400 Skokie Blvd., Suite 500, Northbrook, IL 60062. Frontegra Strategies, LLC, member of FINRA and SIPC, is an affiliate of Frontegra Asset Management, Inc. and Timpani Capital Management LLC, the Funds' investment advisers.

DEAR FELLOW SHAREHOLDERS:

We are pleased to report on the progress of the Frontier Funds over the past six months ending December 31, 2016. The S&P 500 Index was up 7.82% and small capitalization stocks were up, with the Russell 2000® Index returning 18.68%. International stocks, as measured by the MSCI EAFE Index, returned 5.67% over the six month period.

Fund Results

The Frontier MFG Global Equity Fund, managed by MFG Asset Management ("MFG"), returned 6.61% (net) versus the MSCI World Index (Net) return of 6.81% for the six month period ending December 31, 2016.

The Frontier MFG Global Plus Fund, Institutional Class, also managed by MFG, returned 6.27% (net) versus the MSCI World Index (Net) return of 6.81% for the six month period ending December 31, 2016. The Service Class shares returned 6.14% (net) over the same time period.

For the six month period ending December 31, 2016, the Frontier MFG Core Infrastructure Fund, Institutional Class, also managed by MFG, returned -7.29% (net) versus the S&P Global Infrastructure Index return of -1.45%. For the period from July 15, 2016, (inception), through December 31, 2016, the Service Class shares returned -7.06% (net) versus the MSCI World Index (Net) return of 3.79%.

The Frontier Timpani Small Cap Growth Fund, Institutional Class, managed by Timpani Capital Management, returned 6.97% (net) versus the Russell 2000® Growth Index return of 13.12% for the six month period ending December 31, 2016. The Class Y shares returned 6.84% (net) over the same time period. For the period from July 15, 2016, (inception), through December 31, 2016, the Service Class shares returned 2.46% (net) versus the MSCI World Index (Net) return of 8.20%.

For the six month period ending December 31, 2016, the Frontier Netols Small Cap Value Fund, Institutional Class, managed by Netols Asset Management, returned 15.80% (net) versus the Russell 2000® Value Index return of 24.19%. The Class Y shares returned 15.81% (net) over the same time period.

The Frontier Phocas Small Cap Value Fund, Institutional Class, managed by Phocas Financial, returned 18.88% (net) versus the Russell 2000 Value Index return of 24.19% for the six month period ending December 31, 2016. For the period from July 15, 2016, (inception), through December 31, 2016, the Service Class shares returned 14.77% (net) versus the Russell 2000® Value Index return of 18.50%.

Outlook

Calendar year 2016 can be bifurcated into two periods: pre-U.S. election and post-U.S. election. The first ten months of the year were characterized by solid if unspectacular returns in U.S. and non-U.S. equity markets and a strong U.S. dollar, as well as strong returns in the small cap U.S. stocks, especially value-oriented names. Following the November 8th election, equity markets went into overdrive, effectively doubling U.S. and non-U.S. equity returns through year end and turbocharging small cap stocks. As we enter 2017, there is considerable uncertainty, and we will work diligently to navigate markets with the care and diligence necessary in these volatile times.

We will continue to oversee the investment management of the Frontier Funds with the care and diligence that have served our shareholders well in the past. As always, we appreciate your investment and continued confidence in the Frontier Funds.

Best regards,

William D. Forsyth, CFA

President

Frontier Funds, Inc.

page 1

This page intentionally left blank.

FRONTIER

MFG GLOBAL EQUITY FUND

AND

FRONTIER

MFG GLOBAL PLUS FUND

REPORT FROM MFG ASSET MANAGEMENT

Dear Fellow Shareholders:

The investment objective of the Frontier MFG Global Equity Fund and the Frontier MFG Global Plus Fund is capital appreciation. The objective is measured against the MSCI World Index (Net).

Performance Review

The Frontier MFG Global Equity Fund returned 6.61%, net of fees, for the six month period ending December 31, 2016, while the Frontier MFG Global Plus Fund (Institutional Class) returned 6.27%, net of fees, for the same time period. Both Funds underperformed the 6.81% return of their benchmark, the MSCI World Index (Net).

Over the six months to December 31, 2016, the three largest contributors to the Funds' absolute returns were Apple, Microsoft and eBay, with returns in local currency of 22.2%, 22.8% and 26.7%, respectively. Apple performed well following its result release and a positive reaction to the recent release of the iPhone 7 and 7 Plus phones. Microsoft continued to perform well following strong earnings results relative to its guidance targets and the market's consensus estimates. The results featured continued revenue growth within its Productivity and Intelligent Cloud businesses with only a modest contraction in revenues from its Personal Computing segment. eBay's stock price rose strongly in July following its earnings release which was favourably received by the market. The company exceeded market consensus expectations for revenue and earnings per share growth, with the result showing a sequential improvement in U.S. Gross Merchandise Value growth.

Over the six months to December 31, 2016, the three largest detractors from the Funds' absolute returns were CVS Health, Lowe's and Novartis, with returns in local currency of -16.9%, -9.5% and -7.6%, respectively. CVS Health registered a weak performance following its recent earnings update, where management cut its full-year earnings expectations due to volume losses at its retail pharmacy. Lowe's was weak following its second quarter earnings release, with its comparable sales growth slowing to 2%. However, the company maintained full-year guidance of 4% and reiterated confidence in growth improving in the second half of 2016. Novartis' share price reflected weakness in the health care sector associated with the U.S. election and the implications for pharmaceuticals.

We feel strongly that people cannot retire on "relative investment returns"; only by generating investment returns that exceed the rate of inflation (ideally by a satisfactory margin) will investors increase their wealth over time. As such, we are happy to be judged on the absolute returns of our strategy over time.

Fund Outlook and Strategy

We remain cautious about the outlook for equity markets over the next few years, given the environment of abnormally low interest rates, historically elevated price-earnings multiples, risks associated with the recapitalisation of the Italian banking system and the continued withdrawal of U.S. monetary policy stimulus.

We are fairly relaxed about the appointment of the Trump administration and its implications for our investment portfolio. Trump's economic policies such as tax cuts and spending on infrastructure and defense are broadly stimulatory, so there is likely to be some upward pressure on growth, inflation and interest rates in the medium term, which has been priced by bond markets.

Nonetheless, we expect the near term to bring bouts of elevated market volatility, as markets do not like surprises and there remains great uncertainty on the actual policy platform that Trump, and the majority Republicans in Congress, will seek to enact.

Notwithstanding the current macroeconomic uncertainty, we expect to see a continuation of the U.S. economic recovery with modestly rising inflation, a continued slowdown in China (but not a financial crisis or hard landing) and an improvement in the economic outlook for Europe.

page 4

The Funds

Consistent with the stance held over the past two years, we retain a large weight in cash to preserve capital and continue to apply a consistent approach to selecting high quality companies that are well positioned to deliver satisfactory returns over the long term. Many of these companies are structurally advantaged through their exposure to the following major investment themes that are prevalent within the Funds:

• Consumer technology platforms: The leading digital platforms have tremendous opportunities to monetise new services and products (even when they are not the originator). With high switching costs and barriers to entry, their entrenched positions are unlikely to be challenged in the foreseeable future.

• Enterprise software: Established enterprise software vendors benefit from their incumbency. They typically operate in concentrated markets with high barriers to entry, network effects, and high switching costs. The shift to cloud computing presents a significant opportunity for leading vendors to expand their addressable markets and win a greater share of total enterprise IT expenditure.

• Health care and ageing population dynamics: The health care sector has attractive growth tailwinds due to rising patient volumes, increasing expenditure and large unmet health care needs.

• The move to a cashless society: There continues to be a strong secular shift from spending via cash and cheque to cashless forms of payments, such a credit cards, debit cards, electronic funds transfer and mobile payments. The explosion of smart and internet connected devices will accelerate this shift on a global basis.

We retain confidence in the quality and long-term outlook for our investments and are comfortable with the Funds' overall risk profile and construction.

Yours sincerely,

Hamish Douglass

Portfolio Manager

MFG Asset Management

page 5

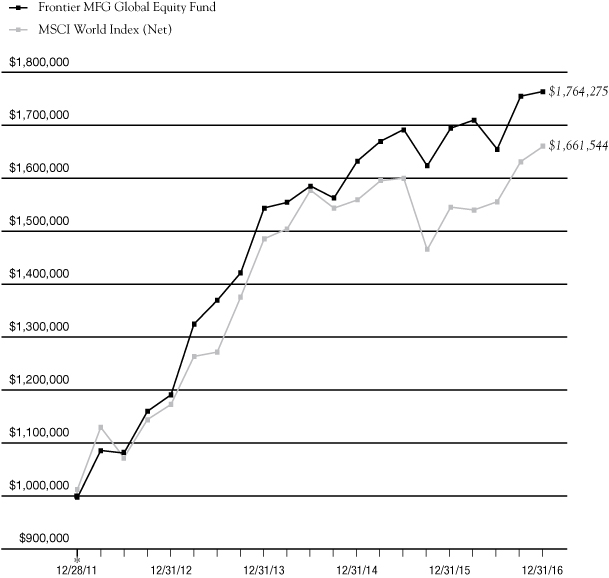

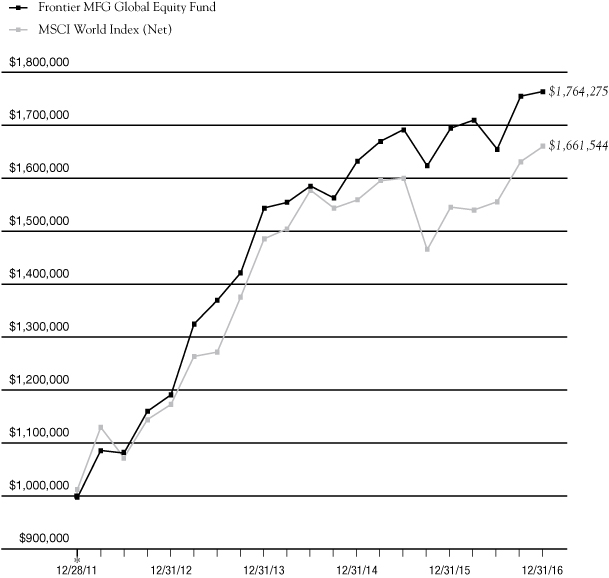

INVESTMENT HIGHLIGHTS

Growth of a $1,000,000 Investment (Unaudited)

* 12/28/11 commencement of operations.

Portfolio Total Return**

FOR PERIODS ENDED 12/31/16 | | FUND | | INDEX | |

SIX MONTHS | | | 6.61 | % | | | 6.81 | % | |

ONE YEAR | | | 4.12 | % | | | 7.51 | % | |

FIVE YEAR

AVERAGE ANNUAL | | | 12.09 | % | | | 10.41 | % | |

AVERAGE ANNUAL

SINCE INCEPTION | | | 12.00 | % | | | 10.67 | % | |

Fund Expenses | |

GROSS EXPENSE RATIO | | | 0.87 | % | |

NET EXPENSE RATIO | | | 0.82 | % | |

This chart assumes an initial gross investment of $1,000,000 made on 12/28/11 (commencement of operations). Returns shown include the reinvestment of all distributions. Past performance is not predictive of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. In the absence of existing fee waivers, total return would be reduced. To receive current to the most recent month-end performance, please call 1-888-825-2100.

The MSCI World Index (Net) represents large and mid cap equities across 23 Developed Markets countries. The index covers approximately 85% of the free float-adjusted market capitalization in each country. The index does not reflect investment management fees, brokerage commissions and other expenses associated with investing in equity securities. A direct investment in the index is not possible.

Frontegra Asset Management, Inc. has contractually agreed through October 31, 2018, to waive its management fee and/or reimburse the Fund's operating expenses to the extent necessary to ensure that the Fund's total operating expenses (excluding taxes, interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) do not exceed 0.80% of the Fund's average daily net assets. The expense ratios presented are based on the annualized expense ratios as reported in the Fund's current prospectus, which may differ from the expense ratios presented in the Fund's financial highlights.

** The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

page 6

INVESTMENT HIGHLIGHTS

Growth of a $1,000,000 Investment (Unaudited)

* 3/23/15 commencement of operations.

Portfolio Total Return**

FOR PERIODS ENDED 12/31/16 | | FUND | | INDEX | |

SIX MONTHS | | | 6.27 | % | | | 6.81 | % | |

ONE YEAR | | | 3.46 | % | | | 7.51 | % | |

AVERAGE ANNUAL

SINCE INCEPTION | | | 1.34 | % | | | 1.17 | % | |

Institutional Class Expenses | |

GROSS EXPENSE RATIO | | | 2.05 | % | |

NET EXPENSE RATIO | | | 0.82 | % | |

This chart assumes an initial gross investment of $1,000,000 made on 3/23/15 (commencement of operations). Returns shown include the reinvestment of all distributions. Past performance is not predictive of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. In the absence of existing fee waivers, total return would be reduced. To receive current to the most recent month-end performance, please call 1-888-825-2100.

The MSCI World Index (Net) represents large and mid cap equities across 23 Developed Markets countries. The index covers approximately 85% of the free float-adjusted market capitalization in each country. The index does not reflect investment management fees, brokerage commissions and other expenses associated with investing in equity securities. A direct investment in the index is not possible.

Frontegra Asset Management, Inc. has contractually agreed through October 31, 2018, to waive its management fee and/or reimburse the Fund's operating expenses to the extent necessary to ensure that the Fund's total operating expenses (excluding taxes, interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) do not exceed 0.80% of the Fund's average daily net assets for the Institutional Class. The expense ratios presented are based on the annualized expense ratios as reported in the Fund's current prospectus, which may differ from the expense ratios presented in the Fund's financial highlights.

** The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The above graph relates to Institutional Class shares of the Fund. Performance for Service Class shares will vary from the performance of the Institutional Class shares shown above due to differences in expenses.

page 7

This page intentionally left blank.

FRONTIER

MFG CORE INFRASTRUCTURE FUND

REPORT FROM MFG ASSET MANAGEMENT

Dear Fellow Shareholders:

The investment objective of the Frontier MFG Core Infrastructure Fund is long-term capital appreciation. The objective is measured against the S&P Global Infrastructure Index.

The types of infrastructure assets in which the Fund invests are generally natural monopolies that provide an essential service to the community. Infrastructure assets offer investors protection from the impacts of inflation because their earnings generally have some direct linkage to inflation. Over time, the stable, reliable earnings of infrastructure assets are expected to lead to a combination of income and capital growth for investors.

The universe of infrastructure assets that are held by the Fund is made up of two main sectors:

• Utilities: Utilities comprise approximately 65% of the Fund and includes both regulated energy utilities and regulated water utilities. Utilities are typically subject to economic regulation. The terms of regulation typically require a utility to efficiently provide an essential service to the community and, in return, permit the utility to earn a fair rate of return on the capital it has invested in its operations. As a utility provides a basic necessity, e.g. energy or water, there is minimal fluctuation in demanded volumes in response to the economic cycle, while the price charged for the utility service can be adjusted with limited impact upon demanded volumes. As a result, the earnings of regulated utilities have been, and are expected to continue to be, stable irrespective of economic conditions.

• Infrastructure: This includes airports, ports, toll roads and broadcast communications infrastructure. Regulation of infrastructure companies is generally less intensive than regulation of utilities and this allows companies to accrue the benefits of volume growth (i.e. the returns of infrastructure companies are linked to growth in passengers, vehicles or containers). As economies develop, grow and become more inter-dependent, we expect the underlying level of aviation, shipping and vehicle traffic to increase. As a result, the revenues and earnings derived by infrastructure assets are expected to grow.

A key feature of the portfolio construction process for the MFG Core Infrastructure strategy is the application of what we call "the 75% rule". This relates to those companies whose assets are a mixture of assets that MFG Asset Management classifies as infrastructure and those assets that do not meet our strict requirements. In those circumstances, we require at least, and on a consistent basis, 75% of the earnings of the company to be derived from the assets that meet our definitional requirement before it can be included in the Fund.

Performance Review

The Frontier MFG Core Infrastructure Fund, Institutional Class, returned -7.29%, net of fees, for the six month period ending December 31, 2016. The Fund's return underperformed the -1.45% return of its benchmark, the S&P Global Infrastructure Index. For the year, the Fund returned 6.18%, net of fees, compared to the benchmark's return of 12.43%.

The second half of 2016 has seen an increase in underlying interest rates in the U.S., UK and Australia as markets regained some confidence that rates would begin normalising. Donald Trump's election spurred those markets even further on the logic that a Trump administration would be good for economic growth and inflation. The companies held within the Fund are seen to be interest rate sensitive by investment markets and have been sold off as rates have risen. We acknowledge that the value of the Fund's assets is sensitive to real interest rates. However, to the extent that inflation pushes bond rates higher, almost all of the stocks in the Fund have either the express (e.g. CPI toll increases) or implied (e.g. regulated utility returns) ability to pass inflation impacts through to customers, thereby preserving the real value of the asset cash flows.

page 10

The period had a number of stocks that delivered negative shareholder returns, with 60 of the 83 stocks in the portfolio delivering negative returns during the period. There were a number of strong returns from companies in the portfolio, with U.S. utility SJW Corp. (Total Shareholder Return (TSR) of +43.5%), Frankfurt airport operator, Fraport (+17.0%) and European satellite operator, Eutelsat (+15.2%). The most negative performers in the portfolio were Mexican airport company, Grupo Aeroportuario del Centro Norte (-17.5%), U.S. utilities NiSource (-15.4%) and Aqua America (-14.7%).

The majority of the sectors in the portfolio were negative in the period, particularly those considered to have more sensitivity to rising interest rates. The Water Utility sector delivered a weighted average TSR of -9.5%, the Gas Utility sector -9.3%, the Integrated Power sector at -5.3%. With the recovery in the oil price over the period, stocks in the Energy Infrastructure sector had positive performance (+3.0%), albeit we expect this is more reflective of investor sentiment in the market and will have limited impact on the earnings of these companies in the short to medium term as our 75% rule screens out companies with significant commodity price exposure.

Geographically, the Fund's U.S. exposures generated a TSR of -6.3% and the UK returned -8.9%. The best performing region was Canada, which rose by 1.5% over the period.

Portfolio Outlook and Strategy

The Fund is designed to provide reliable returns over the medium-to-longer term. We believe that infrastructure and utility assets, with requisite earnings reliability and a linkage of earnings to inflation, offer an attractive, long-term investment proposition. Furthermore, given the predictable nature of earnings and the structural linkage of those earnings to inflation, the investment returns generated by infrastructure assets are different from standard asset classes and offer investors valuable diversification when included in an investment portfolio. In the current uncertain economic and investment climate, the reliable financial performance of infrastructure investments makes them particularly attractive and an investment in listed infrastructure can be expected to reward patient investors with a three to five year timeframe.

Sincerely,

Dennis Eagar

Portfolio Manager

MFG Asset Management

page 11

INVESTMENT HIGHLIGHTS

Growth of a $100,000 Investment (Unaudited)

* 1/18/12 commencement of operations.

Portfolio Total Return**

FOR PERIODS

ENDED

12/31/16 | | FUND | | MSCI

INDEX | | S&P

GLOBAL

INDEX | |

SIX MONTHS | | | (7.29 | )% | | | 6.81 | % | | | (1.45 | )% | |

ONE YEAR | | | 6.18 | % | | | 7.51 | % | | | 12.43 | % | |

AVERAGE

ANNUAL

SINCE

INCEPTION | | | 9.84 | % | | | 9.77 | % | | | 7.59 | % | |

Fund Expenses | |

GROSS EXPENSE RATIO | | | 0.84 | % | |

NET EXPENSE RATIO | | | 0.71 | % | |

This chart assumes an initial gross investment of $100,000 made on 1/18/12 (commencement of operations). Returns shown include the reinvestment of all distributions. Past performance is not predictive of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. In the absence of existing fee waivers, total return would be reduced. To receive current to the most recent month-end performance, please call 1-888-825-2100.

The MSCI World Index (Net) represents large and mid cap equities across 23 Developed Markets countries and covers approximately 85% of the free float-adjusted market capitalization in each country. The S&P Global Infrastructure Index is a global developed markets infrastructure and utilities benchmark. Neither index reflects investment management fees, brokerage commissions or other expenses associated with investing in equity securities. A direct investment in an index is not possible.

Frontegra Asset Management, Inc. has contractually agreed through October 31, 2018, to waive its management fee and/or reimburse the Fund's operating expenses to the extent necessary to ensure that the Fund's total operating expenses (excluding taxes, interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) do not exceed 0.70% of the Fund's average daily net assets. The expense ratios presented are based on the annualized expense ratios as reported in the Fund's current prospectus, which may differ from the expense ratios presented in the Fund's financial highlights.

** The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The above graph relates to Institutional Class shares of the Fund. Performance for Service Class shares will vary from the performance of the Institutional Class shares shown above due to differences in expenses.

page 12

FRONTIER

TIMPANI SMALL CAP GROWTH FUND

REPORT FROM TIMPANI CAPITAL MANAGEMENT LLC

Dear Fellow Shareholders:

The Frontier Timpani Small Cap Growth Fund strives to achieve capital appreciation by investing in a diversified portfolio of growth companies with small market capitalizations. Timpani seeks to:

• Invest in companies where growth is robust, sustainable and underestimated by the market.

• Conduct fundamental research that provides unique insights into the growth gap that exists between market expectations and a company's true growth rate.

• Manage risk by continuously evaluating the size of the growth gap relative to market expectations and monitoring market sentiment.

• Act on new relevant incremental data points, both positive and negative, in an effort to exploit investor biases.

For the six months ended December 31, 2016, the Frontier Timpani Small Cap Growth Fund, Institutional Class, underperformed its benchmark, the Russell 2000® Growth Index, returning 6.97%, net of fees, compared to 13.12% for the benchmark. For the year, the Fund returned -1.06%, net of fees, compared to 11.32% for the Index.

Performance Review

For most of the period, cyclical value stocks, or stocks that are heavily tied to the general economy, significantly outperformed less economically sensitive secular growth stocks. This worked against Timpani's investment approach which heavily weights secular growers. Despite our recent struggles, our outlook is positive as we believe Timpani's specific investment approach is due for a mean-reverting recovery.

Secular, bad. Cyclical, good. This was the theme during the period and we were on the wrong end of both sides of this rotation. Detailed attribution analysis of the portfolio suggests stock selection drove the poor performance while sector allocation was slightly positive. Our overweight in Technology was the main driver of our value-added sector allocation. Health Care stock selection was the biggest contributor to the downside, led by Ligand Pharmaceuticals, a long-term winner for Timpani. Ligand's weakness was caused by a damaging analyst downgrade and poor clinical data from one of its drugs. Another notable underperformer during the period was a Producer Durable stock, Dycom Industries. It provides outsourced engineering and construction services but under-performed due to slowed spending from one of its customers. Our largest individual winner was a Health Care stock, Heska Corporation. It targets the growing animal health industry and is gaining market share due to an improved product offering and a new distribution model. Infrastructure services stocks, MasTec and Quanta Services, were positive contributors within the Producer Durables sector. Finally, laser manufacturer, Coherent, was our best performing Technology stock. We are excited about Coherent's demand outlook from its flat panel display customers as well as its synergy prospects tied to its recent acquisition.

Portfolio Outlook

Small-cap stock indices shined during the period, outperforming mid- and large-cap stocks. Value stocks materially outperformed growth stocks, especially following the November elections which led investors to conclude domestic economic growth is likely to accelerate.

We continue to have a positive outlook for the overall stock market. The combination of steady to improving economic growth and accommodative monetary policy is creating a benign backdrop for equities. Even though interest rates are likely to further rise, absolute levels remain low enough to enable economic growth and strong corporate earnings. In addition, valuation multiples look reasonable compared to prior non-recessionary periods of valuation expansion.

page 14

We are positive on the outlook for Timpani. Over the past 15 months, we have lived through a perfect storm of stylistic headwinds, whereby, our key investment criteria have been under-appreciated by the market. As a result, relative valuation of small cap growth stocks to small cap value stocks has reached an extreme low. In my 20-year career, I have never seen headwinds last for this long or get this extreme. In some ways, one could argue growth is the new value. We think things are stretched and a reversion to the mean recovery is coming for Timpani.

We continue to focus on finding robust and sustainable growers where the growth is being underestimated. That research has resulted in some sector weights that vary from the benchmark weights including an overweight in Technology, where we see notable fundamental strength, and underweights in Financial Services and Materials & Processing.

We will continue to make it our mission to find companies that have characteristics consistent with our investment process. We believe this approach is most value-added for shareholders over the long term.

Thank you for your continued support.

Sincerely,

Brandon Nelson, CFA

Chief Investment Officer

Timpani Capital Management LLC

page 15

INVESTMENT HIGHLIGHTS

Growth of a $100,000 Investment (Unaudited)

* 3/23/11 commencement of operations.

Portfolio Total Return**

FOR PERIODS ENDED 12/31/16 | | FUND | | INDEX | |

SIX MONTHS | | | 6.97 | % | | | 13.12 | % | |

ONE YEAR | | | (1.06 | )% | | | 11.32 | % | |

FIVE YEAR

AVERAGE ANNUAL | | | 12.14 | % | | | 13.74 | % | |

AVERAGE ANNUAL

SINCE INCEPTION | | | 8.64 | % | | | 10.41 | % | |

Institutional Class Expenses | |

GROSS EXPENSE RATIO | | | 1.32 | % | |

NET EXPENSE RATIO | | | 1.10 | % | |

This chart assumes an initial gross investment of $100,000 made on 3/23/11. Returns shown include the reinvestment of all distributions. Past performance is not predictive of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. In the absence of fee waivers, total return would be reduced. To receive current to the most recent month-end performance, please call 1-888-825-2100.

The Russell 2000® Growth Index measures the performance of the small-cap growth segment of the U.S. equity universe. The index does not reflect investment management fees, brokerage commissions and other expenses associated with investing in equity securities. A direct investment in the index is not possible.

Timpani Capital Management LLC has contractually agreed through October 31, 2018, to waive its management fee and/or reimburse the Fund's operating expenses to the extent necessary to ensure that the Fund's total operating expenses (excluding taxes, interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) do not exceed 1.10% of the Fund's average daily net assets of the Institutional Class. The expense ratios presented are based on the annualized expense ratios as reported in the Fund's current prospectus, which may differ from the expense ratios presented in the Fund's financial highlights.

** The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The above graph relates to Institutional Class shares of the Fund. Performance for Class Y and Service Class shares will vary from the performance of the Institutional Class shares shown above due to differences in expenses.

page 16

FRONTIER

NETOLS SMALL CAP VALUE FUND

REPORT FROM NETOLS ASSET MANAGEMENT, INC.

Dear Fellow Shareholders:

The Frontier Netols Small Cap Value Fund strives to achieve capital appreciation by investing at least 80% of its net assets in equity securities of small capitalization companies. The Fund's performance is measured against the Russell 2000® Value Index.

Performance Review

During the six month period ended December 31, 2016, the Frontier Netols Small Cap Value Fund (Institutional Class) returned 15.80%, net of fees, compared to 24.19% for the Russell 2000 Value Index. For the year, the Fund returned 19.62%, net of fees, compared to 31.74% for the Index.

Portfolio Review

During the second half of 2016, the market was driven by a low interest rate environment and the U.S. Presidential Election. Donald Trump's win drove equity markets to record highs on a belief that significant economic change will take hold with the change in administration. Campaign promises of lower taxes, less regulation, bringing jobs back to the United States, and fiscal stimulus drove the reflation trade. This sent equity markets higher, along with the dollar and a reversal in treasury yields. The results of the election overshadowed the Federal Reserve raising rates and promising further hikes in 2017. Inflation appeared to pick up in the fourth quarter and may see an additional boost if OPEC supply cuts hold and December wage inflation is the start of a trend. These factors resulted in outperformance in Financials, Energy, and Information Technology, while Utilities, Real Estate and Health Care underperformed during the period.

Positive Contributions to Relative Performance in the Second Half of 2016:

• Stock selection in Financials sector

• Underweight in Utilities and Real Estate sectors

• Best performing stocks for the period: MGIC Investment Corp., Webster Financial, CenterState Banks, United Rentals, Community Bank System

Negative Contributions to Relative Performance in the Second Half of 2016:

• Stock selection in Information Technology, Consumer Discretionary, and Materials sectors

• Underweight in Financials sector

• Worst performing stocks for the period: Noodles & Co., Performance Sports Group, Avid Technology, Kindred Healthcare, Carter's

Portfolio Outlook

The U.S. economy appears to be steadily improving, anchored by solid employment growth. After years of monetary stimulus, inflation appears to have an upward bias. Going forward, as the Federal Reserve signals additional rate increases, stimulus tools should migrate from monetary to fiscal in nature. Additionally, the upcoming change in administration has driven the level of optimism in the U.S. higher based upon a pro-business stance. However, this will come with some offsets as the U.S. manages trade relations with countries like China, which is currently working to manage capital flows and economic growth. These factors may result in periods of higher volatility as the Fed attempts to normalize rates over a number of years.

The portfolio should perform better if the domestic economy continues to steadily improve and market distortions normalize. With a strong economy and artificially low rates, investors started the year with a reach for yield that morphed into a run to higher beta, lower

page 18

quality names. This happened as the Federal Reserve remained on the sidelines until the potentially disruptive Brexit vote and U.S. election were over, despite the economy approaching full employment. As a result, the Fed waited until December to raise rates and signal multiple increases in the upcoming year. These events created a pause in business activity for our companies that should normalize as we move through 2017. Additionally, capital spending levels could benefit from a more business-friendly environment driven by tax reform and a reduced regulatory burden. This growth leg has been missing in the recent recovery as corporations have chosen to repurchase shares rather than reinvest in their businesses. These factors could provide needed revenue growth for many of our companies to exhibit strong operating leverage created from ongoing efforts to streamline operations.

Thank you for your continued support.

Jeff Netols

President

Netols Asset Management, Inc.

page 19

INVESTMENT HIGHLIGHTS

Growth of a $100,000 Investment (Unaudited)

Portfolio Total Return*

FOR PERIODS

ENDED 12/31/16 | | FUND | | INDEX | |

SIX MONTHS | | | 15.80 | % | | | 24.19 | % | |

ONE YEAR | | | 19.62 | % | | | 31.74 | % | |

FIVE YEAR

AVERAGE ANNUAL | | | 13.14 | % | | | 15.07 | % | |

TEN YEAR

AVERAGE ANNUAL | | | 7.25 | % | | | 6.26 | % | |

Institutional Class Expenses | |

GROSS EXPENSE RATIO | | | 1.21 | % | |

NET EXPENSE RATIO | | | 1.10 | % | |

This chart assumes an initial gross investment of $100,000 made on 12/31/06. Returns shown include the reinvestment of all distributions. Past performance is not predictive of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. In the absence of existing fee waivers, total return would be reduced. To receive current to the most recent month-end performance, please call 1-888-825-2100.

The Russell 2000 Value Index measures the performance of those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values. The index does not reflect investment management fees, brokerage commissions and other expenses associated with investing in equity securities. A direct investment in the index is not possible.

Frontegra Asset Management, Inc. has contractually agreed through October 31, 2018, to waive its management fee and/or reimburse the Fund's operating expenses to the extent necessary to ensure that the Fund's total operating expenses (excluding taxes, interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) do not exceed 1.10% of the Fund's average daily net assets for the Institutional Class. The expense ratios presented are based on the annualized expense ratios as reported in the Fund's current prospectus, which may differ from the expense ratios presented in the Fund's financial highlights.

* The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The above graph relates to Institutional Class shares of the Fund. Performance for Class Y shares will vary from the performance of the Institutional Class shares shown above due to differences in expenses.

page 20

FRONTIER

PHOCAS SMALL CAP VALUE FUND

REPORT FROM PHOCAS FINANCIAL CORPORATION

Dear Fellow Shareholders:

The Frontier Phocas Small Cap Value Fund strives to achieve capital appreciation by investing in a diversified portfolio of equity securities of companies with small market capitalizations. The Fund's performance is measured against the Russell 2000® Value Index.

Performance Review

During the six-month period ended December 31, 2016, the Frontier Phocas Small Cap Value Fund, Institutional Class, returned 18.88%, net of fees, compared to the 24.19% return of the benchmark, the Russell 2000® Value Index (the "Benchmark" or the "Index"). For the calendar year, the Frontier Phocas Small Cap Value Fund, Institutional Class, returned 23.31%, net of fees, compared to 31.74% for the Index.

Portfolio Review and Strategy

For the third quarter, the biggest individual contributors were Intersil Corp. and Nortek Inc. Intersil was acquired by Renesas Electronics for $22.50/share or almost 40x projected 2017 EPS, a very hefty valuation premium. Meanwhile, Nortek, a manufacturer of ventilation equipment, was offered a price of $86/share by Melrose Industries PLC shortly after the quarter started. Within Health Care, Progenics Pharmaceuticals, a biopharma company, was up significantly based on approval of oral Relistor, which has potential to be a very large drug. Within Materials, KapStone Paper rose due to improving corrugated containerboard pricing. During the quarter, Callon Petroleum and Ring Energy helped the Energy sector, both showing double digit gains, respectively. Within Financials and Real Estate, the best performers were Radian Group, a mortgage insurance company, NorthStar Asset Management, and Sabra Health Care REIT. Northstar is involved in a "merger of equals" with Colony Capital, which should be highly accretive to ongoing free cash flow if consummated. Health Care in the Fund had a negative return relative to the Benchmark due to two of our weaker positions this quarter, Lannett Co., Inc. and Aceto Corp. Both are involved in generic pharmaceuticals production which has come under a lot of pricing pressure. Within Financials, one of our largest positions, CNO Financial Group, was a significant laggard due to news that part of their reinsured long-term care reinsurance pool with Beechwood Re, would have to be recaptured. The recapture resulted in a large portion of their excess capital being reallocated as a required backstop; this was originally targeted for share buybacks. This issue is temporary, but the overhead news resulted in a weak quarter.

For the fourth quarter, though we had winners in other sectors, the biggest individual contributors were primarily banks: Heritage Oaks Bancorp (acquired by Pacific Premier Bancorp in a stock deal), Heritage Financial, CenterState Banks (a Florida-based community bank), and United Community Banks. Our best performing Industrial stock was also our largest position within that sector, SkyWest, up. Despite our struggles within Health Care, one of the better performers was our biotechnology investment, Progenics. Within Consumer Discretionary, Ruth's Hospitality Group was up attractively, and we sold it near the end of the quarter. Within Technology, Mentor Graphics also rose significantly due to a takeout offer by Siemens. On the other hand, the Health Care sector had the largest negative relative return due to two of our weaker positions this quarter, Lannett Co., Inc. and Community Health Systems. GameStop, within Consumer Discretionary, was the weakest performer. Within Technology, VASCO Data Security International, a company that designs authentication security solutions, primarily for banking and retail, also declined. VASCO's biggest customers are overseas financial institutions, many of whom were struggling to maintain operations let alone implement security.

We continue to sell highly appreciated positions as well as under-performing names that remain fundamentally challenged. We also continue to reinvest in lower valued names. Despite fair valuations within the broader domestic small cap equity market, select stocks still appear to present attractive investment opportunities.

Thank you for your continued support.

William Schaff, CFA | | Steve Block, CFA | |

Chief Executive Officer and Portfolio Manager | | Portfolio Manager | |

Phocas Financial Corporation | | Phocas Financial Corporation | |

page 22

INVESTMENT HIGHLIGHTS

Growth of a $100,000 Investment (Unaudited)

Portfolio Total Return*

FOR PERIODS ENDED 12/31/16 | | FUND | | INDEX | |

SIX MONTHS | | | 18.88 | % | | | 24.19 | % | |

ONE YEAR | | | 23.31 | % | | | 31.74 | % | |

FIVE YEAR

AVERAGE ANNUAL | | | 15.11 | % | | | 15.07 | % | |

TEN YEAR

AVERAGE ANNUAL | | | 7.90 | % | | | 6.26 | % | |

Fund Expenses | |

GROSS EXPENSE RATIO | | | 1.49 | % | |

NET EXPENSE RATIO | | | 1.10 | % | |

This chart assumes an initial gross investment of $100,000 made on 12/31/06. Returns shown include the reinvestment of all distributions. Past performance is not predictive of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. In the absence of fee waivers, total return would be reduced. Effective October 8, 2010, Phocas Financial Corp. ("Phocas") became subadviser to the Fund and Frontegra Asset Management, Inc. became adviser to the Fund. Prior to October 8, 2010, Phocas served as adviser to the Fund. To receive current to the most recent month-end performance, please call 1-888-825-2100.

The Russell 2000® Value Index measures the performance of those Russell 2000® companies with lower price-to-book ratios and lower forecasted growth values. The index does not reflect investment management fees, brokerage commissions and other expenses associated with investing in equity securities. A direct investment in the index is not possible.

Frontegra Asset Management, Inc. has contractually agreed through October 31, 2018, to waive its management fee and/or reimburse the Fund's operating expenses to the extent necessary to ensure that the Fund's total operating expenses (excluding taxes, interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) do not exceed 1.10% of the Fund's average daily net assets. The expense ratios presented are based on the annualized expense ratios as reported in the Fund's current prospectus, which may differ from the expense ratios presented in the Fund's financial highlights.

* The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The above graph relates to Institutional Class shares of the Fund. Performance for Service Class shares will vary from the performance of the Institutional Class shares shown above due to differences in expenses.

page 23

Frontier Funds

EXPENSE EXAMPLE

December 31, 2016 (Unaudited)

As a shareholder of a mutual fund, you incur two types of costs: (1) transaction costs, including redemption fees, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other fund expenses. Although the Funds charge no sales loads, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Funds' transfer agent. If you request that a redemption be made by wire transfer, currently the Funds' transfer agent charges a $15.00 fee. A redemption fee of 2.00% of the then current value of the shares redeemed may be imposed on certain redemptions of shares made within 30 days of purchase for the Frontier MFG Global Equity, Frontier MFG Global Plus and Frontier MFG Core Infrastructure Funds.

This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (7/1/16 – 12/31/16).

Actual Expenses

The first line of the table on the following page for each Fund provides information about actual account values and actual expenses. The Example includes management fees, registration fees, fee waivers/reimbursements and other expenses. However, the Example does not include portfolio trading commissions and related expenses and other extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During the Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table for each Fund provides information about hypothetical account values and hypothetical expenses based on each of the Fund's actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in each of the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs could have been higher.

page 24

Frontier Funds

EXPENSE EXAMPLE (continued)

December 31, 2016 (Unaudited)

| | Beginning Account

Value 7/1/2016 | | Ending Account

Value 12/31/2016 | | Annualized

Expense Ratio* | | Expenses Paid

During the Period* | |

MFG Global Equity Fund | |

Actual Fund Return | | $ | 1,000.00 | | | $ | 1,066.10 | | | | 0.80 | % | | $ | 4.17 | | |

Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,021.17 | | | | 0.80 | % | | $ | 4.08 | | |

MFG Global Plus Fund –

Institutional Class | |

Actual Fund Return | | $ | 1,000.00 | | | $ | 1,062.70 | | | | 0.80 | % | | $ | 4.16 | | |

Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,021.17 | | | | 0.80 | % | | $ | 4.08 | | |

MFG Global Plus Fund –

Service Class | |

Actual Fund Return | | $ | 1,000.00 | | | $ | 1,061.40 | | | | 0.87 | % | | $ | 4.52 | | |

Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,020.82 | | | | 0.87 | % | | $ | 4.43 | | |

MFG Core Infrastructure

Fund – Institutional Class | |

Actual Fund Return | | $ | 1,000.00 | | | $ | 927.10 | | | | 0.70 | % | | $ | 3.40 | | |

Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,021.68 | | | | 0.70 | % | | $ | 3.57 | | |

Timpani Small Cap Growth

Fund – Institutional Class | |

Actual Fund Return | | $ | 1,000.00 | | | $ | 1,069.70 | | | | 1.10 | % | | $ | 5.74 | | |

Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,019.66 | | | | 1.10 | % | | $ | 5.60 | | |

Timpani Small Cap Growth

Fund – Class Y | |

Actual Fund Return | | $ | 1,000.00 | | | $ | 1,068.40 | | | | 1.50 | % | | $ | 7.82 | | |

Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,017.64 | | | | 1.50 | % | | $ | 7.63 | | |

Netols Small Cap Value

Fund – Institutional Class | |

Actual Fund Return | | $ | 1,000.00 | | | $ | 1,158.00 | | | | 1.10 | % | | $ | 5.98 | | |

Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,019.66 | | | | 1.10 | % | | $ | 5.60 | | |

Netols Small Cap Value

Fund – Class Y | |

Actual Fund Return | | $ | 1,000.00 | | | $ | 1,158.10 | | | | 1.10 | % | | $ | 5.98 | | |

Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,019.66 | | | | 1.10 | % | | $ | 5.60 | | |

Phocas Small Cap Value

Fund – Institutional Class | |

Actual Fund Return | | $ | 1,000.00 | | | $ | 1,188.80 | | | | 1.10 | % | | $ | 6.07 | | |

Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,019.66 | | | | 1.10 | % | | $ | 5.60 | | |

* Expenses are equal to each Fund's annualized expense ratio indicated above, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period.

page 25

Frontier Funds

EXPENSE EXAMPLE (continued)

December 31, 2016 (Unaudited)

| | Beginning Account

Value | | Ending Account

Value 12/31/2016 | | Annualized

Expense Ratio | | Expenses Paid

During the Period | |

MFG Core Infrastructure

Fund – Service Class | |

Actual Fund Return* | | $ | 1,000.00 | | | $ | 929.40 | | | | 0.75 | % | | $ | 3.37 | | |

Hypothetical 5% Return** | | $ | 1,000.00 | | | $ | 1,021.42 | | | | 0.75 | % | | $ | 3.82 | | |

Timpani Small Cap Growth

Fund – Service Class | |

Actual Fund Return* | | $ | 1,000.00 | | | $ | 1,024.60 | | | | 1.10 | % | | $ | 5.19 | | |

Hypothetical 5% Return** | | $ | 1,000.00 | | | $ | 1,019.66 | | | | 1.10 | % | | $ | 5.60 | | |

Phocas Small Cap Value

Fund – Service Class | |

Actual Fund Return* | | $ | 1,000.00 | | | $ | 1,147.70 | | | | 1.10 | % | | $ | 5.50 | | |

Hypothetical 5% Return** | | $ | 1,000.00 | | | $ | 1,019.66 | | | | 1.10 | % | | $ | 5.60 | | |

* Actual expenses are equal to each Fund's annualized expense ratio indicated above, multiplied by the average account value over the period, multiplied by 170/365 to reflect the most recent fiscal period end since the MFG Core Infrastructure Fund — Service Class, Timpani Small Cap Growth Fund — Service Class and Phocas Small Cap Value Fund — Service Class commenced operations on July 15, 2016.

** Hypothetical expenses are equal to each Fund's annualized expense ratio indicated above, multiplied by the average account value over the period commencing July 1, 2016, multiplied by 184/365 to reflect information had the MFG Core Infrastructure Fund — Service Class, Timpani Small Cap Growth Fund — Service Class and Phocas Small Cap Value Fund — Service Class been in operation for the entire fiscal half year.

page 26

Frontier MFG Global Equity Fund

SCHEDULE OF INVESTMENTS

December 31, 2016 (Unaudited)

Number of Shares | | | | Value | |

COMMON STOCKS 86.0% | | | |

| | | Australia 0.6% | |

| | 382,597 | | | Woolworths Ltd. | | $ | 6,654,053 | | |

| | | France 2.9% | |

| | 371,869 | | | Sanofi | | | 30,102,451 | | |

| | | Switzerland 6.4% | |

| | 490,163 | | | Nestle SA | | | 35,162,926 | | |

| | 441,756 | | | Novartis AG | | | 32,145,850 | | |

| | | | 67,308,776 | | |

| | | United Kingdom 5.6% | |

| | 35,252,216 | | | Lloyds Banking Group PLC | | | 27,157,526 | | |

| | 12,240,008 | | | Tesco PLC (a) | | | 31,202,653 | | |

| | | | 58,360,179 | | |

| | | United States 70.5% | |

| | 9,845 | | | Alphabet, Inc. - Class A (a) | | | 7,801,670 | | |

| | 56,303 | | | Alphabet, Inc. - Class C (a) | | | 43,455,790 | | |

| | 602,180 | | | Apple, Inc. | | | 69,744,488 | | |

| | 140,080 | | | Costco Wholesale Corp. | | | 22,428,209 | | |

| | 495,703 | | | CVS Health Corp. | | | 39,115,924 | | |

| | 1,336,919 | | | eBay, Inc. (a) | | | 39,693,125 | | |

| | 301,406 | | | Facebook, Inc. - Class A (a) | | | 34,676,760 | | |

| | 365,023 | | | HCA Holdings, Inc. (a) | | | 27,019,003 | | |

| | 638,445 | | | Intel Corp. | | | 23,156,400 | | |

| | 692,729 | | | Lowe's Companies, Inc. | | | 49,266,887 | | |

| | 296,641 | | | MasterCard, Inc. - Class A | | | 30,628,183 | | |

| | 304,327 | | | McDonald's Corp. | | | 37,042,682 | | |

| | 775,025 | | | Microsoft Corp. | | | 48,160,054 | | |

| | 957,863 | | | Oracle Corp. | | | 36,829,832 | | |

| | 856,214 | | | PayPal Holdings, Inc. (a) | | | 33,794,767 | | |

| | 367,545 | | | QUALCOMM, Inc. | | | 23,963,934 | | |

| | 348,118 | | | Target Corp. | | | 25,144,563 | | |

| | 640,803 | | | Visa, Inc. - Class A | | | 49,995,450 | | |

| | 871,983 | | | Wells Fargo & Co. | | | 48,054,983 | | |

| | 561,619 | | | Yum China Holdings, Inc. (a) | | | 14,669,488 | | |

Number of Shares | | | | Value | |

| | | United States 70.5% (continued) | |

| | 561,619 | | | Yum! Brands, Inc. | | $ | 35,567,331 | | |

| | | | 740,209,523 | | |

| | | Total Common Stocks | |

| | | (Cost $789,869,307) | | | 902,634,982 | | |

SHORT-TERM INVESTMENTS 12.5% | |

| | | Investment Company 12.5% | |

| | 131,370,278 | | | Morgan Stanley Institutional

Liquidity Funds - Government

Portfolio - Institutional Class,

0.44% | | | 131,370,278 | | |

| | | Total Short-Term Investments | |

| | | (Cost $131,370,278) | | | 131,370,278 | | |

| | | Total Investments 98.5% | |

| | | (Cost $921,239,585) | | | 1,034,005,260 | | |

| | | Other Assets in Excess of

Liabilities 1.5% | | | 16,175,608 | | |

| | | TOTAL NET ASSETS 100.0% | | $ | 1,050,180,868 | | |

(a) Non-Income Producing.

PORTFOLIO DIVERSIFICATION

Sectors | | Percentage | |

Information Technology | | | 42.1 | % | |

Consumer Discretionary | | | 15.4 | | |

Consumer Staples | | | 12.8 | | |

Health Care | | | 8.5 | | |

Financials | | | 7.2 | | |

Total Common Stocks | | | 86.0 | | |

Total Short-Term Investments | | | 12.5 | | |

Total Investments | | | 98.5 | | |

Other Assets in Excess of Liabilities | | | 1.5 | | |

Total Net Assets | | | 100.0 | % | |

The accompanying notes are an integral part of these financial statements.

page 27

Frontier MFG Global Plus Fund

SCHEDULE OF INVESTMENTS

December 31, 2016 (Unaudited)

Number of Shares | | | | Value | |

COMMON STOCKS 87.9% | | | |

| | | Australia 0.3% | |

| | 18,751 | | | Woolworths Ltd. | | $ | 326,114 | | |

| | | France 3.1% | |

| | 49,458 | | | Sanofi | | | 4,003,579 | | |

| | | Switzerland 7.0% | |

| | 64,892 | | | Nestle SA | | | 4,655,171 | | |

| | 58,517 | | | Novartis AG | | | 4,258,185 | | |

| | | | 8,913,356 | | |

| | | United Kingdom 2.8% | |

| | 4,688,923 | | | Lloyds Banking Group PLC | | | 3,612,242 | | |

| | | United States 74.7% | |

| | 1,211 | | | Alphabet, Inc. - Class A (a) | | | 959,657 | | |

| | 7,457 | | | Alphabet, Inc. - Class C (a) | | | 5,755,462 | | |

| | 79,214 | | | Apple, Inc. | | | 9,174,565 | | |

| | 17,718 | | | Costco Wholesale Corp. | | | 2,836,829 | | |

| | 65,710 | | | CVS Health Corp. | | | 5,185,176 | | |

| | 177,234 | | | eBay, Inc. (a) | | | 5,262,077 | | |

| | 39,652 | | | Facebook, Inc. - Class A (a) | | | 4,561,963 | | |

| | 48,291 | | | HCA Holdings, Inc. (a) | | | 3,574,500 | | |

| | 81,029 | | | Intel Corp. | | | 2,938,922 | | |

| | 91,133 | | | Lowe's Companies, Inc. | | | 6,481,380 | | |

| | 39,279 | | | MasterCard, Inc. - Class A | | | 4,055,557 | | |

| | 40,251 | | | McDonald's Corp. | | | 4,899,351 | | |

| | 101,958 | | | Microsoft Corp. | | | 6,335,670 | | |

| | 126,696 | | | Oracle Corp. | | | 4,871,461 | | |

| | 109,613 | | | PayPal Holdings, Inc. (a) | | | 4,326,425 | | |

| | 49,151 | | | QUALCOMM, Inc. | | | 3,204,645 | | |

| | 46,311 | | | Target Corp. | | | 3,345,044 | | |

| | 84,302 | | | Visa, Inc. - Class A | | | 6,577,242 | | |

| | 114,713 | | | Wells Fargo & Co. | | | 6,321,833 | | |

| | 73,884 | | | Yum! Brands, Inc. | | | 4,679,074 | | |

| | | | 95,346,833 | | |

| | | Total Common Stocks | |

| | | | | (Cost $109,568,253) | | | 112,202,124 | | |

Number of Shares | | | | Value | |

SHORT-TERM INVESTMENTS 12.1% | |

| | | Investment Company 12.1% | |

| | 15,399,714 | | | Morgan Stanley Institutional

Liquidity Funds - Government

Portfolio - Institutional Class,

0.44% | | $ | 15,399,714 | | |

| | | Total Short-Term Investments | |

| | | (Cost $15,399,714) | | | 15,399,714 | | |

| | | Total Investments 100.0% | |

| | | (Cost $124,967,967) | | | 127,601,838 | | |

| | | Liabilities in Excess of

Other Assets 0.0% | | | (21,128 | ) | |

| | | TOTAL NET ASSETS 100.0% | | $ | 127,580,710 | | |

(a) Non-Income Producing.

PORTFOLIO DIVERSIFICATION

Sectors | | Percentage | |

Information Technology | | | 45.5 | % | |

Consumer Discretionary | | | 15.2 | | |

Consumer Staples | | | 10.2 | | |

Health Care | | | 9.2 | | |

Financials | | | 7.8 | | |

Total Common Stocks | | | 87.9 | | |

Total Short-Term Investments | | | 12.1 | | |

Total Investments | | | 100.0 | | |

Liabilities in Excess of Other Assets | | | 0.0 | | |

Total Net Assets | | | 100.0 | % | |

The accompanying notes are an integral part of these financial statements.

page 28

Frontier MFG Core Infrastructure Fund

SCHEDULE OF INVESTMENTS

December 31, 2016 (Unaudited)

Number of Shares | | | | Value | |

COMMON STOCKS 96.9% | | | |

| | | Australia 8.4% | |

| | 357,536 | | | APA Group | | $ | 2,211,201 | | |

| | 1,087,025 | | | AusNet Services | | | 1,239,437 | | |

| | 810,775 | | | DUET Group | | | 1,603,166 | | |

| | 165,367 | | | Macquarie Atlas Roads Group | | | 602,654 | | |

| | 512,496 | | | Spark Infrastructure Group | | | 880,228 | | |

| | 731,929 | | | Sydney Airport | | | 3,163,905 | | |

| | 664,549 | | | Transurban Group | | | 4,949,192 | | |

| | | | 14,649,783 | | |

| | | Canada 9.5% | |

| | 65,220 | | | Emera, Inc. | | | 2,204,846 | | |

| | 122,326 | | | Enbridge, Inc. | | | 5,147,595 | | |

| | 130,032 | | | Fortis, Inc. | | | 4,015,288 | | |

| | 113,806 | | | TransCanada Corp. | | | 5,131,505 | | |

| | 12,902 | | | Valener, Inc. | | | 201,412 | | |

| | | | 16,700,646 | | |

| | | France 5.4% | |

| | 31,760 | | | Aeroports de Paris | | | 3,403,407 | | |

| | 77,519 | | | Eutelsat Communications SA | | | 1,501,044 | | |

| | 183,162 | | | Groupe Eurotunnel SE | | | 1,741,811 | | |

| | 124,736 | | | SES SA - ADR | | | 2,747,532 | | |

| | | | 9,393,794 | | |

| | | Germany 1.0% | |

| | 29,666 | | | Fraport AG Frankfurt Airport

Services Worldwide | | | 1,754,078 | | |

| | | Hong Kong 2.8% | |

| | 556,428 | | | Power Assets Holdings Ltd. | | | 4,904,488 | | |

| | | Italy 8.7% | |

| | 222,677 | | | Atlantia SpA | | | 5,217,783 | | |

| | 177,656 | | | Enav SpA (a) | | | 614,142 | | |

| | 269,489 | | | Italgas SpA (a) | | | 1,060,390 | | |

| | 1,123,417 | | | Snam SpA | | | 4,628,575 | | |

| | 76,350 | | | Societa Iniziative Autostradali e

Servizi SpA | | | 650,998 | | |

Number of Shares | | | | Value | |

| | | Italy 8.7% (continued) | |

| | 653,923 | | | Terna Rete Elettrica

Nazionale SpA | | $ | 2,995,719 | | |

| | | | 15,167,607 | | |

| | | Mexico 2.1% | |

| | 101,062 | | | Grupo Aeroportuario del Centro

Norte SAB de CV | | | 435,018 | | |

| | 158,813 | | | Grupo Aeroportuario del Pacifico

SAB de CV - Class B | | | 1,305,460 | | |

| | 92,270 | | | Grupo Aeroportuario del Sureste

SAB de CV - Class B | | | 1,328,257 | | |

| | 581,381 | | | OHL Mexico SAB de CV | | | 571,855 | | |

| | | | 3,640,590 | | |

| | | Netherlands 1.1% | |

| | 42,579 | | | Koninklijke Vopak NV | | | 2,011,340 | | |

| | | New Zealand 1.4% | |

| | 382,264 | | | Auckland International

Airport Ltd. | | | 1,659,742 | | |

| | 334,324 | | | Vector Ltd. | | | 752,506 | | |

| | | | 2,412,248 | | |

| | | Spain 9.0% | |

| | 317,831 | | | Abertis Infraestructuras SA | | | 4,448,055 | | |

| | 37,563 | | | Aena SA | | | 5,126,469 | | |

| | 71,047 | | | Cellnex Telecom SAU | | | 1,021,976 | | |

| | 76,618 | | | Enagas SA | | | 1,945,735 | | |

| | 176,032 | | | Red Electrica Corp SA | | | 3,321,516 | | |

| | | | 15,863,751 | | |

| | | Switzerland 1.0% | |

| | 9,854 | | | Flughafen Zuerich AG | | | 1,827,969 | | |

| | | United Kingdom 6.4% | |

| | 449,331 | | | National Grid PLC | | | 5,269,569 | | |

| | 137,780 | | | Pennon Group PLC | | | 1,404,255 | | |

| | 75,652 | | | Severn Trent PLC | | | 2,071,661 | | |

| | 221,777 | | | United Utilities Group PLC | | | 2,462,610 | | |

| | | | 11,208,095 | | |

The accompanying notes are an integral part of these financial statements.

page 29

Frontier MFG Core Infrastructure Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2016 (Unaudited)

Number of Shares | | | | Value | |

| COMMON STOCKS 96.9% (continued) | | | |

| | | United States 40.1% | |

| | 6,810 | | | ALLETE, Inc. | | $ | 437,134 | | |

| | 36,206 | | | Alliant Energy Corp. | | | 1,371,845 | | |

| | 36,936 | | | Ameren Corp. | | | 1,937,663 | | |

| | 60,587 | | | American Electric Power Co., Inc. | | | 3,814,557 | | |

| | 6,560 | | | American States Water Co. | | | 298,874 | | |

| | 34,747 | | | American Tower Corp. | | | 3,672,063 | | |

| | 27,563 | | | American Water Works Co., Inc. | | | 1,994,459 | | |

| | 25,415 | | | Aqua America, Inc. | | | 763,467 | | |

| | 14,957 | | | Atmos Energy Corp. | | | 1,109,062 | | |

| | 8,779 | | | Avista Corp. | | | 351,072 | | |

| | 7,850 | | | California Water Service Group | | | 266,115 | | |

| | 42,610 | | | CMS Energy Corp. | | | 1,773,428 | | |

| | 47,165 | | | Consolidated Edison, Inc. | | | 3,475,117 | | |

| | 42,637 | | | Crown Castle International Corp. | | | 3,699,612 | | |

| | 50,683 | | | Dominion Resources, Inc. | | | 3,881,811 | | |

| | 50,221 | | | Duke Energy Corp. | | | 3,898,154 | | |

| | 49,597 | | | Edison International | | | 3,570,488 | | |

| | 5,972 | | | El Paso Electric Co. | | | 277,698 | | |

| | 48,238 | | | Eversource Energy | | | 2,664,185 | | |

| | 34,284 | | | Great Plains Energy, Inc. | | | 937,667 | | |

| | 7,077 | | | IDACORP, Inc. | | | 570,052 | | |

| | 46,175 | | | NiSource, Inc. | | | 1,022,314 | | |

| | 4,041 | | | Northwest Natural Gas Co. | | | 241,652 | | |

| | 6,623 | | | NorthWestern Corp. | | | 376,650 | | |

| | 7,200 | | | ONE Gas, Inc. | | | 460,512 | | |

| | 63,240 | | | PG&E Corp. | | | 3,843,095 | | |

| | 16,877 | | | Pinnacle West Capital Corp. | | | 1,316,912 | | |

| | 11,214 | | | PNM Resources, Inc. | | | 384,640 | | |

| | 12,744 | | | Portland General Electric Co. | | | 552,197 | | |

| | 105,347 | | | PPL Corp. | | | 3,587,065 | | |

| | 21,907 | | | SCANA Corp. | | | 1,605,345 | | |

| | 37,893 | | | Sempra Energy | | | 3,813,552 | | |

| | 1,405 | | | SJW Corp. | | | 78,652 | | |

| | 6,567 | | | Southwest Gas Corp. | | | 503,164 | | |

| | 6,096 | | | Spire, Inc. | | | 393,497 | | |

Number of Shares | | | | Value | |

| | | United States 40.1% (continued) | |

| | 6,418 | | | The Empire District Electric Co. | | $ | 218,790 | | |

| | 78,627 | | | The Southern Co. | | | 3,867,662 | | |

| | 48,045 | | | WEC Energy Group, Inc. | | | 2,817,839 | | |

| | 20,726 | | | Westar Energy, Inc. | | | 1,167,910 | | |

| | 77,324 | | | Xcel Energy, Inc. | | | 3,147,087 | | |

| | | | 70,163,058 | | |

| | | Total Common Stocks | |

| | | | | (Cost $160,877,824) | | | 169,697,447 | | |

CLOSED-END FUNDS 0.9% | | | |

| | | United Kingdom 0.9% | |

| | 485,186 | | | HICL Infrastructure Co. Ltd. | | | 984,220 | | |

| | 338,970 | | | International Public

Partnerships Ltd. | | | 643,334 | | |

| | | | 1,627,554 | | |

| | | Total Closed-End Funds | |

| | | | | (Cost $1,793,705) | | | 1,627,554 | | |

SHORT-TERM INVESTMENTS 1.9% | | | |

| | | Investment Company 1.9% | |

| | 3,274,684 | | | Morgan Stanley Institutional

Liquidity Funds - Government

Portfolio - Institutional Class,

0.44% | | | 3,274,684 | | |

| | | Total Short-Term Investments | |

| | | | | (Cost $3,274,684) | | | 3,274,684 | | |

| | | Total Investments 99.7% | |

| | | | | (Cost $165,946,213) | | | 174,599,685 | | |

| | | | | Other Assets in Excess of

Liabilities 0.3% | | | 448,903 | | |

| | | | | TOTAL NET ASSETS 100.0% | | $ | 175,048,588 | | |

(a) Non-Income Producing.

ADR - American Depositary Receipt | |

The accompanying notes are an integral part of these financial statements.

page 30

Frontier MFG Core Infrastructure Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2016 (Unaudited)

PORTFOLIO DIVERSIFICATION

Sectors | | Percentage | |

Integrated Power | | | 28.3 | % | |

Transmission & Distribution | | | 17.4 | | |

Airports | | | 11.8 | | |

Toll Roads | | | 10.4 | | |

Energy Infrastructure | | | 8.3 | | |

Gas Utilities | | | 8.2 | | |

Communications | | | 7.2 | | |

Water Utilities | | | 5.3 | | |

Total Common Stocks | | | 96.9 | | |

Social | | | 0.9 | | |

Total Closed-End Funds | | | 0.9 | | |

Total Short-Term Investments | | | 1.9 | | |

Total Investments | | | 99.7 | | |

Other Assets in Excess of Liabilities | | | 0.3 | | |

Total Net Assets | | | 100.0 | % | |

The accompanying notes are an integral part of these financial statements.

page 31

Frontier Timpani Small Cap Growth Fund

SCHEDULE OF INVESTMENTS

December 31, 2016 (Unaudited)

Number of Shares | | | | Value | |

COMMON STOCKS 98.3% | | | |

| | | Consumer Discretionary 20.5% | |

| | 15,888 | | | Bojangles', Inc. (a) | | $ | 296,311 | | |

| | 18,022 | | | Boot Barn Holdings, Inc. (a) | | | 225,635 | | |

| | 12,229 | | | Build-A-Bear Workshop, Inc. (a) | | | 168,149 | | |

| | 8,796 | | | Central Garden & Pet Co. (a) | | | 291,060 | | |

| | 21,101 | | | Century Communities, Inc. (a) | | | 443,121 | | |

| | 58,535 | | | Chegg, Inc. (a) | | | 431,988 | | |

| | 21,562 | | | Conn's, Inc. (a) | | | 272,759 | | |

| | 9,136 | | | Dave & Buster's

Entertainment, Inc. (a) | | | 514,357 | | |

| | 14,509 | | | Fox Factory Holding Corp. (a) | | | 402,625 | | |

| | 5,637 | | | Hibbett Sports, Inc. (a) | | | 210,260 | | |

| | 2,175 | | | Jack in the Box, Inc. | | | 242,817 | | |

| | 11,245 | | | LGI Homes, Inc. (a) | | | 323,069 | | |

| | 3,414 | | | Lithia Motors, Inc. - Class A | | | 330,578 | | |

| | 27,750 | | | Nautilus, Inc. (a) | | | 513,375 | | |

| | 16,489 | | | Nutrisystem, Inc. | | | 571,344 | | |

| | 22,557 | | | Ollie's Bargain Outlet

Holdings, Inc. (a) | | | 641,747 | | |

| | 1,111 | | | Panera Bread Co. - Class A (a) | | | 227,855 | | |

| | 4,247 | | | Papa John's International, Inc. | | | 363,458 | | |

| | 27,788 | | | Planet Fitness, Inc. - Class A | | | 558,539 | | |

| | 4,105 | | | RH (a) | | | 126,023 | | |

| | 8,351 | | | Stamps.com, Inc. (a) | | | 957,442 | | |

| | 3,745 | | | Texas Roadhouse, Inc. | | | 180,659 | | |

| | 5,315 | | | The Children's Place, Inc. | | | 536,549 | | |

| | 14,450 | | | The Habit Restaurants, Inc. -

Class A (a) | | | 249,263 | | |

| | 10,092 | | | Zoe's Kitchen, Inc. (a) | | | 242,107 | | |

| | | | 9,321,090 | | |

| | | Consumer Staples 2.6% | |

| | 6,640 | | | MGP Ingredients, Inc. | | | 331,867 | | |

| | 29,613 | | | Primo Water Corp. (a) | | | 363,648 | | |

| | 12,068 | | | Snyder's-Lance, Inc. | | | 462,687 | | |

| | | | 1,158,202 | | |

Number of Shares | | | | Value | |

| | | Financial Services 3.8% | |

| | 8,511 | | | BofI Holding, Inc. (a) | | $ | 242,989 | | |

| | 6,318 | | | Kinsale Capital Group, Inc. | | | 214,875 | | |

| | 7,472 | | | LendingTree, Inc. (a) | | | 757,287 | | |

| | 10,007 | | | Western Alliance Bancorp (a) | | | 487,441 | | |

| | | | 1,702,592 | | |

| | | Health Care 19.8% | |

| | 3,102 | | | ABIOMED, Inc. (a) | | | 349,533 | | |

| | 30,455 | | | AxoGen, Inc. (a) | | | 274,095 | | |

| | 17,686 | | | BioTelemetry, Inc. (a) | | | 395,282 | | |

| | 12,541 | | | Cardiovascular Systems, Inc. (a) | | | 303,618 | | |

| | 44,180 | | | Castlight Health, Inc. - Class B (a) | | | 218,691 | | |

| | 19,512 | | | Glaukos Corp. (a) | | | 669,262 | | |

| | 16,287 | | | Heska Corp. (a) | | | 1,166,149 | | |

| | 6,327 | | | ICU Medical, Inc. (a) | | | 932,283 | | |

| | 7,774 | | | INC Research Holdings, Inc. -

Class A (a) | | | 408,912 | | |

| | 12,674 | | | Inogen, Inc. (a) | | | 851,313 | | |

| | 4,615 | | | Ligand Pharmaceuticals, Inc. (a) | | | 468,930 | | |

| | 37,131 | | | NeoGenomics, Inc. (a) | | | 318,213 | | |

| | 4,899 | | | Nevro Corp. (a) | | | 355,961 | | |

| | 11,974 | | | NuVasive, Inc. (a) | | | 806,569 | | |

| | 11,170 | | | Penumbra, Inc. (a) | | | 712,646 | | |

| | 7,037 | | | PRA Health Sciences, Inc. (a) | | | 387,879 | | |

| | 10,262 | | | Supernus Pharmaceuticals, Inc. (a) | | | 259,116 | | |

| | 19,569 | | | Synergy Pharmaceuticals, Inc. (a) | | | 119,175 | | |

| | | | 8,997,627 | | |

| | | Materials & Processing 3.6% | |

| | 5,848 | | | Beacon Roofing Supply, Inc. (a) | | | 269,417 | | |

| | 2,688 | | | Patrick Industries, Inc. (a) | | | 205,094 | | |

| | 20,604 | | | Summit Matierals, Inc. -

Class A (a) | | | 490,175 | | |

| | 9,789 | | | U.S. Concrete, Inc. (a) | | | 641,180 | | |

| | | | 1,605,866 | | |

| | | Producer Durables 16.9% | |

| | 12,834 | | | Advanced Energy

Industries, Inc. (a) | | | 702,661 | | |

The accompanying notes are an integral part of these financial statements.

page 32

Frontier Timpani Small Cap Growth Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2016 (Unaudited)

Number of Shares | | | | Value | |

| COMMON STOCKS 98.3% (continued) | | | |

| | | Producer Durables 16.9% (continued) | |

| | 28,509 | | | Air Transport Services

Group, Inc. (a) | | $ | 455,004 | | |

| | 9,855 | | | Atkore International

Group, Inc. (a) | | | 235,633 | | |

| | 6,271 | | | Dycom Industries, Inc. (a) | | | 503,499 | | |

| | 8,181 | | | Granite Construction, Inc. | | | 449,955 | | |

| | 11,463 | | | Hudson Technologies, Inc. (a) | | | 91,819 | | |

| | 9,855 | | | John Bean Technologies Corp. | | | 847,037 | | |

| | 13,903 | | | Knight Transportation, Inc. | | | 459,494 | | |

| | 28,336 | | | MasTec, Inc. (a) | | | 1,083,852 | | |

| | 17,166 | | | NV5 Global, Inc. (a) | | | 573,344 | | |

| | 4,559 | | | Old Dominion Freight

Line, Inc. (a) | | | 391,117 | | |

| | 4,311 | | | OSI Systems, Inc. (a) | | | 328,153 | | |

| | 18,169 | | | Polar Power, Inc. (a) | | | 162,613 | | |

| | 22,642 | | | Quanta Services, Inc. (a) | | | 789,074 | | |

| | 10,716 | | | Swift Transportation Co. (a) | | | 261,042 | | |

| | 1,400 | | | TransDigm Group, Inc. | | | 348,544 | | |

| | | | 7,682,841 | | |

| | | Technology 30.1% | |

| | 24,591 | | | A10 Networks, Inc. (a) | | | 204,351 | | |

| | 14,329 | | | Airgain, Inc. (a) | | | 206,338 | | |

| | 11,582 | | | Asure Software, Inc. (a) | | | 98,563 | | |

| | 39,513 | | | AXT, Inc. (a) | | | 189,662 | | |

| | 24,818 | | | Bazaarvoice, Inc. (a) | | | 120,367 | | |

| | 52,738 | | | Carbonite, Inc. (a) | | | 864,903 | | |

| | 19,247 | | | CEVA, Inc. (a) | | | 645,737 | | |

| | 7,661 | | | Coherent, Inc. (a) | | | 1,052,507 | | |

| | 17,270 | | | CommVault Systems, Inc. (a) | | | 887,678 | | |

| | 8,351 | | | Evolent Health, Inc. - Class A (a) | | | 123,595 | | |

| | 15,142 | | | Fabrinet (a) | | | 610,223 | | |

| | 65,553 | | | Five9, Inc. (a) | | | 930,197 | | |

| | 19,900 | | | Gigamon, Inc. (a) | | | 906,445 | | |

| | 28,705 | | | GTT Communications, Inc. (a) | | | 825,269 | | |

| | 15,360 | | | II-VI, Inc. (a) | | | 455,424 | | |

Number of Shares | | | | Value | |

| | | Technology 30.1% (continued) | |

| | 2,469 | | | iRobot Corp. (a) | | $ | 144,313 | | |

| | 4,263 | | | LogMeIn, Inc. | | | 411,593 | | |

| | 22,888 | | | Lumentum Holdings, Inc. (a) | | | 884,621 | | |

| | 12,778 | | | Match Group, Inc. (a) | | | 218,504 | | |

| | 26,151 | | | Orbotech Ltd. (a) | | | 873,705 | | |

| | 10,252 | | | Q2 Holdings, Inc. (a) | | | 295,770 | | |

| | 21,678 | | | RADCOM Ltd. (a) | | | 385,868 | | |

| | 23,182 | | | RealPage, Inc. (a) | | | 695,460 | | |

| | 9,770 | | | Rudolph Technologies, Inc. (a) | | | 228,130 | | |

| | 21,053 | | | The KEYW Holding Corp. (a) | | | 248,215 | | |