UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-07685 |

|

Frontier Funds, Inc. |

(Exact name of registrant as specified in charter) |

|

400 Skokie Blvd. Suite 500 Northbrook, Illinois | | 60062 |

(Address of principal executive offices) | | (Zip code) |

|

William D. Forsyth III 400 Skokie Blvd., Suite 500 Northbrook, Illinois 60062 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (847) 509-9860 | |

|

Date of fiscal year end: | June 30 | |

|

Date of reporting period: | December 31, 2015 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

SEMI-ANNUAL REPORT

Frontier MFG Global Equity Fund

Frontier MFG Global Plus Fund

Frontier MFG Core Infrastructure Fund

Frontier Timpani Small Cap Growth Fund

Frontier Netols Small Cap Value Fund

Frontier Phocas Small Cap Value Fund

Frontegra Asset Management, Inc.

December 31, 2015

TABLE OF CONTENTS

Shareholder Letter | | | 1 | | |

Frontier MFG Global Equity Fund | |

Report from MFG Asset Management | | | 4 | | |

Investment Highlights | | | 6 | | |

Frontier MFG Global Plus Fund | |

Report from MFG Asset Management | | | 8 | | |

Investment Highlights | | | 10 | | |

Frontier MFG Core Infrastructure Fund | |

Report from MFG Asset Management | | | 12 | | |

Investment Highlights | | | 14 | | |

Frontier Timpani Small Cap Growth Fund | |

Report from Timpani Capital Management LLC | | | 16 | | |

Investment Highlights | | | 18 | | |

Frontier Netols Small Cap Value Fund | |

Report from Netols Asset Management, Inc. | | | 20 | | |

Investment Highlights | | | 21 | | |

Frontier Phocas Small Cap Value Fund | |

Report from Phocas Financial Corporation | | | 24 | | |

Investment Highlights | | | 26 | | |

Expense Example | | | 27 | | |

Schedules of Investments | |

Frontier MFG Global Equity Fund | | | 29 | | |

Frontier MFG Global Plus Fund | | | 30 | | |

Frontier MFG Core Infrastructure Fund | | | 31 | | |

Frontier Timpani Small Cap Growth Fund | | | 34 | | |

Frontier Netols Small Cap Value Fund | | | 37 | | |

Frontier Phocas Small Cap Value Fund | | | 39 | | |

Statements of Assets and Liabilities | | | 42 | | |

Statements of Operations | | | 44 | | |

Statements of Changes in Net Assets | | | 46 | | |

Financial Highlights | | | 49 | | |

Notes to Financial Statements | �� | | 57 | | |

Voting Results of Special Meeting of Shareholders | | | 65 | | |

This report is submitted for the general information of the shareholders of the Funds. It is not authorized for distribution to prospective investors unless accompanied or preceded by an effective Prospectus for the applicable Fund. The Prospectus may be obtained by calling 1-888-825-2100. Each Prospectus includes more complete information about management fees and expenses, investment objectives, risks and operating policies of the applicable Fund. Please read the Prospectus carefully.

Frontier Funds, Inc. are distributed by Frontegra Strategies, LLC, 400 Skokie Blvd., Suite 500, Northbrook, IL 60062. Frontegra Strategies, LLC, member of FINRA and SIPC, is an affiliate of Frontegra Asset Management, Inc., the Funds' investment adviser.

DEAR FELLOW SHAREHOLDERS:

We are pleased to report on the progress of the Frontier Funds over the past six months ending December 31, 2015. The S&P 500 Index was up 0.15% and small capitalization stocks were down, with the Russell 2000® Index returning -8.75%. International stocks, as measured by the MSCI EAFE Index, returned -6.01% over the six month period.

Fund Results

The Frontier MFG Global Equity Fund, managed by MFG Asset Management ("MFG"), returned 0.15% (net) versus the MSCI World Index (Net) return of -3.41% for the six month period ending December 31, 2015.

The Frontier MFG Global Plus Fund, also managed by MFG, returned -0.13% (net) versus the MSCI World Index (Net) return of -3.41% for the six month period ending December 31, 2015.

For the six month period ending December 31, 2015, the Frontier MFG Core Infrastructure Fund, also managed by MFG, returned 4.78% (net) versus the S&P Global Infrastructure Index return of -9.10%.

The Frontier Timpani Small Cap Growth Fund, Institutional Class, managed by Timpani Capital Management, returned -14.05% (net) versus the Russell 2000® Growth Index return of -9.31% for the six month period ending December 31, 2015. The Class Y shares returned -14.19% (net) over the same time period.

For the six month period ending December 31, 2015, the Frontier Netols Small Cap Value Fund, Institutional Class, managed by Netols Asset Management, returned -8.99% (net) versus the Russell 2000® Value Index return of -8.17%. The Class Y shares returned -8.96% (net) over the same time period.

The Frontier Phocas Small Cap Value Fund, managed by Phocas Financial, returned -4.83% (net) versus the Russell 2000 Value Index return of -8.17% for the six month period ending December 31, 2015.

Outlook

Calendar year 2015 was like A Tale of Two Cities. The first six months of the year were generally strong, with small but solid gains in both U.S. and non-U.S. equity markets and very strong performance in small cap U.S. stocks, especially growth-oriented names. The second half of the year was almost the polar opposite; U.S. and non-U.S. equities gave back the gains they had enjoyed in the first half of the year, and small cap U.S. stocks were largely routed. Market volatility spiked during the year, and three overriding themes seemed to have a pervasive effect on markets: 1) a plunge in oil prices, which fell nearly 40%; 2) an unexpectedly sharp rise in the U.S. dollar; and 3) concerns about emerging markets, especially China. As we enter 2016, we will work diligently to navigate markets with the care and diligence necessary in these tumultuous times.

We will continue to oversee the investment management of the Frontier Funds with the care and diligence that have served our shareholders well in the past. As always, we appreciate your investment and continued confidence in the Frontier Funds.

Best regards,

William D. Forsyth, CFA

President

Frontier Funds, Inc.

page 1

This page intentionally left blank.

FRONTIER

MFG GLOBAL EQUITY FUND

REPORT FROM MFG ASSET MANAGEMENT

Dear Shareholders:

The investment objective of the Frontier MFG Global Equity Fund is capital appreciation. The objective is measured against the MSCI World Index (Net).

Performance Review

The Frontier MFG Global Equity Fund returned 0.15%, net of fees, for the six month period ending December 31, 2015, compared to -3.41% for the MSCI World Index (Net). For the year, the Fund returned 3.78%, net of fees, compared to the benchmark's return of -0.87%.

We do not manage the Fund against short-term performance metrics, and it is inevitable the Fund will underperform markets at some point in the future. We feel strongly that people cannot retire on "relative investment returns;" only by generating investment returns that exceed the rate of inflation (ideally by a satisfactory margin) will investors increase their wealth over time. As such, we are happy to be judged on the absolute returns of our strategy over time.

Fund Outlook and Strategy

The current risk pricing environment for high quality assets is quite extraordinary in a historical context. Pricing for sovereign credit, high quality corporate and financial credit and other high quality defensive assets is at, or near, record highs at present. The pricing of high quality assets reflects the prevailing environment of ultra-low policy rates and massive Quantitative Easing (QE) programmes over the past eight years by the G4 central banks (the U.S. Federal Reserve (Fed), the Bank of England (BOE), the Bank of Japan (BOJ) and the European Central Bank (ECB)) and the accumulation of foreign exchange reserves by China, Saudi Arabia and Switzerland, which have had policies to peg their currencies to either the U.S. dollar or the euro. We refer to these collectively as the G7 Central Banks.

Equity markets have become more challenging and value has become harder to find as share prices have continued to rise. While nothing is certain in investing, we predict that the next three years will be challenging for equities as they battle the headwind of rising long-term interest rates.

In April 2015, we increased the cash weighting of the Fund to approximately 15% (cash weighting at December 31, 2015, is approximately 13%). The cash weighting increases the defensiveness of our portfolio and should act as a partial hedge to increasing interest rates. In addition, we have reduced our exposure to emerging markets and euro earnings. We have also materially reduced our exposure to high quality defensive equities, as they are particularly exposed to higher than expected bond yields as relative pricing is very stretched.

We feel comfortable with the Fund's overall risk profile and construction. We believe it is likely to deliver satisfactory returns over the next investment cycle, while also exhibiting below-benchmark downside risk in the event that there is a major downturn in markets.

The Fund

On December 31, 2015, the Fund held 26 investments. Over the six months to December 31, 2015, the three investments, continuously held to the end of the period, with the strongest returns in local currency, were Alphabet (formerly Google) (+48.2%), Microsoft (+27.1%), and Home Depot (+20.0%) while the investments with the weakest returns were Tesco (-29.7%), QUALCOMM (-19.1%) and Yum! Brands (-18.1%). On an absolute basis, the three largest contributors to the Fund's return, in local currency, were Microsoft, Alphabet and eBay which added +1.8%, +1.2% and +0.9% respectively. Conversely, the three bottom contributors were Tesco, Yum! Brands and IBM, which detracted -1.2%, -0.9% and -0.7%, respectively.

page 4

Within the current macroeconomic environment we continue to see value in high-quality companies exposed to certain investment themes. The Fund continues to be exposed to the following major investment themes:

• Technology/software. We believe that the entrenched global enterprise software companies continue to have enormous competitive advantages and exhibit attractive investment characteristics.

• U.S. housing recovery. A recovery in new housing construction should drive a strong cyclical recovery in companies exposed to U.S. housing and also provide a strong boost to the overall economy.

• The move to a cashless society. There continues to be a strong secular shift from spending via cash and cheque to cashless forms of payments such as credit cards, debit cards, electronic funds transfer and mobile payments. In our opinion, the explosion of smart and internet-connected, mobile devices will accelerate this shift on a global basis. We believe that there are only a limited number of companies that are well positioned to directly benefit from this structural shift.

• U.S. interest rates. In our view, it is likely that U.S. short- and long-term interest rates will "normalize" over the next two years as the U.S. economy recovers. Now that the Fed has ended its QE programme, this may occur alongside the shrinking (or sterilisation) of its balance sheet, as well as the normal monetary policy action of lifting the Federal Funds Rate (FFR).

• Emerging market consumption growth. The Fund gains its exposure via selective investments in multinational consumer franchises.

Yours sincerely,

Hamish Douglass

Portfolio Manager

MFG Asset Management

page 5

INVESTMENT HIGHLIGHTS

Growth of a $1,000,000 Investment (Unaudited)

* 12/28/11 commencement of operations.

This chart assumes an initial gross investment of $1,000,000 made on 12/28/11 (commencement of operations). Returns shown include the reinvestment of all distributions. Past performance is not predictive of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. In the absence of existing fee waivers, total return would be reduced. To receive current to the most recent month-end performance, please call 1-888-825-2100.

The MSCI World Index represents large and mid cap equities across 23 Developed Markets countries. The index covers approximately 85% of the free float-adjusted market capitalization in each country. The index does not reflect investment management fees, brokerage commissions and other expenses associated with investing in equity securities. A direct investment in the index is not possible.

Frontegra Asset Management, Inc. has contractually agreed through October 31, 2016, to waive its management fee and/or reimburse the Fund's operating expenses to the extent necessary to ensure that the Fund's total operating expenses (excluding taxes, interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) do not exceed 0.80% of the Fund's average daily net assets. The expense ratios presented are based on the annualized expense ratios as reported in the Fund's current prospectus, which may differ from the expense ratios presented in the Fund's financial highlights.

** The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Portfolio Total Return**

FOR PERIODS ENDED 12/31/15 | | FUND | | INDEX | |

SIX MONTHS | | | 0.15 | % | | | (3.41 | )% | |

ONE YEAR | | | 3.78 | % | | | (0.87 | )% | |

AVERAGE ANNUAL

SINCE INCEPTION | | | 14.06 | % | | | 11.47 | % | |

Fund Expenses | |

GROSS EXPENSE RATIO | | | 0.88 | % | |

NET EXPENSE RATIO | | | 0.82 | % | |

page 6

FRONTIER

MFG GLOBAL PLUS FUND

REPORT FROM MFG ASSET MANAGEMENT

Dear Fellow Shareholders:

The investment objective of the Frontier MFG Global Plus Fund is capital appreciation. The objective is measured against the MSCI World Index (Net).

Performance Review

The Frontier MFG Global Plus Fund returned -0.13%, net of fees, for the six month period ending December 31, 2015, compared to -3.41% the MSCI World Index (Net). Since inception on March 23, 2015, the Fund returned -1.03%, net of fees, compared to the benchmark's return of -5.05%.

We feel strongly that people cannot retire on "relative investment returns;" only by generating investment returns that exceed the rate of inflation (ideally by a satisfactory margin) will investors increase their wealth over time. As such, we are happy to be judged by the Fund's absolute returns over time.

Fund Outlook and Strategy

The current risk pricing environment for high quality assets is quite extraordinary in a historical context. Pricing for sovereign credit, high quality corporate and financial credit and other high quality defensive assets is at, or near, record highs at present. The pricing of high quality assets reflects the prevailing environment of ultra-low policy rates and massive Quantitative Easing (QE) programmes over the past eight years by the G4 central banks (the U.S. Federal Reserve (Fed), the Bank of England (BOE), the Bank of Japan (BOJ) and the European Central Bank (ECB)) and the accumulation of foreign exchange reserves by China, Saudi Arabia and Switzerland, which have had policies to peg their currencies to either the U.S. dollar or the euro. We refer to these collectively as the G7 Central Banks.

Equity markets have become more challenging and value has become harder to find as share prices have continued to rise. While nothing is certain in investing, we predict that the next three years will be challenging for equities as they battle the headwind of rising long-term interest rates.

In April 2015, we increased the cash weighting of the Fund to approximately 15% (cash weighting at December 31, 2015, is approximately 12%). The cash weighting increases the defensiveness of our portfolio and should act as a partial hedge to increasing interest rates. In addition, we have reduced our exposure to emerging markets and euro earnings. We have also materially reduced our exposure to high quality defensive equities, as they are particularly exposed to higher than expected bond yields as relative pricing is very stretched.

We feel comfortable with the Fund's overall risk profile and construction. We believe it is likely to deliver satisfactory returns over the next investment cycle, while also exhibiting below-benchmark downside risk in the event that there is a major downturn in markets.

The Fund

On December 31, 2015, the Fund held 26 investments. Over the six months to December 31, 2015, the three investments, continuously held to the end of the period, with the strongest returns in local currency, were Alphabet (formerly Google) (+48.2%), Microsoft (+27.1%), and Home Depot (+20.0%) while the investments with the weakest returns were Tesco (-29.7%), QUALCOMM (-19.1%) and Yum! Brands (-18.1%). On an absolute basis, the three largest contributors to the Fund's return, in local currency, were Microsoft, Alphabet and eBay which added +1.8%, +1.2% and +0.9%, respectively. Conversely, the three bottom contributors were Tesco, Yum! Brands and IBM, which detracted -1.2%, -0.9% and -0.7%, respectively.

page 8

Within the current macroeconomic environment, we continue to see value in high-quality companies exposed to certain investment themes. The Fund continues to be exposed to the following major investment themes:

• Technology/software. We believe that the entrenched global enterprise software companies continue to have enormous competitive advantages and exhibit attractive investment characteristics.

• U.S. housing recovery. A recovery in new housing construction should drive a strong cyclical recovery in companies exposed to U.S. housing and also provide a strong boost to the overall economy.

• The move to a cashless society. There continues to be a strong secular shift from spending via cash and cheque to cashless forms of payments, such a credit cards, debit cards, electronic funds transfer and mobile payments.

• U.S. interest rates normalizing over the next two years as the U.S. economy continues to recover.

• Emerging market consumption growth via selective investments in multinational consumer franchises.

Yours sincerely,

Hamish Douglass

Portfolio Manager

MFG Asset Management

page 9

INVESTMENT HIGHLIGHTS

Growth of a $1,000,000 Investment (Unaudited)

* 3/23/15 commencement of operations.

This chart assumes an initial gross investment of $1,000,000 made on 3/23/15 (commencement of operations). Returns shown include the reinvestment of all distributions. Past performance is not predictive of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. In the absence of existing fee waivers, total return would be reduced. To receive current to the most recent month-end performance, please call 1-888-825-2100.

The MSCI World Index represents large and mid cap equities across 23 Developed Markets countries. The index covers approximately 85% of the free float-adjusted market capitalization in each country. The index does not reflect investment management fees, brokerage commissions and other expenses associated with investing in equity securities. A direct investment in the index is not possible.

Frontegra Asset Management, Inc. has contractually agreed through October 31, 2016, to waive its management fee and/or reimburse the Fund's operating expenses to the extent necessary to ensure that the Fund's total operating expenses (excluding taxes, interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) do not exceed 0.80% of the Fund's average daily net assets. The expense ratios presented are based on the annualized expense ratios as reported in the Fund's current prospectus, which may differ from the expense ratios presented in the Fund's financial highlights.

** The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Portfolio Total Return**

FOR PERIODS ENDED 12/31/15 | | FUND | | INDEX | |

SIX MONTHS | | | (0.13 | )% | | | (3.41 | )% | |

SINCE INCEPTION | | | (1.03 | )% | | | (5.05 | )% | |

Fund Expenses | |

GROSS EXPENSE RATIO | | | 4.97 | % | |

NET EXPENSE RATIO | | | 0.81 | % | |

page 10

FRONTIER

MFG CORE INFRASTRUCTURE FUND

REPORT FROM MFG ASSET MANAGEMENT

Dear Fellow Shareholders:

The investment objective of the Frontier MFG Core Infrastructure Fund is long-term capital appreciation. The objective is currently measured against the S&P Global Infrastructure Index.

The types of infrastructure assets in which the Fund invests are generally natural monopolies that provide an essential service to the community. Infrastructure assets offer investors protection from the impacts of inflation because their earnings generally have some direct linkage to inflation. Over time, the stable, reliable earnings of infrastructure assets are expected to lead to a combination of income and capital growth for investors.

The universe of infrastructure assets that are held by the Fund is made up of two main sectors:

• Utilities: Utilities comprise approximately 65% of the Fund and includes both regulated energy utilities and regulated water utilities. Utilities are typically subject to economic regulation. The terms of regulation typically require a utility to efficiently provide an essential service to the community and, in return, permit the utility to earn a fair rate of return on the capital it has invested in its operations. As a utility provides a basic necessity, e.g. energy or water, there is minimal fluctuation in demanded volumes in response to the economic cycle, while the price charged for the utility service can be adjusted with limited impact upon demanded volumes. As a result, the earnings of regulated utilities have been, and are expected to continue to be, stable irrespective of economic conditions.

• Infrastructure: This includes airports, ports, toll roads and broadcast communications infrastructure. Regulation of infrastructure companies is generally less intensive than regulation of utilities and this allows companies to accrue the benefits of volume growth (i.e. the returns of infrastructure companies are linked to growth in passengers, vehicles or containers). As economies develop, grow and become more inter-dependent, we expect the underlying level of aviation, shipping and vehicle traffic to increase. As a result, the revenues and earnings derived by infrastructure assets are expected to grow.

Performance Review

The Frontier MFG Core Infrastructure Fund returned 4.78%, net of fees, for the six month period ending December 31, 2015. The Fund's return outperformed the -9.10% return of its benchmark, the S&P Global Infrastructure Index, by 13.88%. For the year, the Fund returned -1.03%, net of fees, compared to the benchmark's return of -11.46%. The negative return for the year was impacted by the appreciation of the U.S. dollar over the period. The U.S. dollar hedged version of the benchmark index was down only 7.4% for the year.

The last year has provided a clear demonstration of the importance of how a global listed infrastructure investor defines their investment universe. As we have noted in previous investor letters, MFG applies a conservative definition of the infrastructure investment universe that is designed to provide investors with predictable, through the cycle, inflation linked returns. This means that MFG excludes those stocks from the investable universe whose earnings are materially impacted by competition, sovereign risk and, importantly in the last year, changes in commodity prices. Outperformance over listed infrastructure and global equities benchmarks reflects the limited exposure of the Fund to stocks impacted by falling energy prices and, to a lesser extent, emerging markets.

Seventy-five of the 89 stocks in the Fund generated a positive shareholder return in the period. Particularly strong returns were provided by U.S. utilities Piedmont Natural Gas (Total Shareholder Return (TSR) of +63.8%), TECO Energy (+53.7%) and Empire District Electric Co. (+31.8%). Other strong performers included Mexican airport company GAPB (+44.6%), Sydney Airport (+30.1%), and other U.S. utilities Westar Energy (+26.3%), PNM Resources (+26.1%) and Atmos Energy (+24.6%).

page 12

All sectors held by the Fund, except Energy Infrastructure, delivered positive returns for the period. The Airports sector provided a weighted average TSR of +18.5%, the Power Transmission & Distribution sector +13.1%, Integrated Power +12.8% and Gas Utilities +11.9%. The Energy Infrastructure sector was clearly impacted by the fall in oil prices; however, we remain confident that this will have only marginal impacts on the earnings of those stocks held in the Fund.

Geographically, the Fund's Latin American exposures generated a TSR of +17.9%, U.S. stocks were up +13.5% and Australian/New Zealand stocks provided a TSR of +12.9%.

As previously mentioned, the performance of the benchmark was negatively impacted by stocks with a material exposure to oil prices. Examples of significantly weighted stocks in the index, but not held by the Fund, caught up in the commodity price falls included Kinder Morgan (TSR of -59.9% for the period), The Williams Companies (-53.6%) and Cheniere Energy (-46.2%).

Portfolio Outlook and Strategy

The Fund is designed to provide reliable returns over the medium-to-longer term. We believe that infrastructure and utility assets, with requisite earnings reliability and a linkage of earnings to inflation, offer an attractive, long-term investment proposition. Furthermore, given the predictable nature of earnings and the structural linkage of those earnings to inflation, the investment returns generated by infrastructure assets are different from standard asset classes and offer investors valuable diversification when included in an investment portfolio. In the current uncertain economic and investment climate, the reliable financial performance of infrastructure investments makes them particularly attractive and an investment in listed infrastructure can be expected to reward patient investors with a three to five year timeframe.

Sincerely,

Dennis Eagar

Portfolio Manager

MFG Asset Management

page 13

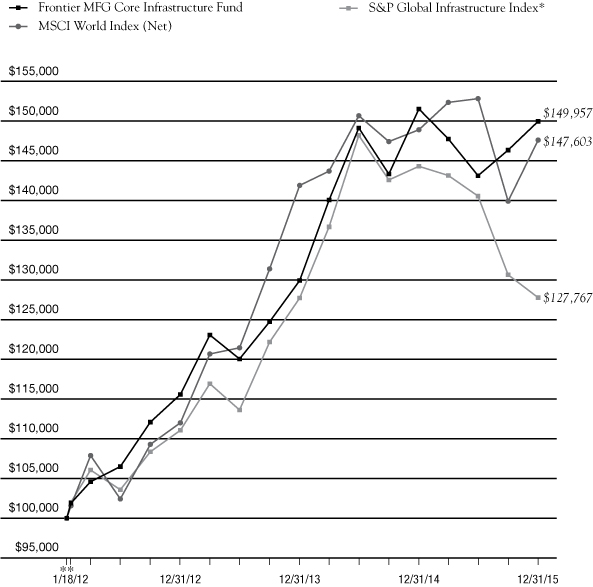

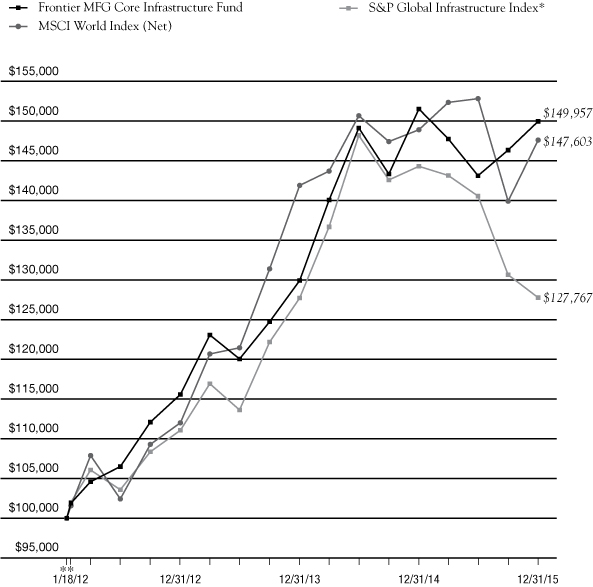

INVESTMENT HIGHLIGHTS

Growth of a $100,000 Investment (Unaudited)

* The UBS Developed Infrastructure & Utilities Index (Net), a former benchmark index for the Frontier MFG Core Infrastructure Fund, was discontinued on April 1, 2015.

** 1/18/12 commencement of operations.

This chart assumes an initial gross investment of $100,000 made on 1/18/12 (commencement of operations). Returns shown include the reinvestment of all distributions. Past performance is not predictive of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. In the absence of existing fee waivers, total return would be reduced. To receive current to the most recent month-end performance, please call 1-888-825-2100.

The MSCI World Index represents large and mid cap equities across 23 Developed Markets countries and covers approximately 85% of the free float-adjusted market capitalization in each country. The S&P Global Infrastructure Index is a global developed markets infrastructure and utilities benchmark. Neither index reflects investment management fees, brokerage commissions or other expenses associated with investing in equity securities. A direct investment in an index is not possible.

Frontegra Asset Management, Inc. has contractually agreed through October 31, 2016, to waive its management fee and/or reimburse the Fund's operating expenses to the extent necessary to ensure that the Fund's total operating expenses (excluding taxes, interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) do not exceed 0.70% of the Fund's average daily net assets. The expense ratios presented are based on the annualized expense ratios as reported in the Fund's current prospectus, which may differ from the expense ratios presented in the Fund's financial highlights.

*** The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Portfolio Total Return***

FOR PERIODS

ENDED

12/31/15 | | FUND | | MSCI

INDEX | | S&P

GLOBAL

INDEX | |

SIX MONTHS | | | 4.78 | % | | | (3.41 | )% | | | (9.10 | )% | |

ONE YEAR | | | (1.03 | )% | | | (0.87 | )% | | | (11.46 | )% | |

AVERAGE

ANNUAL

SINCE

INCEPTION | | | 10.79 | % | | | 10.35 | % | | | 6.39 | % | |

Fund Expenses | |

GROSS EXPENSE RATIO | | | 0.93 | % | |

NET EXPENSE RATIO | | | 0.70 | % | |

page 14

FRONTIER

TIMPANI SMALL CAP GROWTH FUND

REPORT FROM TIMPANI CAPITAL MANAGEMENT LLC

Dear Fellow Shareholders:

The Frontier Timpani Small Cap Growth Fund strives to achieve capital appreciation by investing in a diversified portfolio of growth companies with small market capitalizations. Timpani seeks to:

• Invest in companies where growth is robust, sustainable and underestimated by the market.

• Conduct fundamental research that provides unique insights into the growth gap that exists between market expectations and a company's true growth rate.

• Manage risk by continuously evaluating the size of the growth gap relative to market expectations and monitoring market sentiment.

• Act on new relevant incremental data points, both positive and negative, in an effort to exploit investor biases.

Performance Review

For the six months ended December 31, 2015, the Fund underperformed its benchmark, the Russell 2000® Growth Index, returning -14.05%, net of fees, compared to -9.31% for the benchmark. For the year, the Fund returned -2.68%, net of fees, compared to -1.38% for the Index.

Stock selection drove the majority of the negative impact, while sector allocation was also a negative impact on the portfolio. While we outperformed in the third quarter, the main theme during the fourth quarter was rotation — rotation away from high-performance stocks and into lower-performance stocks. This profit-taking represented a broad-based headwind, especially within Health Care, which had been one of our strongest areas of performance in the first half of calendar 2015. While we also took some profits along the way, the stylistic headwinds were too powerful to overcome. Stock selection within Energy was the only notable positive, while Health Care was a noteworthy headwind to performance. An overweight in Health Care and a slight overweight in Energy were the main detractors to performance from a sector allocation standpoint. We had several individual winners, but the magnitude of contribution was dulled by the aforementioned rotation. Our largest individual winner was LendingTree, a Timpani holding for over three years. It continued to post strong results, especially in its non-mortgage segment. Consumers are increasingly using the internet to shop for money and LendingTree is efficiently connecting those consumers to various financial lenders. Another winner was Health Care stock, INC Research Holdings, a contract research organization. It reported impressive results and a positive outlook relative to expectations. Health Care stocks, Adeptus Health and Horizon Pharma, notable winners from earlier in 2015, were notable losers in the second half of 2015. Adeptus Health operates free-standing emergency medical centers and faced questions about the sustainability of its pricing model. Horizon Pharma was sold from the portfolio as concerns about pricing and the sustainability of organic growth came into question.

Portfolio Outlook

Most stock indices were lower in the second half of the year, and the weakness domestically was led by small cap stocks. The third quarter was characterized by a very weak market and mini-crash, while the fourth quarter saw the market gain its footing and rise.

In December 2015, after months of speculation, the Federal Reserve finally raised interest rates for the first time in about a decade. Commentary from the Fed suggests further increases will be gradual and drawn out over time which should be well-received by markets. Importantly, rising interest rates by the Fed are most likely to be accompanied by further improvement in the domestic economy. The biggest macro risk is economic recession and that seems very unlikely in the intermediate term. Meanwhile, international central banks remain very accommodative, supporting global growth prospects.

page 16

China is a source of anxiety for investors. The dislocation in China's stock market and currency is disturbing, but the likelihood of it derailing U.S. growth seems minimal. Falling commodity prices and its impact on earnings and high-yield debt securities is another source of concern for investors. Timpani has minimal direct exposure to these issues, but is closely monitoring potentially broader implications.

On a micro level, we think the fundamental backdrop remains constructive for the U.S. economy. Data points from company management teams continue to confirm the economy is on solid footing and that secular growth can be found in numerous pockets of the economy. That growth is being sought by investors and can potentially drive upside to analyst estimates and lead to strong stock price performance. Based on where we are in the current stock market cycle, we expect secular growth and upside surprise to be embraced by the marketplace.

During the period, we continued to focus on finding robust and sustainable growers where the growth is being underestimated. That research has resulted in some sector weight changes that vary from the benchmark weights. The only notable overweight is Technology, while notable underweights include Producer Durables and Health Care.

We will continue to make it our mission to find companies that have characteristics consistent with our investment process. We believe this approach is most value-added for shareholders over the long term.

Thank you for your continued support.

Sincerely,

Brandon Nelson, CFA

Chief Investment Officer

Timpani Capital Management LLC

page 17

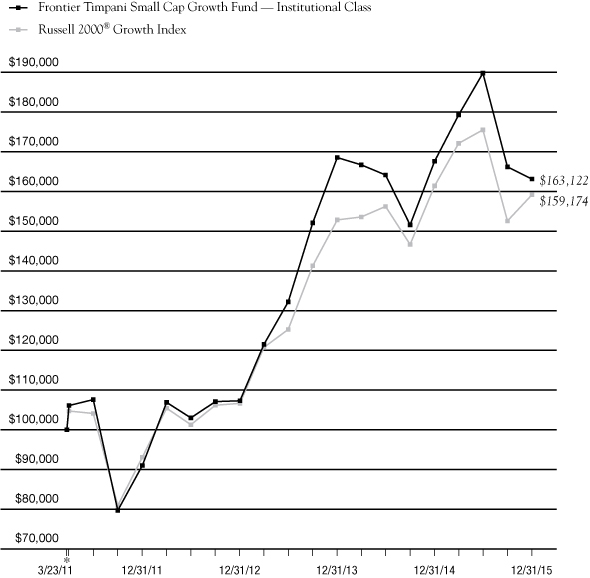

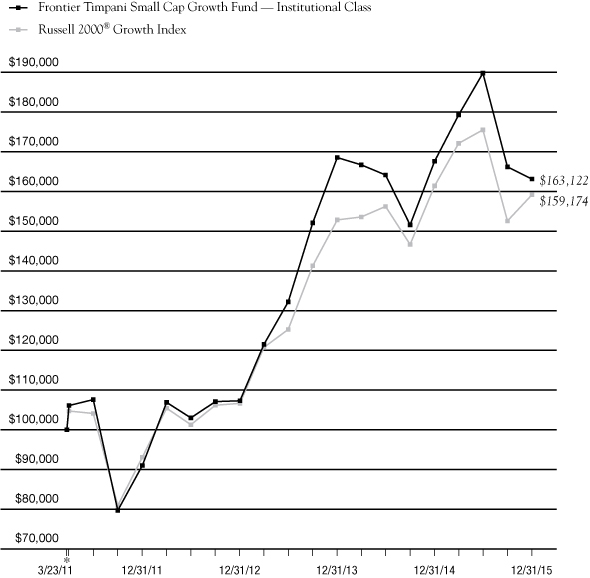

INVESTMENT HIGHLIGHTS

Growth of a $100,000 Investment (Unaudited)

* 3/23/11 commencement of operations.

This chart assumes an initial gross investment of $100,000 made on 3/23/11. Returns shown include the reinvestment of all distributions. Past performance is not predictive of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. In the absence of fee waivers, total return would be reduced. To receive current to the most recent month-end performance, please call 1-888-825-2100.

The Russell 2000® Growth Index measures the performance of the small-cap growth segment of the U.S. equity universe. The index does not reflect investment management fees, brokerage commissions and other expenses associated with investing in equity securities. A direct investment in the index is not possible.

Timpani Capital Management LLC has contractually agreed through October 31, 2016, to waive its management fee and/or reimburse the Fund's operating expenses to the extent necessary to ensure that the Fund's total operating expenses (excluding taxes, interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) do not exceed 1.10% of the Fund's average daily net assets of the Institutional Class. The expense ratios presented are based on the annualized expense ratios as reported in the Fund's current prospectus, which may differ from the expense ratios presented in the Fund's financial highlights.

** The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The above graph relates to Institutional Class shares of the Fund. Performance for Class Y shares will vary from the performance of the Institutional Class shares shown above due to differences in expenses.

Portfolio Total Return**

FOR PERIODS ENDED 12/31/15 | | FUND | | INDEX | |

SIX MONTHS | | | (14.05 | )% | | | (9.31 | )% | |

ONE YEAR | | | (2.68 | )% | | | (1.38 | )% | |

AVERAGE ANNUAL

SINCE INCEPTION | | | 10.79 | % | | | 10.22 | % | |

Institutional Class Expenses | |

GROSS EXPENSE RATIO | | | 1.52 | % | |

NET EXPENSE RATIO | | | 1.10 | % | |

page 18

FRONTIER

NETOLS SMALL CAP VALUE FUND

REPORT FROM NETOLS ASSET MANAGEMENT, INC.

Dear Fellow Shareholders:

The Frontier Netols Small Cap Value Fund strives to achieve capital appreciation by investing at least 80% of its assets in equity securities of small capitalization companies. The Fund's performance is measured against the Russell 2000® Value Index.

Performance Review

During the six month period ended December 31, 2015, the Frontier Netols Small Cap Value Fund (Institutional Class) returned -8.99%, net of fees, compared to -8.17% for the Russell 2000 Value Index. For the year, the Fund returned -6.58%, net of fees, compared to -7.47% for the Index.

Portfolio Review

During the second half of 2015, the main factor impacting the financial markets was the action by the Federal Reserve. After postponing a rate hike in the September quarter, the Fed raised rates in December with the indication of four additional increases in 2016. While this provided some clarity domestically, questions remained about the strength of the world economy. As a result, the ECB cut the savings rate and extended quantitative easing by six months. Additionally, economic weakness in China prompted a 50 basis point rate cut and emerging markets continued to experience capital outflows. The result was a softening of the high yield and equity markets. Overall, more domestically focused Utilities, Financials, and Consumer Staples outperformed on a relative basis while commodity focused Energy and Materials underperformed during the period.

Positive Contributions to Relative Performance in the Second Half of 2015:

• Stock selection in Materials, Energy, Consumer Staples, and Financials sectors

• Overweight in Consumer Staples sector

• Underweight in Energy

• Best performing stocks for the period: Willbros Group, Acuity Brands, Casey's General Stores, Education Realty Trust, Selective Insurance Group

Negative Contributions to Relative Performance in the Second Half of 2015:

• Stock selection in Health Care and Information Technology sectors

• Overweight in Consumer Discretionary sector

• Underweight in Financials and Utilities sectors

• Worst performing stocks for the period: Commercial Vehicle Group, Accuride, Cloud Peak Energy, Bill Barret, Kindred Healthcare

Portfolio Outlook

We believe the U.S. economy remains stable, driven by a modestly improving employment outlook. However, softness in some international economies and in particular China has raised concerns. Added to the mix is increased geopolitical tension in various parts of the world. These factors raise doubts about the ability of the Federal Reserve to continue on the path of higher rates.

Thank you for your continued support.

Jeff Netols

President

Netols Asset Management, Inc.

page 20

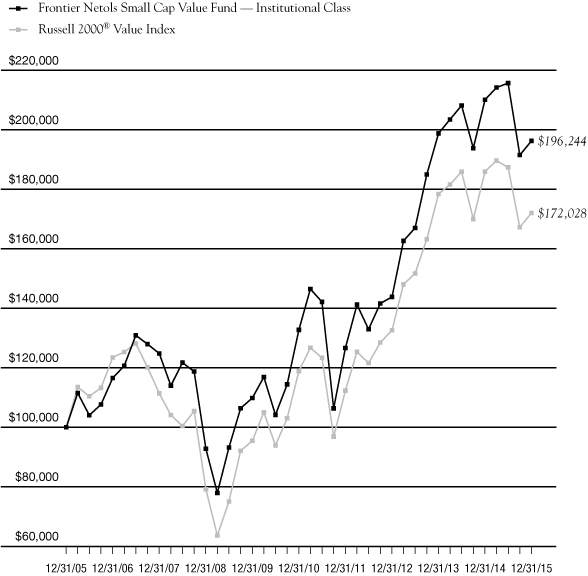

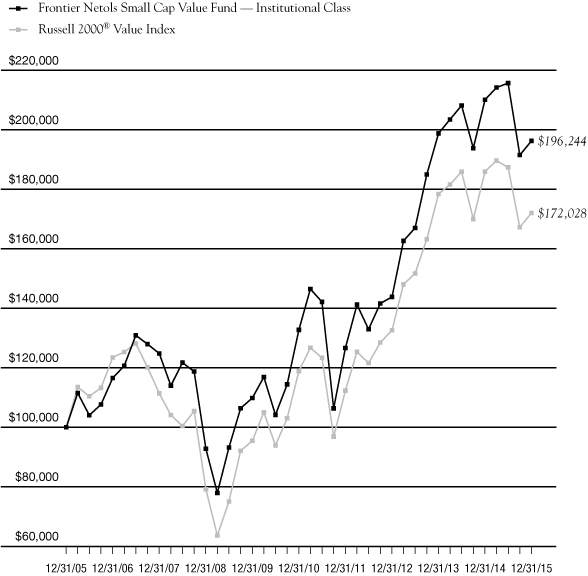

INVESTMENT HIGHLIGHTS

Growth of a $100,000 Investment (Unaudited)

This chart assumes an initial gross investment of $100,000 made on 12/31/05. Returns shown include the reinvestment of all distributions. Past performance is not predictive of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. In the absence of existing fee waivers, total return would be reduced. To receive current to the most recent month-end performance, please call 1-888-825-2100.

The Russell 2000 Value Index measures the performance of those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values. The index does not reflect investment management fees, brokerage commissions and other expenses associated with investing in equity securities. A direct investment in the index is not possible.

Frontegra Asset Management, Inc. has contractually agreed through October 31, 2016, to waive its management fee and/or reimburse the Fund's operating expenses to the extent necessary to ensure that the Fund's total operating expenses (excluding taxes, interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) do not exceed 1.10% of the Fund's average daily net assets for the Institutional Class. The expense ratios presented are based on the annualized expense ratios as reported in the Fund's current prospectus, which may differ from the expense ratios presented in the Fund's financial highlights.

* The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The above graph relates to Institutional Class shares of the Fund. Performance for Class Y shares will vary from the performance of the Institutional Class shares shown above due to differences in expenses.

Portfolio Total Return*

FOR PERIODS

ENDED 12/31/15 | | FUND | | INDEX | |

SIX MONTHS | | | (8.99 | )% | | | (8.17 | )% | |

ONE YEAR | | | (6.58 | )% | | | (7.47 | )% | |

FIVE YEAR

AVERAGE ANNUAL | | | 8.13 | % | | | 7.67 | % | |

TEN YEAR

AVERAGE ANNUAL | | | 6.97 | % | | | 5.57 | % | |

Institutional Class Expenses | |

GROSS EXPENSE RATIO | | | 1.18 | % | |

NET EXPENSE RATIO | | | 1.10 | % | |

page 21

This page intentionally left blank.

FRONTIER

PHOCAS SMALL CAP VALUE FUND

REPORT FROM PHOCAS FINANCIAL CORPORATION

Dear Fellow Shareholders:

The Frontier Phocas Small Cap Value Fund strives to achieve capital appreciation by investing in a diversified portfolio of equity securities of companies with small market capitalizations. The Fund's performance is measured against the Russell 2000® Value Index.

Performance Review

During the six-month period ended December 31, 2015, the Frontier Phocas Small Cap Value Fund returned -4.83%, net of fees, compared to the -8.17% return of the benchmark, the Russell 2000 Value Index (the "Benchmark" or the "Index"). For the calendar year, the Fund returned -4.35%, net of fees, compared to -7.47% for the Index.

Portfolio Review and Strategy

For the third quarter, M&A finally made a statement within the Fund. As we have said in the past, we do not intentionally buy stocks for that reason, but reasonably run small companies valued cheaply tend to make good acquisition targets. Atmel, a semiconductor company, finally announced a deal after reviewing strategic alternatives. Dialog Semiconductor, a London, U.K.-based company, offered to buy Atmel for both cash and stock. Solera Holdings, another technology holding that is also an insurance company underneath, was acquired by Vista Equity Partners, a private equity firm. On the other end of the spectrum, Blackstone, another private equity firm, in September offered to buy Strategic Hotels & Resorts for cash plus assumed debt. Our biggest outperformer in the third quarter was AMERCO (U-Haul). Banks and Real Estate also lifted returns. The biggest individual detractor for the third quarter was Park-Ohio Holdings, a supplier of industrial supply chain logistics closely tied to the transportation industry. A missed EPS quarter, and an out-of-favor Industrial sector did not help, but we remain confident in the company's future. The second largest laggard was Verint Systems. As a provider of large data business analytics, this company has a bright future. Unfortunately, they guided earnings downward and, needless to say, their share price was taken down accordingly. We do not feel anything has changed fundamentally with either company, and continue to hold the positions.

The biggest individual contributor for the fourth quarter was within Financials. NewBridge Bancorp, a North Carolina based community bank, rose more than 40% as it was being acquired by local peer Yadkin Financial Corp. The deal is expected to close in early 2016. Accuray, a medical imaging device company, was up more than 30%, as backlog and sales began to build after their new product launch. Surprisingly, a very modest small electric company, Empire District Electric, was up nearly 30%. Slow and steady won the race during the quarter. Another Health Care company, PharMerica, an institutional pharmacy services company, was our fourth best performer, climbing more than 20%. Given the weakness within Energy, one could easily assume that most of the top detractors would come from that segment. That, however, was not the case. In fact, none of the worst performers came from that sector. The worst performer was within Consumer Discretionary: retailer JC Penney, down nearly 30%. Many of their peers were equally hit hard during the quarter including Wall Street favorite, Macy's. We believe the valuation discount is excessive, and are waiting patiently for price recovery. Within Technology, Mentor Graphics declined, down more than 20%. They badly missed earnings due to the loss of a large client. Their remaining business, though, remains solid, their balance sheet quality is high, and we believe that management will recover much or all of that business revenue elsewhere at better margins. Within Industrials, we had two major names down over 20%: Allegiant Travel, a leisure travel air carrier serving small to medium sized cities, and MYR Group, an industrial company providing electrical construction services focusing on transmission lines, electric substations, and electricity distribution systems. We continue to believe in both of these businesses, as well as their future prospects.

With the strong gains in the U.S. stock market over the last several years, finding attractive significantly undervalued stocks has been more difficult, but there are still values to be found. Safer areas like Consumer Staples, Health Care, and Utilities have become quite fully valued as cautious investors migrate from fixed income and migrate towards equities. Even global investors want more U.S. equities given the strengthening dollar trends. In our opinion, though, some of the more cyclical areas in the equity markets remain undervalued. There are usually unrecognized values in every sector, however, and our perennial mission is to find them.

page 24

We continue to sell off highly appreciated positions as well as under-performing names that remain fundamentally challenged, and also continue to reinvest in low-valued names. Despite fair valuations within the broader domestic equity market, select stocks still continue to represent investment opportunities. We have focused a lot of attention within Consumer Discretionary, as it had a few of the harder hit subsectors this year, especially specialty retail and apparel. We continue to evaluate the quality of assets within the Energy sector complemented by the quality of balance sheets that will allow companies to survive what we think are currently unsustainably low commodity crude and natural gas prices.

We made a number of changes within the portfolio this quarter, positioning to take advantage of various market mispricings, and believe that the Fund is well positioned to benefit from new management teams improving their businesses.

Thank you for your continued support.

William Schaff, CFA | | Steve Block, CFA | |

Chief Executive Officer and Portfolio Manager | | Portfolio Manager | |

Phocas Financial Corporation | | Phocas Financial Corporation | |

page 25

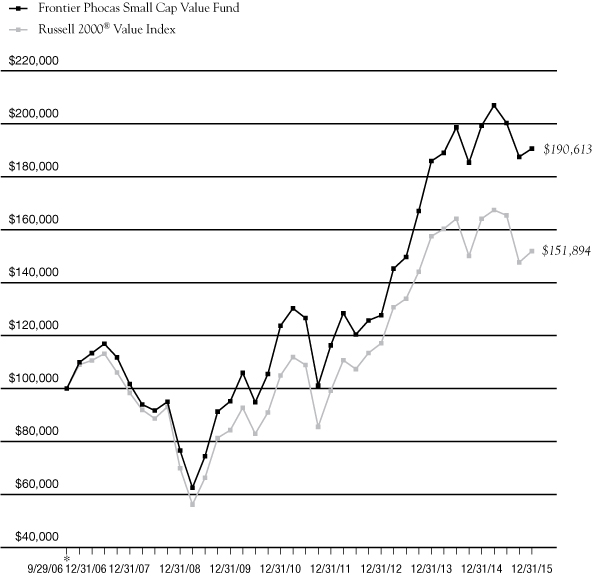

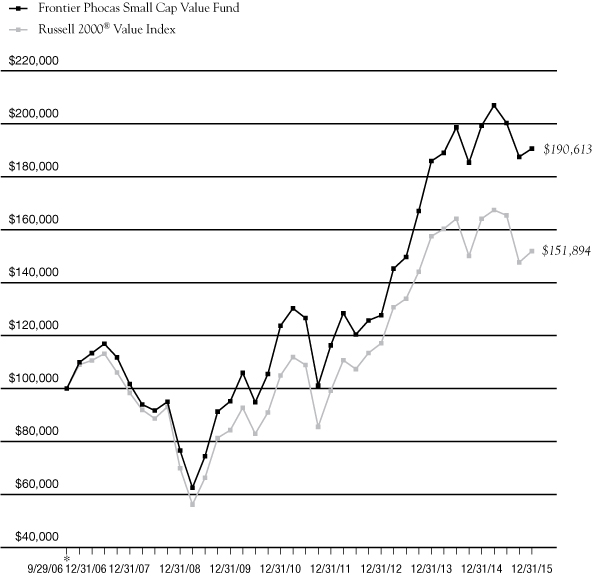

INVESTMENT HIGHLIGHTS

Growth of a $100,000 Investment (Unaudited)

* 9/29/06 commencement of operations.

This chart assumes an initial gross investment of $100,000 made on 9/29/06. Returns shown include the reinvestment of all distributions. Past performance is not predictive of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. In the absence of fee waivers, total return would be reduced. Effective October 8, 2010, Phocas Financial Corp. ("Phocas") became subadviser to the Fund and Frontegra Asset Management, Inc. became adviser to the Fund. Prior to October 8, 2010, Phocas served as adviser to the Fund. To receive current to the most recent month-end performance, please call 1-888-825-2100.

The Russell 2000® Value Index measures the performance of those Russell 2000® companies with lower price-to-book ratios and lower forecasted growth values. The index does not reflect investment management fees, brokerage commissions and other expenses associated with investing in equity securities. A direct investment in the index is not possible.

Frontegra Asset Management, Inc. has contractually agreed through October 31, 2016, to waive its management fee and/or reimburse the Fund's operating expenses to the extent necessary to ensure that the Fund's total operating expenses (excluding taxes, interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) do not exceed 1.10% of the Fund's average daily net assets. The expense ratios presented are based on the annualized expense ratios as reported in the Fund's current prospectus, which may differ from the expense ratios presented in the Fund's financial highlights.

** The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Portfolio Total Return**

FOR PERIODS ENDED 12/31/15 | | FUND | | INDEX | |

SIX MONTHS | | | (4.83 | )% | | | (8.17 | )% | |

ONE YEAR | | | (4.35 | )% | | | (7.47 | )% | |

FIVE YEAR

AVERAGE ANNUAL | | | 9.03 | % | | | 7.67 | % | |

AVERAGE ANNUAL

SINCE INCEPTION | | | 7.22 | % | | | 4.62 | % | |

Fund Expenses | |

GROSS EXPENSE RATIO | | | 1.54 | % | |

NET EXPENSE RATIO | | | 1.10 | % | |

page 26

Frontier Funds

EXPENSE EXAMPLE

December 31, 2015 (Unaudited)

As a shareholder of a mutual fund, you incur two types of costs: (1) transaction costs, including redemption fees, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other fund expenses. Although the Funds charge no sales loads, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Funds' transfer agent. If you request that a redemption be made by wire transfer, currently the Funds' transfer agent charges a $15.00 fee. A redemption fee of 2.00% of the then current value of the shares redeemed may be imposed on certain redemptions of shares made within 30 days of purchase for the Frontier MFG Global Equity, Frontier MFG Global Plus and Frontier MFG Core Infrastructure Funds.

This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (7/1/15 – 12/31/15).

Actual Expenses

The first line of the table on the following page for each Fund provides information about actual account values and actual expenses. The Example includes management fees, registration fees, fee waivers/reimbursements and other expenses. However, the Example does not include portfolio trading commissions and related expenses and other extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During the Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table for each Fund provides information about hypothetical account values and hypothetical expenses based on each of the Fund's actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in each of the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs could have been higher.

page 27

Frontier Funds

EXPENSE EXAMPLE (continued)

December 31, 2015 (Unaudited)

| | Beginning Account

Value 7/1/2015 | | Ending Account

Value 12/31/2015 | | Annualized

Expense Ratio* | | Expenses Paid

During the Period* | |

MFG Global Equity Fund | |

Actual Fund Return | | $ | 1,000.00 | | | $ | 1,001.50 | | | | 0.80 | % | | $ | 4.02 | | |

Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,021.11 | | | | 0.80 | % | | $ | 4.06 | | |

MFG Global Plus Fund | |

Actual Fund Return | | $ | 1,000.00 | | | $ | 998.70 | | | | 0.80 | % | | $ | 4.02 | | |

Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,021.11 | | | | 0.80 | % | | $ | 4.06 | | |

MFG Core Infrastructure Fund | |

Actual Fund Return | | $ | 1,000.00 | | | $ | 1,047.80 | | | | 0.70 | % | | $ | 3.60 | | |

Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,021.62 | | | | 0.70 | % | | $ | 3.56 | | |

Timpani Small Cap Growth

Fund – Institutional Class | |

Actual Fund Return | | $ | 1,000.00 | | | $ | 859.50 | | | | 1.10 | % | | $ | 5.14 | | |

Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,019.61 | | | | 1.10 | % | | $ | 5.58 | | |

Timpani Small Cap Growth

Fund – Class Y | |

Actual Fund Return | | $ | 1,000.00 | | | $ | 858.10 | | | | 1.50 | % | | $ | 7.01 | | |

Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,017.60 | | | | 1.50 | % | | $ | 7.61 | | |

Netols Small Cap Value

Fund – Institutional Class | |

Actual Fund Return | | $ | 1,000.00 | | | $ | 910.10 | | | | 1.10 | % | | $ | 5.28 | | |

Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,019.61 | | | | 1.10 | % | | $ | 5.58 | | |

Netols Small Cap Value

Fund – Class Y | |

Actual Fund Return | | $ | 1,000.00 | | | $ | 910.40 | | | | 1.10 | % | | $ | 5.28 | | |

Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,019.61 | | | | 1.10 | % | | $ | 5.58 | | |

Phocas Small Cap Value Fund | |

Actual Fund Return | | $ | 1,000.00 | | | $ | 951.70 | | | | 1.10 | % | | $ | 5.40 | | |

Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,019.61 | | | | 1.10 | % | | $ | 5.58 | | |

* Expenses are equal to each Fund's annualized expense ratio indicated above, multiplied by the average account value over the period, multiplied by 184/366 to reflect the one-half year period.

page 28

Frontier MFG Global Equity Fund

SCHEDULE OF INVESTMENTS

December 31, 2015 (Unaudited)

Number of Shares | | | | Value | |

COMMON STOCKS 85.0% | | | |

| | | Australia 2.4% | |

| | 1,463,589 | | | Woolworths Ltd. | | $ | 26,129,614 | | |

| | | France 2.4% | |

| | 307,839 | | | Sanofi | | | 26,295,299 | | |

| | | Netherlands 1.7% | |

| | 415,839 | | | Unilever NV | | | 18,124,068 | | |

| | | Switzerland 1.4% | |

| | 208,658 | | | Nestle SA | | | 15,530,605 | | |

| | | United Kingdom 6.5% | |

| | 38,341,677 | | | Lloyds Banking Group PLC | | | 41,301,820 | | |

| | 13,353,171 | | | Tesco PLC (a) | | | 29,429,615 | | |

| | | | 70,731,435 | | |

| | | United States 70.6% | |

| | 10,698 | | | Alphabet, Inc. - Class A (a) | | | 8,323,151 | | |

| | 22,144 | | | Alphabet, Inc. - Class C (a) | | | 16,804,647 | | |

| | 315,896 | | | Apple, Inc. | | | 33,251,213 | | |

| | 442,033 | | | CVS Health Corp. | | | 43,217,566 | | |

| | 1,586,811 | | | eBay, Inc. (a) | | | 43,605,566 | | |

| | 1,504,984 | | | Intel Corp. | | | 51,846,699 | | |

| | 319,256 | | | International Business

Machines Corp. | | | 43,936,011 | | |

| | 669,014 | | | Lowe's Companies, Inc. | | | 50,871,825 | | |

| | 323,619 | | | MasterCard, Inc. - Class A | | | 31,507,546 | | |

| | 1,339,577 | | | Microsoft Corp. | | | 74,319,732 | | |

| | 1,186,678 | | | Oracle Corp. | | | 43,349,347 | | |

| | 1,278,343 | | | PayPal Holdings, Inc. (a) | | | 46,276,017 | | |

| | 402,689 | | | QUALCOMM, Inc. | | | 20,128,410 | | |

| | 308,329 | | | State Street Corp. | | | 20,460,712 | | |

| | 527,162 | | | Target Corp. | | | 38,277,233 | | |

| | 540,887 | | | The Bank of New York

Mellon Corp. | | | 22,295,362 | | |

| | 292,926 | | | The Home Depot, Inc. | | | 38,739,463 | | |

| | 696,621 | | | Visa, Inc. - Class A | | | 54,022,958 | | |

Number of Shares | | | | Value | |

| | | United States 70.6% (continued) | |

| | 849,875 | | | Wells Fargo & Co. | | $ | 46,199,205 | | |

| | 612,394 | | | Yum! Brands, Inc. | | | 44,735,382 | | |

| | | | 772,168,045 | | |

| | | Total Common Stocks | |

| | | | | (Cost $821,000,149) | | | 928,979,066 | | |

SHORT-TERM INVESTMENTS 12.8% | | | |

| | | Investment Company 12.8% | |

| | 139,804,334 | | | STIT Liquid Assets

Portfolio - Institutional

Class, 0.29% | | | 139,804,334 | | |

| | | Total Short-Term Investments | |

| | | | | (Cost $139,804,334) | | | 139,804,334 | | |

| | | Total Investments 97.8% | |

| | | | | (Cost $960,804,483) | | | 1,068,783,400 | | |

| | | | | Other Assets in Excess of

Liabilities 2.2% | | | 24,050,563 | | |

| | | | | TOTAL NET ASSETS 100.0% | | $ | 1,092,833,963 | | |

(a) Non-Income Producing.

PORTFOLIO DIVERSIFICATION

Sectors | | Percentage | |

Information Technology | | | 42.8 | % | |

Consumer Discretionary | | | 15.8 | | |

Consumer Staples | | | 12.1 | | |

Financials | | | 11.9 | | |

Health Care | | | 2.4 | | |

Total Common Stocks | | | 85.0 | | |

Total Short-Term Investments | | | 12.8 | | |

Total Investments | | | 97.8 | | |

Other Assets in Excess of Liabilities | | | 2.2 | | |

Total Net Assets | | | 100.0 | % | |

The accompanying notes are an integral part of these financial statements.

page 29

Frontier MFG Global Plus Fund

SCHEDULE OF INVESTMENTS

December 31, 2015 (Unaudited)

Number of Shares | | | | Value | |

COMMON STOCKS 62.7% | | | |

| | | Australia 1.8% | |

| | 12,523 | | | Woolworths Ltd. | | $ | 223,574 | | |

| | | France 1.8% | |

| | 2,679 | | | Sanofi | | | 228,838 | | |

| | | Netherlands 1.3% | |

| | 3,640 | | | Unilever NV | | | 158,648 | | |

| | | Switzerland 1.0% | |

| | 1,785 | | | Nestle SA | | | 132,859 | | |

| | | United Kingdom 4.7% | |

| | 328,058 | | | Lloyds Banking Group PLC | | | 353,385 | | |

| | 114,252 | | | Tesco PLC (a) | | | 251,805 | | |

| | | | 605,190 | | |

| | | United States 52.1% | |

| | 92 | | | Alphabet, Inc. - Class A (a) | | | 71,577 | | |

| | 194 | | | Alphabet, Inc. - Class C (a) | | | 147,223 | | |

| | 2,707 | | | Apple, Inc. | | | 284,939 | | |

| | 3,787 | | | CVS Health Corp. | | | 370,255 | | |

| | 13,577 | | | eBay, Inc. (a) | | | 373,096 | | |

| | 13,046 | | | Intel Corp. | | | 449,435 | | |

| | 2,765 | | | International Business

Machines Corp. | | | 380,519 | | |

| | 5,732 | | | Lowe's Companies, Inc. | | | 435,860 | | |

| | 2,811 | | | MasterCard, Inc. - Class A | | | 273,679 | | |

| | 11,670 | | | Microsoft Corp. | | | 647,451 | | |

| | 10,153 | | | Oracle Corp. | | | 370,889 | | |

| | 11,186 | | | PayPal Holdings, Inc. (a) | | | 404,933 | | |

| | 3,445 | | | QUALCOMM, Inc. | | | 172,198 | | |

| | 2,638 | | | State Street Corp. | | | 175,058 | | |

| | 4,571 | | | Target Corp. | | | 331,900 | | |

| | 4,628 | | | The Bank of New York

Mellon Corp. | | | 190,766 | | |

| | 2,510 | | | The Home Depot, Inc. | | | 331,948 | | |

| | 6,037 | | | Visa, Inc. - Class A | | | 468,170 | | |

Number of Shares | | | | Value | |

| | | United States 52.1% (continued) | |

| | 7,437 | | | Wells Fargo & Co. | | $ | 404,275 | | |

| | 5,240 | | | Yum! Brands, Inc. | | | 382,782 | | |

| | | | 6,666,953 | | |

| | | Total Common Stocks | |

| | | | | (Cost $8,196,724) | | | 8,016,062 | | |

SHORT-TERM INVESTMENTS 11.5% | | | |

| | | Investment Company 11.5% | |

| | 1,473,239 | | | STIT Liquid Assets

Portfolio - Institutional

Class, 0.29% | | | 1,473,239 | | |

| | | Total Short-Term Investments | |

| | | | | (Cost $1,473,239) | | | 1,473,239 | | |

| | | Total Investments 74.2% | |

| | | | | (Cost $9,669,963) | | | 9,489,301 | | |

| | | | | Other Assets in Excess of

Liabilities 25.8% | | | 3,303,216 | | |

| | | | | TOTAL NET ASSETS 100.0% | | $ | 12,792,517 | | |

(a) Non-Income Producing.

PORTFOLIO DIVERSIFICATION

Sectors | | Percentage | |

Information Technology | | | 31.6 | % | |

Consumer Discretionary | | | 11.6 | | |

Consumer Staples | | | 8.9 | | |

Financials | | | 8.8 | | |

Health Care | | | 1.8 | | |

Total Common Stocks | | | 62.7 | | |

Total Short-Term Investments | | | 11.5 | | |

Total Investments | | | 74.2 | | |

Other Assets in Excess of Liabilities | | | 25.8 | | |

Total Net Assets | | | 100.0 | % | |

The accompanying notes are an integral part of these financial statements.

page 30

Frontier MFG Core Infrastructure Fund

SCHEDULE OF INVESTMENTS

December 31, 2015 (Unaudited)

Number of Shares | | | | Value | |

COMMON STOCKS 96.2% | | | |

| | | Australia 7.6% | |

| | 330,577 | | | APA Group | | $ | 2,090,933 | | |

| | 1,223,041 | | | AusNet Services | | | 1,323,474 | | |

| | 688,628 | | | DUET Group | | | 1,144,108 | | |

| | 593,333 | | | Spark Infrastructure Group | | | 830,133 | | |

| | 661,388 | | | Sydney Airport | | | 3,060,397 | | |

| | 601,862 | | | Transurban Group | | | 4,591,888 | | |

| | | | 13,040,933 | | |

| | | Austria 0.4% | |

| | 6,818 | | | Flughafen Wien AG | | | 649,072 | | |

| | | Canada 8.0% | |

| | 42,156 | | | Emera, Inc. | | | 1,317,051 | | |

| | 148,103 | | | Enbridge, Inc. | | | 4,923,566 | | |

| | 83,123 | | | Fortis, Inc. | | | 2,247,331 | | |

| | 154,791 | | | TransCanada Corp. | | | 5,055,290 | | |

| | 12,902 | | | Valener, Inc. | | | 167,930 | | |

| | | | 13,711,168 | | |

| | | France 6.0% | |

| | 29,358 | | | Aeroports de Paris | | | 3,420,213 | | |

| | 69,056 | | | Eutelsat Communications SA | | | 2,071,298 | | |

| | 162,743 | | | Groupe Eurotunnel SE | | | 2,026,837 | | |

| | 101,933 | | | SES SA - ADR | | | 2,833,103 | | |

| | | | 10,351,451 | | |

| | | Germany 1.1% | |

| | 27,408 | | | Fraport AG Frankfurt Airport

Services Worldwide | | | 1,755,575 | | |

| | 6,286 | | | Hamburger Hafen und

Logistik AG | | | 96,049 | | |

| | | | 1,851,624 | | |

| | | Hong Kong 3.2% | |

| | 588,652 | | | Power Assets Holdings Ltd. | | | 5,415,564 | | |

| | | Italy 8.3% | |

| | 185,719 | | | Atlantia SpA | | | 4,944,864 | | |

| | 1,010,252 | | | Snam SpA | | | 5,302,843 | | |

| | 80,260 | | | Societa Iniziative Autostradali

e Servizi SpA | | | 854,786 | | |

Number of Shares | | | | Value | |

| | | Italy 8.3% (continued) | |

| | 596,278 | | | Terna Rete Elettrica

Nazionale SpA | | $ | 3,081,928 | | |

| | | | 14,184,421 | | |

| | | Mexico 2.2% | |

| | 106,238 | | | Grupo Aeroportuario del

Centro Norte SAB de CV | | | 517,428 | | |

| | 159,984 | | | Grupo Aeroportuario del Pacifico

SAB de CV - Class B | | | 1,413,210 | | |

| | 87,896 | | | Grupo Aeroportuario del Sureste

SAB de CV - Class B | | | 1,245,217 | | |

| | 611,157 | | | OHL Mexico SAB de CV (a) | | | 643,267 | | |

| | | | 3,819,122 | | |

| | | Netherlands 1.0% | |

| | 37,925 | | | Koninklijke Vopak NV | | | 1,635,007 | | |

| | | New Zealand 1.3% | |

| | 353,253 | | | Auckland International

Airport Ltd. | | | 1,389,237 | | |

| | 351,447 | | | Vector Ltd. | | | 761,977 | | |

| | | | 2,151,214 | | |

| | | Spain 9.5% | |

| | 279,816 | | | Abertis Infraestructuras SA | | | 4,381,961 | | |

| | 44,497 | | | Aena SA (a) | | | 5,096,867 | | |

| | 79,062 | | | Cellnex Telecom SAU | | | 1,481,279 | | |

| | 70,825 | | | Enagas SA | | | 2,001,206 | | |

| | 40,130 | | | Red Electrica Corp. SA | | | 3,362,883 | | |

| | | | 16,324,196 | | |

| | | Switzerland 0.8% | |

| | 1,822 | | | Flughafen Zuerich AG | | | 1,370,684 | | |

| | | United Kingdom 6.9% | |

| | 373,252 | | | National Grid PLC | | | 5,158,606 | | |

| | 122,312 | | | Pennon Group PLC | | | 1,552,499 | | |

| | 69,953 | | | Severn Trent PLC | | | 2,245,038 | | |

| | 202,294 | | | United Utilities Group PLC | | | 2,789,882 | | |

| | | | 11,746,025 | | |

The accompanying notes are an integral part of these financial statements.

page 31

Frontier MFG Core Infrastructure Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2015 (Unaudited)

Number of Shares | | | | Value | |

| COMMON STOCKS 96.2% (continued) | | | |

| | | United States 39.9% | |

| | 7,159 | | | ALLETE, Inc. | | $ | 363,892 | | |

| | 18,445 | | | Alliant Energy Corp. | | | 1,151,890 | | |

| | 42,746 | | | Ameren Corp. | | | 1,847,910 | | |

| | 67,166 | | | American Electric Power Co., Inc. | | | 3,913,763 | | |

| | 6,560 | | | American States Water Co. | | | 275,192 | | |

| | 38,958 | | | American Tower Corp. | | | 3,776,978 | | |

| | 31,756 | | | American Water Works Co., Inc. | | | 1,897,421 | | |

| | 31,147 | | | Aqua America, Inc. | | | 928,181 | | |

| | 17,858 | | | Atmos Energy Corp. | | | 1,125,768 | | |

| | 9,229 | | | Avista Corp. | | | 326,430 | | |

| | 7,850 | | | California Water Service Group | | | 182,670 | | |

| | 8,950 | | | Cleco Corp. | | | 467,280 | | |

| | 48,742 | | | CMS Energy Corp. | | | 1,758,611 | | |

| | 48,693 | | | Consolidated Edison, Inc. | | | 3,129,499 | | |

| | 45,169 | | | Crown Castle International Corp. | | | 3,904,860 | | |

| | 52,835 | | | Duke Energy Corp. | | | 3,771,891 | | |

| | 54,842 | | | Edison International | | | 3,247,195 | | |

| | 5,972 | | | El Paso Electric Co. | | | 229,922 | | |

| | 52,734 | | | Eversource Energy | | | 2,693,125 | | |

| | 26,095 | | | Great Plains Energy, Inc. | | | 712,654 | | |

| | 7,439 | | | IDACORP, Inc. | | | 505,852 | | |

| | 27,508 | | | ITC Holdings Corp. | | | 1,079,689 | | |

| | 52,086 | | | NiSource, Inc. | | | 1,016,198 | | |

| | 4,041 | | | Northwest Natural Gas Co. | | | 204,515 | | |

| | 6,962 | | | NorthWestern Corp. | | | 377,689 | | |

| | 7,569 | | | ONE Gas, Inc. | | | 379,737 | | |

| | 71,035 | | | PG&E Corp. | | | 3,778,352 | | |

| | 11,659 | | | Piedmont Natural Gas Co., Inc. | | | 664,796 | | |

| | 17,741 | | | Pinnacle West Capital Corp. | | | 1,143,940 | | |

| | 11,788 | | | PNM Resources, Inc. | | | 360,359 | | |

| | 15,637 | | | Portland General Electric Co. | | | 568,718 | | |

| | 112,772 | | | PPL Corp. | | | 3,848,908 | | |

| | 25,972 | | | Questar Corp. | | | 505,935 | | |

| | 25,178 | | | SCANA Corp. | | | 1,523,017 | | |

| | 40,718 | | | Sempra Energy | | | 3,827,899 | | |

| | 1,405 | | | SJW Corp. | | | 41,658 | | |

| | 6,903 | | | Southwest Gas Corp. | | | 380,769 | | |

Number of Shares | | | | Value | |

| | | United States 39.9% (continued) | |

| | 41,444 | | | TECO Energy, Inc. | | $ | 1,104,483 | | |

| | 6,418 | | | The Empire District Electric Co. | | | 180,153 | | |

| | 6,408 | | | The Laclede Group, Inc. | | | 380,699 | | |

| | 86,675 | | | The Southern Co. | | | 4,055,523 | | |

| | 52,486 | | | WEC Energy Group, Inc. | | | 2,693,057 | | |

| | 24,884 | | | Westar Energy, Inc. | | | 1,055,330 | | |

| | 84,330 | | | Xcel Energy, Inc. | | | 3,028,290 | | |

| | | | 68,410,698 | | |

| | | Total Common Stocks | |

| | | | | (Cost $161,541,716) | | | 164,661,179 | | |

CLOSED-END FUNDS 0.9% | | | |

| | | United Kingdom 0.9% | |

| | 446,232 | | | HICL Infrastructure Co. Ltd. | | | 991,363 | | |

| | 289,267 | | | International Public

Partnerships Ltd. | | | 594,031 | | |

| | | | 1,585,394 | | |

| | | Total Closed-End Funds | |

| | | | | (Cost $1,627,593) | | | 1,585,394 | | |

SHORT-TERM INVESTMENTS 1.7% | | | |

| | | Investment Company 1.7% | |

| | 2,934,092 | | | STIT Liquid Assets

Portfolio - Institutional

Class, 0.29% | | | 2,934,092 | | |

| | | Total Short-Term Investments | |

| | | | | (Cost $2,934,092) | | | 2,934,092 | | |

| | | Total Investments 98.8% | |

| | | | | (Cost $166,103,401) | | | 169,180,665 | | |

| | | | | Other Assets in Excess

of Liabilities 1.2% | | | 2,124,716 | | |

| | | | | TOTAL NET ASSETS 100.0% | | $ | 171,305,381 | | |

(a) Non-Income Producing.

ADR - American Depositary Receipt

The accompanying notes are an integral part of these financial statements.

page 32

Frontier MFG Core Infrastructure Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2015 (Unaudited)

PORTFOLIO DIVERSIFICATION

Sectors | | Percentage | |

Integrated Power | | | 27.5 | % | |

Transmission & Distribution | | | 16.2 | | |

Gas | | | 15.6 | | |

Airport | | | 11.6 | | |

Toll Road | | | 10.2 | | |

Communications | | | 8.2 | | |

Water Utility | | | 5.8 | | |

Port | | | 1.1 | | |

Total Common Stocks | | | 96.2 | | |

Social | | | 0.9 | | |

Total Closed-End Funds | | | 0.9 | | |

Total Short-Term Investments | | | 1.7 | | |

Total Investments | | | 98.8 | | |

Other Assets in Excess of Liabilities | | | 1.2 | | |

Total Net Assets | | | 100.0 | % | |

The accompanying notes are an integral part of these financial statements.

page 33

Frontier Timpani Small Cap Growth Fund

SCHEDULE OF INVESTMENTS

December 31, 2015 (Unaudited)

Number of Shares | | | | Value | |

COMMON STOCKS 96.9% | | | |

| | | Consumer Discretionary 18.1% | |

| | 5,825 | | | American Woodmark Corp. (a) | | $ | 465,884 | | |

| | 4,190 | | | BJ's Restaurants, Inc. (a) | | | 182,139 | | |

| | 8,840 | | | CalAtlantic Group, Inc. | | | 335,213 | | |

| | 18,805 | | | Century Communities, Inc. (a) | | | 333,037 | | |

| | 22,255 | | | Chuy's Holdings, Inc. (a) | | | 697,472 | | |

| | 2,918 | | | Expedia, Inc. | | | 362,708 | | |

| | 3,136 | | | G-III Apparel Group Ltd. (a) | | | 138,799 | | |

| | 2,318 | | | Jack in the Box, Inc. | | | 177,814 | | |

| | 11,998 | | | LGI Homes, Inc. (a) | | | 291,911 | | |

| | 8,207 | | | Lithia Motors, Inc. - Class A | | | 875,441 | | |

| | 15,272 | | | MCBC Holdings, Inc. (a) | | | 209,226 | | |

| | 4,423 | | | Monro Muffler Brake, Inc. | | | 292,891 | | |

| | 23,499 | | | Motorcar Parts of America, Inc. (a) | | | 794,501 | | |

| | 53,181 | | | Nautilus, Inc. (a) | | | 889,186 | | |

| | 33,708 | | | PFSweb, Inc. (a) | | | 433,822 | | |

| | 70,675 | | | Red Lion Hotels Corp. (a) | | | 495,432 | | |

| | 25,016 | | | Skechers U.S.A., Inc. - Class A (a) | | | 755,733 | | |

| | 12,537 | | | Sonic Corp. | | | 405,071 | | |

| | 27,373 | | | Sportsman's Warehouse

Holdings, Inc. (a) | | | 353,112 | | |

| | 8,385 | | | Stamps.com, Inc. (a) | | | 919,080 | | |

| | 38,848 | | | Tile Shop Holdings, Inc. (a) | | | 637,107 | | |

| | | | 10,045,579 | | |

| | | Consumer Staples 1.2% | |

| | 8,562 | | | TreeHouse Foods, Inc. (a) | | | 671,774 | | |

| | | Energy 0.4% | |

| | 8,269 | | | Canadian Solar, Inc. (a) | | | 239,470 | | |

| | | Financial Services 9.6% | |

| | 10,853 | | | Bank of The Ozarks, Inc. | | | 536,789 | | |

| | 6,357 | | | Blackhawk Network Holdings,

Inc. (a) | | | 281,043 | | |

| | 15,407 | | | Euronet Worldwide, Inc. (a) | | | 1,115,929 | | |

| | 3,893 | | | Heartland Payment Systems, Inc. | | | 369,134 | | |

| | 13,109 | | | Home BancShares, Inc. | | | 531,177 | | |

Number of Shares | | | | Value | |

| | | Financial Services 9.6% (continued) | |

| | 21,979 | | | LendingTree, Inc. (a) | | $ | 1,962,285 | | �� |

| | 15,468 | | | Western Alliance Bancorp. (a) | | | 554,682 | | |

| | | | 5,351,039 | | |

| | | Health Care 23.8% | |

| | 7,961 | | | Adeptus Health,

Inc. - Class A (a) | | | 434,034 | | |

| | 22,450 | | | AMN Healthcare Services, Inc. (a) | | | 697,072 | | |

| | 13,891 | | | Avinger, Inc. (a) | | | 315,465 | | |

| | 28,028 | | | BioDelivery Sciences

International, Inc. (a) | | | 134,254 | | |

| | 45,214 | | | BioTelemetry, Inc. (a) | | | 528,100 | | |

| | 15,974 | | | Cambrex Corp. (a) | | | 752,216 | | |

| | 12,888 | | | Cantel Medical Corp. | | | 800,860 | | |

| | 42,434 | | | Cross Country Healthcare, Inc. (a) | | | 695,493 | | |

| | 9,666 | | | Cynosure, Inc. - Class A (a) | | | 431,780 | | |

| | 20,659 | | | Dipexium Pharmaceuticals, Inc. (a) | | | 231,381 | | |

| | 5,787 | | | Eagle Pharmaceuticals, Inc. (a) | | | 513,133 | | |

| | 25,835 | | | Heska Corp. (a) | | | 999,298 | | |

| | 5,120 | | | ICU Medical, Inc. (a) | | | 577,434 | | |

| | 33,306 | | | INC Research Holdings,

Inc. - Class A (a) | | | 1,615,674 | | |

| | 6,162 | | | Inogen, Inc. (a) | | | 247,035 | | |

| | 22,302 | | | iRadimed Corp. (a) | | | 625,125 | | |

| | 20,140 | | | LeMaitre Vascular, Inc. | | | 347,415 | | |

| | 14,885 | | | Ligand Pharmaceuticals, Inc. (a) | | | 1,613,832 | | |

| | 19,624 | | | STERIS plc | | | 1,478,472 | | |

| | 5,267 | | | Vascular Solutions, Inc. (a) | | | 181,132 | | |

| | | | 13,219,205 | | |

| | | Materials & Processing 5.0% | |

| | 29,667 | | | Aceto Corp. | | | 800,416 | | |

| | 48,243 | | | Energy Focus, Inc. (a) | | | 663,341 | | |

| | 21,141 | | | Summit Materials,

Inc. - Class A (a) | | | 423,669 | | |

| | 16,354 | | | U.S. Concrete, Inc. (a) | | | 861,201 | | |

| | | | 2,748,627 | | |

The accompanying notes are an integral part of these financial statements.

page 34

Frontier Timpani Small Cap Growth Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2015 (Unaudited)

Number of Shares | | | | Value | |

| COMMON STOCKS 96.9% (continued) | | | |

| | | Producer Durables 7.9% | |

| | 1,103 | | | Allegiant Travel Co. | | $ | 185,116 | | |

| | 13,664 | | | Benefitfocus, Inc. (a) | | | 497,233 | | |

| | 4,906 | | | CoStar Group, Inc. (a) | | | 1,014,021 | | |

| | 24,179 | | | CUI Global, Inc. (a) | | | 170,220 | | |

| | 7,639 | | | Dycom Industries, Inc. (a) | | | 534,424 | | |

| | 18,252 | | | Kforce, Inc. | | | 461,411 | | |

| | 1,815 | | | OSI Systems, Inc. (a) | | | 160,918 | | |

| | 17,687 | | | Radiant Logistics, Inc. (a) | | | 60,666 | | |

| | 4,745 | | | The Middleby Corp. (a) | | | 511,843 | | |

| | 3,377 | | | TransDigm Group, Inc. (a) | | | 771,476 | | |

| | | | 4,367,328 | | |

| | | Technology 28.5% | |

| | 39,752 | | | Attunity Ltd. (a) | | | 439,260 | | |

| | 36,503 | | | Autobytel, Inc. (a) | | | 823,508 | | |

| | 12,159 | | | CEVA, Inc. (a) | | | 284,034 | | |

| | 14,644 | | | Cvent, Inc. (a) | | | 511,222 | | |

| | 26,509 | | | Digi International, Inc. (a) | | | 301,673 | | |

| | 10,517 | | | EPAM Systems, Inc. (a) | | | 826,847 | | |

| | 28,168 | | | Fabrinet (a) | | | 670,962 | | |

| | 19,983 | | | Five9, Inc. (a) | | | 173,852 | | |

| | 7,425 | | | Fleetmatics Group plc (a) | | | 377,116 | | |

| | 19,751 | | | Globant SA (a) | | | 740,860 | | |

| | 43,573 | | | GTT Communications, Inc. (a) | | | 743,355 | | |

| | 17,010 | | | HubSpot, Inc. (a) | | | 957,833 | | |

| | 14,004 | | | Imperva, Inc. (a) | | | 886,593 | | |

| | 46,651 | | | inContact, Inc. (a) | | | 445,051 | | |