UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-1800 |

|

U.S. GLOBAL INVESTORS FUNDS |

(Exact name of registrant as specified in charter) |

|

7900 CALLAGHAN ROAD SAN ANTONIO, TX | | 78229 |

(Address of principal executive offices) | | (Zip code) |

|

SUSAN B. MCGEE, ESQ. 7900 CALLAGHAN ROAD SAN ANTONIO, TX 78229 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 210-308-1234 | |

|

Date of fiscal year end: | DECEMBER 31, 2011 | |

|

Date of reporting period: | JUNE 30, 2011 | |

| | | | | | | | |

ITEM 1. REPORTS TO STOCKHOLDERS.

U.S. Global Investors Funds

Semi-Annual Report

June 30, 2011

U.S. Global Investors Funds Semi-Annual Report June 30, 2011

U.S. Global Investors Funds

Semi-Annual Report

June 30, 2011

(unaudited)

Table of Contents

| Letter to Shareholders | | | 1 | | |

|

| Definitions for Management Teams' Perspectives | | | 13 | | |

|

| Management Teams' Perspectives | | | 16 | | |

|

| Expense Example | | | 71 | | |

|

| Portfolios of Investments | | | 74 | | |

|

| Notes to Portfolios of Investments | | | 134 | | |

|

| Statements of Assets and Liabilities | | | 146 | | |

|

| Statements of Operations | | | 152 | | |

|

| Statements of Changes in Net Assets | | | 158 | | |

|

| Notes to Financial Statements | | | 167 | | |

|

| Financial Highlights | | | 186 | | |

|

| Additional Information | | | 202 | | |

|

| Privacy Policy | | | |

|

Nasdaq Symbols

U.S. Global Investors Funds

Investor Class

| U.S. Treasury Securities Cash Fund | | USTXX | |

| U.S. Government Securities Savings Fund | | UGSXX | |

| Near-Term Tax Free Fund | | NEARX | |

| Tax Free Fund | | USUTX | |

| All American Equity Fund | | GBTFX | |

| Holmes Growth Fund | | ACBGX | |

| Global MegaTrends Fund | | MEGAX | |

| Global Resources Fund | | PSPFX | |

| World Precious Minerals Fund | | UNWPX | |

| Gold and Precious Metals Fund | | USERX | |

| Eastern European Fund | | EUROX | |

| Global Emerging Markets Fund | | GEMFX | |

| China Region Fund | | USCOX | |

Institutional Class

| Global MegaTrends Fund | | MEGIX | |

| Global Resources Fund | | PIPFX | |

| World Precious Minerals Fund | | UNWIX | |

P.O. Box 659405

San Antonio, Texas 78265-9604

Tel 1•800•US•FUNDS

Fax 1•210•308•1217

www.usfunds.com

U.S. Global Investors Funds

Dear Fellow Shareholder:

We appreciate your trust and perseverance through these volatile markets.

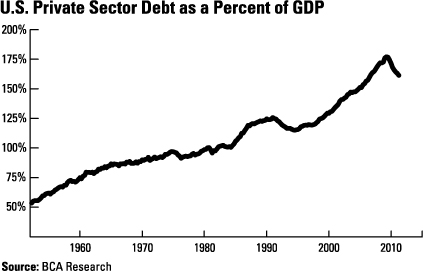

These long, continuous waves of boom and bust inherent in history are called supercycles. Currently, the global economy is experiencing two supercycle S-curves simultaneously evolving: A super debt contraction cycle in Europe and America, and an infrastructure buildout cycle in emerging markets. Based on the history of financial markets, the debt contraction cycle will be a period of frequent, strong headwinds for another two years or so. The good news, however, is that we believe the infrastructure buildout cycle will continue to be a powerful wind hitting investors' sails for another 10 years. These two crosswinds will generate volatility in asset classes, but will also create opportunities.

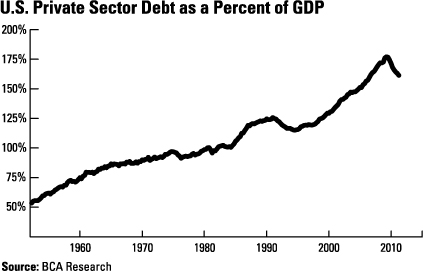

The debt contraction cycle still has a little distance to go. In a comprehensive review of 400 years of market movements, Rodney Sullivan, co-editor of the CFA Digest, identified three distinct patterns among the 47 major financial bubbles: financial innovation, investor exuberance and speculative leverage.

Financial innovation initially benefits society as a whole. During the exuberance stage, the use of these innovations broadens; they become mainstream and attract speculation. The third step – the tipping point for a bubble to form – is when the limbic "greed center" of the brain influences people's decision making. Speculators pile on massive leverage hoping to achieve greater success, but create an imbalance in the marketplace. Eventually, the party comes to an end and the bubble bursts.

During the heyday of the housing boom, government policies encouraged speculators: American homeowners leveraged their homes 100-to-1, Fannie Mae was leveraged 80-to-1, and Wall Street investment firms leveraged themselves over 30-to-1. At its height, private sector debt reached 180 percent of the U.S. GDP.

1

U.S. Global Investors Funds

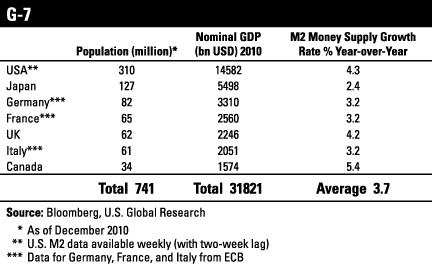

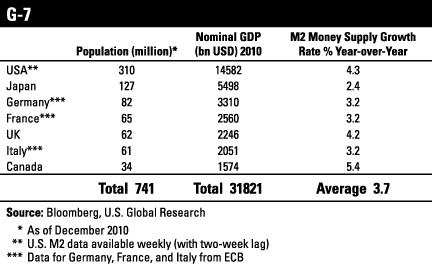

Debt continues to burden many developed countries. A year ago, debt in the developed world climbed so high that the debt-to-GDP ratio of the G-7 group – Canada, France, Germany, Italy, Japan, the U.K. and the U.S. – was at its highest level in 60 years. Since then, many of these countries have been dealing with the reality of their governments' overindulgent borrowing habits by instituting strong austerity measures. These measures help strengthen a country's fiscal balance sheet but put a damper on its economic growth.

Historically, leverage-induced recessions take four years to fully recover. This is longer than a normal recession, when it takes roughly five quarters to repair the damage. Presently, we should be more than halfway through this healing process, yet there appears to be no real policies to spur economic and private sector job growth on the horizon. In fact, many regulations are having the opposite effect. Sadly, there won't be a cure until investors demand that politicians and voters create a deregulation cycle.

In the wake of the credit crisis, the U.S. government hastily passed the 2,300-page Dodd-Frank Wall Street Reform and Consumer Protection Act. According to Wayne Crews of the Competitive Enterprise Institute, there are currently more than 4,000 new regulations in the pipeline and a record 81,405 pages of new rules were created in the Federal Register during 2010. The intentions were good – to protect consumers and to prevent investors from market

2

U.S. Global Investors Funds

manipulations and institutions piling on too much risk – but the government's focus on expedience omitted important cost-benefit analyses from taking place and possible unintended consequences flew under the radar. Intuition and history suggest we don't need thousands of new rules that mainly benefit the regulatory industry while further burdening our already fragile economic system.

Estimates place the total cost of the bill at $6.5 billion, which includes 5,000 new employees to implement it, but that's just the tip of the iceberg. The true cost of Dodd-Frank is much larger in terms of overall economic impact and many thought-leaders believe it is sabotaging the U.S. recovery. The onslaught of new regulations has created an "atmosphere of uncertainty" and companies are unwilling to deploy new capital, despite carrying large amounts of cash on their balance sheets.

When speaking to an oversight panel for the Federal Reserve earlier this year, JPMorgan Chase CEO Jamie Dimon explained these new regulations could spell "suffocation through regulation" for the U.S. economy and questioned whether anyone had "bothered to study the cumulative effect" of them. PIMCO co-CIO Bill Gross, who manages the world's largest bond portfolio, echoed similar sentiments regarding these "oppressive regulations."

One must also consider the inherent cost of compliance with these new regulations. Research from economists Nicole and Mark Crain shows that the net cost of compliance with federal regulations totaled $1.75 trillion in 2009, nearly 12 percent of America's GDP. That's more than $8,000 per employee and up from only about 4 percent of GDP in 1950. Furthermore, businesses with fewer than 20 employees bear a disproportionate share of the federal regulatory burden – 36 percent more per employee than larger companies, according to data from the Small Business Administration. Small businesses have historically created seven out of every 10 jobs, so it isn't surprising that job growth in the U.S. remains weak.

3

U.S. Global Investors Funds

Broad-brush vilifying of business leaders is diverting attention away from the government's fiscal issues which must be fixed. Money flows to where it is most respected. It's shocking to see how much the landscape has changed when the New York Stock Exchange, "the symbol of America's capitalism for more than two centuries," as coined by The New York Times, is to be controlled by a German company.

You may not have direct exposure to these financial regulations, but everyone can experience the inefficiencies and frustrations of an overregulated system when they board an airplane. In essence, everyone is treated as guilty until proven innocent before they fly. Full-body scanners have been commissioned throughout the United States, but there's a reason frequent flyers such as pilots and flight attendants have had their unions fight for exemption from using these scanners. Medical evidence from Columbia University shows that radiation emitted from these machines is 20 times greater than originally estimated. The researchers said the most likely risk is carcinoma, a form of skin cancer, and that children are the most at risk of being affected.

Those who decline exposing themselves to this health risk are subjected to an intimidating and extensive pat-down by Transportation Security Administration (TSA) officials. Last year, a TSA official admitted off-the-record that screeners punish those who decline to be scanned by making the pat-downs so aggressive and uncomfortable that it encourages compliance the next time around. These intrusive pat-downs have ignited a backlash across the country as images taken by appalled travelers showed the inappropriate touching of young children and the elderly. When representatives in Texas presented a bill that would make the extensive pat-downs equivalent to sexual assault if done inappropriately, federal authorities threatened to make Texas a "no-fly zone" and the bill was withdrawn. The idea of selling more regulation as a salve for life's uncertainties has been counterproductive, paralyzing the economic recovery efforts as business leaders are forced to halt hiring in order to digest the full impact of the latest rules.

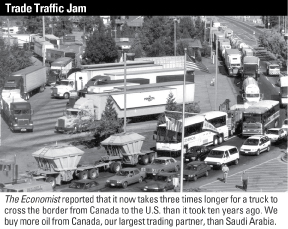

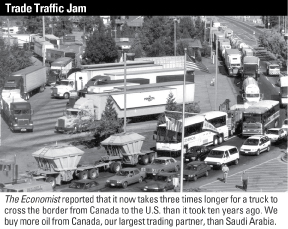

In an age of increasing security threats, it makes sense to strengthen our national defenses, but this heightened security must be applied in a way that revitalizes trade flows and breaks down regulatory barriers, in order to remain competitive in a globalized economy.

4

U.S. Global Investors Funds

One must remember that it is not political parties, but political policies which determine outcomes. As global investors, we watch government policies closely because they have historically been precursors to change. Efficient fiscal and monetary policies can promote prosperity. Policies also can discourage business development; in this case, we tend to allocate our portfolios where policies align with growth and development.

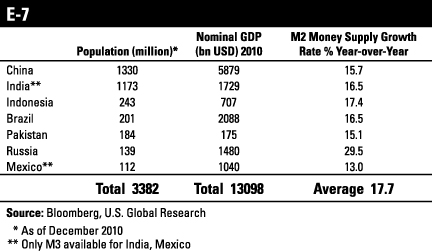

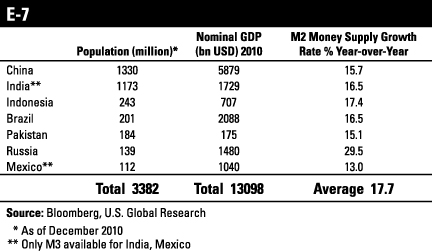

America's entrepreneurial spirit – what made America the greatest economic force in the world – is now being exported to countries such as China, India and Brazil, with policies conducive to developing and building infrastructure, coupled with governments driven to support their growing populations and increase their discretionary income. We keep track of the policies for the E-7 countries, which are the world's largest emerging nations by population. These countries hold nearly half of the world's population but make up less than 20 percent of global GDP. The G-7 industrialized nations are an inverse of this; they contain 11 percent of the world's population but control more than 50 percent of the global economy.

5

U.S. Global Investors Funds

However, the tide is turning. The most business-friendly fiscal and economic policies can be found in emerging markets, where free market policies and massive infrastructure spending are stimulating growth. Many of these emerging economies are averaging over 6 percent GDP growth and personal incomes are rising around 8 percent. Emerging economies are now home to 27 percent of the world's purchasing power, according to economic research firm ISI Group. In addition, with average money supply growth rates in these countries around 20 percent, businesses have ample access to the capital necessary to grow.

6

U.S. Global Investors Funds

Over the past 40 years, the Chinese government has undergone a complete transformation, learning from mistakes and adopting free market capitalism; the country is not alone. Many E-7 countries have implemented forward-looking policies focused on growth, such as building vital infrastructure. Over the next three years, Merrill Lynch estimates that $6 trillion will be spent on infrastructure in emerging countries. In China alone, 18,000 miles of high-speed rail will connect 250 cities and 700 million people.

Some of America's largest and oldest companies have recognized this transformation and shifted capital overseas. This past quarter of financial results showed that more than 50 of the largest companies in the S&P Composite 1500 Index had revenue growth above 10 percent while GDP growth in the U.S. was less than 2 percent. Companies such as General Electric, Caterpillar and Coca-Cola have long outgrown U.S. borders and are now expanding in record levels elsewhere around the world.

The United Parcel Service (UPS) of America has leveraged explosive growth in foreign markets to become "the world's largest package delivery company" with more than 400,000 employees worldwide and nearly 4 billion packages delivered across 220 countries and territories. General Electric (GE), the 130-year old icon of American capitalism, has concentrated its development overseas which has fueled a greater than 500 percent rise in GE's offshore profits to $92 billion last year. Recently, the company announced it was relocating its health care division, which makes MRI machines, from the U.S. to China, another illustration that companies will go where they can grow.

It's the same story for the U.S. car manufacturers General Motors (GM) and Ford. GM says China remains a priority for the "long-term success" of the company. In an interview with journalist Maria Bartiromo for USA Today, Ford CEO Alan Mulally said, "The Ford brand is one of the strongest, most aware brands in the world. In Brazil, with our new products, we're going to be covering nearly 82 percent of the market. In Russia, we have six new models over the next few years. In India, we have eight new models, and we'll be participating in nearly 70 percent of the total market."

These multinational companies are examples of how American business is keeping its entrepreneurial spirit and creating jobs by reinventing itself in the developing world. Growth in these emerging

7

U.S. Global Investors Funds

markets also have powered a strong first half of the year for commodities, including gold.

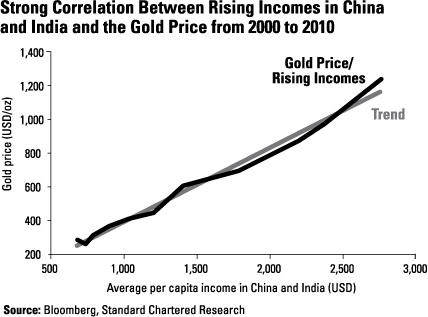

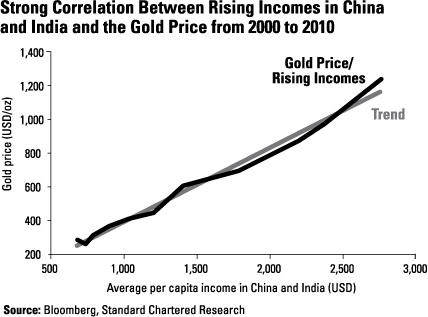

The two main drivers of gold demand – the Fear Trade and Love Trade – have continued to push gold prices to hit new nominal highs. Most pundits and market commentators focus on the Fear Trade, which is driven by negative real interest rates and deficit spending, while the Love Trade is what sets this gold bull market apart from those in the past. The Love Trade is driven by rising incomes in countries that have strong cultural affinities toward the precious metal. Countries such as India, Hong Kong, China and Russia accounted for 60 percent of the entire gold jewelry market in 2010. Visit www.usfunds.com to download our special report The Fear and Love Trade for Gold.

In fact, the rise in gold prices has been closely tied to the rise in gold demand from China and India. When the average per capita income in China and India was well below $1,000 a year, gold prices hovered just above $200 an ounce. As average incomes have approached $3,000 a year over the past decade, gold prices have followed. With the long-term outlook for wages in both these economies rather rosy, gold demand should continue to experience the trickle-down effect.

8

U.S. Global Investors Funds

Another area with potential growth is gold equities, which have lagged bullion significantly this year. In June, the ratio of gold bullion to an index that tracks gold and silver companies (XAU) was at the second-lowest level in nearly 30 years. Gold stocks also have a history of performing well when the U.S. economy hits a bump in the road. Depression-era babies and investors who love history might remember gold stocks' strong performance during the depression of the 1930s.

This divergence sets the stage for a strong rally in gold equities relative to bullion should a mean reversion to historical levels materialize just as it has done in the past. According to Desjardins, one current catalyst for a rebound in gold stocks is increased profitability from rising gold prices and decreased input costs – due to oil's 28 percent decline from 2011 highs. In addition, many quality gold companies are "paying investors to wait" by increasing dividend yield rates above those of money funds. This creates a cash incentive to hold shares of the company and allows investors to participate in rising earnings.

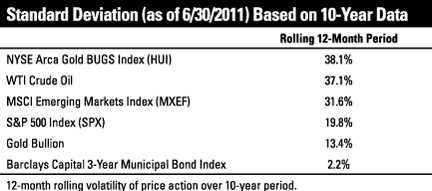

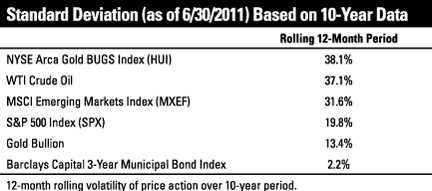

Life is often about managing expectations, gathering facts to recognize cycles and patterns that help us to make informed decisions. Investors must "anticipate before they participate" in assets such as emerging markets and commodities. Gold prices can rise or fall approximately 15 percent within a year – this happens nearly 70 percent of the time. For gold stocks, the volatility is historically around 40 percent. For emerging markets, it's roughly 30 percent. Investors looking to initiate or add to positions in gold or other volatile asset classes must be aware of this volatility and use it to their advantage.

9

U.S. Global Investors Funds

For investors, focusing on the long-term strategy of their portfolios is essential to navigating through today's unpredictable markets and preventing emotion-based decisions. For the many investors still recovering from the 2008 market decline, today's volatility is only exacerbating these familiar feelings. This is particularly true for leveraged investors who are forced to quickly sell assets when they find themselves on the wrong side of the fence.

Anxious investors have poured money into cash, U.S. government debt and money market funds despite the microscopic yields on these investments. Meanwhile, several great American companies, whose balance sheets are the envy of Washington, are carrying dividend yields above the 5-year government note.

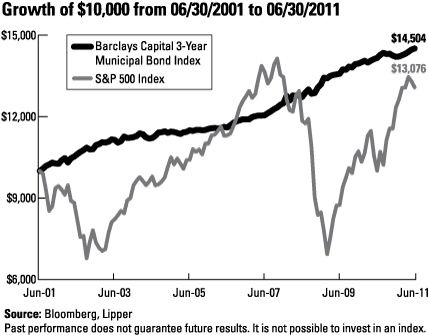

Those investors who can't endure the emotional volatility of stocks can still find opportunities in the marketplace. Like living things, each investment carries its own DNA of volatility. The yields on short-term municipal bonds are currently much more attractive than those of a CD or money market fund. In up and down markets, municipal bond funds have provided steady results. There are also added tax benefits because municipal bond funds seek current income that is exempt from federal income tax.

10

U.S. Global Investors Funds

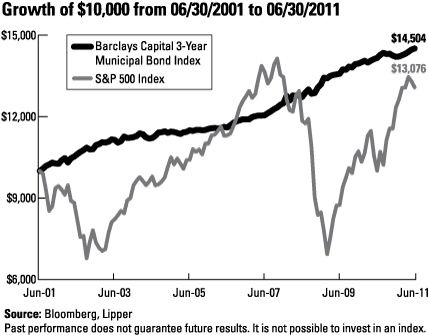

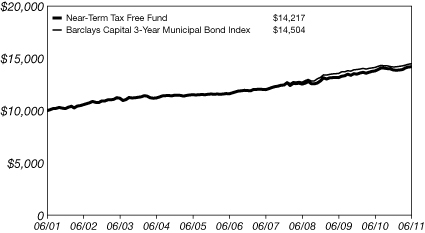

Over the past decade, the Barclays Capital 3-Year Municipal Bond Index has generated a higher return with significantly less volatility than the S&P 500. This is why we suggest that investors consider adding tax-free bond funds to their portfolios. We also suggest that investors consider diversifying their portfolios with up to 25 percent in fixed-income funds, domestic equities, commodity-related investments and international equities. Investors also must remember to rebalance on an annual basis and be opportunistic when sharp selloffs create cheap entry points. Naturally, every investor has a different appetite for returns, tolerance for risk and unique financial circumstances. Visit www.usfunds.com to learn from our educational webcasts, such as Anticipate Before You Participate, and for our latest insights on market events.

A key to U.S. Global Investors' investment process over the past decade has been the tracking of geopolitical and economic changes around the world to seek out the best gold, natural resources, emerging markets and infrastructure opportunities for our shareholders. There will always be some good opportunities and we're working relentlessly to find them. Our investment team will continue to analyze U.S. and international companies and travel to the far corners of capitalism to speak with entrepreneurs and company executives about the future of their businesses. This is how we believe we have created value for shareholders, and how we plan to continue do so in the future.

Thank you for your continued confidence in our investment philosophy.

Sincerely,

Frank Holmes

CEO and Chief Investment Officer

U.S. Global Investors, Inc.

11

U.S. Global Investors Funds

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. An S-curve is a type of curve that shows a rapid, exponential increase in growth for a period of time, followed by a tapering or leveling off. Diversification does not protect an investor from market risks and does not assure a profit. Standard deviation is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is also known as historical volatility. M2 Money Supply is a broad measure of money supply that includes M1 in addition to all time-related deposits, savings deposits, and non-institutional money-market funds. M3 money supply is the broadest monetary aggregate, including physical currency, demand accounts, savings and money market accounts, certificates of deposit, deposits of eurodollars and repurchase agreements.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Barclays 3-Year Municipal Bond Index is a total return benchmark designed for long-term municipal assets. The index includes bonds with a minimum credit rating BAA3, are issued as part of a deal of at least $50 million, have an amount outstanding of at least $5 million and have a maturity of 8 to 12 years. The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The NYSE Arca Gold BUGS (Basket of Unhedged Gold Stocks) Index (HUI) is a modified equal dollar weighted index of companies involved in gold mining. The HUI Index was designed to provide significant exposure to near term movements in gold prices by including companies that do not hedge their gold production beyond 1.5 years. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The S&P 1500 Composite is a broad-based capitalization-weighted index of 1500 U.S. companies and is comprised of the S&P 400, S&P 500, and the S&P 600. The index was developed with a base value of 100 as of December 30, 1994.

Holdings as a percentage of net assets as of June 30, 2011: Caterpillar, Inc. (All American Equity Fund 1.04%, Holmes Growth Fund 2.12%, Global MegaTrends Fund 3.62%), The Coca-Cola Co. (All American Equity Fund 1.03%), Coca-Cola Enterprises, Inc. (All American Equity Fund 1.19%), Ford Motor Company 0.00%, General Motors 0.00%, General Electric Co. (All American Equity Fund 1.03%), JPMorgan Chase & Co. (All American Equity Fund 0.89%, Holmes Growth Fund 1.53%), United Parcel Service of America, Inc. 0.00%.

12

Definitions for Management Teams' Perspectives

Benchmark Index Definitions

Returns for indexes reflect no deduction for fees, expenses or taxes, unless noted.

The Barclays Capital 3-Year Municipal Bond Index is a total return benchmark designed for municipal assets. The index includes bonds with a minimum credit rating of BAA3, are issued as part of a deal of at least $50 million, have an amount outstanding of at least $5 million and have a maturity of two to four years.

The Barclays Capital 10-Year Municipal Bond Index is a total return benchmark designed for long-term municipal assets. The index includes bonds with a minimum credit rating of BAA3, are issued as part of a deal of at least $50 million, have an amount outstanding of at least $5 million and have a maturity of 8 to 12 years.

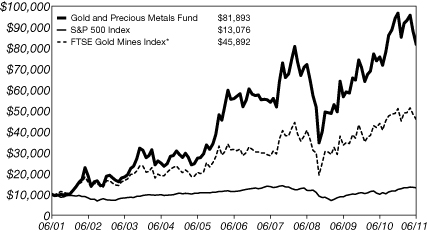

The FTSE Gold Mines Index encompasses all gold mining companies that have a sustainable and attributable gold production of at least 300,000 ounces a year and that derive 75% or more of their revenue from mined gold.

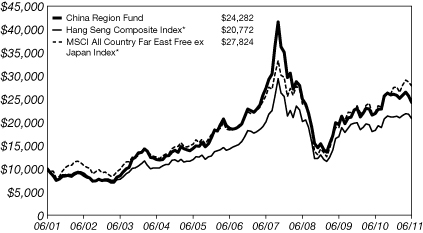

The Hang Seng Composite Index is a market-capitalization weighted index that comprises the top 200 companies listed on the Stock Exchange of Hong Kong, based on average market capitalization for the twelve months.

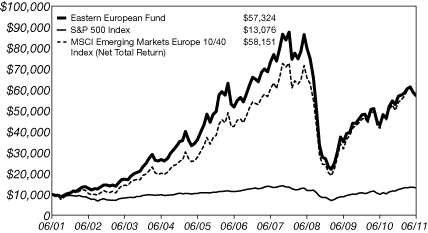

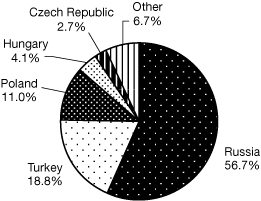

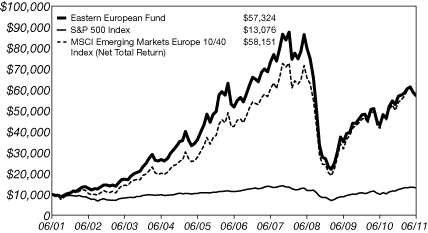

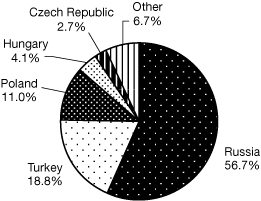

The MSCI Emerging Markets Europe 10/40 Index (Net Total Return) is a free float-adjusted market capitalization index that is designed to measure equity performance in the emerging market countries of Europe (Czech Republic, Hungary, Poland, Russia and Turkey). The index is calculated on a net return basis (i.e., reflects the minimum possible dividend reinvestment after deduction of the maximum rate withholding tax). The index is periodically rebalanced relative to the constituents' weights in the parent index.

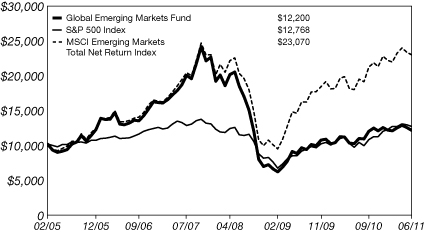

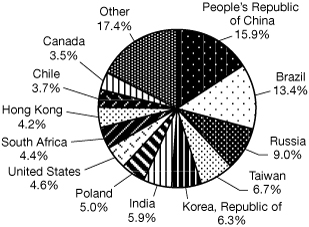

The MSCI Emerging Markets Net Total Return Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in emerging market countries on a net return basis (i.e., reflects the minimum possible dividend reinvestment after deduction of the maximum rate withholding tax).

The Morgan Stanley Commodity Related Equity Index is an equal-dollar weighted index of 20 stocks involved in commodity-related industries such as energy, non-ferrous metals, agriculture and forest products.

The NYSE Arca Gold Miners Index is a modified market capitalization-weighted index comprised of publicly-traded companies involved primarily in the mining for gold and silver.

The S&P 500 Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

13

Definitions for Management Teams' Perspectives

The S&P Composite 1500 Index is a broad-based capitalization-weighted index of 1500 U.S. companies and is comprised of the S&P 400, S&P 500 and the S&P 600.

Other Index Definitions

The Barclays Capital Municipal Bond Index is an unmanaged index representative of the tax-exempt bond market.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns.

The ISM Manufacturing Composite Index is a diffusion index calculated from five of the eight sub-components of a monthly survey of purchasing managers at roughly 300 manufacturing firms from 21 industries in all 50 states.

The KBW Bank Index is a modified capitalization-weighted index consisting of 24 exchange-listed and National Market System stocks, representing national money center banks and leading regional institutions. The index is intended to reflect the evolving financial sector.

The MSCI All Country Far East Free ex Japan Index is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of the Far East, excluding Japan. The index consists of the following developed and emerging market country indices: China, Hong Kong, Indonesia, Korea, Malaysia, New Zealand, Philippines, Singapore, Taiwan and Thailand.

The Purchasing Manager's Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment.

The Reuters/Jefferies CRB Index is an unweighted geometric average of commodity price levels relative to the base year average price.

The S&P Global Infrastructure Index provides liquid and tradable exposure to 75 companies from around the world that represent the listed infrastructure universe. To create diversified exposure across the global listed infrastructure market, the index has balanced weights across three distinct infrastructure clusters: Utilities, Transportation and Energy.

The S&P Oil & Gas Refining and Marketing Index tracks the market performance of downstream oil and gas companies.

14

Definitions for Management Teams' Perspectives

The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar.

Terms Used

M1 and M2 are measures of total money supplies. M1 money supply includes funds that are readily accessible for spending. M2 includes everything in M1 and also all time-related deposits, savings deposits, and non-institutional money-market funds.

15

Money Market Funds

Management Team's Perspective

INTRODUCTION

The U.S. Treasury Securities Cash Fund (USTXX) seeks to obtain a high level of current income while maintaining the highest degree of safety of principal and liquidity. The U.S. Government Securities Savings Fund (UGSXX) seeks to achieve a consistently high yield with safety of principal.

PERFORMANCE

| U.S. Treasury Securities Cash Fund | | As of June 30, 2011 | |

| 7-Day Yield | | | 0.01 | % | |

| 7-Day Effective Yield | | | 0.01 | % | |

| Weighted Average Days to Maturity | | | 6 | | |

| U.S. Government Securities Savings Fund | | As of June 30, 2011 | |

| 7-Day Yield | | | 0.01 | % | |

| 7-Day Effective Yield | | | 0.01 | % | |

| Weighted Average Days to Maturity | | | 10 | | |

An investment in either the U.S. Treasury Securities Cash Fund or the U.S. Government Securities Savings Fund is neither insured nor guaranteed by the Federal Deposit Insurance Corporation (FDIC) or by any other government agency. Although the funds seek to preserve the value of your investments at $1.00 per share, it is possible to lose money by investing in these funds.

Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses to not exceed 1.00% for the U.S. Treasury Securities Cash Fund and 0.45% for the U.S. Government Securities Savings Fund on an annualized basis. In addition, the yields reported above include the effects of the Adviser's voluntary waiver of fees and/or reimbursement of expenses to maintain a minimum net yield for the funds. The Adviser can modify or terminate these arrangements at any time.

THE SIX-MONTH PERIOD IN REVIEW – ECONOMIC AND POLITICAL ISSUES THAT AFFECTED THE FUNDS

The economy hit a soft patch in the first half of 2011 as first and second quarter GDP grew at an anemic 0.4 and 1.3 percent, respectively. Unemployment as of June 2011 was 9.2 percent, little changed from the 9.4 percent at the end of 2010. Many cyclical indicators reached multi-year highs during 2010, such as the ISM Manufacturing Composite Index, which

16

Money Market Funds

hit the highest level in nearly seven years. Since February 2011, the index has declined and, while still positive, the rate of change has slowed significantly. Consumer confidence has declined because of higher gasoline prices, a lack of employment improvement, continued global concerns and ongoing political wrangling in the U.S. The Federal Reserve has largely remained on the sidelines during the first half of the year. The Fed allowed quantitative easing (QE2) to end as scheduled at the end of June. We believe the Fed is in an awkward position as growth is too slow but any additional stimulus would not be politically acceptable, so the Fed will need to walk a fine line in the second half of the year.

Inflation has picked up and can no longer be ignored as the June year-over-year Consumer Price Index hit 3.6 percent. While the Fed insists that inflation is contained and commodity prices have sustained their elevated levels even during the slow growth of the first half, the current environment does not appear transitory.

Fiscal austerity remains in vogue to address long-term fiscal imbalances in the developed world and will likely be a significant drag on growth in the U.S. and Europe for some time. Spending cuts and higher taxes could transform a stimulative fiscal tailwind into a stiff headwind.

Yields on the three-month Treasury bill fell 11 basis points to 0.02 percent, while yields on the six-month bills fell 9 basis points to 0.10 percent. One-year agency discount note yields fell 6 basis points to 0.18 percent. The market was still influenced by periodic bouts of risk aversion or other disruptions, with investors at times seeking to own short-term Treasury securities at almost any cost.

INVESTMENT HIGHLIGHTS

The U.S. Treasury Securities Cash Fund performed in line with the Lipper Treasury money market funds for the six months ending June 30, 2011, returning 0.00 percent, the same as the peer group. The U.S. Government Securities Savings Fund also performed in line with the Lipper government-only money market funds for the year, returning 0.00 percent versus 0.01 percent for the peer group.

The U.S. Treasury Securities Cash Fund took a laddered approach by buying fixed-rate securities across the money market spectrum, with a weighted average maturity of 15 days over the period.

The U.S. Government Securities Savings Fund followed a similar laddered approach with a weighted average maturity of 14 days. The fund took

17

Money Market Funds

advantage of higher yields by selectively extending its ladder, but overall it continued to be a very difficult environment for money market fund investors over the past year.

CURRENT OUTLOOK

The Fed continues to emphasize that it will keep interest rates low for an extended period, and recent developments have reinforced this position. The Fed appears unlikely to change course before 2012, and monetary policy is likely to remain loose for some time.

18

Tax Free Funds

Management Team's Perspective

INTRODUCTION

The Near-Term Tax Free Fund (NEARX) and the Tax Free Fund (USUTX) seek to provide a high level of current income exempt from federal income taxation and to preserve capital. However, a portion of any distribution may be subject to federal and/or state income taxes. The Near-Term Tax Free Fund will maintain a weighted average maturity of less than five years, while the Tax Free Fund will generally maintain a longer weighted average maturity.

PERFORMANCE GRAPHS

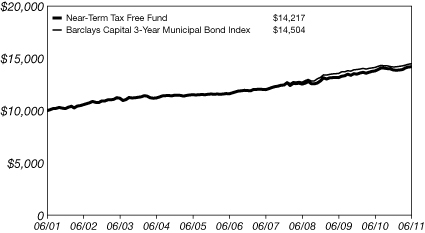

Near-Term Tax Free Fund

Average Annual Performance For the Periods Ended

June 30, 2011

| | | Six Month | | One Year | | Five Year | | Ten Year | |

| Near-Term Tax Free Fund | | | 2.18 | % | | | 2.95 | % | | | 4.13 | % | | | 3.58 | % | |

Barclays Capital 3-Year Municipal

Bond Index | | | 2.17 | % | | | 2.48 | % | | | 4.57 | % | | | 3.79 | % | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. Investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for periods less than one year are not annualized.

Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of acquired fund fees and expenses, extraordinary expenses, taxes, brokerage commissions and interest, and advisory fee performance adjustments, if any) to not exceed 0.45%. The Adviser can modify or terminate this arrangement at any time.

See Definitions for Management Teams' Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

19

Tax Free Funds

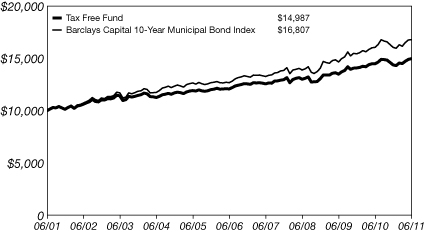

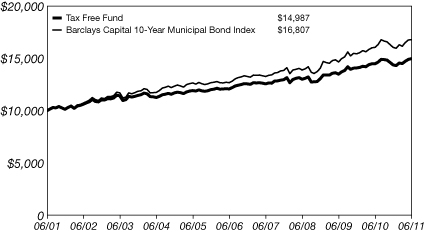

Tax Free Fund

Average Annual Performance For the Periods Ended

June 30, 2011

| | | Six Month | | One Year | | Five Year | | Ten Year | |

| Tax Free Fund | | | 4.17 | % | | | 3.28 | % | | | 4.41 | % | | | 4.13 | % | |

Barclays Capital 10-Year Municipal

Bond Index | | | 4.56 | % | | | 4.49 | % | | | 5.80 | % | | | 5.33 | % | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. Investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for periods less than one year are not annualized.

Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of acquired fund fees and expenses, extraordinary expenses, taxes, brokerage commissions and interest, and advisory fee performance adjustments, if any) to not exceed 0.70%. The Adviser can modify or terminate this arrangement at any time.

See Definitions for Management Teams' Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

THE SIX-MONTH PERIOD IN REVIEW – ECONOMIC AND POLITICAL ISSUES THAT AFFECTED THE FUNDS

The municipal bond market exhibited strong performance over the past six months as the Barclays Capital Municipal Bond Index rose 4.42 percent.

During the first quarter of 2011, the market exhibited mixed performance and overall returns were muted. This followed a difficult fourth quarter of 2010 with municipal bond analyst Meredith Whitney scaring bond investors

20

Tax Free Funds

by telling 60 Minutes that she anticipated substantial municipal defaults during 2011.

Many of those fears subsided and the market gained confidence in the second quarter as actual defaults remained very low and most municipal governments appeared to be making the tough but necessary changes. This has been particularly true for low-quality and long-duration bonds that outperformed during the second quarter of 2011.

The long end of the yield curve benefited the most, as bonds with maturities of 20 years or more rose by about 6 percent. Municipals followed the general trend in Treasuries as yields steadily declined during the quarter. Economic growth was much slower than expected, employment remained stuck in the mud and international events implied weaker global growth.

Revenue-backed municipals modestly outperformed the overall municipal index, driven by hospital and industrial development issues. High-yield bonds rose 4.98 percent, with all the positive returns occurring during the last three months.

In specialty state trading, California and Texas outperformed, while Connecticut and Puerto Rico underperformed.

The Federal Reserve stayed the course during the first half of 2011 and has pledged to keep interest rates low and monetary policy loose for an extended period of time.

INVESTMENT HIGHLIGHTS

Over the six months ended June 30, 2011, the Near-Term Tax Free Fund returned 2.18 percent, outperforming its benchmark, the Barclays Capital 3-Year Municipal Bond Index, which returned 2.17 percent. The Tax Free Fund returned 4.17 percent and trailed the performance of its benchmark, the Barclays Capital 10-Year Municipal Bond Index, which returned 4.56 percent.

The Near-Term Tax Free Fund trailed its Lipper peer group for the past six months, while the Tax Free Fund outperformed its respective Lipper peer group. The performance difference for the funds was primarily driven by fund credit and maturity preferences relative to their benchmarks and peer groups.

Strengths

• The Tax Free Fund maintained significant exposure to hospital-backed municipals, which outperformed.

21

Tax Free Funds

• The Tax Free Fund benefited from significant exposure to Texas and California, which both outperformed.

• From a maturity perspective, the Near-Term Tax Free Fund benefited from a slightly longer maturity profile than its benchmark.

Weaknesses

• The conservative credit profile of both funds proved to be an asset during the first quarter but negatively impacted performance during the second quarter.

• The Tax Free Fund maintained a relatively short maturity/duration profile. This negatively impacted performance in relation to its benchmark, as it was the long end of the market that outperformed.

• Both funds had little to no exposure to industrial development, which was one of the best-performing sectors of the market.

CURRENT OUTLOOK

Opportunities

• There is currently a lot of discussion surrounding the outlook for municipals as governments struggle with bloated budgets and little or no revenue growth. This appears to be an opportunity to purchase high-quality general obligation or essential service debt at distressed levels.

Threats

• Continued outperformance of low-quality bonds is the most significant threat on a relative basis.

• When the Fed reverses its monetary policy stance and begins to raise interest rates, the macro environment could become more difficult.

22

Tax Free Funds

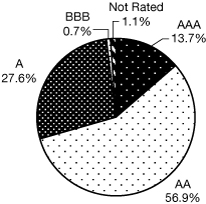

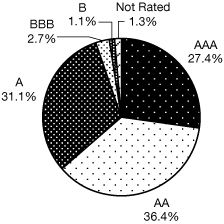

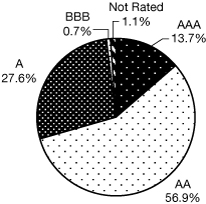

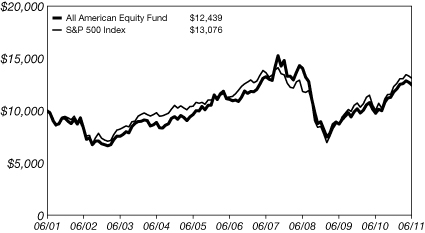

Near-Term Tax Free Fund

Municipal Bond Ratings June 30, 2011

(Based on Total Municipal Bonds)

Tax Free Fund

Municipal Bond Ratings June 30, 2011

(Based on Total Municipal Bonds)

23

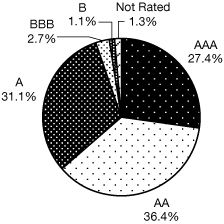

All American Equity Fund

Management Team's Perspective

INTRODUCTION

The principal objective of the All American Equity Fund (GBTFX) is to seek long-term capital appreciation by investing primarily in a broadly diversified portfolio of domestic common stocks. The fund invests in large-capitalization stocks, while retaining the flexibility to seek out promising individual stock opportunities, including stocks with meaningful dividend yields.

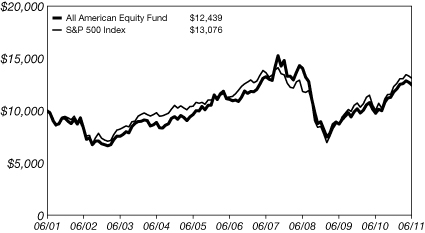

PERFORMANCE GRAPH

All American Equity Fund

Average Annual Performance For the Periods Ended

June 30, 2011

| | | Six Month | | One Year | | Five Year | | Ten Year | |

| All American Equity Fund | | | 5.55 | % | | | 27.69 | % | | | 2.32 | % | | | 2.21 | % | |

| S&P 500 Index | | | 6.02 | % | | | 30.69 | % | | | 2.94 | % | | | 2.72 | % | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. Investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for periods less than one year are not annualized.

Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of acquired fund fees and expenses, extraordinary expenses, taxes, brokerage commissions and interest, and advisory fee performance adjustments, if any) to not exceed 2.20%. The Adviser can modify or terminate this arrangement at any time.

See Definitions for Management Teams' Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

24

All American Equity Fund

THE SIX-MONTH PERIOD IN REVIEW – ECONOMIC AND POLITICAL ISSUES THAT AFFECTED THE FUND

The U.S. real GDP was originally announced to have increased 1.90 percent in the quarter ended March 31, 2011, but was revised down to 0.4 percent following second-quarter results. While economists had estimated a sequential increase of 2.00 percent for the quarter ended June 30, 2011, real GDP was actually lower, increasing only 1.30 percent.

To aid a recovering economy, the Federal Reserve kept its short-term interest rate target in a range of zero to 0.25 percent for the six-month period. The 10-year U.S. Treasury note yield began 2011 at 3.30 percent, rose to a high of 3.74 percent on February 8 and ended the period at a yield of 3.16 percent.

In an effort to stimulate the economy, the Fed continued its second round of quantitative easing (QE2) to purchase $600 billion in U.S. Treasury bonds and concluded QE2 on June 30, 2011.

Inflation remained relatively contained, with year-over-year change in the Consumer Price Index (CPI) registering 1.6 percent in January and rising to 3.6 percent in June. The core CPI, which excludes food and fuel, registered 1.0 percent in January and ended the period at 1.6 percent in June.

The employment picture remained weak. Unemployment was at 9.0 percent in January and ended the period at 9.2 percent.

Stock market performance was marked by an oscillating market. The benchmark S&P 500 Index began the year at 1,257.64, rose to 1,343.01 in mid-February, declined to 1,256.88 in mid-March, rose irregularly to a period high of 1,363.61 in late April, declined to 1,265.42 in mid-June and rose again to finish the period at 1,320.64.

The political environment was one of strongly divided partisan debates, with the Democrats controlling the Presidency and the Senate, and the Republicans controlling the House of Representatives. Issues debated included national healthcare legislation, financial regulatory reform, the federal budget and the national debt. Some observers also interpreted the environment as an anti-business tilt on the part of the current administration and parts of the legislative bodies.

25

All American Equity Fund

INVESTMENT HIGHLIGHTS

Overview

The fund returned 5.55 percent for the six-month period ended June 30, 2011, compared to a 6.02 percent return for the benchmark S&P 500 Index.

Because the fund is actively managed and a holding period is generally not a consideration in investment decisions, the portfolio turnover rate may fluctuate from year to year as the fund adjusts its portfolio composition. Its annual portfolio turnover was, and is expected to continue to be, more than 100 percent.

Strengths

• Although the fund was underweight the consumer staples sector – which was one of the better-performing sectors in the index – stock selection within the sector provided positive returns. Herbalife Ltd.,(1) Lorillard, Inc.(2) and Dr Pepper Snapple Group, Inc.(3) were among the sector investments contributing to performance.

• The fund was overweight the underperforming information technology sector, but stock selection was also strong in this sector, resulting in positive sector performance for the fund. The fund benefited from owning NVIDIA Corp.,(4) JDS Uniphase Corp.(4) and Informatica Corp.(5)

• Defensive option strategies also contributed positively to fund performance.

Weaknesses

• The healthcare sector was the best-performing sector in the benchmark index, but the fund was underweight the sector. In addition, sector stock selection failed to enhance relative performance.

• The fund's underweighting in the industrial sector during the period diminished the fund's return as the sector outperformed in the benchmark. Also, stock selection in the sector was less than optimal.

• The fund was overweight the energy sector, which was the second best-performing sector in the index, but stock selection in the sector detracted from performance.

26

All American Equity Fund

CURRENT OUTLOOK

Opportunities

• The cyclical recovery now underway in the global economy should provide an opportunity for corporate earnings gains, thereby providing a positive fundamental background for stocks.

• Corporate cash levels are high, providing corporations the ability to pursue mergers and acquisitions (M&A). An increase in M&A activity holds promise for both portfolio gains and an increase in overall market valuations.

• Low interest rates, if continued throughout 2011, should provide a favorable backdrop for the economy and stock prices.

Threats

• The market is currently anticipating a "slow patch" in the ongoing economic recovery, and if the slowdown is worse than expected, it would be negative for stocks.

• An escalation in concerns over sovereign debt obligations in Europe would be negative for stocks.

• The end of quantitative easing as of June 30, 2011, by the Federal Reserve might result in unintended consequences.

The fund ended the period overweighted in materials, industrials and utilities, and it maintained an emphasis on dividend paying stocks.

(1)This security comprised 0.78% of the fund's total net assets as of 06/30/11.

(2)This security comprised 1.19% of the fund's total net assets as of 06/30/11.

(3)This security comprised 1.14% of the fund's total net assets as of 06/30/11.

(4)The fund did not hold this security as of 06/30/11.

(5)This security comprised 1.59% of the fund's total net assets as of 06/30/11.

27

All American Equity Fund

Top 10 Holdings Based on Net Assets

(excluding repurchase agreement) June 30, 2011

Halliburton Co.

Oil - Field Services | | | 2.78 | % | |

Ball Corp.

Containers - Metal/Glass | | | 2.09 | % | |

Oracle Corp.

Enterprise Software/Services | | | 1.79 | % | |

Cummins, Inc.

Engines - Internal Combustion | | | 1.69 | % | |

Informatica Corp.

Enterprise Software/Services | | | 1.59 | % | |

Check Point Software Technologies Ltd.

Application Software | | | 1.55 | % | |

Altera Corp.

Electronic Components - Semiconductors | | | 1.51 | % | |

QUALCOMM, Inc.

Wireless Equipment | | | 1.48 | % | |

Netflix, Inc.

E-Commerce/Services | | | 1.43 | % | |

Exxon Mobil Corp.

Oil Companies - Integrated | | | 1.33 | % | |

| TOTAL TOP TEN HOLDINGS | | | 17.24 | % | |

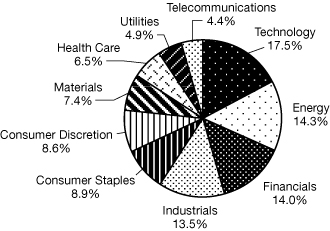

Portfolio Allocation by Industry Sector*

Based on Total Investments June 30, 2011

* Summary information above may differ from the portfolio schedule included in the financial statements due to the use of different classifications of securities for presentation purposes.

28

Holmes Growth Fund

Management Team's Perspective

INTRODUCTION

The Holmes Growth Fund (ACBGX) invests in companies with good growth prospects and strong positive earnings momentum. The fund's primary objective is to seek long-term capital appreciation.

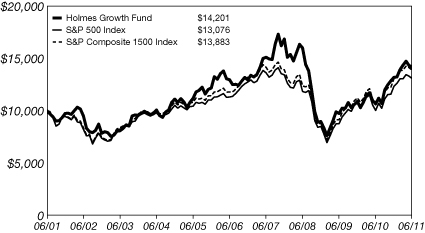

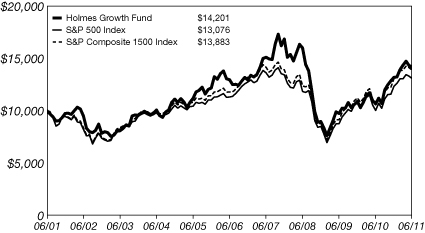

PERFORMANCE GRAPH

Holmes Growth Fund

Average Annual Performance For the Periods Ended

June 30, 2011

| | | Six Month | | One Year | | Five Year | | Ten Year | |

| Holmes Growth Fund | | | 7.61 | % | | | 33.24 | % | | | 1.81 | % | | | 3.57 | % | |

| S&P Composite 1500 Index | | | 6.31 | % | | | 31.71 | % | | | 3.33 | % | | | 3.33 | % | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. Investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for periods less than one year are not annualized.

Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of acquired fund fees and expenses, extraordinary expenses, taxes, brokerage commissions and interest, and advisory fee performance adjustments, if any) to not exceed 2.20%. The Adviser can modify or terminate this arrangement at any time.

See Definitions for Management Teams' Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

29

Holmes Growth Fund

THE SIX-MONTH PERIOD IN REVIEW – ECONOMIC AND POLITICAL ISSUES THAT AFFECTED THE FUND

The U.S. real GDP was originally announced to have increased 1.90 percent in the quarter ended March 31, 2011, but was revised down to 0.4 percent following second-quarter results. While economists had estimated a sequential increase of 2.00 percent for the quarter ended June 30, 2011, real GDP was actually lower, increasing only 1.30 percent.

To aid a recovering economy, the Federal Reserve kept its short-term interest rate target in a range of zero to 0.25 percent for the six-month period. The 10-year U.S. Treasury note yield began 2011 at 3.30 percent, rose to a high of 3.74 percent on February 8 and ended the period at a yield of 3.16 percent.

In an effort to stimulate the economy, the Fed continued its second round of quantitative easing (QE2) to purchase $600 billion in U.S. Treasury bonds and concluded QE2 on June 30, 2011.

Inflation remained relatively contained, with year-over-year change in the Consumer Price Index (CPI) registering 1.6 percent in January and rising to 3.6 percent in June. The core CPI, which excludes food and fuel, registered 1.0 percent in January and ended the period at 1.6 percent in June.

The employment picture remained weak. Unemployment was at 9.0 percent in January and ended the period at 9.2 percent.

Stock market performance was marked by an oscillating market. The benchmark S&P Composite 1500 Index began the year at 290.89, rose to 310.35 in mid-February, declined to 291.40 in mid-March, rose irregularly to a period high of 316.45 in late April, declined to 293.70 in mid-June and rose again to finish the period at 306.38.

The political environment was one of strongly divided partisan debates, with the Democrats controlling the Presidency and the Senate, and the Republicans controlling the House of Representatives. Issues debated included national healthcare legislation, financial regulatory reform, the federal budget and the national debt. Some observers also interpreted the environment as an anti-business tilt on the part of the current administration and parts of the legislative bodies.

30

Holmes Growth Fund

INVESTMENT HIGHLIGHTS

Overview

The fund returned 7.61 percent for the six months ended June 30, 2011, outperforming the benchmark, the S&P Composite 1500 Index, which returned 6.31 percent.

Strengths

• The fund benefited from being overweight the consumer discretionary sector as the fund's holdings outperformed. Stock selection in the sector also benefited performance with the fund's largest holding, Newfoundland Capital Corp. Ltd.,(1) providing significant outperformance. Priceline.com, Inc.,(2) Netflix, Inc.(3) and DIRECTV(4) also aided performance.

• Although the fund was underweight the consumer staples sector in relation to its benchmark, the holdings in the fund had significant outperformance. Stock selection resulted in a positive contribution from investments in the sector as Herbalife Ltd.(5) and The Estee Lauder Cos., Inc.(6) outperformed.

• The fund was underweight healthcare, the best-performing sector in the benchmark; however, stock selection resulted in a positive contribution from the sector. Valeant Pharmaceuticals International, Inc.(7) significantly enhanced the fund's return from the sector.

• Defensive option strategies also aided the fund performance.

Weaknesses

• Relative fund performance was diminished by investments in the energy sector. Although this was the second-best performing sector in the S&P Composite 1500 Index and the fund was slightly overweight the sector, stock selection resulted in diminished performance. Investments in Alange Energy Corp.(8) and Pacific Rubiales Energy Corp.(9) failed to live up to expectations in the period.

• The fund was overweight the underperforming materials sector, and stock selection was less than optimal.

• The fund was approximately equal-weight the industrial sector, but stock selection proved to be disappointing.

31

Holmes Growth Fund

CURRENT OUTLOOK

Opportunities

• The cyclical recovery now underway in the global economy should provide an opportunity for corporate earnings gains, thereby providing a positive fundamental background for stocks.

• Corporate cash levels are high, providing corporations the ability to pursue mergers and acquisitions (M&A). An increase in M&A activity holds promise for both portfolio gains and an increase in overall market valuations.

• Low interest rates, if continued throughout 2011, should provide a favorable backdrop for the economy and stock prices.

Threats

• The market is currently anticipating a "slow patch" in the ongoing economic recovery, and if the slowdown is worse than expected, it would be negative for stocks.

• An escalation in concerns over sovereign debt obligations in Europe would be negative for stocks.

• The end of QE2 by the Fed might result in unintended consequences.

From a fund construction viewpoint, as of June 30, 2011, the fund was in an offensive posture with overweight positions in technology, industrials, materials and consumer discretion.

(1)This security comprised 7.68% of the fund's total net assets as of 06/30/11.

(2)The fund did not hold this security as of 06/30/11.

(3)This security comprised 1.84% of the fund's total net assets as of 06/30/11.

(4)This security comprised 1.07% of the fund's total net assets as of 06/30/11.

(5)This security comprised 1.08% of the fund's total net assets as of 06/30/11.

(6)This security comprised 1.72% of the fund's total net assets as of 06/30/11.

(7)This security comprised 0.85% of the fund's total net assets as of 06/30/11.

(8)This security comprised 1.29% of the fund's total net assets as of 06/30/11.

(9)This security comprised 1.61% of the fund's total net assets as of 06/30/11.

32

Holmes Growth Fund

Top 10 Holdings Based on Net Assets

(excluding repurchase agreement) June 30, 2011

Newfoundland Capital Corp., Ltd.

Radio | | | 7.68 | % | |

WABCO Holdings, Inc.

Automotive - Truck Parts & Equipment | | | 2.42 | % | |

Halliburton Co.

Oil - Field Services | | | 2.39 | % | |

Ball Corp.

Containers - Metal/Glass | | | 2.25 | % | |

Caterpillar, Inc.

Machinery - Construction & Mining | | | 2.12 | % | |

Cummins, Inc.

Engines - Internal Combustion | | | 1.94 | % | |

Netflix, Inc.

E-Commerce/Services | | | 1.84 | % | |

Altera Corp.

Electronic Components - Semiconductors | | | 1.84 | % | |

SolarWinds, Inc.

Communication Software | | | 1.83 | % | |

Baidu, Inc.

Web Portals/Internet Service Providers | | | 1.80 | % | |

| TOTAL TOP TEN HOLDINGS | | | 26.11 | % | |

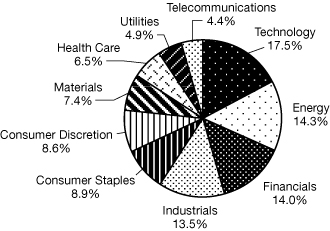

Portfolio Allocation by Industry Sector*

Based on Total Investments June 30, 2011

* Summary information above may differ from the portfolio schedule included in the financial statements due to the use of different classifications of securities for presentation purposes.

33

Global MegaTrends Fund

Management Team's Perspective

INTRODUCTION

The Global MegaTrends Fund (MEGAX and MEGIX) focuses on companies that are well positioned to benefit from future investments in global infrastructure, both in the private and public sectors. The fund considers a broad range of investable opportunities, including publicly traded infrastructure assets (such as airports and toll roads), select utilities, construction and engineering firms, telecom operators, select companies in the alternative energy space, and companies in the steel, cement and raw materials sectors.

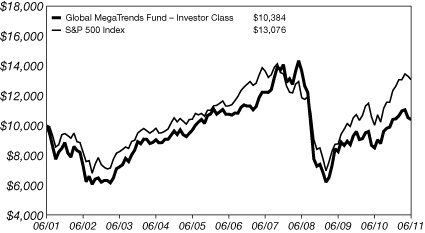

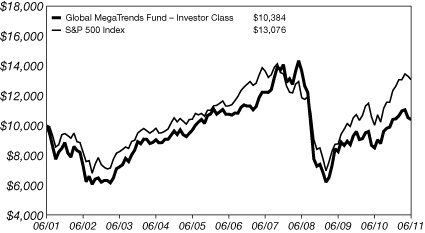

PERFORMANCE GRAPH

Global MegaTrends Fund

Average Annual Performance For the Periods Ended

June 30, 2011

| | | Six Month | | One Year | | Five Year | | Ten Year | | Since Inception

(Institutional

Class) | |

Global MegaTrends Fund

- Investor Class | | | (0.11 | )% | | | 22.60 | % | | | (0.69 | )% | | | 0.38 | % | | | n/a | | |

Global MegaTrends Fund - Institutional

Class (Inception 3/1/10) | | | 0.11 | % | | | 23.18 | % | | | n/a | | | | n/a | | | | 9.76 | % | |

| S&P 500 Index | | | 6.02 | % | | | 30.69 | % | | | 2.94 | % | | | 2.72 | % | | | 15.76 | % | |

| S&P Global Infrastructure Index | | | 8.48 | % | | | 31.96 | % | | | 5.61 | % | | | n/a | | | | 14.65 | % | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. Investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for periods less than one year are not annualized.

The S&P Global Infrastructure Index is not included in the line graph as it had less than ten years of data.

Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of acquired fund fees and expenses, extraordinary expenses, taxes, brokerage commissions and interest, and advisory fee performance adjustments, if any) to not exceed 2.35% for the Investor Class. Also pursuant to a voluntary agreement, the Adviser has agreed to waive all class specific expenses of the Institutional Class. The Adviser can modify or terminate these arrangements at any time.

See Definitions for Management Teams' Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

34

Global MegaTrends Fund

THE SIX-MONTH PERIOD IN REVIEW – ECONOMIC AND POLITICAL ISSUES THAT AFFECTED THE FUND

Political and economic considerations are very influential on the investment climate in which the Global MegaTrends Fund operates.

The Japanese earthquake and devastation of the nuclear plant in Onahama negatively affected some of our holdings in the nuclear industry, in particular, Uranium Energy Corp.(1) and Dongfang Electric Corp. Ltd.(2) Regardless of the short-term negative sentiment toward nuclear stocks, we continue to believe that nuclear energy will play an important role in the buildup of the power generation capacity globally. We plan to monitor for opportunities as sentiment improves.

In May 2011, Chancellor Angela Merkel's ruling coalition announced in a policy reversal after Japan's Fukushima disaster that Germany plans to phase out all nuclear reactors by 2022. In order to replace 17 nuclear reactors that supply around 25 percent of power in the country, Germany will resort to building more coal and gas fired plants as well as further increasing reliance on alternative energy sources. Alternative sources (wind, solar and hydroelectric) currently account for 17 percent of installed capacity in Germany and the government would like to increase this capacity to around 50 percent in the future. It appears that neighboring Switzerland is also tilting toward a gradual phasing out of its nuclear plants (currently producing 40 percent of the country's electricity) with the final closure of nuclear plants expected by 2034.

Barring any unforeseen circumstances, we believe the current negative sentiment toward nuclear energy will subside in coming years with most of the growth occurring in the emerging markets.

INVESTMENT HIGHLIGHTS

Overview

For the six months ended June 30, 2011, the Investor Class of the fund had a negative 0.11 percent return and the Institutional Class posted a positve 0.11 percent return. The benchmark S&P 500 Index returned 6.02 percent, while the S&P Global Infrastructure Index returned 8.48 percent.

Strengths

• Top contributors to fund performance over the six-month period were Brazilian telecom operator Telecomunicacoes de Sao Paulo S.A.(3)

35

Global MegaTrends Fund

(formerly Vivo Participacoes S.A.), CSX Corp.,(4) Rackspace Hosting, Inc.(5) and Kolon Industries, Inc.,(6) all of which had significant double-digit gains.

• Although the fund had no exposure to the U.S. utilities sector, which outperformed within the benchmark S&P 500 Index, Brazil's CPFL Energia S.A.(7) was a top contributing international utility for the fund.

• In general, the fund's overseas holdings significantly outperformed the domestic holdings.

Weaknesses

• The fund's underperformance compared to the benchmark S&P 500 Index was mainly a result of stock selection, both domestic and international.

• The most negative impact for the fund during the six-month period came from Uranium Energy Corp.(1) The first half of the year was characterized by continuation of negative publicity towards nuclear energy with Germany vowing to phase out all of its nuclear plants by 2022.

• Other underperforming holdings included Cameco Corp.(8) and Dongfang Electric Corp. Ltd.(2)

CURRENT OUTLOOK

Based on the continuing trend of population growth and urbanization, particularly in emerging nations, we believe the infrastructure theme will be prominent for years to come. In developed countries, decades of underinvestment in infrastructure assets have resulted in a significant deterioration of existing infrastructure.

We remain encouraged by the awareness of the political leaders around the world that investments in infrastructure are needed to sustain economic growth and competitiveness.

Opportunities

• Until recently China was at the forefront of the infrastructure boom, but it appears that India is now stepping up with an estimated $1 trillion of needed investments.

• Although the lower oil price compared to the peak in 2008 may change the relative attractiveness of wind and solar energy, we believe investments in alternative energy sources will gain traction due to a global need for power. In our view, nuclear energy also fits into this group despite the current headwinds.

36

Global MegaTrends Fund

• Improved water infrastructure will be crucial as emerging economies develop. Opportunities in this space are currently limited, but they offer significant potential, both in desalination and waste treatment.

Threats

• While many countries remain committed to improving their infrastructure, delays due to tight credit conditions and legal impediments appear to affect numerous projects.

• Government subsidies are still required for sustainable development of alternative energy and this support could change as the political climate changes. There appears to be growing opposition from residents to the development of wind farms in various parts of the world on health and aesthetic grounds.

(1)This security comprised 0.96% of the fund's total net assets as of 06/30/11.

(2)The fund did not hold this security as of 06/30/11.

(3)This security comprised 2.17% of the fund's total net assets as of 06/30/11.

(4)This security comprised 3.34% of the fund's total net assets as of 06/30/11.

(5)This security comprised 1.79% of the fund's total net assets as of 06/30/11.

(6)This security comprised 1.52% of the fund's total net assets as of 06/30/11.

(7)This security comprised 2.96% of the fund's total net assets as of 06/30/11.

(8)This security comprised 2.07% of the fund's total net assets as of 06/30/11.

37

Global MegaTrends Fund

Top 10 Holdings Based on Net Assets

(excluding repurchase agreement) June 30, 2011

Caterpillar, Inc.

Machinery - Construction & Mining | | | 3.62 | % | |

CSX Corp.

Transportation - Rail | | | 3.34 | % | |

Compania de Concessoes Rodoviarias

Public Thoroughfares | | | 3.16 | % | |

CPFL Energia S.A.

Electric - Integrated | | | 2.96 | % | |

Cummins, Inc.

Engines - Internal Combustion | | | 2.87 | % | |

Grupo Empresarial Ibiza S.A.

Metal & Mineral Mining | | | 2.72 | % | |

Zhuzhou CSR Times Electric Co., Ltd.

Electric Products - Miscellaneous | | | 2.38 | % | |

SNC-Lavalin Group, Inc.

Engineering/R&D Services | | | 2.24 | % | |

Telecomunicacoes de Sao Paulo S.A.

Telephone - Integrated | | | 2.17 | % | |

McDermott International, Inc.

Engineering/R&D Services | | | 2.07 | % | |

| TOTAL TOP TEN HOLDINGS | | | 27.53 | % | |

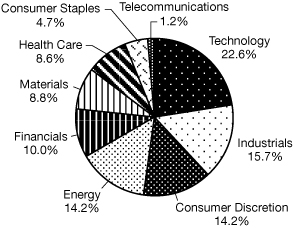

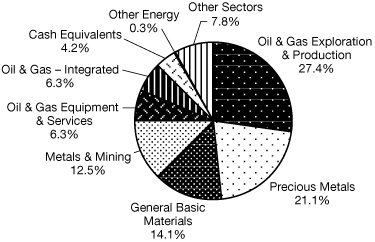

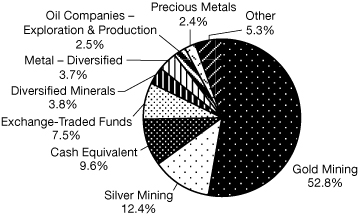

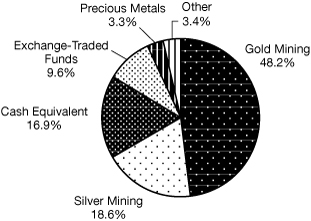

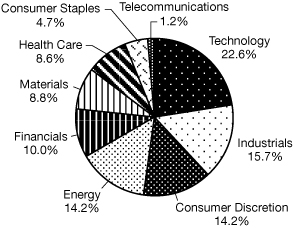

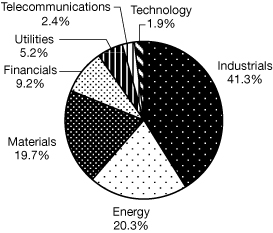

Portfolio Allocation by Industry Sector*

Based on Total Investments June 30, 2011

* Summary information above may differ from the portfolio schedule included in the financial statements due to the use of different classifications of securities for presentation purposes.

38

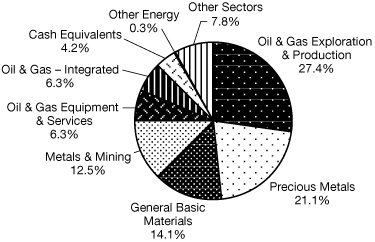

Global Resources Fund

Management Team's Perspective

INTRODUCTION

The Global Resources Fund (PSPFX and PIPFX) is a non-diversified natural resources fund with the principal objective of achieving long-term growth of capital while providing protection against inflation and monetary instability. The fund invests globally in companies involved in the exploration, production, transportation and processing of petroleum, natural gas, industrial commodities, metals, minerals and forestry.

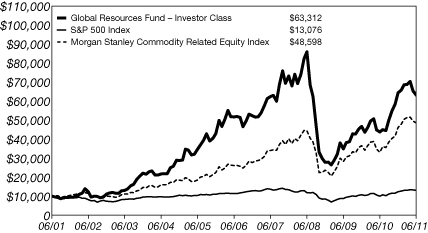

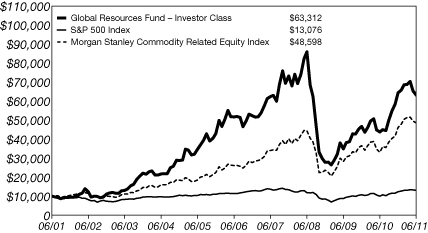

PERFORMANCE GRAPH

Global Resources Fund

Average Annual Performance For the Periods Ended

June 30, 2011

| | | Six Month | | One Year | | Five Year | | Ten Year | | Since Inception

(Institutional

Class) | |

Global Resources Fund - Investor

Class | | | (1.93 | )% | | | 44.47 | % | | | 4.12 | % | | | 20.26 | % | | | n/a | | |

Global Resources Fund - Institutional

Class (Inception 3/1/10) | | | (1.67 | )% | | | 45.34 | % | | | n/a | | | | n/a | | | | 26.13 | % | |

| S&P 500 Index | | | 6.02 | % | | | 30.69 | % | | | 2.94 | % | | | 2.72 | % | | | 15.76 | % | |

Morgan Stanley Commodity

Related Equity Index | | | 5.41 | % | | | 47.06 | % | | | 13.22 | % | | | 17.11 | % | | | 22.31 | % | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. Investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for periods less than one year are not annualized.

Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of acquired fund fees and expenses, extraordinary expenses, taxes, brokerage commissions and interest, and advisory fee performance adjustments, if any) to not exceed 1.90% for the Investor Class. Also pursuant to a voluntary agreement, the Adviser has agreed to waive all class specific expenses of the Institutional Class. The Adviser can modify or terminate these arrangements at any time.

See Definitions for Management Teams' Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

39

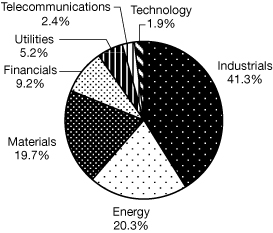

Global Resources Fund

THE SIX-MONTH PERIOD IN REVIEW – ECONOMIC AND POLITICAL ISSUES THAT AFFECTED THE FUND

In a replay of the first half of last year, the global economy and equity markets came under pressure once again in the second quarter following strong gains early in 2011. Financial market volatility increased in the period due to a series of macro events that included waning economic growth, a sovereign debt crisis affecting several European countries on the verge of default, the unwinding of the Federal Reserve's quantitative easing program (QE2), and the national debt limit in the U.S. which was set to expire this summer. Additionally, China bears continued to preach impending doom as the country continued to rein in liquidity that was fueling food and housing inflation. All of these factors pressured global markets after peaking in early April. Year-to-date, the fund's benchmark Morgan Stanley Commodity Related Equity Index gained 5.41 percent, but lost nearly the same amount in the second quarter as investors' risk aversion increased due to macro uncertainty.

Given the global economic headwinds above, as well as heightened investors' risk aversion, management increased its weighting in large capitalization domestic resource companies, which also appeared attractive on a relative value basis.

INVESTMENT HIGHLIGHTS

Overview

In the first half of 2011, the Investor Class of the Global Resources Fund declined 1.93 percent and the Institutional Class declined 1.67 percent, underperforming the fund's benchmark, the Morgan Stanley Commodity Related Equity Index (CRX), which gained 5.41 percent.

After posting solid positive first-quarter results of 6.80 percent, the fund declined 8.18 percent during the second quarter (Investor Class). The second quarter proved to be a volatile period for commodities – the underlying Reuters/Jefferies CRB Index fell 5.95 percent, the worst performance since the fourth quarter of 2008. On a twelve-month basis, the fund posted a total return of 44.47 percent (Investor Class), trailing its benchmark by 2.59 percent, but outperforming the broader S&P 500 Index by 13.78 percentage points.

Because the fund is actively managed and a holding period is generally not a consideration in investment decisions, the portfolio turnover rate may fluctuate from year-to-year as the fund adjusts its portfolio composition. Its annual portfolio turnover was, and is expected to continue to be, more than 100 percent.

40

Global Resources Fund

Strengths

• The S&P Oil & Gas Refining and Marketing Index gained 11 percent year-to-date, driven by strong margins and the wide divergence between West Texas Intermediate crude and the more internationally focused Brent crude. Fund holdings in this sector such as Holly Corp.,(1) Frontier Oil Corp.(2) and Tesoro Corp.(3) all meaningfully contributed to the fund's return in the period.

• Select industrials with exposure to oil and gas or infrastructure performed particularly well in the six-month period, such as Robbins & Myers, Inc.(4)

• Additionally, consistent with higher oil prices that exceeded $100 a barrel, oil & gas service and equipment stocks such as Halliburton Co.,(3) CARBO Ceramics, Inc.(3) and Oil States International, Inc.(5) outperformed the fund's benchmark.

• Individual materials equities outperformed due to firm-specific events. Consolidated Thompson Iron Mines Ltd.(3) returned 25 percent following a bid from Cliffs Natural Resources, Inc.(3) Small capitalization gold explorer NGEx Resources, Inc.(6) gained over 100 percent on better-than-expected drilling results.

Weaknesses

• Despite a 5.6 percent increase in the price of gold bullion from January to June, gold stocks, and particularly small capitalization precious metal equities, underperformed our benchmark. Gran Colombia Gold Corp.,(7) Silvercorp Metals, Inc.(3) and Medoro Resources Ltd.(3) were examples of holdings that underperformed.

• With civil unrest in North Africa and the Middle East, international resource equities such as Niko Resources Ltd.,(8) Pacific Rubiales Energy Corp.,(9) Alange Energy Corp.(10) and ShaMaran Petroleum Corp.(11) underperformed the benchmark.

• China-centric stocks such as Teck Resources Ltd.(3) and Vale S.A.(3) declined as investors became increasingly concerned about further economic growth in the region.

CURRENT OUTLOOK

Opportunities

• The International Energy Agency said that growth in oil demand should average about 1.2 million barrels per day every year for the next five years. It also reported that the 2011 "bull run" in oil was justified by changes in fundamentals.

41

Global Resources Fund

• China's steel demand may increase to between 670 and 750 million tons by 2015. This estimate is based on the assumption that China's economy will grow at a rate of 8 to 9 percent year-over-year in the next five years. The first four months of this year saw China's steel production grow by 8.3 percent year-over-year.

• Global natural gas use may rise more than 50 percent by 2035 from 2010 levels and meet more than a quarter of global energy demand, according to the International Energy Agency.

• Saudi Arabia's Oil Minister Ali Al-Naimi indicated that the OPEC nation will invest $125 billion in the next five years on both upstream and downstream assets to continue to meet the world's oil needs.

Threats

• A potential "hard landing" in China concerning economic growth could derail the bull market for commodities. These risks include a chronic power shortage, auto sales deceleration, weak manufacturing sector data, property market corrections and monetary tightening.

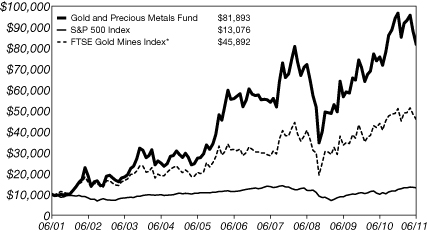

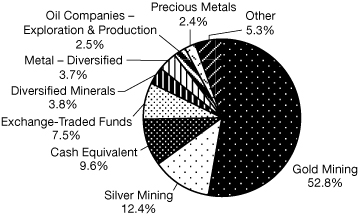

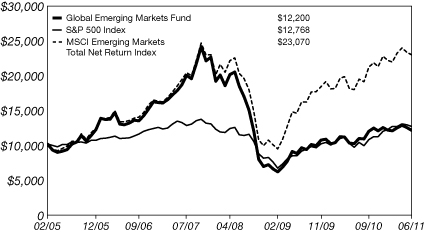

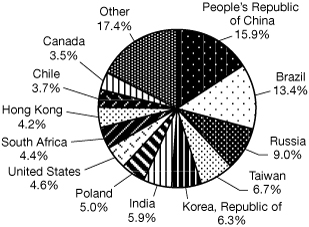

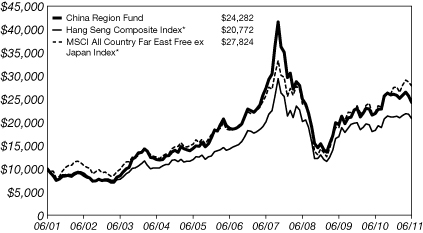

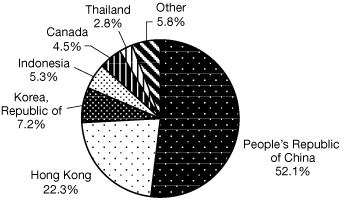

• Price inflation in emerging countries, and budget cuts and fiscal austerity measures in developed countries, may weigh on economic growth over the intermediate term, which could slow the demand for commodities.