UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-1800 |

|

U.S. GLOBAL INVESTORS FUNDS |

(Exact name of registrant as specified in charter) |

|

7900 CALLAGHAN ROAD SAN ANTONIO, TX | | 78229 |

(Address of principal executive offices) | | (Zip code) |

|

SUSAN B. MCGEE, ESQ. 7900 CALLAGHAN ROAD SAN ANTONIO, TX 78229 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 210-308-1234 | |

|

Date of fiscal year end: | DECEMBER 31, 2014 | |

|

Date of reporting period: | JUNE 30, 2014 | |

| | | | | | | | |

ITEM 1. REPORTS TO STOCKHOLDERS.

U.S. Global Investors Funds

Semi-Annual Report

June 30, 2014

U.S. Global Investors Funds

Semi-Annual Report

June 30, 2014

(unaudited)

Letter to Shareholders | | | 1 | | |

Definitions for Management Teams' Perspectives | | | 13 | | |

Management Teams' Perspectives | | | 15 | | |

Expense Example | | | 57 | | |

Portfolios of Investments | | | 59 | | |

Notes to Portfolios of Investments | | | 114 | | |

Statements of Assets and Liabilities | | | 124 | | |

Statements of Operations | | | 128 | | |

Statements of Changes in Net Assets | | | 132 | | |

Notes to Financial Statements | | | 138 | | |

Financial Highlights | | | 155 | | |

Additional Information | | | 166 | | |

Privacy Policy | | | |

U.S. Global Investors Funds

Investor Class

U.S. Government Securities Ultra-Short Bond Fund | | UGSDX | |

Near-Term Tax Free Fund | | NEARX | |

All American Equity Fund | | GBTFX | |

Holmes Macro Trends Fund | | MEGAX* | |

Global Resources Fund | | PSPFX | |

World Precious Minerals Fund | | UNWPX | |

Gold and Precious Metals Fund | | USERX | |

Emerging Europe Fund | | EUROX | |

China Region Fund | | USCOX | |

Institutional Class

Global Resources Fund | | PIPFX | |

World Precious Minerals Fund | | UNWIX | |

Gold and Precious Metals Fund** | | USEIX | |

Emerging Europe Fund** | | EURIX | |

* The Nasdaq symbol for the Holmes Macro Trends Fund changed from ACBGX to MEGAX in March 2014.

** The Institutional Class shares of the Gold and Precious Metals and Emerging Europe Funds have not commenced operations and currently are closed to investors. A notice will be issued when each class commences operations and opens to investors.

Fund Services, LLC

PO Box 701

Milwaukee WI

53201-0701

Tel 1.800.US.FUNDS

www.usfunds.com

U.S. Global Investors Funds

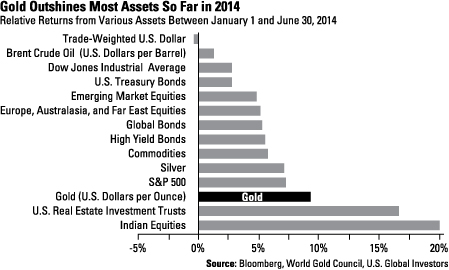

Gold is back in style.

Not that it ever fell completely out of style, mind you. But if you recall, the bears back in January were predicting yet another sluggish year. Spot gold prices plunged 28 percent in 2013, hitting a two-year low, and many investors had little reason to believe that the yellow metal could find its stride again so quickly.

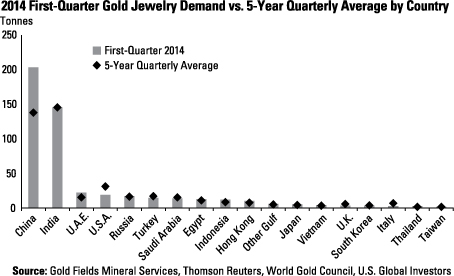

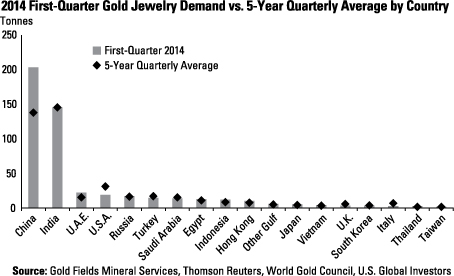

But find its stride it did, dashing many people's doubts and misgivings. Gold stocks and bullion have had a phenomenal six months, delivering just above a 10 percent return. The year began with a bang, set off by huge gold jewelry demand coming out of China – which has overtaken India as the world's strongest gold market – and leading to the largest first-quarter buying volume since 2005.

Gold jewelry demand in most markets, in fact, was above or at least in line with its five-year quarterly average, as you can see in the chart below.

As for India, the recent election of pro-business Narendra Modi has given investors confidence that the Indian government will roll back import restrictions on the precious metal. We're already seeing a hint of the change Modi's administration promises. In June, the country's gold imports surged a jaw-dropping 65 percent after the central bank permitted more investors to buy foreign bullion.

1

U.S. Global Investors Funds

"We've definitely seen the financial markets react very positively to [Modi's] election, and so we're just waiting to see if he can walk the walk as well as talk the talk," John Derrick, Director of Research at U.S. Global Investors, told NPR's Marketplace.

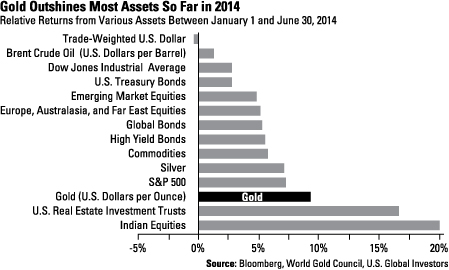

The World Gold Council reported in July that "the current environment of high bond issuance, tight credit spreads and record low volatility continues to offer a prime opportunity for investors to add gold" to their portfolios. The metal's volatility on a 30-day rolling basis is currently below 11 percent, very close to its all-time low.

This constructive activity has been a boon to our Gold and Precious Metals Fund (USERX) and World Precious Minerals Fund (UNWPX), both of which have seen recent increases in return. USERX, in fact, has been recognized for its track record with a four-star rating from Morningstar.*

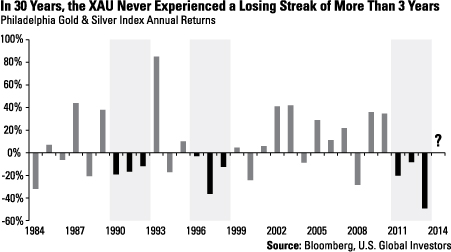

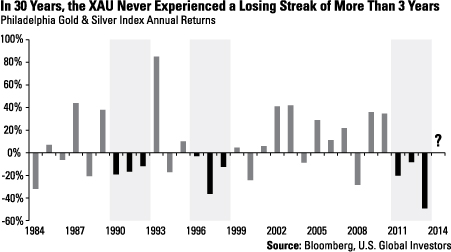

Gold mining stocks have also seen a huge increase this year, outperforming the actual commodity after three consecutive years of losses. I anticipated that gold equities would finally get a boost and wrote about this in the Investor Alert, Frank Talk and Shareholder Report, not to mention the CEO letter in last year's annual report. If you look at the chart on the following page, you'll see that, in three decades, the Philadelphia Gold & Silver Index (XAU) has never had a losing streak longer than three years. Historical precedent suggested that stocks were due for a jump in 2014, and indeed, the NYSE Arca Gold BUGS Index has returned approximately 22 percent year-to-date (YTD).

2

U.S. Global Investors Funds

As always, we recommend a 10 percent weighting in gold investment: 5 percent in bullion, 5 percent in mining stocks, and rebalance every year.

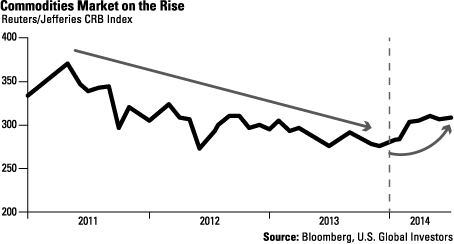

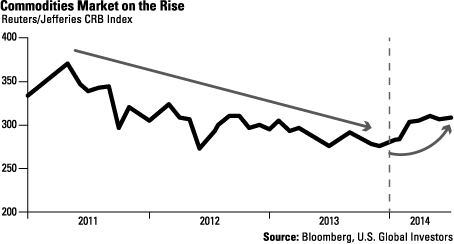

The raw materials market in general exceeded expectations in the first half, powered not only by gold but also steel, nickel and the platinum group metals (PGMs).

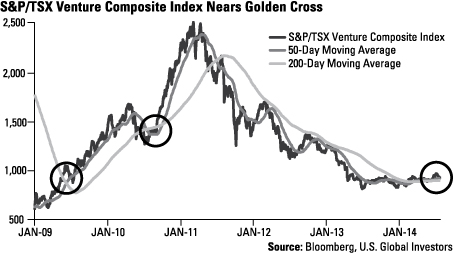

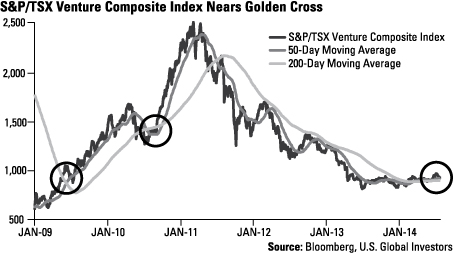

In January, the S&P/TSX Venture Composite Index, which measures Canadian micro-cap venture securities, experienced what's known as a golden cross. A golden cross occurs when the shorter-term 50-day moving average crosses above the 200-day moving average. Historically, investors have interpreted a cross as a rare buying opportunity and, consequently, the index has the potential for a positive trend change. That the S&P/TSX is a resources-heavy index shows just how bullish the market has become on materials and commodities, especially considering that this is the first golden cross in three years.

3

U.S. Global Investors Funds

During the bear market from mid-2011 until February 2014, we saw prices and daily trading volume decline more than 60 percent. This widened the bid-ask spread and made stock price discovery more challenging. Nevertheless, we continued with our models to accumulate undervalued shares since we are long-term "growth at a reasonable price" (GARP) investors. We often nibble on companies that are less expensive than their peers and lagging in relative performance over one day, 20 days and 60 days. Conversely, when these companies show a surge in price and volume using our statistical models, we often trim. This is the definition of active portfolio management. We take advantage of the volatility and use fundamental screens to focus on undervalued companies and quantitative models to trade around our holdings.

We have experienced a three-year decline in real global GDP from 5.2 percent in 2010 to 3 percent in 2013. This decline appeared to have hurt global commodity demand, which led to the domino effect of depressing resource stocks. An expected reversal this year might raise it to 3.5 percent, according to International Strategy & Investment (ISI).

But now that the 50-day moving average has crossed above the 200-day moving average – coupled with a rising purchasing managers index (PMI), which I'll discuss later – it's a positive sign that liquidity might soon return. The wind is now at our backs rather than in our faces.

World politics were largely to thank for the strong performance of commodities, the demand for which rises when supplies fall. Indonesia, the world's second-largest producer of nickel, unexpectedly banned the export of all raw

4

U.S. Global Investors Funds

minerals in January, pushing the price of the silvery-white metal to three-year highs. PGMs were also strong performers as a result of a five-month miners' strike in South Africa, the world's leading producer of platinum, and international trade sanctions against Russia, the leading producer of palladium.

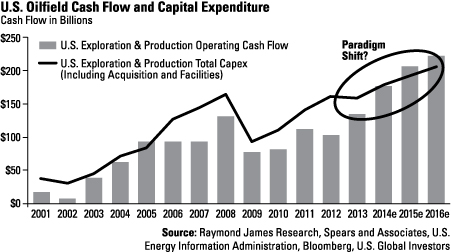

Crude oil has also commanded investors' attention this year. Oil futures look bright. In its July report, the U.S. Energy Information Administration (EIA) forecasted that global consumption of oil, driven largely by China, is expected to reach 94 million barrels a day (bbl/d) by the end of 2015.

Speaking with The Energy Report, Brian Hicks, co-portfolio manager of our Global Resources Fund (PSPFX), detailed our bullishness in the energy space:

"Within our portfolio, we are investing heavily in the shales through upstream oil and gas companies, oil services companies and equipment companies. Shale is transformational. It is really changing the energy landscape. Almost overnight, companies are developing resources that are long-lived and repeatable. Remember, only five years ago we were talking about peak oil. Now we're producing roughly 8.4 million bbl/d. That's the highest we've seen since the mid-80s. It is a trend that is going to continue."

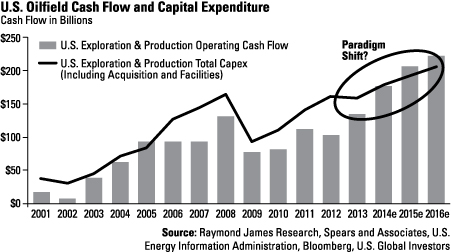

Take a look at the following chart. In the next couple of years, cash flow is expected to surpass capital investment in oil exploration and production (E&P). Driven by prior investment in the shale plays, these securities are starting to pay off as a result of a surge in oil and condensate volumes.

5

U.S. Global Investors Funds

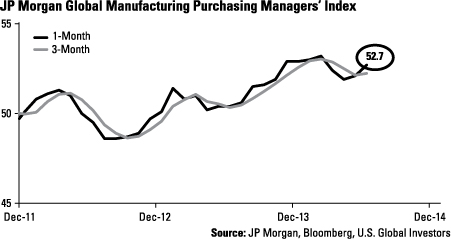

A Rise in Chinese and Global PMI

Just as we've seen with the rise in gold jewelry and crude oil demand, any positive news to come out of China, the world's second-largest economy, bodes very well for the rest of us. Savvy investors look to the Asian country to gauge the performance of the commodities market as a whole. They also know to pay special attention to its PMI, which measures viability in production, inventory levels, new orders and the employment environment. Any number over 50 represents healthy growth, and in June, China's PMI closed at 51, a six-month high.

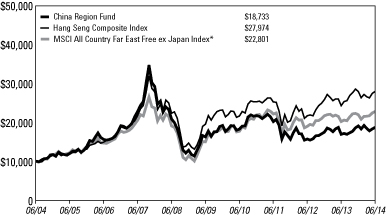

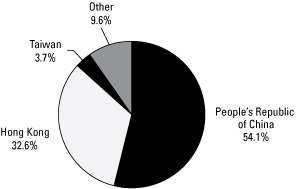

We're proud to offer investors the chance to take advantage of this growth opportunity with our China Region Fund (USCOX).

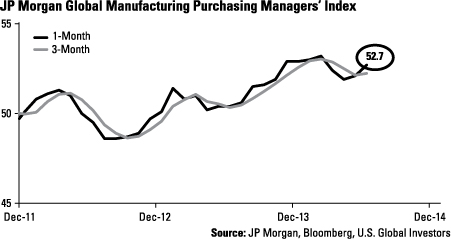

Back in December of last year, I predicted that the global PMI would likely rise in the first half of 2014, and indeed it rose at its fastest rate in three years to close at 52.7, a four-month high. Because the math shows that the upward momentum of the PMI drives commodities and commodity stocks, our investment team actively uses this data to improve our chances of strong returns.

6

U.S. Global Investors Funds

David Hensley, a director at JP Morgan, explains how the constructive PMI news correlates to GDP growth in the second half of the year:

"Gains in the levels of the new orders and employment indices suggest that the underlying trend in global economic conditions remains solid moving forward, pointing to above trend growth of global GDP in the second half of the year."

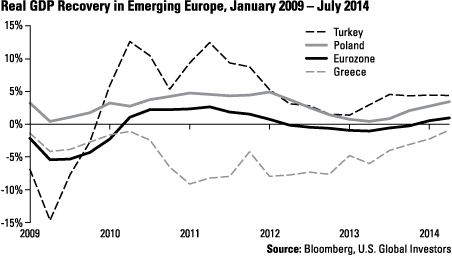

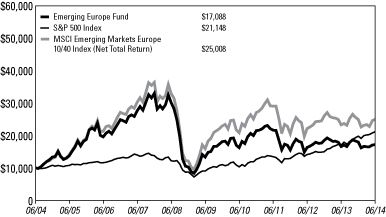

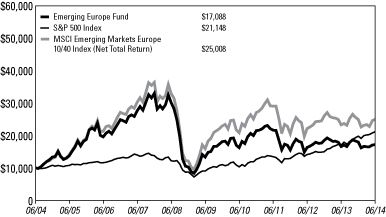

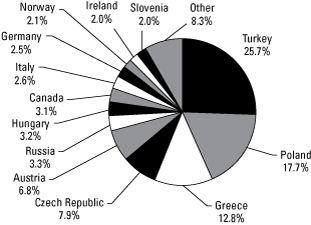

Transitioning Out of Russia, Seeking Stronger European Opportunities

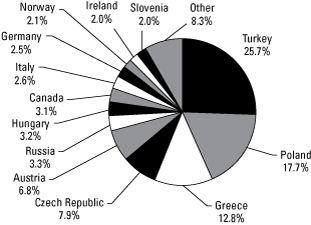

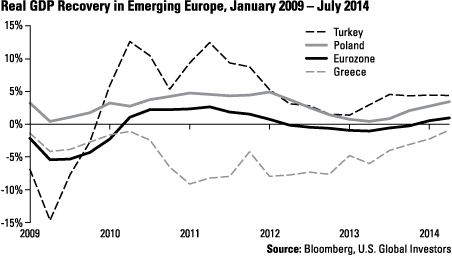

International trade sanctions against Russia following its invasion and annexation of the Crimean Peninsula have compelled us to significantly minimize our exposure to the country in our Emerging Europe Fund (EUROX). As a result, we've heavily increased our investments in other attractive European countries such as Turkey, Poland and Greece.

Although Turkey was hammered by the 2008 recession, it has recently emerged as the best-performing market in EUROX, followed by Poland, the only country in the European Union to have dodged the recession altogether. Both countries have outperformed the eurozone in recent years. Due largely to support from the European Central Bank (ECB), Greece's GDP has risen steadily since the first quarter of last year, narrowing the gap between it and the eurozone.

7

U.S. Global Investors Funds

"Greece is finally starting to see the light at the end of the tunnel," John Derrick told Gavin Graham of VoiceAmerica's Emerging and Frontier Markets Investing in June. "They've made some significant structural changes. Essentially the banking system has been consolidated down. There are now four major players there. All in the last month, they actually have recapitalized and raised money. That put some pressure on the Greek market and banks over the last month or so, and it puts them on a much firmer footing. The banking system can function more properly, and you can actually start seeing real growth."

Preparing for Changing Monetary Policy

Following former Federal Reserve Chairman Ben Bernanke's lead, Janet Yellen has suggested that the Fed's bond-buying program that was enacted soon after the 2008 recession will finally come to an end this October. It's unclear what the results might be, but the possibility of rising interest rates is not out of the question.

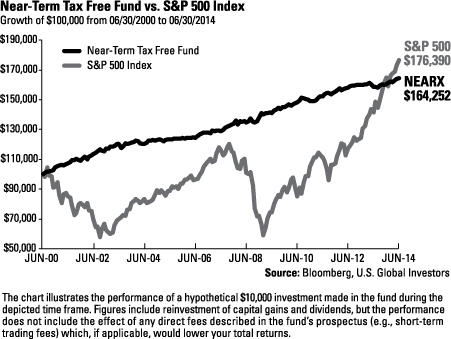

In such a changing climate, our Near-Term Tax Free Fund (NEARX) and U.S. Government Securities Ultra-Short Bond Fund (UGSDX) can be excellent income instruments, as short-term, investment grade municipal and federal bonds are less volatile than long-term, non-investment grade bonds when rates are fluctuating.

8

U.S. Global Investors Funds

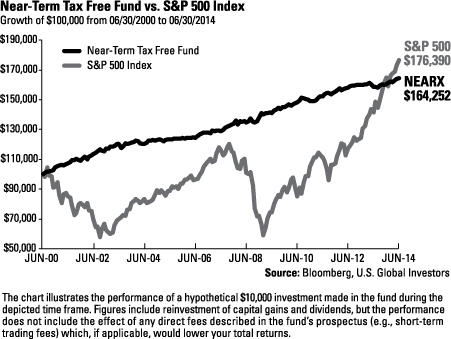

For the last 14 years, NEARX has seen consistent growth, even during and immediately following the 2008 financial crisis. Compared to the S&P 500 Index, which has weathered periods of choppy waters, NEARX has sailed upward relatively smoothly. In fact, since June 2000, it's taken close to a decade and a half for the S&P 500 to outperform the fund.

There are three principal ways in which people get rich: 1) they inherit their wealth, 2) they innovate and produce patentable ideas and 3) they participate in what I call the omega trade.

In the omega trade, investors purchase assets at a discount following a crisis of some kind, when prices plummet below replacement cost. When prices rebound, investors make a profit. A classic practitioner of this strategy is multibillionaire investor Warren Buffett, who routinely snatches up assets such as struggling yet promising farms, retail property and railroads after their prices have collapsed. To make these sorts of purchases, of course, one needs capital.

NEARX and UGSDX have the potential to provide investors with steady income while waiting to participate in a more aggressive omega trade.

9

U.S. Global Investors Funds

Our Investment Strategy

Serial entrepreneur Elon Musk, whose Tesla Motors we own in both our Holmes Macro Trends Fund (MEGAX) and All American Equity Fund (GBTFX), delivered this spring's commencement speech at the University of Southern California's Marshall School of Business. Some of what he said sounded familiar, echoing our investment team's philosophy for managing our nine funds:

"Focus on signal over noise. A lot of companies get confused. They spend money on things that don't actually make the product better."

At U.S. Global, we are always seeking ways to better our products for our clients by identifying and acting on sector and country leadership as well as using a matrix of top-down models and bottom-up micro stock selection models. Judicious stock selection, not to mention record highs for the Dow Jones Industrial Average, has helped both MEGAX and GBTFX flourish, with signs pointing to continued growth.

In the case of MEGAX, the "signal," as Musk puts it, is the 10-20-20 model. That is to say, we focus on companies that are growing revenue at 10 percent and generating a 20 percent earnings growth and 20 percent return on equity.

Everything else is simply "noise."

To stay current on the most recent insights on gold, global resources and emerging markets, remember to subscribe to our award-winning Investor Alert and Frank Talk at usfunds.com/subscribe.

Thank you for your continued trust and confidence in U.S. Global. Happy investing!

Sincerely,

Frank Holmes

CEO and Chief Investment Officer

U.S. Global Investors, Inc.

Please consider carefully a fund's investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus

10

U.S. Global Investors Funds

by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage, Inc.

*Morningstar Overall RatingTM among 71 Equity Precious Metals funds as of 6/30/2014 based on risk-adjusted return.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Bond funds are subject to interest-rate risk; their value declines as interest rates rise.

By investing in a specific geographic region, a regional fund's returns and share price may be more volatile than those of a less concentrated portfolio.

Investments in natural resources and emerging markets are subject to distinct risks as described in the funds' prospectus. Because the Global Resources Fund concentrates its investments in specific industries, the fund may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries.

Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in these sectors.

Stock markets can be volatile and can fluctuate in response to sector-related or foreign-market developments. For details about these and other risks the Holmes Macro Trends Fund may face, please refer to the fund's prospectus.

The Emerging Europe Fund invests more than 25% of its investments in companies principally engaged in the oil & gas or banking industries. The risk of concentrating investments in this group of industries will make the fund more susceptible to risk in these industries than funds which do not concentrate their investments in an industry and may make the fund's performance more volatile.

Tax-exempt income is federal income tax free. A portion of this income may be subject to state and local income taxes, and if applicable, may subject certain investors to the Alternative Minimum Tax as well. The Near-Term Tax Free Fund may invest up to 20% of its assets in securities that pay taxable interest. Income or fund distributions attributable to capital gains are usually subject to both state and federal income taxes. The Near-Term Tax Free Fund may be exposed to risks related to a concentration of investments in a particular state or geographic area. These investments present risks resulting from changes in economic conditions of the region or issuer. Though the Near-Term Tax Free Fund seeks minimal fluctuations in share price, it is subject to the risk that a decline in the credit quality of a portfolio holding could cause a fund's share price to decline.

11

U.S. Global Investors Funds

Morningstar Ratings are based on risk-adjusted return.The Morningstar Rating for a fund is derived from a weighted-average of the performance figures associated with its three-, five- and ten-year (if applicable) Morningstar Rating metrics. Past performance does not guarantee future results. For each fund with at least a three-year history, Morningstar calculates a Morningstar RatingTM based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund's monthly performance (including the effects of sales charges, loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. (Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in the distribution percentages.)

The CRB Metals Index is a subset of the Reuters/Jeffries CRB Index comprised of 22 sensitive basic commodities whose markets are presumed to be among the first to be influenced by changes in economic conditions. The commodities used are in most cases either raw materials or products close to the initial production. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry.

The Philadelphia Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver.

The NYSE Arca Gold BUGS (Basket of Unhedged Gold Stocks) Index (HUI) is a modified equal dollar weighted index of companies involved in gold mining. The HUI Index was designed to provide significant exposure to near term movements in gold prices by including companies that do not hedge their gold production beyond 1.5 years.

The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

Fund portfolios are actively managed, and holdings may change daily. Holdings are reported as of the most recent quarter-end. Holdings in the funds mentioned as a percentage of net assets as of 06/30/2014: Tesla Motors, Inc. (2.03% in All American Equity Fund, 2.77% in Holmes Macro Trends Fund).

12

Definitions for Management Teams' Perspectives

Benchmark Index Definitions

Returns for indices reflect no deduction for fees, expenses or taxes, unless noted.

The Barclays U.S. Treasury Bills 6-9 Months Total Return Index tracks the performance of U.S. Treasury Bills with a maturity of six to nine months.

The Barclays 3-Year Municipal Bond Index is a total return benchmark designed for municipal assets. The index includes bonds with a minimum credit rating of BAA3, are issued as part of a deal of at least $50 million, have an amount outstanding of at least $5 million and have a maturity of two to four years.

The FTSE Gold Mines Index encompasses all gold mining companies that have a sustainable and attributable gold production of at least 300,000 ounces a year and that derive 75% or more of their revenue from mined gold.

The Hang Seng Composite Index is a market-capitalization weighted index that covers about 95% of the total market capitalization of companies listed on the Main Board of the Hong Kong Stock Exchange.

The MSCI Emerging Markets Europe 10/40 Index (Net Total Return) is a free float-adjusted market capitalization index that is designed to measure equity performance in the emerging market countries of Europe (Czech Republic, Greece, Hungary, Poland, Russia and Turkey). The index is calculated on a net return basis (i.e., reflects the minimum possible dividend reinvestment after deduction of the maximum rate withholding tax). The index is periodically rebalanced relative to the constituents' weights in the parent index.

The Morgan Stanley Commodity Related Equity Index (CRX) is an equal-dollar weighted index of 20 stocks involved in commodity-related industries such as energy, non-ferrous metals, agriculture and forest products.

The NYSE Arca Gold Miners Index is a modified market capitalization-weighted index comprised of publicly-traded companies involved primarily in the mining for gold and silver.

The S&P 500 Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

The S&P Composite 1500 Index is a broad-based capitalization-weighted index of 1500 U.S. companies and is comprised of the S&P 400, the S&P 500 and the S&P 600.

13

Definitions for Management Teams' Perspectives

Other Index Definitions

The Barclays Municipal Bond Index is an unmanaged index representative of the tax-exempt bond market.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns.

The MSCI All Country Far East Free ex Japan Index is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of the Far East, excluding Japan. The index consists of the following developed and emerging market country indices: China, Hong Kong, Indonesia, Korea, Malaysia, Philippines, Singapore, Taiwan and Thailand.

The Producer Price Index (PPI) measures prices received by producers at the first commercial sale. The index measures goods at three stages of production: finished, intermediate and crude.

The Purchasing Manager's Index (PMI) is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment.

The Russian Trading Systems Index is a capitalization-weighted index that is calculated in USD. The index is comprised of stocks traded on the Russian Trading System.

The S&P High Yield Dividend Aristocrats Index is designed to measure the performance of the 50 highest dividend yielding S&P Composite 1500 constituents which have followed a managed dividends policy of consistently increasing dividends every year for at least 25 years.

The S&P/Case-Shiller Index tracks changes in home prices throughout the United States by following price movements in the value of homes in 20 major metropolitan areas.

The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar.

14

U.S. Government Securities Ultra-Short Bond Fund

Management Team's Perspective

Introduction

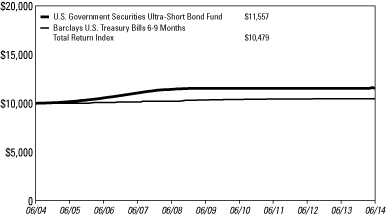

The U.S. Government Securities Ultra-Short Bond Fund (UGSDX) is designed to be used as an investment that takes advantage of the security of U.S. Government bonds and obligations, while simultaneously pursuing a higher level of current income than money market funds offer. The fund's dollar-weighted average effective maturity is two years or less.

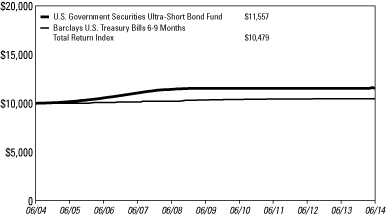

Performance Graph

U.S. Government Securities Ultra-Short Bond Fund

Average Annual Performance For the Periods Ended June 30, 2014

| | | Six Month | | One Year | | Five Year | | Ten Year | |

U.S. Government Securities Ultra-Short

Bond Fund | | | 0.19 | % | | | 0.20 | % | | | 0.05 | % | | | 1.46 | % | |

Barclays U.S. Treasury Bills 6-9 Months

Total Return Index | | | 0.06 | % | | | 0.11 | % | | | 0.25 | % | | | 0.47 | % | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. For all of a portion of the periods, the fund had expense limitations and reimbursements to maintain a minimum yield, without which returns would have been lower. Returns for periods less than one year are not annualized.

The above returns for the U.S. Government Securities Ultra-Short Bond Fund include the fund's results as a money market fund through the date of its conversion (December 20, 2013) to an ultra-short bond fund, and therefore are not representative of the fund's results had it operated as an ultra-short bond fund for the full term of the periods shown.

Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 0.45%. The Adviser can modify or terminate this arrangement at any time. In addition, returns may include the effects of additional voluntary waivers of fees and reimbursements of expenses by the Adviser, including waivers and reimbursements to maintain a minimum net yield for the fund.

See Definitions for Management Teams' Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

15

U.S. Government Securities Ultra-Short Bond Fund

The Six-Month Period In Review - Economic And Political Issues That Affected The Fund

The U.S. economy experienced some economic volatility during the first six months of 2014. A cold, snowy winter, coupled with a late Easter, disrupted economic activity in the first quarter with an associated rebound in the second quarter as somewhat of an offset. First-quarter GDP contracted 2.1 percent, while the second quarter grew 4.0 percent with roughly 3 percent growth expected for the rest of the year. Manufacturing indicators took a dip early in the year, which was largely attributed to weather, and have since rebounded back into very healthy territory. The same general trend of improving manufacturing indicators could be seen on a global basis.

The employment situation is steadily improving with a very consistent nonfarm payroll growth of between 200,000 and 300,000 jobs per month virtually all year. After a lull in the second half of 2013, housing activity has begun to recover. Slowed by sharply higher mortgage rates and rising housing prices last year, the housing market has stabilized and even begun to improve in recent months. The S&P/Case-Shiller Home Price Index indicates housing prices were up 9.3 percent on a year-over-year basis through May. Higher housing prices, along with a strong stock market, have created a "wealth effect," improving consumers' attitudes toward their financial situations. Increasing consumer confidence has driven very strong auto sales, which has many positive effects in the manufacturing sector.

In May 2013, Federal Reserve Chairman Ben Bernanke indicated an inclination to begin reducing the quantitative easing (QE) stimulus program that has been widely described as "tapering." The Fed tapered by $10 billion in December 2013, and that process has since continued at each subsequent Federal Open Market Committee (FOMC) meeting. At the end of June, the Fed was purchasing $35 billion per month, down from an original $85 billion, in Treasuries and mortgage-backed securities each month in an effort to continue to stimulate the economy. It is widely expected the Fed will completely wind down the program at the FOMC meeting on October 29, 2014.

Inflation in the U.S. oscillated between 1 and 2 percent for the past two years, and while we are currently at the high end of that range, the Fed still has plenty of room to maneuver. Global inflation in general has remained low, which has allowed other global central bankers to comfortably maintain pro-growth policies. Key global economies participating in this trend include Japan, China and Europe. Europe in particular has taken new stimulative steps in recent months, taking the equivalent Fed funds' rate into negative territory.

Japan remains committed to an aggressive reflation policy, and China appears comfortable maintaining a stable growth policy. The current Chinese administration has focused on addressing domestic imbalances and, thus, has not been the global growth catalyst it was after the financial crisis. Europe has improved, emerging from a

16

U.S. Government Securities Ultra-Short Bond Fund

lingering shallow recession late last year. Optimism is picking up with regards to the global growth outlook as all major economic areas of the world are showing stable-to-improving economic growth for the remainder of 2014.

Yields on three-month Treasury bills fell 5 basis points to 0.02 percent, while yields on six-month bills fell 3 basis points to 0.06 percent. One-year agency discount note yields fell 2 basis points to 0.14 percent.

Investment Highlights

The U.S. Government Securities Ultra-Short Bond Fund returned 0.19 percent for the six months ending June 30, 2014, outperforming its benchmark, the Barclays U.S. Treasury Bills 6-9 Months Total Return Index, which returned 0.06 percent.

The fund extended its maturity profile at the end of 2013 and very early in 2014 as interest rates on short-term agency securities were relatively attractive, which proved to be very good timing as the market rallied, sending yields lower for essentially the next six months. Short-term Treasury yields have recently spiked, but short-term agency securities the fund primarily invests in have not quite moved back to the high yield levels experienced at the beginning of 2014.

Current Outlook

The Fed continues to remain accommodative in an attempt to offset fiscal tightening and spur employment growth. We believe the U.S. will maintain an accommodative monetary policy but will continue to taper the QE program as the year progresses. Short-term yields could be higher over the next six to twelve months, but it currently appears unlikely that the Fed will take aggressive action or raise the Fed funds rate in 2014.

17

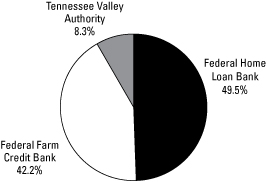

U.S. Government Securities Ultra-Short Bond Fund

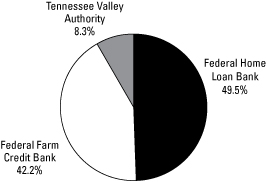

Portfolio Allocation by Issuer June 30, 2014

Portfolio Allocation by Maturity June 30, 2014

| 1 - 3 Months | | $ | 33,199,955 | | | | 49.1 | % | |

| 3 - 12 Months | | | 4,999,075 | | | | 7.4 | % | |

| 1 - 3 Years | | | 5,511,400 | | | | 8.1 | % | |

| 3 - 5 Years | | | 23,973,526 | | | | 35.4 | % | |

| | | $ | 67,683,956 | | | | 100.0 | % | |

18

Management Team's Perspective

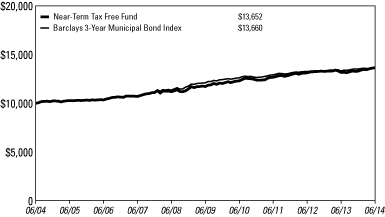

Introduction

The Near-Term Tax Free Fund (NEARX) seeks to provide a high level of current income exempt from federal income taxation and to preserve capital. However, a portion of any distribution may be subject to federal and/or state income taxes. The Near-Term Tax Free Fund will maintain a weighted average maturity of less than five years.

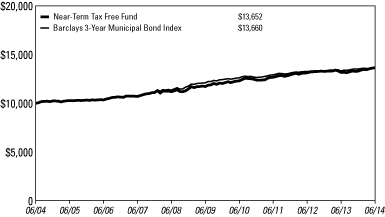

Performance Graph

Near-Term Tax Free Fund

Average Annual Performance For the Periods Ended June 30, 2014

| | | Six Month | | One Year | | Five Year | | Ten Year | |

Near-Term Tax Free Fund | | | 2.52 | % | | | 3.68 | % | | | 3.07 | % | | | 3.16 | % | |

Barclays 3-Year Municipal Bond Index | | | 1.04 | % | | | 2.42 | % | | | 2.44 | % | | | 3.17 | % | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. For all or a portion of the periods, the fund had expense limitations, without which returns would have been lower. Returns for periods less than one year are not annualized.

The Adviser has contractually agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 0.45% on an annualized basis through December 31, 2014.

See Definitions for Management Teams' Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

19

The Six-Month Period In Review - Economic And Political Issues That Affected The Fund

Defying the skeptics who anticipated higher yields and interest rates with corresponding lower bond values, the Barclays Municipal Bond Index, a measure of the general municipal bond markets, rallied 6 percent in the first half of 2014. This comes on the back of a difficult 2013 in which the municipal market experienced its worst performance since 2008. While we have seen good performance year-to-date, the dynamics in the market remains challenging. The yield curve has flattened with yields on the short end flat to higher while the long end of the curve has rallied by as much as 100 basis points.

Generally speaking, the further out the yield curve you move, the higher the returns. The very long end of the yield curve – bonds with maturities of 22 years or more – rose by more than 10 percent so far this year. The Near-Term Tax Free Fund invests in the short and intermediate part of the municipal market, and the Barclays 3-Year Municipal Bond Index rose 1.04 percent during the first half of 2014.

Back in May 2013, Federal Reserve Chairman Ben Bernanke introduced the idea of tapering the Fed's quantitative easing (QE) stimulus program. At the time, the Fed was spending $85 billion per month buying Treasuries and mortgage-backed securities in an attempt to stimulate the economy. This announcement roiled the market, sending yields higher through late December. The key inflection point for the market came right around the end of the year as fears regarding the Fed tapering subsided as the Fed introduced tapering at the December 2013 Federal Open Market Committee (FOMC) meeting. In a classic sense, the market had absorbed all the fears of tapering and what that could potentially mean for the market. By the time it actually occurred, the market had priced it in almost completely and was able to rally nearly uninterrupted for the past six months.

The economy generally cooperated with the Fed. It was weak in the first quarter, but most market observers were willing to look past it as much of the slowness was weather related. Activity in the second quarter bounced back, and prospects for the remainder of the year appear favorable, with roughly 3 percent GDP growth expected.

Revenue-backed municipals outperformed general obligation credits, with specific strength in hospital and industrial development issues. Credit factors also played a significant role as performance differences between low-quality and high-quality bonds were large. AAA-rated municipals rose 4.21 percent, while BBB-rated municipals surged 9.76 percent. There were specific credit events that exacerbated the volatility of BBB returns, such as Puerto Rico-backed debt, but the overall trend still holds. High-yield, or "junk bonds," also outperformed, rising 7.53 percent over the past six months.

In specialty state trading, Puerto Rico was a standout performer, while California and Illinois also outperformed. New York and New Jersey credits underperformed so far in 2014.

20

Investment Highlights

For the six months ended June 30, 2014, the Near-Term Tax Free Fund returned 2.52 percent, outperforming its benchmark, the Barclays 3-Year Municipal Bond Index, which gained 1.04 percent.

The Near-Term Tax Free Fund also outperformed the Short-Intermediate Lipper peer group for the past six months. With a low turnover approach, the fund remained true to form, investing in traditional high-quality municipals. It has been able to outperform due to a slightly longer maturity structure and advantageous yield curve positioning.

Strengths

• The fund's low turnover approach has proven to be an asset. Buying opportunistically and letting that yield advantage work has served the fund favorably over time.

• The fund's longer maturity structure compared to the benchmark was favorable. The market rewarded investors for stepping out on the yield curve.

• The fund benefited from significant exposure to Illinois and Texas, which both outperformed. It also had modest exposure to Puerto Rico, which outperformed by a wide margin.

Weaknesses

• The fund had less exposure to the lower-quality investment grade credits that outperformed by wide margins.

• The fund also has very little exposure to the industrial development and non-investment grade credits that outperformed.

• Bonds that are subject to the alternative minimum tax (AMT) also outperformed; however, the fund has no exposure to these bonds.

Current Outlook

Opportunities

• While the Federal Reserve tapering program that began in December is likely to wind down by the end of October, the rest of the world is beginning to pick up the monetary stimulus slack. The Bank of Japan continues with an aggressive quantitative easing (QE) program of its own, and the European Central Bank (ECB) took the Fed Fund's equivalent rate into negative territory in an attempt to stimulate the European economies. This implies that global inflation remains under control or even that deflation risks still abound. Interest rates may be lower for a longer period than many investors expect.

21

Threats

• Continued outperformance of low-quality bonds is the most significant threat on a relative basis.

• When the Fed reverses its monetary policy stance and begins to raise interest rates, the macro environment could become more difficult.

22

Top 10 Area Concentrations

(Based on Net Assets) June 30, 2014

Texas | | | 14.66 | % | |

Florida | | | 12.18 | % | |

Illinois | | | 9.12 | % | |

Michigan | | | 5.24 | % | |

California | | | 5.02 | % | |

New Jersey | | | 3.65 | % | |

Alabama | | | 3.47 | % | |

New York | | | 3.10 | % | |

Pennsylvania | | | 2.64 | % | |

Arizona | | | 2.61 | % | |

Total Top 10 Areas | | | 61.69 | % | |

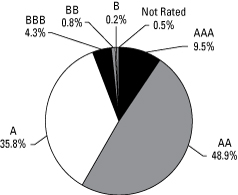

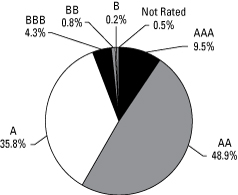

Municipal Bond Ratings*

(Based on Total Municipal Bonds) June 30, 2014

* Credit-quality ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). "Not Rated" is used to classify securities for which a rating is not available. Credit-quality ratings for each issue are obtained from Moody's and S&P, and the higher rating for each issue is used.

23

Management Team's Perspective

Introduction

The principal objective of the All American Equity Fund (GBTFX) is to seek capital appreciation by investing primarily in a broadly diversified portfolio of domestic common stocks. The fund invests in large-capitalization stocks, while retaining the flexibility to seek out promising individual stock opportunities, including stocks with meaningful dividend yields.

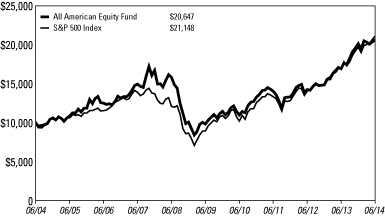

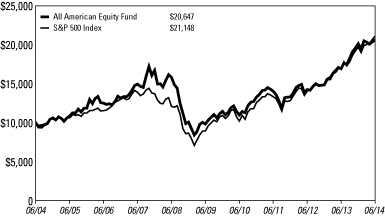

Performance Graph

All American Equity Fund

Average Annual Performance For the Periods Ended June 30, 2014

| | | Six Month | | One Year | | Five Year | | Ten Year | |

All American Equity Fund | | | 2.30 | % | | | 21.75 | % | | | 16.03 | % | | | 7.51 | % | |

S&P 500 Index | | | 7.13 | % | | | 24.60 | % | | | 18.80 | % | | | 7.77 | % | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted.The principal value and investment return of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. For all or a portion of the periods, the fund had expense limitations, without which returns would have been lower. Returns for periods less than one year are not annualized.

Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 2.20%. The Adviser can modify or terminate this arrangement at any time.

See Definitions for Management Teams' Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

24

The Six-Month Period In Review - Economic And Political Issues That Affected The Fund

Because of an unusually severe winter and a late Easter, which pushed some consumer spending into April, first quarter GDP contracted 2.1 percent. The U.S. economy in the second quarter of 2014, however, showed a strong bounce back at 4.0 percent, with GDP growth estimated at 3 percent or better for the remainder of the year.

U.S. stocks have been solid performers so far in 2014, with the S&P 500 Index rising 7.13 percent. Dividend-paying stocks generally performed in-line with the broad market, as measured by the S&P 500 Index, with the S&P High Yield Dividend Aristocrats Index gaining 6.87 percent.

Global manufacturing indicators have shown progress in recent months following a weak March and April, suggesting a constructive economic environment, especially for cyclicals. The automotive sector in particular has performed very well, with annualized sales in June of almost 17 million vehicles, the best showing since 2006. The U.S. housing market has been steady but not quite the positive catalyst many were looking for coming into the year. Combined with a rising equity market, home price appreciation has been solid, boosting the wealth effect for consumers.

In December 2013, the Federal Reserve began tapering its quantitative easing (QE) program, reducing the original $85 billion a month in Treasuries and mortgage-backed securities purchases by $10 billion at each subsequent Federal Open Market Committee (FOMC) meeting. The Fed is on track to complete its tapering at the FOMC meeting on October 29, 2014. A mini-crisis would probably be necessary to disrupt that schedule.

Investment Highlights

Overview

The All American Equity Fund returned 2.30 percent for the six months ended June 30, 2014, underperforming the 7.13 percent return for the S&P 500 Index benchmark.

Because the fund is actively managed and the holding period is generally not a consideration in investment decisions, the portfolio turnover rate may fluctuate from year to year as the fund adjusts its portfolio composition. The fund's annual portfolio turnover was, and is expected to continue to be, more than 100 percent.

Strengths

• The fund's stock selections in consumer staples and materials sectors were particularly strong relative to the benchmark. The fund was modestly overweight

25

in the utilities sector, which was by far the best performing sector in the S&P 500 Index, rising more than 18 percent.

• The fund's exposure to dividend-paying stocks over the past six months was beneficial to relative performance as this portion of the fund outperformed the more growth-oriented portion of the portfolio.

• Westlake Chemical Corp.,(1) Continental Resources, Inc.(2) and United Rentals Inc.(3) were among the best positive contributors to fund performance.

Weaknesses

• Overall, the fund's stock selection compared to the benchmark was detrimental to performance; this was particularly true in the technology sector.

• Cash and defensive option strategies did not aid fund performance over the first half of the year as the market rallied strongly.

• Chicago Bridge & Iron Co. N.V.,(2) MasterCard, Inc.(2) and Tableau Software, Inc.(2) were among the worst individual contributors to performance.

Current Outlook

Opportunities

• The global economy remains in the midst of a synchronized recovery, which bodes particularly well for cyclical and growth sectors in the U.S. economy. We believe the global growth outlook remains strong as developed world monetary policy remains very supportive.

• Corporate cash levels continue to remain high, providing corporations the ability to pursue mergers and acquisitions (M&A). An increase in M&A activity holds promise for both portfolio gains and an increase in overall market valuations.

Threats

• With the S&P 500 trading at nearly 18x earnings, which is at the high end of the historical range, earnings growth will be especially critical to keep the bull market moving forward. Any disappointment during earnings season could mean trouble for the market.

• The market has been on an unusually long, almost uninterrupted winning streak for the past 18 months. A short-term correction would not be a surprise at this point.

• Global government policy delays or outright missteps are a threat to global equity markets, including the U.S.

(1)This security comprised 1.24% of the fund's total net assets as of 06/30/14.

(2)The fund did not hold this security as of 06/30/14.

(3)This security comprised 1.77% of the fund's total net assets as of 06/30/14.

26

Top 10 Equity Holdings Based on Net Assets June 30, 2014

Biogen Idec, Inc.

Medical - Biomedical/Gene | | | 3.33 | % | |

Apple, Inc.

Computers | | | 2.75 | % | |

The Priceline Group, Inc.

E-Commerce/Services | | | 2.54 | % | |

Facebook, Inc.

Internet Content - Entertainment | | | 2.27 | % | |

Tesla Motors, Inc.

Automotive - Cars & Light Trucks | | | 2.03 | % | |

Schlumberger Ltd.

Oil - Field Services | | | 1.99 | % | |

Google, Inc.

Web Portals/Internet Service Providers | | | 1.98 | % | |

Western Refining, Inc.

Oil Refining & Marketing | | | 1.90 | % | |

Halliburton Co.

Oil - Field Services | | | 1.80 | % | |

United Rentals, Inc.

Rental Auto/Equipment | | | 1.77 | % | |

Total Top 10 Equity Holdings | | | 22.36 | % | |

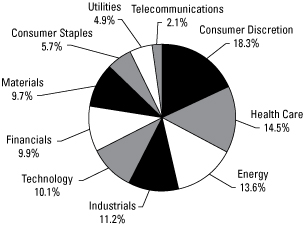

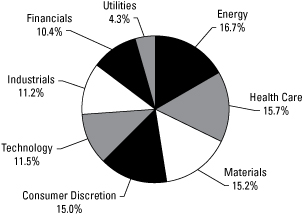

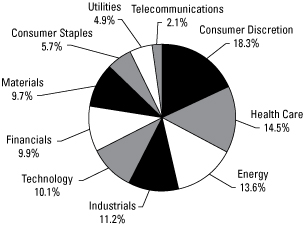

Portfolio Allocation by Industry Sector*

Based on Total Investments June 30, 2014

* Summary information above may differ from the portfolio schedule included in the financial statements due to the use of different classifications of securities for presentation purposes.

27

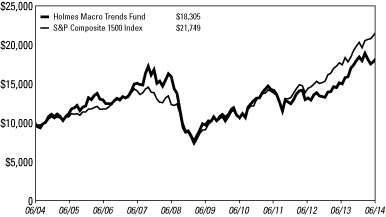

Management Team's Perspective

Introduction

The Holmes Macro Trends Fund (MEGAX) invests in companies with good growth prospects and strong positive earnings momentum. The fund's primary objective is to seek long-term capital appreciation.

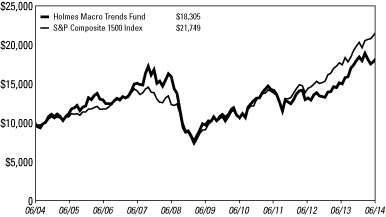

Performance Graph

Holmes Macro Trends Fund

Average Annual Performance For the Periods Ended June 30, 2014

| | | Six Month | | One Year | | Five Year | | Ten Year | |

Holmes Macro Trends Fund | | | (0.78 | )% | | | 22.41 | % | | | 13.61 | % | | | 6.23 | % | |

S&P Composite 1500 Index | | | 7.02 | % | | | 24.69 | % | | | 19.14 | % | | | 8.07 | % | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. For all or a portion of the periods, the fund had expense limitations, without which returns would have been lower. Returns for periods less than one year are not annualized.

Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 2.20%. The Adviser can modify or terminate this arrangement at any time.

See Definitions for Management Teams' Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

28

The Six-Month Period In Review - Economic And Political Issues That Affected The Fund

In the first half of 2014, the U.S. economy sent confusing, mixed signals. First quarter GDP contracted 2.1 percent, but this was almost entirely due to an unusually severe winter, which disrupted a considerable amount of activity. Another factor that also negatively influenced the first quarter was a late Easter, which pushed some consumer spending into April. However, there was a solid bounce back in the second quarter at 4.0 percent, and GDP growth is estimated at 3 percent or better for the remainder of the year.

After a weak March and April, global manufacturing indicators bounced back in recent months, suggesting a positive economic environment and tailwind for cyclical sectors of the economy. The automotive sector has been a bright spot, with annualized sales in June of almost 17 million vehicles, the best showing since 2006.

The Federal Reserve began tapering its quantitative easing (QE) program in December 2013, reducing the original $85 billion a month in Treasuries and mortgage-backed securities purchases by $10 billion at each subsequent Federal Open Market Committee (FOMC) meeting. The Fed is on track to complete its tapering at the FOMC meeting on October 29, 2014. A mini-crisis would probably be necessary to disrupt that schedule.

Central banks around the world are likewise back in easing mode. The Bank of Japan has been particularly aggressive. Its QE program is almost as large as the Fed's but in a much smaller economy. In a historic move, the European Central Bank (ECB) recently moved interest rates into negative territory in an attempt to stimulate eurozone lending.

Inflation in developed economies and the U.S. is not really a concern in the short term, as it has consistently stayed below 2 percent. The global trend for inflation also remains low, which allows global central bankers to comfortably maintain pro-growth policies.

Investment Highlights

Overview

The Holmes Macro Trends Fund fell 0.78 percent over the past six months, underperforming its benchmark, the S&P Composite 1500 Index, which returned 7.02 percent. Overall, smaller companies and growth-oriented stocks underperformed during the first half of 2014, reversing the trend from the second half of 2013. The fund's greater exposure to smaller and more growth-oriented companies than the benchmark has been the primary driver of underperformance.

29

Because the fund is actively managed and holding period is generally not a consideration in investment decisions, the portfolio turnover rate may fluctuate from year to year as the fund adjusts its portfolio composition. The fund's annual portfolio turnover was, and is expected to continue to be, more than 100 percent.

Strengths

• Stock selection was strong in materials, energy and consumer discretionary sectors.

• The fund's underweight positions in consumer staples and telecommunications were beneficial as those sectors of the market underperformed.

• Continental Resources, Inc.,(1) Westlake Chemical Corp.(2) and Skyworks Solutions, Inc.(3) were among the best positive contributors to fund performance.

Weaknesses

• Stock selection within the technology sector was the primary driver of underperformance.

• Cash and defensive option strategies were a drag on performance as the market rallied strongly.

• Investments in Chicago Bridge & Iron Co. N.V.,(1) Pacific Stone Tech., Inc.(4) and Tableau Software, Inc.(1) failed to live up to expectations and were among the worst contributors to the fund's performance.

Current Outlook

Opportunities

• The global economy remains in the midst of a synchronized recovery, which bodes particularly well for cyclical and growth sectors. We believe the global growth outlook remains strong as developed world monetary policy remains very supportive.

• Corporate cash levels continue to remain high, providing corporations the ability to pursue mergers and acquisitions (M&A). An increase in M&A activity holds promise for both portfolio gains and an increase in overall market valuations.

Threats

• We believe Europe remains the largest wildcard. Without coordinated policy actions, there could be risk of falling back into recession. China's leaders appear comfortable with slower growth. The Asian country has been a significant driver of global growth over the past decade, and if this is an era for new government policy, it puts global growth at risk.

30

• The market has been on an unusually long, almost uninterrupted winning streak for the past 18 months. A short-term correction would not be a surprise at this point.

• Deep value and price reversals led the market in 2012 and early 2013. If this trend were to reemerge, as it did during this past March through May, it would be a threat to relative performance.

(1)The fund did not hold this security as of 06/30/14.

(2)This security comprised 2.26% of the fund's total net assets as of 06/30/14.

(3)This security comprised 1.81% of the fund's total net assets as of 06/30/14.

(4)This security comprised 1.75% of the fund's total net assets as of 06/30/14.

31

Top 10 Equity Holdings Based on Net Assets June 30, 2014

Biogen Idec, Inc.

Medical - Biomedical/Gene | | | 3.34 | % | |

Tesla Motors, Inc.

Automotive - Cars & Light Trucks | | | 2.77 | % | |

Eagle Materials, Inc.

Building Products - Cement/Aggregates | | | 2.72 | % | |

Apple, Inc.

Computers | | | 2.68 | % | |

Facebook, Inc.

Internet Content - Entertainment | | | 2.59 | % | |

Old Dominion Freight Line, Inc.

Transportation - Truck | | | 2.45 | % | |

The Priceline Group, Inc.

E-Commerce/Services | | | 2.31 | % | |

Westlake Chemical Corp.

Chemicals - Diversified | | | 2.26 | % | |

Google, Inc.

Web Portals/Internet Service Providers | | | 2.25 | % | |

Western Refining, Inc.

Oil Refining & Marketing | | | 2.17 | % | |

Total Top 10 Equity Holdings | | | 25.54 | % | |

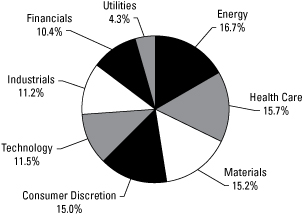

Portfolio Allocation by Industry Sector*

Based on Total Investments June 30, 2014

* Summary information above may differ from the portfolio schedule included in the financial statements due to the use of different classifications of securities for presentation purposes.

32

Management Team's Perspective

Introduction

The Global Resources Fund (PSPFX and PIPFX) is a non-diversified natural resources fund with the principal objective of achieving long-term growth of capital while providing protection against inflation and monetary instability. The fund invests in companies involved in the exploration, production and processing of petroleum, natural gas, coal, alternative energies, chemicals, mining, iron and steel, and paper and forest products around the globe.

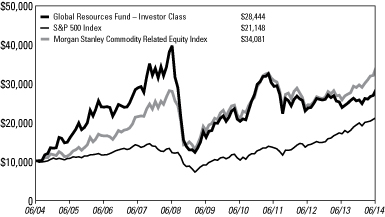

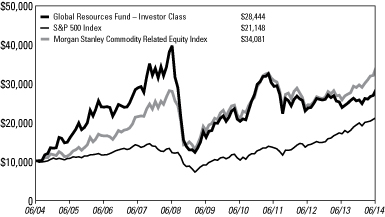

Performance Graph

Global Resources Fund

Average Annual Performance For the Periods Ended June 30, 2014

| | | Six Month | | One Year | | Five Year | | Ten Year | | Since Inception

(Institutional

Class) | |

Global Resources Fund - Investor Class | | | 10.68 | % | | | 19.80 | % | | | 12.06 | % | | | 11.01 | % | | | n/a | | |

Global Resources Fund - Institutional

Class (Inception 3/1/10) | | | 11.08 | % | | | 20.56 | % | | | n/a | | | | n/a | | | | 7.17 | % | |

S&P 500 Index | | | 7.13 | % | | | 24.60 | % | | | 18.80 | % | | | 7.77 | % | | | 16.35 | % | |

Morgan Stanley Commodity Related

Equity Index | | | 15.15 | % | | | 32.36 | % | | | 13.94 | % | | | 13.04 | % | | | 9.12 | % | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. For all or a portion of the periods, the fund had expense limitations, without which returns would have been lower. Returns for periods less than one year are not annualized.

Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 1.90% for the Investor Class. Also pursuant to a voluntary agreement, the Adviser has agreed to waive all class specific expenses of the Institutional Class. The Adviser can modify or terminate these arrangements at any time.

See Definitions for Management Teams' Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

33

The Six-Month Period In Review - Economic And Political Issues That Affected The Fund

Energy and materials stocks outpaced the broader market in the first half of 2014, reversing underperformance in the prior year. Generous liquidity, benign market volatility and stubbornly low U.S. government interest rates fueled the S&P 500 Index to an all-time high of 1,962 in June, nearing the key 2,000 level. Moreover, the Morgan Stanley Commodity Related Equity Index finished the period at the highest level since April 2011, gaining 15 percent in the first half of the year despite slower growth in China, the main source of commodity demand.

Increasingly, global commodity prices have been influenced by supply disruptions rather than the dramatic demand pull from emerging markets that we witnessed in the previous decade. Global oil prices were buoyed by unrest in Iraq that threatened supply. Accordingly, the price of West Texas Intermediate (WTI) crude oil climbed 7 percent to above $100 per barrel from the beginning of the year. Indonesian government policy influenced the price of nickel, which reached two-year highs, as exports of the metal were banned until further investment in the country is made for smelting and downstream value-added products. Conversely, Japan's decision to delay the startup of its nuclear reactors negatively affected uranium prices, which fell 18 percent to $28 per pound in the period, their lowest level since 2005.

Investment Highlights

Overview

For the six months ended June 30, 2014, the Investor Class of the Global Resources Fund gained 10.68 percent and the Institutional Class gained 11.08 percent, underperforming the fund's benchmark, the Morgan Stanley Commodity Related Equity Index (CRX), which returned 15.15 percent.

Because the fund is actively managed and the holding period is generally not a consideration in investment decisions, the portfolio turnover rate may fluctuate from year-to-year as the fund adjusts its portfolio composition. The fund's annual portfolio turnover was, and is expected to continue to be, more than 100 percent.

Strengths

• Natural gas and WTI crude oil prices increased in the period. Moreover, the oil- and gas-related equities held by the fund outperformed the benchmark due in part to robust oil shale exposure. Goodrich Petroleum Corp.,(1) Sanchez Energy Corp.(2) and Anadarko Petroleum Corp.(3) were key contributors.

34

• An underweight allocation to food stocks proved accretive to fund performance in the first half of 2014 compared to the benchmark, as this sub-sector in the benchmark was down.

• Prices for industrial metals rallied on the London Metals Exchange in the six-month period. Additionally, the fund's holdings in base metals outperformed the benchmark. Alcoa, Inc.(4) and Sherritt International Corp.(5) contributed positively to fund performance.

• The fund's precious metals portfolio, including Mandalay Resources Corp.(6) and Gran Colombia Gold Corp.,(7) outperformed as the price of gold gained 10 percent in the January to June period.

Weaknesses

• The market's preference for large-capitalization resource stocks weighed on returns in the period, particularly for equities listed on the London AIM Exchange. Africa Oilfield Logistics Ltd.,(8) Sable Mining Africa Ltd.(9) and Agriterra Ltd.(10) negatively impacted performance relative to the benchmark.

• Clean renewable energy equities underperformed the benchmark during the January to June period, partially due to volatile performance for growth and technology stocks. JinkoSolar Holding Co., Ltd.,(11) Canadian Solar, Inc.(11) and Trina Solar Ltd.(11) negatively affected performance.

• An allocation to transportation equities related to the shipping of iron ore and crude oil negatively influenced fund performance. Star Bulk Carriers Corp.(11) and Tsakos Energy Navigation Ltd.(11) were notable laggards.

Current Outlook

Opportunities

• The International Energy Agency has reported that global oil demand will rise at the fastest pace in five years, climbing 1.5 percent to a record 94.1 million barrels per day in 2015. The dramatic increase is primarily the result of China and other emerging market growth.

• Through recent press releases, Indonesian Economic Minister Chairul Tanjung has implied that an agreement has been reached between the government and Freeport-McMoRan Copper & Gold, Inc.(12) The ongoing export disputes over copper concentrates at Grasberg, which have dropped Freeport's main asset production to roughly 40 percent of its nominal capacity over the last two quarters, may soon be at an end.

• Corporación Nacional del Cobre de Chile,(11) also known as Codelco, a Chilean mining company, is likely to cancel shipments of around 10,000 tonnes of refined copper due to problems in its new Ministro Hales mine. Totaling roughly 3 percent of its 2014 contracted term shipments to China, the cancelled orders will likely lead

35

Chinese importers to purchase spot refined copper on international markets. The result would be supportive for copper prices, which have already risen more than 10 percent since March.

• Heading into the second half of the year, domestic economic growth appears to be accelerating from a weather-induced first quarter slowdown. Job growth continues to advance, which should be supportive for demand and money flows into the commodity complex, particularly given this environment of ample global liquidity. Additionally, we believe the secular long-term trend of urbanization in China and other emerging market countries remains intact and should continue to support per-capita commodity consumption well into the next decade.

• We have enhanced our proprietary quantitative factor model to quickly and dynamically adapt to market forces and changes in a company's financial value drivers. The model focuses on three key factors of growth in revenue, cash flow and dividend income per share, in addition to other bottom-up statistics and top-down analysis.

Threats

• Noncommercial speculative positions in the oil futures market now stand near the highest level on record. If this unwinds abruptly, it could materially weaken near-term oil prices.

• News of increased supply coming out of Libya and new pipelines in the U.S. has created a negative forecast on oil prices through the rest of the year. Futures weakened as a result of the news of increased supply.

• Old and decrepit highways in southern Texas and North Dakota are hindering thousands of 18-wheel trucks. The crumbling roads threaten billions of dollars of investments in oil production in the U.S.

(1)This security comprised 1.46% of the fund's total net assets as of 06/30/14.

(2)This security comprised 1.93% of the fund's total net assets as of 06/30/14.

(3)This security comprised 2.66% of the fund's total net assets as of 06/30/14.

(4)This security comprised 2.45% of the fund's total net assets as of 06/30/14.

(5)This security comprised 1.50% of the fund's total net assets as of 06/30/14.

(6)This security comprised 0.99% of the fund's total net assets as of 06/30/14.

(7)This security comprised 3.20% of the fund's total net assets as of 06/30/14.

(8)This security comprised 2.27% of the fund's total net assets as of 06/30/14.

(9)This security comprised 0.84% of the fund's total net assets as of 06/30/14.

(10)This security comprised 0.52% of the fund's total net assets as of 06/30/14.

(11)The fund did not hold this security as of 06/30/14.

(12)This security comprised 0.13% of the fund's total net assets as of 06/30/14.

36

Top 10 Equity Holdings Based on Net Assets June 30, 2014

Pacific Infrastructure Ventures, Inc.

Real Estate Operating/Development | | | 2.93 | % | |

Devon Energy Corp.

Oil Companies - Exploration & Production | | | 2.72 | % | |

Anadarko Petroleum Corp.

Oil Companies - Exploration & Production | | | 2.66 | % | |

Bellatrix Exploration Ltd.

Oil Companies - Exploration & Production | | | 2.49 | % | |

Alcoa, Inc.

Metal - Aluminum | | | 2.45 | % | |

Schlumberger Ltd.

Oil - Field Services | | | 2.36 | % | |

Africa Oilfield Logistics Ltd.

Oil Companies - Exploration & Production | | | 2.27 | % | |

Baker Hughes, Inc.

Oil - Field Services | | | 2.27 | % | |

Franco-Nevada Corp.

Gold/Mineral Royalty Companies | | | 2.21 | % | |

Royal Gold, Inc.

Gold Mining | | | 2.18 | % | |

Total Top 10 Equity Holdings | | | 24.54 | % | |

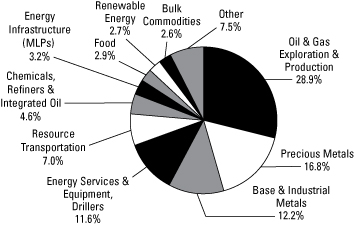

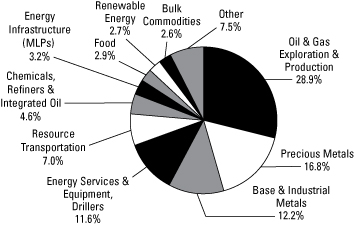

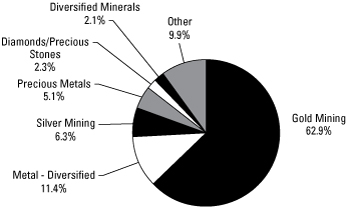

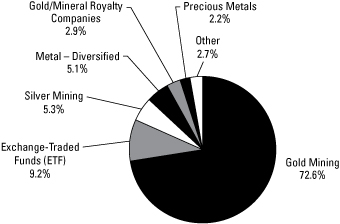

Portfolio Allocation by Industry Sector*

Based on Total Investments June 30, 2014

* Summary information above may differ from the portfolio schedule included in the financial statements due to the use of different classifications of securities for presentation purposes.

37

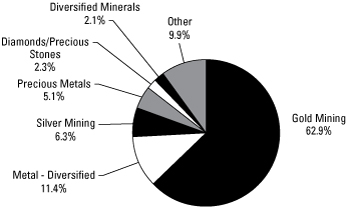

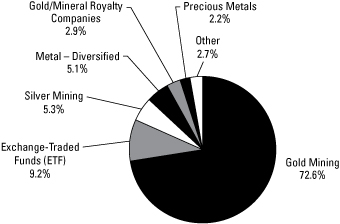

Precious Metals and Minerals Funds

Management Team's Perspective

Introduction

The World Precious Minerals Fund (UNWPX and UNWIX) and the Gold and Precious Metals Fund (USERX) pursue an objective of long-term capital growth through investments in gold, precious metals and mining companies. The Gold and Precious Metals Fund focuses on the equity securities of established gold and precious metals companies and pursues current income as a secondary objective. The World Precious Minerals Fund focuses on equity securities of companies principally engaged in the exploration, mining and processing of precious minerals such as gold, silver, platinum and diamonds. Although this fund has the latitude to invest in a broad range of precious minerals, it currently remains focused on the gold sector.

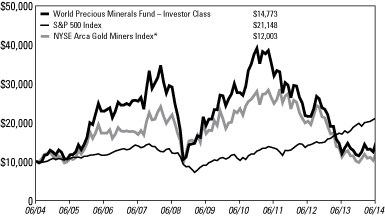

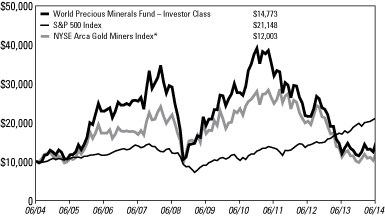

Performance Graphs

World Precious Minerals Fund

Average Annual Performance For the Periods Ended June 30, 2014

| | | Six Month | | One Year | | Five Year | | Ten Year | | Since Inception

(Institutional

Class) | |

World Precious Minerals Fund -

Investor Class | | | 29.88 | % | | | 23.17 | % | | | (5.09 | )% | | | 3.98 | % | | | n/a | | |

World Precious Minerals Fund -

Institutional Class (Inception 3/1/10) | | | 29.55 | % | | | 23.29 | % | | | n/a | | | | n/a | | | | (12.45 | )% | |

S&P 500 Index | | | 7.13 | % | | | 24.60 | % | | | 18.80 | % | | | 7.77 | % | | | 16.35 | % | |

NYSE Arca Gold Miners Index* | | | 24.50 | % | | | 8.09 | % | | | (6.82 | )% | | | 1.84 | % | | | (11.36 | )% | |

* These are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. For all or a portion of the periods, the fund had expense limitations, without which returns would have been lower. Returns for periods less than one year are not annualized.

Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 1.90% for the Investor Class. Also pursuant to a voluntary agreement, the Adviser has agreed to waive all class specific expenses of the Institutional Class. The Adviser can modify or terminate these arrangements at any time.

See Definitions for Management Teams' Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

38

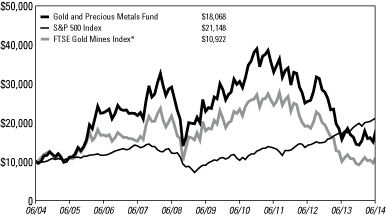

Precious Metals and Minerals Funds

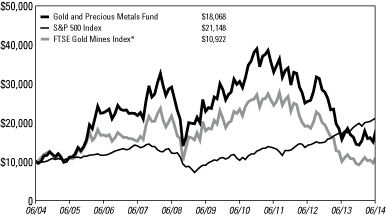

Gold and Precious Metals Fund

Average Annual Performance For the Periods Ended June 30, 2014

| | | Six Month | | One Year | | Five Year | | Ten Year | |

Gold and Precious Metals Fund | | | 27.83 | % | | | 15.69 | % | | | (4.59 | )% | | | 6.09 | % | |

S&P 500 Index | | | 7.13 | % | | | 24.60 | % | | | 18.80 | % | | | 7.77 | % | |

FTSE Gold Mines Index* | | | 20.63 | % | | | 10.20 | % | | | (9.33 | )% | | | 0.89 | % | |

* These are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. For all or a portion of the periods, the fund had expense limitations, without which returns would have been lower. Returns for periods less than one year are not annualized.

Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 1.90%. The Adviser can modify or terminate this arrangement at any time.

See Definitions for Management Teams' Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

The Six-Month Period In Review - Economic And Political Issues That Affected The Funds

Gold posted back-to-back gains over the last two quarters, a rally not witnessed since 2011. In addition, gold prices climbed 10 percent year-to-date, topping most asset classes and leaving behind their worst yearly decline since 1981, in what marked a very turbulent 2013. The outlook remains positive as China's Purchasing Managers Index expanded in June for the first time in six months, posting its highest reading since November 2013 after policymakers continued to implement targeted accommodative policies.

39

Precious Metals and Minerals Funds

Total assets of the Federal Reserve's balance sheet have surpassed $4 trillion, a previously inconceivable size. Not surprisingly, Fed Chairwoman Janet Yellen announced that interest rates will remain low for an extended period of time, disregarding obvious signs of rising inflation as noise.

In "Chindia," domestic demand for gold has exceeded global production, according to Bloomberg's Ken Hoffman. His research indicates that China is consuming gold at a rate of 5.15 million ounces per month, while India is consuming 2.85 million ounces per month at the current import-tariff reduced rate. Thus, Chindia's total consumption is 8 million ounces per month, or 560,000 ounces higher than the estimated 7.44 million ounces per month global mine output.

On a not-so-positive note, a new report by SNL Metals & Mining, coming in at a modest 538 pages, concluded that the cost of building a new mine has increased significantly over the last decade, from $560 per ounce of production capacity in 2004 to more than $2,300 per ounce last year. To make matters worse, SNL analysts argue that curtailment in capital spending since 2013 will take at least until 2015 to reverse the rising trend as current forecasts show costs will balloon to $2,400 per ounce this year. Recent estimates also show that current replacement cost in the industry is $1,500 per ounce.

Investment Highlights

For the six months ended June 30, 2014, the World Precious Minerals Fund Investor Class rose 29.88 percent and the Institutional Class gained 29.55 percent. The fund's benchmark, the NYSE Arca Gold Miners Index, rose 25.28 percent on a total return basis. The strategy of the World Precious Minerals Fund favors junior (exploration and development) stocks and mid-tiered producing stocks. These lower-capitalization stocks have historically outperformed senior gold mining companies over longer time periods, as senior gold miners have typically acquired proven assets of junior gold companies rather than exploring for new mining projects with capital-constrained budgets. Small capitalization stocks, having less access to capital in turbulent markets when investor confidence is lower, underperformed in the prior year. This trend reversed in 2014, however, perhaps signaling a shift in the hierarchy back to more normal markets where small capitalization stocks tend to outperform the biggest companies in the industry.

The Gold and Precious Metals Fund gained 27.83 percent for the six-month period, outperforming its benchmark, the FTSE Gold Mines Index, which rose 21.38 percent on a total return basis. While focusing on established, gold-producing companies, the Gold and Precious Metals Fund holds a higher weighting of mid-tier stocks compared to its benchmark. The fund strongly outperformed its benchmark in the first half of the year as the senior gold mining companies focused on mergers and acquisitions

40

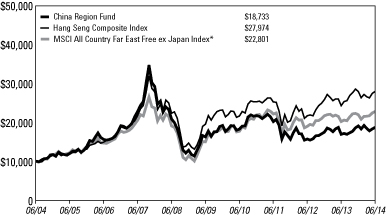

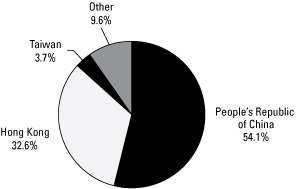

Precious Metals and Minerals Funds