UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-1800 |

|

U.S. GLOBAL INVESTORS FUNDS |

(Exact name of registrant as specified in charter) |

|

7900 CALLAGHAN ROAD SAN ANTONIO, TX | | 78229 |

(Address of principal executive offices) | | (Zip code) |

|

SUSAN B. MCGEE, ESQ. 7900 CALLAGHAN ROAD SAN ANTONIO, TX 78229 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 210-308-1234 | |

|

Date of fiscal year end: | DECEMBER 31, 2013 | |

|

Date of reporting period: | JUNE 30, 2013 | |

| | | | | | | | |

ITEM 1. REPORTS TO STOCKHOLDERS.

U.S. Global Investors Funds

Semi-Annual Report

June 30, 2013

U.S. Global Investors Funds

Semi-Annual Report

June 30, 2013

(unaudited)

Letter to Shareholders | | | 1 | | |

Definitions for Management Teams' Perspectives | | | 11 | | |

Management Teams' Perspectives | | | 13 | | |

Expense Example | | | 66 | | |

Portfolios of Investments | | | 69 | | |

Notes to Portfolios of Investments | | | 138 | | |

Statements of Assets and Liabilities | | | 158 | | |

Statements of Operations | | | 164 | | |

Statements of Changes in Net Assets | | | 170 | | |

Notes to Financial Statements | | | 179 | | |

Financial Highlights | | | 198 | | |

Additional Information | | | 214 | | |

Privacy Policy | | | |

U.S. Global Investors Funds

Investor Class

U.S. Treasury Securities Cash Fund | | USTXX | |

U.S. Government Securities Savings Fund | | UGSXX | |

Near-Term Tax Free Fund | | NEARX | |

Tax Free Fund | | USUTX | |

All American Equity Fund | | GBTFX | |

Holmes Growth Fund | | ACBGX | |

MegaTrends Fund | | MEGAX | |

Global Resources Fund | | PSPFX | |

World Precious Minerals Fund | | UNWPX | |

Gold and Precious Metals Fund | | USERX | |

Emerging Europe Fund | | EUROX | |

Global Emerging Markets Fund | | GEMFX | |

China Region Fund | | USCOX | |

Institutional Class

MegaTrends Fund | | MEGIX | |

Global Resources Fund | | PIPFX | |

World Precious Minerals Fund | | UNWIX | |

P.O. Box 659405

San Antonio, Texas 78265-9604

Tel 1.800.US.FUNDS

Fax 1.210.308.1217

www.usfunds.com

U.S. Global Investors Funds

All that glittered during the first half of the year was not gold. The metal lost a quarter of its value, while gold companies tumbled even more, with the FTSE Gold Mines Index falling 48 percent.

When such a precipitous plummet happens, fear sometimes overrides the fundamental reasons to own gold. Gold is a portfolio diversifier and a store of value. It is a finite resource with increasing global demand. I co-authored a book on gold five years ago based on a lifetime of experience with the metal. My advice hasn't changed: When it comes to gold, moderation is key. Don't try to get rich with the metal because the corresponding risk is simply too high. Limit your exposure to gold as an asset class to 10 percent of your portfolio – no more than 5 percent in bullion and 5 percent in equities. Rebalance each year to keep that level of exposure and use volatility to your advantage.

Take a look at the chart below, which shows how investors benefited from a balanced perspective.

1

U.S. Global Investors Funds

We compare the performance of a hypothetical $10,000 investment of two different portfolios over the past decade, assuming the reinvestment of capital gains and dividends. One shows the growth of $10,000 invested in an S&P 500 Index ETF. The other shows a hypothetical investment with a 5 percent allocation to the World Precious Minerals Fund (UNWPX), a 5 percent allocation to the Gold and Precious Metals Fund (USERX) and a 90 percent allocation to the S&P 500 ETF.

Over 10 years, regardless of the extreme moves seen in gold stocks, the portfolio that included gold stocks never dipped below the portfolio entirely made of U.S. equities. In addition, the combination of gold stocks and U.S. companies increased the portfolio's return by about $1,100! I believe the chart shows the importance of a modest 10 percent weighting in gold mutual funds.

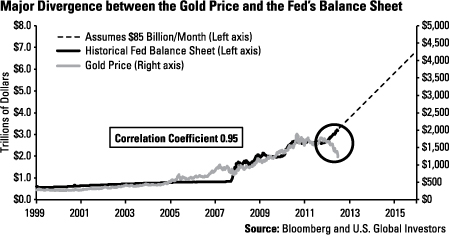

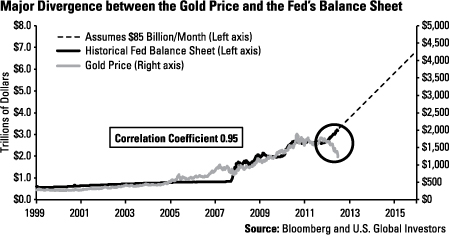

So, what happened to gold during the first half of 2013? In May, the Federal Reserve hinted that signs of a stronger economy could allow for a slowdown of stimulus. By the end of June, the metal fell below $1,200 for the first time since August 2010. Despite the historically high correlation between the gold price and the Fed's balance sheet, monetary easing continued, but gold fell.

2

U.S. Global Investors Funds

The selling of gold put the metal in an extremely oversold territory; mathematically gold was due for a reversal toward the mean by the end of June. On our oscillator chart showing the gold price on a year-over-year percentage change basis, the gold price was nearly at a -3 standard deviation.

There has been an extremely pessimistic view on gold. As one measure of how the bears have ganged up against the yellow metal, take a look at the spike in the level of short positions on the precious metal since the beginning of the year. As of the beginning of July, the number of outstanding gold short contracts was close to 140,000!

3

U.S. Global Investors Funds

In June, while I was on CNBC's Squawk Box, Howard Ward, the chief investment officer of GAMCO Investors, made a bullish call based on the severity of the speculative short position:

"It was off the charts, just like it was a week ago for the short position and the yen, the pound and euro. Well, we've seen what happened to that. You wanted to be on the other side of that trade. I'll take the other side of the gold trade as well. Whenever so many people are on one side, I will take the other side. I think gold probably rallies between here and the end of the year."

What was significant about the first half of 2013 is that gold moved from the weak hands of ETF investors to the strong hands of buyers who prefer the physical metal. Whereas $18 billion left the SPDR Gold Shares ETF in the first half of the year, gold buyers all over the world scooped up a record level of gold coins and bars. On one day alone in April, 63,500 ounces were purchased from the U.S. Mint.

At the same time, in Bangkok, Thailand, crowds of buyers were filling stores, eagerly waiting in multiple lines to purchase gold jewelry and coins.

The most impressive data came from China. Take a look at the chart below, which shows total gold production compared to the gold deliveries on the Shanghai Gold Exchange and the COMEX. Over the first six months of the year, gold imports into China totaled 1,098 metric tons, compared to 1,139 tons for 2012. This is in striking contrast to the gold delivery on the COMEX.

4

U.S. Global Investors Funds

In fact, China's gold demand was so significant that the physical gold delivered on the Shanghai Gold Exchange through June totaled almost all of the official gold reserves in China and about half of the world's gold production for the year.

However, the Love Trade – the buyers with a deep cultural affinity for gold – suffered in India. Historically the world's biggest gold buyer, the country tried to stifle gold demand as the government sought to reduce its record current account deficit. India hiked import tariffs on gold and introduced new constraints on rural lending against gold jewelry and coins.

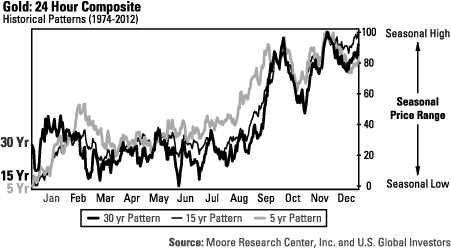

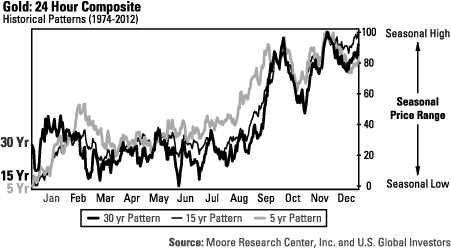

Regardless of this short-term setback, I believe millions of people across Asia and the Middle East will continue to express their love for the precious metal through the giving of gold coins and jewelry for momentous occasions. We look forward to the reigniting of gold's Love Trade as the yellow metal enters its historical period of seasonal strength with Ramadan beginning in July, followed by the Indian Festival of Lights, wedding season, Christmas and Chinese New Year. We have often published on the impact of this powerful seasonal pattern on www.usfunds.com.

Conversely, the U.S. stock market has been one of the best places to invest in recent years. Following the bottom on March 9, 2009 through July 23, 2013, the S&P 500 Index experienced its strongest bull market since 1949, climbing an astonishing 154 percent.

We believe government policy is a precursor to change, and the Fed's massive bond-buying program over the past few years exemplifies the significant change in helping stocks reach this meaningful milestone.

5

U.S. Global Investors Funds

To see how significant Ben Bernanke's policy actions were, compare the presidential cycles going back to 1929. With all the excess money in the system, President Barack Obama's first-term presidential cycle beat the average of all other presidential cycles going back to 1929.

After a few months into his second term, Obama's presidential cycle remains remarkable. The bold line shows this upward trend. In fact, stocks have been so strong that the S&P 500 experienced its best six months since 1998, rising 13.83 percent.

We're pleased to report that U.S. Global's All American Equity Fund (GBTFX) and Holmes Growth Fund (ACBGX) benefited from U.S. equity exposure, increasing 13.90 percent and 12.97 percent, respectively, from January through June.

The Power of Growing Dividends

Did you know that since 1870, half of the S&P 500 Index total return has come from dividend growth? There may be short-term periods when dividend-paying stocks underperform, such as the Technology Boom earlier this century, but overall, they add up.

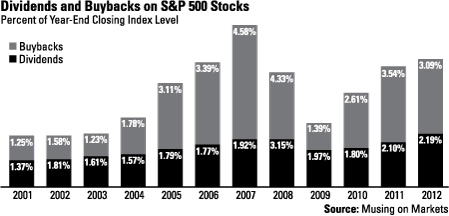

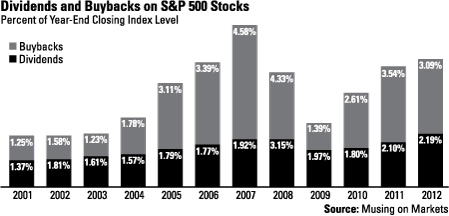

Especially in a low-yielding environment such as today, dividend-paying companies remain attractive. Consider the powerful twin engines of dividend payouts and stock buybacks. You can see in the chart that from 2009 through 2012, companies in the S&P 500 have been buying back more stock and paying out more in dividends. This has led to a fantastic increase of more than 70 percent cumulative return in U.S. stocks over that time frame.

6

U.S. Global Investors Funds

This same increase in buybacks and dividends occurred in 2004 through 2007, with the same result in market rise. In 2007, the S&P 500 hit an intraday record high of 1,576.

Companies have become focused on the return-on-capital model, such as revenues-per-share and earnings-per-share, and the benefits to the investor are numerous. Because of this development, our investment team has shifted focus to seeking companies that offer this value to their investors.

Several of U.S. Global's equity funds offer access to companies with attractive yields. Half of the All American Equity Fund (GBTFX) is dedicated to our shareholder yield model, with the holdings that pay a dividend averaging a dividend yield of 2.90 percent as of June 30, 2013.

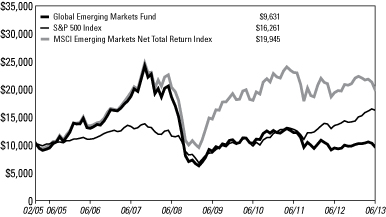

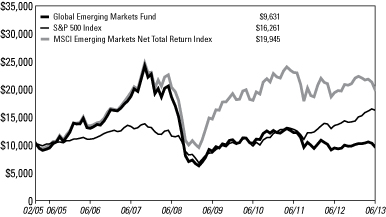

For the emerging markets portion of your portfolio, we offer the China Region Fund (USCOX), the Emerging Europe Fund (EUROX) and the Global Emerging Markets Fund (GEMFX). As of June 30, 2013, the dividend-paying stocks in USCOX and EUROX had an average yield of 2.15 percent and 4.95 percent, respectively, while the companies in GEMFX paid a dividend yield averaging 6.08 percent.

A Potential Solution for Those Who Fear Rising Rates

Fear of rising interest rates as the Fed looks to taper its easing programs sent bond prices falling and bond investors running in the first half of 2013. Many investors are wary of volatility and want a safe place to stash cash.

Yet, money market funds may not be the answer. Although yields for long-term bonds rose, rates of short-term money market funds haven't. In fact, the 90-day Treasury bills continued paying around 5 basis points. For an investor, this translates to 50 cents for every $1,000 invested.

7

U.S. Global Investors Funds

Instead, a better alternative may be an investment that seeks to preserve capital and provide stability and tax-free monthly income. The Near-Term Tax Free Fund (NEARX) focuses on shorter average maturities, and a share price around $2 typically results in less volatility than bond funds with longer average maturities. It has been rare for the fund's share price to move more than a couple of pennies in a month. And, the fund has generated consistent positive total returns (yield + appreciation) for investors for over 10 years in a row.

Rather than trying to time entries and exits in and out of stocks and bonds, we suggest allocating your assets strategically and sticking with your plan for the long term.

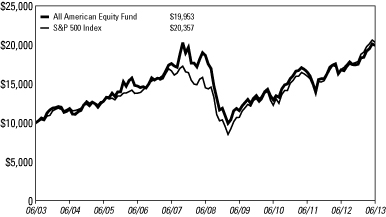

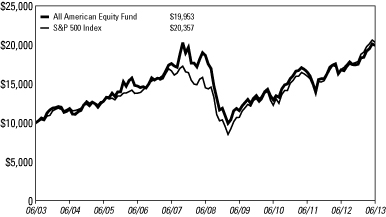

Consider the "couch potato" approach of a portfolio invested in both stocks and bonds. Below are three different hypothetical portfolios over the past 10 years: (1) $10,000 invested in the Near-Term Tax Free Fund (NEARX), (2) $10,000 invested in the All American Equity Fund (GBTFX), and (3) $10,000 portfolio made of 50 percent allocation to NEARX and the remaining 50 percent allocation to GBTFX, rebalanced on an annual basis. Each investment assumes the reinvestment of capital gains and dividends.

While the investment in GBTFX outperformed over the decade, increasing nearly $20,000, the fund experienced more volatility. Conversely, the investment in NEARX grew much more smoothly, but with less upside. Over the past 10 years, the "couch potato" approach grew to $16,820, with less volatility than a portfolio of only U.S. stocks.

8

U.S. Global Investors Funds

From time to time, in bull and bear markets, prices and fundamentals disconnect, as prices swing too far on fear and rise too fast on greed. We believe fundamentals remain solid and many of the short-term swings are much ado about nothing. In volatile markets, it is important to trust your investment processes and asset allocation disciplines.

Thank you for your trust and confidence in U.S. Global Investors.

Sincerely,

Frank Holmes

CEO and Chief Investment Officer

U.S. Global Investors, Inc.

Please consider carefully a fund's investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage, Inc.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. By investing in a specific geographic region, a regional fund's returns and share price may be more volatile than those of a less concentrated portfolio.

The Emerging Europe Fund invests more than 25% of its investments in companies principally engaged in the oil & gas or banking industries. The risk of concentrating investments in this group of industries will make the fund more susceptible to risk in these industries than funds which do not concentrate their investments in an industry and may make the fund's performance more volatile.

Because the Global Resources Fund concentrates its investments in specific industries, the fund may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries.

Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in these sectors.

9

U.S. Global Investors Funds

Tax-exempt income is federal income tax free. A portion of this income may be subject to state and local income taxes, and if applicable, may subject certain investors to the Alternative Minimum Tax as well. Each tax free fund may invest up to 20% of its assets in securities that pay taxable interest. Income or fund distributions attributable to capital gains are usually subject to both state and federal income taxes. Bond funds are subject to interest-rate risk; their value declines as interest rates rise. The tax free funds may be exposed to risks related to a concentration of investments in a particular state or geographic area. These investments present risks resulting from changes in economic conditions of the region or issuer.

Unlike a money market fund, the Near-Term Tax Free Fund is not subject to the same maturity, credit or diversification limitations as a money market fund and may invest in instruments that a money market fund may not purchase. Though the Near-Term Tax Free Fund seeks minimal fluctuations in share price, it is subject to the risk that a decline in the credit quality of a portfolio holding could cause a fund's share price to decline.

Standard deviation is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is also known as historical volatility.

A fund's yield may differ from the average yield of dividend-paying stocks held by the fund.

Diversification does not protect an investor from market risks and does not assure a profit.

Investment objective: The Gold and Precious Metals Fund is an actively managed mutual fund that focuses on gold and precious metals producing companies. The World Precious Minerals Fund is an actively managed fund that focuses on junior and intermediate precious metals exploration companies around the world. The SPDR S&P 500 ETF Trust (SPY) is a passively managed fund that, before expenses, seeks to correspond generally to the price and yield performance of the S&P 500 Index.

Liquidity: The Gold and Precious Metals Fund and World Precious Minerals Fund can be purchased or sold at a net asset value (NAV) determined at the end of each trading day. The SPDR S&P 500 ETF can be purchased or sold intraday. These purchases and redemptions may generate brokerage commissions and other charges not reflected in the ETF's published expense ratio.

Safety/Fluctuations of principal/return: Loss of money is a risk of investing in the Gold and Precious Metals Fund, the World Precious Minerals Fund and the SPDR S&P 500 ETF. Shares of the three securities are subject to sudden fluctuations in value. The SPDR S&P 500 ETF may also be subject to bid-ask premiums or discounts to net asset value (NAV) that could adversely affect a shareholder's actual returns.

Tax features: The Gold and Precious Metals Fund and World Precious Minerals Fund intend to make distributions that may be taxed as ordinary income or capital gains. Under current federal law, long-term capital gains for individual investors in the fund are taxed at a maximum rate of 15%. For the SPDR S&P 500 ETF, long-term capital gain distributions will result from gains on the sale or exchange of capital assets held by the fund for more than one year. Any long-term capital gains distributions you receive from a fund are taxable as long-term capital gain regardless of how long you have owned your shares. Long-term capital gains are currently taxed at a maximum of 15%. Information provided here is neither tax nor legal advice and is general in nature. Federal and state laws and regulations are subject to change.

10

Definitions for Management Teams' Perspectives

Benchmark Index Definitions

Returns for indices reflect no deduction for fees, expenses or taxes, unless noted.

The Barclays Capital 3-Year Municipal Bond Index is a total return benchmark designed for municipal assets. The index includes bonds with a minimum credit rating of BAA3, are issued as part of a deal of at least $50 million, have an amount outstanding of at least $5 million and have a maturity of two to four years.

The Barclays Capital 10-Year Municipal Bond Index is a total return benchmark designed for long-term municipal assets. The index includes bonds with a minimum credit rating of BAA3, are issued as part of a deal of at least $50 million, have an amount outstanding of at least $5 million and have a maturity of 8 to 12 years.

The FTSE Gold Mines Index encompasses all gold mining companies that have a sustainable and attributable gold production of at least 300,000 ounces a year and that derive 75% or more of their revenue from mined gold.

The Hang Seng Composite Index is a market-capitalization weighted index that covers about 95% of the total market capitalization of companies listed on the Main Board of the Hong Kong Stock Exchange.

The MSCI Emerging Markets Europe 10/40 Index (Net Total Return) is a free float-adjusted market capitalization index that is designed to measure equity performance in the emerging market countries of Europe (Czech Republic, Hungary, Poland, Russia and Turkey). The index is calculated on a net return basis (i.e., reflects the minimum possible dividend reinvestment after deduction of the maximum rate withholding tax). The index is periodically rebalanced relative to the constituents' weights in the parent index.

The MSCI Emerging Markets Net Total Return Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in emerging market countries on a net return basis (i.e., reflects the minimum possible dividend reinvestment after deduction of the maximum rate withholding tax).

The Morgan Stanley Commodity Related Equity Index (CRX) is an equal-dollar weighted index of 20 stocks involved in commodity-related industries such as energy, non-ferrous metals, agriculture and forest products.

The NYSE Arca Gold Miners Index is a modified market capitalization-weighted index comprised of publicly-traded companies involved primarily in the mining for gold and silver.

The S&P 500 Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

The S&P Composite 1500 Index is a broad-based capitalization-weighted index of 1500 U.S. companies and is comprised of the S&P 400, S&P 500 and the S&P 600.

11

Definitions for Management Teams' Perspectives

Other Index Definitions

The Barclays Capital Municipal Bond Index is an unmanaged index representative of the tax-exempt bond market.

The MSCI All Country Far East Free ex Japan Index is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of the Far East, excluding Japan. The index consists of the following developed and emerging market country indices: China, Hong Kong, Indonesia, Korea, Malaysia, Philippines, Singapore, Taiwan and Thailand.

The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets.

The MSCI World Index is a capitalization weighted index that monitors the performance of stocks from around the world.

The Philadelphia Oil Service Sector Index (OSX) is price-weighted index composed of 15 companies that provide oil drilling and production services, oil field equipment, support services and geophysical/reservoir services.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver.

The S&P High Yield Dividend Aristocrats Index is designed to measure the performance of the 50 highest dividend yielding S&P Composite 1500 constituents which have followed a managed dividends policy of consistently increasing dividends every year for at least 25 years.

The S&P/Case-Shiller Index tracks changes in home prices throughout the United States by following price movements in the value of homes in 20 major metropolitan areas.

The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar.

12

Management Team's Perspective

Introduction

The U.S. Treasury Securities Cash Fund (USTXX) seeks to obtain a high level of current income while maintaining the highest degree of safety of principal and liquidity. The U.S. Government Securities Savings Fund (UGSXX) seeks to achieve a consistently high yield with safety of principal.

Performance

U.S. Treasury Securities Cash Fund | | As of June 30, 2013 | |

| 7-Day Yield | | | 0.01 | % | |

7-Day Effective Yield | | | 0.01 | % | |

U.S. Government Securities Savings Fund | | As of June 30, 2013 | |

| 7-Day Yield | | | 0.01 | % | |

7-Day Effective Yield | | | 0.01 | % | |

An investment in either the U.S. Treasury Securities Cash Fund or the U.S. Government Securities Savings Fund is neither insured nor guaranteed by the Federal Deposit Insurance Corporation (FDIC) or by any other government agency. Although the funds seek to preserve the value of your investments at $1.00 per share, it is possible to lose money by investing in these funds.

Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses to not exceed 1.00% for the U.S. Treasury Securities Cash Fund and 0.45% for the U.S. Government Securities Savings Fund on an annualized basis. In addition, the yields reported above include the effects of the Adviser's voluntary waiver of fees and/or reimbursement of expenses to maintain a minimum net yield for the funds. The Adviser can modify or terminate these arrangements at any time.

The Six-Month Period In Review - Economic And Political Issues That Affected The Funds

The U.S. economy experienced lackluster growth during the first six months of 2013. The employment situation in the country stabilized but has not shown real signs of improvement. Manufacturing data was generally weak, which is a trend we have seen across the globe.

Economic improvements were seen in the housing market and auto-related areas of the economy. Housing has been robust, with the S&P/Case-Shiller Index climbing 12 percent on a year-over-year basis through May. Housing starts and building permits have steadily increased, as well as overall activity in the sector. This has had a positive effect on consumer confidence, which recently hit multi-year highs. Higher

13

housing prices have created a "wealth effect," improving consumers' attitudes toward their financial situations. In addition to stable gasoline prices, increasing consumer confidence drove very strong auto sales.

The Federal Reserve maintained its position during the first half of the year with regard to its quantitative easing program, purchasing $85 billion in Treasuries and mortgage-backed securities each month in an effort to stimulate the economy. In recent months, though, Chairman Ben Bernanke has indicated an inclination to begin reducing this stimulus as soon as September 2013 in a process that has been widely described as "tapering."

Inflation in the U.S. oscillated between 1 and 2 percent during the first six months of the year and allows the Fed plenty of room to maneuver, as deflation still remains a threat. Global inflation, in general, has remained low, allowing global central bankers to comfortably maintain pro-growth policies. And while we have seen some countries begin to tighten monetary policy in the first half of 2013, the vast majority remains engaged in synchronized global monetary easing.

One of the countries tightening its policy is Japan, which committed to an aggressive reflation policy, and the country has been one of the few bright spots in the global economic context.

However, to address long-term imbalances, fiscal austerity is being implemented across the developed world. This is expected to be a drag on growth in the U.S. and Europe for some time, as spending cuts and higher taxes tend to be a headwind to economic growth.

China appears comfortable with a stable-to-slowing economy, focused on addressing domestic imbalances and, thus, has not been the global growth catalyst it was after the financial crisis. Europe remains mired in a continual mild recessionary environment and it is somewhat difficult to see that changing before year end.

Yields on the three-month Treasury bill fell 1 basis point to 0.03 percent, while yields on the six-month bills fell 2 basis points to 0.09 percent. One-year agency discount note yields rose 3 basis points to 0.15 percent. The market was still influenced by periodic bouts of risk aversion or other disruptions, with investors, at times, seeking to own short-term Treasury securities at almost any cost.

Investment Highlights

The U.S. Treasury Securities Cash Fund performed in line with Lipper's Treasury money market funds for the six months ending June 30, 2013, returning 0.00 percent, the same as the peer group. The U.S. Government Securities Savings Fund also performed in line with the Lipper government-only money market funds, returning 0.00 percent versus 0.01 percent for the peer group.

14

The U.S. Treasury Securities Cash Fund had a weighted average maturity of 2 days over the six-month period, as overnight repurchase agreements were some of the highest yielding options with the least amount of interest rate risk in the Treasury money market universe.

The U.S. Government Securities Savings Fund followed a very short-laddered approach for much of the period and had a weighted average maturity of 7 days over the period. The fund took advantage of higher yields by selectively extending its ladder but also took advantage of relatively higher repo rates. Overall, it remained a very difficult environment for money market fund investors.

Current Outlook

The Fed continues to remain accommodative in an attempt to offset fiscal tightening and spur employment growth. We continue to believe that it is unlikely that the Fed will meaningfully change course during 2013, with monetary policy expected to remain very easy during this time.

15

Management Team's Perspective

Introduction

The Near-Term Tax Free Fund (NEARX) and the Tax Free Fund (USUTX) seek to provide a high level of current income exempt from federal income taxation and to preserve capital. However, a portion of any distribution may be subject to federal and/or state income taxes. The Near-Term Tax Free Fund will maintain a weighted average maturity of less than five years, while the Tax Free Fund will generally maintain a longer weighted average maturity.

Performance Graphs

Near-Term Tax Free Fund

Average Annual Performance For the Periods Ended June 30, 2013

| | | Six Month | | One Year | | Five Year | | Ten Year | |

Near-Term Tax Free Fund | | | (0.80 | )% | | | 0.29 | % | | | 3.31 | % | | | 2.81 | % | |

Barclays Capital 3-Year Municipal Bond

Index | | | (0.05 | )% | | | 0.52 | % | | | 3.28 | % | | | 2.98 | % | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Adviser has contractually agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 0.45% on an annualized basis through April 30, 2014.

See Definitions for Management Teams' Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

16

Tax Free Fund

Average Annual Performance For the Periods Ended June 30, 2013

| | | Six Month | | One Year | | Five Year | | Ten Year | |

Tax Free Fund | | | (3.27 | )% | | | (0.65 | )% | | | 4.21 | % | | | 3.44 | % | |

Barclays Capital 10-Year Municipal Bond

Index | | | (2.77 | )% | | | 0.09 | % | | | 5.94 | % | | | 4.71 | % | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Adviser has contractually agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 0.70% on an annualized basis through April 30, 2014.

See Definitions for Management Teams' Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

The Six-Month Period In Review - Economic And Political Issues That Affected The Funds

The municipal bond market declined over the past six months, with the Barclays Capital Municipal Bond Index falling 2.69 percent. Most of the action took place in June, during which the index fell 2.83 percent, wiping out the small gains in the market up to that point.

The long end of the yield curve was hit the hardest, as bonds with maturities of 20 years or more fell by more than 4 percent in June. Municipal market performance was generally consistent throughout the yield curve, as returns were better among shorter maturities.

17

At the beginning of 2013, there was a growing sense of optimism that the European economy could produce positive economic growth by mid-year. This optimism was founded on the European Central Bank's supportive commentary as well as its actions that began a year ago.

In addition, fears of an economic hard landing in China last year caused many investors to believe the Chinese government would step in and provide either fiscal or monetary stimulus during the first half of 2013.

Since that time, the economies in Europe have not improved significantly and political uncertainty and summer riots have already dampened the mood for the second half of the year. China has refrained from any significant stimulus, instead managing a modest slowdown to achieve longer-term goals and economic restructuring. The Federal Reserve continued with its quantitative easing program to help boost the economy, which began in September 2012. In total, $85 billion per month is currently being used to buy Treasuries and mortgage-backed securities, but the Fed has begun to intimate that this program may be reduced within the next few months.

Revenue-backed municipals underperformed general obligation credits by a slim margin, driven by underperformance in industrial development and water & sewer issues. Credit factors played less of a role as performance differences between low-quality and high-quality bonds were not significant. High-yield, or junk bonds, outperformed, falling 2.19 percent over the past six months.

In specialty state trading, Puerto Rico and Illinois outperformed, while California and New York underperformed.

Investment Highlights

For the six months ended June 30, 2013, the Near-Term Tax Free Fund declined 0.80 percent, underperforming its benchmark, the Barclays Capital 3-Year Municipal Bond Index, which lost 0.05 percent. The Tax Free Fund decreased 3.27 percent, underperforming its benchmark, the Barclays Capital 10-Year Municipal Bond Index, which lost 2.77 percent.

The Near-Term Tax Free Fund outperformed the Short-Intermediate Lipper peer group for the past six months. The Tax Free Fund also outperformed its respective Lipper peer group. The outperformance of the Tax Free Fund compared to its peers was primarily driven by maturity preferences relative to the Lipper peer group. As discussed above, the long end of the yield curve experienced significant underperformance and the fund was positioned more conservatively than its peers in this regard. The Near-Term Tax Free Fund remained true to form, investing in traditional, high-quality municipals which tended to weather the market turbulence in June better than most. Bond structure also played a role as both funds tend to own higher coupons and more defensively structured securities than many competitors.

18

Strengths

• The Tax Free Fund maintained a relatively short maturity and duration profile. This positively affected performance in relation to its peer group, as longer maturities underperformed.

• Historically, the conservative credit profile of both funds proved to be an asset during volatile periods, but negatively affected performance when low-quality credits significantly outperformed. The market experienced significant interest rate volatility in June and, while the impact on relative performance wasn't as large as it has been in past cycles, the funds still benefited from this positioning.

• The Tax Free Fund benefited from relatively significant exposure to Alabama, Illinois and Georgia, which all outperformed.

• The Near-Term Tax Free Fund benefited from significant exposure to Illinois, Michigan and Florida, which all outperformed.

Weaknesses

• Neither fund had exposure to high-yield, junk-rated securities, which outperformed.

• The Tax Free Fund had exposure to long-term zero coupon bonds, which underperformed.

• Bonds that are subject to the alternative minimum tax (AMT) also outperformed; however, neither fund has exposure to these credits.

Current Outlook

Opportunities

• The selloff in the municipal market in June was significant and created an opportunity to add to positions, as the current conditions still appear favorable.

Threats

• Continued outperformance of low-quality bonds is the most significant threat on a relative basis.

• When the Fed reverses its monetary policy stance and begins to raise interest rates, the macro environment could become more difficult.

19

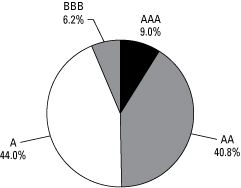

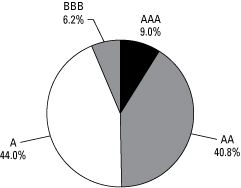

Near-Term Tax Free Fund

Municipal Bond Ratings June 30, 2013

(Based on Total Municipal Bonds)

Tax Free Fund

Municipal Bond Ratings June 30, 2013

(Based on Total Municipal Bonds)

20

Management Team's Perspective

Introduction

The principal objective of the All American Equity Fund (GBTFX) is to seek capital appreciation by investing primarily in a broadly diversified portfolio of domestic common stocks. The fund invests in large-capitalization stocks, while retaining the flexibility to seek out promising individual stock opportunities, including stocks with meaningful dividend yields.

Performance Graph

All American Equity Fund

Average Annual Performance For the Periods Ended June 30, 2013

| | | Six Month | | One Year | | Five Year | | Ten Year | |

All American Equity Fund | | | 13.90 | % | | | 18.81 | % | | | 1.36 | % | | | 7.15 | % | |

S&P 500 Index | | | 13.83 | % | | | 20.70 | % | | | 7.05 | % | | | 7.37 | % | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted.The principal value and investment return of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 2.20%. The Adviser can modify or terminate this arrangement at any time.

See Definitions for Management Teams' Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

21

The Six-Month Period In Review - Economic And Political Issues That Affected The Fund

In the first half of 2013, the U.S. economy experienced lackluster growth, as real GDP rose at an annualized rate of 1.8 percent in the first quarter and 1.7 percent in the second quarter. The weak growth has been driven largely by Europe, as its economy is mired in a mild recession, as well as a larger-than-expected slowdown in China.

Global manufacturing indicators in the U.S. had held up well but weakened during the first half of 2013. On a positive note, the U.S. housing market has been an area of strength as prices moved higher, spurring activity across many sectors of the economy. The auto sector has also been a bright spot, with sales running at about a 16 million annualized rate in recent months.

The Federal Reserve maintained its quantitative easing (QE) policy during the first half of the year and is currently purchasing $85 billion in treasuries and mortgage- backed securities per month in an effort to stimulate the economy. In May and June, the Fed had begun to express a preference for a gradual reduction in this program that it believes may begin as soon as September of this year.

In addition to the Fed, central banks around the world have continued their massive synchronized easing cycle. The Bank of Japan has been particularly aggressive in this regard, and its QE program is almost as large as the Federal Reserve but in a much smaller economy.

Inflation in the U.S. is not really a concern in the short term and has consistently been below 2 percent. The global trend for inflation also remains low, which allows global central bankers to comfortably maintain pro-growth policies.

In many developed countries, fiscal austerity is being implemented to address long-term imbalances. This will act as a drag on growth in the U.S. and Europe for some time, as spending cuts and higher taxes tend to be a headwind to economic growth.

U.S. stocks in the first six months of 2013 have been very robust, with the S&P 500 Index rising 13.83 percent. Dividend-paying stocks performed even better during the first half of 2013, with the S&P High Yield Dividend Aristocrats Index gaining 15.80 percent.

22

Investment Highlights

Overview

The All American Equity Fund returned 13.90 percent for the six months ended June 30, 2013, outperforming the 13.83 percent return for the benchmark S&P 500 Index.

Because the fund is actively managed and holding period is generally not a consideration in investment decisions, the portfolio turnover rate may fluctuate from year to year as the fund adjusts its portfolio composition. The fund's annual portfolio turnover was, and is expected to continue to be, more than 100 percent.

Strengths

• The fund's allocations to consumer staples, health care and industrials sectors positively contributed to relative performance. The fund's stock selection in these three sectors was particularly strong.

• The fund's exposure to dividend-paying stocks over the past six months outperformed other portfolio components.

• MasterCard, Inc.,(1) Celgene Corp.(2) and Constellation Brands, Inc.(3) were among the best positive contributors to fund performance.

Weaknesses

• The fund's allocations to the materials and telecommunication sectors were negative contributors to relative performance.

• Cash and defensive option strategies did not aid fund performance over the past six months as the market rallied strongly.

• Apple, Inc.,(4) Cliffs Natural Resources, Inc.(4) and Randgold Resources Ltd.(4) were among the worst individual contributors to performance.

Current Outlook

Opportunities

• The U.S. economy has been resilient but not spectacular during the past six months. Underwhelming economic data may prove to be a positive surprise for equities in 2013, as it may keep the Fed biased toward maintaining its QE policies.

• Corporate cash levels continue to remain high, providing corporations the ability to pursue mergers and acquisitions (M&A). An increase in M&A activity holds promise for both portfolio gains and an increase in overall market valuations.

23

• The market has been very strong during the first half of the year driven by U.S. economic performance. Any signs of improvement from Europe or China over the next six months could be the next catalyst for the U.S. market.

Threats

• We believe Europe remains the largest wildcard. If the continent remains committed to austerity and political volatility continues, the continent will likely remain in recession.

• China's leaders appear comfortable with slower growth. China has been a significant driver of global growth over past decade and if this is an era for new government policy, it puts global growth at risk.

• Global government policy delays or outright missteps are a threat to global equity markets.

(1)This security comprised 4.37% of the fund's total net assets as of 06/30/13.

(2)This security comprised 1.16% of the fund's total net assets as of 06/30/13.

(3)This security comprised 1.14% of the fund's total net assets as of 06/30/13.

(4)The fund did not hold this security as of 06/30/13.

24

Top 10 Holdings Based on Net Assets June 30, 2013

MasterCard, Inc.

Commercial Services - Financial | | | 4.37 | % | |

Starbucks Corp.

Retail - Restaurants | | | 2.49 | % | |

Wabtec Corp.

Machinery - General Industrial | | | 2.17 | % | |

priceline.com, Inc.

E-Commerce/Services | | | 2.10 | % | |

TJX Companies, Inc.

Retail - Major Department Store | | | 2.03 | % | |

Bank of America Corp.

Diversified Banking Institutions | | | 1.95 | % | |

Union Pacific Corp.

Transportation - Rail | | | 1.95 | % | |

PPG Industries, Inc.

Chemicals - Diversified | | | 1.93 | % | |

Google, Inc.

Web Portals/Internet Service Providers | | | 1.78 | % | |

Continental Resources, Inc.

Oil Companies - Exploration & Production | | | 1.74 | % | |

Total Top 10 Holdings | | | 22.51 | % | |

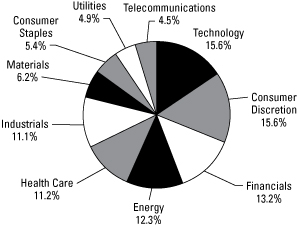

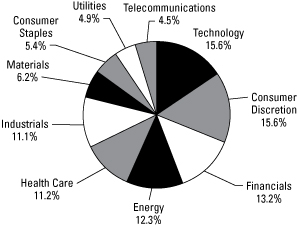

Portfolio Allocation by Industry Sector*

Based on Total Investments June 30, 2013

* Summary information above may differ from the portfolio schedule included in the financial statements due to the use of different classifications of securities for presentation purposes.

25

Management Team's Perspective

Introduction

The Holmes Growth Fund (ACBGX) invests in companies with good growth prospects and strong positive earnings momentum. The fund's primary objective is to seek long-term capital appreciation.

Performance Graph

Holmes Growth Fund

Average Annual Performance For the Periods Ended June 30, 2013

| | | Six Month | | One Year | | Five Year | | Ten Year | |

Holmes Growth Fund | | | 12.97 | % | | | 13.71 | % | | | (1.25 | )% | | | 6.43 | % | |

S&P Composite 1500 Index | | | 13.98 | % | | | 21.25 | % | | | 7.32 | % | | | 7.78 | % | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 2.20%. The Adviser can modify or terminate this arrangement at any time.

See Definitions for Management Teams' Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

26

The Six-Month Period In Review - Economic And Political Issues That Affected The Fund

The U.S. economy continued to muddle through the first half of 2013. In the first quarter, real GDP grew at an annualized rate of 1.8 percent. For the second quarter, the economy grew 1.7 percent. This weak growth has been driven largely by a European economy mired in a mild recession and a larger-than-expected slowdown in China. Global manufacturing indicators in the U.S. continued to indicate expansion but did weaken during the first half of 2013.

Housing remained very robust and has been an area of strength as prices moved higher, spurring activity with knock on effects across many sectors of the economy. The auto sector has also been a bright spot, as auto sales have been increasing at nearly a 16 million annualized rate in recent months. This is the most robust period since 2007.

Central banks around the world have continued with their massive synchronized easing cycle. The Bank of Japan has been particularly aggressive in this regard and its quantitative easing (QE) program is almost as large as the Federal Reserve, only its economy is much smaller.

The Federal Reserve maintained its QE policy during the first half of the year, purchasing $85 billion in Treasuries and mortgage-backed securities per month in an effort to stimulate the economy. The Fed has recently indicated a preference for a gradual reduction in this program that may begin as soon as September.

Inflation in the U.S. is not really a concern in the short term and has consistently been below 2 percent. The global trend for inflation is similar, which allows global central bankers to comfortably maintain pro-growth policies.

In many developed countries, fiscal austerity is being implemented to address long-term imbalances. This will act as a drag on growth in the U.S. and Europe for some time, as spending cuts and higher taxes tend to be a headwind to economic growth.

The markets in 2013 have been very robust with the S&P 1500 Index increasing 13.98 percent in the past six months.

Investment Highlights

Overview

The Holmes Growth Fund rose 12.97 percent over the past six months, underperforming the benchmark, the S&P Composite 1500 Index, which returned 13.98 percent. Overall, growth-oriented stocks underperformed the market, hurting the fund's

27

performance, as it emphasizes sustainable growth and relative strength. Stocks geared to classic value factors, such as deep value and price reversals, outperformed.

Because the fund is actively managed and holding period is generally not a consideration in investment decisions, the portfolio turnover rate may fluctuate from year to year as the fund adjusts its portfolio composition. The fund's annual portfolio turnover was, and is expected to continue to be, more than 100 percent.

Strengths

• The fund benefited from its exposure to industrials, energy and consumer discretionary sectors.

• Industry groups that were standout performers for the fund included hotels, restaurants and leisure, and energy equipment and services.

• Celgene Corp.,(1) LinkedIn Corp.(2) and Chuy's Holdings, Inc.(3) were among the best positive contributors to performance.

Weaknesses

• The fund's exposure to technology and financials was a relative drag on the portfolio. Financials rose nearly 20 percent, but the fund was underweight. Technology was among the worst-performing sectors, and the fund was overweight during the period.

• Cash was a drag on performance as the market rallied strongly.

• Investments in Apple, Inc.,(4) Peregrine Semiconductor Corp.(4) and Cyberonics, Inc.(4) failed to live up to expectations and were among the worst contributors to the fund's performance.

Current Outlook

Opportunities

• The U.S. economy has been resilient but underwhelming during the past six months. This may prove to be a positive surprise for equities in 2013, as the Fed may decide to continue its current QE policies.

• Corporate cash levels are high, providing corporations the ability to pursue mergers and acquisitions (M&A). An increase in M&A activity holds promise for both portfolio gains and an increase in overall market valuations.

• The market has been very strong during the first half of the year because of U.S. economic performance, and any improvement in Europe or China could set up the next catalyst for the market.

28

Threats

• We believe Europe remains the largest wildcard. If the continent remains committed to austerity and political volatility continues the continent will likely remain in recession.

• China's leaders appear comfortable with slower growth. China has been a significant driver of global growth over the past decade and if this is a new era for government policy it puts global growth at risk.

• Deep value and price reversals have led the market. If this trend persists, it is a threat to relative performance.

(1)This security comprised 1.25% of the fund's total net assets as of 06/30/13.

(2)This security comprised 0.98% of the fund's total net assets as of 06/30/13.

(3)This security comprised 1.68% of the fund's total net assets as of 06/30/13.

(4)The fund did not hold this security as of 06/30/13.

29

Top 10 Holdings Based on Net Assets June 30, 2013

MasterCard, Inc.

Commercial Services - Financial | | | 4.24 | % | |

Oasis Petroleum, Inc.

Oil Companies - Exploration & Production | | �� | 3.19 | % | |

Wabtec Corp.

Machinery - General Industrial | | | 2.92 | % | |

Starbucks Corp.

Retail - Restaurants | | | 2.69 | % | |

Michael Kors Holdings Ltd.

Apparel Manufacturers | | | 2.54 | % | |

TJX Companies, Inc.

Retail - Major Department Store | | | 2.46 | % | |

Bank of America Corp.

Diversified Banking Institutions | | | 2.46 | % | |

Continental Resources, Inc.

Oil Companies - Exploration & Production | | | 2.35 | % | |

DaVita HealthCare Partners Inc.

Dialysis Centers | | | 2.31 | % | |

Old Dominion Freight Line, Inc.

Transportation - Truck | | | 2.28 | % | |

Total Top 10 Holdings | | | 27.44 | % | |

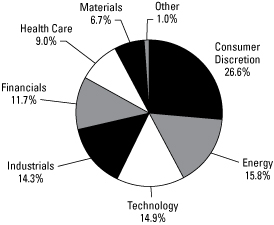

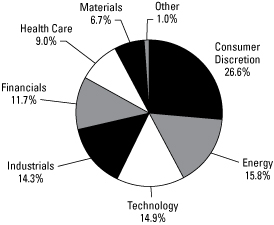

Portfolio Allocation by Industry Sector*

Based on Total Investments June 30, 2013

* Summary information above may differ from the portfolio schedule included in the financial statements due to the use of different classifications of securities for presentation purposes.

30

Management Team's Perspective

Introduction

The MegaTrends Fund (MEGAX and MEGIX) focuses on companies that are well positioned to benefit from substantial and sustainable growth that may occur over a multi-year time frame. The fund considers a broad range of investable opportunities, many of which are created by government policies, technological innovations and/or changes in market fundamentals for a product, service or commodity. The fund has the flexibility to invest globally and within any sector of the economy.

Performance Graph

MegaTrends Fund

Average Annual Performance For the Periods Ended June 30, 2013

| | | Six Month | | One Year | | Five Year | | Ten Year | | Since Inception

(Institutional

Class) | |

MegaTrends Fund - Investor Class | | | 11.26 | % | | | 16.66 | % | | | (4.89 | )% | | | 3.96 | % | | | n/a | | |

MegaTrends Fund - Institutional

Class (Inception 3/1/10) | | | 13.23 | % | | | 19.04 | % | | | n/a | | | | n/a | | | | 5.20 | % | |

S&P 500 Index | | | 13.83 | % | | | 20.70 | % | | | 7.05 | % | | | 7.37 | % | | | 13.99 | % | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 2.35% for the Investor Class. Also pursuant to a voluntary agreement, the Adviser has agreed to waive all class specific expenses of the Institutional Class. The Adviser can modify or terminate these arrangements at any time.

See Definitions for Management Teams' Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

31

The Six-Month Period In Review - Economic And Political Issues That Affected The Fund

Political and economic considerations are very influential on the investment climate in which the MegaTrends Fund operates.

In the first six months of 2013, the domestic equity market, as measured by the S&P 500 Index, posted a robust gain of 13.8 percent. Companies with growing or high dividend yields did particularly well in the period, given the global reach for yield during this historically low interest rate environment. The financial, consumer discretionary and health care sectors led the U.S. market to a fresh all-time high on May 21 to 1,669 for the S&P 500, as a recovery in housing, job growth and waning support for President Barack Obama's health care plan fueled earnings growth and investor sentiment.

As the six-month period came to a close, Ben Bernanke suggested that the Federal Reserve's bond-buying program would begin to slow down and end as early as mid-2014 if the economy continued to improve. His statements put pressure on the equity market and prompted a dramatic selloff in Treasury bonds, pushing the 10-year yield to 2.49 percent at period-end from 1.63 percent earlier in the period.

Investment Highlights

Overview

In the first six months of 2013, the Investor Class of the fund had a positive 11.26 percent return and the Institutional Class posted a positive 13.23 percent return. The benchmark S&P 500 Index returned 13.83 percent in the period.

Because the fund is actively managed and holding period is generally not a consideration in investment decisions, the portfolio turnover rate may fluctuate from year to year as the fund adjusts its portfolio composition. The fund's annual portfolio turnover was, and is expected to continue to be, more than 100 percent.

Strengths

• Fund performance improved in the second quarter of the period with a 3.45 percent return, 53 basis points above the benchmark S&P 500 Index return of 2.92 percent.

• The fund benefited from overweighting the financial sector as banks and insurance companies outperformed the S&P 500 Index by an average of 899 basis points. The fund's position in Discover Financial Services(1) outpaced the S&P 500 financial sector and contributed positively to return.

32

• In the consumer discretionary sector, leadership rotated to housing-related stocks from auto manufacturing and retailing. Overall, the consumer discretionary sector outperformed the S&P 500 Index by 595 basis points. Media and publishing companies Twenty-First Century Fox, Inc.(2) (formerly News Corp.) and Discovery Communications, Inc.(3) outperformed the discretionary sector and were two of the best contributors to return.

• The fund's overweight position in health care stocks added to performance, as the sector led the market and maintained a 643 basis point lead over the S&P 500. Bristol-Myers Squibb Co.(3) returned over 25 percent for the portfolio.

• Other top contributors to fund performance in the period were Pacific Power Generation Corp.,(4) Pacific Stone Tech, Inc.,(5) The Allstate Corp.,(3) Toyota Motor Corp.,(6) ICON plc,(7) Wyndham Worldwide Corp.,(3) Prudential plc(3) and McKesson Corp.(8)

Weaknesses

• The fund's allocation to precious metals and coal mining negatively impacted performance during the six-month period.

• The fund's basic materials positions underperformed due to growth concerns in China, a stronger U.S. dollar and weakening commodity prices.

• Negative contributors to fund performance in the period included the Gran Colombia Gold Corp. 5.00% Silver-Linked Notes,(9) Pacific Green Energy Corp.,(10) Andean Pacific Iron Corp.,(11) Pacific Coal Resources Ltd.,(12) Thor Industries Inc.(3) and United States Steel Corp.(3)

Current Outlook

Opportunities

We believe the following investable trends may prove to be multi-year themes:

• The financial sector is steadily recovering from the 2008 financial crisis and is beginning to see signs of incremental credit demand, partially in response to an improving housing industry.

• The health care sector is aided by the demographic tailwind of an aging population and its growing demand for quality medical products and services.

• The discretionary sector appears to have captured two trends involving the nascent recovery in the U.S. housing sub-sector and the growing market share of discount retailing.

33

Threats

• The Fed's decision to begin unwinding quantitative easing later this year could prove to be premature and adversely impact the domestic economy.

• While policymakers in Europe have made strides to stabilize the current debt crisis, many contagion risks remain, which could lead to a liquidity shock and financial market distress.

(1) This security comprised 1.98% of the fund's total net assets as of 06/30/13.

(2) This security comprised 2.14% of the fund's total net assets as of 06/30/13.

(3) The fund did not hold this security as of 06/30/13.

(4) This security comprised 3.09% of the fund's total net assets as of 06/30/13.

(5) This security comprised 5.31% of the fund's total net assets as of 06/30/13.

(6) This security comprised 2.14% of the fund's total net assets as of 06/30/13.

(7) This security comprised 2.17% of the fund's total net assets as of 06/30/13.

(8) This security comprised 2.13% of the fund's total net assets as of 06/30/13.

(9) This security comprised 0.44% of the fund's total net assets as of 06/30/13. Another 0.04% was held in common stock as of 06/30/13.

(10)This security comprised 0.59% of the fund's total net assets as of 06/30/13.

(11)This security comprised 1.77% of the fund's total net assets as of 06/30/13.

(12)This security comprised 0.14% of the fund's total net assets as of 06/30/13.

34

Top 10 Holdings Based on Net Assets June 30, 2013

Pacific Stone Tech, Inc.

Quarrying | | | 5.31 | % | |

Pacific Power Generation Corp.

Electric - Generation | | | 3.09 | % | |

Pacific Infrastructure, Inc.

Real Estate Operating/Development | | | 2.89 | % | |

Time Warner Cable, Inc.

Cable/Satellite TV | | | 2.34 | % | |

Cigna Corp.

Medical - HMO | | | 2.25 | % | |

ICON plc

Medical Labs & Testing Services | | | 2.17 | % | |

Toyota Motor Corp.

Automotive - Cars & Light Trucks | | | 2.14 | % | |

Twenty-First Century Fox, Inc.

Multimedia | | | 2.14 | % | |

McKesson Corp.

Medical - Wholesale Drug Distribution | | | 2.13 | % | |

Mitsubishi Estate Co., Ltd.

Real Estate Management/Services | | | 2.13 | % | |

Total Top 10 Holdings | | | 26.59 | % | |

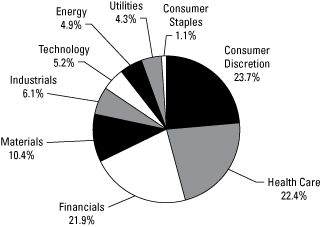

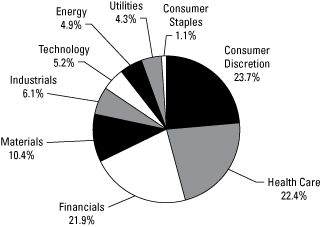

Portfolio Allocation by Industry Sector*

Based on Total Investments June 30, 2013

* Summary information above may differ from the portfolio schedule included in the financial statements due to the use of different classifications of securities for presentation purposes.

35

Management Team's Perspective

Introduction

The Global Resources Fund (PSPFX and PIPFX) is a non-diversified natural resources fund with the principal objective of seeking long-term growth of capital while providing protection against inflation and monetary instability. The fund invests in companies involved in the exploration, production and processing of petroleum, natural gas, coal, alternative energies, chemicals, mining, iron and steel, and paper and forest products around the globe.

Performance Graph

Global Resources Fund

Average Annual Performance For the Periods Ended June 30, 2013

| | | Six Month | | One Year | | Five Year | | Ten Year | | Since Inception

(Institutional

Class) | |

Global Resources Fund - Investor Class | | | (8.27 | )% | | | 0.44 | % | | | (9.76 | )% | | | 14.67 | % | | | n/a | | |

Global Resources Fund - Institutional

Class (Inception 3/1/10) | | | (8.01 | )% | | | 0.99 | % | | | n/a | | | | n/a | | | | 3.45 | % | |

S&P 500 Index | | | 13.83 | % | | | 20.70 | % | | | 7.05 | % | | | 7.37 | % | | | 13.99 | % | |

Morgan Stanley Commodity Related

Equity Index | | | (2.60 | )% | | | 5.19 | % | | | (1.61 | )% | | | 14.02 | % | | | 2.99 | % | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 1.90% for the Investor Class. The Adviser can modify or terminate this arrangement at any time. The Adviser has contractually agreed to waive all class specific expenses of the Institutional Class through April 30, 2014.

See Definitions for Management Teams' Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

36

The Six-Month Period In Review - Economic And Political Issues That Affected The Fund

In the first half of 2013, the energy and materials sectors underperformed the S&P 500 Index by an average of 700 basis points. Concerns over the deceleration in economic growth in China, which experienced 7.5 percent GDP growth in the second quarter, curbed investors' appetite for commodity-related equities, particularly relative to the broader market. Additionally, weakening emerging market currencies and deteriorating economic fundamentals weighed on investor sentiment towards bellwether commodities. Brent crude oil and copper declined by 8 percent and 16 percent, respectively, in the period. Conversely, the broader domestic market posted a robust 13.8 percent gain, especially for companies with growing or high dividend yields. The financial, consumer discretionary and health care sectors led the U.S. market to a fresh all-time high on May 21 to 1,669 for the S&P 500, as a recovery in housing, job growth and waning support for President Barack Obama's health care plan fueled earnings growth and investor sentiment.

Looking ahead to the second half of the year and 2014, we anticipate global growth will follow the U.S. economy's lead and expand at sufficient rates to improve overall commodity demand. Moreover, we believe the secular long-term trend of urbanization in China and other emerging market countries remains intact and will continue to support per-capita commodity consumption well into the next decade.

Investment Highlights

Overview

For the six-month period ended June 30, 2013, the Investor Class of the Global Resources Fund declined 8.27 percent and the Institutional Class declined 8.01 percent, underperforming the fund's benchmark, the Morgan Stanley Commodity Related Equity Index (CRX), which declined 2.60 percent.

Because the fund is actively managed and holding period is generally not a consideration in investment decisions, the portfolio turnover rate may fluctuate from year to year as the fund adjusts its portfolio composition. The fund's annual portfolio turnover was, and is expected to continue to be, more than 100 percent.

Strengths

• Food product stocks outperformed natural resource equities and the broader equity market in the past six months. This is partially due to Chinese meat processor Shuanghui International Holdings Ltd.,(1) which agreed to buy Smithfield Foods, Inc.(1) in a $7.1 billion deal. The fund benefited from its position in Smithfield, which was the largest contributor to fund performance for the six-month period.

37

• The Philadelphia Oil Service Sector Index outperformed the Morgan Stanley Commodity Related Equity Index by 1,828 basis points in the first half of the year. Hornbeck Offshore Services, Inc.(2) positively impacted portfolio returns.

• The portfolio benefited from an allocation to master limited partnerships and select junior exploration and development companies.

Weaknesses

• The precious metals group was the worst-performing sub-sector in the natural resources area in the first half of 2013. The Philadelphia Stock Exchange Gold and Silver Index lost nearly 45 percent in the period. Holdings in Gran Colombia Gold Corp.,(3) Dundee Precious Metals, Inc.(4) warrants and Barrick Gold Corp.(1) negatively affected fund performance.

• The fund has an overweight position in junior natural resources stocks, which performed poorly as measured by a 32 percent decline in the S&P/TSX Venture Composite Index. Holdings which negatively impacted performance included Pacific Coal Resources Ltd.,(5) which declined by 68 percent.

• Concern over slowing economic growth in China weighed on the price of copper during the first half of 2013. The benchmark price for the metal started the year at $3.65 per pound and closed at $3.05 per pound in the second quarter, for a 16 percent decline. Accordingly, copper equities were negatively impacted, including the fund's position in Southern Copper Corp.(6) lost 26 percent year-to-date.

Current Outlook

Opportunities

• According to Macquarie, the latest round of monthly manufacturing purchasing managers' indices (PMIs) tentatively point to the prospect of a modest upturn in demand for metals and bulk commodities in the coming months. PMIs in the U.S. and Japan, which rank first and third, respectively, in the world output, increased sharply. European PMIs, while still weak, remained stable. However, China's PMI dropped, but still signaled an expansion of economic output.

• According to the International Energy Agency (IEA), the economic recovery and emerging markets led by China will boost growth of oil demand to a record high total in 2014. The IEA estimates that demand may rise by 1.2 million barrels daily next year to a record 92.0 million barrels daily, after record demand was already set this year.

• China plans to spend $6.4 trillion to bring 400 million people to cities over the next decade as the government tries to turn the country into a wealthy world power with economic growth generated by an affluent consumer class. China believes that urbanization is the biggest force driving the country's domestic demand. The government hopes 60 percent of the population of almost 1.4 billion people will be urban residents by 2020 and has plans in place to build homes, roads, hospitals and schools in preparation.

38

Threats

• Capital flight out of emerging market economies, due to rising real interest rates in the U.S. and a strengthening dollar, may cause further distress in the developing world that could impact global growth expectations.

• Easing Federal Reserve policy supported the U.S. housing recovery and has provided a catalyst for the timber and forest sector. However, given the Fed's recent announcement that it will taper its purchase of U.S. Treasuries, an economic recovery could be at risk if this decision proves to be premature.

• Growth expectations for China have softened given the government's efforts to curb excess liquidity and an over-heated property market. Any further dip in expectations could have a detrimental impact on commodities and related equities.

(1)The fund did not hold this security as of 06/30/13.

(2)This security comprised 2.87% of the fund's total net assets as of 06/30/13.

(3)This security comprised 3.19% of the fund's total net assets as of 06/30/13.

(4)This security comprised 0.37% of the fund's total net assets as of 06/30/13.

(5)This security comprised 0.35% of the fund's total net assets as of 06/30/13.

(6)This security comprised 1.98% of the fund's total net assets as of 06/30/13.

Top 10 Holdings Based on Net Assets June 30, 2013

Gran Colombia Gold Corp.

Gold Mining | | | 3.19 | % | |

Western Gas Partners L.P.

Pipelines | | | 2.97 | % | |

Hornbeck Offshore Services, Inc.

Oil - Field Services | | | 2.87 | % | |

Continental Resources, Inc.

Oil Companies - Exploration & Production | | | 2.86 | % | |

Enterprise Products Partners L.P.

Pipelines | | | 2.83 | % | |

Kinder Morgan, Inc.

Pipelines | | | 2.69 | % | |

Anadarko Petroleum Corp.

Oil Companies - Exploration & Production | | | 2.63 | % | |

Mosaic Co.

Agricultural Chemicals | | | 2.20 | % | |

Superior Energy Services, Inc.

Oil Field Services | | | 2.09 | % | |

Vulcan Materials Co.

Building Products - Cement/Aggregates | | | 2.04 | % | |

Total Top 10 Holdings | | | 26.37 | % | |

39

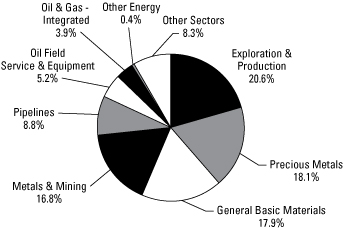

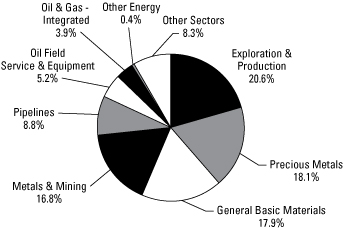

Portfolio Allocation by Industry Sector*

Based on Total Investments June 30, 2013

Energy: | |

Oil & Gas Exploration & Production | | | 20.6 | % | | | |

Oil & Gas Equipment & Services | | | 5.2 | % | | | |

Pipelines | | | 8.8 | % | | | |

Oil & Gas - Integrated (includes Refining and

Marketing) | | | 3.9 | % | | | |

Other Energy | | | 0.4 | % | | | |

Total Energy | | | | | 38.9 | % | |

Basic Materials: | |

Precious Metals (includes Gold/Silver Mining and

Platinum) | | | 18.1 | % | | | |

General Basic Materials | | | 17.9 | % | | | |

Metals & Mining (includes Copper and Coal) | | | 16.8 | % | | | |

Total Basic Materials | | | | | 52.8 | % | |

Other Sectors | | | | | 8.3 | % | |

| | | | 100.0 | % | |

* Summary information above may differ from the portfolio schedule included in the financial statements due to the use of different classifications of securities for presentation purposes.

40

Precious Metals and Minerals Funds

Management Team's Perspective

Introduction

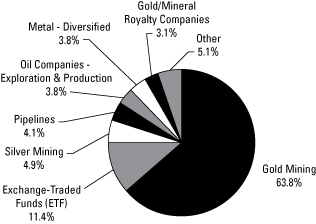

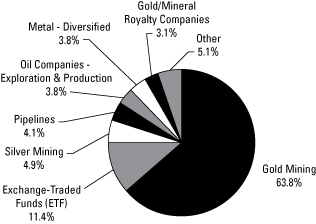

The World Precious Minerals Fund (UNWPX and UNWIX) and the Gold and Precious Metals Fund (USERX) pursue an objective of long-term capital growth through investments in gold, precious metals and mining companies. The Gold and Precious Metals Fund focuses on the equity securities of established gold and precious metals companies and pursues current income as a secondary objective. The World Precious Minerals Fund focuses on equity securities of companies principally engaged in the exploration, mining and processing of precious minerals such as gold, silver, platinum and diamonds. Although this fund has the latitude to invest in a broad range of precious minerals, it currently remains focused on the gold sector.

Performance Graphs

World Precious Minerals Fund

Average Annual Performance For the Periods Ended June 30, 2013

| | | Six Month | | One Year | | Five Year | | Ten Year | | Since Inception

(Institutional

Class) | |

World Precious Minerals Fund -

Investor Class | | | (48.72 | )% | | | (44.29 | )% | | | (16.23 | )% | | | 6.56 | % | | | n/a | | |

World Precious Minerals Fund -

Institutional Class (Inception 3/1/10) | | | (48.59 | )% | | | (44.04 | )% | | | n/a | | | | n/a | | | | (20.99 | )% | |

S&P 500 Index | | | 13.83 | % | | | 20.70 | % | | | 7.05 | % | | | 7.37 | % | | | 13.99 | % | |

NYSE Arca Gold Miners Index* | | | (47.50 | )% | | | (45.33 | )% | | | (12.73 | )% | | | 2.85 | % | | | (16.48 | )% | |

* These are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 1.90% for the Investor Class. Also pursuant to a voluntary agreement, the Adviser has agreed to waive all class specific expenses of the Institutional Class. The Adviser can modify or terminate these arrangements at any time.

See Definitions for Management Teams' Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

41

Precious Metals and Minerals Funds

Gold and Precious Metals Fund

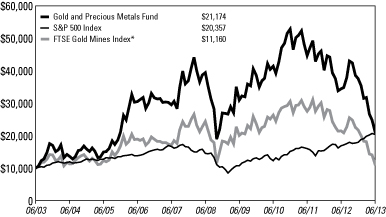

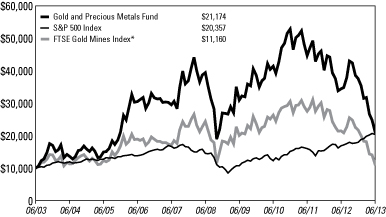

Average Annual Performance For the Periods Ended June 30, 2013