UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-1800 |

|

U.S. GLOBAL INVESTORS FUNDS |

(Exact name of registrant as specified in charter) |

|

7900 CALLAGHAN ROAD SAN ANTONIO, TX | | 78229 |

(Address of principal executive offices) | | (Zip code) |

|

SUSAN B. MCGEE, ESQ. 7900 CALLAGHAN ROAD SAN ANTONIO, TX 78229 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 210-308-1234 | |

|

Date of fiscal year end: | DECEMBER 31, 2012 | |

|

Date of reporting period: | JUNE 30, 2012 | |

| | | | | | | | |

ITEM 1. REPORTS TO STOCKHOLDERS.

U.S. Global Investors Funds

Semi-Annual Report

June 30, 2012

U.S. Global Investors Funds

Semi-Annual Report

June 30, 2012

(unaudited)

Table of Contents

Letter to Shareholders | 1 |

| |

Definitions for Management Teams’ Perspectives | 14 |

| |

Management Teams’ Perspectives | 16 |

| |

Expense Example | 70 |

| |

Portfolios of Investments | 73 |

| |

Notes to Portfolios of Investments | 145 |

| |

Statements of Assets and Liabilities | 161 |

| |

Statements of Operations | 164 |

| |

Statements of Changes in Net Assets | 167 |

| |

Notes to Financial Statements | 172 |

| |

Financial Highlights | 192 |

| |

Additional Information | 208 |

| |

Privacy Policy | |

Nasdaq Symbols

U.S. Global Investors Funds

Investor Class

U.S. Treasury Securities Cash Fund | | USTXX |

| | |

U.S. Government Securities Savings Fund | | UGSXX |

| | |

Near-Term Tax Free Fund | | NEARX |

| | |

Tax Free Fund | | USUTX |

| | |

All American Equity Fund | | GBTFX |

| | |

Holmes Growth Fund | | ACBGX |

| | |

Global MegaTrends Fund | | MEGAX |

| | |

Global Resources Fund | | PSPFX |

| | |

World Precious Minerals Fund | | UNWPX |

| | |

Gold and Precious Metals Fund | | USERX |

| | |

Eastern European Fund | | EUROX |

| | |

Global Emerging Markets Fund | | GEMFX |

| | |

China Region Fund | | USCOX |

Institutional Class

Global MegaTrends Fund | | MEGIX |

| | |

Global Resources Fund | | PIPFX |

| | |

World Precious Minerals Fund | | UNWIX |

P.O. Box 659405 San Antonio, Texas 78265-9604 Tel 1.800.US.FUNDS Fax 1.210.308.1217 www.usfunds.com | |

U.S. Global Investors Funds

Dear Fellow Shareholder,

This summer, the world watched in awe as Michael Phelps became the most decorated Olympian. He has been training in the pool for an average of six hours a day, six days per week, which equates to about 30,000 hours of swimming since age 13. It’s inspiring to see the incredible results of his tremendous sacrifice and commitment.

Investing in global markets requires a similar drive, and we truly appreciate the resiliency and loyalty of our shareholders. During the first half of 2012, as fears of slowing global growth and its effect on commodities have continued, many dug their heels in the ground and resisted owning resources and emerging markets stocks. Negative investor sentiment was perpetuated by the 24/7 news cycle punctuated with pessimism. A commodity bull like me is about as rare as a positive story in the media.

One such fellow is Jeremy Grantham of GMO, who pounded the table for an investment in resources at a conference lately, but you wouldn’t know it by reading the headline of the CNN piece that covered the topic. In its article called, “Our planet will truly be toast,” CNN discussed Grantham’s comments on a global commodities shortage, saying he was “bearish on human resources... but bullish on natural resources investments.”

His argument focused on the swelling population in China, and the fact that the world experienced a “great paradigm shift” around 2000, when commodity prices, which were negative for decades, “abruptly reversed course.” He told the crowd, “in the long run, you can’t afford to miss this opportunity.” We agree.

The beginning of the past decade was clearly a tipping point for resources. When I became the chief investment officer of U.S. Global Investors in 1999, no one wanted to touch resources. Yet we recognized the significance of China and Eastern Europe ushering in free markets, believing this to be a positive change, with emerging markets as big beneficiaries of this massive shift.

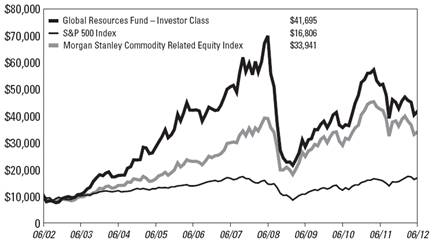

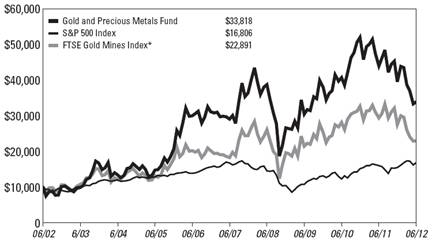

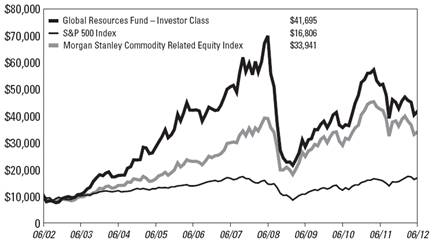

This position has paid off for long-term Global Resources Fund (PSPFX) shareholders: As of June 30, 2012, the fund climbed an annualized 15.33 percent over the past 10 years, outperforming its benchmark, the Morgan Stanley Commodity Related Equity Index, which increased 12.98 percent. A hypothetical $10,000 invested in

1

the fund would have grown to $41,695, compared to a growth of $33,941 in the benchmark.

This outperformance helped the fund earn the top ranking among 32 Lipper global natural resources peers for the 10-year timeframe as of June 30, 2012. For the 1- and 5-year periods, the fund ranked 51 out of 141 and 45 out of 78 Lipper global natural resources funds for total return as of June 30, 2012.

Among Lipper’s entire universe of 9,314 total funds, the fund is ranked 48 for the 10-year period, making it among the top 1 percent as of June 30, 2012. For the 1-year period, the fund is ranked 21,979 out of 22,904 total funds and for the 5-year period, the fund is ranked 13,887 out of 15,767 as of June 30, 2012.

As highlighted in Financial Planning magazine, investors have historically benefited from the inclusion of natural resources as part of a balanced portfolio because of their low correlation to the overall market. Among natural resources funds that had 10-year returns, U.S. Global Investors’ Global Resources Fund added the most return when included in a diversified portfolio and rebalanced annually.

We believe the world is only in the middle of its supercycle with several stages to come. Supercycles, or what we call S-curves, are long, continuous waves of boom and bust inherent in human history. While the overall trend is up, periods of volatility are an intrinsic part of this supergrowth. Not every down period is a sign of permanent demise — even a broken clock is right twice a day.

Investment Strategist Keith Fitz-Gerald noted in a commentary earlier this year that “people forget that world markets dropped 40 to 80 percent in 1987,” and the secular bull market continued. He says, the U.S. has endured some terrible events over the past century, including world wars, the Great Depression, multiple recessions, presidential assassinations, and the September 11 attacks. Still, the stock market has “been the best place to invest for the last 100 years,” Keith concludes.

I like to use the metaphor of an ice cube to explain how new equilibriums can have significant effects. We all understand what happens when you take ice out of the freezer. Above 32 degrees, ice changes form, from solid to liquid, but it’s still made up of hydrogen and oxygen.

2

A change in something the size of an ice cube does not have much impact — it’ll only leave a puddle of water on your counter. Picture a glacier thawing and how this huge chunk of ice drastically affects the world’s ocean level.

Or take H2O in steam form. At 211 degrees, water is way too hot to dip a finger, but it’s still one degree below the boiling point. As explained in the motivational book, 212: The Extra Degree, “Applying one extra degree of temperature to water means the difference between something that is simply very hot and something that generates enough force to power a machine.”

The significance of the changes in states of matter — whether it’s a chunk of melting ice or a steam engine — is that there is a tipping point that significantly alters the dynamics.

This metaphor can be applied to money, with trends including tremendous population growth, urbanization rates, changes in government policies, innovation and discoveries, and development of new technologies having potentially significant changes in the velocity of money. As global investors, we watch for trends like these to know how to invest in commodities and markets, find new opportunities and adjust for risk.

In 1989 when the Berlin Wall fell, famous investors Stanley Druckenmiller and George Soros recognized this event as a significant inflection point in government policies and invested in severely undervalued German marks. This decision paid off, resulting in an investment worth millions of dollars.

Smart investors look past the rampant negativity to see these patterns and anomalies to determine where the opportunities and threats lie. At the heart of James Surowieki’s book, The Wisdom of Crowds, is the idea that “under the right circumstances,” groups of people can make “remarkably intelligent” decisions compared to a single person on his or her own. Surowieki believes that people are “programmed to be collectively smart.”

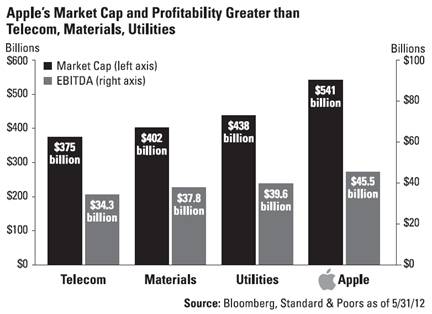

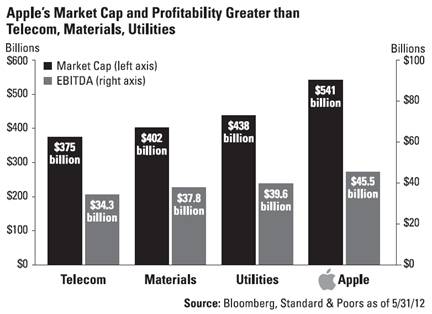

Over the past decade, the “wise crowd” has been investing in Apple’s stock, as they recognized the tremendous effect that iPods, iPhones and iPads would have on the company’s growth. Now Apple’s market capitalization of around $500 billion is a greater market cap than the market cap of all of the utilities companies in the S&P 500, greater than all of the S&P 500 materials companies combined and greater

3

than the telecommunications companies. Apple also generates more profit on an earnings before interest, taxes, depreciation and amortization (EBITDA) basis than any of those sectors.

Clearly, Apple is an admirable company and some of our funds have benefited from holding shares at times. The company’s products are quickly becoming as common as toasters, with a survey by CNBC finding that half of all U.S. households own at least one Apple device! If a household has children, that number jumps to 60 percent.

However, while iPhones are flying off the shelf, natural resources that manufacture, charge and transmit data and voices for the devices seem to be overlooked. To make an iPhone, you need materials like plastics and metals; utilities to charge the device; and telecom companies to allow your phone to function as a mini-computer so you can surf the web and send emails.

Apple’s products cater to our “wants” because we have many choices. Some use BlackBerrys, others prefer Androids. Global resources supply our “needs.” Wants flourish, then fade; needs must always be met. We need companies to grow our food. We need oil, natural gas and coal to fuel our cities. We need to drive to work and school each day, and we need to keep our house warm in the winter and cool in the summer. And so do the other seven billion people on the planet.

4

Research shows that the vast majority of investors do not have exposure to these tremendous needs: According to Investment Company Institute, there is $11 trillion invested in mutual funds around the world. About 45 percent is invested in equity funds, or about $5 trillion. Yet only $50 billion is in natural resources mutual funds, or about 1 percent.

Compare this 1 percent weighting of all equity funds in the world to the fact that about 15 percent of the S&P 500 Index is made of energy and materials. This tells us that global resources are tremendously underappreciated and underweighted in individuals’ portfolios, especially when it comes to natural resources mutual funds.

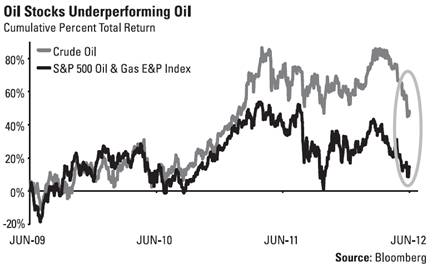

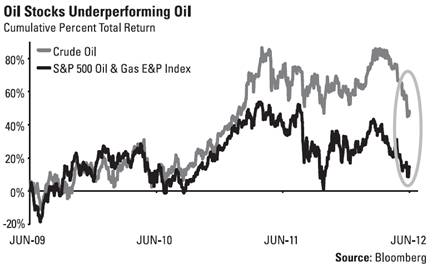

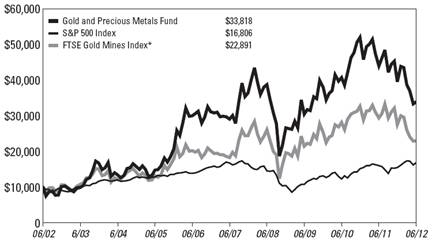

Resources stocks are also underappreciated compared to their underlying commodities. As you can see in the following charts, there’s been a growing disparity between oil and gold compared to oil stocks and gold miners. While the commodities have seen considerable growth over the past three and a half years, oil and gold companies have languished.

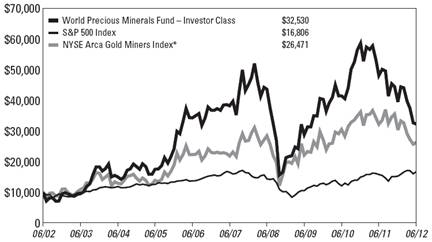

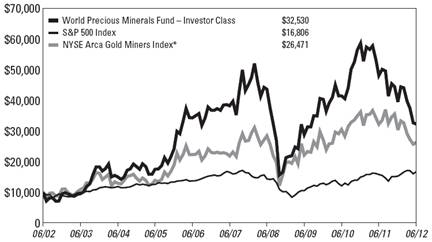

In the first half of 2012 alone, the price of gold rose 2.16 percent, but the FTSE Gold Mines Index fell 15.83 percent and the NYSE Arca Gold Miners Index declined 12.72 percent. At one point in the last six months, the spread between the NYSE Arca Gold Miners Index and gold bullion reached the same extreme level it was during the 2008 credit crisis.

5

We believe either the price of gold should come down or gold stocks should rise, or a combination of both. There are naysayers who think gold is a bubble, but consider the total assets held in gold and gold stocks. The efficient frontier portfolio has historically found that a 90 percent allocation in the S&P 500 Index along with a maximum 10 percent allocation in gold stocks(1) increased return with no additional volatility.

We have always suggested a 5 to 10 percent weighting in gold and gold stocks and if U.S. mutual fund investors followed that recommendation, gold ETF and mutual fund assets would reach $600 billion to $1.2 trillion. As of June 30, 2012, the total assets held in all gold funds and ETFs was $121 billion — that’s only a 1 percent allocation to gold and gold stocks in their mutual fund portfolios.

Adam Hamilton from Zeal Intelligence finds that “beaten-down gold stocks are an incredible fundamental bargain.” Although gold miners have taken on additional mining costs due to rising energy costs, reduced supply and currency swings, he found that profit margins have been growing faster because of the ongoing bull market in gold.

Hamilton’s research discovered that gold companies are “super-cheap” relative to not only the price of gold, but also on an earnings and dividends basis. When he weighted the price-to-earnings ratios of the stocks in the NYSE Arca Gold BUGS Index (HUI) by market capitalization, he found that gold stocks are at the lowest levels that

6

they have been during gold’s entire bull market. Gold companies are also cheaper than the overall stock market, as “a dollar of gold-stock profits costs investors $12, but the same dollar is going for $18 in the general markets,” according to Zeal’s research.

Hamilton says, “Like the rest of the markets, sentiment flows and ebbs in the gold stocks. Sometimes investors love them and bid them up to dizzying heights as greed reigns. But then the great sentiment pendulum starts swinging towards the opposite extreme of fear. And gold stocks are crushed to ridiculous unsustainable lows like we saw last month. Realize neither excessive greed nor excessive fear can persist for long.”

Gold stocks aren’t the only victims of today’s great sentiment swing. Hype over recent tech initial public offerings caused investors to rush into Groupon and Facebook. While the stocks appeared to be positioned to the public as a mainstream investment, I believe people were unaware of the risks involved when they purchased shares. Since the peak on their respective IPO days, these two companies lost a total of $74 billion in market capitalization, which is more than the total assets in Morningstar’s equity precious metals category as of June 30, 2012.

7

Tax Free Opportunities

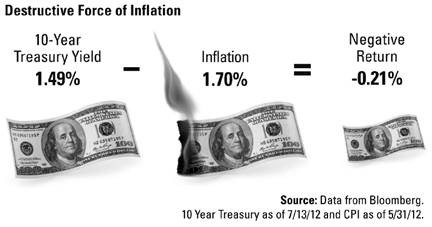

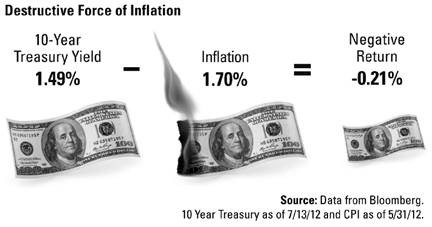

Global investors need to be watchful of biases and impaired thinking that can adversely affect a portfolio. An overreaction to perceived risk has driven down the 10-year Treasury to as low as 1.49 percent. However, inflation burned at 1.7 percent. This means that after you factor in what you’ve lost from the destructive force of inflation, you are left with a negative return.

Instead of being stuck with this potentially losing proposition, we believe there are plenty of opportunities out there. One trend for income along with the potential for capital appreciation is dividend-paying companies. With Treasuries at historic lows, the dividend yield on the S&P 500 is actually higher than the 10-Year Treasury. This is a divergence from the past decade, as “the 10-Year Treasury bond yield has traded well in excess of the S&P 500 dividend yield, with an average yield premium of 222 basis points since 2000,” according to CLSA’s special dividend report. As shown below, the S&P 500 dividend yield is 60 basis points higher than the 10-year Treasury.

| | Dividend Yield | |

10-Year Treasury | | 1.49 | % |

S&P 500 Index | | 2.12 | % |

S&P 500 Energy Sector | | 2.13 | % |

S&P 500 Materials Sector | | 2.33 | % |

S&P 500 Utilities Sector | | 3.87 | % |

10-Year Treasury as of 7/13/12; dividend yields as of 07/23/12. Source: Bloomberg

8

To take advantage of this tremendous opportunity for shareholders, U.S. Global’s equity funds, including the All American Equity Fund (GBTFX), the Eastern European Fund (EUROX), the Global Emerging Markets Fund (GEMFX) and the China Region Fund (USCOX), seek to invest a portion of their assets in well-run, growing companies that pay dividends.

Stocks in the Following Portfolios Have Average Dividend Yield of...

| | Dividend Yield | |

China Region Fund (USCOX) | | 3.38 | % |

All American Equity Fund (GBTFX) | | 4.15 | % |

Eastern European Fund (EUROX) | | 4.60 | % |

Global Emerging Markets Fund (GEMFX) | | 5.79 | % |

Past performance does not guarantee future results. Dividend yields are as of 6-29-2012. These figures do not represent the funds’ yields, which may be materially different from the average yields of the stocks held in the funds.

Source: Bloomberg

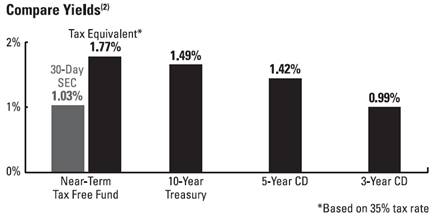

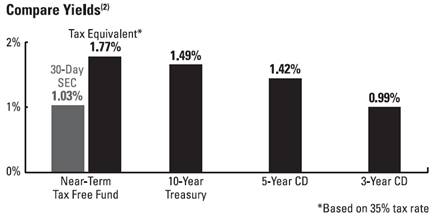

If you need to park some money for a few years, you may have noticed that 3-year certificates of deposit (CDs) offered at a bank were yielding an average of 0.99 percent in July. These CDs lock up your cash for three years and generally come with a penalty for early withdrawal, which can greatly lower returns.

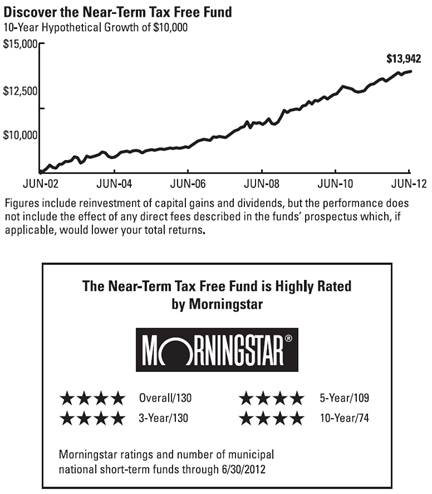

There may be better-yielding alternatives out there for those who can take on some risk as they seek higher returns. For example, U.S. Global Investors’ Near-Term Tax Free Fund (NEARX), which

9

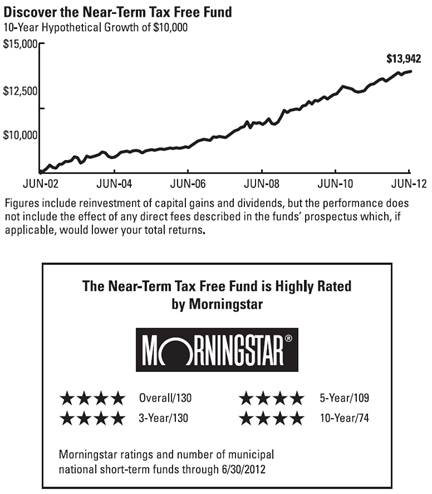

has an overall Morningstar rating of 4 stars, had a higher 30-day SEC yield on a tax-equivalent basis based on a 35 percent tax rate as of June 30, 2012. Also, the fund invests in bonds that have an average maturity of just over 3 years, which is about the same holding period as a 3-year CD.

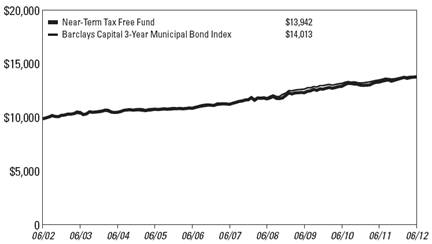

Over the past decade, the fund has provided what we believe to be “peace of mind,” producing positive results every year. As of June 30, 2012, a 10-year hypothetical $10,000 investment in the Near-Term Tax Free Fund has grown to nearly $14,000. The fund shows that sometimes the turtle wins the race.

10

Unlike a CD, the fund is not FDIC insured, but it does provide the flexibility of daily liquidity that comes with a mutual fund.

With the Fed likely keeping interest rates low through 2014, investors’ portfolios cannot afford to remain sidelined. As I like to say, anticipate before you participate, and understand the drivers of the Supercycle growth that will be punctuated with moments of tremendous rises along with temporary setbacks. Global investors who have persevered through these ups and downs have historically been rewarded.

Sincerely,

Frank Holmes

CEO and Chief Investment Officer

U.S. Global Investors, Inc.

(1)Time series for Toronto Gold & Precious Minerals Index is a composite of this index’s returns from 1970 to 2000. Thereafter, the S&P/TSX Gold Index is used. Both series are analyzed based on their returns achieved in U.S. dollar terms.

(2)Near-Term Tax Free Fund data as of 6/30/12; 10-year Treasury yield as of 7/13/12; and CD rates from Bankrate.com site average as of 7/24/2012.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage, Inc.

11

Unlike bank savings accounts, an investment in a municipal bond fund is neither insured nor guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Compare | | Near-Term Tax Free Fund | | Bank CD |

Type of Investment and Objective | | Municipal bond fund; seeks current income that is exempt from federal income tax and seeks preservation of capital | | Certificate of deposit; entitles the bearer to receive interest |

Primary Investments | | Investment grade municipal bonds with relatively short maturity | | A promissory note issued by a bank |

Stable share price? | | No, but seeks minimal fluctuations | | Yes |

Penalty free withdrawals? | | Yes | | No, withdrawal before the maturity date usually incurs a penalty |

Though the Near-Term Tax Free Fund seeks minimal fluctuations in share price, it is subject to the risk that a decline in the credit quality of a portfolio holding could cause a fund’s share price to decline. Tax-exempt income is federal income tax free. A portion of this income may be subject to state and local income taxes, and if applicable, may subject certain investors to the Alternative Minimum Tax as well. The Near-Term Tax Free Fund may invest up to 20% of its assets in securities that pay taxable interest. Income or fund distributions attributable to capital gains are usually subject to both state and federal income taxes. Bond funds are subject to interest-rate risk; their value declines as interest rates rise.

The CD interest rate is typically a fixed rate of interest, and payable on a set maturity date. The 30-day yield is used for bond funds, balanced funds, and stock funds. It consists of the interest income the fund pays over a 30-day period, net of expenses, expressed as an annualized percentage of the fund’s share price. Tax Equivalent Yield is the before-tax yield you would have to get from a higher-paying but taxable investment to equal the yield from a tax-exempt investment and was computed assuming a 35% tax rate.

Morningstar Ratings are based on risk-adjusted return.The Overall Morningstar Rating for a fund is derived from a weighted-average of the performance figures associated with its three-, five- and ten-year (if applicable) Morningstar Rating metrics. Past performance does not guarantee future results. For each fund with at least a three-year history, Morningstar calculates a Morningstar RatingTM based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund’s monthly performance (including the effects of sales charges, loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. (Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in the distribution percentages.)

12

Although Lipper makes reasonable efforts to ensure the accuracy and reliability of the data contained herein, the accuracy is not guaranteed by Lipper. Users acknowledge that they have not relied upon any warranty, condition, guarantee, or representation made by Lipper. Any use of the data for analyzing, managing, or trading financial instruments is at the user’s own risk. This is not an offer to buy or sell securities.

The Toronto Stock Exchange Gold and Precious Minerals Total Return Index is the total return version of the Toronto Stock Exchange Gold and Precious Minerals Index with dividends reinvested. The S&P/TSX Global Gold Index is an international benchmark tracking the world’s leading gold companies with the intent to provide an investable representative index of publicly-traded international gold companies. The S&P 500 Oil & Gas Exploration & Production Index is a capitalization-weighted Index. The index is comprised of six stocks whose primary function is exploring for natural gas and oil resources on land or at sea. The NYSE Arca Gold BUGS (Basket of Unhedged Gold Stocks) Index (HUI) is a modified equal dollar weighted index of companies involved in gold mining. The HUI Index was designed to provide significant exposure to near term movements in gold prices by including companies that do not hedge their gold production beyond 1.5 years.

13

Definitions for Management Teams’ Perspectives

Benchmark Index Definitions

Returns for indexes reflect no deduction for fees, expenses or taxes, unless noted.

The Barclays Capital 3-Year Municipal Bond Index is a total return benchmark designed for municipal assets. The index includes bonds with a minimum credit rating of BAA3, are issued as part of a deal of at least $50 million, have an amount outstanding of at least $5 million and have a maturity of two to four years.

The Barclays Capital 10-Year Municipal Bond Index is a total return benchmark designed for long-term municipal assets. The index includes bonds with a minimum credit rating of BAA3, are issued as part of a deal of at least $50 million, have an amount outstanding of at least $5 million and have a maturity of 8 to 12 years.

The FTSE Gold Mines Index encompasses all gold mining companies that have a sustainable and attributable gold production of at least 300,000 ounces a year and that derive 75% or more of their revenue from mined gold.

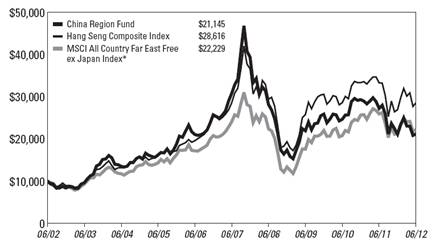

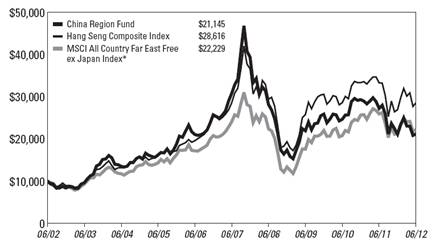

The Hang Seng Composite Index is a market-capitalization weighted index that covers about 95% of the total market capitalization of companies listed on the Main Board of the Hong Kong Stock Exchange.

The MSCI Emerging Markets Europe 10/40 Index (Net Total Return) is a free float-adjusted market capitalization index that is designed to measure equity performance in the emerging market countries of Europe (Czech Republic, Hungary, Poland, Russia and Turkey). The index is calculated on a net return basis (i.e., reflects the minimum possible dividend reinvestment after deduction of the maximum rate withholding tax). The index is periodically rebalanced relative to the constituents’ weights in the parent index.

The MSCI Emerging Markets Net Total Return Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in emerging market countries on a net return basis (i.e., reflects the minimum possible dividend reinvestment after deduction of the maximum rate withholding tax).

The Morgan Stanley Commodity Related Equity Index (CRX) is an equal-dollar weighted index of 20 stocks involved in commodity-related industries such as energy, non-ferrous metals, agriculture and forest products.

The NYSE Arca Gold Miners Index is a modified market capitalization-weighted index comprised of publicly-traded companies involved primarily in the mining for gold and silver.

The S&P 500 Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

14

The S&P Composite 1500 Index is a broad-based capitalization-weighted index of 1500 U.S. companies and is comprised of the S&P 400, S&P 500 and the S&P 600.

Other Index Definitions

The Barclays Capital Municipal Bond Index is an unmanaged index representative of the tax-exempt bond market.

The ISM Manufacturing Composite Index is a diffusion index calculated from five of the eight sub-components of a monthly survey of purchasing managers at roughly 300 manufacturing firms from 21 industries in all 50 states.

The Istanbul Stock Exchange National 100 Index (XU100) is a capitalization-weighted index composed of National Market companies except investment trusts.

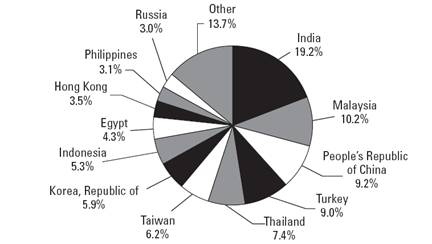

The MSCI All Country Far East Free ex Japan Index is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of the Far East, excluding Japan. The index consists of the following developed and emerging market country indices: China, Hong Kong, Indonesia, Korea, Malaysia, Philippines, Singapore, Taiwan and Thailand.

The MSCI China Index is a free-float weighted equity index that monitors the performance of stocks in the Chinese market.

The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets.

The S&P 100 Index is a market capitalization-weighted index consisting of 100 large blue chip stocks covering a broad-range of industries that is used as a benchmark to measure the performance of large cap stocks.

The S&P GSCI Total Return Index is calculated primarily on a world production weighted basis and is comprised of the principal physical commodities that are the subject of active, liquid futures markets.

The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar.

15

Money Market Funds

Management Team’s Perspective

Introduction

The U.S. Treasury Securities Cash Fund (USTXX) seeks to obtain a high level of current income while maintaining the highest degree of safety of principal and liquidity. The U.S. Government Securities Savings Fund (UGSXX) seeks to achieve a consistently high yield with safety of principal.

Performance

U.S. Treasury Securities Cash Fund | | As of June 30, 2012 | |

7-Day Yield | | 0.01 | % |

7-Day Effective Yield | | 0.01 | % |

U.S. Government Securities Savings Fund | | As of June 30, 2012 | |

7-Day Yield | | 0.01 | % |

7-Day Effective Yield | | 0.01 | % |

An investment in either the U.S. Treasury Securities Cash Fund or the U.S. Government Securities Savings Fund is neither insured nor guaranteed by the Federal Deposit Insurance Corporation (FDIC) or by any other government agency. Although the funds seek to preserve the value of your investments at $1.00 per share, it is possible to lose money by investing in these funds.

Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses to not exceed 1.00% for the U.S. Treasury Securities Cash Fund and 0.45% for the U.S. Government Securities Savings Fund on an annualized basis. In addition, the yields reported above include the effects of the Adviser’s voluntary waiver of fees and/or reimbursement of expenses to maintain a minimum net yield for the funds. The Adviser can modify or terminate these arrangements at any time.

The Six-Month Period In Review - Economic And Political Issues That Affected The Funds

The economy began the year with some positive economic momentum as unemployment was falling, the consumer was spending and manufacturing remained relatively robust. In the first quarter of 2012, the global economy appeared stronger and, as a result, investor sentiment improved. As the year progressed, the economic slowdown in Europe and China proved too much to bear and negatively affected the U.S. economy. In June, the ISM Manufacturing Composite Index fell to 49.7, the lowest level in three years,

16

indicating a modest contraction in the manufacturing sector. This was a surprising reading and was confirmed by a lower global trend for similar manufacturing readings. Consumer confidence fell, even though gasoline prices have been lower.

The ongoing European financial crisis continues without an obvious endpoint in the near future. China has been weak this year as policymakers attempted an economic “soft landing” that became more difficult with Europe’s economic activity deteriorating quicker than expected.

The Federal Reserve maintained its position for the first half of the year by not providing additional stimulus. We believe the Fed is allowing central banks around the world to do the heavy lifting this time as the European Central Bank and the Bank of China will likely be key players.

Inflation in the U.S. decelerated during the first six months of the year and the global trend is for lower inflation, allowing central bankers to comfortably shift to pro-growth policies. The Fed remains inclined to ease more if necessary and has committed to maintaining the extremely low interest rate environment through late-2014.

Fiscal austerity remains in vogue to address long-term fiscal imbalances in the developed world and will likely be a significant drag on growth in the U.S. and Europe for some time. Spending cuts and higher taxes are a stiff headwind to economic growth.

Yields on the three-month Treasury bill rose 7 basis points to 0.08 percent, while yields on the six-month bills rose 10 basis points to 0.16 percent. One-year agency discount note yields climbed 8 basis points to 0.22 percent. The market was still influenced by periodic bouts of risk aversion or other disruptions, with investors, at times, seeking to own short-term Treasury securities, at almost any cost.

Investment Highlights

The U.S. Treasury Securities Cash Fund performed in line with Lipper’s Treasury money market funds for the six months ending June 30, 2012, returning 0.00 percent, the same as the peer group. The U.S. Government Securities Savings Fund performed marginally below the Lipper government-only money market funds, returning 0.00 percent versus 0.01 percent for the peer group.

The U.S. Treasury Securities Cash Fund had a weighted average maturity of 2 days over the six-month period, as overnight repurchase agreements

17

were some of the highest yielding options with the least amount of interest rate risk in the Treasury money market universe.

The U.S. Government Securities Savings Fund followed a short-laddered approach for much of the period and had a weighted average maturity of 17 days over the period. The fund took advantage of higher yields by selectively extending its ladder, but overall the six months continued to be a very difficult environment for money market fund investors.

Current Outlook

The Fed continues its stance to keep interest rates low for an extended period; recent developments reinforced this position. We continue to believe that the Fed will unlikely change course before 2014, with monetary policy likely to remain easy for some time.

18

Tax Free Funds

Management Team’s Perspective

Introduction

The Near-Term Tax Free Fund (NEARX) and the Tax Free Fund (USUTX) seek to provide a high level of current income exempt from federal income taxation and to preserve capital. However, a portion of any distribution may be subject to federal and/or state income taxes. The Near-Term Tax Free Fund will maintain a weighted average maturity of less than five years, while the Tax Free Fund will generally maintain a longer weighted average maturity.

Performance Graphs

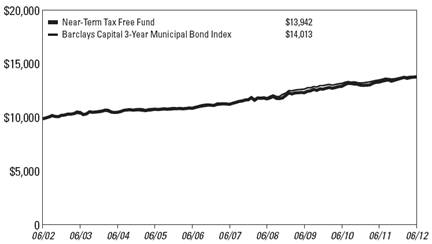

Near-Term Tax Free Fund

Average Annual Performance | | For the Periods Ended June 30, 2012 |

| | Six Month | | One Year | | Five Year | | Ten Year | |

Near-Term Tax Free Fund | | 1.55 | % | 3.60 | % | 4.14 | % | 3.38 | % |

Barclays Capital 3-Year Municipal

Bond Index | | 1.29 | % | 2.56 | % | 4.30 | % | 3.43 | % |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 0.45%. The Adviser can modify or terminate this arrangement at any time.

See Definitions for Management Teams’ Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

19

Tax Free Fund

Average Annual Performance | | For the Periods Ended June 30, 2012 |

| | Six Month | | One Year | | Five Year | | Ten Year | |

Tax Free Fund | | 2.81 | % | 7.52 | % | 5.07 | % | 4.26 | % |

Barclays Capital 10-Year Municipal

Bond Index | | 2.68 | % | 10.30 | % | 6.88 | % | 5.62 | % |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 0.70%. The Adviser can modify or terminate this arrangement at any time.

See Definitions for Management Teams’ Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

The Six-Month Period In Review - Economic And Political Issues That Affected The Funds

The municipal bond market exhibited solid performance over the past six months as the Barclays Capital Municipal Bond Index rose 3.66 percent.

Even with more high profile municipal defaults during the first half of this year along with increased media attention to the issue, municipals have performed very well, with a lower number of defaults so far this year compared to the first half of 2011. Most municipal governments are making the tough but necessary changes to balance their budgets.

20

While yields have steadily declined over the first six months, the very long end of the yield curve has been the standout performer, as bonds with maturities of 22 years or more rose by 6.56 percent. Municipal market performance was consistent throughout the yield curve, as returns were more or less tied to maturity. Returns in the first quarter of 2012 roughly matched the returns in the second quarter. We began 2012 with high hopes for the economy but as the months wore on, economic data deteriorated. The constantly ongoing European financial crisis and fears of an economic hard landing in China drove interest rates lower.

Revenue-backed municipals outperformed general obligation credits by a wide margin, driven by hospital and industrial development issues. Credit factors played a sizable role in performance as low-quality outperformed high-quality bonds. AAA-rated municipals rose by 2.21 percent during the year versus 6.71 percent for BBB-rated bonds. High-yield (“junk”) bonds rose an eye-popping 9.65 percent over the past six months.

In specialty state trading, California and Illinois outperformed, while New York and Ohio underperformed.

The Federal Reserve has continued its plan to keep interest rates low through late-2014 and monetary policy loose for an extended period of time. Globally, central banks continue to cut interest rates and ease monetary policy as inflation has slowed considerably and the focus remains on stimulating growth.

Investment Highlights

Over the six months ended June 30, 2012, the Near-Term Tax Free Fund returned 1.55 percent, outperforming its benchmark, the Barclays Capital 3-Year Municipal Bond Index, which returned 1.29 percent. The Tax Free Fund returned 2.81 percent, also outperforming its benchmark, the Barclays Capital 10-Year Municipal Bond Index, which returned 2.68 percent.

The Near-Term Tax Free Fund modestly outperformed the Short-Intermediate Lipper peer group for the past six months, while the Tax Free Fund trailed its respective Lipper peer group. The underperformance of the Tax Free Fund compared to its peers was primarily driven by fund credit and maturity preferences relative to the Lipper peer group. As discussed above, the long-end of the yield curve experienced significant outperformance and low quality and junk bonds significantly outperformed; the fund was positioned more conservatively.

Strengths

· The Tax Free Fund maintained significant exposure to hospital-backed municipals, which outperformed.

21

· The Tax Free Fund benefited from significant exposure to California, Illinois and Texas, which all outperformed.

· The Near-Term Tax Free Fund benefited from significant exposure to Illinois, Texas and Florida which all outperformed.

· From a maturity perspective, the Near-Term Tax Free Fund benefited from a longer maturity profile than its benchmark.

Weaknesses

· Historically, the conservative credit profile of both funds proved to be an asset during volatile periods, but negatively impacted performance in the first six months of the year when bond markets were strong.

· The Tax Free Fund maintained a relatively short maturity/duration profile. This negatively affected performance in relation to its benchmark and peer group, as longer maturities outperformed.

· Bond structure also played a role in performance as the Tax Free Fund had little exposure to long maturities with discount coupon structures, which significantly outperformed.

Current Outlook

Opportunities

· The long-intermediate portion of the yield curve appears to offer the best opportunity in the current market, as the Fed appears sidelined for an extended period. Globally, other central banks have begun easing aggressively, broadly supporting fixed income markets.

Threats

· Continued outperformance of low-quality bonds is the most significant threat on a relative basis.

· When the Fed reverses its monetary policy stance and begins to raise interest rates, the macro environment could become more difficult.

22

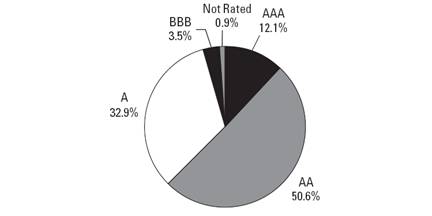

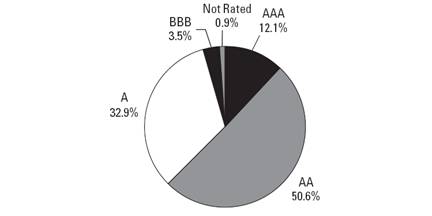

Near-Term Tax Free Fund | | |

Municipal Bond Ratings | | June 30, 2012 |

(Based on Total Municipal Bonds) | | |

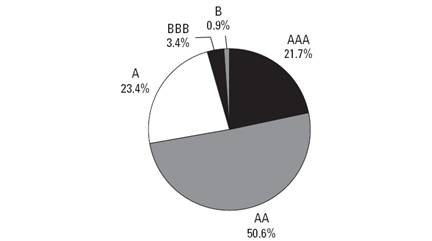

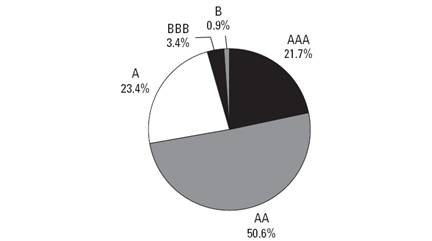

Tax Free Fund | | |

Municipal Bond Ratings | | June 30, 2012 |

(Based on Total Municipal Bonds) | | |

23

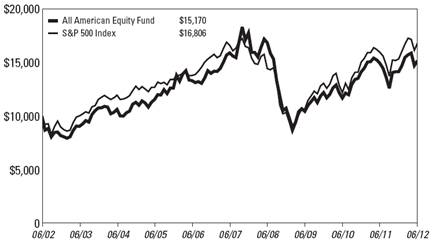

All American Equity Fund

Management Team’s Perspective

Introduction

The principal objective of the All American Equity Fund (GBTFX) is to seek capital appreciation by investing primarily in a broadly diversified portfolio of domestic common stocks. The fund invests in large-capitalization stocks, while retaining the flexibility to seek out promising individual stock opportunities, including stocks with meaningful dividend yields.

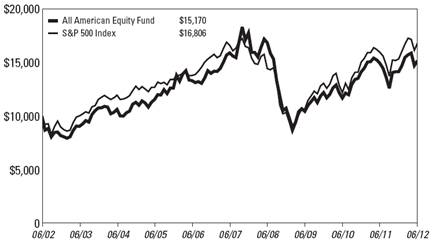

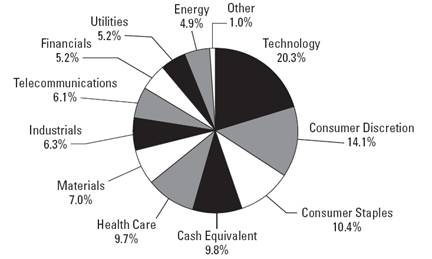

Performance Graph

All American Equity Fund

Average Annual Performance | | For the Periods Ended June 30, 2012 |

| | Six Month | | One Year | | Five Year | | Ten Year | |

All American Equity Fund | | 7.17 | % | 1.68 | % | (0.95 | )% | 4.25 | % |

S&P 500 Index | | 9.49 | % | 5.45 | % | 0.22 | % | 5.32 | % |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted.The principal value and investment return of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 2.20%. The Adviser can modify or terminate this arrangement at any time.

See Definitions for Management Teams’ Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

24

The Six-Month Period In Review - Economic And Political Issues That Affected The Fund

U.S. real GDP grew 1.9 percent in the first quarter and 1.5 percent in the second quarter. This weak growth has been driven largely by a rapidly slowing European economy and also a larger than expected slowdown in China. Manufacturing indicators in the U.S. had held up well and have been a source of strength until recently when the ISM Manufacturing Composite Index fell into contraction territory for the first time in three years.

After showing some improvement early in the year, the employment picture deteriorated quickly, with a sharp slowdown in nonfarm payroll growth in the second quarter of 2012. America’s unemployment rate in June 2012 was 8.2 percent. There were bright spots for the economy, including the fact that a housing recovery appears to be underway.

Inflation in the U.S. has trended lower through the first six months of the years and this has been a global phenomenon. The Federal Reserve remains much more concerned about deflation as economic weakness in Europe and Asia is likely to put downward pressure on global inflation. The Fed has kept its short-term interest rate target in a range of zero to 0.25 percent, which is unchanged for 2012.

The political environment in the U.S. remained one of strongly divided partisan debates, with the Democrats controlling the Presidency and the Senate, while the Republicans controlled the House of Representatives.

However, extreme volatility, fears of an economic hard landing in China, and the deteriorating European financial crisis provided a headwind throughout the first half of 2012. The S&P 500 Index rose 9.49 percent in the first six months of the year.

Investment Highlights

Overview

The All American Equity Fund returned 7.17 percent for the six months ended June 30, 2012, underperforming the 9.49 percent return for the benchmark S&P 500 Index.

Because the fund is actively managed and holding period is generally not a consideration in investment decisions, the portfolio turnover rate may fluctuate from year to year as the fund adjusts its portfolio composition. The fund’s annual portfolio turnover was, and is expected to continue to be, more than 100 percent.

25

Strengths

· The fund’s allocations to energy, consumer staples and telecommunication services sectors positively contributed to relative performance. The fund’s stock selection in energy, consumer staples and materials was particularly strong.

· Industry groups that were standout performers for the fund included chemicals, machinery and pharmaceuticals.

· Apple, Inc.,(1) Monster Beverage Corp.(2) and Starbucks Corp.(3) were among the best positive contributors to performance.

Weaknesses

· The fund’s allocations to financials and technology were negative contributors to relative performance. The fund’s stock selection within the financial sector was the primary driver of underperformance.

· The fund’s exposure to dividend-paying stocks over the past six months, while positive, trailed the broader market, which appreciated sharply in the first half of the year.

· Defensive option strategies did not aid fund performance over the past six months as the market rallied strongly, particularly during the first few months of the period.

· Las Vegas Sands Corp.,(4)��F5 Networks, Inc.(5) and Seagate Technology plc(6) were among the worst individual contributors to performance.

Current Outlook

Opportunities

· The U.S. economy has been surprisingly resilient during the past six months, and the global monetary easing cycle continues, which should be positive for equities in 2012.

· Corporate cash levels continue to remain high, providing corporations the ability to pursue mergers and acquisitions (M&A). An increase in M&A activity holds promise for both portfolio gains and an increase in overall market valuations.

· Low interest rates, if continued throughout 2012, should provide a favorable backdrop for the economy and stock prices.

· Dividend-paying stocks remain attractive as higher yielding investments. As of June 30, 2012, half of the companies in the S&P 500 Index pay a dividend at an annualized rate greater than the yield on the 10-year Treasury.

26

Threats

· Europe is widely believed to be in a recession, and fiscal austerity both at home and abroad will continue to be headwinds in the second half of 2012.

· An economic “hard landing” remains a risk as China has been a significant driver of global growth in recent years.

· Government policy delays or outright missteps are a threat to global equity markets.

The fund ended the period with higher-than-normal cash positions that should enable the fund to take advantage of opportunities as they arise. The fund maintains an emphasis on dividend-paying stocks.

(1)This security comprised 3.43% of the fund’s total net assets as of 06/30/12.

(2)This security comprised 1.64% of the fund’s total net assets as of 06/30/12.

(3)This security comprised 1.88% of the fund’s total net assets as of 06/30/12.

(4)This security comprised 2.54% of the fund’s total net assets as of 06/30/12.

(5)The fund did not hold this security as of 06/30/12.

(6)This security comprised 0.87% of the fund’s total net assets as of 06/30/12.

27

Top 10 Holdings Based on Net Assets | | June 30, 2012 |

(excluding repurchase agreement) | |

MasterCard, Inc.

Commercial Services - Financial | | 3.79 | % |

Apple, Inc.

Computers | | 3.43 | % |

Intel Corp.

Electronic Components - Semiconductors | | 2.66 | % |

Las Vegas Sands Corp.

Casino Hotels | | 2.54 | % |

Questcor Pharmaceuticals, Inc.

Therapeutics | | 2.50 | % |

The Fresh Market, Inc.

Food - Retail | | 1.89 | % |

Starbucks Corp.

Retail - Restaurants | | 1.88 | % |

Tangoe, Inc.

Applications Software | | 1.88 | % |

Bally Technologies, Inc.

Casino Services | | 1.65 | % |

Monster Beverage Corp.

Beverages - Non-alcoholic | | 1.64 | % |

TOTAL TOP TEN HOLDINGS | | 23.86 | % |

Portfolio Allocation by Industry Sector* | | June 30, 2012 |

Based on Total Investments | |

* Summary information above may differ from the portfolio schedule included in the financial statements due to the use of different classifications of securities for presentation purposes.

28

Holmes Growth Fund

Management Team’s Perspective

Introduction

The Holmes Growth Fund (ACBGX) invests in companies with good growth prospects and strong positive earnings momentum. The fund’s primary objective is to seek long-term capital appreciation.

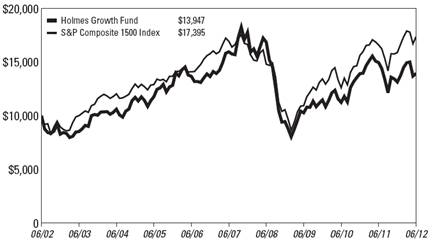

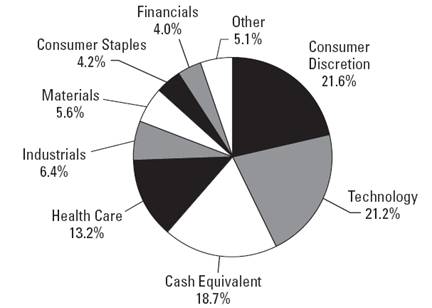

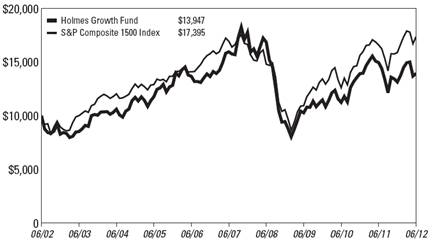

Performance Graph

Holmes Growth Fund

Average Annual Performance | | For the Periods Ended June 30, 2012 |

| | Six Month | | One Year | | Five Year | | Ten Year | |

Holmes Growth Fund | | 6.07 | % | (6.88 | )% | (2.66 | )% | 3.38 | % |

S&P Composite 1500 Index | | 9.33 | % | 4.66 | % | 0.49 | % | 5.69 | % |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 2.20%. The Adviser can modify or terminate this arrangement at any time.

See Definitions for Management Teams’ Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

29

The Six-Month Period In Review - Economic And Political Issues That Affected The Fund

The economy began the year with some positive momentum as employment indicators were improving, retail sales were generally better than expected, housing-related activity was picking up and manufacturing was resilient.

Over the past couple of months, there has been a marked deceleration in economic activity with sharply slower growth out of Europe which has caused negative reverberations across the globe, particularly in China. We live in a global marketplace today and disruptions around the world have impacted many U.S.-based companies. This was reflected in the stock market in May.

Economic activity began faltering in the second quarter, with poor employment readings, weakening retail sales and the ISM Manufacturing Composite Index falling into contraction territory for the first time in three years.

After peaking in late summer 2011, U.S. inflation has trended lower for the past six months. Generally speaking, this has also been the case on a global basis, allowing central bankers around the world to shift their focus from fighting inflation to stabilizing and promoting economic growth. We have seen broad-based easing policies from the world’s central banks, which recognize that the margin for error in preventing a broad-based global recession is very low.

The Federal Reserve has kept its short-term interest rate target in a range of zero to 0.25 percent, unchanged during the past six months. The Fed remains committed to continuing its current accommodative policies and may even provide additional stimulus in the second half of 2012.

The U.S. political environment remains strongly divided and the sunset of Bush-era tax rates and spending cuts looming on January 1, 2013, may cause a significant negative fiscal shock to the U.S. economy unless action is taken. With the upcoming presidential election adding to uncertainty, it is difficult to determine whether a resolution can be reached by year end.

Despite the uncertainty, the fund’s benchmark, the S&P Composite 1500 Index, rose 9.33 percent over the past six months.

30

Investment Highlights

Overview

The fund rose 6.07 percent over the past six months, underperforming the benchmark, the S&P Composite 1500 Index, which returned 9.33 percent. The fund performed well early in the year, but growth-oriented stocks underperformed over the past couple of months. Defensive areas of the market outperformed, allowing the benchmark to catch up and surpass the fund’s performance.

Because the fund is actively managed and holding period is generally not a consideration in investment decisions, the portfolio turnover rate may fluctuate from year to year as the fund adjusts its portfolio composition. The fund’s annual portfolio turnover was, and is expected to continue to be, more than 100 percent.

Strengths

· The fund benefited from being underweight in the consumer staples, utilities and energy sectors, as those areas underperformed.

· Industry groups that were standout performers for the fund included pharmaceuticals, aerospace & defense and beverages.

· Apple, Inc.,(1) Ulta Salon Cosmetics & Fragrance, Inc.(2) and Monster Beverage Corp.(3) were among the best positive contributors to performance.

Weaknesses

· Mega-capitalization stocks outperformed over the past six months, with the S&P 100 Index rising by 10.56 percent. The fund was relatively underweight this market cap group, as its holdings include mid- and small-cap companies, which underperformed not only the S&P 100 but the S&P 1500.

· Cash and defensive option positions were a drag on performance as the market rallied strongly during the past six months.

· Investments in Body Central Corp.(2) and Las Vegas Sands Corp.(4) failed to live up to expectations and were among the worst contributors to the fund’s performance. The fund’s largest holding, Newfoundland Capital Corp., Ltd.(5) also underperformed, falling by 2.95 percent during the period.

31

Current Outlook

Opportunities

· The U.S. economy has been the relative bright spot in the global economy; companies with domestic exposure could outperform. We are now six months or so into a global easing cycle, which should be good for equities for the remainder of 2012.

· Corporate cash levels are high, providing corporations the ability to pursue mergers and acquisitions (M&A). An increase in M&A activity holds promise for both portfolio gains and an increase in overall market valuations.

· At the end of the period, the fund maintained a higher than normal level of cash, which the fund can opportunistically deploy.

Threats

· Fiscal austerity in the U.S. and abroad will continue to create economic headwinds.

· China’s decelerating economic growth remains a risk to the global economy.

· Continued outperformance of mega-cap stocks is a threat to the fund’s relative performance as the fund is relatively underweight this market cap group.

(1)This security comprised 4.08% of the fund’s total net assets as of 06/30/12.

(2)The fund did not hold this security as of 06/30/12.

(3)This security comprised 1.56% of the fund’s total net assets as of 06/30/12.

(4)This security comprised 2.65% of the fund’s total net assets as of 06/30/12.

(5)This security comprised 7.02% of the fund’s total net assets as of 06/30/12.

32

Top 10 Holdings Based on Net Assets | | June 30, 2012 |

(excluding repurchase agreement) | |

Newfoundland Capital Corp., Ltd.

Radio | | 7.02 | % |

Apple, Inc.

Computers | | 4.08 | % |

MasterCard, Inc.

Commercial Services - Financial | | 3.24 | % |

Intel Corp.

Electronic Components - Semiconductors | | 2.90 | % |

Polaris Industries, Inc.

Recreational Vehicles | | 2.87 | % |

Alexion Pharmaceuticals, Inc.

Medical - Biomedical/Gene | | 2.77 | % |

Dunkin’ Brands Group, Inc.

Retail - Restaurants | | 2.69 | % |

Tangoe, Inc.

Applications Software | | 2.68 | % |

Questcor Pharmaceuticals, Inc.

Therapeutics | | 2.68 | % |

Las Vegas Sands Corp.

Casino Hotels | | 2.65 | % |

TOTAL TOP TEN HOLDINGS | | 33.58 | % |

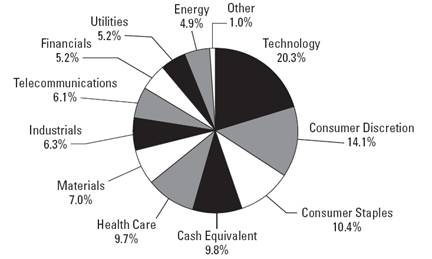

Portfolio Allocation by Industry Sector* | | June 30, 2012 |

Based on Total Investments | |

* Summary information above may differ from the portfolio schedule included in the financial statements due to the use of different classifications of securities for presentation purposes.

33

Global MegaTrends Fund

Management Team’s Perspective

Introduction

The Global MegaTrends Fund (MEGAX and MEGIX) focuses on companies that are well positioned to benefit from substantial and sustainable growth that may occur over a multi-year time frame. The fund considers a broad range of investable opportunities, many of which are created by government policies, technological innovations and/or changes in market fundamentals for a product, service or commodity. The fund has the flexibility to invest globally and within any sector of the economy.

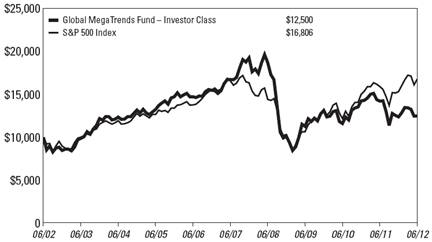

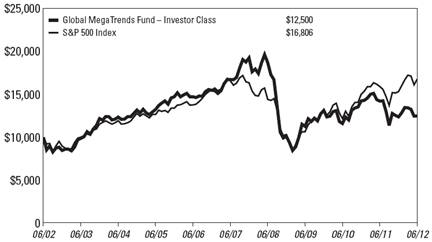

Performance Graph

Global MegaTrends Fund

Average Annual Performance | | For the Periods Ended June 30, 2012 |

| | Six Month | | One Year | | Five Year | | Ten Year | | Since Inception

(Institutional

Class) | |

Global MegaTrends Fund - Investor Class | | 0.78 | % | (12.24 | )% | (5.71 | )% | 2.25 | % | n/a | |

Global MegaTrends Fund - Institutional Class (Inception 3/1/10) | | 0.79 | % | (12.12 | )% | n/a | | n/a | | (0.22 | )% |

S&P 500 Index | | 9.49 | % | 5.45 | % | 0.22 | % | 5.32 | % | 11.20 | % |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 2.35% for the Investor Class. Also pursuant to a voluntary agreement, the Adviser has agreed to waive all class specific expenses of the Institutional Class. The Adviser can modify or terminate these arrangements at any time.

See Definitions for Management Teams’ Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

34

The Six-Month Period In Review - Economic And Political Issues That Affected The Fund

Political and economic considerations are very influential on the investment climate in which the Global MegaTrends Fund operates.

Continuing negative news surrounding the European sovereign debt crisis and weakening global growth negatively affected market sentiment in the first half of the year. This further increased investor risk-aversion, especially toward emerging markets equities and foreign currencies. This was a significant driver for the underperformance of international equities compared to domestic stocks in the fund’s portfolio during the period.

Additionally, commodity- and infrastructure-related companies lagged the broader U.S. market as uncertainty regarding future capital spending plans increased and fears over slowing growth in China gained momentum. In response, China cut its bank reserve requirements and one-year lending rate twice by the middle of the year to avoid further economic deterioration.

Moreover, there has been a global synchronized effort to increase economic stimulus across the globe to offset Europe’s economic contagion.

Investment Highlights

Overview

In the first six months of 2012, the Investor Class of the fund returned 0.78 percent and the Institutional Class posted a return of 0.79 percent. The benchmark S&P 500 Index returned 9.49 percent.

Because the fund is actively managed and holding period is generally not a consideration in investment decisions, the portfolio turnover rate may fluctuate from year to year as the fund adjusts its portfolio composition. The fund’s annual portfolio turnover was, and is expected to continue to be, more than 100 percent.

Strengths

· Top contributors to fund performance in the first half the year included telecommunications and utility stocks as investors sought high dividend yields. AT&T, Inc.,(1) Verizon Communications, Inc.,(2) Suez Environment S.A.(3) and National Grid plc(3) provided strong contributions to fund performance.

35

· In energy, the fund benefited from exposure to Master Limited Partnerships (MLPs) with holdings in Enterprise Products Partners, L.P.(4) and Atlas Energy L.P.(5) The addition of an oil services and equipment stock, National-Oilwell Varco, Inc.,(3) also contributed to fund returns.

· Select international stocks such as Life Healthcare Group Holdings Ltd.,(3) based in South Africa, and PetroMagdalena Energy Corp.(3) from Colombia outperformed the S&P 500 Index.

· Early positions in the period involving cyclical stocks such as Caterpillar, Inc.,(3) Cummins, Inc.,(3) Freeport-McMoRan Copper & Gold, Inc.(3) and CF Industries Holdings, Inc.(3) added to performance.

Weaknesses

· The fund’s underperformance compared to the benchmark S&P 500 Index was mainly a result of sector allocation and stock selection in both domestic and international areas.

· The most negative impact for the fund came from exposure to the industrials sector, which was the third worst performer in the S&P 500. Vitran Corp., Inc.,(3) PT United Tractors Tbk,(3) Primoris Services Corp.(3) and Cascade Corp.(3) were industrials that underperformed for the fund.

· Foreign equities underperformed the S&P 500 Index in the first half of 2012. Historically, the portfolio carries significant exposure to developing economies because of their long-term growth opportunities, but this exposure created a short-term headwind for performance during the period.

· Poor performance relative to the S&P 500 Index was also partially due to the fund’s underweight allocation to the U.S. consumer staples and technology, which outperformed the benchmark.

Current Outlook

Opportunities

· At present, we believe the following investable trends will be multi-year themes:

1. Real Estate Investment Trusts (REITs) and Master Limited Partnerships (MLPs) are in a primary uptrend. Investors are searching for yield and dividend growth in an environment of sub-two percent Treasury yields.

2. The telecom and utility sectors are capitalizing on the current trends of high dividend income, pricing power and visible revenue growth in a competitive global economy.

36

3. The consumer staples sector is benefiting from the globalization of U.S. brand name products abroad, above-average returns on capital and consistent growth.

· A number of government policy actions initiated recently involving rate cuts from the European Central Bank and the Bank of China, along with more quantitative easing from the Bank of England, should be supportive for the economy and equities heading into the second half of the year.

Threats

· While policymakers in Europe have made strides to stabilize the current debt crisis, contagion risks remain, which could lead to a liquidity shock similar to 2008.

· China cut interest rates for the second time as of July 5, 2012, likely indicating that conditions on the ground remain challenging to restart its country’s economic growth.

(1)This security comprised 2.05% of the fund’s total net assets as of 06/30/12.

(2)This security comprised 2.03% of the fund’s total net assets as of 06/30/12.

(3)The fund did not hold this security as of 06/30/12.

(4)This security comprised 1.65% of the fund’s total net assets as of 06/30/12.

(5)This security comprised 1.08% of the fund’s total net assets as of 06/30/12.

37

Top 10 Holdings Based on Net Assets | | June 30, 2012 |

(excluding repurchase agreement) | |

Pacific Stone Tech, Inc.

Quarrying | | 3.96 | % |

TJX Cos, Inc.

Retail - Major Department Store | | 2.59 | % |

Ross Stores, Inc.

Retail - Apparel/Shoe | | 2.51 | % |

Pacific Infrastructure, Inc.

Real Estate Operating/Development | | 2.49 | % |

Southern Co.

Electric - Integrated | | 2.36 | % |

NuStar Energy L.P.

Pipelines | | 2.22 | % |

AES Corp.

Electric - Generation | | 2.15 | % |

Exelon Corp.

Electric - Integrated | | 2.07 | % |

AT&T, Inc.

Telephone - Integrated | | 2.05 | % |

PPL Corp.

Electric - Integrated | | 2.04 | % |

TOTAL TOP TEN HOLDINGS | | 24.44 | % |

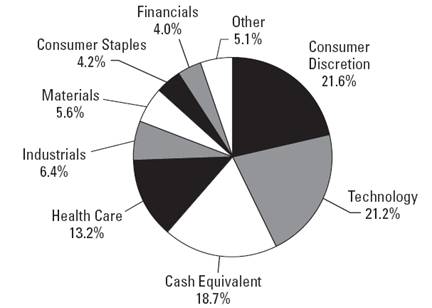

Portfolio Allocation by Industry Sector* | | June 30, 2012 |

Based on Total Investments | |

* Summary information above may differ from the portfolio schedule included in the financial statements due to the use of different classifications of securities for presentation purposes.

38

Global Resources Fund

Management Team’s Perspective

Introduction

The Global Resources Fund (PSPFX and PIPFX) is a non-diversified natural resources fund with the principal objective of achieving long-term growth of capital while providing protection against inflation and monetary instability. The fund invests globally in companies involved in the exploration, production, transportation and processing of petroleum, natural gas, industrial commodities, metals, minerals and forestry.

Performance Graph

Global Resources Fund

Average Annual Performance | | For the Periods Ended June 30, 2012 |

| | Six Month | | One Year | | Five Year | | Ten Year | | Since Inception

(Institutional

Class) | |

Global Resources Fund - Investor Class | | (2.35 | )% | (19.03 | )% | (3.90 | )% | 15.33 | % | n/a | |

Global Resources Fund - Institutional Class (Inception 3/1/10) | | (2.13 | )% | (18.62 | )% | n/a | | n/a | | 4.52 | % |

S&P 500 Index | | 9.49 | % | 5.45 | % | 0.22 | % | 5.32 | % | 11.20 | % |

Morgan Stanley Commodity Related Equity Index | | (6.14 | )% | (20.31 | )% | 2.56 | % | 12.98 | % | 1.79 | % |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 1.90% for the Investor Class. Also pursuant to a voluntary agreement, the Adviser has agreed to waive all class specific expenses of the Institutional Class. The Adviser can modify or terminate these arrangements at any time.

See Definitions for Management Teams’ Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

39

The Six Month Period In Review - Economic And Political Issues That Affected The Fund

Similar to last year, early equity market gains came under pressure by mid-year, as investor risk aversion to the possibility of a sovereign debt default in Europe increased. Additionally, a series of data points indicating a deceleration in China’s economy pressured emerging market stocks. Consequently, capital flowed out of risky assets and strengthened the U.S. dollar, which weighed on commodity prices. This was a significant driver for the underperformance of international equities versus U.S. stocks in the portfolio during the period. The S&P 500 Index gained 9.49 percent in the first half of 2012. The MSCI Emerging Markets Index underperformed the S&P 500 Index by over 500 basis points in the period, and the S&P GSCI Total Return Index declined 7.23 percent.

Given the ongoing global economic headwinds, as well as heightened investor risk aversion, the fund maintained a relatively balanced weighting between the energy and basic materials sectors in the portfolio. Fund management also held a higher weighting in large capitalization domestic resource companies.

Investment Highlights

Overview

For the six-month period ended June 30, 2012, the Investor Class of the Global Resources Fund declined 2.35 percent and the Institutional Class declined 2.13 percent, outperforming the fund’s benchmark, the Morgan Stanley Commodity Related Equity Index (CRX), which declined 6.14 percent.

Because the fund is actively managed and holding period is generally not a consideration in investment decisions, the portfolio turnover rate may fluctuate from year to year as the fund adjusts its portfolio composition. The fund’s annual portfolio turnover was, and is expected to continue to be, more than 100 percent.

Strengths

· Stock selection in the oil exploration industry boosted returns in the quarter with junior oil company Africa Oil Corp.(1) gaining nearly 400% on news of a sizeable oil discovery in a new basin in Kenya.

· The U.S. housing market appears to be recovering and the fund’s holdings in the new housing construction area performed well in the first half of the year. The fund benefited from gains in timber and forest stocks

40

including Weyerhaeuser Co.,(2) Plum Creek Timber Co., Inc.(3) and West Fraser Timber Co., Ltd.(4)

· Merger and acquisition activity in the natural resources sector slowed in the first half of 2012. However, the fund benefited from several transactions including the Glencore International plc(5) bid for Viterra, Inc.,(5) a Canadian-based grains processor, and a junior oil and gas exploration company in Colombia, PetroMagdelena Energy Corp.,(5) which was acquired by Pacific Rubiales Energy Corp.(6)

Weaknesses

· After a strong start to the year, oil prices fell to multi-year lows by May on economic slowdown concerns and easing of geo-political risk related to Iran. Natural gas prices in the U.S. also fell to 12-year lows on oversupply. Both of these factors weighed on upstream oil and gas stocks and oil services and equipment stocks in the first half, including Nabors Industries Ltd.,(7) SM Energy Co.(8) and HRT Participacoes Em Petroleo S.A.(5)

· Investor risk aversion continued to weigh on performance of junior exploration stocks through the first half. The S&P/TSX Venture Composite Index declined 19.85 percent, well below the 6.14 percent losses of the CRX Index. The portfolio has meaningful exposure to junior exploration stocks, and this overweighting created underperformance relative to the benchmark.

· Despite gold prices gaining more than 2 percent, precious metals stocks fell in the first six months, with the NYSE Arca Gold Miners Index down 12.72 percent. Our holdings in Coeur d’Alene Mines Corp.,(5) Randgold Resources Ltd.(5) and Gran Colombia Gold Corp.(9) contributed to losses.

Current Outlook

Opportunities

· Copper looks relatively attractive versus many other base metals as the refined copper industry is expected to be short in supply for another consecutive year in 2012. While demand growth expectations have been tempered, bringing on new capacity has been a challenge to the industry in recent years. Usage of copper stockpiles in China, the world’s largest copper consumer, has whittled down inventories to low levels, and the global stocks-to-use ratio remains tight, at roughly two weeks. Any unanticipated increase in demand for the remainder of 2012 could quickly tighten the market and push prices higher. We remain bullish on copper miners with solid balance sheets that can fund growth projects from cash flow.

41

· With the rapid development of North American oil and gas shale basins, including the Marcellus in Pennsylvania, the Eagle Ford in Texas and the Bakken in North Dakota, infrastructure constraints are being alleviated with new investment in assets to gather, process and transport growing oil and gas volumes. We believe certain Master Limited Partnerships (MLPs) with attractive assets and geographic locations will continue to allow investors to reap the benefits of the prolific development of shale plays in the U.S. and Canada.

· The agricultural and fertilizer sector remains promising. The growing middle class through emerging markets continues to consume more grains, principally through the production of more meat. While we have seen a surge in the production of grains, no additional farmland has been created. Therefore, one of the key ways we’re seeing increased yields out of crop lands is through the increased application of fertilizers. This has provided a boost in demand for nutrients such as potash, nitrogen and phosphate. The stock prices of agricultural chemicals companies were mixed in the first half of 2012 as expectations of volume growth were trimmed. However, recent price spikes in corn, wheat, and soy beans due to global drought conditions in key farming regions have provided a boost to potential application volumes. Farming economics remain very healthy given historically high grain prices, and we think earnings estimates will begin to move higher in 2012, driving the stocks higher as well.

Threats

· Further deterioration of the European debt crisis could result in a significant decline in global economic activity.

· A potential “hard landing” in China concerning economic growth could negatively impact incremental demand for many commodities. These risks include a chronic power shortage, auto sales deceleration, weak manufacturing sector data, property market corrections and monetary tightening.

(1)This security comprised 0.69% of the total net assets of the fund as of 06/30/12.

(2)This security comprised 0.10% of the total net assets of the fund as of 06/30/12.

(3)This security comprised 2.02% of the total net assets of the fund as of 06/30/12.

(4)This security comprised 2.47% of the total net assets of the fund as of 06/30/12.

(5)The fund did not hold this security at 06/30/12.

(6)This security comprised 0.04% of the total net assets of the fund as of 06/30/12.

(7)This security comprised 0.27 % of the total net assets of the fund as of 06/30/12.

(8)This security comprised 0.01% of the total net assets of the fund as of 06/30/12.

(9)This security comprised 1.40% of the total net assets of the fund as of 06/30/12.

42

Top 10 Holdings Based on Net Assets | | June 30, 2012 |

(excluding repurchase agreement) | |

Tyson Foods, Inc.

Food - Meat Products | | 2.78 | % |

HollyFrontier Corp.

Oil Refining & Marketing | | 2.65 | % |

West Fraser Timber Co., Ltd.

Forestry | | 2.47 | % |

Marathon Petroleum Corp.

Oil Companies - Integrated | | 2.33 | % |

Weyerhaeuser Co.

Real Estate Investment Trusts | | 2.22 | % |

Compass Minerals International, Inc.

Quarrying | | 2.20 | % |

Monsanto Co.

Agricultural Chemicals | | 2.19 | % |

Yamana Gold, Inc.

Gold Mining | | 2.18 | % |

Enterprise Products Partners, L.P.

Pipelines | | 2.16 | % |

Southern Copper Corp.

Metal - Copper | | 2.10 | % |

TOTAL TOP TEN HOLDINGS | | 23.28 | % |

43

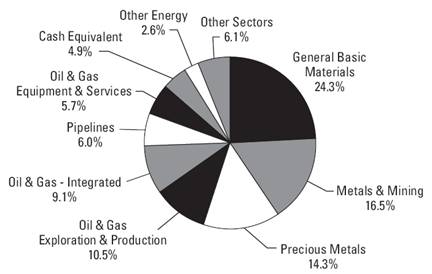

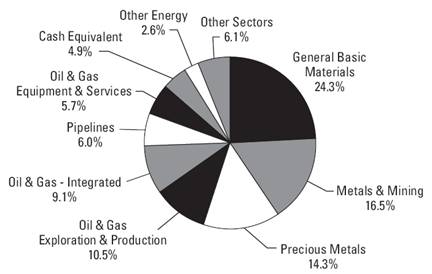

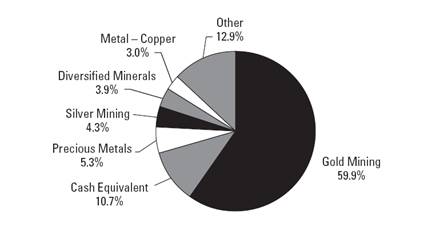

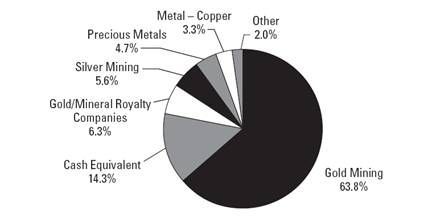

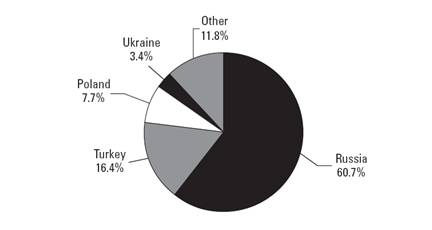

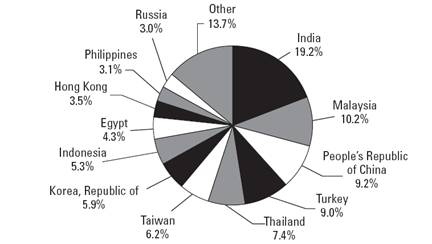

Portfolio Allocation by Industry Sector* | | June 30, 2012 |

Based on Total Investments | |

Energy: | | | | | |

Oil & Gas Exploration & Production | | 10.5 | % | | |

Oil & Gas - Integrated (includes Refining and Marketing) | | 9.1 | % | | |