UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-1800 |

|

U.S. GLOBAL INVESTORS FUNDS |

(Exact name of registrant as specified in charter) |

|

7900 CALLAGHAN ROAD SAN ANTONIO, TX | | 78229 |

(Address of principal executive offices) | | (Zip code) |

|

SUSAN B. MCGEE, ESQ. 7900 CALLAGHAN ROAD SAN ANTONIO, TX 78229 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 210-308-1234 | |

|

Date of fiscal year end: | DECEMBER 31, 2015 | |

|

Date of reporting period: | JUNE 30, 2015 | |

| | | | | | | | |

ITEM 1. REPORTS TO STOCKHOLDERS.

U.S. Global Investors Funds

Semi-Annual Report

June 30, 2015

U.S. Global Investors Funds

Semi-Annual Report

June 30, 2015

(unaudited)

Table of Contents

Message to Shareholders | 1 |

| |

Portfolio of Investments | 2 |

| |

Notes to Portfolios of Investments | 61 |

| |

Statements of Assets and Liabilities | 72 |

| |

Statements of Operations | 76 |

| |

Statements of Changes in Net Assets | 80 |

| |

Notes to Financial Statements | 86 |

| |

Financial Highlights | 102 |

| |

Additional Information | 113 |

| |

Expense Example | 114 |

| |

Privacy Policy | |

Nasdaq Symbols

U.S. Global Investors Funds

Investor Class

U.S. Government Securities Ultra-Short Bond Fund | | UGSDX |

| | |

Near-Term Tax Free Fund | | NEARX |

| | |

All American Equity Fund | | GBTFX |

| | |

Holmes Macro Trends Fund | | MEGAX |

| | |

Global Resources Fund | | PSPFX |

| | |

World Precious Minerals Fund | | UNWPX |

| | |

Gold and Precious Metals Fund | | USERX |

| | |

Emerging Europe Fund | | EUROX |

| | |

China Region Fund | | USCOX |

Institutional Class

Global Resources Fund | | PIPFX |

| | |

World Precious Minerals Fund | | UNWIX |

| | |

Gold and Precious Metals Fund* | | USEIX |

| | |

Emerging Europe Fund* | | EURIX |

* The Institutional Class shares of the Gold and Precious Metals and Emerging Europe Funds have not commenced operations and currently are closed to investors. A notice will be issued when each class commences operations and opens to investors.

Fund Services, LLC

PO Box 701

Milwaukee, WI

53201-0701

Tel 1.800.US.FUNDS

www.usfunds.com

U.S. Global Investors Funds

Dear Fellow Shareholder,

Did you know? The best way to receive timely updates on the events that impact your investments is to subscribe to our free e-newsletter, the Investor Alert.

With a balanced analysis of the markets over the week, the Investor Alert is written for you by the investment team with a special commentary from me.

There’s no need to wait for dated publications like the Semi-Annual Report. Your time is important, so read the newsletter awarded the Best Electronic Newsletter by the Mutual Fund Education Alliance! Sign up at www.usfunds.com/subscribe.

While you are visiting our website, www.usfunds.com, be sure to take a look at additional resources, prepared especially for our fund shareholders:

· My CEO Blog, Frank Talk, where I comment on current market topics

· Monthly fund commentaries, straight from the portfolio managers

· Up-to-date fund performance, including quarterly performance charts

· The Shareholder Report magazine, awarded the Best Shareholder Magazine for eight years!

We hope you enjoy all the resources at your fingertips.

Thank you for investing in U.S. Global Investors Funds!

Happy Investing,

Frank Holmes

CEO and Chief Investment Officer

U.S. Global Investors, Inc.

1

U.S. Government Securities Ultra-Short Bond Fund

Portfolio of Investments (unaudited) | | June 30, 2015 |

| | Coupon

Rate % | | Maturity

Date | | Principal

Amount | | Value | |

| | | | | | | | | |

United States Government and Agency Obligations 92.68% | | | | | | | | | |

| | | | | | | | | |

Federal Farm Credit Bank 30.25% | | | | | | | | | |

Fixed Rates: | | | | | | | | | |

| | 1.93 | | 12/02/19 | | $ | 3,984,000 | | $ | 4,003,048 | |

Variable Rates: | | | | | | | | | |

| | 0.14 | | 07/08/16 | | 2,000,000 | | 1,999,372 | |

| | 0.15 | | 01/30/17 | | 1,650,000 | | 1,649,733 | |

| | 0.18 | | 04/27/17 | | 10,000,000 | | 9,994,640 | |

| | | | | | | | 17,646,793 | |

| | | | | | | | | |

Federal Home Loan Bank 53.01% | | | | | | | | | |

Discount Notes: | | | | | | | | | |

Yield | | 0.13 | | 08/19/15 | | 1,000,000 | | 999,959 | |

Fixed Rates: | | | | | | | | | |

| | 2.88 | | 09/11/15 | | 1,000,000 | | 1,005,083 | |

| | 1.10 | | 12/22/16 | | 10,000,000 | | 10,062,709 | |

| | 5.13 | | 03/10/17 | | 1,000,000 | | 1,074,607 | |

| | 0.88 | | 09/27/17 | | 3,000,000 | | 3,003,192 | |

| | 1.13 | | 03/29/18 | | 750,000 | | 752,862 | |

| | 0.75 | | 06/29/18 | | 5,000,000 | | 5,002,820 | |

| | 1.70 | | 07/26/18 | | 3,000,000 | | 3,021,570 | |

| | 1.50 | | 03/08/19 | | 4,000,000 | | 4,023,916 | |

| | 1.22 | | 04/11/19 | | 2,000,000 | | 1,971,078 | |

| | | | | | | | 30,917,796 | |

| | | | | | | | | |

Tennessee Valley Authority 9.42% | | | | | | | | | |

Fixed Rates: | | | | | | | | | |

| | 6.25 | | 12/15/17 | | 2,930,000 | | 3,302,901 | |

| | 1.75 | | 10/15/18 | | 2,174,000 | | 2,194,010 | |

| | | | | | | | 5,496,911 | |

| | | | | | | | | |

Total United States Government and Agency Obligations | | | | | | | | | |

(cost $53,891,692) | | | | | | | | 54,061,500 | |

| | | | | | | | | | | |

See notes to portfolios of investments and notes to financial statements.

2

U.S. Government Securities Ultra-Short Bond Fund

Portfolio of Investments (unaudited) | | June 30, 2015 |

| | Coupon

Rate % | | Maturity

Date | | Principal

Amount | | Value | |

Overnight Cash Deposit 7.18% | | | | | | | | | |

| | | | | | | | | |

Wells Fargo Bank NA | | | | | | | | | |

(cost $4,190,186) | | 0.03 | | 07/01/15 | | $ | 4,190,186 | | $ | 4,190,186 | |

| | | | | | | | | |

Total Investments 99.86% | | | | | | | | | |

(cost $58,081,878) | | | | | | | | 58,251,686 | |

Other assets and liabilities, net 0.14% | | | | | | | | 80,117 | |

| | | | | | | | | |

Net Assets 100.0% | | | | | | | | $ | 58,331,803 | |

| | | | | | | | | | | |

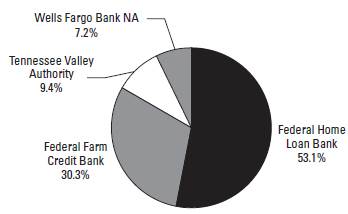

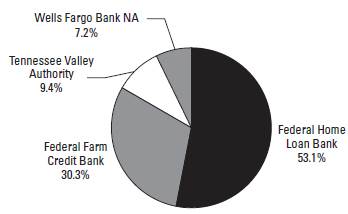

Portfolio Allocation by Issuer | | June 30, 2015 |

Based on Total Investments | |

Portfolio Allocation by Maturity | | June 30, 2015 |

1 - 3 Months | | $ | 6,195,228 | | 10.6 | % |

1 - 3 Years | | 36,842,836 | | 63.3 | % |

3 - 5 Years | | 15,213,622 | | 26.1 | % |

| | $ | 58,251,686 | | 100.0 | % |

See notes to portfolios of investments and notes to financial statements.

3

Near-Term Tax Free Fund

Portfolio of Investments (unaudited) | | June 30, 2015 |

| | Coupon

Rate % | | Maturity

Date | | Principal

Amount | | Value | |

Municipal Bonds 96.64% | | | | | | | | | |

| | | | | | | | | |

Alabama 2.31% | | | | | | | | | |

Alabama Public School & College Authority | | 5.00 | | 12/01/16 | | $ | 290,000 | | $ | 308,090 | |

Bessemer, Alabama Electric Revenue, Refunding | | 3.10 | | 12/01/21 | | 100,000 | | 103,886 | |

Bessemer, Alabama Water Revenue | | 4.00 | | 01/01/16 | | 500,000 | | 502,440 | |

Huntsville City, Alabama Electric System Revenue | | 4.00 | | 12/01/16 | | 60,000 | | 62,906 | |

Jasper Alabama Water Works & Sewer Board, Inc., Utilities Revenue, Series A | | 3.00 | | 06/01/16 | | 90,000 | | 92,016 | |

Limestone County, Water & Sewer Authority | | 2.25 | | 12/01/21 | | 365,000 | | 357,507 | |

Mobile Alabama, Refunding, Series B | | 5.00 | | 02/15/17 | | 45,000 | | 48,127 | |

University of Alabama at Birmingham, Hospital Revenue, Series A | | 5.00 | | 09/01/15 | | 600,000 | | 604,488 | |

| | | | | | | | 2,079,460 | |

| | | | | | | | | |

Alaska 0.39% | | | | | | | | | |

Alaska Municipal Bond Bank Authority, Unrefunded, Series A-2015 | | 4.00 | | 02/01/16 | | 125,000 | | 127,680 | |

Alaska Municipal Bond Bank Authority, Prerefunded, Series A-2015 | | 4.00 | | 02/01/16 | | 70,000 | | 71,485 | |

Alaska Municipal Bond Bank Authority, Prefunded, Series A | | 4.00 | | 02/01/16 | | 105,000 | | 107,227 | |

Valdez Alaska, School District, GO Unlimited | | 4.00 | | 06/30/17 | | 40,000 | | 42,278 | |

| | | | | | | | 348,670 | |

| | | | | | | | | |

Arizona 2.11% | | | | | | | | | |

Arizona Board of Regents Certificates of Participation, Series B | | 4.50 | | 06/01/16 | | 200,000 | | 207,178 | |

Arizona State School Facilities Board Certificates of Participation, Series A-1 | | 5.00 | | 09/01/17 | | 325,000 | | 327,428 | |

Arizona State Transportation Board Excise Tax Revenue | | 5.00 | | 07/01/17 | | 175,000 | | 189,744 | |

Flagstaff, Arizona, Revenue, Refunding | | 3.00 | | 07/01/15 | | 600,000 | | 600,000 | |

McAllister Academic Village LLC, Arizona State University Hassayampa Revenue, Refunding | | 5.75 | | 07/01/18 | | 200,000 | | 225,356 | |

Page, Arizona, Pledged Revenue, Refunding | | 3.00 | | 07/01/16 | | 350,000 | | 358,981 | |

| | | | | | | | 1,908,687 | |

| | | | | | | | | |

California 3.84% | | | | | | | | | |

California State, GO Unlimited | | 5.00 | | 03/01/32 | | 300,000 | | 309,108 | |

California State, GO Unlimited | | 4.75 | | 03/01/34 | | 205,000 | | 209,918 | |

California State, Recreational Facility, Refunding, GO Unlimited | | 5.00 | | 12/01/19 | | 5,000 | | 5,017 | |

| | | | | | | | | | | |

See notes to portfolios of investments and notes to financial statements.

4

Near-Term Tax Free Fund

Portfolio of Investments (unaudited) | | June 30, 2015 |

| | Coupon

Rate % | | Maturity

Date | | Principal

Amount | | Value | |

Municipal Bonds (cont’d) | | | | | | | | | |

| | | | | | | | | |

California (cont’d) | | | | | | | | | |

California State, Health Facilities Financing Authority, Cedars Sinai Medical Center | | 5.00 | | 08/15/15 | | $ | 500,000 | | $ | 502,875 | |

California State, Statewide Communities Development Authority, Enloe Medical Center Revenue, Series A | | 5.25 | | 08/15/18 | | 340,000 | | 382,218 | |

Chaffey Community College District, GO Unlimited, Series C | | 5.00 | | 06/01/32 | | 300,000 | | 324,696 | |

Delano, California Union High School District, Refunding, GO Unlimited, Series A | | 4.75 | | 02/01/17 | | 200,000 | | 212,360 | |

Fresno Unified School District, GO Unlimited | | 4.00 | | 08/01/15 | | 200,000 | | 200,620 | |

Los Angeles Unified School District, Election 2004, GO Unlimited, Series H | | 5.00 | | 07/01/32 | | 200,000 | | 213,566 | |

Santa Clara County, California Financing Authority Revenue, Obstetrics and Gynecology, El Camino Hospital | | 5.00 | | 02/01/18 | | 350,000 | | 380,940 | |

Santa Clara Valley Transportation Authority, Series A | | 5.00 | | 04/01/27 | | 370,000 | | 398,608 | |

Santa Paula Schools Financing Authority, Santa Paula Elementary School District Revenue | | 4.25 | | 11/01/22 | | 300,000 | | 320,721 | |

| | | | | | | | 3,460,647 | |

| | | | | | | | | |

Colorado 2.06% | | | | | | | | | |

Colorado State Department of Transportation, Series B | | 5.00 | | 12/15/15 | | 490,000 | | 500,422 | |

Denver, Colorado, Health & Hospital Authority, Healthcare Revenue, Series A | | 5.00 | | 12/01/16 | | 265,000 | | 279,612 | |

Pueblo County, School District No. 70, GO Unlimited | | 4.00 | | 12/01/24 | | 990,000 | | 1,086,267 | |

| | | | | | | | 1,866,301 | |

| | | | | | | | | |

Connecticut 1.51% | | | | | | | | | |

Connecticut State Health & Educational Facilities Authority Revenue, Bridgeport Hospital, Series D | | 5.00 | | 07/01/19 | | 395,000 | | 442,440 | |

Connecticut State Health & Educational Facilities Authority Revenue, William Backus Hospital, Series G | | 5.00 | | 07/01/25 | | 500,000 | | 500,000 | |

Connecticut State Health & Educational Facilities Authority Revenue, William Backus Hospital, Series G | | 4.00 | | 07/01/20 | | 425,000 | | 425,000 | |

| | | | | | | | 1,367,440 | |

| | | | | | | | | | | |

See notes to portfolios of investments and notes to financial statements.

5

Near-Term Tax Free Fund

Portfolio of Investments (unaudited) | | June 30, 2015 |

| | Coupon

Rate % | | Maturity

Date | | Principal

Amount | | Value | |

Municipal Bonds (cont’d) | | | | | | | | | |

| | | | | | | | | |

District of Columbia 0.67% | | | | | | | | | |

District of Columbia Income Tax Revenue, Series A | | 5.25 | | 12/01/27 | | $ | 300,000 | | $ | 345,678 | |

Washington D.C. Convention Center Authority Dedicated Tax Revenue, Refunding, Series A | | 5.00 | | 10/01/16 | | 250,000 | | 263,398 | |

| | | | | | | | 609,076 | |

| | | | | | | | | |

Florida 9.97% | | | | | | | | | |

Broward County, Florida, Civic Arena Project, Refunding, Series A | | 5.00 | | 09/01/20 | | 500,000 | | 524,875 | |

Broward County, Florida School Board Certificates of Participation, Series A | | 5.00 | | 07/01/15 | | 325,000 | | 325,000 | |

Cape Coral, Florida Gas Tax Revenue, Series A | | 4.00 | | 10/01/16 | | 255,000 | | 265,401 | |

Citizens Property Insurance Co., Senior Secured, Coastal Account, Revenue, Series A-1 | | 4.00 | | 06/01/18 | | 100,000 | | 107,429 | |

Delray Beach Florida, Utilities Tax Revenue, Refunding | | 5.00 | | 06/01/23 | | 505,000 | | 602,202 | |

Escambia County, Florida, Health Facilities Authority Revenue, Baptist Hospital, Inc. Project, Series A | | 5.00 | | 08/15/19 | | 290,000 | | 323,417 | |

Florida Gulf Coast University Financing Corp., Capital Improvement Revenue, Series B | | 3.00 | | 02/01/16 | | 365,000 | | 370,161 | |

Florida State Board of Education Lottery Revenue, Series B | | 5.00 | | 07/01/26 | | 100,000 | | 108,765 | |

Florida State Board of Governors Parking Facility Revenue, Series A | | 3.00 | | 07/01/17 | | 300,000 | | 312,555 | |

Florida State Department of Management Services Certificates of Participation, Refunding, Series A | | 5.00 | | 08/01/19 | | 500,000 | | 572,450 | |

Florida State Department of Management Services Certificates of Participation, Series A | | 5.00 | | 08/01/24 | | 340,000 | | 381,987 | |

Florida State Municipal Power Agency, Stanton Project Revenue, Refunding | | 5.13 | | 10/01/17 | | 300,000 | | 327,363 | |

Fort Pierce, Florida Stormwater Utilities Revenue | | 4.50 | | 10/01/17 | | 255,000 | | 257,420 | |

Hillsborough County, Florida School Board, Refunding, Series A | | 4.25 | | 07/01/25 | | 300,000 | | 325,347 | |

Hillsborough County, Florida School Board, Certificates of Participation, Refunding | | 4.00 | | 07/01/19 | | 100,000 | | 105,560 | |

Jacksonville Florida Special Revenue, Series C | | 5.00 | | 10/01/20 | | 270,000 | | 312,836 | |

Kissimmee Utility Authority, Revenue, Refunding | | 4.00 | | 10/01/15 | | 475,000 | | 479,156 | |

| | | | | | | | | | | |

See notes to portfolios of investments and notes to financial statements.

6

Near-Term Tax Free Fund

Portfolio of Investments (unaudited) | | June 30, 2015 |

| | Coupon

Rate % | | Maturity

Date | | Principal

Amount | | Value | |

Municipal Bonds (cont’d) | | | | | | | | | |

| | | | | | | | | |

Florida (cont’d) | | | | | | | | | |

Leesburg, Florida Capital Improvement Revenue Bonds, Refunding | | 5.00 | | 10/01/21 | | $ | 405,000 | | $ | 458,367 | |

Manatee County, Florida, Revenue, Refunding | | 5.00 | | 10/01/15 | | 420,000 | | 424,796 | |

Margate, Florida Water & Sewer Revenue, Refunding | | 4.00 | | 10/01/19 | | 250,000 | | 264,563 | |

Miami - Dade County, Florida Expressway Authority Toll System Revenue, Series A | | 5.00 | | 07/01/21 | | 430,000 | | 501,909 | |

Miami - Dade County, Florida Water & Sewer Revenue System, Series A | | 4.00 | | 10/01/16 | | 235,000 | | 245,032 | |

Orlando, Florida Community Redevelopment Agency Tax Increment Revenue, Downtown District, Series A | | 4.00 | | 09/01/17 | | 275,000 | | 284,710 | |

Polk County, Florida School District Revenue | | 5.00 | | 10/01/17 | | 215,000 | | 233,417 | |

Reedy Creek, Florida Improvement District Utilities Revenue, Refunding, Series 2 | | 5.00 | | 10/01/16 | | 300,000 | | 303,201 | |

Saint Johns County, Florida Transportation Revenue, Refunding | | 5.00 | | 10/01/20 | | 310,000 | | 361,711 | |

Volusia County, Florida School Board Sales Tax Revenue | | 4.20 | | 10/01/16 | | 200,000 | | 208,522 | |

| | | | | | | | 8,988,152 | |

| | | | | | | | | |

Georgia 2.38% | | | | | | | | | |

Atlanta Downtown Development Authority, Series A | | 4.25 | | 12/01/16 | | 250,000 | | 257,880 | |

Carroll City-County, Georgia Hospital Authority, Tanner Medical Center, Inc. Project | | 5.00 | | 07/01/18 | | 600,000 | | 666,870 | |

Georgia State Municipal Electric Authority Revenue, Unrefunded | | 5.50 | | 01/01/20 | | 80,000 | | 85,637 | |

Georgia State Municipal Gas Authority, Toccoa Project, Refunding | | 5.00 | | 06/01/22 | | 600,000 | | 692,508 | |

Glynn-Brunswick Memorial Hospital Authority, Southeast Georgia Health System and Affiliates Revenue, Anticipation Certificates, Series A | | 4.50 | | 08/01/17 | | 150,000 | | 160,470 | |

Gwinnett County, Georgia, Hospital Authority, Gwinnett Hospital Systems Revenue, Series B | | 5.00 | | 07/01/18 | | 250,000 | | 277,395 | |

| | | | | | | | 2,140,760 | |

| | | | | | | | | |

Guam 0.28% | | | | | | | | | |

Guam Education Financing Foundation Certificate of Participation, Series A | | 4.25 | | 10/01/18 | | 250,000 | | 257,045 | |

| | | | | | | | | | | |

See notes to portfolios of investments and notes to financial statements.

7

Near-Term Tax Free Fund

Portfolio of Investments (unaudited) | | June 30, 2015 |

| | Coupon

Rate % | | Maturity

Date | | Principal

Amount | | Value | |

Municipal Bonds (cont’d) | | | | | | | | | |

| | | | | | | | | |

Idaho 0.29% | | | | | | | | | |

Idaho Housing & Finance Association, Grant & Revenue Anticipation, Federal Highway Trust Fund, Series A | | 5.00 | | 07/15/21 | | $ | 225,000 | | $ | 259,133 | |

| | | | | | | | | |

Illinois 8.47% | | | | | | | | | |

Aurora, Illinois, GO Unlimited, Series B | | 3.00 | | 12/30/15 | | 200,000 | | 202,382 | |

Chicago Board of Education, GO Unlimited | | 5.25 | | 12/01/19 | | 300,000 | | 324,549 | |

Chicago Board of Education, Dedicated Revenues, GO Unlimited, Series F | | 5.00 | | 12/01/16 | | 300,000 | | 306,138 | |

Chicago, Illinois, City Colleges, GO Unlimited | | 5.00 | | 01/01/17 | | 115,000 | | 118,725 | |

Chicago, Illinois, Direct Access Bond, GO Unlimited, Series E-1 B | | 4.00 | | 01/01/19 | | 200,000 | | 200,542 | |

Chicago, Illinois, O’Hare International Airport Revenue, Gen - Third Lien, Series C | | 5.25 | | 01/01/23 | | 250,000 | | 284,235 | |

Clinton Bond Fayette Etc Counties Community College District No. 501 Kaskaskia, GO Unlimited | | 5.75 | | 12/01/19 | | 500,000 | | 576,125 | |

Du Page County, Refunding, GO Unlimited | | 5.60 | | 01/01/21 | | 385,000 | | 431,531 | |

Du Page County School District No. 33 West Chicago, Refunding, Series B | | 4.00 | | 12/01/21 | | 1,000,000 | | 1,096,289 | |

Illinois Finance Authority, Shedd Aquarium Society Project, Refunding | | 5.00 | | 07/01/16 | | 390,000 | | 391,256 | |

Illinois Metropolitan Pier & Exposition Authority, Unrefunded (ZCB) | | 1.71 | (1) | 06/15/18 | | 415,000 | | 395,993 | |

Illinois Regional Transportation Authority, Series A | | 7.20 | | 11/01/20 | | 165,000 | | 190,144 | |

Illinois State, Refunding, GO Unlimited | | 5.00 | | 01/01/16 | | 300,000 | | 305,952 | |

Illinois State, GO Unlimited | | 5.00 | | 03/01/16 | | 340,000 | | 348,935 | |

Illinois State, GO Unlimited | | 5.00 | | 05/01/18 | | 1,000,000 | | 1,062,839 | |

Illinois State Toll Highway Authority, Toll Highway Revenue, Series A | | 5.00 | | 01/01/16 | | 200,000 | | 200,000 | |

Lake & McHenry County, Fox Lake, Illinois, Debt Certificates, Series B | | 3.00 | | 11/01/19 | | 265,000 | | 273,353 | |

Springfield, Illinois Metropolitan Sanitation District, Sewer Revenue, Senior Lien, Series A | | 4.00 | | 01/01/17 | | 570,000 | | 596,374 | |

Will Grundy Etc Counties Community College District No. 525, Joliet Junior College Project, GO Unlimited | | 6.25 | | 06/01/22 | | 300,000 | | 342,903 | |

| | | | | | | | 7,648,265 | |

| | | | | | | | | |

Indiana 2.41% | | | | | | | | | |

Fort Wayne, Indiana Waterworks Utility Revenue | | 2.00 | | 12/01/16 | | 585,000 | | 596,092 | |

| | | | | | | | | | | |

See notes to portfolios of investments and notes to financial statements.

8

Near-Term Tax Free Fund

Portfolio of Investments (unaudited) | | June 30, 2015 |

| | Coupon

Rate % | | Maturity

Date | | Principal

Amount | | Value | |

Municipal Bonds (cont’d) | | | | | | | | | |

| | | | | | | | | |

Indiana (cont’d) | | | | | | | | | |

Indianapolis Local Public Improvement Bond Bank, Waterworks Project, Series 2007 L | | 5.25 | | 01/01/33 | | $ | 305,000 | | $ | 329,620 | |

Merrillville Redevelopment Authority | | 5.00 | | 08/15/20 | | 350,000 | | 400,925 | |

Tri-Creek 2002 High School Building | | 5.00 | | 07/15/19 | | 800,000 | | 851,080 | |

| | | | | | | | 2,177,717 | |

| | | | | | | | | |

Iowa 0.68% | | | | | | | | | |

Johnston Community School District, GO Unlimited | | 4.00 | | 06/01/16 | | 190,000 | | 190,460 | |

University of Iowa Hospitals and Clinics, Iowa State Board of Regents, Hospital Revenue, Series A | | 3.00 | | 09/01/19 | | 400,000 | | 424,896 | |

| | | | | | | | 615,356 | |

| | | | | | | | | |

Kansas 2.32% | | | | | | | | | |

Douglas County, Kansas, Unified School District No. 497 Lawrence, GO Unlimited, Series A | | 3.00 | | 09/01/15 | | 1,225,000 | | 1,230,426 | |

Johnson County Public Building Commission, Series B | | 2.00 | | 09/01/15 | | 355,000 | | 355,994 | |

Kansas State Development Finance Authority Revenue | | 4.00 | | 10/01/15 | | 450,000 | | 454,086 | |

Sedgwick County, Kansas, Unified School District No. 266 Maize, GO Unlimited | | 5.00 | | 09/01/17 | | 50,000 | | 53,748 | |

| | | | | | | | 2,094,254 | |

| | | | | | | | | |

Kentucky 3.70% | | | | | | | | | |

Bowling Green, Kentucky, GO Unlimited, Series B | | 4.00 | | 09/01/16 | | 215,000 | | 223,714 | |

Jefferson County School District Finance, Refunding, Series B | | 4.00 | | 12/01/22 | | 500,000 | | 555,030 | |

Kentucky Asset Liability Commission, University of Kentucky Project, Series A | | 5.00 | | 10/01/15 | | 1,000,000 | | 1,011,419 | |

Kentucky Asset Liability Commission, Federal Highway Trust Fund | | 5.00 | | 09/01/17 | | 450,000 | | 487,832 | |

Kentucky Municipal Power Agency, Power System Revenue, Prairie State Project, Series A | | 5.25 | | 09/01/22 | | 440,000 | | 480,414 | |

Louisville & Jefferson County Metropolitan Sewer District, Series A | | 5.00 | | 05/15/23 | | 500,000 | | 588,805 | |

| | | | | | | | 3,347,214 | |

| | | | | | | | | | | |

See notes to portfolios of investments and notes to financial statements.

9

Near-Term Tax Free Fund

Portfolio of Investments (unaudited) | | June 30, 2015 |

| | Coupon

Rate % | | Maturity

Date | | Principal

Amount | | Value | |

Municipal Bonds (cont’d) | | | | | | | | | |

| | | | | | | | | |

Louisiana 3.30% | | | | | | | | | |

Louisiana State, Citizens Property Insurance Corp., Revenue Bonds, Series B | | 5.00 | | 06/01/21 | | $ | 245,000 | | $ | 254,033 | |

Shreveport, Louisiana, Refunding | | 5.00 | | 05/01/16 | | 2,620,000 | | 2,716,939 | |

| | | | | | | | 2,970,972 | |

| | | | | | | | | |

Massachusetts 0.26% | | | | | | | | | |

Stoughton, Massachusetts Public Improvement, GO Limited | | 4.00 | | 05/01/17 | | 225,000 | | 231,487 | |

| | | | | | | | | |

Michigan 4.22% | | | | | | | | | |

Detroit, Michigan Local Development Financing Authority, Refunding, Series A | | 5.38 | | 05/01/18 | | 105,000 | | 105,239 | |

Detroit, Michigan Sewer Disposal Revenue, Refunding, Series C-1 | | 5.25 | | 07/01/15 | | 400,000 | | 400,000 | |

Gibraltar, Michigan School District, Refunding | | 5.00 | | 05/01/21 | | 475,000 | | 546,991 | |

Michigan Public Power Agency AFEC Project Revenue, Series A | | 4.50 | | 01/01/19 | | 280,000 | | 299,550 | |

Michigan State, Trunk Line Revenue, Refunding | | 4.50 | | 11/01/26 | | 105,000 | | 116,913 | |

Michigan State Grant Anticipation Bonds | | 5.00 | | 09/15/16 | | 200,000 | | 210,308 | |

Michigan State Hospital Finance Authority, Trinity Health, Series A | | 6.00 | | 12/01/18 | | 200,000 | | 230,608 | |

Michigan Strategic Fund, Series A | | 5.00 | | 10/15/17 | | 200,000 | | 218,326 | |

Portage Public Schools, School Building & Site, GO Unlimited | | 5.00 | | 05/01/20 | | 300,000 | | 331,155 | |

Romeo Community School District, Refunding, GO Unlimited | | 3.00 | | 05/01/18 | | 500,000 | | 525,585 | |

Wayne County, Michigan Airport Authority Revenue, Detroit Metropolitan Airport, Refunding, Series C | | 4.00 | | 12/01/19 | | 255,000 | | 277,063 | |

Zeeland Public Schools, Refunding, GO Unlimited | | 5.00 | | 05/01/18 | | 490,000 | | 538,304 | |

| | | | | | | | 3,800,042 | |

| | | | | | | | | |

Minnesota 0.72% | | | | | | | | | |

Minneapolis & St Paul, Minnesota Housing & Redevelopment Authority Health Care Systems, Children’s Health Care, Series B | | 4.00 | | 08/15/16 | | 250,000 | | 258,865 | |

Minneapolis & St Paul, Minnesota Metropolitan Airports Commission, Airport Revenue, Airport Revenue, Refunding, Series B | | 5.00 | | 01/01/19 | | 255,000 | | 270,596 | |

Royalton Independent School District No. 485, GO Unlimited, Series A | | 5.00 | | 02/01/17 | | 110,000 | | 117,459 | |

| | | | | | | | 646,920 | |

| | | | | | | | | | | |

See notes to portfolios of investments and notes to financial statements.

10

Near-Term Tax Free Fund

Portfolio of Investments (unaudited) | | June 30, 2015 |

| | Coupon

Rate % | | Maturity

Date | | Principal

Amount | | Value | |

Municipal Bonds (cont’d) | | | | | | | | | |

| | | | | | | | | |

Mississippi 0.33% | | | | | | | | | |

Madison County School District, Refunding | | 3.75 | | 08/01/15 | | $ | 300,000 | | $ | 300,780 | |

| | | | | | | | | |

Missouri 0.90% | | | | | | | | | |

Kansas City, Missouri Water Revenue, Series F | | 4.00 | | 12/01/22 | | 250,000 | | 282,955 | |

Missouri Development Finance Board, Eastland Center Project, Tax Allocation, Series A | | 5.00 | | 04/01/17 | | 250,000 | | 264,698 | |

Missouri State Health & Educational Facilities Authority, Southwestern Baptist University Revenue | | 3.00 | | 10/01/17 | | 265,000 | | 268,609 | |

| | | | | | | | 816,262 | |

| | | | | | | | | |

Nevada 0.12% | | | | | | | | | |

Clark County, Nevada, GO Limited | | 5.00 | | 11/01/18 | | 100,000 | | 106,061 | |

| | | | | | | | | |

New Hampshire 0.48% | | | | | | | | | |

New Hampshire Health & Education Facilities Authority Revenue, Southern New Hampshire University Project | | 5.00 | | 01/01/18 | | 400,000 | | 429,768 | |

| | | | | | | | | |

New Jersey 3.67% | | | | | | | | | |

Atlantic City, New Jersey, Refunding Tax Appeal, GO Limited | | 4.00 | | 11/01/18 | | 500,000 | | 422,715 | |

Atlantic City, New Jersey Municipal Utilities Authority Revenue, Refunding | | 5.00 | | 06/01/17 | | 150,000 | | 153,020 | |

Elizabeth, New Jersey Parking Authority Project Revenue, Elizabethtown Plaza Redevelopment, Series B | | 4.00 | | 11/01/17 | | 255,000 | | 265,906 | |

Hudson County, New Jersey Improvement Authority Lease Revenue, North Hudson Regional Fire, Refunding, Series A | | 5.63 | | 09/01/18 | | 400,000 | | 436,640 | |

New Jersey Economic Development Authority Revenue, School Facilities Construction, Refunding | | 5.00 | | 12/15/18 | | 710,000 | | 766,473 | |

New Jersey Health Care Facilities Financing Authority Revenue, Holy Name Medical Center, Refunding | | 5.00 | | 07/01/19 | | 215,000 | | 239,768 | |

New Jersey Transportation Trust Fund Authority, Series A | | 5.00 | | 06/15/16 | | 440,000 | | 454,929 | |

Passaic Valley, New Jersey, Sewage Commissioners Revenue, Series G | | 5.75 | | 12/01/21 | | 500,000 | | 582,075 | |

| | | | | | | | 3,321,526 | |

| | | | | | | | | | | |

See notes to portfolios of investments and notes to financial statements.

11

Near-Term Tax Free Fund

Portfolio of Investments (unaudited) | | June 30, 2015 |

| | Coupon

Rate % | | Maturity

Date | | Principal

Amount | | Value | |

Municipal Bonds (cont’d) | | | | | | | | | |

| | | | | | | | | |

New Mexico 0.82% | | | | | | | | | |

Clayton, New Mexico, Jail Project Revenue | | 4.00 | | 11/01/17 | | $ | 235,000 | | $ | 239,268 | |

Los Alamos County, New Mexico, Sales Tax Revenue | | 5.75 | | 06/01/16 | | 470,000 | | 492,240 | |

| | | | | | | | 731,508 | |

| | | | | | | | | |

New York 5.91% | | | | | | | | | |

Arlington Central School District, GO Unlimited | | 5.00 | | 12/15/25 | | 1,000,000 | | 1,186,699 | |

Buffalo, New York, Refunding, Series C | | 4.00 | | 12/01/15 | | 400,000 | | 405,936 | |

Ithaca, New York, Refunding, GO Limited, Series A | | 3.00 | | 01/15/16 | | 750,000 | | 761,010 | |

Long Island Power Authority Revenue, New York Electric Systems, Series E | | 5.00 | | 12/01/17 | | 330,000 | | 349,054 | |

Long Island Power Authority Revenue, Series B | | 5.00 | | 09/01/21 | | 465,000 | | 535,480 | |

Metropolitan Transportation Authority, Series D | | 5.00 | | 11/15/15 | | 375,000 | | 381,375 | |

Nassau County Industrial Development Agency, New York Institute of Technology Project Revenue, Refunding, Remarketing, Series A | | 5.00 | | 03/01/21 | | 350,000 | | 386,092 | |

New York State Dormitory Authority, Series A | | 2.00 | | 10/01/15 | | 500,000 | | 502,040 | |

New York State Dormitory Authority, Nonconstruction Supported Debt, Municipal Facilities Health Lease, Series 1 | | 5.00 | | 01/15/17 | | 300,000 | | 319,059 | |

Patchogue-Medford Union Free School District, GO Unlimited | | 5.00 | | 10/01/17 | | 465,000 | | 506,999 | |

| | | | | | | | 5,333,744 | |

| | | | | | | | | |

North Carolina 3.06% | | | | | | | | | |

Beaufort County, North Carolina, GO Limited | | 5.00 | | 06/01/21 | | 200,000 | | 228,812 | |

Charlotte, North Carolina Certificates of Participation, Series A | | 5.00 | | 10/01/21 | | 1,000,000 | | 1,168,999 | |

North Carolina State, Capital Improvement Limited Obligation, Series 2011A | | 5.00 | | 05/01/16 | | 300,000 | | 311,454 | |

North Carolina State Grant Anticipation, Series 2015 | | 5.00 | | 03/01/16 | | 590,000 | | 606,803 | |

North Carolina State Municipal Power Agency #1, Catawba Electric Revenue, Refunding, Series A | | 5.25 | | 01/01/20 | | 400,000 | | 442,160 | |

| | | | | | | | 2,758,228 | |

| | | | | | | | | |

Ohio 1.37% | | | | | | | | | |

Cleveland, Ohio, Parking Facility Revenue, Prefunding, Refunding | | 5.25 | | 09/15/22 | | 130,000 | | 157,778 | |

| | | | | | | | | | | |

See notes to portfolios of investments and notes to financial statements.

12

Near-Term Tax Free Fund

Portfolio of Investments (unaudited) | | June 30, 2015 |

| | Coupon

Rate % | | Maturity

Date | | Principal

Amount | | Value | |

Municipal Bonds (cont’d) | | | | | | | | | |

| | | | | | | | | |

Ohio (cont’d) | | | | | | | | | |

Lorain County, Ohio, Community College District, Revenue | | 3.25 | | 12/01/17 | | $ | 650,000 | | $ | 680,830 | |

Marion County, Ohio, Variable Refunding, GO Limited | | 4.00 | | 12/01/20 | | 150,000 | | 156,746 | |

Springfield City School District, GO Unlimited | | 3.75 | | 12/01/15 | | 250,000 | | 253,593 | |

| | | | | | | | 1,248,947 | |

| | | | | | | | | |

Oklahoma 1.10% | | | | | | | | | |

Edmond Public Works Authority, Revenue, Refunding | | 5.00 | | 07/01/23 | | 300,000 | | 350,523 | |

Oklahoma Capital Improvement Authority, Series A | | 4.00 | | 07/01/15 | | 300,000 | | 300,000 | |

Oklahoma State Agricultural & Mechanical Colleges, Oklahoma State University, Series A | | 5.00 | | 08/01/21 | | 300,000 | | 347,256 | |

| | | | | | | | 997,779 | |

| | | | | | | | | |

Oregon 0.25% | | | | | | | | | |

Oregon State Facilities Authority, Legacy Health Project Revenue, Refunding, Series A | | 4.50 | | 05/01/20 | | 200,000 | | 225,506 | |

| | | | | | | | | |

Pennsylvania 2.95% | | | | | | | | | |

Allegheny County, Pennsylvania Sanitary Authority | | 5.00 | | 06/01/19 | | 700,000 | | 794,234 | |

Commonwealth of Pennsylvania | | 5.00 | | 07/01/15 | | 250,000 | | 250,000 | |

Delaware Valley, Pennsylvania, Regional Financial Authority Revenue, Permanently Fixed Business Development Services | | 5.50 | | 08/01/18 | | 295,000 | | 328,946 | |

Lycoming County, Pennsylvania Authority Health System, Susquehanna Health Systems Project, Series A | | 5.10 | | 07/01/20 | | 140,000 | | 155,243 | |

Philadelphia School District, Pennsylvania, Refunding, GO Unlimited, Series E | | 5.25 | | 09/01/24 | | 625,000 | | 694,175 | |

Reading, Pennsylvania School District, GO Unlimited, Series A | | 5.00 | | 04/01/20 | | 400,000 | | 438,760 | |

| | | | | | | | 2,661,358 | |

| | | | | | | | | |

Puerto Rico 0.75% | | | | | | | | | |

Commonwealth of Puerto Rico, GO Unlimited, Series A | | 5.00 | | 07/01/15 | | 225,000 | | 225,000 | |

Puerto Rico Infrastructure Financing Authority, Special Tax Revenue, Refunding, Series C | | 5.50 | | 07/01/17 | | 445,000 | | 448,734 | |

| | | | | | | | 673,734 | |

| | | | | | | | | | | |

See notes to portfolios of investments and notes to financial statements.

13

Near-Term Tax Free Fund

Portfolio of Investments (unaudited) | | June 30, 2015 |

| | Coupon

Rate % | | Maturity

Date | | Principal

Amount | | Value | |

Municipal Bonds (cont’d) | | | | | | | | | |

| | | | | | | | | |

Rhode Island 0.29% | | | | | | | | | |

Rhode Island State Economic Development Corporation Revenue, Series A | | 5.00 | | 06/15/17 | | $ | 250,000 | | $ | 260,070 | |

| | | | | | | | | |

South Carolina 1.28% | | | | | | | | | |

Piedmont Municipal Power Agency, Series A-3 | | 5.00 | | 01/01/16 | | 150,000 | | 153,236 | |

Spartanburg County, South Carolina Regional Health Services District, Hospital Revenue, Refunding, Series A | | 5.00 | | 04/15/19 | | 600,000 | | 675,600 | |

Spartanburg County, South Carolina Sanitation Sewer District, Series A | | 3.50 | | 03/01/19 | | 300,000 | | 321,687 | |

| | | | | | | | 1,150,523 | |

| | | | | | | | | |

Tennessee 0.26% | | | | | | | | | |

Memphis, Tennessee Sanitary Sewage System Revenue, Refunding | | 5.00 | | 05/01/20 | | 200,000 | | 231,818 | |

| | | | | | | | | |

Texas 15.08% | | | | | | | | | |

Addison, Texas Certificates of Obligation, GO Limited | | 4.50 | | 02/15/28 | | 140,000 | | 149,772 | |

Addison, Texas Certificates of Obligation, GO Unlimited | | 4.00 | | 02/15/20 | | 250,000 | | 266,920 | |

Annetta, Texas Certificates of Obligation, GO Limited | | 4.00 | | 08/01/16 | | 200,000 | | 207,260 | |

Beaumont Independent School District, GO Unlimited | | 5.00 | | 02/15/23 | | 1,000,000 | | 1,065,809 | |

Brownsville Independent School District, GO Unlimited | | 5.00 | | 08/15/17 | | 455,000 | | 457,434 | |

Brownwood Independent School District, GO Unlimited | | 4.00 | | 02/15/24 | | 730,000 | | 801,854 | |

Center, Texas Certificates of Obligation, GO Limited (ZCB) | | 3.39 | (1) | 02/15/20 | | 150,000 | | 135,366 | |

Clear Lake, Texas, Waterworks & Sewer System, GO Unlimited | | 3.00 | | 03/01/19 | | 125,000 | | 129,291 | |

Conroe Independent School District, GO Unlimited | | 4.00 | | 02/15/17 | | 55,000 | | 57,934 | |

Corpus Christi, Texas Business & Job Development Corporation, Seawall Project, Sales Tax Revenue, Refunding | | 5.00 | | 03/01/20 | | 350,000 | | 398,591 | |

Dallas, Texas Waterworks & Sewer System Revenue, Prerefunded | | 4.50 | | 10/01/19 | | 60,000 | | 64,937 | |

Dallas, Texas Waterworks & Sewer System Revenue, Unrefunded | | 4.50 | | 10/01/19 | | 165,000 | | 177,698 | |

Denton County, Texas Fresh Water Supply District No. 10, GO Limited | | 2.00 | | 09/01/15 | | 150,000 | | 150,383 | |

Forney, Texas, GO Limited | | 5.00 | | 02/15/27 | | 500,000 | | 535,075 | |

| | | | | | | | | | | |

See notes to portfolios of investments and notes to financial statements.

14

Near-Term Tax Free Fund

Portfolio of Investments (unaudited) | | June 30, 2015 |

| | Coupon

Rate % | | Maturity

Date | | Principal

Amount | | Value | |

Municipal Bonds (cont’d) | | | | | | | | | |

| | | | | | | | | |

Texas (cont’d) | | | | | | | | | |

Frisco, Texas Independent School District, School Building, GO Unlimited, Series A | | 4.50 | | 08/15/25 | | $ | 180,000 | | $ | 192,640 | |

Garland, Texas, GO Limited | | 5.00 | | 02/15/25 | | 650,000 | | 744,991 | |

Goose Creek, Texas Independent School District, GO Unlimited, Series A | | 5.25 | | 02/15/18 | | 370,000 | | 397,247 | |

Grand Prairie, Texas Independent School District, Refunding, GO Unlimited (ZCB) | | 4.83 | (1) | 08/15/16 | | 400,000 | | 390,372 | |

Greenville, Texas Independent School District, Refunding, GO Unlimited | | 4.00 | | 08/15/17 | | 120,000 | | 124,582 | |

Harris County, Texas Municipal Utility District No. 382, GO Unlimited | | 3.00 | | 04/01/22 | | 305,000 | | 310,966 | |

Houston Texas, Hotel Occupancy Tax, Unrefunded, Series B | | 5.00 | | 09/01/19 | | 45,000 | | 47,068 | |

Houston Texas, Hotel Occupancy Tax, Prerefunded, Series B | | 5.00 | | 09/01/19 | | 250,000 | | 262,675 | |

Katy, Texas Independent School District, School Building, GO Unlimited, Series D | | 4.50 | | 02/15/19 | | 325,000 | | 333,450 | |

Laredo, Texas, Waterworks & Sewer System Revenue | | 4.25 | | 03/01/18 | | 100,000 | | 105,228 | |

Lavaca-Navidad River Authority, Series A | | 4.00 | | 08/01/22 | | 270,000 | | 295,726 | |

Lavaca-Navidad River Authority, Series B | | 4.00 | | 08/01/22 | | 420,000 | | 460,018 | |

Lewisville, Texas Independent School District, Refunding, GO Unlimited (ZCB) | | 5.45 | (1) | 08/15/15 | | 400,000 | | 399,872 | |

Lockhart, Texas Certificates of Obligation | | 4.00 | | 08/01/23 | | 830,000 | | 917,266 | |

Lower Colorado River Authority, Transmission Contract Revenue, Refunding, Series A | | 5.00 | | 05/15/21 | | 500,000 | | 581,020 | |

North Texas Tollway Authority Revenue, Series F | | 5.75 | | 01/01/38 | | 300,000 | | 334,431 | |

Prosper, Texas Independent School District, Capital Appreciation, School Building, GO Unlimited (ZCB) | | 12.84 | (1) | 08/15/33 | | 1,000,000 | | 389,940 | |

Round Rock Independent School District, GO Unlimited, Series A | | 3.50 | | 08/01/15 | | 250,000 | | 250,678 | |

San Antonio, Texas, Water Revenue, Refunding | | 4.50 | | 05/15/21 | | 400,000 | | 458,348 | |

San Marcos, Texas Tax & Toll Revenue, GO Limited | | 5.10 | | 08/15/27 | | 400,000 | | 436,504 | |

San Patricio, Texas Municipal Water District, Refunding | | 4.00 | | 07/10/18 | | 200,000 | | 200,086 | |

Texarkana, Texas Waterworks & Sanitary Sewer System Revenue | | 3.00 | | 08/01/19 | | 90,000 | | 93,357 | |

Texarkana, Texas Waterworks & Sanitary Sewer System Revenue | | 3.00 | | 08/01/20 | | 95,000 | | 97,980 | |

Texarkana, Texas, Refunding, GO Limited | | 5.00 | | 02/15/21 | | 320,000 | | 366,115 | |

Texas Municipal Power Agency Revenue, Refunding | | 5.00 | | 09/01/17 | | 250,000 | | 270,740 | |

Travis County, Texas, GO Limited | | 1.50 | | 03/01/16 | | 250,000 | | 252,070 | |

| | | | | | | | | | | |

See notes to portfolios of investments and notes to financial statements.

15

Near-Term Tax Free Fund

Portfolio of Investments (unaudited) | | June 30, 2015 |

| | Coupon

Rate % | | Maturity

Date | | Principal

Amount | | Value | |

Municipal Bonds (cont’d) | | | | | | | | | |

| | | | | | | | | |

Texas (cont’d) | | | | | | | | | |

White Settlement, Texas Independent School District, Prerefunded, GO Unlimited | | 4.13 | | 08/15/15 | | $ | 240,000 | | $ | 241,030 | |

White Settlement, Texas Independent School District, Unrefunded, GO Unlimited | | 4.13 | | 08/15/15 | | 60,000 | | 60,283 | |

| | | | | | | | 13,613,007 | |

| | | | | | | | | |

Utah 1.56% | | | | | | | | | |

Salt Lake County, Utah, Westminster College Project Revenue | | 5.00 | | 10/01/24 | | 235,000 | | 248,372 | |

Tooele City, Utah Municipal Building Authority, Municipal Building Authority Lease Revenue, Refunding | | 3.75 | | 12/01/17 | | 285,000 | | 288,326 | |

Utah State Building Ownership Authority, Lease Revenue, Refunding, Series C | | 5.50 | | 05/15/19 | | 500,000 | | 545,780 | |

Washington County-St George Interlocal Agency, Lease Revenue, Refunding, Series A | | 4.00 | | 12/01/19 | | 300,000 | | 327,546 | |

| | | | | | | | 1,410,024 | |

| | | | | | | | | |

Virginia 0.33% | | | | | | | | | |

Virginia College Building Authority Educational Facilities Revenue, Unrefunded, Series A | | 5.00 | | 09/01/15 | | 290,000 | | 292,239 | |

Virginia College Building Authority Educational Facilities Revenue, Prerefunded, Series A | | 5.00 | | 09/01/15 | | 10,000 | | 10,075 | |

| | | | | | | | 302,314 | |

| | | | | | | | | |

Washington 1.68% | | | | | | | | | |

Kent, Washington, Refunding, GO Limited | | 2.00 | | 12/01/15 | | 400,000 | | 402,928 | |

Spokane County, Washington Public Facilities District, Refunding, Series B | | 5.00 | | 12/01/21 | | 950,000 | | 1,112,981 | |

| | | | | | | | 1,515,909 | |

| | | | | | | | | |

Wisconsin 2.56% | | | | | | | | | |

Milwaukee, Wisconsin Sewerage System Revenue, Series S5 | | 5.00 | | 06/01/23 | | 500,000 | | 598,230 | |

New Holstein, Wisconsin Electric System Revenue | | 4.25 | | 05/01/18 | | 270,000 | | 278,335 | |

Waunakee Community School District, Series A | | 5.00 | | 04/01/18 | | 250,000 | | 276,205 | |

Wisconsin State Health & Educational Facilities Authority, Luther Hospital Project | | 5.00 | | 11/15/21 | | 1,000,000 | | 1,130,309 | |

| | | | | | | | | | | |

See notes to portfolios of investments and notes to financial statements.

16

Near-Term Tax Free Fund

Portfolio of Investments (unaudited) | | June 30, 2015 |

| | Coupon

Rate % | | Maturity

Date | | Principal

Amount | | Value | |

Municipal Bonds (cont’d) | | | | | | | | | |

| | | | | | | | | |

Wisconsin (cont’d) | | | | | | | | | |

Wisconsin State, Refunding, GO Unlimited, Series 2 | | 4.13 | | 11/01/16 | | $ | 25,000 | | $ | 25,504 | |

| | | | | | | | 2,308,583 | |

Total Municipal Bonds

(cost $86,352,846) | | | | | | | | 87,215,047 | |

| | | | | | | | | |

Overnight Cash Deposit 2.38% | | | | | | | | | |

| | | | | | | | | |

Wells Fargo Bank NA

(cost $2,147,636) | | 0.03 | | 07/01/15 | | 2,147,636 | | 2,147,636 | |

| | | | | | | | | |

Total Investments 99.02%

(cost $88,500,482) | | | | | | | | 89,362,683 | |

Other assets and liabilities, net 0.98% | | | | | | | | 888,570 | |

| | | | | | | | | |

Net Assets 100.0% | | | | | | | | $ | 90,251,253 | |

| | | | | | | | | | | |

(1)Represents Yield on zero coupon bond.

Municipal Bond Ratings* | June 30, 2015 |

Based on Total Municipal Bonds |

* Credit quality ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). “Not Rated” is used to classify securities for which a rating is not available. Credit-quality ratings for each issue are obtained from Moody’s and S&P, and the higher rating for each issue is used.

See notes to portfolios of investments and notes to financial statements.

17

All American Equity Fund | |

Portfolio of Investments (unaudited) | June 30, 2015 |

| | Shares | | Value | |

Common Stocks 98.09% | | | | | |

| | | | | |

Aerospace/Defense 3.55% | | | | | |

Boeing Co. | | 1,600 | | $ | 221,952 | |

General Dynamics Corp. | | 1,900 | | 269,211 | |

Northrop Grumman Corp. | | 1,600 | | 253,808 | |

| | | | 744,971 | |

Agricultural Operations 1.11% | | | | | |

Archer-Daniels-Midland Co. | | 4,800 | | 231,456 | |

| | | | | |

Applications Software 1.01% | | | | | |

Microsoft Corp. | | 4,800 | | 211,920 | |

| | | | | |

Automotive - Cars & Light Trucks 2.25% | | | | | |

Ford Motor Co. | | 16,800 | | 252,168 | |

General Motors Co. | | 6,600 | | 219,978 | |

| | | | 472,146 | |

Beverages - Non-alcoholic 1.16% | | | | | |

PepsiCo, Inc. | | 2,600 | | 242,684 | |

| | | | | |

Building Products - Cement/Aggregates 1.20% | | | | | |

Vulcan Materials Co. | | 3,000 | | 251,790 | |

| | | | | |

Cable/Satellite TV 1.26% | | | | | |

Comcast Corp., Class A | | 4,400 | | 264,616 | |

| | | | | |

Chemicals - Diversified 2.57% | | | | | |

Dow Chemical Co. | | 5,700 | | 291,669 | |

LyondellBasell Industries N.V., Class A | | 2,400 | | 248,448 | |

| | | | 540,117 | |

Computer Services 2.02% | | | | | |

Computer Sciences Corp. | | 3,500 | | 229,740 | |

International Business Machines Corp. | | 1,200 | | 195,192 | |

| | | | 424,932 | |

Computers 3.91% | | | | | |

Apple, Inc. | | 5,200 | | 652,210 | |

Hewlett-Packard Co. | | 5,600 | | 168,056 | |

| | | | 820,266 | |

| | | | | | |

See notes to portfolios of investments and notes to financial statements.

18

All American Equity Fund | |

Portfolio of Investments (unaudited) | June 30, 2015 |

| | Shares | | Value | |

Common Stocks (cont’d) | | | | | |

| | | | | |

Computers - Memory Devices 1.69% | | | | | |

EMC Corp. | | 7,500 | | $ | 197,925 | |

Western Digital Corp. | | 2,000 | | 156,840 | |

| | | | 354,765 | |

Cosmetics & Toiletries 1.01% | | | | | |

Procter & Gamble Co. | | 2,700 | | 211,248 | |

| | | | | |

Cruise Lines 1.34% | | | | | |

Carnival Corp. | | 5,700 | | 281,523 | |

| | | | | |

Data Processing/Management 1.03% | | | | | |

Fidelity National Information Services, Inc. | | 3,500 | | 216,300 | |

| | | | | |

Diagnostic Equipment 1.22% | | | | | |

Danaher Corp. | | 3,000 | | 256,770 | |

| | | | | |

Diversified Banking Institutions 2.97% | | | | | |

Citigroup, Inc. | | 6,000 | | 331,440 | |

JPMorgan Chase & Co. | | 4,300 | | 291,368 | |

| | | | 622,808 | |

Diversified Manufacturing Operations 2.34% | | | | | |

3M Co. | | 1,500 | | 231,450 | |

General Electric Co. | | 9,800 | | 260,386 | |

| | | | 491,836 | |

Electric - Integrated 0.97% | | | | | |

Entergy Corp. | | 2,900 | | 204,450 | |

| | | | | |

Electronic Components - Miscellaneous 1.03% | | | | | |

Corning, Inc. | | 11,000 | | 217,030 | |

| | | | | |

Electronic Components - Semiconductors 4.13% | | | | | |

Intel Corp. | | 6,200 | | 188,573 | |

Microchip Technology, Inc. | | 5,000 | | 237,125 | |

NVIDIA Corp. | | 11,200 | | 225,232 | |

Texas Instruments, Inc. | | 4,200 | | 216,342 | |

| | | | 867,272 | |

Enterprise Software/Services 1.03% | | | | | |

CA, Inc. | | 7,400 | | 216,746 | |

| | | | | | |

See notes to portfolios of investments and notes to financial statements.

19

All American Equity Fund | |

Portfolio of Investments (unaudited) | June 30, 2015 |

| | Shares | | Value | |

Common Stocks (cont’d) | | | | | |

| | | | | |

Fiduciary Banks 1.12% | | | | | |

Bank of New York Mellon Corp. | | 5,600 | | $ | 235,032 | |

| | | | | |

Food - Confectionery 1.08% | | | | | |

J.M. Smucker Co. | | 2,100 | | 227,661 | |

| | | | | |

Gold Mining 1.19% | | | | | |

Newmont Mining Corp. | | 10,700 | | 249,952 | |

| | | | | |

Investment Management/Advisory Services 2.20% | | | | | |

BlackRock, Inc., Class A | | 600 | | 207,588 | |

Invesco Ltd. | | 6,800 | | 254,932 | |

| | | | 462,520 | |

Life/Health Insurance 1.25% | | | | | |

Prudential Financial, Inc. | | 3,000 | | 262,560 | |

| | | | | |

Medical - Drugs 5.77% | | | | | |

Abbott Laboratories | | 5,600 | | 274,848 | |

AbbVie, Inc. | | 3,400 | | 228,446 | |

Johnson & Johnson | | 2,400 | | 233,904 | |

Merck & Co, Inc. | | 4,500 | | 256,185 | |

Pfizer, Inc. | | 6,500 | | 217,945 | |

| | | | 1,211,328 | |

Medical - HMO 4.34% | | | | | |

Aetna, Inc. | | 2,200 | | 280,412 | |

Anthem, Inc. | | 2,000 | | 328,280 | |

UnitedHealth Group, Inc. | | 2,500 | | 305,000 | |

| | | | 913,692 | |

Medical - Wholesale Drug Distribution 1.08% | | | | | |

Cardinal Health, Inc. | | 2,700 | | 225,855 | |

| | | | | |

Medical Instruments 2.24% | | | | | |

Medtronic plc | | 3,100 | | 229,710 | |

St. Jude Medical, Inc. | | 3,300 | | 241,131 | |

| | | | 470,841 | |

Medical Labs & Testing Services 1.31% | | | | | |

Quest Diagnostics, Inc. | | 3,800 | | 275,576 | |

| | | | | | |

See notes to portfolios of investments and notes to financial statements.

20

All American Equity Fund | |

Portfolio of Investments (unaudited) | June 30, 2015 |

| | Shares | | Value | |

Common Stocks (cont’d) | | | | | |

| | | | | |

Multi-line Insurance 3.71% | | | | | |

Allstate Corp. | | 3,900 | | $ | 252,993 | |

MetLife, Inc. | | 5,000 | | 279,950 | |

XL Group plc | | 6,600 | | 245,520 | |

| | | | 778,463 | |

Multimedia 1.47% | | | | | |

Walt Disney Co. | | 2,700 | | 308,178 | |

| | | | | |

Networking Products 1.05% | | | | | |

Cisco Systems, Inc. | | 8,000 | | 219,680 | |

| | | | | |

Non-hazardous Waste Disposal 2.41% | | | | | |

Republic Services, Inc., Class A | | 6,700 | | 262,439 | |

Waste Management, Inc. | | 5,300 | | 245,655 | |

| | | | 508,094 | |

Office Automation & Equipment 0.82% | | | | | |

Xerox Corp. | | 16,200 | | 172,368 | |

| | | | | |

Oil - Field Services 1.19% | | | | | |

Schlumberger Ltd. | | 2,900 | | 249,951 | |

| | | | | |

Oil & Gas Drilling 1.17% | | | | | |

Helmerich & Payne | | 3,500 | | 246,470 | |

| | | | | |

Oil Companies - Exploration & Production 3.52% | | | | | |

Anadarko Petroleum Corp. | | 3,000 | | 234,180 | |

EOG Resources, Inc. | | 3,000 | | 262,650 | |

Occidental Petroleum Corp. | | 3,100 | | 241,087 | |

| | | | 737,917 | |

Oil Companies - Integrated 1.07% | | | | | |

Exxon Mobil Corp. | | 2,700 | | 224,640 | |

| | | | | |

Oil Refining & Marketing 3.83% | | | | | |

Marathon Petroleum Corp. | | 5,200 | | 272,012 | |

Tesoro Corp. | | 3,000 | | 253,230 | |

Valero Energy Corp. | | 4,500 | | 281,700 | |

| | | | 806,942 | |

Publishing - Newspapers 0.22% | | | | | |

Gannett Co., Inc. | | 3,300 | | 46,167 | * |

| | | | | | |

See notes to portfolios of investments and notes to financial statements.

21

All American Equity Fund | |

Portfolio of Investments (unaudited) | June 30, 2015 |

| | Shares | | Value | |

Common Stocks (cont’d) | | | | | |

| | | | | |

Retail - Apparel/Shoe 1.14% | | | | | |

Coach, Inc. | | 6,900 | | $ | 238,809 | |

| | | | | |

Retail - Computer Equipment 1.23% | | | | | |

GameStop Corp., Class A | | 6,000 | | 257,760 | |

| | | | | |

Retail - Consumer Electronics 0.09% | | | | | |

Best Buy Companies, Inc. | | 600 | | 19,566 | |

| | | | | |

Retail - Discount 0.98% | | | | | |

Wal-Mart Stores, Inc. | | 2,900 | | 205,697 | |

| | | | | |

Retail - Drug Store 1.30% | | | | | |

CVS Health Corp. | | 2,600 | | 272,688 | |

| | | | | |

Retail - Regional Department Store 1.25% | | | | | |

Kohl’s Corp. | | 4,200 | | 262,962 | |

| | | | | |

Security Services 0.90% | | | | | |

ADT Corp. | | 5,600 | | 187,992 | |

| | | | | |

Semiconductor Components - Integrated Circuits 0.98% | | | | | |

Analog Devices, Inc. | | 3,200 | | 205,392 | |

| | | | | |

Super-Regional Banks - US 4.92% | | | | | |

Capital One Financial Corp. | | 3,000 | | 263,910 | |

Fifth Third Bancorp | | 11,000 | | 229,020 | |

Huntington Bancshares, Inc. | | 25,800 | | 291,798 | |

PNC Financial Services Group, Inc. | | 2,600 | | 248,690 | |

| | | | 1,033,418 | |

Telephone - Integrated 2.10% | | | | | |

AT&T, Inc. | | 7,200 | | 255,744 | |

CenturyLink, Inc. | | 6,300 | | 185,094 | |

| | | | 440,838 | |

Television 1.01% | | | | | |

TEGNA, Inc. | | 6,600 | | 211,662 | |

| | | | | |

Toys 1.35% | | | | | |

Hasbro, Inc. | | 3,800 | | 284,202 | |

| | | | | |

Total Common Stocks

(cost $20,328,961) | | | | 20,600,519 | |

| | | | | | |

See notes to portfolios of investments and notes to financial statements.

22

All American Equity Fund | |

Portfolio of Investments (unaudited) | June 30, 2015 |

| | Shares | | Value | |

Rights 0.04% | | | | | |

| | | | | |

Food - Retail 0.04% | | | | | |

Casa Ley, S.A. de C.V., Contingent Value Right | | 7,200 | | $ | 7,308 | *#@ |

Property Development Centers, LLC, Contingent Value Right | | 7,200 | | 351 | *#@ |

| | | | | |

Total Rights

(cost $—) | | | | 7,659 | |

| | | | | |

Total Investments 98.13%

(cost $20,328,961) | | | | 20,608,178 | |

Other assets and liabilities, net 1.87% | | | | 392,213 | |

| | | | | |

Net Assets 100.0% | | | | $ | 21,000,391 | |

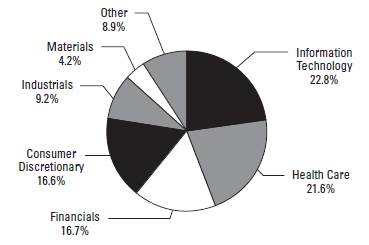

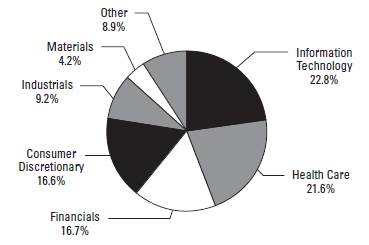

Portfolio Allocation by Industry Sector* | June 30, 2015 |

Based on Total Investments |

* Summary information above may differ from the portfolio schedule included in the financial statements due to the use of different classifications of securities for presentation purposes.

See notes to portfolios of investments and notes to financial statements.

23

Holmes Macro Trends Fund | |

Portfolio of Investments (unaudited) | June 30, 2015 |

| | Shares | | Value | |

Common Stocks 96.94% | | | | | |

| | | | | |

Aerospace/Defense 2.56% | | | | | |

Boeing Co. | | 5,000 | | $ | 693,600 | |

Spirit AeroSystems Holdings, Inc., Class A | | 9,000 | | 495,990 | * |

| | | | 1,189,590 | |

Aerospace/Defense - Equipment 1.07% | | | | | |

Astronics Corp. | | 7,000 | | 496,230 | * |

| | | | | |

Applications Software 1.61% | | | | | |

Paycom Software, Inc. | | 22,000 | | 751,300 | * |

| | | | | |

Athletic Footwear 2.33% | | | | | |

NIKE, Inc., Class B | | 10,000 | | 1,080,200 | |

| | | | | |

Audio/Video Products 1.03% | | | | | |

Harman International Industries, Inc. | | 4,000 | | 475,760 | |

| | | | | |

Building Products - Cement/Aggregates 2.07% | | | | | |

U.S. Concrete, Inc. | | 12,000 | | 454,680 | * |

Vulcan Materials Co. | | 6,000 | | 503,580 | |

| | | | 958,260 | |

Chemicals - Diversified 0.89% | | | | | |

Westlake Chemical Corp. | | 6,000 | | 411,540 | |

| | | | | |

Coal 0.00% | | | | | |

Pacific Coal Resources Ltd. | | 39,830 | | 957 | * |

| | | | | |

Commercial Banks - Eastern US 1.10% | | | | | |

Signature Bank | | 3,500 | | 512,365 | * |

| | | | | |

Commercial Banks - Southern US 2.92% | | | | | |

Bank of the Ozarks, Inc. | | 12,000 | | 549,000 | |

Home BancShares, Inc. | | 22,000 | | 804,320 | |

| | | | 1,353,320 | |

Commercial Banks - Western US 1.09% | | | | | |

Western Alliance Bancorp | | 15,000 | | 506,400 | * |

| | | | | |

Commercial Services - Finance 3.27% | | | | | |

MasterCard, Inc., Class A | | 7,000 | | 654,360 | |

Moody’s Corp. | | 8,000 | | 863,680 | |

| | | | 1,518,040 | |

| | | | | | |

See notes to portfolios of investments and notes to financial statements.

24

Holmes Macro Trends Fund | |

Portfolio of Investments (unaudited) | June 30, 2015 |

| | Shares | | Value | |

Common Stocks (cont’d) | | | | | |

| | | | | |

Computers 4.46% | | | | | |

Apple, Inc. | | 16,500 | | $ | 2,069,513 | |

| | | | | |

Computers - Peripheral Equipment 1.12% | | | | | |

Synaptics, Inc. | | 6,000 | | 520,410 | * |

| | | | | |

Consumer Products - Miscellaneous 1.05% | | | | | |

Helen of Troy Ltd. | | 5,000 | | 487,450 | * |

| | | | | |

Electric - Generation 0.57% | | | | | |

Pacific Power Generation Corp. (RS) | | 349,057 | | 264,585 | *#@ |

| | | | | |

Electronic Components - Miscellaneous 7.44% | | | | | |

Ambarella, Inc. | | 7,800 | | 800,982 | * |

Avago Technologies Ltd. | | 4,000 | | 531,720 | |

Cavium, Inc. | | 8,000 | | 550,480 | * |

Skyworks Solutions, Inc. | | 15,000 | | 1,561,499 | |

| | | | 3,444,681 | |

Energy - Alternate Sources 0.09% | | | | | |

Pacific Green Energy Corp. (RS) | | 100,000 | | 43,460 | *#@ |

| | | | | |

Entertainment Software 1.15% | | | | | |

Electronic Arts, Inc. | | 8,000 | | 532,000 | * |

| | | | | |

Finance - Commercial 1.48% | | | | | |

IOU Financial, Inc. | | 1,709,000 | | 684,147 | * |

| | | | | |

Gold Mining 0.00% | | | | | |

Gran Colombia Gold Corp. | | 2,032 | | 521 | * |

| | | | | |

Human Resources 0.77% | | | | | |

TrueBlue, Inc. | | 12,000 | | 358,800 | * |

| | | | | |

Internet Content - Entertainment 2.22% | | | | | |

Facebook, Inc., Class A | | 12,000 | | 1,029,180 | * |

| | | | | |

Internet Infrastructure Software 1.30% | | | | | |

F5 Networks, Inc. | | 5,000 | | 601,750 | * |

| | | | | |

Internet Security 0.98% | | | | | |

VASCO Data Security International, Inc. | | 15,000 | | 452,850 | * |

| | | | | | |

See notes to portfolios of investments and notes to financial statements.

25

Holmes Macro Trends Fund | |

Portfolio of Investments (unaudited) | June 30, 2015 |

| | Shares | | Value | |

Common Stocks (cont’d) | | | | | |

| | | | | |

Life/Health Insurance 3.02% | | | | | |

Lincoln National Corp. | | 8,000 | | $ | 473,760 | |

Manulife Financial Corp. | | 50,000 | | 929,500 | |

| | | | 1,403,260 | |

Machinery - General Industrial 2.47% | | | | | |

Middleby Corp. | | 6,000 | | 673,380 | * |

Wabtec Corp. | | 5,000 | | 471,200 | |

| | | | 1,144,580 | |

Medical - Biomedical/Gene 4.40% | | | | | |

Cambrex Corp. | | 13,000 | | 571,220 | * |

Gilead Sciences, Inc. | | 8,000 | | 936,640 | |

NewLink Genetics Corp. | | 12,000 | | 531,240 | * |

| | | | 2,039,100 | |

Medical - Drugs 5.67% | | | | | |

Akorn, Inc. | | 11,000 | | 480,260 | * |

Jazz Pharmaceuticals plc | | 2,000 | | 352,140 | * |

Lannett Company, Inc. | | 15,000 | | 891,600 | * |

Merus Labs International, Inc. | | 100,000 | | 235,388 | * |

Valeant Pharmaceuticals International, Inc. | | 3,000 | | 666,450 | * |

| | | | 2,625,838 | |

Medical - Generic Drugs 2.61% | | | | | |

Allergan plc | | 4,000 | | 1,213,840 | * |

| | | | | |

Medical - HMO 2.77% | | | | | |

Aetna, Inc. | | 5,000 | | 637,300 | |

Cigna Corp. | | 4,000 | | 648,000 | |

| | | | 1,285,300 | |

Medical - Hospitals 2.35% | | | | | |

African Medical Investments plc | | 1,000,000 | | 0 | *#@ |

HCA Holdings, Inc. | | 12,000 | | 1,088,640 | * |

| | | | 1,088,640 | |

Medical - Wholesale Drug Distribution 2.42% | | | | | |

McKesson Corp. | | 5,000 | | 1,124,050 | |

| | | | | |

Medical Instruments 1.54% | | | | | |

Edwards Lifesciences Corp. | | 5,000 | | 712,150 | * |

| | | | | |

Multi-line Insurance 1.13% | | | | | |

American Financial Group, Inc. | | 8,000 | | 520,320 | |

| | | | | | |

See notes to portfolios of investments and notes to financial statements.

26

Holmes Macro Trends Fund | |

Portfolio of Investments (unaudited) | June 30, 2015 |

| | Shares | | Value | |

Common Stocks (cont’d) | | | | | |

| | | | | |

Multimedia 2.21% | | | | | |

Walt Disney Co. | | 9,000 | | $ | 1,027,260 | |

| | | | | |

Oil & Gas Drilling 0.94% | | | | | |

Parsley Energy, Inc., Class A | | 25,000 | | 435,500 | * |

| | | | | |

Oil - Field Services 0.80% | | | | | |

Oceaneering International, Inc. | | 8,000 | | 372,720 | |

| | | | | |

Precious Metals 0.92% | | | | | |

Tahoe Resources, Inc. | | 35,000 | | 424,550 | |

| | | | | |

Property/Casualty Insurance 2.13% | | | | | |

Heritage Insurance Holdings, Inc. | | 22,000 | | 505,780 | * |

Universal Insurance Holdings, Inc. | | 20,000 | | 484,000 | |

| | | | 989,780 | |

Real Estate Management/Services 2.11% | | | | | |

HFF, Inc., Class A | | 12,000 | | 500,760 | |

Jones Lang LaSalle, Inc. | | 2,800 | | 478,800 | |

| | | | 979,560 | |

Real Estate Operating/Development 0.78% | | | | | |

Pacific Infrastructure Ventures, Inc. (RS) | | 426,533 | | 359,823 | *#@ |

| | | | | |

Retail - Apparel/Shoe 0.92% | | | | | |

Cato Corp., Class A | | 11,000 | | 426,360 | |

| | | | | |

Retail - Building Products 2.16% | | | | | |

Lowe’s Companies, Inc. | | 15,000 | | 1,004,550 | |

| | | | | |

Retail - Drug Store 2.26% | | | | | |

CVS Health Corp. | | 10,000 | | 1,048,800 | |

| | | | | |

Retail - Major Department Store 2.00% | | | | | |

TJX Companies, Inc. | | 14,000 | | 926,380 | |

| | | | | |

Retail - Perfume & Cosmetics 1.00% | | | | | |

Ulta Salon, Cosmetics & Fragrance, Inc. | | 3,000 | | 463,350 | * |

| | | | | |

Retail - Restaurants 1.85% | | | | | |

Starbucks Corp. | | 16,000 | | 857,840 | |

| | | | | | |

See notes to portfolios of investments and notes to financial statements.

27

Holmes Macro Trends Fund | |

Portfolio of Investments (unaudited) | June 30, 2015 |

| | Shares | | Value | |

Common Stocks (cont’d) | | | | | |

| | | | | |

Retail - Video Rental 1.15% | | | | | |

Outerwall, Inc. | | 7,000 | | $ | 532,770 | |

| | | | | |

Semiconductor Equipment 1.31% | | | | | |

Tessera Technologies, Inc. | | 16,000 | | 607,680 | |

| | | | | |

Television 1.06% | | | | | |

AMC Networks, Inc., Class A | | 6,000 | | 491,100 | * |

| | | | | |

Transport - Services 2.39% | | | | | |

FedEx Corp. | | 6,500 | | 1,107,600 | |

| | | | | |

Total Common Stocks

(cost $39,697,983) | | | | 44,956,010 | |

| | | | | |

Warrants 0.00% | | | | | |

| | | | | |

Gold Mining 0.00% | | | | | |

Gran Colombia Gold Corp., 144A, Warrants (October 2017) | | 3,700 | | 0 | *#@ |

Gran Colombia Gold Corp., 144A, Warrants (March 2019) | | 250 | | 11 | * |

| | | | | |

Total Warrants

(cost $0) | | | | 11 | |

| | | | | | |

| | Principal

Amount | | | |

Gold-Linked Notes 0.19% | | | | | |

| | | | | |

Gold Mining 0.19% | | | | | |

Gran Colombia Gold Corp., 10.00%, maturity 10/31/17 | | $ | 15,000 | | 3,338 | #^@ |

Gran Colombia Gold Corp., 144A, 10.00%, maturity 10/31/17 | | 370,000 | | 82,325 | #^@ |

| | | | | |

Total Gold-Linked Notes

(cost $379,500) | | | | 85,663 | |

| | | | | |

Silver-Linked Notes 0.11% | | | | | |

| | | | | |

Gold Mining 0.11% | | | | | |

Gran Colombia Gold Corp., 5.00%, maturity 08/11/18

(cost $340,261) | | 424,000 | | 51,940 | ^ |

| | | | | | |

See notes to portfolios of investments and notes to financial statements.

28

Holmes Macro Trends Fund | |

Portfolio of Investments (unaudited) | June 30, 2015 |

| | Principal

Amount | | Value | |

Corporate Note 0.49% | | | | | |

| | | | | |

Electric - Generation 0.49% | | | | | |

Pacific Power Generation Corp., 15.00%, maturity 04/03/17 (RS)

(cost $225,000) | | $ | 225,000 | | $ | 225,000 | #@ |

| | | | | |

Overnight Cash Deposit 3.04% | | | | | |

| | | | | |

Wells Fargo Bank NA, 0.03%, maturity 07/01/15

(cost $1,409,688) | | 1,409,688 | | 1,409,688 | |

| | | | | |

Total Investments 100.77%

(cost $42,052,432) | | | | 46,728,312 | |

Other assets and liabilities, net (0.77)% | | | | (355,207 | ) |

| | | | | | |

Net Assets 100.0% | | | | $ | 46,373,105 | |

| | | | | | | | |

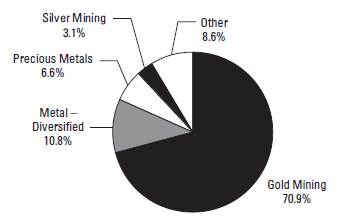

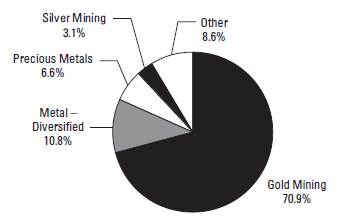

Portfolio Allocation by Industry Sector* | | June 30, 2015 |

Based on Total Investments | |

* Summary information above may differ from the portfolio schedule included in the financial statements due to the use of different classifications of securities for presentation purposes.

See notes to portfolios of investments and notes to financial statements.

29

Global Resources Fund

Portfolio of Investments (unaudited) | | June 30, 2015 |

| | Shares | | Value | |

Common Stocks 92.48% | | | | | |

| | | | | |

Agricultural Chemicals 3.55% | | | | | |

CF Industries Holdings, Inc. | | 75,000 | | $ | 4,821,000 | |

| | | | | |

Agricultural Operations 0.55% | | | | | |

Agriterra Ltd. | | 69,849,776 | | 754,207 | *+ |

| | | | | |

Building Products - Cement/Aggregates 8.00% | | | | | |

Martin Marietta Materials, Inc. | | 30,000 | | 4,245,300 | |

U.S. Concrete, Inc. | | 64,000 | | 2,424,960 | * |

Vulcan Materials Co. | | 50,000 | | 4,196,500 | |

| | | | 10,866,760 | |

Chemicals - Diversified 6.31% | | | | | |

Dow Chemical Co. | | 55,000 | | 2,814,350 | |

LyondellBasell Industries N.V., Class A | | 41,000 | | 4,244,320 | |

Westlake Chemical Corp. | | 22,000 | | 1,508,980 | |

| | | | 8,567,650 | |

Chemicals - Specialty 2.01% | | | | | |

Cytec Industries, Inc. | | 45,000 | | 2,723,850 | |

| | | | | |

Coal 0.34% | | | | | |

Pacific Coal Resources Ltd. | | 4,362,314 | | 104,779 | *+ |

Sable Mining Africa Ltd. | | 28,061,000 | | 363,483 | * |

Walter Energy, Inc., 144A | | 4,293 | | 936 | * |

| | | | 469,198 | |

Containers - Paper/Plastic 2.27% | | | | | |

Sealed Air Corp. | | 60,000 | | 3,082,800 | |

| | | | | |

Diamonds/Precious Stones 0.02% | | | | | |

Diamond Fields International Ltd. | | 1,800,000 | | 21,617 | * |

Rockwell Diamonds, Inc., 144A | | 63,333 | | 11,916 | * |

| | | | 33,533 | |

Diversified Minerals 2.61% | | | | | |

African Potash Ltd. | | 7,965,799 | | 46,998 | * |

Canada Zinc Metals Corp. | | 1,000,000 | | 180,144 | * |

Dundee Sustainable Technologies, Inc. | | 3,587,500 | | 301,591 | * |

Encanto Potash Corp., 144A | | 3,000,000 | | 228,183 | * |

Lundin Mining Corp. | | 600,000 | | 2,464,372 | * |

Niocan, Inc., 144A | | 362,069 | | 45,657 | * |

Woulfe Mining Corp. | | 5,585,100 | | 290,658 | * |

| | | | 3,557,603 | |

| | | | | | |

See notes to portfolios of investments and notes to financial statements.

30

Global Resources Fund

Portfolio of Investments (unaudited) | | June 30, 2015 |

| | Shares | | Value | |

Common Stocks (cont’d) | | | | | |

| | | | | |

Electric - Generation 2.72% | | | | | |

Pacific Power Generation Corp. (RS) | | 4,868,396 | | $ | 3,690,244 | *#@ |

| | | | | |

Energy - Alternate Sources 5.05% | | | | | |

Pacific Ethanol, Inc. | | 127,500 | | 1,315,800 | * |

Pacific Green Energy Corp. (RS) | | 2,400,000 | | 1,043,040 | *+#@ |

SunEdison, Inc. | | 150,000 | | 4,486,500 | * |

| | | | 6,845,340 | |

Food - Meat Products 3.14% | | | | | |

Tyson Foods, Class A | | 100,000 | | 4,263,000 | |

| | | | | |

Food - Miscellaneous/Diversified 1.92% | | | | | |

Cal-Maine Foods, Inc. | | 50,000 | | 2,610,000 | |

| | | | | |

Forestry 0.01% | | | | | |

Bravern Ventures Ltd. | | 254,431 | | 13,241 | * |

| | | | | |

Gold Mining 5.14% | | | | | |

Chesapeake Gold Corp., 144A | | 52,400 | | 83,907 | * |

Corona Minerals Ltd. | | 100,000 | | 386 | *#@ |

Gran Colombia Gold Corp. | | 560,590 | | 143,626 | * |

Kinross Gold Corp. | | 1 | | 0 | * |

Klondex Mines Ltd. | | 1,700,000 | | 4,627,702 | * |

NGEx Resources, Inc. | | 600,000 | | 422,738 | * |

Rusoro Mining Ltd. | | 3,000,000 | | 108,086 | * |

Sunridge Gold Corp. | | 4,600,000 | | 662,930 | *+ |

Sunridge Gold Corp., 144A | | 6,333,788 | | 912,796 | *+ |

| | | | 6,962,171 | |

Medical - Hospitals 0.00% | | | | | |

African Medical Investments plc | | 2,507,500 | | 0 | *#@ |

| | | | | |

Metal - Aluminum 0.92% | | | | | |

Kaiser Aluminum Corp. | | 15,000 | | 1,246,200 | |

| | | | | |

Metal - Copper 3.38% | | | | | |

Catalyst Copper Corp., 144A | | 166,666 | | 25,354 | * |

First Quantum Minerals Ltd. | | 125,000 | | 1,634,307 | |

Southern Copper Corp. | | 100,000 | | 2,941,000 | |

Verona Development Corp. | | 708,800 | | 0 | *#@ |

| | | | 4,600,661 | |

| | | | | | |

See notes to portfolios of investments and notes to financial statements.

31

Global Resources Fund

Portfolio of Investments (unaudited) | | June 30, 2015 |

| | Shares | | Value | |

Common Stocks (cont’d) | | | | | |

| | | | | |

Metal - Diversified 3.44% | | | | | |

Glencore plc, ADR | | 250,000 | | $ | 2,008,750 | |

GoviEx Uranium, Inc., Class A | | 755,000 | | 66,493 | * |

GoviEx Uranium, Inc., 144A, Class A | | 58,000 | | 5,108 | * |

Mandalay Resources Corp. | | 1,109,500 | | 852,778 | |

Orsu Metals Corp., 144A | | 147,605 | | 2,364 | * |

Trevali Mining Corp. | | 2,500,000 | | 1,741,393 | * |

| | | | 4,676,886 | |

| | | | | |

Metal - Iron 0.01% | | | | | |

Oceanic Iron Ore Corp. | | 200,000 | | 17,214 | * |

WAI Capital Investment Corp., 144A | | 292,500 | | 5,855 | * |

| | | | 23,069 | |

| | | | | |

Mining Services 0.25% | | | | | |

Bounty Mining Ltd. | | 22,000,000 | | 339,482 | *#@ |

| | | | | |

Natural Resource Technology 0.10% | | | | | |

I-Pulse, Inc., 144A (RS) | | 15,971 | | 137,351 | *#@ |

| | | | | |

Non - Ferrous Metals 0.01% | | | | | |

Sterling Group Ventures, Inc., 144A | | 500,000 | | 13,000 | * |

| | | | | |

Office Supplies & Forms 2.24% | | | | | |

Avery Dennison Corp. | | 50,000 | | 3,047,000 | |

| | | | | |

Oil - Field Services 2.77% | | | | | |

Atlas Development & Support Services Ltd. | | 63,890,983 | | 3,064,045 | *+ |

RPC, Inc. | | 50,000 | | 691,500 | |

| | | | 3,755,545 | |

| | | | | |

Oil & Gas Drilling 2.43% | | | | | |

Helmerich & Payne, Inc. | | 11,000 | | 774,620 | |

Parsley Energy, Inc., Class A | | 145,000 | | 2,525,900 | * |

| | | | 3,300,520 | |

| | | | | |

Oil Companies - Exploration & Production 23.19% | | | | | |

Africa Energy Corp., 144A | | 2,110,889 | | 236,609 | * |

Bankers Petroleum Ltd. | | 650,000 | | 1,613,291 | * |

BNK Petroleum, Inc. | | 2,800,000 | | 1,165,733 | * |

Diamondback Energy, Inc. | | 50,000 | | 3,769,000 | * |

Ivanhoe Energy, Inc. | | 18,719 | | 0 | *#@ |

Laredo Petroleum, Inc. | | 100,000 | | 1,258,000 | * |

Newfield Exploration Co. | | 120,000 | | 4,334,400 | * |

| | | | | | |

See notes to portfolios of investments and notes to financial statements.

32

Global Resources Fund

Portfolio of Investments (unaudited) | | June 30, 2015 |

| | Shares | | Value | |

Common Stocks (cont’d) | | | | | |

| | | | | |

Oil Companies - Exploration & Production (cont’d) | | | | | |

PDC Energy, Inc. | | 80,000 | | $ | 4,291,200 | * |

Petroamerica Oil Corp. | | 11,158,000 | | 938,022 | * |

Peyto Exploration & Development Corp. | | 60,000 | | 1,466,613 | |

Raging River Exploration, Inc. | | 250,000 | | 1,747,398 | * |

Range Energy Resources, Inc., 144A | | 15,000,000 | | 210,168 | * |

RMP Energy, Inc. | | 800,000 | | 1,498,799 | * |

Royalite Petroleum Co., Inc. | | 2,266,333 | | 1,586 | * |

RSP Permian, Inc. | | 100,000 | | 2,811,000 | * |

Synergy Resources Corp. | | 245,000 | | 2,800,350 | * |

U.S. Oil Sands, Inc. | | 7,777,777 | | 684,992 | * |

U.S. Oil Sands, Inc., 144A | | 9,900,000 | | 871,898 | * |

Whitecap Resources, Inc. | | 170,000 | | 1,793,916 | |

| | | | 31,492,975 | |

| | | | | |

Oil Field Machinery & Equipment 1.24% | | | | | |

Dril-Quip, Inc. | | 11,000 | | 827,750 | * |

Forum Energy Technologies, Inc. | | 42,000 | | 851,760 | * |

| | | | 1,679,510 | |

| | | | | |

Pipelines 3.21% | | | | | |

Energy Transfer Equity, L.P. | | 68,000 | | 4,363,559 | |

| | | | | |

Precious Metals 1.03% | | | | | |

Tahoe Resources, Inc. | | 115,000 | | 1,394,950 | |

| | | | | |

Real Estate Operating/Development 4.62% | | | | | |

Pacific Infrastructure Ventures, Inc. (RS) | | 7,434,544 | | 6,279,374 | *#@ |

| | | | | |

Total Common Stocks

(cost $214,520,100) | | | | 125,610,679 | |

| | | | | |

Master Limited Partnership 2.30% | | | | | |

| | | | | |

Oil - Field Services 2.30% | | | | | |

Rice Midstream Partners LP

(cost $2,575,246) | | 180,000 | | 3,124,799 | |

| | | | | |

Warrants 0.24% | | | | | |

| | | | | |

Diversified Minerals 0.00% | | | | | |

Encanto Potash Corp., 144A, Warrants (October 2015) | | 1,500,000 | | 0 | *#@ |

| | | | | | |

See notes to portfolios of investments and notes to financial statements.

33

Global Resources Fund

Portfolio of Investments (unaudited) | | June 30, 2015 |

| | Shares | | Value | |

Warrants (cont’d) | | | | | |

| | | | | |

Gold Mining 0.24% | | | | | |

Dundee Precious Metals, Inc., Warrants (November 2015) | | 742,895 | | $ | 71,375 | * |

Gran Colombia Gold Corp., 144A, Warrants (October 2017) | | 86,150 | | 0 | *#@ |

Gran Colombia Gold Corp., 144A, Warrants (March 2019) | | 59,500 | | 2,501 | * |

New Gold, Inc., 144A, Warrants (June 2017) | | 822,570 | | 125,131 | * |

Sunridge Gold Corp., 144A, Warrants (October 2017) | | 6,333,788 | | 126,777 | *+ |

| | | | 325,784 | |

| | | | | |

Metal - Copper 0.00% | | | | | |

Catalyst Copper Corp., 144A, Warrants (February 2017) | | 83,333 | | 0 | *#@ |

| | | | | |

Metal - Iron 0.00% | | | | | |

WAI Capital Investment Corp., 144A, Warrants (March 2016) | | 292,500 | | 0 | *#@ |

| | | | | |

Total Warrants

(cost $944,160) | | | | 325,784 | |

| | | | | |

| | Contracts | | | |

Purchased Call Options 1.28% | | | | | |

| | | | | |

Agricultural Chemicals 0.10% | | | | | |

Syngenta AG, Strike Price 90.00, Expiration Dec. 2015 | | 400 | | 134,000 | * |

| | | | | |

Metal - Copper 0.36% | | | | | |

Freeport-McMoRan Copper & Gold, Inc., Strike Price 20.00, Expiration Jan. 2017 | | 1,699 | | 484,215 | * |

| | | | | |

Oil Refining & Marketing 0.82% | | | | | |

Marathon Petroleum Corp., Strike Price 55.00, Expiration Jan. 2016 | | 1,000 | | 292,500 | * |

Phillips 66, Strike Price 82.50, Expiration Jan. 2017 | | 550 | | 437,250 | * |

Valero Energy Corp., Strike Price 65.00, Expiration Jan. 2016 | | 1,000 | | 385,000 | * |

| | | | 1,114,750 | |

| | | | | |

Total Purchased Call Options

(cost $1,913,907) | | | | 1,732,965 | |

| | | | | |

| | Principal

Amount | | | |

Convertible Bond 0.04% | | | | | |

| | | | | |

Diversified Minerals 0.04% | | | | | |