As filed with the Securities and Exchange Commission on August 30, 2018

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-01800

U.S. GLOBAL INVESTORS FUNDS

Three Canal Plaza, Suite 600

Portland, Maine 04101

Jessica Chase, Principal Executive Officer

Three Canal Plaza, Suite 600

Portland, Maine 04101

207-347-2000

Date of fiscal year end: December 31

Date of reporting period: January 1, 2018 – June 30, 2018

ITEM 1. REPORT TO STOCKHOLDERS.

U.S. Global Investors Funds

Semi-Annual Report

June 30, 2018

(Unaudited)

U.S. Global Investors Funds

Semi-Annual Report

June 30, 2018

(unaudited)

Table of Contents

| Letter to Shareholders | 1 |

| Portfolios of Investments | 2 |

| Notes to Portfolios of Investments | 53 |

| Statements of Assets and Liabilities | 70 |

| Statements of Operations | 74 |

| Statements of Changes in Net Assets | 78 |

| Notes to Financial Statements | 84 |

| Financial Highlights | 98 |

| Additional Information | 109 |

| Expense Example | 110 |

| Privacy Policy | 114 |

Nasdaq Symbols

U.S. Global Investors Funds

| Investor Class | |

| U.S. Government Securities Ultra-Short Bond Fund | UGSDX |

| Near-Term Tax Free Fund | NEARX |

| All American Equity Fund | GBTFX |

| Holmes Macro Trends Fund | MEGAX |

| Global Resources Fund | PSPFX |

| World Precious Minerals Fund | UNWPX |

| Gold and Precious Metals Fund | USERX |

| Emerging Europe Fund | EUROX |

| China Region Fund | USCOX |

| | |

| Institutional Class | |

| Global Resources Fund | PIPFX |

| World Precious Minerals Fund | UNWIX |

| Atlantic Fund Services 3 Canal Plaza, Suite 600 Portland, ME 04101 |

| U.S. Global Investors Funds | (unaudited) |

Dear Fellow Shareholder,

Did you know? The best way to receive timely updates on the events that impact your investments is to subscribe to our FREE newsletter, the Investor Alert. There’s no need to wait for dated publications like the Semi-Annual Report!

With a balanced analysis of the markets over the past week, the Investor Alert is written for you by the U.S. Global investments team, featuring a special commentary by me. You can sign up for the Investor Alert—awarded Best Electronic Newsletter by the Mutual Fund Education Alliance (MFEA)—by visiting usfunds.com/ subscribe.

While you’re on the website, be sure to take advantage of additional resources, prepared especially for our fund shareholders:

| ● | My CEO blog, Frank Talk, where I comment on current market topics |

| ● | Frank Talk Live, my weekly video roundup of gold, oil, bitcoin, emerging markets and other asset classes |

| ● | Quarterly fund commentaries, straight from the portfolio managers themselves |

| ● | Up-to-date fund performance, including quarterly performance charts |

We hope you enjoy having these timely resources at your fingertips.

Thank you for investing in U.S. Global Investors Funds!

Sincerely,

Frank E. Holmes

CEO and Chief Investment Officer

U.S. Global Investors, Inc.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-874-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors, Inc. is the investment adviser.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

The Mutual Fund Education Alliance (MFEA) is a national industry association committed to investor education, and its STAR Awards program recognizes marketing communications efforts in the mutual fund industry. The awards competition is judged by industry professionals, and based on criteria including educational value, content, design and functionality.

| U.S. Government Securities Ultra-Short Bond Fund | |

| Portfolio of Investments (unaudited) | June 30, 2018 |

| United States Government and Agency | | Coupon | | | Maturity | | Principal | | | | |

| Obligations 92.06% | | Rate % | | | Date | | Amount | | | Value | |

| Federal Farm Credit Bank 50.24% | | | | | | | | | | | |

| Fixed Rates: | | | | | | | | | | | | | | |

| | | | 1.95 | | | 08/28/18 | | $ | 100,000 | | | $ | 99,996 | |

| Floating Rates: | | | | | | | | | | | | | | |

| (Federal Reserve Bank Effective Rate + 0.12%) | | | 2.03 | | | 02/18/20 | | | 3,000,000 | | | | 2,998,768 | |

| (Federal Reserve Bank Prime Loan + (3.08)%) | | | 1.92 | | | 03/11/19 | | | 7,000,000 | | | | 6,998,145 | |

| (U.S. Treasury 3 Month Bill Money Market Yield + 0.15%) | | | 2.06 | | | 04/12/19 | | | 3,000,000 | | | | 3,003,618 | |

| (U.S. Treasury 3 Month Bill Money Market Yield + 0.09%) | | | 2.01 | | | 06/19/19 | | | 8,000,000 | | | | 8,003,079 | |

| (USD 1 Month LIBOR + 0.05%) | | | 2.14 | | | 02/21/20 | | | 3,000,000 | | | | 3,005,460 | |

| | | | | | | | | | | | | | 24,109,066 | |

| Federal Home Loan Bank 37.29% | | | | | | | | | | | | | | |

| Fixed Rates: | | | | | | | | | | | | | | |

| | | | 5.38 | | | 08/15/18 | | | 480,000 | | | | 481,912 | |

| | | | 1.00 | | | 08/28/18 | | | 4,000,000 | | | | 3,993,576 | |

| | | | 1.75 | | | 12/14/18 | | | 3,000,000 | | | | 2,993,982 | |

| | | | 1.50 | | | 03/08/19 | | | 4,000,000 | | | | 3,979,992 | |

| | | | 1.50 | | | 04/26/19 | | | 5,500,000 | | | | 5,463,634 | |

| | | | 1.20 | | | 05/23/19 | | | 1,000,000 | | | | 989,794 | |

| | | | | | | | | | | | | | 17,902,890 | |

| Tennessee Valley Authority 4.53% | | | | | | | | | | | | | | |

| Fixed Rates: | | | | | | | | | | | | | | |

| | | | 1.75 | | | 10/15/18 | | | 2,174,000 | | | | 2,171,683 | |

| | | | | | | | | | | | | | | |

| Investments, at value 92.06% | | | | | | | | | | | | | 44,183,639 | |

| (cost $44,248,443) | | | | | | | | | | | | | | |

| Other assets and liabilities, net 7.94% | | | | | | | | | | | | | 3,812,959 | |

| | | | | | | | | | | | | | | |

| Net Assets 100.00% | | | | | | | | | | | | $ | 47,996,598 | |

See notes to portfolios of investments and notes to financial statements.

| U.S. Government Securities Ultra-Short Bond Fund | |

| Portfolio of Investments (unaudited) | June 30, 2018 |

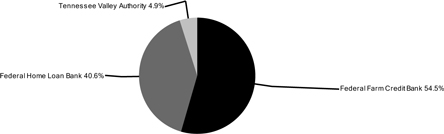

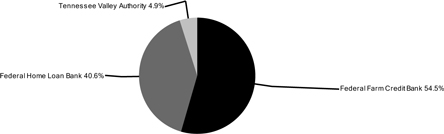

Portfolio Allocation by Issuer Based on Total Investments | June 30, 2018 |

| Portfolio Allocation by Maturity | | | | | June 30, 2018 | |

| 1-3 Months | | $ | 4,575,484 | | | | 10.3 | % |

| 3-12 Months | | | 33,603,927 | | | | 76.1 | % |

| 1-3 Years | | | 6,004,228 | | | | 13.6 | % |

| | | $ | 44,183,639 | | | | 100.0 | % |

See notes to portfolios of investments and notes to financial statements.

| Near-Term Tax Free Fund | |

| Portfolio of Investments (unaudited) | June 30, 2018 |

| | | Coupon | | | Maturity | | Principal | | | | |

| Municipal Bonds 92.09% | | Rate % | | | Date | | Amount | | | Value | |

| Alabama 1.04% | | | | | | | | | | | |

| City of Bessemer Electric Revenue, Alabama, Refunding, RB AGM | | | 3.10 | | | 12/01/21 | | $ | 100,000 | | | $ | 102,148 | |

| University of South Alabama, Alabama, Refunding, RB | | | 5.00 | | | 11/01/18 | | | 500,000 | | | | 505,670 | |

| | | | | | | | | | | | | | 607,818 | |

| Arizona 0.72% | | | | | | | | | | | | | | |

| City of Tempe, Arizona, GO Unlimited, Series A | | | 2.00 | | | 07/01/19 | | | 220,000 | | | | 221,060 | |

| McAllister Academic Village, LLC, Arizona State University Hassayampa, Arizona, Refunding, RB | | | 5.75 | | | 07/01/18 | | | 200,000 | | | | 200,000 | |

| | | | | | | | | | | | | | 421,060 | |

| Arkansas 2.06% | | | | | | | | | | | | | | |

| Atkins School District No. 18, Arkansas, Refunding, GO Limited | | | 1.00 | | | 02/01/19 | | | 420,000 | | | | 417,644 | |

| Cave City School District No. 2-A, Arkansas, Refunding, GO Limited | | | 1.00 | | | 02/01/19 | | | 260,000 | | | | 258,315 | |

| City of Hot Springs Wastewater Revenue, Arkansas, RB | | | 4.00 | | | 12/01/19 | | | 510,000 | | | | 525,632 | |

| | | | | | | | | | | | | | 1,201,591 | |

| California 1.16% | | | | | | | | | | | | | | |

| California Statewide Communities Development Authority, Enloe Medical Center, California, RB, Series A | | | 5.25 | | | 08/15/18 | | | 340,000 | | | | 341,588 | |

| Newman-Crows Landing Unified School District, California, Refunding, GO Unlimited AGM | | | 4.00 | | | 08/01/19 | | | 115,000 | | | | 118,148 | |

| Riverside County Redevelopment Successor Agency, California, Refunding, Tax Allocation Bond | | | 5.00 | | | 10/01/19 | | | 200,000 | | | | 208,492 | |

| State of California, California, GO Unlimited | | | 5.00 | | | 12/01/19 | | | 5,000 | | | | 5,014 | |

| | | | | | | | | | | | | | 673,242 | |

| Colorado 2.04% | | | | | | | | | | | | | | |

| City & County of Denver Airport System Revenue, Colorado, RB, Series B | | | 5.00 | | | 11/15/27 | | | 300,000 | | | | 333,198 | |

| City of Glendale, Colorado, Refunding, COP AGM | | | 5.00 | | | 12/01/25 | | | 750,000 | | | | 855,683 | |

| | | | | | | | | | | | | | 1,188,881 | |

See notes to portfolios of investments and notes to financial statements.

| Near-Term Tax Free Fund | |

| Portfolio of Investments (unaudited) | June 30, 2018 |

| | | Coupon | | | Maturity | | Principal | | | | |

| Municipal Bonds (cont’d) | | Rate % | | | Date | | Amount | | | Value | |

| Florida 8.06% | | | | | | | | | | | |

| City of Jacksonville, Florida, Refunding, RB, Series C | | | 5.00 | | | 10/01/20 | | $ | 270,000 | | | $ | 289,100 | |

| City of Leesburg, Florida, Refunding, RB | | | 5.00 | | | 10/01/21 | | | 405,000 | | | | 441,239 | |

| City of Margate Water & Sewer Revenue, Florida, Refunding, RB AGM | | | 4.00 | | | 10/01/19 | | | 250,000 | | | | 256,952 | |

| City of Miramar, Florida, Refunding, RB | | | 5.00 | | | 10/01/22 | | | 305,000 | | | | 340,859 | |

| County of St. Johns, Florida, Refunding, RB AGM | | | 5.00 | | | 10/01/20 | | | 310,000 | | | | 330,727 | |

| Escambia County Health Facilities Authority, Baptist Hospital, Inc. Project, Florida, RB, Series A | | | 5.00 | | | 08/15/19 | | | 290,000 | | | | 300,338 | |

| Florida Department of Management Services, Florida, Refunding, COP, Series A | | | 5.00 | | | 08/01/19 | | | 500,000 | | | | 518,580 | |

| Florida Department of Management Services, Florida, COP, Series A | | | 5.00 | | | 08/01/24 | | | 340,000 | | | | 344,774 | |

| Orlando Utilities Commission, Florida, RB ‡ | | | 1.53 | | | 10/01/33 | | | 870,000 | | | | 870,000 | |

| Pinellas County Health Facilities Authority, Florida, RB ‡ | | | 1.55 | | | 11/01/38 | | | 1,000,000 | | | | 1,000,000 | |

| | | | | | | | | | | | | | 4,692,569 | |

| Georgia 1.97% | | | | | | | | | | | | | | |

| Carroll City-County Hospital Authority, Tanner Medical Center, Inc. Project, Georgia, RB | | | 5.00 | | | 07/01/18 | | | 600,000 | | | | 600,000 | |

| Cobb County Hospital Authority, Georgia, RB ‡ | | | 1.51 | | | 04/01/36 | | | 300,000 | | | | 300,000 | |

| Gwinnett County Hospital Authority, Georgia, RB, Series B AGM | | | 5.00 | | | 07/01/18 | | | 250,000 | | | | 250,000 | |

| | | | | | | | | | | | | | 1,150,000 | |

| Idaho 0.42% | | | | | | | | | | | | | | |

| Idaho Housing & Finance Association, Grant & Revenue Anticipation, Federal Highway Trust Fund, Idaho, RB, Series A | | | 5.00 | | | 07/15/21 | | | 225,000 | | | | 244,769 | |

| | | | | | | | | | | | | | | |

| Illinois 4.47% | | | | | | | | | | | | | | |

| Chicago Board of Education, Illinois, GO Unlimited, Series A NATL | | | 5.25 | | | 12/01/19 | | | 300,000 | | | | 309,672 | |

| Clinton Bond Fayette Etc Counties Community College District No. 501 Kaskaskia, Illinois, Refunding, GO Unlimited | | | 5.75 | | | 12/01/19 | | | 500,000 | | | | 526,310 | |

| County of Du Page, Jail Project, Illinois, Refunding, GO Unlimited | | | 5.60 | | | 01/01/21 | | | 210,000 | | | | 221,895 | |

| Du Page County School District No. 33 West Chicago, Illinois, Refunding, GO Unlimited, Series B | | | 4.00 | | | 12/01/21 | | | 1,000,000 | | | | 1,060,180 | |

See notes to portfolios of investments and notes to financial statements.

| Near-Term Tax Free Fund | |

| Portfolio of Investments (unaudited) | June 30, 2018 |

| | | Coupon | | | Maturity | | Principal | | | | |

| Municipal Bonds (cont’d) | | Rate % | | | Date | | Amount | | | Value | |

| Illinois (cont’d) | | | | | | | | | | | |

| Regional Transportation Authority, Illinois, RB, Series A, AMBAC | | | 7.20 | | | 11/01/20 | | $ | 95,000 | | | $ | 101,745 | |

| Village of Fox Lake, Debt Certificates, Illinois, RB, Series B | | | 3.00 | | | 11/01/19 | | | 265,000 | | | | 269,359 | |

| Will Grundy Etc Counties Community College District No. 525, Joliet Junior College, Illinois, GO Unlimited | | | 6.25 | | | 06/01/22 | | | 115,000 | | | | 115,232 | |

| | | | | | | | | | | | | | 2,604,393 | |

| Indiana 1.12% | | | | | | | | | | | | | | |

| Clark-Pleasant School Building Corp., Indiana, Refunding, RB | | | 5.00 | | | 01/15/19 | | | 275,000 | | | | 279,928 | |

| Merrillville Redevelopment Authority, Indiana, Tax Allocation Bond | | | 5.00 | | | 08/15/20 | | | 350,000 | | | | 372,099 | |

| | | | | | | | | | | | | | 652,027 | |

| Iowa 1.10% | | | | | | | | | | | | | | |

| City of Clive, Iowa, Refunding, GO Unlimited, Series A | | | 2.00 | | | 06/01/19 | | | 235,000 | | | | 236,058 | |

| Iowa State Board of Regents, University of Iowa Hospitals and Clinics, Iowa, Refunding, RB, Series A | | | 3.00 | | | 09/01/19 | | | 400,000 | | | | 406,040 | |

| | | | | | | | | | | | | | 642,098 | |

| Kentucky 0.95% | | | | | | | | | | | | | | |

| Louisville & Jefferson County Metropolitan Sewer District, Kentucky, RB, Series A | | | 5.00 | | | 05/15/23 | | | 500,000 | | | | 550,825 | |

| | | | | | | | | | | | | | | |

| Louisiana 1.54% | | | | | | | | | | | | | | |

| State of Louisiana, Louisiana, Prefunding, GO Unlimited, Series A | | | 5.00 | | | 08/01/26 | | | 800,000 | | | | 895,856 | |

| | | | | | | | | | | | | | | |

| Massachusetts 0.52% | | | | | | | | | | | | | | |

| Massachusetts Transportation Trust Fund Metropolitan Highway System Revenue, Massachusetts, RB ‡ | | | 1.49 | | | 01/01/37 | | | 300,000 | | | | 300,000 | |

See notes to portfolios of investments and notes to financial statements.

| Near-Term Tax Free Fund | |

| Portfolio of Investments (unaudited) | June 30, 2018 |

| | | Coupon | | | Maturity | | Principal | | | | |

| Municipal Bonds (cont’d) | | Rate % | | | Date | | Amount | | | Value | |

| Michigan 2.56% | | | | | | | | | | | |

| City of Wyoming, Water Supply System, Michigan, Refunding, RB | | | 4.00 | | | 06/01/20 | | $ | 215,000 | | | $ | 224,009 | |

| Michigan Public Power Agency, AFEC Project, Michigan, RB, Series A | | | 4.50 | | | 01/01/19 | | | 280,000 | | | | 283,564 | |

| Michigan State Hospital Finance Authority, Trinity Health, Michigan, RB, Series A | | | 6.00 | | | 12/01/18 | | | 200,000 | | | | 203,638 | |

| Oxford Area Community School District, Michigan, Refunding, GO Unlimited, Series A Q-SBLF | | | 5.00 | | | 05/01/22 | | | 365,000 | | | | 405,289 | |

| State of Michigan Trunk Line Revenue, Michigan, Refunding, RB | | | 4.50 | | | 11/01/26 | | | 105,000 | | | | 108,420 | |

| Wayne County Airport Authority, Detroit Metropolitan Airport, Michigan, Refunding, RB, Series C | | | 4.00 | | | 12/01/19 | | | 255,000 | | | | 263,068 | |

| | | | | | | | | | | | | | 1,487,988 | |

| Minnesota 0.55% | | | | | | | | | | | | | | |

| City of Minneapolis MN/St Paul Housing & Redevelopment Authority, Minnesota, RB AGM ‡ | | | 1.52 | | | 08/15/25 | | | 320,000 | | | | 320,000 | |

| | | | | | | | | | | | | | | |

| Missouri 4.21% | | | | | | | | | | | | | | |

| City of Kansas City, Missouri, Refunding, RB, Series B | | | 5.00 | | | 08/01/19 | | | 650,000 | | | | 673,016 | |

| City of Kansas City Water Revenue, Missouri, RB, Series F AGM | | | 4.00 | | | 12/01/22 | | | 250,000 | | | | 270,458 | |

| County of Jackson, Truman Sports Complex Project, Special Obligation, Missouri, Refunding, RB | | | 5.00 | | | 12/01/18 | | | 215,000 | | | | 217,952 | |

| Missouri State Board of Public Buildings, Missouri, RB, Series A | | | 3.00 | | | 04/01/26 | | | 750,000 | | | | 768,900 | |

| Missouri State Regional Convention & Sports Complex Authority, Missouri, Refunding, RB, Series A | | | 5.00 | | | 08/15/19 | | | 500,000 | | | | 519,070 | |

| | | | | | | | | | | | | | 2,449,396 | |

| Nevada 0.56% | | | | | | | | | | | | | | |

| Las Vegas Valley Water District, Nevada, Refunding, GO Limited, Series D | | | 5.00 | | | 06/01/27 | | | 315,000 | | | | 324,614 | |

See notes to portfolios of investments and notes to financial statements.

| Near-Term Tax Free Fund | |

| Portfolio of Investments (unaudited) | June 30, 2018 |

| | | Coupon | | | Maturity | | Principal | | | | |

| Municipal Bonds (cont’d) | | Rate % | | | Date | | Amount | | | Value | |

| New Jersey 2.40% | | | | | | | | | | | |

| City of Atlantic City, Tax Appeal, New Jersey, Refunding, GO Unlimited | | | 4.00 | | | 11/01/18 | | $ | 500,000 | | | $ | 498,685 | |

| Hudson County Improvement Authority, North Hudson Regional Fire, New Jersey, Refunding, RB, Series A AGM | | | 5.63 | | | 09/01/18 | | | 400,000 | | | | 402,620 | |

| Middlesex County Improvement Authority, New Jersey, RB | | | 5.00 | | | 07/01/25 | | | 425,000 | | | | 498,746 | |

| | | | | | | | | | | | | | 1,400,051 | |

| New York 12.36% | | | | | | | | | | | | | | |

| City of New York, New York, GO Unlimited ‡ | | | 1.58 | | | 08/01/44 | | | 1,000,000 | | | | 1,000,000 | |

| City of New York, New York, GO Unlimited, Series B | | | 5.00 | | | 08/01/19 | | | 400,000 | | | | 414,864 | |

| City of New York, New York, GO Unlimited, Series E | | | 5.25 | | | 08/01/22 | | | 875,000 | | | | 987,280 | |

| City of New York, New York, GO Unlimited, Series I | | | 5.00 | | | 08/01/22 | | | 1,000,000 | | | | 1,118,570 | |

| Long Island Power Authority, New York, RB, Series B | | | 5.00 | | | 09/01/21 | | | 465,000 | | | | 508,561 | |

| Metropolitan Transportation Authority, New York, RB ‡ | | | 1.54 | | | 11/01/35 | | | 325,000 | | | | 325,000 | |

| Nassau County Industrial Development Agency, New York Institute of Technology Project, New York, Refunding, RB, Series A | | | 5.00 | | | 03/01/21 | | | 350,000 | | | | 369,009 | |

| New York City Water & Sewer System, New York, RB ‡ | | | 1.51 | | | 06/15/38 | | | 200,000 | | | | 200,000 | |

| New York State Dormitory Authority, New York, Refunding, RB, Series B | | | 5.00 | | | 02/15/26 | | | 750,000 | | | | 884,415 | |

| New York State Housing Finance Agency, New York, RB ‡ | | | 1.50 | | | 05/15/37 | | | 500,000 | | | | 500,000 | |

| New York State Urban Development Corp., New York, RB, Series A-2 NATL | | | 5.50 | | | 03/15/19 | | | 615,000 | | | | 632,798 | |

| New York State Urban Development Corp., New York, Refunding, RB, Series D | | | 5.50 | | | 01/01/19 | | | 250,000 | | | | 255,020 | |

| | | | | | | | | | | | | | 7,195,517 | |

| North Carolina 2.21% | | | | | | | | | | | | | | |

| City of Charlotte, Equipment Acquisition & Public Facilities, North Carolina, COP, Series A | | | 5.00 | | | 10/01/21 | | | 1,000,000 | | | | 1,072,110 | |

| County of Beaufort, North Carolina, RB | | | 5.00 | | | 06/01/21 | | | 200,000 | | | | 216,646 | |

| | | | | | | | | | | | | | 1,288,756 | |

See notes to portfolios of investments and notes to financial statements.

| Near-Term Tax Free Fund | |

| Portfolio of Investments (unaudited) | June 30, 2018 |

| | | Coupon | | | Maturity | | Principal | | | | |

| Municipal Bonds (cont’d) | | Rate % | | | Date | | Amount | | | Value | |

| Ohio 1.25% | | | | | | | | | | | |

| City of Cleveland Parking Facility Revenue, Ohio, Refunding, RB AGM | | | 5.25 | | | 09/15/22 | | $ | 130,000 | | | $ | 146,767 | |

| County of Hamilton, Ohio, Refunding, GO Limited, Series A | | | 5.00 | | | 12/01/24 | | | 500,000 | | | | 580,360 | |

| | | | | | | | | | | | | | 727,127 | |

| Oregon 0.36% | | | | | | | | | | | | | | |

| Oregon State Facilities Authority, Legacy Health Project, Oregon, Refunding, RB, Series A | | | 4.50 | | | 05/01/20 | | | 200,000 | | | | 209,700 | |

| | | | | | | | | | | | | | | |

| Pennsylvania 2.96% | | | | | | | | | | | | | | |

| Allegheny County Sanitary Authority, Pennsylvania, Refunding, RB AGM | | | 5.00 | | | 06/01/19 | | | 700,000 | | | | 721,238 | |

| Delaware Valley Regional Finance Authority, Permanently Fixed Business Development Services, Pennsylvania, RB, AMBAC | | | 5.50 | | | 08/01/18 | | | 295,000 | | | | 295,917 | |

| Reading School District, Pennsylvania, GO Unlimited, Series A | | | 5.00 | | | 04/01/20 | | | 400,000 | | | | 419,192 | |

| Wilkes-Barre Finance Authority, University of Scranton, Pennsylvania, Refunding, RB, Series A | | | 5.00 | | | 11/01/19 | | | 275,000 | | | | 286,044 | |

| | | | | | | | | | | | | | 1,722,391 | |

| Rhode Island 2.06% | | | | | | | | | | | | | | |

| Rhode Island Housing & Mortgage Finance Corp., Rhode Island, RB ‡ | | | 1.59 | | | 04/01/39 | | | 1,200,000 | | | | 1,200,000 | |

| | | | | | | | | | | | | | | |

| South Carolina 3.32% | | | | | | | | | | | | | | |

| City of Columbia SC Waterworks & Sewer System Revenue, South Carolina, RB ‡ | | | 1.51 | | | 02/01/38 | | | 100,000 | | | | 100,000 | |

| City of North Charleston SC, South Carolina, Tax Allocation Bond ‡ | | | 1.53 | | | 12/01/18 | | | 435,000 | | | | 435,000 | |

| City of North Charleston SC, South Carolina, Tax Allocation Bond ‡ | | | 1.53 | | | 09/01/37 | | | 480,000 | | | | 480,000 | |

| Spartanburg Regional Health Services District, South Carolina, Refunding, RB, Series A | | | 5.00 | | | 04/15/19 | | | 600,000 | | | | 615,324 | |

| Spartanburg Sanitation Sewer District, South Carolina, RB, Series A AGC | | | 3.50 | | | 03/01/19 | | | 300,000 | | | | 303,768 | |

| | | | | | | | | | | | | | 1,934,092 | |

See notes to portfolios of investments and notes to financial statements.

| Near-Term Tax Free Fund | |

| Portfolio of Investments (unaudited) | June 30, 2018 |

| | | Coupon | | | Maturity | | Principal | | | | |

| Municipal Bonds (cont’d) | | Rate % | | | Date | | Amount | | | Value | |

| Tennessee 0.97% | | | | | | | | | | | |

| City of Memphis Sanitary Sewerage System Revenue, Tennessee, Refunding, RB AGM | | | 5.00 | | | 05/01/20 | | $ | 200,000 | | | $ | 211,898 | |

| The Public Building Authority of Sevier County TN, Tennessee, RB ‡ | | | 1.52 | | | 06/01/32 | | | 350,000 | | | | 350,000 | |

| | | | | | | | | | | | | | 561,898 | |

| Texas 22.78% | | | | | | | | | | | | | | |

| Bryan Independent School District, Texas, GO Unlimited, Series A PSF-GTD | | | 5.00 | | | 02/15/22 | | | 410,000 | | | | 453,001 | |

| City of Arlington, Certificates of Obligation, Texas, GO Limited, Series B | | | 2.00 | | | 08/15/19 | | | 500,000 | | | | 502,645 | |

| City of Austin/TX, Texas, Refunding, RB ‡ | | | 1.51 | | | 11/15/29 | | | 1,000,000 | | | | 1,000,000 | |

| City of Cedar Hill, Texas, Refunding, GO Limited | | | 5.00 | | | 02/15/22 | | | 800,000 | | | | 881,256 | |

| City of Center, Certificates of Obligation, Texas, GO Limited AGM ◊ | | | 3.07 | | | 02/15/20 | | | 150,000 | | | | 145,437 | |

| City of Fort Worth Water & Sewer System Revenue, Texas, Refunding, RB | | | 5.00 | | | 02/15/19 | | | 800,000 | | | | 817,056 | |

| City of Longview Waterworks & Sewer System Revenue, Texas, Refunding, RB | | | 3.00 | | | 03/01/22 | | | 610,000 | | | | 626,848 | |

| City of Pharr, Texas, Refunding, GO Limited, Series A | | | 5.00 | | | 08/15/20 | | | 285,000 | | | | 302,932 | |

| City of Plano, Texas, Refunding, GO Limited | | | 5.00 | | | 09/01/19 | | | 1,000,000 | | | | 1,039,880 | |

| City of Round Rock, Texas, Refunding, GO Limited | | | 2.00 | | | 08/15/19 | | | 465,000 | | | | 466,841 | |

| City of Texarkana Waterworks & Sanitary Sewer System Revenue, Texas, RB | | | 3.00 | | | 08/01/19 | | | 90,000 | | | | 91,379 | |

| City of Texarkana Waterworks & Sanitary Sewer System Revenue, Texas, RB | | | 3.00 | | | 08/01/20 | | | 95,000 | | | | 97,001 | |

| Clear Lake City Water Authority, Waterworks & Sewer System, Texas, GO Unlimited | | | 3.00 | | | 03/01/19 | | | 125,000 | | | | 126,244 | |

| Corpus Christi Business & Job Development Corp., Seawall Project, Texas, Refunding, RB | | | 5.00 | | | 03/01/20 | | | 350,000 | | | | 368,477 | |

| Dimmitt Independent School District, Texas, GO Unlimited PSF-GTD | | | 3.00 | | | 02/15/22 | | | 305,000 | | | | 313,863 | |

| Harris County Municipal Utility District No. 382, Texas, Refunding, GO Unlimited BAM | | | 3.00 | | | 04/01/22 | | | 305,000 | | | | 309,014 | |

| Lower Colorado River Authority, LCRA Transmission Services Corp., Texas, Refunding, RB, Series A | | | 5.00 | | | 05/15/21 | | | 500,000 | | | | 543,180 | |

| Lubbock-Cooper Independent School District, Texas, GO Unlimited PSF-GTD | | | 3.00 | | | 02/15/22 | | | 755,000 | | | | 781,470 | |

See notes to portfolios of investments and notes to financial statements.

| Near-Term Tax Free Fund | |

| Portfolio of Investments (unaudited) | June 30, 2018 |

| | | Coupon | | | Maturity | | Principal | | | | |

| Municipal Bonds (cont’d) | | Rate % | | | Date | | Amount | | | Value | |

| Texas (cont’d) | | | | | | | | | | | |

| Olmos Park Higher Education Facilities Corp., University of the Incarnate Word, Texas, Refunding, RB | | | 5.00 | | | 12/01/21 | | $ | 500,000 | | | $ | 544,895 | |

| Red River Education Finance Corp., Texas, RB ‡ | | | 1.52 | | | 03/15/35 | | | 700,000 | | | | 700,000 | |

| San Antonio Water System, Texas, Refunding, RB | | | 4.50 | | | 05/15/21 | | | 400,000 | | | | 429,456 | |

| State of Texas, Texas, Refunding, GO Unlimited | | | 5.00 | | | 10/01/20 | | | 550,000 | | | | 589,539 | |

| Texas State Public Finance Authority Charter School Finance Corp., Texas, Prefunding, RB, Series A | | | 6.20 | | | 02/15/40 | | | 2,000,000 | | | | 2,137,560 | |

| | | | | | | | | | | | | | 13,267,974 | |

| Utah 0.94% | | | | | | | | | | | | | | |

| County of Davis, Utah, Refunding, GO Unlimited | | | 5.00 | | | 02/01/19 | | | 200,000 | | | | 204,080 | |

| Utah State Building Ownership Authority, State Facilities Master Lease Program, Utah, Refunding, RB, Series C AGM | | | 5.50 | | | 05/15/19 | | | 35,000 | | | | 36,206 | |

| Washington County-St George Interlocal Agency, Utah, Refunding, RB, Series A | | | 4.00 | | | 12/01/19 | | | 300,000 | | | | 309,576 | |

| | | | | | | | | | | | | | 549,862 | |

| Washington 5.43% | | | | | | | | | | | | | | |

| County of Thurston, Washington, Refunding, GO Limited | | | 5.00 | | | 12/01/20 | | | 1,625,000 | | | | 1,750,726 | |

| Spokane Public Facilities District, Washington, Refunding, RB, Series B | | | 5.00 | | | 12/01/21 | | | 950,000 | | | | 1,042,844 | |

| Tacoma Metropolitan Park District, Washington, Refunding, GO Unlimited, Series B | | | 4.00 | | | 12/01/19 | | | 355,000 | | | | 366,988 | |

| | | | | | | | | | | | | | 3,160,558 | |

| | | | | | | | | | | | | | | |

| Investments, at value 92.09% | | | | | | | | | | | | | 53,625,053 | |

| (cost $53,920,096) | | | | | | | | | | | | | | |

| Other assets and liabilities, net 7.91% | | | | | | | | | | | | | 4,608,477 | |

| | | | | | | | | | | | | | | |

| Net Assets 100.00% | | | | | | | | | | | | $ | 58,233,530 | |

See notes to portfolios of investments and notes to financial statements.

| Near-Term Tax Free Fund | |

| Portfolio of Investments (unaudited) | June 30, 2018 |

Municipal Bond Ratings* Based on Total Municipal Bonds | June 30, 2018 |

| * | Credit quality ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). “Not Rated” is used to classify securities for which a rating is not available. Credit quality ratings for each issue are obtained from Moody’s and S&P, and the higher rating for each issue is used. |

See notes to portfolios of investments and notes to financial statements.

| All American Equity Fund | |

| Portfolio of Investments (unaudited) | June 30, 2018 |

| Common Stocks 94.11% | | Shares | | | Value | |

| | | | | | | |

| Aerospace/Defense 2.84% | | | | | | |

| The Boeing Co. | | | 1,300 | | | $ | 436,163 | |

| | | | | | | | | |

| Apparel Manufacturers 3.33% | | | | | | | | |

| Hanesbrands, Inc. | | | 23,200 | | | | 510,864 | |

| | | | | | | | | |

| Beverages - Wine/Spirits 3.14% | | | | | | | | |

| Constellation Brands, Inc., Class A | | | 2,200 | | | | 481,514 | |

| | | | | | | | | |

| Chemicals - Diversified 2.70% | | | | | | | | |

| PPG Industries, Inc. | | | 4,000 | | | | 414,920 | |

| | | | | | | | | |

| Commercial Banks 3.29% | | | | | | | | |

| Zions Bancorp. | | | 9,600 | | | | 505,824 | |

| | | | | | | | | |

| Commercial Services - Finance 2.81% | | | | | | | | |

| Total System Services, Inc. | | | 5,100 | | | | 431,052 | |

| | | | | | | | | |

| Computer Services 2.26% | | | | | | | | |

| DXC Technology Co. | | | 4,300 | | | | 346,623 | |

| | | | | | | | | |

| Cosmetics & Toiletries 3.34% | | | | | | | | |

| The Estee Lauder Cos., Inc. | | | 3,600 | | | | 513,684 | |

| | | | | | | | | |

| Cruise Lines 4.61% | | | | | | | | |

| Carnival Corp. | | | 6,200 | | | | 355,322 | |

| Royal Caribbean Cruises, Ltd. | | | 3,400 | | | | 352,240 | |

| | | | | | | | 707,562 | |

| | | | | | | | | |

| Diversified Manufacturing Operations 3.04% | | | | | | | | |

| Ingersoll-Rand PLC | | | 5,200 | | | | 466,596 | |

| | | | | | | | | |

| Electronic Components - Semiconductors 6.03% | | | | | | | | |

| Broadcom, Inc. | | | 1,820 | | | | 441,605 | |

| Texas Instruments, Inc. | | | 4,400 | | | | 485,100 | |

| | | | | | | | 926,705 | |

| | | | | | | | | |

| Enterprise Software/Services 2.73% | | | | | | | | |

| Oracle Corp. | | | 9,500 | | | | 418,570 | |

| | | | | | | | | |

| Fiduciary Banks 3.51% | | | | | | | | |

| The Bank of New York Mellon Corp. | | | 10,000 | | | | 539,300 | |

See notes to portfolios of investments and notes to financial statements.

| All American Equity Fund | |

| Portfolio of Investments (unaudited) | June 30, 2018 |

| Common Stocks (cont’d) | | Shares | | | Value | |

| | | | | | | |

| Finance - Credit Card 3.62% | | | | | | |

| Visa, Inc., Class A | | | 4,200 | | | $ | 556,290 | |

| | | | | | | | | |

| Medical - Biomedical/Genetics 3.25% | | | | | | | | |

| Amgen, Inc. | | | 2,700 | | | | 498,393 | |

| | | | | | | | | |

| Medical - Drugs 3.11% | | | | | | | | |

| Zoetis, Inc. | | | 5,600 | | | | 477,064 | |

| | | | | | | | | |

| Medical - HMO 2.91% | | | | | | | | |

| Humana, Inc. | | | 1,500 | | | | 446,445 | |

| | | | | | | | | |

| Medical Products 3.80% | | | | | | | | |

| Baxter International, Inc. | | | 7,900 | | | | 583,336 | |

| | | | | | | | | |

| Oil Companies - Exploration & Production 2.90% | | | | | | | | |

| Cabot Oil & Gas Corp. | | | 18,700 | | | | 445,060 | |

| | | | | | | | | |

| Oil Refining & Marketing 6.49% | | | | | | | | |

| Marathon Petroleum Corp. | | | 6,000 | | | | 420,960 | |

| Valero Energy Corp. | | | 5,200 | | | | 576,316 | |

| | | | | | | | 997,276 | |

| | | | | | | | | |

| REITS - Diversified 2.72% | | | | | | | | |

| American Tower Corp. REIT | | | 2,900 | | | | 418,093 | |

| | | | | | | | | |

| Retail - Building Products 3.68% | | | | | | | | |

| The Home Depot, Inc. | | | 2,900 | | | | 565,790 | |

| | | | | | | | | |

| Retail - Discount 2.86% | | | | | | | | |

| Costco Wholesale Corp. | | | 2,100 | | | | 438,858 | |

| | | | | | | | | |

| Super-Regional Banks-US 3.28% | | | | | | | | |

| KeyCorp | | | 25,800 | | | | 504,132 | |

| | | | | | | | | |

| Supranational Bank 2.90% | | | | | | | | |

| Comerica, Inc. | | | 4,900 | | | | 445,508 | |

| | | | | | | | | |

| Telephone - Integrated 2.75% | | | | | | | | |

| Verizon Communications, Inc. | | | 8,400 | | | | 422,604 | |

| | | | | | | | | |

| Tools - Hand Held 3.04% | | | | | | | | |

| Snap-on, Inc. | | | 2,900 | | | | 466,088 | |

See notes to portfolios of investments and notes to financial statements.

| All American Equity Fund | |

| Portfolio of Investments (unaudited) | June 30, 2018 |

| Common Stocks (cont’d) | | Shares | | | Value | |

| | | | | | | |

| Water 3.17% | | | | | | |

| American Water Works Co., Inc. | | | 5,700 | | | $ | 486,666 | |

| | | | | | | | | |

| Total Common Stocks | | | | | | | 14,450,980 | |

| (cost $13,842,605) | | | | | | | | |

| | | | | | | | | |

| Exchange Traded Funds 0.95% | | | | | | | | |

| Consumer Discretionary Select Sector SPDR Fund ETF | | | 700 | | | | 76,510 | |

| Innovator IBD 50 ETF | | | 2,000 | | | | 70,200 | |

| | | | | | | | | |

| Total Exchange Traded Funds | | | | | | | 146,710 | |

| (cost $148,279) | | | | | | | | |

| | | | | | | | Notional | | | | | | | |

| | | Strike | | | Exp. | | Contract | | | | | | | |

| Put Option Purchased 0.70% | | Price | | | Date | | Value | | | Contracts | | | | |

| | | | | | | | | | | | | | | |

| Exchange Traded Fund 0.70% | | | | | | | | | | | | | | |

| SPDR S&P 500 ETF Trust | | $ | 270.00 | | | 01/19 | | $ | 2,658,544 | | | | 98 | | | | 107,310 | |

| (premiums paid $134,820) | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Investments, at value 95.76% | | | | | | | | | | | | | | | | | 14,705,000 | |

| (cost $14,125,704) | | | | | | | | | | | | | | | | | | |

| Other assets and liabilities, net 4.24% | | | | | | | | | | | | | | | | | 650,326 | |

| | | | | | | | | | | | | | | | | | | |

| Net Assets 100.00% | | | | | | | | | | | | | | | | $ | 15,355,326 | |

See notes to portfolios of investments and notes to financial statements.

| All American Equity Fund | |

| Portfolio of Investments (unaudited) | June 30, 2018 |

Portfolio Allocation by Industry Sector* Based on Total Investments | June 30, 2018 |

| * | Summary information above may differ from the portfolio schedule included in the financial statements due to the use of different classifications of securities for presentation purposes. |

See notes to portfolios of investments and notes to financial statements.

| Holmes Macro Trends Fund | |

| Portfolio of Investments (unaudited) | June 30, 2018 |

| Common Stocks 91.81% | | Shares | | | Value | |

| | | | | | | |

| Airlines 4.01% | | | | | | |

| Hawaiian Holdings, Inc. | | | 44,000 | | | $ | 1,581,800 | |

| | | | | | | | | |

| Batteries/Battery Systems 3.26% | | | | | | | | |

| Energizer Holdings, Inc. | | | 20,400 | | | | 1,284,384 | |

| | | | | | | | | |

| Beverages - Non-alcoholic 2.19% | | | | | | | | |

| Coca-Cola Bottling Co. Consolidated | | | 6,400 | | | | 864,832 | |

| | | | | | | | | |

| Building - Residential/Commercial 2.33% | | | | | | | | |

| LGI Homes, Inc. * | | | 15,900 | | | | 917,907 | |

| | | | | | | | | |

| Casino Hotels 4.96% | | | | | | | | |

| Wynn Resorts, Ltd. | | | 11,700 | | | | 1,957,878 | |

| | | | | | | | | |

| Chemicals - Specialty 3.59% | | | | | | | | |

| The Chemours Co. | | | 31,900 | | | | 1,415,084 | |

| | | | | | | | | |

| Commercial Services 3.57% | | | | | | | | |

| Medifast, Inc. | | | 8,800 | | | | 1,409,408 | |

| | | | | | | | | |

| Commercial Services - Finance 7.54% | | | | | | | | |

| S&P Global, Inc. | | | 14,600 | | | | 2,976,794 | |

| | | | | | | | | |

| Consumer Products - Miscellaneous 3.04% | | | | | | | | |

| Kimberly-Clark Corp. | | | 11,400 | | | | 1,200,876 | |

| | | | | | | | | |

| Diversified Manufacturing Operations 2.59% | | | | | | | | |

| EnPro Industries, Inc. | | | 14,600 | | | | 1,021,270 | |

| | | | | | | | | |

| Electronic Secure Devices 3.39% | | | | | | | | |

| Allegion PLC | | | 17,300 | | | | 1,338,328 | |

| | | | | | | | | |

| Energy - Alternate Sources 0.00% | | | | | | | | |

| Pacific Green Energy Corp. #*@ | | | 100,000 | | | | 0 | |

| | | | | | | | | |

| Food - Miscellaneous/Diversified 2.96% | | | | | | | | |

| B&G Foods, Inc. | | | 39,000 | | | | 1,166,100 | |

| | | | | | | | | |

| Home Furnishings 2.01% | | | | | | | | |

| Sleep Number Corp. * | | | 27,400 | | | | 795,148 | |

See notes to portfolios of investments and notes to financial statements.

| Holmes Macro Trends Fund | |

| Portfolio of Investments (unaudited) | June 30, 2018 |

| Common Stocks (cont’d) | | Shares | | | Value | |

| | | | | | | |

| Medical - Drugs 7.60% | | | | | | |

| Corcept Therapeutics, Inc. * | | | 95,000 | | | $ | 1,493,400 | |

| Mallinckrodt PLC * | | | 80,600 | | | | 1,503,996 | |

| | | | | | | | 2,997,396 | |

| | | | | | | | | |

| Medical - Hospitals 0.00% | | | | | | | | |

| African Medical Investments PLC #*@ | | | 1,000,000 | | | | 0 | |

| | | | | | | | | |

| Medical Laser Systems 2.60% | | | | | | | | |

| Cutera, Inc. * | | | 25,500 | | | | 1,027,650 | |

| | | | | | | | | |

| Office Automation & Equipment 3.02% | | | | | | | | |

| Pitney Bowes, Inc. | | | 139,000 | | | | 1,191,230 | |

| | | | | | | | | |

| Oil Companies - Exploration & Production 0.08% | | | | | | | | |

| PentaNova Energy Corp., 144A #*∆ | | | 500,000 | | | | 30,426 | |

| | | | | | | | | |

| Pastoral & Agricultural 3.85% | | | | | | | | |

| Phibro Animal Health Corp. | | | 33,000 | | | | 1,519,650 | |

| | | | | | | | | |

| Power Conversion/Supply Equipment 3.94% | | | | | | | | |

| SPX Corp. * | | | 44,300 | | | | 1,552,715 | |

| | | | | | | | | |

| Real Estate Operating/Development 0.82% | | | | | | | | |

| Pacific Infrastructure Ventures, Inc. #*@+ | | | 426,533 | | | | 322,118 | |

| | | | | | | | | |

| REITS - Diversified 3.85% | | | | | | | | |

| Potlatch Corp. REIT | | | 29,900 | | | | 1,520,415 | |

| | | | | | | | | |

| REITS - Regional Malls 4.14% | | | | | | | | |

| Taubman Centers, Inc. REIT | | | 27,800 | | | | 1,633,528 | |

| | | | | | | | | |

| Semiconductor Equipment 2.39% | | | | | | | | |

| Axcelis Technologies, Inc. * | | | 47,600 | | | | 942,480 | |

| | | | | | | | | |

| Telecom Equipment Fiber Optics 2.90% | | | | | | | | |

| Ciena Corp. * | | | 43,097 | | | | 1,142,502 | |

| | | | | | | | | |

| Television 4.35% | | | | | | | | |

| AMC Networks, Inc., Class A * | | | 27,600 | | | | 1,716,720 | |

| | | | | | | | | |

| Transportation - Services 4.63% | | | | | | | | |

| United Parcel Service, Inc., Class B | | | 17,200 | | | | 1,827,156 | |

See notes to portfolios of investments and notes to financial statements.

| Holmes Macro Trends Fund | |

| Portfolio of Investments (unaudited) | June 30, 2018 |

| Common Stocks (cont’d) | | Shares | | | Value | |

| | | | | | | |

| Web Hosting/Design 2.20% | | | | | | |

| NIC, Inc. | | | 55,811 | | | $ | 867,861 | |

| | | | | | | | | |

| Total Common Stocks | | | | | | | 36,221,656 | |

| (cost $35,135,834) | | | | | | | | |

| | | Coupon | | | Maturity | | Principal | | | | |

| Corporate Non-Convertible Bond 0.59% | | Rate % | | | Date | | Amount | | | | |

| | | | | | | | | | | | |

| Electric - Generation 0.59% | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Interamerican Energy Corp. #@+ | | | 15.00 | | | 11/08/21 | | $ | 233,829 | | | | 233,829 | |

| (cost $233,829) | | | | | | | | | | | | | | |

| Exchange Traded Funds 0.99% | | Shares | | | | |

| Consumer Discretionary Select Sector SPDR Fund ETF | | | 1,800 | | | | 196,740 | |

| Innovator IBD 50 ETF | | | 5,500 | | | | 193,050 | |

| | | | | | | | | |

| Total Exchange Traded Funds | | | | | | | 389,790 | |

| (cost $394,214) | | | | | | | | |

| | | Exercise | | | Exp. | | | | | | |

| Warrants 0.00% | | Price | | | Date | | | | | | |

| | | | | | | | | | | | |

| Gold Mining 0.00% | | | | | | | | | | | |

| Gran Colombia Gold Corp. * | | $ | 48.75 | | | 03/18/19 | | | 250 | | | | 8 | |

| | | | | | | | | | | | | | | |

| Oil Companies - Exploration & Production 0.00% | | | | | | | | | | | | | | |

| PentaNova Energy Corp., 144A #*@∆ | | | 1.05 | | | 07/31/22 | | | 500,000 | | | | 0 | |

| | | | | | | | | | | | | | | |

| Total Warrants | | | | | | | | | | | | | 8 | |

| (cost $0) | | | | | | | | | | | | | | |

| | | | | | | | Notional | | | | | | | |

| | | Strike | | | Exp. | | Contract | | | | | | | |

| Put Option Purchased 0.71% | | Price | | | Date | | Value | | | Contracts | | | Value | |

| | | | | | | | | | | | | | | |

| Exchange Traded Fund 0.71% | | | | | | | | | | | | | | |

| SPDR S&P 500 ETF Trust | | $ | 270.00 | | | 01/19 | | $ | 6,944,768 | | | | 256 | | | | 280,320 | |

| (premiums paid $352,064) | | | | | | | | | | | | | | | | | | |

See notes to portfolios of investments and notes to financial statements.

| Holmes Macro Trends Fund | |

| Portfolio of Investments (unaudited) | June 30, 2018 |

| Investments, at value 94.10% | | $ | 37,125,603 | |

| (cost $36,115,941) | | | | |

| Other assets and liabilities, net 5.90% | | | 2,327,275 | |

| | | | | |

| Net Assets 100.00% | | $ | 39,452,878 | |

Portfolio Allocation by Industry Sector* Based on Total Investments | June 30, 2018 |

| * | Summary information above may differ from the portfolio schedule included in the financial statements due to the use of different classifications of securities for presentation purposes. |

See notes to portfolios of investments and notes to financial statements.

| Global Resources Fund | |

| Portfolio of Investments (unaudited) | June 30, 2018 |

| Common Stocks 87.67% | | Shares | | | Value | |

| | | | | | | |

| Building & Construction Products - Miscellaneous 1.24% | | | | | | |

| Louisiana-Pacific Corp. | | | 38,600 | | | $ | 1,050,692 | |

| | | | | | | | | |

| Building Products - Wood 1.47% | | | | | | | | |

| Norbord, Inc. | | | 30,400 | | | | 1,250,085 | |

| | | | | | | | | |

| Chemicals - Diversified 7.36% | | | | | | | | |

| Braskem SA, ADR | | | 42,800 | | | | 1,112,800 | |

| Covestro AG | | | 11,200 | | | | 995,496 | |

| Dongyue Group, Ltd. | | | 1,124,500 | | | | 941,310 | |

| Huchems Fine Chemical Corp. | | | 42,900 | | | | 1,125,851 | |

| LyondellBasell Industries NV, Class A | | | 11,000 | | | | 1,208,350 | |

| Tosoh Corp. | | | 55,650 | | | | 860,471 | |

| | | | | | | | 6,244,278 | |

| | | | | | | | | |

| Chemicals - Specialty 3.36% | | | | | | | | |

| China Sanjiang Fine Chemicals Co., Ltd. | | | 2,684,700 | | | | 894,009 | |

| Daicel Corp. | | | 101,700 | | | | 1,123,466 | |

| Daqo New Energy Corp., ADR * | | | 23,400 | | | | 831,636 | |

| | | | | | | | 2,849,111 | |

| | | | | | | | | |

| Coal 5.53% | | | | | | | | |

| Arch Coal, Inc. | | | 14,200 | | | | 1,113,706 | |

| Caribbean Resources Corp. #*@~ | | | 17 | | | | 0 | |

| China Shenhua Energy Co., Ltd., H Shares | | | 439,700 | | | | 1,039,999 | |

| Jastrzebska Spolka Weglowa SA * | | | 48,900 | | | | 994,663 | |

| Peabody Energy Corp. | | | 33,900 | | | | 1,541,772 | |

| Walter Energy, Inc., 144A #*∆ | | | 4,293 | | | | 0 | |

| | | | | | | | 4,690,140 | |

| | | | | | | | | |

| Commercial Service - Finance 0.39% | | | | | | | | |

| BIG Blockchain Intelligence Group, Inc. * | | | 2,000,000 | | | | 327,083 | |

| | | | | | | | | |

| Diamonds/Precious Stones 0.29% | | | | | | | | |

| Barksdale Capital Corp. * | | | 400,000 | | | | 243,411 | |

| Rockwell Diamonds, Inc., 144A #*@∆ | | | 63,333 | | | | 0 | |

| | | | | | | | 243,411 | |

See notes to portfolios of investments and notes to financial statements.

| Global Resources Fund | |

| Portfolio of Investments (unaudited) | June 30, 2018 |

| Common Stocks (cont’d) | | Shares | | | Value | |

| | | | | | | |

| Diversified Minerals 6.85% | | | | | | |

| Anglo American PLC | | | 59,300 | | | $ | 1,316,516 | |

| Caledonia Mining Corp. PLC | | | 62,911 | | | | 530,906 | |

| Encanto Potash Corp., 144A *∆ | | | 300,000 | | | | 50,203 | |

| Golden Reign Resources, Ltd. * | | | 1,148,600 | | | | 166,002 | |

| Libero Copper Corp. *~ | | | 3,250,000 | | | | 228,673 | |

| Lumina Gold Corp. * | | | 804,100 | | | | 464,851 | |

| Lundin Mining Corp. | | | 193,800 | | | | 1,077,608 | |

| Niocan, Inc., 144A *∆ | | | 362,069 | | | | 19,279 | |

| Salazar Resources, Ltd. * | | | 3,000,000 | | | | 296,657 | |

| Teck Resources, Ltd. | | | 33,900 | | | | 863,584 | |

| Teck Resources, Ltd. | | | 18,000 | | | | 458,100 | |

| VR Resources, Ltd. * | | | 1,125,000 | | | | 333,739 | |

| | | | | | | | 5,806,118 | |

| | | | | | | | | |

| Electronics - Military 0.17% | | | | | | | | |

| Global UAV Technologies, Ltd. * | | | 2,225,000 | | | | 143,860 | |

| | | | | | | | | |

| Energy - Alternate Sources 4.38% | | | | | | | | |

| Pacific Green Energy Corp. #*@~ | | | 2,400,000 | | | | 0 | |

| Polaris Infrastructure, Inc. | | | 50,000 | | | | 535,504 | |

| Siemens Gamesa Renewable Energy SA | | | 65,400 | | | | 874,212 | |

| TPI Composites, Inc. * | | | 46,700 | | | | 1,365,508 | |

| Vestas Wind Systems A/S | | | 15,200 | | | | 938,392 | |

| | | | | | | | 3,713,616 | |

| | | | | | | | | |

| Finance - Investment Banker/Broker 0.52% | | | | | | | | |

| GoldMoney, Inc. * | | | 200,000 | | | | 441,182 | |

| | | | | | | | | |

| Forestry 4.25% | | | | | | | | |

| Canfor Corp. * | | | 51,600 | | | | 1,241,870 | |

| Interfor Corp. * | | | 61,800 | | | | 1,186,970 | |

| West Fraser Timber Co., Ltd. | | | 17,100 | | | | 1,177,027 | |

| | | | | | | | 3,605,867 | |

| | | | | | | | | |

| Gold Mining 10.93% | | | | | | | | |

| Centerra Gold, Inc. * | | | 181,100 | | | | 1,006,991 | |

| Chesapeake Gold Corp., 144A *∆ | | | 52,400 | | | | 79,717 | |

| Continental Gold, Inc. * | | | 82,800 | | | | 238,704 | |

| CopperBank Resources Corp. * | | | 1,300,000 | | | | 84,053 | |

See notes to portfolios of investments and notes to financial statements.

| Global Resources Fund | |

| Portfolio of Investments (unaudited) | June 30, 2018 |

| Common Stocks (cont’d) | | Shares | | | Value | |

| | | | | | | |

| Gold Mining (cont’d) | | | | | | |

| Corona Minerals, Ltd. #*@ | | | 5,000 | | | $ | 0 | |

| Evolution Mining, Ltd. | | | 193,866 | | | | 507,084 | |

| Gran Colombia Gold Corp. * | | | 4,100 | | | | 8,982 | |

| Highland Gold Mining, Ltd. | | | 563,000 | | | | 1,061,974 | |

| NGEx Resources, Inc. * | | | 461,000 | | | | 387,825 | |

| NGEx Resources, Inc. * | | | 255,900 | | | | 202,439 | |

| Northern Star Resources, Ltd. | | | 102,100 | | | | 552,739 | |

| OceanaGold Corp., 144A ∆ | | | 395,500 | | | | 1,098,068 | |

| Radisson Mining Resources, Inc. * | | | 1,160,900 | | | | 105,966 | |

| Ramelius Resources, Ltd. * | | | 729,200 | | | | 315,756 | |

| Red Pine Exploration, Inc. * | | | 1,500,000 | | | | 68,459 | |

| Revival Gold, Inc. * | | | 434,000 | | | | 274,005 | |

| Royal Road Minerals, Ltd. * | | | 5,750,000 | | | | 393,641 | |

| Sandstorm Gold, Ltd. * | | | 115,000 | | | | 517,500 | |

| St Barbara, Ltd. | | | 338,000 | | | | 1,215,498 | |

| Teranga Gold Corp. * | | | 321,300 | | | | 1,146,234 | |

| | | | | | | | 9,265,635 | |

| | | | | | | | | |

| Information Technology 0.43% | | | | | | | | |

| Abaxx Technologies, Inc., 144A #*@+∆ | | | 1,250,000 | | | | 361,313 | |

| | | | | | | | | |

| Medical - Hospitals 0.00% | | | | | | | | |

| African Medical Investments PLC #*@ | | | 2,507,500 | | | | 0 | |

| | | | | | | | | |

| Metal - Aluminum 1.35% | | | | | | | | |

| Alcoa Corp. * | | | 24,400 | | | | 1,143,872 | |

| | | | | | | | | |

| Metal - Copper 2.50% | | | | | | | | |

| Hudbay Minerals, Inc. | | | 168,500 | | | | 939,493 | |

| OZ Minerals, Ltd. | | | 168,700 | | | | 1,176,367 | |

| | | | | | | | 2,115,860 | |

| | | | | | | | | |

| Metal - Diversified 5.43% | | | | | | | | |

| Aguia Resources, Ltd. * | | | 2,949,500 | | | | 438,247 | |

| Aguia Resources, Ltd. * | | | 714,286 | | | | 93,724 | |

| Chakana Copper Corp. #* | | | 320,000 | | | | 138,744 | |

| Filo Mining Corp. * | | | 134,650 | | | | 244,790 | |

| Filo Mining Corp. * | | | 115,250 | | | | 195,743 | |

| Galway Metals, Inc. * | | | 500,000 | | | | 76,066 | |

See notes to portfolios of investments and notes to financial statements.

| Global Resources Fund | |

| Portfolio of Investments (unaudited) | June 30, 2018 |

| Common Stocks (cont’d) | | Shares | | | Value | |

| | | | | | | |

| Metal - Diversified (cont’d) | | | | | | |

| Glencore PLC | | | 25,300 | | | $ | 120,119 | |

| GoviEx Uranium, Inc. * | | | 2,100,000 | | | | 367,398 | |

| GoviEx Uranium, Inc., 144A #*∆ | | | 58,000 | | | | 10,147 | |

| Ivanhoe Mines, Ltd. * | | | 305,900 | | | | 628,251 | |

| NorthIsle Copper & Gold, Inc. * | | | 1,000,000 | | | | 95,082 | |

| Novo Resources Corp. * | | | 138,600 | | | | 448,066 | |

| Orsu Metals Corp., 144A #*∆ | | | 14,761 | | | | 2,190 | |

| Sandfire Resources NL | | | 214,900 | | | | 1,455,111 | |

| Troilus Gold Corp. * | | | 294,000 | | | | 292,960 | |

| | | | | | | | 4,606,638 | |

| | | | | | | | | |

| Metal - Iron 1.41% | | | | | | | | |

| Consolidated Growth Holdings, Ltd. #*@ | | | 19,859,173 | | | | 0 | |

| Vale SA, ADR | | | 93,000 | | | | 1,192,260 | |

| WAI Capital Investment Corp., 144A #*@∆ | | | 292,500 | | | | 0 | |

| | | | | | | | 1,192,260 | |

| | | | | | | | | |

| Mining Services 2.00% | | | | | | | | |

| Bounty Mining, Ltd. * | | | 1,692,307 | | | | 488,433 | |

| Eramet | | | 9,200 | | | | 1,206,944 | |

| | | | | | | | 1,695,377 | |

| | | | | | | | | |

| Natural Resource Technology 0.02% | | | | | | | | |

| I-Pulse, Inc., 144A #*@+∆ | | | 15,971 | | | | 14,875 | |

| | | | | | | | | |

| Non-Ferrous Metals 0.49% | | | | | | | | |

| Giyani Metals Corp. * | | | 727,272 | | | | 120,322 | |

| Group Eleven Resources Corp. * | | | 650,000 | | | | 82,817 | |

| InZinc Mining, Ltd. * | | | 2,000,000 | | | | 182,558 | |

| Sterling Group Ventures, Inc., 144A #*∆ | | | 500,000 | | | | 32,500 | |

| | | | | | | | 418,197 | |

| | | | | | | | | |

| Oil - Field Services 3.31% | | | | | | | | |

| Atlas African Industries, Ltd. #*@~ | | | 255,854,621 | | | | 0 | |

| Petrofac, Ltd. | | | 157,900 | | | | 1,212,996 | |

| TGS NOPEC Geophysical Co. ASA | | | 43,300 | | | | 1,590,191 | |

| | | | | | | | 2,803,187 | |

See notes to portfolios of investments and notes to financial statements.

| Global Resources Fund | |

| Portfolio of Investments (unaudited) | June 30, 2018 |

| Common Stocks (cont’d) | | Shares | | | Value | |

| | | | | | | |

| Oil Companies - Exploration & Production 5.80% | | | | | | |

| Africa Energy Corp., 144A *∆ | | | 2,110,889 | | | $ | 256,907 | |

| Aker BP ASA | | | 43,700 | | | | 1,607,425 | |

| Beach Energy, Ltd. | | | 1,105,900 | | | | 1,431,450 | |

| CNOOC, Ltd., ADR | | | 7,200 | | | | 1,232,928 | |

| Ivanhoe Energy, Inc. * | | | 18,719 | | | | 6 | |

| PentaNova Energy Corp. * | | | 2,750,000 | | | | 167,345 | |

| PentaNova Energy Corp. #*@+ | | | 750,000 | | | | 42,673 | |

| PentaNova Energy Corp., 144A #*∆ | | | 2,000,000 | | | | 121,705 | |

| Range Energy Resources, Inc., 144A *∆ | | | 15,000,000 | | | | 57,049 | |

| U.S. Oil Sands, Inc., 144A #*@∆ | | | 198,000 | | | | 0 | |

| | | | | | | | 4,917,488 | |

| | | | | | | | | |

| Oil Companies - Integrated 2.52% | | | | | | | | |

| China Petroleum & Chemical Corp., ADR | | | 12,400 | | | | 1,114,016 | |

| LUKOIL PJSC, ADR | | | 15,000 | | | | 1,025,700 | |

| | | | | | | | 2,139,716 | |

| | | | | | | | | |

| Oil Companies - US Royalty Trusts 0.01% | | | | | | | | |

| San Juan Basin Royalty Trust | | | 2,000 | | | | 11,580 | |

| | | | | | | | | |

| Oil Refining & Marketing 2.75% | | | | | | | | |

| Grupa Lotos SA | | | 72,900 | | | | 1,104,516 | |

| Saras SpA | | | 509,000 | | | | 1,230,216 | |

| | | | | | | | 2,334,732 | |

| | | | | | | | | |

| Petrochemicals 0.96% | | | | | | | | |

| Lotte Chemical Corp. | | | 2,600 | | | | 810,501 | |

| | | | | | | | | |

| Poultry 1.02% | | | | | | | | |

| Pilgrim's Pride Corp. * | | | 43,000 | | | | 865,590 | |

| | | | | | | | | |

| Real Estate Operating/Development 6.63% | | | | | | | | |

| Pacific Infrastructure Ventures, Inc. #*@+ | | | 7,443,544 | | | | 5,621,364 | |

| | | | | | | | | |

| Silver Mining 1.21% | | | | | | | | |

| Silvercorp Metals, Inc. | | | 389,600 | | | | 1,028,344 | |

See notes to portfolios of investments and notes to financial statements.

| Global Resources Fund | |

| Portfolio of Investments (unaudited) | June 30, 2018 |

| Common Stocks (cont’d) | | Shares | | | Value | |

| | | | | | | |

| Steel - Producers 3.09% | | | | | | |

| China Oriental Group Co., Ltd. | | | 1,656,100 | | | $ | 1,162,478 | |

| Evraz PLC | | | 218,800 | | | | 1,460,365 | |

| | | | | | | | 2,622,843 | |

| | | | | | | | | |

| Total Common Stocks | | | | | | | 74,334,815 | |

| (cost $129,707,715) | | | | | | | | |

| | | Coupon | | | Maturity | | Principal | | | | |

| Corporate Non-Convertible Bond 3.31% | | Rate % | | | Date | | Amount | | | | |

| | | | | | | | | | | | |

| Electric - Generation 3.31% | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Interamerican Energy Corp. #@+ | | | 15.00 | | | 11/08/21 | | $ | 2,805,938 | | | | 2,805,938 | |

| (cost $2,805,938) | | | | | | | | | | | | | | |

| | | Exercise | | | Exp. | | | | | | |

| Warrants 0.00% | | Price | | | Date | | Shares | | | | |

| | | | | | | | | | | | |

| Diversified Minerals 0.00% | | | | | | | | | | | |

| VR Resources, Ltd. *@ | | $ | 0.60 | | | 03/21/19 | | | 562,500 | | | | 0 | |

| | | | | | | | | | | | | | | |

| Gold Mining 0.00% | | | | | | | | | | | | | | |

| Gran Colombia Gold Corp. * | | | 48.75 | | | 03/18/19 | | | 59,500 | | | | 1,924 | |

| Troilus Gold Corp. #*@ | | | 2.50 | | | 11/21/20 | | | 294,000 | | | | 0 | |

| | | | | | | | | | | | | | 1,924 | |

| | | | | | | | | | | | | | | |

| Metal - Diversified 0.00% | | | | | | | | | | | | | | |

| Aguia Resources, Ltd., 144A #*@∆ | | | 0.65 | | | 06/30/20 | | | 1,450,000 | | | | 0 | |

| | | | | | | | | | | | | | | |

| Non-Ferrous Metals 0.00% | | | | | | | | | | | | | | |

| Giyani Metals Corp., 144A #*@∆ | | | 0.40 | | | 08/07/19 | | | 174,318 | | | | 0 | |

| Group Eleven Resources Corp., 144A #*@∆ | | | 0.60 | | | 12/15/18 | | | 650,000 | | | | 0 | |

| | | | | | | | | | | | | | 0 | |

See notes to portfolios of investments and notes to financial statements.

| Global Resources Fund | |

| Portfolio of Investments (unaudited) | June 30, 2018 |

| | | Exercise | | | Exp. | | | | | | |

| Warrants (cont’d) | | Price | | | Date | | Shares | | | Value | |

| | | | | | | | | |

| Oil Companies - Exploration & Production 0.00% | | | | | | | | | | | | | | |

| PentaNova Energy Corp., 144A #*@∆ | | $ | 1.05 | | | 07/31/22 | | | 2,000,000 | | | $ | 0 | |

| | | | | | | | | | | | | | | |

| Total Warrants | | | | | | | | | | | | | 1,924 | |

| (cost $0) | | | | | | | | | | | | | | |

| | | | | | | | Notional | | | | | | | |

| | | Strike | | | Exp. | | Contract | | | | | | | |

| Call Options Purchased 1.34% | | Price | | | Date | | Value | | | Contracts | | | Value | |

| | | | | �� | | | | | | | | | | |

| Agricultural Chemicals 0.13% | | | | | | | | | | | | | | | | | | |

| Nutrien, Ltd. | | $ | 55.00 | | | 01/19 | | $ | 1,650,000 | | | | 300 | | | | 111,000 | |

| | | | | | | | | | | | | | | | | | | |

| Diversified Minerals 0.20% | | | | | | | | | | | | | | | | | | |

| BHP Billiton, Ltd. | | | 50.00 | | | 01/19 | | | 2,300,000 | | | | 460 | | | | 168,820 | |

| | | | | | | | | | | | | | | | | | | |

| Exchange Traded Fund 0.32% | | | | | | | | | | | | | | | | | | |

| SPDR S&P Global Natural | | | | | | | | | | | | | | | | | | |

| Resources ETF | | | 53.00 | | | 09/18 | | | 5,830,000 | | | | 1,100 | | | | 55,000 | |

| SPDR S&P Global Natural | | | | | | | | | | | | | | | | | | |

| Resources ETF | | | 52.00 | | | 09/18 | | | 7,280,000 | | | | 1,400 | | | | 101,500 | |

| SPDR S&P Global Natural | | | | | | | | | | | | | | | | | | |

| Resources ETF | | | 51.00 | | | 09/18 | | | 5,100,000 | | | | 1,000 | | | | 112,500 | |

| | | | | | | | | | | | | | | | | | 269,000 | |

| | | | | | | | | | | | | | | | | | | |

| Gold Mining 0.02% | | | | | | | | | | | | | | | | | | |

| Franco-Nevada Corp. | | | 85.00 | | | 01/19 | | | 1,275,000 | | | | 150 | | | | 20,250 | |

| | | | | | | | | | | | | | | | | | | |

| Metal - Copper 0.12% | | | | | | | | | | | | | | | | | | |

| Freeport-McMoRan, Inc. | | | 20.00 | | | 08/18 | | | 600,000 | | | | 300 | | | | 8,400 | |

| Freeport-McMoRan, Inc. | | | 22.00 | | | 01/19 | | | 880,000 | | | | 400 | | | | 22,000 | |

| Freeport-McMoRan, Inc. | | | 20.00 | | | 01/19 | | | 1,400,000 | | | | 700 | | | | 74,200 | |

| | | | | | | | | | | | | | | | | | 104,600 | |

| | | | | | | | | | | | | | | | | | | |

| Oil Companies - Integrated 0.55% | | | | | | | | | | | | | | | | | | |

| BP PLC | | | 45.00 | | | 01/19 | | | 2,295,000 | | | | 510 | | | | 153,510 | |

| Chevron Corp. | | | 135.00 | | | 01/19 | | | 2,160,000 | | | | 160 | | | | 64,000 | |

| Exxon Mobil Corp. | | | 85.00 | | | 07/18 | | | 2,550,000 | | | | 300 | | | | 15,000 | |

| Royal Dutch Shell PLC | | | 70.00 | | | 01/19 | | | 1,960,000 | | | | 280 | | | | 91,000 | |

See notes to portfolios of investments and notes to financial statements.

| Global Resources Fund | |

| Portfolio of Investments (unaudited) | June 30, 2018 |

| | | | | | | | Notional | | | | | | | |

| Call Options | | Strike | | | Exp. | | Contract | | | | | | | |

| Purchased (cont’d) | | Price | | | Date | | Value | | | Contracts | | | Value | |

| | | | | | | | | | | | | | | |

| Oil Companies - Integrated (cont’d) | | | | | | | | | | | | | | | | | | |

| TOTAL SA | | $ | 62.50 | | | 01/19 | | $ | 3,750,000 | | | | 600 | | | $ | 142,500 | |

| | | | | | | | | | | | | | | | | | 466,010 | |

| | | | | | | | | | | | | | | | | | | |

| Total Purchased Call Options | | | | | | | | | | | | | | | | | 1,139,680 | |

| (premiums paid $1,608,174) | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Investments, at value 92.32% | | | | | | | | | | | | | | | | | 78,282,357 | |

| (cost $134,121,827) | | | | | | | | | | | | | | | | | | |

| Other assets and liabilities, net 7.68% | | | | | | | | | | | | | | | | | 6,508,827 | |

| | | | | | | | | | | | | | | | | | | |

| Net Assets 100.00% | | | | | | | | | | | | | | | | $ | 84,791,184 | |

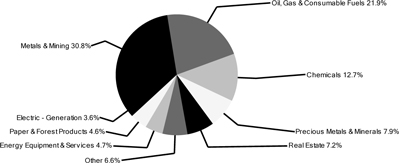

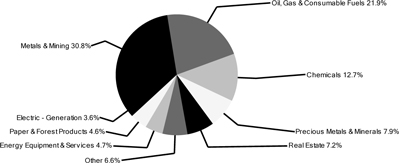

Portfolio Allocation by Industry Sector* Based on Total Investments | June 30, 2018 |

| * | Summary information above may differ from the portfolio schedule included in the financial statements due to the use of different classifications of securities for presentation purposes. |

See notes to portfolios of investments and notes to financial statements.

| World Precious Minerals Fund | |

| Portfolio of Investments (unaudited) | June 30, 2018 |

| Common Stocks 91.30% | | Shares | | | Value | |

| | | | | | | |

| Advanced Materials/Production 3.05% | | | | | | | | |

| Nano One Materials Corp. * | | | 3,000,000 | | | $ | 2,989,389 | |

| | | | | | | | | |

| Capital Pools 0.07% | | | | | | | | |

| Pinecrest Resources, Ltd. * | | | 400,000 | | | | 66,938 | |

| | | | | | | | | |

| Coal 0.13% | | | | | | | | |

| Caribbean Resources Corp. #*@ | | | 4 | | | | 0 | |

| Draig Resources, Ltd. * | | | 1,000,000 | | | | 125,985 | |

| | | | | | | | 125,985 | |

| | | | | | | | | |

| Diamonds/Precious Stones 1.38% | | | | | | | | |

| Barksdale Capital Corp. *~ | | | 2,233,000 | | | | 1,358,841 | |

| Rockwell Diamonds, Inc., 144A #*@∆ | | | 171,667 | | | | 0 | |

| | | | | | | | 1,358,841 | |

| | | | | | | | | |

| Diversified Minerals 5.52% | | | | | | | | |

| Adamera Minerals Corp., 144A #*∆ | | | 1,492,543 | | | | 65,281 | |

| Argo Gold, Inc. *~ | | | 2,342,500 | | | | 231,640 | |

| Auryn Resources, Inc. * | | | 1,250,000 | | | | 1,350,169 | |

| Bluebird Battery Metals, Inc. * | | | 1,993,500 | | | | 492,821 | |

| Calibre Mining Corp. * | | | 4,500,000 | | | | 188,263 | |

| Erdene Resource Development Corp. * | | | 300,000 | | | | 87,856 | |

| Golden Predator Mining Corp. * | | | 1,200,000 | | | | 383,372 | |

| Golden Reign Resources, Ltd. * | | | 1,500,000 | | | | 216,788 | |

| Indochine Mining, Ltd. #*@ | | | 10,000 | | | | 0 | |

| Lithium Power International, Ltd. * | | | 500,000 | | | | 101,542 | |

| Lithoquest Diamonds, Inc. * | | | 750,000 | | | | 282,394 | |

| Lumina Gold Corp. * | | | 1,000,000 | | | | 578,101 | |

| Rubicon Minerals Corp. * | | | 500,000 | | | | 418,362 | |

| Salazar Resources, Ltd. * | | | 1,500,000 | | | | 148,328 | |

| VR Resources, Ltd. *~ | | | 2,950,000 | | | | 875,138 | |

| | | | | | | | 5,420,055 | |

| | | | | | | | | |

| Gold Mining 51.35% | | | | | | | | |

| Alamos Gold, Inc. | | | 200,000 | | | | 1,138,000 | |

| Alexandria Minerals Corp. * | | | 6,500,000 | | | | 197,771 | |

| Algold Resources, Ltd. #* | | | 5,400,000 | | | | 328,605 | |

| Alio Gold, Inc. * | | | 359,999 | | | | 523,028 | |

| Alio Gold, Inc., 144A ∆ | | | 132,924 | | | | 193,120 | |

See notes to portfolios of investments and notes to financial statements.

| World Precious Minerals Fund | |

| Portfolio of Investments (unaudited) | June 30, 2018 |

| Common Stocks (cont’d) | | Shares | | | Value | |

| | | | | | | |

| Gold Mining (cont’d) | | | | | | | | |

| Allegiant Gold, Ltd. * | | | 2,000,000 | | | $ | 722,626 | |

| Aurelius Minerals, Inc. * | | | 1,250,000 | | | | 38,033 | |

| Barkerville Gold Mines, Ltd. * | | | 500,000 | | | | 173,050 | |

| Black Dragon Gold Corp. * | | | 4,000,000 | | | | 502,035 | |

| Bonterra Resources, Inc. * | | | 3,000,000 | | | | 924,200 | |

| Canyon Resources, Ltd. * | | | 15,000,000 | | | | 1,076,784 | |

| Chesapeake Gold Corp., 144A *∆ | | | 192,199 | | | | 292,396 | |

| Comstock Mining, Inc. * | | | 533,000 | | | | 138,580 | |

| Contact Gold Corp. * | | | 500,000 | | | | 136,919 | |

| CopperBank Resources Corp. *~ | | | 15,805,418 | | | | 1,021,915 | |

| CopperBank Resources Corp., 144A #*~∆ | | | 174,000 | | | | 11,250 | |

| Coral Gold Resources, Ltd. * | | | 750,000 | | | | 208,230 | |

| Corona Minerals, Ltd. #*@ | | | 81,250 | | | | 0 | |

| Eastmain Resources, Inc. * | | | 1,000,000 | | | | 148,328 | |

| Enforcer Gold Corp. * | | | 3,000,000 | | | | 119,804 | |

| Fiore Gold, Ltd. * | | | 2,000,000 | | | | 715,019 | |

| Fremont Gold, Ltd. * | | | 2,000,000 | | | | 182,558 | |

| Gascoyne Resources, Ltd. * | | | 1,600,000 | | | | 589,059 | |

| Gold Standard Ventures Corp. * | | | 1,000,000 | | | | 1,365,000 | |

| Golden Star Resources, Ltd. * | | | 750,000 | | | | 506,250 | |

| GoldQuest Mining Corp. * | | | 1,500,000 | | | | 216,788 | |

| IDM Mining, Ltd. * | | | 5,000,000 | | | | 266,231 | |

| IDM Mining, Ltd., 144A #*∆ | | | 95,000 | | | | 5,058 | |

| Jaguar Mining, Inc. * | | | 2,000,000 | | | | 555,281 | |

| K92 Mining, Inc. * | | | 1,250,000 | | | | 855,741 | |

| Kirkland Lake Gold, Ltd. | | | 55,000 | | | | 1,161,600 | |

| Klondex Mines, Ltd. * | | | 3,747,174 | | | | 8,655,972 | |

| Klondike Gold Corp. * | | | 2,250,000 | | | | 402,198 | |

| Leagold Mining Corp. * | | | 200,000 | | | | 394,021 | |

| Leagold Mining Corp., 144A #∆ | | | 333,000 | | | | 656,045 | |

| Lundin Gold, Inc. * | | | 500,000 | | | | 1,741,908 | |

| Malbex Resources, Inc., 144A #*∆ | | | 133,333 | | | | 30,426 | |

| Mammoth Resources Corp. *~ | | | 2,171,200 | | | | 74,319 | |

| McEwen Mining, Inc. | | | 134,764 | | | | 278,826 | |

| Mirasol Resources, Ltd. * | | | 2,000,000 | | | | 2,616,666 | |

| NGEx Resources, Inc. * | | | 1,500,000 | | | | 1,186,628 | |

See notes to portfolios of investments and notes to financial statements.

| World Precious Minerals Fund | |

| Portfolio of Investments (unaudited) | June 30, 2018 |

| Common Stocks (cont’d) | | Shares | | | Value | |

| | | | | | | |

| Gold Mining (cont’d) | | | | | | | | |

| Nighthawk Gold Corp. * | | | 1,855,000 | | | $ | 592,629 | |

| Northern Empire Resources Corp. * | | | 1,000,000 | | | | 912,790 | |

| NV Gold Corp. * | | | 1,000,000 | | | | 152,132 | |

| OceanaGold Corp., 144A ∆ | | | 5,348 | | | | 14,848 | |

| Oklo Resources, Ltd. * | | | 4,000,000 | | | | 889,129 | |

| Orca Gold, Inc. * | | | 4,010,000 | | | | 1,891,150 | |

| Otis Gold Corp. * | | | 1,500,000 | | | | 211,083 | |

| Petaquilla Minerals, Ltd., 144A #*@∆ | | | 2,660,000 | | | | 0 | |

| Pretium Resources, Inc. * | | | 200,000 | | | | 1,468,000 | |

| Pure Gold Mining, Inc. * | | | 3,200,000 | | | | 1,630,852 | |

| Radisson Mining Resources, Inc. * | | | 6,000,000 | | | | 547,674 | |

| Radius Gold, Inc., 144A #*∆ | | | 125,000 | | | | 9,508 | |

| Red Pine Exploration, Inc. * | | | 8,000,000 | | | | 365,116 | |

| Redstar Gold Corp. * | | | 15,000,000 | | | | 399,346 | |

| Revival Gold, Inc. * | | | 1,029,000 | | | | 649,656 | |

| Rise Gold Corp. * | | | 2,000,000 | | | | 136,919 | |

| Royal Gold, Inc. | | | 12,000 | | | | 1,114,080 | |

| Seabridge Gold, Inc. * | | | 45,000 | | | | 501,750 | |

| Seafield Resources, Ltd., 144A #*@∆ | | | 1,300,000 | | | | 0 | |

| Silver Lake Resources, Ltd. * | | | 1,000,000 | | | | 447,609 | |

| Strikepoint Gold, Inc. * | | | 1,100,000 | | | | 204,998 | |

| Taurus Gold, Ltd., 144A #*@∆ | | | 2,448,381 | | | | 0 | |

| TMAC Resources, Inc. * | | | 100,000 | | | | 425,969 | |

| Tolima Gold, Inc., 144A #*∆ | | | 4,100,000 | | | | 31,187 | |

| TriStar Gold, Inc. *~ | | | 27,110,500 | | | | 3,918,149 | |

| Wesdome Gold Mines, Ltd. * | | | 1,500,000 | | | | 3,502,833 | |

| | | | | | | | 50,367,675 | |

| | | | | | | | | |

| Medical - Hospitals 0.00% | | | | | | | | |

| African Medical Investments PLC #*@ | | | 4,637,500 | | | | 0 | |

| | | | | | | | | |

| Metal - Copper 0.30% | | | | | | | | |

| Aston Bay Holdings, Ltd. #* | | | 825,000 | | | | 125,509 | |

| Highland Copper Co., Inc. * | | | 2,986,000 | | | | 170,349 | |

| | | | | | | | 295,858 | |

See notes to portfolios of investments and notes to financial statements.

| World Precious Minerals Fund | |

| Portfolio of Investments (unaudited) | June 30, 2018 |

| Common Stocks (cont’d) | | Shares | | | Value | |

| | | | | | | |

| Metal - Diversified 10.23% | | | | | | | | |

| Cardinal Resources, Ltd. * | | | 7,100,000 | | | $ | 2,252,784 | |

| Cardinal Resources, Ltd. * | | | 5,025,000 | | | | 1,758,263 | |

| Cartier Resources, Inc. * | | | 1,000,000 | | | | 91,279 | |

| Chakana Copper Corp. #*~ | | | 4,525,000 | | | | 1,961,929 | |

| Columbus Gold Corp. * | | | 750,000 | | | | 139,771 | |

| Filo Mining Corp. * | | | 400,000 | | | | 727,190 | |

| Genesis Metals Corp. * | | | 583,000 | | | | 31,042 | |

| Genesis Metals Corp., 144A #*∆ | | | 2,917,000 | | | | 155,319 | |

| Ivanhoe Mines, Ltd. * | | | 400,000 | | | | 821,511 | |

| Kaizen Discovery, Inc. * | | | 8,250,000 | | | | 345,149 | |

| New Age Metals, Inc., 144A #*∆ | | | 143,518 | | | | 8,188 | |

| Novo Resources Corp. * | | | 100,000 | | | | 323,280 | |

| Orex Minerals, Inc. * | | | 5,000,000 | | | | 494,428 | |

| Orsu Metals Corp., 144A #*∆ | | | 186,922 | | | | 27,726 | |

| Rockcliff Metals Corp., 144A #*∆ | | | 2,620,000 | | | | 59,788 | |

| RTG Mining, Inc. * | | | 2,289,378 | | | | 212,244 | |

| Sirios Resources, Inc. #* | | | 1,600,000 | | | | 243,411 | |

| Torq Resources, Inc. * | | | 1,000,000 | | | | 380,329 | |

| | | | | | | | 10,033,631 | |

| | | | | | | | | |

| Mining Services 0.34% | | | | | | | | |

| Argent Minerals, Ltd. * | | | 21,100,000 | | | | 329,337 | |

| | | | | | | | | |

| Non-Ferrous Metals 1.10% | | | | | | | | |

| Adventus Zinc Corp. * | | | 627,500 | | | | 448,675 | |

| InZinc Mining, Ltd. * | | | 3,000,000 | | | | 273,837 | |

| NextSource Materials, Inc. * | | | 4,710,000 | | | | 358,270 | |

| | | | | | | | 1,080,782 | |

| | | | | | | | | |

| Oil Companies - Exploration & Production 0.00% | | | | | | | | |

| Big Sky Energy Corp. #*@ | | | 2,000,000 | | | | 0 | |

| | | | | | | | | |

| Optical Recognition Equipment 0.01% | | | | | | | | |

| Nexoptic Technology Corp., 144A *∆ | | | 12,083 | | | | 9,191 | |

| | | | | | | | | |

| Precious Metals 17.42% | | | | | | | | |

| Amani Gold, Ltd. * | | | 54,500,000 | | | | 364,326 | |

| Barsele Minerals Corp. #*~ | | | 7,250,000 | | | | 3,529,456 | |

| Brixton Metals Corp. * | | | 2,500,000 | | | | 408,854 | |

See notes to portfolios of investments and notes to financial statements.

| World Precious Minerals Fund | |

| Portfolio of Investments (unaudited) | June 30, 2018 |

| Common Stocks (cont’d) | | Shares | | | Value | |

| | | | | | | |

| Precious Metals (cont’d) | | | | | | | | |

| Candente Gold Corp., 144A #*∆ | | | 4,875,000 | | | $ | 120,517 | |

| Corvus Gold, Inc. * | | | 250,000 | | | | 490,625 | |

| Dolly Varden Silver Corp. #*~ | | | 8,000,000 | | | | 3,103,488 | |

| GFG Resources, Inc. * | | | 2,000,000 | | | | 349,903 | |

| Kootenay Silver, Inc. * | | | 1,000,000 | | | | 114,099 | |

| Liberty Gold Corp. * | | | 500,000 | | | | 167,345 | |

| Metalla Royalty & Streaming, Ltd. | | | 1,000,000 | | | | 585,707 | |

| New Pacific Metals Corp. * | | | 1,000,000 | | | | 1,201,841 | |

| Probe Metals, Inc. #* | | | 1,000,000 | | | | 988,856 | |

| Roxgold, Inc. * | | | 2,500,000 | | | | 2,129,844 | |

| Silver Viper Minerals Corp. * | | | 1,300,000 | | | | 138,440 | |

| SilverCrest Metals, Inc. * | | | 650,000 | | | | 1,354,733 | |

| Terrax Minerals, Inc. * | | | 1,000,000 | | | | 292,854 | |

| Toachi Mining, Inc. *~ | | | 4,000,000 | | | | 425,969 | |

| Toachi Mining, Inc., 144A #~∆ | | | 2,000,000 | | | | 212,984 | |

| Wheaton Precious Metals Corp. | | | 50,000 | | | | 1,103,000 | |

| | | | | | | | 17,082,841 | |

| | | | | | | | | |

| Silver Mining 0.40% | | | | | | | | |

| Americas Silver Corp. * | | | 100,000 | | | | 312,631 | |

| Santacruz Silver Mining, Ltd. * | | | 1,000,000 | | | | 76,066 | |

| | | | | | | | 388,697 | |

| | | | | | | | | |

| Total Common Stocks | | | | | | | 89,549,220 | |

| (cost $136,294,374) | | | | | | | | |

| | | Coupon | | | Maturity | | Principal | | | | |

| Corporate Non-Convertible Bond 0.76% | | Rate % | | | Date | | Amount | | | | |

| | | | | | | | | | | | |

| Electric - Generation 0.76% | | | | | | | | | | | | | | |

| Interamerican Energy Corp. #@+ | | | 15.00 | | | 11/08/21 | | $ | 748,250 | | | | 748,250 | |

| (cost $748,250) | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Right 0.32% | | | | | | | | Shares | | | | | |

| | | | | | | | | | | | | | | |

| Metal - Diversified 0.32% | | | | | | | | | | | | | | |

| Cardinal Resources, Ltd. * | | | | | | | | | 1,500,000 | | | | 310,821 | |

| (cost $13,109) | | | | | | | | | | | | | | |

See notes to portfolios of investments and notes to financial statements.

| World Precious Minerals Fund | |

| Portfolio of Investments (unaudited) | June 30, 2018 |

| Exchange Traded Funds 4.07% | | Shares | | | Value | |

| Direxion Daily Gold Miners Index Bull 3X Shares ETF | | | 80,000 | | | $ | 1,946,400 | |

| Direxion Daily Junior Gold Miners Index Bull 3x Shares | | | | | | | | |

| ETF * | | | 150,000 | | | | 2,047,500 | |

| | | | | | | | | |

| Total Exchange Traded Funds | | | | | | | 3,993,900 | |

| (cost $4,624,402) | | | | | | | | |

| | | Exercise | | | Exp. | | | | | | |

| Warrants 0.22% | | Price | | | Date | | | | | | |

| | | | | | | | | | | | |

| Diversified Minerals 0.00% | | | | | | | | | | | |

| VR Resources, Ltd. *@~ | | $ | 0.60 | | | 03/21/19 | | | 862,500 | | | | 0 | |

| | | | | | | | | | | | | | | |

| Gold Mineral Exploration & Development 0.00% | | | | | | | | | | | | | | |

| Western Exploration & Development, Ltd., 144A #*@∆ | | | 0.50 | | | 12/31/49 | | | 600,000 | | | | 0 | |

| | | | | | | | | | | | | | | |

| Gold Mining 0.22% | | | | | | | | | | | | | | |

| Alexandria Minerals Corp., 144A #*@∆ | | | 0.10 | | | 06/20/19 | | | 1,256,195 | | | | 0 | |

| Bonterra Resources, Inc. #*@ | | | 0.30 | | | 07/06/18 | | | 625,000 | | | | 47,541 | |

| Fiore Gold, Ltd. #*@ | | | 0.45 | | | 09/26/20 | | | 1,300,000 | | | | 0 | |

| Gran Colombia Gold Corp. * | | | 48.75 | | | 03/18/19 | | | 96,250 | | | | 3,112 | |

| Osisko Gold Royalties, Ltd. * | | | 36.50 | | | 02/18/22 | | | 177,200 | | | | 150,289 | |

| Osisko Mining, Inc. * | | | 3.00 | | | 08/25/18 | | | 1,000,000 | | | | 3,803 | |

| Redstar Gold Corp. #*@ | | | 0.14 | | | 05/03/19 | | | 2,500,000 | | | | 0 | |

| Revival Gold, Inc., 144A #*@∆ | | | 0.90 | | | 10/19/19 | | | 482,500 | | | | 0 | |

| TriStar Gold, Inc., 144A #*@~∆ | | | 0.45 | | | 04/28/19 | | | 1,000,000 | | | | 0 | |

| Westgold Resources, Ltd. * | | | 2.00 | | | 06/30/19 | | | 100,000 | | | | 14,061 | |

| | | | | | | | | | | | | | 218,806 | |

| | | | | | | | | | | | | | | |

| Metal - Diversified 0.00% | | | | | | | | | | | | | | |

| Genesis Metals Corp., 144A #*@∆ | | | 0.23 | | | 06/05/19 | | | 1,604,500 | | | | 0 | |

| Minera Alamos, Inc. #*@ | | | 0.15 | | | 05/13/19 | | | 2,225,000 | | | | 0 | |

| Murchison Minerals, Ltd., 144A #*@∆ | | | 0.30 | | | 08/31/18 | | | 1,500,000 | | | | 0 | |

| | | | | | | | | | | | | | 0 | |

| | | | | | | | | | | | | | | |

| Total Warrants | | | | | | | | | | | | | 218,806 | |

| (cost $558,898) | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Investments, at value 96.67% | | | | | | | | | | | | | 94,820,997 | |

| (cost $142,239,033) | | | | | | | | | | | | | | |

| Other assets and liabilities, net 3.33% | | | | | | | | | | | | | 3,267,613 | |

| | | | | | | | | | | | | | | |

| Net Assets 100.00% | | | | | | | | | | | | $ | 98,088,610 | |

See notes to portfolios of investments and notes to financial statements.

| World Precious Minerals Fund | |

| Portfolio of Investments (unaudited) | June 30, 2018 |

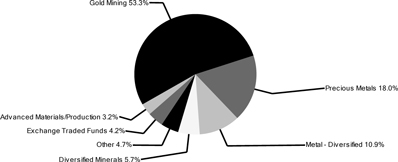

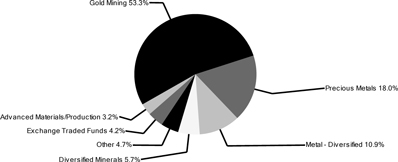

Portfolio Allocation by Industry* Based on Total Investments | June 30, 2018 |