As filed with the Securities and Exchange Commission on September 5, 2017

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-01800

U.S. GLOBAL INVESTORS FUNDS

Three Canal Plaza, Suite 600

Portland, Maine 04101

Jessica Chase, Principal Executive Officer

Three Canal Plaza, Suite 600

Portland, Maine 04101

207-347-2000

Date of fiscal year end: December 31

Date of reporting period: January 1, 2017 – June 30, 2017

ITEM 1. REPORT TO STOCKHOLDERS.

U.S. Global Investors Funds Semi-Annual Report

June 30, 2017

U.S. Global Investors Funds

Semi-Annual Report

June 30, 2017

(unaudited)

Table of Contents

Letter to Shareholders | 1 |

Portfolios of Investments | 10 |

Notes to Portfolios of Investments | 58 |

Statements of Assets and Liabilities | 68 |

Statements of Operations | 72 |

Statements of Changes in Net Assets | 76 |

Notes to Financial Statements | 82 |

Financial Highlights | 99 |

Additional Information | 110 |

Expense Example | 111 |

Privacy Policy | |

Nasdaq Symbols

U.S. Global Investors Funds

Investor Class | |

U.S. Government Securities Ultra-Short Bond Fund | UGSDX |

Near-Term Tax Free Fund | NEARX |

All American Equity Fund | GBTFX |

Holmes Macro Trends Fund | MEGAX |

Global Resources Fund | PSPFX |

World Precious Minerals Fund | UNWPX |

Gold and Precious Metals Fund | USERX |

Emerging Europe Fund | EUROX |

China Region Fund | USCOX |

| | |

Institutional Class | |

Global Resources Fund | PIPFX |

World Precious Minerals Fund | UNWIX |

| Atlantic Fund Services

3 Canal Plaza, Suite 600

Portland, ME

04101 |

U.S. Global Investors Funds | (unaudited) |

Dear Fellow Shareholder,

Thank you for your investment in U.S. Global Investors Funds. If you joined our investment family recently, welcome! And if you are a long-time shareholder, I want to especially thank you for your commitment.

We want to keep in touch with you!

If you aren’t already receiving our emails, please share your email address with us. This is a convenient way to be notified of fund updates, such as when quarterly fund fact sheets are published. Also, we like hearing from our shareholders so drop us a line at info@usfunds.com or give us a call at 1-800-US-FUNDS (1-800-873-8637).

Don’t Miss Out on Investor Alert!

The best way to receive timely updates on the events that impact your investments is to subscribe to our free e-newsletter, the Investor Alert. With a balanced analysis of the markets over the week that is comprehensive yet concise, the Investor Alert is written for you by the investment team with a special commentary from me. Your time is important, so read the newsletter that has won multiple awards from the Mutual Fund Education Alliance! Sign up at www.usfunds.com/subscribe. While you are there, also sign up for my CEO blog, Frank Talk, where I comment on current market topics.

Learning from the Past and Looking Ahead

The mid-year point is a good time to take another look at what we are doing with U.S. Global Investors Funds. We often discuss our investment process which combines a top-down, macro perspective with bottom-up, fundamental stock selection. This remains true with the ongoing trend in the asset management industry in using artificial intelligence and quantitative analysis. Industry influencers have been talking about something called “quantamental” investing. I believe this is more than a catchy phrase, but actually a term that formalizes what we have been diving into for some time—the combination of fundamental stock selection with computing power to screen and analyze large quantities of information. If you have attended one of the conferences where I’ve spoken in the last year, you may have heard my presentation titled “What’s Driving Gold: The Invasion of the Quants.”

If you are a regular reader of Frank Talk, you’ll recognize that we are using quantamental models in managing our funds. I’d like to take a look back and remind readers and shareholders of what we are doing.

Global Debt on Alert

Recently I wrote a blog post, “Mother of All Bubbles Keeps Gold in Focus,” which resonated with many of my readers. The record amount of global debt could potentially spell trouble for the investor who hasn’t adequately prepared with some allocation in a “safe haven.”

1

U.S. Global Investors Funds | (unaudited) |

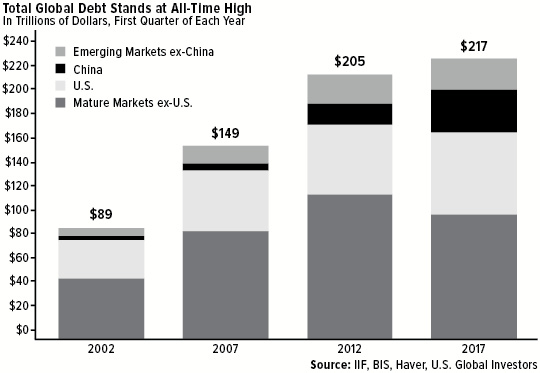

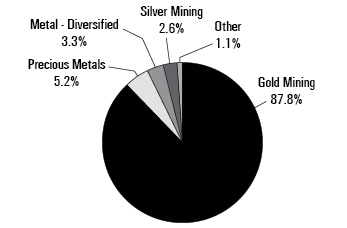

According to the highly-respected Institute of International Finance (IIF), global debt levels reached an astronomical $217 trillion in the first quarter of 2017—that’s 327 percent of world gross domestic product (GDP). Notice that before the financial crisis, global debt was “only” around $150 trillion, meaning we’ve added close to $120 trillion in as little as a decade. Much of the leveraging occurred in emerging markets, specifically China, which is spending big on international infrastructure projects.

It goes without saying that this is a huge risk. Some are calling this mountain of debt “the mother of all bubbles,” and we all remember how the last two bubbles ended, in 2000 (the tech or dotcom bubble) and 2007 (the housing bubble).

And now big changes could be coming in the Federal Reserve’s monetary policy. In a recent address to the Economic Club of Las Vegas, President and CEO of the Federal Reserve Bank of San Francisco John Williams said the Fed will likely begin the process of monetary normalization as soon as next quarter. This includes unwinding the Fed’s $4.5 trillion balance sheet, composed of long-term Treasuries and mortgage-backed securities (MBS). The process could take up to four years to complete.

With the Fed removing the punchbowl of easy money, and investors facing the potential risk of recession, it is just prudent to have gold in your portfolio.

2

U.S. Global Investors Funds | (unaudited) |

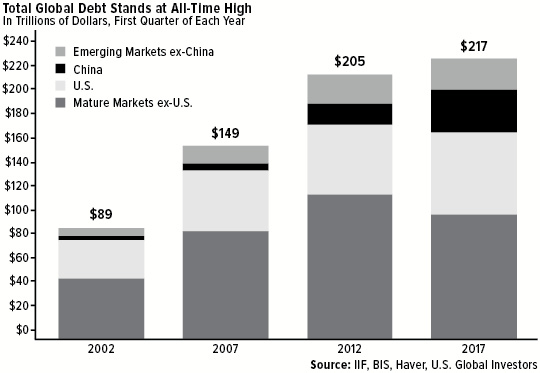

Gold Prices Have Beaten the Market So Far this Century

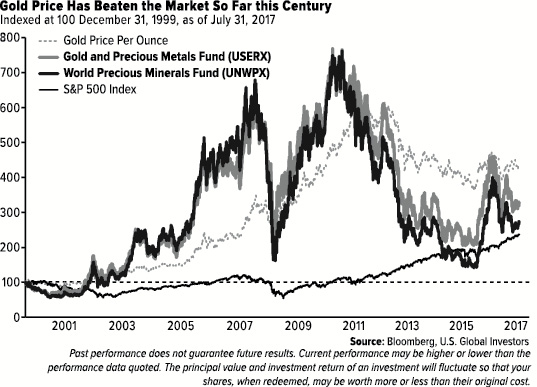

You won’t want to miss this chart that I shared with readers recently. The price of gold has outperformed the S&P 500 Index so far this century, returning 86 percent more than the market if we index both asset classes at 100 on December 31, 1999. Over the past 17 years, the S&P 500 has undergone two major contractions, both of them resulting in a loss of around 40 percent. Gold, meanwhile, has held its value well, boosting its appeal as a portfolio diversifier.

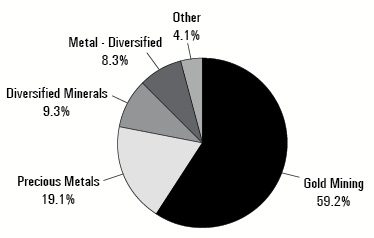

Our two gold funds have similarly outperformed the market so far this century, as you can see above. The Gold and Precious Metals Fund (USERX) and World Precious Minerals Fund (UNWPX) are co-managed by myself and precious metals expert Ralph Aldis. Not only do Ralph and I rely on fundamentals to make stock selection and weighting decisions, but we also maintain close, productive relationships with mining company management teams across the globe.

I have long advocated for a basic 10 percent allocation into gold—5 percent in physical gold such as bullion, and 5 percent in quality gold stocks and funds. And it is important to set your calendar to rebalance each year.

3

U.S. Global Investors Funds | (unaudited) |

New Year, New Models for Our Domestic Equity Funds

Back in January I introduced readers to a new investment methodology for our domestic equity funds, the All American Equity Fund (GBTFX) and the Holmes Macro Trends Fund (MEGAX).

For the All American Equity Fund, we seek to capture the performance of the “growthiest” companies in the fund’s benchmark, the S&P 500, by focusing on those whose most recent quarter’s sales per share is greater than the average of the previous four quarters. So if a company’s average sales per share for the past four quarters is $30, let’s say, it needs to show something higher than that in the current quarter to be considered for inclusion in the fund. In addition, we screen for companies whose cash flow return on invested capital (CFROIC) is above the average for the S&P 500 over the past 12 months.

Small- and mid-cap stocks have been an exciting place to be since the presidential election in November. These are the kinds of stocks that the Holmes Macro Trends Fund is focused on. Mid-cap companies are especially attractive because they’ve reached a point in their enterprise life cycle where the challenges inherent to smaller companies—raising capital early on and managing capacity growth, for example—are mostly behind them. At the same time, they remain dynamic enough for rapid growth to be possible.

That’s why mid-cap stocks account for 40 percent of our new MEGAX model. Meanwhile, 36 percent is in small caps, the remaining 24 percent in large caps.

To screen for the very best companies, we take a similar approach as GBTFX, focusing on those whose sales per share is greater than their average for the past four quarters.

Looking for Regulatory and Tax Reform

I’ve commented many times in my blog that in order for economic growth to occur, U.S. businesses need to see reform coming out of Washington, D.C. I mentioned in May in “Hedge Fund Managers Pour SALT on U.S. Stocks, Look to Europe” that I attended the SkyBridge Alternatives (SALT) hedge fund conference, where I heard former Federal Reserve Chair Ben Bernanke. He said there are really three parties jockeying for control in the capital—Republicans, Democrats... and the “beltway party.” It’s this last group, composed of deeply entrenched lobbyists and career bureaucrats, that gives Washington outsiders such as Trump the hardest time and actively tries to sabotage agendas that shake up the status quo.

So far Congress has had little success in delivering on President Donald Trump’s political agenda, but I still remain hopeful that Trump will enact some much-needed reforms to alleviate the regulatory and tax burdens that cost this country $1.9 trillion each year, according to the Competitive Enterprise Institute.

4

U.S. Global Investors Funds | (unaudited) |

Don’t Miss Opportunities in Energy and Emerging Markets

I’ve been writing about the transition that’s taking place in the energy sector. In June I highlighted the growth of opportunities in natural gas and renewable energy in “Does Coal Stand a Chance Against Renewable Energy?” In the past year, we’ve overweighted renewable energy stocks in our Global Resources Fund (PSPFX), and the allocation is now a core driver of the fund’s performance.

Also remember, China’s middle class is already larger than that found here in the U.S., according to Credit Suisse. In October 2015, the investment bank reported that, for the first time, the size of China’s middle class had exceeded that of America’s middle class, 109 million to 92 million. As incomes rise, so too does demand for durables, luxury goods, vehicles, air travel, energy and more.

One of the best ways to take advantage of this growth in spending power, I believe, is with our China Region Fund (USCOX), which invests in securities in the authorized China securities markets (Hong Kong, Shenzhen and Shanghai) as well as the surrounding countries, including India. For the six months from the start of the year through June 30, the fund has returned an impressive 28.83 percent.

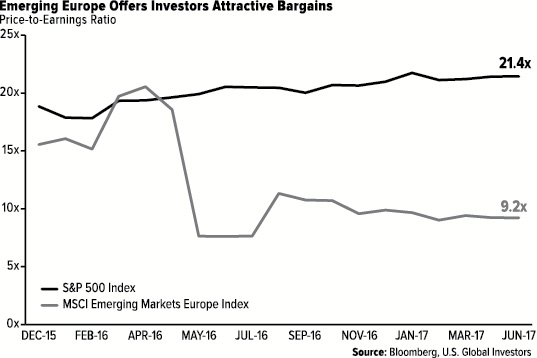

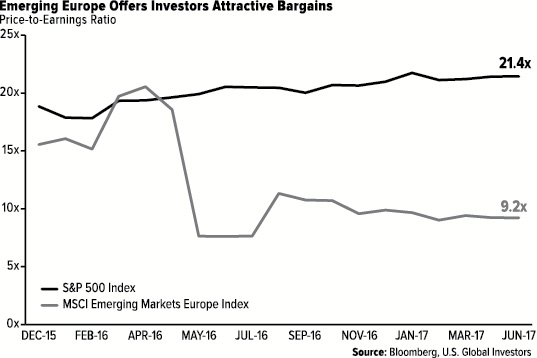

And looking to our European neighbors, I believe one of the most attractive destinations for your investment dollars right now is emerging European countries. Below you can see a valuation comparison between U.S. and emerging European equities. Trading at 9.2 times earnings, the latter are offering a potential bargain for investors seeking a “better bang for the buck.”

5

U.S. Global Investors Funds | (unaudited) |

More than that, though, “core” Central and Eastern Europe (CEE) countries—including Poland, the Czech Republic, Romania and Hungary—are currently among the fastest growing in the world. In a recent series on the region, the Financial Times put it succinctly: “The former communist countries that have joined the European Union (EU) since 2004 offer superior growth to western Europe and many other emerging markets, combined with the benefits and protections of EU membership.”

These are key markets in the Emerging Europe Fund (EUROX), which has returned 6.73 percent for the first half of the year.

Stay Calm with Municipal Bonds

I also urge investors to remember that shorter-duration, tax-free munis have a history of delivering positive returns even during economic downturns and in environments of rising and lowering interest rates. This is why we like to think of the Near-Term Tax Free Fund (NEARX) as a calm place in the midst of stormy markets.

I urge shareholders to take a closer look at your investment goals and plans. If you are curious about one of our funds that you are not already invested in, remember that our ABC Investment Plan makes it easy and affordable to invest. For those who commit to investing monthly with us, we reduce our minimum initial investment to just $1,000. This dollar-cost averaging plan can be a great tool to encourage younger family members to invest as well. You can learn more about this by vising our website at www.usfunds.com or calling 1-800-US-FUNDS (1-800-873-8637).

6

U.S. Global Investors Funds | (unaudited) |

Thank you for investing in U.S. Global Investors Funds!

Happy investing!

Frank Holmes

CEO and Chief Investment Officer

U.S. Global Investors, Inc.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Total Annualized Returns as of 6/30/2017

Fund | One-Year | Five-Year | Ten-Year | Gross

Expense Ratio |

Near-Term Tax Free Fund | -0.52% | 1.30% | 2.72% | 0.97% |

All American Equity Fund | 2.56% | 7.33% | 3.11% | 1.76% |

Holmes Macro Trends Fund | 21.07% | 8.41% | 2.72% | 1.68% |

Global Resources Fund | 9.26% | -8.13% | -6.04% | 1.85% |

World Precious Metals Fund | -19.09% | -8.55% | -5.98% | 2.10% |

Gold and Precious Metals Fund | -20.33% | -7.46% | -2.30% | 1.86% |

Emerging Europe Fund | 19.17% | -3.93% | -7.05% | 2.33% |

China Region Fund | 33.80% | 7.01% | -0.35% | 2.76% |

S&P 500 Index | 17.90% | 14.63% | 7.18% | N/A |

Bloomberg Barclays 3-Year Municipal Bond Index | 0.43% | 1.24% | 2.76% | N/A |

Expense ratios as stated in the most recent prospectus.

The Adviser of the World Precious Minerals Fund has voluntarily limited total fund operating expenses (exclusive of acquired fund fees and expenses of 0.11%, extraordinary expenses, taxes, brokerage commissions and interest, and advisory fee performance adjustments) to not exceed 1.90%. With the voluntary expense waiver amount of 0.04%, total annual expenses after reimbursement were 1.95%.

The Adviser of the China Region Fund has voluntarily limited total fund operating expenses (exclusive of acquired fund fees and expenses of 0.02%, extraordinary expenses, taxes, brokerage commissions and interest, and advisory fee performance adjustments) to not exceed 2.55%. With the voluntary expense waiver amount of 0.38%, total annual expenses after reimbursement were 2.36%.

U.S. Global Investors, Inc. can modify or terminate the voluntary limits at any time, which may lower a fund’s yield or return.

7

U.S. Global Investors Funds | (unaudited) |

The Adviser of the Near-Term Tax Free Fund has contractually limited, through April 30, 2018, the total fund operating expenses (exclusive of acquired fund fees and expenses, extraordinary expenses, taxes, brokerage commissions and interest) to not exceed 0.45%. Total annual expenses after the waiver of 0.60% were 0.45%.

Performance data quoted above is historical. Past performance is no guarantee of future results. Results reflect the reinvestment of dividends and other earnings. For a portion of periods, the fund had expense limitations, without which returns would have been lower. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance does not include the effect of any direct fees described in the fund’s prospectus which, if applicable, would lower your total returns. Performance quoted for periods of one year or less is cumulative and not annualized. Obtain performance data current to the most recent month-end at www.usfunds.com or 1-800-US-FUNDS.

Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in these sectors.

Stock markets can be volatile and share prices can fluctuate in response to sector-related and other risks as described in the fund prospectus.

Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. By investing in a specific geographic region, a regional fund’s returns and share price may be more volatile than those of a less concentrated portfolio. The Emerging Europe Fund invests more than 25% of its investments in companies principally engaged in the oil & gas or banking industries. The risk of concentrating investments in this group of industries will make the fund more susceptible to risk in these industries than funds which do not concentrate their investments in an industry and may make the fund’s performance more volatile. Because the Global Resources Fund concentrates its investments in specific industries, the fund may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries.

Bond funds are subject to interest-rate risk; their value declines as interest rates rise. Though the Near-Term Tax Free Fund seeks minimal fluctuations in share price, it is subject to the risk that the credit quality of a portfolio holding could decline, as well as risk related to changes in the economic conditions of a state, region or issuer. These risks could cause the fund’s share price to decline. Tax-exempt income is federal income tax free. A portion of this income may be subject to state and local taxes and at times the alternative minimum tax. The Near-Term Tax Free Fund may invest up to 20% of its assets in securities that pay taxable interest. Income or fund distributions attributable to capital gains are usually subject to both state and federal income taxes.

Diversification does not protect an investor from market risks and does not assure a profit.

A program of regular investing doesn’t assure a profit or protect against loss in a declining market. You should evaluate your ability to continue in such a program in view of the possibility that you may have to redeem fund shares in periods of declining share prices as well as in periods of rising prices.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

8

U.S. Global Investors Funds | (unaudited) |

The Bloomberg Barclays 3-Year Municipal Bond Index is a total return benchmark designed for short-term municipal assets. The index includes bonds with a minimum credit rating BAA3, are issued as part of a deal of at least $50 million, have an amount outstanding of at least $5 million and have a maturity of 2 to 4 years.

The MSCI Emerging Markets Europe Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the emerging markets countries of Europe (Czech Republic, Hungary, Poland, Russia, and Turkey).

Cash Flow Return on Invested Capital (CFROIC) is defined as consolidated cash flow from operating activities minus capital expenditures, the difference of which is divided by the difference between total assets and non-interest bearing current liabilities.

Price-Earnings Ratio (P/E Ratio) is determined by dividing the price of the stock by the company’s forecasted earnings per share.

9

U.S. Government Securities Ultra-Short Bond Fund

Portfolio of Investments (unaudited) | June 30, 2017 |

United States Government and Agency Obligations 97.32% | | Coupon Rate % | | Maturity Date | | Principal Amount | | | Value | |

Federal Farm Credit Bank 33.72% | |

Fixed Rates: | | | | | | | | | | |

| | | | 1.13 | | 09/22/17 | | $ | 2,000,000 | | | $ | 1,999,824 | |

| | | | 1.16 | | 10/23/17 | | | 1,000,000 | | | | 1,000,260 | |

| | | | 5.05 | | 06/22/18 | | | 500,000 | | | | 518,817 | |

| | | | 1.95 | | 08/28/18 | | | 100,000 | | | | 100,691 | |

Variable Rates: | | | | | | | | | | | | | |

| | | | 1.14 | | 10/13/17 | | | 4,100,000 | | | | 4,101,722 | |

| | | | 1.25 | | 03/22/18 | | | 3,000,000 | | | | 3,003,054 | |

| | | | 1.17 | | 03/11/19 | | | 7,000,000 | | | | 6,998,221 | |

| | | | | | | | | | | | | 17,722,589 | |

Federal Home Loan Bank 53.74% | |

Fixed Rates: | | | | | | | | | | | | | |

| | | | 0.88 | | 09/27/17 | | | 3,000,000 | | | | 2,997,918 | |

| | | | 1.00 | | 12/19/17 | | | 7,000,000 | | | | 6,993,819 | |

| | | | 1.13 | | 03/29/18 | | | 750,000 | | | | 749,327 | |

| | | | 1.13 | | 04/25/18 | | | 5,000,000 | | | | 4,994,535 | |

| | | | 1.00 | | 06/12/18 | | | 1,000,000 | | | | 996,367 | |

| | | | 5.38 | | 08/15/18 | | | 480,000 | | | | 501,441 | |

| | | | 1.00 | | 08/28/18 | | | 4,000,000 | | | | 3,984,560 | |

| | | | 1.75 | | 12/14/18 | | | 3,000,000 | | | | 3,016,164 | |

| | | | 1.50 | | 03/08/19 | | | 4,000,000 | | | | 4,005,572 | |

| | | | | | | | | | | | | 28,239,703 | |

Tennessee Valley Authority 9.86% | |

Fixed Rates: | | | | | | | | | | | | | |

| | | | 6.25 | | 12/15/17 | | | 2,930,000 | | | | 2,996,174 | |

| | | | 1.75 | | 10/15/18 | | | 2,174,000 | | | | 2,185,505 | |

| | | | | | | | | | | | | 5,181,679 | |

| |

Total Investments 97.32% | | | | 51,143,971 | |

(cost $51,129,888) | | | | | | | | | | | | | |

Other assets and liabilities, net 2.68% | | | | | | | | | 1,411,031 | |

| | | | | | | | | | | | | | |

Net Assets 100.0% | | | | | | | | | | | $ | 52,555,002 | |

See notes to portfolios of investments and notes to financial statements.

10

U.S. Government Securities Ultra-Short Bond Fund

Portfolio of Investments (unaudited) | June 30, 2017 |

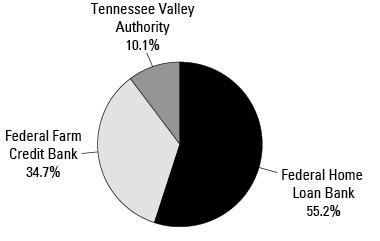

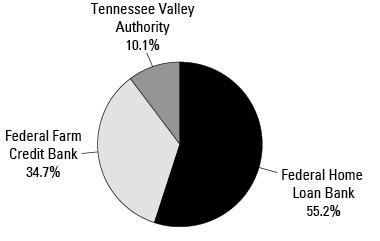

Portfolio Allocation by Issuer

Based on Total Investments | June 30, 2017 |

|

Portfolio Allocation by Maturity | | June 30, 2017 | | |

1-3 Months | | $ | 4,997,742 | | | | 9.8 | % | |

3-12 Months | | | 25,354,075 | | | | 49.6 | % | |

1-3 Years | | | 20,792,154 | | | | 40.6 | % | |

| | | $ | 51,143,971 | | | | 100.0 | % | |

| | | | | | | | | | |

See notes to portfolios of investments and notes to financial statements.

11

Near-Term Tax Free Fund

Portfolio of Investments (unaudited) | June 30, 2017 |

Municipal Bonds 90.31% | | Coupon Rate % | | Maturity Date | | Principal Amount | | | Value | |

Alabama 1.34% | |

Bessemer, Alabama Electric Revenue, Refunding, AGM | | | 3.10 | | 12/01/21 | | $ | 100,000 | | | $ | 104,339 | |

Limestone County, Water & Sewer Authority | | | 2.25 | | 12/01/21 | | | 365,000 | | | | 366,069 | |

Pelham, Alabama, GO Unlimited | | | 2.00 | | 02/01/18 | | | 130,000 | | | | 130,825 | |

University of South Alabama, University Revenue, Refunding | | | 5.00 | | 11/01/18 | | | 500,000 | | | | 525,060 | |

| | | | | | | | | | | | | 1,126,293 | |

| | | | | | | | | | | | | | |

Arizona 0.72% | |

Arizona State Transportation Board Excise Tax Revenue | | | 5.00 | | 07/01/17 | | | 175,000 | | | | 175,000 | |

McAllister Academic Village LLC, Arizona State University Hassayampa Revenue, Refunding | | | 5.75 | | 07/01/18 | | | 200,000 | | | | 209,156 | |

Tempe, Arizona, GO Unlimited, Series A | | | 2.00 | | 07/01/19 | | | 220,000 | | | | 224,011 | |

| | | | | | | | | | | | | 608,167 | |

| | | | | | | | | | | | | | |

Arkansas 1.63% | |

Atkins School District No. 18, Refunding, GO Limited | | | 1.00 | | 02/01/19 | | | 420,000 | | | | 417,526 | |

Cave City School District No. 2-A, Refunding, GO Limited | | | 1.00 | | 02/01/19 | | | 260,000 | | | | 257,860 | |

Hot Springs, Arizona Wastewater Revenue | | | 4.00 | | 12/01/19 | | | 510,000 | | | | 539,600 | |

Paris School District No. 7, Refunding, GO Limited | | | 1.00 | | 06/01/18 | | | 150,000 | | | | 150,041 | |

| | | | | | | | | | | | | 1,365,027 | |

| | | | | | | | | | | | | | |

California 1.85% | |

California State, Recreational Facility, Refunding, GO Unlimited | | | 5.00 | | 12/01/19 | | | 5,000 | | | | 5,014 | |

California State, Statewide Communities Development Authority, Enloe Medical Center Revenue, Series A | | | 5.25 | | 08/15/18 | | | 340,000 | | | | 356,079 | |

Los Angeles Unified School District, Election 2004, GO Unlimited, Series H, AGM | | | 5.00 | | 07/01/32 | | | 200,000 | | | | 200,000 | |

Newman-Crows Landing Unified School District, GO Unlimited, AGM | | | 4.00 | | 08/01/19 | | | 115,000 | | | | 121,464 | |

Riverside County, California Redevelopment Successor Agency, Refunding, Tax Allocation | | | 5.00 | | 10/01/19 | | | 200,000 | | | | 216,346 | |

See notes to portfolios of investments and notes to financial statements.

12

Near-Term Tax Free Fund

Portfolio of Investments (unaudited) | June 30, 2017 |

Municipal Bonds (cont’d) | | Coupon Rate % | | Maturity Date | | Principal Amount | | | Value | |

California (cont’d) | |

Santa Clara County, California Financing Authority Revenue, Obstetrics and Gynecology, El Camino Hospital, AMBAC | | | 5.00 | | 02/01/18 | | $ | 350,000 | | | $ | 351,005 | |

Santa Paula Schools Financing Authority, Santa Paula Elementary School District Revenue, AGM | | | 4.25 | | 11/01/22 | | | 300,000 | | | | 302,970 | |

| | | | | | | | | | | | | 1,552,878 | |

| | | | | | | | | | | | | | |

District of Columbia 0.39% | |

District of Columbia Income Tax Revenue, Series A | | | 5.25 | | 12/01/27 | | | 300,000 | | | | 328,239 | |

| | | | | | | | | | | | | | |

Florida 5.90% | |

Citizens Property Insurance Co., Senior Secured, Coastal Account, Revenue, Series A-1 | | | 4.00 | | 06/01/18 | | | 100,000 | | | | 102,625 | |

Escambia County, Florida, Health Facilities Authority Revenue, Baptist Hospital, Inc. Project, Series A | | | 5.00 | | 08/15/19 | | | 290,000 | | | | 307,374 | |

Florida State Board of Education Lottery Revenue, Series B, BHAC | | | 5.00 | | 07/01/26 | | | 100,000 | | | | 101,000 | |

Florida State Board of Governors Parking Facility Revenue, Series A | | | 3.00 | | 07/01/17 | | | 300,000 | | | | 300,000 | |

Florida State Department of Management Services, Certificates of Participation, Refunding, Series A | | | 5.00 | | 08/01/19 | | | 500,000 | | | | 538,715 | |

Florida State Department of Management Services, Certificates of Participation, Series A | | | 5.00 | | 08/01/24 | | | 340,000 | | | | 357,153 | |

Florida State Municipal Power Agency, Stanton Project Revenue, Refunding | | | 5.13 | | 10/01/17 | | | 300,000 | | | | 302,919 | |

Hillsborough County, Florida School Board, Refunding, Certificates of Participation, Series A | | | 4.25 | | 07/01/25 | | | 300,000 | | | | 323,547 | |

Hillsborough County, Florida School Board, Certificates of Participation, Refunding, NATL | | | 4.00 | | 07/01/19 | | | 100,000 | | | | 100,000 | |

Jacksonville Florida Special Revenue, Series C | | | 5.00 | | 10/01/20 | | | 270,000 | | | | 300,915 | |

Leesburg, Florida Capital Improvement Revenue Bonds, Refunding | | | 5.00 | | 10/01/21 | | | 405,000 | | | | 457,974 | |

See notes to portfolios of investments and notes to financial statements.

13

Near-Term Tax Free Fund

Portfolio of Investments (unaudited) | June 30, 2017 |

Municipal Bonds (cont’d) | | Coupon Rate % | | Maturity Date | | Principal Amount | | | Value | |

Florida (cont’d) | |

Margate, Florida Water & Sewer Revenue, Refunding, AGM | | | 4.00 | | 10/01/19 | | $ | 250,000 | | | $ | 263,633 | |

Miami - Dade County, Florida Expressway Authority Toll System Revenue, Series A | | | 5.00 | | 07/01/21 | | | 430,000 | | | | 488,377 | |

Orange County School Board, Certificates of Participation, Series A, NATL | | | 5.00 | | 08/01/32 | | | 275,000 | | | | 275,784 | |

Orlando, Florida Community Redevelopment Agency Tax Increment Revenue, Downtown District, Tax Allocation, Series A | | | 4.00 | | 09/01/17 | | | 170,000 | | | | 170,534 | |

Polk County, Florida School District Revenue, AGM | | | 5.00 | | 10/01/17 | | | 215,000 | | | | 217,004 | |

Saint Johns County, Florida Transportation Revenue, Refunding, AGM | | | 5.00 | | 10/01/20 | | | 310,000 | | | | 346,227 | |

| | | | | | | | | | | | | 4,953,781 | |

| | | | | | | | | | | | | | |

Georgia 2.03% | |

Carroll City-County, Georgia Hospital Authority, Tanner Medical Center, Inc. Project | | | 5.00 | | 07/01/18 | | | 600,000 | | | | 623,070 | |

Georgia State Municipal Gas Authority, Toccoa Project, Refunding, AGM | | | 5.00 | | 06/01/22 | | | 600,000 | | | | 674,208 | |

Glynn-Brunswick Memorial Hospital Authority, Southeast Georgia Health System and Affiliates Revenue, Certificates of Participation, Series A | | | 4.50 | | 08/01/17 | | | 150,000 | | | | 150,359 | |

Gwinnett County, Georgia, Hospital Authority, Gwinnett Hospital Systems Revenue, Series B, AGM | | | 5.00 | | 07/01/18 | | | 250,000 | | | | 259,485 | |

| | | | | | | | | | | | | 1,707,122 | |

| | | | | | | | | | | | | | |

Idaho 0.30% | |

Idaho Housing & Finance Association, Grant & Revenue Anticipation, Federal Highway Trust Fund, Series A | | | 5.00 | | 07/15/21 | | | 225,000 | | | | 255,364 | |

| | | | | | | | | | | | | | |

Illinois 4.34% | |

Chicago Board of Education, GO Unlimited, NATL | | | 5.25 | | 12/01/19 | | | 300,000 | | | | 319,044 | |

Chicago, Illinois, O’Hare International Airport Revenue, Gen - Third Lien, Series C, AGC | | | 5.25 | | 01/01/23 | | | 250,000 | | | | 271,515 | |

See notes to portfolios of investments and notes to financial statements.

14

Near-Term Tax Free Fund

Portfolio of Investments (unaudited) | June 30, 2017 |

Municipal Bonds (cont’d) | | Coupon Rate % | | Maturity Date | | Principal Amount | | | Value | |

Illinois (cont’d) | |

Clinton Bond Fayette Etc Counties Community College District No. 501 Kaskaskia, GO Unlimited | | | 5.75 | | 12/01/19 | | $ | 500,000 | | | $ | 544,255 | |

Du Page County, Refunding, GO Unlimited | | | 5.60 | | 01/01/21 | | | 270,000 | | | | 294,627 | |

Du Page County School District No. 33 West Chicago, Redunding, GO Unlimited, Series B | | | 4.00 | | 12/01/21 | | | 1,000,000 | | | | 1,093,149 | |

Illinois Metropolitan Pier & Exposition Authority, Unrefunded, NATL (ZCB) | | | 1.78(1) | | 06/15/18 | | | 415,000 | | | | 405,289 | |

Illinois Regional Transportation Authority, Series A, AMBAC | | | 7.20 | | 11/01/20 | | | 120,000 | | | | 131,576 | |

Lake & McHenry County, Fox Lake, Illinois, Debt Certificates, Series B | | | 3.00 | | 11/01/19 | | | 265,000 | | | | 273,472 | |

Will Grundy Etc Counties Community College District No. 525, Joliet Junior College Project, GO Unlimited | | | 6.25 | | 06/01/22 | | | 300,000 | | | | 313,365 | |

| | | | | | | | | | | | | 3,646,292 | |

| | | | | | | | | | | | | | |

Indiana 1.18% | |

Clark-Pleasant, Indiana School Building | | | 5.00 | | 01/15/19 | | | 275,000 | | | | 290,829 | |

Indianapolis Local Public Improvement Bond Bank, Waterworks Project, Series 2007 L, NATL | | | 5.25 | | 01/01/33 | | | 305,000 | | | | 311,466 | |

Merrillville Redevelopment Authority, Tax Allocation | | | 5.00 | | 08/15/20 | | | 350,000 | | | | 385,714 | |

| | | | | | | | | | | | | 988,009 | |

| | | | | | | | | | | | | | |

Iowa 0.78% | |

Clive, Iowa, GO Unlimited, Series A | | | 2.00 | | 06/01/19 | | | 235,000 | | | | 239,016 | |

University of Iowa Hospitals and Clinics, Iowa State Board of Regents, Hospital Revenue, Series A | | | 3.00 | | 09/01/19 | | | 400,000 | | | | 414,300 | |

| | | | | | | | | | | | | 653,316 | |

| | | | | | | | | | | | | | |

Kansas 1.43% | |

Sedgwick County, Kansas, Unified School District No. 261 Haysville, GO Unlimited | | | 5.00 | | 11/01/17 | | | 885,000 | | | | 896,505 | |

Sedgwick County, Kansas, Unified School District No. 266 Maize, GO Unlimited, NATL | | | 5.00 | | 09/01/17 | | | 50,000 | | | | 50,313 | |

Wichita, Kansas, Refunding, GO Unlimited, Series A | | | 5.00 | | 12/01/17 | | | 250,000 | | | | 254,160 | |

| | | | | | | | | | | | | 1,200,978 | |

See notes to portfolios of investments and notes to financial statements.

15

Near-Term Tax Free Fund

Portfolio of Investments (unaudited) | June 30, 2017 |

Municipal Bonds (cont’d) | | Coupon Rate % | | Maturity Date | | Principal Amount | | | Value | |

Kentucky 1.76% | |

Fort Thomas Independent School District Finance Corp., Series C | | | 2.00 | | 11/01/17 | | $ | 465,000 | | | $ | 466,535 | |

Kentucky Municipal Power Agency, Power System Revenue, Prairie State Project, Series A, NATL | | | 5.25 | | 09/01/22 | | | 440,000 | | | | 442,917 | |

Louisville & Jefferson County Metropolitan Sewer District, Series A | | | 5.00 | | 05/15/23 | | | 500,000 | | | | 571,735 | |

| | | | | | | | | | | | | 1,481,187 | |

| | | | | | | | | | | | | | |

Louisiana 1.96% | |

Louisiana Office Facilities Corp, Refunding | | | 5.00 | | 11/01/17 | | | 700,000 | | | | 708,806 | |

Louisiana State, GO Unlimited, Series A | | | 5.00 | | 08/01/26 | | | 800,000 | | | | 939,176 | |

| | | | | | | | | | | | | 1,647,982 | |

| | | | | | | | | | | | | | |

Michigan 4.31% | |

Detroit, Michigan Local Development Financing Authority, Refunding, Tax Allocation, Series A | | | 5.38 | | 05/01/18 | | | 35,000 | | | | 35,032 | |

Gibraltar, Michigan School District, Refunding, GO Unlimited, AGM | | | 5.00 | | 05/01/21 | | | 475,000 | | | | 520,994 | |

Michigan Public Power Agency AFEC Project Revenue, Series A | | | 4.50 | | 01/01/19 | | | 280,000 | | | | 292,256 | |

Michigan State, Trunk Line Revenue, Refunding | | | 4.50 | | 11/01/26 | | | 105,000 | | | | 112,028 | |

Michigan State Hospital Finance Authority, Trinity Health, Series A | | | 6.00 | | 12/01/18 | | | 200,000 | | | | 213,312 | |

Michigan Strategic Fund, Series A, AGC | | | 5.00 | | 10/15/17 | | | 200,000 | | | | 202,148 | |

Oxford Area Community School District, GO Unlimited, Series A, Q-SBLF | | | 5.00 | | 05/01/22 | | | 365,000 | | | | 420,867 | |

Portage Public Schools, School Building & Site, GO Unlimited, AGM | | | 5.00 | | 05/01/20 | | | 300,000 | | | | 309,891 | |

Romeo Community School District, Refunding, GO Unlimited, Q-SBLF | | | 3.00 | | 05/01/18 | | | 500,000 | | | | 507,520 | |

Wayne County, Michigan Airport Authority Revenue, Detroit Metropolitan Airport, Refunding, Series C | | | 4.00 | | 12/01/19 | | | 255,000 | | | | 270,236 | |

Wyoming, Michigan, Water Supply System, Refunding | | | 4.00 | | 06/01/20 | | | 215,000 | | | | 230,020 | |

Zeeland Public Schools, Refunding, GO Unlimited | | | 5.00 | | 05/01/18 | | | 490,000 | | | | 506,155 | |

| | | | | | | | | | | | | 3,620,459 | |

See notes to portfolios of investments and notes to financial statements.

16

Near-Term Tax Free Fund

Portfolio of Investments (unaudited) | June 30, 2017 |

Municipal Bonds (cont’d) | | Coupon Rate % | | Maturity Date | | Principal Amount | | | Value | |

Minnesota 0.89% | |

Chaska, Minnesota Electric Revenue, Refunding, Series A | | | 3.00 | | 10/01/17 | | $ | 535,000 | | | $ | 537,472 | |

Lake Washington Sanitary District, GO Unlimited, Series A, AGM | | | 2.00 | | 02/01/18 | | | 205,000 | | | | 206,302 | |

| | | | | | | | | | | | | 743,774 | |

| | | | | | | | | | | | | | |

Mississippi 0.48% | |

Rankin County School District, GO Limited | | | 2.00 | | 08/01/19 | | | 400,000 | | | | 405,944 | |

| | | | | | | | | | | | | | |

Missouri 2.39% | |

Jackson County, Missouri, Special Obligation Refunding, Truman Sports Complex Project | | | 5.00 | | 12/01/18 | | | 215,000 | | | | 226,358 | |

Kansas City, Missouri, Refunding, Series B | | | 5.00 | | 08/01/19 | | | 650,000 | | | | 696,592 | |

Kansas City, Missouri Water Revenue, Series F, AGM | | | 4.00 | | 12/01/22 | | | 250,000 | | | | 282,733 | |

Missouri State Health & Educational Facilities Authority, Southwestern Baptist University Revenue | | | 3.00 | | 10/01/17 | | | 265,000 | | | | 266,004 | |

Missouri State Regional Convention & Sports Complex Authority | | | 5.00 | | 08/15/19 | | | 500,000 | | | | 537,045 | |

| | | | | | | | | | | | | 2,008,732 | |

| | | | | | | | | | | | | | |

New Hampshire 0.72% | |

New Hampshire, Federal Highway Grant Anticipation Bonds | | | 5.00 | | 09/01/17 | | | 200,000 | | | | 201,202 | |

New Hampshire Health & Education Facilities Authority Revenue, Southern New Hampshire University Project | | | 5.00 | | 01/01/18 | | | 400,000 | | | | 407,404 | |

| | | | | | | | | | | | | 608,606 | |

| | | | | | | | | | | | | | |

New Jersey 3.46% | |

Atlantic City, New Jersey, Refunding Tax Appeal, GO Unlimited | | | 4.00 | | 11/01/18 | | | 500,000 | | | | 485,755 | |

Camden County, New Jersey Improvement Authority, Refunding | | | 4.00 | | 01/15/18 | | | 600,000 | | | | 609,654 | |

Cumberland County, New Jersey Improvement Authority, Technical High School Project, AGM | | | 3.00 | | 09/01/17 | | | 550,000 | | | | 551,722 | |

Elizabeth, New Jersey Parking Authority Project Revenue, Elizabethtown Plaza Redevelopment, Series B | | | 4.00 | | 11/01/17 | | | 255,000 | | | | 257,504 | |

See notes to portfolios of investments and notes to financial statements.

17

Near-Term Tax Free Fund

Portfolio of Investments (unaudited) | June 30, 2017 |

Municipal Bonds (cont’d) | | Coupon Rate % | | Maturity Date | | Principal Amount | | | Value | |

New Jersey (cont’d) | |

Hudson County, New Jersey Improvement Authority Lease Revenue, North Hudson Regional Fire, Refunding, Series A, AGM | | | 5.63 | | 09/01/18 | | $ | 400,000 | | | $ | 420,244 | |

Passaic Valley, New Jersey, Sewage Commissioners Revenue, Series G | | | 5.75 | | 12/01/21 | | | 500,000 | | | | 585,310 | |

| | | | | | | | | | | | | 2,910,189 | |

| | | | | | | | | | | | | | |

New York 9.08% | |

Greece, New York Central School District, GO Unlimited | | | 2.00 | | 06/15/19 | | | 455,000 | | | | 463,022 | |

Long Island Power Authority Revenue, Series B | | | 5.00 | | 09/01/21 | | | 465,000 | | | | 531,690 | |

Nassau County Industrial Development Agency, New York Institute of Technology Project Revenue, Refunding, Remarketing, Series A | | | 5.00 | | 03/01/21 | | | 350,000 | | | | 384,717 | |

New York City, GO Unlimited, Series E | | | 5.25 | | 08/01/22 | | | 875,000 | | | | 1,034,591 | |

New York City, GO Unlimited, Series B | | | 5.00 | | 08/01/19 | | | 400,000 | | | | 431,572 | |

New York City, GO Unlimited, Series I | | | 5.00 | | 08/01/22 | | | 1,000,000 | | | | 1,170,229 | |

New York State Thruway Authority, Series B | | | 5.00 | | 04/01/27 | | | 1,335,000 | | | | 1,347,949 | |

New York State Urban Development,

Series D | | | 5.50 | | 01/01/19 | | | 250,000 | | | | 266,363 | |

New York State Urban Development, NATL | | | 5.50 | | 03/15/19 | | | 615,000 | | | | 661,297 | |

North Castle, New York, Public Improvement, GO Unlimited | | | 3.88 | | 12/01/22 | | | 210,000 | | | | 212,581 | |

Patchogue-Medford Union Free School District, GO Unlimited | | | 5.00 | | 10/01/17 | | | 465,000 | | | | 469,390 | |

Sodus, New York Central School District, Refunding, GO Unlimited | | | 3.00 | | 06/15/18 | | | 640,000 | | | | 651,603 | |

| | | | | | | | | | | | | 7,625,004 | |

| | | | | | | | | | | | | | |

North Carolina 2.58% | |

Beaufort County, North Carolina, GO Limited | | | 5.00 | | 06/01/21 | | | 200,000 | | | | 224,978 | |

Charlotte, North Carolina, Certificates of Participation, Series A | | | 5.00 | | 10/01/21 | | | 1,000,000 | | | | 1,114,499 | |

North Carolina Medical Care Commission, Firsthealth Carolina Project, Refunding, Series C | | | 4.00 | | 10/01/17 | | | 420,000 | | | | 423,079 | |

North Carolina State Municipal Power Agency #1, Catawba Electric Revenue, Refunding, Series A | | | 5.25 | | 01/01/20 | | | 400,000 | | | | 408,480 | |

| | | | | | | | | | | | | 2,171,036 | |

See notes to portfolios of investments and notes to financial statements.

18

Near-Term Tax Free Fund

Portfolio of Investments (unaudited) | June 30, 2017 |

Municipal Bonds (cont’d) | | Coupon Rate % | | Maturity Date | | Principal Amount | | | Value | |

Ohio 0.96% | |

Cleveland, Ohio, Parking Facility Revenue, Prefunding, Refunding, AGM | | | 5.25 | | 09/15/22 | | $ | 130,000 | | | $ | 154,330 | |

Lorain County, Ohio, Community College District, Revenue | | | 3.25 | | 12/01/17 | | | 650,000 | | | | 655,883 | |

| | | | | | | | | | | | | 810,213 | |

| | | | | | | | | | | | | | |

Oklahoma 0.40% | |

Oklahoma State Agricultural & Mechanical Colleges, Oklahoma State University, Series A | | | 5.00 | | 08/01/21 | | | 300,000 | | | | 331,953 | |

| | | | | | | | | | | | | | |

Oregon 0.26% | |

Oregon State Facilities Authority, Legacy Health Project Revenue, Refunding, Series A | | | 4.50 | | 05/01/20 | | | 200,000 | | | | 217,136 | |

| | | | | | | | | | | | | | |

Pennsylvania 3.27% | |

Allegheny County, Pennsylvania Sanitary Authority, AGM | | | 5.00 | | 06/01/19 | | | 700,000 | | | | 749,749 | |

Delaware Valley, Pennsylvania, Regional Financial Authority Revenue, Permanently Fixed Business Development Services, AMBAC | | | 5.50 | | 08/01/18 | | | 295,000 | | | | 308,824 | |

Muhlenberg Township, Pennsylvania, GO Unlimited, AGM | | | 3.00 | | 11/01/17 | | | 280,000 | | | | 280,403 | |

Philadelphia School District, Pennsylvania, Refunding, GO Unlimited, Series E | | | 5.25 | | 09/01/24 | | | 625,000 | | | | 678,556 | |

Reading, Pennsylvania School District, GO Unlimited, Series A | | | 5.00 | | 04/01/20 | | | 400,000 | | | | 433,008 | |

Wilkes-Barre Finance Authority, University of Scranton, Refunding, Series A | | | 5.00 | | 11/01/19 | | | 275,000 | | | | 294,247 | |

| | | | | | | | | | | | | 2,744,787 | |

| | | | | | | | | | | | | | |

South Carolina 1.13% | |

Spartanburg County, South Carolina Regional Health Services District, Hospital Revenue, Refunding, Series A | | | 5.00 | | 04/15/19 | | | 600,000 | | | | 638,820 | |

Spartanburg County, South Carolina Sanitation Sewer District, Series A, AGC | | | 3.50 | | 03/01/19 | | | 300,000 | | | | 311,304 | |

| | | | | | | | | | | | | 950,124 | |

See notes to portfolios of investments and notes to financial statements.

19

Near-Term Tax Free Fund

Portfolio of Investments (unaudited) | June 30, 2017 |

Municipal Bonds (cont’d) | | Coupon Rate % | | Maturity Date | | Principal Amount | | | Value | |

Tennessee 0.26% | |

Memphis, Tennessee Sanitary Sewage System Revenue, Refunding, AGM | | | 5.00 | | 05/01/20 | | $ | 200,000 | | | $ | 220,242 | |

| | | | | | | | | | | | | | |

Texas 24.80% | |

Addison, Texas Certificates of Obligation, GO Limited | | | 4.50 | | 02/15/28 | | | 140,000 | | | | 143,067 | |

Addison, Texas Certificates of Obligation, GO Limited | | | 4.00 | | 02/15/20 | | | 250,000 | | | | 254,720 | |

Arlington, Texas, GO Limited, Series B | | | 2.00 | | 08/15/19 | | | 500,000 | | | | 508,930 | |

Bryan Independent School District, GO Unlimited, Series A, PSF-GTD | | | 5.00 | | 02/15/22 | | | 410,000 | | | | 473,858 | |

Cedar Hill Texas, Refunding, GO Limited | | | 5.00 | | 02/15/22 | | | 800,000 | | | | 926,144 | |

Center, Texas Certificates of Obligation, GO Limited, AGM (ZCB) | | | 3.63(1) | | 02/15/20 | | | 150,000 | | | | 142,745 | |

Clear Lake, Texas, Waterworks & Sewer System, GO Unlimited | | | 3.00 | | 03/01/19 | | | 125,000 | | | | 128,879 | |

Corpus Christi, Texas Business & Job Development Corporation, Seawall Project, Sales Tax Revenue, Refunding | | | 5.00 | | 03/01/20 | | | 350,000 | | | | 381,161 | |

Culberson County-Allamoore Independent School District, GO Unlimited, PSF-GTD | | | 3.00 | | 02/15/19 | | | 860,000 | | | | 885,834 | |

Dallas, Texas Waterworks & Sewer System Revenue, Unrefunded, AMBAC | | | 4.50 | | 10/01/19 | | | 165,000 | | | | 166,416 | |

Dallas, Texas Waterworks & Sewer System Revenue, Prerefunded, AMBAC | | | 4.50 | | 10/01/19 | | | 60,000 | | | | 60,508 | |

Denton, Texas, Refunding, GO Limited | | | 5.00 | | 02/15/19 | | | 500,000 | | | | 531,410 | |

Dimmitt Independent School District, GO Unlimited, PSF-GTD | | | 3.00 | | 02/15/22 | | | 305,000 | | | | 325,014 | |

Fort Worth, Texas Water & Sewer System Revenue | | | 5.00 | | 02/15/19 | | | 800,000 | | | | 849,856 | |

Frisco, Texas Independent School District, School Building, GO Unlimited, Series A, PSF-GTD | | | 4.50 | | 08/15/25 | | | 180,000 | | | | 180,713 | |

Garland, Texas, GO Limited | | | 5.00 | | 02/15/25 | | | 650,000 | | | | 711,503 | |

Harris County, Texas Municipal Utility District No 290, GO Unlimited, Series A, BAM | | | 1.50 | | 09/01/17 | | | 200,000 | | | | 200,142 | |

Harris County, Texas Municipal Utility District No. 382, GO Unlimited, BAM | | | 3.00 | | 04/01/22 | | | 305,000 | | | | 314,586 | |

Hays County, Texas, GO Limited | | | 5.00 | | 02/15/23 | | | 500,000 | | | | 512,155 | |

Houston Community College System, GO Limited | | | 5.00 | | 02/15/19 | | | 755,000 | | | | 802,429 | |

Houston, Texas, Hotel Occupancy Tax, Unrefunded, Series B | | | 5.00 | | 09/01/19 | | | 45,000 | | | | 45,113 | |

See notes to portfolios of investments and notes to financial statements.

20

Near-Term Tax Free Fund

Portfolio of Investments (unaudited) | June 30, 2017 |

Municipal Bonds (cont’d) | | Coupon Rate % | | Maturity Date | | Principal Amount | | | Value | |

Texas (cont’d) | |

Houston, Texas Combined Utility System Revenue, Prerefunded, AGM | | | 5.00 | | 11/15/27 | | $ | 150,000 | | | $ | 152,189 | |

Hutto Independent School District, GO Unlimited, AGC | | | 4.75 | | 08/01/31 | | | 600,000 | | | | 601,602 | |

Longview, Texas Waterworks & Sewer System Revenue, Refunding | | | 3.00 | | 03/01/22 | | | 610,000 | | | | 652,102 | |

Lower Colorado River Authority, Transmission Contract Revenue, Refunding, Series A | | | 5.00 | | 05/15/21 | | | 500,000 | | | | 565,960 | |

Lubbock-Cooper Independent School District, GO Unlimited, PSF-GTD | | | 3.00 | | 02/15/22 | | | 755,000 | | | | 805,932 | |

Montgomery County, Texas Municipal Utility District No 113, GO Unlimited, BAM | | | 2.00 | | 09/01/17 | | | 260,000 | | | | 260,361 | |

Montgomery County, Texas Municipal Utility District No 119, GO Unlimited, Series A, AGM | | | 4.00 | | 04/01/18 | | | 315,000 | | | | 321,253 | |

North Texas Tollway Authority Revenue, Series F | | | 5.75 | | 01/01/38 | | | 300,000 | | | | 307,011 | |

Olmos Park Higher Education Facilities Corp, University of the Incarnate Word, Refunding | | | 5.00 | | 12/01/21 | | | 500,000 | | | | 564,935 | |

Pharr, Texas, Refunding, GO Limited, Series A | | | 5.00 | | 08/15/20 | | | 285,000 | | | | 314,446 | |

Plano, Texas, Refunding, GO Limited | | | 5.00 | | 09/01/19 | | | 1,000,000 | | | | 1,082,059 | |

Round Rock, Texas, GO Limited | | | 2.00 | | 08/15/19 | | | 465,000 | | | | 472,524 | |

San Antonio, Texas, Water Revenue, Refunding | | | 4.50 | | 05/15/21 | | | 400,000 | | | | 447,688 | |

San Marcos, Texas Tax & Toll Revenue, GO Limited, AGM | | | 5.10 | | 08/15/27 | | | 400,000 | | | | 401,820 | |

Texarkana, Texas Waterworks & Sanitary Sewer System Revenue | | | 3.00 | | 08/01/19 | | | 90,000 | | | | 92,610 | |

Texarkana, Texas Waterworks & Sanitary Sewer System Revenue | | | 3.00 | | 08/01/20 | | | 95,000 | | | | 98,677 | |

Texarkana, Texas, Refunding, GO Limited | | | 5.00 | | 02/15/21 | | | 320,000 | | | | 360,154 | |

Texas Municipal Power Agency Revenue, Refunding, AGC | | | 5.00 | | 09/01/17 | | | 250,000 | | | | 251,508 | |

Texas State Public, Finance Authority Charter School Finance, Series A | | | 6.20 | | 02/15/40 | | | 2,000,000 | | | | 2,241,719 | |

Texas State, Public Finance Authority, Refunding, GO Unlimited | | | 5.00 | | 10/01/20 | | | 1,150,000 | | | | 1,287,505 | |

Travis County, Texas Water Control & Improvement District No. 10, GO Unlimited | | | 2.00 | | 08/15/19 | | | 500,000 | | | | 507,670 | |

See notes to portfolios of investments and notes to financial statements.

21

Near-Term Tax Free Fund

Portfolio of Investments (unaudited) | June 30, 2017 |

Municipal Bonds (cont’d) | | Coupon Rate % | | Maturity Date | | Principal Amount | | | Value | |

Texas (cont’d) | |

Waxahachie, Texas, Refunding, GO Limited, AMBAC | | | 4.20 | | 08/01/22 | | $ | 500,000 | | | $ | 501,420 | |

| | | | | | | | | | | | | 20,836,328 | |

| | | | | | | | | | | | | | |

Utah 1.43% | |

Davis County, Utah, GO Unlimited | | | 5.00 | | 02/01/19 | | | 200,000 | | | | 212,232 | |

Utah State Building Ownership Authority, Lease Revenue, Refunding, Series C, AGM | | | 5.50 | | 05/15/19 | | | 180,000 | | | | 187,412 | |

Washington County-St George Interlocal Agency, Lease Revenue, Refunding, Series A | | | 4.00 | | 12/01/19 | | | 300,000 | | | | 317,265 | |

Weber County, Utah, GO Unlimited | | | 4.00 | | 01/15/22 | | | 430,000 | | | | 480,056 | |

| | | | | | | | | | | | | 1,196,965 | |

| | | | | | | | | | | | | | |

Virginia 0.68% | |

Lynchburg, Virginia, Refunding, GO Unlimited | | | 5.00 | | 02/01/19 | | | 540,000 | | | | 573,199 | |

| | | | | | | | | | | | | | |

Washington 7.29% | |

Cowlitz County, Washington, Refunding, GO Limited, Series A | | | 3.00 | | 04/01/18 | | | 195,000 | | | | 197,952 | |

Snohomish County, Washington Public Utility District No 1, Refunding | | | 5.00 | | 12/01/17 | | | 550,000 | | | | 558,927 | |

Spokane County, Washington Public Facilities District, Refunding, Series B | | | 5.00 | | 12/01/21 | | | 950,000 | | | | 1,077,243 | |

Tacoma, Washington Metropolitan Park District, GO Unlimited, Series B | | | 4.00 | | 12/01/19 | | | 355,000 | | | | 379,168 | |

Thurston County, Washington, Refunding, GO Limited | | | 5.00 | | 12/01/20 | | | 1,625,000 | | | | 1,821,023 | |

Washington State Health Care Facilities Authority, Seattle Children's Hospital Project | | | 5.00 | | 10/01/17 | | | 150,000 | | | | 151,470 | |

Washington State, Motor Vehicle Fuel Tax, GO Unlimited, Series C | | | 5.00 | | 02/01/19 | | | 830,000 | | | | 881,161 | |

Washington State, Refunding, GO Unlimited, Series A | | | 5.00 | | 01/01/19 | | | 1,000,000 | | | | 1,058,550 | |

| | | | | | | | | | | | | 6,125,494 | |

See notes to portfolios of investments and notes to financial statements.

22

Near-Term Tax Free Fund

Portfolio of Investments (unaudited) | June 30, 2017 |

Municipal Bonds (cont’d) | | Coupon Rate % | | Maturity Date | | Principal Amount | | | Value | |

Wisconsin 0.31% | |

Waunakee Community School District, GO Unlimited, Series A | | | 5.00 | | 04/01/18 | | $ | 250,000 | | | $ | 257,388 | |

| |

Total Investments 90.31% | | | | 75,872,208 | |

(cost $75,580,461) | | | | | | | | | | | | | |

Other assets and liabilities, net 9.69% | | | | | | | 8,137,204 | |

| | | | | | | | | | | | | | |

Net Assets 100.0% | | | | | | | | | | | $ | 84,009,412 | |

(1) | Represents Yield on zero coupon bond. |

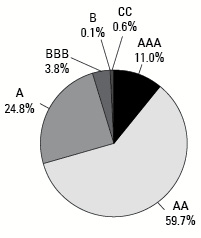

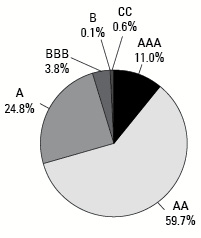

Municipal Bond Ratings*

Based on Total Municipal Bonds | June 30, 2017 |

|

* | Credit quality ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). “Not Rated” is used to classify securities for which a rating is not available. Credit-quality ratings for each issue are obtained from Moody’s and S&P, and the higher rating for each issue is used |

See notes to portfolios of investments and notes to financial statements.

23

All American Equity Fund

Portfolio of Investments (unaudited) | June 30, 2017 |

Common Stocks 89.19% | | Shares | | | Value | |

Airlines 4.39% | |

Southwest Airlines Co. | | | 11,779 | | | $ | 731,947 | |

| | | | | | | | | |

Beverages - Wine/Spirits 2.99% | |

Brown-Forman Corp., Class B | | | 10,249 | | | | 498,101 | |

| | | | | | | | | |

Chemicals - Diversified 2.48% | |

LyondellBasell Industries N.V., Class A | | | 4,900 | | | | 413,511 | |

| | | | | | | | | |

Computers 2.74% | |

Apple, Inc. | | | 3,174 | | | | 457,120 | |

| | | | | | | | | |

Computers - Memory Devices 1.90% | |

NetApp, Inc. | | | 7,897 | | | | 316,275 | |

| | | | | | | | | |

Cruise Lines 3.19% | |

Carnival Corp. | | | 8,090 | | | | 530,461 | |

| | | | | | | | | |

Distribution/Wholesale 1.57% | |

WW Grainger, Inc. | | | 1,451 | | | | 261,949 | |

| | | | | | | | | |

Electric - Integrated 2.58% | |

Entergy Corp. | | | 5,605 | | | | 430,296 | |

| | | | | | | | | |

Electronic Components - Miscellaneous 6.42% | |

Corning, Inc. | | | 18,468 | | | | 554,964 | |

TE Connectivity Ltd. | | | 6,540 | | | | 514,567 | |

| | | | | | | | 1,069,531 | |

| | | | | | | | | |

Electronic Components - Semiconductors 3.26% | |

Xilinx, Inc. | | | 8,452 | | | | 543,633 | |

| | | | | | | | | |

Food - Meat Products 3.37% | |

Tyson Foods, Inc., Class A | | | 8,967 | | | | 561,603 | |

| | | | | | | | | |

Food - Miscellaneous/Diversified 2.33% | |

Kraft Heinz Co. | | | 4,526 | | | | 387,607 | |

| | | | | | | | | |

Investment Management/Advisory Services 2.63% | |

Ameriprise Financial, Inc. | | | 3,438 | | | | 437,623 | |

| | | | | | | | | |

Medical - Drugs 2.02% | |

Pfizer, Inc. | | | 10,000 | | | | 335,900 | |

| | | | | | | | | |

Medical - Generic Drugs 2.90% | |

Allergan plc | | | 1,990 | | | | 483,749 | |

See notes to portfolios of investments and notes to financial statements.

24

All American Equity Fund

Portfolio of Investments (unaudited) | June 30, 2017 |

Common Stocks (cont’d) | | Shares | | | Value | |

Medical - Wholesale Drug Distribution 3.09% | |

Cardinal Health, Inc. | | | 6,611 | | | $ | 515,129 | |

| | | | | | | | | |

Medical Labs & Testing Services 3.39% | |

Quest Diagnostics, Inc. | | | 5,074 | | | | 564,026 | |

| | | | | | | | | |

Multi-line Insurance 5.66% | |

American International Group, Inc. | | | 7,265 | | | | 454,208 | |

Hartford Financial Services Group, Inc. | | | 9,283 | | | | 488,007 | |

| | | | | | | | 942,215 | |

Oil Companies - Exploration & Production 3.32% | |

Occidental Petroleum Corp. | | | 9,236 | | | | 552,959 | |

| | | | | | | | | |

Oil Companies - Integrated 2.70% | |

ExxonMobil Corp. | | | 5,572 | | | | 449,828 | |

| | | | | | | | | |

Oil Refining & Marketing 2.98% | |

Valero Energy Corp. | | | 7,355 | | | | 496,168 | |

| | | | | | | | | |

Property/Casualty Insurance 3.15% | |

Travelers Co., Inc. | | | 4,140 | | | | 523,834 | |

| | | | | | | | | |

REITS - Regional Malls 2.44% | |

Macerich Co. | | | 6,997 | | | | 406,246 | |

| | | | | | | | | |

Retail - Bedding 2.46% | |

Bed Bath & Beyond, Inc. | | | 13,467 | | | | 409,397 | |

| | | | | | | | | |

Retail - Discount 3.83% | |

Target Corp. | | | 12,215 | | | | 638,722 | |

| | | | | | | | | |

Retail - Regional Department Store 3.17% | |

Kohl's Corp. | | | 13,645 | | | | 527,652 | |

| | | | | | | | | |

Semiconductor Components - Integrated Circuits 2.10% | |

QUALCOMM, Inc. | | | 6,343 | | | | 350,260 | |

| | | | | | | | | |

Telephone - Integrated 2.03% | |

AT&T, Inc. | | | 8,970 | | | | 338,438 | |

| | | | | | | | | |

Transportation - Rail 4.10% | |

Union Pacific Corp. | | | 6,266 | | | | 682,430 | |

| |

Total Common Stocks | | | | | | | 14,856,610 | |

(cost $14,359,784) | | | | | | | | |

See notes to portfolios of investments and notes to financial statements.

25

All American Equity Fund

Portfolio of Investments (unaudited) | June 30, 2017 |

Exchange-Traded Funds 4.31% | | Shares | | | Value | |

| | | | | | | |

Direxion Daily Technology Bull 3X Shares | | | 2,300 | | | $ | 165,347 | |

Financial Select Sector SPDR Fund | | | 3,300 | | | | 81,411 | |

Health Care Select Sector SPDR Fund | | | 2,200 | | | | 174,328 | |

Industrial Select Sector SPDR Fund | | | 700 | | | | 47,677 | |

ProShares Ultra Financial | | | 800 | | | | 83,152 | |

ProShares Ultra Real Estate | | | 700 | | | | 87,941 | |

Utilities Select Sector SPDR Fund | | | 1,500 | | | | 77,940 | |

| |

Total Exchange-Traded Funds | | | | | | | 717,796 | |

(cost $709,814) | | | | | | | | |

| | | | | | | | | |

Rights 0.00% | | | | | | | | |

| | | | | | | | | |

Food - Retail 0.00% | |

Casa Ley, S.A. de C.V., Contingent Value Right | | | 7,200 | | | 0 | *#@ |

Property Development Centers, LLC, Contingent Value Right | | | 7,200 | | | 0 | *#@ |

| |

Total Rights | | | | | | | 0 | |

(cost $—) | | | | | | | | |

| |

Total Investments 93.50% | | | | | | | 15,574,406 | |

(cost $15,069,598) | | | | | | | | |

Other assets and liabilities, net 6.50% | | | | | | | 1,083,579 | |

| | | | | | | | | |

Net Assets 100.0% | | | | | | $ | 16,657,985 | |

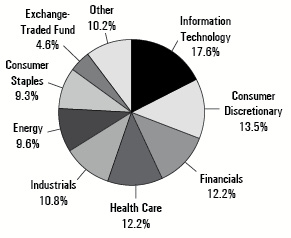

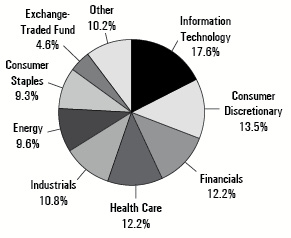

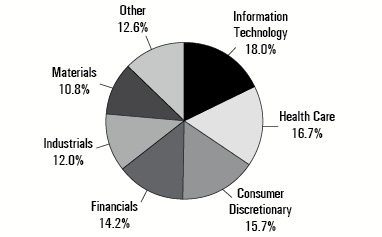

Portfolio Allocation by Industry Sector* Based on Total Investments | June 30, 2017 |

|

* | Summary information above may differ from the portfolio schedule included in the financial statements due to the use of different classifications of securities for presentation purposes. |

See notes to portfolios of investments and notes to financial statements.

26

Holmes Macro Trends Fund

Portfolio of Investments (unaudited) | June 30, 2017 |

Common Stocks 84.58% | | Shares | | | Value | |

Aerospace/Defense 1.66% | |

Rockwell Collins, Inc. | | | 6,332 | | | $ | 665,337 | |

| | | | | | | | | |

Airlines 2.45% | |

Allegiant Travel Co., Class A | | | 7,255 | | | | 983,778 | |

| | | | | | | | | |

Athletic Equipment 3.28% | |

Nautilus, Inc. | | | 68,741 | | | | 1,316,390 | * |

| | | | | | | | | |

Bicycle Manufacturing 1.98% | |

Fox Factory Holding Corp. | | | 22,333 | | | | 795,055 | * |

| | | | | | | | | |

Building - Residential/Commercial 2.89% | |

LGI Homes, Inc. | | | 28,959 | | | | 1,163,573 | * |

| | | | | | | | | |

Building Products - Air & Heating 3.85% | |

Lennox International, Inc. | | | 8,421 | | | | 1,546,432 | |

| | | | | | | | | |

Chemicals - Fibers 3.85% | |

Rayonier Advanced Materials | | | 98,315 | | | | 1,545,512 | |

| | | | | | | | | |

Chemicals - Specialty 2.83% | |

Kraton Corp. | | | 32,969 | | | | 1,135,452 | * |

| | | | | | | | | |

Commercial Services - Finance 6.74% | |

S&P Global, Inc. | | | 18,558 | | | | 2,709,282 | |

| | | | | | | | | |

Containers - Paper/Plastic 3.31% | |

Sealed Air Corp. | | | 29,726 | | | | 1,330,536 | |

| | | | | | | | | |

Data Processing/Management 3.25% | |

CSG Systems International, Inc. | | | 32,231 | | | | 1,307,934 | |

| | | | | | | | | |

E-Commerce/Products 5.29% | |

eBay, Inc. | | | 60,907 | | | | 2,126,872 | * |

| | | | | | | | | |

Electronic Security Devices 3.18% | |

Allegion plc | | | 15,752 | | | | 1,277,802 | |

| | | | | | | | | |

Energy - Alternate Sources 0.00% | |

Pacific Green Energy Corp. | | | 100,000 | | | 0 | *#@ |

| | | | | | | | | |

Finance - Commercial 0.40% | |

IOU Financial, Inc. | | | 1,099,000 | | | | 161,019 | * |

See notes to portfolios of investments and notes to financial statements.

27

Holmes Macro Trends Fund

Portfolio of Investments (unaudited) | June 30, 2017 |

Common Stocks (cont’d) | | Shares | | | Value | |

Finance - Investment Banker/Broker 0.96% | |

Greenhill & Co., Inc. | | | 19,224 | | | $ | 386,402 | |

| | | | | | | | | |

Finance - Other Services 5.06% | |

CBOE Holdings, Inc. | | | 22,239 | | | | 2,032,645 | |

| | | | | | | | | |

Home Furnishings 4.29% | |

Select Comfort Corp. | | | 48,633 | | | | 1,725,985 | * |

| | | | | | | | | |

Medical - Drugs 12.48% | |

AbbVie, Inc. | | | 27,663 | | | | 2,005,844 | |

Eagle Pharmaceuticals, Inc. | | | 13,900 | | | | 1,096,571 | * |

Supernus Pharmaceuticals, Inc. | | | 44,409 | | | | 1,914,028 | * |

| | | | | | | | 5,016,443 | |

| | | | | | | | | |

Medical - Hospitals 0.00% | |

African Medical Investments plc | | | 1,000,000 | | | 0 | *#@ |

| | | | | | | | | |

Protection - Safety 2.96% | |

Landauer, Inc. | | | 22,746 | | | | 1,189,616 | |

| | | | | | | | | |

Real Estate Operating/Development 0.83% | |

Pacific Infrastructure Ventures, Inc. (RS) | | | 426,533 | | | 333,464 | *#@ |

| | | | | | | | | |

REITS - Regional Malls 2.85% | |

Taubman Centers, Inc. | | | 19,240 | | | | 1,145,742 | |

| | | | | | | | | |

Retail - Discount 2.07% | |

HSN, Inc. | | | 26,030 | | | | 830,357 | |

| | | | | | | | | |

Semiconductor Equipment 4.06% | |

KLA-Tencor Corp. | | | 17,846 | | | | 1,633,088 | |

| | | | | | | | | |

Web Hosting/Design 1.17% | |

NIC, Inc. | | | 24,911 | | | | 472,064 | |

| | | | | | | | | |

Wireless Equipment 2.89% | |

InterDigital, Inc. | | | 15,020 | | | | 1,161,046 | |

| |

Total Common Stocks | | | | | | | 33,991,826 | |

(cost $31,885,496) | | | | | | | | |

Exchange-Traded Funds 5.28%

| | | | | | | | |

Consumer Staples Select Sector SPDR Fund | | | 3,500 | | | | 192,290 | |

Direxion Daily Technology Bull 3X Shares | | | 8,000 | | | | 575,120 | |

See notes to portfolios of investments and notes to financial statements.

28

Holmes Macro Trends Fund

Portfolio of Investments (unaudited) | June 30, 2017 |

Exchange-Traded Funds (cont’d) | | Shares | | | Value | |

| | | | | | | |

Financial Select Sector SPDR Fund | | | 7,900 | | | $ | 194,893 | |

Health Care Select Sector SPDR Fund | | | 5,200 | | | | 412,048 | |

Industrial Select Sector SPDR Fund | | | 1,600 | | | | 108,976 | |

ProShares Ultra Financial | | | 2,000 | | | | 207,880 | |

ProShares Ultra Real Estate | | | 1,500 | | | | 188,445 | |

USCF Restaurant Leaders Fund | | | 2,400 | | | | 42,720 | |

Utilities Select Sector SPDR Fund | | | 3,800 | | | | 197,448 | |

| |

Total Exchange-Traded Funds | | | | | | | 2,119,820 | |

(cost $2,102,247) | | | | | | | | |

| | | | | | | | | |

Subscription Receipts 1.41% | | | | | | | | |

| | | | | | | | | |

Oil Companies - Exploration & Production 1.41% | |

PentaNova Energy Corp. (RS) | | | 1,000,000 | | | 566,780 | *#@ |

(cost $379,694) | | | | | | | | |

| | | | | | | | | |

Warrants 0.00% | | | | | | | | |

| | | | | | | | | |

Gold Mining 0.00% | |

Gran Colombia Gold Corp., 144A, Warrants (October 2017) | | | 3,700 | | | 0 | *#@ |

Gran Colombia Gold Corp., Warrants (March 2019) | | | 250 | | | | 4 | * |

| |

Total Warrants | | | | | | | 4 | |

(cost $0) | | | | | | | | |

| | | | | | | | | |

| | | Principal

Amount | | | | | |

Convertible Debenture 0.70% | | | | | | | | |

| | | | | | | | | |

Gold Mining 0.70% | |

Gran Colombia Gold Corp., 8.00%, maturity 01/02/24, 144A | | $ | 332,971 | | | | 283,026 | |

(cost $175,839) | | | | | | | | |

| | | | | | | | | |

Corporate Note 0.58% | | | | | | | | |

| | | | | | | | | |

Electric Generation 0.58% | |

Interamerican Energy Corp., 15.00%, maturity 11/08/21 (RS) | | | 233,829 | | | 233,829 | #@ |

(cost $233,829) | | | | | | | | |

| |

Total Investments 92.55% | | | | | | | 37,195,285 | |

(cost $34,777,105) | | | | | | | | |

Other assets and liabilities, net 7.45% | | | | | | | 2,994,838 | |

| | | | | | | | | |

Net Assets 100.0% | | | | | | $ | 40,190,123 | |

See notes to portfolios of investments and notes to financial statements.

29

Holmes Macro Trends Fund

Portfolio of Investments (unaudited) | June 30, 2017 |

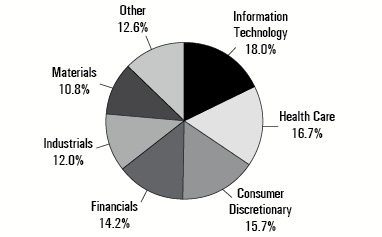

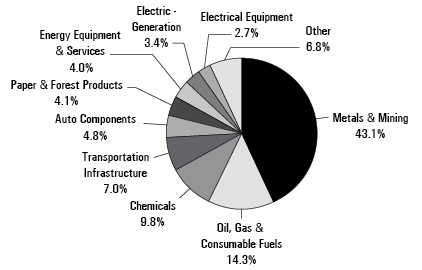

Portfolio Allocation by Industry Sector* Based on Total Investments | June 30, 2017 |

|

* | Summary information above may differ from the portfolio schedule included in the financial statements due to the use of different classifications of securities for presentation purposes. |

See notes to portfolios of investments and notes to financial statements.

30

Global Resources Fund

Portfolio of Investments (unaudited) | June 30, 2017 |

Common Stocks 75.62% | | Shares | | | Value | |

Agricultural Chemicals 1.55% | |

PhosAgro PJSC, GDR | | | 20,540 | | | $ | 265,808 | |

Terra Nitrogen Company, L.P. | | | 13,300 | | | | 1,141,938 | |

| | | | | | | | 1,407,746 | |

| | | | | | | | | |

Agricultural Operations 0.20% | |

Agriterra Ltd. | | | 69,849,776 | | | | 184,227 | *+ |

| | |

Automotive Truck Parts & Equipment - Original 2.40% | |

Lear Corp. | | | 7,900 | | | | 1,122,432 | |

Magna International, Inc. | | | 22,800 | | | | 1,056,324 | |

| | | | | | | | 2,178,756 | |

| | | | | | | | | |

Chemicals - Diversified 5.24% | |

Dongyue Group, Ltd. | | | 2,364,500 | | | | 1,138,723 | * |

Kanto Denka Kogyo Co., Ltd. | | | 174,700 | | | | 1,541,924 | |

Kuraray Co., Ltd. | | | 51,800 | | | | 943,228 | |

Tosoh Corp. | | | 109,900 | | | | 1,132,653 | |

| | | | | | | | 4,756,528 | |

| | | | | | | | | |

Chemicals - Fibers 1.11% | |

Rayonier Advanced Materials, Inc. | | | 64,200 | | | | 1,009,224 | |

| | | | | | | | | |

Chemicals - Specialty 1.47% | |

Kingboard Laminates Holdings Ltd. | | | 1,107,400 | | | | 1,335,385 | |

| | |

Coal 3.58% | |

Alliance Holdings GP | | | 40,800 | | | | 966,960 | |

Caribbean Resources Corp. | | | 17 | | | 0 | *+#@ |

China Shenhua Energy Co., Ltd. H shares | | | 464,700 | | | | 1,033,899 | |

Consolidated Growth Holdings, Ltd. | | | 19,859,173 | | | 0 | *#@ |

Jastrzebska Spolka Weglowa SA | | | 62,300 | | | | 1,243,588 | * |

Walter Energy, Inc., 144A | | | 4,293 | | | | 172 | * |

| | | | | | | | 3,244,619 | |

| | | | | | | | | |

Diamonds/Precious Stones 1.23% | |

Diamond Fields International Ltd. | | | 360,000 | | | | 37,477 | * |

Lucara Diamond Corp. | | | 506,100 | | | | 1,077,141 | |

Rockwell Diamonds, Inc., 144A | | | 63,333 | | | 2,442 | *#@ |

| | | | | | | | 1,117,060 | |

| | | | | | | | | |

Diversified Minerals 1.29% | |

Ciner Resources LP | | | 23,592 | | | | 646,421 | |

Dundee Sustainable Technologies, Inc. | | | 3,587,500 | | | | 138,321 | * |

Encanto Potash Corp., 144A | | | 3,000,000 | | | | 150,370 | * |

Niocan, Inc., 144A | | | 362,069 | | | | 34,202 | *# |

See notes to portfolios of investments and notes to financial statements.

31

Global Resources Fund

Portfolio of Investments (unaudited) | June 30, 2017 |

Common Stocks (cont’d) | | Shares | | | Value | |

Diversified Minerals (cont’d) | |

VR Resources Ltd. | | | 1,125,000 | | | $ | 199,530 | * |

| | | | | | | | 1,168,844 | |

| | | | | | | | | |

Energy - Alternate Sources 3.49% | |

Pacific Green Energy Corp. | | | 2,400,000 | | | 0 | *+#@ |

SolarEdge Technologies, Inc. | | | 45,700 | | | | 914,000 | * |

VERBIO Vereinigte BioEnergie AG | | | 91,900 | | | | 1,037,275 | |

Vestas Wind Systems A.S. | | | 13,100 | | | | 1,210,012 | |

| | | | | | | | 3,161,287 | |

| | | | | | | | | |

Forestry 3.77% | |

Bravern Ventures Ltd. | | | 254,431 | | | | 19,130 | * |

Canfor Corp. | | | 75,800 | | | | 1,145,066 | * |

West Fraser Timber Co., Ltd. | | | 25,300 | | | | 1,197,497 | |

Western Forest Products, Inc. | | | 587,000 | | | | 1,059,207 | |

| | | | | | | | 3,420,900 | |

| | | | | | | | | |

Gold Mining 12.07% | |

Centerra Gold, Inc. | | | 225,800 | | | | 1,232,776 | |

Chesapeake Gold Corp., 144A | | | 52,400 | | | | 127,283 | * |

Continental Gold, Inc. | | | 180,000 | | | | 530,228 | * |

Corona Minerals Ltd. | | | 100,000 | | | 0 | *#@ |

Doray Minerals Ltd. | | | 2,113,000 | | | | 495,151 | * |

Evolution Mining Ltd. | | | 79,666 | | | | 147,864 | |

Highland Gold Mining Ltd. | | | 595,300 | | | | 1,097,893 | |

Kinross Gold Corp. | | | 1 | | | | 4 | * |

Leagold Mining Corp. | | | 500,000 | | | | 909,932 | * |

NGEx Resources, Inc. | | | 720,500 | | | | 467,719 | |

Northern Star Resources Ltd. | | | 433,400 | | | | 1,585,577 | |

Radisson Mining Resources, Inc. | | | 2,100,000 | | | | 267,196 | * |

Ramelius Resources Ltd. | | | 3,489,800 | | | | 1,208,642 | * |

Regis Resources Ltd. | | | 373,900 | | | | 1,088,119 | |

Rye Patch Gold Corp. | | | 2,334,000 | | | | 413,957 | * |

St Barbara Ltd. | | | 616,000 | | | | 1,380,089 | * |

| | | | | | | | 10,952,430 | |

| | | | | | | | | |

Medical - Hospitals 0.00% | |

African Medical Investments plc | | | 2,507,500 | | | 0 | *#@ |

| | | | | | | | | |

Metal - Copper 0.09% | |

Highland Copper Co., Inc. | | | 1,000,000 | | | | 80,969 | * |

| | | | | | | | | |

Metal - Diversified 4.96% | |

Aguia Resources Ltd. | | | 500,000 | | | | 161,347 | * |

Aguia Resources Ltd., 144A | | | 2,900,000 | | | | 936,152 | *# |

See notes to portfolios of investments and notes to financial statements.

32

Global Resources Fund

Portfolio of Investments (unaudited) | June 30, 2017 |

Common Stocks (cont’d) | | Shares | | | Value | |

Metal - Diversified (cont’d) | |

Filo Mining Corp. | | | 230,000 | | | $ | 369,172 | |

Glencore plc | | | 54,300 | | | | 203,475 | |

GoviEx Uranium, Inc., Class A | | | 1,956,100 | | | | 286,597 | * |

GoviEx Uranium, Inc., Class A, 144A | | | 58,000 | | | | 8,498 | *# |

Ivanhoe Mines Ltd., Class A | | | 354,300 | | | | 1,139,290 | * |

Mandalay Resources Corp. | | | 837,300 | | | | 242,125 | |

Orsu Metals Corp., 144A | | | 147,605 | | | | 2,845 | *# |

Sandfire Resources NL | | | 264,300 | | | | 1,147,176 | |

| | | | | | | | 4,496,677 | |

| | | | | | | | | |

Metal - Iron 2.72% | |

Ferrexpo plc | | | 447,000 | | | | 1,203,890 | |

Fortescue Metals Group Ltd. | | | 316,300 | | | | 1,266,176 | |

WAI Capital Investment Corp., 144A | | | 292,500 | | | 0 | *#@ |

| | | | | | | | 2,470,066 | |

| | | | | | | | | |

Mining Services 0.00% | |

Bounty Mining Ltd. | | | 1,692,308 | | | 0 | *#@ |

| | | | | | | | | |

Natural Resource Technology 0.15% | |

I-Pulse, Inc, 144A (RS) | | | 15,971 | | | 137,351 | *#@ |

| | | | | | | | | |

Non - Ferrous Metals 0.03% | |

Sterling Group Ventures, Inc. | | | 500,000 | | | | 30,000 | * |

| | | | | | | | | |

Oil - Field Services 1.19% | |

Atlas African Industries Ltd. | | | 255,854,621 | | | 0 | *+#@ |

Subsea 7 SA | | | 79,700 | | | | 1,074,630 | |

| | | | | | | | 1,074,630 | |

| | | | | | | | | |

Oil Companies - Exploration & Production 2.93% | |

Africa Energy Corp., 144A | | | 2,110,889 | | | | 292,998 | *# |

Beach Energy Ltd. | | | 2,296,000 | | | | 1,013,452 | |

Ivanhoe Energy, Inc. | | | 18,719 | | | | 328 | * |

Range Energy Resources, Inc., 144A | | | 15,000,000 | | | | 260,256 | *# |

SVT Capital Corp. | | | 23,626 | | | 1,913 | *#@ |

U.S. Oil Sands, Inc., 144A | | | 198,000 | | | 4,580 | *#@ |

Ultra Petroleum Corp. | | | 99,600 | | | | 1,080,660 | * |

| | | | | | | | 2,654,187 | |

| | | | | | | | | |

Oil Companies - Integrated 1.29% | |

Chevron Corp. | | | 1,300 | | | | 135,629 | |

China Petroleum & Chemical Corp., Sponsored ADR | | | 13,200 | | | | 1,037,520 | |

| | | | | | | | 1,173,149 | |

See notes to portfolios of investments and notes to financial statements.

33

Global Resources Fund

Portfolio of Investments (unaudited) | June 30, 2017 |

Common Stocks (cont’d) | | Shares | | | Value | |

Oil Refining & Marketing 1.14% | |

CVR Refining LP | | | 108,800 | | | $ | 1,033,600 | |

| | |

Oil-Field Services 3.55% | |

Maire Tecnimont S.p.A. | | | 206,800 | | | | 962,299 | |

Petrofac Ltd. | | | 195,100 | | | | 1,121,825 | |

TGS NOPEC Geophysical Co. ASA | | | 55,200 | | | | 1,132,558 | |

| | | | | | | | 3,216,682 | |

| | | | | | | | | |

Petrochemicals 2.31% | |

Braskem, Sponsored ADR | | | 49,900 | | | | 1,033,928 | |

Sinopec Shanghai Petrochemical Co., Ltd., H shares | | | 1,980,700 | | | | 1,059,940 | |

| | | | | | | | 2,093,868 | |

| | | | | | | | | |

Power Converters/Supply Equipment 1.10% | |

Gamesa Tecnologica S.A. | | | 46,800 | | | | 1,001,314 | |

| | | | | | | | | |

Precious Metals 1.33% | |

Silver Standard Resources, Inc. | | | 123,700 | | | | 1,201,127 | * |

| | | | | | | | | |

Real Estate Operating/Development 6.42% | |

Pacific Infrastructure Ventures, Inc. (RS) | | | 7,443,544 | | | 5,819,363 | *#@ |

| | | | | | | | | |

Rubber - Tires 1.30% | |

Goodyear Tire & Rubber Co. | | | 33,800 | | | | 1,181,648 | |

| | | | | | | | | |

Rubber/Plastic Products 0.71% | |

Hyundai Engineering Plastics Co., Ltd. | | | 92,816 | | | | 641,586 | |

| | | | | | | | | |

Steel - Producers 5.52% | |

BlueScope Steel Ltd. | | | 113,200 | | | | 1,146,041 | |

Magnitogorsk Iron & Steel Works OJSC, GDR | | | 166,500 | | | | 1,230,018 | |

Ternium, Sponsored ADR | | | 48,900 | | | | 1,373,601 | |

Tokyo Steel Manufacturing Co., Ltd. | | | 148,700 | | | | 1,260,253 | |

| | | | | | | | 5,009,913 | |

| | | | | | | | | |

Steel - Specialty 1.48% | |

Sanyo Special Steel Co., Ltd. | | | 236,700 | | | | 1,343,313 | |

| |

Total Common Stocks | | | | | | | 68,596,449 | |

(cost $139,156,336) | | | | | | | | |

See notes to portfolios of investments and notes to financial statements.

34

Global Resources Fund

Portfolio of Investments (unaudited) | June 30, 2017 |

Subscription Receipts 3.75% | | Shares | | | Value | |

Oil Companies - Exploration & Production 3.75% | |

PentaNova Energy Corp. (RS) | | | 6,000,000 | | | $ 3,400,679 | *#@ |

(cost $2,278,164) | | | | | | | |

Warrants 0.00%

| | | | | | | |

Diversified Minerals 0.00% | |

VR Resources Ltd., Warrants (March 2019) | | | 562,500 | | | 0 | *#@ |

| | | | | | | | |

Gold Mining 0.00% | |

Gran Colombia Gold Corp., Warrants (October 2017) | | | 86,150 | | | 0 | *#@ |

Gran Colombia Gold Corp., Warrants (March 2019) | | | 59,500 | | | | 1,032 | * |

| |

Total Warrants | | | | | | | 1,032 | |

(cost $0) | | | | | | | | |

Purchased Call Options 1.62%

| | Contracts | | | | | |

Exchange-Traded Fund 0.10% | |

SPDR S&P Oil & Gas Exploration & Production ETF, Strike Price 44.00, Expiration Jan. 2018 | | | 1,890 | | | | 38,745 | * |

VanEck Vectors Junior Gold Miners ETF, Strike Price 35.00, Expiration Aug. 2017 | | | 550 | | | | 56,650 | * |

| | | | | | | | 95,395 | |

| | | | | | | | | |

Gold Mining 0.48% | |

Franco-Nevada Corp., Strike Price 65.00, Expiration Jan. 2018 | | | 140 | | | | 147,700 | * |

Sandstorm Gold Ltd., Strike Price 4.00, Expiration Jan. 2018 | | | 6,100 | | | | 289,750 | * |

| | | | | | | | 437,450 | |

| | | | | | | | | |

Metal - Copper 0.26% | |

Freeport-McMoRan, Inc., Strike Price 15.00, Expiration Jan. 2018 | | | 1,340 | | | | 69,680 | * |

Freeport-McMoRan, Inc., Strike Price 13.00, Expiration Jan. 2018 | | | 700 | | | | 71,750 | * |

Turquoise Hill Resources Ltd., Strike Price 2.00, Expiration Jan. 2018 | | | 1,400 | | | | 91,000 | * |

| | | | | | | | 232,430 | |

| | | | | | | | | |

Metal - Diversified 0.40% | |

BHP Billiton Ltd., Strike Price 37.50, Expiration Jan. 2018 | | | 500 | | | | 89,000 | * |