As filed with the Securities and Exchange Commission on March 4, 2020

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-01800

U.S. GLOBAL INVESTORS FUNDS

Three Canal Plaza, Suite 600

Portland, Maine 04101

Jessica Chase, Principal Executive Officer

Three Canal Plaza, Suite 600

Portland, Maine 04101

207-347-2000

Date of fiscal year end: December 31

Date of reporting period: January 1, 2019 – December 31, 2019

ITEM 1. REPORT TO SHAREHOLDERS

U.S. Global Investors Funds

December 31, 2019

Beginning on January 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund or your financial intermediary electronically by contacting the Fund at (800) 873-8637, or by contacting your financial intermediary directly.

You may elect to receive all future reports in paper free of charge. You can inform the Fund or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by contacting the Fund at (800) 873-8637, or by contacting your financial intermediary directly. Your election to receive reports in paper will apply to all Funds held with U.S. Global Investors Funds.

U.S. Global Investors Funds

Annual Report

December 31, 2019

Table of Contents

| Letter to Shareholders (unaudited) | 1 |

| Definitions for Management Teams’ Perspectives (unaudited) | 5 |

| Management Team’s Perspective (unaudited) | 8 |

| Portfolios of Investments | 41 |

| Notes to Portfolios of Investments | 78 |

| Statements of Assets and Liabilities | 96 |

| Statements of Operations | 100 |

| Statements of Changes in Net Assets | 104 |

| Notes to Financial Statements | 110 |

| Financial Highlights | 125 |

| Report of Independent Registered Public Accounting Firm | 134 |

| Trustees and Officers (unaudited) | 136 |

| Approval of Investment Advisory Agreement (unaudited) | 138 |

| Additional Information (unaudited) | 143 |

| Expense Example (unaudited) | 145 |

Nasdaq Symbols

U.S. Global Investors Funds

Investor Class

| U.S. Government Securities Ultra-Short Bond Fund | UGSDX |

| Near-Term Tax Free Fund | NEARX |

| All American Equity Fund | GBTFX |

| Holmes Macro Trends Fund | MEGAX |

| Global Resources Fund | PSPFX |

| World Precious Minerals Fund | UNWPX |

| Gold and Precious Metals Fund | USERX |

| Emerging Europe Fund | EUROX |

| China Region Fund | USCOX |

| Apex Fund Services 3 Canal Plaza, Suite 600 Portland, ME 04101 |

| | |

| U.S. Global Investors Funds | (unaudited) |

Dear Fellow Shareholder,

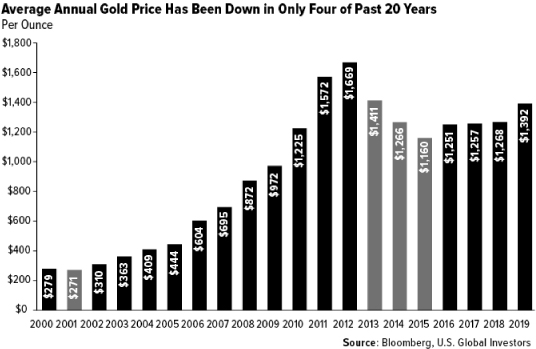

Gold in 2019 had its best year since 2010, finishing up 18.31 percent for the year. The yellow metal’s historical role as a store of value shined brightly in the second half of the year when the pool of negative-yielding debt around the world began to skyrocket, eventually topping out at around $17 trillion in August. Gold briefly broke above $1,600 an ounce for the first time since April 2013 on the news that Iran launched a counterstrike against U.S.-occupied military bases in Iraq.

Safe haven-seeking investors around the world piled into gold-backed ETFs in 2019, making it the best year on record for gold holdings. Assets under management (AUM) in gold bullion ETFs expanded 37 percent from the previous year, adding $19.2 billion, or 400 tonnes, according to the World Gold Council (WGC). During the fourth quarter, total holdings hit a jaw-dropping 2,900 tonnes, the equivalent of 102 million ounces, which is the most on record.

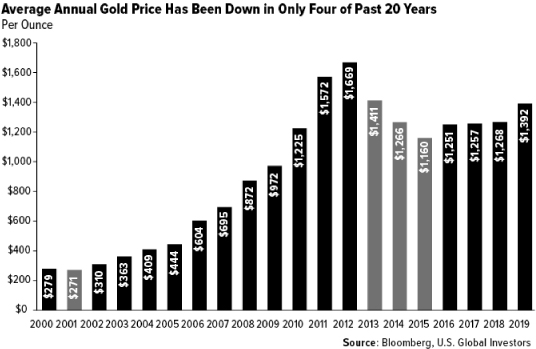

In the past two decades, gold has helped investors limit market volatility and portfolio losses. Between 2000 and 2019, the precious metal’s average annual price was down in only four years. Put another way, gold was up on average in four out of every five years—a remarkable track record.

Enhance Your Gold Position With Precious Metal Royalty Companies

There are other ways to get exposure to gold than coins and bars, of course. One of the best ways to enhance your gold position, I believe, is with precious metal royalty and streaming companies. Think Franco-Nevada, Wheaton Precious Metals, Royal Gold and others.

| U.S. Global Investors Funds | (unaudited) |

Loyal readers of Investor Alert and my CEO blog Frank Talk should know that I’ve discussed royalty companies a number of times before. Even so, I still come across new research and data that demonstrates their superiority in the metals and mining industry.

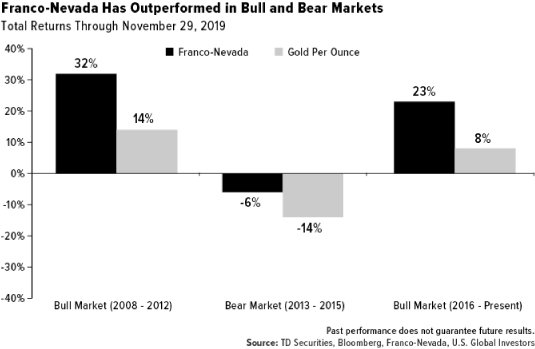

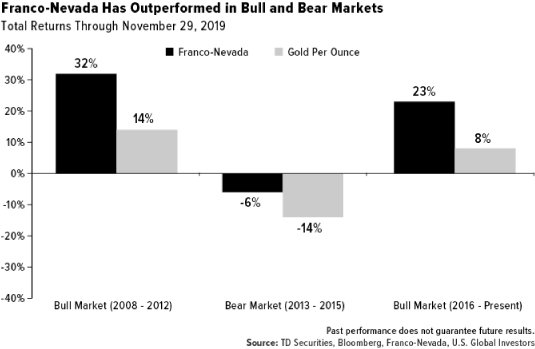

Take a look at the chart below. The world’s largest royalty and streaming company with a market cap of $26 billion, Franco-Nevada has outperformed gold bullion and gold equities in both bull markets and bear markets. Investors who like gold do so because they understand that the yellow metal may limit losses in their equity position and reduce volatility. Adding a royalty company such as Franco-Nevada to the mix could potentially have additional benefits.

Although, they have enjoyed a lot of the upside potential when gold prices were rising, royalty companies have shared very little of the downside potential with producers and explorers when the metal was in decline. Royalty companies have been better insulated from bear markets because they have historically maintained a diversity of high-quality active mines in their portfolio.

What’s more, they’re not the ones spending money to develop a project. They simply put up the capital, and in exchange they enjoy either a royalty on whatever the miner produces or rights to a stream of metal supply at a fixed, lower-than-average cost.

“Buy-and-Hold” Has Historically Been a Winning Investment Strategy

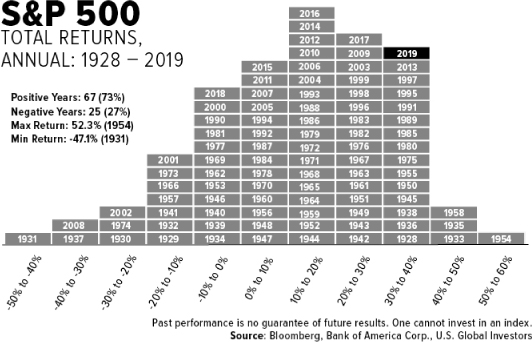

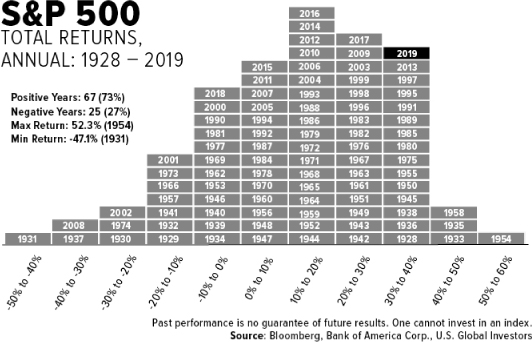

Domestic stocks also exceeded expectations in 2019, with the S&P 500 Index increasing more than 31 percent, putting 2019 among the very best going all the way back to 1928. Since 1928, the market has ended in positive territory 73 percent of the time, with a gain “equal to or in excess of 30 percent (like 2019) occurring 19 out of 92 years, or 20 percent of the time,” according to Lauren Sanfilippo, vice president and market strategy analyst at Bank of America Merrill Lynch.

| U.S. Global Investors Funds | (unaudited) |

Negative years, by comparison, occurred 27 percent of the time. And even then, years in which stocks fell no more than 10 percent were most frequent, happening 12 out of 25 negative years, or 48 percent of the time.

Looking at the chart above tells me a couple of things in particular. Number one, stocks have historically been more likely to end the year with a gain than a loss. The implication, then, is that a buy-and-hold strategy has worked out for a lot of investors in general—even those who still may have memories of the tech bubble 20 years ago and financial crisis more than 10 years ago.

And number two, the naysayers and “perma-bears”—those who’ve repeatedly predicted an end to the economic expansion, now in its 10th year—have not only been wrong time and again but may have also discouraged some investors from participating in this historic bull market.

Think back just 12 months ago. At the beginning of 2019, a number of economists and so-called experts were sounding the alarm bell over the inverted yield curve, not to mention U.S.-China trade tensions and slowing global economic growth. And yet look what happened. The market went on to hit as many as 35 record highs from start to finish, ending the year up nearly 300 percent from December 2009.

My point is not that you should put blinders on and ignore the risks completely. But neither should you take action every time Chicken Little warns you the sky’s about to come crashing down. Investors who continued to participate in 2019, despite the warnings, were rewarded.

To get the latest insights and commentary on gold, commodities, emerging markets, bitcoin and much, much more, subscribe to our award-winning Investor Alert and to my personal CEO blog, Frank Talk. Both can be reached by visiting usfunds.com.

| U.S. Global Investors Funds | (unaudited) |

Thank you for your continued trust and confidence in U.S. Global Investors. We wish you and your family good health and prosperity in 2020.

Sincerely,

Frank E. Holmes

CEO and Chief Investment Officer

U.S. Global Investors, Inc.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. The U.S. Dollar Index is an index of the value of the United States dollar relative to a basket of foreign currencies, often referred to as a basket of U.S. trade partners' currencies. The Index goes up when the U.S. dollar gains "strength" when compared to other currencies. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. An inverted yield curve represents a situation in which long-term debt instruments have lower yields than short-term debt instruments of the same credit quality.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of 12/31/19: Franco-Nevada Corp., Wheaton Precious Metals Corp., Royal Gold, Inc.

| Definitions for Management Teams’ Perspectives | (unaudited) |

Benchmark Index Definitions

Returns for indices reflect no deduction for fees, expenses or taxes, unless noted.

The Bloomberg Barclays U.S. Treasury Bills 6-9 Months Total Return Index tracks the performance of U.S. Treasury Bills with a maturity of six to nine months.

The Bloomberg Barclays 3 Year Municipal Bond Index is a total return benchmark designed for municipal assets. The index includes bonds with a minimum credit rating of BAA3, that are issued as part of a deal of at least $50 million, have an amount outstanding of at least $5 million and have a maturity of two to four years.

The FTSE Gold Mines Index encompasses all gold mining companies that have a sustainable and attributable gold production of at least 300,000 ounces a year and that derive 75% or more of their revenue from mined gold.

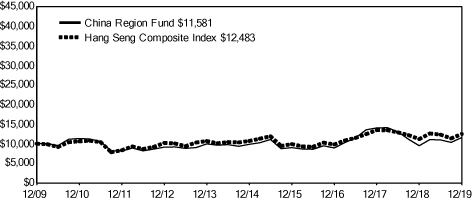

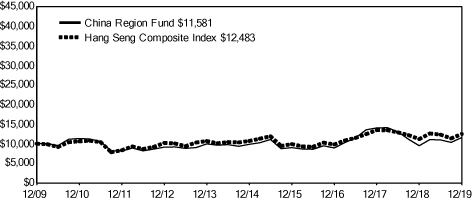

The Hang Seng Composite Index is a market-capitalization weighted index that covers about 95% of the total market capitalization of companies listed on the Main Board of the Hong Kong Stock Exchange.

The MSCI Emerging Markets Europe 10/40 Index (Net Total Return) is a free float-adjusted market capitalization index that is designed to measure equity performance in the emerging market countries of Europe (Czech Republic, Greece, Hungary, Poland, Russia and Turkey). The index is calculated on a net return basis (i.e., reflects the minimum possible dividend reinvestment after deduction of the maximum rate withholding tax). The index is periodically rebalanced relative to the constituents’ weights in the parent index.

The NYSE Arca Gold Miners Index is a modified market capitalization-weighted index comprised of publicly-traded companies involved primarily in the mining for gold and silver.

The S&P Global Natural Resources Index (Net Total Return) includes 90 of the largest publicly-traded companies in natural resources and commodities businesses that meet specific investability requirements, offering investors diversified, liquid and investable equity exposure across 3 primary commodity-related sectors: Agribusiness, Energy, and Metals & Mining. The index is calculated on a net return basis (i.e., reflects the minimum possible dividend reinvestment after deduction of the maximum rate withholding tax).

The S&P 500 Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

The S&P Composite 1500 Index is a broad-based capitalization-weighted index of 1500 U.S. companies and is comprised of the S&P 400, the S&P 500 and the S&P 600.

Other Index Definitions

The Bloomberg Barclays High Yield Municipal Bond Index is a rules-based, market-value-weighted index that measures the non-investment grade and non-rated U.S. tax-exempt bond market.

| Definitions for Management Teams’ Perspectives | (unaudited) |

The Bloomberg Barclays U.S. Municipal Index covers the USD-denominated long-term tax exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds and pre-refunded bonds.

The China Manufacturing Purchasing Managers Index (PMI) provides an early indication each month of economic activities in the Chinese manufacturing sector.

The Hang Seng Index is a capitalization-weighted index of 33 companies that represent approximately 70 percent of the total market capitalization of The Stock Exchange of Hong Kong.

The Institute of Supply Management (ISM) Manufacturing Purchasing Managers Index (PMI) Report on Business is based on data compiled from monthly replies to questions asked of purchasing and supply executives in over 400 industrial companies. For each of the indicators measured (New Orders, Backlog of Orders, New Export Orders, Imports, Production, Supplier Deliveries, Inventories, Customers Inventories, Employment, and Prices), this report shows the percentage reporting each response, the net difference between the number of responses in the positive economic direction and the negative economic direction and the diffusion index. Responses are raw data and are never changed.

The MSCI Emerging Markets Europe Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the emerging markets countries of Europe (Czech Republic, Hungary, Poland, Russia, and Turkey).

The Purchasing Manager’s Index (PMI) is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment.

The S&P GSCI is the first major investable commodity index. It is one of the most widely recognized benchmarks that is broad-based and production weighted to represent the global commodity market beta. The index is designed to be investable by including the most liquid commodity futures, and provides diversification with low correlations to other asset classes.

The STOXX Europe 600 Index is derived from the STOXX Europe Total Market Index (TMI) and is a subset of the STOXX Global 1800 Index. With a fixed number of 600 components, the STOXX Europe 600 Index represents large, mid and small capitalization companies across 17 countries of the European region: Austria, Belgium, Denmark, Finland, France, Germany, Ireland, Italy, Luxembourg, the Netherlands, Norway, Poland, Portugal, Spain, Sweden, Switzerland and the United Kingdom.

The Taiwan Capitalization Weighted Stock Index is a stock market index for companies traded on the Taiwan Stock Exchange. TAIEX covers all of the listed stocks excluding preferred stocks, full-delivery stocks and newly listed stocks, which are listed for less than one calendar month.

| Definitions for Management Teams’ Perspectives | (unaudited) |

The Warsaw Stock Exchange Index (WIG) is the oldest stock exchange index, calculated at the first market session. The basic index values are calculated on the basis of the prices of shares of all stock exchange companies with at least 10% of freely-traded shares with a value equivalent to 1 million euro. WIG is a total-return index, and the revenues from both dividends and subscription rights are taken into account in its calculation.

| U.S. Government Securities Ultra-Short Bond Fund | (unaudited) |

Management Team’s Perspective

Introduction

The U.S. Government Securities Ultra-Short Bond Fund (UGSDX) is designed to be used as an investment that takes advantage of the security of U.S. Government bonds and obligations, while simultaneously pursuing a higher level of current income than money market funds offer. The fund’s dollar-weighted average effective maturity is two years or less. The fund seeks to provide current income and preserve capital.

Performance Graph

U.S. Government Securities Ultra-Short Bond Fund

| Average Annual Performance | | For the Periods Ended December 31, 2019 | |

| | One Year | Five Year | Ten Year | |

| U.S. Government Securities Ultra-Short Bond Fund | 1.50% | 0.83% | 0.46% | |

| Bloomberg Barclays U.S. Treasury Bills 6-9 Months | | | | |

| Total Return Index | 2.60% | 1.15% | 0.67% | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. For all or a portion of the periods, the fund had expense limitations and reimbursements to maintain a minimum yield, without which returns would have been lower. The above returns for the U.S. Government Securities Ultra-Short Bond Fund include the fund’s results as a money market fund through the date of its conversion (December 20, 2013) to an ultra-short bond fund, and therefore are not representative of the fund’s results had it operated as an ultra-short bond fund for the full term of the periods shown. Returns greater than one year are annualized.

Gross expense ratio as stated in the most recent prospectus is 0.99%. Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 0.45%. The Adviser can modify or terminate this arrangement at any time. In addition, returns may include the effects of additional voluntary waivers of fees and reimbursements of expenses by the Adviser, including waivers and reimbursements to maintain a minimum net yield for the fund.

See Definitions for Management Teams’ Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

| U.S. Government Securities Ultra-Short Bond Fund | (unaudited) |

The Year in Review – Economic and Political Issues that Affected the Fund

As 2019 began, the big economic stories were the Federal Reserve’s interest rate hiking cycle, the ongoing U.S. government shutdown, the December 2018 stock market drop, and the escalating U.S.-China trade war. As the year progressed, there was movement on all fronts. The Fed’s 2018 interest rate hikes were partially reversed as the FOMC cut rates three times in the second half of the year in reaction to a growing number of signals flashing an economic slowdown. The 35-day U.S. government shutdown, which ended on January 25, 2019, was the longest U.S. government shutdown in history. With many federal agencies closed and federal employees across the country furloughed or working without pay, the Congressional Budget Office estimated that the shutdown cost the economy $11 billion, $3 billion of which was permanently lost. The oscillations of U.S.-China trade negotiations sent global markets on a roller coaster ride throughout the year. As the year came to a close, the U.S. reached a so-called “Phase 1” trade agreement with China that reduced some of the tariffs imposed over the last 18 months and stopped the imposition of a new set of tariffs that had been set to go into effect on December 15. For its part, China agreed to purchase more U.S. agricultural products. While the agreement helped to diffuse global anxiety surrounding the growing trade tensions, it failed to address significant concerns around technology and intellectual property rights. Still, markets responded positively to the news, surging to new highs.

After repeated hawkish commentary throughout the fourth quarter of 2018 contributed to the largest S&P 500 correction since the 2008 financial crisis, Fed Chairman Powell did an about face in early January by essentially saying the balance sheet reduction program was no longer on auto pilot. In the following months, the increasing trade war rhetoric, falling inflation expectations, weakening economic data, and yield curve inversion drove the Fed into a “mid-cycle adjustment” of three, 25 basis point rate cuts in as many meetings commencing on July 31. Days before the September meeting, the Fed lost control of the short-term funding markets as overnight repos ballooned to ten percentage points and the fed funds rate rocketed 75 bps above the top end of the 2 percent - 2.25 percent target range. Temporary repo facilities and a $60 billion monthly Treasury bill purchase plan were quickly implemented, and the government’s balance sheet rose 11 percent from its low of $3.76 trillion on August 28 to $4.17 trillion in late December. Powell made it clear the bill purchases were not quantitative easing (QE), but with roughly $6 trillion - $7 trillion of paper that needs to be rolled every six months, some speculate this was the start of QE4 which in time could require the purchases of longer dated maturities. The Fed’s dovish pivot was cemented in the fourth quarter when Powell said the committee would need to see persistent inflation above the 2 percent level before even considering a change to short-term rates.

Treasury bonds had their best rally since 2014 as global flows sought safe havens due to continued weakness in the global economy, uncertainty from trade wars, and a new round of easing by global central banks. The U.S. Treasury 2-year yield declined 92 bps year-over-year and with it ended a streak of seven consecutive years in the green. The U.S. Treasury 10-year declined 77 bps year-over-year for its biggest drop since 2014. The Fed’s three rate cuts help to reverse a deeply inverted yield curve. Net supply of fixed income securities was notably higher in 2019. Net issuance of Treasuries went up as the federal budget deficit increased and corporate bond issuance was robust as well. Demand for U.S. fixed income remained broad-based as well. Foreign investors were major buyers, likely driven by wide interest rate differentials. On the domestic front, mutual fund demand remained steady while that from the banking sector picked up. This likely reflected pent-up demand for high quality liquid assets given the steady decline in reserve balances over time.

Investment Highlights

The U.S. Government Securities Ultra-Short Bond Fund returned 1.50 percent for the year ended December 31, 2019, underperforming its benchmark, the Bloomberg Barclays U.S. Treasury Bills 6-9 Months Total Return Index, which returned 2.60 percent.

The main source of underperformance came from floating rate bonds, as yields drifted lower overall due to geopolitical uncertainty.

| U.S. Government Securities Ultra-Short Bond Fund | (unaudited) |

Current Outlook

Waning recession fears should tilt the probabilities toward higher Treasury yields in 2020. One of the key drivers behind the steep drop in yields in 2019 was fear of a recession, as manufacturing activity fell and tariffs weighed on the growth outlook. However, rate cuts by the Federal Reserve have helped ease those concerns. In 2020, the lagged impact of the Fed’s interest rate cuts, signs of stabilization in the global economy, and an easing of trade tensions should provide a boost to bond yields. U.S economic growth is set to remain modest, but even at a GDP growth rate of between 2-3 percent, we believe there is still room for bond yields to move modestly higher.

The Federal Reserve has made it clear that after three rate cuts in 2019, bringing the federal funds rate to a range of 1.50 percent to 1.75 percent, monetary policy is on hold for the foreseeable future. The policy rate should be low enough to provide stimulus to the economy, keep credit flowing to businesses and consumers, and raise inflation expectations from very low levels. The Fed is also reportedly considering a policy of allowing inflation to hold above 2 percent without countering it in order to bolster positive inflation expectations.

The section labeled Portfolio of Investments contains a complete list of the fund’s holdings.

| | Portfolio Allocation by Issuer | | | | | | |

| | Based on Total Investments | | | | | December 31, 2019 | |

| | Federal Farm Credit Bank | | | 48.2% | |

| | U.S. Treasury Note | | | 16.9% | |

| | Federal Home Loan Mortgage Corporation | | | 11.3% | |

| | Vanguard Short-Term Treasury ETF | | | 10.6% | |

| | Federal Home Loan Bank | | | 7.0% | |

| | U.S. Treasury Bill | | | 6.0% | |

| | Total | | | | | 100.0% | |

| | | | | | | |

| | | | | | | |

| | Portfolio Allocation by Maturity | | | | December 31, 2019 | |

| | Less than 1 Month | $ | 4,379,760 | 10.6% | |

| | 1-3 Months | | 9,497,462 | 22.9% | |

| | 3-12 Months | | 17,272,357 | 41.6% | |

| | 1-3 Years | | 10,360,332 | | 24.9% | |

| | | $ | 41,509,911 | | 100.0% | |

| | | | | | | | |

| Near-Term Tax Free Fund | (unaudited) |

Management Team’s Perspective

Introduction

The Near-Term Tax Free Fund (NEARX) seeks to provide a high level of current income exempt from federal income taxation and to preserve capital. However, a portion of any distribution may be subject to federal and/or state income taxes. The Near-Term Tax Free Fund will maintain a weighted average maturity of less than five years.

Performance Graph

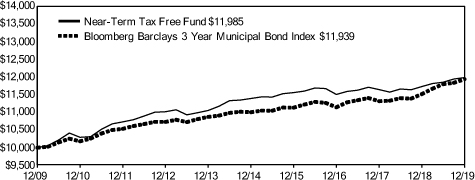

Near-Term Tax Free Fund

Average Annual Performance | | For the Periods Ended December 31, 2019 | |

| |

| |

| | One Year | Five Year | Ten Year | |

| |

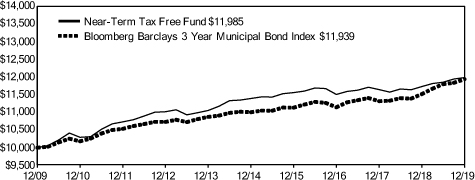

| Near-Term Tax Free Fund | 2.18% | 1.02% | 1.83% | |

| Bloomberg Barclays 3 Year Municipal Bond Index | 3.67% | 1.64% | 1.79% | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. For all or a portion of the periods, the fund had expense limitations, without which returns would have been lower. Returns greater than one year are annualized.

Gross expense ratio as stated in the most recent prospectus is 1.01%. The Adviser has contractually agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, extraordinary expenses, taxes, brokerage commissions and interest) to not exceed 0.45% on an annualized basis through April 30, 2020.

See Definitions for Management Teams’ Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

The Year in Review – Economic and Political Issues that Affected the Fund

The municipal bond market had a banner year in 2019 thanks to a combination of tax reform, rising state revenues, declining default rates and improving credit quality. The U.S. municipal bond market posted additional positive performance, with the Bloomberg Barclays Municipal Index returning 7.5 percent, marking the sixth straight year of positive total returns. In addition to strong performance for investment-grade munis, the Bloomberg Barclays Municipal High Yield Index generated total returns of 10.7 percent.

| Near-Term Tax Free Fund | (unaudited) |

Supply was equally robust, with $418 billion of issuance, 21 percent higher than the amount issued the previous year. Net issuance for 2019 finished at +$51 billion, making 2019 the fourth out of the last five years to see muni market growth. After last year’s outflows, muni funds brought in a record $92 billion of inflows, with investment-grade muni funds experiencing $73 billion of inflows and high-yield muni funds seeing net inflows of about $19 billion on the year.

Unlike 2018 when fixed income and equity performance diverged, 2019 saw positive returns in both asset classes, with the latter especially outperforming. The macroeconomic environment was challenging throughout the year, with uncertainty brought about by U.S.-China trade negotiations, Brexit concerns and slower global growth. A dovish tone from the Federal Reserve in January surprised the market and set the tone for the year, as it pivoted from a hiking cycle to one of easing. The Fed lowered the fed funds rate three times in 2019, a reversal from the four rate hikes in 2018. As a result of the macro uncertainty and rate cuts by the Fed, rates dropped substantially. The first eight months of the year saw Treasury and muni yields drop by 100 basis points (with a majority of the decline occurring in August), with rates remaining range bound for the rest of the year. Consequently, the Bloomberg Barclays muni and treasury indices hit their peak in the third quarter, and remained steady for the rest of the year. Investment grade and high yield muni fund flows came in at a record pace as investors likely realized the effects of tax reform after filing their taxes. Strong mutual fund flows offset the lack of tax-exempt demand from banks and property and casualty insurers. The strong demand supported the tax-exempt market, particularly in the first half of the year, when supply came in much lower than investor expectations. While supply picked up in the second half of the year, a large part of that was taxable issuance. The muni curves flattened over the year, driven primarily by intermediate and long bonds as inflation fears subsided and investors reached for yield by extending.

The American Society of Civil Engineers estimates the cumulative funding gap for U.S. infrastructure is close to $5 trillion through 2040. With the lack of a federal infrastructure plan, state and local borrowers have picked up the slack on transportation and infrastructure borrowing in recent years. Transportation-bond issuance was $50 billion in 2019, a 25 percent increase from 2018. The $18 billion of issuance for airports led all transportation borrowing, followed by toll roads at $13 billion and public transportation at $5 billion. Acknowledging the poor state of infrastructure, voters have supported borrowing on the state and local level, with bond measures in cities in Maine, Arizona, Texas and Pennsylvania easily passing in November elections.

Investment Highlights

For the year ended December 31, 2019, the Near-Term Tax Free Fund returned 2.18 percent, underperforming its benchmark, the Bloomberg Barclays 3 Year Municipal Bond Index, which gained 3.67 percent.

Strengths

| ● | | The fund’s allocation to bonds from Colorado, Alabama and Louisiana outperformed. |

| ● | | The fund benefited from its allocation to school district, single-family housing and transportation bonds, which outperformed. |

| ● | | The fund’s allocation in the 7-10 year area of the yield curve outperformed. |

Weaknesses

| ● | | The fund’s allocation to bonds from Tennessee, Minnesota and Oregon underperformed. |

| ● | | The fund’s exposure to medical, utility and water bonds underperformed. |

| ● | | The fund’s allocation in the 1-3 year area of the yield curve underperformed. |

| Near-Term Tax Free Fund | (unaudited) |

Current Outlook

Opportunities

The Federal Reserve has signaled it will remain on hold through 2020. According to the minutes of the December meeting, monetary policy was “likely to remain appropriate for a time,” even with signs of some persistent downside risks. Given the concern of global economic market slowdowns and prospects of elevated global tensions following a U.S. military strike that killed Iran’s top general, perceived “safe-haven” investments, including municipal bonds, have been expected to benefit amid continued global uncertainty.

Looking ahead, the economic conditions that impact the three major sources of revenue for municipalities—income, sales taxes and property taxes—are all generally favorable. As a result, credit conditions are expected to remain mostly positive in the muni market. The long and slow economic recovery has generally benefited state and local governments, with many municipalities now in a better financial position than they were prior to the 2008 credit crisis.

Threats

Despite improvement in the broader equity markets in 2018-19, average state pension-plan funding only improved 1.5 percent. Median improvement aside, the number of states where the funding ratio declined more than doubled since fiscal 2017. In total, 14 saw their gap widen versus six in 2017. For the fourth straight year, New Jersey, Kentucky, Illinois and Connecticut claim top spots for lowest state-pension funding ratios, according to Bloomberg-compiled data.

Cyber security risks are an increasing concern for investors as well. Nearly 1,000 state and local governments, health care providers, universities, colleges and school districts were victims of cyber-attacks in 2019, according to security firm EMSISOFT. The outcomes of these attacks vary, but almost always require heavy investments in technology and security software. Rating agencies incorporate cyber risks into their analyses including such factors as vulnerability, preparedness, policies and procedures, technology investments and infrastructure, and insurance coverage.

The section labeled Portfolio of Investments contains a complete list of the fund’s holdings.

| | Top 10 Area Concentrations | | |

| | (Based on Net Assets) | December 31, 2019 | |

| | | Texas | 29.83% | |

| | | New York | 8.22% | |

| | | Florida | 6.61% | |

| | | Washington | 6.28% | |

| | | Illinois | 4.27% | |

| | | Louisiana | 3.14% | |

| | | North Carolina | 2.88% | |

| | | Colorado | 2.80% | |

| | | Michigan | 2.53% | |

| | | Total Top 10 Areas | 66.56% | |

| | | | | |

| Near-Term Tax Free Fund | (unaudited) |

| | Municipal Bond Ratings* | | |

| | Based on Total Municipal Bonds | December 31, 2019 | |

| | Bond | Percentage | |

| | AAA | 15.8% | |

| | AA | 62.1% | |

| | A | 15.4% | |

| | BBB | 5.5% | |

| | Not Rated | 1.2% | |

| | Total | 100.0% | |

| | | | |

| * | | Credit quality ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). “Not Rated” is used to classify securities for which a rating is not available. Credit quality ratings for each issue are obtained from Moody’s and S&P Global Ratings, and the higher rating for each issue is used. |

| All American Equity Fund & Holmes Macro Trends Fund | (unaudited) |

Management Team’s Perspective

Introduction

The principal objective of the All American Equity Fund (GBTFX) is to seek capital appreciation by investing primarily in a broadly diversified portfolio of domestic common stocks. The fund invests in large-capitalization stocks while retaining the flexibility to seek out promising individual stock opportunities, including stocks with meaningful dividend yields.

The Holmes Macro Trends Fund (MEGAX) invests in companies with good growth prospects and strong positive earnings momentum. The fund’s primary objective is to seek long-term capital appreciation.

Performance Graphs

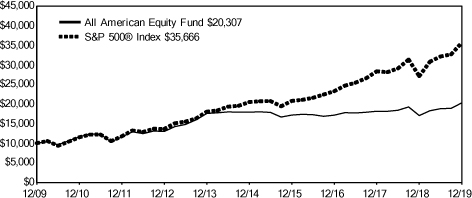

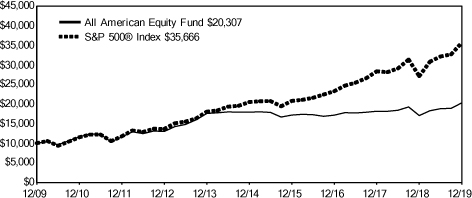

All American Equity Fund

| Average Annual Performance | | For the Periods Ended December 31, 2019 | |

| | One Year | Five Year | Ten Year | |

| All American Equity Fund | 19.01% | 2.52% | 7.34% | |

| S&P 500® Index | 31.49% | 11.70% | 13.56% | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. For all or a portion of the periods, the fund had expense limitations, without which returns would have been lower. Returns greater than one year are annualized.

Gross expense ratio as stated in the most recent prospectus is 1.86%. Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 2.20%. The Adviser can modify or terminate this arrangement at any time.

See Definitions for Management Teams’ Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

| All American Equity Fund & Holmes Macro Trends Fund | (unaudited) |

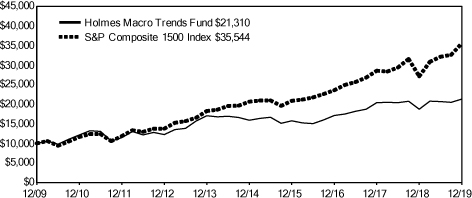

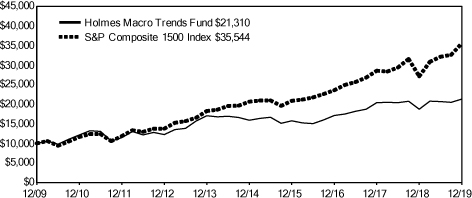

Holmes Macro Trends Fund

| Average Annual Performance | For the Periods Ended

December 31, 2019 | |

| One Year | Five Year | Ten Year | |

| Holmes Macro Trends Fund | 13.84% | 6.02% | 7.86% | |

| S&P Composite 1500 Index | 30.90% | 11.46% | 13.52% | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. For all or a portion of the periods, the fund had expense limitations, without which returns would have been lower. Returns greater than one year are annualized.

Gross expense ratio as stated in the most recent prospectus is 1.77%. Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 2.20%. The Adviser can modify or terminate this arrangement at any time.

See Definitions for Management Teams’ Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

The Year in Review – Economic and Political Issues that Affected the Funds

The economy entered 2019 on precarious footing with the Federal Reserve just completing its third rate hike in December of 2018. Jerome Powell, the current Fed Chairman, telegraphed to the nation that our economy was firing on all cylinders and the prudent approach for 2019 would consist of pivoting away from ratcheting interest rates higher and now watching, waiting and analyzing the upcoming future economic data for any signs of cracking.

It didn’t take long. In May, investors witnessed the start of the trade war. Talks stretched into the summer, with the lead U.S. negotiators and China going tit for tat, opening and closing the door to future negotiations driving worry into the minds of business people and investors alike. Their sentiments curdled and businesses shared thoughts of caution announcing intentions of scaling back operations in anticipation of a possible upcoming economic slowdown. Analysts lowered GDP estimates due to the threat of price increases upwards of 25 percent on goods arriving from China. Analysts were now pricing in 2 percent GDP.

| All American Equity Fund & Holmes Macro Trends Fund | (unaudited) |

As September arrived, anxious investors found some solace. The Fed pivoted to an accommodative stance. The constant pressure from the current administration pressuring the Fed to lower rates and analysts shaving off percentage points of GDP finally paid off.

The Fed reduced rates at the September meeting and then subsequently two additional times before the year concluded. And then, during mid-December, hints of a trade deal started to surface and the media conveyed to investors the president agreed to a “phase-one” trade deal with China.

There are a few motivations driving why we feel the market may continue to reward investors with future price appreciation in 2020.

First, the Fed has expressed its intention to keep interest rates low for the foreseeable future. In doing so, the U.S. consumer, especially the individuals with the inclination to spend will most likely seek to buy additional goods and services to enrich their lifestyle and provide additional boost to GDP.

Secondly, mortgage rates have recently declined to near decade lows and homeowner vacancies are near 38-year lows. Consumers and future home buyers alike are going to purchase big ticket items, and the current low interest rate environment is going to help them achieve those products sooner rather than later.

And finally, we feel combining the diminishing tax-like effects from tariffs along with personal incomes achieving a near 3 percent increase year-over-year will bolster our consumer driven economy.

Investment Highlights

The All American Equity Fund returned 19.01 percent for the year, underperforming its benchmark, the S&P 500, which returned 31.49 percent. The Holmes Macro Trends Fund returned 13.84 percent in 2019, underperforming its benchmark, the S&P Composite 1500 Index, which returned 30.90 percent.

Overall, mega-capitalization equities outperformed value and dividend-oriented companies, while the lagging sectors, energy and health care, just didn’t grab investor attention. The primary driver of underperformance in 2019 was the fact that both funds had more exposure to smaller and growth-oriented companies than their respective benchmarks. Our investment model was effectively out of favor with money flows, evidenced by the fact that the market did not reward securities we selected based on growth metrics. We believe this is transitory and that our growth at a reasonable price (GARP) investment style will ultimately be rewarded.

Our funds are actively managed, and because the holding period is generally not a consideration in investment decisions, the portfolios’ turnover rate might fluctuate from year to year as the funds adjust their portfolio composition. The funds’ annual portfolio turnovers were, and are expected to continue to be, more than 100 percent.

All American Equity Fund

Strengths

| ● | | The fund’s investments in consumer staples and consumer discretionary attributed the most to its return. |

| ● | | Stock selection was better than the index in the consumer materials and energy sectors. |

| ● | | Anadarko Petroleum, Zoetis and Union Pacific were the best contributors to fund performance. |

Weaknesses

| ● | | The fund’s investments in information technology and health care were a drag on performance. |

| ● | | Stock selection was worse than the index in utilities and financials. |

| ● | | Investments in Cabot Oil, A.O. Smith and Abbvie were the worst contributors to performance. |

| All American Equity Fund & Holmes Macro Trends Fund | (unaudited) |

Holmes Macro Trends Fund

Strengths

| ● | | Investments in consumer discretionary, financials and consumer staples attributed the most to the fund. |

| ● | | The fund’s stock selection in consumer discretionary and financials outpaced the index. |

| ● | | Versum Materials, MSCI and Tempur Sealy were among the best performers in the fund. |

Weaknesses

| ● | | The fund’s holdings in cash and health care attributed the least for the year. |

| ● | | Stock selection in the communication services and health care underperformed the benchmark’s securities in the same sector. |

| ● | | Pitney Bowes, AMC Networks and Stamps.com were among the worst contributors to the fund’s performance. |

Current Outlook

Opportunities

| ● | | The aerospace and defense industries look to be on good footing going into 2020. Spending is projected to grow in relation to increasing fuel efficiency and, within defense, exploring and countering new areas of threat including hypersonic weapons and cyber security. |

| ● | | Transportation infrastructure is shaping up to be another growth area in 2020. Capital expenditures are forecast to remain significant, mainly to address capacity constraints, tightening emissions regulations, and digitalization, including continued conversion by roads to all-electronic toll collection. |

| ● | | S&P Global’s outlook for U.S. homebuilding credit quality has shifted to a positive bias, with support from a continued favorable, but uneven, national housing market. The group believes positive rating actions could outnumber negative ones in 2020, given a 7 to 3 positive outlook bias. |

Threats

| ● | | Tensions between the U.S. and Iran have some market observers creating parallels between now and the Persian Gulf War three decades ago. Back then, equities had also just finished a banner year with the S&P 500 Index jumping 27 percent in 1989. Stocks peaked in July the following year, one month before the Gulf War began with a massive U.S.-led air offensive against Iraq. Over a stretch of three months, the benchmark tumbled as much as 20 percent. |

| ● | | During the past year, Americans were able to accumulate near record amounts of credit card debt, boosting the average balance per household to $8,701. Adding to the burden of reducing this debt, industry experts feel creditors will be reluctant to reduce the rates they charge even though the majority of interest rates in the U.S. continue to decline. Even more troubling, the cap established by the Consumer Financial Protection Bureau for consumers missing payments was recently increased from $1 to $39. |

| ● | | The median economic forecaster estimates a 33 percent probability of recession in the next 12 months. It seems many forecasters are referencing the classic “low unemployment rate” and flat yield curve. |

| All American Equity Fund & Holmes Macro Trends Fund | (unaudited) |

The section labeled Portfolio of Investments contains a complete list of the funds’ holdings.

All American Equity Fund

| | Top 10 Equity Holdings (Based on Net Assets) | December 31, 2019 | |

| | | Allegion PLC | 4.07% | |

| | | Electronic Secure Devices | | |

| | | Wynn Resorts, Ltd. | 3.65% | |

| | | Casino Hotels | | |

| | | HCA Healthcare, Inc. | 3.60% | |

| | | Medical - Hospitals | | |

| | | Altria Group, Inc. | 3.60% | |

| | | Tobacco | | |

| | | Regions Financial Corp. | 3.59% | |

| | | Commercial Banks - Southern US | | |

| | | The Sherwin-Williams Co. | 3.52% | |

| | | Coatings/Paint | | |

| | | MSCI, Inc. | 3.39% | |

| | | Decision Support Software | | |

| | | Starbucks Corp. | 3.37% | |

| | | Retail - Restaurants | | |

| | | The Charles Schwab Corp. | 3.35% | |

| | | Finance - Investment Banker/Broker | | |

| | | Broadcom, Inc. | 3.33% | |

| | | Electronic Components - Semiconductors | | |

| | | Total Top 10 Equity Holdings | 35.47% | |

| | | | |

| | Portfolio Allocation by Industry Sector* | | |

| | Based on Total Investments | December 31, 2019 | |

| | | Financials | 16.7% | |

| | | Information Technology | 15.9% | |

| | | Consumer Discretionary | 13.2% | |

| | | Health Care | 13.0% | |

| | | Industrials | 10.6% | |

| | | Consumer Staples | 9.8% | |

| | | Energy | 9.0% | |

| | | Materials | 5.8% | |

| | | Real Estate | 3.1% | |

| | | Other | 2.9% | |

| | | Total | 100.0% | |

| | | | | |

| * | | Summary information above may differ from the portfolio schedule included in the financial statements due to the use of different classifications of securities for presentation purposes. |

| All American Equity Fund & Holmes Macro Trends Fund | (unaudited) |

Holmes Macro Trends Fund

| | Top 10 Equity Holdings (Based on Net Assets) | December 31, 2019 | |

| | | MSCI, Inc. | 5.46% | |

| | | Decision Support Software | | |

| | | Moody's Corp. | 5.30% | |

| | | Commercial Service - Finance | | |

| | | Allegion PLC | 5.06% | |

| | | Electronic Secure Devices | | |

| | | Tempur Sealy International, Inc. | 4.86% | |

| | | Home Furnishings | | |

| | | The Home Depot, Inc. | 4.61% | |

| | | Retail - Building Products | | |

| | | Fair Isaac Corp. | 4.60% | |

| | | Data Processing/Management | | |

| | | The Scotts Miracle-Gro Co. | 4.45% | |

| | | Garden Products | | |

| | | IDEXX Laboratories, Inc. | 4.42% | |

| | | Diagnostic Kits | | |

| | | Pool Corp. | 3.94% | |

| | | Distribution/Wholesale | | |

| | | Ingevity Corp. | 3.83% | |

| | | Chemicals - Specialty | | |

| | | Total Top 10 Equity Holdings | 46.53% | |

| | | | |

| | Portfolio Allocation by Industry Sector* | | |

| | Based on Total Investments | December 31, 2019 | |

| | | Consumer Discretionary | 24.5% | |

| | | Information Technology | 14.5% | |

| | | Health Care | 14.2% | |

| | | Energy | 12.1% | |

| | | Materials | 10.1% | |

| | | Consumer Staples | 8.6% | |

| | | Communication Services | 6.3% | |

| | | Industrials | 5.2% | |

| | | Financials | 4.1% | |

| | | Other | 0.4% | |

| | | Total | 100.0% | |

| | | | | |

| * | | Summary information above may differ from the portfolio schedule included in the financial statements due to the use of different classifications of securities for presentation purposes. |

| Global Resources Fund | (unaudited) |

Management Team’s Perspective

Introduction

The Global Resources Fund (PSPFX) is a natural resources fund with the principal objective of seeking long-term growth of capital while providing protection against inflation and monetary instability. The fund invests in companies involved in the exploration, production and processing of petroleum, natural gas, coal, alternative energies, chemicals, mining, iron and steel, and paper and forest products around the globe.

Performance Graph

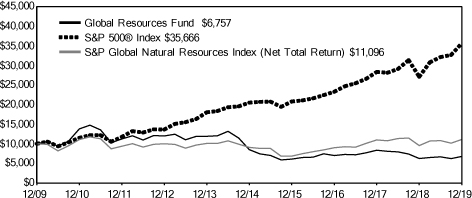

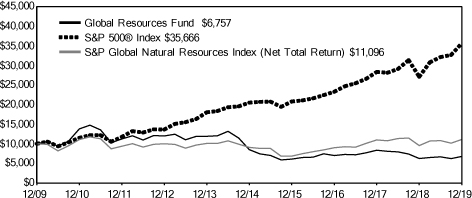

Global Resources Fund

| Average Annual Performance | For the Periods Ended December 31, 2019 | |

| | One Year | Five Year | Ten Year | |

| Global Resources Fund | 8.55% | (4.46)% | (3.84)% | |

| S&P 500® Index | 31.49% | 11.70% | 13.56% | |

| S&P Global Natural Resources Index (Net Total Return) | 16.41% | 4.14% | 1.05% | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. For all or a portion of the periods, the fund had expense limitations, without which returns would have been lower. Returns greater than one year are annualized.

Gross expense ratio as stated in the most recent prospectus is 1.57%. Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 1.90%. The Adviser can modify or terminate this arrangement at any time. See Definitions for Management Teams’ Perspectives for index definitions. Please visit our website at www.usfunds.com for updated performance information for different time periods.

The Year in Review – Economic and Political Issues that Affected the Fund

The Global Resources Fund outperformed its benchmark, the S&P Global Natural Resources Index in the second quarter of 2019, following an underperforming first quarter. The fund was predominately fully

| Global Resources Fund | (unaudited) |

invested, unlike the first quarter of 2019 where the fund had high cash levels at the start of the quarter. Oil had a significant run in the first quarter but those gains faded in the second quarter with weaker economic data starting to hit the tape, due to tariffs and economic sanctions on Venezuela and Iran.

In the third quarter, tariff fatigue and slower growth made the economic outlook less attractive; thus, the fund averaged just under 5 percent cash. Oil continued its second quarter decline of 3.56 percent, extending the downtrend another 7.13 percent drop in third quarter.

Oil was back on the rise in the fourth quarter and ended up 14.52 percent as the Organization of Petroleum Exporting Countries (OPEC) made cuts and the U.S.-China trade deal neared. Natural gas, on the other hand, took a big tumble, ending the quarter down 15.42 percent. Copper and precious metals were the better performers in the metals arena, but zinc, lead, iron and nickel did poorly.

Investment Highlights

Overview

For the year ended December 31, 2019, the Global Resources Fund returned 8.55, trailing the fund’s benchmark, the S&P Global Natural Resources Index (Net Total Return), which rose 16.41 percent. The fund outperformed for the month of December 2019, however, returning 9.05 percent versus 5.89 percent for the benchmark, as precious metals stocks climbed with gold. The fund had a higher weighting in gold mining stocks relative to the benchmark as central banks around the world added to their official reserves as debts rose.

Strengths

| ● | | The three strongest commodities for the year were palm oil, nickel and crude oil, up 36.80 percent, 31.55 percent and 25.59 percent, respectively. Direct exposure to palm oil via equity holdings is difficult to obtain. Nickel was strong on the imposition of an export ban of raw nickel ores from Indonesia in hopes of having a smelter built locally. Crude oil rallied hard in the first quarter but gave up most of those gains only to rally again in the fourth quarter with the prospect of an easing of sanctions with China. |

| ● | | The three best sector calls for the fund were an overweight position in precious metals, an underweight position in integrated oil and an underweight position in steel. Despite the fund’s overweighting in gold and precious metals, the return for that sector was consistent with the benchmark due to stock selection. But our stock selection within integrated oil and steel delivered better returns than the benchmark holdings. |

| ● | | The three best performing stock decisions were Royal Road Minerals and Ivanhoe Mines, followed by avoidance of any ownership in benchmark name Glencore. The list of regulatory agencies with open investigations regarding various ESG (environmental, social and governance) violations at Glencore continued to lengthen this year. Both Royal Road and Ivanhoe benefited from their precious metals components, but Ivanhoe also got a boost at year end with a potential rollback in tariffs. |

Weaknesses

| ● | | The three weakest commodities for the year were natural gas, tin and zinc, down 26.98 percent, 12.00 percent and 9.49 percent, respectively. Natural gas supplies remain abundant, and warmer weather trends have taken their toll. Direct exposure to tin via equity holdings is difficult to obtain. Zinc demand, being an industrial metal, was impacted by sanctions. |

| ● | | The fund’s sector underweight positions in pulp and paper as well as container/packaging stocks negatively impacted the fund. The fund’s more North America-centric stock selection did not do as well versus Europe in pulp and paper and containers/packaging stocks, which had stronger gains. |

| ● | | Infrastructure Ventures and Sun Metals were the biggest detractors from fund performance. Sun Metals’ drill plan had disappointing grades of copper, which may mean the deposit is small. |

| Global Resources Fund | (unaudited) |

Current Outlook

Opportunities

| ● | | Renewable energy such as wind and solar are cheaper than coal and in some cases more competitive than natural gas. Thus, we are seeing some disruption of the current energy mix. The leadership forward on the environmental side has not been at the bequest of government regulation as much as it has been shareholders’ interest that there are real consequences to ignoring the current trend in global warming. Demand for copper, nickel, lithium, cobalt and rare earth metals can have a future in supplying materials for energy storage. |

| ● | | The infrastructure spending plan that has been talked about in Congress will likely be resurrected with presidential elections coming in 2020. With tariffs still being a point of trade contention, capital allocation decisions are beginning to see pause as ISM Manufacturing PMI declined to 47.2 by December, a low for the year, after spiking higher in October. |

| ● | | Commodities as a whole had a mostly positive 2019, returning 16.53 percent as measured by the S&P GSCI. This far surpasses commodities' five-year average return of about negative 11.52 percent, between 2014 and 2018. Precious metals were responsible for much of the growth. Palladium, used widely in the production of catalytic converters, increased an incredible 54.21 percent to end 2019 at $1,912 an ounce. |

Threats

| ● | | While oil and natural gas are not going away, the prospects of a supply squeeze or potential recession next year seems buffered; thus, higher prices are likely in check for now. The Railroad Commission of Texas, which regulates oil and gas production, recently gave the market some pause when it raised some concern that routine flaring of natural gas may not stay “routinely approved.” |

| ● | | In the U.S. alone, assets under management (AUM) in ESG-oriented funds and ETFs have more than doubled from approximately $40 billion in 2013 to $90 billion in 2019, according to Morningstar data. Greater investments into renewable energy could take money away from traditional fossil fuels and hurt producers. |

| ● | | At the beginning of 2020, lawmakers in the U.S. passed a bill that will require the Environmental Protection Agency (EPA) to limit Americans’ exposure to chemicals connected to health problems. There is a growing concern about the quality of drinking water nationwide and the bill pushes for a limit to the maximum limit of chemicals allowed in sources of drinking water. This is a big threat to chemical producers, among others. |

The section labeled Portfolio of Investments contains a complete list of the fund’s holdings.

| Global Resources Fund | (unaudited) |

| | | | |

| | Top 10 Equity Holdings (Based on Net Assets) | December 31, 2019 | |

| | | Infrastructure Ventures, Inc. | 5.14% | |

| | | Real Estate Operating/Development | | |

| | | Ivanhoe Mines, Ltd. | 3.23% | |

| | | Metal - Diversified | | |

| | | LUKOIL PJSC | 2.88% | |

| | | Oil Companies - Integrated | | |

| | | Lundin Gold, Inc. | 2.59% | |

| | | Gold Mining | | |

| | | CNOOC, Ltd. | 2.39% | |

| | | Oil Companies - Exploration and Production | | |

| | | AngloGold Ashanti, Ltd. | 2.01% | |

| | | Gold Mining | | |

| | | Royal Road Minerals, Ltd. | 1.95% | |

| | | Gold Mining | | |

| | | Vestas Wind Systems A/S | 1.81% | |

| | | Energy - Alternate Sources | | |

| | | Champion Iron, Ltd. | 1.68% | |

| | | Metal - Iron | | |

| | | MMC Norilsk Nickel PJSC | 1.65% | |

| | | Metal - Diversified | | |

| | | Total Top 10 Equity Holdings | 25.33% | |

| | | | | |

| | Portfolio Allocation by Industry Sector* | | |

| | Based on Total Investments | December 31, 2019 | |

| | | Metals & Mining | 35.3% | |

| | | Oil, Gas & Consumable Fuels | 28.0% | |

| | | Precious Metals & Minerals | 11.3% | |

| | | Real Estate | 6.7% | |

| | | Exchange Traded Funds | 4.1% | |

| | | Other | 14.6% | |

| | | Total | 100.0% | |

| | | | | |

| * | | Summary information above may differ from the portfolio schedule included in the financial statements due to the use of different classifications of securities for presentation purposes. |

| Precious Metals and Minerals Funds | (unaudited) |

Management Team’s Perspective

Introduction

The World Precious Minerals Fund (UNWPX) and the Gold and Precious Metals Fund (USERX) pursue an objective of long-term capital growth through investments in gold, precious metals and mining companies. The World Precious Minerals Fund focuses on equity securities of companies principally engaged in the exploration, mining and processing of precious minerals such as gold, silver, platinum and diamonds. Although this fund has the latitude to invest in a broad range of precious minerals, it currently remains focused on the gold sector. The Gold and Precious Metals Fund focuses on the equity securities of established gold and precious metals companies and pursues current income as a secondary objective.

World Precious Minerals Fund

| Average Annual Performance | For the Periods Ended

December 31, 2019 | |

| | One Year | Five Year | Ten Year | |

| World Precious Minerals Fund | 22.59% | 3.47% | (8.33)% | |

| S&P 500® Index | 31.49% | 11.70% | 13.56% | |

| NYSE Arca Gold Miners Index | 41.26% | 11.11% | (3.20)% | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. For all or a portion of the periods, the fund had expense limitations, without which returns would have been lower. Returns greater than one year are annualized.

Gross expense ratio as stated in the most recent prospectus is 1.54%. Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 1.90%. The Adviser can modify or terminate this arrangement at any time. See Definitions for Management Teams’ Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

| Precious Metals and Minerals Funds | (unaudited) |

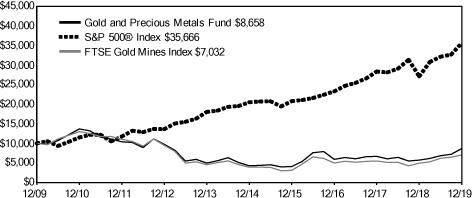

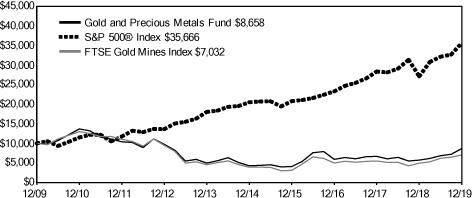

Gold and Precious Metals Fund

| Average Annual Performance | | For the Periods Ended

December 31, 2019 | |

| | One Year | Five Year | Ten Year | |

| Gold and Precious Metals Fund | 51.34% | 15.21% | (1.43)% | |

| S&P 500® Index | 31.49% | 11.70% | 13.56% | |

| FTSE Gold Mines Index | 42.68% | 12.58% | (3.46)% | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. For all or a portion of the periods, the fund had expense limitations, without which returns would have been lower. Returns greater than one year are annualized.

Gross expense ratio as stated in the most recent prospectus is 1.78%. Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 1.90%. The Adviser can modify or terminate this arrangement at any time.

See Definitions for Management Teams’ Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

The Year in Review - Economic and Political Issues that Affected the Funds

Venezuelan gold selling was a major headwind to a rising gold price early in 2019. Whenever it appears as if the South American country is approaching the market, prices have dropped due to the market recognizing a distressed seller is seeking liquidity.

Billionaire and founder of Equity Group Investments Sam Zell said in a Bloomberg interview that he has bought gold for the first time in his life “because it is a good hedge.” Zell continued to say that “supply is shrinking and that is going to have a positive impact on the price.”

The seasonal strength in gold prices during the first quarter of 2019 amounted to about a $50 lift in prices with half of that amount given up by the end of the quarter. Gold bullion jumped $104 in the month of June, nearly an 8 percent gain. Gold stocks responded in kind, with the largest and most liquid/leveraged companies seeing the most price appreciation.

| Precious Metals and Minerals Funds | (unaudited) |

Gold bullion continued to move higher in the third quarter, with spot prices gaining 4.47 percent. Tariffs and economic uncertainty continue to be key drivers. The Federal Reserve responded to market expectations with two 25 basis point interest rate cuts, at the July and then the September meetings. Gold prices rallied strongly in July and exceeded $1,550 per ounce by August. By the September interest rate cut, gold traders essentially were consolidating their positions at the $1,500 level, waiting for a new catalyst. Senior gold mining stocks rose on the price change in gold, but money flows into the precious metals space broadened with silver gaining 10.98 percent and platinum 5.79 percent for the quarter, better than gold’s price change.

Gold bullion fell early in the fourth quarter and then rallied as we entered December, with spot prices gaining 3.04 percent over the last three months of 2019. The yellow metal was driven by safe haven demand due to global geopolitical uncertainty, with total holdings in gold bullion ETFs reaching the most on record in the fourth quarter at 2,900 tonnes.

Investment Highlights

For the year ended December 31, 2019, the World Precious Minerals Fund returned 22.59 percent, underperforming its benchmark. The fund’s benchmark, the NYSE Arca Gold Miners Index, rose 41.26 percent on a total return basis.

The strategy of the World Precious Minerals Fund favors junior exploration and development stocks and mid-tiered producing stocks. These lower-capitalization stocks have historically outperformed senior gold mining companies over longer periods, as senior gold miners have typically acquired proven assets of junior gold companies rather than explored for new mining projects with capital-constrained budgets.

The Gold and Precious Metals Fund gained 51.34 percent for the year, outperforming its benchmark, the FTSE Gold Mines Index, which rose 42.68 percent on a total return basis. While focusing on established, gold-producing companies, the Gold and Precious Metals Fund holds a higher weighting of mid-tier stocks compared to its benchmark.

Both funds employed a defensive investment position from time to time in the past year with higher-than-average cash balances on hand to help protect the liquidity of the funds. However, to maintain varying degrees of investment exposure to the gold market, the funds utilized some call options positions and directional ETFs, which are more liquid than options, to hedge the funds’ benchmark risks and provide optionality to upswings in gold stocks.

Gold finished the year up 18.31 percent, while silver rose 15.21 percent. Palladium ended the year strongest with a gain of 54.20 percent, primarily driven by a shift in Europe to gasoline engines from diesel and a greater need for pollution reduction, particularly in China. This increases the demand for palladium, which is used in pollution-scrubbing catalytic converters. Platinum also put in a gain of 21.48 percent.

Strengths

| ● | | Wesdome Gold Mines Ltd. was one of both fund’s largest positions over the course of the year and was the best contributor to returns for both Gold and Precious Metals Fund (USERX) and World Precious Minerals Fund (UNWPX) with a 141.00 percent return. Wesdome is not a member of either of the funds’ benchmarks. |

| ● | | K92 Mining, Inc. was the second best dollar gainer for USERX, with a 259.92 percent gain. The second best contributor to UNWPX was Silvercrest Metals, Inc., which returned 208.57 percent. Neither K92 nor Silvercrest is a member of either of the benchmarks. |

| ● | | Diverting money away from index heavy-weight Newmont Goldcorp Corp. was our third best contributor to our relative performance as their price gain of 30.57 percent underperformed USERX and its benchmark. The third biggest contributor to UNPWX was New Pacific Metals Corp., a non-benchmark holding, where we gained 208.57 percent before closing out the position. |

| Precious Metals and Minerals Funds | (unaudited) |

Weaknesses

| ● | | Our average cash balance of 5.33 percent was the largest drag on the USERX’s return of 51.34 percent. For UNWPX, Cardinal Resources, a non-benchmark holding, was the largest detractor with a price slide of 29.76 percent over the year with asset sales and balance sheet repairs being the first order of business in 2019 versus taking on new projects. |

| ● | | St Barbara, a FTSE Gold Index member, was our second biggest detractor for USERX with its 39.01 percent slide over the year on the disappointing acquisition of Atlantic Gold Corp. Dolly Varden Silver Corp., a non-benchmark holding, was our second biggest drag on UNWPX with its price falling 31.22 percent. |

| ● | | An unfulfilled opportunity in USERX this year was Menē, Inc., which finished the year 3.45 percent lower despite sales and earnings continuing to grow for this online retailer of 24-karat gold jewelry. Nano One Materials Corp., a larger weighting in UNWPX, was also a drag on performance with its price drifting 1.47 percent lower over the year. Both Menē and Nano One are non-benchmark names. |

Current Outlook

Opportunities

| ● | | Central banks around the world, notably China, and including some that haven’t bought gold in decades, are adding bullion to their official reserves at a brisk rate compared to years past. Negative-yielding government debt appears to be a driver of higher prices for gold as pension investors search for alternative investments and central banks around the world are de-dollarizing where they can. Citigroup is very bullish on gold with a $2,000 per ounce forecast. |

| ● | | Palladium continued to perform with increased pollution standards on gasoline powered vehicles amid tight fiscal supplies. Palladium has been one of the strongest of the precious metals with increased pollution standards on gasoline powered vehicles. Platinum has been under pressure with a significant shift in consumer preference in Europe away from diesel powered vehicles, post the Volkswagen emissions scandal, towards gasoline fuel. |

| ● | | Gold broke through $1,500 per ounce in the third quarter, dipped a bit mid-quarter, and and then finished the year stong, which has raised its profile among investors. Senior gold mining stocks rose on the price change in gold, and we saw several major miners make smart transactions. |

Threats

| ● | | South Africa continued to experience rolling blackouts that pose big risks for the mining industry. In an effort to avoid a total grid collapse, state-run Eskom has implemented rotating blackouts and is working to assess the breakdowns across the grid which pose a safety and operating risk to the companies and their employees. |

| ● | | Tariffs have disrupted economic growth and this has kept silver prices subdued, relative to gold. Should the tariff issue be resolved, that could negatively impact gold. Despite the Fed cutting interest rates twice in 2019, the dollar has remained resilient and this has been a headwind for gold. Should higher interest rates make a comeback in 2020, we would expect the dollar to remain firm. |

| ● | | We are entering an election year, so the current administration is looking for economic wins that would enhance their reelection; hence positive economic action could derail the gold rally. Most of the past year was spent by the major gold miners on deleveraging their balance sheet with asset sales. One major problem in front of the senior gold companies is their reserve life relative to their current production. Global gold mining company reserves have fallen every year since 2012, almost a 50 percent drop. We now are seeing some of the senior and intermediate gold mining companies begin to take equity stakes in some of the junior miners, which could signal a bullish turn in the market. |

| Precious Metals and Minerals Funds | (unaudited) |

The section labeled Portfolio of Investments contains a complete list of the funds’ holdings.

World Precious Minerals Fund

| | Top 10 Equity Holdings (Based on Net Assets) | December 31, 2019 | |

| | | TriStar Gold, Inc. | 6.01% | |

| | | Gold Mining | | |

| | | Wesdome Gold Mines, Ltd. | 5.16% | |

| | | Gold Mining | | |

| | | SilverCrest Metals, Inc. | 4.45% | |

| | | Precious Metals | | |

| | | Cardinal Resources, Ltd.. | 4.29% | |

| | | Metal - Diversified | | |

| | | Lundin Gold, Inc. | 4.23% | |

| | | Gold Mining | | |

| | | Barsele Minerals Corp. | 3.81% | |

| | | Precious Metals | | |

| | | Nano One Materials Corp. | 3.77% | |

| | | Advanced Materials/Production | | |

| | | K92 Mining, Inc. | 3.66% | |

| | | Gold Mining | | |

| | | Direxion Daily Junior Gold Miners Index Bull 3x Shares ETF | 3.30% | |

| | | Exchange Traded Funds | | |

| | | Dolly Varden Silver Corp. | 2.97% | |

| | | Precious Metals | | |

| | | Total Top 10 Equity Holdings | 41.65% | |

| | | | |

| | Portfolio Allocation by Industry* | | |

| | Based on Total Investments | December 31, 2019 | |

| | | Gold Mining | 43.0% | |

| | | Precious Metals | 22.3% | |

| | | Metal - Diversified | 13.5% | |

| | | Exchange Traded Funds | 6.6% | |

| | | Diversified Minerals | 5.4% | |

| | | Advanced Materials/Production | 3.8% | |

| | | Other | 5.4% | |

| | | Total | 100.0% | |

| | | | | |

| * | | Summary information above may differ from the portfolio schedule included in the financial statements due to the use of different classifications of securities for presentation purposes. |

| Precious Metals and Minerals Funds | (unaudited) |

Gold and Precious Metals Fund

| | Top 10 Equity Holdings (Based on Net Assets) | December 31, 2019 | |

| | | Wesdome Gold Mines, Ltd. | 6.34% | |

| | | Gold Mining | | |

| | | K92 Mining, Inc. | 4.49% | |

| | | Gold Mining | | |

| | | Sandstorm Gold, Ltd. | 3.92% | |

| | | Gold Mining | | |

| | | Direxion Daily Gold Miners Index Bull 3X Shares ETF | 3.89% | |

| | | Exchange Traded Funds | | |

| | | Direxion Daily Junior Gold Miners Index Bull 3x Shares ETF | 3.72% | |

| | | Exchange Traded Funds | | |

| | | Wheaton Precious Metals Corp. | 3.61% | |

| | | Precious Metals | | |

| | | SSR Mining, Inc. | 3.12% | |

| | | Precious Metals | | |

| | | Maverix Metals, Inc. | 3.09% | |

| | | Precious Metals | | |

| | | Roxgold, Inc. | 2.59% | |

| | | Precious Metals | | |

| | | Torex Gold Resources, Inc. | 2.56% | |

| | | Gold Mining | | |

| | | Total Top 10 Equity Holdings | 37.33% | |

| | | | |

| | Portfolio Allocation by Industry* | | |

| | Based on Total Investments | December 31, 2019 | |

| | | Gold Mining | 59.2% | |

| | | Precious Metals | 18.1% | |

| | | Exchange Traded Funds | 8.1% | |

| | | Silver Mining | 5.4% | |

| | | Other | 9.2% | |

| | | Total | 100.0% | |

| | | | | |

| * | | Summary information above may differ from the portfolio schedule included in the financial statements due to the use of different classifications of securities for presentation purposes. |

| Emerging Europe Fund | (unaudited) |

Management Team’s Perspective

Introduction

The investment objective of the Emerging Europe Fund (EUROX) is to achieve long-term capital growth by investing in a non-diversified portfolio of equity securities of companies located in the emerging markets of Europe.(1)

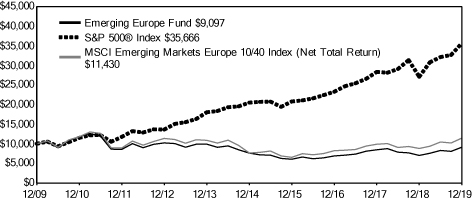

Performance Graph

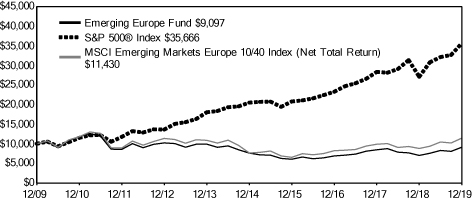

Emerging Europe Fund

| Average Annual Performance | For the Periods Ended

December 31, 2019 | |

| | One Year | Five Year | Ten Year | |