As filed with the Securities and Exchange Commission on March 6, 2018

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-01800

U.S. GLOBAL INVESTORS FUNDS

Three Canal Plaza, Suite 600

Portland, Maine 04101

Jessica Chase, Principal Executive Officer

Three Canal Plaza, Suite 600

Portland, Maine 04101

207-347-2000

Date of fiscal year end: December 31

Date of reporting period: January 1, 2017 – December 31, 2017

ITEM 1. REPORT TO STOCKHOLDERS.

U.S. Global Investors Funds

Annual Report

December 31, 2017

U.S. Global Investors Funds

Annual Report

December 31, 2017

Table of Contents

| Letter to Shareholders (unaudited) | 1 |

| Definitions for Management Teams’ Perspectives (unaudited) | 9 |

| Management Team’s Perspective (unaudited) | 11 |

| Portfolios of Investments | 45 |

| Notes to Portfolios of Investments | 93 |

| Statements of Assets and Liabilities | 110 |

| Statements of Operations | 114 |

| Statements of Changes in Net Assets | 118 |

| Notes to Financial Statements | 124 |

| Financial Highlights | 139 |

| Report of Independent Registered Public Accounting Firm | 150 |

| Trustees and Officers (unaudited) | 152 |

| Approval of Investment Advisory Agreement (unaudited) | 154 |

| Additional Information (unaudited) | 159 |

| Expense Example (unaudited) | 161 |

Nasdaq Symbols

U.S. Global Investors Funds

Investor Class | |

| U.S. Government Securities Ultra-Short Bond Fund | UGSDX |

| Near-Term Tax Free Fund | NEARX |

| All American Equity Fund | GBTFX |

| Holmes Macro Trends Fund | MEGAX |

| Global Resources Fund | PSPFX |

| World Precious Minerals Fund | UNWPX |

| Gold and Precious Metals Fund | USERX |

| Emerging Europe Fund | EUROX |

| China Region Fund | USCOX |

| | |

Institutional Class | |

| Global Resources Fund | PIPFX |

| World Precious Minerals Fund | UNWIX |

| Atlantic Fund Services

3 Canal Plaza, Suite 600

Portland, ME

04101 |

| U.S. Global Investors Funds | (unaudited) |

Dear Fellow Shareholder,

The price of gold and gold mining stocks were very competitive in 2017. For the second straight year, the yellow metal ended positively, rising a little more than 13 percent to end the year above $1,300 an ounce. This made it gold’s best year since 2010. Gold stocks, meanwhile, gained more than 12 percent, as measured by the NYSE Arca Gold Miners Index. All of this occurred even as large-cap stocks regularly closed at all-time highs and cryptocurrencies invited massive speculation.

We can thank the Fear Trade for much of gold’s performance last year. The Fear Trade, of course, is driven by low to negative real interest rates—when inflation erodes away at government bond yields—deficit spending, a weaker U.S. dollar and geopolitical uncertainty.

I believe these forces could only intensify in 2018. With inflation finally showing green shoots and President Donald Trump’s $1.5 trillion tax reform law expected to increase deficit spending, this year could provide the right conditions to spur gold prices higher.

I was thrilled by the performance of our Gold and Precious Metals Fund (USERX), which returned more than 13 percent in 2017—in line with the price of gold and beating its benchmark, the FTSE Gold Mines Index.

The World Precious Minerals Fund (UNWPX), however, ended the year down, mostly as a result of the massive rebalance trade we saw in June involving the VanEck Vectors Junior Gold Miners ETF (GDXJ). Because it had grown so large and was getting close to owning more than 20 percent of several underlying stocks—which would violate IRS diversification requirements and possibly trigger takeover laws in Canada—GDXJ had to dump as much as 50 percent of its shares in smaller gold firms, a value of $3 billion. This created heightened volatility and valuation compression in the gold market, triggering outflows from many gold- related mutual funds, ours included.

Commodities Demand Driven by Surging Manufacturing and Housing Sectors

Commodities barely eked out a win for the second straight year in 2017, edging up 0.7 percent, as measured by the Bloomberg Commodity Index. Spurred by a weaker U.S. dollar and strengthening materials demand from factories, the index headed higher thanks to a breathtaking rally late in the year that lasted a record 14 consecutive days.

The dollar appears to have peaked, making materials less expensive for overseas markets, and the Global Manufacturing Purchasing Manager’s Index (PMI) ended 2017 at 54.5, close to a seven-year high. December marked the 22nd year of expansion, with the eurozone signaling its fastest growth in the series’ two-decade history.

| U.S. Global Investors Funds | (unaudited) |

Strong manufacturing and construction expansion here in the U.S. is also supportive of commodity prices. December’s ISM Manufacturing PMI clocked in at a historically high 59.7. New orders grew 5.4 percent from the previous month to 59.4, its highest reading since January 2004. What’s more, U.S. construction spending in November rose to an all-time high of $1.257 trillion, according to the Census Bureau.

Mortgage securities firm Freddie Mac called 2017 the “best year in a decade” for the U.S. housing market by a variety of measures. These include low inflation, strong jobs growth and historically-low mortgage rates. Home builders right now are more confident of the future than they’ve been in over 18 years. December’s National Association of Home Builders (NAHB)/ Wells Fargo Housing Market Index (HMI) soared to 74, eight points up from the November reading and its highest report since July 1999.

Increased optimism and home demand is good news for resources and raw materials. According to home-construction services firm Happho, for every 1,000 square feet of new housing, nearly 8,820 pounds of steel are required, as well as 400 bags of cement, 1,800 cubic feet of sand and 1,350 cubic feet of gravel and other aggregate. This doesn’t begin to touch on finishers such as brick, paint and tiles, or fittings such as windows, doors, plumbing and electrical.

Of particular note is the increase in spending at building, hardware and garden stores. The most recent Visa Retail Spending Monitor found that consumption on home improvement and do-it-yourself (DIY) goods and services rose 12.8 percent in August compared to the same month in 2016.

I believe this was a windfall for our Holmes Macro Trends Fund (MEGAX), which ended the year up 19 percent. Not only is consumer discretionary the fund’s largest sector weighting, but it also invested in names associated with building and home improvement.

| U.S. Global Investors Funds | (unaudited) |

Jeffrey Gundlach: Time to Add Commodities

Appearing on CNBC, billionaire money manager Jeffrey Gundlach, founder of DoubleLine Capital, said he thought “investors should add commodities to their portfolios” for 2018, pointing out that they are just as cheap relative to stocks as they were at historical turning points. Below, you can see that the S&P GSCI Total Return Index-to-S&P 500 Index ratio is now at its lowest point since the dotcom bubble, meaning commodities and mining stocks are highly undervalued relative to large-cap stocks. We could see mean reversion begin to happen sometime this year, triggering a commodities super-cycle the likes of which we haven’t seen since the 2000s.

“We’re at that level where in the past you would have wanted commodities” in your portfolio, Gundlach said. “The repetition of this is almost eerie. And so if you look at that chart, the value in commodities is, historically, exactly where you want it to be a buy.”

For more, check out our Global Resources Fund (PSPFX), which returned close to 20 percent in 2017.

Emerging Markets Were the Big Winner

Domestic stocks were a great place to invest in 2017, but hopefully you didn’t overlook opportunities overseas. Emerging markets in Asia, Latin America, Europe and elsewhere had a gangbusters year, surging more than 37.5 percent with dividends reinvested, as measured by the MSCI Emerging Markets Index.

| U.S. Global Investors Funds | (unaudited) |

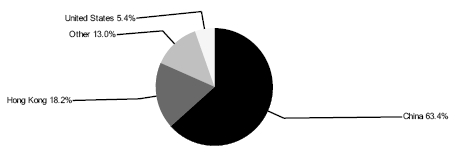

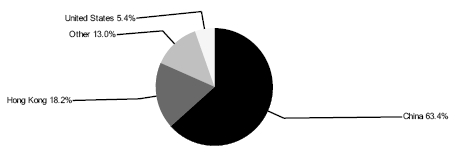

This was a boon for our China Region Fund (USCOX) and Emerging Europe Fund (EUROX), both of which crushed their benchmarks in 2017. USCOX was our best performing fund of the year, returning a phenomenal 57.67 percent, compared to the Hang Seng Composite Index, which rose nearly 43 percent. Our bets in Chinese automakers, as well as our overweight in technology firms, were particularly well-made.

EUROX, which invests in companies domiciled in Central and Eastern Europe (CEE) economies, beat its benchmark, the MSCI Emerging Markets Europe 10/40 Index, by 2.4 percentage points. Throughout 2017, the fund traded consistently above its 200-day moving averages and ended the year up 22.73 percent.

| U.S. Global Investors Funds | (unaudited) |

I’m optimistic this upswing can be sustained in 2018, supported by low unemployment, low inflation and record manufacturing growth. The European Central Bank (ECB) has also indicated it will continue its accommodative monetary policy by keeping rates low and expanding its balance sheet some 270 billion euros ($326 billion) through the first three quarters of 2018.

Effective September of this year, Poland will be upgraded from the “advanced emerging” category to “developed” by FTSE Russell. Poland, then, will be in the same company as, among others, the U.S., U.K., Japan, Germany and Singapore. The country is the first in the CEE region to receive “developed” status, and I believe the news will attract even more inflows from foreign investors.

Among the decisive factors behind the upgrade were the country’s advanced infrastructure, secure trading and a high gross national income (GNI) per capita. The World Bank forecasts its economy to grow 3.3 percent this year on the back of a strong labor market, improved consumption and the child benefit program Family 500+.

Economists aren’t the only ones noticing the improvement. Young Polish expats who had formerly sought work in the U.K. and elsewhere are now returning home in large numbers to participate in the booming economy. Banks and other companies, including JPMorgan Chase and Goldman Sachs, are similarly considering opening branches in Poland and hiring local talent.

| U.S. Global Investors Funds | (unaudited) |

Stay on the Short End of the Yield Curve

Finally, a few words on fixed income. The Federal Reserve hiked interest rates again in December, and many economists expect to see three additional hikes this year. We can’t be absolutely certain of anything, however, as the Fed will undergo a changing of the guard in 2018, with current chair Janet Yellen being replaced by Trump-nominee Jerome Powell. Although Powell has been described as someone who’ll mostly hold to the status quo established by his two immediate predecessors, he’s a question mark at this point, having served as a member of the Federal Reserve Board of Governors since only 2012.

In any case, with rates rising, it might be prudent to stay on the short end of the yield curve when it comes to fixed income such as Treasuries and municipal bonds. Shorter-term bonds are less sensitive to rate increases than longer-term bonds, whose maturities are further out. In 2017 we began to see the yield curve flatten, with the 10-year Treasury yield only half a percentage point more than the two-year Treasury yield as of December 29.

Remember, these are Treasuries—which, unlike municipal bonds, are backed by the full faith and credit of the U.S. government—but munis could be similarly affected.

If this is a concern, I urge you to consider our Near-Term Tax Free Fund (NEARX). NEARX invests primarily in munis with a maturity between one and five years, which could help reduce volatility longer-term instruments are likely to see in a rising interest rate environment.

To get the latest insights and commentary on gold, commodities, emerging markets, bitcoin and much, much more, subscribe to our award-winning Investor Alert and to my personal CEO blog, Frank Talk. Both can be reached by visiting usfunds.com.

Thank you for your continued trust and confidence in U.S. Global Investors. We wish you and your family good health and prosperity in 2018.

Sincerely,

Frank E. Holmes

CEO and Chief Investment Officer

U.S. Global Investors, Inc.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Stock markets can be volatile and share prices can fluctuate in response to sector-related and other risks as described in the fund prospectus. Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in these sectors. Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. By investing in a specific geographic region, a regional fund’s returns and share price may be more volatile than those of a less concentrated portfolio. The Emerging Europe Fund invests more than 25% of its investments in companies principally engaged in the oil & gas or banking industries. The risk of concentrating investments in this group of industries will make the fund more susceptible to risk in these industries than funds which do not concentrate their investments in an industry and may make the fund’s performance more volatile. Because the Global Resources Fund concentrates its investments in specific industries, the fund may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. Bond funds are subject to interest-rate risk; their value declines as interest rates rise. Though the Near-Term Tax Free Fund seeks minimal fluctuations in share price, it is subject to the risk that the credit quality of a portfolio holding could decline, as well as risk related to changes in the economic conditions of a state, region or issuer. These risks could cause the fund’s share price to decline. Tax-exempt income is federal income tax free. A portion of this income may be subject to state and local taxes and at times the alternative minimum tax. The Near-Term Tax Free Fund may invest up to 20% of its assets in securities that pay taxable interest. Income or fund distributions attributable to capital gains are usually subject to both state and federal income taxes.

| U.S. Global Investors Funds | (unaudited) |

The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The index benchmark value was 500.0 at the close of trading on December 20, 2002.

The FTSE Gold Mines Index Series encompasses all gold mining companies that have a sustainable and attributable gold production of at least 300,000 ounces a year, and that derive 75% or more of their revenue from mined gold.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

The Bloomberg Commodity Index is made up of 22 exchange-traded futures on physical commodities. The index represents 20 commodities, which are weighted to account for economic significance and market liquidity.

The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment.

The Housing Market Index (HMI) is based on a monthly survey of NAHB members designed to take the pulse of the single-family housing market. The survey asks respondents to rate market conditions for the sale of new homes at the present time and in the next six months as well as the traffic of prospective buyers of new homes.

The S&P GSCI Total Return Index in USD is widely recognized as the leading measure of general commodity price movements and inflation in the world economy. Index is calculated primarily on a world production weighted basis, comprised of the principal physical commodities futures contracts.

| U.S. Global Investors Funds | (unaudited) |

The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets.

The MSCI Emerging Markets Europe 10/40 Index (Net Total Return) is a free float-adjusted market capitalization index that is designed to measure equity performance in the emerging market countries of Europe (Czech Republic, Greece, Hungary, Poland, Russia, and Turkey). The index is calculated on a net return basis (i.e., reflects the minimum possible dividend reinvestment after deduction of the maximum rate withholding tax). The index is periodically rebalanced relative to the constituents’ weights in the parent index.

Mean reversion is the theory suggesting that prices and returns eventually move back toward the mean or average. This mean or average can be the historical average of the price or return, or another relevant average such as the growth in the economy or the average return of an industry.

There is no guarantee that the issuers of any securities will declare dividends in the future or that, if declared, will remain at current levels or increase over time.

| Definitions for Management Teams’ Perspectives | (unaudited) |

Benchmark Index Definitions

Returns for indices reflect no deduction for fees, expenses or taxes, unless noted.

The Bloomberg Barclays U.S. Treasury Bills 6-9 Months Total Return Index tracks the performance of U.S. Treasury Bills with a maturity of six to nine months.

The Bloomberg Barclays 3-Year Municipal Bond Index is a total return benchmark designed for municipal assets. The index includes bonds with a minimum credit rating of BAA3, are issued as part of a deal of at least $50 million, have an amount outstanding of at least $5 million and have a maturity of two to four years.

The FTSE Gold Mines Index encompasses all gold mining companies that have a sustainable and attributable gold production of at least 300,000 ounces a year and that derive 75% or more of their revenue from mined gold.

The Hang Seng Composite Index is a market-capitalization weighted index that covers about 95% of the total market capitalization of companies listed on the Main Board of the Hong Kong Stock Exchange.

The MSCI Emerging Markets Europe 10/40 Index (Net Total Return) is a free float- adjusted market capitalization index that is designed to measure equity performance in the emerging market countries of Europe (Czech Republic, Greece, Hungary, Poland, Russia and Turkey). The index is calculated on a net return basis (i.e., reflects the minimum possible dividend reinvestment after deduction of the maximum rate withholding tax). The index is periodically rebalanced relative to the constituents’ weights in the parent index.

The NYSE Arca Gold Miners Index is a modified market capitalization-weighted index comprised of publicly-traded companies involved primarily in the mining for gold and silver.

The S&P Global Natural Resources Index (Net Total Return) includes 90 of the largest publicly-traded companies in natural resources and commodities businesses that meet specific investability requirements, offering investors diversified, liquid and investable equity exposure across 3 primary commodity-related sectors: Agribusiness, Energy, and Metals & Mining. The index is calculated on a net return basis (i.e., reflects the minimum possible dividend reinvestment after deduction of the maximum rate withholding tax).

The S&P 500 Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

The S&P Composite 1500 Index is a broad-based capitalization-weighted index of 1500 U.S. companies and is comprised of the S&P 400, the S&P 500 and the S&P 600.

Other Index Definitions

The Bloomberg Commodity Index is made up of 22 exchange-traded futures on physical commodities. The index represents 20 commodities, which are weighted to account for economic significance and market liquidity.

| Definitions for Management Teams’ Perspectives | (unaudited) |

The Caixin China Manufacturing Purchasing Manager’s Index is a composite indicator designed to provide an overall view of activity in the manufacturing sector and acts as a leading indicator for the whole economy. When the PMI is below 50.0 this indicates that the manufacturing economy is declining and a value above 50.0 indicates an expansion of the manufacturing economy.

The FTSE 100 Index is an index composed of the 100 largest companies listed on the London Stock Exchange (LSE). It was launched on January 3, 1984, and had a start value of 1,000.

The Purchasing Manager’s Index (PMI) is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment.

The S&P 500 Telecommunication Services Index comprises those companies included in the S&P 500 that are classified as members of the telecommunication services sector.

| U.S. Government Securities Ultra-Short Bond Fund | (unaudited) |

Management Team’s Perspective

Introduction

The U.S. Government Securities Ultra-Short Bond Fund (UGSDX) is designed to be used as an investment that takes advantage of the security of U.S. Government bonds and obligations, while simultaneously pursuing a higher level of current income than money market funds offer. The fund’s dollar-weighted average effective maturity is two years or less.

Performance Graph

| U.S. Government Securities Ultra-Short Bond Fund |

|

| Average Annual Performance | For the Periods Ended December 31, 2017 |

| | One Year | Five Year | Ten Year |

| U.S. Government Securities Ultra-Short Bond Fund | 0.69% | 0.38% | 0.39% |

| Bloomberg Barclays U.S. Treasury Bills 6-9 Months | | | |

| Total Return Index | 0.72% | 0.32% | 0.40% |

| | Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. For all or a portion of the periods, the fund had expense limitations and reimbursements to maintain a minimum yield, without which returns would have been lower. The above returns for the U.S. Government Securities Ultra-Short Bond Fund include the fund’s results as a money market fund through the date of its conversion (December 20, 2013) to an ultra-short bond fund, and therefore are not representative of the fund’s results had it operated as an ultra-short bond fund for the full term of the periods shown. Returns greater than one year are annualized. Gross expense ratio as stated in the most recent prospectus is 1.00%. Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 0.45%. The Adviser can modify or terminate this arrangement at any time. In addition, returns may include the effects of additional voluntary waivers of fees and reimbursements of expenses by the Adviser, including waivers and reimbursements to maintain a minimum net yield for the fund. See Definitions for Management Teams��� Perspectives for index definitions. Please visit our website at www.usfunds.com for updated performance information for different time periods. | |

| U.S. Government Securities Ultra-Short Bond Fund | (unaudited) |

The Year in Review – Economic and Political Issues that Affected the Fund

The year was generally tumultuous, marked by natural disasters, geopolitical tensions and deep political divisions in many countries. On the economic front, however, 2017 was generally a positive year, with gross domestic product (GDP) accelerating over much of the world in the broadest cyclical upswing since the start of the decade. Nonetheless, wage growth has remained puzzlingly tepid in advanced economies despite falling unemployment rates. Continued slack in labor markets—in the form of still high unemployment in some countries or high levels of involuntary part time unemployment—along with weak productivity growth explain much of the lack of wage growth. Equity valuations continued their ascent and ended the year near record highs as central banks maintained accommodative monetary policies amid weak inflation. This was part of a broader trend across global financial markets where low interest rates, an improved economic outlook, and increased risk appetite boosted asset prices and suppressed volatility. While easier financial conditions bolstered growth momentum, they also pose risks if the reach for yield extends too far.

The Federal Reserve raised the target range for the fed funds rate three times in 2017 and began its balance sheet normalization process, curtailing the reinvestment of principal from maturing bonds. As a credit to the Federal Reserve’s communications policy, the change in policy was taken in stride by the stock market. The effectiveness was a result of the Fed’s repeated reminders that it expects the pace of interest rate hikes to be gradual. While its rate hikes hit the short end of the Treasury yield curve, with the two-year note yield rising 62 basis points in 2017 to 1.88 percent, the long end of the yield curve responded in the opposite direction. The yield on the 10-year note dropped seven basis points in 2017 to 2.41 percent, which led to the narrowest spread between the two-year 10-year note since October 2007. This was mainly as a result of the lack of inflation, which tends to be a driver of the long end of the curve. Furthermore, a flattening curve is often viewed as a harbinger of slower economic growth, yet the dovish policy accommodation still being provided by the European Central Bank (ECB) and the Bank of Japan (BoJ) fueled an interest rate differential trade that suppressed long-term rates in the U.S. and created some possible misdirection about the economic messaging coming across in the flattening yield curve.

Investment Highlights

The U.S. Government Securities Ultra-Short Bond Fund returned 0.69 percent for the year ended December 31, 2017, underperforming its benchmark, the Bloomberg Barclays U.S. Treasury Bills 6-9 Months Total Return Index, which returned 0.72 percent.

Current Outlook

The Federal Reserve, and other major central banks, will continue to play a key role in the market’s behavior in 2018. However, the Fed will soon be directed by Jerome Powell who will supplant Janet Yellen in February as Chairman of the Board of Governors. While it previously seemed that 2018 would feature broad-based policy tightening, the outlook has since become less hawkish on concerns about lagging inflation, economic risks and geopolitical tensions. Overall, the Fed is still expected to be more hawkish than other central banks in 2018. The ECB seems likely to follow in the Fed’s tightening path as it has already signaled a substantial reduction in asset purchases. In contrast, the Bank of England (BoE) has indicated that Brexit risks will preclude it from raising interest rates much further. Finally, the BoJ will likely remain the most dovish.

| U.S. Government Securities Ultra-Short Bond Fund | (unaudited) |

The section labeled Portfolio of Investments contains a complete list of the fund’s holdings.

Portfolio Allocation by Issuer

Based on Total Investments | December 31, 2017 |

| | |

|

| Portfolio Allocation by Maturity | | | | | December 31, 2017 | | |

| 1-3 Months | | $ | 3,750,857 | | | | 7.7 | % | |

| 3-12 Months | | | 16,244,975 | | | | 33.6 | % | |

| 1-3 Years | | | 28,461,462 | | | | 58.7 | % | |

| | | $ | 48,457,294 | | | | 100.0 | % | |

| | | | | | | | | | |

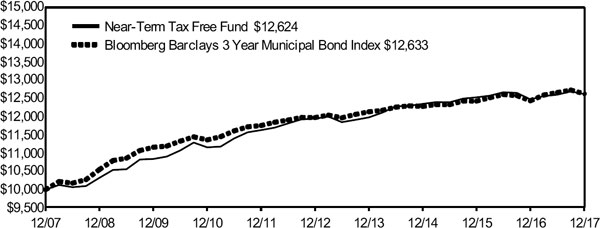

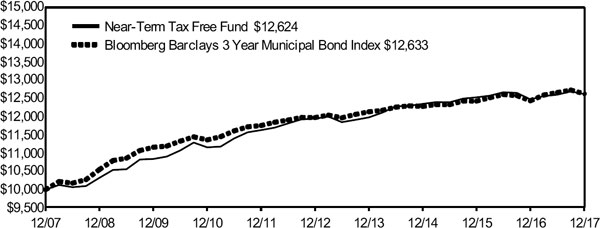

| Near-Term Tax Free Fund | (unaudited) |

Management Team’s Perspective

Introduction

The Near-Term Tax Free Fund (NEARX) seeks to provide a high level of current income exempt from federal income taxation and to preserve capital. However, a portion of any distribution may be subject to federal and/or state income taxes. The Near-Term Tax Free Fund will maintain a weighted average maturity of less than five years.

Performance Graph

| Near-Term Tax Free Fund | |

| | |

|

| | |

| Average Annual Performance | For the Periods Ended December 31, 2017 |

| | One Year | Five Year | Ten Year |

| Near-Term Tax Free Fund | 1.20% | 1.11% | 2.36% |

| Bloomberg Barclays 3 Year Municipal Bond Index | 1.56% | 1.07% | 2.36% |

| | Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. For all or a portion of the periods, the fund had expense limitations, without which returns would have been lower. Returns greater than one year are annualized. Gross expense ratio as stated in the most recent prospectus is 0.97%. The Adviser has contractually agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, extraordinary expenses, taxes, brokerage commissions and interest) to not exceed 0.45% on an annualized basis through April 30, 2018. See Definitions for Management Teams’ Perspectives for index definitions. Please visit our website at www.usfunds.com for updated performance information for different time periods. | |

The Year in Review – Economic and Political Issues that Affected the Fund

Three interest rate hikes in March, June and December signaled the Federal Reserve’s improving confidence in the U.S. economy and resulted in a federal funds rate that rose above 1 percent for the first time since September 2008. Meanwhile, long rates didn’t budge much due to a lack of inflation, despite stronger economic data. The municipal yield curve began to flatter, which generally has had a negative impact on short duration bonds while benefitting longer duration bonds. Further, bonds with lower credit ratings generally outperformed bonds of higher quality as a stronger economy fueled investors’ risk appetites. Early in 2017, the Fed communicated that it would begin paring back its balance sheet in October by reducing the reinvestment of principal payments on securities that it acquired through quantitative easing. Unlike the taper tantrum of 2013, the announcement and subsequent policy initiation was implemented with minimal volatility to the overall bond market.

| Near-Term Tax Free Fund | (unaudited) |

While overall state revenues continued to rise as the economy improved, some states remained in a perilous fiscal condition. After two full years without a budget, the State of Illinois began its 2017/18 fiscal year without a budget, but its legislature eventually overrode the governor’s veto to enact a budget that increased personal income taxes from 3.75 percent to 4.95 percent. New Jersey, Connecticut and Maine also started the fiscal year without a budget. The governor of Texas enacted legislation to improve the funding ratios of pension plans in Dallas and Houston. The reforms for Dallas raised the retirement age from 55 to 58, increased the employee contribution from 8.5 percent to 13.5 percent of pay and boosted the city’s contribution from 27.5 percent to 34.5 percent. The legislature for Houston lowered the plan’s assumed rate of return to 7 percent from between 8 and 8.5 percent. It also provided for reductions in benefits or increases in employee contributions if rates of return fall short of expectations.

Tax revenue for state and local governments continued to increase, although the rate of increase for state revenues was tepid. During the 12 months through June 2017, state revenue from individual income tax increased 2 percent, 2.8 percent from sales tax, but receipts from corporate income tax fell 4.3 percent. Local governments, which depend heavily on property taxes, fared better, as their property tax revenue grew 4.0 percent in the 12 months through June 2017 compared to the same period in 2016.

The tax bills passed by the U.S. House and Senate led to a rise in yields towards the end of the year. The proposed tax reform reduced or eliminated the tax advantages of certain types of municipal bonds, most notably advance refunding bonds, which caused many issuers to push their schedules forward and issue new bonds before the end of the year.

Investment Highlights

For the year ended December 31, 2017, the Near-Term Tax Free Fund returned 1.20 percent, underperforming its benchmark, the Bloomberg Barclays 3-Year Municipal Bond Index, which gained 1.56 percent.

Strengths

| ● | The fund’s overweight in highly rated bonds was a safeguard against market shocks. |

| ● | The fund benefited from its allocation to bonds from New Jersey and Illinois, which outperformed. |

| ● | The fund benefited from its allocation to school district bonds, which outperformed. |

Weaknesses

| ● | The fund’s underweight allocation to industrial development bonds was a drag on performance, as those bonds outperformed. |

| ● | The fund’s exposure to high quality general obligation bonds underperformed. |

| ● | The fund was hurt by its exposure to the short end of the yield curve, which underperformed the long end. |

Current Outlook

Opportunities

| ● | Tax reform could have the biggest impact on the muni bond market next year. The proposed legislation would make general obligation bonds more attractive for tax reduction purposes while limiting new issuances to borrowings from states and local governments. This could translate to less supply of higher-yield revenue bonds and more demand for specialty state general obligation bonds. |

| Near-Term Tax Free Fund | (unaudited) |

Threats

| ● | President Donald Trump appointed Jerome H. Powell as the next Chairman of the Federal Reserve to replace Janet Yellen. Powell is largely considered a non-interventionist and favors traditional monetary policy measures and a free market approach. He has always voted alongside Janet Yellen on policy decisions in the past and his speeches suggest that he favors a cautious approach. Some experts, however, believe he could be less dovish than Yellen, so the market will closely be watching where he falls on the spectrum. |

The section labeled Portfolio of Investments contains a complete list of the fund’s holdings.

| Top 10 Area Concentrations | | |

| (Based on Net Assets) | December 31, 2017 | |

| | Texas | 28.06% | |

| | New York | 9.54% | |

| | Washington | 7.67% | |

| | Florida | 5.44% | |

| | Illinois | 5.16% | |

| | Michigan | 4.86% | |

| | Pennsylvania | 3.98% | |

| | New Jersey | 3.75% | |

| | Missouri | 3.61% | |

| | North Carolina | 2.47% | |

| | Total Top 10 Areas | 74.54% | |

| Municipal Bond Ratings* | December 31, 2017 |

| Based on Total Municipal Bonds |

|

| * | Credit quality ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). “Not Rated” is used to classify securities for which a rating is not available. Credit-quality ratings for each issue are obtained from Moody’s and S&P Global Ratings, and the higher rating for each issue is used. |

| All American Equity Fund & Holmes Macro Trends Fund | (unaudited) |

Management Team’s Perspective

Introduction

The principal objective of the All American Equity Fund (GBTFX) is to seek capital appreciation by investing primarily in a broadly diversified portfolio of domestic common stocks. The fund invests in large-capitalization stocks while retaining the flexibility to seek out promising individual stock opportunities, including stocks with meaningful dividend yields.

The Holmes Macro Trends Fund (MEGAX) invests in companies with good growth prospects and strong positive earnings momentum. The fund’s primary objective is to seek long-term capital appreciation.

Performance Graphs

| All American Equity Fund |

|

| Average Annual Performance | For the Periods Ended December 31, 2017 |

| | One Year | Five Year | Ten Year |

| All American Equity Fund | 5.90% | 6.96% | 2.22% |

| S&P 500 Index | 21.83% | 15.79% | 8.50% |

| | Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. For all or a portion of the periods, the fund had expense limitations, without which returns would have been lower. Returns greater than one year are annualized. Gross expense ratio as stated in the most recent prospectus is 1.76%. Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 2.20%. The Adviser can modify or terminate this arrangement at any time. See Definitions for Management Teams’ Perspectives for index definitions. Please visit our website at www.usfunds.com for updated performance information for different time periods. | |

| All American Equity Fund & Holmes Macro Trends Fund | (unaudited) |

| Holmes Macro Trends Fund |

|

| Average Annual Performance | For the Periods Ended December 31, 2017 |

| | One Year | Five Year | Ten Year |

| Holmes Macro Trends Fund | 19.17% | 10.77% | 2.78% |

| S&P Composite 1500 TR | 21.13% | 15.74% | 8.69% |

| | Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. For all or a portion of the periods, the fund had expense limitations, without which returns would have been lower. Returns greater than one year are annualized. Gross expense ratio as stated in the most recent prospectus is 1.68%. Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 2.20%. The Adviser can modify or terminate this arrangement at any time. See Definitions for Management Teams’ Perspectives for index definitions. Please visit our website at www.usfunds.com for updated performance information for different time periods. | |

The Year in Review – Economic and Political Issues that Affected the Funds

There is always a first time for everything, and 2017 gave investors one for the record books. For the first time ever in its nearly 90-year history, the S&P 500 Index had a “perfect” year. The index of large-cap companies ended positively every month of the year, propelled by the promise of corporate tax cuts, a possible new infrastructure plan, historically low interest rates, a weak U.S. dollar and strong earnings growth.

The capitalization-weighted S&P 500 returned 21.8 percent, with dividends reinvested. The large market-capitalization equities were the driving theme behind the index’s advance. Investor preference for mega-capitalization was so pronounced that the top 10 most heavily weighted companies in the index accounted for more than a quarter of the index’s 21.8 percent return. The biggest drivers of performance were technology stocks, with Amazon up 55 percent; Apple, 48 percent, Facebook, 53 percent and Google, 35 percent. Investor demand was insatiable. With so many technology companies delivering dream-like returns, it should come as no surprise that the sector was the strongest of the year, returning 36.9 percent in total.

| All American Equity Fund & Holmes Macro Trends Fund | (unaudited) |

The S&P 500 Telecommunication Services Index, which has only three members, had the worst performance, declining 5.9 percent. With so few members, we need to evaluate the next worst performer, energy, which declined 3.8 percent. For the first eight months of the year, crude oil continued to slide until finally bottoming at $42.26 per barrel. The prolonged slide seemed to weigh on investor sentiment until traders and investors became “believers” in the turnaround. Crude finished the year at $59.82 per barrel.

Investment Highlights

The Holmes Macro Trends Fund (MEGAX) appreciated 19.17 percent in 2017, underperforming its benchmark, the S&P Composite 1500 Index, which returned 21.13 percent. The All American Equity Fund (GBTFX) rose 5.90 percent for the year, underperforming its benchmark, the S&P 500.

Overall growth-oriented stocks outperformed value and dividend-oriented companies, while utilities and more defensive areas of the market just didn’t capture investors’ fancy. The primary driver of underperformance in 2017 was the fact that the fund had more exposure to smaller and growth-oriented companies than the benchmark. Our investment style was effectively out of favor, and the market did not reward the same stocks we selected based on growth metrics. We believe this is transitory and our growth at a reasonable price (GARP) investment style will ultimately be rewarded.

Because the funds are actively managed, and because the holding period is generally not a consideration in investment decisions, the portfolios’ turnover rate might fluctuate from year to year as the funds adjust their portfolio composition. The funds’ annual portfolio turnovers were, and are expected to continue to be, more than 100 percent.

All American Equity Fund

Strengths

| ● | The fund’s allocation in financials and health care helped fund performance. |

| ● | Stock selection was better than the index in the energy and telecommunications sectors. |

| ● | Southwest Airlines, Ameriprise Financial and PulteGroup were the best contributors to fund performance. |

Weaknesses

| ● | The fund’s allocation in energy and information technology just didn’t seem to add to the bottom line. |

| ● | Investments in Bed Bath & Beyond, Foot Locker and Signet Jewelers were the worst contributors to performance |

Holmes Macro Trends Fund

Strengths

| ● | Stock selection was strong in select health care and consumer staples companies. |

| ● | The fund’s underweight position in health care was beneficial as the sector was leading its peers. |

| ● | S&P Global, LGI Homes and AbbVie were among the most positive contributors to fund performance. |

Weaknesses

| ● | Sector allocations in information technology and industrials did not perform as well as anticipated. |

| ● | Stock selection was fair across the board as our growth-oriented investment style was out of favor and the primary driver of lagging performance. |

| ● | Tenpur Sealy International, PentaNova Energy and Eagle Pharmaceuticals failed to live up to expectations and were among the worst contributors to the fund’s performance. |

| All American Equity Fund & Holmes Macro Trends Fund | (unaudited) |

Current Outlook

Opportunities

| ● | The economic outlook in the United States should improve due to the recently implemented tax bill. Companies are already starting to “pay if forward,” giving employees additional bonuses and 401(k) contributions. |

| ● | The majority of jobless rates across the world are in decline. Japan, Hong Kong, the U.S., Israel, the U.K. and Portugal, among other countries, registered 15-year lows. If this continues, investors can anticipate continued growth optimism. |

Threats

| ● | In November, Americans’ personal savings rate fell to 2.9 percent, its lowest reading since soon before the recession. This comes as Americans rely more and more on credit cards to make transactions. According to the just-released Federal Reserve Payments Study, credit card payments grew from 103.5 billion in 2015 to 111.1 billion in 2016, with the value surging from $5.65 trillion to almost $6 trillion. |

| ● | Will the North America Free Trade Agreement (NAFTA) get renegotiated or collapse altogether? The Trump administration is pushing to get talks wrapped up by the end of the first quarter of 2018, but there are still some major issues outstanding. |

| ● | If the Federal Reserve continues with its anticipated rate hikes and if the long end of the curve (30-year yields) fails to lift, we could see yield inversion, which would most likely become a drag on the economy. |

The section labeled Portfolio of Investments contains a complete list of the funds’ holdings.

All American Equity Fund

| Top 10 Equity Holdings (Based on Net Assets) | December 31, 2017 | |

| | The Boeing Co. | 4.26% | |

| | Aerospace/Defense | | |

| | Direxion Daily S&P 500 Bull 3X ETF | 3.90% | |

| | N.A. | | |

| | Visa, Inc., Class A | 3.72% | |

| | Finance - Credit Card | | |

| | Discover Financial Services | 3.72% | |

| | Finance - Credit Card | | |

| | DXC Technology Co. | 3.69% | |

| | Computer Services | | |

| | Total System Services, Inc. | 3.67% | |

| | Commercial Services - Finance | | |

| | Marathon Petroleum Corp. | 3.60% | |

| | Oil Refining & Marketing | | |

| | The Home Depot, Inc. | 3.45% | |

| | Retail - Building Products | | |

| | Constellation Brands, Inc., Class A | 3.44% | |

| | Beverages - Wine/Spirits | | |

| | The Estee Lauder Cos., Inc. | 3.43% | |

| | Cosmetics & Toiletries | | |

| | Total Top 10 Equity Holdings | 36.88% | |

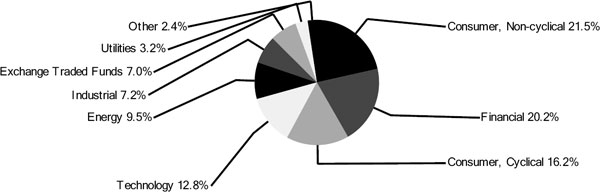

| All American Equity Fund & Holmes Macro Trends Fund | (unaudited) |

All American Equity Fund

| Portfolio Allocation by Industry Sector* | December 31, 2017 |

| Based on Total Investments |

|

| * | Summary information above may differ from the portfolio schedule included in the financial statements due to the use of different classifications of securities for presentation purposes. |

Holmes Macro Trends Fund

| Top 10 Equity Holdings (Based on Net Assets) | December 31, 2017 | |

| | HFF, Inc. | 6.38% | |

| | Real Estate Management/Services | | |

| | Wynn Resorts, Ltd. | 5.92% | |

| | Casino Hotels | | |

| | S&P Global, Inc. | 4.93% | |

| | Commercial Services - Finance | | |

| | Medifast, Inc. | 4.78% | |

| | Commercial Services | | |

| | PetMed Express, Inc. | 4.66% | |

| | Retail - Pet Food & Supplies | | |

| | Pool Corp. | 4.46% | |

| | Distribution/Wholesale | | |

| | Lennox International, Inc. | 4.46% | |

| | Building Products - Air & Heating | | |

| | Trex Co., Inc. | 4.17% | |

| | Building & Construction Products - Miscellaneous | | |

| | LGI Homes, Inc. | 4.17% | |

| | Building - Residential/Commercial | | |

| | Valvoline, Inc. | 3.64% | |

| | Chemicals - Specialty | | |

| | Total Top 10 Equity Holdings | 47.57% | |

| All American Equity Fund & Holmes Macro Trends Fund | (unaudited) |

Holmes Macro Trends FundPortfolio Allocation by Industry Sector* Based on Total Investments | December 31, 2017 |

|

| * | Summary information above may differ from the portfolio schedule included in the financial statements due to the use of different classifications of securities for presentation purposes. |

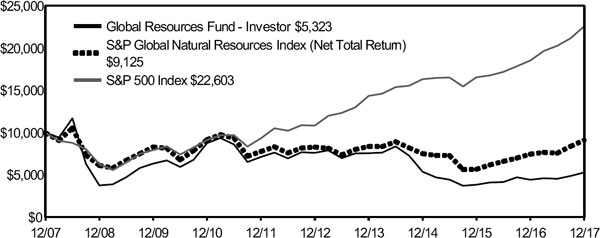

| Global Resources Fund | (unaudited) |

Management Team’s Perspective

Introduction

The Global Resources Fund (PSPFX and PIPFX) is a non-diversified natural resources fund with the principal objective of seeking long-term growth of capital while providing protection against inflation and monetary instability. The fund invests in companies involved in the exploration, production and processing of petroleum, natural gas, coal, alternative energies, chemicals, mining, iron and steel, and paper and forest products around the globe.

Performance Graph

| Global Resources Fund |

|

| Average Annual Performance | For the Periods Ended December 31, 2017 |

| | One Year | Five Year | Ten Year | Since Inception (Institutional Class) |

| Global Resources Fund - Investor Class | 19.57% | -6.99% | -6.11% | n/a |

| Global Resources Fund - Institutional Class (Inception 3/1/10) | 20.95% | -6.29% | n/a | -1.63% |

| S&P Global Natural Resources Index (Net Total Return) | 21.98% | 1.88% | -0.91% | 2.03% |

| S&P 500 Index | 21.83% | 15.79% | 8.50% | 14.17% |

| | Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. For all or a portion of the periods, the fund had expense limitations, without which returns would have been lower. Returns greater than one year are annualized. Gross expense ratio as stated in the most recent prospectus is 1.85% for the Investor Class and 5.41% for the Institutional Class. Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 1.90% for the Investor Class. Also pursuant to a voluntary agreement, the Adviser has agreed to waive all class specific expenses of the Institutional Class. The Adviser can modify or terminate these arrangements at any time. See Definitions for Management Teams’ Perspectives for index definitions. Please visit our website at www.usfunds.com for updated performance information for different time periods. | |

| Global Resources Fund | (unaudited) |

The Year in Review – Economic and Political Issues that Affected the Fund

The Bloomberg Commodity Index rose a meager 0.75 percent through the year 2017, posting its second consecutive annual advance since 2010. All major commodities rallied, with crude oil, copper and gold prices rallying 12, 31, and 13 percent respectively. Agricultural commodities lagged the spike in industrial commodities and dragged the Index lower. Corn production hit all-time highs in numerous high-production countries, resulting in increased global inventories, and depressed crop values.

The global manufacturing sector beat all expectations, and the year in review was marked by a steady upward trajectory in manufacturing activity across the globe. This was evidenced by JP Morgan’s Global Manufacturing PMI barometer, which steadily rose to an all-time high of 54.5 in December 2017. China’s manufacturing sector expanded at its fastest rate in four months in December. The Caixin-Markit manufacturing purchasing managers’ index rose to 51.5 in December. Eurozone manufacturers reported the strongest month on record—the manufacturing purchasing managers’ index for the eurozone as a whole came in at 60.6 in December, its strongest level since the survey began in mid-1997.

Crude oil’s advance was driven by the extension of self-imposed production caps by Organization of Petroleum Exporting Countries (OPEC) members. An increase in demand by developed countries, led by the U.S., resulted in substantially tighter inventory builds earlier in the year, and was replaced by a lengthy destocking period which ran into year end. For many market analysts, the global crude oil market is showing signs of being balanced for the first time since 2013.

The base metals complex, highly susceptible to manufacturing activity globally, rallied as Chinese imports of metals hit new records. Copper, nickel and zinc posted double-digit returns in 2017, a reflection of unexpected record demand for the metals. In addition, markets reacted to a number of supply cuts, mainly in the zinc market, and supply disruptions in the copper and nickel markets, which supported stronger pricing. The metals closed the year near 52-week highs on speculation that a “reflation” trade led by President-elect Trump could drive a demand boost from the metals-intensive infrastructure sector.

Gold rose for a second consecutive year in 2017, posting its best annual rise since 2010. Despite further interest rate increments arising from the Federal Reserve tightening cycle, the U.S. dollar posted its worst year since 2003, dropping nearly 10 percent. The weaker dollar and stronger industrial commodities have resulted in appreciating emerging market currencies which have boosted demand for physical gold.

Investment Highlights

Overview

For the year ended December 31, 2017, the Investor Class of the Global Resources Fund rose 19.57 percent and the Institutional Class rose 20.95 percent, trailing the fund’s benchmark, the S&P Global Natural Resources Index (Net Total Return), which rose 21.98 percent.

The fund employed a defensive investment position targeting value-driven opportunities with lower-than-average beta. However, to maintain varying degrees of investment exposure to the commodities market, the fund utilized a number of rolling call option positions to hedge the fund’s benchmark risks and provide optionality to upswings in commodities stocks. The options hedging model was highly successful in 2017, and provided upside protection for the fund.

Because the fund is actively managed and holding period is generally not a consideration in investment decisions, the portfolio turnover rate may fluctuate from year to year as the fund adjusts its portfolio composition. The fund’s annual portfolio turnover was, and is expected to continue to be, more than 100 percent.

Strengths

| ● | Commodities posted a third consecutive year of inflows in 2017 as global growth accelerated. Exchange-traded funds (ETFs) linked to raw materials attracted $9 billion dollars, capping a third straight annual inflow, the longest since 2010. Goldman Sachs analysts said the outlook is brighter over the next year, as they predict the sector will post a 7.5 percent return. |

| Global Resources Fund | (unaudited) |

| ● | The fund’s overweight in renewable energy, paper and forest, as well as its underweight in oil services and agricultural products stocks, had a positive contribution to the fund in excess of its benchmark. |

| ● | The fund had superior stock selection in the renewable energy, paper and forest, agricultural products and chemicals sectors. The best performing stocks were SolarEdge Technologies, Daqo New Energy and CVR Refining. |

Weaknesses

| ● | The Bloomberg Commodity Index, a measure of a basket of commodities, ended the year up a meager 0.75 percent, dragged lower by agricultural commodities, which lagged the spike in industrial and precious metals. Corn production hit all-time highs in numerous high-production countries, resulting in increased global inventories, and depressed crop values. |

| ● | The fund’s overweight in precious metals and consumer stocks, as well as its underweight in base and industrial metals stocks, had a negative contribution to the fund relative to its benchmark. |

| ● | The fund had inferior stock selection in the base and industrial metals sector and the oil and gas exploration and development sectors. The worst performing stocks were Pentanova Energy, Mandalay Resources and Siemens Gamesa Renewable Energy. |

Current Outlook

Opportunities

| ● | A major and extended 10-year bull market run in commodity prices may be in the cards, beginning in 2018, says Shawn Hackett, president of Hackett Financial Advisors. The Standard & Poor’s GSCI Total Return Index, which tracks 24 raw materials, is hovering near a record low valuation relative to the S&P 500 Index. According to Hackett, stocks were a screaming buy at the end of 2008 based on the same metric. Tis time the inverse is true, and the same metric is flashing a screaming buy for raw materials. |

| ● | Oil prices rose to their highest since 2015 after OPEC extended its production curbs into 2018; U.S. crude inventories continued to drop, even after the seasonal destocking period ended; and Saudi fiscal authorities revealed they expect prices to rise to $75 per barrel over the next five years. |

| ● | Precious metals prices rallied as the U.S. dollar extended its loss. Gold posted its best rally since October as macro analysts suggest the U.S. may see higher-than-expected inflation in 2018 as a result of the enactment of the tax overhaul, and see the potential for a major infrastructure plan funded using fiscal stimulus. |

Threats

| ● | Hopes of a spring bounce in Chinese commodity demand are becoming less clear, reports Bloomberg. China growth and commodities bulls aren’t hearing what they want from some members of the macro elite in Beijing, with two People’s Bank of China (PBOC) members and a party official talking down expectations for gross domestic product (GDP) growth. Fears of overleveraging, municipal bankruptcies and advocating for slower growth to ease debt and environmental burdens, are the reasons cited by the aforementioned macro elite members. |

| ● | China’s commitment to renewable energy, pollution control and environmental policy has weakened the dependence of the world’s largest consumer of commodities from raw materials producers. At the forefront of China’s environmental push are electric vehicles. The Asian nation will extend a tax rebate on purchases of these vehicles until the end of 2020, away from the traditional internal combustion engine. Similarly, policy-makers have shunned polluting steel mills and forced early closures, while imports of lower quality raw copper have also been suspended. |

| Global Resources Fund | (unaudited) |

| ● | The restoring of pipeline capacity, which caused supply disruptions into yearend, poses a challenge to the recent crude oil rally. The Forties pipeline in the U.K. is nearing full service following an unexpected shutdown. Similarly, the explosion at a Lybian pipeline, which affected nearly 1 million barrels a day of production, is expected to be restored to full capacity in the first weeks of 2018. |

The section labeled Portfolio of Investments contains a complete list of the fund’s holdings.

| Top 10 Equity Holdings (Based on Net Assets) | December 31, 2017 | |

| | Pacific Infrastructure, Inc. | 7.15% | |

| | Real Estate Operating/Development | | |

| | Daqo New Energy Corp., ADR | 2.36% | |

| | Chemicals - Specialty | | |

| | St Barbara, Ltd. | 1.93% | |

| | Gold Mining | | |

| | PentaNova Energy Corp. | 1.91% | |

| | Oil Companies - Exploration & Production | | |

| | CVR Refining LP | 1.87% | |

| | Oil Refining & Marketing | | |

| | Beach Energy, Ltd. | 1.79% | |

| | Oil Companies - Exploration & Production | | |

| | Rayonier Advanced Materials, Inc. | 1.77% | |

| | Chemicals - Fibers | | |

| | Northern Star Resources, Ltd. | 1.74% | |

| | Gold Mining | | |

| | Sandfire Resources NL | 1.58% | |

| | Metal - Diversified | | |

| | Teck Resources, Ltd. | 1.57% | |

| | Diversified Minerals | | |

| | Total Top 10 Equity Holdings | 23.67% | |

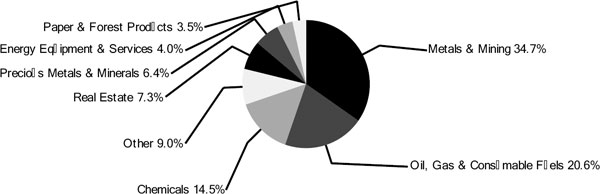

| Global Resources Fund | (unaudited) |

Portfolio Allocation by Industry Sector* Based on Total Investments | December 31, 2017 |

|

| * | Summary information above may differ from the portfolio schedule included in the financial statements due to the use of different classifications of securities for presentation purposes. |

| Precious Metals and Minerals Funds | (unaudited) |

Management Team's Perspective

Introduction

The World Precious Minerals Fund (UNWPX and UNWIX) and the Gold and Precious Metals Fund (USERX) pursue an objective of long-term capital growth through investments in gold, precious metals and mining companies. The World Precious Minerals Fund focuses on equity securities of companies principally engaged in the exploration, mining and processing of precious minerals such as gold, silver, platinum and diamonds. Although this fund has the latitude to invest in a broad range of precious minerals, it currently remains focused on the gold sector. The Gold and Precious Metals Fund focuses on the equity securities of established gold and precious metals companies and pursues current income as a secondary objective.

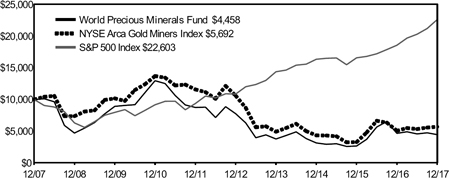

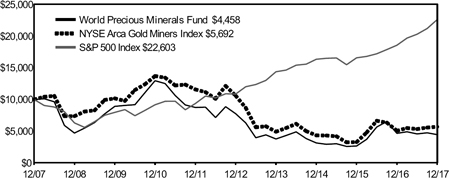

World Precious Minerals Fund | |

| | |

| |

| | |

| Average Annual Performance | For the Periods Ended December 31, 2017 | |

| | One Year | Five Year | Ten Year | Since Inception (Institutional Class) | |

| World Precious Minerals Fund - Investor Class | -4.16% | -10.49% | -7.76% | n/a | |

| World Precious Minerals Fund - Institutional Class (Inception 3/1/10) | -3.71% | -10.06% | n/a | -7.97% | |

| NYSE Arca Gold Miners Index | 12.47% | -11.69% | -5.48% | -6.76% | |

| S&P 500 Index | 21.83% | 15.79% | 8.50% | 14.17% | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. For all or a portion of the periods, the fund had expense limitations, without which returns would have been lower. Returns greater than one year are annualized. Gross expense ratio as stated in the most recent prospectus is 2.10% for the Investor Class and 2.71% for the Institutional Class. Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 1.90%. Also pursuant to a voluntary agreement, the Adviser has agreed to waive all class specific expenses of the Institutional Class. The Adviser can modify or terminate these arrangements at any time. See Definitions for Management Teams’ Perspectives for index definitions. Please visit our website at www.usfunds.com for updated performance information for different time periods. | |

| Precious Metals and Minerals Funds | (unaudited) |

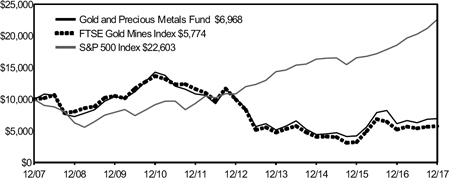

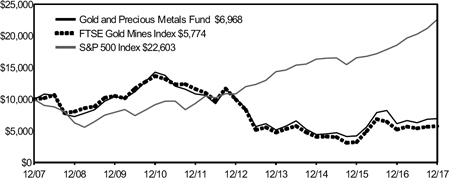

| Gold and Precious Metals Fund | |

| | |

| |

| | |

| Average Annual Performance | For the Periods Ended December 31, 2017 | |

| | One Year | Five Year | Ten Year | |

| Gold and Precious Metals Fund | 13.07% | -7.27% | -3.55% | |

| FTSE Gold Mines Index | 10.23% | -10.40% | -5.34% | |

| S&P 500 Index | 21.83% | 15.79% | 8.50% | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. For all or a portion of the periods, the fund had expense limitations, without which returns would have been lower. Returns greater than one year are annualized. Gross expense ratio as stated in the most recent prospectus is 1.86%. Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 1.90%. The Adviser can modify or terminate this arrangement at any time. See Definitions for Management Teams’ Perspectives for index definitions. Please visit our website at www.usfunds.com for updated performance information for different time periods. | |

The Year in Review - Economic and Political Issues that Affected the Funds

Gold started 2017 strong despite the prospect of further interest rate hikes. Following the Federal Reserve’s 25 basis point rate hike in March, gold bounced over $20 the next day, reflecting that the decision was already baked into the price. Fed Chair Janet Yellen said the central bank intends to keep its monetary policy accommodative for “some time.” Gold rose 8.43 percent in the first quarter quarter, its best performance in a year.

China’s purchase of bullion bars in the first half of the year rose 51 percent. June imports of gold in India more than doubled compared to the same month last year, as consumers rushed to act before the country’s new tax law went into effect. Demand rose to 72 metric tons in June, up from 31.8 tons a year earlier. Sberbank, Russia’s largest bank, looked to finance the direct import of gold to India, according to Aleksei Kechko, managing director of the company’s Indian subsidiary. India is the world’s second largest importer of gold, and a direct trade between India and Russia would be beneficial to both countries. Russian officials have already signaled their desire to conduct transactions with BRICS nations (Brazil, Russia, India, China and South Africa) using gold, writes Russia Insider.

| Precious Metals and Minerals Funds | (unaudited) |

Amid unease over a congressional hearing on possible links between Russia and the Trump campaign, holdings in the world’s largest gold-backed ETF climbed to their highest-ever level in 2017 on the back of safe haven demand. In the two weeks through the end of May, hedge funds and other large speculators boosted their bullish bets on the precious metal 37 percent, the most since 2007, according to government data.

Perhaps the biggest gold miner story of the second quarter of 2017 was the reorganization of the index methodology for the VanEck Vectors Junior Gold Miners ETF (GDXJ). The ETF’s holdings in many of the junior names were approaching 20 percent of the outstanding shares, so their index group chose to downsize weightings in existing holdings by about 50 percent and reinvest the proceeds in more larger mid-tiered gold producers. This triggered a wave of price weakness throughout the junior gold stocks universe as much as $3 billion dollars of the $5.5 billion fund was projected to be sold in the June rebalancing and depressed values for the junior miners for much of the year.

North Korea fired a ballistic missile over Japan in August, sending gold to its highest level for the year. Gold bullion finished the third quarter up 3.11 percent after giving up about half of its quarterly gains as we entered September. This was led by 12 weeks of bullish outlook surveys of traders on bullion, but they turned somewhat pessimistic as President Trump began actively pushing his tax overhaul plan. This in turn led to somewhat of a pick-up in the value of the U.S. dollar as it hit 11-month lows. The gold price responded negatively to Fed officials’ announcement that the central bank would begin unwinding its $4.5 trillion balance sheet as soon as October and also signaled additional rate hikes in 2018 following a December hike.

2017 was the second year in a row that policy changes in India strained gold sales. Consumption was seen between 650 and 750 metric tons, compared to the annual average of around 850 tons in the previous half decade. The Indian government’s push to boost financial transparency cut consumption this year as they enacted a new consumer tax system. Gold prices in India were at their widest discount to international prices in 11 months.

The weakness of the dollar was a positive driver of the price, helping gold close the year up 13.09 percent. Nevertheless, traders were still reluctant to bet against gold even with impending tax cuts and rate hikes, thought to be negative for the yellow metal. Gold counter-intuitively rallied the last five times the Fed raised interest rates, leading some to believe gold had no reason not to rally again. Ray Dalio, manager of the world’s largest hedge fund at Bridgewater Associates, recommended that investors place 5 to 10 percent of their assets in gold. Dalio stated that given current geopolitical risks and the loss of faith in the effectiveness of our political processes, it would make sense to have a portion of a portfolio in gold as a hedge.

Investment Highlights

For the year ended December 31, 2017, the World Precious Minerals Fund Investor Class lost 4.16 percent and the Institutional Class fell 3.71 percent. The fund’s benchmark, the NYSE Arca Gold Miners Index, gained 12.47 percent on a total return basis.

The strategy of the World Precious Minerals Fund favors junior exploration and development stocks and mid-tiered producing stocks. These lower-capitalization stocks have historically outperformed senior gold mining companies over longer periods, as senior gold miners have typically acquired proven assets of junior gold companies rather than explored for new mining projects with capital-constrained budgets. The VanEck Vectors Junior Gold Miners ETF (GDXJ) down-weighting of the junior mining stocks at mid-year depressed the values of many of the stocks we held.

The Gold and Precious Metals Fund gained 13.07 percent for the year, outperforming its benchmark, the FTSE Gold Mines Index, which rose 10.23 percent on a total return basis. While focusing on established, gold-producing companies, the Gold and Precious Metals Fund holds a higher weighting of mid-tier stocks compared to its benchmark.

Both funds employed a defensive investment position from time to time in the past year with higher-than- average cash balances on hand to protect the liquidity of the funds. However, to maintain varying degrees of investment exposure to the gold market, the funds utilized some call options positions and directional ETFs, which are more liquid than options, to hedge the funds’ benchmark risks and provide optionality to upswings in gold stocks.

| Precious Metals and Minerals Funds | (unaudited) |

In addition to the rise in gold, silver finished the year up 6.42 percent, platinum only 2.99 percent. Palladium ended the year strongest with a gain of 50.25 percent, primarily driven by strong auto sales and greater need for pollution reduction, particularly in China.

Strengths

| ● | Kirkland Lake Gold became our largest position over the course of the year and was the best contributor to returns of our Gold and Precious Metals Fund (USERX), with a 195 percent return. Avoiding Barrick Gold in the World Precious Minerals Fund (UNWPX), relative to its large weighting in the fund’s benchmark, was the biggest positive contributor, as Barrick finished the year down 9 percent. |

| ● | St. Barbara was the second best dollar gainer for USERX, with a 107 percent gain. The second best contributor to UNWPX was Novo Resources, with a 579 percent gain for the year. The market took a serious interest in Novo’s large gold nugget conglomerate discovery in Northwestern Australia. |

| ● | The third best contributor to UNWPX was Cardinal Resources, which gained 141 percent in 2017. For USERX, our choice not to own Barrick Gold had the third highest attribution effect to fund performance relative to our benchmark. |

Weaknesses

| ● | For both gold oriented funds, Klondex Mines was our worst dollar contributor, with shares falling 44 percent over the year. Klondex had purchased the True North Mine in Canada, out of receivership and the Hollister Mine from private holders in the past year. Essentially, guidance for the ramp up of the two operations, particularly True North, was too optimistic over the course of the year with poor communication from its public relations firm. After the end of the year, Klondex announced it would put True North on care and maintenance, and the PR firm was terminated. We expect to see the share price make up lost ground in 2018. |

| ● | Jaguar Mining was the second biggest dollar detractor for USERX with the share price down 36 percent for the year. Barsele Minerals, down 30 percent, was the second largest dollar detractor for UNWPX. |

| ● | Comstock Mining was the third largest detractor for USERX, sliding 70 percent over the course of the year, while UNWPX missed not owning Franco-Nevada, which gained 36 percent in 2017. |

Current Outlook

Opportunities

| ● | China is preparing to launch a crude oil futures contract denominated in Chinese yuan and convertible into gold, the Nikkei Asian Review reports. This could potentially create the most important Asian oil benchmark and allow oil exporters to bypass the U.S.-dollar denominated benchmarks by trading in yuan. To make the yuan-denominated contract more attractive, China plans the yuan to be fully convertible in gold on the Shanghai and Hong Kong exchanges. |

| ● | Gold miners have cut costs but trade at a fraction of peak valuations, reports Bloomberg Intelligence. Since peak levels in 2008, gold-miner valuations have fallen over 50 percent based on enterprise value-to-reserves and resources. Miners have cut staff, focused on shrinking debt and are using new technology to garner cost efficiencies. Valuations don’t yet reflect these efforts. So do the miners see the value opportunity? Yes. In fact, the Canadian Imperial Bank of Commerce (CIBC) reports that gold miners invested around $290 million in exploration companies during the first six months of 2017, the highest level recorded in the past decade. In addition, nearly half of equity raised by junior gold stocks on the Toronto Stock Exchange (TSX) last year were through direct investments—no previous year had exceeded 20 percent, the CIBC continues. |

| Precious Metals and Minerals Funds | (unaudited) |

| ● | INK Research on gold stock sentiment was approaching a two-year high of 361 percent despite the growing popularity of bitcoin and digital currencies. The research showed insiders of gold mining companies were buying the gold stock dip as the year closed out, betting that gold could compete with cryptocurrencies as a form of insurance against unforeseen, negative market-moving events. Insiders buying stock in their own company generally is seen as a good sign to investors. In addition, the ratio of the S&P 500 Index relative to gold shows that gold is trading at a ratio of 0.50. The implication is that stocks, with record valuation levels, are expensive relative to gold. |

Threats

| ● | The world’s 20 leading gold producers’ share of metal output is expected to fall to its lowest level in a decade in 2019, according to Bloomberg industry analyst Eily Ong. The mining group’s share of world output fell from 47 percent in 2010 to 39 percent in 2016, and it could fall even further by 2019. As gold producers’ focus shifts from volume to profitable ounces, their existing gold mines’ life expectancies have also declined. With few deals completed in 2017 and negative investor relations, the total value of mining deals involving North American companies is $3.7 billion, down 40 percent from the same time in 2016. Possible explanations for the lack of deals may center on displeasure with results of transactions in prior years. |

| ● | Gold consumption in the world’s second biggest importer, India, was on track to hit a seven-year low in 2017 after tax and regulatory changes dampened demand, according to the World Gold Council (WGC). Factors hampering demand included increased purity standard, a revised anti-money laundering act and an uneven monsoon season that hurt income. |