As filed with the Securities and Exchange Commission on March 07, 2016

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-01800

U.S. GLOBAL INVESTORS FUNDS

Three Canal Plaza, Suite 600

Portland, Maine 04101

Jessica Chase, Principal Executive Officer

Three Canal Plaza, Suite 600

Portland, Maine 04101

207-347-2000

Date of fiscal year end: December 31

Date of reporting period: January 1, 2015 – December 31, 2015

ITEM 1. REPORT TO STOCKHOLDERS.

U.S. Global Investors Funds Annual Report

December 31, 2015

U.S. Global Investors Fund

Annual Report

December 31, 2015

Table of Contents

Letter to Shareholders | 1 |

Definitions for Management Teams' Perspectives | 10 |

Management Team's Perspective | 12 |

Portfolios of Investments | 52 |

Notes to Portfolios of Investments | 108 |

Statements of Assets and Liabilities | 120 |

Statements of Operations | 124 |

Statements of Changes in Net Assets | 128 |

Notes to Financial Statements | 134 |

Financial Highlights | 151 |

Report of Independent Registered Public Accounting Firm | 162 |

Trustees and Officers | 163 |

Additional Information | 166 |

Expense Example | 175 |

Nasdaq Symbols

U.S. Global Investors Funds

Investor Class | |

U.S. Government Securities Ultra-Short Bond Fund | UGSDX |

Near-Term Tax Free Fund | NEARX |

All American Equity Fund | GBTFX |

Holmes Macro Trends Fund | MEGAX |

Global Resources Fund | PSPFX |

World Precious Minerals Fund | UNWPX |

Gold and Precious Metals Fund | USERX |

Emerging Europe Fund | EUROX |

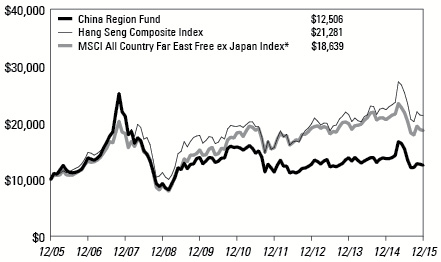

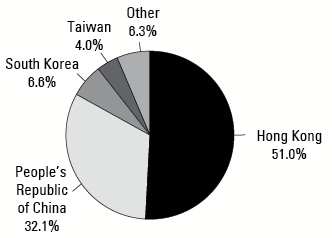

China Region Fund | USCOX |

| | |

Institutional Class | |

Global Resources Fund | PIPFX |

World Precious Minerals Fund | UNWIX |

Gold and Precious Metals Fund* | USEIX |

Emerging Europe Fund* | EURIX |

* | The Institutional Class shares of the Gold and Precious Metals and Emerging Europe Funds have not commenced operations and currently are closed to investors. A notice will be issued when each class commences operations and opens to investors. |

| Fund Services, LLC

PO Box 701

Milwaukee, WI

53201-0701

Tel 1.800.US.FUNDS

www.usfunds.com |

U.S. Global Investors Funds | (unaudited) |

Dear Fellow Shareholder, |

|

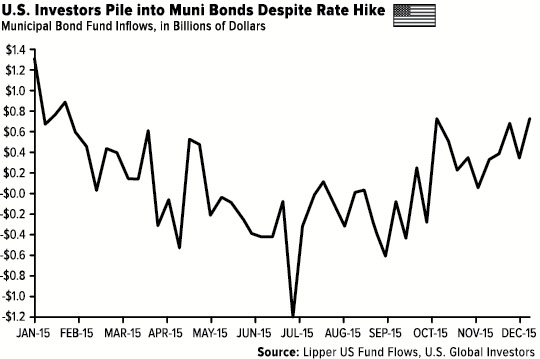

After much anticipation, the Federal Reserve finally made easy money a little less easy by lifting interest rates in mid-December. It was the first rate hike in nearly a decade.

Over the last few years, many investors, seeking higher yields, had entered riskier investments—corporate junk bonds among them. Because they carry a higher default risk than investment-grade bonds, junk bonds offer higher yields.

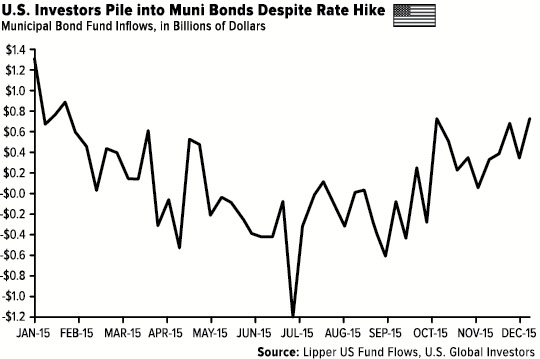

But with default rates and liquidity risks beginning to spike in late 2015, and faced with the implications of higher interest rates, many investors turned to investment-grade, short-term municipal bonds. Bond prices move in the opposite direction of interest rates, but shorter-term munis are less sensitive to rate fluctuations than longer-term bonds.

As a result, muni inflows in December came at the fastest pace of the year since January 2015.

Our Near-Term Tax Free Fund (NEARX), which invests mostly in high-quality munis, ended the year up 1.45 percent, the 21st straight year it has had a positive return. Out of more than 31,000 equity and bond funds, only 39 have had 21 consecutive years of positive annual returns, according to Morningstar data. NEARX is one of those 39.

This is a rare achievement indeed, one we’re especially proud of, and we’re committed to continuing the tradition this year and in the years to come.

1

U.S. Global Investors Funds | (unaudited) |

More significant than the rate hike, however, is the $1.1 trillion deal that Congress voted on, and President Barack Obama signed, in December. The deal includes $680 billion in tax cuts for small businesses over the next decade, which should help accelerate the velocity of money and lead to the creation of jobs.

Equities and Commodities Pressured by Strong U.S. Dollar

If you follow seasonal trading patterns, you might be aware that pre-election years have historically been the best performers in the four-year presidential election cycle. This is a phenomenon first described by Yale Hirsch, founder of the Stock Trader’s Almanac, which is now edited by his son Jeffrey. In pre-election years starting in 1833, annual gains in the Dow Jones Industrial Average averaged over 10 percent, topping the other three years. Not since 1939, when German tanks were rolling into Poland, has a pre-election year ended down.

And yet that’s precisely what happened in 2015, with the Dow Jones declining 2.23 percent. Excluding dividends, the S&P 500 Index fell 0.73 percent for the year. (With dividends reinvested, the index finished with a small gain of 1.38 percent.)

Indeed, 2015 will be remembered as the most challenging year for markets since the 2008 financial crisis.

2

U.S. Global Investors Funds | (unaudited) |

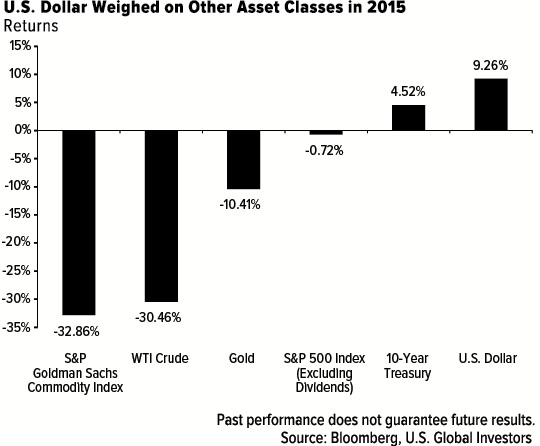

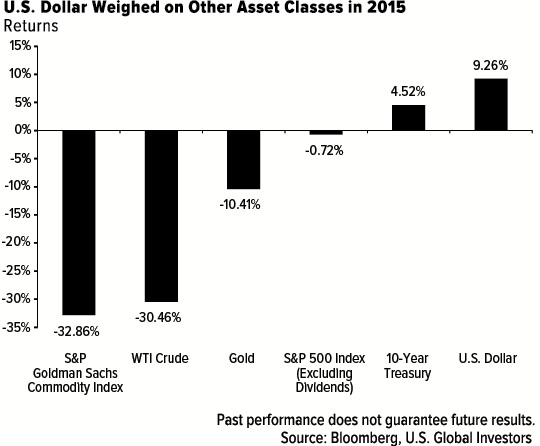

The U.S. dollar extended one of its strongest rallies in 30 years, putting pressure on American exports and global commodities, many of which are priced in dollars.

Commodities were hit especially hard, as you can see below. Year after year, the Periodic Table of Commodity Returns continues to be one of our most popular pieces. You can find the full-color, high-resolution version on our website, www.usfunds.com.

The widely-used S&P Goldman Sachs Commodity Index (GSCI) fell more than 32 percent in 2015, its fourth-largest annual loss since 1970. Of the 24 commodities in the index, only cocoa and cotton ended with a gain. All components were losers, with precious metals as a group losing 11 percent; grains, 19 percent; industrial metals, 24 percent; and energy, 41 percent. Energy and oil and gas companies were among the worst performers in the S&P 500.

3

U.S. Global Investors Funds | (unaudited) |

Among the strongest headwinds facing oil in 2015 was oversupply. Although many American producers significantly cut operations, the Organization of Petroleum Exporting Countries (OPEC), responsible for generating about 40 percent of the world’s oil, chose to maintain its production level of 30 million barrels per day.

While lower oil prices hurt explorers and refiners, the biggest winners were consumers, shipping companies and airlines. According to Credit Suisse, carriers retained between 50 and 75 percent of windfalls from lower fuel costs. This is largely the reason the International Air Transport Association (IATA) predicts the global airlines industry to post a record $33 billion in net profits in 2015.

In a Frank Talk from December 2014, I called the drop in oil prices the “$330 Billion Global Tax Break.” Today, low fuel costs are still helping businesses and consumers save billions.

China Shifts Gears Toward Domestic Consumption

Global growth stalled in 2015, with much of the slowdown led by China, the world’s second-largest economy.

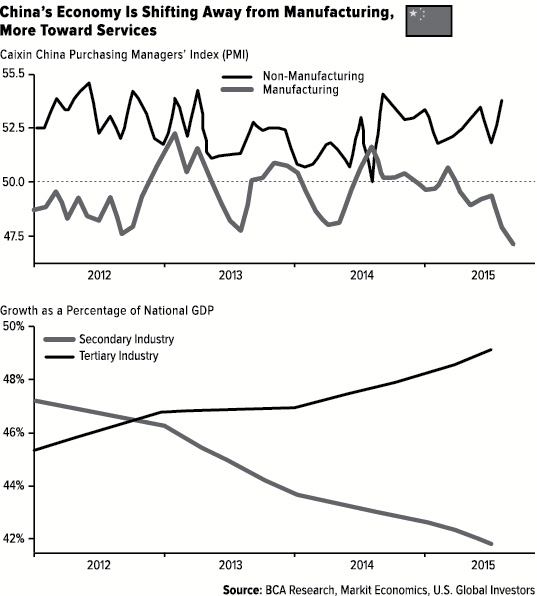

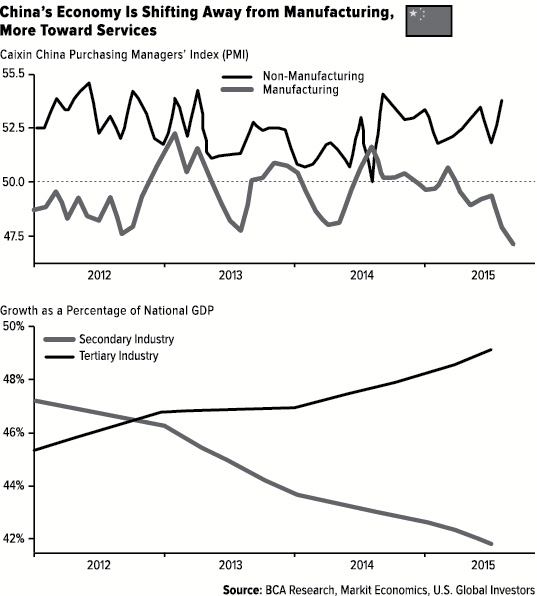

However, as I mentioned in a Frank Talk in August, China’s economy isn’t weakening so much as it’s changing.

For one, the size of China’s middle class overtook the U.S. for the first time in 2015—109 million Chinese compared to 92 million Americans. This is significant for domestic consumption and very important for the country’s airline industry. According to the World Tourism Organization, Chinese tourists are the top spenders in the world—they spent $165 billion abroad in 2014—and now that visa policy has been relaxed between China and the U.S., we should expect to see more Chinese business and leisure travelers arriving in America.

The chart below, courtesy of BCA Research, clearly shows that the Asian giant has begun to shift away from manufacturing (secondary industry) and more toward consumption and the service industries (tertiary industry).

4

U.S. Global Investors Funds | (unaudited) |

5

U.S. Global Investors Funds | (unaudited) |

China’s manufacturing sector, as expressed by its purchasing manager’s index (PMI), contracted in all but one month in 2015. I’ve said several times before that China is the 800-pound commodities gorilla, consuming biblical amounts of nickel, copper, zinc, steel and aluminum, and the PMI is the leading indicator of this activity.

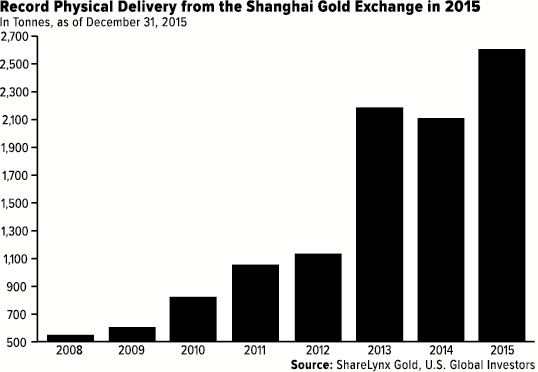

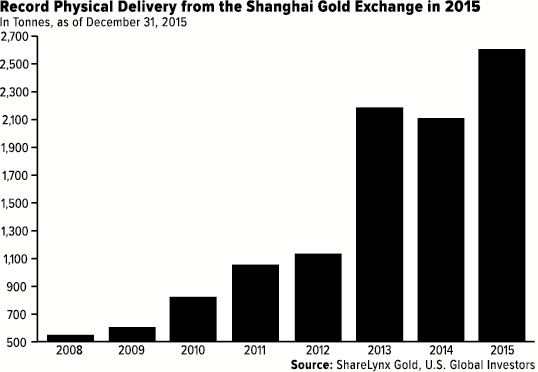

But even as demand for these metals cooled, retail demand for gold in China was exceptionally strong. In 2015, a record 2,596 tonnes of the yellow metal, or 80 percent of total global output for the year, were delivered from the Shanghai Gold Exchange.

Gold purchased by the People’s Bank of China were also up. The central bank reported adding 19 more tonnes in December, bringing its total amount held in reserves to over 1,762 tonnes.

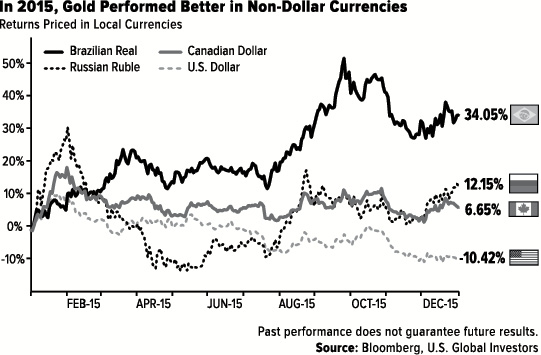

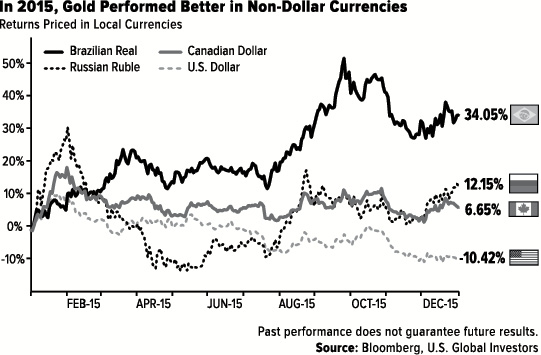

In the U.S., gold ended the year down 10.42 percent, its third straight negative year, but in many non-dollar economies, buyers actually saw either a steady or even rising gold price. The metal was up in Brazil, Russia, Canada and many countries around the globe. There’s always a bull market somewhere.

6

U.S. Global Investors Funds | (unaudited) |

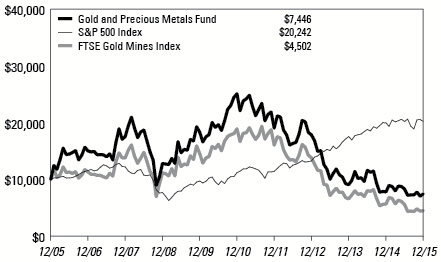

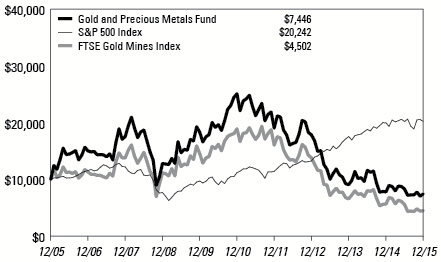

Despite the challenging environment, our Gold and Precious Metals Fund (USERX), expertly managed by Ralph Aldis, ended the year down only 4.78 percent, beating both gold bullion and its benchmark, the FTSE Gold Mines Index, which lost 20.47 percent.

Trans-Pacific Partnership Expected to Eliminate 18,000 Global Tariffs

In the past few years, fiscal drag has intensified as more and more regulations and taxes have impeded progress that not even cheap money can offset. A 2014 report by the National Association of Manufacturers (NAM) revealed that federal regulations in the U.S. alone cost businesses more than $2 trillion a year.

To ignite growth, G20 nations should commit themselves to cutting red tape.

That’s precisely what the Trans-Pacific Partnership (TPP) promises to do.

After nearly seven years of negotiations, representatives from 12 Pacific Rim nations, including the U.S. and Canada, signed the TPP trade pact in early October. Once in effect, it will deliver unprecedented free and fair global trade among the participating nations. As many as 18,000 tariffs are expected to be eliminated. The TPP will remove barriers to foreign investment, streamline customs procedures and create an international investor-state dispute settlement (ISDS) system, among much more.

7

U.S. Global Investors Funds | (unaudited) |

Today, the 12 members control more than a quarter of all global trade. But once the TPP goes live, that percentage could climb to as high as 50 percent, according to CLSA (Credit Lyonnais Securities Asia).

The trade pact couldn’t have come at a better time. As I said, global growth is slowing, and mounting tariffs threaten to suffocate trade ever further. Even though the TPP’s full implementation is some time ahead of us, it’s encouraging to know that positive change is on the way. The world has needed such an agreement for years now to bring unilateral trade liberalization into the 21st century.

For in-depth analysis of gold, energy, emerging markets and more, subscribe to our award-winning newsletter, the Investor Alert, and my personal CEO blog, Frank Talk by visiting www.usfunds.com.

Thank you for your continued trust and confidence in U.S. Global Investors. We wish you and your family good health and prosperity in 2016.

Sincerely,

Frank E. Holmes

CEO and Chief Investment Officer

U.S. Global Investors, Inc.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors, Inc. is the investment adviser.

Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in these sectors.

Though the Near-Term Tax Free Fund seeks minimal fluctuations in share price, it is subject to the risk that the credit quality of a portfolio holding could decline, as well as risk related to changes in the economic conditions of a state, region or issuer. These risks could cause the fund’s share price to decline. Tax-exempt income is federal income tax free. A portion of this income may be subject to state and local taxes and at times the alternative minimum tax. The Near-Term Tax Free Fund may invest up to 20% of its assets in securities that pay taxable interest. Income or fund distributions attributable to capital gains are usually subject to both state and federal income taxes.

8

U.S. Global Investors Funds | (unaudited) |

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The S&P GSCI Total Return Index in USD is widely recognized as the leading measure of general commodity price movements and inflation in the world economy. Index is calculated primarily on a world production weighted basis, comprised of the principal physical commodities futures contracts. The FTSE Gold Mines Index Series encompasses all gold mining companies that have a sustainable and attributable gold production of at least 300,000 ounces a year, and that derive 75% or more of their revenue from mined gold.

The Caixin China Manufacturing PMI is a composite indicator designed to provide an overall view of activity in the manufacturing sector and acts as a leading indicator for the whole economy. When the PMI is below 50.0 this indicates that the manufacturing economy is declining and a value above 50.0 indicates an expansion of the manufacturing economy.

The sections labeled Portfolio of Investments contain complete lists of the funds’ holdings.

There is no guarantee that the issuers of any securities will declare dividends in the future or that, if declared, will remain at current levels or increase over time.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

9

Definitions for Management Teams’ Perspectives | (unaudited) |

Benchmark Index Definitions

Returns for indices reflect no deduction for fees, expenses or taxes, unless noted.

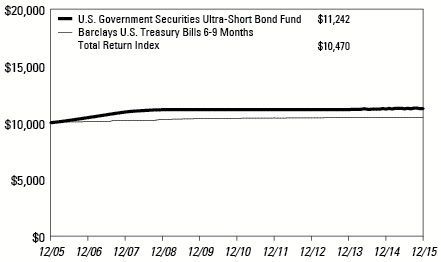

The Barclays U.S. Treasury Bills 6-9 Months Total Return Index tracks the performance of U.S. Treasury Bills with a maturity of six to nine months.

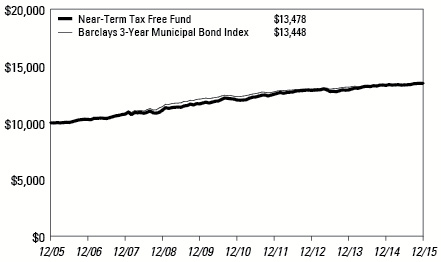

The Barclays 3-Year Municipal Bond Index is a total return benchmark designed for municipal assets. The index includes bonds with a minimum credit rating of BAA3, are issued as part of a deal of at least $50 million, have an amount outstanding of at least $5 million and have a maturity of two to four years.

The FTSE Gold Mines Index encompasses all gold mining companies that have a sustainable and attributable gold production of at least 300,000 ounces a year and that derive 75% or more of their revenue from mined gold.

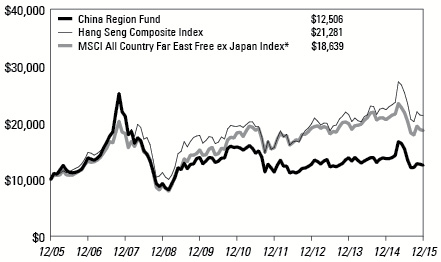

The Hang Seng Composite Index is a market-capitalization weighted index that covers about 95% of the total market capitalization of companies listed on the Main Board of the Hong Kong Stock Exchange.

The MSCI Emerging Markets Europe 10/40 Index (Net Total Return) is a free float-adjusted market capitalization index that is designed to measure equity performance in the emerging market countries of Europe (Czech Republic, Greece, Hungary, Poland, Russia and Turkey). The index is calculated on a net return basis (i.e., reflects the minimum possible dividend reinvestment after deduction of the maximum rate withholding tax). The index is periodically rebalanced relative to the constituents’ weights in the parent index.

The NYSE Arca Gold Miners Index is a modified market capitalization-weighted index comprised of publicly-traded companies involved primarily in the mining for gold and silver.

The S&P Global Natural Resources Index (Net Total Return) includes 90 of the largest publicly-traded companies in natural resources and commodities businesses that meet specific investability requirements, offering investors diversified, liquid and investable equity exposure across 3 primary commodity-related sectors: Agribusiness, Energy, and Metals & Mining. The index is calculated on a net return basis (i.e., reflects the minimum possible dividend reinvestment after deduction of the maximum rate withholding tax).

The S&P 500 Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

The S&P Composite 1500 Index is a broad-based capitalization-weighted index of 1500 U.S. companies and is comprised of the S&P 400, the S&P 500 and the S&P 600.

10

Definitions for Management Teams’ Perspectives | (unaudited) |

Other Index Definitions

The Baltic Dry Freight Index is an economic indicator that portrays an assessed price of moving major raw materials by sea as compiled by the London-based Baltic Exchange.

The Bloomberg Commodity Index is made up of 22 exchange-traded futures on physical commodities. The index represents 20 commodities, which are weighted to account for economic significance and market liquidity.

The Caixin China Manufacturing Purchasing Manager’s Index is a composite indicator designed to provide an overall view of activity in the manufacturing sector and acts as a leading indicator for the whole economy. When the PMI is below 50.0 this indicates that the manufacturing economy is declining and a value above 50.0 indicates an expansion of the manufacturing economy.

The MICEX Index is a capitalization-weighted composite index calculated based on the prices of the 50 most liquid Russian stocks of the largest and dynamically developing Russian issuers presented on the Moscow Exchange. The MICEX Index is calculated in real time and denominated by the Moscow Exchange in Russian rubles.

The MSCI All Country Far East Free ex Japan Index is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of the Far East, excluding Japan. The index consists of the following developed and emerging market country indices: China, Hong Kong, Indonesia, Korea, Malaysia, the Philippines, Singapore, Taiwan and Thailand.

The Purchasing Manager’s Index (PMI) is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment.

The Shanghai Composite Index is an index of all stocks that trade on the Shanghai Stock Exchange.

The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar.

11

U.S. Government Securities Ultra-Short Bond Fund | (unaudited) |

Management Team’s Perspective

Introduction

The U.S. Government Securities Ultra-Short Bond Fund (UGSDX) is designed to be used as an investment that takes advantage of the security of U.S. Government bonds and obligations, while simultaneously pursuing a higher level of current income than money market funds offer. The fund’s dollar-weighted average effective maturity is two years or less.

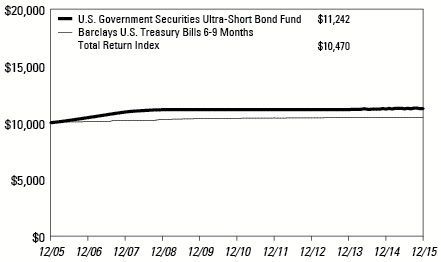

Performance Graph

U.S. Government Securities Ultra-Short Bond Fund | |

| |

Average Annual Performance | For the Years Ended

December 31, 2015 | |

| | One Year | Five Year | Ten Year | |

U.S. Government Securities Ultra-Short Bond Fund | 0.34% | 0.15% | 1.18% | |

Barclays U.S. Treasury Bills 6-9 Months Total Return Index | 0.15% | 0.15% | 0.46% | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. For all or a portion of the periods, the fund had expense limitations and reimbursements to maintain a minimum yield, without which returns would have been lower. The above returns for the U.S. Government Securities Ultra-Short Bond Fund include the fund’s results as a money market fund through the date of its conversion (December 20, 2013) to an ultra-short bond fund, and therefore are not representative of the fund’s results had it operated as an ultra-short bond fund for the full term of the periods shown. Gross expense ratio as stated in the most recent prospectus is 1.07%. Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 0.45%. The Adviser can modify or terminate this arrangement at any time. In addition, returns may include the effects of additional voluntary waivers of fees and reimbursements of expenses by the Adviser, including waivers and reimbursements to maintain a minimum net yield for the fund. See Definitions for Management Teams’ Perspectives for index definitions. Please visit our website at www.usfunds.com for updated performance information for different time periods. | |

12

U.S. Government Securities Ultra-Short Bond Fund | (unaudited) |

The Year in Review – Economic and Political Issues that Affected the Fund

2015 was a difficult year for most asset classes. U.S. stocks, led by the S&P 500 Index, ended slightly positive for the year. Excluding American securities, stocks and bonds posted negative returns in U.S. dollar terms due to a strengthening U.S. dollar and global growth concerns. Plain vanilla U.S. fixed-income was the best-performing asset class this year, led by municipal debt and intermediate (5- and 10-year) Treasuries. Riskier sectors, notably high-yield debt, underperformed this year as many energy borrowers came under financial stress due to the precipitous drop in energy prices. Global commodities and precious metals came under the most pressure this year, led by a slowdown in commodity consumption—most notably in China—resulting in a glut of oversupply. U.S. real estate investment trusts (REITs) turned in a better year of performance as the asset class benefited from robust industry demand and a benign rate environment. Yields for the one- and two-year bond maturities showed the greatest increase, primarily as a result of the anticipation of the Federal Reserve finally being able to increase interest rates at its December meeting. Yields for the 5-, 10- and 30-year maturities were up only slightly for the year.

The U.S. bond market barely budged in 2015 even as the labor market strengthened and the Fed raised interest rates for the first time in nearly a decade. The yield on the benchmark 10-year Treasury note settled at 2.27 percent at the last trading session of 2015, compared with 2.17 percent at the end of 2014. Many fund managers, rate strategists and bond traders at the beginning of 2015 had predicted that the yield would rise toward 3 percent by the end of 2015. The divergent path of interest rate policy between the U.S. and many other countries further complicated the growth and inflation outlook. A stronger dollar driven by higher interest rates in the U.S. hurt American exports and firms’ corporate earnings from overseas operations. That, along with a sharp decline in commodities prices, generated disinflationary pressures. Inflation ran persistently below targets set by central banks in the U.S., eurozone, U.K. and Japan.

Investment Highlights

The U.S. Government Securities Ultra-Short Bond Fund returned 0.34 percent for the year ended December 31, 2015, outperforming its benchmark, the Barclays U.S. Treasury Bills 6-9 Months Total Return Index, which returned 0.15 percent.

The fund extended its maturity profile toward the latter half of 2015 as interest rates on short-term agency securities moved higher in anticipation of the Fed’s rate hike. This allowed the fund to capture extra yield at a time of market stress.

13

U.S. Government Securities Ultra-Short Bond Fund | (unaudited) |

Current Outlook

The Fed’s move to finally lift off in 2015 after several false starts ushers in the next phase of the post-crisis policy response: normalization. Now that the Fed has achieved liftoff, the outlook for rates going forward is all about the pace of the hikes. The Fed promises a slow pace of normalization and data dependence rather than any sort of prescribed, consecutive meeting hikes as implied by past tightening cycles. However, such guidance of pace is forecast dependent and the Fed has a poor forecasting track record. Hence, the market is pricing a more benign pace of hikes in 2016 than the Fed’s “dots plot” indicates—two hikes next year versus the four implied in the Fed’s Statement of Economic Projections.

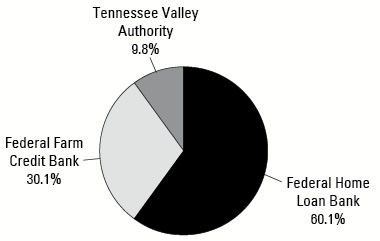

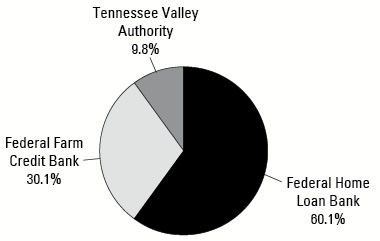

Portfolio Allocation by Issuer

Based on Total Investments | December 31, 2015 |

|

Portfolio Allocation by Maturity | | December 31, 2015 | |

6 – 12 Months | | $ | 12,030,722 | | | | 21.7 | % |

1 – 3 Years | | | 37,341,452 | | | | 67.5 | % |

3 – 5 Years | | | 5,963,586 | | | | 10.8 | % |

| | | $ | 55,335,760 | | | | 100.0 | % |

| | | | | | | | | |

14

Near-Term Tax Free Fund | (unaudited) |

Management Team’s Perspective

Introduction

The Near-Term Tax Free Fund (NEARX) seeks to provide a high level of current income exempt from federal income taxation and to preserve capital. However, a portion of any distribution may be subject to federal and/or state income taxes. The Near-Term Tax Free Fund will maintain a weighted average maturity of less than five years.

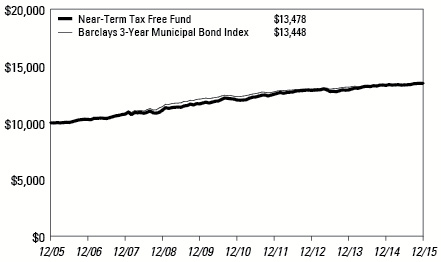

Performance Graph

Near-Term Tax Free Fund | |

| |

Average Annual Performance | For the Years Ended

December 31, 2015 | |

| | One Year | Five Year | Ten Year | |

Near-Term Tax Free Fund | 1.45% | 2.34% | 3.03% | |

Barclays 3-Year Municipal Bond Index | 1.18% | 1.81% | 3.01% | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. For all or a portion of the periods, the fund had expense limitations, without which returns would have been lower. Gross expense ratio as stated in the most recent prospectus is 1.08%. The Adviser has contractually agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 0.45% on an annualized basis through April 30, 2016. See Definitions for Management Teams’ Perspectives for index definitions. Please visit our website at www.usfunds.com for updated performance information for different time periods | |

15

Near-Term Tax Free Fund | (unaudited) |

The Year in Review – Economic and Political Issues that Affected the Fund

Avoiding the spread widening that plagued corporate bonds and the volatility that buffeted equities, the municipal bond market finished strong for the year with a 1.18 percent total return, according to the Barclays 3-Year Municipal Bond Index.

As the year began, there was ongoing speculation over when the U.S. Federal Reserve would initiate a cycle of rate hikes after several years of maintaining a zero interest rate policy. However, the Fed remained in a data‐dependent “wait and see” mode for almost the entire period, despite the overall modest upward progress of the U.S. economy. The Fed’s patient stance was supported by a strong dollar and the absence of upward pressures on U.S. inflation and wages, as well as a global backdrop of heightened macroeconomic and geopolitical uncertainty. In early 2015, the European Central Bank (ECB) began a program of sovereign bond purchases in an effort to avert deflation. The next several months in Europe were dominated by the threat of a Greek default and exit from the common currency. The Greek crisis was eventually displaced in global economic headlines by heightened concerns over slowing growth in China, which has for some time been the primary source of incremental demand for the global economy. The Chinese concerns were spotlighted in mid‐August by the government’s devaluation of the renminbi over three days, which raised fears of a global currency war. Against this backdrop, there was little upward pressure on interest rates, outside of some emerging markets impacted by currency weakness.

Municipal bonds faced an increasingly challenging supply backdrop, as issuance rose significantly at the beginning of 2015. From the standpoint of demand, flows into municipal mutual funds were positive for most of the year. Performance was generally strongest for longer‐maturity municipals, based on the incremental income they offered, despite rates moving slightly higher further out on the curve.

16

Near-Term Tax Free Fund | (unaudited) |

Puerto Rico was the biggest story of the year as it had its first technical default and is now months into legal negotiations on how to restructure its $70+ billion outstanding debt. Illinois continued to capture investor attention due to its lack of a budget and inability to successfully implement pension reform following a legal challenge. New Jersey also captured much of the negative spotlight as pension and other post-employment benefits liabilities continue to be hot button topics in the municipal bond market. Pennsylvania has also become a focus more recently, as a budgetary impasse has drawn attention to other existing pressures. Looking ahead and absent a turnaround or at least stabilization in oil prices, Alaska is also worth watching given its reliance on related tax revenue.

Investment Highlights

For the year ended December 31, 2015, the Near-Term Tax Free Fund returned 1.45 percent, outperforming its benchmark, the Barclays 3-Year Municipal Bond Index, which gained 1.18 percent.

The Near-Term Tax Free Fund remained true to form, with a low turnover approach and investing in traditional high-quality municipals. The fund has been able to outperform due to advantageous yield curve positioning.

Strengths

● | Buying opportunistically during multi-standard deviation moves in the municipal bond market and letting the yield advantage work in the fund’s favor over time has proven to be advantageous, as has the fund’s low turnover approach. |

● | The fund benefited from an overweight position in school district bonds. |

● | The fund benefited from significant exposure to Texas, which outperformed. |

Weaknesses

● | The fund was negatively impacted from exposure to New Jersey, which underperformed. |

● | The fund had very little exposure to the industrial development and airport revenue bonds that outperformed. |

● | The fund was hurt by its exposure to the shorter end of the yield curve, which underperformed the longer end. |

17

Near-Term Tax Free Fund | (unaudited) |

Current Outlook

Opportunities

● | Manageable supply, healthy demand and stable credit outlooks should aid U.S. municipal bond performance in 2016. The fund’s barbell positioning further out on the yield curve, coupled with very short-term investments, should continue to be a winning approach. |

Threats

● | Geopolitical concerns and rising interest rates may prove to be a headwind for the municipal market in 2016. |

18

Near-Term Tax Free Fund | (unaudited) |

Top 10 Area Concentrations

(Based on Net Assets) | December 31, 2015 |

Texas | 17.36% |

Florida | 7.36% |

Illinois | 6.36% |

New Jersey | 5.33% |

New York | 4.62% |

Louisiana | 4.53% |

California | 4.44% |

Washington | 3.28% |

Michigan | 3.15% |

Wisconsin | 3.12% |

Total Top 10 Areas | 59.55% |

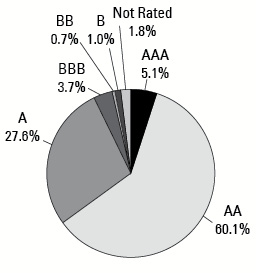

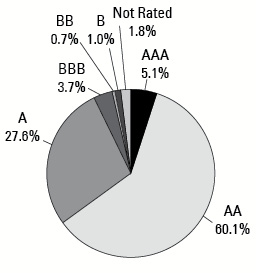

Municipal Bond Ratings*

Based on Total Municipal Bonds | December 31, 2015 |

|

* | Credit quality ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). “Not Rated” is used to classify securities for which a rating is not available. Credit-quality ratings for each issue are obtained from Moody’s and S&P, and the higher rating for each issue is used. |

19

All American Equity Fund & Holmes Macro Trends Fund | (unaudited) |

Management Team’s Perspective

Introduction

The principal objective of the All American Equity Fund (GBTFX) is to seek capital appreciation by investing primarily in a broadly diversified portfolio of domestic common stocks. The fund invests in large-capitalization stocks while retaining the flexibility to seek out promising individual stock opportunities, including stocks with meaningful dividend yields.

The Holmes Macro Trends Fund (MEGAX) invests in companies with good growth prospects and strong positive earnings momentum. The fund’s primary objective is to seek long-term capital appreciation.

Performance Graphs

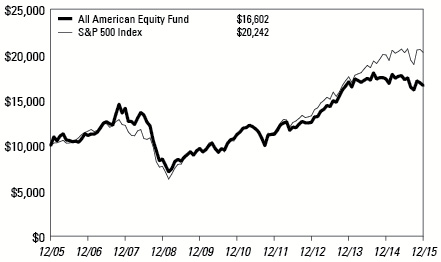

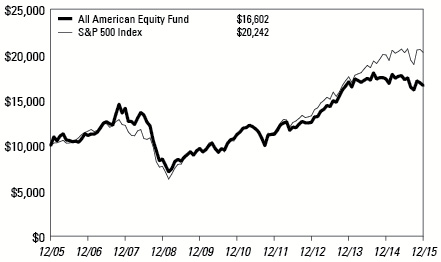

All American Equity Fund | |

| |

Average Annual Performance | For the Years Ended

December 31, 2015 | |

| | One Year | Five Year | Ten Year | |

All American Equity Fund - Investor Class | (4.20)% | 8.19% | 5.20% | |

S&P 500 Index | 1.38% | 12.57% | 7.31% | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. For all or a portion of the periods, the fund had expense limitations, without which returns would have been lower. Gross expense ratio as stated in the most recent prospectus is 2.16%. Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 2.20%. The Adviser can modify or terminate this arrangement at any time. See Definitions for Management Teams’ Perspectives for index definitions. Please visit our website at www.usfunds.com for updated performance information for different time periods. | |

20

All American Equity Fund & Holmes Macro Trends Fund | (unaudited) |

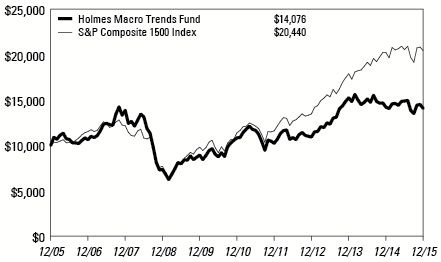

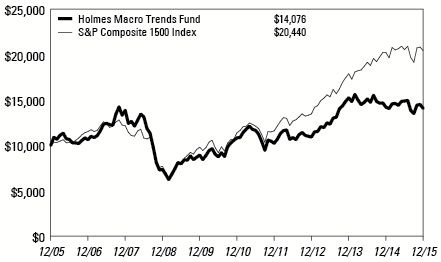

Holmes Macro Trends Fund | |

| |

Average Annual Performance | For the Years Ended

December 31, 2015 | |

| | One Year | Five Year | Ten Year | |

Holmes Macro Trends Fund | (0.94)% | 5.37% | 3.48% | |

S&P Composite 1500 Index | 1.01% | 12.39% | 7.41% | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. For all or a portion of the periods, the fund had expense limitations, without which returns would have been lower. Gross expense ratio as stated in the most recent prospectus is 1.94%. Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 2.20%. The Adviser can modify or terminate this arrangement at any time. See Definitions for Management Teams’ Perspectives for index definitions. Please visit our website at www.usfunds.com for updated performance information for different time periods. | |

The Year in Review – Economic and Political Issues that Affected the Funds

After nine years, it seems the U.S. economic engine might be able to run on its own without the need for “near zero” interest rates. This is evidenced by the unemployment rate declining to nearly 5 percent and GDP increasing at an annual rate of 2 percent in the third quarter. Therefore, the Federal Reserve Board decided to raise rates 25 basis points on December 16, 2015, and hinted toward four additional rate hikes in 2016. The initial hike increased volatility in December and caused markets to decline for a few days before seasonal year-end trading picked up.

21

All American Equity Fund & Holmes Macro Trends Fund | (unaudited) |

The S&P 500 Index rose 1.38 percent in 2015 and did so with a slightly higher level volatility than in 2014. The strongest sector was consumer discretionary, which appreciated 8.4 percent, followed by health care, which rose 5.2 percent. The decline in commodities, coupled with a strong U.S. dollar, caused the energy sector to decline the most, falling 23.5 percent, followed by the basic materials sector, which declined 10.3 percent for the year.

Investment Highlights

Overview

The All American Equity Fund lost 4.20 percent for the year, underperforming its benchmark, the S&P 500, which returned 1.38 percent. The Holmes Macro Trends Fund fell 0.94 percent over 2015, underperforming its benchmark, the S&P Composite 1500 Index, which returned 1.01 percent. Overall, smaller companies and growth-oriented stocks underperformed, while utilities and more defensive areas of the market outperformed. The primary driver of underperformance in 2015 was the fact that the fund has more exposure to smaller and growth-oriented companies than the benchmark. Our investment style was effectively out of favor, and the market did not reward companies demonstrating superior growth metrics. We believe this is transitory and our growth at a reasonable price (GARP) investment style will ultimately be rewarded.

Because the funds are actively managed, and because holding period is generally not a consideration in investment decisions, the portfolios’ turnover rate might fluctuate from year to year as the funds adjust their portfolio composition. The funds’ annual portfolio turnovers were, and are expected to continue to be, more than 100 percent.

All American Equity Fund

Strengths

● | The fund’s underweight position in materials helped fund performance. |

● | Stock selection was better than the index in the energy and materials sectors. |

● | Tesoro, Valero and Marathon were the best contributors to fund performance. |

Weaknesses

● | Sector allocation weightings to health care, consumer staples and information technology were in line with the benchmark, but stock selection caused the fund to lag in these sectors. |

● | Investments in Fidelity National Information Systems, Facebook and Western Digital were the worst contributors to performance |

22

All American Equity Fund & Holmes Macro Trends Fund | (unaudited) |

Holmes Macro Trends Fund

Strengths

● | Stock selection was strong in select energy and consumer staples companies. |

● | The fund’s underweight position in energy was beneficial as the sector underperformed the market. |

● | Alphabet, Starbucks and Facebook were among the best positive contributors to fund performance. |

Weaknesses

● | Sector allocation was a drag, as defensive sectors tended to outperform. Cash and defensive option strategies also held back relative performance as the market rallied strongly. |

● | Stock selection was weak across the board as our growth-oriented investment style was out of favor and the primary driver of underperformance. |

● | Investments in Sun Edison, Microsemi and Five Below failed to live up to expectations and were among the worst contributors to the fund’s performance. |

Current Outlook

Opportunities

● | The global economic outlook should improve as 2016 progresses. Additional government policy support from many areas around the globe should be supportive of an improving global macro outlook. The U.S. has been the single engine of growth in the developed world, and if the European or Chinese markets improved, it would provide a lift to the U.S. equity market. |

● | Falling gasoline and crude prices have given consumers more disposable income, creating an opportunity for many discretionary areas such as restaurants, retailers and airline companies. |

● | The continued dollar strength continues to favor companies that obtain the majority of their revenue domestically. |

Threats

● | Global GDP has been revised down recently, and the surge in the dollar will most likely weigh on exports. |

● | With the S&P 500 Index trading at nearly 18x earnings—the high end of the historical range—earnings growth will be especially critical to keep the bull market moving forward. Expectations for 2015 are in the low single digits, with big cuts coming from the energy sector in recent months. |

23

All American Equity Fund & Holmes Macro Trends Fund | (unaudited) |

● | The market has been trending higher for an unusually long time. A correction should not be dismissed at this point. |

● | As crude continues to decline, many companies in the energy sector may see lower revenues, which could cause concern over their ability to service debt. Ultimately, this could harm investor enthusiasm and hinder future market expectations. |

The section labeled Portfolio of Investments contains a complete list of the funds’ holdings.

24

All American Equity Fund & Holmes Macro Trends Fund | (unaudited) |

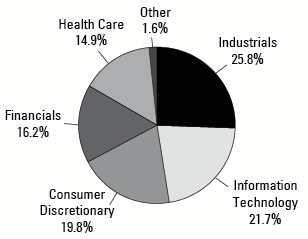

All American Equity Fund

Top 10 Equity Holdings (Based on Net Assets) | December 31, 2015 |

Microsoft Corp. | 3.05% |

Applications Software | |

Visa, Inc. | 2.84% |

Finance - Credit Card | |

MasterCard, Inc. | 2.80% |

Finance - Credit Card | |

NIKE, Inc. | 2.62% |

Athletic Footwear | |

JPMorgan Chase & Co. | 2.59% |

Diversified Banking Institutions | |

CVS Health Corp. | 2.56% |

Retail - Drug Store | |

Accenture plc | 2.46% |

Computer Services | |

Altria Group, Inc. | 2.44% |

Tobacco | |

UnitedHealth Group, Inc. | 2.22% |

Medical - HMO | |

Apple, Inc. | 2.20% |

Computers | |

Total Top 10 Equity Holdings | 25.78% |

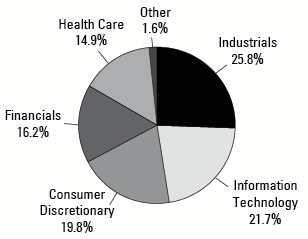

Portfolio Allocation by Industry Sector* Based on Total Investments | December 31, 2015 |

|

* | Summary information above may differ from the portfolio schedule included in the financial statements due to the use of different classifications of securities for presentation purposes. |

25

All American Equity Fund & Holmes Macro Trends Fund | (unaudited) |

Holmes Macro Trends Fund

Top 10 Equity Holdings (Based on Net Assets) | December 31, 2015 |

Regeneron Pharmaceuticals, Inc. | 4.75% |

Medical - Biomedical/Gene | |

Boeing Co. | 4.71% |

Aerospace/Defense | |

Home Depot, Inc. | 4.66% |

Retail - Building Products | |

Starbucks Corp. | 4.66% |

Retail - Restaurants | |

Gilead Sciences, Inc. | 4.58% |

Medical - Biomedical/Gene | |

Southwest Airlines Co. | 4.56% |

Airlines | |

Apple, Inc. | 4.55% |

Computers | |

O'Reilly Automotive, Inc. | 4.50% |

Retail - Auto Parts | |

Skyworks Solutions, Inc. | 4.09% |

Electronic Components - Semiconductors | |

Principal Financial Group, Inc. | 3.98% |

Life/Health Insurance | |

Total Top 10 Equity Holdings | 45.04% |

Portfolio Allocation by Industry Sector* Based on Total Investments | December 31, 2015 |

|

* | Summary information above may differ from the portfolio schedule included in the financial statements due to the use of different classifications of securities for presentation purposes. |

26

Global Resources Fund | (unaudited) |

Management Team’s Perspective

Introduction

The Global Resources Fund (PSPFX and PIPFX) is a non-diversified natural resources fund with the principal objective of seeking long-term growth of capital while providing protection against inflation and monetary instability. The fund invests in companies involved in the exploration, production and processing of petroleum, natural gas, coal, alternative energies, chemicals, mining, iron and steel, and paper and forest products around the globe.

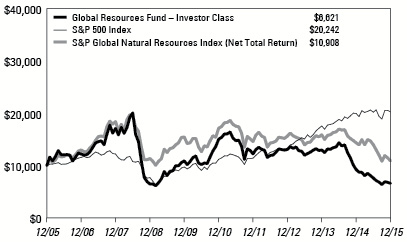

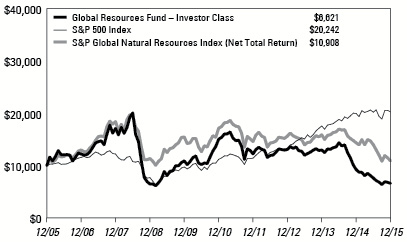

Performance Graph

Global Resources Fund | |

| |

Average Annual Performance | For the Periods Ended

December 31, 2015 | |

| | One Year | Five Year | Ten Year | Since Inception (Institutional Class) | |

Global Resources Fund - Investor Class | (28.43)% | (15.13)% | (4.04)% | n/a | |

Global Resources Fund - Institutional Class (Inception 3/1/10) | (27.73)% | (14.57)% | n/a | (7.63)% | |

S&P 500 Index | 1.38% | 12.57% | 7.31% | 13.29% | |

S&P Global Natural Resources Index (Net Total Return) | (24.50)% | (9.15)% | 0.37% | (5.25)% | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. For all or a portion of the periods, the fund had expense limitations, without which returns would have been lower. Gross expense ratio as stated in the most recent prospectus is 1.45% for the Investor Class and 1.13% for the Institutional Class. Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 1.90% for the Investor Class. Also pursuant to a voluntary agreement the Adviser has agreed to waive all class specific expenses of the Institutional Class. The Adviser can modify or terminate these arrangements at any time. See Definitions for Management Teams’ Perspectives for index definitions. Please visit our website at www.usfunds.com for updated performance information for different time periods. | |

27

Global Resources Fund | (unaudited) |

The Year in Review – Economic and Political Issues that Affected the Fund

The Bloomberg Commodity Index fell 24.70 percent for the year ended December 31, 2015, its worst annual performance since 2008. It was primarily dragged down by the 30.47 decline in crude oil and the 26.10 percent decline in copper. Amid deteriorating global growth prospects in emerging markets, and the speculation of an interest rate hike, the U.S. dollar posted a second consecutive rally, rising 9.26 percent in 2015 and intensifying the current depressed commodity environment. Concerns that the global economy is slowing, particularly due to weaker economic data from China, resulted in growth-oriented energy and basic materials sectors lagging the S&P 500 Index by 23 and 10 percent, respectively.

Energy’s significant relative underperformance to the broader market materialized during the back half of 2015. A surge in supply from the Organization of Petroleum Exporting Countries (OPEC) producers, coupled with resilient supply from U.S. shale producers, intensified a global glut of oil. Declining global GDP growth exacerbated the imbalance between supply and demand. Crude inventories in the U.S., Europe and China have reached unprecedented levels, putting a strain on available storage facilities. In its last meeting of 2015, OPEC un-officially abandoned its self-imposed cap of 31.5 million barrels a day as Middle Eastern producers battle for market share ahead of the expected lifting of Iran’s sanctions, which are set to bring additional crude supply to world markets.

The much anticipated supply cuts did not materialize in 2015, further exacerbating the supply glut. OPEC produced 32.6 million barrels per day of oil in December, significantly above its annual average, and above the previously self-imposed quotas of 31.5 and 30.5 million barrels. U.S. producers ended the year with production levels at a 4 month high and nearly unchanged from December 2014 at 9.2 million barrels. Similarly, Russia, in the last week of 2015 reached a production record of 10.8 million barrels.

Base metals slumped with oil, particularly into the second half of the year after record inventory builds at the London Metals Exchange warehouses, proved the Indonesian export bans of unprocessed ore implemented in 2014 had no tangible impact on the market. Copper posted a 26.10 percent decline, its worst annual performance since 2008. Nickel and zinc also posted their biggest declines since 2008. On the demand side, export volumes to China continued to rise but were outpaced by a continuation of supply growth.

28

Global Resources Fund | (unaudited) |

Investment Highlights

Overview

For the year ended December 31, 2015, the Investor Class of the Global Resources Fund declined 28.43 percent and the Institutional Class declined 27.73 percent, trailing the fund’s benchmark, the S&P Global Natural Resources Index (Net Total Return), which fell 24.50 percent.

The fund employed a defensive investment position from time to time in the past year with higher-than-average cash balances on hand to protect the liquidity of the fund. However, to maintain varying degrees of investment exposure to the commodities market, the fund utilized a number of rolling call option positions to hedge the fund’s benchmark risks and provide optionality to upswings in commodities stocks.

Because the fund is actively managed and holding period is generally not a consideration in investment decisions, the portfolio turnover rate may fluctuate from year to year as the fund adjusts its portfolio composition. The fund’s annual portfolio turnover was, and is expected to continue to be, more than 100 percent.

Strengths

● | The fund’s mining allocation outperformed the mining portion of the S&P Global Natural Resources Index. This was due in part to an underweighting in large underperforming sectors such as iron, steel and copper, especially the underweight in benchmark holdings such as Glencore and Anglo American. Positive absolute contribution came from Kaiser Aluminum. |

● | Despite a sharp decline in the price of agricultural commodities, the fund outperformed the benchmark in the agricultural products industry group. A focus on companies with greater downstream exposure yielded significant absolute gains to the fund. Key contributors included Phosagro OJSC and Kernel Holding. |

● | Construction materials stocks outperformed the broader natural resources complex during the year as economic activity in the sector strengthened and Congress passed a five-year highway bill with marked increases in highway funding. Accordingly, equity positions in Vulcan Materials, Martin Marietta Materials and U.S. Concrete were beneficial to fund performance. |

29

Global Resources Fund | (unaudited) |

Weaknesses

● | The fund’s core weighting in junior natural resources equities underperformed the large-cap-focused S&P benchmark during a period of declining commodity prices and risk aversion typical of a rising dollar. Notable underperformers included Atlas Development & Support Services and Trevali Mining. |

● | An underweight position in paper and forest contributed negatively to the performance of the fund. The integrated nature of many companies in the space allowed them to increase their margins as they maintained retail prices stable while commodity input prices fell. |

● | An underweight position in integrated oil and gas companies adversely affected relative performance for the period as the major global integrated producers significantly outperformed the junior oil space owing to their stronger balance sheets and greater ability to withstand extended oil price declines. |

Current Outlook

Opportunities

● | The seasonality of commodity investing suggests that such investors will have the wind at their sail for the next four months. According to a study published by VTB Capital, over the past 20 years the Bloomberg Commodity Index has posted strong rallies in the first four months of the year. The report goes on to suggest that despite the ongoing negative investor sentiment toward the sector, there is reason to believe the seasonal pattern will play again in 2016. |

● | Ten trillion dollars is the level of investment needed by 2040 to supply the oil and gas market, according to OPEC’s World Oil Outlook for 2015. OPEC expects global oil demand to reach 110 million barrels per day in 2040, a volume that current fields could not come even close to supplying. As a result, the organization believes investments of $10 trillion will be necessary to ensure adequate infrastructure and supply. |

● | Based on latest estimates, the total short exposure in commodities has reached $200 billion. This unprecedented buildup in fund shorts has created a major headwind for commodity prices in the short-term. However, when considering the size of total managed long commodity assets, which has declined to about $200 billion—very close to the total commodity shorts—any partial unwinding of the short trade should bode well for commodities during 2016. |

30

Global Resources Fund | (unaudited) |

Threats

● | Iron ore prices may dip into the $20 range in 2016 before rallying to end the year higher, according to a recent report by Capital Economics. The report suggests prices will drop initially as more low-cost supplies help majors expand their market share. Following this initial response, higher cost production will be cut, aiding a price rebound into year-end. |

● | The Baltic Dry Index, the shipping benchmark that serves as a bellwether for global trade and economic activity, fell to an all-time low in November 2015. The record low suggests China’s demand for commodities continues a downward trend. |

● | The global manufacturing purchasing manager’s index (PMI) slipped back to 50.9 in December 2015, crossing below its three-month moving average of 51.1, as output, exports and new orders all eased lower. China, India, Brazil and Russia all reported PMIs below 50 as manufacturing output in emerging markets remains in contraction. With PMIs having shown to be among the best predictive tools for commodity prices, the outlook for the first few months of the year has turned more challenging. |

The section labeled Portfolio of Investments contains a complete list of the fund’s holdings.

31

Global Resources Fund | (unaudited) |

Top 10 Equity Holdings (Based on Net Assets) | December 31, 2015 |

Pacific Infrastructure Ventures, Inc. | 5.58% |

Real Estate Operating/Development | |

Klondex Mines Ltd. | 3.62% |

Gold Mining | |

Tyson Foods, Inc. | 3.01% |

Food - Meat Products | |

Cal-Maine Foods, Inc. | 2.44% |

Food - Miscellaneous/Diversified | |

Syngenta, AG | 2.44% |

Agricultural Chemicals | |

Rio Tinto plc | 2.04% |

Metal - Diversified | |

LyondellBasell Industries N.V. | 2.02% |

Chemicals - Diversified | |

Western Forest Products, Inc. | 1.74% |

Forestry | |

Parsley Energy, Inc. | 1.64% |

Oil & Gas Drilling | |

DHT Holdings, Inc. | 1.63% |

Transportation - Marine | |

Total Top 10 Equity Holdings | 26.16% |

Portfolio Allocation by Industry Sector* Based on Total Investments | December 31, 2015 |

|

* | Summary information above may differ from the portfolio schedule included in the financial statements due to the use of different classifications of securities for presentation purposes. |

32

Precious Metals and Minerals Funds | (unaudited) |

Management Team’s Perspective

Introduction

The World Precious Minerals Fund (UNWPX and UNWIX) and the Gold and Precious Metals Fund (USERX) pursue an objective of long-term capital growth through investments in gold, precious metals and mining companies. The World Precious Minerals Fund focuses on equity securities of companies principally engaged in the exploration, mining and processing of precious minerals such as gold, silver, platinum and diamonds. Although this fund has the latitude to invest in a broad range of precious minerals, it currently remains focused on the gold sector. The Gold and Precious Metals Fund focuses on the equity securities of established gold and precious metals companies and pursues current income as a secondary objective.

World Precious Minerals Fund | |

| |

Average Annual Performance | For the Periods Ended December 31, 2015 | |

| | One Year | Five Year | Ten Year | Since Inception (Institutional Class) | |

World Precious Minerals Fund - Investor Class | (15.64)% | (27.16)% | (6.75)% | n/a | |

World Precious Minerals Fund - Institutional Class (Inception 3/1/10) | (15.07)% | (26.82)% | n/a | (18.29)% | |

S&P 500 Index | 1.38% | 12.57% | 7.31% | 13.29% | |

NYSE Arca Gold Miners Index | (25.52)% | (25.88)% | (8.11)% | (18.19)% | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. For all or a portion of the periods, the fund had expense limitations, without which returns would have been lower. Gross expense ratio as stated in the most recent prospectus is 1.99% for the Investor Class and 4.86% for the Institutional Class. Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 1.90%. The Adviser can modify or terminate this arrangement at any time. See Definitions for Management Teams’ Perspectives for index definitions. Please visit our website at www.usfunds.com for updated performance information for different time periods. | |

33

Precious Metals and Minerals Funds | (unaudited) |

Gold and Precious Metals Fund | |

| |

Average Annual Performance | For the Year Ended

December 31, 2015 | |

| | One Year | Five Year | Ten Year | |

Gold and Precious Metals Fund | (4.78)% | (21.57)% | (2.91)% | |

S&P 500 Index | 1.38% | 12.57% | 7.31% | |

FTSE Gold Mines Index | (20.47)% | (24.95)% | (7.67)% | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. For all or a portion of the periods, the fund had expense limitations, without which returns would have been lower. Gross expense ratio as stated in the most recent prospectus is 1.97%. Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 1.90%. The Adviser can modify or terminate this arrangement at any time. See Definitions for Management Teams’ Perspectives for index definitions. Please visit our website at www.usfunds.com for updated performance information for different time periods. | |

34

Precious Metals and Minerals Funds | (unaudited) |

The Year in Review - Economic and Political Issues that Affected the Funds

In anticipation that the Federal Reserve would start raising interest rates, the U.S. dollar began to rally in the middle of 2014 and moved to its highest level during the first quarter of 2015. Thereafter, the value of the dollar receded slightly and remained range-bound in a choppy market as investors began to sense the data the Fed was watching was losing some momentum. With the 9.26 percent gain in the dollar, precious metals had a difficult year. Gold was the best-performing precious metal in 2015 with a loss of 10.42 percent. Silver was off slightly more at 11.75 percent. The worst-performing precious metals for 2015 were platinum and palladium, with losses of 26.07 percent and 29.43 percent, respectively. The platinum mining stocks in southern Africa were off on average by more than 70 percent for the year.

Investors’ appetite for precious metals was dampened by the six-year bull market in U.S. stocks, one of the best price gains since 1999, and a 60 percent surge in the first half of the year for the Shanghai Stock Exchange. According to the World Gold Council, global demand for jewelry, coins and bars fell 5 percent in the first quarter from a year earlier as shoppers in the Middle East, China and the U.S. reigned in purchases. Two straight years of drought in India were also a headwind to gold demand. Chinese stocks began to roll over in the third quarter of the year as economic data came out weaker than expected, and by August, all of their gains achieved earlier in the year were gone. Gold demand finally caught a break. In response to their country’s stock market selloff, Chinese investors began returning to precious metals as a haven. Retail sales of gold and silver in China during August rose 17.4 percent year-over-year, representing about $3.9 billion in sales.

Low gold prices in the third quarter attracted bargain hunters, with U.S. buyers buying up far more coins and bars than they did in any other quarter over the past five years. Demand surged by 207 percent in November from a year ago. The U.S. Mint sold out of its 2015 one-ounce American Eagle gold coins in November, according to Bloomberg.

By December, the Fed finally believed it had a good enough read on the data to lift interest rates from zero to 25 basis points. What might portend a sentiment shift is that for the last three regularly scheduled Fed meetings of 2015, gold was stronger on the day of the announcement for any Fed action. Absent were the manipulative middle-of-the-night $1 billion+ dumping trades of gold bullion to push gold prices down on the Fed meeting dates.

After the Fed’s rate hike, it was reported that some traders closed their bearish positions on the metal before year end on speculation that physical purchases might pick up. Further, Bloomberg notes that the put-to-call ratio on SPDR Gold Shares reached its lowest level since 2008, perhaps indicating that investors who were betting on further declines in gold prices were losing enthusiasm for this trade. Hedge funds

35

Precious Metals and Minerals Funds | (unaudited) |

also reduced bets that the dollar would advance, according to Bloomberg. Despite the bursting of the bubble in Chinese equities, Shanghai Gold Exchange withdrawals totaled a record 2,596 tonnes in 2015, up 19 percent from the previous year.

Investment Highlights

For the year ended December 31, 2015, the World Precious Minerals Fund Investor Class lost 15.64 percent and the Institutional Class lost 15.07 percent. The fund’s benchmark, the NYSE Arca Gold Miners Index, lost 25.52 percent on a total return basis. The strategy of the World Precious Minerals Fund favors junior exploration and development stocks and mid-tiered producing stocks. These lower-capitalization stocks have historically outperformed senior gold mining companies over longer periods, as senior gold miners have typically acquired proven assets of junior gold companies rather than explored for new mining projects with capital-constrained budgets.

The Gold and Precious Metals Fund lost 4.78 percent for the year, outperforming its benchmark, the FTSE Gold Mines Index, which lost 20.47 percent on a total return basis. While focusing on established, gold-producing companies, the Gold and Precious Metals Fund holds a higher weighting of mid-tier stocks compared to its benchmark.

Both funds employed a defensive investment position from time to time in the past year with higher-than-average cash balances on hand to protect the liquidity of the funds. However, to maintain varying degrees of investment exposure to the gold market, the funds utilized a number of call option positions and directional ETFs, which are more liquid than options, to hedge the funds’ benchmark risks and provide optionality to upswings in gold stocks.

Spot gold finished the period at $1,061.42 per ounce, down $123.44, or 10.42 percent. The S&P 500 Index posted a positive return of 1.38 percent, the Trade Weighted U.S. Dollar Index gained 9.26 percent and the yield on a 90-day Treasury bill finished the year at 0.16 percent.

Because the funds are actively managed and holding period is generally not a consideration in investment decisions, the portfolio turnover rate may fluctuate from year to year as each fund adjusts its portfolio composition. The annual portfolio turnover for the Gold and Precious Metals Fund was, and is expected to continue to be, more than 100 percent.

Strengths

● | With Gran Colombia emerging from debt-restructuring near year end, its bond prices began to climb and it delivered the biggest dollar gains for the World Precious Minerals Fund for the year. St. Barbara, the largest contributor to performance for the Gold and Precious Metals Fund and the third best contributor |

36

Precious Metals and Minerals Funds | (unaudited) |

| to the World Precious Minerals Fund, reaped returns for shareholders as new CEO Bob Vassie implemented changes that turned the company around with more than a five-fold gain in the company’s share price. |

● | Klondex Mines was the second and third best performer for World Precious Minerals and Gold and Precious Metals, respectively. Klondex is one of few gold miners to have positive consecutive returns for each of the last three years, compounding at 17.66 percent per year on average. |

● | Northern Star Resources was the second best performer for the World Precious Minerals Funds. Bill Beament, CEO of Northern Star, purchased a significant suite of assets from Barrick Gold and Newmont Mining several years ago, almost on distressed terms, as it cut much of its Australian exposure, a game changing transaction. Northern Star was successful at bringing its culture of ownership to the new assets. |

Weaknesses

● | Underweighting Newcrest Mining and Newmont Mining relative to the benchmark for the Gold and Precious Metals Fund were the two biggest drags on our performance. The fund’s exposure to Australian gold miners largely offset the gains Newcrest would have contributed, as St. Barbara and Northern Star both outperformed Newcrest. The market largely underestimated how fast Newmont seemed to right the ship in 2015. The company sold assets, paid down some of its debt and completed an acquisition of the Cripple Creek Victor mining complex in Colorado, which it believes has significant underground potential to unlock. |

● | Underweighting Newmont Mining and Agnico-Eagle Mines relative to the benchmark for the World Precious Minerals Fund were the two biggest drags on the fund’s performance. Agnico-Eagle had a flawless year in terms of execution and likely added to its resource base with a grassroots discovery of the Amaruq deposit, relatively close to its Meadowbank Mine, which might improve its economics through a shared milling scenario. |

● | Exposure to Dundee Precious Metals relative to the benchmark for the Gold and Precious Metals Fund was reminiscent of a value trap in a challenged gold market. More than 90 percent of its 2015 copper production, about 25 percent of revenue, was hedged at $3.21 per pound, significantly higher than spot. In addition, Dundee Precious operates the Tsumeb copper smelter in northern Namibia, one of only a handful of copper smelters in the world that can safely handle high arsenic copper ores. Demand for such environmental safety in the handling of arsenic is on the rise. For the World Precious Minerals Fund, the third biggest markdown came from Taurus Gold, a private company that has done the necessary work to arrive at a production decision for several projects, but has been unable to secure full funding to start construction. |

37

Precious Metals and Minerals Funds | (unaudited) |

Current Outlook

Opportunities

● | The gold mine supply issue is coming to a head, according to Credit Suisse’s 2015 Year-End Preview report. Reserve life has fallen from 14 to 10 years since 2011, and grades processed are 9 percent above reserve grade in 2015. A worrisome trend coming from presenters at this year’s Denver Gold Show is the slashing of exploration budgets, particularly by junior miners. This has implications for gold production sustainability given long discovery-to-production cycles, currently pegged at 27 years and growing due to increasing regulatory, social and environmental pressures. The latest quarterly update of exploration spending from the Australian Bureau of Statistics shows that spending on mineral exploration in the country hit a near-decade low. The lack of new investment and the long time line to new production should reduce new mine supply in the future. |

● | According to research from Cornerstone Macro, the dollar has historically appreciated before the first hike and depreciated afterwards. If the historical pattern is any indication, the dollar might not strengthen further as many prognosticators have pontificated. In addition, according to Capital Economics, the headwinds for gold could be behind us, pointing to tighter labor markets and perhaps even inflation. The report notes that inflation should snap back in most economies over the next few months as the big declines in oil prices in late 2014 drop out of the annual comparison. The group’s 2016 year-end forecast is $1,400 per ounce. |

● | Klondex Mines announced in mid-December its acquisition of the Rice Lake Mine near Bissett, Manitoba. For the total purchase price of $32 million, Klondex is acquiring a fully operational mine, mill and fleet of equipment that was recently put on care and maintenance as the property went into receivership earlier in the year. Over $375 million of capital improvements have been made on the property since 2007, and the mobile equipment fleet was appraised at close to $20 million. Klondex plans to calculate a new resource for the operation and design a new mine plan for developing the ore in a profitable manner. It will likely be the fourth quarter of 2016 before it resumes production. In our opinion, the previous operator had oversized the mill and dropped the cutoff grade to try and grow the number of ounces produced. To accomplish this, the company also became overextended on the debt side. Klondex has a great opportunity here to do the proper work to remain profitable. The company still offers investors an attractive opportunity to participate in the turnaround of Rice Lake. |

38

Precious Metals and Minerals Funds | (unaudited) |

Threats

● | According to UBS, India’s plan to tap idle gold could exceed expectations. A company survey shows a “significantly large” proportion of respondents are likely, or highly likely, to participate in the government’s monetization plan and aren’t resistant to temple gold being deposited with banks. Nonetheless, the plan should take time to gain traction, especially in rural areas. Also key will be the willingness of women in rural areas to participate. |

● | BCA Research says that deflation now plagues more than half of the industry groups that they cover. In its analysis of the broad U.S. equity market at year end, BCA found industry group pricing power shows that 32 out of 60 industries have had to cut selling prices, up from 26 in BCA’s last update. |

● | According to a recent report, “Unwinding the Great Liquidity Cycle,” by Julien Garran of Macro Strategy Partnership, the decline in global foreign exchange reserves at central banks is almost twice as aggressive today as it was during the Great Recession. The implications are a reversing bid for U.S. Treasuries and credit when the Fed does not want interest rates to rise aggressively, should there be a policy mistake. Garran recommends that investors be positioned short U.S. equities, long cash and long gold and gold equities. Another investor showing confidence in gold is Ray Dalio, founder of Bridgewater Associates, who said in 2015: “If you don’t own gold, you know neither history nor economics.” |

The section labeled Portfolio of Investments contains a complete list of the funds’ holdings.

39

Precious Metals and Minerals Funds | (unaudited) |

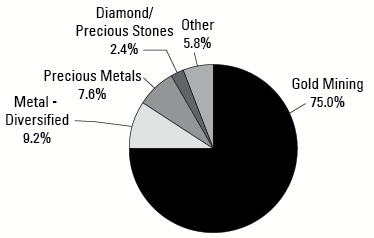

World Precious Minerals Fund

Top 10 Equity Holdings (Based on Net Assets) | December 31, 2015 |

Klondex Mines Ltd. | 15.80% |

Gold Mining | |

Osisko Gold Royalties Ltd. | 5.90% |

Gold Mining | |

Pretium Resources, Inc. | 3.86% |

Gold Mining | |

St Barbara Ltd. | 3.07% |

Gold Mining | |

Lundin Gold, Inc. | 2.93% |

Precious Metals | |

TriStar Gold, Inc. | 2.91% |

Gold Mining | |

Lake Shore Gold Corp. | 2.85% |

Gold Mining | |

Claude Resources, Inc. | 2.60% |

Gold Mining | |

Roxgold, Inc. | 2.26% |

Precious Metals | |

Gold Standard Ventures Corp. | 1.87% |

Gold Mining | |

Total Top 10 Equity Holdings | 44.05% |

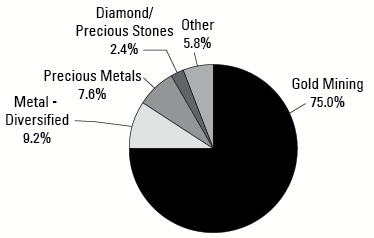

Portfolio Allocation by Industry* Based on Total Investments | December 31, 2015 |

|

* | Summary information above may differ from the portfolio schedule included in the financial statements due to the use of different classifications of securities for presentation purposes. |

40

Precious Metals and Minerals Funds | (unaudited) |

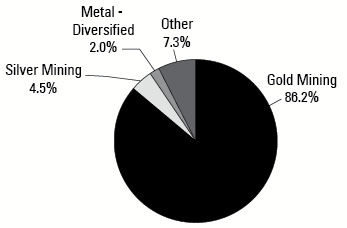

Gold and Precious Metals Fund

Top 10 Equity Holdings (Based on Net Assets) | December 31, 2015 |

Klondex Mines Ltd. | 14.49% |

Gold Mining | |

Osisko Gold Royalties Ltd. | 10.57% |

Gold Mining | |

St Barbara Ltd. | 6.45% |

Gold Mining | |

Lake Shore Gold Corp. | 5.32% |

Gold Mining | |

Northern Star Resources Ltd. | 5.23% |

Gold Mining | |

Agnico Eagle Mines Ltd. | 4.51% |

Gold Mining | |

Claude Resources, Inc. | 4.07% |

Gold Mining | |

OceanaGold Corp. | 2.45% |

Gold Mining | |

Detour Gold Corp. | 2.23% |

Gold Mining | |

Comstock Mining, Inc. | 2.19% |

Gold Mining | |

Total Top 10 Equity Holdings | 57.51% |

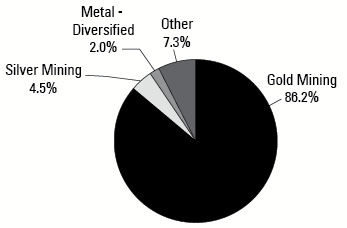

Portfolio Allocation by Industry* Based on Total Investments | December 31, 2015 |

|

* | Summary information above may differ from the portfolio schedule included in the financial statements due to the use of different classifications of securities for presentation purposes. |

41

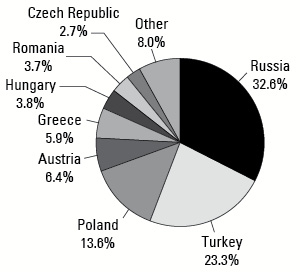

Emerging Europe Fund | (unaudited) |

Management Team’s Perspective

Introduction

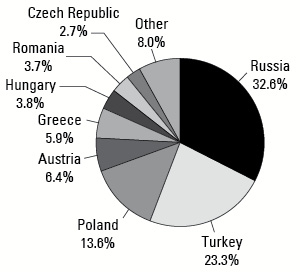

The investment objective of the Emerging Europe Fund (EUROX) is to achieve long-term capital growth by investing in a non-diversified portfolio of equity securities of companies located in the emerging markets of Europe.

Performance Graph

Emerging Europe Fund | |

| |

Average Annual Performance | For the Years Ended

December 31, 2015 | |

| | One Year | Five Year | Ten Year | |

Emerging Europe Fund | (20.73)% | (12.67)% | (5.25)% | |

S&P 500 Index | 1.38% | 12.57% | 7.31% | |

MSCI Emerging Markets Europe 10/40 Index (Net Total Return) | (14.70)% | (11.16)% | (2.43)% | |

* Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. For all or a portion of the periods, the fund had expense limitations, without which returns would have been lower. Gross expense ratio as stated in the most recent prospectus is 2.29%. Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 2.85%. The Adviser can modify or terminate this arrangement at any time. See Definitions for Management Teams’ Perspectives for index definitions. Please visit our website at www.usfunds.com for updated performance information for different time periods. | |

42

Emerging Europe Fund | (unaudited) |