UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-1800 |

|

U.S. GLOBAL INVESTORS FUNDS |

(Exact name of registrant as specified in charter) |

|

7900 CALLAGHAN ROAD | | |

SAN ANTONIO, TX | | 78229 |

(Address of principal executive offices) | | (Zip code) |

|

SUSAN B. MCGEE, ESQ. |

7900 CALLAGHAN ROAD |

SAN ANTONIO, TX 78229 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 210-308-1234 | |

|

Date of fiscal year end: | DECEMBER 31, 2012 | |

|

Date of reporting period: | DECEMBER 31, 2012 | |

| | | | | | | | |

ITEM 1. REPORTS TO STOCKHOLDERS.

U.S. Global Investors Funds

Annual Report

December 31, 2012

U.S. Global Investors Funds

Annual Report

December 31, 2012

Letter to Shareholders | | | 1 | | |

Definitions for Management Teams' Perspectives | | | 10 | | |

Management Teams' Perspectives | | | 12 | | |

Expense Example | | | 63 | | |

Portfolios of Investments | | | 66 | | |

Notes to Portfolios of Investments | | | 134 | | |

Statements of Assets and Liabilities | | | 148 | | |

Statements of Operations | | | 154 | | |

Statements of Changes in Net Assets | | | 160 | | |

Notes to Financial Statements | | | 169 | | |

Financial Highlights | | | 187 | | |

Additional Information | | | 207 | | |

U.S. Global Investors Funds

Investor Class

U.S. Treasury Securities Cash Fund | | USTXX | |

U.S. Government Securities Savings Fund | | UGSXX | |

Near-Term Tax Free Fund | | NEARX | |

Tax Free Fund | | USUTX | |

All American Equity Fund | | GBTFX | |

Holmes Growth Fund | | ACBGX | |

MegaTrends Fund | | MEGAX | |

Global Resources Fund | | PSPFX | |

World Precious Minerals Fund | | UNWPX | |

Gold and Precious Metals Fund | | USERX | |

Eastern European Fund | | EUROX | |

Global Emerging Markets Fund | | GEMFX | |

China Region Fund | | USCOX | |

Institutional Class

MegaTrends Fund | | MEGIX | |

Global Resources Fund | | PIPFX | |

World Precious Minerals Fund | | UNWIX | |

P.O. Box 659405

San Antonio, Texas 78265-9604

Tel 1.800.US.FUNDS

Fax 1.210.308.1217

www.usfunds.com

U.S. Global Investors Funds

Investor pessimism toward stocks continued during 2012, with uncertainty over many global economic events undermining sentiment. The European crisis was punctuated by footage of unionized government workers organizing anti-austerity riots in the streets of Greece and Spain. Worsening economic data in China led to a rising fear of a hard landing. In the U.S., investors were consumed by the presidential election closely followed by the "fiscal cliff" debate that didn't conclude until New Year's Eve.

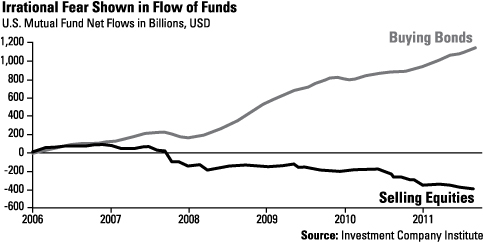

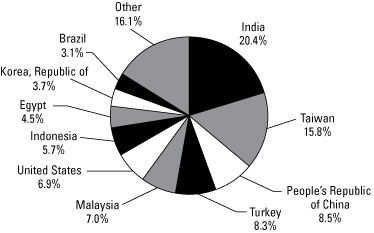

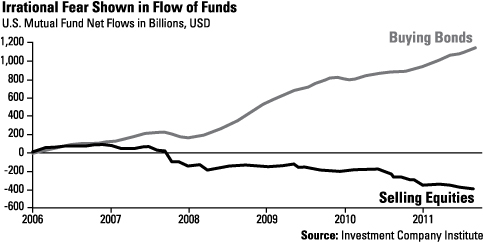

In addition to the constant drumbeat of negative news, investors' emotions remained anchored to the distressing experience of 2008, and the selling out of perceived "risky" equity funds to purportedly safe havens in long-term bond funds continued throughout 2012. Data from the Investment Company Institute shows the persistence of this extreme behavior of billions of dollars flowing into bond funds and out of stock funds.

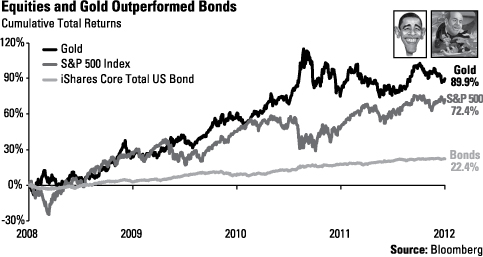

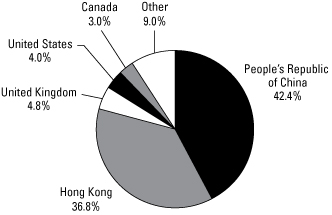

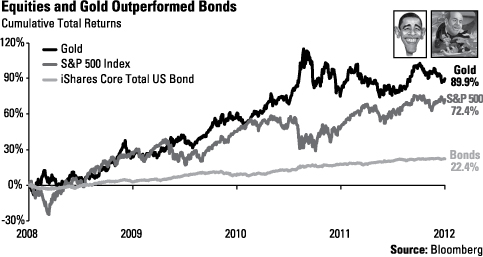

This move has been costing investors, as performance in recent years has been phenomenal for equity and gold bullion investors. Take a look at the following chart, showing the cumulative returns of gold, the S&P 500 Index and the iShares Core Total U.S. Bond ETF from the beginning of 2009 through December 31, 2012. The last four years were better than you may have thought: Gold rose nearly 90 percent and the 500 largest U.S. companies climbed more than 70 percent, while the bond investment increased only 22 percent.

1

U.S. Global Investors Funds

As Bloomberg recently quantified, "Americans have missed out on almost $200 billion of stock gains as they drained money from the market in the past four years."

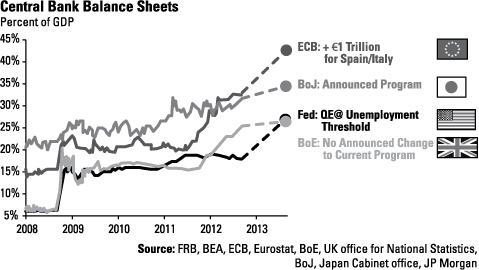

I often say it's important to follow government policies, not political parties, because of the dramatic effect that monetary and fiscal policies can have on markets and gold. Thanks to President Barack Obama and Federal Reserve Chairman Ben Bernanke, stocks and bullion have had astounding performance as the Fed has been on a massive bond-buying frenzy during three rounds of quantitative easing (QE). This spree has pushed the central bank's balance sheet to nearly $3 trillion by January. As reported in USA Today, this is "more than three times the size of the Fed's holdings before the financial crisis" in the fall of 2008.

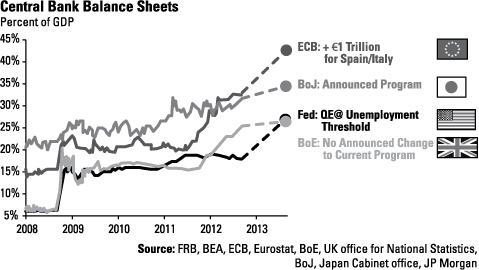

All the excess money in the system, compliments of not only the Fed, but also the European Central Bank (ECB), the Bank of Japan and the Bank of England, should help gold continue its bull run another year. Take a look at the projected rise in the balance sheets as a percent of GDP from the developed countries. The ECB is estimated to have a balance sheet that is nearly 50 percent of its GDP by the end of the year. The Bank of Japan is right behind the ECB, with its balance sheet projected to be nearly 35 percent of GDP.

2

U.S. Global Investors Funds

With developed governments lacking courage for fiscal discipline, emerging markets have continued purchasing gold as a currency hedge, in an effort to diversify away from their dependence on U.S. dollars and the euro. Countries such as Mexico, the Philippines, Russia, Turkey and Ukraine have added gold over the past year. Net official sector purchases of 425 tons, as of November 2012, are a drastic divergence compared to only a few years ago when central banks were net sellers of the precious metal.

Even though gold purchases in India have been subdued because of duties imposed on gold imports, we see sunshine at the end of the tunnel, not a train's headlight. We believe the country's cultural affinity for the precious metal and rising incomes will continue to drive demand. Also, since China's new leadership was announced through the middle of January, about $40 billion has flowed into emerging markets. This emerging trend appears to be a powerful precursor for a stronger 2013, which we believe will help to reignite the gold buying in China and India.

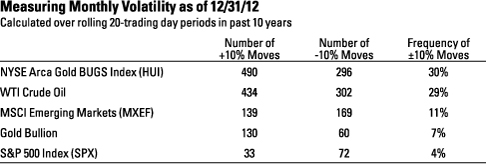

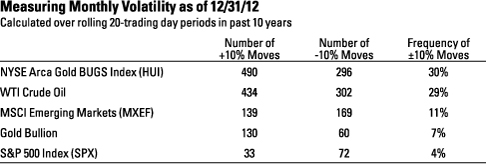

What's important for gold investors to remember is the volatility of the yellow metal. Take a look at the frequency of 10 percent moves up or down over any 20 trading days. The metal is only slightly more volatile than the S&P 500. Gold companies, crude oil and the MSCI Emerging Markets Index have all experienced more up and down moves than gold.

3

U.S. Global Investors Funds

Whereas card counting at a blackjack table can get you booted from casinos and barred for life, as an investor, you are allowed to take full advantage of the 10 percent moves. Over 2013, you can count on gold moving in both directions, but as the metal experiences extreme volatility, dips in price can offer potential buying opportunities. Keep in mind though, that it's prudent to invest only 5 to 10 percent of your total portfolio in gold and gold stocks.

Ideas for Investing in Volatile Markets

Consider the famous words once spoken by boxer Mike Tyson: "Everybody has a plan until they get punched in the face." With the incredible results from gold and the stock markets, an investment plan that sold equities and bought bonds typically was dealt a terrible blow. Life is about managing expectations, and in the ring, a champion quickly shifts his strategy or faces a knockout. Here are three investment strategies to get your money to work for you.

1. Choose Active Management When Investing in Commodities

Commodities have wide price fluctuations from year to year due to the many factors affecting supply and demand, such as government policies, union strikes and currency volatility. The price movement has historically been seasonal and cyclical, which is why we believe investors should hold a diversified basket of commodities actively managed by professionals who understand these specialized assets and the global trends affecting them.

You can see the ebb and flow of commodity prices over the past decade on our Periodic Table of Commodity Returns. As an example, gold's 10-year trend shows a unique record no other commodity can claim, with positive results every year. What's fascinating is the three-year rising pattern relative to other commodities. Over the past 10 years, gold has risen in position compared with the others for three years in a row, and then fallen in relative position in the fourth year before repeating the cycle. You can view the relative returns of the other commodities for yourself by going to www.usfunds.com.

4

U.S. Global Investors Funds

2. Look for Gold Stocks to Rebound

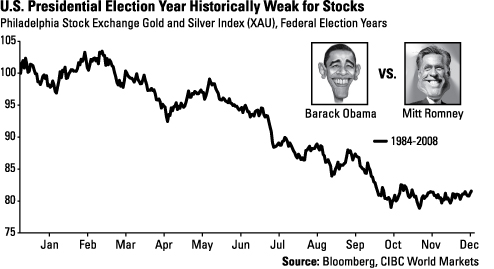

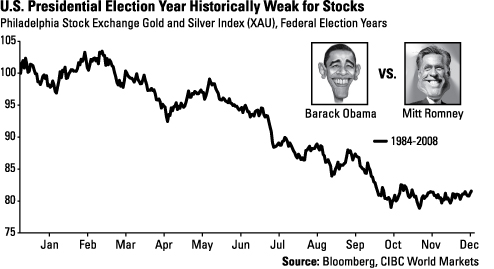

One potential opportunity awaiting investors is the historical trend favoring gold stocks, according to research from the highly respected gold analyst, Barry Cooper from CIBC World Markets. One chart shows the returns of the Philadelphia Stock Exchange Gold and Silver Index during the year of a U.S. presidential election and one illustrates the returns of the index the year after the election.

Regardless of which party is in the White House and which party wants to take it back, going back to 1984, the index of gold and silver stocks has historically performed poorly during the year Americans are headed to the voting polls.

5

U.S. Global Investors Funds

However, the math suggests gold stocks may stage a significant comeback during 2013. Historically, the index of gold and silver stocks has seen significant gains in the year following a federal election.

6

U.S. Global Investors Funds

3. Implement a Simple Asset Allocation Approach

Money fund yields have been disappointing investors, and as long as they remain low, are ill-equipped to provide investors with meaningful returns. For those investors willing to take on a little more risk, there may be better-yielding alternatives. For example, take a closer look at U.S. Global Investors' Near-Term Tax Free Fund (NEARX), with an overall Morningstar rating of 4 stars among 135 municipal national short-term funds as of December 31, 2012. NEARX invests in municipal bonds that have an average maturity of about 3 years and, based on a 35 percent tax rate, offers a tax-equivalent yield of 1.49 percent as of the end of 2012.

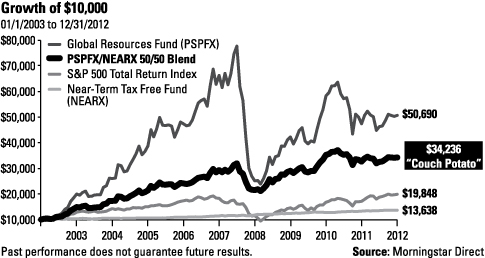

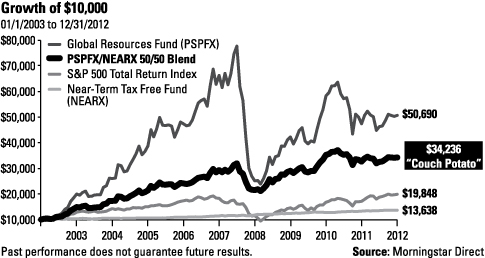

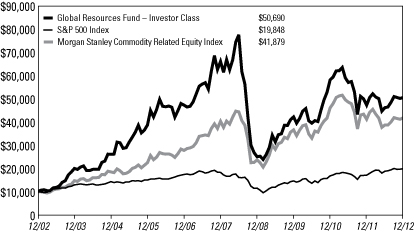

Rather than take the risk of owning assets that may not provide you with enough appreciation to meet your investment goals, consider a simple asset allocation strategy we call the "couch potato" portfolio. The chart on the next page compares three different hypothetical investments:

• $10,000 invested in only NEARX

• $10,000 invested in only the S&P 500 Index of U.S. companies

• $10,000 invested in only the growth-oriented Global Resources Fund (PSPFX)

• $10,000 invested in the "couch potato" portfolio: a 50 percent allocation to NEARX and a 50 percent allocation to PSPFX, rebalanced on a semi-annual basis

Over the past 10 years as of December 31, 2012, the S&P 500 increased about 7 percent while the Near-Term Tax Free Fund rose 3 percent. The Global Resources Fund outperformed these stock and bond investments, rising 17.61 percent. However, the Global Resources Fund also experienced the most volatility, as you can see in the hypothetical growth chart below.

In a hypothetical investment of $10,000 with half of the assets in the Near-Term Tax Free Fund and half in the Global Resources Fund, rebalanced semi-annually, most of the outperformance of the Global Resources Fund is captured, only with less risk. Over the past 10 years, this simple "couch potato" portfolio would have grown to more than $34,000, with significantly less volatility. This is substantially more than a 10-year hypothetical investment in the S&P 500, which grew to $19,848.

7

U.S. Global Investors Funds

With the European crisis appearing in the rear view mirror and global central banks positioning to continue their easing policies, we encourage global investors to resist the negative headlines and make sure to appropriately allocate for long-term growth and income.

Thank you for putting your trust and confidence in U.S. Global Investors. Throughout 2013, we wish you and your family peace and prosperity.

Sincerely,

Frank Holmes

CEO and Chief Investment Officer

U.S. Global Investors, Inc.

Please consider carefully a fund's investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage, Inc.

Morningstar ratings are based on risk-adjusted return. The overall Morningstar rating for a fund is derived from a weighted average of performance figures associated with its 3-, 5-year and 10-year (if applicable) time periods. Past performance does not guarantee future results. For each fund with at least a three-year history, Morningstar calculates a Morningstar RatingTM based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund's

8

U.S. Global Investors Funds

monthly performance (including the effects of sales charges, loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. (Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in the distribution percentages.)

Though the Near-Term Tax Free Fund seeks minimal fluctuations in share price, it is subject to the risk that a decline in the credit quality of a portfolio holding could cause a fund's share price to decline. Tax-exempt income is federal income tax free. A portion of this income may be subject to state and local income taxes, and if applicable, may subject certain investors to the Alternative Minimum Tax as well. The Near-Term Tax Free Fund may invest up to 20% of its assets in securities that pay taxable interest. Income or fund distributions attributable to capital gains are usually subject to both state and federal income taxes. The Near-Term Tax Free Fund is subject to interest-rate risk; its value declines as interest rates rise. The Near-Term Tax Free Fund may be exposed to risks related to a concentration of investments in a particular state or geographic area. These investments present risks resulting from changes in economic conditions of the region or issuer.

Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. Because the Global Resources Fund concentrates its investments in a specific industry, the fund may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

9

Definitions for Management Teams' Perspectives

Benchmark Index Definitions

Returns for indices reflect no deduction for fees, expenses or taxes, unless noted.

The Barclays Capital 3-Year Municipal Bond Index is a total return benchmark designed for municipal assets. The index includes bonds with a minimum credit rating of BAA3, are issued as part of a deal of at least $50 million, have an amount outstanding of at least $5 million and have a maturity of two to four years.

The Barclays Capital 10-Year Municipal Bond Index is a total return benchmark designed for long-term municipal assets. The index includes bonds with a minimum credit rating of BAA3, are issued as part of a deal of at least $50 million, have an amount outstanding of at least $5 million and have a maturity of 8 to 12 years.

The FTSE Gold Mines Index encompasses all gold mining companies that have a sustainable and attributable gold production of at least 300,000 ounces a year and that derive 75% or more of their revenue from mined gold.

The Hang Seng Composite Index is a market-capitalization weighted index that covers about 95% of the total market capitalization of companies listed on the Main Board of the Hong Kong Stock Exchange.

The MSCI Emerging Markets Europe 10/40 Index (Net Total Return) is a free float-adjusted market capitalization index that is designed to measure equity performance in the emerging market countries of Europe (Czech Republic, Hungary, Poland, Russia and Turkey). The index is calculated on a net return basis (i.e., reflects the minimum possible dividend reinvestment after deduction of the maximum rate withholding tax). The index is periodically rebalanced relative to the constituents' weights in the parent index.

The MSCI Emerging Markets Net Total Return Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in emerging market countries on a net return basis (i.e., reflects the minimum possible dividend reinvestment after deduction of the maximum rate withholding tax).

The Morgan Stanley Commodity Related Equity Index (CRX) is an equal-dollar weighted index of 20 stocks involved in commodity-related industries such as energy, non-ferrous metals, agriculture and forest products.

The NYSE Arca Gold Miners Index is a modified market capitalization-weighted index comprised of publicly-traded companies involved primarily in the mining for gold and silver.

The S&P 500 Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

The S&P Composite 1500 Index is a broad-based capitalization-weighted index of 1500 U.S. companies and is comprised of the S&P 400, S&P 500 and the S&P 600.

10

Definitions for Management Teams' Perspectives

Other Index Definitions

The Barclays Capital Municipal Bond Index is an unmanaged index representative of the tax-exempt bond market.

The China Purchasing Managers' Index, a gauge of nationwide manufacturing activity, is issued by the China Federation of Logistics & Purchasing and co-compiled by the National Bureau of Statistics.

The ISM Manufacturing Composite Index is a diffusion index calculated from five of the eight sub-components of a monthly survey of purchasing managers at roughly 300 manufacturing firms from 21 industries in all 50 states.

The JP Morgan Global Manufacturing PMI Index is an indicator of global economic and business conditions derived monthly from data produced using internationally comparable methodologies covering around 10,000 survey respondents in over twenty countries.

The Macquarie Global Infrastructure Index is designed to reflect the stock performance of companies within the infrastructure industry, principally those engaged in the management, ownership and or operation of infrastructure and utility assets.

The MSCI All Country Far East Free ex Japan Index is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of the Far East, excluding Japan. The index consists of the following developed and emerging market country indices: China, Hong Kong, Indonesia, Korea, Malaysia, Philippines, Singapore, Taiwan and Thailand.

The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver.

The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The Warsaw Stock Exchange Top 20 Index is a modified capitalization-weighted index of twenty Polish stocks which are listed on the main market.

The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar.

11

Management Team's Perspective

Introduction

The U.S. Treasury Securities Cash Fund (USTXX) seeks to obtain a high level of current income while maintaining the highest degree of safety of principal and liquidity. The U.S. Government Securities Savings Fund (UGSXX) seeks to achieve a consistently high yield with safety of principal.

Performance

U.S. Treasury Securities Cash Fund | | As of December 31, 2012 | |

| 7-Day Yield | | | 0.01 | % | |

7-Day Effective Yield | | | 0.01 | % | |

U.S. Government Securities Savings Fund | | As of December 31, 2012 | |

| 7-Day Yield | | | 0.01 | % | |

7-Day Effective Yield | | | 0.01 | % | |

An investment in either the U.S. Treasury Securities Cash Fund or the U.S. Government Securities Savings Fund is neither insured nor guaranteed by the Federal Deposit Insurance Corporation (FDIC) or by any other government agency. Although the funds seek to preserve the value of your investments at $1.00 per share, it is possible to lose money by investing in these funds.

Pursuant to a voluntary arrangement, U.S. Global Investors, Inc. (Adviser) has agreed to limit total fund operating expenses to not exceed 1.00% for the U.S. Treasury Securities Cash Fund and 0.45% for the U.S. Government Securities Savings Fund on an annualized basis. In addition, the yields reported above include the effects of the Adviser's voluntary waiver of fees and/or reimbursement of expenses to maintain a minimum net yield for the funds. The Adviser can modify or terminate these arrangements at any time.

The Year In Review - Economic And Political Issues That Affected The Funds

At the beginning of 2012, there was positive economic momentum as unemployment was falling, the consumer was spending and manufacturing remained relatively robust. In the first quarter of 2012, the global economy appeared stronger and, as a result, investor sentiment improved.

As the year progressed, the economic slowdown in Europe and China proved too much to bear and negatively affected the U.S. economy. In June, the ISM Manufacturing Composite Index fell to 49.7, the lowest level in three years, indicating a modest contraction in the manufacturing sector. This was a surprising reading and

12

was confirmed by a lower global trend for similar manufacturing readings. Consumer confidence fell, even though gasoline prices had been lower.

After a summer lull, the economy began to pick up again with GDP growing 3.1 percent in the third quarter. In the fourth quarter, the U.S. presidential election and the impending fiscal cliff dominated the news but the economy appeared to be maintaining the momentum that began in the third quarter. Housing remains an area of strength as prices have moved higher, which spurs activity and makes the banks more inclined to lend.

The European financial crisis has largely been diffused over the past six months as European Central Bank (ECB) President Mario Draghi vowed in late July to do "whatever it takes" to save the euro. Essentially, the ECB put its reputation on the line and since then, markets have stabilized.

China was surprisingly weak early in the year as policymakers failed to act decisively, but as the year progressed and a power transition took place, the economy stabilized and policymakers succeeded in an economic "soft landing."

The Federal Reserve maintained its position during the first half of the year of not providing additional stimulus, but began a $40 billion per month open-ended quantitative easing (QE) program in September. In December, the Fed rolled an existing program that was scheduled to end in December into an additional $45 billion per month QE program. In total, the Fed is currently purchasing $85 billion in treasuries and mortgage-backed securities each month in an effort to stimulate the economy.

In addition to the ECB and the U.S., policymakers worldwide are engaged in a synchronized easing cycle.

Inflation in the U.S. decelerated during the first six months of the year and has been oscillating around 2 percent in recent months. The global trend for inflation has also been lower, allowing central bankers to comfortably shift to pro-growth policies.

Fiscal austerity is being implemented across the developed world to address long-term imbalances and is expected to be a drag on growth in the U.S. and Europe for some time. Spending cuts and higher taxes are a headwind to economic growth.

Yields on the three-month Treasury bill rose 3 basis points to 0.04 percent, while yields on the six-month bills rose 5 basis points to 0.11 percent. One-year agency discount note yields fell 2 basis points to 0.12 percent. The market was still influenced by periodic bouts of risk aversion or other disruptions, with investors, at times, seeking to own short-term Treasury securities at almost any cost.

13

Investment Highlights

The U.S. Treasury Securities Cash Fund performed in line with Lipper's Treasury money market funds for the year ending December 31, 2012, returning 0.01 percent, the same as the peer group. The U.S. Government Securities Savings Fund also performed in line with the Lipper government-only money market funds, returning 0.01 percent versus 0.01 percent for the peer group.

The U.S. Treasury Securities Cash Fund had a weighted average maturity of 2 days over the 12-month period, as overnight repurchase agreements were some of the highest yielding options with the least amount of interest rate risk in the Treasury money market universe.

The U.S. Government Securities Savings Fund followed a very short-laddered approach for much of the period and had a weighted average maturity of 14 days over the period. The fund took advantage of higher yields by selectively extending its ladder but also took advantage of relatively higher repo rates. Overall, it remained a very difficult environment for money market fund investors.

Current Outlook

The Fed continues to remain accommodative in an attempt to offset fiscal tightening and spur employment growth. We continue to believe that it is unlikely that the Fed will meaningfully change course during 2013, with monetary policy expected to remain very easy during this time.

14

Management Team's Perspective

Introduction

The Near-Term Tax Free Fund (NEARX) and the Tax Free Fund (USUTX) seek to provide a high level of current income exempt from federal income taxation and to preserve capital. However, a portion of any distribution may be subject to federal and/or state income taxes. The Near-Term Tax Free Fund will maintain a weighted average maturity of less than five years, while the Tax Free Fund will generally maintain a longer weighted average maturity.

Performance Graphs

Near-Term Tax Free Fund

Average Annual Performance For the Years Ended

December 31, 2012

| | | One Year | | Five Year | | Ten Year | |

Near-Term Tax Free Fund | | | 2.67 | % | | | 3.62 | % | | | 3.15 | % | |

Barclays Capital 3-Year Municipal Bond

Index | | | 1.86 | % | | | 3.66 | % | | | 3.17 | % | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 0.45%. The Adviser can modify or terminate this arrangement at any time.

See Definitions for Management Teams' Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

15

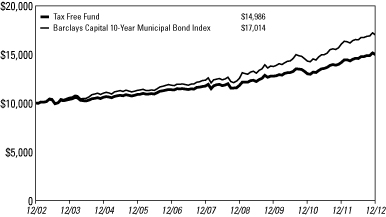

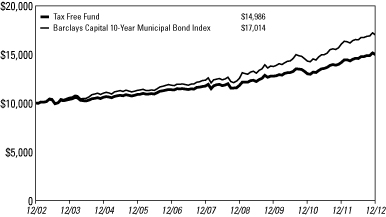

Tax Free Fund

Average Annual Performance For the Years Ended

December 31, 2012

| | | One Year | | Five Year | | Ten Year | |

Tax Free Fund | | | 5.60 | % | | | 4.97 | % | | | 4.12 | % | |

Barclays Capital 10-Year Municipal Bond

Index | | | 5.70 | % | | | 6.60 | % | | | 5.45 | % | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 0.70%. The Adviser can modify or terminate this arrangement at any time.

See Definitions for Management Teams' Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

The Year In Review - Economic And Political Issues That Affected The Funds

The municipal bond market exhibited solid performance over the past year as the Barclays Capital Municipal Bond Index rose 6.78 percent.

Despite more high profile municipal defaults during the first half of the year and increased media scrutiny, municipals have performed very well and overall defaults were not unusually high. Most municipal governments are making the tough but necessary changes to balance their budgets.

16

Yields steadily declined over the course of the year, with the very long end of the yield curve outperforming, as bonds with maturities of 22 years or more rose by 11.26 percent. Municipal market performance was consistent throughout the yield curve, as returns were relatively tied to maturity.

At the beginning of 2012, there was a growing sense of optimism for the economy but as the months wore on, economic data deteriorated. The ongoing European financial crisis and fears of an economic hard landing in China drove interest rates lower. This reached a tipping point in late July when European Central Bank (ECB) President Mario Draghi stated that the ECB would do "whatever it takes" to save the euro.

Since that time, markets in Europe have stabilized and global policymakers remain supportive of economic growth. The Federal Reserve also helped stabilize the global markets by implementing another round of quantitative easing in September and then adding to the program in December. In total, $85 billion per month is being used to buy Treasuries and mortgage-backed securities to help boost the economy. This will continue until the Fed is satisfied that the economy is on solid footing.

Revenue-backed municipals outperformed general obligation credits by a wide margin, driven by hospital and industrial development issues. Credit factors played a sizable role in performance as low-quality outperformed high-quality bonds. AAA-rated municipals rose by 4.52 percent during the year compared to BBB-rated bonds, which rose 9.80 percent. High-yield, or junk, bonds rose an eye-popping 18.14 percent over the past year.

In specialty state trading, California and Illinois outperformed, while New York and Puerto Rico underperformed.

Investment Highlights

For the year ended December 31, 2012, the Near-Term Tax Free Fund returned 2.67 percent, outperforming its benchmark, the Barclays Capital 3-Year Municipal Bond Index, which returned 1.86 percent. The Tax Free Fund returned 5.60 percent, slightly underperforming its benchmark, the Barclays Capital 10-Year Municipal Bond Index, which returned 5.70 percent.

The Near-Term Tax Free Fund modestly underperformed the Short-Intermediate Lipper peer group for the past year. The Tax Free Fund also trailed its respective Lipper peer group. The underperformance of the Tax Free Fund compared to its peers was primarily driven by fund credit and maturity preferences relative to the Lipper peer group. As discussed above, the long end of the yield curve experienced significant outperformance and low quality and junk bonds significantly outperformed; the fund was positioned more conservatively. The Near-Term Tax Free Fund outperformed more than half of the funds in the Lipper peer group but, due to very strong

17

outlier performance by a handful of funds, the overall peer group average was skewed higher.

Strengths

• The Tax Free Fund maintained significant exposure to hospital-backed municipals, which outperformed.

• The Tax Free Fund benefited from significant exposure to California, Illinois and Texas, which all outperformed.

• The Near-Term Tax Free Fund benefited from significant exposure to Illinois, Texas and Florida, which all outperformed.

• From a maturity perspective, the Near-Term Tax Free Fund benefited from a longer maturity profile than its benchmark.

Weaknesses

• Historically, the conservative credit profile of both funds proved to be an asset during volatile periods, but negatively affected performance this year when low quality credits significantly outperformed.

• The Tax Free Fund maintained a relatively short maturity/duration profile. This negatively affected performance in relation to its benchmark and peer group, as longer maturities outperformed.

• Bond structure also played a role in performance as the Tax Free Fund had little exposure to long maturities with discount coupon structures, which significantly outperformed.

Current Outlook

Opportunities

• The long-intermediate portion of the yield curve appears to offer the best opportunity in the current market, as the Fed remains accommodative and, globally, other central banks are following a similar path.

Threats

• Continued outperformance of low-quality bonds is the most significant threat on a relative basis.

• When the Fed reverses its monetary policy stance and begins to raise interest rates, the macro environment could become more difficult.

18

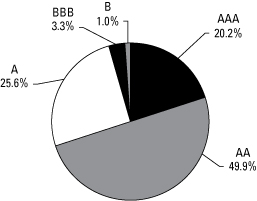

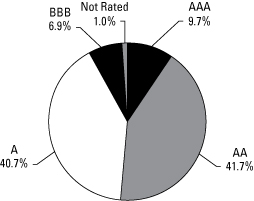

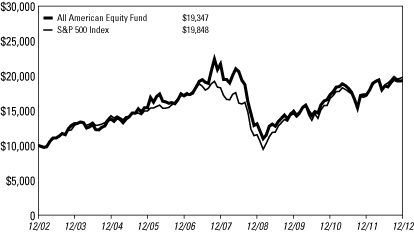

Near-Term Tax Free Fund

Municipal Bond Ratings December 31, 2012

(Based on Total Municipal Bonds)

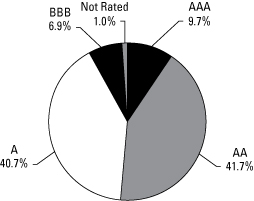

Tax Free Fund

Municipal Bond Ratings December 31, 2012

(Based on Total Municipal Bonds)

19

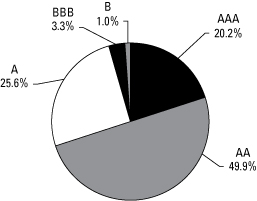

Management Team's Perspective

Introduction

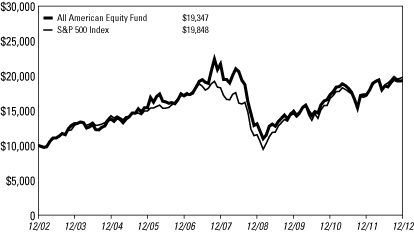

The principal objective of the All American Equity Fund (GBTFX) is to seek capital appreciation by investing primarily in a broadly diversified portfolio of domestic common stocks. The fund invests in large-capitalization stocks, while retaining the flexibility to seek out promising individual stock opportunities, including stocks with meaningful dividend yields.

Performance Graph

All American Equity Fund

Average Annual Performance For the Years Ended

December 31, 2012

| | | One Year | | Five Year | | Ten Year | |

All American Equity Fund | | | 11.80 | % | | | (2.30 | )% | | | 6.82 | % | |

S&P 500 Index | | | 16.00 | % | | | 1.66 | % | | | 7.09 | % | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted.The principal value and investment return of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 2.20%. The Adviser can modify or terminate this arrangement at any time.

See Definitions for Management Teams' Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

20

The Year In Review - Economic And Political Issues That Affected The Fund

U.S. real GDP grew at an annualized rate of 2.0 percent in the first quarter and 1.3 percent in the second quarter. This weak growth has been driven largely by a rapidly slowing European economy and also a larger-than-expected slowdown in China. Manufacturing indicators in the U.S. had held up well and were a source of strength until mid-year when the ISM Manufacturing Composite Index fell into contraction territory for the first time in three years. The economy bottomed during the summer and third quarter GDP was surprisingly strong at 3.1 percent. In the fourth quarter, the U.S. presidential election and the impending "fiscal cliff" dominated the news, but the real economy powered ahead. As the year ended, housing remained an area of strength as prices moved higher, spurring activity across many sectors of the economy.

The European financial crisis was a significant source of volatility and uncertainty during the first half of the year but has largely been diffused over the past six months. The European Central Bank President Mario Draghi vowed in late July to do "whatever it takes" to save the euro and preserve the eurozone from collapse, and since that time, markets have stabilized, allowing policymakers to focus on the real economic issues. China was weak early in the year as the government failed to act decisively. However, after the power transition took place, the economy stabilized.

The Federal Reserve maintained its policy during the first half of the year but began a $40 billion per month open-ended quantitative easing (QE) program in September. In December, the Fed rolled an existing program scheduled to end in December into an additional $45 billion per month QE program. In total, the Fed is currently purchasing $85 billion in treasuries and mortgage backed securities per month in an effort to stimulate the economy.

In addition to the ECB and the Fed, central banks around the world have continued a massive easing cycle.

Inflation in the U.S. decelerated during the first six months of the year and has been oscillating around 2 percent in recent months. The global trend for inflation has also been lower, allowing central bankers to comfortably shift to pro-growth policies.

In many developed countries, fiscal austerity is being implemented to address long-term imbalances. We believe this will be a drag on growth in the U.S. and Europe for some time, as spending cuts and higher taxes tend to be a headwind to economic growth.

The political environment in the U.S. remained one of strongly divided partisan debates, with the Democrats controlling the Presidency and the Senate, while the

21

Republicans controlled the House of Representatives. The debt ceiling debate will take center stage early in the new year.

The markets in 2012 could be described as "better than it felt." The S&P 500 Index rose 16.00 percent for the year along with most equity markets around the world. Even though the first half of the year was volatile and the partisan political process in the second half of the year was difficult and often left investors with negative connotations, the market produced solid returns, climbing the proverbial "wall of worry."

Investment Highlights

Overview

The All American Equity Fund returned 11.80 percent for the year ended December 31, 2012, underperforming the 16.00 percent return for the benchmark S&P 500 Index.

Because the fund is actively managed and holding period is generally not a consideration in investment decisions, the portfolio turnover rate may fluctuate from year to year as the fund adjusts its portfolio composition. The fund's annual portfolio turnover was, and is expected to continue to be, more than 100 percent.

Strengths

• The fund's allocations to materials, consumer staples and energy sectors positively contributed to relative performance. The fund's stock selection in these three sectors was particularly strong.

• Industry groups that were standout performers for the fund included metals and mining, beverages and chemicals.

• The fund's exposure to dividend-paying stocks over the past year performed in-line with the other portfolio components.

• MasterCard, Inc.,(1) Monster Beverage Corp.(2) and The Gap, Inc.(2) were among the best positive contributors to performance.

Weaknesses

• The fund's allocations to the financials and consumer discretion sectors were negative contributors to relative performance. While financials was the best performing sector in the S&P 500 in 2012, the fund was underweight, and stock selection within the sector was subpar.

• Cash and defensive option strategies did not aid fund performance over the past year as the market rallied strongly.

22

• Tangoe, Inc.,(2) F5 Networks, Inc.(2) and Best Buy Co., Inc.,(3) were among the worst individual contributors to performance.

Current Outlook

Opportunities

• The U.S. economy has been surprisingly resilient during the past six months and may prove to be a positive surprise for equities in 2013.

• Corporate cash levels continue to remain high, providing corporations the ability to pursue mergers and acquisitions (M&A). An increase in M&A activity holds promise for both portfolio gains and an increase in overall market valuations.

• Low interest rates, if continued throughout 2013, should provide a favorable backdrop for the economy and stock prices.

• Dividend-paying stocks remain attractive. As of December 31, 2012, the S&P 500 Index dividend yield was 2.24 percent, which is greater than the 1.76 percent yield on the 10-year Treasury. The fund maintains an emphasis on dividend-paying stocks.

Threats

• We believe Europe remains the largest wildcard. If the continent is in recession and employs much-needed fiscal austerity, these actions will severely crimp growth.

• China's economy appears to have turned a corner, but with new leadership in place, it may increase the risk of a policy misstep.

• Global government policy delays or outright missteps are a threat to global equity markets.

(1)This security comprised 4.37% of the fund's total net assets as of 12/31/12.

(2)The fund did not hold this security as of 12/31/12.

(3)This security comprised 0.50% of the fund's total net assets as of 12/31/12.

23

Top 10 Holdings Based on Net Assets

(excluding repurchase agreement) December 31, 2012

Apple, Inc.

Computers | | | 5.70 | % | |

MasterCard, Inc.

Commercial Services - Financial | | | 4.37 | % | |

Wabtec Corp.

Machinery - General Industrial | | | 2.60 | % | |

Celgene Corp.

Medical - Biomedical/Gene | | | 2.34 | % | |

Union Pacific Corp.

Transportation - Rail | | | 2.24 | % | |

Watson Pharmaceuticals, Inc.

Medical - Generic Drugs | | | 2.04 | % | |

Gartner, Inc.

Consulting Services | | | 1.91 | % | |

D.R. Horton, Inc.

Building - Residential/Commercial | | | 1.88 | % | |

eBay, Inc.

E-Commerce/Products | | | 1.82 | % | |

Google, Inc.

Web Portals/Internet Service Providers | | | 1.68 | % | |

Total Top 10 Holdings | | | 26.58 | % | |

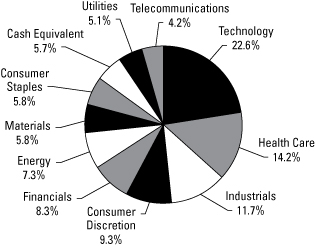

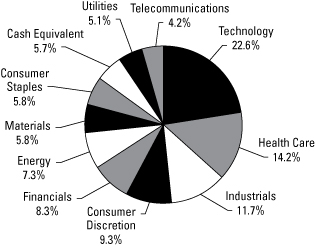

Portfolio Allocation by Industry Sector*

Based on Total Investments December 31, 2012

* Summary information above may differ from the portfolio schedule included in the financial statements due to the use of different classifications of securities for presentation purposes.

24

Management Team's Perspective

Introduction

The Holmes Growth Fund (ACBGX) invests in companies with good growth prospects and strong positive earnings momentum. The fund's primary objective is to seek long-term capital appreciation.

Performance Graph

Holmes Growth Fund

Average Annual Performance For the Years Ended

December 31, 2012

| | | One Year | | Five Year | | Ten Year | |

Holmes Growth Fund | | | 6.77 | % | | | (4.63 | )% | | | 5.45 | % | |

S&P Composite 1500 Index | | | 16.30 | % | | | 2.11 | % | | | 7.54 | % | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 2.20%. The Adviser can modify or terminate this arrangement at any time.

See Definitions for Management Teams' Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

25

The Year In Review - Economic And Political Issues That Affected The Fund

The U.S. economy grew at a sluggish pace in the first half of the year with real GDP growing at an annualized rate of 2.0 percent in the first quarter and 1.3 percent in the second quarter. One of the drivers of slow growth was continued uncertainty in Europe. In late December 2011, the European Central Bank (ECB) implemented the long-term refinancing operation (LTRO) program in which banks could borrow funds for three years. This was a key step in dealing with the crisis and the market rallied sharply early in the year, but it did not last.

Manufacturing indicators in the U.S. held up well and were a source of strength until mid-year when the ISM Manufacturing Composite Index fell into contraction territory for the first time in three years.

In Europe, a mini-crisis seemed to erupt every couple of months until ECB President Mario Draghi pledged in late July to do "whatever it takes" to save the euro. The U.S. economy bottomed during the summer and third quarter GDP was surprisingly strong at 3.1 percent. In the fourth quarter, the U.S. presidential election and the impending fiscal cliff dominated the news, but the economy powered ahead. Housing remains an area of strength as prices have moved higher, which spurs activity across many sectors of the economy. While inflation in the U.S. decelerated during the first six months of the year, it has been oscillating around 2 percent in recent months.

The European slowdown impacted China more than many had expected. However, as the year progressed and a power transition took place, its economy stabilized and policymakers succeeded in an economic "soft landing" in 2012, which was a very positive development from a global growth perspective.

The Federal Reserve maintained its policy during the first half of the year but began a $40 billion per month open-ended quantitative easing (QE) program in September. In December, the Fed rolled an existing program that was scheduled to end in December into an additional $45 billion per month QE program. In total, the Fed is currently purchasing $85 billion in treasuries and mortgage backed securities per month in an effort to stimulate the economy. Since global inflation has slowed, policy makers throughout the world are engaged in a synchronized global easing cycle.

The global trend for inflation has also been lower, allowing central bankers to comfortably shift to pro-growth policies.

Fiscal austerity is being implemented across the developed world to address long-term fiscal imbalances and will be a drag on growth in the U.S. and Europe for some time. Spending cuts and higher taxes are a headwind to economic growth.

26

The political environment in the U.S. remained one of strongly divided partisan debates, with the Democrats controlling the Presidency and the Senate, while the Republicans controlled the House of Representatives. The debt ceiling debate will take center stage early in the year.

The markets in 2012 could be described as "better than it felt." The S&P 500 Index gained 16.00 percent along with most equity markets around the world. Even though the first half of the year was volatile and the partisan political process in the second half of the year was difficult and often left investors with negative connotations, the market continued to produce solid results.

Investment Highlights

Overview

The Holmes Growth Fund rose 6.77 percent over the past year, underperforming the benchmark, the S&P Composite 1500 Index, which returned 16.30 percent. The fund performed well early in the year, but growth-oriented stocks underperformed overall. The fund emphasizes sustainable growth and relative strength. Stocks geared to classic value factors such as deep value and price reversals outperformed.

Because the fund is actively managed and holding period is generally not a consideration in investment decisions, the portfolio turnover rate may fluctuate from year to year as the fund adjusts its portfolio composition. The fund's annual portfolio turnover was, and is expected to continue to be, more than 100 percent.

Strengths

• The fund benefited from its exposure to energy, materials and staples.

• Industry groups that were standout performers for the fund included oil and gas producers, aerospace & defense and precious metals miners.

• Gulfport Energy Corp.,(1) Ulta Salon Cosmetics & Fragrance, Inc.(2) and MasterCard, Inc.(3) were among the best positive contributors to performance.

Weaknesses

• The fund's exposure to consumer discretion, financials and health care were relative drags on the portfolio.

• Cash and defensive option positions were a drag on performance as the market rallied strongly for the year.

• Investments in Body Central Corp.,(4) Tangoe, Inc.(4) and F5 Networks, Inc.(4) failed to live up to expectations and were among the worst contributors to the fund's performance.

27

Current Outlook

Opportunities

• The U.S. economy has been resilient and the economy appears to have picked up momentum in the second half of the year. The Fed remains extremely accommodative and is likely to maintain this stance for much of 2013.

• Corporate cash levels are high, providing corporations the ability to pursue mergers and acquisitions (M&A). An increase in M&A activity holds promise for both portfolio gains and an increase in overall market valuations.

• At the end of the period, the fund maintained a higher than normal level of cash, which the fund can opportunistically deploy.

Threats

• Fiscal austerity in the U.S. and abroad will continue to create economic headwinds.

• While Europe and China appear to be on improving trends, policy missteps cannot be ruled out.

• Deep value and price reversals have led the market. If this trend persists, it is a threat to relative performance.

(1)This security comprised 2.65% of the fund's total net assets as of 12/31/12.

(2)This security comprised 1.99% of the fund's total net assets as of 12/31/12.

(3)This security comprised 3.83% of the fund's total net assets as of 12/31/12.

(4)The fund did not hold this security as of 12/31/12.

28

Top 10 Holdings Based on Net Assets

(excluding repurchase agreement) December 31, 2012

Apple, Inc.

Computers | | | 6.77 | % | |

MasterCard, Inc.

Commercial Services - Financial | | | 3.83 | % | |

Wabtec Corp.

Machinery - General Industrial | | | 3.03 | % | |

United Rentals, Inc.

Rental Auto/Equipment | | | 2.89 | % | |

CommVault Systems, Inc.

Data Processing/Management | | | 2.82 | % | |

Watson Pharmaceuticals, Inc.

Medical - Generic Drugs | | | 2.73 | % | |

Gulfport Energy Corp.

Oil Companies - Exploration & Production | | | 2.65 | % | |

eBay, Inc.

E-Commerce/Products | | | 2.50 | % | |

Celgene Corp.

Medical - Biomedical/Gene | | | 2.50 | % | |

Polaris Industries, Inc.

Recreational Vehicles | | | 2.43 | % | |

Total Top 10 Holdings | | | 32.15 | % | |

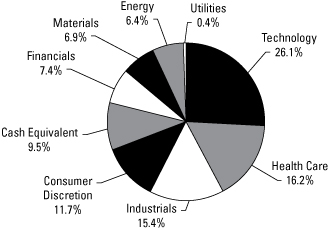

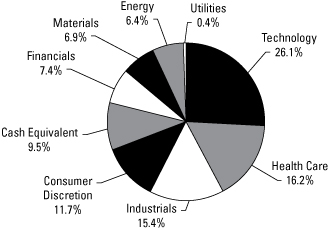

Portfolio Allocation by Industry Sector*

Based on Total Investments December 31, 2012

* Summary information above may differ from the portfolio schedule included in the financial statements due to the use of different classifications of securities for presentation purposes.

29

Management Team's Perspective

Introduction

The MegaTrends Fund (MEGAX and MEGIX) focuses on companies that are well positioned to benefit from substantial and sustainable growth that may occur over a multi-year time frame. The fund considers a broad range of investable opportunities, many of which are created by government policies, technological innovations and/or changes in market fundamentals for a product, service or commodity. The fund has the flexibility to invest globally and within any sector of the economy.

Performance Graph

MegaTrends Fund

Average Annual Performance For the Periods Ended December 31, 2012

| | | One Year | | Five Year | | Ten Year | | Since Inception

(Institutional

Class) | |

MegaTrends Fund - Investor Class | | | 5.67 | % | | | (7.44 | )% | | | 4.47 | % | | | n/a | | |

MegaTrends Fund - Institutional Class

(Inception 3/1/10) | | | 5.95 | % | | | n/a | | | | n/a | | | | 1.59 | % | |

S&P 500 Index | | | 16.00 | % | | | 1.66 | % | | | 7.09 | % | | | 11.36 | % | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 2.35% for the Investor Class. Also pursuant to a voluntary agreement, the Adviser has agreed to waive all class specific expenses of the Institutional Class. The Adviser can modify or terminate these arrangements at any time.

See Definitions for Management Teams' Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

30

The Year In Review - Economic And Political Issues That Affected The Fund

Political and economic considerations are very influential on the investment climate in which the MegaTrends Fund operates.

In the first half of the year, inaction by European policymakers raised fears that the global economy was headed toward a severe recession, and weighed heavily on equity markets during the summer months. After European Central Bank (ECB) President Mario Draghi publicly made the statement that the ECB would do "whatever it takes" to protect the eurozone from collapsing, officials were able to stabilize the global credit markets via political measures and a series of financial support programs. The ECB lowered interest rates to aid the economy, and provided inexpensive loans to maintain money flows in the European banks.

In the fall, the U.S. presidential election consumed the financial headlines. However, immediately following the election, it did not take long for investors' fears over the U.S. "fiscal cliff" to arise. There was a lack of clarity surrounding the repeal of $600 billion worth of tax and fiscal spending initiatives, which slowed market gains as 2012 ended.

Conversely, China gained economic momentum in the fourth quarter, as prior pro-growth policy changes spurred the economy and ignited demand for commodities and basic materials.

Investment Highlights

Overview

For the year ended December 31, 2012, the Investor Class of the fund returned 5.67 percent and the Institutional Class returned 5.95 percent. The benchmark S&P 500 Index returned 16.00 percent during the year.

Because the fund is actively managed and holding period is generally not a consideration in investment decisions, the portfolio turnover rate may fluctuate from year to year as the fund adjusts its portfolio composition. The fund's annual portfolio turnover was, and is expected to continue to be, more than 100 percent.

In mid-2012, the fund expanded on its previous emphasis of the global infrastructure theme to align the holdings toward broader top-down investment themes. The fund seeks to deploy capital into the most robust areas of the economy by ranking sector performance on a relative strength basis. The fund dynamically identifies themes and adapts to market trends that appear to be emerging.

31

Strengths

• Management's de-emphasis of the global infrastructure theme in the second half of the year proved successful, as the fund outperformed the Macquarie Global Infrastructure Index by 142 basis points. The index holds companies located around the world that are within the infrastructure industry.

• Top contributors to fund performance for 2012 included Sprint Nextel Corp.,(1) PulteGroup, Inc.(2) Lennar Corp.,(3) Atlas Energy L.P.(1) and Life Healthcare Group Holdings Ltd.(1)

• The fund benefited from owning certain securities in the telecommunications and financial sectors, with outperformance from Crown Castle International Corp.,(1) Verizon Communications, Inc.,(1) Bank of America Corp.(4) and the Royal Bank of Scotland Group plc.(5)

• Select international equities also contributed meaningfully to performance such as Suez Environment SA,(1) CCR S.A.(1) and PetroMagdalena Energy Corp.(1)

Weaknesses

• The fund's underperformance compared to the benchmark S&P 500 was mainly a result of sector allocation and stock selection in both domestic and international areas.

• The fund's emphasis on the infrastructure theme in the first six months of the year was a detriment to performance. The technology, telecommunication and financial sectors all outperformed the benchmark S&P 500 by an average of 682 basis points. The Macquarie Global Infrastructure Index underperformed the S&P 500 Index by 693 basis points during this period.

• Primary negative contributors to fund performance in 2012 included Dalian Port (PDA) Co., Ltd.,(1) Cementos Pacasmayo S.A.A.,(1) Golar LNG Ltd.(1) and Spirit Airlines, Inc.(1)

• From a sector standpoint, exposure to the U.S. utilities sector proved to be an opportunity cost, as this sector underperformed the S&P 500 Index by 1,472 basis points.

Current Outlook

Opportunities

Our investment process has identified the following investable trends that could prove to be multi-year megatrends:

• The basic materials and industrial sectors appear to be on the mend, and may be within the early stages of an uptrend given the economic rebound in China and the pro-growth synchronized monetary easing cycle taking place around the globe.

32

• The financial sector is steadily recovering from the 2008 financial crisis and is beginning to see signs of incremental credit demand, partially in response to an improving labor and housing market.

• The discretionary sector appears to have captured two trends involving the nascent recovery in the U.S. housing sector and the growing market share of discount retailing.

Threats

• While policymakers in Europe have made strides to stabilize the current debt crisis, many contagion risks remain, which could lead to a liquidity shock similar to 2008.

• If China's recovery proves to be fleeting, recent strength in cyclical sectors of the economy could be at risk of a reversal.

(1)The fund did not hold this security as of 12/31/12.

(2)This security comprised 2.43% of the fund's total net assets as of 12/31/12.

(3)This security comprised 2.22% of the fund's total net assets as of 12/31/12.

(4)This security comprised 2.55% of the fund's total net assets as of 12/31/12.

(5)This security comprised 2.48% of the fund's total net assets as of 12/31/12.

33

Top 10 Holdings Based on Net Assets

(excluding repurchase agreement) December 31, 2012

Pacific Stone Tech, Inc.

Quarrying | | | 4.97 | % | |

Pacific Infrastructure, Inc.

Real Estate Operating/Development | | | 3.12 | % | |

Toyota Motor Corp.

Automotive - Cars & Light Trucks | | | 2.68 | % | |

McKesson Corp.

Medical - Wholesale Drug Distribution | | | 2.60 | % | |

VF Corp.

Apparel Manufacturers | | | 2.56 | % | |

Bank of America Corp.

Diversified Banking Institutions | | | 2.55 | % | |

Royal Bank of Scotland Group plc

Diversified Banking Institutions | | | 2.48 | % | |

InterContinental Hotels Group plc

Hotels & Motels | | | 2.45 | % | |

News Corp.

Multimedia | | | 2.44 | % | |

PulteGroup, Inc.

Building - Residential/Commercial | | | 2.43 | % | |

Total Top 10 Holdings | | | 28.28 | % | |

Portfolio Allocation by Industry Sector*

Based on Total Investments December 31, 2012

* Summary information above may differ from the portfolio schedule included in the financial statements due to the use of different classifications of securities for presentation purposes.

34

Management Team's Perspective

Introduction

The Global Resources Fund (PSPFX and PIPFX) is a non-diversified natural resources fund with the principal objective of achieving long-term growth of capital while providing protection against inflation and monetary instability. The fund invests globally in companies involved in the exploration, production, transportation and processing of petroleum, natural gas, coal, alternative energies, chemicals, mining, iron and steel, and paper and forest products.

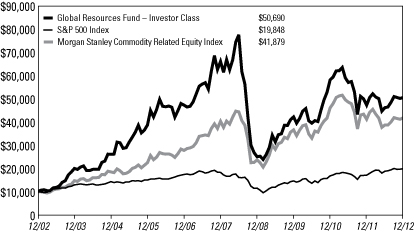

Performance Graph

Global Resources Fund

Average Annual Performance For the Periods Ended December 31, 2012

| | | One Year | | Five Year | | Ten Year | | Since Inception

(Institutional

Class) | |

Global Resources Fund - Investor Class | | | 6.93 | % | | | (5.22 | )% | | | 17.61 | % | | | n/a | | |

Global Resources Fund - Institutional Class

(Inception 3/1/10) | | | 7.44 | % | | | n/a | | | | n/a | | | | 7.17 | % | |

S&P 500 Index | | | 16.00 | % | | | 1.66 | % | | | 7.09 | % | | | 11.36 | % | |

Morgan Stanley Commodity Related

Equity Index | | | 1.36 | % | | | 0.75 | % | | | 15.38 | % | | | 4.27 | % | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 1.90% for the Investor Class. Also pursuant to a voluntary agreement, the Adviser has agreed to waive all class specific expenses of the Institutional Class. The Adviser can modify or terminate these arrangements at any time.

See Definitions for Management Teams' Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

35

The Year In Review - Economic And Political Issues That Affected The Fund

In 2012, market sentiment was dominated by fear-inducing economic headlines related to the ongoing European sovereign debt crisis, the U.S. presidential election and the U.S. "fiscal cliff." However, despite generally negative news flow, the S&P 500 Index climbed a "wall of worry" and posted a positive double-digit return for the year.

In the first half of the year, gridlock among European policymakers raised fears that the global economy was heading toward a severe recession. This weighed heavily on equity markets during the summer months. Fortunately, officials were able to stabilize the European bond market via political measures and a series of financial support programs. The European Central Bank (ECB) lowered interest rates to aid the economy, and provided loans to maintain money flows among European banks. In the fall of 2012, the market's attention focused on the U.S. presidential election and Barack Obama's victory over Mitt Romney. However, after the election, investors' fears over the U.S. "fiscal cliff" weighed on sentiment as the year ended.

This environment of "risk on/risk off" drove volatility in commodities, with prices falling as much as 10 percent into mid-year before rallying in the third quarter and then declining in the fourth quarter. This volatility created a headwind for the commodity-related stocks in general.

Also, as a significant consumer of commodities, China faced a weakening trend in its economy in the first three quarters of 2012 as GDP growth decelerated and inventories of goods were destocked. This weighed on commodity prices. Sentiment began to turn as the Chinese government proactively cut its bank reserve requirements in the fourth quarter, which may have signaled to the market a more pro-growth policy change. In fact, the China Purchasing Managers' Index expanded in December after a brief decline below the key level of 50. Moreover, the JP Morgan Global Manufacturing PMI Index also improved by the end of the year following three consecutive months of contraction.

Investment Highlights

Overview

For the year ended December 31, 2012, the Investor Class of the Global Resources Fund returned 6.93 percent and the Institutional Class gained 7.44 percent. These results were well ahead of the fund's benchmark, the Morgan Stanley Commodity Related Equity Index (CRX), which returned 1.36 percent.

36

Because the fund is actively managed and a holding period is generally not a consideration in investment decisions, the portfolio turnover rate may fluctuate from year to year as the fund adjusts its portfolio composition. The fund's annual portfolio turnover was, and is expected to continue to be, more than 100 percent.

Strengths

• Lumber prices surged to a six-year high by the end of the year as a recovery in the U.S. housing sector continued to unfold. Several stocks in the forest and paper industry contributed to fund performance, including West Fraser Timber Co., Ltd.,(1) Weyerhaeuser Co.(2) and International Paper Co.(3)

• The U.S. oil refining industry benefited from rising export opportunities of refined product and wide basin discounts of crude oil relative to international benchmarks, which provided significantly elevated profits for the industry. The fund held several stocks in this sector, such as HollyFrontier Corp.,(4) Valero Energy Corp.(5) and Marathon Petroleum Corp.,(6) which were top performers for the fund in 2012.

• Record drought conditions in the U.S. this past summer boosted corn and soybean prices to record levels and drove agricultural-related shares higher. The fund benefited from positions in Viterra, Inc.,(7) CF Industries Holdings, Inc.,(8) Monsanto Co.(9) and Bunge Ltd.(10)

Weaknesses

• Gold stocks performed poorly in 2012 as they fell in absolute terms and underperformed relative to gold bullion, which posted its twelfth consecutive year of positive returns. Several gold and silver mining stocks contributed negatively to performance, including Coeur d'Alene Mines Corp.,(7) Randgold Resources Ltd.(11) and Gran Colombia Gold Corp.(12)

• Junior exploration stocks were also a headwind for performance as the S&P/TSX Venture Composite Index fell 15.53 percent during 2012. The fund was negatively affected by holdings in several junior exploration companies, including Pacific Coal Resources Ltd.,(13) Horn Petroleum Corp.(14) and African Potash Ltd.(15)

• U.S. natural gas prices fell to multi-year lows in mid-2012, negatively impacting shares of companies that produce natural gas, including SM Energy Co.(7) and Newfield Exploration Corp.(16)

Current Outlook

Opportunities

• With the U.S. Federal Reserve continuing its policy of an open-ended quantitative easing program, the portfolio managers remain constructive on the likelihood that rising commodities prices resulting from global central bank easing will be a

37

catalyst for relative performance of commodity-related stocks. Under this scenario, gold and precious metals stocks continue to look attractive.

• The U.S. housing recovery remains a catalyst for the timber and forest sector, as the construction industry slowly recovers.

• Record high prices for agricultural commodities provide a incentive for fertilizer companies, seed companies and agricultural processors.

• Additionally, recent data show an uptick in growth prospects for the Chinese economy, which is bullish for natural resources.

Threats

• Further deterioration of the European debt crisis could result in a significant decline in global economic activity.

(1) This security comprised 1.92% of the total net assets of the fund as of 12/31/12.

(2) This security comprised 1.93% of the total net assets of the fund as of 12/31/12.

(3) This security comprised 2.02% of the total net assets of the fund as of 12/31/12.

(4) This security comprised 1.53% of the total net assets of the fund as of 12/31/12.

(5) This security comprised 1.28% of the total net assets of the fund as of 12/31/12.

(6) This security comprised 1.48% of the total net assets of the fund as of 12/31/12.

(7) The fund did not hold this security at 12/31/12.

(8) This security comprised 1.16% of the total net assets of the fund as of 12/31/12.

(9) This security comprised 1.96% of the total net assets of the fund as of 12/31/12.

(10)This security comprised 1.84% of the total net assets of the fund as of 12/31/12.

(11)This security comprised 1.86% of the total net assets of the fund as of 12/31/12.

(12)This security comprised 3.99% of the total net assets of the fund as of 12/31/12.

(13)This security comprised 0.78% of the total net assets of the fund as of 12/31/12.

(14)This security comprised 0.14% of the total net assets of the fund as of 12/31/12.

(15)This security comprised 0.14% of the total net assets of the fund as of 12/31/12.

(16)This security comprised 0.73% of the total net assets of the fund as of 12/31/12.

38

Top 10 Holdings Based on Net Assets

(excluding repurchase agreement) December 31, 2012

Gran Colombia Gold Corp.

Gold Mining | | | 3.99 | % | |

Sociedad Quimica y Minera de Chile S.A.

Chemicals - Diversified | | | 2.76 | % | |

Kinder Morgan, Inc.

Pipelines | | | 2.18 | % | |

Martin Marietta Materials, Inc.

Building Products - Cement/Aggregates | | | 2.16 | % | |

Consol Energy, Inc.

Coal | | | 2.14 | % | |

Pioneer Natural Resources Co.

Oil Companies - Exploration & Production | | | 2.13 | % | |

Oil States International, Inc.

Oil - Field Services | | | 2.08 | % | |

National-Oilwell Varco, Inc.

Oil Field Machinery & Equipment | | | 2.05 | % | |

Plum Creek Timber Co., Inc.

Real Estate Investment Trusts | | | 2.04 | % | |

BHP Billiton Ltd.

Diversified Minerals | | | 2.03 | % | |

Total Top 10 Holdings | | | 23.56 | % | |

39

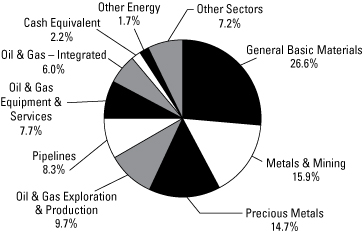

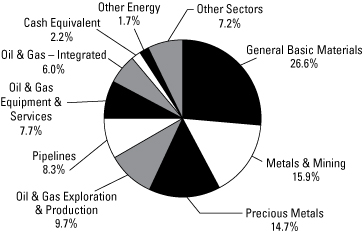

Portfolio Allocation by Industry Sector*

Based on Total Investments December 31, 2012

Energy: | |

Oil & Gas Exploration & Production | | | 9.7 | % | | | |

Pipelines | | | 8.3 | % | | | |

Oil & Gas Equipment & Services | | | 7.7 | % | | | |

Oil & Gas - Integrated (includes Refining and

Marketing) | | | 6.0 | % | | | |

Other Energy | | | 1.7 | % | | | |

Total Energy | | | | | 33.4 | % | |

Basic Materials: | |

Precious Metals (includes Gold/Silver Mining and

Platinum) | | | 14.7 | % | | | |

General Basic Materials | | | 26.6 | % | | | |

Metals & Mining (includes Copper and Coal) | | | 15.9 | % | | | |

Total Basic Materials | | | | | 57.2 | % | |

Other Sectors | | | | | 7.2 | % | |

Repurchase Agreement | | | | | 2.2 | % | |

| | | 100.0 | % | |

* Summary information above may differ from the portfolio schedule included in the financial statements due to the use of different classifications of securities for presentation purposes.

40

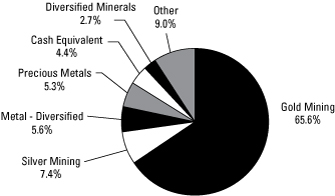

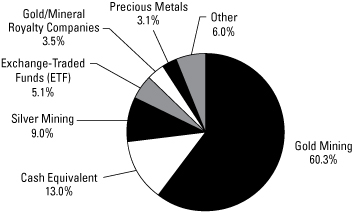

Precious Metals and Minerals Funds

Management Team's Perspective

Introduction

The World Precious Minerals Fund (UNWPX and UNWIX) and the Gold and Precious Metals Fund (USERX) pursue an objective of long-term capital growth through investments in gold, precious metals and mining companies. The Gold and Precious Metals Fund focuses on the equity securities of established gold and precious metals companies and pursues current income as a secondary objective. The World Precious Minerals Fund focuses on equity securities of companies principally engaged in the exploration, mining and processing of precious minerals such as gold, silver, platinum and diamonds. Although this fund has the latitude to invest in a broad range of precious minerals, it currently remains focused on the gold sector.

Performance Graphs

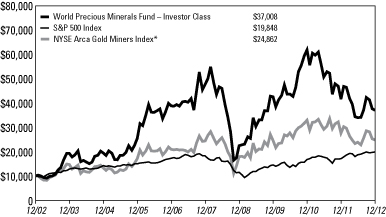

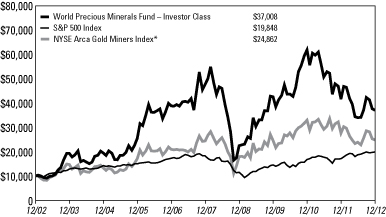

World Precious Minerals Fund

Average Annual Performance For the Periods Ended December 31, 2012

| | | One Year | | Five Year | | Ten Year | | Since Inception

(Institutional

Class) | |

World Precious Minerals Fund - Investor Class | | | (11.23 | )% | | | (4.95 | )% | | | 13.97 | % | | | n/a | | |

World Precious Minerals Fund -

Institutional Class (Inception 3/1/10) | | | (10.76 | )% | | | n/a | | | | n/a | | | | (4.15 | )% | |

S&P 500 Index | | | 16.00 | % | | | 1.66 | % | | | 7.09 | % | | | 11.36 | % | |

NYSE Arca Gold Miners Index* | | | (9.85 | )% | | | 0.34 | % | | | 9.53 | % | | | 1.56 | % | |

* These are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 1.90% for the Investor Class. Also pursuant to a voluntary agreement, the Adviser has agreed to waive all class specific expenses of the Institutional Class. The Adviser can modify or terminate these arrangements at any time.

See Definitions for Management Teams' Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

41

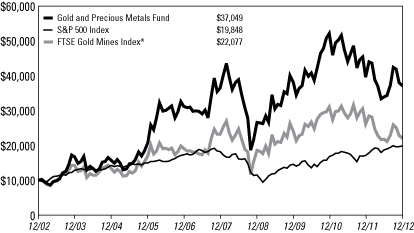

Precious Metals and Minerals Funds

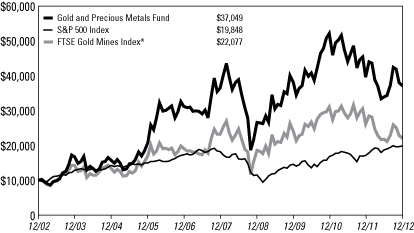

Gold and Precious Metals Fund

Average Annual Performance For the Years Ended

December 31, 2012

| | | One Year | | Five Year | | Ten Year | |

Gold and Precious Metals Fund | | | (6.44 | )% | | | 0.33 | % | | | 13.98 | % | |

S&P 500 Index | | | 16.00 | % | | | 1.66 | % | | | 7.09 | % | |

FTSE Gold Mines Index* | | | (15.43 | )% | | | (0.95 | )% | | | 8.23 | % | |

* These are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 1.90%. The Adviser can modify or terminate this arrangement at any time.

See Definitions for Management Teams' Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

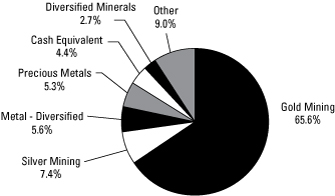

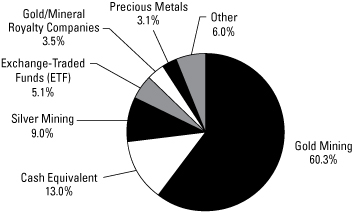

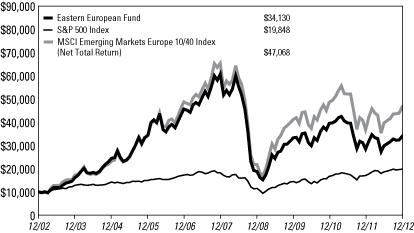

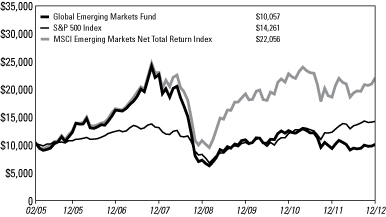

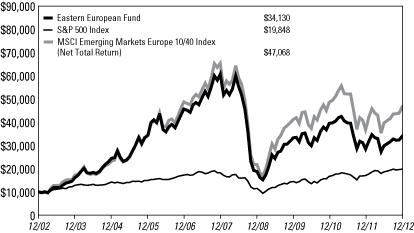

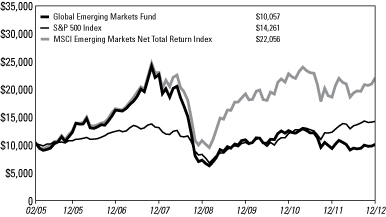

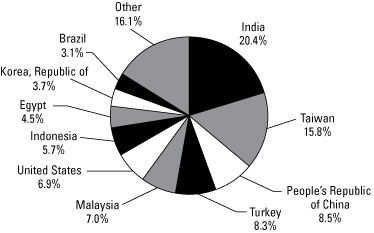

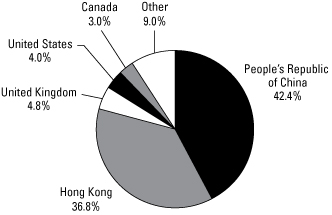

The Year In Review - Economic And Political Issues That Affected The Funds