UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-1800 |

|

U.S. GLOBAL INVESTORS FUNDS |

(Exact name of registrant as specified in charter) |

|

7900 CALLAGHAN ROAD SAN ANTONIO, TX | | 78229 |

(Address of principal executive offices) | | (Zip code) |

|

SUSAN B. MCGEE, ESQ. 7900 CALLAGHAN ROAD SAN ANTONIO, TX 78229 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 210-308-1234 | |

|

Date of fiscal year end: | DECEMBER 31, 2014 | |

|

Date of reporting period: | DECEMBER 31, 2014 | |

| | | | | | | | |

ITEM 1. REPORTS TO STOCKHOLDERS.

U.S. Global Investors Funds

Annual Report

December 31, 2014

U.S. Global Investors Funds

Annual Report

December 31, 2014

Letter to Shareholders | | | 1 | | |

Definitions for Management Teams' Perspectives | | | 16 | | |

Management Team's Perspective | | | 18 | | |

Expense Example | | | 63 | | |

Portfolios of Investments | | | 65 | | |

Notes to Portfolios of Investments | | | 118 | | |

Statements of Assets and Liabilities | | | 128 | | |

Statements of Operations | | | 132 | | |

Statements of Changes in Net Assets | | | 136 | | |

Notes to Financial Statements | | | 142 | | |

Financial Highlights | | | 161 | | |

Report of Independent Registered Public Accounting Firm | | | 172 | | |

Trustees and Officers | | | 173 | | |

Additional Information | | | 175 | | |

U.S. Global Investors Funds

Investor Class

U.S. Government Securities Ultra-Short Bond Fund | | UGSDX | |

Near-Term Tax Free Fund | | NEARX | |

All American Equity Fund | | GBTFX | |

Holmes Macro Trends Fund | | MEGAX* | |

Global Resources Fund | | PSPFX | |

World Precious Minerals Fund | | UNWPX | |

Gold and Precious Metals Fund | | USERX | |

Emerging Europe Fund | | EUROX | |

China Region Fund | | USCOX | |

Institutional Class | |

Global Resources Fund | | PIPFX | |

World Precious Minerals Fund | | UNWIX | |

Gold and Precious Metals Fund** | | USEIX | |

Emerging Europe Fund** | | EURIX | |

* The Nasdaq symbol for the Holmes Macro Trends Fund changed from ABCGX to MEGAX in March 2014.

** The Institutional Class shares of the Gold and Precious Metals and Emerging Europe Funds have not commenced operations and currently are closed to investors. A notice will be issued when each class commences operations and opens to investors.

Fund Services, LLC

PO Box 701

Milwaukee, WI

53201-0701

Tel 1.800.US.FUNDS

www.usfunds.com

U.S. Global Investors Funds (unaudited)

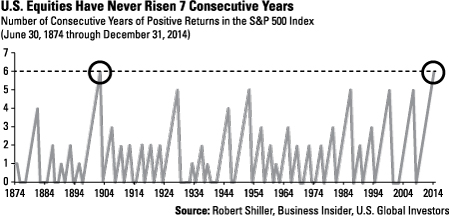

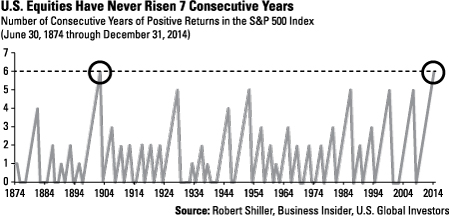

Six years. That's the longest duration of time that U.S. equities have consecutively risen, according to research by Nobel Prize-winning economist Robert Shiller.

Since 1871, it's happened only twice – once between 1898 and 1903, and again between 2009 and 2014. Note that the chart below shows only historical price changes and not total returns, including dividends.

What this means is that we're currently in one of the longest-running bull markets in U.S. equities history.

While this might sound exciting, a quick glance at the chart reveals what some could perceive as troubling news. A majority of the winning streaks lasted only two or three years before dipping into the red. What the bull giveth, the bear taketh away.

Yet this is how the market (normally) works. One year it's up, the next it's down, and there's money to be made in both directions. As Warren Buffett famously quipped, "I'd be a bum on the street with a tin cup if the market was always efficient."

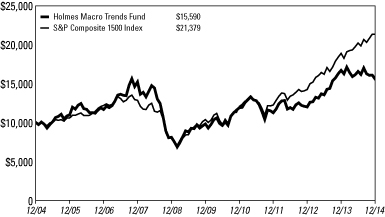

Indeed, you can make the argument that the market tends to do exactly that which displeases the most people. Take, for instance, the S&P Composite 1500 Index, the benchmark for our Holmes Macro Trends Fund (MEGAX). Even though the S&P 1500 returned 13.08 percent in 2014, smaller-cap and growth-oriented companies – the kind of names MEGAX has an overweight position in – were generally out-of-favor and therefore underperformed,

1

U.S. Global Investors Funds (unaudited)

after a successful 2013. The same can be said of our All American Equity Fund (GBTFX). It ended the year in positive territory but still came in under its benchmark, the S&P 500 Index.

But just as a smooth sea never makes a skilled sailor, an ever-efficient market never leads to skilled investment management.

If you want to know what "skilled" looks like, check out the following chart:

What resembles the Manhattan skyline is actually the 20 straight years of positive returns in our Near-Term Tax Free Fund (NEARX). Amazingly, that's more than three times the number of such years the general equities market has delivered in its longest stretch of year-over-year growth. Since its inception in 1990, NEARX has been down only one year.

According to Lipper, among 25,000 equity and bond funds in the U.S., only 30 have achieved the feat of giving investors positive returns for the past 20 years.

That equates to a rare 0.1 percent.

2

U.S. Global Investors Funds (unaudited)

Here's another way of looking at it:

As you can see, a hypothetical $100,000 invested in an S&P 500 index fund in December 1999 would have taken almost 14 years to catch up to and surpass a similar investment in NEARX.

Although we can't guarantee how the fund will perform in the future, NEARX has historically shown an ability to dodge the dramatic swings and volatility in the equities market, similar to the ones we experienced during the first decade of the century – the dotcom bubble, for instance, and the Great Recession. And there will be times, of course, when products such as an S&P 500 index fund will strongly outperform NEARX.

But unlike the equities market, NEARX has a time-tested history of no drama. As one has swung wildly this way and that, the other has calmly, confidently ticked up each year.

3

U.S. Global Investors Funds (unaudited)

What's more, NEARX continued to maintain its coveted 5-star overall rating from Morningstar, among 173 Municipal National Short-Term funds as of December 31, 2014, based on risk-adjusted return.

Municipal bonds, by the way, just had their best year in approximately two decades, posting their "longest string of monthly gains" and "outpacing gains in corporate bonds and U.S. government debt," according to the Wall Street Journal.

Call us at 1-800-386-3847 to request a copy of "Can You Handle the Stress of Losing 40 Percent in the Market?" and "A Little Pillow Talk Turned Her Husband on to Bonds" to better understand the benefits of planning your retirement dollars by investing in NEARX.

Actively Managing Emerging Markets

Since we've experienced an equity bull run for six years now, it's easy to presume that an index fund will be able to catch all the upside. But what about the downside? A correction is likely to occur at some point. As opposed to an index fund, active management can help to curtail volatility, such as what we've seen lately in certain sectors such as commodities and emerging markets, and mitigate risk.

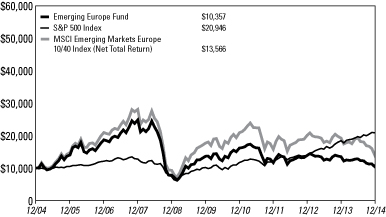

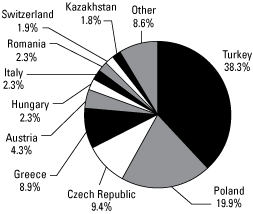

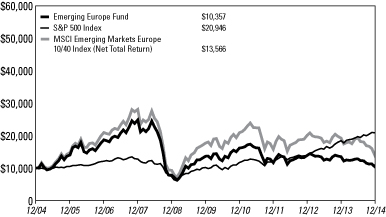

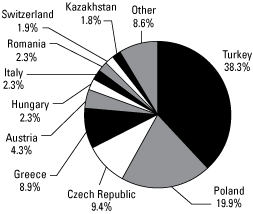

A perfect example of this was our exit from Russia in 2014. The benchmark of our Emerging Europe Fund (EUROX), the MSCI Emerging Markets Europe 10/40 Index, maintains a 51-percent weighting in Russia. But because of prudent active management, we were able to limit our exposure to Russia and avoid many of the downturns incurred by international sanctions, falling oil prices and a weakening ruble.

Lately, however, we've seen Russian stocks outperform and have begun again to build indirect exposure to the country through American depository receipts (ADRs), global depository receipts (GDRs) and exchange-traded funds (ETFs).

The European slowdown has received much attention, in my own blog and elsewhere, but there are still plenty of investment opportunities. A recent InvestmentNews piece finds that "European 'quality growth' companies, which include euro-area and non-euro-area firms, are trading at a significant discount to their small-cap peers in other regions." Additionally, the writers' analysis "suggests that European companies have the most potential to improve returns... as a more sustainable European recovery takes hold."

4

U.S. Global Investors Funds (unaudited)

Indeed, several European businesses are making admirable strides. Names that EUROX owns that paid a dividend in 2014 include Italy's UniCredit and Brembo and Switzerland's Straumann Holding. Poland has also been good to the fund. For 2014, Energa S.A. had a 12-month dividend yield of 4.6 percent; PKO Bank Polski, 2.3 percent; and insurer PZU Group, 7.1 percent.

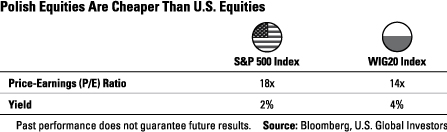

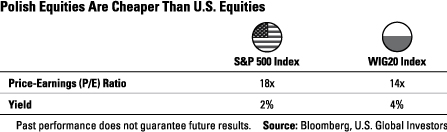

Take a look at the following chart. What it shows is that Polish equities, indicated by the WIG20 Index, are not only cheaper than U.S. equities, but they also pay out twice the dividend yield. Simply put, you're getting more for less.

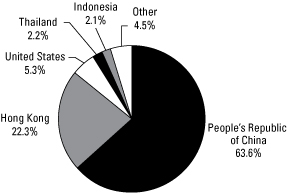

Chinese stocks in the MSCI China Index are also currently valued below their own historical averages, making them both attractive and competitive. They are trading at 10 times earnings, whereas U.S. stocks in the S&P 500 Index are trading at 18 times.

5

U.S. Global Investors Funds (unaudited)

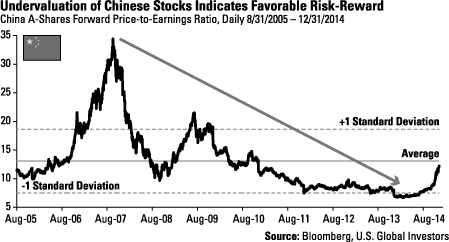

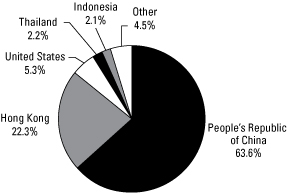

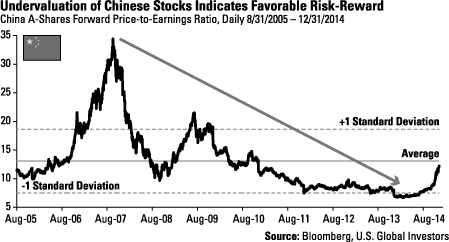

Chinese A-Shares – stocks that are typically available only to mainland Chinese citizens – surprised the market by breaking out last summer and delivering 54 percent for the 12-month period ending December 31, 2014.

What's more, the upside is unlikely to have been exhausted. Although they aren't as stellar of a bargain as they once were, A-Shares are not yet overvalued, and retail and institutional investors might accumulate on pullbacks.

"The better the Chinese markets perform, the more global liquidity they might attract," Xian Liang, portfolio manager of our China Region Fund (USCOX), says.

H-Shares, or Chinese stock that's listed on foreign stock exchanges, comprise the vast majority of USCOX's exposure to Chinese equities, with additional minimal exposure gained through A-Share exchange-traded funds (ETFs). In today's environment, we believe investable H-Shares, driven by the A-Share market, to be less risky; last year they returned 15.5 percent.

6

U.S. Global Investors Funds (unaudited)

Epic Commodities Price Reversal

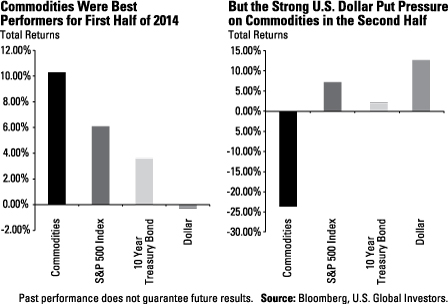

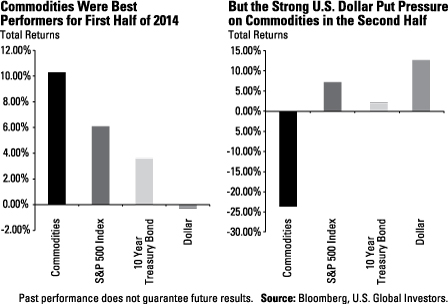

If you want to know what happened in 2014 with regard to gold and oil, it's important to appreciate the inverse relationship between the U.S. dollar and commodities that we typically see. The following charts are a good place to start:

Whereas total returns for the S&P 500 Index and 10-Year Treasury bond stayed relatively stable throughout the year, commodities and the U.S. dollar both made an incredible about-face starting around late June, early July. As I've discussed on multiple occasions, the strong dollar has weighed heavily on the commodities we track very closely and report on here at U.S. Global Investors, especially gold and crude oil. We're happy to see, however, that the yellow metal has risen approximately 2.5 percent since the beginning of the new year, while West Texas Intermediate (WTI) crude has appeared to have found support at $45 per barrel.

But this is why it's so important to manage expectations. As I wrote in my most recent whitepaper:

A keen awareness of the ebbs and flows of historical and socioeconomic conditions, on both the macro and micro scales, allows our investment management strategy to be more proactive than reactive.

7

U.S. Global Investors Funds (unaudited)

Everything operates in cycles, including the weather, gold seasonal trends, four-year election terms and more. The domestic and global markets are no different. Commodities might be down this year, but as recently as 2009 and 2010, they were the best-performing asset class.

It might be hard to believe now, but oil was the second-best-performing commodity in 2013, returning 7.19 percent, while gold had its worst year since 1981.

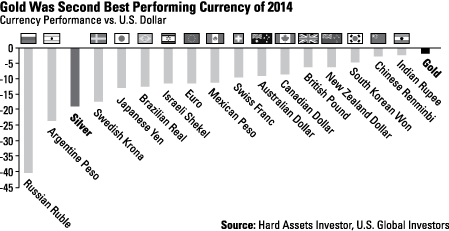

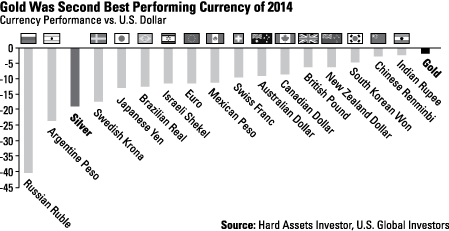

How things have reversed. Even though it fell 1.72 percent, gold was actually the second-best-performing currency of 2014, behind the U.S. dollar:

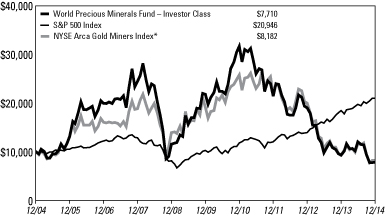

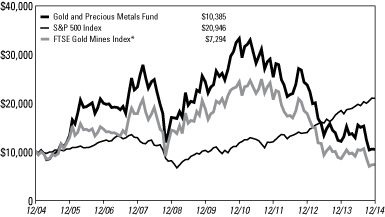

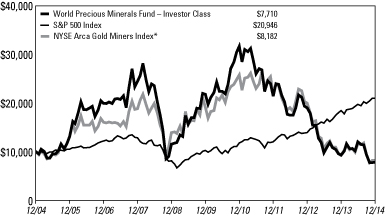

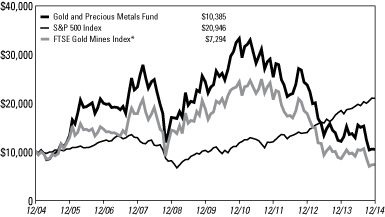

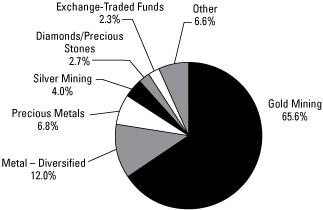

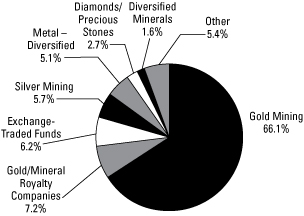

Gold might have fallen close to 2 percent in 2014, but gold stocks fell even further. Despite this, our Gold and Precious Metals Fund (USERX) slightly outperformed its benchmark, the FTSE Gold Miners Index. Whereas the FTSE Gold Miners Index lost 14.18 percent for the year, USERX lost 14.00 percent.

Such is the nature of investing. Every asset class, as I often say, has its own DNA of volatility.

It should come as no surprise that oil dominated the news in the second half of 2014. Since its peak in June, when WTI crude was priced at around $105 per barrel, oil has tumbled more than half to settle below $50 per barrel as of January 2015. We haven't seen a decline such as this since the financial collapse of 2008-2009.

So how did prices get here? How did they fall so steeply, so unexpectedly?

8

U.S. Global Investors Funds (unaudited)

It's been a perfect storm, to be sure. For one, the U.S. shale boom has brought about what some call an oil glut in the market. The Saudis have also resisted oil production curbs with the intention of undercutting the world's competition, namely the U.S., Russia and fellow members of the Organization of the Petroleum Exporting Countries (OPEC).

The chart below shows the inverse relationship between crude and the dollar, going back to 1984. The current standard deviation spread between the two is clearly widening to 1985 and 2008-2009 levels. But in both episodes, as strong as the dollar or as depressed as oil got, both eventually reverted back to their means.

The drop in oil prices, strong U.S. dollar and weak global growth all contributed to the underperformance of our Global Resources Fund (PSPFX), which fell 28.74 percent in 2014. For PSPFX, we continue to use a 5-factor model that focuses on fundamentals.

Granted, battered oil prices have led to cheap gasoline, giving consumers all over the globe a welcome multibillion-dollar "tax break." In the U.S. alone, according to BCA Research:

The decline in gasoline prices should boost household disposable incomes by around $150 billion [in 2015]... The money spent, in turn,

9

U.S. Global Investors Funds (unaudited)

will generate additional demand for goods and services. This will lead to faster employment growth, translating into more income and spending.

Despite some turbulence, such as an October selloff and the Ebola scares, airline stocks have continued to ascend because of low fuel prices:

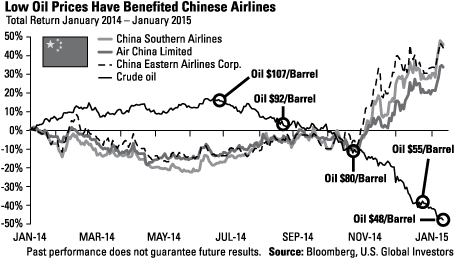

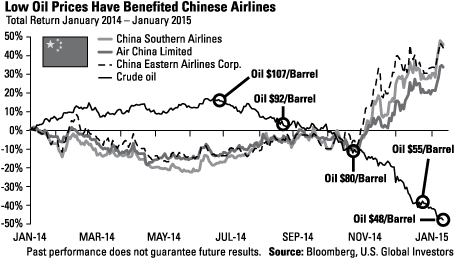

This isn't just an American phenomenon; Chinese airlines have also benefited:

10

U.S. Global Investors Funds (unaudited)

But not all sectors and industries have fared as well as the airlines have. Many oil companies involved in hydraulic fracturing, which is a pricier process than more conventional production methods, are feeling the pinch. Several have already been forced to abandon exploration and temporarily close rigs in pricier shale regions such as the Bakken formation in North Dakota. Schlumberger, the world's largest oilfield services company, announced in mid-January 2015 that it would cut 9,000 of its workers.

As calamitous as this might sound, there are still investment opportunities aplenty. Speaking to Fox Business in January 2015, the portfolio manager of our Global Resources Fund (PSPFX), Brian Hicks, explained where we continue to see opportunity and value in this low-price environment:

Certainly the [oil] selloff is getting long in the tooth and we're actually becoming more and more constructive as [it] continues... These prices are not sustainable [and] not high enough to replace production going down a few years from now. We think the stocks look very attractive here, and if you look at their performance to crude oil, they've actually been outperforming since mid-December.

Diversifying Your Portfolio

At U.S. Global Investors, we've always advocated a balance between equities and bonds, and rebalancing annually. This helps soften the kind of volatility

11

U.S. Global Investors Funds (unaudited)

we've seen recently and capture gains while buying assets on sale. The basic rule of thumb is that your level of investment in short-term municipal bonds should be proportionate to your age. So at 50 years of age, as a rule of thumb it's prudent to be 50 percent invested in bonds, 50 percent in equities; at 60 years, the weighting is 60 percent in short-term munis, 40 percent in stocks; and so on.

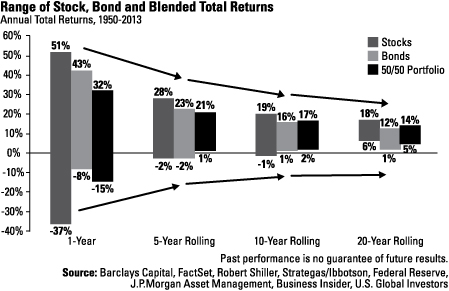

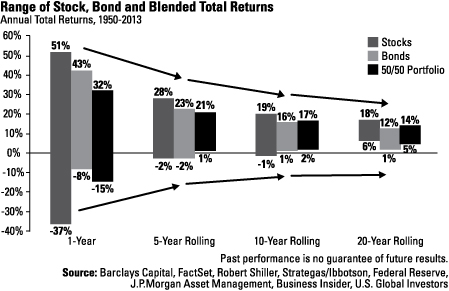

The following chart, last seen in a December Frank Talk, shows the benefits of diversifying a portfolio, especially now that we're experiencing a major price correction in commodities:

Using data collected between 1950 and 2013, we can see that the returns of a portfolio composed strictly of stocks have greatly outperformed those of bonds and a blended portfolio in the short term, or one-year period. The risks, on the other hand, have also far exceeded the other two scenarios, by a spread of at least 22 percentage points: stocks' -37 percent versus a blended portfolio's -15 percent.

But when blended portfolios were held for five, 10 and 20 years, they began to do two curious things: 1) they gradually outperformed bonds, and 2) they demonstrated less risk than stocks. In other words, they helped smooth out the ride and decreased the likelihood of hitting turbulence along the way.

12

U.S. Global Investors Funds (unaudited)

That's why savvy investors know to be patient with their holdings and not easily give in to the prevailing culture of instant gratification. I've run multiple marathons over the years and am very familiar with the personal rewards of going the distance. A similar investing strategy can come with similar rewards.

To get the latest insight and commentary on gold and other commodities, emerging markets, municipal bonds and much more, subscribe to our Investor Alert and to my personal blog, Frank Talk. Both can be reached by visiting usfunds.com.

Happy investing!

Frank Holmes

CEO and Chief Investment Officer

U.S. Global Investors, Inc.

Please consider carefully a fund's investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage, Inc.

MorningstarTM | | | |

***** (5 Stars) | | Overall/173 | |

***** (5 Stars) | | 3-Year/173 | |

***** (5 Stars) | | 5-Year/142 | |

**** (4 Stars) | | 10-Year/103 | |

Morningstar ratings based on risk-adjusted return and number of funds

Category: Municipal National Short-term funds

Through: 12/31/2014

13

U.S. Global Investors Funds (unaudited)

Morningstar Ratings are based on risk-adjusted return.The Morningstar Rating for a fund is derived from a weighted-average of the performance figures associated with its three-, five- and ten-year (if applicable) Morningstar Rating metrics. Past performance does not guarantee future results. For each fund with at least a three-year history, Morningstar calculates a Morningstar RatingTM based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund's monthly performance (including the effects of sales charges, loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. (Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in the distribution percentages.)

Stock markets can be volatile and share prices can fluctuate in response to sector-related and other risks as described in the fund prospectus.

Bond funds are subject to interest-rate risk; their value declines as interest rates rise. Though the Near-Term Tax Free Fund seeks minimal fluctuations in share price, it is subject to the risk that the credit quality of a portfolio holding could decline, as well as risk related to changes in the economic conditions of a state, region or issuer. These risks could cause the fund's share price to decline. Tax-exempt income is federal income tax free. A portion of this income may be subject to state and local taxes and at times the alternative minimum tax. The Near-Term Tax Free Fund may invest up to 20% of its assets in securities that pay taxable interest. Income or fund distributions attributable to capital gains are usually subject to both state and federal income taxes.

Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. Because the Global Resources Fund concentrates its investments in specific industries, the fund may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries.

Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in these sectors.

Because the Global Resources Fund concentrates its investments in specific industries, the fund may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

The S&P 1500 Composite is a broad-based capitalization-weighted index of 1500 U.S. companies and is comprised of the S&P 400, S&P 500, and the S&P 600. The index was developed with a base value of 100 as of December 30, 1994.

The MSCI China Free Index is a capitalization weighted index that monitors the performance of stocks from the country of China.

The WIG20 Index is a modified capitalization-weighted index of 20 Polish stocks which as listed on the main market. The index is the underlying instrument for futures transactions listed on the Warsaw Stock Exchange.

14

U.S. Global Investors Funds (unaudited)

The MSCI Emerging Markets Europe 10/40 Index (Net Total Return) is a free float-adjusted market capitalization index that is designed to measure equity performance in the emerging market countries of Europe (Czech Republic, Greece, Hungary, Poland, Russia, and Turkey). The index is calculated on a net return basis (i.e., reflects the minimum possible dividend reinvestment after deduction of the maximum rate withholding tax). The index is periodically rebalanced relative to the constituents' weights in the parent index.

The NYSE Arca Airline Index is an equal dollar weighted index designed to measure the performance of highly capitalized companies in the airline industry. The XAL Index tracks the price performance of major U.S. and overseas airlines.

The FTSE Gold Mines Index Series encompasses all gold mining companies that have a sustainable and attributable gold production of at least 300,000 ounces a year, and that derive 75% or more of their revenue from mined gold.

Although Lipper makes reasonable efforts to ensure the accuracy and reliability of the data contained herein, the accuracy is not guaranteed by Lipper. Users acknowledge that they have not relied upon any warranty, condition, guarantee, or representation made by Lipper. Any use of the data for analyzing, managing, or trading financial instruments is at the user's own risk. This is not an offer to buy or sell securities.

Standard deviation is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is also known as historical volatility.

There is no guarantee that the issuers of any securities will declare dividends in the future or that, if declared, will remain at current levels or increase over time.

Diversification does not protect an investor from market risks and does not assure a profit.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

15

Definitions for Management Teams' Perspectives (unaudited)

Benchmark Index Definitions

Returns for indices reflect no deduction for fees, expenses or taxes, unless noted.

The Barclays U.S. Treasury Bills 6-9 Months Total Return Index tracks the performance of U.S. Treasury Bills with a maturity of six to nine months.

The Barclays 3-Year Municipal Bond Index is a total return benchmark designed for municipal assets. The index includes bonds with a minimum credit rating of BAA3, are issued as part of a deal of at least $50 million, have an amount outstanding of at least $5 million and have a maturity of two to four years.

The FTSE Gold Mines Index encompasses all gold mining companies that have a sustainable and attributable gold production of at least 300,000 ounces a year and that derive 75% or more of their revenue from mined gold.

The Hang Seng Composite Index is a market-capitalization weighted index that covers about 95% of the total market capitalization of companies listed on the Main Board of the Hong Kong Stock Exchange.

The MSCI Emerging Markets Europe 10/40 Index (Net Total Return) is a free float-adjusted market capitalization index that is designed to measure equity performance in the emerging market countries of Europe (Czech Republic, Greece, Hungary, Poland, Russia and Turkey). The index is calculated on a net return basis (i.e., reflects the minimum possible dividend reinvestment after deduction of the maximum rate withholding tax). The index is periodically rebalanced relative to the constituents' weights in the parent index.

The S&P Global Natural Resources Index (Net Total Return) includes 90 of the largest publicly-traded companies in natural resources and commodities businesses that meet specific investability requirements, offering investors diversified, liquid and investable equity exposure across 3 primary commodity-related sectors: Agribusiness, Energy, and Metals & Mining. The index is calculated on a net return basis (i.e., reflects the minimum possible dividend reinvestment after deduction of the maximum rate withholding tax).

The S&P Global Natural Resources/Morgan Stanley Commodity Related Equity Blended Index – The Morgan Stanley Commodity Related Equity Index (CRX) is an equal-dollar weighted index of 20 stocks involved in commodity-related industries such as energy, non-ferrous metals, agriculture and forest products. This index was discontinued on July 4, 2014. The Global Resources Fund's benchmark then changed to the S&P Global Natural Resources Index (Net Total Return) (see definition above). For purposes of the fund's performance fee adjustment, until the new benchmark has been in place one full year, the fund's performance is compared to a blend of the CRX and the S&P Global Natural Resources Index (Net Total Return), using the performance of the CRX through June 30, 2014, and the performance of the S&P Global Natural Resources Index (Net Total Return) after June 30, 2014.

The NYSE Arca Gold Miners Index is a modified market capitalization-weighted index comprised of publicly-traded companies involved primarily in the mining for gold and silver.

16

Definitions for Management Teams' Perspectives (unaudited)

The S&P 500 Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

The S&P Composite 1500 Index is a broad-based capitalization-weighted index of 1500 U.S. companies and is comprised of the S&P 400, the S&P 500 and the S&P 600.

Other Index Definitions

The Barclays Municipal Bond Index is an unmanaged index representative of the tax-exempt bond market.

The Bloomberg Commodity Index is calculated on an excess return basis and reflects commodity futures price movements. The index rebalances annually weighted 2/3 by trading volume and 1/3 by world production and weight-caps are applied at the commodity, sector and group level for diversification.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns.

The ISM Manufacturing Composite Index is a diffusion index calculated from five of the eight sub-components of a monthly survey of purchasing managers at roughly 300 manufacturing firms from 21 industries in all 50 states.

The MSCI All Country Far East Free ex Japan Index is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of the Far East, excluding Japan. The index consists of the following developed and emerging market country indices: China, Hong Kong, Indonesia, Korea, Malaysia, Philippines, Singapore, Taiwan and Thailand.

The Purchasing Manager's Index (PMI) is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment.

The S&P High Yield Dividend Aristocrats Index is designed to measure the performance of the 50 highest dividend yielding S&P Composite 1500 constituents which have followed a managed dividends policy of consistently increasing dividends every year for at least 25 years.

The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The Stoxx Europe 600 Index represents large, mid and small capitalization companies across 18 countries of the European region.

The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar.

17

U.S. Government Securities Ultra-Short Bond Fund (unaudited)

Management Team's Perspective

Introduction

The U.S. Government Securities Ultra-Short Bond Fund (UGSDX) is designed to be used as an investment that takes advantage of the security of U.S. Government bonds and obligations, while simultaneously pursuing a higher level of current income than money market funds offer. The fund's dollar-weighted average effective maturity is two years or less.

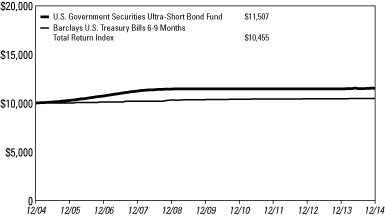

Performance Graph

U.S. Government Securities Ultra-Short Bond Fund

Average Annual Performance For the Years Ended

December 31, 2014

| | | One Year | | Five Year | | Ten Year | |

U.S. Government Securities Ultra-Short Bond Fund | | | 0.36 | % | | | 0.08 | % | | | 1.41 | % | |

Barclays U.S. Treasury Bills 6-9 Months

Total Return Index | | | 0.07 | % | | | 0.20 | % | | | 0.45 | % | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. For all or a portion of the periods, the fund had expense limitations and reimbursements, without which returns would have been lower.

The above returns for the U.S. Government Securities Ultra-Short Bond Fund include the fund's results as a money market fund through the date of its conversion (December 20, 2013) to an ultra-short bond fund, and therefore are not representative of the fund's results had it operated as an ultra-short bond fund for the full term of the periods shown.

Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 0.45%. The Adviser can modify or terminate this arrangement at any time. In addition, returns may include the effects of additional voluntary waivers of fees and reimbursements of expenses by the Adviser, including waivers and reimbursements to maintain a minimum net yield for the fund.

See Definitions for Management Teams' Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

18

U.S. Government Securities Ultra-Short Bond Fund (unaudited)

The Year In Review - Economic And Political Issues That Affected The Fund

The U.S. economy experienced a relatively robust 2014 with the exception of a weak first quarter, which was disrupted by frigid weather and a late Easter. First quarter GDP contracted 2.1 percent, while the second and third quarters expanded 4.6 and 5.0 percent, respectively. Fourth quarter GDP was a moderate 2.6 percent but continues the positive economic momentum.

The ISM Manufacturing Composite Index reached its highest level since 2011 in the second half of the year before pulling back at year-end. The manufacturing sector has been a source of strength for the economy, with auto- and energy-related areas of the economy making solid contributions. Global manufacturing indicators peaked in the first quarter and have been broadly trending lower since then. The U.S. decoupled from the world in this regard and has been a bright spot for global economic growth.

Employment steadily improved all year with very consistent nonfarm payroll growth of between 200,000 and 300,000 jobs per month. Housing activity hasn't been as much of a tailwind for the economy as it has been in the past. Generally higher housing prices, along with a strong stock market, have created a "wealth effect." This, combined with sharply lower gasoline prices in the fourth quarter, led to improved consumer attitudes toward their financial safety. Increasing consumer confidence drove very strong auto sales in 2014, which has positively affected the manufacturing sector.

In May 2013, then Federal Reserve Chairman Ben Bernanke indicated an inclination to begin reducing the quantitative easing (QE) stimulus program that has been widely described as "tapering." The Fed tapered by $10 billion in December 2013, and that process has continued at every Federal Open Market Committee (FOMC) meeting until the program completely wound down at the meeting on October 29, 2014. The Fed has also shifted its stance in recent months and appears to be preparing the market for an interest rate increase sometime in mid-2015.

Inflation in the U.S. has oscillated between 1 and 2 percent for more than two years. We are currently at the low end of that range. However, the Fed is posturing for an interest rate increase. Global inflation has generally remained low and is trending lower, which has allowed other global central bankers to comfortably maintain pro-growth policies. Key global economies participating in this trend include Japan, China and Europe. Europe in particular has taken new stimulative steps in recent months, taking the equivalent Fed funds rate into negative territory. It's expected to do more in 2015.

Japan remains committed to an aggressive reflation policy, and China appears comfortable maintaining a stable growth policy. The current Chinese administration has

19

U.S. Government Securities Ultra-Short Bond Fund (unaudited)

focused on addressing domestic imbalances and, thus, has not been the global growth catalyst it was after the financial crisis. Europe, after improving in 2013 and early 2014, has fallen back to virtually no growth.

Yields on the three-month Treasury bill were just 4 basis points at the end of 2014, while yields on the two-year Treasury ended the year at 0.67 percent, well above levels of 0.38 percent just a year ago.

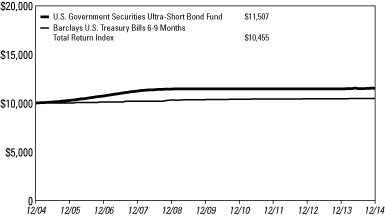

Investment Highlights

The U.S. Government Securities Ultra-Short Bond Fund returned 0.36 percent for the year ended December 31, 2014, outperforming its benchmark, the Barclays U.S. Treasury Bills 6-9 Months Total Return Index, which returned 0.07 percent.

The fund extended its maturity profile at the end of 2013 and very early in 2014 as interest rates on short-term agency securities were relatively attractive, which proved to be very good timing as the market rallied, sending yields lower for most of the year. We recently saw short-term agency yields move back near the high-yield levels experienced a year ago and used this volatility as an opportunity to extend duration.

Current Outlook

The Fed continues to remain accommodative but has clearly shifted its thinking toward interest rate normalization. We believe the U.S. will maintain a more amenable monetary policy than is generally expected in the market as global weakness and deflation fears will force it to stay on the sidelines.

20

U.S. Government Securities Ultra-Short Bond Fund (unaudited)

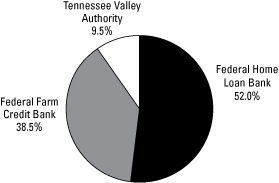

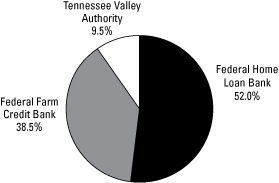

Portfolio Allocation by Issuer

Based on Total Investments December 31, 2014

Portfolio Allocation by Maturity December 31, 2014

| 1 - 3 Months | | $ | 24,283,702 | | | | 41.6 | % | |

| 3 - 12 Months | | | 2,998,279 | | | | 5.1 | % | |

| 1 - 3 Years | | | 5,751,853 | | | | 9.9 | % | |

| 3 - 5 Years | | | 25,351,032 | | | | 43.4 | % | |

| | | $ | 58,384,866 | | | | 100.0 | % | |

21

Near-Term Tax Free Fund (unaudited)

Management Team's Perspective

Introduction

The Near-Term Tax Free Fund (NEARX) seeks to provide a high level of current income exempt from federal income taxation and to preserve capital. However, a portion of any distribution may be subject to federal and/or state income taxes. The Near-Term Tax Free Fund will maintain a weighted average maturity of less than five years.

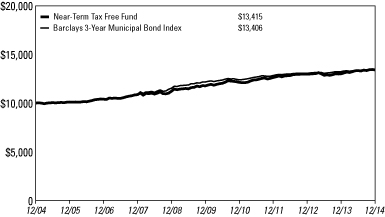

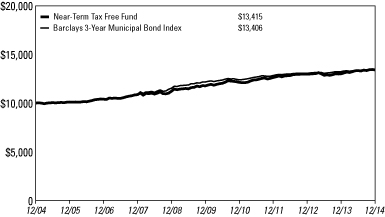

Performance Graph

Near-Term Tax Free Fund

Average Annual Performance For the Years Ended

December 31, 2014

| | | One Year | | Five Year | | Ten Year | |

Near-Term Tax Free Fund | | | 3.07 | % | | | 2.64 | % | | | 2.98 | % | |

Barclays 3-Year Municipal Bond Index | | | 1.22 | % | | | 1.93 | % | | | 2.97 | % | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. For all or a portion of the periods, the fund had expense limitations, without which returns would have been lower.

The Adviser has contractually agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 0.45% on an annualized basis through December 31, 2015.

See Definitions for Management Teams' Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

22

Near-Term Tax Free Fund (unaudited)

The Year In Review - Economic And Political Issues That Affected The Fund

Defying the skeptics who anticipated higher yields and interest rates in 2014 with corresponding lower bond values, the Barclays Municipal Bond Index, a measure of the general municipal bond market, rallied 9.05 percent. This comes on the back of a difficult 2013 in which the municipal market experienced its worst performance since 2008. The yield curve experienced significant flattening with yields on the short end rising 20 to 40 basis points, while the long end of the curve saw yields fall more than 100 basis points.

With the yield curve dynamics mentioned above, there was a very linear relationship between maturity and total return in 2014; the further out the yield curve you moved, the higher the returns. The very long end of the yield curve – bonds with maturities of 22 years or more – rose more than 15 percent. However, the Near-Term Tax Free Fund tends to invest in the short and intermediate part of the municipal market. This segment of the market rose 1.22 percent during 2014, as measured by the Barclays 3-Year Municipal Bond Index.

Back in May 2013, then Federal Reserve Chairman Ben Bernanke introduced the idea of tapering the Fed's quantitative easing stimulus program. At that time, the Fed was spending $85 billion per month buying Treasuries and mortgage-backed securities in an attempt to stimulate the economy. This announcement roiled the market, sending yields higher through late December 2013. The key inflection point for the market came right around the end of 2013 when fears regarding tapering subsided as the Fed introduced tapering at the December 2013 Federal Open Market Committee (FOMC) meeting. In a classic sense, the market had absorbed all the fears of tapering and what that could potentially mean. By the time tapering actually occurred, the market had already priced it in and was able to rally almost uninterrupted in 2014.

The economy was a steady performer this year, with consistent employment gains and a strong manufacturing sector. Consumer confidence strengthened for most of the year. The icing on the cake came with the dramatic fall in gasoline prices during the fourth quarter, boosting consumers' spending power in the heart of the holiday retail season. After icy weather disrupted the first quarter, GDP came on strong in the second and third quarters, and had moderate growth in the fourth quarter.

Revenue-backed municipals outperformed general obligation credits, with specific strength in hospital and industrial development issues. Credit factors also played a significant role as performance differences between low-quality and high-quality bonds were large. AAA-rated municipals rose 6.34 percent, while BBB-rated municipals surged 14.47 percent. There were specific credit events that exacerbated the volatility of BBB returns, such as Puerto Rico-backed debt, but the overall trend still held. High-yield, or "junk bonds," also outperformed, rising 13.84 percent in 2014.

23

Near-Term Tax Free Fund (unaudited)

In specialty state trading, Puerto Rico was a standout performer, as were California and Illinois, while New York and New Jersey credits underperformed in 2014.

Investment Highlights

For the year ended December 31, 2014, the Near-Term Tax Free Fund returned 3.07 percent, outperforming its benchmark, the Barclays 3-Year Municipal Bond Index, which gained 1.22 percent.

The Near-Term Tax Free Fund also outperformed the Lipper Short-Intermediate Municipal Bond Funds peer group in 2014. The Near-Term Tax Free Fund remained true to form, with a low turnover approach and investing in traditional high-quality municipals. The fund has been able to outperform due to a slightly longer maturity structure and advantageous yield curve positioning.

Strengths

• Buying opportunistically and letting that yield advantage work in the fund's favor over time, as well as the fund's low turnover approach, have proven to be advantageous.

• The fund's longer maturity structure was favorable, as the market rewarded investors for stepping out on the yield curve.

• The fund benefited from significant exposure to Illinois, which outperformed.

Weaknesses

• The fund had less exposure to the lower-quality investment grade credits that outperformed by wide margins.

• The fund also had very little exposure to the industrial development and non-investment grade credits that outperformed.

• Bonds that are subject to the alternative minimum tax (AMT) also outperformed; however, the fund has no exposure to these bonds.

Current Outlook

Opportunities

• 2015 could end up looking a lot like 2014. The Federal Reserve continues to transition to a more normalized monetary policy approach, even as the rest of the developed world is battling a deflation threat. The short-end of the yield curve could continue rising while the long-end rallies on the expectation that Fed tightening will slow economic growth. The fund's recent barbell positioning further out on the yield curve, coupled with very short-term investments, might turn out to be a winning approach.

24

Near-Term Tax Free Fund (unaudited)

Threats

• Continued outperformance of low-quality bonds is the most significant threat on a relative basis.

• When the Fed reverses its monetary policy stance and begins to raise interest rates, the macro interest rate environment could become more difficult from a total return standpoint.

25

Near-Term Tax Free Fund (unaudited)

Top 10 Area Concentrations

(Based on Net Assets) December 31, 2014

Texas | | | 18.26 | % | |

Illinois | | | 8.04 | % | |

Florida | | | 7.67 | % | |

New Jersey | | | 4.81 | % | |

New York | | | 4.08 | % | |

California | | | 3.44 | % | |

Michigan | | | 3.13 | % | |

Indiana | | | 2.80 | % | |

Pennsylvania | | | 2.72 | % | |

Oklahoma | | | 2.47 | % | |

Total Top 10 Areas | | | 57.42 | % | |

Municipal Bond Ratings*

Based on Total Municipal Bonds December 31, 2014

* Credit quality ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). "Not Rated" is used to classify securities for which a rating is not available. Credit-quality ratings for each issue are obtained from Moody's and S&P, and the higher rating for each issue is used.

26

All American Equity Fund (unaudited)

Management Team's Perspective

Introduction

The principal objective of the All American Equity Fund (GBTFX) is to seek capital appreciation by investing primarily in a broadly diversified portfolio of domestic common stocks. The fund invests in large-capitalization stocks while retaining the flexibility to seek out promising individual stock opportunities, including stocks with meaningful dividend yields.

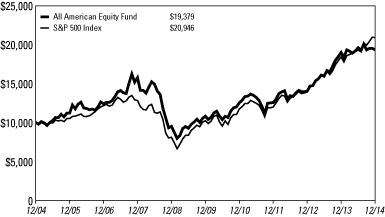

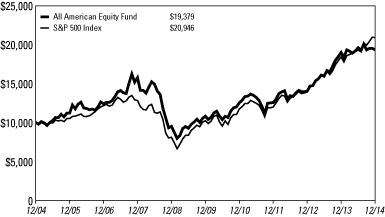

Performance Graph

All American Equity Fund

Average Annual Performance For the Years Ended

December 31, 2014

| | | One Year | | Five Year | | Ten Year | |

All American Equity Fund | | | 1.94 | % | | | 12.39 | % | | | 6.84 | % | |

S&P 500 Index | | | 13.69 | % | | | 15.45 | % | | | 7.67 | % | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. For all or a portion of the periods, the fund had expense limitations, without which returns would have been lower.

Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 2.20%. The Adviser can modify or terminate this arrangement at any time.

See Definitions for Management Teams' Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

27

All American Equity Fund (unaudited)

The Year In Review - Economic And Political Issues That Affected The Fund

Economic growth during 2014 in the U.S. has been generally better than expected. After a slow start because of icy weather, GDP growth bounced back and accelerated in the second and third quarters of the year, rising 4.6 and 5.0 percent, respectively. Fourth quarter GDP came in moderately below estimates at 2.6 percent but continues the positive economic momentum.

U.S. stocks were solid performers in 2014, with the S&P 500 Index rising 13.69 percent. Dividend-paying stocks generally outperformed the broad market, as measured by the S&P 500 Index, with the S&P High Yield Dividend Aristocrats Index gaining 14.26 percent.

Indicators for global manufacturing, which tends to have a huge influence on the domestic market, ended the year on a weakening trend. This is symptomatic of sluggish growth from the key global economic players outside the U.S. Europe is on the verge of returning to recession and the European Central Bank (ECB) is expected to implement its own quantitative easing (QE) program in the first quarter of 2015 to address this weakness. China is also shifting to a policy of reform and deemphasizing growth at all cost.

In the U.S., the automotive sector in particular has performed very well, with annualized sales in December of 16.8 million vehicles; this is its best performance since 2006. The U.S. housing market has been steady but not quite the positive catalyst many were looking for coming into the year. Combined with a rising equity market, home price appreciation has been solid, boosting the wealth effect for consumers.

The Fed completed its QE program at the October 29 Federal Open Market Committee (FOMC) meeting in an attempt to begin normalizing monetary policy. The Fed is also preparing the market for an interest rate increase by mid-2015. With deflation concerns in Europe and falling inflation expectations in the U.S., combined with a weak global growth outlook, the Fed might not be able to follow through with these projections.

Investment Highlights

Overview

The All American Equity Fund returned 1.94 percent for the year ending December 31, 2014, underperforming the 13.69 percent return for the S&P 500 Index benchmark.

28

All American Equity Fund (unaudited)

Because the fund is actively managed and the holding period is generally not a consideration in investment decisions, the portfolio turnover rate may fluctuate from year to year as the fund adjusts its portfolio composition. The fund's annual portfolio turnover was, and is expected to continue to be, more than 100 percent.

Strengths

• The fund's stock selections in the consumer staples, industrials and materials sectors were better than the benchmark. The fund was modestly overweight in the utilities sector, which was by far the best performing sector in the S&P 500 Index, rising 29 percent.

• The fund's exposure to dividend-paying stocks over the past year was beneficial to relative performance as this portion of the fund outperformed the more growth-oriented portion of the portfolio.

• Facebook, Inc.,(1) Continental Resources, Inc.(1) and Apple, Inc.(2) were among the best contributors to fund performance.

Weaknesses

• The fund's overall stock selection was a drag on relative performance; this was particularly true in the technology and energy sectors.

• Cash and defensive option strategies did not aid fund performance as the market rallied strongly.

• Chicago Bridge & Iron Co. N.V.,(1) MasterCard, Inc.(1) and Halliburton Co.(1) were among the worst individual contributors to performance.

Current Outlook

Opportunities

• The global economic outlook should improve as the year progresses. Additional government policy support from many areas around the globe should be supportive of an improving global macro outlook. The U.S. has virtually been the single engine of growth in the developed world, and if Europe or China can improve, it would provide a lift to the U.S. equity market.

• Falling gasoline prices have created an opportunity for many consumer-oriented areas, ranging from restaurants and retailers to airline companies as consumers have more disposable income.

• Corporate cash levels continue to remain high, providing corporations the ability to pursue mergers and acquisitions (M&A). An increase in M&A activity holds promise for both portfolio gains and an increase in overall market valuations.

29

All American Equity Fund (unaudited)

Threats

• With the S&P 500 trading at nearly 18x earnings, which is at the high end of the historical range, earnings growth will be especially critical to keep the bull market moving forward. Expectations for 2015 are in the low single digits, with big cuts coming from the energy sector in recent months.

• The market has been on an unusually long, almost uninterrupted winning streak for the past two years. A short-term correction of 10 percent or more would not be a surprise at this point.

• Global government policy delays or outright missteps are a threat to global equity markets, including the U.S.

(1)The fund did not hold this security as of 12/31/14.

(2)This security comprised 3.52% of the fund's total net assets as of 12/31/14.

30

All American Equity Fund (unaudited)

Top 10 Equity Holdings Based on Net Assets December 31, 2014

Apple, Inc.

Computers | | | 3.52 | % | |

Northrop Grumman Corp.

Aerospace/Defense | | | 1.34 | % | |

Union Pacific Corp.

Transportation - Rail | | | 1.25 | % | |

Allstate Corp.

Multi-line Insurance | | | 1.25 | % | |

Waste Management, Inc.

Non-hazardous Waste Disposal | | | 1.24 | % | |

Emerson Electric Co.

Electric Products - Miscellaneous | | | 1.24 | % | |

Huntington Bancshares, Inc.

Super-Regional Banks - US | | | 1.24 | % | |

Prudential Financial, Inc.

Life/Health Insurance | | | 1.24 | % | |

Marathon Petroleum Corp.

Oil Refining & Marketing | | | 1.23 | % | |

MetLife, Inc.

Multi-line Insurance | | | 1.23 | % | |

Total Top 10 Equity Holdings | | | 14.78 | % | |

Portfolio Allocation by Industry Sector*

Based on Total Investments December 31, 2014

* Summary information above may differ from the portfolio schedule included in the financial statements due to the use of different classifications of securities for presentation purposes.

31

Holmes Macro Trends Fund (unaudited)

Management Team's Perspective

Introduction

The Holmes Macro Trends Fund (MEGAX) invests in companies with good growth prospects and strong positive earnings momentum. The fund's primary objective is to seek long-term capital appreciation.

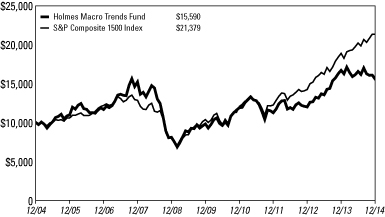

Performance Graph

Holmes Macro Trends Fund

Average Annual Performance For the Years Ended

December 31, 2014

| | | One Year | | Five Year | | Ten Year | |

Holmes Macro Trends Fund | | | (6.74 | )% | | | 9.73 | % | | | 4.54 | % | |

S&P Composite 1500 Index | | | 13.08 | % | | | 15.62 | % | | | 7.89 | % | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. For all or a portion of the periods, the fund had expense limitations, without which returns would have been lower.

Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 2.20%. The Adviser can modify or terminate this arrangement at any time.

See Definitions for Management Teams' Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

32

Holmes Macro Trends Fund (unaudited)

The Year In Review - Economic And Political Issues That Affected The Fund

After icy weather slowed growth at the beginning of the year, the economy bounced back nicely in 2014. GDP expanded 4.6 percent in the second quarter and 5.0 percent in the third quarter, the best back-to-back quarters since the global financial crisis. Fourth quarter GDP came in moderately below estimates at 2.6 percent but continues the positive economic momentum.

The S&P 500 Index rose 13.69 percent in 2014 and did so with an unusually low level of volatility, essentially grinding higher virtually all year. Defensive sectors of the market outperformed as bond yields were loosely inversely correlated. At the beginning of 2014, expectations were for interest rates to head higher and for the Federal Reserve to normalize monetary policy. The market responded by sending bond yields steadily lower all year, with interest rate-sensitive stocks outperforming relative to more growth-oriented names.

Global economic performance disappointed, with China and Europe being the main culprits. Global manufacturing indicators were moving lower as we headed into year end. This economic sluggishness has put Europe back on the verge of recession and the pressure is on the European Central Bank (ECB) to implement its own quantitative easing (QE) program in the first quarter of 2015 to address this weakness. China has also shifted to a policy of economic reform and has deemphasized outsized growth. China still needs to grow to maintain social stability but is managing for a reduced level of growth.

In the U.S., the automotive sector in particular has performed very well, with annualized sales in December of 16.8 million vehicles; this is its best performance since 2006. The U.S. housing market has been steady but not quite the positive catalyst many were seeking coming into the year. Combined with a rising equity market, home price appreciation has been solid, boosting the wealth effect for consumers.

The Fed completed its QE program at the October 29, 2014 Federal Open Market Committee (FOMC) meeting in an attempt to begin normalizing monetary policy. The Fed is also preparing the market for an interest rate increase by mid-2015. The Fed might not be able to follow through with these projections due to a weak global growth outlook, deflation concerns in Europe and falling inflation expectations in the U.S.

33

Holmes Macro Trends Fund (unaudited)

Investment Highlights

Overview

The Holmes Macro Trends Fund fell 6.74 percent over the past year, underperforming its benchmark, the S&P Composite 1500 Index, which returned 13.08 percent. Overall, smaller companies and growth-oriented stocks underperformed, while utilities and more defensive areas of the market outperformed. The fund is very growth-oriented and has more exposure to both smaller companies and growth-oriented companies than the benchmark. This has been the primary driver of underperformance. Effectively, our investment style was out of favor, and the market did not reward companies demonstrating superior growth metrics. We believe this is transitory and our growth at a reasonable price (GARP) investment style will ultimately be rewarded.

Because the fund is actively managed and holding period is generally not a consideration in investment decisions, the portfolio turnover rate may fluctuate from year to year as the fund adjusts its portfolio composition. The fund's annual portfolio turnover was, and is expected to continue to be, more than 100 percent.

Strengths

• Stock selection was strong in select semiconductor and biotechnology names.

• The fund's underweight in telecommunications was beneficial as the sector underperformed the market.

• Old Dominion Freight Line, Inc.,(1) Facebook, Inc.(2) and Skyworks Solutions, Inc.(3) were among the best positive contributors to fund performance.

Weaknesses

• Stock selection was weak across the board as our growth-oriented investment style was out of favor and the primary driver of underperformance.

• Sector allocation was also a drag, as defensive sectors tended to outperform. Cash and defensive option strategies were also a drag on relative performance as the market rallied strongly.

• Investments in Chicago Bridge & Iron Co.,(4) Pacific Stone Tech, Inc.(5) and Halliburton Co.(4) failed to live up to expectations and were among the worst contributors to the fund's performance.

34

Holmes Macro Trends Fund (unaudited)

Current Outlook

Opportunities

• The global economic outlook should improve as the year progresses. Additional government policy support from many areas around the globe should be supportive of an improving global macro outlook. The U.S. has virtually been the single engine of growth in the developed world, and if Europe or China can improve it would provide a lift to the U.S. equity market.

• Falling gasoline prices have given consumers more disposable income, creating an opportunity for many discretionary areas such as restaurants, retailers and airline companies.

• Corporate cash levels continue to remain high, providing corporations the ability to pursue mergers and acquisitions (M&A). An increase in M&A activity holds promise for both portfolio gains and an increase in overall market valuations.

Threats

• With the S&P 500 trading at nearly 18x earnings, which is at the high end of the historical range, earnings growth will be especially critical to keep the bull market moving forward. Expectations for 2015 are in the low single digits, with big cuts coming from the energy sector in recent months.

• The market has been on an unusually long, almost uninterrupted winning streak for the past two years. A short-term correction of 10 percent or more would not be a surprise at this point.

• Deep value and price reversals led the market in 2012 and early 2013. If this trend were to reemerge, as it did during this past March through May, it would be a threat to relative performance.

(1)This security comprised 3.02% of the fund's total net assets as of 12/31/14.

(2)This security comprised 3.37% of the fund's total net assets as of 12/31/14.

(3)This security comprised 2.83% of the fund's total net assets as of 12/31/14.

(4)The fund did not hold this security as of 12/31/14.

(5)This security comprised 1.39% of the fund's total net assets as of 12/31/14.

35

Holmes Macro Trends Fund (unaudited)

Top 10 Equity Holdings Based on Net Assets December 31, 2014

Apple, Inc.

Computers | | | 5.37 | % | |

Facebook, Inc.

Internet Content - Entertainment | | | 3.37 | % | |

Old Dominion Freight Line, Inc.

Transportation - Truck | | | 3.02 | % | |

Skyworks Solutions, Inc.

Electronic Components - Miscellaneous | | | 2.83 | % | |

Actavis plc

Medical - Generic Drugs | | | 2.78 | % | |

SM Energy Co.

Oil Companies - Exploration & Production | | | 2.50 | % | |

Gilead Sciences, Inc.

Medical - Biomedical/Gene | | | 2.45 | % | |

Mylan, Inc.

Medical - Generic Drugs | | | 2.44 | % | |

Alexion Pharmaceuticals, Inc.

Medical - Biomedical/Gene | | | 2.40 | % | |

Cavium, Inc.

Electronic Components - Miscellaneous | | | 2.27 | % | |

Total Top 10 Equity Holdings | | | 29.43 | % | |

Portfolio Allocation by Industry Sector*

Based on Total Investments December 31, 2014

* Summary information above may differ from the portfolio schedule included in the financial statements due to the use of different classifications of securities for presentation purposes.

36

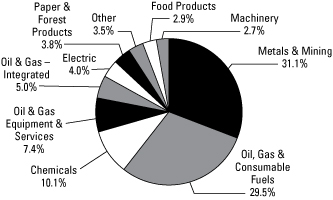

Global Resources Fund (unaudited)

Management Team's Perspective

Introduction

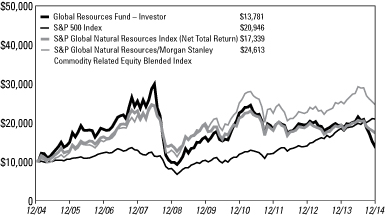

The Global Resources Fund (PSPFX and PIPFX) is a non-diversified natural resources fund with the principal objective of seeking long-term growth of capital while providing protection against inflation and monetary instability. The fund invests in companies involved in the exploration, production and processing of petroleum, natural gas, coal, alternative energies, chemicals, mining, iron and steel, and paper and forest products around the globe.

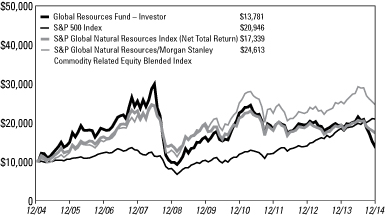

Performance Graph

Global Resources Fund

Average Annual Performance For the Periods Ended December 31, 2014

| | | One Year | | Five Year | | Ten Year | | Since Inception

(Institutional

Class) | |

Global Resources Fund - Investor Class | | | (28.74 | )% | | | (3.22 | )% | | | 3.26 | % | | | n/a | | |

Global Resources Fund - Institutional Class

(Inception 3/1/10) | | | (28.28 | )% | | | n/a | | | | n/a | | | | (2.81 | )% | |

S&P 500 Index | | | 13.69 | % | | | 15.45 | % | | | 7.67 | % | | | 15.91 | % | |

S&P Global Natural Resources Index

(Net Total Return) | | | (10.18 | )% | | | (1.96 | )% | | | 5.65 | % | | | (0.69 | )% | |

S&P Global Natural Resources/Morgan Stanley

Commodity Related Equity Blended Index | | | (3.03 | )% | | | 4.36 | % | | | 9.42 | % | | | 4.38 | % | |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. For all or a portion of the periods, the fund had expense limitations, without which returns would have been lower.

Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 1.90% for the Investor Class. Also pursuant to a voluntary agreement, the Adviser has agreed to waive all class specific expenses of the Institutional Class. The Adviser can modify or terminate these arrangements at any time.

See Definitions for Management Teams' Perspectives for index definitions.

Please visit our website at www.usfunds.com for updated performance information for different time periods.

37

Global Resources Fund (unaudited)

The Year In Review - Economic And Political Issues That Affected The Fund

The Bloomberg Commodity Index fell 17 percent through the year 2014, primarily dragged down by the decline in crude oil. Fueled by deteriorating global growth and the official end of quantitative easing, a sharp rise in the dollar during the back half of the year is the most striking indicator of the current depressed commodity environment. Concerns that the global economy is slowing, particularly due to weaker economic data from China and the eurozone, pushed down Treasury yields as investors packed into fixed-income and U.S. equities. As a result, the growth-oriented energy and basic materials sectors lagged the S&P 500 Index by 21 and 7 percent, respectively.

Energy's significant relative underperformance to the broader commodities space materialized during the back half of 2014. A surge in supply from U.S. shale producers created a global glut of oil while declining global GDP growth disrupted the balance between supply and demand. The catalyst for oil's rapid decline was the Organization of the Petroleum Exporting Countries' (OPEC's) announcement that it would not cut production, despite the negative impact lower oil prices would have on Saudi Arabia as well as other fiscally-challenged nations of the cartel. Thus, Brent crude prices ended the year down 48 percent to $57 a barrel.

Initially, the global crude market was quick to discount unfavorable supply and demand fundamentals in 2014 but remained relatively complacent regarding rising geopolitical instability in key oil-producing countries such as Libya, Nigeria and Iraq. Going forward, it is likely these tensions could escalate given falling oil revenues, which would threaten government entitlement programs.

With respect to geopolitical concerns, the conflict between Russia and Ukraine, which began with the Russian invasion in Crimea in March, only escalated throughout the year. Both the Russian and Ukrainian economies have seen substantial losses. The combination of tough sanctions and rapidly declining oil prices led the Russian ruble to plunge a staggering 84 percent against the dollar, forcing the government to intervene by selling foreign reserves and raising borrowing costs. The latter of these two interventions has effectively strangled credit markets in Russia, leading analysts to forecast a sharp contraction in Russian GDP growth for 2015. The situation in Ukraine is just as dismal, with bond yields skyrocketing as the financial system braces for a crisis.

Moving into 2015, the eurozone should continue to face deflationary pressures, prompting many to assume a higher probability the European Central Bank (ECB) will enact quantitative easing (QE). Such easing should be positive for regional, and therefore global, growth in the long term as it should boost commodity demand. In the short run, however, heavy monetary stimulus in the eurozone would most likely

38

Global Resources Fund (unaudited)

depress the euro further against the dollar, causing the dollar to rise even higher than it did in 2014. Such a breakout in the dollar could initially harm investor sentiment toward the commodity space.

While many are forecasting further stimulus in Europe, the market is still pricing in a rate increase here in the U.S. However, the likelihood that the Federal Reserve will hike the funds rate has shrunk dramatically over the past year for two main reasons. First, the economic situation outside the U.S. has become much more dismal, as indicated by the collapse of 10-year Treasury yields back to 2.17 percent and the rapid rise in the dollar. The Fed would risk exacerbating both of these effects if rates were allowed to rise any time soon. Second, inflation expectations have come down significantly in the U.S. along with the rest of the world, despite being more than five years into a recovery. If rates should be kept lower in the U.S. for longer than expected, the result should be supportive for commodities

Investment Highlights

Overview

For the year ended December 31, 2014, the Investor Class of the Global Resources Fund declined 28.74 percent and the Institutional Class declined 28.28 percent, trailing the fund's new benchmark, the S&P Global Natural Resources Index (Net Total Return), which fell 10.18 percent. Please note that the fund adopted a new performance benchmark following the discontinuation of the Morgan Stanley Commodity Related Equity Index (CRX) in early July 2014. For purposes of the fund's performance fee calculation, until the new benchmark has been in place one full year, the fund will be compared to a blend of the two indices. For the year ended December 31, 2014, the blended index declined 3.03 percent.

The fund employed a defensive investment position from time to time in the past year with higher-than-average cash balances on hand to protect the liquidity of the fund. However, to maintain varying degrees of investment exposure to the commodities market, the fund utilized a number of rolling call option positions to hedge the fund's benchmark risks and provide optionality to upswings in commodities stocks.

Because the fund is actively managed and holding period is generally not a consideration in investment decisions, the portfolio turnover rate may fluctuate from year to year as the fund adjusts its portfolio composition. The fund's annual portfolio turnover was, and is expected to continue to be, more than 100 percent. Portfolio turnover was higher this year due in part to the fund's transition to a new performance benchmark.

39

Global Resources Fund (unaudited)

Strengths

• The fund outperformed on both an absolute and relative basis versus the benchmark, the S&P Global Natural Resources Index (Net Total Return), within the metals and mining industry group due in part to an underweighting in large index holdings such as BHP Billiton Ltd.(1) and Freeport McMoran, Inc.(2) Positive absolute contributions came from Nevsun Resources, Ltd.,(3) Nickel Asia Corp.(4) and Alcoa Inc.(2) equity options.

• Despite a sharp decline in the price of crude oil in the year, the fund outperformed the benchmark in the oil and gas – exploration/production industry group. Key contributors included Goodrich Petroleum Corp.,(2) Anadarko Petroleum Corp.(2) equity options, and Continental Resources, Inc.(2)

• Oil refining stocks outperformed the broader energy complex during the year as product margins were more resilient than the underlying commodity. Accordingly, equity positions in Valero Energy Corp.,(5) Marathon Petroleum Corp.(6) and Tesoro Corp.(7) were beneficial to fund performance.

Weaknesses

• The fund's core weighting in junior natural resources equities underperformed the large-cap S&P benchmark during a period of declining commodity prices and risk aversion typical of a rising dollar. Notable underperformers included Sable Mining Africa Ltd.,(8) Gran Colombia Gold Corp. notes,(9) Pacific Infrastructure Ventures, Inc.,(10) and Agriterra Ltd.(11)

• Falling crude oil prices and ongoing capital expenditures from oil and gas producers spurred a dramatic selloff in the service and equipment group. Onshore drilling and fracking companies bore the brunt of the selling: Patterson-UTI Energy, Inc.,(2) Halliburton Co.(12) and Hi-Crush Partners L.P.(2) negatively impacted fund performance.

• An underweight position in fertilizer companies adversely affected relative performance for the period as companies rebounded from falling corn prices.

Current Outlook

Opportunities

• Saudi Arabia is assuming $80-per-barrel oil in its budget for 2015, implying the world's largest exporter sees oil recovering soon. In fact, Saudi Arabia Oil Minister Ali Al-Naimi said recently that he is 100 percent sure that prices will go up as they have nowhere else to go. Furthermore, Iraq's Oil Minister, Adel Abdul Mahdi, said that OPEC will need to step in if oil declines further. It would appear that oil prices have reached their bottom. The long-awaited rally in oil prices should be a huge tailwind for energy producers.

40

Global Resources Fund (unaudited)

• Value investors are turning bullish on depressed energy stocks. Large inflows into energy-related exchange-traded funds (ETFs) occurred in December, despite the continued decline in oil prices. This divergence may be signaling a bottom in the energy bear market.

• Libyan oil production is falling due to Islamist militant attacks on various energy facilities. Output is at the lowest level since May 2014, and with no clear resolution to the fighting, supply from Libya may continue to be strained.

Threats

• The dollar continues to reach new highs. Strong growth prospects in the U.S. have caused the greenback to break its key 2009 resistance level. Associated with falling commodity prices, the rising dollar remains a threat and a sign of a global growth imbalance.

• The Federal Reserve Bank's cancellation of its QE program could negatively impact market liquidity and pressure asset prices if economic growth stalls.

• The instability and volatility surrounding Russia has become a serious concern for global investors. Any contagion from the ruble's decline could prove disastrous for the global economic recovery and, therefore, commodities.

(1) This security comprised 3.69% of the fund's total net assets as of 12/31/14.

(2) The fund did not hold this security as of 12/31/14.

(3) This security comprised 1.18% of the fund's total net assets as of 12/31/14.

(4) This security comprised 1.28% of the fund's total net assets as of 12/31/14.

(5) This security comprised 1.58% of the fund's total net assets as of 12/31/14.

(6) This security comprised 1.59% of the fund's total net assets as of 12/31/14.

(7) This security comprised 1.64% of the fund's total net assets as of 12/31/14.

(8) This security comprised 0.16% of the fund's total net assets as of 12/31/14.

(9) This security comprised 1.68% (including 1.53% in notes) of the fund's total net assets as of 12/31/14.

(10)This security comprised 3.79% of the fund's total net assets as of 12/31/14.

(11)This security comprised 0.36% of the fund's total net assets as of 12/31/14.

(12)This security comprised 0.23% of the fund's total net assets as of 12/31/14.

41

Global Resources Fund (unaudited)

Top 10 Equity Holdings Based on Net Assets December 31, 2014

Atlas Development & Support Services Ltd.

Oil - Field Services | | | 5.22 | % | |

Pacific Infrastructure Ventures, Inc.

Real Estate Operating/Development | | | 3.79 | % | |

BHP Billiton Ltd.

Diversified Minerals | | | 3.69 | % | |

TransGlobe Energy Corp.

Oil Companies - Exploration & Production | | | 3.20 | % | |

Potash Corporation of Saskatchewan, Inc.

Agricultural Chemicals | | | 2.98 | % | |

Exxon Mobil Corp.

Oil Companies - Integrated | | | 2.85 | % | |

Syngenta AG

Agricultural Chemicals | | | 2.66 | % | |

Chevron Corp.

Oil Companies - Integrated | | | 2.35 | % | |

Glencore plc

Metal - Diversified | | | 2.29 | % | |

Pacific Power Generation Corp.

Electric - Generation | | | 2.28 | % | |

Total Top 10 Equity Holdings | | | 31.31 | % | |

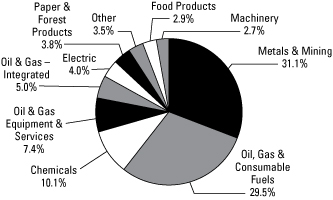

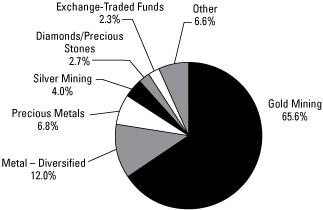

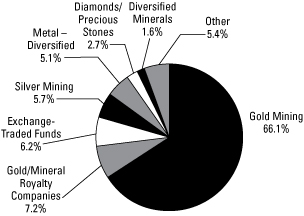

Portfolio Allocation by Industry Sector*

Based on Total Investments December 31, 2014