As filed with the Securities and Exchange Commission on March 7, 2017

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-01800

U.S. GLOBAL INVESTORS FUNDS

Three Canal Plaza, Suite 600

Portland, Maine 04101

Jessica Chase, Principal Executive Officer

Three Canal Plaza, Suite 600

Portland, Maine 04101

207-347-2000

Date of fiscal year end: December 31

Date of reporting period: January 1, 2016 – December 31, 2016

ITEM 1. REPORT TO STOCKHOLDERS.

U.S. Global Investors Funds Annual Report

December 31, 2016

U.S. Global Investors Funds

Annual Report

December 31, 2016

Table of Contents

Letter to Shareholders | 1 |

Definitions for Management Teams' Perspectives | 10 |

Management Team's Perspective | 12 |

Portfolios of Investments | 54 |

Notes to Portfolios of Investments | 98 |

Statements of Assets and Liabilities | 110 |

Statements of Operations | 114 |

Statements of Changes in Net Assets | 118 |

Notes to Financial Statements | 124 |

Financial Highlights | 140 |

Report of Independent Registered Public Accounting Firm | 151 |

Trustees and Officers | 152 |

Approval of Investment Advisory Agreement | 155 |

Additional Information | 162 |

Expense Example | 164 |

Nasdaq Symbols

U.S. Global Investors Funds

Investor Class | |

U.S. Government Securities Ultra-Short Bond Fund | UGSDX |

Near-Term Tax Free Fund | NEARX |

All American Equity Fund | GBTFX |

Holmes Macro Trends Fund | MEGAX |

Global Resources Fund | PSPFX |

World Precious Minerals Fund | UNWPX |

Gold and Precious Metals Fund | USERX |

Emerging Europe Fund | EUROX |

China Region Fund | USCOX |

| | |

Institutional Class | |

Global Resources Fund | PIPFX |

World Precious Minerals Fund | UNWIX |

Gold and Precious Metals Fund* | USEIX |

Emerging Europe Fund* | EURIX |

* | The Institutional Class shares of the Gold and Precious Metals and Emerging Europe Funds have not commenced operations and currently are closed to investors. A notice will be issued when each class commences operations and opens to investors. |

| Atlantic Fund Services

3 Canal Plaza, Suite 600

Portland, ME

04101 |

U.S. Global Investors Funds | (unaudited) |

Dear Fellow Shareholder,

2016 was a banner year for gold. After finishing in the red for three straight years, the yellow metal made a remarkable turnaround, ending 2016 up 8.56 percent.

In the first half of the year—gold’s best since 1974—demand was driven largely by the Fear Trade. Government bond yields in countries such as Japan, Switzerland and Germany plunged below zero, prompting overseas investors to pile into gold, not to mention American municipal debt. A shaky stock market early in the year, not to mention geopolitical uncertainty—specifically the risk of Brexit in the United Kingdom and the rise of Donald J. Trump here in the United States—also boosted demand.

In the second half, gold began to stall as investors awaited the results of the U.S. presidential election and anticipated a December rate hike. Immediately following Trump’s win, equities took off and the U.S. dollar surged, causing gold to fall out of favor. Between November 8 and December 31, 2016, the precious metal retreated nearly 10 percent.

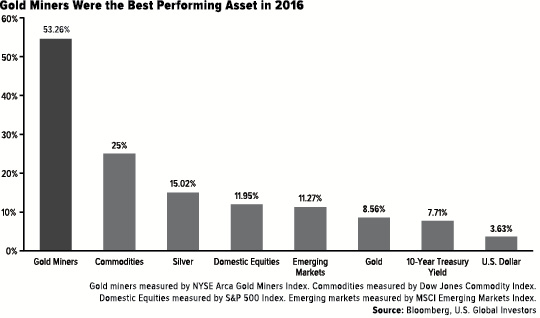

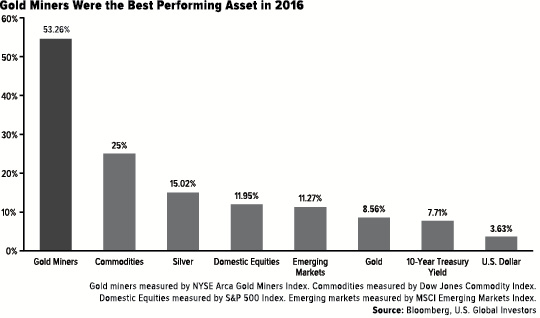

Despite the downturn, gold miners managed to strike gold in 2016. The group, as measured by the NYSE Arca Gold Miners Index, finished the year up an amazing 53.26 percent, based on simple price appreciation, handily beating all other asset classes shown below.

I was immensely happy with the performance of our two gold funds, the Gold and Precious Metals Fund (USERX) and the World Precious Minerals Fund (UNWPX), both of which led many of their peers.

1

U.S. Global Investors Funds | (unaudited) |

The two funds also received special recognition from Morningstar in 2016. USERX earned a 5-Star Overall Rating (as of December 31, among 71 Equity Precious Metals funds, based on risk-adjusted returns), while UNWPX was honored with a 5-Star Rating over the three-year period (again, as of December 31, among 71 Equity Precious Metals funds, based on risk-adjusted returns).

Gold should continue to be supported in 2017 by even deeper negative real rates, which could fall to their lowest level in two years as inflation outpaces nominal interest rate increases, according to UBS. In October, Federal Reserve Chair Janet Yellen suggested there might be some benefit in allowing inflation to exceed the central bank’s target rate of 2 percent before another hike is considered, which is good news for gold. Numerous times in the past I’ve shown that the yellow metal has tended to rise when real rates—what you get when you subtract inflation from the federal funds rate—fell into negative territory.

Global Manufacturing Improved, Supporting Commodity Prices

Commodities were the second-best asset class last year, responding to improved manufacturing activity and trade volumes around the world. Global manufacturing expanded for the fourth straight month in December, reaching 52.7, its highest reading since February 2014.

Purchasing manager’s index (PMI) readings for the U.S., Germany, Japan and the eurozone all recorded their highest posts in at least a year after building on a strengthening uptrend that had been in place since September. International trade volume expansion hit a 27-month high in December. And despite the “negative” consequence of Brexit, the U.K. Manufacturing PMI posted an amazing 56.1, up from 53.4 in November.

2

U.S. Global Investors Funds | (unaudited) |

Despite a strengthening dollar, commodity prices remained relatively resilient, presumably on hopes that Trump’s proposed $1 trillion infrastructure spending package would be realized.

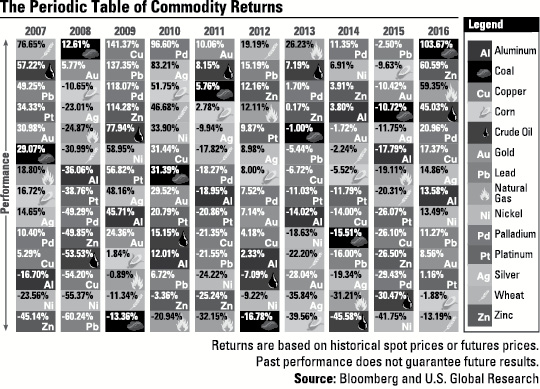

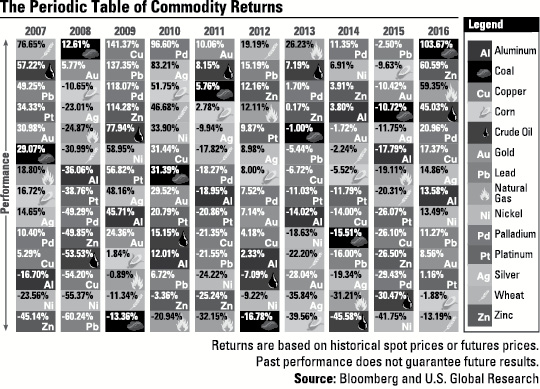

Year after year, the Periodic Table of Commodity Returns continues to be one of our most popular pieces. You can find the full-color, high-resolution version on our website, www.usfunds.com.

China’s commodities trading volume was also impressive in 2016. For the seventh consecutive year, the Asian giant maintained its rank as the biggest importer of raw materials. This helped solidify China’s role as the world’s top engine of economic growth, contributing an estimated 33.2 percent to global economic expansion in 2016, according to China’s National Bureau of Statistics.

Small Business Optimism Soared to 12-Year High

Here in the U.S., President Trump’s pledge to lower taxes and slash regulations is working wonders for business optimism. In December, the Index of Small Business Optimism soared a phenomenal 7.4 points to 105.8, its highest reading since 2004. The National Federation of Independent Business (NFIB), which conducts the survey, reported that attitudes toward capital spending and job creation in particular surprised to the upside.

3

U.S. Global Investors Funds | (unaudited) |

Small-cap stocks, as measured by the Russell 2000 Index, surged on bets that Trump’s “America First” policies will benefit domestics with limited exposure to foreign markets, more so than multinational blue-chip stocks.

4

U.S. Global Investors Funds | (unaudited) |

The president’s proposals are aggressively inward-facing, which bodes well for companies with little foreign exposure. As a group, small caps have far less exposure to foreign markets than larger, multinational companies do. Because they rely a lot less on exports, they’re not as negatively affected by a strong U.S. dollar, which has the effect of making American-made products more expensive for foreign buyers.

New Models for Our Domestic Equities Funds

We’re committed to taking advantage of this upside, which is why we adjusted and dramatically improved the methodology for our two domestic equities funds, the All American Equity Fund (GBTFX) and the Holmes Macro Trends Fund (MEGAX).

Among other changes, we seek to capture the performance of the “growthiest” companies in All American’s benchmark, the S&P 500 Index, by focusing on those whose most recent quarter’s sales per share is greater than the average of the previous four quarters. So if a company’s average sales per share for the past four quarters is $30, let’s say, it needs to show something higher than that in the current quarter to be considered. We want the most active, productive companies on a per-share basis, and we’ve found that sales per share (also known as revenue per share) is one of the best ways to measure this.

The benchmark for MEGAX is the S&P Composite 1500 Index, which introduces small- and mid-cap stocks to our universe of investable companies. Again, many of these stocks have been among the best performers since the November election.

Mid-cap companies are especially attractive because they’ve reached a point in their enterprise life cycle where the challenges inherent to smaller companies—raising capital early on and managing capacity growth, for example—are mostly behind them. At the same time, they remain dynamic enough for rapid growth to be possible.

That’s why mid-cap stocks now account for 40 percent of our new MEGAX model. Meanwhile, 36 percent is in small caps, the remaining 24 percent in large caps.

We’re very excited about the changes and have a lot of confidence in them going forward.

Warren Buffett’s Big Bet on Airlines

After years of deriding the airline industry, billionaire investor Warren Buffett confirmed in November that his holding company invested nearly $1.3 billion in the four big-name domestic carriers.

This was a dramatic reversal for the 86-year-old investing wizard, who previously called the airline industry a capital “death trap” and once joked that investors would have been served well had Orville Wright’s plane been shot down at Kitty Hawk.

5

U.S. Global Investors Funds | (unaudited) |

The thing is, Buffett held these opinions long before airlines began making the fundamental changes that would flip their fortunes from bankruptcy to record profitability. When Buffett first tried his hand at making money in the aviation industry in 1989, airlines were still struggling in a fiercely competitive marketplace.

But following the massive wave of industry consolidation between 2005 and 2010, a new business environment emerged, one characterized by disciplined capacity growth, new sources of revenue, greater efficiency and a commitment to repairing balance sheets.

Buffett professes to like airlines now for the same reason he’s long been a fan of railroads—namely, the barriers to entry are extremely high if not entirely impenetrable to new competitors. This is the “moat” Buffett refers to when talking about rail. What’s more, as a value investor, he prefers inexpensive stocks, and among industrials, airlines were cheapest of all, based on price-to-earnings and cash flow.

Muni Bonds a Key to Making America Great Again

Again, President Trump has proposed a spending package as high as $1 trillion over the next 10 years. Although the private sector will be expected to finance a large portion of the work, massive amounts of public debt will be necessary.

6

U.S. Global Investors Funds | (unaudited) |

As such, this could be a “very big item for the muni market in the coming years,” according to John Vahey, managing director of federal policy for Bond Dealers of America, a trade association for fixed-income dealers. Demand is high at the moment. On Election Day alone, U.S. voters approved $55.7 billion in new debt, the highest single-day issuance since 2008.

Even though rates were lifted only 0.25 percent in December, it’s important to be aware that when rates rise, bond prices fall. At first glance, this inverse relationship might seem illogical, but it makes sense. If newly-issued bonds carry a higher yield, the value of existing bonds with lower rates declines.

That’s why investors should consider taking advantage of shorter-duration, investment-grade munis, which are less sensitive to rate increases than longer-term bonds whose maturities are further out.

Our Near-Term Tax Free Fund (NEARX) invests primarily in high-quality, investment-grade muni bonds in attractive jurisdictions. We believe after all, a well-structured, diversified portfolio—one that also includes munis—is still the most prudent strategy going forward.

To get the latest insights and commentary on gold and other commodities, emerging markets, municipal bonds and much, much more, subscribe to our Investor Alert and to my personal CEO blog, Frank Talk. Both can be reached by visiting usfunds.com.

Thank you for your continued trust and confidence in U.S. Global Investors.

Happy investing!

Frank E. Holmes

CEO and Chief Investment Officer

U.S. Global Investors, Inc.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. The Funds are distributed by Foreside Fund Services, LLC. U.S. Global Investors is the investment adviser.

7

U.S. Global Investors Funds | (unaudited) |

Morningstar ratings based on risk-adjusted return and number of funds

Category: Equity Precious Metals

Through: 12/31/2016

The Morningstar Rating™ for funds, or “star rating”, is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product’s monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and 10-year (if applicable) Morningstar Rating metrics. The weights are: 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns, and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns. While the 10-year overall star rating formula seems to give the most weight to the 10-year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods.

Bond funds are subject to interest-rate risk; their value declines as interest rates rise. Though the Near-Term Tax Free Fund seeks minimal fluctuations in share price, it is subject to the risk that the credit quality of a portfolio holding could decline, as well as risk related to changes in the economic conditions of a state, region or issuer. These risks could cause the fund’s share price to decline. Tax-exempt income is federal income tax free. A portion of this income may be subject to state and local taxes and at times the alternative minimum tax. The Near-Term Tax Free Fund may invest up to 20% of its assets in securities that pay taxable interest. Income or fund distributions attributable to capital gains are usually subject to both state and federal income taxes.

Stock markets can be volatile and share prices can fluctuate in response to sector-related and other risks as described in the fund prospectus.

Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in these sectors.

The S&P 500 Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The NYSE Arca Gold Miners Index is a modified market capitalization-weighted index comprised of publicly-traded companies involved primarily in the mining for gold and silver. The index benchmark value was 500.0 at the close of trading on December 20, 2002. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance

8

U.S. Global Investors Funds | (unaudited) |

in the global emerging markets. The Russell 2000 Index is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000. The Russell 3000 Index consists of the 3,000 largest U.S. companies as determined by total market capitalization. The S&P Composite 1500 is a broad-based capitalization-weighted index of 1500 U.S. companies and is comprised of the S&P 400, the S&P 500 and the S&P 600. The index was developed with a base value of 100 as of December 30, 1994.

The JPMorgan Global Manufacturing Purchasing Manager’s Index is an indicator of the economic health of the global manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment.

The Small Business Optimism Index is compiled from a survey that is conducted each month by the National Federation of Independent Business (NFIB) of its members.

U.S. Global Investors is not affiliated with Warren Buffett or Berkshire Hathaway.

The sections labeled Portfolio of Investments contain complete lists of the funds’ holdings.

There is no guarantee that the issuers of any securities will declare dividends in the future or that, if declared, will remain at current levels or increase over time.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

9

Definitions for Management Teams’ Perspectives | (unaudited) |

Benchmark Index Definitions

Returns for indices reflect no deduction for fees, expenses or taxes, unless noted.

The Bloomberg Barclays U.S. Treasury Bills 6-9 Months Total Return Index tracks the performance of U.S. Treasury Bills with a maturity of six to nine months.

The Bloomberg Barclays 3-Year Municipal Bond Index is a total return benchmark designed for municipal assets. The index includes bonds with a minimum credit rating of BAA3, are issued as part of a deal of at least $50 million, have an amount outstanding of at least $5 million and have a maturity of two to four years.

The FTSE Gold Mines Index encompasses all gold mining companies that have a sustainable and attributable gold production of at least 300,000 ounces a year and that derive 75% or more of their revenue from mined gold.

The Hang Seng Composite Index is a market-capitalization weighted index that covers about 95% of the total market capitalization of companies listed on the Main Board of the Hong Kong Stock Exchange.

The MSCI Emerging Markets Europe 10/40 Index (Net Total Return) is a free float-adjusted market capitalization index that is designed to measure equity performance in the emerging market countries of Europe (Czech Republic, Greece, Hungary, Poland, Russia and Turkey). The index is calculated on a net return basis (i.e., reflects the minimum possible dividend reinvestment after deduction of the maximum rate withholding tax). The index is periodically rebalanced relative to the constituents’ weights in the parent index.

The NYSE Arca Gold Miners Index is a modified market capitalization-weighted index comprised of publicly-traded companies involved primarily in the mining for gold and silver.

The S&P Global Natural Resources Index (Net Total Return) includes 90 of the largest publicly-traded companies in natural resources and commodities businesses that meet specific investability requirements, offering investors diversified, liquid and investable equity exposure across 3 primary commodity-related sectors: Agribusiness, Energy, and Metals & Mining. The index is calculated on a net return basis (i.e., reflects the minimum possible dividend reinvestment after deduction of the maximum rate withholding tax).

The S&P 500 Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

The S&P Composite 1500 Index is a broad-based capitalization-weighted index of 1500 U.S. companies and is comprised of the S&P 400, the S&P 500 and the S&P 600.

10

Definitions for Management Teams’ Perspectives | (unaudited) |

Other Index Definitions

The Bloomberg Commodity Index is made up of 22 exchange-traded futures on physical commodities. The index represents 20 commodities, which are weighted to account for economic significance and market liquidity.

The Caixin China Manufacturing Purchasing Manager’s Index is a composite indicator designed to provide an overall view of activity in the manufacturing sector and acts as a leading indicator for the whole economy. When the PMI is below 50.0 this indicates that the manufacturing economy is declining and a value above 50.0 indicates an expansion of the manufacturing economy.

The MSCI All Country Far East Free ex Japan Index is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of the Far East, excluding Japan. The index consists of the following developed and emerging market country indices: China, Hong Kong, Indonesia, Korea, Malaysia, the Philippines, Singapore, Taiwan and Thailand.

The Purchasing Manager’s Index (PMI) is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment.

The Shanghai Composite Index is an index of all stocks that trade on the Shanghai Stock Exchange.

The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar.

11

U.S. Government Securities Ultra-Short Bond Fund | (unaudited) |

Management Team’s Perspective

Introduction

The U.S. Government Securities Ultra-Short Bond Fund (UGSDX) is designed to be used as an investment that takes advantage of the security of U.S. Government bonds and obligations, while simultaneously pursuing a higher level of current income than money market funds offer. The fund’s dollar-weighted average effective maturity is two years or less.

Performance Graph

U.S. Government Securities Ultra-Short Bond Fund |

|

Average Annual Performance | For the Years Ended

December 31, 2016 |

| | One Year | Five Year | Ten Year |

U.S. Government Securities Ultra-Short Bond Fund | 0.47% | 0.24% | 0.78% |

Bloomberg Barclays U.S. Treasury Bills 6-9 Months Total Return Index | 0.49% | 0.20% | 0.40% |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. For all or a portion of the periods, the fund had expense limitations and reimbursements to maintain a minimum yield, without which returns would have been lower. The above returns for the U.S. Government Securities Ultra-Short Bond Fund include the fund’s results as a money market fund through the date of its conversion (December 20, 2013) to an ultra-short bond fund, and therefore are not representative of the fund’s results had it operated as an ultra-short bond fund for the full term of the periods shown. Gross expense ratio as stated in the most recent prospectus is 1.13%. Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 0.45%. The Adviser can modify or terminate this arrangement at any time. In addition, returns may include the effects of additional voluntary waivers of fees and reimbursements of expenses by the Adviser, including waivers and reimbursements to maintain a minimum net yield for the fund. See Definitions for Management Teams’ Perspectives for index definitions. Please visit our website at www.usfunds.com for updated performance information for different time periods. |

12

U.S. Government Securities Ultra-Short Bond Fund | (unaudited) |

The Year in Review – Economic and Political Issues that Affected the Fund

Despite no tangible change in economic fundamentals, the risk-off sentiment that dominated the beginning of the year completely reversed by the first quarter’s end. To start the year, depressed oil prices and global growth concerns, particularly in China, led to significant spread widening across the credit markets, a sharp drop in equity markets and a rally in Treasuries. However, the market rebounded in mid-February on little data, causing oil prices to rise by nearly 10 percent, the S&P 500 Index to post a positive 1.2 percent return, and high-yield debt to recover amidst significant inflows. Poor liquidity conditions exacerbated market volatility in the first quarter. The depth to which the markets fell and the speed at which prices rebounded without any significant fundamental catalyst are evidence of the challenges investors face in the illiquid environment. Trading volumes have failed to keep pace with an increase in issuance across corporate and sovereign bonds, increasing the likelihood that smaller trading volumes will have an outsize impact on market pricing. Given the volatility that dominated the beginning of the year and increasing evidence of a slowing U.S. economy, the market largely expected the Federal Reserve (the Fed) to keep rates on hold at its March meeting. The Fed delivered, keeping the benchmark lending rate steady at between 0.25 and 0.50 percent. The Fed emphasized the uncertainty surrounding the outlook and the rising risks from abroad as some of the key factors weighing on its decision. Furthermore, Fed officials scaled back its forecast for rate hikes during the remainder of the year, expecting to raise rates twice in 2016, compared to their December 2015 projection of four times. By focusing on financial market turmoil as a key element that factored into its decision, the Fed appeared to be reversing course on the importance of market volatility. Previously, the Fed dismissed volatility in oil prices or markets as a normal phenomenon that did not drive policy. Now, the Fed stated it is uncomfortable raising rates in the context of market volatility like that seen during the first quarter.

The second quarter saw the unprecedented phenomenon of more than $10 trillion in negative-yielding government debt stretching around the world, defying the boundaries of what should be possible according to traditional economics. Central banks’ pumping continued monetary stimulus, coupled with weak fundamentals, drove markets to extreme levels. Concerns over a number of potential tail risks during previous months resulted in intense market volatility with sharp selloffs, followed by exuberant rallies. The Brexit surprise was the latest such event that appeared on most investors’ list of concerns, and if realized, was expected to result in a market selloff. While a selloff did occur, it was only a moderate one over a period of just two days. A rally then persisted not only for risky assets but U.S. Treasuries as well. This trend was representative of broader forces at work, all of which resulted in increased market volatility. As investors awaited the remaining half of the year, there were many potential market disruptors that included the U.S. elections, other referendums (Scotland, Catalonia), potential policy error by the Fed, China’s economic rebalancing, sluggish global growth, troubled Italian banks, negative

13

U.S. Government Securities Ultra-Short Bond Fund | (unaudited) |

interest rate policies (NIRP) and other geopolitical events. As disruptive as it was, NIRP ironically had a silver lining. The lack of yield across the globe implied that U.S. fixed income markets were one of the world’s most attractive, particularly on a risk adjusted basis. This was reflected in the strong performance of U.S. fixed income during the second quarter. The U.S. Treasury curve flattened, with 10+ year maturity bonds exhibiting declines of 30 basis points (bps) or more. The 10-year ended the quarter at 1.47 percent. Corporate bond performance, maintaining the momentum from the first quarter, was mostly positive with energy and metals & mining leading the charge. Spreads shrugged off the Brexit vote late in June.

The month of September was dominated by central bank meetings as the Federal Reserve, Bank of Japan, European Central Bank (ECB) and the Bank of England all held policy meetings. Importantly, the sentiment around September’s meetings was a bit different than in past years as the market started to question the efficacy of further central bank easing. Judging by Treasury market price action, the aggregate of global central bank action for September left the market wanting as Treasury yields finished lower on the month. The release of the September statement showed a Fed that hoped a tightening could be warranted in December. It was apparent from the release of the staff economic projections that hiking aspirations for 2017 and beyond were significantly more tepid than they were previously. The staff’s forecasts for the fed funds rate called for one rate hike in 2016 (down from two before), two hikes in 2017 (down from three before) and three hikes in 2018 (same as before). These downward revisions suggested the notion that monetary policy is less accommodative at current levels than previously thought was beginning to take hold inside the Federal Reserve Open Market Committee (FOMC).

While the ECB elected to ease policy in roundabout fashion at their December policy meeting, the FOMC decided to tighten policy at its own December meeting, raising the policy rate from 25-50 bps to 50-70 bps. This move did not come as much of a surprise to market participants, as it was fully priced into fed funds future contracts prior to the meeting. Similarly, the release of the FOMC statement was very much as expected, delivering an even-handed, non-committal assessment of the U.S. macroeconomic backdrop. However, the Fed did deliver one final surprise to the market in the form of an upgrade to the policy-tightening forecast for 2017. The median participant now looks for three hikes in 2017, up from two in September, and the mean outlook for the funds rate at the end of next year was revised up 7 bps from 1.31 percent to 1.38 percent. The level of the funds rate projection for 2018 and 2019 was shifted up slightly, though the pace of hikes in those years was generally little changed from the September projections. Interestingly, this upgraded 2017 tightening guidance did not come with any upgrades to the FOMC’s economic forecast projections. The Fed expects slightly better growth next year of 2.1 percent versus its prior forecast of 2 percent. The 2018 growth forecast was left unchanged at 2 percent. Despite offering minimal forward guidance, the 25 bps policy tightening seemed to temporarily reawaken the animal spirits in the U.S. Treasury market as yields surged higher, led by the middle segment of the curve.

14

U.S. Government Securities Ultra-Short Bond Fund | (unaudited) |

Investment Highlights

The U.S. Government Securities Ultra-Short Bond Fund returned 0.47 percent for the year ended December 31, 2016, underperforming its benchmark, the Bloomberg Barclays U.S. Treasury Bills 6-9 Months Total Return Index, which returned 0.49 percent.

The fund shortened its maturity profile toward the latter half of 2016 as interest rates on short-term agency securities moved higher in anticipation of the Fed’s rate hike and after the U.S. election. This allowed the fund to mitigate losses.

Current Outlook

Interest rates rose much further and faster than expected in 2016. From a post-Brexit low of 1.37 percent in July, the benchmark 10-year Treasury yield hit a high of 2.64 percent in December, after the Fed hiked the fed funds rate for the first time all year, and indicated that it may raise it three more times in 2017. Elections and geopolitical events around the world seem to be pointing to a paradigm shift. Populist forces eager for faster growth have led to a shift from monetary policy to fiscal stimulus. In the U.S., expectations are running high that the pro-growth policies of Donald Trump will lead to a more hawkish Fed and higher rates.

The section labeled Portfolio of Investments contains a complete list of the fund’s holdings.

Portfolio Allocation by Issuer

Based on Total Investments | December 31, 2016 |

|

Portfolio Allocation by Maturity | | December 31, 2016 | |

6 – 12 Months | | $ | 40,778,171 | | | | 74.5 | % |

1 – 2 Years | | | 13,940,322 | | | | 25.5 | % |

| | | $ | 54,718,493 | | | | 100.0 | % |

| | | | | | | | | |

15

Near-Term Tax Free Fund | (unaudited) |

Management Team’s Perspective

Introduction

The Near-Term Tax Free Fund (NEARX) seeks to provide a high level of current income exempt from federal income taxation and to preserve capital. However, a portion of any distribution may be subject to federal and/or state income taxes. The Near-Term Tax Free Fund will maintain a weighted average maturity of less than five years.

Performance Graph

Near-Term Tax Free Fund |

|

Average Annual Performance | For the Years Ended

December 31, 2016 |

| | One Year | Five Year | Ten Year |

Near-Term Tax Free Fund | -0.45% | 1.40% | 2.69% |

Bloomberg Barclays 3-Year Municipal Bond Index | 0.08% | 1.13% | 2.71% |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. For all or a portion of the periods, the fund had expense limitations, without which returns would have been lower. Gross expense ratio as stated in the most recent prospectus is 1.09%. The Adviser has contractually agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 0.45% on an annualized basis through April 30, 2017. See Definitions for Management Teams’ Perspectives for index definitions. Please visit our website at www.usfunds.com for updated performance information for different time periods. |

16

Near-Term Tax Free Fund | (unaudited) |

The Year in Review – Economic and Political Issues that Affected the Fund

Municipal bond yields declined during the first quarter of the year, which drove prices higher. A higher exposure to cash, given unattractive yields, was a drag on fund performance. As short-term rates rose and longer-term yields declined, the municipal yield curve flattened. As a result, longer-term bonds outperformed. The front end of the yield curve, in the area with less-than-two-year maturities, had the weakest returns. The fund benefited modestly from its barbell positioning. Within the main sectors, revenue bonds and general obligations outperformed and pre-refunded bonds lagged. Of the largest states, New Jersey had the best returns for the quarter. Illinois outperformed to a lesser extent, and California lagged slightly. Investors’ fears about falling commodity prices, a slowing Chinese economy and market volatility abated during the first quarter, which led to a greater appetite for risk and allowed lower-rated and longer-maturity bonds to outperform. The fund’s large exposure to higher quality bonds was a source of underperformance. While overall credit fundamentals remain sound, specific issuers were newsworthy. Illinois remained without a state budget, and the impasse continued to pressure state universities and the Chicago Board of Education, among others. Energy-producing states North Dakota, Alaska and Louisiana were downgraded in response to ongoing weakness in oil prices. Draft legislation from the U.S. House of Representatives was set to allow Puerto Rico to restructure some of its $70 billion debt under a federal oversight board, and this legislation was slated to be formally introduced to the U.S. Congress in April.

The second quarter saw unprecedented geopolitical outcomes. Most notably, in a historic decision, the U.K. voted to exit the European Union. Despite polls showing a close race, markets were taken aback by the “leave” decision and sold off sharply. The pound dropped 12 percent to a 30-year low. Global stock markets also suffered large corrections. Meanwhile, global rates saw immediate flight-to-safety moves with the 10-year U.S. Treasury yield touching 1.40 percent and German 10-year yields reaching negative 0.16 percent. In U.S. markets, the dollar, U.S. Treasuries and equities saw the greatest price impacts following the Brexit vote, but they rebounded quickly as fears faded that Brexit was a new “Lehman moment.” Central banks stepped in to backstop risk by providing ample liquidity to the market, but the 10-year U.S. Treasury yield remained hovering around 1.5 percent, roughly 30 bps below where it was pre-Brexit, reflecting the significant uncertainty that still hung over the market. With nearly 50 percent of global fixed income securities yielding 1 percent or lower, the search for yield drove investors into riskier assets and overshadowed worsening fundamentals. During the quarter, the spread between the 2-year Treasury note and the 10-year was less than 90 bps, the lowest level since 2007. In contrast to previous episodes of curve flattening, which were driven by Federal Reserve rate hikes on the front end, this instance of curve flattening was driven by a rally in 10-year rates. Amid worries about jobs growth and low inflation, the Fed opted to hold off on a rate hike at the June meeting. Bringing its views more in line with market expectations, the Fed revised its forecast for growth in

17

Near-Term Tax Free Fund | (unaudited) |

2016, from 2.2 percent to 2 percent, and lowered projections of future rate increases. As of the June meeting, most members still anticipated two hikes, though a greater number of officials forecasted just one increase. In municipal market developments, the U.S. Senate passed the bill protecting Puerto Rico from creditors. The legislation created a financial control board to help restructure the island’s $70 billion in debt and oversee its finances, marking the largest federal intervention ever into the U.S. municipal bond market. Illinois had its bond ratings dropped to levels not seen for a U.S. state in over a decade because of a protracted political deadlock that had left it veering toward its second straight year without a budget. Moody’s cut its grade on about $28.8 billion of general-obligation and sales-tax debt by one level to Baa2, its lowest for a state since Massachusetts in 1992. S&P Global Ratings followed by dropping it one step to BBB+. Atlantic City got a lifeline as New Jersey Governor Chris Christie signed two bills that pulled the city from the brink of bankruptcy and gave it about five months to right its finances, a task that if unmet would result in an unprecedented state takeover. The measures infused Atlantic City with enough cash to pay bills and workers through October. Officials had until then to craft a five-year plan to restore fiscal stability. Tennessee was awarded a AAA general-obligation bond rating from S&P Global Ratings, which cited the strengthening state economy, growing reserves and consistent payment of its required contribution to the state’s pension system. It became the eighth state to receive the top bond rating ranking from both S&P Global Ratings and Moody’s. The others are Delaware, Maryland, Missouri, North Carolina, Texas, Utah and Virginia.

As was widely expected, in their September meeting, the Federal Reserve’s Open Market Committee (FOMC) opted to keep the federal funds rate unchanged. Fed Chair Janet Yellen and her allies maintained that employment and inflation data did not warrant an increase and they continued to resist pressures to tighten monetary policy. While the Fed was reluctant to act, the end of the lower-for-longer era of U.S. central bank policy appeared to be drawing closer and a December rate hike looked likely. The FOMC upgraded its assessment of near-term risks, describing them as “roughly balanced.” The Fed also clearly signaled its intent in its Summary of Economic Projections by showing a preponderance of participants still expected an increase in 2016. Investors’ focus for the remainder of the quarter shifted toward the November elections and December’s FOMC meeting. In state and municipal government news, a report from Moody’s evaluated the impact of low oil and gas prices on energy-dependent state and local governments. It noted that the hardest hit states were Alaska, Louisiana, North Dakota, Oklahoma and New Mexico. In other news, Chicago approved a plan to raise the city’s water and sewer taxes to shore up its pension funds. The plan calls for a hike in the taxes of about 33 percent over five years. California had its credit rating raised by Fitch Ratings to AA- because of the strength of its economy and strong budget management. Lastly, in a report analyzing the fiscal resilience among U.S. states, S&P Global Ratings deemed Illinois, Pennsylvania, New Jersey and Connecticut to have “only a limited capacity” to withstand the effect of a moderate recession. The report also found Washington, Florida and New York as the best positioned.

18

Near-Term Tax Free Fund | (unaudited) |

November’s surprise election outcome proved to be a boon for risk assets and a bust for so-called “safe havens,” including Treasuries and municipal bonds. Muni prices sank as a result of a rally in yields and, to a lesser degree, concerns over future infrastructure spending and tax policies. It was the market’s worst performance month since the 2008 financial crisis. Fund flows, a measure of demand, turned sharply negative, ending 56 weeks of inflows. More than $10 billion left muni funds in November. The California Public Employees’ Retirement System (CalPERS), the nation’s largest public pension fund, voted to reduce its discount rate or rate of return on its investments from 7.5 percent to 7 percent over the next three years. CalPERS determined that achieving a 7.5 percent investment return over the next 10 years would be a significant challenge. Reducing the discount rate will undoubtedly result in higher contribution rates for California local governments that participate in the CalPERS plan. Furthermore, CalPERS’ decision to lower its discount rate has far reaching implications beyond California to the broader state and local government sector. Given the size of the fund (more than $300 billion), CalPERS has been a bellwether for investment trends at other public plans. Any change it makes will likely influence others to follow suit and lower their own discount rates, which, in turn, will result in incremental credit pressure for the sector. Overall, rating agencies do a good job of incorporating the implications of changes in discount rate assumption into their analysis by using their own hypothetical standardized discount rates to calculate the unfunded pension liabilities. However, the ratings don’t necessarily fully incorporate the potential budgetary impact of a reduction in discount rates. As a result, as broader public pension funds continue to reduce discount rates, state and local governments will likely feel incremental negative ratings pressure.

Investment Highlights

For the year ended December 31, 2016, the Near-Term Tax Free Fund returned -0.45 percent, underperforming its benchmark, the Bloomberg Barclays 3-Year Municipal Bond Index, which gained 0.08 percent.

Strengths

● | Buying opportunistically during multi-standard deviation moves in the municipal bond market and letting the yield advantage work in the fund’s favor over time has proven to be advantageous, as has the fund’s low turnover approach. |

● | The fund benefited from its allocation to bonds from New York, New Hampshire and New Jersey. |

● | The fund benefited from its allocation to medical and higher education bonds. |

Weaknesses

● | The fund was negatively impacted from an overweight position in Texas bonds, which underperformed. |

● | The fund’s exposure to general obligation bonds underperformed. |

19

Near-Term Tax Free Fund | (unaudited) |

● | The fund was hurt by its exposure to the longer end of the yield curve, which underperformed the shorter end. |

Current Outlook

Opportunities

● | Concerns about overburdened pensions place increasingly more pressure on troubled state’s general obligation bonds. As a result, focusing on high quality essential revenue bonds instead of general obligation bonds is likely to be an area of opportunity. |

Threats

● | Tax reform, which has been a Republican priority, is likely to garner increasing interest. While the value of tax exemption would be lessened if the top marginal tax rate were reduced from 39.6 percent to 33 percent, the correction necessary to overcome this lower-tax environment is likely to be manageable. While the elimination of the tax exemption is unlikely, it poses a major threat to the municipal market. |

The section labeled Portfolio of Investments contains a complete list of the fund’s holdings.

Top 10 Area Concentrations

(Based on Net Assets) | December 31, 2016 |

Texas | 23.95% |

New York | 9.54% |

Washington | 8.90% |

Florida | 5.21% |

Illinois | 4.48% |

Michigan | 3.86% |

Pennsylvania | 3.17% |

New Jersey | 3.16% |

California | 2.68% |

Missouri | 2.38% |

Total Top 10 Areas | 67.33% |

20

Near-Term Tax Free Fund | (unaudited) |

Municipal Bond Ratings*

Based on Total Municipal Bonds | December 31, 2016 |

|

* | Credit quality ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). “Not Rated” is used to classify securities for which a rating is not available. Credit-quality ratings for each issue are obtained from Moody’s and S&P Global Ratings, and the higher rating for each issue is used. |

21

All American Equity Fund & Holmes Macro Trends Fund | (unaudited) |

Management Team’s Perspective

Introduction

The principal objective of the All American Equity Fund (GBTFX) is to seek capital appreciation by investing primarily in a broadly diversified portfolio of domestic common stocks. The fund invests in large-capitalization stocks while retaining the flexibility to seek out promising individual stock opportunities, including stocks with meaningful dividend yields.

The Holmes Macro Trends Fund (MEGAX) invests in companies with good growth prospects and strong positive earnings momentum. The fund’s primary objective is to seek long-term capital appreciation.

Performance Graphs

All American Equity Fund |

|

Average Annual Performance | For the Years Ended

December 31, 2016 |

| | One Year | Five Year | Ten Year |

All American Equity Fund | -0.14% | 8.12% | 4.10% |

S&P 500 Index | 11.96% | 14.66% | 6.95% |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. For all or a portion of the periods, the fund had expense limitations, without which returns would have been lower. Gross expense ratio as stated in the most recent prospectus is 1.94%. Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 2.20%. The Adviser can modify or terminate this arrangement at any time. See Definitions for Management Teams’ Perspectives for index definitions. Please visit our website at www.usfunds.com for updated performance information for different time periods. |

22

All American Equity Fund & Holmes Macro Trends Fund | (unaudited) |

Holmes Macro Trends Fund |

|

Average Annual Performance | For the Years Ended

December 31, 2016 |

| | One Year | Five Year | Ten Year |

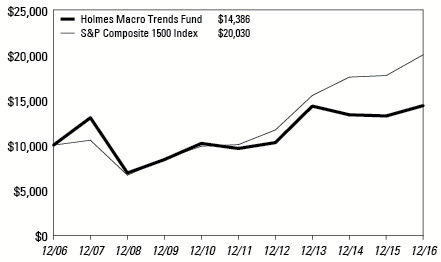

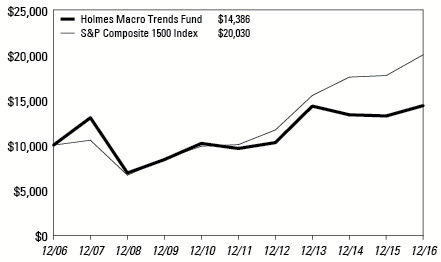

Holmes Macro Trends Fund | 8.66% | 8.36% | 3.70% |

S&P Composite 1500 Index | 13.03% | 14.78% | 7.19% |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. For all or a portion of the periods, the fund had expense limitations, without which returns would have been lower. Gross expense ratio as stated in the most recent prospectus is 1.81%. Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 2.20%. The Adviser can modify or terminate this arrangement at any time. See Definitions for Management Teams’ Perspectives for index definitions. Please visit our website at www.usfunds.com for updated performance information for different time periods. |

The Year in Review – Economic and Political Issues that Affected the Funds

The fundamental manager struggled in 2016 against a sea of macro related surprises. For example, volatility spiked the first few months of the year, Brexit surprised investors in June, the world experienced a surprise outcome with a Donald Trump win in the U.S. presidential election and the Federal Reserve raised rates in December.

Despite the macro surprises, U.S. equities performed well, finishing the year with a 11.96 percent gain.

23

All American Equity Fund & Holmes Macro Trends Fund | (unaudited) |

The top performing factors in 2015 failed to continue their winning ways in 2016. Returns, balance sheet, size and volatility started off strong early in the year, but reversed and continued to be weak the remainder of the year due to reflationary expectations on investors’ minds. Value was the best performing factor in 2016.

In December, the Fed raised its benchmark rate 25 bps. This will be a slight headwind going into 2017, but the Fed believes the economy should remain on its current pace of growth. The Fed is so confident about economic growth, in fact, that it warned about a possible two additional hikes before the end of 2017.

Investment Highlights

The All American Equity Fund returned -0.14 percent for the year ending 2016, underperforming the 11.96 percent return for the benchmark S&P 500 Index. The Holmes Macro Trends Fund returned 8.66 percent for the year ending 2016, underperforming the 13.03 percent return for the benchmark S&P Composite 1500 Index.

Because the funds are actively managed and the holding period is generally not a consideration in investment decisions, the portfolio turnover rate may fluctuate from year to year as the funds adjust their portfolio composition. The funds’ annual portfolio turnovers were, and are expected to continue to be, more than 100 percent.

All American Equity Fund

Strengths

● | Health care, telecommunication services and utilities were the top three best-performing sectors. |

● | Darden Restaurants was the biggest contributor to the fund. |

● | The underweighting in telecommunications helped the fund outperform the benchmark’s allocation. |

Weakness

● | Consumer discretionary, cash and financials were the three allocations that detracted from the fund the most. |

● | Tractor Supply Co. was the single largest detractor from the fund. |

● | The fund’s underweighting in financials reduced its potential performance. |

Holmes Macro Trends Fund

Strengths

● | The industrials and health care sectors as well as the fund’s ETF allocations were the top contributors to fund performance. |

24

All American Equity Fund & Holmes Macro Trends Fund | (unaudited) |

● | LogMeIn was the biggest contributor to the fund. |

● | The overweighting in the industrial sector helped the fund outperform the benchmark’s allocation. |

Weaknesses

● | Materials and energy as well as the fund’s cash allocations were the largest drags on fund performance. |

● | Regeneron Pharmaceuticals was the single largest detractor from the fund. |

● | The fund’s overweighting in cash reduced potential returns. |

Current Outlook

Opportunities

● | The Donald J. Trump administration has been telegraphing increased infrastructure stimulus. This should bode well for the country’s growth prospects. |

● | Global leading indicators continue to improve. This should provide the needed support necessary for investors to feel comfortable with elevated price-to-earnings (P/E) ratios. |

● | The continuing combination of improved consumer and business confidence and surging U.S. stock markets should boost investors’ future expectations of the equities growth. |

Threats

● | U.S. equities are considered to be in an eight-year bull market. It is not unreasonable to anticipate a possible correction. |

● | The Federal Reserve is now tasked with returning the benchmark interest rates to “normal” levels. The latest minutes imply possibly two rate hikes in 2017. |

● | A large risk to the future outlook of the markets and economy is a negative shock to sentiment. |

The section labeled Portfolio of Investments contains a complete list of the funds’ holdings.

25

All American Equity Fund & Holmes Macro Trends Fund | (unaudited) |

All American Equity Fund

Top 10 Equity Holdings (Based on Net Assets) | December 31, 2016 |

Whirlpool Corp. | 3.25% |

Appliances | |

Public Storage | 3.22% |

REITS - Storage | |

Delta Air Lines, Inc. | 3.18% |

Airlines | |

Phillips 66 | 3.14% |

Oil Companies - Integrated | |

Travelers Companies, Inc. | 3.10% |

Property/Casualty Insurance | |

CVS Health Corp. | 3.10% |

Retail - Drug Store | |

PulteGroup, Inc. | 3.09% |

Building - Residential/Commercial | |

Patterson Companies, Inc. | 3.08% |

Dental Supplies & Equipment | |

Pfizer, Inc. | 3.05% |

Medical - Drugs | |

Entergy Corp. | 3.05% |

Electric - Integrated | |

Total Top 10 Equity Holdings | 31.26% |

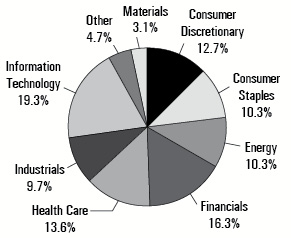

Portfolio Allocation by Industry Sector* Based on Total Investments | December 31, 2016 |

|

* | Summary information above may differ from the portfolio schedule included in the financial statements due to the use of different classifications of securities for presentation purposes. |

26

All American Equity Fund & Holmes Macro Trends Fund | (unaudited) |

Holmes Macro Trends Fund

Top 10 Equity Holdings (Based on Net Assets) | December 31, 2016 |

Kimberly-Clark Corp. | 5.89% |

Consumer Product - Miscellaneous | |

Altria Group, Inc. | 5.65% |

Tobacco | |

IDEXX Laboratories, Inc. | 5.25% |

Diagnostic Kits | |

Pool Corp. | 4.87% |

Distribution/Wholesale | |

Pitney Bowes, Inc. | 4.78% |

Office Automation & Equipment | |

Tempur Sealy International, Inc. | 4.19% |

Home Furnishings | |

Lennox International, Inc. | 3.95% |

Building Products - Air & Heating | |

B/E Aerospace, Inc. | 3.70% |

Aerospace/Defense - Equipment | |

NewMarket Corp. | 3.64% |

Chemicals - Specialty | |

Hawaiian Holdings, Inc. | 3.47% |

Airlines | |

Total Top 10 Equity Holdings | 45.39% |

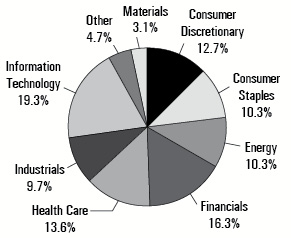

Portfolio Allocation by Industry Sector* Based on Total Investments | December 31, 2016 |

|

* | Summary information above may differ from the portfolio schedule included in the financial statements due to the use of different classifications of securities for presentation purposes. |

27

Global Resources Fund | (unaudited) |

Management Team’s Perspective

Introduction

The Global Resources Fund (PSPFX and PIPFX) is a non-diversified natural resources fund with the principal objective of seeking long-term growth of capital while providing protection against inflation and monetary instability. The fund invests in companies involved in the exploration, production and processing of petroleum, natural gas, coal, alternative energies, chemicals, mining, iron and steel, and paper and forest products around the globe.

Performance Graph

Global Resources Fund |

|

Average Annual Performance | For the Periods Ended

December 31, 2016 |

| | One Year | Five Year | Ten Year | Since Inception (Institutional Class) |

Global Resources Fund - Investor Class | 14.99% | -9.04% | -4.62% | n/a |

Global Resources Fund - Institutional Class (Inception 3/1/10) | 15.43% | -8.49% | n/a | -4.56% |

S&P 500 Index | 11.96% | 14.66% | 6.95% | 13.08% |

S&P Global Natural Resources Index (Net Total Return) | 31.45% | -0.82% | 0.55% | -0.60% |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. For all or a portion of the periods, the fund had expense limitations, without which returns would have been lower. Gross expense ratio as stated in the most recent prospectus is 1.58% for the Investor Class and 1.35% for the Institutional Class. Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 1.90% for the Investor Class. Also pursuant to a voluntary agreement, the Adviser has agreed to waive all class specific expenses of the Institutional Class. The Adviser can modify or terminate these arrangements at any time. See Definitions for Management Teams’ Perspectives for index definitions. Please visit our website at www.usfunds.com for updated performance information for different time periods. |

28

Global Resources Fund | (unaudited) |

The Year in Review – Economic and Political Issues that Affected the Fund

The Bloomberg Commodity Index rose 11.4 percent through the year 2016, posting its first positive year since 2010. All major commodities rallied, with crude oil, copper and gold prices rallying 45, 17.4, and 8.6 percent, respectively. Initial concerns that the global economy was slowing, particularly due to weaker economic data from China, did not materialize. In a sharp contrast to expectations, the global manufacturing sector beat all expectations, and the year in review was marked by a steady upward trajectory in manufacturing activity across the globe. This was evidenced by JP Morgan’s Global Manufacturing PMI barometer, which troughed in February and steadily rose to an 18-month high in December 2016. Both U.S. and Chinese manufacturing activity rallied throughout the year and also ended 2016 on their highest respective points, both denoting solid expansionary momentum.

Crude oil’s significant relative outperformance to the broader market was driven by lower U.S. oil production and self-imposed caps by Organization of Petroleum Exporting Nations (OPEC) members. U.S. shale producers slashed production earlier in the year in response to prices below $35 per barrel, removing as many as 600,000 barrels per day from the market, and leading the market closer to a supply-demand balance. Once prices stabilized in the second quarter, stronger manufacturing activity, as well as increasing gasoline demand, supported a price rally back into the $40 to $50 range. In the second half of the year, OPEC took decisive leadership and engineered a self-imposed cap on production, which helped improve sentiment toward the sector by signaling that OPEC members can still work together.

The base metals complex, highly susceptible to manufacturing activity globally, rallied as Chinese imports of metals hit new records. Copper, nickel and zinc posted double-digit returns in 2016, a reflection of unexpected record demand for the metals. In addition, markets reacted to a number of supply cuts, mainly in the zinc market, and supply disruptions in the copper and nickel markets, which supported stronger pricing. The metals closed the year near 52-week highs on speculation that a “reflation” trade led by President Donald Trump could drive a demand boost from the metals-intensive infrastructure sector.

Gold rose for the first time in four years. The first Federal Reserve rate-hike in the tightening cycle, which happened back in December 2015, gave way to a gold rally, as investors were quick to realize the Fed could not achieve its initial pace for rate hikes, which weighed on the U.S. dollar. Most important, however, was gold’s safe haven status, which helped the metal garner assets after U.K. voters surprisingly voted in favor of an exit from the EU.

29

Global Resources Fund | (unaudited) |

Investment Highlights

Overview

For the year ended December 31, 2016, the Investor Class of the Global Resources Fund returned 14.99 percent and the Institutional Class returned 15.43 percent, trailing the fund’s benchmark, the S&P Global Natural Resources Index (Net Total Return) (SPGNRUT), which rose 31.45 percent.

The fund employed a defensive investment position from time to time in the past year with higher-than-average cash balances on hand to protect the liquidity of the fund. However, to maintain varying degrees of investment exposure to the commodities market, the fund utilized a number of rolling call option positions to hedge the fund’s benchmark risks and provide optionality to upswings in commodities stocks.

Because the fund is actively managed and holding period is generally not a consideration in investment decisions, the portfolio turnover rate may fluctuate from year to year as the fund adjusts its portfolio composition. The fund’s annual portfolio turnover was, and is expected to continue to be, more than 100 percent.

Strengths

● | The fund’s overweighting in precious metals, construction materials and junior natural resource stocks, as well as its underweight in fertilizers and chemicals, paper and forest and oil exploring and developer stocks had a positive contribution to the fund relative to its benchmark. |

● | The fund had superior stock selection in oil explorers and developers, precious metals, construction materials, industrials and fertilizer and chemicals’ sectors. This superior stock selection resulted in positive contribution to the fund relative to its benchmark. |

● | The securities that provided the highest contribution to the fund were Klondex Mines, Gran Colombia Gold, Richmont Mines and Claude Resources. |

Weaknesses

● | The fund’s overweighting in industrials, agribusiness, oil and gas refining and renewable stocks, as well as its underweighting in base and industrial metals stocks, had a negative contribution to the fund relative to its benchmark. |

● | The fund had inferior stock selection in the base and industrial metals sector, the oil and gas refining sector, the oil services sector, paper and forest companies and the integrated oil sector. |

● | The securities that resulted in the largest negative contribution to the fund were Atlas African Industries, Pacific Green Energy, Doray Minerals, DHT Holdings and Pacific Infrastructure. |

30

Global Resources Fund | (unaudited) |

Current Outlook

Opportunities

● | Commodity prices may continue to rally as supply and demand dynamics are tightening, according to Citigroup. With 2016 almost in the books, commodities are posting their best annual performance in over five years. The trend should continue in 2017, says Citigroup, a bank which has been notoriously bearish on commodities, by stating that “there is absolutely no doubt that commodity markets are at a turning point.” |

● | The Brent forward curve is signaling that oil storage tanks will start emptying the second half of 2017, according to oil traders surveyed by Reuters. As crude oil trades range bound and overhang continues to exist in inventories, higher demand in the future is slowly starting to emerge where oil fundamentals may turn bullish in late 2017. |

● | 2016 led rallies in zinc and coal, but 2017 could be the year of nickel and oil. Nickel will be finishing 2016 with a rally of 22 percent; however, developments such as the Philippines President Rodrigo Duterte’s rally against mining companies and Indonesia’s export ban may dramatically hamper the metals fundamentals and create a severe supply shortage. |

Threats

● | China may fall short of its 6.5 percent in economic growth objective according to president Xi Jinping. Xi stated that the country doesn’t need to meet its objective if doing so will create too much systematic risk and jeopardize its long term growth prospects. In 2015 policymakers pledged an annual growth rate of at least 6.5 percent through 2020. Falling short of its growth objectives will have negative ramifications for industrial metals demand, a negative read-through for base metals. |

● | Commodity prices may be susceptible to major swings in 2017 as commodity exporting nations prepare for the potential of protectionist measures in the U.S. Following the victory of President Donald Trump, markets have reacted to a stronger U.S. dollar and are making preparations for potential protectionist policies against their imports. Some economic commentators have warned that a wave of protectionist measures may sink the world into a global recession, with negative implications for commodity prices. |

● | General Motors is temporarily idling five U.S. assembly plants in an attempt to reduce bloated inventories. The sector has experienced rapid growth over the past five years as a result of cheap consumer financing; however, interest rates on car loans are slowly rising while terms are much longer than before. According to the research organization IHS Automotive, sales could slide by more than 200,000 vehicles if the company permanently suspends production from these plants—a negative read-through for platinum group metals and steel demand. |

The section labeled Portfolio of Investments contains a complete list of the fund’s holdings.

31

Global Resources Fund | (unaudited) |

Top 10 Equity Holdings (Based on Net Assets) | December 31, 2016 |

Klondex Mines Ltd. | 7.09% |

Gold Mining | |

Pacific Infrastructure Ventures, Inc. | 5.23% |

Real Estate Operating/Development | |

Regis Resources Ltd. | 1.63% |

Gold Mining | |

Northern Star Resources Ltd. | 1.43% |

Gold Mining | |

Resolute Mining | 1.43% |

Gold Mining | |

Nippon Light Metal Holdings Co., Ltd. | 1.42% |

Metal - Aluminum | |

Interfor Corp. | 1.39% |

Forestry | |

Evolution Mining Ltd. | 1.34% |

Gold Mining | |

Nevsun Resources Ltd. | 1.34% |

Metal - Copper | |

Vestas Wind Systems A.S. | 1.33% |

Energy - Alternate Sources | |

Total Top 10 Equity Holdings | 23.63% |

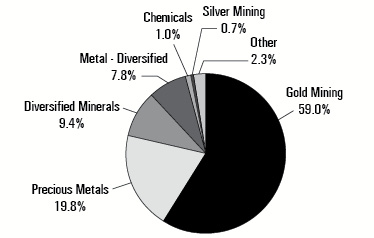

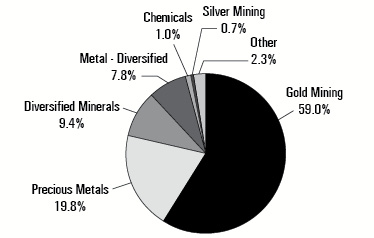

Portfolio Allocation by Industry Sector* Based on Total Investments | December 31, 2016 |

|

* | Summary information above may differ from the portfolio schedule included in the financial statements due to the use of different classifications of securities for presentation purposes. |

32

Precious Metals and Minerals Funds | (unaudited) |

Management Team’s Perspective

Introduction

The World Precious Minerals Fund (UNWPX and UNWIX) and the Gold and Precious Metals Fund (USERX) pursue an objective of long-term capital growth through investments in gold, precious metals and mining companies. The World Precious Minerals Fund focuses on equity securities of companies principally engaged in the exploration, mining and processing of precious minerals such as gold, silver, platinum and diamonds. Although this fund has the latitude to invest in a broad range of precious minerals, it currently remains focused on the gold sector. The Gold and Precious Metals Fund focuses on the equity securities of established gold and precious metals companies and pursues current income as a secondary objective.

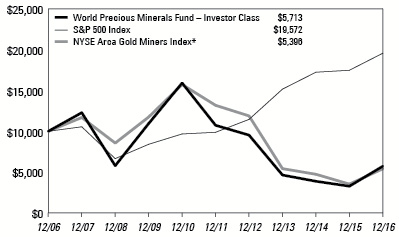

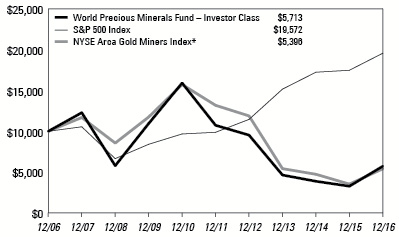

World Precious Minerals Fund |

|

Average Annual Performance | For the Periods Ended December 31, 2016 |

| | One Year | Five Year | Ten Year | Since Inception (Institutional Class) |

World Precious Minerals Fund - Investor Class | 75.08% | -11.85% | -5.45% | n/a |

World Precious Minerals Fund - Institutional Class (Inception 3/1/10) | 75.97% | -11.42% | n/a | -8.58% |

S&P 500 Index | 11.96% | 14.66% | 6.95% | 13.08% |

NYSE Arca Gold Miners Index* | 53.26% | -16.36% | -5.98% | -10.33% |

* These are not the total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment. Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. For all or a portion of the periods, the fund had expense limitations, without which returns would have been lower. Gross expense ratio as stated in the most recent prospectus is 2.01% for the Investor Class and 20.56% for the Institutional Class. Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 1.90%. Also pursuant to a voluntary agreement, the Adviser has agreed to waive all class specific expenses of the Institutional Class. The Adviser can modify or terminate these arrangements at any time. See Definitions for Management Teams’ Perspectives for index definitions. Please visit our website at www.usfunds.com for updated performance information for different time periods. |

33

Precious Metals and Minerals Funds | (unaudited) |

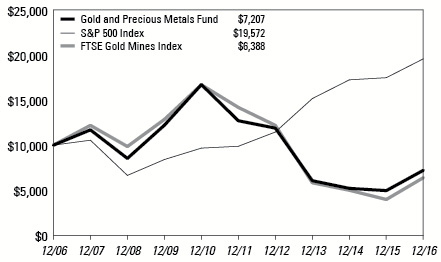

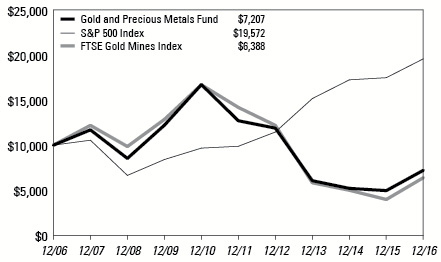

Gold and Precious Metals Fund |

|

Average Annual Performance | For the Year Ended

December 31, 2016 |

| | One Year | Five Year | Ten Year |

Gold and Precious Metals Fund | 45.36% | -10.72% | -3.22% |

S&P 500 Index | 11.96% | 14.66% | 6.95% |

FTSE Gold Mines Index | 60.72% | -14.75% | -4.38% |

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. For all or a portion of the periods, the fund had expense limitations, without which returns would have been lower. Gross expense ratio as stated in the most recent prospectus is 2.20%. Pursuant to a voluntary arrangement, the Adviser has agreed to limit total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) to not exceed 1.90%. The Adviser can modify or terminate this arrangement at any time. See Definitions for Management Teams’ Perspectives for index definitions. Please visit our website at www.usfunds.com for updated performance information for different time periods. |

34

Precious Metals and Minerals Funds | (unaudited) |

The Year in Review - Economic and Political Issues that Affected the Funds

Gold started the year strong following the first rate hike in December 2015, marking the first rate hike in eight years. Precious metals got an early boost following Janet Yellen’s remarks stating that the Federal Reserve will proceed “cautiously” with rate hikes this year. Gold investors started pouring money into gold ETFs at the fastest pace since 2009, with negative rates in Europe boosting its appeal. Hence, gold bullion prices clocked their best quarterly rally in 30 years.

Momentum continued into the second quarter, helped by the market turmoil following the United Kingdom’s decision to leave the European Union late in June. Gold rallied more in the first half of the year than in any other year since 1974, with prices pushed up 24 percent. The funds were the beneficiaries of two significant transactions in the first half of the year. In the first major deal, Tahoe Resources announced its definitive agreement to acquire Lake Shore Gold for $678 million in an all-stock transaction. The premium paid was about 15 percent to the prior closing price of Lake Shore. In the second transaction, Silver Standard Resources announced its agreement to buy all the outstanding common shares of Claude Resources, with the offer valuing Claude at C$337 million. According to Bloomberg, the price is about a 25 percent premium to the 20-day weighted average price of Claude and a 30 percent premium to Claude’s closing price on March 4. Our gold funds held slightly more than 9 million shares of Claude, almost 5 percent of the company.

China introduced a new yuan-priced gold fix, and within a week of the new fix being introduced, Russia and China announced a new gold trading platform. The trading platform the Chinese and Russians have adopted may eventually be a mechanism to set prices for goods or services in terms of gold and to break the dollar’s place as the currency of international trade. Platts reported that both Chinese and Russian banks increased their gold purchases during the month of June after they had both slowed their gold purchases in May. Russia added around 18 metric tons, and China added around 15 metric tons. China is now the sixth-largest holder of gold reserves, and Russia is the seventh-largest. The two countries have accounted for over 95 percent of total central bank purchases of gold in the last two years in their efforts to diversify away from foreign currency.

The surge in gold prices did have some drawbacks as price-sensitive India cut demand for the precious metal to the lowest in seven years. Weak demand forced dealers to sell gold at a discount to clear inventories. In addition, India’s gold imports in June were just 32 tonnes and were 43 percent less than June last year. This is a significant drop for India, one of the top countries for gold consumption, along with China. China consumption had its own headwinds with anti-corruption measures taking a toll on gold jewelry purchases, with demand falling 17.4 percent compared to 2015. Meanwhile, the investment-related demand for gold picked up, with gold bar and coin purchases up 25.3 percent and 17.3 percent, respectively.

35

Precious Metals and Minerals Funds | (unaudited) |

China’s gold withdrawals surged in November as prices fell with the anticipated U.S. rate hike in December. According to the monthly report from the Shanghai Gold Exchange, purchases increased to 214.72 tonnes and was a 40 percent rise over the October figure. According to Bloomberg Intelligence, the five-year average gold premium is typically around $5.50 an ounce in China, but has soared to almost $40 an ounce, as falling prices invite “bargain buying” among the Chinese. This level of demand puts China on track to potentially maintain its position as the world’s largest gold consumer. Rumors and reports indicate that international banks are having difficulties with their imports, as the People’s Bank of China is taking longer to approve each importing transaction. The central bank may be trying to unofficially restrict gold imports to curb high capital outflows from China’s investors.