UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-7739

Harding, Loevner Funds, Inc.

(Exact name of registrant as specified in charter)

50 Division Street

Somerville, NJ 08876

(Address of principal executive offices) (Zip code)

Owen T. Meacham, Esq.

The Northern Trust Company

50 South LaSalle Street, B-9

Chicago, IL 60603

(Name and address of agent for service)

Registrant’s telephone number, including area code: (877) 435-8105

Date of fiscal year end: 10/31/2010

Date of reporting period: 10/31/2010

Item 1. Reports to Stockholders.

Harding, Loevner Funds, Inc.

Table of Contents

Harding, Loevner Funds, Inc.

Expense Example

October 31, 2010 (unaudited)

As a shareholder of a Harding Loevner Portfolio, you incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of fund shares; and (2) ongoing costs, including management fees and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars and cents) of investing in the Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested on May 1, 2010 and held for the entire six month period from May 1, 2010 to October 31, 2010 for the Global Equity Portfolio—Institutional Class, International Equity Portfolio—Institutional Class, Institutional Emerging Markets Portfolio and Frontier Emerging Markets Portfolio—Institutional Class.

Actual Expenses

The first line under the Portfolio in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line for the Portfolio under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line under each Portfolio in the table below provides information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of fund shares. Therefore, the second line under the Portfolio in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | Beginning Account Value May 1, 2010 | | | Ending Account Value October 31, 2010 | | | Annualized Expense Ratio | | | Expenses Paid During Period* (May 1, 2010 to October 31, 2010) | |

Global Equity Portfolio—Institutional Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,055.63 | | | | 1.00% | | | $ | 5.18 | |

Hypothetical (5% annual return before expenses) | | | 1,000.00 | | | | 1,020.16 | | | | 1.00% | | | | 5.09 | |

International Equity Portfolio—Institutional Class | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,095.92 | | | | 0.93% | | | | 4.91 | |

Hypothetical (5% annual return before expenses) | | | 1,000.00 | | | | 1,020.52 | | | | 0.93% | | | | 4.74 | |

Institutional Emerging Markets Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,111.85 | | | | 1.30% | | | | 6.92 | |

Hypothetical (5% annual return before expenses) | | | 1,000.00 | | | | 1,018.65 | | | | 1.30% | | | | 6.61 | |

Frontier Emerging Markets Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,100.56 | | | | 2.00% | | | | 10.59 | |

Hypothetical (5% annual return before expenses) | | | 1,000.00 | | | | 1,015.12 | | | | 2.00% | | | | 10.16 | |

| | | | | | | | | | | | | |

* Expenses are calculated using each Portfolio’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by number of days in the period (184 days), and divided by the number of days in the year (365 days).

Harding, Loevner Funds, Inc.

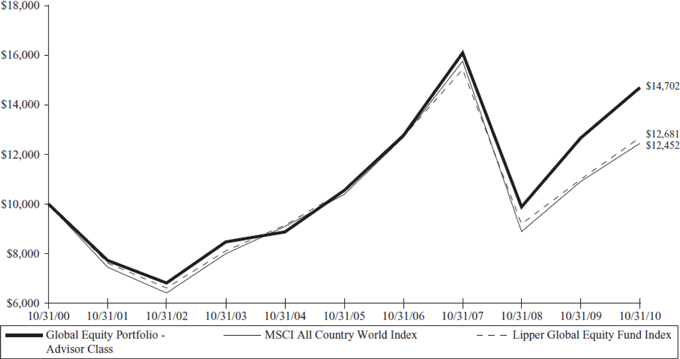

Global Equity Portfolio (Institutional Class) — Overview

(unaudited)

October 31, 2010

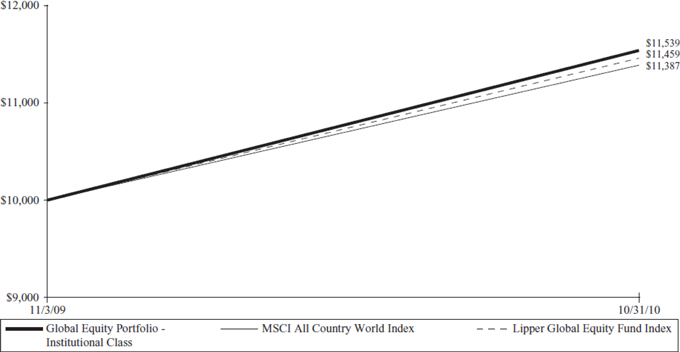

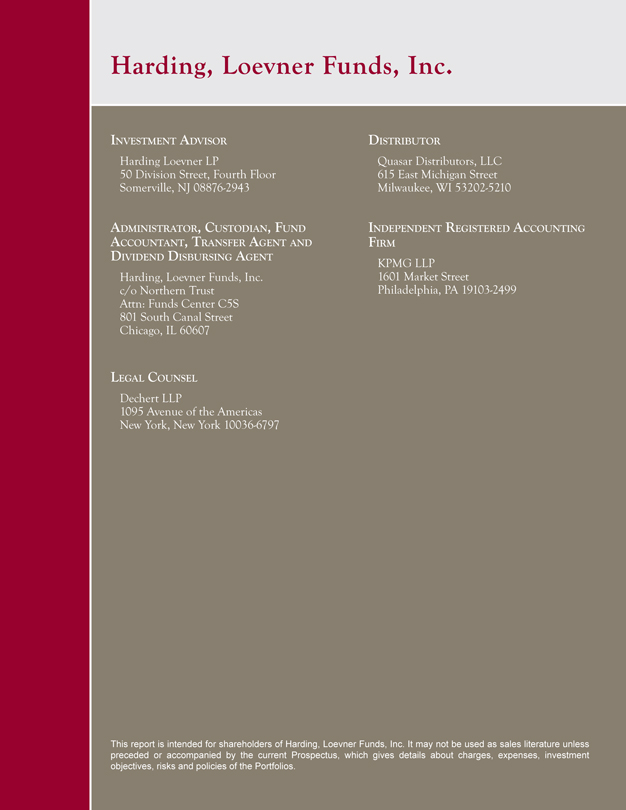

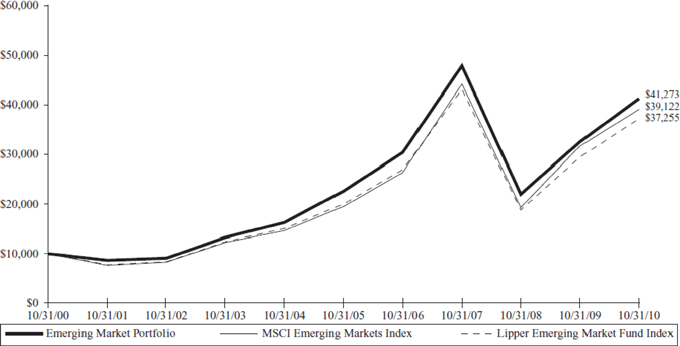

Hypothetical Comparison Of Changes In Value Of $10,000 Investment In Harding, Loevner Funds, Inc. -

Global Equity Portfolio And The Lipper Global Equity Fund Index

(Net Dividends Reinvested)

And The MSCI All Country World Index (Net Dividend)

| | | | |

| | | | | |

| | | Returns for the Year Ended October 31, 2010 | | |

| | | |

| | | Cumulative Total Returns | | |

FUND NAME | | Inception | | |

Global Equity Portfolio—Institutional Class (Inception date 11/3/09) | | 15.39% | | |

MSCI All Country World Index (Net Dividends) | | 13.87% | | |

Lipper Global Equity Fund Index | | 14.59% | | |

| | | | | |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than the performance quoted and may be obtained by visiting the website at www.hardingloevnerfunds.com.

Investment return reflects voluntary fee waivers in effect. Absence such waivers, total return would be reduced. The performance provided does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions.

3

Harding, Loevner Funds, Inc.

Global Equity Portfolio (Institutional Class) - Overview

(unaudited)

October 31, 2010

The Global Equity Portfolio gained 15.39% since inception (November 3, 2009) through the fiscal year ending October 31, 2010. In comparison, its benchmark, the MSCI All Country World Index, rose 13.87%.

Consistent with its investment objectives and policies, the Portfolio was invested in the securities of global companies that exhibit the fundamental characteristics of sustainable growth, financial strength, management quality, and durable competitive advantage.

The Portfolio’s relative outperformance derived from both stock selection and the resulting sector allocations. Our continued bias against—and resulting small weighting in—the Financials sector was the biggest contributor from sector allocation, and our preference for Emerging Markets-oriented banks, which translated as good stock selection, augmented that contribution. We also saw excellent performance within the Health Care sector, including from diabetes specialists Novo Nordisk and Fresenius, and from Genzyme and Talecris Biotherapeutics, both of which are the subject of ongoing acquisition bids from other Health Care companies. In addition, our Consumer Discretionary and Information Technology holdings made positive contributions. The main detractor was the Portfolio’s dreadful relative performance within Consumer Staples and Materials. The former was due to poor returns from two agriculture-related stocks, Bunge and Olam International (sold early in the year), as well as Walgreen. Disappointing performance from Monsanto hurt returns in Materials.

Geographically, the Portfolio enjoyed strong relative returns in Europe, both in the eurozone and in the non-European Monetary Union countries. Good stock selection in these regions was due in large part to our preference for multinational consumer-oriented companies—such as Swatch Group, LVMH Moët Hennessy, and L’Oréal—and to a small weighting in domestically-oriented Financials. We also enjoyed strong stock selection in Japan, led by robot manufacturer Fanuc. Our stocks in the US lagged, however, especially Adobe Systems and the aforementioned Monsanto and Walgreen. The US holdings outperformed the benchmark Index overall, however, the Portfolio’s large overweight in the US was beneficial.

Past performance does not guarantee future results.

The Portfolio invests in foreign securities, which will involve greater volatility and political, economic, and currency risks and differences in accounting methods. It also invests in emerging markets, which involve unique risks, such as exposure to economies less diverse and mature than the U.S. or other more established foreign markets. Economic and political instability may cause larger price changes in emerging markets securities than other foreign securities. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investment by the Portfolio in lower rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities.

Please see the Statement of Net Assets on page 5 for fund holdings as of October 31, 2010. Fund holdings and sector allocations are subject to change and are not recommendations to buy or sell any security.

The MSCI All Country World Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global developed and emerging markets. The Index consists of 45 developed and emerging market countries. The Index is net of foreign withholding taxes on dividends. You cannot invest directly in this Index.

4

Harding, Loevner Funds, Inc.

Global Equity Portfolio

Statement of Net Assets

October 31, 2010

| | | | | | |

| Industry | | Percentage of Net Assets |

Agriculture | | | 1.1 | % | | |

Apparel | | | 3.0 | | | |

Banks | | | 9.2 | | | |

Beverages | | | 0.9 | | | |

Biotechnology | | | 2.4 | | | |

Chemicals | | | 8.6 | | | |

Commercial Services | | | 2.1 | | | |

Computers | | | 6.1 | | | |

Cosmetics/Personal Care | | | 8.5 | | | |

Distribution/Wholesale | | | 3.0 | | | |

Diversified Financial Services | | | 2.0 | | | |

Electrical Components & Equipment | | | 2.7 | | | |

Electronics | | | 1.8 | | | |

Food | | | 2.2 | | | |

Healthcare - Products | | | 2.6 | | | |

Holding Companies - Diversified | | | 0.9 | | | |

Internet | | | 8.2 | | | |

Machinery - Diversified | | | 2.4 | | | |

Media | | | 1.1 | | | |

Miscellaneous Manufacturing | | | 1.8 | | | |

Mutual Funds | | | 1.4 | | | |

Office/Business Equipment | | | 1.0 | | | |

Oil & Gas | | | 4.1 | | | |

Oil & Gas Services | | | 1.9 | | | |

Pharmaceuticals | | | 4.1 | | | |

Retail | | | 8.9 | | | |

Software | | | 6.5 | | | |

Telecommunications | | | 1.4 | | | |

| | | | | | |

Total Investments | | | 99.9 | | | |

Other Assets Less Liabilities | | | 0.1 | | | |

| | | | | | |

Net Assets | | | 100.0 | % | | |

| | | | | | |

See Notes to Financial Statements

5

Harding, Loevner Funds, Inc.

Global Equity Portfolio

Statement of Net Assets

October 31, 2010 (continued)

| | | | | | | | |

| | | Shares | | | Value (1) | |

Common Stocks - 98.4% | | | | | | | | |

| | |

Australia - 0.9% | | | | | | | | |

Cochlear Ltd. (Healthcare - Products) | | | 19,930 | | | $ | 1,386,950 | |

| | | | | | | | |

| | |

Austria - 0.8% | | | | | | | | |

Erste Group Bank AG (Banks) | | | 27,900 | | | | 1,258,192 | |

| | | | | | | | |

| | |

Bermuda - 1.1% | | | | | | | | |

Bunge Ltd. (Agriculture) | | | 27,870 | | | | 1,674,151 | |

| | | | | | | | |

| | |

Canada - 0.9% | | | | | | | | |

Encana Corp. (Oil & Gas) | | | 47,090 | | | | 1,328,880 | |

| | | | | | | | |

| | |

China - 0.9% | | | | | | | | |

China Merchants Holdings International Co., Ltd. (Holding Companies - Diversified) | | | 398,000 | | | | 1,393,225 | |

| | | | | | | | |

| | |

Denmark - 1.4% | | | | | | | | |

Novo Nordisk AS, Class B (Pharmaceuticals) | | | 19,500 | | | | 2,048,261 | |

| | | | | | | | |

| | |

France - 7.5% | | | | | | | | |

Air Liquide SA (Chemicals) | | | 18,737 | | | | 2,428,390 | |

Dassault Systemes SA (Software) | | | 32,450 | | | | 2,487,213 | |

L’Oreal SA (Cosmetics/Personal Care) | | | 29,910 | | | | 3,514,166 | |

Schlumberger Ltd. (Oil & Gas Services) | | | 40,590 | | | | 2,836,835 | |

| | | | | | | | |

| | | | | | | 11,266,604 | |

| | | | | | | | |

| | |

Germany - 1.5% | | | | | | | | |

Hamburger Hafen und Logistik AG (Commercial Services) | | | 39,100 | | | | 1,713,139 | |

Qiagen NV (Healthcare - Products)* | | | 27,278 | | | | 517,652 | |

| | | | | | | | |

| | | | | | | 2,230,791 | |

| | | | | | | | |

| | |

Hong Kong - 3.0% | | | | | | | | |

Li & Fung Ltd. (Distribution/Wholesale) | | | 855,800 | | | | 4,538,696 | |

| | | | | | | | |

| | |

India - 1.8% | | | | | | | | |

ICICI Bank Ltd. - Sponsored ADR (Banks) | | | 51,300 | | | | 2,697,354 | |

| | | | | | | | |

| | |

Indonesia - 1.4% | | | | | | | | |

Bank Central Asia Tbk PT (Banks) | | | 2,654,000 | | | | 2,080,752 | |

| | | | | | | | |

| | |

Israel - 0.7% | | | | | | | | |

Teva Pharmaceutical Industries Ltd. - Sponsored ADR (Pharmaceuticals) | | | 21,600 | | | | 1,121,040 | |

| | | | | | | | |

| | |

Japan - 9.2% | | | | | | | | |

ABC-Mart, Inc. (Retail) | | | 37,000 | | | | 1,258,398 | |

Canon Inc. - Sponsored ADR (Office/Business Equipment) | | | 31,200 | | | | 1,435,200 | |

Fanuc Ltd. (Machinery - Diversified) | | | 24,900 | | | | 3,623,180 | |

See Notes to Financial Statements

6

Harding, Loevner Funds, Inc.

Global Equity Portfolio

Statement of Net Assets

October 31, 2010 (continued)

| | | | | | | | |

| | |

| | | Shares | | | Value (1) | |

| | |

Japan - 9.2% - (continued) | | | | | | |

Keyence Corp. (Electronics) | | | 10,760 | | | $ | 2,652,654 | |

M3 Inc. (Internet) | | | 327 | | | | 1,497,550 | |

Unicharm Corp. (Cosmetics/Personal Care) | | | 89,400 | | | | 3,407,241 | |

| | | | | | | | |

| | | | | | | 13,874,223 | |

| | | | | | | | |

| | |

Mexico - 0.9% | | | | | | |

Coca-Cola Femsa SAB de CV - Sponsored ADR (Beverages) | | | 17,500 | | | | 1,390,725 | |

| | | | | | | | |

| | |

Russia - 1.3% | | | | | | |

Gazprom OAO - Sponsored ADR (Oil & Gas) | | | 72,200 | | | | 1,580,611 | |

Wimm-Bill-Dann Foods OJSC - ADR (Food) | | | 13,456 | | | | 341,244 | |

| | | | | | | | |

| | | | | | | 1,921,855 | |

| | | | | | | | |

| | |

South Africa - 0.9% | | | | | | |

Sasol Ltd. (Oil & Gas) | | | 31,730 | | | | 1,429,061 | |

| | | | | | | | |

| | |

Switzerland - 9.0% | | | | | | |

Lonza Group AG, Reg S (Chemicals) | | | 29,700 | | | | 2,604,943 | |

Nestle SA - Sponsored ADR, Reg S (Food) | | | 53,255 | | | | 2,921,037 | |

Novartis AG, Reg S (Pharmaceuticals) | | | 29,620 | | | | 1,717,712 | |

Sonova Holding AG, Reg S (Healthcare - Products) | | | 17,980 | | | | 2,084,037 | |

Swatch Group AG, Bearer (Retail) | | | 11,070 | | | | 4,234,867 | |

| | | | | | | | |

| | | | | | | 13,562,596 | |

| | | | | | | | |

| | |

United Kingdom - 5.3% | | | | | | |

Autonomy Corp. plc (Software)* | | | 55,800 | | | | 1,308,054 | |

RPS Group plc (Commercial Services) | | | 460,000 | | | | 1,514,430 | |

Standard Chartered plc (Banks) | | | 118,300 | | | | 3,424,391 | |

WPP plc (Media) | | | 143,370 | | | | 1,669,566 | |

| | | | | | | | |

| | | | | | | 7,916,441 | |

| | | | | | | | |

| | |

United States - 49.9% | | | | | | |

3M Co. (Miscellaneous Manufacturing) | | | 31,670 | | | | 2,667,247 | |

Abbott Laboratories (Pharmaceuticals) | | | 26,380 | | | | 1,353,822 | |

Adobe Systems Inc. (Software)* | | | 41,690 | | | | 1,173,574 | |

Amazon.com, Inc. (Internet)* | | | 11,200 | | | | 1,849,568 | |

Apple Inc. (Computers)* | | | 8,900 | | | | 2,677,743 | |

Charles Schwab Corp. (Diversified Financial Services) | | | 84,700 | | | | 1,304,380 | |

Cisco Systems Inc. (Telecommunications)* | | | 94,915 | | | | 2,166,909 | |

Citrix Systems, Inc. (Software)* | | | 25,200 | | | | 1,614,564 | |

Coach Inc. (Apparel) | | | 91,600 | | | | 4,580,000 | |

Colgate-Palmolive Co. (Cosmetics/Personal Care) | | | 28,250 | | | | 2,178,640 | |

eBay Inc. (Internet)* | | | 172,100 | | | | 5,130,301 | |

EMC Corp. (Computers)* | | | 164,250 | | | | 3,450,893 | |

Emerson Electric Co. (Electrical Components & Equipment) | | | 73,370 | | | | 4,028,013 | |

Exxon Mobil Corp. (Oil & Gas) | | | 27,890 | | | | 1,853,848 | |

See Notes to Financial Statements

7

Harding, Loevner Funds, Inc.

Global Equity Portfolio

Statement of Net Assets

October 31, 2010 (continued)

| | | | | | | | |

| | | Shares | | | Value (1) | |

| | |

United States - 49.9% - (continued) | | | | | | | | |

Genzyme Corp. (Biotechnology)* | | | 28,300 | | | $ | 2,041,279 | |

Google Inc., Class A (Internet)* | | | 6,247 | | | | 3,829,349 | |

Greenhill & Co., Inc. (Diversified Financial Services) | | | 21,600 | | | | 1,677,672 | |

JPMorgan Chase & Co. (Banks) | | | 46,300 | | | | 1,742,269 | |

McDonald’s Corp. (Retail) | | | 18,900 | | | | 1,469,853 | |

Monsanto Co. (Chemicals) | | | 51,700 | | | | 3,072,014 | |

Oracle Corp. (Software) | | | 109,210 | | | | 3,210,774 | |

Praxair Inc. (Chemicals) | | | 20,520 | | | | 1,874,297 | |

Procter & Gamble Co. (Cosmetics/Personal Care) | | | 57,600 | | | | 3,661,632 | |

Sigma-Aldrich Corp. (Chemicals) | | | 47,600 | | | | 3,018,792 | |

Staples Inc. (Retail) | | | 161,910 | | | | 3,314,298 | |

Talecris Biotherapeutics Holdings Corp. (Biotechnology)* | | | 66,200 | | | | 1,623,224 | |

Teradata Corp. (Computers)* | | | 79,000 | | | | 3,109,440 | |

Walgreen Co. (Retail) | | | 91,900 | | | | 3,113,572 | |

Wells Fargo & Co. (Banks) | | | 94,760 | | | | 2,471,341 | |

| | | | | | | | |

| | | | | | | 75,259,308 | |

| | | | | | | | |

| | |

Total Common Stocks (Cost $119,670,724) | | | | | | | 148,379,105 | |

| | | | | | | | |

| | |

Rights - 0.1% | | | | | | | | |

| | |

United Kingdom - 0.1% | | | | | | | | |

Standard Chartered PLC (Banks)* | | | 14,787 | | | | 124,508 | |

| | | | | | | | |

| | |

Total Rights (Cost $88,560) | | | | | | | 124,508 | |

| | | | | | | | |

| | |

Cash Equivalent - 1.4% | | | | | | | | |

Northern Institutional Funds - Diversified Assets Portfolio (Mutual Funds) | | | 2,059,862 | | | | 2,059,862 | |

| | | | | | | | |

Total Cash Equivalent (Cost $2,059,862) | | | | | | | 2,059,862 | |

| | | | | | | | |

| | |

Total Investments — 99.9% (Cost $ 121,819,146) | | | | | | $ | 150,563,475 | |

| | | | | | | | |

Summary of Abbreviations

| | |

ADR | | American Depository Receipt |

Reg S | | Security sold outside United States without registration under the Securities Act of 1933. |

| (1) | See Note 2 to Financial Statements. |

| * | Non-income producing security. |

See Notes to Financial Statements

8

Harding, Loevner Funds, Inc.

Global Equity Portfolio

Statement of Net Assets

October 31, 2010

| | | | |

| | | Value (1) | |

Other Assets, Net of Liabilities - 0.1% | | | |

Cash | | $ | 2,315 | |

Dividends and interest receivable | | | 146,262 | |

Foreign currency (cost $2,731) | | | 3,017 | |

Receivable for Fund shares sold | | | 147,916 | |

Tax reclaim receivable | | | 38,957 | |

Prepaid expenses | | | 23,658 | |

Payable to Investment Advisor | | | (123,550 | ) |

Payable for Fund shares redeemed | | | (11,861 | ) |

Other liabilities | | | (64,694 | ) |

| | | | |

| | | 162,020 | |

| | | | |

Net Assets - 100% | | | |

Institutional Class | | | | |

Applicable to 4,432,600 outstanding $.001 par value shares (authorized 200,000,000 shares) | | $ | 104,275,890 | |

| | | | |

| |

Net Asset Value, Offering Price and Redemption Price Per Share | | $ | 23.52 | |

| | | | |

| |

Advisor Class | | | | |

Applicable to 1,978,267 outstanding $.001 par value shares (authorized 200,000,000 shares) | | $ | 46,449,605 | |

| | | | |

| |

Net Asset Value, Offering Price and Redemption Price Per Share | | $ | 23.48 | |

| | | | |

| |

Components of Net Assets as of October 31, 2010 were as follows: | | | |

Paid-in capital | | $ | 121,854,102 | |

Accumulated undistributed net investment income | | | 288,950 | |

Accumulated net realized loss from investment transactions | | | (168,006 | ) |

Net unrealized appreciation on investments and on assets and liabilities denominated in foreign currencies | | | 28,750,449 | |

| | | | |

| | $ | 150,725,495 | |

| | | | |

See Notes to Financial Statements

9

Harding, Loevner Funds, Inc.

International Equity Portfolio (Institutional Class) — Overview

(unaudited)

October 31, 2010

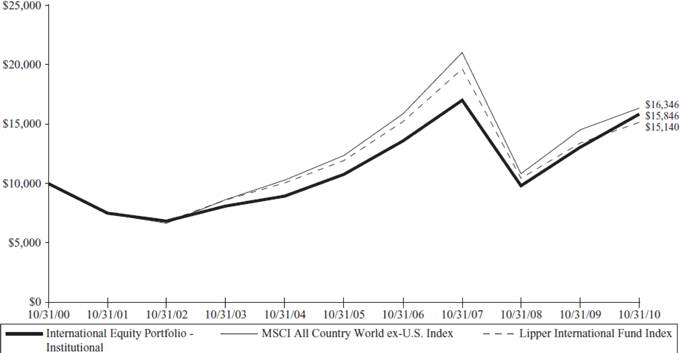

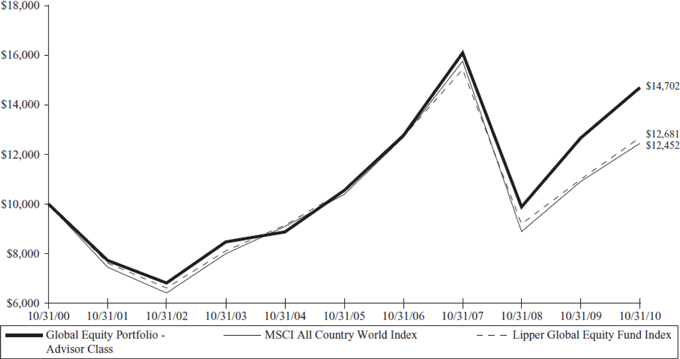

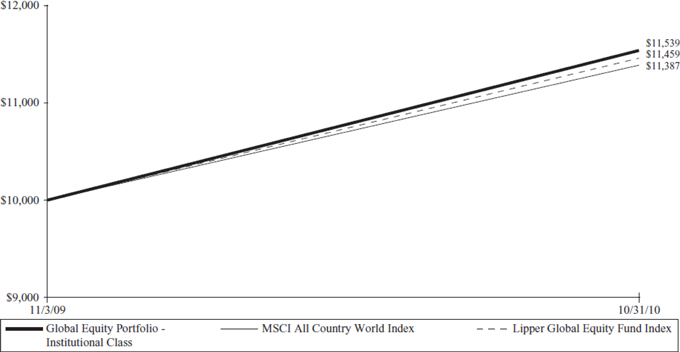

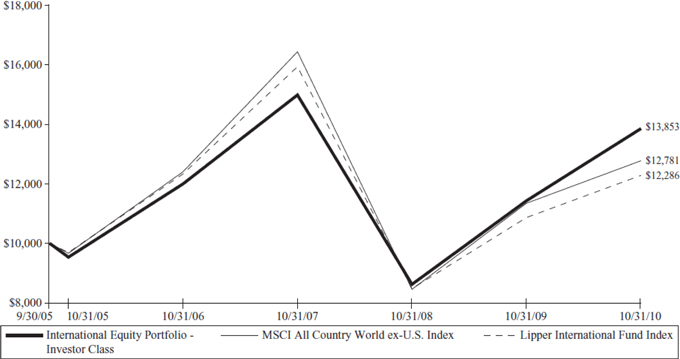

Hypothetical Comparison Of Changes In Value Of $10,000 Investment In Harding, Loevner Funds, Inc. -

International Equity Portfolio - Institutional Class And The Lipper International Equity Fund Index

(Net Dividends Reinvested)

And The MSCI All Country World ex-US Index

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | Returns for the Year Ended October 31, 2010 | |

| | | Cumulative Total Returns | | | | | | Average Annualized Total Return | |

| FUND NAME | | Last 12 Months | | | 5YR | | | 10YR | | | | | | 5YR | | | 10YR | |

International Equity Portfolio— Institutional Class (Inception date 11/1/94) | | | 21.50% | | | | 46.97% | | | | 58.46% | | | | | | | | 8.00% | | | | 4.71% | |

MSCI All Country World ex-US Index (Net dividends) | | | 12.65% | | | | 32.23% | | | | 63.47% | | | | | | | | 5.75% | | | | 5.04% | |

Lipper International Fund Index | | | 12.98% | | | | 26.78% | | | | 51.39% | | | | | | | | 4.86% | | | | 4.23% | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than the performance quoted and may be obtained by visiting the website at www.hardingloevnerfunds.com.

Investment return reflects voluntary fee waivers in effect. Absence such waivers, total return would be reduced. The performance provided does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions.

10

Harding, Loevner Funds, Inc.

International Equity Portfolio (Institutional Class) – Overview

(unaudited)

October 31, 2010

The International Equity Portfolio gained 21.50% for the fiscal year ending October 31, 2010. In comparison, its benchmark, the MSCI All Country World ex-US Index, rose 12.65%.

Consistent with its investment objectives and policies, the Portfolio was invested in the securities of non-US companies that exhibit the fundamental characteristics of sustainable growth, financial strength, management quality, and durable competitive advantage.

The Portfolio’s relative outperformance derived from both stock selection and the resulting sector allocations. Our continued bias against—and resulting small weighting in—the Financials sector was the biggest contributor from sector allocation, while an even larger contribution came from stock selection due to our preference for Emerging Markets-oriented banks. We also saw good performance within the Consumer Discretionary sector (luxury goods makers LVMH Moët Hennessy and Swatch Group were stand outs), in Information Technology (notably ARM Holdings), within Industrials (especially from capital goods producers such as Japan’s Fanuc and Sweden’s Atlas Copco), and finally in Health Care (led by the diabetes specialists Fresenius and Novo Nordisk). These strong results were slightly offset by our underweight in the out-performing Materials sector, and by poor stock selection within both Materials and Consumer Staples.

Geographically, the Portfolio enjoyed strong relative returns in Europe, both in the eurozone and in the non-European Monetary Union countries. Good stock selection in these regions was due in large part to our preference for multinational consumer-oriented companies—such as Swatch, LVMH, WPP, and L’Oréal—and to a small weighting in domestically-oriented Financials. Our holdings in Japan also outperformed, led by robot manufacturer Fanuc. Portfolio returns were hurt, however, by our lagging stocks within the best-performing region, Emerging Markets, as well as within Canada, whose resource-rich market nearly matched the returns of Emerging Markets.

Past performance does not guarantee future results.

The Portfolio invests in foreign securities, which will involve greater volatility and political, economic, and currency risks. It also invests in emerging markets, which involve unique risks, such as exposure to economies less diverse and mature than the U.S. or other more established foreign markets. Economic and political instability may cause larger price changes in emerging markets securities than other foreign securities. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investment by the Portfolio in lower-rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities. The portfolio invests in smaller companies which involve additional risks such as limited liquidity and greater volatility.

Please see the Statement of Net Assets on page 12 for fund holdings as of October 31, 2010. Fund holdings and sector allocations are subject to change and are not recommendations to buy or sell any security.

The MSCI All Country World ex-US Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global developed and emerging markets, excluding the US. The Index consists of 44 developed and emerging market countries. The Index is net of foreign withholding taxes on dividends. You cannot invest directly in this Index.

11

Harding, Loevner Funds, Inc.

International Equity Portfolio

Statement of Net Assets

October 31, 2010

| | | | |

| Industry | | Percentage of Net Assets |

| | | | | | |

Agriculture | | | 1.0 | % | | |

Auto Parts & Equipment | | | 1.2 | | | |

Banks | | | 10.0 | | | |

Biotechnology | | | 1.1 | | | |

Chemicals | | | 4.7 | | | |

Computers | | | 1.1 | | | |

Cosmetics/Personal Care | | | 4.0 | | | |

Distribution/Wholesale | | | 2.3 | | | |

Electrical Components & Equipment | | | 2.5 | | | |

Electronics | | | 2.8 | | | |

Food | | | 5.9 | | | |

Healthcare - Products | | | 6.5 | | | |

Holding Companies - Diversified | | | 3.8 | | | |

Insurance | | | 3.7 | | | |

Internet | | | 1.0 | | | |

Leisure Time | | | 1.3 | | | |

Machinery - Construction & Mining | | | 1.5 | | | |

Machinery - Diversified | | | 2.7 | | | |

Media | | | 4.5 | | | |

Metal Fabrication/Hardware | | | 1.0 | | | |

Mutual Funds | | | 7.6 | | | |

Oil & Gas | | | 7.8 | | | |

Oil & Gas Services | | | 1.6 | | | |

Pharmaceuticals | | | 3.5 | | | |

Retail | | | 4.3 | | | |

Semiconductors | | | 5.6 | | | |

Software | | | 5.9 | | | |

Telecommunications | | | 6.0 | | | |

| | | | | | |

Total Investments | | | 104.9 | | | |

Liabilities Less Other Assets | | | (4.9 | ) | | |

| | | | | | |

Net Assets | | | 100.0 | % | | |

| | | | | | |

See Notes to Financial Statements

12

Harding, Loevner Funds, Inc.

International Equity Portfolio

Statement of Net Assets

October 31, 2010 (continued)

| | | | | | | | |

| | |

| | | Shares | | | Value (1) | |

Common Stocks - 93.5% | | | | | | |

| | |

Australia - 2.2% | | | | | | |

Cochlear Ltd. (Healthcare - Products) | | | 92,900 | | | $ | 6,465,012 | |

CSL Ltd. (Biotechnology) | | | 209,800 | | | | 6,755,622 | |

| | | | | | | | |

| | | | | | | 13,220,634 | |

| | | | | | | | |

| | |

Austria - 1.9% | | | | | | |

Erste Group Bank AG (Banks) | | | 255,720 | | | | 11,532,071 | |

| | | | | | | | |

| | |

Bermuda - 1.0% | | | | | | |

Bunge Ltd. (Agriculture) | | | 103,380 | | | | 6,210,037 | |

| | | | | | | | |

| | |

Brazil - 0.2% | | | | | | |

Petroleo Brasileiro SA - ADR (Oil & Gas) | | | 43,988 | | | | 1,500,871 | |

| | | | | | | | |

| | |

Canada - 2.1% | | | | | | |

Encana Corp. (Oil & Gas) | | | 136,882 | | | | 3,862,810 | |

Imperial Oil Ltd. (Oil & Gas) | | | 226,290 | | | | 8,775,526 | |

| | | | | | | | |

| | | | | | | 12,638,336 | |

| | | | | | | | |

| | |

Cayman Islands - 1.2% | | | | | | |

Xinyi Glass Holdings Ltd. (Auto Parts & Equipment) | | | 9,224,000 | | | | 7,386,697 | |

| | | | | | | | |

| | |

China - 1.1% | | | | | | |

China Resources Enterprise Ltd. (Holding Companies - Diversified) | | | 1,536,000 | | | | 6,470,488 | |

| | | | | | | | |

| | |

Denmark - 1.3% | | | | | | |

Novo Nordisk A/S, Class B (Pharmaceuticals) | | | 77,700 | | | | 8,161,533 | |

| | | | | | | | |

| | |

France - 16.3% | | | | | | |

Air Liquide SA (Chemicals) | | | 172,602 | | | | 22,369,911 | |

Dassault Systemes SA (Software) | | | 280,700 | | | | 21,514,964 | |

L’Oreal SA (Cosmetics/Personal Care) | | | 111,770 | | | | 13,132,007 | |

LVMH Moet Hennessy Louis Vuitton SA (Holding Companies - Diversified) | | | 106,930 | | | | 16,768,969 | |

Schlumberger Ltd. (Oil & Gas Services) | | | 143,000 | | | | 9,994,270 | |

Schneider Electric SA (Electrical Components & Equipment) | | | 109,050 | | | | 15,466,744 | |

| | | | | | | | |

| | | | | | | 99,246,865 | |

| | | | | | | | |

| | |

Germany - 5.6% | | | | | | |

Allianz SE, Reg S (Insurance) | | | 121,500 | | | | 15,219,880 | |

Fresenius SE (Healthcare - Products) | | | 125,768 | | | | 11,099,696 | |

QIAGEN NV (Healthcare - Products)* | | | 415,470 | | | | 7,884,341 | |

| | | | | | | | |

| | | | | | | 34,203,917 | |

| | | | | | | | |

| | |

Hong Kong - 2.3% | | | | | | |

Li & Fung Ltd. (Distribution/Wholesale) | | | 2,652,200 | | | | 14,065,821 | |

| | | | | | | | |

See Notes to Financial Statements

13

Harding, Loevner Funds, Inc.

International Equity Portfolio

Statement of Net Assets

October 31, 2010 (continued)

| | | | | | | | |

| | | Shares | | | Value (1) | |

| | |

India - 1.8% | | | | | | | | |

ICICI Bank Ltd. - Sponsored ADR (Banks) | | | 206,300 | | | $ | 10,847,254 | |

| | | | | | | | |

| | |

Indonesia - 1.8% | | | | | | | | |

Telekomunikasi Indonesia Tbk PT - Sponsored ADR (Telecommunications) | | | 265,540 | | | | 10,725,161 | |

| | | | | | | | |

| | |

Israel - 0.6% | | | | | | | | |

Teva Pharmaceutical Industries Ltd. - Sponsored ADR (Pharmaceuticals) | | | 75,360 | | | | 3,911,184 | |

| | | | | | | | |

| | |

Japan - 10.6% | | | | | | | | |

Fanuc Ltd. (Machinery - Diversified) | | | 111,900 | | | | 16,282,483 | |

Hoya Corp. (Electronics) | | | 437,600 | | | | 10,179,047 | |

Jupiter Telecommunications Co., Ltd. (Media) | | | 6,855 | | | | 7,413,396 | |

Keyence Corp. (Electronics) | | | 28,765 | | | | 7,091,412 | |

M3 Inc. (Internet) | | | 1,350 | | | | 6,182,548 | |

MISUMI Group Inc. (Metal Fabrication/Hardware) | | | 297,600 | | | | 6,353,761 | |

Unicharm Corp. (Cosmetics/Personal Care) | | | 294,700 | | | | 11,231,700 | |

| | | | | | | | |

| | | | | | | 64,734,347 | |

| | | | | | | | |

| | |

Mexico - 5.0% | | | | | | | | |

America Movil SAB de CV, Series L - ADR (Telecommunications) | | | 238,200 | | | | 13,639,332 | |

Wal-Mart de Mexico SAB de CV, Class V - Sponsored ADR (Retail) | | | 609,840 | | | | 16,715,714 | |

| | | | | | | | |

| | | | | | | 30,355,046 | |

| | | | | | | | |

| | |

Panama - 1.3% | | | | | | | | |

Carnival Corp. (Leisure Time) | | | 178,500 | | | | 7,705,845 | |

| | | | | | | | |

| | |

Poland - 0.9% | | | | | | | | |

Bank Pekao SA - GDR, Reg S (Banks)# | | | 89,060 | | | | 5,821,202 | |

| | | | | | | | |

| | |

Russia - 1.7% | | | | | | | | |

Gazprom OAO - Sponsored ADR (Oil & Gas) | | | 484,270 | | | | 10,601,696 | |

| | | | | | | | |

| | |

Singapore - 0.9% | | | | | | | | |

DBS Group Holdings Ltd. (Banks) | | | 504,083 | | | | 5,424,239 | |

| | | | | | | | |

| | |

South Africa - 2.7% | | | | | | | | |

MTN Group Ltd. (Telecommunications) | | | 661,800 | | | | 11,889,549 | |

Sasol Ltd. (Oil & Gas) | | | 95,641 | | | | 4,307,494 | |

| | | | | | | | |

| | | | | | | 16,197,043 | |

| | | | | | | | |

| | |

South Korea - 0.9% | | | | | | | | |

Samsung Electronics Co., Ltd. - GDR, Reg S (Semiconductors) | | | 16,920 | | | | 5,655,780 | |

| | | | | | | | |

| | |

Sweden - 1.5% | | | | | | | | |

Atlas Copco AB, Class A (Machinery - Construction & Mining) | | | 431,200 | | | | 9,016,704 | |

| | | | | | | | |

See Notes to Financial Statements

14

Harding, Loevner Funds, Inc.

International Equity Portfolio

Statement of Net Assets

October 31, 2010 (continued)

| | | | | | | | |

| | | Shares | | | Value (1) | |

| | |

Switzerland - 10.8% | | | | | | | | |

Alcon Inc. (Healthcare - Products) | | | 84,570 | | | $ | 14,184,080 | |

Logitech International SA, Reg S (Computers)* | | | 343,400 | | | | 6,452,486 | |

Lonza Group AG, Reg S (Chemicals) | | | 74,000 | | | | 6,490,431 | |

Nestle SA - Sponsored ADR, Reg S (Food) | | | 362,150 | | | | 19,863,928 | |

Roche Holding AG, Genusschein (Pharmaceuticals) | | | 63,750 | | | | 9,360,524 | |

Swatch Group AG, Bearer (Retail) | | | 25,380 | | | | 9,709,208 | |

| | | | | | | | |

| | | | | | | 66,060,657 | |

| | | | | | | | |

| | |

Taiwan - 0.9% | | | | | | | | |

Taiwan Semiconductor Manufacturing Co., Ltd. (Semiconductors) | | | 2,834,125 | | | | 5,822,190 | |

| | | | | | | | |

| | |

United Kingdom - 16.9% | | | | | | | | |

Admiral Group plc (Insurance) | | | 273,300 | | | | 7,137,944 | |

ARM Holdings plc (Semiconductors) | | | 2,907,100 | | | | 17,063,729 | |

Autonomy Corp. plc (Software)* | | | 606,900 | | | | 14,226,847 | |

BG Group plc (Oil & Gas) | | | 612,880 | | | | 11,922,944 | |

Standard Chartered plc (Banks) | | | 563,810 | | | | 16,320,424 | |

Tesco plc (Food) | | | 1,499,380 | | | | 10,254,934 | |

Unilever plc (Food) | | | 205,725 | | | | 5,933,212 | |

WPP plc (Media) | | | 1,720,320 | | | | 20,033,390 | |

| | | | | | | | |

| | | | | | | 102,893,424 | |

| | | | | | | | |

| | |

Total Common Stocks (Cost $435,258,637) | | | | | | | 570,409,042 | |

| | | | | | | | |

| | |

Preferred Stocks - 3.7% | | | | | | | | |

| | |

Brazil - 2.8% | | | | | | | | |

Itau Unibanco Holding SA - ADR (Banks) | | | 412,600 | | | | 10,133,456 | |

Petroleo Brasileiro SA - Sponsored ADR (Oil & Gas) | | | 211,300 | | | | 6,590,447 | |

| | | | | | | | |

| | | | | | | 16,723,903 | |

| | | | | | | | |

| | |

South Korea - 0.9% | | | | | | | | |

Samsung Electronics Co., Ltd. - GDR, Reg S (Semiconductors) | | | 23,200 | | | | 5,691,213 | |

| | | | | | | | |

| | |

Total Preferred Stocks (Cost $19,957,840) | | | | | | | 22,415,116 | |

| | | | | | | | |

| | |

Rights - 0.1% | | | | | | | | |

| | |

United Kingdom - 0.1% | | | | | | | | |

Standard Chartered plc (Banks)* | | | 68,351 | | | | 575,524 | |

| | | | | | | | |

| | |

Total Rights (Cost $403,547) | | | | | | | 575,524 | |

| | | | | | | | |

See Notes to Financial Statements

15

Harding, Loevner Funds, Inc.

International Equity Portfolio

Statement of Net Assets

October 31, 2010 (continued)

| | | | | | | | |

| | | Shares | | | Value (1) | |

Cash Equivalent - 7.6% | | | | | | | | |

Northern Institutional Funds - Diversified Assets Portfolio (Mutual Funds) | | | 46,293,164 | | | $ | 46,293,164 | |

| | | | | | | | |

Total Cash Equivalent (Cost $46,293,164) | | | | | | | 46,293,164 | |

| | | | | | | | |

| | |

Total Investments — 104.9% | | | | | | | | |

(Cost $ 501,913,188) | | | | | | $ | 639,692,846 | |

| | | | | | | | |

Summary of Abbreviations

| | |

ADR | | American Depository Receipt |

GDR | | Global Depositary Receipt |

Reg S | | Security sold outside United States without registration under the Securities Act of 1933. |

| (1) | See Note 2 to Financial Statements. |

| # | Security valued at fair value as determined in good faith under policies and procedures established by and under the supervision of the Portfolio’s Board of Directors. |

| * | Non-income producing security. |

See Notes to Financial Statements

16

Harding, Loevner Funds, Inc.

International Equity Portfolio

Statement of Net Assets

October 31, 2010 (continued)

| | | | |

| | | Value (1) | |

Liabilities, Net of Other Assets - (4.9)% | | | | |

Dividends and interest receivable | | $ | 665,290 | |

Foreign currency (cost $533,862) | | | 533,516 | |

Receivable for Fund shares sold | | | 2,254,726 | |

Tax reclaim receivable | | | 298,125 | |

Prepaid expenses | | | 8,076 | |

Payable to Investment Advisor | | | (358,999 | ) |

Payable for investments purchased | | | (32,778,081 | ) |

Payable for Fund shares redeemed | | | (266,393 | ) |

Payable for distribution fees | | | (77,468 | ) |

Other liabilities | | | (156,901 | ) |

| | | | |

| | $ | (29,878,109 | ) |

| | | | |

Net Assets - 100% | | | | |

Institutional Class | | | | |

Applicable to 34,011,256 outstanding $.001 par value shares (authorized 200,000,000 shares) | | $ | 493,349,666 | |

| | | | |

| |

Net Asset Value, Offering Price and Redemption Price Per Share | | $ | 14.51 | |

| | | | |

| |

Investor Class | | | | |

Applicable to 8,050,174 outstanding $.001 par value shares (authorized 200,000,000 shares) | | $ | 116,465,071 | |

| | | | |

| |

Net Asset Value, Offering Price and Redemption Price Per Share | | $ | 14.47 | |

| | | | |

| |

Components of Net Assets as of October 31, 2010 were as follows: | | | | |

Paid-in capital | | $ | 473,875,065 | |

Accumulated undistributed net investment income | | | 2,516,364 | |

Accumulated net realized loss from investment transactions | | | (4,367,531 | ) |

Net unrealized appreciation on investments and on assets and liabilities denominated in foreign currencies | | | 137,790,839 | |

| | | | |

| | $ | 609,814,737 | |

| | | | |

See Notes to Financial Statements

17

Harding, Loevner Funds, Inc.

Institutional Emerging Markets Portfolio — Overview

(unaudited)

October 31, 2010

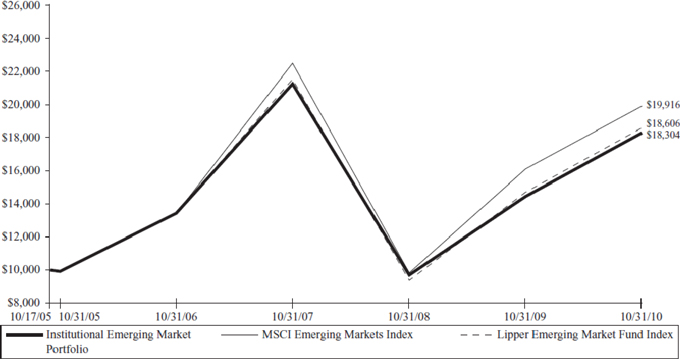

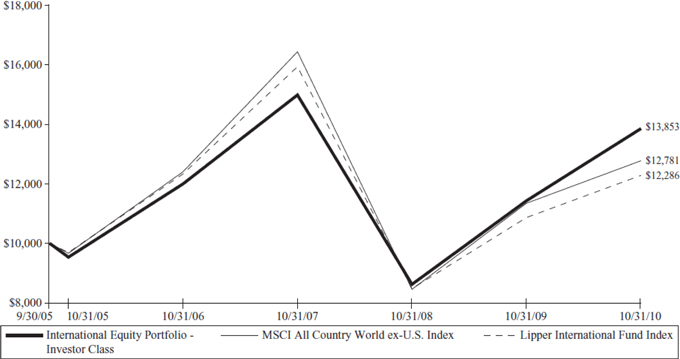

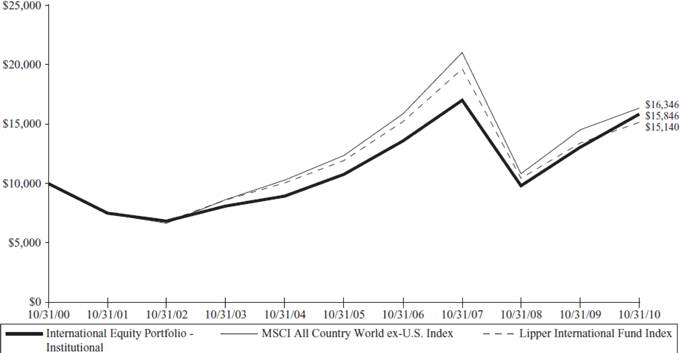

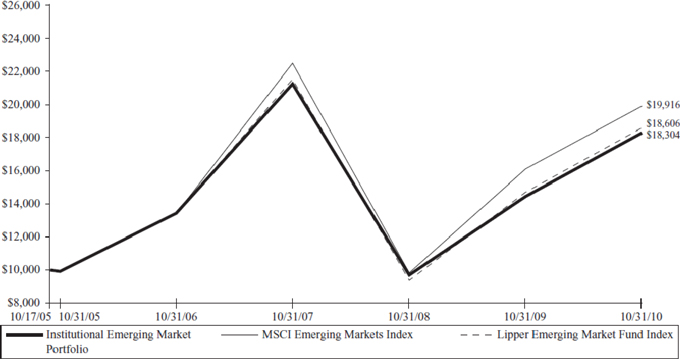

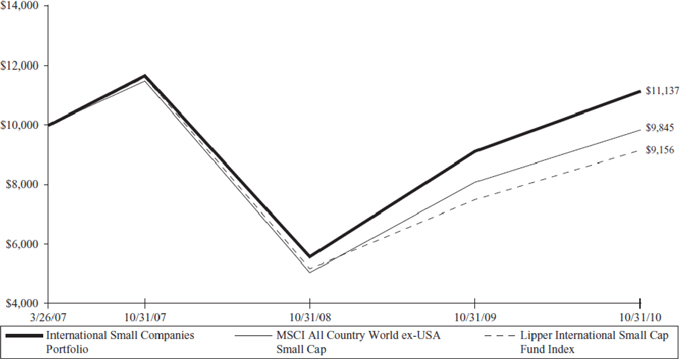

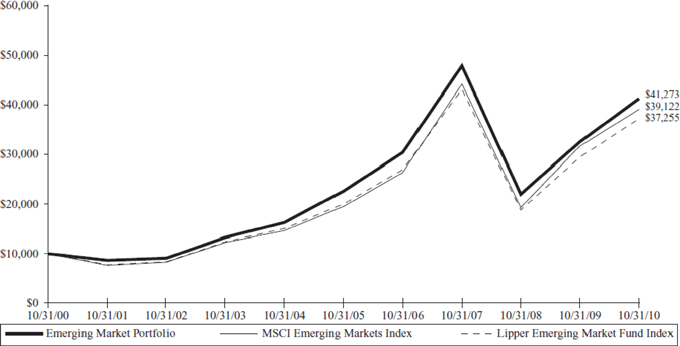

Hypothetical Comparison Of Changes In Value Of $10,000 Investment In Harding, Loevner Funds, Inc. -

Institutional Emerging Markets Portfolio And The Lipper Emerging Markets Fund Index

And The MSCI Emerging Markets Index

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | Returns for the Year Ended October 31, 2010 | |

| | | Cumulative Total Returns | | | Average Annualized

Total Return | |

| FUND NAME | | Last 12 Months | | | 5 YR | | | Inception | | | 5 YR | | | Inception | |

Institutional Emerging Markets Portfolio

(Inception date 10/17/05) | | | 26.50% | | | | 84.33 | % | | | 83.05% | | | | 13.01 | % | | | 12.75 | % |

MSCI Emerging Markets (Net dividend) | | | 23.51% | | | | 100.41 | % | | | 99.15% | | | | 14.92 | % | | | 14.64 | % |

Lipper Emerging Markets Funds Index | | | 26.36% | | | | 86.36 | % | | | 86.04% | | | | 13.26 | % | | | 13.10 | % |

| | | | | | | | | | | | | | | | | | | | | |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than the performance quoted and may be obtained by visiting the website at www.hardingloevnerfunds.com.

Investment return reflects voluntary fee waivers in effect. Absence such waivers, total return would be reduced. The performance provided does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions.

18

Harding, Loevner Funds, Inc.

Institutional Emerging Markets Portfolio - Overview

(unaudited)

October 31, 2010

The Institutional Emerging Markets Portfolio gained 26.50% for the fiscal year ending October 31, 2010, as compared to a gain of 23.51% for its benchmark, the MSCI Emerging Markets Index.

Consistent with its investment objectives and policies, the Portfolio was invested in the securities of emerging markets companies that exhibit the fundamental characteristics of durable growth, financial strength, management quality, and sustainable competitive advantage.

The Portfolio’s outperformance derived in part from strong selection within four sectors (Financials, Health Care, Materials, and Telecom Services), where our focus on high-quality companies with, in our opinion, strong secular (as opposed to cyclical) growth trends served us well this period. Our sector weighting decisions were also beneficial, as over 25% of the Portfolio was held in the outperforming Consumer Staples and Consumer Discretionary sectors while we were underweight the lagging Energy sector.

Stock selection was strongest within the Financials sector, where we enjoyed significant gains from well-capitalized banks in smaller countries such as Banco Santander Chile and Credicorp of Peru, Bancolombia of Colombia, and Bank Rakyat of Indonesia. These banks are experiencing falling levels of non-performing loans and are benefitting from solid growth in their domestic economies. Stock selection was the weakest in Industrials. Both China Communications Construction and Egypt’s Orascom Construction declined, as their results failed to live up to investors’ profit growth expectations.

From a geographic perspective, our approach to China—one of the worst-performing markets this period—was the most notable contributor to returns. Both our underweight and stock selection added value. China’s market is dominated by large, state-controlled enterprises, but we favored smaller, private-sector companies focused on the domestic market, a number of which were positive contributors, including New Oriental, Hengan International, Shandong Weigao, and Wumart.

Past performance does not guarantee future results.

The Portfolio invests in foreign securities, which will involve greater volatility and political, economic, and currency risks and differences in accounting methods. It also invests in emerging markets, which involve unique risks, such as exposure to economies less diverse and mature than the U.S. or other more established foreign markets. Economic and political instability may cause larger price changes in emerging markets securities than other foreign securities. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investment by the Portfolio in lower-rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities.

Please see the Schedule of Net Assets on page 20 for fund holdings as of October 31, 2010. Fund holdings and sector allocations are subject to change and are not recommendations to buy or sell any security.

The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The Index consists of 21 emerging market countries. The Index is net of foreign withholding taxes on dividends. You cannot invest directly in this Index.

19

Harding, Loevner Funds, Inc.

Institutional Emerging Markets Portfolio

Statement of Net Assets

October 31, 2010

| | |

| Industry | | Percentage of Net Assets |

| | | | |

Airlines | | | 0.4 | % |

Auto Parts & Equipment | | | 0.7 | |

Banks | | | 19.2 | |

Beverages | | | 3.2 | |

Beverages, Food & Tobacco | | | 1.0 | |

Building Materials | | | 4.1 | |

Chemicals | | | 1.5 | |

Commercial Services | | | 4.4 | |

Computers | | | 1.3 | |

Cosmetics & Personal Care | | | 2.7 | |

Distribution/Wholesale | | | 1.1 | |

Diversified Financial Services | | | 0.6 | |

Electric | | | 0.9 | |

Electrical Components & Equipment | | | 2.6 | |

Electronics | | | 3.0 | |

Engineering & Construction | | | 1.3 | |

Food | | | 2.1 | |

Healthcare - Products | | | 3.6 | |

Home Furnishings | | | 1.8 | |

Insurance | | | 2.4 | |

Internet | | | 1.3 | |

Iron & Steel | | | 0.5 | |

Leisure Time | | | 2.0 | |

Media | | | 0.7 | |

Mining | | | 3.1 | |

Miscellaneous Manufacturing | | | 0.6 | |

Mutual Funds | | | 2.0 | |

Oil & Gas | | | 8.6 | |

Pharmaceuticals | | | 3.2 | |

Pipelines | | | 1.1 | |

Real Estate | | | 0.9 | |

Retail | | | 2.9 | |

Semiconductors | | | 7.2 | |

Telecommunications | | | 8.0 | |

| | | | |

Total Investments | | | 100.0 | |

Liabilities Less Other Assets | | | 0.0 | |

| | | | |

Net Assets | | | 100.0 | % |

| | | | |

See Notes to Financial Statements

20

Harding, Loevner Funds, Inc.

Institutional Emerging Markets Portfolio

Statement of Net Assets

October 31, 2010 (continued)

| | | | | | | | |

| | | Shares | | | Value (1) | |

Common Stocks - 90.0% | | | | | | | | |

| | |

Argentina - 0.5% | | | | | | | | |

Banco Macro SA - ADR (Banks) | | | 38,220 | | | $ | 1,905,267 | |

| | | | | | | | |

| | |

Brazil - 11.5% | | | | | | | | |

Anhanguera Educacional Participacoes SA (Commercial Services) | | | 326,956 | | | | 6,480,278 | |

Banco Bradesco SA - ADR (Banks) | | | 401,478 | | | | 8,350,742 | |

Cyrela Brazil Realty SA Empreendimentos e Participacoes (Real Estate) | | | 250,800 | | | | 3,466,330 | |

Hypermarcas SA (Pharmaceuticals)* | | | 264,900 | | | | 4,362,289 | |

Natura Cosmeticos SA (Cosmetics & Personal Care) | | | 217,700 | | | | 6,235,364 | |

Petroleo Brasileiro SA - ADR (Oil & Gas) | | | 168,446 | | | | 5,747,378 | |

Usinas Siderurgicas de Minas Gerais SA (Iron & Steel) | | | 114,400 | | | | 1,668,600 | |

Vale SA - Sponsored ADR (Mining) | | | 208,740 | | | | 6,708,904 | |

| | | | | | | | |

| | | | | | | 43,019,885 | |

| | | | | | | | |

| | |

Chile - 3.1% | | | | | | | | |

Banco Santander Chile - ADR (Banks) | | | 63,536 | | | | 5,885,975 | |

Sociedad Quimica y Minera de Chile SA - Sponsored ADR (Chemicals) | | | 110,800 | | | | 5,739,440 | |

| | | | | | | | |

| | | | | | | 11,625,415 | |

| | | | | | | | |

| | |

China - 13.4% | | | | | | | | |

Anhui Conch Cement Co., Ltd., Class H (Building Materials) | | | 970,000 | | | | 4,109,407 | |

ASM Pacific Technology Ltd. (Semiconductors) | | | 444,900 | | | | 4,016,544 | |

China Mobile Ltd. - Sponsored ADR (Telecommunications) | | | 111,000 | | | | 5,702,070 | |

China Taiping Insurance Holdings Co., Ltd. (Insurance)* | | | 1,236,000 | | | | 4,537,340 | |

CNOOC Ltd. - ADR (Oil & Gas) | | | 19,900 | | | | 4,157,508 | |

Hengan International Group Co., Ltd. (Healthcare - Products) | | | 811,500 | | | | 7,707,839 | |

Jiangsu Expressway Co., Ltd., Class H (Commercial Services) | | | 4,707,000 | | | | 5,648,000 | |

New Oriental Education & Technology Group - Sponsored ADR (Commercial Services)* | | | 40,000 | | | | 4,294,800 | |

Shandong Weigao Group Medical Polymer Co., Ltd., Class H (Healthcare - Products) | | | 1,303,000 | | | | 3,417,606 | |

Tencent Holdings Ltd. (Internet) | | | 216,000 | | | | 4,970,172 | |

Wumart Stores Inc. (Retail) | | | 788,000 | | | | 1,859,583 | |

| | | | | | | | |

| | | | | | | 50,420,869 | |

| | | | | | | | |

| | |

Colombia - 1.5% | | | | | | | | |

BanColombia SA - Sponsored ADR (Banks) | | | 84,370 | | | | 5,690,757 | |

| | | | | | | | |

| | |

Czech Republic - 0.4% | | | | | | | | |

Central European Media Enterprises Ltd., Class A (Media)* | | | 62,530 | | | | 1,441,316 | |

| | | | | | | | |

| | |

Egypt - 0.8% | | | | | | | | |

Orascom Construction Industries - GDR (Engineering & Construction) | | | 63,800 | | | | 2,957,727 | |

| | | | | | | | |

| | |

Greece - 0.7% | | | | | | | | |

Coca Cola Hellenic Bottling Co. SA (Beverages) | | | 99,830 | | | | 2,582,767 | |

| | | | | | | | |

See Notes to Financial Statements

21

Harding, Loevner Funds, Inc.

Institutional Emerging Markets Portfolio

Statement of Net Assets

October 31, 2010 (continued)

| | | | | | | | |

| | | Shares | | | Value (1) | |

| | |

Hong Kong - 1.1% | | | | | | | | |

Li & Fung Ltd. (Distribution/Wholesale) | | | 770,000 | | | $ | 4,083,660 | |

| | | | | | | | |

| | |

Hungary - 0.5% | | | | | | | | |

Richter Gedeon Nyrt. (Pharmaceuticals) | | | 7,620 | | | | 1,813,164 | |

| | | | | | | | |

| | |

India - 9.0% | | | | | | | | |

Ambuja Cements Ltd. (Building Materials) | | | 1,757,300 | | | | 5,536,817 | |

Axis Bank Ltd. (Banks) | | | 191,900 | | | | 6,375,166 | |

Bajaj Auto Ltd. (Leisure Time) | | | 223,600 | | | | 7,598,517 | |

Dabur India Ltd. (Cosmetics & Personal Care) | | | 1,801,000 | | | | 4,042,373 | |

HDFC Bank Ltd. - ADR (Banks) | | | 26,503 | | | | 4,583,959 | |

Jain Irrigation Systems Ltd. (Miscellaneous Manufacturing) | | | 446,500 | | | | 2,330,308 | |

NTPC Ltd. (Electric) | | | 789,400 | | | | 3,467,800 | |

| | | | | | | | |

| | | | | | | 33,934,940 | |

| | | | | | | | |

| | |

Indonesia - 1.6% | | | | | | | | |

Bank Rakyat Indonesia Persero Tbk PT (Banks) | | | 4,738,000 | | | | 6,043,316 | |

| | | | | | | | |

| | |

Luxembourg - 1.3% | | | | | | | | |

Millicom International Cellular SA (Telecommunications) | | | 51,400 | | | | 4,862,440 | |

| | | | | | | | |

| | |

Mexico - 8.5% | | | | | | | | |

America Movil SAB de CV, Series L - ADR (Telecommunications) | | | 192,877 | | | | 11,044,154 | |

Coca-Cola Femsa SAB de CV - Sponsored ADR (Beverages, Food & Tobacco) | | | 45,400 | | | | 3,607,938 | |

Grupo Aeroportuario del Sureste SAB de CV - ADR (Engineering & Construction) | | | 40,905 | | | | 2,061,612 | |

Grupo Financiero Banorte SAB de CV, Class O (Banks) | | | 925,080 | | | | 3,945,362 | |

Grupo Televisa SA - Sponsored ADR (Media) | | | 47,600 | | | | 1,068,620 | |

Urbi Desarrollos Urbanos SAB de CV (Building Materials)* | | | 1,256,800 | | | | 2,677,511 | |

Wal-Mart de Mexico SAB de CV - Sponsored ADR (Retail) | | | 267,230 | | | | 7,324,774 | |

| | | | | | | | |

| | | | | | | 31,729,971 | |

| | | | | | | | |

| | |

Panama - 0.4% | | | | | | | | |

Copa Holdings SA, Class A (Airlines) | | | 32,300 | | | | 1,638,579 | |

| | | | | | | | |

| | |

Peru - 1.6% | | | | | | | | |

Credicorp Ltd. (Banks) | | | 48,000 | | | | 6,042,240 | |

| | | | | | | | |

| | |

Philippines - 0.4% | | | | | | | | |

Philippine Long Distance Telephone Co. - Sponsored ADR (Telecommunications) | | | 23,155 | | | | 1,438,620 | |

| | | | | | | | |

| | |

Poland - 1.0% | | | | | | | | |

Bank Pekao SA (Banks) | | | 55,454 | | | | 3,624,931 | |

Central European Distribution Corp. (Beverages)* | | | 11,460 | | | | 286,156 | |

| | | | | | | | |

| | | | | | | 3,911,087 | |

| | | | | | | | |

See Notes to Financial Statements

22

Harding, Loevner Funds, Inc.

Institutional Emerging Markets Portfolio

Statement of Net Assets

October 31, 2010 (continued)

| | | | | | | | |

| | | Shares | | | Value (1) | |

| | |

Russia - 6.6% | | | | | | | | |

Gazprom OAO - Sponsored ADR, United States Exchange (Oil & Gas) | | | 13,000 | | | $ | 284,050 | |

Gazprom OAO - Sponsored ADR, London Exchange (Oil & Gas) | | | 290,500 | | | | 6,359,660 | |

Lukoil OAO - Sponsored ADR (Oil & Gas) | | | 116,078 | | | | 6,482,956 | |

Sberbank of Russia (Banks) | | | 1,082,000 | | | | 3,580,064 | |

Wimm-Bill-Dann Foods OJSC - ADR (Food) | | | 34,450 | | | | 873,652 | |

X5 Retail Group NV - GDR, Reg S (Food)* | | | 168,156 | | | | 7,048,181 | |

| | | | | | | | |

| | | | | | | 24,628,563 | |

| | | | | | | | |

| | |

South Africa - 5.1% | | | | | | | | |

Aspen Pharmacare Holdings Ltd. (Healthcare - Products)* | | | 172,800 | | | | 2,304,113 | |

MTN Group Ltd. (Telecommunications) | | | 384,250 | | | | 6,903,232 | |

Pretoria Portland Cement Co., Ltd. (Building Materials) | | | 646,800 | | | | 3,081,732 | |

SABMiller plc (Beverages) | | | 128,300 | | | | 4,151,088 | |

Standard Bank Group Ltd. (Banks) | | | 185,732 | | | | 2,734,384 | |

| | | | | | | | |

| | | | | | | 19,174,549 | |

| | | | | | | | |

| | |

South Korea - 4.7% | | | | | | | | |

Hankook Tire Co., Ltd. (Auto Parts & Equipment) | | | 93,600 | | | | 2,429,658 | |

KB Financial Group Inc. - ADR (Diversified Financial Services) | | | 47,591 | | | | 2,136,836 | |

LG Electronics Inc. (Electrical Components & Equipment) | | | 31,600 | | | | 2,789,508 | |

Samsung Electronics Co., Ltd. - GDR, Reg S (Semiconductors) | | | 17,330 | | | | 5,792,830 | |

Samsung Fire & Marine Insurance Co., Ltd. (Insurance) | | | 26,460 | | | | 4,544,932 | |

| | | | | | | | |

| | | | | | | 17,693,764 | |

| | | | | | | | |

| | |

Taiwan - 9.0% | | | | | | | | |

Delta Electronics Inc. (Electrical Components & Equipment) | | | 1,688,189 | | | | 6,986,312 | |

Hon Hai Precision Industry Co., Ltd. (Electronics) | | | 1,265,680 | | | | 4,809,104 | |

MediaTek Inc. (Semiconductors) | | | 374,431 | | | | 4,712,294 | |

Quanta Computer Inc. (Computers) | | | 2,547,000 | | | | 4,678,779 | |

Synnex Technology International Corp. (Electronics) | | | 2,683,351 | | | | 6,571,677 | |

Taiwan Semiconductor Manufacturing Co., Ltd. (Semiconductors) | | | 2,974,577 | | | | 6,110,723 | |

| | | | | | | | |

| | | | | | | 33,868,889 | |

| | | | | | | | |

| | |

Thailand - 2.5% | | | | | | | | |

PTT Exploration & Production pcl, Class F (Oil & Gas) | | | 917,000 | | | | 5,230,082 | |

Siam Commercial Bank pcl, Class F (Banks) | | | 1,203,170 | | | | 4,113,333 | |

| | | | | | | | |

| | | | | | | 9,343,415 | |

| | | | | | | | |

| | |

Turkey - 3.3% | | | | | | | | |

Arcelik A/S (Home Furnishings) | | | 1,203,800 | | | | 6,628,879 | |

Turkiye Garanti Bankasi A/S (Banks) | | | 921,700 | | | | 5,597,331 | |

| | | | | | | | |

| | | | | | | 12,226,210 | |

| | | | | | | | |

See Notes to Financial Statements

23

Harding, Loevner Funds, Inc.

Institutional Emerging Markets Portfolio

Statement of Net Assets

October 31, 2010 (continued)

| | | | | | | | |

| | | Shares | | | Value (1) | |

| | |

United Kingdom - 1.5% | | | | | | | | |

Hikma Pharmaceuticals plc (Pharmaceuticals) | | | 462,620 | | | $ | 5,825,449 | |

| | | | | | | | |

| | |

Total Common Stocks (Cost $251,395,587) | | | | | | | 337,902,859 | |

| | | | | | | | |

| | |

Preferred Stocks - 7.6% | | | | | | | | |

| | |

Brazil - 4.7% | | | | | | | | |

Cia de Bebidas das Americas - ADR (Beverages) | | | 35,700 | | | | 4,970,868 | |

Itau Unibanco Holding SA - ADR (Banks) | | | 149,495 | | | | 3,671,597 | |

Petroleo Brasileiro SA - Sponsored ADR (Oil & Gas) | | | 130,200 | | | | 4,060,938 | |

Vale SA - Sponsored ADR (Mining) | | | 175,300 | | | | 5,036,369 | |

| | | | | | | | |

| | | | | | | 17,739,772 | |

| | | | | | | | |

| | |

Russia - 1.1% | | | | | | | | |

AK Transneft OAO (Pipelines) | | | 3,429 | | | | 4,149,090 | |

| | | | | | | | |

| | |

South Korea - 1.8% | | | | | | | | |

Samsung Electronics Co., Ltd. - 144A - GDR (Semiconductors)(2) | | | 4,177 | | | | 1,023,365 | |

Samsung Electronics Co., Ltd. - GDR (Semiconductors) | | | 22,547 | | | | 5,531,025 | |

| | | | | | | | |

| | | | | | | 6,554,390 | |

| | | | | | | | |

| | |

Total Preferred Stocks (Cost $22,354,833) | | | | | | | 28,443,252 | |

| | | | | | | | |

| | |

Participation Notes - 0.4% | | | | | | | | |

| | |

Saudi Arabia - 0.4% | | | | | | | | |

Jarir Marketing Co., Issued by HSBC Bank plc, Maturity Date 6/4/12 (Retail)(2)* | | | 39,000 | | | | 1,608,015 | |

| | | | | | | | |

| | |

Total Participation Notes (Cost $1,641,430) | | | | | | | 1,608,015 | |

| | | | | | | | |

| | |

Cash Equivalent - 2.0% | | | | | | | | |

Northern Institutional Funds - Diversified Assets Portfolio (Mutual Funds) | | | 7,539,311 | | | | 7,539,311 | |

| | | | | | | | |

Total Cash Equivalent (Cost $7,539,311) | | | | | | | 7,539,311 | |

| | | | | | | | |

| | |

Total Investments - 100.0% | | | | | | | | |

(Cost $ 282,931,161) | | | | | | $ | 375,493,437 | |

| | | | | | | | |

See Notes to Financial Statements

24

Harding, Loevner Funds, Inc.

Institutional Emerging Markets Portfolio

Statement of Net Assets

October 31, 2010 (continued)

Summary of Abbreviations

| | |

ADR | | American Depository Receipt |

GDR | | Global Depositary Receipt |

Reg S | | Security sold outside United States without registration under the Securities Act of 1933. |

| (1) | See Note 2 to Financial Statements. |

| (2) | Security exempt from registration pursuant to Rule 144A of the Securities Act of 1933. This security, which represents 0.3% of net assets as of October 31, 2010, is considered liquid and may be resold in transactions exempt from registration, normally to qualified buyers. |

| * | Non-income producing security. |

See Notes to Financial Statements

25

Harding, Loevner Funds, Inc.

Institutional Emerging Markets Portfolio

Statement of Net Assets

October 31, 2010 (continued)

| | | | |

| | | Value (1) | |

Liabilities, Net of Other Assets - (0.0)% | | | | |

Dividends and interest receivable | | $ | 270,903 | |

Foreign currency (cost $94,138) | | | 94,113 | |

Receivable for Fund shares sold | | | 674,730 | |

Tax reclaim receivable | | | 15,481 | |

Prepaid expenses | | | 48,303 | |

Payable to Investment Advisor | | | (386,217 | ) |

Payable for investments purchased | | | (515,926 | ) |

Payable for Fund shares redeemed | | | (7,936 | ) |

Payable for capital gains tax | | | (209,295 | ) |

Other liabilities | | | (103,939 | ) |

| | | | |

| | $ | (119,783 | ) |

| | | | |

Net Assets - 100% | | | | |

Applicable to 22,474,386 outstanding $.001 par value shares (authorized 450,000,000 shares) | | $ | 375,373,654 | |

| | | | |

| |

Net Asset Value, Offering Price and Redemption Price Per Share | | $ | 16.70 | |

| | | | |

| |

Components of Net Assets as of October 31, 2010 were as follows: | | | | |

Paid-in capital | | $ | 334,998,411 | |

Accumulated undistributed net investment income | | | 1,078,294 | |

Accumulated net realized loss from investment transactions | | | (53,055,122 | ) |

Net unrealized appreciation on investments and on assets and liabilities denominated in foreign currencies | | | 92,352,071 | |

| | | | |

| | $ | 375,373,654 | |

| | | | |

See Notes to Financial Statements

26

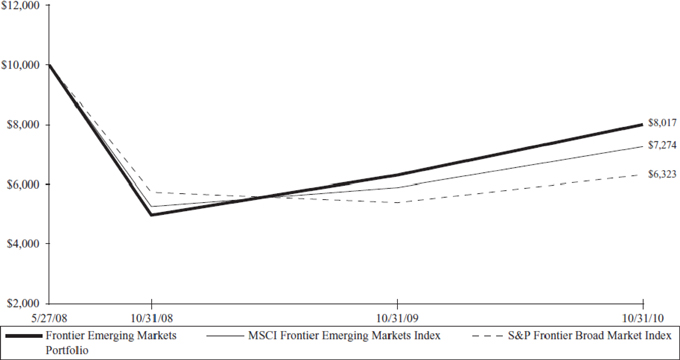

Harding, Loevner Funds, Inc.

Frontier Emerging Markets Portfolio — Overview

(unaudited)

October 31, 2010

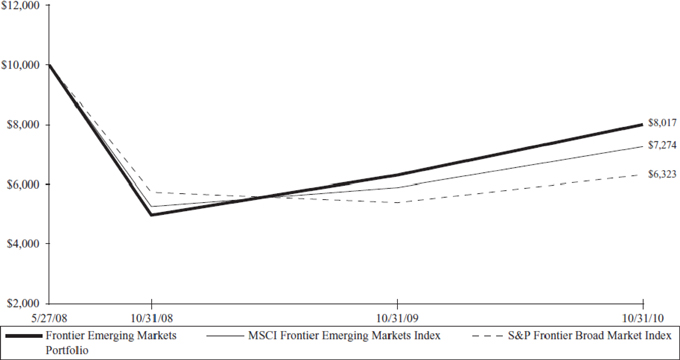

Hypothetical Comparison Of Changes In Value Of $10,000 Investment In Harding, Loevner Funds, Inc. -

Frontier Emerging Markets Portfolio - Institutional Class And The MSCI Frontier Emerging Markets Index

(Net Dividends)

And S&P Frontier Broad Market Index

| | | | | | |

| | | | | | | |

| | | Returns for the Year Ended October 31,2010 |

| | | Cumulative Total Returns | | Average Annualized

Total Return |

| FUND NAME | | Last 12 Months | | Inception | | Inception |

Frontier Emerging Markets Portfolio (Inception date 5/27/08) | | 27.04% | | -19.83% | | -8.69% |

MSCI Frontier Emerging Markets Index (Net dividends) | | 23.21% | | -27.26% | | -12.27% |

S&P Frontier Broad Market Index | | 17.18% | | -36.77% | | -17.19% |

| | | | | | | |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than the performance quoted and may be obtained by visiting the website at www.hardingloevnerfunds.com.

Investment return reflects voluntary fee waivers in effect. Absence such waivers, total return would be reduced. The performance provided does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions.

27

Harding, Loevner Funds, Inc.

Frontier Emerging Markets Portfolio - Overview

(unaudited)

October 31, 2010

The Frontier Emerging Markets Portfolio gained 27.04% for the fiscal year ending October 31, 2010, as compared to a gain of 23.21% for its benchmark, the MSCI Frontier Emerging Markets Index.

Consistent with its investment objectives and policies, the Portfolio was invested in the securities of companies with strong growth prospects in frontier and smaller emerging markets countries that we regard as both economically stable and offering attractive long-term investment potential.

Strong stock selection in Asia, Europe, and Africa was the major reason for the Portfolio’s outperformance this period. Standout stocks included Ukrainian food company Astarta, Thailand’s Home Product Center, a do-it-yourself retailer, and Kenya’s Equity Bank. Our overweights in Kenya and Sri Lanka and relatively small exposure to the Gulf region also helped returns.

The main detractor was the Portfolio’s underweight in Latin America, the strongest region in the Index, as well as weak stock selection in Argentina and Colombia. Holdings in both countries performed well on an absolute basis—including Colombia’s Cementos Argos, the country’s largest cement company in terms of tonnage—but still did not match the extraordinary rise of the country’s overall market. The poor returns from our Nigerian bank stocks hurt overall performance in Africa. For much of the year, these stocks were hurt by uncertainty amidst the Nigerian government’s severe restructuring of the banking industry. We maintained exposure to Nigeria and its local banks, however, as we feel valuations are attractive, the economic situation is improving, and economic growth should re-emerge.

Finally, Portfolio returns benefitted from a large weighting in the outperforming Consumer Staples sector, but suffered from its overweights in Health Care (the only sector to decline this period) and Industrials.

Past performance does not guarantee future results.

Foreign investments involve additional risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. Emerging markets countries involve greater risks, such as immature economic structures, national policies restricting investments by foreigners, and different legal systems. Such risks may be magnified with respect to securities of issuers in frontier emerging markets. The Portfolio can have significant concentration in a single industry, and investment opportunities in frontier markets may be concentrated in the banking industry. The Portfolio will be vulnerable to factors affecting an industry in which it is concentrated. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investment in lower-rated and non-rated securities presents a greater risk of loss of principal and interest than higher-rated securities. Mutual fund investing involves risk. Principal loss is possible.

Please see the Statement of Net Assets on page 29 for fund holdings as of October 31, 2010. Fund holdings and sector allocations are subject to change and are not recommendations to buy or sell any security.

The MSCI Frontier Emerging Markets Index is a free float-adjusted market capitalization index designed to measure equity market performance in all countries from the MSCI Frontier Markets Index and the lower size spectrum of the MSCI Emerging Markets Index. The Index consists of 26 frontier markets and 5 emerging markets. The Index is net of foreign withholding taxes on dividends. You cannot invest directly in this Index.

28

Harding, Loevner Funds, Inc.

Frontier Emerging Markets Portfolio

Statement of Net Assets

October 31, 2010

| | |

| Industry | | Percentage of Net Assets |

| | | | |

Agriculture | | | 2.8 | % |

Airlines | | | 0.6 | |

Auto Manufacturers | | | 1.5 | |

Banks | | | 32.4 | |

Beverages | | | 1.3 | |

Building Materials | | | 3.5 | |

Chemicals | | | 2.0 | |

Commercial Services | | | 3.2 | |

Distribution/Wholesale | | | 2.0 | |

Diversified Financial Services | | | 1.3 | |

Electric | | | 3.3 | |

Electrical Components & Equipment | | | 1.0 | |

Engineering & Construction | | | 2.2 | |

Food | | | 3.4 | |

Holding Companies - Diversified | | | 3.7 | |

Home Furnishings | | | 1.6 | |

Internet | | | 0.5 | |

Investment Companies | | | 1.9 | |

Iron/Steel | | | 0.4 | |

Lodging | | | 0.4 | |

Machinery - Construction & Mining | | | 0.4 | |

Media | | | 1.1 | |

Mining | | | 4.1 | |

Mutual Funds | | | 10.0 | |

Oil & Gas | | | 4.5 | |

Pharmaceuticals | | | 4.9 | |

Real Estate | | | 0.5 | |

Retail | | | 1.8 | |

Telecommunications | | | 5.9 | |

Textiles | | | 1.3 | |

Transportation | | | 1.2 | |

| | | | |

Total Investments | | | 104.7 | |

Liabilities Less Other Assets | | | (4.7 | ) |

| | | | |

Net Assets | | | 100.0 | % |

| | | | |

See Notes to Financial Statements

29

Harding, Loevner Funds, Inc.

Frontier Emerging Markets Portfolio

Statement of Net Assets

October 31, 2010 (continued)

| | | | | | | | |

| | | Shares | | | Value (1) | |

Common Stocks - 87.8% | | | | | | | | |

| | |

Argentina - 5.3% | | | | | | | | |

Banco Macro SA - ADR (Banks) | | | 30,100 | | | $ | 1,500,485 | |

Cresud SACIF y A - Sponsored ADR (Agriculture) | | | 60,600 | | | | 1,192,002 | |

Molinos Rio de la Plata SA (Food) | | | 201,118 | | | | 1,024,918 | |

| | | | | | | | |

| | | | | | | 3,717,405 | |

| | | | | | | | |

| | |

Bangladesh - 3.9% | | | | | | | | |

Lafarge Surma Cement Ltd. (Building Materials)* | | | 48,900 | | | | 478,802 | |

Power Grid Co. of Bangladesh Ltd. (Electric) | | | 40,600 | | | | 725,318 | |

Square Pharmaceuticals Ltd. (Pharmaceuticals) | | | 28,983 | | | | 1,546,272 | |

| | | | | | | | |

| | | | | | | 2,750,392 | |

| | | | | | | | |

| | |

Colombia - 8.9% | | | | | | | | |

BanColombia SA - Sponsored ADR (Banks) | | | 30,580 | | | | 2,062,621 | |

Cementos Argos SA - Sponsored ADR (Building Materials)# | | | 38,740 | | | | 1,337,460 | |

Ecopetrol SA - Sponsored ADR (Oil & Gas) | | | 16,100 | | | | 768,614 | |

Grupo de Inversiones Suramericana SA - Sponsored ADR (Investment Companies)# | | | 30,800 | | | | 1,373,132 | |

Interconexion Electrica SA - ADR (Electric)# | | | 3,700 | | | | 734,247 | |

| | | | | | | | |

| | | | | | | 6,276,074 | |

| | | | | | | | |

| | |

Croatia - 2.7% | | | | | | | | |

Atlantic Grupa (Distribution/Wholesale) | | | 9,267 | | | | 1,444,681 | |

Ericsson Nikola Tesla (Telecommunications) | | | 1,771 | | | | 429,725 | |

| | | | | | | | |

| | | | | | | 1,874,406 | |

| | | | | | | | |

| | |

Democratic Republic of Congo - 1.8% | | | | | | | | |

Katanga Mining Ltd. (Mining)* | | | 895,575 | | | | 1,281,970 | |

| | | | | | | | |

| | |

Egypt - 5.7% | | | | | | | | |

ElSwedy Electric Co. (Electrical Components & Equipment)* | | | 75,300 | | | | 704,004 | |

Ghabbour Auto (Auto Manufacturers) | | | 121,540 | | | | 1,023,488 | |

Orascom Construction Industries - GDR (Engineering & Construction) | | | 19,050 | | | | 883,146 | |

Orascom Telecom Holding SAE - GDR, Reg S, London Exchange (Telecommunications)* | | | 119,769 | | | | 464,076 | |

Orascom Telecom Holding SAE - GDR, Reg S, United States Exchange (Telecommunications)* | | | 18,000 | | | | 69,822 | |

Oriental Weavers (Textiles) | | | 162,852 | | | | 901,845 | |

| | | | | | | | |

| | | | | | | 4,046,381 | |

| | | | | | | | |

| | |

Estonia - 1.2% | | | | | | | | |

Tallink Group plc (Transportation)* | | | 881,120 | | | | 858,411 | |

| | | | | | | | |

| | |

Ghana - 0.4% | | | | | | | | |

Ghana Commercial Bank Ltd. (Banks) | | | 216,151 | | | | 286,393 | |

| | | | | | | | |

| | |

Indonesia - 1.3% | | | | | | | | |

Bank Rakyat Indonesia (Banks) | | | 725,903 | | | | 925,889 | |

| | | | | | | | |

See Notes to Financial Statements

30

Harding, Loevner Funds, Inc.

Frontier Emerging Markets Portfolio

Statement of Net Assets

October 31, 2010 (continued)

| | | | | | | | |

| | | Shares | | | Value (1) | |

Jordan - 1.5% | | | | | | | | |

Arab Bank plc (Banks) | | | 50,565 | | | $ | 746,591 | |

Arab Potash Co. (Mining) | | | 5,618 | | | | 283,774 | |

| | | | | | | | |

| | | | | | | 1,030,365 | |

| | | | | | | | |

| | |

Kazakhstan - 2.1% | | | | | | | | |

Halyk Savings Bank of Kazakhstan JSC - GDR, Reg S (Banks)* | | | 105,899 | | | | 984,424 | |

KazMunaiGas Exploration Production - GDR (Oil & Gas) | | | 26,650 | | | | 458,702 | |

Steppe Cement Ltd. (Building Materials)* | | | 72,320 | | | | 48,120 | |

| | | | | | | | |

| | | | | | | 1,491,246 | |

| | | | | | | | |

| | |

Kenya - 7.8% | | | | | | | | |

AccessKenya (Internet) | | | 1,730,400 | | | | 370,536 | |

East African Breweries Ltd. (Beverages) | | | 361,800 | | | | 949,857 | |

Equity Bank Ltd. (Banks) | | | 4,612,200 | | | | 1,499,313 | |

KenolKobil Ltd. Group (Oil & Gas) | | | 3,237,000 | | | | 431,190 | |

Kenya Airways Ltd. (Airlines) | | | 771,500 | | | | 427,995 | |

Nation Media Group Ltd. (Media) | | | 376,340 | | | | 764,366 | |

Safaricom Ltd. (Telecommunications) | | | 18,139,400 | | | | 1,089,444 | |

| | | | | | | | |

| | | | | | | 5,532,701 | |

| | | | | | | | |

| | |

Lebanon - 0.7% | | | | | | | | |

Banque Audi sal- Audi Saradar Group - GDR, Reg S (Banks)* | | | 59,090 | | | | 492,637 | |

| | | | | | | | |

| | |

Mauritius - 1.4% | | | | | | | | |

Mauritius Commercial Bank (Banks) | | | 137,680 | | | | 673,309 | |

Sun Resorts Ltd., Class A (Lodging) | | | 158,700 | | | | 315,794 | |

| | | | | | | | |

| | | | | | | 989,103 | |

| | | | | | | | |

| | |

Morocco - 2.2% | | | | | | | | |

Douja Promotion Groupe Addoha SA (Real Estate) | | | 26,588 | | | | 354,578 | |

Managem (Mining)* | | | 7,552 | | | | 490,345 | |

Maroc Telecom (Telecommunications) | | | 36,005 | | | | 681,298 | |

| | | | | | | | |

| | | | | | | 1,526,221 | |

| | | | | | | | |

| | |

Nigeria - 6.1% | | | | | | | | |

Access Bank plc (Banks) | | | 17,992,430 | | | | 999,845 | |

Dangote Sugar Refinery plc (Food) | | | 4,164,070 | | | | 461,417 | |

Diamond Bank plc (Banks)* | | | 17,511,872 | | | | 917,399 | |

First Bank of Nigeria plc (Banks) | | | 10,247,784 | | | | 876,634 | |

UAC of Nigeria plc (Holding Companies - Diversified) | | | 4,090,080 | | | | 1,084,902 | |

| | | | | | | | |

| | | | | | | 4,340,197 | |

| | | | | | | | |

| | |

Pakistan - 2.1% | | | | | | | | |

Engro Corp. Ltd. (Chemicals) | | | 234,316 | | | | 478,761 | |

MCB Bank Ltd. (Banks) | | | 55,415 | | | | 130,736 | |

See Notes to Financial Statements

31

Harding, Loevner Funds, Inc.

Frontier Emerging Markets Portfolio

Statement of Net Assets

October 31, 2010 (continued)

| | | | | | | | |

| | | Shares | | | Value (1) | |

| | |

Pakistan - 2.1% - (continued) | | | | | | | | |

Pakistan Petroleum Ltd. (Oil & Gas) | | | 389,672 | | | $ | 848,180 | |

| | | | | | | | |

| | | | | | | 1,457,677 | |

| | | | | | | | |

| | |

Peru - 4.2% | | | | | | | | |

Cementos Lima SA (Building Materials) | | | 34,742 | | | | 515,202 | |

Credicorp Ltd. (Banks) | | | 17,580 | | | | 2,212,970 | |

Ferreyros SA (Machinery - Construction & Mining) | | | 195,105 | | | | 268,413 | |

| | | | | | | | |

| | | | | | | 2,996,585 | |

| | | | | | | | |

| | |

Philippines - 1.6% | | | | | | | | |

Philippine Long Distance Telephone Co. - Sponsored ADR (Telecommunications) | | | 17,760 | | | | 1,103,429 | |

| | | | | | | | |

| | |

Qatar - 5.4% | | | | | | | | |

Commercial Bank of Qatar (Banks) | | | 37,630 | | | | 861,933 | |

Industries Qatar (Chemicals) | | | 29,100 | | | | 927,260 | |

Qatar Electricity & Water Co. (Electric) | | | 27,550 | | | | 865,649 | |

Qatar National Bank SAQ (Banks) | | | 25,130 | | | | 1,132,183 | |

| | | | | | | | |

| | | | | | | 3,787,025 | |

| | | | | | | | |

| | |

Senegal - 0.4% | | | | | | | | |

Sonatel (Telecommunications) | | | 995 | | | | 306,121 | |

| | | | | | | | |

| | |

Serbia - 0.4% | | | | | | | | |

AIK Banka AD (Banks)* | | | 4,000 | | | | 159,044 | |

Energoprojekt Holding ad Beograd (Holding Companies - Diversified)* | | | 11,650 | | | | 141,643 | |

| | | | | | | | |

| | | | | | | 300,687 | |

| | | | | | | | |

| | |

Slovenia - 2.9% | | | | | | | | |

Gorenje Velenje (Home Furnishings)* | | | 59,214 | | | | 1,094,111 | |

Krka dd Novo mesto (Pharmaceuticals) | | | 10,860 | | | | 950,477 | |

| | | | | | | | |

| | | | | | | 2,044,588 | |

| | | | | | | | |

| | |