UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07739

Harding, Loevner Funds, Inc.

(Exact name of registrant as specified in charter)

400 Crossing Boulevard

Fourth Floor

Bridgewater, NJ 08807

(Address of principal executive offices) (Zip code)

Tanya S. Tancheff

The Northern Trust Company

333 South Wabash Avenue

Chicago, IL 60604

With a copy to:

Stephen H. Bier, Esq.

Dechert LLP

1095 Avenue of the Americas

New York, NY 10036

(Name and address of agent for service)

Registrant’s telephone number, including area code: (877) 435-8105

Date of fiscal year end: 10/31

Date of reporting period: 10/31/2022

Item 1. Reports to Stockholders.

| (a) | The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1) |

| | |

| | Global Equity Portfolio International Equity Portfolio International Small Companies Portfolio Institutional Emerging Markets Portfolio Emerging Markets Portfolio Frontier Emerging Markets Portfolio Global Equity Research Portfolio International Equity Research Portfolio Emerging Markets Research Portfolio Chinese Equity Portfolio Emerging Markets ex China Portfolio International Developed Markets Equity Portfolio |

Harding Loevner Funds

Global equity investing is Harding Loevner’s exclusive focus. Through Harding Loevner Funds it offers distinct global strategies based on its quality-and-growth investment philosophy. It seeks to purchase shares of growing, financially strong, well-managed companies at favorable prices. Harding Loevner manages each of the Funds’ Portfolios according to a disciplined, research-based investment process. It identifies companies with sustainable competitive advantages and assesses the durability of their earnings growth by conducting in-depth fundamental research into global industries. In constructing portfolios, Harding Loevner diversifies carefully to limit risk.

Receive Investor Materials Electronically

Shareholders may sign up for electronic delivery of investor materials. By doing so, you will receive the information faster and help us reduce the impact on the environment of providing these materials. To enroll in electronic delivery,

| | 1. | Go to http://www.icsdelivery.com |

| | 2. | Select the first letter of your brokerage firm’s name. |

| | 3. | From the list that follows, select your brokerage firm. If your brokerage firm is not listed, electronic delivery may not be available. Please contact your brokerage firm. |

| | 4. | Complete the information requested, including the e-mail address where you would like to receive notifications for electronic documents. |

Your information will be kept confidential and will not be used for any purpose other than electronic delivery. If you change your mind, you can cancel electronic delivery at any time and revert to physical delivery of your materials. Just go to http://www.icsdelivery.com, perform the first three steps above, and follow the instructions for cancelling electronic delivery. If you have any questions, please contact your brokerage firm.

Table of Contents

Must be preceded or accompanied by a current Prospectus.

Quasar Distributors, LLC, Distributor

Letter To Our Shareholders

October 31, 2022

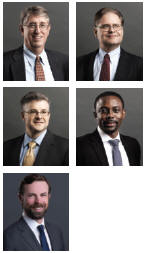

David Loevner, CFA

Chairman of the Funds

and Chief Executive Officer of the Adviser

Ferrill Roll, CFA

Chief Investment Officer of the Adviser

Simon Hallett, CFA

Vice Chairman of the Adviser

The past year has been a difficult one for investors. The headwinds for high-priced growth stocks transmogrified into a deep bear market across all asset classes except commodities. Our emphasis on high-quality companies has done little, so far this year, to shelter our Portfolios from the ravages of soaring energy prices, tight labor markets, rising interest rates, crumbling Chinese property markets, and fraught geopolitics. The last six months have hinted at the resilience of the businesses and the robustness of the balance sheets of the companies in which we invest, with most of the Portfolios outperforming their benchmarks modestly as anticipation of global recession rises. Small solace indeed. Our portfolio managers and analysts remain focused on reviewing the investment case for each holding and on uncovering bargains made available by the lower prices on offer. You will read about those efforts to respond to the changing landscape in the accompanying pages.

Meanwhile, we’ve taken steps to serve the needs of our investors in additional, if more prosaic, ways. Asset owners themselves face new challenges and priorities, and their different return objectives, investment horizons, risk tolerances, and strong views about the best—or worst—sources of future returns can require investment vehicles more narrowly defined than our longstanding offerings. In response, we’ve introduced new Portfolios that attempt to meet those changing investment objectives and specific preferences.

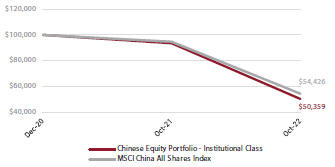

As an example, our Emerging Markets (EM) strategy has exposure limits for each country; two years ago, the limit for China was 35%. With the Chinese market’s outperformance in 2020 due to China’s early containment of COVID-19, some shareholders were dissatisfied with the underweight that

constraint produced relative to the EM benchmark. With them in mind, we launched our Chinese Equity Portfolio, which allows investors who favor following our bottom-up approach to identifying high-quality growing companies to deepen and tailor their exposure to the Chinese market as they desire.

This year, we expanded upon that logic by launching a complementary fund, the Emerging Markets ex China Portfolio, as a means for investors to manage their China and EM exposures independently—including the ability to avoid exposure to China altogether if, for instance, they have come to believe that China’s recent regulatory interventions, the scale of its property bubble, or its more aggressive posture toward Taiwan have rendered the market suspect, or even “uninvestable.” We believe these two Portfolios, because they share portfolio managers with our EM strategy and draw from the opportunity set qualified by our research team, should deliver good risk-adjusted returns over time even though each individual Portfolio may prove to be more volatile than their more diversified progenitor, our main Emerging Markets Portfolio.

With emerging markets having generally disappointed in the past few years and been so tumultuous recently, some investors have become disenchanted with the entire market segment. To accommodate that view (which, to be clear, we do not share), we added to the Harding, Loevner Funds’ lineup a Portfolio that expressly de-emphasizes emerging markets. The International Developed Markets Equity Portfolio makes broadly accessible a strategy that we’ve managed very successfully for institutional clients for over a decade. This strategy is managed in conjunction with our flagship International Equity strategy by a member of the latter’s portfolio management team.

Strong views abound on fossil fuels and the urgency of the need to lower carbon emissions. The energy crisis triggered by Russia’s invasion of Ukraine has highlighted the world’s unreadiness to do without fossil fuels in the short or even medium term, affording spectacular profits to those able to deliver product to make up the shortfall. The recent high returns to fossil fuel investments have betrayed the wishful thinking that the alignment of investments according to environmental, social, and governance (ESG) criteria would in and of itself lead to superior returns. Regardless, asset owners who wish to help address the looming crisis posed by a rapidly warming climate are undeterred. Because some are asking for restrictions on fossil fuel investments or positive bias toward companies lowering their carbon emissions, we’ve introduced pooled funds that steer heavily toward investments that align with carbon emission reduction goals. Following on the launch earlier this year of a Global Paris-Aligned strategy through our European UCITS fund family, we are set shortly to launch a similarly oriented International Carbon Transition Equity strategy that will

be available through Harding, Loevner Funds. Both strategies will exclude fossil fuel companies from the portfolio (among other exclusions) and screen companies’ emission reduction practices to determine whether there is a viable pathway to net-zero greenhouse gas (GHG) emissions.

Our approach to assessing the risks of regulation and environmental damage and the growth opportunities stemming from climate change has always been to incorporate our analysis into the full panel of investment considerations against which we make financial judgments about companies and their shares. Our approach to assessing the investment risks and opportunities related to China and emerging markets falls along similar lines. And yet we recognize that consideration of material financial

risks and opportunities at the company level may be inadequate to the needs of some investors. By offering more customized building blocks, we aim to help meet those needs while still pursuing superior returns and limiting risk to the absolute best of our ability. Each of these new strategies is closely related to an existing strategy and relies on its portfolio managers; therefore, the incremental demands on the investment team are not burdensome. That strikes us as a win-win: to increase opportunities for shareholders to benefit from our core investment insights in whichever configuration they may need, while keeping our investment eyes scouring the landscape for the opportunities—or still-hidden risks—that the difficult environment may expose.

| | | | |

Sincerely, | | | | |

| | |

| |  | |  |

| | |

| David R. Loevner, CFA | | Ferrill D. Roll, CFA | | Simon Hallett, CFA |

Opinions expressed are those of Harding Loevner and are not intended to be forecasts of future events, a guarantee of future results, nor investment advice. Please read the separate disclosure page for important information, including the risks of investing in the Portfolios. Past performance is not a guarantee of future results.

Global Equity Portfolio

Institutional Investors: HLMVX and HLGZX | Individual Investors: HLMGX

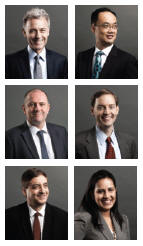

Portfolio Management Team

| | |

| | Peter Baughan, CFA Co-Lead Portfolio Manager Jingyi Li Co-Lead Portfolio Manager Scott Crawshaw Portfolio Manager Christopher Mack, CFA Portfolio Manager Richard Schmidt, CFA Portfolio Manager Moon Surana, CFA Portfolio Manager |

Performance Summary

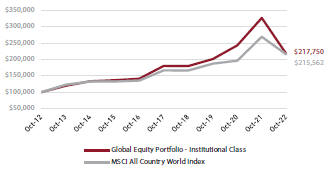

For the Global Equity Portfolio, the Institutional Class fell 33.35% (net of fees and expenses) in the twelve-month period ended October 31, 2022. The Portfolio’s benchmark, the MSCI All Country World Index, fell 19.96% (net of source taxes).

Market Review

Global stock markets are down significantly for the trailing twelve months, a period marked by persistent inflation and ongoing economic consequences of the Russia-Ukraine conflict. Every region and nearly every sector finished in the red.

Early in the period, amid worldwide supply chain issues, the emergence of the COVID-19 Omicron variant dealt a hiccup to investor confidence; markets were still processing the economic impact of the outbreak and governments’ responses to it when Russia invaded Ukraine in late February. The US and other Western governments imposed crippling economic sanctions on Russia; prices of commodities for which Russia is a key exporter rose sharply, furthering inflation and prompting central banks to tighten monetary policy.

Amidst rising prices, the US Federal Reserve, following pledges to increase rates until inflation is under control, boosted its benchmark interest rate three times between April and October. Other central banks, including the Bank of England, the European Central Bank, and the Central Bank of Australia, raised their rates as well. A notable exception was the Bank of Japan, which remained committed to its ultra-accommodative monetary policy in the period. In June, the World Bank forecasted economic growth slowing to 2.9% for 2022, a drop

| | |

|

| Fund Facts at October 31, 2022 |

| |

Total Net Assets | | $1,015.2M |

| |

Sales Charge | | None |

| |

Number of Holdings | | 68 |

| |

Turnover (5 Yr. Avg.) | | 48% |

| |

Dividend Policy | | Annual |

| | | | | | |

| | |

| | | Institutional Investors | | Individual Investors |

| | | |

| | | Inst. Class | | Inst. Class Z | | Advisor Class |

| | | |

Ticker | | HLMVX | | HLGZX | | HLMGX |

| | | |

CUSIP | | 412295602 | | 412295727 | | 412295206 |

| | | |

Inception Date | | 11/3/2009 | | 8/1/2017 | | 12/1/1996 |

| | | |

Minimum Investment | | $100,0001 | | $10,000,000 | | $5,0001 |

| | | |

Expense Ratio2 | | 0.87%3 | | 0.80%4 | | 1.08%5 |

1Lower minimums available through certain brokerage firms; 2The Expense Ratios are as of the most recent Prospectus and have been restated to reflect current fees; 3Harding Loevner’s contractual agreement caps the net expense ratio at 0.90% through February 28, 2023. The expense ratio (without cap) is applicable to investors; 4Harding Loevner’s contractual agreement caps the net expense ratio at 0.80% through February 28, 2023. The expense ratio (without cap) is applicable to investors; 5Harding Loevner’s contractual agreement caps the net expense ratio at 1.20% through February 28, 2023. The expense ratio (without cap) is applicable to investors.

from the 4.1% growth it forecasted at the start of the calendar year. In July, markets took a brief reprise from declining, with improving US core inflation measures raising the possibility of an earlier-than-expected end to the Federal Reserve’s monetary tightening. But the brightening of sentiment proved fleeting. While headline inflation continued to moderate due to oil and gas prices coming down off their previous highs, underlying measures indicated that price increases could become entrenched, and rising expectations of future inflation introduced the specter of a wage-price spiral; global stock markets resumed their retreat by late August.

On a sector basis, Energy was the only sector to rise; commodity prices soared in 2022 due to supply shocks from war and sanctions. Communication Services and Consumer Discretionary performed the worst. Communication Services companies—largely comprised of highly priced growth stocks—were impacted by central bank efforts to tame inflation and faced slowing advertising spending while Consumer Discretionary companies, generally more sensitive to business and consumer confidence, were impacted by persistent inflation.

All regions fell, though Emerging Markets, anchored by China, and eurozone markets suffered the most. The eurozone continued to grapple with the impacts of sanctions against Russia, while China fell sharply in the final months of the period due to dimming economic prospects stemming from its severe property slowdown and strict COVID-19 lockdowns. Non-eurozone European countries fell the least despite the

Performance (% Total Return)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| | | For periods ended September 30, 2022 | | | For periods ended October 31, 2022 | |

| | | | | | | | | | |

| | | 1 | | | 3 | | | 5 | | | 10 | | | Since Inception* | | | 1 | | | 3 | | | 5 | | | 10 | | | Since Inception* | |

| | | Year | | | Years | | | Years | | | Years | | | Nov-09 | | | Aug-17 | | | Dec-96 | | | Year | | | Years | | | Years | | | Years | | | Nov-09 | | | Aug-17 | | | Dec-96 | |

| | | | | | | | | | | | | | |

| Global Equity Portfolio – Inst. Class | | | -32.39 | | | | 2.29 | | | | 3.57 | | | | 7.39 | | | | 7.80 | | | | | | | | | | | | -33.35 | | | | 2.66 | | | | 3.82 | | | | 8.09 | | | | 8.07 | | | | | | | | | |

| | | | | | | | | | | | | | |

| Global Equity Portfolio – Inst. Class Z | | | -32.36 | | | | 2.36 | | | | 3.63 | | | | – | | | | | | | | 3.73 | | | | | | | | -33.31 | | | | 2.74 | | | | 3.89 | | | | – | | | | | | | | 4.44 | | | | | |

| | | | | | | | | | | | | | |

| Global Equity Portfolio – Advisor Class | | | -32.54 | | | | 2.10 | | | | 3.36 | | | | 7.14 | | | | | | | | | | | | 6.45 | | | | -33.50 | | | | 2.47 | | | | 3.61 | | | | 7.84 | | | | | | | | | | | | 6.59 | |

| | | | | | | | | | | | | | |

| MSCI All Country World Index | | | -20.66 | | | | 3.75 | | | | 4.44 | | | | 7.28 | | | | 7.48 | | | | 4.67 | | | | – | | | | -19.96 | | | | 4.85 | | | | 5.24 | | | | 7.98 | | | | 7.91 | | | | 5.77 | | | | – | |

Returns are annualized for periods greater than 1 year. *Inception of the Institutional Class, November 3, 2009. Inception of the Institutional Class Z, August 1, 2017. Inception of the Advisor Class, December 1, 1996. Index performance prior to January 1, 2001 cannot be shown since it relies on back-filled data.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Portfolio may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling (877) 435-8105 or visiting hardingloevnerfunds.com.

UK’s economic calamities, which involved its bonds tumbling and the pound falling to a record low against the US dollar after then-PM Liz Truss’s announcement of aggressive tax cuts and greater borrowing. The Bank of England, caught unaware, hastily announced it would buy bonds “on whatever scale necessary” to stabilize markets, effectively abandoning its earlier commitment to begin reducing the size of its balance sheet.

Performance Attribution

The Portfolio’s concentration in expensive stocks, a hazard of our commitment to investing in the stocks of high-quality rapidly growing businesses, hurt relative performance in a period during which investors fled from richly priced companies. So stiff was this style headwind that, when viewed through the standard lenses of sector and geographic attribution, our Portfolio underperformed within each region and nearly all sectors.

Weak Health Care, Information Technology, and Financials stocks detracted from relative performance. Chinese biologics services provider WuXi Biologics was placed on a US “Unverified List” of export destinations in December 2021 due to COVID-19 lockdowns preventing officials from inspecting its facilities; WuXi saw more share price pressure three quarters later from a September 2022 executive order by the Biden administration intended to accelerate development of the domestic biotech industry, which investors worried could impede the company’s access to the US market. US-based SVB Financial Group suffered from the negative outlook for technology and startup companies, which make up the bulk of its clients. The Portfolio’s underweight in Energy also hurt. Strong Industrials stocks helped; US agricultural machinery producer John Deere reported strong fiscal third quarter growth in 2022, affirming the company’s ability to overcome supply chain challenges and rising raw materials costs.

Viewing our returns in terms of the Portfolio’s exposure to growth and valuation factors, the Portfolio’s emphasis on companies in the most expensive quintile continued to hurt, accounting for more than a quarter of our underperformance in the period. Weak stock selection within the same quintile, which is heavy in Health Care and Information Technology companies,

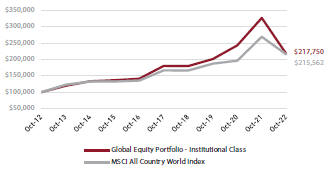

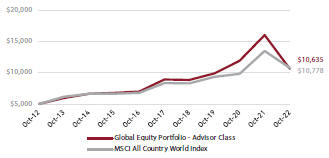

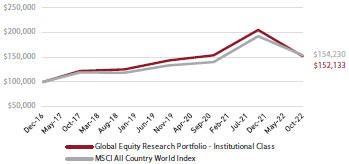

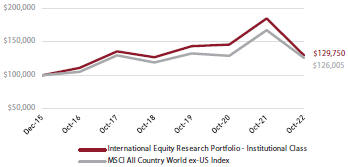

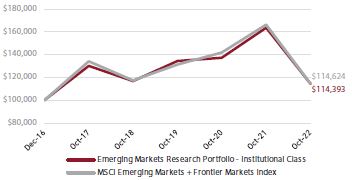

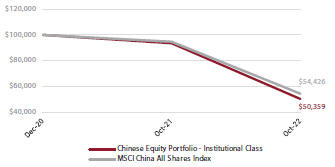

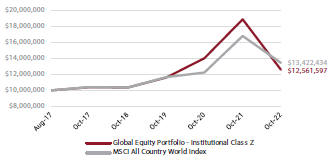

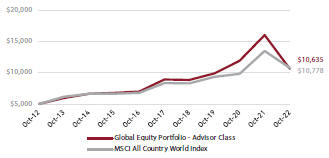

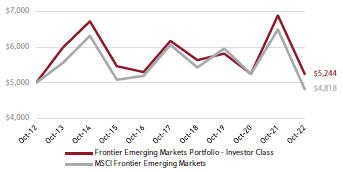

Total Return Based on a $100,000 Investment Institutional Class

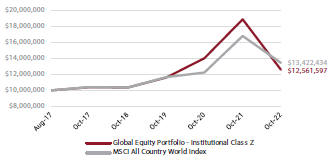

Total Return Based on a $10,000,000 Investment Institutional Class Z

Total Return Based on a $5,000 Investment Advisor Class

The charts above illustrate the hypothetical return of an investment made in the corresponding share classes. Investment return reflects voluntary fee waivers in effect. Absent such waivers, total return would be reduced. The performance provided in the table and charts above do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

also hurt significantly. Our parallel emphasis on quality provided no defense in the period.

Perspective and Outlook

Within a few months in the summer and fall of 2022, markets lurched from a consensus that the fight against inflation would soon be won toward a despairing view that slaying inflation would require sustained punishment by high interest rates. As practiced observers of both markets and policymakers, we have not put much belief in either narrative or tried to predict which outcome will ultimately drive the markets.

Instead, we have intensified our efforts to reconfirm the long-term business prospects of the companies we own and those qualified by our analysts for investment. We aim to build a portfolio of companies that is resilient to changes in the economic environment, knowing full well that we can’t predict which environment they will face tomorrow. We are continuously questioning whether they have as defensible a competitive position, as resilient a business model, and as robust a balance sheet as we had previously thought. We seek to uncover unseen vulnerabilities to worsening or new threats. Such threats could be economic in nature, such as a reversion to persistent inflation following two generations of disinflation. They could be financial, such as a shift from negative to positive real interest rates. Or they could be geopolitical, including risks of widening military conflicts with potentially cataclysmic effects on the global economy.

This last one is no longer simply academic. The global economy has already been dramatically affected by the Ukrainian conflict, including by the still-unfolding energy crisis in Europe. Nancy Pelosi’s August visit to Taiwan, coming as it did in the wake of the West’s strikingly unified response to Russia’s invasion of Ukraine, and China’s military exercises launched in response offered stark reminders of the risk that Taiwan could be the fuse to ignite an armed conflict pitting the US and its allies against a confident China. The concept of “de-globalization” comes into sharper focus when we imagine entire markets being lost to some of the world’s most successful companies, the severing of supply chains, or the destruction of financial or physical assets.

We have viewed that risk as both low and distant in time, and still view it as low. Several factors (such as China’s unsettled domestic economic situation and the unified Western response to and military debacle encountered by Russia in Ukraine) substantially reduce the likelihood of imminent invasion. Nevertheless, there is good reason we don’t presume to be experts in US-Sino relations. And even a low probability risk must be considered when the event can have catastrophic consequences if preparations aren’t made.

Beyond geopolitical risks, the threat from inflation remains at the fore. Few securities analysts working today are experienced in examining companies’ resilience to persistent inflation, since

for the last 40 years the trend in developed economies has been toward disinflation. We have a leg up since many of our analysts have covered companies in developing countries where inflation has been a persistent concern. Moreover, for at least the past 15 years our valuation models have explicitly incorporated inflation assumptions for every company we cover.

A further complication of analysis under inflationary conditions is that the growth of intangible assets has made it hard to parse the effects of today’s inflation on sustainability of profits. In prior inflationary periods, what distinguished winners from losers was pricing power—that is, whether a company could pass higher input costs through to its customers without affecting its unit sales. Today, the value of intellectual property (IP), such as embedded research and development costs, plays a far larger role in fostering the profits of the most rapidly growing companies, and this secondary effect is more difficult to quantify, since there is too little visibility into the accounting inputs to those intangible costs. Also, compared with the ability to renew physical plant and equipment, the ability to renew IP is more vulnerable to the high employment mobility of younger, more educated digital workers. These contemporary twists mean that pricing power may no longer be the paramount measure of a company’s inflation resilience; instead, its bargaining power

Portfolio Positioning (% Weight) at October 31, 2022

| | | | | | | | |

| | |

| Sector | | Portfolio | | | Benchmark1

| |

| | |

Comm Services | | | 9.0 | | | | 6.9 | |

| | |

Cons Discretionary | | | 7.7 | | | | 10.8 | |

| | |

Cons Staples | | | 2.7 | | | | 7.6 | |

| | |

Energy | | | 1.8 | | | | 5.8 | |

| | |

Financials | | | 13.2 | | | | 14.8 | |

| | |

Health Care | | | 22.7 | | | | 13.3 | |

| | |

Industrials | | | 16.8 | | | | 9.8 | |

| | |

Info Technology | | | 22.5 | | | | 20.9 | |

| | |

Materials | | | 0.0 | | | | 4.6 | |

| | |

Real Estate | | | 0.3 | | | | 2.5 | |

| | |

Utilities | | | 0.0 | | | | 3.0 | |

| | |

Cash | | | 3.3 | | | | – | |

| | |

| Geography | | Portfolio | | | Benchmark1 | |

| | |

Canada | | | 0.0 | | | | 3.2 | |

| | |

Emerging Markets | | | 8.7 | | | | 10.2 | |

| | |

Europe EMU | | | 10.3 | | | | 7.5 | |

| | |

Europe ex-EMU | | | 10.2 | | | | 7.8 | |

| | |

Frontier Markets2 | | | 0.0 | | | | – | |

| | |

Japan | | | 2.5 | | | | 5.2 | |

| | |

Middle East | | | 0.0 | | | | 0.2 | |

| | |

Pacific ex-Japan | | | 1.0 | | | | 2.9 | |

| | |

United States | | | 64.0 | | | | 63.0 | |

| | |

Cash | | | 3.3 | | | | – | |

1MSCI All Country World Index; 2Includes countries with less-developed markets outside the Index.

over its IP suppliers (including its employees) has in some cases become more critical.

If 40 years have passed since analysts needed to worry about inflation, it’s only been a decade since analysts and portfolio managers last operated in an environment where they needed to take account of positive real interest rates. Although short-term rates are still far below headline inflation in most countries, in the developed world real yields on long sovereign bonds have tipped into positive territory. After a period during which there were almost no limits to the demand for borrowing for just about any purpose, positive real long-term interest rates should at least lead to a more efficient allocation of capital.

The journey to sustained higher interest rates, if indeed that is where we are headed, is bound to be bumpy. The most concerning vulnerability exposed (so far) has been the weaknesses hidden in some underfunded UK corporate pension plans that had built up opaque and contorted derivative and collateral structures predicated on well-behaved long-term interest rates. Their struggles to meet ensuant margin calls were the catalyst for the intervention by the Bank of England in its domestic bond market. Might similar vulnerabilities exist elsewhere waiting to be exposed? As always, our preference for transparency and insistence on financial strength at our companies is designed to keep our portfolios relatively sheltered from this kind of distress.

Portfolio Highlights

No sector better encapsulates the challenges for companies inherent in the current economic environment than Industrials. The pandemic laid bare the vulnerability of global industrial supply chains to unforeseen disruption, and rising geopolitical risks are eroding the economic logic that drove their geographic expansion. Manufacturers already reeling from rising costs for labor, materials, energy, and transport are also vulnerable to shortages of critical inputs and the threat of slowing global growth. Such a confluence of challenges will test even the most insightful and capable management teams.

That said, recent data suggest just how fluid the current environment is. Even as concerns mounted that inflation was becoming entrenched, costs of certain key inputs, such as steel, iron ore, and aluminum, have fallen in US dollar terms in 2022. Although it’s too early to draw any broad conclusions, we’ll note simply that shortages are typically followed by gluts.

Supply chain near-shoring and increased adoption of automation to alleviate shortages of skilled workers are creating tailwinds for industrial equipment makers. US government policies promoting clean energy, semiconductor, and biotechnology production domestically may hurt some China-based companies but could also create new markets for US-based firms in their own backyard. Many of our manufacturing-related and other types of industrial holdings are net beneficiaries of these emerging trends.

| | | | | | | | |

| Ten Largest Holdings by Weight at October 31, 2022 | | | | |

| | | |

| Company | | Sector | | Market | | % | |

| | | |

Vertex Pharmaceuticals | | Health Care | | US | | | 4.0 | |

| | | |

Alphabet | | Comm Services | | US | | | 3.4 | |

| | | |

John Deere | | Industrials | | US | | | 3.3 | |

| | | |

Schneider Electric | | Industrials | | France | | | 3.1 | |

| | | |

UnitedHealth Group | | Health Care | | US | | | 2.8 | |

| | | |

First Republic Bank | | Financials | | US | | | 2.7 | |

| | | |

Microsoft | | Info Technology | | US | | | 2.6 | |

| | | |

Amazon.com | | Cons Discretionary | | US | | | 2.2 | |

| | | |

HDFC Bank | | Financials | | India | | | 2.1 | |

| | | |

L’Oréal | | Cons Staples | | France | | | 2.1 | |

Rockwell Automation, a Milwaukee-based industrial automation company, struggled early in the year with component shortages that prevented it from clearing its overflowing order books and rising input costs. Uncertainty arising from China’s COVID-19 lockdowns and the Ukraine war prompted management to warn in May of lower profits for the rest of the year. Behind the frustrations, however, were indications that the business outlook remained strong, as order volume continued to grow following price increases at the end of 2021. In the recent quarter, the company reported stronger results despite ongoing supply chain issues that hindered its ability to fulfill orders. To mitigate the risk of supply disruptions, Rockwell has been accumulating inventory and redesigning certain products. We believe Rockwell will see its revenues expand as its resilience improves and supply shortages recede.

Founded in 1987 by its current CEO, Andrew Florance, CoStar has tackled the problem of information asymmetry in the commercial real estate (CRE) market, where transaction data was once dispersed among individual brokers, sellers, buyers, and landlords. It has built a comprehensive database of commercial property data and transaction information, access to which it offers on a subscription basis. The service has lowered the cost of price discovery for smaller participants, leveling the playing field in this highly competitive industry and making itself indispensable to them. In addition to expanding its database to provide similar services in the US residential real estate market, CoStar is looking to expand its global CRE footprint. It has been building a property and transaction database in the UK for more than a decade and recently acquired CRE data businesses in Germany and France. Because of CoStar’s essential role in price discovery, it is relatively insulated from the cyclicality of the CRE market. With US$4.5 billion in cash, much of it earmarked for acquisitions, CoStar can take advantage of any compression in earnings multiples in a downturn to further consolidate its position.

As with the leadership of Rockwell, CoStar’s management has demonstrated ambition and an ability to execute on long-term plans. While no guarantee of success, a credible growth plan, experienced leadership, and substantial financial capacity make CoStar another business with the formula to meet expectations even in the currently challenging environment.

Please read the separate disclosures page for important information, including the risks of investing in the Portfolio.

International Equity Portfolio

Institutional Investors: HLMIX and HLIZX | Individual Investors: HLMNX

| | |

Portfolio Management Team |

| | Ferrill Roll, CFA Co-Lead Portfolio Manager Andrew West, CFA Co-Lead Portfolio Manager Bryan Lloyd, CFA Portfolio Manager Babatunde Ojo, CFA Portfolio Manager Patrick Todd, CFA Portfolio Manager |

|

|

|

|

|

|

|

|

|

|

|

Performance Summary

For the International Equity Portfolio, the Institutional Class declined 28.42%, the Institutional Class Z declined 28.36%, and the Investor Class declined 28.63% (net of fees and expenses) in the twelve-month period ended October 31, 2022. The Portfolio’s benchmark, the MSCI All Country World ex-US Index, declined 24.73% (net of source taxes).

Market Review

International equity markets fell sharply in the period amid aggressive central bank rate hikes intended to cool inflation, commodity supply shocks emanating from the war in Ukraine, and overall weakness in China.

The period began with consumer prices in the US climbing at the fastest pace since 1982, leading the US Federal Reserve (Fed) to signal several interest rate increases and an imminent end to its bond-buying program. So far, the Fed has hiked interest rates six times, taking rates from between 0% and 0.25% at the start of the period to between 3.75% and 4% by November 2. Other central bankers across developed and emerging markets continued to raise their own borrowing rates, with Bank of Japan the notable exception as it remained committed to an ultra-accommodative monetary policy.

Russia’s invasion of Ukraine in the closing days of February prompted a swift and emphatic response by Western governments, which nevertheless sought to strike a balance between punishing Russian aggression and avoiding an escalating military conflict. The US and its allies enacted crippling economic sanctions, including freezing a significant

| | | | |

|

| Fund Facts at October 31, 2022 |

| | |

Total Net Assets | | $14,025.4M | | |

| | |

Sales Charge | | None | | |

| | |

Number of Holdings | | 60 | | |

| | |

Turnover (5 Yr. Avg.) | | 17% | | |

| | |

Dividend Policy | | Annual | | |

| | | | | | |

| | |

| | | Institutional Investors | | Individual Investors |

| | | |

| | | Inst. Class | | Inst. Class Z | | Investor Class |

| | | |

Ticker | | HLMIX | | HLIZX | | HLMNX |

| | | |

CUSIP | | 412295107 | | 412295719 | | 412295503 |

| | | |

Inception Date | | 5/11/1994 | | 7/17/2017 | | 9/30/2005 |

| | | |

Minimum Investment | | $100,0001 | | $10,000,000 | | $5,0001 |

| | | |

Expense Ratio2 | | 0.79%3 | | 0.71%4 | | 1.11%5 |

1Lower minimums available through certain brokerage firms; 2The Expense Ratios are as of the most recent Prospectus and have been restated to reflect current fees; 3Harding Loevner’s contractual agreement caps the net expense ratio at 1.00% through February 28, 2023. The expense ratio (without cap) is applicable to investors; 4Harding Loevner’s contractual agreement caps the net expense ratio at 0.80% through February 28, 2023. The expense ratio (without cap) is applicable to investors; 5Harding Loevner’s contractual agreement caps the net expense ratio at 1.25% through February 28, 2023. The expense ratio (without cap) is applicable to investors.

share of Russian central bank reserve assets, cutting off many of the country’s banks from SWIFT (Society for Worldwide Interbank Financial Telecommunications), and outlawing the export of a variety of industrial and luxury goods to Russia. The revulsion over Russia’s actions also provoked an exodus of Western companies from Russian markets. With foreign investors effectively unable to trade, major market index providers expunged all Russian securities from their indices.

The war’s contribution to inflation was twofold. In September, Russia retaliated against European sanctions by cutting off the flow of natural gas to the continent, sending energy prices soaring as countries scrambled to find other sources. In emerging markets (EMs), the pressures were largely felt in ballooning food prices. Prior to the war, Ukraine was one of the world’s largest suppliers of grains and vegetable oils, and EM countries have been hard-pressed to find alternatives.

China grappled with its own set of challenges. The government’s sweeping lockdown measures in response to waves of COVID-19 cases in major Chinese cities hurt businesses in various industries and caused investors to lose their appetite for Chinese stocks. In the Real Estate sector, regulators’ efforts to prick the country’s residential real estate bubble caused severe strain, as even less-leveraged developers faced resistance to rolling over their debt or issuing new bonds. In Health Care, shares of Chinese biological pharmaceutical companies came under pressure after US President Joe Biden issued an executive order advancing a “secure American bioeconomy,” fueling fears that these businesses may get shut out from the lucrative US market.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Performance (% Total Return) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| | | For periods ended September 30, 2022 | | | For periods ended October 31, 2022 | |

| | | | | | | | | | |

| | | 1 | | | 3 | | | 5 | | | 10 | | | Since Inception* | | | 1 | | | 3 | | | 5 | | | 10 | | | Since Inception* | |

| | | Year | | | Years | | | Years | | | Years | | | May-94 | | | Jul-17 | | | Sep-05 | | | Year | | | Years | | | Years | | | Years | | | May-94 | | | Jul-17 | | | Sep-05 | |

| | | | | | | | | | | | | | |

Intl. Equity Portfolio – Inst. Class | | | -27.28 | | | | -0.02 | | | | 0.45 | | | | 4.65 | | | | 5.39 | | | | | | | | | | | | -28.42 | | | | -0.34 | | | | 0.50 | | | | 4.84 | | | | 5.46 | | | | | | | | | |

| | | | | | | | | | | | | | |

Intl. Equity Portfolio – Inst. Class Z | | | -27.22 | | | | 0.05 | | | | 0.51 | | | | – | | | | | | | | 1.22 | | | | | | | | -28.36 | | | | -0.27 | | | | 0.58 | | | | – | | | | | | | | 1.66 | | | | | |

| | | | | | | | | | | | | | |

Intl. Equity Portfolio – Investor Class | | | -27.48 | | | | -0.33 | | | | 0.12 | | | | 4.31 | | | | | | | | | | | | 4.78 | | | | -28.63 | | | | -0.65 | | | | 0.17 | | | | 4.51 | | | | | | | | | | | | 4.90 | |

| | | | | | | | | | | | | | |

MSCI All Country World ex-US Index | | | -25.17 | | | | -1.52 | | | | -0.81 | | | | 3.01 | | | | – | | | | -0.13 | | | | 3.16 | | | | -24.73 | | | | -1.68 | | | | -0.60 | | | | 3.27 | | | | – | | | | 0.43 | | | | 3.32 | |

Returns are annualized for periods greater than 1 year. *Inception of the Institutional Class, May 11, 1994. Inception of the Institutional Class Z, July 17, 2017. Inception of the Investor Class, September 30, 2005. Index performance prior to January 1, 2001 cannot be shown since it relies on back-filled data.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Portfolio may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling (877) 435-8105 or visiting hardingloevnerfunds.com.

On a sector basis, only Energy was able to eke out modest gains during the period, as supply shocks from the war produced a meteoric rise in commodities prices. Consumer Discretionary and Information Technology (IT) performed the worst; the former was impacted by slumping consumer confidence in the face of surging prices, while central bank efforts to tame inflation hurt IT’s high-priced growth stocks.

All major regions declined. EMs performed the worst, largely due to Russia and China. The eurozone also performed poorly as the sharp rise in energy prices compounded the difficulties of countries already grappling with mounting inflation.

Style factors played a significant role. The most expensive stocks suffered from the regulatory mauling of many Chinese growth leaders and from a reassessment of discount rates in the face of rising inflation. Shares of the fastest-growing companies significantly underperformed their slowest-growing peers, while the highest-quality stocks failed to offer any protection, slightly underperforming their lowest-quality peers.

Performance Attribution

The Portfolio underperformed as style headwinds sustained throughout the period contributed to a negative stock-selection effect across most regions and sectors.

By sector, poor performers in Energy, Health Care, and Communication Services detracted the most from relative performance. In Energy and Communication Services, returns were dragged down by our Russian holdings: oil and gas company Lukoil and internet-search provider Yandex. As the Russian invasion unfolded, we marked down the value of our Russian holdings to zero on March 7, the point at which these US-and UK-listed shares became untradeable because of Western sanctions and actions taken by stock exchanges and brokers. In Health Care, Sysmex, a leading Japanese provider of hematology equipment and reagents, reported disappointing sales in China following the country’s lockdowns and its “Buy China” policy initiative, which overshadowed positive results for the company’s groundbreaking early-detection blood tests for Alzheimer’s. Strong stocks in Materials, including Australian mining company

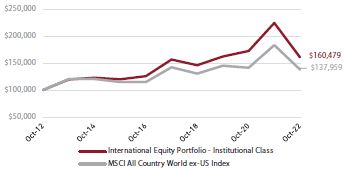

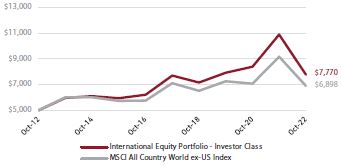

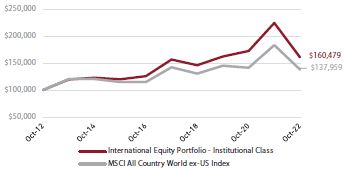

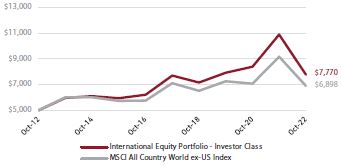

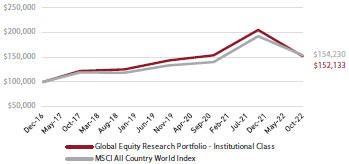

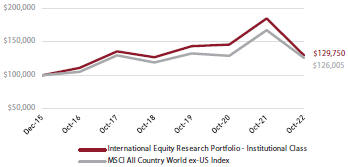

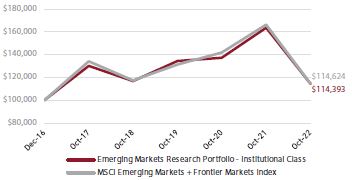

Total Return Based on a $100,000 Investment Institutional Class

Total Return Based on a $10,000,000 Investment Institutional Class Z

Total Return Based on a $5,000 Investment Investor Class

The charts above illustrate the hypothetical return of an investment made in the corresponding share classes. Investment return reflects voluntary fee waivers in effect. Absent such waivers, total return would be reduced. The performance provided in the table and charts above do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

BHP Group, helped our relative performance. Shares of BHP rose alongside the prices of commodities for which Russia is a major producer. It also helped that the Portfolio was underweight the poorly performing Consumer Discretionary sector.

On a regional basis, weak stocks in Japan, Europe—both in the eurozone and outside it—and Emerging Markets (Russia) were the biggest detractors from relative performance. In the eurozone, high-priced IT stocks, such as Dutch payment processor Adyen and French software and technology solutions company Dassault Systèmes, hurt returns, along with cyclically exposed German semiconductor maker Infineon Technologies. Outside the eurozone, Swiss contract drug manufacturer Lonza fell despite strong operating results, as investors became wary of expensive health care stocks. Pacific ex-Japan was a bright spot. Singapore-based bank DBS Group continued to show strong business momentum, supported by the financial strength that it has demonstrated throughout the pandemic. DBS also benefited from Singapore’s central bank tightening monetary conditions; net interest margins should rise alongside interest rates.

Perspective and Outlook

Within the span of a few months in the summer and fall of 2022, markets lurched from a consensus that the fight against inflation would soon be won toward a despairing view that slaying inflation would require sustained punishment by high interest rates. As practiced observers of both markets and policymakers, we have not put much belief in either narrative or tried to predict which outcome will ultimately drive the markets. Instead, we intensified our efforts to reaffirm the long-term prospects of the companies we own and those qualified for purchase by our analysts. We aim to build a portfolio of companies that is resilient to many different economic environments, knowing that we can’t predict which environment they will face tomorrow.

The global economy has been dramatically affected by Russia’s invasion of Ukraine and the still-unfolding energy crisis in Europe. Looking ahead, the risk that Taiwan could be the epicenter of a conflict between the US and China is one that we must push higher up the list of risks that our portfolio must be built to withstand. We have long viewed this risk as both low and distant; it is no longer distant. Nevertheless, we don’t pretend to be experts in US-China relations or try to forecast geopolitical events. Our strict adherence to our portfolio guidelines, including the requirement of ample geographic diversification, is one way we protect against the most catastrophic consequences.

Beyond geopolitical risks, the threat of inflation remains at the fore. Analyzing businesses’ resilience to persistent inflation is an area where we think we have a small leg up because many of our analysts have covered companies in developing countries where inflation has been an enduring concern. Moreover, for the last 15 years, our fair value estimates have explicitly incorporated inflation assumptions for every company we cover.

Yet another factor we must consider is an environment of positive real rates, which is exposing vulnerabilities built up over decades of easy money. The most concerning thus far have been the weaknesses hidden in some UK pension plans, whose structures were predicated on well-behaved interest rates. Their struggle to meet margin calls was the catalyst for the “whatever scale necessary” intervention by the Bank or England in its domestic bond market in September. Though similar vulnerabilities likely exist elsewhere, our longstanding preference for transparency and insistence on financial strength at the companies we hold is designed to keep our portfolios relatively sheltered from this kind of distress.

Portfolio Highlights

While heightened risk aversion fed by the war in Ukraine, dramatic currency movements, and interest rate hikes has roiled stock markets, we see far more underlying business resiliency than what is reflected in share prices. We continue to add to our investments in Japan, where many companies with global revenues benefit from the yen’s weakness. Recent additions have brought us close to the benchmark weight.

| | | | | | | | |

| Portfolio Positioning (% Weight) at October 31, 2022 | |

| | |

| Sector | | Portfolio | | | Benchmark1 | |

| | |

Comm Services | | | 2.7 | | | | 5.7 | |

| | |

Cons Discretionary | | | 4.5 | | | | 10.7 | |

| | |

Cons Staples | | | 12.2 | | | | 9.1 | |

| | |

Energy | | | 2.8 | | | | 6.6 | |

| | |

Financials | | | 21.2 | | | | 20.9 | |

| | |

Health Care | | | 13.4 | | | | 10.0 | |

| | |

Industrials | | | 15.4 | | | | 12.5 | |

| | |

Info Technology | | | 13.7 | | | | 10.9 | |

| | |

Materials | | | 9.5 | | | | 8.1 | |

| | |

Real Estate | | | 0.0 | | | | 2.2 | |

| | |

Utilities | | | 1.1 | | | | 3.3 | |

| | |

Cash | | | 3.5 | | | | – | |

| | |

| Geography | | Portfolio | | | Benchmark1 | |

| | |

Canada | | | 4.3 | | | | 8.5 | |

| | |

Emerging Markets | | | 22.3 | | | | 27.5 | |

| | |

Europe EMU | | | 20.8 | | | | 20.3 | |

| | |

Europe ex-EMU | | | 25.0 | | | | 21.2 | |

| | |

Frontier Markets2 | | | 0.0 | | | | – | |

| | |

Japan | | | 13.5 | | | | 14.1 | |

| | |

Middle East | | | 0.0 | | | | 0.6 | |

| | |

Pacific ex-Japan | | | 9.1 | | | | 7.8 | |

| | |

Other3 | | | 1.5 | | | | – | |

| | |

Cash | | | 3.5 | | | | – | |

1MSCI All Country World ex-US Index; 2Includes countries with less-developed markets outside the Index. 3Includes companies classified in countries outside the Index.

Overall, a weak yen is likely to be a modest net positive for our Japanese companies’ earnings by boosting their global competitiveness. These companies typically have leading global positions in their industries and generate much of their revenue outside their domestic market; in the short run, this results in a large translation gain for their yen-denominated earnings. Offsetting higher foreign revenues are rising imported costs for inputs such as energy and other raw materials along with semiconductors. Producer prices in Japan, which are heavily reliant on imported inputs, have risen more sharply on a year-over-year basis than Japanese consumer prices. In contrast, Japanese labor costs have risen only modestly over the year, and in foreign-currency terms they have fallen sharply, potentially giving our Japanese companies an enduring edge over their global competitors if they can, through cultural affinity, continue to retain talent without ballooning costs.

Our four Japanese Industrials holdings generate on average more than two-thirds of their sales outside of Japan and, based on latest estimates, appear to be on track to deliver positive 2022 earnings growth. Our biggest concern for these companies is that weaker global growth may erode the demand for capital goods.

Our most recent Japanese investment, Shimano, the world’s leading manufacturer of bicycle components with roughly a 70% global share of the high-end drivetrain and braking system market, has an even higher share of foreign sales, almost 90%. More than half of its sales come from Europe and North America, where customers pay a premium for its products. Sales are receiving a boost from the growing market for electric bikes, where Shimano components also dominate the top end. Yen weakness has provided an additional fillip, resulting in year-over-year sales and profit growth of 15% and 22%, respectively, in the first half of this year. The weaker exchange rate is making Shimano and the four industrial companies much more potent in competing against European and US manufacturers, so long as they can contain their domestic costs.

Japanese drugmakers Chugai Pharmaceutical and Shionogi are also enjoying an earnings boost from the weaker yen, as they generate on average a majority of their sales abroad, mainly in the form of royalties. Hematology testing systems maker Sysmex anticipates growth in 2023, helped by a large share of foreign revenues (84%) despite Chinese volumes being suppressed by that country’s lingering lockdowns. Despite producing 69% of its sales abroad, cosmetics maker Shiseido has not been so lucky due to its high direct exposure to the Chinese market (a third of revenues) and indirect exposure through domestic sales to Chinese tourists. To the extent that China’s consumer slowdown is a consequence of the lockdowns, and assuming travel restrictions eventually lift, we expect Shiseido’s revenues to recover in time.

NITORI, a furniture and home-accessories retailer, is our only Japanese holding where yen weakness is an unmitigated negative given that the company sells goods to domestic consumers that it primarily makes in China or Vietnam. The cost in yen to produce its merchandise is therefore rising, pressuring

| | | | | | | | |

| Ten Largest Holdings by Weight at October 31, 2022 | | | | |

| | | |

| Company | | Sector | | Market | | % | |

| | | |

DBS Group | | Financials | | Singapore | | | 3.5 | |

| | | |

Samsung Electronics | | Info Technology | | South Korea | | | 3.4 | |

| | | |

Roche | | Health Care | | Switzerland | | | 3.4 | |

| | | |

Atlas Copco | | Industrials | | Sweden | | | 3.3 | |

| | | |

L’Oréal | | Cons Staples | | France | | | 3.3 | |

| | | |

Schneider Electric | | Industrials | | France | | | 2.8 | |

| | | |

SE Banken | | Financials | | Sweden | | | 2.6 | |

| | | |

ICICI Bank | | Financials | | India | | | 2.6 | |

| | | |

BHP | | Materials | | Australia | | | 2.6 | |

| | | |

AIA Group | | Financials | | Hong Kong | | | 2.5 | |

Nitori’s margins. In the first half of 2022, Nitori held the line on retail prices while investing in ways to cut its operating costs, which at least has been easier than for peers given its vertical integration across manufacturing, distribution, and online and brick-and-mortar points of sale. Recently, management indicated it will hike prices on selected products by as much as 20%, having seen competitors do the same and noting Japanese shoppers’ reluctant acceptance of increases across consumer categories.

As interest rates rise globally, we have become more optimistic about the Financials sector; incremental purchases and relative performance over the period increased our holdings by more than a third so that we now hold the index weight in banks and remain overweight insurance. Banks and life insurance companies are among businesses that should benefit most from higher interest rates. Rising rates tend to increase net interest margins for banks, and they augment the returns from new fixed income investments for life insurance companies while reducing the capital they need to set aside today to meet future claims. The Financials sector has performed relatively well during the period—notwithstanding the potential for loan losses a global recession might inflict on banks—outperforming all other sectors except Energy and Utilities.

But, while higher interest rates are positive for business, extreme volatility in bond markets is not, given banks’ and insurers’ roles as counterparties to complex derivative contracts and holders of collateral against leveraged positions of more prosaic instruments. In balancing sentiment in the short term, fear of as yet unseen exposures can outweigh the greed of longer-term benefits of higher yields. The insurance sector fell victim recently to extreme volatility in the gilts market. While shares of our own insurance holdings such as AIA Group, Ping An Insurance, and Allianz likely have been dented by negative marks in their investment portfolios, we view this and their pandemic-related disruptions (in the case of AIA Group and Ping An Insurance) and regulatory compliance lapses (Allianz) to be transitory. We value their low leverage and the low sensitivity of their product sales to the economic cycle.

Please read the separate disclosures page for important information, including the risks of investing in the Portfolio.

International Small Companies Portfolio

Institutional Investors: HLMRX | Individual Investors: HLMSX

Portfolio Management Team

Jafar Rizvi, CFA

Co-Lead Portfolio Manager

Anix Vyas, CFA

Co-Lead Portfolio Manager

Performance Summary

For the International Small Companies Portfolio, the Institutional Class declined 31.20% and the Investor Class declined 31.39% (net of fees and expenses) in the twelve-month period ended October 31, 2022. The Portfolio’s benchmark, the MSCI All Country World ex-US Small Cap Index, declined 27.75% (net of source taxes).

What Happened

International small capitalization stocks fell sharply in the period amid aggressive central bank rate hikes intended to cool inflation, commodity supply shocks emanating from the war in Ukraine, and overall weakness in China.

The period began with consumer prices in the US climbing at the fastest pace since 1982, leading the US Federal Reserve (Fed) to signal several interest rate increases and an imminent end to its bond-buying program. So far, the Fed has hiked interest rates six times, taking rates from between 0% and 0.25% at the start of the period to between 3.75% and 4% by November 2. Other central bankers across developed and emerging markets continued to raise their own borrowing rates, with Bank of Japan the notable exception as it remained committed to an ultra-accommodative monetary policy.

Russia’s invasion of Ukraine in the closing days of February prompted a swift and emphatic response by Western governments, which nevertheless sought to strike a balance between punishing Russian aggression and avoiding an escalating military conflict. The US and its allies enacted crippling economic sanctions, including freezing a significant

| | | | |

|

| Fund Facts at October 31, 2022 |

| | |

Total Net Assets | | $488.0M | | |

| | |

Sales Charge | | None | | |

| | |

Number of Holdings | | 86 | | |

| | |

Turnover (5 Yr. Avg.) | | 31% | | |

| | |

Dividend Policy | | Annual | | |

| | | | |

| | |

| | | Institutional Investors | | Individual Investors |

| | |

| | | Institutional Class | | Investor Class |

| | |

Ticker | | HLMRX | | HLMSX |

| | |

CUSIP | | 412295875 | | 412295883 |

| | |

Inception Date | | 6/30/2011 | | 3/26/2007 |

| | |

Minimum Investment1 | | $100,000 | | $5,000 |

| | |

Net Expense Ratio2 | | 1.12%3 | | 1.30%4 |

| | |

Gross Expense Ratio2 | | 1.12% | | 1.46% |

1Lower minimums available through certain brokerage firms; 2The Gross and Net Expense Ratios are as of the most recent Prospectus and have been restated to reflect current fees; 3Harding Loevner’s contractual agreement caps the net expense ratio at 1.15% through February 28, 2023. The expense ratio (without cap) is applicable to investors; 4The Net Expense Ratio is shown net of Harding Loevner’s contractual agreement through February 28, 2024. Harding Loevner’s contractual agreement caps the net expense ratio at 1.30%. The Net Expense Ratio is applicable to investors.

share of Russian central bank reserve assets, cutting off many of the country’s banks from SWIFT (Society for Worldwide Interbank Financial Telecommunications), and outlawing the export of a variety of industrial and luxury goods to Russia. The revulsion over Russia’s actions also provoked an exodus of Western companies from Russian markets. With foreign investors effectively unable to trade, major market index providers expunged all Russian securities from their indexes.

The war’s contribution to inflation was twofold. In September, Russia retaliated against European sanctions by cutting off the flow of natural gas to the continent, sending energy prices soaring as countries scrambled to find other sources. In emerging markets (EMs), the pressures were largely felt in ballooning food prices. Prior to the war, Ukraine was one of the world’s largest suppliers of grains and vegetable oils, and EM countries have been hard-pressed to find alternatives.

China grappled with its own set of challenges. The government’s sweeping lockdown measures in response to waves of COVID-19 cases in major Chinese cities hurt businesses in various industries and caused investors to lose their appetite for Chinese stocks. In the Real Estate sector, regulators’ efforts to prick the country’s residential real estate bubble caused severe strain, as even less-leveraged developers faced resistance to rolling over their debt or issuing new bonds. In Health Care, shares of Chinese biological pharmaceutical companies came under pressure after US President Joe Biden issued an executive order

Performance (% Total Return)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| | | For periods ended September 30, 2022 | | | For periods ended October 31, 2022 | |

| | | | | | | | | | |

| | | 1 Year | | | 3 Years | | | 5

Years | | | 10 Years | | | Since Inception* Jun-11 Mar-07 | | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | | | Since Inception* Jun-11 Mar-07 | |

| | | | | | | | | | | | |

Intl. Small Companies Portfolio – Inst. Class | | | -31.40 | | | | 0.29 | | | | 0.15 | | | | 5.46 | | | | 4.32 | | | | | | | | -31.20 | | | | 0.36 | | | | 0.67 | | | | 5.88 | | | | 4.61 | | | | | |

| | | | | | | | | | | | |

Intl. Small Companies Portfolio – Investor Class | | | -31.58 | | | | 0.03 | | | | -0.10 | | | | 5.20 | | | | | | | | 4.51 | | | | -31.39 | | | | 0.11 | | | | 0.41 | | | | 5.62 | | | | | | | | 4.71 | |

| | | | | | | | | | | | |

MSCI All Country World ex-US Small Cap Index | | | -28.93 | | | | 0.38 | | | | -0.56 | | | | 4.44 | | | | 3.04 | | | | – | | | | -27.75 | | | | 0.13 | | | | -0.29 | | | | 4.77 | | | | 3.30 | | | | – | |

Returns are annualized for periods greater than 1 year. *Inception of the Institutional Class, June 30, 2011. Inception of the Investor Class, March 26, 2007. Index performance prior to June 1, 2007 cannot be shown since it relies on back-filled data.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Portfolio may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling (877) 435-8105 or visiting hardingloevnerfunds.com.

advancing a “secure American bioeconomy,” fueling fears that these businesses may get shut out from the lucrative US market.

Energy was the only positive sector during the period, soaring over 20% as supply shocks from the war produced a meteoric rise in commodities prices. Health Care, Communication Services, Information Technology (IT), Consumer Discretionary, and Real Estate all declined by more than 30%. Consumer Discretionary stocks were impacted by slumping consumer confidence in the face of surging prices, while central bank efforts to tame inflation hurt fast-growing stocks that comprise the IT sector.

All major regions declined. Europe (both inside and outside the eurozone) performed the worst as the sharp rise in energy prices compounded the difficulties of countries already grappling with mounting inflation. EMs also performed poorly, largely due to Russia and China.

Style factors played a significant role. Shares of the fastest-growing and highest-quality companies significantly underperformed their slowest-growing and lowest-quality peers. By value, the cheapest stocks were favored, outperforming the most expensive by more than 1,700 basis points.

How We Did

The Portfolio’s concentration of richly valued, fast-growing, and high-quality companies, a hazard of our investment philosophy, hurt relative performance in a period during which investors fled these stocks. The Portfolio’s emphasis on companies in the highest-quality cohort accounted for approximately 45% of our underperformance in the period. Many of these high-quality companies also happened to be among the most expensive, which provided a dual headwind given value’s outperformance. Examples include Bechtle, a Germany-based provider of IT services and related hardware and Dechra, a UK-based manufacturer of animal pharmaceuticals. Bechtle detracted as higher wages, as well as increases in travel and energy costs, impacted margins and offset good revenue growth. Dechra declined in the face of cost inflation and increased competition from generics. The company also completed two acquisitions that will be dilutive to earnings this year and next. However, the drug pipelines in both deals look promising for Dechra’s growth

outlook, which is underpinned by rising demand in the US for pet medicines.

By sector, poor performers in Materials and Industrials detracted the most from relative returns. In Materials, Vietnamese steel producer Hoa Phat Group fell as troubles in Vietnam’s real estate market reduced demand for steel; meanwhile, the price of coking coal (which accounts for a sizable percentage of steel production costs) has risen sharply since Russia’s invasion of Ukraine. In Industrials, shares of Switzerland-based industrial-components supplier Bossard

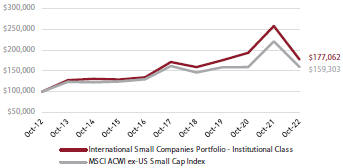

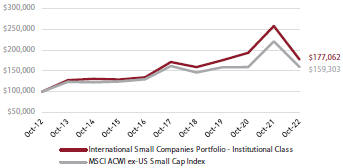

Total Return Based on a $100,000 Investment Institutional Class

Total Return Based on a $5,000 Investment Investor Class

The charts above illustrate the hypothetical return of an investment made in the corresponding share classes. Investment return reflects voluntary fee waivers in effect. Absent such waivers, total return would be reduced. The performance provided in the table and charts above do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

fell despite continued strong demand for its fasteners, as investors grew wary of the company’s exposure to the weakening European economy. Strong stocks in Communication Services helped, particularly Swedish video game maker Paradox Interactive. Paradox announced record profits in both the first and second quarters, helped by weakness in the Swedish krona (much of the company’s revenue is in US dollars) and a management reshuffle that’s led to a renewed focus on Paradox’s core gaming franchises.

On a regional basis, weak stocks in Japan and the Portfolio’s off-benchmark exposure to Frontier Markets (Vietnam) detracted. Our worst performer in Japan was Infomart, the dominant business-to-business online-ordering platform for the country’s restaurant industry. Inflation and the lingering impact of the pandemic on restaurants have put a damper on some of the business’s near-term growth. Over the long term, we expect Infomart’s online-invoicing technology to benefit from regulations intended to promote greater adoption of online and digital services to combat Japan’s persistent labor shortages. Strong stocks in Europe outside the eurozone and in Emerging Markets were positive contributors. UK-listed but Georgia-based Bank of Georgia has prospered not just despite, but also because of its proximity to the Ukrainian conflict, as businesses and workers fleeing nearby Russia have led to more money flowing through Georgia’s economy, including into restaurants and real estate. Brazilian rental-car business Localiza reported strong quarterly results throughout 2022, including strong profit and margin growth, as supply-chain challenges eased and allowed the company to obtain new vehicles. Localiza also finalized its merger with Unidas in July.

What’s On Our Minds

Our exposure to Europe warrants a closer look. Although the Portfolio remains diversified across 10 countries and many sectors, compared with the index it has a strikingly high presence in Germany and seemingly the UK. The notional overweight to the UK is deceptive, as it includes four London-listed companies—roughly 5% of portfolio weight—that don’t generate meaningful sales or profits in the country: telecommunications carrier Airtel Africa, Lithuania-based Baltic Classifieds, the aforementioned Bank of Georgia, and payments company Network International, which generates most of its revenue in the Middle East and Africa.

That said, we haven’t neglected the UK itself. During the third quarter, we added Grafton, the parent of the Woodie’s chain of retail home improvement stores and construction materials distributors such as Selco and Chadwicks. In a competitive market the company’s edge comes from its knowledgeable staff and large product selection. In recent years, it has expanded into Finland, Ireland, and the Netherlands, and could stand to benefit from the weaker pound. As a skilled capital allocator armed with a net-cash balance sheet in a deteriorating economy, Grafton may successfully unearth more businesses ripe for acquisition.

The Grafton purchase illustrates that we invest in companies, not countries, and that our investment process is based upon bottom-up business forecasts rather than macroeconomic forecasts. Focusing on businesses that are growing on the back of durable competitive advantages, well led by properly incentivized management teams, financially strong, and reasonably valued has helped us generate excess returns through past economic cycles.

That last criterion—valuation—caused us to reduce some holdings in favor of more attractively priced alternatives. As investors’ fears of a collapse in the UK housing market weigh on Rightmove, the country’s dominant online real estate platform, we decided to reduce this holding to make room for Rightmove’s Lithuanian counterpart, Baltic Classifieds, which was the cheapest stock in the online-classifieds industry despite posting the fastest growth and facing low competitive threats. We also added to Cranswick, a UK chicken and pork processor, following a tour of its new processing facility. Cranswick’s focus on both low-cost and premium cuts is advantageous in a period of economic uncertainty.

Portfolio Positioning (% Weight) at October 31, 2022

| | | | | | | | |

| | |

| Sector | | Portfolio | | | Benchmark1 | |

| | |

Comm Services | | | 12.0 | | | | 3.6 | |

| | |

Cons Discretionary | | | 4.3 | | | | 11.5 | |

| | |

Cons Staples | | | 8.4 | | | | 6.2 | |

| | |

Energy | | | 1.9 | | | | 4.5 | |

| | |

Financials | | | 7.9 | | | | 11.4 | |

| | |

Health Care | | | 12.1 | | | | 7.0 | |

| | |

Industrials | | | 17.3 | | | | 19.9 | |

| | |

Info Technology | | | 22.6 | | | | 10.6 | |

| | |

Materials | | | 6.7 | | | | 11.7 | |

| | |

Real Estate | | | 0.6 | | | | 9.9 | |

| | |

Utilities | | | 2.2 | | | | 3.7 | |

| | |

Cash | | | 4.0 | | | | – | |

| | |

| Geography | | Portfolio | | | Benchmark1 | |

| | |

Canada | | | 2.0 | | | | 8.0 | |

| | |

Emerging Markets | | | 23.1 | | | | 26.2 | |

| | |

Europe EMU | | | 18.6 | | | | 13.0 | |

| | |

Europe ex-EMU | | | 30.7 | | | | 19.6 | |

| | |

Frontier Markets2 | | | 5.1 | | | | – | |

| | |

Japan | | | 11.9 | | | | 20.5 | |

| | |

Middle East | | | 2.2 | | | | 2.1 | |

| | |

Pacific ex-Japan | | | 0.3 | | | | 10.6 | |

| | |

Other3 | | | 2.1 | | | | – | |

| | |

Cash | | | 4.0 | | | | – | |

1MSCI All Country World ex-US Small Cap Index; 2Includes countries with less-developed markets outside the Index; 3Includes companies classified in countries outside the Index.

Ten Largest Holdings by Weight at October 31, 2022

| | | | | | |

| | | |

| Company | | Sector | | Market | | % |

| | | |

Cyberark | | Info Technology | | Israel | | 2.2 |

| | | |

Reply | | Info Technology | | Italy | | 2.2 |

| | | |

Rubis | | Utilities | | France | | 2.2 |

| | | |

Abcam | | Health Care | | United Kingdom | | 2.2 |

| | | |

Senior | | Industrials | | United Kingdom | | 2.1 |

| | | |

Bank of Georgia | | Financials | | United Kingdom | | 2.1 |

| | | |

Kinaxis | | Info Technology | | Canada | | 2.0 |

| | | |

Alten | | Info Technology | | France | | 2.0 |

| | | |

Keywords Studios | | Info Technology | | United Kingdom | | 2.0 |

| | | |

Sarana Menara Nusantara | | Comm Services | | Indonesia | | 2.0 |

In Germany, a crucible in the European energy crisis, none of our holdings directly faces natural gas supply risks. Pressure can be felt in electricity costs, but generally these are a small component of overall costs. One company that warrants our watching closely is Fuchs Petrolub, the world’s top producer of lubricants, used to grease everything from vehicle steering wheels and transmission systems to wind turbines. Lubricants are made from base oils, a byproduct of the oil-refining process. Should Fuchs’s German suppliers experience production cuts that force it to tap the global market for raw materials, it would suffer higher costs and perhaps lower margins. So far, though, Fuchs has exhibited tremendous pricing power in an inflationary environment. Looking further ahead, Fuchs is poised to benefit from the growing interest in wind energy and the shift to electric vehicles, which require specialized greases.

We have continued to be net buyers in Germany, most recently adding Evotec, shares of which had gotten cheaper relative to historical levels. Evotec is a contract research company focused on discovering new drug candidates for its clients. The company provides a differentiated offering through its extensive experience with pluripotent stem cells (which can self-renew and develop into other cells in the body), genomics (the study of genes), and proteomics (the systematic study of proteins). Evotec also utilizes its platforms to discover its own drug candidates and then partners with biopharmaceutical companies at the point of clinical trial. Revenue increased 24% in the first half of 2022, and the factors currently hurting its stock price—a global pullback in biotech funding and Europe’s energy crisis—appear to be temporary.

Please read the separate disclosures page for important information, including the risks of investing in the Portfolio.

Emerging Markets Portfolio

Institutional Investors: HLMEX and HLEZX | Individual Investors: HLEMX

Portfolio Management Team

Pradipta Chakrabortty

Co-Lead Portfolio Manager

Scott Crawshaw

Co-Lead Portfolio Manager

Richard Schmidt, CFA

Portfolio Manager

Performance Summary

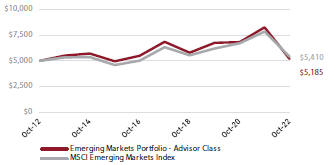

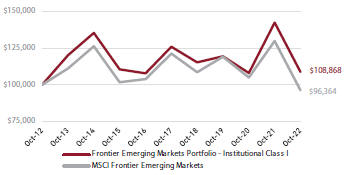

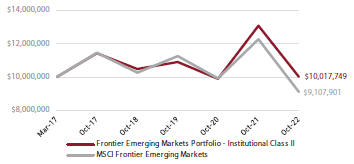

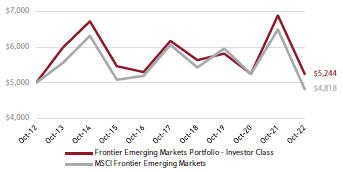

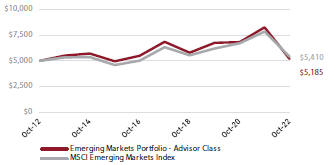

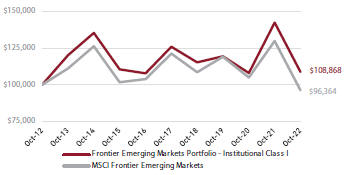

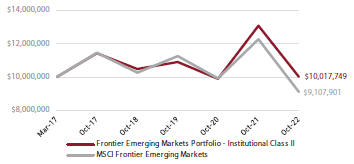

The Institutional Emerging Markets Portfolio (Institutional Class and Institutional Class Z) and the Emerging Markets Portfolio (Advisor Class)—collectively, the “Portfolios”—are both managed in strict accordance with Harding Loevner’s Emerging Markets Equity strategy model portfolio. Therefore, the Portfolios have highly similar holdings and characteristics. We have provided a single commentary to cover both Portfolios. The specific performance and characteristics of each are presented separately in the tables that follow.

For the Institutional Emerging Markets Portfolio, the Institutional Class fell 37.14%, and Institutional Class Z fell 37.07% (net of fees and expenses) for the fiscal year ended October 31, 2022. In the same time period, the Emerging Markets Portfolio Advisor Class declined 37.18% (net of fees and expenses). The Portfolios’ benchmark, the MSCI Emerging Markets Index, fell 31.03% (net of source taxes).

Market Review

Emerging markets (EMs) were burdened by a series of adverse macroeconomic and geopolitical events this fiscal year. The period began with heightened concerns over inflation and a slowdown in China’s economic growth, and fears of a global recession intensified over the course of the 12 months. In February came Russia’s appalling attack on Ukraine, which led the US and its allies to enact severe sanctions against Russia and caused spikes in energy and commodities prices. The US Federal Reserve’s hawkish monetary policy to combat inflation—including four 75-basis-point interest rate hikes from June to November—stoked a surge in the value of the US dollar.

| | | | | | |

|

| Fund Facts at October 31, 2022 |

| | | |

Sales Charge | | None | | | | |

| | | |

Number of Holdings | | 78 | | | | |

| | | |

Dividend Policy | | Annual | | | | |

| | | | | | |

| | |

| | | Institutional Investors | | Individual Investors |

| | | |

Total Net Assets | | $2,664.4M | | | | $1,397.8M |

| | | |

Turnover (5 Yr. Avg.) | | 20% | | | | 22% |

| | | |

| | | Inst. Class | | Inst. Class Z | | Advisor Class |

| | | |

Ticker | | HLMEX | | HLEZX | | HLEMX |

| | | |

CUSIP | | 412295701 | | 412295693 | | 412295305 |

| | | |

Inception Date | | 10/17/2005 | | 3/5/2014 | | 11/9/1998 |

| | | |

Minimum Investment | | $500,0001 | | $10,000,000 | | $5,0001 |

| | | |

Net Expense Ratio2 | | 1.10%3 | | 1.00%4 | | 1.19%5 |

| | | |

Gross Expense Ratio2 | | 1.10% | | 1.01% | | 1.19% |

1Lower minimums available through certain brokerage firms; 2The Gross and Net Expense Ratios are as of the most recent Prospectus and have been restated to reflect current fees; 3Harding Loevner’s contractual agreement caps the net expense ratio at 1.10% through February 28, 2023. The expense ratio (without cap) is applicable to investors; 4The Net Expense Ratio is shown net of Harding Loevner’s contractual agreement through February 28, 2023. Harding Loevner’s contractual agreement caps the net expense ratio at 1.00%. The Net Expense Ratio is applicable to investors; 5Harding Loevner’s contractual agreement caps the net expense ratio at 1.30% through February 28, 2023. The expense ratio (without cap) is applicable to investors.

While the strength of the dollar weighed on dollar-denominated EM returns, the currencies of many developing countries held up better against the greenback than those of developed countries. In Latin America, central banks, including Brazil’s, were ahead of the Fed in lifting rates, bringing these nations closer to the peaks of their tightening cycles. By contrast, Asian countries, including India and Indonesia, resisted pressure to match the Fed’s hikes. China’s monetary policy remained loose, in keeping with the government’s imperative to stimulate a slowing economy.

Markets in the Middle East and Latin America were among the strongest, buoyed in part by the rising (albeit volatile) price of oil. Brazil was boosted by returns from energy giant Petrobras along with an uptick in consumer spending and a recovery in the job market. Signs that the country’s inflation had crested also provided a lift to growth stocks.