UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07739

Harding, Loevner Funds, Inc.

(Exact name of registrant as specified in charter)

400 Crossing Boulevard

Fourth Floor

Bridgewater, NJ 08807

(Address of principal executive offices) (Zip code)

Marcia Y. Lucas

The Northern Trust Company

333 South Wabash Avenue

Chicago, IL 60604

With a copy to:

Stephen H. Bier, Esq.

Dechert LLP

1095 Avenue of the Americas

New York, NY 10036

(Name and address of agent for service)

Registrant’s telephone number, including area code: (877) 435-8105

Date of fiscal year end: 10/31

Date of reporting period: 10/31/2021

Item 1. Reports to Stockholders.

| (a) | The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1) |

| | | | |

| Global Equity Portfolio | | Institutional Emerging Markets Portfolio | | Global Equity Research Portfolio |

| | |

| International Equity Portfolio | | Emerging Markets Portfolio | | International Equity Research Portfolio |

| | |

| International Small Companies Portfolio | | Frontier Emerging Markets Portfolio | | Emerging Markets Research Portfolio |

| | |

| Chinese Equity Portfolio | | | | |

Harding Loevner Funds

Global equity investing is Harding Loevner’s exclusive focus. Through Harding Loevner Funds it offers distinct global strategies based on its quality-and-growth investment philosophy. It seeks to purchase shares of growing, financially strong, well-managed companies at favorable prices. Harding Loevner manages each of the Funds’ Portfolios according to a disciplined, research-based investment process. It identifies companies with sustainable competitive advantages and assesses the durability of their earnings growth by conducting in-depth fundamental research into global industries. In constructing portfolios, Harding Loevner diversifies carefully to limit risk.

Receive Investor Materials Electronically

Shareholders may sign up for electronic delivery of investor materials. By doing so, you will receive the information faster and help us reduce the impact on the environment of providing these materials. To enroll in electronic delivery,

| | 1. | Go to http://www.icsdelivery.com |

| | 2. | Select the first letter of your brokerage firm’s name. |

| | 3. | From the list that follows, select your brokerage firm. If your brokerage firm is not listed, electronic delivery may not be available. Please contact your brokerage firm. |

| | 4. | Complete the information requested, including the e-mail address where you would like to receive notifications for electronic documents. |

Your information will be kept confidential and will not be used for any purpose other than electronic delivery. If you change your mind, you can cancel electronic delivery at any time and revert to physical delivery of your materials. Just go to http://www.icsdelivery.com, perform the first three steps above, and follow the instructions for cancelling electronic delivery. If you have any questions, please contact your brokerage firm.

Table of Contents

Contact

| | | | | | |

| Harding, Loevner Funds, Inc. | | | | | | |

| c/o Northern Trust | | | | | | |

| Attn: Funds Center, Floor 38 | | | | | | |

| 333 South Wabash Avenue | | | | | | |

| Chicago, IL 60604 | | | | | | |

| | | |

| Phone: (877) 435-8105 | | | | | | |

| Fax: (312) 267-3657 | | | | | | Must be preceded or accompanied by a current Prospectus. |

| www.hardingloevnerfunds.com | | | | | | Quasar Distributors, LLC, Distributor |

Letter To Our Shareholders

October 31, 2021

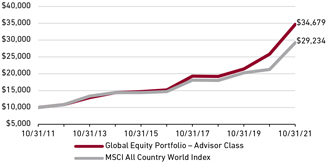

David Loevner, CFA, CIC

Chairman of the Funds

and Chief Executive Officer of the Adviser

Ferrill Roll, CFA

Chief Investment Officer of the Adviser

Simon Hallett, CFA

Vice Chairman of the Adviser

The fiscal year just ended began with two market-moving events that continue to reverberate: one, the approval of the first COVID-19 vaccine, delivered a positive shock. It launched an immediate resurgence in the stocks of more cyclical, more leveraged, and slower-growing companies whose beaten-down share prices had fallen far behind those of rapidly growing, high-quality companies since the onset of the pandemic, but whose prospects now brightened. We wrote in our letter to you a year ago of our skepticism concerning the much-ballyhooed demise of value investing but could not have anticipated how quickly the tables would turn. The renewed attention to cheaper stocks of companies with murky growth prospects has been a headwind for our investment strategies for much of these last twelve months, with returns of the respective “value” indexes significantly outpacing those of the corresponding “growth” indexes. We have delivered a mixed set of results relative to the strong returns of the broad market benchmarks in the year. But, given the headwinds for our growth-oriented investment style, turning in results close to those of the benchmarks, let alone modest outperformance, is a welcome relief.

The other event was a negative shock to markets: the eleventh-hour quashing by China’s regulators of the huge initial public offering of Ant Financial, the fintech affiliate of e-commerce giant Alibaba. Though not apparent at the time, the scuppering of Ant’s IPO turned out to be the first of a succession of jump scares in the shape of unexpected Chinese governmental interventions that progressively soured sentiment toward Chinese stocks. The regulatory assault on the for-profit tutoring industry vaporized the equity value of an entire industry in the summer. Anti-trust sanctions, data security requirements, and tighter restrictions on online gaming by minors came hard and fast in the following months, hitting the shares of many of China’s previous market darlings in e-commerce, ridesharing, online games, and social media.

The property sector has played an outsized role in China’s economy for many years, as a key driver of capital spending and employment growth and as a major store of wealth, accounting for 70% to 80% of household wealth according to Moody’s. (Even in the home-ownership-obsessed US, the comparable figure is only 50%.) The government’s efforts to de-emphasize fixed asset investment as the main source of economic growth, including shrinking its bloated property sector, may yet deliver the biggest horror scene of all. A tightening of financial regulations in December 2020 finally caught up with Chinese property developers. China Evergrande, the country’s second-largest developer by sales and a poster child for excessive leverage, was left scrambling to meet its obligations by the end of September (and ultimately defaulted), with the effects rippling out to building supply chains, the financial and industrial sectors, and retail spending.

Naturally, such perturbing of the economy and consequent roiling of the Chinese stock and credit markets brought out a mix of opinions in the investor community, from cries of Communist Party treachery to post hoc social justifications for the swingeing actions taken by government actors. As those who know our investment culture would expect, our colleagues offered their own wide range of opinion and analysis. Our embrace of dissent is displayed in a panel discussion among six colleagues in August, as well as in the Third Quarter 2021 investment reports for eight of our strategies.

We have resisted any temptation to follow those critics who have advised turning away from China as an investment destination. We made our view of the long-term opportunity clear by launching the Chinese Equity Portfolio, our first single-country fund, last year; the events of this year have, if anything, reinforced our view that some investors will want the means to regulate their exposure to the opportunities and risks in the largest emerging market independently.

The irony is that amid the disquieting regulatory changes we are finding more high-quality businesses in China that meet our investment criteria now than at any point in our firm’s history. Descriptions of such companies are sprinkled throughout the commentaries collected in this report. What the turmoil has done is renewed our analysts’ investigation of the forces—including regulatory forces—shaping the competitive industry structures for the Chinese companies we research and own. We’ve spent time trying to grasp the long-term goals behind the regulatory interventions and concluded that a number of these goals—reducing wealth disparities, promoting healthier lifestyles, curbing the lopsided economic power for the very largest and most disruptive companies in China that might challenge the political power centers and social norms—would not, on their face, be out of place in the US or other developed markets. In short, we view the parsing of issues and risks for Chinese companies as problems of analysis that are common to varying degrees to all companies. Many businesses

worldwide are subject to regulatory fiat in one form or another and thus exposed to shifts in the regulatory winds; we believe that our fundamental process acquits itself well in discriminating between degrees of risk. Whether intentional or not, Chinese regulators have certainly succeeded in blowing the froth off the top of the Chinese stock market. We believe the more risk-aware environment in China should reward our sustained quest to identify companies with resilient businesses and strong growth prospects.

With widening access to vaccines and new drug treatments fostering a return to more normal economic activity in many countries, and the spread between the prices of the most- and

least-expensive quintiles of stocks diminishing in most markets, there are indications that indifference to price and risk may be losing its fizz globally as well. Assuming the style headwinds eventually settle down, this more grounded approach to assessing value should advantage our focus on the business fundamentals enabling companies’ long-term growth. Still, with the challenge of nascent inflation and the potential for central banks acting to counter it, not to mention the pandemic’s undiminished ability to deliver unpleasant surprises, we look ahead to the coming year with a cautious eye.

As always, we thank you for your trust in us.

| | | | |

| Sincerely, | | | | |

| | |

| |  | |  |

| | |

| David R. Loevner, CFA, CIC | | Ferrill D. Roll, CFA | | Simon Hallett, CFA |

Opinions expressed are those of Harding Loevner and are not intended to be forecasts of future events, a guarantee of future results, nor investment advice. Please read the separate disclosure page for important information, including the risks of investing in the Portfolios. Past performance is not a guarantee of future results.

Global Equity Portfolio

Institutional Investors: HLMVX & HLGZX | Individual Investors: HLMGX

Portfolio Management Team

| | |

| | Peter Baughan, CFA Co-Lead Portfolio Manager Jingyi Li Co-Lead Portfolio Manager Scott Crawshaw Portfolio Manager Christopher Mack, CFA Portfolio Manager Richard Schmidt, CFA Portfolio Manager |

Performance Summary

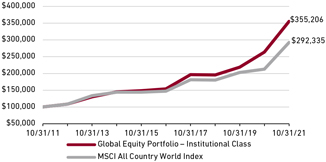

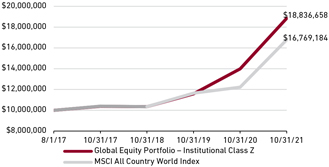

For the Global Equity Portfolio, the Institutional Class gained 34.57%, the Institutional Class Z gained 34.66%, and the Advisor Class gained 34.28% (net of fees and expenses) in the twelve-month period ended October 31, 2021. The Portfolio’s benchmark, the MSCI All Country World Index, gained 37.28% (net of source taxes).

Fund Facts at October 31, 2021

| | | | | | |

| Total Net Assets | | $1,788.2M |

| |

| Sales Charge | | None |

| |

| Number of Holdings | | 72 |

| |

| Turnover (5 Yr. Avg.) | | 48% |

| |

| Dividend Policy | | Annual |

| | Institutional Investors | | Individual Investors |

| | | Inst. Class | | Inst. Class Z | | Advisor Class |

| | | |

| Ticker | | HLMVX | | HLGZX | | HLMGX |

| | | |

| CUSIP | | 412295602 | | 412295727 | | 412295206 |

| | | |

| Inception Date | | 11/3/2009 | | 8/1/2017 | | 12/1/1996 |

| | | |

| Minimum Investment1 | | $100,000 | | $10,000,000 | | $5,000 |

| | | |

| Net Expense Ratio2 | | 0.88%3 | | 0.80%4 | | 1.07%5 |

| | | |

| Gross Expense Ratio2 | | 0.88% | | 0.83% | | 1.07% |

1Lower minimums available through certain brokerage firms. 2As of the most recent Prospectus and based on expenses for the fiscal year end. 3Harding Loevner has contractually agreed to cap the expense ratio at 0.90% through February 28, 2022. The expense ratio (without cap) is applicable to investors. 4The Net Expense Ratio is shown net of Harding Loevner’s contractual agreement through February 28, 2022. Harding Loevner’s contractual agreement caps the expense ratio at 0.80%. The Net Expense Ratio is applicable to investors. 5Harding Loevner has contractually agreed to cap the expense ratio at 1.20% through February 28, 2022. The expense ratio (without cap) is applicable to investors.

Market Review

Global stock markets increased in the twelve months ended October 31, with all sectors and regions finishing in positive territory.

The period began with a dramatic rise in global stock markets as vaccinations were approved and rolled out, unleashing demand that had been pent up throughout the pandemic. In the first three months of 2021, US retail sales climbed to the strongest level on record. The incoming Biden administration also passed a colossal US$1.9 trillion relief package, sending direct payments to millions of Americans and extending unemployment insurance. In China, electricity generation and rail cargo volume rose substantially year over year, though consumer spending remained subdued despite much of daily life having returned to normal. The European Union (EU) approved an €800 billion recovery fund aimed at infrastructure investment and support for businesses.

But while the economic recovery continued for most of the period several underlying pressures came to the fore during its final few months. Inflation expectations ballooned as tight labor markets, pandemic-mangled supply chains, and the resumption of more normal consumer and business activity led to shortages across industries. Additionally, commodity prices accelerated as economic

activity increased. In response to these inflationary pressures, central banks began to signal the impending end of unprecedented monetary support and, in some cases, acted by reducing bond buying or raising interest rates. Meanwhile, an aggressive series of interventions by Chinese regulators heightened the regulatory malaise. The crackdowns, which began in November 2020 with the tabling of the Ant Financial initial public offering (IPO), expanded with the remanding of the entire after-school tutoring sector to non-for-profit status, the adoption of anti-monopoly measures against the country’s internet giants, and new rules to limit the time spent by minors playing video games, among other provisions. Combined with the apparent impending debt default (later avoided) by the property giant Evergrande—itself the result of policy moves designed to force the heavily indebted sector to de-lever—the regulatory sweep savaged Chinese share prices, leaving them down 9% for the period.

On a sector basis, Energy was the strongest performer, surging in lockstep with rising oil prices. Financials also performed strongly, aided by a steepening yield curve and surprisingly low credit defaults. Information Technology (IT) also outperformed despite heightened scrutiny from regulators in Europe, China, and the US. Less-cyclical sectors—Consumer Staples, Health Care, and Utilities—all underperformed for the period.

Performance (% Total Return)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | For periods ended September 30, 2021 | | For periods ended October 31, 2021 |

| | | | | |

| | | 1 | | 3 | | 5 | | 10 | | Since Inception* | | 1 | | 3 | | 5 | | 10 | | Since Inception* |

| | | Year | | Years | | Years | | Years | | Nov-09 | | Aug-17 | | Dec-96 | | Year | | Years | | Years | | Years | | Nov-09 | | Aug-17 | | Dec-96 |

| | | | | | | | | | | | | | |

| Global Equity Portfolio – Inst Class | | 24.93 | | 15.83 | | 16.48 | | 13.99 | | 12.10 | | | | | | 34.57 | | 22.00 | | 18.22 | | 13.51 | | 12.51 | | | | |

| | | | | | | | | | | | | | |

| Global Equity Portfolio – Inst Class Z | | 25.02 | | 15.92 | | – | | – | | | | 14.95 | | | | 34.66 | | 22.08 | | – | | – | | | | 16.07 | | |

| | | | | | | | | | | | | | |

| Global Equity Portfolio - Advisor Class | | 24.67 | | 15.60 | | 16.23 | | 13.72 | | | | | | 8.42 | | 34.28 | | 21.76 | | 17.97 | | 13.24 | | | | | | 8.62 |

| | | | | | | | | | | | | | |

| MSCI All Country World Index | | 27.44 | | 12.58 | | 13.20 | | 11.90 | | 10.25 | | 11.87 | | – | | 37.28 | | 17.47 | | 14.72 | | 11.32 | | 10.64 | | 12.94 | | – |

Returns are annualized for periods greater than 1 year. *Inception of the Institutional Class, November 3, 2009. Inception of the Institutional Class Z, August 1, 2017. Inception of the Advisor Class, December 1, 1996. Index performance prior to January 1, 2001 cannot be shown since it relies on back-filled data.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Portfolio may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling (877) 435-8105 or visiting www.hardingloevnerfunds.com.

Viewed by geography, the eurozone outperformed as some of the countries hit hardest by the virus, such as Spain and Italy, began to recover. Canada performed strongly, helped by its large weighting in banks and Energy. Japan significantly underperformed as the country instituted a new, more stringent state of emergency in response to another virus wave in late summer and early fall. Emerging Markets (EMs) underperformed due to the weakness in China following its regulatory crackdowns.

Performance Attribution

The Portfolio underperformed due to both poor stock selection and negative sector and regional allocations. Weak stocks in Communication Services, Materials, and Real Estate detracted the most during the period. In Communication Services, Polish video game producer, CD Projekt, declined as the highly anticipated launch of Cyberpunk 2077 late in 2020 was marred by bugs and as a ransomware attack delayed the company’s efforts to patch the game. In Materials, German flavors and fragrance supplier Symrise lagged as the company experienced slower organic sales growth in its beverage and sweets segments and faced rising raw material prices. In Real Estate, Country Garden Services, a leading Chinese property manager, detracted as China’s regulatory crackdowns and turmoil in the sector left few companies unscathed. The Portfolio’s underweight in Energy and overweight in Health Care also weighed on relative returns.

Strong stocks in Industrials and Health Care contributed. In Industrials, shares of Protolabs, a US-based provider of 3D printing and other rapid prototyping and mold machining services, soared early in January after the company announced an acquisition of another on-demand digital manufacturing platform. In Health Care, shares of US-based life science products and services company Illumina gained as the company announced strong first-quarter results accompanied by upbeat forward guidance for 2021. The Portfolio’s underweights in Consumer Staples and Utilities were also helpful.

Geographically, weak stocks in EMs (Poland, Brazil, and China) and the eurozone (Germany) dragged on relative returns. In

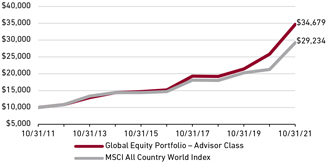

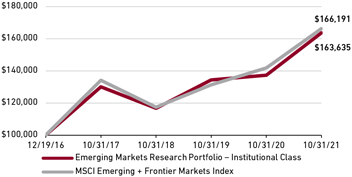

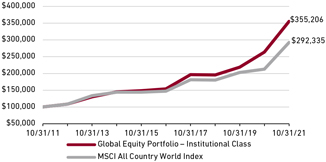

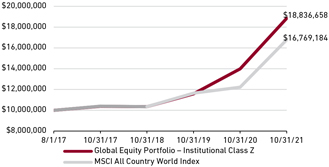

Total Return Based on a $100,000 Investment

Institutional Class

Total Return Based on a $10,000,000 Investment

Institutional Class Z

Total Return Based on a $10,000 Investment

Advisor Class

The charts above illustrate the hypothetical return of an investment made in the corresponding share classes. Investment return reflects waivers in effect. Absent such waivers, total return would be reduced. The performance provided in the table and charts above do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

China, e-commerce giant Alibaba faced a slew of regulatory headwinds, starting with the blocking of its Ant Group IPO and ultimately encompassing guidelines on the utilization of user data and restricting the exclusivity arrangements it could demand from merchants on its platform. In the eurozone, German provider of remote connectivity software TeamViewer detracted as investors reacted negatively to the company’s results for the quarter ended in September. The Portfolio’s small cash weight also dragged on relative performance. Strong stocks in the US contributed, particularly SVB Financial Group and First Republic Bank. SVB, which focuses on the tech and biotech communities, benefited from rising expectations for increased deal activity, higher interest rates, and strong loan and deposit growth. The company also reported exceptional earnings growth during the period. First Republic, with its focus on high-net-worth individuals, posted strong earnings during the period, benefiting from its low levels of underperforming loans, the ongoing economic rebound, and the prospect of higher rates.

Perspective and Outlook

In our 2020 first quarter letter, at the early stage of the global pandemic, we marveled at the resiliency of the Chinese stock market, which we ascribed to the country’s success in containing the domestic spread of the coronavirus through draconian lockdowns, whose efficacy was made possible by its authoritarian political system. Eighteen months later, a similarly authoritarian intervention has left investors reeling. While government intervention is not uncommon in China, the scale and pace of this latest crop of reforms is unprecedented. Is Xi Jinping, China’s most powerful leader since Chairman Mao, revealing his allegiance to a collectivist ideology long thought to be discredited? Or is he boldly grasping the nettle of reform to redress economic imbalances and social ills before they become more entrenched and undermine the Chinese Communist Party’s (CCP’s) legitimacy?

Despite headlines conjuring memories of the CCP’s gruesome past, we accept that on balance the policy changes are intended to benefit the long-term health of Chinese society and economy, especially its middle class. The message the Party is sending to business leaders across China is clear: compete on a level playing field and pay a fair wage. For instance, much of the coverage of Ant Group’s canceled IPO focused on the ostensible desire of the CCP to clip the wings of its tech oligarchs. More persuasive in our view is that having observed and learned from the West’s subprime debacle a decade prior, Chinese financial regulators are not keen to allow loan origination to be divorced from the underlying credit risks of the loans—a source of moral hazard that would potentially destabilize a financial system still dominated by lumbering state-owned banks with weak credit cultures and poor management systems. Antitrust interventions targeting the largest e-commerce platforms echo the statements (if not yet the achievements) of many Western policymakers to improve competition by increasing the bargaining power of smaller businesses versus the giants.

Meanwhile, although the gutting of the private educational tutoring sector may seem disproportionate, it has with the stroke of a pen stigmatized one of the educational advantages of affluence while

inhibiting the exam preparation arms race that many middle-class families feel has spiraled out of control. Actions taken to strengthen the data privacy protections of social media companies, tighten local ownership of Macau casinos, and rein in speculation in the high-end liquor market would not be out of place in Europe or the US. Not to minimize the serious consequences of these abrupt and radical reforms for private businesses; as investors we are viewing these actions mainly as problems requiring further analysis rather than as indications that China has become too unpredictable to be investable.

More troubling for China’s long-term prospects (although less of an immediate danger to our portfolio) is the near-collapse of Evergrande. For years, the Chinese government has promised to wean the economy from fixed asset investments in favor of consumption, with little to show for the rhetoric. Regional governments have continued to rely on a red-hot property sector to provide their funding and achieve their mandated growth targets. Alarmed by the outsized role of property development in the economy, and the associated risks to the financial system of too much property speculation, the central government pushed through a series of policies last year to force the property sector to deleverage. Evergrande’s plight looks like the direct consequence

Portfolio Positioning (% Weight) at October 31, 2021

| | | | | | |

| Geography | | Portfolio | | | Benchmark1 |

| | |

| Canada | | | 0.0 | | | 2.9 |

| | |

| Emerging Markets | | | 15.0 | | | 11.5 |

| | |

| Europe EMU | | | 5.7 | | | 8.3 |

| | |

| Europe ex-EMU | | | 8.0 | | | 7.9 |

| | |

| Frontier Markets2 | | | 0.0 | | | – |

| | |

| Japan | | | 2.5 | | | 5.7 |

| | |

| Middle East | | | 0.0 | | | 0.2 |

| | |

| Pacific ex-Japan | | | 1.5 | | | 2.9 |

| | |

| United States | | | 65.4 | | | 60.6 |

| | |

| Cash | | | 1.9 | | | – |

| | |

| Sector | | Portfolio | | | Benchmark1 |

| | |

| Comm Services | | | 12.7 | | | 8.9 |

| | |

| Consumer Discretionary | | | 8.0 | | | 12.8 |

| | |

| Consumer Staples | | | 1.0 | | | 6.6 |

| | |

| Energy | | | 2.1 | | | 3.6 |

| | |

| Financials | | | 13.7 | | | 14.5 |

| | |

| Health Care | | | 23.1 | | | 11.5 |

| | |

| Industrials | | | 11.1 | | | 9.6 |

| | |

| Information Technology | | | 24.1 | | | 22.7 |

| | |

| Materials | | | 0.0 | | | 4.6 |

| | |

| Real Estate | | | 1.8 | | | 2.6 |

| | |

| Utilities | | | 0.5 | | | 2.6 |

| | |

| Cash | | | 1.9 | | | – |

1MSCI All Country World Index; 2Includes countries with less-developed markets outside the index.

of those blunt top-down mandates as the heavily indebted company started to find itself cut off from its usual credit lines. While the government may be happy to make an example of the company, the spillover effects to the rest of the economy will be hard to contain and likely to require yet more interventions.

Equally disturbing to us are the rolling power outages afflicting as many as 20 provinces. Dueling top-down mandates with competing objectives seem to be playing a role here. Earlier in the year, the central government renewed its commitment to “dual control,” a mandate to curb carbon emissions by limiting both energy usage and the intensity (i.e., the amount of energy used per unit of GDP). That directive was issued, however, without anticipating this year’s spike in industrial output, whose emissions far exceed those from less energy-intensive sectors. Once they met their local growth targets, regional administrators rushed to institute power shutdowns to avoid breaching stipulated emission ceilings. To be sure, there are other factors contributing to the power crisis—not least, skyrocketing coal prices whose rise was exacerbated by China’s boycott of Australian coal imports in retaliation for that country’s insistence on re-opening the inquiry into the origins of the COVID-19 virus—but the policy disconnects didn’t help.

Nobel Prize-winning economist Friedrich Hayek would have predicted that the Chinese government would ultimately fail to manage its economy by mandate, because officials can’t foresee and prevent every unintended consequence of their own actions. If China’s growth slows further, more such shortcomings are likely to surface. The Chinese authorities exhibited competence at virus management, but even when their intentions are good, leaders inevitably miscalculate. When the views of authoritarians are subjected to little debate and their mandates are implemented without checks and balances, miscalculations can have outsized consequences. It’s unclear to us when a greater trust in the spontaneous order spawned by private actors and market forces, however well-mitigated by regulation and taxation, will take hold in China. Likely not as soon as we had hoped.

Portfolio Highlights

The prospects for our Chinese holdings have recently dominated our internal debates and garnered a disproportionate share of client questions. In China we face a somewhat daunting paradox. Despite the disquieting regulatory changes, we are finding more high-quality growing businesses that meet our investment criteria in China than at any point in our firm’s history.

During the period we sold Alibaba and bought Baidu. Alibaba has withstood several rounds of regulatory change in the past, but the expanded regulatory focus now puts almost every aspect of its business in the line of fire. Smaller, faster-growing competitors such as JD.com, Meituan, and Pinduoduo have been quick to adapt to the new standards while continuing to grow their market share at Alibaba’s expense. Rivalry, in both its core e-commerce business and in new business areas such as community-based purchasing, it seems will only be getting fiercer. In contrast, Baidu undertook and is now emerging from a much-needed branching out from

Ten Largest Holdings by Weight at October 31, 2021

| | | | | | |

| Company | | Sector | | Market | | % |

| | | |

| First Republic Bank | | Financials | | US | | 3.9 |

| | | |

| Alphabet | | Comm Services | | US | | 3.6 |

| | | |

| SVB Financial Group | | Financials | | US | | 3.4 |

| | | |

| Amazon.com | | Cons Discretionary | | US | | 2.9 |

| | | |

| John Deere | | Industrials | | US | | 2.5 |

| | | |

| Microsoft | | Info Technology | | US | | 2.5 |

| | | |

| Adobe Systems | | Info Technology | | US | | 2.2 |

| | | |

| Illumina | | Health Care | | US | | 2.2 |

| | | |

| Nike | | Cons Discretionary | | US | | 2.2 |

| | | |

| Wuxi Biologics | | Health Care | | China | | 2.2 |

its original business of internet search, which has faced waves of regulatory threats and ferocious competition from other new online ad formats. Over the past several years it has invested heavily in the next long-term growth opportunities in AI, what it sees as its real core competency. Baidu’s AI initiatives—including in autonomous driving, which has led to a robo electric taxi service that has already taken to the streets in four Chinese cities—should be viewed favorably by regulators because they align with overarching central government objectives around technology leadership and reducing carbon emissions.

The growing importance of AI across industries, the increasing uptake of electric vehicles, and broad adoption of the internet of things (IoT) and fifth-generation (5G) mobile networks are all enabled by advanced semiconductors. In addition to Taiwan-based semiconductor manufacturer TSMC and South Korea’s Samsung Electronics, the Portfolio also holds positions in several companies that supply the pair of dominant foundries. These include Dutch semiconductor lithography company ASML, US-based computer-aided design software company Synopsys, and US-based specialized semiconductor equipment manufacturer Applied Materials. Furthermore, the proliferation of devices using chips, whether EVs, “things” in IoT, or embedded systems more generally, results in the generation of oceans of data that need to be processed and analyzed. NVIDIA, the US-based chip designer known for its graphic processing units, is at the forefront of harnessing the foundries’ most advanced fabrication technologies to provide the platforms needed to analyze the full potential of all that data.

During the period we sold cosmetic producer Estée Lauder, which we bought in March 2020. As the stock has since appreciated, the resulting valuation now leaves no room for error, such as a potential shift of Chinese consumers’ tastes away from US brands. We purchased US-based CoStar, the dominant player in information services for the commercial real estate industry and online classified ads for commercial property. Its online marketplace business owns valuable websites including Apartments.com and the business listing service LoopNet. Over 80% of its revenue is recurring, as its offerings are typically integrated with the workflow of its customers.

Please read the separate disclosures page for important information, including the risks of investing in the Portfolio.

International Equity Portfolio

Institutional Investors: HLMIX & HLIZX | Individual Investors: HLMNX

Portfolio Management Team

| | |

| | Ferrill Roll, CFA Co-Lead Portfolio Manager Andrew West, CFA Co-Lead Portfolio Manager Bryan Lloyd, CFA Portfolio Manager Babatunde Ojo, CFA Portfolio Manager Patrick Todd, CFA Portfolio Manager |

Performance Summary

For the International Equity Portfolio, the Institutional Class gained 30.16%, the Institutional Class Z gained 30.25%, and the Investor Class gained 29.74% (net of fees and expenses) in the twelve-month period ended October 31, 2021. The Portfolio’s benchmark, the MSCI All Country World ex-US Index, gained 29.66% (net of source taxes).

Market Review

International stock markets increased in the twelve months ended October 31, with all sectors and regions finishing in positive territory.

The period began with a dramatic rise in global stock markets as vaccinations were approved and rolled out, unleashing demand that had been pent up throughout the pandemic. In the first three months of 2021, US retail sales climbed to the strongest level on record and restaurant bookings and the number of airline passengers improved. The incoming Biden administration also passed a colossal US$1.9 trillion relief package, sending direct payments to millions of Americans and extending unemployment insurance. In China, electricity generation and rail cargo volume rose substantially year over year, though consumer spending remained subdued despite much of daily life having returned to normal. The EU approved an €800 billion recovery fund aimed at infrastructure investment and support for businesses.

But while the economic recovery continued at a steady (albeit regionally uneven) pace for most of the period, several underlying pressures came to the fore in the period’s final few months. Inflation expectations, which had hit rock bottom in May 2020, ballooned

Fund Facts at October 31, 2021

| | | | | | |

| Total Net Assets | | $21,912.8 M |

| |

| Sales Charge | | None |

| |

| Number of Holdings | | 60 |

| |

| Turnover (5 yr. avg.) | | 17% |

| |

| Dividend Policy | | Annual |

| | Institutional Investors | | Individual Investors |

| | | Inst. Class | | Inst. Class Z | | Investor Class |

| | | |

| Ticker | | HLMIX | | HLIZX | | HLMNX |

| | | |

| CUSIP | | 412295107 | | 412295719 | | 412295503 |

| | | |

| Inception Date | | 5/11/1994 | | 7/17/2017 | | 9/30/2005 |

| | | |

| Minimum Investment1 | | $100,000 | | $10,000,000 | | $5,000 |

| | | |

| Expense Ratio2 | | 0.81%3 | | 0.73%4 | | 1.13%5 |

1Lower minimums available through certain brokerage firms; 2As of the most recent Prospectus and based on expenses for the fiscal year end. The Expense Ratio is shown net of Harding Loevner’s contractual agreement through February 28, 2022. 3Harding Loevner’s contractual agreement caps the Net Expense Ratio at 1.00%. 4Harding Loevner’s contractual agreement caps the net expense ratio at 0.80%. 5Harding Loevner’s contractual agreement caps the net expense ratio at 1.25%. The Expense Ratio (without cap) is applicable to investors.

as tight labor markets, pandemic-mangled supply chains, and the resumption of more normal consumer and business activity led to shortages across industries. Additionally, commodity prices—particularly those linked with industrial activity such as copper and Brent crude—accelerated as economic activity increased. In response to these inflationary pressures, central banks turned more hawkish. Many began to signal the impending end of unprecedented monetary support and, in some cases, acted by reducing bond buying or raising interest rates. Meanwhile, an aggressive series of interventions by Chinese regulators heightened the regulatory malaise. The crackdowns, which began in November 2020 with the tabling of the IPO for Alibaba subsidiary Ant Group, expanded with the remanding of the entire after-school tutoring sector to not-for-profit status, the adoption of anti-monopoly measures against the country’s internet giants, and new rules to strengthen the data security of social media platforms and limit the time spent by minors playing video games, among other provisions. Combined with the apparent impending debt default (later avoided) by the property giant Evergrande—itself the result of policy moves designed to force the heavily indebted sector to de-lever—the regulatory sweep savaged Chinese share prices, leaving them down 9% for the period.

On a sector basis, Energy was the strongest performer, surging in lockstep with rising oil prices. Financials also performed strongly, aided by a steepening yield curve and surprisingly low credit defaults. Information Technology (IT) also outperformed despite heightened scrutiny from regulators in Europe, China, and the US. Less-cyclical sectors—Consumer Staples, Health Care, and Utilities—all underperformed for the period.

Performance (% Total Return)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | For periods ended September 30, 2021 | | For periods ended October 31, 2021 |

| | | | | |

| | | 1 | | 3 | | 5 | | 10 | | Since Inception* | | 1 | | 3 | | 5 | | 10 | | | | Since Inception* |

| | | Year | | Years | | Years | | Years | | May-94 | | Jul-17 | | Sep-05 | | Year | | Years | | Years | | Years | | May-94 | | Jul-17 | | Sep-05 |

| | | | | | | | | | | | | | |

| Intl. Equity Portfolio – Inst. Class | | 20.50 | | 9.93 | | 10.78 | | 9.98 | | 6.83 | | | | | | 30.16 | | 15.42 | | 12.26 | | 9.35 | | 6.96 | | | | |

| | | | | | | | | | | | | | |

| Intl. Equity Portfolio – Inst. Class Z | | 20.58 | | 10.01 | | – | | – | | | | 9.47 | | | | 30.25 | | 15.51 | | – | | – | | | | 10.30 | | |

| | | | | | | | | | | | | | |

| Intl. Equity Portfolio – Investor Class | | 20.09 | | 9.57 | | 10.40 | | 9.62 | | | | | | 7.22 | | 29.74 | | 15.04 | | 11.89 | | 8.98 | | | | | | 7.44 |

| | | | | | | | | | | | | | |

| MSCI All Country World ex-US Index | | 23.91 | | 8.03 | | 8.94 | | 7.48 | | – | | 6.96 | | 5.25 | | 29.66 | | 12.00 | | 9.77 | | 6.66 | | – | | 7.41 | | 5.37 |

Returns are annualized for periods greater than 1 year. *Inception of the Institutional Class, May 11, 1994. Inception of the Institutional Class Z, July 17, 2017. Inception of the Investor Class, September 30, 2005. Index performance prior to January 1, 2001 cannot be shown since it relies on back-filled data.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Portfolio may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling (877) 435-8105 or visiting www.hardingloevnerfunds.com.

Viewed by geography, the eurozone outperformed as some of the countries hit hardest by the virus, such as Spain and Italy, began to recover. Canada also performed strongly, helped by its large weighting in banks and Energy. Japan significantly underperformed as the country instituted a new, more stringent state of emergency in response to another virus wave in late summer and early fall. Emerging Markets (EMs) also underperformed due to the weakness in China following its regulatory crackdowns.

Performance Attribution

The Portfolio outperformed due to both strong stock selection and positive sector allocation. Strong stocks in Health Care, Consumer Staples, and Industrials contributed the most during the period. In Health Care, Swiss hearing aid manufacturer Sonova Holding benefitted; business rebounded strongly from 2020’s lockdown as management raised earnings guidance for 2021. Sonova also announced the acquisition of the consumer audio division of Sennheiser, intended as a line of defense against the recent entry into the hearing aid market by Bose and potentially other consumer audio brands. In Consumer Staples, French cosmetics manufacturer L’Oréal rose as the company has continued to demonstrate strong sales growth in both its e-commerce segment and in China. In Industrials, Swedish manufacturer of heat transfer and fluid separation machines Alfa Laval contributed; strong order growth through September suggests its business momentum is accelerating. The Portfolio’s underweight in Consumer Discretionary and overweight in IT were also helpful.

Poor stocks in Consumer Discretionary and Materials detracted. In Consumer Discretionary, shares of Chinese e-commerce company Alibaba fell as the company faced both increased industry rivalry and regulatory pressures throughout the year. In Materials, Australia-based BHP—which engages in the exploration, development, production, and processing of iron ore, metallurgical coal, and copper—detracted as plummeting iron ore prices in the third quarter weighed on the company’s stock.

Geographically, strong stocks in Emerging Markets (EMs) and the eurozone boosted relative returns. In the former, shares of Russian oil and gas company Lukoil were helped by surging energy prices.

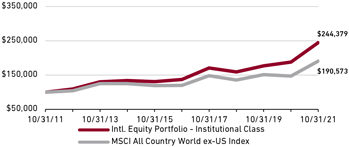

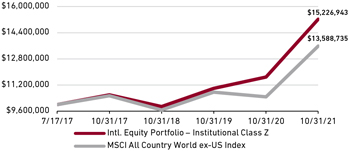

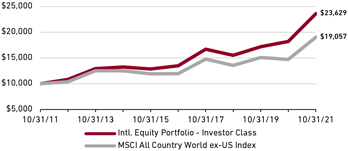

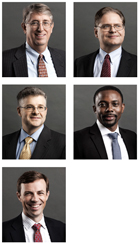

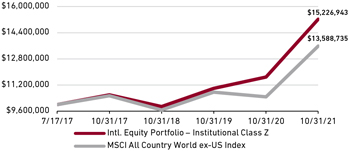

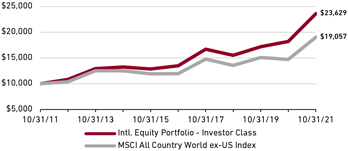

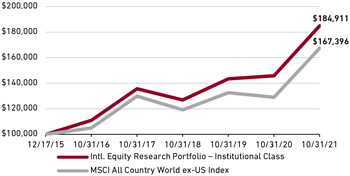

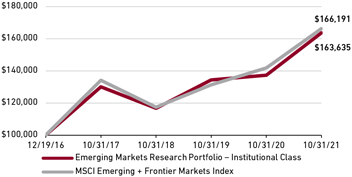

Total Return Based On a $100,000 Investment

Institutional Class

Total Return Based On a $10,000,000 Investment

Institutional Class Z

Total Return Based On a $10,000 Investment

Investor Class

The charts above illustrate the hypothetical return of an investment made in the corresponding share classes. Investment return reflects waivers in effect. Absent such waivers, total return would be reduced. The performance provided in the table and charts above do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

In the eurozone, Spanish bank BBVA benefitted as the company announced the sale of its anemic US business for a healthy price. Additionally, the bank’s Mexican subsidiary proved resilient due to generous loss provisions front-loaded into first and second quarters of 2021, and to recovering transaction and lending activity. Weak stocks in Japan detracted, especially manufacturer of hygiene and household cleaning products Unicharm. Shares declined in response to rising input costs (like oil) and a market style shift to stocks of more-cyclical companies. The Portfolio’s underweight in Canada and small cash weight also dragged on relative performance.

Perspective and Outlook

In our 2020 first quarter letter, at the early stage of the global pandemic, we marveled at the resiliency of the Chinese stock market, which we ascribed to the country’s success in containing the domestic spread of the coronavirus through draconian lockdowns, whose efficacy was made possible by its authoritarian political system. Eighteen months later, a similarly authoritarian intervention has left investors reeling. While government intervention is not uncommon in China, the scale and pace of this latest crop of reforms is unprecedented. Is Xi Jinping, China’s most powerful leader since Chairman Mao, revealing his allegiance to a collectivist ideology long thought to be discredited? Or is he boldly grasping the nettle of reform to redress economic imbalances and social ills before they become more entrenched and undermine the Chinese Communist Party’s (CCP’s) legitimacy?

Despite headlines conjuring memories of the CCP’s gruesome past, we accept that on balance the policy changes are intended to benefit the long-term health of Chinese society and economy, especially its middle class. The message the Party is sending to business leaders across China is clear: compete on a level playing field and pay a fair wage. For instance, much of the coverage of Ant Group’s canceled IPO focused on the ostensible desire of the CCP to clip the wings of its tech oligarchs. More persuasive in our view is that having observed and learned from the West’s subprime debacle a decade prior, Chinese financial regulators are not keen to allow loan origination to be divorced from the underlying credit risks of the loans—a source of moral hazard that would potentially destabilize a financial system still dominated by lumbering state-owned banks with weak credit cultures and poor management systems. Antitrust interventions targeting the largest e-commerce platforms echo the statements (if not yet the achievements) of many Western policymakers to improve competition by increasing the bargaining power of smaller businesses versus the giants.

Meanwhile, although the gutting of the private educational tutoring sector may seem disproportionate, it has with the stroke of a pen stigmatized one of the educational advantages of affluence while inhibiting the exam preparation arms race that many middle-class families feel has spiraled out of control.

Actions taken to strengthen the data privacy protections of social media companies, tighten local ownership of Macau casinos, and rein in speculation in the high-end liquor market would not be out of place in Europe or the US. Not to minimize the serious consequences of these abrupt and radical reforms for private businesses; as investors we are viewing these actions mainly as problems requiring further analysis rather than as indications that China has become too unpredictable to be investable.

More troubling for China’s long-term prospects (although less of an immediate danger to our portfolio) is the near-collapse of Evergrande. For years, the Chinese government has promised to wean the economy from fixed asset investments in favor of consumption, with little to show for the rhetoric. Regional governments have continued to rely on a red-hot property sector to provide their funding and achieve their mandated growth targets. Alarmed by the outsized role of property development in the economy, and the associated risks to the financial system of too much property speculation, the central government pushed through a series of policies last year to force the property sector to deleverage. Evergrande’s plight looks like the direct consequence of those blunt top-down mandates as the heavily indebted company

Portfolio Positioning (% Weight) at October 30, 2021

| | | | | | |

| Geography | | Portfolio | | | Benchmark1 |

| | |

| Canada | | | 2.1 | | | 7.4 |

| | |

| Emerging Markets | | | 25.2 | | | 29.2 |

| | |

| Europe EMU | | | 21.5 | | | 21.2 |

| | |

| Europe ex-EMU | | | 26.0 | | | 20.1 |

| | |

| Frontier Markets2 | | | 0.0 | | | – |

| | |

| Japan | | | 12.6 | | | 14.5 |

| | |

| Middle East | | | 1.2 | | | 0.4 |

| | |

| Pacific ex-Japan | | | 7.2 | | | 7.2 |

| | |

| Other3 | | | 1.1 | | | – |

| | |

| Cash | | | 3.1 | | | – |

| | |

| Sector | | Portfolio | | | Benchmark1 |

| | |

| Comm Services | | | 5.3 | | | 6.2 |

| | |

| Consumer Discretionary | | | 2.4 | | | 12.9 |

| | |

| Consumer Staples | | | 12.5 | | | 8.5 |

| | |

| Energy | | | 3.4 | | | 5.0 |

| | |

| Financials | | | 15.8 | | | 19.5 |

| | |

| Health Care | | | 13.7 | | | 9.4 |

| | |

| Industrials | | | 16.2 | | | 12.1 |

| | |

| Information Technology | | | 18.5 | | | 13.1 |

| | |

| Materials | | | 8.2 | | | 7.9 |

| | |

| Real Estate | | | 0.0 | | | 2.4 |

| | |

| Utilities | | | 0.9 | | | 3.0 |

| | |

| Cash | | | 3.1 | | | – |

1MSCI All Country World ex-US Index; 2Includes countries with less-developed markets outside the index. 3Includes companies classified in countries outside the index.

started to find itself cut off from its usual credit lines. While the government may be happy to make an example of the company, the spillover effects to the rest of the economy will be hard to contain and likely to require yet more interventions.

Equally disturbing to us are the rolling power outages afflicting as many as 20 provinces. Dueling top-down mandates with competing objectives seem to be playing a role here. Earlier in the year, the central government renewed its commitment to “dual control,” a mandate to curb carbon emissions by limiting both energy usage and the intensity (i.e., the amount of energy used per unit of GDP). That directive was issued, however, without anticipating this year’s spike in industrial output, whose emissions far exceed those from less energy-intensive sectors. Once they met their local growth targets, regional administrators rushed to institute power shutdowns to avoid breaching stipulated emission ceilings. To be sure, there are other factors contributing to the power crisis—not least, skyrocketing coal prices whose rise was exacerbated by China’s boycott of Australian coal imports in retaliation for that country’s insistence on re-opening the inquiry into the origins of the COVID-19 virus—but the policy disconnects didn’t help.

Nobel Prize-winning economist Friedrich Hayek would have predicted that the Chinese government would ultimately fail to manage its economy by mandate, because officials can’t foresee and prevent every unintended consequence of their own actions. If China’s growth slows further, more such shortcomings are likely to surface. The Chinese authorities exhibited competence at virus management, but even when their intentions are good, leaders inevitably miscalculate. When the views of authoritarians are subjected to little debate and their mandates are implemented without checks and balances, miscalculations can have outsized consequences. It’s unclear to us when a greater trust in the spontaneous order spawned by private actors and market forces, however well-mitigated by regulation and taxation, will take hold in China. Likely not as soon as we had hoped.

Portfolio Highlights

Although our Chinese holdings comprise only 8% of the portfolio, their prospects have recently been dominating our internal discourse and sparking a disproportionate share of clients’ questions. In China, we face a daunting paradox. Despite disquieting regulatory changes, we are finding more high-quality growing businesses that meet our investment criteria than at any point in our firm’s history. Our persistent underweight over the past 12 years has reflected, in part, our effort to limit portfolio risk from that source. But as other investors appear to be waking up to Chinese country risk, our inclination is to invest in otherwise-solid Chinese companies on share price weakness. To mitigate the potential impact of stricter regulation or reprisals on any one company or sector, we maintain substantial stock-level and industry-level diversification within China. And even while hunting for new opportunities, we are scrutinizing our existing Chinese holdings to make sure they continue to meet our investment criteria.

Ten Largest Holdings by Weight at October 30, 2021

| | | | | | |

| Company | | Sector | | Market | | % |

| | | |

| Atlas Copco | | Industrials | | Sweden | | 3.6 |

| | | |

| L’Oréal | | Cons Staples | | France | | 3.4 |

| | | |

| TSMC | | Info Technology | | Taiwan | | 3.4 |

| | | |

| Infineon Technologies | | Info Technology | | Germany | | 3.4 |

| | | |

| Tencent | | Comm Services | | China | | 3.2 |

| | | |

| Samsung Electronics | | Info Technology | | South Korea | | 3.1 |

| | | |

| Adyen | | Info Technology | | Netherlands | | 2.8 |

| | | |

| Roche | | Health Care | | Switzerland | | 2.8 |

| | | |

| AIA Group | | Financials | | Hong Kong | | 2.7 |

| | | |

| Schneider Electric | | Industrials | | France | | 2.7 |

One of the high-quality, growing companies we identified is Sanhua Intelligent Controls, a Chinese manufacturer of thermal management components. Its main business is making parts for home appliances, particularly HVAC systems, where it has scale and technological advantages in higher-value valves, pumps, and high-efficiency components. These advantages are also flowing into its smaller, but faster-growing, automotive parts business, which is growing explosively in heating and cooling systems for electric vehicles. We expect rising volumes to lead this division to achieve 30% annualized revenue growth for years to come.

To put the size of our exposure to China in perspective, our approximate 8% weight is exceeded by our 11% weight in Switzerland and similar to our weights in each of France, Germany, and Sweden. Our notional exposure to these countries is a byproduct of the multinational companies domiciled in these countries that we’ve identified for investment. No doubt these companies chose to remain in their historical birthplaces in large part because of the stable and hospitable business climate provided by their home countries. We are very rarely asked about the political and regulatory risks that companies based in these countries face—likely because these risks stem primarily from their operations outside their borders.

Our three Swedish industrial companies—Atlas Copco, Alfa Laval, Epiroc—each derive less than 5% of their global sales in Sweden; they have used their stable domestic environment as a base from which to expand their technological and competitive advantages abroad. Our other Swedish holding, SE Banken, generates most of its revenues domestically, but mostly by serving the banking needs of multinational corporations headquartered in Sweden. Our six Swiss companies also generate an inordinate amount of their sales outside the country. Contract drug manufacturer Lonza is the most domestically focused, generating 10% of its revenues in Switzerland, while the other five each generate less than 5% at home.

Please read the separate disclosures page for important information, including the risks of investing in the Portfolio.

International Small Companies Portfolio

Institutional Investors: HLMRX | Individual Investors: HLMSX

Portfolio Management Team

Jafar Rizvi, CFA

Co-Lead Portfolio Manager

Anix Vyas, CFA

Co-Lead Portfolio Manager

Performance Summary

For the International Small Companies Equity Portfolio, the Institutional Class gained 33.16% and the Investor Class gained 32.84% (net of fees and expenses) in the twelve-month period ended October 31, 2021. The Portfolio’s benchmark, the MSCI ACWI ex-US Small Cap Index, gained 38.83% (net of source taxes).

Fund Facts at October 31, 2021

| | | | |

| Total Net Assets | | $599.7M |

| |

| Sales Charge | | None |

| |

| Number of Holdings | | 81 |

| |

| Turnover (5 Yr. Avg.) | | 30% |

| |

| Dividend Policy | | Annual |

| | Institutional Investors | | Individual Investors |

| | | Institutional Class | | Investor Class |

| | |

| Ticker | | HLMRX | | HLMSX |

| | |

| CUSIP | | 412295875 | | 412295883 |

| | |

| Inception Date | | 6/30/2011 | | 3/26/2007 |

| | |

| Minimum Investment1 | | $100,000 | | $5,000 |

| | |

| Net Expense Ratio2 | | 1.15%3 | | 1.40%4 |

| | |

| Gross Expense Ratio2 | | 1.18% | | 1.50% |

1Lower minimums available through certain brokerage firms; 2As of the most recent Prospectus and based on the fiscal year ended October 31, 2021. The Net Expense Ratio is shown net of Harding Loevner’s contractual agreement through February 28, 2022. 3Harding Loevner’s contractual agreement caps the net expense ratio at 1.15%. 4Harding Loevner’s contractual agreement caps the net expense ratio at 1.40%. The Net Expense Ratio is applicable to investors.

Market Review

International small cap shares rose strongly in the 12 months ended October 31, buoyed by easy monetary policy, worldwide fiscal stimulus, and steady vaccine rollouts worldwide that facilitated a return to relative normalcy. Investors were also optimistic about the ability of corporate capital expenditures to underpin a global economic rebound. Much of this newf investment has been expected to come from spending on information technology (IT); The Economist projected that IT capital spending for 2021 would eclipse 2019’s figures by 42 percent.

The pace of economic recovery slowed toward the end of the fund year, however, due to the spread of the COVID-19 Delta variant and supply chain bottlenecks including a semiconductor shortage that hobbled automobile and consumer electronics manufacturers. Labor shortages contributed to a surge in inflation and brought forward the inevitable prospect of higher interest rates. In response, central banks began signaling the impending end of unprecedented monetary support and, in some cases, acted by reducing bond buying (European Central Bank) or directly raising interest rates (Norway, Brazil, and Russia). The US Federal Reserve also adopted a more hawkish tone following its September 2021 meeting, suggesting it could soon begin to scale back its monthly bond purchases.

Every region posted large positive returns. Europe, both inside and outside the monetary union, was a key outperformer, with some of the markets most impacted by the pandemic last year surging after vaccines became available. Emerging Markets (EMs) was also among the strongest regions, despite the underperformance of Chinese stocks in the wake of sweeping new regulations and investor concerns over its heavily leveraged real estate sector. Japan, which struggled to contain COVID cases in the lead-up to the postponed Summer Olympics, was the weakest-performing region. Its market has begun bouncing back in recent months, however, in reaction to an increased focus on vaccination and expectations that newly appointed prime minister Fumio Kishida would continue predecessor Shinzō Abe’s fiscal stimulus and structural reforms.

Every sector posted positive returns during the period, with Energy, Industrials, and Financials leading. Financials companies, particularly banks based in emerging markets, enjoyed strong economic recoveries in their home markets, bolstered by monetary policy support. Energy company stocks surged due to a spike in oil prices, with Brent crude trading just over US$80 at the end of October, the highest price since 2018. Consumer Staples stocks lagged as public uncertainty over the spread of the Delta variant hampered the retail sector in the second half of the fund year.

Performance (% Total Return)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | For periods ended September 30, 2021 | | For periods ended October 31, 2021 |

| | | | | |

| | | 1 | | 3 | | 5 | | 10 | | Since Inception* | | 1 | | 3 | | 5 | | 10 | | Since Inception* |

| | | Year | | Years | | Years | | Years | | Jun-11 | | Mar-07 | | Year | | Years | | Years | | Years | | Jun-11 | | Mar-07 |

| | | | | | | | | | | | |

| Intl Small Companies Portfolio – Inst Class | | 26.92 | | 12.11 | | 12.61 | | 11.52 | | 8.68 | | | | 33.16 | | 17.40 | | 13.79 | | 10.94 | | 8.93 | | |

| | | | | | | | | | | | |

| Intl Small Companies Portfolio – Investor Class | | 26.60 | | 11.84 | | 12.34 | | 11.24 | | | | 7.60 | | 32.84 | | 17.10 | | 13.52 | | 10.67 | | | | 7.78 |

| | | | | | | | | | | | |

| MSCI All Country World ex-US Small Cap Index | | 33.07 | | 10.33 | | 10.28 | | 9.44 | | 6.84 | | – | | 38.83 | | 14.75 | | 11.21 | | 8.72 | | 6.94 | | – |

Returns are annualized for periods greater than 1 year. *Inception of the Institutional Class, June 30, 2011. Inception of the Investor Class, March 26, 2007. Index performance prior to June 1, 2007 cannot be shown since it relies on back-filled data.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Portfolio may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling (877) 435-8105 or visiting www.hardingloevnerfunds.com.

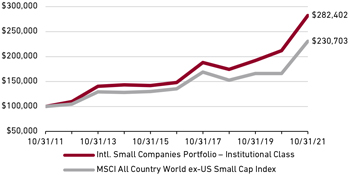

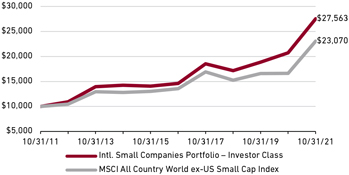

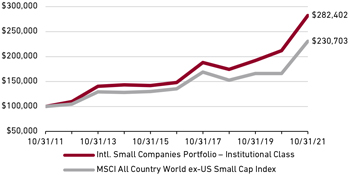

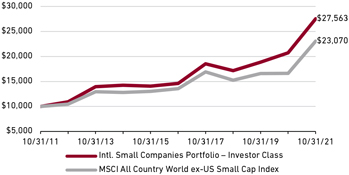

The charts below illustrate the hypothetical return of an investment made in the corresponding share classes. Investment return reflects waivers in effect. Absent such waivers, total return would be reduced. The performance provided in the table and charts above do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

Total Return Based On a $100,000 Investment

Institutional Class

Total Return Based On a $10,000 Investment

Investor Class

Performance Attribution

The Portfolio trailed the index in this 12-month period primarily due to weak holdings in Consumer Staples and Communication Services. In the former, Japanese manufacturer of seasoning products Ariake suffered from deteriorating restaurant sales caused by extended lockdowns in its home country, with sales of its home meal kits in supermarkets and convenience stores failing to offset this decline. In Communication Services, shares of Swedish videogame maker Paradox Interactive fell as it continued to work through the repercussions of delayed and cancelled rollouts earlier this year. Recent controversies in the video game industry also weighed on the company, as reports describing toxic workplace cultures at high-profile rivals Activision Blizzard and Ubisoft paralleled a scandal surrounding Paradox’s CEO, Fredrik Wester, who apologized for an incident of self-described “inappropriate behavior” from 2018.

We had strong relative returns in Materials due to Vietnamese steelmaker Hoa Phat Group, which benefited from a combination of rising global steel prices, strong demand inside Vietnam, and a new, state-of-the-art production complex that is helping the company grow export sales to China.

By region, holdings in the Economic and Monetary Union (EMU) and EMs detracted the most. In Germany, software company TeamViewer saw the COVID-19-related tailwind for its remote work products abate. In France, Rubis, a storage terminal and petroleum products distributor, detracted as sales fell in several regions where tourism rates remain low due to the pandemic, especially the Caribbean. In EMs, Malaysian oil & gas services provider Dialog Group Berhad fell as it was unable to continue the development of its Pengerang refinery due to COVID restrictions. The stock of Polish videogame developer CD Projekt was weighed down by its botched December rollout of the much-anticipated Cyberpunk 2077, which included the game being pulled from the PlayStation Store due to technical issues.

In ex-EMU countries, where our stock selection fared slightly better, Swiss distributor of fasteners Bossard reported strong sales growth, driven in part by newly won customer projects in the railway, construction, and medical technology industries. Shares of UK-based aerospace technology producer Senior rose sharply in late May after a private equity firm made an unsuccessful offer to purchase the company.

Perspective and Outlook

Semiconductor chip shortages have resulted in automotive production cuts around the globe. Toyota’s recently announced 40% cut in production follows similar cuts by established carmakers Volkswagen, General Motors, and Nissan, as well as newer entrants such as China’s Nio. As dramatic as its effects have been, the chip shortage should be transitory: we expect that the worst of the backlogs should be cleared by mid-2022. We are more focused on fundamental changes like the adoption of electric vehicles (EVs) and autonomous driving that could impact the structure of the industry.

The legacy auto industry has benefited from massive economies of scale, including steep capital requirements, learning curves, and design costs, which historically have represented significant barriers to entry for new auto component suppliers. But the shift to EVs, while creating opportunity for existing suppliers, also opens the door to new entrants specializing in components previously not used in cars. The pace of adoption of autonomous driving is hard to predict given its earlier stage of development, but we estimate that increasingly stringent emissions regulations could drive EV unit sales to 50% of total industry sales within 15 years. Suppliers stand to benefit from a combination of faster overall segment growth and increased fragmentation in their customer base as aspirants seek to enter the auto manufacturing business.

As small cap investors looking for durable growth, we focus on identifying leading makers of components that are critical but nonetheless represent only a small portion of an end-product’s total bill of materials, which better insulates them from pricing pressure. We insist on management foresight and financial strength since they underpin a company’s ability to navigate significant market changes.

Fuchs Petrolub is an example of a longtime auto supplier whose management is investing to extend its competitive advantage. The company, headquartered in Germany, makes lubricants for automotive and other industrial applications and is the largest wholly dedicated lubricant supplier in the world. Fuchs’s legacy automotive products, which represent about 30% of its total sales, were developed for use in internal combustion engines (ICEs). However, the company is expanding its focus to EVs, having opened a new plant in Germany to produce polyurea grease, a specialty product with the high-temperature, noise-reducing properties needed in EV lubricants.

Historically, the company’s competitive advantages have been its dense distribution networks around its plants and its close relationships with customers in niche product areas too small to attract big rivals like the major oil companies. Fuchs has invested to secure this advantage in recent years. Its new German plant is the final piece of a US$350 million investment program launched in 2016 to expand and update its manufacturing and R&D facilities worldwide, including in the US, China, Australia, and Sweden.

Not everything changes in the transition to EVs: all cars need things like tires and lights. Japan-based Stanley Electric has been

manufacturing headlamps and tail lamps for 100 years. Originally part of the vertically integrated auto supply chain for Honda (which still owns 5.3% of Stanley and buys 40% of its output), Stanley has diversified its customer base over the years. It now ranks second (with a 26% share) in the Japanese car lamp market.

A rule of thumb among automotive suppliers is that prices for their products decline 5% a year on average. But car lamps are one of the few components that have risen in average price as light sources have evolved for greater energy efficiency and, more recently, for features such as adaptive driving beams (ADB) that rotate or shine brighter in the direction the car signals it is about to turn. Stanley’s key competitive advantages—its relationships with auto manufacturers and its technical know-how—position it as a partner to its customers as they seek to develop the next generation of head and tail lamps. For example, in order to optimize EVs’ battery life, there will be great pressure for the lights to get smaller and even more efficient. ADBs, already valued by safety-conscious end consumers, should become an important frontier in

Portfolio Positioning (% Weight) at October 31, 2021

| | | | | | |

| Geography | | Portfolio | | | Benchmark1 |

| | |

| Canada | | | 2.1 | | | 6.8 |

| | |

| Emerging Markets | | | 18.8 | | | 24.2 |

| | |

| Europe EMU | | | 20.7 | | | 14.5 |

| | |

| Europe ex-EMU | | | 31.3 | | | 23.9 |

| | |

| Frontier Markets2 | | | 7.5 | | | – |

| | |

| Japan | | | 13.7 | | | 18.9 |

| | |

| Middle East | | | 1.8 | | | 2.1 |

| | |

| Pacific ex-Japan | | | 0.4 | | | 9.6 |

| | |

| Other3 | | | 1.0 | | | – |

| | |

| Cash | | | 2.7 | | | – |

| | |

| Sector | | Portfolio | | | Benchmark1 |

| | |

| Communication Services | | | 8.8 | | | 4.2 |

| | |

| Consumer Discretionary | | | 4.3 | | | 11.8 |

| | |

| Consumer Staples | | | 8.9 | | | 5.5 |

| | |

| Energy | | | 1.4 | | | 2.8 |

| | |

| Financials | | | 6.6 | | | 10.5 |

| | |

| Health Care | | | 12.7 | | | 7.3 |

| | |

| Industrials | | | 18.9 | | | 21.2 |

| | |

| Information Technology | | | 26.1 | | | 12.2 |

| | |

| Materials | | | 7.2 | | | 10.6 |

| | |

| Real Estate | | | 0.9 | | | 10.5 |

| | |

| Utilities | | | 1.5 | | | 3.4 |

| | |

| Cash | | | 2.7 | | | – |

1MSCI All Country World ex-US Small Cap Index; 2Includes countries with less-developed markets outside the index; 3Includes companies classified in countries outside the index.

the development of self-driving cars, since lights occupy the four corners of a vehicle, meaning that future generations of lights could also incorporate sensors.

Where headlamps help the driver see better, sensors help the car see better. Sensata Technologies is a leader in the US$10 billion automotive market for high-value sensors, where it has about 20% market share. In some niches within the sensor market, Sensata has extremely high market share, such as its 70% share of the market for tire pressure sensors, which are still needed in EVs. In the short term, Sensata expects the number of its existing sensors per vehicle to increase as car makers respond to stricter fuel standards and the rising demand for safety and comfort-related control systems including electronic stability control and driver assistance.

The US-based1 company also plans to meet the need for new products and already has more content per vehicle on EVs than it does on Internal Combustion Engine (ICE) cars. For example, the transition from traditional hydraulic brakes to EVs’ electromechanical braking and regenerative braking systems requires more, and different types of, pressure and force sensing. The company recently acquired adjacent technologies with which it can expand its product line. In 2018, it acquired Gigavac, a leading manufacturer of high-voltage contactors, a mechanical device used in EV powertrains. The acquisition gives Sensata visibility at the early stage of EV development into new sensor types and enabling technologies—and an additional route to engage in that process.

LEM Holdings, though not widely viewed as an “automotive supplier,” is taking advantage of its core competency to grab a share of what it, too, sees as a major long-term growth opportunity. The Swiss company’s main product, transducers, are used for measuring and regulating electrical parameters such as current and voltage. They have a wide range of applications, including renewable energy systems, but the automotive industry represents about 30% of LEM’s sales, of which transducers for electric and hybrid powertrains represent the vast majority of revenues. EVs are full of transducers: motor control transducers calibrate the voltage and current sent to the motor, while other transducers help manage the high voltages of the battery. In 2020, LEM introduced transducers for EV charging stations that support advanced integrated functions, including more accurate measurement—for billing purposes—of the amount of electricity used. Charging infrastructure represents a large, addressable market for LEM, as most countries are just beginning to address the coming need.

Portfolio Highlights

Beside the global chip shortage and its impact on supply chains, another focus for global investors has been the changing economic environment in China. Following several years of rapid economic growth and expansion of its property and internet sectors, which

1Though headquartered in the US, Sensata’s extensive operations and share of its revenue generated in Brazil, Europe, and Asia qualify it for classification in our rubric as “international.”

Ten Largest Holdings by Weight at October 31, 2021

| | | | | | |

| Company | | Sector | | Market | | % |

| | | |

| Reply | | Info Technology | | Italy | | 3.9 |

| | | |

| Hoa Phat Group | | Materials | | Vietnam | | 3.8 |

| | | |

| STRATEC | | Health Care | | Germany | | 2.7 |

| | | |

| Dechra | | Health Care | | UK | | 2.6 |

| | | |

| TOMRA | | Industrials | | Norway | | 2.4 |

| | | |

| Alten | | Info Technology | | France | | 2.4 |

| | | |

| Globant | | Info Technology | | Argentina | | 2.2 |

| | | |

| Bechtle | | Info Technology | | Germany | | 2.2 |

| | | |

| Abcam | | Health Care | | UK | | 2.2 |

| | | |

| Senior | | Industrials | | UK | | 2.2 |

have led China’s stock market to be among the world’s best performing, the spate of national policy changes since the end of 2020 has rattled Chinese stocks. But the sell-off has mostly affected large cap stocks, especially those directly in the regulatory crosshairs. There has been less of an impact on small cap stocks, where China represents a smaller portion globally. In our own small cap Portfolio, the exposure to China is lower still.

In recent years, rich valuations of high-quality Chinese growth companies, both in an absolute and relative sense, have been the biggest impediment to our adding to our exposure. Sharply lower valuations in the wake of the recent regulatory actions have caused us to reassess the trade-offs between risk and prospective returns for existing and new holdings, potentially changing that picture. In most cases, the reforms have little direct adverse impact on small companies and may even improve their competitive positioning vis-a-vis larger rivals. But that is not to say small companies aren’t feeling adverse indirect effects. Haitian International is the leading plastic injection molding equipment company in China. The company has been gaining market share from higher-end German and Japanese firms through steady improvement of its machines, whose increasing energy efficiency also aligns nicely with China’s carbon emission reduction goals. Yet, knock-on effects of recent policy changes like the rolling power curbs and the Evergrande collapse have dented consumer and manufacturer confidence. After a sharp uptick in new orders over the past year, Haitan’s business may cool down and could be in for a few bumpy quarters, a concern that has weighed on its stock price.

Our aim is to construct a well-diversified portfolio that can withstand the full spectrum of unknowns. We do this by investing in businesses, like Haitian, that have durable competitive advantages in industries we understand, the financial strength to weather unforeseen challenges, and management teams that operate with incentives that are aligned with sustained long-term returns. With their valuations looking more attractive, we expect to add more such businesses in China. In the meantime, we adjusted our internal guidelines by raising the ceiling for permitted exposure to China, from 10% to 20%.

Please read the separate disclosures page for important information, including the risks of investing in the Portfolio.

Emerging Markets Portfolio

Institutional Investors: HLMEX & HLEZX | Individual Investors: HLEMX

Portfolio Management Team

| | |

| | Scott Crawshaw Co-Lead Portfolio Manager Craig Shaw, CFA Co-Lead Portfolio Manager Pradipta Chakrabortty Portfolio Manager Richard Schmidt, CFA Portfolio Manager |

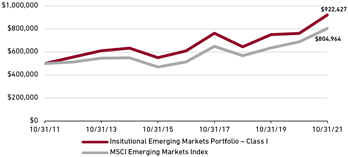

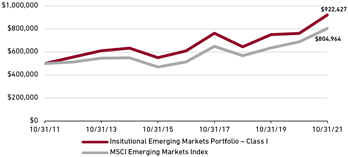

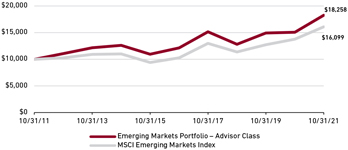

The Institutional Emerging Markets Portfolio (Institutional Class and Institutional Class Z) and the Emerging Markets Portfolio (Advisor Class)—collectively, the “Portfolios”—are both managed in strict accordance with Harding Loevner’s Emerging Markets Equity strategy model portfolio. Therefore, the Portfolios have highly similar holdings and characteristics. We have provided a single commentary to cover both Portfolios. The specific performance and characteristics of each are presented separately in the tables that follow.

Fund Facts at October 31, 2021

| | | | | | |

| Sales Charge | | None |

| |

| Number of Holdings | | 78 |

| |

| Dividend Policy | | Annual |

| | | Institutional Investors | | Individual Investors |

| | |

| Total Net Assets | | $6,493.9M | | $3,813.3M |

| | |

| Turnover (5 Yr. Avg.) | | 19% | | 19% |

| | | |

| | | Inst. Class | | Inst. Class Z | | Advisor |

| | | |

| Ticker | | HLMEX | | HLEZX | | HLEMX |

| | | |

| CUSIP | | 412295701 | | 412295693 | | 412295305 |

| | | |

| Inception Date | | 10/17/2005 | | 3/5/2014 | | 11/9/1998 |

| | | |

| Minimum Investment1 | | $500,000 | | $10,000,000 | | $5,000 |

| | | |

| Net Expense Ratio2 | | 1.10%3 | | 1.00%4 | | 1.20%5 |

| | | |

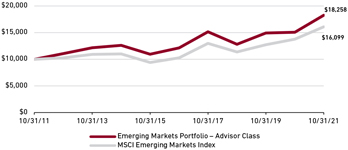

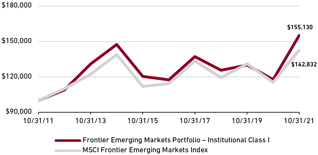

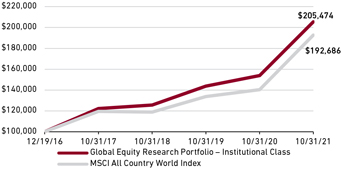

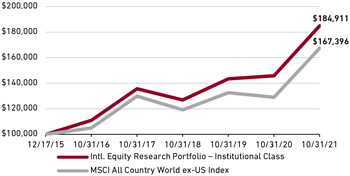

| Gross Expense Ratio2 | | 1.12% | | 1.04% | | 1.20% |